Decmeber 28, 2022

Health Care Market Oversight

Transaction 005

Amazon & One Medical

30-Day Review Summary Report

30-Day Review Summary Report – 005 Amazon-One Medical 2

About this Report

This report summarizes analyses and findings from Oregon Health Authority’s preliminary (30-day)

review of the proposed material change transaction of Amazon and One Medical. It accompanies

the Findings of Fact, Conclusions of Law, and Final Order (“Preliminary Review Order”) issued by

Oregon Health Authority on December 28, 2022. For legal requirements related to the proposed

transaction, please reference the Preliminary Review Order.

You can get this document in other languages, large print, braille or a format you prefer free of

charge. Contact us by email at hcmo[email protected]regon.gov or by phone at 503-385-5948. We

accept all relay calls.

If you have any questions about this report or would like to request more information, please

contact hcmo.info@oha.oregon.gov.

Contents

Contents .......................................................................................................................................... 2

Executive Summary ........................................................................................................................ 3

Introduction ..................................................................................................................................... 5

Proposed Transaction ..................................................................................................................... 6

One Medical’s Model of Primary Care ........................................................................................... 14

Findings & Potential Impacts ......................................................................................................... 18

Conclusions ................................................................................................................................... 44

Acronyms & Glossary .................................................................................................................... 46

Appendix A: OHA’s Review ........................................................................................................... 47

References .................................................................................................................................... 49

30-Day Review Summary Report – 005 Amazon-One Medical 3

Executive Summary

The Health Care Market Oversight (HCMO) program reviews proposed heath care business deals

to make sure they support statewide goals related to cost, equity, access, and quality. After

completing a review, the Oregon Health Authority (OHA) issues a decision about whether a

business deal, or transaction, involving a health care company should proceed. On November 29,

2022, OHA received a completed Notice of Material Change Transaction (the “Notice”) from

Amazon.

Proposed Transaction

In this transaction, Amazon plans to purchase One Medical for approximately $3.9 billion. One

Medical is a for-profit primary care organization operating more than 180 medical offices across the

country, including five primary care clinics in Oregon. Amazon is a multi-national corporation that

operates across several industries, including e-commerce, infrastructure computing services,

electronic devices, digital media content and logistics. In Oregon, One Medical partners with

Providence Health & Services to support clinical care and administrative services.

OHA’s Review

OHA conducted a 30-day preliminary review of the proposed transaction. During the review, OHA

gathered background information about the companies involved and assessed the likely impact of

the transaction across four domains: cost, access, quality, and equity. OHA held a 14-day public

comment period and received 36 public comments. Most public comments opposed the

transaction, with many citing concerns about for-profit health care companies prioritizing profits

over patients.

Key Findings

Cost

OHA does not have concerns about price increases resulting from

consolidation, as the transaction will not meaningfully change Amazon

and One Medical’s market share for primary care services in Oregon.

Commercial insurance payment rates for One Medical are negotiated

through the partnership with Providence. OHA has no reason to believe

that One Medical will be able to negotiate higher rates because of this

transaction.

Access

OHA does not have specific concerns about reductions in access to care

resulting from this transaction. The entities have stated that they do not

plan to reduce access to essential services. The entities have also stated

that they plan to expand One Medical’s network of clinics, which may

provide additional access to services. One Medical clinics are located in

urban areas with many other primary care providers.

Quality

OHA has limited insight into quality for One Medical locations, since its

Portland clinics opened in 2020 and 2021 and One Medical does not

participate in some programs that require regular quality reporting.

Amazon’s business model also has the potential to impact quality. OHA

will require on-going quality reporting to monitor for concerns.

30-Day Review Summary Report – 005 Amazon-One Medical 4

Equity

OHA identified potential equity concerns resulting from this transaction.

This transaction could potentially result in One Medical siphoning off

commercially insured patients with higher payment rates from clinics that

serve more Medicaid and Medicare-covered patients. Those concerns

are somewhat mitigated by the fact that One Medical has a small

footprint in Oregon and operates in urban areas with many other primary

care provider options.

Conclusions and Decision

Based on preliminary review findings, OHA approved this transaction with conditions on

December 28, 2022. (See the review order for more details.) OHA made this decision based on

these criteria:

1. The transaction is unlikely to substantially reduce access to affordable health care in

Oregon. In the locations where One Medical operates in Oregon, patients have many other

options to access similar types of services. OHA does not anticipate that this transaction

will result in increased prices. Combining with Amazon, with its advanced supply chain and

purchasing power, may generate efficiencies and savings for One Medical, though any

savings would not necessarily be passed to consumers.

2. Comprehensive review of the material change transaction is not warranted given the

size effects of the transaction. One Medical currently operates five clinics in the Portland

Metro area. One Medical’s patients represent a small number of primary care patients in the

Portland Metro region and the transaction does not impact other geographic areas in the

state.

This transaction is approved on the condition that Amazon and/or One Medical report information

about the services they provide, the patients they serve, quality of care, and any governance or

organizational changes for the locations in Oregon. The reports are required to be submitted every

six months for five years following the transaction.

OHA will monitor the impact of the transaction by conducting follow up analyses one year, two

years, and five years after the business deal is completed. During these reviews, OHA will analyze

the impact of the transaction on quality of care, access to care, affordability, and health equity,

specifically following up on concerns or observations noted in the review summary report. OHA will

also assess whether the parties to the transaction have kept to the commitments stated in the

Notice regarding cost, access, and quality of care.

30-Day Review Summary Report – 005 Amazon One Medical 5

Introduction

In 2021, the Oregon Legislature passed House Bill 2362, giving the Oregon Health Authority (OHA)

the responsibility to review and decide whether some transactions involving health care entities

should proceed. In March 2022, OHA launched the Health Care Market Oversight program

(HCMO). This program reviews proposed health care transactions such as mergers, acquisitions,

and affiliations to ensure they support statewide goals related to cost, equity, access, and quality.

The HCMO program is governed by Oregon Revised Statute (ORS) 415.500 et seq. and Oregon

Administrative Rules (OAR) 409-070-0000 through -0085. The HCMO program fits within OHA’s

broader mission of ensuring all people and communities can achieve optimum physical, mental,

and social well-being through partnerships, prevention, and access to quality, affordable health

care.

In the authorizing statute, the Oregon Legislature specified what types of proposed transactions

are subject to review and the criteria OHA must use when analyzing a given proposed transaction.

The Oregon Legislature also authorized OHA to decide the outcome of a proposed transaction.

After analyzing a given proposed transaction, OHA may approve, approve with conditions, or reject

it.

When reviewing transactions, HCMO focuses solely on analyses within the scope of the program’s

authority. Certain other analyses do not fall within the HCMO program’s scope of review.

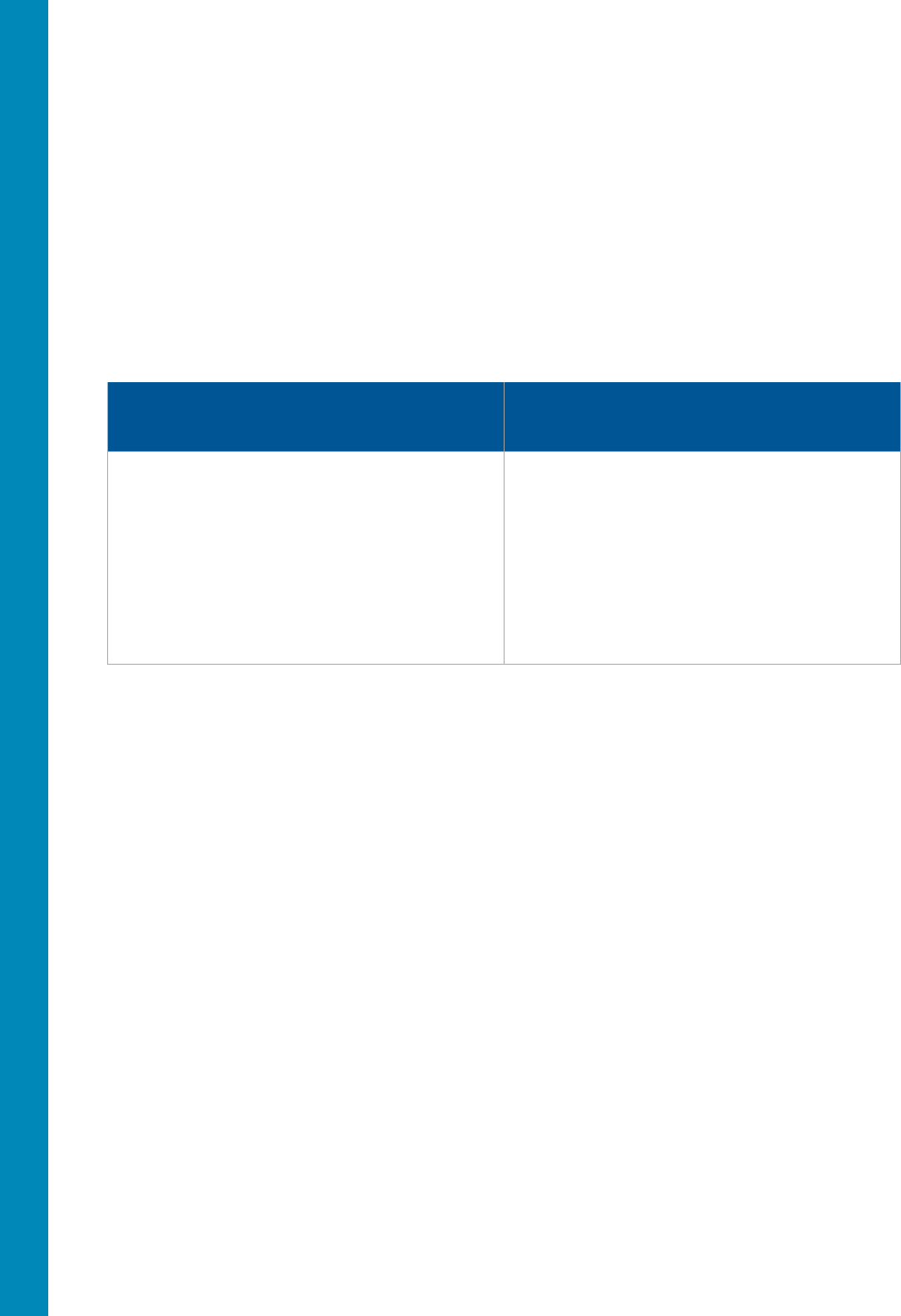

What is in HCMO’s scope

What is not in HCMO’s scope

Compliance with ORS 415.500 et seq, and

accompanying administrative rules

Compliance with other laws and regulations (though

HCMO may notify other authorities if a clear

violation is uncovered)

How the proposed transaction affects competition

and market concentration

Compliance with labor and/or workforce laws and

regulations

How the proposed transaction affects access to care

Compliance with data privacy and security laws and

regulations (including HIPAA)

How the proposed transaction affects health equity,

including rectifying current and historical factors that

drive inequities

Compliance with environmental, building code, and

facility laws and regulations

How the proposed transaction affects the quality of

health care

Compliance with credentialling, licensing, and/or

accreditation requirements

30-Day Review Summary Report – 005 Amazon One Medical 6

Proposed Transaction

On November 29, 2022, OHA confirmed receipt of a complete Notice of Material Change

Transaction (the “Notice”) from Amazon.com, Inc. (“Amazon”). This Notice describes a proposed

transaction where Amazon will merge with 1Life Healthcare, Inc. (“One Medical”) and Negroni

Merger Sub, Inc. (“Merger Sub”). The Notice outlines the intent of Amazon to merge with One

Medical.

OHA reviewed the Notice and determined that the transaction is subject to review under HCMO

rules. The parties to the proposed transaction meet the revenue thresholds specified in OAR 409-

070-0015(1) and the proposed transaction is otherwise covered by the program in accordance with

OAR 409-070-0010. After confirming receipt of the complete Notice, OHA began a 30-day

preliminary review of the proposed transaction. OHA accepted public comments on this transaction

from November 29, 2022, through December 14, 2022.

This report describes the proposed transaction, OHA’s approach to the review, its findings, and its

conclusions based on these findings.

Entities Involved

The main entities involved in this transaction are Amazon and One Medical. Although not a party to

the transaction, Providence Health & Services Oregon has a partnership with One Medical to

deliver care in Oregon and is included below.

Amazon

Amazon is a multinational technology company

focusing on e-commerce, cloud computing, online

advertising, digital streaming and media content,

electronic devices, and artificial intelligence.

Amazon is a publicly traded, for-profit company,

incorporated in Delaware and headquartered in

Seattle, WA.

Amazon organizes operations into three

segments: North America, International, and

Amazon Web Services (AWS). AWS offers “a

broad set of on-demand technology services,

including compute, storage, database, analytics,

and machine learning, and other services.”

1

Amazon operates online and physical stores, as

well as a platform where third parties can sell

products and operate businesses online. Amazon

also has fulfillment networks throughout the world to process, ship, and deliver products to

customer.

In 2021, Amazon reported:

2

• 1,608,000 full-time and part-time employees, making it the second largest private employer

in the United States.

• $469.8 billion in net sales and $33.4 billion in net income

• Approximately 200 million Amazon Prime members

3

We seek to be Earth’s most customer-

centric company.

We are guided by four principles:

customer obsession rather than competitor

focus, passion for invention, commitment

to operational excellence, and long-term

thinking. In each of our segments, we

serve our primary customer sets,

consisting of consumers, sellers,

developers, enterprises, content creators,

advertisers, and employees.

- Amazon 2021 Annual Report SEC Filing

30-Day Review Summary Report – 005 Amazon One Medical 7

Amazon has made several efforts to expand into

health care, often with mixed results. A common

stated goal across Amazon’s health care efforts

has been to make health care more convenient

and accessible for consumers.

4

The One Medical

deal would be Amazon’s largest health care

acquisition to date.

PillPack and Amazon Pharmacy

In 2018, Amazon acquired PillPack, an online Pharmacy service focused on recurring monthly

medications, for $750 million. Amazon currently operates PillPack as a distinct service for

customers managing multiple daily medications for chronic conditions.

PillPack became the foundation for Amazon Pharmacy, an online pharmacy service that Amazon

launched in 2020, promising low prices, convenience, and quick delivery.

5

Amazon Prime

members receive free two-day delivery on Amazon Pharmacy prescriptions. Neither Amazon

Pharmacy nor PillPack are authorized to ship Schedule II medications, such as opioids.

Amazon also offers an Amazon Prime prescription savings benefit, which advertises discounts of

up to 40% off brand name drugs and 80% off generic drugs for Amazon Prime members that pay

without using insurance. The Amazon Prime prescriptions savings benefit includes a digital Rx

card that Prime members can use for savings at participating pharmacies, including CVS, Rite Aid,

and Fred Meyer, among others. This benefit is automatically included in Amazon Prime

memberships.

6

Since its launch, Amazon Pharmacy has had fairly low use among Amazon Prime members. One

survey found that 2% of Prime members use Amazon Pharmacy, compared with 73% who use

two-day shipping and 58% who use Prime video.

7

Amazon Clinic

On November 15, 2022, Amazon announced the launch of Amazon Clinic, a “message-based

virtual care service that connects customers with affordable virtual care options.”

8

In their

announcement, Amazon stated a desire to “make it dramatically easier for people to get and stay

healthy.”

Amazon Clinic operates as a direct-to-consumer virtual health “storefront” where users can search

for, compare, and connect with third party providers. Patients can also pay for virtual care services

through the platform, which have a flat fee that users can see when they search for services.

Amazon Clinic is a message-based, “asynchronous” care platform; after a patient answers

questions about their condition, providers consult with patients via messages.

Amazon Clinic initially launched in 32 states, including Oregon, and offers 24/7 access to care for

common conditions, such as pink eye and urinary tract infections, as well as prescription renewals

for common medications, like high blood pressure or asthma drugs. As of this report, Amazon

Clinic does not accept health insurance for consults with providers, though patients can use

insurance to pay for prescriptions resulting from the consultation.

i

The Amazon Clinic website

includes the note that “at this time, Amazon Clinic isn’t intended for individuals who receive

i

The Amazon Clinic website includes this note: “At this time, Amazon Clinic isn’t intended for individuals who

receive coverage from federal or state healthcare payors. We encourage you to visit a covered provider who

is contracted with your health plan for services.”

We think health care is high on the list of

experiences that need reinvention.

- Neil Lindsay, SVP of Amazon Health

Services in a press release

30-Day Review Summary Report – 005 Amazon One Medical 8

coverage from federal or state healthcare payors. We encourage you to visit a covered provider

who is contracted with your health plan for services.”

Past health care efforts: Haven, Amazon Care, and HIPAA-Compliant Alexa

In 2018, Amazon launched a partnership with JP Morgan and Berkshire Hathaway to overhaul

health coverage and health care for employees of the three companies. The companies created

Haven, a non-profit joint venture focused on creating “simplified, high-quality and transparent

health care at a reasonable cost” for US employees.

9

At its launch, Amazon had expressed hopes

that Haven would disrupt the health care industry, but nonetheless abandoned the effort in 2021.

Media reports cited insufficient market power and the COVID-19 pandemic as factors that

contributed to Haven’s failure.

10

In 2019, Amazon launched Amazon Care, a primary and urgent care service for employees.

Services were primarily virtual, with some home visit and in-office options. Amazon aimed to

expand the service to other employers but was unsuccessful and, per the Notice, Amazon Care will

sunset at the end of 2022.

Also in 2019, Amazon launched HIPAA-compliant skills kit for developers for its Alexa voice

assistant devices. The goal was to allow health care organizations to build HIPAA-compliant apps

that could securely transmit protected health information. As of Dec 9, 2022, this service will no

longer be supported.

11

One Medical (1Life Healthcare, Inc.)

One Medical was founded in 2007 by a physician

turned entrepreneur. One Medical provides

primary care services to individuals who have a

membership. One Medical serves people with

commercial and Medicare insurance; as of this

report, they did not accept patients with Medicaid

insurance coverage. The company is for-profit,

publicly traded, incorporated in Delaware, and

based in San Francisco. One Medical announced

its initial public offering (IPO) in 2020. According to

its website, One Medical has 200+ locations in 29

markets nationwide.

One Medical builds memberships by marketing

directly to consumers and by partnering with

employers who offer One Medical membership as

a benefit. Around 60% of members are through

employers or enterprise clients.

12

Technology is

central to One Medical’s approach to offer 24/7 on-

demand digital and virtual care options. They have

built a proprietary technology platform and electronic health records system. As of December 2020,

the company reported five times as many digital as in-person encounters.

13

One Medical partners

with established health systems in local markets to deliver care and provide access to specialty,

hospital, and other non-primary care services. Through these partnerships, One Medical is able to

integrate into existing networks, rather than building their own, and leverage existing relationships

with insurers. These partnerships are a crucial component of One Medical’s model. In One

Medical’s 2021 Annual Report, they stated: “Our business model and future growth are

substantially dependent on the success of our strategic relationships with health network partners,

enterprise clients and distribution partners.”

14

One Medical is a membership-based

primary care practice on a mission to

make getting quality care more affordable,

accessible, and enjoyable for all through a

blend of human-centered design,

technology, and an exceptional team. Our

members enjoy seamless access to

comprehensive care at calming offices

near where they work, live, and shop in

twelve major U.S. markets, as well as 24/7

access to virtual care. In addition to a

direct-to-consumer membership model, we

work with more than 8,000 companies to

provide One Medical health benefits to

their employees.

- One Medical website

30-Day Review Summary Report – 005 Amazon One Medical 9

One Medical’s Partnership with Providence

In Oregon, One Medical partners with Providence Health & Service Oregon to deliver clinical care

and bill for services. One Medical also refers to Providence facilities and providers for hospital,

specialty, and other non-primary care services.

Providence Health & Services Oregon is part of Providence St. Joseph Health, a non-profit, tax

exempt, Catholic health care system operating in seven states and including more than 50

hospitals, 800 non-acute locations, home health services, and health plans. Providence operates

eight hospitals in Oregon and Providence Medical Group operates more than 90 clinics with 600

employed physicians. In Oregon, Providence Health Plan offers commercial, self-insured,

individual and group, Medicare, and Medicaid insurance.

15

In 2019, One Medical and Providence entered into a partnership in advance of One Medical

opening primary care locations in Oregon. The partnership covers clinical, administrative, and

payment services. Through this partnership One Medical patients can be referred to Providence

specialists and facilities. One Medical bills for its clinical services under a Providence National

Provider Identifier (NPI) and Providence retains all fees for the professional and clinical services

provided. Providence pays One Medical a per member per month payment, which may be adjusted

to consider various factors.

Amazon described this relationship in more detail in the Notice:

Under its strategic partnership with Providence Health & Services Oregon (“Providence”),

Providence contracts with One Medical Group, Inc. for professional clinical services and

separately contracts with 1Life for management, operational and administrative services. All

professional clinical services are billed under a Providence NPI and Providence retains all fees

for the professional clinical services provided. Providence pays each of 1Life and One Medical

Group, Inc. on a “per member per month basis”, and such payment may be adjusted based on

various factors such as visit rates, other primary care relationships the health system has, and

the rates the health system receives from payers.

Governance

In this report, “One Medical” refers to entities doing business under the One Medical brand,

including 1Life Healthcare, which provides administrative and management services, and One Life

Medical Group, Inc., physician owned professional corporations that are affiliated with One Medical

and deliver clinical services.

Currently, One Medical is governed by a 10-member board of directors.

16

The board of the

directors provides oversight, strategic guidance, counseling, and direction to One Medical’s

management. The board includes two physicians, representing a pharmaceutical company and

health care investments company. Other board members have backgrounds in cybersecurity,

childcare, retail clothing and beverages, venture capital, and private equity. Aside from the board

chair and CEO, no board members appear to have a background in primary care. Members are

elected for three-year terms. In 2021, non-employee board members were paid between $27,475

and $271,776 in cash and stocks.

17

30-Day Review Summary Report – 005 Amazon One Medical 10

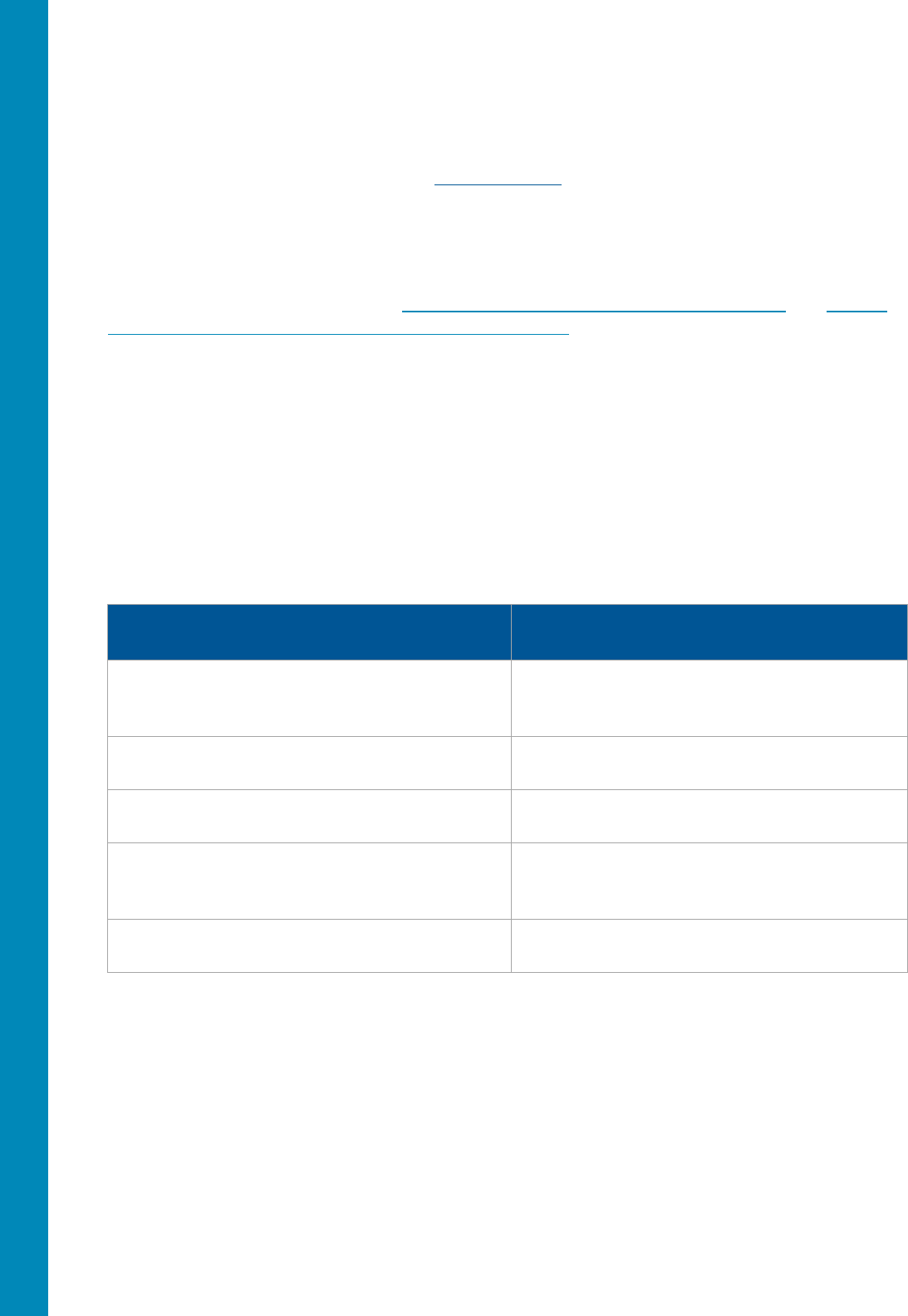

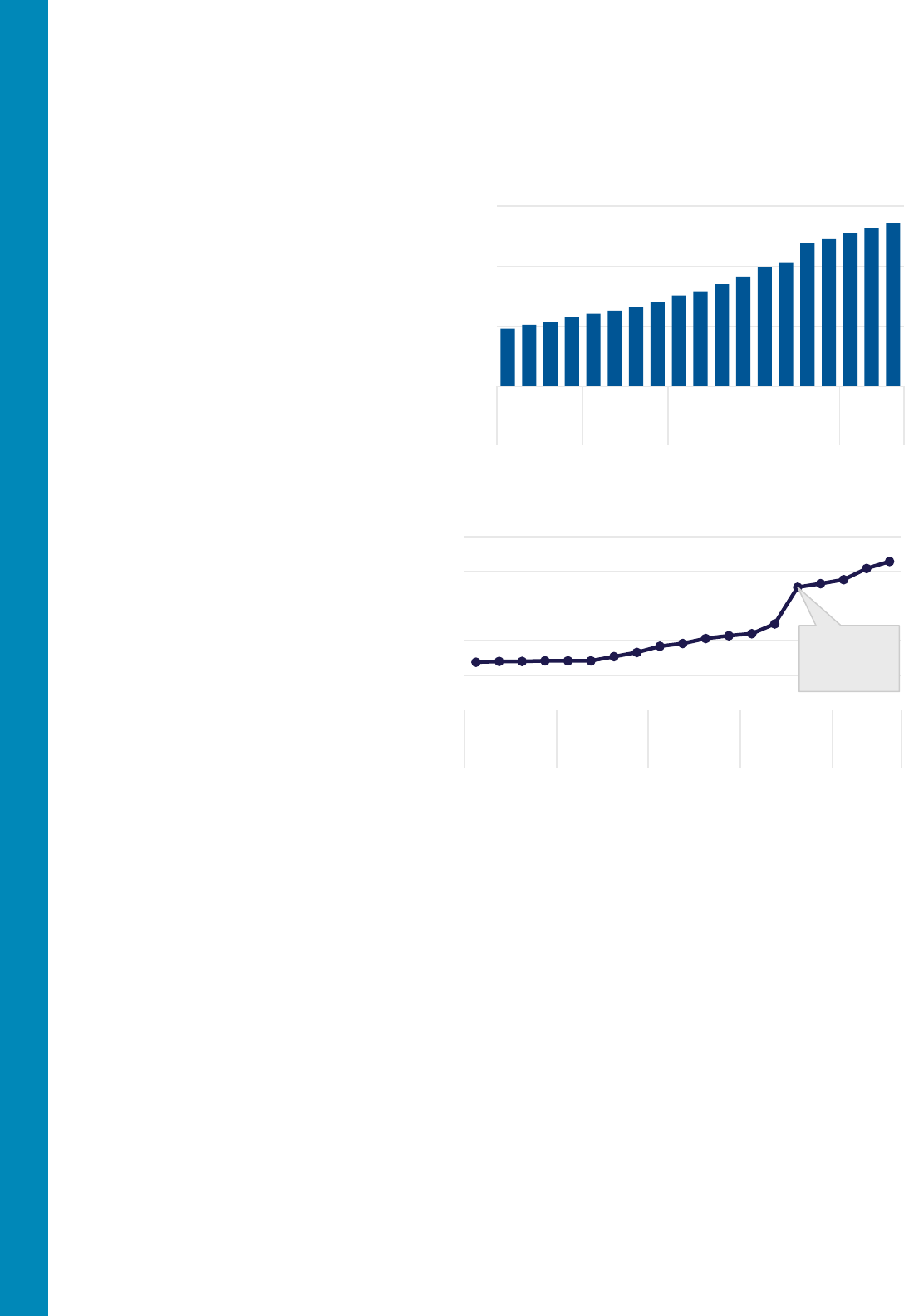

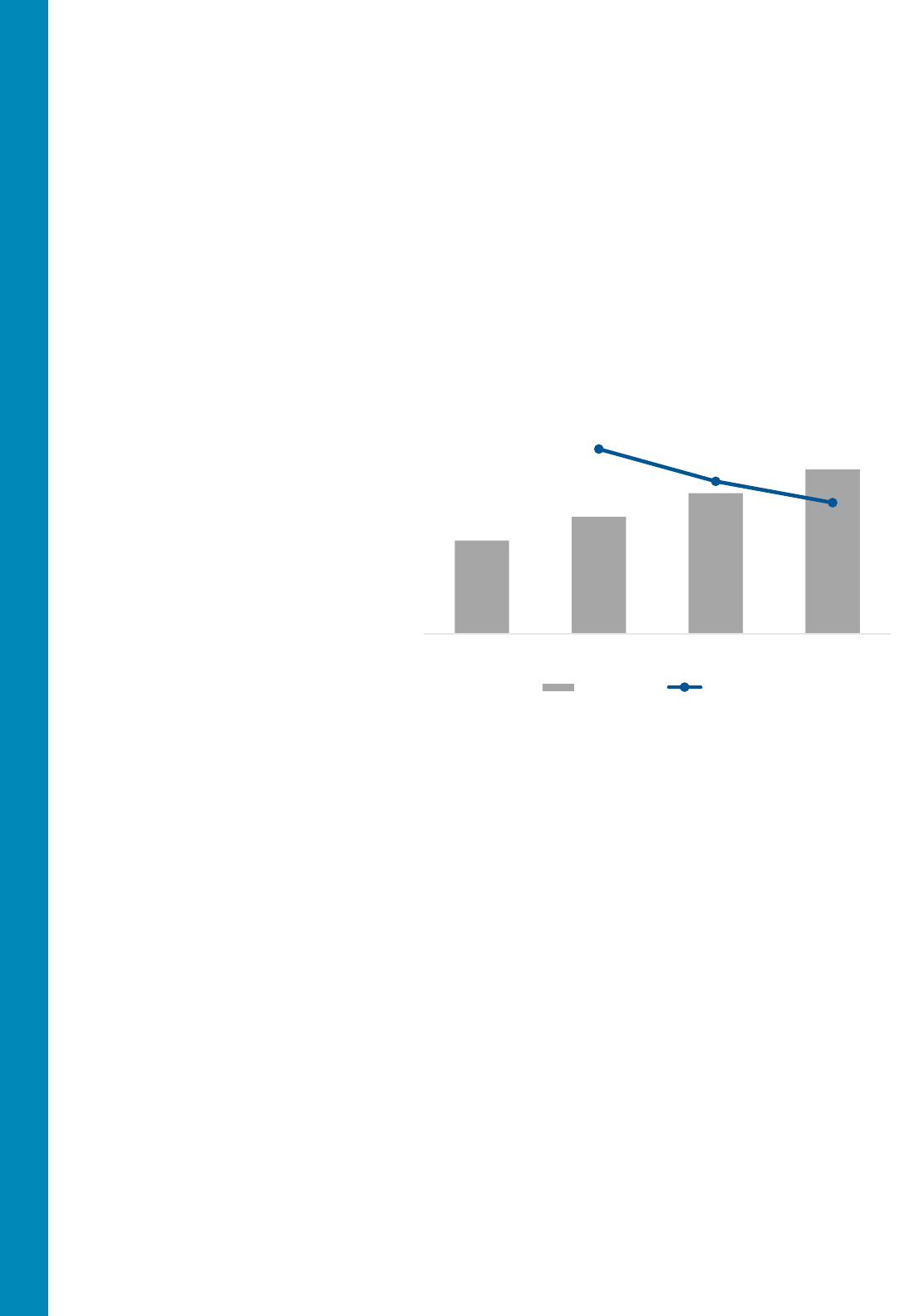

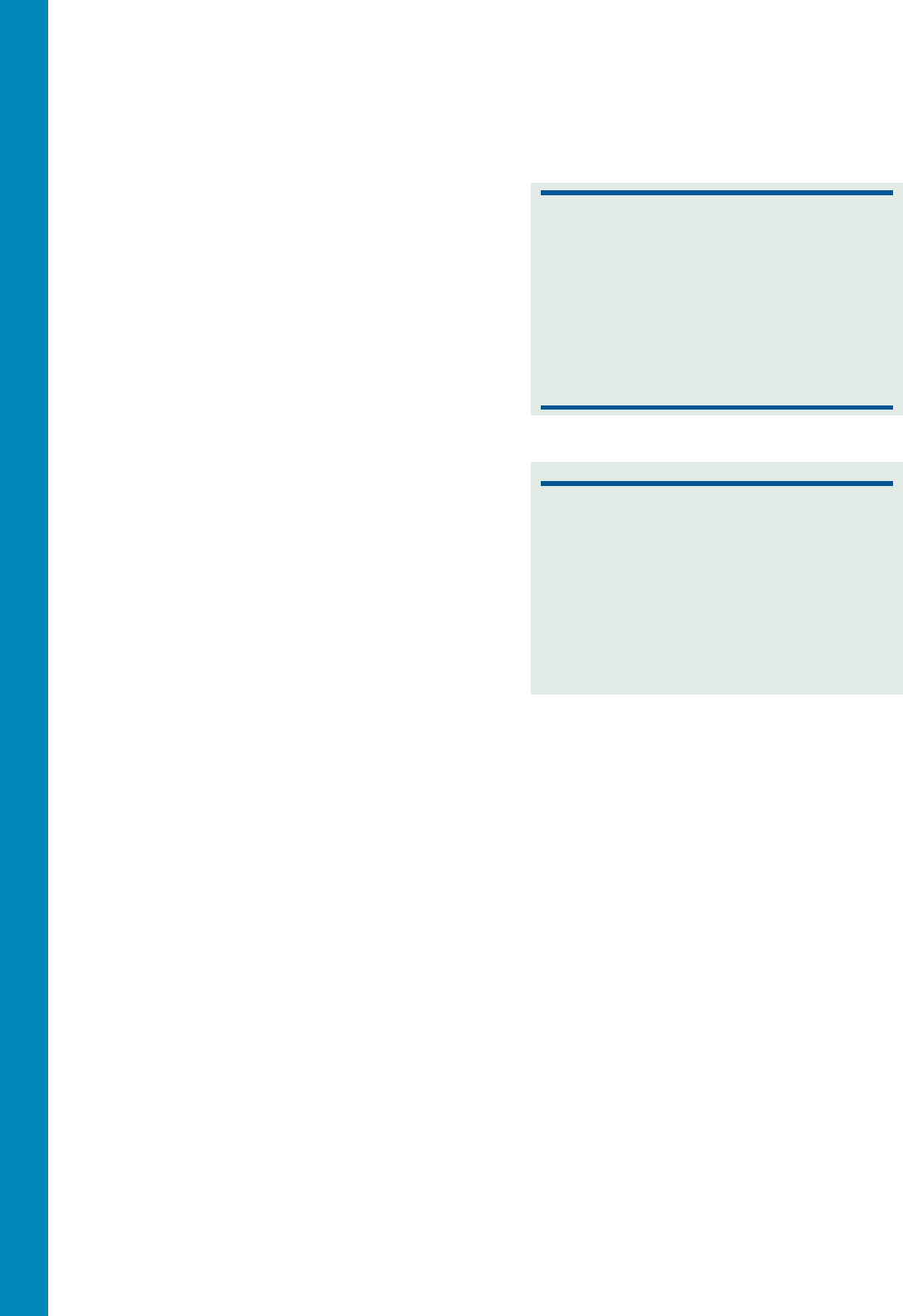

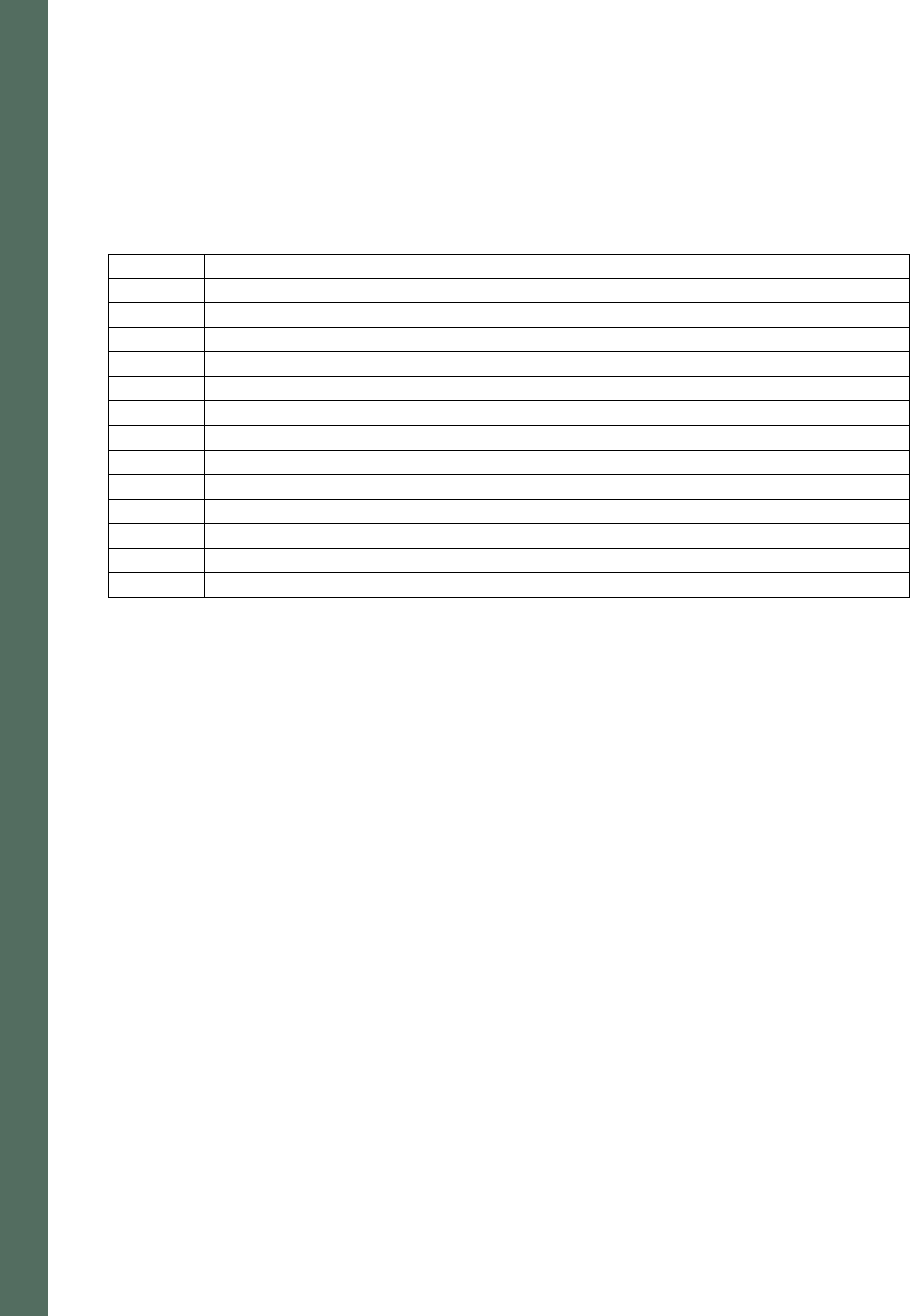

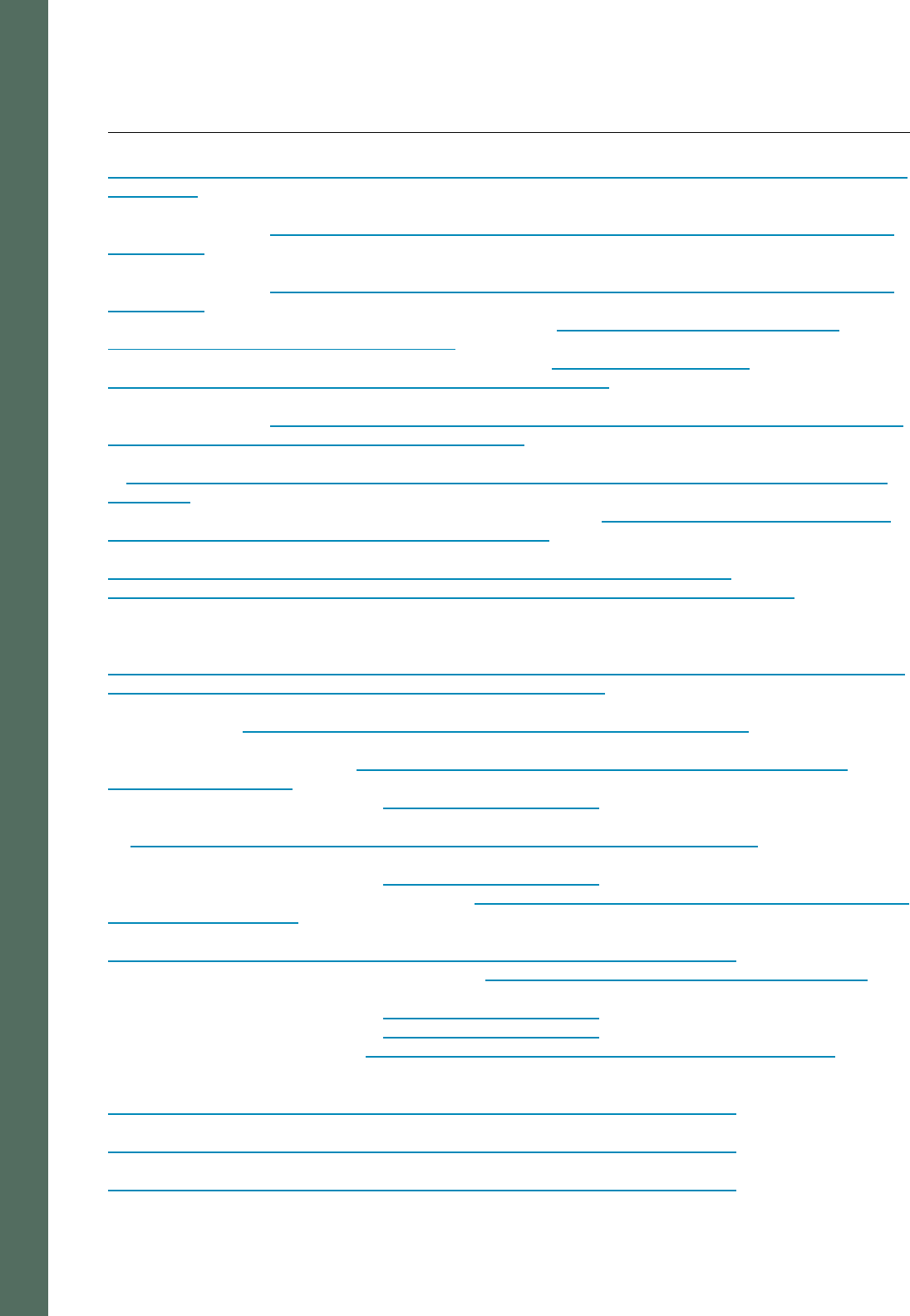

Growth and expansion

One Medical has expanded rapidly

in the past few years, growing from

about 70 clinics and 300,000

members in 2018 to 200 clinics and

815,000 members nationally in

2022.

18

19

One Medical began

operating clinics in Oregon in 2022.

Along with this rapid growth, One

Medical has not yet proven to be

profitable. The company has

consistently reported operating

losses, including $117.3 million in

losses for the third quarter of 2022.

20

The company has stated its intent to

continue to pursue growth, seeking

to transform and disrupt health care

in the process. In its 2021 annual

report, One Medical outlined its

strategies for continued growth and

expansion:

• Grow in existing markets

through increasing consumer

memberships, gaining new

enterprise clients, and

expansion of Medicare

Advantage payers and

members

• Expand into new markets

• Grow health network partnerships, including moving into markets where existing partners

have an established presence.

• Expand services and populations to provide care for members across all stages of life

One Medical mergers and acquisitions history

In 2021, One Medical acquired Iora Health, a value-based primary care group serving Medicare

patients at 47 offices in ten markets across the US. This was an opportunity for One Medical to

move into the large and growing Medicare market: “By acquiring Iora, we’ll be able to better

address the needs of Medicare patients, an important step in our mission to transform healthcare

for all.”

21

Iora is now branded as “Iora with One Medical,” but its website notes that it is transitioning

to become One Medical Seniors. According to the One Medical 2021 Annual report, the company

states that the acquisition of Iora Health “extends reach across locations representing 40% of the

U.S. population.”

22

This map below shows One Medical and Iora Health markets, with * indicating upcoming markets.

69

71

83

107

Iora Health

acquisition

182

214

0

50

100

150

200

250

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3

2018 2019 2020 2021 2022

One Medical more than tripled its number of clinics

nationally from spring 2018 to fall 2022

-

300,000

600,000

900,000

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3

2018 2019 2020 2021 2022

The number of One Medical members nationally more

than doubled between spring 2018 and fall 2022

30-Day Review Summary Report – 005 Amazon One Medical 11

According to media reports, prior to entering the deal with Amazon, One Medical considered and

rejected acquisition interest from CVS Health.

23

Transaction Terms

On July 20, 2022, Amazon entered into an Agreement and Plan of Merger (“Merger Agreement”)

with 1Life Healthcare, Inc. and Negroni Merger Sub, Inc. (“Merger Sub”), a wholly owned

subsidiary of Amazon. Terms of the Merger Agreement include:

• Merger Sub will be merged with and into 1Life Healthcare. 1Life Healthcare will be the

surviving corporation in the merger and will become a wholly owned subsidiary of Amazon.

• At the Effective Time (as defined in the Merger Agreement), each share of 1Life Healthcare

common stock issued and outstanding immediately prior to the Effective Time (other than

dissenting or excluded shares) will be automatically converted into the right to receive $18

in cash.

• Amazon will provide loan of up to $300 million to 1Life Healthcare. Funds will be provided

as monthly payments of $30 million starting in March 2023 and until the close of the merger

or termination of the Merger Agreement, whichever comes first.

24

Amazon further clarifies in the Notice that the physician owned One Medical Professional Entities

are not party to the agreement. 1Life Healthcare does not have any ownership interest in these

professional entities, and the transaction will not change their current ownership. The transaction is

valued at approximately $3.9 billion, including net debt of 1Life Healthcare.

Rationale for the Transaction

The Notice describes the merger as an opportunity for Amazon to advance the mission of One

Medical:

Through One Medical, Amazon sees an opportunity to further One Medical's mission to

make quality care more affordable, accessible, and enjoyable through a combination of in-

30-Day Review Summary Report – 005 Amazon One Medical 12

person, digital, and virtual health care services that are convenient to where people work,

shop, and live.

In press releases and other public statements, Amazon and One Medical executives have

presented the merger as a way to transform or “disrupt” health care through innovation, technology

and focusing on the patient experience. A representative of Amazon Health Services described

health care as “high on the list of experiences that need reinvention.”

25

As described above, Amazon has made various

efforts to enter the health care space, with mixed

results. By acquiring an established network of

primary care clinics with a pre-existing customer

base, they will quickly obtain a nationwide foothold

in primary care. Press coverage has also noted

that Amazon could offer its other products and

services to One Medical’s clients and patients,

such mail-order pharmacy (PillPack/Amazon

Pharmacy), nutritious food (Whole Foods and

Amazon Fresh) and wearable technology (e.g.,

smartwatches and activity trackers), possibly using

medical information to offer recommendations

(although it would need to comply with HIPAA

requirements).

26

Analysts have commented that One Medical likely sees the merger as a way to stabilize its

financial situation by raising capital. (We discuss the potential impact of the transaction on One

Medical’s financial condition below.) The company has consistently lost money, and its stock price

has dropped significantly in the last 18 months. With Amazon’s financial backing and data

expertise, One Medical may be in a stronger position to compete with other primary care groups

and grow its Medicare Advantage business.

27

Post-Transaction Plans

Following the close of the transaction, Amazon

plans to maintain 1Life’s and One Medical Group,

Inc.’s leadership teams, including 1Life’s current

CEO. Per the Notice, current members of 1Life’s

board of directors will step down, leaving CEO

Amir Dan Rubin as the sole board member.

Despite public statements about disruption and

reinvention of health care, the Notice states that

Amazon and One Medical “do not expect the

proposed transaction to result in a change in

health care services.”

Amazon further says in the Notice that it expects to

retain One Medical employees and contractors

following the close of the transaction. It also plans

to expand One Medical’s network of clinics and

make investments in technology and services to

improve access to health care services and reduce

One of the things we’re trying to do at One

Medical is say, we would love to serve

everyone, regardless of choices.

So imagine a world where we can serve

you when you’re young through our

pediatrics programs. And then you start

getting your first job and work for an

employer who’s paying for One Medical.

You happen to leave that employer, you

can pay a membership fee yourself. You

become a senior, you join a plan, we serve

you. If you decide not to join a plan, we

can serve you in direct contracting.

- Rushika Frenandopulle, One Medical

CIO

The opportunity to transform health care

and improve outcomes by combining One

Medical’s human-centered and

technology-powered model and

exceptional team with Amazon’s customer

obsession, history of invention, and

willingness to invest in the long-term is so

exciting

- Amir Dan Rubin, One Medical’s CEO, in

a press release

30-Day Review Summary Report – 005 Amazon One Medical 13

costs. Amazon asserts in its Notice that it has no intention of restricting services available to One

Medical patients:

Amazon does not intend to restrict or otherwise reduce the scope of professional medical

services delivered by the One Medical Professional Entities. Amazon also has no intention

of limiting any patient’s freedom of choice with respect to pharmacy, specialty care, or other

health services.

Federal Review of the Amazon-One Medical Transaction

The Federal Trade Commission (FTC) is currently reviewing the merger. Federal law (the Hart-

Scott Rodino Antitrust Improvements Act of 1976) requires companies to notify the FTC and the

U.S. Department of Justice of certain large transactions before they occur. Hart-Scott Rodino

reviews generally examine the effect of the transaction on competition.

Amazon and One Medical filed notification of their intent to merge on August 3, 2022. On

September 2, 2022, they received a request for additional information and documents from the

FTC for purposes of its review. Both parties said they expected to respond “promptly” to the

request and “continue to work cooperatively with the FTC.”

28

Once Amazon and One Medical have

provided all the requested information and documents, the FTC has 30 days to review the

transaction before it is allowed to close.

Following the merger’s announcement in July 2022, various groups urged the FTC to launch an

investigation. Concerns raised included:

29

• Amazon’s ability to leverage its dominant position in the online retail market to gain an

unfair advantage in the health care market.

• The possibility that Amazon could misuse patients’ personal health data to enhance sales

of its other products and services, leading to privacy and antitrust violations.

• The risk that Amazon-One Medical will grow by “cherry picking” healthier, more affluent

patients, leaving other providers to care for sicker, less well-insured patients and

exacerbating health inequities.

• Quality of care at One Medical could decline under Amazon due to over-reliance on virtual

care and focus on generating cost efficiencies.

• Deterioration of working conditions at One Medical given Amazon’s poor track record of

respecting workers’ rights.

In a letter to the FTC, Senator Amy Klobuchar raised concerns about anticompetitive effects

resulting from Amazon’s potential access to health care data and from Amazon’s existing

presence in pharmacy.

30

She also highlighted Amazon’s history of engaging in “business practices

that raise serious anticompetitive concerns,” citing a 2020 report from the House Judiciary

Committee.

31

The report found that Amazon has engaged in extensive anticompetitive conduct in

its treatment of third-party sellers that use Amazon to reach online customers. Amazon has been

involved in multiple antitrust lawsuits and regulatory investigations in the U.S and elsewhere in

connection with its treatment of rival sellers on the Amazon storefront.

32

OHA’s review did not address potential implications of the transaction for data privacy or workers’

rights, as these are outside the scope of HCMO’s statutory authority. We discuss other concerns

described above as they may relate to Oregon in the analysis of potential impacts on

consolidation, cost, access, quality, and health equity.

30-Day Review Summary Report – 005 Amazon One Medical 14

One Medical’s Model of Primary Care

What is primary care?

Primary care provides a range of prevention and wellness services, as well as treatment for

common illnesses and conditions. Primary care providers include physicians, nurses, nurse

practitioners, and physician assistants who help patients manage day-to-day health needs. Primary

care providers often maintain regular, long-term relationships with patients and may coordinate

care with other providers and specialists. Through regular check-ins, primary care providers play a

crucial role in preventing health problems, identifying issues early, and getting treatment sooner.

There are many different models that provide primary care and adjacent services. Models differ in

the types of services provided, as well as how payments are structured.

Primary Care Model

Description

Medical home (also called patient-

centered medical home)

Team-based care designed to manage a patient’s overall physical

and behavioral health needs and coordinate care across different

providers. Medical homes generally accept most types of insurance.

Medical homes often have expanded hours and/or offer messaging

tools for patients to connect with providers.

Direct primary care (also called

direct patient contracting)

Patients pay a monthly fee directly to providers to access most typical

primary care services. Direct Primary Care providers may advertise

having shorter wait times for appointments, more access to

physicians, or unlimited primary care services included in the monthly

fee. Providers generally don’t bill insurance for services.

Concierge medicine

Patients pay a monthly retainer or fee to access care. Concierge

providers may bill insurance, and advertise easy, quick access to

providers and longer appointment times.

On-demand care (also called

express care)

Express care clinics are designed to treat mild illnesses or injuries for

patients who need to be seen soon but are unable to visit a primary

care provider. These clinics provide same-day or walk-in

appointments, often with extended hours on weekends and

weekdays.

Urgent care

Urgent care treats non-life-threatening illness and injury that needs to

be addressed as soon as possible (such as stitches or flu symptoms).

Urgent care is often has extended hours and may cost more than

express care but is less expensive than the emergency room.

30-Day Review Summary Report – 005 Amazon One Medical 15

How One Medical delivers care

One Medical is a membership-based primary care provider that

combines aspects of other primary care models like concierge

medicine, on-demand care, and direct primary care. One Medical

advertises key elements of their model:

33

• Same day appointments and 24/7 access to care via in-

person and virtual care

• Proprietary technology tools

• On-site laboratory services

• Conveniently located and attractively designed offices

• Partnerships with established health networks to provide

access to specialty care and insurance plans

• Memberships can be for individuals or as a benefit offered

by employers

One Medical is seeking to transform health care and address

current issues in the health care system. One Medical has

designed its primary care model to address key issues and

opportunities for improvement in the current health care system:

34

• Consume dissatisfaction with long wait times, lack of

access to providers, limited after-hours appointments,

short visits with providers, and lack of care coordination

• Employers find health benefits offerings do not support

objectives such as engaging employees, improving

employee productivity, reducing absenteeism, producing

better health outcomes, increasing safety of the workplace,

or managing health care costs.

• Providers experience burnout, driven by misaligned fee-

for-service compensation, excessive administrative and

electronic health record (EHR) tasks, and convoluted

insurance procedures.

Patients

One Medical focuses on patients who live in urban areas and

have commercial and Medicare coverage. One Medical serves

patients of all ages, though not every clinic has providers that

serve patients at all stages of life. In Portland, for example, the

Cedar Hills and Tigard clinics see all ages; other clinics serve

patients 18 and older.

35

One Medical also seeks agreements with employers to offer One

Medical as a benefit and about 60% of members have their

membership paid by an employer.

36

Members can also pay out of

pocket, but as of this report, they do not accept Medicaid

insurance. (In Oregon, Medicaid is called the Oregon Health

Plan.)

We have developed a

modernized healthcare

membership model based on

direct consumer enrollment and

third-party sponsorship across

commercially insured and

Medicare populations. Our

membership model includes

seamless access to 24/7 digital

health services paired with

inviting in-office care routinely

covered by most health care

payers…

Our digital health services and

our well-appointed offices, which

tend to be located in highly

convenient locations, are staffed

by a team of clinicians who are

not paid on a fee-for-service

basis, and therefore free of

misaligned compensation

incentives prevalent in health

care. Additionally, we have

developed clinically and digitally

integrated partnerships with

health networks, better

coordinating more timely access

to specialty care when needed

by members. Together, this

approach allows us to engage in

value-based care across all age

groups, including through At-

Risk arrangements with

Medicare Advantage payers and

CMS, in which One Medical is

responsible for managing a

range of healthcare services and

associated costs of our

members.

- One Medical Q2 2022 Report

30-Day Review Summary Report – 005 Amazon One Medical 16

As of September 30, 2022, One Medical had 815,000 members, of which 40% were at-risk.

37

For

“at-risk” members, One Medical is responsible for managing a range of health care services under

a capitated or per member per month contract.

ii

One Medical also has consumer and enterprise

members, defined as people who registered with and paid for a membership with One Medical or

whose membership has been sponsored by an enterprise, employer, or third party.

Services

One Medical offers in-person, video, and message-based interactions with providers.

Physical health

One Medical advertises a range of primary care services, including wellness and prevention,

everyday care, chronic conditions, children and family, mental health, LGBTQIA+ services, urgent

care, and sexual health care. Some of their services have specific branding. For example, Impact

is a program to manage chronic conditions that features a team-based approach, patient-centered

plan, coaching and group classes, specialist care with health system partners, and technology

platform that can connect to devices.

38

Mental health

One Medical integrates mental health care into primary care. According to their website: “We’re

confident our primary care providers can handle most things that come in the door… If you need or

want more specialized care, we have a curated referral network of therapists and psychiatrists who

we know and trust that we can send you to.”

39

They also offer virtual therapy and coaching through

video session and, in some areas, group programs.

Workplace programs

One Medical offers return to workplace programs for employers that can be tailored to include

services such COVID testing and screening, workplace safety protocols, and employee

communication resources.

Health System Partnerships

When One Medical enters a new geographic market, they typically partner with an existing large

health system operating in the area. These strategic partnerships allow One Medical to integrate

into existing networks of providers and insurers. Partnerships support clinical care, referrals, and

reimbursements from insurance companies. In Oregon, Washington, and Southern California,

Providence is One Medical’s partner health system. Other partners include Dignity Health in

Phoenix, Emory Healthcare in Atlanta, and Mount Sinai in New York City. In the Notice, Amazon

states:

In many of its geographic areas, including Oregon, One Medical partners with an area

health system to offer One Medical members a clinically integrated care delivery network

that improves care coordination, increases access to specialist physicians, and reduces

costs… These partnerships with health systems are a cornerstone of One Medical’s

business model as they advance more seamless member access to partner specialists and

facilities when needed, while supporting reductions in duplicative testing and excessive

delays often seen across uncoordinated healthcare settings.

ii

With capitated payments, a provider receives an amount of money for each patient attributed to them for a

designated period of time, regardless of how many services the patient seeks or receives.

30-Day Review Summary Report – 005 Amazon One Medical 17

Payments

One Medical currently accepts commercial insurance and Medicare. In Oregon, One Medical

accepts many major commercial health insurance plans, including Aetna, Cigna, Providence,

United Healthcare, Moda, and others. One Medical also accepts Medicare Part B (also known as

original or fee-for-service Medicare) but does not currently accept any Medicare Advantage plans.

In some other markets, such as Phoenix and New York, One Medical accepts Medicare

Advantage.

40

One Medical executives have expressed a “huge interest” in accepting Medicaid

coverage but cite structural barriers such as high volume of churn among Medicaid patients and

state budgeting practices.

41

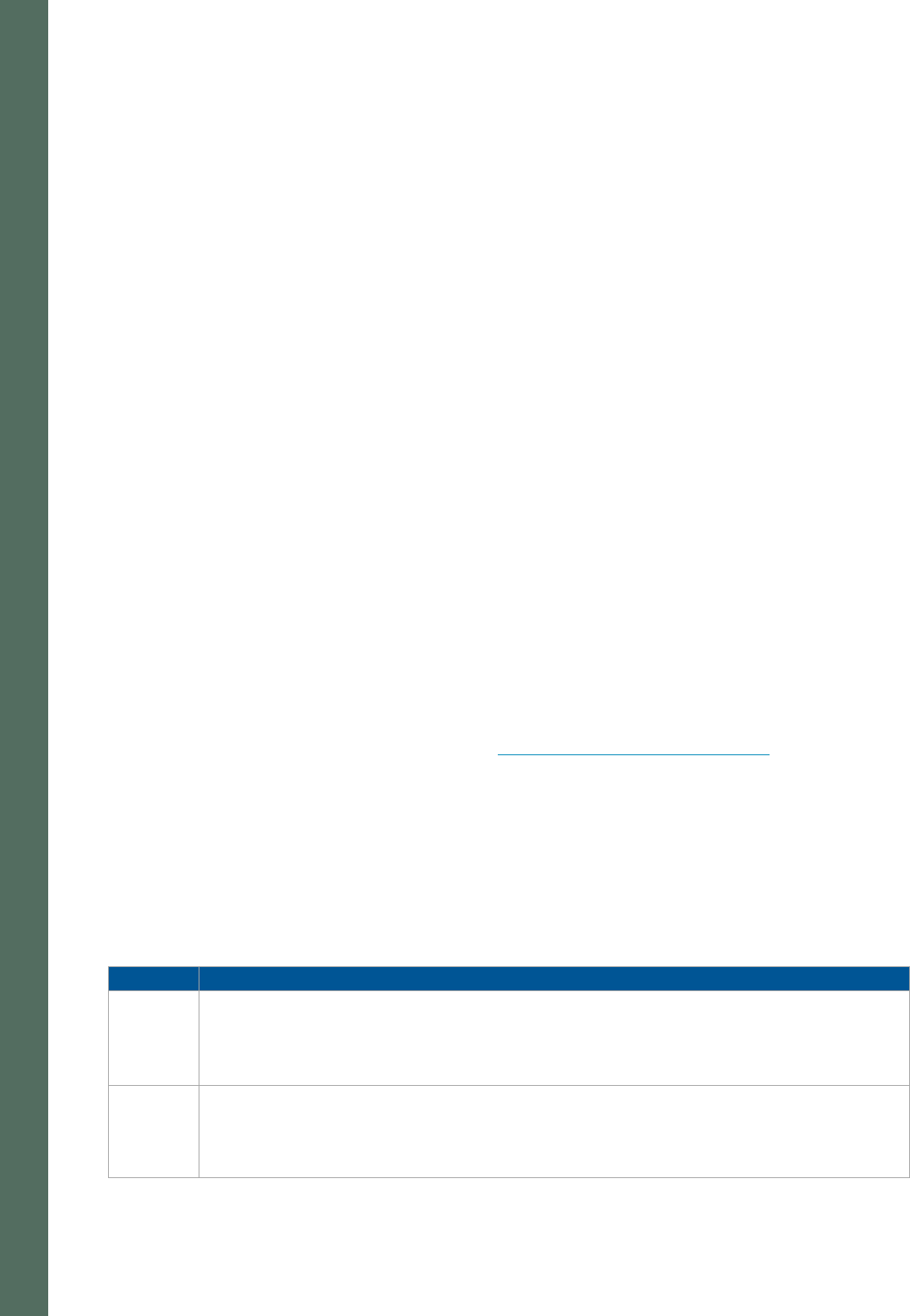

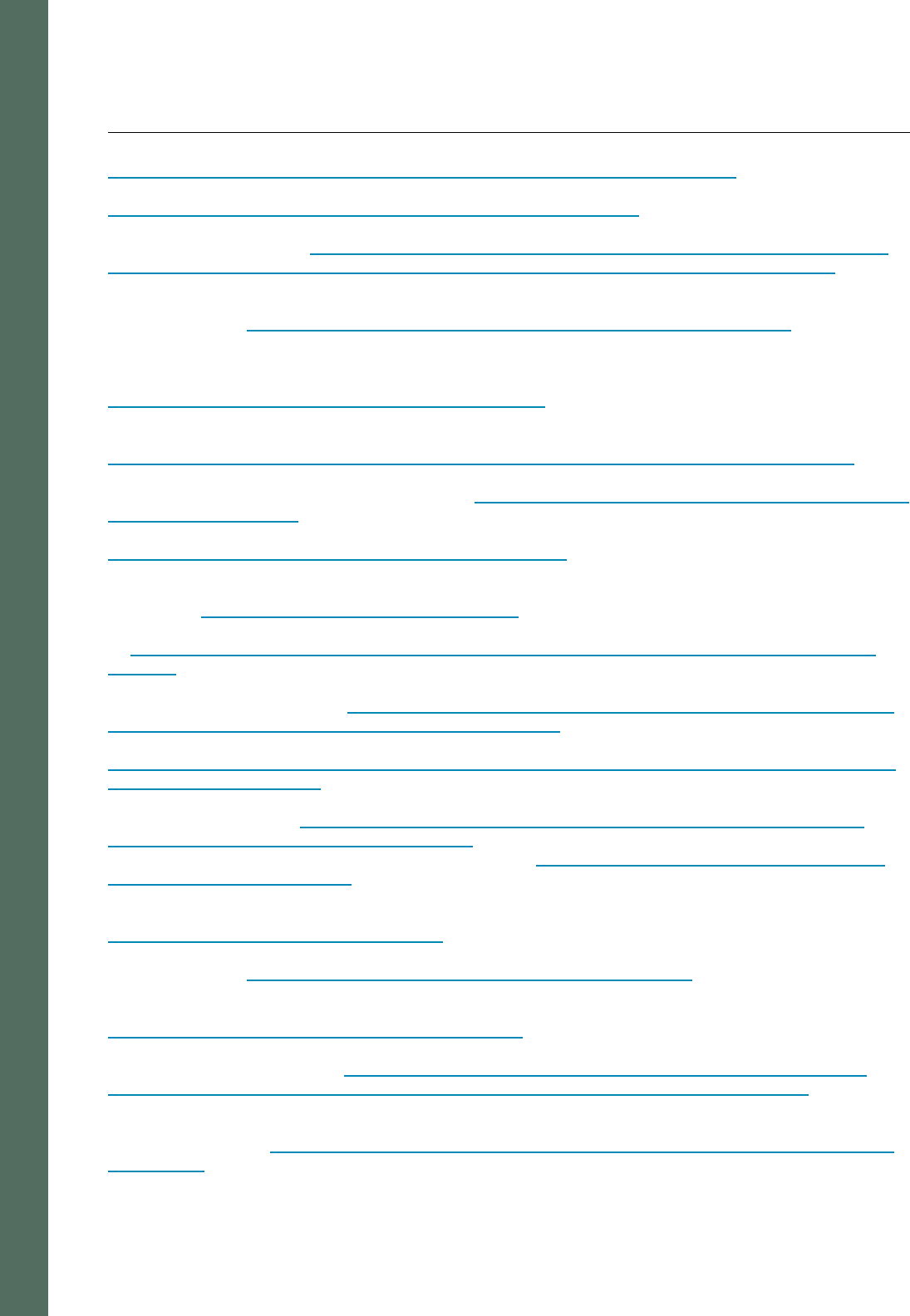

In its Q2 2022 quarterly report, One Medical describes two main buckets of revenue: Medicare and

commercial.

42

For capitated payments, per-member per-month amounts may be adjusted based on the member’s

health status.

iii

Capitated revenue represented 98% of One Medical’s Medicare revenue and 50%

of total net revenue for the three months ending September 30, 2022.

43

For the three months

ending September 30, 2022, partnership and membership revenue together accounted for 72% of

commercial revenue.

44

One Medical notes in its financial reporting that its revenues have

historically been concentrated among a small number of customers. In 2021, the top three

customers (commercial payers and a health network partner) accounted for 32% of the company’s

net revenue.

45

One Medical’s 2021 annual report also mentions that One Medical participates in the Centers for

Medicare and Medicaid Services (CMS) direct contracting program:

We are one of a select group of companies that participate in the Direct Contracting

Program, which is an initiative with a new payment model in which CMS contracts directly

with provider-entities designated by CMS as Direct Contracting Entities. As a result, we

have an opportunity to expand our Direct Contracting service offering to new geographies

over time.

iii

Capitated revenue comes from at-risk arrangements with Medicare Advantage plans, where One Medical

receives a per-member per-month payment to manage a range of health care services for members.

Partnership revenue includes per-member per-month received from contracts with health system partners

and revenue from enterprise contracts, where One Medical receives a fixed price per employee. Net fee-for-

service revenue consists mainly of fee-for-service reimbursements from insurance plans or members based

on contracted rates. Membership revenue consists of annual membership fees paid by consumer

(individual) or corporate (enterprise) clients.

Medicare Revenue

51%

Commercial Revenue

49%

Partnership

revenue

25%

Fee-for-

service

14%

Membership

revenue

10%

Capitated

revenue

50%

Fee-for-

service/other

1%

Total Net Revenue

$261.4 million

30-Day Review Summary Report – 005 Amazon One Medical 18

Findings & Potential Impacts

OHA compiled available data and information to understand and examine the potential impacts of

the transaction across four domains: access, cost, quality, and equity. To assess the potential

impacts of the proposed transaction on Oregon residents’ equitable access to affordable care,

OHA considered transaction terms, market characteristics, statements made by the entities, public

comments, and publicly available data, research, and reports.

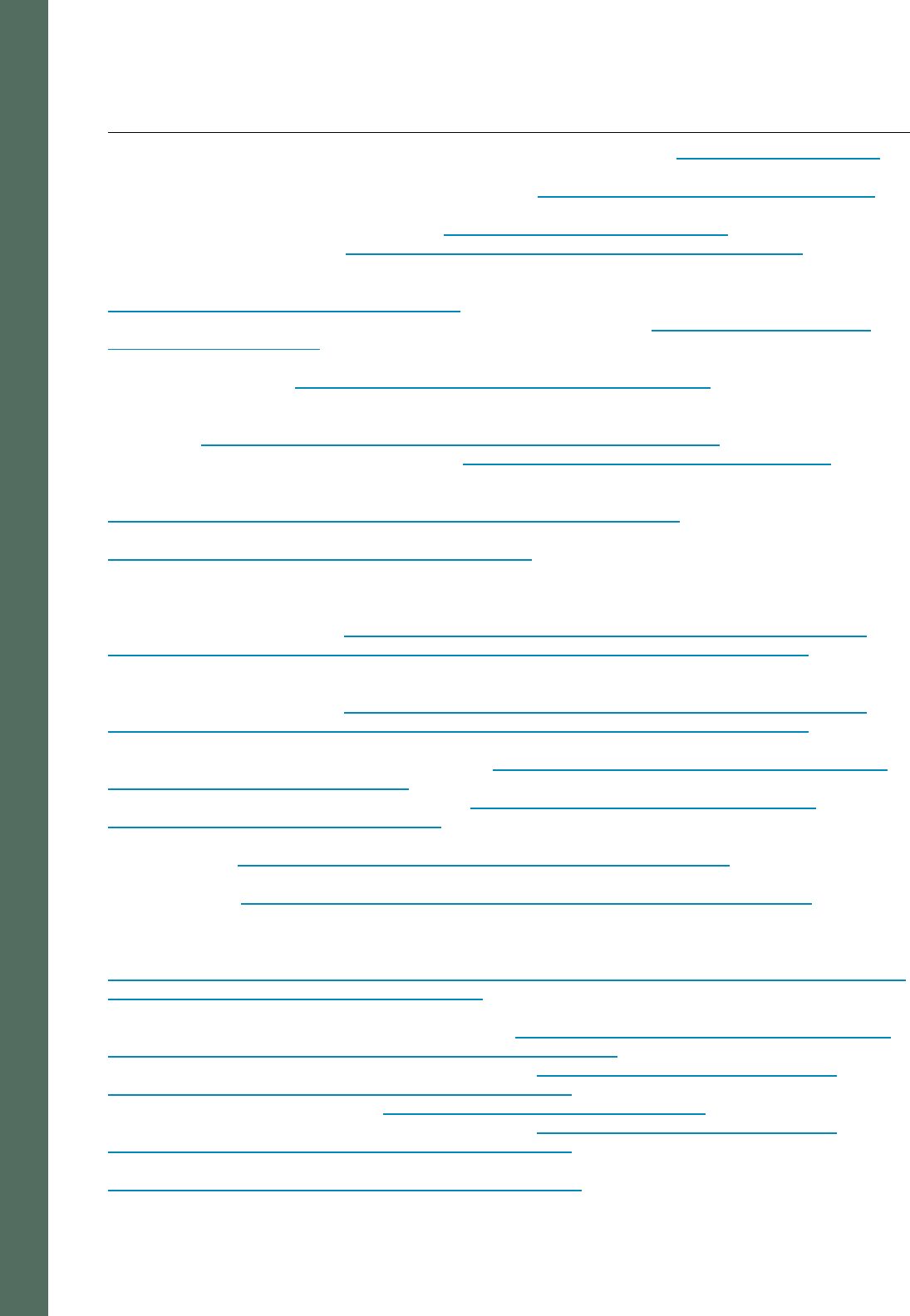

Overview

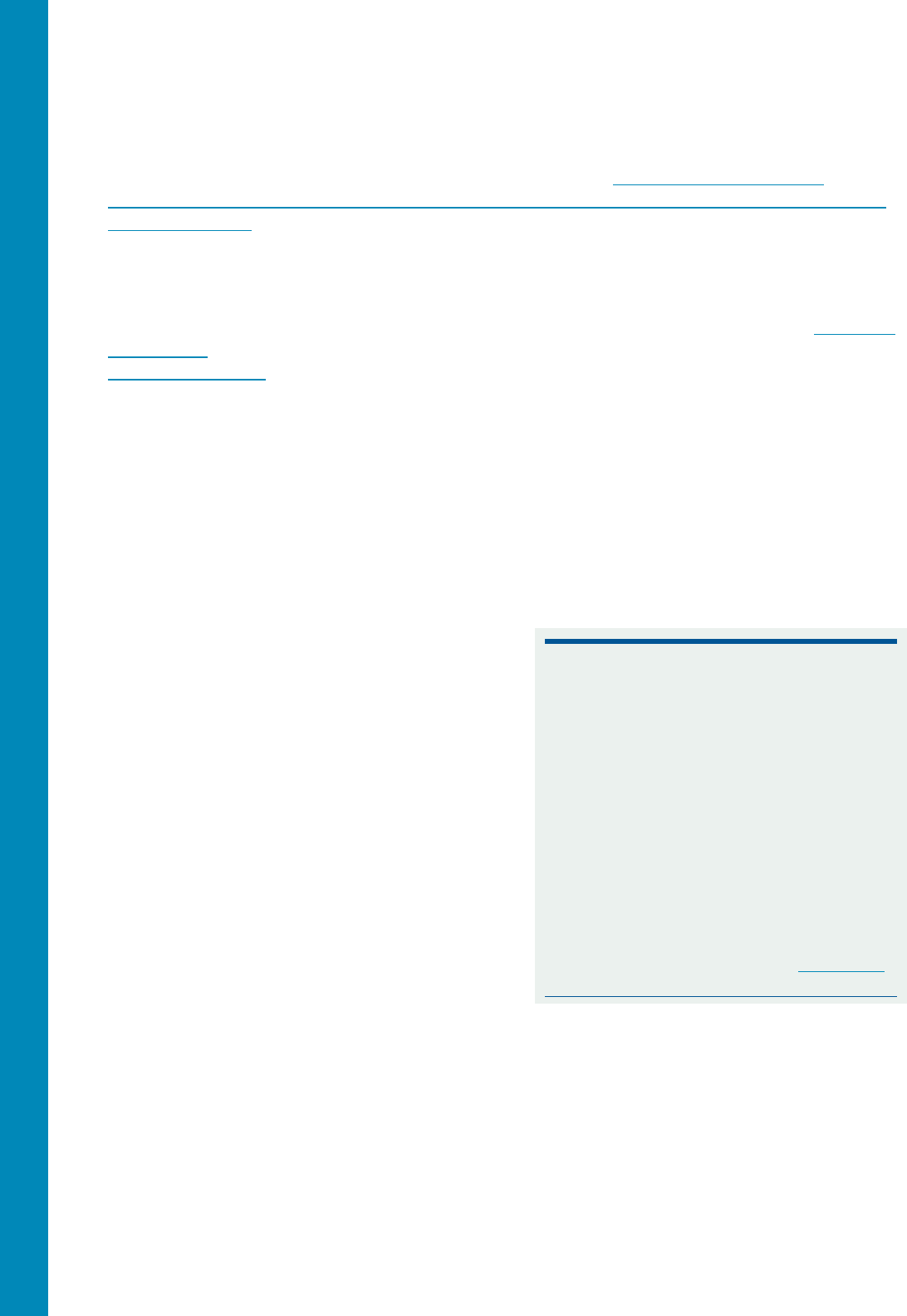

One Medical Service Area(s)

One Medical currently has five locations in Oregon, all in the Portland metropolitan area.

• North Williams: 20 N Skidmore St, Portland, OR 97217

• Pearl: 1122 NE Everett St, Portland, OR 97209

• Downtown: 601 SW 4

th

Ave, Portland, OR 97204

• Cedar Hills: 2865 SW Cedar Hills Blvd, Beaverton, OR 97005

• Tigard: 12180 SW Scholls Ferry Rd, Tigard, OR 97223

Typically, OHA uses administrative

claims data from Oregon’s All

Payer All Claims (APAC) database

to calculate a primary service area

for an entity, analyze volume of

visits, and present a profile of

patient demographics and payer

mix. For One Medical, APAC data

represent only about 25% of the

volume reported by the entities;

therefore, OHA could not perform

these analyses to look at One

Medical services, patients, and

payments. This lack of data is likely

due to One Medical serving many

patients who have employer self-

insured plans or pay out of pocket,

neither of which are required to

submit data to APAC.

Instead, we defined the service

area for this transaction as all zip

codes within 10 miles of the five

One Medical locations, excluding

zip codes in Washington State. Zip

codes are represented as the

darker gray areas in map. These zip codes are primarily located in Multnomah, Washington and

Clackamas counties.

Data from the American Community Survey (ACS) 2020 five-year population estimates suggest

that 1.4 million people reside in this area.

One Medical’s service area in Oregon includes zip

codes in Clackamas, Multnomah, and Washington

counties.

30-Day Review Summary Report – 005 Amazon One Medical 19

Equitable access to primary care services in any given region is impacted by the social and

economic characteristics of the local population. Barriers to access systematically exist for people

who are non-White, non-English speaking, older and lack health insurance. Understanding the

profile of the regional population allows us to determine how well a provider is responding to the

needs of the community and serving a representative patient population. One Medical clinics are

mostly located in areas of greater economic affluence in the region and their patient population is

predominantly commercially insured and employed, younger (and therefore more likely to be

healthy) and White. Socio-economic characteristics vary across this Portland service area, with

notable variation in the zip codes of One Medical locations.

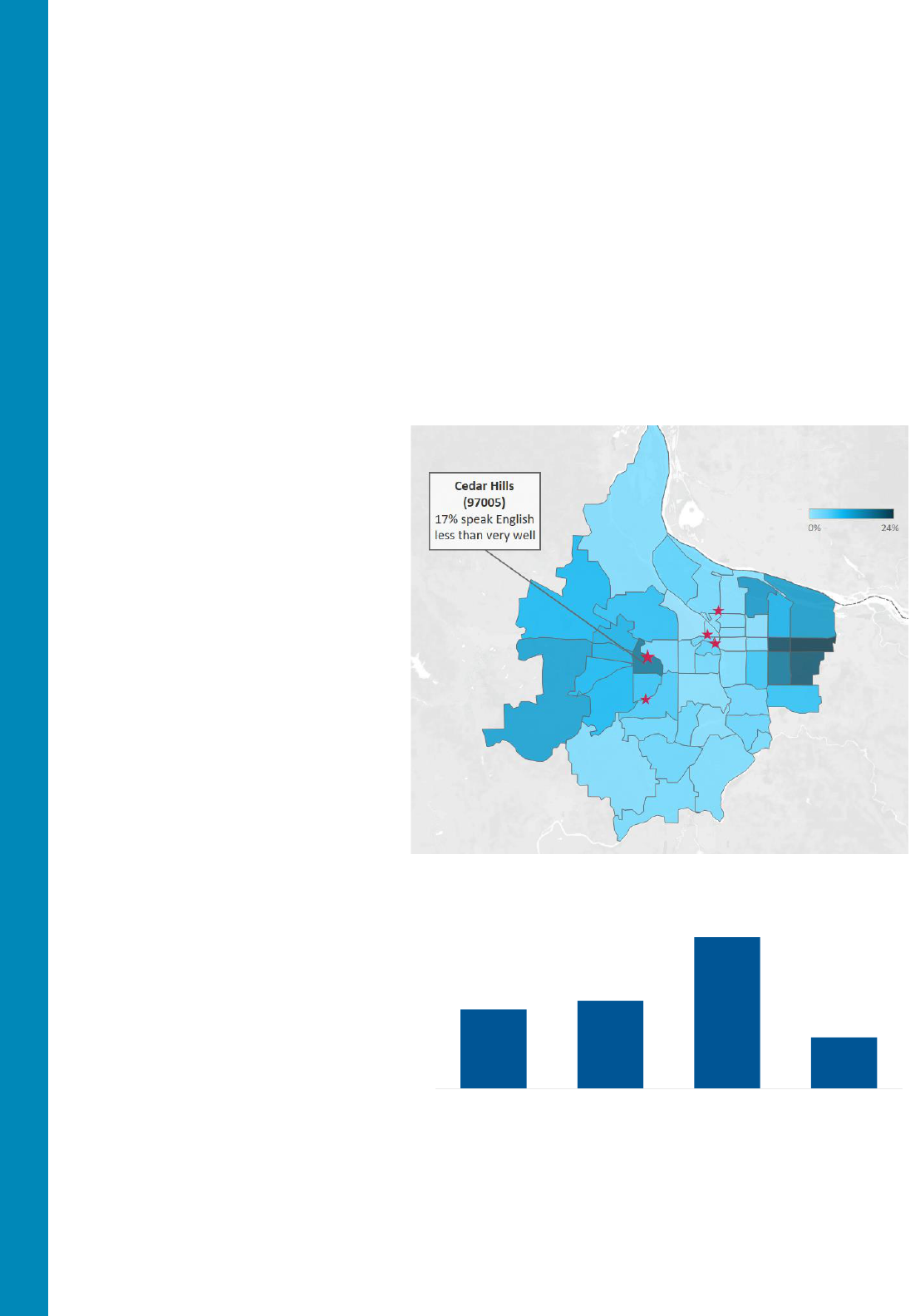

Race and spoken languages

About 25% of this population are

people of color and 3% reported

speaking English less than very

well. In the zip code where Cedar

Hills One Medical is located, 17%

of residents identify as speaking

English less than very well. Zip

codes to the west of this location

also have higher rates, ranging

from 8% to 12% of the residents.

Age groups

Roughly 41% of residents in the

service are between ages 35 and

64; however, this varies by zip code,

with a concentration of younger

adult residents (aged 20 – 34) in the

zip codes surrounding the North

Williams, Pearl and Downtown One

Medical locations. Children under

19 are mostly likely to be covered

by Medicaid.

21%

24%

41%

14%

<19 19 - 34 35 - 64 65+

In One Medical's service area, 41% of the overall

population is ages 35-64.

Portion of the population living in One Medical’s service

area that speaks English less than “very well.”

30-Day Review Summary Report – 005 Amazon One Medical 20

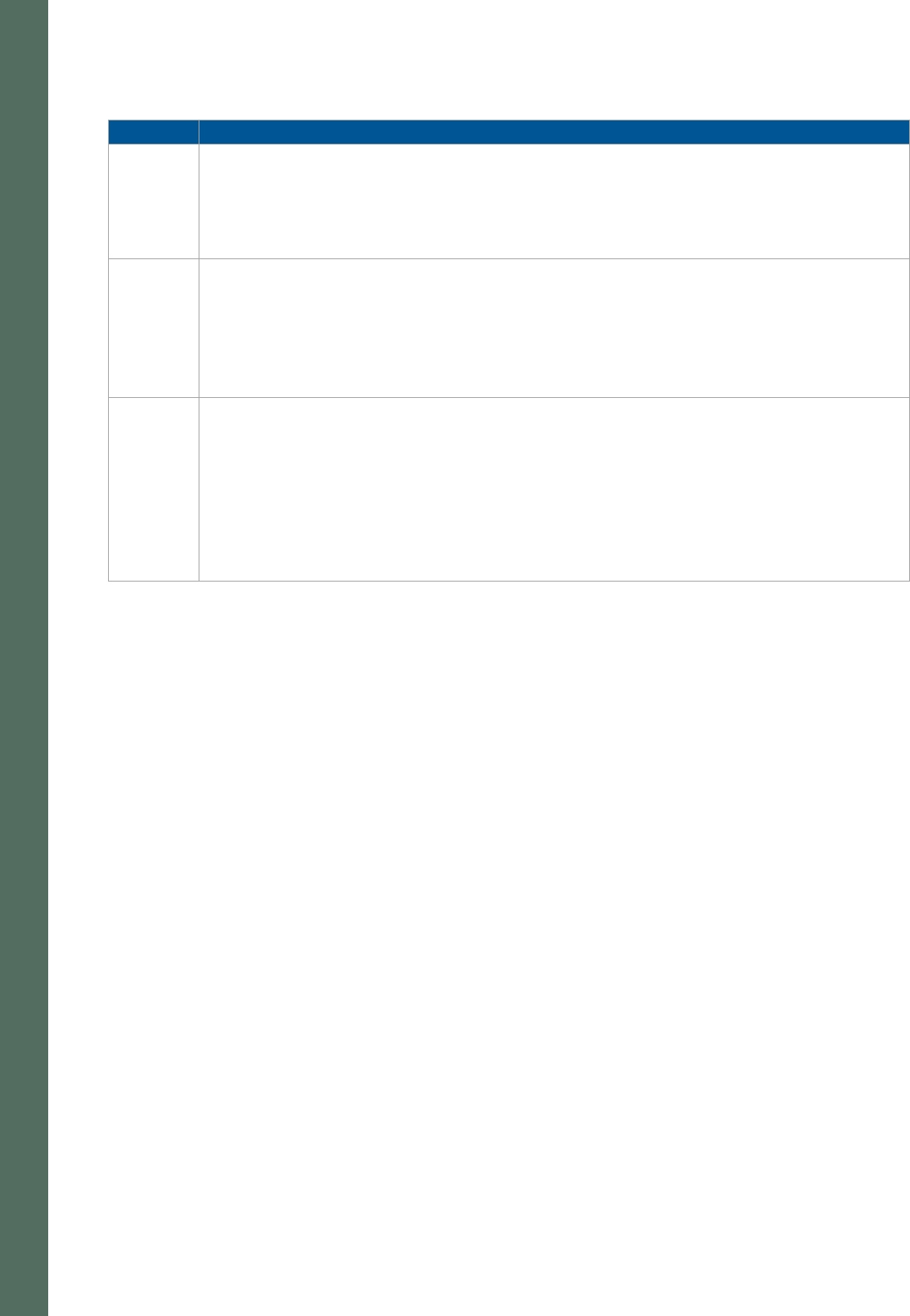

Insurance coverage

The vast majority of residents in

the One Medical service area

have health insurance, but rates

and types vary by age group.

Most individuals under age 65

have a single type of insurance

coverage, predominantly

employer based. The population

aged over 65 is more likely to

have multiple types of insurance

coverage, most frequently

including Medicare. Adults aged

19 – 34 have the highest rate of

uninsurance (10%).

Children under 19 have the highest

rates of Medicaid coverage, while

adults ages 35-64 have the highest

rates of commercial coverage.

Residents ages 19-64 make up

65% of the overall population and

77% of the population with

commercial insurance. Children

comprise 21% of the service area

population and 38% of the

population with Medicaid coverage.

Because One Medical mostly

accepts commercial insurance in

Oregon, the population they serve

is likely to be within the 19-64 years age range.

Economic factors

The estimated unemployment rate for the service area is 5%, with notable variation by age group

and geography. Unemployment for all 20 to 24 year olds is nearly double the average (9.3%), but

residents in this age group living in the zip codes surrounding the Pearl One Medical location (zip

code 97209) have particularly high rates of unemployment (18 – 21%).

The overall rate of people living below the federal poverty level in the service area is 11%, with zip

code poverty rates ranging from 3% to 55%. The Downtown Portland clinic is located in the zip

code with the highest poverty rate (55%). In this area, Black and Hispanic or Latinx residents are

more likely to live below the poverty level. In the zip code surrounding the Downtown Portland

clinic, 90% of people identifying as Black live below the poverty level.

Market Share & Consolidation

Market Share

One Medical’s membership-based primary care model has similarities to concierge medicine and

direct primary care models, and their same day access offers similar services to on-demand care

(also known as express care) and urgent care providers. Patient-centered medical home clinics

1%

7%

10%

3%

33%

86%

85%

91%

66%

7%

5%

6%

65+

35-64

19-34

<19

No Insurance One type Two or more types

Most residents in One Medical's service area have health

insurance.

38%

22%

23%

27%

31%

50%

7%

1%

Medicaid

Commercial

<19 19-34 35-64 65+

Adults ages 35-64 account for half of people with

commercial coverage in the service area.

30-Day Review Summary Report – 005 Amazon One Medical 21

and independent primary care providers also provide similar services. One Medical’s model of care

overlaps to some extent with each of these other provider types, making it difficult to quantify their

share of the market in this region.

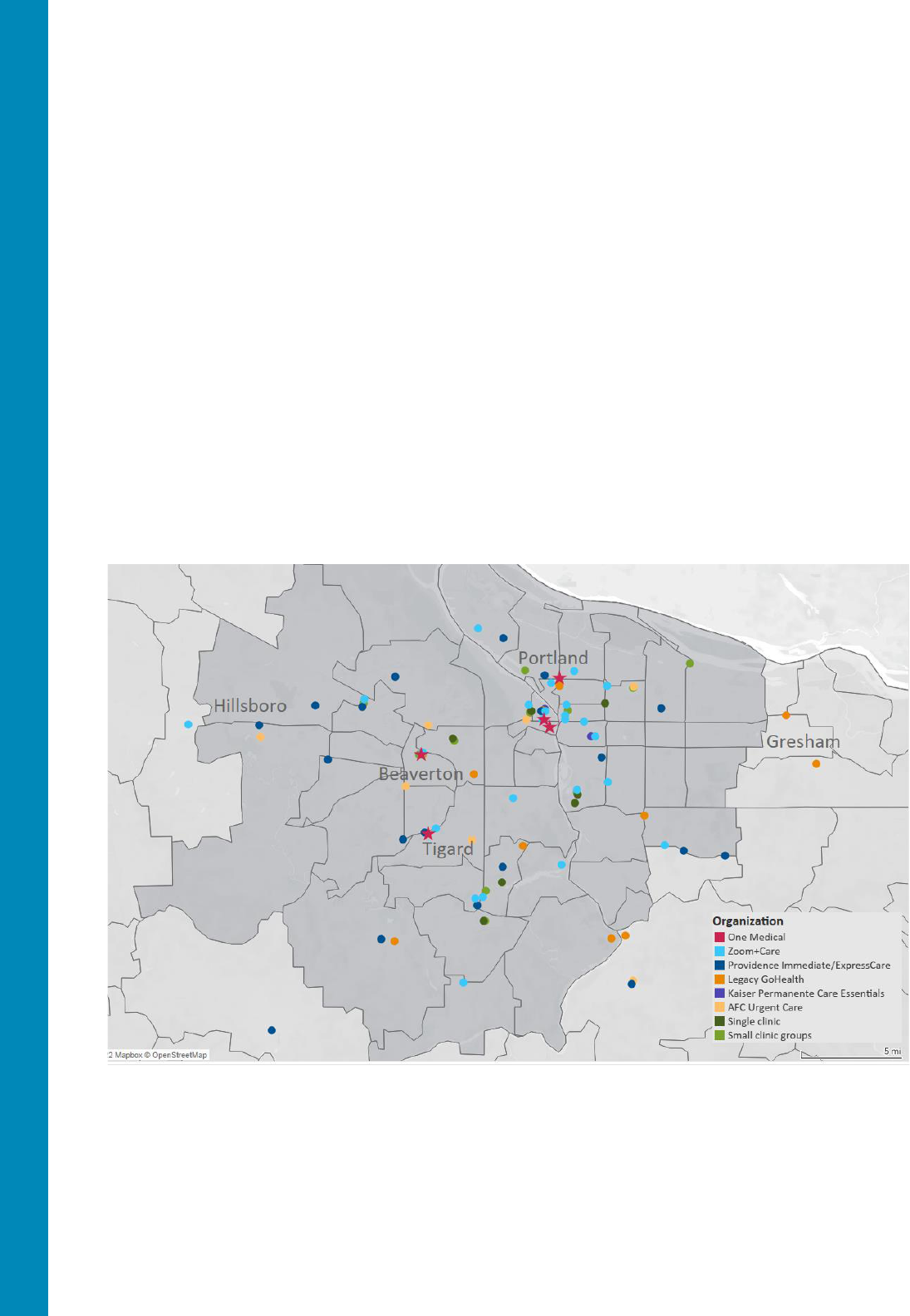

Within One Medical’s geographic service area, there are multiple providers offering similar types of

care (see map below). Other primary care clinics following the patient-centered medical home

(PCMH) model also offer same-day appointments and urgent care hours, with priority typically

given to established patients with in-network insurance coverage. Availability of these

appointments may be more limited than at on-demand or direct primary care clinics. Oregon’s

Patient-Centered Primary Care Home (PCPCH) program has recognized 171 clinics located in One

Medical’s service area and hundreds of independent primary care physicians and private family

medicine or internal medicine practices operate in the area

46

.

As described below, many direct primary care, concierge, on-demand, and urgent care providers

operate in the same area as the five One Medical clinics. The five One Medical clinics collectively

serve a small portion of the 1.4 million residents in the area. Proximity and access to other options

for primary care and urgent care needs vary within this geography but are numerous throughout

the region.

Many Direct Primary Care, Concierge, On-Demand and Urgent Care Providers operate in the

One Medical Service Area

Horizontal Consolidation

Amazon Clinic services are also available to residents of this area, which fills a unique niche in the

spectrum of primary and urgent care. For a set visit fee, asynchronous digital consults are provided

to patients experiencing a limited number of urgent conditions that are most frequently identified

without diagnostic testing and addressed with a prescription medication. Prescriptions for

previously diagnosed chronic conditions can also be filled without the need for an in-person visit.

30-Day Review Summary Report – 005 Amazon One Medical 22

There is some overlap in the conditions treated through Amazon Clinic and those addressed

through One Medical’s services, such that the two services may compete for a very small subset of

the regional population. Amazon Clinic is available to anyone and does not accept insurance,

whereas One Medical services are for members.

Amazon Pharmacy is also available to residents of the Portland metro region. Analysis of recent

APAC data (2020 – 2021) suggest very few One Medical patients also received prescription

medication from Amazon Pharmacy. It’s worth noting that Amazon Pharmacy encourages out of

pocket payments by offering discounts. Many Amazon Pharmacy patients pay out of pocket and

are not reflected in APAC data, so there may be a larger overlap of self-pay patients that utilize

both services that we are unable to capture in our data.

Vertical Consolidation

This transaction represents a vertical consolidation in health care markets through the combination

of Amazon Pharmacy (prescription services) with One Medical (primary care services). Vertical

consolidation has the potential to reduce competition when a company leverages a significant

share of one market to disadvantage competitors in the other market, for example, by refusing to

supply the inputs (e.g., supplies) its competitors need. Because both One Medical and Amazon

Pharmacy have a small share of the markets for primary care and pharmacy services in Oregon,

respectively, OHA views the likelihood of this happening as small. Additionally, Amazon states in

the notice that it has no plans to restrict One Medical patients’ ability to choose a pharmacy other

than Amazon Pharmacy.

Competition

Amazon is a dominant player in various consumer markets outside the health sector, notably in

online retail. With the addition of One Medical, Amazon could potentially leverage that dominance

to gain an unfair competitive advantage in primary care. This concern has been raised by several

advocacy groups commenting on the transaction nationally, as well as in public comments

received by OHA (discussed below). For example, Amazon could use data on customers of

Amazon.com, Amazon Prime members, or users of Amazon wearable devices to target advertising

for One Medical’s services or offer One Medical membership as an add-on to Amazon Prime

membership. Such actions could allow Amazon to rapidly grow One Medical’s membership to the

detriment of other primary care providers. While OHA recognizes this concern, we are not aware of

this happening for Amazon Pharmacy or other Amazon health care ventures. Furthermore, the

current federal review of this transaction is expected to carefully consider any such risks.

OHA does not have immediate concerns about the impact of the transaction on

horizontal consolidation.

Given that One Medical currently has a limited presence in Oregon and serves a small portion of

residents and Amazon Clinic only launched in November 2022, there is currently little concern

about horizontal consolidation in digital asynchronous primary care services as an immediate result

of this transaction. However, as Amazon seeks to increase its footprint in health care and expand

is user base of technology-driven services like Amazon Clinic, the digital support features of the

One Medical application, and the convenient online ordering and home delivery of prescription

medications through Amazon Pharmacy, there is potential for Amazon-owned health services to

greatly increase their market share in Oregon in the coming years.

30-Day Review Summary Report – 005 Amazon One Medical 23

Access

Access to primary care refers to the ability of people to get the care they need when they need it.

Our analyses look at availability of services and providers, types of services, care for different

patient groups, and barriers to getting care.

Access to primary care services can be limited by cost arrangements with insurance plans,

provider capacity, and the health needs of the population being served. For patients with insurance

coverage, primary care providers typically must be in-network for services to be covered.

Accessing services from out-of-network providers typically requires patients to pay more—or

sometimes all—of the visit costs. Given variable reimbursement rates for commercial insurance

and publicly funded coverage like Medicare cand Medicaid, providers may limit how many patients

they can take with certain kinds of coverage in order to maximize revenue. This can include setting

specific limits on how many patients without insurance are accepted and how much charity care or

financial assistance they offer.

Regardless of patient insurance status, providers must also have the capacity to take new patients

onto their panel. Panel sizes are often difficult to calculate and range by practice, but several

recent studies have placed the average panel size for standard patient centered medical home

model clinics at around 1600 - 1800 patients per primary care provider.

47

The panel size a provider

can serve depends on their scheduled hours, qualifications, and the number and length of visits

they are able to routinely offer.

48

The patient volume a primary care provider can serve also depends on the complexity of patient

medical needs. Younger, healthier patients may only require annual preventive care or an

occasional visit for unexpected illness or injury, while patients with multiple chronic conditions may

require more frequent visits or longer visits to achieve and maintain effective disease management.

Providers may also need to spend additional time communicating and coordinating with other

specialists who support patients in treating complex or chronic conditions.

49

Current Performance

Patient and Visit Volume

As detailed above, One Medical’s five locations in the Portland metro area serve a small segment

of the service area population. Each clinic has one to three providers, all with qualifications as

medical doctor (MD), physician assistant (PA), osteopath (DO) or nurse practitioner (NP).

Payer and Patient Mix

Most of the insurance plans One Medical accepts in Oregon are commercial plans, which includes

employer self-insured plans. The One Medical website for Portland-area locations indicates that

Medicare Part B (Original Medicare) is currently accepted, but not Medicare Advantage plans or

Medicaid (coverage through the Oregon Health Plan and Coordinated Care Organizations).

Medicare mostly covers older adults and Medicaid provides coverage to children and people with

low incomes. Compared to the service area population, One Medical’s patient mix may include

more younger adults and fewer children or older adults.

One Medical highlights some key partners on their website, including large technology companies

(e.g., Google), financial investment firms (e.g., NASDAQ) and organizations offering professional

services (such as law firms and communications consultants). One Medical markets their

enterprise membership packages to employers that are likely to have working age and more

affluent employees, which generally makes for healthier patients.

30-Day Review Summary Report – 005 Amazon One Medical 24

Influence of Cost on Access

One Medical services are only available to members who pay a fee, currently $199 for an

individual annual membership. A majority of One Medical patients have their membership

sponsored by their employer as part of their employee health benefit package.

50

These employee

benefit packages may also include a commercial or employer self-insured health plan. Individual

memberships make up a smaller share of One Medical members, who may pay for membership in

addition to the monthly insurance premiums and annual deductibles required by their insurance

plan. Some members pay for care out of pocket, in lieu of having any insurance coverage.

The membership fee does not cover visits at the One Medical clinics; per-service fees are charged

for each visit or virtual consultation. For patients with an employer self-insured plan, the employer

negotiates visit rates with One Medical and patients may be required to cover some part of the visit

cost. One Medical accepts an array of commercial insurance plans and charges fees to patients’

insurance for visits and services provided. Patients may be responsible for copays or coinsurance

depending on the terms of their insurance plan. Patients without insurance coverage are required

to pay the full cost of the visit out-of-pocket.

Membership payment

Other coverage costs

Enterprise or employer-sponsored

Frequently paired with employer self-insured plan that may have a

monthly premium, per-visit copays, and/or other cost sharing

Individual or self-paid, with

insurance

May have monthly premium and annual deductible; per-visit copays

and/or coinsurance depending on visit type

Individual or self-paid, without

insurance

No monthly premium or annual deductible; full out-of-pocket

payment for all visits and services

Financial assistance is available to help defer some of the cost of the membership fee and/or visit

costs for eligible applicants who have no or limited insurance and meet certain financial criteria –

but this assistance is only available to existing members. One Medical also offers a Limited Access

option that includes in-person visits but none of the digital supports and virtual visits. The financial

criteria for receiving assistance and the cost of a Limited Access membership are not publicly

available.

51

The cost of One Medical’s membership fee may not pose a barrier to access for some patients,

particularly those whose employers cover their fee. The annual membership and full out-of-pocket

costs for healthier patients without insurance may be more affordable than annual premium fees

and deductible obligations under some insurance plans, particularly if they qualify for One

Medical’s financial assistance. Those who may experience the greatest barrier to accessing

services at One Medical are patients with insurance coverage who are required to pay the

membership fee themselves, in addition to other associated costs with their insurance plan, and

uninsured patients with greater health care needs who cannot afford to pay full out-of-pocket costs

for higher number of visits.

Concerns about equity in access with the concierge or retainer model have been raised for over a

decade. A 2005 study found that retainer clinics served fewer patients who were African American

or Hispanic, had diabetes, or were covered by Medicaid than non-retainer counterparts.

52

In 2015

the American College of Physicians issued a position paper about the implications of expanding

direct contracting or retainer practices on the broader health care system, noting pros and cons for

30-Day Review Summary Report – 005 Amazon One Medical 25

both patients and providers. The paper highlights the ethical implications of practice models that

exclude certain patients based on financial or insurance status, noting:

Physicians have both individual and collective responsibilities to care for all. Such ethical

considerations must guide physicians in considering the types of practices they choose to

participate in and what they must do to ensure their practices provide accessible care to

patients in a nondiscriminatory manner. Practices that, by design, exclude certain

categories of patients should be understood to create a greater potential of being

discriminatory against underserved populations and require special attention by physicians

to the ethical considerations involved

The paper continues to stress the importance of opening

practices to Medicaid-covered patients, emphasizing that:

The College also believes that physicians in all

types of practices should strive to take care of

patients enrolled in Medicaid. Medicaid is a crucial

part of the safety net for poor persons

One in four residents is covered by the Oregon’s Medicaid

program, either through the centrally-run fee-for-service

program OpenCard, or the managed care of local

Coordinated Care Organizations throughout the state. By

not accepting Medicaid, One Medical presents a

significant barrier to access for a quarter of the

community.

Potential Impacts

In the notice, Amazon indicated its intention not only to

maintain current services and locations but to expand One

Medical’s market share in Oregon:

One Medical currently has a limited presence in

Oregon, and Amazon expects to retain One

Medical's current employees and contractors and

to continue or expand One Medical's service

offerings. Amazon plans over time to increase One

Medical's presence by expanding its network of

clinics, thereby providing additional convenient,

affordable, and accessible options for primary care

services.

One Medical has been expanding quickly and has

demonstrated that their model is not currently profitable—or even revenue neutral—as they have

reported increasing operating losses over the last several years. Amazon is unlikely to invest in an

organization that will only lose them money indefinitely, so we anticipate changes to the One

Medical model that will seek to increase revenue and decrease operating costs. OHA asked

Amazon for more information about their expansion plans and they provided this response:

Applicable law limits Amazon and One Medical from engaging in extensive coordination

over business activities unless and until the proposed transaction closes. As such,

We need to distinguish between

succeeding as a business — getting a

return for investors — and succeeding as

a positive influence on our health care

system. There’s no question many of

these start-ups will make money. What I’m

uncertain about is whether that will result

in cheaper and better care for the

population as a whole. They may be good

at providing convenient care to relatively

healthy people and maybe a fraction of the

not-so-healthy people who have serious

but not complicated illness. But I’m

concerned about whether they will take

care of people whose insurance is not

desirable or patients who are very

complex and hard to manage. Smaller

start-ups have to give their investors a

payback within three to five years. That’s

what gives me pause, though I think some

new market entrants are exciting and

potentially positive.

- David Blumenthal, Commonwealth Fund

President, discussing what it will take for

new start-ups to fundamentally change

healthcare

30-Day Review Summary Report – 005 Amazon One Medical 26

discussions concerning expansion of One Medical’s service offerings or presence in

Oregon have not taken place and will not take place until closing. That said, Amazon and

One Medical believe they can and will help more people get better care, when and how

they need it. They look forward to delivering on that long-term mission.

Given that current revenue generation depends on the number of members, in the form of both

annual fees and monthly per-member payments from partners, it is likely that Amazon will make

pushes to expand One Medical’s membership base. Adding additional members will increase

demand for visits and other provider coordination activities, which may decrease availability of

same-day or next-day appointments for existing members.

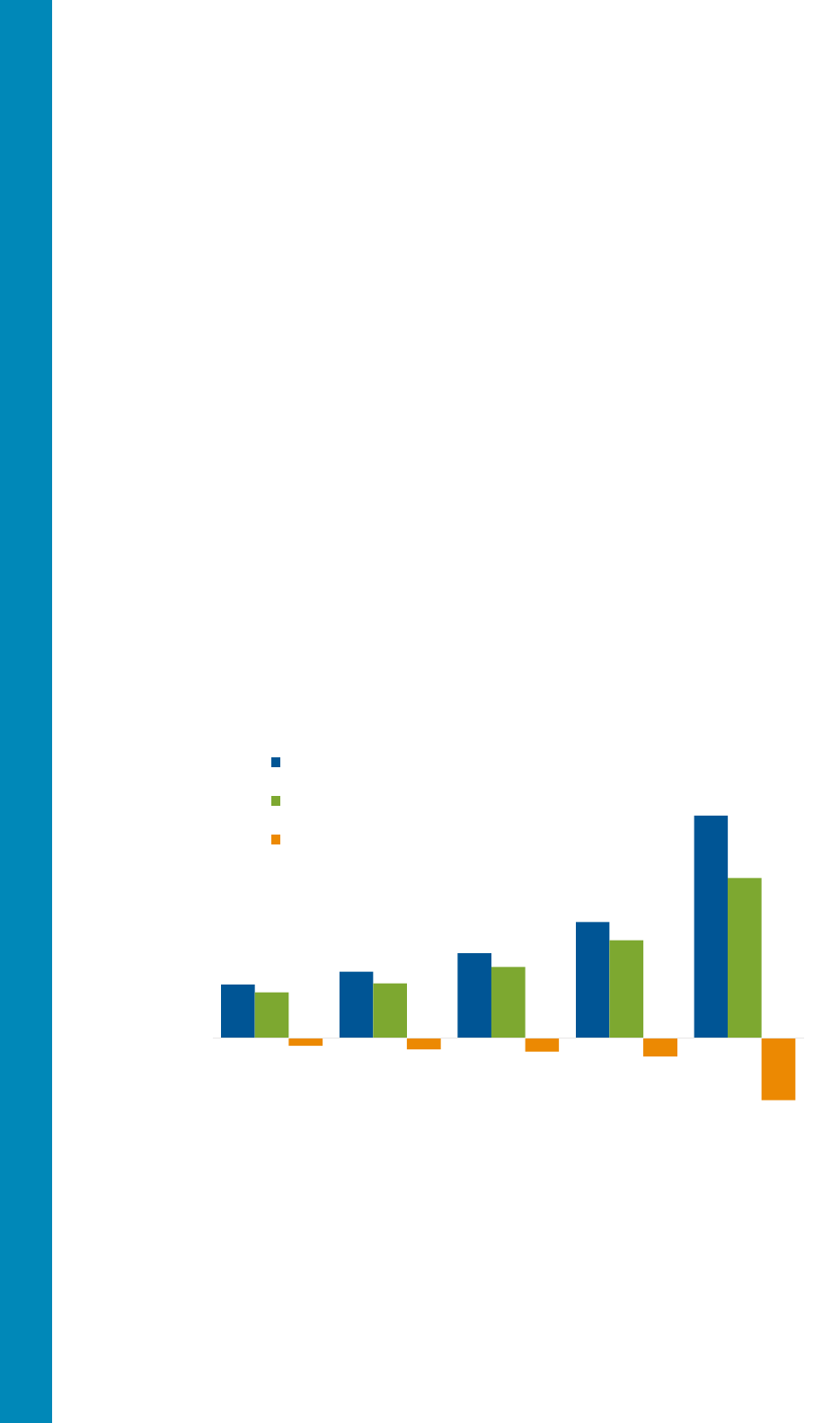

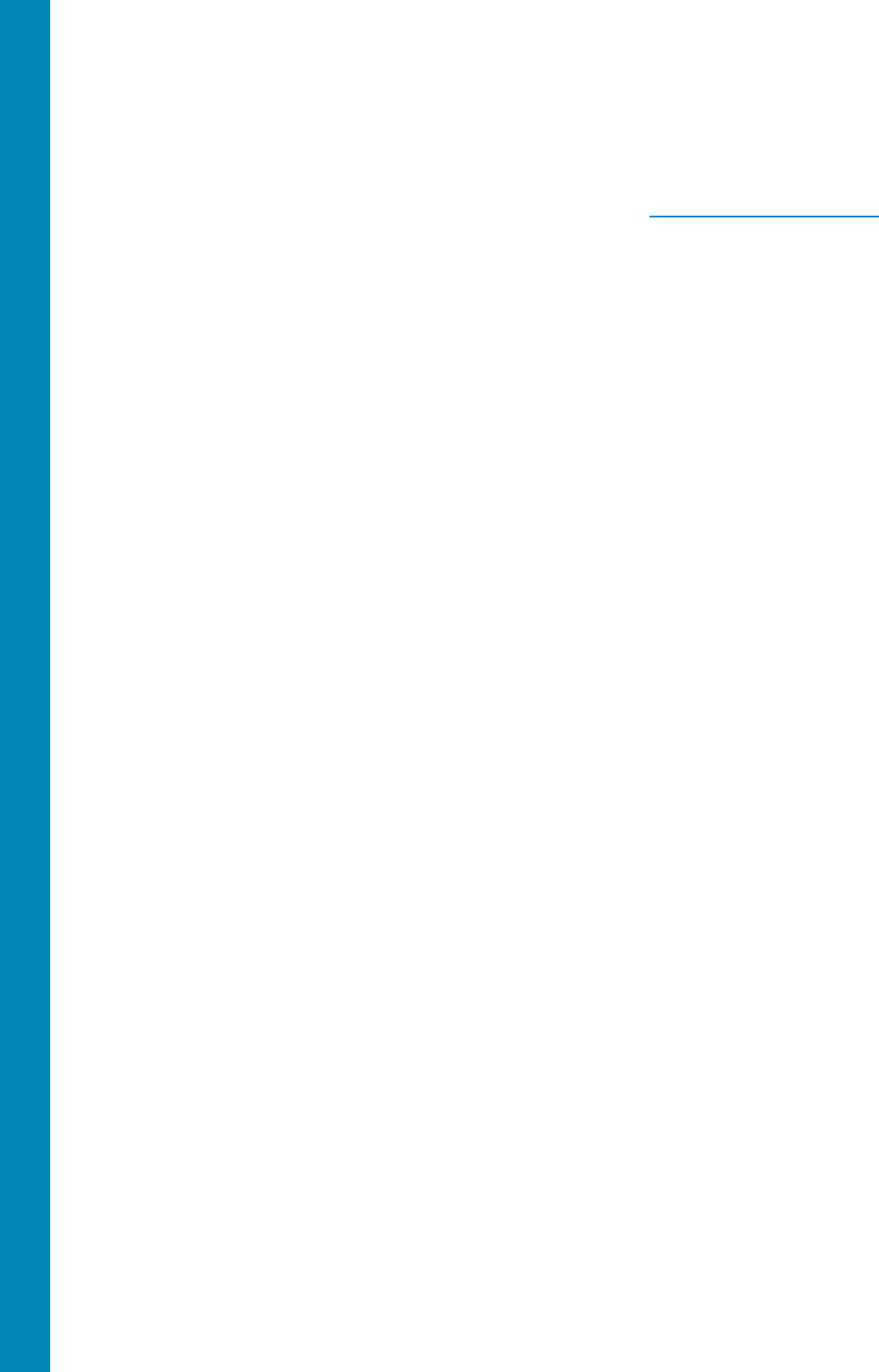

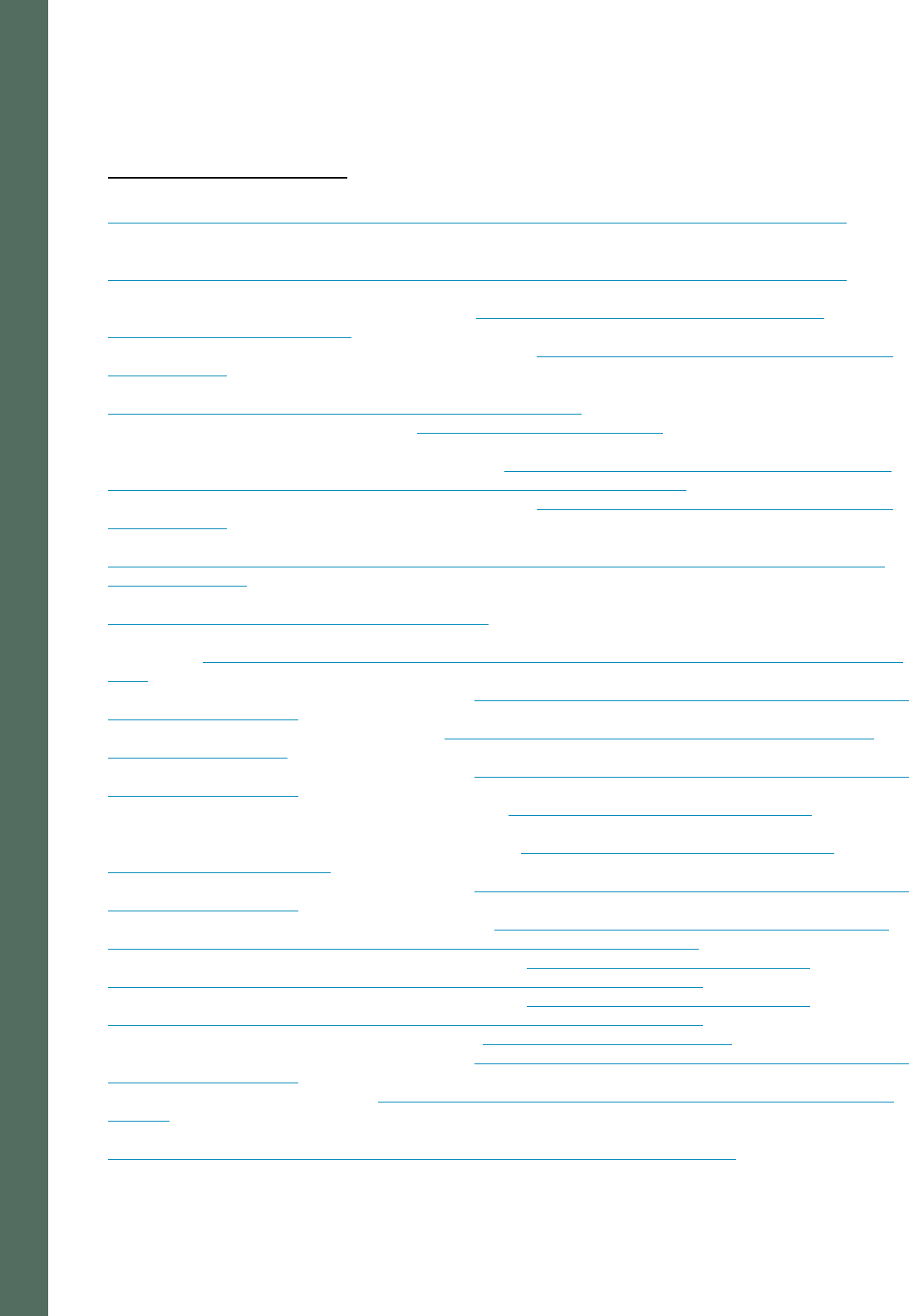

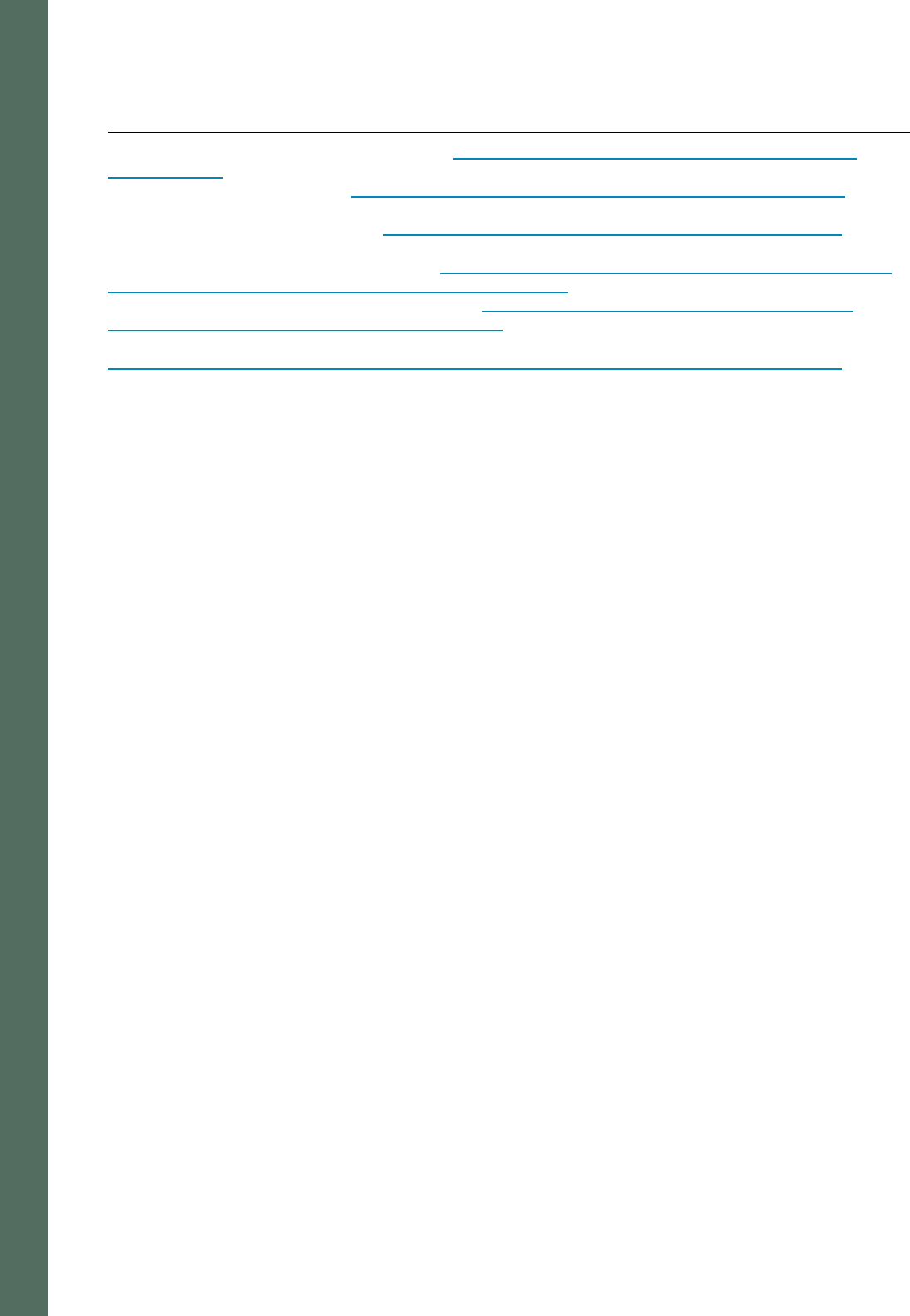

Amazon could also seek to

increase the annual One Medical

membership fee, as it has with its

Amazon Prime service. Prime

membership remained steady for

nearly a decade but has seen

more frequent $20 increases in the

last 8 years.

53

Increases to the

annual membership fee, or prices

charged for individual visits, may

make One Medical services less

accessible to low-income

community members without

insurance.

Amazon may also encourage One

Medical to accept patients with

Medicare Advantage coverage in Oregon, which would increase access to primary care services

for the older adult population that is likely to be underrepresented in their patient pool. Capitated

payments from Medicare Advantage plans represent 50% of One Medical’s revenue nationally, so

this change could help bolster the financial stability of locations in Oregon, particularly if the

intended clinic expansion strategically targets areas with higher percentages of older adults.

While additional clinics are a welcome increase in the supply of primary care services in the region,

there is concern that too-rapid expansion of clinics without concrete plans to stabilize the financial

position of One Medical for the long term may leave a larger number of patients with uncertain

access to providers and services upon which they have come to depend. Amazon’s press releases

frequently reference their desire to “disrupt health care,” but their track record has been one of

short-term ventures that have resulted in rapid expansion of programs or services that have

ultimately been shut down after only 3 years, leaving affected patients to reestablish pathways to

connect to needed care.

$79 $99 $119 $139

25%

20%

17%

2005 2014 2018 2022

Annual fee % increase

Amazon Prime annual membrship fees increased

from $79 in 2005 to $139 in 2022

30-Day Review Summary Report – 005 Amazon One Medical 27

Program

Services offered

Started

Ended

Haven