Personal Umbrella Product Information

USLI writes unsupported personal umbrella liability for the

broadest range of applicant types in the industry. We offer

coverage for preferred, standard and high risk households, as

well as high profile individuals and farm and ranch owners.

PREFERRED APPLICANTS:

Operators between 23 and 75 years old

Limited exposure units (home, autos, RVs and watercraft)

Driving discounts apply

Zero accidents/DUIs; no more than 2 convictions

Limits up to $10 million on any quote ($5 million - FL;

$1 million - AL, MS, NH and VT; CT and ME if rentals)

Admitted in 45 states

STANDARD APPLICANTS:

Unlimited number of autos, RVs and watercraft up to 75’

Up to fifteen 1-4 family residential locations

Operator ages can range from age 23 through age 89

Six convictions in a household (3 years)

Three fault accidents in a household (3 years)

Limits up to $5 million on any quote ($1 million - AL, MS, NH

and VT; CT and ME if rentals)

Admitted in 45 states

HIGH RISK APPLICANTS:

Operators of any age; no maximum

Ten convictions in a household (3 years)

Five fault accidents in a household (3 years)

Any DUI in 5 years (zero if under age 23 or over age 89)

Limits up to $5 million ($1 million - AL, MS, NH and VT; CT

and ME if rentals)

Now admitted in most states

Any major category conviction in a household (3 years)

FARM AND RANCH OWNERS:

Farm revenues up to $1 million

2000 acres

250 grazing animals

Underlying liability must be on a personal lines form

CELEBRITY APPLICANTS:

Designed for high profile individuals such as pro athletes,

entertainers, politicians, Fortune 500 CEOs, TV and radio

personalities and authors

Admitted for preferred or standard applicant types

This document does not amend, extend or alter the coverage afforded by the policy. For a complete understanding of any insurance you purchase, you must first read your policy,

declaration page and any endorsements and discuss them with your broker. A specimen policy is available from an agent of the company. Your actual policy conditions may be

amended by endorsement or affected by state laws. .

Umbrella Product Information 1/14

USLI.COM

888-523-5545

ATTACHMENT REQUIREMENTS:

$250,000/$500,000/$100,000 or $300,000 CSL for autos,

home, watercraft or RVs

$500,000/$500,000/$100,000 or $500,000 CSL for autos and

watercraft for any account defined to be at risk

$500,000/$500,000/$100,000 or $500,000 CSL for autos and

personal liability for any farm and ranch applicant

$500,000 C.S.L. or $500,000/$500,000/$100,000 for all

exposures - Celebrity Applicants

$1,000,000 for any watercraft 51’ - 75’ or for autos with any

operator age 90 or over

COVERAGE FEATURES:

Optional excess UM/UIM available up to $1,000,000, $25,000

included in base rates

Broad definition of bodily injury and personal injury

True umbrella with drop down coverage for non owned

watercraft up to 26’, non owned RVs and non owned autos

outside the US

Worldwide coverage

Zero deductible

No aggregate limits

Coverage for both pre and post judgement interest

ADDITIONAL USLI ADVANTAGES:

Personal umbrella can be written in the name of individuals,

trusts, LLCs, LLPs or the estate of, if primary residence is

included

Quote instantly via phone, live web chat or 24-7 online

Direct access to underwriters to get what you need

A++ rated carrier and a Berkshire Hathaway Company

Automatic renewals with no renewal applications required

Direct Bill at new business and renewal with multiple

installments, all with no fees or interest

Instant access for service, endorsement changes and help

Personal Umbrella for Standard Applicants

Our Personal Umbrella for Standard Applicants is

designed for individuals with acceptable, but not perfect

driving records, mid-sized watercraft, and/or multiple

home and automobile exposures. It is available for

individuals who do not have local or national name and

face recognition. This product is now available on an

admitted basis in most states.

PRODUCT FEATURES:

u True Umbrella coverage

u Limits available up to $10,000,000 for risks that qualify

u $25,000 of Excess Uninsured/Underinsured Motorists

coverage included in the basic premium. Additional excess

UM/UIM limits are available

u Personal Injury Protection automatically included when

provided by underlying coverage

u First dollar coverage for Non-owned Watercraft and

Recreational Vehicles

u A.M. Best rated A++ carrier

PRODUCT ELIGIBILITY:

u Coverage available for vehicles, motorcycles, jet skis and

recreational vehicles

u Underlying coverage on a Personal lines form except for

underlying Business Auto or Garage forms

u One at fault accident

u Up to four violations in the household

u Unlimited number of watercraft if less than 25 feet

u Up to one watercraft 26-50 feet

ADDITIONAL ADVANTAGES:

u Fast and easy access to quote this product on our website

u Quick turnaround time on submissions

u Superior Policy Issuance

This document does not amend, extend or alter the coverage afforded by the Policy. For a complete understanding of any insurance you purchase, you must first read your Policy,

Declaration Page and any Endorsements and discuss them with your Broker. A specimen policy is available from an Agent of the Company. Your actual Policy Conditions may be

amended by Endorsement or affected by State Laws.

PUSA-NR (11/05)

USLI.COM

USLI.COM

888-523-5545

888-523-5545

Personal Umbrella Product

Claim Examples

EEaacchh ddaayy bbrriinnggss nneeww ppoossssiibbiilliittiieess ffoorr uunnffoorrttuunnaattee aacccciiddeennttss aanndd

lliiaabbiilliittyy ccllaaiimmss.. MMaannyy ppeeooppllee ddoonn''tt rreeccooggnniizzee tthheeiirr lloossss

eexxppoossuurreess,, wwhhiicchh ccaann uunnffoorrttuunnaatteellyy rreessuulltt iinn ccaattaassttrroopphhiicc lloossss

aanndd ssiiggnniiffiiccaanntt ffiinnaanncciiaall bbuurrddeenn.. TThhee ffoolllloowwiinngg ccllaaiimmss sscceennaarriiooss

aarree ffaaccttuuaall ccllaaiimmss tthhaatt ccaann bbee uusseedd aass aann eeffffeeccttiivvee mmaarrkkeettiinngg ttooooll

ttoo hhiigghhlliigghhtt tthhee rreeaall ppoossssiibbiilliittyy ooff lloossss.. YYoouurr rreettaaiill ccuussttoommeerrss

sshhoouulldd uussee tthhee ffoolllloowwiinngg sscceennaarriiooss ttoo rreemmiinndd tthheeiirr ccuussttoommeerr

pprroossppeeccttss tthhaatt ffaaiilluurree ttoo ppuurrcchhaassee PPeerrssoonnaall UUmmbbrreellllaa iinnssuurraannccee

ccoouulldd ccoosstt tthheeiirr ffaammiillyy aa ffoorrttuunnee!!

IInntteerrnneett BBllooggggeerr::

The insured’

s daughter hated math class as

well as the teacher. The daughter made several

“disparaging” and false remarks about her teacher online.

The teacher sued the parents for personal injury and

$750,000 was paid.

FFaauullttyy FFuurrnnaaccee::

The insured’s tenant claims she became ill

from carbon monoxide poisoning resulting from a faulty

furnace. The tenant claimed permanent brain damage and

demanded $750,000.

CCooaacchhiinngg CCiirrccuummssttaanncceess::

A teena

ger, who was destined for

greatness as a softball player, filed a $700,000 lawsuit

against her former coach, alleging his “incorrect” teaching

style ruined her chances for an athletic scholarship.

FFaalllliinngg CCoonnccrreettee::

A hillside on the insured’s property was

covered with concrete to prevent erosion. The concrete had

been installed before the insured purchased the property.

Approximately 5 feet of the concrete fell to the neighboring

property knocking the claimant’s home from its foundation.

The resulting claim was settled for $970,000.

PPaaiinnttbbaallll MMiissffoorrttuunnee::

The insured permitted several of her

children and their friends to play paintball in her large back

yard. The children were experienced and advised of all the

safety rules including the use of headgear at all times. A

participant removed her headgear as she was leaving the

field in order to better hear someone calling her name. The

minor claimant was hit in the eye resulting in a $475,000

settlement.

BBeeaacchh EExxpplloossiioonn::

The insureds hosted a beach party for their

daughter. One of the attendees found what was believed to

be an empty and discarded propane tank. The tank was

thrown into a beach bonfire and subsequently exploded

resulting in severe injuries to several guests. A $20,000,000

claim was filed alleging the insured failed to properly

supervise the party.

This document does not amend, extend or alter the coverage afforded by the Policy. For a complete understanding of any insurance you purchase, you must first read your Policy,

Declaration Page and any Endorsements and discuss them with your Broker. A specimen policy is available from an Agent of the Company. Your actual Policy Conditions may be

amended by Endorsement or affected by State Laws.

PU-CLA (9/06)

USLI.COM

USLI.COM

888-523-5545

888-523-5545

C

OVERAGE

F

EATURES

O

UR

G

ROUP

C

OMPETITORS

’

P

OLICY

Personal Injury coverage Provided if it is on underlying Umbrella

P

?

Coverage provided on a Following Form Basis

P

?

Worldwide Coverage, No limitation on where the suit is brought

against you

P

?

Limits of Liability up to $10,000,000

P

?

WHY CHOOSE TO BE INSURED WITH UNITED STATES LIABILITY INSURANCE GROUP?

u One of only 20 A++ rated insurance groups in the United States by A.M. Best.

u A proud member of the Berkshire Hathaway Group, recently voted the #1 most admired Property & Casualty Company in

the world (Fortune Magazine 2004).

Insure your financial well-being with a stable Company that will be there to pay your claim.

YOU HAVE WORKED HARD TO CREATE YOUR WEALTH, BUT ARE YOUR UMBRELLA LIMITS HIGH ENOUGH TO PROTECT IT WHEN

SOMEONE WANTS TO TAKE YOU TO COURT? YOU MAY BE TARGETED FOR A LAWSUIT BASED ON YOUR PERCEIVED NET WORTH.

u How much is enough liability insurance? If your liability coverage doesn't equal at least your net worth- the value of your home, cars,

retirement accounts and other possessions- you could lose it all!

u You can be held liable for what you say, write, or do to another person

u What if you hosted a party where alcohol is served? One of your guests leaves your party after having a few drinks and gets into an

automobile accident where they damage property and injured another driver on the road. You can be held liable

u What if you are involved in an accident, but you’re out of the country? Accidents happen everywhere not just at home. Your

exposures are the same while at home or away

ARE YOU PREPARED?

u Jury Verdicts continue to increase; they are up 240% since 1994 and this is in addition to Defense Costs

Not all Excess Personal Umbrella Policies are created equal. The following are important features; make sure you have them all:

Excess Personal Umbrella - Personal Lines

This document does not amend, extend or alter the coverage afforded by the Policy. For a complete understanding of any insurance you purchase, you must first read your Policy,

Declaration Page and any Endorsements and discuss them with your Broker. A specimen policy is available from an Agent of the Company. Your actual Policy Conditions may be

amended by Endorsement or affected by State Laws.

XPL-POS-6-05

USLI.COM

USLI.COM

888-523-5545

888-523-5545

Excess Personal Umbrella Product - Personal Lines

This product is designed for those applicants who have a primary

personal umbrella policy with another company and desire higher

limits. Eligibility for this product is the same as our primary

personal umbrella.

PRODUCT FEATURES:

u Limits available up to $10,000,000; $5,000,000 in FL and

$1,000,000 in IN, VT, NH, MS & AL

u Available at a primary personal umbrella attachment point of

$1,000,000

PRODUCT ELIGIBILITY:

u No limit on the number of drivers, autos, recreational vehicles

and watercraft up to 75 feet

u Risks with multiple accidents and violations

u Households with up to 10 violations and five accidents

among all dri

vers

u Households with up to 10 violations and five accidents

among all dri

vers

u Indi

vidual drivers, over age 22, with one drug or alcohol

rela

ted offense

u Households with up to three major viola

tions, but not more

than tw

o per operator

u Co

verage available for farms with up to 2,000 acres, 250

g

razing liv

estock and revenues not exceeding $1,000,000

u Coverage available for high profile applicants

ADDITIONAL ADVANTAGES:

u Risks in the name of a trust, estate, LLC or LP are eligible

u A.M. Best rated A++ carrier

u Efficient online capabilities

u Motor vehicle reports ordered by the company

u Follow form umbrella coverage

This document does not amend, extend or alter the coverage afforded by the policy. For a complete understanding of any insurance you purchase, you must first read your policy,

declaration page and any endorsements and discuss them with your broker. A specimen policy is available from an agent of the company. Your actual policy conditions may be

amended by endorsement or affected by state laws.

EPL-NR (5/11)

USLI.COM

USLI.COM

888-523-5545

888-523-5545

Excess Personal Umbrella Product

Claim Examples

EEaacchh ddaayy bbrriinnggss nneeww ppoossssiibbiilliittiieess ffoorr uunnffoorrttuunnaattee aanndd

uunnffoorreesseeeeaabbllee aacccciiddeennttss.. MMaannyy ppeeooppllee ddoonn’’tt rreeccooggnniizzee tthheeiirr lloossss

eexxppoossuurreess,, wwhhiicchh ccaann rreessuulltt iinn ccaattaassttrroopphhiicc lloossss aanndd ssiiggnniiffiiccaanntt

ffiinnaanncciiaall bbuurrddeenn.. TThhee ffoolllloowwiinngg ccllaaiimmss sscceennaarriiooss aarree ffaaccttuuaall

ccllaaiimmss tthhaatt ccaann bbee uusseedd aass aann eeffffeeccttiivvee mmaarrkkeettiinngg ttooooll ttoo hhiigghhlliigghhtt

tthhee rreeaall ppoossssiibbiilliittyy ooff lloossss.. YYoouurr rreettaaiill ccuussttoommeerrss sshhoouulldd uussee tthhee

ffoolllloowwiinngg sscceennaarriiooss ttoo rreemmiinndd tthheeiirr ccuussttoommeerr pprroossppeeccttss tthhaatt ffaaiilluurree

ttoo ppuurrcchhaassee EExxcceessss PPeerrssoonnaall UUmmbbrreellllaa iinnssuurraannccee ccoouulldd ccoosstt tthheeiirr

ffaammiillyy aa ffoorrttuunnee!!

IInntteerrnneett BBllooggggeerr::

The insured’ s daughter hated math c

lass as

well as the teacher. The daughter made several

“disparaging” and false remarks about her teacher online.

The teacher sued the parents for personal injury in the

amount of $1 million.

FFaauullttyy FFuurrnnaaccee::

The insured’s tenant claimed she became ill

from carbon monoxide poisoning resulting from a faulty

furnace. The tenant claimed permanent brain damage and

demanded $750,000.

CCooaacchhiinngg CCiirrccuummssttaanncceess::

A teenager, who w

as destined for

greatness as a softball player, filed a $700,000 lawsuit

against her former coach, alleging his “incorrect” teaching

style ruined her chances for an athletic scholarship.

FFaalllliinngg CCoonnccrreettee::

A hillside on the insured’s property was

covered with concrete to prevent erosion. The concrete had

been installed before the insured purchased the property.

Approximately 5 feet of the concrete fell to the neighboring

property knocking the claimant’s home from its foundation.

The resulting claim was settled for $970,000.

PPaaiinnttbbaallll MMiissffoorrttuunnee::

The insured permitted several of her

children and their friends to play paintball in her large back

yard. The children were experienced and advised of all the

safety rules including the use of headgear at all times. A

participant removed her headgear as she was leaving the

field in order to better hear someone calling her name. The

minor claimant was hit in the eye resulting in a $475,000

settlement.

BBeeaacchh EExxpplloossiioonn::

The insureds hosted a beach party for their

daughter. One of the attendees found what was believed to

be an empty and discarded propane tank. The tank was

thrown into a beach bonfire and subsequently exploded

resulting in severe injuries to several guests. A $20,000,000

claim was filed alleging the insured failed to properly

supervise the party.

This document does not amend, extend or alter the coverage afforded by the Policy. For a complete understanding of any insurance you purchase, you must first read your Policy,

Declaration Page and any Endorsements and discuss them with your Broker. A specimen policy is available from an Agent of the Company. Your actual Policy Conditions may be

amended by Endorsement or affected by State Laws.

EPU-CLA (10/06)

USLI.COM

USLI.COM

888-523-5545

888-523-5545

USLI.COM

888-523-5545

Personal Umbrella/Excess Personal Umbrella Application

YOU CAN OBTAIN A QUOTE BY PROVIDING THE INFORMATIONI IN THE INSTANT QUOTE SECTION, SUBJECT TO THE REMAINDER PROVIDED PRIORTOBINDING.

I. INSTANT QUOTE INFORMATION

Instant Quote is only available for accounts with no losses in the past three years. If there is loss history, please complete the entire application.

Applicant’s name:_____________________________________________Occupation_________________________

Applicant type:

Individual(s) Trust Limited liability company Limited liability partnership Limited partnership Estate

NOTE: any type other than individual(s) requires submitting a completed Trust LLC Supplemental Questionnaire

E-mail address of applicant or applicant primary contact:__________________________________________________________________

Address of primary residence:______________________________________________________

Same as mailing address

City:______________________________________________________State:_______________________Zip:_______________________

Primary Personal Umbrella

Underlying personal liability limit:__________________________________________

Underlying auto bodily injury liability limit:____________________________________

Underlying U.M./U.I.M. limit:________________________________________________

Excess Personal Umbrella. If so, underlying primary umbrella limit: ________________

Does the applicant or any resident of the applicant’s household currently or have they at any time had

an occupation as an elected or appointed federal or state political figure, a professional athlete or coach,

entertainer, media personality or a senior executive or officer of a publicly traded company?

Yes No

Does the applicant own or lease any location used for Farm or Ranch operations?

Yes No

NOTE: Any “Yes” response requires submitting a completed Supplemental Farm Application

In addition to the primary residence:

Enter the number of owner occupied secondary residences ___________

Enter the number of 1-4 family residential units rented to others (Duplex = 2 units) ___________

How many Automobiles or Motor Homes are owned or furnished for the regular use of all operators in the household? ___________

How many Motorcycles, scooters, or other vehicles with less than four wheels and licensed for road use are owned

or furnished for the regular use of all operators in the household? ___________

How many recreational vehicles (vehicles not licensed for road use) are there in the household? ___________

Any watercraft? If "Yes," please complete watercraft information section

Yes No

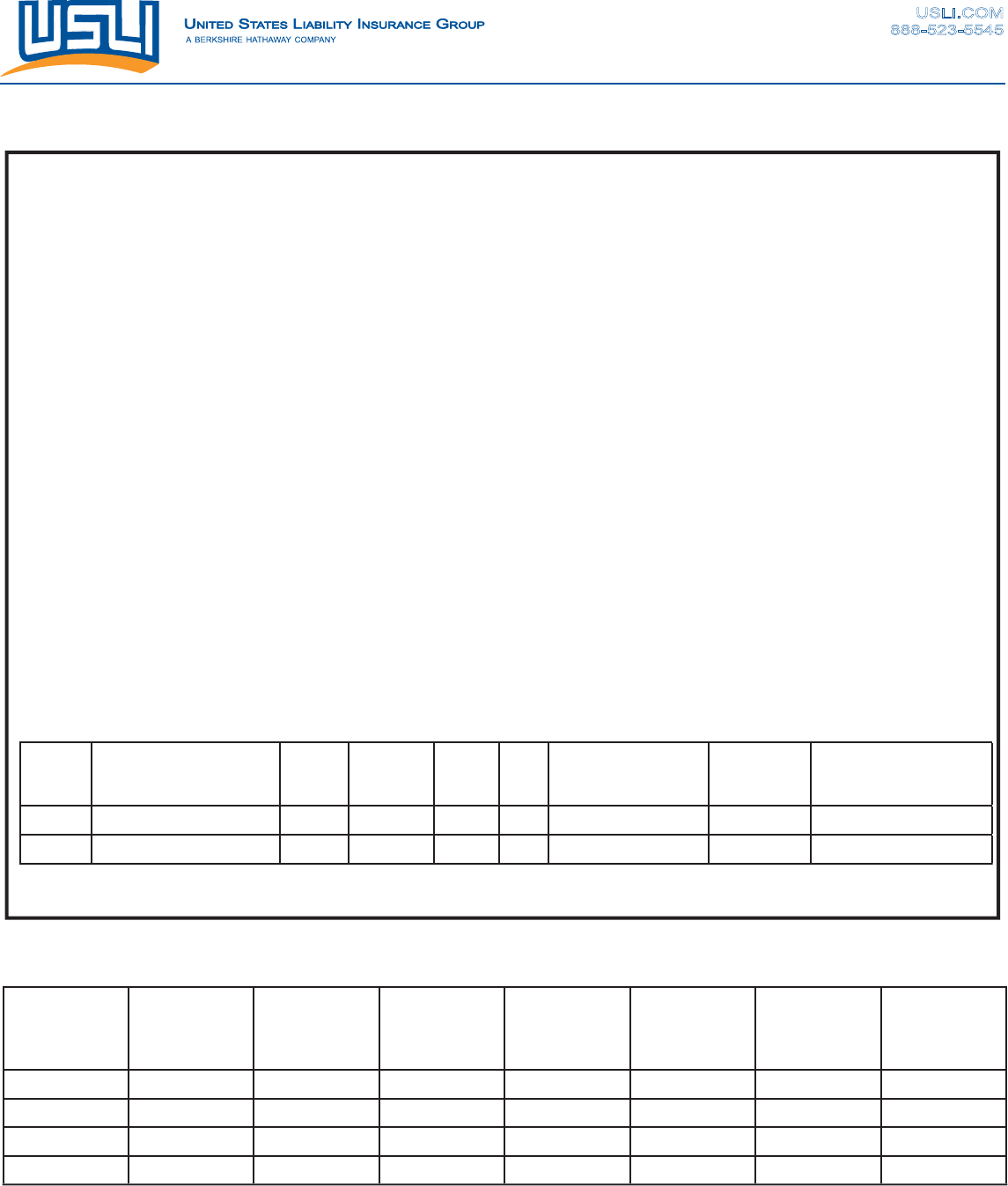

Watercraft Information

Please list all watercraft owned, leased, chartered, or furnished for regular use

*1.Sailboat 2. Powerboat 3. Jet Ski / Wave Runner

**1. Inland U.S. 2. Coastal U.S. 3. International Waters

Year Description

(Make and Model)

Length *Type Max

Speed

Total

HP

**Waters Navigated Any Paid

Crew or

Captain

Underlying

Liability

Operator Information (Automobiles, Watercraft, Recreational Vehicles)

Please list all members of the applicants household age 14 or older, and all operators of Automobiles, Motorcycles, Watercraft

and Recreational Vehicles. NOTE: Please include those household members that are not yet licensed.

Driver Name Date of

Birth

License

Number

License State Moving

Violation

Convictions

(Last 3 Years)

*Major Moving

Violation

Convictions

(Last 3 years)

At Fault

Accidents

(Last 3 years)

Drug Alcohol

Related

Offenses

(Last 5 Years)

*Major moving violation convictions include, but are not limited to, speeding 25 or more over the posted limit, evading the Police,

leaving the scene, vehicular homicide, driving under a suspended license and reckless driving.

Personal Umbrella-APP 12/12- USLI

page 1 of 4

II.ELIGIBILITY QUESTIONS NOTE:

For any “Yes” response, please provide complete information in remarks area

1. Does the applicant or any member of the applicant’s household currently have any active policies

with the United States Liability Insurance Company, Mount Vernon Fire Insurance Company

or U.S. Underwriters Insurance Company?

Yes No

2. Has the applicant or any resident of the applicant’s household been convicted of or plead guilty to

a felony in the past fi ve years?

Yes No

3. Has the applicant or any resident of the applicant’s household had a liability loss greater than $50,000

in the past fi ve years or is there an open liability claim or lawsuit pending against them?

Yes No

4. Are any locations used as rooming houses, student housing other than a college dormitory room, assisted

living facilities or group home facilities?

Yes No

5. Are any locations to be included subsidized housing? (subsidized housing question N.A. in the states

of CA, CT, DC, ME, MA, NJ, OR, UT, VT, WI)

Yes No

6. Is there a pool at any location that is either unfenced or has a diving board or waterslide?

Yes No

7. Does the applicant or any resident of the applicant’s household operate any business or conduct any

professional activities that are covered by primary policies at any location to be covered?

Yes No

8. Are any locations leased to others for hunting, fi shing or other sporting or recreational purposes?

Yes No

9. Does the applicant or any resident of the applicant’s household own any exotic pets?

Yes No

10. Is there a dog exclusion on any primary homeowners or comprehensive personal liability policy?

Yes No

11. Is there an animal exclusion on any primary homeowners or comprehensive personal liability policy?

Yes No

12. Are the minimum underlying limits for automobiles covered completely by a business auto or garage policy?

Yes No

13. Is any of the required underlying Insurance provided by a commercial general liability policy or coverage form?

Yes No

14. Does any household operator have any restriction on his/her driver’s license other than glasses or

corrective lenses? NOTE: Any “Yes” response requires submitting a completed L252R Physicians Medical Statement.

Yes No

15. Do any of the Required Underlying Insurance Policies contain sublimits, have reduced limits of liability, or exclude

coverage for specifi c individuals or exposures?

Yes No

16. Is there currently, or during the next 12 months will there be, any construction, renovation or demolition at any

residential 1-4 family residence or condominium owned by or rented to the applicant?

Yes No

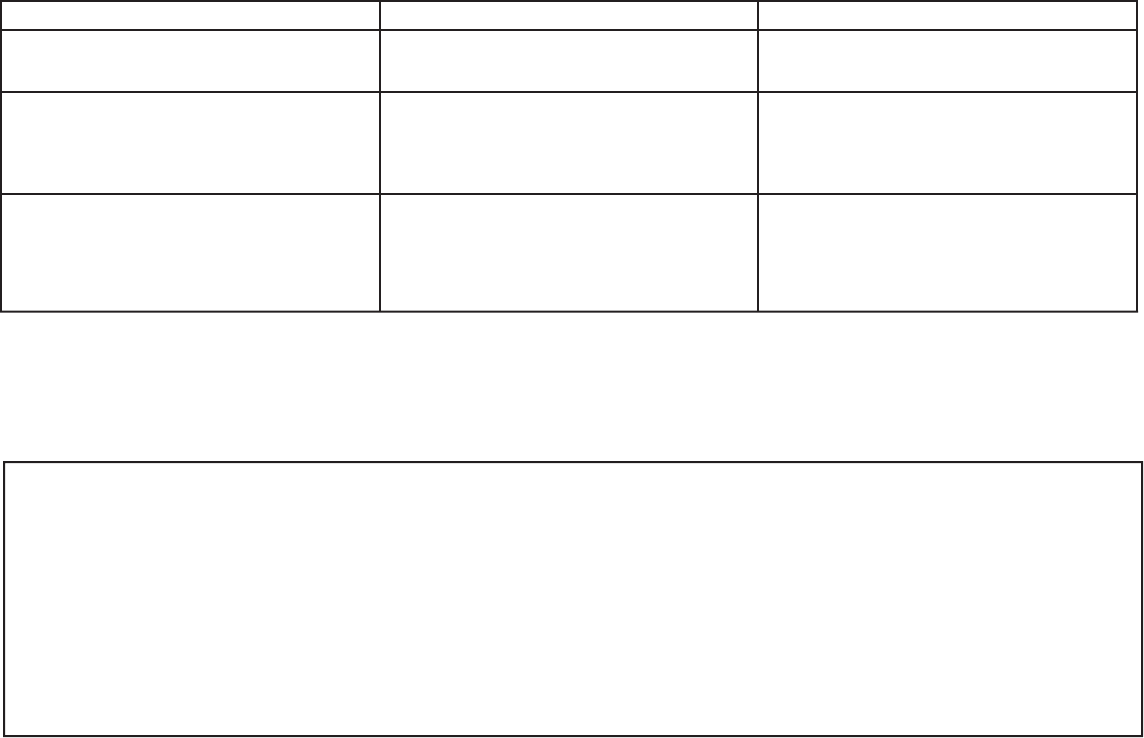

Residential Properties/Rental units and Apartments/Farms/Vacant Land. Include all units (duplex = 2 units)

Location Occupancy Underlying Liability Limit

Primary residence address

#units_____________________

Owner occupied

Tenant occupied #units____

Farm #acres____

Vacant land #acres____

Owner occupied

Tenant occupied #units____

Farm #acres____

Vacant land #acres____

* Any individual dwellings containing more than four units are ineligible

III.ADDITIONAL APPLICANT INFORMATION

Applicant’s mailing address (if different than primary residence address): ______________________________________________________

City:_______________________________________________________State: _____________________________Zip: _________________

Phone:________________________________________________________________________________________

Remarks

page 2 of 4

FRAUD STATEMENTS

Arizona Notice: Misrepresentations, omissions, concealment of facts and incorrect statements shall prevent recovery under the policy only if the

misrepresentations, omissions, concealment of facts or incorrect statements are; fraudulent or material either to the acceptance of the risk, or to the

hazard assumed by the insurer or the insurer in good faith would either not have issued the policy, or would not have issued a policy in as large an

amount, or would not have provided coverage with respect to the hazard resulting in the loss, if the true facts had been made known to the insurer as

required either by the application for the policy or otherwise.

Colorado Fraud Statement: It is unlawful to knowingly provide false, incomplete, or misleading facts or information to an insurance company for the

purpose of defrauding or attempting to defraud the company. Penalties may include imprisonment, fines, denial of insurance and civil damages. Any

insurance company or agent of an insurance company who knowingly provides false, incomplete, or misleading facts or information to a policyholder or

claimant for the purpose of defrauding or attempting to defraud the policyholder or claimant with regard to a settlement or award payable from insurance

proceeds shall be reported to the Colorado division of insurance within the department of regulatory agencies.

District of Columbia Fraud Statement: WARNING: It is a crime to provide false or misleading information to an insurer for the purpose of defrauding

the insurer or any other person. Penalties include imprisonment and/or fines. In addition, an insurer may deny insurance benefits if false information

materially related to a claim was provided by the applicant.

Florida Fraud Statement: Any person who knowingly and with intent to injure, defraud, or deceive any insurer files a statement of claim or an

application containing any false, incomplete, or misleading information is guilty of a felony of the third degree.

Florida Notice: (Applies only if policy is non-admitted) You are agreeing to place coverage in the surplus lines market. Superior coverage may be

available in the admitted market and at a lesser cost. Persons insured by surplus lines carriers are not protected under the Florida Insurance Guaranty

Act with respect to any right of recovery for the obligation of an insolvent unlicensed insurer.

Florida Fraud Statement: You are agreeing to place coverage in the surplus lines market. Superior coverage may be available in the admitted market

and at a lesser cost. Persons insured by surplus lines carriers are not protected under the Florida Insurance Guaranty Act with respect to any right of

recovery for the obligation of an insolvent unlicensed insurer.

Florida and Illinois Notice: I understand that there is no coverage for punitive damages assessed directly against an insured under Florida and Illinois

law. However, I also understand that punitive damages that are not assessed directly against an insured, also known as “vicariously assessed punitive

damages”, are insurable under Florida and Illinois law. Therefore, if any Policy is issued to the Applicant as a result of this Application and such Policy

provides coverage for punitive damages, I understand and acknowledge that the coverage for Claims brought in the State of Florida and Illinois is limited

to “vicariously assessed punitive damages” and that there is no coverage for directly assessed punitive damages.

Kansas Fraud Statement: Any person who, knowingly and with intent to defraud, presents, causes to be presented or prepares with knowledge or

belief that it will be presented to or by an insurer, purported insurer, broker or any agent thereof, any written statement as part of, or in support of,

an application for the issuance of, or the rating of an insurance policy for personal or commercial insurance, or a claim for payment or other benefit

pursuant to an insurance policy for commercial or personal insurance which such person knows to contain materially false information concerning any

fact material thereto; or conceals, for the purpose of misleading, information concerning any fact material thereto may be guilty of a crime and may be

subject to fines and confinement in prison.

Kentucky Fraud Statement: Any person who knowingly and with intent to defraud any insurance company or other person files an application for

insurance containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto

commits a fraudulent insurance act, which is a crime.

Maine Fraud Statement: It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the

purpose of defrauding the company. Penalties may include imprisonment, fines or a denial of insurance benefits. A binder may not be

withdrawn but a prospective notice of cancellation may be sent and coverage denied for fraud or material misrepresentation in obtaining

coverage. A policy may not be unilaterally rescinded or voided.

Washington Fraud Statement: It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the

purpose of defrauding the company. Penalties may include imprisonment, fines or a denial of insurance benefits.

Maryland: Any person who knowingly or willfully presents a false or fraudulent claim for payment of a loss or benefit or who knowingly or willfully

presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.Minnesota Notice:

Authorization or agreement to bind the insurance may be withdrawn or modified only based on changes to the information contained in this application

prior to the effective date of the insurance applied for that may render inaccurate, untrue or incomplete any statement made with a minimum of 10 days

notice given to the insured prior to the effective date of cancellation when the contract has been in effect for less than 90 days or is being canceled for

nonpayment of premium.

New Jersey Fraud Statement: Any person who includes any false or misleading information on an application for an insurance policy is subject to

criminal and civil penalties.

New York Disclosure Notice: This policy is written on a claims made basis and shall provide no coverage for claims arising out of incidents,

occurrences or alleged Wrongful Acts or Wrongful Employment Acts that took place prior to retroactive date, if any, stated on the declarations. This

policy shall cover only those claims made against an insured while the policy remains in effect for incidents reported during the Policy Period or any

subsequent renewal of this Policy or any extended reporting period and all coverage under the policy ceases upon termination of the policy except for

the automatic extended reporting period coverage unless the insured purchases additional extend reporting period coverage. The policy includes an

automatic 60 day extended claims reporting period following the termination of this policy. The Insured may purchase for an additional premium an

additional extended reporting period of 12 months, 24 months or 36 months following the termination of this policy. Potential coverage gaps may arise

upon the expiration for this extended reporting period. During the first several years of a claims-made relationship, claims-made rates are comparatively

lower than occurrence rates. The insured can expect substantial annual premium increases independent overall rate increases until the claims-made

relationship has matured.

North Dakota Fraud Statement: Notice to North Dakota applicants – Any person who knowingly and with the intent to defraud and insurance company

or other person, files an application for insurance or statement of claim containing any materially false information, or conceals for the purpose of

misleading, information concerning any fact material thereto, commits a fraudulent insurance act, which is a crime and shall also be subject to a civil

penalty.

Ohio Fraud Statement: Any person who, with intent to defraud or knowing that he is facilitating a fraud against an insurer, submits an application or

files a claim containing a false or deceptive statement is guilty of insurance fraud.

Ohio Notice: By acceptance of this policy, the Insured agrees the statements in the application (new or renewal) submitted to the company are true and

correct. It is understood and agreed that, to the extent permitted by law, the Company reserves the right to rescind this policy, or any coverage provided

page 3 of 4

herein, for material misrepresentations made by the Insured. It is understood and agreed that the statements made in the insurance applications are

incorporated into, and shall form part of, this policy. I understand that any material misrepresentation or omission made by me on this application may act

to render any contract of insurance null and without effect or provide the company the right to rescind it.

Oklahoma Fraud Statement: WARNING: Any person who knowingly, and with intent to injure, defraud or deceive any insurer, makes any claim for the

proceeds of an insurance policy containing any false, incomplete or misleading information is guilty of a felony.

Oregon Fraud Statement: Notice to Oregon applicants: Any person who, with intent to defraud or knowing that he is facilitation a fraud against an insurer,

submits an application or files a claim containing a false or deceptive statement may be guilty of insurance fraud.

Pennsylvania Fraud Statement: Any person who knowingly and with intent to defraud any insurance company or other person files an application for

insurance or statement of claim containing any materially false information or conceals for the purpose of misleading, information concerning any fact

material thereto commits a fraudulent insurance act, which is a crime and subjects such person to criminal and civil penalties.

Tennessee and Virginia Fraud Statement: It is a crime to knowingly provide false, incomplete or misleading information to an insurance

company for the purpose of defrauding the company. Penalties include imprisonment, fines and denial of insurance benefits.

Utah Notice: I understand that Punitive Damages are not insurable in the state of Utah. There will be no coverage afforded for Punitive Damages for

any Claim brought in the State of Utah. Any coverage for Punitive Damages will only apply if a Claim is filed in a state which allows punitive or exemplary

damages to be insurable. This may apply if a Claim is brought in another state by a subsidiary or additional location(s) of the Named Insured, outside the

state of Utah, for which coverage is sought under the same policy.

Vermont Fraud Statement: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false

information in an application for insurance may be subject to fines and confinement in prison.

Virginia Notice: This Policy is written on a claims-made basis. Please read the policy carefully to understand your coverage. You have an option to

purchase a separate limit of liability for the extended reporting period. If you do not elect this option, the limit of liability for the extended reporting period

shall be part of the and not in addition to limit specified in the declarations. If you have any questions regarding the cost of an extended reporting period,

please contact your insurance company or your insurance agent. Statements in the application shall be deemed the insured’s representations. A statement

made in the application or in any affidavit made before or after a loss under the policy will not be deemed material or invalidate coverage unless it is clearly

proven that such statement was material to the risk when assumed and was untrue.

Virginia Fraud Statement: Any person who knowingly and with intent to defraud an insurer, submits an Application for insurance or files a claim

containing a false or deceptive statement is guilty of insurance fraud.

Utah Fraud Statement: Any person who, with intent to defraud or knowing that he is facilitating a fraud against an insurer, submits an application or files a

claim containing a false or deceptive statement is guilty of insurance fraud.

Washington Fraud Statement: Any person, who, knowing it to be such:

(1) Presents, or causes to be presented, a false or fraudulent claim or any proof in support of such a claim, for the payment of a Loss under a contract of

insurance; or

(2) Prepares, makes, or subscribes any false or fraudulent account, certificate, affidavit, or proof of Loss, or other document or writing, with intent that it

be presented or used in support of such a claim, is guilty of a gross misdemeanor, or if such claim is in excess of one thousand five hundred dollars, of a

class C felony.

Fraud Statement (All Other States): Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly

presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

If your state requires that we have information regarding your Authorized Retail Agent or Broker, please provide below.

Retail agency name: License#:

Agent’s signature: ____________________________________________________Main agency phone number _________________________________

(Required in New Hampshire)

Agency mailing address: ______________________________________________________________________________________________________

City: _____________________________________State: _____________________________ Zip: _________________________

The undersigned represents that to the best of his/her knowledge and belief the particulars and statements set forth herein are true and agrees that those

particulars and statements are material to acceptance of the risk assumed by the Company. The undersigned further declares that any changes to the

information contained in this application prior to the effective date of the insurance applied for which may render inaccurate, untrue, or incomplete any

statement made will immediately be reported in writing to the Company and the Company may withdraw or modify any outstanding quotations and/or

authorization or agreement to bind the insurance. The Company is hereby authorized, but not required to make any investigation and inquiry in connection

with the information, statements and disclosures provided in this application. The decision of the Company not to make or to limit any investigation or

inquiry shall not be deemed a waiver of any rights by the Company and shall not stop the Company from relying on any statement in this application. The

signing of this application does not bind the undersigned to purchase the insurance, nor does the review of this application bind the Company to issue a

policy. It is understood the Company is relying on this application in the event the Policy is issued. It is agreed that this Application, including any material

submitted there with, shall be the basis of the contract should a policy be issued and it will be attached and become a part of the policy.

New York Fraud Statement: Any person who knowingly and with intent to defraud any insurance company or other person files an application for

insurance or statement of claim containing any materially false information, or conceals for the purpose of misleading, information concerning any fact

material thereto, commits a fraudulent insurance act, which is a crime and shall also be subject to a civil penalty not to exceed five thousand dollars and

the stated value of the claim for each such violation.

Signature: __________________________________________________________________________________________________________________

(Chairperson of the Board, Managing Member, President or Executive Director)

Title: _______________________________________________________________ Date: _________________________________________________

page 4 of 4