AnnualComprehensive

FinancialReport

FortheFiscalYearEnded

August31,2021

LEWISVILLEINDEPENDENTSCHOOLDISTRICT

1565AW.MainStreet,Lewisville,Texas75067

PreparedbytheDivisionofFinance

R.MarkYoungs,MBA,RTSBA

ChiefFinancialOfficer

RosemaryTrevino,MBA,RTSBA

ExecutiveDirectorofAccounting

LewisvilleISD2021ACFR

LEWISVILLEINDEPENDENTSCHOOLDISTRICT

TABLEOFCONTENTS

Exhibit/

Page Table

IntroductorySection

TransmittalLetter i

PrincipalOfficialsandAdvisors vi

CertificateofBoard vii

OrganizationalChart viii

GFOACertificateofAchievementix

ASBOCertificateofExcellence x

FinancialSection

IndependentAuditor’sReport 3

Management’sDiscussionandAnalysis 7

BasicFinancialStatements

Government‐wideFinancialStatements:

StatementofNetPosition 17

A‐1

StatementofActivities 18 B‐1

GovernmentalFundFinancialStatements:

BalanceSheet 20 C‐1

ReconciliationofGovernmentalFundsBalanceSheettotheStatementofNetPosition 23 C‐1R

StatementofRevenues,Expenditures,andChangesinFundBalance 24 C‐2

Reconciliation of Statement of Revenues, Expenditures,and

Changes in Fund Balance of

GovernmentalFundstotheStatementofActivities 26 C‐3

StatementofRevenues,Expenditures,andChangesinFundBalance‐Budget(GAAP)and

Actual‐GeneralFund 27 C‐4

ProprietaryFunds:

StatementofNetPosition 28 D‐1

StatementofRevenues,Expenses,andChangesinFund

NetPosition 29 D‐2

StatementofCashFlows 30 D‐3

FiduciaryFunds:

StatementofFiduciaryNetPosition 31 E‐1

StatementofChangesinFiduciaryNetPosition 32 E‐2

NotestotheBasicFinancialStatements 33 F‐1

RequiredSupplementaryInformation

ScheduleoftheDistrict’sProportionateShare

oftheNetPensionLiabilityTeacherRetirement

SystemofTexas 71 G‐1

ScheduleoftheDistrict’sPensionContributionsTeacherRetirementSystemofTexas 72 G‐2

ScheduleoftheDistrict’sProportionateShareoftheNetOPEBLiabilityTeacherRetirement

SystemofTexas 73 G‐3

ScheduleoftheDistrict’sOPEB

ContributionsTeacherRetirementSystemofTexas 74 G‐4

NotestoRequiredSupplementaryInformation‐Pension 75

NotestoRequiredSupplementaryInformation‐OPEB 76

OtherSupplementaryInformation

CombiningandIndividualFundFinancialStatementsandSchedules:

CombiningBalanceSheet‐NonmajorGovernmentalFunds 80 H‐1

CombiningStatementofRevenues,Expenditures,andChanges

inFundBalance‐Nonmajor

GovernmentalFunds 82 H‐2

LEWISVILLEINDEPENDENTSCHOOLDISTRICT

TABLEOFCONTENTS(continued)

LewisvilleISD2021ACFR

Exhibit/

Page Table

OtherSupplementaryInformation(continued)

CombiningandIndividualFundFinancialStatementsandSchedules:

StatementofChangesinFiduciaryNetPosition 84 H‐3

CombiningStatementofChangesinFiduciaryNetPosition 85 H‐4

SupplementalSchedules:

ScheduleofDelinquentTaxesReceivable 88 J‐1

ScheduleofRevenues,Expenditures,andChangesinFund

Balance‐Budget(GAAPBasis)

andActual‐FoodServiceFund 90 J‐2

ScheduleofRevenues,Expenditures,andChangesinFundBalance‐Budget(GAAPBasis)

andActual‐DebtServiceFund 91 J‐3

StatisticalSection(Unaudited)

Government‐wideInformation:

ChangesinNetPosition‐Government‐wide 96 1

ChangesinNetPosition

byComponent‐Government‐wide 98 2

FundInformation:

ChangesinFundBalances‐AllGovernmentalFunds 100 3

FundBalances‐AllGovernmentalFunds 102 4

PropertyTaxLeviesandCollections 104 5

ScheduleofTaxRateDistributionPer$100Valuation 105 6

AssessedandActualValueofTaxableProperty 106 7

PropertyTaxRates‐DirectandOverlappingGovernments 108 8

PrincipalPropertyTaxpayers 110 9

ComputationofDirectandOverlappingDebt 111 10

RatioofNetBondedDebttoAssessedValueandNetBondedDebttoPersonalIncome‐All

GovernmentalFunds 112 11

LegalDebtMarginInformation 114 12

RatioofAnnual

DebtServiceExpendituresforGeneralBondedDebttoTotalExpenditures 116 13

RatioofAnnualDebtServiceExpendituresforOutstandingDebtbyType 117 14

PerStudentCalculations(GeneralFundOnly)BasedonRevenuesandExpenditures 119 15

DemographicDataandEconomicStatistics 120 16

PrincipalEmployers 122 17

Expenditures,

AverageDailyAttendance,andPerPupilCosts 123 18

Full‐timeEquivalentDistrictEmployeesbyFunction 124 19

TeacherSalaryandEducation 126 20

SchoolBuildingInformation 128 21

FederalAwardsSection

IndependentAuditor’sReportonInternalControloverFinancialReportingandonCompliance

andOtherMattersBasedonan

AuditofFinancialStatementsPerformedinAccordancewith

GovernmentAuditingStandards 141

IndependentAuditor’sReportonComplianceforeachMajorFederalProgramandReporton

InternalControloverComplianceRequiredbytheUniformGuidance 143

ScheduleofFindingsandQuestionedCosts 145

ScheduleofExpendituresofFederalAwards 147 K‐

1

NotestoScheduleofExpendituresofFederalAwards 149 K‐2

SummaryScheduleofPriorAuditFindings 151

CorrectiveActionPlan 152

LewisvilleISD2021ACFR

INTRODUCTORYSECTION

LewisvilleISD2021ACFR

i LewisvilleISD2021ACFR

December13,2021

TotheBoardofTrusteesandtheCitizensoftheLewisvilleIndependentSchoolDistrict:

TheTexasEducationCoderequiresthatallschooldistrictsfileasetoffinancialstatementswiththeTexasEducation

Agency(TEA)within150daysofthecloseofeachfiscalyear.Thefinancialstatementsmustbepresentedinconformity

withgenerallyacceptedaccountingprinciples(GAAP)andauditedbyafirmof

licensedcertified publicaccountants

inaccordancewithgenerallyacceptedauditingstandards.Pursuanttothisrequirement,weherebyissuetheAnnual

ComprehensiveFinancialReportoftheLewisvilleIndependentSchoolDistrict(theDistrict)forthefiscalyearended

August31,2021.

This report consists of management’s representations concerning the finances of the

District. Consequently,

managementassumesfullresponsibilityforthecompletenessandreliabilityofalltheinformationpresentedinthis

report.Tothebestofourknowledgeandbelief,thisfinancialreportiscompleteandreliableinallmaterialrespects.

ThefinancialstatementsoftheDistricthavebeenauditedbyWhitleyPennL.L.P.,afirmoflicensedcertifiedpublic

accountants.Thegoaloftheindependentauditistoprovidereasonableassurancethatthefinancialstatementsof

theDistrictforthefiscal yearendedAugust31,2021,arefreeofmaterialmisstatement.

The independentaudit

involves examining, on a testbasis,evidencesupportingtheamountsanddisclosuresinthefinancialstatements;

assessingtheaccountingprinciplesusedandsignificantestimatesmadebymanagement;andevaluatingtheoverall

financial statement presentation. The independent auditors concluded, based upon the audit, that there was a

reasonable

basisforrendering an unmodified opinionthattheDistrict’sfinancialstatements fortheyear ended

August31,2021arefairlypresentedinconformitywithGAAP.Theindependentauditor’sreportispresentedasthe

firstcomponentofthefinancialsectionofthisreport.

Theindependentauditofthefinancialstatementsis

partofabroader,federallymandated“SingleAudit”designed

tomeetthespecialneedsoffederalgrantoragencies. ThestandardsgoverningSingleAuditengagementsrequirethe

independentauditorstoreportnotonlyonthefairpresentationofthefinancialstatements,butalsoontheaudited

government’sinternalcontrolsandcompliancewith

legalrequirements,withspecialemphasisoninternalcontrols

andlegalrequirementsinvolvingtheadministrationoffederalawards.ThesereportsmaybefoundintheFederal

Awards section of thisreport. GAAP requires that management provide a narrative introduction, overview, and

analysistoaccompanythebasicfinancialstatementsintheform

ofManagement’sDiscussionandAnalysis(MD&A).

This letter of transmittal is designed to complementtheMD&Aandshouldbereadin conjunctionwith it. The

District’sMD&Acanbefoundimmediatelyfollowingthereportoftheindependentauditors.

PROFILEOFTHEDISTRICT

LewisvilleISDincludesallthefundsoftheDistrict,aswellasanycomponentunitsforwhichtheDistrictisfinancially

accountable.

LewisvilleISDisanindependentpubliceducationalagencyoperatingunderapplicablelawsandregulationsofthe

State of Texas providing a full range of educational services appropriate to

grade levels ranging from pre‐

kindergartenthroughgradetwelve.LISDislocatednorthoftheDallas/FortWorthMetroplex.LISDencompasses127

squaremilesandismadeupofall,orpartof,thirteendifferentcommunities:Lewisville,FlowerMound,TheColony,

Highland Village, Double Oak, Copper Canyon, north Carrollton, western Plano, and

portions of Frisco, Hebron,

Coppell,Grapevine,andArgyle.TheDistrictiscomprisedoffivehighschools,three9thgradecampuses,two9th‐

10th grade campuses, two career centers, one learning center, fifteen middle schools, thirty‐nine elementary

ii LewisvilleISD2021ACFR

schools,oneearlychildhoodcenter,onestudentsuccesscenterandonevirtuallearningacademy.Themajoritywere

builtwithinthepast20years,keepingpacewithrapidgrowth.

Duringthecurrentfiscalyear,theDistrictservedmorethan49,360enrolledstudents.Sincethe2019

‐2020school

year, the District’s student enrollment declined by 2,000 students, mostly due to COVID. The District’s student

enrollmenthasbeguntostabilizeandslightlydeclinefromtherapidgrowthexperiencedinthepast.

ThesevenmembersoftheBoardofTrustees(Board)serve,withoutcompensation,athree‐yearterm

inoffice.On

arotatingbasis,twoorthreeplacesarefilledduringannualelectionsheldthefirstSaturdayinMay.Vacanciesmay

befilledbyappointmentuntilthenextelection.TheBoardhasfinalcontroloverlocalschoolmatterslimitedonlyby

the state legislature, by the courts, and

by the will of the people as expressed in school Board elections. Board

decisionsarebasedonamajority voteofthosepresent. Ingeneral, theBoardadoptspolicies, setsdirection for

curriculum,employstheSuperintendent,andoverseestheoperationsoftheDistrictanditsschools.Besidesgeneral

Boardbusiness,Trustees

arechargedwithnumerousstatutoryregulationsincludingcallingtrusteeandotherschool

electionsandcanvassingtheresults,organizingtheBoard,andelectingitsofficers.TheBoardisalsoresponsiblefor

settingthetaxrate,setting salary schedules,and actingas aboardofappealsinpersonnelandstudentmatters,

confirming

recommendationsfortextbookadoptions,andadoptingandamendingtheannualbudget.

EDUCATION

The District is a public‐school system whose mission recognizes that students, staff and community design and

implementalearningorganizationthatprovidesengaging,innovativeexperienceseveryday. Recognizingthatthe

qualityoflife,bothtodayandin

thefuture,dependsuponthequalityofeducationprovidedbythepublicschools,

theLewisvilleIndependentSchoolDistrictisdedicatedtoeducationandcommittedtomeetingtheneedsofevery

individual. TheDistrict’svisionisbuiltonfourcornerstones:

StudentLearning

o Profoundlearningforstudentsoccurswhenwe

providemeaningfulandrelevanteducational

opportunities.

o InLISD,wearepreparingthedreamerstobethedoersbydevelopingengaged,collaborative

learnerswhoareequippedforsuccess.

StudentExperience

o Athrivingstudentexperiencecomesfromanenvironmentthatengagesandconnects

studentstoeachotherandwith

staff.

o InLISD,weknowstudentsthrivewhentheyareengagedintheirlearningandfeelasenseof

belonginginourschools.

o Whenstudentsareprovidedenrichingopportunitiesoutsidetheclassroom,theywillfind

successnotonlyinschoolbutintheirlivesbeyondourhallways.

Community

Engagement

o Webelieveeducationisasharedresponsibilitybetweenourdistrictandthecommunitieswe

serve.

o CommunityengagementiscriticaltothesuccessofLISD.

o Throughintentionalstrategicpartnershipsatthecampusanddistrictlevel,wecantapintothe

deepwellofcommunitysupportforLISD

toforgestrongerbondswithourstakeholdersand

developrelationshipstobenefitschools,localbusinessesandthecommunity.

ResourceStewardship

o InLISD,whenwesaywewanttobegoodstewardsofourresources,wearen'tjusttalking

abouttaxpayerdollars.

o Resourcestewardshipisaboutthreethings:our

time,talentandtreasure.

o Strikeapositivework/lifebalancewithourtime;

o Nurtureourtalentsaseducatorsthroughmeaningfulprofessionallearning;

o Manageourtreasureinafiscallyresponsiblewaywhilestillmeetingstudentneeds.

iii LewisvilleISD2021ACFR

TheDistrict isdedicatedto enrichingeducation opportunitiesforourstudentsandleading thewayinclassroom

technologyintegrations.Utilizinggroundbreaking,transformativeandflexiblelearningenvironmentsthroughuseof

technologyandinitiativeprogramsprovidesourstudentsthetoolstoaccess,createandcollaborateas

thriving,21

st

centurydigitalcitizens.

FINANCIALPOLICIES

InternalControls.ThemanagementoftheDistrictisresponsibleforestablishingandmaintaininganinternalcontrol

structuredesignedtoensurethattheassetsoftheDistrictareprotectedfromloss,theftormisuse,andtoensurethat

adequateaccounting data are compiled

to allow for the preparation of financial statements in conformity with

generallyacceptedaccountingprinciples.Theinternalcontrolstructureisdesignedtoprovidereasonable,butnot

absolute,assurancethattheseobjectivesaremet.Theconceptof“reasonableassurance”recognizesthat:(1)the

costofacontrolshouldnotexceedthe

benefitslikelytobederivedfromitsimplementation;and(2)thevaluation

ofcostandbenefitsrequiresestimatesandjudgmentsbymanagement.Managementbelievestheinternalcontrols

adequatelymeettheaboveobjectives.

BudgetaryControls.Inaddition,theDistrictmaintainsbudgetarycontrols.Theobjectiveofthesebudgetarycontrols

istoensure

compliancewithlegalprovisionsembodiedintheannualbudgetapprovedbytheBoardofTrustees.

Everyschool districtinTexas isrequired,by law,toprepare andfile abudgetwiththeTexasEducationAgency.

Activities of the General Fund, Food Service Fund, and Debt Service Fund are includedin the

District’s formally

adoptedbudget.BudgetsforSpecialRevenuefunds(otherthantheFoodServiceFund)andCapitalProjectsFund

arepreparedonaprojectbasis,basedongrantregulationsorapplicablebondordinances.Budgetarycontrol(the

level at which expenditures cannot legally exceed appropriations) is maintained at the functional category

level

withineachfund.ThesefunctionalcategoriesaredefinedbytheTexasEducationAgencyandidentifythepurpose

oftransactions.OversightcontrolofallexpendituresismaintainedatthislevelbytheAccountingandBudgetstaff.

TheDistrictalsomaintainsanencumbranceaccountingsystemasonetechniqueofaccomplishingbudgetarycontrol.

Outstandingencumbrancesattheendofafiscalyeararerolledforwardintothesubsequentfiscalperiodwiththe

budgetamendedaccordingly.Asdemonstratedbythestatementsandschedulesincludedinthefinancialsectionof

thisreport,theDistrictcontinuesmeetingitsresponsibilityforsoundfinancialmanagement.

MAJORINITIATIVES

CapitalProjects.InMay2017,votersoftheDistrictapproveda$737.5millionbondreferendumdesignedtofinance

theconstruction,acquisitionandequipmentofschoolbuildingsintheDistrictandthepurchaseofthenecessary

sitesforschoolbuildings.InthefiscalyearendedAugust31,2020,theDistrictissued

UnlimitedTaxSchoolBuilding

Bonds,Series2020,resultingina$285.0milliondeposittotheCapitalProjectsFund.Thebondproceedswereissued

forconstructionandrenovationofschoolbuildingsandequipmentandmajortechnologyupgradesthroughoutthe

District.

DebtPortfolioManagement.DuringthefiscalyearAugust31,2021,theDistrict

calledaportionofthepreviously

issuedUnlimitedTaxRefundingbonds,Series2013Band2013EforRedemptionPriortoMaturity.Thesecalledbonds

intheamountof$13.2millionand$39.5millionwereredeemedpriortomaturity.TheDistrictutilizedfundsfrom

itsDebtServiceFundbalanceforthepurpose

ofthisdebtreduction.Thisresultsinpresentvaluesavingsof$6.9

million.

TheDistricthasissueditsbondsonarelativelyshortrepaymentperiodoftwentyyears.Districtpersonnelcontinually

workwiththeDistrict’sFinancialAdvisorstomonitortheinterestratemarketandtheoutstandingdebtportfoliofor

opportunitiesfor

interestsavings.

RelevantFinancialPolicy.TheBoardrecognizestheimportanceofmaintainingsufficientfundbalancetosustainthe

Districtthroughuncertaineconomictimes. AcknowledgingthattheDistrict’sfinancialpositionisimpactedgreatlyby

thelegislature’sactionsandthelevelofthestate’savailableresources,theBoardhasbeenproactivein

buildingthe

District’sfundbalancesovertime.InJune2019,theBoardadoptedaresolutiondelegatingtotheSuperintendent

orhisdesigneeauthoritytoassignfundbalanceinanamountequivalenttothreemonthsoperatingexpendituresin

iv LewisvilleISD2021ACFR

the General Fund. The Resolution further establishedastheDistrict’s targetoptimumfund balanceanamount

equivalenttotenpercentoftheannualdebtservicerequiredonbondsapprovedbythevotersoftheDistrictasits

minimum fund balance in the Debt Service

Fund each year. Those parameters are designed to assure a strong

financialpositionintheeventofreductionsinenrollment,taxrevenuesorotherfundingsources:

The District’s fund balance at August 31, 2021 in both the General Fund and the Debt Service Fund exceed these

parameters.

Long‐term Financial Planning.

TheDistricthasgrown the fund balancetoensurethat the neededresourcesare

availabletoprovideforenrollmentdeclinesandunexpectedsituations.Projectionsassumedinbudgetingforthe

subsequentfiscalyearinclude:

TheMaintenanceandOperationstaxratewillbereducedto$0.9276per$100valuationforthe

fiscalyear

endingAugust31,2022.

TheDistrictisexpectedtobesubjecttorecapturepaymentsunderChapter41oftheTexasEducationCode

forthefiscalyearendingAugust31,2022intheamountof$57.4million.

TheDistricthasexperiencedgrowthintaxablepropertyvaluesofapproximately

7.5percent.Thisincrease

isexpectedtoresultinincreasedad‐valoremtaxcollections.Approximately9.9percentofad‐valoremtax

collectionsisexpectedtobepaidtotheStateintheformofrecapturepaymentsforthefiscalyearending

August31,2022.

DuetoCOVID‐19,student

enrollmentgrowthforfiscalyear2022areexpectedtodecreasebylessthanone

percent.

ECONOMICCONDITIONANDOUTLOOK

ThelocaleconomyintheDistrictremainsstrong.NewbusinessescontinuetolocatebothinandneartheDistrict.

Theresultingeconomicactivityhascreatedstrongpropertyvaluegrowth.Thediversity

ofthelocalbusinesses,the

range of available housing, the transportation grid, and the proximity to Dallas‐Fort Worth and Alliance airports

provideastrongclimateforbusinessgrowthwithintheDistrict.

ThetaxablepropertyoftheDistrict’slargesttaxpayeraccountsforonly0.15percentofthetaxablevalueofthe

District.

Thisindicatesasignificantdiversificationinthetaxbase.Thislackofdependenceonasingleemployerorbusiness

segmentmeansthatthelossofevenalargebusinesswillnotnegativelyimpacttheeducationofchildrenorimperil

thefuturepaymentofobligationsbytheDistrict.

TheDistrict

haselectedto providethe“Freeportexemption”forqualifyingbusinesses.It isbelieved thatthiswill

continuetobeapositiveeconomicfactorfortheDistrictandwillensurethatbusinessneedingthefacilitiesofDFW

andAllianceairportswillconsiderandselectLewisvilleISDfortheirnewplansandtheir

plantexpansions.

TheCityofLewisvilleissuedmorethan46buildingpermitsinSeptemberof2021,whichincludesacombinationof

newconstructionforbusinessandremodelingforbothresidentialandcommercialproperties.Constructioncontinues

ontheTowerBayLofts,aresort‐styleluxuryapartmentdevelopmentwithmorethan300

unitsnearLewisvilleLake,

eastofI‐35E,northofGardenRidgeBoulevard.Plannedamenities includedanenclosedparkinggarage,askylounge

that includes an indoor/outdoor kitchen, and an outdoor television wall. In May 2020 construction began and

continuesontheVillasatRockbrook,aprivate,gatedsingle‐familyrental

communitylocatedinLewisvillewitheasy

accesstoI‐35E,Highway121andtheDARTHebronStationonly30minutesfromdowntownDallasand10minutes

fromDFWInternationalAirport.FinalpassinginspectionsforthisprojectwereissuedonAugust10,2020.

AWARDS

The School Financial IntegrityRatingSystem

of Texas (FIRST) program, a financial accountability system for Texas

school districts, was developed by the Texas Education Agency in response to Senate Bill 875 of the 76th Texas

Legislaturein1999.TheprimarygoalofFIRSTistoachievequalityperformanceinthemanagementofschooldistricts’

financialresources,a

goalmademoresignificantduetothecomplexityofaccountingassociatedwiththeTexasschool

financesystem.TheDistrictreceivedaratingofA=SuperiorunderTexas’SchoolsFIRSTfinancialaccountabilityrating

system. Thisisthestate’shighestfinancialrating,demonstratingthequalityoftheDistrict’ssoundfiscalmanagement

v LewisvilleISD2021ACFR

andreporting system.TheDistrictachievedthehighestavailable ratingeachyearsincetheinceptionoftheFIRST

program.

The Government Finance Officers Association of the United States and Canada (GFOA) awarded a Certificate of

AchievementforExcellenceinFinancialReportingtotheDistrict

foritsComprehensiveAnnualFinancialReportfor

thefiscalyearended August 31,2020.Thiswasthetwentiethconsecutiveyearthatthe Districthas achievedthis

prestigiousaward.Inordertobeawardeda CertificateofAchievement,agovernmentunitmustpublishaneasily

readableandefficientlyorganizedcomprehensiveannual

financialreport.Thereportmustalsosatisfybothgenerally

acceptedaccountingprinciplesandapplicablelegalrequirements.

ACertificateofAchievementisvalidforaperiodofoneyearonly.Webelieve thecurrentAnnualComprehensive

Financial Report continues to meet the requirements of the Certificate of Achievement Program, and we

are

submittingittotheGFOAtodetermineitseligibilityforanothercertificate.

Inaddition,theDistrictwasawardedtheCertificate ofExcellenceinFinancialReportingbytheAssociationofSchool

Business OfficialsInternational(ASBO)foritsComprehensiveAnnualFinancialReportfortheyearendedAugust31,

2020. Thisaward

hasalsobeenreceivedforthetwentiethconsecutiveyear.WebelievetheAnnualComprehensive

FinancialReportfortheyearendedAugust31,2021continuestoconformtothestandardsforwhichtheseawards

weregranted.

ACKNOWLEDGEMENTS

WeappreciatethesupportoftheBoardofTrustees,thecitizensoftheDistrict,andthebusinesscommunity,allwho

workcooperativelytoensurethebesteducationforitsstudentsandtheprudentdevelopmentoftheDistrict.This

cooperationisindicativeofthestrongsupportfortheattainmentofexcellence

intheDistrict’seducationalprograms.

Also, we would like to express our appreciation to all employees of the District for their interest and support in

planningandconductingthefinancialaffairsoftheDistrictinaresponsibleandprogressivemanner.Thepreparation

ofthisreportonatimelybasiscouldnot

beaccomplishedwithouttheefficientanddedicatedservicesoftheentire

staffoftheFinanceoffice.

Respectfullysubmitted,

vi LewisvilleISD2021ACFR

LEWISVILLEINDEPENDENTSCHOOLDISTRICT

ANNUALCOMPREHENSIVEFINANCIALREPORT

YEARENDEDAUGUST31,2021

PRINCIPALOFFICIALSANDADVISORS

PrincipalOfficials

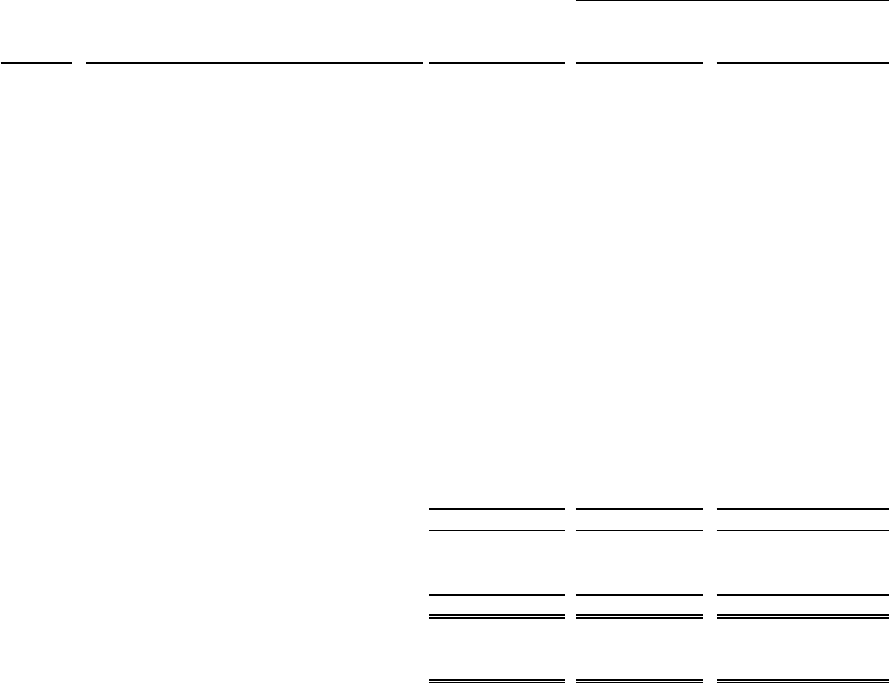

BoardofTrustees DateElected TermExpires Occupation

TracyScottMiller,President 2014 2023

Director,StrategicSolutionsfora

MultinationalCorporation

AllisonLassahn,VicePresident 2018 2024 IndependentConsultant

KatherineSells,Secretary 2016 2022 CommunityVolunteer

Dr.BuddyBonner 2021 2024 ChamberofCommerceEmployee

AngieCox 2013 2022 Escrow

Officer,BusinessOwner

KristiHassett 2014 2023 IndependentConsultant

JennyProznik 2016 2022 CommunityVolunteer

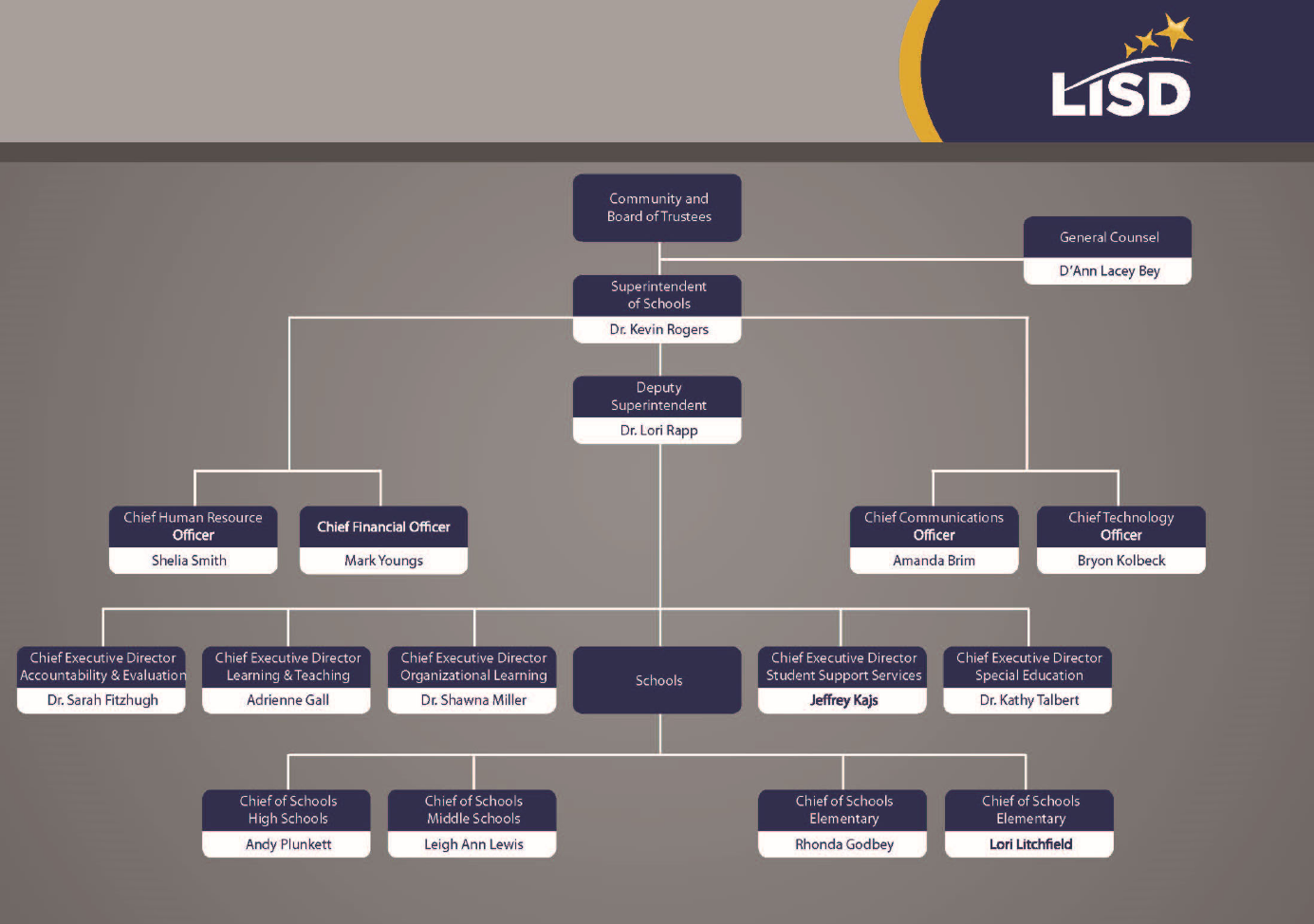

AdministrativeOfficials

Dr.KevinRogers,Superintendent

Dr.LoriRapp,DeputySuperintendent

R.MarkYoungs,ChiefFinancialOfficer

D’AnnLaceyBey,GeneralCounsel

AmandaBrim,ChiefCommunicationsOfficer

BryonKolbeck,ChiefTechnologyOfficer

SheliaSmith,ChiefHumanResourcesOfficer

ConsultantsandAdvisors

WhitleyPennL.L.P.,Dallas,Texas

IndependentAuditors

McCall,Parkhurst&HortonL.L.P.,Dallas,Texas

BondCounsel

HilltopSecurities,Dallas,Texas

FinancialAdvisors

WalshGallegosTreviñoKyle&RobinsonP.C.,Austin,Texas

Attorneys

vii LewisvilleISD2021ACFR

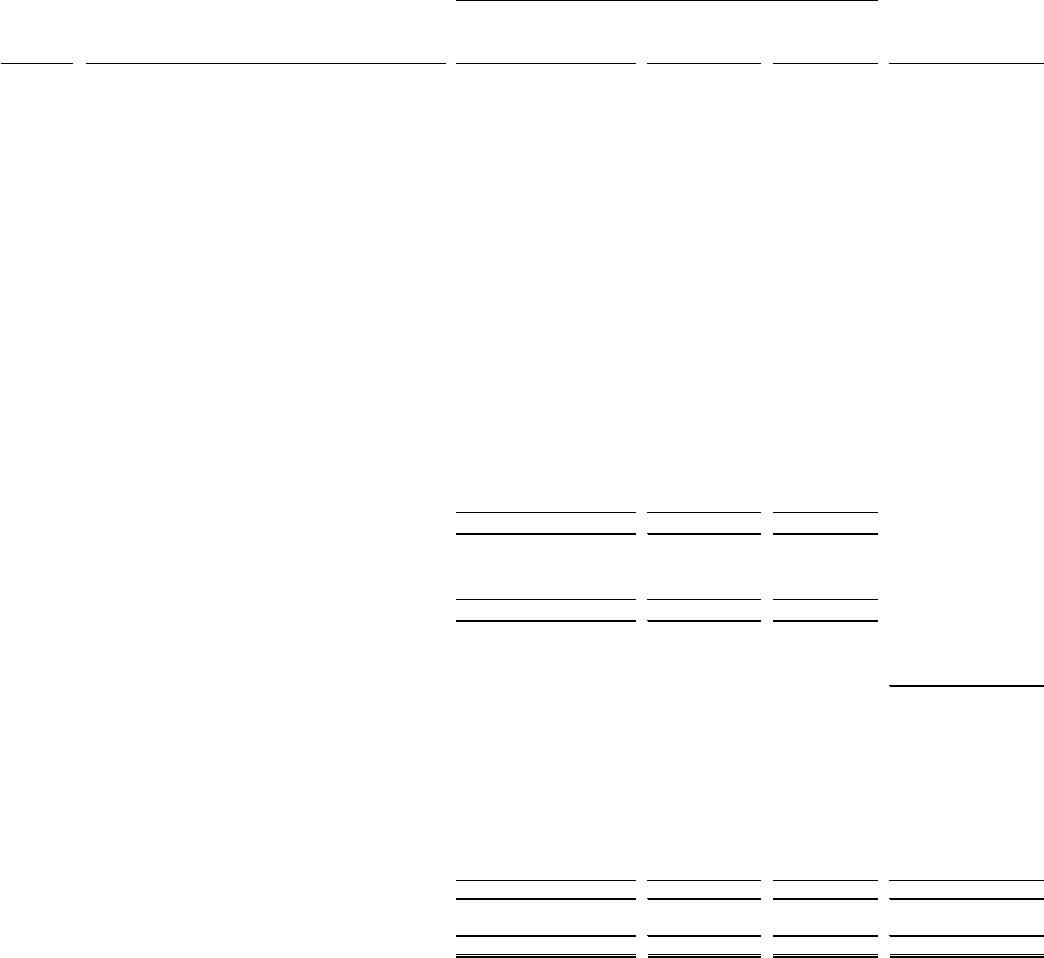

CERTIFICATEOFBOARD

LewisvilleIndependentSchoolDistrict Denton 061‐902

NameofSchoolDistrict County County‐DistrictNo.

We,theundersigned,certifythattheattachedannualfinancialreportsoftheabove‐namedschooldistrictwerereviewed

and_____ approved______disapprovedfortheyearendedAugust31,2021,atameetingofBoardofTrustees ofsuch

schooldistrict

onthe13thdayofDecember,2021.

____________________________ ____________________________

SignatureofBoardSecretary SignatureofBoardPresident

viii LewisvilleISD2021ACFR

ix LewisvilleISD2021ACFR

x LewisvilleISD2021ACFR

1 LewisvilleISD2021ACFR

FINANCIALSECTION

2 LewisvilleISD2021ACFR

DallasOffice

8343DouglasAvenue

Suite400

Dallas,Texas75225

214.393.9300Main

whitleypenn.com

3 LewisvilleISD2021ACFR

INDEPENDENTAUDITOR’SREPORT

TotheBoardofTrustees

LewisvilleIndependentSchoolDistrict

Lewisville,Texas

ReportontheFinancialStatements

Wehaveauditedtheaccompanyingfinancialstatementsofthegovernmentalactivities,business‐typeactivities,eachmajor

fund,andtheaggregateremainingfundinformationofLewisvilleIndependentSchoolDistrict(the“District”)asofandfor

theyearendedAugust31,2021,andtherelatednotestothefinancialstatements,whichcollectivelycomprisetheDistrict’s

basicfinancialstatementsaslistedinthetableofcontents.

Management’sResponsibilityfortheFinancialStatements

Management is responsible for the preparation and fair presentation of these financial statements in accordance with

accounting principles generally accepted in the United States of America; this includes the design, implementation, and

maintenanceofinternalcontrolrelevanttothepreparationandfairpresentationoffinancialstatementsthatarefreefrom

materialmisstatement,whetherduetofraudorerror.

Auditor’sResponsibility

Ourresponsibilityistoexpressopinionsonthesefinancialstatementsbasedonouraudit.Wedidnotauditthediscretely

presentedcomponentunitfinancialstatementsoftheLewisvilleEducationFoundation,Inc.asof andfortheyearended

December31,2020.Thosestatementswere audited by other auditors whosereporthasbeen furnished tous,andour

opinion,insofarasitrelatestotheamountsincludedforLewisvilleEducationFoundation,Inc.,isbasedsolelyonthereport

oftheotherauditors.WeconductedourauditinaccordancewithauditingstandardsgenerallyacceptedintheUnitedStates

of America and the standards applicable to financial audits contained Government Auditing Standards, issued by the

ComptrollerGeneraloftheUnitedStates.Thosestandardsrequirethatweplanandperformtheaudittoobtainreasonable

assuranceabout whether the financialstatements arefreefrommaterialmisstatement.Thefinancial statementsofthe

LewisvilleEducationFoundation,Inc.werenotauditedinaccordancewithGovernmentalAuditingStandards.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial

statements.Theproceduresselecteddependontheauditor’sjudgment,includingtheassessmentoftherisksofmaterial

misstatementofthefinancial statements,whetherdue to fraud orerror.Inmaking thoseriskassessments,the auditor

considersinternalcontrolrelevanttotheentity’spreparationandfairpresentationofthefinancialstatementsinorderto

designauditproceduresthatareappropriateinthecircumstances,butnotforthepurposeofexpressinganopiniononthe

effectivenessoftheentity’sinternalcontrol.Accordingly,weexpressnosuchopinion.Anauditalsoincludesevaluatingthe

appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by

management,aswellasevaluatingtheoverallpresentationofthefinancialstatements.

TotheBoardofTrustees

LewisvilleIndependentSchoolDistrict

4 LewisvilleISD2021ACFR

Webelievethattheauditevidencewehaveobtainedissufficientandappropriatetoprovideabasisforourauditopinions.

Opinions

Inouropinion,basedonourauditandthereportofotherauditors,thefinancialstatementsreferredtoabovepresentfairly,

inallmaterialrespects,therespectivefinancialpositionofthegovernmentalactivities,business‐typeactivities,eachmajor

fund,andtheaggregateremainingfundinformationofLewisvilleIndependentSchoolDistrictasofAugust31,2021,andthe

respective changes in financial position, the respective budgetary comparison schedule for the general fund and, where

applicable,cashflowsthereoffortheyearthenendedinaccordancewithaccountingprinciplesgenerallyacceptedinthe

UnitedStatesofAmerica.

OtherMatters

RequiredSupplementaryInformation

Accounting principles generally accepted in the United States of America require that the management’sdiscussion and

analysis andpensioninformationandotherpost‐employment benefit information, as listedonthetableofcontents,be

presented to supplement the basic financial statements.Such information, although not a part of the basic financial

statements,isrequiredbytheGovernmentalAccountingStandardsBoard,whoconsidersittobeanessentialpartoffinancial

reportingforplacingthebasicfinancialstatementsinanappropriateoperational,economic,orhistoricalcontext.Wehave

applied certain limited procedures to the required supplementary information in accordance with auditing standards

generally accepted in the United States of America, which consisted of inquiries of management about the methods of

preparingtheinformationandcomparingtheinformationforconsistencywithmanagement’sresponsestoourinquiries,the

basicfinancialstatements,andotherknowledgeweobtainedduringourauditofthebasicfinancialstatements.Wedonot

expressanopinionorprovideany assurance on the information because thelimitedproceduresdo not provide us with

sufficientevidencetoexpressanopinionorprovideanyassurance.

OtherInformation

Ouraudit wasconducted for the purpose of forming opinions on the financialstatementsthat collectively comprise the

District’s basic financial statements.The other supplementary information, as described in the table of contents, are

presentedforpurposesofadditionalanalysisandarenotarequiredpartofthebasicfinancialstatements.Thescheduleof

expendituresoffederalawardsispresentedforthepurposeofadditionalanalysisasrequiredbyTitle2U.S.CodeofFederal

Regulation(CFR)Part200,UniformAdministrationRequirements,CostPrinciples,and

AuditRequirementsforFederalAwards

andotherinformation,suchastheintroductoryandstatisticalsections,arealsopresentedforthepurposesofadditional

analysisandarenotarequiredpartofthebasicfinancialstatements.

Theother supplementaryinformation,asdescribedinthetableofcontents,andtheschedule ofexpendituresoffederal

awardsaretheresponsibilityofmanagementandwasderivedfromandrelatesdirectlytotheunderlyingaccountingand

otherrecordsusedtopreparethebasicfinancialstatements.Suchinformationhasbeensubjectedtotheauditingprocedures

appliedintheauditofthebasicfinancialstatementsandcertainadditionalprocedures,includingcomparingandreconciling

suchinformationdirectlytotheunderlyingaccountingandotherrecordsusedtopreparethebasicfinancialstatementsor

to the basic financial statements themselves, and other additional procedures in accordance with auditing standards

generally accepted in the United States of America by us and other auditors. In our opinion, based on our audit, the

proceduresperformedasdescribedabove,andthereportoftheotherauditors,theothersupplementaryinformation,as

describedinthetableofcontents,andthescheduleofexpendituresoffederalawardsisfairlystated,inallmaterialrespects,

inrelationtothebasicfinancialstatementsasawhole.

Theintroductoryandstatisticalsectionshavenotbeensubjectedtotheauditingproceduresappliedintheauditofthebasic

financialstatementsand,accordingly,wedonotexpressanopinionorprovideanyassuranceonthem.

TotheBoardofTrustees

LewisvilleIndependentSchoolDistrict

5 LewisvilleISD2021ACFR

OtherReportingRequiredbyGovernmentAuditingStandards

In accordance with Government Auditing Standards, we have also issued our report dated December 6, 2021 on our

consideration of the District’s internal control over financial reporting and on our tests of its compliance with certain

provisionsoflaws,regulations,contracts,andgrantagreementsandothermatters.Thepurposeofthatreportistodescribe

thescopeofourtestingofinternalcontroloverfinancialreportingandcomplianceandtheresultsofthattesting,andnotto

provideanopiniononinternalcontroloverfinancialreportingoroncompliance.Thatreportisanintegralpartofanaudit

performedinaccordancewithGovernment Auditing Standardsin consideringthe District’sinternalcontrolover financial

reportingandcompliance.

Dallas,Texas

December6,2021

6 LewisvilleISD2021ACFR

7 LewisvilleISD2021ACFR

LEWISVILLEINDEPENDENTSCHOOLDISTRICT

MANAGEMENT'SDISCUSSIONANDANALYSIS

The management of the Lewisville Independent School District offers readers of the District's financial statements this

narrativeoverviewandanalysisofthefinancialactivitiesforthefiscalyearendedAugust31,2021.Readersareencouraged

to considertheinformationpresentedhere in conjunctionwiththe transmittal

letteratthefrontof this report and the

District'sfinancialstatements,whichfollowthisanalysis.

FINANCIALHIGHLIGHTS

TheassetsanddeferredoutflowsoftheDistrictexceededitsliabilitiesanddeferredinflowsatthecloseofthefiscal

yearby$76.3million.Thedeficitinunrestricted netposition is

duetotheDistrict’snoncurrent liabilitiesof$120

millionfortheDistrict’sportionoftheTeacherRetirementSystem(TRS)netpensionliabilityand$139.6millionforthe

District’s portion of the TRS net other post‐employment benefits liability. The pension and OPEBrelated deferred

outflows of $72.7 million are offset

by deferred inflows of $164.6 million, which also contributes to the deficit

unrestrictednetposition.

TheDistrict’stotalnetpositionincreasedby$54.4million,mainlyduetoincreasedpropertytaxrevenueandfederal

grants.

TheDistrict'sgovernmentalfundsfinancialstatementsreportedacombinedendingfundbalanceof$436.0

million.

Thisbalanceconsistsof$170.8millionintheGeneralFundofwhich$132.4millionisassignedand$38.0millionis

unassignedandavailableforspendingattheDistrict'sdiscretion.Restrictedfundbalancetotals$258.8millionandis

usedbythe Debt ServiceFund, Capital ProjectsFundsandNon‐major

Funds.Non‐spendablefund balanceis $0.9

million,andtheremainingbalanceconsistsof$6.0millioncommittedintheNon‐majorgovernmentalfunds.

Duringthefiscalyear,theDistrictissued$52.1millioninrefundingbondsto refundbondsintheamountof$52.7

million.Therefundingbondshadapremiumof$5.7millionandwereplacedinescrow.

TheGeneralFundhad$519.1millioninrevenues,whichprimarilyconsistedofstateaidandpropertytaxes,and$529.7

millioninexpenditures,includingapaymenttotheStateforrecaptureintheamountof$50.7million.TheGeneral

Fundfundbalancedecreasedthisyearby$10.5million,largelydueto

therecaptureowedbytheDistrictduringthe

settle‐upprocessperformedbytheTexasEducationAgency.

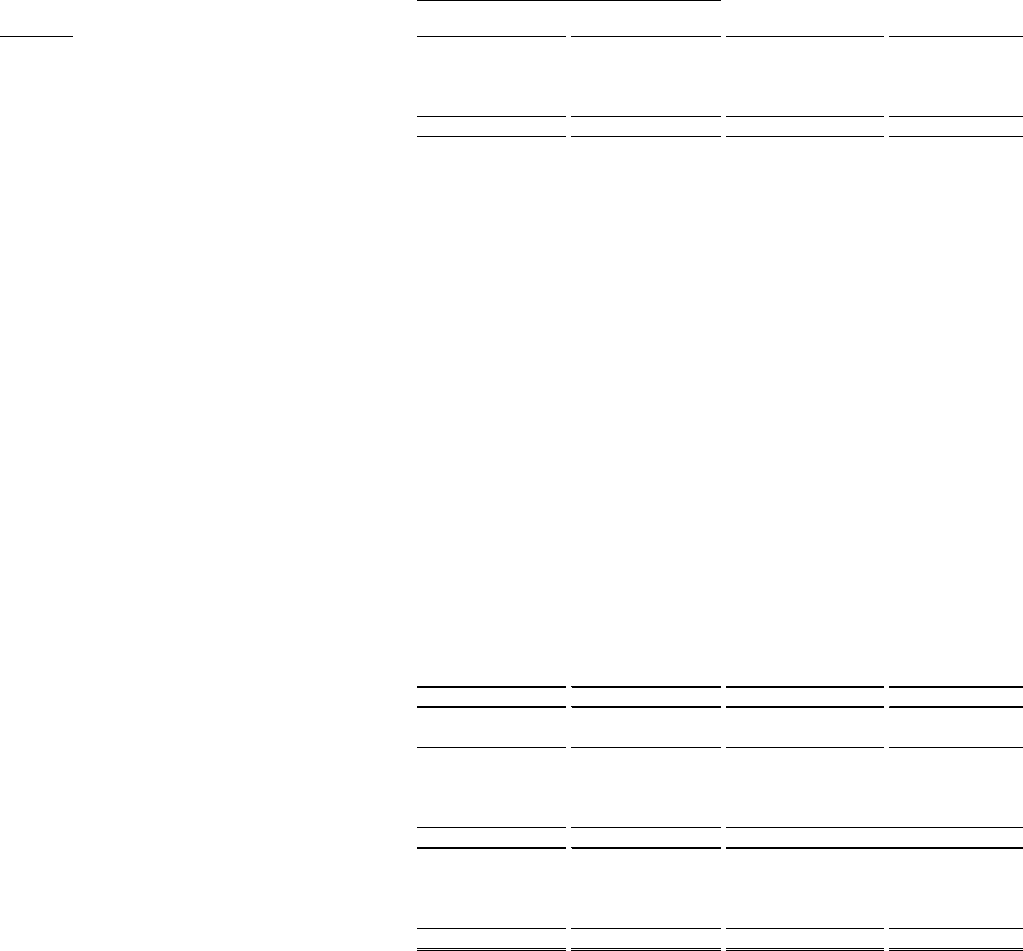

OVERVIEWOFTHEFINANCIALSTATEMENTS

This discussion and analysis is intended to serve as an introduction to the District's financial statements.The financial

statementscomprisefourcomponents:(1)government‐widefinancialstatements,

(2)fundfinancialstatements,(3)notesto

the basic financial statements, and (4) federal awards section.The statements are followed by a section of other

supplementaryinformationthatfurtherexplainsandsupportstheinformationinthefinancialstatements.Thefollowing

chartsummarizesthemajorfeaturesoftheDistrict'sfinancialstatements,including

theportionoftheDistricttheycoverand

thetypesofinformationtheycontain.

AlsoincludedasadiscretelypresentedcomponentunitistheLewisvilleEducationFoundation,Inc.,anonprofitorganization

thatprovidessupporttotheDistrict,teachers,andstudents.

LEWISVILLEINDEPENDENTSCHOOLDISTRICT

MANAGEMENT'SDISCUSSIONANDANALYSIS(continued)

8 LewisvilleISD2021ACFR

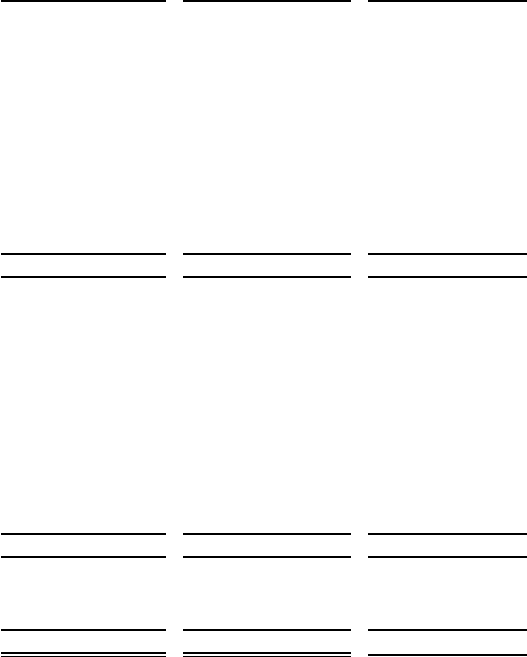

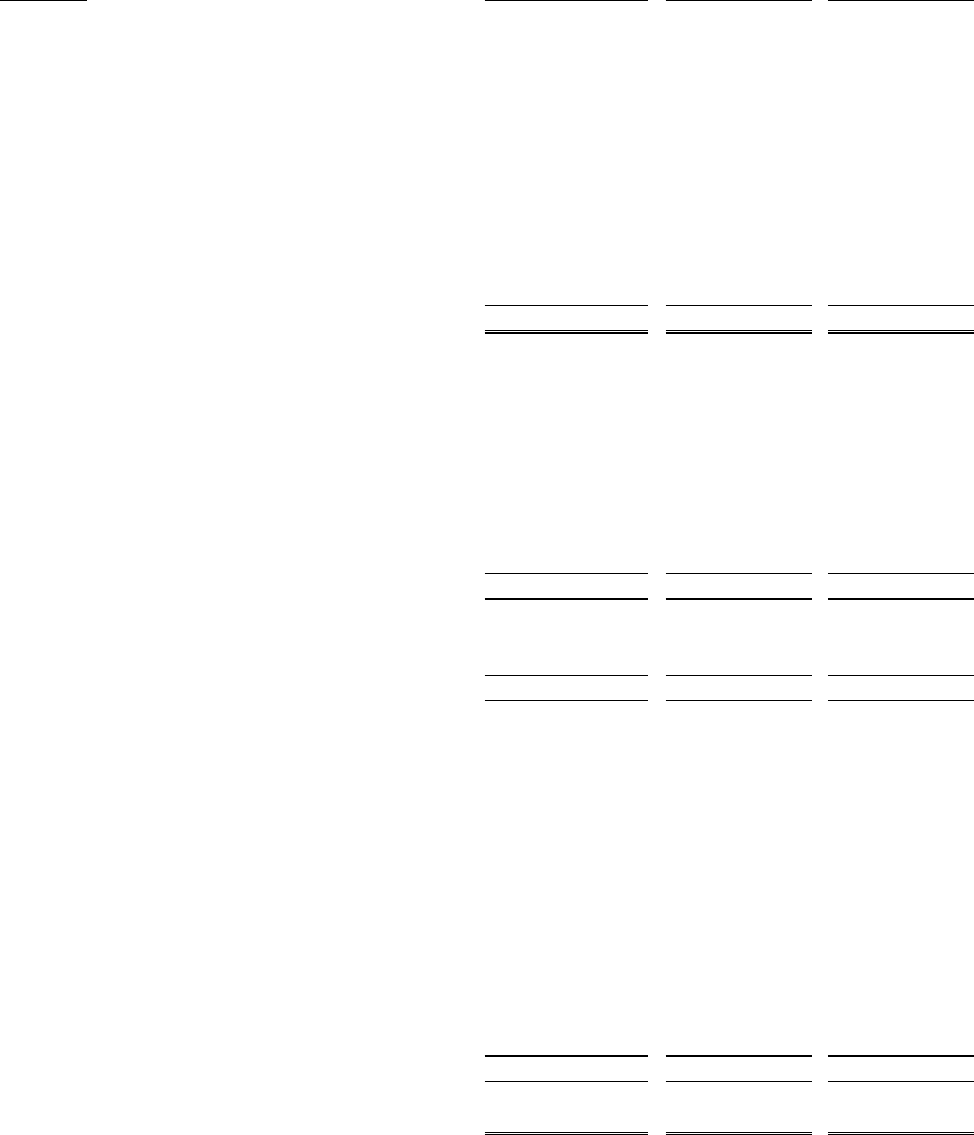

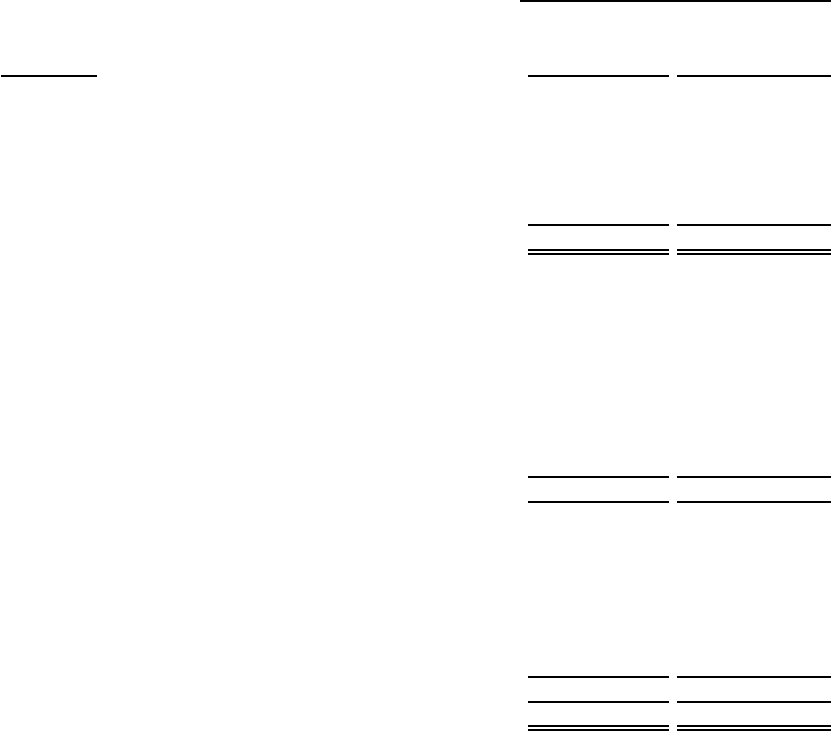

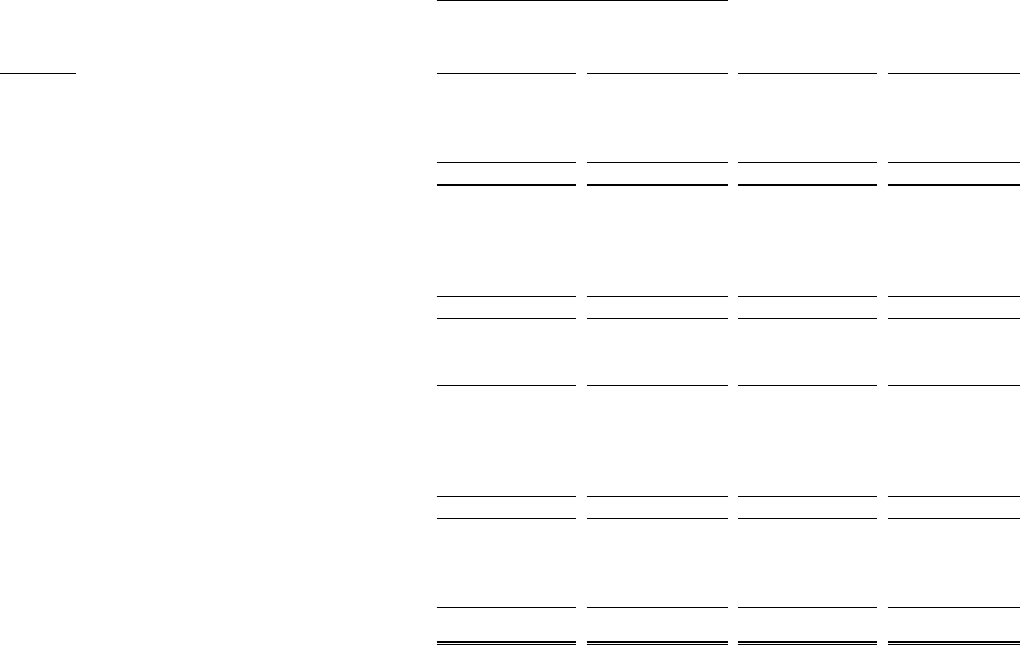

Government‐wide GovernmentalFunds Proprietar yFunds Fi duc ia ryFunds

Scope

EntireDi strict(except

fiduc ia ryfunds)

Theactivi ti es ofthe

Districtthatarenot

propr ieta r yor

fiduc ia ry,suchas

HealthandWorker s '

Compensation

Acti vi ti estheDistrict

operatessimilarto

privatebusiness‐

heal thinsuranceand

workers'

compensati on

Instancesinwhi chthe

Districtisthetrus teeor agent

forsomeone

els e's resources ,

suchasstudentactivi ty

a cc ounts

StatementofNetPosition Balancesheet

Statementofnet

position

Statementoffiduciarynet

position

StatementofActi vi ties

Statementofrevenues,

ex pendi turesand

changesinfund

ba la nce

Statementofrevenues,

ex pens esandchanges

infundnetposition

Statementofchanges in

fiduc ia r ynetposition(if

applicable)

Accountingbasisand

measurementfocus

Accruala ccounti ngand

economic resources focus

Modifiedaccrual

a cc ountingandcurrent

financialresources

focus

Accrual a cc ounting

andeconomi c

res ourcesfocus

Accrual a cc ountingand

economi cresourcesfocus

Typeofasset/liability

information

Al l assetsandliabilities,

bothfinancialandcapita l

short‐termandlong‐term

Onlyassetsexpectedto

beusedupand

liabilities

thatcome

dueduringtheyearor

soonthereafter;no

Al l assetsand

liabilities,both

financialandcapita l ,

andshort‐termand

long‐term

Al l assetsandliabilities,both

short‐termandlong‐term;the

District'sfiduc ia ryfundsdo

notcurrentlycontaincapital

assets,al thoughtheycan

Typeof

inflow/outflow

information

Al l

revenuesandexpenses

duringtheyear ,regardles s

ofwhenca s hisrecei vedor

pa id

Revenuesforwhi ch

cas hisrecei vedduring

orsoonaftertheendof

theyear;expendi tures

whengoodsor servi ces

ha vebeenrecei vedand

pa ymentisdueduring

theyearor soon

thereafter.

Al l revenuesand

ex pens es

duringthe

year,regardles sof

whencas hisrecei ved

orpai d

Al l revenuesandexpenses

duringtheyear,regardles s of

whencas hisrecei vedorpai d

(notapplicabletoagency

funds )

FundSta tements

Requiredfinancial

statements

Government‐widefinancialstatements.Thegovernment‐widefinancialstatementsaredesignedtoprovidereaderswitha

broadoverviewoftheDistrict'sfinances,inamannersimilartoaprivate‐sectorbusiness.TheStatementofNetPosition

includesallofthegovernment'sassets,deferredoutflows,liabilities,and deferredinflows.Allof

thecurrentyear'srevenues

andexpensesareaccountedforintheStatementofActivitiesregardlessofwhencashisreceivedorpaid.

The two government‐wide statements report the District's net position and how they have changed.Net position, the

difference between the District's assets, deferred outflows, liabilities and deferred

inflows, is one way to measure the

District'sfinancialhealthorposition.

Overtime,increasesordecreasesintheDistrict'snetpositionisanindicatorofwhetheritsfinancialhealthisimproving

ordeteriorating,respectively.

ToassesstheoverallhealthoftheDistrict,additionalnonfinancialfactors,suchas

changesintheDistrict'staxbase,

shouldbeconsidered.

Thegovernment‐widefinancialstatementsoftheDistrictincludeonlygovernmentalactivities.TheDistrict'sbasicservices

included here are instruction, extracurricular activities, curriculum and staff development, health services, and general

administration.Propertytaxes,stateaidandgrantsfinancemostofthese

activities.

Fund financial statements. The fund financial statements provide more detailed information about the District's most

significantfunds‐nottheDistrictasawhole.Afundisagroupingofrelatedaccountsthatisusedtomaintaincontrolover

resourcesthathavebeensegregatedforspecificactivitiesorobjectives.The

District,likeotherstateandlocalgovernments,

uses fund accounting to ensure and demonstrate compliance with finance‐related legal requirements.Some funds are

requiredbystatelawandbybondcovenants,whilemanyotherfundsareestablishedbytheDistricttohelpmanagemoney

forparticularpurposesandcompliancewithvarious

grantprovisions.AllofthefundsoftheDistrictcanbedividedintothree

categories:governmentalfunds,proprietaryfunds,andfiduciaryfunds.

LEWISVILLEINDEPENDENTSCHOOLDISTRICT

MANAGEMENT'SDISCUSSIONANDANALYSIS(continued)

9 LewisvilleISD2021ACFR

Governmentalfunds‐MostoftheDistrict'sbasicservicesareincludedingovernmentalfunds,whichfocuson(1)how

cashandotherfinancialassetsthatcanreadilybeconvertedtocashflowinandout,and(2)thebalances

leftatyear‐

endthatareavailableforspending.Consequently,thegovernmentalfundstatementsprovideadetailedshort‐term

viewthathelpsthereaderdeterminewhethertherearemoreorfewerfinancialresourcesthatcanbespentinthe

nearfuturetofinancetheDistrict'sprograms.Becausethisinformationdoes

notencompasstheadditionallong‐term

focusofthegovernment‐widestatements,weprovideadditionalinformationonthesubsequentpagethatexplains

therelationship(ordifferences)betweenthem.

TheDistrictmaintainsindividualgovernmentalfunds.Informationispresentedseparatelyinthegovernmentalfund

balancesheetand inthegovernmentalfundstatement

ofrevenues,expenditures,andchangesinfundbalanceofthe

GeneralFund,theDebtServiceFundandtheCapitalProjectsFund,allofwhichareconsideredtobemajorfunds.Data

fromtheothergovernmentalfundsarecombinedintoasingleaggregatedpresentation.Individualfunddataforeach

ofthesenonmajor

governmentalfundsisprovidedintheformofcombiningstatementselsewhereinthisreport.

Proprietaryfunds‐ServicesforwhichtheDistrictchargescustomersafeearegenerallyreportedinproprietaryfunds.

Proprietaryfunds,likethegovernment‐widestatements,providebothlong‐termandshort‐termfinancialinformation.

The

DistrictusesinternalservicefundstoreportactivitiesthatprovidesuppliesandservicesfortheDistrict'sother

programs and activities‐such as the Workers' Compensation Fund. The District established an enterprise fund to

accountforitsCulinaryArtsprogram.

Fiduciaryfunds‐TheDistrictisthetrustee,orfiduciary,for

certainfunds.TheDistrictisresponsibleforensuringthat

theassetsreportedinthesefundsareusedfortheirintendedpurposes.TheDistrict'sfiduciaryactivitiesarereported

inaseparatestatementsoffiduciarynetpositionandchangesinnetposition.Weexcludetheseactivitiesfromthe

District'sgovernment‐widefinancialstatements

becausetheDistrictcannotusetheseassetstofinanceitsoperations.

Notestothebasicfinancialstatements.Thenotesprovideadditionalinformationthatisessentialtoafullunderstandingof

thedataprovidedinthegovernment‐wideandfundfinancialstatements.

Otherinformation.Inadditiontothebasicfinancial

statementsandaccompanyingnotes,thisreportalsopresentscertain

othersupplementaryinformationconcerningtheDistrict.

FINANCIALANALYSISOFTHEDISTRICT ASAWHOLE

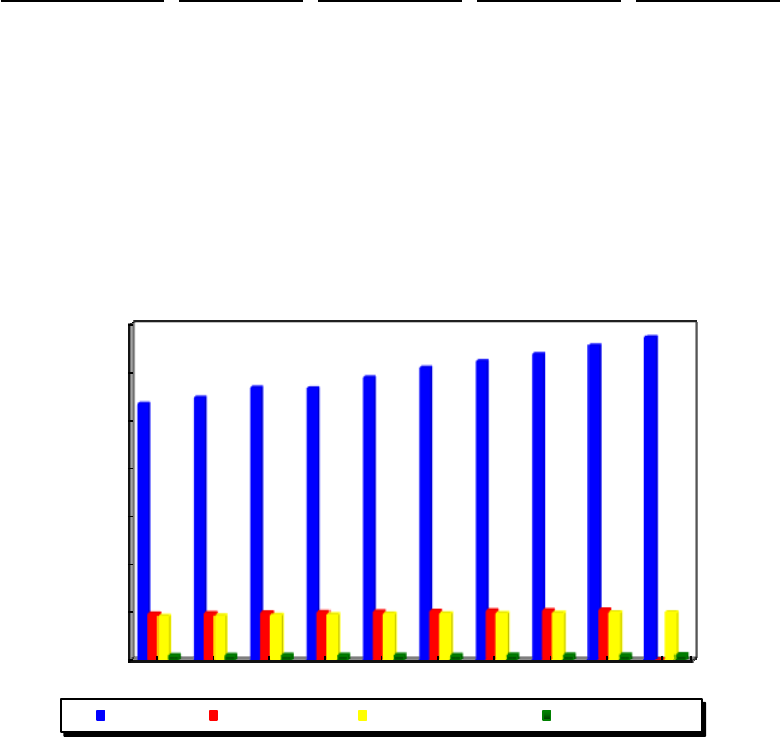

NetPosition.Asnotedearlier,netpositionmayserveovertimeasausefulindicatorofaDistrict'sfinancialposition.The

District'scombinednetpositionincreasedbetween

fiscalyears2021and2020‐increasingby$54.4millionascanbeseenon

thefollowingtable.TheDistrict'snetinvestmentincapitalassetsincludesitsinvestmentsincapitalassets(e.g.land,building,

equipment,improvements,andconstructioninprogress)lessanydebt,usedtoacquirethoseassetsthatarestill

outstanding.

TheDistrict'snetinvestmentincapitalassetsis$200.9million.

TheDistrictusesthesecapitalassetstoprovideservicetocitizens;consequently,theseassetsarenotavailableforfuture

spending.AlthoughtheDistrict'sinvestmentinitscapitalassetsisreportednetofrelateddebt,itshouldbenotedthat

the

resourcesneededtorepaythisdebtmustbeprovidedfromothersources,sincethecapitalassetsthemselvescannotbeused

toliquidatetheseliabilities.

LEWISVILLEINDEPENDENTSCHOOLDISTRICT

MANAGEMENT'SDISCUSSIONANDANALYSIS(continued)

10 LewisvilleISD2021ACFR

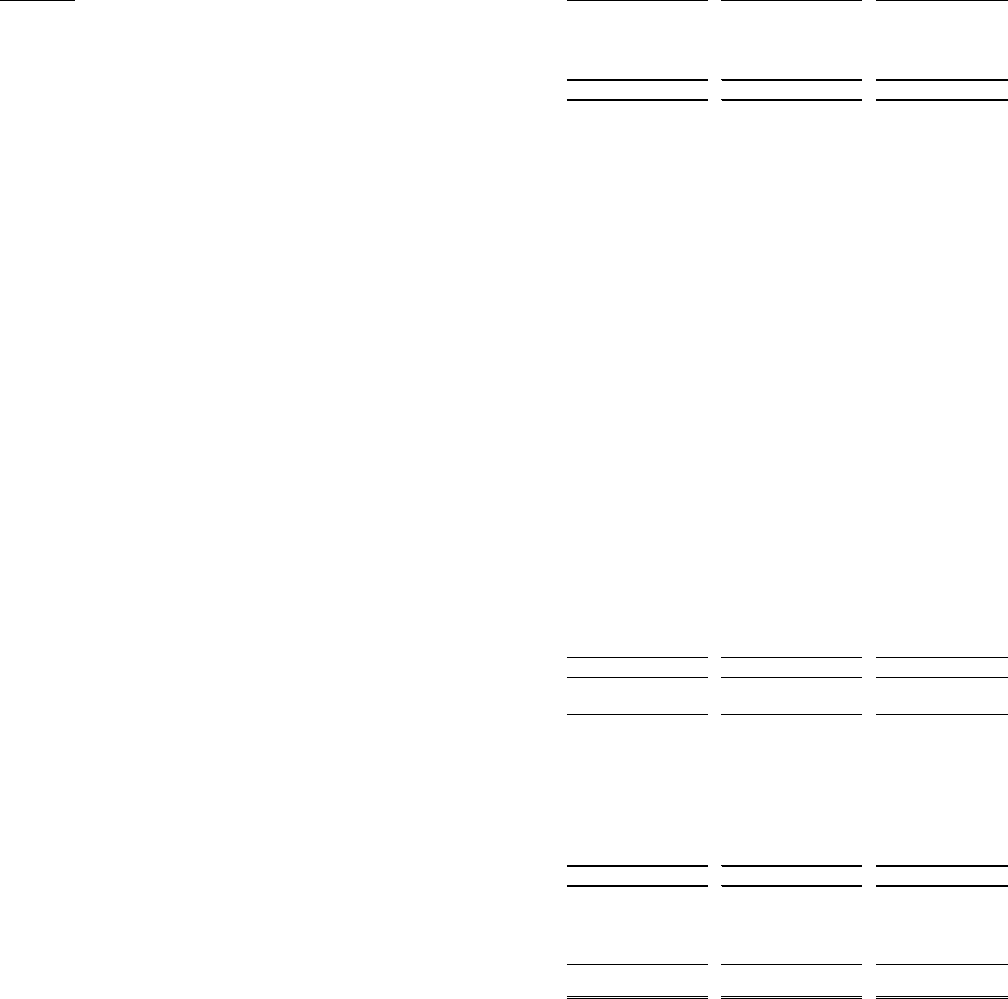

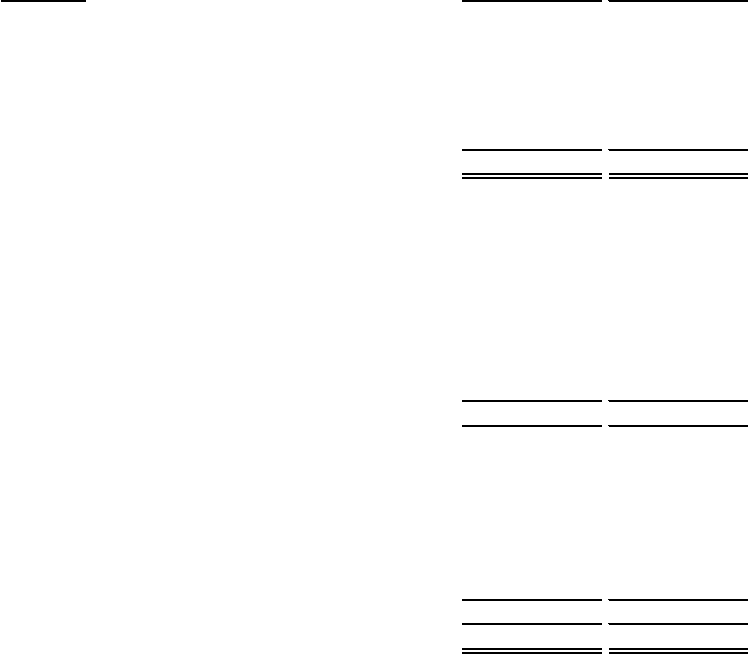

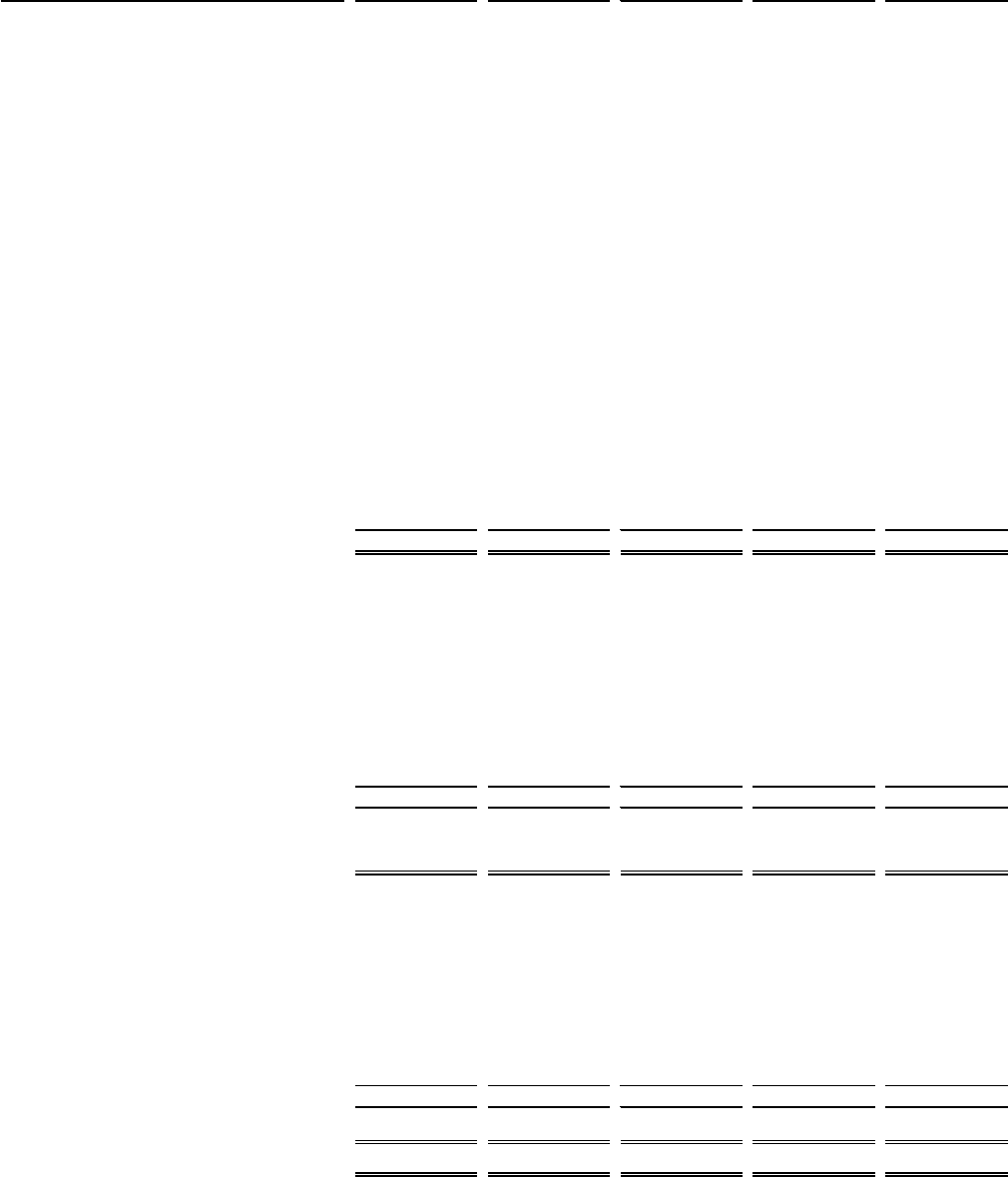

Thefollowingtableprovidesasummaryoftheassets,deferredoutflows,liabilities,deferredinflows,andnetpositionfor

governmentalactivitiesfortheyearsendedAugust31,2021and2020,respectively.

2021 2020

Currentandotherassets 538,972,765$ 702,320,233$

Capitalassets 1,429,252,261 1,325,516,748

TotalAssets 1,968,225,026 2,027,836,981

TotalDeferredOutflowsofResources 90,528,680 122,102,945

Currentliabilities 94,556,356 99,441,710

Long‐termliabilities 1,723,329,922 1,917,412,276

TotalLiabilities 1,817,886,278 2,016,853,986

TotalDeferredInflowsofResources 164,617,571 111,269,268

NetPosition

Netinvestmentin capitalassets

200,858,641 327,756,322

Restricted 71,500,147 52,223,170

Unrestricted (196,108,931) (358,162,820)

TotalNet

Position 76,249,857$ 21,816,672$

Aportionofthenetpositionisrestrictedastothepurposeforwhichtheycanbeused.Unrestrictednetpositiondecreased

by$5.8million.

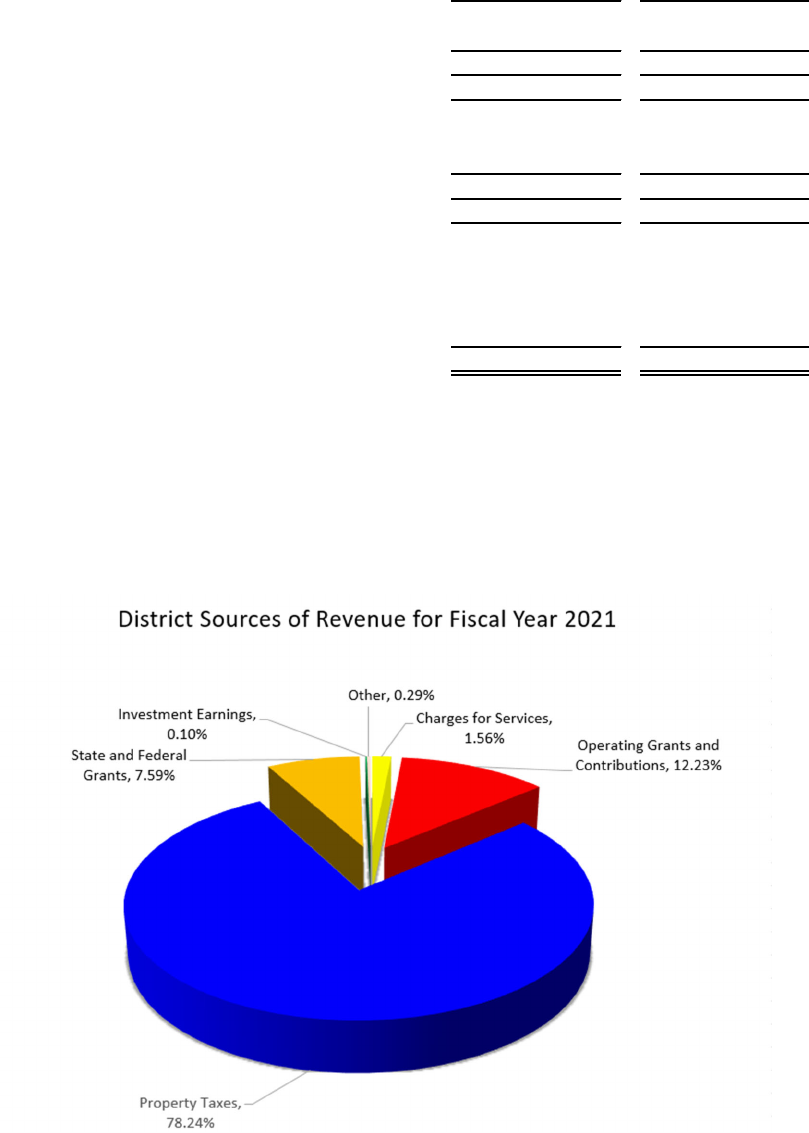

Changesinnetposition.TheDistrict'stotalrevenueswere$762.5millionrepresentinganincreaseof$10.2millionfromthe

previousyear.Themajorityofthis

increaseiscausedbytheincreaseinlocalpropertytaxrevenueof$29.6milliondueto

higherassessedvaluesonproperties.Asseenbelow,approximately78%oftheDistrict'srevenuecomesfromtaxeswhilethe

remainingcomesprimarilyfromstateandfederalsources.

LEWISVILLEINDEPENDENTSCHOOLDISTRICT

MANAGEMENT'SDISCUSSIONANDANALYSIS(continued)

11 LewisvilleISD2021ACFR

Government‐WideActivities

Funding for these government‐wide activities is by the specific program revenue or through general revenues such as

propertytaxesandinvestmentearnings.Thefollowingisasummaryofthegovernmentalfundsactivities:

•The

costofallgovernmentalactivitiesfortheyearwas$708.0million,anincreaseof$32.2millionfromtheprevious

year.

•Someofthegovernmentalactivitiescostwas fundedbyprogramrevenuesdirectlyattributabletospecificactivities.The

programrevenuesamountedto$105.1million,anincreasefromprioryearof

$0.7million.

ThefollowingtablepresentsthecostoftheDistrict'slargestgovernmentalfunctionsaswellastheirrelatednetcost(total

costlessfeesgeneratedby theactivities andintergovernmentalaid).Thenetcostreflectswhat wasfundedbylocaltax

dollars,staterevenuesandothermiscellaneousgeneralrevenues.

TotalCost NetCost

ofServices ofServices

Instructionandins tructionrelatedservices 369,612,709$ 312,867,831$

Schoolleadershipandadminstration 47,745,052 43,997,462

Support servicesstudent(pupil) 86,384,528 59,082,774

Support servicesnonstudentbased 68,288,109 61,830,439

Debtservice 47,337,256 45,262,683

619,367,654$ 523,041,189$

Asseeninthefollowingschedule:

Theamountthatourtaxpayerspaidfortheseactivitiesthroughpropertytaxeswas$596.5million.

Thosewhodirectlybenefitedfromtheprogramspaid$11.9million.

Operatinggrantsandcontributionstotaled$93.2million.

LEWISVILLEINDEPENDENTSCHOOLDISTRICT

MANAGEMENT'SDISCUSSIONANDANALYSIS(continued)

12 LewisvilleISD2021ACFR

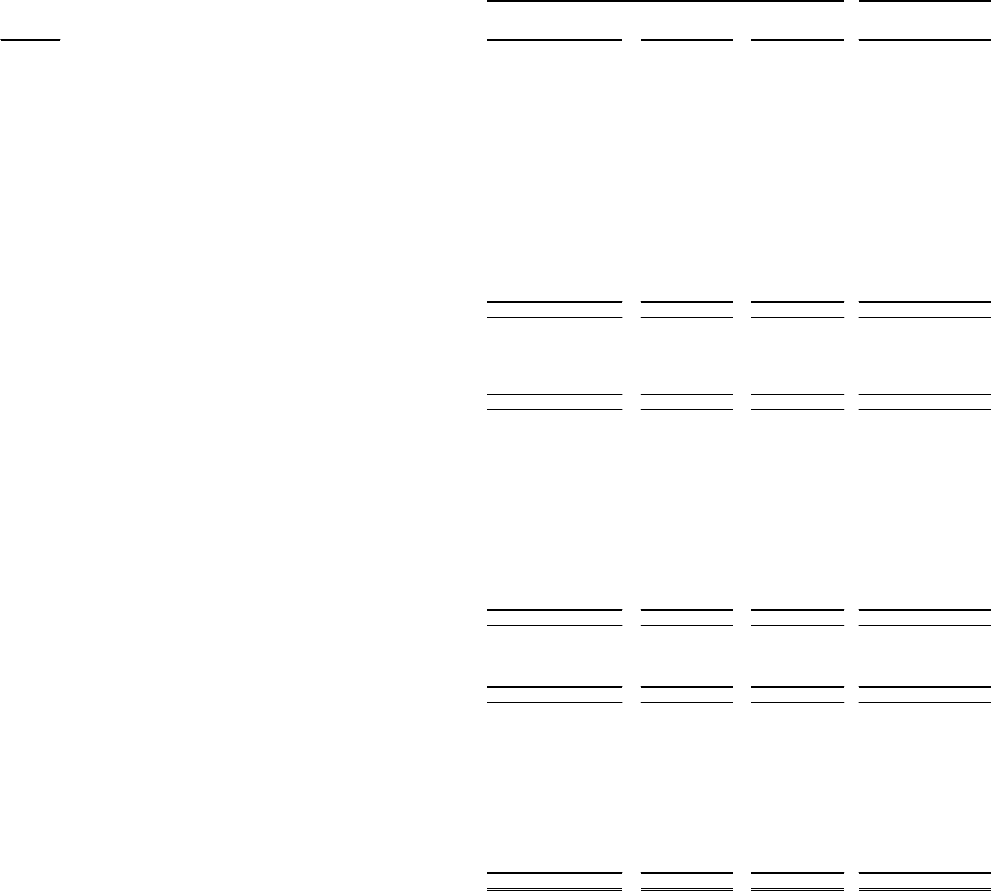

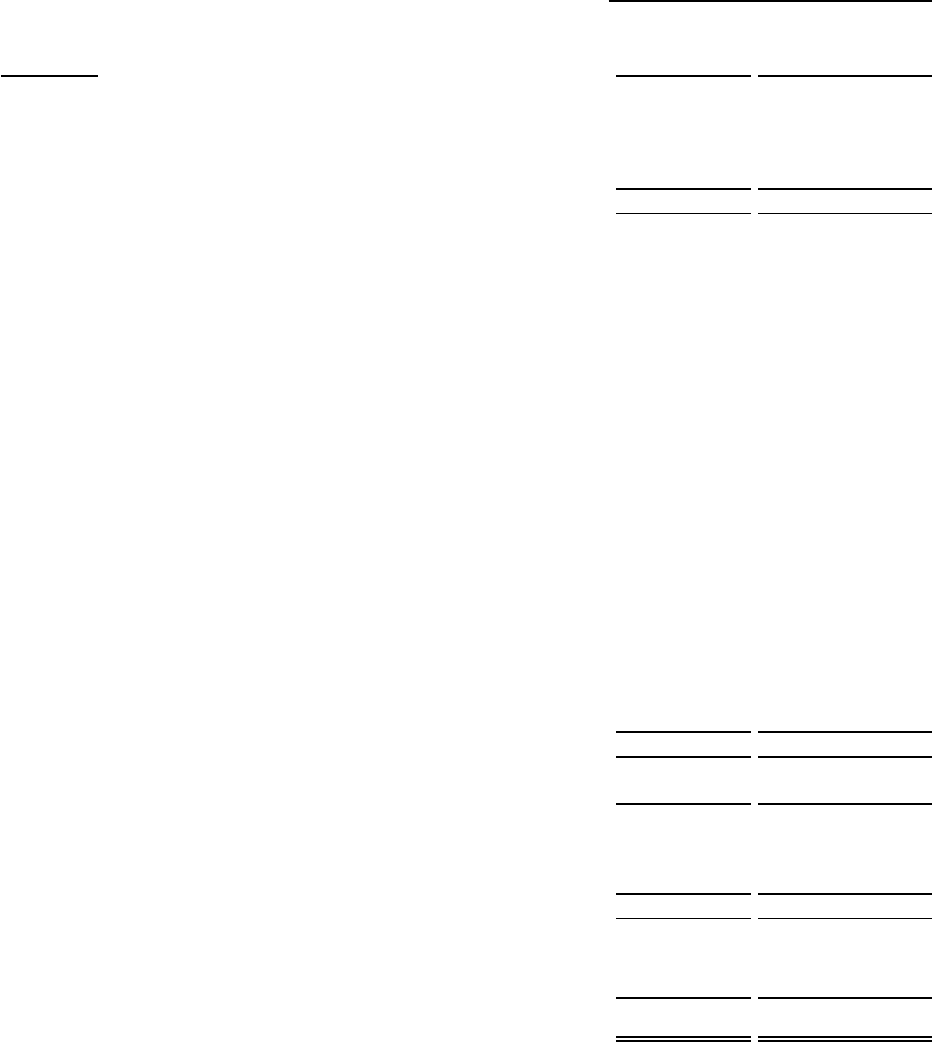

Percentage

Changefrom

2021 2020 PriorYear

Revenues

ProgramRevenues:

Chargesforservices

11,866,667$ 21,153,088$ ‐43.90%

Operatinggrantsandcontributions

93,222,170 83,270,862 11.95%

GeneralRevenues:

Propertytaxes

596,531,617 566,972,949 5.21%

Stateandfederalgrants

57,729,140 48,649,501 18.66%

Investmentearnings

727,385 7,072,349 ‐89.72%

Miscellaneous

2,233,651 6,330,253 ‐64.71%

Specialitem

‐ 18,820,008 ‐100.00%

TotalRevenues

762,310,630 752,269,010 1.33%

Expenses

Instructionandinstructionrelatedservices

369,612,709 377,152,486 ‐

2.00%

Instructionalandschoolleadership

47,745,052 49,833,692 ‐4.19%

Supportservicesstudent(pupil)

86,384,528 88,054,072 ‐1.90%

Administrativesupportservices

11,709,998 11,525,327 1.60%

Supportservicesnonstudentbased 68,288,109 63,512,846 7.52%

Ancillaryservices

6,075,696 7,879,785 ‐22.90%

Interestandfiscalcharges

47,337,256 41,706,705 13.50%

Otherfacilitycosts

16,377,376 18,059,205 ‐9.31%

Intergovernmentalcharges

54,346,721 18,142,147 199.56%

TotalExpenses

707,877,445 675,866,265 4.74%

Increase(decrease)innetposition

54,433,185 76,402,745 ‐28.75%

NetPosition‐September1 21,816,672 (54,586,073) ‐139.97%

NetPosition‐August31 76,249,857$ 21,816,672$ 249.50%

ChangesintheDistrict'sNetPosition

RevenuesfortheDistrict'sgovernmentalactivitiesincreasedyearoveryearoverallby$10.1millionforthefiscalyearended

August31,2021.Theincreaseismainlycausedbytheincreaseinpropertytaxrevenueof$29.6millionduetoincreased

propertyvalues.TheDistrict’snewenterprisefund,CulinaryArts,generated

$12thousanddollars.

ExpensesfortheDistrict'sgovernmentalactivitiesincreasedyearoveryearby$32.2millionforthefiscalyearendedAugust

31,2021.Theincreasecausedbyintergovernmentalchargeswhichincludestherecapturepaymentof$51million.

TheDistrict’scombinedpropertytaxrateincreasedto$1.3473per$100of

assessedvaluefrom$1.3375per$100ofassessed

value.Thisgeneratedtaxrevenuesof$596.5millioninfiscalyear2021,anincreaseof$29.6millionoverthe2020fiscalyear.

LEWISVILLEINDEPENDENTSCHOOLDISTRICT

MANAGEMENT'SDISCUSSIONANDANALYSIS(continued)

13 LewisvilleISD2021ACFR

FINANCIALANALYSISOFTHEDISTRICT'SFUNDS

GovernmentalFunds.ThefocusoftheDistrict'sgovernmentalfundsistoprovideinformationonnear‐terminflows,outflows,

and balances of spendable resources. Such information is useful in assessing the District's financing

requirements. In

particular,theunassignedfundbalancemayserveasausefulmeasureofagovernment'snetresourcesavailableforsp ending

attheendofthefiscalyear.

Asoftheendofthecurrentfiscalyear,theDistrict'sgovernmentalfundsreportedcombinedendingfundbalancesof$435.9

million,a

decreaseof$162.0millionincomparisonwiththeprioryear.Approximately9%ofthistotalamount($38.0million)

constitutesanunassignedfundbalance,whichisavailableforspendingattheDistrict'sdiscretion.Theremainingfundbalance

isnotavailableforspendingbecauseithasalreadybeencommitted,restricted,assignedoris

nonspendable.TheDistricthas

self‐imposedalimitationontheuseofotherwiseavailableexpendablefinancialresourcesingovernmentalfunds.TheBoard

hasresolvedthattheDistrictshallnotdropbelowaminimumofthreemonthsofexpenditures($132.4million)inassigned

fundbalanceintheGeneralFund.TheDistrict

has$187.8millioninrestrictedunspentbondproceedsinitscapitalprojects

fund.

GeneralFund.TheGeneralFundisthechiefoperatingfundof theDistrict.Attheendofthecurrentfiscalyear,unassigned

fundbalancefortheGeneralFundwas$38.0million,whiletotalfundbalancewas$170.8

million.Asameasureofthegeneral

fund'sliquidity,itmaybeusefultocomparebothunassignedfundbalanceandtotalfundbalancetototalfundexpenditures.

Unassignedfundbalancerepresents7.0%oftotalGeneralFundexpenditures,whiletotalfundbalancesrepresent32.2%of

thatsameamount.

TheDistrict'sGeneralFund

balancedecreasedby$10.4millionduringthecurrentfiscalyearincomparisontoanincreasein

theprioryearof$16.6million.Localrevenuesincreasedby$7.9millionprimarilyduetopropertytaxes.Staterevenues

increasedby$2.8million.

DebtServiceFund.TheDebtServiceFundhasatotalfund

balanceof$62.2million,allofwhichisrestrictedforthepayment

ofdebtservice.ThenetincreaseinfundbalanceduringthecurrentyearintheDebtServiceFundwas$14.4million.During

theyeartheDistrictalsoissuedrefundingbondsof$52.1million.

LEWISVILLEINDEPENDENTSCHOOLDISTRICT

MANAGEMENT'SDISCUSSIONANDANALYSIS(continued)

14 LewisvilleISD2021ACFR

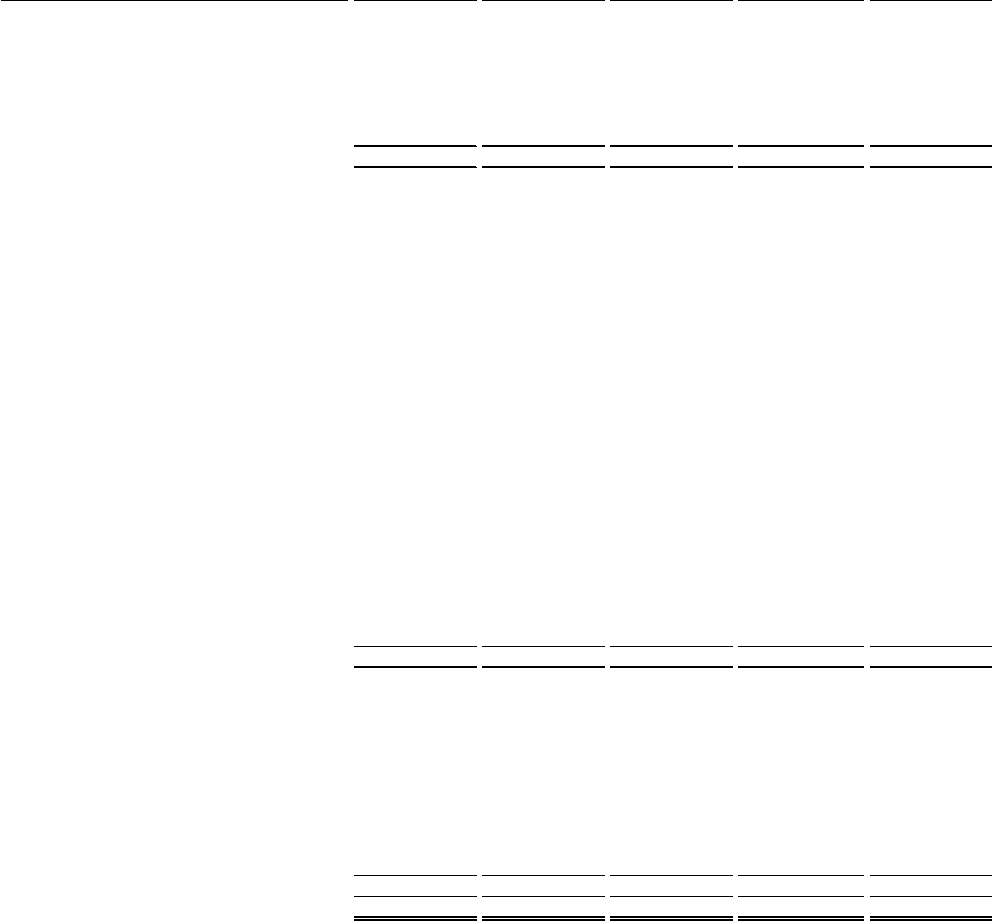

Thetablethatfollowsassistsinillustratingthefinancialactivitiesand balanceoftheDebtServiceFund.

2021 2020

Revenues

Propertytaxes 167,538,716$ 155,804,985$

Investmentincome 103,520 1,094,553

Staterevenues 1,578,452 1,892,667

TotalRevenues 169,220,688 158,792,205

Expendituresbyfunction

Principal 89,000,233 96,021,916

Interest 66,283,947 91,721,341

TotalExpenditures 155,284,180 187,743,257

OtherFinancingSources(Uses)

Refundingbondsissued 52,055,000 25,840,000

Netpremiumsonissuanceofbonds 5,672,637 4,960,452

TotalOtherFinancingSources(Uses) 579,919 30,800,452

Netchangeinfund

balance 14,516,427 1,849,400

Fundbalance‐September1 47,860,122 46,010,722

Fundbalance‐August31

62,376,549$ 47,860,122$

CapitalProjectsFund.TheCapitalProjectsFundhasatotalfundbalanceof$187.8million,allofwhichisrestrictedforongoing

capitalprojects.Thefundbalancedecreasedby$168.0millionduringthecurrentfiscalyearduetoongoingconstruction

projects.TheDistrict'sCapitalProjectsFundisusedtoaccount

forfinancialresourcesusedfortheacquisitionorconstruction

ofmajorcapitalfacilitiesspecificallyfundedbybondsapprovedbythevoters.Furtherdiscussionofthecurrentyearuseof

capitalprojectscanbefoundundertheCapitalAssetssection.

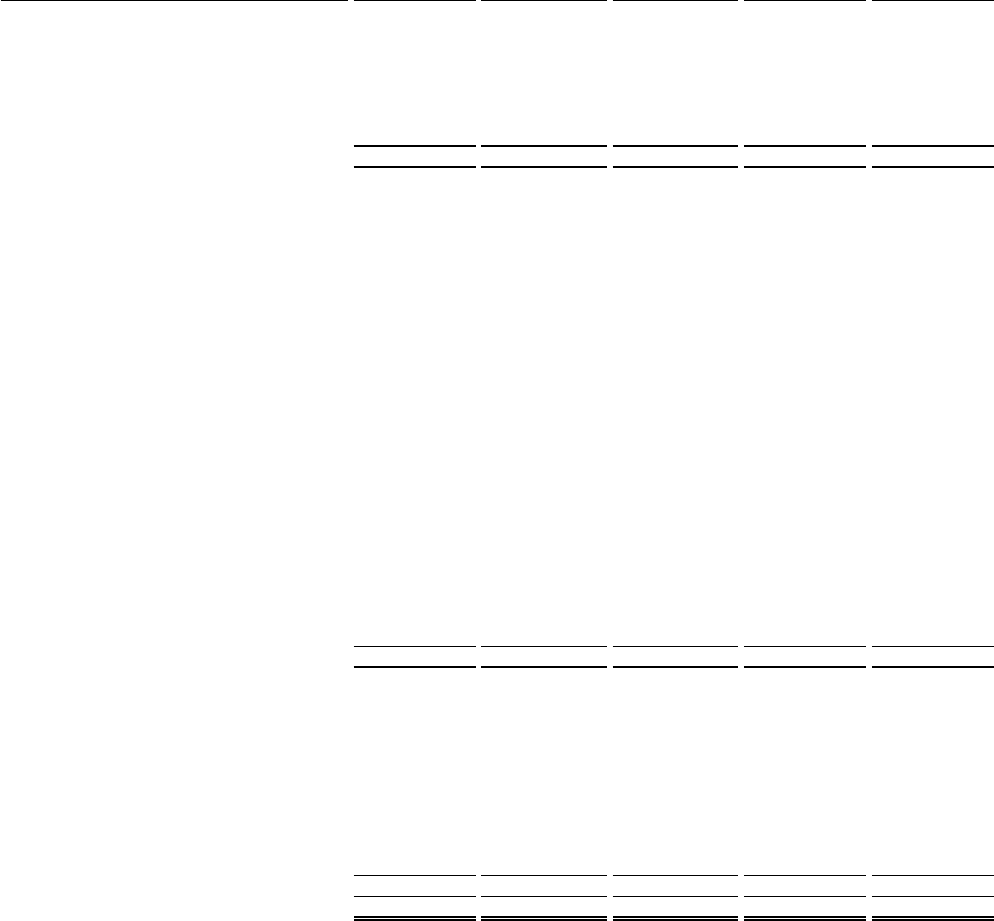

GeneralFundBudgetaryHighlights

InaccordancewithBoardPolicyCE

(Local),theDistrictsubmitsamendmentsduringthecourseofthebudgetyear.Approval

forbudgetincreasesforformallyadoptedfundsshallbemadebytheBoardofTrustees.TheBoarddelegatestheauthority

forapprovalofbudgetfunctionaltransferstothebudgetdepartment.TheDistrict'smajorbudgetamendmentspresented

tothe

BoardofTrusteesthroughouttheyeararesummarizedasfollows:

Variances of original expenditure budget compared to amended budget‐The amended expenditure budget

increasedintheGeneralFundby$6.2millionfromtheoriginalbudget.

Variances of amended budget to actual expenditures‐Expenditureswere $19.6millionless

thanfinalbudgeted

amounts.Purchasedandcontractedserviceswere$10.7millionunderbudget,avarianceof11.0%.Thevariance

includes utilities, transportation, contracted maintenance projects and other contracted services.Supplies and

materialswereunderbudgetby$2.6millionor15.8%.

Variances of original revenue budget compared to actual revenue

‐ Local revenueswereunder budget by $21.3

million.Staterevenueswere$0.3millionunderbudget.Federalrevenueexceededbudgetby$6.5millionprimarily

duetoImpactAid,SHARSrevenueandindirectcosts.

LEWISVILLEINDEPENDENTSCHOOLDISTRICT

MANAGEMENT'SDISCUSSIONANDANALYSIS(continued)

15 LewisvilleISD2021ACFR

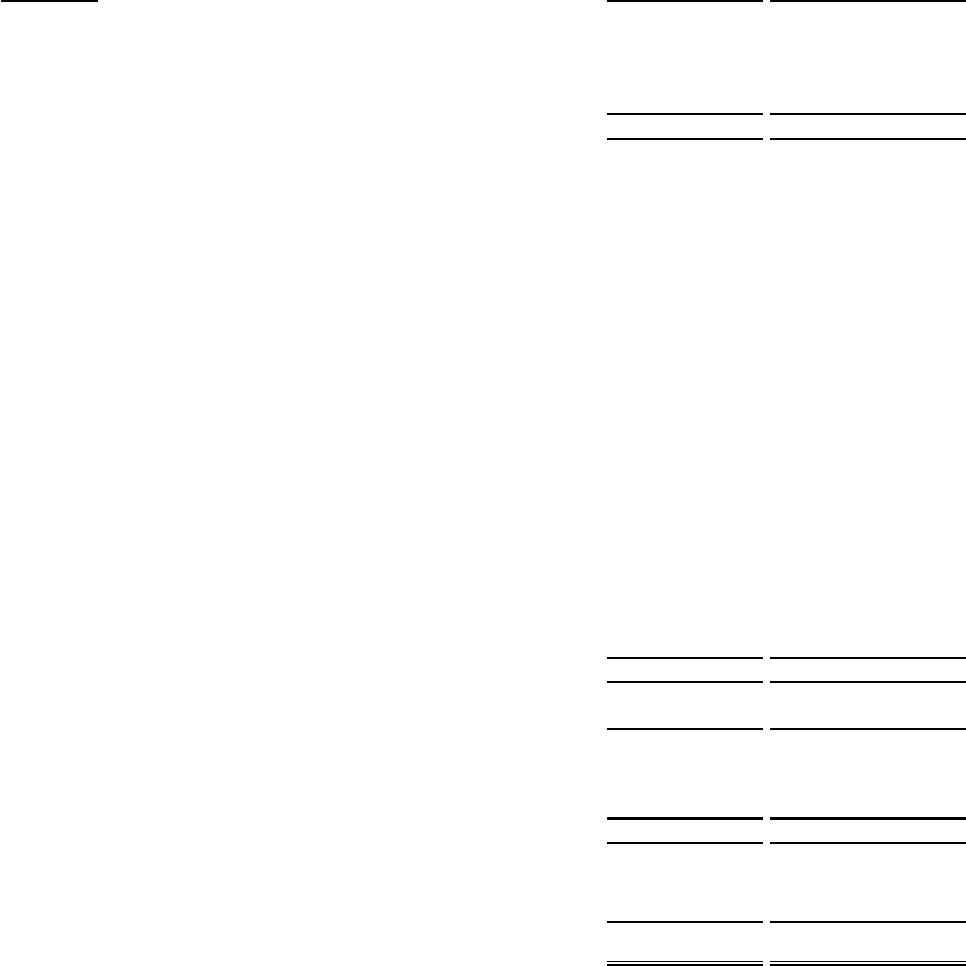

CapitalAssets

Attheendof2021,theDistrictinvested$1.4billioninabroadrangeofcapitalassets,includingland,equipment,buildings,

andconstructioninprogress.Thisamountrepresentsanetincreaseof$103.7millionor8%

fromlastyear.

ListedinthetablebelowarethecapitalassetsforgovernmentalactivitiesforthefiscalyearendedAugust31,2021and2020,

respectively:

Total%

2021 2020 Change

Land 103,359,677$ 103,359,677$ 0.00%

Buildingsandimprovements

1,738,990,874 1,605,712,241 8.30%

Vehicles

32,632,514 32,624,701 0.02%

Furnitureandequipment

27,399,078 26,828,050 2.13%

Constructioninprogress

106,921,213 87,679,756 21.95%

TotalatHistoricalCost

2,009,303,356 1,856,204,425 8.25%

Lessaccumulateddepreciationfor:

Buildingsandimprovements

555,479,758 510,423,284 8.83%

Vehicles

6,309,055 3,771,860 67.27%

Furnitureandequipment

18,262,282 16,492,533 10.73%

TotalAccumulatedDepreciation

580,051,095 530,687,677

9.30%

NetCapitalAssets

1,429,252,261$ 1,325,516,748$ 7.83%

AdditionalinformationontheDistrict'scapitalassetscanbefoundinNote5ofthisreport.

DebtAdministration

Attheendofthe2020‐2021fiscalyear,theDistricthadtotalbondeddebtof$1.463billion,adecreaseof7%percentfrom

theprioryear.Duringthefiscalyear,

theDistrictissuedrefundingbondswithaparvalueof$52.1millionandapremium

of$5.7million.

TheDistrictcontinuestoenjoyexcellentbondratings.TheDistrict’sbondspresentlycarryveryfavora bleratingsasfollows:

•

StandardandPoor’s“AA+”

•

FitchInvestorService“AA+”

MoredetailedinformationabouttheDistrict'sdebtispresentedintheNotestotheFinancialStatements(Note9).

The2021‐2022appraisedpropertyvaluesincreasedbyapproximately7.5%.ThepassageofHouseBill3bythe86thTexas

LegislaturechangedtheStatefundingformulastofocus

primarilyonrevenuesdeemedappropriateforvariouscategoriesof

student instructional settings. The funding for the District as projected under the provisions of House Bill 3 results in

approximatelysimilaramountsofavailablerevenueswithanincreaseintheprojectedrecapturepaymentsofapproximately

$1.5overprior.TheDistrictis

expectingtopayrecapturepaymentstotheStateinaccordancewithChapter49oftheTexas

EducationCodeintheamountof$57million.

TheMaintenanceandOperations(M&O)taxratedecreasedfrom$0.9664per$100valuationto$0.9276per$100valuation

forthe2021‐22fiscalyearinaccordance

withrequirementsofstatelaw.TheInterestandSinking(I&S)taxremainedthesame

at$0.38090per$100valuationfor2021‐22schoolyear.Studentenrollmentisexpectedtodecline slightlyfrom49,361to

49,209forfiscalyear2021‐2022.

LEWISVILLEINDEPENDENTSCHOOLDISTRICT

MANAGEMENT'SDISCUSSIONANDANALYSIS(continued)

16 LewisvilleISD2021ACFR

GeneralFundexpendituresarebudgetedtoincreaseby$36millionor6.7percentovertheprioryearbudgetedexpenditures.

Majorexpenditurechangesincludeasalaryincreaseforteachers,aone‐timepayforeachdistrictemployee,newpositions,

increases

forsubstitutespayandrecapturepaymentsof$57million.

Iftheestimatesarerealized,theDistrict’sbudgetaryGeneralFundbalanceisexpectedtodecreaseby$26.6millionbythe

closeof2022fiscalyear.

RequestforInformation

Thisfinancialreportisdesignedtoprovideourcitizens,taxpayers,customers,investors,

andcreditorswithageneraloverview

oftheDistrict'sfinancesandtodemonstratetheDistrict'saccountabilityforthemoneyitreceives.Ifyouhavequestions

about this report or need additional financial information, contact the District's Chief Financial Officer at Lewisville

IndependentSchoolDistrictAdministrativeCenter,1565AWestMainStreet,

Lewisville,TX75067.

Seenotestothebasicfinancialstatements. 17 LewisvilleISD2021ACFR

LEWISVILLEINDEPENDENTSCHOOLDISTRICT ExhibitA‐1

STATEMENTOFNETPOSITION

August31,2021

ComponentUnit

(December31,2020)

GovernmentalActivities

Business‐Type

Activities Total

LewisvilleEducation

Foundation

Assets

1110 Cashandcashequivalents 496,568,066$ 12,655$ 496,580,721$ 5,143,220$

Receivables:

1225 Propertytaxes 8,070,429 ‐ 8,070,429 ‐

1230 Allowanceforuncollectibletaxes (897,989) ‐ (897,989) ‐

1240 Duefromothergovernments 16,289,604 ‐ 16,289,604 ‐

1250 Accruedinterest 7,422 ‐ 7,422 ‐

1290 Otherreceivables 77,392 ‐ 77,392 15,092

1300 Inventoriesat

cost 710,308 ‐ 710,308 ‐

1410 Prepaiditems 165,974 ‐ 165,974 6,878

Capitalassets(netofaccumulationdepreciationwhereapplicable): ‐

1510 Land 103,359,677 ‐ 103,359,677 ‐

1580 Constructioninprogress 106,921,213 ‐ 106,921,213 ‐

1520 Buildingsandimprovements 1,183,511,116 1,183,511,116 ‐

1531 Vehicles 26,323,459 26,323,459 ‐

1530 Furnitureandequipment 9,136,796 9,136,796 ‐

1810 RestrictedCashandInvestments 17,981,559 ‐ 17,981,559 ‐

1000 TotalAssets 1,968,225,026 12,655 1,968,237,681 5,165,190

DeferredOutflows

ofResources

Deferredoutflows‐chargeonrefunding

17,767,251 17,767,251 ‐

Deferredoutflows‐pension

46,920,117 46,920,117 ‐

Deferredoutflows‐OPEB

25,841,312 25,841,312 ‐

1700

TotalDeferredOutflowsofResources

90,528,680 ‐ 90,528,680 ‐

Liabilities

2110 Accountspayable 40,136,728 ‐ 40,136,728 15,693

2140 Interestpayable 2,232,856 ‐ 2,232,856 ‐

2150 Payrolldeductionsandwithholdingspayable 4,247,105 ‐ 4,247,105 ‐

2160 Accruedwagespayable 37,660,622 ‐ 37,660,622 ‐

2180 Dueto

othergovernments 8,735,303 ‐ 8,735,303 ‐

2300 Unearnedrevenue 1,543,742 ‐ 1,543,742 ‐

NoncurrentLiabilities: ‐

2501 Duewithinoneyear 99,786,242 ‐ 99,786,242 ‐

2502 Dueinmorethanoneyear 1,363,899,687 ‐ 1,363,899,687 ‐

2540 Netpensionliability 120,078,526 ‐ 120,078,526 ‐

2545 NetOtherPostEmploymentBenefits(OPEB)liability 139,565,467 ‐ 139,565,467 ‐

2000 TotalLiabilities 1,817,886,278 ‐ 1,817,886,278 15,693

DeferredInflowsofResources

Deferredinflows‐pension

46,924,901 ‐ 46,924,901 ‐

Deferredinflows‐OPEB

117,692,670 ‐ 117,692,670 ‐

2600

TotalDeferredInflowsofResources

164,617,571 ‐ 164,617,571 ‐

NetPosition

3200 Netinvestmentincapitalassets 200,858,641 ‐ 200,858,641 ‐

Restrictedfor:

3840 Foodservice 7,353,837 ‐ 7,353,837 ‐

3820 Grants 1,772,472 ‐ 1,772,472 ‐

3850 Debtservice 62,373,838 ‐ 62,373,838 ‐

3860 Capitalprojects ‐ ‐ ‐ ‐

3890 Expendable ‐ ‐ ‐ 528,4 57

3890 Nonexpendable ‐ ‐ ‐ 3,359,769

3900 Unrestricted

(196,108,931) 12,655 (196,096,276) 1,261,271

3000 TotalNetPosition(Deficit) 76,249,857$ 12,655$ 76,262,512$ 5,149,497$

Data

Control

Codes

PrimaryGovernment(August31,2021)

Seenotestothebasicfinancialstatements. 18 LewisvilleISD2021ACFR

LEWISVILLEINDEPENDENTSCHOOLDISTRICT ExhibitB‐1

STATEMENTOFACTIVITIES Page1of2

FortheYearEndedAugust31,2021

Data

Control

Codes Functions/Programs Expenses

Chargesfor

Services

OperatingGrantsand

Contributions

PrimaryGovernment:

Governmentalactivities:

11 Instruction 357,161,456$ 1,003,841$ 53,929,333$

12 Instructionresources&mediaservices 7,834,404 15,601 157,375

13 Curriculum&instructionalstaffdevelopment 4,616,849 16,473 1,622,255

21 Instructionalleadership 12,473,021 52,519 1,055,652

23 Schooladministration 35,272 ,031 255,768 2,383,651

31 Guidanceandcounseling 25,434,888 214,687 1,994,112

32 Socialworkservices 426,078 ‐ 461,556

33 Healthservices 7,275,834 549

514,855

34 Pupiltransportation 16,040,794 ‐ 68,135

35 Foodservices 20,248,533 1,953,858 18,753,236

36 Co‐curricularactivities 16,958,401 2,759,958 580,808

41 Generaladministration 11,709,998 144,193 4,414,724

51 Plantmaintenanceandoperation 47,871,728 1,662,503 1,835,651

52 Securityandmonitoring 4,052,939 ‐ 693,882

53 Dataprocessingservices 16,363,442 ‐ 2,265,634

61 Communityservices 6,075,696 3,786,717 395,221

71 Interestandfiscalchargesonlong‐termdebt 47,337,256 ‐ 2,074,573

81 Otherfacilitycosts 16,377,376 ‐ 21,517

91 PurchaseofWADA 50,745,313 ‐ ‐

93

Fiscalagent/memberdistrict

ofsharedservicearrangement 131,200 ‐ ‐

99 Otherintergovernmentalcharges 3,470,208 ‐ ‐

TG TotalGovernmentalActivities 707,877,445 11,866,667 93,222,170

Business‐TypeActivities:

01 CulinaryArts 995 13,650 ‐

TP Totalprimarygovernment 707,878,440$ 11,880,317$ 93,222,170$

ComponentUnits:

LewisvilleEducationFoundation,Inc. 873,071$ ‐$ 1,310,780$

ProgramRevenue

Seenotestothebasicfinancialstatements. 19 LewisvilleISD2021ACFR

LEWISVILLEINDEPENDENTSCHOOLDISTRICT ExhibitB‐1

STATEMENTOFACTIVITIES Page2of2

FortheYearEndedAugust31,2021

Data

Control

Codes Functions/Programs GovernmentalActivities

Business‐Type

Activities Total

ComponentUnitYear

Ended

December31,2020

PrimaryGovernment:

Governmentalactivities:

11 Instruction (302,228,282)$ (302,228,282)

12 Instructionresources&mediaservices (7,661,428) (7,661,428)

13 Curriculum&instructionalstaffdevelopment (2,978,121) (2,978,121)

21 Instructionalleadership (11,364,850) (11,364,850)

23 Schooladministration (32,632,612) (32,632,612)

31 Guidanceandcounseling (23,226,089) (23,226,089)

32 Socialworkservices 35,478 35,478

33 Healthservices (6,760,430) (6,760,430)

34 Pupiltransportation (15,972,659) (15,972,659)

35 Foodservices 458,561 458,561

36 Co‐curricularactivities (13,617,635)

(13,617,635)

41 Generaladministration (7,151,081) (7,151,081)

51 Plantmaintenanceandoperation (44,373,574) (44,373,574)

52 Securityandmonitoring (3,359,057) (3,359,057)

53 Dataprocessingservices (14,097,808) (14,097,808)

61 Communityservices (1,893,758) (1,893,758)

71 Interestandfiscalchargesonlong‐termdebt (45,262,683) (45,262,683)

81 Otherfacilitycosts (16,355,859) (16,355,859)

91 PurchaseofWADA (50,745,313) (50,745,313)

93

Fiscalagent/memberdistrict

ofsharedservicearrangement (131,200) (131,200)

99 Otherintergovernmentalcharges (3,470,208) (3,4 70,208)

TG TotalGovernmentalActivities (602,788,608) ‐ (602,788,608)

Business‐

TypeActivities:

01 CulinaryArts ‐ 12,655 12,655

TP Totalprimarygovernment (602,775,953) 12,655 (602,775,953)

ComponentUnits:

LewisvilleEducationFoundation,Inc. 437,709$

GeneralRevenues:

Taxes:

MT Propertytaxes‐maintenance&operations 428,000,897 428,000,897 ‐

DT Propertytaxes‐debtservices 168,530,720 168,530,720 ‐

SF Unrestrictedstateaidformulagrants 43,800,094 43,800,094 ‐

GC Medicaidreimbursements 8,008,708 8,008,7 08 ‐

GC Unrestrictedfederalandstategrants 5,920,338 5,920,338 ‐

IE Investmentearnings(loss) 727,385 727,385 49,943

MI Miscellaneous 2,233,651 2,233,651 ‐

TR

TotalGeneralRevenues 657,221,793 ‐ 657,221,793 49,943

CN Changeinnetposition 54,433,185 12,655 54,445,840 487,652

NB NetPosition‐Beginning 21,816,672 ‐ 21,816,672 3,920,719

NE NetPosition‐Ending 76,249,857$ 12,655$ 76,262,512$ 5,149,497$

Net(Expense)Revenueand

ChangesinNetPosition(August31,2021)

Seenotestothebasicfinancialstatements. 20 LewisvilleISD2021ACFR

LEWISVILLEINDEPENDENTSCHOOLDISTRICT ExhibitC‐1

BALANCESHEET‐GOVERNMENTALFUNDS Page1of2

August31,2021

Data

Control

Codes Gener alFund

DebtServic e

Fund

CapitalProjects

Fund

Assets

1110 Ca s handtemporaryi nves tments 207,734,142$ 44,609,286$ 221,475,847$

Receivables:

1220 Deli nquentproper tytaxesreceivables 5,829,641 2,240,788 ‐

1230 All owanceforuncollectibletaxes (credit) (656,018) (241,971) ‐

1240 Recei vabl es fro mothergovernm e nts 1,511,982 17,022 ‐

1250 Accruedinteres t 7,422 ‐ ‐

1260 Duefro motherfunds 18 ,119 ,410 ‐ ‐

1290 Other receivables 77,392 ‐ ‐

1300 Inventori es ,atcos t 180,852 ‐ ‐

1410 Prepaid

i tems 165,974 ‐ ‐

1810 Res tr i ctedCashandInvestments ‐ 17,981,559 ‐

1000 TotalAssets 232,970,797$ 64,606,684$ 221,475,847$

Liabilities,DeferredInflows,andFundBalance

Liabilities:

2110 Accounts payabl e 5,113 ,099$ ‐$ 32,108,413$

2150 Payroll deduc tionsandwithholdings 4,247,105 ‐ ‐

2160 Accruedwagespayabl e 37,427,503 ‐ ‐

2170 Duetootherfunds 277,983 ‐ 1,566,542

2180 Payabl etoothergovernments 8,732,630 ‐ ‐

2300 Unea rnedrevenue 804,6 54 ‐ ‐

2000 TotalLiabilities 56,602,974 ‐

33,674,955

DeferredInflowsofResources

Unavailabl erevenue‐propertytaxes 5,756,769 2,230,135 ‐

2600 TotalDeferredInflowsofResources 5,756,769 2,230,135 ‐

FundBalance:

N onspe ndable:

3410 Inventories 180,852 ‐ ‐

3430 Prepa i di tems 1 65,974 ‐ ‐

Restricted:

3450 Gra nts ‐ ‐ ‐

3470 Capitala cquisitionprogram ‐ ‐ 187,800,892

3480 Debtservice ‐ 62,376,549 ‐

Committed:

3545 Campusactivi ty‐ ‐ ‐

Assigned:

3590 Mini mumfundba lancepoli cy 132,414,318 ‐ ‐

3600 Unassigned 37,849,910 ‐ ‐

3000 TotalFund

Balances 170,611,054 62,376,549 187,800,892

4000

TotalLia bilities,DeferredInflows,and

FundBalance

232,970,797$ 64,606,684$ 221,475,847$

Seenotestothebasicfinancialstatements. 21 LewisvilleISD2021ACFR

LEWISVILLEINDEPENDENTSCHOOLDISTRICT ExhibitC‐1

BALANCESHEET‐GOVERNMENTALFUNDS Page2of2

August31,2021

Data

Control

Codes FederalFunds

Nonmajor

Governmental

Funds

Total

Governmental

Funds

Assets

1110 Cashandtem poraryinvestments 4,186,134$ 14,703,810$ 492,709,219$

Receivables:

1220 Delinquentpropertytaxesreceivables ‐ 8,070,429

1230 Allowanceforuncollectibletaxes(credit) ‐ (897,989)

1240 Receivablesfromothergovernments 12,677,289 2,083,313 16,289,606

1250 Accruedinterest ‐ 7,422

1260 Duefromotherfunds ‐ 18,119,410

1290 Otherreceivables ‐ 77,392

1300 Inventories,atcost 529,456

710,308

1410 Prepaiditems ‐ 165,974

1810 RestrictedCashandInvestments ‐ 17,981,559

1000 TotalAssets 16,863,423$ 17,316,579$ 553,233,330$

Liabilities,DeferredInflows,andFundBalance

Liabilities:

2110 Accountspayable 316,072$ 1,255,193$ 38,792,777$

2140 Accruedinterestpayable ‐ ‐

2150 Payrolldeductionsandwithholdings ‐ 4,247,105

2160 Accruedwagespayable 233,119 37,660,622

2170 Duetoother funds 16 ,547 ,351 5,517 18,397,393

2180 Payabletoother

governments 2,673 8,735,303

2300 Unearnedrevenue 739,088 1,543,742

2000 TotalLiabilities 16,863,423 2,235,590 109,376,942

DeferredInflowsofResources

Unavailablerevenue‐property taxes ‐ 7,986,904

2600 TotalDeferredInflowsofResources ‐ ‐ 7,986,904

FundBalance:

Nonspendable:

3410 Inventories 529,456 710,308

3430 Prepaiditems ‐ 165,974

Restricted:

3450 Grants ‐ 8,596,853 8,596,853

3470 Capitalacquisit ion program ‐ 187,800,892

3480 Debtservice ‐ 62,376,549

Committed:

3545 Campusactivity 5,954,680 5,954,680

Assigned:

3590 Minimum

fundbalancepolicy ‐ 132,414,318

3600 Unassigned ‐ 37,849,910

3000 TotalFundBalances ‐ 15,080,989 435,869,484

4000

TotalLiabilities,DeferredInflows,and

FundBalance

16,863,423$ 17,316,579$ 553,233,330$

Seenotestothebasicfinancialstatements. 22 LewisvilleISD2021ACFR

Seenotestothebasicfinancialstatements. 23 LewisvilleISD2021ACFR

LEWISVILLEINDEPENDENTSCHOOLDISTRICT ExhibitC‐1R

RECONCILIATIONOFGOVERNMENTALFUNDSBALANCESHEETTOTHESTATEMENTOFNETPOSITION

August31,2021

Data

Control

Codes

Totalfundbal ance,governmenta lfunds 435,869,484$

Amounts reportedforgovernmentalacti vi ties inthes tatementofnetpositi on(A‐

1)aredi fferentbecause:

1 Capita lass etsusedingovernmentalactivi tiesarenotfina ncialres ourcesand

thereforearenotreportedasassetsingovernmentalfunds . 2,009,303,356

2

Accumula teddepr eciationhasnotbeenincluded

inthegovernmentalfund

financials ta tements . (580,051,095)

3 Propertytaxesreceivableha vebeenleviedandareduethi syea r,butarenot

avail abl esoonenoughtopayforthecurrentper iod'sexpenditures,these

propertytaxesandrel a tedpenaltyandinterestamounts(n etofallowancefor

uncollectiblea ccounts ).

7,986,904

4 Deferredcha rges onrefundi ng 17,767,251

5 Deferredinflowsandoutflowsrel a tedtopensionliability (4,784)

6 Deferredinflowsandoutflowsrel a tedtoOPEBliability (91,851,358)

Long‐termliabilities,includingbondspa yable,arenotdueandpaya bleinthe

currentperiod,andthereforearenotreportedasliabilitiesinthefunds .Long‐

termliabilitiesatyea rendconsi s tof:

7

Generalobligationbonds (1,315,387,363)

8 Premiums oniss ua nce (118,574,400)

9 Accretedinterestonpr emi umcompoundinterestbonds (26,212,025)

10 Accruedcompensatedabsences (3,512,141)

11 Accruedinterestpayabl e (2,232,858)

12 Netpensionliability (120,078,526)

13 NetOPEBliability (139,565,467)

19 Additi onofInterna lServicefundnetpos i tion 2,792,879

TotalNetPosition‐GovernmentalActivities 76,249,857$

Seenotestothebasicfinancialstatements. 24 LewisvilleISD2021ACFR

LEWISVILLEINDEPENDENTSCHOOLDISTRICT ExhibitC‐2

STATEMENTOFREVENUES,EXPENDITURES,ANDCHANGESINFUNDBALANCE Page1of2

FortheYearEndedAugust31,2021

Data

Contr ol

Codes GeneralFund DebtServiceFund

CapitalProjects

Fund

Revenues

5700 Loca l ,intermediate,andout‐of‐s tate 432,991,060$ 167,642,236$ 202,664$

5800 Statepr ogramrevenues 69,606,559 1,578,452 ‐

5900 Federa lprogramrevenues 16,379,921 ‐ 996,131

5020 TotalRevenues 518,977,540 169,220,688 1,198,795

Expe nditures

Current:

0011 Ins truction 293,623,560 ‐ ‐

0012 Ins tructi onal res ources andmedi aservic es 6,489,203 ‐ ‐

0013 Cur ri cul umandinstructionalstaffdevel opment 3,208,721 ‐ ‐

0021 Ins tructi onal leaders hi p 11,780,121 ‐ ‐

0023 School

l ea ders hi p 33,125,033 ‐ ‐

0031 Gui dance,counselingandeval uati ons ervi ces 24,110,374 ‐ ‐

0032 Social workservi ces 373,315 ‐ ‐

0033 Healthser vic es 7,041,696 ‐ ‐

0034 Studenttra ns porta tion 13,520,165 ‐ ‐

0035 Foodservic es 43,322 ‐ ‐

0036 Extra c urri cul a ra ctivi ties 9,942,511 ‐ ‐

0041 Generaladmi ni s tr ation 11,106,432 ‐ ‐

0051 Faci l ities maintenanc eandopera ti ons 41,578,802 ‐ ‐

0052 Securi tyandmoni torings ervi ces 3,241,666 ‐ ‐

0053 Data pr ocessings ervi ces 11,071,527 ‐ ‐

0061 Communi tys ervi ces 4,990,116 ‐ ‐

Debtservice:

0071 Pri nci palonlong‐termdebt

‐ 89,000,233 ‐

0072 Interes tonlong‐termdebtandfees ‐ 66,283,947 ‐

Capitaloutlay:

0081 Faci l ities acquisitionandconstruc tionexpendi tures 63,990 ‐ 170,106,538

Intergovernmental:

0091 PurchaseofWADA 50,745,313 ‐ ‐

0093 Payments rel a tedtosharedservi ces arra ngements 131,200 ‐ ‐

0099 Otherintergovernmentalcha rges 3,470,208 ‐ ‐

6030 TotalExpenditures 529,657,275 155,284,180 170,106,538

1100 Excess(deficiency)ofrevenues overexpendi tures (10,679,735) 13,936,508 (168,907,743)

Other FinancingSources

(Uses)

7901 Refundingbondsissued ‐ 52,055,000 ‐

7912 Sal eofreal orpersonalproperty 139,053 ‐ 918,000

7915 Tr ans fers in ‐ ‐ ‐

7916 Premiumor discountonissuanceofbonds ‐ 5,672,637 ‐

8911 Tr ans fers out (2,325) ‐ ‐

8949 PaymenttoBondRefundingEscrowAgent ‐ (57,147,718) ‐

7080 TotalOther FinancingSourcesandUses 136,728 579,919 918,000

1200 Netcha ngeinfundbal a nces (10,543,007)

14,516,427 (167,989,743)

0100 FundBalance‐Beginning 181,154,061 47,860,122 355,790,635

3000

FundBalance‐Ending

170,611,054$ 62,376,549$ 187,800,892$

Seenotestothebasicfinancialstatements. 25 LewisvilleISD2021ACFR

LEWISVILLEINDEPENDENTSCHOOLDISTRICT ExhibitC‐2

STATEMENTOFREVENUES,EXPENDITURES,ANDCHANGESINFUNDBALANCE Page2of2

FortheYearEndedAugust31,2021

Data

Control

Codes

Federal

Funds

Nonmajor

Governmental

Funds

TotalGovernmental

Funds

Revenues

5700 Local,intermediate,andout‐of‐state ‐$ 5,998,628$ 606,834,588$

5800 Stateprogramrevenues ‐ 3,004,131 74,189,142

5900 Federalprogramrevenues 34,295,306 19,020,629 70,691,987

5020 TotalRevenues 34,295,306 28,023,388 751,715,717

Expenditures

Current:

0011 Instruction 29,393,931 4,245,518 327,263,009

0012 Instructionalresourcesandmediaservices 12,001 56,186 6,557,390

0013

Curriculumandinst ructionalstaffdevelopment 1,316,917

39,298 4,564,936

0021 Instructionalleadership 312,630 1,902 12,094,653

0023 Schoolleadership 225,197 541,785 33,892,015

0031

Guidance,counselingandevaluationservices 324,918 511,960 24,947,252

0032 Socialworkservices ‐ ‐ 373,315

0033 Healthservices 6,521 1,630 7,049,847

0034 Studenttransportation 67,610 ‐ 13,587,775

0035 Foodservices ‐ 17,603,931 17,647,253

0036 Extracurricularactivities 14,452 705,379 10,662,342

0041 Generaladministration 311,723 19,139 11,437,294

0051 Facilitiesmaintenanceandoperations 6,695 1,687,869 43,273,366

0052 Securityand

monitoringservices 3,851 619,938 3,865,455

0053 Dataprocessingservices 2,060,666 ‐ 13,132,193

0061 Communityservices 238,194 3,995 5,232,305

Debtservice:

0071 Principalonlong‐termdebt ‐ 89,000,233

0072 Interestonlong‐termdebtandfees ‐ 66,283,947

Capitaloutlay:

0081

Facilitiesacquisitionandconstructionexpenditures ‐ 170,170,528

Intergovernmental:

0091

PurchaseofWADA ‐ 50,745,313

0093

Paymentsrelatedtosharedservicesarrangements ‐

131,200

0099 Otherintergovernmentalcharges ‐ 3,470,208

6030 TotalExpenditures 34,295,306 26,038,530 915,381,829