GYPSY BI LLC

FinJinni Professional

Administrator’s Guide

and Installation Manual

© 2018-2024 Gypsy BI LLC For assistance contact: support@gypsybi.com

Table of Contents

Introduction ...............................................................................1

Before You Begin ......................................................................2

Installation.................................................................................2

Trial Version ..............................................................................3

FinJinni First Time Setup ..........................................................5

First Time Setup Online .......................................................... 10

Using FinJinni Professional ..................................................... 12

Running Queries and Creating Reports .................................. 15

Licensing FinJinni ................................................................... 16

QuickBooks Company Setup .................................................. 18

Cash-Reporting Settings ......................................................... 22

Advanced Inventory Settings .................................................. 23

Using Custom Fiscal Years ..................................................... 25

Budget Reporting for QuickBooks Desktop ............................. 27

Reporting on QuickBooks Reimbursed Expenses ................... 28

Advanced Loading Options ..................................................... 29

Consolidating Multiple Companies .......................................... 32

Using Multiple Currencies ....................................................... 36

Automating an Extract ............................................................. 41

Sending eMail Event Notifications ........................................... 43

Advanced Data Loading Features:

Extending the QuickBooks Data Model with Custom Fields ... 45

Customizing the Chart of Accounts .............................................. 45

Adding Custom Fields to Classes ................................................ 46

Adding Additional Custom Fields to Items and Entities ................ 47

Using the Upload Function In Excel ............................................. 47

Consolidated/Combined Format for Uploading Custom Fields..... 48

Loading Budget Data from Outside QuickBooks ..................... 50

Loading Journal Entries from Outside QuickBooks ................. 52

Loading Other Transactions into QuickBooks ......................... 55

Adding Customers and Vendors to QuickBooks ...................... 58

Loading Data into User-Defined Tables .................................. 60

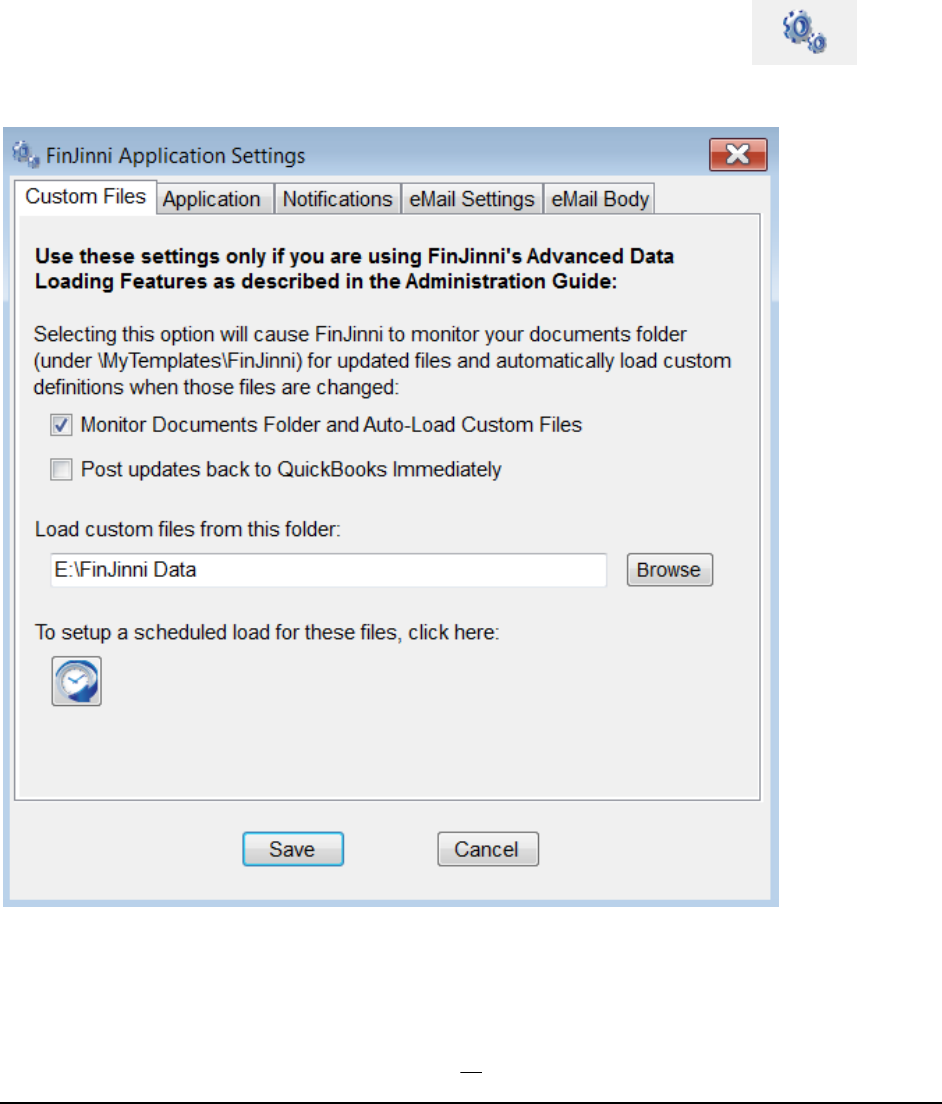

Automatically Loading Custom Data Files ............................... 61

(continued)

Table of Contents

SQL Server Topics For Advanced Users:

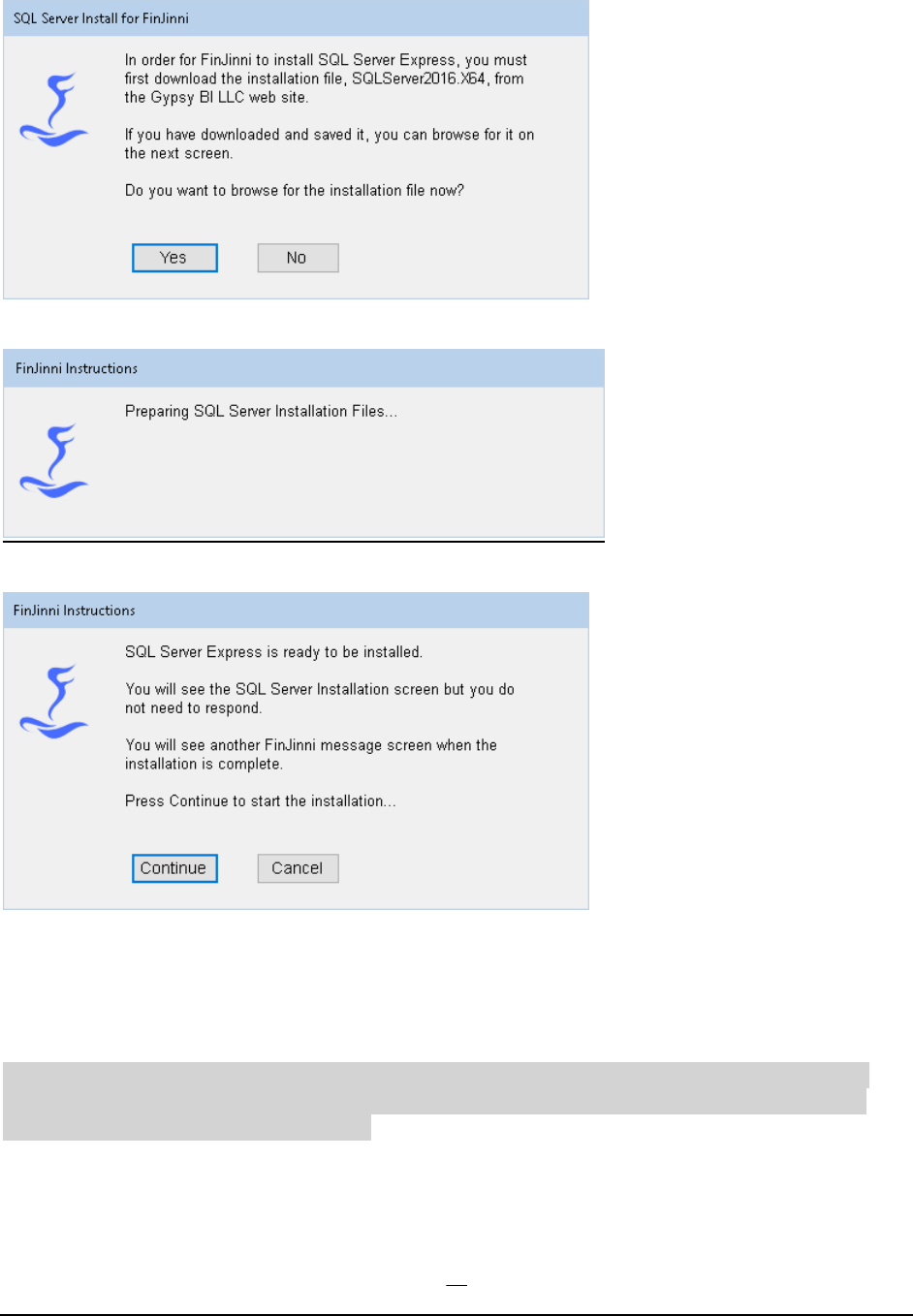

Installing and Configuring SQL Server Express ................................... 64

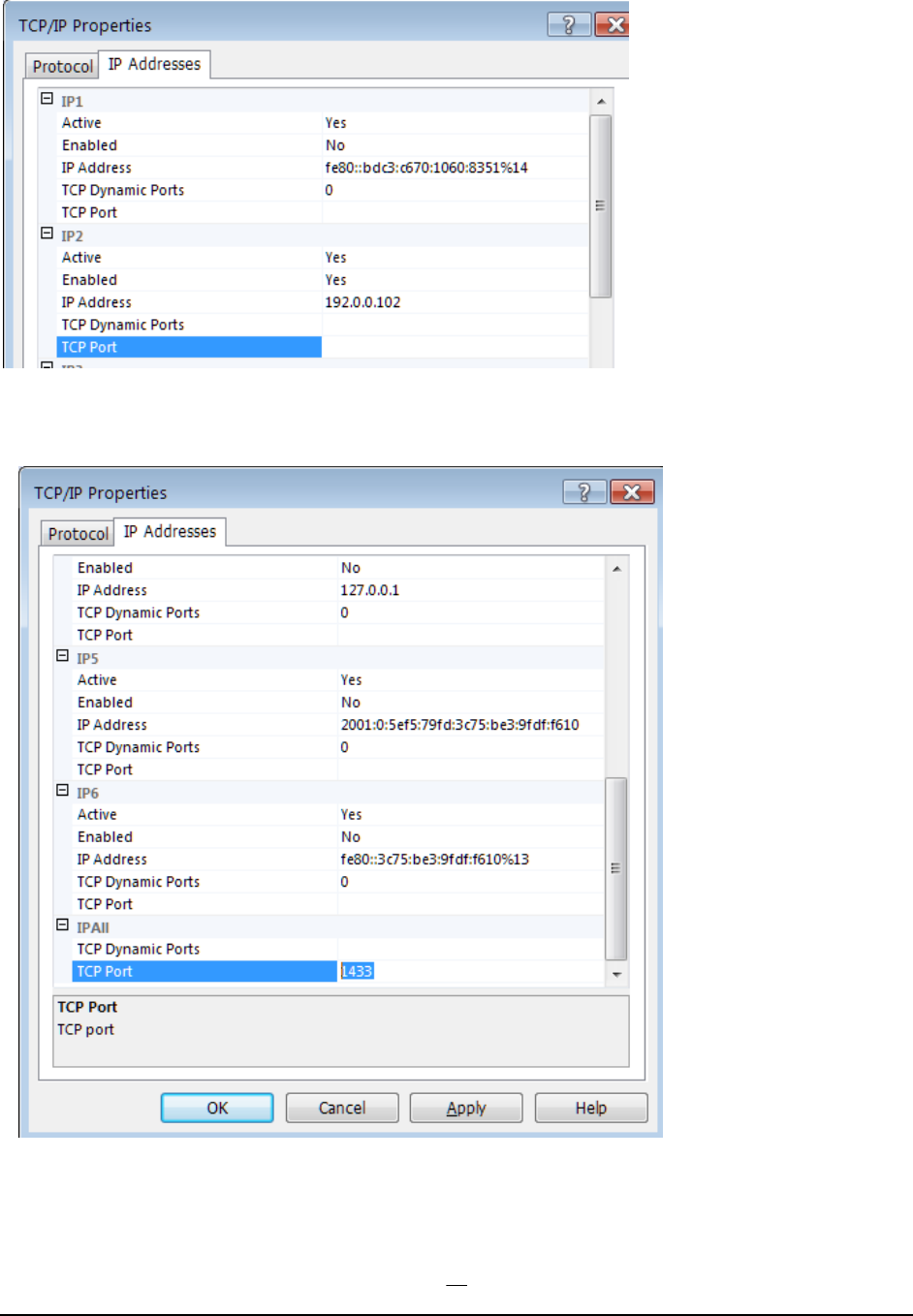

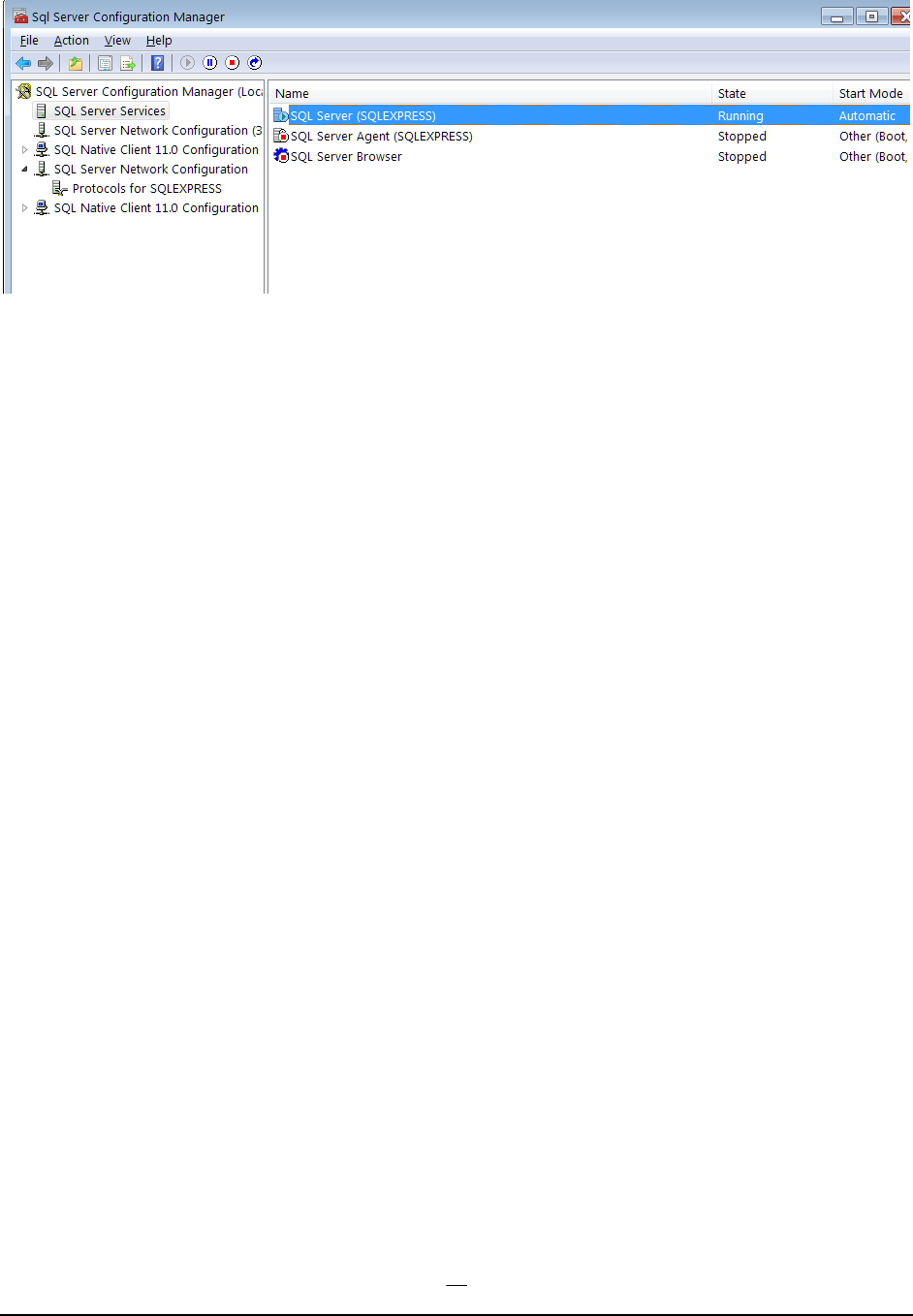

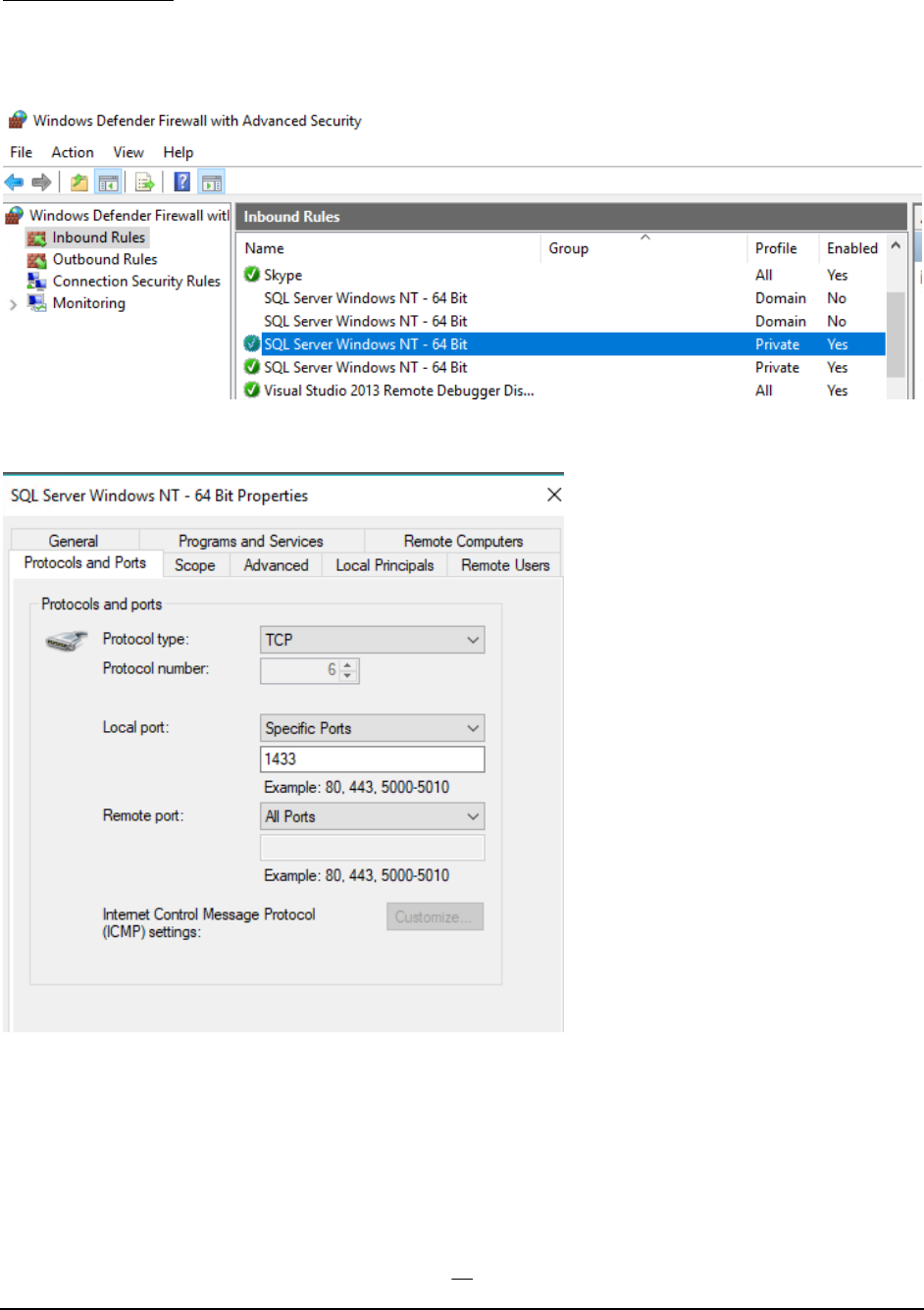

Setting Up Shared Access for SQL Server Express; Multi-User Access ....... 67

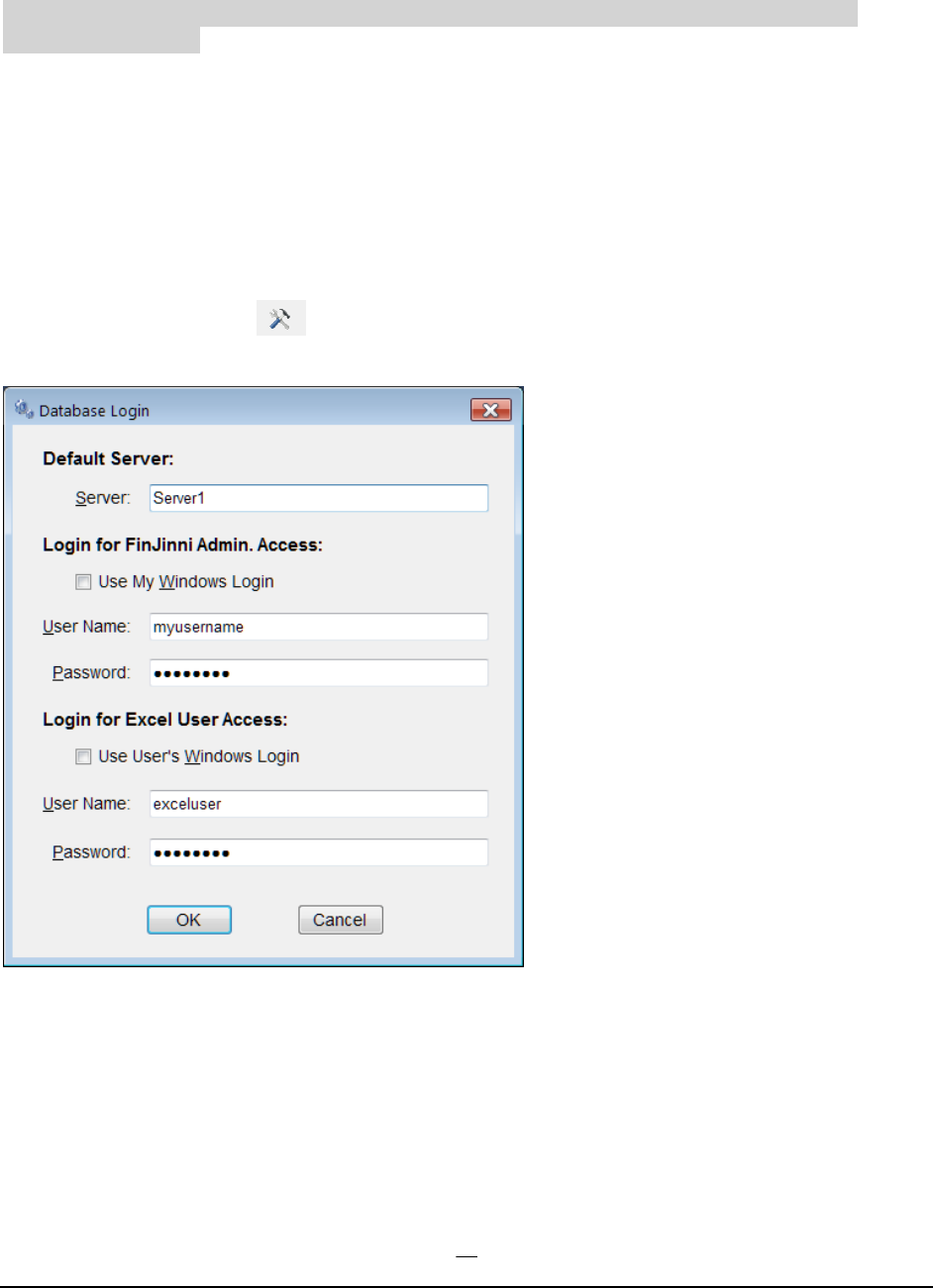

Using Custom SQL Logins ................................................................... 72

Using FinJinni to Manage Your Databases .......................................... 74

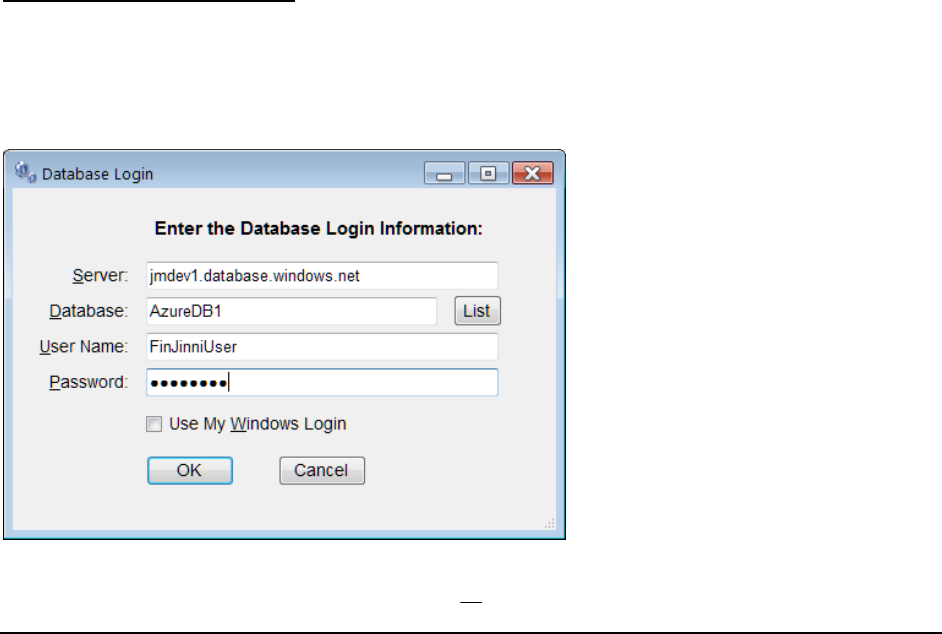

Using Azure SQL Databases ............................................................... 75

Setting Up Azure in FinJinni .......................................................................... 75

QuickBooks Load Performance with an Azure Database .............................. 76

F I N J I N N I P R O F E S S I O N A L

1

Introduction

FinJinni® Professional, called FinJinni Pro for short, is a data warehouse and reporting application for

Intuit QuickBooks companies. FinJinni Pro extracts the information stored in one or more companies

and makes it available for reporting in Excel and other tools*.

Both Desktop and Online are supported and FinJinni Pro allows for the consolidation of multiple

companies.

Using Microsoft SQL Server as its storage mechanism enables a wide range of data capacities. FinJinni

comes with an Excel add-in so that reports can be run directly from Excel. Other visualization tools such

as Microsoft Power BI and SAP Crystal Reports can access the FinJinni database.

This document describes the setup and administration of FinJinni. A separate document, “FinJinni Pro

Queries Manual” describes how to build queries and reports in Microsoft Excel. To view that document,

use the Help icon on the FinJinni Ribbon bar in Excel. You can also download it from the Gypsy BI LLC

web site, www.gypsybi.com.

* Intuit and QuickBooks are trademarks and service marks of Intuit Inc., registered in the United States and other counties. FinJinni

is a registered trademark of Gypsy BI LLC. SQL Server and Power BI are trademarks of Microsoft Corporation. Crystal Reports

is a trademark of SAP SE.

NOTICE

While this information is presented in good faith and believed to be accurate, Gypsy BI LLC disclaims the implied

warranties of merchantability and fitness for a particular purpose and makes no express warranties except as may

be stated in its written agreement with and for its customers. In no event is Gypsy BI LLC liable to anyone for any

indirect, special, or consequential damages. The information and specifications in this document are subject to

change without notice.

F I N J I N N I P R O F E S S I O N A L

2

Before You Begin

You should install Microsoft SQL Server. A free version, SQL Server Express, for a single user is

available from Microsoft and is included when you download FinJinni.

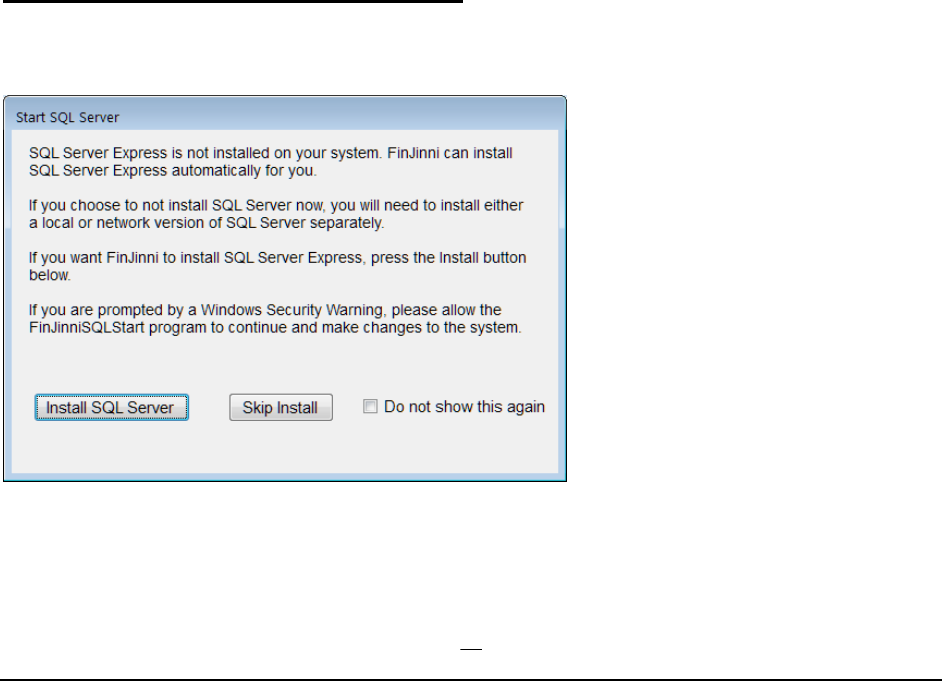

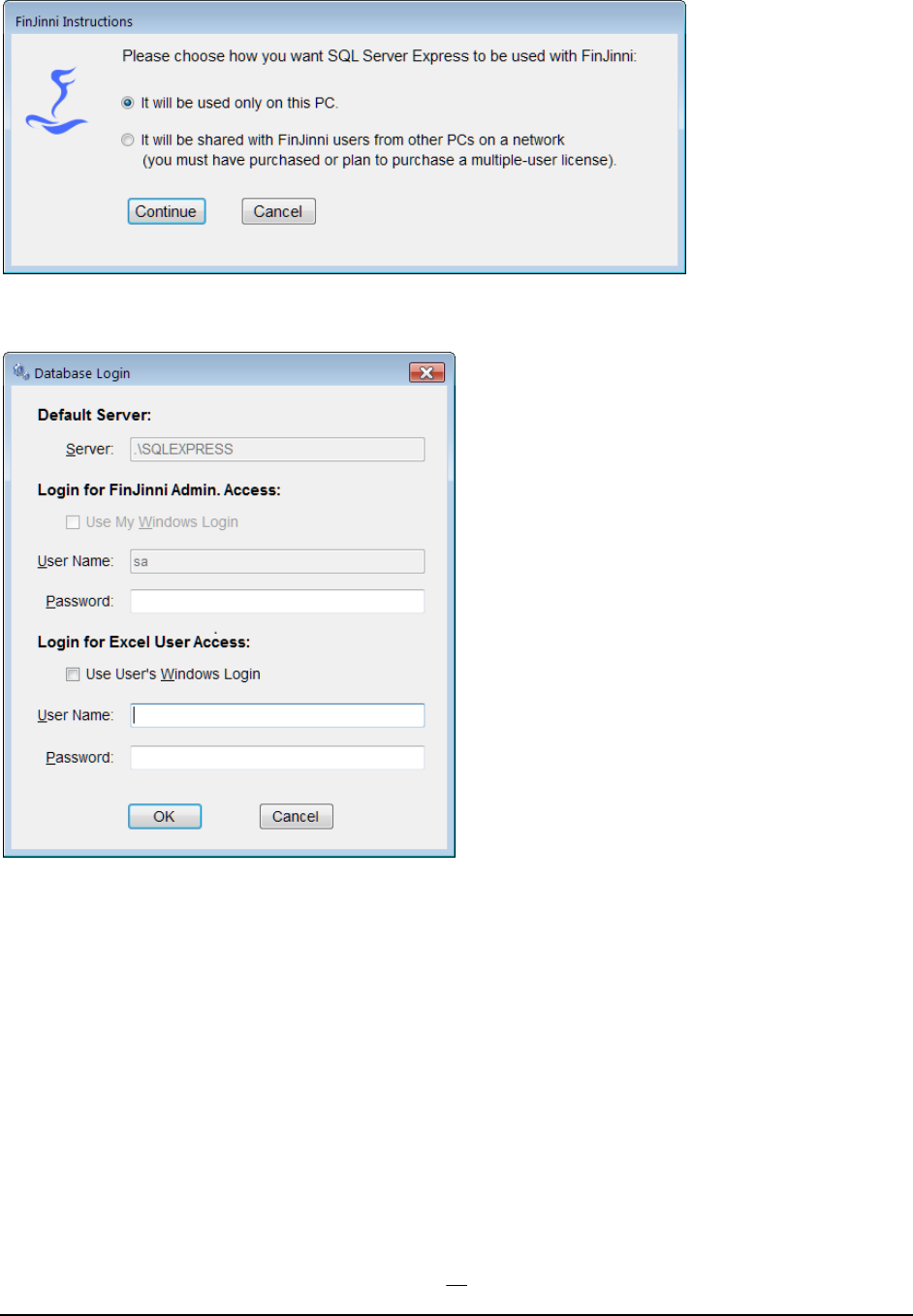

If FinJinni detects that SQL Server is not installed, it will automatically install SQL Server Express

version 2019, which requires Windows 10 or above (or Windows Server 2016 or above). This

installation uses default settings and requires no user interaction on your part. Under most

conditions, FinJinni’s automatic install will suffice.

If you will be working with many companies, additional Excel users, or tools other than Excel, it is

recommended that you also install SQL Server Management Studio, which is a tool for managing

databases and user access to databases.

Microsoft Azure SQL Database is also supported by FinJinni if you do not want to install SQL

Server locally. Microsoft will charge a monthly fee for the use of a “cloud hosted” Azure database.

Refer to the section “Using Azure SQL Databases” at the end of this document for more

information on Azure.

Refer to the section “Installing and Configuring SQL Server Express” at the end of this document

for more information on setting up SQL Server. The section “Automatic Install of SQL Server

Express” describes how FinJinni will give you the option to install SQL Server for you.

Installation

Downloading FinJinni

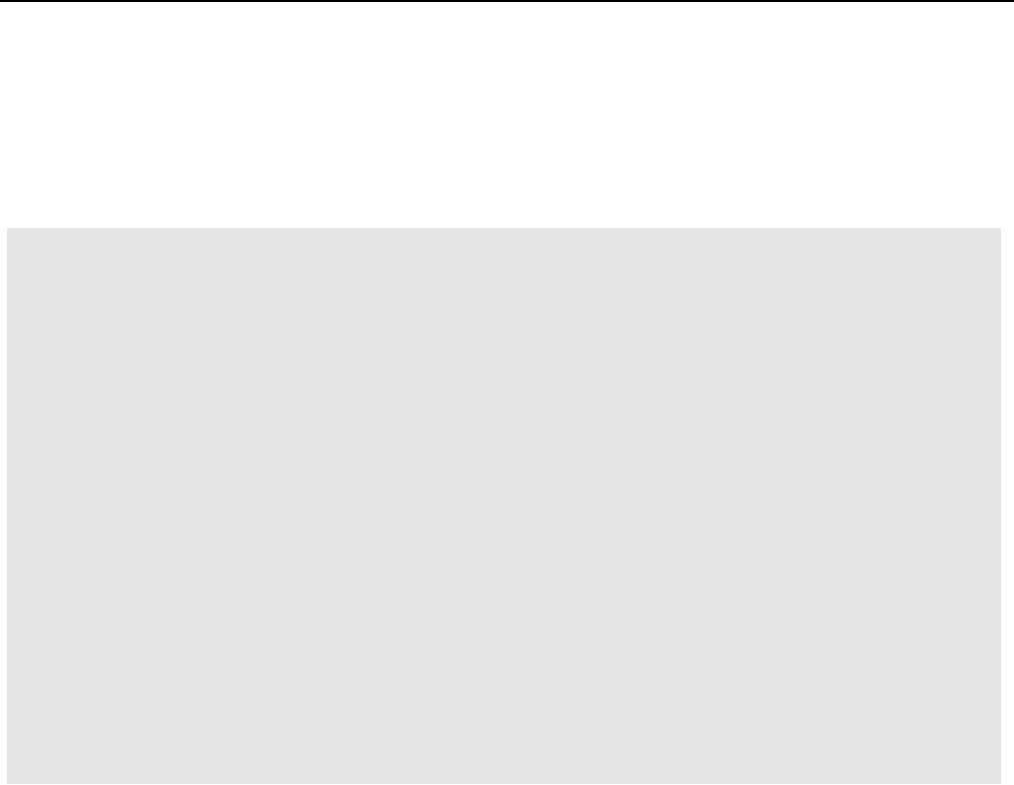

Start FinJinni installation by downloading the installation module, FJProSetup.exe, from the location

that Gypsy BI will give you. Run FJProSetup.exe. After an initial status panel, you'll see this panel:

3

Click Next on this screen and the following screens to start the installation. When the installation completes,

you will see this screen:

Leave the “Launch” box checked. Click Finish to start the FinJinni program.

Trial Version

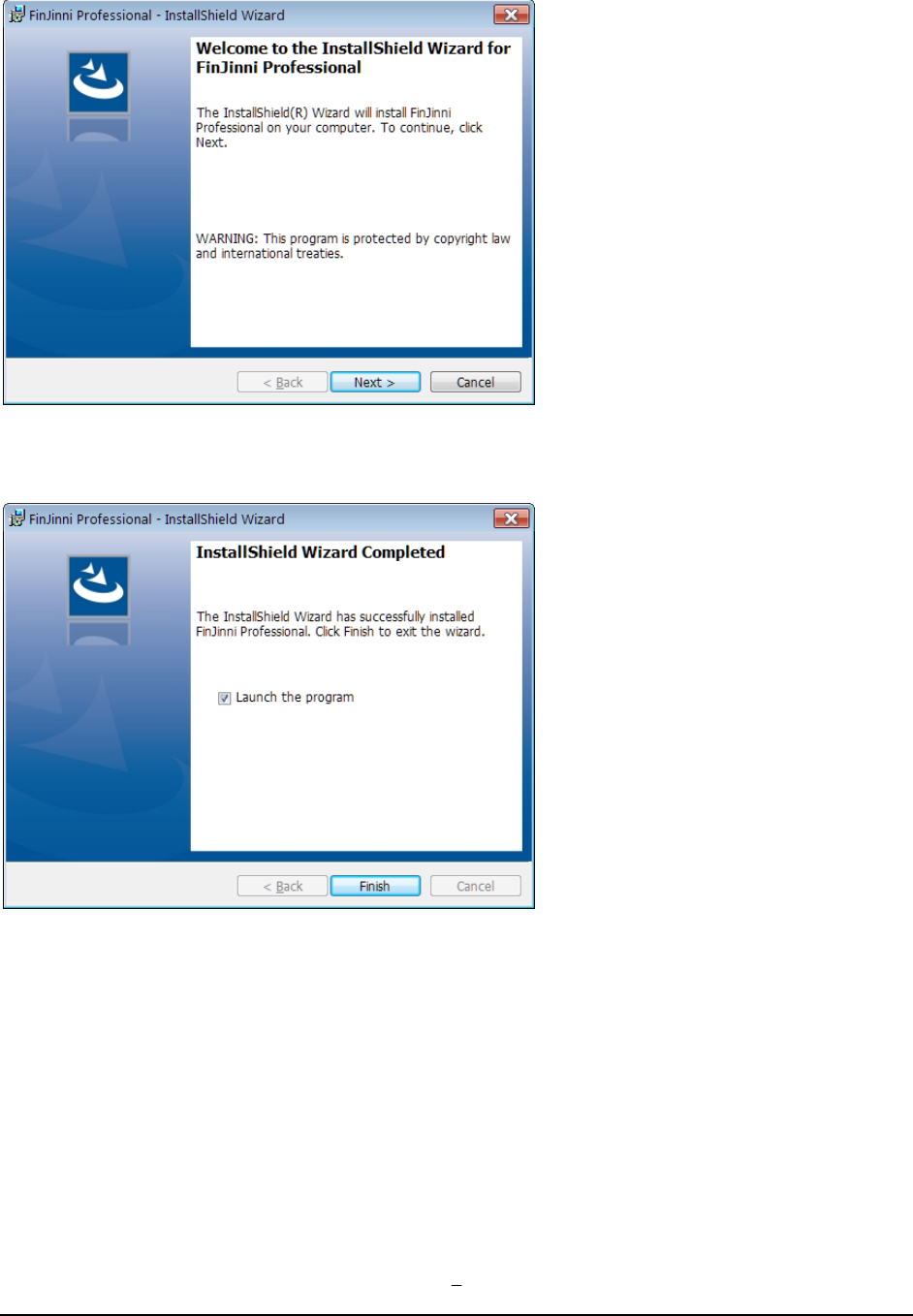

FinJinni is distributed with a 15 day fully-functional trial version with a limit of two company files.

When the product is first launched, you will see this screen:

4

The above screen will be presented each time FinJinni is launched during the trial. To purchase

FinJinni and obtain a permanent license key, see the section ”Licensing” in this document. Until

then, just press Continue.

5

FinJinni First Time Setup

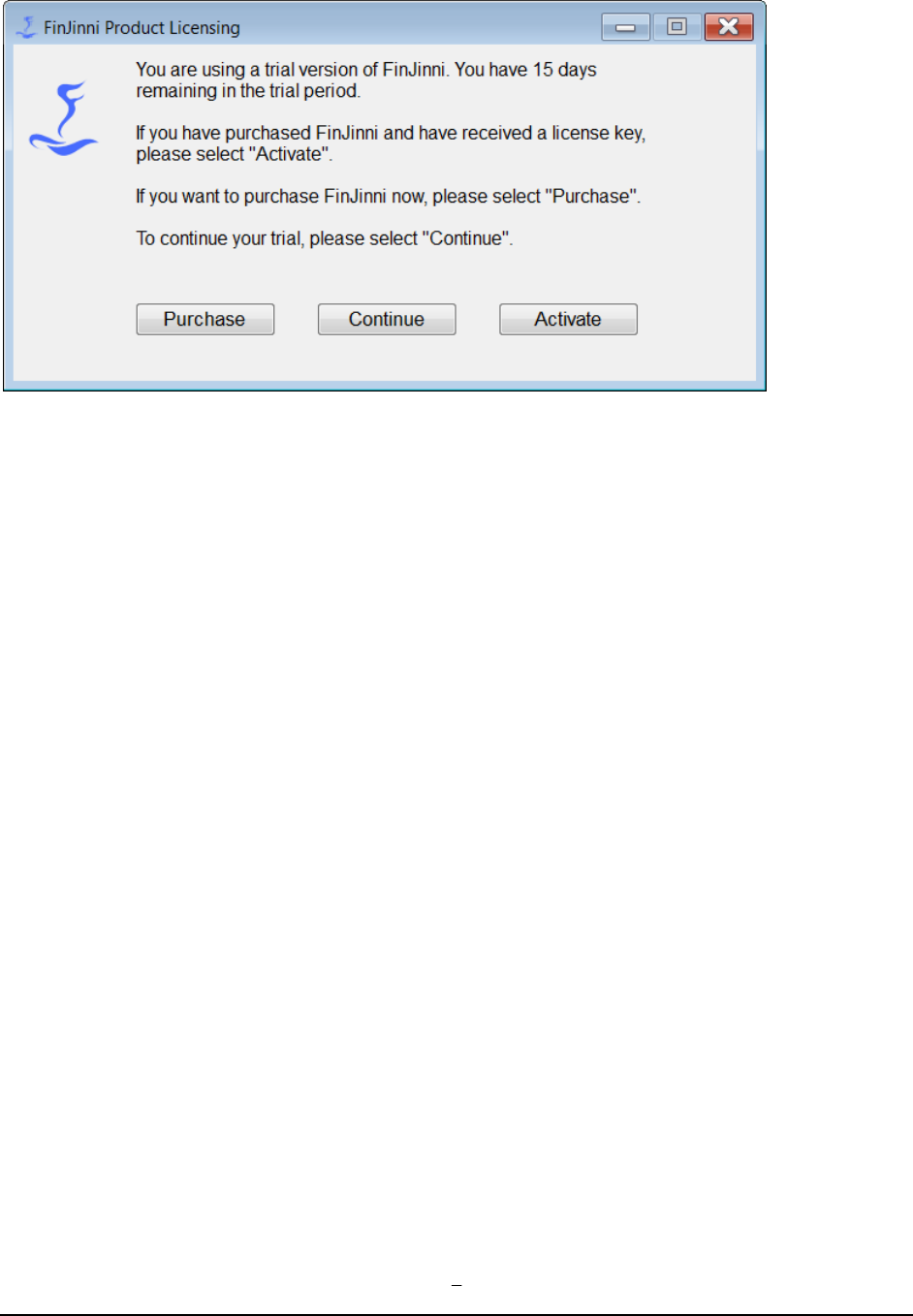

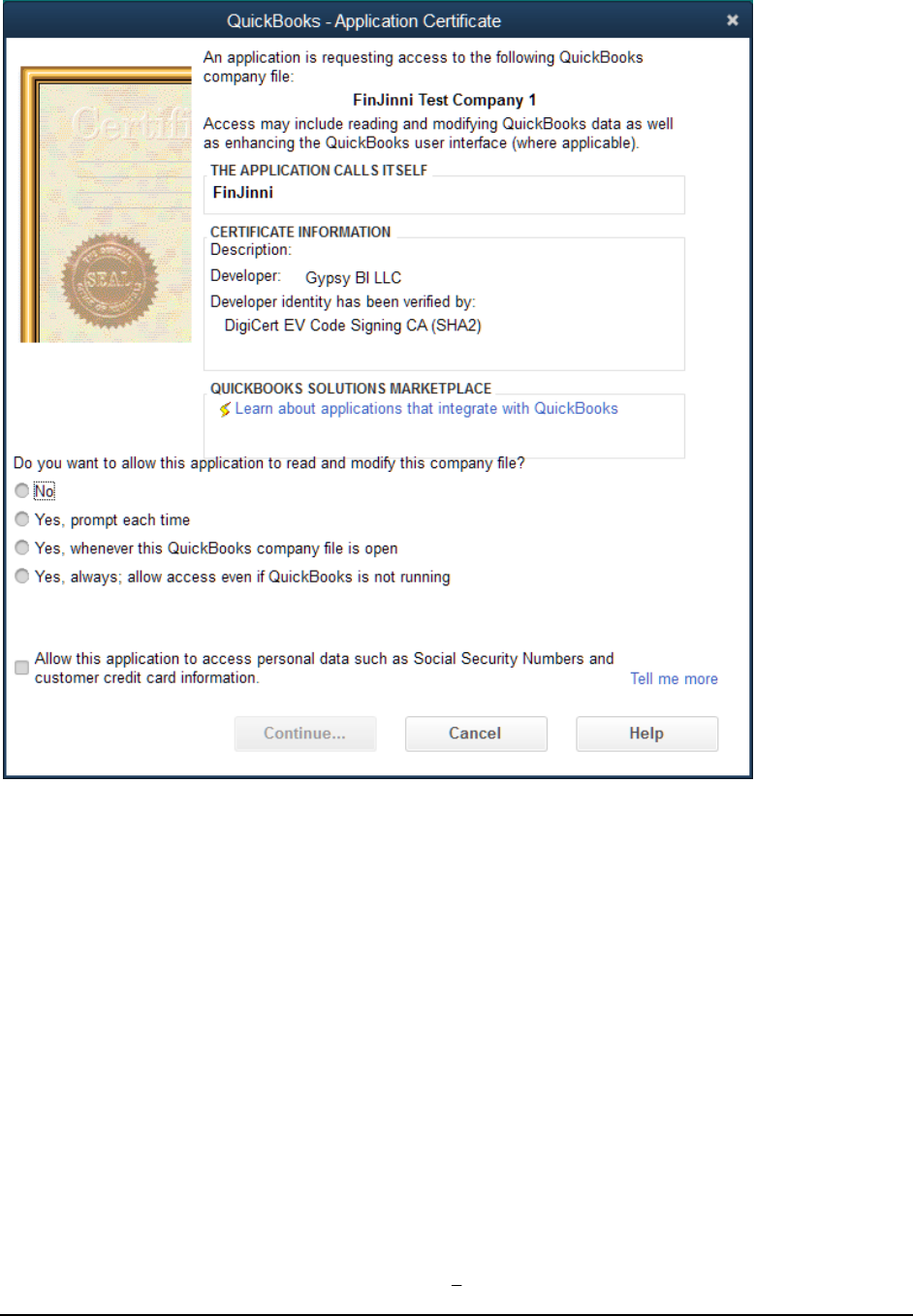

The first time that you run FinJinni, you will be prompted for your QuickBooks file information. Select

your QuickBooks company on the screens provided and choose a database name for your data repository.

The screens displayed in sequence are:

If you choose Online skip to the next section.

If you choose Desktop, you will see this screen next:

If you press Continue, QuickBooks will display its authorization screen so that you can authorize FinJinni

to access the company file.

6

You do not need to give FinJinni access to personal data. Please press Continue and then Yes and

Done on the confirmation screens.

Next you will be asked for a short “nick-name” to be used to identify the company. This is used in drop-

down lists to select the company and is also available in reports as an identifier when you are using multiple

companies.

This is the screen:

7

You will then be asked for a database in which the extracted company data will be stored.

We recommend using a more meaningful name than this default. Please note that the name can only

contain letters, numbers, and the characters # @ - _. Blanks are not allowed in this name.

If the database does not exist, you will be given the option to create it:

8

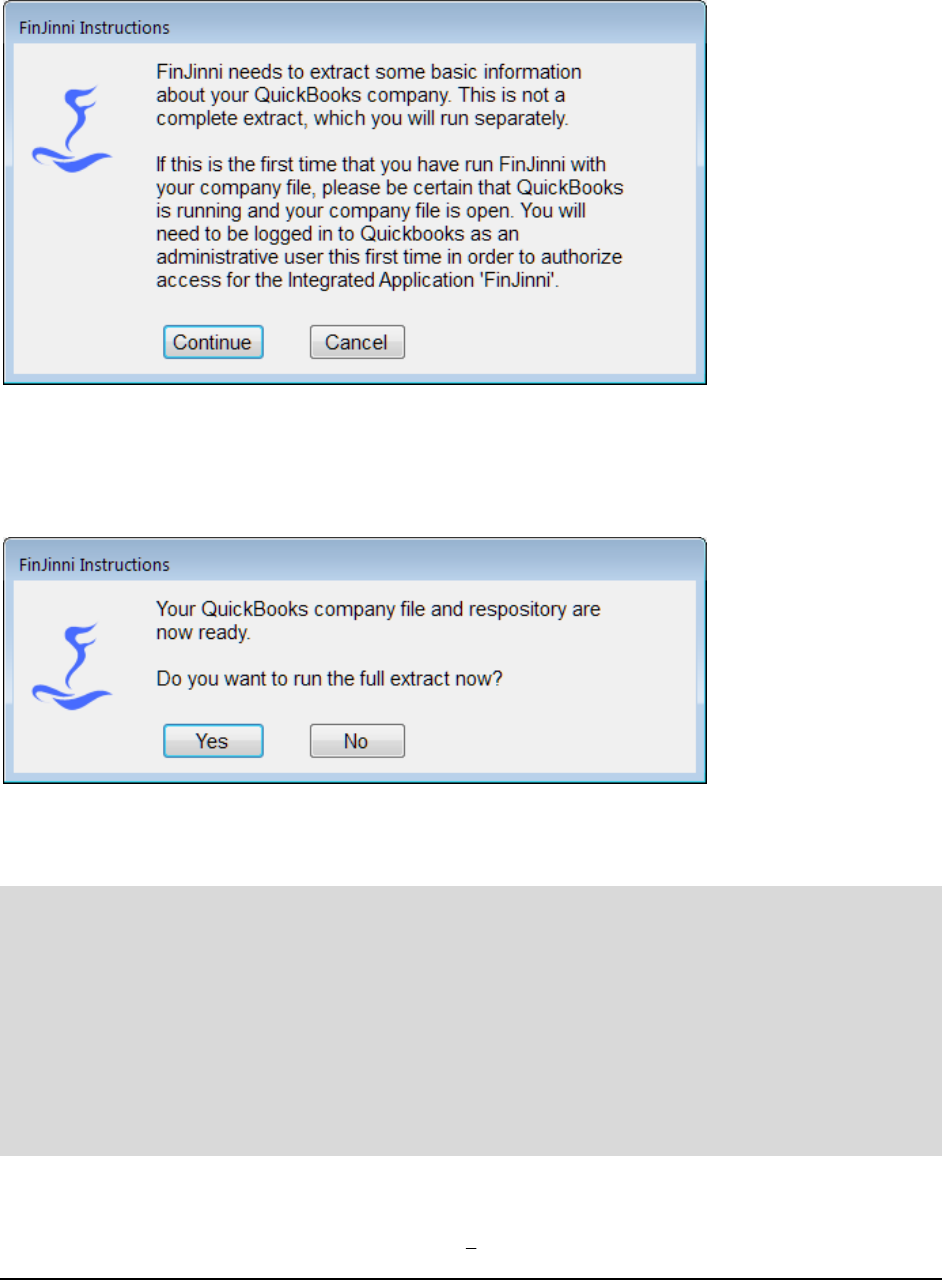

FinJinni will then attempt to connect to your company file and extract some basic information. This is not

a full extract, which you will run after setup is complete.

When you press Continue, FinJinni will connect to your company file and retrieve some basic company

and account information.

Your company file is now ready to have its data extracted. The next screen displayed will be:

Choose Yes to extract or No to return to the main screen where you can perform additional setup if

needed.

A few important tips for this first extract:

1. The full extract is only needed the first time that you run FinJinni for your company file. After

that, refreshes are done incrementally so that only new or changed data is loaded. The first load

can take a considerable amount of time if your company file is very large. One way to speed this

up is to open your company file in single-user mode for this initial load.

2. If you are using cash-basis reporting, or want to use job-time reporting, be sure to check those

Options in Setup before running the full extract. See “QuickBooks Company Setup” below for

this and other options.

9

3. If you want to produce reports mapping Bill Payments to their original Bill items, or Received

Payments to their original Invoice items, you must turn on cash-basis reporting even if you are

an accrual-only company. This will not affect any accrual-basis reports, it makes payment reports

available.

10

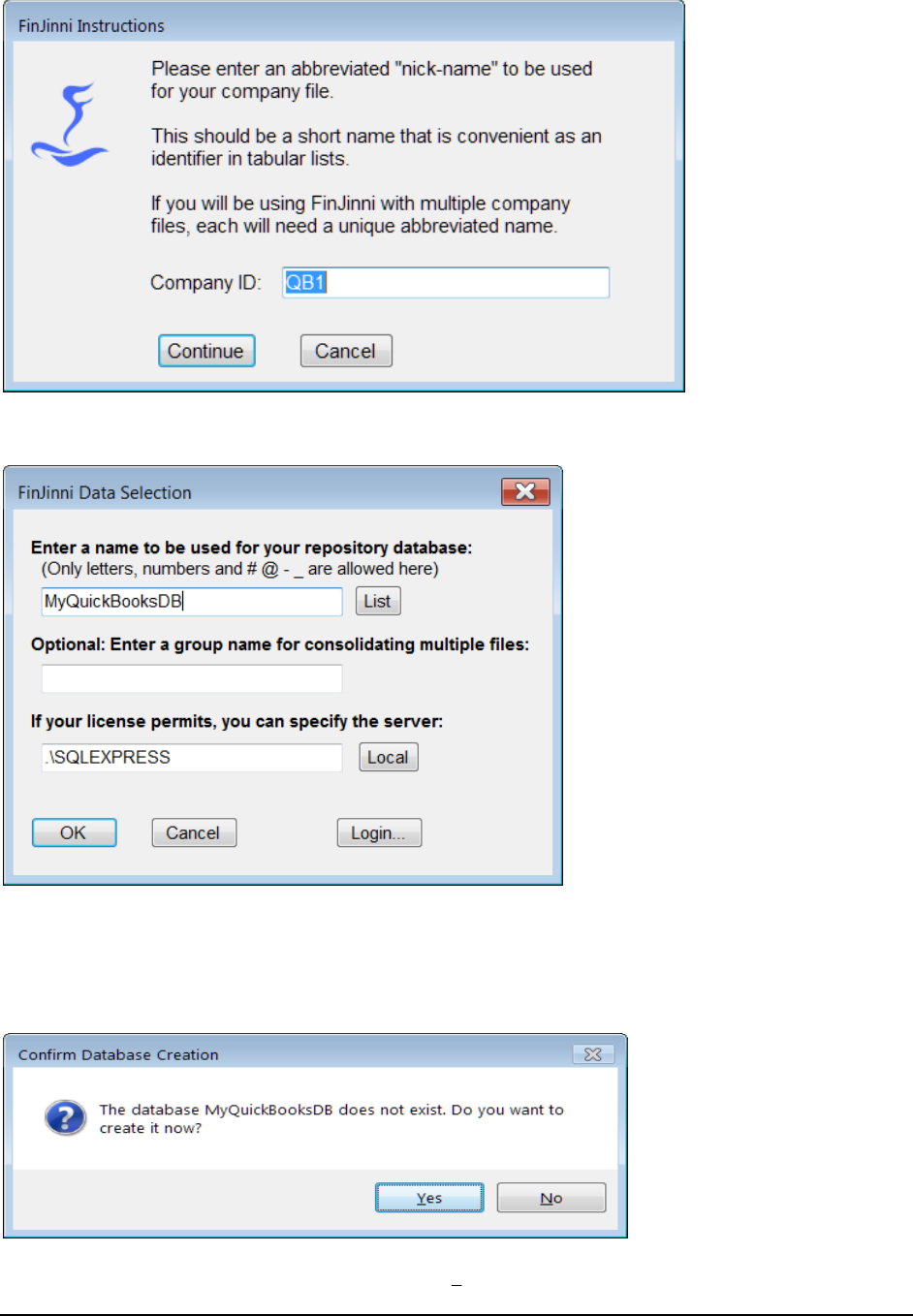

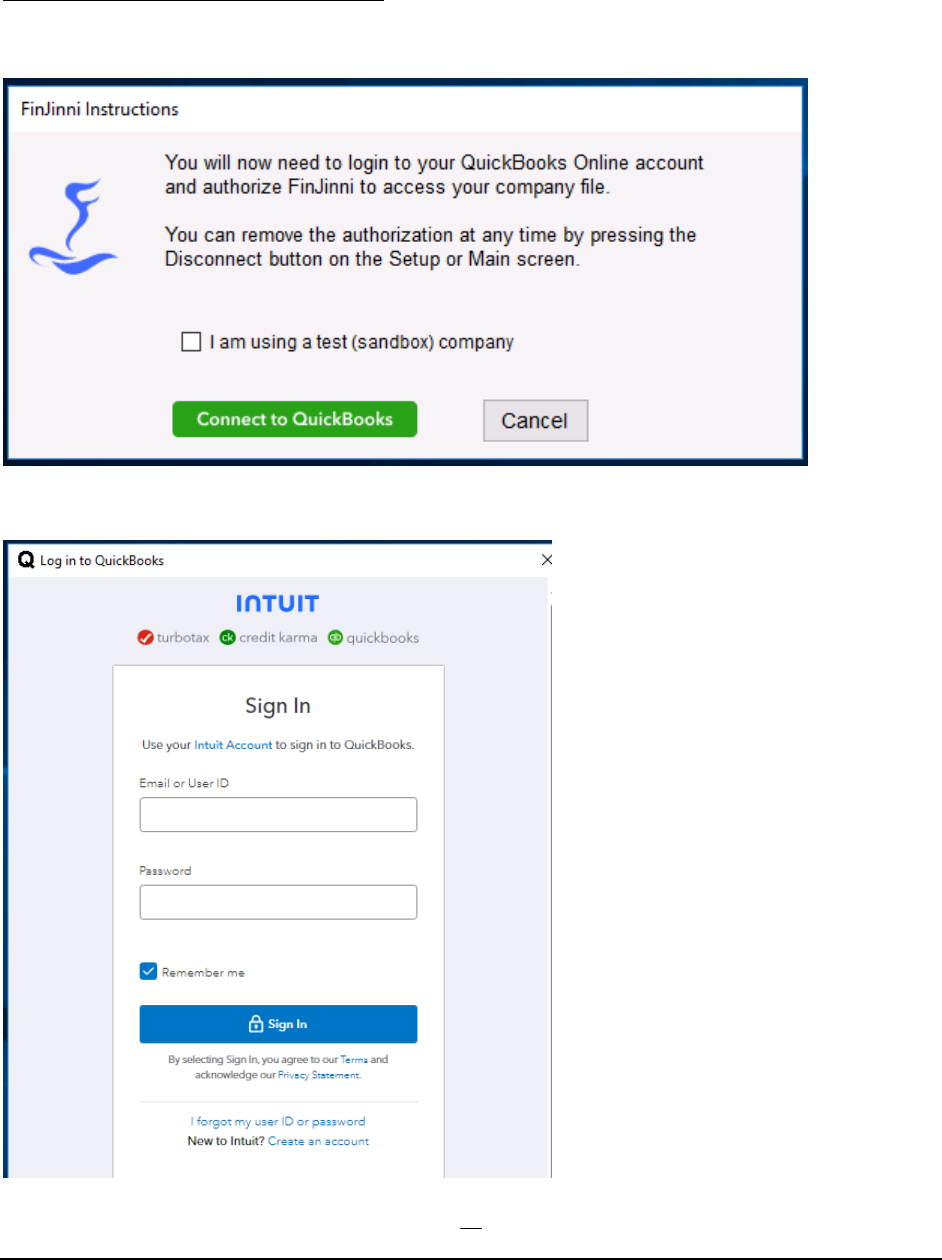

First Time Setup Online

If you chose to add an Online company

In this case, you will see the screen:

Press Connect to QuickBooks and you will be given the Intuit logon:

11

You will now need to login and authorize the access to your company.

Notice: FinJinni uses a Microsoft Edge component to login to your Intuit account. This is included

on most current Windows installations for Windows 10 or 11. Certain older system do not have this

component. On these systems, FinJinni will prompt you to install it and start the installation

automatically. If you have any difficulties, please contact GypsyBI support for assistance.

For future extracts, you will not need to log in again until your authorization expires; QuickBooks

Online will keep your authorization active for up to 100 days. You will see this status on the main

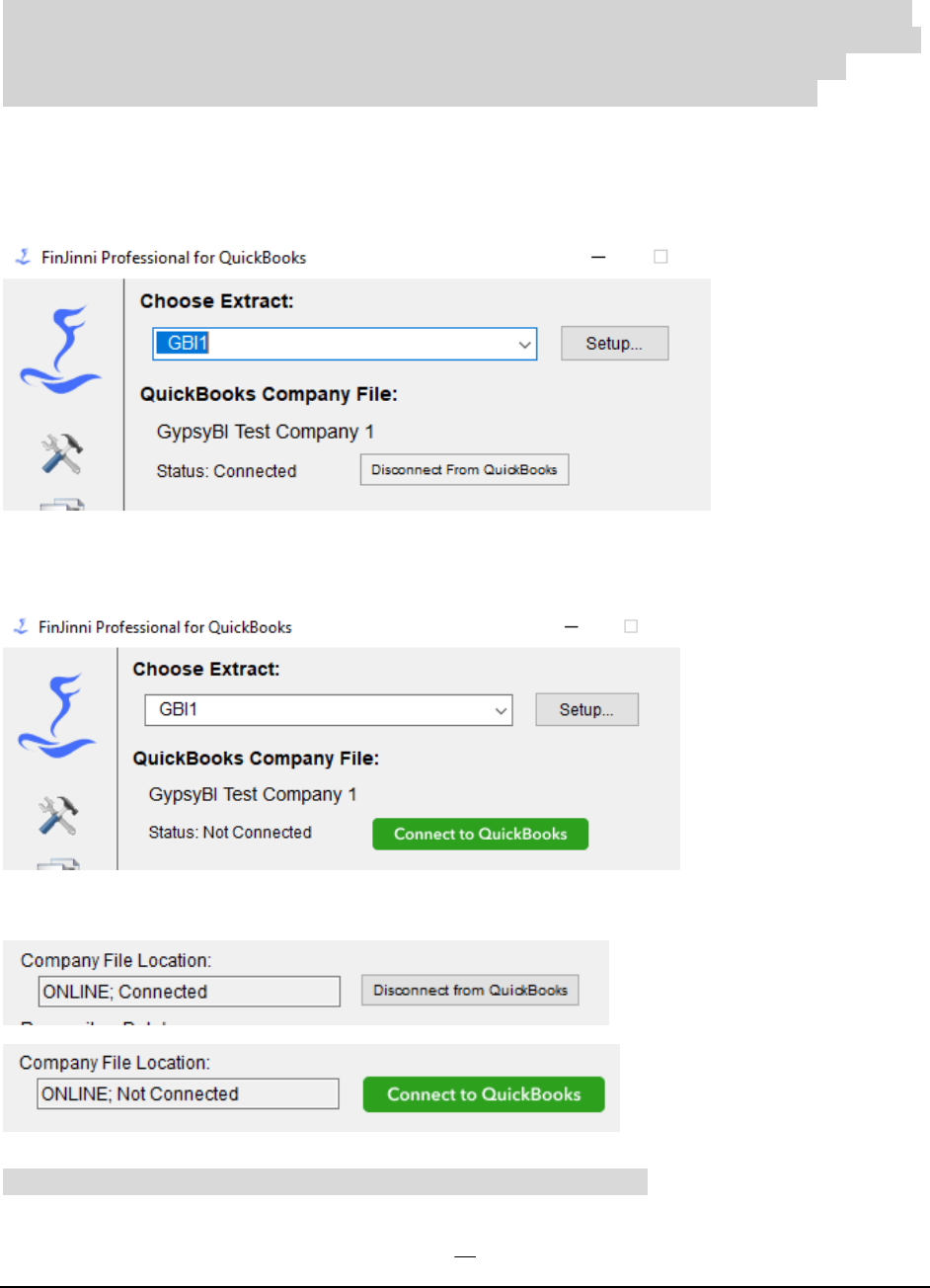

screen to indicate FinJinni is still connected to QuickBooks Online:

If FinJinni detects that you are no longer authorized, you will see this status and you will need to press the

Connect button to log into QuickBooks Online again:

On the setup screen, here is what you will see instead of the above screens:

Important: FinJinni must be Connected before you can run an extract.

12

Using FinJinni Professional

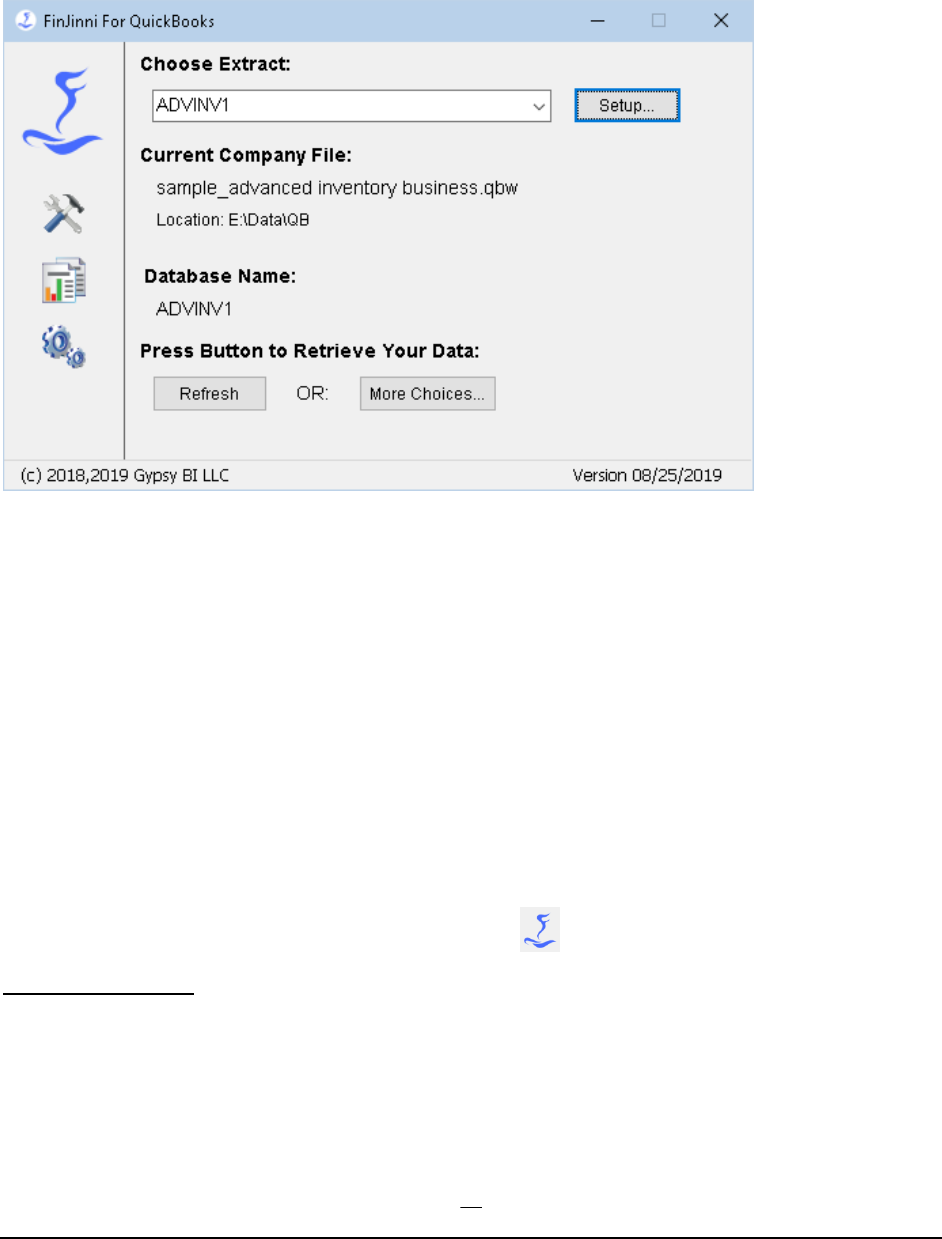

This is the FinJinni main screen:

To use an existing extract, simply choose the name of your file from the drop down menu and press the

Refresh button. To edit an extract or create a new extract press Setup.

The Refresh button will run an incremental load of all information that has changed since the last load.

Normally, this is the proper and fastest way to extract data.

Additional load choices are available by pressing More Choices. If you want to reload all data (e.g. if you

restored an older backup file), use this and choose “Reload ALL Data”. If you want a complete reset of

your database (e.g. if you are switching to a completely different file), choose “Rebuild the Database”. These

and other choices are listed in more detail below.

Note: If you have extracted an older file and are given a new version of the same company, the incremental

load will work properly as long as only the new company file has been modified (it is a direct “descendent”

of the old file). Otherwise, use a Full Reload.

For help, updates and license information, click on the

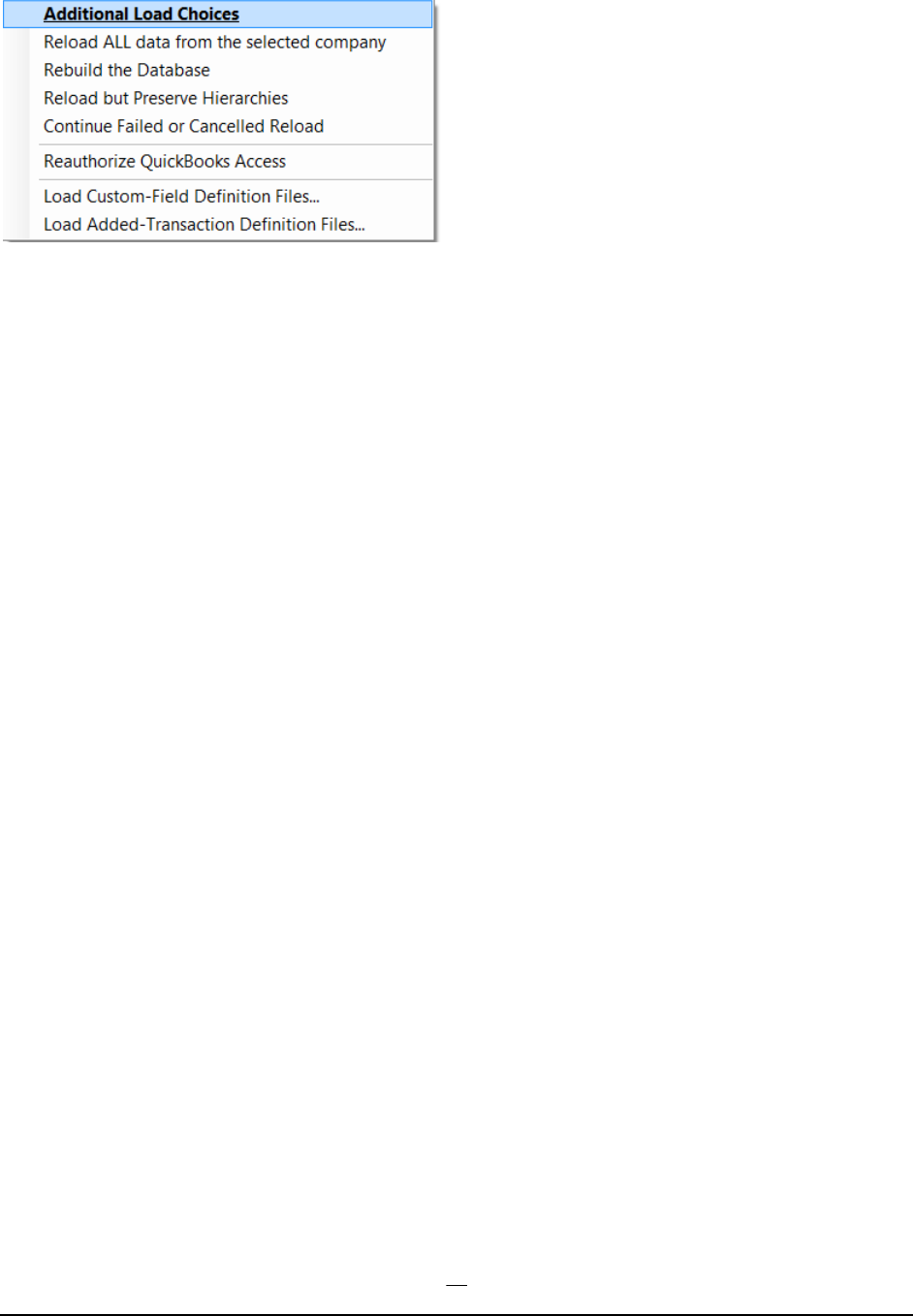

More Load Choices

When you press “More Choices…”, you will see this menu:

13

The choices are:

Reload ALL data from the selected company

This will perform a complete reload of all data from the selected company file, or the group of

company files if a group is selected. All existing data is deleted and reload. If a single company is

selected and other companies are loaded into the same database, those companies will be

unaffected.

Rebuild the Database

This will reload all data and will also completely rebuild the database, clearing all data from all

companies that have been loaded.

Reload but Preserve Hierarchies

This is used in special instances where custom reporting hierarchies have been created. Those

hierarchies will be preserved on reload when this choice is used.

Continue Failed or Cancelled Reload

If a reload fails in the middle (e.g. the QuickBooks data server or the Internet connection to

QuickBooks Online fails) or you cancel the reload for some other reason, you can pick it up

where it left off by using this option.

Please use this option with care: Any entities or transaction types that have already been loaded

will not be checked for new changes when the load is restarted. Use this if you know that no

QuickBooks changes have been made since the previous load was stopped. You can also run

another incremental refresh after the continued load finishes to be certain any changes are picked

up.

Reauthorize QuickBooks Access

This will connect FinJinni to QuickBooks and re-authorize the access within QuickBooks. You

can use this to re-authorize FinJinni without reloading any data.

Load Custom-Field Definition Files

This allows you to immediately load custom field definition files without starting a QuickBooks

refresh (these files are otherwise automatically loaded on each refresh). You will be given a choice

of which type of entity file to load. For more information, refer to the section “Advanced Data

Loading Features” later in this document.

Load Added-Transaction Definition Files

14

This allows you to immediately load added-transactions, budget, and other custom data files

without starting a QuickBooks refresh (these files are otherwise automatically loaded on each

refresh). You will be given a choice of which type of data file to load. For more information, refer

to the section “Advanced Data Loading Features” later in this document.

15

Running Queries and Creating Reports

We recommend that you use Microsoft Excel to analyze the data extracted from FinJinni. In Excel,

there will be a FinJinni menu choice and a Help button on the FinJinni ribbon bar. From there, you

can bring up the documentation for Queries, or you can manually open the file FinJinni Pro Queries

Manual.pdf in the Program Files folder.

If you want to build queries from FinJinni Pro outside of Excel, click on this icon on the left side of

the main screen:

Refer to the Queries manual for information on how to proceed.

16

Licensing FinJinni

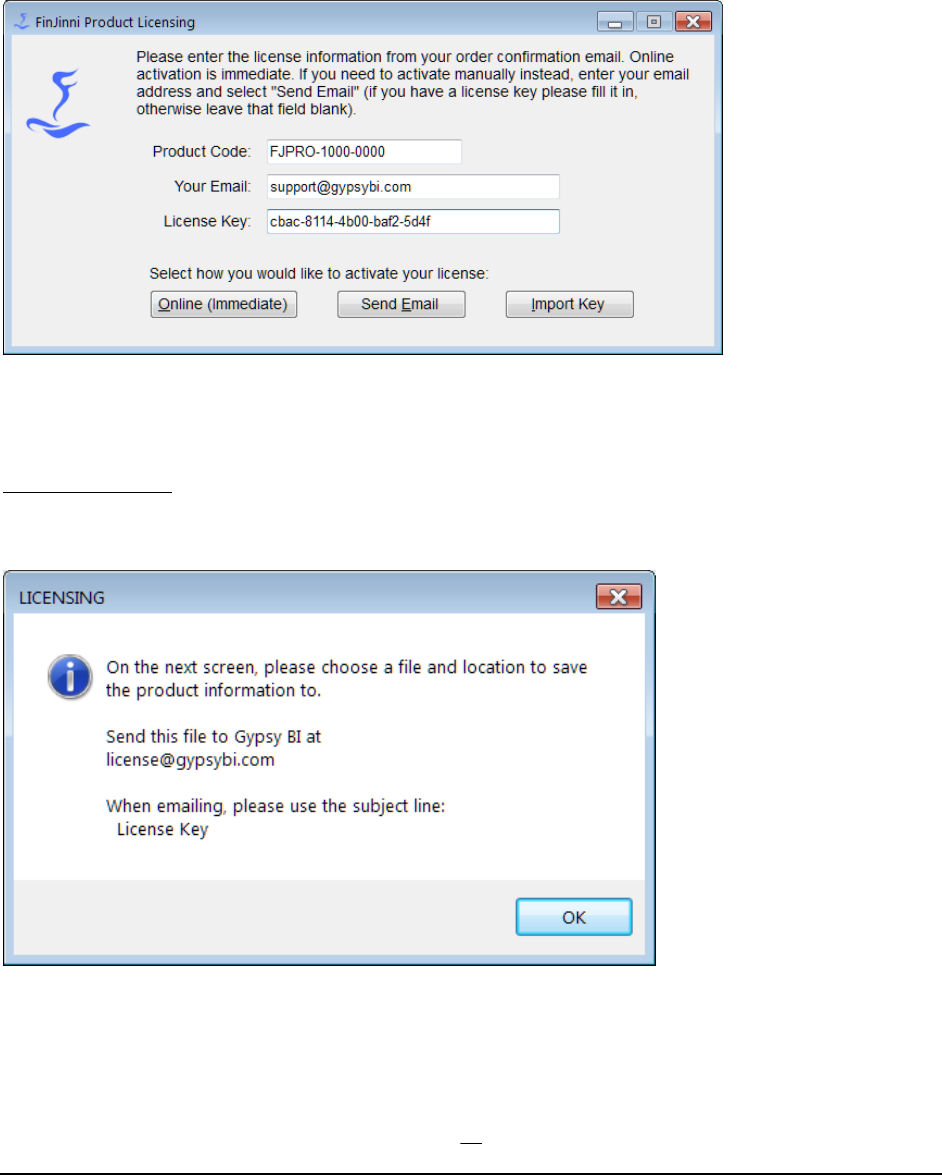

FinJinni is distributed with a fully-functional trial version, within a limit of 15 days and two companies. You

can purchase a permanent license for FinJinni from the GypsyBI online store. Once you purchase, you will

be given the licensing information in the order confirmation email. Press Activate on the Trial screen and

you will be given the Licensing screen where you can enter this information:

Note: If you have purchased add-on licenses for more than 3 companies, you will receive an updated

product code and license key from GypsyBI in a separate email.

Offline Licensing

On the license screen, if you select Send Email, you will be given these instructions:

When you click OK, you will be presented with a “Save As” dialog to save the file “FJLicenseRequest.txt”.

Please save this in a convenient location, such as your “Documents “folder.

Once you receive your license key, use the Import Key button to import the license file

“FJLicenseResponse.txt”.

17

You can also do either of the above steps from the main product screen by clicking on the FinJiini icon.

18

QuickBooks Company Setup

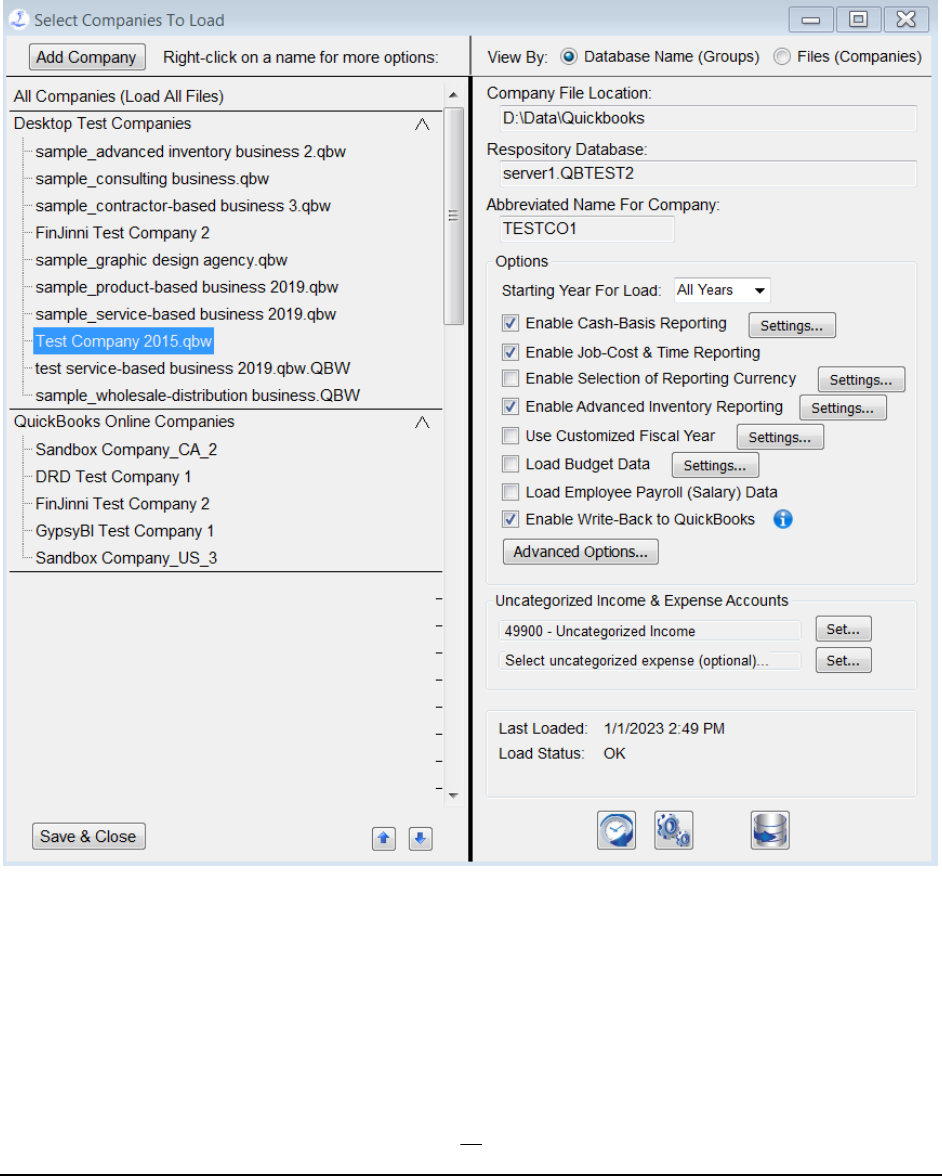

When you press the Setup button on the main screen, you will be presented with the Setup screen. This

displays all the QuickBooks companies that have been identified to FinJinni, for example:

All extracts that you have added will be listed on the left side. The settings for the selected extract are

displayed on the right.

If you're using FinJinni’s consolidated reporting, you can define groups of companies as shown above. Any

one company can be in multiple groups.

To add a new company file, press the Add Company button. The screens displayed will be the same as

described in “FinJinni First Time Setup”.

19

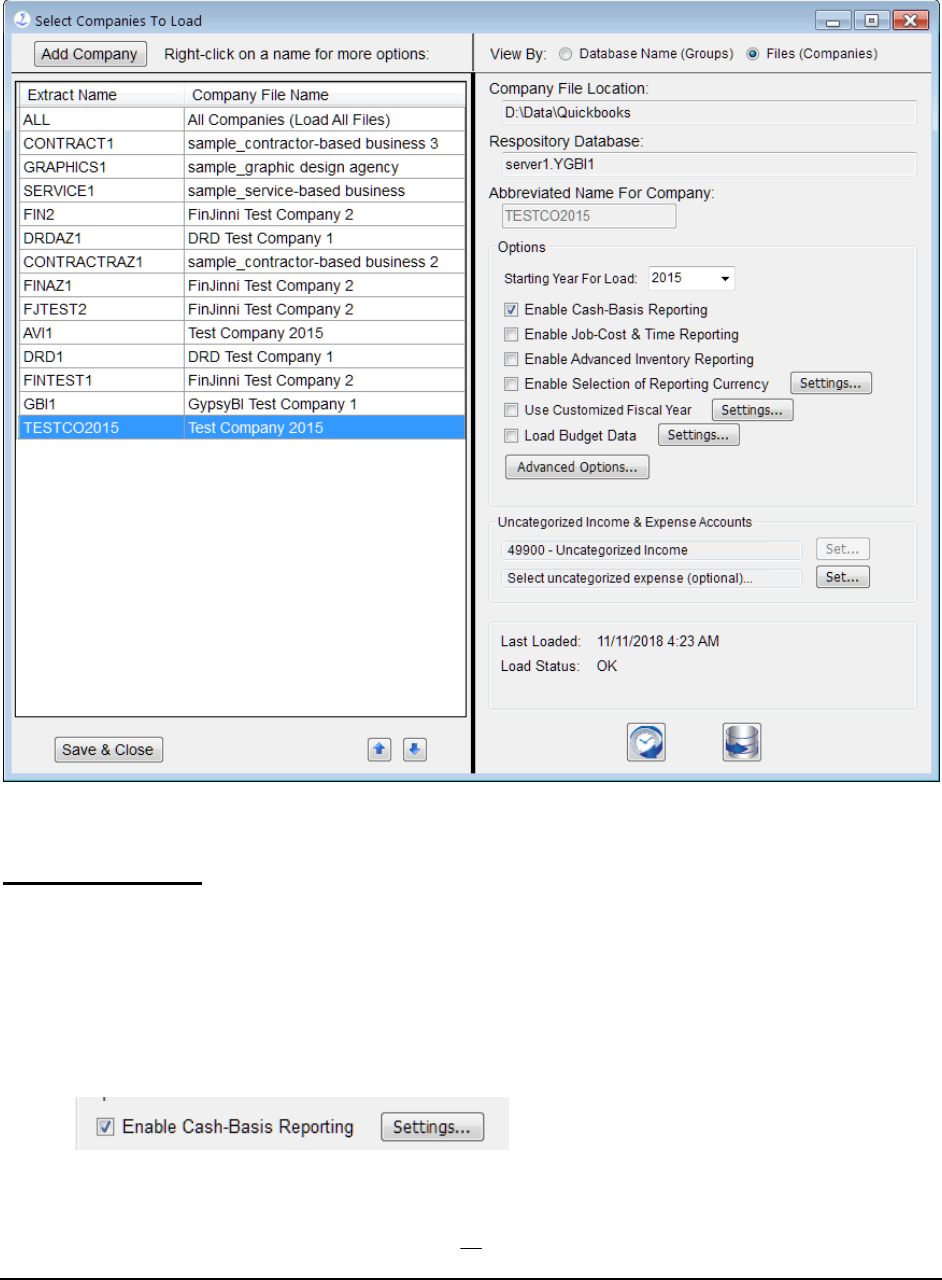

If you are only reporting on separate companies, you can use the display as shown or select the View By

Files radio button on the upper right of the screen to get a list view:

Important Options

There are two settings that are important for reliable reporting:

1. Enable Cash-Basis Reporting: You must select this before extracting if you will be using cash-

basis reporting. Accrual-basis reporting is always supported; checking this option will load both

and allow the basis to be chosen at the time of each report.

For a QuickBooks Online company, there will be a Settings button:

See the section “Cash Reporting Settings” below for a description. For QuickBooks desktop, no

additional settings are required.

20

2. Uncategorized Income Account: Certain income is not categorized when received. Normally,

FinJinni will select the account QuickBooks uses for uncategorized income. You can change that

here for special cases.

Other Options:

Other options are used for specialized reporting:

3. Starting Year for Load: Normally, FinJinni will load all historical data available in the QuickBooks

file on the first load. After that, only incremental changes are loaded when a refresh is performed.

However, the first load can take a considerable amount of time (from ½ hour up to several hours)

if you have a large amount of data in QuickBooks. You can use the starting-year option to restrict

the load of information starting with the year specified. FinJinni will obtain a starting balance for

balance-sheet accounts at the beginning of that year and only load transaction data starting at that

date.

Note: If you are using a non-calendar fiscal year, this selection is the fiscal year number.

4. Enable Job-Cost and Time Reporting: You must select this if you want FinJinni to extract payroll

costs and employee time by job from QuickBooks.

5. Enable Advanced Inventory Reporting: You must select this if you want FinJinni to extract

Advanced Inventory data from QuickBooks. There are several additional options you should

review and set as necessary. See the following section for more information.

6. Enable Selection of Reporting Currency: For multi-currency companies, allows the reporting

currency to be selected at the time a report is created. See the section “Using Multiple Currencies”

for more information.

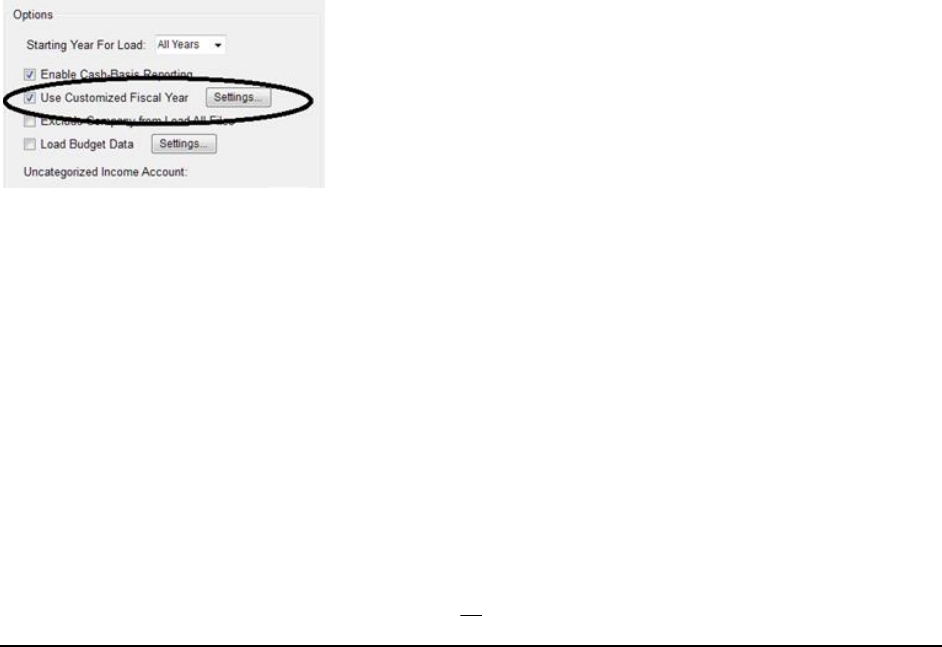

7. Use Customized Fiscal Year: Use this to have FinJinni recalculate the financial data based on a fiscal

year other than what is set in QuickBooks. See the following section for more information.

8. Load Budget Data: You must select this if you want FinJinni to extract budget data from

QuickBooks. The setup for this option is described below.

9. Load Employee Payroll (Salary) Data. QuickBooks considers salary data to be sensitive information.

You must check this option so that FinJinni knows to request this information from QuickBooks.

(This option applies to QuickBooks Desktop only).

10. Enable Write-Back to QuickBooks: Select this option if you will be using FinJinni to update

QuickBooks by posting List Items or Transactions, as described later in this document. If you leave

this option unchecked, FinJinni will only read from to your QuickBooks company and never write

transactions back, even if you set up data files to upload.

11. Advanced Options: Additional options that are less frequently used. See the section below on these

options for information.

21

22

Cash-Reporting Settings

Selecting Settings for Cash Reporting will display a pop-up with a single setting:

Selecting this option will tell FinJinni to run an allocation process whereby bill payments and received

payments are mapped back to their original transactions (Bills, Invoices, etc.) and allocated to the

individual transaction lines. This is used for payment break-down reports. Selecting this option will

increase the load time for large files and should only be used if payment break-down reporting is

desired.

Note: For QuickBooks Desktop, this mapping is always performed and no option is needed.

23

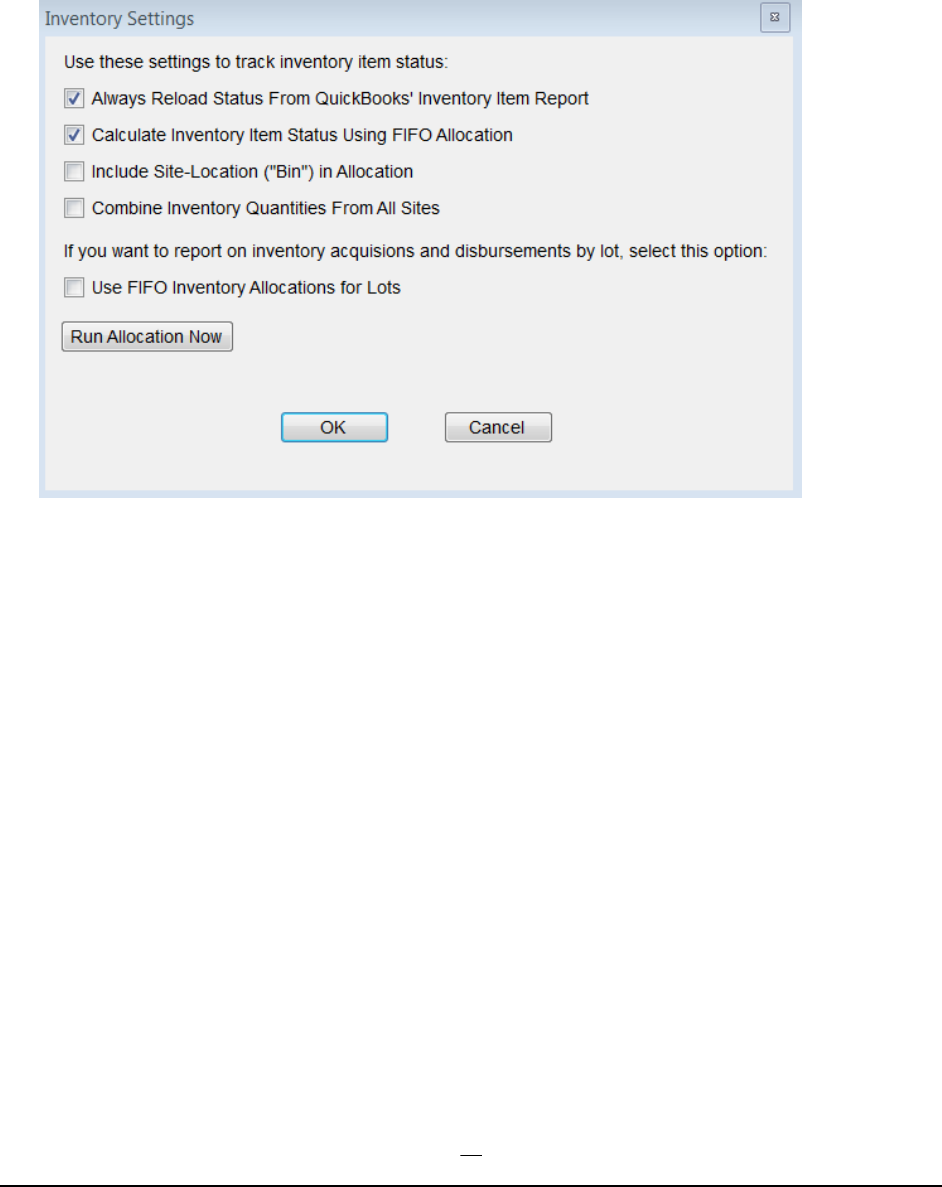

Advanced Inventory Settings

If you are using QuickBooks Enterprise with Advanced Inventory, FinJinni can provide additional

analysis reports based on the inventory data in QuickBooks. There are several settings you can choose

on the Settings screen for Advanced Inventory:

Always Reload Status From QuickBooks' Inventory Item Report

This option loads item on-hand quantities from the Inventory Item Status report as of the

current date instead of using the quantities from the item list, which can include future pending

transactions.

Calculate Inventory Item Status Using FIFO Allocation

This option will run an inventory-allocation process to match up acquisitions (purchases) and

distributions (sales) of inventory. It is the equivalent to how QuickBooks uses the “FIFO” option

in advanced inventory for reporting.

Note: This allocation process does not take item lots into account. If you want to use FIFO

allocation to report on lots, use the next option:

Include Site-Location (\"Bin\") in Allocation

If this option is selected, the FIFO allocation will include the intra-site location, usually called

“bin”. Purchase and sales transactions will not cross bins unless inventory transfers are properly

entered.

Combine Inventory Quantities From All Sites

24

If this option is selected, the FIFO allocation will ignore the inventory site and calculate total

quantities from all sites.

Use FIFO Inventory Allocations for Lots

This option will run a similar FIFO allocation process for Item Lots when those are used. It can

be chosen either with or independently from the general item options above.

25

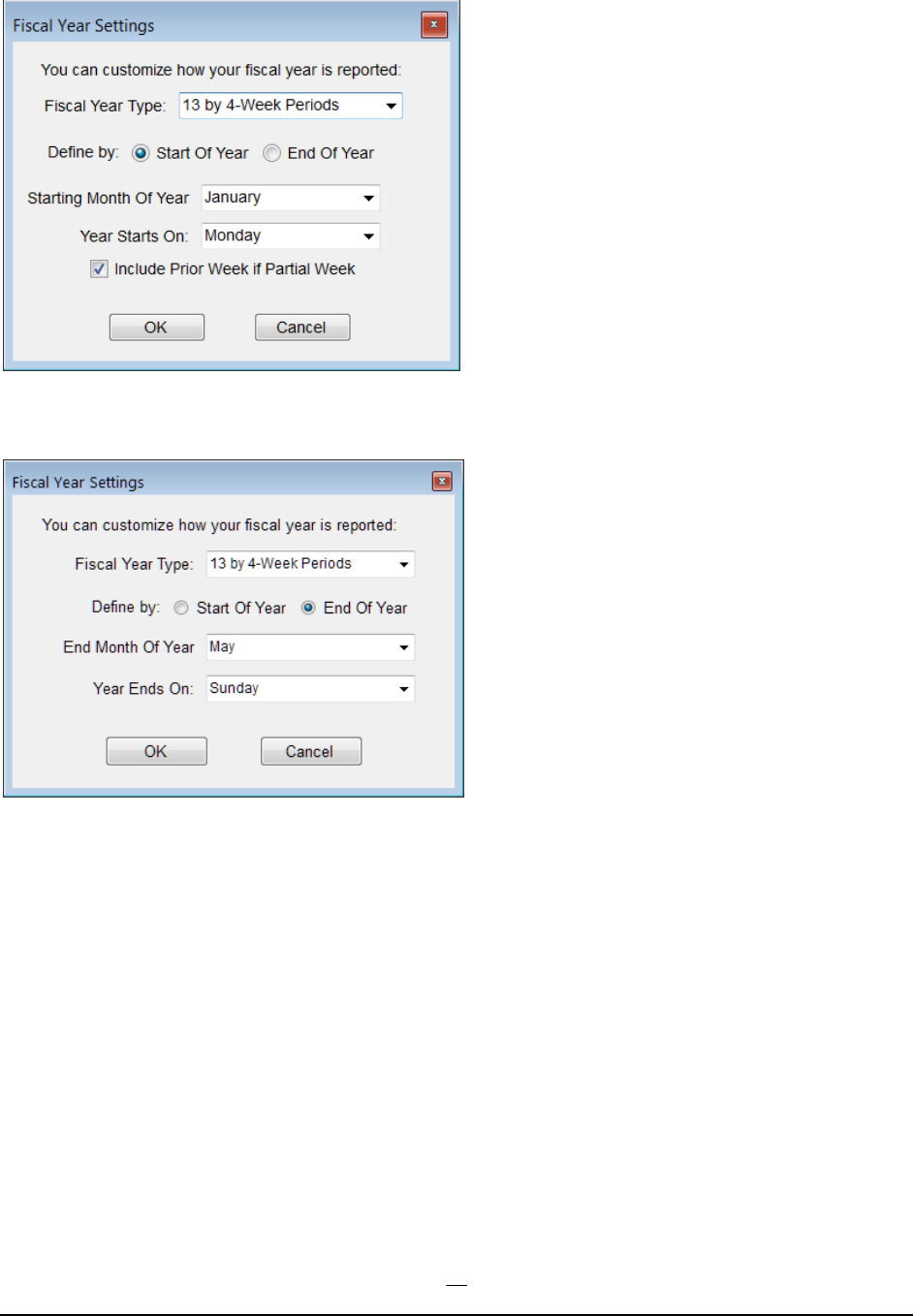

Using Custom Fiscal Years

FinJinni provides several options for customizing your fiscal year reporting:

1. Annual: You can use a starting month other than January. The fiscal year will start on the first

date of that month. If you specify a starting month in QuickBooks, FinJinni will use that by

default. For specialized reporting needs, you can change the month in FinJinni without modifying

your QuickBooks company.

2. 13 by 4-Week Periods: The year consists of 52 weeks divided into 13 “months” of 4 weeks

each. A 53th week is added when needed. This setting only affects reporting in FinJinni. Your

QuickBooks company is unchanged.

3. 4-4-5-Week Periods: The year consists of 52 weeks divided into 4 quarters of 13 weeks each. A

53th week is added when needed. This setting only affects reporting in FinJinni. Your

QuickBooks company is unchanged.

For options #2 and #3, you should specify a starting day of week for the fiscal year to use a consistent day

of the week instead of the first of the month.

You can also define the fiscal year by the day on which it ends. For example, choose the last Sunday in

May. The fiscal year will then start on the Monday following, which can either be the last Monday in May

or June 1.

To select a custom fiscal year, press the Settings button as shown here:

You will be presented with this selection screen:

26

Or, if defining the end of the year:

Notes:

1. When you change these reporting settings, you must perform a full reload of your company

data for them to take effect.

2. When you are consolidating multiple companies, all companies in the same database must

have the same fiscal year settings.

3. The settings you choose do not need to be the same as what you have defined in

QuickBooks. Fiscal periods are recalculated as FinJinni loads data from QuickBooks.

4. You can verify the date calculations by using a query Transaction Date to Fiscal Period

Mapping" under “System Maintenance Queries". Refer to the Queries Manual for

instructions on how to run queries.

27

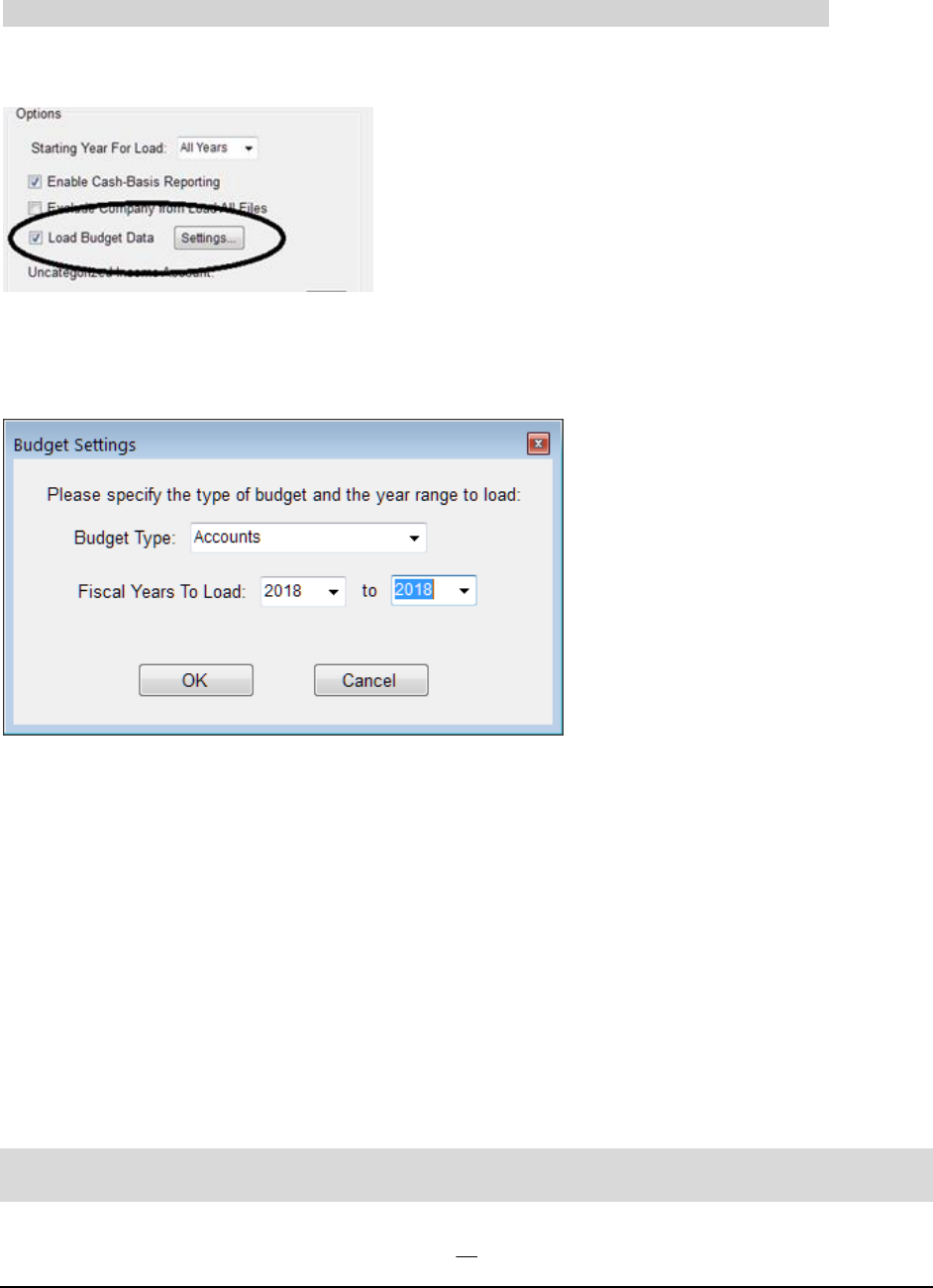

Budget Reporting for QuickBooks Desktop

For QuickBooks Online, budgets are always loaded if present. No special setup is needed.

If you want to load budget data from QuickBooks Desktop for reporting in FinJinni, you must specify the

budget type and years. There is a setting on the company setup screen for this:

When you check Load Budget Data the first time, or use the Settings button after that, you will see this

screen:

The choices for Budget Type are the same as in QuickBooks, namely:

Accounts

Accounts And Classes

Accounts And Customers

Please note the following:

1. Budget data from QuickBooks is available in a summary form by account and month, and class or

customer if selected. It is important that you select the correct budget type since QuickBooks can

have multiple budgets for the same year.

2. After making these changes, refresh your company data on the FinJinni main screen. Budgets are

reloaded whenever a refresh is requested.

FinJinni can also load budget data created outside QuickBooks. See the section “Loading Budget Data from

Outside QuickBooks” later in this document form more information.

28

Reporting on QuickBooks Reimbursed Expenses

This option applies to QuickBooks Desktop only. No additional setting is needed for QuickBooks

Online.

If you use the reimbursed expense feature in QuickBooks, Invoices can be created without the Item field

filled in on the line items. FinJinni normally requires this field to identify the associated account. QuickBooks

does not provide the account to third-party applications if the item field is not filled in.

To show the proper account balances for reimbursed expenses, FinJinni normally uses the daily trial balance

to identify the total of reimbursed expenses for each account and day.

If you want a finer level of detail, FinJinni can use an expense report from QuickBooks to fill in the

additional information and report the account and class on each reimbursed expense line. The load option

“Track Individual Reimbursed Expenses on Invoices” must be checked for this to be done.

When using QuickBooks reports to obtain additional information, it is important to use distinct account

names. If you have multiple accounts with the same name, they appear the same on QuickBooks reports,

even if they have different parent accounts. For example, if you have accounts “Homeowners:Insurance”

and “Auto:Insurance”, they both appear only as “Insurance”. FinJinni cannot tell which account is being

used on an individual expense line in this case.

Another way to handle these duplicate account names is to use an account description and set the

QuickBooks preference “Name and Description” under “Reports & Graphs”, “Show Accounts By”. The

account name and description will both appear on reports, e.g. “Insurance (Auto)” if the account description

is set to “Auto”.

29

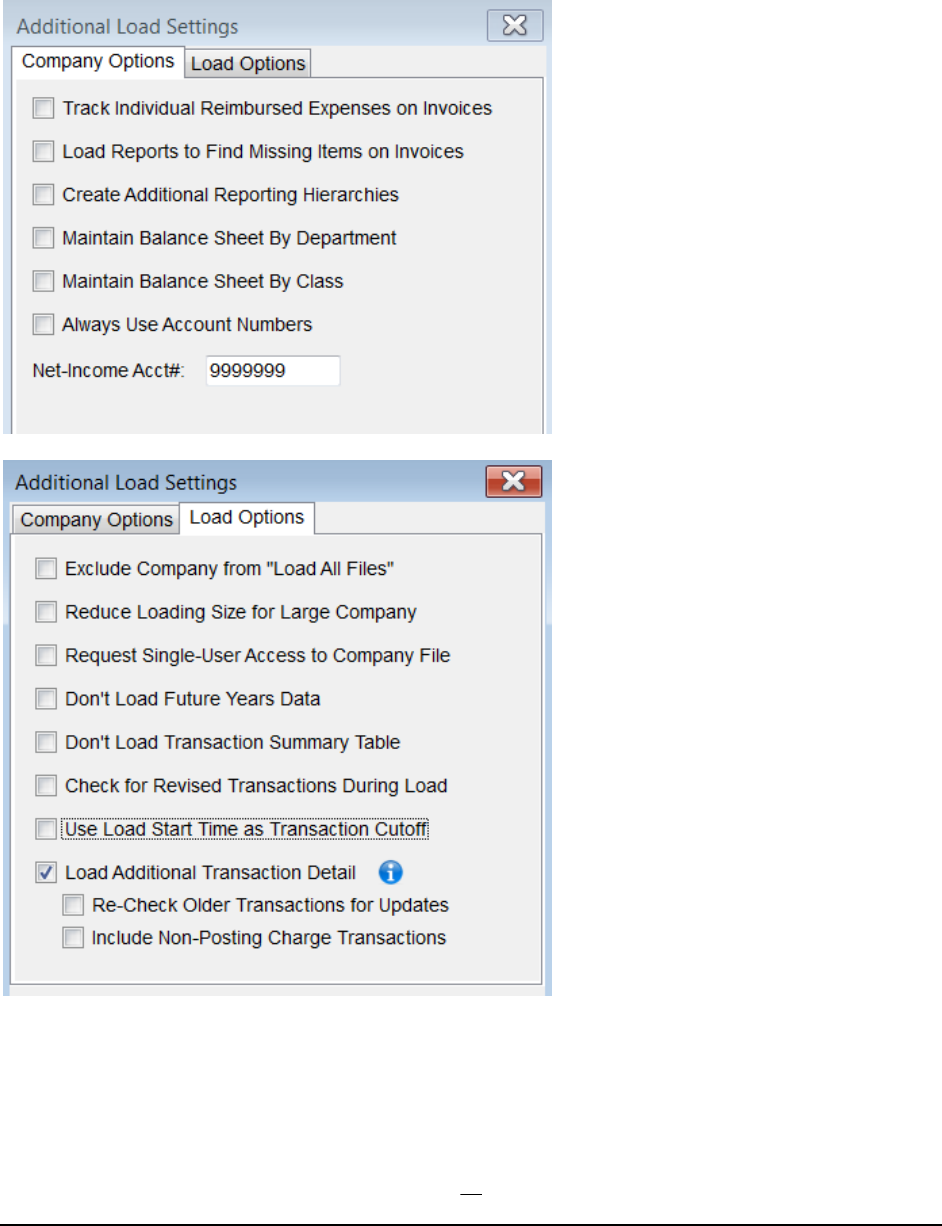

Advanced Loading Options

These additional options are set in special circumstances. Note that the Advanced Options window

has two tabs, one labelled Company Options and one labelled Load Options:

These options are:

• Track Individual Reimbursed Expenses on Invoices: If you use the reimbursed expense feature in

QuickBooks, Invoices can be created without the Item field filled in on the line items. FinJinni

requires this field to identify the associated account and reports daily totals for reimbursed expenses

30

by account. If you set this option, FinJinni will use an expense report from QuickBooks to fill in

the additional information.

(This option applies to QuickBooks Desktop only).

• Load Reports to Find Missing Items on Invoices: In QuickBooks, when you create an

Invoice, you specify the product or service that is sold. You do not specify the

income/expense account. QuickBooks determines that from the item setup. But Intuit

provides a back-door for external applications that allows them to specify the account on the

invoice without an item. When this is done, it does not allow other applications, like

FinJinni, to read back the account. If you set this option, FinJinni will use an invoice detail

report from QuickBooks to fill in the account information for both income and liability

accounts.

(This option applies to QuickBooks Desktop only).

• Create Additional Reporting Hierarchies: FinJinni always creates hierarchies of the various

QuickBooks entities so that they can be selected when reporting, e.g. selected customers,

vendors, etc. These are called “All Customers”, “All Vendors” and so on. If you select the

option to create additional hierarchies, FinJinni will also create hierarchies such as

“Customer by Bill State”, so that you can select an entire state. Additional hierarchies are

available for custom reporting.

• Maintain Balance Sheet by Department: Normally, the balance sheet is only maintained by

account. Selecting this option allows filtering of the balance sheet by department, also called

location.

• Maintain Balance Sheet by Class: Normally, the balance sheet is only maintained by account.

Selecting this option allows filtering of the balance sheet by class.

• Always Use Account Numbers: By default, FinJinni will only use account numbers if that

preference is set for the company in QuickBooks. This option overrides that setting and will

use account numbers whenever they are present.

• Net Income Acct #: When Net Income is displayed on the balance sheet, this is the account

number used for that row. Please note that this is a common setting shared by all company

files in a single database.

• Exclude Company from “Load All Files”: If checked, this company will not be loaded when

a group of companies or All Companies is selected to load in a batch.

• Reduce Loading Size for Large Company: QuickBooks has limits on the amount of data and

size of reports that can be retrieved. FinJinni usually determines these limits dynamically but

that can add time to the load for very large companies or QuickBooks can still return an

error. If you have a great deal of data in one or more years, setting this option will cause

FinJinni to request the data in smaller batches.

31

• Request Single-User Access to Company File: For QuickBooks desktop: Normally, FinJinni

will use either Single- or Multi- User access to QuickBooks, whichever QuickBooks is set to

use. This option will force use of Single-User access, which can speed up the load but

requires administrative privileges to use.

• Don’t Load Future Years Data: QuickBooks will allow postings in the future and this can

add to the load time. Check this box to exclude all postings past the end of the current year.

Any transactions up to the end of the current year are always included.

• Don’t Load Transaction Summary Table: This option skips loading of the QuickBooks

“Transaction” table, which is a summary of all transactions. This is a very large table in some

circumstances and can take a great deal of time to load for large companies. Since FinJinni

compiles its data from all of the individual tables, this summary table is not always needed.

Note: This option is still undergoing testing and should only be used with the guidance of

Gypsy BI support staff.

• Check for Revised Transactions During Load. If set, during an incremental load, FinJinni

will alter the loading process by checking each modified transaction to see if it is an updated

transaction or a new one before performing the update. This can reduce the overall amount

of additional data FinJinni needs to update at the expense of extra lookups. It primarily helps

to reduce updates with Azure, particularly when you have many future postings.

• Use Load Start Time as Transaction Cutoff. Normally, FinJinni will perform an incremental

load looking for any changed transactions changed. If other people are updating

QuickBooks during the load, it is possible for incomplete transactions or groups of

transactions to be loaded. This option causes any transaction changed since the start of the

load to ignored. This can provide more consistent reporting.

• Load Additional Transaction Detail: QuickBooks does not supply the Class used for the

parent transaction on Bills and Vendor Credits with the transaction data (i.e. on the balance

sheet side of the transaction). It also does not supply the “cleared” status on checks. FinJinni

will take the extra step of retrieving this data from separate QuickBooks reports. This option

defaults to being on and should normally be left on. In can be turned off in specific

circumstances to speed up the load at the expense of reporting these fields.

• Re-Check Older Transactions for Updates: This causes FinJinni to load additional data for

transactions that QuickBooks does not report as changed. At present, this is used to insure

that changes to the Billable status of items on bills are properly reflected.

• Include Non-Posting Charge Transactions: This will load additional non-posting transactions

that can be used in custom reports. At present, this applies to QuickBooks Online only.

32

Consolidating Multiple Companies

These instructions will show you how to setup FinJinni Professional for consolidated or

comparative reporting of multiple companies:

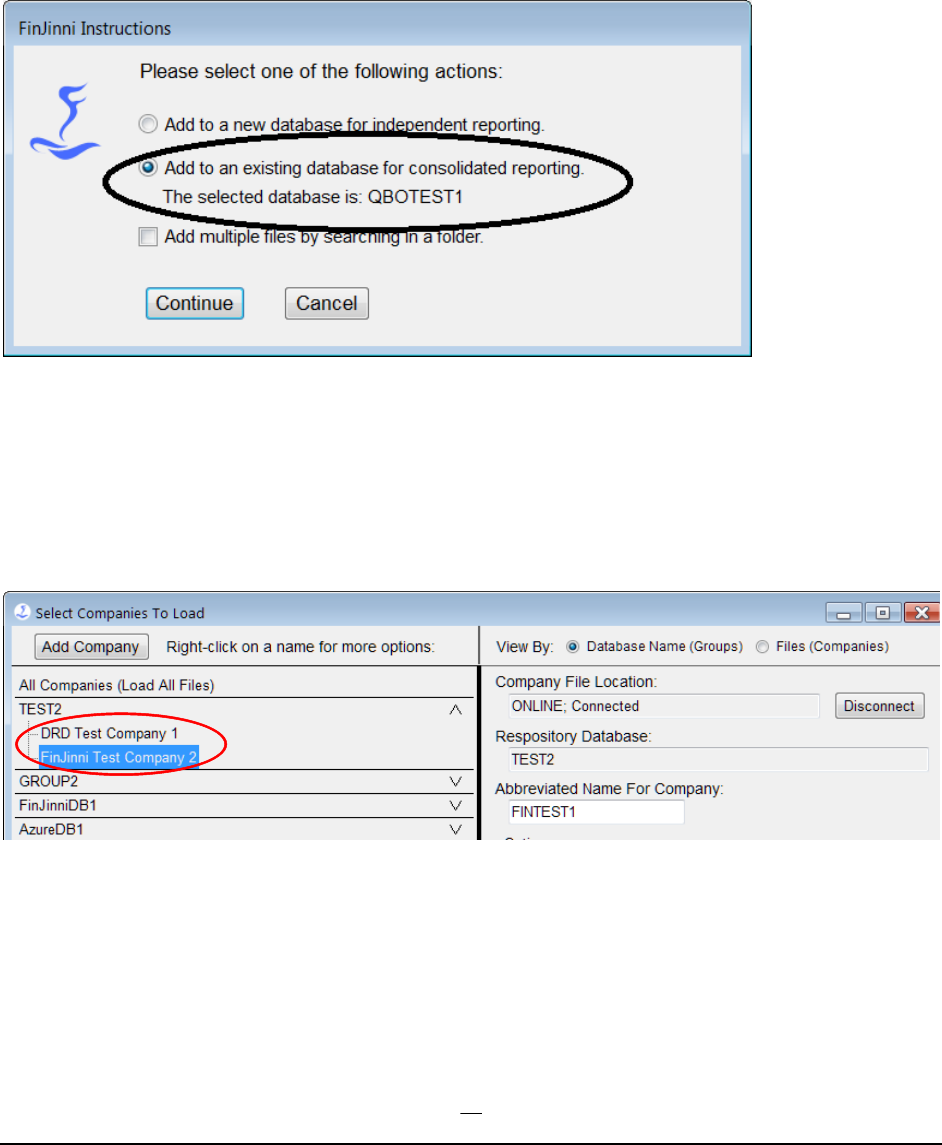

After adding the first company, when you press the Add Company button on Setup, you will first

choose Desktop or Online. After that, this screen will appear:

Select “Add to an existing database…” to enable consolidated reporting.

(If you don’t see the text “The selected database is …” it means that you didn’t have the original

database selected when you pressed the Add Company button. Please Cancel and try again.)

After adding the new company, you should see the display similar to this:

If you leave a single company selected, that will be displayed and loaded on the main screen. If you

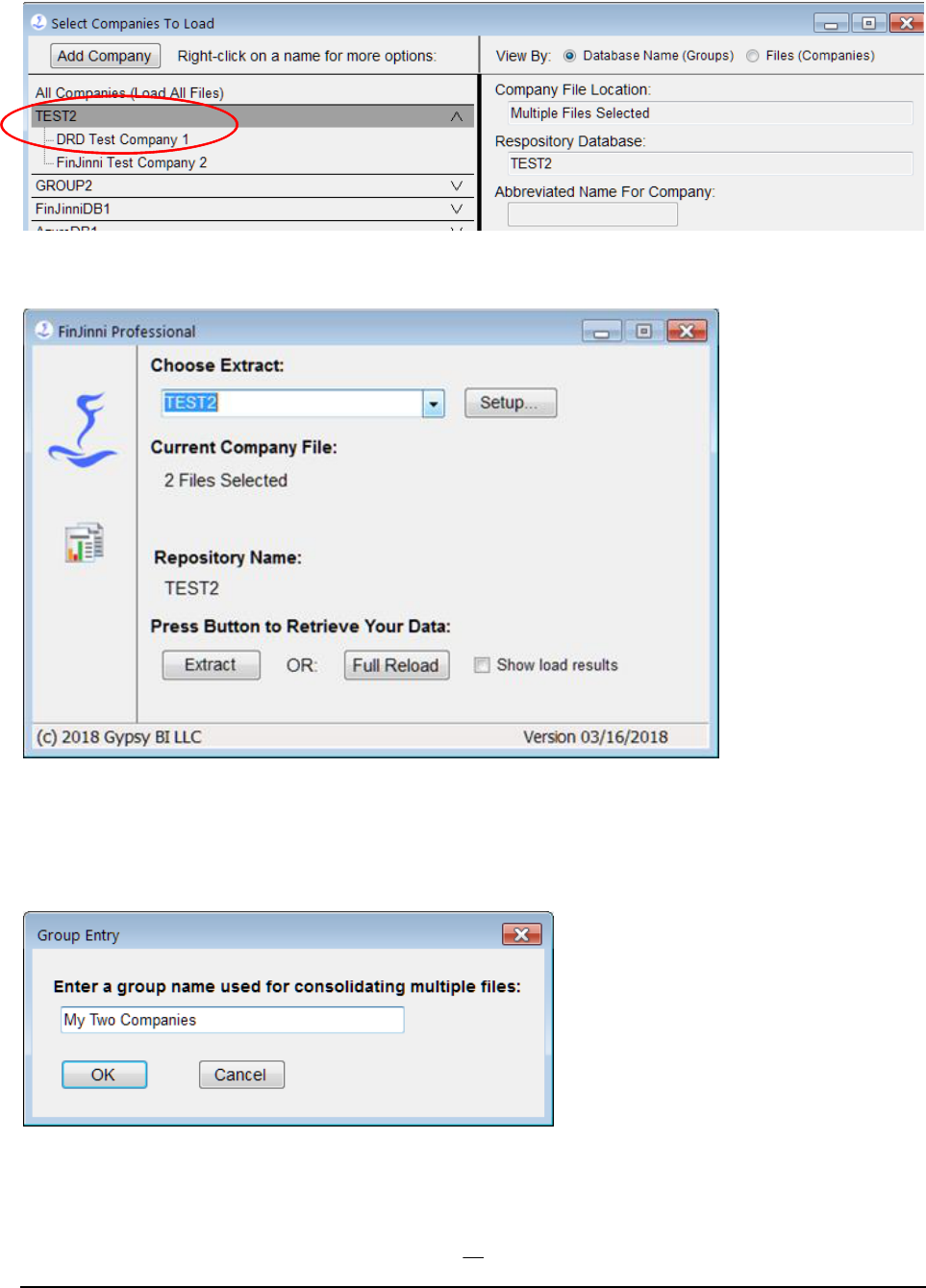

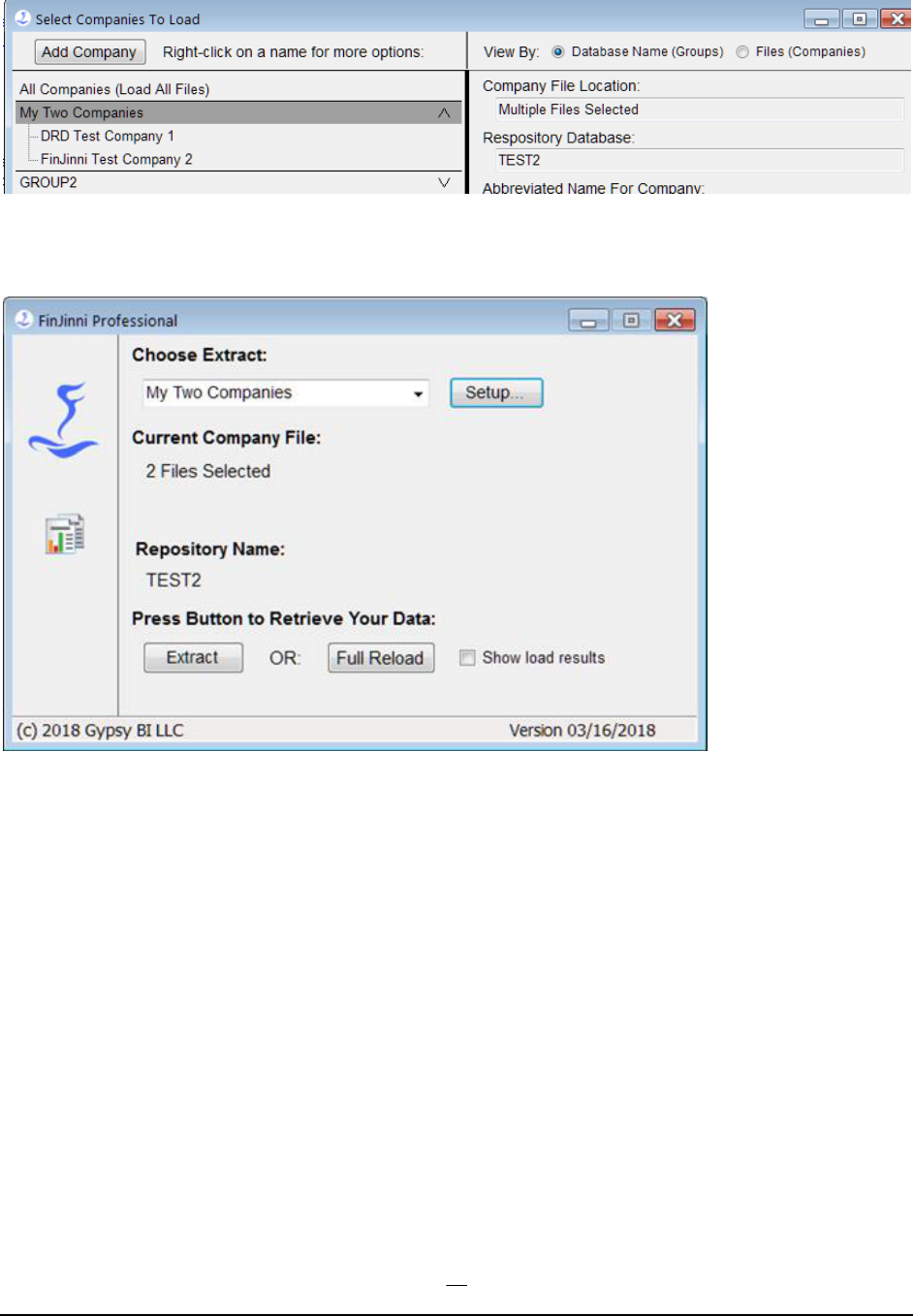

want to load multiple companies automatically, select the database name:

33

When you press Save and Close, the main screen will then appear as:

You can also assign a more meaningful name to the multi-company extract. On the Setup screen,

right click on the database name (TEST2 in this example) and you will see a choice “Rename

Group” in the drop-down. This gives you the screen:

Which then will show as:

34

And on the main screen:

35

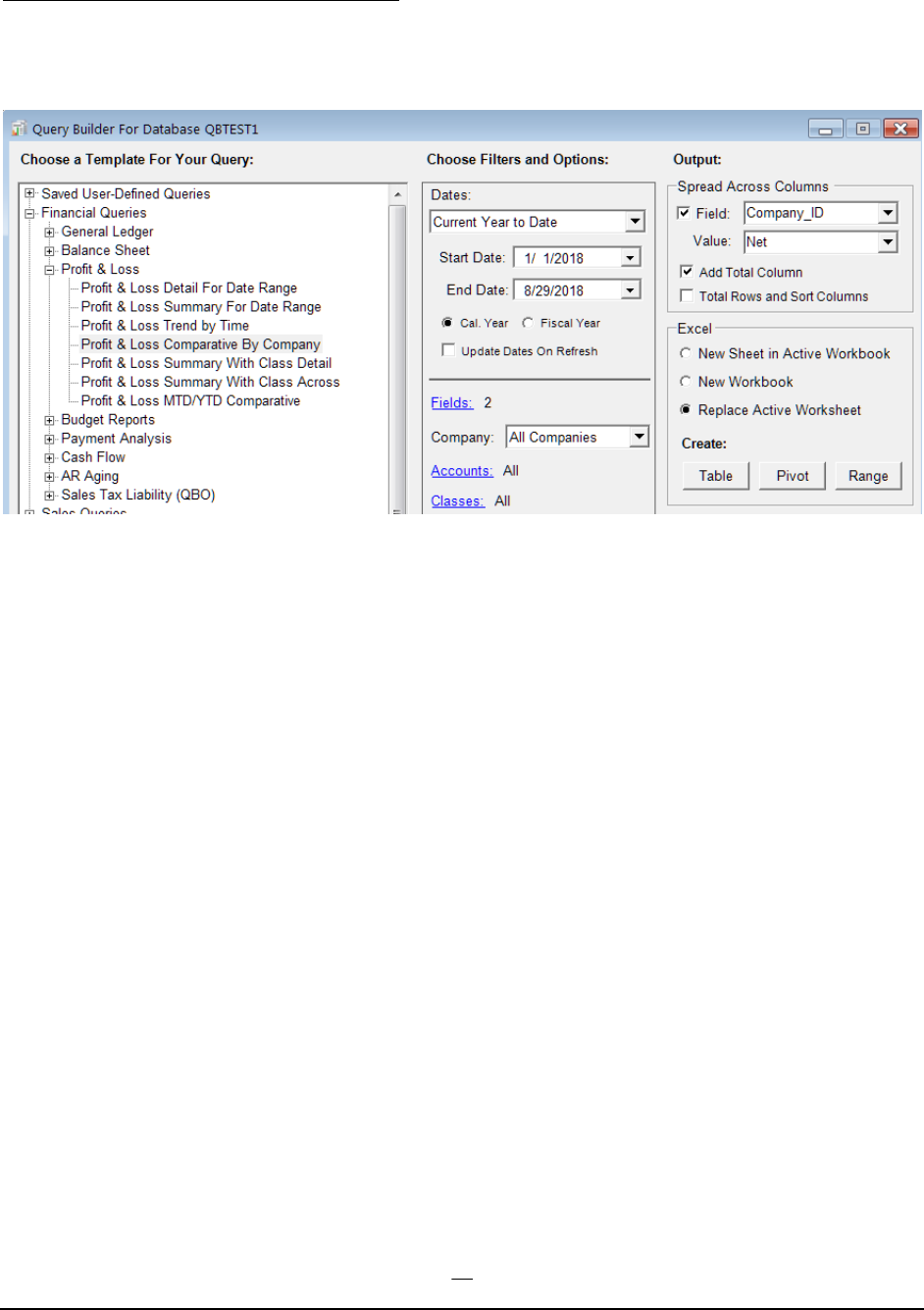

Building Consolidated Queries in Excel

It is common to want a report that shows the companies in columns across the spreadsheet for

comparative purposes. Here is what the Query build screen should look like to create this:

You can choose options such as adding a total column, or sorting the columns in order of total

value. See the FinJinni Pro Queries Manual for more information.

36

Using Multiple Currencies

FinJinni can be used to create reports when QuickBooks is using multiple currencies. FinJinni can even create

reports using currencies that are not defined in QuickBooks. For example, if you have a US and a Canadian

company, you can report on both together in US dollars, Canadian dollars, or even a different currency such

as Euros.

The currency conversions that FinJinni does are supported for both QuickBooks Desktop and Online.

The Multi-Currency feature must first be turned on in QuickBooks before it can be used for FinJinni.

How Currency Conversion Works

QuickBooks records a currency code and exchange rate for each transaction. FinJinni uses this

information to record its General Ledger in the home currency for the company file. All reports

start by using this home currency value.

You can then define reporting-currencies and exchange rates, which FinJinni will use to convert

values to a currency which is selectable at the time of reporting.

If you are consolidating results from multiple companies, all currency values reported will be

converted to the currency that you select for the report, even if each company uses a different home

currency.

Different reports can be created using different selected currencies.

Turning on Multi-Currency Reporting and Exchange Rates

You must enable multi-currency reporting in FinJinni before you load data from your company files.

Once you turn this on, only an incremental refresh is required.

Here is the option on the setup screen that must be checked:

37

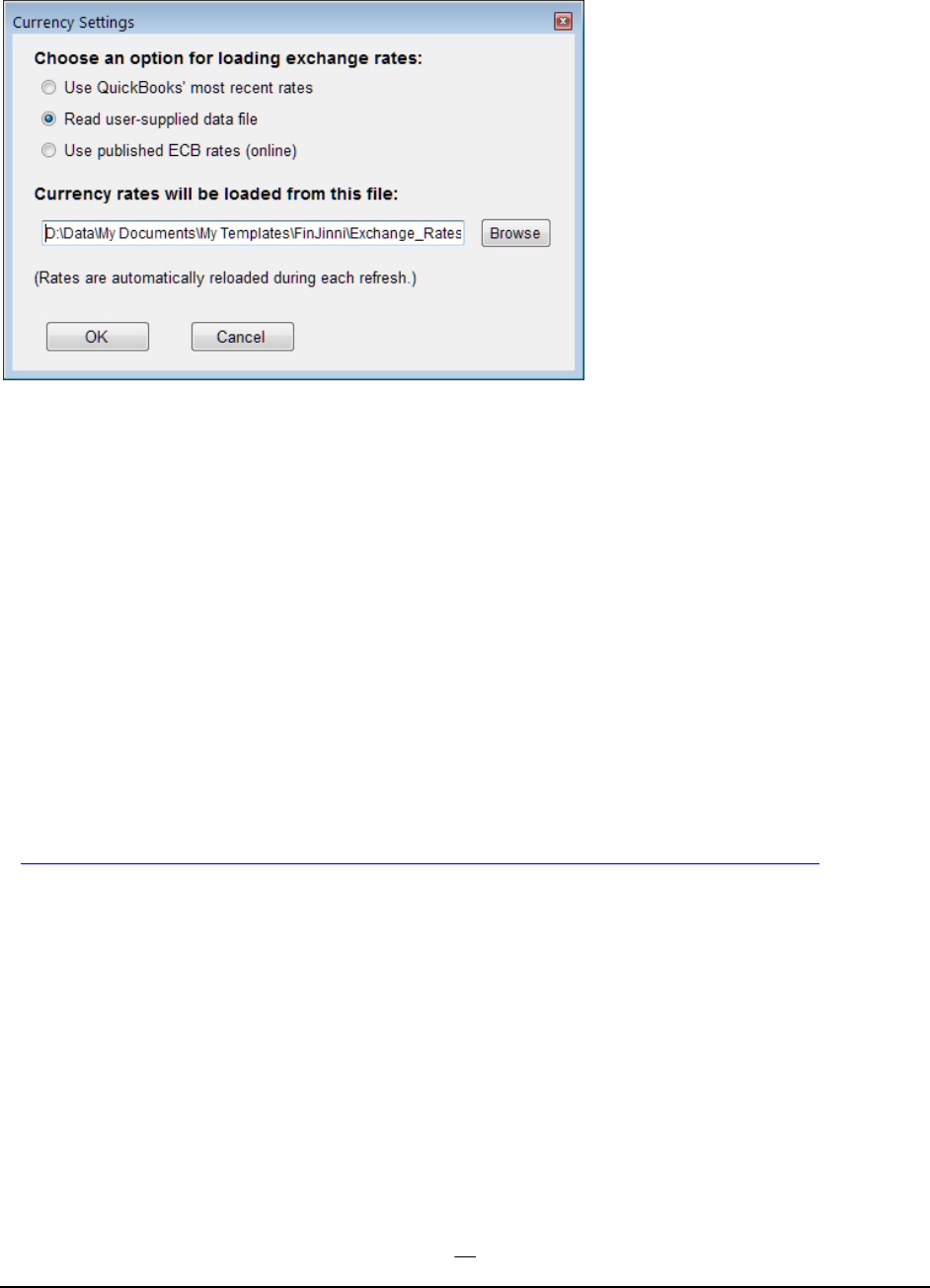

Then use the Settings button to specify how exchange rates will be loaded:

Selections available are:

Use QuickBooks' most recent rates

Will use the rates defined in the QuickBooks company file for the latest “as of date” up to and

including the date when the load is performed.

Read user-supplied data file

Allows you to create your own data file containing rates for reporting. This also allows different

rates to be specified for P&L reports and Balance Sheet reports. See the section below for

instructions in setting up this file.

Use published ECB rates (online)

Downloads the published European Central Bank exchange rates. For more information, see:

https://www.ecb.europa.eu/stats/policy_and_exchange_rates/euro_reference_exchange_rates/html/index.en.html

Notes:

1. The rates are loaded once when the OK button is pressed. They are then automatically

reloaded whenever a FinJinni refresh is performed.

2. Even though the ECB rates only show conversions in Euro’s, rates between other currencies

will be calculated using these values (e.g. CAD to USD = (CAD to EURO) * (EURO to

USD))

3. These settings are common to all companies in a single database. So if you have loaded

multiple companies for consolidated reporting, you only need to specify the currency

38

settings once. If you are using multiple databases, you must setup currency reporting for

each one.

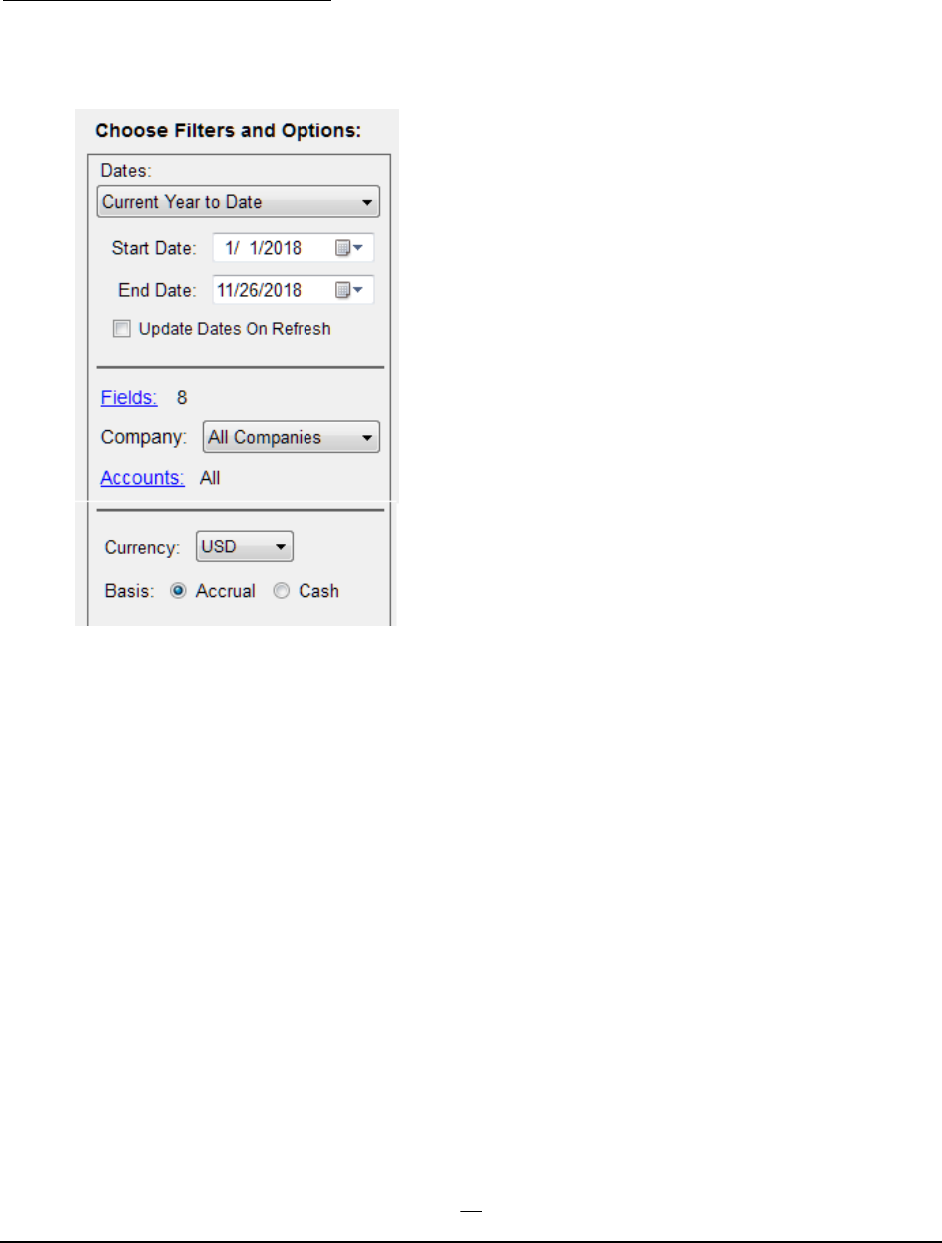

Choosing the Reporting Currency

When you enable multi-currency reporting in FinJinni, the Query Builder screen will have a drop-down

to select the currency for the report:

39

Supplying a User-Defined Exchange Rate File

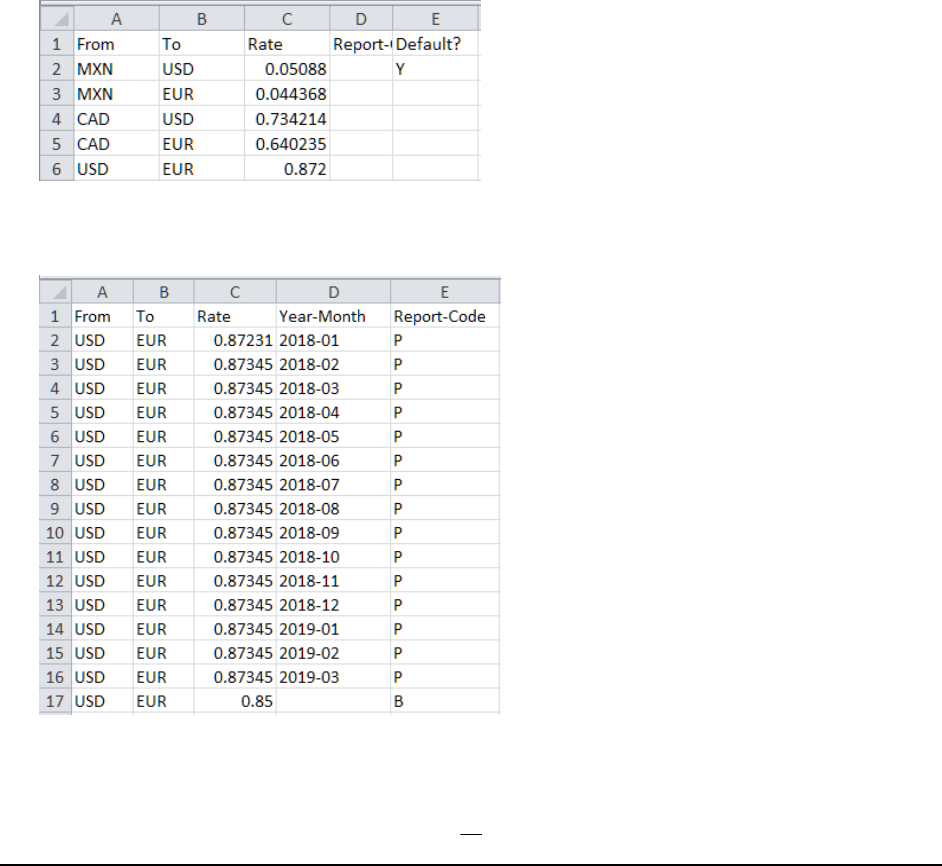

To specify your own exchange rates for reporting, create a Comma-Separated-Value (CSV) file,

usually in Excel. This file has three or more columns and requires a header with the column name in

the first row:

1. From

The “from” currency code

2. To

The “to” currency code

3. Rate

The exchange rate, i.e. the multiplier used to convert 1 unit of “from” currency.

4. Report-Code

A single-character report code for FinJinni to match to report categories: “P” is used for Profit &

Loss reporting, “B” is used for Balance Sheet reporting, and “O” is used for other reports that

don’t fall into either category. Omit this column or leave it blank to supply a single exchange

rate for all reports.

Use an “F” to supply a fixed rate applied to a specific account. The company ID and account

description must be supplied in additional columns

Three additional codes are available for custom conversion rates that you apply to one or more

accounts: “Y”, “R”, and “C”. Usually, “Y” is used for a year-to-date average by month, “R” is used

for an annual retained earnings value, and “C” for an additional custom rate. However, you can

use these rates for any purpose. You map them to specific accounts by creating a custom field

on the account called Currency_Code (to which FinJinni will add the _Acct_ prefix).

5. Year-Month

The year and month for this exchange rate, as exactly 7 characters “yyyy-mm” (e.g. “2018-12”).

For P&L reporting, the individual transaction dates will be matched to this date. For Balance

Sheet reporting, the specified end date for the report will be matched to this date. Omit this

column or leave it blank to use the same reporting value regardless of the date.

6. Default?

A “Y” to indicate that the “to” currency on this line is the default currency for FinJinni reports.

This will be chosen in the drop-down on the Query Builder screen.

7. Company_ID

40

When using a fixed rate for a specific account, this is the company ID (FinJinni’s Extract Name)

that you provided when you set up the company.

8. Account

When using a fixed rate for a specific account, this is the account number or description (in the

“number – name” format used in FinJinni reports).

Notes:

1. All of the “to” currencies will be displayed in FinJinni’s drop-down to select a reporting currency.

2. You can leave off an inverse exchange rate and FinJinni will add it automatically. That means

that you can enter the rates in either direction, e.g. USD to EUR or EUR to USD.

Here is a sample of a simple exchange-rate file for CAD, MXN, and USD that allows any of these to be

chosen when a report is created:

This sample includes a date:

41

Automating an Extract

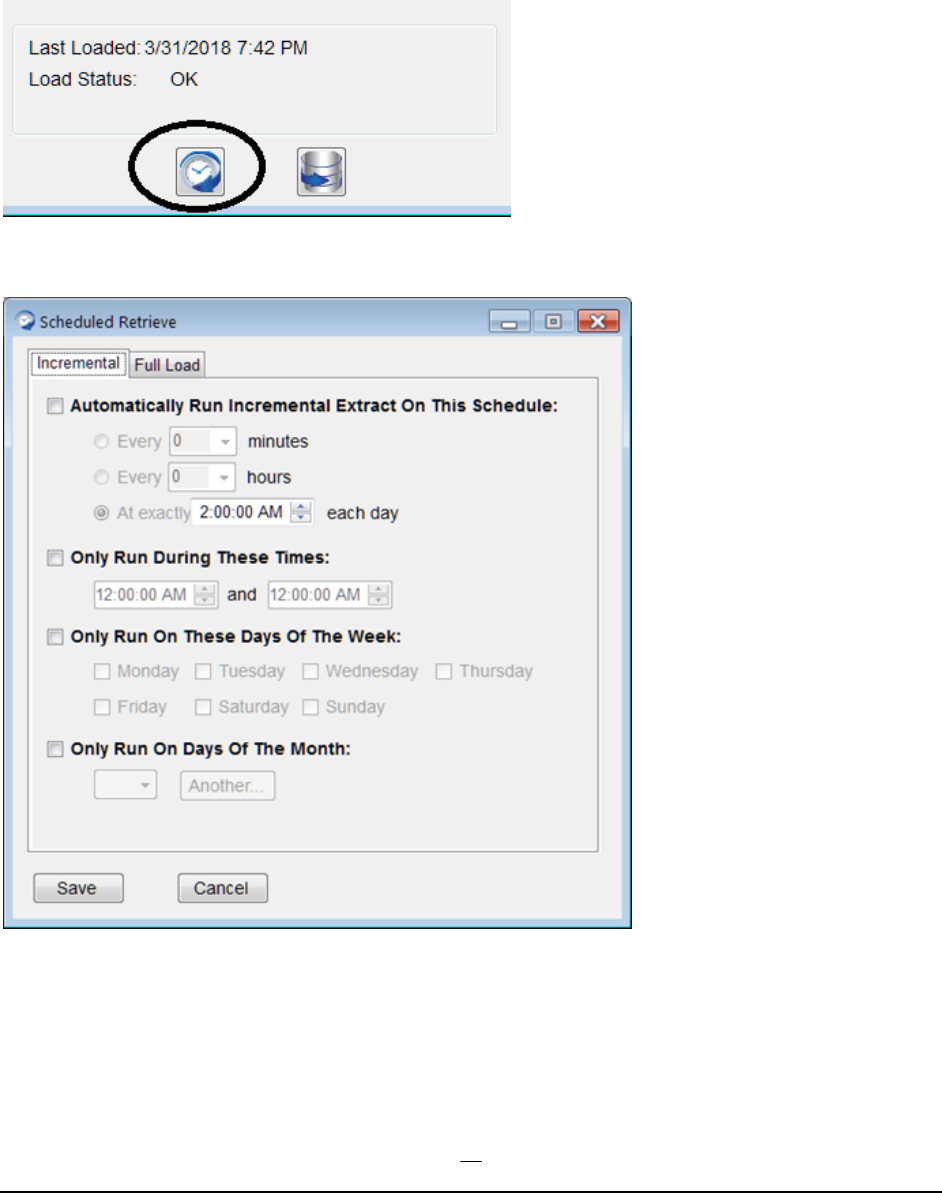

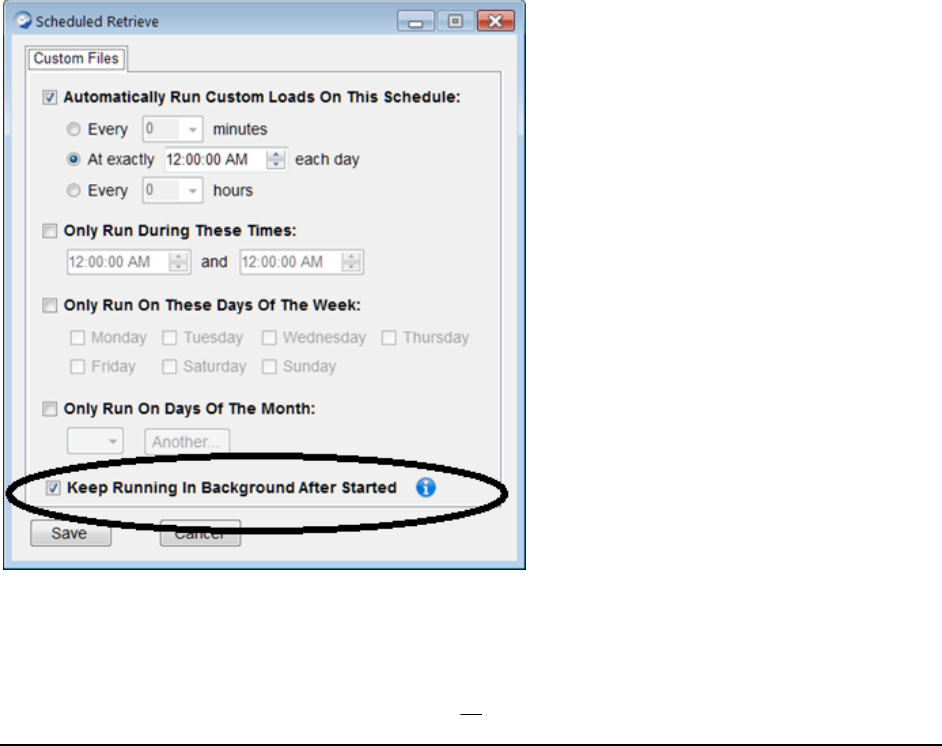

A FinJinni extract can be set to run automatically by using the Schedule button on the company

setup screen:

You will then see this screen:

The scheduled-retrieve setup screen has two tabs, one for an incremental load and one for a full

load. Normally, you would just use the incremental load. You can set a full load on an independent

schedule if you have a reason to reload a complete company file (e.g. you are given a new file from

an outside source).

42

If you have advanced scheduling requirements, you can use the Windows Task Scheduler to update

the load information. Look for the “FinJinni Refresh” task folder in Task Scheduler.

After you choose the schedule information, you will be asked to either enter your Windows

username and password so that Windows can automatically log you on at the scheduled time, or you

can choose to only run when you are already logged on, which of course requires you to leave your

user logged on.

Note: Intuit does not support QuickBooks Desktop running with automatic login. They

require your Windows user to be already logged in. Contact Gypsy BI support if you want

more information on this topic.

While FinJinni can run multiple copies simultaneously in order to load multiple companies, there are

several restrictions when using simultaneous or overlapped loads:

1. Only one copy of QuickBooks Desktop can be run at any one time. This is a QuickBooks

limitation.

2. Running multiple loads into the same database at the same time can cause performance

issues. Please avoid this case.

How FinJinni automation works

FinJinni accepts command arguments to initiate various automatic actions. A FinJinni extract can be set to

run automatically by creating a shortcut to the file

"C:\Program Files (x86)\GypsyBI\FinJinni Professional\Bin\FinJinniPro.exe"

On the Target option of the shortcut, add these arguments:

/ex “extract-name”

When the shortcut is invoked, the named extract will be run and then FinJinni will exit.

To execute a full reload instead of an incremental refresh, supply these arguments:

/reload “extract-name”

43

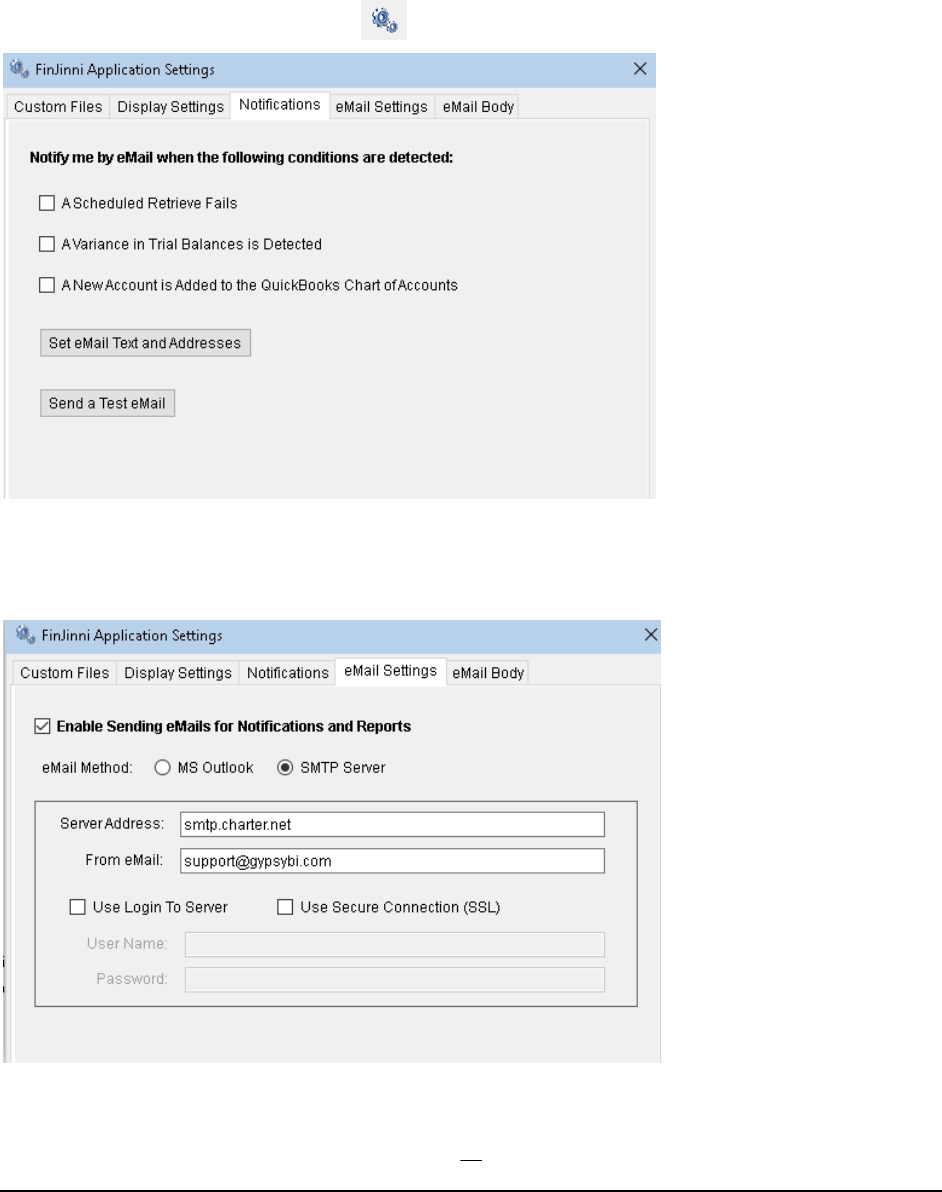

Sending eMail Event Notifications

FinJinni can automatically send eMail “alerts” when certain conditions are encountered during the

data load. These notifications are most useful when you are running a scheduled extract.

Select these notifications on the FinJinni Application Settings screen, which you bring up by

selecting this icon on the main screen:

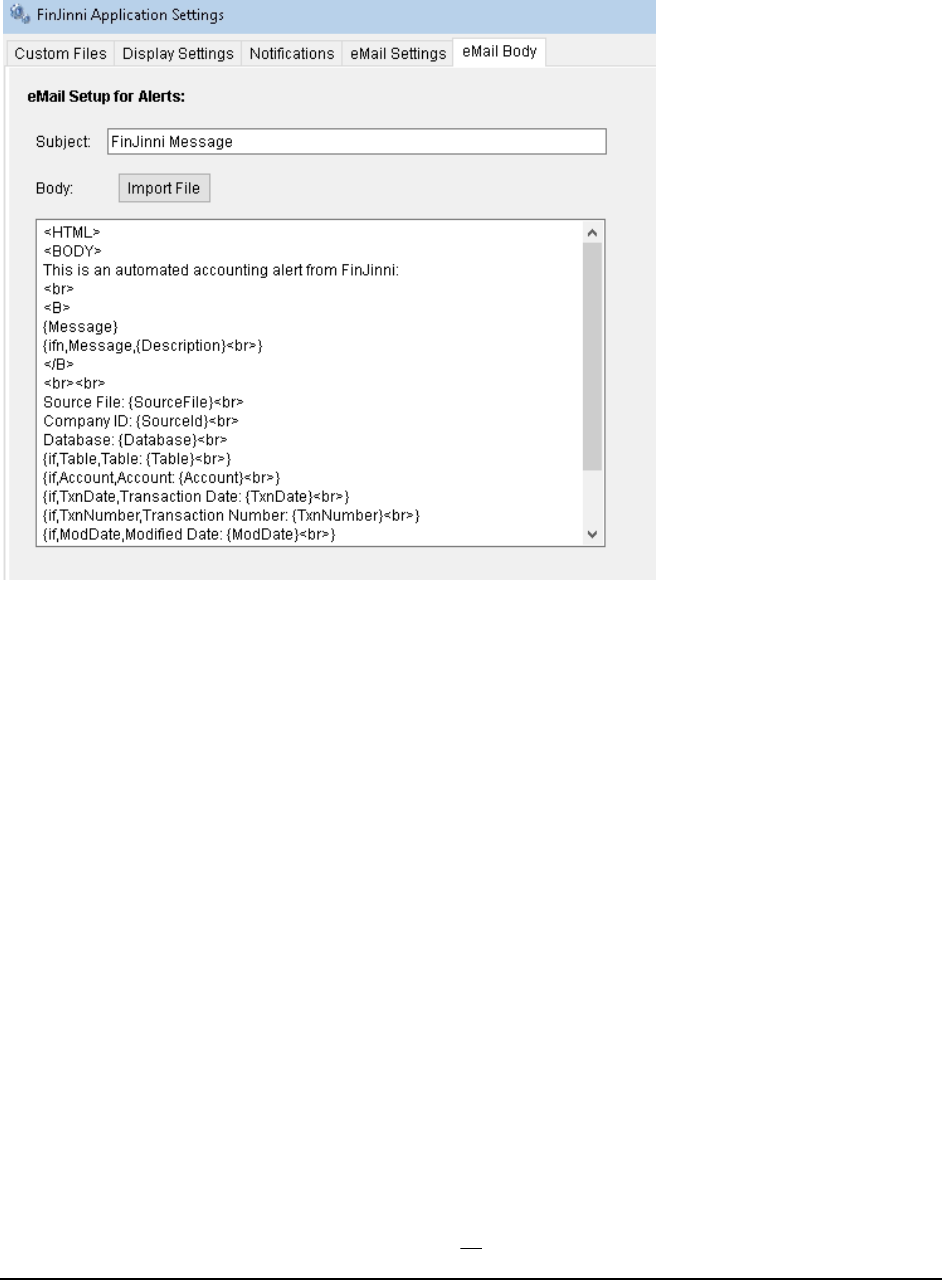

Use the eMail Settings tab and the email Body tab to define how the email is sent and what the body

of the message consists of. In the settings you can choose either to use MS Outlook for sending mail

messages or a direct connection to your ISP’s email server:

44

The body is in HTML format and can be edited directly or imported from a file. You also specify the email

subject here.

The text in braces is substituted by FinJinni when the email is created.

45

Extending the QuickBooks Data Model with Custom Fields

You can define your own custom fields outside of QuickBooks using data files that FinJinni will load and

automatically combine with the QuickBooks data describing various QuickBooks entities. Various use cases

are described next.

These custom fields can be used for either QuickBooks Desktop or QuickBooks Online (which does not

otherwise support custom fields).

FinJinni’s custom fields are stored in CSV-format files than you can create with Excel. There is a

separate file for each QuickBooks company. All files should be saved in the folder

“documents”\My Templates\FinJinni, where “documents” is your normal documents folder.

FinJinni will read these files when it loads the company data from QuickBooks. If you change the

file, you will need to reload your company data (only an incremental refresh is needed, any changes

to these files will be picked up at that time).

The FinJinni Excel Add-In can assist in saving these CSV-format data files from Excel worksheets.

Once you create a worksheet with the columns described below, use the Upload button on the

FinJinni ribbon bar in Excel to save the worksheet as a CSV file. You can also save it using the

normal Excel menu - the FinJinni Upload button is a convenient shortcut. See “Using the Upload

Function” below.

Customizing the Chart of Accounts

For specific reporting requirements, and particularly when consolidating multiple companies,

FinJinni will allow you to report on accounts and groups of accounts using names and grouping

different from what is used in QuickBooks.

To do this, you will assign custom fields to accounts. QuickBooks does not let you use custom fields

with accounts, but FinJinni does. For example, you can assign “_Acct_Alias” and “_Acct_Group”

to each account with an alias name and grouping for reporting. You can then use those fields in

place of the usual Account_Description or Account_Type. Whatever fields you use in a summary

query (e.g. P&L Summary) is what FinJinni will total by.

These files are named “companyid_Accounts.csv”, where “companyid” is the company identifier

(aka nick-name) that you assigned when you added the company to FinJinni.

This file has three columns and requires a header with the column name in the first row:

1. Account_Description

The account-number and name assigned by FinJinni from the QuickBooks accounts. This

has the format “number - name” where “number” is the account number from QuickBooks

and “name” is the account name from QuickBooks. If you are not using account numbers,

only use the name.

2. Field_Name

The custom field name that you want to assign to the account. For example, “Alias” or

“Group”. FinJinni will add a prefix “_Acct_” to these names but you should not.

46

3. Field_Value

The field value. This would be the account alias or group in this example.

For an example, look at the supplied file “samplecompany_Accounts.csv”. Then replace

“samplecompany” with the name you have used for your company in FinJinni.

Any names you put in the “Field_Name” column will appear in FinJinni’s Field list in the Custom

Fields section with a prefix “_Acct_”. Refer to the FinJinni Pro Queries Manual for instructions on

how to use customized queries.

Tip: You can obtain a list of all the accounts in your company using the query under “System

Information Queries, Account Information” for all accounts or “System Information Queries,

Posting Accounts Only” to choose only accounts that have GL postings.

Defining an Alias field

FinJinni recognizes the custom field “Alias” in a special manner. You can use it normally as

“_acct_Alias”, but FinJinni will also create a field named “Account_Alias” as a convenience for

reporting. It will also fill in a field called “Account_Hierarchy_Alias” which contains the complete

account hierarchy using the Alias field so that reports showing parent-child accounts can show the

alias value.

Adding Custom Fields to Classes

QuickBooks also does not allow you to create your own custom fields for classes. FinJinni can

create custom fields for Classes in the same way used for accounts described in the previous section.

The class file is named “companyid_Classes.csv”, where “companyid” is the company identifier (aka

nick-name) that you assigned when you added the company to FinJinni.

This file has three columns and requires a header with the column name in the first row:

1. Class_Name

The class name from QuickBooks. This must be the full name in the form “parent:child”

when parent classes are used.

2. Field_Name

The custom field name that you want to assign to the account. For example, “Alias” or

“Group”. FinJinni will add a prefix “_Class_” to these names but you should not.

3. Field_Value

The field value. This would be the class alias or group in this example.

Any names you put in the “Field_Name” column will appear in FinJinni’s Field list in the Custom

Fields section with the “_Class_” prefix. Refer to the FinJinni Pro Queries Manual for instructions

on how to use customized queries.

47

FinJinni recognizes the custom field “Alias” in a special manner. You can use it normally as “_class_Alias”,

but FinJinni will also create a field named “Class_Alias” as a convenience for reporting.

Adding Additional Custom Fields to Items and Entities

Even though QuickBooks has custom fields for items and other entities, you can still create your

own custom fields using FinJinni. FinJinni can create new custom fields for Items and Entities

(Customers, Employees, and Vendors) in the same way used for accounts and classes described

above.

The item file is named “companyid_Items.csv”, where “companyid” is the company identifier (aka nick-

name) that you assigned when you added the company to FinJinni. Similarly, the Customer, Employee, and

Vendor files are named “companyid_Customers”, “companyid_Employees”, and

“companyid_Vendors”. Jobs are included in the customer file. For QuickBooks Online, sub-customers

and projects are treated the same way as jobs.

This file has three columns and requires a header with the column name in the first row:

1. Item_Name -or- Entity_Name

The item or entity name from QuickBooks. This must be the full name in the form

“parent:child” when parent and child items or entities are used.

2. Field_Name

The custom field name that you want to assign to the account. For example, “Alias” or

“Group”. FinJinni will add a prefix to these names but you should not. The prefix FinJinni

adds is one of: “_Item_”, “_Cust_”, “_Job_”, “_Empl_”, and “_Vend_”.

3. Field_Value

The field value.

Any names you put in the “Field_Name” column will appear in FinJinni’s Field list in the Custom

Fields section with an item or entity-type prefix. Refer to the FinJinni Pro Queries Manual for

instructions on how to use customized queries.

For an example, look at the supplied file “samplecompany_Customers.csv”. Then replace

“samplecompany” with the name you have used for your company in FinJinni.

FinJinni recognizes the custom field “Alias” in a special manner. You can use it normally as “_[entity]_Alias”

where “[entity]” is Item, Customer, etc, but FinJinni will also create a field named “[Entity]_Alias” as a

convenience for reporting.

Using the Upload Function In Excel

The FinJinni Excel Add-In provides a simple means of saving the data files for the FinJinni

application to upload. You can create an Excel workbook with one or more worksheets and then

use this upload function to save individual worksheets as CSV data files.

48

Please note that this is only a shortcut to saving the worksheets manually. It does not create or

change the data uploaded.

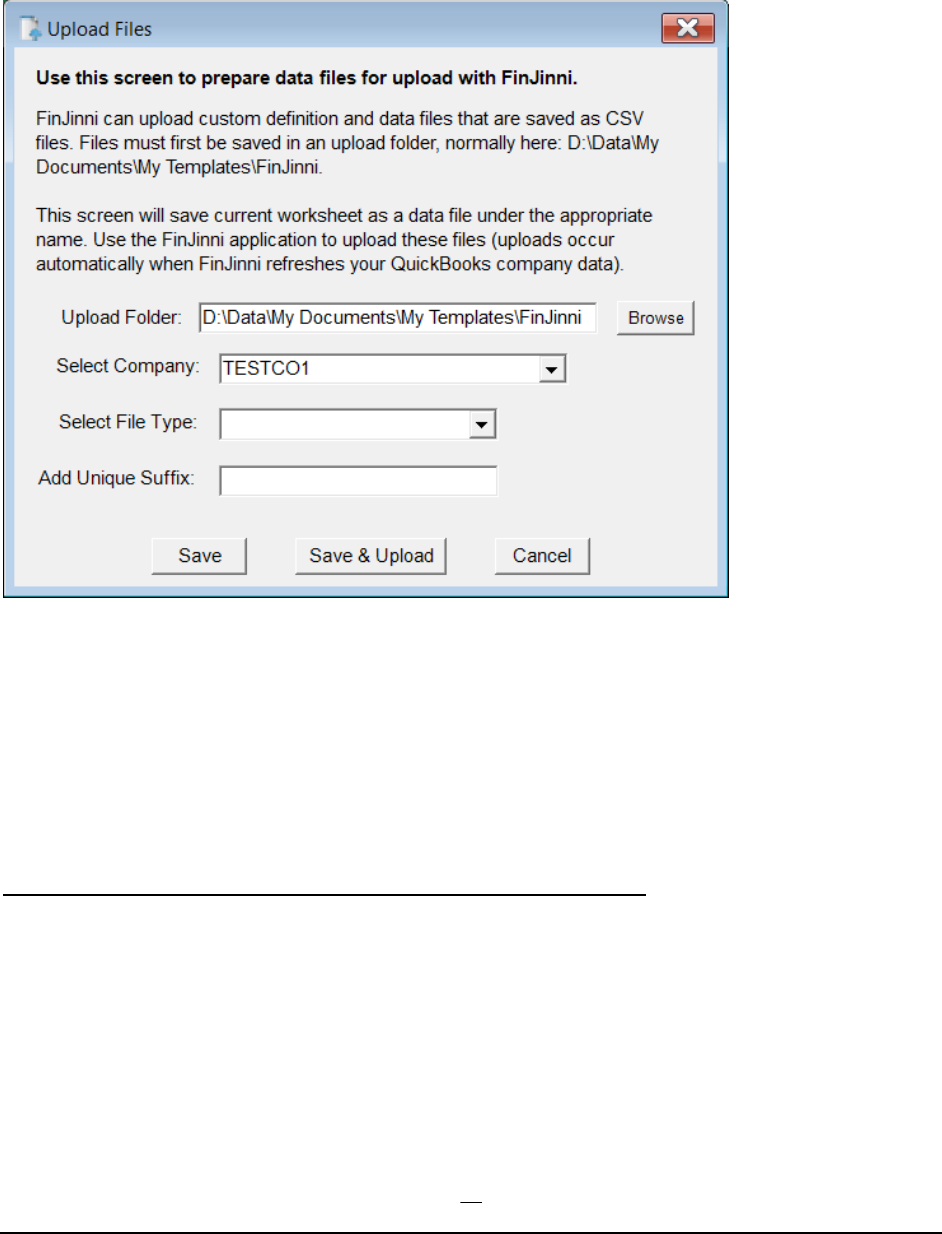

When you press the Upload button on the FinJinni ribbon bar in Excel, you will see this screen:

Select the company and type of data file to load. If necessary, add a unique file suffix. The file will be

saved under the name “company_filetype_suffix.csv”.

If you are the administrator and have the FinJinni application installed on your PC, you will have the

choice to either “Save” the file or to “Save & Upload”, which will launch the FinJinni application

immediately to read and process the file. Users who do not have the FinJinni application can only

create and save files that the administrator will need to process.

Consolidated/Combined Format for Uploading Custom Fields

As a convenience for defining custom fields with multiple companies and/or multiple custom fields,

the FinJinni Excel-Add in provides an improved means of creating the data files described above.

The selected file type must be one of the custom field file types: Accounts, Classes, Customers,

Employees, Items, or Vendors.

The Excel worksheet must have a single row for each entity and the following columns with

appropriate headers:

49

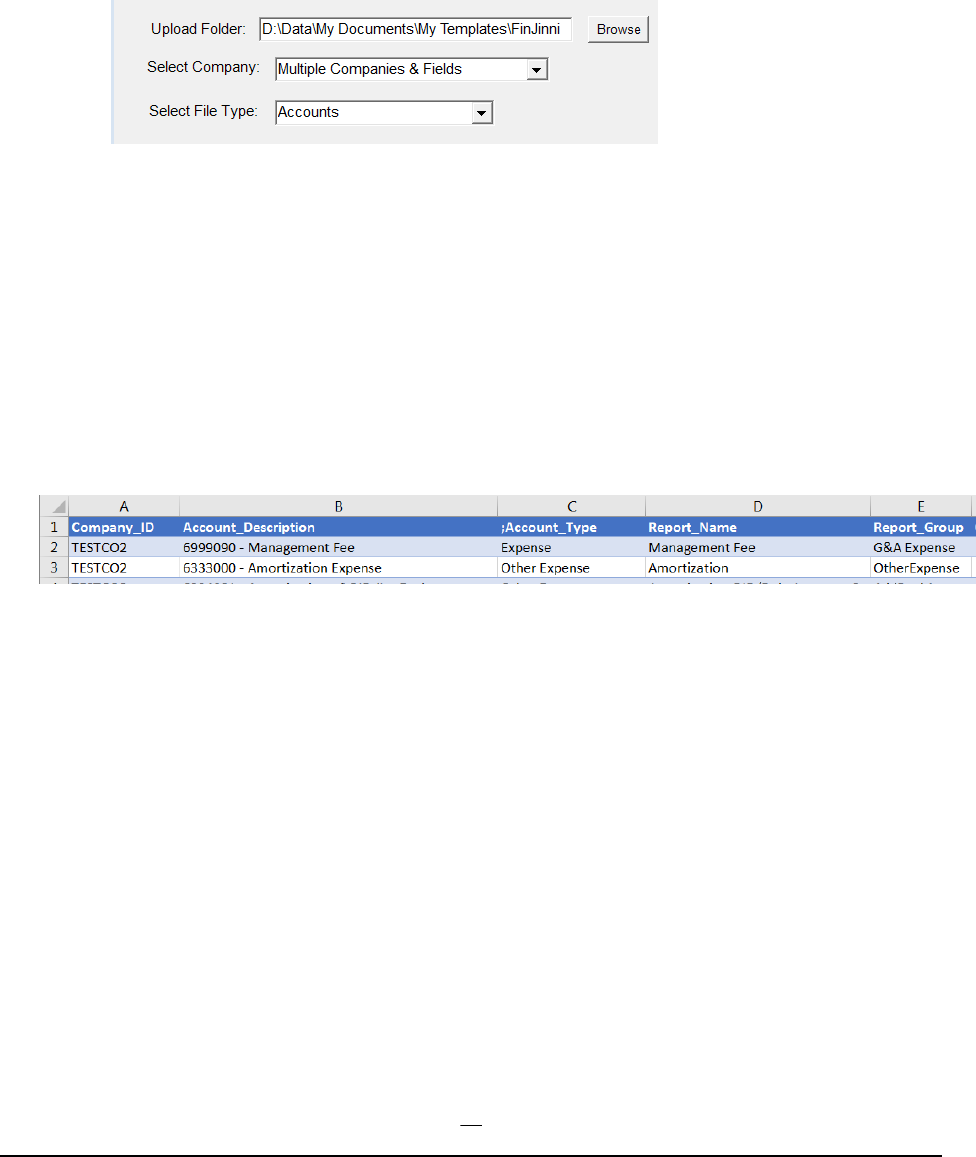

A. The company identifier (extract name in FinJinni). Include this column if you want to load

data for multiple companies from a single worksheet. FinJinni will separate them into the

appropriate company files for loading. The data must be sorted on this column so that all

rows for a company are grouped together.

To use this feature, select “Multiple Companies & Fields” from the company drop-down on

the upload screen:

B. The account description or entity name, with the header name appropriate for that custom

field type (see the sections above for defining custom fields). You must use the specific

name, such as Item_Name, not the generic Entity_Name.

C. Zero or more descriptive fields. These are ignored by FinJinni but can be used to maintain

the worksheet. The header for ignored columns must begin with a “;”.

D. One or more custom field values. The field name is defined in the header.

For example, here is an account custom field definition that defines two custom fields,

Report_Name and Report_Group. Account_Type is ignored.

50

Loading Budget Data from Outside QuickBooks

If you want to report on budgets but don’t use QuickBooks for your budgeting, FinJinni can

incorporate a data file that you supply with budget data. This also allows you to create a more-

detailed budget, using accounts, classes, customers, and other entities (such as sales reps or

departments).

This feature is only available if you have purchased the license for the FinJinni Importer advanced

data loading feature. It is enabled in the trial versions so that you can preview it.

FinJinni’s will load budget data from CSV-format files that you can create with Excel. There is a

separate file for each QuickBooks company and you can either create a separate file for each budget

or combine multiple budgets in one file. All files should be saved in the folder “documents”\My

Templates\FinJinni, where “documents” is your normal documents folder.

These files can be created directly from Excel spreadsheets using simple Excel programming

macros. For examples of how to enter and create these budgets, please contact GypsyBI LLC sales

or support.

The budget data files that FinJinni will load are named “companyid_budget_[suffix].csv”, where

“companyid” is the company identifier (aka nick-name) that you assigned when you added the

company to FinJinni and “suffix” is a value to uniquely identify the file if needed - you can pick

anything you want for this, such as a year.

The FinJinni Excel Add-In can also assist in saving these CSV-format data files from Excel

worksheets. Once you create a worksheet with the columns described below, use the Upload button

on the FinJinni ribbon bar in Excel to save the worksheet as a CSV file. You can also save it using

the normal Excel menu - the FinJinni Upload button is a convenient shortcut.

These files have the following columns and require a header with the column name in the first row:

1. BudgetName

A name for the budget. You can use any name you like. Only the first data row of a budget

needs to have this value, you can leave it blank on subsequent rows.

2. Date

The date for the budget line. This is generally day 1 of a month, but it can be a different date

in special circumstances – Most of FinJinni’s reports will use a date range and as long as the

budget date lies within the range, it will be picked up.

3. Account

The account name or description (in the format “number - name”). This can also be the

full name for an account (in the format “parent:child” used by QuickBooks). Any of these

formats that uniquely identifies the account is sufficient.

4. Amount

The budget amount.

51

5. Class

A class name. If you have parent & child classes, this must be the full name in the format

“parent:child”. This is an optional column, omit or leave blank if not used.

6. Customer

A customer, or full sub-customer name in the format “parent:child”. Projects or jobs are

sub-customers and need their parent customer identified. This is an optional column, omit

or leave blank if not used.

7. OtherEntity

An employee or vendor name. This is an optional column, omit or leave blank if not used.

8. Sub_Budget

Enter a budget sub-name to divide a budget into multiple sub-budgets, each of which is

loaded from a separate file. All sub-budgets with the same budget name are combined for

reporting. This is an optional column, omit or leave blank if not used.

For an example, look at the supplied file “samplecompany_Budget_2018.csv”. Then replace

“samplecompany” with the name you have used for your company in FinJinni and “2018” with a

value of your choice.

Usage Notes:

1. If you are using this feature with a QuickBooks Desktop file, do not check the “Load

Budget Data” option on the setup screen. That option is only used to load budgets from

QuickBooks.

2. Budget files are automatically loaded whenever a refresh is performed. FinJinni will detect

whenever the budget file is changed (or a new file is added) and load the file.

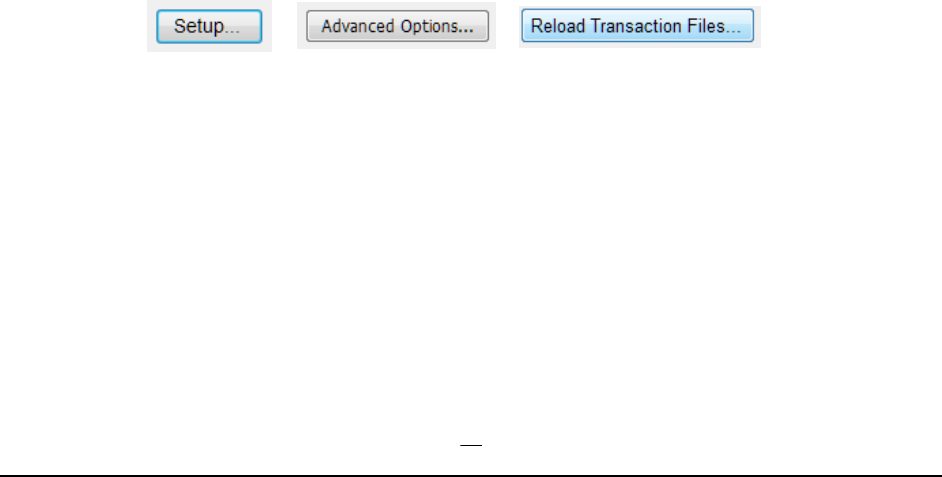

3. You can perform an initial load manually, using the Advanced Options button on the Setup

screen, that options screen has a “Reload Transaction Files” button - i.e., press these buttons

in sequence, then choose the option Reload Custom Budget Data.

4. If you need to delete or rename a budget, keep in mind that FinJinni loads budgets

incrementally and that budgets are identified by name, not date. There are two ways that a

budget will be deleted if you have removed it from the data files:

A. When a full load of the company is performed. All old budget data is cleared before

loading budget data from your files.

B. If a line containing only the budget name (no accounts or values) is placed in a budget

data file. All data for that particular budget name is deleted when the file is loaded.

52

Loading Journal Entries from Outside QuickBooks

You can use FinJinni to add General Journal Entries to the data retrieved from QuickBooks. These

journal entries can be created using an Excel spreadsheet or other program to create a data file that

FinJinni will load. You have the option to either:

1. Have FinJinni write these Journal Entries back to QuickBooks.

2. Keep the Journal Entries in FinJinni’s reporting database without updating QuickBooks. They

will appear in all of FinJinni’s reports but your QuickBooks company will not be modified.

This feature is only available if you have purchased the license for the FinJinni Importer advanced

data loading feature. It is enabled in the trial versions so that you can preview it.

FinJinni’s will load journal entries from CSV-format files that you can create with Excel. There are

separate files for each QuickBooks company and you may have multiple files for one company. All

files should be saved in the folder “documents”\My Templates\FinJinni, where “documents” is

your normal documents folder.

The data files that FinJinni will load are named “companyid_journal_[suffix].csv”, where

“companyid” is the company identifier (aka nick-name) that you assigned when you added the

company to FinJinni and “suffix” is a value to uniquely identify the file if needed - you can pick

anything you want for this, such as a year.

The FinJinni Excel Add-In can assist in saving these CSV-format data files from Excel worksheets.

Once you create a worksheet with the columns described below, use the Upload button on the

FinJinni ribbon bar in Excel to save the worksheet as a CSV file. You can also save it using the

normal Excel menu - the FinJinni Upload button is a convenient shortcut.

These files have the following columns and require a header with the column name in the first row:

1. TxnDate

The date for the transaction.

2. RefNumber

The Journal Entry number. This must be unique to a single Journal entry.

Multiple line items for the Journal Entry must have the same transaction date and

reference number. Each line item occupies a separate line in the data file and all line items

must be in sequence.

3. Account

The account name or description (in the format “number - name”). This can also be the

full name for an account (in the format “parent:child” used by QuickBooks). Any of these

formats that uniquely identifies the account is sufficient.

4. Amount

The amount.

53

5. DebitOrCredit

“D” or “Debit” for a debit, “C” or “Credit” for a credit.

6. Description

The description (memo) for the line item. This value is optional.

7. Memo

The memo field value for the transaction. This value is used for QuickBooks online only

and is optional.

8. PostBack

“1” to write back this journal entry to QuickBooks. “0” or blank to leave it in FinJinni’s

reporting database without modifying QuickBooks.

9. IsAdjustment

“1” if this should be marked as an adjustment entry in QuickBooks, “0” or blank

otherwise.

10. Revised

“Y” to revise an existing QuickBooks journal entry. “N” or blank otherwise.

Note: You can change the values on FinJinni’s journal entry at any time. However,

changed values will not be normally written back to QuickBooks after the journal entry is

initially added. If you set this field to “Y”, FinJinni will update the journal entry in

QuickBooks on the next refresh regardless.

Revised journal entries cannot have new line items. If you need to add new line items, void

the journal entry and create a new one.

11. Voided

“V” to void an existing QuickBooks journal entry (note: “V” not “Y” here). “D” to delete

an existing journal entry. Otherwise leave blank.

12. Class

A class name. If you have parent & child classes, this must be the full name in the format

“parent:child”. This is an optional column, omit or leave blank if not used.

13. Customer

A customer, or full sub-customer name in the format “parent:child”. Projects or jobs are

sub-customers and need their parent customer identified. This is an optional column, omit

or leave blank if not used.

14. Vendor

A vendor name. This is an optional column, omit or leave blank if not used.

Usage Notes:

54

1. Journal entry files are automatically loaded whenever a refresh is performed. FinJinni will

detect whenever the file is changed (or a new file is added) and load the file.

2. If you want FinJinni to write back Journal Entries to QuickBooks, you must select the option

“Enable Write-Back to QuickBooks” on the company setup screen.

3. You can perform an initial load manually, using the Advanced Options button on the Setup

screen, that options screen has a “Reload Custom Budget File” button - i.e., press these

buttons in sequence, then choose the option Reload Custom Journal Entry Data:

Note: This manual load does not immediately write back journal entries to QuickBooks if that

option is chosen. The journal entries are recorded in FinJinni and written back to

QuickBooks the next time that a refresh is performed.

4. FinJinni does not check for Journal Entries in balance. For Journal Entries written back to

QuickBooks, this check is performed by QuickBooks.

If QuickBooks cannot record the Journal Entry due to an error (such as the entry not in

balance), FinJinni will not display an error. Instead, a log file is created in the My Templates

folder with the error message contained in that file. The file is named

“companyid_JournalEntries.Log”.

You can also check the status of all user-defined journal entries from Excel using the

FinJinni Query “User-Defined Journal Entries” under the section “System Information

Queries”.

Creating Multiple Company Data Files in Excel

You can use the FinJinni Upload function in Excel to create multiple data files from a single Excel

worksheet. To use this feature in this way, add a Company_ID column as the first column of your

worksheet and choose select “Multiple Companies & Fields” from the company drop-down on the

upload screen. FinJinni will separate the rows into their appropriate company files.

55

Loading Other Transactions into QuickBooks

You can use FinJinni to add general transactions to QuickBooks. These transactions can be created

using an Excel spreadsheet or other program to create a data file that FinJinni will load. FinJinni will

then write these transactions to QuickBooks.

This feature is only available if you have purchased the license for the FinJinni Importer advanced

data loading feature. It is enabled in the trial versions so that you can preview it.

The following transaction types are supported at this time:

For QuickBooks Desktop

For QuickBooks Online

Bill

Bill

Check

Purchase

CreditCardCharge

CreditCardCredit

CreditMemo

CreditMemo

Deposit

Deposit

Estimate

Invoice

Invoice

PurchaseOrder

PurchaseOrder

RefundReceipt

SalesOrder

SalesReceipt

SalesReceipt

VendorCredit

VendorCredit

Accounts, Classes, and Entities that are referenced by these transactions must already exist in

QuickBooks. You can add Customers, Vendors, and Jobs/Projects to QuickBooks using a separate

data file, described below, but these must be added prior to loading the transaction file.

FinJinni’s will load these transactions from CSV-format files that you can create with Excel. There

are separate files for each QuickBooks company and you may have multiple files for one company.

All files should be saved in the folder “documents”\My Templates\FinJinni, where

“documents” is your normal documents folder.

The data files that FinJinni will load are named “companyid_Transaction_[suffix].csv”, where

“companyid” is the company identifier (aka nick-name) that you assigned when you added the

company to FinJinni and “suffix” is a value to uniquely identify the file if needed - you can pick

anything you want for this, such as a date.

The FinJinni Excel Add-In can assist in saving these CSV-format data files from Excel worksheets.

Once you create a worksheet with the columns described below, use the Upload button on the

FinJinni ribbon bar in Excel to save the worksheet as a CSV file. You can also save it using the

normal Excel menu - the FinJinni Upload button is a convenient shortcut.

There are a large number of supported data fields for transactions. Generally, the QuickBooks name

assigned to a field is used. For a complete list of all the fields, refer to one of these sample

transaction spreadsheets supplied with FinJinni:

Sample_ ImportData _QBD.xlsx -or- Sample_ ImportData _QBO.xlsx

56

Each transaction must have a “parent” row in the file and one or more detail rows. All line items for

the transaction must have the same transaction date and reference number. Each line item occupies

a separate row in the data file and all line items must be in sequence following the parent.

These files have at minimum the following columns and require a header with the column name in

the first row:

1. TxnType

The type of the transaction, from the list above.

2. TxnDate

The date for the transaction.

3. RefNumber

The transaction reference number. This must be unique for each transaction. For

QuickBooks transactions that do not support a reference number (e.g. Deposits), this value

is still required and is used to uniquely identify the transaction within FinJinni.

4. Account

The account name or description (in the format “number - name”). This can also be the

full name for an account (in the format “parent:child” used by QuickBooks). Any of these

formats that uniquely identifies the account is sufficient.

5. Amount

The amount for line items. For the parent transaction, QuickBooks will automatically

calculate the total amount from these individual line amounts.

A few other commonly used fields are these. Some may be required for certain transactions.

6. Description

The description (memo) for a line item.

7. Memo

The memo field value for the transaction.

8. Revised

Y to revise an existing QuickBooks transaction. N or blank otherwise.

Change values will not be automatically written back to QuickBooks after a transaction is

initially added. If you set this field to “Y”, FinJinni will update the transaction in

QuickBooks on the next refresh regardless.

Revised transaction cannot have new line items. If you need to add new line items, void or

delete the transaction and create a new one.

9. Voided

V to void an existing QuickBooks transaction (note: “V” not “Y” here). Otherwise leave

blank. D to delete an existing transaction.

57

10. Class

A class name. If you have parent & child classes, this must be the full name in the format

“parent:child”.

11. Customer

A customer, or full sub-customer name in the format “parent:child”. Projects or jobs are

sub-customers and need their parent customer identified.

12. Vendor

A vendor name.

Usage Notes:

1. Transaction files are automatically loaded whenever a refresh is performed. FinJinni will

detect whenever the file is changed (or a new file is added) and load the file.

2. You must select the option “Enable Write-Back to QuickBooks” on the company setup

screen in order to allow FinJinni to write data to your QuickBooks company.

3. You can also check the status of all user-defined transactions from Excel using the FinJinni

Query “User-Defined Transaction Postings” under the section “System Information

Queries”.

Creating Multiple Company Data Files in Excel

You can use the FinJinni Upload function in Excel to create multiple data files from a single Excel

worksheet. To use this feature in this way, add a Company_ID column as the first column of your

worksheet and choose select “Multiple Companies & Fields” from the company drop-down on the

upload screen. FinJinni will separate the rows into their appropriate company files.

58

Adding Customers and Vendors to QuickBooks

You can use FinJinni to add Customers and Vendors to QuickBooks. Sub-Customers can also be

added as Jobs for QuickBooks Desktop or Projects for QuickBooks Online. These entity definitions

can be created using an Excel spreadsheet or other program to create a data file that FinJinni will

load. FinJinni will then add these entities to QuickBooks.

This feature is only available if you have purchased the license for the FinJinni Importer advanced

data loading feature. It is enabled in the trial versions so that you can preview it.

FinJinni’s will load these entities from CSV-format files that you can create with Excel. There are

separate files for each QuickBooks company and you may have multiple files for one company. All

files should be saved in the folder “documents”\My Templates\FinJinni, where “documents” is

your normal documents folder.

The data files that FinJinni will load are named “companyid_Entity_[suffix].csv”, where

“companyid” is the company identifier (aka nick-name) that you assigned when you added the

company to FinJinni and “suffix” is a value to uniquely identify the file if needed - you can pick

anything you want for this, such as a date.

The FinJinni Excel Add-In can assist in saving these CSV-format data files from Excel worksheets.

Once you create a worksheet with the columns described below, use the Upload button on the

FinJinni ribbon bar in Excel to save the worksheet as a CSV file. You can also save it using the

normal Excel menu - the FinJinni Upload button is a convenient shortcut.

There are a large number of supported data fields for entities. Generally, the QuickBooks name

assigned to a field is used. For a complete list of all the fields, refer to one of these sample

transaction spreadsheets supplied with FinJinni:

Sample_ImportData_QBD.xlsx -or- Sample_ ImportData _QBO.xlsx

These files have at minimum the following columns and require a header with the column name in

the first row:

1. EntityType

The type of the entity: Customer or Vendor.

2. EntityName

The entity name. For sub-customers, this must be the full name in the format “parent:child”

as used by QuickBooks. This is the full entity name, also called the Display Name in

QuickBooks.

A few other commonly used fields are these:

1. Memo

The Notes value for the entity.

2. JobDesc

The Description for a Job.

59

3. Revised

Y to revise an existing QuickBooks entity. N or blank otherwise.

Change values will not be automatically written back to QuickBooks after an entity is initially

added. If you set this field to Y, FinJinni will update the entity in QuickBooks on the next

refresh regardless.

4. Voided

D to delete an existing entity.

60

Loading Data into User-Defined Tables

FinJinni can also load user-data files into database tables that are independent of FinJinni’s managed

database structure. This is provided as a convenience for loading additional data into the reporting

database.

FinJinni’s will load this data from CSV-format files that you can create with Excel. There are