FM 1-06

FINANCIAL

MANAGEMENT

OPERATIONS

APRIL 2011

DISTRIBUTION RESTRICTION: Distribution for public release;

distribution is unlimited.

HEADQUARTERS

DEPARTMENT OF THE ARMY

*FM 1-06

Field Manual

Headquarters

Department of the Army

No. 1-06

Washington, DC, 4 April 2011

FINANCIAL MANAGEMENT OPERATIONS

Contents

Page

PREFACE..............................................................................................................vi

INTRODUCTION ..................................................................................................vii

Chapter 1 FINANCIAL MANAGEMENT OPERATIONS .................................................... 1-1

Section I – Financial Management Mission and Purpose ............................ 1-1

Principles of Financial Management .................................................................. 1-2

Financial Management Core Competencies ...................................................... 1-5

Section II – Financial Management and the Sustainment Warfighting

Function............................................................................................................. 1-8

Financial Management and the Elements of Combat Power ............................. 1-9

The Fiscal Triad ................................................................................................ 1-10

Financial Management Support to Force Projection ........................................ 1-11

Section III – Army Financial Management with Interorganizational

Partners (Joint, Multinational, Intergovernmental, Interagency, and

Nongovernmental) .......................................................................................... 1-12

Section IV – Financial Management Support to Stability Operations ....... 1-15

Financial Management Supporting Tasks ........................................................ 1-16

Section V – Financial Management Organizations, Responsibilities and

Organizational Relationships ........................................................................ 1-17

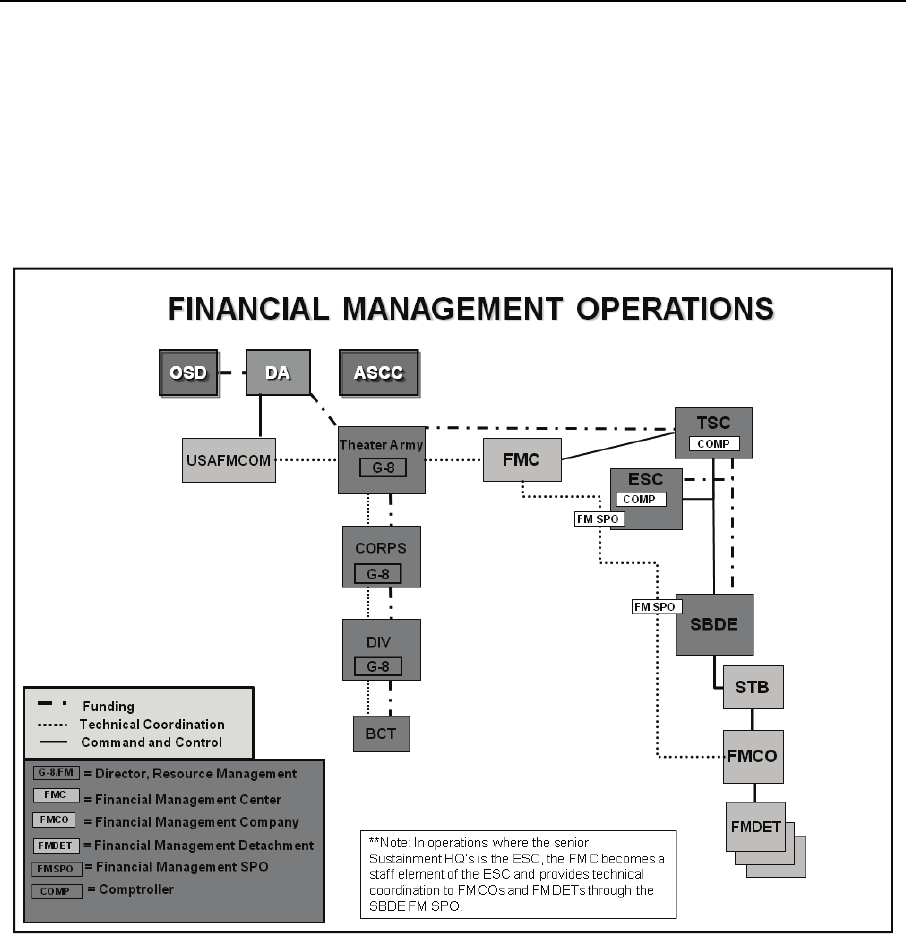

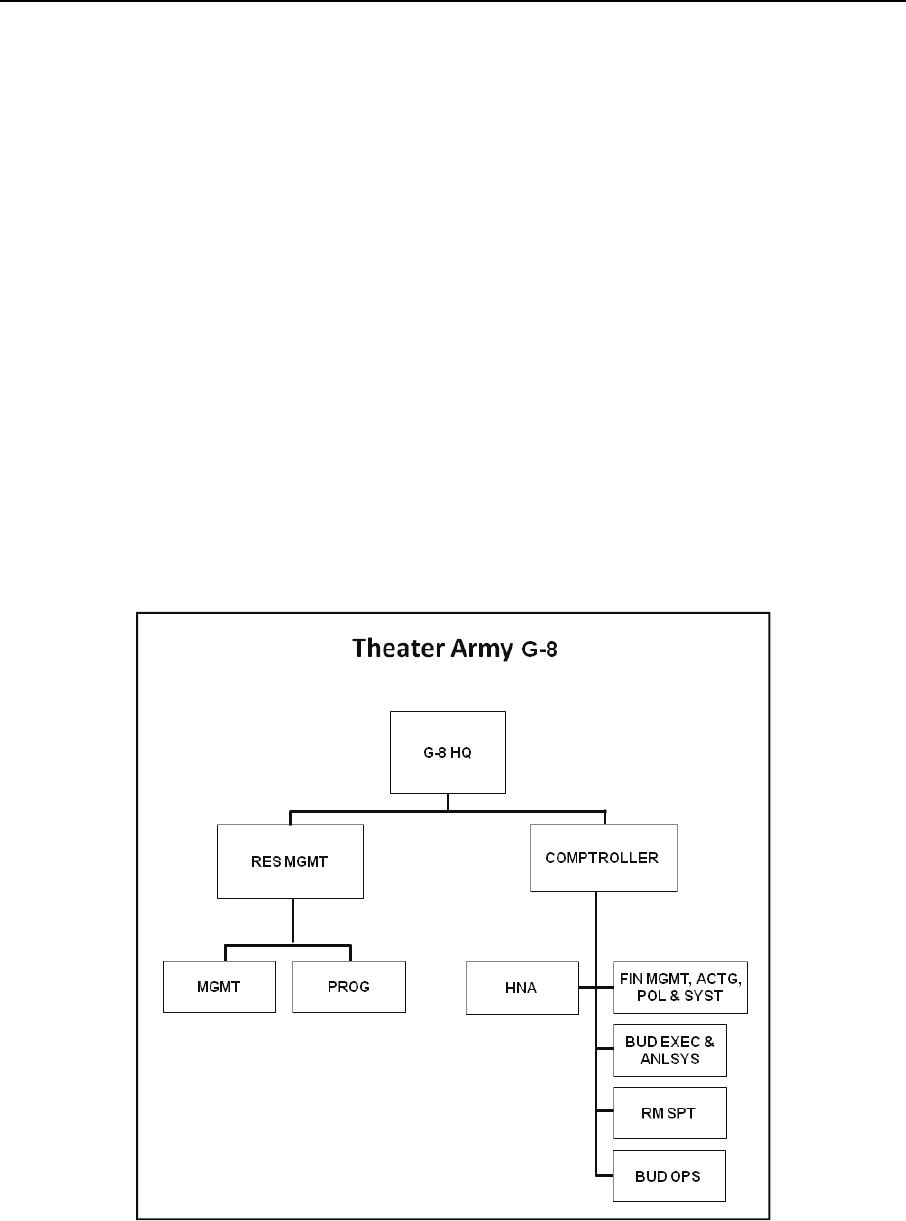

Strategic Financial Management ...................................................................... 1-18

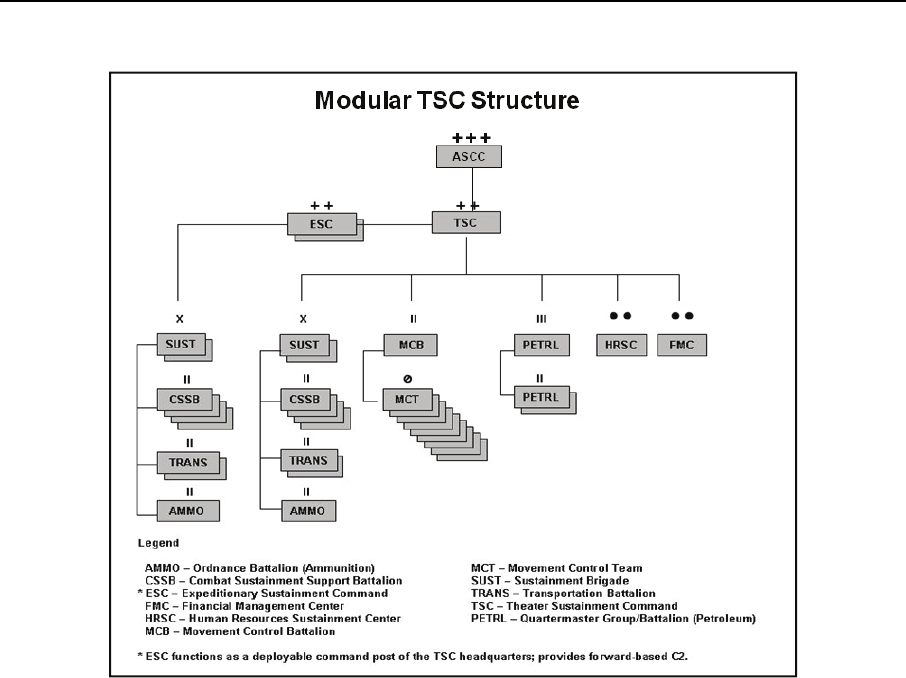

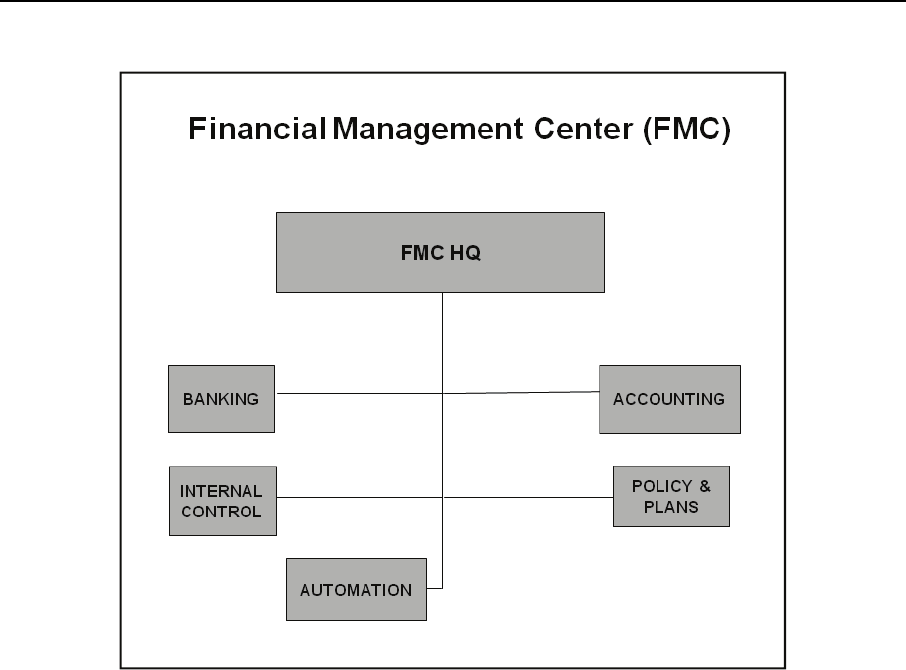

Operational Financial Management ................................................................. 1-20

Tactical Financial Management ........................................................................ 1-28

Brigade Level Financial Management .............................................................. 1-37

Chapter 2 FUND THE FORCE............................................................................................ 2-1

Section I – Appropriations/Authorization Process ....................................... 2-1

Administrative Control and Distribution of Funds ............................................... 2-3

Basic Appropriations That Fund the Army.......................................................... 2-5

The Legislative Proposal Process in Support of Contingency Operations ......... 2-7

Section II – Fiscal Law ..................................................................................... 2-8

Basic Tenets of Fiscal Law ................................................................................. 2-8

Distribution Restriction: Distribution for public release; distribution is unlimited.

*This publication supersedes FM 1-06, 21 September 2006.

4 April 2011 i

Contents

Anti-Deficiency Act (ADA) ................................................................................... 2-9

Section III – Resource Management Support ...............................................2-10

Resource Management Support to Stability Operations................................... 2-10

Funding Contingency Operations .....................................................................2-11

Strategic Resource Management .....................................................................2-13

Operational Resource Management .................................................................2-16

Tactical Resource Management .......................................................................2-17

Chapter 3 BANKING AND DISBURSING SUPPORT ........................................................3-1

Section I – Banking Support ............................................................................3-1

Banking and Host Nation Support ....................................................................... 3-1

Cash Management..............................................................................................3-2

Economic Impact................................................................................................. 3-3

Section II – Disbursing Operations .................................................................3-3

Cash Verification .................................................................................................3-4

Reporting and Analysis .......................................................................................3-4

Irregularities in Disbursing Officer Accounts .......................................................3-4

Managing a Limited Depositary Account ............................................................3-5

Transfer of Accountability (Settlement) ...............................................................3-5

Types of Disbursing Support ...............................................................................3-5

Special Payments ...............................................................................................3-9

Miscellaneous Disbursing Support .................................................................... 3-10

Disbursing Roles ............................................................................................... 3-11

Chapter 4 PAY SUPPORT ..................................................................................................4-1

Section I – Active Duty Pay.............................................................................. 4-1

Key FM Reports ..................................................................................................4-2

Separation of Duties............................................................................................ 4-2

Section II – Reserve Component Pay.............................................................. 4-3

Mobilization/Demobilization ................................................................................4-4

Section III – Case Management System .........................................................4-4

Types of CMS Cases ..........................................................................................4-4

Chapter 5 ACCOUNTING SUPPORT AND COST MANAGEMENT ..................................5-1

Section I – Accounting Support ......................................................................5-2

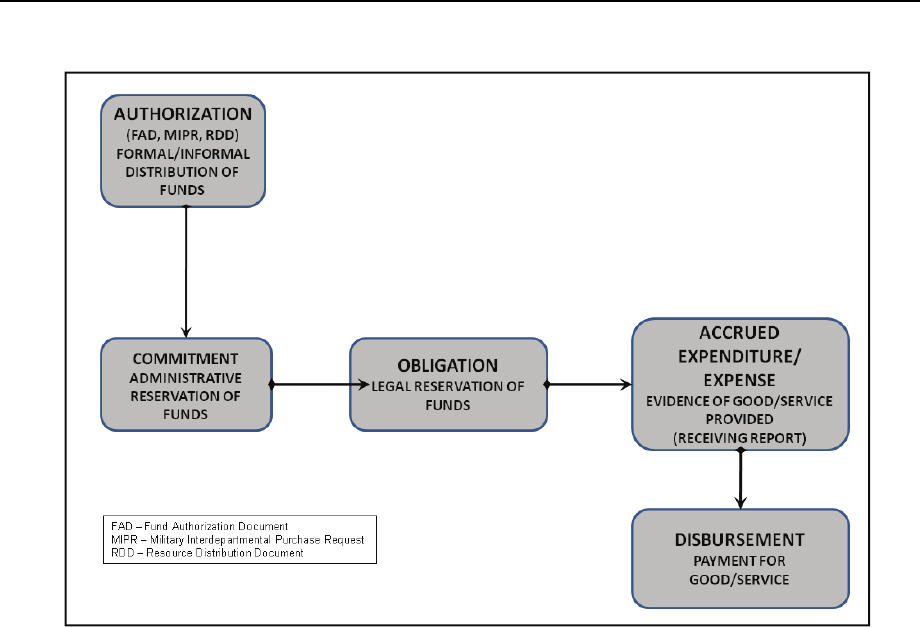

Stages of a Transaction ......................................................................................5-3

Obligation Management ...................................................................................... 5-5

Strategic Level Accounting Support ....................................................................5-6

Operational Level Accounting Support ...............................................................5-7

Tactical Level Accounting Support ...................................................................... 5-8

General Fund Enterprise Business Systems (GFEBS) ...................................... 5-9

Section II – Cost Management Support .......................................................... 5-9

Cost Culture ......................................................................................................5-10

Cost Management Support ............................................................................... 5-10

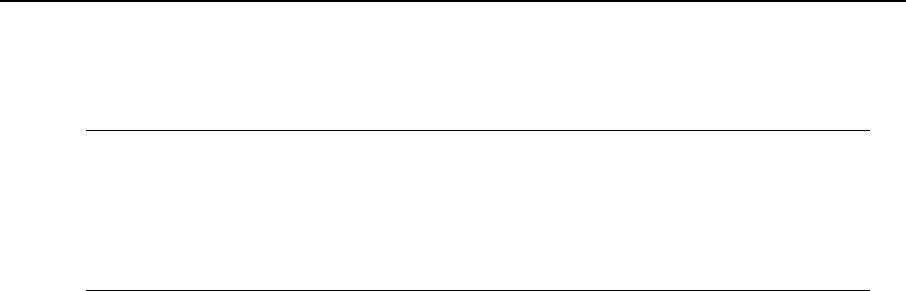

The Cost Management Process .......................................................................5-11

Cost Management Concepts ............................................................................5-15

Full Cost

............................................................................................................5-16

Cost Management During Contingency Operations .........................................5-17

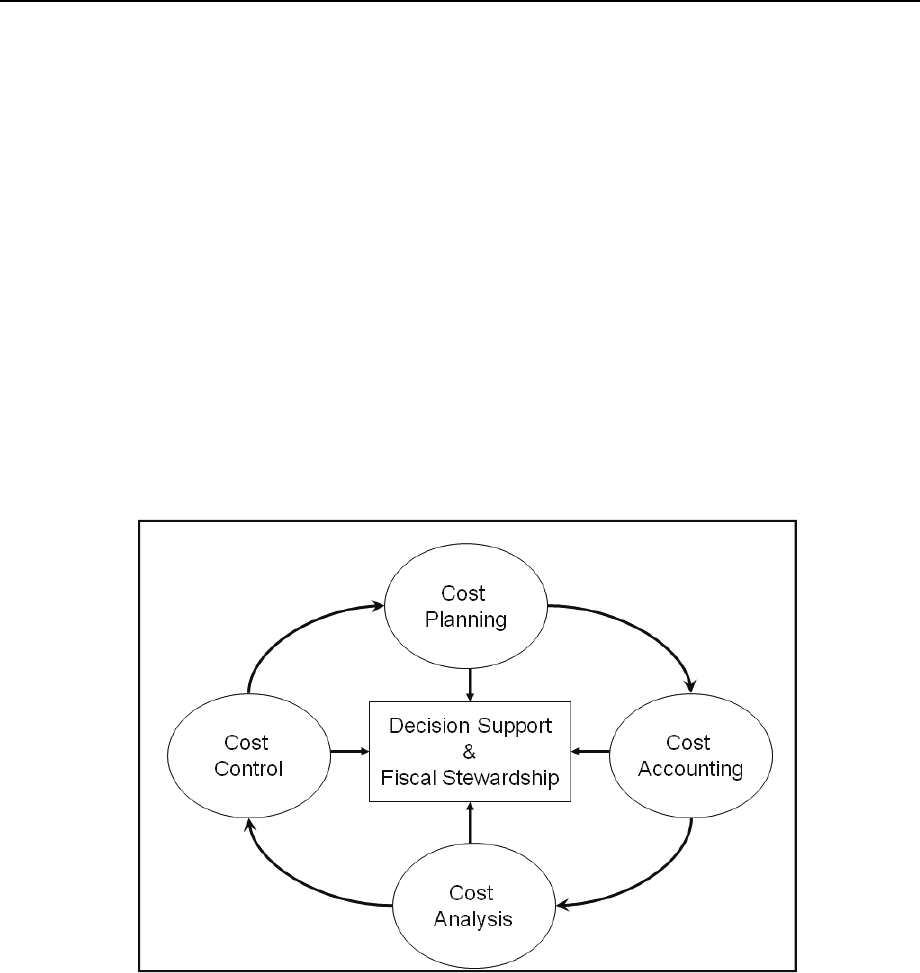

Cost Estimates for Contingency Operations ..................................................... 5-18

FM 1-06 4 April 2011 ii

Contents

Contingency Cost Reporting ............................................................................ 5-19

Cost Collection ................................................................................................. 5-20

Chapter 6 PLANNING AND OPERATIONS ....................................................................... 6-1

Section I – Planning ......................................................................................... 6-2

FM Planning Using the Military Decisionmaking Process (MDMP) .................... 6-3

Section II – Preparation.................................................................................... 6-7

Troop Leading Procedures (TLP) ....................................................................... 6-7

Section III – Execution ..................................................................................... 6-7

Command and Control ....................................................................................... 6-7

Financial Management Support Operations (FM SPO) ..................................... 6-8

Considerations in Support of the Procurement Process .................................. 6-10

Section IV - Assessment ................................................................................ 6-13

Assessment of FM Operations ......................................................................... 6-13

Chapter 7 MANAGEMENT INTERNAL CONTROLS ......................................................... 7-1

Section I – Management Responsibilities ...................................................... 7-1

Army Management Responsibility for Internal Control....................................... 7-1

Key Managers’ Internal Control Concepts .......................................................... 7-2

Establishing Accountability and Stewardship ..................................................... 7-3

Authority.............................................................................................................. 7-3

Responsibilities ................................................................................................... 7-4

Section II – Internal Control Process.............................................................. 7-5

Section III – Assessments and Corrective Actions ....................................... 7-7

Risk Assessment and Control Activities ............................................................. 7-7

Reporting, Correcting, and Tracking Material Weaknesses ............................... 7-8

Chapter 8 INFORMATION MANAGEMENT ....................................................................... 8-1

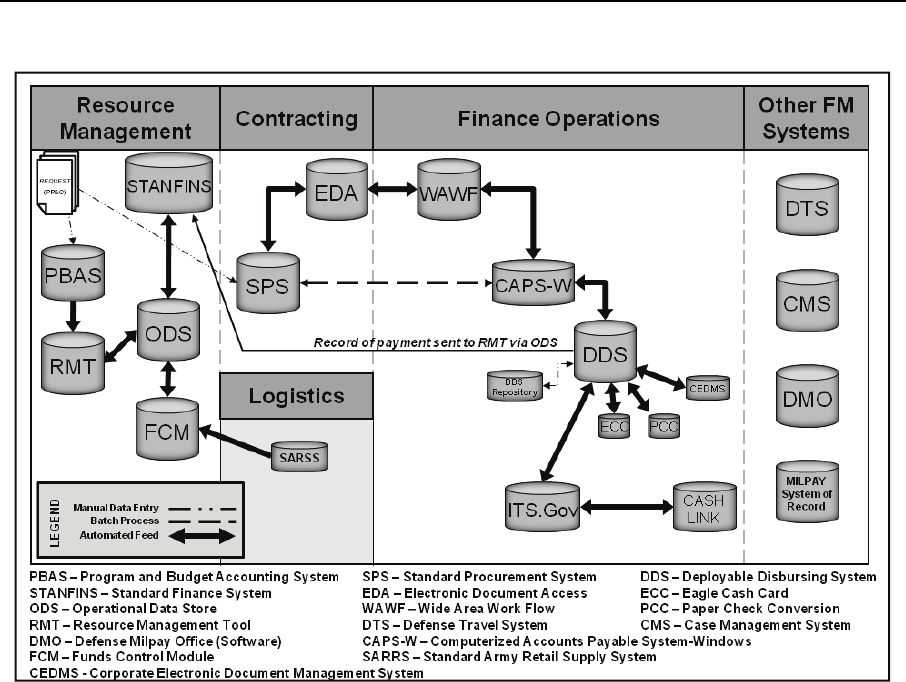

Section I – Financial Management Information Systems (FMIS) ................. 8-1

Resource Management ...................................................................................... 8-2

Logistics .............................................................................................................. 8-3

Contracting ......................................................................................................... 8-4

Finance Operations ............................................................................................ 8-4

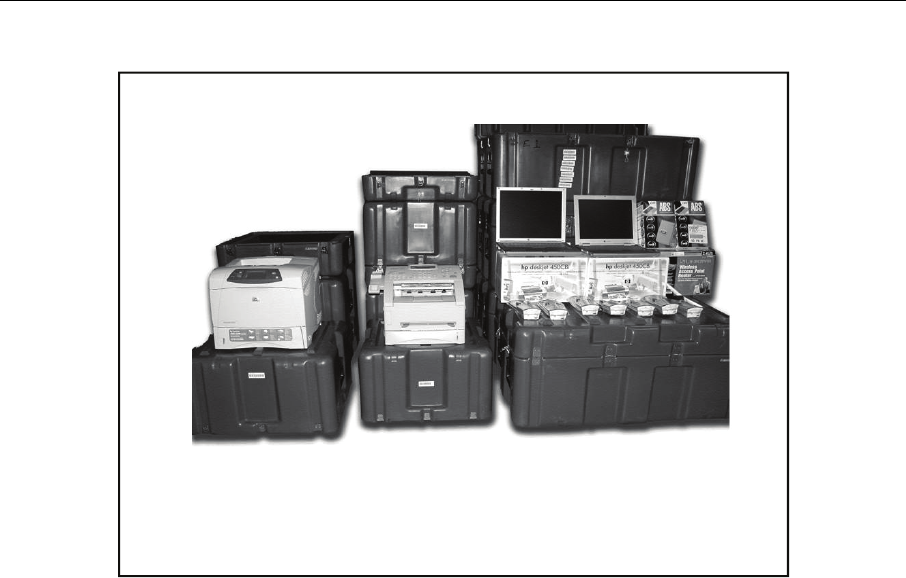

Section II – Financial Management Tactical Platform ................................... 8-6

Communication Requirements ........................................................................... 8-6

Disbursing ........................................................................................................... 8-7

Resource Management ...................................................................................... 8-7

Vendor Support .................................................................................................. 8-8

Travel .................................................................................................................. 8-8

Pay Support ........................................................................................................ 8-8

Section III – Communications ......................................................................... 8-8

Communication Modes ....................................................................................... 8-8

Internal Fixed Site Communications ................................................................. 8-10

Base and Remote Support Operations ............................................................ 8-10

Tactical Operations Interface ........................................................................... 8-10

Communications Security ................................................................................. 8-10

Signal Operating Instructions (SOI)

.................................................................. 8-10

Communication Networks ................................................................................. 8-10

4 April 2011 FM 1-06 iii

Contents

Theater Services ...............................................................................................8-11

Section IV – Organizational Information Technology (IT) Capabilities .....8-11

Section V – E-Commerce ...............................................................................8-12

Appendix A LEGAL ............................................................................................................... A-1

Appendix B FISCAL APPROPRIATIONS, AUTHORITIES, AND AGREEMENTS .............. B-1

Appendix C FINANCIAL MANAGEMENT SUPPORT TO MILITARY OPERATIONS IN A

MULTINATIONAL ENVIRONMENT .................................................................. C-1

Appendix D GUIDE TO OPERATION PLAN/ORDER DEVELOPMENT .............................. D-1

Appendix E FM PLANNING AND OPERATIONS ACTIVITIES ........................................... E-1

GLOSSARY .......................................................................................... Glossary-1

REFERENCES .................................................................................. References-1

INDEX ......................................................................................................... Index-1

Figures

Figure 1-1. Financial Management Core Functions ............................................................... 1-2

Figure 1-2. Principles of Financial Management ................................................................... 1-3

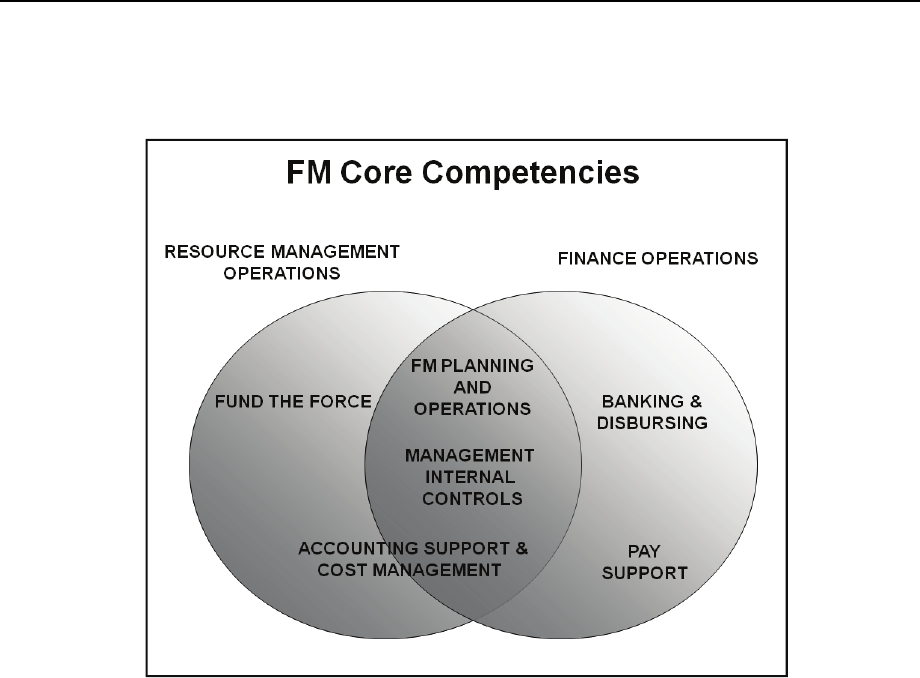

Figure 1-3. Financial Management Core Competencies ....................................................... 1-5

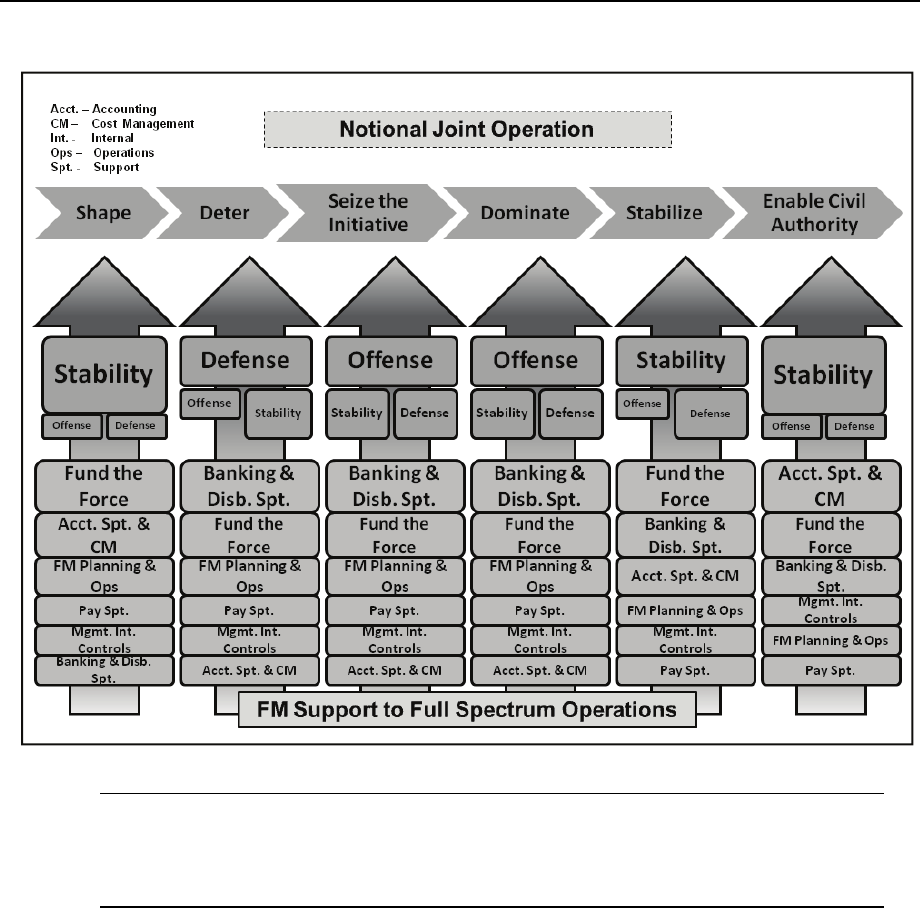

Figure 1-4. Example of Combining FM Support to FSO in a Notional Operation .................. 1-9

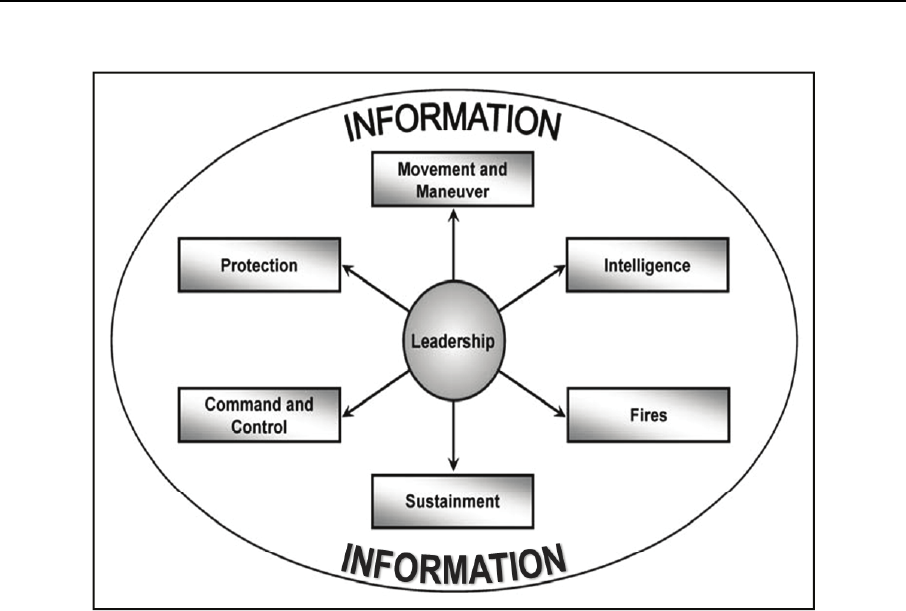

Figure 1-5. Elements of Combat Power ............................................................................... 1-10

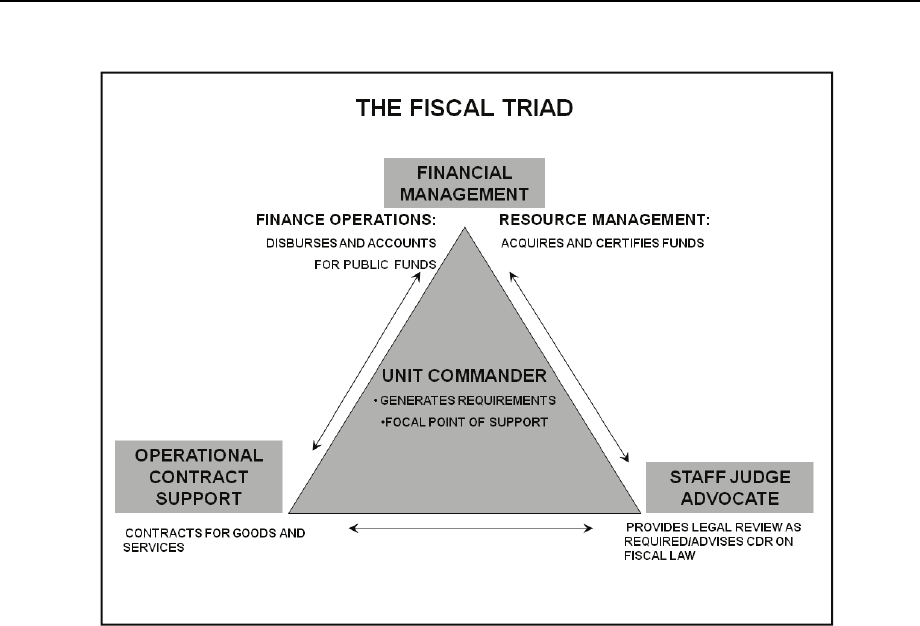

Figure 1-6. Fiscal Triad ........................................................................................................ 1-11

Figure 1-7. Authorities for Theater Army Sustainment Responsibilities .............................. 1-13

Figure 1-8. ART 7.3 Conduct Stability Operations ............................................................... 1-16

Figure 1-9. Notional FM Subtasks in Stability Operation ..................................................... 1-17

Figure 1-10. Financial Management Operations ................................................................. 1-18

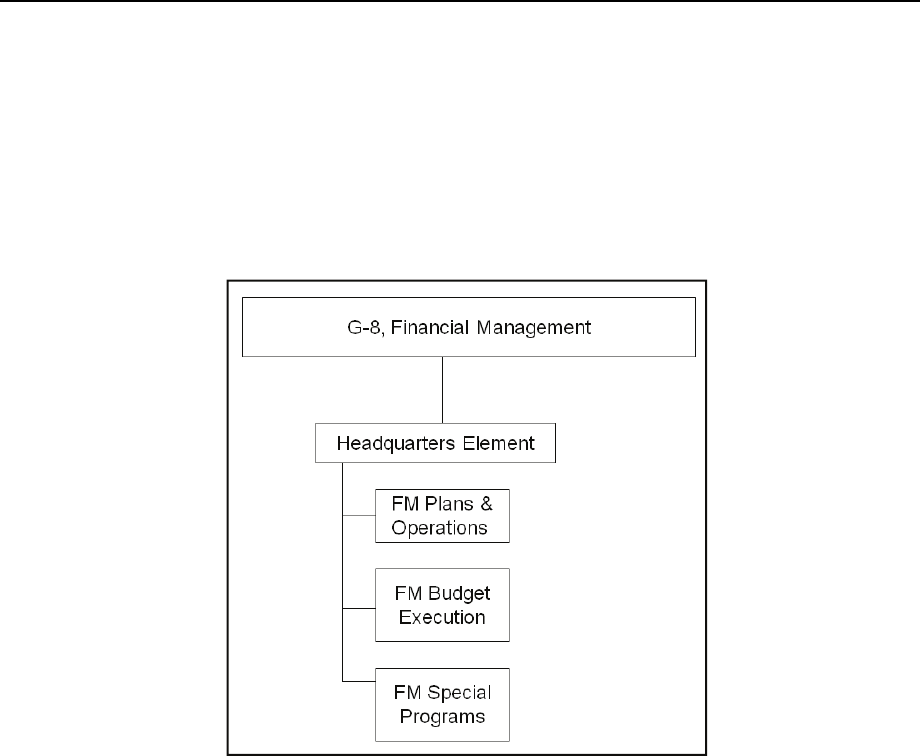

Figure 1-11. Theater Army G-8 ............................................................................................ 1-20

Figure 1-12. Theater Sustainment Command ..................................................................... 1-24

Figure 1-13. Financial Management Center (FMC) ............................................................. 1-26

Figure 1-14. Corps G-8 Organizational Structure ................................................................ 1-29

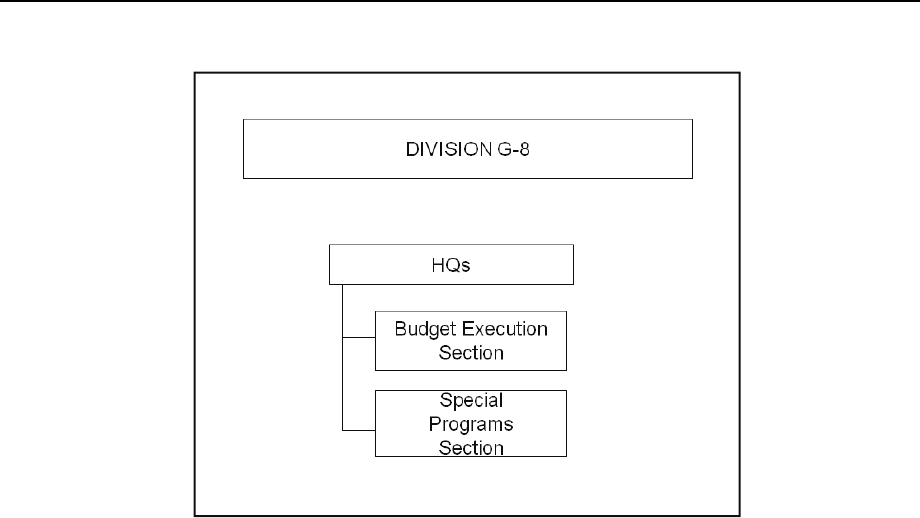

Figure 1-15. Division G-8 Organizational Structure ............................................................. 1-31

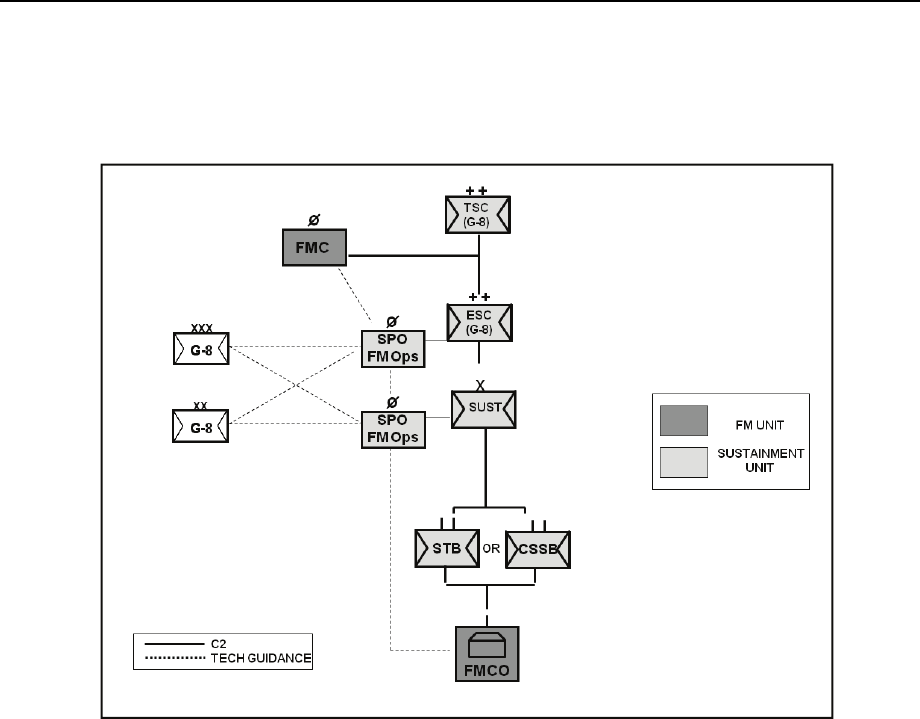

Figure 1-16. Financial Management Support Operations (FM SPO) .................................. 1-33

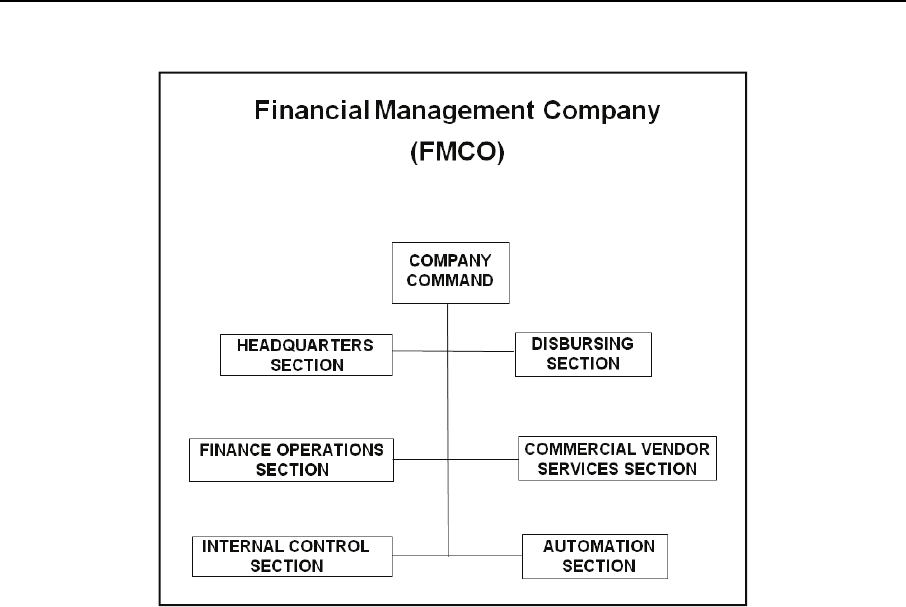

Figure 1-17. Financial Management Company (FMCO) ...................................................... 1-34

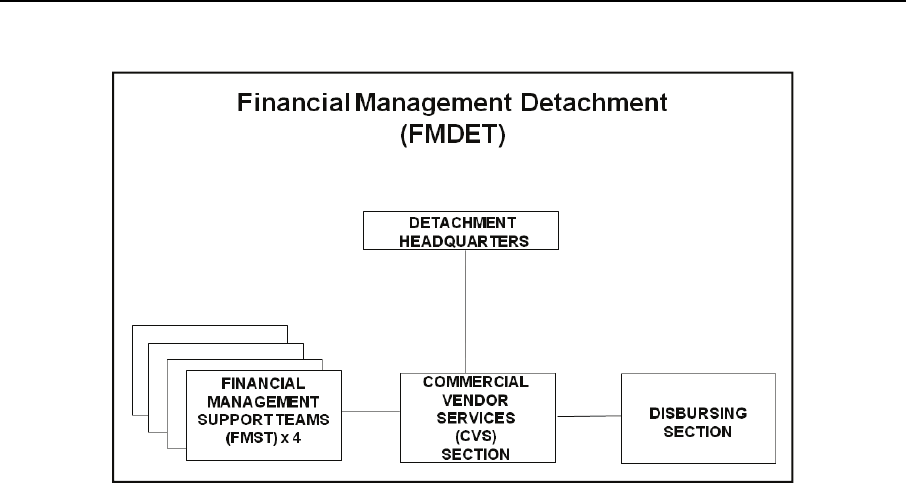

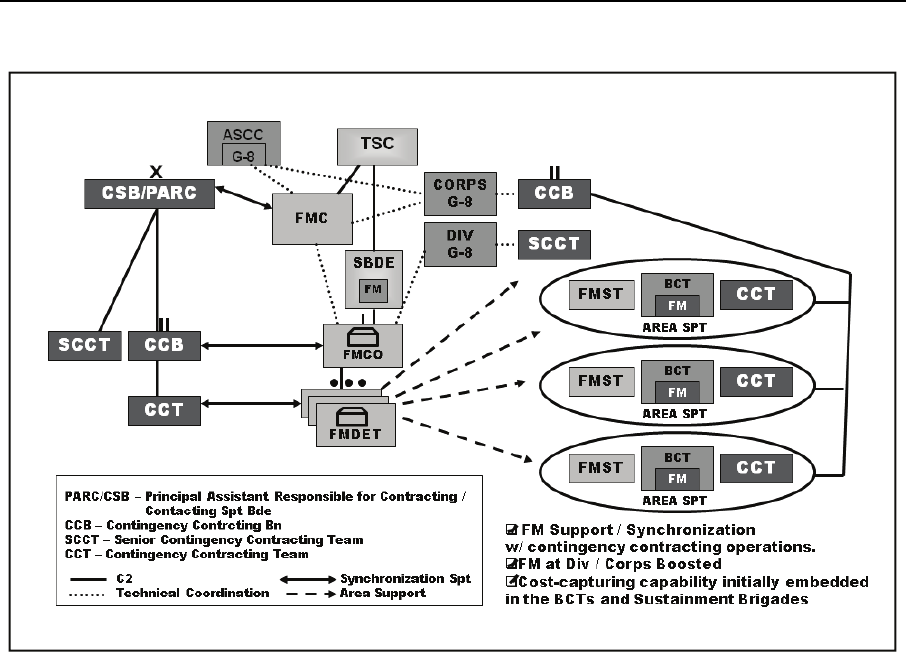

Figure 1-18. Financial Management Detachment (FMDET) ................................................ 1-36

Figure 1-19. GFEBS Enabled FM Operations ..................................................................... 1-38

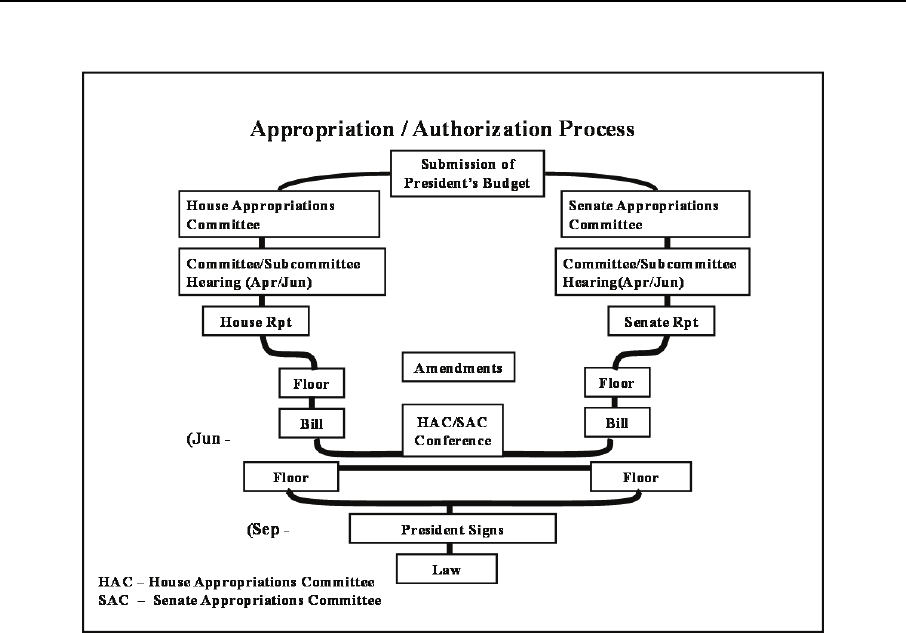

Figure 2-1. Appropriation/Authorization Process ................................................................... 2-2

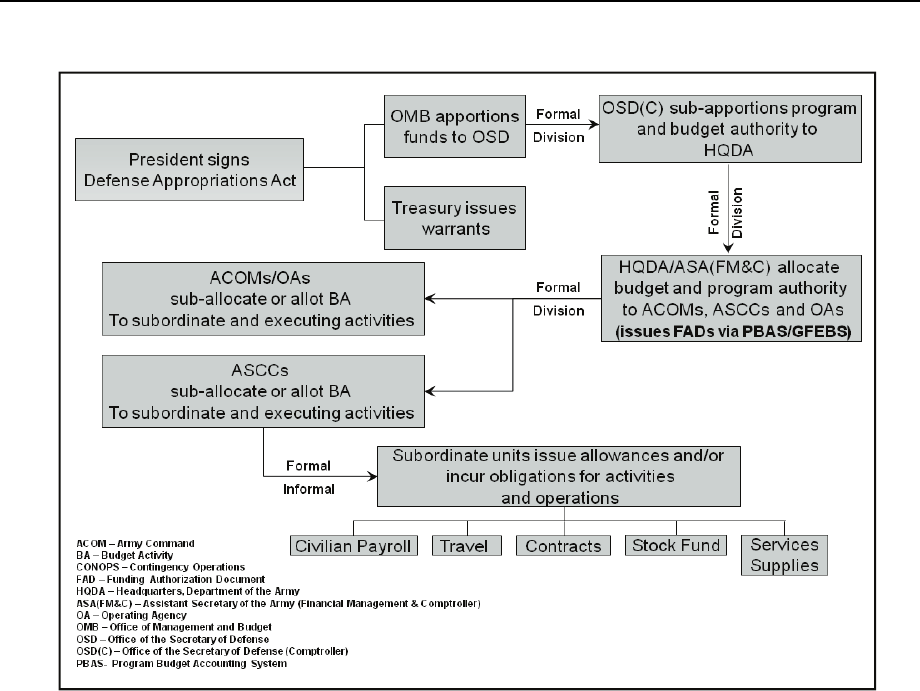

Figure 2-2. Distribution of Funds ............................................................................................ 2-5

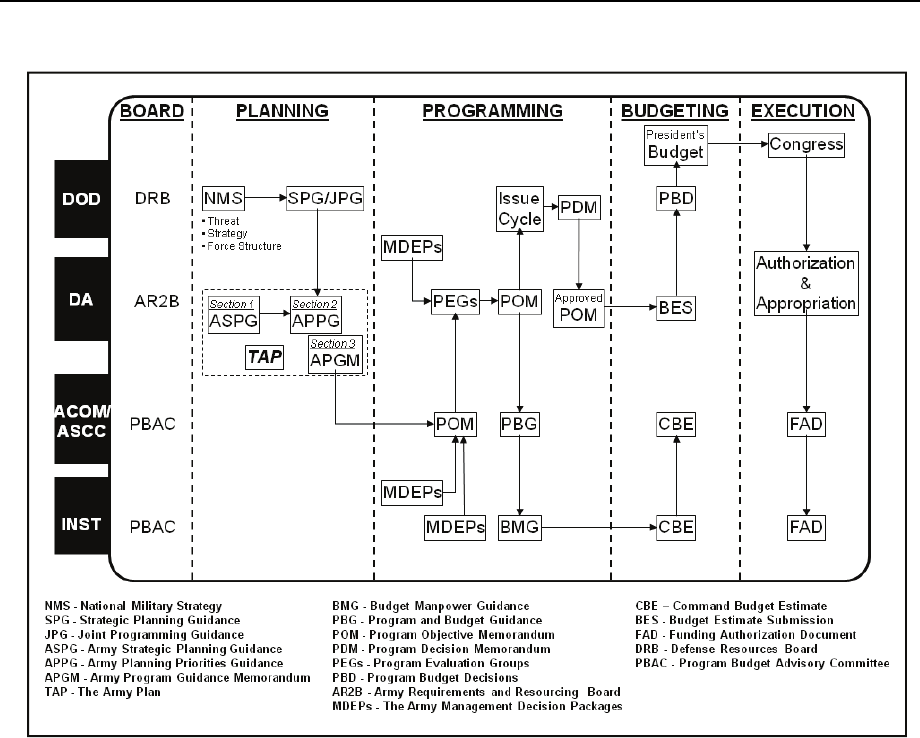

Figure 2-3. PPBE Flow Chart............................................................................................... 2-15

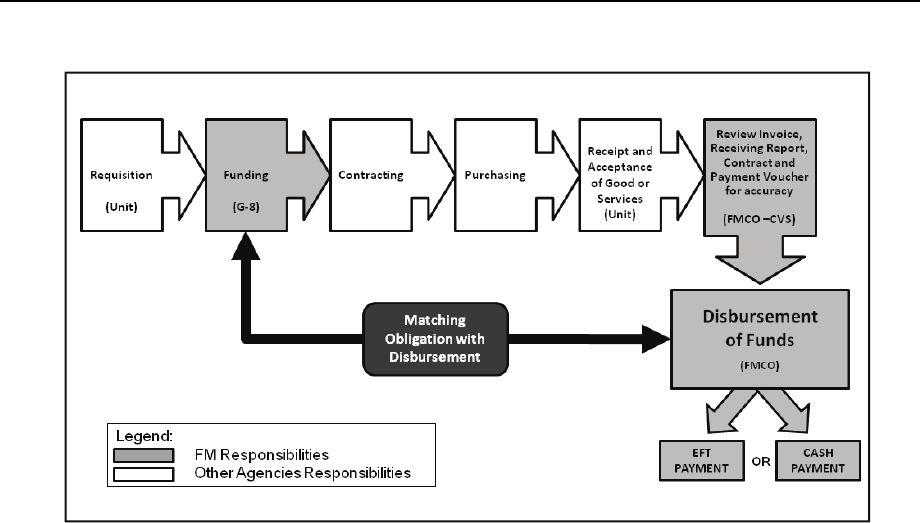

Figure 3-1. Procure to Pay Process (FM Procurement Support) ........................................... 3-7

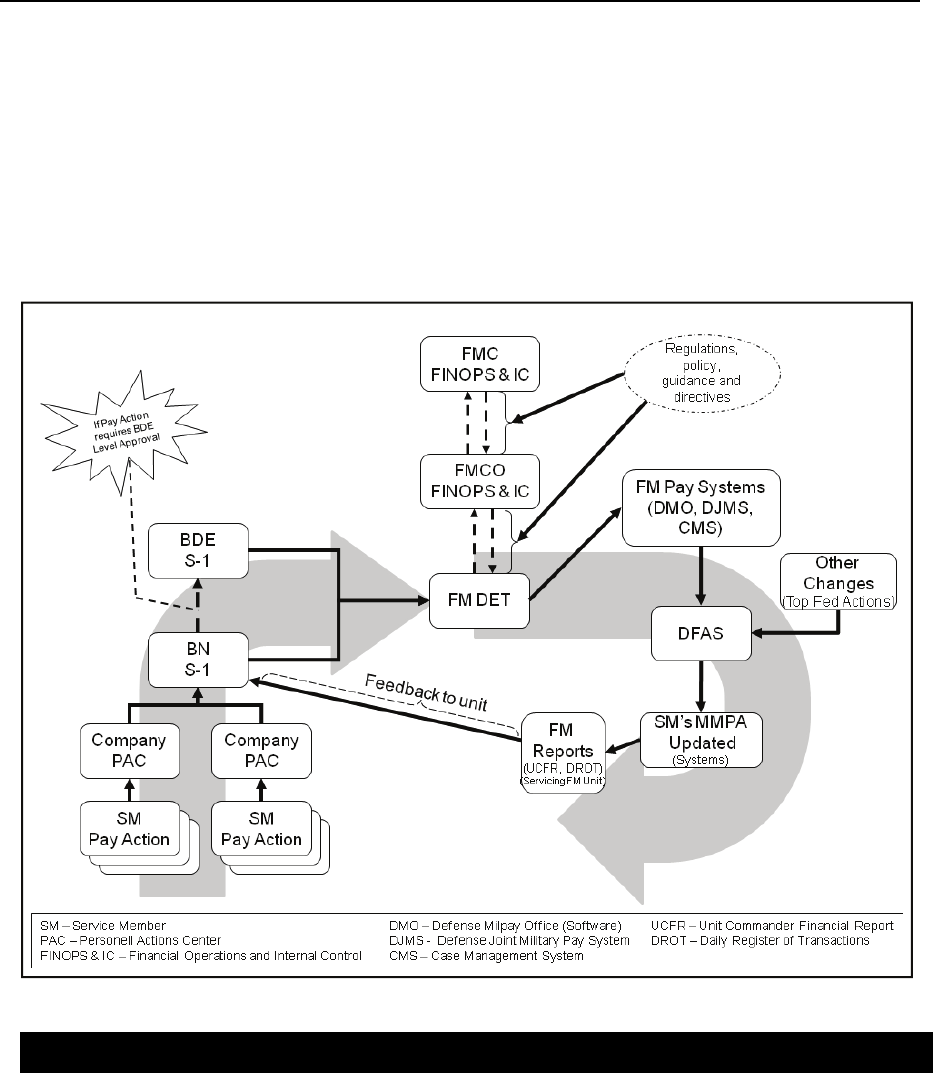

Figure 4-1. Pay Support Changes Document Flow ............................................................... 4-3

Figure 5-1. Stages of a Transaction....................................................................................... 5-3

Figure 5-2. Cost Management Process ............................................................................... 5-11

FM 1-06 4 April 2011 iv

Contents

Figure 5-3. Cost Management Support to Resourcing Operations ...................................... 5-13

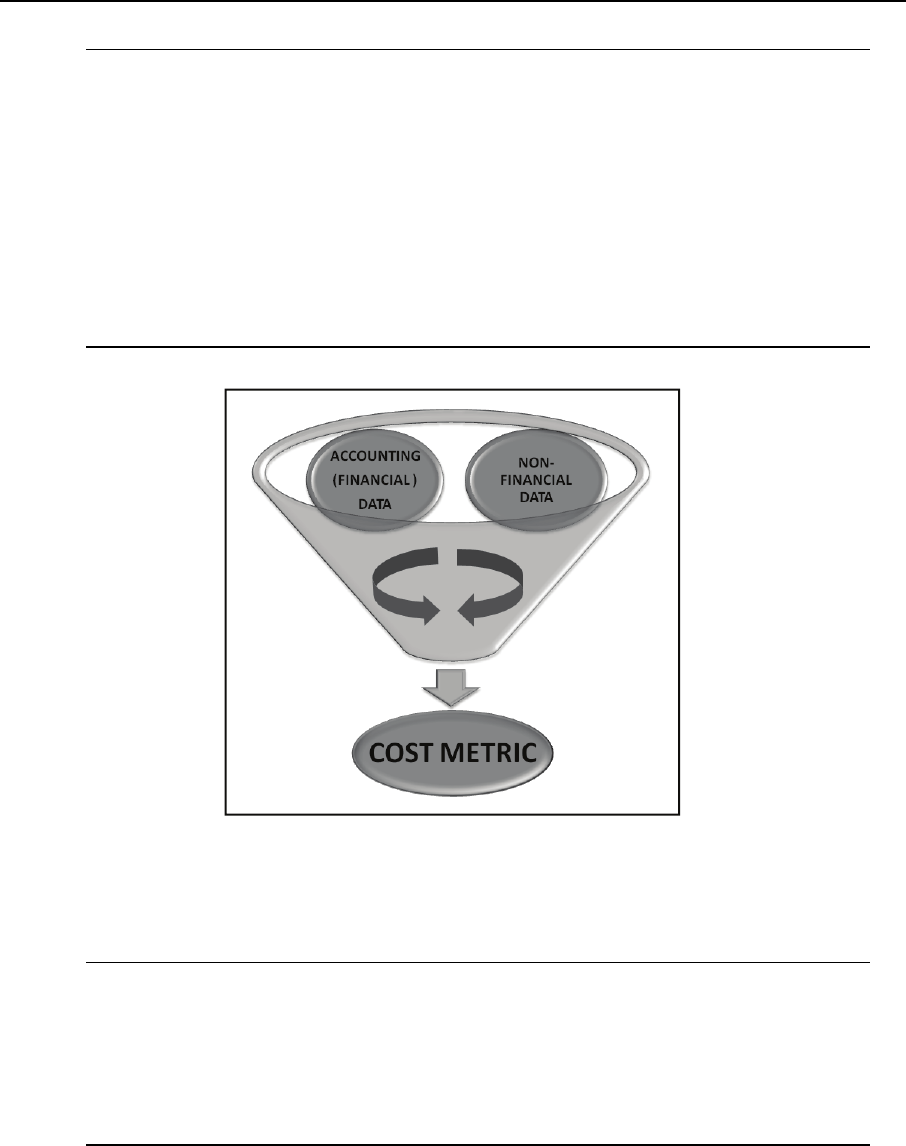

Figure 5-4. Developing the Cost Metric ................................................................................5-14

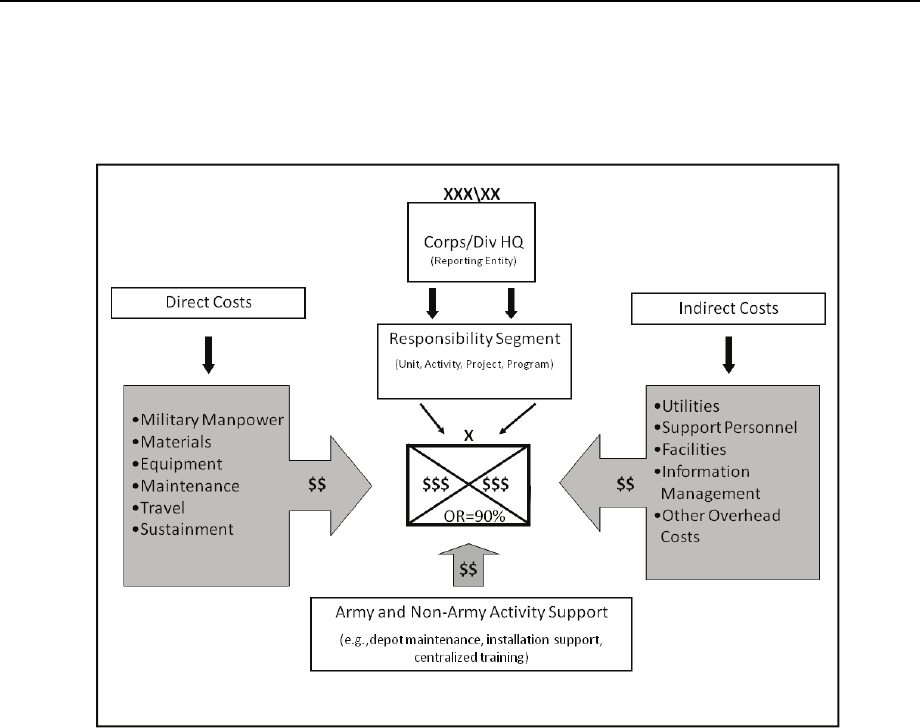

Figure 5-5. Example of Full Cost Concept for a BCTs Operational Readiness ...................5-17

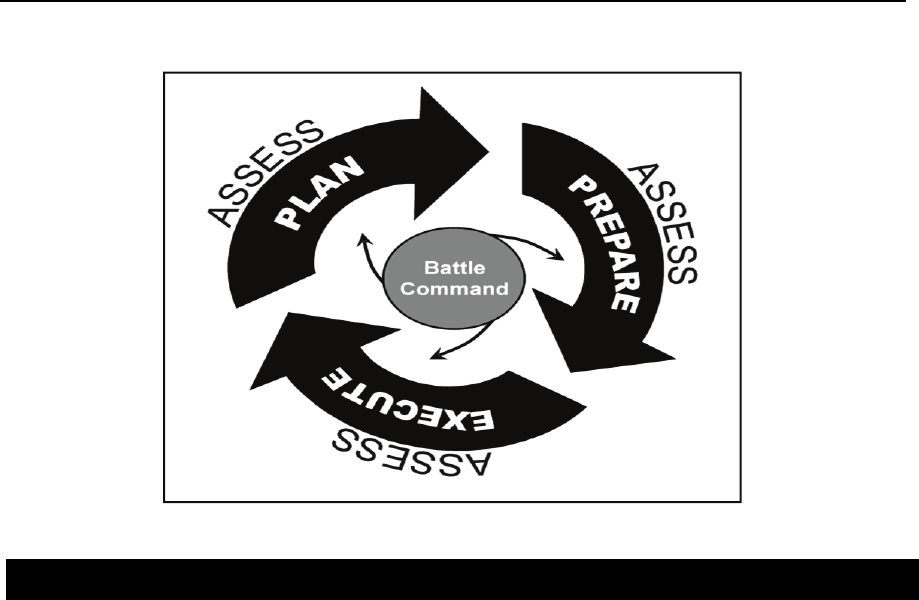

Figure 6-1. Operations Process.............................................................................................. 6-2

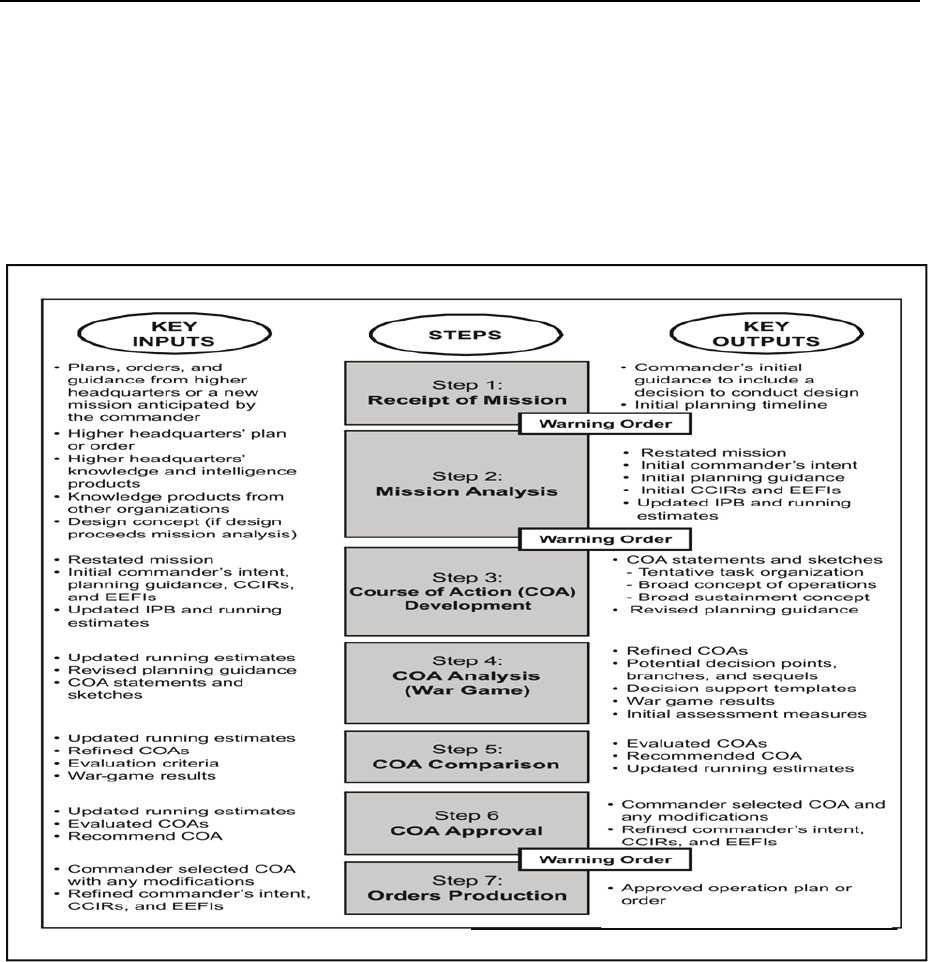

Figure 6-2. Military Decisionmaking Process .........................................................................6-3

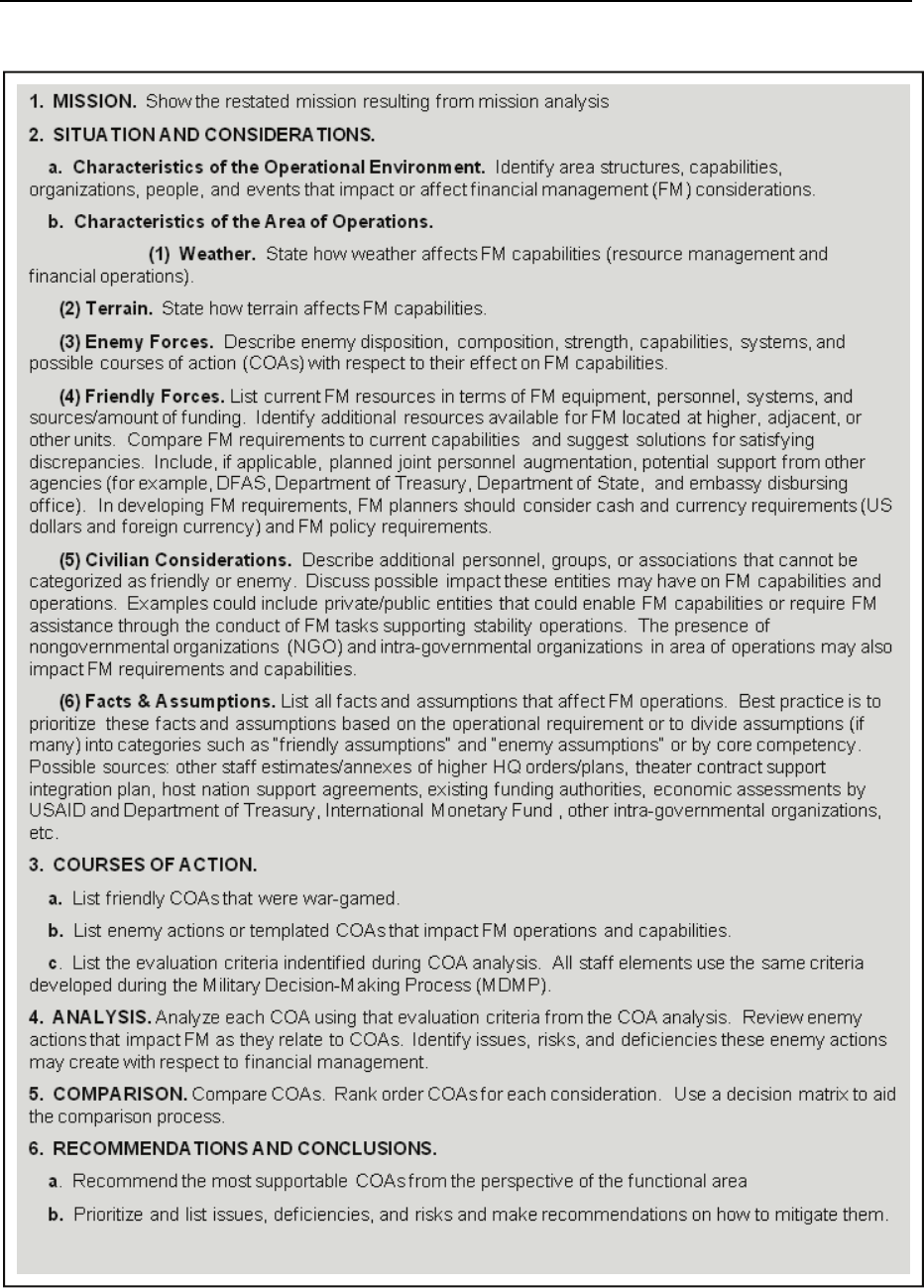

Figure 6-3. Example of FM Running Estimate Template ....................................................... 6-5

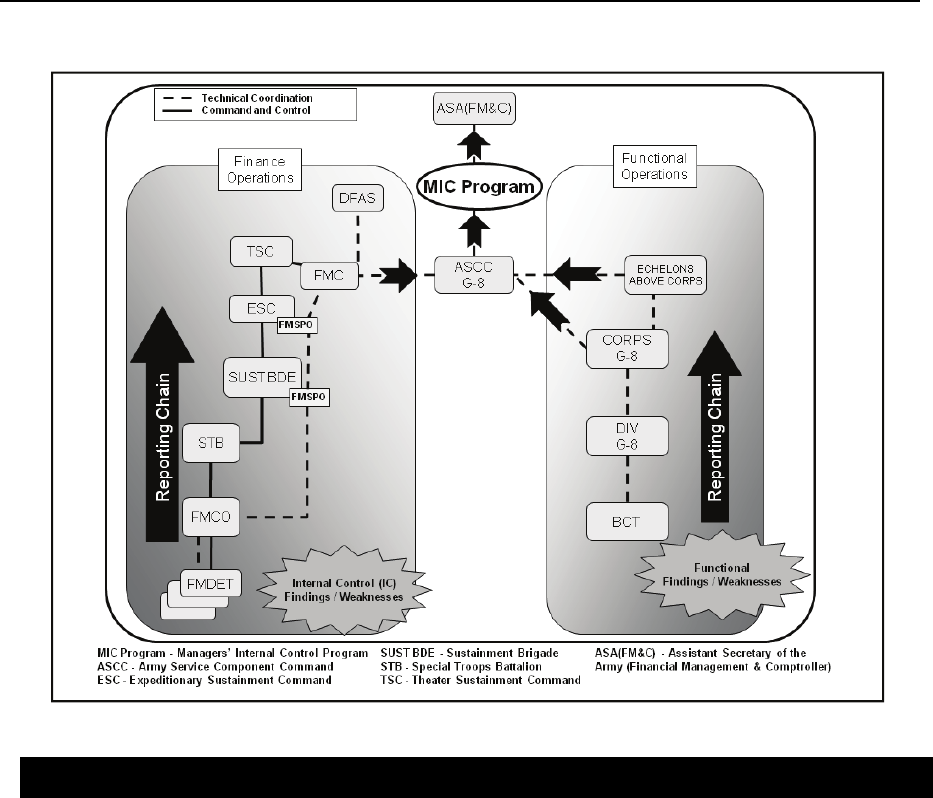

Figure 7-1. Management Control ...........................................................................................7-5

Figure 7-2. G-8 MIC Program ................................................................................................. 7-7

Figure 8-1. Financial Management Information Systems (FMIS) ........................................... 8-2

Figure 8-2. Financial Management Tactical Platform (FMTP) ............................................... 8-7

Figure D-1. FM Appendix to the Service Support Annex of OPLAN/OPORD ....................... D-1

Tables

Table 2-1. Strategic Level Resource Management Tasks ...................................................2-16

Table 2-2. Operational Level Resource Management Tasks ............................................... 2-17

Table 2-3. Tactical Level Resource Management Tasks ..................................................... 2-18

4 April 2011 FM 1-06 v

Preface

FM 1-06 is the Army’s keystone manual for Financial Management (FM). Its purpose is to provide the

authoritative doctrine on how FM supports the full spectrum of operations as a component of the theater

sustainment warfighting function. It expands on existing doctrine introduced in FM 4-0, Sustainment, to

incorporate a broader approach to supporting the fighting force. The intent of this manual is to describe how FM

complements combat power, supports strategic and operational reach, and enables endurance. This manual

provides the foundation of FM doctrine, organizations, training, materiel, leadership and education, personnel,

and facilities development to support the modular Army, and establishes how FM operations are integrated and

synchronized into the overall operations process – plan, prepare, execute and assess. The term “Financial

Management” refers to both finance operations (FO) and resource management (RM) responsibilities.

The fundamental purpose of the Army is to provide joint force commanders with sustained and decisive land

forces necessary to fight and win the nation’s wars. Focused FM support that is responsive, flexible, and precise

is crucial to the Army’s ability to rapidly project power with the most capable forces at the decisive time and

place. FM must provide support during the simultaneous execution of the elements of full spectrum operations:

offense, defense, stability, or civil support.

The manual recognizes that FM is provided by active and reserve components, Department of Defense and

Department of the Army civilians, joint, and multinational assets. This manual also recognizes that FM, like

other sustainment functions, is a commander’s combat multiplier, and must be involved throughout the entire

military decisionmaking process. It is managed, executed, and assessed through all stages to enable

commanders to execute and sustain full spectrum operations.

The intended audiences for the manual are: (1) commanders at all levels, to provide a universal understanding

of how FM is organized and functions to sustain Army, joint, interagency, intergovernmental, nongovernmental,

and multinational forces (interorganizational partners); (2) sustainment community, staffs, and doctrinal

proponents, to institutionalize the integration of FM into all Army components, and interorganizational

partners’ missions; and (3) Soldiers at all levels and within all branches of the Army, to provide a broad

knowledge of the FM structure and functions. Army headquarters serving as a joint force land component

command or a joint task force headquarters should also refer to JP 1-06, Financial Management Support in Joint

Operations.

This publication applies to the Active Army, the Army National Guard (ARNG)/Army National Guard of the

United States (ARNGUS), and the United States Army Reserve (USAR) unless otherwise stated.

The proponent of this publication is the United States Army Training and Doctrine Command (TRADOC) and

the preparing agent is the U.S. Army Soldier Support Institute (SSI). Send comments and recommendations to

jacksonatsgcdidfmdoctrine@conus.army.mil or on DA Form 2028 (Recommended Changes to Publications and

Blank Forms) to Commander, U.S. Army Soldier Support Institute, ATTN: ATSG-CDI, Building 10000, Fort

Jackson, SC 29207-7045.

Unless stated otherwise, masculine nouns or pronouns do not refer exclusively to men.

FM 1-06 4 April 2011 vi

Introduction

The Army’s two capstone publications, FM 1, The Army, and FM 3-0, Operations, describe future United States

military operations as joint campaigns requiring the cooperation of, and coordination with, joint, interagency,

and multinational organizations in addition to Army forces, which have transformed from a fixed division-based

warfighting force to a modular brigade-based force. The core unit, the brigade combat team (BCT) consists of

organic forces that are augmented and organized based on mission, enemy, terrain and weather, troops and

support available, time available and civil considerations (METT-TC). The modular Army force remains

echeloned. There are three headquarters organizations above brigade level, each changed from its recent

organization and structure: Army Service Component Command (ASCC), Corps and Division. The Army is

fielding joint capable stand-alone corps and division headquarters with no division or corps troops except those

in their respective headquarters battalion.

Financial Management (FM) has also changed tremendously since the last publication in September 2006 to

better support this modular brigade-based force. On 1 October 2008, the Army merged Basic Branch 44

(Finance) and Functional Area 45 (Comptroller) into Basic Branch 36. The merger combines resource

management (RM) and finance operations (FO) into one multi-functional specialty for all FM operations. The

integration of FO and RM under FM offers the commander a single focal point for FM operations. The

individual with singular responsibility for FM at the theater Army, corps, and division level is the G-8, who

consults with the Financial Management Center (FMC). Additionally, the Army has successfully deployed its

new modular FM units as part of the new Sustainment Warfighting Function within the Theater Sustainment

Command (TSC), Expeditionary Sustainment Command (ESC), and the Sustainment Brigade (Sust Bde). These

changes along doctrine and leader development spectrums provide the commander an integrated modular FM

capability to better synchronize operations with the Army's new modular contracting units, thereby creating

efficiencies for sustainment operations at echelons above battalion.

In January 2009, the Army Chief of Staff called on the Army to undergo an institutional adaptation that better

postured the Army’s institutions to support an Army on a rotational cycle in an era of persistent conflict. The

change described the necessary elements to institutional adaptation; one of these elements speaks directly to a

primary FM task: resource management. This element requires the Army to reform its requirements and

resource processes by establishing a more responsive and realistic requirements process and inculcating a cost

culture that incentivizes good stewardship. A key component of the Army’s adaptation is the fielding of an

Enterprise Resource Planning (ERP) system that will significantly impact FM processes. This system is the

General Fund Enterprise Business System (GFEBS). GFEBS enables the Army to fund and execute down to

the brigade level and provides cost-analysis and real time accounting information to better support the Army as

it migrates from budget execution to a cost-centric environment. Additionally, GFEBS enhances FMs ability to

support the procurement (contracting) process.

The FM mission transformed to include support to stability operations such as providing FM support to host

nation banking institutions, developing economic assessments for a theater of operation, and coordinating with

nongovernmental, interagency, and intergovernmental organizations to implement the U.S. instrument of

economic power.

Given these changes, FM has revised its core competencies to reflect the broad reach of FM operations

throughout the Army. These six core competencies are fund the force, provide banking and disbursing support,

provide pay support, provide accounting support and cost management, conduct FM planning and operations

and perform management internal controls. Details describing these core competencies are found in chapters

two through seven.

4 April 2011 FM 1-06 vii

This page intentionally left blank.

Chapter 1

Financial Management Operations

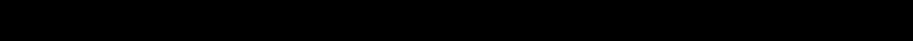

Financial Management (FM) is defined as the sustainment of U.S. Army, joint,

interagency, interdepartmental, and multinational operations through the execution of

two mutually supporting core functions, Resource Management (RM) and Finance

Operations (FO). These two functions are comprised of the following core

competencies: fund the force, banking and disbursing support, pay support,

accounting support and cost management, FM planning and operations, and

management internal controls. FM operations have transformed to better support the

combatant commander (CCDR) by integrating FO and RM capabilities. When

properly combined and synchronized by financial managers, RM and FO enable

commanders to leverage fiscal policy and economic power in creating favorable

effects that support their operations.

SECTION I – FINANCIAL MANAGEMENT MISSION AND PURPOSE

1-1. The FM mission is to ensure that proper financial resources are available to accomplish the mission

in accordance with (IAW) commanders’ priorities. These capabilities are conducted by properly sized,

modular FM structures in the context of FM operations planned and executed in consideration of

operational variables such as political, military, economic, social, information, infrastructure, physical

environment and time and mission variables such as mission, enemy, terrain and weather, troops and

support available, time available and civil considerations (METT-TC). FM is found at the Army’s strategic,

operational and tactical levels of support. The primary purpose of FM is to sustain and support operations

until successful mission accomplishment. Figure 1-1 depicts FM core functions.

1-2. The RM mission is to analyze resource requirements, ensure commanders are aware of existing

resource implications in order for them to make resource informed decisions, and then obtain the necessary

funding that allows the commander to accomplish the overall unit mission. Key RM tasks are providing

advice and recommendations to the commander; identifying sources of funds; forecasting, capturing,

analyzing and managing costs; acquiring funds; distributing and controlling funds; tracking costs and

obligations; establishing and managing reimbursement processes; and establishing and managing the Army

Managers’ Internal Control Program (MIC Program).

1-3. The Finance Operations (FO) mission is to support the sustainment of Army, joint, and multinational

operations through the execution of key FO tasks. These key FO tasks are to provide timely commercial

vendor and contractual payments, various pay and disbursing services, oversee and manage the Army’s

Banking Program and to implement FM policies and guidance prescribed by the Office of the Under

Secretary of Defense (Comptroller) (OUSD(C)) and national FM providers (e.g., U.S. Treasury, Defense

Finance and Accounting Service (DFAS), Federal Reserve Bank (FRB)). The combined efforts of RM and

FO work to extend Army forces’ operational reach and prolong operational endurance, thereby allowing

commanders to accept risk and create opportunities for decisive results.

4 April 2011 FM 1-06 1-1

Chapter 1

Figure 1-1. Financial Management Core Functions

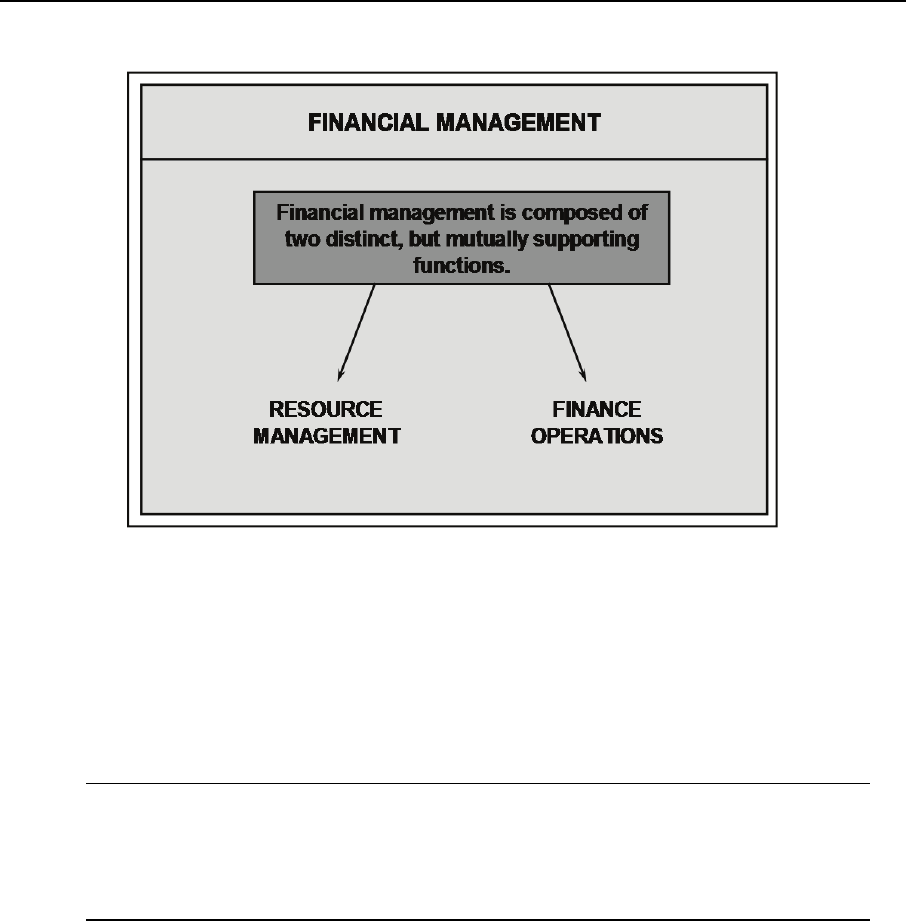

PRINCIPLES OF FINANCIAL MANAGEMENT

1-4. Similar to sustainment, there are six FM principles: stewardship, synchronization, anticipation,

improvisation, simplicity, and consistency. These principles are critical to maintaining combat power,

operational reach throughout the levels of war, and the endurance of Army forces. Although independent of

one another, these principles must be integrated in the planning and execution of FM operations at the

strategic, operational and tactical levels of war. This integration facilitates the optimal allocation of

financial resources to accomplish the mission. FM Principles are depicted in Figure 1-2.

Example. FM leaders must provide responsive FM support that meets the changing nature of the

operational environment (OE). They must be able to anticipate changing requirements created by

changes in the mission or the OE. By applying the simplicity principle, FM leaders ensure the

transparency of their operations and demonstrate stewardship through the proper use of

resources by complying with existing regulations and statutes.

1-2 FM 1-06 4 April 2011

Financial Management Operations

Figure 1-2. Principles of Financial Management

S

TEWARDSHIP

1-5. From an FM perspective, “stewardship” can be defined as the careful and responsible management of

those resources entrusted to the government in order to execute responsible governance. The Department of

Defense (DOD) is entrusted by the American people as a steward of vital resources (funds, people,

material, land, and facilities) provided to defend the nation (JP 1-06, Financial Management Support in

Joint Operations). The Army operates under the mandate to use all available resources in the most effective

and efficient means possible to support the CCDR. Although not mutually exclusive, these two goals –

effectiveness and efficiency do not have the same meaning. FM leaders must understand that effectiveness

describes how well consumed resources achieve the desired outcome or endstate or simply stated, “doing

the right thing”. Efficiency speaks to the manner in which those resources are consumed in order to

produce the maximum amount of output regardless of whether the output achieves the desired outcome –

“doing things the right way”. Certainly the efficient use of resources is always an important consideration

for Army leaders and financial managers; however, the primary focus regarding the use of financial

resources must always center on accomplishing the mission and/or attaining the desired endstate. Good

stewardship requires the availability of timely and accurate financial information to facilitate sound

decisionmaking and ensure that resources are used in compliance with existing statutory and regulatory

guidance.

S

YNCHRONIZATION

1-6. Synchronization is the arrangement of military actions in time, space, and purpose to produce

maximum relative combat power at a decisive place and time (FM 1-02, Operational Terms and Graphics).

Synchronization of FM operations requires that FM leaders arrange the placement of FM units and

personnel in time, space, and purpose in order to ensure that commanders receive the requisite FM support.

In order to achieve synchronization, FM leaders coordinate with the appropriate Military Services, DOD

organizations, national FM providers and intergovernmental organizations, as necessary, to align FM

capabilities to theater requirements. Financial managers use the planning and orders process to synchronize

FM throughout all phases of an operation and tailor FM support to the unique and changing dynamics of

the OE and mission.

4 April 2011 FM 1-06 1-3

Chapter 1

ANTICIPATION

1-7. Anticipation is the ability of FM leaders to forecast requirements based upon professional judgment

honed by experience, knowledge, education, intelligence, and intuition. The ability to anticipate

requirements in support of the mission enhances the commander’s understanding of the situational context

in which his forces operate, and the commander’s visualization of his desired end state are key components

of battle command (FM 3-0, Operations). The FM leader must also visualize future operations and

determine the appropriate FM support. This requires a flexible and responsive execution of FM operations

providing FM support to the right place, at the right time and in the right composition. Anticipating FM

requirements necessitates staying abreast of operational plans (OPLANs), continuously coordinating with

supported units and higher headquarters, constant assessment of the OE, and positioning FM assets within

the area of operation (AO) to meet present and future operational needs in a continually evolving OE.

Financial managers anticipate changes in their mission and the OE through detailed FM planning and

continual coordination with supported commanders’ staff. FM leaders frequently survey the OE to

anticipate shifts in requirements that impact FM operations. Anticipation also involves adjusting training

plans prior to deployment to ensure FM units and staffs can execute directed missions once in theater. For

example, in 2009, a Financial Management Center (FMC) from Fort Hood deployed to Afghanistan to

support the RM mission rather than its traditional FO mission.

IMPROVISATION

1-8. Improvisation is the ability to adapt operations and plans for FM to changing situations and missions.

It includes task organizing FM units in non-traditional formations, submitting fiscal legislative proposals to

acquire new fiscal authorities, applying existing financial and communication technologies in new ways,

and creating new tactics, techniques and procedures to meet evolving requirements resulting from changes

in the OE and consequent modifications to the mission.

SIMPLICITY

1-9. Simplicity is defined as the freedom from complexity in the sustainment of operations. This principle

speaks to FM processes and procedures and the requirement to minimize complexity in FM functions in

order to reduce confusion. Simplicity fosters efficiency in the conduct of FM operations and enhances the

effective control of FM support to our forces. Clarity of tasks, standardized and interoperable procedures,

and clearly defined command relationships contribute to simplicity. Simplicity facilitates the optimal

utilization of resources, while ensuring effective FM support of forces.

CONSISTENCY

1-10. The principle of consistency involves the provision of consistent FM support and guidance to forces

throughout the AO. FM providers must coordinate with the appropriate DOD organizations and other

Military Services to ensure the uniform provision of FM support to all forces in theater. This includes

making appropriate provisions for pay support and services, establishing banking and currency support,

payment of travel entitlements and cash operations to support the procurement process (JP 1-06).

Consistent FM guidance requires involvement in the running estimate process and the command’s

requirements board’s process, developing FM appendices to OPLANS, and close coordination among FM

units within theater.

1-4 FM 1-06 4 April 2011

Financial Management Operations

FINANCIAL MANAGEMENT CORE COMPETENCIES

1-11. Figure 1-3 illustrates the FM core competencies as described in the following paragraphs.

Figure 1-3. Financial Management Core Competencies

F

UND

T

HE

F

ORCE

1-12. Fund the force is the critical capability within the FM competency resource management that

matches legal and appropriate sources of funds with thoroughly vetted and validated requirements. FM

leaders execute this core FM capability across the full spectrum of military operations. Fund the force

applies to all levels of war – strategic, operational and tactical. FM 3-0 defines the strategic level of war as

the level of war at which a nation, often as a member of a group of nations, determines national or

multinational strategic security objectives and guidance, and develops and uses national resources to

achieve these objectives. Fund the force at the strategic level entails resource management operations that

include setting policy, planning resources, interpreting DOD and specific OUSD(C) guidance, coordinating

DFAS policies, following congressional legislation, and maintaining effective oversight of execution at the

program level.

1-13. The operational level of war links the tactical employment of forces to strategic objectives. At the

operational level, FM provides commanders the required resources and ensures the resources are used

effectively and efficiently in compliance with existing fiscal laws and regulations. The operational level of

resource management involves executing resources, anticipating future requirements, and planning

supporting operations. At the operational level, the primary objective is to establish conditions favorable to

the successful conduct of tactical operations.

1-14. At the tactical level of war, commanders employ and arrange forces in relation to each other adopting

tactics in the conduct of battles, engagements, and small unit actions to accomplish missions. Resource

management operations at the tactical level focus on short term objectives that enable the mission of

maneuver units to succeed. At this level, fund the force tasks encompass immediate receipt and distribution

of funding.

4 April 2011 FM 1-06 1-5

Chapter 1

BANKING AND DISBURSING SUPPORT

1-15. Banking support is the provision of cash, non-cash and E-Commerce mechanisms necessary to

support the theater procurement process to provide support to U.S. and non-U.S. military personnel,

civilians, and contractors, and to make payments for special programs such as the Commander’s

Emergency Response Program (CERP) and the DOD Small Rewards Program. Banking support subtasks

include selecting limited depositary (LD) institutions and establishing limited depositary accounts (LDA)

as necessary to make contract payments in foreign currency and to provide for foreign currency

replenishment. Another subtask within banking support is the requirement to coordinate with the State

Department, local U.S. Embassy, the U.S. Army Financial Management Command (USAFMCOM), the

U.S. Agency for International Development (USAID), DFAS, the U.S. Department of State, Provincial

Reconstruction Teams (PRTs), the Embedded Provincial Reconstruction Teams, the Office of the Secretary

of Defense (OSD), Task Force for Business Stability Operations (TFBSO) and/or the Department of

Treasury (Treasury) when conducting business with HN banking facilities. Banking support leverages E-

Commerce technologies to achieve effectiveness and efficiencies in FM operations as well as reduce the

amount of physical cash in the theater of operations.

1-16. Disbursing support is comprised of currency management and procurement support. Currency

management includes supplying U.S. cash, non-cash mechanisms (e.g., debit cards, stored value cards),

foreign currencies, U.S. Treasury checks and occasionally, receiving and controlling precious metals (gold

and silver). FM units provide currency and coins to Army and Air Force Exchange Service (AAFES)

facilities, tactical field exchanges (TFEs), postal organizations, and authorized in-theater defense

contractors, as operational considerations allow. Proper control and management of currency is essential to

controlling black market activities, securing the money of individual Soldiers, and assisting the HN in

avoiding unforeseen fluctuations in domestic currency valuations resulting from the infusion of U.S.

dollars.

1-17. The success of sustainment operations depends greatly on the successful planning and execution of

operational contract support (OCS) in the operational area. The mission of OCS, including contingency and

expeditionary contracting, is to conduct procurement planning then responsively, effectively, and legally

contract for the supplies, services and construction necessary to support the mission of the operational ground

force and Joint commanders (JP 4-10, Operational Contract Support & FM 4-92, Contracting Support

Brigade). FM operations are critical to successful contracting operations. A large percentage of FO

contingency efforts support this process. Oversight is critical in preventing improper or illegal commercial

vendor payments and ensuring the considerable fiscal resources of the U.S. government are properly

applied. All FM Soldiers must understand the roles of the key players involved and their relationships in

the proper execution of the procurement process.

PAY SUPPORT

1-18. FM includes the provision of full U.S. pay support (including civilian pay where not supported by

DFAS), travel support, local and partial payments, check-cashing and currency exchange to Soldiers,

civilians and U.S. contractors, and non-U.S. pay support (e.g., enemy prisoner of war (EPW), host nation

employees, day laborers, civilian internee (CI)). Pay support also includes support to noncombatant

evacuation operations (NEO) in the form of travel advances. FM units providing pay support must ensure

that all Soldiers, regardless of component, receive timely and accurate pay in accordance with existing

statute and regulations.

ACCOUNTING SUPPORT AND COST MANAGEMENT

1-19. Accounting requirements for full spectrum operations are immense, and they begin before the first

troop deployment. The quality of accounting records depends on the timely receipt and accuracy of

financial information. The level of accounting support depends upon the level of conflict and the

complexity of the operation. Accounting support also entails the accurate and complete recording of

financial transactions within the Army FM Information Systems (FMIS). Additional accounting support

involves review and reconciliation of these financial transactions to ensure the proper expenditure of

entrusted funds.

1-6 FM 1-06 4 April 2011

Financial Management Operations

1-20. Effective decisionmaking necessitates the consideration of resource implications of possible courses

of action in relation to both short term and long term objectives. Cost management enhances effective

decisions by collecting and linking financial (cost) data with non-financial output and performance data,

thereby presenting information in a way directly related to major mission objectives whether at the

Headquarters Department of the Army (HQDA) level or at the tactical unit level. Cost management will

provide Army leaders and managers--from HQDA down to brigade level -- with real-time costs that are

tied to operational and functional activities.

1-21. Cost management transforms accounting data into valuable and accurate cost information that

enables the commanders’ decisionmaking process. Commanders throughout the Army use cost information

for effective decisionmaking and performance management by analyzing their decisions in the context of

both short and long-term cost implications, selecting effective trade-off decisions in order to achieve the

optimal application of limited resources, and holding subordinates accountable for improving the

effectiveness and efficiency of their operations. For FM leaders, cost management demands a departure

from the previous FM culture that focused on input. “Maximize the budget” was the mantra that drove

many decisions regarding resource management. The new “cost” culture requires the Army and in

particular, the FM community to “optimize the use of fiscal resources” by focusing on output and

outcomes. Army leaders at all levels must formulate and effect timely decisions that capitalize on available

resources to achieve the best outcomes in support of mission accomplishment. See Chapter 5, Accounting

Support and Cost Management, for more information.

FINANCIAL MANAGEMENT PLANNING AND OPERATIONS

1-22. Full spectrum operations require a standardized and systematic approach to planning that remains

flexible and responsive in light of constant changes to the OE. The Army relies primarily on two planning

processes to guide the planning effort: the Military Decisionmaking Process (MDMP) and Troop Leading

Procedures (TLP). MDMP is more appropriate for headquarters with staffs; whereas, leaders at company

level and below employ TLP to plan and prepare for operations (FM 5-0, The Operation Process). FM

leaders and planners must be well versed with the MDMP and TLP, as described in FM 5-0 in order to

participate meaningfully in the planning, preparing, and executing of full spectrum operations at all levels

of war. FM leaders continuously combine analytic and intuitive methodologies to their decisionmaking in

planning and executing FM operations. The analytic approach to decisionmaking entails generating several

alternative solutions, comparing these solutions to a set of criteria, and selecting the best course of action

(COA). Intuitive decisionmaking employs pattern recognition based on leaders’ knowledge, judgment,

experience, education, intelligence, boldness, perception and character to recognize the key elements and

implications of a particular problem or situation to arrive at an adequate solution. Planning is a critical

activity in the execution of effective FM operations whether conducted at the strategic level when

forecasting funding requirements for a contingency operation; or at the operational level when estimating

the cost associated with the execution of an operational plan; or at the tactical level when planning mobile

Financial Management Support Team (FMST) missions in support of a BCT. FM planners should be

integrated in the command staff planning effort at all echelons. In execution of the FM mission, FM leaders

perform and coordinate functions and activities needed to conduct and sustain FM support operations.

These activities and functions include planning, mission preparation, staff coordination and establishment,

and operations of FM units. Planning is the means by which the commander envisions a desired outcome,

lays out effective ways of achieving it, and communicates to his subordinates his vision, intent and

decisions, focusing on the results he expects to achieve (FM 3-0). The benchmark for a successful plan is

not whether or not it was executed exactly as planned, but whether the plan facilitates effective action in the

face of unforeseen events (FM 5-0). FM leaders and planners develop and execute plans and orders that—

Foster mission command by clearly conveying the commander’s intent.

Assign tasks and purposes to subordinates.

Contain the minimum coordinating measures necessary to synchronize the operation.

Allocate or reallocate resources.

Direct preparation activities and establish times or conditions for execution.

See Chapter 6, Planning and Operations, for more information.

4 April 2011 FM 1-06 1-7

Chapter 1

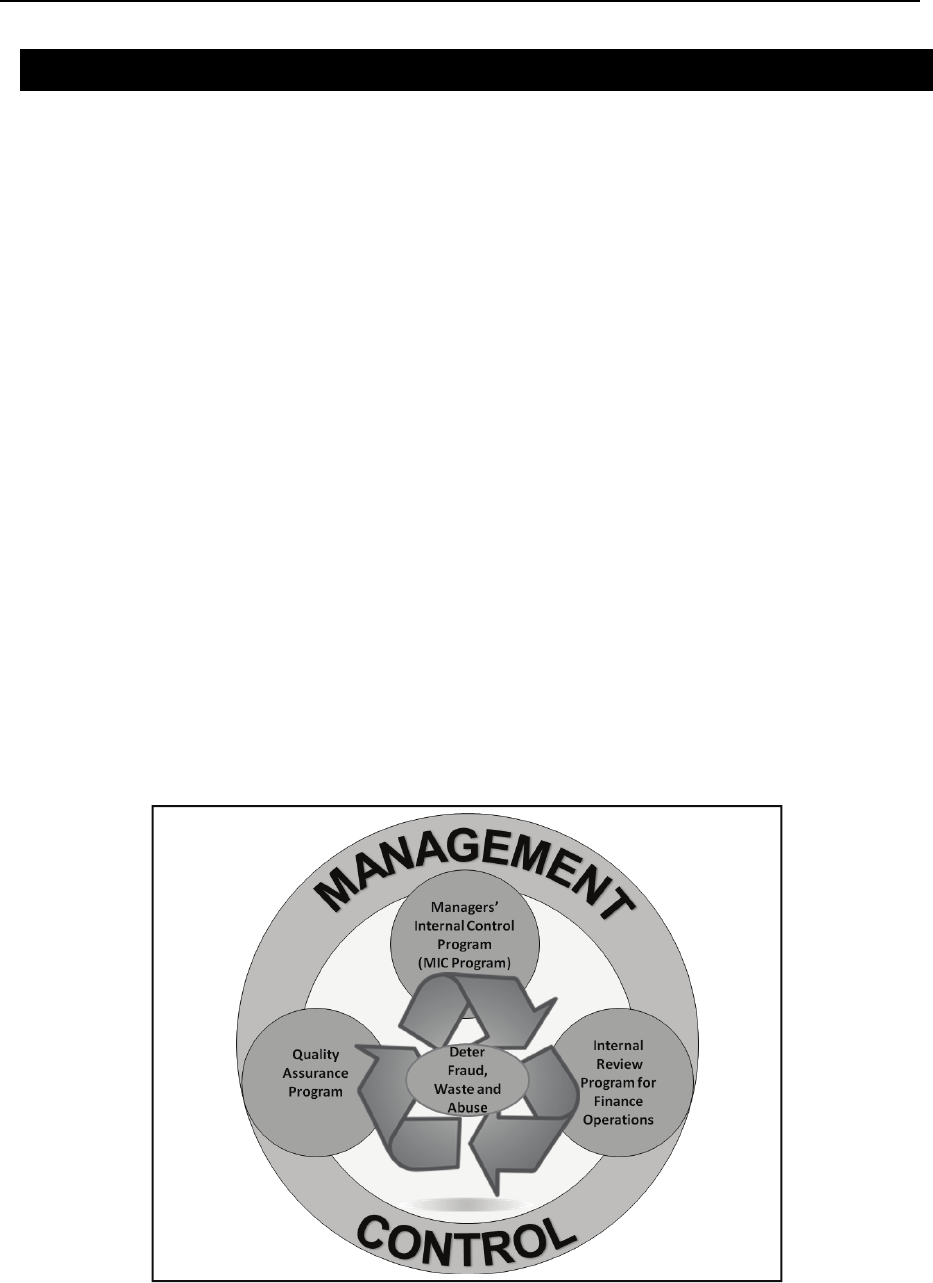

MANAGEMENT INTERNAL CONTROLS

1-23. In accordance with AR 11-2, Managers’ Internal Control Program, all commanders and managers

have a statutory and inherent responsibility to establish and maintain effective management controls, assess

areas of risk, identify and correct weaknesses in those controls and keep their superiors informed. Financial

managers coordinate management controls throughout the unit. The MIC Program is designed to provide

reasonable assurance that established accountability and control procedures comply with applicable laws

and regulations. As it pertains to FM, the MIC Program provides reasonable assurance that obligations and

costs comply with applicable laws, funds are protected, payments are properly disbursed, and proper

accounting is kept of all expenditures (stewardship). The MIC Program must be established as soon as

possible, but not at the expense of operational or tactical considerations. See Chapter 7, Management

Internal Controls, for more information.

SECTION II – FINANCIAL MANAGEMENT AND THE SUSTAINMENT

WARFIGHTING FUNCTION

1-24. FM operations support the Army in its role as the provider to combatant commanders of versatile

land forces ready to fight and win the Nation’s wars. The Army contributes to joint operations through its

capability to exert landpower, defined as the ability—by threat, force, or occupation—to promptly gain,

sustain, and exploit control over land, resources, and people (FM 3-0). The integration of FMs two core

functions enables the Army’s application of landpower. This integration of FO and RM supports the

Army’s ability to establish and maintain a stable environment that sets the conditions for political and

economic development; addresses the consequences of catastrophic events – both natural and man-made –

to restore infrastructure and reestablish basic civil services and support; and provides a base from which

joint forces can operate. FM operations extend the Army forces operational reach by allowing for the

exploitation of initiatives. FM operations also prolong the forces operational endurance, giving

commanders the ability to accept risk and create opportunities for decisive results.

1-25. The foundations for Army operations are contained in its operational concept—full spectrum

operations. An operational concept describes how Army forces, as part of a joint force, conduct operations.

Full-spectrum operations require the Army force to combine offensive, defensive, and stability or civil

support operations simultaneously as part of an independent joint force to seize, retain, and exploit the

initiative, accepting prudent risk to create opportunities to achieve decisive results (FM 3-0). FM provides

support to the elements of full spectrum operations. The mission determines the relative weight of effort

among the different elements of full spectrum operations (FSO): offense, defense, stability operations and

civil support operations. Likewise, FM operations, its composition and missions, vary dependent upon

which operational element or elements (offense, defense, stability and civil support) comprise the nature of

the operation.

1-26. Consider Figure 1-4 depicting a notional joint operation executed in six phases: shape, deter, seize

the initiative, dominate, stabilize and enable civil authority. In this illustration, the elements of FSO are

combined and weighed across the phases of the notional campaign plan based on anticipated changes in

operational conditions. Similarly, FM operations supporting FSO will also change in priority of effort and

composition. The graphic also portrays the changing nature of FM support of FSO through all phases of the

plan. These changes are illustrative of a notional situation and not a fixed template for all situations. FM

leaders adjust FM support of the plan based on changes to conditions in the OE and the missions that are

anticipated and included in the phases of the operations. The relative weight given to each FM task (i.e.,

fund the force, banking and disbursing support, pay support, accounting support and cost management

(CM), FM planning and operations, management internal controls) varies with the actual or predicted

conditions.

1-8 FM 1-06 4 April 2011

Financial Management Operations

Figure 1-4. Example of Combining FM Support to FSO in a Notional Operation

Example: During the stabilize phase of the joint operation and in support of stability operations,

providing funding for special programs and training and equipping of host nation security forces

may be the main efforts for FM operations in support of the Army’s efforts to provide the local

populace with security, restore essential services, and self governance.

FINANCIAL MANAGEMENT AND THE ELEMENTS OF COMBAT

POWER

1-27. Full spectrum operations require the continuous generation and application of combat power

throughout the length of operations. Combat power is the total means of destructive, constructive, and

information capabilities that a military unit/formation can apply at a given time (FM 3-0). As depicted by

Figure 1-5, eight elements comprise combat power: leadership, information, movement and maneuver,

intelligence, fires, sustainment, command and control (C2), and protection.

4 April 2011 FM 1-06 1-9

Chapter 1

Figure 1-5. Elements of Combat Power

1-28. Six of these elements (movement and maneuver, intelligence, fires, sustainment, command and

control and protection) are categorized as warfighting functions. A warfighting function is a group of tasks

and systems (people, organizations, information, and processes) united by a common purpose that

commanders use to accomplish missions and training objectives (FM 3-0). The sustainment warfighting

function is the related tasks and systems that provide support and services to ensure freedom of action,

extend operational reach, and prolong endurance. Sustainment subtasks are captured under three categories:

logistics, personnel services and health services support (FM 4-0). The Army’s operational endurance relies

primarily on sustainment. FM operations support the Army’s endurance through RM and FO. FM

operations fall within the sustainment warfighting function to extend the depth and duration of Army

operations.

THE FISCAL TRIAD

1-29. The Fiscal Triad, depicted in Figure 1-6, illustrates the legally-binding process that governs the

critical path between contracting and FM for acquisition management, internal controls, and fiscal law

prescribed for the procurement process. FM, contracting and legal counsel (staff judge advocate (SJA)

fiscal lawyer) comprise a system that fulfills the full spectrum of required fiscal support, from the

acquisition and certification of funds, to the legal review of the proposed contracting action, to the

contracting for goods and services, and finally to the disbursing and accounting of public funds. At the

center of the Fiscal Triad is the unit commander who generates mission requirements that initiate the

process. This illustration emphasizes that the process exists solely to satisfy the unit commander’s mission

requirements. All elements of the Fiscal Triad must coordinate to conform to existing policies, regulations,

and laws to prevent fraud, waste and abuse of government funds. To ensure separation of duties, each

element of the triad is independent, yet each element works closely with the other to obtain products or

services to meet the commander’s needs in compliance with applicable laws and regulations. See Chapter

6, Planning and Operations, for more information.

1-10 FM 1-06 4 April 2011

Financial Management Operations

Figure 1-6. Fiscal Triad

FINANCIAL MANAGEMENT SUPPORT TO FORCE PROJECTION

1-30. Force projection is the military element of national power that systemically and rapidly moves

military forces in response to requirements across the spectrum of conflict (FM 3-35, Army Deployment

and Redeployment). Force projection requires the Army, as part of a joint force, to alert, mobilize, rapidly

deploy, and operate effectively anywhere in the world. Successful force projection relies on the proper and

expeditious reception, staging, onward movement and integration (RSOI) of combat forces into a theater of

operations in support of a joint force commander. RSOI supports generating the requisite combat power

made available to a joint force commander to execute his mission in support of national objectives. FM

support to the RSOI process and supporting theater opening operations is critical to the expeditious build

up and sustainment of combat forces in a theater of operations. During a crisis response, the Army deploys

an assessment team composed of elements from the contingency command post (CCP) within the ASCC

headquarters. Integration of the Fiscal Triad elements into the assessment team enhances the capabilities of

the CCP to meet mission requirements as the situation develops.

1-31. As the tactical military unit responsible for the Theater Opening (TO) mission, the Sust Bde will be

one of the first organizations into a theater of operations and designated as the Sustainment Brigade TO.

Elements from the FMCO and/or FMDETS should deploy along with the Sust Bde TO in order to execute

finance operations critical to the success of RSOI. Likewise, the G-8 within the responsible corps or

division should immediately deploy their early entry personnel in order to perform necessary RM tasks. TO

is the ability to rapidly establish and initially operate ports of debarkation (air, sea, and rail) to establish

sustainment bases and to facilitate port throughput for the reception, staging, and onward movement of

forces within a theater of operations (FMI 4-93.2, The Sustainment Brigade). These operations rely heavily

on initial reception support in the form of contracted support, host nation support, and/or military assets to

immediately support the arrival of deploying units and their equipment. As part of the Fiscal Triad, FM

capabilities must be part of the initial flow of forces into theater to support the contracting effort and to

provide essential financial services to deployed personnel. Initial FM capability include:

Fund the force.

Identify and obtain appropriate funding.

4 April 2011 FM 1-06 1-11

Chapter 1

Certify funds and track costs.

Banking and disbursing support.

Currency support.

Procurement support.

E-Commerce program support.

Pay support.

Start applicable deployment entitlements.

1-32. Well planned RSOI ensures that the required FM capabilities, along with representatives from other

elements of the Fiscal Triad, are sequenced early in the time-phased force and deployment data and are in

theater functioning before the first unit arrives. Even if this means initial displacement of some combat

forces, the benefits accrued include higher throughput, faster buildup of combat power, and earlier force

closure in the operation.

SECTION III – ARMY FINANCIAL MANAGEMENT WITH

INTERORGANIZATIONAL PARTNERS (JOINT, MULTINATIONAL,

INTERGOVERNMENTAL, INTERAGENCY, AND NONGOVERNMENTAL)

1-33. Today, the Army finds itself operating not only with other Services but other U.S. agencies ((e.g.,

Department of State (DOS), Treasury, USAID), intergovernmental organizations and other nations as well.

In the current OE, successful FM support requires a broad understanding of the unique capabilities that

other U.S. agencies, intergovernmental organizations and our multinational partners bring to a theater of

operations, typically in support of stability operations. Along with these considerable capabilities, these

partners introduce new complexities with respect to FM planning and operations. Careful and constant

coordination reduces the degree of complexity and improves interoperability between U.S. Army forces

and these other organizations. Intergovernmental organizations exert either global or regional influence.

These organizations possess well defined structures, roles, responsibilities, expertise and resources to not

only participate in complex operations but lead these operations as well.

Examples of global intergovernmental organizations are the United Nations (UN), its agencies

and the World Bank. Examples of regional intergovernmental organizations are North Atlantic

Treaty Organization (NATO), the African Union, the European Union and the Organization of

American States. During stability operations, FM may entail either the provision to or the receipt

of support from these organizations requiring the use of one or more legal authorities. For

example, the Foreign Assistance Act of 1961, the United Nations Participation Act of 1945, and

Executive Order 10206 authorize various types of U.S. military support to the UN, either on a

reimbursable or non-reimbursable basis.

1-34. Each of the Services retains Title 10 United States Code (USC) responsibilities for the sustainment of

its respective forces. Title 10 USC Sec. 3013 grants the Secretary of the Army authority necessary to

conduct all affairs of the Department of the Army to include: recruiting, organizing, supplying, equipping

(including research and development), training, servicing, mobilizing, demobilizing administering

(including the morale and welfare of personnel), maintaining, and other functions described in the statute.

The Secretary of the Army exercises its Title 10 responsibilities through the Chief of Staff for the Army

(CSA) and the ASCC commander assigned to each combatant command. The ASCC is responsible for all

Army Title 10 functions within the combatant commander’s (CCDR) area of responsibility (AOR). When

assigned in support of a geographical combatant command (GCC), the ASCC is designated as a theater

army and exercises administrative control (ADCON) over all Army forces within the combatant

commander’s AOR. The ASCC is responsible for preparing, training, equipping, administering, and

sustaining Army forces assigned to the CCDR.

1-35. Joint integration requires joint interoperability at all levels. This integration of joint forces and its

attendant capabilities create a joint interdependence where one or more of the Services purposely rely on

another Service’s capabilities to maximize the complementary and reinforcing effects of all Services

involved in the joint operation. Army forces operate as part of an interdependent joint force. The other

1-12 FM 1-06 4 April 2011

Financial Management Operations

Services depend on Army forces to complement their capabilities. Combined joint capabilities defeat

enemy forces by destroying their ability to operate as a coherent, effective entity. One area of joint

interdependence is joint sustainment (FM 4-0). Sustainment of joint forces is the deliberate, mutual reliance

by each Service component on the capabilities of two or more Service components (FM 3-0). Figure 1-7

describes the authorities that define the theater army sustainment responsibilities.

Figure 1-7. Authorities for Theater Army Sustainment Responsibilities

1-36. The Secretary of Defense (SecDef) may designate an executive agent (EA) IAW DOD Directive

(DODD) 5101.1, DOD Executive Agent. This EA normally is the Secretary of a Military Department and

with the EA designation retains the responsibilities, functions, and authorities to provide defined levels of

support for operational missions, administrative, or other designated activities that involve two or more

DOD components. By definition, the designation as an EA makes the organization responsible for a joint

capability within the boundaries of the EA designation (FM 4-0).

1-37. The CCDR possesses Directive Authority For Logistics (DAFL) authorizing the CCDR to issue

directives to subordinate commanders, to include directives regarding the provision of common user

logistics (CUL). Under DAFL, the CCDR may select a Service component as the Lead Service to execute

specific CUL functions to include planning and execution of one or multiple common user logistic

functions. The CCDR may augment the Lead Service logistics organization with capabilities from another

component(s) logistics organization as appropriate. The Lead Service must plan issue procedures and

sustainment funding for all services/support issued to other Services as well as a method for collecting

reimbursement or items from the other Services (FM 4-0). FM leaders must be aware of such designations

and the impact of these designations on resource requirements in support of the assigned mission.

1-38. The supported CCDR designates the Lead Service for FM in the joint operation plan or order; the

CCDR should designate the same Service as Lead Service for both FM and contracting. When designated

as the Lead Service for FM, the Army will normally fund multi-Service contract costs, unique joint force

operational costs, special programs, joint force headquarters (HQ) operational costs, and any other

designated support costs. During joint operation planning, the subordinate JFC, based on guidance from the

supported CCDR, must delineate funding responsibilities between the FM Lead Service and other Service

components. When required by DOD, separate cost accounts are established to capture direct costs incurred

in support of other organizations such as multinational forces and nongovernmental organizations (NGO)

(JP 1-06).

4 April 2011 FM 1-06 1-13

Chapter 1

1-39. Joint FM doctrine identifies four FM objectives to facilitate unified action and the prudent use of

resources. These four objectives are:

Provide mission-essential funding as quickly and efficiently as possible using the proper source

and authority of funds as directed in applicable guidance and agreements.

Reduce the impact of insufficient funding on readiness. Financial managers can accomplish this

through alternative funding sources and accurate cost identification used to determine timely

reimbursement of Service component appropriated expenses.

Ensure fiscal year integrity and avoid anti-deficiency violations. Fiscal year integrity and

possible anti-deficiency violations are legal concerns in joint operations.

Ensure detailed FM planning is conducted and coordinate efforts between the Services and

combatant commands to provide and sustain resources.

1-40. These objectives and their application in the development of FM concepts of support for operational

plans and orders are discussed in detail in JP 1-06.

1-41. When the Army is appointed the lead Service responsible for common FM support, the FM mission

with interorganizational partners ensures RM and FO needed to support all aspects and agencies involved

in the mission are present. The mission also involves financial analysis and recommendations to help the

joint force make the most efficient use of its fiscal resources. Effective FM support across the operational

themes from peacetime military engagement to major combat operations is a combat multiplier in that it

provides the commander with the financial resources needed to accomplish the mission. FM support

structure must provide the essential funding to support contracting requirements and accomplish joint

special programs.

1-42. Early and active participation by the senior joint task force (JTF) financial manager, in the deliberate

and crisis action planning processes is critical to successful integration of all components’ FM operations.

The senior financial manager must obtain and analyze the economic assessment of the joint operations area

(JOA) and begin initial coordination with the DFAS crisis coordination center. Furthermore, this individual

recommends JOA FM policies and develops the concept of FM operations support outlined in the FM

appendix to the operation plan (OPLAN)/operation order (OPORD). Other sources of information available

to the JTF FM element include the Department of State, the local embassy, the U.S. Department of the

Treasury, U.S. Department of Commerce, and the Central Intelligence Agency’s The World Fact Book

country reports. For a more detailed description of and instruction on the economic analysis, refer to

JP 1-06.

1-43. FM during humanitarian and disaster relief operations is critical to ensuring the proper use and

allocation of scarce fiscal resources supporting these complex operations and accomplishing the mission.

Humanitarian assistance and disaster relief operations are normally of relatively short duration-usually less

than 12 months. When the Army and the other Services provide assistance to an area outside the United

States, other nations participating in the relief operation will likely provide some financial assistance. At

the same time, U.S. costs will be incurred in providing support to other participating nations. Due to the

nature of the emergency, participating forces must engage in operations with minimal planning. Other

Federal departments and agencies will also be involved. The Federal Emergency Management Agency

(FEMA) coordinates the federal government's role in preparing for, responding to, and recovering from

domestic disasters. The USAID and the Office of Disaster Assistance extend assistance to countries

recovering from foreign disasters. These organizations address FM issues related to reimbursement, burden

sharing, assistance in kind (AIK), and cash contributions from other nations.

1-44. As a nation, the United States wages war employing all instruments of national power — diplomatic,

informational, military, and economic (JP 3-0, Joint Operations). For the purposes of this manual, the term

“instrument of economic power” refers to the employment of a nation’s fiscal resources through financial

activities at the strategic through tactical levels of war to create the desired effects necessary to support the

attainment of national security objectives. At the strategic level, these activities could include providing

foreign aid, granting or denying market access, seizing financial assets and imposing or lifting economic

sanctions. Examples at the operational level include, security assistance, fiscal policies regarding the use of

local versus U.S. currency, funding for employment generation programs, and support to host nation

banking institutions. Finally at the tactical level, fiscal authorities such as CERP, infuse millions of dollars

into local economies creating local employment and supporting local communities.

1-14 FM 1-06 4 April 2011

Financial Management Operations

1-45. CCDRs and subordinate JFCs must work with U.S. chiefs of missions, DOS, and other agencies to

best integrate military operations with the diplomatic, economic, and informational instruments of national

power to promote unity of effort in securing national objectives. FM operations in partnership with

interorganizational partners could include direct and indirect support to the theater commander’s efforts to

synchronize military operations and resources with those of other U.S. agencies in the application of the

nation’s economic power. In this role FM leaders must work as part of an integrated civilian-military team

ensuring security, developing local governance structures, promoting bottom-up economic activity,

rebuilding infrastructure, and building indigenous capacity for self governance. See Appendix C, Financial

Management Support to Military Operations in a Multinational Environment.

SECTION IV – FINANCIAL MANAGEMENT SUPPORT TO STABILITY

OPERATIONS

1-46. Department of Defense Instruction (DODI) 3000.05 established stability operations as a core military

mission on par with offensive and defensive operations stating:

Stability operations are a core U.S. military mission that the Department of Defense shall be

prepared to conduct and support. They shall be given priority comparable to combat operations

and be explicitly addressed and integrated across all DOD activities including doctrine,

organizations, training, education, exercises, materiel, leadership, personnel, facilities, and

planning.

1-47. Stability operations encompass various military missions, tasks, and activities conducted outside the

United States in coordination with other instruments of national power to maintain or reestablish a safe and

secure environment, provide essential governmental services, emergency infrastructure reconstruction, and

humanitarian relief (JP 3-0).

1-48. Stability operations leverage the coercive and constructive capabilities of the military force to

establish a safe and secure environment; facilitate reconciliation among local or regional adversaries;

establish political, legal, social and economic institutions; and facilitate the transition of responsibility to a

legitimate civil authority. Through stability operations, military forces provide security and control in order

to stabilize the security environment within the operational area and thus enable other instruments of

national power, as well as other international organizations, foreign entities, and nongovernmental

organizations to succeed in achieving the broad goals of conflict transformation. The United States usually

conducts stability operations in support of a host nation; however, in the absence of a legitimate

government, stability operations may support a transitional civil or military authority. When the host-nation

government, designated civil authorities, agencies or organizations prove incapable of fulfilling the basic

needs of the people, the military provides essential civil services until a civil authority or the host nation

can provide these services. In this capacity and under Congressional authority, military forces perform

specific functions as part of a broader response effort, supporting the activities of other agencies,

organizations, and institutions.

1-49. To achieve conditions that ensure a stable and lasting peace, stability operations capitalize on

coordination, cooperation, integration, and synchronization among military and nonmilitary organizations.

FM 3-07, Stability Operations, describes five primary end state conditions for stability operations:

A safe and secure environment.

Established rule of law.

Social well-being.

Stable governance.

A sustainable economy.

4 April 2011 FM 1-06 1-15

Chapter 1

FINANCIAL MANAGEMENT SUPPORTING TASKS

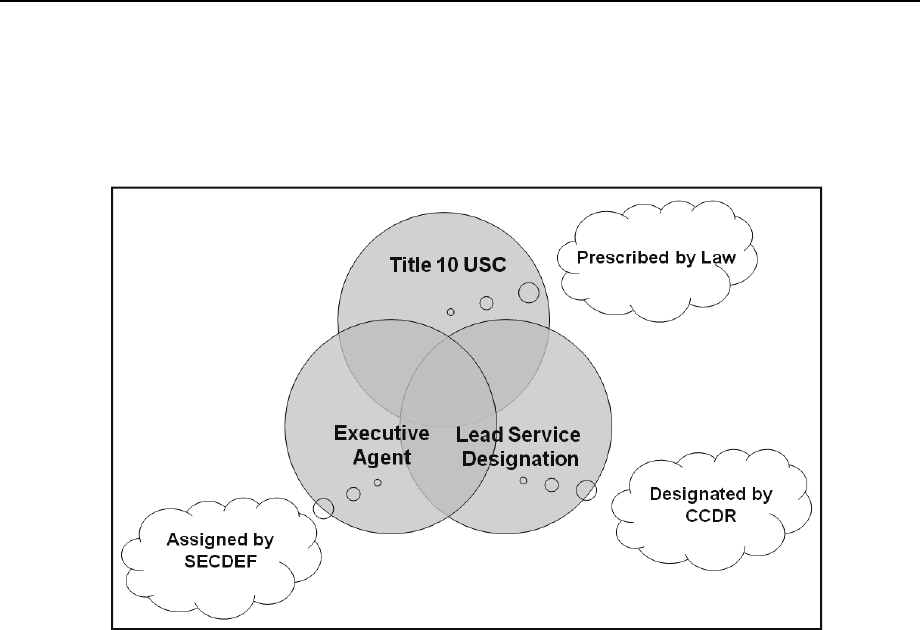

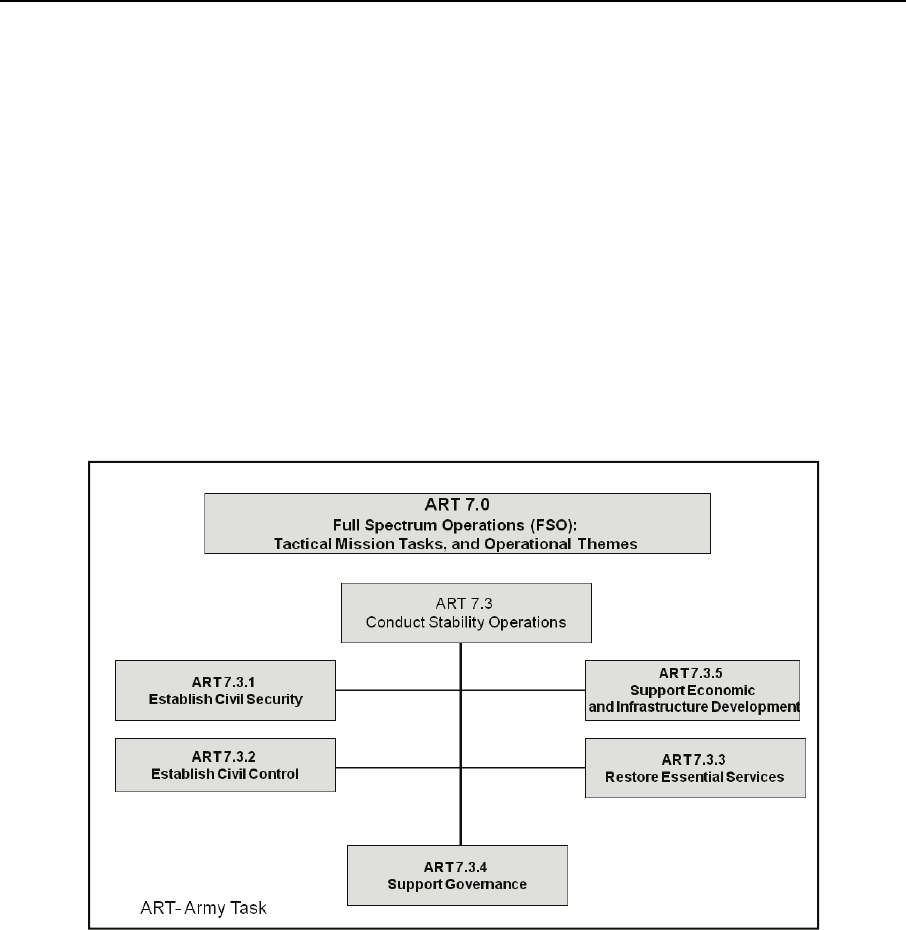

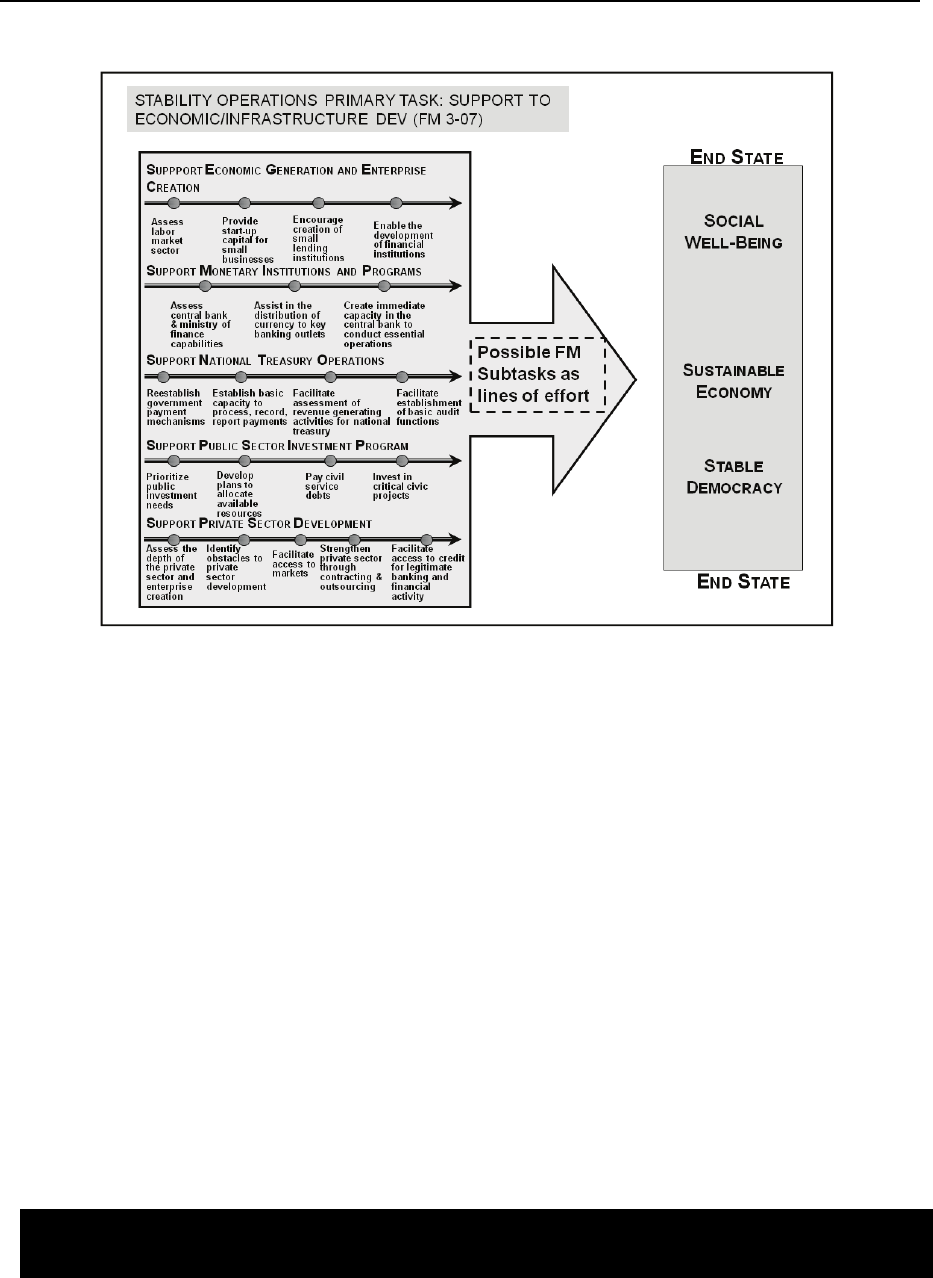

1-50. Full spectrum FM includes FM support to stability operations and requires FM leaders to develop a