Annual Report | 2023

We also accelerated our eorts to increase consideration for lululemon through global

brand campaigns and activations. For example, in Los Angeles, we hosted a Dupe Swap

event, where about 50% of the guests who traded in product dupes were new to our

brand. And in China Mainland, our World Mental Health Day activations brought

in over 9,000 participants across six cities.

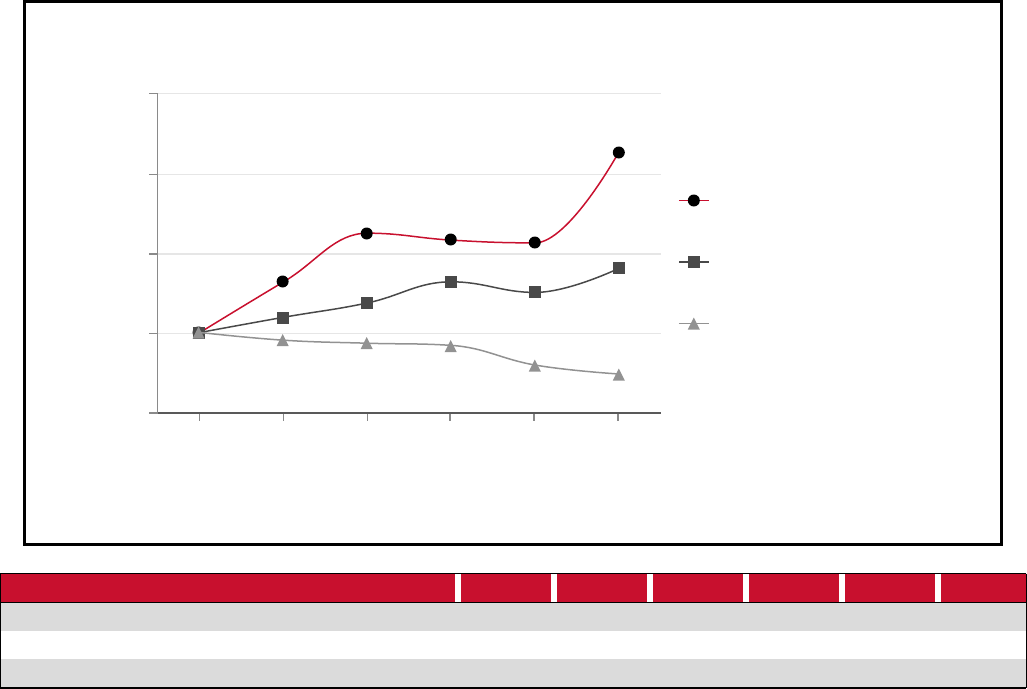

We believe our community-building approach resonates across geographies,

generations, and cultures, and led to gains in brand awareness throughout key growth

markets around the world over the past year – the US increased from 25% to 31%, and

China Mainland increased from 9% to 14%. Relative to peers, our brand awareness

globally represents an opportunity for lululemon. We believe our runway for growth is

substantial, and I am optimistic about the future as we continue to expand our business.

Our Impact

We are committed to advancing our Impact Agenda goals and multi-year strategies for

the wellbeing of people and the planet. This work supports our growth strategy as a

critical business function, as our company continues to grow and serve more guests and

communities around the world.

For our people, we are committed to our goals of supporting physical, mental, and social

wellbeing for all, and creating environments that are equitable, inclusive, and welcoming

for every person within our global collective. We continued to advance our Inclusion,

Diversity, Equity, and Action (IDEA) commitments across our business and invest in the

wellbeing of the people who make our products.

We also released lululemon’s third annual Global Wellbeing Report uncovering the state of

wellbeing around the world, and announced the formation of our Mental Wellbeing Global

Advisory Board to help deepen the impact of wellbeing initiatives across our industry. And,

through our lululemon Centre for Social Impact, we expanded our partnerships with global

and community-led wellbeing organizations to accelerate their work, investing a total of

$44.8 million to date.

1

For our planet, we are on a journey to contribute to a climate-stable future through our

products and actions. We believe sustainable innovation will play a critical role, and we

continue to advance our material innovation through strategic industry partnerships, as we

know collaboration is essential to achieving a circular ecosystem and helping to address

global challenges. Looking to the future, we remain focused on driving innovations across

our business that contribute to supporting the health of our planet.

In Closing

On behalf of myself and the entire leadership team, I want to express our sincere gratitude

to the people across lululemon who champion our brand every day and made our strong

results possible.

To our shareholders, thank you for your continued support. As we drive the business

forward, we will remain agile and continue to adapt to all that is around us. My confidence

in our leadership and our people remains high, as we have consistently demonstrated the

strength and resilience of our brand.

We are pleased with our momentum and know that we remain in the early innings of our

growth story. We recognize the significant opportunity in front of us to elevate lululemon

to the next level around the world in 2024 and beyond, and I remain excited and energized

for what lies ahead for our brand.

Calvin McDonald

Chief Executive Oicer

In 2023, we celebrated our 25th anniversary and our teams continued to deliver strong

and balanced results. As our product innovations, guest experiences, and market

expansions connected us with our guests and communities, we saw growth across

each of our categories, channels, and regions, and ended the year with $9.6 billion in

net revenue, representing a year-over-year increase of 19%.

I am grateful to our teams around the world for driving our performance and our goals to

advance the wellbeing of people and the planet through our Impact Agenda. Community

has been at the core of lululemon since day one, and we believe the deep, genuine

connections across our global collective are a true dierentiator for our brand.

Our Growth Pillars

We remain committed to our Power of Three ×2 growth plan, which is grounded in our

goals to double our men’s business, double our digital business, and quadruple our

international business – to ultimately double our revenue from 2021 levels to $12.5 billion

by 2026. In 2023, we advanced our plan with progress across each of our three growth

pillars, and I am proud of all that we achieved as we continued to navigate a dynamic

consumer and macro environment.

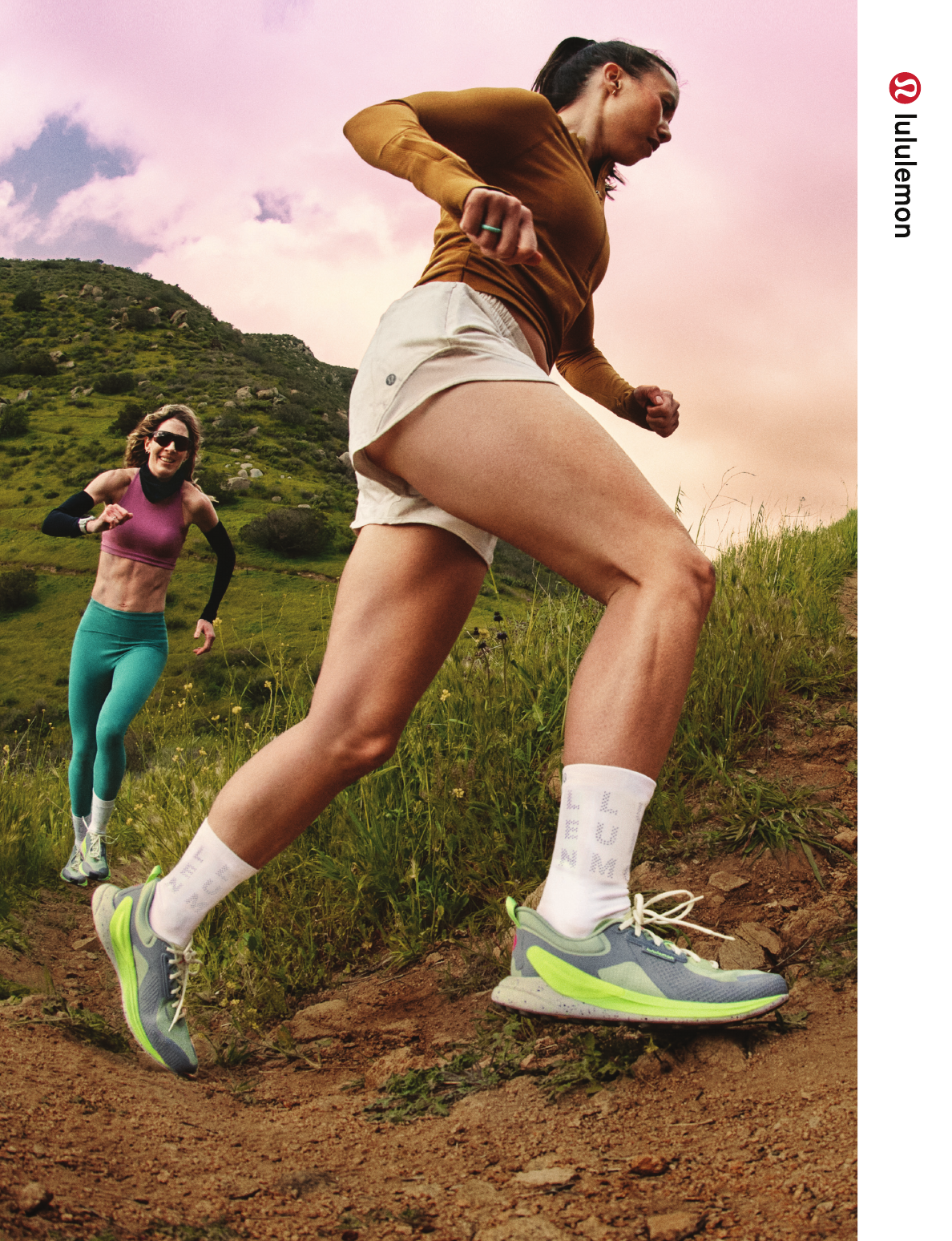

Within product innovation, we continued to put product at the center of everything

we do, leveraging the latest research, technologies, and materials to solve for the unmet

needs of our guests. We grew our men’s business by 15%, our women’s business by 17%,

and net revenue from our other categories increased 36%.

We believe one of our competitive advantages is our ability to consistently bring newness

and innovation into our assortment, and that our proprietary fabrics, innovative designs,

and functional technology set us apart. With our focus on feel, functionality, fit, and

versatility, people of all ages and backgrounds can see themselves in lululemon.

Our core and new product launches continued to resonate with guests. We saw strength

in many of our key franchises including Align, Scuba, and ABC, and leveraged the

versatility of our core assortment to expand our oerings within our Play categories

including golf and tennis. We also engineered new sensations within collections such as

Wundermost bodywear for women, expanded our casual oerings for men with Steady

State and Soft Jersey loungewear, and launched updated and enhanced versions of our

Blissfeel and Chargefeel footwear styles.

Looking to 2024, I am excited by our impressive pipeline of product innovation, from our

first-ever men’s footwear collection to innovations created with and inspired by world-

class athletes from Team Canada and our FURTHER women’s ultramarathon.

Within guest experience, our omni-operating model continued to serve our guests both

in-store and online. We saw strength across both channels, with company-operated

store net revenue increasing 21% and e-commerce net revenue increasing 17%, as well

as our single biggest day of traic and revenue in company history on Black Friday.

We continued to leverage our successful grassroots approach to cultivating

relationships with our guests at the local level. By creating connection points across

both the physical and digital, we engage with guests in ways that go beyond a

transaction, creating an ecosystem of connection that helps build our brand

awareness and drive loyalty.

In-store and online, our Educators supported guests in learning about our products and

innovations. In our communities, our teams created unforgettable experiences at the

local and global level, from store events to larger-scale community activations such as

10K runs. Through our membership program, which has grown to more than 17 million

members in the first year, we gained deeper knowledge on what aspects of our brand

are most meaningful to them. And we announced a multi-year strategic partnership

between lululemon and Peloton, expanding our reach and awareness.

Within market expansion, our business remained strong across our global regions

with 12% growth in the Americas, 67% in China Mainland, and 43% in Rest of World. We

entered new markets in EMEA and APAC, including our first store in Bangkok, Thailand.

In China Mainland, we were proud to celebrate our 10-year anniversary and end the year

approaching $1 billion in revenue. In total, we opened 56 net new company-operated

stores across the globe contributing to 15% square footage growth, ending 2023 with

711 company-operated stores worldwide.

AR | 2023

To our shareholders

1

Included within our Impact Agenda is a goal to invest a total of $75.0 million USD to advance equity in wellbeing by 2025. As of January 28, 2024, we have contributed

$44.8 million to lululemon’s Centre for Social Impact, $32.4 million of which has been contributed directly to social impact organizations. The remaining $12.4 million

primarily consists of contributions toward a donor-advised fund for future grant making.

UNITEDSTATESSECURITIESANDEXCHANGECOMMISSION

Washington,D.C.20549

_______________________________________

Form10-K

_______________________________________

☑ ANNUALREPORTPURSUANTTOSECTION13OR15(d)OFTHESECURITIESEXCHANGEACTOF1934

ForthefiscalyearendedJanuary28,2024

OR

☐ TRANSITIONREPORTPURSUANTTOSECTION13OR15(d)OFTHESECURITIESEXCHANGEACTOF1934

Forthetransitionperiodfromto

Commissionfilenumber001-33608

_______________________________________

lululemonathleticainc.

(Exactnameofregistrantasspecifiedinitscharter)

_______________________________________

Delaware

20-3842867

(Stateorotherjurisdictionof

incorporationororganization)

(I.R.S.Employer

IdentificationNumber)

1818CornwallAvenue,Vancouver,BritishColumbiaV6J1C7

(Addressofprincipalexecutiveoffices)

Registrant'stelephonenumber,includingareacode:(604)732-6124

SecuritiesregisteredpursuanttoSection12(b)oftheAct:

Titleofeachclass Tradingsymbol(s) Nameofeachexchangeonwhichregistered

CommonStock,parvalue$0.005pershare

LULU

NasdaqGlobalSelectMarket

_______________________________________

Indicatebycheckmarkiftheregistrantisawell-knownseasonedissuer,asdefinedinRule405oftheSecuritiesAct.Yes☑No☐

IndicatebycheckmarkiftheregistrantisnotrequiredtofilereportspursuanttoSection13orSection15(d)oftheAct.Yes☐No☑

Indicatebycheckmarkwhethertheregistrant(1)hasfiledallreportsrequiredtobefiledbySection13or15(d)oftheSecuritiesExchangeActof1934duringthepreceding

12months(orforsuchshorterperiodthattheregistrantwasrequiredtofilesuchreports),and(2)hasbeensubjecttosuchfilingrequirementsforthepast

90days.Yes☑No☐

IndicatebycheckmarkwhethertheregistranthassubmittedelectronicallyeveryInteractiveDataFilerequiredtobesubmittedpursuanttoRule405ofRegulationS-Tduringthe

preceding12months(orforsuchshorterperiodthattheregistrantwasrequiredtosubmitsuchfiles).Yes☑No☐

Indicatebycheckmarkwhethertheregistrantisalargeacceleratedfiler,anacceleratedfiler,anon-acceleratedfiler,asmallerreportingcompany,oranemerginggrowth

company.Seethedefinitionsof"largeacceleratedfiler,""acceleratedfiler,""smallerreportingcompany,"and"emerginggrowthcompany"inRule12b-2oftheExchangeAct.

LargeAcceleratedFiler ☑ Acceleratedfiler ☐

Non-acceleratedfiler ☐ Smallerreportingcompany ☐

Emerginggrowthcompany ☐

Ifanemerginggrowthcompany,indicatebycheckmarkiftheregistranthaselectednottousetheextendedtransitionperiodforcomplyingwithanyneworrevisedfinancial

accountingstandardsprovidedpursuanttoSection13(a)oftheExchangeAct.☐

Indicatebycheckmarkwhethertheregistranthasfiledareportonandattestationtoitsmanagement'sassessmentoftheeffectivenessofitsinternalcontroloverfinancial

reportingunderSection404(b)oftheSarbanes-OxleyAct(15U.S.C.7262(b))bytheregisteredpublicaccountingfirmthatpreparedorissueditsauditreport.☑

IfsecuritiesareregisteredpursuanttoSection12(b)oftheAct,indicatebycheckmarkwhetherthefinancialstatementsoftheregistrantincludedinthefilingreflectthe

correctionofanerrortopreviouslyissuedfinancialstatements.☐

Indicatebycheckmarkwhetheranyofthoseerrorcorrectionsarerestatementsthatrequiredarecoveryanalysisofincentive-basedcompensationreceivedbyanyofthe

registrant’sexecutiveofficersduringtherelevantrecoveryperiodpursuantto§240.10D-1(b).☐

Indicatebycheckmarkwhethertheregistrantisashellcompany(asdefinedinrule12b-2oftheAct).Yes☐No☑

Theaggregatemarketvalueofthevotingstockheldbynon-affiliatesoftheregistrantonJuly28,2023wasapproximately$40,905,000,000.Suchaggregatemarketvaluewas

computedbyreferencetotheclosingpriceofthecommonstockasreportedontheNasdaqGlobalSelectMarketonJuly28,2023.Forpurposesofdeterminingthisamount

only,theregistranthasdefinedaffiliatesasincludingtheexecutiveofficers,directors,andownersof10%ormoreoftheoutstandingvotingstockoftheregistrantonJuly28,

2023.

CommonStock:AtMarch15,2024therewere120,892,132sharesoftheregistrant'scommonstock,parvalue$0.005pershare,outstanding.

ExchangeableandSpecialVotingShares:AtMarch15,2024,therewereoutstanding5,115,961exchangeablesharesofLuluCanadianHolding,Inc.,awholly-ownedsubsidiaryof

theregistrant.Exchangeablesharesareexchangeableforanequalnumberofsharesoftheregistrant'scommonstock.

Inaddition,atMarch15,2024,theregistranthadoutstanding5,115,961sharesofspecialvotingstock,throughwhichtheholdersofexchangeablesharesofLuluCanadian

Holding,Inc.mayexercisetheirvotingrightswithrespecttotheregistrant.Thespecialvotingstockandtheregistrant'scommonstockgenerallyvotetogetherasasingleclass

onallmattersonwhichthecommonstockisentitledtovote.

_______________________________________

DOCUMENTSINCORPORATEDBYREFERENCE

PortionsoftheProxyStatementforthe2024AnnualMeetingofStockholdershavebeenincorporatedbyreferenceintoPartIIIofthisAnnualReportonForm10-K.

TABLEOFCONTENTS

Page

PARTI

Item1.

Business 1

Item1A.

RiskFactors 10

Item1C.

Cybersecurity 22

Item2.

Properties 24

Item3.

LegalProceedings 24

Item4. MineSafetyDisclosures 24

PARTII

Item5.

MarketforRegistrant'sCommonEquity,RelatedStockholderMattersandIssuerPurchasesofEquitySecurities 25

Item6.

SelectedConsolidatedFinancialData 26

Item7.

Management'sDiscussionandAnalysisofFinancialConditionandResultsofOperations 27

Item7A.

QuantitativeandQualitativeDisclosuresAboutMarketRisk 44

Item8.

FinancialStatements 46

IndexforNotestotheConsolidatedFinancialStatements 54

Item9A.

ControlsandProcedures 79

Item9B.

OtherInformation 80

Item9C. DisclosureRegardingForeignJurisdictionsthatPreventInspections 81

PARTIII

Item10.

Directors,ExecutiveOfficersandCorporateGovernance 82

Item11.

ExecutiveCompensation 82

Item12.

SecurityOwnershipofCertainBeneficialOwnersandManagementandRelatedStockholderMatters 82

Item13.

CertainRelationshipsandRelatedTransactions,andDirectorIndependence 83

Item14.

PrincipalAccountantFeesandServices 83

PARTIV

Item15.

ExhibitsandFinancialStatementSchedule 84

Item16. Form10-KSummary 86

Signatures

87

[This page intentionally left blank]

PARTI

SpecialNoteRegardingForward-LookingStatements

Thisreportandsomedocumentsincorporatedhereinbyreferenceincludeestimates,projections,statementsrelating

toourbusinessplans,objectives,andexpectedoperatingresultsthatare"forward-lookingstatements"withinthemeaningof

thePrivateSecuritiesLitigationReformActof1995,Section27AoftheSecuritiesActof1933andSection21EoftheSecurities

ExchangeActof1934.Weusewordssuchas"anticipates,""believes,""estimates,""may,""intends,""expects,"andsimilar

expressionstoidentifyforward-lookingstatements.Discussionscontainingforward-lookingstatementsmaybefoundinthe

materialsetforthunder"Business","Management'sDiscussionandAnalysisofFinancialConditionandResultsof

Operations",andinothersectionsofthereport.Allforward-lookingstatementsareinherentlyuncertainastheyarebasedon

ourexpectationsandassumptionsconcerningfutureevents.Anyorallofourforward-lookingstatementsinthisreportmay

turnouttobeinaccurate.Wehavebasedtheseforward-lookingstatementslargelyonourcurrentexpectationsand

projectionsaboutfutureeventsandfinancialtrendsthatwebelievemayaffectourfinancialcondition,resultsofoperations,

businessstrategy,andfinancialneeds.Theymaybeaffectedbyinaccurateassumptionswemightmakeorbyknownor

unknownrisksanduncertainties,includingtherisks,uncertaintiesandassumptionsdescribedinthesectionentitled"Item1A.

RiskFactors"andelsewhereinthisreport.Inlightoftheserisks,uncertaintiesandassumptions,theforward-lookingevents

andcircumstancesdiscussedinthisreportmaynotoccurascontemplated,andouractualresultscoulddiffermateriallyfrom

thoseanticipatedorimpliedbytheforward-lookingstatements.Allforward-lookingstatementsinthisreportaremadeasof

thedatehereof,basedoninformationavailabletousasofthedatehereof,andweassumenoobligationtoupdateany

forward-lookingstatement.

Thisannualreportincludeswebsiteaddressesandreferencestoadditionalmaterialsfoundonthosewebsites.These

websitesandinformationcontainedonoraccessiblethroughthesewebsitesarenotincorporatedbyreferenceinto,anddo

notformapartof,thisAnnualReportoranyotherreportordocumentwefilewiththeSEC,andanyreferencestoany

websitesareintendedtobeinactivetextualreferencesonly.

ITEM1.BUSINESS

General

lululemonathleticainc.isprincipallyadesigner,distributor,andretaileroftechnicalathleticapparel,footwear,and

accessories.Wehaveavisiontocreatetransformativeproductsandexperiencesthatbuildmeaningfulconnections,unlocking

greaterpossibilityandwellbeingforall.Sinceourinception,wehavefosteredadistinctivecorporateculture;wepromotea

setofcorevaluesinourbusinesswhichincludetakingpersonalresponsibility,actingwithcourage,valuingconnectionand

inclusion,andchoosingtohavefun.Thesecorevaluesattractpassionateandmotivatedemployeeswhoaredriventoachieve

personalandprofessionalgoals,andshareourpurpose"toelevatehumanpotentialbyhelpingpeoplefeeltheirbest."

InthisAnnualReportonForm10-KforthefiscalyearendedJanuary28,2024,lululemonathleticainc.(togetherwithits

subsidiaries)isreferredtoas"lululemon,""theCompany,""we,""us,"or"our."WerefertothefiscalyearendedJanuary28,

2024as"2023,"thefiscalyearendedJanuary29,2023as"2022,"andthefiscalyearendedJanuary30,2022as"2021."Our

nextfiscalyearendsonFebruary2,2025andisreferredtoas"2024."

Componentsofthisdiscussionofourbusinessinclude:

• OurProducts

• OurMarketsandSegments

• IntegratedMarketing

• ProductDesignandDevelopment

• SourcingandManufacturing

• DistributionFacilities

• Competition

• Seasonality

• HumanCapital

• IntellectualProperty

• SecuritiesandExchangeCommissionFilings

OurProducts

Weofferacomprehensivelineofperformanceapparel,footwear,andaccessoriesmarketedunderthelululemon

brand.Ourapparelassortmentincludesitemssuchaspants,shorts,tops,andjacketsdesignedforahealthylifestyleincluding

1

athleticactivitiessuchasyoga,running,training,andmostotheractivities.Wealsoofferappareldesignedforbeingonthe

moveandfitness-inspiredaccessories.Weexpecttocontinuetobroadenourmerchandiseofferingsthroughexpansionacross

theseproductareas.

Ourdesignanddevelopmentteamcontinuestosourcetechnicallyadvancedfabrics,withnewfeelandfit,andcraft

innovativefunctionalfeaturesforourproducts.Throughourverticalretailstrategyanddirectconnectionwithourcustomers,

whomwerefertoasguests,weareabletocollectfeedbackandincorporateuniqueperformanceandfashionneedsintoour

designprocess.Inthisway,webelievewearebetterpositionedtoaddresstheneedsofourguests,helpingusadvanceour

productlinesanddifferentiateusfromourcompetitors.

During2023,ourwomen'srangerepresented64%ofnetrevenueandourmen'srangerepresented23%ofnet

revenue.Ourcomprehensivemen'slineisakeypillarofourstrategicgrowthplans.Webelievenetrevenuefromourmen's

rangeisgrowingasmoreguestsdiscoverthetechnicalrigorandpremiumqualityofourmen'sproducts,andareattractedby

ourdistinctivebrand.

Wecontinuetoinnovateandintroducenewproductsforourguests.Thisincludesintroducingnewproductcategories

andexpandingouraccessoriesassortment.Webelievethisisanotherwayinwhichwecanattractnewguestsandenable

themtoexperienceourproducts.Netrevenuefromourotherproductcategoriesrepresented13%ofnetrevenuein2023.

OurMarketsandSegments

Weoperateinover25countriesaroundtheworldandorganizeouroperationsintofourregionalmarkets:Americas,

ChinaMainland,AsiaPacific("APAC"),andEuropeandtheMiddleEast("EMEA").

Wereportthreesegments,Americas,ChinaMainland,andRestofWorld,whichiscomprisedoftheAPACandEMEA

regionsonacombinedbasis.

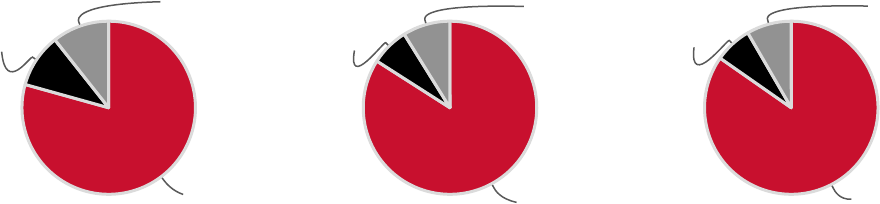

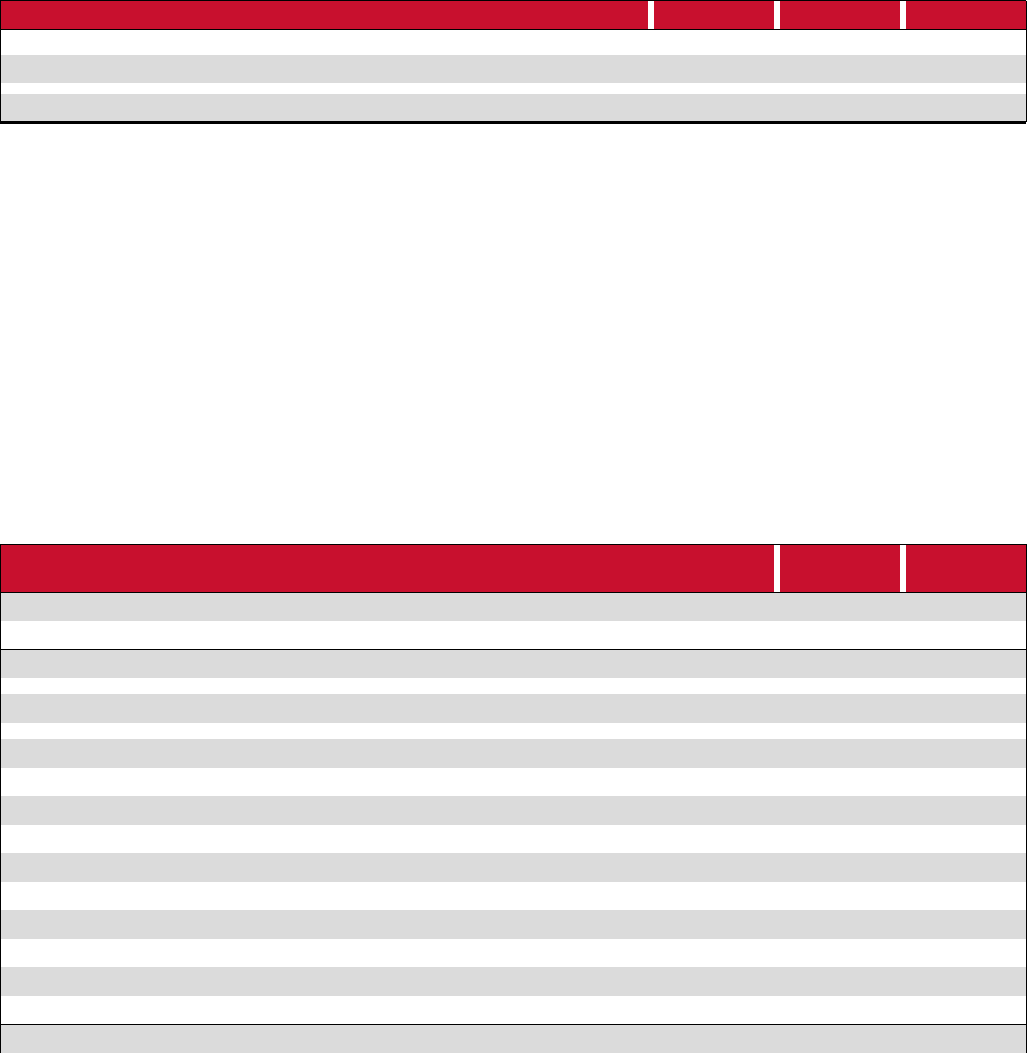

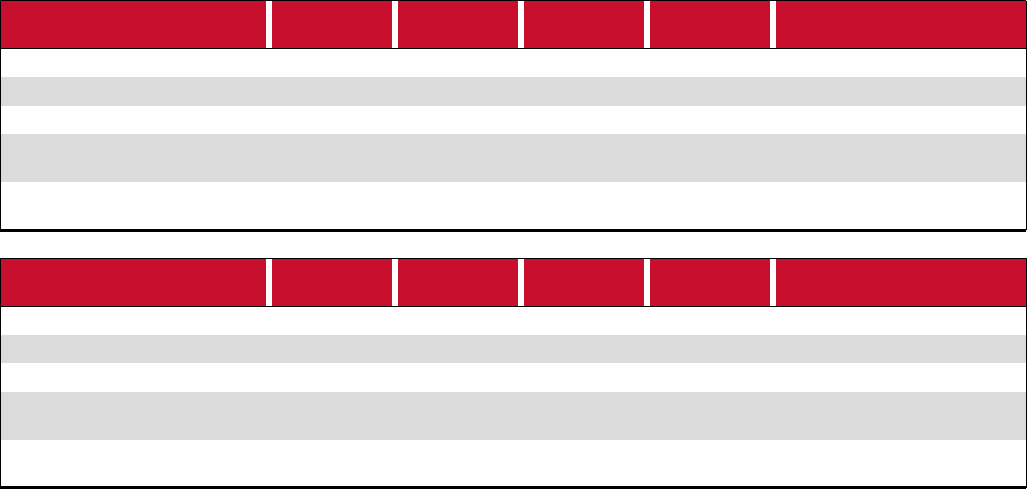

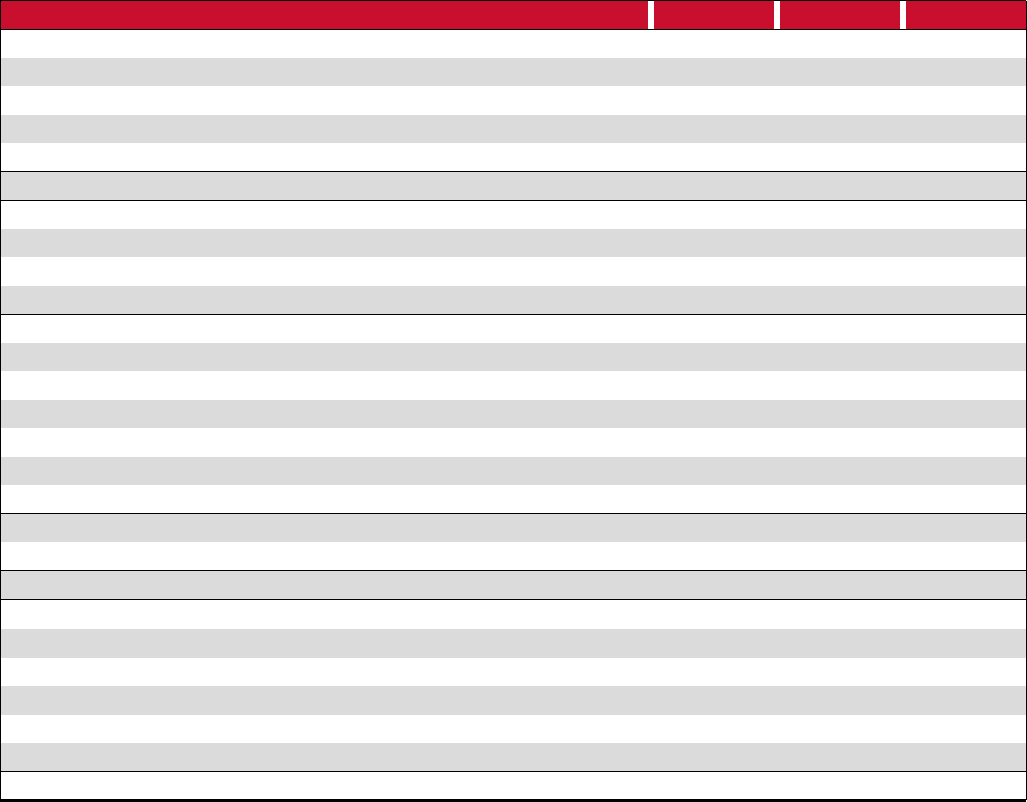

2023NetRevenue

Americas

79%

China

Mainland

10%

Restof

World

11%

2022NetRevenue

Americas

84%

China

Mainland

7%

Restof

World

9%

2021NetRevenue

Americas

85%

China

Mainland

7%

Restof

World

8%

Duringthefourthquarterof2023,werevisedthefinancialinformationwhichourChiefExecutiveOfficer,whoisour

chiefoperatingdecisionmaker("CODM"),usestoevaluateperformanceandallocateresources.Thisresultedinachangein

ouridentifiedoperatingsegments.Aswehavefurtherexecutedonouromni-channelretailstrategy,andcontinuedtoexpand

ouroperationsininternationalmarkets,ourperformancereviewsandresourceallocationdecisionshaveevolvedtobemade

onaregionalmarketbasis.Oursegmentresultshavebeenrecasttoreflectourregionalmarket-basedstructure.Historically,

oursegmentswerebasedonsellingchannel.Wecontinuetomonitorourrevenueperformancebyoursellingchannelswhich

arefurtherdescribedbelow.

Weoperateanomni-channelretailmodelandaimtoefficientlyandeffectivelyserveourguestsinthewaysmost

convenienttothem.Wecontinuetoevolveandintegrateourdigitalandphysicalchannelsinordertoenrichourinteractions

withourguests,andtoprovideaseamlessomni-channelexperience.Wehaveinvestedintechnologieswhichenableour

omni-channelretailingmodel.Ourcapabilitiesdifferbymarketandinclude:

• Buyonlinepick-upinstore-guestscanpurchaseourproductsviaourwebsiteordigitalappandthencollectthat

productfromaretaillocation;

• Back-backroom-ourstoreeducatorscanaccessinventorylocatedatourotherlocationsandhaveproductshipped

directlytoaguest'saddressorastore;

2

• Shipfromstore–weareabletofulfille-commerceordersbyaccessinginventoryatbothourdistributioncentersand

atourretaillocations,expandingthepoolofaccessibleinventory;

• Returnsprocessing–e-commerceguestsareabletoreturnproductseitheronlineorin-store;and

• Oneinventorypool–weareabletoviewandallocatetheproductheldatourdistributioncenterstoeitherour

physicalretaillocations,ormakeitavailabletofulfillonlinedemand.

Weoperateacombinationofphysicalretaillocationsande-commerceservicesviaourwebsites,otherregion-specific

websites,digitalmarketplaces,andmobileapps.Ourphysicalretaillocationsremainakeypartofourgrowthstrategyandwe

viewthemasavaluabletoolinhelpingusbuildourbrandandproductlineaswellasenablingouromni-channelcapabilities.

Weplantocontinuetoexpandsquarefootageandopennewcompany-operatedstorestosupportourgrowthobjectives.

Americas

WehaveoperatedintheAmericasforover25years.WeopenedourfirsteverstoreinVancouver,Canadain1998.In

2023,thenetrevenuewegeneratedintheAmericasrepresented79%ofourtotalnetrevenue.

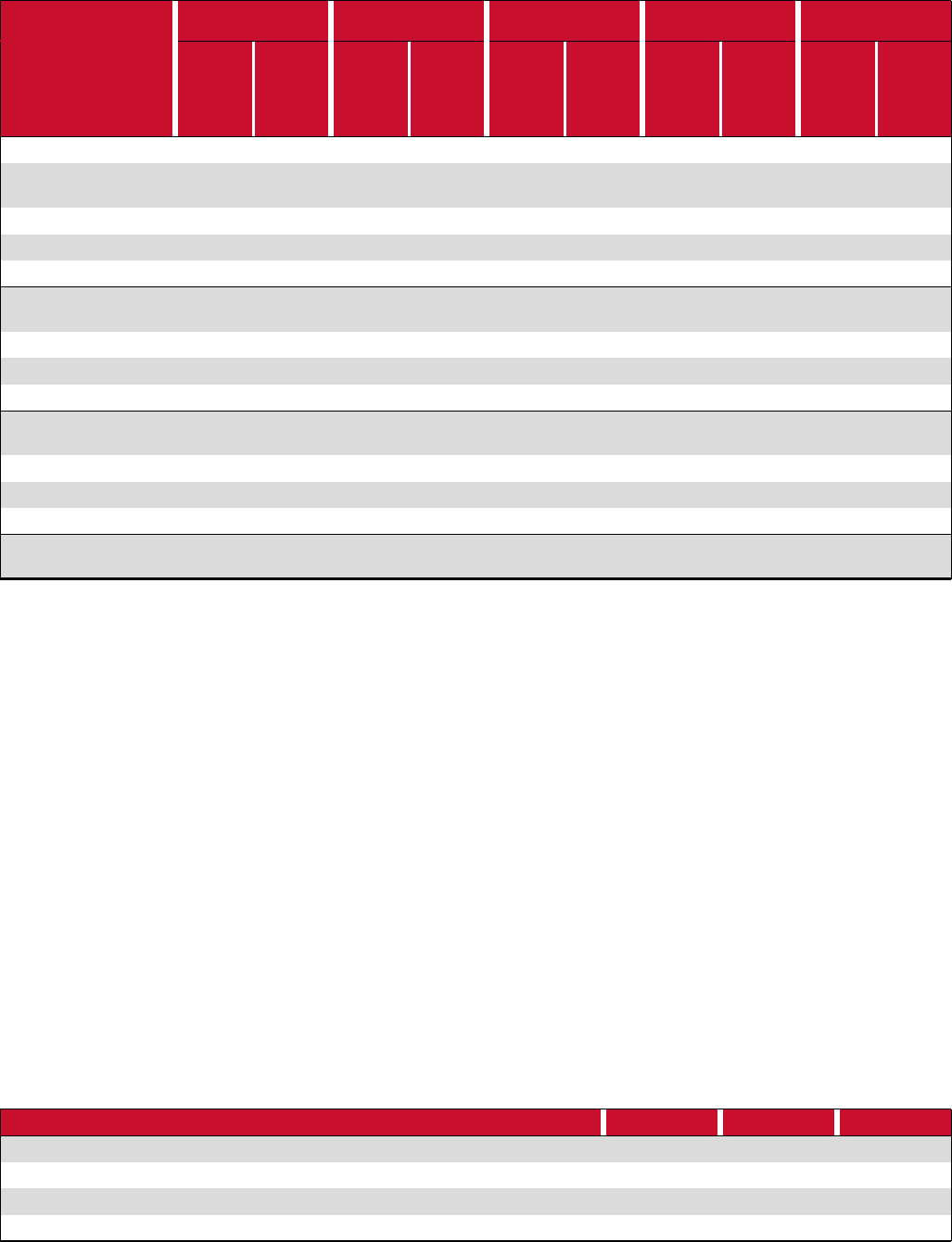

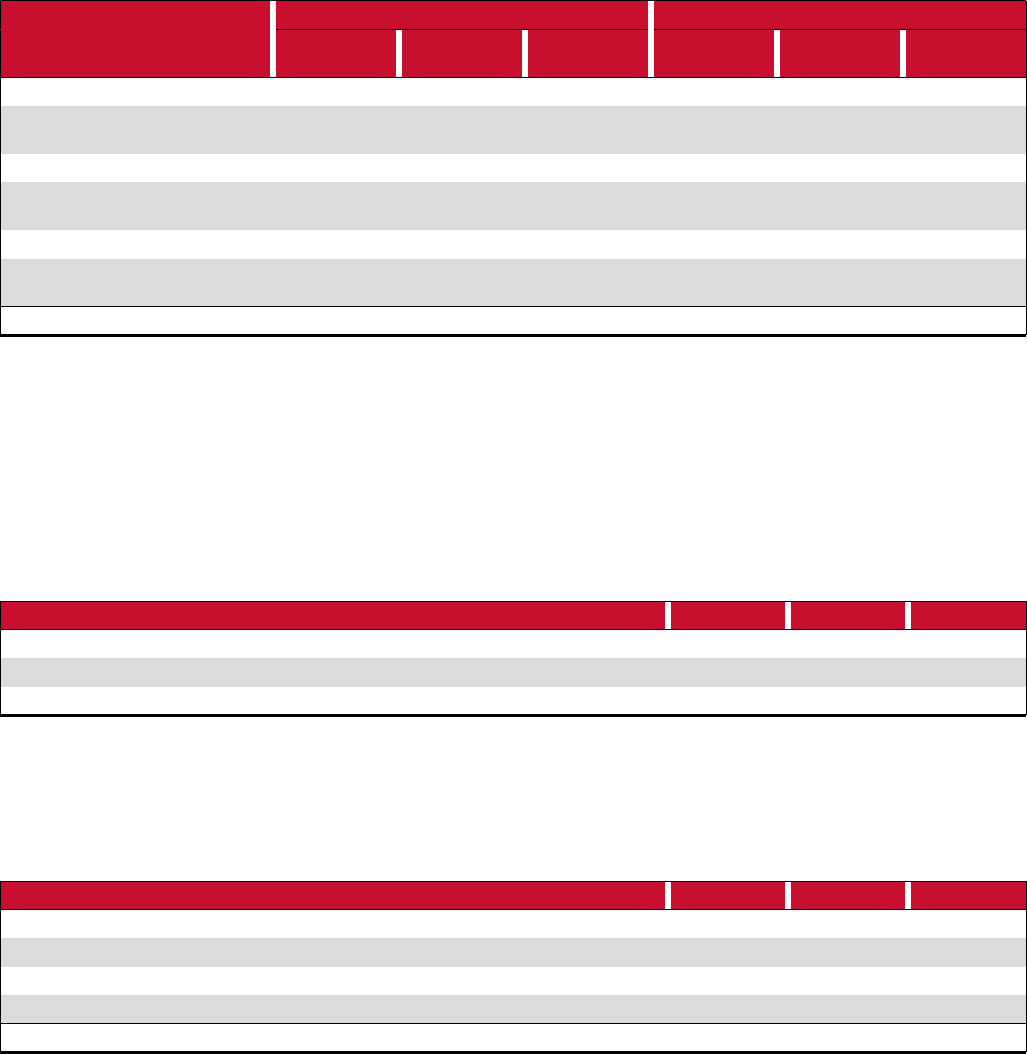

2023 2022 2021

(Inthousands)

Netrevenue $ 7,631,647 $ 6,817,454 $ 5,299,906

Netrevenuegrowth 11.9% 28.6% 40.3%

OuroperationsintheAmericasarecoretoourbusinessandweaimtocontinuetogrowournetrevenueinthismarket

throughongoingproductinnovationandbybuildingbrandawareness.Wealsoplantocontinuetoinvestinouromni-channel

capabilities,toopennewretaillocations,andtorelocate,optimize,andrenovateourexistinglocationsasneeded.

WegeneratenetrevenueintheAmericasthroughourlululemonbrandedretaillocationswhichincludedifferentsizes

ofcompany-operatedstores,outlets,pop-ups,othertemporarylocations,andstoresoperatedbyathird-partyunderasupply

andlicenseagreementinMexico.Wealsoserveourguestsviaoure-commercewebsitewww.lululemon.com,ourmobile

app,our“LikeNew”re-commerceprogram,andthroughcertainwholesalearrangementsincludingcertainyogaandfitness

studios,universitycampusretailers,andotherselectpartners.

ChinaMainland

WeopenedourfirststoreinChinaMainlandinfiscal2014.In2023,thenetrevenuewegeneratedinChinaMainland

represented10%ofourtotalnetrevenue.

2023 2022 2021

(Inthousands)

Netrevenue $ 963,760 $ 576,503 $ 434,261

Netrevenuegrowth 67.2% 32.8% 80.3%

WehaveexperiencedsignificantnetrevenuegrowthinChinaMainlandandbelievethataswecontinuetoexpandour

operationsandbuildourbrandawareness,netrevenuewillcontinuetoincreaseinthismarket.WebelieveChinaMainland

netrevenuegrowthwilldriveanincreaseinouroverallinternationalnetrevenue.WeplantocontinuetoinvestinChina

Mainlandandexpectthatthemajorityofourcompany-operatedstoreopeningsin2024willbeinthismarket.

WeoperatelululemonbrandedretaillocationsinChinaMainlandinavarietyofdifferentformatsincludingdifferent

sizesofcompany-operatedstores,outlets,pop-ups,andothertemporarylocations.WealsoserveourguestsviaourWeChat

storeandonthirdpartymarketplacessuchasT-MallandJD.com.

3

RestofWorld

In2023,thenetrevenuewegeneratedinAPACandEMEArepresented11%ofourtotalnetrevenue.

2023 2022 2021

(Inthousands)

Netrevenue $ 1,023,871 $ 716,561 $ 522,450

Netrevenuegrowth 42.9% 37.2% 36.3%

WehaveexperiencedsignificantnetrevenuegrowthinAPACandEMEAandintendtocontinuetoinvestinthese

marketstobuildbrandawareness.Whereweidentifygrowthopportunities,weplantoopennewretaillocations,includingin

newmarketsacrosstheEMEAandAPACregions.

Weoperatelululemonbrandedretaillocationsinthesemarketsinavarietyofdifferentformatsincludingdifferentsizes

ofcompany-operatedstores,outlets,pop-ups,andstoresoperatedbythird-partiesundersupplyandlicenseagreementsin

theMiddleEastandIsrael.Wealsoserveourguestsviaourcountryspecificwebsites,ourmobileapp,andthroughthirdparty

regionalmarketplaces,suchasZalando,Lazada,andSSG.

OurSellingChannels

Weconductourbusinessthroughanumberofdifferentchannelsineachmarket:

Company-operatedstores:Inadditiontoservingasavenuetosellourproducts,ourstoresgiveusadirectconnection

toourguests,whichweviewasavaluabletoolinhelpingusbuildourbrandandproductlinesaswellasenablingouromni-

channelcapabilities.Ourretailstoresarelocatedprimarilyonstreetlocations,inlifestylecenters,andinmalls.Oursalesper

squarefootwas$1,609,$1,580,and$1,443for2023,2022,and2021respectively.

UnitedStates 367 350

Canada 71 69

Americas 438 419

ChinaMainland 127 99

Australia 33 32

SouthKorea 19 16

HongKongSAR 9 9

Japan 8 7

NewZealand 8 8

Taiwan 8 7

Singapore 7 8

Malaysia 3 2

MacauSAR 2 2

Thailand 1 —

APAC 98 91

Numberofcompany-operatedstoresbymarket

January28,

2024

January29,

2023

4

UnitedKingdom 20 20

Germany 9 10

France 6 4

Ireland 4 4

Spain 3 3

Netherlands 2 1

Sweden 2 2

Norway 1 1

Switzerland 1 1

EMEA 48 46

Totalcompany-operatedstores 711 655

Numberofcompany-operatedstoresbymarket

January28,

2024

January29,

2023

E-commerce:Webelievee-commerceisconvenientforourguestsandalsoallowsustoreachandserveguestsin

marketsbeyondwhereourphysicalretaillocationsarebased.Webelievethischanneliseffectiveinbuildingbrand

awareness,especiallyinnewmarkets.Weserveourguestsviaoure-commercewebsites,othercountryandregion-specific

websites,digitalmarketplaces,andmobileapps.E-commercenetrevenueincludesourbuyonlinepick-upinstore,back-back

room,andshipfromstoreomni-channelretailingcapabilities.

Otherchannels:Wealsousecertainotherdistributionchannels,generallywiththegoalofbuildingbrandawareness

andprovidingbroaderaccesstoourproducts.Theseotherchannelsinclude:

• Temporarylocations-Ourseasonalstoresandpop-upsaretypicallyopenedforashortperiodoftimeenablingusto

serveguestsduringpeakshoppingperiodsinmarketswherewedonotordinarilyhaveaphysicallocation,orto

expandaccessinmarketswhereweseehighdemandatourexistinglocations.

• Wholesale-Weselltopartnersthatofferconvenientaccessforbothcoreandnewguests,includingyogaandfitness

studios,universitycampusretailers,andotherselectpartners.

• Outlets-Weutilizeoutletstosellslowermovinginventoryandinventoryfrompriorseasonsatdiscountedprices.As

ofJanuary28,2024,weoperated47outlets,themajorityofwhichwereintheAmericas.

• LikeNew-Ourre-commerceprogramallowsgueststoexchangetheirgentlyusedlululemonproductsfor

merchandisecredit.Thoseproductsarethenverifiedandqualitycheckedbeforebeingresoldonlineat

likenew.lululemon.com.Webelievethisprogramisasteptowardsacirculareco-systemandhelpsreduceour

environmentalfootprint.

• Licenseandsupplyarrangements-Weenterintolicenseandsupplyarrangementswhenwebelieveitwillbetoour

advantagetopartnerwiththirdpartieswithsignificantexperienceandprovensuccessincertaintargetmarkets.

Underthesearrangementswehavegrantedcertainthirdpartiestherighttooperatelululemonbrandedretail

locationsandtoselllululemonproductsonwebsitesinspecificcountries.

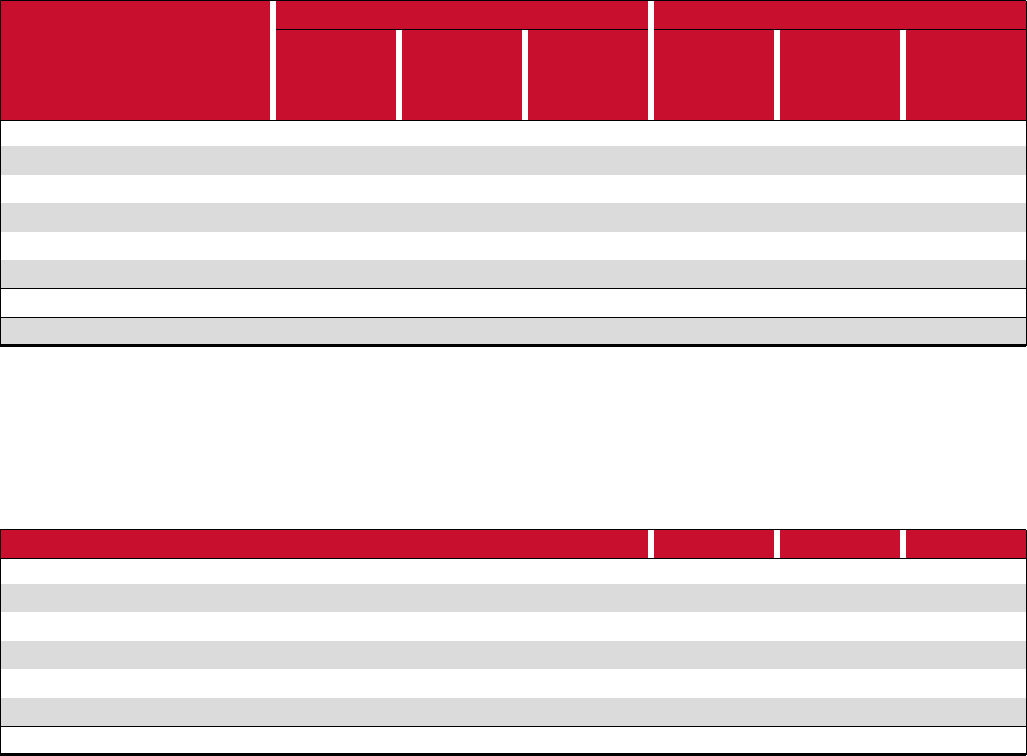

Numberofretaillocationsoperatedbythirdpartiesbymarket

January28,

2024

January29,

2023

Mexico 15 12

UnitedArabEmirates 8 7

SaudiArabia 6 3

Israel 3 —

Kuwait 3 1

Qatar 3 3

Bahrain 1 —

Totallocationsoperatedbythirdpartiesunderlicenseandsupplyarrangements 39 26

5

IntegratedMarketing

Webelievethatourbrandawarenessisrelativelylow,especiallyoutsideoftheAmericas,andalsowithourmale

guests.Thisrepresentsanopportunityforusandwehaveamulti-facetedstrategytobuildbrandawareness,affinity,and

guestloyalty.Thisstrategyisdesignedtoleverageownedandpaidchannels,ourambassadornetwork,brandpartners,

events,andcontent–todriveawareness,consideration,engagement,conversion,andultimatelyloyaltyandengagementat

theglobal,regional,andlocallevels.

ProductDesignandDevelopment

Ourproductdesignanddevelopmenteffortsareledbyateamofresearchers,scientists,engineers,anddesigners.Our

teamiscomprisedofathletesandusersofourproductswhoembodyourdesignphilosophyanddedicationtopremium

quality.Ourdesignanddevelopmentteamidentifiestrendsbasedonmarketintelligenceandresearch,proactivelyseeksthe

inputofourguestsandourambassadors,andbroadlyseeksinspirationconsistentwithourgoalsoffunction,style,and

technicalsuperiority.

Aswestrivetocontinuetoprovideourguestswithtechnicallyadvancedfabrics,ourteamworkscloselywithour

supplierstoincorporatethelatestintechnicalinnovation,bringingparticularspecificationstoourproducts.Wepartnerwith

independentinspection,verification,andtestingcompanies,whoconductavarietyoftestsonourfabrics,testing

performancecharacteristicsincludingpilling,shrinkage,abrasionresistance,andcolorfastness.Wedevelopproprietary

fabricsandcollaboratewithleadingfabricandtrimssupplierstomanufacturefabricsandtrimsthatwegenerallyseekto

protectthroughagreements,trademarks,andastrade-secrets.

SourcingandManufacturing

Wedonotownoroperateanymanufacturingfacilities.Werelyonalimitednumberofsupplierstoprovidefabricsfor,

andtoproduce,ourproducts.Thefollowingstatisticsarebasedoncost.

Weworkwithagroupofapproximately49vendorsthatmanufactureourproducts,fiveofwhichproduced55%ofour

productsin2023,withthelargestmanufacturerproducing17%.During2023,42%ofourproductsweremanufacturedin

Vietnam,16%inCambodia,11%inSriLanka,10%inIndonesia,and8%inBangladesh,andtheremainderinotherregions.

Weworkwithagroupofapproximately67supplierstoprovidethefabricsforourproducts.In2023,52%ofourfabrics

wereproducedbyourtopfivefabricsuppliers,withthelargestmanufacturerproducing19%.During2023,40%ofourfabrics

originatedfromTaiwan,26%fromChinaMainland,and12%fromSriLanka,andtheremainderfromotherregions.

Wealsosourceotherrawmaterialswhichareusedinourproducts,includingitemssuchascontentlabels,elastics,

buttons,clasps,anddrawcordsfromsupplierslocatedpredominantlyinAPACandChinaMainland.

Wehavedevelopedlong-standingrelationshipswithanumberofourvendorsandtakecaretoensurethattheyshare

ourcommitmenttoqualityandethics.Wedonot,however,haveanylong-termcontractswiththemajorityofoursuppliers

ormanufacturingsourcesfortheproductionandsupplyofourfabricsandgarments,andwecompetewithothercompanies

forfabrics,rawmaterials,andproduction.WerequirethatallofoursuppliersandmanufacturersadheretoourVendorCode

ofEthicsregardingsocialandenvironmentalsustainabilitypractices.Ourproductqualityandsustainabilityteamsclosely

assessandmonitoreachsupplier'scompliancewithapplicablelawsandourVendorCodeofEthics,includingbypartnering

withleadinginspectionandverificationfirms.

DistributionFacilities

WeoperateanddistributefinishedproductsfromourdistributionfacilitiesintheUnitedStates,Canada,andAustralia.

WeownourdistributioncenterinGroveport,Ohio,andleaseourotherdistributionfacilities.Wealsoutilizethird-party

logisticsprovidersinanumberofcountriesinwhichweoperatetowarehouseanddistributefinishedproductsfromtheir

warehouselocations.Weregularlyevaluateourdistributioninfrastructureandconsolidateorexpandourdistribution

capacityaswebelieveappropriateforouroperationsandtomeetanticipatedneeds.

Competition

Competitionintheathleticapparelindustryisbasedprincipallyonbrandimageandrecognitionaswellasproduct

quality,innovation,style,distribution,andprice.Webelievewesuccessfullycompeteonthebasisofourpremiumbrand

imageandourtechnicalproductinnovation.Wealsobelieveourabilitytointroducenewproductinnovations,combine

functionandfashion,andconnectthroughin-store,online,andcommunityexperiencessetsusapartfromourcompetition.In

6

addition,webelieveourverticalretaildistributionstrategyandcommunity-basedmarketingdifferentiatesusfurther,

allowingustomoreeffectivelycontrolourbrandimageandconnectwithourguests.

Themarketforathleticapparelishighlycompetitive.Itincludesincreasingcompetitionfromestablishedcompanies

thatareexpandingtheirproductionandmarketingofperformanceproducts,aswellasfromfrequentnewentrantstothe

market.Weareindirectcompetitionwithwholesalersanddirectsellersofathleticapparelandfootwear,suchasNike,Inc.,

adidasAG,PUMA,UnderArmour,Inc.,andColumbiaSportswearCompany.Wealsocompetewithretailerswhohave

expandedtoincludewomen'sathleticapparelincludingTheGap,Inc.(includingtheAthletabrand),Victoria'sSecretwithits

sportandloungeoffering,andUrbanOutfitters,Inc.

Seasonality

Ourbusinessisaffectedbythegeneralseasonaltrendscommontotheretailapparelindustry.Ourannualnetrevenue

istypicallyweightedmoreheavilytowardourfourthfiscalquarter,reflectingourhistoricalstrengthinsalesduringtheholiday

seasonintheAmericas,whileouroperatingexpensesaregenerallymoreequallydistributedthroughouttheyear.Asaresult,

asubstantialportionofouroperatingprofitsaretypicallygeneratedinthefourthquarterofourfiscalyear.Forexample,we

generatedapproximately43%ofourfullyearoperatingprofitduringthefourthquarterof2023.

HumanCapital

OurImpactAgendasetsoutoursocialandenvironmentalgoalsandstrategyacrossthreepillars-BeHuman,BeWell,

andBePlanet.DetailscanbefoundinourImpactReportonourwebsite(https://corporate.lululemon.com/our-impact).

IncludedwithinourImpactAgendaisagoaltoinvestatotalof$75.0milliontoadvanceequityinwell-beingbytheend

of2025.AsofJanuary28,2024,wehaveinvestedatotalof$44.8million

(1)

towardsthisgoal.

TheBeHumanpillarofourImpactAgendasetsoutourfocusareaswithrespecttohumancapital,including:

• Inclusion,Diversity,Equity,andAction(“IDEA”);

• Employeeempowerment;and

• Fairlaborpracticesandthewell-beingofthepeoplewhomakeourproducts.

Inclusion,Diversity,EquityandAction

WebelieveIDEAisfundamentalforshapingandbuildingourcompany,industry,andcommunities,andforcreatinga

sharedsenseofrespectandbelonging.Bycontinuouslystrivingtobeaninclusive,diverse,andequitableorganization,weaim

toreflectavarietyofperspectivesandmeettheneedsoftheglobalcommunitiesweserve.Weareproudthatasof

January28,2024,approximately50%ofourboardofdirectors,70%ofourseniorexecutiveleadershipteam,and50%ofour

vicepresidentsandabovearewomen,whileapproximately75%ofouroverallworkforcearewomen.

(2)

7

(1)

Wehavecontributed$44.8milliontolululemon'sCentreforSocialImpact,$32.4millionofwhichhasbeencontributeddirectlytosocialimpact

organizations.Theremaining$12.4millionprimarilyconsistsofcontributionstowardadonor-advisedfundforfuturegrantmaking.

(2)

Whilewetrackmaleandfemalegenders,weacknowledgethisisnotfullyencompassingofallgenderidentities.

Weuseanannualvoluntaryglobalsurveytohelpusunderstandthedemographicsofouremployeebaseandprovide

uswithaccesstotangiblemetricstohelpusunderstandouremployees’senseofinclusionandbelonging.

(3)

In2023,the

participationratewasapproximately85%.Ouroverallgoalistoreflecttheracialdiversity

(4)

ofthecommunitiesweserveand

inwhichweoperate.

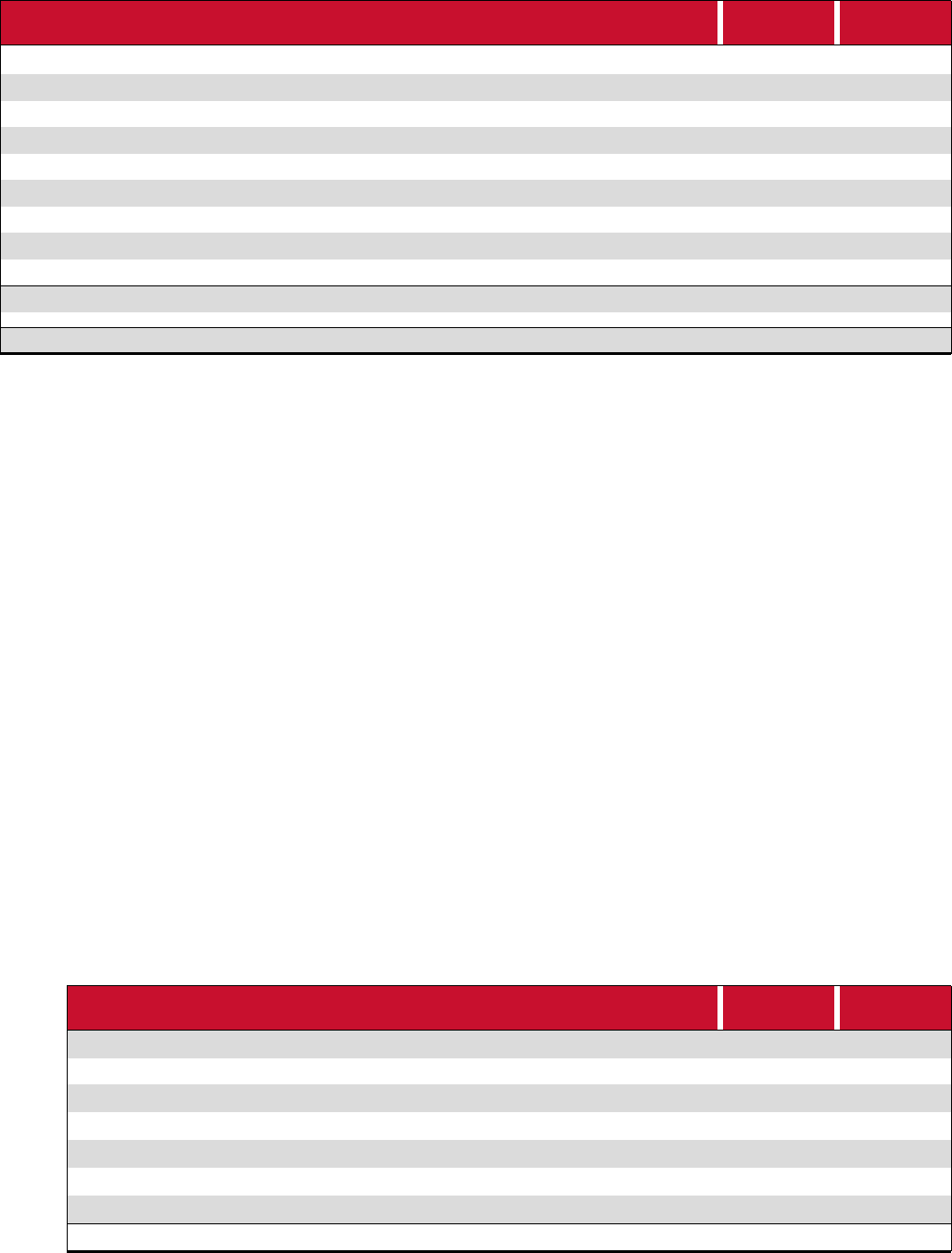

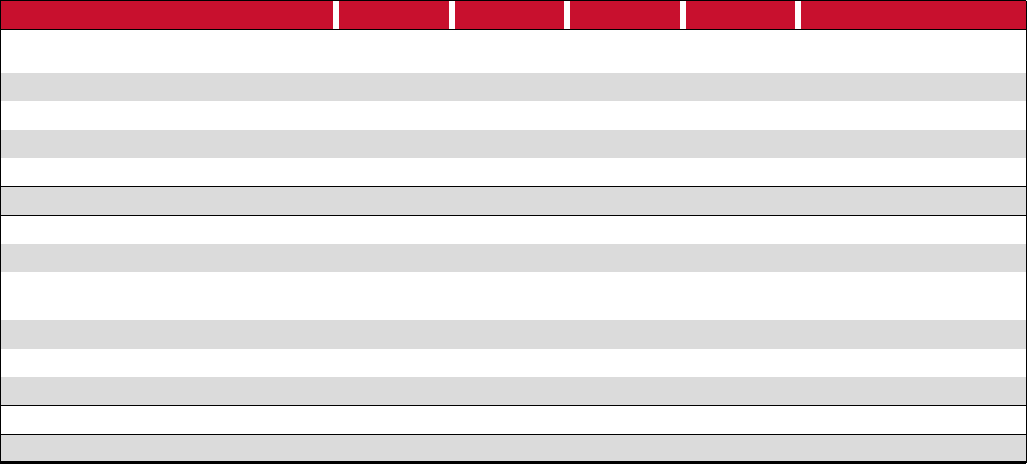

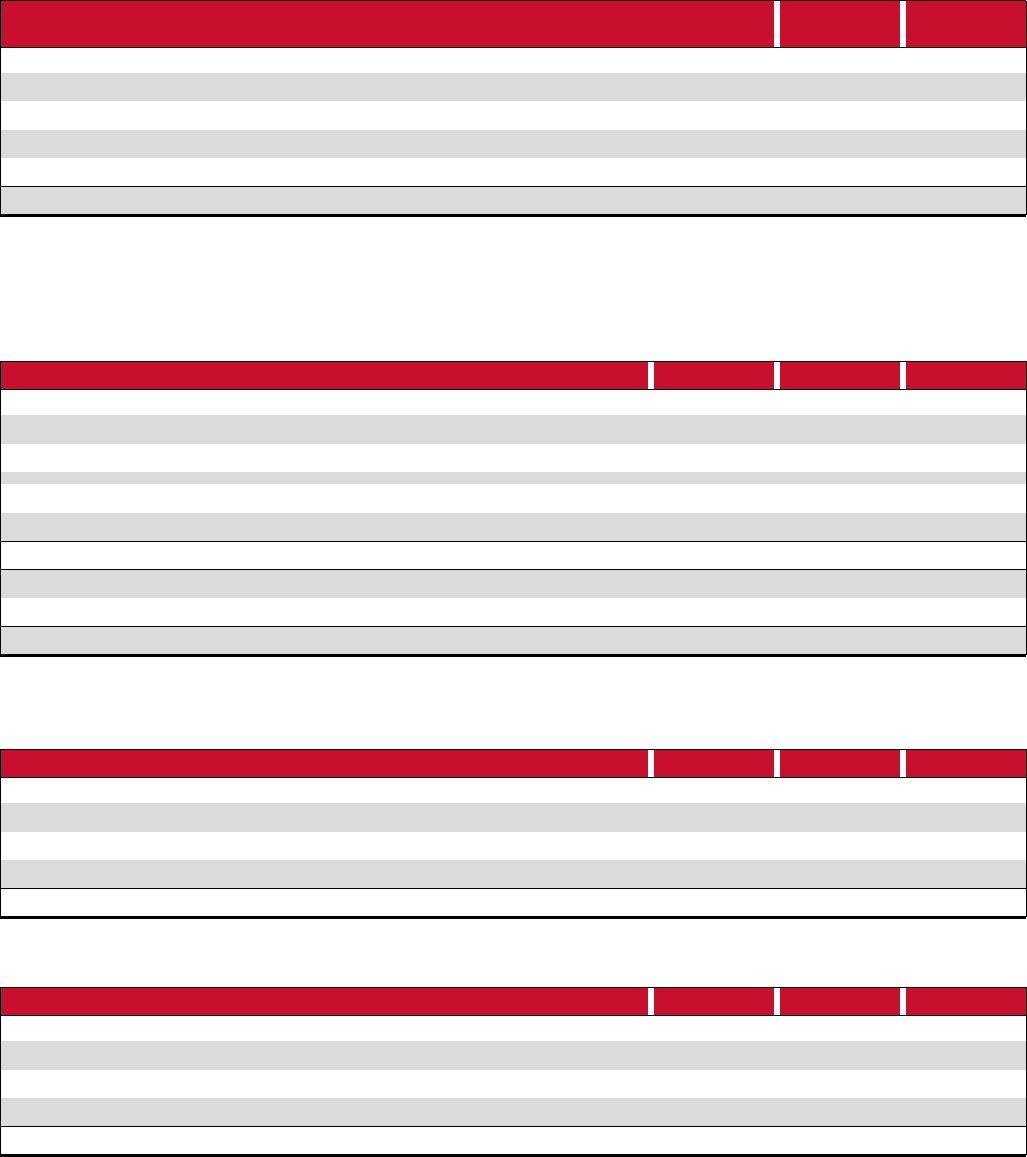

DirectorandAssistantStoreManagerand

AboveRacialDiversity

23%

27% 27%

2021 2022 2023

—%

5%

10%

15%

20%

25%

30%

35%

StoreEmployeeRacialDiversity

37%

40%

41%

2021 2022 2023

—%

5%

10%

15%

20%

25%

30%

35%

40%

45%

Weseektomaintain100%genderpayequitywithinourentireglobalemployeepopulation,meaningequalpayfor

equalworkacrossgenders,bygeography.Wehaveachievedfullpayequity,includinggenderandrace,intheUnitedStates,

whichistheonlycountrywherewecurrentlycollectindividuallyattributableracedata.

WeofferallemployeesIDEAeducation,training,andguidedconversationsonavarietyoftopics,includinganti-racism,

anti-discrimination,andinclusiveleadershipbehaviors.WehaveestablishedPeopleNetworks,whichareemployeeresource

groupsforemployeeswhohavemarginalizedandhistoricallyunderrepresentedidentities.Weseesignificantengagementin

IDEAeducationandtrainingacrossourglobalemployeebase.WeaimtofosteracultureofinclusionbymakingIDEApartof

oureverydayconversation,andfrequentlyreviewourpolicies,programs,andpracticestoidentifywaystobemoreinclusive

andequitable.

EmployeeEmpowerment

Webelieveourpeoplearekeytothesuccessofourbusiness.AsofJanuary28,2024weemployedapproximately

38,000peopleworldwide.Westrivetofosteradistinctiveculturerootedinourcorevaluesthatattractsandretains

passionateandmotivatedemployeeswhoaredriventoachievepersonalandprofessionalgoals.Webelieveourpeople

succeedbecausewecreateanenvironmentthatfostersgrowthandisdiverseandequitable.

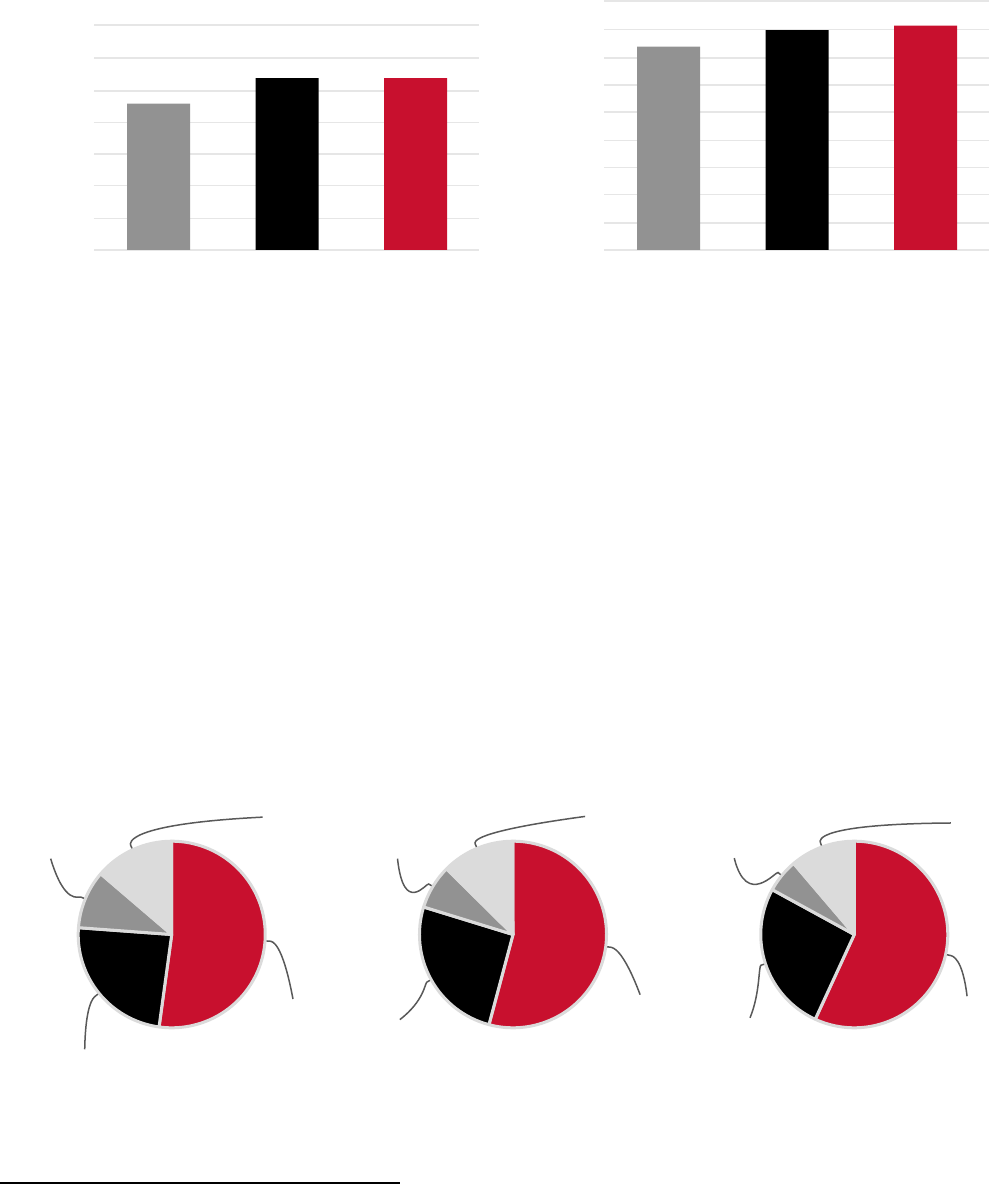

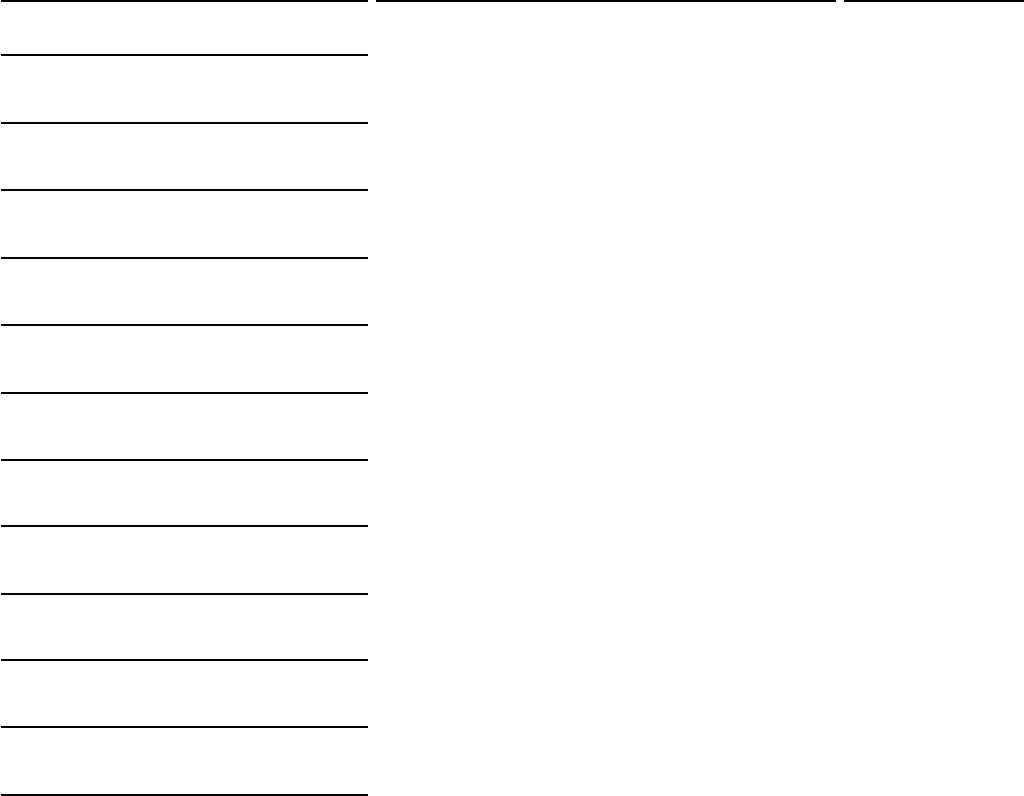

2023EmployeesbyRegion

United

States

52%

Canada

24%

China

Mainland

10%

Restof

World

14%

2022EmployeesbyRegion

United

States

54%

Canada

26%

China

Mainland

8%

Restof

World

12%

2021EmployeesbyRegion

United

States

57%

Canada

26%

China

Mainland

6%

Restof

World

11%

8

(3)

ThevoluntarydemographicsurveyresultspresentedaboverelatetoallofouremployeesintheAmericas,Europe,Australia,andNewZealand.

(4)

"Racialdiversity"isusedtomeasurethenon-whitepopulation.

Weassessourperformanceandidentifyopportunitiesforimprovementthroughanannualemployeeengagement

survey.In2023,theparticipationratewasapproximately85%andouremployeeengagementscoreexceededtheretail

industryaverage.

(5)

Ourengagementscoresuggestsourpeopleareproudtoworkforlululemon,theyaremotivatedto

contributetoworkthatalignswiththeirpurpose,andtheyrecommendlululemonasagreatplacetowork.

Weunderstandthathealthandwealthprogramsneedtoofferchoiceatallstagesoflife.Ourcurrentofferingssupport

ourgoalofbecomingthenumberoneplacewherepeoplecometodevelopandgrowasinclusiveleaders,andweregularly

usefeedbacktoinformopportunitiestosupportthisgoal.Theseofferingsinclude,amongotherthings:

• Competitivecompensationwhichrewardsexceptionalperformance;

• AFundyourFutureprogramforeligibleemployeeswhichofferspartialcontributionmatchestoapensionplanand

employeesharepurchaseplan;

• AnannualpaidVALUES(Volunteer,Awareness,Life,Unity,Empowerment,Support)Day,competitivepaidtimeoff,

andsickleave;

• Anemployeediscountprogram,whichincludesalifetimediscounttocelebratethecontributionofourlong-tenured

employeestokeepthemwithinourcollective,evenwhentheyhavemovedontopursuegoalsoutsideoflululemon;

• Reimbursementprogramswhichrewardphysicalactivity;

• Aparenthoodprogramwhichisagender-neutralbenefitthatprovidesalleligibleemployeesuptosixmonthsofpaid

leave;

• Anemployeeassistanceprogramwhichprovidesfreeconfidentialsupporttoallouremployeesandtheirfamiliesina

varietyofareasfrommentalwell-beingtofinancialservicestoadvicefornewparents;and

• Traininganddevelopmentofallofouremployeesincluding,butnotlimitedto,mentorshipprograms,IDEA

internships,leadershipdevelopment,visionandgoals,andcoaching.

FairLaborPracticesandtheWell-BeingofthePeoplewhoMakeourProducts

Weworkwithsupplierswhowebelieveshareourvaluesandcollaboratewithustoupholdrobuststandards,address

systemicchallenges,andsupportthewell-beingofpeoplewhomakeourproducts.OurResponsibleSupplyChainprogramis

builtonthreepillars:

• Monitoring-Assessingandimprovingworkingconditionsinfactories.

• Integration-Integratingresponsiblepurchasingpracticesacrossenterprisestrategies,processes,andtools.

• Collaboration-Workingwithmulti-stakeholderorganizations,industry,suppliers,andbrandstosupportsystemic

changeandimpact.

OurVendorCodeofEthicsoutlinesourcommitmenttorespecthumanandlaborrights,andpromotesafeandfair

workingconditionsforpeopleinoursupplychain.Thecode,whichisbasedoninternationalstandards,setstheminimum

standardsforoursupplierpartnersandisacomponentofoursupplierandmanufactureragreements.Ourfinishedgoodsand

fabricsuppliersareassessedagainsttheVendorCodeofEthicspriortoformingabusinessrelationship,andregularly

thereafter;weworkwithfactoriesthatcanupholdourstrictrequirements.

OurForeignMigrantWorkerStandardsetsoutourminimumrequirementsforwhatwebelievearetheappropriateand

ethicalrecruitment,employment,andrepatriationofforeignmigrantworkers.

IntellectualProperty

Wehavetrademarkrightsonmanyofourproductsandbelievehavingdistinctivemarksthatarereadilyidentifiableis

animportantfactorinbuildingourbrandimageandindistinguishingourproductsfromtheproductsofothers.Weconsider

ourlululemonandwavedesigntrademarkstobeamongourmostvaluableassets.Inaddition,weownmanyother

trademarksforthenamesofseveralofourbrands,slogans,fabricsandproducts.WeownregisteredandpendingU.S.and

foreignutilityanddesignpatents,industrialdesignsinCanada,andregisteredcommunitydesignsinEuropethatprotectour

productinnovations,distinctiveapparel,andaccessorydesigns.

9

(5)

Basedonanindustrybenchmarkprovidedbythethirdpartythatadministersthissurveytoouremployees.

SecuritiesandExchangeCommissionFilings

Ourwebsiteaddressiswww.lululemon.com.Weprovidefreeaccesstovariousreportsthatwefilewith,orfurnishto,

theUnitedStatesSecuritiesandExchangeCommission,ortheSEC,throughourwebsite,assoonasreasonablypracticable

aftertheyhavebeenfiledorfurnished.Thesereportsinclude,butarenotlimitedto,ourannualreportsonForm10-K,

quarterlyreportsonForm10-Q,currentreportsonForm8-K,andanyamendmentstothosereports.OurSECreportscanalso

beaccessedthroughtheSEC'swebsiteatwww.sec.gov.AlsoavailableonourwebsiteareprintableversionsofourGlobal

CodeofBusinessConductandEthicsandchartersofthestandingcommitteesofourboardofdirectors.Information

containedonoraccessiblethroughourwebsitesisnotincorporatedinto,anddoesnotformapartof,thisAnnualReportor

anyotherreportordocumentwefilewiththeSEC,andanyreferencestoourwebsitesareintendedtobeinactivetextual

referencesonly.

ITEM1A.RISKFACTORS

InadditiontotheotherinformationcontainedinthisForm10-K,thefollowingriskfactorsshouldbeconsideredin

evaluatingourbusiness.Ourbusiness,financialcondition,orresultsofoperationscouldbemateriallyadverselyaffectedasa

resultofanyoftheserisks.

Risksrelatedtoourbusinessandindustry

Oursuccessdependsonourabilitytomaintainthevalueandreputationofourbrand.

Thelululemonnameisintegraltoourbusinessaswellastotheimplementationofourexpansionstrategies.

Maintaining,promoting,andpositioningourbrandwilldependlargelyonthesuccessofourmarketingandmerchandising

effortsandourabilitytoprovideaconsistent,highqualityproduct,andguestexperience.Werelyonsocialmedia,asoneof

ourmarketingstrategies,tohaveapositiveimpactonbothourbrandvalueandreputation.Ourbrandandreputationcould

beadverselyaffectedifwefailtoachievetheseobjectives,ifourpublicimagewastobetarnishedbynegativepublicity,

whichcouldbeamplifiedbysocialmedia,ifwefailtodeliverinnovativeandhighqualityproductsacceptabletoourguests,or

ifwefaceormishandleaproductrecall.Ourreputationcouldalsobeimpactedbyadversepublicity,whetherornotvalid,

regardingallegationsthatwe,orpersonsassociatedwithusorformerlyassociatedwithus,haveviolatedapplicablelawsor

regulations,includingbutnotlimitedtothoserelatedtosafety,employment,discrimination,harassment,whistle-blowing,

privacy,corporatecitizenship,improperbusinesspractices,orcybersecurity.Certainactivitiesonthepartofstakeholders,

includingnongovernmentalorganizationsandgovernmentalinstitutions,couldcausereputationaldamage,distractsenior

management,anddisruptourbusiness.Additionally,whilewedevoteconsiderableeffortandresourcestoprotectingour

intellectualproperty,iftheseeffortsarenotsuccessfulthevalueofourbrandmaybeharmed.Anyharmtoourbrandand

reputationcouldhaveamaterialadverseeffectonourfinancialcondition.

Changesinconsumershoppingpreferences,andshiftsindistributionchannelscouldmateriallyimpactourresultsof

operations.

Weoperateanomni-channelretailmodelandaimtoefficientlyandeffectivelyserveourguestsinthewaysmost

convenienttothem.Weoperateacombinationofphysicalretaillocationsande-commerceservicesviaourwebsites,other

region-specificwebsites,digitalmarketplaces,andmobileapps.Ourphysicalretaillocationsremainakeypartofourgrowth

strategyandweviewthemasavaluabletoolinhelpingusbuildourbrandandproductlineaswellasenablingouromni-

channelcapabilities.Weplantocontinuetoexpandsquarefootageandopennewcompany-operatedstorestosupportour

growthobjectives.Thediversionofsalesfromourcompany-operatedstorescouldadverselyimpactourreturnoninvestment

andcouldleadtoimpairmentchargesandstoreclosures,includingleaseexitcosts.Wecouldhavedifficultyinrecreatingthe

in-storeexperiencethroughdirectchannels.Ourfailuretosuccessfullyintegrateourdigitalandphysicalchannelsand

respondtotheserisksmightadverselyimpactourbusinessandresultsofoperations,aswellasdamageourreputationand

brand.

Ifanyofourproductshavemanufacturingordesigndefectsorareotherwiseunacceptabletousorourguests,ourbusiness

couldbeharmed.

Wehaveoccasionallyreceived,andmayinthefuturereceive,shipmentsofproductsthatfailtocomplywithour

technicalspecificationsorthatfailtoconformtoourqualitycontrolstandards.Wehavealsoreceived,andmayinthefuture

receive,productsthatareotherwiseunacceptabletousorourguests.Underthesecircumstances,unlessweareableto

obtainreplacementproductsinatimelymanner,weriskthelossofnetrevenueresultingfromtheinabilitytosellthose

productsandrelatedincreasedadministrativeandshippingcosts.Additionally,iftheunacceptabilityofourproductsisnot

discovereduntilaftersuchproductsaresold,ourguestscouldloseconfidenceinourproductsorwecouldfaceaproduct

recallandourresultsofoperationscouldsufferandourbusiness,reputation,andbrandcouldbeharmed.

10

OurlululemonStudiosubsidiaryofferscomplexhardwareandsoftwareproductsandservicesthatcanbeaffectedby

designandmanufacturingdefects.Sophisticatedoperatingsystemsoftwareandapplications,suchasthoseofferedby

lululemonStudio,oftenhaveissuesthatcanunexpectedlyinterferewiththeintendedoperationofhardwareorsoftware

products.Defectsmayalsoexistincomponentsandproductsthatwesourcefromthirdparties.Anydefectscouldmakeour

productsandservicesunsafeandcreateariskofenvironmentalorpropertydamageorpersonalinjuryandwemaybecome

subjecttothehazardsanduncertaintiesofproductliabilityclaimsandrelatedlitigation.Theoccurrenceofrealorperceived

defectsinanyofourproducts,noworinthefuture,couldresultinadditionalnegativepublicity,regulatoryinvestigations,or

lawsuitsfiledagainstus,particularlyifguestsorotherswhouseorpurchaseourlululemonStudioproductsareinjured.Even

ifinjuriesarenottheresultofanydefects,iftheyareperceivedtobe,wemayincurexpensestodefendorsettleanyclaims

andourbrandandreputationmaybeharmed.

Weoperateinahighlycompetitivemarketandourcompetitorsmaycompetemoreeffectivelythanwecan,resultingina

lossofourmarketshareandadecreaseinournetrevenueandprofitability.

Themarketfortechnicalathleticapparelishighlycompetitive.Competitionmayresultinpricingpressures,reduced

profitmarginsorlostmarketshare,orafailuretogrowormaintainourmarketshare,anyofwhichcouldsubstantiallyharm

ourbusinessandresultsofoperations.Wecompetedirectlyagainstwholesalersanddirectretailersofathleticapparel,

includinglarge,diversifiedapparelcompanieswithsubstantialmarketshare,andestablishedcompaniesexpandingtheir

productionandmarketingoftechnicalathleticapparel,aswellasagainstretailersspecificallyfocusedonwomen'sathletic

apparel.Wealsofacecompetitionfromwholesalersanddirectretailersoftraditionalcommodityathleticapparel,suchas

cottonT-shirtsandsweatshirts.Manyofourcompetitorsarelargeapparelandsportinggoodscompanieswithstrong

worldwidebrandrecognition.Becauseofthefragmentednatureoftheindustry,wealsocompetewithotherapparelsellers,

includingthosespecializinginyogaapparelandotheractivewear.Manyofourcompetitorshavesignificantcompetitive

advantages,includinglongeroperatinghistories,largerandbroadercustomerbases,moreestablishedrelationshipswitha

broadersetofsuppliers,greaterbrandrecognitionandgreaterfinancial,researchanddevelopment,storedevelopment,

marketing,distribution,andotherresourcesthanwedo.Ourcompetitorsmaybeabletoachieveandmaintainbrand

awarenessandmarketsharemorequicklyandeffectivelythanwecan.

Wemayfailtoacknowledgeorreactappropriatelytotheentryorgrowthofaviablecompetitorordisruptiveforce,and

couldstruggletocontinuetoinnovate,differentiate,andsustainthegrowthofourbrand.Theincreasingdominanceand

presenceofourbrandmayalsodrivegueststowardsalternativeemergingcompetitors.

Inaddition,becauseweholdlimitedpatentsandexclusiveintellectualpropertyrightsinthetechnology,fabricsor

processesunderlyingourproducts,ourcurrentandfuturecompetitorsareabletomanufactureandsellproductswith

performancecharacteristics,fabricationtechniques,andstylingsimilartoourproducts.

Oursalesandprofitabilitymaydeclineasaresultofincreasingcostsanddecreasingsellingprices.

Ourbusinessissubjecttosignificantpressureoncostsandpricingcausedbymanyfactors,includingintense

competition,constrainedsourcingcapacityandrelatedinflationarypressure,theavailabilityofqualifiedlaborandwage

inflation,pressurefromconsumerstoreducethepriceswechargeforourproducts,andchangesinconsumerdemand.These

andotherfactorshave,andmayinthefuture,causeustoexperienceincreasedcosts,reduceourpricestoconsumersor

experiencereducedsalesinresponsetoincreasedprices,anyofwhichcouldcauseouroperatingmargintodeclineifweare

unabletooffsetthesefactorswithreductionsinoperatingcostsandcouldhaveamaterialadverseeffectonourfinancial

condition,operatingresults,andcashflows.

Ifweareunabletoanticipateconsumerpreferencesandsuccessfullydevelopandintroducenew,innovative,and

differentiatedproducts,wemaynotbeabletomaintainorincreaseoursalesandprofitability.

Oursuccessdependsonourabilitytoidentifyandoriginateproducttrendsaswellastoanticipateandreactto

changingconsumerdemandsinatimelymanner.Allofourproductsaresubjecttochangingconsumerpreferencesthat

cannotbepredictedwithcertainty.Ifweareunabletointroducenewproductsornoveltechnologiesinatimelymanneror

ournewproductsortechnologiesarenotacceptedbyourguests,ourcompetitorsmayintroducesimilarproductsinamore

timelyfashion,whichcouldhurtourgoaltobeviewedasaleaderintechnicalathleticapparelinnovation.Ournewproducts

maynotreceiveconsumeracceptanceasconsumerpreferencescouldshiftrapidlytodifferenttypesofathleticapparelor

awayfromthesetypesofproductsaltogether,andourfuturesuccessdependsinpartonourabilitytoanticipateandrespond

tothesechanges.Ourfailuretoanticipateandrespondinatimelymannertochangingconsumerpreferencescouldleadto,

amongotherthings,lowersalesandexcessinventorylevels.Wemaynothaverelevantdatatoeffectivelyunderstandand

reacttoconsumerpreferencesandexpectations.Evenifwearesuccessfulinanticipatingconsumerpreferences,ourabilityto

adequatelyreacttoandaddressthosepreferenceswillinpartdependuponourcontinuedabilitytodevelopandintroduce

innovative,high-qualityproducts.Ourfailuretoeffectivelyintroducenewproductsthatareacceptedbyconsumerscould

11

resultinadecreaseinnetrevenueandexcessinventorylevels,whichcouldhaveamaterialadverseeffectonourfinancial

condition.

Ourresultsofoperationscouldbemateriallyharmedifweareunabletoaccuratelyforecastguestdemandforour

products.

Toensureadequateinventorysupply,wemustforecastinventoryneedsandplaceorderswithourmanufacturers

basedonourestimatesoffuturedemandforparticularproducts.Ourabilitytoaccuratelyforecastdemandforourproducts

couldbeaffectedbymanyfactors,includinganincreaseordecreaseinguestdemandforourproductsorforproductsofour

competitors,ourfailuretoaccuratelyforecastguestacceptanceofnewproducts,productintroductionsbycompetitors,

unanticipatedchangesingeneralmarketconditions(forexample,becauseofglobaleconomicconcernssuchasinflation,an

economicdownturn,ordelaysanddisruptionsresultingfromlocalandinternationalshippingdelaysandlaborshortages),and

weakeningofeconomicconditionsorconsumerconfidenceinfutureeconomicconditions(forexample,becauseof

inflationarypressures,orbecauseofsanctions,restrictions,andotherresponsesrelatedtogeopoliticalevents).Ifwefailto

accuratelyforecastguestdemand,wemayexperienceexcessinventorylevelsorashortageofproductsavailableforsalein

ourstoresorfordeliverytoguests.

Inventorylevelsinexcessofguestdemandmayresultininventorywrite-downsorwrite-offsandthesaleofexcess

inventoryatdiscountedprices,whichwouldcauseourgrossmargintosufferandcouldimpairthestrengthandexclusivityof

ourbrand.Conversely,ifweunderestimateguestdemandforourproducts,ourmanufacturersmaynotbeabletodeliver

productstomeetourrequirements,andthiscouldresultindamagetoourreputationandguestrelationships.

Ourlimitedoperatingexperienceandlimitedbrandrecognitioninnewinternationalmarketsandnewproductcategories

maylimitourexpansionandcauseourbusinessandgrowthtosuffer.

OurfuturegrowthdependsinpartonourexpansioneffortsoutsideoftheAmericas.Wehavelimitedexperiencewith

regulatoryenvironmentsandmarketpracticesinternationally,andwemaynotbeabletopenetrateorsuccessfullyoperatein

anynewmarket.InconnectionwithourexpansioneffortswemayencounterobstacleswedidnotfaceintheAmericas,

includingculturalandlinguisticdifferences,differencesinregulatoryenvironments,laborpracticesandmarketpractices,

difficultiesinkeepingabreastofmarket,businessandtechnicaldevelopments,andinternationalguests'tastesand

preferences.Wemayalsoencounterdifficultyexpandingintonewinternationalmarketsbecauseoflimitedbrandrecognition

leadingtodelayedacceptanceofourtechnicalathleticapparelbyguestsinthesenewinternationalmarkets.Ourfailureto

developourbusinessinnewinternationalmarketsordisappointinggrowthoutsideofexistingmarketscouldharmour

businessandresultsofoperations.

Inaddition,ourcontinuedgrowthdependsinpartonourabilitytoexpandourproductcategoriesandintroducenew

productlines.Wemaynotbeabletosuccessfullymanageintegrationofnewproductcategoriesorthenewproductlines

withourexistingproducts.Sellingnewproductcategoriesandlineswillrequireourmanagementtotestanddevelop

differentstrategiesinordertobesuccessful.Wemaybeunsuccessfulinenteringnewproductcategoriesanddevelopingor

launchingnewproductlines,whichrequiresmanagementofnewsuppliers,potentialnewcustomers,andnewbusiness

models.Ourmanagementmaynothavetheexperienceofsellinginthesenewproductcategoriesandwemaynotbeableto

growourbusinessasplanned.Forexample,inJuly2020,weacquiredMIRROR,anin-homefitnesscompanywithan

interactiveworkoutplatformthatfeaturesliveandon-demandclasses.Ifweareunabletoeffectivelyandsuccessfullyfurther

developtheseandfuturenewproductcategoriesandlines,wemaynotbeabletoincreaseormaintainoursalesandour

operatingmarginsmaybeadverselyaffected.Thismayalsodiverttheattentionofmanagementandcauseadditional

expenses.

Wemay,fromtimetotime,evaluateandpursueotherstrategicinvestmentsoracquisitions.Theseinvolvevarious

inherentrisksandthebenefitssoughtmaynotberealized.

Ifwecontinuetogrowatarapidpace,wemaynotbeabletoeffectivelymanageourgrowthandtheincreasedcomplexity

ofourbusinessandasaresultourbrandimageandfinancialperformancemaysuffer.

Ifouroperationscontinuetogrowatarapidpace,wemayexperiencedifficultiesinobtainingsufficientrawmaterials

andmanufacturingcapacitytoproduceourproducts,aswellasdelaysinproductionandshipments,asourproductsare

subjecttorisksassociatedwithoverseassourcingandmanufacturing.Wecouldberequiredtocontinuetoexpandoursales

andmarketing,productdevelopmentanddistributionfunctions,toupgradeourmanagementinformationsystemsandother

processesandtechnology,andtoobtainmorespaceforourexpandingworkforce.Thisexpansioncouldincreasethestrainon

ourresources,andwecouldexperienceoperatingdifficulties,includingdifficultiesinhiring,training,andmanagingan

increasingnumberofemployees.Thesedifficultiescouldresultintheerosionofourbrandimagewhichcouldhaveamaterial

adverseeffectonourfinancialcondition.

12

Wearesubjecttorisksassociatedwithleasingretailanddistributionspacesubjecttolong-termandnon-cancelableleases.

Weleasethemajorityofourstoresunderoperatingleasesandourinabilitytosecureappropriaterealestateorlease

termscouldimpactourabilitytogrow.Ourleasesgenerallyhaveinitialtermsofbetweentwoand15years,andgenerallycan

beextendedinincrementsbetweentwoandfiveyears,ifatall.Wegenerallycannotcanceltheseleasesatouroption.Ifan

existingornewstoreisnotprofitable,andwedecidetocloseit,aswehavedoneinthepastandmaydointhefuture,we

maynonethelessbecommittedtoperformourobligationsundertheapplicableleaseincluding,amongotherthings,paying

thebaserentforthebalanceoftheleaseterm.Similarly,wemaybecommittedtoperformourobligationsunderthe

applicableleasesevenifcurrentlocationsofourstoresbecomeunattractiveasdemographicpatternschange.Inaddition,as

eachofourleasesexpire,wemayfailtonegotiaterenewals,eitheroncommerciallyacceptabletermsoratall,whichcould

requireustoclosestoresindesirablelocations.

Wealsoleasethemajorityofourdistributioncentersandourinabilitytosecureappropriaterealestateorleaseterms

couldimpactourabilitytodeliverourproductstothemarket.

Ourfuturesuccessissubstantiallydependentontheserviceofourseniormanagementandourabilitytomaintainour

cultureandtoattract,manage,andretainhighlyqualifiedindividuals.

Theperformanceofourseniormanagementteamandotherkeyemployeesmaynotmeetourneedsandexpectations.

Also,thelossofservicesofanyofthesekeyemployees,oranynegativepublicperceptionwithrespecttotheseindividuals,

maybedisruptiveto,orcauseuncertaintyin,ourbusinessandcouldhaveanegativeimpactonourabilitytomanageand

growourbusinesseffectively.Suchdisruptioncouldhaveamaterialadverseimpactonourfinancialperformance,financial

condition,andthemarketpriceofourstock.

Ifweareunabletosuccessfullymaintainandevolveouruniqueculture,offercompetitivecompensationandbenefits,

andadesirableworkmodel,wemaybeunabletoattractandretainhighlyqualifiedindividualstosupportourbusinessand

continuedgrowth.Ourworkmodelmaynotmeettheneedsandexpectationsofouremployeesandmaynotbeperceivedas

favorablecomparedtoothercompanies.Unionizationeffortsorotheremployeeorganizingactivitiescouldleadtohigher

peoplecostsorreduceourflexibilitytomanageouremployeeswhichmaynegativelydisruptouroperations.Wealsoface

risksrelatedtoemployeeengagementandproductivitywhichcouldresultinincreasedheadcountandleadtoincreasedlabor

costs.

Ourbusinessisaffectedbyseasonality,whichcouldresultinfluctuationsinouroperatingresults.

Ourbusinessisaffectedbythegeneralseasonaltrendscommontotheretailapparelindustry.Ourannualnetrevenue

istypicallyweightedmoreheavilytowardourfourthfiscalquarter,reflectingourhistoricalstrengthinsalesduringtheholiday

season,whileouroperatingexpensesaremoreequallydistributedthroughouttheyear.Thisseasonality,alongwithother

factorsthatarebeyondourcontrol,includingweatherconditionsandtheeffectsofclimatechange,couldadverselyaffectour

businessandcauseourresultsofoperationstofluctuate.

Risksrelatedtooursupplychain

Disruptionsofoursupplychaincouldhaveamaterialadverseeffectonouroperatingandfinancialresults.

Disruptionofoursupplychaincapabilitiesduetotraderestrictions,politicalinstability,severeweather,natural

disasters,publichealthcrises,war,terrorism,productrecalls,laborsupplyshortagesorstoppages,thefinancialoroperational

instabilityofkeysuppliersandcarriers,changesindiplomaticortraderelationships(includinganysanctions,restrictions,and

otherresponsessuchasthoserelatedtocurrentgeopoliticalevents),orotherreasonscouldimpairourabilitytodistribute

ourproducts.Totheextentweareunabletomitigatethelikelihoodorpotentialimpactofsuchevents,therecouldbea

materialadverseeffectonouroperatingandfinancialresults.

Werelyoninternationalsuppliersandanysignificantdisruptiontooursupplychaincouldimpairourabilitytoprocureor

distributeourproducts.

Wedonotmanufactureourproductsorrawmaterialsandrelyonsuppliersandmanufacturerslocatedpredominantly

inAPACandChinaMainland.Wealsosourceothermaterialsusedinourproducts,includingitemssuchascontentlabels,

elastics,buttons,clasps,anddrawcords,fromsupplierslocatedprimarilyinthisregion.Basedoncost,during2023:

• Approximately42%ofourproductsweremanufacturedinVietnam,16%inCambodia,11%inSriLanka,10%in

Indonesia,and8%inBangladesh,andtheremainderinotherregions.

13

• Approximately40%ofthefabricusedinourproductsoriginatedfromTaiwan,26%fromChinaMainland,12%from

SriLanka,andtheremainderfromotherregions.

Theentireapparelindustry,includingourcompany,couldfacesupplychainchallengesasaresultoftheimpactsof

globalpublichealthcrises,politicalinstability,inflationarypressures,macroeconomicconditions,andotherfactors,including

reducedfreightavailabilityandincreasedcosts,portdisruption,manufacturingfacilityclosures,andrelatedlaborshortages

andothersupplychaindisruptions.

Oursupplychaincapabilitiesmaybedisruptedduetotheseorotherfactors,suchassevereweather,naturaldisasters,

warorothermilitaryconflicts,terrorism,laborsupplyshortagesorstoppages,thefinancialoroperationalinstabilityofkey

suppliersorthecountriesinwhichtheyoperate,orchangesindiplomaticortraderelationships(includinganysanctions,

restrictions,andotherresponsestogeopoliticalevents).Anysignificantdisruptioninoursupplychaincapabilitiescould

impairourabilitytoprocureordistributeourproducts,whichwouldadverselyaffectourbusinessandresultsofoperations.

Arelativelysmallnumberofvendorssupplyandmanufactureasignificantportionofourproducts,andlosingoneormore

ofthesevendorscouldadverselyaffectourbusinessandresultsofoperations.

Manyofthespecialtyfabricsusedinourproductsaretechnicallyadvancedtextileproductsdevelopedand

manufacturedbythirdpartiesandmaybeavailable,intheshort-term,fromonlyoneoralimitednumberofsources.We

havenolong-termcontractswithanyofoursuppliersormanufacturersfortheproductionandsupplyofourrawmaterials

andproducts,andwecompetewithothercompaniesforfabrics,otherrawmaterials,andproduction.During2023,we

workedwithapproximately49vendorstomanufactureourproductsand67supplierstoprovidethefabricforourproducts.

Basedoncost,during2023:

• Approximately55%ofourproductsweremanufacturedbyourtopfivevendors,thelargestofwhichproduced

approximately17%ofourproducts;and

• Approximately52%ofourfabricswereproducedbyourtopfivefabricsuppliers,thelargestofwhichproduced

approximately19%offabricused.

Wehaveexperienced,andmayinthefutureexperience,asignificantdisruptioninthesupplyoffabricsorrawmaterials

andmaybeunabletolocatealternativesuppliersofcomparablequalityatanacceptableprice,oratall.Inaddition,ifwe

experiencesignificantincreaseddemand,orifweneedtoreplaceanexistingsupplierormanufacturer,wemaybeunableto

locateadditionalsuppliesoffabricsorrawmaterialsoradditionalmanufacturingcapacityontermsthatareacceptabletous,

oratall,orwemaybeunabletolocateanysupplierormanufacturerwithsufficientcapacitytomeetourrequirementsorfill

ourordersinatimelymanner.Identifyingasuitablesupplierisaninvolvedprocessthatrequiresustobecomesatisfiedwith

itsqualitycontrol,responsivenessandservice,financialstability,andlaborandotherethicalpractices.Evenifweareableto

expandexistingorfindnewmanufacturingorfabricsources,wemayencounterdelaysinproductionandaddedcostsasa

resultofthetimeittakestotrainoursuppliersandmanufacturersinourmethods,products,andqualitycontrolstandards.

Oursupplyoffabricormanufactureofourproductscouldbedisruptedordelayedbyeconomicorpoliticalorglobal

healthconditions,andtherelatedgovernmentandprivatesectorresponsiveactionssuchasclosures,restrictionsonproduct

shipments,andtravelrestrictions.Delaysrelatedtosupplierchangescouldalsoariseduetoanincreaseinshippingtimesif

newsuppliersarelocatedfartherawayfromourmarketsorfromotherparticipantsinoursupplychain.Inaddition,freight

capacityissuescontinuetopersistworldwideasthereismuchgreaterdemandforshippingandreducedcapacityand

equipment.Anydelays,interruption,orincreasedcostsinthesupplyoffabricormanufactureofourproductscouldhavean

adverseeffectonourabilitytomeetguestdemandforourproductsandresultinlowernetrevenueandincomefrom

operationsbothintheshortandlongterm.

OurbusinesscouldbeharmedifoursuppliersandmanufacturersdonotcomplywithourVendorCodeofEthicsor

applicablelaws.

WhilewerequireoursuppliersandmanufacturerstocomplywithourVendorCodeofEthics,whichincludeslabor,

healthandsafety,andenvironmentstandards,wedonotcontroltheiroperations.Ifsuppliersorcontractorsdonotcomply

withthesestandardsorapplicablelawsorthereisnegativepublicityregardingtheproductionmethodsofanyofour

suppliersormanufacturers,evenifunfoundedornotspecifictooursupplychain,ourreputationandsalescouldbeadversely

affected,wecouldbesubjecttolegalliability,orcouldcauseustocontractwithalternativesuppliersormanufacturing

sources.

14

Thefluctuatingcostofrawmaterialscouldincreaseourcostofgoodssold.

Thefabricsusedtomakeourproductsincludesyntheticfabricswhoserawmaterialsincludepetroleum-basedproducts.

Ourproductsalsoincludesilverandnaturalfibers,includingcotton.Ourcostsforrawmaterialsareaffectedby,amongother

things,weather,consumerdemand,speculationonthecommoditiesmarket,therelativevaluationsandfluctuationsofthe

currenciesofproducerversusconsumercountries,andotherfactorsthataregenerallyunpredictableandbeyondourcontrol.

Anyandallofthesefactorsmaybeexacerbatedbyglobalclimatechange.Inaddition,politicalinstability,traderelations,

sanctions,inflationarypressure,orothergeopoliticaloreconomicconditionscouldcauserawmaterialcoststoincreaseand

haveanadverseeffectonourfuturemargins.Increasesinthecostofrawmaterials,includingpetroleumorthepriceswepay

forsilverandourcottonyarnandcotton-basedtextiles,couldhaveamaterialadverseeffectonourcostofgoodssold,results

ofoperations,financialcondition,andcashflows.

Ifweencounterproblemswithourdistributionsystem,ourabilitytodeliverourproductstothemarketandtomeetguest

expectationscouldbeharmed.

Werelyonourdistributionfacilitiesforsubstantiallyallofourproductdistribution.Ourdistributionfacilitiesinclude

computercontrolledandautomatedequipment,whichmeanstheiroperationsmaybesubjecttoanumberofrisksrelatedto

securityorcomputerviruses,theproperoperationofsoftwareandhardware,electronicorpowerinterruptions,orother

systemfailures.Inaddition,ouroperationscouldalsobeinterruptedbylabordifficulties,pandemics,theimpactsofclimate

change,extremeorsevereweatherconditionsorbyfloods,fires,orothernaturaldisastersnearourdistributioncenters.Ifwe

encounterproblemswithourdistributionsystem,ourabilitytomeetguestexpectations,manageinventory,completesales,

andachieveobjectivesforoperatingefficienciescouldbeharmed.

IncreasinglaborcostsandotherfactorsassociatedwiththeproductionofourproductsinSouthAsiaandSouthEastAsia

couldincreasethecoststoproduceourproducts.

AsignificantportionofourproductsareproducedinSouthAsiaandSouthEastAsiaandincreasesinthecostsoflabor

andothercostsofdoingbusinessinthecountriesinthisareacouldsignificantlyincreaseourcoststoproduceourproducts

andcouldhaveanegativeimpactonouroperationsandearnings.Factorsthatcouldnegativelyaffectourbusinessinclude

laborshortagesandincreasesinlaborcosts,labordisputes,pandemics,theimpactsofclimatechange,difficultiesand

additionalcostsintransportingproductsmanufacturedfromthesecountriestoourdistributioncentersandsignificant

revaluationofthecurrenciesusedinthesecountries,whichmayresultinanincreaseinthecostofproducingproducts.Also,

theimpositionoftradesanctionsorotherregulationsagainstproductsimportedbyusfrom,orthelossof"normaltrade

relations"statuswithanycountryinwhichourproductsaremanufactured,couldsignificantlyincreaseourcostofproducts

andharmourbusiness.

Risksrelatedtoinformationsecurityandtechnology

Wemaybeunabletosafeguardagainstsecuritybreacheswhichcoulddamageourcustomerrelationshipsandresultin

significantlegalandfinancialexposure.

Aspartofournormaloperations,wereceiveconfidential,proprietary,andpersonallyidentifiableinformation,including

creditcardinformation,andinformationaboutourcustomers,ouremployees,jobapplicants,andotherthirdparties.Our

businessemployssystemsandwebsitesthatallowforthestorageandtransmissionofthisinformation.However,despiteour

safeguardsandsecurityprocessesandprotections,securitybreachescouldexposeustoariskoftheftormisuseofthis

information,andcouldresultinlitigationandpotentialliability.

Theretailindustry,inparticular,hasbeenthetargetofmanyrecentcyber-attacks.Wemaynothavetheresourcesor

technicalsophisticationtobeabletoanticipateorpreventrapidlyevolvingtypesofcyber-attacks.Attacksmaybetargetedat

us,ourvendorsorcustomers,orotherswhohaveentrusteduswithinformation.Inaddition,despitetakingmeasuresto

safeguardourinformationsecurityandprivacyenvironmentfromsecuritybreaches,ourcustomersandourbusinesscould

stillbeexposedtorisk.Actualoranticipatedattacksmaycauseustoincurincreasingcostsincludingcoststodeployadditional

personnelandprotectiontechnologies,trainemployeesandengagethirdpartyexpertsandconsultants.Advancesin

computercapabilities,newtechnologicaldiscoveriesorotherdevelopmentsmayresultinthetechnologyusedbyusto

protecttransactionorotherdatabeingbreachedorcompromised.Measuresweimplementtoprotectagainstcyber-attacks

mayalsohavethepotentialtoimpactourcustomers'shoppingexperienceordecreaseactivityonourwebsitesbymaking

themmoredifficulttouse.

Dataandsecuritybreachescanalsooccurasaresultofnon-technicalissuesincludingintentionalorinadvertentbreach

byemployeesorpersonswithwhomwehavecommercialrelationshipsthatresultintheunauthorizedreleaseofpersonalor

15

confidentialinformation.Anycompromiseorbreachofoursecuritycouldresultinaviolationofapplicableprivacyandother

laws,significantlegalandfinancialexposure,anddamagetoourbrandandreputationorotherharmtoourbusiness.

Inaddition,theincreaseduseofemployee-owneddevicesforcommunicationsaswellaswork-from-home

arrangementspresentadditionaloperationalriskstoourtechnologysystems,includingincreasedrisksofcyber-attacks.

Further,likeothercompaniesintheretailindustry,wehaveinthepastexperienced,andweexpecttocontinueto

experience,cyber-attacks,includingphishing,andotherattemptstobreach,orgainunauthorizedaccessto,oursystems.To

date,theseattackshavenothadamaterialimpactonouroperations,buttheymayhaveamaterialimpactinthefuture.

Privacyanddataprotectionlawsincreaseourcomplianceburden.

Wearesubjecttoavarietyofprivacyanddataprotectionlawsandregulationsthatchangefrequentlyandhave

requirementsthatvaryfromjurisdictiontojurisdiction.Forexample,wearesubjecttosignificantcomplianceobligations

underprivacylawssuchastheGeneralDataPrivacyRegulation("GDPR")intheEuropeanUnion,thePersonalInformation

ProtectionandElectronicDocumentsAct(“PIPEDA”)inCanada,theCaliforniaConsumerPrivacyAct("CCPA")modifiedbythe

CaliforniaPrivacyRightsAct(“CPRA”),andthePersonalInformationProtectionLaw(“PIPL”)inthePeople'sRepublicofChina

("PRC")

(6)

.Someprivacylawsprohibitthetransferofpersonalinformationtocertainotherjurisdictions.Wearesubjectto

privacyanddataprotectionauditsorinvestigationsbyvariousgovernmentagencies.Ourfailuretocomplywiththeselaws

subjectsustopotentialregulatoryenforcementactivity,fines,privatelitigationincludingclassactions,andothercosts.Our

effortstocomplywithprivacylawsmaycomplicateouroperationsandaddtoourcompliancecosts.Asignificantprivacy

breachorfailureorperceivedfailurebyusorourthird-partyserviceproviderstocomplywithprivacyordataprotectionlaws,

regulations,policiesorregulatoryguidancemighthaveamateriallyadverseimpactonourreputation,businessoperations

andourfinancialconditionorresultsofoperations.

Disruptionofourtechnologysystemsorunexpectednetworkinterruptioncoulddisruptourbusiness.

Weareincreasinglydependentontechnologysystemsandthird-partiestooperateoure-commercewebsites,process

transactions,respondtoguestinquiries,manageinventory,purchase,sellandshipgoodsonatimelybasis,andmaintaincost-

efficientoperations.Thefailureofourtechnologysystemstooperateproperlyoreffectively,problemswithtransitioningto

upgradedorreplacementsystems,ordifficultyinintegratingnewsystems,couldadverselyaffectourbusiness.Inaddition,

wehavee-commercewebsitesintheUnitedStates,Canada,andinternationally.Ourtechnologysystems,websites,and

operationsofthirdpartiesonwhomwerely,mayencounterdamageordisruptionorslowdowncausedbyafailureto

successfullyupgradesystems,systemfailures,viruses,computer"hackers",naturaldisasters,orothercauses.Thesecould

causeinformation,includingdatarelatedtoguestorders,tobelostordelayedwhichcould,especiallyifthedisruptionor

slowdownoccurredduringtheholidayseason,resultindelaysinthedeliveryofproductstoourstoresandguestsorlost

sales,whichcouldreducedemandforourproductsandcauseoursalestodecline.Theconcentrationofourprimaryoffices,

severalofourdistributioncenters,andanumberofourstoresalongthewestcoastofNorthAmericacouldamplifythe

impactofanaturaldisasteroccurringinthatareatoourbusiness,includingtoourtechnologysystems.Inaddition,ifchanges

intechnologycauseourinformationsystemstobecomeobsolete,orifourinformationsystemsareinadequatetohandleour

growth,wecouldloseguests.Wehavelimitedback-upsystemsandredundancies,andourtechnologysystemsandwebsites

haveexperiencedsystemfailuresandelectricaloutagesinthepastwhichhavedisruptedouroperations.Anysignificant

disruptioninourtechnologysystemsorwebsitescouldharmourreputationandcredibility,andcouldhaveamaterialadverse

effectonourbusiness,financialcondition,andresultsofoperations.

Ourtechnology-basedsystemsthatgiveourcustomerstheabilitytoshopwithusonlinemaynotfunctioneffectively.

Manyofourcustomersshopwithusthroughoure-commercewebsitesandmobileapps.Increasingly,customersare

usingtabletsandsmartphonestoshoponlinewithusandwithourcompetitorsandtodocomparisonshopping.Weare

increasinglyusingsocialmediaandproprietarymobileappstointeractwithourcustomersandasameanstoenhancetheir

shoppingexperience.Anyfailureonourparttoprovideattractive,effective,reliable,user-friendlye-commerceplatformsthat

offerawideassortmentofmerchandisewithrapiddeliveryoptionsandthatcontinuallymeetthechangingexpectationsof

onlineshopperscouldplaceusatacompetitivedisadvantage,resultinthelossofe-commerceandothersales,harmour

16

(6)

PRCincludesChinaMainland,HongKongSAR,Taiwan,andMacauSAR.

reputationwithcustomers,haveamaterialadverseimpactonthegrowthofoure-commercebusinessgloballyandcould

haveamaterialadverseimpactonourbusinessandresultsofoperations.

Risksrelatedtoenvironmental,social,andgovernanceissues

Climatechange,andrelatedlegislativeandregulatoryresponsestoclimatechange,mayadverselyimpactourbusiness.

Thereisincreasingconcernthatagradualriseinglobalaveragetemperaturesduetoincreasedconcentrationofcarbon

dioxideandothergreenhousegasesintheatmospherewillcausesignificantchangesinweatherpatternsaroundtheglobe,

anincreaseinthefrequency,severity,anddurationofextremeweatherconditionsandnaturaldisasters,andwaterscarcity

andpoorwaterquality.Theseeventscouldadverselyimpactthecultivationofcotton,whichisakeyresourceinthe

productionofourproducts,disrupttheoperationofoursupplychainandtheproductivityofourcontractmanufacturers,

increaseourproductioncosts,imposecapacityrestraintsandimpactthetypesofapparelproductsthatconsumerspurchase.