Semi-Annual Report

As of and for the six months ended June 30, 2023

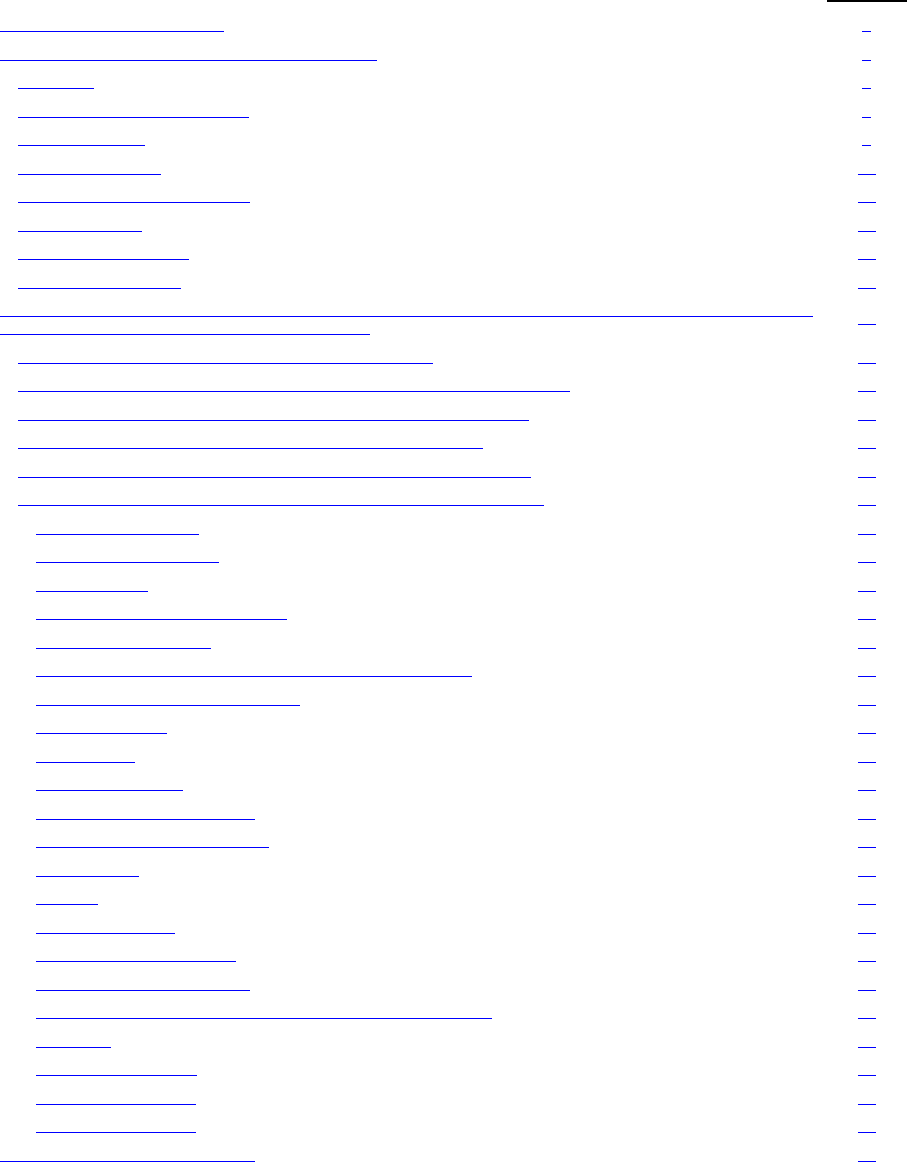

TABLE OF CONTENTS

CERTAIN DEFINED TERMS 5

MANAGEMENT DISCUSSION AND ANALYSIS 6

Highlights 6

Non-GAAP Financial Measures 7

Company Results 9

Results by Segment 15

Liquidity and Capital Resources 24

Important Events 29

Risks and Uncertainties 31

Guidance and Outlook 32

SEMI-ANNUAL CONDENSED CONSOLIDATED FINANCIAL STATEMENTS AND NOTES AS OF AND

FOR THE SIX MONTHS ENDED JUNE 30, 2023

33

Semi-Annual Condensed Consolidated Income Statement 34

Semi-Annual Condensed Consolidated Statement of Comprehensive Income 35

Semi-Annual Condensed Consolidated Statement of Financial Position 36

Semi-Annual Condensed Consolidated Statement of Cash Flows 37

Semi-Annual Condensed Consolidated Statement of Changes in Equity 38

Notes to the Semi-Annual Condensed Consolidated Financial Statements 39

1. Basis of preparation 39

2. Scope of consolidation 42

3. Net revenues 45

4. Net financial expenses/(income) 46

5. Tax expense/(benefit) 46

6. Goodwill and intangible assets with indefinite useful lives 47

7. Other assets and prepaid expenses 47

8. Financial assets 48

9. Inventories 48

10. Working Capital 49

11. Share-based compensation 49

12. Employee benefits liabilities 50

13. Provisions 51

14. Debt 51

15. Other liabilities 53

16. Fair value measurement 54

17. Related party transactions 56

18. Guarantees granted, commitments and contingent liabilities 58

19. Equity 63

20. Earnings per share 65

21. Segment reporting 66

22. Subsequent events 69

RESPONSIBILITY STATEMENT 70

Page

2

Cautionary Statements Concerning Forward Looking Statements

Statements contained in this Semi-Annual Report, particularly those regarding possible or assumed future

performance, competitive strengths, costs, dividends, reserves, our growth, industry growth and other trends and projections

and estimated company earnings are “forward-looking statements” that contain risks and uncertainties. In some cases, words

such as “may”, “will”, “expect”, “could”, “should”, “intend”, “estimate”, “anticipate”, “believe”, “remain”, “on track”,

“design”, “target”, “objective”, “goal”, “forecast”, “projection”, “outlook”, “prospects”, “plan”, or similar terms are used to

identify forward-looking statements. These forward-looking statements reflect our current views with respect to future events

and involve significant risks and uncertainties that could cause actual results to differ materially.

These risks and uncertainties include, without limitation:

• our ability to launch new products successfully and to maintain vehicle shipment volumes;

• changes in the global financial markets, general economic environment and changes in demand for automotive

products, which is subject to cyclicality;

• our ability to realize the anticipated benefits of the merger;

• our ability to offer innovative, attractive products, and to develop, manufacture and sell vehicles with advanced

features, including enhanced electrification, connectivity and autonomous-driving characteristics;

• the continued impact of unfilled semiconductor orders;

• our ability to successfully manage the industry-wide transition from internal combustion engines to full

electrification;

• our ability to produce or procure electric batteries with competitive performance, cost and at required volumes;

• our ability to successfully launch new businesses and integrate acquisitions;

• a significant malfunction, disruption or security breach compromising information technology systems or the

electronic control systems contained in our vehicles;

• exchange rate fluctuations, interest rate changes, credit risk and other market risks;

• increases in costs, disruptions of supply or shortages of raw materials, parts, components and systems used in

our vehicles;

• changes in local economic and political conditions;

• changes in trade policy, the imposition of global and regional tariffs or tariffs targeted to the automotive

industry, the enactment of tax reforms or other changes in laws and regulations;

• the level of governmental economic incentives available to support the adoption of battery electric vehicles;

• the impact of increasingly stringent regulations regarding fuel efficiency requirements and reduced greenhouse

gas and tailpipe emissions;

• various types of claims, lawsuits, governmental investigations and other contingencies, including product

liability and warranty claims and environmental claims, investigations and lawsuits;

• material operating expenditures in relation to compliance with environmental, health and safety regulations;

• the level of competition in the automotive industry, which may increase due to consolidation and new entrants;

• our ability to attract and retain experienced management and employees;

3

• exposure to shortfalls in the funding of our defined benefit pension plans;

• our ability to provide or arrange for access to adequate financing for dealers and retail customers and associated

risks related to the establishment and operations of financial services companies;

• our ability to access funding to execute our business plan;

• our ability to realize anticipated benefits from joint venture arrangements;

• disruptions arising from political, social and economic instability;

• risks associated with our relationships with employees, dealers and suppliers;

• our ability to maintain effective internal controls over financial reporting;

• developments in labor and industrial relations and developments in applicable labor laws;

• earthquakes or other disasters; and

• other factors discussed elsewhere in this report.

Furthermore, in light of the inherent difficulty in forecasting future results, any estimates or forecasts of particular

periods that are provided in this report are uncertain. We expressly disclaim and do not assume any liability in connection

with any inaccuracies in any of the forward-looking statements in this report or in connection with any use by any third party

of such forward-looking statements. Actual results could differ materially from those anticipated in such forward-looking

statements. We do not undertake an obligation to update or revise publicly any forward-looking statements.

Additional factors which could cause actual results and developments to differ from those expressed or implied by

the forward-looking statements are included in the section — Risks and Uncertainties of this Semi-Annual Report.

4

CERTAIN DEFINED TERMS

In this Semi-Annual Report, unless otherwise specified, the terms “we”, “our”, “us”, the “Company” and

“Stellantis” refer to Stellantis N.V., together with its consolidated subsidiaries, or any one or more of them, as the context

may require.

References to “FCA” and “FCA N.V.” mean Fiat Chrysler Automobiles N.V. or Fiat Chrysler Automobiles N.V.

together with its consolidated subsidiaries, or any one or more of them, as the context may require.

References to “PSA” and “Groupe PSA” mean Peugeot S.A. or Peugeot S.A. together with its consolidated

subsidiaries, or any one or more of them, as the context may require.

References to the “merger” refer to the merger between PSA and FCA completed on January 16, 2021 and resulting

in the creation of Stellantis.

All references in this Semi-Annual Report to “Euro” and “€” refer to the currency issued by the European Central

Bank. Stellantis’ financial information is presented in Euro. All references to “U.S. Dollars”, “U.S. Dollar”, “USD” and “$”

refer to the currency of the United States of America (“U.S.”).

The Semi-Annual Report is filed with the Dutch Authority for Financial Markets (Autoriteit Financiële Markten, the

“AFM”) and is furnished to the U.S. Securities and Exchange Commission (“SEC”) on the Form 6-K.

5

MANAGEMENT DISCUSSION AND ANALYSIS

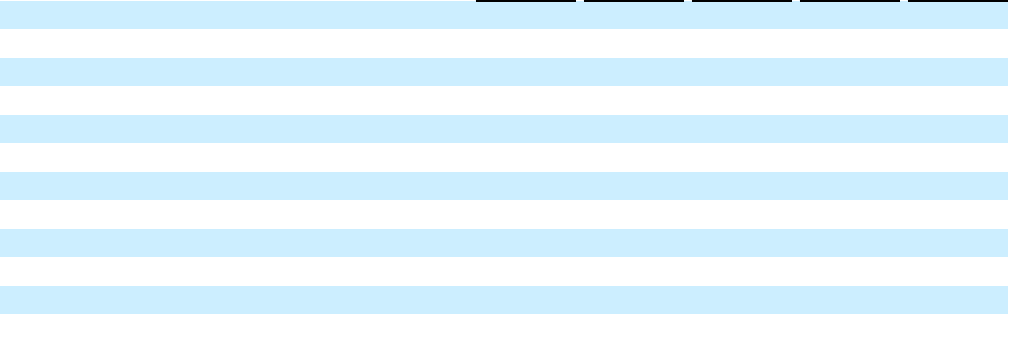

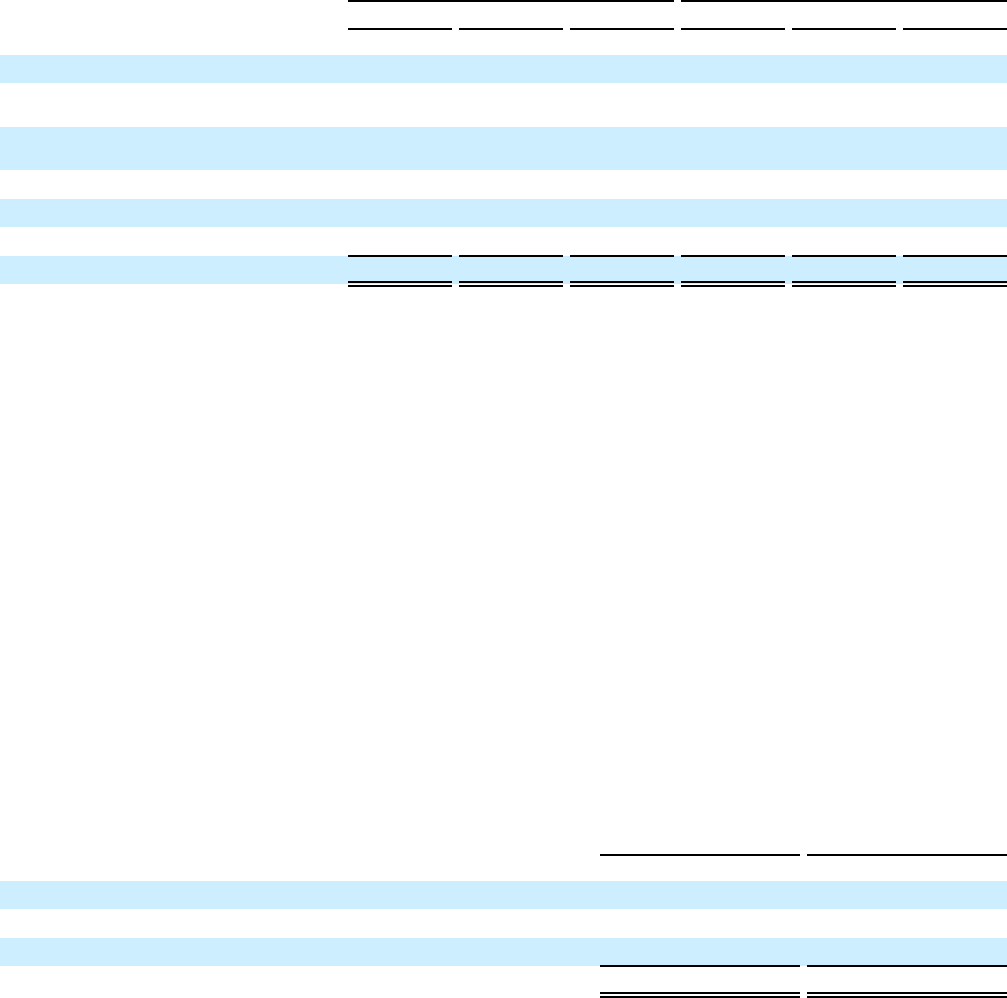

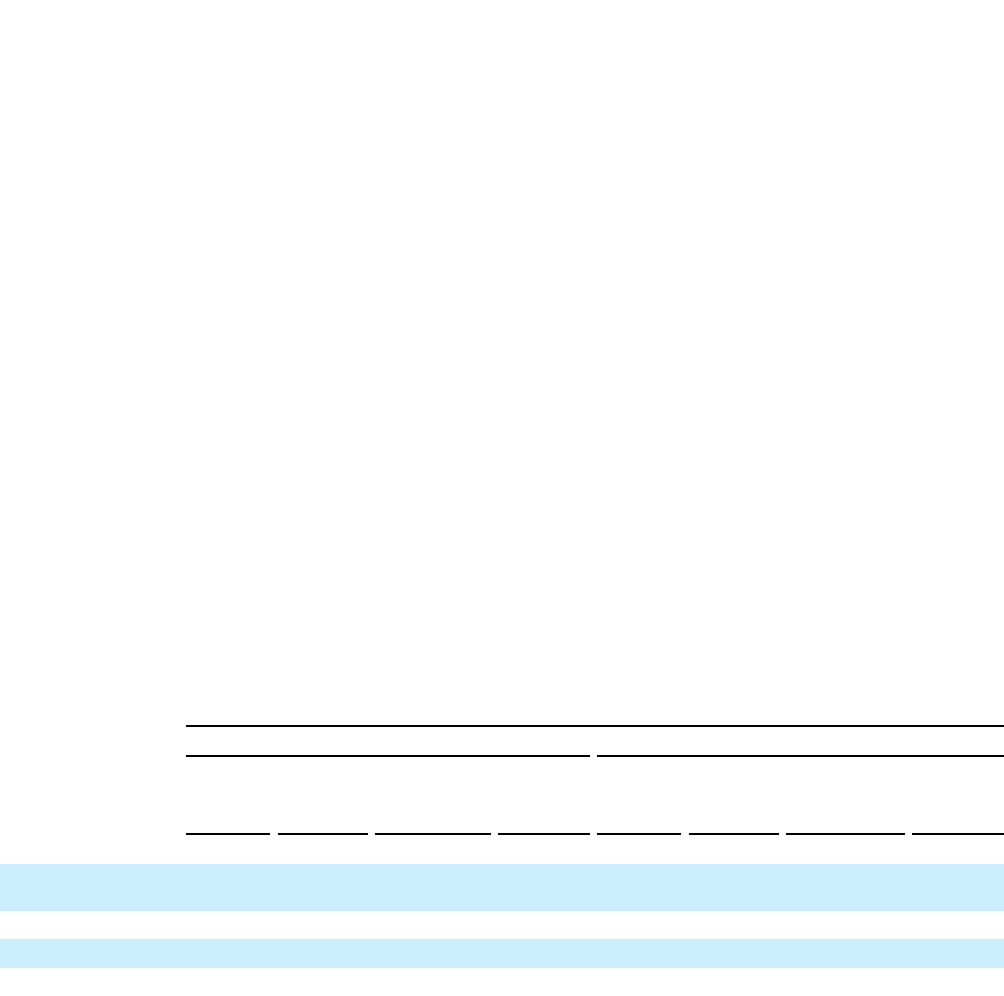

Highlights

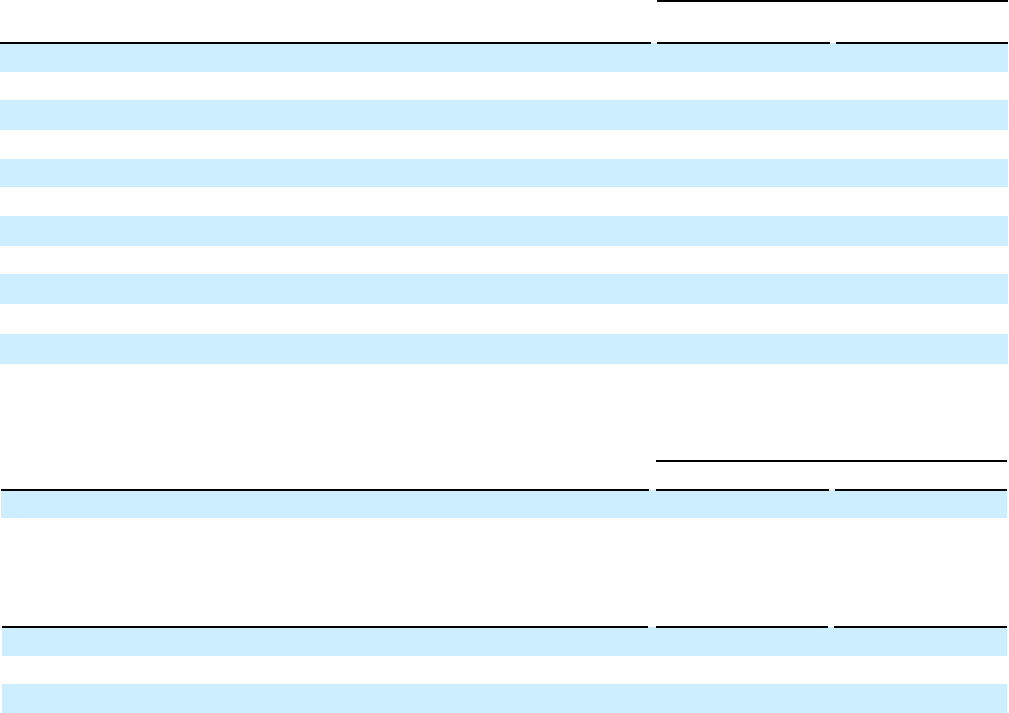

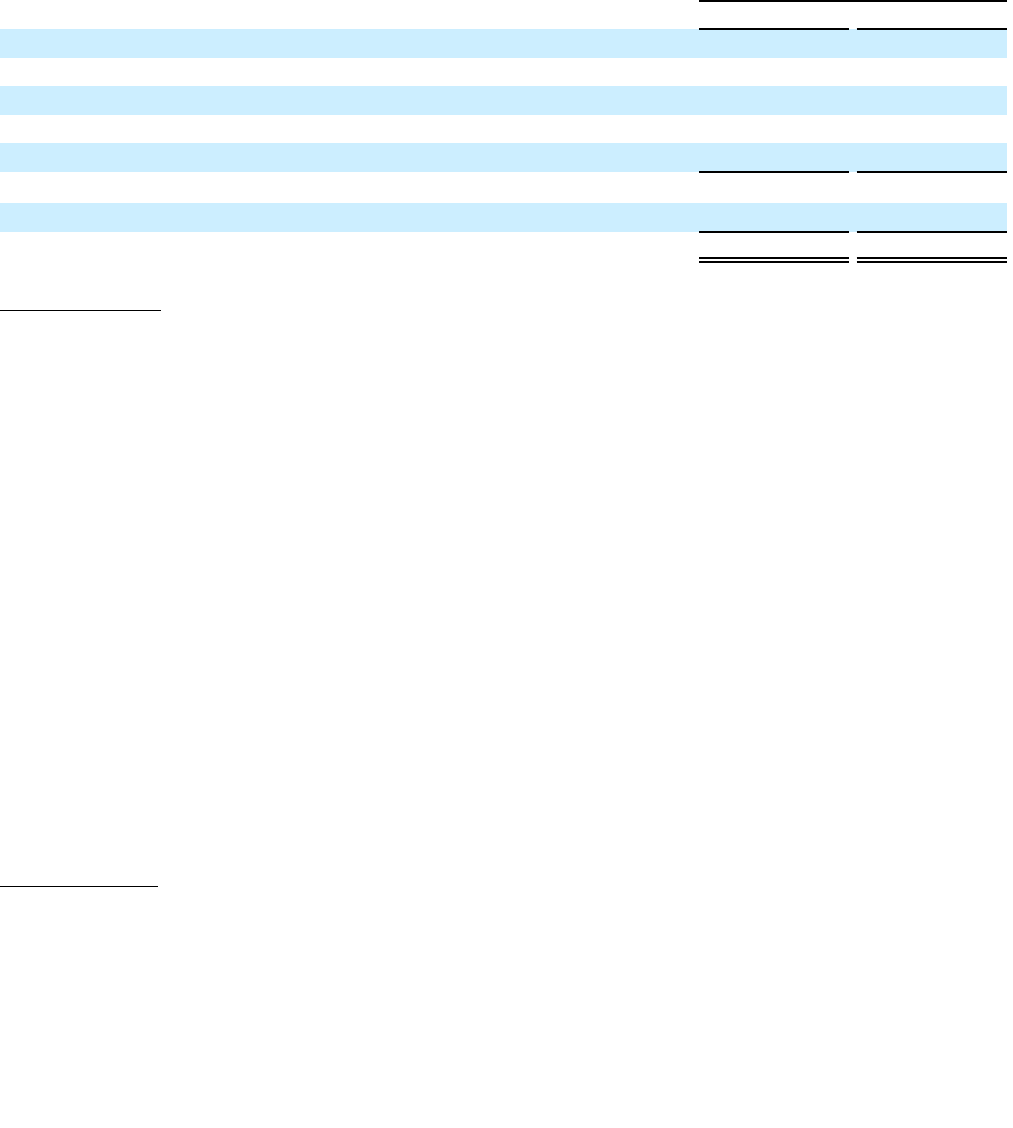

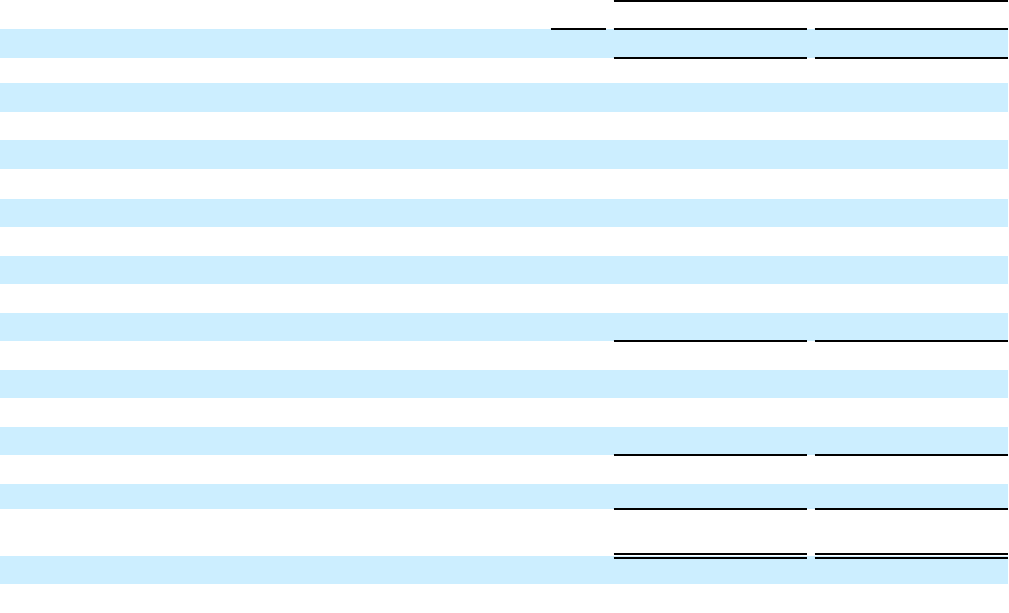

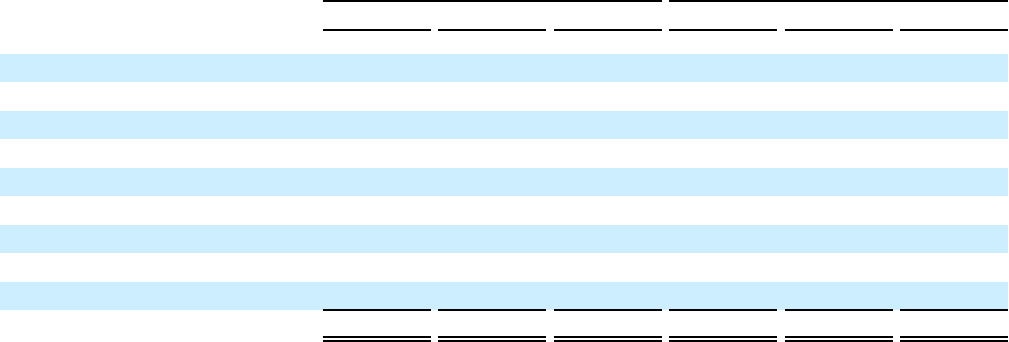

Six months ended June 30,

(€ million, except shipments, which are in thousands of units, and per share amounts)

2023 2022

Combined shipments

(1)

3,327 3,033

Consolidated shipments

(2)

3,202 2,934

Net revenues 98,368 87,999

Net profit/(loss) 10,918 7,960

Adjusted operating income

(3)

14,126 12,727

Earnings per share

(4)

Basic earnings per share (€) 3.48 2.54

Diluted earnings per share (€) 3.45 2.47

Ordinary dividends, per share (€) 1.34 1.04

Six months ended June 30,

(€ million)

2023 2022

Net cash from/(used in) operating activities € 13,393 € 9,843

Industrial free cash flows 8,655 5,319

(€ million)

At June 30, 2023

At December 31,

2022

Available Liquidity € 65,590 € 62,705

Of which: Industrial Available liquidity 63,884 61,316

Industrial net financial position

(5)

29,797 25,705

________________________________________________________________________________________________________________________________________________

(1) Combined shipments include shipments from Stellantis' consolidated subsidiaries and unconsolidated joint ventures

(2) Consolidated shipments only include shipments from Stellantis' consolidated subsidiaries

(3) Refer to sections — Non-GAAP Financial Measures, Company Results and Results by Segment in this Semi-Annual Report for further discussion

(4) Refer to Note 20, Earnings per share, in the Semi-Annual Condensed Consolidated Financial Statements included in this Semi-Annual Report

(5) Refer to sections — Non-GAAP Financial Measures and Liquidity and Capital Resources in this Semi-Annual Report for further discussion

6

Non-GAAP Financial Measures

We monitor our operations through the use of several non-generally accepted accounting principles (“non-GAAP”)

financial measures: Adjusted operating income, Industrial free cash flows and Industrial net financial position. We believe

that these non-GAAP financial measures provide useful and relevant information regarding our operating results and enhance

the overall ability to assess our financial performance and financial position. They provide us with comparable measures

which facilitate management’s ability to identify operational trends, as well as make decisions regarding future spending,

resource allocations and other operational decisions. These and similar measures are widely used in the industry in which we

operate, however, these financial measures may not be comparable to other similarly titled measures of other companies and

are not intended to be substitutes for measures of financial performance as prepared in accordance with International

Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”), as well as

IFRS as adopted by the European Union.

Adjusted operating income/(loss): Adjusted operating income/(loss) excludes from Net profit/(loss) adjustments

comprising restructuring, impairments, asset write-offs, disposals of investments and unusual operating income/(expense)

that are considered rare or discrete events and are infrequent in nature, as inclusion of such items is not considered to be

indicative of the Company's ongoing operating performance, and also excludes Net financial expenses/(income) and Tax

expense/(benefit).

Effective from January 1, 2023, our Adjusted operating income/(loss) includes Share of the profit/(loss) of equity

method investees. The comparatives for the six months ended June 30, 2022, have been adjusted accordingly. This change

was implemented as management believes these results are becoming increasingly relevant due to the number of partnerships

Stellantis has recently engaged in, and will continue to engage in in the future, around electrification and other areas critical

to the future of mobility.

Unusual operating income/(expense) are impacts from strategic decisions, as well as events considered rare or

discrete and infrequent in nature, as inclusion of such items is not considered to be indicative of the Company's ongoing

operating performance. Unusual operating income/(expense) includes, but may not be limited to:

• Impacts from strategic decisions to rationalize Stellantis’ core operations;

• Facility-related costs stemming from Stellantis’ plans to match production capacity and cost structure to market

demand; and

• Convergence and integration costs directly related to significant acquisitions or mergers.

Adjusted operating income/(loss) is used for internal reporting to assess performance and as part of the Company's

forecasting, budgeting and decision making processes as it provides additional transparency to the Company's core

operations. We believe this non-GAAP measure is useful because it excludes items that we do not believe are indicative of

the Company’s ongoing operating performance and allows management to view operating trends, perform analytical

comparisons and benchmark performance between periods and among our segments. We also believe that Adjusted operating

income/(loss) is useful for analysts and investors to understand how management assesses the Company’s ongoing operating

performance on a consistent basis. In addition, Adjusted operating income/(loss) is one of the metrics used in the

determination of the annual performance bonus for the Chief Executive Officer of the Company and other eligible employees,

including members of the Top Executive Team.

Refer to the sections Company Results and Results by Segment below for further discussion and for a reconciliation

of this non-GAAP measure to Net profit/(loss), which is the most directly comparable measure included in our Semi-Annual

Condensed Consolidated Income Statement. Adjusted operating income/(loss) should not be considered as a substitute for

Net profit/(loss), cash flow or other methods of analyzing our results as reported under IFRS.

7

Industrial free cash flows: is our key cash flow metric and is calculated as Cash flows from operating activities less:

cash flows from operating activities from discontinued operations; cash flows from operating activities related to financial

services, net of eliminations; investments in property, plant and equipment and intangible assets for industrial activities;

contributions of equity to joint ventures and minor acquisitions of consolidated subsidiaries and equity method and other

investments; and adjusted for: net intercompany payments between continuing operations and discontinued operations,

proceeds from disposal of assets and contributions to defined benefit pension plans, net of tax. The timing of Industrial free

cash flows may be affected by the timing of monetization of receivables, factoring and the payment of accounts payables, as

well as changes in other components of working capital, which can vary from period to period due to, among other things,

cash management initiatives and other factors, some of which may be outside of the Company’s control. In addition,

Industrial free cash flows is one of the metrics used in the determination of the annual performance bonus for the Chief

Executive Officer of the Company and other eligible employees, including members of the Top Executive Team.

Refer to Liquidity and Capital Resources —Industrial free cash flows for further information and the reconciliation

of this non-GAAP measure to Cash flows from operating activities, which is the most directly comparable measure included

in our Semi-Annual Condensed Consolidated Statement of Cash Flows. Industrial free cash flows should not be considered as

a substitute for Net profit/(loss), cash flow or other methods of analyzing our results as reported under IFRS.

Industrial net financial position is calculated as: Debt plus derivative financial liabilities related to industrial

activities less (i) cash and cash equivalents, (ii) financial securities that are considered liquid, (iii) current financial

receivables from the Company or its jointly controlled financial services entities and (iv) derivative financial assets and

collateral deposits. Therefore, debt, cash and cash equivalents and other financial assets/liabilities pertaining to Stellantis’

financial services entities are excluded from the computation of the Industrial net financial position. Industrial net financial

position includes the Industrial net financial position classified as held for sale. We believe Industrial net financial position is

useful in providing a measure of the Company’s net cash, considering cash and cash equivalents and financial securities. Due

to different sources of cash flows used for the repayment of the financial debt between industrial activities and financial

services (by cash from operations for industrial activities and by collection of financial receivables for financial services) and

the different business structure and leverage implications, we provide a separate analysis of Net financial position between

industrial activities and financial services. Refer to Liquidity and Capital Resources —Industrial net financial position for

further information.

8

Company Results

The following is a discussion of the Company's results of operations for the six months ended June 30, 2023

compared to the six months ended June 30, 2022. Share of the profit/(loss) of equity method investees is included in our

Operating income/(loss) and Adjusted operating income effective January 1, 2023. The comparatives for the six months

ended June 30, 2022, have been adjusted accordingly.

Net revenues € 98,368 € 87,999

Cost of revenues 76,934 69,865

Selling, general and other costs 4,921 4,460

Research and development costs 2,735 2,547

Gains/(losses) on disposal of investments 22 31

Restructuring costs 552 838

Share of the profit/(loss) of equity method investees 293 56

Operating income/(loss) 13,541 10,376

Net financial expenses/(income) (69) 431

Profit/(loss) before taxes 13,610 9,945

Tax expense/(benefit) 2,692 1,985

Net profit/(loss) € 10,918 € 7,960

Net profit/(loss) attributable to:

Owners of the parent € 10,923 € 7,960

Non-controlling interests € (5) € —

Six months ended June 30,

(€ million)

2023 2022

Net revenues

(€ million) 2023 2022 2023 vs. 2022

Net revenues € 98,368 € 87,999 11.8 %

Six months ended June 30, Increase/(Decrease)

See — Results by Segment below for a discussion of Net revenues for each of our six reportable segments (North

America, Enlarged Europe, Middle East & Africa, South America, China and India & Asia Pacific, and Maserati).

Cost of revenues

(€ million) 2023 2022 2023 vs. 2022

Cost of revenues € 76,934 € 69,865 10.1 %

Cost of revenues as % of Net revenues 78.2 % 79.4 %

Six months ended June 30, Increase/(Decrease)

The increase in Cost of revenues during the six months ended June 30, 2023 compared to the corresponding period

in 2022, primarily related to (i) higher shipment volumes in North America and Middle East & Africa, (ii) higher raw

materials and logistics costs, partially offset by (iii) increased synergies and cost efficiencies.

9

Selling, general and other costs

(€ million) 2023 2022 2023 vs. 2022

Selling, general and other costs € 4,921 € 4,460 10.3 %

Selling, general and other costs as % of Net revenues 5.0 % 5.1 %

Six months ended June 30, Increase/(Decrease)

The increase in Selling, general and other costs during the six months ended June 30, 2023 compared to the

corresponding period in 2022, primarily related to higher selling expenses as a result of higher volumes.

Research and development costs

Research and development expenditures expensed € 1,631 € 1,605 1.6 %

Amortization of capitalized development expenditures 1,088 931 16.9 %

Impairment and write-off of capitalized development expenditures 16 11 45.5 %

Total Research and development costs € 2,735 € 2,547 7.4 %

Six months ended June 30, Increase/(Decrease)

(€ million) 2023 2022 2023 vs. 2022

Six months ended June 30,

2023 2022

Research and development expenditures expensed as % of Net revenues 1.7 % 1.8 %

Amortization of capitalized development expenditures as % of Net revenues 1.1 % 1.1 %

Impairment and write-off of capitalized development expenditures as % of Net revenues — % — %

Total Research and development cost as % of Net revenues 2.8 % 2.9 %

Research and development expenditures expensed during the six months ended June 30, 2023 are substantially

unchanged as compared to the corresponding period in 2022.

The increase in Amortization of capitalized development expenditures during the six months ended June 30, 2023,

compared to the corresponding period in 2022, is primarily related to the amortization of development costs for vehicles

launched during 2022, particularly in Enlarged Europe and Maserati, including the all-new Maserati GranTurismo as well as

the smart car platform.

Total Research and development expenditures during the six months ended June 30, 2023 and 2022 were as follows:

Six months ended June 30, Increase/(Decrease)

(€ million) 2023 2022 2023 vs. 2022

Capitalized development expenditures

(1)

€ 2,014 € 1,444 39.5 %

Research and development expenditures expensed 1,631 1,605 1.6 %

Total Research and development expenditures € 3,645 € 3,049 19.5 %

Capitalized development expenditures as % of Total Research and

development expenditures

55.3 % 47.4 %

Total Research and development expenditures as % of Net

revenues

3.7 % 3.5 %

________________________________________________________________________________________________________________________________________________

(1) Does not include capitalized borrowing costs of €68 million and €48 million for the six months ended June 30, 2023 and 2022, respectively, in accordance with IAS 23 -

Borrowing costs (Revised)

The increase in total Research and development expenditures during the six months ended June 30, 2023 compared

to the corresponding period in 2022, is primarily due to increased capital development expenditures for the development of

vehicles and products, including the battery electric vehicle (“BEV”) rollout plan set out in our Dare Forward 2030 strategic

plan.

10

Restructuring costs

Six months ended June 30, Increase/(Decrease)

(€ million) 2023 2022 2023 vs. 2022

Restructuring costs € 552 € 838

(34.1) %

The decrease in Restructuring costs during the six months ended June 30, 2023 compared to the corresponding

period in 2022 is primarily due to Enlarged Europe with the prior year being significantly impacted by workforce reduction

plans, partially offset by an increase in North America.

Share of the profit/(loss) of equity method investees

Six months ended June 30,

Increase/(Decrease)

(€ million) 2023 2022 2023 vs. 2022

Share of the profit/(loss) of equity method investees

€ 293 € 56 423.2 %

The increase in the Share of the profit of equity method investees during the six months ended June 30, 2023,

compared to the corresponding period in 2022, was primarily due to impairments of €297 million related to our joint venture

with GAC Fiat Chrysler Automobiles Co (“GAC-Stellantis JV”) recognized during the six months ended June 30, 2022.

These amounts have been excluded from Adjusted operating income. Refer to Note 2, Scope of Consolidation - GAC

Stellantis JV, within the Semi-Annual Condensed Consolidated Financial Statements for additional information.

Net financial expenses/(income)

(€ million) 2023 2022 2023 vs. 2022

Net financial expenses/(income) € (69) € 431

(116.0) %

Six months ended June 30, Increase/(Decrease)

During the six months ended June 30, 2023 there was €69 million net financial income as compared to €431 million

net financial expense in the same period in 2022, primarily reflecting the improved yield on investments, which is driven by

the increase in interest rates and is partially offset by increased foreign exchange losses on cash denominated in Argentinean

Peso, the write-down of the investment in supply chain finance funds and the cost the new bond issuances. Refer to Note 8,

Financial assets, within the Semi-Annual Condensed Consolidated Financial Statements for additional information.

Tax expense/(benefit)

(€ million) 2023 2022 2023 vs. 2022

Tax expense/(benefit) € 2,692 € 1,985

35.6 %

Effective tax rate 19.8 % 20.0 %

Six months ended June 30,

Increase/(Decrease)

The effective tax rate of 19.8 percent for the six months ended June 30, 2023, is relatively flat compared to the

effective tax rate of 20.0 percent for the six months ended June 30, 2022. The increase in tax expense is primarily driven by

increased results, primarily in Enlarged Europe and North America, and corresponding increase in tax expense.

11

Net profit/(loss)

(€ million) 2023 2022 2023 vs. 2022

Net profit/(loss)

€ 10,918 € 7,960 37.2 %

Six months ended June 30,

Increase/(Decrease)

The increase in Net profit during the six months ended June 30, 2023 compared to the corresponding period in 2022,

is primarily due to the improved operating performance, lower restructuring costs and items excluded from Adjusted

operating income as well as a surplus of financial income over expense, partially offset by higher tax expense due primarily

to increased profit before taxes.

Adjusted operating income

2023 2022 (€ million)

2023 vs. 2022

€ 14,126 € 12,727 Adjusted operating income

11.0 %

14.4 % 14.5 % Adjusted operating income margin (%) -10 bps

Six months ended June 30, Increase/(Decrease)

Six months ended June 30, 2022

(€ million) As reported

Share of profit/(loss) of

equity method investees As adjusted

Adjusted operating income 12,374 353 12,727

Adjusted operating income margin (%) 14.1 %

+40 bps

14.5 %

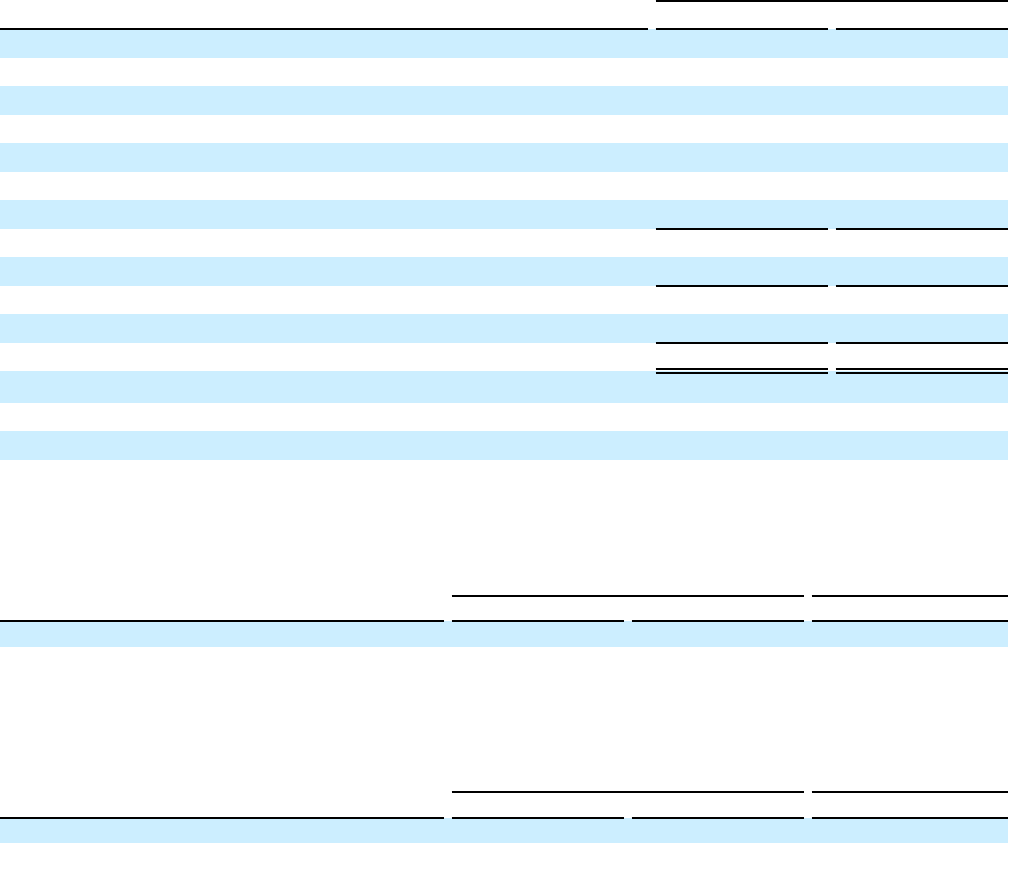

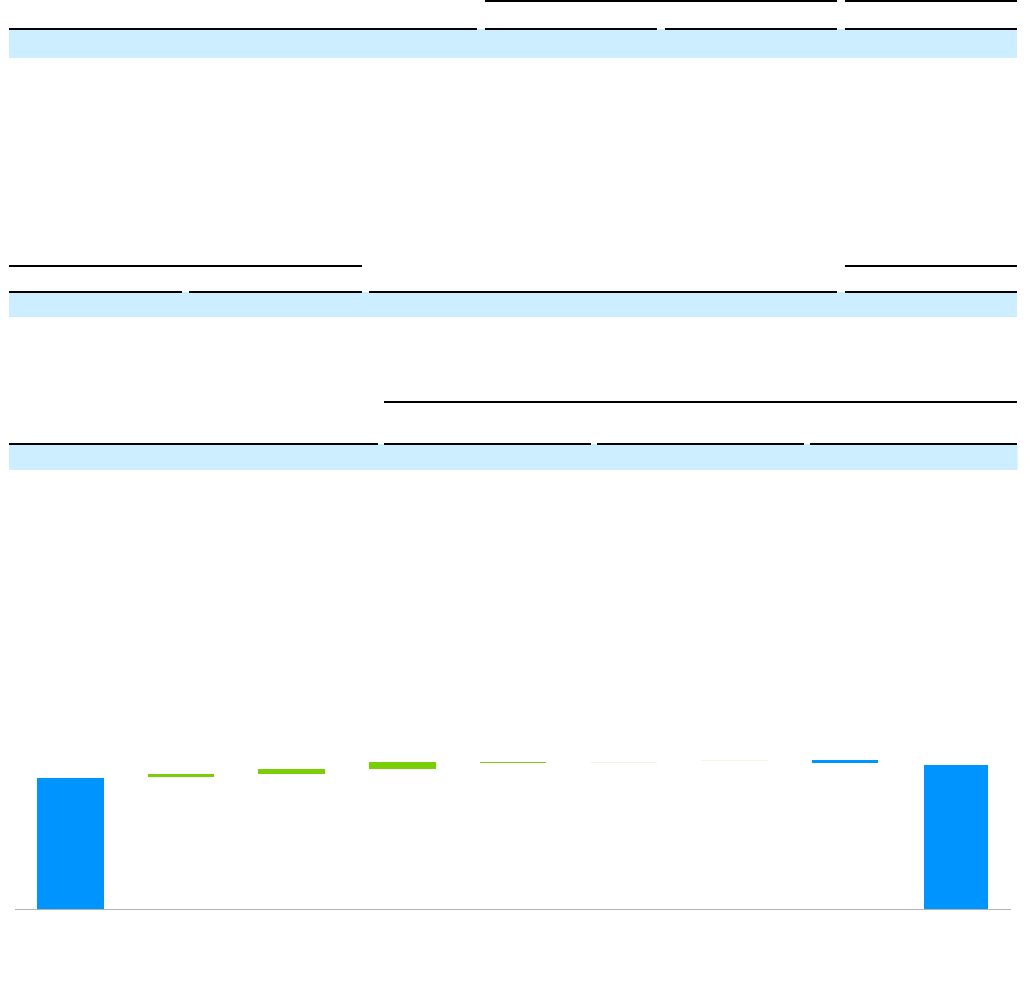

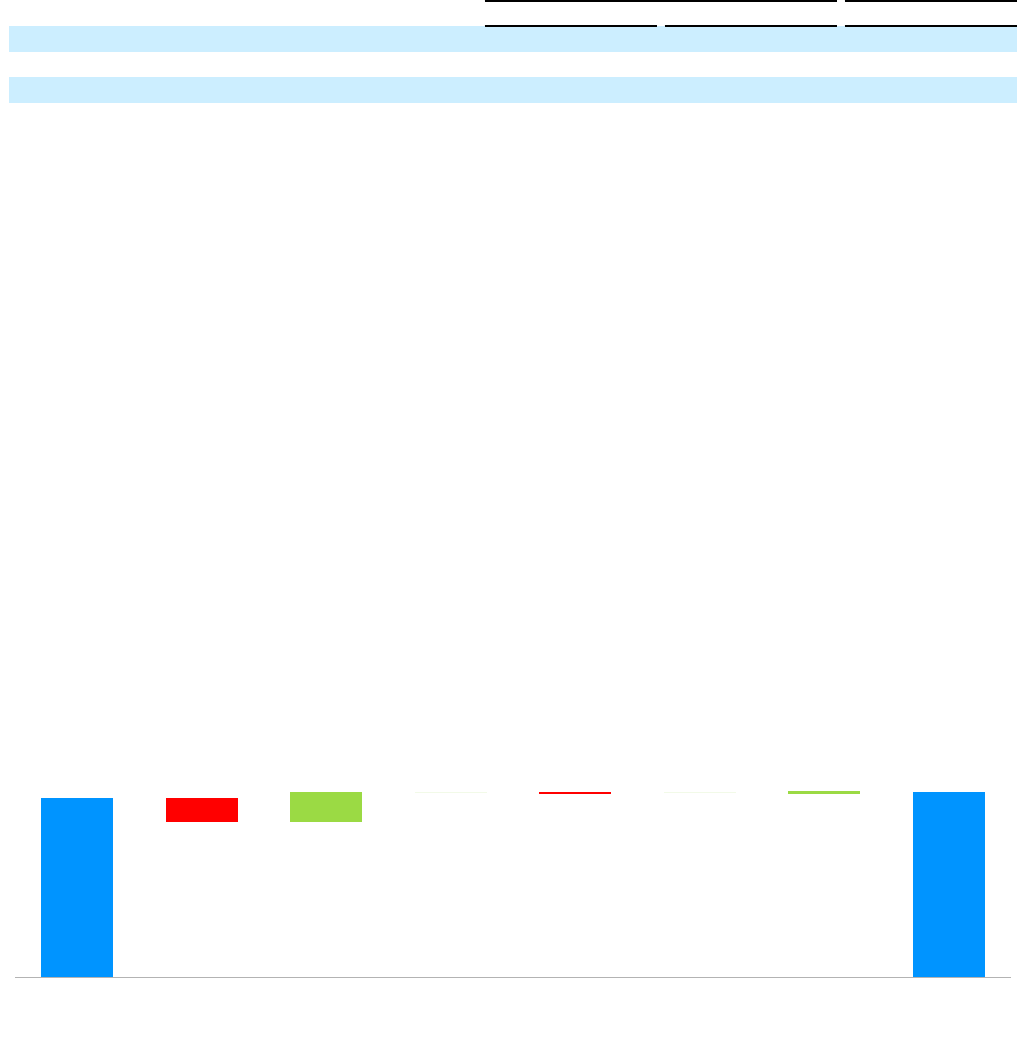

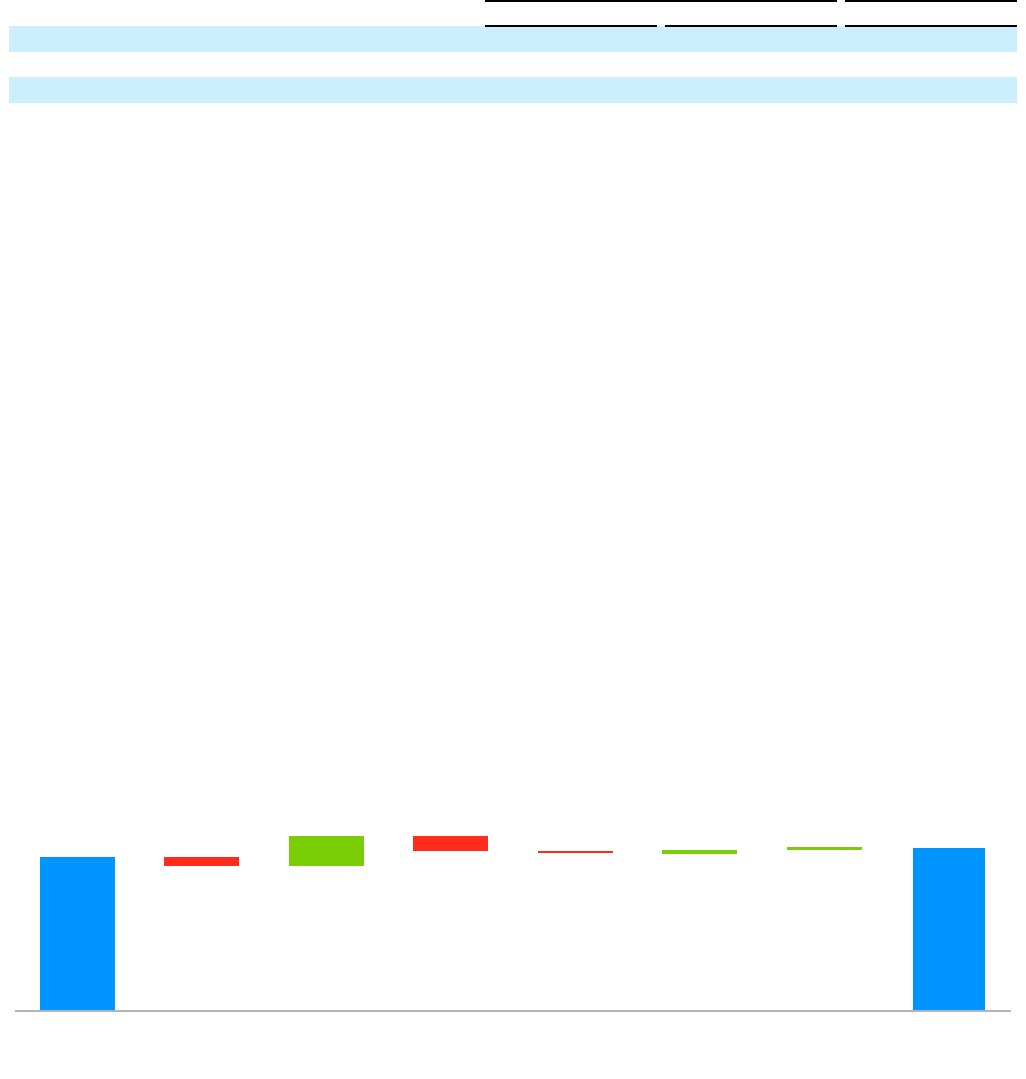

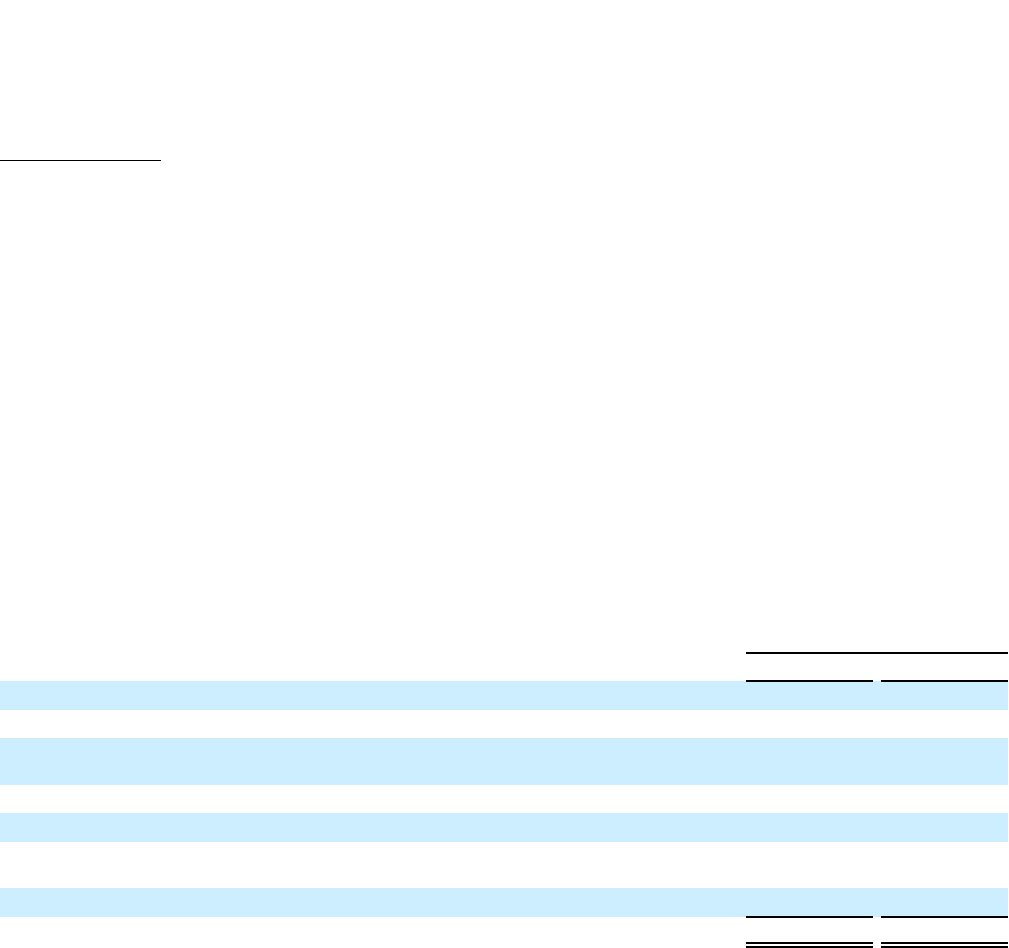

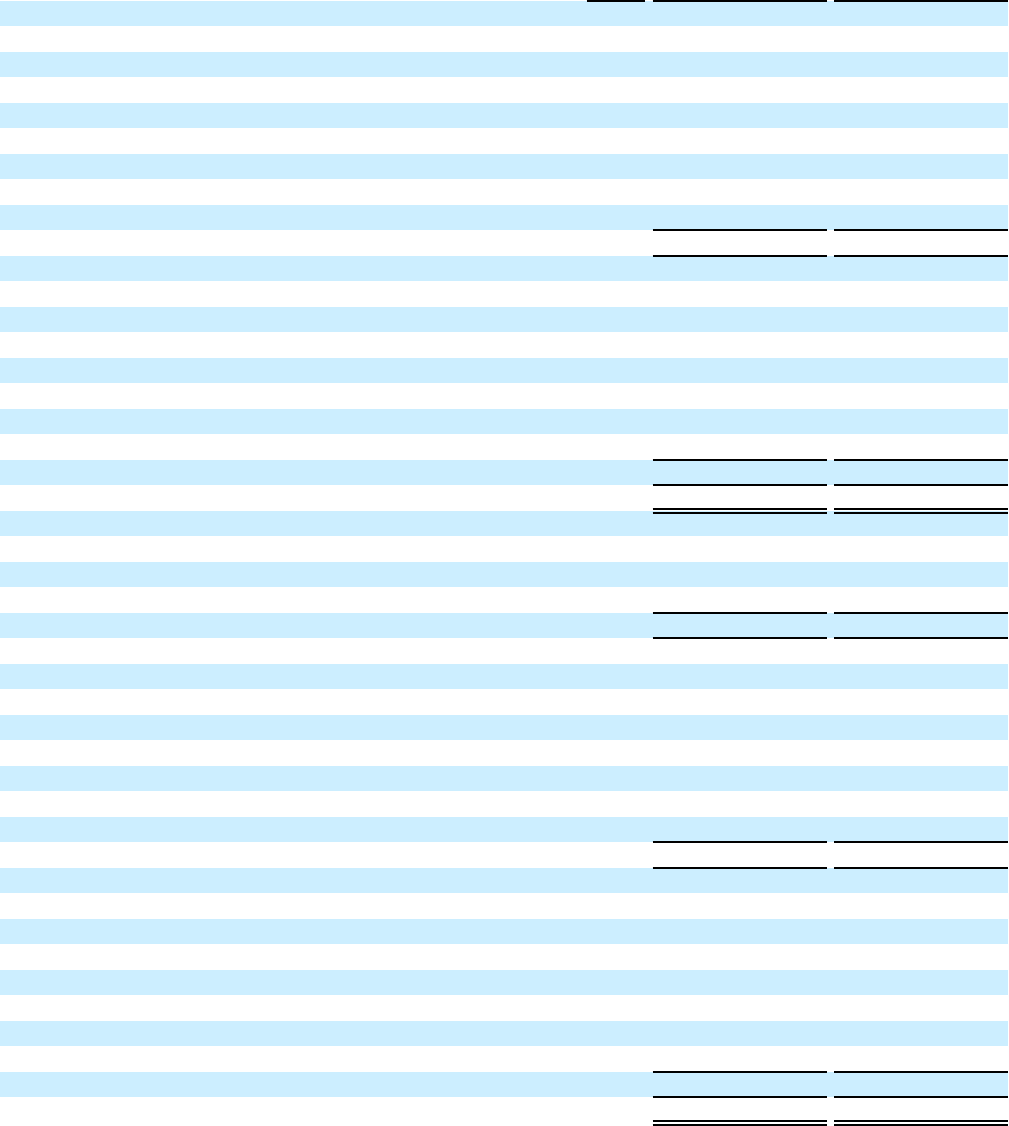

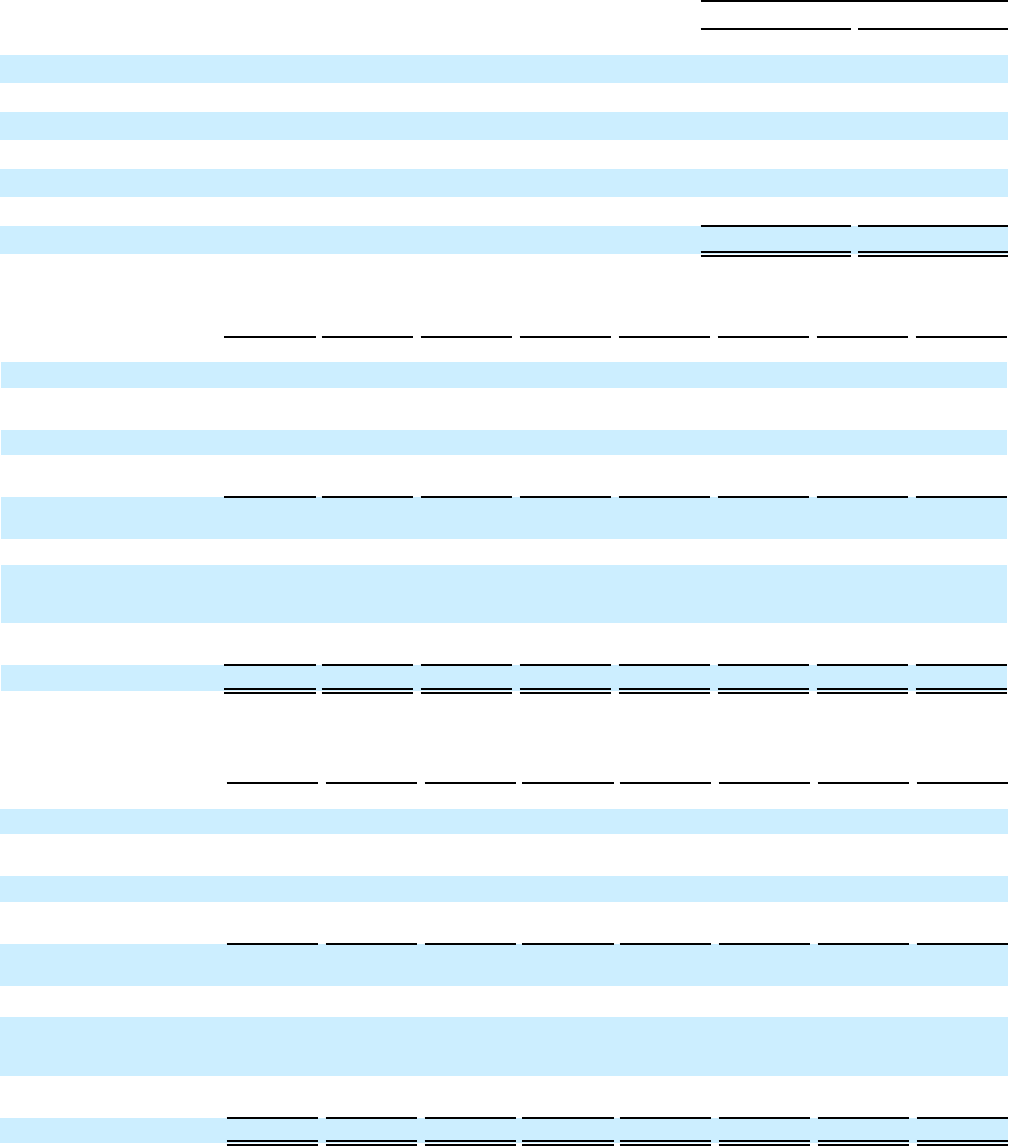

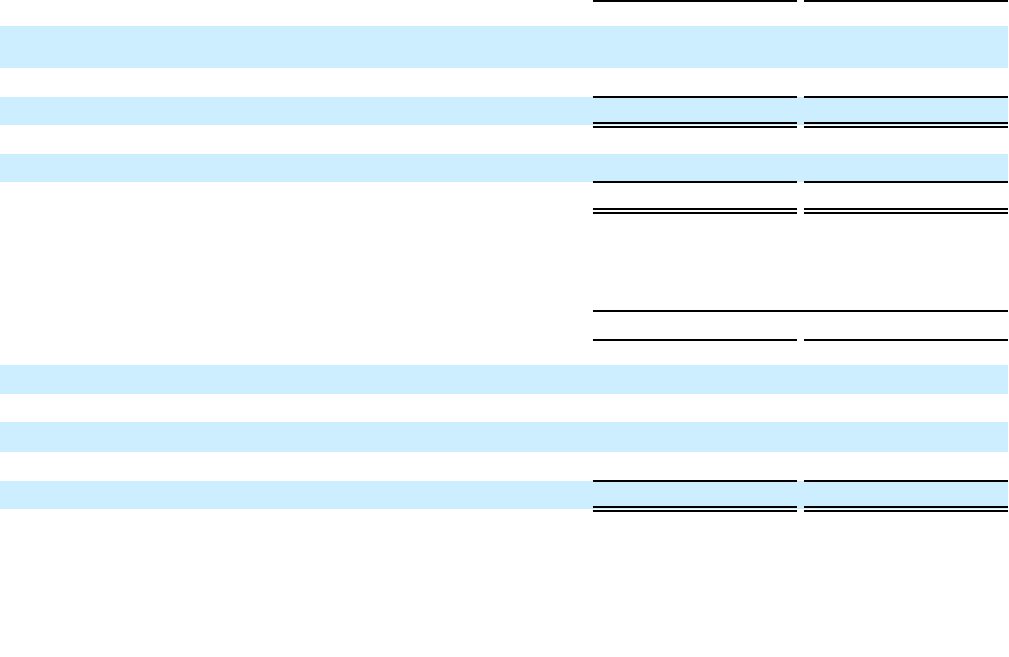

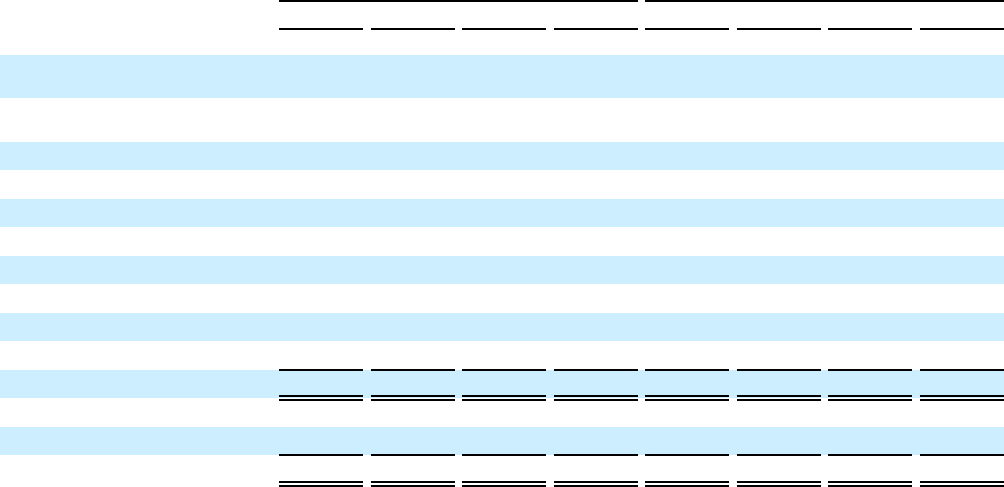

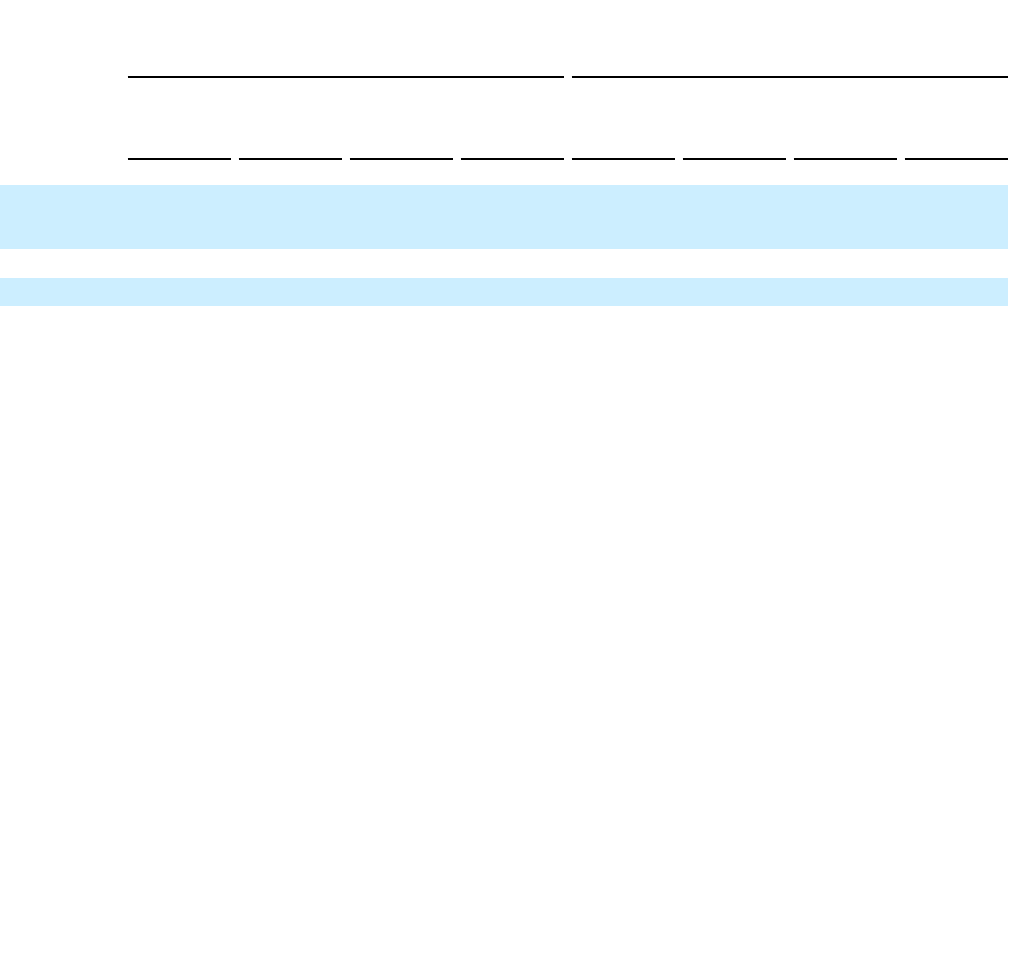

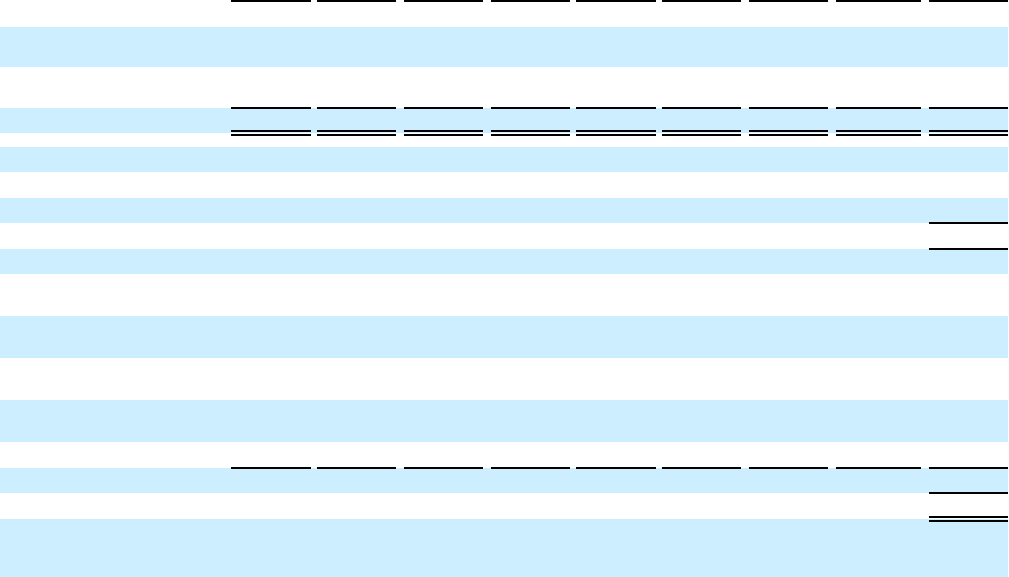

The following chart presents the change in Adjusted operating income by segment for the six months ended June 30,

2023 compared to the corresponding period in 2022.

Adjusted operating income change by segment

YTD 2023 vs. YTD 2022

(€ million)

14,126

12,727

344

495

689 73 25

59

(286)

YTD 2022 North

America

Enlarged

Europe

Middle East

& Africa

South

America

China and

India & Asia

Pacific

Maserati Other &

Eliminations

YTD 2023

Refer to — Results by Segment below for a discussion of Adjusted operating income for each of our six reportable

segments (North America, Enlarged Europe, Middle East & Africa, South America, China and India & Asia Pacific, and

Maserati).

12

The following table is the reconciliation of Net profit/(loss), which is the most directly comparable measure included

in the Semi-Annual Condensed Consolidated Income Statement, to Adjusted operating income:

Net profit/(loss)

€ 10,918

Tax expense/(benefit)

2,692

Net financial expenses/(income)

(69)

Operating income/(loss)

€ 13,541

Adjustments:

Restructuring and other costs, net of reversals

€ 594

Reorganization of financial services

140

Impairment expense and supplier obligations

14

Takata airbags recall campaign, net of recoveries

(55)

Other

(108)

Total Adjustments

585

Adjusted operating income

€ 14,126

(€ million)

Six Months Ended June

30, 2023

Net profit/(loss)

€ 7,960

Tax expense/(benefit)

1,985

Net financial expenses/(income)

431

Operating income/(loss)

€ 10,376

Adjustments:

Restructuring and other costs, net of reversals

€ 838

CAFE penalty rate

660

Takata recall campaign

562

Impairment of GAC-Stellantis JV

297

Patents litigation

134

Impairment expense and supplier obligations

67

Other

(207)

Total Adjustments

2,351

Adjusted operating income

€ 12,727

(€ million)

Six Months Ended June

30, 2022

During the six months ended June 30, 2023, Adjusted operating income excluded adjustments primarily related to:

• €594 million of restructuring and other costs, primarily related to workforce reductions;

• €140 million of net costs associated with the reorganization of our financial services activities in Europe;

• €14 million of impairments, net of reversals; and

• €108 million of Other, mainly related to gains on disposals of investments.

During the six months ended June 30, 2022, Adjusted operating income excluded adjustments primarily related to:

• €838 million of restructuring costs, primarily related to workforce reductions mainly in Enlarged Europe, North

America and South America;

• €660 million, resulting from an increase in provision related to Model Year 2019 - 2021 CAFE penalty rate

adjustment;

13

• €562 million for an extension of Takata airbags recall campaign in Enlarged Europe, Middle East & Africa and

South America;

• €297 million of the full impairment of our equity method investment and includes write off of balances relating

to loan receivables, trade receivables and capitalized development expenditures. Refer to Company Results -

Share of the profit/(loss) of equity method investees for further information;

• €134 million of provision related to litigation by certain patent owners related to the use of certain technologies

in prior periods; and

• €207 million of Other, mainly related to release of litigation provisions, changes in ownership of equity method

investments, partially offset by net losses on disposals.

14

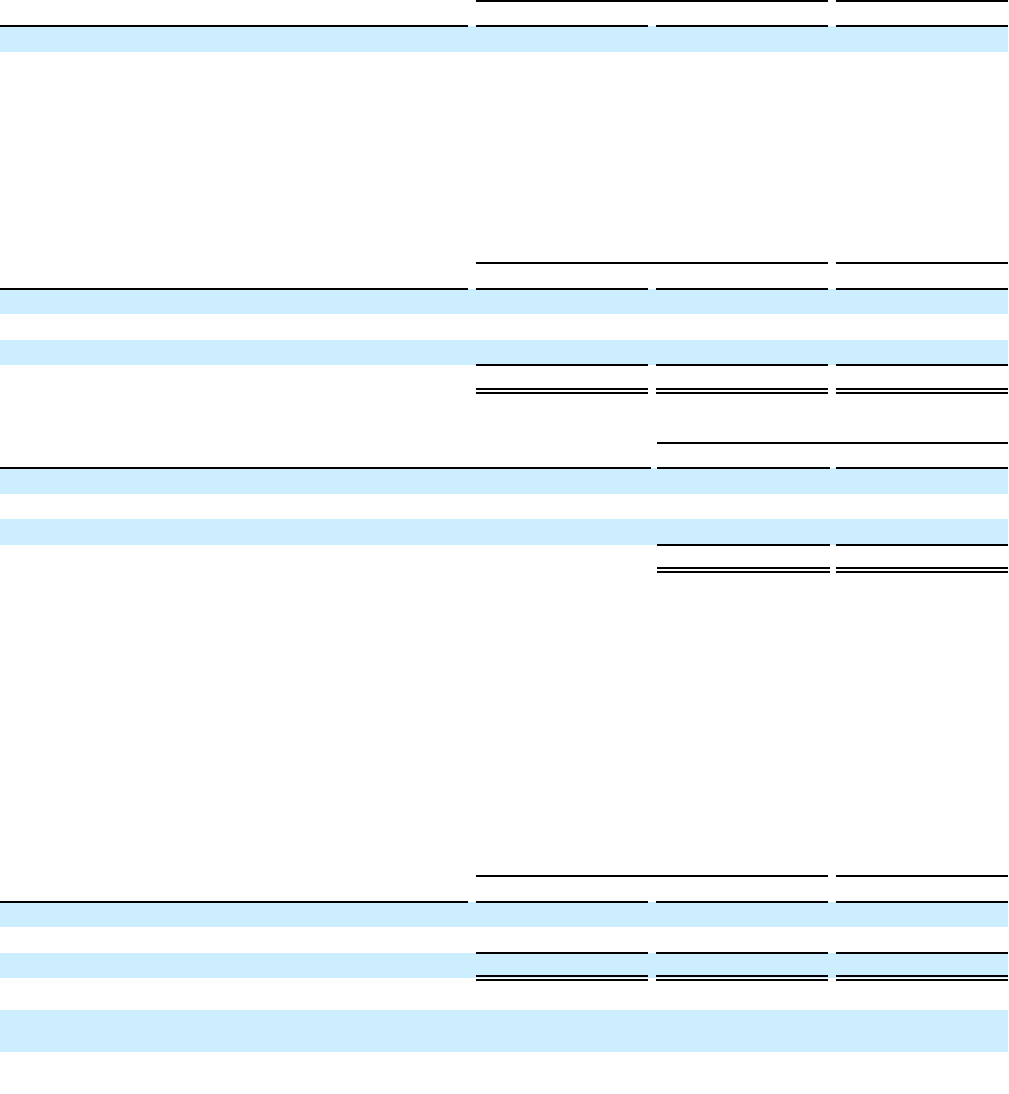

Results by Segment

The following are the results by segment for the six months ended June 30, 2023 and 2022:

Net revenues Adjusted operating income Consolidated Shipments

Six months ended June 30,

(€ million, except shipments

which are in thousands of

units)

2023 2022 2023 2022 2023 2022

North America € 45,916 € 42,443 € 8,027 € 7,683 1,023 959

Enlarged Europe 34,861 31,319 3,725 3,230 1,478 1,362

Middle East & Africa 4,698 3,039 1,218 529 208 138

South America 7,563 7,233 1,075 1,002 420 403

China and India & Asia

Pacific

1,986 2,152 294 269 58 62

Maserati 1,309 941 121 62 15 10

Other activities 2,474 1,513 (126) 128 — —

Unallocated items &

eliminations

(1)

(439) (641) (208) (176) — —

Total € 98,368

€ 87,999

€ 14,126 € 12,727 3,202 2,934

________________________________________________________________________________________________________________________________________________

(1) Primarily includes intercompany transactions which are eliminated on consolidation

The following are the market shares by segment for the six months ended June 30, 2023 and 2022:

Market share

(1)

Six months ended June 30,

2023 2022

North America 10.0 % 11.3 %

Enlarged Europe 17.8 % 19.6 %

Middle East & Africa 15.1 % 11.9 %

South America 23.7 % 23.3 %

India & Asia Pacific 0.7 % 0.8 %

China 0.3 % 0.5 %

Maserati 2.5 % 2.1 %

________________________________________________________________________________________________________________________________________________

(1) Industry and market share information is derived from third-party industry sources (e.g. Agence Nationale des Titres Sécurisés (“ANTS”), Associação Nacional dos

Fabricantes de Veículos Automotores (“ANFAVEA”), Ministry of Infrastructure and Sustainable Mobility (“MIMS”), Ward’s Automotive) and internal information. Represents

PC and LCVs, except as noted

• Middle East & Africa exclude Iran, Sudan and Syria

• South America excludes Cuba

• India & Asia Pacific reflects aggregate for major markets where Stellantis competes (Japan (PC), India (PC), South Korea (PC + Pickups), Australia, New Zealand and

South East Asia)

• China represents PC only

• Maserati reflects aggregate for 17 major markets where Maserati competes and is derived from S&P Global data, Maserati competitive segment and internal

information

Figures may not add due to rounding. Prior period figures have been updated to reflect current information provided by third-party industry sources

Refer to Note 21, Segment reporting in the Semi-Annual Condensed Consolidated Financial Statements for

additional information on the Company’s reportable segments.

15

The following is a discussion of Net revenues, shipments and Adjusted operating income for each of our six

reportable segments for the six months ended June 30, 2023 as compared to the six months ended June 30, 2022. Until

December 31, 2022, the operating environment impacts, primarily of pricing, market share, product and market mix and costs

were reported separately from the impacts of Company performance. From January 2023, we no longer separate changes

between the operating environment and the Company performance and instead report all changes by nature. As a result,

volume changes are now allocated to one driver whereas prior to 2023, they were split between the operating environment

and Company performance which included the difference between shipments to the network and sales to end customers.

Likewise, mix changes are no longer split between industry mix and mix attributable to Company performance. We believe

that this provides a straightforward and easier explanation of the variances.

• Volume & Mix: reflects changes in new car volumes (consolidated shipments), driven by industry volume,

market share and dealer stocks, and mix evolutions such as channel, product line and trim mix. It also reflects

the impact of some non-pricing items;

• Vehicle Net Price: reflects changes in prices, net of discounts and other sales incentive programs;

• Industrial: reflects manufacturing and purchasing cost changes associated with content, technology and

enhancement of vehicle features, as well as industrial, logistics and purchasing efficiencies and inefficiencies.

The impact of fixed manufacturing costs absorption related to the change in production output is included here.

Cost changes to purchasing of raw materials, warranty, compliance costs, as well as depreciation and

amortization related to property, plant and equipment are also included here;

• SG&A: primarily includes costs for advertising and promotional activities, purchased services, information

technology costs and other costs not directly related to the development and manufacturing of Stellantis

products;

• R&D: includes research and development costs, as well as amortization; and

• FX and Other: includes other items not mentioned above, such as used cars, parts & services, sales to partners,

royalties, as well as foreign currency exchange translation, transaction and hedging.

16

North America

Six months ended June 30, Increase/(Decrease)

2023 2022 2023 vs. 2022

Shipments (thousands of units) 1,023 959 6.7 %

Net revenues (€ million) € 45,916 € 42,443 8.2 %

Adjusted operating income (€ million) € 8,027 € 7,683 4.5 %

Adjusted operating income margin (%) 17.5 % 18.1 % -60 bps

The Company's market share

(1)

in North America of 10.0 percent for the six months ended June 30, 2023 reflected a

decrease of 130 bps from 11.3 percent in the same period in 2022. The U.S. market share

(1)

of 10.2 percent reflected a

decrease of 150 bps from 11.7 percent in the same period in 2022.

Shipments

The North America shipments increased in the six months ended June 30, 2023 compared to the corresponding

period in 2022, mainly on higher volumes of Chrysler Pacifica, Dodge Charger and Durango, and Jeep Compass, offsetting

lower Jeep Wrangler and Gladiator shipments.

Net revenues

The increase in North America Net revenues in the six months ended June 30, 2023 compared to the corresponding

period in 2022 was primarily due to strong net pricing and higher volumes, partially offset by unfavorable mix.

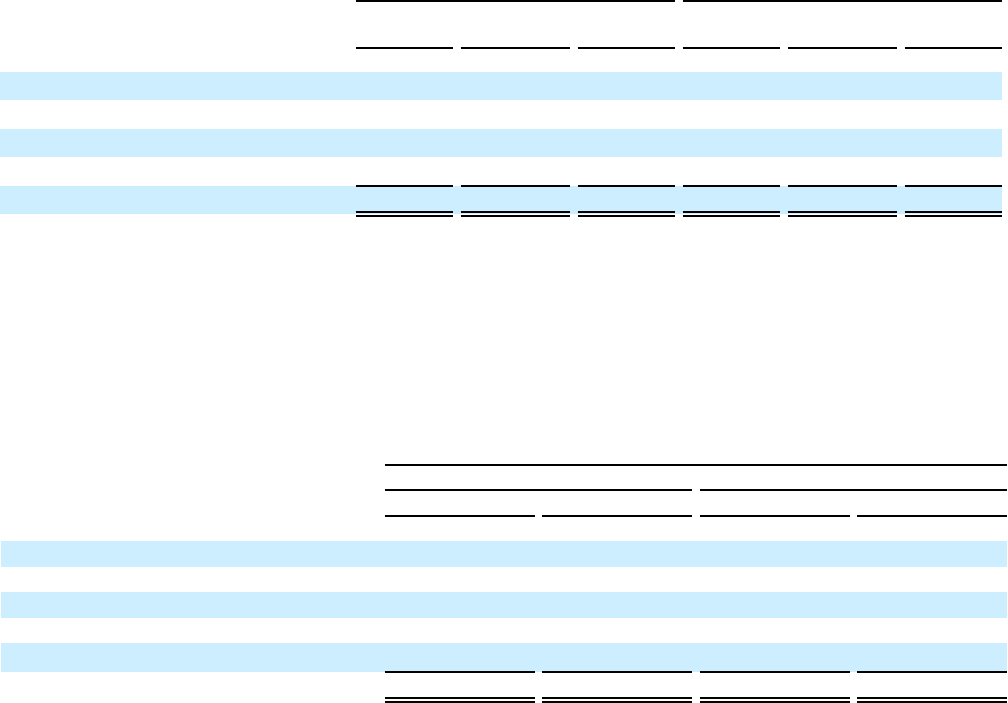

Adjusted operating income

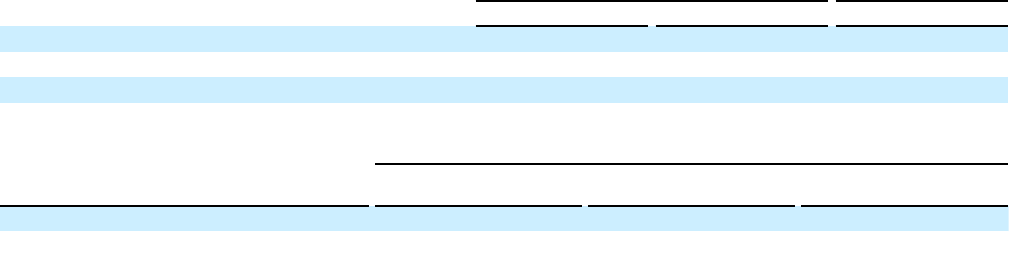

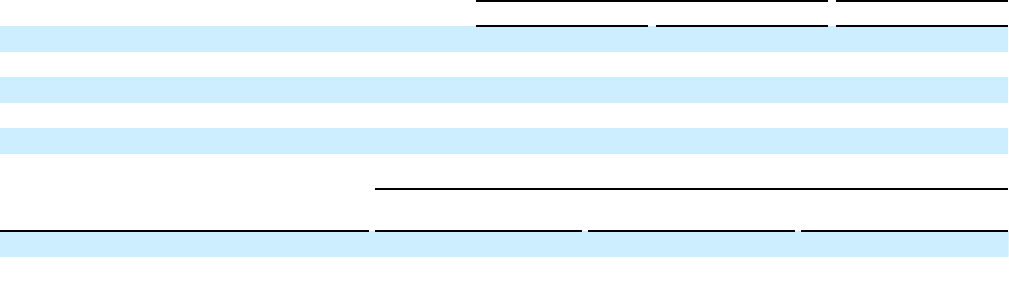

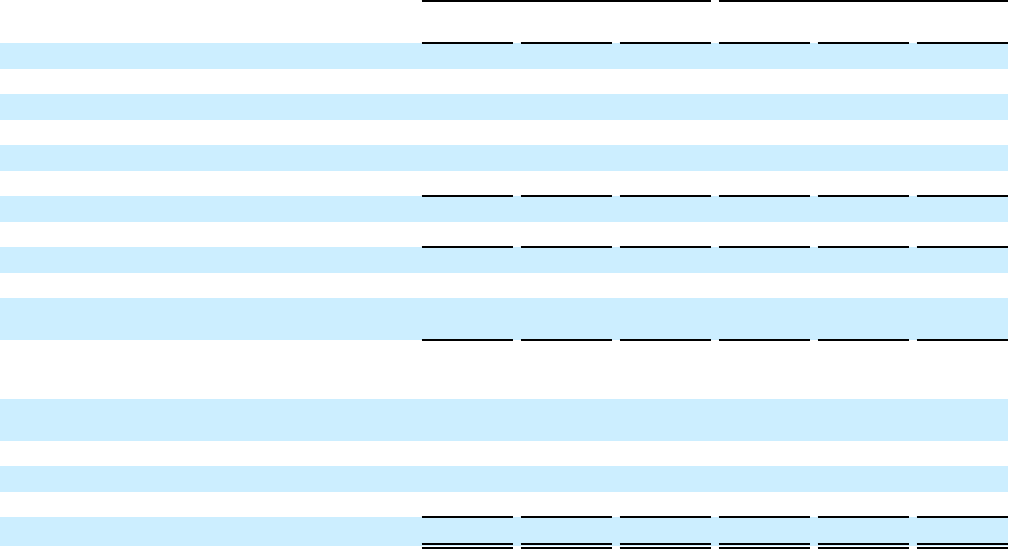

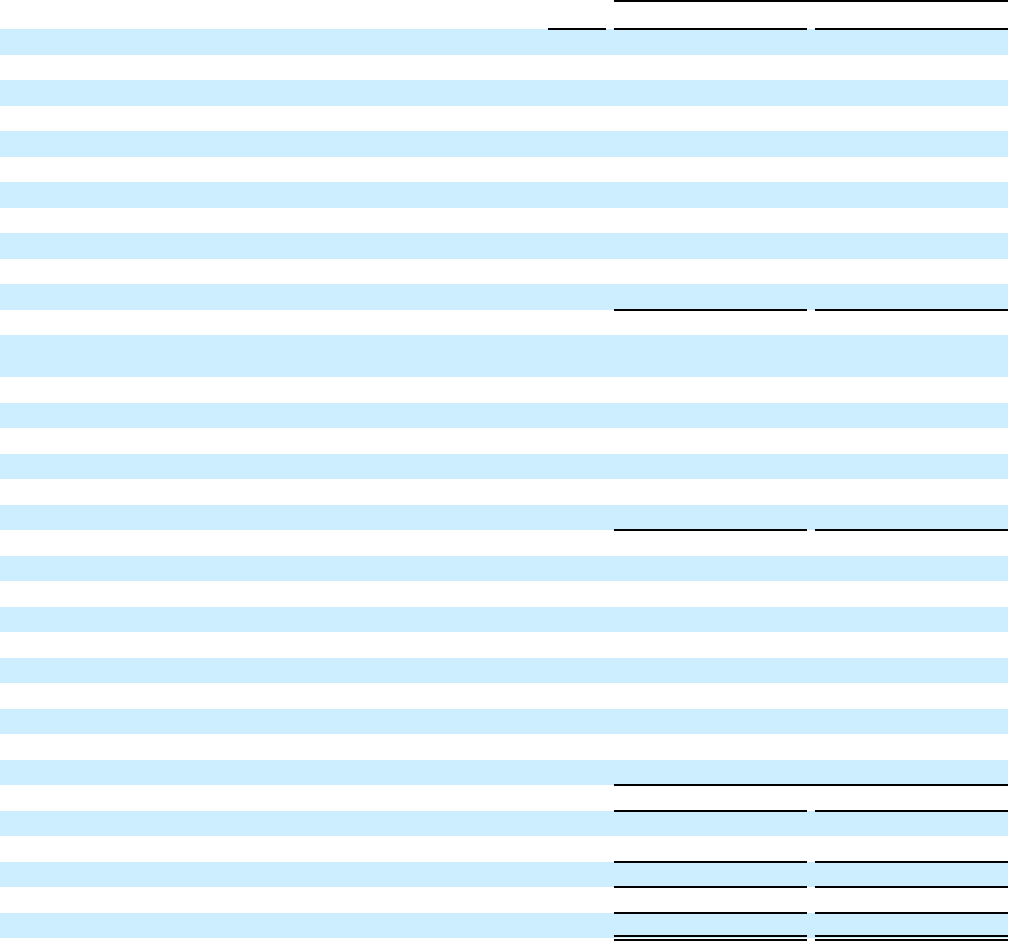

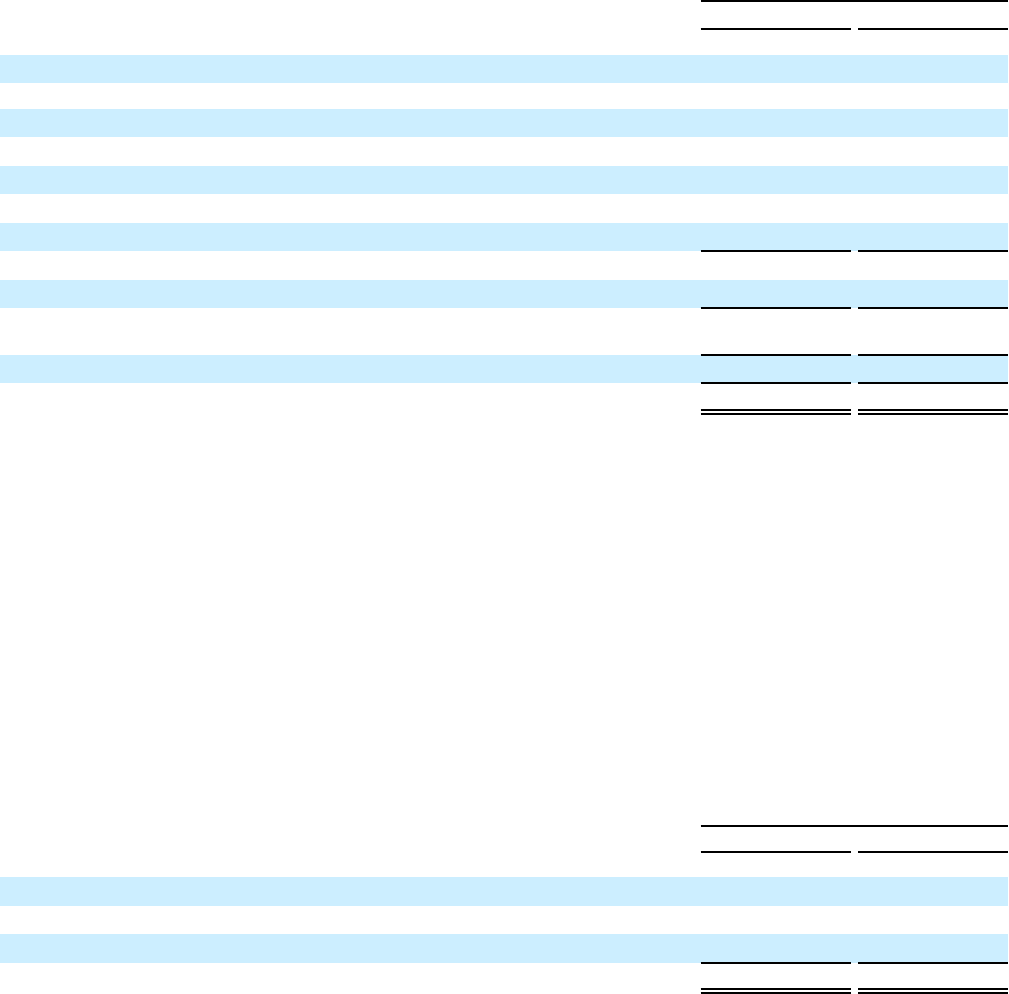

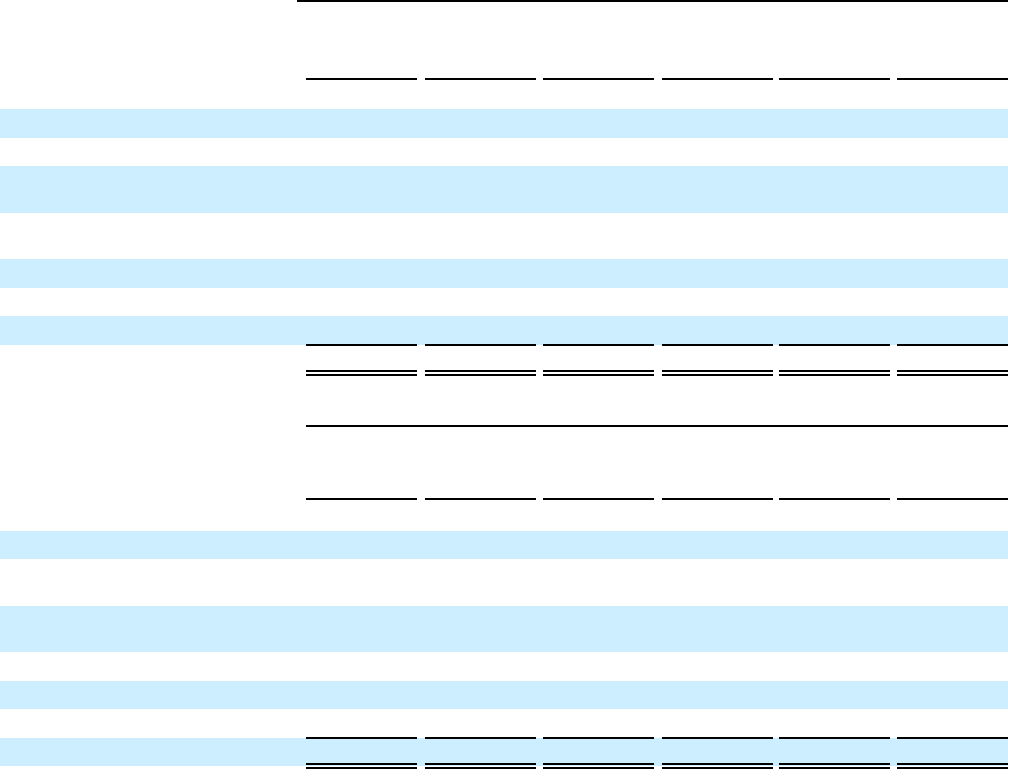

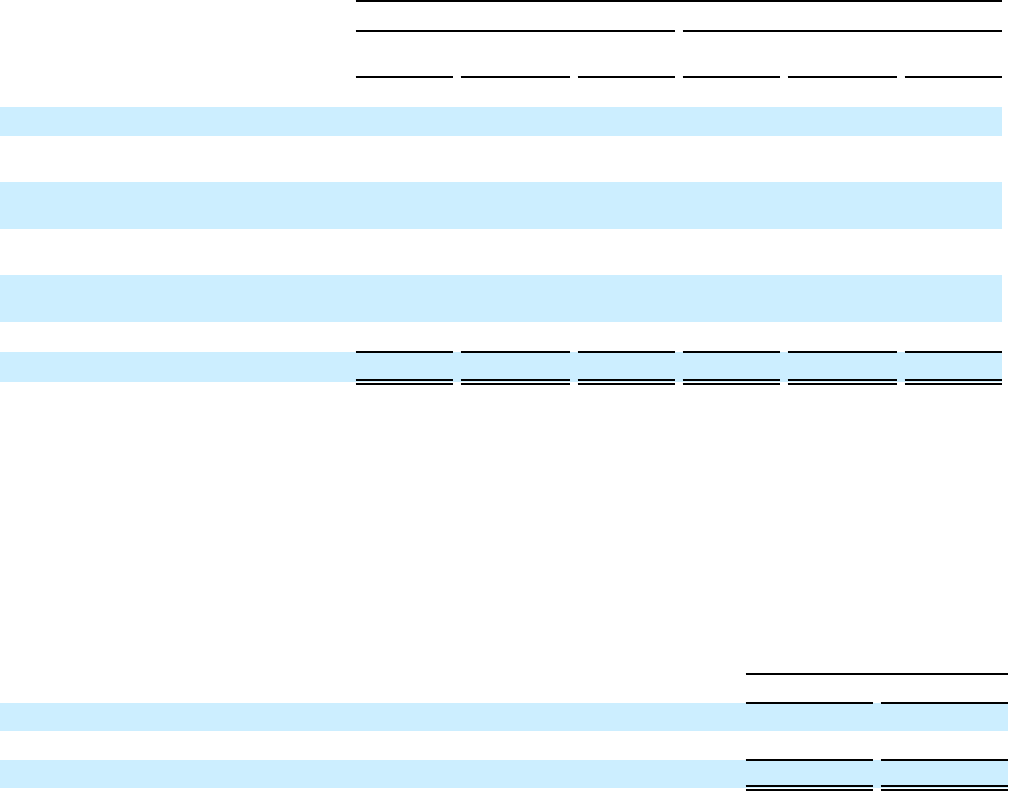

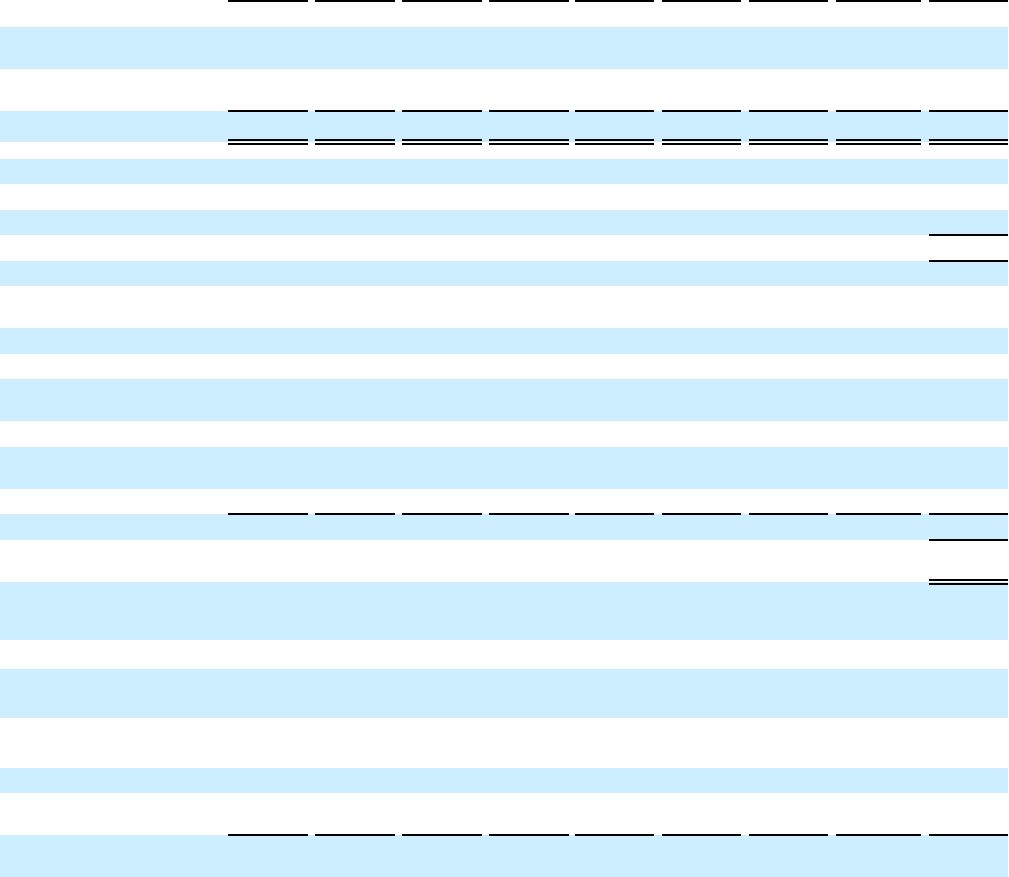

The following chart reflects the change in North America Adjusted operating income by operational driver for the

six months ended June 30, 2023 compared to the same period in 2022.

Adjusted operating income by operational driver

YTD 2023 vs. YTD 2022

(€ million)

7,683

(1,057)

1,304 24

(74)

26

121

8,027

YTD 2022 Volume & Mix Vehicle Net

Price

Industrial SG&A R&D FX and Other YTD 2023

The increase in North America Adjusted operating income in the six months ended June 30, 2023 compared to the

same period in 2022 was primarily due to higher net pricing, volume growth and favorable foreign exchange translation and

transaction effects, partially offset by product mix and market mix.

_______________________________________________________________________________________________________________________________________________

(1) Industry and market share information is derived from third-party industry sources (e.g. Agence Nationale des Titres Sécurisés (“ANTS”), Associação Nacional dos

Fabricantes de Veículos Automotores (“ANFAVEA”), Ministry of Infrastructure and Sustainable Mobility (“MIMS”), Ward’s Automotive) and internal information

17

Enlarged Europe

Six months ended June 30, Increase/(Decrease)

2023 2022 2023 vs. 2022

Shipments (thousands of units) 1,478 1,362 8.5 %

Net revenues (€ million) € 34,861 € 31,319 11.3 %

Adjusted operating income (€ million) € 3,725 € 3,230 15.3 %

Adjusted operating income margin (%) 10.7 % 10.3 % +40 bps

Six months ended June 30, 2022

(€ million) As reported

Share of profit/(loss) of

equity method investees As adjusted

Adjusted operating income 3,267 (37) 3,230

Adjusted operating income margin (%) 10.4 %

-10 bps

10.3 %

The Company's market share

(1)

in the EU30 for the six months ended June 30, 2023, decreased 220 bps to 19.0

percent from 21.2 percent in the same period in 2022.

Shipments

Shipments in Enlarged Europe increased in the six months ended June 30, 2023 compared to the corresponding

period in 2022, with increased shipments for Fiat Professional Ducato, Fiat 500, Alfa Romeo Tonale, Opel Astra and Corsa,

and Jeep Avenger; growth in BEV deliveries led by Fiat New 500, Opel Mokka and Citroën Berlingo.

Net revenues

The increase in Enlarged Europe Net revenues in the six months ended June 30, 2023 compared to the

corresponding period in 2022 was mainly due to higher shipment volumes, positive net pricing, and favorable vehicle mix,

driven by new models, BEVs and PHEVs, partially offset by higher buyback commitments.

_____________________________________________________________________________________________________________________________________________

(1) EU30 = EU27 (excluding Malta) and including Iceland, Norway, Switzerland and UK. Industry and market share information is derived from third-party industry sources (e.g.

Agence Nationale des Titres Sécurisés (“ANTS”), Associação Nacional dos Fabricantes de Veículos Automotores (“ANFAVEA”), Ministry of Infrastructure and Sustainable

Mobility (“MIMS”), Ward’s Automotive) and internal information

18

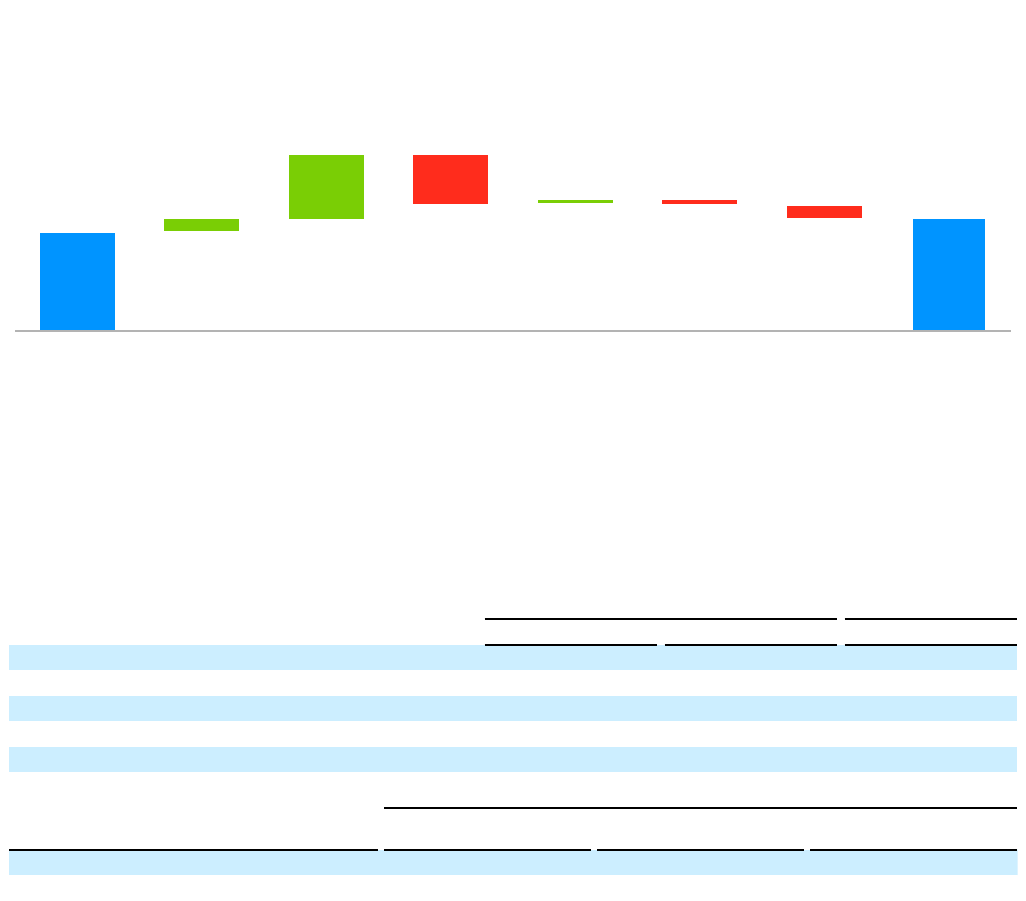

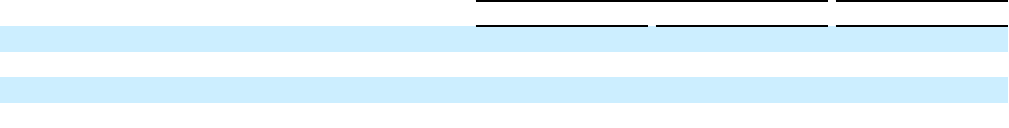

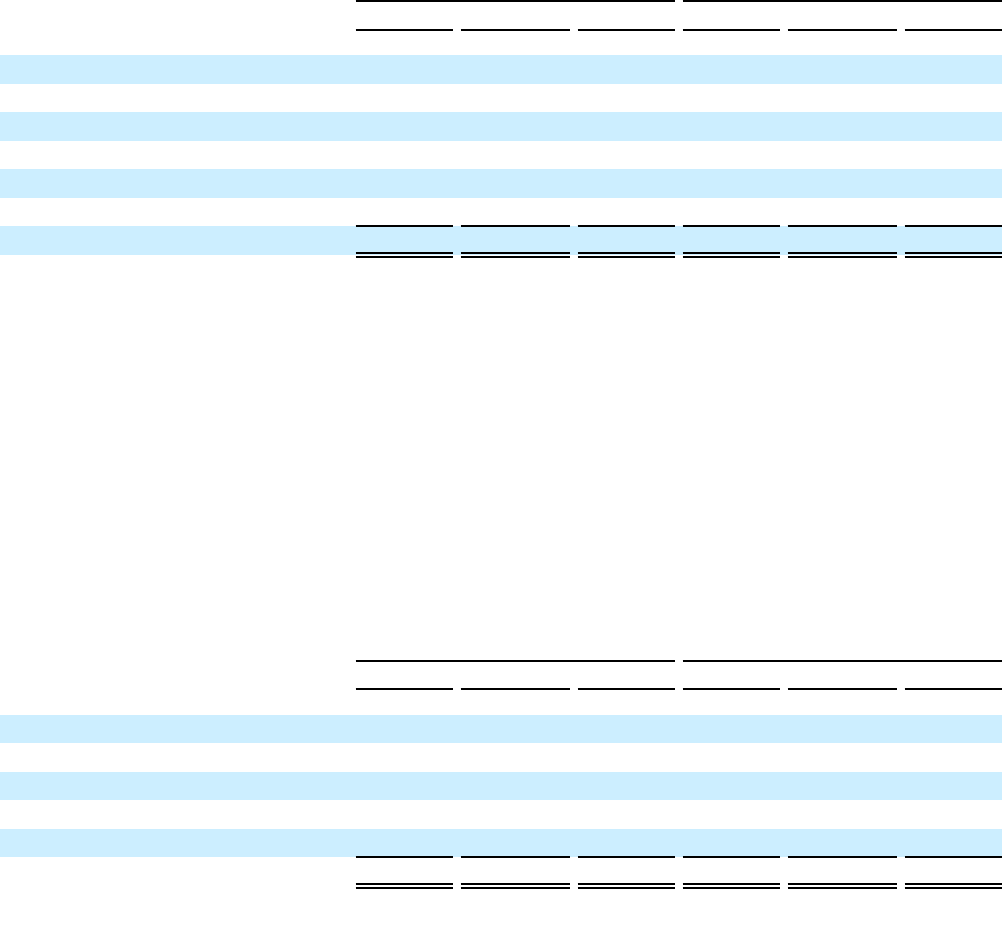

Adjusted operating income

The following chart reflects the change in Enlarged Europe Adjusted operating income by operational driver for the

six months ended June 30, 2023 compared to the same period in 2022.

Adjusted operating income by operational driver

YTD 2023 vs. YTD 2022

(€ million)

3,725

3,230

413

2,118

(1,607)

119

(167)

(381)

YTD 2022 Volume & Mix Vehicle Net

Price

Industrial SG&A R&D FX and Other YTD 2023

The increase in Enlarged Europe Adjusted operating income in the six months ended June 30, 2023 compared to the

same period in 2022 was primarily due to higher net pricing, favorable volume, partially offset by increased industrial costs

due to supply chain costs and higher raw materials.

Middle East & Africa

Six months ended June 30, Increase/(Decrease)

2023 2022 2023 vs. 2022

Combined shipments (thousands of units) 301 199 51.3 %

Consolidated shipments (thousands of units) 208 138 50.7 %

Net revenues (€ million) € 4,698 € 3,039 54.6 %

Adjusted operating income (€ million) € 1,218 € 529 130.2 %

Adjusted operating income margin (%) 25.9 % 17.4 % +850 bps

Six months ended June 30, 2022

(€ million) As reported

Share of profit/(loss) of

equity method investees As adjusted

Adjusted operating income 472 57 529

Adjusted operating income margin (%) 15.5 %

+190 bps

17.4 %

The Company's market share

(1)

in the Middle East & Africa for the six months ended June 30, 2023, increased 320

bps to 15.1 percent from 11.9 percent in the same period in 2022.

_______________________________________________________________________________________________________________________________________________

(1) Industry and market share information is derived from third-party industry sources (e.g. Agence Nationale des Titres Sécurisés (“ANTS”), Associação Nacional dos

Fabricantes de Veículos Automotores (“ANFAVEA”), Ministry of Infrastructure and Sustainable Mobility (“MIMS”), Ward’s Automotive) and internal information

19

Shipments

The increase in consolidated shipments in Middle East & Africa in the six months ended June 30, 2023 compared to

the corresponding period in 2022 was led by higher volumes of Citroën, Peugeot, Opel and Fiat brands, mainly the Citroën

Berlingo, Peugeot 2008, Opel Corsa and Fiat Ducato.

Net revenues

The increase in Middle East & Africa Net revenues in the six months ended June 30, 2023 compared to the

corresponding period in 2022 was primarily due to higher volumes, higher net pricing and improved vehicle mix, partially

offset by negative foreign exchange translation effects, mainly driven by the Turkish lira.

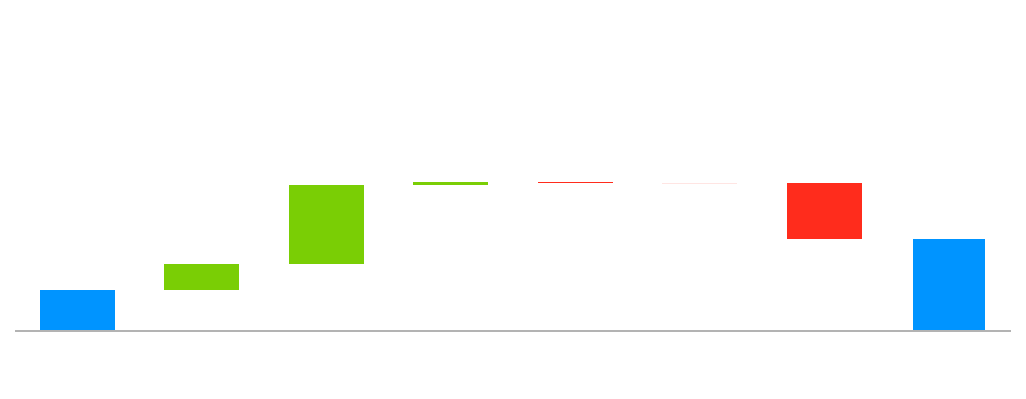

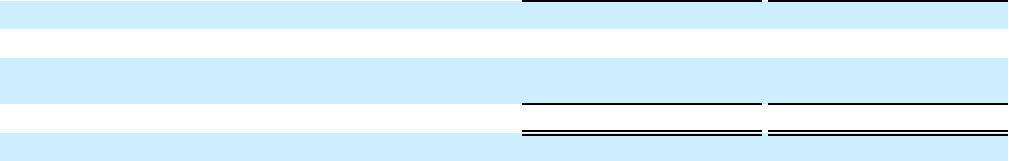

Adjusted operating income

The following chart reflects the change in Middle East & Africa Adjusted operating income by operational driver for

the six months ended June 30, 2023 compared to the same period in 2022.

Adjusted operating income by operational driver

YTD 2023 vs. YTD 2022

(€ million)

1,218

529

333

1,054

41

(13) (2)

(724)

YTD 2022 Volume & Mix Vehicle Net

Price

Industrial SG&A R&D FX and Other YTD 2023

The increase in Middle East & Africa Adjusted operating income in the six months ended June 30, 2023 compared

to the same period in 2022 was primarily due to higher net pricing and higher volumes, mainly in Turkey, as well as

favorable product mix, partially offset by devaluation of the Turkish lira.

20

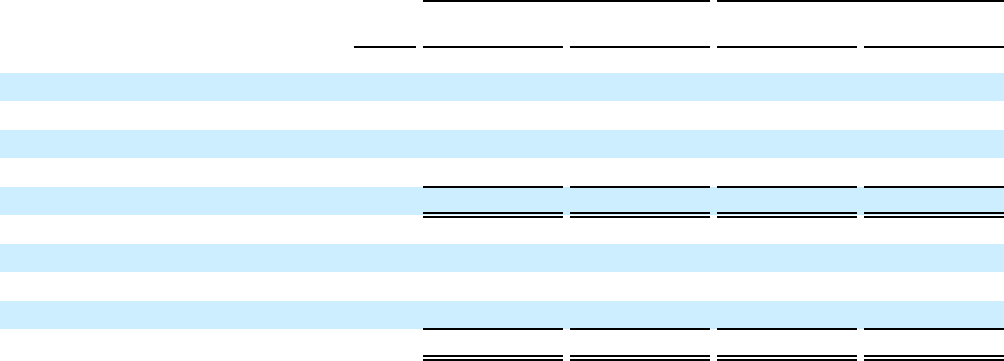

South America

Six months ended June 30, Increase/(Decrease)

2023 2022 2023 vs. 2022

Shipments (thousands of units) 420 403 4.2 %

Net revenues (€ million) € 7,563 € 7,233 4.6 %

Adjusted operating income (€ million) € 1,075 € 1,002 7.3 %

Adjusted operating income margin (%) 14.2 % 13.9 % +30 bps

The Company's market share

(1)

in South America for the six months ended June 30, 2023 increased 40 bps to 23.7

percent from 23.3 percent in the same period in 2022. The Company's market share in Brazil and Argentina for the six

months ended June 30, 2023 decreased 130 bps to 32.3 percent from 33.6 percent and decreased 250 bps to 31.2 percent from

33.7 percent, respectively, compared to the corresponding period in 2022.

Shipments

Shipments in South America increased in the six months ended June 30, 2023 compared to the corresponding period

in 2022, with higher volumes of Citroën C3, Fiat Fastback, Fiat Argo and Peugeot 208, more than offsetting declines in

shipments from Jeep and Ram vehicles.

Net revenues

The increase in South America Net revenues in the six months ended June 30, 2023 compared to the corresponding

period in 2022 was primarily due to higher volume and higher net pricing, partially offset by negative foreign exchange

translation effects, mainly Argentine Peso, as well as vehicle mix.

Adjusted operating income

The following chart reflects the change in South America Adjusted operating income by operational driver for the

six months ended June 30, 2023 compared to the same period in 2022.

Adjusted operating income by operational driver

YTD 2023 vs. YTD 2022

(€ million)

1,075

1,002

(64)

202

(97)

(14)

29

17

YTD 2022 Volume & Mix Vehicle Net

Price

Industrial SG&A R&D FX and Other YTD 2023

The increase in South America Adjusted operating income in the six months ended June 30, 2023 compared to the

same period in 2022 was mainly due to higher net pricing in Brazil, partially offset by unfavorable mix and higher industrial

costs due to raw material inflation.

_______________________________________________________________________________________________________________________________________________

(1) Industry and market share information is derived from third-party industry sources (e.g. Agence Nationale des Titres Sécurisés (“ANTS”), Associação Nacional dos

Fabricantes de Veículos Automotores (“ANFAVEA”), Ministry of Infrastructure and Sustainable Mobility (“MIMS”), Ward’s Automotive) and internal information

21

China and India & Asia Pacific

Six months ended June 30, Increase/(Decrease)

2023 2022 2023 vs. 2022

Combined shipments (thousands of units) 90 100 (10.0) %

Consolidated shipments (thousands of units) 58 62 (6.5) %

Net revenues (€ million) € 1,986 € 2,152 (7.7) %

Adjusted operating income (€ million) € 294 € 269 9.3 %

Adjusted operating income margin (%) 14.8 % 12.5 % +230 bps

Six months ended June 30, 2022

(€ million) As reported

Share of profit/(loss) of

equity method investees As adjusted

Adjusted operating income 289 (20) 269

Adjusted operating income margin (%) 13.4 %

-90 bps

12.5 %

In China, we distribute imported vehicles primarily for the Jeep brand through an asset-light approach. For

information on our GAC-Stellantis JV, refer to Note 2, Scope of consolidation within the Semi-Annual Condensed

Consolidated Financial Statements. We also locally manufacture vehicles under the Dongfeng Peugeot and Dongfeng Citroën

brands in China through the 50 percent owned Dongfeng Peugeot Citroën Automobiles (“DPCA JV”), based in Wuhan. The

Dongfeng Peugeot Citroën Automobile Sales Co (“DPCS“) markets the vehicles produced by DPCA JV in China.

The results of these joint ventures are accounted for using the equity method, with recognition of our share of the net

result of the joint venture in the line item “Share of the profit of equity method investees” within the Consolidated Income

Statement. We fully impaired the equity method investment in GAC-Stellantis JV at June 30, 2022. Refer to Note 2, Scope of

consolidation in the Semi-Annual Condensed Consolidated Financial Statements for additional information.

We also produce the Jeep Compass and Jeep Meridian in India through our joint operation with Fiat India

Automobiles Private Limited (“FIAPL”) and we recognize our related interest in the joint operation on a line by line basis.

Shipments distributed by our consolidated subsidiaries, which include vehicles produced by FIAPL, are reported in

both consolidated and combined shipments. Shipments of the GAC-Stellantis JV and DPCA JV are not included in

consolidated shipments and are only in combined shipments.

Shipments

The decrease in China and India & Asia Pacific consolidated shipments in the six months ended June 30, 2023

compared to the corresponding period in 2022 was mainly due to a decrease in China due to dealer stock clearance in 2023

following introduction of new emission standards and delayed launches.

Net revenues

The decrease in China and India & Asia Pacific Net revenues in the six months ended June 30, 2023 compared to

the corresponding period in 2022 was mainly due to dealer stock clearance in China which is partially offset by favorable net

pricing and mix.

Adjusted operating income

The increase in China and India & Asia Pacific Adjusted operating income in the six months ended June 30, 2023

compared to the same period in 2022 was mainly driven by favorable net pricing and lower SG&A, partially offset by lower

volumes and negative foreign exchange impacts.

22

Maserati

Six months ended June 30, Increase/(Decrease)

2023 2022 2023 vs. 2022

Shipments (thousands of units) 15.3 10.2 50.0 %

Net revenues (€ million) € 1,309 € 941 39.1 %

Adjusted operating income (€ million) € 121 € 62 95.2 %

Adjusted operating income margin (%) 9.2 % 6.6 % +260 bps

Shipments

The increase in Maserati shipments in the six months ended June 30, 2023 compared to the corresponding period in

2022 was due to the ramp-ups of all-new Grecale and GranTurismo.

Net revenues

The increase in Maserati Net revenues in the six months ended June 30, 2023 compared to the corresponding

period in 2022 was primarily due to higher volumes and net price which is partially offset by mix.

Adjusted operating income

The increase in Maserati Adjusted operating income in the six months ended June 30, 2023 compared to the same

period in 2022 was mainly due to favorable volume from respective ramp-ups of all-new Grecale and GranTurismo and

higher net pricing.

23

Liquidity and Capital Resources

Available Liquidity

The following table summarizes our total Available liquidity:

Cash, cash equivalents and financial securities

(1)

€ 52,918 € 49,960

Undrawn committed credit lines 12,672 12,680

Cash, cash equivalents and financial securities - included within

Assets held for sale

— 65

Total Available liquidity

(2)

€ 65,590 € 62,705

of which: Available liquidity of the Industrial Activities

€ 63,884 € 61,316

(€ million) At June 30, 2023 At December 31, 2022

________________________________________________________________________________________________________________________________________________

(1) Financial securities are comprised of short term or marketable securities which represent temporary investments but do not satisfy all the requirements to be classified as cash

equivalents as they may be subject to risk of change in value (even if they are short-term in nature or marketable)

(2) The majority of our liquidity is available to our treasury operations in Europe and U.S.; however, liquidity is also available to certain subsidiaries which operate in other

countries. Cash held in such countries may be subject to restrictions on transfer depending on the foreign jurisdictions in which these subsidiaries operate. Based on our review

of such transfer restrictions in the countries in which we operate and maintain material cash balances, (and in particular in Argentina, in which we have €943 million cash and

securities at June 30, 2023 (€959 million at December 31, 2022), and Russia, in which we have €90 million cash at June 30, 2023 (€121 million at December 31, 2022)) we do

not believe such transfer restrictions had an adverse impact on the Company’s ability to meet its liquidity requirements at the dates presented above. Cash and cash equivalents

also include €216 million at June 30, 2023 (€107 million at December 31, 2022) held in bank deposits which are restricted to the operations related to securitization programs

and warehouses credit facilities of Stellantis Financial Services U.S.

Available liquidity of the Industrial Activities at June 30, 2023, increased by €2.6 billion from December 31, 2022,

primarily due to the €8.7 billion Industrial free cash flow of the period, the issuance of new bonds for €2.5 billion and €1.5

billion net proceeds related to the reorganization of financial services in Europe, partially offset by €4.2 billion dividends

distribution, €1.9 billion bonds repayment, €0.7 billion share buyback, the €1.6 billion increase in net funding to financial

services and €0.7 billion increase in financial receivables from financial services joint ventures and negative currency

translation effect of €0.5 billion due to depreciation of the U.S. Dollar versus EUR rate on U.S. Dollar denominated cash.

Our Available liquidity is subject to intra-month and seasonal fluctuations resulting from business and collection-

payment cycles as well as to changes in foreign exchange conversion rates. Moreover, we tend to operate with negative

working capital as we generally receive payment for vehicles within a few days of shipment, whereas there is a lag between

the time when parts and materials are received from suppliers and when we pay for such parts and materials; therefore, in

periods in which our vehicle shipments decline materially we will suffer a significant negative impact on cash flow and

liquidity as we continue to pay suppliers for components purchased in a high volume environment during a period in which

we receive lower proceeds from vehicle shipments. Plant shutdowns, whether associated with model year changeovers, or

other factors such as temporary supplier interruptions or government-imposed restrictions, such as we have experienced in

response to the COVID-19 pandemic, can have a significant negative impact on our revenues and working capital as we

continue to pay suppliers while we do not receive proceeds from vehicle sales. Refer to the section — Cash Flows below for

additional information regarding the change in cash and cash equivalents.

Our liquidity is principally denominated in Euro and U.S. Dollar, with the remainder being distributed in various

countries and denominated in the relevant local currencies. Out of the total cash, cash equivalents and financial securities

available at June 30, 2023, €25.3 billion, or 48 percent (€22.1 billion, or 44 percent at December 31, 2022), were

denominated in Euro and €21.9 billion, or 41 percent (€21.6 billion, or 43 percent at December 31, 2022), were denominated

in U.S. Dollar.

At June 30, 2023, undrawn committed credit lines of €12.7 billion include the syndicated revolving credit facility

(“RCF”) of €12.0 billion, signed in 2021 with a group of relationship banks. The RCF is available for use in general corporate

purposes, and is structured in two tranches: €6.0 billion, with a 3 year tenor, and €6.0 billion, with a 5 year tenor, each

tranche benefiting from two further extension options, each of 1-year. In June 2023, the second-year extension option has

been exercised. Current maturities are July 6, 2026 and July 6, 2028, respectively, for the two tranches.

24

Euro Medium Term Note Programme Notes

The Company issued two notes during the period ended June 30, 2023:

• In March 2023, a Green Bond was issued with a principal amount of €1.25 billion with an interest rate of 4.375

percent and matures in March 2030. Stellantis will allocate an amount equal to the net proceeds of any Green

Bond issued to investments and expenditures meeting the eligibility criteria (the “Eligible Green Projects”). The

Eligible Green Projects include design, development and manufacturing of zero emissions vehicles, that are

battery electric vehicles and hydrogen fuel cell vehicles; and

• In June 2023, the Company issued notes with principal amount of €1.25 billion with an interest rate of 4.25

percent and matures in June 2031.

Other Notes

In April 2023, Stellantis repaid, at maturity, a €500 million note formerly issued by PSA in 2016, and a U.S.$1.5

billion (€1.4 billion) note formerly issued by FCA in 2015.

Warehouse Credit Facilities

On June 30, 2023, the First Investors Auto Receivables Corporation (“FIARC”) warehouse, with a capacity of $300

million, was extended to mature on June 30, 2025. In conjunction with the renewal, the benchmark rate was transitioned from

London Interbank Offered Rate (“LIBOR”) to daily compound Secured Overnight Funding Rate (“SOFR”) plus a spread.

Asset-backed Securities (“ABS”) Term Notes

On April 17, 2023, the Company elected to exercise its clean-up call on €17 million ($19 million) in ABS Term

Notes issued by First Investors Auto Owner Trust 2018-2.

On June 30, 2023, Stellantis Financial Services U.S., through SFS Auto Owner Trust 2023-1, issued seven classes of

ABS Term Notes totaling $1 billion in aggregate. The notes issued in each class bear a fixed rate of interest except for the

€55 million ($60 million) Class A-2-B note which bears interest daily compound SOFR plus a spread. The ABS Term Notes

are secured by a pool of prime retail loans.

Ratings

Stellantis terminated its rating agreement with Fitch, with effect from April 1, 2023. Therefore, any securities issued

after April 1, 2023 will only be rated by Moody’s and S&P.

On May 31, 2023, Moody’s affirmed Stellantis rating at “Baa2” and changed outlook to positive.

25

Cash Flows

The following table summarizes the cash flows from operating, investing and financing activities for the six months

ended June 30, 2023 and 2022. Refer to the Semi-Annual Condensed Consolidated Statement of Cash Flows for the six

months ended June 30, 2023 and 2022 included in this Semi-Annual Report for additional detail.

(€ million) 2023 2022

Net cash from/(used in) operating activities € 13,393 € 9,843

Net cash from/(used in) investing activities (5,916) (4,666)

Net cash from (used in) financing activities (4,497) (10,088)

Effects of changes in exchange rates (500) 1,637

(Increase)/decrease in cash and cash equivalents included in asset held for sale 65 —

Increase/(decrease) in cash and cash equivalents 2,545 (3,274)

Net cash and cash equivalents at beginning of period 46,433 49,629

NET CASH AND CASH EQUIVALENTS AT END OF PERIOD € 48,978 € 46,355

Six months ended June 30,

Operating Activities

For the six months ended June 30, 2023, cash flows from operating activities was the result of Net profit of €10,918

million primarily adjusted: (1) to add back €3,740 million for depreciation and amortization expense, (2) a €369 million

increase in deferred tax assets, (3) a €1,134 million net increase in provisions, primarily due to sales incentives and

restructuring in North America, and (4) for the negative effect of the change in working capital of €2,756 million, which

includes (i) an increase of €1,970 million in inventories mostly driven by higher level of production and logistics constraints

in Enlarged Europe, (ii) an increase of €3,858 million in trade receivables mainly reflecting the planned reduction of factoring

(iii) a net absorption of €202 million in other receivables and payables, partially offset by (iv) an increase of €3,274 million in

trade payables primarily reflecting increases in both inventories and raw materials, increased components costs and a strong

level of production in May and June.

For the six months ended June 30, 2022, cash flows from operating activities was the result of Net profit of €7,960

million primarily adjusted: (1) to add back €3,225 million for depreciation and amortization expense, (2) a €142 million

change in deferred taxes, (3) a €1,400 million net increase in provisions, primarily due to accruals for CAFE penalty rates and

restructuring and (4) for the negative effect of the change in working capital of €2,801 million, which includes (i) an increase

of €3,607 million in inventories reflecting seasonal trend and increases in raw materials and components costs and safety

stock, as well as, an increase in new vehicle inventory levels, (ii) an increase of €1,348 million in trade receivables mainly

due to seasonality and some reduction in level of factoring, (iii) changes in other receivables and payables with a net

absorption of €874 million primarily related to changes in indirect tax positions in North America and Enlarged Europe and

payment of prior years variable compensation to employees, partially offset by (iv) an increase of €3,028 million in trade

payables primarily reflecting higher volumes and different mix of production in May-June 2022 as compared to November-

December 2021 as well as increased costs of raw materials and components.

Investing Activities

For the six months ended June 30, 2023, cash used in investing activities was primarily the result of (1) €4,447

million of investment in properties, plant and equipment and intangible assets, including €2,014 million of capitalized

development expenditures, partly offset by €233 million increase in payables related to the investments in properties, plant

and equipment and intangible assets, (2) €662 million investment for acquisitions of consolidated subsidiaries and equity

method and other investments of which approximately €460 million in capital injections to joint ventures and associates and

€200 million in acquisitions of minority interests as part of strategic supply agreements, and (3) an increase in receivables

from financing activities of €2,079 million, which was mainly attributable to increased retail financing of Stellantis Financial

Services U.S. that were partially offset by €994 million net proceeds from disposals of shares in consolidated companies and

of investments in non-consolidated companies, including net proceeds of €675 million from the disposal of FCA Bank. Refer

to Note 2, Scope of consolidation within the Semi-Annual Condensed Consolidated Financial Statements for additional

information.

26

For the six months ended June 30, 2022, cash used in investing activities was primarily the result of (1) €3,963

million of investment in properties, plant and equipment and intangible assets, including €1,444 million of capitalized

development expenditures, (2) €446 million decrease in payables related to the investments in properties, plant and

equipment and intangible assets, and (3) an increase in receivables from financing activities of €319 million, which was

mainly attributable to increased retail financing of Stellantis Financial Services U.S. and dealer financing in Brazil.

Financing Activities

For the six months ended June 30, 2023, cash used in financing activities resulted primarily from (1) the payment of

dividends of €4,208 million, (2) share buybacks of €674 million, (3) the increase in securities of €455 million mainly related

to investments which are not classified as cash equivalents, partially offset by (4) the net increase in long-term debt of €450

million, including (i) the issuance of bonds for €2,500 million, (ii) the proceed from new other long-term debt for €123

million, partially offset by (iii) the repayment of bonds for €1,857 million and of other long-term debt for €315 million, and

by (5) a positive net change of €392 million in short-term debt and other financial assets and liabilities.

For the six months ended June 30, 2022, cash used in financing activities resulted primarily from (1) the repayment

of €6,300 million Intesa San Paolo credit facility, and (2) payment of dividends of €3,260 million, partially offset by (3)

€1,000 million of proceeds from a Medium Term Note issuance.

Industrial free cash flows

The following table provides a reconciliation of Cash flows from operating activities, the most directly comparable

measure included in our Semi-Annual Condensed Consolidated Statement of Cash Flows, to Industrial free cash flows for the

six months ended June 30, 2023 and 2022:

Six months ended June 30,

(€ million) 2023 2022

Cash flows from/(used in) operating activities 13,393 9,843

Less: Operating activities not attributable to industrial activities (211) 129

Less: Capital Expenditures and capitalized research and development expenditures and change in

amounts payable on property, plant and equipment and intangible assets for industrial activities

4,196 4,388

Add: Proceeds from disposal of assets and other changes in investing activities 1,726 251

Less: Net proceeds related to the reorganization of financial services in Europe

(1)

1,464 —

Less: Contributions of equity to joint ventures and minor acquisitions of consolidated subsidiaries

and equity method and other investments

1,058 293

Add: Defined benefit pension contributions, net of tax 43 35

Industrial free cash flows € 8,655 € 5,319

________________________________________________________________________________________________________________________________________________

(1) The net consideration of €1,566 million for the sale of 50 percent interest held in FCA Bank to Crédit Agricole Consumer Finance S.A. (“CACF”) related to industrial

activities is offset by payments of €102 million in relation to the transfer of leasing activities.

27

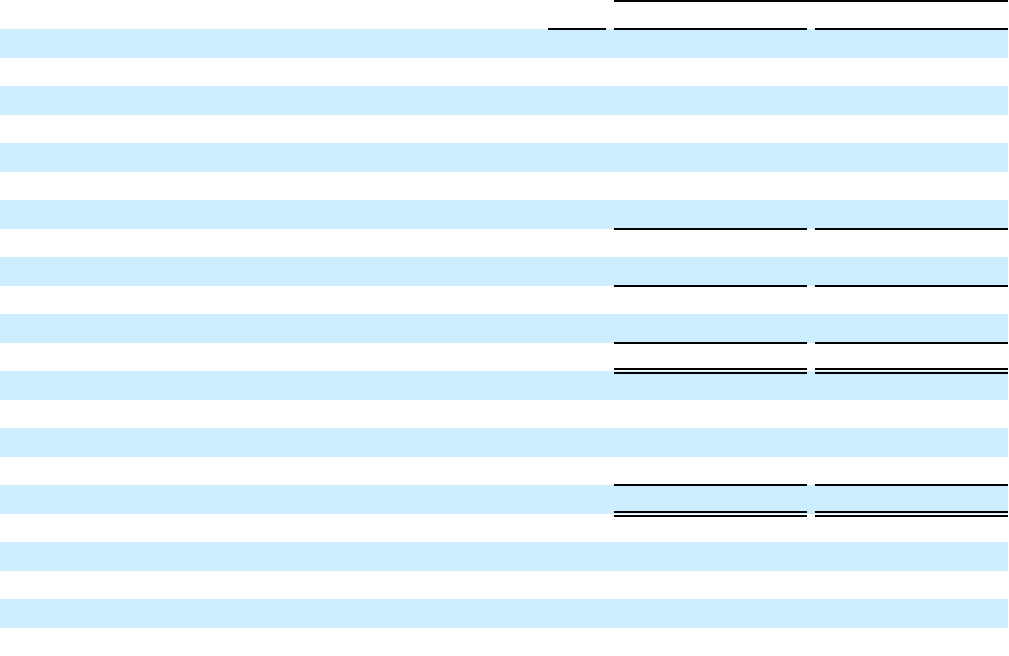

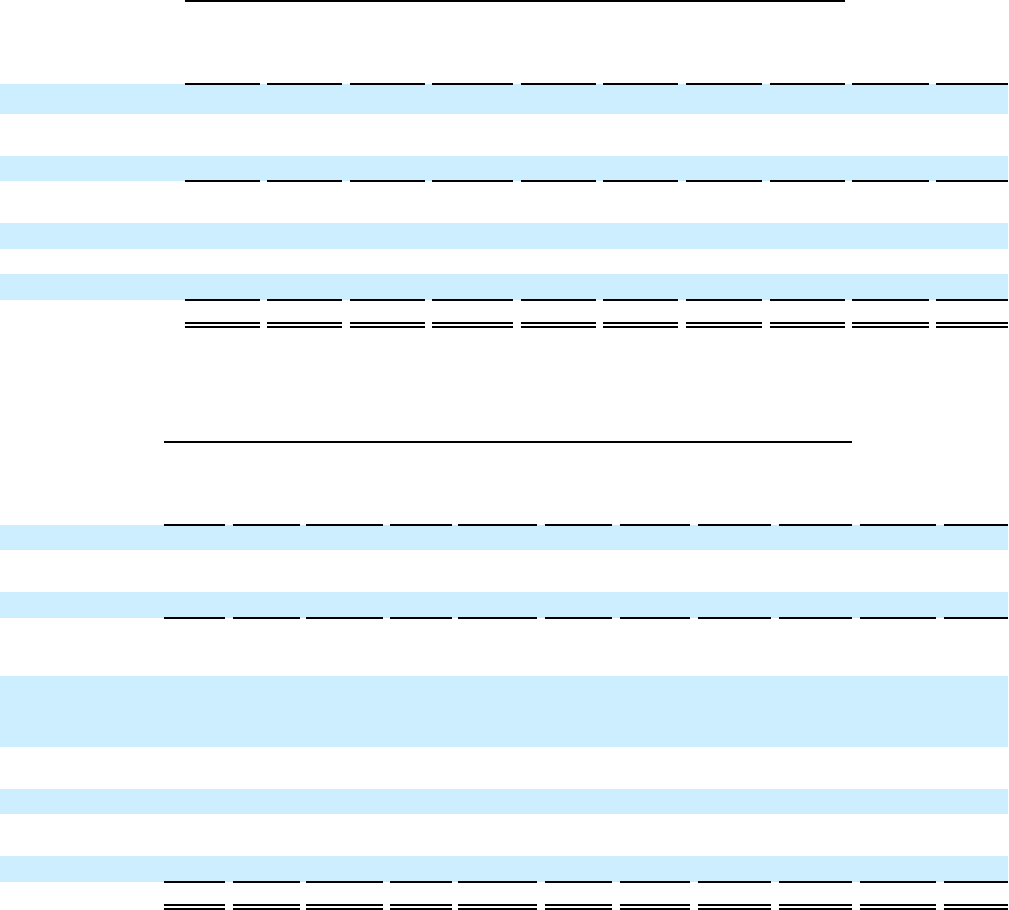

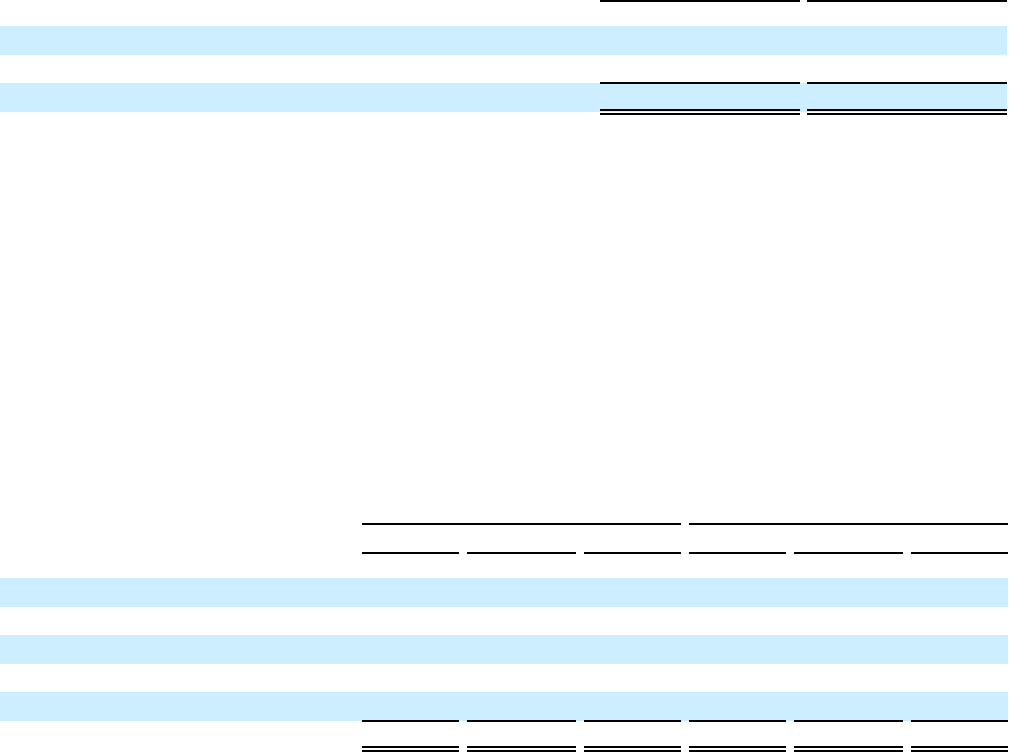

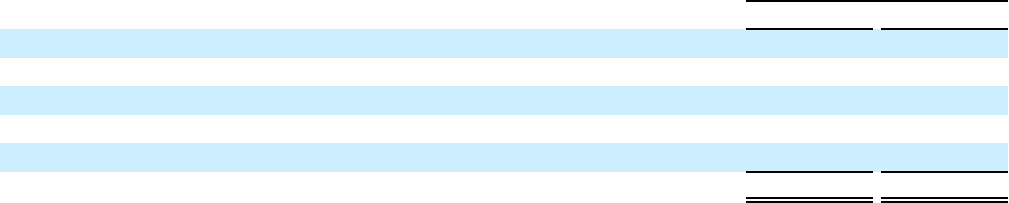

Industrial net financial position

At June 30, 2023 At December 31, 2022

(€ million)

Stellantis

Industrial

activities

Financial

services Stellantis

Industrial

activities

Financial

services

Third parties debt (Principal) € (28,790) € (24,383) € (4,407) € (26,335) € (23,508) € (2,827)

Capital market

(1)

(19,856) (19,026) (830) (19,088) (18,488) (600)

Bank debt (3,288) (2,516) (772) (2,937) (2,264) (673)

Other debt

(2)

(3,471) (685) (2,786) (2,051) (517) (1,534)

Lease liabilities (2,175) (2,156) (19) (2,259) (2,239) (20)

Accrued interest and other adjustments

(3)

(677) (646) (31) (818) (793) (25)

Debt with third parties (excluding held for sale) (29,467) (25,029) (4,438) (27,153) (24,301) (2,852)

Debt classified as held for sale — — — (11) (11) —

Debt with third parties including held for sale (29,467) (25,029) (4,438) (27,164) (24,312) (2,852)

Intercompany, net

(4)

— 2,513 (2,513) — 918 (918)

Current financial receivables from jointly-controlled financial

services companies

(5)

985 985 — 321 321 —

Debt, net of intercompany, and current financial

receivables from jointly-controlled financial service

companies

(28,482) (21,531) (6,951) (26,843) (23,073) (3,770)

Derivative financial assets/(liabilities), net of collateral

deposits

(6)

14 26 (12) 52 52 —

Financial securities

(7)

3,940 3,560 380 3,527 3,326 201

Cash and cash equivalents 48,978 47,742 1,236 46,433 45,335 1,098

Cash and cash equivalents classified as held for sale — — — 65 65 —

Net financial position

€ 24,450 € 29,797 € (5,347) € 23,234 € 25,705 € (2,471)

________________________________________________________________________________________________________________________________________________

(1) Includes notes issued under the Medium Term Programme, or Medium Term Note (“MTN”) Programme, and other notes for €18,541 million at June 30, 2023 (€18,003 million

at December 31, 2022), Schuldschein for €485 million (€485 million at December 31, 2022) and other financial instruments issued in financial markets, mainly from South

America financial services companies for €830 million (€600 million at December 31, 2022)

(2) Includes asset-backed financing, i.e. sales of receivables for which de-recognition is not allowed under IFRS, for €197 million at June 30, 2023 (€128 million at December 31,

2022) and debt for securitizations programs, for €2,734 million at June 30, 2023 (€1,527 million at December 31, 2022)

(3) Includes adjustments for purchase accounting and net (accrued)/deferred interest and other amortizing cost adjustments

(4) Net amount between industrial activities entities' financial receivables due from financial services entities (€2,731 million at June 30, 2023 and €1,116 million at December 31,

2022) and industrial activities entities' financial payables due to financial services entities (€218 million at June 30, 2023 and €198 million at December 31, 2022)

(5) Financial receivables due from Stellantis Financial Services (at June 30,2023), FCA Bank and from the Banque PSA Finance joint ventures with Group Santander Consumer

Finance and with BNP Paribas Personal Finance (at December 31, 2022)

(6) Fair value of derivative financial instruments (net negative €6 million at June 30, 2023 and net positive €16 million at December 31, 2022) and collateral deposits (€20 million

at June 30, 2023 and €36 million at December 31, 2022)

(7) Excludes certain financial securities held pursuant to applicable regulations (€354 million at June 30, 2023 and €330 million at December 31, 2022) and non-liquid equity

investments (€536 million at June 30, 2023 and €321 million at December 31, 2022) and other non-liquid securities (€914 million at June 30, 2023 and €143 million at December

31, 2022)

The €4.1 billion improvement in Industrial net financial position at June 30, 2023, as compared to December 31,

2022, primarily reflects the €8.7 billion Industrial free cash flow of the period and the €1.5 billion net proceeds related to the

reorganization of financial services in Europe, partially offset by €4.2 billion dividends distribution, €1.0 billion impact of the

share buyback and a negative foreign exchange translation.

28

Important events during the six months ended June 30, 2023

In January 2023, Stellantis announced that it will contribute technology, expertise and capital to Archer Aviation

Inc. for the manufacture of Archer’s electric vertical take-off and landing aircraft. Stellantis committed to €138 million (U.S.

$150 million) in capital injections subject to certain milestone achievements. Refer to Note 2, Scope of consolidation within

the Semi-Annual Condensed Consolidated Financial Statements for additional information.

In January 2023, the Ram 1500 Revolution BEV concept was unveiled at CES which demonstrates Ram’s

commitment to electric vehicle leadership.

In January 2023, Stellantis announced the signing of a binding agreement with Element 25 Limited to supply battery

grade high purity manganese sulfate monohydrate to Stellantis for use in electric vehicle battery packs. The five-year

agreement calls for shipments to begin in 2026, and options to extend the supply term and volumes.

Two binding agreements were signed with Vulcan Energy Resources Limited in 2023. In January, Stellantis

announced for the first phase of a multiphase project to develop new geothermal projects aimed at decarbonizing the energy

mix of Stellantis’ Rüsselsheim industrial site in Germany. In addition, in May, a binding agreement was announced to cover

the Mulhouse industrial site in France. Based upon current assumptions, the projects could provide a significant portion of the

industrial sites’ annual energy needs starting in 2025 and 2026, respectively.

In January 2023, Stellantis announced the signing of a supply agreement with Terrafame Ltd. for nickel sulfate to be

used in EV batteries. Commencing in 2025, Terrafame will supply Stellantis with nickel sulfate over the five-year term of the

agreement. The Terrafame agreement is a part of Stellantis’ electrification strategy and will cover a significant portion of the

needs for sustainable regionally sourced nickel.

In February 2023, the Stellantis Board of Directors approved a share buyback program of up to €1.5 billion (total

purchase price excluding ancillary costs), to be executed on the market with the intent to cancel the common shares acquired

through the share buyback program. The shares will be purchased over a period ending December 31, 2023 on NYSE /

Euronext Milan / Euronext Paris. The first tranche of €500 million started on March 17, 2023 and was completed on May 18,

2023. In June 2023, a second tranche of €500 million started and will end no later than September 7, 2023. Common shares

purchased under the program will be cancelled in due course. Refer to Note 19, Equity within the Semi-Annual Condensed

Consolidated Financial Statements for additional information.

In February 2023, Stellantis finalized a €144 million (U.S. $155 million) investment which represents a 14.2 percent

equity stake in McEwen Copper, a subsidiary of Canadian mining company McEwen Mining, which owns the Los Azules

project in Argentina. This investment will make a major contribution to the Company’s plan to become carbon net zero by

2038. Refer to Note 8, Financial assets within the Semi-Annual Condensed Consolidated Financial Statements for additional

information.

In February 2023, Stellantis announced a €144 million (U.S.$155 million) investment in three plants in Kokomo,

Indiana to produce new electric drive modules that will help power future electric vehicles assembled in North America and

support the goal of 50 percent battery electric sales in the U.S. by 2030.

In March 2023, Stellantis announced a new strategic agreement with Koç Holding to expand their existing Tofaş

joint venture and enhance the potential of its operations in Turkey. Tofaş will acquire the entire share capital of Stellantis

Otomotiv Pazarlama A.S., the Stellantis Türkiye distribution company. As a result, all Stellantis brands available for

distribution in Turkey: Alfa Romeo, Fiat, Citroën, DS Automobiles, Jeep, Maserati, Opel and Peugeot will be distributed by

Tofaş.

In March 2023, Stellantis announced the brands Leasys and Free2move will consolidate their activities to create a

new multi-brand operational leasing company. Stellantis and Crédit Agricole Consumer Finance will each have 50 percent

shareholding rights. In the same month Stellantis and Crédit Agricole Consumer Finance announced that they have signed a

binding agreement for the acquisition of ALD and LeasePlan’s activities in Portugal and Luxembourg, respectively.

In April 2023, Stellantis announced that the former Banque PSA Finance has been renamed to Stellantis Financial

Services, which will have a single financing entity covering all Stellantis brands. In addition, it was announced that Leasys

will be the multi-brand operational leasing company which will include the lease brand, Free2move.

29

In April, Stellantis completed the sale of the 50 percent interest held in FCA Bank to CACF. Refer to Note 2, Scope

of consolidation - Disposal within the Semi-Annual Condensed Consolidated Financial Statements for additional information.

In April 2023, Stellantis announced the signing of a binding offtake agreement with Alliance Nickel Ltd for the

supply of nickel sulfate and cobalt sulfate over an initial five-year period. In addition, Stellantis agreed to purchase €8 million

(AUD 15 million) in new equity in Alliance Nickel, giving us an 11.5 percent shareholding on completion, and rights to

nominate one director to the Alliance board.

In May 2023, Stellantis announced the signing of a binding agreement to acquire a 33.3 percent stake in Symbio

with Faurecia and Michelin remaining shareholders with 33.3 percent holding each. Symbio produces hydrogen fuel cells

which will support our fuel cell light commercial vehicle production in France. The agreement is subject to customary closing

conditions, including regulatory approval.

In June 2023, Stellantis signed a non-binding memorandum of understanding to enter into exclusive negotiations to

form a joint venture focused on End-of-Life Vehicle (“ELV”) recycling as part of the automaker’s continued commitment to

build its circular economy activities. The Stellantis-Galloo joint venture will work with selected authorized treatment

facilities to collect ELVs from the last owner, enabling the recovering of parts for reuse, remanufacturing, and recycling. The

service is expected to launch at the end of 2023 with an initial focus on France, Belgium and Luxembourg, and then