AMERICAN DENTAL EDUCATION ASSOCIATION

Public Service Loan Forgiveness:

What Every Dental Student, Resident and Fellow Should Know

Quick Facts About Public Service Loan Forgiveness (PSLF)

• PSLF was passed into law in 2007 to encourage borrowers to enter and remain in the public

sector for at least 10 years by promising to forgive their remaining federal debt at that time.

• Forgiveness amount under PSLF is not subject to tax under current tax law.

• Not degree specific; any borrower meeting the eligibility requirements can qualify for PSLF,

including dental school graduates.

• While proposed legislation eliminates PSLF, the legislation grandfathers in current direct loan

borrowers; thus we anticipate current direct loan borrowers would still qualify if they meet the

eligibility requirements referenced below, even if the program is eliminated.

How Borrowers Qualify

• Borrowers must do three things at the same time to qualify for PSLF:

1. Make 120 timely, scheduled payments with an eligible income-driven repayment plan

(Income-Based Repayment [IBR], Pay As You Earn [PAYE] or Revised Pay As You Earn

[REPAYE])

2. On direct loans (e.g., direct unsubsidized, direct PLUS or direct consolidation), and

3. Work full time for an eligible public service employer (such as a nonprofit, including

academic dental institutions).

• Payments do not have to be consecutive.

• Borrowers do not apply for PSLF until they have made all required payments.

• Borrowers may confirm that their employer is an eligible PSLF employer and get help tracking

eligible PSLF payments by submitting the PSLF Employment Certification Form (ECF), available

at StudentAid.ed.gov/publicservice

. While not required, it is highly recommended that borrowers

interested in PSLF submit the ECF each year and when they change employers.

• Borrowers with nondirect federal loans can consolidate them into the federal direct consolidation

loan program to maximize their potential forgiveness amount.

• Many teaching hospitals for advanced dental education qualify as eligible PSLF employers;

hence payments tied to income made on direct loans during hospital-based residency should

count as eligible payments toward PSLF, if the hospital qualifies.

Resources

• Association of American Medical Colleges/ADEA Dental Loan Organizer and Calculator

(AAMC/ADEA DLOC) at adea.org/DLOC

.

o See AAMC/ADEA DLOC tutorial and fact sheet at adea.org/DLOC.

• StudentAid.ed.gov/publicservice (look for the PSLF Q&A document).

• MyFedloan.org.

o Fedloan Servicing is the designated loan servicer for borrowers interested in PSLF.

Dental Students and Public Service Loan Forgiveness

AMERICAN DENTAL EDUCATION ASSOCIATION

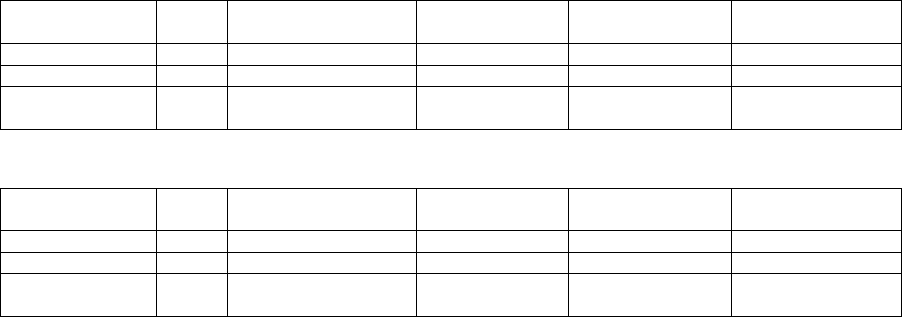

Potential Forgiveness Amounts*

Please note the following assumptions used in the repayment estimate tables below:

• $280,000 educational debt (median for indebted students in the class of 2017).

o $162,000 direct unsubsidized; $118,000 direct PLUS (Grad PLUS).

o Appropriate interest rates used for each loan based on year borrowed.

• $53,791 stipend as first-year general practice resident (GPR); $160,000 starting salary.

• No aggressive payments (no payments over required minimum).

• Single/family size of one for income-driven repayment plan calculations.

• PSLF estimates assume the graduate works continuously in nonprofit sector during first 10 years

of repayment.

Scenario 1: No residency, immediately into nonprofit employment

Repayment

plan

Years

Monthly payment

Total

repayment

PSLF paid

PSLF forgiven

Program

forgiveness

Standard

10

$3,600

$431,962

NA

NA

Extended

25

$2,103

$630,994

NA

NA

REPAYE

25

$1,183 to $2,492*

$528,601

$164,009

$338,645

$254,447 taxable

Scenario 2: One-year GPR, then nonprofit employment

Repayment

plan

Years

Monthly payment

Total

repayment

PSLF paid

PSLF forgiven

Program

forgiveness

Standard

10

$2,600

$431,962

NA

NA

Extended

25

$2,103

$630,994

NA

NA

REPAYE

25

$297 to $2,413

$501,456

$148,513

$346,615

$279,879 taxable

* AAMC/ADEA DLOC used for all repayment and forgiveness estimates.

Please note that the initial payments under PAYE and REPAYE are much lower during residency (when

the gap between salary or stipend and debt is often substantial), which causes the forgiveness amounts

with PSLF to increase. Borrowers doing longer hospital-based residency programs may see higher

forgiveness amounts, since payments should be lower for a longer period of time.

Note also that monthly payments under both the standard 10 year and extended 25 year plans are not

dependent on income and family size. Borrowers may start in these plans and apply for PAYE or

REPAYE later if needed.

Finally, Income-Based Repayment (IBR) is an older income-driven repayment plan and is not displayed

here. However, the AAMC/ADEA DLOC will run repayment and forgiveness estimates under IBR for

borrowers who might be interested in IBR.

January 2018