1

Internet Payday Lending:

How High-priced Lenders Use the Internet to

Mire Borrowers in Debt and Evade State

Consumer Protections

A CFA Survey of Internet Payday Loan Sites

Jean Ann Fox

Anna Petrini

Consumer Federation of America

November 30, 2004

Consumer Federation of America 1424 16

th

Street NW Suite 604 Washington, DC 20036

www.consumerfed.org

2

Table of Contents

Executive Summary 4

Introduction 5

Payday Loans Migrate from Store Fronts to Cyberspace 5

Banks Play a Key Role in Internet Payday Lending 7

Internet Payday Lending Latest Tactic to Evade Consumer Protections 7

State Small Loan and Payday Loan Limits 7

Jurisdiction and Enforcement 8

Kansas Cases 10

New York Order 11

Colorado Advisories 12

Internet Payday Lenders Difficult to Identify 12

Making Payday Loans via the Internet: How It Works 13

Qualifications 13

Applications 14

Consent at the Click of A Mouse 15

Contracts and Authorization Forms 15

Documentation 16

Loan Approvals 16

Electronic Delivery and Payment 17

Repayment Options 17

Collections 17

Marketing Internet Payday Loans 17

Search Results 18

Print Advertising 18

Yellow Pages Ads 19

E-Mail 19

Referral Fees/Affiliate Marketing 19

“Advice” Sites 20

CFA Survey of 100 Internet Payday Loan Sites 20

Who and Where Are Lenders 20

Who Regulates Lenders 21

Where Loans Are Available 21

Whose Law Lenders Claim 22

Loan Size Offered 22

Cost of Internet Payday Loans 22

Disclosure of Finance Charges 23

Disclosure of Annual Percentage Rates 23

Loan Terms Offered on Websites 23

Repayment Options/Collection Terms 24

3

Table of Contents, contd.

Signing Away Rights 24

Privacy and Security Features 25

Customer Service and Contact Information 26

Serious Risks to Consumers of Internet Payday Lending 26

Factors that Create a Debt Trap 26

Extreme High Cost of Loans 27

Overextended with Multiple Loans 27

Automatic Renewals 27

Collection Problems Exacerbated by Electronic Lending 28

Security and Privacy Risks of Internet Payday Lending 30

Electronic Fund Transfers Rules and Debit-Based Payday Lending 31

Electronic Fund Transfers Act and Reg E 32

NACHA Rules 32

WEB Rule Requirements 33

PPD Rule Requirements 34

Prohibition on Required Electronic Payment as a Condition of a Loan 34

Liability Limits and Unauthorized Use of Debits 34

Stopping Payment on Debits 34

Withdrawing Authorization for Electronic Transactions 35

Multiple Presentments to Collect Checks Electronically 36

Collecting NSF Fees Through the ACH System 36

Enforcing NACHA Rules 36

Complaints about EFTA/Reg E 37

Recommendations 37

Advice to Consumers 37

Appendix A: CFA Internet Payday Loan Survey Methodology and Sampling Protocol 39

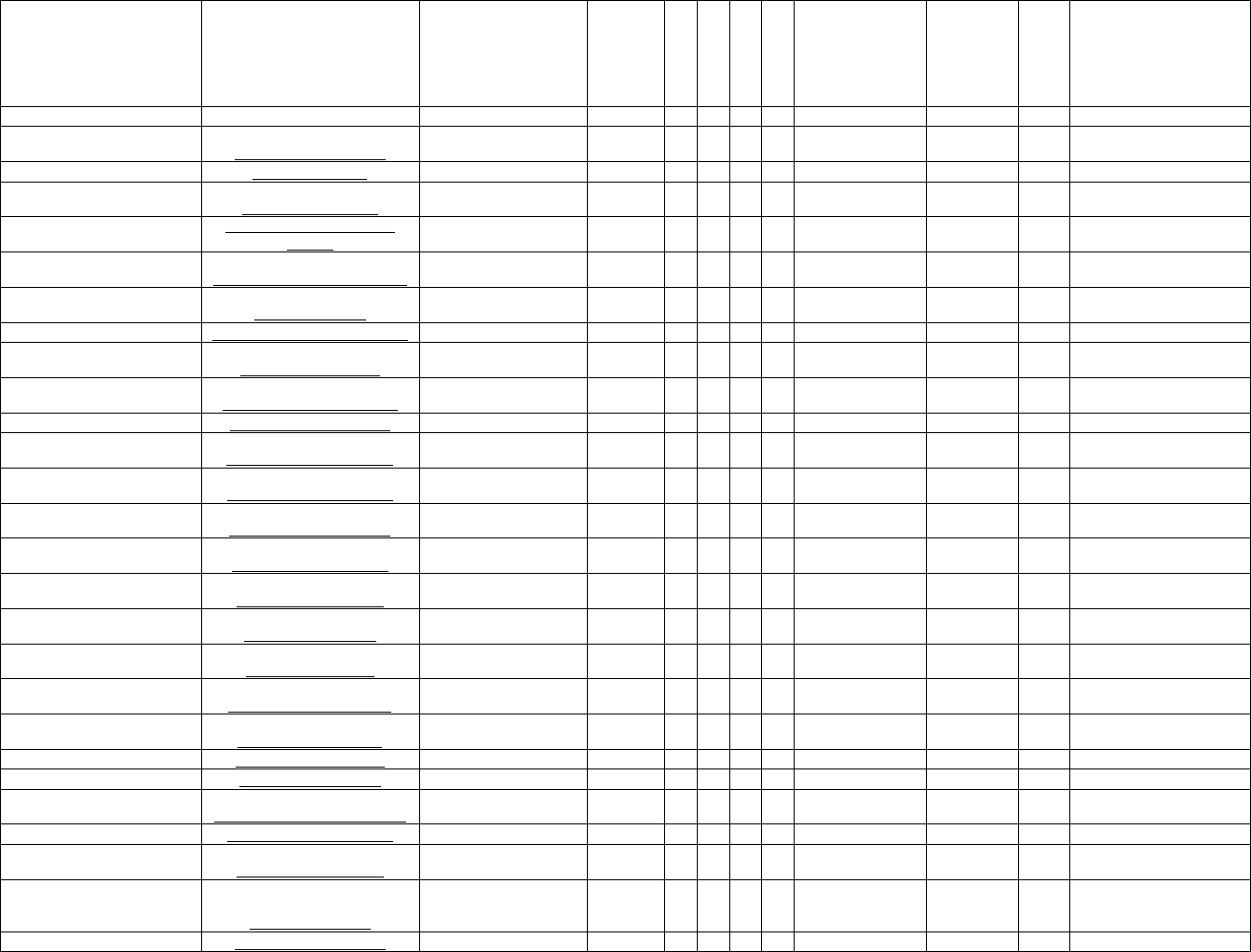

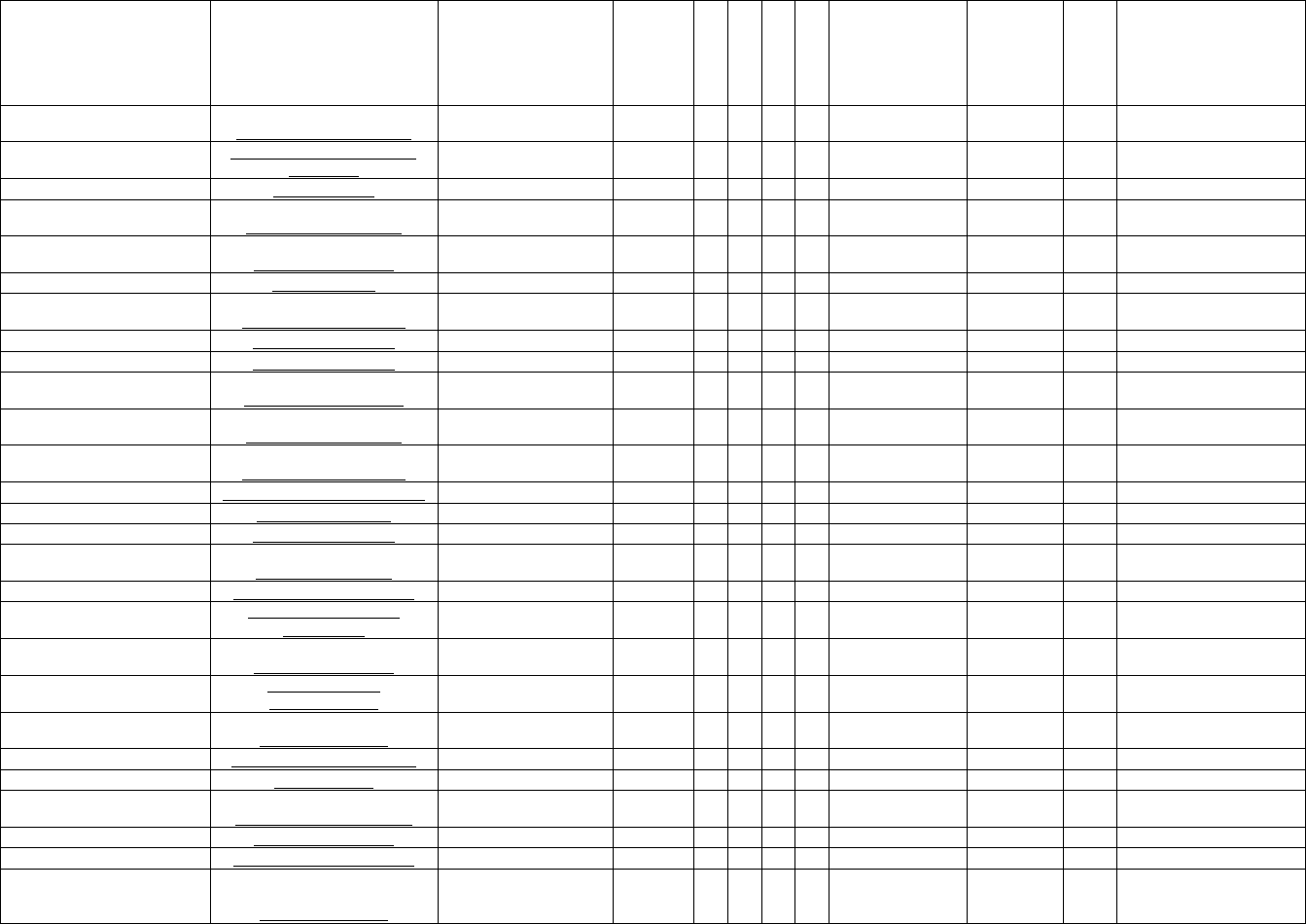

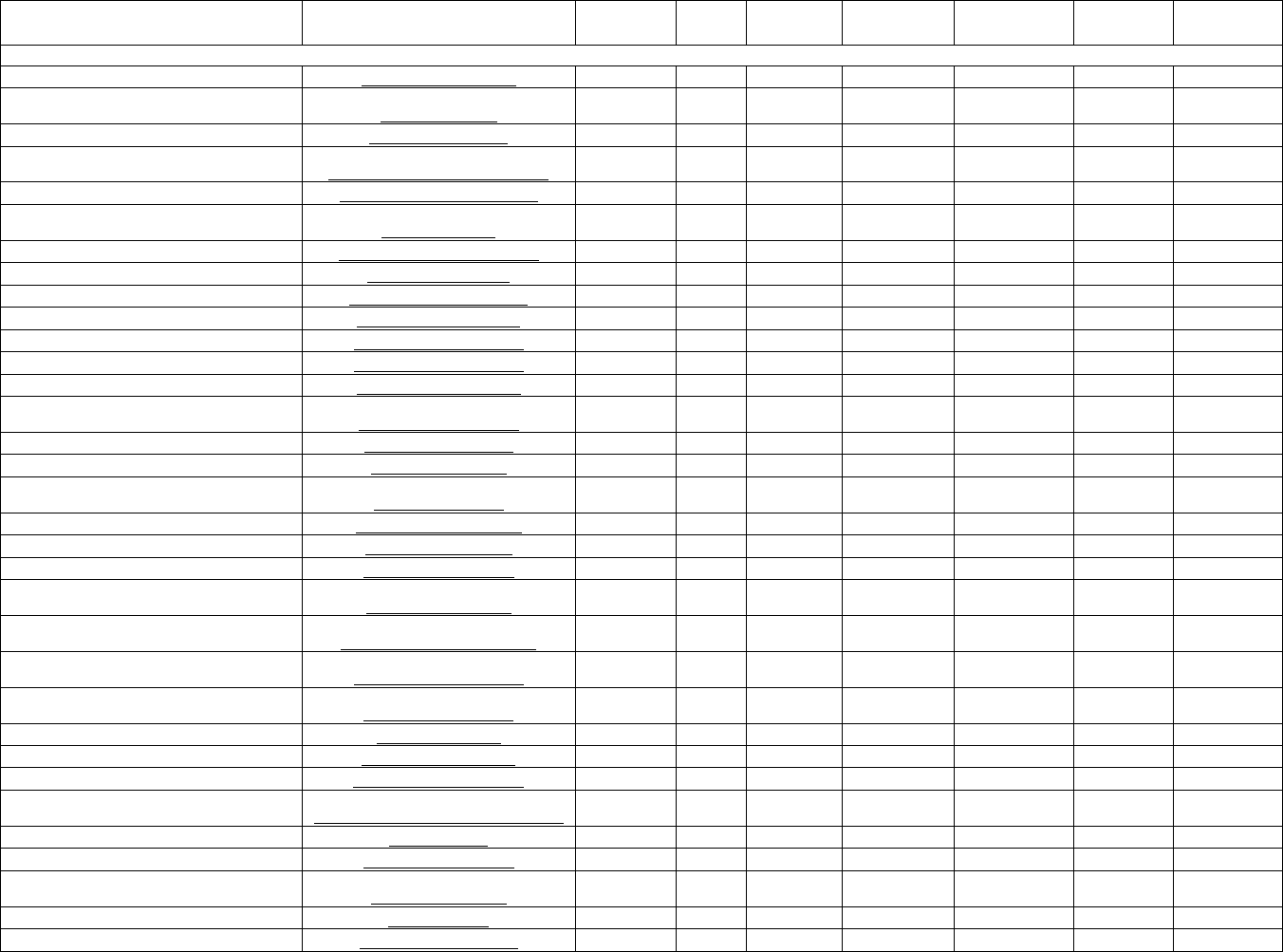

Appendix B: CFA Surveyed Lender Key and Summary Chart 41

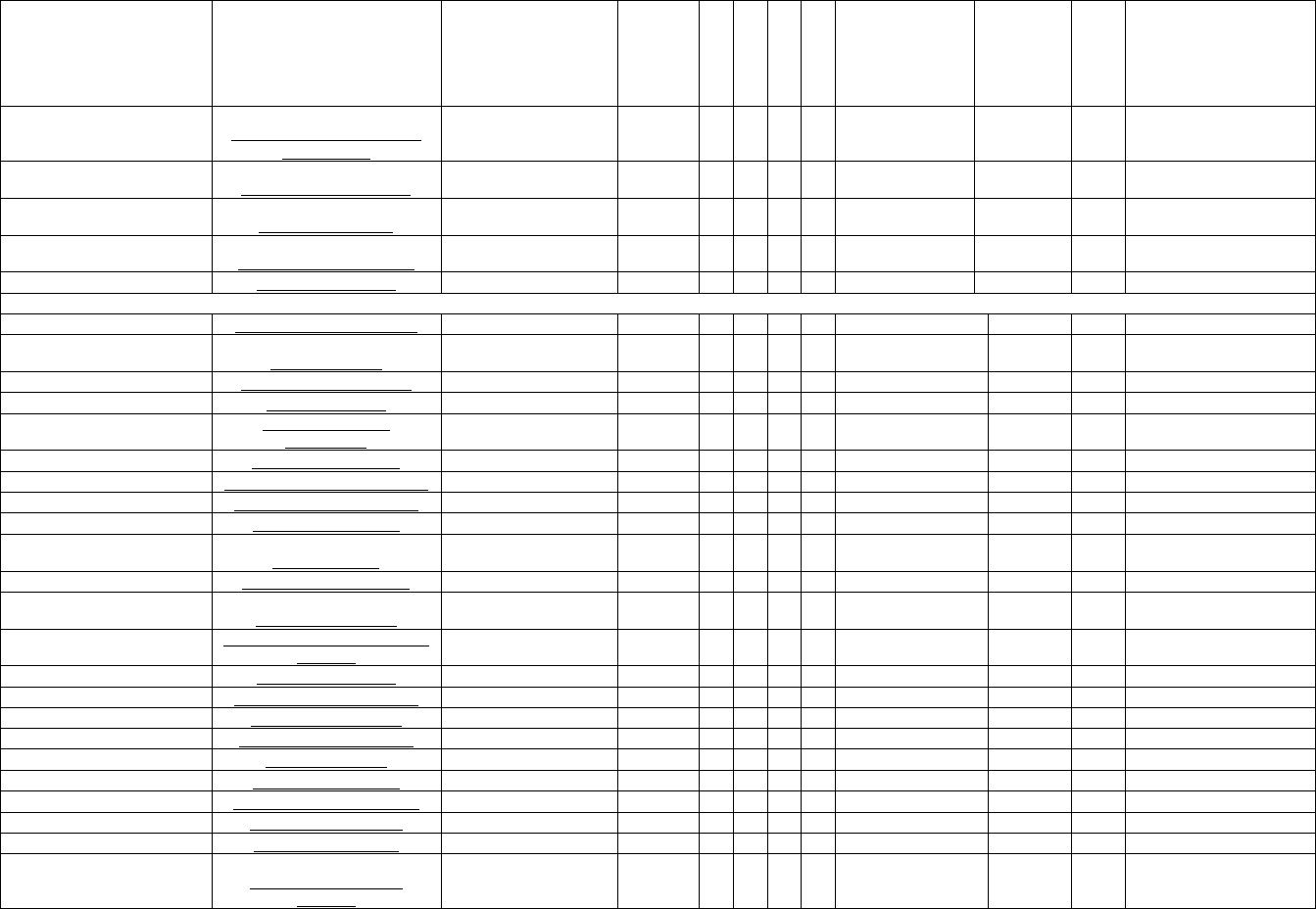

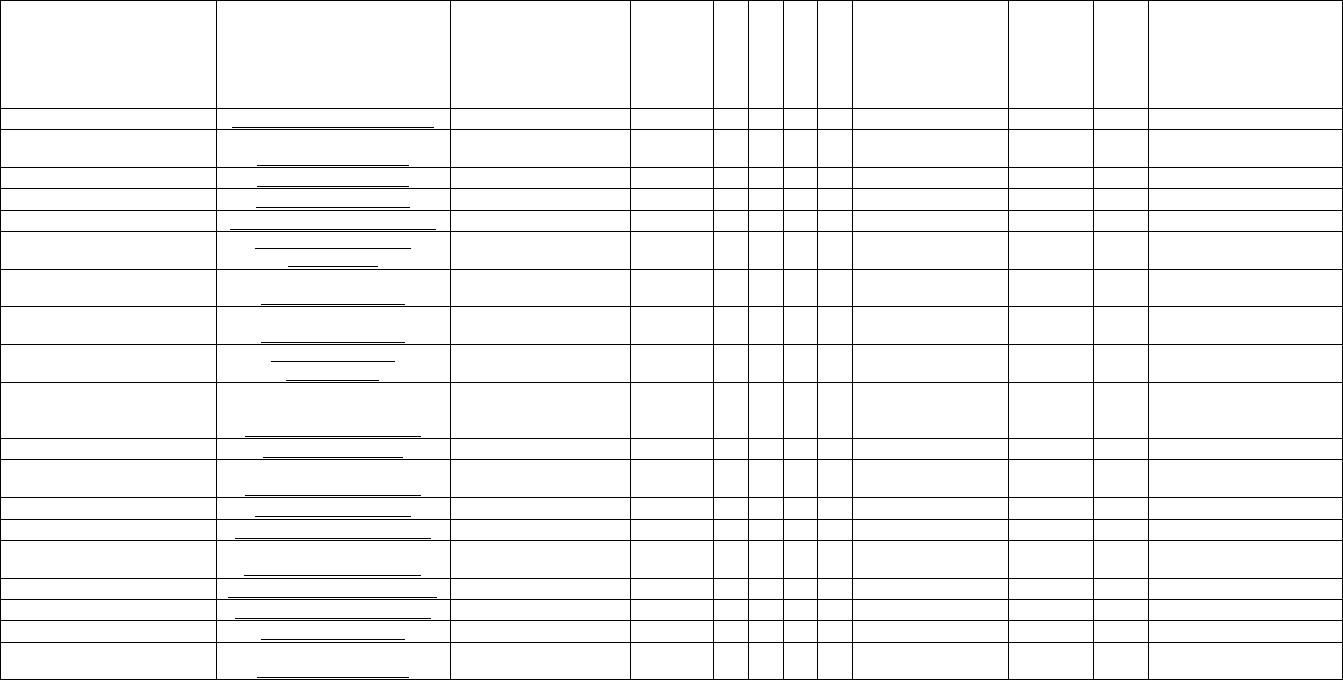

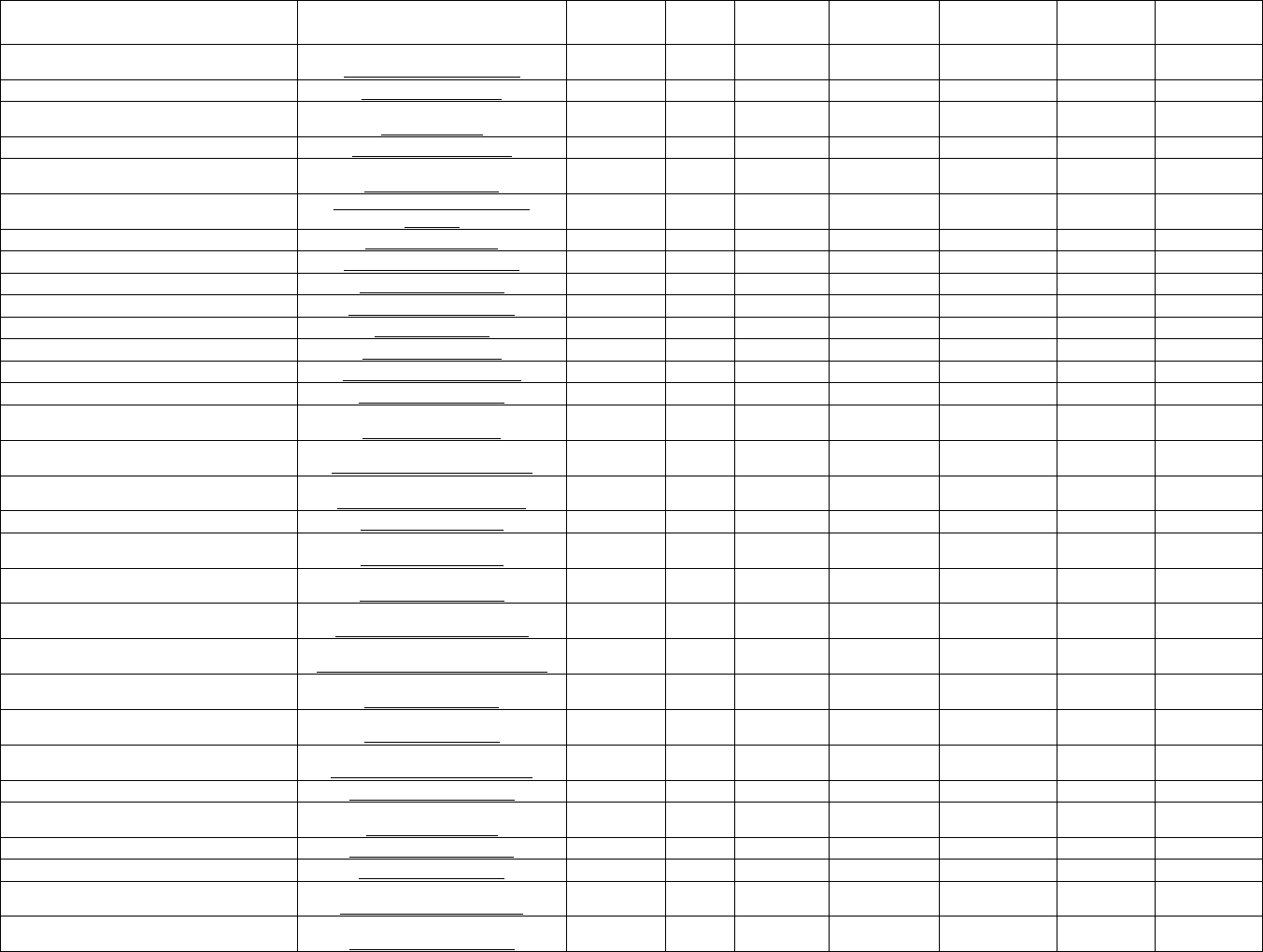

Appendix C: CFA Survey Key and Summary Chart on Loan Terms and Limits 46

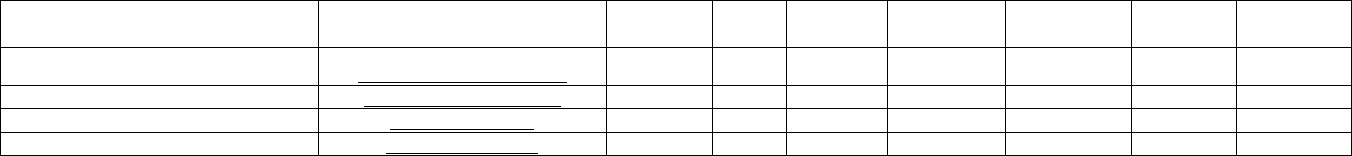

Appendix D: CFA Terms of State Payday and Small Loan Laws for Check-Based Loans 51

4

Internet Payday Lending:

How High-Priced Lenders Use the Internet to Mire Borrowers in Debt and Evade State

Consumer Protections

November 30, 2004

Executive Summary

• Payday lending has expanded from check cashing outlets, pawn shops and payday loan outlets to

the Internet. Loans are marketed, delivered and collected online at rates and terms that mire cash-

strapped consumers in repeat borrowing at extremely high costs. Finance charges are in the $25

(650% APR) to $30 (780% APR) per $100 borrowed range, with built in loan flipping in many

contracts.

• Web sites marketing and/or delivering small loans are growing rapidly, with numerous referral

sites feeding applications to actual lenders. Lenders are hard to locate, identify or contact. Some

are licensed in their home states, while others hide behind anonymous domain registrations or are

located outside the United States.

• Banks are involved in Internet payday loans through the Automated Clearing House System

(ACH) used to electronically deliver loans to consumers’ bank accounts and to withdraw

payments. County Bank of Rehoboth Beach, DE, participates directly in Internet payday lending.

• Internet payday lenders bypass state usury laws and consumer protections by locating in lax

regulatory states and making loans without complying with licensing requirements or state

protections in the borrower’s home state. State regulators, notably in Kansas, New York and

Colorado, are beginning to enforce state usury and small loan laws against lenders making loans

online to state consumers.

• Payday loan applications made online expose consumers to privacy and security risks as bank

account numbers, Social Security numbers, and other personal financial information are

transmitted to lenders, often over unsecure web links. Privacy policies do not protect privacy.

• Federal electronic banking laws and industry self regulatory rules for use of the Automated

Clearing House (ACH) system do not adequately protect consumers who use electronic fund

transfers to borrow and repay loans from bank accounts.

5

Introduction

The new frontier in the fringe small loan market in cyberspace is payday loans marketed online,

delivered directly to borrowers’ bank accounts and collected electronically with no personal contact

between lender and borrower. Reports published by Consumer Federation of America over the last seven

years have documented the growth of check-based lending, the ruses and scams used by some to evade

state usury and small loan laws, and rent-a-bank partnerships employed by leading payday lenders to

avoid state efforts to regulate the small loan industry. Reports from CFA and other organizations and

state officials demonstrate the debt trap set for cash-strapped consumers by check-based lenders and the

collection tactics used to ensure repeat borrowing by consumers at storefront operations.

1

This report summarizes a survey of a sample of one hundred Internet sites offering payday loans

and explores the additional risks to consumers who borrow from distant lenders by providing access to

personal bank accounts to receive loan proceeds and make payments via electronic funds transfer.

Internet payday lending is the latest ploy used by small loan companies to evade consumer protections

and usury laws in the state where borrowers apply for and receive loans and few state regulators have

attempted to enforce state credit laws against online lenders.

Payday lending on the Internet involves a confusing mix of referral sites, loan sites, websites that

appear to offer financial education or counseling, or sites that hold themselves out as payday lender rating

services. Consumers are urged to get up to $2,500 deposited overnight in their bank accounts by filling

out online applications and/or faxing applications and support documents without knowing to whom or

where that personal financial information goes. Online payday loans are delivered and collected through

electronic fund transfers.

Payday loans made online combine the negative aspects of store-front payday loans (extreme high

cost, loan flipping and coercive collection tactics) with the additional problems of jurisdiction and

applicable law, security and privacy risks of entering personal financial information online, and gaps in

the federal laws and industry rules for electronic fund transfers and the Automated Clearing House system

industry self-regulation rules. Consumers who borrow online have additional difficulties with locating

and communicating with web lenders who are hard to find or identify to resolve disputes.

1

See, “Unsafe and Unsound: Payday Lenders Hide Behind FDIC Bank Charters to Peddle Usury,” report by Consumer

Federation of America, March 2004, www.consumerfed.org/pdlrentabankreport.pdf

“Rent-A-Bank Payday Lending: How Banks Help Payday Lenders Evade State Consumer Protections,” report by Consumer

Federation of America and the U. S. Public Interest Research Group, November 2001, www.consumerfed.org/paydayreport.pdf

“Show Me The Money,” report by Consumer Federation of America and the U. S. Public Interest Research Group, February

2000, http://uspirg.org/uspirg.asp?id2=5043&id3=USPIRG&

“Safe Harbor for Usury: Recent Developments in Payday Lending,” Consumer Federation of America, September 1999,

www.consumerfed.org/safeharbor.pdf

“The Growth of Legal Loan Sharking: A Report on the Payday Loan Industry,” Consumer Federation of America, November

1998.

6

Payday Loans Migrate from Store Front to Cyberspace

Payday loans are small cash loans based on borrowers’ personal checks held for future deposit or

on electronic access to borrowers’ bank accounts. Check-based loans of $100 to $500 or more cost triple-

digit interest rates, typically 390% to 780% annual interest rates for two-week loans with $15 to $30

finance charges per $100 loaned. These single-payment loans are due in full on the borrower’s next

payday, typically in two weeks. Borrowers must have a bank account in relatively good standing and a

source of income or benefits to qualify for loans. Lenders do not determine the borrower’s ability to

repay through conventional credit checks or application information. Payday lenders entice cash-strapped

consumers to write checks without funds on deposit and then use those checks to coerce repeat

transactions or collections. The combination of relatively large loan size, expensive finance charges,

short repayment terms, and check holding results in loan flipping that traps many vulnerable consumers in

debt.

According to industry sources, there are about 22,000 storefront payday loan outlets, making $40

billion a year in loans and collecting $6 billion in finance charges from borrowers.

2

We know of no

industry-wide or government studies that measure the size of the Internet payday loan market, or the

number of actual lenders (versus the proliferation of referral sites). The Yahoo Shopping directory listed

almost 140 payday lenders in late August. One marketer claims that over seventy million Americans

relied on the Internet for online payday loan sites last year.

3

PDL Marketing LLC claims that its affiliate

web sites generate over 10,000 fresh, exclusive payday loan applications every single week.

4

A Google

search for “payday loan” and “application” resulted in 252,000 hits on October 27, 2004. While some

Internet lenders are licensed in their home states, none of those states publish annual report data on the

number, dollar value, or price of licensee lending, either online or at storefront locations.

One of the few sources of payday loan industry data, Stephens Inc., a Little Rock investment bank,

reported in late 2003 that over 50 separate websites offered payday loans, not counting sites for store-

based lenders. Stephens found that fees range from 15% to 35% with a median rate of 25% of the loan,

that most sites offered loans of up to $500 while a few sites loaned up to $1,000, and that many online

payday lenders were based in California, Delaware or offshore locations such as Costa Rica.

5

An early survey of Internet payday lending by the Massachusetts Division of Banks on Internet

payday lending in 2000, noted how little information was provided by some companies about themselves

and how much information was required from their customers.

6

Of the sixteen web sites surveyed,

Massachusetts regulators found that only seven disclosed any information about fees or interest rates. The

New York Banking Department also surveyed Internet payday lenders in 2000 and found thirty-two

listings, some with multiple outlet locations. CFA resurveyed the New York list of sites in mid-2004 and

found that about a dozen were still actively making loans four years later and that some domain names

were now owned by others or were up for sale.

2

Dennis Telzrow, “The 3U Consumer Finance Monthly,” Stephens, Inc., March 29, 2004, p. 2.

3

MaxOutLoan.com, www.maxoutloan.com/affiliates.html, visited August 16, 2004.

4

Email from [email protected] to Alaska Public Interest Research Group, August 16, 2004.

5

Jerry L. Robinson, “Update on the Payday Loan Industry: Observations on Recent Industry Developments,” Stephens Inc.,

Sept. 26, 2003, p. 18.

6

Massachusetts Division of Banking, “Internet Payday Loans – Risky Business,” May 30, 2000,

www.state.ma.us/dob/payday.htm, viewed August 27, 2002.

7

Banks Play a Key Role in Internet Payday Lending

Banks are involved on both ends of every Internet payday loan delivered by the ACH system. A

consumer’s bank receives the loan proceeds direct deposited into the consumer’s account and

electronically withdraws payment on the due date. If funds are not sufficient to cover the withdrawal, an

insufficient funds fee is levied. The payday lender’s bank initiates the loan electronically and receives the

payment on the due date. The National Automated Clearing House Association (NACHA), the industry

self-regulatory group, writes and enforces the voluntary rules that govern bank use of the ACH system.

County Bank of Rehoboth Beach, DE was the only bank found by the survey as the purported

lender for online non-bank payday lenders. A Google search in March 2004 for County Bank turned up

over twenty-nine URLs for sites where loans were made online.

7

Many of the URLs led back to the same

web site. The County Bank-affiliated web sites stated that loans are not made to consumers in one or

more states, including Colorado, Delaware, Florida, New York, California, Idaho, and West Virginia.

The cost of payday loans marketed on these sites ranged from 573% APR to 782% APR in the instances

where cost information could be found.

8

A complaint filed in New Jersey alleged that County Bank made

loans through servicing agents costing 780% for a two-week term despite New Jersey’s 30% usury cap.

9

Internet Payday Lending Latest Tactic to Evade Consumer Protections

State Small Loan and Payday Loan Limits

Payday loans are small loans subject to state small loan, usury or payday loan laws. Fifteen states

prohibit payday lending under state usury and small loan laws. Thirty-three states and the District of

Columbia have enacted laws or regulations to authorize check-based payday lending. Alaska enacted a

payday loan-authorization law that will take effect in 2005. Two additional states, New Mexico and

Wisconsin, permit licensed lenders to make payday loans without substantive restrictions on loan terms.

States that legalize payday loans typically require lenders to be licensed or registered and to comply with

a range of provisions, including maximum loan size, duration, and terms.

10

(See Appendix D.)

Internet payday lenders evade state usury and payday loan laws that protect consumers by getting

licenses in states without meaningful restrictions, by operating without state licensing at all, or by locating

out of the country and claiming that loans are made subject to the laws of the lender’s purported home

7

www.moneybyfax.com, www.cashnet500.com/index.asp, www.cashreserve.net/, www.loansbyfax.com/index.htm,

www.fastcashovernight.com, www.emerbencyloansnow.com, http://cashxpress.com, www.needaloannow.com,

www.cashdoctors.com/index.htm, www.webfastcash.com/?page=infor&type=appinfo, www.500cashhotline.com,

www.myautocash.com, www.fastcashhasslefree.com, www.mrspeedycash.com, www.speedwaycash.com,

www.fastcashnoquestions.com, www.500emergencycash.com, www.911emergencycash.com, www.911cashmoney.com,

www.shortermloan.net, www.choicecash.com/TermsConditions.aspx, www.firstchoicecash.com,

www.ezmoneypaydayloan.com/mainpage.html, www.500radiocash.com, www.684cash.com, www.212cash.com,

www.cashauto.net, www.advantage-insuranceinc.com/ezcash/, www.paydayexpressloan.com/mainpage.html,

www.222cash.com

8

Survey of Google search for “County Bank” conducted by CFA, March , 2004. On file with author.

9

Jaliyah Muhammad v. County Bank of Rehoboth Beach, Delaware, Easycash, Telecash and Main Street Service Corporation,

filed in Superior Court of New Jersey Union County.

8

country. In addition Internet payday lenders often claim a choice of law in states with few restrictions and

no usury caps.

At its web site, USAdvance.com says “You have entered the legal domain of the Federation of

Saint Christopher and Nevis.” Transactions will be “deemed to have taken place in the Federation,”

despite the fact that arbitration hearings for disputes with this website will be conducted in Wilmington,

DE.

11

A major online lender, United Cash Loans, provides a Carson City, Nevada address although the

domain is registered to a Vancouver, Canada marketing firm, but is not licensed by Nevada payday loan

regulators.

PaydayConnection.com states that “we are currently providing our services for residents of the

states listed below,” then provides links to sites in cities, such as Philadelphia, New York, Baltimore, and

Boston, all in states with usury or small loan rate caps that do not permit payday lending.

12

The

disclaimer at FastCashAdvancePaydayLoan.com states that its service “does not constitute any offer or

solicitation for a short term or payday loans cash advance loans in any state…may or may not be available

in your particular state…” Then the site provides links to all fifty states and cities in states where payday

lending is not legal.

13

Paydayconnection posts a notice that “by applying for a loan with us, you are

agreeing that your loan transactions will be governed by the laws of the State of Delaware. Delaware

laws and regulations may be different from your state of residence.”

14

Another site provides an

application for Georgia payday loans, a state where small lenders are required to be licensed by the state

and charge no more than 60% annual interest. Paydayconnection.com will lend $1,000 to California

residents, despite that state’s cap of $300 for the loan plus finance charge.

15

Some sites try to have it both ways, by providing links for payday loans in all fifty states while

including a disclaimer that “This ad does not constitute an offer or solicitation for short term payday

loans, payday advance, payroll loans, or personal loans in all states. The source lenders we use may or

may not be available in your particular state.”

16

Only a few sites in the CFA survey actually refused to

accept loan applications coming from specific states.

Jurisdiction and Enforcement

Questions of jurisdiction and applicable law are not unique to payday loan web sites. Justice

Lebedeff ruled in a New York Internet commerce case that “invocation of ‘the Internet’ is not the

equivalent to a cry of ‘sanctuary’ upon a criminal’s entry into a medieval church,” in finding that a

magazine seller was subject to and had violated New York’s consumer protection laws. The judge also

found that Commerce Clause concerns did not apply because the consumer protections being enforced

were media neutral.

17

11

www.usadvance.com/ visited 8/24/04.

12

www.paydayconnection.com/payday_advance/ visited 8/14/04.

13

www.fast-cash-advance-payday-loan.com, visited 8/28/04.

14

www.paydayconnection.com/payday_loan_states/, visited 8/14/04.

15

www.paydayconnection.com, visited 8/13/04.

16

www.instant-payday-loans.us/payday-loans-map.shtml, visited 8/28/04.

17

People v. Lipsitz, NYLJ, June 25, 1997, at 1A, (N.Y. Sup. Ct. 1997). Reported in NAAG Consumer Protection Report,

“Internet Jurisdiction Issues,” Eric A. Wenger and Jane Azia, August-September 1997.

9

State “long-arm statutes” have long held that states have jurisdiction over businesses that enter

their states to conduct business, regardless of where the business is actually located. In Zippo

Manufacturing v. ZippoDot Com, Federal court set a sliding scale to determine whether a business located

in a state outside of the consumer’s state can be held to the laws of the consumer’s state. If a business

merely advertises or provides information, or the information provided is clearly intended for a specific

audience in a particular state, the business does not come under the jurisdiction of a consumer who solely

views the advertisement or information in another state. At the other end of the scale, if a business

solicits business, accepts business, and continues to transact business with a consumer in another state, the

court held that, in fact, the “electronic” business is conducting business in the consumer’s state, and

therefore, is subject to the laws and courts of that state.

18

In an Internet gambling case, an injured Texas consumer sued a California-based gaming website

under Texas law. The website argued that it was not based in Texas, its servers were in California, and its

customers signed a choice of law agreement stating that they would abide by California law. The US

District court held that the gaming site was indeed doing business in Texas and was, regardless of the

contract choice of law, covered by Texas law, permitting Texas consumers to sue the California gaming

site under Texas law in Texas state court.

19

States have broad power to protect citizens where federal law does not directly conflict.

20

The National Consumer Law Center Cost of Credit manual notes that courts generally find that web sites

by which a lender conducts business with residents of the state in question, such as entering into contracts

and exchanging files, meets the minimum contacts test to give the consumer’s state jurisdiction in e-

commerce cases.

21

States are just beginning to come to grips with regulatory issues resulting from loans

made to state residents by out-of-state lenders via the Internet. Iowa’s Uniform Consumer Credit Code

prohibits waiver of rights, such as choice of law provisions in contracts. Regulators hold that interactive

Internet loans made with an Iowa consumer by an out-of-state lender are subject to Iowa credit laws.

22

Other states are adapting credit laws to cover loans made via the Internet. The Colorado Uniform

Consumer Credit Code was amended in 2000 to specifically cover consumer loans made over the Internet,

if the consumer is physically in the state with the transaction is made.

23

Maine’s lending jurisdiction law

was amended to deal with Internet communications and now reads, “This Act…applies to…transactions

… if … (t)he creditor, wherever located, induces the consumer … to enter into the transaction … by …

mail, telephone or electronic mail solicitation…”

24

The Virginia Bureau of Financial Institutions

18

952 F. Supp. 1119, 1124-15 (W.D.Pa. 1997)

19

998 F.Supp. 738, 744 (W.D. Tex. 1998).

20

City of Philadelphia v. New Jersey, 437 U.S. 617, 624-625 (1978).

21

National Consumer Law Center, The Cost of Credit: Regulation and Legal Challenges, p. 392.

22

Electronic communication, Kathleen Keest, Assistant Attorney General, Iowa, received Nov. 15, 2002, on file with author.

23

CO 5-1-201. Territorial application – definitions. (1) Except as otherwise provided in this section, this code applies to

consumer credit transactions made in this state and to modifications, including refinancing, consolidations, and deferrals, made

in this state, of consumer credit transactions, wherever made. For purposes of this code, a consumer credit transaction is made

in this state if: (a) A written agreement evidencing the obligation or offer of the consumer is received by the creditor in this

state; or (b) A consumer who is a resident of this state enters into the transaction with a creditor who has solicited or advertised

in this state by any means, including but not limited to mail, brochure, telephone, print, radio, television, internet, or any other

electronic means. (2) Notwithstanding paragraph (b) of subsection (1) of this section, unless made subject to this code by

agreement of the parties, a consumer credit transaction is not made in this state if a resident of this state enters into the

transaction while physically present in another state.

24

Title 9-A Maine Revised Statutes Annotated, section 1-201(1), “Territorial application”

10

regulation implementing the payday loan law prohibits loans secured by electronic access to the

borrower’s bank account. The only security for the loan in Virginia is the paper check. Since all Internet

payday loans employ ACH or electronic fund transfer to deliver loans, Virginia regulators view internet

lending as prohibited although no enforcement has been attempted.

25

Utah requires Internet payday

lenders to comply with state requirements to disclose a complete schedule of interest and fees charged for

a loan, a phone number the consumer can call to file a complaint with Utah regulators, and a list of states

where the check casher is registered or authorized to offer deferred deposit loans through the Internet or

other electronic means.

26

Some states require out-of-state lenders to get a state license. New Mexico requires non-resident

lenders to be licensed to make loans to consumers.

27

Oklahoma’s payday loan law was amended in 2004

to expressly apply to loans made via the Internet, although state regulators already thought they had that

authority.

28

The North Carolina usury law applies to out-of-state lenders if the borrower accepts the loan

offer in North Carolina even if the solicitation comes from outside the state. The NC Consumer Finance

Act provides that loans made from outside the state to a North Carolina borrower are not enforceable in

North Carolina if the rates exceed the rates permitted under the Consumer Finance Act. Non-bank

internet lenders would be subject to state law in North Carolina.

29

Also, Washington law requires that

state usury limits apply to loans made to Washington residents from outside the state. “Whenever a loan

or forbearance is made outside Washington state to a person then residing in this state the usury laws

found in chapter 19.52 RCW, as now or hereafter amended, shall be applicable in all courts of this state to

the same extent such usury laws would be applicable if the loan or forbearance was made in this state.”

30

A site with links to all fifty states says that “When applying for a loan on the internet, the

company you are dealing with is bound by the rules of the state where they are operating in.”

31

State

credit regulators are challenging out-of-state Internet payday lenders who make loans to consumers

without complying with state licensing requirements or state payday loan limits. Loans may be

unenforceable if made without complying with credit laws where the consumer resides.

Kansas Cases

The Kansas Office of State Bank Commissioner has been the leader in enforcing the state’s

payday loan law and licensing requirement with out-of-state Internet lenders. A loan is considered made

in Kansas and subject to state regulation where a creditor induces a Kansas resident to enter into the

transaction by solicitation in the state by any means including mail, telephone, television, or any other

electronic means including the Internet.

32

Kansas regulators have argued that state regulators have

jurisdiction over out-of-state Internet lenders, describing the loan process as deliberately targeting local

consumers.

25

See: Case No. BFI-2002-00012 at www.state.va.us/scc/caseinfo/orders.htm

26

Utah Code Ann. 7-23-105.

27

New Mexico Statutes 58-15-3, Code of New Mexico Rules, Title 12, Chapter 18, Part 8. Licensing of Nonresident Lenders.

28

“The provisions of this act shall apply to transactions if the lender, wherever located, enters into the transaction with the

debtor by mail, brochure, telephone, print, radio, television, Internet, or any other means.” Okla. Stat. Tit. 59 Sec. 3103.C.

29

G.S. 24-2.1, G.S. 53-190, North Carolina.

30

Wash. Rev. Code § 19.52.034. Washington courts are not free to engage in conflict of law analysis to determine whether the

parties’ own choice of law provision should apply, NCLC Cost of Credit, p. 391.

31

www.instant-payday-loans.us/payday_loan_staterules.shtm, visited 8/28/04.

32

K.S.A. 16a-1-201

11

When construction of the website and viewing of that website by a Kansas consumer

results in the Kansas consumer obtaining a payday loan from the company operating the website,

it is logical to assume that the website constituted a ‘solicitation,” in the plain and ordinary sense

of the word, of that consumer. Respondent’s website contains information regarding the

availability of loans, and allows a Kansas consumer to ‘Apply in Under 2 Minutes’ by answering

five questions. Once the consumer answers the five questions and clicks on ‘apply now,’ the next

screen viewed by the consumer says, ‘Congratulations! You have been pre qualified for UP TO a

$500.00 loan.’ This statement constitutes a solicitation, and is certainly an inducement to the

individual consumer, who has just provided their personal e-mail address and the answers to the

five questions, to continue filling out the loan application. Once the consumer finishes filling out

the remainder of the loan application, and submits it to Respondent electronically, the consumer

receives an e-mail from Respondent with an electronic version of the loan form that has been

completed with all of the consumer’s personal information and loan terms. That form is then

printed and signed by the consumer, and faxed back to Respondent for final processing. That

fully-individualized loan form, sent to the consumer electronically by Respondent, also constitutes

a solicitation of the consumer.

33

Kansas regulators settled cases for unlicensed payday lending by Mycashnow.com of

Chattanooga, TN,

34

and National Opportunities of New Castle, DE (operating a web site

www.itsyourpayday.com).

35

These unlicensed lenders agreed to refund finance charges collected from

Kansas consumers. Kansas regulators also have a pending case against Cash Advance and United Cash

Loans of Nevada. When that case was filed in 2003, regulators sought $4.5 million in fines. The

companies which share the same owner appealed a preliminary order and a hearing was scheduled.

Regulators reported that the two companies made loans to at least nine hundred Kansas consumers. Cash

Advance charged $90 for a two-week $300 loan that would cost $23 if made according to the Kansas

payday loan law. The $75 finance charge for a $250 loan by United Cash Loans also exceeded Kansas

rate limits.

36

New York Order

A Nevada-licensed Internet payday lender agreed to stop making loans in New York according to

a November 2004 agreement with Attorney General Eliot Spitzer. Cashback Payday Loans, Inc., based in

Las Vegas, charged 650% APR for two week loans in a state with a 25% criminal usury law and a 16%

civil usury cap. The consumer who complained to New York regulators paid $825 in interest on a $470

loan and was told she owed another $925.

37

The Assurance of Discontinuance states “The Attorney

General believes, by offering and making the above described ‘payday loans’ without a license to do so in

New York State and by repeatedly and persistently making loans to New York consumers at interest rates

that exceed twenty-five percent (25%) per year, Cashback has violated of GOL 5-501, Penal Law 190.40

and Executive Law 63(12).” Cashback did not admit violation of law in signing the agreement to stop

33

Kansas, Plaintiff’s Memorandum in Opposition to Respondent’s Motion to Dismiss, In the Matter of: United Cash Loans,

2533 N. Carson Street #5020, Carson City, Nevada 89706 and All Owners, Officers and Members, Respondent. Served July

28, 2003.

34

Summary Order to Cease and Desist and Pay Fine, Office of State Bank Commissioner v. Mycashnow.com Inc.

35

Amended Summary Order to Cease and Desist and Pay Fine, Office of State Bank Commissioner v. National Opportunities

Unlimited Inc., Feb. 21, 2003.

36

Deb Gruver, “State orders two online lenders to stop doing business,” The Witchita Eagle, Nov. 13, 2003

37

Michael Gormley, “Payday Company Forced to Forgive Loans,” Newsday, November 22, 2004.

12

making loans to New York consumers. Cashback is required to make restitution to every New York

borrower for the difference between rates charged and New York’s civil 16% interest cap. Open loans

and loans in collection will be null and void.

38

Colorado Advisories

In late November, Colorado’s consumer credit regulator issued cease and desist advisories to three

Internet payday lenders believed to be offering deferred deposit loans in Colorado without complying

with state law. The advisories warn lenders that failure to obtain a supervised lender’s license when

required can trigger injunctions, refunds of all finance charges, and potential criminal liability.

Companies warned by Colorado regulators include Preferred Cash Loans and Cash Advance, both of

Carson City, Nevada; and Quik Payday Inc., located in Logan, Utah.

39

Quik Payday charges $20 per

$100 for loans up to $500, while Colorado’s deferred presentment law caps rates at 20% of the first $300

and 7.5% for loan amounts over $300 to $500.

Internet Payday Lenders Difficult to Identify

The online payday loan industry is a confusing mix of lender sites, referral sites, and layers of

click-through entities. Consumers who click through links on referral sites may have no idea who is

making the actual loan or collecting their personal information. A consumer clicking on moneybyfax.com

ends up at the application page on instantcashusa.com. A visitor to internetfastcash.com clicks through to

paydayconnection.com. A borrower who starts at paydayadvanceonline.com encounters paperwork

giving AccessEZ Cash, Inc. authorization to withdraw payment of the loan and EasyCashNow.com the

right to “initiate either the whole amount or portions of the amount until fully paid.”

40

Consumers could

easily lose track of which web site they used to get a loan.

Some sites are payday lenders with a physical location in addition to making loans online, while

others only lend via the Internet. Some are licensed in a state with lax regulatory requirements but located

elsewhere.

41

Many are referral sites that collect applications from potential borrowers and then hand them

off to actual lenders for a fee (see Marketing Internet Payday Loans.) These referral sites carry

disclaimers, such as “Advance Cash Loans is not an online provider of online payday cash advances. We

simply connect people seeking fast cashadvances with online providers of instant cashadvances so they

can get the advancecash that they need as soon as possible. Thank you for visiting Advance Cash Loans.

We wish you luck on your search for online payday cashadvances.”

42

Looking up web site addresses, or URLs, on domain registries often does not provide information

on the actual owners of web sites. Several sites in the survey sample are registered through Domains by

Proxy in Arizona, an anonymous service that hides the ownership and location of web site owners. In

some cases marketing firms are registered as the domain owner, with a Vancouver company listed as

38

Attorney General New York, Assurance of Discontinuance In the Matter of Cashback Payday Loans, Inc., November 3,

2004.

39

Cease and Desist Advisories, State of Colorado Office of the Attorney General, issued November 23, 2004, on file with

author.

40

www.paydayadvanceonline.com, visited 8/30/04.

41

MyCashTime.com has a NM license

42

www.advancecashloans.com/info.html, visited August 26, 2004.

13

owning several sites in the survey. FastBucks.com has a Virginia registry listing, despite the fact that the

company is located in New Mexico.

Some consultants offer turnkey payday web sites that include the domain name registry, hosting,

monitoring, a secure site seal, help with search engines and access to the Automated Clearinghouse

Network.

43

PDLMarketing LLC claims to have developed over three hundred “live” domains and

expects to be the top payday loan lead generation source by the third quarter of 2005.

44

Cash Now, a

Canadian payday lender with offices in Pennsylvania, markets franchises to people who want to become

storefront or Internet lenders. Washington, California, and Illinois securities regulators have halted Cash

Now’s sale of franchises in their states.

45

Internet payday lenders may involve a complex set of interlocking company names for marketing

purposes, loan servicing, and collections. A lawsuit filed in Texas against a Canadian consortium of

lenders named multiple company names involved in one loan transaction.

46

A pro-bono attorney assisting

consumers filed a complaint with Kansas regulators about a lender apparently located in Kansas with a

domain name registered in Nevada by a registered agent for foreign corporations.

47

Tracking down the real lender at a physical location is a difficult process for lawyers and

regulators, much less for borrowers trying to contact the lender or resolve complaints. As noted in the

website survey, companies making payday loans via the Internet are located outside the United States,

making it even more difficult to exercise consumer rights, bring enforcement cases, or resolve disputes.

Making Payday Loans via the Internet: How it works

Although offers and arrangements vary from site to site, the typical Internet payday loan involves

an online or faxed application in which the borrower provides extensive personal and financial

information, direct deposit of the loan proceeds into the borrower’s bank account through the Automated

Clearing House system on the same or next day, and an agreement to permit the payday lender to

withdraw the loan and finance charge electronically from the consumer’s bank account on his/her next

payday.

Qualifications

Qualification requirements on the purported County Bank application are typical. To be eligible for a

$500 loan, a consumer must have a steady income, be able to show a verifiable source of recurring

income payments, have a checking account with the consumer’s name printed on the checks, be able to be

contacted after work, be at least 18 years old, have a gross income of at least $1000 per month or a

minimum of $800 per month in Social Security or other benefits income. Applicants must not be

delinquent on a prior loan from County Bank or other short term loan lenders, and must have access to a

43

“Turnkey Payday Loan Web Sites,” www.fastcashconsulting.com/payday-loan-turnkey-web-sites.htm, visited April 19,

2004.

44

www.pdlmarketing.com/, visited September 24, 2004.

45

CALIFORNIA decision, press release from Cash Now.

46

Rhonda Green v. Payroll Loans Direct, Limited Partnership d/b/a PRL Direct.com, et al. District Court Dallas, TX.

47

Consumer complaint to Kansas regulators, on file with author.

14

fax machine.

48

Required borrower income levels generally range from $800 to $1200 per month. One

lender claims they will never allow applicants to bite off more than they can chew by not approving loan

amounts for more than your biweekly net pay.

49

Lenders advertise no credit checks but use databases,

such as TeleTrack, to screen applicants for returned check history and payday loan use.

Applications

Sites use multi-stage applications to draw applicants into the process. The first set of questions, pre-filled

in with “yes” answers, covers the basic qualifications and asks for name and email address. When the

consumer clicks “apply,” a graphic of a check filled out for $500 payable to the borrower pops up,

followed by a much longer set of questions.

Consumers encounter a variety of methods to apply for payday loans used by Internet lenders.

Consumers fill out detailed application forms online, including bank account information and routing

numbers for their checks. A completed application form pops up which the applicant confirms and files

online. Or, more commonly, consumer information from an online application is entered into a set of

forms, which the applicant is instructed to print, sign and fax back with additional documentation.

Applicants may access this paperwork through pop-ups or icons at the end of the online application or

through links that have been sent to their email accounts. In both methods, applicants enter their bank

account numbers, Social Security numbers, birth date, and other personal financial information online to

transmit to the lender. A third method bypasses online applications altogether. Consumers are directed to

download applications, print out and complete them, and then fax the forms and documentation. Many

lenders have different procedures and requirements in place for returning customers.

The portion of the Cashnet500 application which is printed out and faxed back requests personal and

contact information, a Social Security number, whether the borrower rents or owns her home, and the

birth date. Employment information that must be supplied includes the supervisor’s name, shift hours,

and phone number, net take home pay and schedule of pay periods, whether the pay is made through

direct deposit, the next pay day and the second pay date. Applicants must give the names and phone

number for two contact persons. No questions are asked about other debts or obligations that would

enable a lender to determine ability to repay the loan.

Some applications ask very intrusive questions. Onlinepaydayadvance.com asks if a consumer has ever

filed for bankruptcy, had property foreclosed or made a settlement for a creditor’s benefit. It asks if the

consumer is party to any lawsuit or legal action or has an unsatisfied judgment against her. Is the

consumer an officer, director or shareholder of a financial institution? Have you filed all required tax

returns?

50

Applications are available in Spanish on request at some sites.

48

Htpp://216.203.40.180/lps?application_id=3235089987444963488, visited August 30, 2004. Five page application for

payday loan from County Bank via the referral web site www.payday-now.net, on file with author.

49

www.payday-now.net/payday-loans/ visited August 30, 2004.

50

www.onlinepaydayadvance.com, visited 8/16/04.

15

Consent at the Click of a Mouse

Under the federal E-Sign law, consumers can now “sign” contracts and receive required disclosures

through electronic means if federal requirements for consent and capacity are met. As electronic

signature includes any “electronic sound, symbol or process,” such as pressing a touch-tone key on the

phone, clicking “OK” on a salesperson’s computer, or through a simple email or click.

51

A contract is

“signed” by clicking “I accept.” Industry NACHA rules also require that the record creating the ACH

transaction must be signed in a way that evidences the identity of the person who signed and that person’s

assent to the terms of the contract. A payday loan borrower can electronically sign using a digital

signature, PIN, password, shared secret. A hard copy record can be authenticated via the telephone by the

consumer speaking or key-entering a code provided on the record.

52

Several sites in the survey permitted

consumers to “sign” by typing their names and clicking an “I accept” button.

Contracts and Authorization Forms

The packet of paperwork or online forms typically include a loan application, a loan note and disclosure

form, and an authorization to access the bank account. Application forms include an agreement to

arbitrate all disputes, and agreement not to bring or participate in class action lawsuits. The applicant

signs and dates the form.

The contract is often called a “Loan Note & Disclosure” and spells out the Truth in Lending cost

disclosures, the payment schedule, prepayment policy, and itemization of the loan and the finance charge.

Contracts repeat the agreement to arbitrate all disputes, not to join a class action lawsuit, a promise not to

file for bankruptcy, and agreement that the contract is bound by the law of the state where the payday

lender claims to be located.

A third form that must be signed by the borrower is the Authorization Agreement for Preauthorized

Payment. This agreement gives the lender the right to access the consumer’s bank account to deposit the

loan proceeds and to withdraw loan payment on the due date. Some agreements permit the lender to

initiate multiple withdrawals to collect a single loan. The right to withdraw access authorization no later

than three business days before payment is due is typically included. If authorization is withdrawn, the

borrower agrees that the lender will turn the electronic withdrawal into checks that will be collected from

the consumer’s account. The Cashnet500 agreement states “This authorization to prepare and submit

checks on your behalf may not be revoked by you until such time as the loan is paid in full.”

53

Contracts completed online require consumers to electronically sign contracts. Efastcash.com requires

consumers to check that they have read the terms of the application for, the privacy policy, an

authorization agreement to access the borrower’s bank account, and the loan note and disclosure. To

“sign” electronically, a consumer merely types in her full name and clicks the “I agree” button.

54

51

Brian Livingston, “Beware: E-signatures Can be Easily Forged,” News.com, July 14, 2000.

52

NACHA Operating Guidelines at 8, B.1.

53

Authorization Agreement for Preauthorized Payment, www.cashnet500.com on file with author.

54

http://efastcash.com, visited 8/27/04.

16

Documentation

At most sites, applicants are required to fax a variety of personal financial documents, typically a voided

personal check, a recent pay stub, a current bank statement, along with the signed contract and an

agreement to allow the payday lender access to the borrower’s bank account.

United Cash Loans paperwork to be faxed includes a copy of a personal check marked “void,” a copy of

the most recent bank statement, a copy of the most recent pay stub, a completed loan application with

printed and signed name, the signed Note and Disclosure form, a congratulations sheet with required

items attached, and the signed electronic payment authorization form.

55

Some sites enable consumers to access their bank statements online in order to complete applications.

Emergency Cash Loans lists over four hundred banks for applicants to click on to print off the required

bank statement in order to fax in an application with supporting documents.

56

Other sites have links to

Kinko’s to help applicants locate a commercial fax center. Others permit paperwork to be shipped by

overnight delivery.

Loan Approvals

Cashadvancefast.com claims its 30 minute approval process is “quicker than getting a pizza delivered.”

Consumers either receive an email or a phone call to let them know the loan has been approved. Lenders

use specialized credit reporting databases such as TeleTrack to screen applicants. Some verify addresses

with US Postal Service lists.

A typical claim of no credit checks: “Don’t worry about your credit rating. At Payday-loans.org, there

are absolutely no credit checks. Payday-loans.org works with providers of payday loans that will loan

you payday loans regardless of your credit history.”

57

Another site states “Don’t worry about your credit

rating. At Payday Loans Overnight, there are absolutely no credit checks.”

58

One site says: “Can I still get an unsecured loan if I have bad credit or a bankruptcy? Yes. Our list has

over 80 little-known companies willing to give ‘high risk’ loans to people with bad credit or even a

bankruptcy.”

59

“Even bankruptcy, bounced checks, charge-offs and other credit hassles don’t prevent you

from getting the cash advance you need!”

60

One lender claims to “approve 96% of payday loan

customers for up to $1,000 dollar (sic) in just 30 SECONDS!”

61

ZippyCheck will even make loans to

borrowers with current insufficient check fees, based on take home pay. If the borrower has $2,500 take

home pay, not more than $400 overdrawn is acceptable.

62

55

www.mypayday.com, linking to United Cash Loans, visited 8/27/04.

56

www.emergency-cash-loan.com/findbankfax.asp, visited September 2, 2004.

57

www.payday-loans.org/requirements.html, visited 8/28/04.

58

www.paydayloans-overnight.com, visited 8/28/04.

59

www.fast-cash-advance-payday-loan.com/guaranteed-loans.html, visited 8/28/04.

60

www.rapidcashpoviderapp.com, visited 8/30/04.

61

www.top-rated-cash-advnce-company.co/index.asp, visited 8/23/04

62

www.zippycheck.com/Zippy_approval.asp, visited 8/26/04.

17

Electronic Delivery and Payment

Payday lenders use the Automated Clearinghouse system to deliver and collect loans. This electronic

funds transfer system involves a bank on both ends of the transaction and operates under industry self-

regulatory rules administered by the National Automated Clearinghouse Association.

Internet lenders typically promise that loan proceeds will be direct deposited into the borrower’s bank

account by the next business day. On the loan due date, the loan amount and finance charge are

electronically withdrawn from the consumer’s bank account. No paper checks are involved. A few sites

will wire loan proceeds for an additional fee.

Sites make claims of reliability as a result of ACH capacity. One site disclosed: “We are authorized to

use the Federal Reserve Wire System and we must follow all FDIC and NACHA regulations, so we are

only authorized to withdraw the amount authorized by your payday loans request.”

63

Repayment Options

Lenders typically offer three choices for repayment/loan renewal. In many cases, the default option is to

pay the finance charge only and renew the loan for another payday. If a consumer does nothing, the loan

is automatically flipped. A consumer who wants to repay the loan in full must notify the lender three

days before the loan due date or sign a separate section of the contract. After a set number of renewals,

the lender may provide the option of paying down the loan principal in $50 increments plus another

finance charge each payday. A minority of sites require payment in full on the next payday.

Collections

Payment is electronically processed without action by the consumer. If funds are not available to repay

the loan, a fee for insufficient funds is charged by the lender and another fee is imposed by the

consumer’s bank. The FastCashConsulting firm claims that ACH is an “awesome collection tool,

enabling it to collect $20,000 or more from customers that had been written off in just two months.

64

Some loan agreements permit the lender to split the payment into multiple withdrawals.

Marketing Internet Payday Loans

Payday loans are aggressively marketed via the Internet and email. A small industry of Internet

payday loan marketing companies has emerged. PDLMarketing LLC claims to have created the online

marketing programs for a majority of the top payday loan businesses, taking clients from $100,000 a

month in “new loans” to over $3 million in just six months.

65

FastCashConsulting offers turnkey payday

loan web sites that permit consumers to apply for a loan via the Internet and use the Automated

Clearinghouse Network to deposit or withdraw funds electronically. The deal includes a domain name,

web site hosting, monitoring of site traffic, a site secured by Thawte, a Verisign Company, email, auto

responders, help with search engines, Internet classified ads, links to other sites (search engines rate by

popularity), meta tags/keywords/descriptions to help search engines find a site. Fast Cash provides the

63

www.overnight-payday-loan.com/payday_loan_faq.html, visited 8/28/04.

64

www.fastcashconsulting.com/payday-loan-turnkey-web-sites.htm, visited April 19, 2004.

65

www.pdlmarketing.com/, visited September 24, 2004.

18

turn key operation for $500 plus $50 as well as all applications outside the local geographic area of the

turn key operator.

66

Search results

Search is the leading marketing tool for Internet payday lenders. Internet merchants use sophisticated

search engine optimization tools to make sure their web sites show up on the first page in search engine

results. Marketers claim that search engine optimization is replacing pay-per-click as the preferred

method of driving more consumers to web sites to produce more sales. Methods that TBBI.net offers

include keyword selection by language linguistics research, keyword saturation throughout the site, site

design elements and HTML attributes, site navigation elements and site architecture, HTML coding by

hand, link popularity integration, submission order and sequence, search engine partnering, web analytics

and consumer business profiling, among others. The company claims its search engine optimization is

100% ethical.

67

One Delaware marketer claims that the average payday loan prospect visits a minimum

of five to ten web sites before filling out an application.

68

Sites include multiple links to other payday lenders to augment search results and to earn referral fees. As

one site states, “We exchange site links for our business to be successful in being listed in Google or

Yahoo and other prominent search engines.”

69

PaydayDirect.com’s page on cash advances and payday

loans information has forty-six links to payday loan sites, including links to “military cash advance” and

“military payday loan.” Another page on that site has 185 links to payday loan related destinations.

70

Quickcashloans.com includes links to dozens of casinos.

71

Print Advertising

Internet payday lenders advertise in print media as well as online. Despite Massachusetts’ small loan law,

the Metro shopper paper in Boston ran ads this summer for www.acepays.com which offered “Fast Cash!

$100-$1000, Job & Checking account Required/NO Credit Check.” The fine print states “This is a cash

rebate for joining the www.acepays.com website. This is not a loan product. Recipient keeps the cash

rebate! Early Termination Fee applicable for cancellation or termination.”

72

Other ads in the Boston

paper include “CASH BY PHONE. Get $100 - $500! Next Day! Call Now! Why Wait! 98% approval

rate for all new applicants! Required: Checking Account, Steady Job or Recurring Income, Access to a

Fax.” www.cashnet500.com”

73

800MONEY4U.com also advertises in the Boston

74

newspaper, claiming

“No credit? No Problem!” The Washington Post’s Express paper ran an ad for “FAST CASH! $200 -

$750. No Credit? No Problem! Job and DD Req’d. www.yourcashbank.com.”

75

A visit to that web site

found loans for up to $500 from a company listed as United Capital in Salt Lake City, UT.

76

66

www.fastcashconsulting.com/Why-turnkey-web-sites.htm, visited April 19, 2004.

67

TBBI.net Search Engine Optimization, www.tbbi.net/search-engine-optimization/index.html, visited August 30, 2004.

68

www.pdlmarketing.com/, visited September 24, 2004.

69

www.top-rated-cash-advance-company.com, visited 8/23/04.

70

www.paydaydirect.com, visited 8/28/04.

71

www.quickcashloan.org/links.aspz, visited 8/29/04.

72

AcePays.com advertisement, “Metro,” Page 6, August 25, 2004.

73

CashNet500 ad, “Metro,” Page 9, August 25, 2004.

74

Payday lending is prohibited by the Massachusetts small loan law which applies to brokers and lenders.

75

Express, Washington, DC, Page 2, December 5, 2003, on file with author.

76

www.yourcashbank.com, visited December 8, 2003.

19

Yellow Pages Ads

The San Diego Yellow Pages includes dozens of listings for store front payday loan outlets. It also

advertises websites offering loans that do not comply with California payday loan limits which provide

that the check used to obtain a payday loan cannot exceed $300, including the finance charge. Typically

the maximum loan in California is $255, yet www.unitedquickcash.com advertises up to $600 Loan by

Phone to San Diego consumers. www.getcash911.com offers loans up to $500. www.cashnet500.com, a

web site affiliated with County Bank of Rehoboth Beach, DE, offers loans up to $500. Checkexpress.com

loans up to $500 and displays a Better Business Bureau seal on its Yellow Pages ad.

77

E-Mail

Consumers browsing the Internet and using email are bombarded with offers of quick cash and instant

credit from payday lenders. A typical unsolicited commercial email: “Subject Line: Cash Advance

Today – up to $1,000, no credit check. NEED CASH FAST? Borrow up to $1,000 until your next

payday!!! No Credit Check. Cash in Under 24 Hours! One Hour Approval.”

78

Missouri Attorney

General Jay Nixon snagged payday loan e-mail in one of the first cases brought to enforce Missouri’s

anti-spam law which requires that commercial email be labeled with the phrase “ADV” in the first four

characters of the subject line. A suit was filed in October 2003 against Fundetective.com of Boca Raton,

Fla. for sending several payday loan spam messages without the advertising label.

79

Applicants to online payday lenders end up on commercial email lists, under the terms of most “privacy”

policies. A North Carolina consumer got a series of payday loan mail, prefaced by “You are receiving

this email because you have completed the Pre-Qualification form or applied for a cash advance from

123onlinecash.com or one of our affiliated cash advance sites.” Payday lending at over 36 percent annual

interest is illegal under North Carolina’s small loan law.

Referral Fees/Affiliate Marketing

Affiliates are web sites that link to Internet payday lender sites by buttons or banner ads to feed payday

loan applications into the system. To make affiliate marketing work, a web site employs an affiliate

tracking system to keep count of leads and the payment due to the affiliate.

80

For example, ShareaSale

software tracks each person that visits the Rapid-Advance web site, from a referral web site.

81

TBBI.net

touts itself as “the undisputed indusry (sic) leader in payday loan web site marketing” and states that its

clients pay from $12 to $50 per application for payday loans.

82

Referral fees from the survey varied from

one site to the next for either buying or selling leads, ranging from $4 to $50. Cashadvance.com claims to

have 1,000 “satisfied affiliates” and to provide real-time tracking of referral fee income.

83

77

San Diego Yellow Pages, Loan listings, page 949-955. Collected June 2004.

78

http://www.lendergateway.com/page.php?p=500_page_payroll.htm&m=M6PD102802, Delivered Nov. 4, 2002.

79

Jefferson City News Tribune Online Edition, “Nixon Files Suits under New Anti-Spam Law,” St. Louis, MO, October 10,

2003. http://newstribune.com/stories/101003/sta_1010030065.asp, viewed October 20, 2003.

80

www.tbbi.net/affiliate-marketing/index.html, visited August 30, 2004.

81

www.rapid-advance.com/fast-cash-affiliate-information.html, visited April 14, 2004.

82

Electronic communication from [email protected] to Self-Help Credit Union, March 18, 2004, on file with author.

83

www.cashadvance.com/affiliates/index.html, visited 8/27/04.

20

Some lenders also pay their customers a bounty to refer their friends. Loan Me Cash pays $15 for every

referral who qualifies for a loan.

84

PaydayOK pays a $10 fee to customers who forward email to a friend

who then gets a loan.

85

“Advice” Sites Marketing Loans

Several Internet payday loan sites market loans along with financial management advice and articles

about payday lending. MSpayday.com speaks of “empowerment lending” and provides information for

women. Other sites include news articles along with loan applications, even articles that criticize payday

lending. Advance Cash Loans gives budget and spending tips with links to applications for United Cash

Loans.

86

These sites include credit counseling contacts, and provide links to debt settlement companies.

Another site gives tips on how to save for college and how to save for retirement along with links to

payday loans.

87

AdvanceCashLoans.com offers spending and budget tips along with its payday loan offers

at 521.4% annual interest.

88

In one case the surveyor entered information into an online payday loan

application only to be sent another company’s application for credit repair services with the same

information already filled in.

89

CFA Survey of 100 Internet Payday Loan Sites

CFA surveyed a sample of 100 Internet sites that market payday loans directly to consumers. The

sample was selected, using top listings in several search engines, directories of lenders, and from e-mail

messages. Researchers collected all web pages available through each site, and clicked through links

present on web sites. We filled out online application forms with nonsense data in order to gain access to

multi-part application forms and disclosures about loan terms that in some cases were not available on the

lenders’ homepages or pages available without an application. Another purpose for “sending”

applications was to see if a secure link was provided for transmission of personal financial information.

CFA did not take out any payday loans as a part of this survey project.

In addition to observing web sites, CFA performed domain registry searches for each site and tried

to determine if lenders were licensed in their home states. For further information on the survey

methodology, please see Appendix A.

Who and Where Are Lenders

The Internet payday loan sites surveyed by CFA were categorized as lender or referral sites. Based on the

information available on the sampled web sites, we concluded that fifty-eight of the 100 sites made loans

to consumers, while forty-two were referral sites.

Some companies had multiple web sites in the sample. Internet Cash Advance Marketing, based in

Vancouver, is listed as the domain owner for six United Cash Loan primary or referral sites.

84

www.loan-me-cash.com/referral_program.html, visited August 30, 2004.

85

www.connectcommerce.com/secure/partner-app.html....

86

Also, see http://jowston.org/ visited August 26, 2004..

87

www.paydaycenter.com/financialtips.html, visited 8/28/04.

88

www.advancecashloans.com connecting to www.mypayday.com visited August 26, 2004.

89

www.paychecksinadvance.com connecting to https://lexingtonlaw.com/SignUpSecure.php visited August 17, 2004.

21

CashAdvanceNow.com, Payday One XL, Liberty Capital Investments, Benjamin Thomas LLC, Michael

Gibbons, and Network Solutions had two registrations each. Web Check Services had three registrations.

CFA conducted a domain name search for each surveyed site, noting the location of the domain name

registration. Eight sites were registered through Domains by Proxy, based in Arizona, a service that

makes web site ownership anonymous. California had the most registered sites with eighteen, followed

by ten in Canada, and nine each in Florida and Nevada. In all, twenty states were listed by domain

registry filings as well as Canada with ten, and Costa Rica and Grenada. Contact information for one site

listed a bank in the Bahamas.

90

One site claims to be a Nevada based lender with Nevada law applicable

to its loans; however, it directs consumers with questions to call the Utah State Department of Financial

Institutions.

91

Who Regulates Lenders

Of the 100 surveyed sites, fifteen sites claimed to be licensed in one of seven states (SD, DE, UT, NV,

CA, ID, NM) while two additional sites claimed to be licensed but did not say in which state. CFA

attempted to verify claims of state licensing and to check the license status of the primary lender sites. In

ten instances the web site claimed state licensing which CFA was able to confirm. Another ten Internet

lenders were listed as licensed in their home states but did not disclose their state licensing status on their

web sites. Six lenders claimed to have state licenses but CFA could not confirm that with state regulators.

In part, this uncertainty resulted from web site names having no relationship to licensed lender names, the

absence of physical addresses, and hidden domain registry information.

Where Loans Are Available

CFA also noted claims on web sites about states where loans would not be made and other limits on the

geographic availability of payday loans made via the Internet. Twelve sites listed states where loans are

not available. Two sites claimed that loans are available in all 50 states and three sites said loans are

available in the US and Canada. One site each claimed loans are made in US, Canada and the UK; only

in CA and NV; and only available in Nevada. A total of fifteen states were listed as states where loans are

not available from one or more lenders. The most frequent listings were for New York and Georgia (six

each), Kansas with five mentions, and Nebraska, Colorado, and Idaho with three sites each.

Some sites require an applicant to type in a zip code before being permitted to fill out the application.

Other sites send a message - “Error, pick a new state” - if an applicant types in a state where loans are not

made. It is not clear whether a consumer is actually denied a loan if she enters another state in response.

Other sites say they permit consumers from all fifty states to apply, such as the ad claim by FastBucks:

“Easy to apply. With Fast Bucks’ advance payday system, you get the money you need! Anywhere in

the U.S.”

92

90

www.advancepaychecknow.com/contact.htm, visited 8/30/04.

91

www.qloot.com/ga.aspx, visited 8/23/04

92

www.fastbucks.com/fast_application.asp, visited 8/13/04

22

Whose Law Lenders Claim

Twenty-eight Internet payday loan sites stated a choice of law claimed to govern loans made, with nine

states and three foreign countries mentioned. Another three sites claimed “Federal” law applied to their

loans.

93

States listed under choice of law included Delaware (6), Nevada (6), and California and New

Mexico with three listings each. Utah was listed by two sites, and Arizona, South Dakota, Pennsylvania

and Idaho were given as the choice of law on one site each. Other countries whose laws were claimed to

apply were Grenada, Costa Rica, and St. Christopher.

A review of loan terms compared to state limits for payday loans demonstrates that choice of law claims

do not always mean compliance with that choice. Delaware’s payday loan law caps loans at $500, yet

half the surveyed lenders who claim to be subject to Delaware law offer loans up to $1,000.

94

Two of the

three sites claiming California law make loans of up to $415 and $500, despite the California payday loan

law that limits the face value of the check used to get a loan at $300.

95

Loan Size Offered

The size of loans available at the surveyed sites ranged from $200 to $2,500. The most frequent loan size

was $500, at sixty-seven percent of surveyed sites. Seventeen sites will make loans of $1,000. Other loan

limits included $245, $255, $300, $415, $510, $1300, and $1500.

Cost of Internet Payday Loans

The most frequently disclosed finance charge for borrowing $100 was $25, listed on 18 sites; $30 on 12

sites, and either $17.50/$17.65 or $20 listed on five sites each. The lowest price quoted by two sites was

$10 per $100 and the highest quoted rate was the site charging $25 per $100 plus a $10 fee, for a $35 total

cost to get $100 until payday. One site claims that it is “in compliance with federal and state laws. Our

fees take all this into consideration and are available anywhere from $30 to $90, depending upon your

salary and other factors.”

96

The finance charge for loans is not the only cost to payday loan borrowers. If funds are not on deposit in

the consumer’s bank to repay loans on the due date (and borrowers have not agreed to automatic loan

renewals), lenders impose bounced check fees (NSF) which are electronically withdrawn from the

consumer’s bank account. Twenty-seven surveyed sites listed their NSF fees which ranged from $15 to

$30 per overdraft, while another two sites indicated that they charged NSF fees but did not specify an

amount. Over half the sites that listed an NSF fee charge $25 per returned withdrawal.

93

Quickest-Payday Loan.com claims that the borrower is responsible for complying with any local laws that apply to payday

lending and claim that federal law applies to its loans.

94

See Survey, www.americashadvance.com, www.paydayconnection.com, and www.internetfastcash.com.

95

See Survey, www.aeroadvance.com, www.quikmoneyonline.com.

96

www.paychecksinadvance.com/faq.html, visited 8/17/04.

23

Disclosure of Finance Charges

Only fifty-seven percent of sites posted the finance charge for loans and this information almost never

was made on the home page for the site. Finance charge disclosures were buried in FAQ pages or on a

separate disclosure page. Forty-three surveyed sites disclosed no finance charge amounts, with

consumers encouraged to apply for loans with no idea of the cost. The FAQ page at

Rapidcashprovider.com answers the “What does it cost?” question without quoting a dollar finance charge

or a typical APR. Instead the lender says “Your fees are less than the cost of not having the cash you

need.” and “Actual fees are determined based on the information you provide when you submit your loan

application.”

97

Yourcashnetwork.com answers the “what does it cost?” question with “your fees are less

than the cost of not having the cash you need when you need it.”

98

Disclosure of Annual Percentage Rates

The Federal Truth in Lending Act requires lenders to quote the annual percentage rate (APR) for loans

when advertising other trigger terms for loans, such as the finance charge. Some sites include the APR on

the same page with finance charge disclosures, while others require consumers to click onto a separate

page.

99

Although 57 sites quoted the finance charge, only 38 sites listed the APR for their loans on a page

that was accessible to consumers who had not filled out an application. Another two incorrectly quoted

the finance charge as the APR. The most frequently quoted APR for a $100 two week loan was 652% at

fifteen sites, followed by 782% at eight sites.

Some contracts generated by the lender using application information provided by the surveyor contained

inaccurate APRs. Mypayday.com stated a 26.5133% APR for a two-week loan with a finance charge of

$30 per $100 instead of 780% APR.

100

Americashadvance.com’s FAQ page lists the finance charge

without an APR disclosure.

101

Getcash911.com quotes the finance charge in a manner that could confuse

consumers about the APR. The site’s FAQ says “The APR formula is 15.0% for 1-10 day loan terms.

17.5% for 11-20 day loan terms, and 25.0% for 21-30 day loan terms.” After the application is submitted,

the consumer receives a rate disclosure page stating, “A loan of 1-10 days is only 15%; 11-20 days for

17.5%; 21-30 days for 25%.” Only the subsequent filled-in loan contract discloses the APR for a 31 day

loan at 294% APR. The more typical 14-day loan would cost 455% APR.

102

YourCashBank.com posts a

fee chart, listing the amount borrowed, the flat fee, a wiring fee, and the payback amount but does not

include an APR disclosure along with the finance charge.

103

Loan terms offered on Websites

Loan duration periods offered at online payday lenders varied. Thirty-one sites offered loans due on the

borrower’s next payday. Twelve sites make loans with a maximum duration of fifteen days while nine

97

www.rapidcashproviderapp.com, visited 8/30/04.

98

www.yourcashnetwork.com, visited 8/25/04. No cost information appears elsewhere on the site.

99

Example, www.americashadvance.com, includes a separate APR chart for combinations of loan size and term.

www.mycashnow.com posts finance charges, with a separate page for disclosures stating a 485.450% APR.

100

www.mypayday.com/process, visited 8/27/04

101

www.americashadvance.com/faq.htm, visited 8/30/04.

102

http://getcash911.com/pdl/help.asp?SID.com, visited 8/14/04.

103

www.yourcashbank.com/application.asp, visited 8/14/04.

24

sites will allow loans for as long as thirty days. Just three sites give over thirty days to repay loans, with

the longest term of 37 days.

Surveyed sites promised that loans would be delivered promptly to consumers’ bank accounts through the

ACH Network or electronic funds transfers. About three-fourths of sites promised loans delivered by the

next day. Two sites promised loans in one hour.

Repayment Options/Collection Terms

Repayment provisions for many payday lenders trap borrowers in a cycle of repeat loans. Instead of

consumers having to walk into a payday loan store to buy back their check with cash and write a new

check to renew loans, internet sites make it easy to automatically renew loans.

Options for repayment typically include permitting the lender to withdraw only the finance charge from

the borrower’s bank account on the due date, extending the loan for another pay cycle; paying the finance

charge plus a portion of the loan; or repaying the loan and finance charge in full on the next payday.

Payment options from United Cash Loans, as offered through referral site www.mypayday.com:

a. Refinance. Your loan will be refinanced on every due date unless you notify us of your desire to pay in full or to

pay down your principle amount borrowed. You will accrue a new fee every time your loan is refinanced. Any fees

accrued will not go toward the principle amount owed. On your fifth refinance and every refinance thereafter, your

loan will be paid down by $50.00. This means your account will be debited for the finance charge plus $50.00, this

will continue until your loan is paid in full.

b. Pay Down. You can pay down your principle amount by increments of $50.00. Paying down will decrease the fee