1

© 2010 School of Government. e University of North Carolina at Chapel Hill

NO. 157 | SEPTEMBER 2010PROPERTY TAX BULLETIN

Property Tax Collection on Mobile Homes

Christopher B. McLaughlin

Mobile homes—or manufactured homes, trailers, single-wides, or double-wides, as they are

variously known—are constant problems for tax ocials. ese problems often arise during

the listing process, because mobile homes can be reclassied from real property to personal

property and back again. Problems also arise during the collection process, in part because

mobile homes and their owners sometimes disappear from the taxing unit without notice. is

bulletin is intended to reduce the confusion related to this type of property for tax collectors

and taxpayers alike.

Although the terms “manufactured home” and “mobile home” are often used interchangeably,

they carry distinct technical meanings under the Machinery Act. Mobile home is dened as

any type of structure that can be moved by attaching wheels to its frame and that is used as an

oce, dwelling, or similar “place of habitation.”

1

A manufactured home is a mobile home that sat-

ises additional criteria: it must be at least 8 feet wide and 40 feet long when in “traveling mode,”

is 320 or more square feet when erected on site, is built on a permanent chassis, and is to be used

as a dwelling.

2

Neither denition turns on whether the structure is a single- or double-wide.

All mobile homes—and therefore all manufactured homes—are subject to the moving permit

requirement described in Question 3. But only manufactured homes—that is, mobile homes of a

certain size that are to be used as residences and not oces—can be listed as real property, and

only if they satisfy the requirements described in Question 1.

1. Should manufactured homes be listed as real property or personal property?

It depends on the home’s physical characteristics, use, and location. A manufactured home must

be listed as real property if it satises the criteria included in Section 105-273(13) of the North

Carolina General Statutes (hereinafter G.S.), the Machinery Act’s denition of real property:

a. It is a residential structure;

b. It has the moving hitch, wheels, and axles removed;

Christopher B. McLaughlin is a School of Government faculty member who specializes in local taxation.

McLaughlin is writing a book to update and replace William A. Campbell’s seminal work, Property Tax

Collection in North Carolina, the most recent edition of which was published more than a decade ago.

is bulletin represents one chapter of the new publication.

1. N.C. G. S. (hereinafter G.S.) § 105-316.7. Presumably, the only type of movable structure that

would not constitute a mobile home would be one used for storage and not “habitation.”

2. G.S. 105-273(13) adopts the denition of manufactured home used in G.S. 143-143.9(6), one of the

statutes concerning manufactured home warranties.

2 Property Tax Bulletin

© 2010 School of Government. e University of North Carolina at Chapel Hill

2 Property Tax Bulletin

c. It is placed on a permanent foundation; and

d. It is sited on land owned by the owner of the manufactured home or on land in which the

owner of the manufactured home has a leasehold interest with a term of at least 20 years

and the lease provides for the disposition of the home upon the lease’s termination.

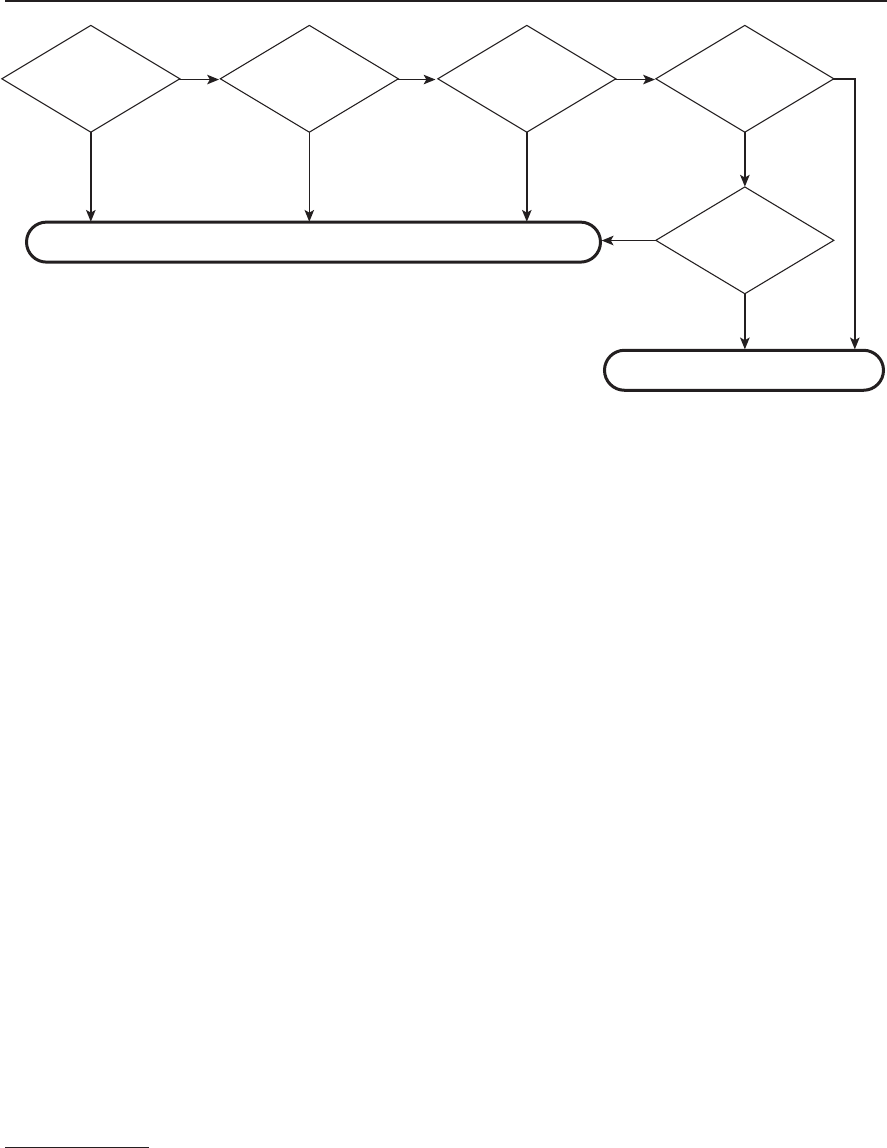

e four requirements are presented in visual format in gure 1.

Before these requirements were claried in 2001, many counties listed all double-wide manu-

factured homes as leasehold improvements, a type of real property, even if they did not satisfy

all of the requirements in G.S. 105-273(13).

3

Since the 2001 changes, the fact that a manufac-

tured home is a single-wide or a double-wide should have no bearing on whether it is listed as

real or personal property. If all four requirements are met, the manufactured home must be

listed as real property. If the manufactured home fails to meet even one of the requirements, it

must be listed as personal property.

To be a residential structure, the manufactured home must be intended to be used as a place

for someone to live, not just a place for someone to conduct business. e home need not be

someone’s permanent residence nor must it be the owner’s residence. For example, a manufac-

tured home owned by the owner of a mobile home park and rented to families on a monthly

basis could qualify as real property. e fact that business might be conducted out of the home

would not disqualify it so long as it was also used for residential purposes. For example, if Tom

Tarheel lives in a manufactured home but also runs his landscaping business from the home,

that home could still qualify as real property.

e requirement that the home’s hitch, wheels, and axles be removed is self-explanatory.

But the same cannot be said for the requirement that the home be on a “permanent founda-

tion.” Exactly what does this mean? e statute provides no explanation, but the Department

of Revenue advises that, to be “permanent,” a manufactured home’s foundation must satisfy the

3. S.L. 2001-506 eliminated the requirement that a manufactured home be “multi-section” to qualify

as real property and claried that all manufactured homes that failed to satisfy all of the requirements in

G.S. 105-273(13) must be listed as personal property.

Figure 1. Classication of manufactured homes as real or personal property ( G.S. 105-273(13))

YES

NO

NO NO NO

YES

YES YES YES

Personal Property

NO

Real Property

Residential

structure?

Hitch,

wheels, and axles

removed?

Permanent

foundation?

On land

owned by owner of

mobile home?

20+

year lease with

disposition terms?

Property Tax Collection on Mobile Homes 3

© 2010 School of Government. e University of North Carolina at Chapel Hill

Property Tax Collection on Mobile Homes 3

applicable building code requirements, which can vary from county to county.

4

If the founda-

tion has been inspected by the appropriate local government and found to satisfy the building

code, then it is permanent. If not, the foundation is not permanent and the manufactured home

that sits thereon is personal property, not real property.

e fourth requirement is the one that prevents many manufactured homes from being clas-

sied as real property. If the manufactured home sits on land not owned by the owner of the

manufactured home, it cannot be listed as real property unless the homeowner has a long-term

lease on the land. For example, if Wanda Wolfpack owns a manufactured home that sits on land

she owns, the home must be listed as real property if it satises the other three requirements.

If Wanda’s home sits on land owned by her sister, Wilma Wolfpack, the home must be listed

as personal property unless Wanda is leasing Wilma’s land for a term of at least 20 years and

the lease has specic provisions for what happens to the mobile home when the lease ends. If

Wanda’s home sits on land owned jointly by Wanda and Wilma, the home must be listed as real

property if it satises the other three requirements. e fact that Wanda owns a joint inter-

est and not an exclusive interest in the property does not disqualify the home from having real

property status. But if Wanda’s home sits on land owned jointly by Wanda and her husband

Walter as tenants by the entirety, the manufactured home could not be listed as real property

absent a long-term lease because the owner of the home (Wanda) is dierent from the owner of

the land (the marital couple of Wanda and Walter). Similarly, if Wanda’s manufactured home

sits on land owned by WW, Inc., a corporation of which Wanda is the only shareholder, the

home could not be listed as real property without a long-term lease on the land because Wanda

and her corporation are dierent taxpayers.

Record ownership of mobile homes should be based on documents led with the N.C.

Department of Motor Vehicles (DMV) or the county register of deeds. Mobile homes are titled

and registered by the DMV unless and until they satisfy the Machinery Act’s denition of real

property.

5

Record ownership of a mobile home properly classied as personal property should be

based on the DMV title and registration documents. Once a mobile home is properly classied

as real property and no longer registered with the DMV, record ownership should be based on

the recorded deeds for the land on which the home sits.

2. What remedies are available to collect taxes on mobiles homes?

e remedies available depend in large part on whether the mobile home is classied as real or

personal property.

If the mobile home is properly classied as real property, the taxes on the mobile home are a

lien upon the land on which the home sits. e collector may use the foreclosure remedy against

4. Letter from John C. Bailey, Director, Property Tax Division, N.C. Dept. of Revenue, to county asses-

sors (February 1, 2002), referencing building codes for manufactured homes issued by the N.C. Dept. of

Insurance that require piers and footings, the depth of which can vary by county based on the frost line.

5. All vehicles “intended to be operated on the highways of this state” must be registered with the

Department of Motor Vehicles (DMV). G.S. 20-50. A mobile home with its hitch, wheels, and axles

attached is considered a vehicle because it is a “device in, upon, or by which any person or property is or

may be transported or drawn upon a highway.” G.S. 20-4.01(49). e obligation to register a mobile home

can be terminated by ling with the DMV form MVR-46G, an adavit that the home now satises the

real property requirements found in G.S. 105-273(13).

4 Property Tax Bulletin

© 2010 School of Government. e University of North Carolina at Chapel Hill

the land as well as attachment, garnishment, and levy remedies against the responsible tax-

payer’s personal property. e responsible taxpayer for taxes on real property is the owner as of

the delinquency date, which is January 6 of the scal year for which the taxes are levied, plus all

subsequent owners.

6

If the mobile home is properly classied as personal property, the tax collector will be lim-

ited to remedies against the responsible taxpayer’s personal property. e responsible taxpayer

for taxes on personal property is the owner of record on the listing date, which is the previous

January 1.

7

If that listing taxpayer also owned real property in the taxing unit, then the tax col-

lector could pursue foreclosure on that real property.

8

For example, assume that Billy Blue Devil owns a manufactured home that sits on land

owned by Suze Seahawk. e home must be listed as personal property in Billy’s name and the

taxes on the home will not be a lien on Suze’s land. e tax collector could not pursue any col-

lection remedies against Suze if the taxes on Billy’s home become delinquent. Instead, the tax

collector could pursue remedies against Billy’s personal property such as a wage garnishment,

a bank account attachment, or the seizure and sale of the mobile home or Billy’s car. If Billy

owned real property elsewhere in the county, the taxes on Billy’s manufactured home would be

a lien on that property and the tax collector could initiate a foreclosure action against it.

Assume Billy sells the mobile home to Suze in February 2011, when the 2010 taxes on the

home are delinquent. Can the tax collector now proceed against Suze’s property to collect the

delinquent 2010 taxes on the mobile home? No. Billy remains the only responsible taxpayer for

the 2010 taxes because he was the listing taxpayer. Billy will also be responsible for the 2011

taxes on the home, because as of January 1, 2011, the home was still properly classied as per-

sonal property and Billy was the listing owner. e home will nally be listed in Suze’s name for

2012 taxes, assuming she still owns it as of January 1, 2012, when it should be listed as real prop-

erty if it satises the three other requirements. If the 2012 taxes remain unpaid on January 6,

2013, while Suze still owns the land, then Suze will be personally responsible for those taxes.

But Suze will never be responsible for the taxes from prior years.

3. When is a moving permit required?

To help with tax collection, the Machinery Act requires a person who wishes to move a mobile

home to a dierent property to rst obtain a moving permit from the tax collector.

9

If the

mobile home is moved to a dierent site on the same property, no permit is required. But if

the mobile home is moved to any other property, even property owned by the same taxpayer, a

permit is required.

Manufacturers and retailers of mobile homes are exempt from the permit requirement,

except when they are repossessing a previously sold home. (Repossession is discussed in more

detail in Question 5.) us, when a newly purchased mobile home is moved by the retailer to the

buyer’s property, no moving permit is required. Also exempt from the moving permit require-

ment are licensed carriers, the trucking companies that actually transport the homes. Although

6. G.S. 105-365.1(b)(1). For example, the delinquency date for 2011 real property taxes is January 6, 2012.

7. G.S. 105-365.1(b)(2).

8. Taxes on personal property are a lien on all real property owned by the same taxpayer in the same

taxing unit. G.S. 105-355(a).

9. G.S. 105-316.1(a).

Property Tax Collection on Mobile Homes 5

© 2010 School of Government. e University of North Carolina at Chapel Hill

not required to obtain permits themselves, these carriers are responsible for ensuring that the

owners obtain the required permits and can be subject to criminal penalties if the owners fail to

do so.

10

4. What must an applicant do to obtain a moving permit?

An applicant must rst do one of three things to obtain a moving permit:

• Pay all property taxes due to be paid by the owner to the county, city, and special districts.

• Provide proof that no taxes are due to be paid.

• Demonstrate that the removal of the mobile home will not jeopardize the collection of any

property taxes due or to become due.

11

Read literally, the rst requirement suggests that the only taxes at issue are those owed by the

current owner of the mobile home. But this interpretation could allow buyers of mobile homes

to obtain moving permits even if many years of taxes remain outstanding on those homes,

clearly not the result intended by the Machinery Act or desired by tax collectors.

For example, assume that in February 2011 Mitch Mountaineer buys a mobile home from

Fred Fortyniner. Fred owes 2010 taxes on the mobile home and on his boat. Mitch owns no real

property and the only taxable personal property he owns is a car, on which no taxes are out-

standing. If Mitch wants to move the mobile home, what taxes, if any, must he pay to obtain the

necessary moving permit?

If the moving permit statutes were interpreted to require payment only of taxes owed by the

current owner of the mobile home, then Mitch could obtain the permit without paying any

additional taxes because, as of the date on which the permit is requested, Mitch is the current

owner and owes no taxes. e mobile home is not listed in Mitch’s name and will not be listed

in his name until 2012, meaning as of February 2011 Fred is the responsible taxpayer for the

taxes owed on the mobile home.

12

Most tax collectors would instead require Mitch to pay both 2010 and 2011 taxes on the

mobile home, despite the fact that the home was listed in Fred’s name for those years. And many

tax collectors would require Mitch also to pay the taxes on Fred’s boat, because the statute

refers to “all taxes due to be paid” by the (presumably former) owner.

Also subject to varying interpretations is the option of demonstrating that the removal of

the mobile home will not “jeopardize” the collection of outstanding property taxes. e statute

provides no guidance as to when or how a tax collector can make this determination. Most tax

collectors err on the side of caution and very rarely, if ever, conclude that removal of a mobile

home creates no risk to tax collection.

After paying the taxes, proving that the taxes have been paid, or demonstrating that the

removal will not aect the collection of taxes, the applicant must provide his or her name and

address, the addresses from which and to which the mobile home is to be moved, and the name

and address of the carrier who will transport the home.

13

10. G.S. 105-316.1(b).

11. G.S. 105-316.2(a).

12. G.S. 105-365.1(b)(2).

13. G.S. 105-316.2(b).

6 Property Tax Bulletin

5. What are the moving permit requirements when a mobile home is repossessed?

A North Carolina resident taking possession of a mobile home through the enforcement of a

lien on that home and planning to move the home to another location in North Carolina can

obtain a moving permit without initially paying any taxes.

14

e repossessing party must notify

the tax collector of the intent to move the home when applying for the required permit and

within seven days must pay all taxes due on the mobile home itself. e repossessing party is

not required to pay any other taxes owed by the mobile home’s former owner. If the repossessing

party is not a resident of North Carolina, it is subject to the same obligations described in Ques-

tion 4 and must pay the taxes prior to obtaining a permit. e same applies to North Carolina

repossessors who intend to move the mobile home out of state.

6. How can the tax collector enforce the moving permit requirement?

Not very well, unfortunately. e moving permit statutes do not make a party who moves a

mobile home without a moving permit personally liable for the taxes owed on the mobile home.

Nor do they make a repossessor liable for the unpaid taxes if it fails to pay them within seven

days of the move. As a result, tax collectors may not use Machinery Act collection remedies

against new owners or repossessors based solely on their failure to obtain a permit. e statutes

do provide for criminal misdemeanor liability for parties that fail to satisfy the moving permit

requirements, but it is unclear if anyone has ever been prosecuted for a moving permit violation

anywhere in the state.

15

Even if a local district attorney were willing to attempt such a prosecu-

tion, the penalties are extremely light: the harshest sentence a rst-time oender can receive is a

ten-day suspended jail sentence and a $200 ne.

16

e most frequent violators of the moving permit requirement are mobile home retailers

and nancing companies that repossess and move homes on which they have liens without

providing notice or payment of outstanding taxes. Often these companies do not have oces

in the taxing unit, making it extremely dicult for tax collectors to enforce the companies’

Machinery Act obligations. Regardless, it is good practice for tax collectors to seek out these

companies and remind them of the criminal sanctions they could face for violating the moving

permit requirement.

14. G.S. 105-316.4. is exception applies whether the repossessor is acting in reliance on a court

order or on the terms of a nancing agreement.

15. G.S. 105-316.6 makes it a Class 3 misdemeanor to move a mobile home without a permit.

16. G.S. 15A-1340.23.

is bulletin is published and posted online by the School of Government to address issues of interest to government

ocials. is publication is for educational and informational use and may be used for those purposes without permission.

Use of this publication for commercial purposes or without acknowledgment of its source is prohibited.

To browse a complete catalog of School of Government publications, please visit the School’s website at www.sog.unc.edu

or contact the Publications Division, School of Government, CB# 3330 Knapp-Sanders Building, UNC Chapel Hill,

Chapel Hill, NC 27599-3330; e-mail sales@sog.unc.edu; telephone 919.966.4119; or fax 919.962.2707.