June 25, 2024

AMERICAN CUSTOMER SATISFACTION INDEX

ACSI

®

Restaurant and Food Delivery

Study 2024

Restaurant Satisfaction Increases as Inflation

Forces Competition to Retain Customers;

Food Delivery Debuts in ACSI With Customers

Focused on Fees

As consumers face increasingly dicult decisions about food spending, restaurant chains

that can dierentiate themselves in terms of quality and value will have a competitive

advantage. The 1% customer satisfaction gain to an ACSI score of 79 for fast food restaurants

is encouraging, as Chick-fil-A leads the way among individual chains for the tenth consecutive

year. The 4% gain for full-service restaurants to 84 is impressive, as companies need to retain

their loyal customers during periods of economic uncertainty. Consumers continue to show

a preference for steaks as LongHorn Steakhouse and Texas Roadhouse tie for the top spot

among full-service restaurants.

FULLSERVICE

RESTAURANTS

+%

FOOD DELIVERY

WWW.THEACSI.ORG INFO@THEACSI.ORG ©2024 AMERICAN CUSTOMER SATISFACTION INDEX LLC. ALL RIGHTS RESERVED. 1

FAST FOOD

RESTAURANTS

+%

WWW.THEACSI.ORG INFO@THEACSI.ORG ©2024 AMERICAN CUSTOMER SATISFACTION INDEX LLC. ALL RIGHTS RESERVED. 2

Inflation is weighing heavily on the industry as same-store restaurant sales growth slowed in the second half of 2023 despite

higher quarterly growth in the first half of the year. While U.S. Census Bureau data show growth in restaurant spending

outpacing inflation, rising prices are reducing restaurant visits for those with household incomes under $75,000. ACSI data

indicate that both full-service and fast food restaurant customers are skewing a bit more toward higher income levels and

college graduates. Additionally, customers are being forced to make decisions between groceries and restaurants. Full-service

restaurant inflation has been roughly two times that of groceries in the past year, while fast food and fast casual restaurants

have raised prices at about three times the rate of groceries. All considered, customers are increasingly viewing dining out as a

luxury.

Along the same lines, the newly measured food delivery industry shows customers being concerned about fees for this service

above and beyond rising restaurant meal prices.

ACSI results are based on surveys conducted over a 12-month period ending in March 2024. ACSI scores are reported on a 0 to

100 scale.

Key Takeaways

FULL-SERVICE RESTAURANTS

• Customer satisfaction with full-service restaurants climbs 4% to 84, placing the industry at the top of the Index overall and

helping to explain the overall growth in restaurant spending despite some consumers cutting back.

• Customers continue to show preferences for steaks with LongHorn Steakhouse and Texas Roadhouse both gaining 4% to tie for

the industry lead at 85.

• As lower-income consumers cut back on restaurant spending, brands such as Olive Garden and Chili’s are focusing on their

value propositions, and in turn satisfaction rises 4% to 83 and 80, respectively.

• Consumers who are still eating out are likely enjoying value-oriented deals oered by many dierent chains.

FAST FOOD RESTAURANTS

• The fast food industry’s ACSI score ticks up 1% to 79. Among major chains, Chick-fil-A leads for the tenth consecutive year,

despite a 2% decline to 83.

• Following the leader, competition is tight with KFC unchanged at 81 and four brands at 80: ACSI newcomer Culver’s, Panera

(+5%), Arby’s (+4%), and Starbucks (+3%).

• Order accuracy and mobile performance receive high scores as improving technology may be increasing accuracy in filling

customer orders.

FOOD DELIVERY

• Food delivery premieres in the ACSI with an industry score of 73, well below the customer satisfaction levels of full-service and

fast food restaurants.

• Uber Eats (74) outpaces the other reported major brands, DoorDash (73) and Grubhub (71). The group of smaller food delivery

services leads the field (79).

• Customers using food delivery for convenience have higher satisfaction, on average, than those ordering out of necessity.

Customers in the latter group give lower ratings on value-related measures.

Study Findings

Customer satisfaction is a driving force that impacts the financial outlook of individual firms and the health of the U.S. economy

at large. New results from the American Customer Satisfaction Index (ACSI®) provide customer satisfaction benchmarks for three

industries: full-service restaurants, fast food restaurants, and food delivery. The ACSI also captures consumer opinions about

critical elements of the customer experience, tailored individually to each measured industry.

WWW.THEACSI.ORG INFO@THEACSI.ORG ©2024 AMERICAN CUSTOMER SATISFACTION INDEX LLC. ALL RIGHTS RESERVED. 3

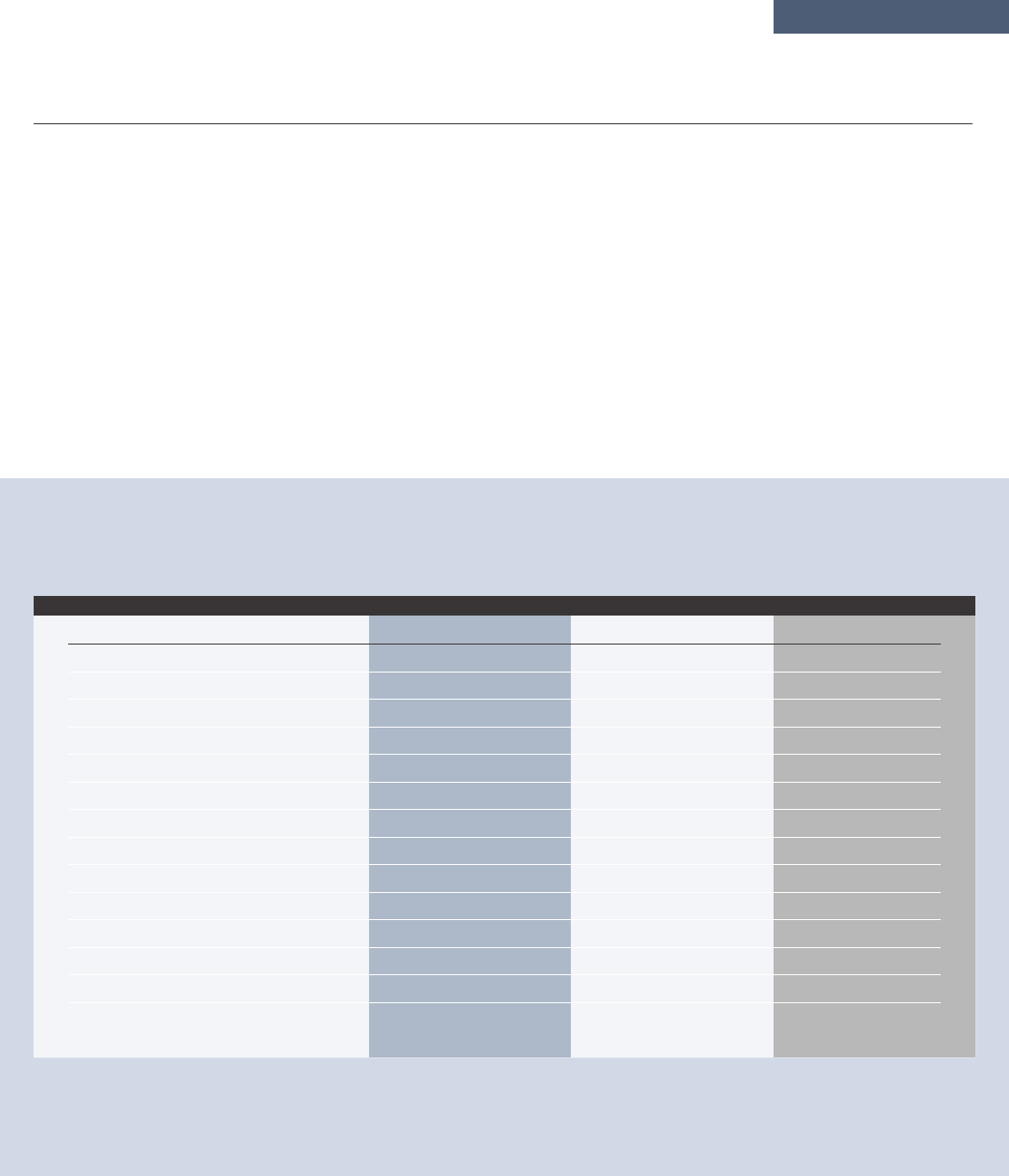

FULL-SERVICE RESTAURANTS

ACSI results again show consumer preferences for steaks as LongHorn Steakhouse and Texas Roadhouse both gain 4% to

85, tying for the top spot among full-service restaurants. LongHorn demonstrates its commitment to customer satisfaction by

running counter to the shrinkflation trend and providing more value to diners. The chain is also working to maintain a quality-

focused culture. Meanwhile, Texas Roadhouse is focusing on keeping prices low, despite inflation, while investing heavily in

stang to maintain team continuity.

Olive Garden climbs 4% to an ACSI score of 83, successfully focusing on operational quality and keeping prices lower than many

competitors. Still, the chain faces some risk as lower-income consumers cut back on restaurant spending. Chili’s also improves

4% to 80. The chain benefits from a combination of high perceived value through their “3 for Me” menu and service strength

through employee retention. Chili’s value proposition has led to speculation about whether eating at Chili’s can be less expensive

than some fast food outlets.

Although still well behind the leaders, IHOP shows impressive progress, jumping 8% to 78. Menu changes that bring more variety

are receiving a favorable response from customers. Last year’s category leader, Outback Steakhouse, drops 4% to 80. Outback

appears to be challenged by a slowdown in spending by lower-income consumers consistent with ACSI findings regarding their

customers’ price sensitivity.

AMERICAN CUSTOMER SATISFACTION INDEX:

FULL-SERVICE RESTAURANTS

0-100 Scale

Source: ACSI Restaurant and Food Delivery Study 2024. © 2024 American Customer Satisfaction Index LLC. All rights reserved.

Charts extracted from this study for media use must include a statement identifying the study of origin and the publisher as the American Customer Satisfaction Index LLC.

No advertising or other promotional use can be made of the data and information in this study without the express prior written consent of ACSI.

2023 ACSI

81

82

82

81

80

82

77

83

79

79

72

79

78

77

77

2024 ACSI

84

85

85

84

83

82

80

80

79

79

78

78

78

76

76

% CHANGE

4%

4%

4%

4%

4%

0%

4%

-4%

0%

0%

8%

-1%

0%

-1%

-1%

COMPANY

Full-Service Restaurants

LongHorn Steakhouse (Darden)

Texas Roadhouse

All Others

Olive Garden (Darden)

Cracker Barrel

Chili’s

Outback Steakhouse

Applebee’s (Dine Brands)

Bualo Wild Wings (Inspire Brands)

IHOP (Dine Brands)

Red Lobster

The Cheesecake Factory

Denny’s

Red Robin

WWW.THEACSI.ORG INFO@THEACSI.ORG ©2024 AMERICAN CUSTOMER SATISFACTION INDEX LLC. ALL RIGHTS RESERVED. 4

AMERICAN CUSTOMER SATISFACTION INDEX:

FULL-SERVICE RESTAURANTS

Customer Experience Benchmarks Year-Over-Year Industry Trends

0-100 Scale

Source: ACSI Restaurant and Food Delivery Study 2024. © 2024 American Customer Satisfaction Index LLC. All rights reserved.

Charts extracted from this study for media use must include a statement identifying the study of origin and the publisher as the American Customer Satisfaction Index LLC.

No advertising or other promotional use can be made of the data and information in this study without the express prior written consent of ACSI.

2024 2023

Accuracy of food order

Courtesy and helpfulness of waitsta

Beverage quality (taste, temperature)

Food quality (taste, temperature, freshness of ingredients)

Restaurant layout and cleanliness

Variety of beverages on menu

Speed with which food order was received at table

Variety of food on menu

Website satisfaction

Quality of mobile app

Reliability of mobile app (minimal down time, crashes, lags)

92

90

89

89

89

88

87

87

87

85

85

88

86

86

86

85

83

83

84

85

87

87

Customers indicate better performance across most aspects of the full-service restaurant experience, appreciating restaurants’

eorts to satisfy customers despite inflation. Providing an outstanding customer experience will be even more critical for

consumers feeling pressured to cut back on discretionary spending. Full-service restaurant respondents for this study have

somewhat higher income levels and college graduation rates than in 2023, supporting reporting that lower-income consumers

are eating in restaurants less frequently.

WWW.THEACSI.ORG INFO@THEACSI.ORG ©2024 AMERICAN CUSTOMER SATISFACTION INDEX LLC. ALL RIGHTS RESERVED. 5

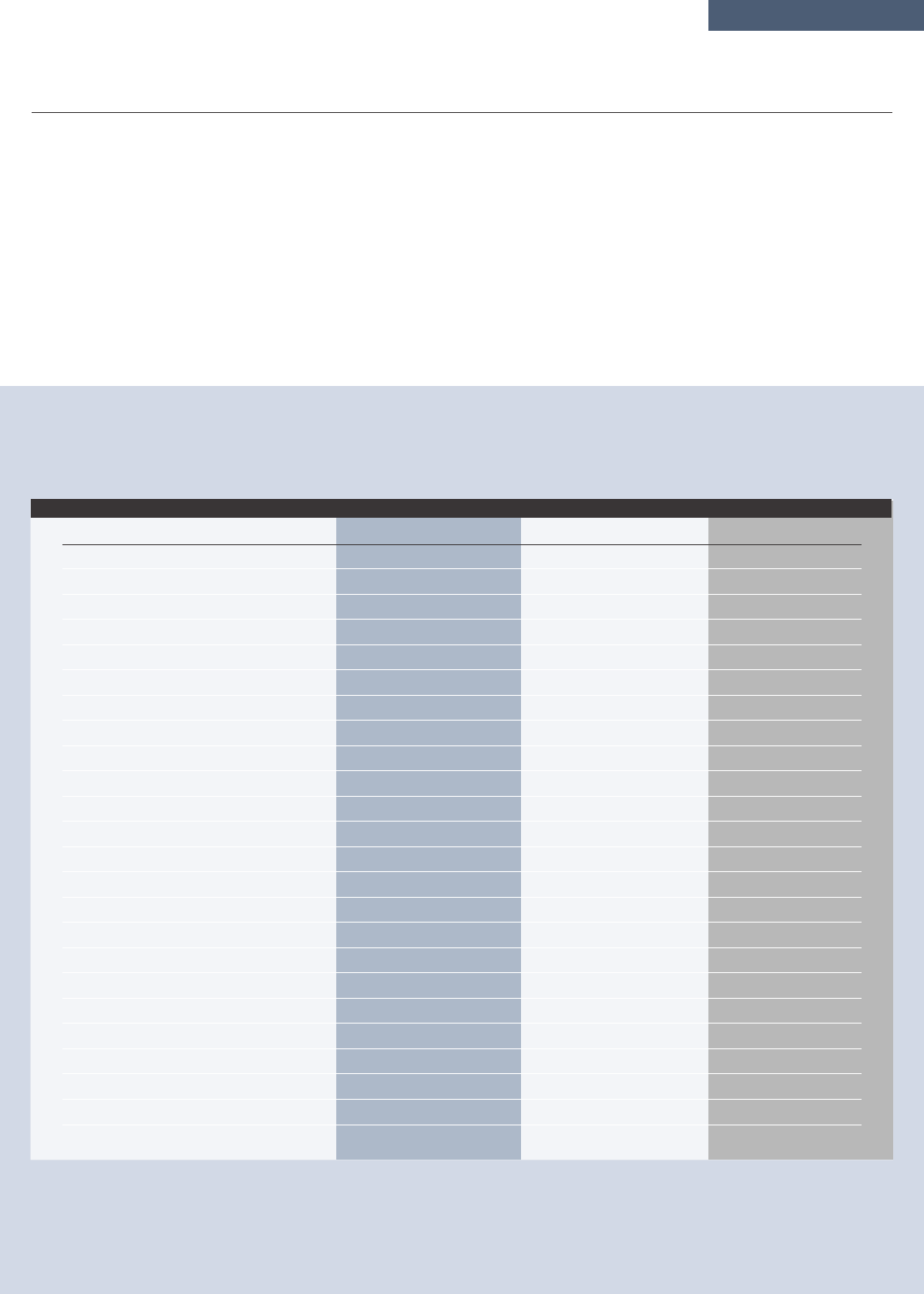

AMERICAN CUSTOMER SATISFACTION INDEX:

FAST FOOD RESTAURANTS

0-100 Scale

2023 ACSI

78

82

85

81

77

NM

76

78

78

80

78

78

76

75

77

77

72

74

74

75

75

71

73

74

69

2024 ACSI

79

83

83

81

80

80

80

80

79

79

79

78

77

77

77

77

76

76

75

74

74

73

72

72

71

% CHANGE

1%

1%

-2%

0%

4%

NA

5%

3%

1%

-1%

1%

0%

1%

3%

0%

0%

6%

3%

1%

-1%

-1%

3%

-1%

-3%

3%

COMPANY

Fast Food Restaurants

All Others

Chick-fil-A

KFC (Yum! Brands)

Arby’s (Inspire Brands)

Culver’s

Panera Bread

Starbucks

Domino’s

Papa Johns

Pizza Hut (Yum! Brands)

Five Guys

Burger King (RBI)

Chipotle

Dunkin’ (Inspire Brands)

Panda Express

Sonic (Inspire Brands)

Wendy’s

Little Caesars

Dairy Queen

Subway

Taco Bell (Yum! Brands)

Jack in the Box

Popeyes (RBI)

McDonald’s

NM = Not Measured

NA = Not Available

Source: ACSI Restaurant and Food Delivery Study 2024. © 2024 American Customer Satisfaction Index LLC. All rights reserved.

Charts extracted from this study for media use must include a statement identifying the study of origin and the publisher as the American Customer Satisfaction Index LLC.

No advertising or other promotional use can be made of the data and information in this study without the express prior written consent of ACSI.

FAST FOOD RESTAURANTS

Chick-fil-A drops 2% to an ACSI score of 83 but still leads among individual fast food chains for the tenth consecutive year. This

long-term success is reflected in revenue, as the chain’s non-mall locations had an average revenue of $9.4 million in 2023 (more

than double that of McDonald’s while being open one day less per week). Total U.S. sales growth for Chick-fil-A was nearly 15%

last year. KFC finishes second at 81 (unchanged), appearing to hold on to highly loyal customers as competitors cut into their

domestic market share.

There is a four-way tie for third place at 80 between ACSI newcomer Culver’s, Panera (+5%), Arby’s (+4%), and Starbucks (+3%).

Culver’s continues to open locations at a consistent rate while also growing revenue per location. Among the company’s changes

are a switch from Pepsi to Coke and the rollout of new thick-cut bacon. Panera has responded to cost-conscious customers with

its Value Duets menu, enjoying higher trac and an improved value proposition. An encouraging sign for Starbucks is growth of

its mobile order and payment revenue, which should be helped by the coming expansion of its mobile order option beyond just

loyalty program members. Arby’s enjoys higher satisfaction as customers appear to respond well to the chain’s menu variety and

tweaks to value meals, which may be reflected in much stronger value perceptions this year.

WWW.THEACSI.ORG INFO@THEACSI.ORG ©2024 AMERICAN CUSTOMER SATISFACTION INDEX LLC. ALL RIGHTS RESERVED. 6

AMERICAN CUSTOMER SATISFACTION INDEX:

FAST FOOD RESTAURANTS

Customer Experience Benchmarks Year-Over-Year Industry Trends

0-100 Scale

Source: ACSI Restaurant and Food Delivery Study 2024. © 2024 American Customer Satisfaction Index LLC. All rights reserved.

Charts extracted from this study for media use must include a statement identifying the study of origin and the publisher as the American Customer Satisfaction Index LLC.

No advertising or other promotional use can be made of the data and information in this study without the express prior written consent of ACSI.

2024 2023

Accuracy of food order

Quality of mobile app

Reliability of mobile app (minimal down time, crashes, lags)

Beverage quality (taste, temperature)

Courtesy and helpfulness of sta

Food quality (taste, temperature, freshness of ingredients)

Restaurant layout and cleanliness

Speed of check-out or delivery

Website satisfaction

Variety of beverages on menu

Variety of food on menu

86

86

85

84

84

84

83

83

83

82

82

85

84

84

83

83

83

82

82

83

80

80

Order accuracy (86), mobile quality (86), and mobile reliability (85) receive high scores as improving technology may be in-

creasing accuracy in filling customer orders. In fact, mobile quality exceeds that of full-service chains. Fast food restaurants also

receive high benchmarks for sta courtesy and both food and beverage quality (all 84), although sit-down chains outperform fast

food on these measures.

As noted for full-service restaurants, pressure for some consumers to reduce discretionary spending will require restaurants to

provide an exceptional customer experience to maintain their loyalty. As with full-service restaurants, fast food respondents for

the 2024 study have somewhat higher income levels and college graduation rates compared to the prior year, consistent with

reporting that lower-income consumers are eating out less frequently.

WWW.THEACSI.ORG INFO@THEACSI.ORG ©2024 AMERICAN CUSTOMER SATISFACTION INDEX LLC. ALL RIGHTS RESERVED. 7

FOOD DELIVERY

Restaurant delivery services grew rapidly during the pandemic. The food delivery industry continues to expand as many

consumers learn to appreciate the convenience of enjoying restaurant food at home without having to leave home for carryout.

The food delivery industry debuts in the ACSI with a score of 73 that is significantly lower than both full-service restaurants (84)

and fast food restaurants (79). Uber Eats at 74 edges out the other reported brands, DoorDash (73) and Grubhub (71). At 79, the

group of smaller food delivery services outpaces all three major competitors.

Satisfaction varies based on the customer’s reason for using the service. Those looking for convenience (for example, work

schedule, spending time with family, avoiding cooking or grocery shopping) are more satisfied than those ordering due to need

(for example, health, not having a vehicle or not wanting to drive). While these groups show similar scores for the ordering

process, those using delivery services out of necessity are more frustrated with pricing.

AMERICAN CUSTOMER SATISFACTION INDEX:

FOOD DELIVERY

0-100 Scale

2023 ACSI

NM

NM

NM

NM

NM

2024 ACSI

73

79

74

73

71

% CHANGE

NA

NA

NA

NA

NA

COMPANY

Food Delivery

All Others

Uber Eats

DoorDash

Grubhub

NM = Not Measured

NA = Not Available

Source: ACSI Restaurant and Food Delivery Study 2024. © 2024 American Customer Satisfaction Index LLC. All rights reserved.

Charts extracted from this study for media use must include a statement identifying the study of origin and the publisher as the American Customer Satisfaction Index LLC.

No advertising or other promotional use can be made of the data and information in this study without the express prior written consent of ACSI.

WWW.THEACSI.ORG INFO@THEACSI.ORG ©2024 AMERICAN CUSTOMER SATISFACTION INDEX LLC. ALL RIGHTS RESERVED. 8

AMERICAN CUSTOMER SATISFACTION INDEX:

FOOD DELIVERY

Customer Experience Benchmarks 2024

0-100 Scale

Source: ACSI Restaurant and Food Delivery Study 2024. © 2024 American Customer Satisfaction Index LLC. All rights reserved.

Charts extracted from this study for media use must include a statement identifying the study of origin and the publisher as the American Customer Satisfaction Index LLC.

No advertising or other promotional use can be made of the data and information in this study without the express prior written consent of ACSI.

Mobile app satisfaction

Website satisfaction

Food and restaurant ordering options

Ordering process

Payment options

Alerts and notifications while waiting

Courtesy of delivery person

Process for rating the delivery person

Process for tipping the delivery person

Speed of delivery

Accuracy of quoted delivery times

Ease of understanding fees

Order accuracy

Food temperature

Loyalty or reward program

Fairness of food prices

Fairness of pre-tip taxes and service fees

82

81

80

77

75

73

69

80

80

78

77

75

71

69

76

76

75

Customers give the highest ratings to the mobile apps (82) and websites (81) used to place orders. While the ordering process

overall receives a score of 80, those that order via websites (77) are less satisfied than those that order using mobile apps (80).

Part of that dierence represents the score gap for alerts and notifications while waiting, where mobile apps perform better.

The cost of food delivery is a concern in terms of the fairness of food prices (69) and pre-tip taxes and service fees (69). There is

a risk of perceptions getting worse as lack of fee transparency gets more attention from consumers and politicians. DoorDash has

been promoting its eorts to lower fees, which could create an advantage.

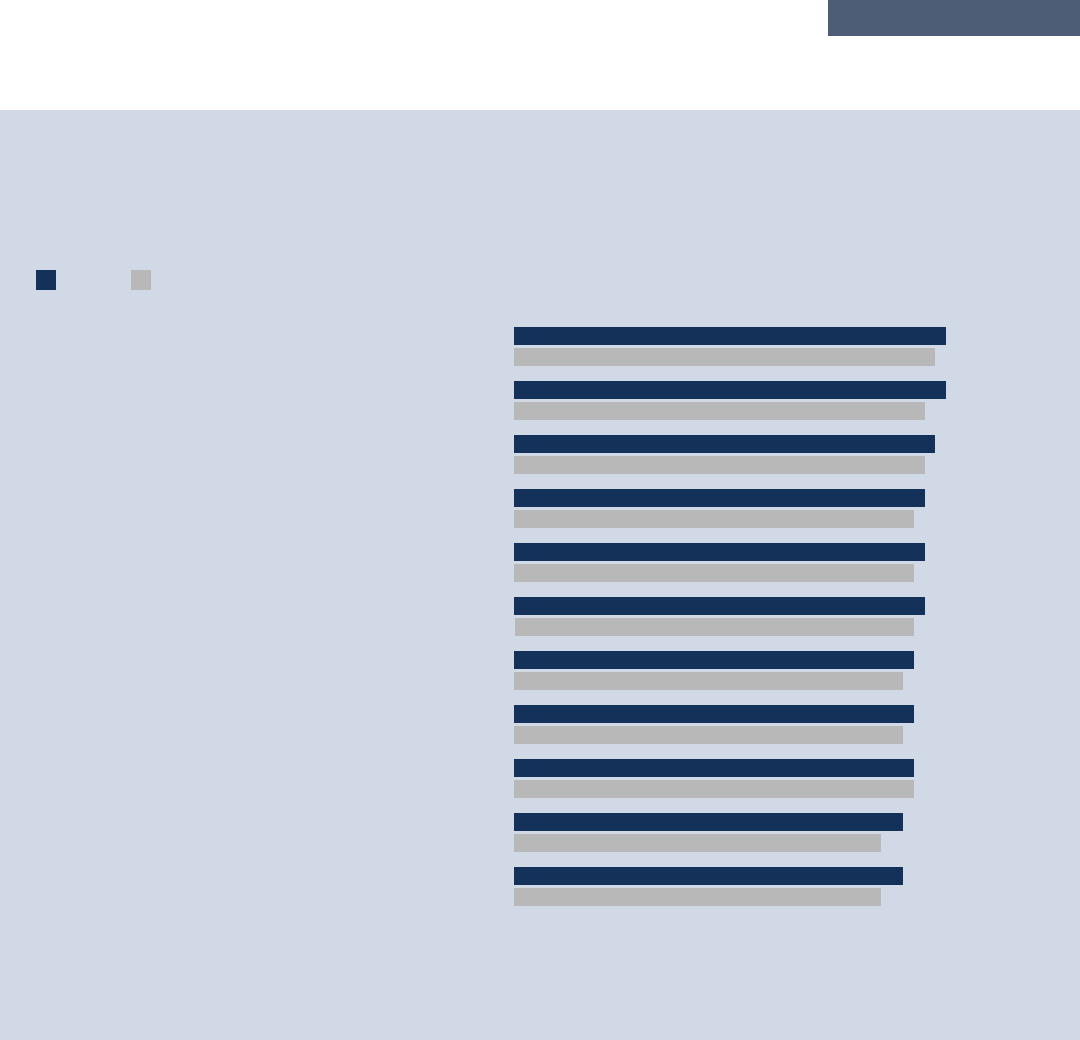

AMERICAN CUSTOMER SATISFACTION INDEX (ACSI®):

Customer Satisfaction Benchmarks by Industry

0-100 Scale

WWW.THEACSI.ORG INFO@THEACSI.ORG ©2024 AMERICAN CUSTOMER SATISFACTION INDEX LLC. ALL RIGHTS RESERVED. 9

Full-Service Restaurants

Athletic Shoes

Soft Drinks

Breweries

Food Manufacturing

Personal Care and Cleaning Products

Cell Phones

Household Appliances

Nonhospital Care

Televisions

Banks

Financial Advisors

Life Insurance

Online Retailers

Personal Computers

Search Engines and Information

Apparel

Automobiles

Credit Unions

Fast Food Restaurants

Online Investment

Specialty Retailers

Supermarkets

Video Streaming Service

Consumer Shipping

Drugstores

General Merchandise Retailers

Property and Casualty Insurance

Airlines

Car Rentals

Health Insurance

Online Travel Agencies

Wireless Phone Service

Energy Utilities

Gas Stations

Hotels

Hospitals

U.S. Postal Service

Food Delivery

Social Media

Internet Service Providers

Subscription TV Service

80

83

79

84

83

82

81

80

81

79

79

81

82

75

76

80

77

80

81

79

77

77

80

82

80

79

76

76

79

79

75

79

77

76

74

75

74

71

70

73

76

Source: ACSI Restaurant and Food Delivery Study 2024. © 2024 American Customer Satisfaction Index LLC. All rights reserved.

Charts extracted from this study for media use must include a statement identifying the study of origin and the publisher as the American Customer Satisfaction Index LLC.

No advertising or other promotional use can be made of the data and information in this study without the express prior written consent of ACSI.

73

WWW.THEACSI.ORG INFO@THEACSI.ORG ©2024 AMERICAN CUSTOMER SATISFACTION INDEX LLC. ALL RIGHTS RESERVED. 10

Methodology

The ACSI Restaurant and Food Delivery Study 2024 is based on 14,604 completed surveys. Customers were chosen at random

and contacted via email between April 2023 and March 2024 for the restaurant industries and between November 2023 and

March 2024 for food delivery. Customers are asked to evaluate their recent experiences with the largest companies in terms of

market share, plus an aggregate category consisting of “all other”—and thus smaller—companies in those industries.

ACSI survey data are used as inputs to the Index’s cause-and-eect econometric model, which estimates customer satisfaction

as the result of the survey-measured inputs of customer expectations, perceptions of quality, and perceptions of value. The

ACSI model, in turn, links customer satisfaction with the survey-measured outcomes of customer complaints and customer

loyalty. ACSI clients receive confidential industry-competitive and best-in-class data on all modeled variables and customer

experience benchmarks.

About ACSI

The American Customer Satisfaction Index (ACSI®) is a national economic indicator of customer evaluations of the quality

of products and services available to household consumers in the United States. The ACSI uses data from roughly 200,000

responses annually as inputs to an econometric model for analyzing customer satisfaction with approximately 400 companies in

about 40 industries and 10 economic sectors, including various services of federal and local government agencies. ACSI results

are released throughout the year, with all measures reported on a scale of 0 to 100.

ACSI data have proven to be strongly related to several essential indicators of micro and macroeconomic performance. For

example, firms with higher levels of customer satisfaction tend to have higher earnings and stock returns relative to competitors.

Stock portfolios based on companies that show strong performance in ACSI deliver excess returns in up markets as well as down

markets. At the macro level, customer satisfaction has been shown to be predictive of both consumer spending and GDP growth.

Contact Information

For more information regarding this study; the full-service restaurant, fast food restaurant, and food delivery industries;

and how the ACSI can help your company harness the power of customer satisfaction to improve your bottom line,

visit www.theacsi.org or contact:

ACSI LLC | 3916 Ranchero Drive | Ann Arbor, MI 48108

Phone: (734) 913-0788 | E-mail: [email protected]

No advertising or other promotional use can be made of the data and information in this study

without the express prior written consent of ACSI LLC.

ACSI and its logo are Registered Marks of American Customer Satisfaction Index LLC.