Capitol Specialty Insurance Corporation

A Stock Company

CapSpecialty.com

P. O. Box 5900

Madison, WI 53705-0900

Real Estate Agent / Broker or Property Management Supplemental Application

CS-AS 127 (06/19)

© 2019 CapSpecialty, Inc. All rights reserved.

Page 1 of 3

SOME RESPONSES MAY REQUIRE MORE SPACE THAN THAT PROVIDED. PLEASE PROVIDE THOSE RESPONSES ON A SEPARATE PAGE AND ATTACH

IT TO THIS SUPPLEMENTAL APPLICATION.

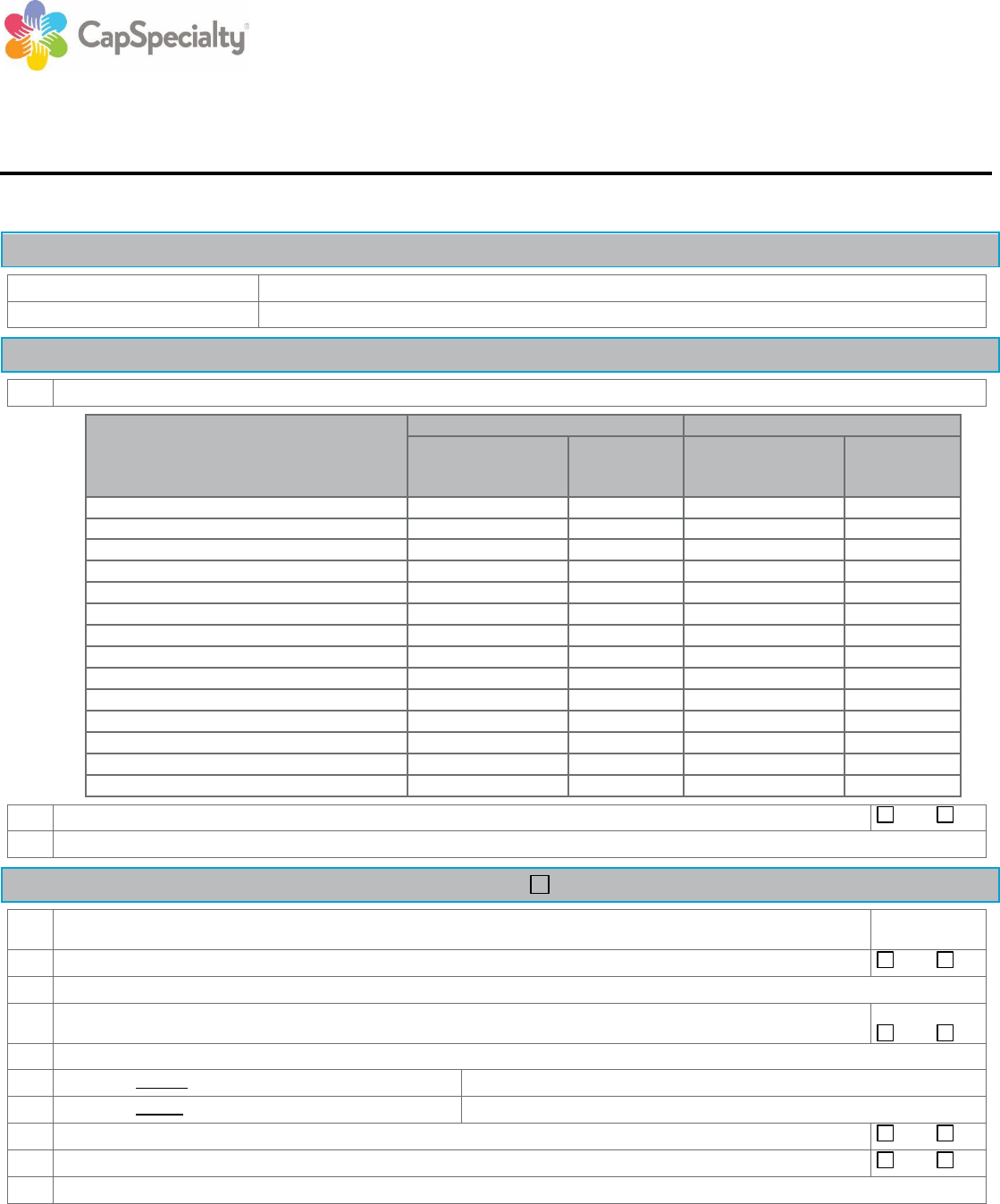

I. APPLICANT

Named Insured:

Policy No.:

II. REVENUE/COMMISSIONS/FEES

1.

Please complete the following breakout of all income, fees, and commissions in each category:

Past Twelve Months

Projected Next 12 Months

Type of Service

Revenue /

Commission / Fees

Generated

Number of

Transactions

Revenue /

Commission / Fees

Generated

Number of

Transactions

Residential Property Sales/Brokerage

$

$

Commercial Property Sales/Brokerage

$

$

Property Management Fees/Commercial

$

$

Property Management Fees/Residential

$

$

Commercial Space Leasing

$

$

Land or Farm Sales

$

$

Real Estate Appraisals

$

$

Real Estate Consulting/Counseling

$

$

Property Development

$

$

Business Opportunity Brokerage

$

$

Construction/Construction Management

$

$

Mortgage Brokering/Mortgage Banking

$

$

Insurance

$

$

TOTAL

$

$

2.

In addition to the services listed above, does Applicant provide any other services to clients?

Yes No

If Yes, please describe:

III. REAL ESTATE AGENT / BROKER PRACTICES AND PROCEDURES NOT APPLICABLE

1.

What percentage of Applicant’s residential transactions in past twelve (12) months involved the sale of a home warranty by

Applicant?

%

2.

Does Applicant sell time shares?

Yes No

If Yes, please describe:

3.

In the past five (5) years, has the Applicant, or any affiliated individual or entity or immediate family member, had any

ownership or equity interest in any property which Applicant sold?

Yes No

If Yes, please explain circumstances for each such property, including percentage of ownership or equity interest:

4.

What is the average value of properties sold?

$

5.

What is the highest value of properties sold?

$

6.

Does the Applicant (agent / broker) ever represent both the buyer and seller in the same property transaction?

Yes No

If Yes, is a dual agency disclosure form signed by all parties 100% of the time?

Yes No

If No, please explain:

Real Estate Agent / Broker or Property Management Supplemental Application

CS-AS-127 (06/19)

© 2019 CapSpecialty, Inc. All rights reserved.

Page 2 of 3

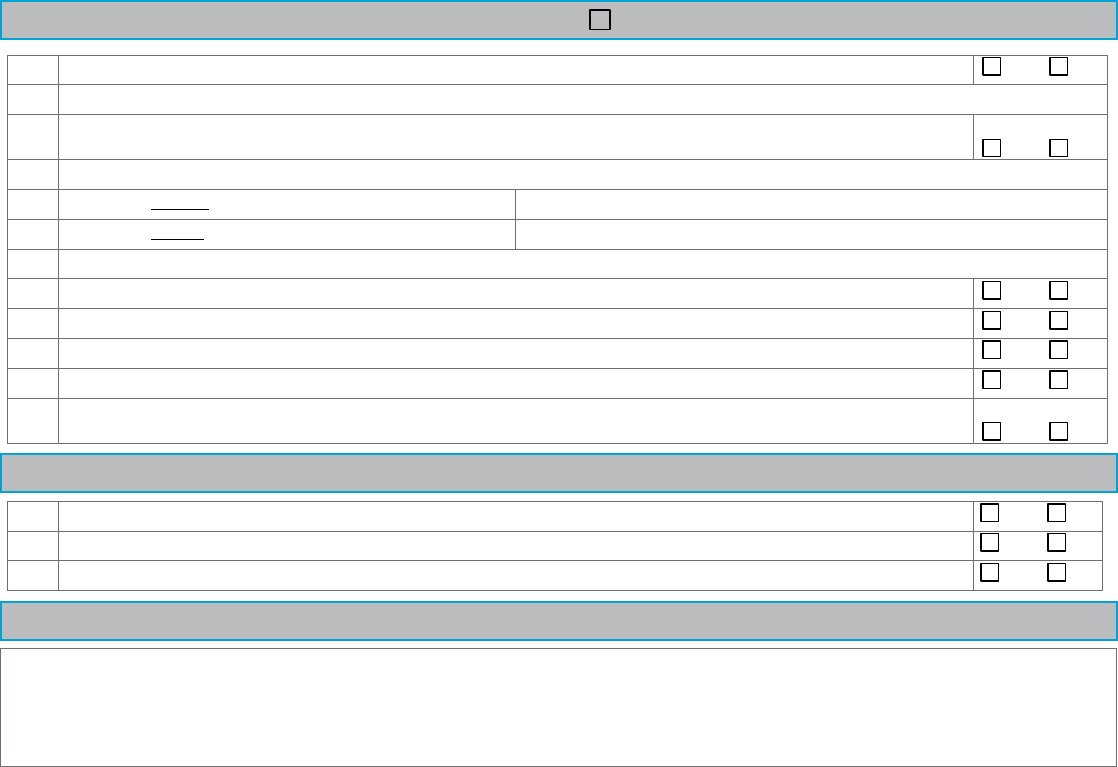

IV. PROPERTY MANAGEMENT PRACTICES AND PROCEDURES NOT APPLICABLE

1.

Does Applicant manage any Homeowners’ Association (HOA), or provide services to any HOA (as a contractor or employee)?

Yes No

If Yes, please describe:

2.

In the past five (5) years, has the Applicant, or any affiliated individual or entity or immediate family member, had any

ownership or equity interest in any property which Applicant managed?

Yes No

If Yes, please explain circumstances for each such property, including percentage of ownership or equity interest:

3.

What is the average value of properties managed?

$

4.

What is the highest value of properties managed?

$

5.

If Applicant provides property management services, please advise if Applicant provides the following:

(a) Prepares annual budgets for owners

Yes No

(b) Obtains credit reports on prospective tenants

Yes No

(c) Negotiates, places, or maintains insurance for the properties managed

Yes No

(d) Manage leasing and rental contracts with tenants

Yes No

6.

Does Applicant obtain a written and signed lease or rental agreement from each tenant/renter, with respect to all properties

rented or leased?

Yes No

V. LICENSING PROCEEDINGS/COMPLAINTS

1.

If Applicant is a realtor, or performing other services that requires a license, is Applicant’s license in good standing?

Yes No

2.

Has Applicant had any professional complaint filed against them in the past five (5) years, or any licensing proceeding?

Yes No

3.

Has Applicant ever had their license to provide professional services suspended or revoked?

Yes No

VI. FRAUD WARNINGS

Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance containing any

materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent

insurance act, which is a crime and subjects that person to criminal and civil penalties.

(Not applicable in AL, AR, CO, DC, FL, KY, KS, LA, ME, MD, NJ, NM, NY, OH, OK, OR, PA, RI, TN, VA, VT, WA and WV).

APPLICABLE IN AL, AR, DC, LA, MD, NM, RI AND WV

Any person who knowingly (or willfully)* presents a false or fraudulent claim for payment of a loss or benefit or knowingly (or willfully)* presents

false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison. *Applies in MD only.

APPLICABLE IN CO

It is unlawful to knowingly provide false, incomplete, or misleading facts or information to an insurance company for the purpose of defrauding

or attempting to defraud the company. Penalties may include imprisonment, fines, denial of insurance and civil damages. Any insurance

company or agent of an insurance company who knowingly provides false, incomplete, or misleading facts or information to a policyholder or

claimant for the purpose of defrauding or attempting to defraud the policyholder or claimant with regard to a settlement or award payable from

insurance proceeds shall be reported to the Colorado Division of Insurance within the Department of Regulatory Agencies.

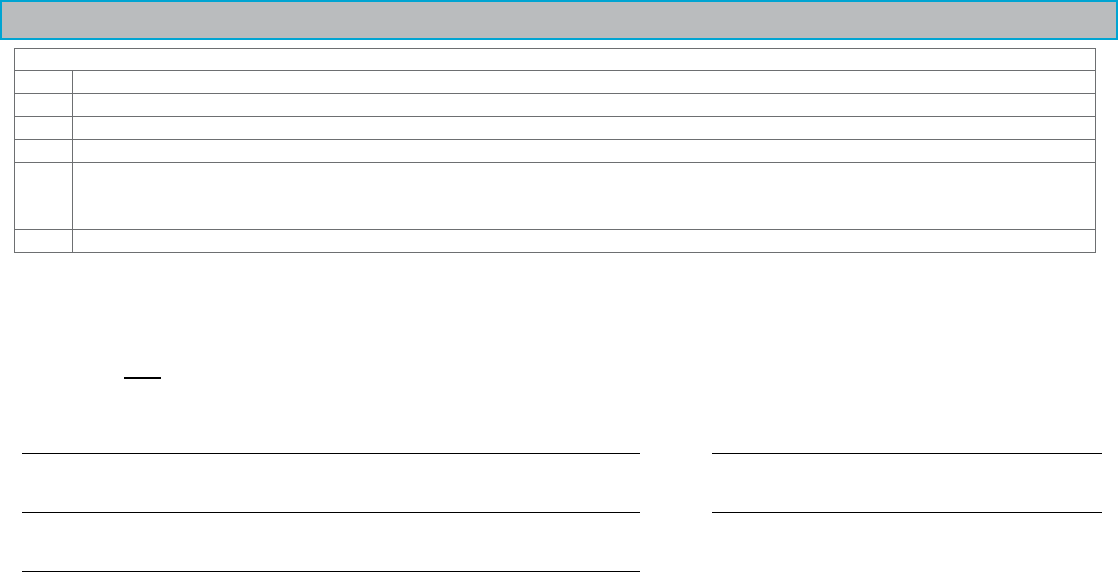

APPLICABLE IN FL AND OK

Any person who knowingly and with intent to injure, defraud, or deceive any insurer files a statement of claim or an application containing any

false, incomplete, or misleading information is guilty of a felony (of the third degree)*. *Applies in FL only.

APPLICABLE IN KS

Any person who, knowingly and with intent to defraud, presents, causes to be presented or prepares with knowledge or belief that it will be

presented to or by an insurer, purported insurer, broker or any agent thereof, any written, electronic, electronic impulse, facsimile, magnetic,

oral, or telephonic communication or statement as part of, or in support of, an application for the issuance of, or the rating of an insurance

policy for personal or commercial insurance, or a claim for payment or other benefit pursuant to an insurance policy for commercial or personal

insurance which such person knows to contain materially false information concerning any fact material thereto; or conceals, for the purpose

of misleading, information concerning any fact material thereto commits a fraudulent insurance act.

APPLICABLE IN KY, NY, OH AND PA

Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of

claim containing any materially false information or conceals for the purpose of misleading, information concerning any fact material thereto

commits a fraudulent insurance act, which is a crime and subjects such person to criminal and civil penalties (not to exceed five thousand dollars

and the stated value of the claim for each such violation)*. *Applies in NY only.

APPLICABLE IN ME, TN, VA AND WA

It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the

company. Penalties (may)* include imprisonment, fines and denial of insurance benefits. *Applies in ME only.

Real Estate Agent / Broker or Property Management Supplemental Application

CS-AS-127 (06/19)

© 2019 CapSpecialty, Inc. All rights reserved.

Page 3 of 3

APPLICABLE IN NJ

Any person who includes any false or misleading information on an application for an insurance policy is subject to criminal and civil penalties.

APPLICABLE IN OR

Any person who knowingly and with intent to defraud or solicit another to defraud the insurer by submitting an application containing a false

statement as to any material fact may be violating state law.

APPLICABLE IN VT

Any person who knowingly presents a false statement in an application for insurance may be guilty of a criminal offense and subject to penalties

under state law.

VII. REPRESENTATIONS and SIGNATURE

By signing this Application, the undersigned represents, on behalf of the Applicant and all proposed insureds, the following:

a.

After conducting due diligence, the statements in the furnished to the Company are accurate and complete;

b.

Those statements furnished to the Company are representations Applicant makes on behalf of all proposed Insureds;

c.

Those representations are a material inducement to the Company to provide a premium proposal;

d.

If a policy is issued, the Company will have issued this Policy in reliance upon those representations;

e.

If there is any material change in the Applicant’s condition or in the Applicant’s activities, services, or answers provided in this Application

that occurs or is discovered between the date this Application is signed and the Effective Date of any policy, if issued, Applicant will

immediately report such material change to the Company in writing; and

f.

The Company reserves the right, upon receipt of such notice, to change or rescind any proposal previously offered by the Company.

As used above, the term “Company” refers to Capitol Specialty Insurance Corporation.

NOTHING IN THIS APPLICATION SHOULD BE INTERPRETED TO MEAN THAT COVERAGE WILL BE OFFERED OR THAT ANY ITEMS REFERENCED IN

QUESTIONS OR ANSWERS TO QUESTIONS WILL BE COVERED EVEN IF COVERAGE IS OFFERED AND BOUND.

This Application must be signed by an authorized partner, officer or other principal of Applicant shown in Section 1 of this Application.

Signature of authorized representative of Applicant

Title

Type / Print name of authorized representative

Date

E-mail address of authorized representative