July 2023

Repositioning for

Sustainable

Growth

2023-2025 Strategic Plan

Forward-Looking Statements

2

The Company may from time to time make written or oral “forward-looking statements,” including statements contained in this presentation. The

forward-looking statements contained herein are subject to certain risks and uncertainties that could cause actual results to differ materially from

those projected in the forward-looking statements. For example, risks and uncertainties can arise with changes in: general economic conditions,

including turmoil in the financial markets and related efforts of government agencies to stabilize the financial system; the impact of the COVID-19

pandemic on our business and results of operation; geopolitical conflict and inflationary pressures including Federal Reserve interest rate hikes;

the adequacy of our allowance for credit losses and our methodology for determining such allowance; adverse changes in our loan portfolio and

credit risk-related losses and expenses; concentrations within our loan portfolio, including our exposure to commercial real estate loans; inflation;

changes to our primary service area; changes in interest rates; our ability to identify, negotiate, secure and develop new branch locations and

renew, modify, or terminate leases or dispose of properties for existing branch locations effectively; business conditions in the financial services

industry, including competitive pressure among financial services companies, new service and product offerings by competitors, price pressures

and similar items; deposit flows; loan demand; the regulatory environment, including evolving banking industry standards, changes in legislation

or regulation; our securities portfolio and the valuation of our securities; accounting principles, policies and guidelines as well as estimates and

assumptions used in the preparation of our financial statements; rapidly changing technology; our ability to regain compliance with Nasdaq

Listing Rules 5250(c)(1) and 5620(a); the failure to maintain current technologies; failure to attract or retain key employees; our ability to access

cost-effective funding; fluctuations in real estate values; litigation liabilities, including costs, expenses, settlements and judgments; and other

economic, competitive, governmental, regulatory and technological factors affecting our operations, pricing, products and services. You should

carefully review the risk factors described in the Annual Report on Form 10-K for the year ended December 31, 2021, and other documents the

Company files from time to time with the Securities and Exchange Commission (the “SEC”). The words "would be," "could be," "should be,"

"probability," "risk," "target," "objective," "may," "will," "estimate," "project," "believe," "intend," "anticipate," "plan," "seek," "expect" and similar expressions

or variations on such expressions are intended to identify forward-looking statements. All such statements are made in good faith by the

Company pursuant to the "safe harbor" provisions of the U.S. Private Securities Litigation Reform Act of 1995. We do not undertake to update any

forward-looking statement, whether written or oral, that may be made from time to time by or on behalf of the Company, except as may be

required by applicable law or regulations.

2023-2025 Strategic Plan

Disclaimer

3

NO OFFER OR SOLICITATION

This document is not a prospectus or offering document for any securities. This document does not constitute or form part of any offer or invitation

to sell or issue, or any solicitation of any offer to purchase or subscribe for, any securities of Republic First Bancorp, Inc. (the ''Company," "us" or ''we"),

nor shall any part of it nor the fact of its dissemination form part of or be relied on in connection with any contract or investment decision relating

thereto. This document is for informational purposes only and is being furnished on a confidential basis to a limited number of institutional

accredited investors. Any such offering may be made only by a purchase agreement and the information contained herein will be superseded in

its entirety by such purchase agreement. This document does not contain all the information you should consider before investing in securities of

the Company and should not be construed as investment, legal, regulatory or tax advice. You should consult with your own advisors as needed to

assist you in making an investment decision and to advise you whether you are legally permitted to purchase securities.

No representation or warranty as to the accuracy, completeness, or fairness of such information is being made by the Company or any other

person, and neither the Company nor any other person shall have any liability for any information contained herein, or for any omissions from this

document or any other written or oral communications transmitted to the recipient by the Company or any other person in the course of the

recipient's evaluation of a potential investment in the securities. This document speaks as of the date hereof. The Company assumes no obligation

to update any information contained herein.

NON-GAAP FINANCIAL MEASURES

This document contains supplemental financial information determined by methods other than in accordance with accounting principles

generally accepted in the United States of America ("GAAP"), such as efficiency ratio. We use these non-GAAP measures in the analysis of our

performance. These measures should not be considered a substitute for GAAP basis measures nor should they be viewed as a substitute for

operating results determined in accordance with GAAP. The Appendix to this document contains a reconciliation of the non-GAAP financial

measures to the most directly comparable GAAP financial measures. While we believe that these non-GAAP financial measures are useful in

evaluating results, the information should be considered supplemental in nature and not as a substitute for or superior to the relevant financial

information prepared in accordance with GAAP. The non-GAAP financial measures we use may differ from the non-GAAP financial measures other

financial institutions use to measure their results of operations. This information should be reviewed in conjunction with the financial results

disclosed in our Annual Report on Form 10-K for the year ended December 31, 2021, subsequent quarterly 2022 Form 10-Q filings and other

subsequent filings with the SEC.

2023-2025 Strategic Plan

Important Information

4

The Company intends to file a definitive proxy statement and may file a WHITE proxy card with the the SEC in connection with the 2022 Annual

Meeting of Shareholders (the “2022 Annual Meeting”) and, in connection therewith, the Company, certain of its directors and executive officers will

be participants in the solicitation of proxies from the Company’s shareholders in connection with such meeting. SHAREHOLDERS OF THE COMPANY

ARE STRONGLY ENCOURAGED TO READ SUCH PROXY STATEMENT, ACCOMPANYING WHITE PROXY CARD AND ALL OTHER DOCUMENTS FILED WITH THE SEC

CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE 2022 ANNUAL MEETING.

The Company’s definitive proxy statement for the 2021 annual meeting of shareholders contains information regarding the direct and indirect

interests, by security holdings or otherwise, of the Company’s directors and executive officers in the Company’s securities. Information regarding

subsequent changes to their holdings of the Company’s securities can be found in the SEC filings on Forms 3, 4, and 5, which are available on the

Company’s website at http://investors.myrepublicbank.com/ or through the SEC’s website at www.sec.gov. Information can also be found in the

Company’s Annual Report on Form 10-K for the year ended December 31, 2021 on file with the SEC. Updated information regarding the identity of

potential participants, and their direct or indirect interests, by security holdings or otherwise, will be set forth in the definitive proxy statement and

other materials to be filed with the SEC in connection with the 2022 Annual Meeting. Shareholders will be able to obtain the definitive proxy

statement, any amendments or supplements to the proxy statement and other documents filed by the Company with the SEC at no charge at the

SEC’s website at www.sec.gov. Copies will also be available at no charge at the Company’s website at http://investors.myrepublicbank.com.

2023-2025 Strategic Plan

Table of Contents

5

Section Title Page

I

Executive Summary

6

II

Our Strong Foundation for Growth

14

III

Our Plan to Refocus and Execute

23

IV

Conclusion

32

V

Appendix

35

Executive

Summary

Section One

2023-2025 Strategic Plan

Executive Summary

7

Republic Bank is a service

-

focused, relationship

-driven

banking institution

We have a strong foundation

We are executing a new

strategy to refocus the

business and create value

▪ We are one of the largest banks

headquartered in the metropolitan

Philadelphia and Southern New Jersey

markets

▪ We have an attractive niche, ideally

situated between small community

banks that are resource-constrained

and large national banks that lack our

local expertise

▪ There are few mid-size, locally-

focused

competitors in our core market

▪ We have a distinct brand based on

“fanatic,” personalized customer

service

▪ We have 33 retail branches

1

with

approximately $4.9 billion in deposits

2

▪ We have broad and deep customer

relationships

▪ We have a disciplined credit culture

and a diversified loan portfolio, both of

which help to mitigate risk in today’s

uncertain economic environment

▪ Our employee base is loyal and our

technology and product set are

scalable

▪ We recently refreshed our leadership

team, bringing in a new CEO, CFO and

General Counsel, and enhanced our

Board with new skills and perspectives

▪ Our new leadership team has been

developing and executing a new

strategic plan to reposition the

business

▪ The strategy seeks to:

– Renew the bank’s focus on its

core business;

– Improve operational efficiency

and profitability;

– Enhance capital ratios;

– Strengthen customer

relationships;

– Build trust with stakeholders; and

– Right-size the balance sheet

▪ We believe this strategy can deliver

sustainable value, and we are

targeting ROAA of ~1.0% and an

efficiency ratio of <60% in the mid-term

1. As of July 14, 2023.

2. As of March 31, 2023.

2023-2025 Strategic Plan

Republic First Bancorp (Nasdaq: FRBK) Overview

8

▪ Republic Bank was founded in 1988 and for the

first 20 years grew with a focus on commercial

clients and opportunities in the metropolitan

Philadelphia and Southern New Jersey markets

▪ Under prior management, the bank expanded

into New York City and new business lines; at the

time, the Board was divided, with several

directors loyal to the previous CEO, despite these

strategic missteps

▪ In 2022, our directors oversaw an effort to refresh

the Board and leadership team, bringing in three

new directors and a new CEO and CFO; we also

brought in a new General Counsel in 2023

▪ Our new leadership team has prioritized

stabilizing the business while executing a new

strategic plan

▪ Our mission is to deliver an unmatched

commercial and consumer banking experience,

and we are focused on providing “fanatic”

customer service

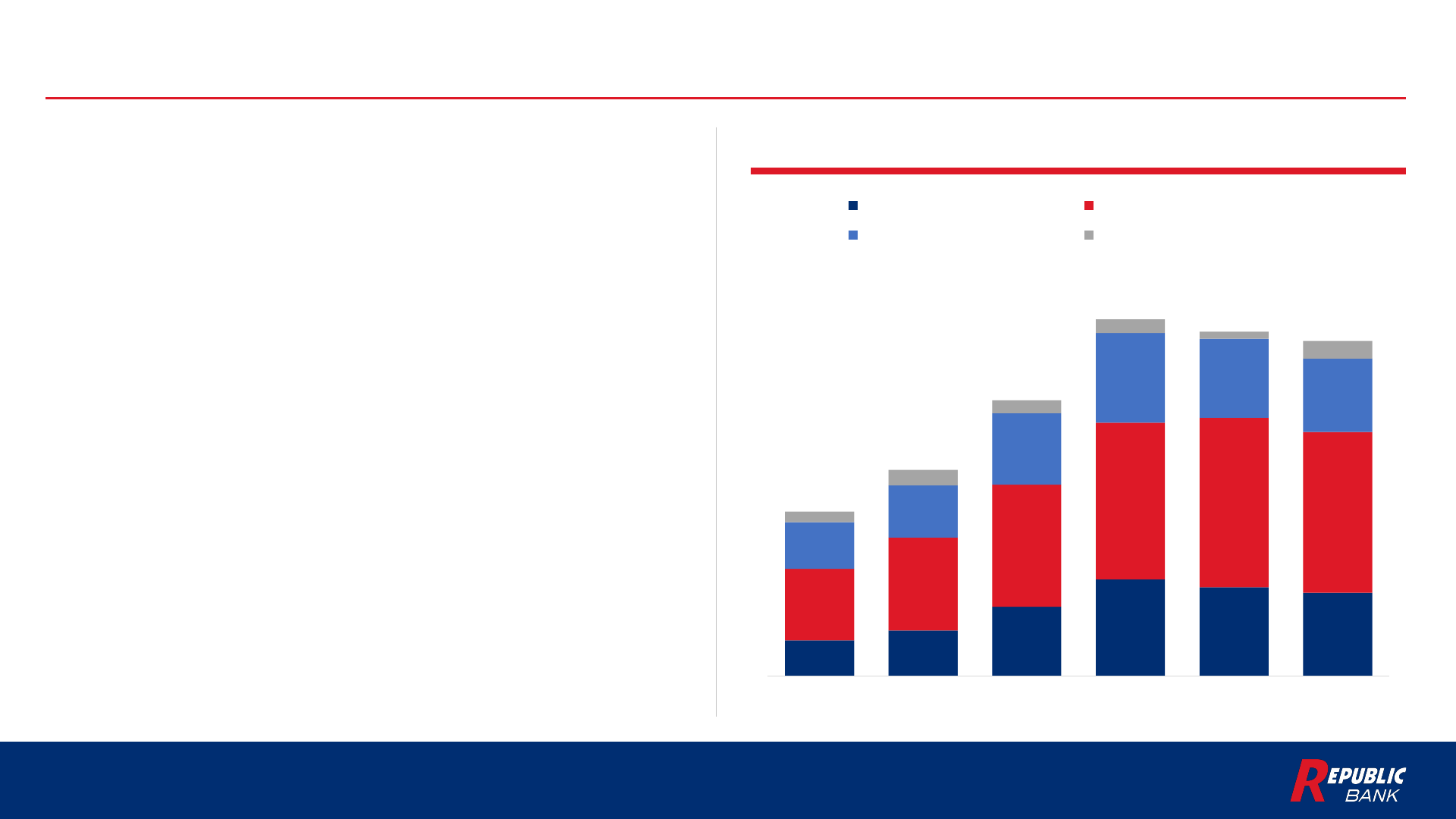

Deposits ($M)

1

Financial Highlights

1

Stock Price

$0.77

Market Value ($M)

$49

P/TBV

0.25x

Loans ($M)

$3,142

Deposits ($M)

$4,878

Loans/Deposits

64.4%

Total Equity ($M)

$197

Total Assets ($M)

$6,157

Tier 1 Capital Ratio

9.7%

Total Equity/Total Assets

5.6%

1. Source: FactSet and Company filings. Stock price, market value and P/TBV data as of July 14, 2023. All other data as of March 31, 2023.

Loan Portfolio ($M)

1

Investment Securities ($M)

1

$1,210

$2,344

$1,067

$257

Demand - NIB

Demand - IB

Money

Market/Savings

Time Deposits

$895

$304

$289

$570

$87

$992

$6

Commercial Real

Estate

Construction & Land

Development

Commercial &

Industrial

Owner Occupied

Real Estate

Consumer & Other

Residential

Mortgage

Paycheck Protection

Program

$64

$680

$1,537

$56

$193

U.S. Government

Agencies

Collateralized

Mortgage

Obligations

Agency Mortgage-

Backed Ssecurities

Municipal Securities

Corporate Bonds

2023-2025 Strategic Plan

Deposit Base and Liquidity Profile

9

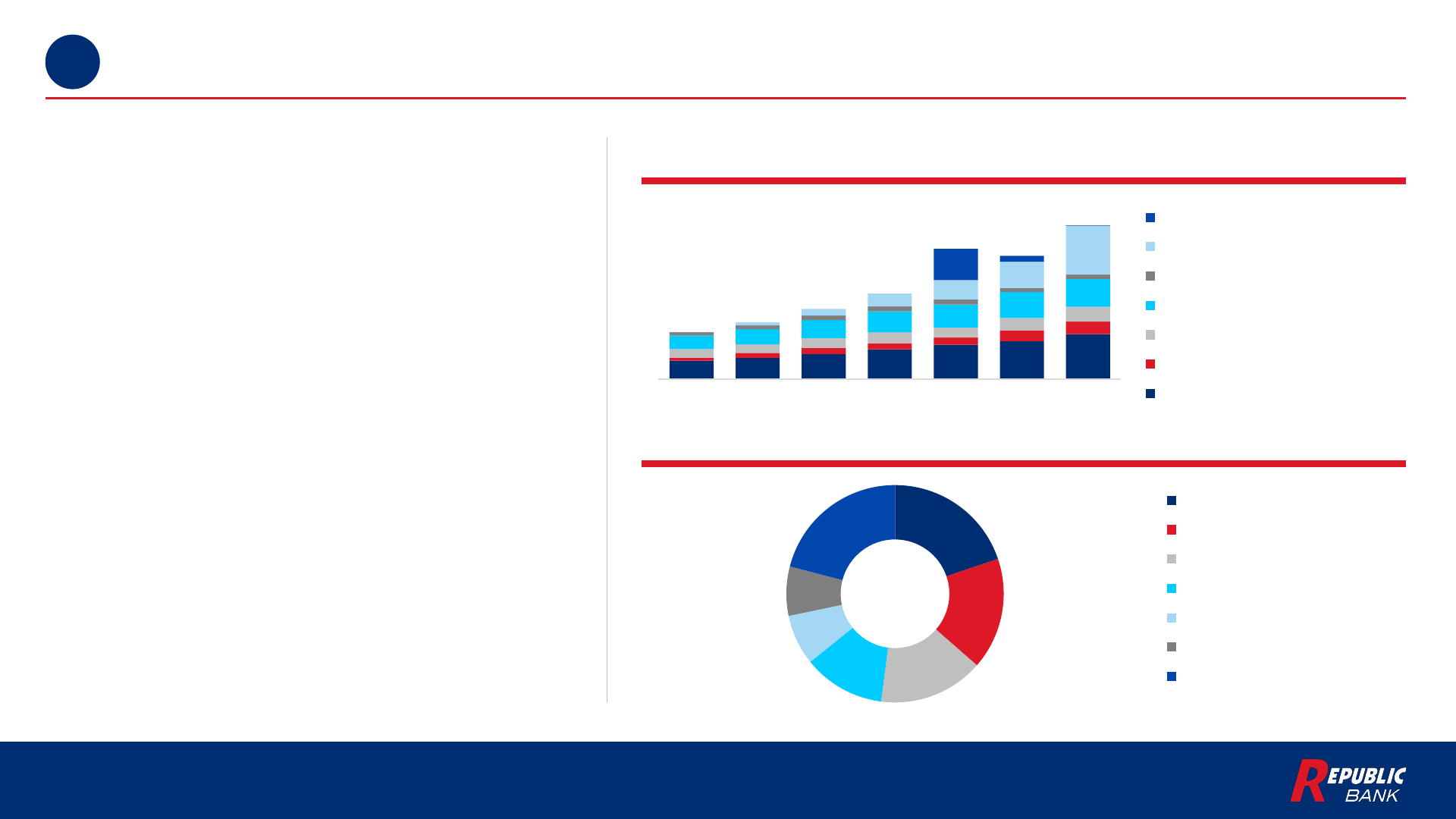

▪ During Q1 2023, our strong community banking brand,

commitment to customers and focus on relationship

banking allowed us to maintain steady deposit levels

in a challenging environment

▪ Even as deposit balances declined 2.7% during Q1 2023,

the number of deposit relationships with the bank

increased by 5.2% in the period

▪ More than 76% of total deposits are FDIC-insured or

fully collateralized

2

; net of fully collateralized public

funds, 60% of deposits are FDIC insured

2

▪ Newly-added reciprocal deposit programs have

expanded the bank’s offerings for current and potential

customers while providing an additional channel for

core deposit gathering

▪ We are focused on leveraging Republic Bank’s strong

consumer deposit acquisition culture to enhance our

liquidity position and reduce reliance on wholesale

funds

1. Source: Company filings.

2. As of March 31, 2023.

Total Deposits

1

$0.5

$0.7

$1.0

$1.4

$1.3

$1.2

$1.0

$1.4

$1.8

$2.3

$2.5

$2.3

$0.7

$0.8

$1.0

$1.3

$1.1

$1.1

$0.2

$0.2

$0.2

$0.2

$0.1

$0.3

$2.4

$3.0

$4.0

$5.2

$5.0

$4.9

2018 2019 2020 2021 2022 Q1 2023

Demand (Non-Interest Bearing) Demand (Interest Bearing)

Money Market and Savings Time Deposits

2023-2025 Strategic Plan

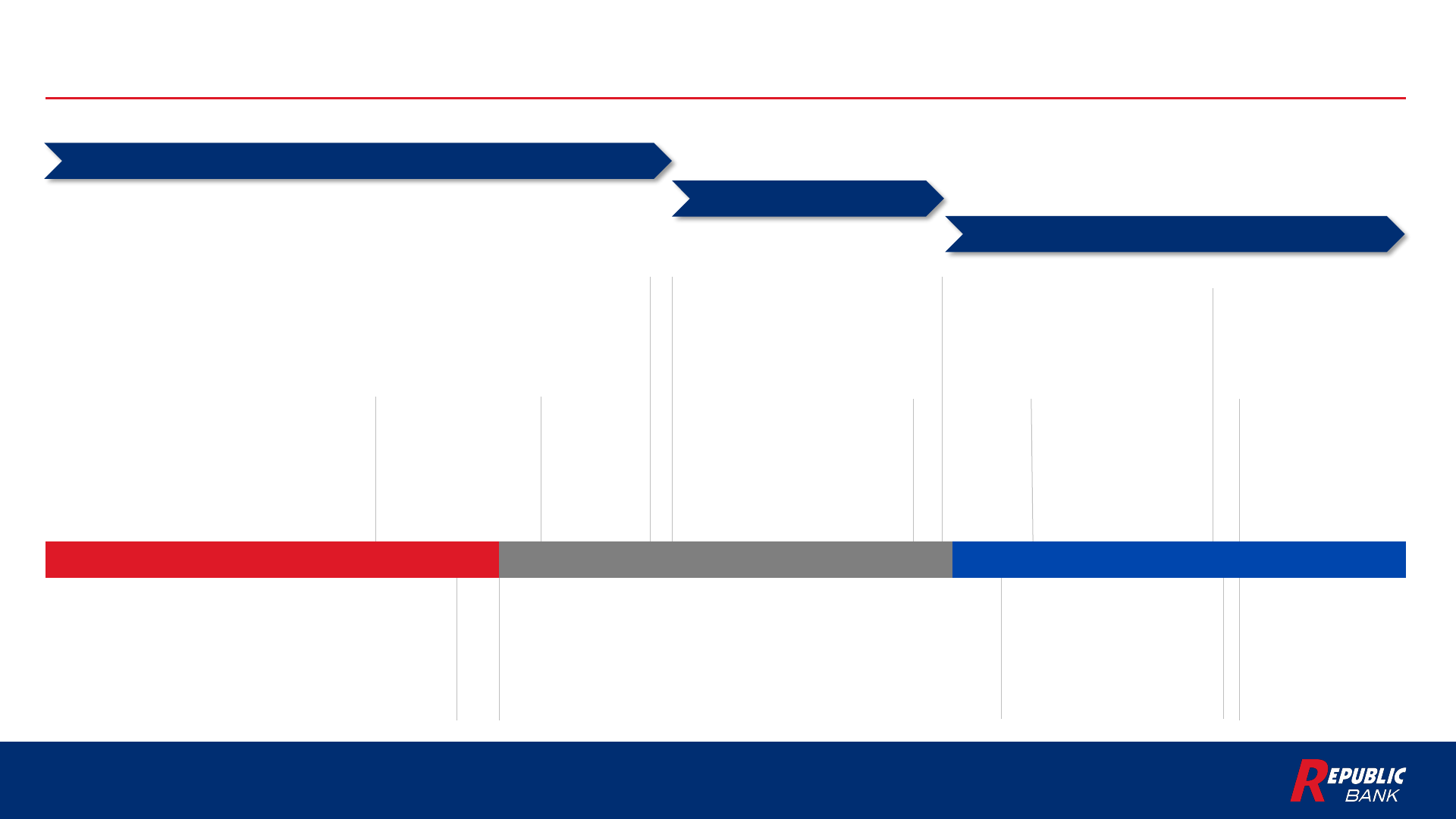

The Board, Leadership & Strategy Have Changed Significantly

10

Republic Bank CEO

Vernon Hill

Harry Madonna

Tom Geisel

March 2023

Announced $125M

capital raise

SVB and Signature

Bank fail, spurring

banking crisis

December 2022

Tom Geisel joins as

President & CEO and

appointed to the Board;

Mike Harrington joins as CFO

January 2022

Norcross Group

files 13D

August 2022

Harry Madonna

named Interim

CEO and Executive

Chair

July 2022

Vernon Hill resigns

as CEO

1

; Benjamin

Duster appointed

to the Board

October 2022

Peter Bartholow

appointed to the Board

pursuant to cooperation

agreement with Driver

Management

Q4 2021

Previous leadership invests

heavily in long-duration

securities with low fixed

interest rates; as rates

increase, those securities

decline in value

June 2023

Announced actions to

enhance efficiency

and streamline

operations, including

exiting NY and

mortgage banking

June 2023

Andrew Cohen

appointed

Independent Chair

of the Board

January 2023

Michael LaPlante

appointed SVP,

Chief Accounting

Officer

1H 2022

Previous leadership continues

aggressive expansion, opening new

branch in PA and increasing presence

in NY market, and grows jumbo

residential mortgage portfolio at

below-market interest rates

May 2023

Unveiled new

strategy to refocus

on core services

and markets

December 2021

Driver

Management

submits notice of

intention to

nominate directors

2021 2022 1H 2023

June 2023

Francis Mitchell

appointed SVP,

Treasurer and Chief

Investment Officer;

Brian Doran joins as

General Counsel

1. Mr. Hill’s letter of resignation was dated July 6, 2022, but was not effective until August 8, 2022.

2023-2025 Strategic Plan

11

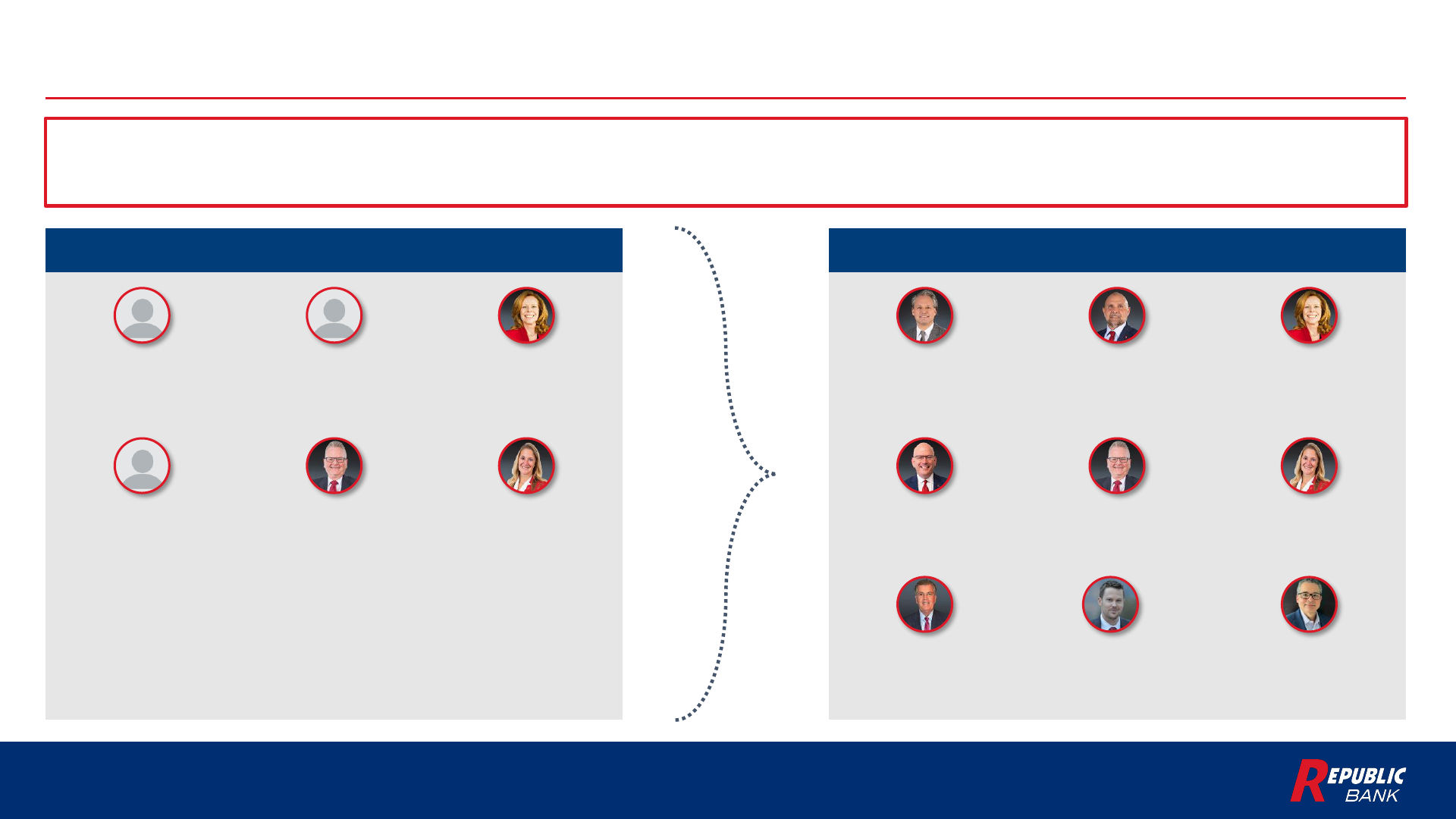

We Have Substantially Refreshed the Leadership Team

We have refreshed the management team and organizational structure to add and promote

new talent to execute on our strategy

JULY 2021 JULY 2023

Michael W. Harrington

EVP, CFO

Dec. 2022

Thomas X. Geisel

President & CEO

Dec. 2022

Sharon Hammel

EVP, Chief Retail Officer

2017

1

Jay Neilon

EVP, Chief Credit Officer

2012

1

Steve McWilliams

EVP, Chief Lending Officer

2022

1

Tracie Young

EVP, Chief Risk Officer

2015

1

Brian F. Doran, Esq.

EVP, General Counsel

2023

Frank A. Cavallaro

EVP, CFO

Vernon W. Hill II

Chair & CEO

Sharon Hammel

EVP, Chief Retail Officer

Jay Neilon

EVP, Chief Credit Officer

Andrew Logue

President & COO

Tracie Young

EVP, Chief Risk Officer

Source: Company documents.

1. Represents year in which they were promoted to a new role or assumed new responsibilities within the organization.

Francis Mitchell

SVP, Treasurer and Chief

Investment Officer

2023

Michael LaPlante

SVP, Chief Accounting

Officer

2023

2023-2025 Strategic Plan

We Are Executing on a New Strategy

12

Topic Previous Management’s Strategy Our New Strategy

Branch footprint

▪

Focused on aggressive expansion of the Company’s

branch footprint, including into the challenging New

York City market, which required significant capital

and led to a lack of focus

▪ Exit non-core markets, consolidate branches and

refocus on the Company’s core metropolitan

Philadelphia and Southern New Jersey markets

Lending activity

▪ Developed an active mortgage lending business,

specializing in jumbo mortgage products with

aggressive rates, which had higher risk and lower

risk-adjusted rates of return than other asset

classes

▪ Wind down and exit the mortgage origination

business

Balance sheet

▪ Grew the balance sheet significantly to support

expansion, which put pressure on capital ratios

▪ Stabilize and shrink the balance sheet

▪ Build, maintain and manage capital

Asset portfolio

▪ Invested heavily in long-dated, fixed-

rate mortgage

bonds and expanded the jumbo mortgage loan

portfolio (at below-market rates and when interest

rates were at long-term lows), the value of which

have declined substantially in a rising rate

environment

▪ Attempt to sell the bonds at attractive prices or

allow them to roll off the balance sheet

▪ Increase hedging to mitigate risk

2023-2025 Strategic Plan

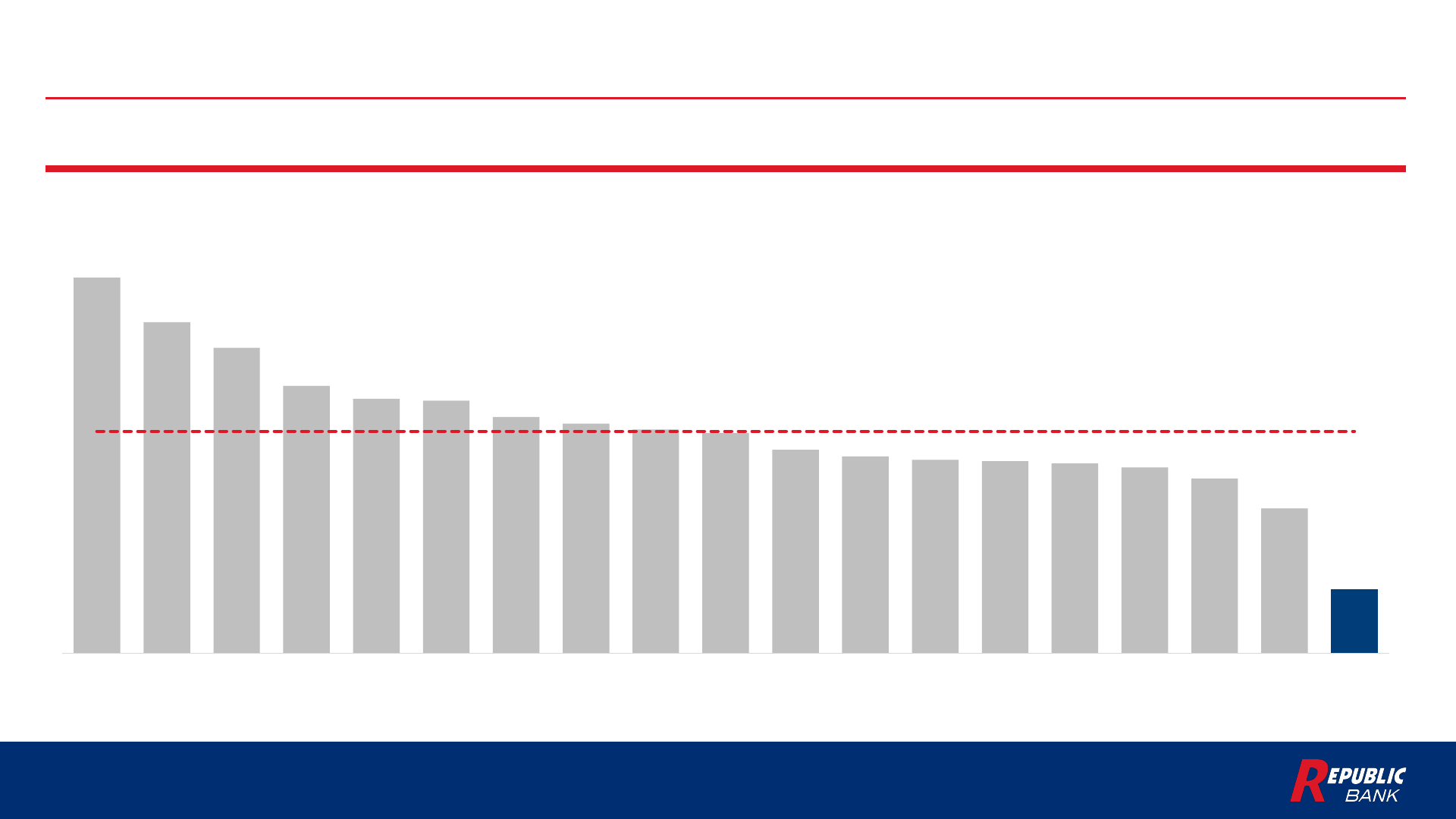

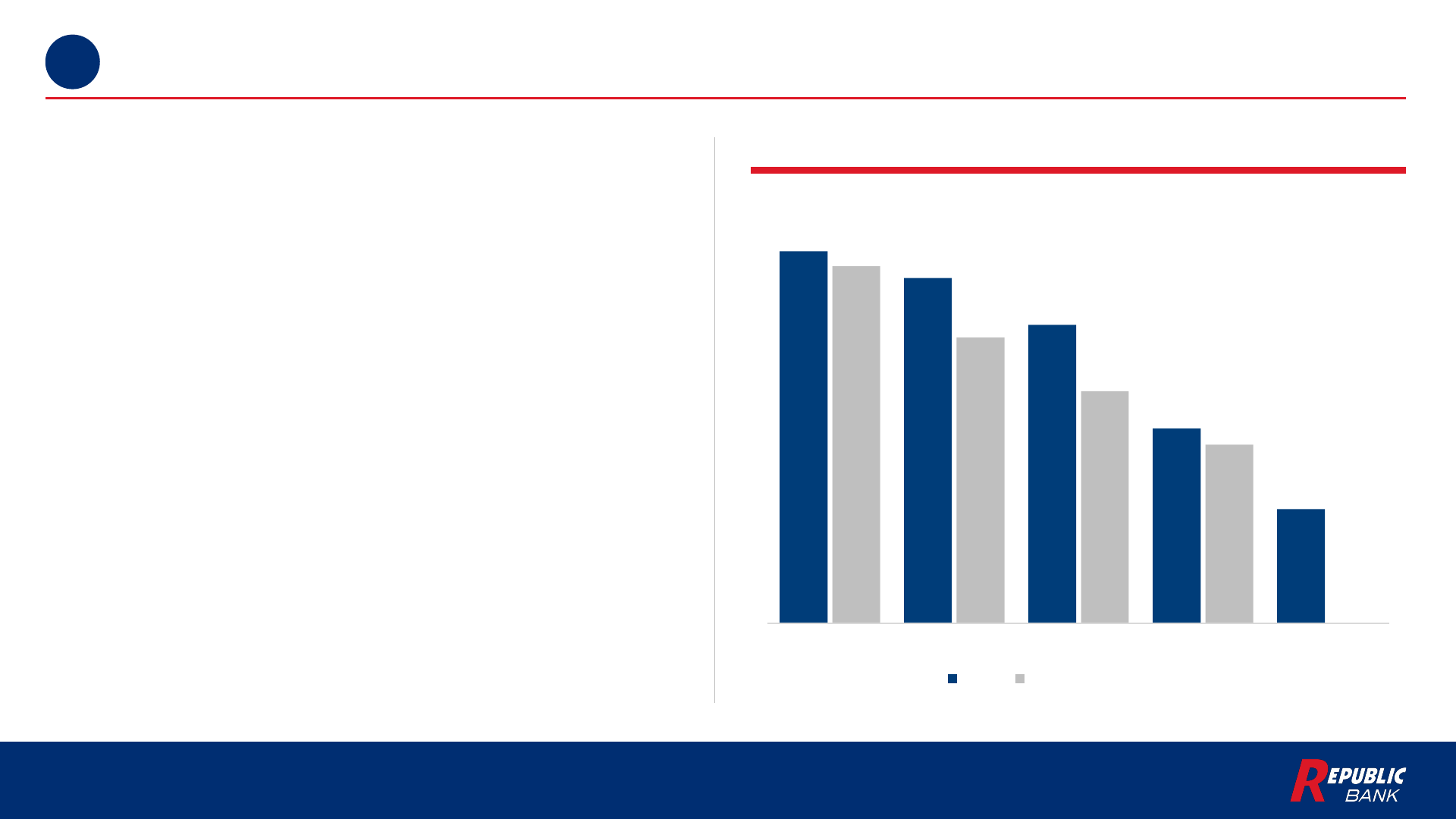

Republic First Is a Compelling Investment

13

Current Valuation

1

1. Source: FactSet. Data as of July 14, 2023.

1.46x

1.29x

1.19x

1.04x

0.99x

0.98x

0.92x

0.90x

0.87x

0.86x

0.79x

0.77x

0.75x

0.75x

0.74x

0.72x

0.68x

0.57x

0.25x

Peer Median:

0.87x

TMP STBA PFIS AMAL AROW PGC MPB TRST UVSP CCNE NFBK CNOB MCB FISI FLIC KRNY BCBP FFIC FRBK

P/TBV

Our Strong

Foundation

for Growth

Section Two

2023-2025 Strategic Plan

Our Areas of Strength Support a Path to Sustainable Growth

15

Strong customer relationships and market position

Disciplined credit culture and strong asset quality

Balanced, diversified loan portfolio

Stable team and strong technology base

Experienced, recently refreshed leadership team

1

2

3

5

4

2023-2025 Strategic Plan

16

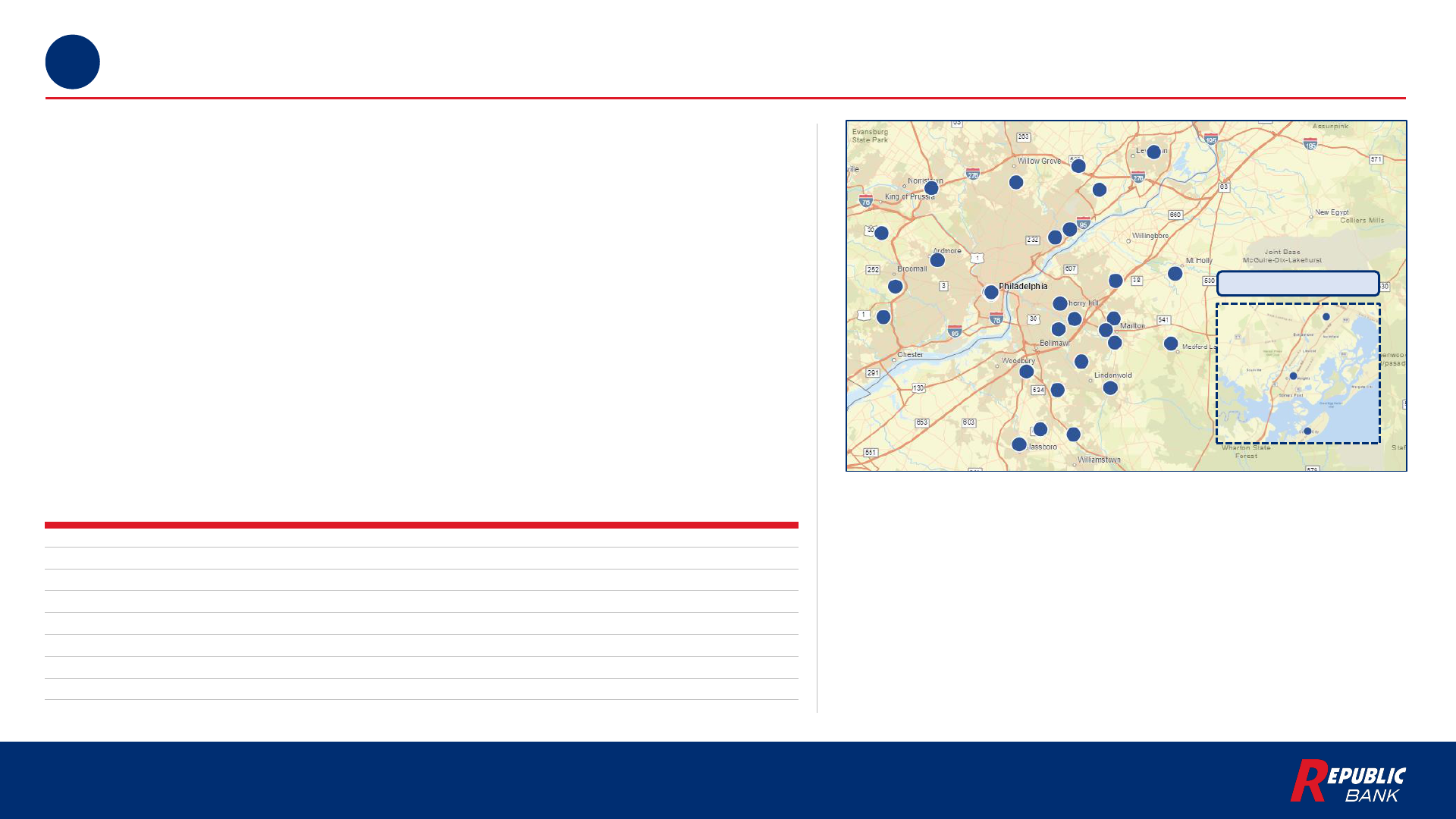

We Have a Strong Position in Our Core Markets

1

County State Rank (Deposits)

1

Share of Deposits

1

Bucks

PA 22 0.8%

Delaware

PA 9 1.6%

Montgomery

PA 13 1.4%

Philadelphia

PA 10 1.3%

Atlantic

NJ 8 2.5%

Burlington

NJ 7 5.5%

Camden

NJ 4 9.3%

Cape May

NJ 11 0.1%

Gloucester

NJ 6 5.6%

▪ The Company’s primary service area consists of the Greater

Philadelphia and Southern New Jersey markets, in which we have

a strong position, ideally situated between the large national

banks and smaller local institutions

▪ We are the 9th-ranked bank across these markets based on

deposits, ahead of significantly larger institutions like M&T, Truist

and KeyBanc

1

▪ In the Company’s core markets, we have 2.4% market share

based on a percentage of deposits

1

▪ We believe there are significant opportunities in Republic’s core

markets for a commercially focused hometown bank with local

decision-making, superior customer service and significant scale

1. Source: FDIC Summary of Deposits. Data as of June 30, 2022.

2. As of July 14, 2023.

Jersey Shore

Total Deposits in

PA/NJ Markets

2

Branches in

Philadelphia

MSA

2

Rank by Total

Deposits in

PA/NJ Markets

1

$4.9B 33

9

th

2023-2025 Strategic Plan

17

Current Capital Ratios

2

Capital Position

1

▪ Republic Bank’s capital ratios are all in excess of

regulatory minimums

▪ Republic Bank employs a disciplined approach to

managing capital, balancing considerations of

efficiency and shareholder value against risk appetite

and regulatory standards

▪ Tangible capital is currently negatively impacted by

unrealized losses on the bond position built under the

prior leadership team

▪ We are in the process of repositioning and reducing

the size of the balance sheet, which we expect to lead

to higher capital ratios

▪ Our current strategy is to manage the business as if

no new capital is raised; we are focused on capital

preservation and deployment of capital to initiatives

with the highest risk-adjusted returns

1. Source: Company documents. Data as of March 31, 2023.

10.42%

9.67%

8.36%

5.45%

3.20%

10.00%

8.00%

6.50%

5.00%

Total Capital Tier 1 Capital CET1 Tier 1 Leverage TCE

FRBK Regulatory Well Capitalized

2023-2025 Strategic Plan

18

We Have a Disciplined Credit Culture

2

Nonperforming Assets / Total Assets

1

Loan Loss Reserves / Total Loans

1

▪ We have a strong risk management culture and credit

framework established throughout the organization,

with consistent policies and underwriting standards

▪ The loan portfolio has grown significantly over the last

few years while non-performing assets have declined

▪ The Company’s historically conservative credit culture

supports asset quality entering a potential recession

1. Source: FactSet, Bloomberg and Company documents. Peers include Amalgamated Financial, Arrow Financial, BCB Bancorp, CNB Financial, ConnectOne Bancorp, Financial Institutions, First

of Long Island, Flushing Financial, Kearny Financial, Metropolitan Bank, Mid Penn Bancorp, Northfield Bancorp, Peapack-Gladstone Financial, Peoples Financial Services, S&T Bancorp,

Tompkins Financial, TrustCo Bank and Univest Financial.

0.59%

0.53%

0.48%

0.75%

0.77%

0.80%

0.93%

0.88%

1.15%

1.06%

1.01%

0.98%

2018 2019 2020 2021 2022 Q1 2023

FRBK Peer Median

0.60%

0.42%

0.28%

0.24%

0.30%

0.31%

0.43%

0.42%

0.44%

0.30%

0.29%

0.35%

2018 2019 2020 2021 2022 Q1 2023

FRBK Peer Median

2023-2025 Strategic Plan

19

We Have a Robust, Diversified Loan Portfolio

3

Loans by Type ($M)

1

▪ Recently completed third party loan review

covered more than 70% of commercial (including

C&I) loan portfolio

▪ Strict underwriting criteria and proactive credit

monitoring supported by results of outside loan

review and credit quality metrics

▪ Current loan loss reserve covers >100% of third

party loan review estimated portfolio losses under

Moody’s Base Case economic scenario

▪ Annual internal review conducted on all

relationships >$3mm

▪ Limited exposure to commercial and office real

estate:

– Investor CRE is less than 30% of the current

loan portfolio; office assets are less than 7%

– Total office CRE represents less than 10% of

all commercial loans

– NYC office CRE represents less than 1% of

total CRE

$965

$1,162

$1,437

$1,748

$2,658

$2,514

$3,136

2016 2017 2018 2019 2020 2021 2022

Paycheck Protection Program

Residential Mortgage

Consumer & Other

Owner Occupied Real Estate

Commercial & Industrial

Construction & Land Development

Commercial Real Estate

Loan Collateral Composition

1

$330

$277

$260

$203

$125

$122

$349

Retail

Office

Construction

Industrial

Hospitality

Multifamily

Other (Incl. 1-4 Family Investor)

1. Source: Company documents. Data as of December 31, 2022.

2023-2025 Strategic Plan

20

We Have a Stable and Engaged Team

▪ The Company’s employee base remains resilient and engaged despite external challenges

– Republic Bank continues to be a preferred place of employment in the metropolitan Philadelphia market; we were

named one of the “Top Workplaces” by the Philadelphia Inquirer in 2018, 2019, 2020, 2022 and 2023

– Our new leadership team is committed to newly empowering Republic’s people with the information and freedom

they need to make optimal decisions for customers and other stakeholders

– The senior executive team has been retained, with no unplanned executive departures since the new leadership team

was put in place

– Current leadership team has a strong mix of fresh perspectives and valuable institutional knowledge and experience

within the Company

– We are updating our incentive model that helps us attract and retain talented people and better reward measurable

performance and success

4

2023-2025 Strategic Plan

21

We Have a Strong Technology Base

▪ We leverage the Company’s culture of “fanatic” customer service and enhance it with technology

– We are enhancing non-interest income with enhanced Treasury Management services with focus on payments

facilitation / integration and expanded services including interest rate derivatives (IRD) and Foreign Exchange (FX)

– We are leveraging the existing technology platform to deploy new digital and technology tools that support and

enhance the customer experience, including payments integration

4

2023-2025 Strategic Plan

22

We Have the Right Team to Execute Our Strategy

5

Thomas X. Geisel

President, CEO & Director

Joined Dec. 2022

Michael W. Harrington

EVP, Chief Financial Officer

Joined Dec. 2022

Sharon Hammel

EVP, Chief Retail Officer

Joined 2012

Steve McWilliams

EVP, Chief Lending Officer

Joined 2009

Jay Neilon

EVP, Chief Credit Officer

Joined 2009

Tracie Young

EVP, Chief Risk Officer

Joined 2010

Brian F. Doran, Esq.

EVP, General Counsel

Joined 2023

Francis Mitchell

SVP, Treasurer & Chief Investment Officer

Joined 2023

Michael LaPlante

SVP, Chief Accounting Officer

Joined 2023

▪ 29 years in financial services

▪ Previously held senior executive positions at Webster Bank

▪ Earlier in his career, served as President & CEO of Sun

Bancorp and President of the Northeast region at KeyCorp

▪ 30 years in financial services

▪ Previously served as President of Republic Bank’s

Philadelphia Metro Market

▪ Joined Republic from Commerce Bank, where he served

as a Vice President

▪ 36 years in financial services

▪ Previously served as Banker-in-Residence at JAM Special

Opportunity Ventures

▪ Held CFO roles at Bryn Mawr Trust Co., Susquehanna

Bancshares & First Niagara

▪ 47 years in financial services

▪ Has been a local banker in the Philadelphia area for over

30 years

▪ Previously served in a variety of roles at Commerce Bank

and Fidelity Bank

▪ 25 years in financial services

▪ Responsible for leading Republic’s consumer lending,

marketing, branch administration and other functions

▪ Previously Sr. Retail Market Manager at Commerce Bank

▪ 31 years in financial services

▪ Responsible for leading Republic’s compliance and risk

departments

▪ Previously Director of Internal Audit and Risk Management

at Harleysville National Bank

▪ 24 years in financial services

▪ Previously served as Chief Administrative Officer, General

Counsel and Corporate Secretary at Investors Bank

▪ Served as a Senior Associate at Jones Day and served as

Partner at McConnell Valdés

▪ 18 years in financial services

▪ Previously served as Director, Fixed Income & Depositary

Strategies at Truist

▪ Also served in Treasury and Portfolio Management roles at

Webster Bank and TD

▪ 28 years in financial services

▪ Experienced Chief Accounting Officer, having previously

worked at Bryn Mawr Trust and Bank of Princeton

▪ Previously held senior accounting roles at Deloitte and

RSM

Our Plan to

Refocus and

Execute

Section Three

2023-2025 Strategic Plan

Our Plan to Refocus and Execute

24

Drive Revenue Growth by Focusing on Core Strengths

Improve Focus and Efficiency

Realign Balance Sheet and Asset Portfolio

Strengthen and Deepen Customer Relationships

Build Trust with Stakeholders

1

2

3

4

5

2023-2025 Strategic Plan

Drive Revenue Growth by Focusing on Core Strengths

25

1

Core Strength

Strategic Initiatives Benefits

Strong position in the

metropolitan

Philadelphia and

Southern NJ markets

▪ Focus on growing franchise value in metropolitan

Philadelphia and Southern New Jersey markets

▪ Exit non-core geographies and optimize branch footprint

+

Increased management focus

+

Stronger regional brand

+

Reduced expenses

Deep customer

relationships

▪ Leverage strong consumer deposit acquisition culture to

reposition deposit base

▪ Emphasize services to SMBs

+

Reduced reliance on wholesale

funds

+

Maximized risk-adjusted returns

and diversified loan portfolio

Customer service focus

▪ Expand and enhance service offerings, with a focus on

payments facilitation/integration

▪ Leverage technology to improve customer experience

and improve colleague efficiency

+

Increased non-interest income

+ Cost savings through streamlining

of back-office processes

+

More efficient client acquisition

Strong company culture

▪ Maintain high employee morale

▪ Update incentive compensation model to focus on

performance and success

+

Enhanced employee retention,

motivation and alignment

2023-2025 Strategic Plan

Improve Focus and Efficiency

26

2

Exit non

-

core businesses and

markets

▪ Exit residential mortgage business

▪ Reduce New York presence and reallocate front line and supporting staff

▪ Discontinue unprofitable products

Optimize branch footprint

▪ Reduce hours at branch locations to reflect customers’ growing use of digital solutions

▪ Optimize retail branch operations to improve efficiency while maintaining high levels of

customer service

▪ Eliminate redundant or unnecessary positions

Continue shift to digital

channels

▪ Invest in technology solutions and continue customer migration to digital channels

▪ Bring dispute processing in-house

▪ Convert customers from paper to eStatements

Normalize proxy

-

related and

other non

-recurring

expenses

▪ We expect proxy-related legal and professional fees and other non-recurring expenses to

normalize in the coming quarters, reducing non-interest expense

2023-2025 Strategic Plan

27

Improve Focus and Efficiency (Continued)

2

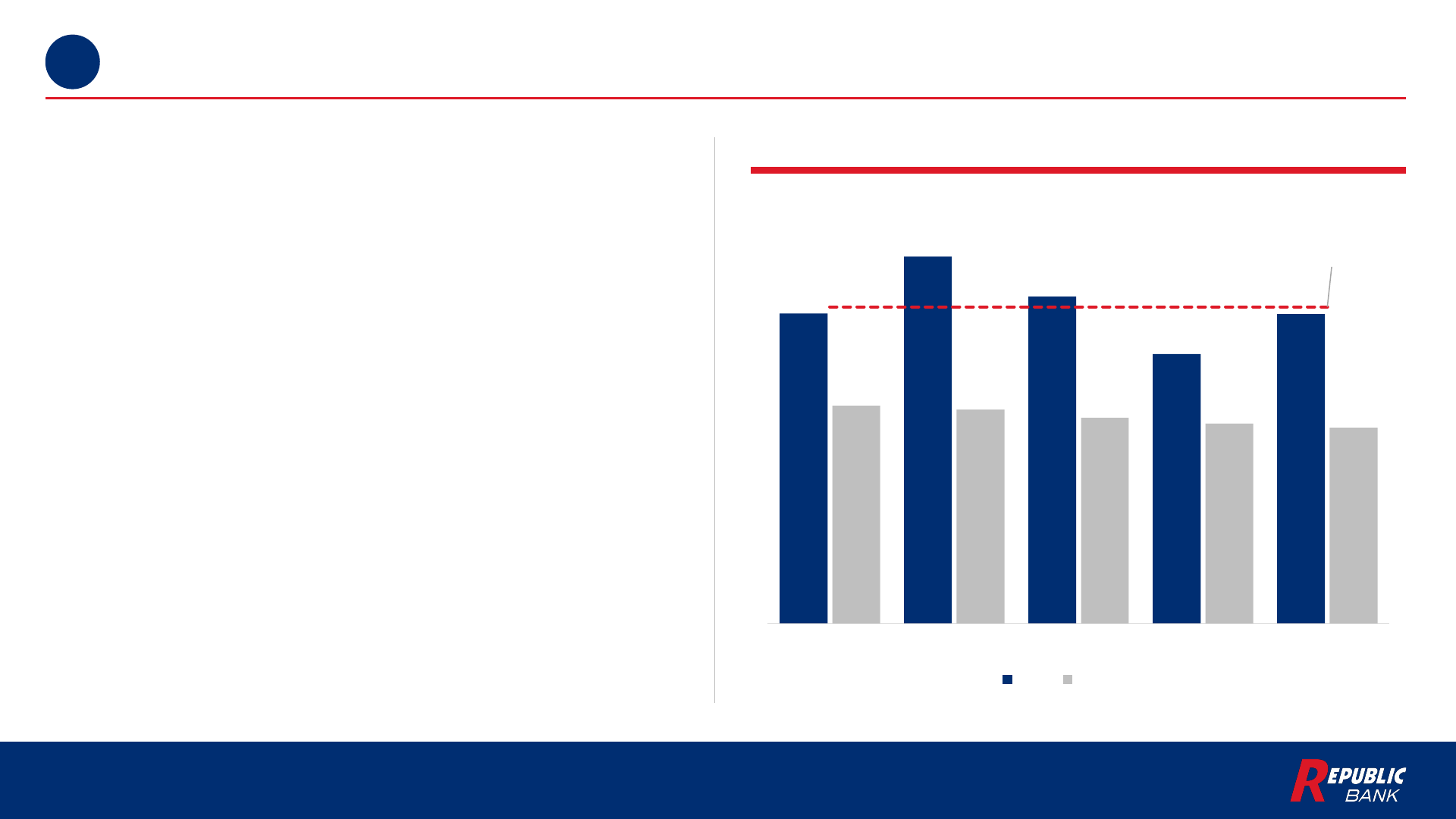

Efficiency Ratio

1

▪ We are implementing an organization-wide focus on

efficiency and expense discipline, which had not been

a priority for the previous leadership team

– Historically, the Company’s leadership had

focused heavily on expansion, with the idea that

top-line growth would eventually result in a

lower efficiency ratio

• The downside to this approach became

apparent when the Company pulled back

from its expansion strategy and growth

slowed due to macroeconomic conditions

and banking sector disruptions

▪ Our new leadership team is working to aggressively

reduce expenses and focus resources on strategic

priorities in order to improve operating results and

drive profitability to peer levels

– Spending on financial statement remediation

and shareholder matters is expected to decline

in the near- to mid-term

1. Source: FactSet and Company documents. Peers include Amalgamated Financial, Arrow Financial, BCB Bancorp, CNB Financial, ConnectOne Bancorp, Financial Institutions, First of Long

Island, Flushing Financial, Kearny Financial, Metropolitan Bank, Mid Penn Bancorp, Northfield Bancorp, Peapack-Gladstone Financial, Peoples Financial Services, S&T Bancorp, Tompkins

Financial, TrustCo Bank and Univest Financial.

87.0%

102.9%

91.7%

75.6%

86.9%

61.1%

60.1%

57.8%

56.1%

55.0%

2018-2022

Average

88.8%

2018 2019 2020 2021 2022

FRBK Peer Median

2023-2025 Strategic Plan

Realign Balance Sheet and Asset Portfolio

28

3

Restructure balance sheet

▪ Continuously evaluate portfolio for opportunities within the prevailing rate environment

▪ Sell securities and right-size balance sheet, including loan portfolio

▪ Evaluate branch and back-office real estate and drive reduction in investment

Realign loan and securities

portfolio; diversify asset

generation

▪ Reinvest cash flow from securities to fund loan growth

▪ Focus asset allocation on commercial products with diversified production, emphasizing

C&I, multifamily and specialty finance to optimize risk-adjusted returns

Reposition deposit base

▪ Stabilize deposit base with promotional rate offers targeting both consumers and SMBs

▪ Reduce reliance on wholesale funds

▪ Drive higher percentage of deposits from commercial customers

2023-2025 Strategic Plan

Strengthen and Deepen Customer Relationships

29

4

Leverage technology to

better serve customers

▪ More fully leverage capabilities from available technology already in place

▪ Develop and deploy online account opening capabilities for consumers and SMBs

▪ Operationalize technology solutions to drive improved customer experiences

Expand capabilities to

support commercial

businesses

▪ Expand commercial services (interest rate derivatives / foreign exchange)

▪ Enhance Treasury Management cross-sell and expand Payments offerings for SMBs

▪ Create syndication capabilities

Engage with the community

▪ Align CRA-related investments, sponsorships and corporate philanthropy with renewed

commitment to core markets

▪ Increase focus on community initiatives, such as financial literacy programming and

community events

▪ Enhance collaboration with stakeholders to ensure that the bank is meeting the

community’s financial services needs

Modify customer

engagement approach

▪ Transition to a single point-of-contact team model

2023-2025 Strategic Plan

Build Trust with Stakeholders

30

5

Fulfill regulatory obligations

and maintain compliance

▪ Enhance internal controls environment

▪ File 2022 10-K by August 15, 2023 and hold 2022 Annual Meeting on October 5, 2023

▪ File Q3 2023 10-Q and become current on all filings by the end of 2023

Improve communications

with investors and analysts

▪ Enhance engagement with current and prospective investors and the sell-side community

▪ Enhance investor-facing materials and begin attending industry events and conferences

▪ Communicate strategic plan and attract new, long-term investors

Augment company culture to

support success

▪ Update incentive model to help attract and retain talent and better reward measurable

performance and success

▪ Strategically acquire new talent to support transformation

▪ Collect and integrate employee feedback to boost engagement

2023-2025 Strategic Plan

We Believe Our Strategy Will Drive Sustainable Value

31

Return on Average Assets

1

Efficiency Ratio

1

Our goal: Create a diverse and digitally fluent commercial bank that provides an exceptional

client and colleague experience

▪ By executing on our strategy, we believe we can drive

significant operating leverage and reposition the

Company for profitable growth

▪ The near-term focus is on fortifying our foundation—

people, capital and liquidity—and identifying

immediate efficiency opportunities

▪ In parallel with stabilizing and reorienting the

business, we are leveraging the strengths of the

Republic brand and strong consumer deposit culture

to drive sustainable and profitable growth

▪ We are confident that, over the mid-term, we can

grow returns and improve efficiency levels to

approach those of our peers

0.21%

1.0%

2022 Actual Mid-Term Target

87%

<60%

2022 Actual Mid-Term Target

1. Source: Company documents.

Conclusion

Section Four

2023-2025 Strategic Plan

Our Areas of Strength Support a Path to Sustainable Growth

33

Strong customer

relationships and

market position

▪ Strong position in core Pennsylvania and New Jersey markets as one of the top banks based on

deposits

▪ Serving communities with stable and growing populations in markets that we know well and in which

we have a strong reputation

Disciplined credit

culture and strong

asset quality

▪ Strong risk management culture and credit framework, with consistent policies and underwriting

standards

▪ Conservative credit culture supports asset quality

Balanced, diversified

portfolio

▪ Strict underwriting criteria and proactive credit monitoring

▪ Diversified portfolio limits risk ahead of a potential recession

Stable team and

strong technology

base

▪ High employee morale and retention

▪ Good treasury management product set and expansive technology suite

Experienced, recently

refreshed leadership

team

▪ Recently refreshed the leadership team with experienced CEO, CFO and General Counsel to develop

and execute a new strategy and lead the Company forward

▪ Augmented the Board with new perspectives and experiences, including appointing a new director

recommended by one of the Company’s largest shareholders; appointed new Chairman with

significant ownership, further aligning the Company’s leadership with shareholder interests

1

2

3

5

4

2023-2025 Strategic Plan

Our Plan to Refocus and Execute

34

Drive Growth by

Focusing on Core

Strengths

▪ Leverage the Company’s market position and brand in the metropolitan Philadelphia and Southern New

Jersey markets

▪ Continue Republic’s tradition of deep relationships and of providing “fanatic” customer service

Improve Focus and

Efficiency

▪ Exit non-core businesses and markets

▪ Optimize branch footprint

▪ Continue shift to digital channels

▪ Normalize proxy-related and other non-recurring expenses

Realign Balance

Sheet and Asset

Portfolio

▪ Restructure balance sheet

▪ Right-size loan and securities portfolio; diversify asset generation

▪ Reposition deposit base

Strengthen and

Deepen Customer

Relationships

▪ Leverage technology and digital capabilities to drive new business development

▪ Expand capabilities to support commercial businesses

▪ Engage with the community

Build Trust with

Stakeholders

▪ Fulfill regulatory obligations and maintain compliance

▪ Improve communications with investors and analysts

▪ Update and align incentive compensation structure and augment company culture to support success

1

2

3

4

5

Appendix:

Board of

Directors

Section Five

2023-2025 Strategic Plan

36

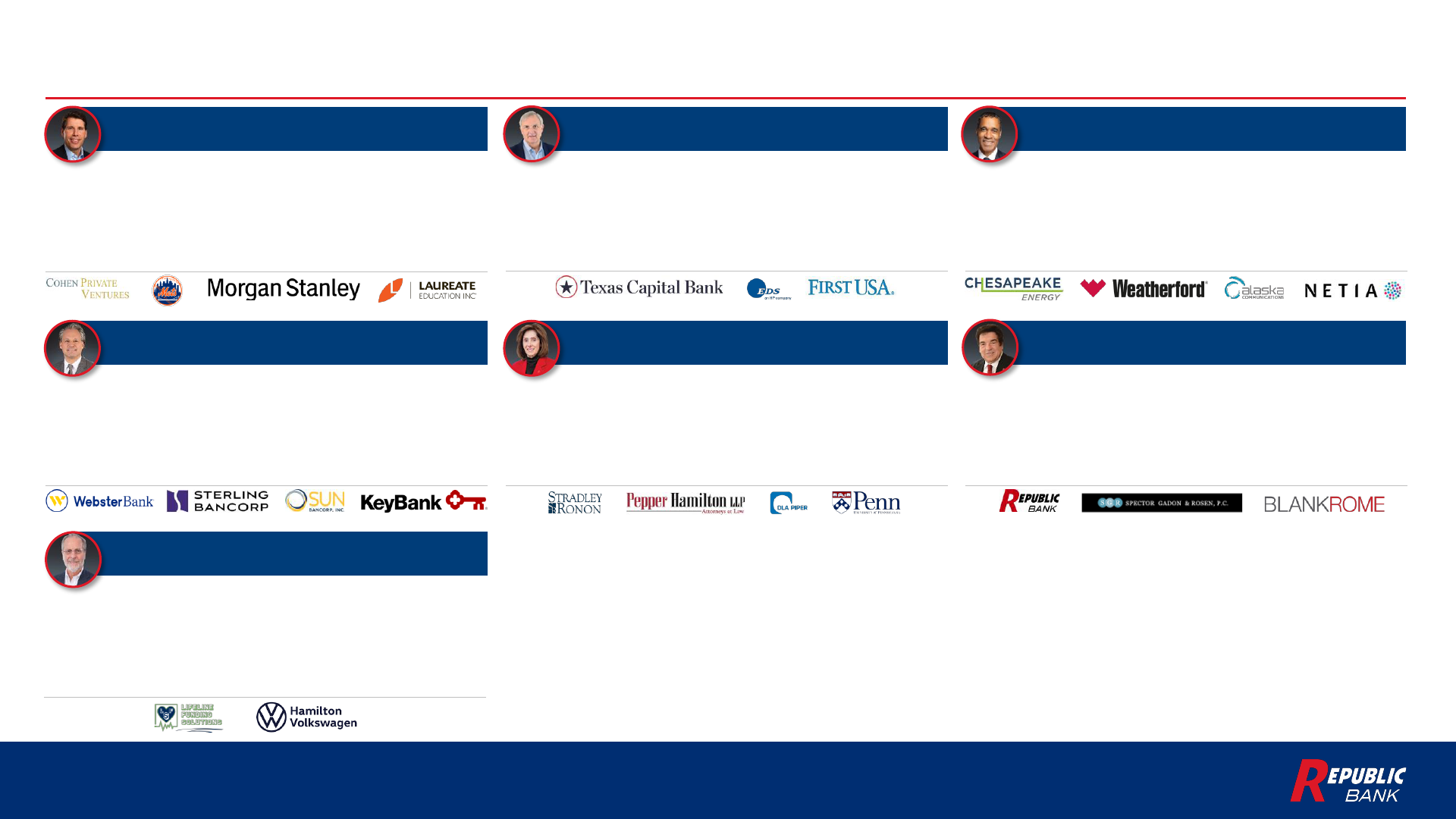

We Have an Experienced, Highly Qualified Board

Andrew B. Cohen, Chair

Director Since 2017; Chair Since 2023

Peter B. Bartholow

Director Since 2022

Benjamin C. Duster, IV

Director Since 2022

Thomas X. Geisel

President, CEO and Director Since 2022

Lisa Jacobs

Director Since 2017

Harry D. Madonna

Director Since 1988

Harris Wildstein

Director Since 1988

▪ Chief Investment Officer and Co-Founder of Cohen Private

Ventures

▪ Previously served as a Partner and Managing Director at

Dune Capital Management

▪ Vice Chair of the board and Chair of the Compensation

Committee at Laureate Education

▪ Seasoned and innovative leader with 29 years of

experience in financial services

▪ Previously held senior executive positions at Webster Bank,

including President of Corporate Banking

▪ Earlier in his career, served as President & CEO of Sun

Bancorp and President of the Northeast region at KeyCorp

▪ Served in a variety of roles at Texas Capital Bancshares,

including COO, CFO and director

▪ Former President, CEO & Chair of MCorp and CFO of First

USA

▪ Previously served as Corporate VP of Finance at EDS

▪ Partner at Stradley Ronon Stevens & Young

▪ Republic Bank’s corporate secretary since May 2022

▪ Was previously a Partner at DLA Piper and Pepper

Hamilton

▪ Vice Chair of Greater Philadelphia YMCA; previously on the

board of the Women Business Collaborative (2019-2021)

▪ Founder of Cormorant IV Corporation and CFO of Mobile

Tech, Inc.

▪ Experienced public company director, having served on

the boards of Chesapeake Energy, Cardone Industries and

Weatherford International

▪ Serves on the board of the 1921 Institute

▪ Founder of Republic Bank and has served on the Board

continuously and in a variety of executive roles, including

the CEO and Chair roles

▪ Previously a Partner at Blank Rome LLP and counsel at

Spector Gadon & Rosen

▪ Owner and officer of Lifeline Funding, a pre-settlement

funding organization

▪ Vice President of R&S Imports, Ltd. and President of HVW,

Inc., both automobile dealerships, since 1977 and 1982,

respectively

Appendix:

Q1 2023 Financial

Highlights

Section Five

2023-2025 Strategic Plan

Q1 2023 Financial Highlights

38

YoY Financial Comparison

▪ Net interest income was $24.0 million in Q1 2023, decreasing

$12.1 million from $36.1 million in the year-ago period, as higher

yields and average balances of interest earning assets were

more than offset by higher funding costs, an increase in the

average balance of higher cost short term borrowings and a

9.4% year-over-year decline in average noninterest bearing

deposit balances

▪ Non-interest income (excluding the impact of a loss on a

preferred equity investment) was $4.4 million in the first quarter,

a 0.5% increase from the $4.3 million recognized in Q1 2022

▪ Non-interest expense excluding extraordinary legal, audit and

other professional fees related to ongoing legacy litigation and

shareholder matters was approximately $31.7 million,

representing a 1.5% decline from Q1 2022 reported non-interest

expense of $32.2 million, as management’s strategic efficiency

initiatives delivered positive results

▪ Operating earnings per share for the period declined to -$0.05

from $0.08 for Q1 2022, primarily driven by the $12.1 million

decline in net interest income

▪ Equity excluding accumulated other comprehensive income

declined $4.2 million YoY as the Q1 2023 net loss more than

offset positive reported 2022 earnings

Dollars

in thousands except per share data

Q1 2023 Q1 2022

Balance Sheet Summary

Gross Loans

$3,139,418

$2,557,167

Total Deposits

4,878,239

5,310,236

Total Equity

196,795

275,736

Total Equity (Excluding AOCI)

1

333,374

337,572

Income Statement

Summary

Net Interest Income

$23,993

$36,140

Provision Expense

43

(72)

Loss on Signature Bank Preferred Equity Investment

(3,100)

$0

Other Non-interest Income

4,369

4,347

Extraordinary Legal, Audit and Other Professional

Fees

5,500

0

Other Non-interest Expense

31,715

32,195

Pre

-tax Income

(12,396)

8,364

Tax Expense

(3,320)

2,129

Net Income

(9,076)

6,235

Preferred Dividends

644

866

Net Income to Common

(9,720)

5,369

EPS

($0.15)

$0.08

Operating Income Metrics

Operating Net

Income to Common

1, 2

($3,423)

$5,369

Operating EPS

1

($0.05)

$0.08

Source: Company documents.

1. Non-GAAP financial metric. Please refer to the Appendix for non-GAAP reconciliations.

2. Excludes loss on preferred equity investment in Signature Bank and extraordinary legal, audit and other professional fees. Assumes a 26.8% effective tax rate on operating income

adjustments, equal to the reported Q1 2023 effective tax rate. See Appendix for full reconciliation.

Appendix:

Peer Group Data

Section Five

2023-2025 Strategic Plan

Peer Group Data

40

Peers include major exchange-traded banks headquartered in NJ, NY and PA with total assets

between $3 billion and $10 billion; excludes merger targets and mutuals

General Information Market Data

Name

Ticker Headquarters Employees Branches Assets ($M) Deposits ($M) Market Value ($M) P/TBV

ConnectOne Bancorp, Inc.

CNOB

Englewood Cliffs, NJ

515

24

$9,960

$7,753

$664

0.77x

S&T Bancorp, Inc.

STBA

Indiana, PA

1,182

73

$9,193

$7,153

$1,096

1.29x

Flushing Financial Corporation

FFIC

Uniondale, NY

560

25

$8,479

$6,734

$370

0.57x

Kearny Financial Corp.

KRNY

Fairfield, NJ

596

45

$8,349

$5,803

$486

0.72x

Amalgamated Financial Corp

AMAL

New York, NY

409

5

$7,836

$7,041

$524

1.04x

Tompkins Financial Corporation

TMP

Ithaca, NY

1,072

60

$7,644

$6,509

$815

1.46x

Univest Financial Corporation

UVSP

Souderton, PA

973

37

$7,359

$5,835

$542

0.87x

Peapack

-Gladstone Financial Corporation

PGC

Bedminster, NJ

498

16

$6,480

$5,309

$500

0.98x

Metropolitan Bank Holding Corp.

MCB

New York, NY

239

6

$6,310

$5,132

$458

0.75x

TrustCo

Bank Corp NY

TRST

Glenville, NY

754

143

$6,046

$5,212

$550

0.90x

Financial Institutions, Inc.

FISI

Warsaw, NY

672

48

$5,967

$5,141

$249

0.75x

Northfield Bancorp, Inc.

NFBK

Woodbridge, NJ

400

38

$5,663

$3,847

$522

0.79x

CNB Financial Corporation

CCNE

Clearfield, PA

759

47

$5,583

$4,754

$379

0.86x

Mid Penn Bancorp, Inc.

MPB

Harrisburg, PA

611

43

$4,583

$3,878

$359

0.92x

First of Long Island Corporation

FLIC

Glen Head, NY

303

41

$4,188

$3,399

$275

0.74x

Arrow Financial Corporation

AROW

Glens Falls, NY

-

-

$3,970

$3,498

$328

0.99x

Peoples Financial Services Corp.

PFIS

Scranton, PA

415

28

$3,678

$3,236

$316

1.19x

BCB Bancorp, Inc.

BCBP

Bayonne, NJ

301

27

$3,763

$2,867

$199

0.68x

Republic First Bancorp, Inc.

FRBK

Philadelphia, PA

556

34

$6,157

$4,878

$49

0.25x

Average

603

42

$6,392

$5,172

$480

0.91x

Median

560

38

$6,178

$5,177

$472

0.87x

1. Source: FactSet. Data as of July 14, 2023.

Appendix:

Reconciliation of

GAAP and Non-

GAAP Measures

Section Five

2023-2025 Strategic Plan

Price/Tangible Book Value

42

Price/Tangible Book Value

Non

-GAAP Financial Metric Reconciliation to GAAP

(dollars in thousands, except for share data)

TBV on 3/31/2023

Total shareholders equity

$196,795

Less: goodwill

$0

Non

-GAAP tangible common equity (numerator)

$196,795

Common shares outstanding, end of Period (denominator)

63,867,092

Non

-GAAP tangible book value per common share

$3.08

P/TBV on 5/26/2023

Closing common share price 5/26/2023 (numerator)

$1.48

Non

-GAAP tangible book value per common share 3/31/2023 (denominator)

$3.08

Non

-GAAP price/tangible book value (P/TBV)

0.48x

2023-2025 Strategic Plan

Efficiency Ratio

43

Efficiency Ratio

Non

-GAAP Financial Metric Reconciliation to GAAP

(dollars in thousands)

As of or for the Years Ended December 31,

Revenue

2018

2019 2020 2021 2022

Net interest income

$75,904

$77,807

$91,832

$129,212

$145,474

Total noninterest income

$20,322

$23,738

$36,235

$32,745

$19,854

Non

-GAAP revenue

$96,226

$101,545

$128,067

$161,957

$165,328

Efficiency Ratio

Total noninterest expense (numerator)

$83,721

$104,490

$117,423

$122,505

$143,592

Non

-GAAP revenue (denominator)

$96,226

$101,545

$128,067

$161,957

$165,328

Non

-GAAP efficiency ratio

87.0%

102.9%

91.7%

75.6%

86.9%

2023-2025 Strategic Plan

Operating Net Income

44

Operating Net Income

Non

-GAAP Financial Metric Reconciliation to GAAP

(dollars in thousands, except per share data)

As of or for the Quarters Ended March 31,

2023 2022

Net Interest Income

$ 23,993

$ 36,140

Provision Expense

443

(72)

Non

-Interest Income

1,269

4,347

Non

-Interest Expense

37,215

32,195

Pre

-Tax Income

(12,396)

8,364

Plus: Write

-down from Signature Bank Securities

3,100

-

Plus: Legal and Professional Fees Related to Shareholder Matters

5,500

-

Operating Pre

-Tax Income

(3,796)

8,364

Less: Tax Expense

(1,017)

2,129

Operating Net Income

(2,779)

6,235

Less: Preferred Dividends

644

866

Operating Net Income to Common

(3,423)

5,369

Basic Shares Outstanding

63,867,092

63,739,566

Operating EPS

$ (0.05)

$ 0.08