Background

Paper

81-4

MOBILE

HOME

TAXATION

MOBILE

HOME

TAXATION

Table

of

Contents

I.

Introduction

• • •

1

II.

Overview

of

Mobile

Home

Taxation

in

Nevada.

1

III.

1973-74

Legislative

Interim

Study

of

Mobile

Home

Taxation

•.

••••

1979-80

Interim

Study

of

the

Problems

of

Owners

and

Renters

of

Mobile

Homes • • •

Recent

Trends

in

Mobile

Home

Values

• •

IV.

Recent

Tax

Commission

Actions

Regarding

Mobile

Home

Valuation

in

Nevada

V.

Summary

and

Conclusion

VI.

Suggested

Reading

VII.

Appendix

••••••

2

4

5

7

• •

10

. •

12

14

MOBILE

HOME

TAXATION

I

INTRODUCTION

When

house

or

automobile

trailers

first

made

their

appearance

on

the

American

scene

in

the

late

1920's,

their

taxation

presented

no

new

problems.

They

were

universally

considered

personal

property

and

taxable

as

such

under

most

state

laws

or

local

ordinances

imposing

a

personal

property

tax.

Many

changes

have

taken

place

in

the

last

50

years.

The

vehicle

that

is

towed

from

place

to

place

is

now

called

a

travel

trailer,

while

the

structure

that

is

usually

intended

to

make

only

one

trip,

to

a

residential

site,

is

called

a

mobile

home.

The

mobile

home

has

had

a

dramatic

impact

on

the

housing

market

and

has

raised

new

issues

concerning

taxation.

With

the

soaring

costs

of

conventional

homes,

many

Nevadans

are

seeking

alternate

forms

of

housing

which

can

meet

their

needs

at

more

modest

price

levels.

A

viable

option

for

many

has

been

the

mobile

home.

In

1970,

the

U.S.

Bureau

of

the

Census

counted

20,662

mobile

homes

in

Nevada.

The

department

of

taxation

advises

that

the

current

figure

is

approximately

51,000.

The

1980's

should

see

continued

growth

in

mobile

homes

in

Nevada

-

especially

if

the

MX

system

is

deployed

primarily

in

the

proposed

12-county

Nevada

and

Utah

deployment

region.

If

this

occurs,

the

Air

Force

estimates

that

the

net

increase

in

MX

related

mobile

home

housing

in

Nevada

could

be

over

10,000

mobile

homes

by

1986.

This

growth

in

mobile

homes

and any

changes

in

their

method

of

taxation

or

assessment

could

affect

greatly

state

and

local

revenues.

This

paper

provides

a

brief

review

of

recent

events

relating

to

mobile

home

taxation

in

Nevada.

The

primary

focus

is

mobile

home

valuation

for

tax

purposes.

II

OVERVIEW

OF

MOBILE

HOME

TAXATION

IN

NEVADA

A

mobile

home

in

Nevada

is

subject

to

sales

and

use

taxes

and

to

either

the

ad

valorem

personal

property

or

real

property

tax

depending

on

whether

its

running

gear

is

removed,

it

is

permanently

affixed

to

land

which

is

owned

by

the

owner

of

the

mobile

home

and

other

conditions

are

met.

Mobile

homes

are

also

subject

to

registration

and

licensing

fees

if

they

are

moved

over

public

highways.

1.

Mobile

Home

Depreciation

Schedules

Historically,

mobile

homes

have

been

valued

for

assessment

purposes

in

Nevada

based

on

various

depreciation

schedules.

These

schedules

have

been

modified

to

meet

the

changing

nature,

use,

quality

and

life

expectancy

of

the

homes.

The

schedules

have

also

been

the

subject

of

much

contro-

versy

and

legislative

concern,

especially

in

the

mid

to

late

1970's.

In

the

1971-72

tax

year,

county

assessors

used

a

straight

line

8

percent

depreciation

schedule

based

on

a

10-year

life

with

a 20

percent

residual

value.

Under

this

schedule,

mobile

homes

were

depreciated

8

percent

each

year

for

10

years,

at

which

time

they

reached

"20

percent

good."

Mobile

homes

then

remained

at

"20

percent

good"

for

tax

purposes

for

the

balance

of

their

lives.

A

revision

of

this

schedule

took

place

during

the

1972-73

tax

year

when

market

data

indicated

that

mobile

homes

were

experiencing

a

marked

depreciation

in

their

early

years

and

that

their

service

lives

were

actually

longer

than

10

years.

Sales

data

at

that

time

indicated

that

the

actual

service

life

of

a

typical

mobile

home

was

closer

to

20

years,

and

that

most

mobile

homes

were

selling

at

a

price

well

above

20

percent

of

their

original

retail

price

at

that

age.

The

mobile

home

depreciation

schedule

was

revised

again

during

the

1973-74

tax

year.

Sales

data

from

Nevada's

counties

used

for

the

first

time

and

from

the

"Official

Mobile

Home

Market

Report"

showed

that

mobile

homes

were

depreciating

less

rapidly

in

their

early

years

and

so

the

1972-73

schedule

was

adjusted

to

"curve"

less

sharply

in

those

years.

Since

the

1973-74

tax

year,

the

same

basic

depreciation

schedule

has

been

used

in

Nevada

to

value

mobile

homes

for

personal

property

tax

purposes.*

Mobile

homes

which

are

classified

as

real

property

pursuant

to

the

provisions

of

NRS

361.244

are

valued

by

assessors

according

to

NRS

361.227

as

is

all

other

real

property.

1973-74

Legislative

Interim

Study

of

Mobile

Home

Taxation

Concern

about

issues

pertaining

to

mobile

home

taxation

surfaced

during

the

1973

legislative

session

and

that

legislature

passed

Assembly

Concurrent

Resolution

No.

35

which

directed

the

legislative

commission

to

study

the

methods,

procedures

and

bases

of

taxation

of

mobile

homes.

The

resolution

expressed

the

legislature's

belief

that

such

a

study

was

necessary

to

ensure

that

mobile

homes

be

taxed

*The

appendix

contains

the

Nevada

tax

commission's

current

instructions

for

the

assessment

of

mobile

homes.

2.

fairly

and

to

bring

about

the

maximum

permissible

revenue

for

the

state.

The

legislative

commission's

subcommittee

which

studied

the

matter*

made

the

following

seven

recommendations:

1.

That

ad

valorem

property

taxation

of

mobile

homes

be

retained.

2.

That

all

mobile

homes

be

assessed

and

taxed

as

real

property

at

the

option

of

the

owner,

but

the

taxes

so

assessed

should

not

become

a

lien

on

land

owned

by

any-

one

other

than

the

mobile

home

owner.

3.

That

mobile

home

owners

be

granted

similar

benefits

in

the

quarterly

payment

of

property

taxes

and

a

redemption

period

for

delinquent

taxes

as

are

enjoyed

by

other

homeowners.

The

increasing

permanence

of

mobile

homes

has

become

such

that

differentiation

of

the

basis

of

mobility

has

lost

much

of

its

vitality.

4.

That

stratified

depreciation

for

mobile

homes

be

studied

now

with

the

object

of

implementation

in

the

near

future.

5.

That

the

city-county

relief

tax

generated

by

mobile

homes

be

returned

to

the

county

of

placement

if

different

from

the

county

of

sale

to

help

finance

community

services.

6.

That

a

5-day

trip

permit

issued

by

the

county

assessor

replace

the

current

license

plate

to

close

off

present

opportunities

for

"skipping."

7.

That

the

Nevada

tax

commission

"computerize"

its

valuation

program

for

mobile

homes.

Computerization

is

now

warranted

by

the

rapid

growth

in

Nevada's

mobile

home

population.

*The

final

report

of

the

subcommittee

is

LCB

Bulletin

No.

119.

This

bulletin

provides

a

comprehensive

discussion

of

mobile

home

taxation

in

Nevada

and

elsewhere

and

covers

such

topics

as

valuation,

methods

of

mobile

home

taxation,

bases

of

mobile

home

taxation

and

basic

policy

considera-

tions

in

mobile

home

taxation.

3.

Most

of

these

recommendations

have

been

carried

out:

(1)

The

ad

valorem

property

taxation

of

mobile

homes

has

been

retained;

(2)

A.B.

211

passed

by

the

1979

legisla-

ture

permits

certain

permanently

affixed

mobile

homes

to

be

assessed

and

taxed

as

real

property;

(3)

In

counties

having

populations

over

100,000

mobile

home

owners

may

pay

their

taxes

quarterly

(see

NRS

361.483)

and

mobile

homes

constituting

real

property

are

provided

a

2-year

redemption

period

prior

to

the

sale

for

delinquent

taxes

(see

NRS

361.565),

and;

(4)

A

trip

permit

system

has

been

put

into

effect

to

close

off

opportunities

for

"skipping"

(see

NRS

489.601).

Conversely,

however,

the

Nevada

tax

commission

has

never

computerized

a

valuation

system

for

mobile

homes.

According

to

the

department

of

taxation,

$40,000

was

appropriated

to

the

1975-77

fiscal

year

department

budget.

This

money

was

not

used

and

it

reverted

to

the

general

fund

in

1978.

Moreover,

the

1975

legislature,

through

A.B.

224

(chapter

587,

Statutes

of

Nevada

1975)

required

the

Nevada

tax

commission

to

classify

all

mobile

homes

in

the

state

on

the

basis

of

those

factors

which

most

closely

determine

their

service

lives

and

fix

and

establish

their

value

for

assessment

purposes.

As

discussed

later,

the

tax

commission

took

no

action

to

modify

the

mobile

home

depreciation

schedule

until

December,

1980.

1979-80

Interim

Study

of

the

Problems

of

Owners

and

Renters

of

Mobile

Homes

Mobile

home

taxation

issues

resurfaced

during

a

legislative

commission

subcommittee

study

of

the

problems

of

owners

and

renters

of

mobile

homes

during

the

recent

legislative

interim.

The

interim

report

recommends

that

mobile

homes

treated

as

real

property

be

exempt

from

sales

tax

and

that

the

depre-

ciation

schedule

for

mobile

homes

be

revised.

In

referring

to

the

existing

depreciation

schedule,

the

subcommittee's

report

says,

in

part:

According

to

several

witnesses,

the tax

commission's

existing

mobile

home

depreciation

schedule

is

outdated

and

based

on

faulty

assumptions

concerning

the

time

frame

within

which

mobile

homes

depreciate

in

value

and

the

rate

at

which

they

depreciate.

Presentations

to

the

subcommittee

indicate

that

certain

mobile

homes

actually

appreciate

in

value.

Some

persons

appearing

before

the

subcommittee

pointed

out

that

new

mobile

home

tax

appraisal

guides,

such

as

the

National

Automobile

Dealers

Association's

"Mobile

Home

Appraisal

Guide,"

could

be

of

use

to

the tax

commission

in

revising

its

mobile

home

depreciation

schedule

* * *

4.

* * *No

matter

what

guide

is

used,

the

subcommittee

believes

that

the

department

of

taxation's

mobile

horne

depreciation

schedule

needs

to

be

updated

* *

*.

* *

*A

revised

mobile

horne

depreciation

schedule

will

help

dispel

the

view

that

mobile

horne

owners

are

not

"paying

their

fair

share"

and

also

provide

for

more

equitable

taxation

of

all

property

owners

during

this

time

of

concern

about

equitable

and

appropriate

tax

levels.*

III

RECENT

TRENDS

IN

MOBILE

HOME

VALUES

Recent

studies

show

that

contrary

to

most

depreciation

schedules

in

use

for

tax

purposes,

mobile

homes

appreciate

in

value

in

most

states.**

The

degree

of

appreciation

appears

to

be

related

to

several

factors

including

age,

size,

location,

upkeep

and

main-

tenance,

original

quality

of

the

horne,

supply

and

demand

for

housing

within

a

particular

area

and

turn-over

rate.

A

1979

study

by

Foremost

Insurance

Company

found

that,

nationwide,

double-wide

mobile

homes

appreciate

between

4

and

10

percent

per

year.

A

similar

study

by

the

Arizona

Manufactured

Housing

Association

indicates

that

the

average

mobile

horne

appreciates

about

6

percent

per

year,

while

newer

homes

increase

more

than

12

percent.***

The

Foremost

study

said

that

the

level

of

appreciation

is

also

affected

to

some

degree

by

geographic

area

within

the

United

States

which

Foremost

breaks

down

into:

Type

1 -

Rapid

Appreciation,

Type

2 -

Steady

Increase,

and

Type

3 -

Depreciation.

States

with

"rapid

appreciation"

include

*See

pages

16

and

17

of

LCB

Bulletin

No.

81-9,

The

Problems

of

Owners

and

Renters

of

Mobile

Homes,

which

was

prepared

pursuant

to

A.C.R.

3

of

the

1979

legislative

session.

**See

"Old

Myth

Laid

to

Rest:

Mobile

Homes

Appreciate

in

Value."

Manufactured

Housing

Dealer,

(January

1980)

and

"States

Reconsider

Mobile

Horne

Taxation."

The

Wall

Street

Journal,

(November

26,

1980).

***See

the

Wall

Street

Journal

article

referenced

in

the

previous

note.

5.

Alaska,

Arizona,

California,

Florida,

New

Jersey,

Oregon

and

Washington.

California's

rate

is

extremely

high,

10-15

percent

per

year,

no

matter

the

size

of

the

home.

Colorado,

Idaho,

Montana,

Nevada,

New

Mexico,

and

Utah

are

classified

by

the

Foremost

study

as

nsteady

increase"

states.

In

certain

states

in

the

east

and

south,

such

as

Alabama,

Delaware,

Georgia,

Maine,

North

Carolina,

Vermont

and

others,

mobile

homes

still

depreciate,

according

to

the

Foremost

study.

Significant

factors

determining

the

rate

of

appreciation

of

a

mobile

home

are

availability

of

park

spaces

and

the

degree

to

which

restrictive

zoning

laws

exist.

There

is

a

definite

positive

correlation,

the

Fore-

most

study

says,

between

park

space

availability

and

increasing

mobile

home

values.*

California

recently

modified

its

laws

and

regulations

affect-

ing

the

taxation

and

assessment

of

mobile

homes

to

reflect

the

changing

value

of

mobile

homes.

For

many

years,

mobile

homes

in

California

were

subject

to

the

state's

vehicle

licensing

fee

law,

which

is

in

lieu

of

local

property

taxes.

During

the

1979

portion

of

its

1979-80

regular

session,

the

California

legislature

enacted

two

bills,

A.B.

887

and

S.B.

1004

(chapters

1160

and

1180

of

the

statutes

of

1979)

which

subjected

certain

mobile

homes

to

property

taxation.

Under

the

laws,

all

new

mobile

homes

sold

after

July

1,

1980,

are

subject

to

property

tax.

Older

homes

are

still

licensed

and

are

only

required

to

pay

in

lieu

fees.

If

pay-

payment

of

those

fees

becomes

delinquent

for

more

than

120

days,

however,

the

homes

then

go

on

the

property

tax

roll.

Moreover,

all

mobile

homes

that

are

permanently

affixed

to

real

property

become

subject

to

property

taxation

as

real

property

regardless

of

the

date

of

sale.

California's

new

mobile

home

tax

laws

also

provide

sales

tax

reductions

and

exemptions

for

the

sale

of

mobile

homes.

Concomitant

with

California's

legislative

change

to

its

mobile

home

taxation

laws

was

the

development

by

the

California

State

Board

of

Equalization

of

new

mobile

home

assessment

standards.

These

standards

address

bases

of

cost

and

a

classification

system

which

is

designed

to

coincide

with

California's

single-family

residential

quality

class

system.

Under

the

new

mobile

home

valuation

system,

the

value

of

each

mobile

home

must

be

determined

by

an

actual

physical

inspection

of

the

home.

Factors

*The

shortage

of

mobile

home

spaces

in

certain

mobile

home

parks

in

Nevada

and

restrictive

zoning

ordinances

are

addressed

in

LCB

Bulletin

No.

81-9,

The

Problems

of

Owners

and

Renters

of

Mobile

Homes.

6.

considered

include

square

foot

replacement

cost,

individual

components,

accessories

and

"upgrades"

and

the

condition

of

the

horne.

California's

new

appraisal

guide

contains

a

depreciation

schedule,

which

declines

to

44

percent

good

after

25

years

but

cautions:

The

depreciation

table

in

this

manual

is

suggested

as

a

guide

to

appraisers.

The

percentage

rates

are

appli-

cable

to

the

replacement

cost

estimates

and

no

minimum

percent

good

is

intended.

They

are

averages

based

upon

an

analysis

of

actual

market

purchase

price

infor-

mation,

and

revisions

to

the

table

may

be

necessary

as

more

market

data

becomes

available.

The

percentages

only

apply

to

mobile

homes

in

average

condition.

A

separate

adjustment

should

be

considered

for

deferred

maintenance

(cost

to

cure).

It

is

strongly

suggested

that

the

appraiser

carefully

evaluate

the

effective

age

of

the

mobile

horne.

This

is

a

critical

adjustment

that

will

dramatically

affect

the

cost

approach.

Investigation

has

shown

that

the

condition

of

the

mobile

horne

may

have

a

greater

influence

on

value

than

age.*

IV

RECENT

TAX

COMMISSION ACTIONS

REGARDING

MOBILE

HOME

VALUATION

IN

NEVADA

According

to

an

October

6,

1980

report

by

the

division

of

assessment

standards,

the

department

of

taxation

took

several

actions

from

1975

to

1978

in

response

to

the

passage

of

A.B.

224

of

the

1975

legislative

session

(see

NRS

361.325(1)

(b))

which

requires

it

to

"classify

all

mobile

homes

on

the

basis

of

those

factors

which

most

closely

determine

their

service

lives

for

assessment

purposes."

The

report,

"DOAS

Report

on

Mobile

Homes

for

the

Nevada

Tax

Commission,

October

6,

1980,"

says

certain

of

those

actions

included

the

fOllowing:

*See

page

20

of

the

California

State

Board

of

Equalization's

publication

entitled

Mobile

Homes.

7.

Obtained

* * *

(information)

from

different

firms

or

agencies

involved

in

appraisal

work

outlining

their

methods

of

mobile

homes

appraisal

and

classification

methods

used.

Obtained

* * *

(information)

from

mobile

home

builders

con-

cerning

"quality

grade"

of

their

homes

by

model

names.

Obtained

* * *

(information)

from

mobile

home

dealers

throughout

the

state

concerning

suggested

appraisal

methods

for

mobile

homes

and

possible

methods

of

classi-

fication.

Obtained

* *

*(information)

from

many

states

outlining

their

methods

presently

under

use

to

appraise

mobile

homes,

and

specific

classification

systems

utilized.

Investigated

alternative

methods

of

obtaining

suggested

retail

price

of

mobile

homes.

Investigated

a

stratified

or

classification

system

of

depreciation

schedules

based

upon

the

Marshall

Swift

classification

system.

Investigated

the

National

Automobile

Dealers

Association

(NADA)

system

of

valuing

mobile

homes.

Polled

county

assessors

on

their

reactions

to

NADA

and

obtained

appraisal

comparisons

between

the

NADA

system

and

the

depreciation

schedule

originally

adopted

in

1973-74,

and

between

actual

market

sales.

Analyzed

350

sales

from

several

counties

in

a

study

requested

by

the

Nevada

tax

commission

to

compare

differences

between

the

present

depreciation

schedule,

the

NADA

system,

and

actual

market

sales.

The

NADA

system

was

recommended

tentatively

for

approval

by

the

department

of

taxation.*

In

late

1978,

the

department

presented

its

findings

on

the

National

Automobile

Dealers

Association's

stratified

system

for

valuing

mobile

homes

to

the

Nevada

tax

commission.

According

to

correspondence

from

the

department

of

taxation,

The

Nevada

tax

commission

did

not

adopt

the

system

because

of

the

perceived

cost

to

the

counties.**

*See

pages

4

and

5

of

the

DOAS

Report

on

Mobile

Homes

for

the

Nevada

tax

commission,

October

6,

1980.

**See

memorandum

dated

December

22,

1980,

from

Jeanne

Hannafin,

deputy

executive

director

of

the

department

of

taxation,

to

Donald

A.

Rhodes,

chief

deputy

research

director.

The

subject

of

the

memorandum

is

"Valuation

of

Mobile

Homes

for

Taxation

Purposes".

8 •

The

mobile

home

valuation

matter

was

once

again

considered

by

the

Nevada

tax

commission

at

an

October

6,

1980

meeting.

At

that

time

the

department

of

taxation's

division

of

assessment

standards

submitted

a

series

of

valuation

methods

which

it

believed

could

be

used

to

achieve

the

legislative

mandate

contained

in

A.B.

224

of

the

1975

legislative

session

(see

NRS

361.325(1)

(b))

and

to

provide

a

realistic

valuation

of

all

mobile

homes

in

Nevada.*

According

to

correspondence

from

the

department

of

taxation,

the

commission

was

impressed

with

a

proposal

based

on

the

California

system

but

felt

that

it

would

place

expanded

responsibility

on

the

county

assessors

by

requiring

physical

inspection

of

all

mobile

homes.

Accordingly,

it

directed

staff

to

meet

with

the

assessors

prior

to

taking

any

action

and

also

directed

that

additional

comments

and

advice

be

solicited

from

the

general

public.

A

meeting

was

held

with

the

assessors

in

November

and

a

public

hearing

was

conducted

on

December

2,

1980.

The

assessors

expressed

several

concerns

about

the

proposed

system,

including

the

cost

and

the

need

for

additional

man-

power

to

carry

it

out.

The

department

advises,

however,

that

there

was

a

consensus

among

the

assessors

that

the

new

system

would

provide

an

equitable

and

accurate

method

for

the

valuation

of

mobile

homes.

Certain

members

of

the

public,

the

department

of

taxation

says,

expressed

the

opinion

that

the

proposed

mobile

home

valuation

system

would

cause

unfair

taxation

of

mobile

homes

and

exacerbate

existing

inequities

in

the tax

laws

and

regulations.

According

to

the

department,

the

following

are

the

major

concerns

expressed

by

the

public

about

mobile

home

taxation

in

Nevada:

Mobile

homes,

as

personal

property,

are

subject

to

sales

tax,

both

upon

original

purchase

and,

if

through

a

broker

or

dealer,

on

resales.

Accessories

or

appurtenances

such

as

skirting

or

steps,

while

required

to

be

valued

for

property

tax

purposes,

are

often

reduced

to

scrap

value

upon

any

relocation

of

the

mobile

home.

*The

DOAS

Report,

referenced

earlier,

discusses

these

approaches

which

include

"non-physical

approach

methods,"

such

as

the

system

currently

in

use

and

various

"physical

appraisal

methods"

including

the

NADA

Complete

Appraisal

System,

and

the

Marco,

Marshall

Swift

and

California

systems.

9.

Services

received

from

local

governments

by

mobile

home

residents

are

not

equal

to

those

received

by

the

owner

of

a

conventional

home,

(i.e.:

individual

street

maintenance,

street

lighting,

etc.)*

After

weighing

these

comments

and

presentations,

the

Nevada

tax

commission

decided,

at

the

December

2,

1980,

meeting,

to

adopt

the

department's

proposal

which

is

similar

to

California's

mobile

home

classification

system.

The

tax

commission

determined

that

the

new

system

should

be

put

into

effect

on

July

1,

1982,

for

those

mobile

homes

on

the

unsecured

roll

and

on

July

1,

1983,

for

those

on

the

secured

roll.

These

dates

were

chosen,

the

department

of

taxation

advises,

to

provide

the

county

assessors

18

months

to

prepare

the

necessary

computer

programs

and

budgets

and

to

hire

the

necessary

personnel

to

make

the

physical

inspec-

tions

of

mobile

homes.

According

to

a

December

22

memorandum

from

the

department

of

taxation

to

the

research

division:

The

new

system

provides

for

valuation

of

mobile

homes

based

on

the

following

factors:

(a)

Cost

per

square

foot

(b)

Quality

(c)

Condition

(d)

Accessories*

* *

* *

*The

new

method

of

appraisal

will

substantially

increase

the

assessments

of

mobile

homes,

particularly

older

models.

It

will

create

a

more

equitable

and

uniform

method

of

assessment

which

will

shift

some

of

the tax

burden

presently

borne

by

"stick-housing"

to

mobile

home

owners.

(See

December

22,

1980,

memorandum

referenced

earlier.)

v

SUMMARY

AND

CONCLUSION

The

ideal

tax

system

strives

towards

the

goal

of

horizontal

equity:

the

property

tax

should

affect

equally

all

those

who

own

similar

kinds

of

property

of

the

same

value.

There

are

disagreements

over

the

similarities

and

dissimilarities

between

mobile

and

conventional

homes.

Those

disagreements

*See

December

5,

1980,

letter

from

Roy

E.

Nixon,

executive

director

of

the

department

of

taxation

to

Andrew

P.

Grose,

research

director.

10.

are

becoming

less

pronounced,

however,

with

the

changing

appearance,

construction

and

expected

life

of

mobile

homes.

Mobile

homes

must

be

built

in

accordance

with

a

federal

standard

which

is

substantially

equivalent

to

the

codes

adhered

to

by

local

jurisdictions

for

site

built

housing.*

In

Nevada,

although

certain

mobile

homes

may

be

classified

as

real

property,

most

mobile

homes

are

classified

as

personal

property

and

conventional

homes

are

classified

as

real

property.

Both

are

assessed

and

taxed

at

a

uniform

and

equal

rate.

One

primary

difference,

however,

is

the

depreciation

schedule

used

to

value

mobile

homes

and

this

difference

has

led

to

criticisms

about

tax

equity

and

mobile

homes

not

contributing

their

fair

share

of

taxes

to

the

governments

of

the

localities

in

which

they

are

sited.

The

effects

of

these

criticisms,

it

is

said,

include

the

imposition

of

restrictive

zoning

against

mobile

homes

and,

to

some

extent,

the

dampening

of

the

moti-

vation

of

certain

lenders

to

provide

long-term

financing

for

mobile

home

purchases.

The

Nevada

legislature

addressed

the

mobile

home

valuation

system

in

1975

in

NRS

361.325(1)

(b)

which

requires

the

Nevada

tax

commission

to

classify

mobile

homes

on

the

basis

of

those

factors

which

most

closely

determine

their

service

lives

and

fix

and

establish

their

valuation

for

assessment

purposes.

The

Nevada

tax

commission

has

used

the

same

basic

mobile

home

depreciation

schedule

and

classification

system

since

the

early

1970's.

At

its

December

2,

1980,

meeting

it

determined

that

the

system

and

schedule

should

be

modified

beginning

July

1,

1982.

*See

the

National

Mobile

Home

Construction

and

Safety

Standards

Act

of

1974,

42

USCA

5041

et

~.

and

the

regulations

known

as

the

Mobile

Home

Construction

and

Safety

Standards,

24

CFR

3280

et

seq.

of

the

Department

of

Housing

and

Urban

Development.

11.

VI

SUGGESTED READING*

Bulletin

No.

145,

Instructions

For

Assessment

of

Land,

Live-

stock,

Merchandise

Stock,

Mobile

Homes,

Campers,

Oil

and

Gas

Leases,

Possessory

Interest.

Nevada

Tax

Commission,

(July

1,

1980).

"California's

Ad

Valorem

Tax

on

Mobilehomes."

Speech

prepared

by

Richard

Nevins,

Fourth

District

Member

California

State

Board

of

Equalization

for

delivery

at

September

22,

1980,

Western

States

Association

of

Tax

Administrators'

Conference,

Salt

Lake

City,

Utah.

December

22,

1980,

memorandum

from

Jeanne

Hannafin,

deputy

executive

director,

Nevada

department

of

taxation

to

Donald

A.

Rhodes,

chief

deputy

research

director,

subject:

"Valua-

tion

of

Mobile

Homes

for

Taxation

Purposes".

DOAS

Report

on

Mobile

Homes

For

The

Nevada

Tax

Commission,

October

6,

1980.

January

23,

1980,

memorandum

from

Jeanne

B.

Hannafin,

deputy

executive

director,

Nevada

department

of

taxation

to

Donald

A.

Rhodes,

chief

deputy

research

director,

subject:

"Response

to

Recommendations

Proposed

in

Bulletin

No.

119

Pertaining

to

Mobile

Horne

Taxation".

LCB

Bulletin

No.

119,

Mobile

Horne

Taxation,

(September

1974).

LCB

Bulletin

No.

81-9,

The

Problems

of

Owners

and

Renters

of

Mobile

Homes,

(August

1980).

Letter

dated

December

5,

1980,

from

Roy

E.

Nickson,

executive

director,

department

of

taxation

to

Andrew

P.

Grose,

research

director.

Letter

dated

September

11,

1980,

from

Roy

E.

Nickson,

executive

director,

department

of

taxation

to

Andrew

P.

Grose,

research

director.

*These

and

other

publications

pertaining

to

rent

control

are

available

for

review

in

the

research

division's

library.

Also

available

are

copies

of

relevant

state

statutes.

12.

Malnight,

John.

"Old

Myth

Laid

to

Rest:

Mobile

homes

appreciate

in

value."

Manufactured

Housing

Dealer,

(January

1980).

March

18,

1980,

memorandum

to

the

chairman

and

members

of

the

legislative

commission's

subcommittee

to

study

the

problems

of

owners

and

renters

of

mobile

homes

from

Donald

A.

Rhodes,

chief

deputy

research

director,

subject:

"Responses

to

staff

survey

letter

inquiring

if

mobile

homes

are

taxed

as

real

property

and

excluded

from

sales

tax."

Memorandum

from

Chuck

Chinnock,

supervisor,

division

of

assessment

standards

to

Nevada

tax

commission,

Subject:

"Department

of

Taxation's

Position

on

Mobile

Home

Taxation--

Classification

and

Consideration

of

Locational

Value."

Mobile

Home

Assessment

Workshop,

Assessment

Standards

Division,

California

State

Board

of

Equalization,

(November

3,

1980).

Mobile

Homes,

California

State

Board

of

Equalization.

A.H.

531.35,

3-1-81.

Mobile

Home

Property

Taxation

Laws

Enacted

Prior

to

1

July

1980

at

the

1979-80

regular

session

of

the

Legislature

of

the

State

of

California.

Mrozek,

Donald

Lee.

"The

Search

For

an

Equitable

Approach

to

Mobile

Home

Taxation",

De

Paul

Law

Review,

(Vol.

XXI

1972),

1008-1035.

States

Reconsider

Mobile

Home

Taxation,

The

Wall

Street

Journal,

(November

26,

1980).

"Taxation

of

Mobile

Homes"

The

Air

Force

Law

Review,

(Spring

1977)

240-249.

"Taxation

of

Mobilehomes

on

and

after

July

1,

1980,"

Mobile

Home

Information

Handout,

California

State

Board

of

Equalization

(8-80).

Thacher,

David

0.,

Ronald

L.

Shane

and

Michael

E.

Wetzstein.

"Nevada

Mobile

Home

Taxation:

Proposed

Changes."

Nevada

Review

of

Business

and

Economics,

(Fall

1978),

8-10.

13.

VII

APPENDIX

ASSESSMENT

OF

MOBILE

HOMES

1980-1981

In

accordance

with

NRS

361.325

on

or

before

the

1st

Monday

of

June,

1980

the

Nevada

Tax

Commission

fixed

the

following

method

of

determining

the

assessed

value

of

mobile

homes

and

campers

for

the

fiscal

year

1980-1981.

(Values

from

this

bulletin

apply

only

to

mobile

homes

that

are

considered

per-

sonal

property.)

NRS

361.561

1.

"Camper-shell"

means

a

covered

canopy

mounted

on

a

motor

vehicle,

and

which

is

not

equipped

with

permanent

facilities

for

the

preparation

or

storage

of

food

or

for

sleeping

purposes.

2.

"Mobile

Home"

means

a

vehicular

structure,

built

on

a

chassis

or

frame,

which

is

designed

to

be

used

with

or

without

a

permanent

foundation

and

is

capable

of

being

drawn

by

a

motor

vehicle.

It

may

be

used

as

a

dwelling

when

connected

to

utilities

or

may

be

used

permanently

or

temporarily

for

the

advertising,

sales,

display

or

promotion

of

merchandise

or

services.

3.

"Slide-in

Camper"

means

a

portable

unit

designed

to

be

loaded

and

unloaded

from

the

bed

of

a

pickup

truck,

and

so

constructed

as

to

provide

temporary

living

quarters

for

travel,

camping

or

recreational

use.

"Slide-in

camper"

does

not

include

a

covered

canopy

mounted

on

a

motor

vehicle

and

which

is

not

equipped

with

permanent

facilities

for

the

preparation

or

storage

of

food

or

for

sleeping

purposes.

4.

Those

units

identified

as

"chassis

camper,"

"mini

motor

home,"

"motor

home,"

"utility

trailer"

and

"van

conversion"

in

Chapter

482

of

NRS

and

any

other

vehicle

required

to

be

registered

with

the

department

of

motor

vehicles

are

subject

to

the

personal

property

tax

unless

registered

and

taxed

pursuant

to

Chapter

371

of

NRS.

Such

unregistered

units

shall

be

taxed

as

any

other

personal

property.

New

mobile

homes

and

campers

shall

be

valued

for

assessment

purposes

at

35

percent

of

fair

retail

delivered

price.

14.

NRS

361.244

-

Mobile

homes

that

constitute

real

property:

1.

A

mobile

home,

as

defined

in

NRS

361.561,

constitutes

real

property

if

the

running

gear

is

removed

and:

(a)

It

becomes,

on

or

after

July

1,

1979,

permanently

affixed

to

land

which

is

owned

by

the

owner

of

the

mobile

home;

or

(b)

It

became

so

affixed

before

July

1,

1979,

and

the

owner

files

with

the

county

assessor

by

May

1,

1980,

a

statement

declaring

his

desire

to

have

the

mobile

home

classified

as

real

property.

If

a

mobile

home

is

classified

as

real

property,

it

shall

be

valued

by

the

assessor

according

to

NRS

361.227

as

all

other

real

property.

There

will

be

no

requirement

for

the

assessor

to

issue

a

decal

as

provided

in

NRS

361.5643.

In

the

event

the

personal

property

taxes

are

paid

for

a

fiscal

year

and

later

in

that

same

fiscal

year,

the

unit's

running

gear

is

removed,

and

the

unit

is

affixed

to

land

owned

by

the

owner

of

the

unit,

thus

qualifying

the

unit

as

real

property,

the

unit

should

not

be

placed

on

the

secured

roll

until

the

following

fiscal

year.

15.

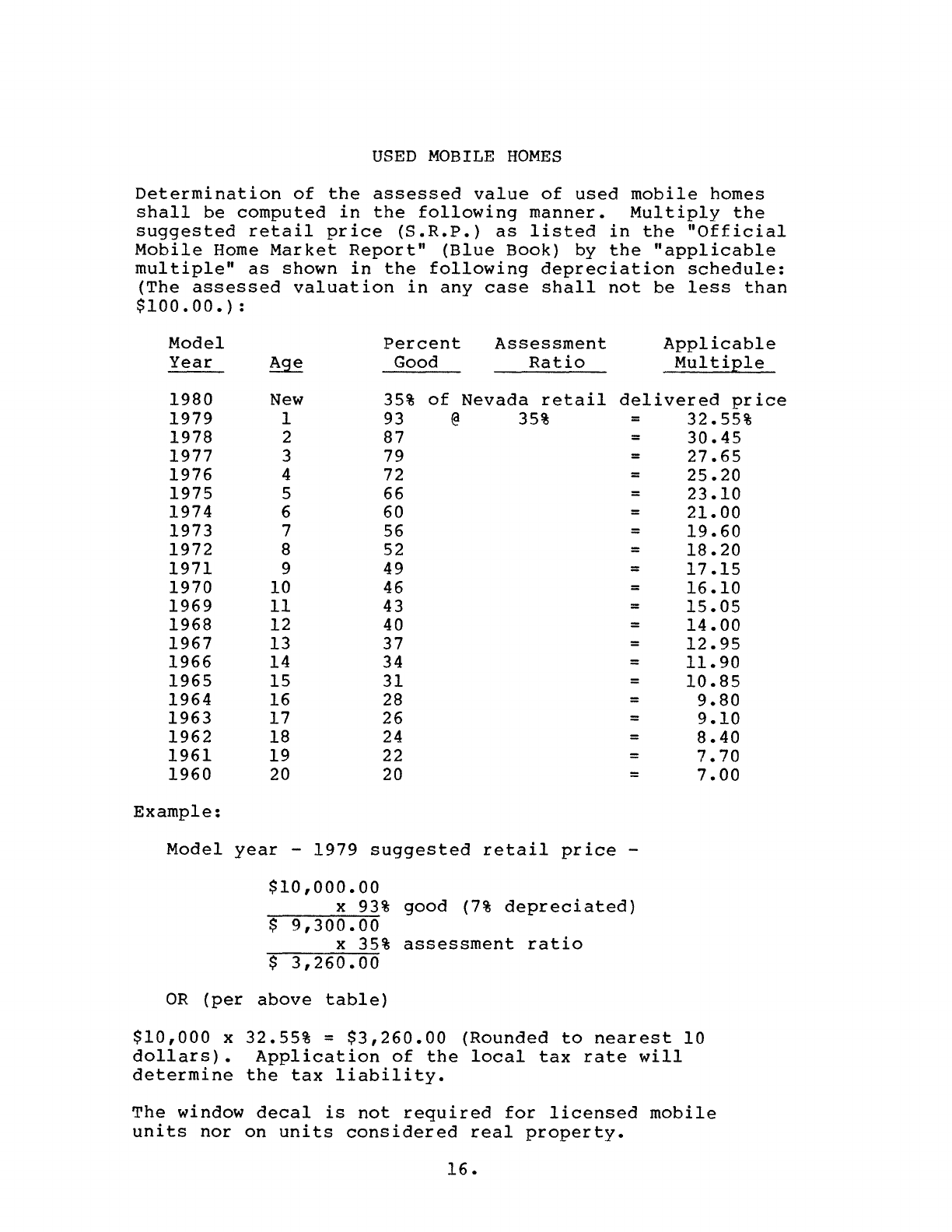

USED

MOBILE

HOMES

Determination

of

the

assessed

value

of

used

mobile

homes

shall

be

computed

in

the

following

manner.

Multiply

the

suggested

retail

price

(S.R.P.)

as

listed

in

the

"Official

Mobile

Horne

Market

Report"

(Blue

Book)

by

the

"applicable

multiple"

as

shown

in

the

following

depreciation

schedule:

(The

assessed

valuation

in

any

case

shall

not

be

less

than

$100.00.):

Model

Percent

Assessment

Applicable

Year

Age

Good

Ratio

Multiple

1980

New

35%

of

Nevada

retail

delivered

price

1979

1

93

@

35%

=

1978

2

87

=

1977

3

79

=

1976

4

72

=

1975

5

66

=

1974

6

60

=

1973

7

56

=

1972

8

52

=

1971

9

49

=

1970

10

46

=

1969

11

43

=

1968

12

40

=

1967

13

37

=

1966

14

34

=

1965

15

31

=

1964

16

28

=

1963

17

26

=

1962

18

24

=

1961

19

22

=

1960

20 20

=

Example:

Model

year

-

1979

suggested

retail

price

-

$10,000.00

~~~~x~9~3%

good

(7%

depreciated)

$

9,300.00

x

35%

assessment

ratio

~~~~-=-=-

$

3,260.00

OR

(per

above

table)

32.55%

30.45

27.65

25.20

23.10

21.00

19.60

18.20

17.15

16.10

15.05

14.00

12.95

11.90

10.85

9.80

9.10

8.40

7.70

7.00

$10,000

x

32.55%

=

$3,260.00

(Rounded

to

nearest

10

dollars).

Application

of

the

local

tax

rate

will

determine

the

tax

liability.

The

window

decal

is

not

required

for

licensed

mobile

units

nor

on

units

considered

real

property.

16.