Investor

Presentation

Financial Institutions, Inc. (NASDAQ: FISI)

Investor Presentation

June 18, 2024

Important Information

Safe Harbor Statement

Statements contained in this presentation which are not historical facts and which pertain to future operating results of Financial Institutions, Inc. (the “Company”)

and its subsidiaries constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Similarly, statements that

describe the objectives, plans or goals of the Company are forward-looking. These forward-looking statements can generally be identified as such by the context of

the statements, including words such as “believe,” “continues,” “expect,” “anticipate,” “preliminary,” “plan,” “may,” “will,” “should,” “would,” “intend,” “estimate,”

“guidance” and other similar expressions, whether in the negative or affirmative. These forward-looking statements involve significant risks and uncertainties and

are subject to change. All forward-looking statements made herein are qualified by the cautionary language in the Company’s Annual Report on Form 10-K, its

Quarterly Reports on Form 10-Q and other documents filed with the Securities and Exchange Commission. These documents contain and identify important factors

that could cause actual results to differ materially from those contained in our projections or forward-looking statements. Except as required by law, the Company

assumes no obligation to update any information presented herein. This presentation includes certain non-GAAP financial measures intended to supplement, not

substitute for, comparable GAAP measures. Reconciliations of those non-GAAP financial measures to GAAP financial measures are provided in the Appendix to

this presentation.

Due to rounding, numbers presented throughout this and other documents may not add up precisely to the totals presented.

Table of Contents

2

Company Overview 3 Revenue 25 Appendix 33

Quarterly Results 7 Expense Management & Operating Leverage 29 Leadership Team 34

High Quality Lending 12 Capital Management & Investment Considerations 30 Strategy Map 35

Securities and Deposits 22 Non-GAAP Reconciliations 36

Overview of Financial Institutions, Inc.

3

Company Overview

NASDAQ: FISI

• Innovative financial holding company headquartered in

Western New York offering banking and wealth management

services through its subsidiaries, Five Star Bank and Courier

Capital, LLC

• Positioned for growth through key initiatives, including

Banking-as-a-Service (BaaS)

• Financially stable geography, with 49 banking locations

1

in 14

contiguous Upstate New York counties, as well as commercial

loan production offices serving the Mid-Atlantic and Central New

York regions

• Experienced management team with extensive market

knowledge and industry experience

• Generating consistent, strong operating results

1

48 branches and 1 motor branch in Olean, NY

Note: Information on this slide is as of March 31, 2024 unless noted otherwise

$291M

Market cap

$4.44B

Total loans

$5.40B

Total deposits

$6.30B

Total assets

Why FISI

4

Company Overview

Strategic focus designed to deliver long-term value

4.7%

Total loan growth

year-over-year

5.0%

Total deposit growth

year-over-year

• Results-driven community bank with strong retail and commercial franchises

◦ Serving financially stable Upstate New York markets and well-positioned for growth in metros of Buffalo and Rochester

◦ Launched commercial lending platforms in Baltimore, MD serving the Mid-Atlantic region in 2022 and in Syracuse, NY

serving the Central New York region in 2023

• Disciplined credit culture with strong credit quality

◦ From 2008 through 2023, year-end non-performing assets (NPAs)

1

ranged from 0.17% to 0.58% of total assets, while

annual net charge-offs (NCOs) to average loans ranged from 0.14% to 0.54%

◦ Indirect auto lending is a core competency with attractive risk-adjusted return profile and consistent results though several

economic cycles

• Fee-generating business line revenue complements core banking franchise

◦ Well-regarded investment advisory firm supports noninterest income and has been enhanced by bolt-on acquisitions in

recent years

◦ BaaS presents additional fee-based revenue opportunities

• Complementary fintech and digital partnerships driving exceptional digital experiences

◦ BaaS enables financial technology firms (fintechs) to offer banking products and services to their end users

◦ Presenting new fee-based revenue opportunities through service, interchange and other fees

1

Non-performing assets, or NPAs, include nonaccrual loans, loans past due 90 days or more and still accruing, and foreclosed assets

Note: Information on this slide is as of March 31, 2024 unless noted otherwise

2

1 1

2 2

10

11

7

2 2

2

1

2

2

2

1 1

2

2

2

1

1 1

4

4

4

4

5

1

2

4

5 5

7

8

18

19

14

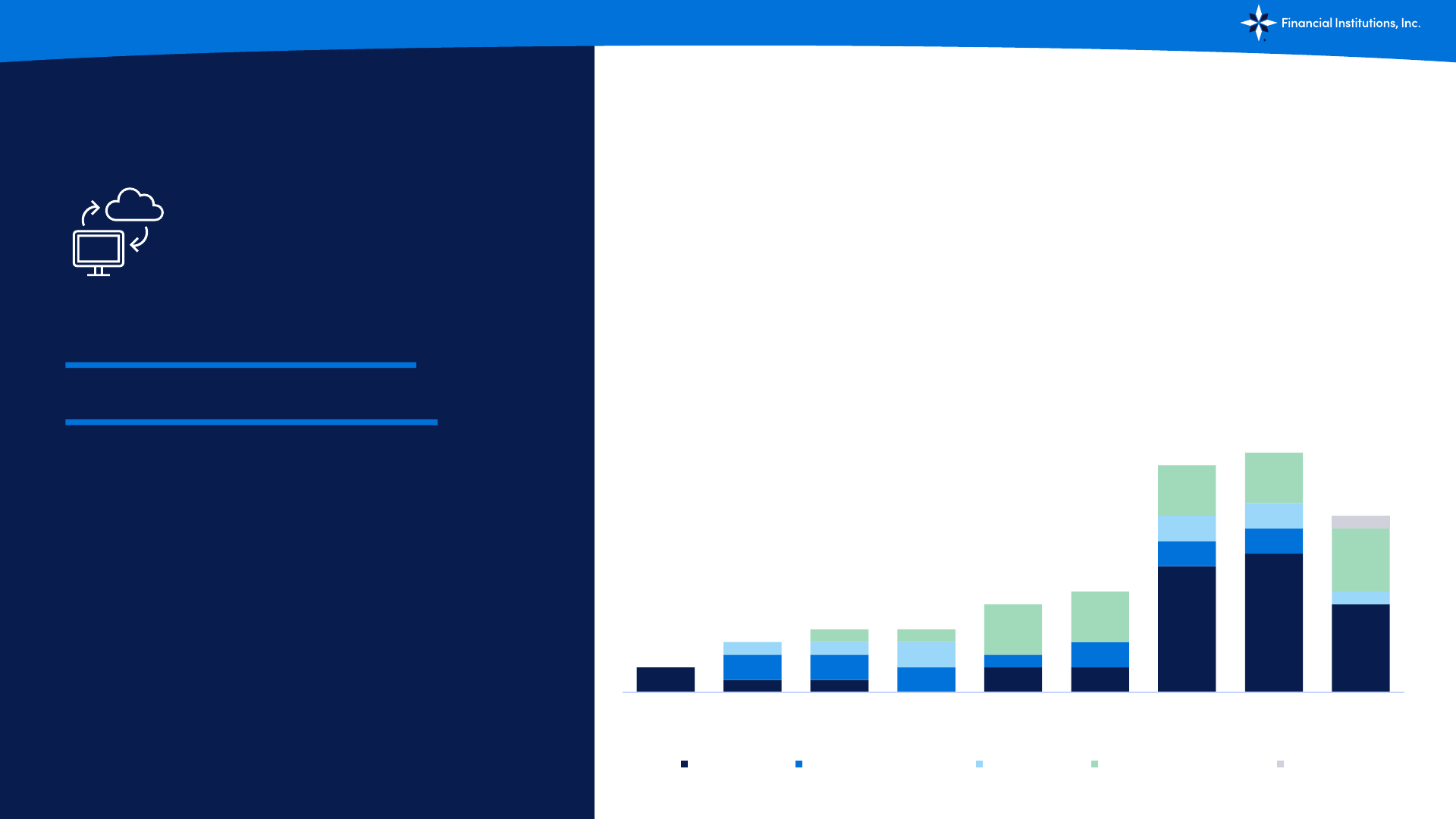

Mar-22 Jun-22 Sep-22 Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Mar-24

Closed/Won Integration/Onboarding Testing/Pilot Live/General Availability Offboarding

Banking-as-a-

Service (BaaS)

5

Company Overview

Creating new revenue opportunities

and market differentiation

With BaaS, we are leveraging our digital and infrastructure investments to deliver

value to select fintechs serving SMBs, affinity groups and niche markets

• Enabling fintechs to offer banking products and services to their end users, leading

primarily to deposit growth as well as creating fee generation opportunities for FISI

• Focused on BaaS client partnerships within meaningful and defensible market

opportunities: B2B, select affinity groups, wealth management and niche areas

BaaS Client Partnerships

Value-driven, disciplined approach to cultivating partnerships

with select fintechs aligned with our values and risk appetite

6

Company Overview

FISI sees BaaS as complementary

to the existing franchise

Fee-based line of business with potential to generate

lower-cost deposits

Services offered to BaaS clients:

◦ Program sponsorship

◦ Open API banking

◦ Risk and compliance management

◦ Financial transactions clearing

◦ Industry expertise and advisory services

◦ Digital banking and wealth management platform

◦ Card-as-a-Service (CaaS)

◦ Center of Excellence, e.g., loan servicing and contact center

BaaS has potential to expand revenue sources to help improve earnings,

including though:

◦ Service, interchange, advisory and servicing fees

◦ Other revenue sharing

Primarily focused on five key

BaaS client types where we see

strong opportunity

Business-to-Business

Help B2B fintechs innovate solutions for enduring issues

while creating new market opportunities and efficiencies

Affinity Groups

Empower traditionally under-banked communities with

expanded financial services access

Sustainable Finance

Meet consumer-led environmental demands by partnering

with early movers in the green banking space

Cannabis-Related Businesses

Tap into the multi-billion-dollar cannabis market by

leveraging regulatory experience for sustained operations

Wealth Management

Enable wealth managers to meet accelerating client demand

for banking services

• Total deposits were $5.40B, up $183.8M, or 3.5%, from December 31, 2023, and up $255.5M, or 5.0%,

from one year prior.

• Total loans were $4.44B, reflecting a decrease of $20.1M, or 0.5%, from December 31, 2023 and an

increase of $198.7M, or 4.7%, from March 31, 2023.

• Net income available to common shareholders was $1.7M, or $0.11 per diluted share, compared to

$9.4M, or $0.61 per diluted share, in 4Q ’23 and $11.7M, or $0.76 per diluted share, in 1Q ’23.

◦ Current quarter results were negatively impacted by the Company’s previously disclosed deposit-

related fraud event, which was the primary driver of noninterest expense variances from the linked and

year-ago periods. Excluding the impact of this fraud event, the Company’s adjusted net income

available to common shareholders was $17.7M, or $1.12 per diluted share.

1

• The company recorded a benefit for credit losses of $5.5M in 1Q ‘24, compared to a provision of $5.3M

in the linked quarter and a provision of $4.2M in 1Q ’23.

• Net interest income of $40.1M increased $0.2M, or 0.5%, from 4Q ’23 and decreased $1.7M, or 4.1%,

from 1Q ‘23, amid the higher interest rate environment that has driven funding costs higher.

• Noninterest income was $10.9M, down $4.5M, or 29.1%, from 4Q ’23, when the Company recorded

$9.1M of company owned life insurance revenue, of which ~$8M related to the investment of premium

into a separate account product during that period from our surrender and redeploy strategy. Noninterest

income was flat with 1Q ’23.

• Noninterest expense was $54.0M in the current quarter and included ~$19.0M in expenses related to

the previously disclosed fraud matter. Noninterest expense was $35.0M in 1Q ‘24 and $33.5M in 1Q ’23.

• Maintained strong credit quality metrics, including annualized NCOs to average loans of 0.28% and

NPAs to total assets of 0.43% at March 31, 2024.

First Quarter

2024 Key Results

7

As of March 31, 2024

1

Please see Appendix for reconciliation of non-GAAP Financial measures for the computation of these non-GAAP measures.

Financial Highlights

Second Quarter Progress

8

Financial Highlights

Modest margin expansion and strong and stable asset quality metrics through May 31, 2024

• Margin trends experienced through May 31

st

align with the full year guidance

◦ Building on stability achieved in linked first quarter

• Continued asset quality strength and stability through May 31

st

, with net charge-offs to average loans through first two months of the second quarter

showing improvement from the end of the linked first quarter

◦ Commercial net charge-offs negligible through May 31, 2024

◦ Indirect auto net charge-offs through May 31, 2024 showing improvement from March 31, 2024, as expected, given first quarter 2024 reduction in consumer

indirect delinquencies relative to year-end 2023

• Successful divestiture of insurance subsidiary early in second quarter bolsters capital position in an efficient and non-dilutive manner, while

supporting future earnings potential

◦ Compelling price of $27.0M takes advantage of strong valuations for insurance brokerage businesses

• Continuing to actively pursue all legal recourse available to recover additional funds from previously-disclosed deposit-related fraud event

◦ Recorded full exposure of $18.4M deposit-related charge-off in the first quarter and factored anticipated legal expenses into forward guidance

◦ Any further recoveries would be recorded as a benefit in future periods

Insurance Subsidiary Transaction

Supports Earnings and Capital Positions

9

Financial Highlights

Compelling price of $27.0M takes advantage of strong valuations for

insurance brokerage businesses

$27.0M

cash proceeds from

transaction

$11.3M

of goodwill and other

intangibles eliminated

• As previously disclosed, on April 1, 2024, the Company announced and closed the sale of the assets of its wholly-

owned subsidiary, SDN Insurance, LLC, to NFP Property & Casualty Services, Inc., a privately-held property and

casualty broker and benefits consultant

• Sale price represents approximately 4.0x 2023 insurance revenue

• Generates significant after-tax gain of $11.2M before selling costs

• Eliminates $11.3M of goodwill and other intangibles

• Meaningful capital impact

◦ More than 40 basis point positive impact to common equity tier 1 (“CET1”) ratio

1

• Supports earning potential and focus on core banking business

◦ Expect to deploy some of the proceeds into our core banking business through high-quality, credit-disciplined

loan origination to build higher-yielding earning assets

1

Pro forma capital ratio are prior to potential deployment of proceeds, as published in first quarter 2024 investor presentation on April 25, 2024

2024 Guidance Update

1

10

Financial Highlights

Focused on executing strategic initiatives that will improve profitability and operating leverage over time

1-3% full year loan growth

driven by commercial loans

1-3% full year deposit growth

driven by non-public deposits

285-295 bps

Full-year NIM of 2.85-2.95%

using a spot-rate forecast as

of quarter-end

Noninterest income of

$36.5-$38M

for full year 2024

1

Noninterest expense of

$135M-$136M

for full year 2024,

excluding the previously

disclosed fraud event

2024 effective tax rate of 13-15%

including the impact of the previously

disclosed fraud event, insurance

transaction and the amortization of

tax credit investments placed in

service in recent years

30-40 bps

Annual net charge-offs to full year

average assets

reflective of credit-disciplined lending

and strong fundamental

underwriting processes

1

As published in first quarter 2024 investor presentation on April 25, 2024

2

Noninterest income excludes gains/losses on securities, impairment of investment tax credits, limited partnership income, and gains/losses on assets, including the 2Q ’24 insurance transaction

Recent Earnings Performance

11

Financial Highlights

Last five quarters

Earnings Summary

(1)

1Q ’23

2Q ’23

3Q ’23

4Q ’23

1Q ’24

Average interest

-earning assets

$5,486.0

$5,691.9

$5,704.1

$5,726.6

$5,804.9

Net interest margin (tax equivalent basis)

3.09%

2.99%

2.91%

2.78%

2.78%

Net interest income

41.8

42.3

41.7

39.9

40.1

Noninterest income

10.9

11.5

10.5

15.4

10.9

Total revenue

$52.7

$53.8

$52.2

$55.3

$51.0

Noninterest expense

(33.7)

(33.8)

(34.7)

(35.0)

(54.0)

Benefit (provision) for credit losses

(4.2)

(3.2)

(1.0)

(5.3)

5.5

Income before income taxes

14.9

16.8

16.5

14.9

2.4

Income tax expense

(2.8)

(2.4)

(2.4)

(5.2)

(0.4)

Net income

$12.1

$14.4

$14.0

$9.8

$2.1

Preferred stock dividends

(0.4)

(0.4)

(0.4)

(0.4)

(0.4)

Net income available to common shareholders

$11.7

$14.0

$13.7

$9.4

$1.7

Earnings per share

– diluted

$0.76

$0.91

$0.88

$0.61

$0.11

Weighted average common shares outstanding

– diluted

15.4

15.4

15.5

15.5

15.5

1

Amounts in millions, except percentages and per share amounts.

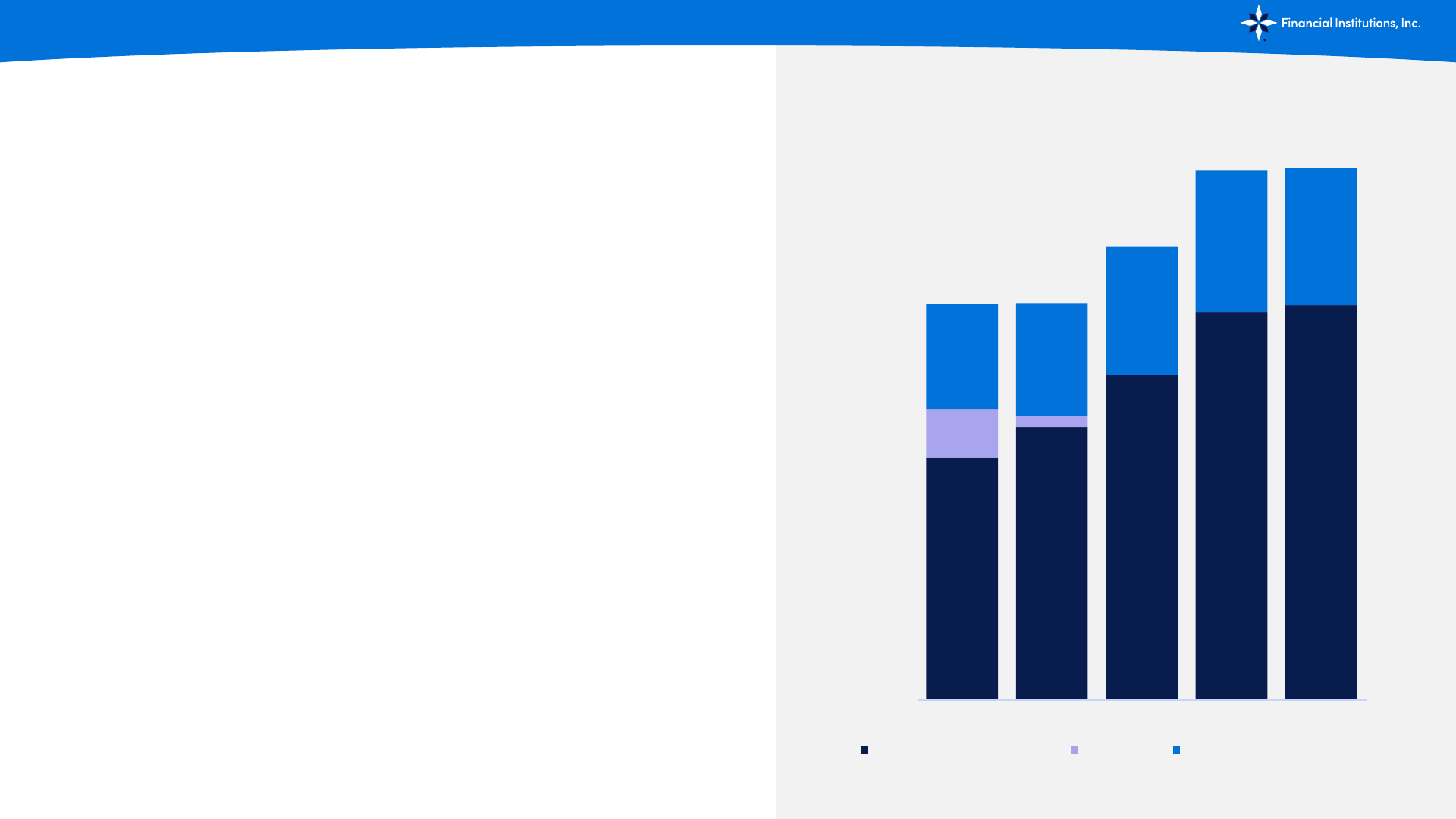

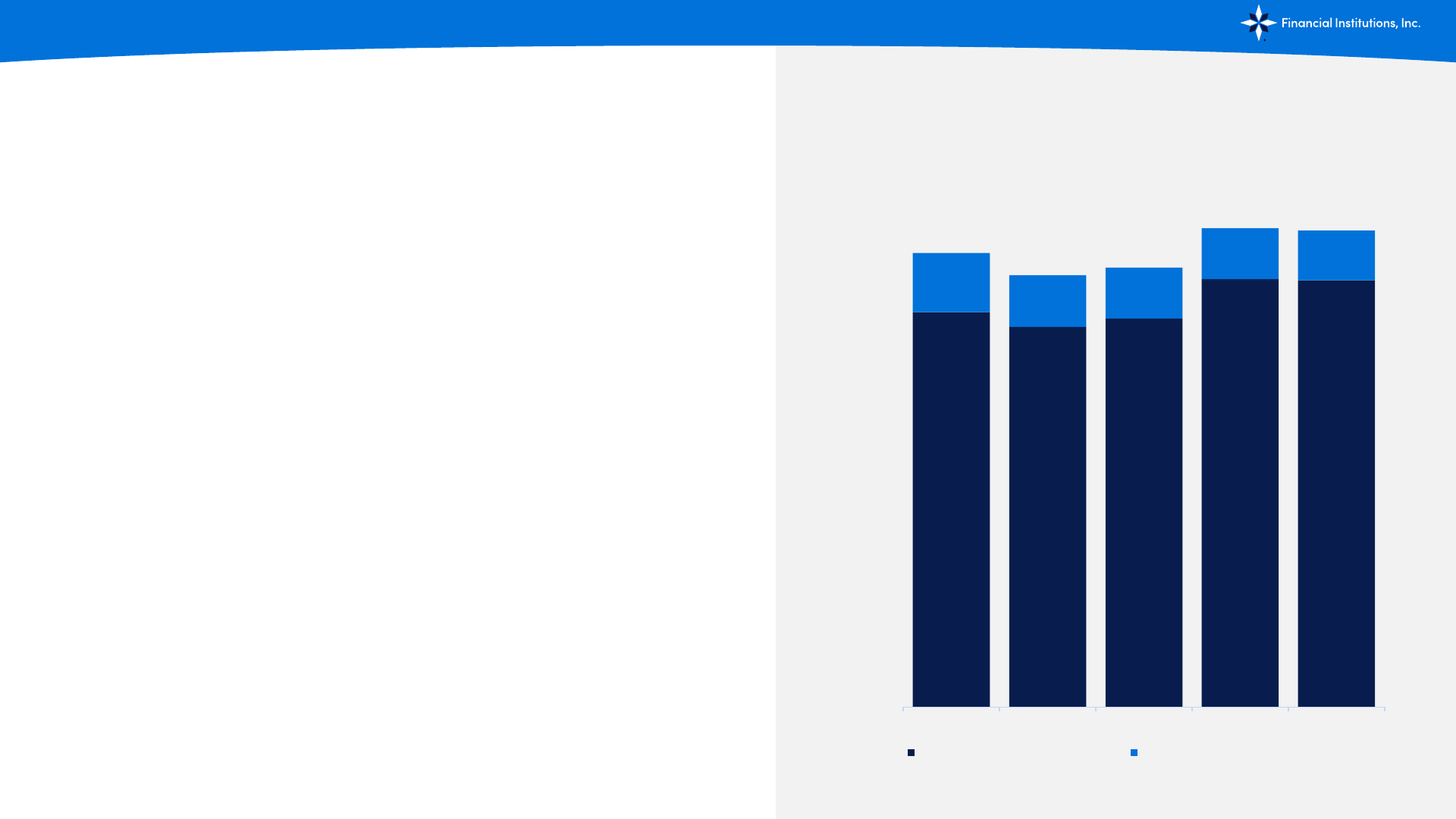

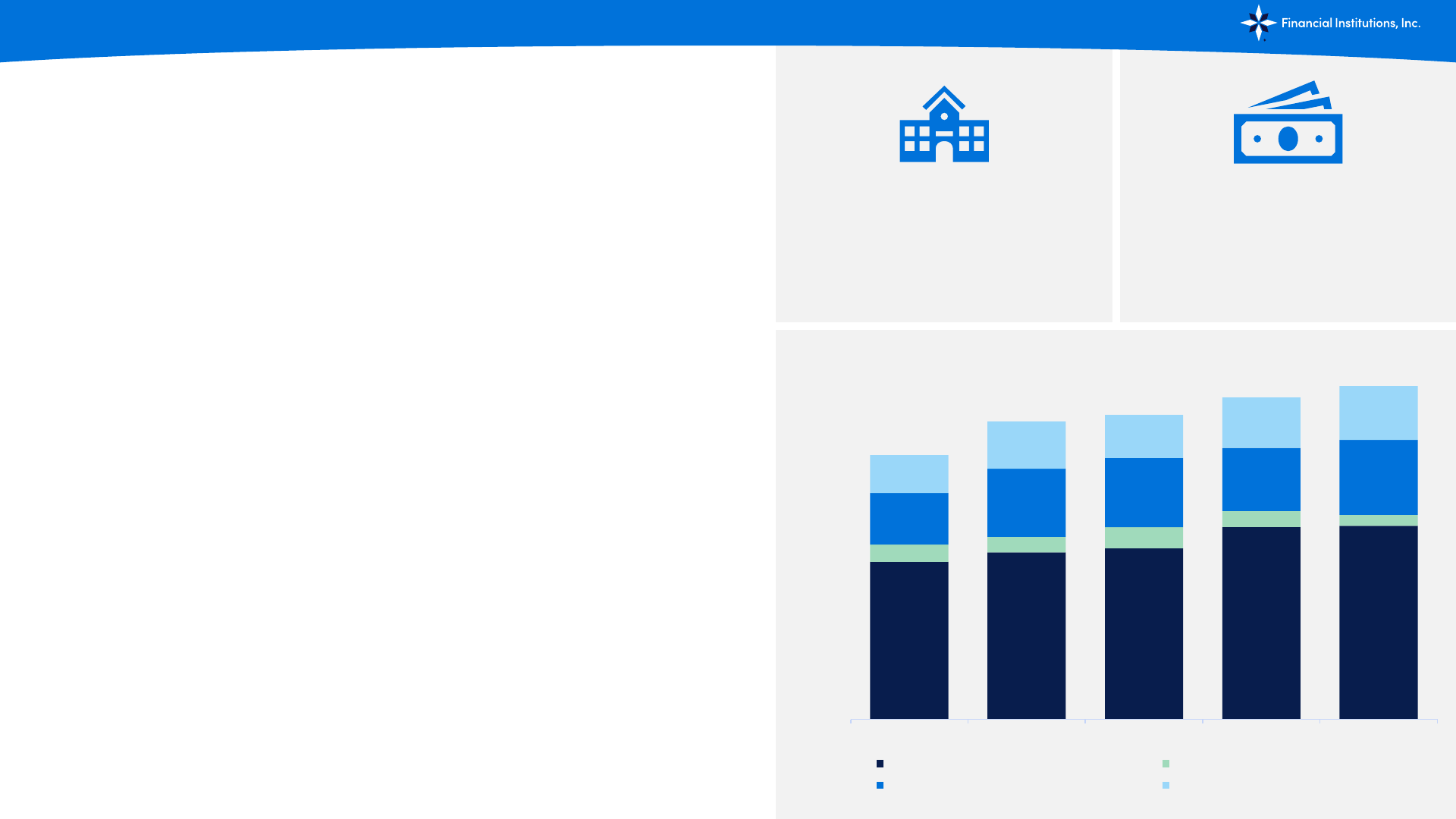

Organic Loan

Growth

12

High Quality Lending

$4.44B of total loans at March 31, 2024

and average yield of 6.33% in the first

quarter 2024

Total loans increased $198.7M, or 4.7%, from March

31, 2023, driven by commercial loan growth

6.3% CAGR

Total Loans

$2.05

$2.05

$2.34

$2.74

$2.75

$0.02

$0.01

$0.02

$0.05

$0.05

$0.84

$0.96

$1.02

$0.95

$0.92

$0.69

$0.66

$0.67

$0.73

$0.72

$3.60

$3.68

$4.05

$4.46

$4.44

$0.00

$0.50

$1.00

$1.50

$2.00

$2.50

$3.00

$3.50

$4.00

$4.50

$5.00

12/31/2020 12/31/2021 12/31/2022 12/31/2023 3/31/2024

Billions

Commercial Loans Other Consumer Loans Consumer Indirect Loans Residential Loans & Lines

13

High Quality Lending

Commercial Lending

Outstanding balance of $2.75B at March 31, 2024

• Commercial loans increased $11.6M, or 0.4%, during the first quarter of 2024 and

$216.0M, or 8.5%, year-over-year

• Commercial loans made up 62% of total loan portfolio at March 31, 2024 and are

comprised of Commercial & Industrial (C&I), Commercial Real Estate (CRE) and

Business Banking Unit (BBU)

1

◦ CRE makes up 66% of commercial loans and 41% of total loans

◦ C&I makes up 30% of commercial loans and 18% of total loans

◦ BBU makes up 4% of commercial loans and 3% of total loans

• The vast majority of the commercial loan portfolio is within the Bank's footprint,

which operates in Upstate New York and the Mid-Atlantic region

• Disciplined approach to credit and risk management supports strong asset quality

metrics

8.7% CAGR

Total Commercial Loans

1

Business Banking Unit refers to small business lending through commercial franchise

>$0.01

>$0.01

>$0.01

$1.25

$1.41

$1.68

$2.01

$2.05

$0.25

$0.06

$0.55

$0.58

$0.66

$0.73

$0.71

$2.05

$2.05

$2.34

$2.74

$2.75

$0.0

$0.5

$1.0

$1.5

$2.0

$2.5

12/31/2020 12/31/2021 12/31/2022 12/31/2023 3/31/2024

Billions

Commercial Mortgage Loans PPP Loans Commercial Business Loans (ex. PPP)

14

High Quality Lending

Commercial Lending

Committed credit exposure of $3.56B at March 31, 2024

• Commercial business operates across the Bank’s core Upstate New York

markets and in the Mid-Atlantic region, following its successful expansion there

in 2022

• Suburban Baltimore, MD commercial loan production office (“LPO”) provides

important geographic and client diversification, leveraging decades of in-market

and industry experience and deep relationships of CRE lending team there

• Similarly, 2023 opening of LPO in Syracuse, NY builds on Five Star’s Upstate

New York market and houses team of C&I lenders, led by market president with

more than 25 years of local commercial banking experience who joined the Bank

in 2018

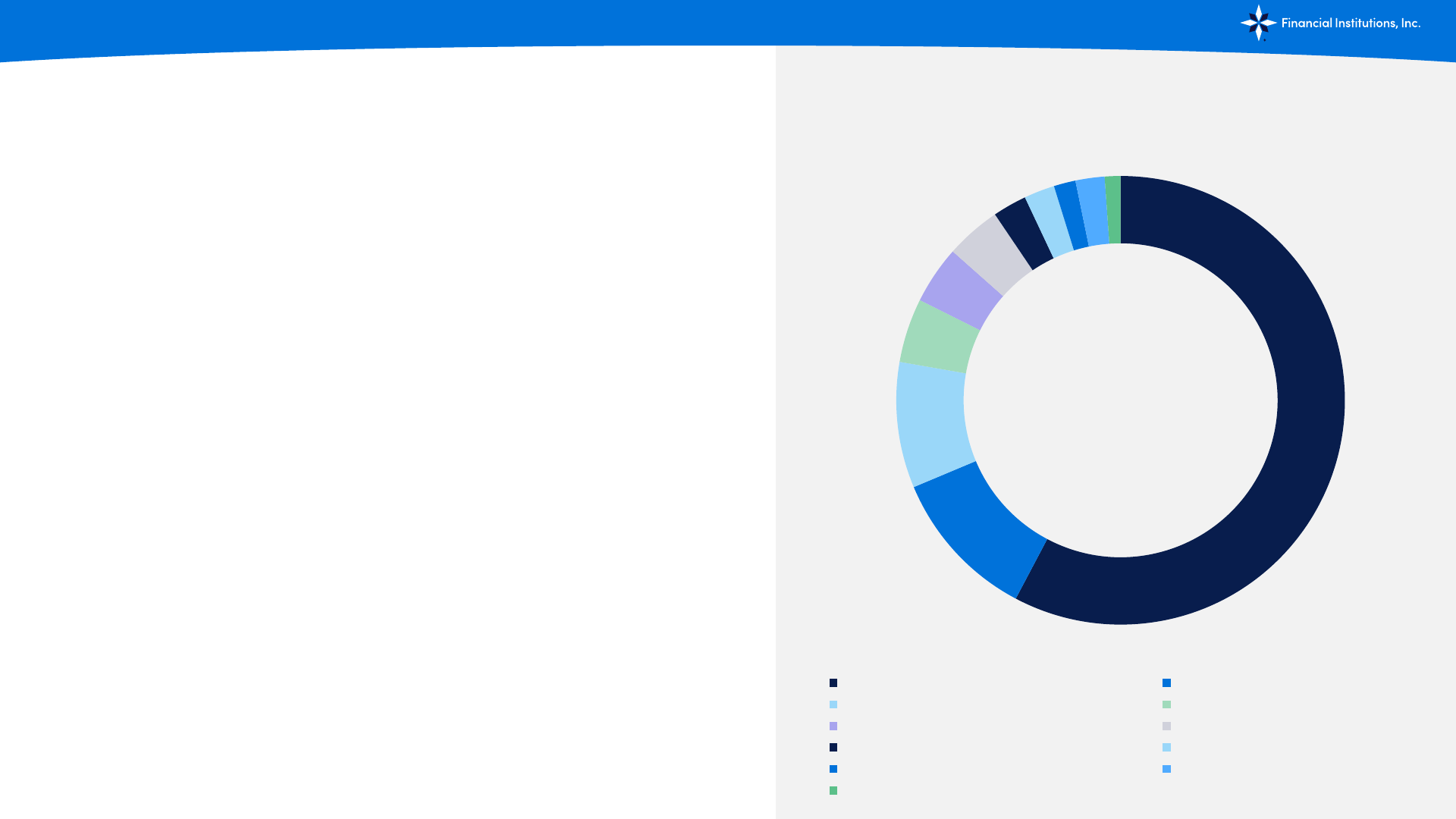

Overall Commercial Portfolio Exposure Mix

58%

11%

9%

5%

4%

4%

2%

2%

2%

2%

1%

Real Estate and Rental / Leasing Construction

Manufacturing Other

Accommodation and Food Services Wholesale Trade

Health Care Retail

Scientific and Technical Services Finance & Insurance

Agriculture

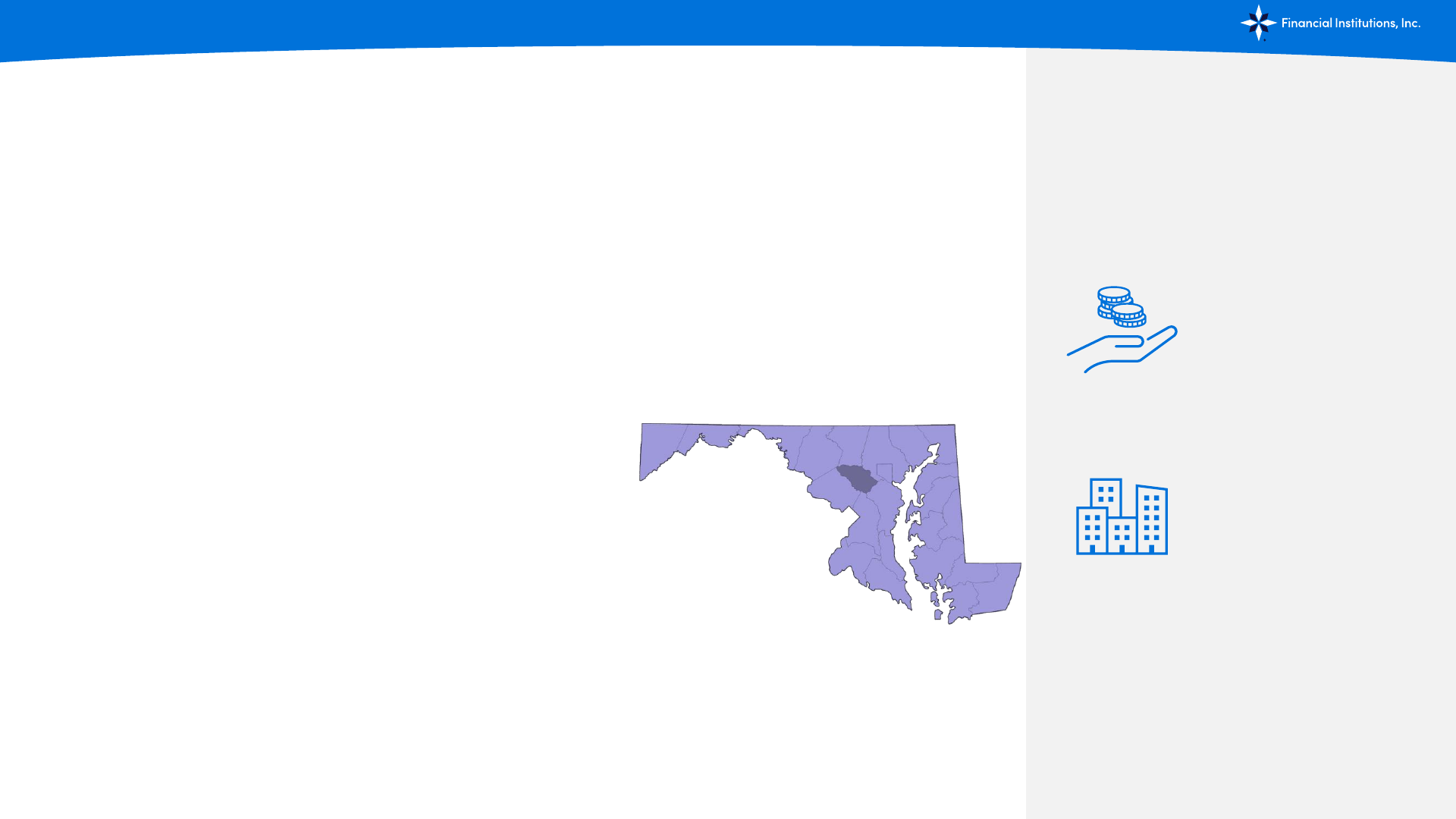

Strong Mid-Atlantic Performance &

Opportunity

15

High Quality Lending

Leveraging technology to seamlessly collaborate with Mid-Atlantic team and

onboard new customers despite geographic divide

$307M

in outstandings

~48%

low average LTV

1

• Commercial loan production office opened in Baltimore suburb of Ellicott City in 1Q ’22 serving the Mid-Atlantic

region

◦ Consolidation in the market allowed us to add a four-person team and capitalize on opportunities where a

community banking approach provides a competitive advantage

Note: Information on this slide is as of March 31, 2024 unless noted otherwise

1

Original appraised value used for loan-to-value ratio

• This Mid-Atlantic team has strong relationships with very high-

quality sponsors and serves customers headquartered in and

around Baltimore and the Greater Washington, D.C. area

◦ Mid-Atlantic portfolio consists of a mix of stabilized projects, construction projects and

residential acquisition and development (AD&C) projects

◦ About 27% of committed exposure in this portfolio relates to suburban office space

located around Baltimore, MD and Washington, D.C., with a large concentration located

near hospitals with medical related tenants and high return to office metric

42%

17%

8%

7%

7%

7%

4%

3%

4%

1%

1%

Multifamily Office Retail Hospitality

Home Builder Industrial Other Mixed Use

Land Developer LOC Unsecured

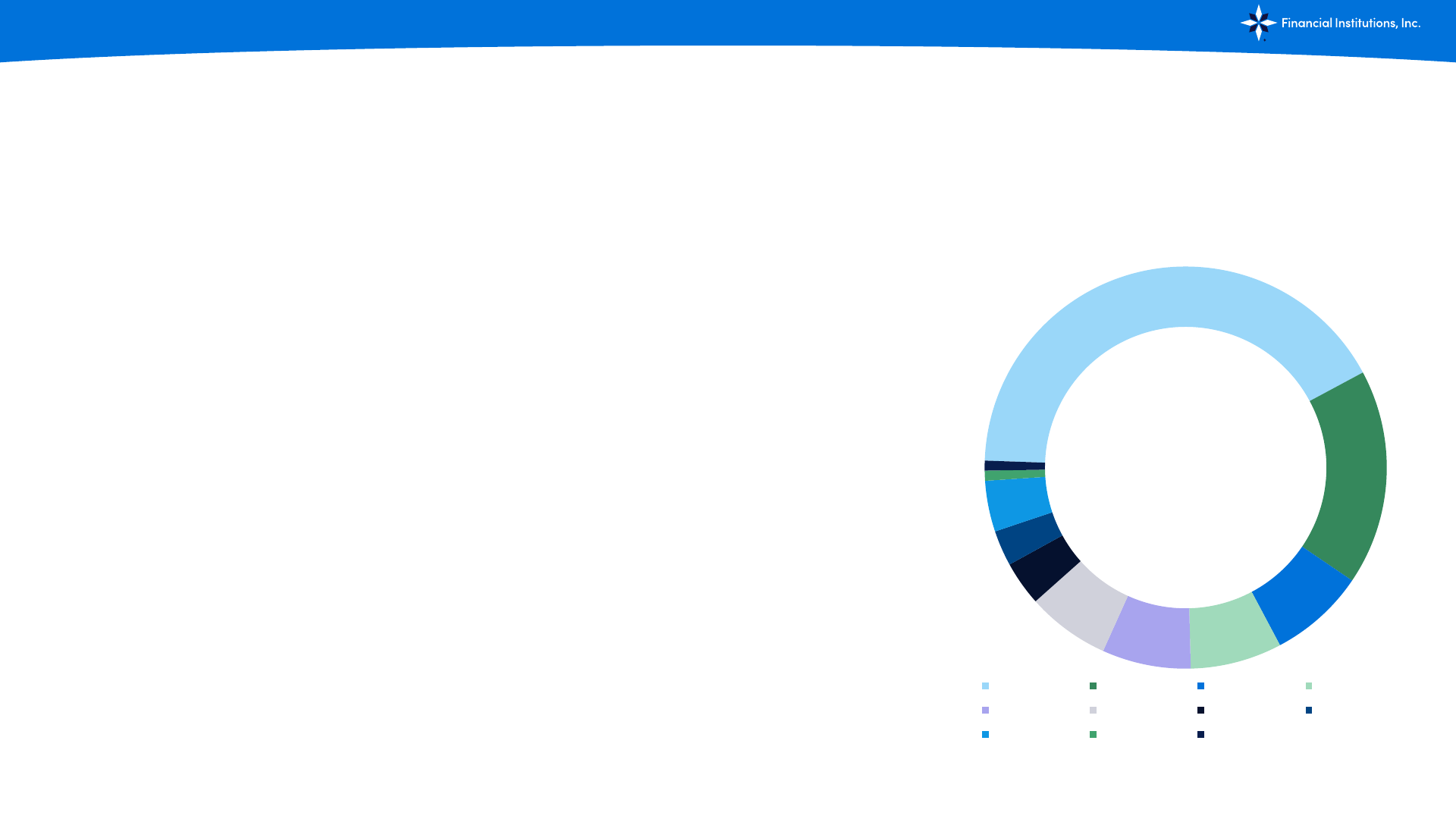

Commercial Real Estate (CRE)

16

High Quality Lending

Outstanding balances of $1.82B and committed credit exposure of $2.15B as of March 31, 2024

• Well diversified, with ~750 loan facilities consolidated into ~270 separate lending relationships, with

~$2.8M average loan size

◦ 82% of CRE clients have loan relationships <$10M

• Growth achieved without compromising strong credit culture

◦ Portfolio factors in loan rollover risk, with 17% of exposure scheduled to mature within next 12 months

and another 22% within 24 months

◦ More than 90% of CRE loans have full or limited personal or corporate recourse, providing comfort with

loan rollover risk

1

◦ Average LTV of 59% for overall CRE portfolio

1

◦ Internal stress testing conducted on a quarterly basis to analyze performance data of several of our

largest CRE asset classes, including multifamily, office, hospitality, retail, mixed-use and industrial; variety

of scenarios stressing loans with NOI downside and higher interest rates still result in the large majority

continuing to have coverage ratios at or greater than 1:1 coverage

CRE Exposure

by Property

Type

1

Recourse and loan-to-value (“LTV”) ratio calculated as of March 31, 2024; original appraised value used for LTV ratio

2

Central Business District

40%

30%

16%

14%

0.4%

Office - Class B Office - Medical

Office - Class A Flex Office

Office - Class C

Office and Multifamily CRE

17

High Quality Lending

Office and multifamily CRE outstanding balances of $353M and $742M, respectively, as of March 31, 2024

• Office CRE committed credit exposure of $373M at March 31, 2024

◦ <$40M of office exposure in central business districts, or CBDs, represents ~10% of office and <2% of total CRE exposure

◦ Average loan size of $3.2M and average LTV 55%

1

◦ >70% have full or limited personal or corporate recourse; those without have average LTV of ~60%

1

and DSCR of ~1.4X

◦ ~$13M, or <4% of asset class, within criticized/classified

◦ ~52% of office CRE loans are fixed and ~48% are variable rate

2

• Multifamily CRE committed credit exposure of $909M at March 31, 2024

◦ Expansion into Mid-Atlantic providing geographic and customer diversification

◦ Average loan size of $3.5M and average LTV 60%

1

◦ >90% have full or limited personal or corporate recourse; those without have average LTV of ~56%

1

and DSCR of >1.6X

◦ ~$29M, or ~3% of asset class, within criticized/classified

◦ 40% of multifamily CRE loans are fixed and 60% are variable rate

2

Office

Property by

Class

3

1

Recourse and loan-to-value(“LTV”) ratio calculated as of March 31, 2024; original appraised value used for LTV ratio

2

Loans with overlaying interest rate swaps are considered variable

3

Chart displays property mix as of March 31, 2024. Please note that first quarter 2024 investor presentation published April 24, 2024 erroneously displayed December 31, 2023 percentages

70% of FISI’s office exposure, or

12% of CRE exposure, relates to

Class B or Medical space

18

High Quality Lending

Residential Real Estate

$723.8M portfolio at March 31, 2024

• Residential portfolio was down a modest $3.4M, or 0.5%, from year-end 2023

and up $55.9M, or 8.4%, from March 31, 2023

• High quality portfolio in stable Upstate New York market

◦ As of quarter-end, our residential real estate loans had a weighted average

FICO score of 741 at origination and an average balance of ~$96,000, while our

home equity lines of credit, or HELOCs, had an average score of 767 and

average balance of $22,000

• Full product menu featuring competitive portfolio and saleable products including

government loan programs

• In-market originations through mortgage loan originators and Five Star Bank

branch network

1.5% CAGR

Residential Lending Portfolio

$599.8

$577.3

$589.9

$649.8

$648.2

$89.8

$78.5

$77.7

$77.4

$75.7

$689.6

$655.8

$667.6

$727.2

$723.8

$0

$100

$200

$300

$400

$500

$600

$700

12/31/2020 12/31/2021 12/31/2022 12/31/2023 3/31/2024

Millions

Residential Real Estate Loans Residential Real Estate Lines

Consumer Indirect Portfolio

19

High Quality Lending

Indirect Auto Remains Core

Competency

$920.4M portfolio at March 31, 2024

• Effective January 1, 2024, the Company exited the Pennsylvania auto market as

it focuses on its core Upstate New York service area, which includes a strong

network of ~375 new auto dealers

• Consumer indirect portfolio was down $28.4M, or 3.0%, from year-end 2023 and

down $101.8M, or 10.0%, from March 31, 2023

• Prime lending operation with average portfolio FICO score of 714

• Relatively short duration averaging ~3.3 years and natural risk dispersion due to

small loan size, with an average loan balance of $20,000

• Demonstrated track record of consistent performance through economic

expansions, recessions and stagnation

◦ Annual charge-offs ranged 0.45% to 0.87% for 2008 through 2023, excluding

the exceptionally low 0.14% reported in 2021

◦ NCO levels normalized in 2022 and remain within our historical range

◦ Consumer indirect charge-off ratio was 128 bps in 1Q ’24 and 130 bps in 4Q ’23

2.8% CAGR

$840.4

$958.0

$1,023.6

$948.8

$920.4

$0

$200

$400

$600

$800

$1,000

12/31/2020 12/31/2021 12/31/2022 12/31/2023 3/31/2024

Millions

Consumer Indirect Loans

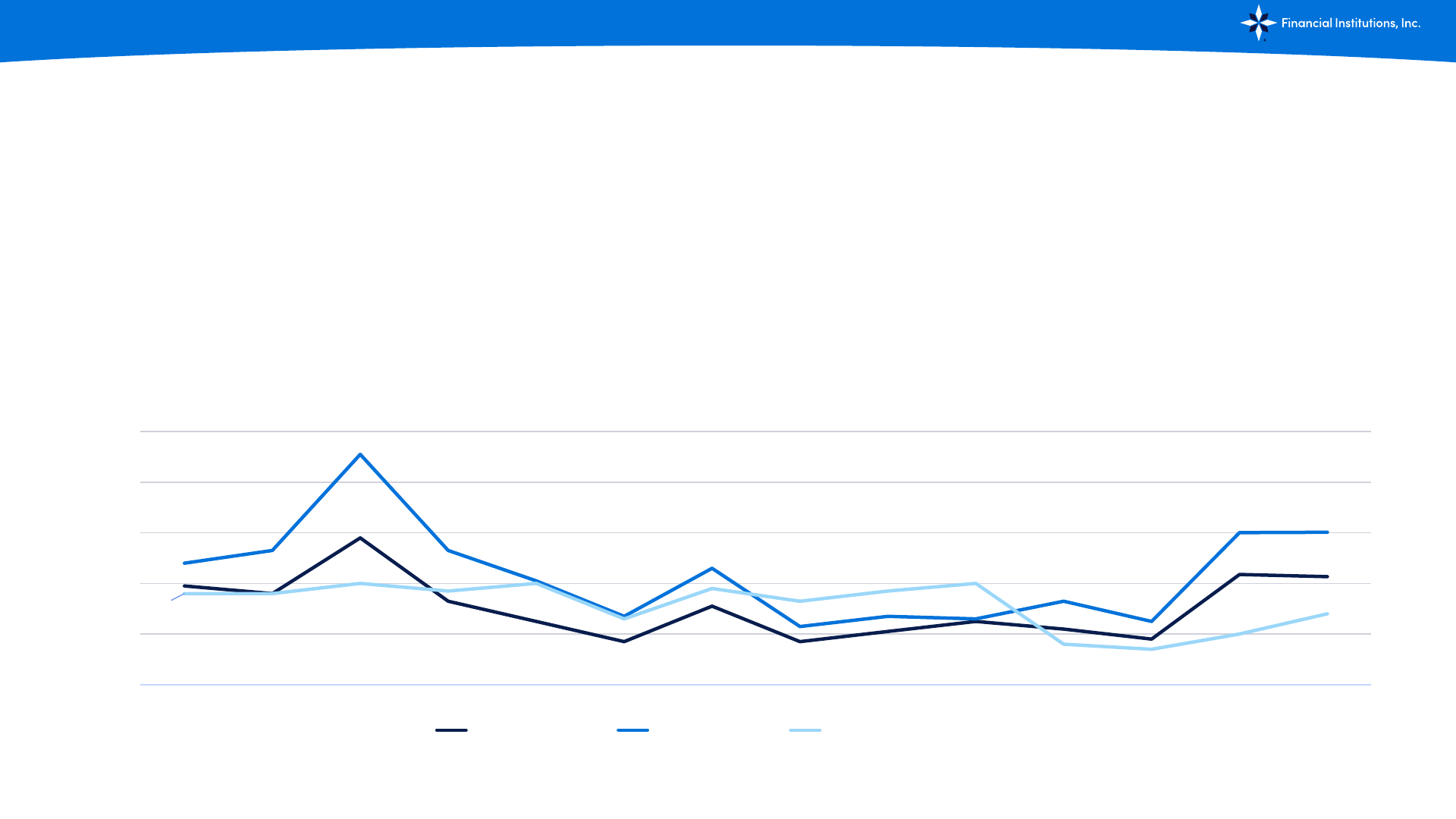

Solid Asset Quality

20

High Quality Lending

Disciplined credit culture supports consistently strong asset quality metrics

• Thorough credit review exercise undertaken at the outset of COVID-19 pandemic reinforced confidence in health of loan portfolio

◦ During 2Q ’22, COVID-19 at-risk pool was eliminated, and all credits now monitored as part of standard loan monitoring process

1

Non-performing assets, or NPAs, include nonaccrual loans, loans past due 90 days or more and still accruing, and foreclosed assets

Select Asset Quality Metrics

0.39%

0.43%

0.48%

0.60%

0.36%

0.28%

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 1Q '24

NPAs /Total Assets NPLs/Total Loans NCOs (Recoveries)/Average Loans

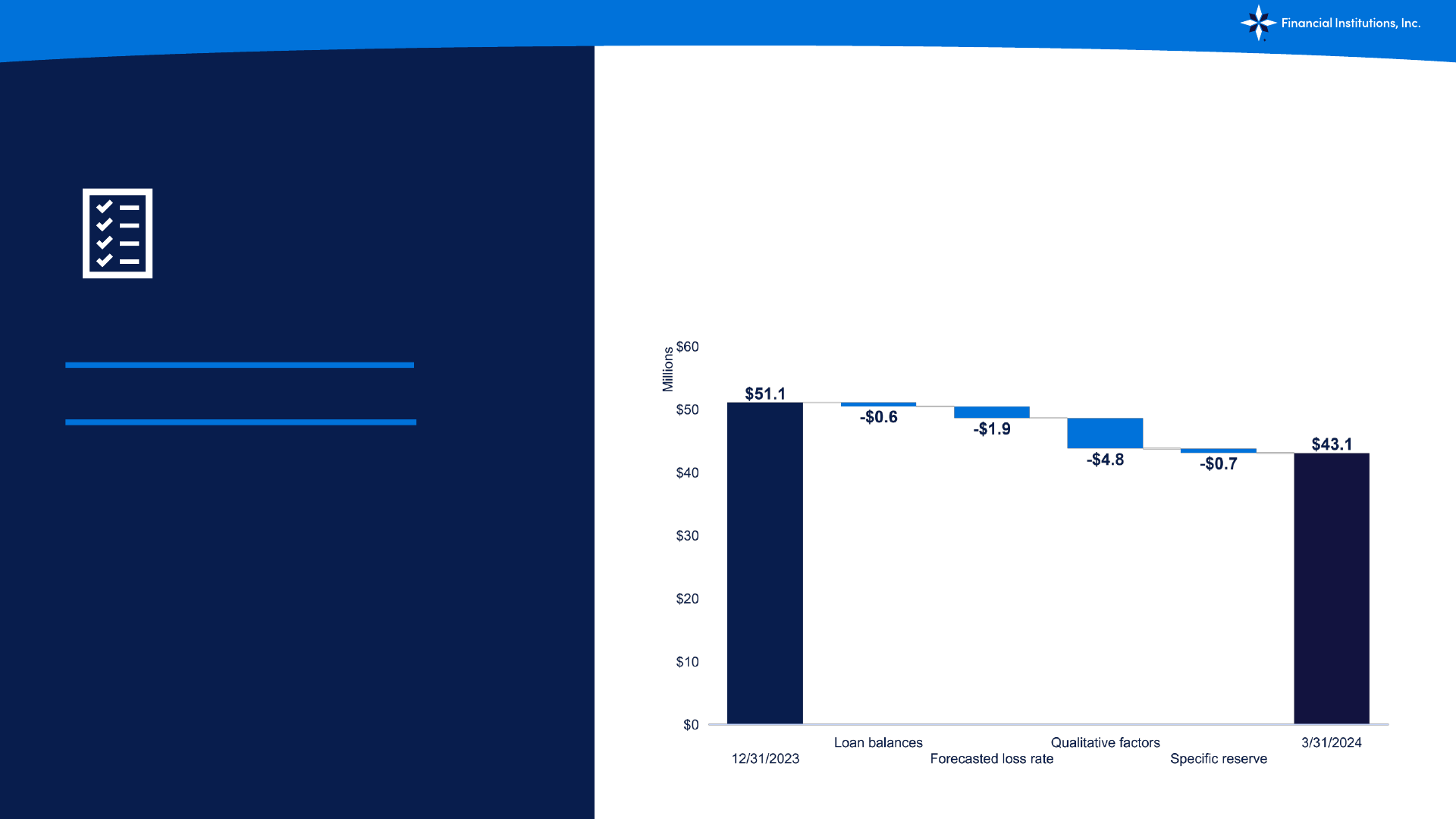

Allowance for

Credit Losses

21

High Quality Lending

1Q ’24 reserve release driven by

improvement in consumer indirect

delinquencies and an improvement in

forecasted losses

• 1Q ’24 benefit for credit losses of $5.5M was primarily driven by ~$8M reserve release

along with a $0.6M credit to the allowance for unfunded commitments, partially offset by

$3.2M of net charge-offs during the period

• Reserve release driven primarily by positive trends in qualitative factors, including a

reduction in consumer indirect loan delinquencies during the period, and improved

forecasted losses, which are based in part on the national unemployment forecast

Allowance for Credit Losses – Loans

22

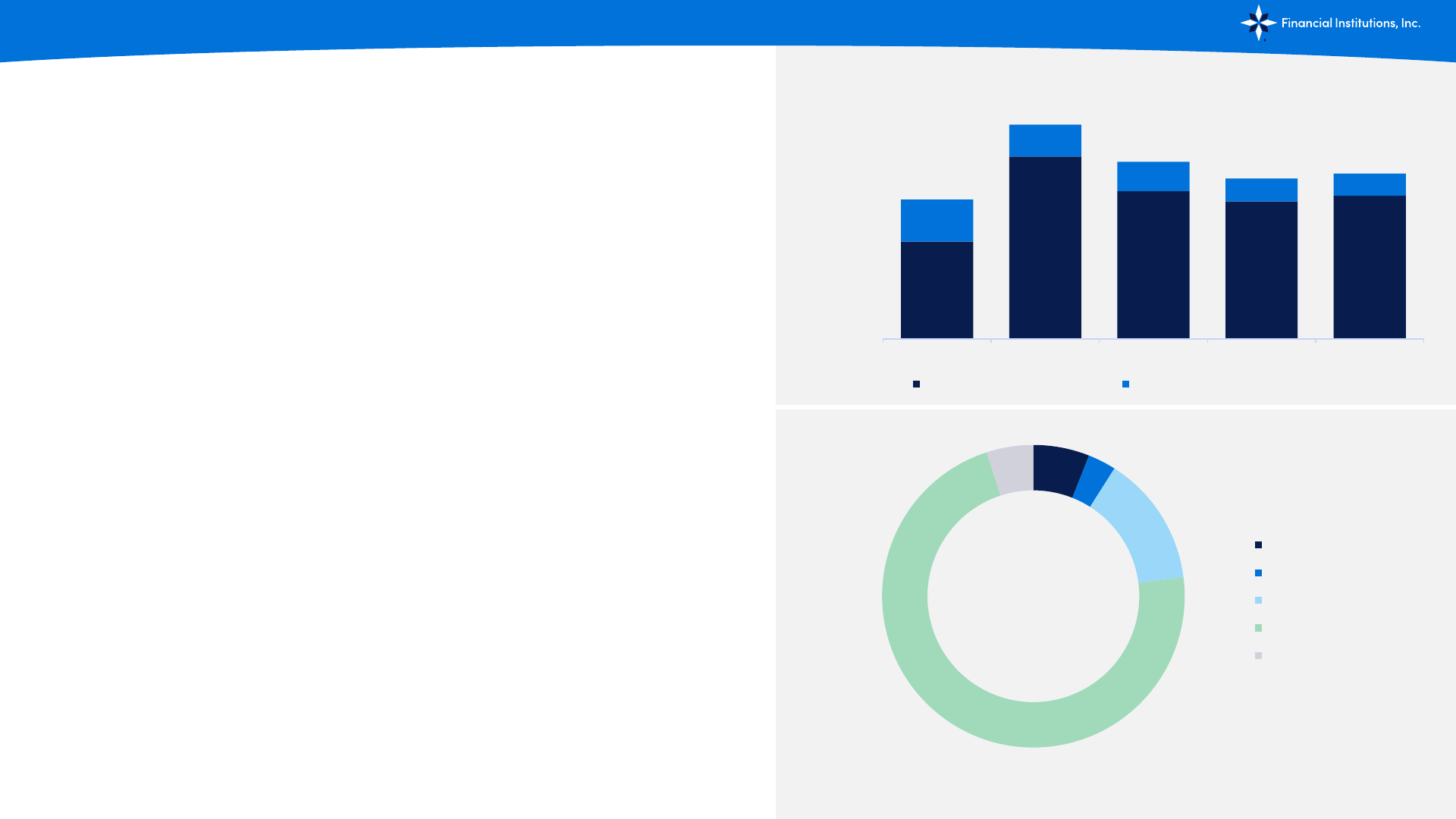

Securities and Deposits

Securities Portfolio

$1.07B at March 31, 2024

• Primarily comprised of agency wrapped mortgage-backed securities with

intermediate durations, which provide ongoing cash flow, coupled with investment

grade municipal bonds that are classified as held-to-maturity

• In 4Q ‘23, the Company repositioned a segment of our securities portfolio, selling

~$54M of agency mortgage-backed securities at an after-tax loss of $2.8M and

reinvesting the proceeds into higher yielding bonds

◦ Associated $1.4M of annual income equates to two year earn-back

• Average yield on a tax equivalent basis was 2.09% for 1Q ’24, up from 2.03% in

linked quarter, reflective of a full quarter of repositioning

• Cash flow from the securities portfolio allows for reinvestment into loans or

additional investment securities

◦ Principal cash flow of ~$211M expected over next 12 months

Note: Shown as a percentage of amortized cost basis

5.1% CAGR

6%

3%

14%

72%

5%

Municipal

Agency Debt

Agency CMOs

Agency MBS

US Treasury

$628

$1,178

$954

$888

$924

$272

$206

$189

$148

$144

$900

$1,384

$1,143

$1,036

$1,067

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

12/31/2020 12/31/2021 12/31/2022 12/31/2023 3/31/2024

Millions

Securities Available for Sale Securities Held to Maturity, net

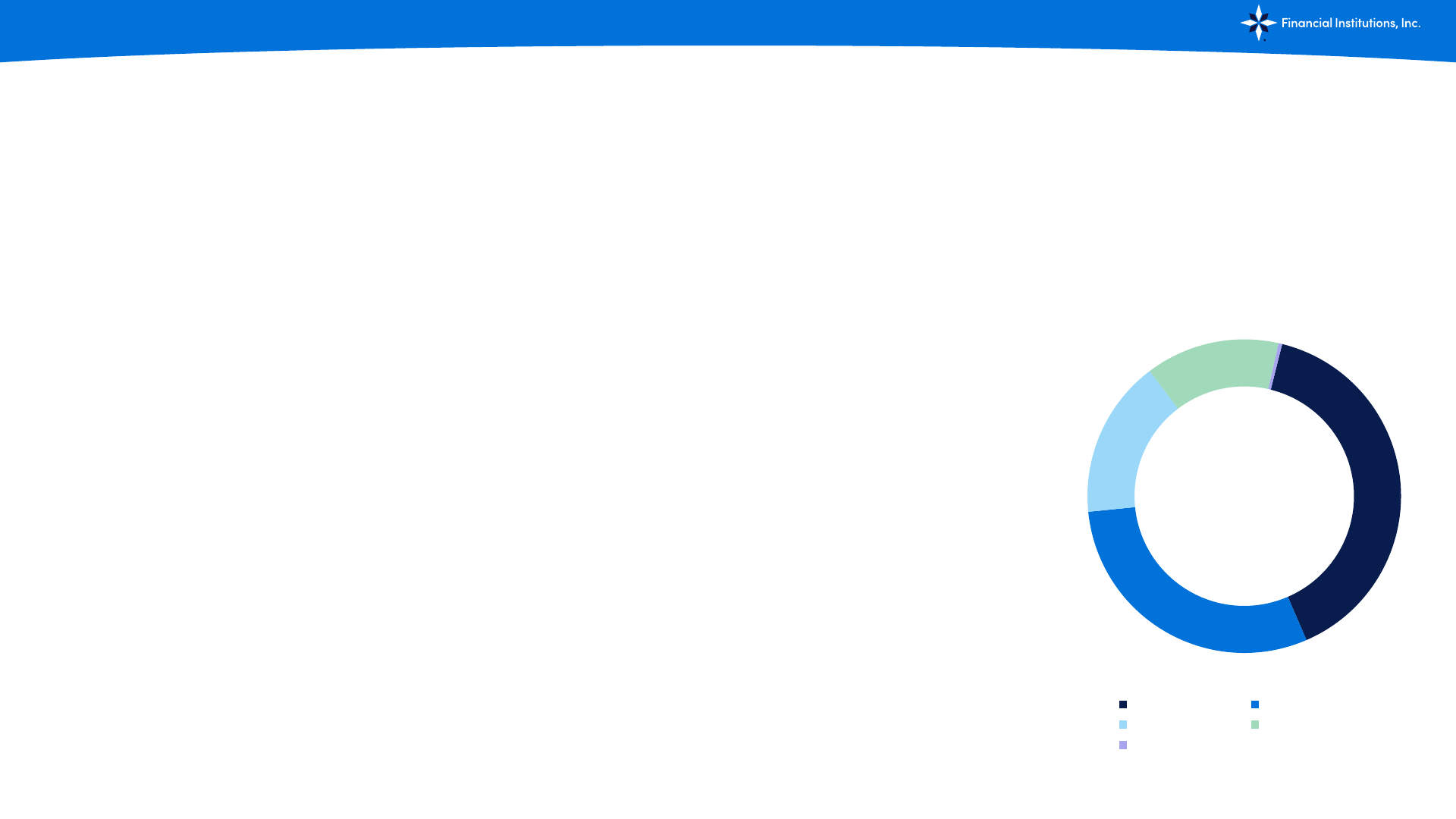

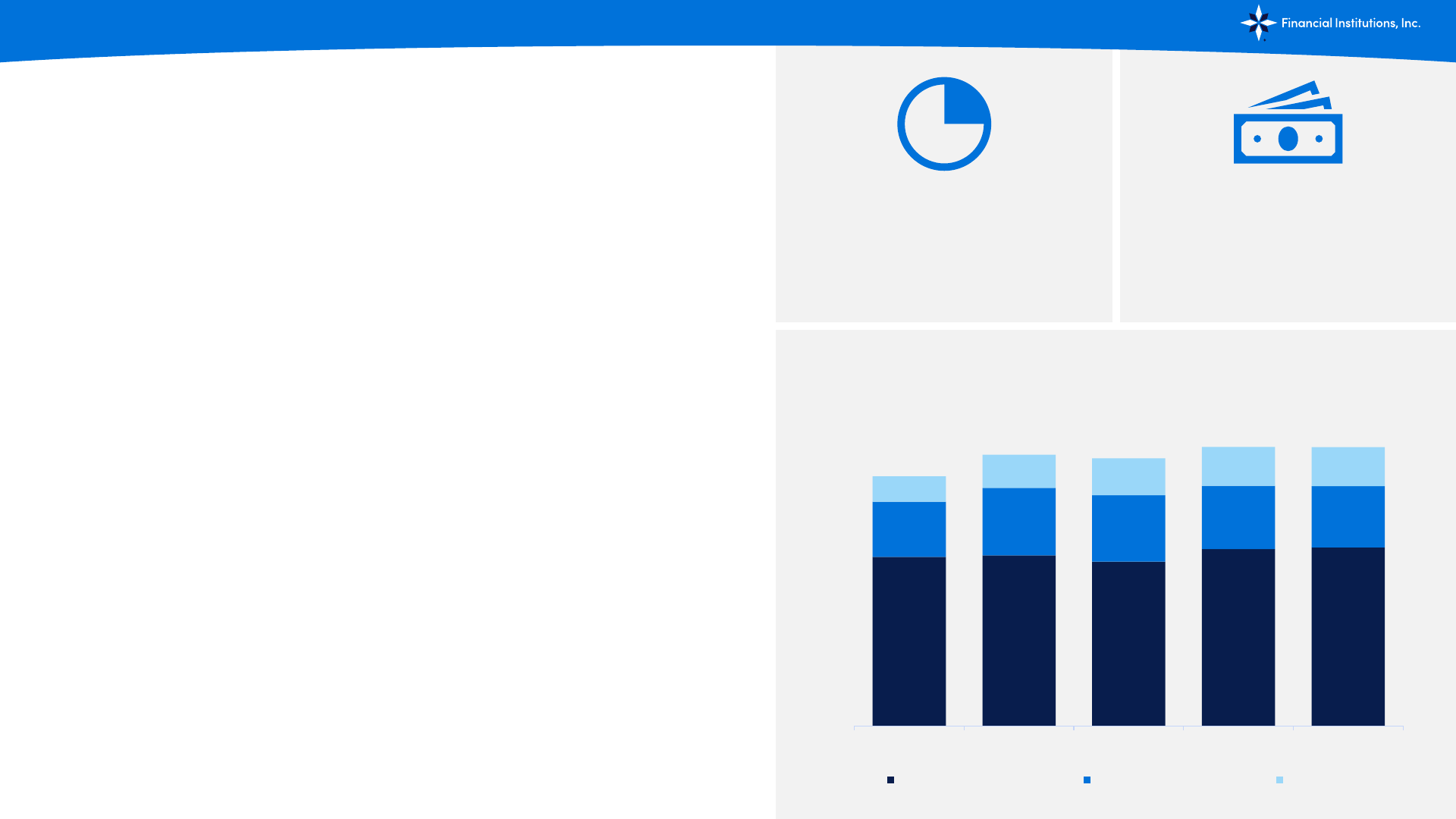

$2.55

$2.70

$2.77

$3.12

$3.13

$0.28

$0.25

$0.35

$0.26

$0.18

$0.83

$1.10

$1.12

$1.02

$1.21

$0.62

$0.77

$0.70

$0.82

$0.87

$4.28

$4.83

$4.93

$5.21

$5.40

$0.0

$1.0

$2.0

$3.0

$4.0

$5.0

12/31/2020 12/31/2021 12/31/2022 12/31/2023 3/31/2024

Billions

Total Nonpublic Deposits Total Brokered Deposits

Total Public Deposits Total Reciprocal Deposits

23

Securities and Deposits

Deposit Growth

$5.40B at March 31, 2024

329

municipal

customers as of

MRQ-end

3.23%

6.9% CAGR

• Total deposits were $5.40B, up $183.8M, or 3.5%, from December 31, 2023, and

up $255.5M, or 5.0%, from one year prior

◦ The linked quarter increase is reflective of seasonal public deposit inflows, while

the improvement over the prior year was driven by nonpublic deposit growth

• Granularity of community banking franchise benefits deposit portfolio

◦ Average deposit balances per branch of approximately $85.5M, excluding

reciprocal and brokered deposits

◦ Lower-cost deposits from rural markets fund higher growth in metro markets

• Offering a variety of public (municipal) deposit products to the towns, villages,

counties and school districts providing seasonal, lower-cost funding source

◦ Public deposit balances represented 22% of total deposits at March 31, 2024,

20% at December 31, 2023, and 23% at March 31, 2023

• Current interest rate environment has led to disintermediation from core

transaction type accounts to time deposits

◦ Time deposits made up 29% of total deposits at March 31, 2024

1Q ‘24 cost of

average interest-

bearing deposits

$550

$613

$574

$809

$906

$226

$445

$158

$175

$30

$224

$202

$156

$291

$365

$33

$27

$57

$40

$184

$1,033

$1,287

$945

$1,314

$1,484

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

12/31/2020 12/31/2021 12/31/2022 12/31/2023 3/31/2024

Millions

FRB Discount Window Unencumbered Securities FHLBNY FRB Excess Cash

24

Securities and Deposits

Liquidity

Diverse deposit gathering capabilities and eligible

collateral support a robust liquidity position

• 1Q ’24 available committed liquidity remains strong, as supported through

unencumbered collateral in the securities portfolio, borrowing capacity at the

FHLB, and tertiary liquidity via the FRB discount window, which totaled more than

$1.48B at quarter-end

• The decrease in unencumbered securities is due to the inflow of municipal

deposits, which require collateralization

• Further, uninsured nonpublic deposits make up approximately 14.2% of our total

deposits, when considering the secured nature of our public and reciprocal

portfolios, which typically have larger balances

~14.2%

of total deposits

are uninsured

nonpublic deposits

~82%

Loan to deposit

ratio

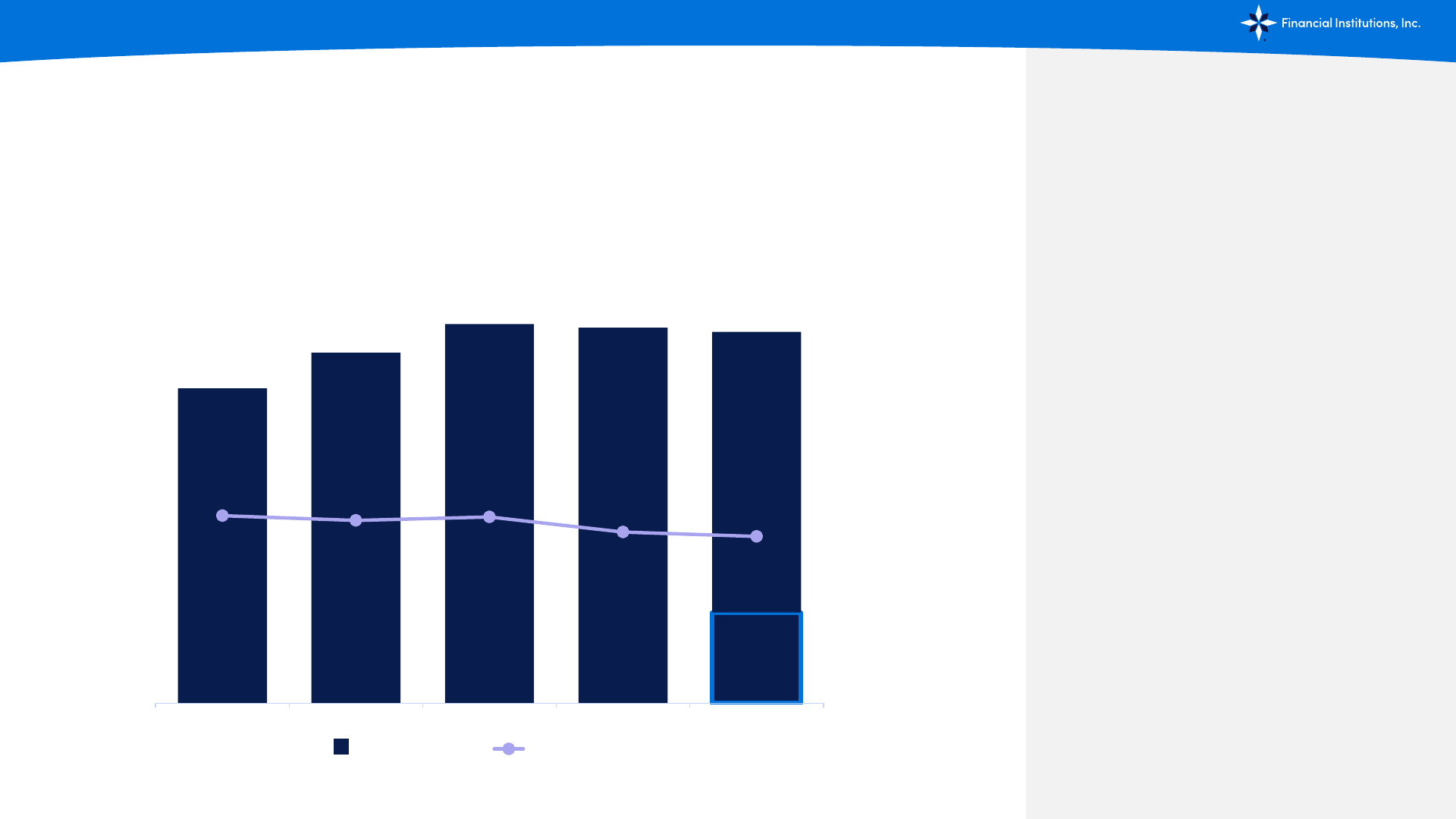

Net Interest Income & Margin

25

Revenue

1Q ’24 net interest income of $40.1M and net interest margin of 2.78%

• Net interest income of $40.1M increased

$0.2M, or 0.5%, from the linked fourth

quarter and decreased $1.7M, or 4.1%,

from the year-ago quarter

• Net interest margin was 2.78% for the

current quarter, consistent with the linked

quarter and 31 bps lower than the year-

ago quarter

◦ Margin has been impacted by the current

higher interest rate environment that has

driven higher funding costs

1Q '24

$40

$139

$155

$167

$166

$164

3.22%

3.14%

3.20%

2.94%

2.87%

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

7.00%

$0

$20

$40

$60

$80

$100

$120

$140

$160

$180

2020 2021 2022 2023 TTM 1Q '24

Millions

Net interest income Net interest margin

Select Interest Earning

Assets

2023

Yield

1Q ‘24

Yield

1Q ‘24

Roll Off

Yield

Balance at

3/31/2024

Average

NTM

Monthly

Cash Flow

1

Investment Securities

1.92%

2.09%

2.45%

$1,067, 478

$19,654

Commercial Real Estate

Loans

6.83%

7.10%

7.39%

$1,816,916

$35,096

Commercial & Industrial

Loans

6.43%

6.80%

6.20%

$818,571

$14,429

Small Business Loans

2

6.65%

6.99%

8.40%

$116,266

$1,344

Residential Real Estate Loans

3.71%

3.99%

4.26%

$648,160

$6,041

Consumer Indirect Loans

5.36%

5.90%

6.16%

$920,428

$26,829

Balance Sheet

Providing Ample

Cash Flow

26

Revenue

Combined ~$1.1B in anticipated cash flow

over the next 12 months from investment

securities and loan portfolios

Ample cash flow allows for redeployment of funds in

higher interest earning assets, supporting incremental

margin expansion

1

NTM = next twelve months. Average monthly loan cash flow projections based on contractual loan terms and historical

prepayment assumptions that are based on a 12-month historical average.

2

Small business represents small business loans generated through retail network and commercial Business Banking Unit

27

Revenue

Noninterest Income

Noninterest income was $10.9M in 1Q ‘24

• Noninterest income was $10.9M, down $4.5, or 29.1%, from 4Q ’23 and flat with

the year-ago quarter.

◦ The linked quarter variance was primarily driven by higher company owned life

insurance revenue in Q4 ’23 of $9.1M, of which approximately $8M related to

the investment of premium into a separate account product during that period

from our surrender and redeploy strategy. Noninterest income was flat with the

1Q ’23.

• Investment advisory income, which totaled $2.6M in Q1 ’24, is primarily derived

from the Company’s wealth management subsidiary Courier Capital, LLC

22.7%

of TTM net

revenue from non-

interest income

$2.99B

in assets managed

by Courier Capital

at quarter-end

Annual Noninterest Income

Note: Information on this slide is as of March 31, 2024 unless noted otherwise

$29.2

$29.5

$28.4

$30.6

$30.9

$9.5

$11.7

$11.5

$11.0

$10.6

$4.4

$5.8

$6.4

$6.7

$6.8

$0.0

$46.9

$46.3

$48.2

$48.2

$0

$10

$20

$30

$40

$50

$60

2020 2021 2022 2023 TTM 1Q '24

Millions

All Other Noninterest Income Investment Advisory Income Insurance Income

Wealth Management Business Positioned for Growth

28

Revenue

Providing customized investment management, retirement planning, and consulting services for mass affluent

and high-net-worth individuals and families, businesses, institutions, and foundations

• Since entering the investment advisory space in 2016 with the acquisition of Courier Capital, the Company has completed two additional wealth

management acquisitions in 2017 and 2018

• Combination of FISI’s subsidiary wealth management firms enhanced size and scale as next natural step in evolution of this business line

◦ On May 1, 2023, FISI’s wholly-owned SEC-registered investment advisory firm subsidiaries completed a merger, under which HNP Capital merged with and into

Courier Capital

◦ One of the largest registered investment advisory firms in Western New York

• Merger streamlines ability to provide innovative financial products and services to current and prospective clients and unites Western New York

service footprint

◦ One brand streamlines business development efforts, including cross-selling opportunities

◦ Courier Capital is headquartered in downtown Buffalo, NY and the majority of the former HNP Capital team is based in the Rochester, NY market, with additional

offices located in Jamestown, NY and Pittsburgh, PA

• In October 2023, the Company announced a leadership succession at Courier Capital

◦ Promoted internal candidate with two decades of experience in private banking with several large U.S. banks to President

◦ New leadership structure allows the firm to continue serving its wealth management, retirement plan and institutional services clients at the highest level, while

positioning the firm for continued growth moving forward

$35.0

$19.0

$33.7

$33.8

$34.7

$35.0

$54.0

$0

$10

$20

$30

$40

$50

$60

$70

1Q '23 2Q '23 3Q '23 4Q '23 1Q '24

Millions

Noninterest expense March 2024 fraud event

$138.5

$19.0

$109.3

$112.8

$129.4

$137.2

$157.6

$0

$20

$40

$60

$80

$100

$120

$140

$160

2020 2021 2022 2023 TTM 1Q '24

Millions

Noninterest expense March 2024 fraud event

29

Expense Management & Operating Leverage

Noninterest Expense

1Q ’24 expense of $54.0M included ~$19M of noninterest

expense related to previously disclosed fraud event

• 1Q ’24 expense of $54.0M is up $19.0M, or 54.1%, from the linked quarter and

up $20.4M, or 60.5%, from the prior year period

◦ Expenses were impacted by approximately $18.4M in deposit-related charge-

offs and $0.7M of legal and consulting expenses related to the Company’s

previously disclosed fraud matter.

• In 4Q ’23, the Company announced leadership changes and improvements to its

organizational structure to strengthen its ability to execute its long-term strategy

while also reflecting proactive measures to manage noninterest expenses

heading into 2024

• 2022 expenses included investments in strategic initiatives that we believe will

support improved operating leverage over the coming years, including related to

enhanced customer relationship management solution, digital banking and BaaS

• 1Q ‘24 efficiency ratio of 106%, or 69% when excluding expenses related to the

fraud event

1

Quarterly Noninterest Expense

Annual Noninterest Expense

1

Efficiency ratio is calculated by dividing noninterest expense by net revenue, i.e., the sum of net interest income (fully taxable equivalent) and

noninterest income before net gains on investment securities. This is a banking industry measure not required by GAAP. Please see Appendix for

additional details on this non-GAAP measure.

Well-Capitalized

30

Capital Management & Investment Considerations

Exceeding well-capitalized regulatory thresholds and well-positioned to support future growth

Capital Ratio

As of March 31, 2024 Well-Capitalized Threshold

Leverage

8.03%

5.00%

CET1 capital

9.43%

6.50%

Tier 1 capital

9.76%

8.00%

Total RBC

12.04%

10.00%

8.25%

8.23%

8.33%

8.18%

8.03%

10.18%

10.28%

9.42%

9.43% 9.43%

10.63%

10.68%

9.78%

9.76% 9.76%

13.61%

13.12%

12.13% 12.13%

12.04%

0%

2%

4%

6%

8%

10%

12%

14%

16%

12/31/2020 12/31/2021 12/31/2022 12/31/2023 3/31/2024

Leverage Ratio Common Equity Tier 1 Capital Ratio Tier 1 Capital Ratio Total Risk-Based Capital Ratio

31

Capital Management & Investment Considerations

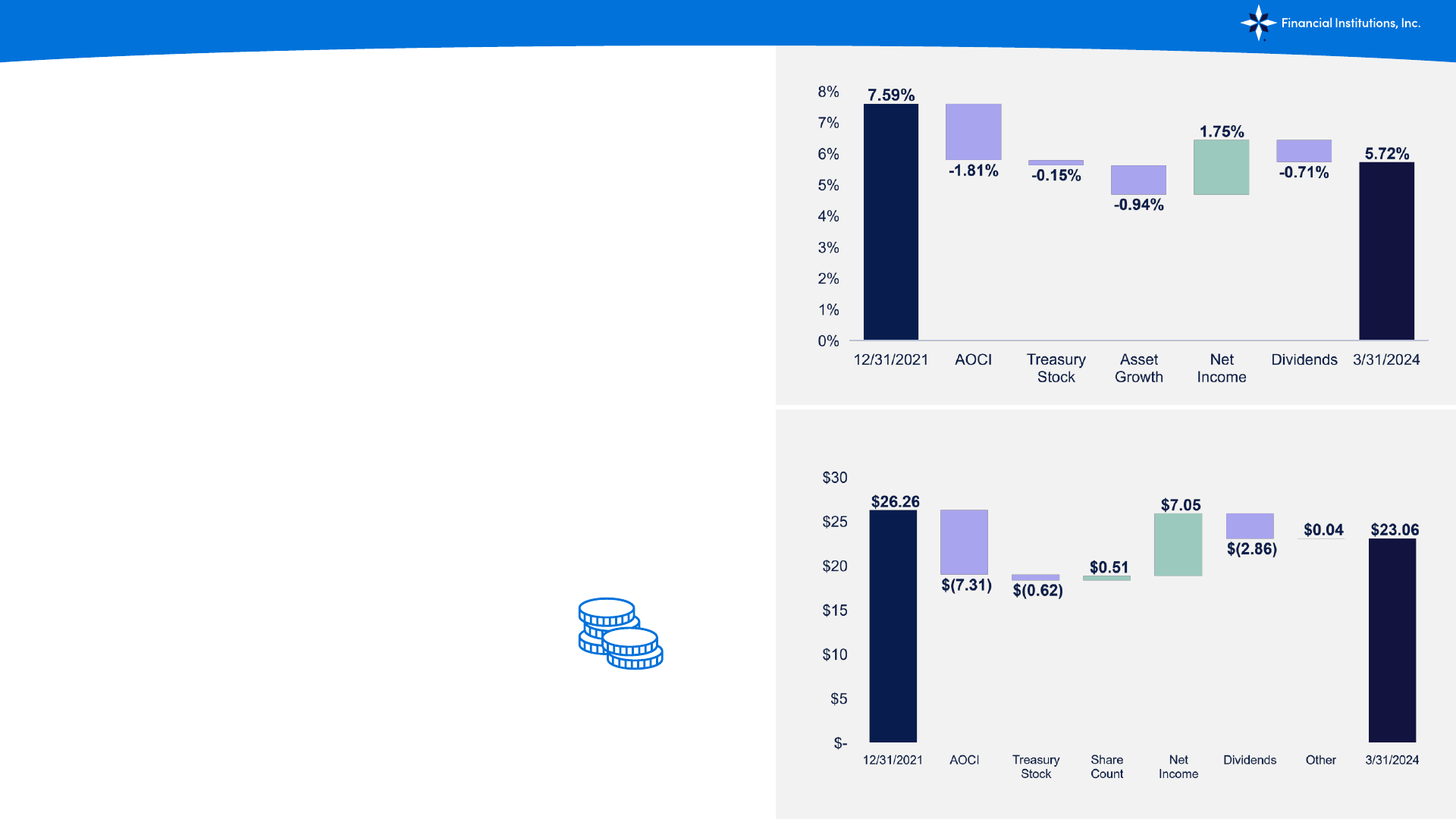

AOCI Impact on TCE & TCBV

1

Unrealized losses believed to be temporary in nature

• AOCI losses are believed to be temporary in nature, as they are associated with

the increase in interest rates which has resulted in an increase in the unrealized

loss position of the available for sale securities portfolio

• We expect these metrics to return to more normalized levels over time given the

high credit quality of our investment portfolio

• Excluding the AOCI impact, TCE ratio and tangible common book value per share

would have been 7.53% and $30.37, respectively.

FISI believes a stock buyback

program is an important part of the

capital markets tool kit and

announced a new stock repurchase

program in June 2022 for up to ~5%

of then outstanding common shares

1

AOCI= Accumulated other comprehensive income (loss). TCE = Tangible common equity to tangible assets. TCBV = Tangible common book

value per share. Please see Appendix for reconciliation of non-GAAP Financial measures for the computation of these non-GAAP measures.

Change in TCE

Change in TCBV

FISI Presents a Compelling Valuation

32

Capital Management & Investment Considerations

Longstanding commitment to rewarding shareholders through meaningful

dividend yield and 29-year cash dividend history

Results-driven

community bank with

strong retail and

commercial franchises

Disciplined credit

culture with strong

credit quality

Investment Profile

As of March 31, 2024

Closing Price

$18.82

52

-week High

$23.11

52

-week Low

$17.70

Common Shares Outstanding

15.4M

Market Capitalization

$290.7M

Price/LTM EPS

7.5x

Price/NTM Consensus EPS

6.5x

Price/Common Book Value Per Share

0.68

Float

97.2%

Average Daily Volume (3 mos.)

~52,000

Dividend Per Share (annualized MRQ)

$1.20

Dividend Yield (annualized MRQ)

6.41%

Common Dividend Payout Ratio

273%

Fee-based business

diversifies revenue

and complements core

banking franchise

Complementary

fintech and digital

partnerships driving

exceptional digital

experiences

Appendix

33

Thank you for your

interest in

Financial Institutions, Inc.

NASDAQ: FISI

Investor Relations Contacts

Kate Croft

Director of Investor and

External Relations

Jack Plants

Chief Financial Officer &

Corporate Treasurer

FISI-Investors@five-starbank.com

Learn more at

www.FISI-Investors.com

Strong Executive Leadership Team Positioned to Drive

Growth and Operational Excellence

34

Appendix

Martin K. Birmingham

President & Chief Executive Officer

Reid A. Whiting

SVP, Chief Banking Officer

overseeing retail and digital banking,

consumer lending, residential

mortgage and BaaS

Samuel J. Burruano Jr.

EVP, Chief Legal Officer & Corporate

Secretary

overseeing legal, corporate governance,

ESG and internal audit

W. Jack Plants II

EVP, CFO & Treasurer

overseeing financial planning and analysis,

accounting, tax, investor and external

relations, treasury, operations and

technology

Laurie R. Collins

SVP, Chief Human Resources Officer

overseeing talent recruitment and

development, training and incentives,

and DEI

Gary A. Pacos

SVP, Chief Risk Officer

overseeing enterprise risk, BSA/AML,

fraud, compliance, information security and

credit administration

Kevin B. Quinn

SVP, Chief Commercial Banking Officer

overseeing CRE and C&I lending, treasury

management, merchant services and

community development

Blake G. Jones

SVP, Chief Marketing Officer

overseeing marketing, brand

strategy and enterprise sales

Strategy Map

35

Appendix

Optimal capital

& funding

Robust, usable

data &

technology

Scalable &

efficient

operating model

Sound risk &

compliant

environment

Recognized &

trusted brand

Talented &

empowered

employees

Value

-added

products &

services

Complementary

fintech & digital

partnerships

Exceptional CX

& engagement

Grow & sustain

deposits

Foundation of Human Capital Supported by Organizational Framework

Culture | Leadership | Teamwork | Alignment

Exceptional

digital

experiences

Credit

disciplined loan

growth

Sustainable

business

practice

Diversify

revenues

Maintain

expense

discipline

Attractive long-term

returns for

shareholders

Meaningful

customer experiences

& relationships

Effective engagement

& communications

with regulators

Positive

contributions to our

communities

Engaged &

motivated

associates

FISI’s vision is to be an independent, high-performing community bank offering

best-in-class financial services to all of the communities we serve

Non-GAAP Reconciliations

36

Appendix

In addition to results presented in accordance with U.S. generally accepted accounting principles (“GAAP”), this presentation contains certain non-GAAP financial

measures. The Company believes that providing certain non-GAAP financial measures provides investors with information useful in understanding our financial

performance, performance trends and financial position. Our management uses these measures for internal planning and forecasting purposes and we believe that

our presentation and discussion, together with the accompanying reconciliations, allows investors, security analysts and other interested parties to view our

performance and the factors and trends affecting our business in a manner similar to management. These non-GAAP measures should not be considered a

substitute for GAAP measures and we strongly encourage investors to review our consolidated financial statements in their entirety and not to rely on any single

financial measure to evaluate the Company. Non-GAAP financial measures have inherent limitations, are not uniformly applied and are not audited. Because non-

GAAP financial measures are not standardized, it may not be possible to compare these financial measures with other companies’ non-GAAP financial measures

having the same or similar names.

Amounts in thousands, except per share data and percentages

12/31/2021 3/31/2024

Computation of ending tangible common equity:

Common shareholders' equity

$ 487,850 $ 448,442

Less: Goodwill and other intangible assets, net

74,400 72,287

Tangible common equity

413,450 356,155

Computation of ending tangible assets:

Total assets

$ 5,520,779 $ 6,225,760

Less: Goodwill and other intangible assets, net

74,400 72,409

Tangible assets

5,446,379 6,153,351

Tangible common equity to tangible assets

1

7.59% 6.80%

Common shares outstanding

15,745 15,447

Tangible common book value per share

2

$ 26.26 $ 23.06

1

Tangible common equity divided by tangible assets.

2

Tangible common equity divided by common shares outstanding.

Source: Company filings

Non-GAAP Reconciliations Continued

37

Appendix

Amounts in thousands, except per share data and percentages

As of and for the quarter ended March 31, 2024

Adjusted Net Income and Adjusted Earnings Per Share (EPS):

Income before

income taxes

Provision for

income taxes

Net income

Preferred stock

dividends

Diluted EPS

As reported

$ 2,426 $ 356 $ 2,070 $ 365 $ 0.11

Add back:

March 2024 fraud event related expenses 19,035 4,877 14,158 - 0.91

Impact of full year effective tax rate – interim period adjustment - (1,471) 1,471 - 0.10

As adjusted

$ 21,461 $ 3,762 $ 17,699 $ 365 $ 1.12

Adjusted Return on Average Assets (ROAA):

As reported Adjustments As adjusted

Average total assets

$ 6,225,760 - $ 6,225,760

Net income

2,070 15,629 17,699

Net income (annualized)

8,280 62,516 70,796

Return on average assets

0.13% 1.00% 1.14%

Adjusted Efficiency Ratio:

As reported Adjustments As adjusted

Non

-interest expenses $ 54,013 $ 19,035 $ 34,978

Net interest income

40,082 - 40,082

Non

-interest income 10,901 - 10,901

Efficiency ratio

106% -37% 69%

Source: Company filings