32 UK Customer Satisfaction Index | January 2023UK Customer Satisfaction Index | January 2023

I’m often asked by organisations what they need

to do to improve customer satisfaction - what are

the key things the high performing organisations

do that others don’t ? Our research, and

engagement with organisations and leaders

shows that that customer service and business

performance outcomes are impacted by a range

of long-term drivers, not just service initiatives

- leadership and organisational culture are key,

rather than one off activities or short term

investments. That’s why in this report we’ve set

out some of the essential elements and enablers

of a service culture and recommendations about

how to develop them.

I hope that this UKCSI – and full range of

products, services and research The Institute

provides - will help you interpret a complex and

evolving environment, support you in achieving

sustainable customer service and business results

as well as galvanise you into action!

Average levels of financial well-being do not

appear to have changed significantly compared

to 2021: perhaps we are yet to see the full

impact of inflation and economic pressures on

personal finances. But there is evidence of a

distinct polarisation in levels of financial well-

being. In our research, around 45% of customers

described their financial well-being as “good” or

“very good” and 15% felt it was “poor” or very

poor.” Around a quarter of customers believe

their debt will rise in the next six months: many

of these customers are concerned about the

consequences for their purchasing capacity and

financial well-being.

Despite a widespread priority to economise on

spending, more than a third of customers would

be willing to pay more to guarantee excellent

service and this continues to rise.

This UKCSI reports that 16.5% of customers

experienced a problem with an organization,

around the same level as a year ago but 2.9

percentage points more than in January 2020,

the last UKCSI published before the Covid-19

pandemic. We should all be concerned about

this level of problems: it damages customer

satisfaction, impedes organisations’ performance

and profitability and has significant implications

for the productivity of the UK economy.

The key differences between the highest

performing organisations and the rest span all

dimensions of customer satisfaction, not just

complaint handling and pricing, but crucially

from a customer’s view the level of emotional

connection and the level of trust they might have.

Companies with higher levels of satisfaction: make

their customers feel reassured, design experiences

around customers and keep promises.

All aspects of customer experience – efficiency

in transactional experiences, problem-solving,

innovation, ethical standards, and impact, and

genuinely focusing on customers’ personal needs

– are interlinked and require focus. The leading

organisations know this and will continue to

invest as a business imperative.

As we emerge from the Covid-19 pandemic

and face into challenges of rising costs and

skills shortages, this feels like a critical inflection

point. Organisations need to determine what

their customer experience will look like, which

customers they serve, how customer needs and

behaviours are evolving and how to respond.

Collectively, the decisions that organisations

make will determine whether we create a

stronger service nation - with the economic

benefits that come from that - or continue to

be fixated on immediate crises and problems.

Crucially, organisations need to focus more

on developing the capabilities for sustainable,

long-term performance, even as they

address immediate challenges of operational

performance and resourcing.

The January 2023 UK Customer Satisfaction

Index shows a slight decline in average customer

satisfaction of 0.7 points to 77.7 (out of 100). But

I am concerned this overall average score masks

deeper issues that could threaten organisations’

performance, long term profitability and the quality

of customer experience, in 2023 and beyond.

Looking at the latest results, we see that more

companies have declined than improved. In 2021

and 2022, customer satisfaction with complaint

handling showed a steady improvement but this

has now stalled and other areas of customer

satisfaction that are predictive of business

performance, such as measures of a company’s

emotional connection with its customers, their

customer ethos and ethics, have also declined.

We are seeing a greater polarisation in customer

satisfaction performance, with some companies

pulling away from the pack and others alas falling

considerably behind. Overall, this is not good for

the UK’s standing and we need to address this

decline to ensure we can really transform our

trading position as a country as well as lift the

spirits of customers and employees alike.

We know customer attitudes and behaviours

have changed in the last six months and will

continue to evolve: not only are people thinking

more carefully about spending due to the cost-of-

living crisis, by reducing their level of spending,

shopping around more to find the best deals

and making fewer impulse or large purchases;

there are longer term changes in behaviour

that embody trends towards more mindful

consumption and environmental sustainability.

Foreword

Joanna Causon Chief Executive

5UK Customer Satisfaction Index | January 20234 UK Customer Satisfaction Index | January 2023

Executive summary

Part 1 The state of customer satisfaction in the UK

Part 2 Customer satisfaction and business performance

Part 3 How the rising cost of living is impacting customer needs

and behaviours

Part 4 Recommendations: building a culture of service excellence

UKCSI Key facts

Organisations in the UKCSI

About the UKCSI

UKCSI sector reports

Breakthrough research from The Institute

About The Institute

Contents

6

24

46

60

78

96

97

98

99

100

102

7UK Customer Satisfaction Index | January 2023

Executive

Summary

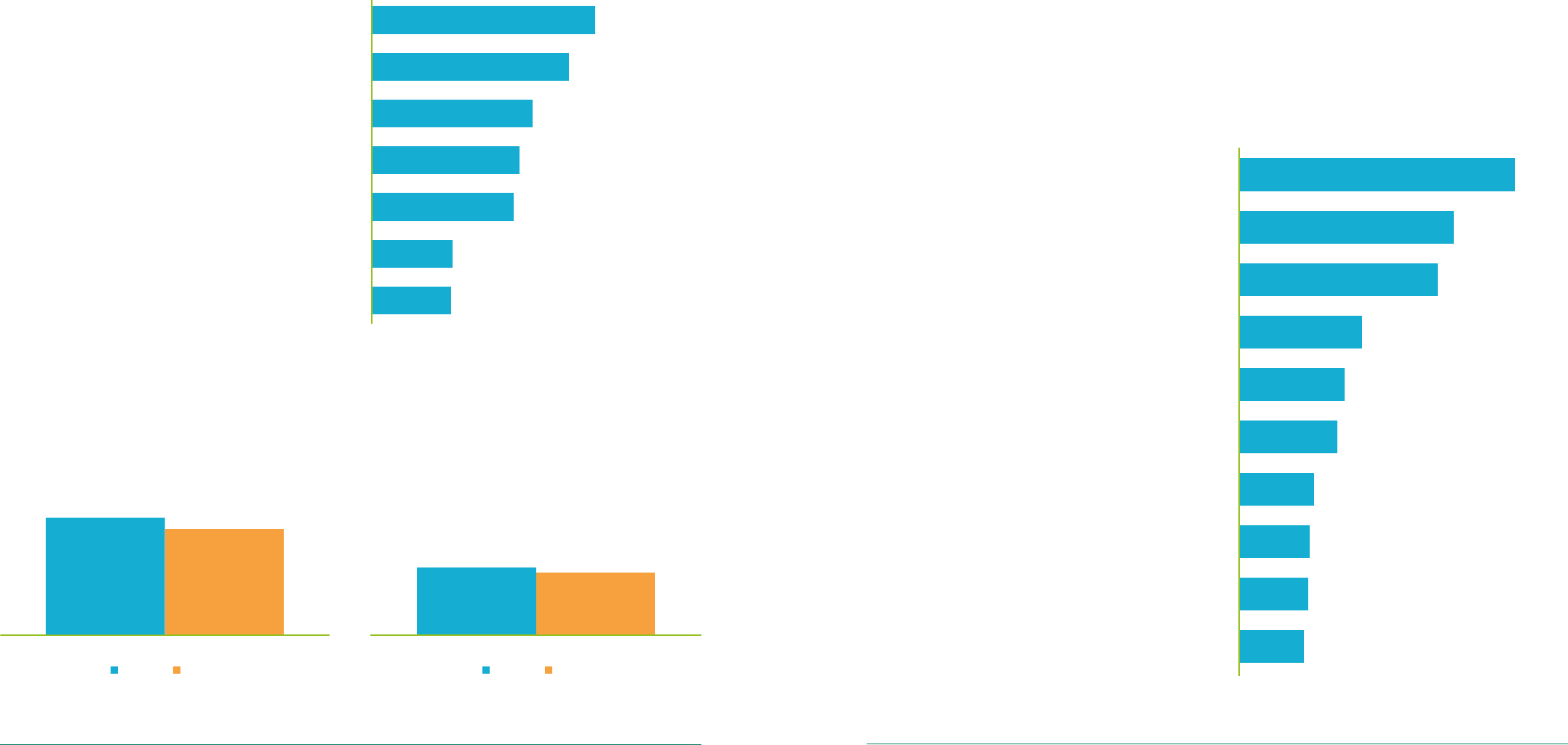

The January 2023 UK Customer Satisfaction Index

(UKCSI) is 77.7 (out of 100), a decline of 0.7 points

compared to both the July 2022 and January 2022 surveys

The UKCSI is a national benchmark of customer satisfaction covering 281 organisations or organisation

types across 13 sectors. The UKCSI score is based on how customers rate organisations across 26

measures covering satisfaction with transactional experiences as well as broader relationship needs.

Much of the improvement in overall customer satisfaction through 2021 and 2022 was fuelled by

stronger satisfaction with complaint handling. However, the improvement in complaint handling appears

to have stalled and satisfaction has declined slightly across all dimensions of customer satisfaction. This

suggests that further sustained growth in customer satisfaction will require increased focus and action in

all dimensions of customer satisfaction.

Jul-21 Jan-22 Jan-23Jul-22Jan-21Jul-20Jan-20Jul-19Jan-19Jul-18Jan-18Jul-17Jan-17Jul-16Jan-16Jul-15Jan-15Jul-14Jan-14Jul-13Jan-13Jul-12Jan-12Jul-11Jan-11Jul-10Jan-10Jul-09Jan-09

77.4

78.4 78.4

76.9 77.0

76.8

77.1

77.7

77.9

78.1

78.2

77.8

77.4

77.0

76.2

76.0

76.3

77.1

77.9

78.2

78.0

77.4

77.3

76.7

75.6

75.2

74.1

72.0

77.7

98 UK Customer Satisfaction Index | January 2023UK Customer Satisfaction Index | January 2023

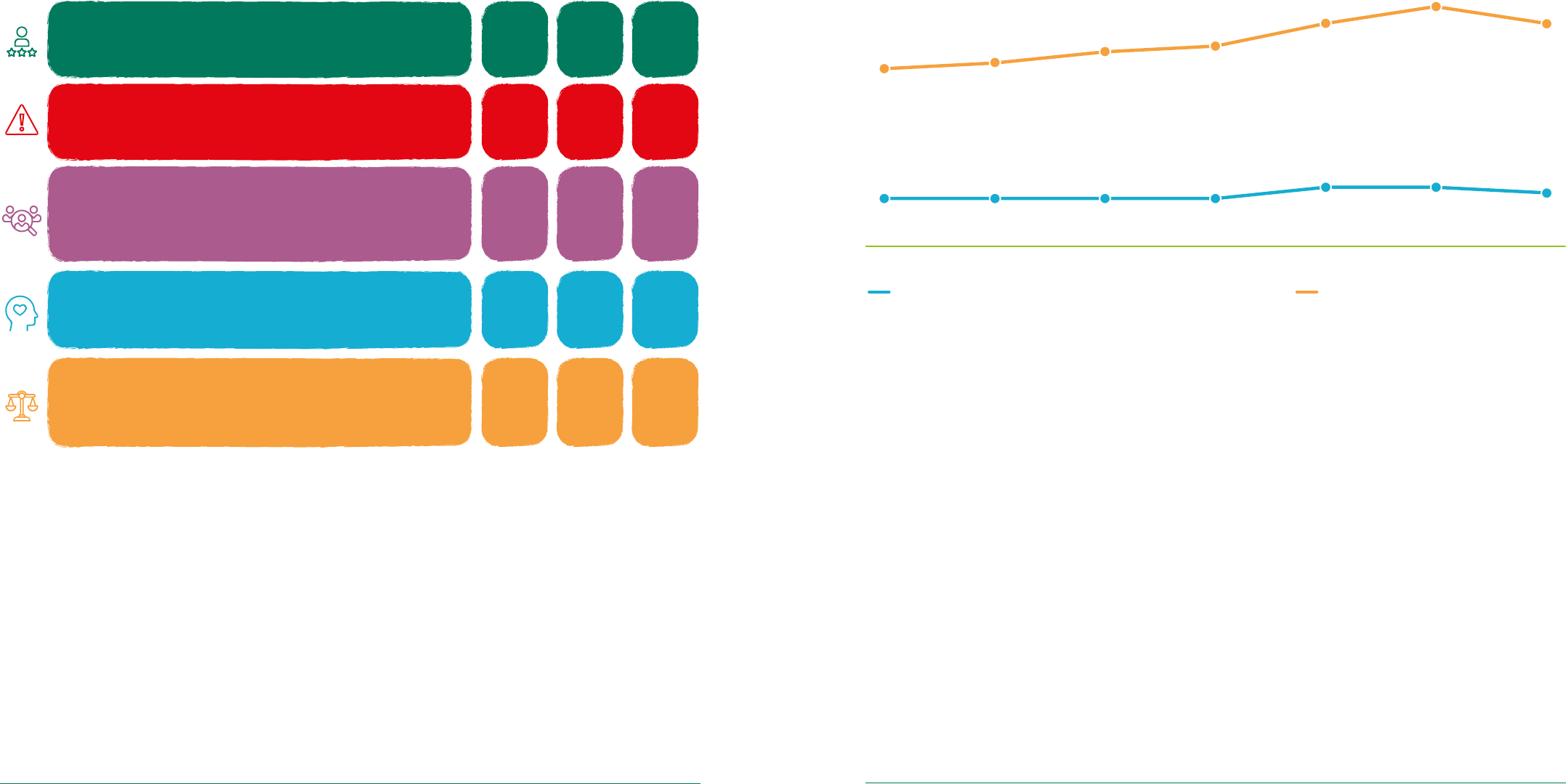

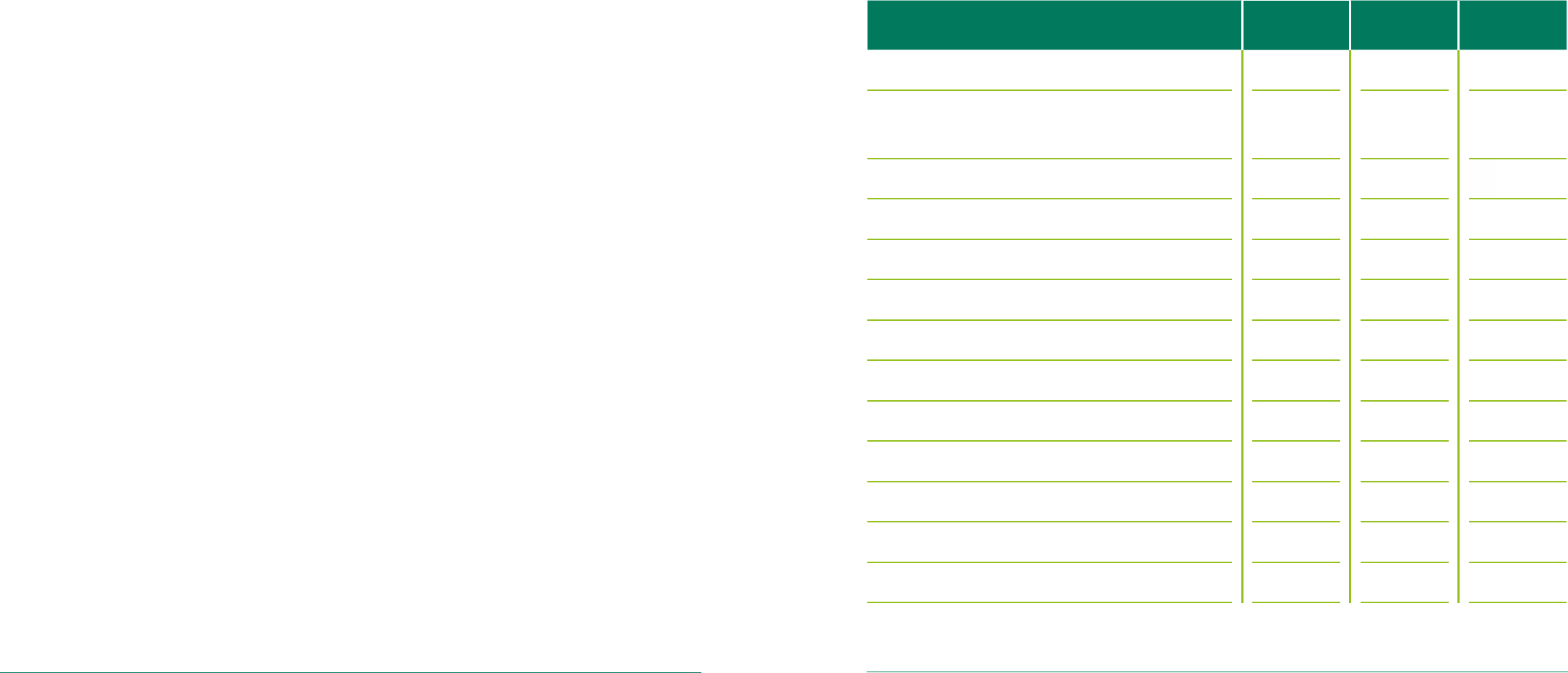

Experience

Measures the quality of customers’ experiences and

interactions with organisations

Dimension (score out of 100)

Jan

2023

Ethics

Reputation, openness and transparency and the extent

to which an organisation is deemed to “do the right thing”

Customer Ethos

Extent to which customers perceive that organisations

genuinely care about customers and build the experience

around their customers’ needs

Complaint Handling

How organisations respond and deal with problems and

complaints

Emotional Connection

The extent to which an organisation engenders feelings

of trust and reassurance

78.7

75.8

77.0

63.3

76.8

Jan

2022

79.3

76.8

77.8

65.8

77.8

Year-on-

year

change

-0.6

-1.0

-0.8

-2.5

-1.0

16.5% of customers experienced a problem with an

organisation, around the same level as January 2022

but 2.9 percentage points more than January 2020

% customers experiencing a problem with an organisation and satisfaction with complaint handling

5.8 5.8

5.7

6.0

6.5 6.6

6.3

13.6

14.1

14.6

14.9

16.4

17.3

16.5

Jan-20 Jul-20 Jan-21 Jul-21 Jan-22 Jul-22

Jan-23

Average satisfaction with

handling of the complaint (1 - 10)

% of customers who recently experienced

a problem with an organisation

The leading causes of problems experienced by customers are quality or reliability, suitability and

availability of goods and services. The extent of problems has significant implications not just for

customer satisfaction, but for organisations’ productivity, costs and profitability.

1110 UK Customer Satisfaction Index | January 2023UK Customer Satisfaction Index | January 2023

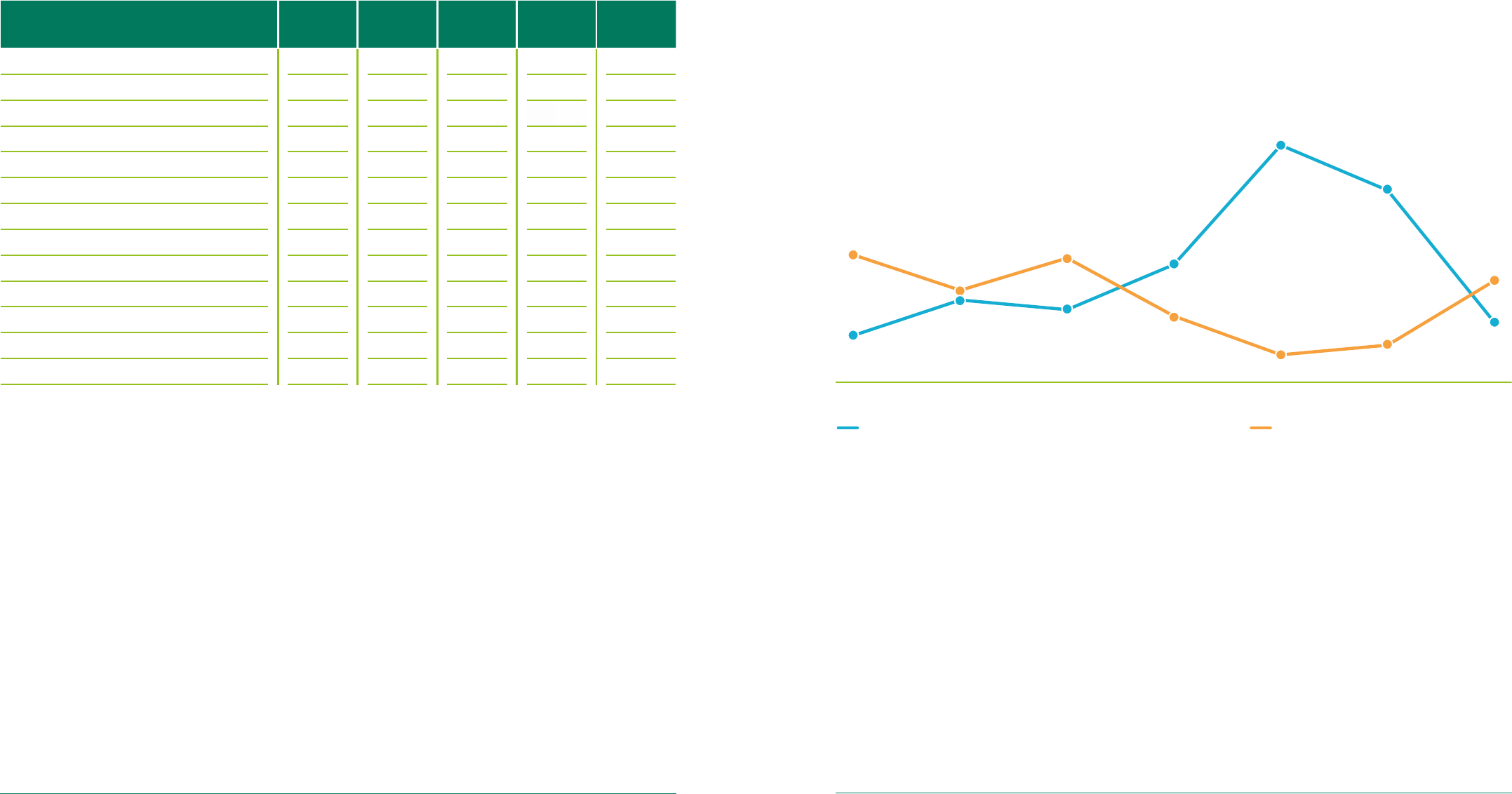

5 of the 13 sectors measured in the UKCSI – Public

Services (Local and National), Services, Transport and

Utilities - have dropped by at least 1 point compared to

January 2022

Jan-23 Jul-22 Jan-22 Change from

Jan-22 to

Jan-23

Change from

Jul-22 to

Jan-23

Retail (Non-food)

81.7 81.9 81.5 0.2 -0.2

Tourism

80.9 80.7 80.4 0.5 0.2

Leisure

80.8 81.8 81.7 -0.9 -1.0

Retail (Food)

80.5 81.7 81.0 -0.5 -1.2

Banks & Building Societies

80.3 80.3 80.2 0.1 0.0

Automotive

80.1 81.0 80.7 -0.6 -0.9

Insurance

80.0 80.8 80.5 -0.5 -0.8

Services

76.3 76.7 77.4 -1.1 -0.4

Telecommunications & Media

75.8 76.6 76.3 -0.5 -0.8

Public Services (National)

75.1 75.3 76.9 -1.8 -0.2

Transport

74.1 75.8 75.1 -1.0 -1.7

Public Services (Local)

72.2 72.3 73.4 -1.2 -0.1

Utilities

71.7 74.1 74.5 -2.8 -2.4

In the other 8 sectors, customer satisfaction has have moved, up or down, by less than 1 point.

Average customer satisfaction in the Utilities sector is 71.7 (out of 100), a drop of 2.8 points compared

to January 2022 and its lowest score since January 2015.

Within the Utilities sector, average satisfaction with Energy companies is 70.3, a decline of 3.8 points

compared to a year ago. They biggest fall in customer satisfaction was for pricing, down 0.9 points

compared to January 2022, to 6.0 (out of 10). Average levels of trust and an organisation making you

feel reassured decreased by 0.5 points (out of 10).

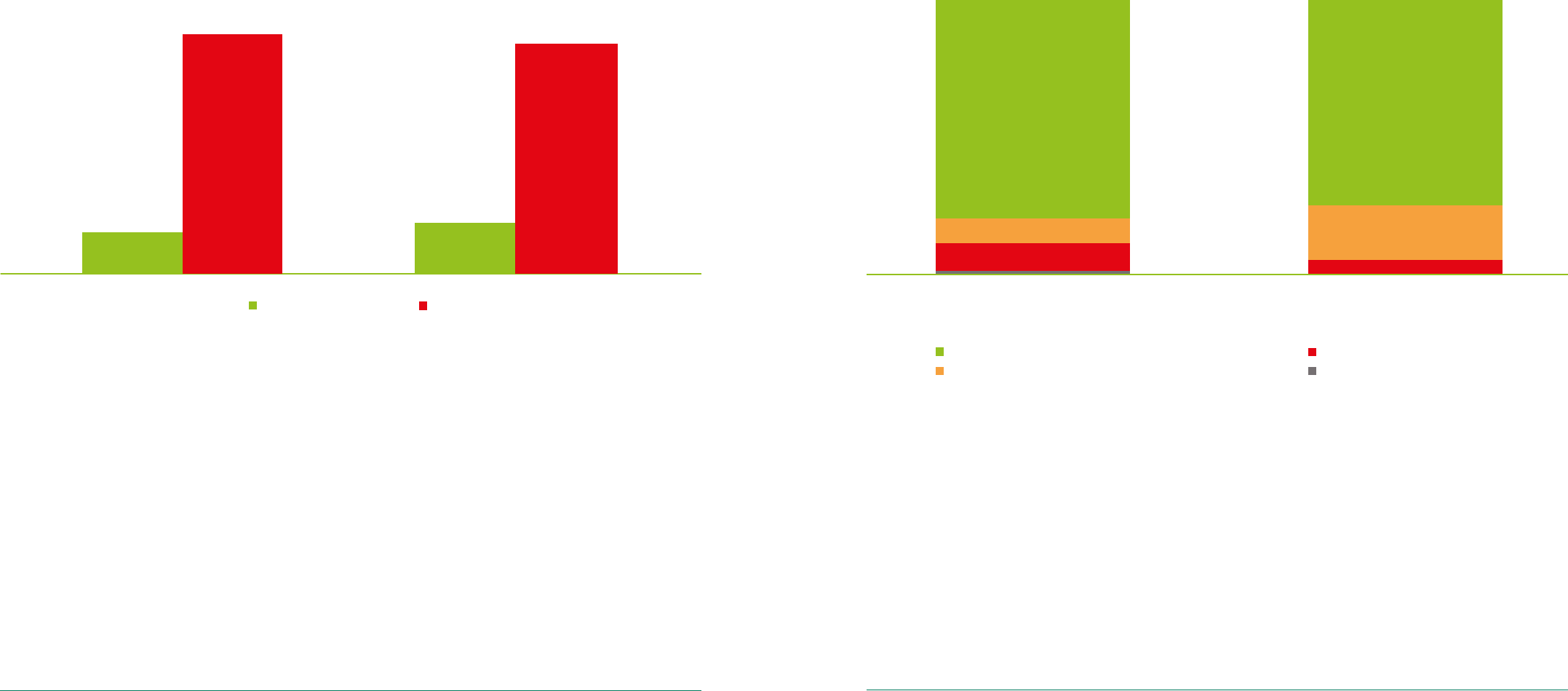

Almost half of the organisations that have declined

by at least 2 points compared to a year ago are in the

Transport and Utilities sectors

In the January 2023 UKCSI, 37 organisations (13% of the total receiving a UKCSI score) have improved

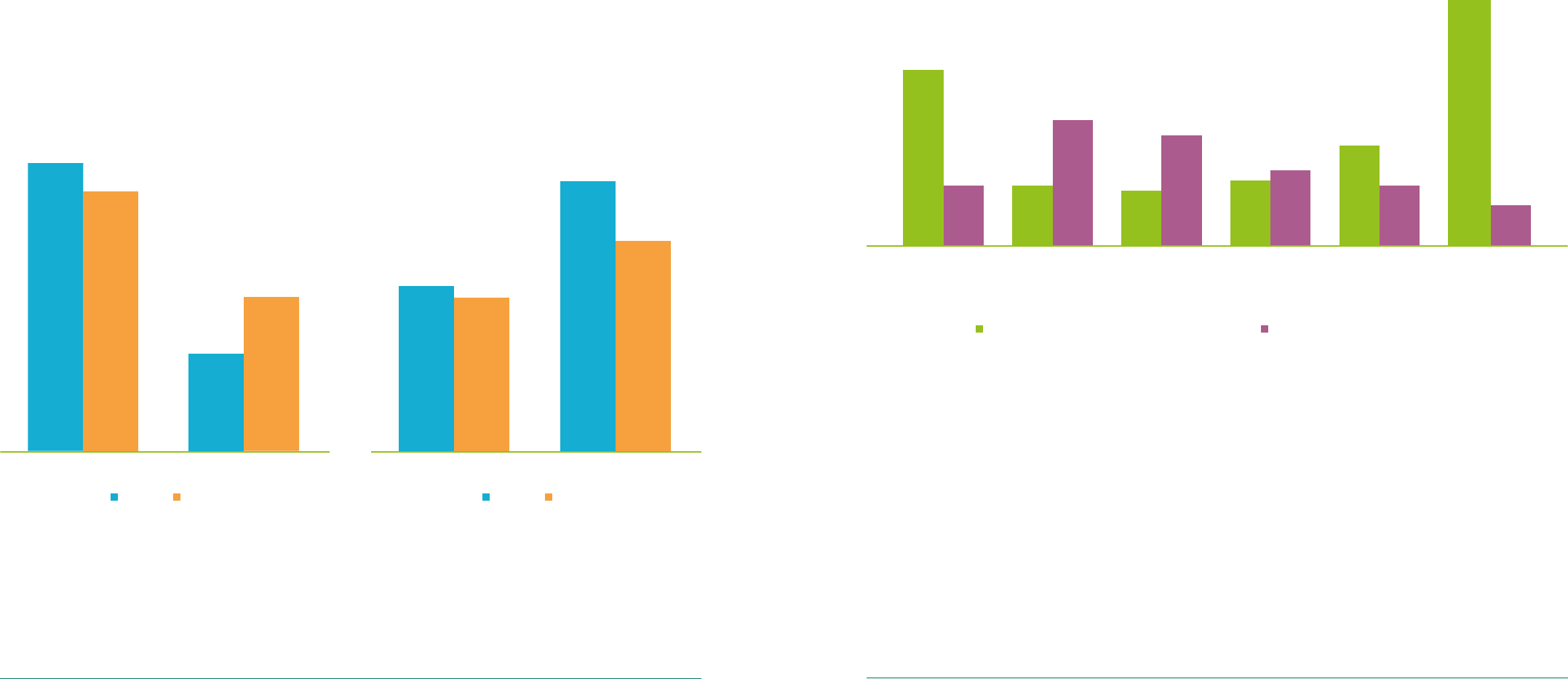

by at least 2 points compared to a year ago, the lowest number since January 2020. 63 organisations

(22% of those receiving a UKCSI score) have fallen by 2 points or more.

10%

18% 16%

26%

52%

42%

13%

28%

20%

27%

14%

6%

8%

22%

Jan-20 Jul-20 Jan-21Jul-21 Jan-22 Jul-22 Jan-2

3

% of organisations whose UKCSI has

improved yoy by at least 2 points

% organisations whose UKCSI score has

declined yoy by at least 2 points

% of organisations that have improved or fallen by at least 2 points compared to the previous year

q Fall in UKCSI score by less than one point q Fall in UKCSI score by more than 1 point

1312 UK Customer Satisfaction Index | January 2023UK Customer Satisfaction Index | January 2023

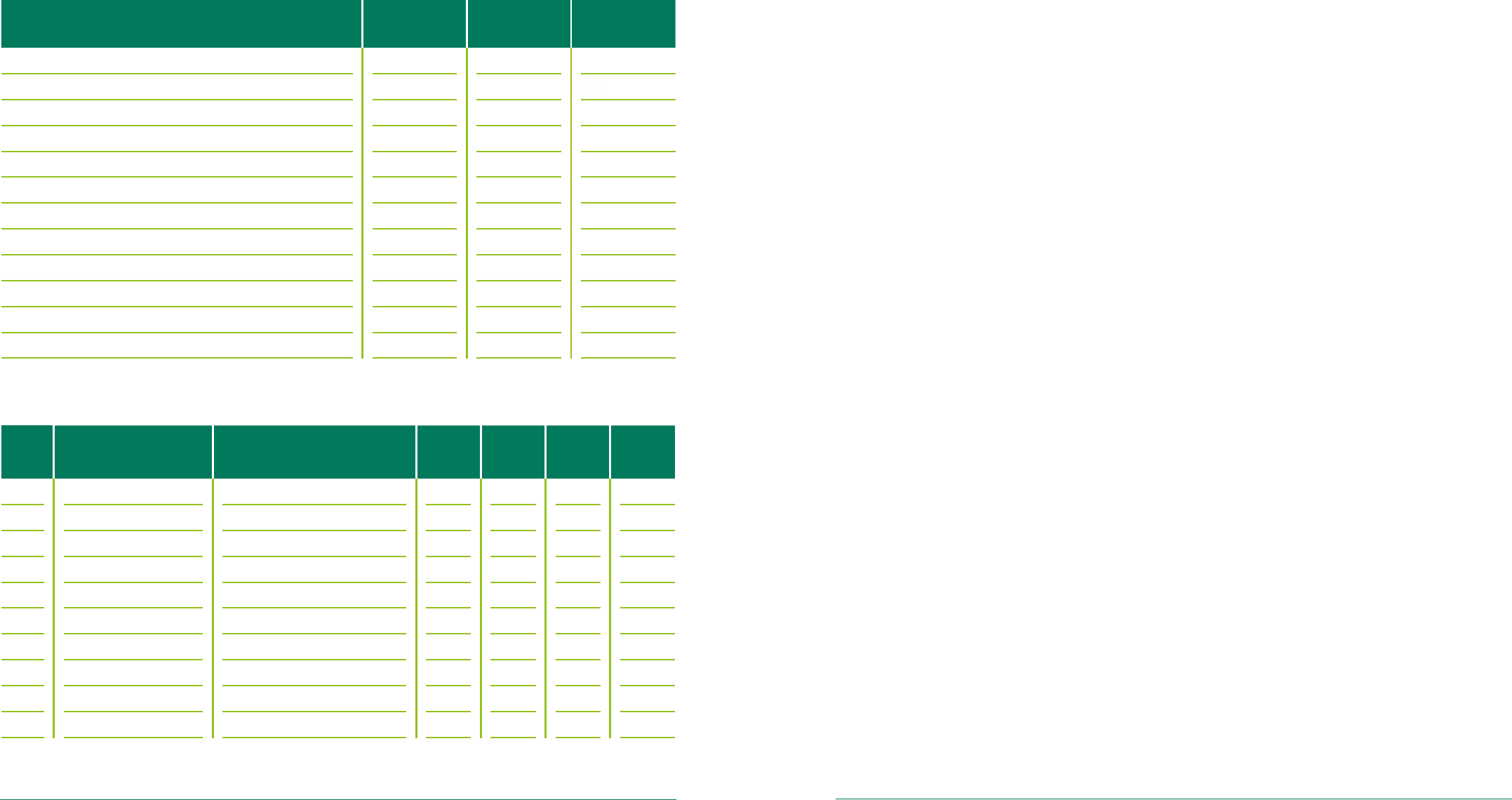

Key differences between the top 50 organisations and

the rest include measures of complaint handling, price

and cost, emotional connection and customer ethos

Measure (on a scale of 1 - 10 except where indicated) Top 50 organisations Other organisations Gap

UKCSI 83.3 77.0 6.3

Speed of resolving your complaint 7.4 6.2 1.2

The handling of the complaint 7.5 6.3 1.2

The attitude of staff (complaints) 7.6 6.6 1.0

Price / cost 8.2 7.4 0.8

XX designs the experience around its customers 8.2 7.5 0.7

XX makes you feel reassured 8.3 7.6 0.7

XX cares about their customers 8.2 7.5 0.7

You trust XX 8.3 7.6 0.7

XX keeps their promises 8.3 7.6 0.7

% customers experiencing a problem 12.0% 16.5% 4.5% points

% experiences right first time 86.5% 79.8% 6.7% points

Key differentiators of the top 50 organisations in the UKCSI (scores out of 10 unless stated)

10 highest rated organisations

Jan-23

Rank

Organisation Sector Jan-23

Score

Jan-22

Score

Jan-22

Rank

Change

in score

Jan-22 to

Jan-23

1

rst direct

Banks & Building Societies 86.2 85.7 2 0.5

2

John Lewis

Retail (Non-food) 85.6 84.7 7 0.9

3

UK Power Networks

Utilities 85.4 85.4 4 0.0

4=

Tesco Mobile

Telecommunications & Media 85.2 83.7 22 1.5

4=

M & S (food)

Retail (Food) 85.2 84.2 11 1.0

6

Starling Bank

Banks & Building Societies 85.1

NO DATA NO DATA NO DATA

7

Next

Retail (Non-food) 85.0 81.4 63 3.6

8=

Suzuki

Automotive 84.6 84.0 17 0.6

8=

M & S

Retail (Non-food) 84.6 84.0 17 0.6

10

Amazon.co.uk

Retail (Non-food) 84.4 83.8 21 0.6

p Increase in UKCSI score of at least one point

In the Retail (Food) sector, an environment of rising

costs and changing customer behaviours has shaped

the relationship between customer satisfaction and

business performance

Kantar’s research* reported that take-home

grocery sales grew by 5.9% year on year in the

12 weeks preceding 27 November 2022, driven

by an increase in store visits compared to the

previous year as well as the rise in inflation.

Sales of own label products grew by 11.7% year

on year but sales of premium products also rose,

by 6.1%. These contrasting trends in buying

behaviour are reflected in the UKCSI. 16.7% of

customers expressed a preference for lowest

cost, no frills service, up by 1.3 percentage

points compared to a year ago. But 31.9% of

Retail (Food) customers indicated that they

prefer excellent service, even if it means paying

more, up by 2.7 percentage points compared to

January 2022**.

Aldi’s sales increased by 24% but in September

2022 the company reported a drop in profits

because of increased supplier, staff and Covid-

related costs. These issues may also have

affected Aldi’s customer satisfaction. Over

the past 3 years, Aldi’s UKCSI average score is

82.8, more than 2 points higher than the sector

average. However, in the January 2023 UKCSI,

Aldi received a score of 81.0, down by 2.7 points

compared to a year ago.

Lidl’s sales rose by 22%, giving it a market share

of 7.4%. Over the past 3 years, the average

level of customer satisfaction with Lidl has been

slightly lower than the sector average, by 0.9

points. But compared to January 2020, Lidl is

one of the sector’s most improved organisations

for customer satisfaction and in the January

2023 UKCSI Lidl’s customer satisfaction rating

of 81.0 (out of 100) is for the first time slightly

higher than the Retail (Food) average, 80.5.

Morrisons sales fell year on year by 4.7% and its

UKCSI score of 76.2 is the lowest of

any food retailer in the January 2023. Morrisons

may have been particularly exposed to

inflationary pressures because it has its own

manufacturing operations and around half of its

food is produced in-house.

*

Source: Kantar World Panel

**

Customers were asked to score the balance of price and service they would prefer to accept. A score of 8 -10 implies a preference for excellent service, even if it

costs more. A score of 1 – 3 is interpreted as a preference for low-cost, no-frills service.

1514 UK Customer Satisfaction Index | January 2023UK Customer Satisfaction Index | January 2023

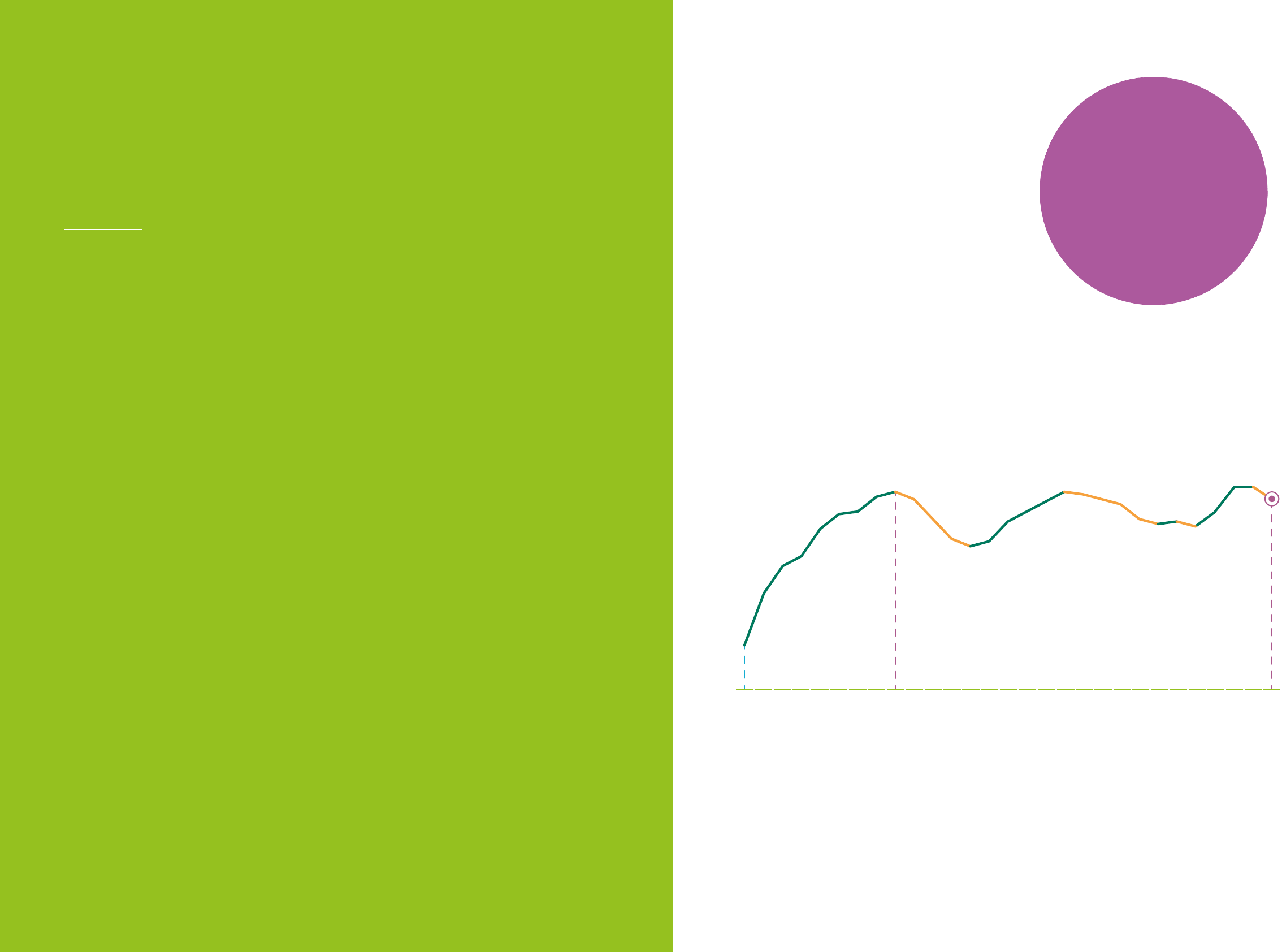

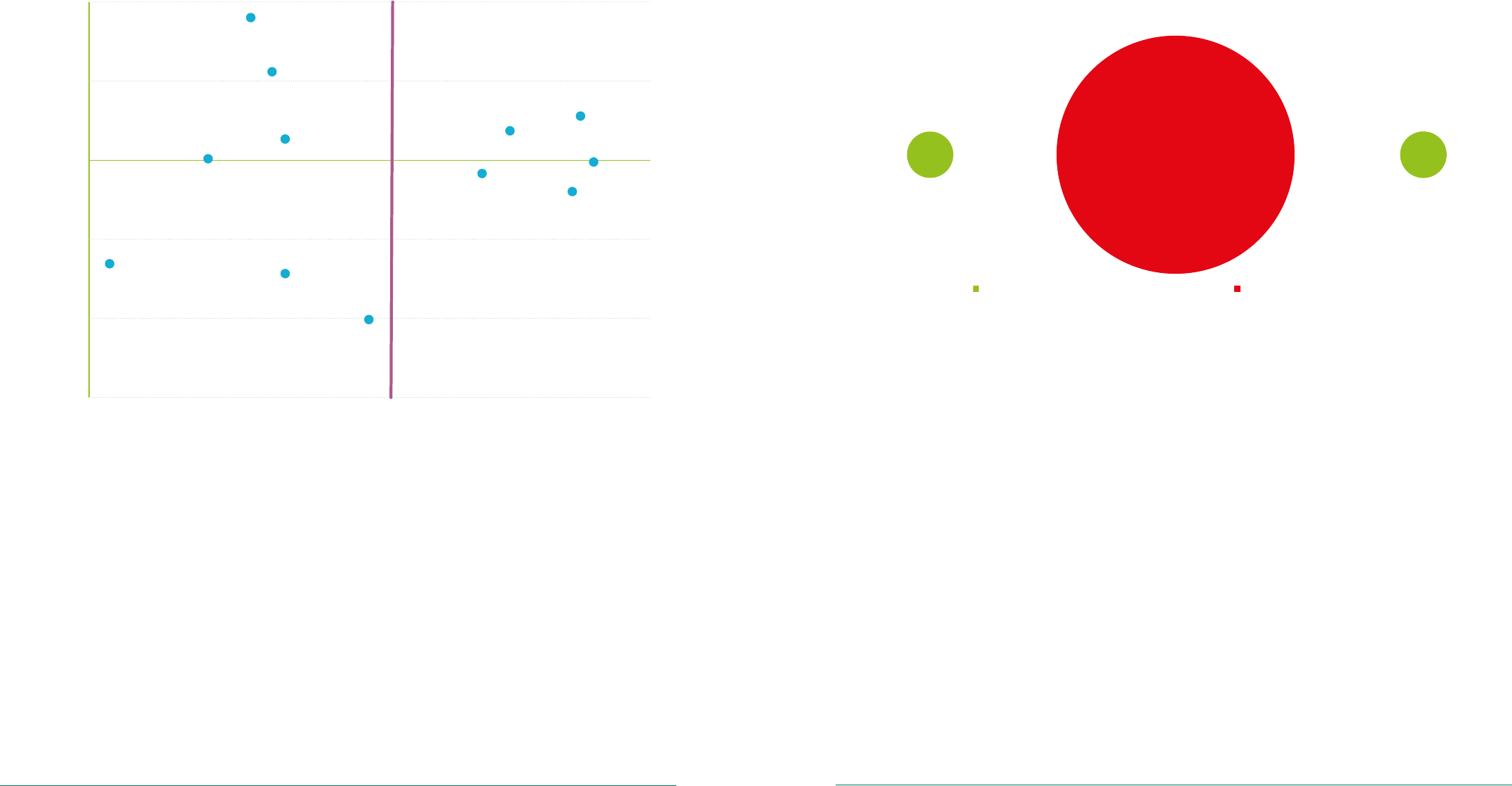

In the banking sector, there appears to be a long-term

relationship between customer satisfaction and net

current account gains

The performance of the 12 organisations that have appeared in both the UKCSI and the Current Account

Switch Service Dashboard* between 2014 and 2022 shows that organisations averaging a UKCSI score

at least 1 point above the sector recorded an average of 240,279 net current account gains, compared

to 173,838 net losses for organisations average a UKCSI score that is 1 point or more below the sector

average.

* Current Account Switch Service Dashboard 2014 - 2022

Banks & Building Societies

with UKCSI within 1 point

( +/- ) of sector average

Banks & Building Societies with

a UKCSI at least 1 point above

sector average

240,279 -152,136

Banks & Building Societies

with a UKCSI at least 1 point

below sector average

-173,838

Net current account gains Net current account losses Net current account losses

Net current account gains and losses 2014 - 2022

In this UKCSI we examine the impact of the rising cost of living on customer behaviours and needs and

the implications for organisations.

15% of customers described their nancial well-being

as poor or very poor, a similar number to January 2021,

when it was 14.5%

But the average state of mental well-being appears to have improved: 59% of people describe their

mental well-being as good or very good, compared to 52% in the January 2021 UKCSI.

How would you describe your current level of well-being?

Very good Good Average Poor Very poor Prefer not to say

Your nancial well-being

14.6% 31.8% 37.5% 10.2% 4.8%

202

3

Jan

202

1

Jan

11.3% 35.9% 37.3% 10.3% 4.2%

Your physical well-being

14.4% 40.1% 31.5% 10.0% 3.2%

Jan

202

3

Jan

202

1

11.3% 39.3% 33.7% 11.7% 3.2%

Your mental well-being

20.9% 38.0% 27.5% 9.5% 3.1%

Jan

202

3

Jan

202

1

16.0% 35.7% 32.1% 10.9% 4.3%

1716 UK Customer Satisfaction Index | January 2023UK Customer Satisfaction Index | January 2023

Many customers' spending

behaviour has become

more mindful and

cautious

How have your spending habits changed in the last 6 months?

Alongside the January 2023 UKCSI, The Institute

conducted an additional survey of 1,001 customers

to assess further attitudes and behaviours

concerned with spending and personal debt.

35% of people have sold items to generate income.

This behaviour perhaps reflects growing concern

for recycling and sustainability as well as financial

pressures caused by the rising cost of living.

27% have cancelled a subscription service and

25% have used a third party company for “buy

now, pay later” services.

29% of customers have increased their access

to credit either by requesting an overdraft, or

applying for a credit card, or increasing their

credit limit.

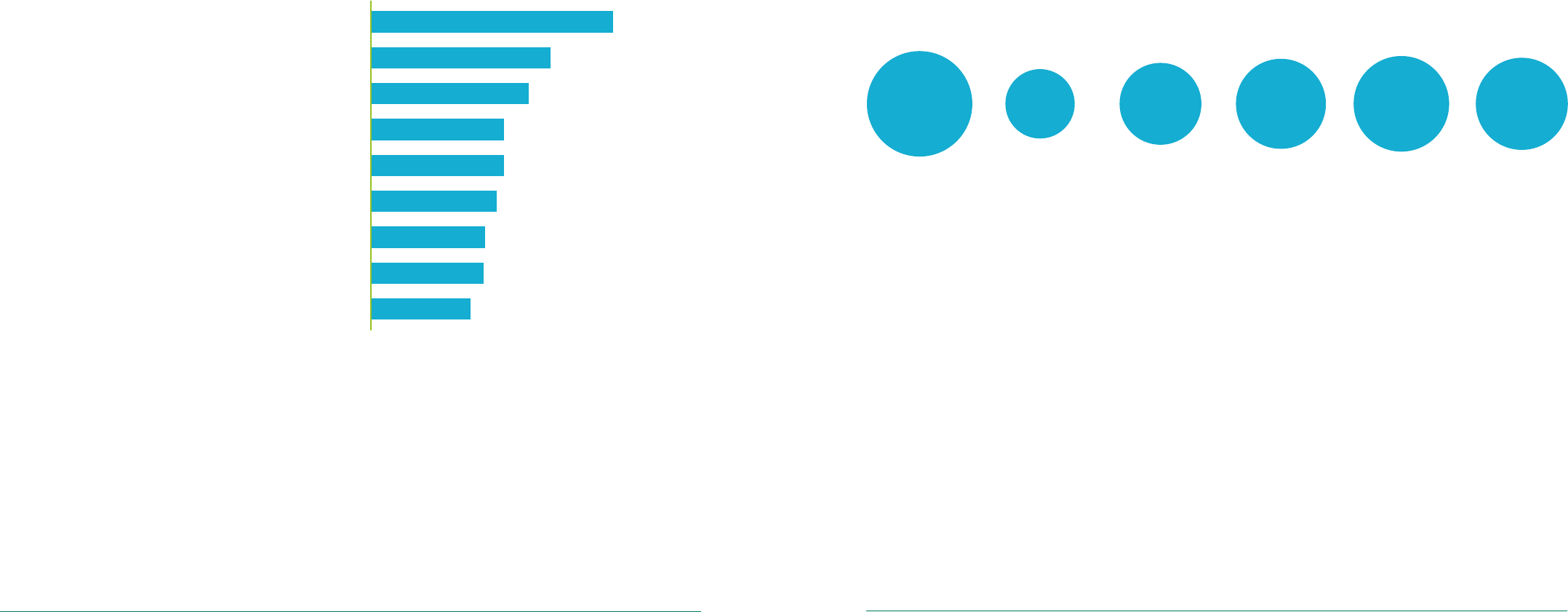

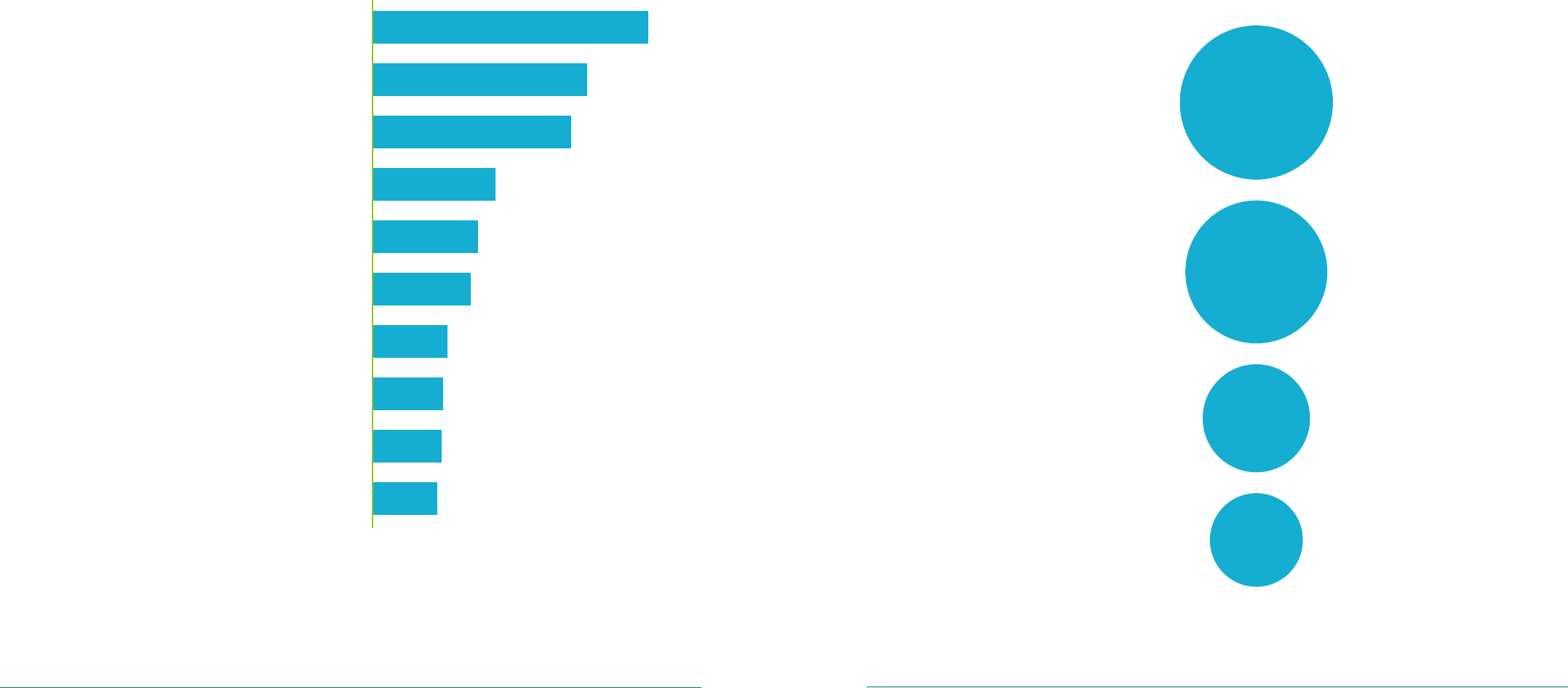

24.5%

20.0%

18.3%

17.6%

10.0%

9.8%

7.2%

27.8%

I've thought more carefully about

what I spend money on

I've tried to reduce what I'm spending

- because I have less to spend

I've shopped around more to make

sure I'm getting the best deals

I've tried to reduce what I'm spending

- so that I can save more

I've made fewer impulse purchases

I've bought more online

I've avoided making big expensive purchases

(car, home improvements)

I've chosen to spend money with companies I trust

6.2%

I've chosen to spend money with

local, independent companies

3.8%I've chosen to spend more with ethical companies

8%

9%

9%

9%

12%

13%

16%

25%

27%

35%

Chose to use an organisation because they offer more

exible payment options (e.g. pay in instalments)

Spoken to an organisation about agreeing new

terms of more exibility with payments

Used credit to pay for household bills

Applied for an additional credit card

Requested or increased my overdraft

Directly asked an organisation for a discount

on the product or service I was buying

Increased the credit limit on my credit card

Used a third-party company for 'buy now pay later' services

Cancelled a subscription service

Sold items to generate income

Changes in customer behaviour in response to the rising cost of living:

have you done any of the following in the last 6 months?

The latest research in the UKCSI suggests that the main ways in which customer behaviours have responded

to the rise in the cost of living are to think more carefully about spending, reduce their level of spending,

shop around more to find the best deals and make fewer impulse purchases.

34.7%

34.0%

UK all-sector average

12.4%

11.4%

UK all-sector average

Jan-23 Jan-22Jan-23 Jan-22

% of customers who prefer excellent

service, even if it costs more

% customers who prefer lowest cost,

no-frills service

*

Customers were asked, to score the balance of price and service they would prefer to accept. A score of 8 -10 implies a preference for excellent service, even if it

costs more. A score of 1 – 3 is interpreted as a preference for low-cost, no-frills service.

Despite the growing priority to economise, 34.7% of customers would be prepared to pay more to

guarantee excellent service*.

1918 UK Customer Satisfaction Index | January 2023UK Customer Satisfaction Index | January 2023

28% of customers expect to use a credit card to pay for

household bills such as utilities and food in the next 6

months

Gives me more exibility

to manage my money

I get rewards such as cash back or

points for using my credit card

I use credit cards when

I run out of money

I prefer to use my credit card

when transacting online

(fraud or security concerns)

As a % of all

customers surveyed

58%

49%

37%

33%

17%

14%

11%

9%

The main reasons for using a credit card in this context are greater flexibility in managing personal

finances and taking advantage of rewards such as cashback or points. But 37% of customers who

expect to use a credit card to pay for utilities and food (11% of all customers surveyed) will do so

because they have run out of money.

26% of customers believe their personal debt will

increase in the next 6 months

Will decrease a little

Will decrease a lot

Will increase a lot

Will increase a little

Will stay the same

Don't know

Not applicable -

I don't have any debt

8% 18% 26% 10% 3% 5% 30%

How do you think your level of debt will change in the next 6 months?

Amongst customers who believe their level of debt

will increase in the next 6 months, 72% are concerned

about the impact on their purchasing capacity and

nancial well-being

11% of these customers fear they will be unable to afford everyday essentials and a further 16% will

need to cut back on non-essential items. In addition, 45% of customers whose level of debt is likely to

rise agree that it “gives me some concern".

Perspectives of customers who believe their level of debt will increase in the next 6 months:

how do you feel about your level of personal debt (e.g. mortgage, overdraft, credit card)?

28% 16% 45% 11%

I can manage comfortably

It means I am not able to afford non-essentials It gives me some concern

It means I am not able to afford everyday essentials

2120 UK Customer Satisfaction Index | January 2023UK Customer Satisfaction Index | January 2023

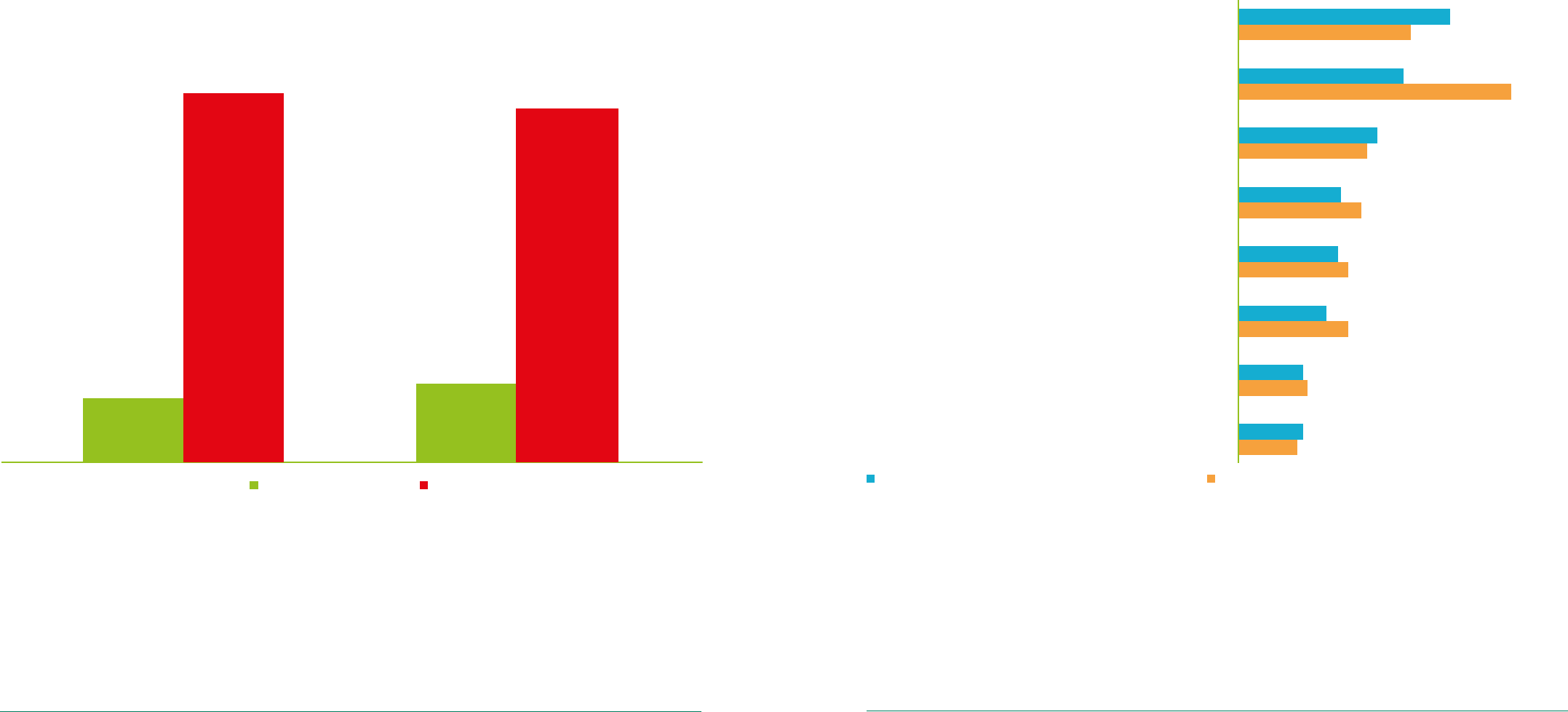

15% of all customers surveyed have directly asked a

company for help or advice to deal with the rising cost

of living. 18% have been approached by a company

offering help and advice for the same reason

The leading types of assistance given by companies are advice on using products and services more

efficiently, discounts and flexible payment options. Companies tend to be more likely to offer advice about

using products and service more efficiently than they are to offer other kinds of advice related to cost savings.

80% of customers who asked a company for help to

manage the cost of living said that, as a result of their

contact, their trust in that company had increased

Similarly, 75% of people who have been contacted by a company offering help or advice affirmed that

their level of trust in that organisation has risen.

10%

1%

5%

9% 20%

80%

75%

I asked a company for help and advice to

manage the cost of living

A company approached me to give help or

advice to manage the cost of living

I trust them more

Did not change the way I feel about the organisation

I haven't received a response yet

I trust them less

Impact of companies giving customers help or advice to manage the cost of living

Yes No

15%

85%

18%

82%

Have you directly asked a company for help

and/or advice to help you deal with the

rising cost of living?

Has a company proactively approached

you to give help or advice to deal

with the cost of living?

2322 UK Customer Satisfaction Index | January 2023UK Customer Satisfaction Index | January 2023

Most customers believe regulators, government and

companies need to do more to help alleviate the

impact of the rising cost of living

70% of customers strongly agree that regulators should limit the amount companies can charge for essential

services and 64% say that government should provide more financial support to customers in need.

More than 60% of people believe that companies should hold prices for essential products and services,

be proactive in giving advice to help customers make savings and reduce costs in their business

operations. In addition, 66% of respondents strongly agree that shareholders and investors should be

prepared to accept lower profits.

70%

66%

66%

64%

62%

61%

58%

43%

31%

Regulators should limit the amount that companies

are allowed to charge for essential services

Shareholders and investors should be

prepared to accept lower prots

Companies should hold prices for

essential products and services

Government should provide extra

nancial support for people in need

Companies should be proactive in giving information and advice

about how customers can make savings on what they spend

Companies should make savings in their business

operations so they can minimise the need to increase prices

Companies should operate low tariffs a social tariff on

essential services for people who are struggling nancially

Customers should be allowed to defer payment on

essential services, which they will repay at a later date

Customers who can afford to, should pay a bit

more for essential products and services

Customers' perspectives on how organisations should

support customers during the cost of living crisis

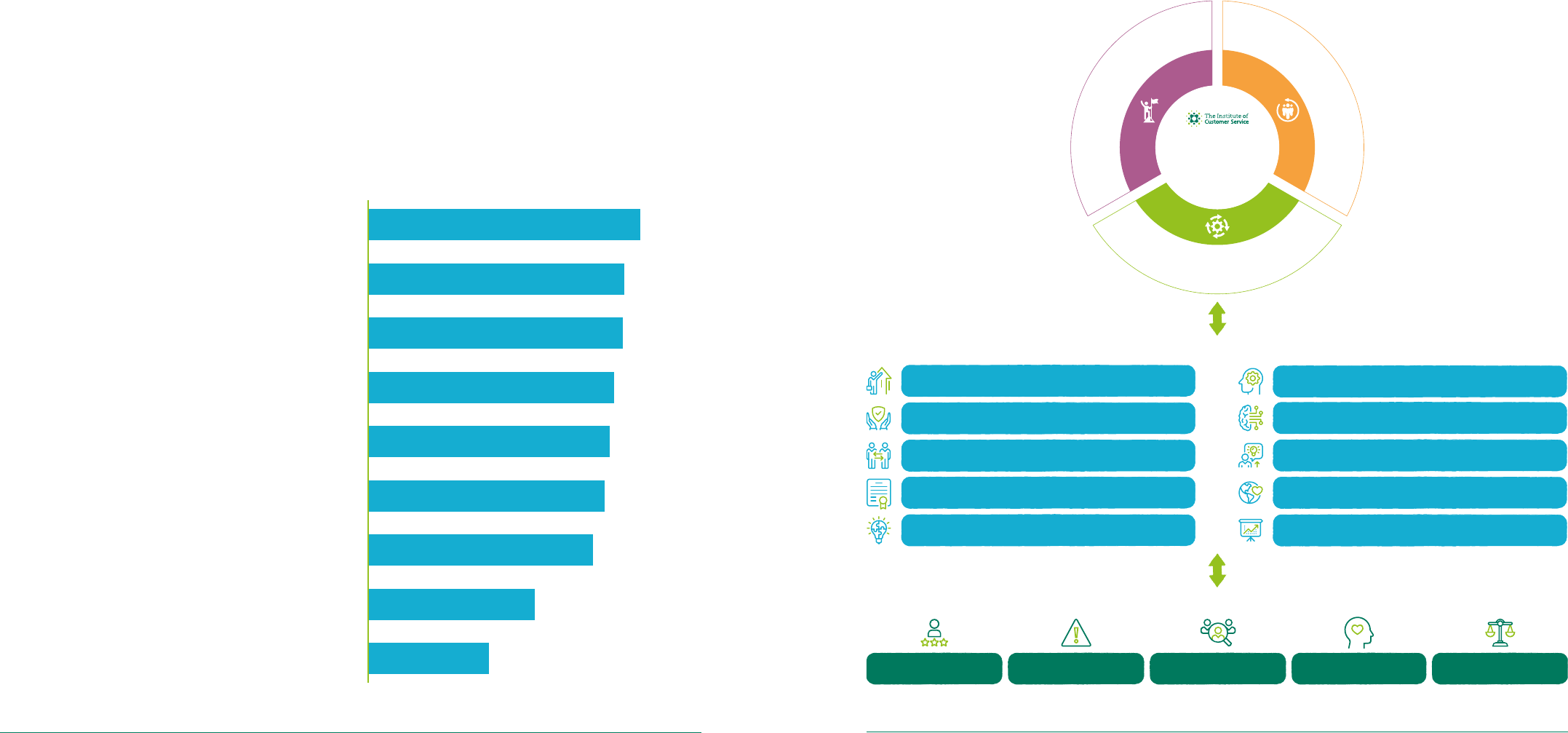

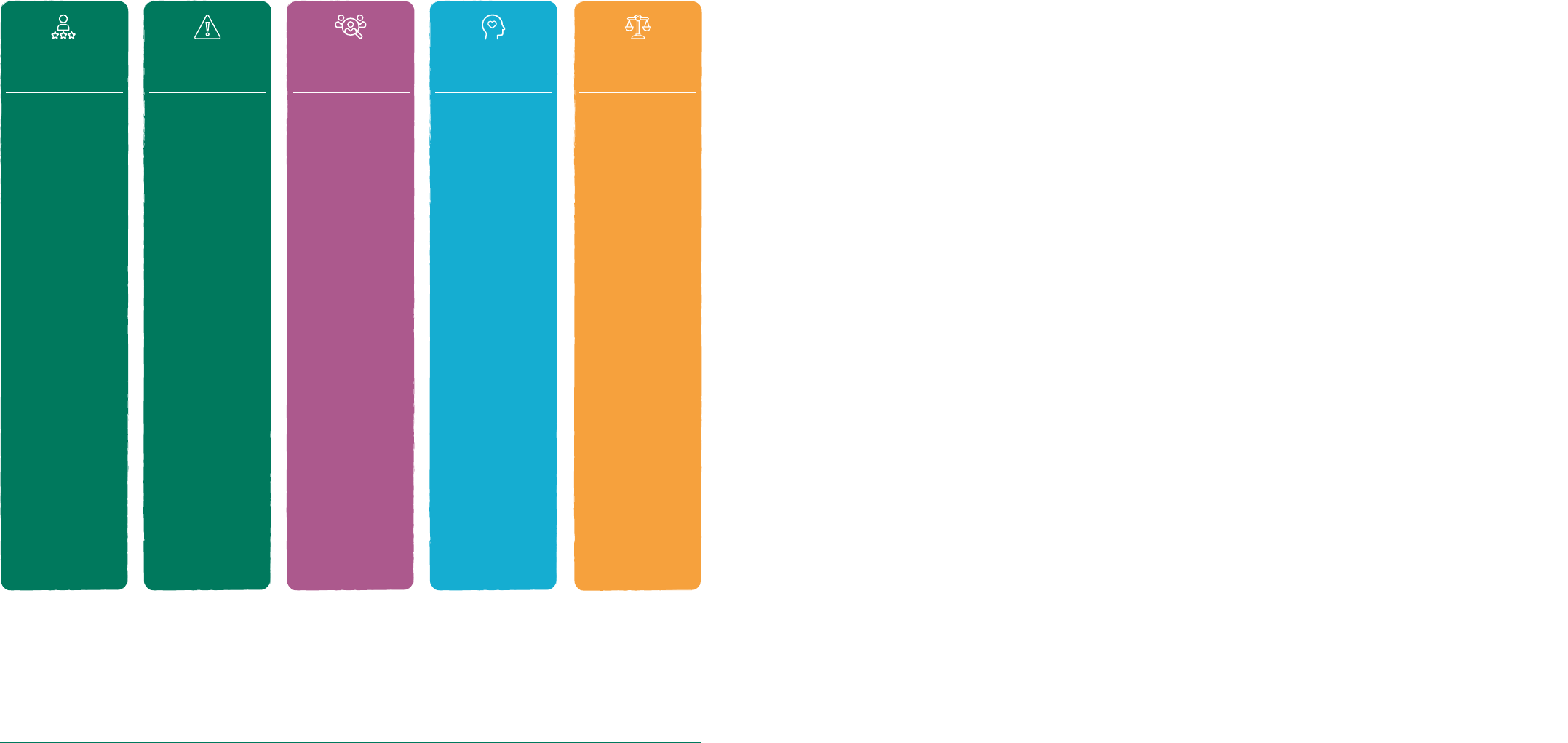

Building a culture of

service excellence

Our research, and engagement with organisations and leaders, suggests that customer service and

business performance outcomes are more the product of organisational culture than of specific activities

or investments. The January 2023 UKCSI concludes by highlighting recommendations to develop the key

enablers of a culture of service excellence.

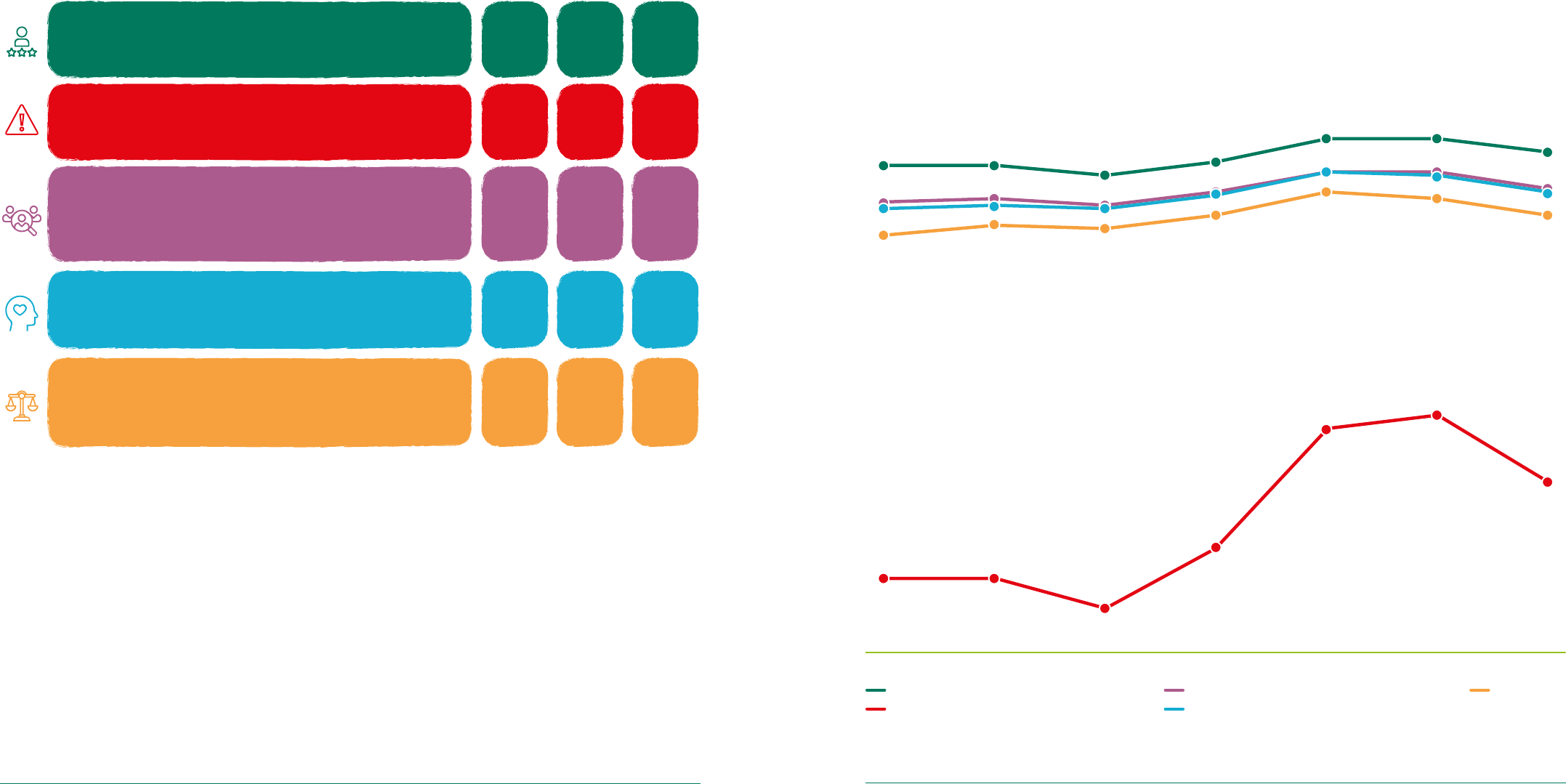

Competence, reliability and dependability

Leadership, purpose and a long-term focus

Proactive customer engagement

Governance

Innovation and agility

Developing the right blend of technology and people

Employee skills, behaviours and engagement

Using insight to improve customer experience

A positive impact on society

Measuring the right things

Experience Complaint Handling Customer Ethos Emotional ConnectionEthics

The Service Experience Model

The Service Experience Model

Enablers of a Service Culture

Enablers of a Service Culture

UKCSI Dimension of Customer Satisfaction

UKCSI Dimension of Customer Satisfaction

S

t

r

a

t

e

g

y

&

L

e

a

d

e

r

s

h

i

p

O

p

e

r

a

t

i

o

n

a

l

D

e

l

i

v

e

r

y

C

u

l

t

u

r

e

&

E

n

g

a

g

e

d

P

e

o

p

l

e

Reputation

Performance

Growth

Protability

Trust

2524 UK Customer Satisfaction Index | January 2023UK Customer Satisfaction Index | January 2023

The state of

customer

satisfaction

in the UK

1

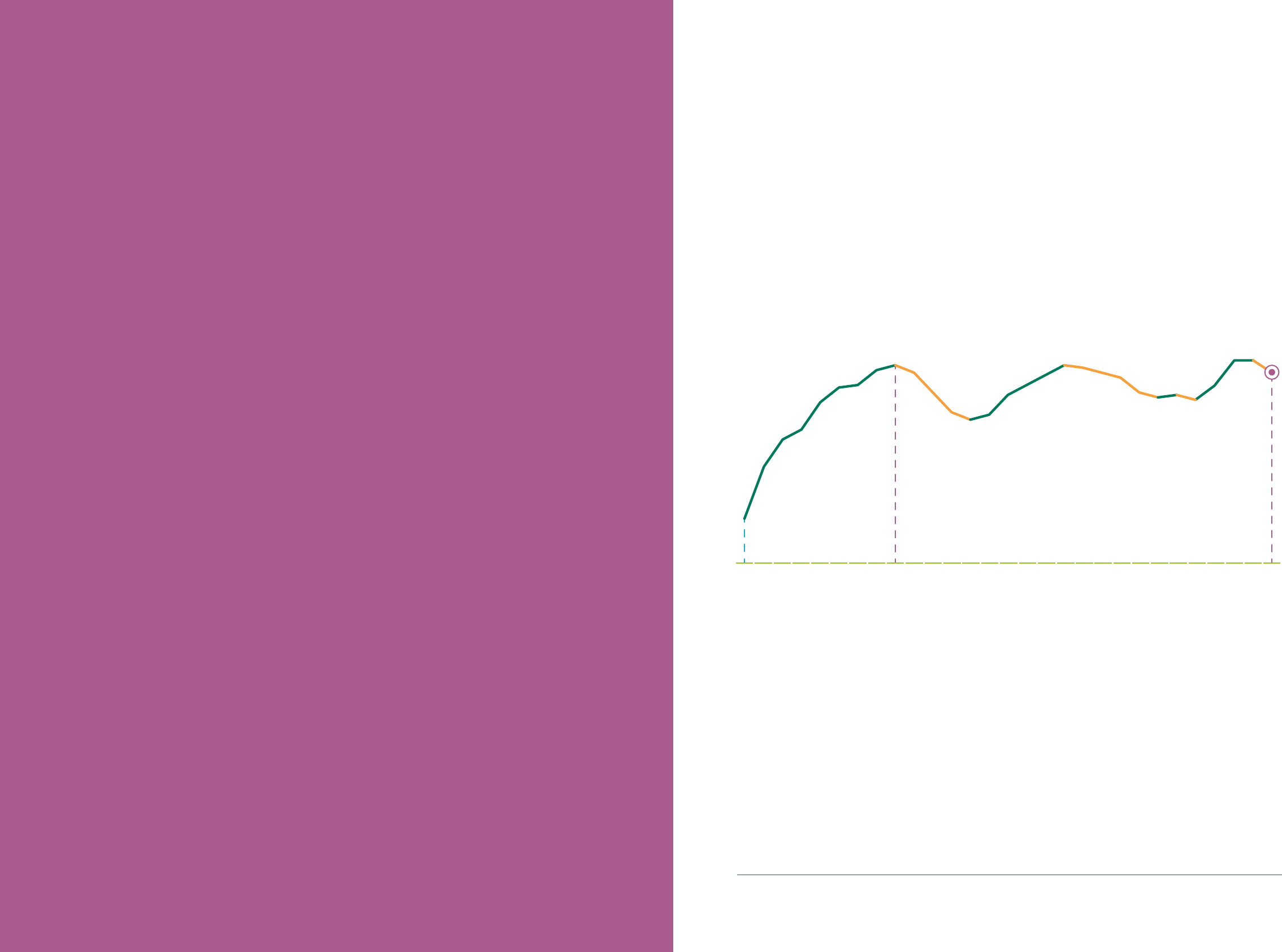

The January 2023 UK Customer Satisfaction Index

(UKCSI) is 77.7 (out of 100), a decline of 0.7 points

compared to both the July and January 2022 surveys

Compared to

January 2022, customer

satisfaction has fallen in

all 5 dimensions, with the

biggest decline evident for

complaint handling.

Jul-21 Jan-22 Jan-23Jul-22Jan-21Jul-20Jan-20Jul-19Jan-19Jul-18Jan-18Jul-17Jan-17Jul-16Jan-16Jul-15Jan-15Jul-14Jan-14Jul-13Jan-13Jul-12Jan-12Jul-11Jan-11Jul-10Jan-10Jul-09Jan-09

77.4

78.4 78.4

76.9 77.0

76.8

77.1

77.7

77.9

78.1

78.2

77.8

77.4

77.0

76.2

76.0

76.3

77.1

77.9

78.2

78.0

77.4

77.3

76.7

75.6

75.2

74.1

72.0

77.7

The UKCSI is a national benchmark of customer satisfaction covering 281 organisations or organisation

types across 13 sectors. The UKCSI score is based on how customers rate organisations across 26

measures which are summarised in 5 dimensions of customer satisfaction. Compared to January 2022,

customer satisfaction has fallen in all 5 dimensions measured in the UKCSI, with the biggest decline

evident for complaint handling.

Index scores out of 100

2726 UK Customer Satisfaction Index | January 2023UK Customer Satisfaction Index | January 2023

Experience

Measures the quality of customers’ experiences and

interactions with organisations

Dimension (score out of 100)

Jan

2023

Ethics

Reputation, openness and transparency and the extent

to which an organisation is deemed to “do the right thing”

Customer Ethos

Extent to which customers perceive that organisations

genuinely care about customers and build the experience

around their customers’ needs

Complaint Handling

How organisations respond and deal with problems and

complaints

Emotional Connection

The extent to which an organisation engenders feelings

of trust and reassurance

78.7

75.8

77.0

63.3

76.8

Jan

2022

79.3

76.8

77.8

65.8

77.8

Year-on-

year

change

-0.6

-1.0

-0.8

-2.5

-1.0

The improvement in satisfaction with complaint

handling seen in 2021 and 2022 has stalled

January 2023 UKCSI:

dimensions of customer

satisfaction

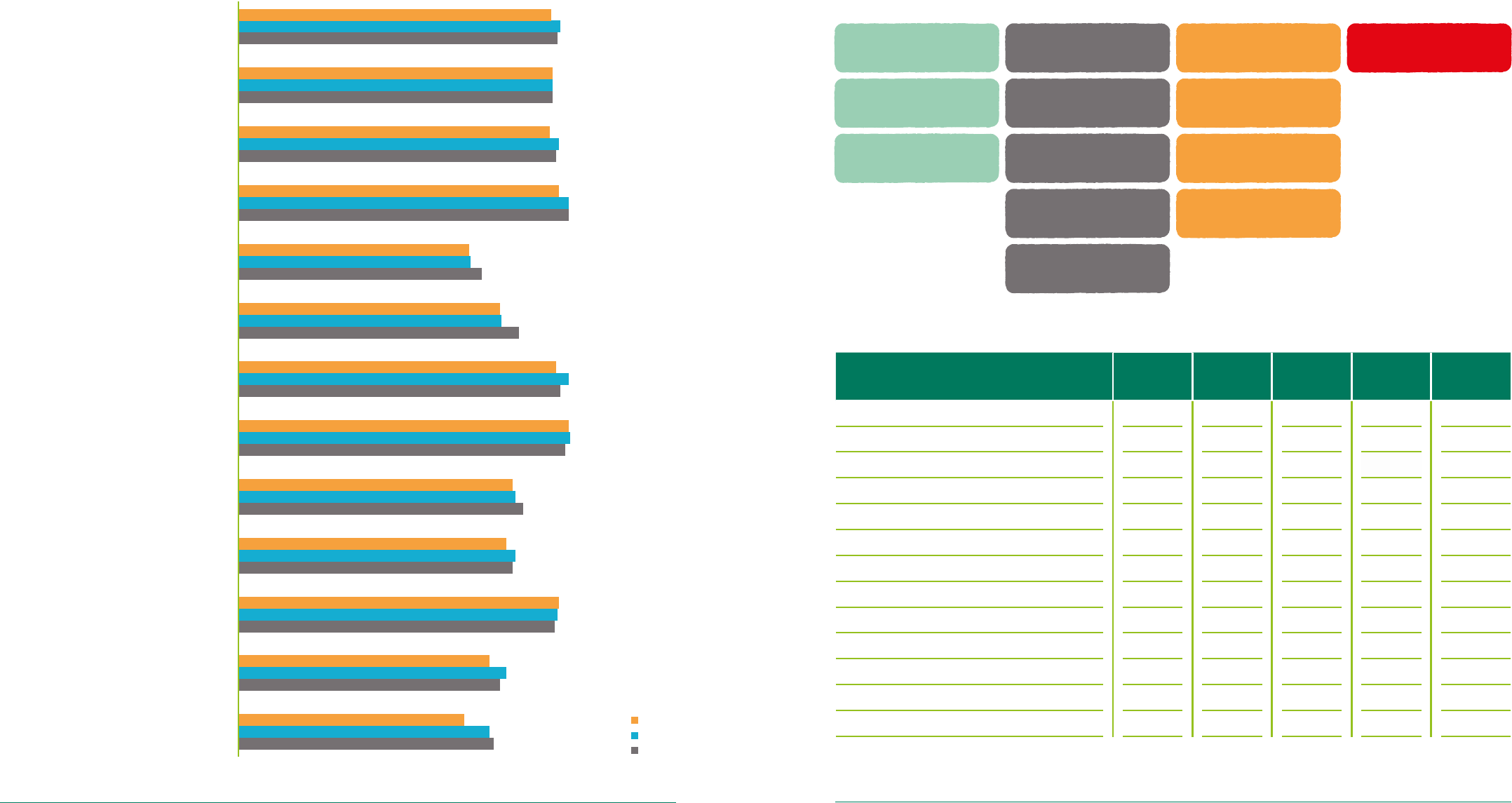

Looking back over the past 3 years, most customer satisfaction index measures have been relatively

stable, though there have been more pronounced movements in customer satisfaction with individual

organisations. Much of the improvement in overall customer satisfaction through 2021 and 2022 was

fuelled by stronger satisfaction with complaint handling. However, the improvement in complaint

handling appears to have stalled and other areas of customer satisfaction have also fallen. This suggests

that further sustained growth in customer satisfaction will require increased focus and actions in all

dimensions of customer satisfaction.

78.1

78.0

77.7

78.3

79.3 79.4

78.7

58.8

58.8

57.4

60.2

65.8

66.4

63.3

74.9

75.2

75.2

75.8

76.8

76.6

75.8

76.0

77.6

76.4

77.7

77.0

76.5

76.2

76.8

77.8

Jan-20 Jul-20 Jan-21 Jul-21 Jan-22 Jul-22

Jan-23

Customer EthosExperience

Emotional ConnectionComplaint Handling

Ethics

76.2

76.1

76.7

77.8

76.8

Customer satisfaction dimensions 2020-2023

Index scores out of 100

2928 UK Customer Satisfaction Index | January 2023UK Customer Satisfaction Index | January 2023

16.5% of customers experienced a problem with an organisation, around the same number as a year

ago (16.4%) and slightly lower than in July 2022 (17.3%). However, the current level of problems is

2.9 percentage points more than it was in January 2020, the last UKCSI published before the Covid-19

pandemic.

% customers experiencing a problem with an organisation and satisfaction with complaint handling

The distribution of problems by type of issue is similar to that recorded for January 2022. However,

compared to January 2021 there has been a 9.9 percentage point increase in the number of problems

concerned with quality or reliability of goods and services. The extent of problems has significant

implications not just for customer satisfaction, but for organisations’ productivity, costs and profitability.

Types of problems experienced by customers

(% refers to the frequency with which each issue was cited in relation to a problem. For some problems

multiple issues are cited)

5.8 5.8

5.7

6.0

6.5 6.6

6.3

13.6

14.1

14.6

14.9

16.4

17.3

16.5

Jan-20 Jul-20 Jan-21 Jul-21 Jan-22 Jul-22 Jan-23

Average satisfaction with

handling of the complaint (1 - 10)

% of customers who recently experienced

a problem with an organisation

The number of customers experiencing a problem with

an organisation is around the same level as a year ago

but higher than it was before the Covid-19 pandemic

The leading causes of problems experienced by

customers are quality or reliability, suitability and

availability of goods and service

Jan-20 Jan-21 Jan-22 Jan-23

Quality or reliability of goods/services 33.8% 31.8% 41.2% 41.7%

Suitability of goods/services

(e.g. didn`t do what you expected)

22.7% 20.4% 25.1% 24.1%

Availability of goods/services

(e.g. couldn`t find what you wanted)

17.5% 19.5% 23.4% 22.2%

Late delivery or slow service 22.5% 21.9% 19.4% 20.9%

Staff competence 23.5% 20.2% 18.5% 20.0%

Staff attitude 17.5% 17.4% 15.1% 16.4%

Cost 11.9% 11.7% 11.2% 10.8%

XX not keeping its promises and commitments 17.3% 16.9% 13.9% 15.6%

3130 UK Customer Satisfaction Index | January 2023UK Customer Satisfaction Index | January 2023

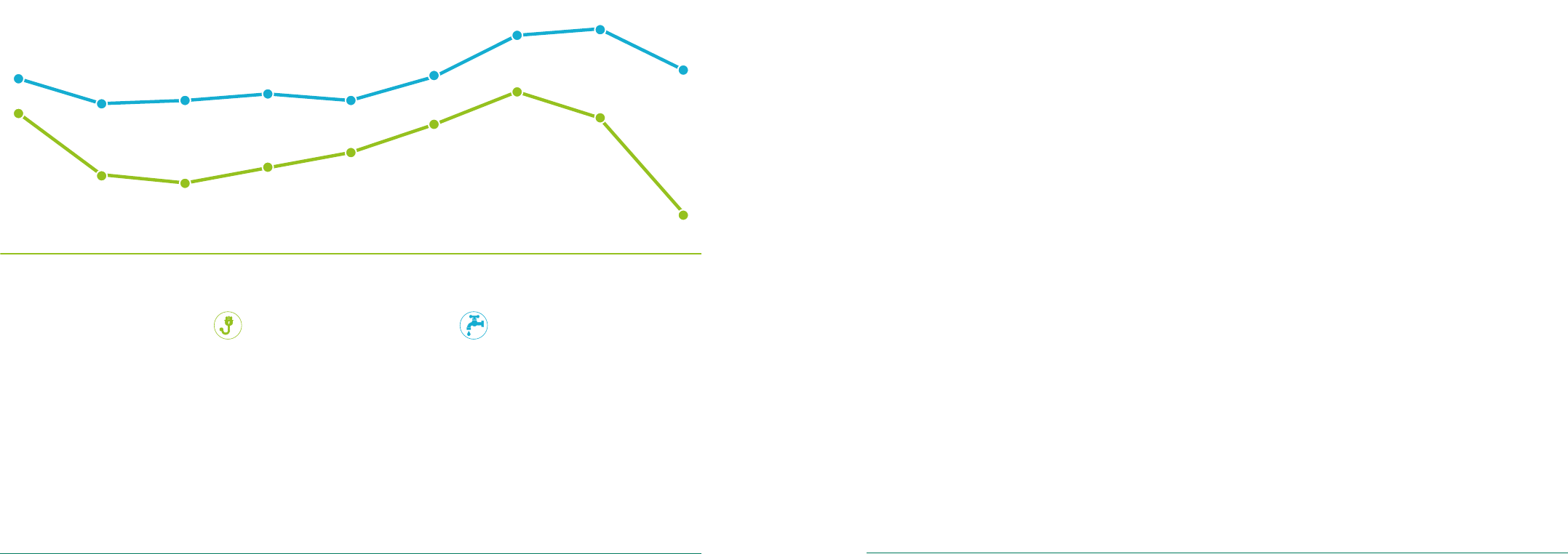

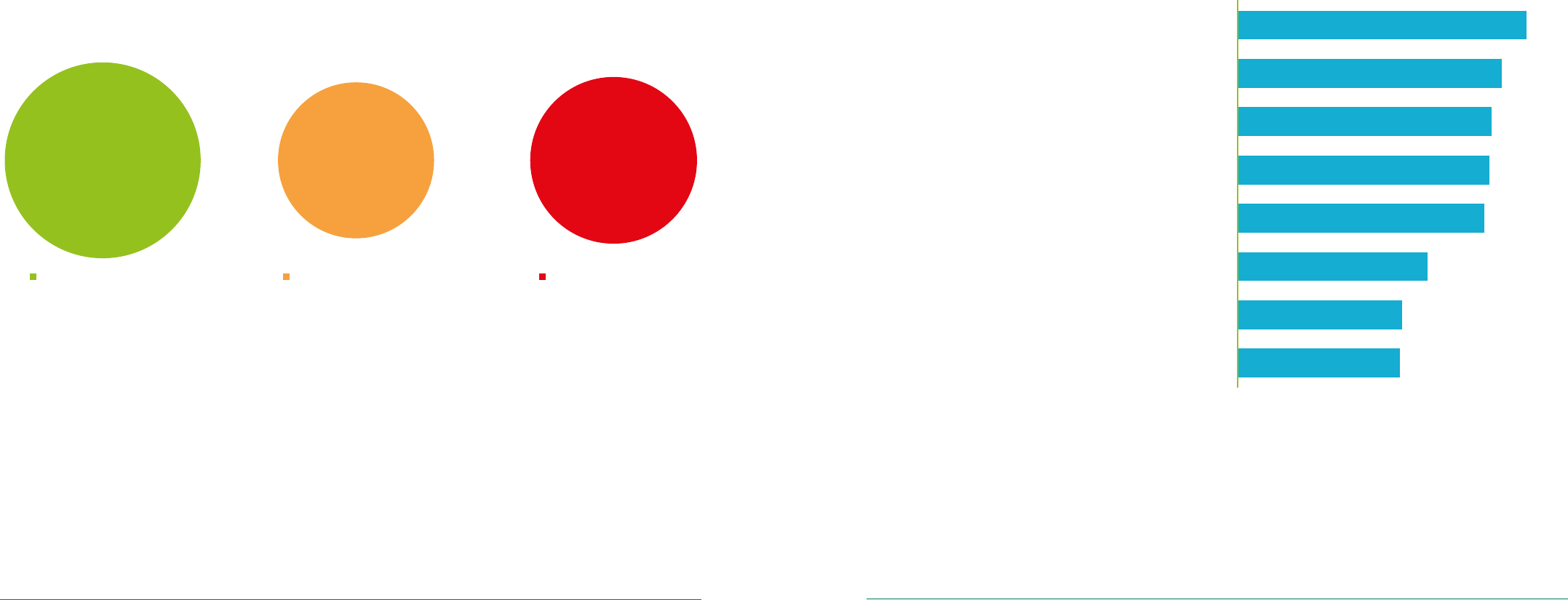

5 sectors - Public Services (Local and National), Services,

Transport and Utilities - have dropped by at least 1

points compared to January 2022

Utilities

Transport

Tourism

Telecommunications & Media

Services

Retail (Non-food)

Retail (Food)

Public Services (National)

Public Services (Local)

Leisure

Insurance

Banks & Building Societies

Automotive

80.7

80.2

80.5

81.7

73.4

76.9

81.0

81.5

77.4

76.3

80.4

75.1

74.5

81.0

80.3

80.8

81.8

72.3

75.3

81.7

81.9

76.7

76.6

80.7

75.8

74.1

80.1

80.3

80.0

80.8

72.2

75.1

80.5

81.7

76.3

75.8

80.9

74.1

71.7

Jan-23

Jul-22

Jan-22

Customer satisfaction by sector: Jan 2022 – Jan 2023

Change in customer

satisfaction by sector,

compared to January 2022

5 sectors down by

less than 1 point

Automotive

Insurance

Leisure

Retail (Food)

Telecomms &

Media

3 sector up by less

than 1 point

Banks & Building

Societies

Retail

(Non-food)

Tourism

1 sector down by

more than 2 points

Utilities

4 sectors down by

between 1 and 1.8 points

Public Services

(Local)

Public Services

(National)

Services

Transport

Index scores out of 100

Highest rated sectors in the January 2023 UKCSI

q Fall in UKCSI score by less than one point q Fall in UKCSI score by more than 1 point

Jan-23 Jul-22 Jan-22 Change from

Jan-22 to

Jan-23

Change from

Jul-22 to

Jan-23

Retail (Non-food)

81.7 81.9 81.5 0.2 -0.2

Tourism

80.9 80.7 80.4 0.5 0.2

Leisure

80.8 81.8 81.7 -0.9 -1.0

Retail (Food)

80.5 81.7 81.0 -0.5 -1.2

Banks & Building Societies

80.3 80.3 80.2 0.1 0.0

Automotive

80.1 81.0 80.7 -0.6 -0.9

Insurance

80.0 80.8 80.5 -0.5 -0.8

Services

76.3 76.7 77.4 -1.1 -0.4

Telecommunications & Media

75.8 76.6 76.3 -0.5 -0.8

Public Services (National)

75.1 75.3 76.9 -1.8 -0.2

Transport

74.1 75.8 75.1 -1.0 -1.7

Public Services (Local)

72.2 72.3 73.4 -1.2 -0.1

Utilities

71.7 74.1 74.5 -2.8 -2.4

3332 UK Customer Satisfaction Index | January 2023UK Customer Satisfaction Index | January 2023

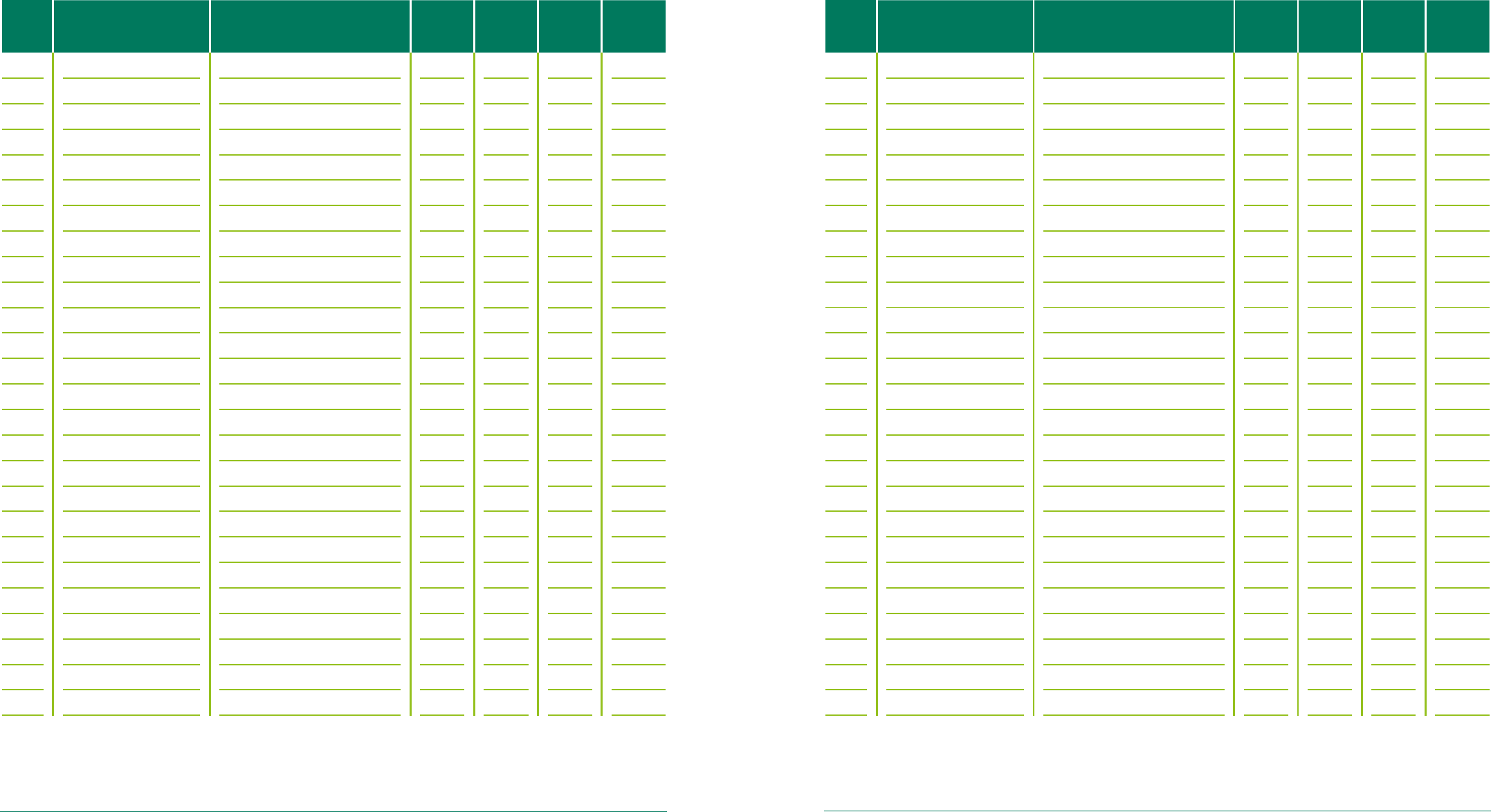

Average customer satisfaction in the Utilities sector is

71.7 (out of 100), a drop of 2.8 points compared to January

2022

This is the sector’s lowest score since July 2015, when it was 71.4.

Within the Utilities sector, average satisfaction with Energy companies is 70.3, a decline of 3.8 points

compared to a year ago. The biggest fall in customer satisfaction was for pricing, down 0.9 points

compared to January 2022, to 6.0 (out of 10). Average levels of trust and an organisation making you

feel reassured decreased by 0.5 points (out of 10). The number of experiences rated as being right first

time declined by 4.4 percentage points to 68.4%.

Average satisfaction with Water companies fell by 1.1 points to 74.8. Most of the 26 measures that

make up the UKCSI fell slightly (by 0.1 – 0.2 points out of 10) compared to a year ago. Average

satisfaction with the speed of resolving a complaint declined by 0.4 points to 7.0 (out of 10).

Energy

Water

73.4

71.3

71.2

71.7

72.2

73.1

74.1

73.2

70.3

74.5

73.4

73.8 74.0

73.8

74.6

75.9

76.1

74.8

Jan-19 Jul-19 Jan-20 Jul-20 Jan-21 Jul-21 Jan-22 Jul-22

Jan-23

Average customer satisfaction with Energy and Water organisations

Average customer satisfaction with Public Services

organisations fell by at least 1 point compared to a year

ago

Customer satisfaction with Public Services

(National) sector organisations dropped by 1.8

points to 75.1.

Average satisfaction for Public Services (Local)

organisations fell by 1.2 points to 72.2. The

decrease in satisfaction was significantly

influenced by a 3.6 point drop for GP surgery /

health centre to 70.2, the lowest score recorded

for this category. Your housing association, your

local Fire Service and your local Police Service also

received average customer satisfaction ratings at

least 1 point below their January 2022 levels.

Average satisfaction for organisations in

the Services sector is 76.3, down 1.1 points

compared to January 2022. Around three

quarters of customer responses in this sector

refer to either automotive or postal / courier

services. The biggest fall in satisfaction is for

postal / courier services, down by 1.4 points to

74.0.

Index scores out of 100

3534 UK Customer Satisfaction Index | January 2023UK Customer Satisfaction Index | January 2023

In the Transport sector,

the improvements

recorded in recent UKCSI

reports have stalled

Across the sector as a whole average customer satisfaction is 74.1, down 1 point compared to January

2022.

75.4

74.7

75.0

74.3

69.8

70.5

76.6

78.3

75.4

69.9

68.6

69.2

69.7

69.5

72.1

74.7

75.5

74.4

69.3

68.8

68.5

70.3

70.2

71.6 73.7

72.8

71.1

Jan-19 Jul-19 Jan-20 Jul-20 Jan-21 Jul-21 Jan-22 Jul-22

Jan-23

Rail / Train

Coach / BusAir

Customer satisfaction with Transport organisations

The UKCSI results are based on two sets of data: the first set of data was collected in March and April

2022; the second set was collected in September and October 2022. In the most recent data, there are

signs that customer satisfaction is under growing pressure.

Customer satisfaction with Rail companies is 74.4, slightly lower, by 0.3 points than in January 2022.

However, average satisfaction for experiences recorded in September and October 2022 is 3.2 points

lower than for those in the preceding April and March, influenced in particular by lower scores for

satisfaction with complaint handling.

Customer satisfaction with Airlines is 75.4, a decline of 1.2 points compared to January 2022. Average

satisfaction for experiences recorded in September and October 2022 is 4.7 points lower than for those

in April and March, partly caused by a sharp drop in satisfaction for complaint handling.

8 sectors have moved by less than 1 point compared to January 2022. Customer satisfaction in the

Banks and Building Societies, Retail (Non-food) and Tourism sectors is broadly unchanged compared to a

year ago: each sector has improved slightly, by between 0.1 and 0.5 points.

Average customer satisfaction in the Automotive, Insurance, Leisure, Retail (Food) and

Telecommunications and Media sectors is similar to the levels recorded in January 2022: each sector has

declined slightly, by less than 1 point. However, compared to July 2022, average satisfaction with Retail

(Food) and Leisure organisations has fallen by 1.2 points and 1 point respectively.

281

Organisations

and organisation

types in the

UKCSI

Organisations

have improved

yoy by at least

two points

37

63

Organisations

have fallen by at least

2 points compared to

January 2022

In the January 2023 UKCSI, 37 organisations (13% of the total receiving a UKCSI score) have improved

by at least 2 points compared to the previous year, the lowest number since January 2020. 63

organisations (22% of those receiving a UKCSI score) have fallen by 2 points or more.

Index scores out of 100

3736 UK Customer Satisfaction Index | January 2023UK Customer Satisfaction Index | January 2023

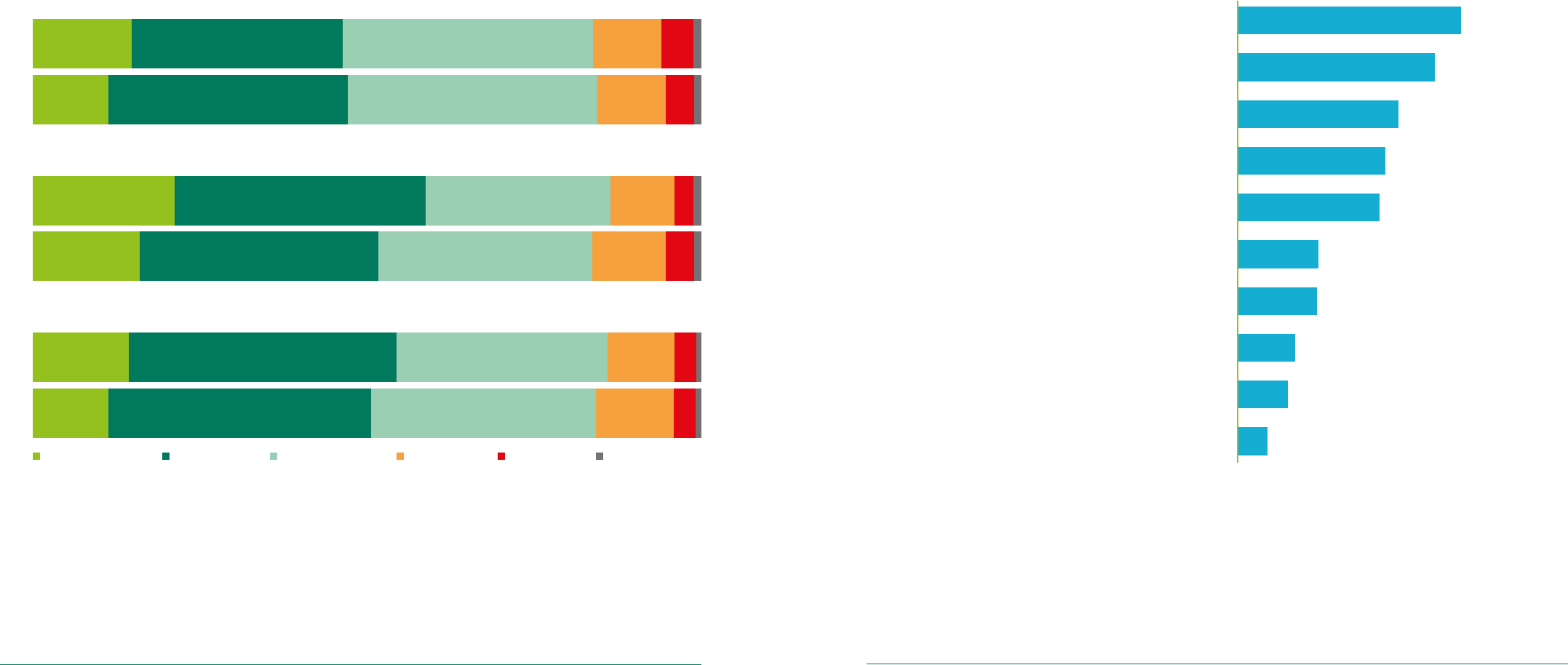

10%

18% 16%

26%

52%

42%

13%

28%

20%

27%

14%

6%

8%

22%

Jan-20 Jul-20 Jan-21Jul-21 Jan-22 Jul-22 Jan-2

3

% of organisations whose UKCSI has

improved yoy by at least 2 points

% organisations whose UKCSI score has

declined yoy by at least 2 points

% of organisations that have improved or fallen by at least 2 points compared to the previous year

Almost half of the organisations that have declined

by at least 2 points compared to a year ago are in the

Transport and Utilities sectors

In the Utilities sector the gap between the highest and lowest rated organisation is 21.1 points, more

than any other sector. The gap between the highest and lowest scoring organisations is the least

pronounced in the Tourism, Automotive, Insurance and Retail (Food) sectors.

Sector Total number of

organisations

Number of

organisations

that have

improved by 2

points or more

Number of

organisations

that have moved

by less than 2

points

Number of

organisations

that have

dropped by 2

points or more

Gap between

highest

and lowest

organisation

Automotive

27 3 18 6 8.5

Banks & Building Societies

19 2 14 1 10.0

Insurance

26 6 12 7 8.6

Leisure

27 3 15 3 14.3

Public Services (Local)

7 0 6 1 18.5

Public Services (National)

13 1 5 5 14.2

Retail (Food)

12 1 9 1 9.0

Retail (Non-food)

24 3 17 2 15.4

Services

19 2 13 3 17.1

Telecommunications & Media

14 0 11 3 16.4

Tourism

21 6 13 1 7.8

Transport

38 7 15 14 15.3

Utilities

34 3 11 16 21.1

3938 UK Customer Satisfaction Index | January 2023UK Customer Satisfaction Index | January 2023

Jan-23

Rank

Organisation Sector Jan-23

Score

Jan-22

Score

Jan-22

Rank

Change

in score

Jan-22 to

Jan-23

26=

Trivago

Tourism 82.8 83.4 29 -0.6

28=

Home Bargains

Retail (Non-food) 82.6 83.4 29 -0.8

28=

Nationwide

Banks & Building Societies 82.6 83.7 22 -1.1

30=

Costco

Retail (Non-food) 82.5 81.7 52 0.8

30=

Sky Mobile

Telecommunications & Media 82.5 82.7 38 -0.2

30=

Apple

Retail (Non-food) 82.5 83.4 29 -0.9

33

Tesco

Banks & Building Societies 82.4 78.9 140 3.5

34=

Kia

Automotive 82.3 81.7 52 0.6

34=

giffgaff

Telecommunications & Media 82.3 82.3 40 0.0

36=

Subway

Leisure 82.2 79.3 129 2.9

36=

Hyundai

Automotive 82.2 81.8 49 0.4

38=

Now TV

Leisure 82.1 81.5 59 0.6

38=

Jet2

Transport 82.1 84.1 13 -2.0

38=

Ikea

Retail (Non-food) 82.1 80.6 85 1.5

41=

Monzo Bank

Banks & Building Societies 82.0

NO DATA NO DATA NO DATA

41=

H&M

Retail (Non-food) 82.0 80.9 79 1.1

43=

Caffe Nero

Leisure 81.9 81.8 49 0.1

43=

SAGA Insurance

Insurance 81.9 85.5 3 -3.6

43=

Expedia

Tourism 81.9 80.3 97 1.6

43=

Merseyrail

Transport 81.9

NO DATA NO DATA NO DATA

47

Hoseasons

Tourism 81.8 77.1 183 4.7

48=

Bank of Scotland

Banks & Building Societies 81.7 81.5 59 0.2

48=

Nationwide Insurance

Insurance 81.7 80.4 94 1.3

48=

Toby Carvery

Leisure 81.7 82.2 42 -0.5

48=

Co-op Insurance

Insurance 81.7 75.7 208 6.0

48=

Audi

Automotive 81.7 80.5 89 1.2

Jan-23

Rank

Organisation Sector Jan-23

Score

Jan-22

Score

Jan-22

Rank

Change

in score

Jan-22 to

Jan-23

1

rst direct

Banks & Building Societies 86.2 85.7 2 0.5

2

John Lewis

Retail (Non-food) 85.6 84.7 7 0.9

3

UK Power Networks

Utilities 85.4 85.4 4 0.0

4=

Tesco Mobile

Telecommunications & Media 85.2 83.7 22 1.5

4=

M & S (food)

Retail (Food) 85.2 84.2 11 1.0

6

Starling Bank

Banks & Building Societies 85.1

NO DATA NO DATA NO DATA

7

Next

Retail (Non-food) 85.0 81.4 63 3.6

8=

Suzuki

Automotive 84.6 84.0 17 0.6

8=

M & S

Retail (Non-food) 84.6 84.0 17 0.6

10

Amazon.co.uk

Retail (Non-food) 84.4 83.8 21 0.6

11

Timpson

Services 84.2 85.3 5 -1.1

12=

Hotels.com

Tourism 84.1 80.1 98 4.0

12=

Jet2holidays.com

Tourism 84.1 84.6 8 -0.5

14

Greggs

Leisure 84.0 84.3 9 -0.3

15

Northern Powergrid

Utilities 83.9

NO DATA NO DATA NO DATA

16

Marriott

Tourism 83.8 81.7 52 2.1

17

Amazon Prime Video

Leisure 83.7 82.8 37 0.9

18

Green Flag

Services 83.6 84.2 11 -0.6

19

The Co-operative Bank

Banks & Building Societies 83.4 83.7 22 -0.3

20

AA Insurance

Insurance 83.3 81.1 71 2.2

21

booking.com

Tourism 83.1 83.0 35 0.1

22=

Superdrug

Retail (Non-food) 82.9

NO DATA NO DATA NO DATA

22=

Metro Bank

Banks & Building Societies 82.9 83.0 35 -0.1

22=

Waitrose

Retail (Food) 82.9 83.5 27 -0.6

22=

Ocado

Retail (Food) 82.9 80.6 85 2.3

26=

Premier Inn

Tourism 82.8 81.7 52 1.1

The top

50 organisations

p Increase in UKCSI score of at least one point p Increase in UKCSI score of less than one point q Fall in UKCSI score p Increase in UKCSI score of at least one point p Increase in UKCSI score of less than one point q Fall in UKCSI score

4140 UK Customer Satisfaction Index | January 2023UK Customer Satisfaction Index | January 2023

13 of the top 50 organisations are from the

Retail (Non-food) or Retail (Food) sectors. John

Lewis, M & S (Food and Non-food) Next and

Amazon are amongst the 10 highest rated

organisations. Next is amongst the top 10

highest rated organisations for the first time

since January 2020.

8 Banks or Building Societies appear in the top

50 organisations. first direct is the highest rated

organisation in the January 2023 UKCSI, with

a score of 86.2. Starling Bank has received a

UKCSI score for the first time since July 2021 and

is amongst the 10 highest rated organisations.

Monzo Bank appears in the UKCSI for the first

time.

Despite the overall decline in customer

satisfaction in Transport and Utilities, each of

these sectors has two representatives in the

top 50 organisations. Jet2 is the highest rated

organisation in the Transport sector although

its UKCSI score is 2 points lower than it was a

year ago. Merseyrail is the highest rated train

company: its UKCSI score of 81.9 is 7.5 points

higher than the average of all train companies in

the UKCSI.

UK Power Networks and Northern Powergrid are

the highest rated organisations in the Utilities

sector: both are electricity distribution network

operators.

Key differences between the top 50 organisations and

the rest include satisfaction with complaint handling,

price and cost and measures of emotional connection

and customer ethos

The biggest gaps between the top 50 organisations and others are for satisfaction with complaint

handling, price / cost and the number of experiences rated as being right first time. There are also

notable differences between the top 50 organisations and other organisations for Emotional Connection

measures of trust and making customers feel reassured and Customer Ethos measures such as an

organisation designing experiences around its customers, caring about its customers and keeping

promises.

Measure (on a scale of 1 - 10 except where indicated) Top 50 Other organisations Gap

UKCSI 83.3 77.0 6.3

Proportion of customers giving a 9 or 10 out of 10

for overall satisfaction

37.4% 26.2% 11.2% points

Speed of resolving your complaint 7.4 6.2 1.2

The handling of the complaint 7.5 6.3 1.2

The attitude of staff (complaints) 7.6 6.6 1.0

Price / cost 8.2 7.4 0.8

XX designs the experience around its customers 8.2 7.5 0.7

XX makes you feel reassured 8.3 7.6 0.7

XX cares about their customers 8.2 7.5 0.7

You trust XX 8.3 7.6 0.7

XX keeps their promises 8.3 7.6 0.7

% customers experiencing a problem 12.0% 16.5% 4.5% points

% experiences right first time 86.5% 79.8% 6.7% points

Key differentiators of the top 50 organisations in the UKCSI

4342 UK Customer Satisfaction Index | January 2023UK Customer Satisfaction Index | January 2023

Top rated organisations

by customer satisfaction

dimension

An organisation’s UKCSI score is based on how customers rate it across 26 measures which are

summarised in 5 dimensions of customer satisfaction.

UKCSI dimensions

rst direct

Amazon.co.uk

John Lewis

Tesco Mobile

Starling Bank

Next

UK Power

Networks

Amazon

Prime Video

M & S (food)

Suzuki

Amazon

Prime Video

Afnity Water

UK Power

Networks

Netix

Tesco

(Banks & Building

Societies)

Northern

Powergrid

SP Energy

Networks

AA Insurance

Wessex Water

C2C

Suzuki

rst direct

UK Power

Networks

Next

M & S (food)

Tesco Mobile

Timpson

M & S

(Retail Non-food)

Now TV

John Lewis

John Lewis

UK Power

Networks

M & S (food)

Starling Bank

Suzuki

Next

Northern

Powergrid

Marriott

Tesco Mobile

rst direct

M & S (food)

UK Power

Networks

Starling Bank

John Lewis

rst direct

Next

Tesco Mobile

Marriott

Jet2holidays.com

Suzuki

Experience

Complaint

Handling

Customer

Ethos

Emotional

Connection

Ethics

UK Power Networks is amongst the highest rated

organisations on all 5 dimensions of customer

satisfaction.

first direct, John Lewis, Tesco Mobile, Next,

M & S (food) and Suzuki are amongst the highest

rated organisations on 4 dimensions: Experience;

Customer Ethos; Emotional Connection and

Ethics.

The Complaint Handling dimension features

a wider spread of organisations amongst the

top performers than the other dimensions. For

Complaint Handling, only organisations for

whom at least 10 complaints were recorded

receive a published score. This means that,

whereas for the Experience, Customer Ethos,

Emotional Connection and Ethics dimensions

every organisation receives a score, organisations

generating particularly low levels of complaints

may not receive published ratings for satisfaction

with complaint handling.

4544 UK Customer Satisfaction Index | January 2023UK Customer Satisfaction Index | January 2023

20 most improved

organisations

20 most improved organisations

over one year

UKCSI

score Jan

2022

UKCSI

score Jan

2023

YOY

Change

Compared

to sector

average

Sector

Co-op Insurance

75.7 81.7 6.0 1.7 Insurance.5

Wessex Water

74.4 80.4 6.0 8.7 Utilities.1

Ryanair

63.3 69.0 5.7 -5.1 Transport.4

ScotRail / ScotRail Trains

70.5 75.4 4.9 1.3 Transport

Hoseasons

77.1 81.8 4.7 0.9 Tourism

Seat

76.8 81.5 4.7 1.4 Automotive

Legal and General

74.7 79.2 4.5 -0.8 Insurance

Prudential

76.4 80.9 4.5 0.9 Insurance

Thameslink

68.5 72.9 4.4 -1.2 Transport

Grand Central

76.1 80.2 4.1 6.1 Transport

Hotels.com

80.1 84.1 4.0 3.2 Tourism

Fiat

73.5 77.2 3.7 -2.9 Automotive

Next

81.4 85.0 3.6 3.3 Retail (Non-food)

Tesco (Bank)

78.9 82.4 3.5 2.1 Banks & Building Societies

Sainsbury's (Insurance)

77.8 81.1 3.3 1.1 Insurance

Holiday Inn

78.2 81.4 3.2 0.5 Tourism

Subway

79.3 82.2 2.9 1.4 Leisure

Burger King

77.2 80.1 2.9 -0.7 Leisure

Butlins

75.6 78.3 2.7 -2.6 Tourism

Mitsubishi

75.6 78.3 2.7 -1.8 Automotive

Organisation is at least 1 point higher than the sector average Organisation is at least 1 point lower than the sector average

A diverse range of sectors is represented

amongst the 20 most improved organisations

compared to January 2022.

The Transport, Tourism and Insurance sectors

each account for 4 of the 20 most improved

organisations, compared to January 2022. 3

of the most improved organisations are in the

Automotive sector and 2 are Leisure companies.

Across these 20 organisations the biggest

improvements are for the number of experiences

rated as being right first time, a fall in the

number of customers experiencing a problem

with an organisation and satisfaction with

complaint handling.

10 of the 20 most improved organisations have

received a UKCSI score that is at least 1 point

higher than their sector average but only one

organisation - Grand Central – was also higher

than its sector average in January 2022.

Next is the most improved organisation in the

Retail (Non-food) sector and has received its

highest UKCSI score since January 2020.

4746 UK Customer Satisfaction Index | January 2023UK Customer Satisfaction Index | January 2023

Customer

satisfaction

and business

performance

2

In this section we examine evidence of the relationship between customer satisfaction and business

performance in the Retail (Food) and Banks and Building Societies sectors.

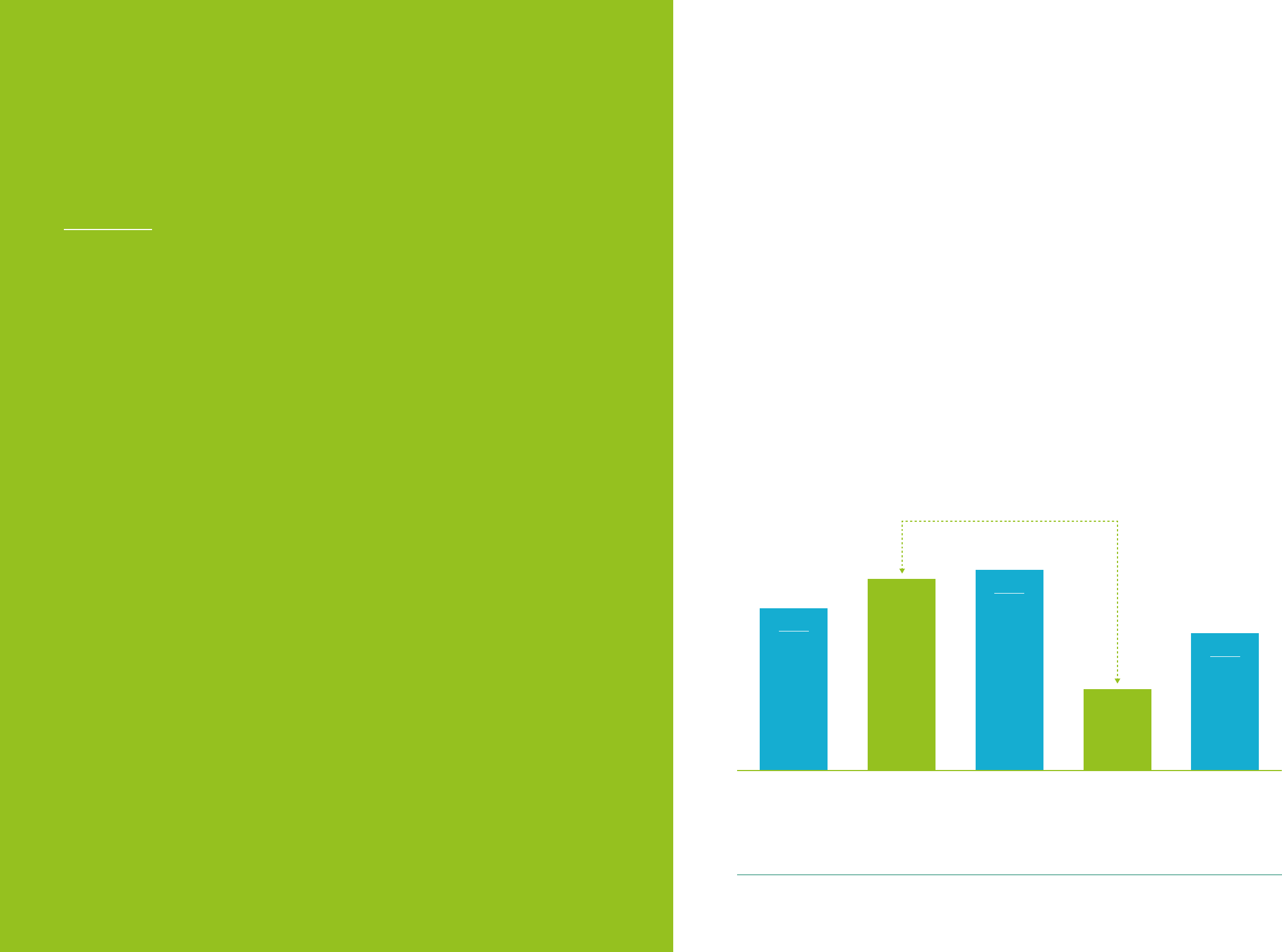

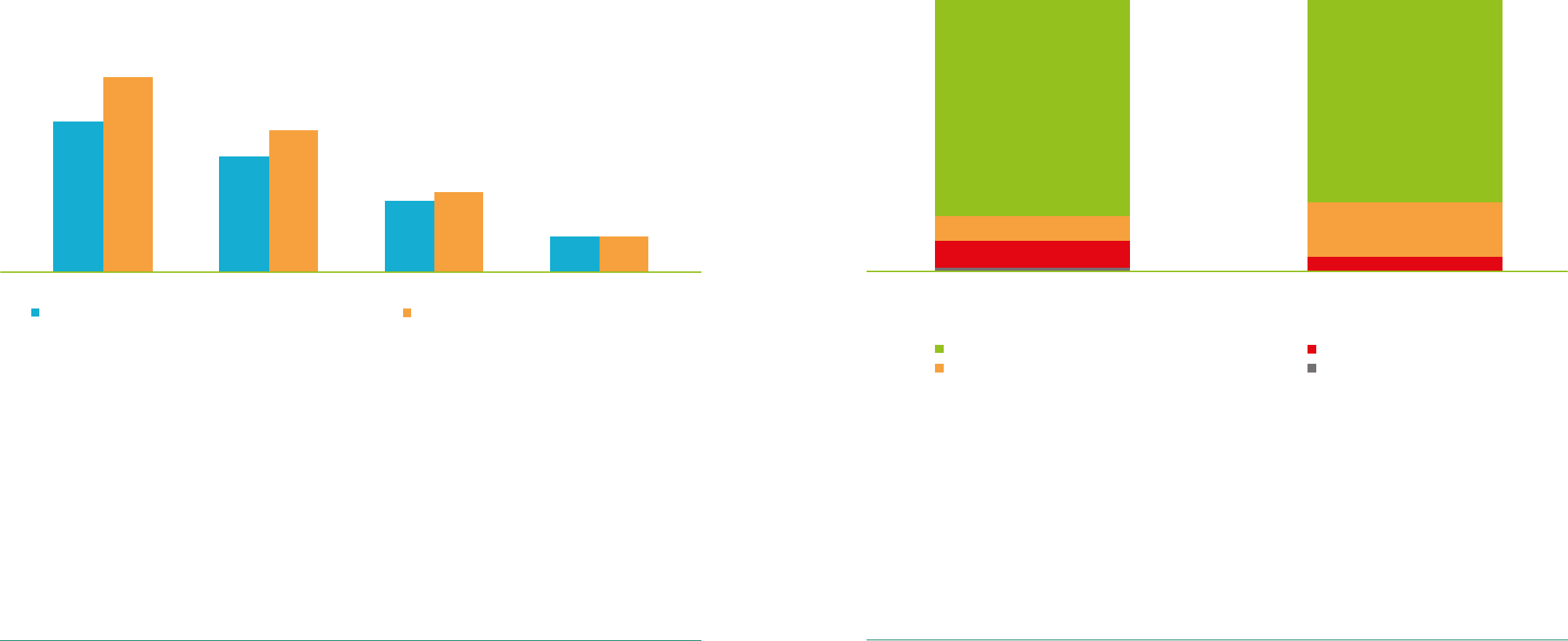

In the Retail (Food) sector, customer satisfaction for

experiences recorded in September and October 2022 is 2

points lower than for those recorded in March and April

2022

In an environment described by a senior executive as a “gathering storm”, rising supplier, energy,

transport and staff costs and changing customer behaviours are affecting organisations’ performance

and profitability. We examine evidence of the relationship between customer satisfaction and financial

performance in the Retail (Food) sector, drawing on the latest UKCSI results, Kantar’s analysis of the UK

grocery market and interim financial statements from some of the sector’s leading players

Average customer satisfaction in the Retail (Food) sector is 80.5 (out of 100), slightly lower, by 0.5

points, than in January 2022. However, there appears to be a more pronounced drop in customer

satisfaction in the most recent UKCSI data. The January 2023 UKCSI is based on two sets of fieldwork,

collected in March and April 2022 and in September and October 2022. Average satisfaction for

customer experiences recorded in September and October 2022 (79.5) is 2 points lower than for those

recorded in March and April 2022 (81.5). The decline in satisfaction is most evident for customers'

perceptions about an organisation’s emotional connection, customer ethos, as well as the quality of

experiences.

81.0

81.5

81.7

79.5

80.5

Jan 2022

UKCSI

July 2022

UKCSI

Jan 2023

UKCSI

Satisfaction with

experiences recorded

21 March - 14 April 2022

Satisfaction with

experiences recorded

5 September - 3 October 2022

Customer responses

that make up the Jan 2023 UKCSI

Index scores out of 100

Customer satisfaction in the Retail (Food) sector

4948 UK Customer Satisfaction Index | January 2023UK Customer Satisfaction Index | January 2023

Retail (Food) January 2023 UKCSI = 80.5

Annual sales growth for the 12 weeks to 27 November 2022

Source: Kantar Worldpanel

Aldi

Ocado

Co-op

Food

Waitrose

Sainsbury's

Iceland

Tesco

ASDA

Morrisons

Lidl

-6%

-4%

-2%

0%

2%

4%

6%

8%

10%

12%

14%

16%

18%

20%

22%

24%

26%

76 77 78 79 80 81 82 83 84

UKCSI score

Customer satisfaction and sales growth: the Retail (Food) sector*

Sales of both own brand and premium products lines

have increased year on year

Kantar’s research on the UK grocery market

1

reported that take-home grocery sales increased

by 5.9% year on year in the 12 weeks preceding

27 November 2022, the fastest level of growth

since March 2021. The increase in sales is likely

to have been influenced by a revival in the

number of in store shopping trips compared to

the previous year as well as the rise in inflation.

Sales of own label products grew by 11.7%

year on year, with sales of the cheapest product

lines increasing by 46.3%. At the same time,

sales of premium products also rose, by 6.1%.

These contrasting trends in buying behaviour

are reflected in the UKCSI. 16.7% of customers

expressed a preference for lowest cost, no frills

service, up by 1.3 percentage points compared

to a year ago

*

. But 31.9% of customers indicated

that they prefer excellent service, even if it

means paying more, up by 2.7 percentage points

compared to January 2022.

1

Source: Kantar. See www.kantar.com/uki/inspiration/fmcg/2022-wp-hint-of-xmas-relief-for-uk-consumers-as-grocery-inflation-dips-for-first-time-in-21-months

*

Customers were asked, to score the balance of price and service they would prefer to accept. A score of 8 -10 implies a preference for excellent service, even if it

costs more. A score of 1 – 3 is interpreted as a preference for low-cost, no-frills service.

*

Note: M &S (food) is the highest rated organisation in the Retail (Food) sector with a UKCSI score of 85.2. M & S is not included in Kantar's research so does not

appear here.

Contrasting buying and service preferences in the Retail (Food) sector

31.9%

16.7%

29.2%

15.4%

% customers who prefer excellent

service, even if it means paying more

% customers who prefer lowest cost,

no frills service

Jan-23 Jan-22

Against a backdrop of rising cost and changing

customer behaviours the relationship between customer

satisfaction and sales performance is complex

Two of the highest rated food retailers for customer satisfaction in the January 2023 UKCSI - Ocado

and Waitrose – each registered a fall in year on year sales in Kantar’s analysis covering the 12 weeks

preceding 27 November 2022. Organisations within 1 point of the UKCSI sector average tended to show

relatively strong sales growth. This was significantly influenced by Aldi and Lidl’s performance but also

reflects increased sales growth for Sainsbury’s, Tesco, Co-op Food and Iceland. The two organisations

that received a UKCSI score at least 1 point below the sector average have experienced contrasting

fortunes in sales performance: Asda’s sales grew by 6.1% but Morrisons’ sales fell by 4.7%.

5150 UK Customer Satisfaction Index | January 2023UK Customer Satisfaction Index | January 2023

Annual sales growth for the 12 weeks to 27 November 2022

A closer examination of organisations’ results gives indicators about the factors impacting customer

satisfaction and sales performance and how organisations are responding to them.

Aldi and Lidl have

continued to grow and

account for a combined

market share of 16.7%

Aldi’s sales increased by 24%, with market

reaching a record 9.3%. In September 2022

Aldi reported a significant increase in its volume

of customers but a drop in profits because of

increased costs associated with suppliers, staff

and Covid-related expenses

2

. These issues may

also have affected customer satisfaction with

Aldi. Over the past 3 years, Aldi’s UKCSI average

score is 82.8, more than 2 points higher than the

sector average. However, in the January 2023

UKCSI, Aldi received a score of 81.0, down by

2.7 points compared to a year ago. Along with

Lidl, Aldi has the highest customer satisfaction in

the Retail (Food) sector for price / cost (8.4 out

of 10) but it has fallen slightly below the sector

average for satisfaction with product / service

range, quality and reliability.

Lidl’s sales rose by 22% to give it a market share

of 7.4%. Over the past 3 years, the average

level of customer satisfaction with Lidl has

been slightly lower than the sector average,

by 0.9 points. But compared to January 2020,

Lidl is one of the most improved organisations

for customer satisfaction in the sector. In the

January 2023 UKCSI Lidl’s customer satisfaction

rating of 81.0 (out of 100) is for the first time

slightly above the Retail (Food) average, 80.5.

Across many of the 26 measures that make

up the UKCSI customer satisfaction with Lidl is

rated around the same level as the Retail (Food)

average but satisfaction with Lidl’s price / cost,

8.4 (out of 10), is 0.6 points higher than the

sector average.

2

Source: Evening Standard 26 September 2022. Accessed at www.standard.co.uk/business/aldi-supermarket-grocer-inflation-b1028072.html

Food retailers with a UKCSI

score at least 1 point

below the sector average

0.7%

Food retailers with a UKCSI

score within + / - 1 point

of the sector average

10.7%

Food retailers with

a UKCSI score at least 1 poin

t

above the sector average

-1.0%

5352 UK Customer Satisfaction Index | January 2023UK Customer Satisfaction Index | January 2023

Protability has been impacted by competitive pricing,

innovation to attract customers at different price

points and rising staff, energy and supplier costs

M & S is the highest rated Retail (Food)

organisation for customer satisfaction, both in the

January 2023 and over the period January 2020 –

January 2023.

Although M & S is not included in Kantar’s

grocery sales and market share analysis, M & S’

statements in November 2022

3

indicate how

the company is managing an environment of

cost and supply chain pressures and changing

customer behaviours. M & S reported that it had

outperformed the market, both for value and

volume, but operating profit had declined. M & S’s

food sales were up 3% but profits fell by 42%: the

company said it had not passed on the full effect

of an 11% increase in supplier costs; and food

waste rose as consumer demand changed through

the summer. By contrast, as Covid-19 conditions

eased, clothing and homewares profits grew

by over a third and sales by 14%, illustrating the

particular challenges of the Retail (Food) market.

Tesco received a UKCSI score of 80.7, down 1.2

points compared to January 2022 but around the

same level as the sector average, 80.5.

Kantar’s research suggests that Tesco’s sales grew

by 3.9% year on year in the 12 weeks preceding

27 November 2022. Tesco’s interim 2022 /

2023 statement emphasised its strategy to offer

competitive prices through price matching and

helping customers to save money by using its

finest range as an attractive alternative to eating

out

4

. Tesco also announced its biggest single year

investment in colleague pay to help employees

deal with the rising cost of living, and ongoing

plans to work with suppliers to mitigate the

effects of inflation.

Customer satisfaction with Asda is 79.1, around

the same level as a year ago (79.3) and 1.4 points

below the sector average.

Kantar reported that Asda’s sales grew ahead of

the sector, up by 6.1%, maintaining its market

share at 14.0%. Asda reported that it has focused

on value initiatives, expanding its Just Essentials

range and holding prices on 250 products. It has

launched an app which enables additional savings

at the point of purchase. Asda also claims to have

launched over 100 new products to appeal to

customers at different price points

5

. Asda’s future

plans include entry to the retail convenience

market through acquisition of 129 convenience

stores and attached petrol stations from Co-op.

Sainsbury’s UKCSI score is 80.9, similar to

January 2022 (when it was 80.5) and slightly

above the sector average, 80.5.

Kantar reported that Sainsbury’s sales increased by

4.3% in the 12 weeks up to 27 November 2022.

Sainsbury’s interim results published in September

2022 highlighted its investment in keeping prices

low to defend market share; innovation, new

product launches and store enhancements; and

increasing colleagues’ pay to support them in

delivering high standards of service

6

.

Morrisons has a UKCSI score of 76.2, down

by 1.1 points compared to January 2022 and

4.3 points below the sector average: this is the

lowest customer satisfaction of any food retailer

in the January 2023.

In Kantar’s analysis, Morrisons sales fell year

on year by 4.7% and its market share by 1

percentage point. Morrisons appears to have

lost market share to the benefit of Aldi and Lidl.

Some analysts also commented that Morrisons

has been particularly exposed to inflationary

pressures because it has its own manufacturing

operations and around half of its food is

produced in-house

7

.

3

Source: The Guardian 9 November 2022. Accessed at www.theguardian.com/business/2022/nov/09/m-and-s-faces-gathering-storm-as-joint-venture-with-ocado-

makes-loss-marks-and-spencer#:~:text=Profits%20at%20M%26S's%20food%20business,demand%20changed%20over%20the%20summer.

4

Source: Tesco Interims announcement 2022 / 23. Published 5 October 2022

5

Source: Asda’s update on its Q3 trading performance. Accessed at https://corporate.asda.com/newsroom/2022/11/11/asda-returns-to-positive-like-for-like-sales-in-

q3-and-steps-up-support-for-customers-affected-by-the-cost-of-living-crisis

6

Source: Sainsbury’s Interim Results for the 28 weeks ended 17 September 2022. Published 3 November 2022

7

Source: FT 28 September 2022. Accessed at www.ft.com/content/228627fa-d701-422d-9ec4-b0d79c5209a4

5554 UK Customer Satisfaction Index | January 2023UK Customer Satisfaction Index | January 2023

Polarisation and diversity

of customer behaviours

are likely to become more

evident in 2023

Whilst many customers seek to reduce their spending and some suffer genuine hardship, there will

also be growth opportunities in both value and premium product range markets. Many customers are

looking to organisations to deliver competitive pricing but it is also clear that customers attach high

priority to quality, a range of appropriate products and in-store experiences.

For Retail (Food) organisations the outlook is very challenging. Cost pressures – especially energy,

transport, packaging, food materials and staff – will continue to be significant. Some analysts believe

that inflation will begin to ease in 2023 but this is likely to be contingent on global weather, harvests,

the situation in Ukraine and the strength of sterling.

What should the Retail (Food) organisation you dealt with improve*?

18.8%

14.0%

12.3%

10.4%

10.3%

9.8%

8.8%

8.8%

7.8%

Availability of product / service

Product / service range

More friendly / helpful staff

Have more staff available

More knowledgeable staff

Better website navigation

Quality of product / service

Easier to contact the right person to help me

Reliability of product / service

Maintaining customer satisfaction, performance and profitability in this environment will require

heightened levels of leadership, employee engagement, risk management and operational delivery.

Organisations will need to review continually their operational processes and collaborative relationships

with suppliers to identify innovation and productivity gains and implement them with agility. Employee

engagement will be critical, not just to retain key people but to develop the skills and capabilities that

generate customer satisfaction and business improvement. Organisations will need to be clear about the

customer segments they are focusing on and carefully track their customers' evolving and diverse needs

and behaviours.

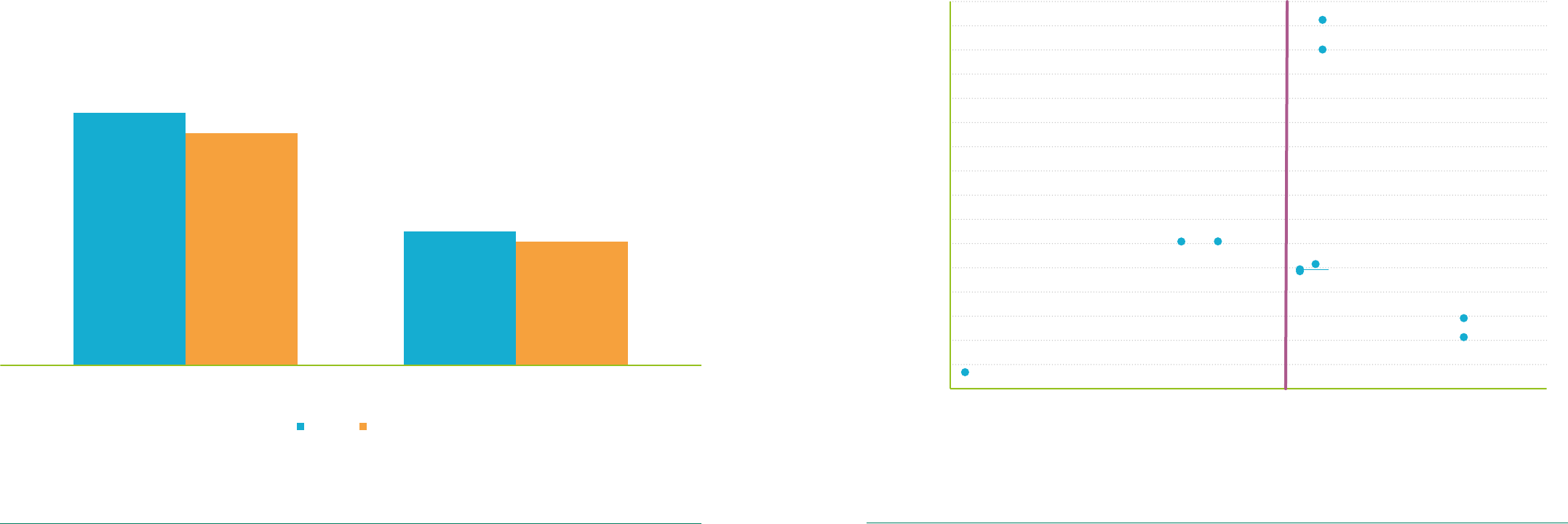

In the Banks and Building Societies the volume of

current account switching has grown in the last year

The latest available data from the Current Account Switching Service

8

dashboard reported 413,885

current account switches between April and September 2022, an increase of 5% on the same period in

2021 and 76% higher than during the first Covid-19 lockdown in 2020.

Volumes of current account switching 2019 - 2022

Oct 19 - March 20 Apri 20 - Sept 20 Oct 20 - March 21 April 21 - Sept 21 Oct 21 - March 22 April 22 - Sept 22

542,626 234,767 327,249 395,345 445,866 413,885

8

See Current Account Switch Service Dashboard Issue 36

When considering the net current account gains for individual banks alongside their customer satisfaction

scores for the corresponding UKCSI report (July 2022), there does not appear to be an obvious link

between levels of customer satisfaction and net current account gains.

Banks and Building Societies receiving a UKCSI score at least 1 point better than the July 2022 sector

average registered an average of 748 net current gains, compared to 754 for organisations whose UKCSI

score was 1 point or more below the sector average. Santander’s UKCSI score was almost the same as the

sector average (0.3 points below) but it suffered the highest rate of net current account losses, - 20,220. It

should be noted that Starling Bank and Monzo, two of the leading performers for customer satisfaction in

the January 2023 UKCSI, both gained substantial numbers of current accounts but are not included in this

analysis because they did not receive sufficient customer responses to appear in the July 2022 UKCSI.

*

Customers were asked to identify the top three things the organisation they dealt with should do, in order to improve its service. The chart shows the number

of times each issue was identified as a priority for improvement. The full list of issues is included in the sector resource pack provided to organisational Institute

members alongside the UKCSI sector report.

5756 UK Customer Satisfaction Index | January 2023UK Customer Satisfaction Index | January 2023

According to the Current Account Switching

Service dashboard, the main reasons cited by

customers for preferring their new account are

online banking (cited by 48% of respondents),

customer service (41%) and ease of using an

organisation’s mobile banking / banking app

(38%). 25% of people preferred their new current

account because it gave a better interest rate.