NBER WORKING PAPER SERIES

CAPITAL GAINS TAXES AND STOCK REACTIONS TO

QUARTERLY EARNINGS ANNOUNCEMENTS

Jennifer L. Blouin

Jana Smith Raedy

Douglas A. Shackelford

Working Paper 7644

http://www.nber.org/papers/w7644

NATIONAL BUREAU OF ECONOMIC RESEARCH

1050 Massachusetts Avenue

Cambridge, MA 02138

April 2000

We appreciate the helpful comments from two anonymous referees, Jeff Abarbanell, Linda Bamber (editor),

Mary Barth, Merle Erickson, Robert Lipe, Sylvia Madeo (associate editor), Ed Maydew, Kevin Raedy, and

workshop participants at the 1999 Duke/North Carolina Accounting Research Fall Camp and the Duke/North

Carolina public finance workshop. We also acknowledge the contribution of I/B/E/S International Inc. for

providing earnings per share forecast data available through the Institutional Brokers Estimate System.

These data have been provided as part of a broad academic program to encourage earnings expectations.

The views expressed herein are those of the authors and do not necessarily reflect the position of the National

Bureau of Economic Research.

© 2000 by Jennifer L. Blouin, Jana Smith Raedy, and Douglas A. Shackelford. All rights reserved. Short

sections of text, not to exceed two paragraphs, may be quoted without explicit permission provided that full

credit, including © notice, is given to the source.

Capital Gains Taxes and Stock Reactions to Quarterly Earnings Announcements

Jennifer L. Blouin, Jana Smith Raedy, and Douglas A. Shackelford

NBER Working Paper No. 7644

April 2000

JEL No. H24, G12, G14

ABSTRACT

This paper examines the impact of capital gains taxes on equity pricing. Examining three-day

cumulative abnormal returns for quarterly earning announcements from 1983-1997, we present

evidence consistent with shareholders’ capital gains taxes affecting stock price responses. To our

knowledge, this is the first study to link shareholder taxes and share price responses to earnings

releases. The results imply that shares trade at higher (lower) prices when individual investors face

incremental taxes (tax savings) created by selling appreciated (depreciated) shares before they qualify

for long-term treatment. Unlike prior studies that have focused on price reactions in settings where

shareholder taxes are unusually salient (e.g., tax law changes, turn-of-the-year trading, or tax-

sensitive transactions), this study finds the imprint of capital gains taxes in a more general setting.

Jennifer L. Blouin Jana Smith Raedy

Kenan-Flagler Business School Kenan-Flagler Business School

Campus Box 3490, McColl Building Campus Box 3490, McColl Building

University of North Carolina University of North Carolina

Chapel Hill, NC 27599-3490 Chapel Hill, NC 27599-3490

Douglas A. Shackelford

Kenan-Flagler Business School

Campus Box 3490, McColl Building

University of North Carolina

Chapel Hill, NC 27599-3490

and NBER

Capital Gains Taxes and Stock Reactions to Quarterly Earnings Announcements

I. INTRODUCTION

No issue is more fundamental to accounting, finance, and economics than price

formation. Many accounting studies investigate whether taxes are a determinant of prices.

Settings include merger and acquisition premiums (e.g., Hayn 1989; Erickson 1998; Erickson

and Wang 1999; Maydew, Schipper and Vincent 1999; Henning, Shaw and Stock 2000; Henning

and Shaw 2000; Ayers, Lefanowicz and Robinson 2000), non-equity securities (e.g., Shackelford

1991; Guenther, 1994; Engel, Erickson and Maydew 1999), leases (e.g., Stickney, Weil and

Wolfson, 1983), research and development (e.g., Berger 1993), and insurance (e.g., Ke, Petroni

and Shackelford, 2000). A particularly active area in accounting is the impact of investor-level

taxes (dividends and capital gains) on share prices (Dhaliwal and Trezevant 1993; Landsman and

Shackelford 1995; Erickson 1998; Erickson and Maydew 1998; Blouin, Raedy, and Shackelford

1999; Guenther 1999; Guenther and Willenborg 1999; Harris and Kemsley 1999; Collins, Hand

and Shackelford 2000; Collins and Kemsley 2000; Gentry, Kemsley and Mayer 2000; Harris,

Hubbard, and Kemsley 2000; Lang and Shackelford 2000; among others).

This paper extends this literature to analyze the impact of shareholders’ capital gains

taxes on stock price responses to quarterly earnings announcements. This enables us to assess

whether price movements associated with capital gains tax incentives exist in a generalized

setting. Focusing on a public disclosure of primary interest to accountants, quarterly earnings

announcements, we predict that the price-earnings relation varies with measures involving the

spread between long-term and short-term capital gains tax rates, whether the news is good or

bad, and the stock performance during the preceding holding period (currently one year). The

2

wider the spread, the better the news, and the greater the past price appreciation, the more likely

individual capital gains tax incentives apply upward price pressure around the earnings release.

The intuition behind these relations is straightforward. Suppose a public disclosure, such

as an earnings announcement, induces investors to rebalance their portfolio. If sellers are

individuals who have held the stock for less than one year, any gains will be taxed at the federal

short-term capital gains tax rate (currently capped at 39.6 percent). If the individual investors

had intended to hold the stock until it qualified for long-term capital gains tax rates (currently

capped at 20 percent), then investors must trade-off the benefits of rebalancing with the tax costs

of selling (i.e., taxes under short-term treatment versus taxes under long-term treatment).

Under such conditions, good (bad) news disclosures can constrict (expand) the supply of

equity, creating upward (downward) price pressure (see Shackelford and Verrecchia 2000).

Thus, for good news, it may be necessary for buyers to compensate sellers through higher prices

for incremental taxes associated with short-term capital gains taxes. For bad news disclosures,

sellers may accept less compensation to garner favorable short-term capital losses.

Unrealized gains and losses associated with past stock performance further complicate

the sales decision. If the stock has appreciated during the long-term capital gains holding period,

sellers can face incremental short-term capital gains taxes, whether the news is good or bad.

Thus, sellers may demand compensation through higher prices for incremental taxes. Likewise,

if the stock has depreciated, sellers may enjoy favorable short-term capital loss treatment,

whether the news is good or bad.

1

Therefore, sellers may accept lower prices to ensure favorable

1

Another potential price determinant is the “lock-in” effect of the capital gains tax. Similar to the tax incentives to

defer selling until shares qualify for long-term treatment, which this study investigates, the lock-in effect is the

incentive to defer selling appreciated property, thus postponing taxation indefinitely. Unlike the individual short-

term/long-term tradeoffs that are the focus of this study, the lock-in effect applies to all taxable taxpayers, individual

and other, and applies regardless of the holding period. The empirical tests in this study include an explanatory

variable to control for any possible lock-in effects.

3

short-term capital loss treatment.

The evidence in this paper is generally consistent with capital gains tax incentives

affecting share prices. We regress three-day cumulative abnormal returns for 1983-1997

quarterly earnings announcements on unexpected earnings, the spread between short-term and

long-term rates (ranging from zero to 30 percentage points), the change in the firm’s price during

the holding period (ranging from six to 18 months), interactions of these variables, and controls.

The interactions are constructed to estimate the incremental capital gains taxes faced under short-

term treatment, rather than long-term treatment. Consistent with capital gains taxes affecting

share prices, we find that cumulative abnormal returns are increasing in the incremental short-

term capital gains taxes.

To assess the robustness of our finding that capital gains tax incentives affect price-

earnings relations in short windows, we conduct several additional tests. They include

evaluating price responses to another public disclosure (joining the S&P 500), trading volume

around earnings releases, firms’ ownership structure, and post-announcement abnormal returns.

After considering all the evidence, we remain unable to reject the original finding that capital

gains tax incentives affect share responses to quarterly earnings announcements.

To our knowledge, this is the first study to link shareholder taxes and share price

responses to earnings announcements. It differs from most recent documentations of capital

gains taxes affecting share prices because it tests whether capital gains taxes affect equity value

in a generalized setting, rather than a setting where shareholder taxes might be unusually salient.

To maximize power, prior studies typically focus on settings where capital gains tax effects

should be unusually strong, including changes in the tax law (e.g., Amoako-Adu, Rashid, and

Stebbins 1992; Guenther and Willenborg 1999; Blouin, Raedy, and Shackelford 1999; Guenther

4

1999; Lang and Shackelford 2000; Sinai and Gyourko 2000), companies held mostly by

individuals, such as initial public offerings, where individual tax incentives likely are more

influential (e.g., Reese 1998; Guenther and Willenborg 1999; Blouin, Raedy, and Shackelford

1999), periods when tax planning likely is most prevalent, such as year-end, (e.g., Dhaliwal and

Trezevant 1993; Poterba and Weisbenner 1998) and transactions where tax factors are known to

be important, such as mergers and acquisitions (e.g., Hayn 1989; Landsman and Shackelford

1995; Erickson 1998; Erickson and Wang 1999; Henning, Shaw and Stock 2000). Rather than

examine conditions that enhance the probability that capital gains taxes matter, this study

intentionally evaluates an event, quarterly earnings announcements, that should not bias in favor

of finding that taxes matter.

2

The paper develops as follows. The next section reviews salient capital gains tax

provisions. Section III develops testable hypotheses. Sections IV and V detail empirical tests.

Closing remarks follow.

II. CAPITAL GAINS TAXES

All taxable shareholders recognize gain (loss) to the extent a stock sells for more (less)

than the investor’s tax basis. Individuals alone, however, face different tax rates depending on

how long they have owned the property.

3

Under current U.S. law, the maximum personal

2

In this regard, this paper resembles Collins and Kemsley (2000) who report dividend tax and capital gains tax

capitalization from an analysis of 68,283 observations from 1975-1997, using a modification of Ohlson’s (1995)

residual-income valuation model. However, unlike Collins and Kemsley, this paper relies on a capital markets event

study approach to assess whether capital gains taxes affect stock prices.

3

Before 1987, corporations also enjoyed favorable long-term capital gains taxation. For example, from 1979-1986,

the maximum statutory corporate long-term capital gains tax rate was 28 percent while other corporate taxable

income was taxed at a maximum statutory tax rate of 46 percent. Conclusions are insensitive to inclusion of pre-

1987 years in our analysis. Both individuals and corporations face limitations on the immediate deductibility of

capital losses. Currently individuals are limited to an annual $3000 deduction for capital losses in excess of capital

gains. Corporations cannot deduct capital losses in excess of capital gains.

5

statutory tax rate for gains on property held for more than a year (“long-term”) is 20 percent

while the maximum personal statutory tax rate for other gains (“short-term”) is 39.6 percent.

Determining whether the favorable long-term tax rate applies to an individual’s sale is a

complex calculation. Shackelford (2000) shows that the distinction between long-term and

short-term capital gains tax rates only matters if during the taxable year, an individual realizes (i)

no more short-term capital losses than short-term capital gains and (ii) no more long-term capital

losses than long-term capital gains. If both conditions hold, then postponing one dollar of gain

until it qualifies as a long-term capital gain reduces total taxes by 19.6 cents (the short-term

capital gains tax rate of 39.6 percent less the long-term capital gains tax rate of 20 percent), using

current tax rates. Similarly, if both conditions hold, accelerating one dollar of loss so that it

avoids long-term capital loss treatment reduces total taxes by 19.6 cents. If either condition does

not hold (i.e., total short-term capital losses exceed total short-term capital gains or total long-

term capital losses exceed total long-term capital gains), then the same marginal tax rate applies

to a capital gain or loss, no matter whether it is long-term or short-term.

4

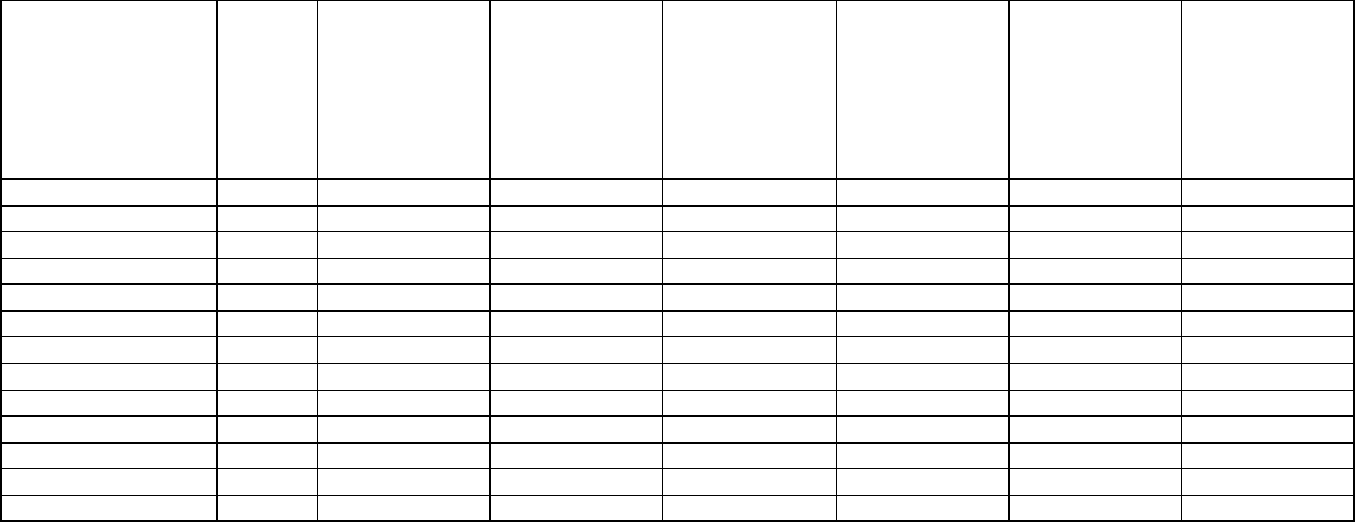

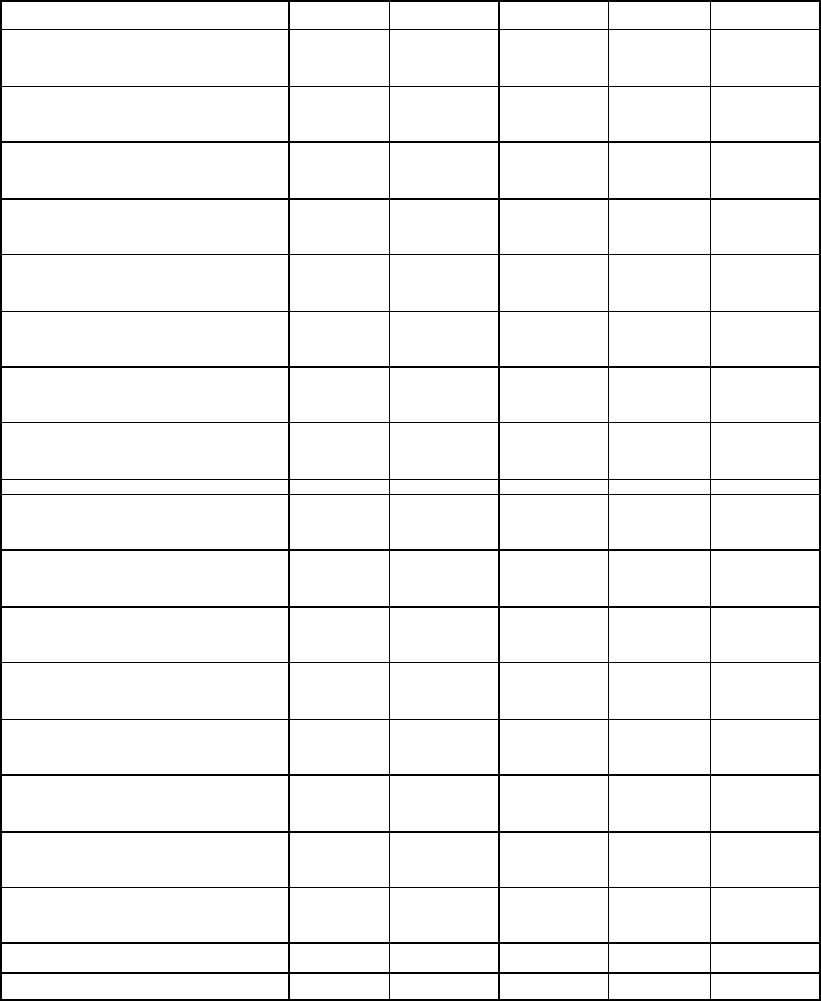

Table 1 details the marginal tax rates under various assumptions from 1978 to 1998. The

tests throughout this paper assume that the conditions and rates under column III apply, i.e., an

investor’s long-term capital gains equal or exceed long-term capital losses and short-term capital

gains equal or exceed short-term capital losses. To the extent this assumption is erroneous (and

4

To illustrate, assume (a) long-term capital gains exceed long-term capital losses, (b) short-term capital losses

exceed short-term capital gains, and (c) total (long plus short) capital gains exceed total (long plus short) capital

losses. To compute taxable gain or loss, long-term capital gains are netted against long-term capital losses and

short-term capital gains are netted against short-term capital losses. The resulting net long-term capital gains are

furthered reduced by the net short-term capital losses, leaving a single gain amount that is taxed at the preferential

long-term capital gains rate. Applying current rates, an additional dollar of long-term capital gains increases taxes

by 20 cents because long-term capital gains, after all nettings, have risen by one dollar. However, an additional

dollar of short-term capital gains also increases taxable income by 20 cents. The short-term gain reduces the amount

by which the short-term losses exceed the short-term gains. Since short-term losses (net of short-term gains) offset

long-term gains, an additional dollar of short-term capital gain increases net long-term capital gains by one dollar

and taxes by 20 cents.

6

certainly it is not true for many investors), we bias against rejecting the null hypothesis that taxes

do not matter.

Even if some individuals could benefit from the preferential long-term capital gains tax

rate by postponing (accelerating) the sale of appreciated (depreciated) stock, several additional

conditions must hold for the long-term capital gains tax rate differential to alter share prices.

Shackelford (2000) details the necessary conditions for a change in the capital gains tax rate

differential to affect share prices. With slight modification, the same conditions must hold for

static capital gains tax rates to affect equity values.

Briefly, the necessary conditions include the marginal investor being a compliant

individual who intends to sell in a taxable transaction. His investment horizon must approximate

the long-term holding period, which is currently one year. If his investment horizon is shorter,

then the differential will not affect behavior. All gains and losses will be subject to short-term

rates. If his investment horizon is longer, then the differential will not affect behavior. All gains

and losses will be subject to long-term rates.

The tests in this study are predicated on the marginal investor being an individual who

meets these conditions. To the extent this assumption is not true, we should fail to detect

variation in price-earnings relations across different spreads in long-term and short-term capital

gains tax rate regimes.

III. HYPOTHESIS DEVELOPMENT

This paper is guided by Shackelford and Verrecchia’s (1999) (hereafter, SV) analysis of

the impact of capital gains taxes on share price responses to public disclosures. Briefly, they

construct a three-period model with two investor groups and two assets. The groups are

7

identical, except that in the first period, each awaits a public disclosure, holding different weights

of a taxable risky asset and a riskless, tax-free asset. In the second period the disclosure occurs,

and investors rebalance their portfolio. In the third period the asset is liquidated, and the

investors consume. The short-term capital gains tax rate applies to gains in the second period,

and the tax-favored long-term capital gains tax rate applies to gains in the third period. SV

conclude that the declining tax rates applied to capital gains will induce some investors to

postpone sales from the second period to the third period. This tax-motivated restriction in

equity capital gives the appearance of prices overreacting to the public disclosure.

To understand the intuition behind SV’s analysis, assume a “good news” disclosure, i.e.,

one that causes the price of the risky asset to rise. If tax rates are constant (i.e., long-term capital

gains tax rates equal short-term capital gains tax rates), then risk-averse investors who own the

appreciated taxable risky asset will reduce the risk of an uncertain future by selling shares of the

risky asset. However, if tax rates are declining (i.e., long-term capital gains tax rates are less

than short-term capital gains tax rates), investors must choose between the reduced risk from

selling and the reduced taxes from postponing the sale. As a result, investors unwind less of

their positions at the disclosure than they would if rates were not declining. This equity shortage

causes prices to rise, assuming the demand for the firm is downward sloping. The price

appreciation is increasing in the spread between long-term and short-term capital tax rates.

Alternatively stated, individual investors price shares as though they will face long-term capital

gains tax treatment. To entice investors to sell before long-term qualification, buyers must

compensate sellers for the additional taxes arising from short-term treatment.

Conversely, if the disclosure is “bad” news and tax rates are declining, investors benefit

from accelerating their sales and generating tax-favored short-term capital losses. This results in

8

more selling than would be undertaken if tax rates were constant over time. Equity expands and

prices fall further. The price decline is increasing in the spread between long-term and short-

term capital tax rates. Alternatively stated, investors assume long-term capital loss treatment.

To garner favorable short-term capital loss treatment, sellers are willing to accept a lower sales

price. This leads to the first hypothesis, stated in alternative form:

H

1

: With a good (bad) news disclosure, a firm’s share price increases (decreases) in the

difference between short-term capital gains tax rates and long-term capital gains tax

rates.

In SV’s stylized setting, fair market value equals tax basis before the disclosure. Thus,

the disclosure provides the sole price movement and fully determines the taxable gain or loss. In

reality, the gain or loss when shares are sold following a disclosure depends on the price changes

created by both the disclosure and the stock’s performance since the investor acquired the shares.

If the share price appreciated before the disclosure, then selling at the disclosure triggers capital

gains taxes arising from that appreciation. If the stock has not been held for the requisite long-

term holding period, then the appreciation will be taxed as a disfavored short-term capital gain.

Thus, conditional on the disclosure, the greater the past stock appreciation, the greater the taxes

upon realization, and, assuming short-term capital gains, the greater the predicted stock price

increase at disclosure.

Conversely, if the share price depreciated before the disclosure, then selling at the

disclosure generates capital losses arising from depreciation before the disclosure. If the stock

has not been held for the requisite long-term holding period, then the depreciation will be taxed

as a tax-favored short-term capital loss. Thus, conditional on the disclosure, the greater the past

stock depreciation, the greater the tax savings upon realization, and, assuming short-term capital

9

losses, the greater the predicted stock price decrease at disclosure. Formally, the second

alternative hypothesis can be stated as:

H

2

: When a share is sold at disclosure, its price increases (decreases) in the incremental

taxes (tax savings) generated from the short-term capital gains (losses) on its past

price appreciation (depreciation).

To summarize, the first hypothesis states that tax incentives to defer selling following

good news (and accelerate selling following bad news) affects price responses to disclosures.

The second hypothesis adds that trading following a disclosure will be further impacted by the

firm’s past price performance. That is, selling appreciated (depreciated) stocks will trigger

taxable gains (losses), whether the disclosure is good or bad news.

IV. PRIMARY EMPIRICAL ANALYSIS

Research Equation

SV propose, but do not undertake, a test of their theory using stock price reactions around

the release of quarterly earnings announcements. To undertake such a test, we estimate equation

(1):

CAR UE PAST DRATE UE DRATE PAST DRATE

YEAR UE YEAR

it it it t it t it t

j t j

j

it t

j

it

= + + + + +

+ + +

==

∑∑

b b b b b b

b b e

0 1 2 3 4 5

6 7

83

96

83

96

1

∆ ∆* *

* ( )

where:

CAR

it

= firm i’s three-day, cumulative, buy-and-hold abnormal return,

beginning on day t-1, where t is the day that earnings are announced;

UE

it

= reported quarterly earnings for firm i on day t less the median IBES

forecast within the 60 days preceding day t, scaled by firm i’s share

price at the end of the quarter including day t;

∆

PAST

it

= the difference between firm i’s stock price at day t-1, adjusted for

stock splits and stock dividends, and its stock price at day t-n when n

is the number of days in the holding period on day t, divided by its

stock price at day t-n;

10

DRATE

t

= the maximum statutory short-term capital gains tax rate less the

maximum statutory long-term capital gains tax rate on day t;

YEAR

t

= categorical variable that equals one if day t is in year j, where j=1983

to 1996.

A positive coefficient on

UE

*

DRATE

is consistent with the first alternative hypothesis, i.e.,

earnings response coefficients vary with the spread between short-term and long-term capital

gains tax rates. A positive coefficient on ∆

PAST

*

DRATE

is consistent with the second

alternative hypothesis, i.e., tax implications associated with the prior price movements affect the

price response when earnings are released.

Sample

All 97,478 firm-quarters from 1983-1997 on CRSP, IBES, and Compustat’s industrial

annual, full coverage, and research files are examined. Firms are deleted from the final sample if

data are missing (1,338),

UE

are zero (7,589), stock prices do not change over the holding

period (5,238), or earnings are negative (11,942).

5

The final sample includes 71,371

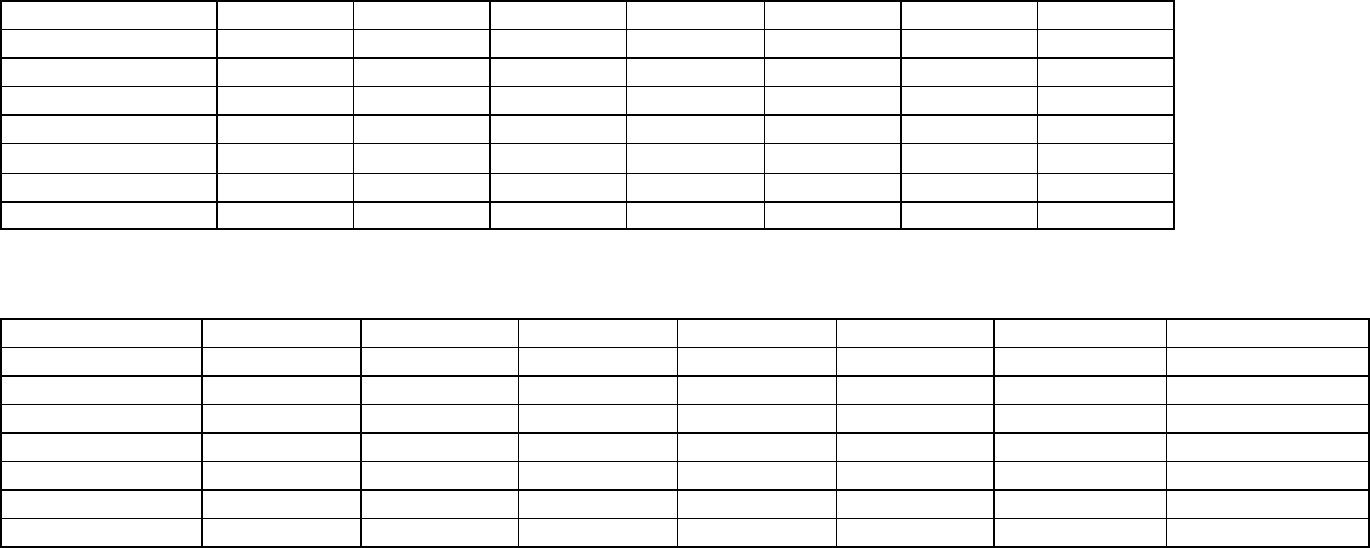

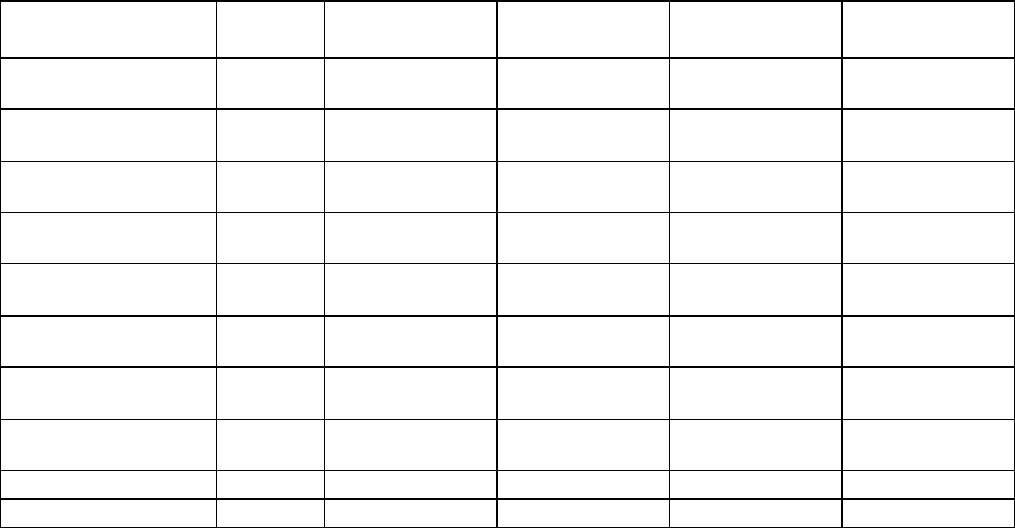

observations. Table 2 presents descriptive statistics and Pearson and Spearman correlation

coefficients for the regression variables.

5

By eliminating companies with zero

UE

, we eliminate firms for which no price movement is anticipated. By

eliminating companies with zero ∆

PAST

, we reduce the risk that our sample includes firms that are inefficiently

priced because of thin markets. We drop loss firms because Hayn (1995) documents that earnings response

coefficients are significantly different between profitable and loss firms. Results, however, are qualitatively

unaltered if these screens are ignored.

11

Explanatory variables

UE

and

YEAR

A positive regression coefficient estimate is anticipated on

UE

, consistent with the well-

documented positive correlation between abnormal returns and unexpected earnings.

6

Besides

its interaction with

DRATE

, which provides one of the two variables of interest,

UE

is also

interacted with a yearly indicator variable (

YEAR

). The year interaction is intended to control

for a steady increase in earnings response coefficients during the investigation period, as

documented in McKeown and Raedy (2000).

YEAR

also is separately included in the regression

to control for any other possible sources of variation across years.

∆

PAST

Past price performance is measured as the percentage change in stock prices during the

previous six, 12 or 18 months. The applicable duration depends on the long-term capital gains

holding period at the time of the earnings release. Table 1 shows the holding period during the

investigation period. We assume the holding period is one year for all days, except June 23,

1985 through June 30, 1988, when it is six months, and July 29, 1997 through December 31,

1997, when it is 18 months.

7

6

Extreme values of

UE

are winsorized at the 1 percent and 99 percent levels.

7

Throughout the investigation period, the long-term capital gains holding period is determined by the date of sale

with one exception. The holding period is six months for assets purchased after June 22, 1984 and before January 1,

1988. Therefore, it is unclear whether investments sold from December 24, 1984 through June 22, 1985 face the

new six-month holding period or the prior 12-month holding period. We assume a 12-month holding period;

however, results are qualitatively insensitive to assuming a 6-month holding period. Similarly, sales during the first

half of 1988 may have faced either a six-month holding period or a 12-month holding period. Because no sale

during the first half of 1988 could have qualified for long-term treatment unless it had been purchased before 1988

and thus faced a six-month holding period, we assume a six-month holding period for all sales in the first half of

1988. Note that during the second half of 1988, no investments shifted from short-term to long-term status. Assets

purchased in 1988 faced a 12-month holding period, which could not lapse until 1989. Assets purchased before

1988 had already qualified for long-term treatment by July 1, 1988. This apparent measurement problem is

diminished in this study because the rate differential during 1988 was zero. However, to ensure that this unusual

12

This duration is selected because the difference between long-term and short-term rates is

most relevant for investors who are near long-term qualification at disclosure. Thus, ∆

PAST

is

computed as though the marginal investor is an individual who has held the stock for precisely

one day less than necessary to obtain long-term capital gains tax treatment. Such an individual

would have the greatest incentive to postpone a sale and receive long-term capital gains tax

treatment or to accelerate a sale and receive short-term capital loss tax treatment.

We expect the coefficient on ∆

PAST

will be positive for at least two reasons. First,

Jegadeesh and Titman (1993), Bernard, Thomas and Wahlen (1998) and Raedy (2000), among

others, show that stocks that experience short-term positive (negative) returns will continue to

experience positive (negative) returns for the next few quarters. To the extent such price

momentum exists, a positive relation is expected between price movements in the three-day

window around the earnings announcements and price movements in the preceding holding

period.

Second, to the extent prices have risen during the holding period, tax costs associated

with selling have increased, even for investors unaffected by the long-term/short-term capital

gains tax tradeoffs investigated in this paper. For example, when prices are rising, an individual

who has held shares for more than the long-term holding period faces increasing long-term

capital gains taxes. Thus, he demands additional compensation to cover the additional taxes,

potentially resulting in a seller’s strike and further price increases. Although different from the

tax effect examined here, this price pressure from this “lock-in” effect may induce a positive

coefficient on ∆

PAST

. For these two reasons, we include ∆

PAST

as a separate explanatory

period does not affect our analysis, we reestimate the regression equation, excluding the second half of 1988.

Inferences are qualitatively unaltered.

13

variable, ensuring that these potential effects do not impact the interpretation of the variables of

interest.

8

DRATE

The ideal tax measure would capture the change in capital gains taxes, if any, that

individual shareholders encounter if they sold shares at the disclosure date rather than in the

future when the long-term rate applies. Unfortunately, we cannot observe individual investors’

marginal tax rates, holding periods, or total portfolio of realized gains and losses, all of which are

necessary to compute the ideal tax measure.

Instead we employ a cruder measure, the difference in short-term capital gains tax rates

and the long-term capital gains tax rates at disclosure, assuming long-term capital gains equal or

exceed long-term capital losses and short-term capital gains equal or exceed short-term capital

losses. Using the spreads for this assumption in Table 1, column III,

DRATE

is 30 from 1983-

1987, 10.5 in 1987, 0 from 1988-1990, 3 from 1991-1992, 11.6 from 1993 to May 6, 1997, and

19.6 since then. No prediction is advanced for the coefficient on

DRATE

, when it is included

separately in the regression. The sole purpose for its inclusion is to ensure that any unspecified

variation in

DRATE

does not affect the interpretation of the interaction coefficients.

9

The variables of primary interest in this study are

DRATE

interacted with

UE

and

∆

PAST

. Both interaction coefficients are predicted to be positive.

8

Inferences concerning the sign and overall significance of the variables of interest are unchanged if ∆

PAST

is

excluded from the regression. However, the coefficient on ∆

PAST

*

DRATE

, one of the two variables of

interest, becomes much larger and more significant if ∆

PAST

is dropped.

9

Inferences are unchanged if

DRATE

is excluded from the regression.

14

Results

Table 3, column A presents estimated coefficients from the ordinary least squares

regression using the quarterly earnings announcement sample (year intercepts and their

interaction with unexpected earnings are not tabulated).

10

The findings are consistent with

individual investors’ capital gains taxes affecting share price responses to earnings

announcements. The results suggest that the large body of accounting research that examines

share price reactions to financial reporting disclosures may omit an important price determinant,

shareholders’ capital gains taxes.

As predicted, the coefficients on both interactions are positive, consistent with share

prices increasing in capital gains taxes. Review of the other coefficients reveals that the

coefficients on

UE

and ∆

PAST

are positive, as expected. The coefficient on

DRATE

, for

which no prediction is offered, is not significantly different from zero.

The coefficient on

UE

*

DRATE

is significantly greater than zero at the 0.05 level, using

a one-tailed test. The economic significance implied by the coefficient is non-trivial. A one

standard deviation increase in

UE

*

DRATE

increases three-day cumulative abnormal returns by

0.21 percentage points (18 percent annualized) or a 71 percent increase in returns for the mean

firm.

11

In other words, conditional on the price implications of altering

UE

,

DRATE

or any

10

The empirical results do not appear to suffer from cross-sectional dependence for two reasons. First, by

examining returns from three-day windows, we avoid the cross-sectional dependence problems typically associated

with long windows, such as one quarter or one year (Bernard 1987). Second, cross-sectional dependence problems

typically cluster in intra-industry analysis as opposed to inter-industry analysis (Bernard 1987). The sample in this

study includes 262 three-digit SICs; only six of which represent more than 2% of the sample. Furthermore, when

we exclude firms that announce earnings on the same day as three or more firms in their three-digit SIC, leaving

60,642 observations, results are qualitatively unchanged. On the other hand, multicollinearity, which exists between

DRATE

and the year indicator variables (e.g., multiple variance inflation factors exceed 10 and the condition

index is 24), may be a serious econometric problem, inflating standard errors and biasing against rejecting the null

hypothesis that taxes do not matter. To address the stability of the regression coefficients, we reestimate the model,

dropping

DRATE

. Results are qualitatively unaltered. Finally, we control for nonlinearities in the return-

earnings relation using the approach in Lipe, Bryant and Widener (1998). Again, conclusions are unchanged.

11

0.21 percentage points are the product of ∆

RATE

*

UE

’s standard deviation of 0.00145 and its regression

coefficient estimate of 1.475. 71 percent is the 0.21 percentage points divided by the mean

CAR

of 0.003.

15

other explanatory variable, a one standard deviation increase in the interaction enhances equity

returns by 71 percent.

This finding is consistent with individual investors demanding compensation for the

additional short-term capital gains (or reduced short-term capital losses) created by good news

disclosures. Likewise, it is also consistent with individual investors accepting lower share prices

to garner the additional short-term capital losses (or reduced short-term capital gains) created by

bad news disclosures.

The coefficient on ∆

PAST

*

DRATE

is significantly greater than zero at the 0.001 level.

Using the same computation as above, a one standard deviation increase in ∆

PAST

*

DRATE

increases three-day cumulative abnormal returns by 0.13 percentage points (11 percent

annualized) or a 45 percent increase in returns for the mean firm. This finding is consistent with

buyers compensating individuals for the short-term capital gains that they incur on the

appreciation in their shares before the earnings announcement. It also is consistent with

individuals accepting less compensation because they enjoy favorable short-term capital losses

on the sale of depreciated shares.

Sensitivity Tests

The results are robust to several sensitivity tests. First, to test the robustness of the

∆

PAST

*

DRATE

results, we segregate the sample into three periods based on the spread

between short-term and long-term capital gains tax rates (see Table 1, column III): (a) when the

spread is zero or three (1988-1992), (b) when the spread is greater than 10 and less than 20

(1987, 1993-1997), and (c) when the spread is 30 (1983-1986). The regression is then estimated

separately for each period with only two explanatory variables,

UE

and ∆

PAST

.

16

If price responses vary with past prior performance, we would expect the coefficients on

∆

PAST

to be increasing in the long-term capital gains tax differential. Consistent with this

prediction, we find that the coefficient on ∆

PAST

is largest when the spread is 30. It is double

the smallest coefficient, which occurs when the spread is zero or three. Unfortunately, the

increase in earnings response coefficients over the investigation period prevents repeating this

robustness check for the

UE

*

DRATE

result.

Second, to ensure that the results are not solely driven by the three years when short-term

rates equal long-term rates (1988 to 1990), we reestimated equation (1) without those years.

Conclusions are qualitatively unaltered. Third, during the fourth quarter of 1986, extraordinary

levels of capital gains were realized in anticipation of the 1987 increase in long-term capital

gains tax rates. When earnings releases in the fourth quarter of 1986 are excluded from the

study, inferences are qualitatively unaltered.

Fourth, an individual’s marginal tax rate for capital gains and losses is determined

annually. Thus, tax planning could become more precise as individuals near year-end.

However, we find no such evidence. Inferences are qualitatively unchanged when disclosures in

December are deleted from the study and when disclosures in October, November, and

December are deleted from the study.

V. ADDITIONAL EMPIRICAL ANALYSES

The remainder of the paper extends the analysis of capital gains taxes and equity pricing

in four directions. First, to mitigate any concerns that earnings announcements release

unspecified information that the earlier tests might misconstrue as capital gains tax effects, we

replicate the tests in a different disclosure setting—when stocks are added to the Standard &

17

Poor’s 500. Second, we test whether capital gains tax effects are detected in trading volume

around earnings announcements. In both extensions, we find capital gains tax effects related to

past price performance, but not the information from the disclosure.

Third, we test whether companies held predominantly by individuals are marked by more

pronounced capital gains tax effects. We find limited evidence that results vary with ownership

structure, however, this test is hampered by an inability to measure individual ownership

precisely. Finally, we test whether prices revert back to their original levels in the days

following the earnings announcement or inclusion in the S&P 500. Some price reversion is

detected.

Standard & Poor’s 500 Additions

One possible explanation for the findings is that earnings announcements release

unspecified information that this study mischaracterizes as capital gains tax effects. To address

this concern, we repeat the analysis with a different public disclosure, the announcement that a

firm will be added to the S&P 500.

This is a particularly attractive setting for conducting a robustness check for at least three

reasons. First, the announcement provides no information about the taxes of the firm or its

shareholders. In fact, many studies of S&P 500 additions are motivated by an assumed absence

of any information, tax or otherwise (e.g., Harris and Gurel 1986 and Shleifer 1986). Second,

S&P 500 firms should be among the most efficiently priced in the world. They are the largest

U.S. companies, publicly-traded, and closely followed by many analysts. Third, non-individuals

(particularly institutions) have large stockholdings in these firms. The impact of individual

taxation of capital gains and losses should be less for these companies than others.

18

Because S&P 500 index funds commit to investing in such firms, overall demand should

increase when Standard & Poor’s announces that it is adding a firm to the index, consistent with

Harris and Gurel (1986) and Shleifer (1986).

12

An increase in demand should boost share prices,

i.e., joining the index should be good news. If the difference in short-term and long-term capital

gains tax rates affects equity values, then stock price changes should reflect the compensation

that index funds provide individual investors to entice them to sell at the tax-disfavored short-

term capital gains tax rate.

To test whether capital gains tax incentives affect price responses to inclusion in the S&P

500, we reestimate equation (1) with two modifications. First, consistent with Shleifer’s (1986)

S&P 500 study, the dependent variable is firm i’s five-day, cumulative, buy-and-hold abnormal

returns, beginning on day t, where t is the first trading day following the announcement.

Because the S&P announces additions to the index after the market closes, we begin our

computation of cumulative abnormal returns on the following day. Abnormal returns range from

–27 percent to 34 percent with a mean and median of 4 percent.

Second, unexpected earnings (

UE

) is replaced with a measure of the demand by index

funds for a firm when it joins the S&P 500.

JOIN

is the percentage of equity mutual fund assets

Money (April 1999, p.102).

13

Consistent with a dramatic increase in the number and holdings of S&P 500 index funds during

the investigation period,

JOIN

increases steadily from 0.2 percent in 1978 to 6.5 percent in

12

In theory, deletions from the S&P 500 should have the opposite effect. However, most deletions concern unusual

transactions, such as mergers, acquisitions, bankruptcy, or other liquidations. Thus, consistent with prior studies, we

restrict the analysis to additions.

13

Results are qualitatively unaltered if alternative measures of price pressure from index funds are used, including

Vanguard’s number of index funds, Vanguard’s percentage of assets in index funds, and natural logarithm of

Vanguard’s index fund assets, all as reported in Bogle (1999).

19

1998. The percentage decreased in only two years, 1983 and 1986.

14

As index funds have

become more active in the equity markets, the price pressure from joining the S&P 500 should

have increased accordingly. Therefore, a positive coefficient is expected on

JOIN

when it is

included as a separate regressor, indicating increased upward price pressure in recent years,

ignoring any tax effects.

All other variables remain unaltered. The variables of interest remain two interactions,

JOIN

*

DRATE

and ∆

PAST

*

DRATE

. Coefficients on both are expected to be positive.

We purchased from Standard & Poor’s a list of the 473 firms added to the S&P 500 from

January 1, 1978 to December 31, 1998. From the Standard & Poor’s list, we delete 62 additions

attributable to restructurings of existing S&P 500 firms and 12 additions for which data are

missing. The final sample includes 399 S&P 500 additions. Four firms are included twice in the

sample. Annual additions range from 6 in 1992 to 33 in 1998. Before 1990, S&P 500

announcement and addition dates were identical. Since 1990, the announcement has preceded

the addition by seven days, on average, but the lapse has been as great as 100 days. Table 4

presents descriptive statistics and Pearson and Spearman correlation coefficients for the

regression variables used in the S&P 500 tests.

Table 3, column B presents the regression coefficient estimates from estimating equation

(1) for the S&P additions. Contrary to expectations, the coefficient on

JOIN

*

DRATE

is

negative, though not significantly different from zero. This finding provides no evidence that

individual investors demand compensation for the additional short-term capital gains created by

14

The steady increase in

JOIN

creates extreme multicollinearity, which we address by dropping the year indicator

variables from the model. Consequently, besides capturing the intended increase in demand from S&P 500 index

funds over time, the coefficient on

JOIN

may capture other unspecified intertemporal changes. The other

intertemporal institutional change that we are aware is that before 1990 announcements coincided with additions to

the index. Now announcements precede additions by several days.

20

the price increase from joining the index.

Consistent with predictions, the coefficient on ∆

PAST

*

DRATE

is positive and

significant at the 0.01 level. A one standard deviation increase in ∆

PAST

*

DRATE

boosts five-

day cumulative abnormal returns by 1.2 percentage points (60 percent annualized) or a 27

percent increase in returns for the mean firm. This finding is consistent with buyers

compensating individuals for the short-term capital gains that they incur on the appreciation in

their shares before the disclosure. It also is consistent with individuals accepting less

compensation because they enjoy favorable short-term capital losses on the sale of depreciated

shares. In either case, the results imply that individual investors’ capital gains taxes affect prices

when firms join the S&P 500 index.

15

Review of the other coefficients reveals that the intercept is positive, indicating a general

price increase when a firm enters the S&P 500. As predicted, the coefficient on

JOIN

also is

positive, consistent with the price pressure increasing as index funds have grown. Contrary to

expectations, the coefficient on ∆

PAST

is negative.

16

The coefficient on ∆

RATE

, for which no

prediction is offered, is not significantly different from zero. Results are uniformly robust to

sensitivity tests similar to those conducted for the earnings announcements tests.

15

One possible reason why the results for the past price performance are stronger than the results for the response to

joining the index is that past price movements are larger and more important from a tax perspective than the price

movements at announcement. Theoretically, if capital gains tax rate differentials affect stock prices, then price

movements created from both the announcement and the past should affect share responses. However, except under

the most unusual conditions, a single disclosure will not move prices as much as the cumulative effect of the

previous six to eighteen months of trading. Thus, the tax effect from the past appreciation or depreciation likely

dominates the tax effects from the immediate disclosure.

16

One reason why the coefficient on ∆

PAST

could be negative is leakage associated with S&P additions in the

earlier years of the investigation period. As discussed above, before 1990, the S&P added firms on the day of the

announcement. Reportedly, investors speculated about future additions to the index (New York Times, May 21,

1986). If so, the ∆

PAST

measurement period may include price increases attributable to speculation about a firm

joining the index. Consistent with this explanation, ∆

PAST

is not significantly different from zero if the

∆

PAST

measurement period concludes one month preceding the S&P 500 announcement or if years before 1990

are excluded from the study. Of more relevance to this study, inferences on the interactive variables of interest hold

under these alternative specifications.

21

This S&P 500 extension confirms that the price determinant captured in the

∆

PAST

*

DRATE

coefficient is not unique to earnings releases. The results show that share

prices are increasing (decreasing) around both earnings announcements and S&P 500 additions

in years when the spread between long-term and short-term rates is greatest for firms with the

most appreciation (depreciation) during the previous six to 18 months. Unable to identify any

other reason for this relation, we conclude that this determinant is the impact of the long-term

capital gains tax differential.

Trading Volume around Earnings Announcements

The next extension shifts from stock return analysis to trading volume analysis. SV

predict that differential capital gains tax rates cause trading volume to move inversely with

prices. That is, individual shareholders respond to good news by withdrawing from the equity

markets to await long-term treatment, causing prices to rise. Thus, trading volume decreases

create price increases. Likewise, bad news creates incentives to sell and realize short-term

capital losses. Thus, trading volume increases create price decreases.

Suppose tax-exempt organizations, tax-deferred pension plans, individuals’ whose shares

already qualify for long-term capital gains treatment, foreign investors, and others unaffected by

long-term capital gains differentials can fully supply the shares to meet demand when earnings

are released. Then sellers will not face incremental short-term capital gains, and the above

results apparently relate to some other unspecified price determinant. Conversely, if sellers do

face incremental short-term capital gains taxes (i.e., long-term capital gains tax differentials

matter to the marginal investor), then trading volume should vary as SV predict. In other words,

22

trading volume is another venue for testing whether spreads in long-term and short-term capital

gains taxes affect the equity markets.

To test whether capital gains tax incentives affect trading volume when earnings are

announced, we reestimate equation (1) substituting abnormal volume (

AV

it

) as the dependent

variable. Abnormal volume is the firm i’s average volume over days t-1, t, and t+1 less the

median volume for the 100 days preceding day t-1, where volume is trading volume divided by

shares outstanding. Mean (median) abnormal volume is 0.004 (0.001) with a standard deviation

of 0.011 (Table 2, panel A).

17

The variables of interest remain the interactions with the long-

term differential rate,

UE

*

DRATE

and ∆

PAST

*

DRATE

. However, these coefficients are

now predicted to be negative.

Table 3, column C presents estimated coefficients from the trading volume regression.

18

As in the S&P 500 extension, the coefficient on

UE

*

DRATE

has the wrong sign, though not

significantly different from zero. This result provides no evidence to support capital gains taxes

affecting trading volume.

On the other hand, as predicted, the coefficient on ∆

PAST

*

DRATE

is negative and

significantly less than zero at the 0.001 level. This finding is consistent with individual holders

of appreciated (depreciated) stock restricting (expanding) the supply of equity more in years with

larger long-term capital gains tax differentials. Economic significance, however, is modest. A

one standard deviation increase in ∆

PAST

*

DRATE

increases three-day cumulative abnormal

volume by 8 percent for the mean firm. Results are robust to the sensitivity tests conducted

using returns.

17

Conclusions are unchanged if abnormal volume is winsorized at the 1 percent and 99 percent levels.

18

To test whether asymmetric volume responses to price increases versus price decreases (Karpoff, 1987, Bamber

and Cheon, 1995) affect the conclusions in this paper, a categorical variable indicating the sign of the three-day raw

return surrounding the earnings announcement is added as an explanatory variable. Inferences are unaltered.

23

The capital gains tax incentives examined in this paper should not affect trading volume

around S&P 500 additions because index funds must acquire shares and will bid up the price

until shares trade. Thus, we predict that S&P 500 additions increase trading volume, but that

volume does not vary for tax reasons. Consistent with this prediction, when we reestimate the

trading volume equation using S&P 500 additions, trading volume increases with the growth of

index funds (the coefficient on

JOIN

is positive and significant with a t-statistic of 2.4), but the

coefficients on the interactions are not significantly different from zero. Table 3, column C

shows the coefficient on

UE

*

DRATE

is 0.005 (t -statistic of 1.15). The coefficient on

∆

PAST

*

DRATE

is –0.002 (t-statistic of –0.26).

Individual Ownership

The third extension evaluates another SV prediction. SV show that the tax-motivated

response to disclosures should be greatest among companies held by individual investors subject

to differential capital gains tax rates. Unfortunately, determining the extent to which individuals

hold taxable shares is problematic. The capital gains and losses on individuals’ tax returns are

affected by many investments, including personal holdings, street-name holdings, trusts, mutual

funds, partnerships, S corporations, limited liability corporations, and other entities that pass-

through taxable gains and losses. Individuals also hold shares through many accounts that are

unaffected by the long-term rate differential, such as closely-held C corporations, individual

retirement accounts, 401(k) retirement accounts, and other defined contribution plans.

Because publicly available data lack sufficient detail for us to identify taxable individual

shareholdings with precision, we resort to a categorical variable from Spectrum.

IND

equals

one if 75 percent of firm i’s shares on day t are owned by non-institutions and zero otherwise.

24

IND

is interacted with all of the other explanatory variables, except the year indicator variables.

Including

IND

and its interactions modifies the original regression equation as follows:

CAR UE PAST DRATE UE DRATE PAST DRATE

YEAR UE YEAR IND IND UE

IND PAST IND DRATE IND UE DRATE

IND PAST DRATE

it it it t it t it t

j t j

j

it t

j

it it it

it it it t it it t

it it t it

= + + + + +

+ + + +

+ + +

+ +

==

∑∑

b b b b b b

b b b b

b b b

b e

0 1 2 3 4 5

6 7

83

96

83

96

8 9

9 10 11

12

2

∆ ∆

∆

∆

* *

* *

* * * *

* * ( )

Positive coefficients on

b

11

and

b

12

will be interpreted as evidence that capital gain taxes affect

prices more in companies held mostly by individuals.

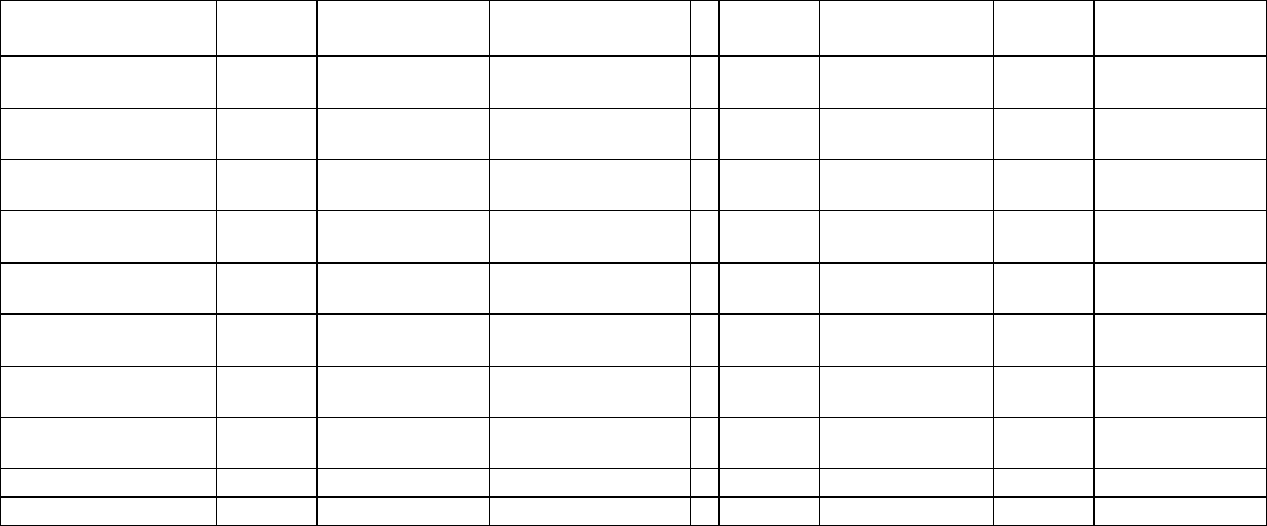

Table 5 reports selected regression coefficients from estimating equation (2). When the

dependent variable is cumulative abnormal returns around earnings announcements,

b

11

, the

coefficient on

IND

UE

DRATE

*

*

is positive and weakly significant (t-statistic of 1.7). This is

consistent with the cumulative abnormal returns around earnings releases increasing more in

unexpected earnings when the long-term capital gains tax differential is largest and the firm is

mostly owned by individuals. Conversely,

b

12

, the coefficient on

IND

PAST

DRATE

*

*

∆ , is

negative, providing no evidence that this relation holds for past stock performance.

When the abnormal returns around S&P 500 additions are examined,

b

11

is again

positive and significant (t-statistic of 2.0), further evidence that the tax-induced response to the

disclosure is greatest in companies controlled by individuals.

b

12

is positive, but not

significantly different from zero.

When the dependent variable is abnormal volume, the pattern reverses. The sign of

b

11

,

the coefficient on

IND

UE

DRATE

*

*

, is now contrary to expectations. Conversely,

b

12

, the

coefficient on

IND

PAST

DRATE

*

*

∆ , is now significant (t-statistic of -2.0) in the predicted

25

direction (negative). The

b

12

result is consistent with trading volume around earnings releases

increasing more in the incremental taxes from past performance for firms held mostly by

individuals.

In summary, we find mixed support for individual ownership affecting the capital gains

tax influence on price and volume around public disclosures. Measurement error likely weakens

the power of these tests. For instance, Spectrum classifies taxable individual mutual fund

accounts as institutional holdings. Thus, in an attempt to identify a more precise measure, we

conducted additional tests using a Spectrum’s indicator variable equaling one when individuals

and mutual funds combined control at least 75 percent of the shares. Results remain murky.

Likewise, we used a firm’s dividend yield, which should be inversely related to taxable

individual ownership. It also produces conflicting results.

Price Reversion

SV are silent on whether the price changes at the time of public disclosure are permanent

or temporary. However, if prices move because capital gains taxes create a temporary shortage

(or excess) of sellers, then prices should revert back to original levels at some point. The

problem in constructing a test of price reversion is determining when reversion should be

expected. Because we are unable to specify how quickly investors unaffected by long-term

capital gains rate differentials can reestablish prices at their original level, we assert no

hypothesis about price reversion and are cautious to infer price reversions from the data.

Nevertheless, an examination of post-disclosure abnormal returns produces regression coefficient

estimates consistent with at least some price reversion in the days following the disclosure.

26

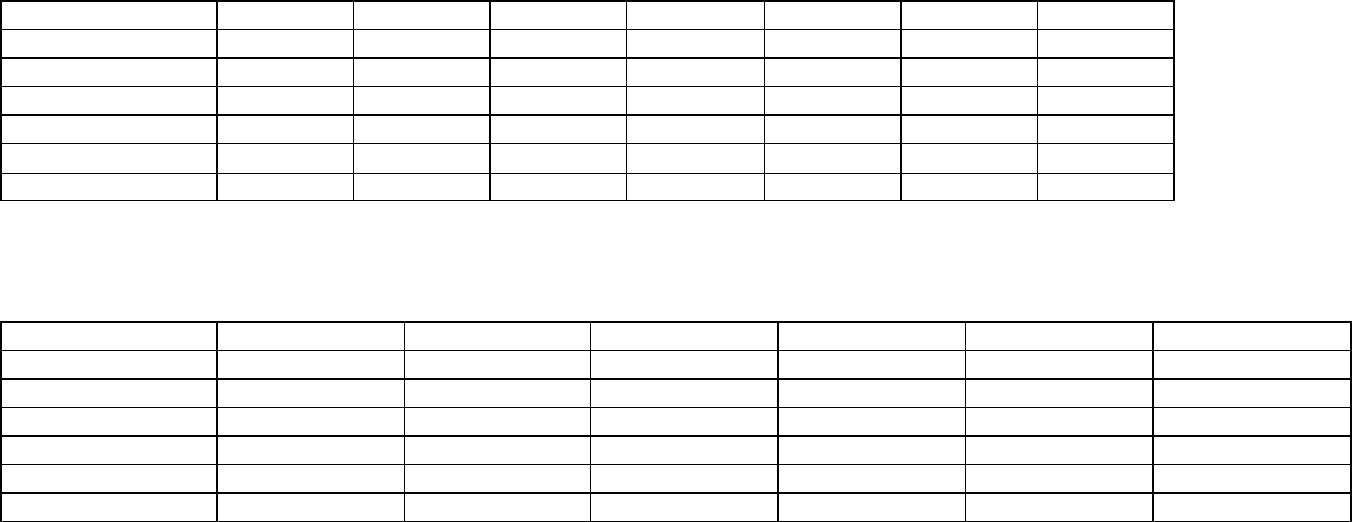

Table 6 reports results for the price reversion tests. For earnings releases, we reestimate

equation (1), substituting three-day cumulative abnormal returns for the days immediately

following the period examined above, i.e., days t+2 through t+4. All other variables are retained

and measured identically. If price reversion occurs, we would expect the coefficients on the

interactions (

UE

*

DRATE

and ∆

PAST

*

DRATE

) to be of opposite sign from the original

regression, i.e., negative.

Consistent with a rebound, column A’s coefficient on

UE

*

DRATE

is negative and

significant at 0.01. The regression coefficient estimate is slightly larger than the coefficient from

the original model, implying that price fully rebounds from this effect in three days. However,

by the sixth post-announcement date, cumulative abnormal returns associated with the

coefficient on

UE

*

DRATE

are no longer significantly less than zero at the 10 percent level.

They remain insignificant at the end of the first ten post-announcement period trading days

(column B). In other words, it appears that prices fully rebound within three days from the

UE

*

DRATE

price effect and then stabilize.

Conversely, column A’s coefficient on ∆

PAST

*

DRATE

is positive after three post-

disclosure trading days. This is not consistent with an immediate price rebound. However, an

analysis of daily, noncumulative returns reveals that for five of the next seven days, the

coefficient is negative. In fact, the coefficient on ∆

PAST

*

DRATE

for days t+5 through t+7 is

significantly less than zero, consistent with a delayed price reversion. Column B shows that the

coefficient on ∆

PAST

*

DRATE

for the 10 days following the disclosure period is negative

(-0.008), though not significant at conventional levels (t-statistic of –1.1). Thus, it appears that

price reversion from the ∆

PAST

*

DRATE

effect is limited and lags the reversion from the

UE

*

DRATE

effect.

27

For S&P 500 additions, we substitute five-day cumulative abnormal returns for the days

immediately following the period examined above, i.e., days t+5 through t+9. All other variables

are retained and measured identically. If price reversion occurs, we would expect the coefficient

on ∆

PAST

*

DRATE

to be of the opposite sign from the original regression, i.e., negative.

19

Column C shows that the coefficient on ∆

PAST

*

DRATE

is negative, as predicted, and

significant at the 0.05 level using a one-tailed test. The coefficient estimate is roughly half its

value in the original regression, suggesting that prices revert after five days to about half the

original level. Additional analysis of days t+10 through t+14 reveals no further price reversion

associated with ∆

PAST

*

DRATE

. Column D adds that the coefficient on ∆

PAST

*

DRATE

for

the ten trading days following the post-announcement period is not significantly different from

zero.

VI. CLOSING REMARKS

This paper produces evidence consistent with the difference between long-term and

short-term capital gains tax rates affecting stock prices around public disclosures. Specifically,

we find that price responses to quarterly earnings releases are increasing in the additional taxes

that investors would pay under short-term capital gains tax treatment. Similar findings related to

the firm’s past price performance are detected for returns around a firm’s addition to the S&P

500 and for trading volume around earnings announcements.

The strongest results throughout the analysis generally come from the interaction

∆

PAST

*

DRATE

. We conclude that the results are generally consistent with individual

investors demanding compensation for the incremental taxes created by selling appreciated

19

No price reversion is expected for the coefficient on

JOIN

*

DRATE

because this interaction is not significant

during the disclosure period.

28

shares before they qualify for long-term treatment. The findings also are consistent with

individuals accepting reduced prices on depreciated shares because they trigger favorable short-

term capital losses.

The primary contribution of this study is its documentation that capital gains taxes affect

share prices around earnings announcements. Unlike prior studies that have focused on price

reactions in settings where shareholder taxes might be unusually salient (e.g., tax law changes,

turn-of-the-year trading, or tax-sensitive transactions), this study finds the imprint of capital

gains taxes in more generalized settings. This paper documents a pervasiveness to the

capitalization of capital gains taxes that previous studies could not infer.

The findings in this study should interest scholars and practitioners interested in both firm

valuation and taxation. In addition, the findings should contribute to ongoing policy debates

about capital gains tax policy, one of the least stable and most controversial aspects of the tax

law. For example, the results are suggestive about the lock-in effect. Among other implications,

the lock-in effect gives investors an incentive to avoid long-term capital gains by holding stocks

until death. The results in this paper would suggest that some investors may demand

compensation for long-term capital gains taxes as enticement to sell shares before death.

Two directions for future research seem promising. First, this study’s inability to find

less ambiguous tax responses for companies held by individuals is troubling. Although

measurement error most likely accounts for the failure to reject the null hypothesis, finding

variation by shareholder-types would greatly strengthen our confidence in the conclusions drawn

from this study.

Second, this study shows that capital gains taxes affect trading even when disclosures are

not about taxes. A next step is to extend this study to investigate trading in settings where no

29

firm-specific information is being disclosed. Individuals face capital gains or losses with every

trade. Each day a steady flow of shares qualifies for favorable long-term capital gains tax

treatment at every firm. Learning whether capital gains tax effects can be detected in normal

daily trading would be an important extension to the emerging literature linking equity prices and

shareholder taxes.

Finally, this paper contributes to the growing documentation that investor-level taxes

affect stock prices (Guenther and Willenborg 1999; Collins and Kemsley 2000; Lang and

Shackelford 2000; among others). These findings are important, partly because they are

inconsistent with an assumption underpinning the prominent valuation models in accounting

research (e.g., Edwards-Bell-Ohlson’s residual income valuation, discounted cash flows or

dividends, capital asset pricing models, arbitrage pricing models). Typically these theoretical

models and the empirical tests that rely on them ignore shareholder taxes. The recent findings, to

which this paper contributes, suggest that shareholder taxes may be an important factor in equity

valuation. Similarly, these findings may imply that accounting courses, such as financial

statement analysis, and popular valuation texts (e.g., Palepu, Bernard and Healy, 1996) should

consider incorporating investor-level taxes in their analyzes.

30

References

Amoako-Adu, B., M. Rashid, and M. Stebbins. 1992. Capital gains tax and equity values:

Empirical test of stock price reaction to the introduction and reduction of capital gains tax

exemption. Journal of Banking and Finance 16: 275-287.

Ayers, B., Lefanowicz, C., and J. Robinson. 2000. The effects of goodwill tax deductions on the

market for corporate acquisitions. Journal of American Taxation Association,

Supplement, forthcoming.

Bamber, L. and Y. Cheon. 1995. Differential price and volume reactions to accounting earnings

announcements. The Accounting Review 70: 417-441.

Berger, P. 1993. Explicit and implicit tax effects of the R&D tax credit. Journal of Accounting

Research 31: 131-171.

Bernard, V. 1987. Cross-sectional dependence and problems in inference in market-based

accounting research. Journal of Accounting Research 25: 1-48.

______, J. Thomas, and J. Wahlen. 1997. Accounting-based stock price anomalies: Separating

market inefficiencies from risk. Contemporary Accounting Research 14: 89-136.

Blouin, J., J. Raedy, and D. Shackelford. 1999. Stock prices and capital gains taxes: Evidence

from the 1998 reduction in the long-term capital gains holding period, Working paper,

University of North Carolina, Chapel Hill, NC.

Bogle, J. 1999. The first index mutual fund: A history of Vanguard index trust and the Vanguard

index strategy, Vanguard web site, http://www.vanguard.com.

Collins, J., J. Hand, and D. Shackelford. 2000. Valuing deferral: The effect of permanently

reinvested foreign earnings on stock prices. In International Taxation and Multinational

Activity, ed. Hines, J., (Chicago: University of Chicago Press), forthcoming.

______, and D. Kemsley. 2000. Capital gains and dividend capitalization in firm valuation:

Evidence of triple taxation. Working paper, University of North Carolina, Chapel Hill,

NC.

Dhaliwal, D. and R. Trezevant. 1993. Capital gains and turn-of-the-year stock price pressures.

Advances in Quantitative Analysis of Finance and Accounting 2: 139-154.

Engel, E., M. Erickson, and E. Maydew. 1999. Debt-equity hybrid securities. Journal of

Accounting Research 37: 249-274.

Erickson, M. 1998. The effect of taxes on the structure of corporate acquisitions. Journal of

Accounting Research 36: 279-298.

31

______ and E. Maydew. 1998. Implicit taxes in high dividend yield stocks. The Accounting

Review 73: 435-458.

______ and S. Wang. 1999. The effect of transaction structure on price: Evidence from

subsidiary sales. Working paper, University of Chicago, Chicago, IL.

Gentry, W., D. Kemsley, and C. Mayer. 2000. Are dividend taxes capitalized into share prices?

Evidence from real estate investment trusts. Working paper, Columbia University, New

York, NY.

Guenther, D. 1999. Investor reaction to anticipated 1997 capital gains tax rate reduction,

Working paper, University of Colorado, Boulder, CO.

______. 1994. The relation between tax rates and pretax returns: Direct evidence from the 1981

and 1986 tax rate reductions. Journal of Accounting and Economics 18: 379-393.

______ and M. Willenborg. 1999. Capital gains tax rates and the cost of capital for small

business: Evidence from the IPO market. Journal of Financial Economics 53: 385-408.

Harris, L. and E. Gurel. 1986. Price and volume effects associated with changes in the S&P 500

list: New evidence for the existence of price pressures. Journal of Finance 41: 815-829.

Harris, T., R. Hubbard and D. Kemsley. 2000. The share price effects of dividend taxes and tax

imputation credits. Journal of Public Economics. forthcoming.

______ and D. Kemsley. 1999. Dividend taxation in firm valuation: New evidence. Journal of

Accounting Research 37: 275-291.

Hayn, C. 1995. The information content of losses. Journal of Accounting and Economics 20:

125-153.

______. 1989. Tax attributes as determinants of shareholder gains in corporate acquisitions.

Journal of Financial Economics. 121-153.

Henning, S. and W. Shaw. 2000. The effect of the tax deductibility of goodwill on purchase price

allocations. Journal of the American Taxation Association. forthcoming.

______, W. Shaw, and T. Stock. 2000. The effect of taxes on acquisition prices and transaction

structure. Journal of the American Taxation Association, Supplement. forthcoming.

Jegadeesh, N. and S. Titman. 1993. Returns to buying winners and selling losers: Implication of

stock market efficiency. Journal of Finance 44: 135-148.

Karpoff, J. 1987. The relation between price changes and trading volume: A survey. Journal of

Financial and Quantitative Analysis 22: 109-126.

32

Ke, B., Petroni, K., and D. Shackelford. 2000. The impact of state taxes on self-insurance.

Journal of Accounting and Economics 29:3, forthcoming.

Landsman, W. and D. Shackelford. 1995. The lock-in effect of capital gains taxes: Evidence

from the RJR Nabisco leveraged buyout. National Tax Journal 48: 245-59.

Lang, M. and D. Shackelford. 2000. Capitalization of capital gains taxes: Evidence from stock

price reactions to the 1997 rate reductions. Journal of Public Economics 76: 69-85.

Lipe, R., L. Bryant, and S. Widener. 1998. Do nonlinearity , firm-specific coefficients, and losses

represent distinct factors in the relation between stock returns and accounting earnings?

Journal of Accounting and Economics 25:2, 195-214.

McKeown, J. and J. Raedy, 2000, Problems inherent in the use of cross-sectional earnings

response coefficients. Working paper, University of North Carolina, Chapel Hill, NC.

Maydew, E., K. Schipper, and L. Vincent. 1999. The impact of taxes on the choice of divestiture

method. Journal of Accounting and Economics 28: 117-150.

Ohlson, J. 1995. Earnings , book values and dividends in security valuation. Contemporary

Accounting Research. 661-687.

Palepu, K., V. Bernard, and P. Healy. 1996. Business Analyst and Valuation. Cincinnati, OH.,

Southwestern Publishing.

Poterba, J. and S. Weisbrenner. 1998. Capital gains tax rules, tax loss trading, and turn-of-the-

year returns. Working Paper, National Bureau of Economic Research, Cambridge, MA.

Raedy, J. 2000. A reconciliation of stock market anomalies. Working paper, University of North

Carolina, Chapel Hill, NC.

Reese, W. 1998. Capital gains taxation and stock market activity: Evidence from IPOs. Journal

of Finance 53: 1799-1820.

Shackelford, D. 1991. The market for tax benefits: Evidence from leveraged ESOPs. Journal of

Accounting and Economics 14: 117-145.

______. 2000. Stock market reaction to capital gains tax changes: Empirical evidence from the

1997 and 1998 Tax Acts, in Tax Policy and the Economy. Vol. 14. ed. J. Poterba, MIT Press.

Cambridge, MA. forthcoming.

______ and R. Verrecchia. 1999. Intertemporal tax discontinuities, Working Paper #7451,

National Bureau of Economic Research, Cambridge, MA.

Shleifer, A. 1986. Do demand curves for stocks slope down? Journal of Finance 61: 579-590.

33

Sinai, T. and J. Gyourko. 1999. The asset price incidence of capital gains taxes: Evidence from

the Taxpayer Relief Act of 1997 and publicly-traded real estate firms. Working paper,

University of Pennsylvania, Philadelphia, PA.

Stickney, C., Weil, R. and M. Wolfson. 1983. Income taxes and tax transfer leases: General

Electric’s accounting for a Molotov cocktail. The Accounting Review 58: 439-459.

34

Table 1

Change in Marginal Tax Rate for an Individual Investor in Highest Statutory Tax Rate when Stock Qualifies for Long-term Treatment

(adapted from Shackelford, 2000)

I II III IV V

Date of Sale

Holding

Period

Statutory tax

rate

Short-term

Gain (STG) or

Loss (STL)

(A)

Statutory tax

rate

Long-term

Gain (LTG)

(B)

Effective tax

rate

Long-term

Loss (LTL)

a

(C)

Change in

marginal tax rate

when stock goes

long-term if

LTG$LTL &

STG$STL

(A)—(B)

Change in

marginal tax rate

when stock goes

long-term if

LTG#LTL &

STG#STL

b

(A)—(C)

Change in

marginal tax rate

when stock goes

long-term for all

other combos of

LTG, LTL,

STG, & STL

1/1/78—10/31/78 12 70 35 35 35 35 0

11/1/78—12/31/81 12 70 28 35 42 35 0

1/1/82—12/23/84 12 50 20 25 30 25 0

12/24/84—6/22/85 6 or 12

c

50 20 25 30 25 0

6/23/85—12/31/86 6 50 20 25 30 25 0

1987 6 38.5 28 38.5 10.5 0 0

1/1/88—1/1/89 6 or 12

d

28 28 28 0 0 0

1/2/89—12/31/90 12 28 28 28 0 0 0

1991—1992 12 31 28 31 3 0 0

1/1/93—5/6/97 12 39.6 28 39.6 11.6 0 0

5/7/97—7/28/97 12 39.6 20 39.6 19.6 0 0

7-29-97—12-31-97 18 39.6 20

e

39.6 19.6 0 0

1998 12 39.6 20 39.6 19.6 0 0

a

The effective rate for long-term losses is the statutory rate in all years except before 1987, when only half of net long-term capital losses could be deducted.

Thus, in those years, the effective rate is half of the statutory rate.

b