2024

A Complete Guide

to Your UC Health

and Welfare Benefits

MEDICAL, DENTAL, VISION, LIFE AND MORE

GETTING HELP

MEDICAL PLANS

CORE, UC Care, UC Health Savings Plan uchealthplans.com

• Accolade (Health Care Advocate): 866‑406‑1182

or member.accolade.com

• Anthem Blue Cross (Medical): anthem.com/ca

• Navitus Health Solutions (Pharmacy): 833‑837‑4308

Formulary: benetplans.navitus.com/university-of-california

Contact Accolade for all your health care questions. Anthem

processes claims and provides ID cards, and Navitus is phar‑

macy benet manager.

Health Savings Account (HealthEquity)

866‑212‑4729 learn.healthequity.com/uc/hsa

Kaiser HMO (Kaiser Permanente—California,

Optum Behavioral Health)

• Kaiser: 800‑324‑9208 select.kp.org/university-of-california

• Optum: 888‑440‑8225 liveandworkwell.com (access code:

11280)

UC Blue & Gold HMO (Health Net, MHN Behavioral Health)

• Health Net: 800‑539‑4072 healthnet.com/uc

• Health Net Behavioral Health: 800‑663‑9355

OTHER BENEFITS

Delta Dental PPO (Delta Dental)

800‑777‑5854 www1.deltadentalins.com/group-sites/uc.html

DeltaCare

®

USA Dental HMO (Delta Dental)

800‑422‑4234 www1.deltadentalins.com/group-sites/uc.html

VSP Vision Plan (VSP)

866‑240‑8344 vsp.com

Accident, Critical Illness, Hospital Indemnity, Life, Accidental

Death & Dismemberment (Prudential)

855‑483‑1438

Business Travel Accident

ucal.us/businesstravel

Disability—Basic, Voluntary Short-Term,

Voluntary Long-Term (Lincoln Financial)

800‑838‑4461 (claims) mylincolnportal.com

OTHER PLANS

Adoption Assistance Plan (WEX Health)

844‑561‑1338 ucal.us/adoptionassistance

Auto/Homeowner Farmers Insurance Choice

SM

866‑700‑3113

Family Care Resources (Bright Horizons Enhanced Family Supports)

888‑748‑2489 clients.brighthorizons.com/universityofcalifornia

Flexible Spending Accounts Health, Limited Purpose and

Dependent Care

(WEX Health)

844‑561‑1338 uc-fsa.com

Legal (ARAG)

800‑828‑1395 araglegal.com/ucinfo

Pet Insurance (Nationwide)

877‑738‑7874 petinsurance.com/uc

UC SYSTEMWIDE RESOURCES

UCnet

ucnet.universityofcalifornia.edu

UCPath

855‑982‑7284 ucpath.universityofcalifornia.edu

UC Retirement At Your Service (UCRAYS)

retirementatyourservice.ucop.edu

UC BENEFITS OFFICES

Agriculture & Natural

Resources

530‑752‑1774

Berkeley

510‑664‑9000, option 3

Davis

530‑752‑1774

Davis Health

916‑734‑8099

Irvine

949‑824‑0500

Irvine Health

949‑824‑0500

Los Angeles

310‑794‑0830

Los Angeles Health

310‑794‑0500

Merced

209‑355‑7178

Oce of the President

855‑982‑7284

Riverside

951‑827‑4766

San Diego

858‑534‑2816

San Diego Health

619‑543‑3200

San Francisco

415‑476‑1400

San Francisco Health

415‑353‑4545

Santa Barbara

805‑893‑2489

Santa Cruz

831‑459‑2013

Lawrence Berkeley

National Lab

510‑486‑6403

ASUCLA

310‑825‑7055

UC Law San Francisco

(formerly UC Hastings)

415‑565‑4703

Chapter Title

1

Welcome to the University of California!

As a University of California employee, you help shape the quality

of life for people throughout California and around the world.

Every faculty and sta member plays an important role in UC’s

mission of education, research and public service; UC’s high-quality,

comprehensive benets are among the rewards you receive in return.

These benets are an important part of your total compensation.

Our health and welfare benets program provides both choice and

value to meet the needs of our diverse workforce.

We know that making benets choices can be a bit overwhelming.

So we have tools and information to help you make the right choices

for you and your family.

This booklet oers a comprehensive overview of your health

and welfare benets options, including details about eligibility,

enrollment and the plans available to you. It also explains how

changes in your life and in your employment status can aect your

benets. Keep this booklet, and Your Benets at a Glance (included

in your Welcome Kit), for future reference.

UCnet (ucnet.universityofcalifornia.edu) oers additional tools and

information, along with ongoing updates about your benets. Visit

UCnet whenever you have questions about your benets or want to

make changes. You can also call your local Benets Oce or any of

the plans. You’ll nd their contact information on the insert at the

front of this booklet.

The information in this booklet reects the terms of the benet plans as in eect Jan. 1, 2024. Please note that this is a summary of your benets only; additional

requirements, limitations and exclusions may apply. Refer to applicable plan documents and regulations for details. The applicable policy issued by the carrier and the

University of California Group Insurance Regulations and other applicable UC policies will take precedence if there is a dierence between the provisions therein and those

of this document.

Welcome to UC

Chapter Title

2

Chapter Title

3

General Eligibility Rules for UC Health and

Welfare Benets

............................................................................................... 5

Enrollment

............................................................................................................ 16

Medical Plans

..................................................................................................... 19

Dental Plans

........................................................................................................ 24

Vision Plan

............................................................................................................ 28

Accident, Critical Illness and Hospital Indemnity

...................... 29

Disability Insurance

....................................................................................... 31

Basic and Voluntary Disability

.................................................................... 31

Life Insurance

..................................................................................................... 34

Basic and Core Life Insurance

..................................................................... 34

Supplemental Life Insurance

....................................................................... 35

Dependent Life Insurance

............................................................................. 37

Accidental Death and Dismemberment Insurance

.......................... 39

Business Travel Accident Insurance

......................................................... 41

Adoption Assistance Plan

.......................................................................... 42

Legal Insurance

................................................................................................. 43

Pet Insurance

...................................................................................................... 45

Family Care Resources

.................................................................................. 46

Flexible Spending Accounts

...................................................................... 47

Health Flexible Spending Account

........................................................... 47

Dependent Care Flexible Spending Account

...................................... 48

Legal Notices

...................................................................................................... 51

Participation Terms and Conditions

........................................................ 51

HIPAA Notication for Medical Program Eligibility

........................ 52

Notice Regarding Administration of Benets

..................................... 53

Table of Contents

Table of Contents

4

Chapter Title

5

General Eligibility Rules for UC Health and Welfare Benets

UC oers three benets packages for faculty and sta — Full,

Mid-Level and Core. Your eligibility for a particular benets

package depends on the type of job you have, the percentage of

time you work and the length of your appointment.

The eligibility requirements are listed below. See the chart on

pages 10 to 12 for a list of the benets available to you, based on

the level of benets for which you qualify.

REQUIREMENTS FOR EMPLOYEES IN CAREER,

ACADEMIC, LIMITED, PARTIAL-YEAR CAREER, CONTRACT

AND FLOATER APPOINTMENTS

FULL BENEFITS

You are eligible for Full Benets if you are an active UCRP

member, an active Savings Choice participant or have begun the

90-day election period during which you can choose between

Pension Choice and Savings Choice.

1

There are two ways to qualify for these primary retirement

benets:

• You are appointed to work in a retirement-eligible position at

least 50 percent time for a year or more

2

or

• You complete 1,000 hours in a retirement-eligible position

within a rolling 12-month period (750 hours in certain

instances

3

).

MID-LEVEL BENEFITS

You are eligible for Mid-Level Benets if:

• You are appointed to work 100 percent time for at least three

months but for less than one year or

• You are appointed to work at least 50 percent time for a year

or more in a position that does not qualify you for the primary

retirement benets noted above.

CORE BENEFITS

You are eligible for Core Benets if you are appointed to work at

least 43.75 percent time.

REQUIREMENTS FOR EMPLOYEES IN PER DIEM,

CASUAL/RESTRICTED (STUDENTS), BY AGREEMENT AND

SEASONAL APPOINTMENTS

CORE BENEFITS

You are eligible for Core Benets if you are appointed to work at

least 75 percent time for at least three months.

ELIGIBLE FAMILY MEMBERS

You may enroll one eligible adult family member in addition

to yourself. Your children are also eligible for enrollment as

outlined below.

ELIGIBLE ADULT

You may enroll your spouse or an eligible domestic partner.

4

No declaration form or documentation is needed to initially

enroll your domestic partner, but you will be asked to submit

documentation after enrollment (see “Supporting

Documentation” in Benets for Domestic Partners) to establish

ongoing eligibility for health and welfare benets. To be eligible

for health and welfare benets, your domestic partnership must

meet one of the following requirements:

• Registered with the State of California or other valid

jurisdiction OR

• Able to meet the requirements on page 13 for a partnership

that has not been registered, with appropriate supporting

documentation upon request

Please note: Enrolling your domestic partner in health benets

and successfully completing the eligibility verication process

will establish your partner as your survivor for UC Retirement

Plan benets, subject to additional eligibility requirements.

1

In a few specically dened situations, UC employees may be eligible to

participate in UC health and welfare benets while being enrolled in a non-UC

retirement plan. Eligible employees may have been covered by entities that were

acquired by the University and/or they may have opted to remain in a previous

public retirement plan at the time of UC employment.

2

Or your appointment form shows that your ending date is for funding purposes

only and that your employment is intended to continue for more than a year.

3

If you’re a member of the Non-Senate Instructional Unit, you qualify for

participation in the Retirement Choice Program after working 750 hours in an

eligible position within a 12-month period.

4

An adult dependent relative is not eligible for coverage in UC plans unless

enrolled prior to Dec. 31, 2003 and continuously eligible and enrolled since that

date. Also, remember: If your eligible adult dependent relative is still enrolled in

the plan, you cannot enroll your spouse or domestic partner. The eligible adult

may be enrolled only in the same plans as you. See the chart on page 10 for

more information on eligible plans.

General Eligibility Rules for UC Health and Welfare Benets

Chapter Title

6

General Eligibility Rules for UC Health and Welfare Benets

ELIGIBLE CHILD

You may enroll your eligible children up to age 26 in the same

plans as those in which you enroll. A disabled child may be

covered past age 26, if the disability is veried by the carrier or a

physician. You may also enroll your legal ward up to age 18 in the

same plan(s) as those in which you enroll. The Family Member

Eligibility chart on pages 13 and 14 gives the eligibility criteria

for children, stepchildren, grandchildren, disabled children and

legal wards. You may enroll your eligible domestic partner’s child

or grandchild, even if you do not enroll your partner.

In order to be eligible for UC-sponsored coverage, your

grandchild, step-grandchild, or legal ward (see Family Member

Eligibility chart) must be claimed as a tax dependent by you or

your spouse. Your eligible domestic partner’s grandchild must

be claimed as a tax dependent by you or your domestic partner.

Also eligible are children UC is legally required by administrative

or court order to provide with group health coverage.

Overage disabled children must be claimed as a tax dependent

by either you or your spouse/domestic partner. If overage

disabled children are not claimed as a dependent for income tax

purposes, the overage disabled child must be eligible for Social

Security income or Supplemental Security Income (SSI) as a

disabled person or work in supported employment which may

oset the Social Security or SSI.

Your children (or legal ward) are eligible for only the plans for

which you are eligible and in which you have enrolled (See

“Benets Overview,” pages 10–12).

Except as provided in the following paragraph, application for

coverage beyond age 26 due to disability must be made to the

plan 60 days prior to the date coverage is to end due to the

child reaching limiting age. If application is received within this

timeframe but the plan does not complete determination of the

child’s continuing eligibility by the date the child reaches the

plan’s upper age limit, the child will remain covered pending the

plan’s determination. The plan may periodically request proof

of continued disability, but not more than once a year after the

initial certication. Disabled children approved for continued

coverage are eligible to participate in university-sponsored

medical, dental, vision, accident, critical illness, hospital

indemnity, legal, dependent life and AD&D plans for faculty and

sta. If enrollment is transferred from one UC plan to another, a

new application for continued coverage is not required; however,

the new plan may require proof of continued disability, but not

more than once a year.

If you are a newly hired employee with a disabled child over age

26 or if you acquire a disabled child over age 26 (through

marriage, adoption or domestic partnership), you may also apply

for coverage for that child. The child’s disability must have begun

prior to the child turning age 26. Additionally, the child must have

had continuous group health coverage since age 26. The plan will

ask for proof of continued disability, but not more than once a

year after the initial certication.

TAX IMPLICATIONS OF ENROLLING A DOMESTIC PARTNER

In most cases, your domestic partner and your partner’s children

do not automatically qualify as your dependents under the

Internal Revenue Code (IRC). That means any UC contribution

toward their medical, dental and vision coverage will be

considered “imputed income” or taxable income for federal tax

purposes. This income is reected in your annual W-2 statement.

If your domestic partner and partner’s children or grandchildren

are your dependents as dened by the IRC, you are not subject

to imputed income on UC contributions toward health coverage

for these family members.

In order for your payroll records to accurately reect this tax

dependency, you’ll need to report it to UC. Indicate the tax

status of your partner and/or partner’s children on UCPath when

you enroll them in benets.

UC’s contribution for medical, dental and vision coverage is

not considered imputed income for California state income tax

purposes if you and your domestic partner have registered your

partnership with the state of California. Also, if your partner’s

child is considered your stepchild under state law, federal

imputed income will not apply to UC’s contribution toward the

child’s coverage.

If your domestic partner is covered as your family member and

the two of you marry, be sure to update your information in

UCPath so that imputed income and state taxes no longer apply.

OTHER ELIGIBILITY RULES AND INFORMATION

NO DUPLICATE COVERAGE

UC rules do not allow duplicate coverage. This means you may not

be covered in UC-sponsored plans as an employee and as an eligible

family member of a UC employee or retiree at the same time.

If you are covered as an eligible family member and then become

eligible for UC coverage yourself, you have two options:

• You can opt out of your own employee coverage and remain

covered as another employee’s or retiree’s family member or

• You can enroll in your own coverage; before you enroll,

though, you must make sure the UC employee or retiree

who has been covering you disenrolls you from his or her

UC-sponsored plan.

Family members of UC employees may not be enrolled in more

than one UC employee’s plan. For example, if spouses both work

for UC, their children cannot be covered by both parents.

General Eligibility Rules for UC Health and Welfare Benets

Chapter Title

7

If duplicate enrollment occurs, UC will cancel the plan with

later enrollment. UC and the plans reserve the right to collect

reimbursement for any duplicate premium payments due to the

duplicate enrollment.

ELIGIBILITY VERIFICATION

When you enroll anyone in a plan as a family member, you

must provide documentation specied by the University

verifying that the individual(s) you have enrolled meet the

eligibility requirements outlined above. The plan may also

require documentation verifying eligibility status. In addition,

the University and/or the plan reserve the right to periodically

request documentation to verify the continued eligibility of

enrolled family members.

UnifyHR, which administers the family member eligibility

verication process, will send you a packet of materials to help

you complete the verication process. If you fail to provide the

required documentation by the deadline specied in these

materials, your family member(s) will be disenrolled until

verication is provided (upon verication, re-enrollment is

prospective, not retroactive). Individuals who are not eligible

family members will be permanently disenrolled.

You also may be responsible for any UC-paid premiums due to

enrollment of ineligible individuals.

WHEN COVERAGE BEGINS

The following eective dates apply provided the appropriate

enrollment transaction (electronic or paper form) has been

completed within the applicable enrollment period.

• If you enroll during a Period of Initial Eligibility (PIE), coverage

for you and your family members is eective the date the PIE

starts.

• If you enroll during Open Enrollment, the eective date of

coverage is the date announced by the University. In most

cases, it is the Jan. 1 following Open Enrollment.

• If you complete a 90-day waiting period for medical coverage,

such coverage is eective on the 91st consecutive calendar

day after the date the enrollment form is received.

FAMILY MEMBERS

When you have a family status change, coverage begins on the

rst day you have a new family member — such as a spouse,

domestic partner, newborn or newly adopted child. However,

if you request to change to a dierent medical plan at the time

you add a new family member, coverage under the new plan is

eective the rst of the following month for all family members.

If you are already enrolled in adult plus child(ren) or family

coverage, you may add additional children, if eligible, at any time

after their PIE.

CONTINUING ELIGIBILITY

UC bases your ongoing eligibility for benets on your average

hours of service

5

over a 12‑month, standard measurement

period (SMP). UC’s SMP for monthly-paid employees is

Nov. 1–Oct. 31; for bi-weekly paid employees, the SMP includes

the pay periods inclusive of those same dates (for example, in

2024, it runs from Nov. 6, 2023, until Nov. 5, 2024).

If your hours during the SMP meet the threshold to be oered

coverage, then that coverage must be oered, and if accepted,

will be provided during the subsequent stability period,

regardless of your number of hours during the stability period

(as long as you remain employed). UC’s standard stability period

for all employees is Jan. 1–Dec. 31.

If your hours during the SMP do not meet the threshold, then all

coverage ends on Dec. 31.

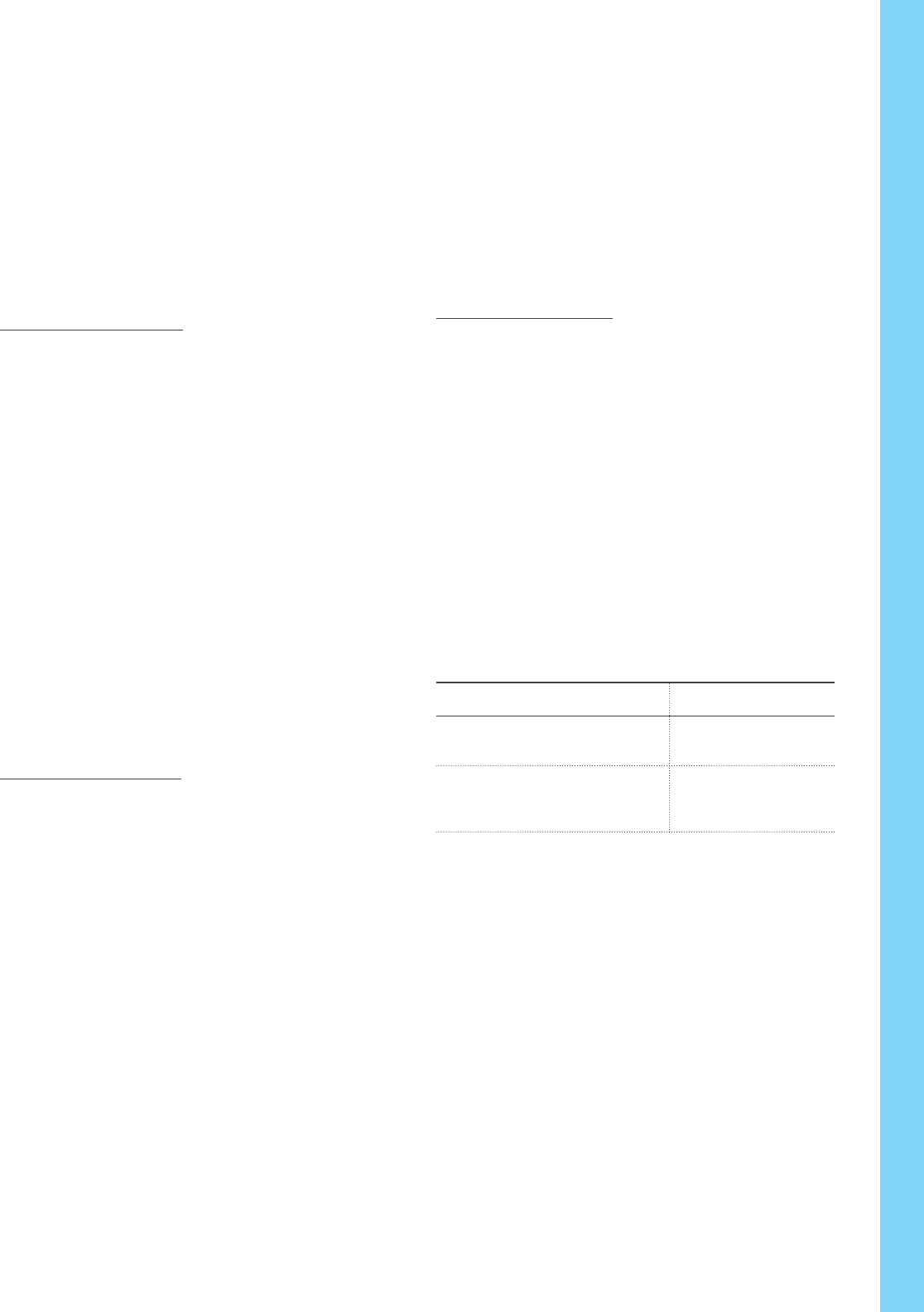

The required average hours of service threshold is:

Appointment Type Average Hours Threshold

Career, Academic, Limited, Partial-Year

Career, Contract, Floater

17.5 hours per week

Per Diem, Casual/Restricted (students),

By Agreement or other at-dollar

payments, Seasonal

30 hours per week

General Eligibility Rules for UC Health and Welfare Benets

5

Dened as all hours on pay status (including hours on call, hours on paid

vacation, paid holiday, paid sick leave, paid sabbatical, paid jury duty, or any

other paid leave) as well as hours on unpaid leave protected by the federal

Family & Medical Leave Act, unpaid jury duty, and unpaid leave protected by the

Uniformed Services Employment & Reemployment Rights Act. May also include

up to 501 hours during the SMP due to “employment break periods” of at least

4 consecutive weeks (e.g., academic breaks, etc.).

8

General Eligibility Rules for UC Health and Welfare Benets

General Eligibility Rules for UC Health and Welfare Benets

WHEN COVERAGE ENDS

The termination of coverage provisions established by the

University are summarized below.

DISENROLLMENT DUE TO LOSS OF ELIGIBLE STATUS

If you are an employee and lose eligibility, your coverage and

that of any enrolled family members ends at the end of the

month in which eligible status is lost. See pages 48-49 for rules

pertaining to Flexible Spending Accounts.

OTHER DISENROLLMENTS

If you are enrolled in a health and welfare plan that requires

premium payments, and you do not continue payment, your

coverage will be terminated at the end of the last month for

which you paid.

You and/or your family members may be disenrolled if you and/

or a family member misuse the plan, as described in the Group

Insurance Regulations. Misuse includes, but is not limited to,

actions such as falsifying enrollment or claims information;

allowing others to use the plan identication card; intentionally

enrolling, or failing to disenroll, individuals who are not/no longer

eligible family members; threats or abusive behavior toward plan

providers or representatives.

LEAVE OF ABSENCE, LAYOFF, CHANGE IN EMPLOYMENT

STATUS OR RETIREMENT

Coverage may end when you go on unpaid leave or leave UC

employment. For information about continuing your coverage

in the event of an authorized leave of absence, layo, change

of employment status or retirement, contact the person who

handles benets for your location.

FAMILY CHANGES THAT RESULT IN LOSS OF COVERAGE

If your family member loses eligibility, you must complete the

appropriate transaction to remove him or her from coverage

within 31 days of the eligibility loss event.

Divorce, legal separation, termination of domestic

partnership, annulment. Eligibility for your spouse or domestic

partner and any children for whom you are not the legal parent/

guardian ends on the last day of the month in which the event

occurs. Your legally separated spouse, former spouse or former

domestic partner and the former partner’s child or grandchild

may continue certain coverage under COBRA (Consolidated

Omnibus Budget Reconciliation Act of 1985) or they may

seek individual coverage, including through the health care

marketplace (coveredca.com). If a settlement agreement

between you and your legally separated/former spouse or

domestic partner requires you to provide coverage, you must do

so on your own.

An eligible child turning age 26. Unless a child is eligible to

continue coverage because of disability, coverage ends at the

end of the month in which the child reaches age 26. This rule

applies to your biological and adopted children, stepchildren,

grandchildren, step-grandchildren and your domestic partner’s

children or grandchildren. Certain coverage may be continued

under COBRA or they may seek individual coverage, including

through the health care marketplace (coveredca.com).

A legal ward turning age 18. Eligibility ends at the end of

the month in which the legal ward turns 18. Your legal ward

may continue certain coverage under COBRA or they may

seek individual coverage, including through the health care

marketplace (coveredca.com).

Death of a family member. Coverage for the family member

ends the last day of the month in which the death occurs. It

is important to contact your local Benets Oce for further

assistance in the event of an enrolled family member’s death.

CONTRACT TERMINATION

Health and welfare benets coverage is terminated when the group

contract between the University and the plan vendor is terminated.

Benets will cease to be provided as specied in the contract and

you may have to pay for the cost of those benets incurred after

the contract terminates. You may be entitled to continued benets

under terms described in the plan evidence of coverage booklet. (If

you apply for an individual conversion plan, the benets may not

be the same as you had under the original plans.)

OPPORTUNITIES FOR CONTINUATION

If you separate from UC employment, generally, your

UC-sponsored benets will stop. If you retire from UC, see

the Group Insurance Eligibility Fact Sheet for Retirees and Eligible

Family Members (available on the UCnet website at

ucnet.universityofcalifornia.edu/forms/pdf/group-insurance-

eligibility-factsheet-for-retirees.pdf) for more details.

COBRA (Consolidated Omnibus Budget Reconciliation Act

of 1985): If you or any family member(s) lose eligibility for

UC-sponsored medical, dental and/or vision coverage, you may

be able to continue group coverage through COBRA.

If you are enrolled in the Health Flexible Spending Account (FSA)

and you leave UC employment during the plan year, you may be

able to continue your participation under COBRA through the

end of the current plan year (Dec. 31) by making direct, after-tax

payments to your account.

If you lose eligibility, the COBRA administrator will send you a

“Qualifying Event Notice,” which explains the procedure for

continuing your participation. If your family member loses

eligibility, you must request a COBRA package through UCPath.

More information about COBRA continuation privileges is

available online at ucal.us/COBRA or from your Benets Oce.

9

General Eligibility Rules for UC Health and Welfare Benets

Conversion/Portability: Within 31 days after UC-sponsored

coverage ends (if your participation has been continuous), you

may be able to convert your group coverage to individual

policies or continue (“port”) your group coverage. See the

specic plan sections which follow for details.

Also, you may wish to contact the California Department of

Managed Health Care at dmhc.ca.gov

or 888‑466‑2219 to

determine whether you are eligible for HIPAA Guaranteed Issue

individual plan coverage or Covered California, California’s health

insurance marketplace, at coveredca.com

or 800‑300‑1506 to

review options for purchasing individual plan coverage.

ELIGIBILITY FOR STATE PREMIUM ASSISTANCE

If you are eligible for health coverage from UC, but cannot aord

the premiums, some states have premium assistance programs

that can help pay for coverage from their Medicaid or Children’s

Health Insurance Program (CHIP) funds.

If you live in California, you can contact the California Medicaid

(Medi-Cal) oce for further information via email (HIPP@dhcs.

ca.gov) or visit their website (dhcs.ca.gov). If you live outside

California, go online to ucal.us/chipra for a list of states that

currently provide premium assistance. You can also contact the

U.S. Department of Health and Human Services, Centers for

Medicare & Medicaid Services at cms.hhs.gov

; 877-267-2323.

FOR MORE INFORMATION

• Participation Terms and Conditions on page 51

• Benets for Domestic Partners

• Your local benets oce

10

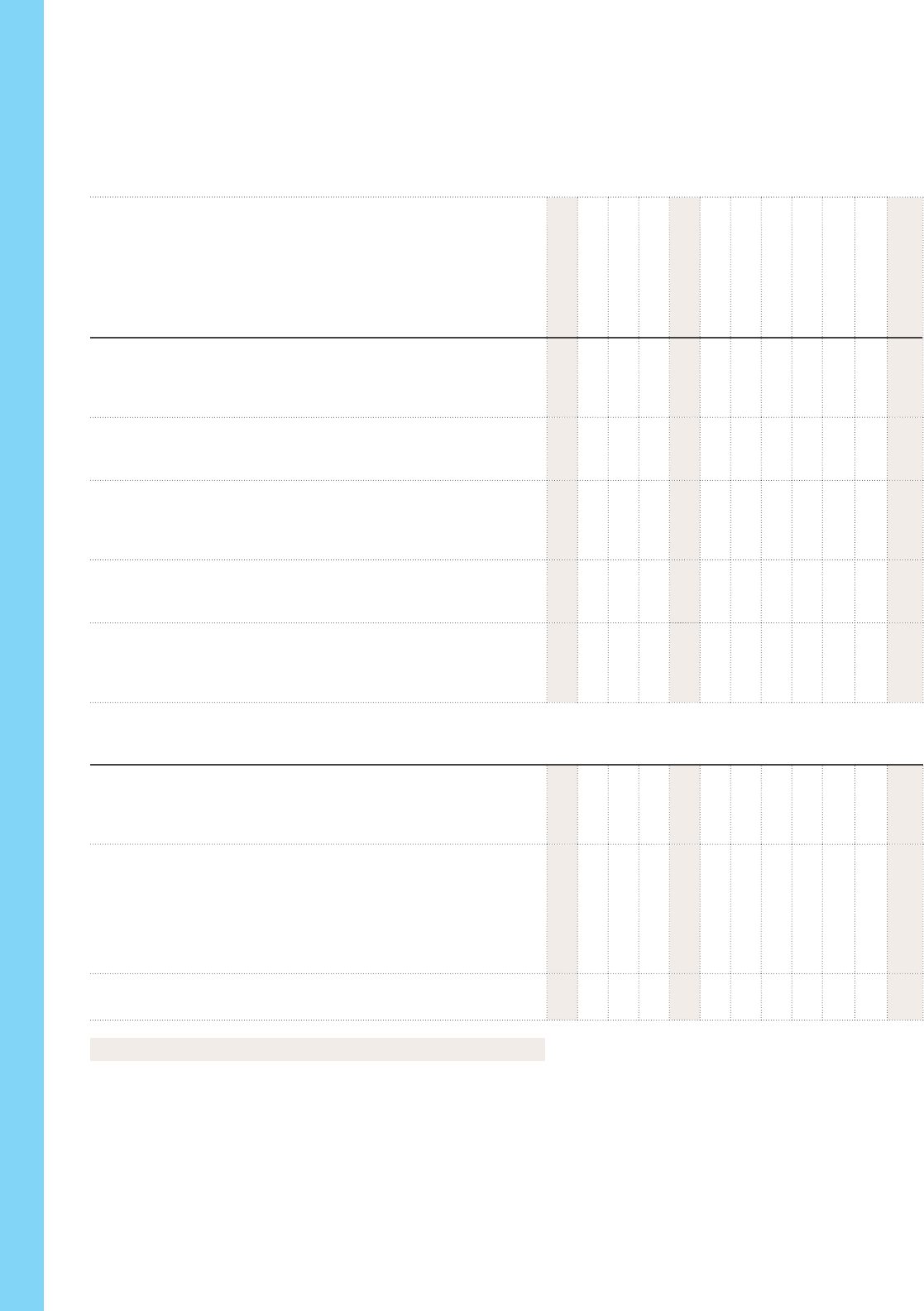

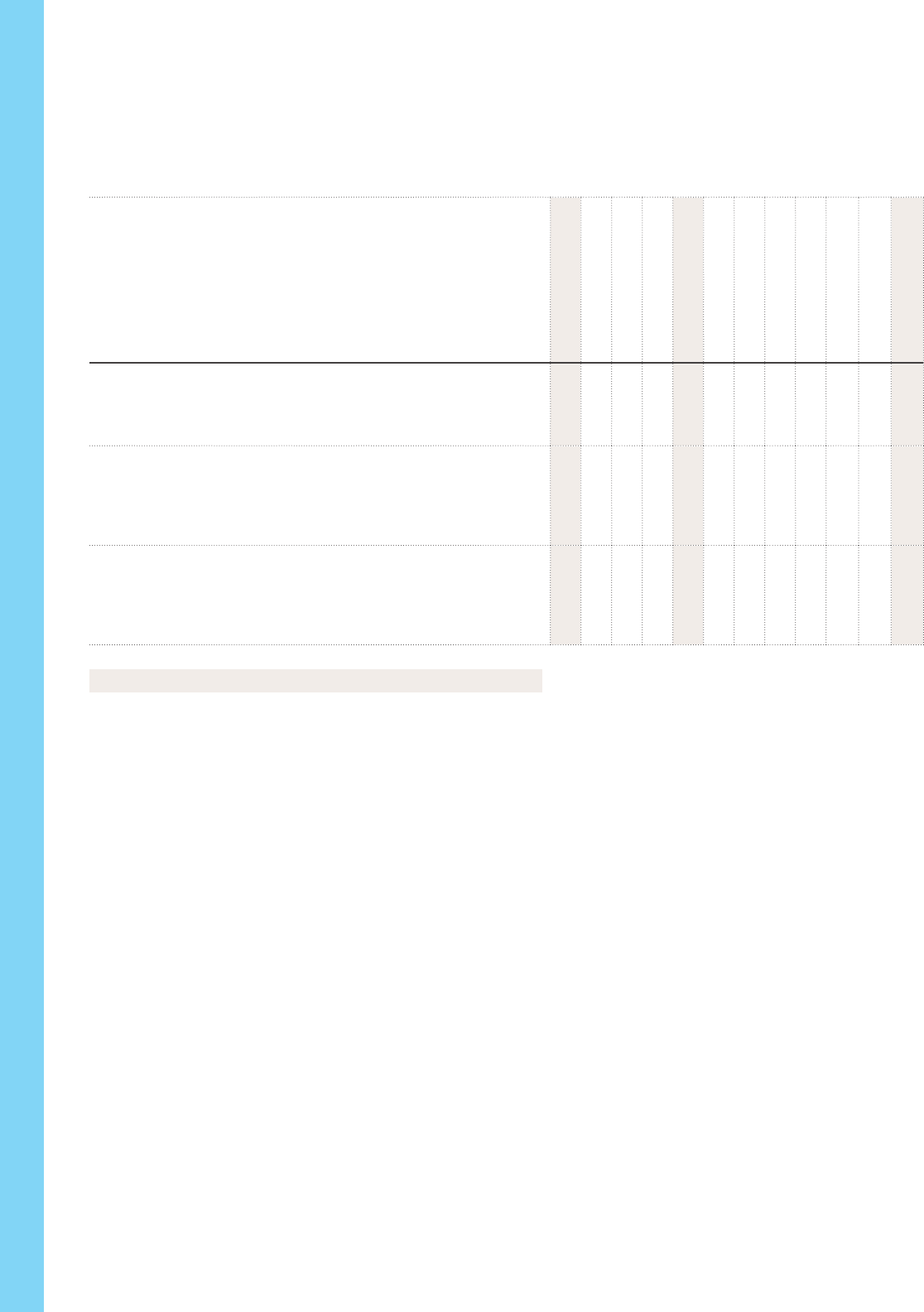

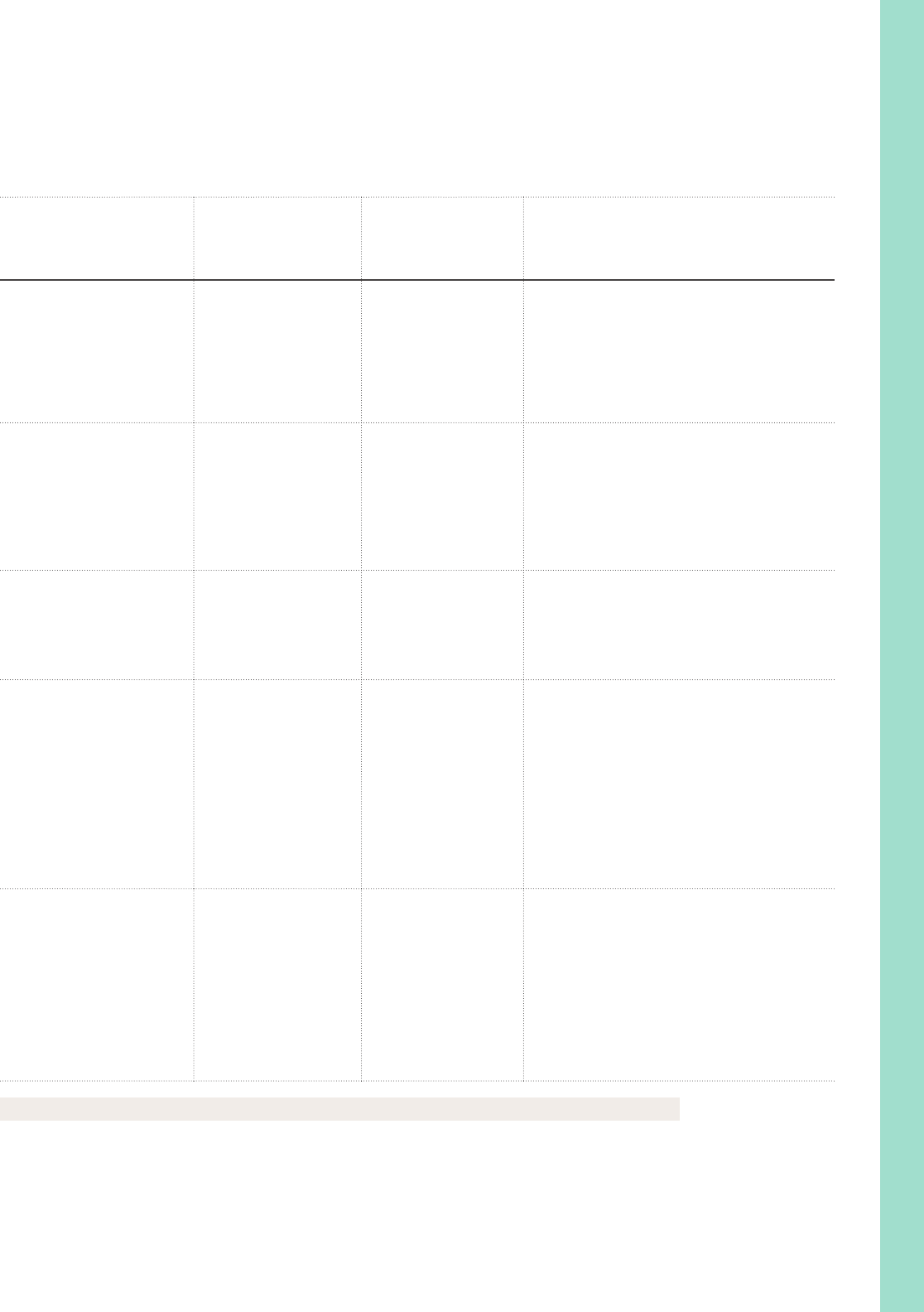

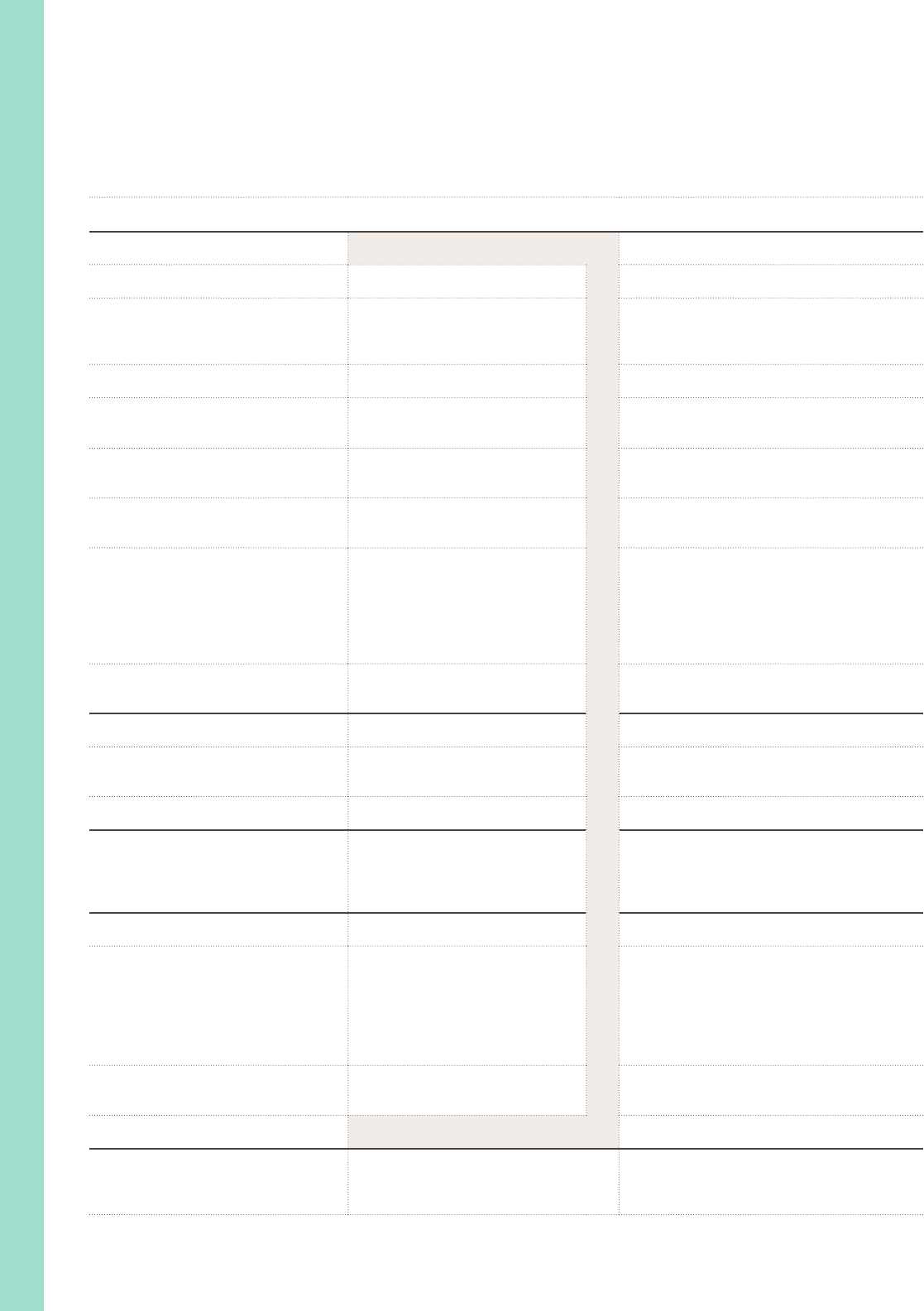

Benets Overview

Benets Overview

HEALTH CARE

Benets Packages

Full

Mid‑Level

Core

When You May Enroll

During PIE

During OE

90‑Day Wait¹

Automatic

With SOH²

Anytime

Premium Paid By

Medical³

Choice of various options depending on your address, including health

maintenance organization (HMO), preferred provider organization (PPO) or

a PPO with a health savings account. See page 19.

• • • • •

You

and

UC

Medical — CORE

Fee-for-service plan with no employee premium and a $3,000 individual

deductible. See page 19.

• • • • • •

UC

Dental³

Choice of two plans: Delta Dental PPO, a fee-for-service plan, or DeltaCare® USA,

a dental HMO (network available in California only). Both cover preventive, basic

and prosthetic dentistry, as well as orthodontics. See page 24.

• • •

UC

Vision³

Plan covers a variety of vision care services including eye exams, corrective lenses

and frames. See page 28.

• • •

UC

Accident, Critical Illness and Hospital Indemnity

These plans are designed to complement medical and disability benets, but

are not a replacement for them. Plans pay cash benets directly to you if you

experience a covered accident, illness or hospital stay.

• • • • •

You

DISABILITY INSURANCE

Basic Disability

4

Provides basic coverage when unable to work due to pregnancy/childbirth or due to

a disabling injury or illness not related to work. Pays 55% of eligible earnings for up

to six months ($800 monthly maximum), after a waiting period. See page 31.

• • • •

UC

Voluntary Short-Term

4

and/or Voluntary Long-Term Disability

5

Provides short-term and/or long-term coverage for disabilities that are not related

to work, such as pregnancy/childbirth, injury or illness. Supplements employer-paid

Basic Disability and other sources of disability income you may receive (e.g.,

Workers’ Compensation or Social Security), up to 60% of eligible earnings ($15,000

maximum monthly benet). Enroll in Voluntary Short-Term Disability, Voluntary

Long-Term Disability or both. See page 31.

• • • • •

You

Workers’ Compensation

Provides state-mandated coverage for work-related injuries.

• • • •

UC

PIE: Period of Initial Eligibility OE: Open Enrollment SOH: Statement of Health

1

The 90-day waiting period is available when the PIE is missed. See page 19. You

may need to pay part of your premiums on an after-tax basis.

2

If you do not enroll during the PIE, you may apply for coverage by submitting an

evidence of insurability/statement of health. The carrier may or may not approve

your enrollment based on medical information in your application.

3

When you enroll in any UC-sponsored medical, dental or vision plan, you will not

be excluded from enrollment based on your health, nor will your premium or level

of benets be based on any genetic information or pre-existing health conditions.

The same applies to your eligible family members.

4

Employees are not covered under California State Disability Insurance for period

of employment at UC.

5

If you have a pre-existing condition which causes you to be disabled in your rst

year of coverage, your Voluntary Long-Term Disability benets will not be payable.

For more information, see the insurance carrier’s summary plan description and

Your Guide to UC Disability Benets.

11

Benets Overview

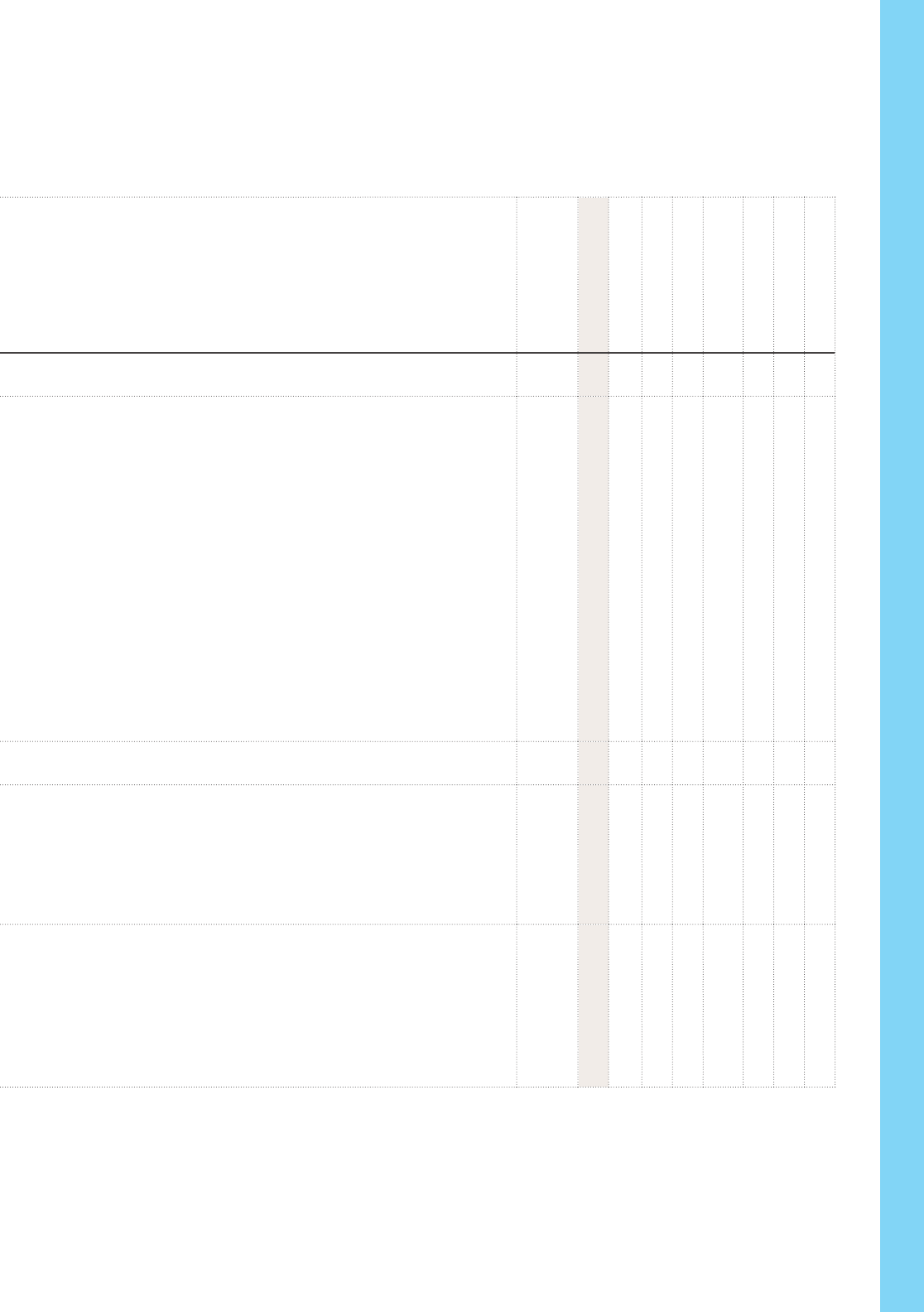

LIFE AND ACCIDENT INSURANCE

Benets Packages

Full

Mid‑Level

Core

When You May Enroll

During PIE

During OE

90‑Day Wait

Automatic

With SOH

Anytime

Premium Paid By

Basic Life

Provides employees eligible for Full Benets with life insurance equal to annual

base salary, up to $50,000. Coverage is adjusted if appointment is less than

100% time. See page 34.

• •

UC

Core Life

Provides employees eligible for Core or Mid-Level Benets with $5,000 of life

insurance. See page 34.

• • •

UC

Supplemental Life

Provides employees with additional life insurance at group rates. Coverage up to

four times annual salary (to $1,000,000 maximum). See page 35.

• • • •

You

Basic Dependent Life (Spouse/Domestic Partner)

Provides $5,000 of coverage. See page 37.

• • • •

You

Basic Dependent Life (Child/ren)

Provides $5,000 for each child. See page 37.

• • • •

You

Expanded Dependent Life (Spouse/Domestic Partner)

Coverage for 50% (up to $200,000) of employee’s Supplemental Life amount.

See page 37.

• • • •

You

Expanded Dependent Life (Child/ren)

Covers each child for $10,000. See page 37.

• • • •

You

Accidental Death & Dismemberment (AD&D)

You may enroll at any time. Provides up to $500,000 protection for employee and

family for accidental death, loss of limb, sight, speech or hearing, or for complete

and irreversible paralysis. See page 39.

• • • • •

You

Business Travel Accident

Provides up to $500,000 of coverage when an employee travels on ocial UC

business. See page 41 for enrollment instructions.

• • •

UC

OTHER BENEFITS

Adoption Assistance

No enrollment is required; see page 42.

• • • •

UC

Legal

Provides basic legal assistance for consultation/representation, domestic, consumer

and limited defensive legal services and identity theft benets. See page 43.

• • • • •

You

Pet Insurance

You may enroll at any time; see page 45.

• • • •

You

Automobile and Homeowner

You may enroll at any time, subject to underwriting approval from the insurer.

Call 866-700-3113 for details.

• • • •

You

Family Care Resources

Provides access to prescreened caregivers, pet sitters, tutors and other family

services. You may enroll at any time; see page 46.

• • • •

You

Chapter Title

12

Benets Overview

TAX-SAVINGS PROGRAMS

Benets Packages

Full

Mid‑Level

Core

When You May Enroll

During PIE

During OE

90‑Day Wait

Automatic

With SOH

Anytime

Pretax Salary Reduction

General Purpose Health Flexible Spending Account (Health FSA)

Lowers taxable income by allowing payment for up to $3,050 of eligible out-of-

pocket health care expenses on a pretax basis. Can be paired with any UC medical

plan other than UC Health Savings Plan. See page 47.

• • • • • •

Dependent Care Flexible Spending Account (DepCare FSA)

Lowers taxable income by allowing payment for up to $5,000 (or $3,000 if considered

a “highly compensated employee” by the IRS; $2,500 if married and ling a separate

income tax return) of eligible dependent care expenses on a pretax basis. See

page 48.

• • • • • •

Health Savings Account (HSA) — Paired with UC Health Savings Plan

You and UC contribute to the HSA, up to the limits set each year by the IRS — for

2024, this limit is $4,150 for individual coverage and $8,300 for family coverage.

People age 55 and over can make an additional “catch-up” contribution of $1,000.

Can only be paired with UC Health Savings Plan. See page 47.

• • • • •

PIE: Period of Initial Eligibility OE: Open Enrollment SOH: Statement of Health

Benets Overview

Chapter Title

13

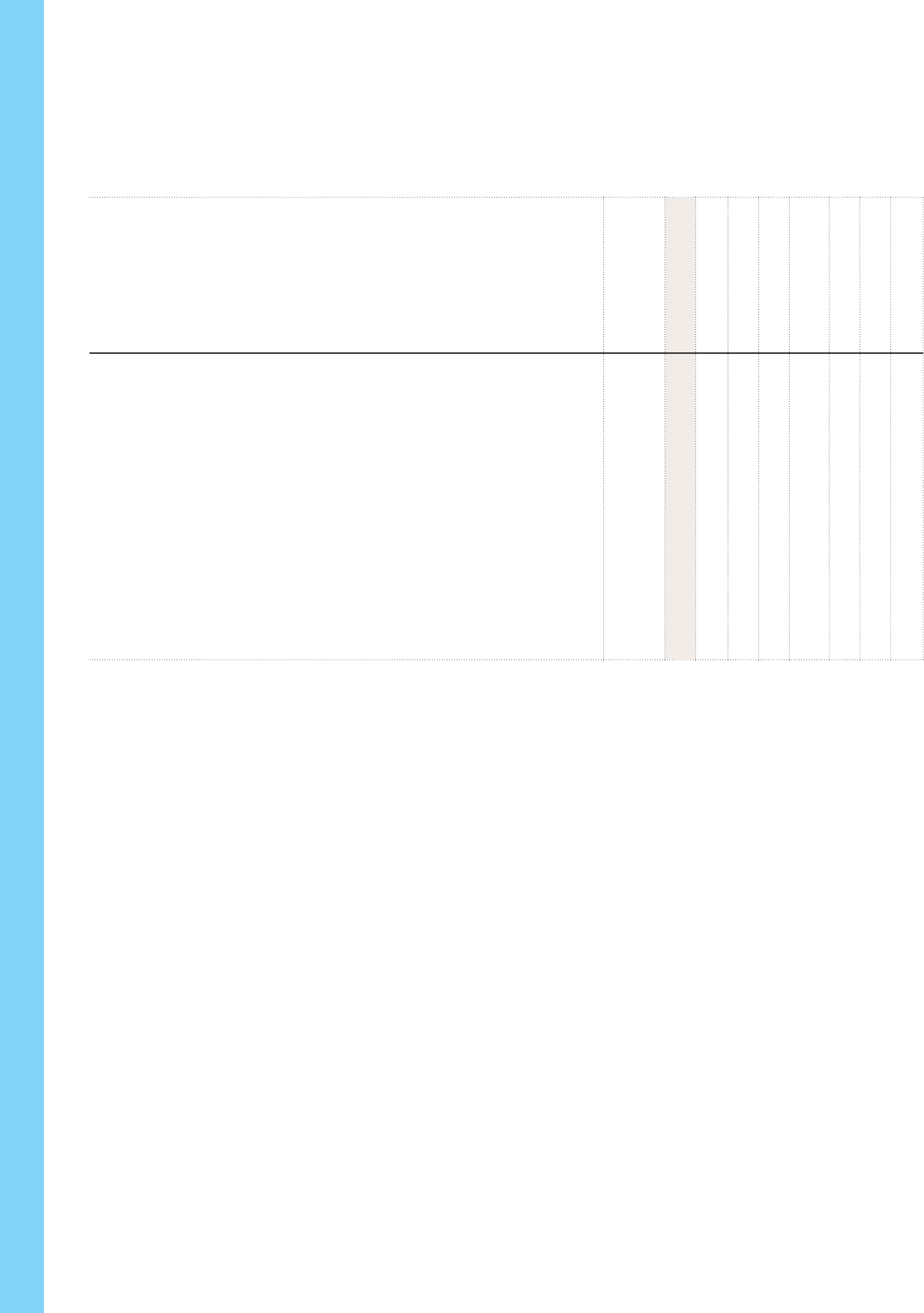

Benets Overview

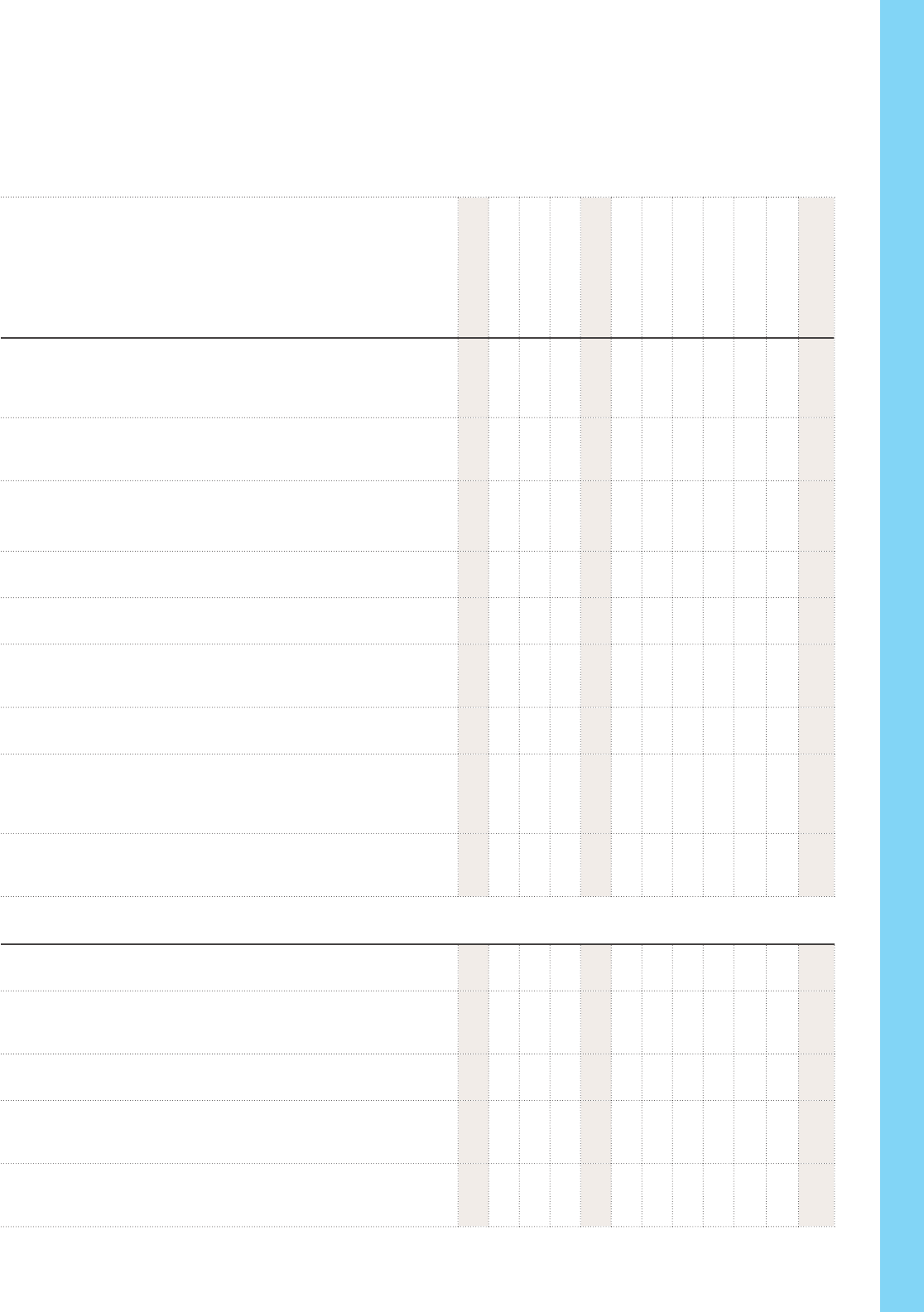

ELIGIBLE FAMILY MEMBERS

Eligibility

May enroll in

Medical

Dental

Vision

Accident, Critical Illness

and Hospital Indemnity

Dependent Life

AD&D

Legal

Legal Spouse

1

Eligible

• • • • • • •

Domestic Partner

A domestic partnership is eligible if it is:

• Registered with the state of California or

• A valid union, other than a marriage, entered into in another jurisdiction and recognized

in California as substantially equivalent to a California registered domestic partnership or

• Unregistered, but meets all of the following criteria:

– Parties must be each other’s sole domestic partner in a long-term, committed

relationship and must intend to remain so indenitely

– Neither party may be legally married or be a partner in another domestic partnership

– Parties must not be related to each other by blood to a degree that would prohibit legal

marriage in the State of California

– Both parties must be at least 18 years old and capable of consenting to the relationship

– Both parties must be nancially interdependent

– Parties must share a common residence

Eligible

• • • • • • •

Biological or adopted child, stepchild, domestic partner’s child

2

To age 26

• • • • • • •

Grandchild, step-grandchild, domestic partner’s grandchild

2

• Unmarried

• Living with you

• Supported by you or your spouse/domestic partner (50% or more)

• Claimed as a tax dependent by you or your spouse/domestic partner

To age 26

• • • • • • •

Legal ward

• Unmarried

• Living with you

• Supported by you or your spouse/domestic partner (50% or more)

• Claimed as your tax dependent

• Court-ordered guardianship required

To age 18

• • • • • • •

1

A legally separated or divorced spouse is not eligible for UC-sponsored coverage.

2

Domestic partner must be eligible for UC-sponsored health coverage.

Chapter Title

14

ELIGIBLE FAMILY MEMBERS

Eligibility

May enroll in

Medical

Dental

Vision

Accident, Critical Illness

and Hospital Indemnity

Dependent Life

AD&D

Legal

Overage disabled child (except a legal ward) of employee

• Unmarried

• Incapable of self-support due to a mental or physical disability incurred prior to age 26

• Enrolled in a UC group medical plan before age 26 and coverage is continuous; if eligible

for enrollment in a UC plan after age 26 (during your PIE, qualifying life event or Open

Enrollment, or if you newly acquire a disabled child over age 26), the child must have had

continuous coverage since age 26

• Chiey dependent upon you, your spouse or eligible domestic partner for support (50%

or more)

• Claimed as your, your spouse’s or your eligible domestic partner’s dependent for income

tax purposes or eligible for Social Security income or Supplemental Security Income as a

disabled person. The overage disabled child may be working in supported employment

that may oset the Social Security or Supplemental Security Income

• Must be approved by the carrier before age 26 or by the carrier upon initial enrollment

Age 26

or older

• • • • • • •

Benets Overview

Benets Overview

Chapter Title

15

16

Enrollment

Enrollment

To be certain you get the benets coverage you want, you should

enroll yourself and your eligible family members when you rst

become eligible.

For step‑by‑step instructions on how to enroll, see Your

Benets at a Glance, which you received in your Welcome Kit.

WHEN TO ENROLL

DURING A PERIOD OF INITIAL ELIGIBILITY (PIE)

A PIE is a time during which you may enroll yourself and/or your

eligible family members in UC-sponsored health and welfare

plans. A PIE generally starts on the rst day of eligibility — for

example, the day you are hired into a position that makes you

eligible for benets. It ends 31 days later.

You should enroll online and complete the transaction by the

last day of the applicable PIE. Paper enrollment forms are

available and need to be received at the location noted on the

form by the last day of the applicable PIE. (If the last day falls

on a weekend or holiday, the PIE is extended to the following

work day.)

You may enroll your eligible family members during the 31-day

PIE that begins on the rst day the family member meets all

eligibility requirements. If your enrollment is completed during

your PIE, coverage is eective the date the PIE began.

The PIE to enroll newly eligible family members starts the day

your family member becomes eligible:

• For a spouse, on the date of marriage.

• For a domestic partner, on the date the domestic partnership

is registered or the date that you verify that the partnership

meets UC’s criteria (see page 13).

• For a newborn child, on the child’s date of birth

• For an adopted child, the earlier of:

– the date the child is placed for adoption with you, or

– the date you or your spouse/domestic partner has the legal

right to control the child’s health care.

A child is “placed for adoption” as of the date you assume and

retain a legal obligation for the child’s total or partial support

in anticipation of the child’s adoption.

If the child is not enrolled during the PIE beginning on that

date, there is an additional PIE beginning on the date the

adoption becomes nal.

• For a legal ward, the eective date of the legal guardianship.

Where there is more than one eligibility requirement, the PIE

begins on the date all requirements are satised.

During this family member PIE, some plans allow you to also

enroll yourself and/or any other eligible family member who was

not already enrolled during an earlier PIE. See the plan-specic

sections at the back of this booklet. Remember that family

members are only eligible for coverage in medical, dental, vision,

accident, critical illness and hospital indemnity, legal, AD&D and

dependent life coverage and must be enrolled in the same plans

in which you are enrolled.

OTHER ENROLLMENT OPPORTUNITIES

If you don’t enroll in benets during your initial 31-day period

of eligibility, you may be able to enroll yourself and your family

members in some plans at other times, including:

OPEN ENROLLMENT

Usually held in the fall, Open Enrollment is your annual

opportunity to make changes to your benets, including:

• Transferring to a dierent medical or dental plan

• Adding or disenrolling eligible family members

• Enrolling in or opting out of UC-sponsored medical, dental,

vision, accident, critical illness, hospital indemnity and legal

plans

• Enrolling or re-enrolling in the Health and Dependent Care

Flexible Spending Accounts

Changes made during Open Enrollment are eective Jan. 1 of

the following year. Not all plans are available during every Open

Enrollment.

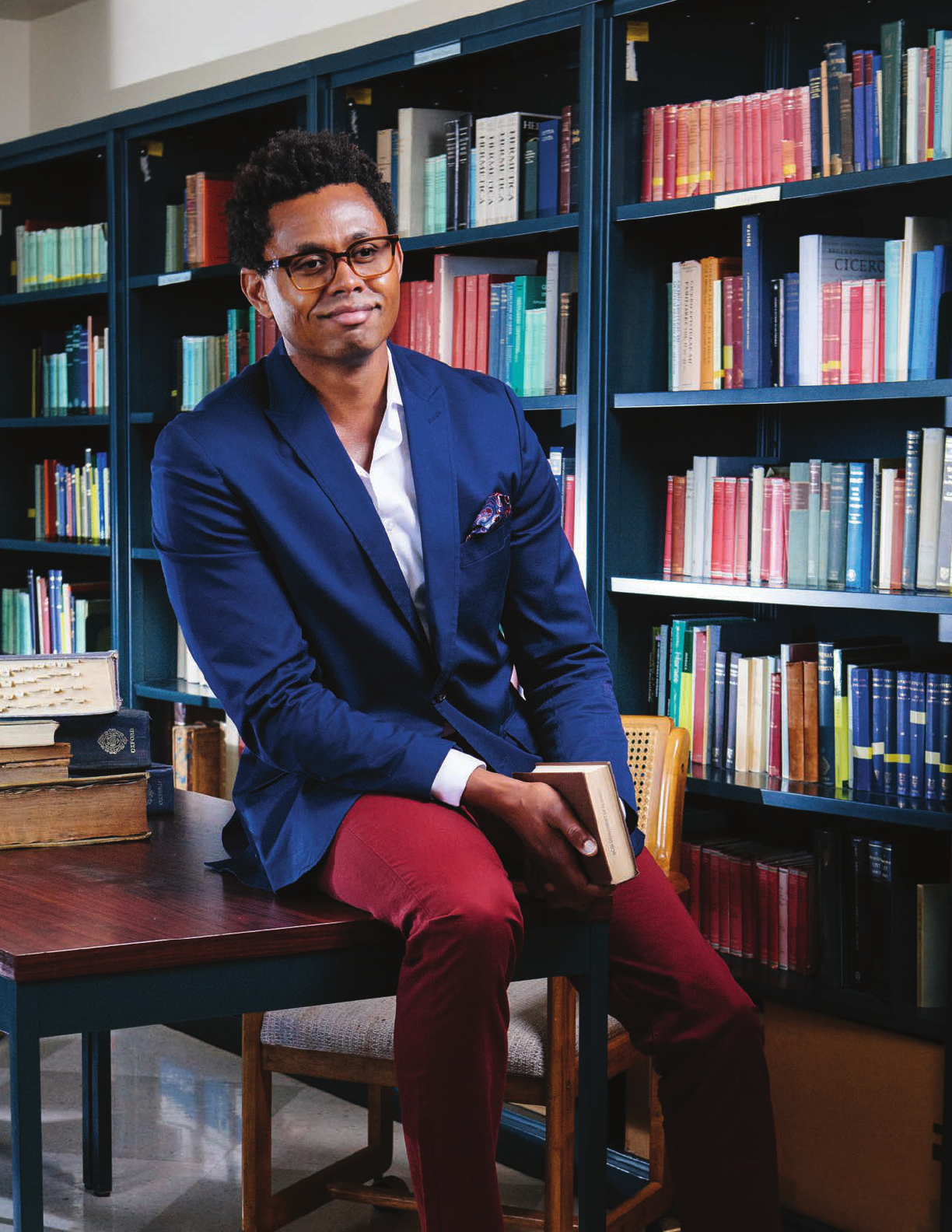

Meet ALEX!

Choosing benets doesn’t have to be complicated. ALEX is a

condential online tool that helps you select the best benets

for you and your family.

Tell ALEX a little about yourself and get personalized guidance

for making the most of your UC benets.

start.myalex.com/uc

17

Enrollment

WHEN YOU HAVE A FAMILY CHANGE

When you have a new family member, such as a spouse, domestic

partner, newborn or newly adopted child, you may enroll yourself,

the new family member and any other eligible family members not

already enrolled in your UC-sponsored health plans. Other plans

have dierent rules; see the plan-specic sections in this guide

for details.

If you are enrolled in a UC-sponsored medical plan, you may

transfer to a dierent plan. (This change to a new medical plan

will go into eect the rst day of the following month.) You

may also enroll in or increase your Legal insurance, Accident,

Critical Illness and Hospital Indemnity insurance, Supplemental

Life insurance and Dependent Life insurance during this

eligibility period (however, restrictions apply to Dependent Life

insurance). There is no opportunity to enroll in Voluntary

Short-Term or Voluntary Long-Term Disability insurance.

You have 31 days from the date your new family member becomes

eligible to enroll the new member or to make any permitted plan

changes (for example, 31 days from the day you marry or your

child is born). You must enroll family members in your UCPath

account; enrollment is not automatic.

You will be required to complete the Family Member Eligibility

Verication process after enrolling the new family member. If

you do not respond by the given deadline, your new family

member may be disenrolled from the plans.

WHEN YOU LOSE OTHER COVERAGE

If you decline UC-sponsored coverage because you and/or your

family members are covered elsewhere, and you later lose the

other coverage, you may be eligible to enroll yourself and/or

your eligible family members in a UC-sponsored plan. The same

is true if you are enrolled in another employer-sponsored plan

and the employer stops contributing to the cost of the coverage.

For medical, dental and vision coverage, you may enroll without

waiting for the University’s next open enrollment period if you

have met all of the following requirements:

• You were covered under another health plan as an individual

or dependent, including coverage under COBRA or CalCOBRA

(or similar program in another state), the Children’s Health

Insurance Program or “CHIP” (called the Healthy Families

Program in California), or Medicaid (called Medi-Cal in

California).

• Coverage under another health plan for you and/or your

eligible family members ended because you/they lost

eligibility under the other plan or employer contributions

toward coverage under the other plan terminated, coverage

under COBRA or CalCOBRA continuation was exhausted, or

coverage under CHIP or Medicaid was lost because you/they

were no longer eligible for those programs.

• You properly le an enrollment form with the University

during the 31-day PIE which starts on the day after the other

coverage ends. Note that if you lose coverage under CHIP or

Medicaid, your PIE is 60 days. You may need to provide proof

of loss of coverage.

OTHER SPECIAL CIRCUMSTANCES

For medical, dental and vision coverage, you may enroll without

waiting for the University’s next open enrollment period if you

are otherwise eligible under any one of the circumstances below:

• You or your eligible family members are not currently enrolled

in UC-sponsored medical, dental or vision coverage and you

or your eligible family members become eligible for premium

assistance under the Medi‑Cal Health Insurance Premium

Payment (HIPP) Program or a Medicaid or CHIP premium

assistance program in another state. Your PIE is 60 days from

the date you are determined eligible for premium assistance.

If the last day of the PIE falls on a weekend or holiday, the PIE

is extended to the following work day if you are enrolling with

paper forms.

• A court has ordered the University of California to provide

coverage for a dependent child under your UC-sponsored

medical, dental or vision plan pursuant to applicable law. The

child must meet UC eligibility requirements.

IF YOU ARE A NEW FACULTY MEMBER

Newly appointed faculty members who don’t enroll within 31 days

of their start date have a second period of eligibility that begins

on the rst day of classes for the semester or quarter in which the

appointment starts or the rst day the faculty member arrives at

the campus, whichever comes rst.

Appeals

Any appeals regarding coverage denials that relate to

eligibility or enrollment requirements are subject to the

University of California Group Insurance Regulations. To

obtain a copy of the Eligibility Claims Appeal Process, please

contact the person who handles benets for your location or

visit UCnet.

Chapter Title

18

Chapter Title

19

Medical Plans

Benets packages: Full, Mid‑Level, Core

Who’s covered: You and your eligible family members

Who pays the premium: You and UC, for most plans

Medical coverage is one of the most important benets that

UC oers you and your eligible family members, and UC makes

medical coverage as accessible and aordable as possible.

UC oers a range of high-quality medical plans with

comprehensive coverage so you can choose the coverage that

best meets your needs.

You should carefully evaluate your family circumstances and plan

costs before selecting medical plan coverage. If you need more

information about a specic medical plan, you’ll nd telephone

numbers and links to all the plans’ websites on the inside cover of

this guide.

In addition to the general eligibility rules beginning on page 5

and plan eligibility rules found in each plan’s evidence of

coverage booklet, the following rules and information apply to

UC medical plans.

ELIGIBILITY

The medical plans you’re eligible for are based on whether your

overall benets package is Full, Mid-Level or Core.

If you are eligible for coverage, you must take action to enroll.

You may enroll in certain medical plans only if you meet the

plan’s geographic service area criteria.

If you or a covered family member is enrolled in Medicare,

you are not eligible for the UC Health Savings Plan due to IRS

rules that do not allow Medicare members to make or receive

contributions to a Health Savings Account.

WITH A 90-DAY WAITING PERIOD

If you miss your initial enrollment period, you may enroll yourself

and/or your family members in medical coverage at any time by

submitting an enrollment form to your Benets Oce. Your

medical coverage will become eective 90 calendar days from

the date your form is received. Your premiums will be paid on an

after-tax basis until the following Jan. 1.

IF YOU MOVE OUT OF A PLAN’S SERVICE AREA

If you move out of a plan service area, or will be away for more

than two months, you and your eligible family members must

transfer into a dierent plan available in your new location. If

you later return to your original location, you will have a Period

of Initial Eligibility during which you can re-enroll in your original

plan if you choose.

TRANSITIONING TO MEDICARE

If you continue working at UC past age 65 and you have a UC-

sponsored employee medical plan, you are not required to sign

up for Medicare Parts A, B or D. Any family member covered by

your employee plan, with the exception of your domestic partner

in some cases, who becomes eligible for Medicare may also defer

signing up for Medicare.

If you and/or any covered family members lose eligibility for

the UC-sponsored employee plan, you and/or your Medicare-

eligible family members should immediately enroll in Medicare or

another employer group health plan to avoid any penalties from

the Centers for Medicare and Medicaid Services (CMS).

If you plan to retire in 2024 and take a monthly retirement

benet, are eligible for retiree health insurance and expect to

enroll in Medicare during the year, think carefully about the UC

medical plan you choose. The choice you make will aect which

Medicare plan you’re transferred into when you turn 65. See

ucal.us/medicare for more information.

WHAT THE PLANS COVER

UC’s medical plans provide comprehensive coverage, including

doctor visits, hospital services, prescription drugs and behavioral

health services. Preventive care such as physical exams and

immunizations are free of charge in all plans; some restrictions,

such as using in-network providers, may apply.

There are no exclusions for pre-existing conditions.

An overview of the plans UC oers is on pages 20 to 22. The

chart on page 23 provides a comparison of the plans. Only UC

Health Savings Plan is compatible with a health savings account

(HSA). Other UC medical plans can be paired with UC’s Health

Flexible Spending Account (FSA). See page 47 to learn more.

COST OF COVERAGE

Your medical plan’s monthly cost depends on:

• The plan you choose

• Whether you choose to cover yourself only or yourself and

other family members and

• Your annual full-time equivalent salary from UC

Premium costs are available online at ucal.us/medicalpremiums

and in Which Medical Plan is Right for You? included in your

Welcome Kit.If you enroll in a medical plan that requires you to

pay a premium, your premium is deducted from your paycheck

each month before taxes are calculated.

Medical Plans

Chapter Title

20

Medical Plans

Please note: Premium rates for certain employee groups may

vary from those posted or printed. If you are represented by a

union, your premiums are subject to collective bargaining. To

conrm your premiums, sign in to your online benets account

or talk to your Benets Oce.

HEALTH MAINTENANCE ORGANIZATIONS (HMO)

HMOs require you to choose a primary care physician (PCP) from

their network of providers to coordinate your care. To see a

specialist, you must have a referral from your PCP. The HMO

covers your expenses only if your PCP has authorized the services,

unless it’s an emergency. You pay a copayment for some products

and services, and there is no annual deductible.

You must live (or work, depending on the plan’s rules) in the

plan’s service area to be eligible. Service areas are established

by ZIP codes; you cannot use a P.O. box to establish eligibility.

If you want to know whether your ZIP code is in a plan’s service

area, check the plan’s website or call the plan directly.

UC’s HMOs are available only if you and your covered family

members live and work in certain counties in California.

Health Net is the administrator of medical, behavioral health

and pharmacy benets for UC Blue & Gold HMO. Kaiser

Permanente — CA is the administrator of medical, behavioral

health and pharmacy benets for Kaiser HMO. The

administrator of your plan processes claims, creates a network of

health care providers and pharmacies and sets clinical policies

and guidelines.

UC’S HMO PLANS

UC Blue & Gold HMO Oers a tailored network of medical groups, doctors and hospitals, and includes all of UC’s medical centers

and medical groups. For more information, see healthnet.com/uc.

Kaiser HMO Oers a closed network, meaning you must use only Kaiser doctors and hospitals. For more information, see

select.kp.org/university-of-california.

Medical Plans

PREFERRED PROVIDER ORGANIZATIONS (PPO)

PPOs oer a broad network of providers and allow you the

exibility to see non-network providers if you wish. You don’t

need a referral to see specialists. Usually, you must meet the

plan’s deductible and then you pay coinsurance, which is a

percentage of the cost of services. You pay a smaller percentage

for in-network providers.

Anthem Blue Cross is the administrator of medical and

behavioral health benets for UC’s PPO plans, and Navitus

Health Solutions (Navitus) is the administrator of prescription

drug benets.

Contact Accolade Health Care Advocate for all member services,

including benets and coverage questions.

UC’s PPOs are the best option if you or your covered family

members live outside California.

UC’S PPO PLANS

UC Health Savings Plan with

Health Savings Account

This is the only UC medical plan paired with a Health Savings Account (HSA), which you can use to pay your

eligible medical expenses. UC contributes to the HSA every year you are enrolled in the plan, and you can,

too — federal tax-free. You pay the cost of medical services until you meet the deductible, then you pay a

percentage of the cost of services, with lower costs when you use in-network providers. Your unused HSA

funds roll over each year (funds are not use-it-or-lose-it). And, any funds you or UC contributes to your HSA

are yours to keep, even if you leave UC. You can continue to contribute to your HSA as long as you are

enrolled in a qualifying high deductible health plan. For more information, see uchealthplans.com and

learn.healthequity.com/uc/hsa

UC Care

This is a PPO plan with three tiers of doctors and hospitals. If you use providers in the UC Select Network,

which includes UC medical center doctors, hospitals and other facilities as well as select providers near UC

locations without a medical center, you pay copayments for services. If you use other providers in the

Anthem Preferred network, you pay 30 percent coinsurance once you’ve met the deductible. You pay a

higher deductible and a greater percent of the coinsurance if you use a provider outside the network. For

more information, see uchealthplans.com

CORE This plan has no monthly employee premium, but has a higher deductible. You can choose any doctor, hospital,

clinic or behavioral health provider, but you pay less if you use a provider in the Anthem Blue Cross PPO

network. After you have met the plan’s annual deductible, the plan pays for part of the cost of services. If you

use non-network providers, you may need to pay for services up front and submit a claim; you receive

reimbursement if the plan covers the service. For more information, see uchealthplans.com

Chapter Title

21

ABOUT THE UC HEALTH SAVINGS PLAN (HSP) WITH

HEALTH SAVINGS ACCOUNT (HSA)

The Health Savings Account (HSA), which is part of the UC

Health Savings Plan (HSP), lets you pay for your out-of-pocket

health care expenses with pretax contributions from you and

federal tax-free contributions from UC.

With the HSA, administered by HealthEquity, you can use the

funds at any time for qualied medical expenses or save them for

future health care needs. Your HSA account balance rolls over

annually; you keep the balance in the account, even if you don’t

use it or leave UC. You can use your HSA funds for qualifying

medical expenses without paying any federal taxes — whether you

pay with your HSA debit card or you pay out-of-pocket and le a

claim directly with HealthEquity to get reimbursed. You earn

interest on your account, and can invest any funds in excess of

$1,000 — the same way you invest funds in retirement savings

accounts, except interest accrues federal tax-free. Contributions

and earnings are subject to California income tax.

For 2023, the IRS allows HSA contributions up to $3,850 for

single/individual coverage and up to $7,750 for family coverage

(if you are covering at least one family member), inclusive of UC

contributions. UC contributes up to $500 for individual coverage

and up to $1,000 for all other coverage levels, depending on the

eective date of your HSP coverage. You can also contribute with

pretax payroll deductions, subject to payroll deadlines. You are

responsible for making sure the combined HSA contributions are

within the IRS limits. Individuals age 55 and older can make an

additional “catch-up” contribution of $1,000. You can make the

additional contribution through your UCPath account. If you

enroll in the UC Health Savings Plan anytime after January,

UC’s contribution to your HSA will be prorated for the

calendar year. The proration schedule is available online

(ucnet.universityofcalifornia.edu/compensation-and-benets/

health‑plans/medical/hsa‑proration‑schedule.html).

Because of IRS rules, you must enroll in the UC Health Savings

Plan and have a valid Social Security number and U.S. address to

be eligible for and establish your HSA. In addition, you and your

covered family members cannot enroll in UC’s or in any

general-purpose Health Flexible Spending Account.

If you or your dependent(s) are enrolled in Medicare, covered under

TRICARE, or receiving Social Security Disability Insurance (SSDI),

you cannot enroll in this plan, according to the IRS. Due to the UC

contribution to your HSA, if you cover a family member and the

family member is enrolled in Medicare, you cannot enroll in this

plan unless you disenroll your Medicare-enrolled family member

from your coverage. Remember that the entire UC contribution is

deposited automatically at the beginning of the year and is based

on your coverage level (individual or family).

Here are a few things to keep in mind if you become an HSP

member. As an HSA owner, you must decide:

• Whether you are eligible to make contributions to an HSA

• The amount of the eligible contribution to the HSA for any

calendar year

• The withdrawal of any excess contributions

• How funds in your HSA will be spent

You cannot delegate these responsibilities to the University

or to HealthEquity. As the HSA owner, you are responsible for

reporting all contributions and distributions to the IRS on your

Form 1040.

BEHAVIORAL HEALTH AND SUBSTANCE ABUSE BENEFITS

Kaiser members have access to Kaiser’s integrated behavioral

health services as well as Optum Behavioral Health in‑network

services. Kaiser and Optum do not coordinate care or costs of

behavioral health services. Each plan has specic requirements.

Kaiser members should understand plan and authorization

guidelines when they consider their options for behavioral

health services.

UC Blue & Gold HMO members have behavioral health and

substance abuse coverage provided by Managed Health

Network (MHN, a Health Net company).

The rst three in-network outpatient mental health oce visits

are covered at no cost to you for UC Blue & Gold and Kaiser

members.

Behavioral health and substance abuse coverage is provided by

Anthem Blue Cross for employees and retirees enrolled in:

• CORE

• UC Care

• UC Health Savings Plan (HSP)

The rst three in-network mental health oce visits are covered at

no cost to you for UC Care.

If you enroll in CORE, UC Health Savings Plan or UC Care, you

have access to both in-network and out-of-network behavioral

health services. All other plans have in-network benets only.

UC LIVING WELL PROGRAM

UC is committed to the well-being of employees and their

family members and supports healthy living through the

systemwide UC Living Well program.

UC Living Well oers faculty, sta and retirees access to programs,

activities and resources that support healthy lifestyles.

Medical Plans

Chapter Title

22

Medical Plans

UC Living Well includes:

• Campus and health system wellness activities

• Programs and support from UC’s benets providers

• Preventive exams and screenings through UC’s health plans

• Disease management programs oered by UC’s medical plans

to help manage chronic conditions such as diabetes and heart

disease

Participation in on‑site campus and health system wellness

programs varies by location; contact your location’s wellness

coordinator for details.

For more information, visit the UC Living Well website

(uclivingwell.ucop.edu).

GENERAL INFORMATION

CHOOSING A PRIMARY CARE PHYSICIAN (PCP)

UC’s HMO plans require you to select a primary care physician

(PCP). You may choose a dierent PCP for each family member or

the same PCP for the entire family. You may choose a pediatrician

as the PCP for your child(ren). If you use your work address to

qualify for a plan, you must pick PCPs in the service area of your

work address.

If you or your eligible family members do not select a PCP, your

medical plan will assign one to you. You may change your PCP at

any time by calling the plan directly.

If you want to receive care from a particular doctor, you should

call the plan or check the plan’s online doctor directory to conrm

that the doctor is in their network and accepting new patients.

ID CARDS

Once you enroll, the medical plan will send identication cards for

you and your enrolled family members. Although you’re covered

as soon as you enroll, it may take 30 to 60 days for the plan to

have a record of your membership and send your ID card(s). If you

need immediate services before you receive your card, rst check

with your plan to see if it has a record of your enrollment; if not,

contact UCPath. You may also be able to download and print a

temporary card from your carrier’s website.

WHEN COVERAGE ENDS

Please note that if you lose eligibility for medical coverage while you

are hospitalized or undergoing treatment for a medical condition

covered by your medical plan, benets will cease and you may have

to pay for the cost of those services yourself. If you or a family

member loses eligibility for medical coverage, you can, however,

continue coverage under COBRA (Consolidated Omnibus Budget

Reconciliation Act of 1985) for a period of time. If you are laid o,

you may transfer to UC’s lowest cost medical plan through COBRA.

You may be able to convert your coverage to an individual policy

if you apply within 31 days of the date your UC-sponsored

coverage or COBRA continuation coverage ends. Conversion

options are generally more expensive and may provide fewer

benets than UC-sponsored plans. See your medical plan

booklet or call your plan for more information. You may also

seek individual coverage, including through the health care

marketplace (coveredca.com).

FOR MORE INFORMATION

Evidence of Coverage booklets for all of UC’s medical plans are

available online at ucal.us/EOCs or from the carriers (see front

of booklet for contact information).

If you have other questions about your medical benets, including

services, benets, billing and claims, call the medical plan directly.

Medical Plans

TIPS:

If you want access to UC medical centers and doctors:

• UC Health Savings Plan

• UC Blue & Gold HMO (if you are within service area)

• UC Care

• CORE

If you want lower monthly premiums:

• CORE

• Kaiser HMO

• UC Blue & Gold HMO

If you want more exibility in choosing doctors:

• UC Health Savings Plan with HSA

• UC Care

• CORE

If you want predictable costs:

• UC Blue & Gold HMO

• Kaiser HMO

If you reside or have a child in college outside California:

• UC Health Savings Plan

• UC Care

• CORE

If you want one doctor to manage all your care:

• UC Blue & Gold HMO

• Kaiser HMO

Chapter Title

23

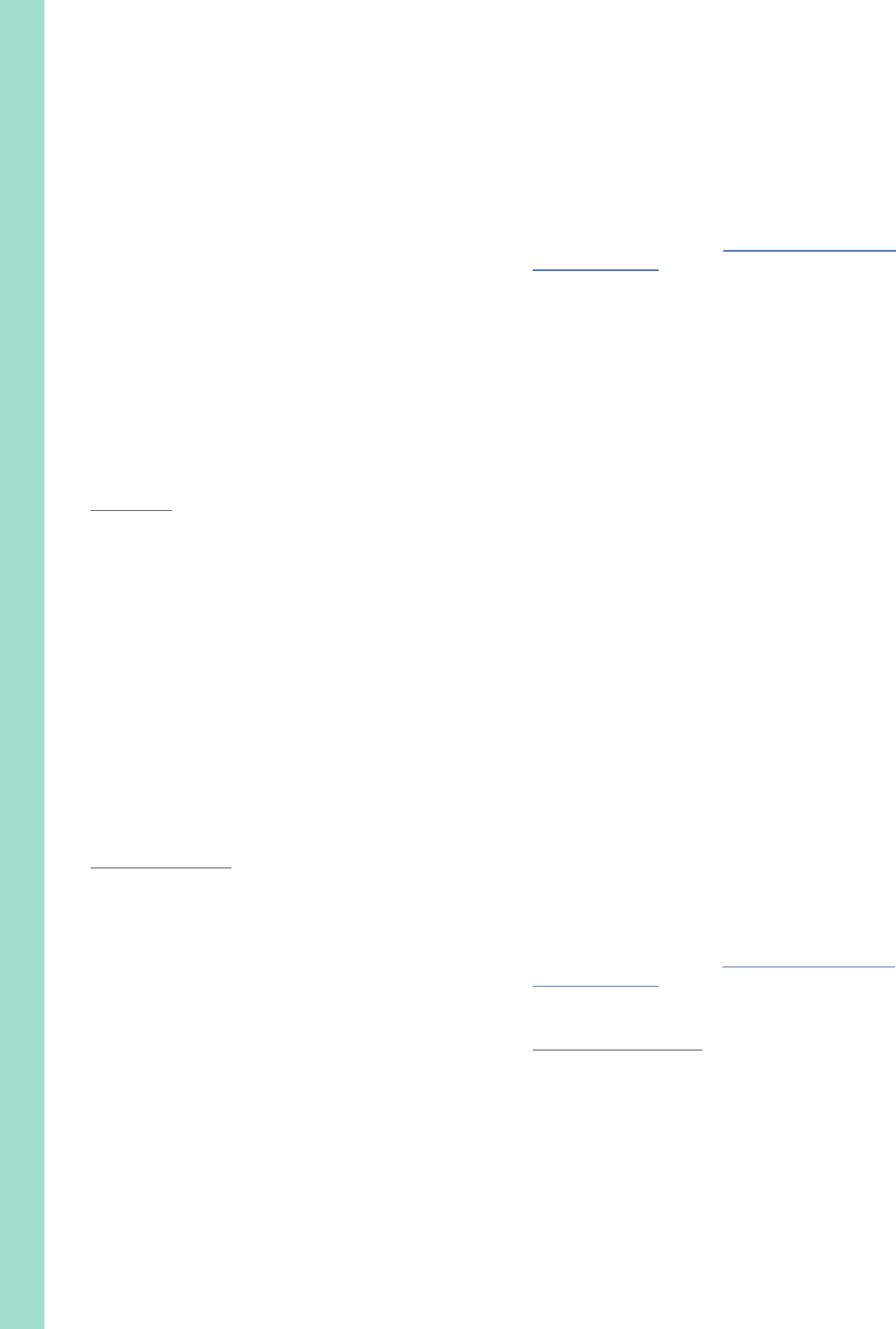

UC MEDICAL PLANS Your Costs for Services

Your Cost for

Prescription Drugs:

Generic/Brand/

Non-formulary Best Fit for People Who:

CORE

You may use any doctor, but you’ll

pay less if you use a network

provider.

$$$+

Except for certain

preventive services, you

pay the full cost until you

reach the $3,000 individual

deductible. Then you pay

20%.

20% • Want to pay no monthly premium

• Want protection for catastrophic care

• Are willing to risk incurring high out-of-pocket costs

• Want direct access to many providers without need

for referrals (includes UC Health providers)

UC Blue & Gold HMO

Must use custom network

of providers, except in

emergencies

$

No deductible; you pay a

copay for oce visits and

hospital stays; most other

services have no charge.

Retail (30‑day supply)

$5/$25/$40

Mail order (up to 90 days)

$10/$50/$80

• Want low, predictable out-of-pocket costs at time

of service

• Are comfortable with HMO model: primary

care physician manages care; no out-of-network

coverage

• Are content with the selection of community

providers (includes UC Health providers)

Kaiser HMO

Must use network providers,

except in emergencies

$

No deductible; you pay a

copay for oce visits and

hospital stays; most other

services have no charge.

Retail (30‑day supply)

$5/$25/NA

Mail order (31–100 days)

$10/$50/NA

• Want low, predictable out-of-pocket costs at time

of service

• Appreciate the integrated care provided within the

Kaiser network

UC Care

May use most doctors without

referral from a primary care

physician; you pay copayment for

UC Select Network providers;

in‑network providers cost less

than out-of-network providers.

$/$$/$$$

UC Select Network

providers: no deductible,

and copay for oce visits

and hospital stays; Anthem

Preferred providers:

calendar year deductible

and then 30% coinsurance;

out-of-network: calendar

year deductible and then

50% coinsurance.

Retail (30‑day supply)

$5/ $25/ $40

Mail order (up to 90 days)

$10/$50/$80

• Want direct access to many providers without a

referral (includes UC Health providers)

• Want no deductible and xed copay for using

providers in the UC Select network

• Want coverage when you are traveling or living

abroad

• You and/or your family members live outside

California

UC Health Savings Plan

May use most doctors without

referral from primary care

physician; in-network providers

cost less. Health Savings

Account (HSA) covers part of

annual deductible before PPO

coinsurance applies.

$$

You have higher out-of-

pocket costs until the

deductible is met; you pay

coinsurance thereafter.

You may make pretax

contributions to the Health

Savings Account to help

pay your out-of-pocket

costs.

Full cost up to deductible;

then 20% at in-network

pharmacies; 40% at

non‑network pharmacies

• Want broad access to providers

• Are able to risk incurring greater out-of-pocket

costs

• Want tax-free savings for current and future health

care costs

• Want direct access to many providers without need

for referrals (includes UC Health providers)

$ Lowest costs in relation to all plans $$ Mid-range of costs in relation to all plans $$$ Highest costs in relation to all plans

Medical Plans

Chapter Title

24

Dental Plans

Benets packages: Full

Who’s covered: You and your eligible family members

Who pays the premium: UC

Proper dental care plays an important role in your overall health.

That’s why UC provides dental coverage for you and your family,

including routine preventive care and llings, oral surgery,

dentures, bridges and braces. You have a choice of two plans, a

PPO and an HMO.

The following rules and information about UC’s dental plans are

in addition to the general eligibility rules beginning on page 5.

ELIGIBILITY

You are eligible to enroll in dental coverage only if you have Full

Benets.

If you are eligible for dental benets, you must take action to

enroll.

You may enroll in DeltaCare

®

USA only if you meet the plan’s

geographic service area criteria.

IF YOU MOVE OUT OF A PLAN’S SERVICE AREA

If you move out of a DeltaCare

®

USA plan service area, you and

your eligible family members must transfer into a dierent plan

available in your new location. If you later return to your original

location, you will have a Period of Initial Eligibility to re-enroll in

the DeltaCare

®

USA plan if you choose.

UC’S DENTAL PLANS

DELTA DENTAL PPO

The Delta Dental PPO plan, available worldwide, provides you and

your family with the exibility to choose any licensed dentist or

specialist. Your share of the cost of services depends on whether

you use a dentist in Delta Dental’s PPO network or an out-of-

network dentist.

If you choose a PPO dentist from Delta Dental’s network, you

will usually pay less for services, so it makes sense to use a PPO

dentist. In-network PPO dentists agree to accept a reduced fee

for services, and the dentist will complete and submit all claim

forms for you at no charge. Preventive dentistry (exams and

cleanings) is free of charge. After a small deductible, basic

dentistry (such as llings and extractions) is covered at 80

percent, and most other dental care is covered at 50 percent,

up to $1,700 per year.

Delta has more than 43,000 PPO dentists in California and

270,000 nationwide. To see a list of Delta Dental PPO dentists,

visit the Delta Dental website: www1.deltadentalins.com/

group-sites/uc.html.

Delta’s Premier dentists are not in the PPO network but have

agreed to accept a reduced fee for services and also will complete

and submit claim forms for you. Delta Dental covers 75 percent

of basic dentistry costs if you use a Premier dentist, up to $1,500

per year.

If you go to a dentist not aliated with Delta Dental, the plan will

cover 75 percent of allowed basic dentistry costs, up to $1,500

per year. However, you may have to pay the dentist’s total fee and

then submit your claim form to Delta Dental for reimbursement.

Non-Delta Dental dentists have not agreed to Delta Dental’s

allowed costs and are free to bill you for any dierence between

what Delta Dental pays and the submitted fee.

DELTACARE

®

USA

DeltaCare

®

USA is a dental HMO that provides you and your

family with comprehensive benets and easy referrals to

specialists. You must live in California to enroll.