For Individuals

FARM LOANS

Application

Quick Guide

The USDA Farm Loan Programs are administered by the Farm Service

Agency (FSA), an agency of USDA. USDA is an equal opportunity provider,

employer, and lender. Updated June 2019

Use this guide to better

understand how to

prepare for your first visit

to a Service Center and

apply for a loan. In this

guide you will find:

How do you use this guide?

Information About the Loan Process ...............................................Page 2

Information on Partnering With A Loan Oicer ..........................Page 3

Direct Farm Loans Overview ................................................................Page 4

Eligibility Requirements ........................................................................Page 5

FSA Required Forms Checklist ..........................................................Page 6

Additional Documentation Checklist ...............................................Page 7

Resources if You Still Need Help ....................................................... Page 8

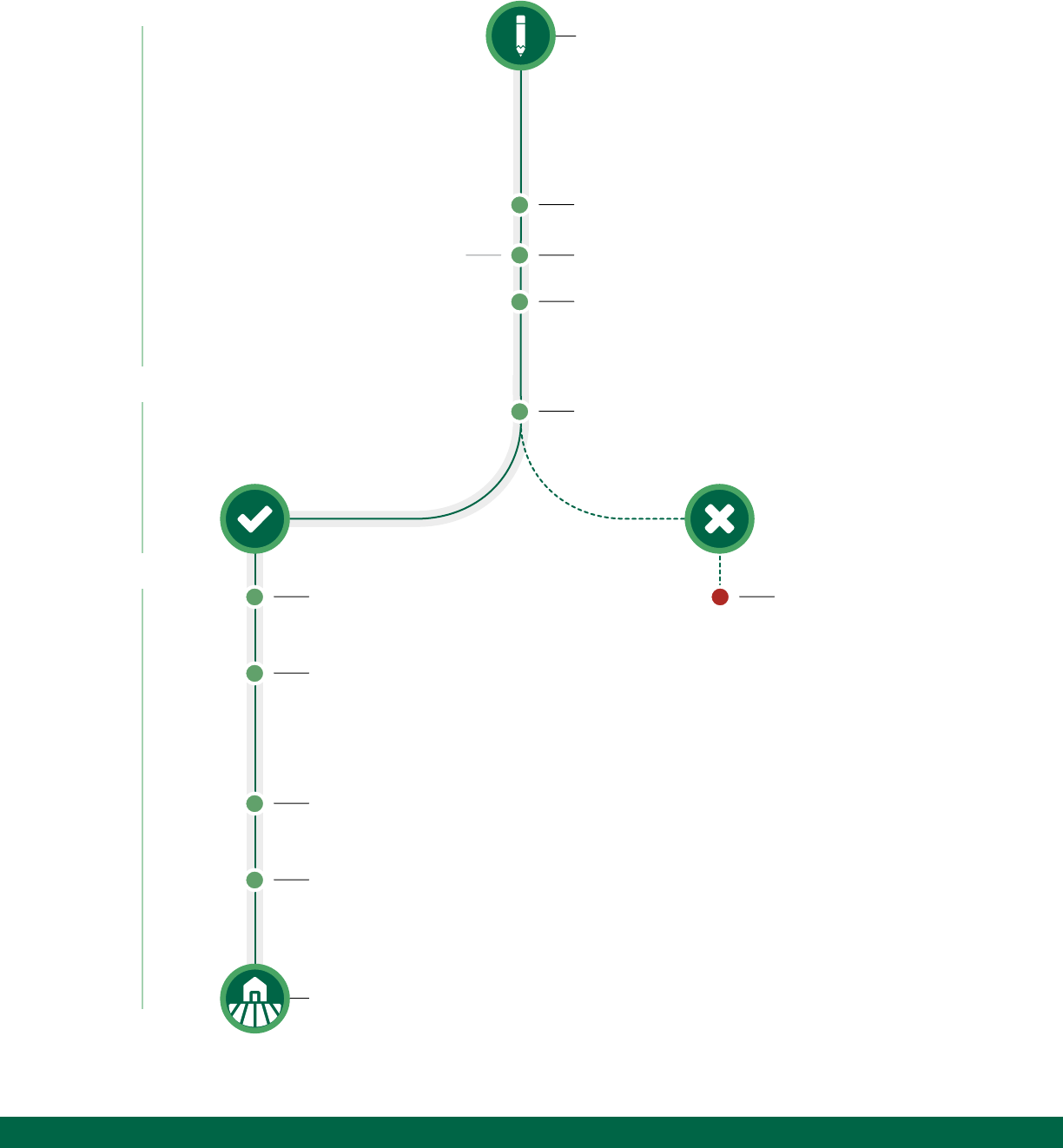

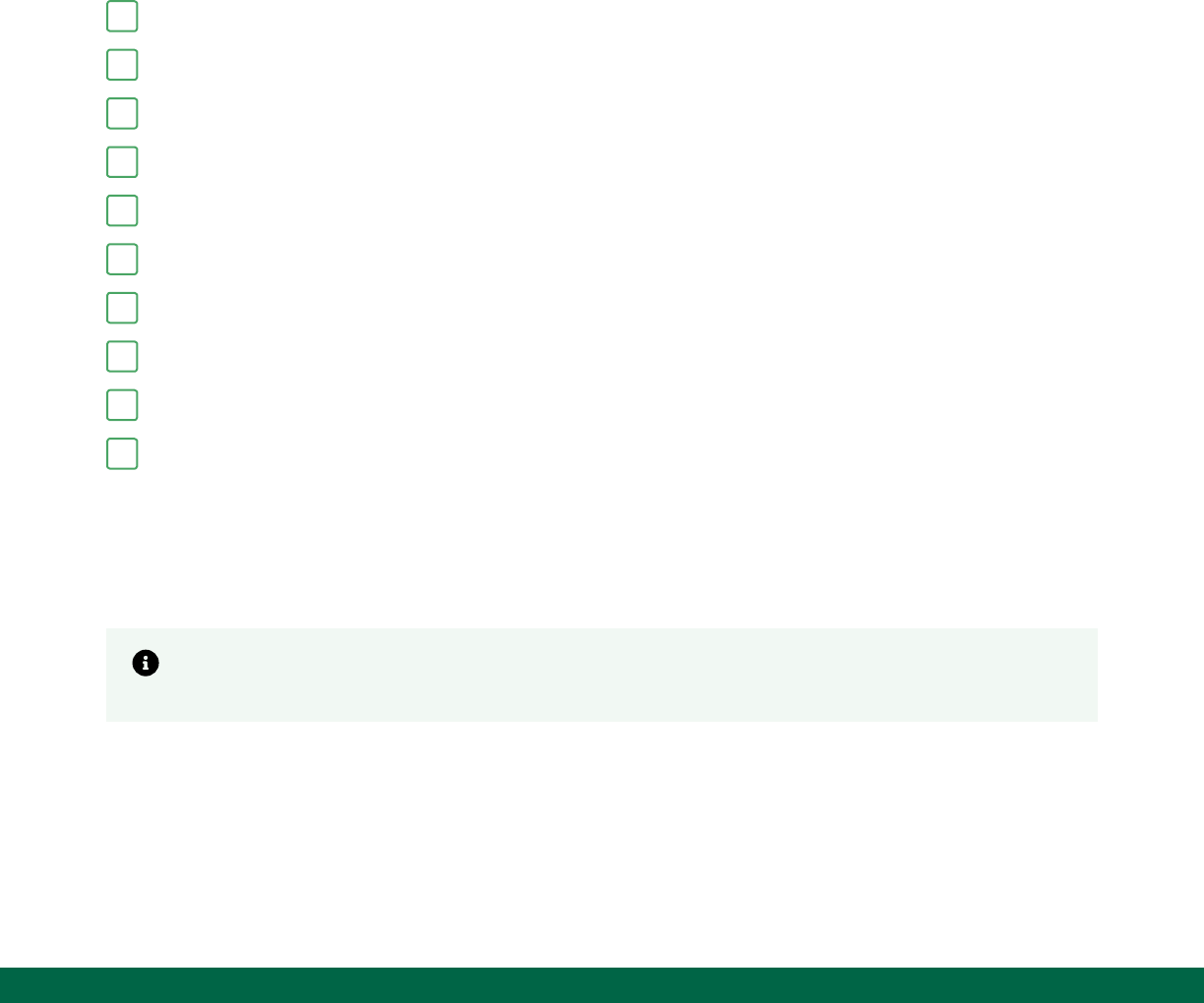

Loan Process

Here’s what to expect on your Farm Loan journey.

Work on Your Application

• Review loan eligibility requirements.

• Develop a farm business plan and farming goals.

• Determine which USDA Service Center to visit.

• Discuss the requirements with a Loan Oicer.

• Complete the required FSA forms.

• Gather required application documentation.

Finalize and Submit Your Application

Notification of Complete Application

Farm Visit

A Loan Oicer will visit you at your farm.

They may conduct an environmental

review and chattel appraisal (if applicable).

Receive Loan Decision Letter by Mail

Receive the Money

Funds will be disbursed by direct deposit or

through the closing agent.

Loan Servicing

Follow the terms of your loan agreement.

Make sure to account for all loan funds

(including providing receipts for items you buy).

Grow Your Operation!

Loan Denial

Discuss the loan decision

and further options with

a Loan Oicer.

Approval Decision Application

Approved Denied

Verify Adequate Security

The FSA will assess the value of your assets

and/or FSA may request an appraisal (if applicable).

Close Loan

Review all closing requirements and accept the

loan conditions presented in the approval letter.

Once an FSA representative or a closing agent

receives all your documents, they will schedule

your loan closing.

Notification of

Incomplete Application

If your application is incomplete, a Loan

Oicer will tell you what is missing.

Next, provide the missing information

to make the application complete.

Application Quick Guide | Individual 2

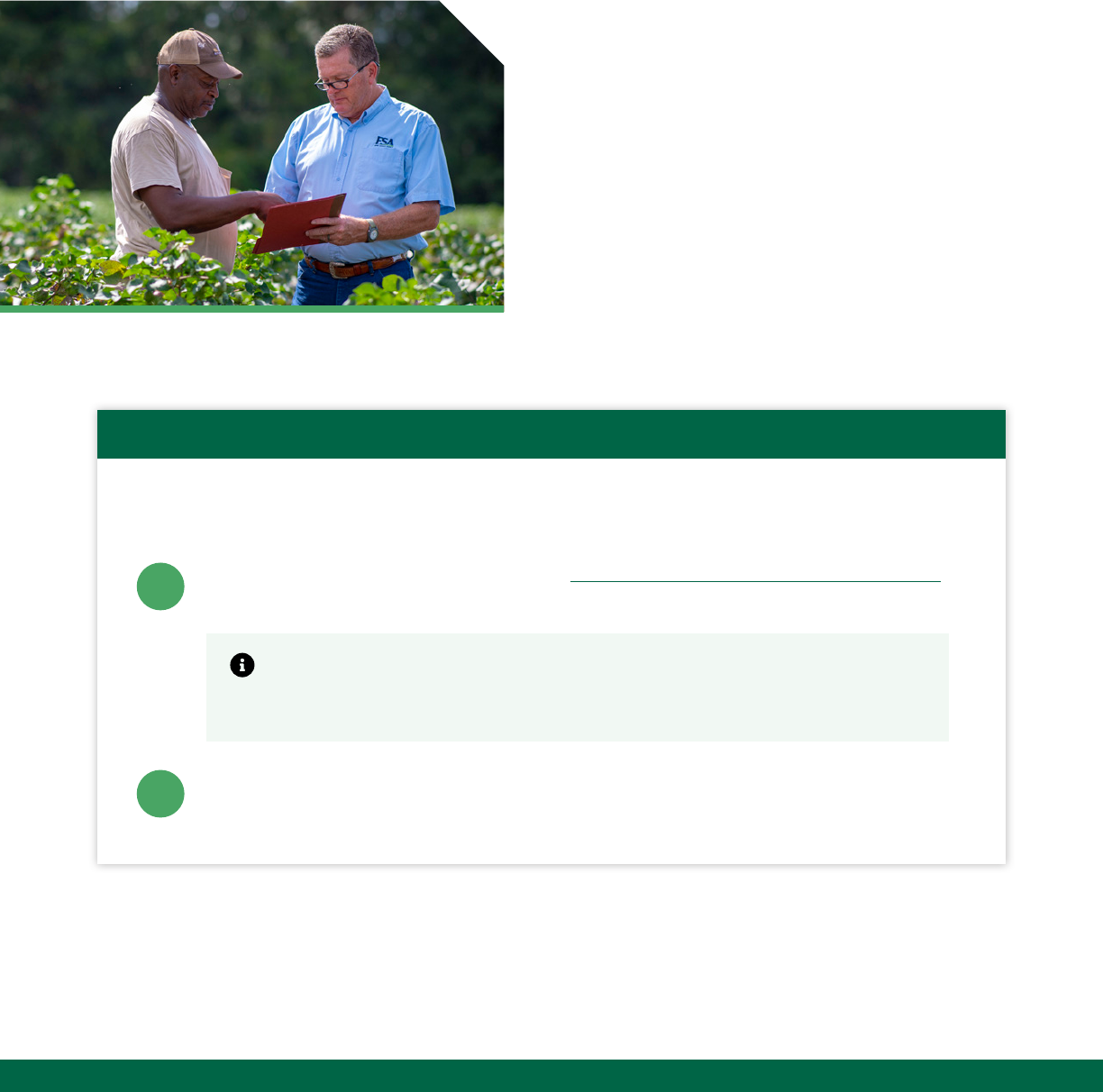

Partner With A Loan Oicer

Service Center employees are here to assist you throughout

your loan journey.

Loan Oicers will:

• Assist you during the entire loan process.

• Provide supervision throughout the life of

the loan.

• Give feedback and suggestions on your

business operating plan.

• Work with you to develop opportunities

to build your business and move on to a

traditional form of credit.

• Work with you in person, via email, and

on the phone.

Are you ready to connect with a Loan Oicer?

Find your local Service Center online at: https://www.farmers.gov/service-locator

or contact an agriculture representative to find out where a Service Center is located.

Follow These Steps:

Call before visiting a Service Center. If the Service Center you call does

not have Farm Loan Programs employees, you will be directed to a Service

Center that does.

Call to schedule an appointment with a Loan Oicer at a Service Center. (Walk-ins

are welcome, but Loan Oicers may be unavailable at that time.)

1

2

Application Quick Guide | Individual 3

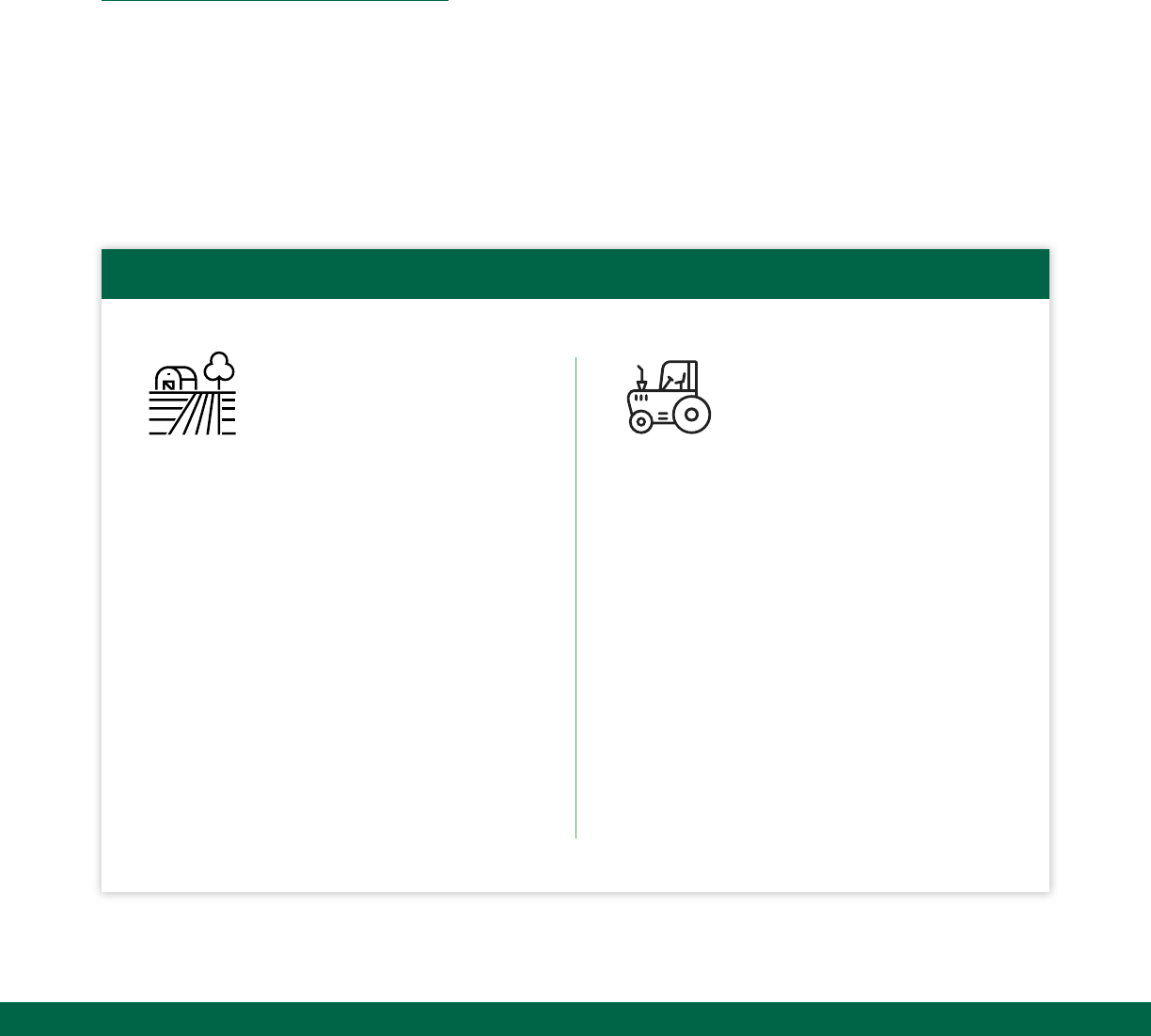

Direct Farm Loans

Farm Loan Programs oer access to funding for a wide range

of farmer and rancher needs, from purchasing land to buying

equipment and/or livestock.

All FSA Direct Farm Loans are funded and serviced by the FSA through local Loan Oicers.

The funding comes from congressional appropriations as part of the USDA budget. Interest

rates are calculated monthly and are posted on the 1st of each month; view them here:

https://www.fsa.usda.gov/farmloans.

Loan Limitations

Funds cannot be used to finance exotic birds, tropical fish, dogs, or horses used for racing, pleasure,

show, and boarding or any other enterprises not typically associated with human consumption, fiber

or draft use.

What is the dierence between Farm Ownership and Farm Operating Loans?

Operating Loans

Equipment, Feed,

Livestock, etc.

The maximum loan amount is $400,000.

Used to pay costs associated with

reorganizing a farm to improve

profitability; purchase livestock, including

poultry; purchase farm equipment; pay

farm operating expenses, make minor

improvements or repairs to buildings;

refinance certain farm-related debts,

excluding real estate; aid in land and

water development, use, or conservation;

and pay loan closing and borrower

training costs.

Ownership Loans

Land Purchase or

Construction Project

The maximum loan amount is $600,000.

Used to buy a farm; enlarge an existing

operation; make a down payment on a

farm; purchase easements; construct,

purchase or improve farm dwellings,

service buildings or other facilities

and improvements essential to the

farm operation; promote soil and water

conservation and protection; and pay

loan closing costs.

Generally, you need experience operating

a farm-related business.

Application Quick Guide | Individual 4

Eligibility Requirements

Here are general eligibility requirements you need to meet.

General eligibility requirements include:

• Not having federal or state conviction(s) for planting, cultivating, growing, producing,

harvesting, storing, traicking, or possession of controlled substances.

• The legal ability to accept responsibility for the loan obligation.

• An acceptable credit history.

• Be a United States citizen, non-citizen national or legal resident alien of the United States,

including Puerto Rico, the U.S. Virgin Islands, Guam, American Samoa, and certain former

Pacific Trust Territories.

• Being unable to obtain suicient credit elsewhere, with or without an FSA loan guarantee.

• No delinquency on a federal debt, other than IRS tax debt, at the time of loan closing.

• Not being ineligible due to disqualification resulting from a federal crop insurance violation.

• Have suicient managerial ability to assure a reasonable expectation of loan repayment.

Note: There may also be additional requirements that your Loan Oicer will discuss with you.

Application Quick Guide | Individual 5

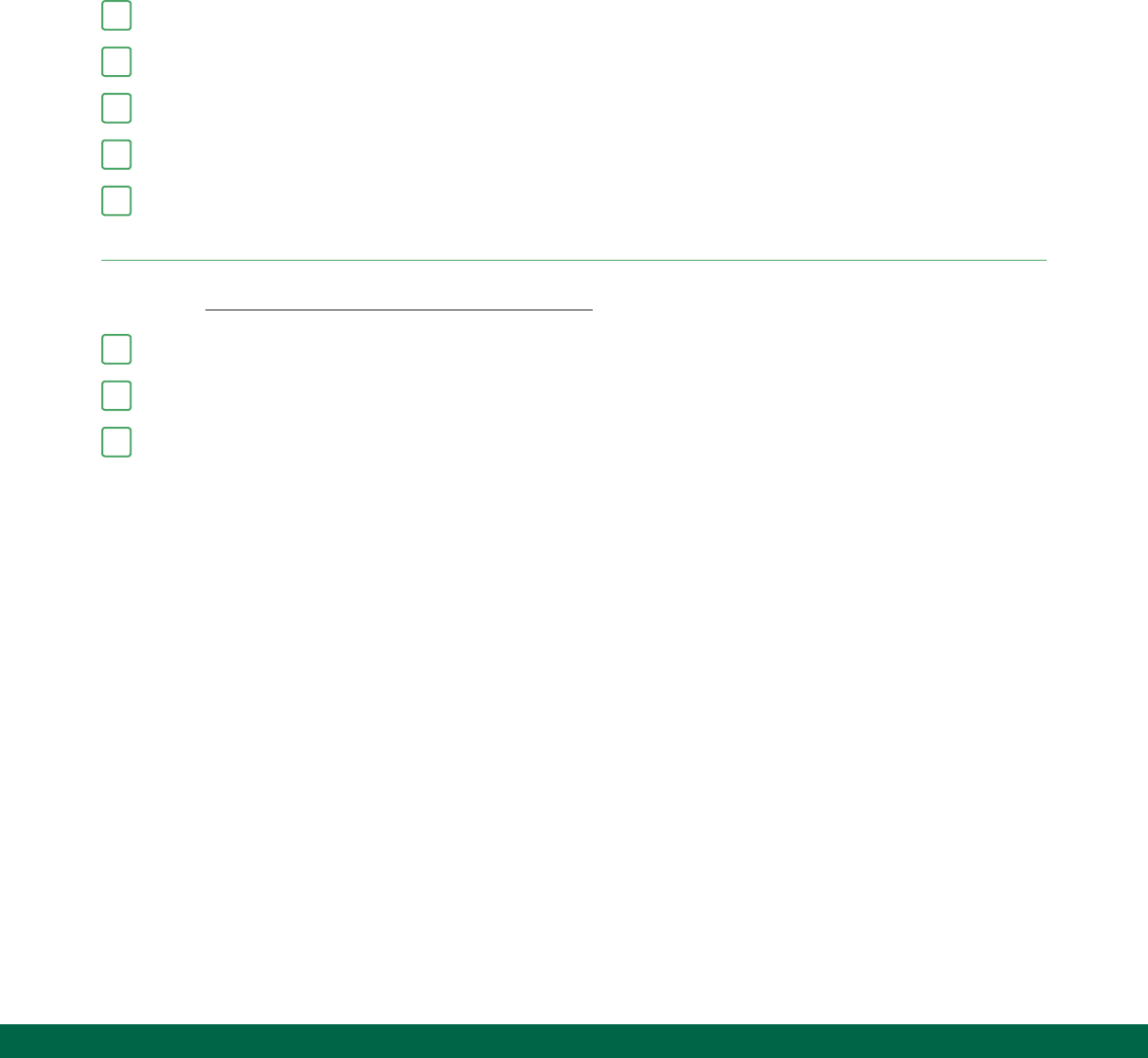

FSA Required Forms

These are the forms the FSA needs to complete your

loan application.

Check the boxes below as you fill out each form to ensure a complete application. You may need

other forms and may be able to replace some forms with comparable farm records. A Loan Oicer

can provide you with an application package with the comprehensive application requirements.

Note: A signature is required for every form.

Form Number and Name

FSA-2001: “Request for Direct Loan Assistance”

FSA-2002: “Three-Year Financial History”

FSA-2003: “Three-Year Production History”

FSA-2004: “Authorization to Release Information”

FSA-2005: “Creditor List”

FSA-2006: “Property Owned and Leased”

FSA-2037: “Farm Business Plan Worksheet” (Balance Sheet)

FSA-2038: “Farm Business Plan Worksheet” (Projected/Annual Income Expense)

FSA-2302: “Description of Farm Training and Experience”

AD-1026: “Highly Erodible Land Conservation and Wetland Conservation Certification”

The Authorized Agency Official will assess your farm’s environmental compliance and

recommend next steps, which may include additional forms and a visit to your local county office.

There are online resources on the last page of this document that may help answer additional

questions you may have about these forms or the application process.

Application Quick Guide | Individual 6

Additional Documentation

These are some of the items you will need to complete

your application.

Check the boxes below as you gather each item to ensure a complete application.

Item Name

Credit report fee, using personal or bank check, made payable to the Farm Service Agency

Complete tax returns, including Schedule F if available, for the past 3 years

Copies of all leases, contracts, options, and other agreements

Proof of legal name such as a driver’s license or Green Card

Verification of income, debts, and assets (for example, recent pay stubs and statements

for credit cards, loans, and bank accounts)

If you are applying for a Farm Ownership Loan, please provide these items, too.

Legal descriptions of all farm property owned or to be acquired

Copy of ratified purchase agreement

Construction plans (if applicable)

Note: Complete legal descriptions are usually found in a deed from the courthouse.

Application Quick Guide | Individual 7

Still Need Help?

The following online resources can help answer

your questions.

Talk to a Loan Oicer, local agriculture representative, or community organization to learn more.

If you do not have internet access, a Loan Oicer can send you resources and provide state-specific

resources. Also, consider getting in touch with your state’s agricultural extension.

Farmers.gov

https://www.farmers.gov

Farmers.gov provides farmers, ranchers,

private foresters, and agricultural producers

with educational materials, engagement

opportunities, and business tools to increase

eiciency and productivity.

Find Your Local Service Center

https://www.farmers.gov/service-locator

Use this online tool to search for your Farm

Service Agency, Natural Resources Conservation

Service, and Risk Management Agency Service

Centers by state and county.

FSA Farm Loan Programs

https://fsa.usda.gov/farmloans

In-depth information about everything related to

the FSA Farm Loan Programs including forms.

Assistance for Socially Disadvantaged

Farmers and Ranchers

https://www.fsa.usda.gov/minority-and-women-

farmers-ranchers

FSA continues to develop innovative loan products

and initiatives to improve its ability to serve

traditionally underserved farmers and ranchers.

View this information online or talk to a Loan

Oicer to learn about initiatives that may be in

place to assist you.

New Farmers Resources

https://newfarmers.usda.gov

Find the resources you need to get started or

personalize your search with the Discover Tool.

Make a Farm Business Plan

https://newfarmers.usda.gov/make-farm-

business-plan

This is your roadmap to start-up, profitability,

and growth, and provides the foundation for your

conversation with USDA about how our programs

can complement your operation. Your Loan Oicer

can provide guidance on how to develop the plan

as well.

Getting an FSA Farm Number

https://newfarmers.usda.gov/first-steps

A farm number will allow you to access key USDA

programs and vote in county Farm Service Agency

elections. Call your Service Center to learn more

about how to get an FSA Farm Number.

Application Quick Guide | Individual 8