April 2023.

Pension Scheme for

Special Needs Assistants

Handbook

2

Note

This handbook is not a legal interpretation of existing superannuation provisions for

Special Needs Assistants, nor does it purport to deal with every query that may

arise. Care has been taken to ensure that it is accurate but nothing can override the

rules of the Scheme, as set out in relevant Statutes (including the Taxes

Consolidation Act 1997), Regulations and other official documentation.

3

Preface

This handbook relates only to the Pension Scheme for Special Needs Assistants.

Information about the Single Public Service Pension Scheme, which applies to public

servants recruited since the start of 2013, can be found at

https://singlepensionscheme.gov.ie/

Pensions Unit (Department of Education)

4

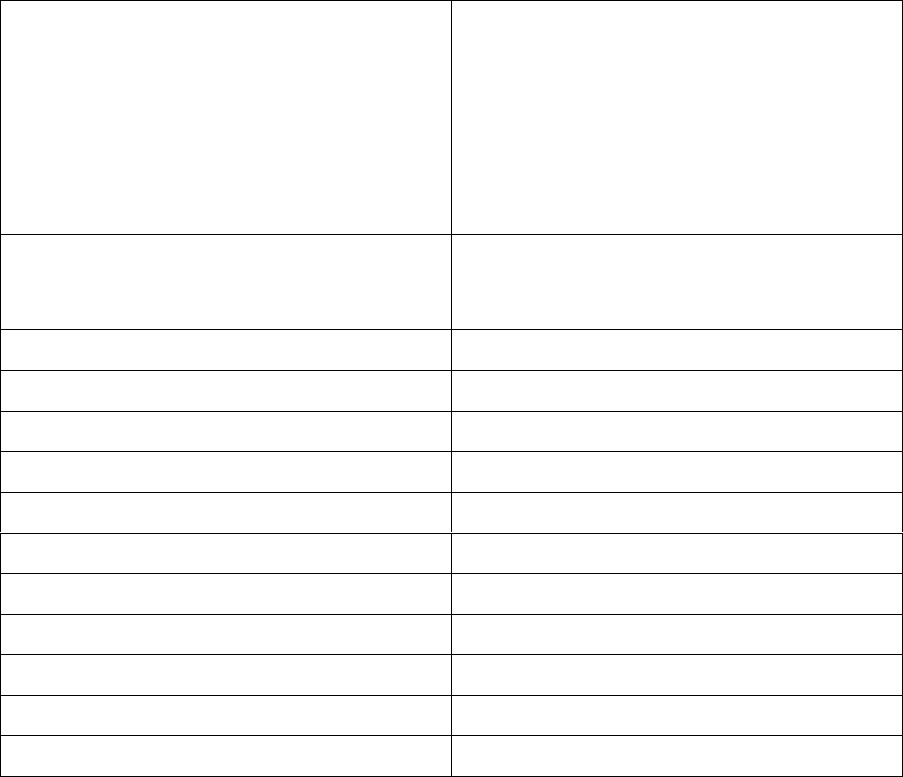

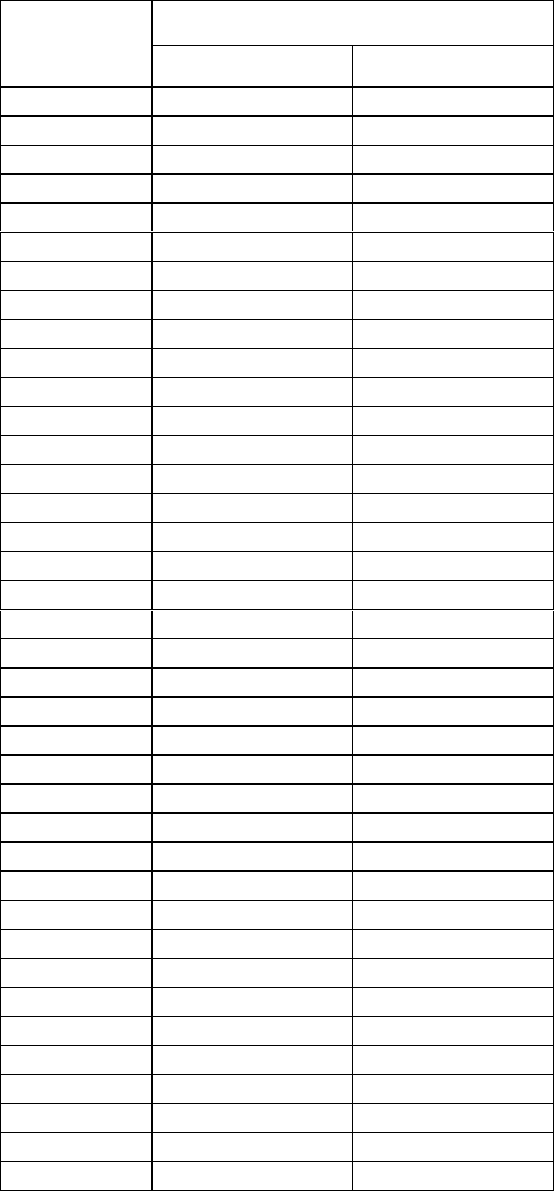

CONTENTS

Membership

1. Membership

Benefits and Conditions for Benefits

2. Overview of benefits

3. Factors that determine benefits

4. Rate of PRSI

5. Contributions

6. Qualifying conditions for benefits

Pensionable Service

7. Reckonable service for benefits

8. Reckonability of wholetime service

9. Reckonability of part-time service, including prior part-time service not

pensionable at the time

10. Work-sharing and job-sharing service

11. Career break

12. Unpaid leave

13. Previous service in the public sector

14. Purchase of notional service to increase or maximize benefits

Retirement Age and Pension Calculations

15. Retirement age and minimum pension age

16. Pensionable remuneration

17. Retirement lump sum calculation

18. Pension calculation

19. Retirement from part-time employment

5

20. Supplementary Pension

21. Resignation from service

22. Preserved benefits

23. Cost Neutral Early Retirement

24. Retirement on medical grounds

25. Gratuities

Death Benefits

26. Death in service and death after leaving service

27. Survivors’ and Children’s Benefits

Application for and Payment of Benefits

28. Application for benefits (including declarations)

29. Payment of pensions

Miscellaneous Provisions

30. Abatement of pension

31. Implications of the Family Law Acts

32. Dispute resolution and appeals

33. Pension Adjustments

34. Tax relief on superannuation contributions

35. Taxation

36. Chapter 4 of the Public Service Pensions (Single Scheme and Other

Provisions) Act 2012 in so far as it relates to the Pension Scheme for Special

Needs Assistants

Appendix 1: Cost Neutral Early Retirement – tables of actuarial reduction factors

Appendix 2: Notional Service Purchase – tables of contributions payable

Appendix 3: Notional Service Purchase – tables of actuarial reduction factors

6

Pension Scheme for Special Needs Assistants

Membership

1. Membership

1.1 Membership of the Pension Scheme for Special Needs Assistants (SNA

Scheme) is compulsory for Special Needs Assistants who are employed by a

primary, secondary or community & comprehensive school, and who are not

members of the Single Public Service Pension Scheme (see section 1.3).

1.2 In addition to retirement benefits for members, the SNA Scheme also provides

pensions for the survivors and/or dependant children of members who die in service

or after qualifying for a pension or preserved pension.

1.3 In general, persons whose employment as Special Needs Assistants began

on or after 1 January 2013 are members of the Single Public Service Pension

Scheme. Information on that scheme can be found at

www.singlepensionscheme.gov.ie

7

Benefits and Conditions for Benefits

2. Overview of Benefits

2.1 The benefits provided by the Pension Scheme for Special Needs Assistants

are as follows:

Retirement lump sum and pension (sections 17 and 18)

Preserved pension and lump sum – for qualifying members who resign before

minimum pension age (section 22)

Cost Neutral Early Retirement – this facility enables payment of actuarially

reduced pensions and retirement lump sums to members who wish to retire

up to 10 years before minimum pension age (section 23)

Medical grounds retirement – lump sum and pension (section 24)

Death gratuity (section 26)

Survivors’ and Children’s Pensions (section 27)

8

3. Factors that Determine Benefits

3.1 Superannuation benefits in the SNA Scheme are dependent on several

factors, the most important of which are as follows:

Reckonable Service, which includes:

o actual pensionable service (years and days worked)

o notional service, which may be purchased

o ill-health added years, in qualifying cases of retirement on medical

grounds

Pensionable Remuneration, which is essentially salary level at the time of

retirement, resignation, or death in service

3.2 All SNA Scheme members must pay the appropriate contributions (see

section 5).

9

4. Rate of PRSI

4.1 All Special Needs Assistants pay PRSI at the full rate – PRSI Class A.

10

5. Contributions

Definitions and calculation

5.1 Members pay contributions in the SNA Scheme as follows:

(a) For personal scheme benefits:

(i) 1.5% of gross pensionable remuneration

PLUS

(ii) 3.5% of net pensionable remuneration

PLUS

(b) For dependant benefits (Survivor’s and Children’s benefits):

1.5% of net pensionable remuneration.

Gross pensionable remuneration means salary expressed on a full-time working

basis.

Net pensionable remuneration (also known as co‐ordinated pay) means gross

pensionable remuneration less twice the maximum personal rate of State Pension

(Contributory) (SPC).

5.2 Therefore the total contributions deducted from Scheme members are as

follows:

1.5% of gross pensionable remuneration

PLUS

5.0% of net pensionable remuneration

Calculation in the case of work-sharers, job-sharers and part-time members

5.3 When members work on a part-time basis (including work-sharing and job-

sharing), they pay contributions on a pro rata basis. This means that the total

contribution due from such a member is calculated by:

working out first the amount the member would pay if working full-time (see

section 5.1 above); and

then applying to that amount the particular work pattern (e.g. 50%, 80%)

which describes the member’s contracted or rostered attendance (FTE).

Examples

5.4 Member pension calculations are shown in two examples below. Note that the

State Pension (Contributory) rate used throughout this Handbook is €248.30, the

weekly payment rate as of 1 January 2021.

11

Example 1:

A Special Needs Assistant working full-time on a salary of €35,845 pays

contributions worked out as follows:

Gross pensionable remuneration = €35,845

State Pension (Contributory) = €12,956 [€248.30 (weekly) x

52.18]

State Pension x 2 = €25,913

Net pensionable remuneration = €35,845 – €25,913 = €9,932

1.5% of gross pensionable remuneration = €538

5.0% of net pensionable remuneration = €497

Total contribution due = €1,035 (€538 + €497)

Example 2:

A part-time Special Needs Assistant with work pattern of 60% is paid on the basis

of an annual salary, expressed in full-time terms, of €34,726. She pays contributions

calculated as set out below. Note that the calculation method first works out the total

contribution due as if she was working full-time, and only then applies a 60% pro-rata

reduction based on her work pattern.

Gross pensionable remuneration (salary)= €34,726

State Pension (Contributory) = €12,956 [€248.30 (weekly) x

52.18]

State Pension x 2 = €25,913

Net pensionable remuneration = €34,726 – €25,913 = €8,814

1.5% of gross pensionable remuneration = €521

5.0% of net pensionable remuneration = €441

Total contribution before pro-rata adjustment = €962 (€521 + €441)

Total contribution due applying 60% pro-rata= €577

12

6. Qualifying Conditions for Benefits

6.1 For an SNA Scheme member leaving employment on or after 2 June 2002,

qualifying service is a minimum period of two calendar years’ service, regardless

of whether attendance is full‐time, work-sharing, job-sharing or regular part‐time. For

example, 1 September 2010 to 31 August 2012 is two calendar years. Transferred

service and prior reckonable service also count towards qualifying service. This

qualifying service period of two calendar years is also known as the vesting period.

It is the required minimum service to be eligible for Retirement Benefits, but not for

Death in Service Benefits.

6.2 Prior to 2 June 2002, qualifying service was defined as a minimum period of

five years’ actual pensionable service. In measuring actual pensionable service,

part-time work counts only pro rata to, or in proportion to, full-time service. This

means, for example, that six years’ part-time service on a 50% work pattern is three

years’ actual pensionable service.

13

Pensionable Service

7. Reckonable Service for Benefits

7.1 The following service is reckonable for benefits:

Pensionable service in the Pension Scheme for Special Needs Assistants

Temporary wholetime service which is pensionable on an ongoing basis, or

temporary wholetime service which was not pensionable when the service

was given but can now be reckoned for pension purposes

Part‐time service (see section 9)

Transferred service

Additional or added service in respect of ill‐health added years (see section

24) or the purchase of added years under the Notional Service Purchase

Scheme (see section 14)

Certain service in respect of which the member may have already received a

gratuity or refund of contributions

7.2 For service to be reckonable, the appropriate contributions must be paid.

7.3 From 28 July 2012 onwards, the aggregate of a public servant’s reckonable

service for superannuation purposes across all public service pension schemes

(excluding the Single Scheme) cannot exceed 40 years. This is subject to the

exception that if, on 27 July 2012 service in excess of 40 years has been earned in

more than one public service pension scheme, the service is capped at the service

accrued on that date. For further details of this service cap see section 36.2.

14

8. Reckonability of Wholetime Service

8.1 Wholetime Service is reckonable based on the number of years and days the

member is employed for.

Example:

A member working in a full‐time capacity is employed from 1 September 2003 to 31

December 2020. This is reckonable as follows:

1 September 2003 to 31 August 2020 = 17 years

1 September 2020 to 31 December 2020 = 122 days

In this case, the reckonable service for pension benefit purposes is 17.3342

years. This is calculated as follows:

Complete years: 17

PLUS

Part-years: (122 / 365) = 0.3342

Note that the divisor for part-years is always 365, not 365.25.

8.2 Contributions are paid on an ongoing basis for permanent wholetime service.

15

9. Contributions for Part-time Service, Including Prior Part-time

Service Not Pensionable at the Time

9.1 When members currently work on a part-time basis (including work-sharing

and job-sharing), they pay contributions on a pro-rata basis. This means that the

total contribution due from such a member is calculated by:

working out first the amount the member would pay if working full-time (see

sections 5.1(a) and (b) above);

then applying to that amount the particular work pattern (e.g. 50%, 80%)

which applies to the member.

9.2 The cost of reckoning prior part-time service is as follows:

1.5% of current wholetime equivalent pensionable pay

plus 3.5% of current net pensionable remuneration (current co-ordinated pay)

for each year and part thereof of reckonable prior part-time service calculated on

pensionable salary at date of application.

9.3 Outstanding contributions due in respect of earlier service which is recognized

as pensionable are deducted from the retirement lump sum.

9.4 The calculation of contributions due in respect of earlier service does not

include contributions due for survivors’ and children’s (S&C) benefits. A member can

opt to pay additional S&C contributions of 1.5% of net pensionable remuneration

over the corresponding period of service (i.e. matching period of service to be

reckoned). If the member does not so opt, then 1% of retirement salary for each year

or part thereof of S&C liability will be deducted from the retirement lump sum.

16

10. Work-sharing and Job-sharing Service

10.1 Work-sharing/job‐sharing means that a member works less hours than a

wholetime comparator (i.e. the hours worked are reduced for the period of work-

sharing or job-sharing). In accordance with the provisions of the SNA Scheme, a

work-sharer/job‐sharer is credited with pro‐rata pensionable service in respect of

each year of work sharing/job‐sharing service. If a work sharer/job‐sharer retires

whilst on reduced hours, pension benefits are based on the wholetime equivalent

of their salary at retirement.

17

11. Career Break

11.1 Career breaks are not reckonable for pension purposes because they are

periods of unpaid leave. However, a Pension Scheme member who has at least nine

years’ potential service by age 65 can purchase service in respect of their career

break in accordance with the limits in section 14. There are two ways in which a

member can purchase service in order to make the period of their career break

reckonable for pension purposes.

(a) When a member returns to employment:

A member can opt to purchase the career break by purchasing notional

service for the same period of service (or less). The contribution due may be

made either by lump sum payment, or by periodic contributions from salary

where the member decides to purchase at least one year. An option to

purchase by lump sum must be made within six months of returning to duty.

The cost of the lump sum payment will be based on the member’s salary at

the date the option is made, and the rate will be calculated on the age next

birthday in accordance with the notional service purchase tables in Appendix

2.

(b) Purchasing the service loss while on a career break:

The service loss while on a career break may be purchased while on the

career break. In this case, the contribution will be based on the rate of salary

on the last date of paid service prior to the commencement of the career

break and will take account of any changes in salary that may arise during the

career break. The rate of contribution is based on the lump sum purchase

rates in accordance with the notional service tables in Appendix 2 and is

determined by the member’s age next birthday at the time the quarterly

payment due is being calculated. There are two different rates, and the rate

applying will depend on whether the member’s minimum retirement age is age

60 or age 65. In the case of a new entrant (member appointed on or after 1

April 2004 – see section 15.3), the only rates available are the rates in the

purchase-to-age-65 table, labelled Table B at Appendix 2. This is due to the

minimum retirement age being 65 for new entrants.

18

12. Unpaid Leave

12.1 Unpaid leave or sick leave paid at the Temporary Rehabilitation

Remuneration (TRR) rate is not reckonable for pension purposes. During such

periods of leave the member was not receiving any salary, and therefore

superannuation contributions were not deducted.

12.2 Examples of non‐reckonable unpaid periods of leave or absence are: unpaid

parental leave, unpaid maternity leave, career breaks, special leave without pay and

strike days.

19

13. Previous Service in the Public Sector

13.1 Prior public service is normally transferable into the SNA Scheme, subject to

the rules of the Public Sector Transfer Network. Where contributions in respect of the

earlier service are outstanding, these must be repaid to the current employer in

accordance with the Transfer Network rules.

13.2 If the member received a refund of contributions from any public sector body

in the Public Sector Transfer Network in lieu of any retirement benefits, the member

can re‐instate this service by paying the appropriate contributions ((i.e. repaying the

adjusted gross refund received) to the current employer. In the event that PRD

(Pension Related Deduction) or ASC (Additional Superannuation Contribution)

deductions were also returned to the member on ceasing employment then this

amount must be repaid, plus compound interest, to the former employer in order to

re-instate the service.

13.3 If the member had previous service in another public body that was not

pensionable at the time of their employment but would have been pensionable had

the member still been employed in that organisation (i.e. part‐time service), then this

service may be transferred via the Public Sector Transfer Network and reckoned on

payment of the appropriate contributions due. Such transfer is permitted whether or

not the member is vested.

13.4 The transfer option only applies to organisations that are part of the Public

Sector Transfer Network or the Local Government Transfer Network. The Public

Sector Transfer Network is administered under rules set by the Department of Public

Expenditure and Reform. The Department of Public Expenditure and Reform

maintains a list of organisations approved for participation in the Public Service

Transfer Network.

20

14. Purchase of Notional Service to Increase or Maximise

Benefits

14.1 There is a Notional Service Purchase Scheme that allows members who do

not have a full pension at retirement to purchase additional years to make up some

or all of the difference.

Purchase Conditions and Rates

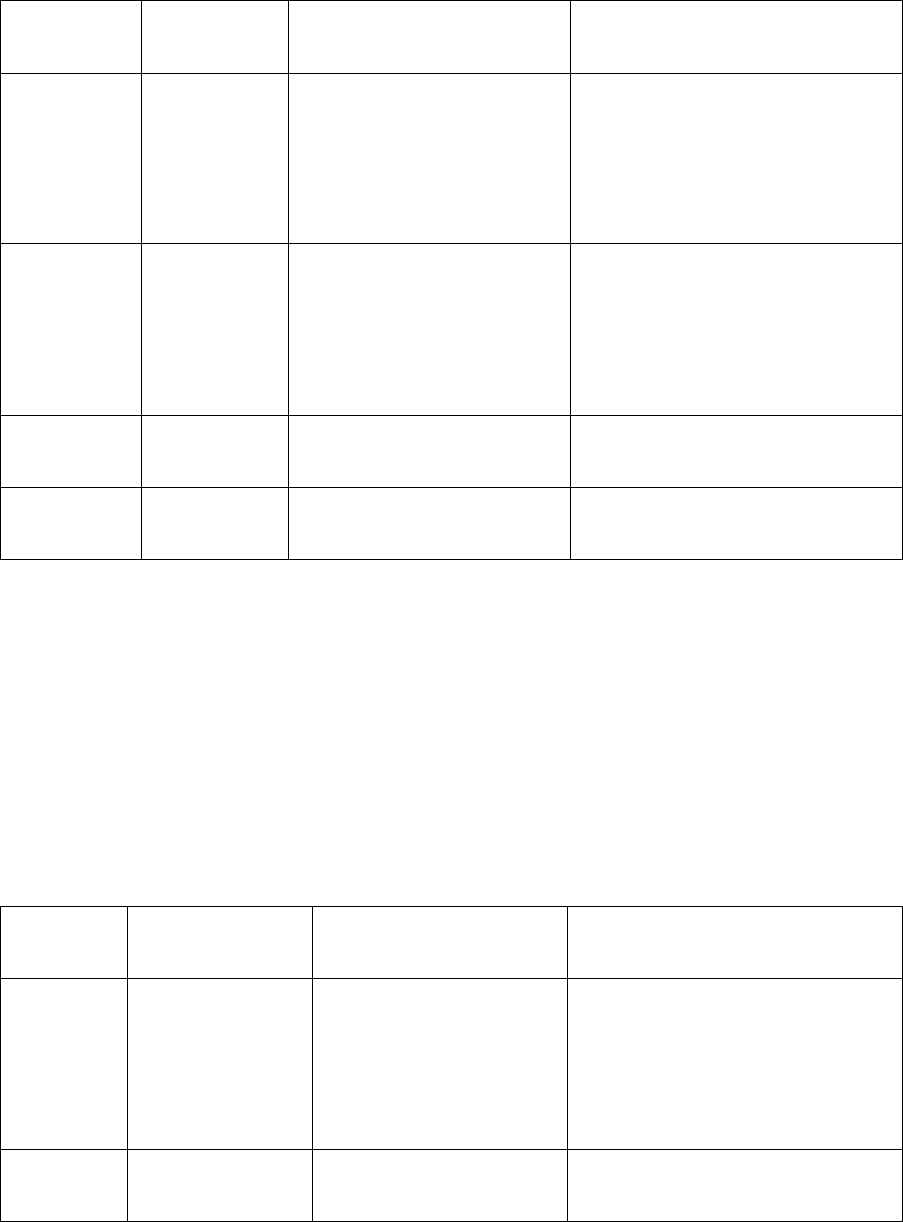

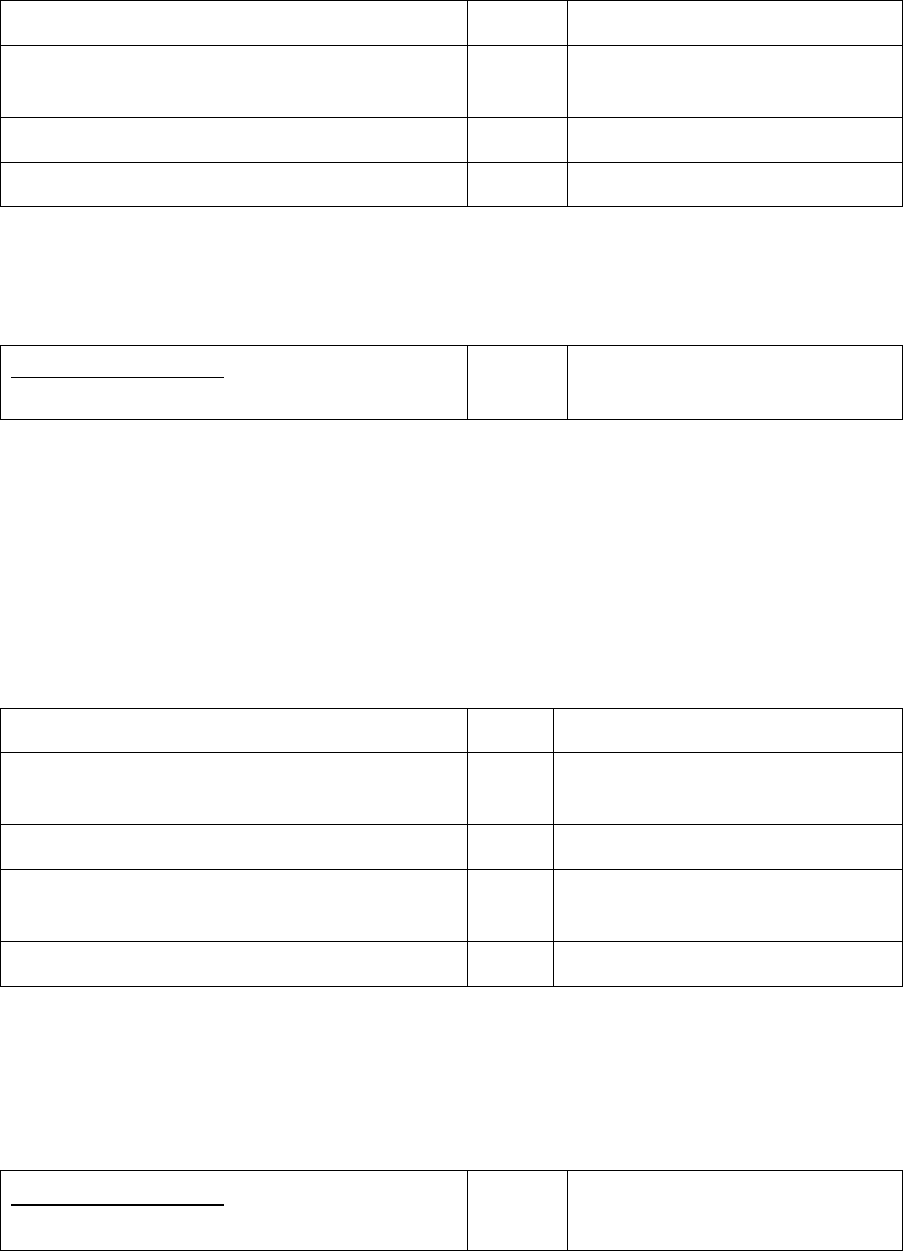

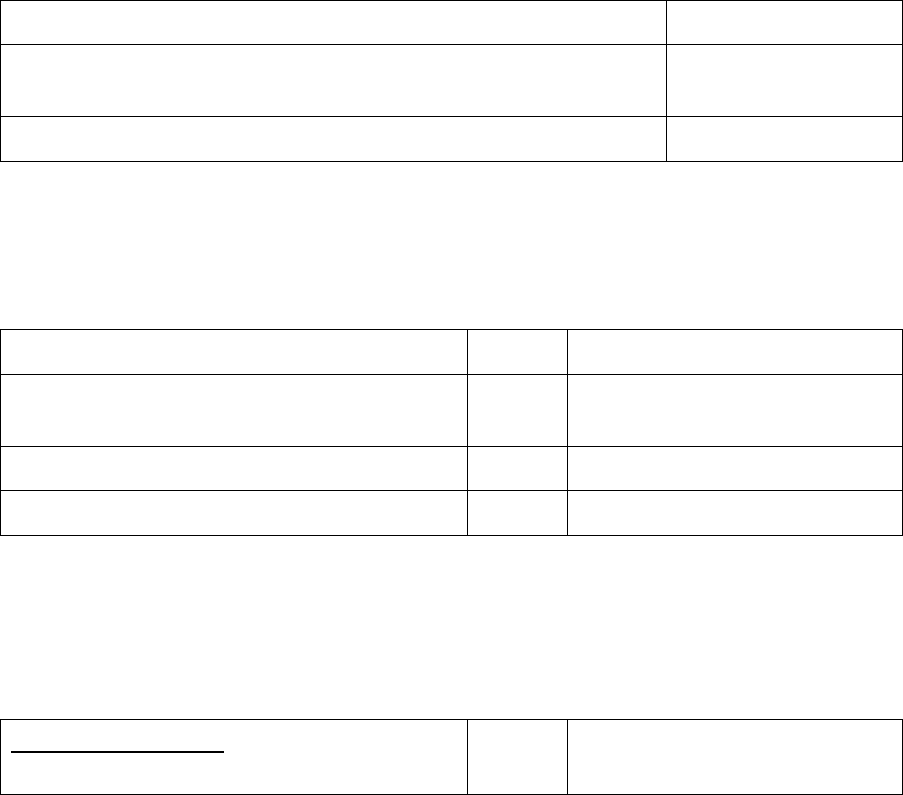

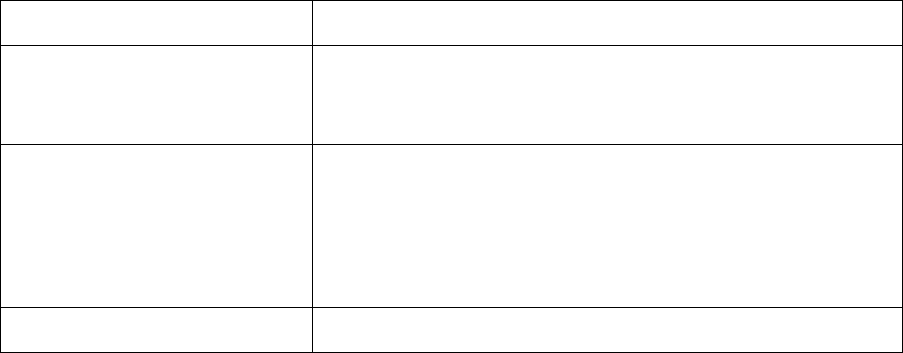

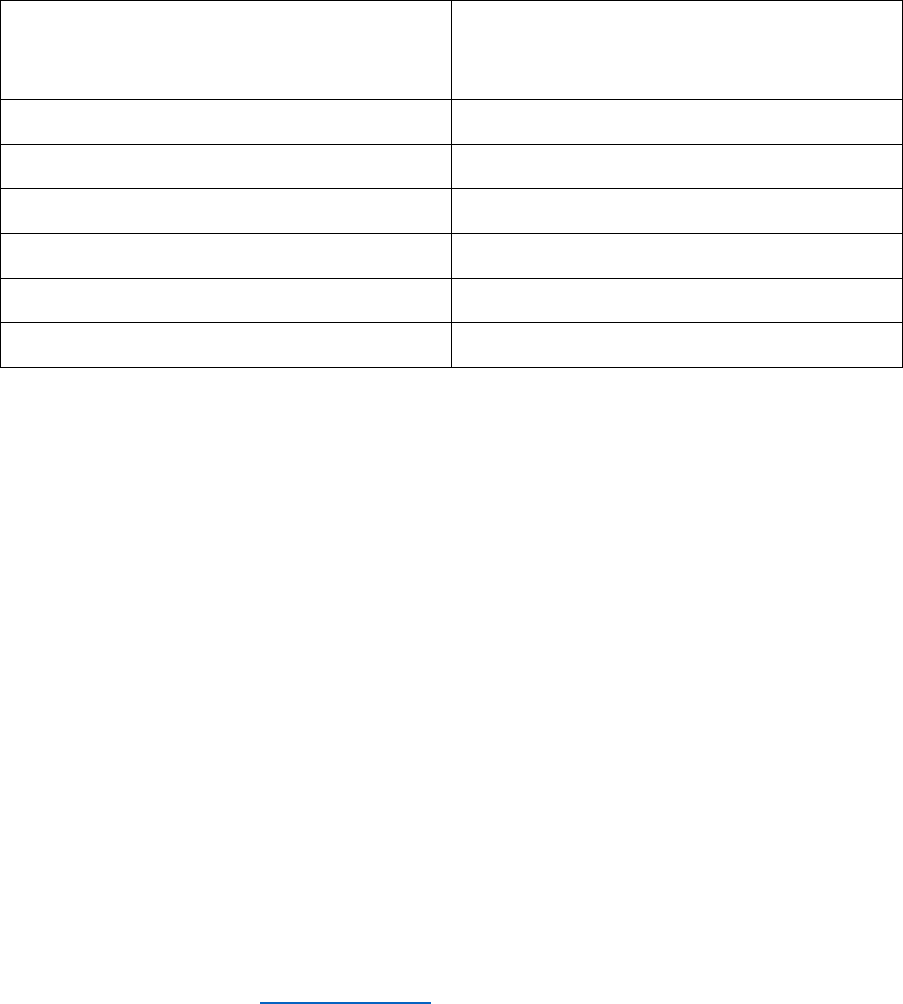

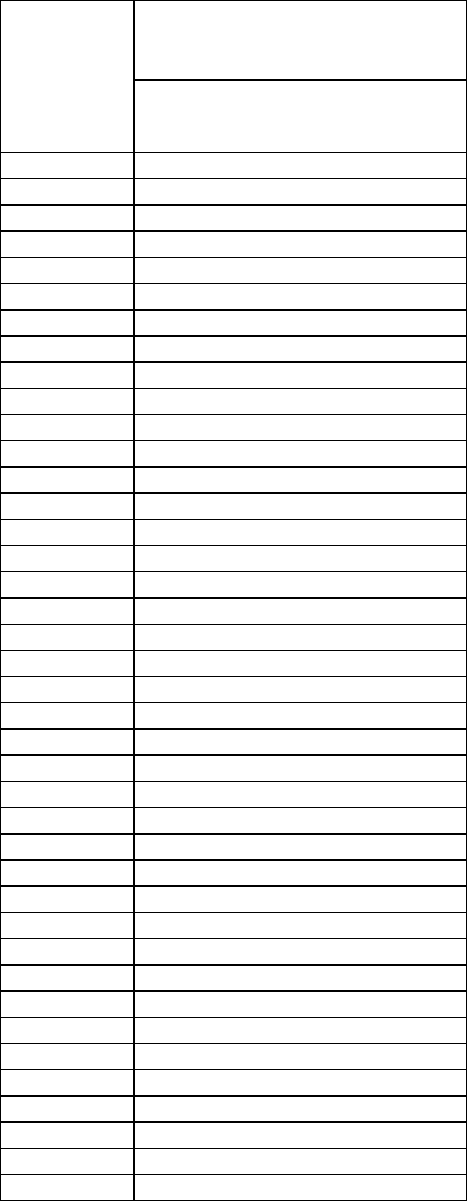

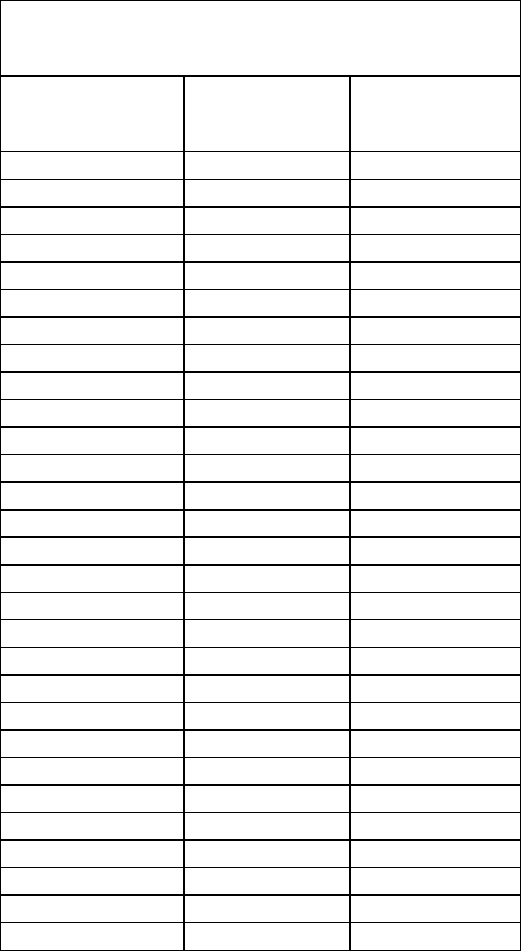

14.2 There are limitations on the amount of service that can be purchased.

Actual Reckonable service (including

transferred service and prior actual

service which was “bought back”,

but excluding purchased notional

and notional added years) which the

member would have if remaining in

service until age 60 or 65 as

appropriate (FTE Years)

Maximum service which can be

purchased

20 years or more

Difference between 40 years and

reckonable service at age 60 or 65 as

appropriate

19 years

17 years

18 years

15 years

17 years

13 years

16 years

11 years

15 years

9 years

14 years

7 years

13 years

5 years

12 years

4 years

11 years

3 years

10 years

2 years

9 years

1 year

The limits above are subject to the overriding restriction that the amount of

service which is reckonable plus the notional service being purchased does

not exceed 40 years.

14.3 Contribution rates vary by reference to age. Rates also depend on whether

purchase is by reference to age 60 (only applicable to staff employed prior to 1 April

2004) or to age 65. The purchase rates are set out in Appendix 2.

21

14.4 Members who wish to purchase notional service must fulfil the following

conditions:

(a) Must be in service.

(b) Must have at least nine years’ actual pensionable service (i.e. excluding

notional service) to age 60 or 65 as appropriate.

(c) Cannot be on sick leave, on special leave without pay, or suspended from

duty (with or without pay) or likely to retire on medical grounds.

Purchase options

14.5 There are two methods of purchase for notional service:

(a) Periodic deductions

This involves paying additional contributions from

salary, each payment based on the rate applicable at

the member’s age next birthday and continuing up to

age 60 or 65 as applicable. As it is based on a fixed

percentage, the amount of payment will increase

according as salary increases. This option can be

made at any time up to two years before the

appropriate retirement age

(b) Lump sum

contribution

This involves paying a once-off contribution based on

salary at the time the option is exercised, with the rate

based on the member’s age next birthday. This option

can be made once in a calendar year provided that the

amount is 10% or more of gross pay

14.6 With regard to the age-purchased-to, the position of members who otherwise

meet the conditions for purchase of notional service is as follows:

Members who are not new entrants can purchase to age 60 or to age 65.

Members who are new entrants can purchase to age 65 only.

See section 15.3 for the definition of new entrant.

Part-time working and unpaid absence

14.7 Where a member is paid less than full salary for any period, contributions are

calculated and deducted as if full salary was payable for that period. However, no

deductions are made during any unpaid periods of absence – in such cases the

service credit in respect of purchased service is reduced using a set formula.

Purchase examples

14.8 Two example cases of purchase of notional service are set out below:

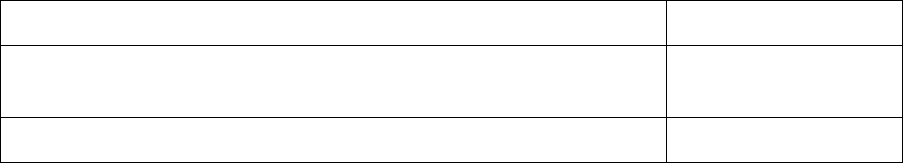

Example 1:

A member wishes to purchase one year of notional service at age 52. The member

has a salary of €40,590 per annum and commenced service prior to 1 April 2004 (i.e.

is not a new entrant – see section 15.3).

22

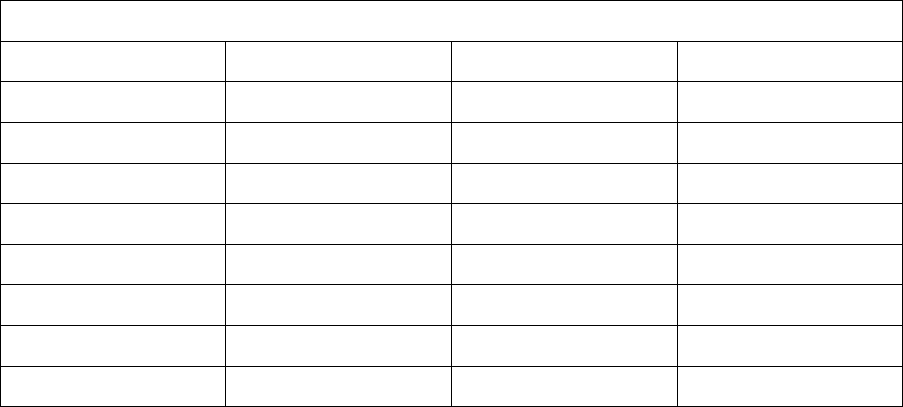

Option

Retirement

age

Rate applicable at age

53

Cost of purchase

Periodic

deduction

65

0.29% of gross salary

plus 1.87% of net

salary*

(€40,590 x 0.29%) +

((€40,590 – €25,913) x

1.87%)

= €392.17 p.a. (initial cost**)

until age 65

Periodic

deduction

60

0.51% of gross salary

plus 3.74% of net

salary*

(€40,590 x 0.51%) +

((€40,590 – €25,913) x

3.74%)

= €755.93 (initial cost**) p.a.

until age 60

Lump Sum

65

22.5% of salary

€40,590 x 22.5% =

€9,132.75

Lump Sum

60

26.0% of salary

€40,590 x 26.0% =

€10,533.40

* Net salary is gross salary less twice the annual State Pension (Contributory) (SPC)

rate. The weekly SPC rate is €248.30 (rate at May 2021) therefore the offset is

€248.30 x 52.18 x 2 = €25,913 per annum.

** Since it is a percentage-basis contribution, the initial annual cost will rise over the

course of the purchase agreement according as salary increases. The annual cost

will also be affected by any changes in the rate of State Pension (Contributory).

Example 2:

A member wishes to purchase one year of notional service at age 44. The member

has a salary of €34,726 per annum and commenced service after 1 April 2004 (i.e. is

a new entrant – see section 15.3).

Option

Retirement

age

Rate applicable at

age 45

Cost of purchase

Periodic

deduction

65

0.17% of gross salary

plus 1.13% of net

salary*

(€34,726 x 0.17%) +

((€34,726 – €25,913) x

1.13%)

= €158.62 p.a. (initial cost**)

until age 65

Lump

Sum

65

28.0% of salary

€34,726 x 28.0% =

€9,723.28

As this member is a new entrant, he or she can only purchase notional service by

reference to age 65 since this is the minimum age for pension payment.

23

* Net salary is gross salary less twice the annual State Pension (Contributory) (SPC)

rate. The weekly SPC rate is €248.30 (rate at May 2021) therefore the offset is

€248.30 x 52.18 x 2 = €25,913 per annum.

** Since it is a percentage-basis contribution, the initial annual cost will rise over the

course of the purchase agreement according as salary increases. The annual cost

will also be affected by any changes in the rate of State Pension (Contributory).

Cancelling a notional service purchase contract

14.9 A periodic purchase option cannot be completely revoked once payments

have commenced. However, a member who wishes to cease making periodic

contributions can do so by giving notice, in writing, of his or her intention to cancel

the purchase agreement. The deductions from salary will cease from the next

available salary payment. The service credit accrued up to that date is calculated by

the formula:

A X B

C

where:

A = the number of years of notional service which the member originally opted

to purchase;

B = the period during which periodic contributions have been made; and

C = the total period during which periodic contributions should have been

made had the member completed the purchase agreement.

14.10 The formula at section 14.9 is also used to calculate the service credit taking

account of missed contributions during a periodic purchase agreement (e.g. due to a

period of special leave without pay) or retiring or leaving before the purchase

contract period has been completed.

14.11 The example below shows how purchase contract cancellation works:

Example

A member commenced purchase of 4 years of notional service from 30 April 2014 by

periodic contributions up to age 65. The original purchase contract was for 14 years

and was cancelled with effect from 1 December 2020.

The purchase of 4 years is reduced by use of the formula at section 14.9 above,

which calculates the member’s service credit as follows:

A = 4.0000

B = 6.5890 (30 April 2014 to 30 November 2020)

C = 14.0000 (30 April 2014 to 29 April 2028)

4.0000 x 6.5890 = 1.8826 years credited

14.0000

24

If the member in this example retires prior to age 65, a further reduction will be made

in accordance with the actuarial reduction factors in the tables at Appendix 3.

Actuarial reduction resulting from early drawdown of pension

14.12 If a member retires prior to age 60 or 65 (whether in the ordinary course, on

medical grounds or on CNER terms), the formula at section 14.9 is also used to

take account of missed contributions due to an earlier retirement.

14.13 Where a member who is purchasing notional service:

(i) retires on medical grounds with an immediate pension;

(ii) retires on pension between ages 60 and 65 in the case of a member with a

preserved age of 60 purchasing to age 65; or

(iii) retires on Cost Neutral Early Retirement (CNER) terms in the case of a

member with a preserved age of 60 who is purchasing by reference to age 65,

there will be an actuarial reduction using the appropriate Table (purchase to age 65

Table or purchase to age 60 Table) at Appendix 3. Each of these three case

categories is considered further below:

(i) Purchasing member retires on medical grounds with an immediate pension.

Example

An SNA Scheme member with preserved pension age of 65 years retires on medical

grounds at age 57. She has a salary of €40,590. At the time of retirement, she has

17 years’ actual service, and has completed 2.5 years of a periodic payment-of-

service agreement, in which she contracted to buy 3 years’ service.

The formula at 14.9 is applied to determine the amount of purchased service which

should be included for calculating her pension benefits:

A X B =

C

3 [years contracted to buy] X 2.5 [years during which payments were

made]

10 [total years of payment had full payment been completed]

Therefore 0.75 years purchased service is added to the SNA’s actual service of 17

years, so that a total of 17.75 years’ service is used to calculate her pension and

lump sum.

(ii) Purchasing member retires on pension between ages 60 and 65 in the case

of a member with a preserved age of 60 purchasing to age 65

Example

An SNA Scheme member with preserved pension age of 60 retires on her 63

rd

birthday. She has a salary of €40,590. At the time of retirement, she has 19 years’

25

actual service, and has completed 6 years of a periodic payment-of-service

agreement, in which she contracted to buy 2 years’ service.

The formula at 14.9 is applied to determine the amount of purchased service which

should be included for calculating her pension benefits:

A X B =

C

2 [years contracted to buy] X 6 [years during which payments were

made]

8 [total years of payment had full payment been completed]

Therefore 1.5 years purchased service is added to the SNA’s actual service of 17

years, so that a total of 18.5 years’ service is used to calculate her pension and lump

sum.

(iii) Purchasing member

retires on Cost Neutral Early Retirement (CNER) terms in the case of a member

with a preserved age of 60 who is purchasing by reference to age 65,

For the CNER case type at (iii), the purchase actuarial reduction will reduce the

purchased element of service by applying the reduction factors from the age-60

(“Age last birthday”) row of the purchase to age 65 table at Appendix 3. The

purchased service element, reduced in this way, will then be added to actual service.

Only then will the separate reduction factors relevant to CNER (see section 23) be

applied to the resultant total service.

Purchase of service by work-sharing / job-sharing / part-time members

14.14 Purchase of service by members who do not work full-time is subject to the

following conditions:

(a) Work-sharing, job-sharing or part‐time members who have completed at least

two years’ consecutive service in such work patterns may, subject to the

normal purchase scheme rules, consider purchasing service on the

assumption that they will continue to work in that pattern to the appropriate

retirement age. The maximum amount of service which may be purchased is

determined by the scheme rules in the normal way.

(b) Where there is an increase in the working pattern of the part‐time member or

if the work/job-sharing member resumes full‐time work, and as a result of any

such change, the service purchased or being purchased exceeds the amount

required to bring the member’s potential reckonable service, by age 60 or 65,

as appropriate, to 40 years, then the contribution rate(s) must be adjusted (or

purchase contributions cancelled altogether if required) and any excess

26

contributions (including all contributions if necessary) should be refunded

through the payroll system.

Refunds of notional service

14.15 Payments made for purchased service – whether by periodic or lump sum

contributions – are refundable through the payroll system and only in the following

limited circumstances:

where a member resigns, does not qualify for superannuation benefits, and

does not transfer his or her service to another employment;

where a member who is purchasing service leaves before attaining the

minimum service requirement of nine years. In that situation all purchase

contributions must be refunded. If a member who is purchasing service leaves

the employer having attained nine years’ service but before attaining the

minimum service required in the table for limitations on service to be

purchased (see section 14.2) an appropriate refund of purchase contributions

must be made for any service in excess of the limitations;

where a member, having exercised an option to purchase service,

subsequently has service transferred-in, and as a result, his or her total

service would be in excess of the maximum reckonable (40 years);

where an excess contributions instance (as described in section 14.14(b)

above) arises.

Where a member opts to work beyond the (purchase target age of 60 or 65)

and as a result will have in excess of 40 years’ service at retirement.

27

Retirement Age and Pension Calculations

15. Retirement Age and Minimum Pension Age

Minimum and compulsory retirement ages

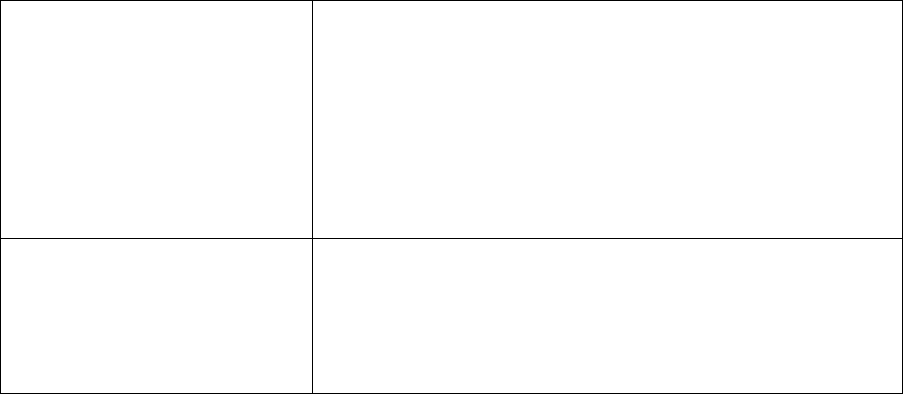

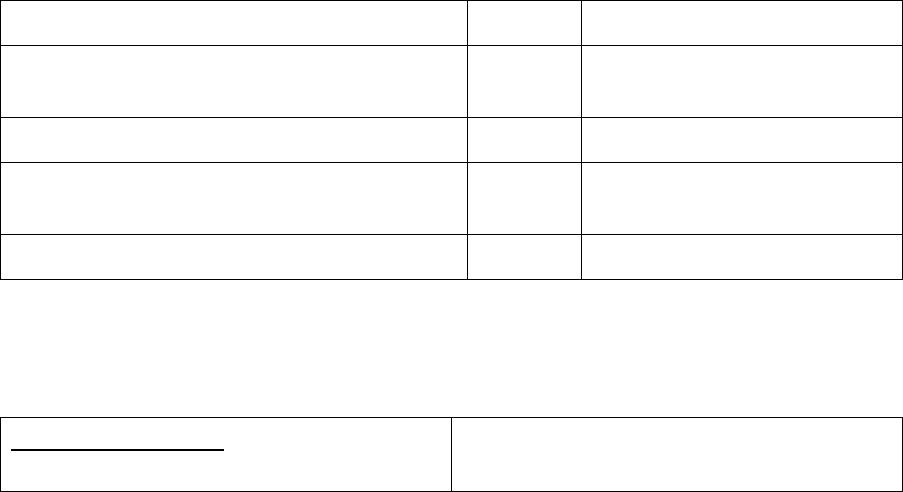

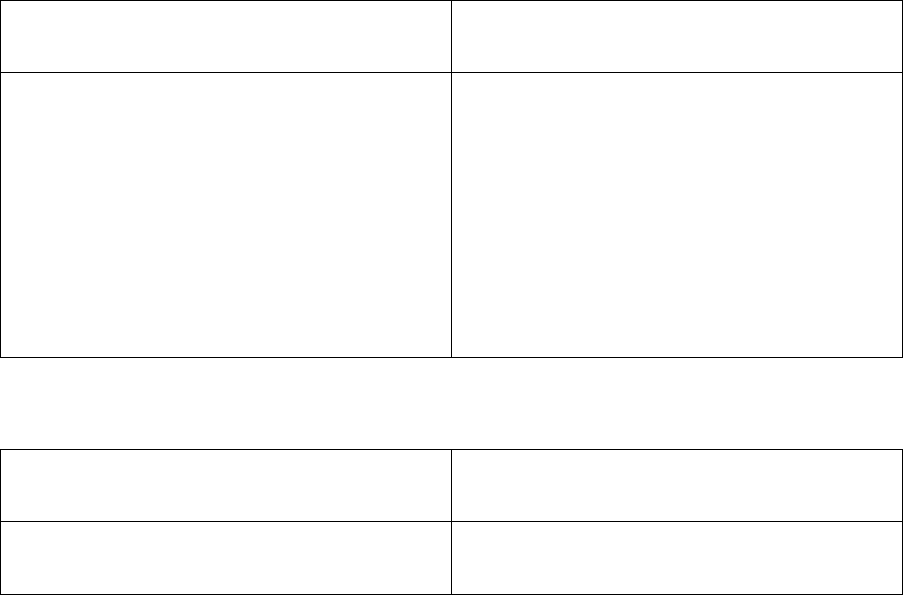

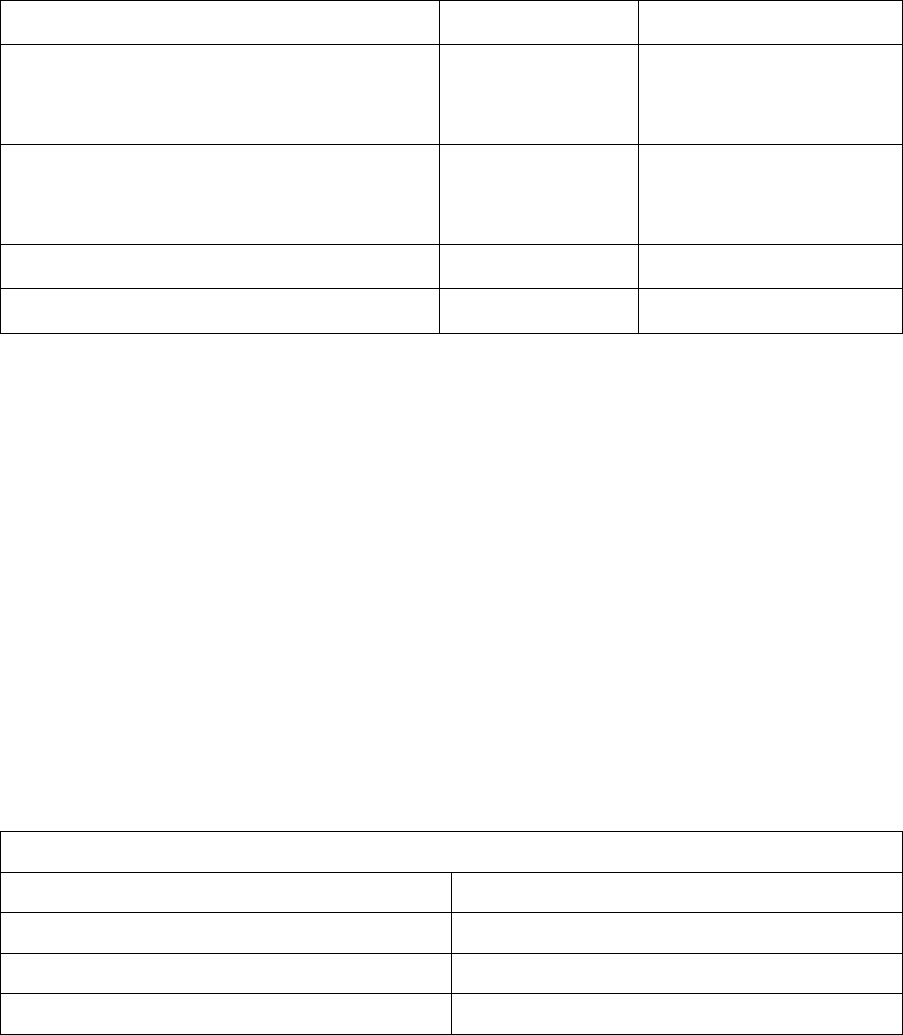

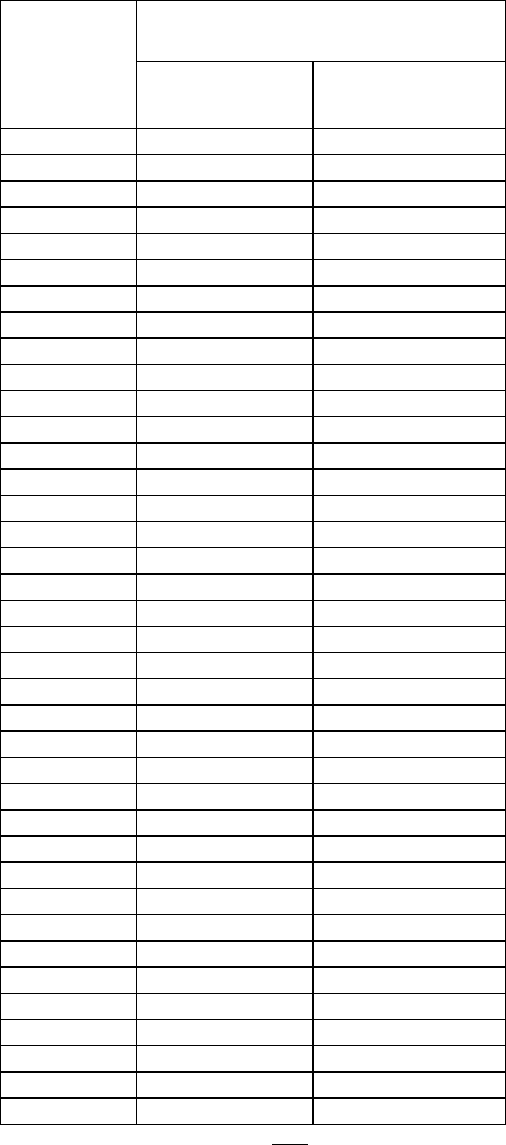

15.1 The ages at which a Scheme member may retire with pension are shown in

the following table:

Member cohort

Retirement Age

SNAs employed in the public

sector before 1 April 2004

Normal (minimum) retirement age: 60

CNER* minimum age: 50

Compulsory retirement age: End of school

year in which age 70 is reached**

SNAs not employed in the public

sector before 1 April 2004

(see section 15.2 below)

Normal (minimum) retirement age: 65

CNER* minimum age: 55

Compulsory retirement age: None

* CNER = Cost Neutral Early Retirement – see section 23.

** This applies to SNAs in this group attaining the age of 65 after 26 December 2018.

15.2 Special Needs Assistants recruited on or after 1 January 2013 do not in

general belong to the Pension Scheme for Special Needs Assistants. Instead, they

are members of the Single Public Service Pension Scheme. Further details of that

scheme are available at www.singlepensionscheme.gov.ie.

“2004 New Entrant”

15.3 Scheme members appointed on or after 1 April 2004, who were not employed

in the public sector before that date, are "new entrants" for the purposes of

superannuation. This means that, as indicated in the table at section 15.1 above,

their normal (minimum) retirement age is 65, and they have no compulsory

retirement age. However there are some exceptions:

(a) staff on paid or unpaid leave or on secondment from public service bodies on

31 March 2004 will not be regarded as new entrants on their return;

(b) staff who received a written offer of employment prior to 1 April 2004 but had

not taken up duty by that date will not be regarded as new entrants on

accepting that appointment;

(c) staff who were employed in a temporary or seasonal capacity prior to 1 April

2004 will not be regarded as new entrants if they resume duty in the public

service within the same contract of employment;

28

(d) any public servant who was serving on 31 March 2004 and who leaves

employment but subsequently returns, within a period of 26 weeks, to

employment in the public service, will not be regarded as a new entrant;

(e) any public servant

(i) who was serving on 31 March 2004 or within 26 weeks prior to that date,

or

(ii) any public servant to whom (i) applies who leaves employment but

subsequently returns within a period of 26 weeks, to employment in the

public service;

will not be regarded as new entrants on their return.

15.4 “2004 New Entrant” as defined at section 15.3 above essentially distinguishes

between:

members of the SNA scheme who were recruited to the public sector before 1

April 2004, who are not new entrants; and

members of the SNA scheme who were recruited to the public sector from 1

April 2004 onward, who are new entrants.

It is important not to confuse this new entrant member category with membership of

the Single Public Service Pension Scheme.

29

16. Pensionable Remuneration

16.1 Pensionable Remuneration is the annual rate of incremental salary held on

the last day of service.

30

17. Retirement lump sum calculation

17.1 Retirement lump sum is 3/80ths of pensionable remuneration for each year of

reckonable service, subject to a maximum of 1½ times pensionable remuneration.

Example:

A Scheme member retires on a wholetime equivalent salary (pensionable

remuneration) of €40,590, with 40 years’ reckonable service. She receives a

retirement lump sum of €60,885, calculated as follows:

€40,590 x 40.0000 x 3/80ths = €60,885 (maximum payable)

31

18. Pension Calculation

18.1 The Pension Scheme for Special Needs Assistants is an integrated scheme.

This means that the pension at retirement is calculated with an offset in respect of

the State Pension (Contributory) (SPC) and in addition to benefits from the SNA

Scheme a member may qualify for a SPC.

Integration method of pension calculation

18.2 A revised integration method of pension calculation applies to all Special

Needs Assistants who qualify for benefits on or after 1 January 2004. The method of

calculation is as follows:

1/200th of pensionable remuneration up to 3 1/3 times SPC* x service

PLUS

1/80th of any pay balance in excess of 3 1/3 times SPC* x service

Overall reckonable service for pension benefits is subject to a maximum of 40 years.

*Note: The SPC rate is the maximum State Pension (Contributory) rate payable by

the Department of Social Protection to a single person without dependants on the

last day of the member's pensionable service.

A multiplier of 3.333333 (i.e. six decimal places) is used to calculate 3 1/3 times

SPC, which is the threshold pay level for moving from the lower (1/200) to the

higher (1/80) pension accrual rate.

Based on the 2021 weekly SPC rate of €248.30, the threshold value in annual terms

is:

(€248.30 x 52.18 x 3.333333) = €43,187.64.

Integrated pension calculation method before 1 January 2004

18.3 Prior to 1 January 2004 the method of calculation of pension for staff

appointed on or after 6 April 1995 was:

1/80th of net pensionable remuneration (pensionable remuneration minus

twice the SPC) multiplied by the number of years of reckonable service,

subject to a maximum of 40 years.

Pension calculation examples

18.4 The three examples below show the current integration method of pension

calculation (in each case the member retires on or after 1 January 2004).

Example 1:

A Special Needs Assistant retires on 31 August 2021 with the following earnings and

service.

32

Actual remuneration at retirement

=

€40,590

State Pension (Contributory) annual rate

at retirement (31 August 2021)

=

€12,956

3 1/3 x State Pension (Contributory) rate

=

€43,188

Service (actual reckonable)

=

30 years

Pension =

1/200 x pensionable remuneration up to €43,188 x service, plus

[There is no pay balance over €43,188 to which 1/80

th

would be applied]

€40,590 x 30.0000

200

=

€6,088

Total pension: €6,088 per annum

Example 2:

A Special Needs Assistant was employed full‐time for 20.00 years and then in a 50%

work-sharing capacity for 18.00 years. On retirement on 31 August 2021 her total

reckonable actual service is 29.0000 years. This 29 years’ service is comprised of 20

years from her full‐time attendance and 9 years (18 x 50% = 9) from her subsequent

period of work-sharing.

Actual remuneration at retirement

=

€20,295

State Pension (Contributory) annual rate

at retirement (31 August 2021)

=

€12,956

3 1/3 x State Pension (Contributory)

=

€43,188

Pensionable remuneration (notional full-

time)

=

€40,590

Service (actual reckonable)

=

29 years

Pension =

1/200 x pensionable remuneration up to €43,188 x service, plus

[There is no pay balance over €43,188 to which 1/80

th

would be applied]

€40,590 x 29.0000

200

=

€5,886

Total pension: €5,886 per annum

33

Example 3:

A Special Needs Assistant was employed in a 60% part-time capacity for 20 years.

On retirement on 31 August 2021 her total reckonable actual service is 12.0000

years (20 x 60% = 12).

Actual remuneration at retirement

=

€24,354

State Pension (Contributory) annual rate

at retirement (31 August 2021)

=

€12,956

3 1/3 x State Pension (Contributory)

=

€43,188

Pensionable remuneration (notional full-

time)

=

€40,590

Service (actual reckonable)

=

12 years

Pension =

1/200 x pensionable remuneration up to €43,188 x service, plus

[There is no pay balance over €43,188 to which 1/80

th

would be applied]

€40,590 x 12.0000

200

= €2,435

Total pension: €2,435 per annum

34

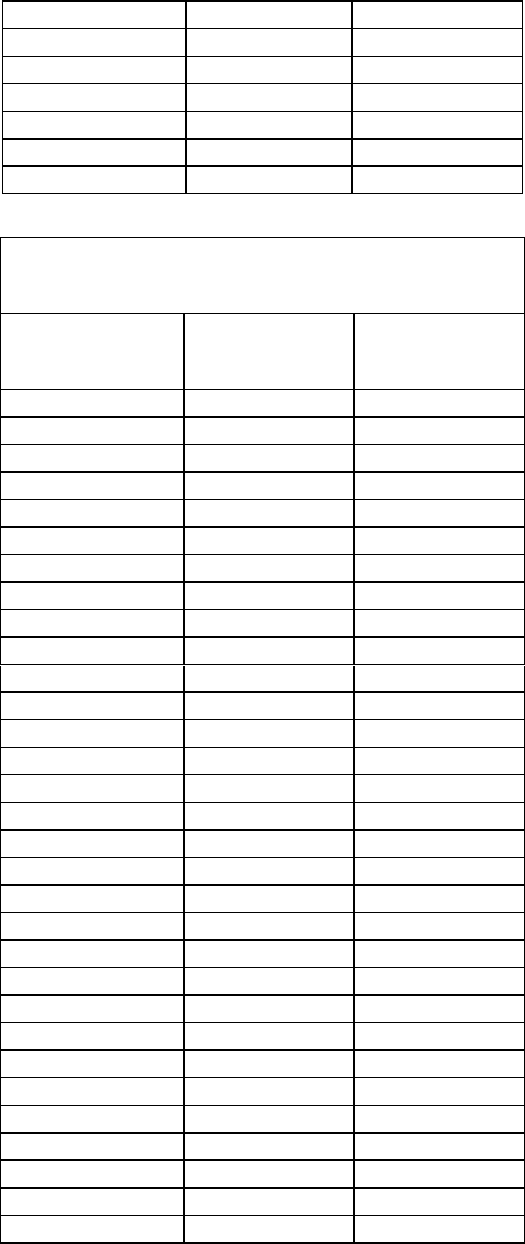

19. Retirement from Part-time Employment

19.1 Where an SNA retires from pensionable part-time employment, pension

benefits under the SNA Scheme are calculated on the basis of pro-rata integration.

This means that award of pension and lump sum is based on:

wholetime equivalent salary at retirement;

and

actual pensionable service, whereby the retiring SNA is given pro‐rata service

for each year of part‐time service.

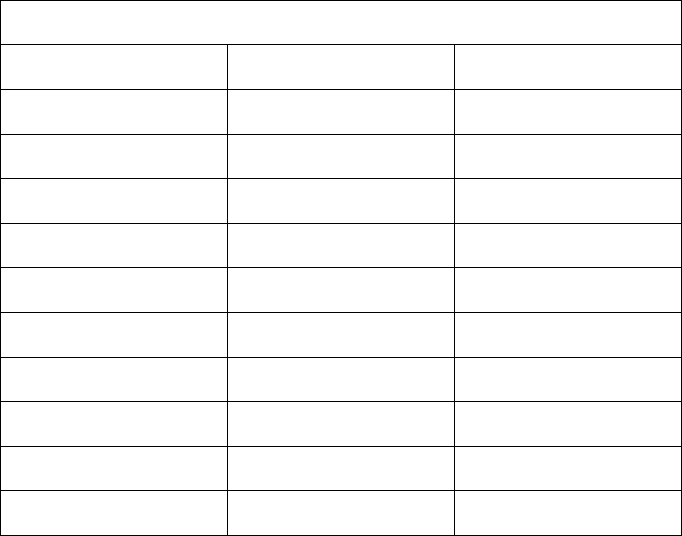

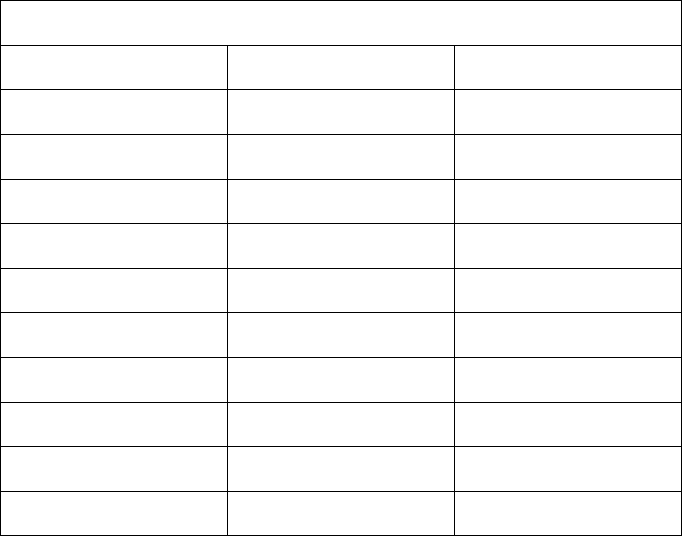

Example:

A Special Needs Assistant was employed in a part-time capacity for 12 years during

which time her specific work pattern varied as shown in the table below. On

retirement on 31 August 2021 her total reckonable actual service is calculated as

being 8.05 years.

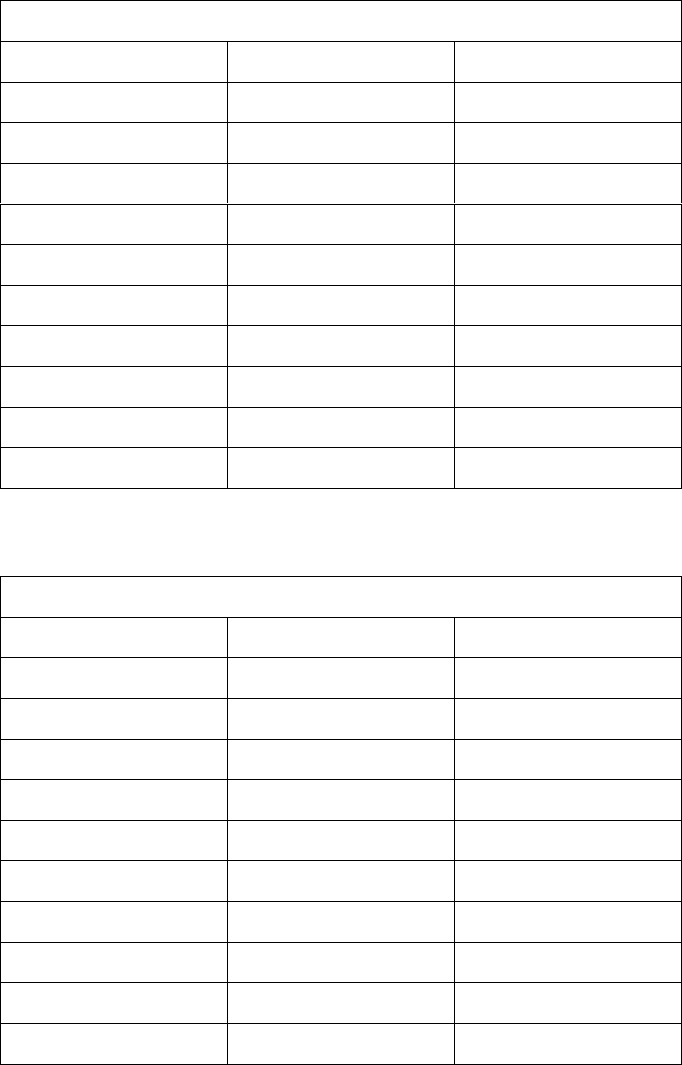

Employment dates

(School years basis)

Work pattern

(% of full-

time)

Pro-rata service

1 September 2009 – 31 August 2010

50%

0.5000 years

1 September 2010 – 31 August 2011

50%

0.5000 years

1 September 2011 – 31 August 2012

50%

0.5000 years

1 September 2012 – 31 August 2013

60%

0.6000 years

1 September 2013 – 31 August 2014

60%

0.6000 years

1 September 2014 – 31 August 2015

60%

0.6000 years

1 September 2015 – 31 August 2016

75%

0.7500 years

1 September 2016 – 31 August 2017

80%

0.8000 years

1 September 2017 – 31 August 2018

80%

0.8000 years

1 September 2018 – 31 August 2019

80%

0.8000 years

1 September 2019 – 31 August 2020

80%

0.8000 years

1 September 2020 – 31 August 2021

80%

0.8000 years

Total Service

8.0500 years

Pension Calculation:

Wholetime salary

Reckonable

Service

Pension (1/200

th

of salary up to

€43,188 for each year of

service)

€40,590

8.0500 years

€1,634 per annum

35

Lump Sum Calculation:

Wholetime salary

Reckonable

Service

Lump Sum (3/80

th

of salary for

each year of service)

€40,590

8.0500 years

€12,253

36

20. Supplementary Pension

Assumptions and related

20.1 In calculating a pension for an SNA Scheme member (and other fully insured

public servants), the State Pension (Contributory) (SPC) is factored into the

calculation. Where this happens, it is assumed that the member:

(a) is entitled to social insurance benefits, and

(b) is entitled to the maximum personal rate of such benefits.

20.2 However, the member may not qualify for social insurance benefits, or if

qualifying, may only be entitled to a reduced benefit. This can arise from insufficient

social insurance contributions. In such cases, the member may apply for a

supplementary pension, to take account of the difference between their personal

circumstances and the general assumptions on which the pension calculation is

based (see section 20(1) above).

Conditions and calculation

20.3 In order to be considered for a supplementary pension, the member must:

(a) for reasons outside of his or her control, fail to qualify for a social insurance

benefit, or qualify for a social insurance benefit only at a rate which is less

than the full State Pension Contributory (SPC) rate ;

(b) be unemployed; and

(c) other than a person in receipt of a pension on medical grounds, have reached

the minimum pension age or, in the case of a member in receipt of a Cost

Neutral Early Retirement pension (see section 23), the preserved pension

age.

If the employer is satisfied that these preconditions are met, the member may, at the

discretion of the employer and subject to the calculation at 20.4, be paid a

supplementary pension.

20.4 The supplementary pension payable (if any) is calculated by comparing:

(a) the amount of the actual SNA pension awarded to the member plus the

amount (if any) of the personal rate of State Pension (Contributory) or other

social insurance benefit (e.g. Job-seeker Benefit) payable to him or her; and

(b) the amount of the SNA pension which would have been awarded to the

member if that pension had been calculated by reference to the

calculation method for public servants whose pension is not integrated

with social insurance.

37

If (b) is higher than (a), then a supplementary pension equal to the difference

between them is payable. (b) is a “modified” Class D (PRSI) comparator case,

whereas (a) is the member’s actual SNA Scheme pension (not including any

supplementary pension), plus any social insurance benefit.

20.5 Notional service is excluded in the calculation of a supplementary pension.

Examples

20.6 The examples below show how supplementary pension eligibility is

established and how the payment rate calculated:

Example 1:

An SNA Scheme member paying Class A PRSI and with salary of €40,590 retires on

31 August 2021. She has 28 years’ service:

Pensionable remuneration

=

€40,590

State Pension (Contributory) annual rate

at retirement (31 August 2021)

=

€12,956

3 1/3 x State Pension (Contributory) rate

=

€43,188

Reckonable service

=

28 years

SNA Scheme Pension

= 1/200 x pensionable remuneration up to €43,188 x service, plus

[There is no pay balance over €43,188 to which 1/80

th

would be applied]

€40,590 x 28.0000

200

=

€5,683

Total SNA Scheme pension: €5,683 per annum

The member qualifies for a reduced-rate benefit from the Department of Social

Protection. That benefit is Jobseeker’s Benefit, payable to the member at a personal

reduced weekly rate of €159. In annual terms this amounts to €8,297.

Therefore, the total annual relevant income for the member, comprising SNA

Scheme pension and the reduced-rate Department of Social Protection benefit is:

€13,980 (€5,683 + €8,297)

Pension calculation for Class D comparator:

If the member had paid the modified rate of PRSI (Class D), then her SNA Scheme

pension would have been calculated as follows:

€40,590 (pensionable remuneration) x 28.0000 years’ service x 1/80

= €14,207

38

(This €14,207 is the pension that would be awarded to the member if her pension

was based on the calculation method for public servants whose pension is not

integrated with social insurance.)

Therefore, the supplementary pension payable is:

Pension payable based on PRSI Class D calculation

€14,207

Pension payable from the SNA Scheme, plus the reduced

rate social insurance benefit (Jobseeker’s) being received

€13,980

Supplementary pension payable

€227 (per year)

Example 2:

An SNA Scheme member paying Class A PRSI and with salary of €40,590 retires on

31 August 2021. He has 19 years’ service:

Pensionable remuneration

=

€40,590

State Pension (Contributory) annual rate

at retirement (31 August 2021)

=

€12,956

3 1/3 x State Pension (Contributory) rate

=

€43,188

Reckonable service

=

19 years

SNA Scheme Pension =

1/200 x pensionable remuneration up to €43,188 x service, plus

[There is no balance over €43,188 to which 1/80

th

would be applied]

€40,590 x 19.0000

200

=

€3,856

Total SNA Scheme Pension: €3,856 per annum

The member qualifies for a benefit from the Department of Social Protection. That

benefit is Jobseeker’s Benefit, payable to the member at the full weekly rate of €203.

In annual terms this amounts to €10,593.

Therefore, the total annual relevant income for the member, comprising SNA

Scheme pension and the Department of Social Protection benefit is:

€14,449 (€3,856 + €10,593)

Pension calculation for Class D comparator:

If the member had paid the modified rate of PRSI (Class D), then his SNA Scheme

pension would have been calculated as follows:

39

€40,590 (pensionable remuneration) x 19.0000 years’ service x 1/80

= €9,640

(This €9,640 is the pension that would be awarded to the member if his pension was

based on the calculation method for public servants whose pension is not integrated

with social insurance.)

Therefore, the supplementary pension payable is:

Pension payable based on PRSI Class D calculation

€9,640

Pension payable from the SNA Scheme, plus the full rate

social insurance benefit (Jobseeker’s)

€14,449

Supplementary pension payable

NONE

Supplementary pension on retirement under Cost Neutral Early Retirement

20.7 Supplementary pension, where appropriate, is only payable to members

availing of Cost Neutral Early Retirement (see section 23) on reaching the relevant

preserved pension age (60 or 65 years, as appropriate).

Survivor’s supplementary pension

20.8 Where a serving or retired member dies, and where his or her surviving

spouse or civil partner fails to qualify for a social welfare contributory survivor’s

pension, or if qualifying is only entitled to a reduced rate of such survivor’s pension,

then, at the absolute discretion of the Minister for Education, a survivor’s

supplementary pension may be paid under the scheme, subject to the conditions in

section 20.3.

40

21. Resignation from Service

21.1 Where a member resigns not having accrued the minimum service for

preservation of benefits (see section 22 for details), the following options may be

available.

(a) If the member intends returning to employment covered by the SNA Scheme,

then he or she need do nothing in regard to their pension contributions and,

on return will accrue further service. The earlier service will be taken into

account for calculation of benefit on ultimate retirement.

(b) If moving to another body that participates in the Public Sector Transfer

Network, the member may transfer the service to that body.

(c) Application by the member for a refund of the contributions paid to the SNA

Scheme. The refund currently payable is the total contributions paid less 20%

tax.

21.2 Where the member leaves service before pension age but has accrued the

minimum service for preservation of benefit, a refund of contributions is not available.

The following options are available:

(a) If the member intends returning to employment covered by this scheme, then

he or she need do nothing in regard to their superannuation contributions and,

on return will accrue further service. The earlier service will be taken into

account for calculation of benefit on ultimate retirement.

(b) If the member never returns to any public service employment, then a

preserved benefit based on the accrued service will be payable on reaching

preserved pension age. (This preserved pension age is 60 years in the case

of a person whose employment commenced before 1 April 2004, and 65

years in the case of a person who is a new entrant [see section 15.3]). NB: A

member who has left service must apply for payment of the preserved

benefits. Application should be made at least three months before

reaching pension age.

(c) Transferring Service: If moving to another public sector body that participates

in the Public Sector Transfer Network, the member may opt to transfer the

service for pension purposes to that body. A member’s decision on whether to

transfer service to the new employment or instead preserve benefit in the

former employment may be influenced by a number of factors, including

potential pay progression in the new employment and the comparative range

of benefits available in each pension scheme. The Department of Education

will not provide any advice to a member on whether to transfer service or not.

This is solely a matter for the member themselves.

41

21.3 As stated at sections 21.1(b) and 21.2(c) above, a member who ceases to be

employed as a Special Needs Assistant and who takes up employment with a body

which is a member of the Public Sector Transfer Network may have an option to

transfer SNA Scheme service into that body’s pension scheme. Please note however

that such transfer is not possible where, on subsequently joining a public service

body, the person is a member of the Single Public Service Pension Scheme.

Persons who take up employment in the public service on or after 1 January 2013

following a break of more than 26 weeks since previously being employed in the

public service normally become members of the Single Public Service Pension

Scheme. Therefore, in order for 21.1 (a), 21.1 (b), 22.2 (a) and 22.2 (c) to apply an

individual must not have a break of more than 26 weeks between public service

employment.

42

22. Preserved Benefits

Eligibility

22.1 An SNA Scheme member who:

(a) leaves the public service having completed a minimum of two years’

qualifying service (calendar years’ service – see section 6.1);

(b) has not reached the minimum pension age (see section 15);

(c) is not entitled to immediate superannuation benefits;

(d) does not avail of Cost Neutral Early Retirement; and

(e) does not transfer his or her service to another employment,

is entitled to preserved superannuation benefits payable, on application, at the

preserved pension age.

22.2 Regarding section 22.1(a) above, note that a minimum of five years’ actual

reckonable service was required for preserved benefits entitlement in the case of

resignations prior to 2 June 2002.

Benefits

22.3 The preserved benefits are:

(a) preserved lump sum and pension; or

(b) preserved ill-health lump sum and pension, if approved, prior to reaching

preserved pension age,

(c) preserved death gratuity (if the member dies before an entitlement to

preserved pension and lump sum arises);

and

(d) preserved survivors’ and children’s pensions, where applicable.

Calculation

22.4 The method of calculation of preserved benefits is as set out in sections 17

and 18. The preserved pension and preserved lump sum are based on:

reckonable service;

the member’s pensionable remuneration on his or her last day of service; and

the State Pension (Contributory) (SPC) rate on his or her last day of service;

as increased by reference to salary adjustments occurring between the date of

resignation and the date the preserved benefits become payable from.

Payment

22.5 Preserved lump sum and pension benefits are normally paid, on application,

with effect from minimum pension age. However, if before reaching that age, a

former member incurs permanent ill‐health and satisfies the ill‐health retirement

qualifying condition that if still serving, he or she would have been eligible to retire on

43

grounds of incapacity, then the preserved benefits, based on reckonable service at

the date of resignation with no ill-health added years, may be paid from the date of

the former member's application.

Death prior to payment of preserved benefits

22.6 If a former member with eligibility for preserved benefits dies before preserved

pension and lump sum become payable to him or her, a preserved death gratuity

equal to the amount of the preserved lump sum is payable, on application, to his or

her legal personal representative. A survivor’s pension may also be payable based

on the former member’s reckonable service at the date of resignation, with no ill-

health added years.

44

23. Cost Neutral Early Retirement

23.1 Cost Neutral Early Retirement (CNER) allows qualifying scheme members

retire up to ten years before preserved pension age, subject to employer approval. It

provides immediate payment of pension and retirement lump sum, both of which are

calculated by actuarially reducing the preserved benefit values that would arise if the

person was resigning on the early retirement date. This actuarial reduction, which is

described in sections 23.4 to 23.6 below, draws on tables of age-graduated

reduction factors at section 23.7. For ease of reference these tables are also set out

in Appendix 1.

Eligibility

23.2 A member who:

(i) has completed two years’ qualifying service (see section 6.1), and

(ii) at intended date of early retirement is

aged at least 50 if a preserved pension age of 60 applies, or

aged at least 55 if a preserved pension age of 65 applies,

may opt to apply for Cost Neutral Early Retirement.

23.3 The member’s application for Cost Neutral Early Retirement must be made

and approved not later than the intended early retirement date. This means that the

member must be in service in order to apply for CNER; application after resignation

is not possible. If a Scheme member resigns with preserved pension entitlements

and is subsequently enrolled in the Single Public Service Pension Scheme in a new

employment, then that person cannot apply for CNER benefits from the SNA

Scheme.

Calculation

23.4 Members whose applications are approved will have their pension and lump

sum actuarially reduced. The reduced pension and lump sum will be calculated by

applying the relevant percentages from the appropriate table at section 23.7 below to

the preserved benefit, with adjustment as necessary for exact age (years and days)

at retirement.

23.5 In adjusting for exact age at retirement, pension and lump sum will be

calculated in accordance with the following formula:

[A + ((B / 365) × (C – A))] × preserved benefit based on service

where

A is the actuarial reduction factor (pension or lump sum, as appropriate) in the

correct table below (preserved age 60 or 65), appropriate to the person’s age

at his or her last birthday,

B is the number of days since his or her last birthday, and

45

C is the actuarial reduction factor (pension or lump sum, as appropriate) in the

correct table below ((a) preserved age 60 or (b) preserved age 65),

appropriate to the person’s age at his or her next birthday. Where next

birthday is the actual preserved age then C = 100%.

23.6 Any unpaid contributions under in respect of Survivors’ and Children's benefits

must be deducted from the “preserved” lump sum. This means that the preserved

gross lump sum should first be calculated and the unpaid contributions for survivors’

and children’s benefits should then be deducted from this amount. The appropriate

cost neutral early retirement factor, as determined using the formula at section 23.5

is then applied to the resultant net lump sum. Outstanding main scheme

contributions (if any) will be deducted from the lump sum gratuity as appropriate.

CNER Reduction Factor Tables with Examples

23.7 The factors to be applied to convert preserved benefit values to actuarially

reduced benefit values are set out in the tables at Appendix 1. They are also set out,

with examples, in the Tables at (a) and (b) below:

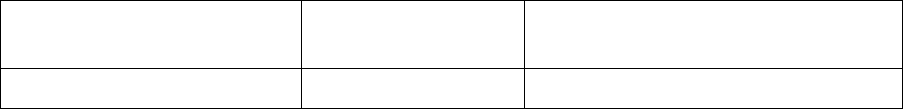

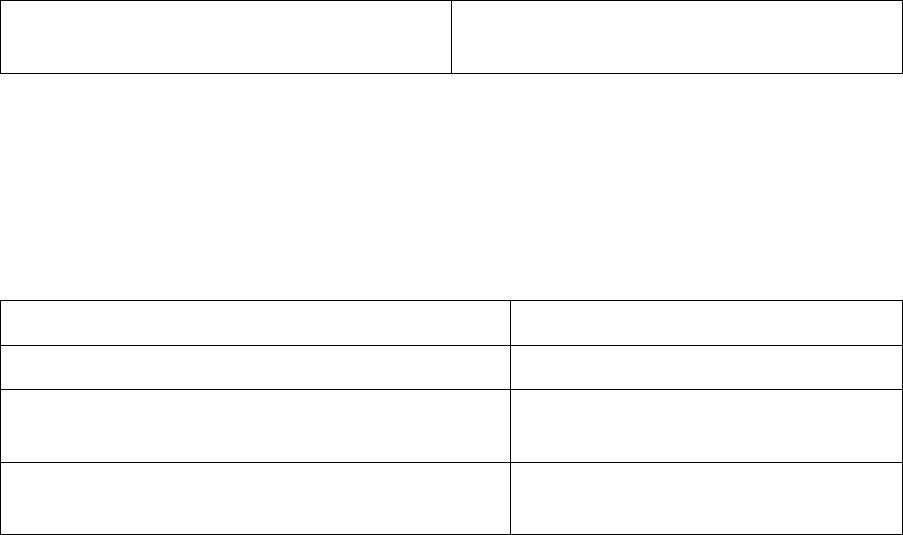

(a) Preserved age of 60:

Persons with a preserved age of 60

Age last birthday

Pension

Lump Sum

50

62.4%

82.2%

51

65.1%

83.9%

52

67.9%

85.5%

53

71.0%

87.2%

54

74.3%

88.9%

55

77.8%

90.7%

56

81.6%

92.4%

57

85.7%

94.3%

58

90.1%

96.1%

59

94.8%

98.0%

Example 1:

A Scheme member with a preserved pension age of 60 applies for Cost Neutral

46

Early Retirement, with intended retirement date of 15 June 2021. The date of birth is

2 September 1965.

The member has 31.7863 years’ reckonable service at retirement, pensionable

remuneration is €40,590, and full-rate PRSI (Class A) applies.

The pension benefit award is calculated as follows:

Cost Neutral Pension Calculation:

Calculate the preserved pension value first:

Pension = (1/200

th

for salary up to €43,188 plus 1/80

th

for any balance above that) x

service

€40,590 x 1/200 x 31.7863 = €6,451

[no pay balance at 1/80

th

]

Total preserved pension: €6,451

The preserved pension value should then be actuarially reduced by the

percentage formula:

[A + ((B / 365) × (C – A))]

A = factor in table above relevant to age last birthday (age 55) = 77.8%

B = days since last birthday (period of 3 September 2020 to 15 June 2021) = 286

days

C = factor in table above relevant to age next birthday (age 56) = 81.6%

[77.8 + ((286 / 365) x (81.6 – 77.8))]

= [77.8 + (0.7836 x 3.8)]

= [77.8 + 2.98]

= 80.78%

Therefore pension above will be actuarially reduced under CNER as follows:

€6,451 x 80.78% = €5,211 per annum

Cost Neutral Lump Sum Calculation:

Calculate the preserved lump sum value first:

Lump sum = Pensionable remuneration x 3/80 x service

€40,590 x 3/80 x 31.7863 = €48,383

The preserved lump sum value should then be actuarially reduced by the

percentage formula:

47

[A + ((B / 365) × (C – A))]

A = factor in table above relevant to age last birthday (age 55) = 90.7%

B = days since last birthday (period of 3 September 2020 to 15 June 2021) = 286

days

C = factor in table above relevant to age next birthday (age 56) = 92.4%

[90.7 + ((286 / 365) x (92.4 – 90.7))]

= [90.7 + (0.7836 x 1.7)]

= [90.7 + 1.33]

= 92.03%

Therefore lump sum above will be actuarially reduced under CNER as follows:

€48,383 x 92.03% = €44,532 per annum

Example 1A:

In Example 1 just above, the member retires early under CNER terms with a

preserved pension age of 60. If he or she were to subsequently die leaving qualifying

dependants, then the survivors’ and children’s benefits payable to those dependants

would be calculated by reference to the preserved pension of €6,451, not the

actuarially reduced pension of €5,211.

(b) Preserved age 65:

Persons with a preserved age of 65

Age last birthday

Pension

Lump Sum

55

58.2%

82.4%

56

61.1%

84.0%

57

64.1%

85.6%

58

67.4%

87.3%

59

71.0%

89.0%

60

74.8%

90.7%

61

79.0%

92.5%

62

83.6%

94.3%

63

88.5%

96.1%

64

94.0%

98.0%

48

Example 2:

A Scheme member with a preserved pension age of 65 applies for Cost Neutral

Early Retirement, with intended retirement date of 28 May 2021. The date of birth is

5 August 1959.

The member has 15.8137 years’ reckonable service at retirement, pensionable

remuneration is €40,590, and full-rate PRSI (Class A) applies.

The pension benefit award is calculated as follows:

Cost Neutral Pension Calculation:

Calculate the preserved pension value first:

Pension = (1/200

th

for salary up to €43,188 plus 1/80

th

for any balance above that) x

service

€40,590 x 1/200 x 15.8137 = €3,209

[no balance at 1/80

th

]

Total preserved pension: €3,209

The preserved pension value should then be actuarially reduced by the

percentage formula:

[A + ((B / 365) × (C – A))]

A = factor in table above relevant to age last birthday (age 61) = 79.0%

B = days since last birthday (period of 6 August 2020 to 28 May 2021) = 296 days

C = factor in table above relevant to age next birthday (age 62) = 83.6%

[79.0 + ((296 / 365) x (83.6 – 79.0))]

= [79.0 + (0.8110 x 4.6)]

= [79.0 + 3.73]

= 82.73%

Therefore, pension above will be actuarially reduced under CNER as follows:

€3,209 x 82.73% = €2,655 per annum

Cost Neutral Lump Sum Calculation:

Calculate the preserved lump sum value first:

Lump sum = Pensionable remuneration x 3/80 x service

€40,590 x 3/80 x 15.8137 = €24,070

49

The preserved lump sum value should then be actuarially reduced by the

percentage formula:

[A + ((B / 365) × (C – A))]

A = factor in table above relevant to age last birthday (age 61) = 92.5%

B = number of days since last birthday (period of 6 August 2020 to 28 May 2021) =

296 days

C = factor in table above relevant to age next birthday (age 62) = 94.3%

[92.5 + ((296 / 365) x (94.3 – 92.5))]

= [92.5 + (0.8110 x 1.8)]

= [92.5 + 1.46]

= 93.96%

Therefore, lump sum above will be actuarially reduced under CNER as follows:

€24,070 x 93.96% = €22,616 per annum

23.8 The actuarially reduced rate applies throughout the lifetime of the

payment of a pension subject to adjustments in line with public service

pension increases, as appropriate. A member who avails of cost neutral early

retirement cannot subsequently switch to payment of a preserved pension at

normal preservation age (60 or 65 years).

Survivors’ & Children’s benefits in relation to Cost Neutral Early Retirement

23.9 Benefits payable to Survivors and Children are not affected by Cost Neutral

Early Retirement. This means that any such benefits payable in respect of a member

who retired on CNER terms will be the same as if that member had instead resigned

with preserved benefits on the date he or she retired early.

Supplementary Pension in relation to Cost Neutral Early Retirement

23.10 Supplementary pensions, where appropriate, are only payable to members

availing of Cost Neutral Early Retirement on reaching the relevant preserved pension

age (60 or 65 years as appropriate).

Cost Neutral Early Retirement and impact on purchase of notional service:

23.11 Cost Neutral Early Retirement will have an impact on the benefit derived from

purchase options. Two reductions will apply:

(i) Firstly, the relevant purchase scheme reduction arrangements, as

appropriate including

50

(a) the application in some cases of purchase scheme actuarial reduction

factors appropriate to payment of pension at preserved pension age,

and specifically in a case where a member with preserved age 60 is

purchasing to age 65 (see Appendix 3), and

(b) The application in all cases of the purchase scheme reduction

arrangements applying in the case of early cessation of periodic

contributions.

(ii) Secondly, the resultant purchased service – as reduced, if appropriate, at (a)

and in all cases at (b) – will then be added to actual service which will be used

to calculate a preserved pension and preserved Lump Sum, with the relevant

Cost Neutral Early Retirement factor only then being applied to that

preserved pension and Lump Sum.

Implications for Social Protection benefits:

23.12 Since the arrangements for securing social insurance credits may vary from

time to time, all members should check their individual situation with the Department

of Social Protection prior to availing of Cost Neutral Early Retirement. They should

also check periodically thereafter as to the up‐to‐date position. Failure to make these

checks could adversely affect any subsequent entitlement to social protection

benefits, such as State Pension or social welfare survivor’s pension.

51

24. Retirement on Medical Grounds

Procedure for applying for retirement on medical grounds

24.1 The following procedure is required to be followed in all cases of application

for retirement on medical grounds:

An application for retirement on medical grounds is made by completing two

forms:

RET.D2 (application for benefits) – which is returned to the Pension Unit,

Department of Education, Cornamaddy, Athlone, Co. Westmeath.

TMED 2 form – the member must complete the relevant part of this form and

give to his/her treating physician for completion.

The physician should complete the form and attach a confidential doctor to

doctor medical report. This is returned directly to the occupational health

service (OHS) details of which are listed on the form. It is essential that the

medical evidence submitted is comprehensive and includes all relevant

clinical details. It must address diagnosis, treatment and prognosis.

On receipt of TMED 2 (including all the necessary reports) and notification

from the Pension Unit that RET.D2 has been received, the OHS will contact

the member to arrange an appointment.

The member will attend for a medical assessment, part of which will involve

completing an assessment form.

A recommendation will issue to the Pension Unit, following medical

assessment by the OHS.

A report will be retained on file by the OHS.

The decision to approve or reject an application for ill‐health retirement is

made by the Minister for Education in their role as pension scheme provider.

The decision is based on the recommendation of the OHS. The member may

appeal the recommendation of the OHS to another occupational health

physician or service nominated by the Department. The Ill-Health Retirement

Procedures will be provided on application for ill-health retirement.

Ill-health vesting period

24.2 The ill-health vesting period means the period of service that must be attained

in order that a person approved for retirement on medical grounds can be paid an

immediate pension and retirement lump sum. The ill-health vesting period, covering

retirements on or after 1 August 2012, is five calendar years’ service.

Added years

24.3 Where a member retires on medical grounds having completed at least five

years’ actual service, notional service may be added to his or her actual service on

52

the basis set out below, so as to enhance (increase) the retirement pension and

lump sum:

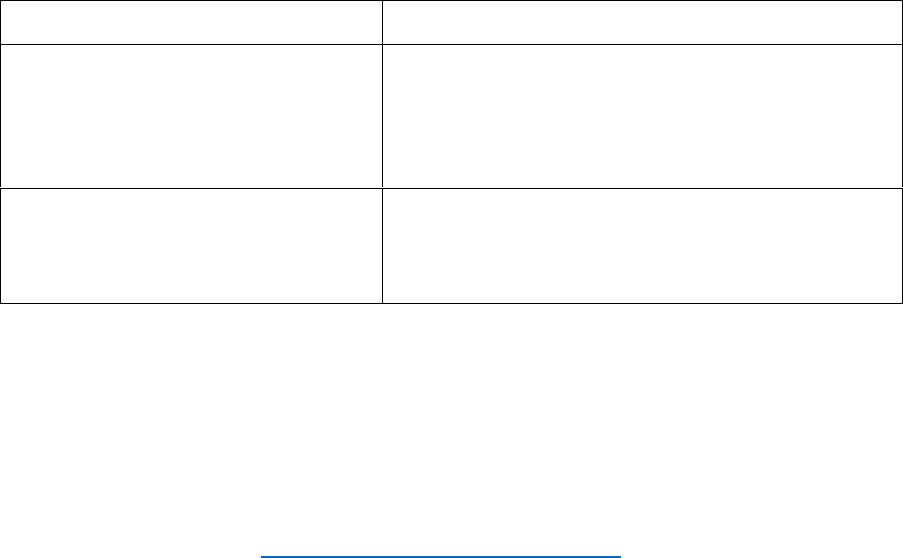

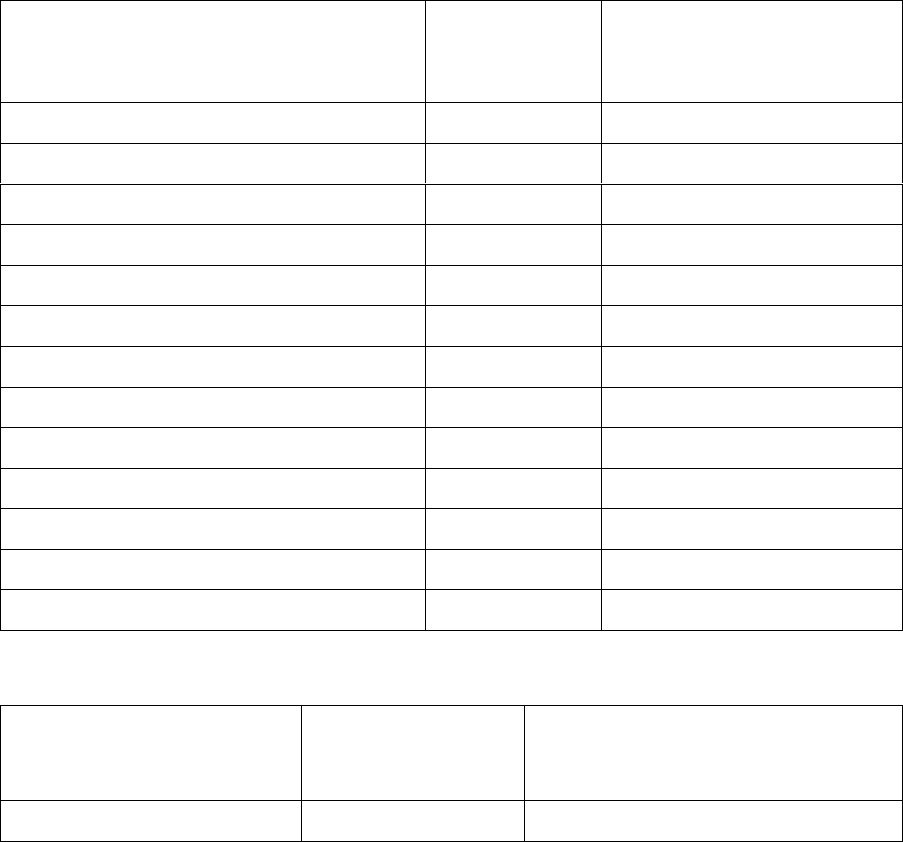

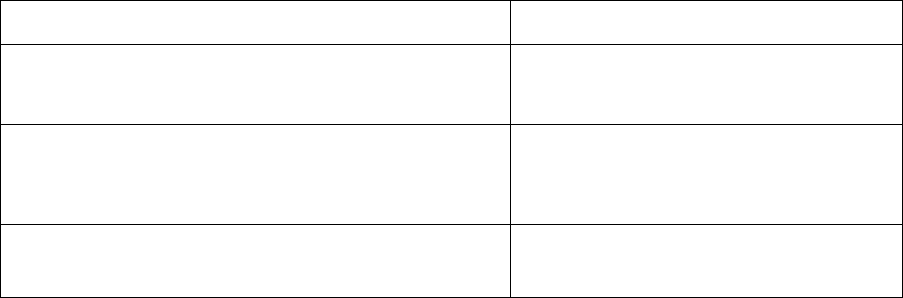

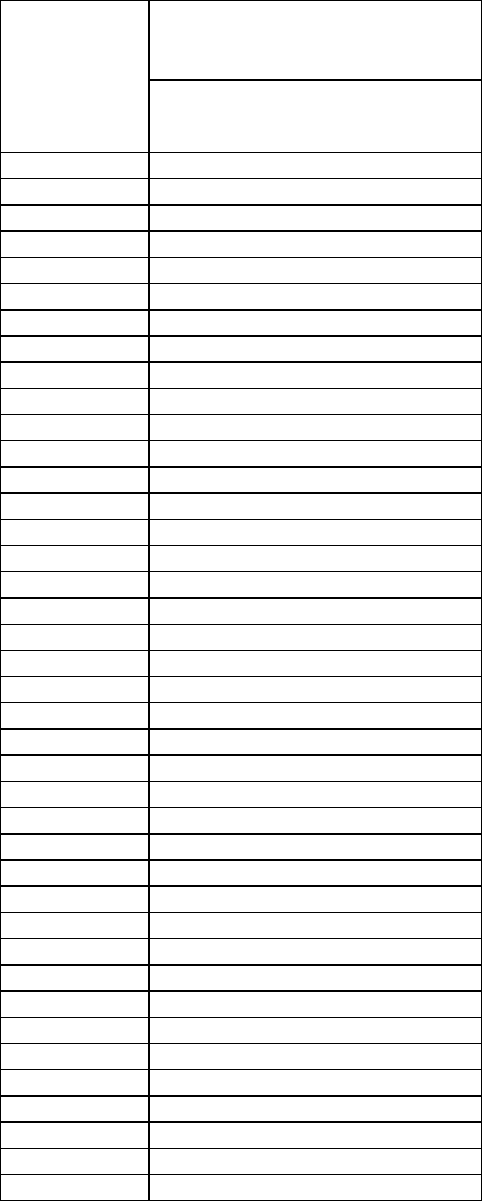

Actual Service

Added years:

Between 5 – 10 years

Equivalent amount of added service subject to

potential service to age 65. Service doubled or

potential service to age 65 – whichever is the lesser.

Between 10 – 20 years

The more favourable of:

(i) the difference between actual service and 20

years subject to potential service to age 65, or

(ii) 6.6667 years subject to potential service to

age 60.

Over 20 years

As at (ii) above.

As can be seen in the above table, "potential service" to age 60 or age 65 may be a

factor in determining the amount of added service granted to a medical grounds

retiree. The calculation of this potential service for part-time members of the Pension

Scheme may be based on the working/attendance pattern at the time of retirement,

thereby delivering a lower added years award than would be the case were that

person to be a full-time attendee. In certain circumstances a different basis of

calculation may apply. In cases where a person’s contract requires them to work

fluctuating hours, or where a person’s normal working hours were reduced in the last

three years of pensionable service, a working / attendance pattern may be based on

the average annual number of hours worked in the last three years of pensionable

service. In all cases of ill-health retirement involving work-sharing members of the

Pension Scheme, Department of Public Expenditure and Reform Circular 11 of 2012

(paragraphs 19-20) should be consulted.

24.4 In the event of a member who has retired on medical grounds recovering from

an illness and returning to employment, pension will cease. On subsequent

retirement, pension and lump sum will be based on total pensionable service,

excluding the added years previously awarded on the earlier retirement on medical

grounds. In addition, the amount of lump sum paid on the retirement on medical

grounds will be recovered from the final lump sum payment.

53

25. Gratuities

Short Service Gratuity

25.1 A short service gratuity is payable to a Scheme member who retires on

medical grounds and who has at least one year of actual reckonable service but less

than the ill-health vesting period (five calendar years’ service – see section 24.2).

25.2. The amount of the short service gratuity is:

(a) 1/12th of pensionable remuneration for each year of actual reckonable

service;

PLUS

(b) 3/80ths of pensionable remuneration per year of actual reckonable service

provided that the member has served the scheme membership vesting

period (two calendar years’ service – see section 6.1).

A member with more than two calendar years’ service may opt for a preserved

benefits award in lieu of the Short Service Gratuity in the instance at (b) above.

Death Gratuity

25.3 See section 26.1 for details of death gratuity.

Balancing Death Gratuity

25.4 See section 26.2 for details of balancing death gratuity.

54

Death Benefits

26. Death in Service and Death after Leaving Service

Death in service

26.1 When a Scheme member dies, whether in service or after retirement:

(a) a death gratuity may be payable to his or her legal personal representative

(i.e. to his or her estate) – see sections 26.2 and 26.3 below for details; and

(b) pensions may be payable to his or her surviving spouse / civil partner and

qualifying children – see section 27 for details.

An example covering these both payment categories – (a) and (b) above – following

a member’s death is given at section 27.17.

26.2 If a full-time Scheme member dies in service, his or her legal personal

representative is paid a death gratuity equal to the greater of:

(a) the deceased member's pensionable remuneration (see section 16 for

details);

or

(b) the amount of the retirement lump sum which the member would have

received if he/she had retired on grounds of ill‐health on the date of his or her

death.

If a part-time Scheme member dies in service, his or her legal personal

representative is paid a death gratuity equal to the greater of:

(a) the deceased member's actual salary (not wholetime equivalent salary, see

paragraphs 22 and 23 of Department of the Public Service Circular 11/2012);

or

(b) the amount of the retirement lump sum which the member would have

received if he/she had retired on grounds of ill‐health on the date of his or her

death.

A pension may also be granted to the survivor or any eligible children (see section

27).

Death after retirement

26.3 If a member dies after retiring with immediate pension and lump sum, and the

amount of the lump sum, plus total pension payments up to the date of death, is less

than the deceased member’s pensionable remuneration, a balancing death

gratuity equal to the amount of that shortfall is payable to the deceased member's

legal personal representative.

A pension may also be granted to the survivor or any eligible children (see section

27).

55

Payment of death gratuity or balancing gratuity

26.4 In order for any death gratuity (section 26.2) or balancing death gratuity

(section 26.3) to be paid, the original probate of the will, or if the member dies

intestate original letters of administration, should be submitted to the deceased

member’s employer.

56

27. Survivors’ and Children’s Benefit

27.1 The Survivor's and Children's benefits payable under the SNA Scheme

provide pensions for the survivor and/or dependant children of a member who dies in

service or after qualifying for a pension award.