Tables of Contents

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________________

FORM 10-K

☑

Annual Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended July 31, 2021

OR

☐

Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from to

Commission File Number 0-21180

INTUIT INC.

(Exact name of registrant as specified in its charter)

Delaware 77-0034661

(State or other jurisdiction of incorporation or organization) (IRS Employer Identification No.)

2700 Coast Avenue, Mountain View, CA 94043

(Address of principal executive offices, including zip code)

(650) 944-6000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

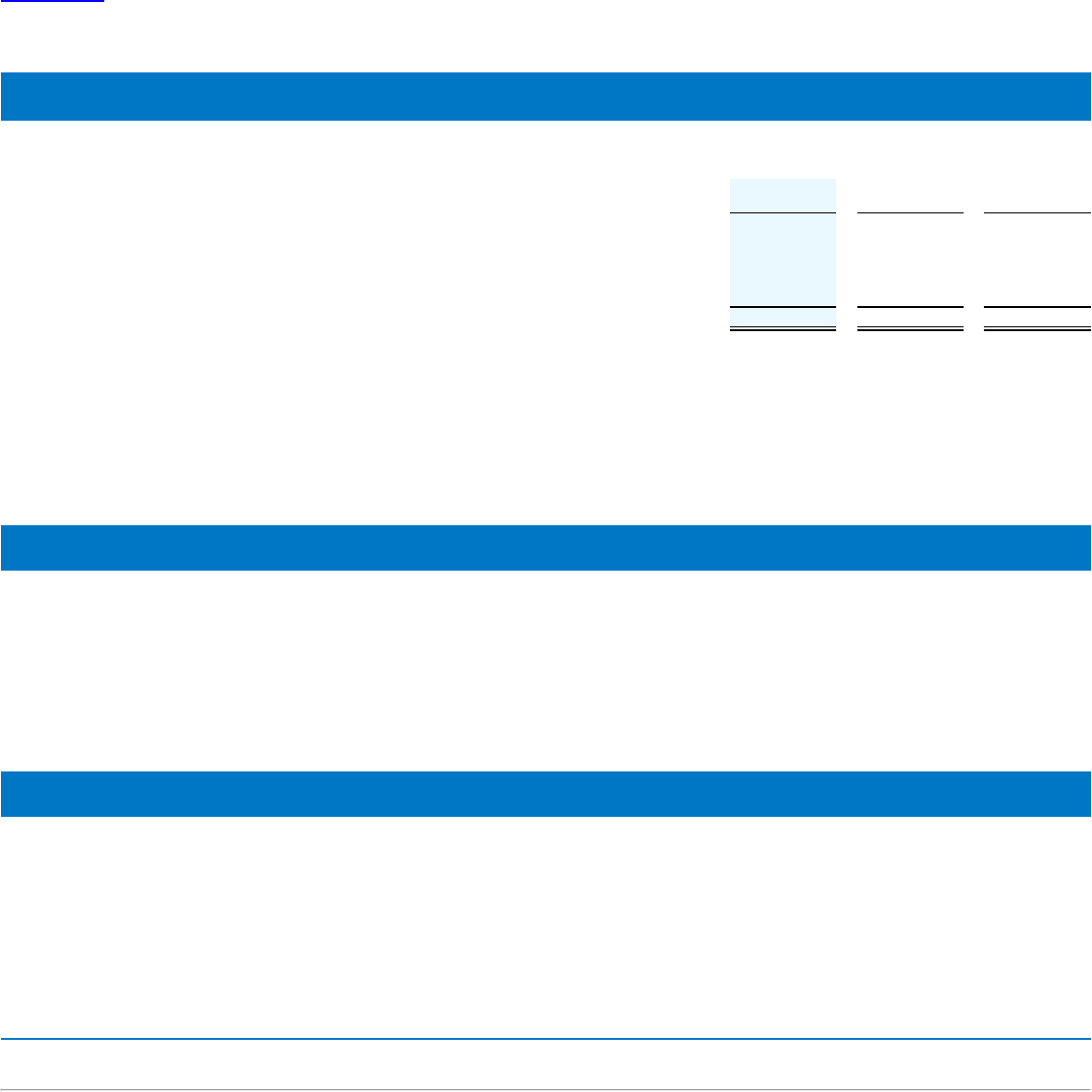

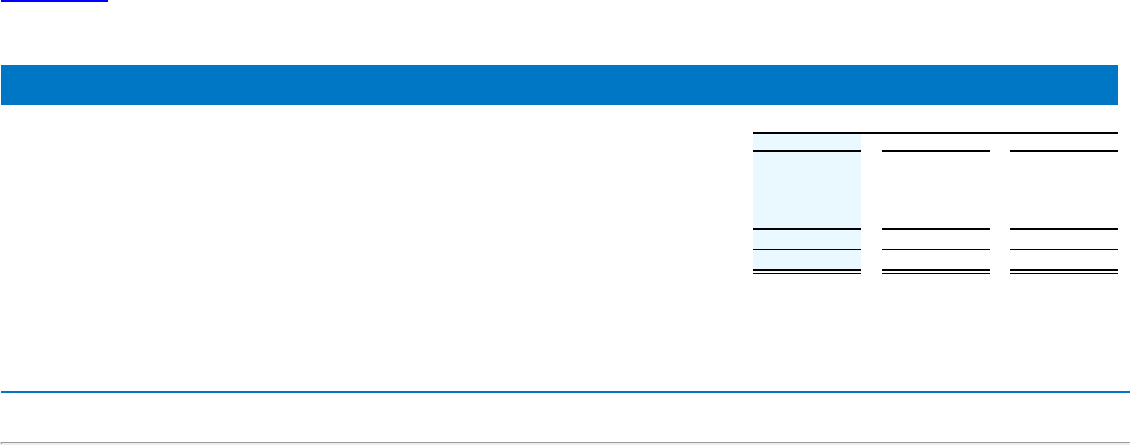

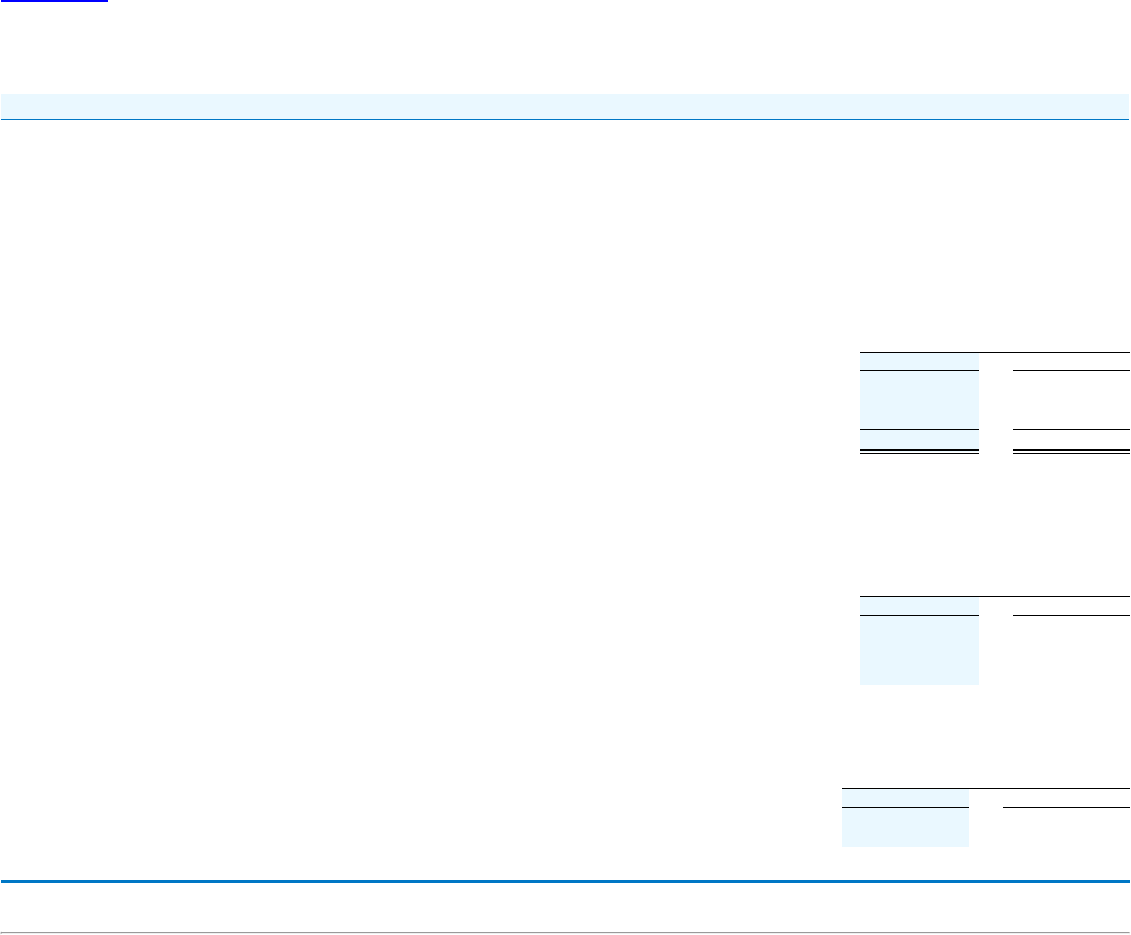

Title of each class Trading Symbol Name of each exchange on which registered

Common Stock, $0.01 par value INTU Nasdaq Global Select Market

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding

12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth

company. See definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check

one)

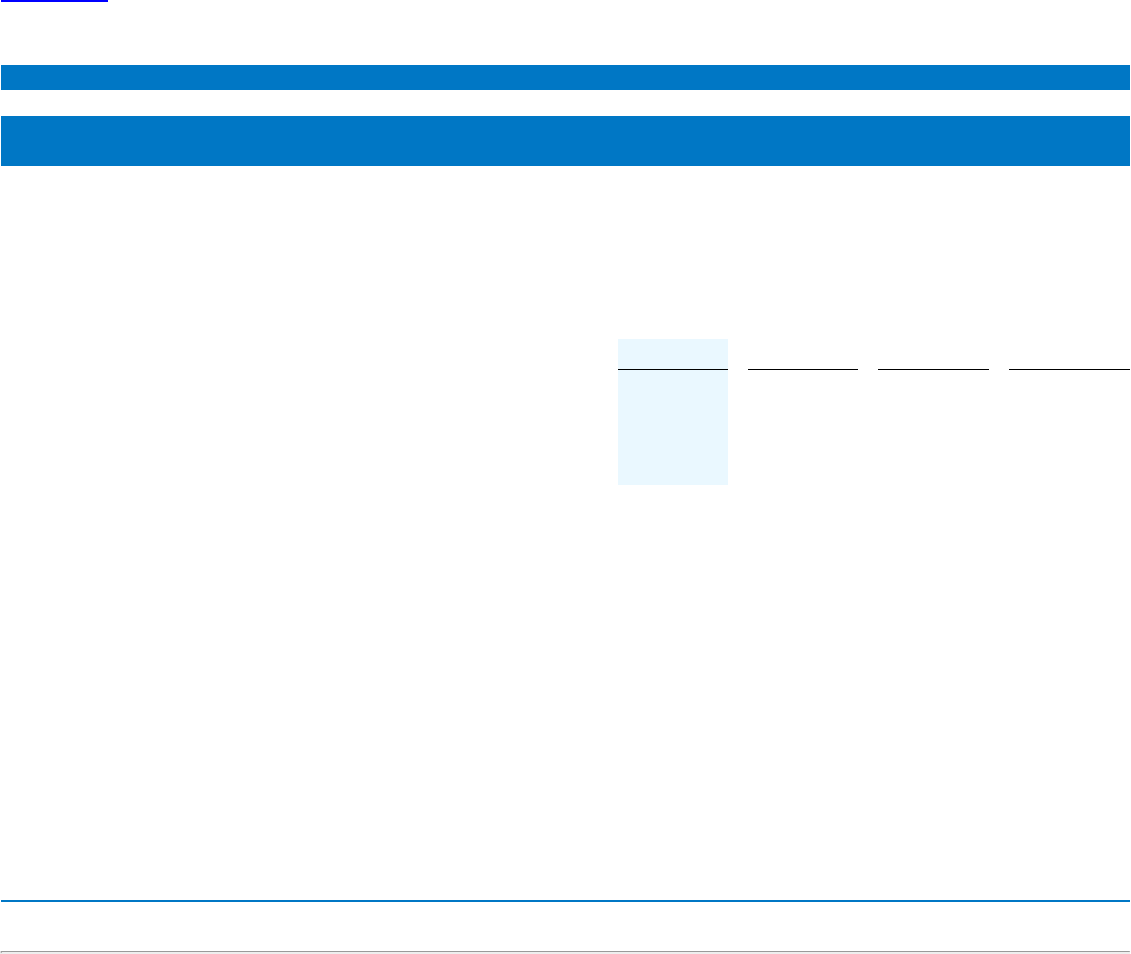

Large accelerated filer ☑ Accelerated filer ☐ Non-accelerated filer ☐

Smaller reporting

company ☐

Emerging growth

company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

The aggregate market value of Intuit Inc. outstanding common stock held by non-affiliates of Intuit as of January 31, 2021, the last business day of our most recently completed

second fiscal quarter, based on the closing price of $361.23 reported by the Nasdaq Global Select Market on that date, was $96.2 billion.

There were 273,091,929 shares of Intuit voting common stock outstanding as of August 31, 2021.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for its Annual Meeting of Stockholders to be held on January 20, 2022 are incorporated by reference in Part III of this Annual

Report on Form 10-K.

Tables of Contents

INTUIT INC.

FISCAL 2021 FORM 10-K

INDEX

Page

PART I

ITEM 1: Business 5

ITEM 1A: Risk Factors 18

ITEM 1B: Unresolved Staff Comments 31

ITEM 2: Properties 31

ITEM 3: Legal Proceedings 31

ITEM 4: Mine Safety Disclosures 31

PART II

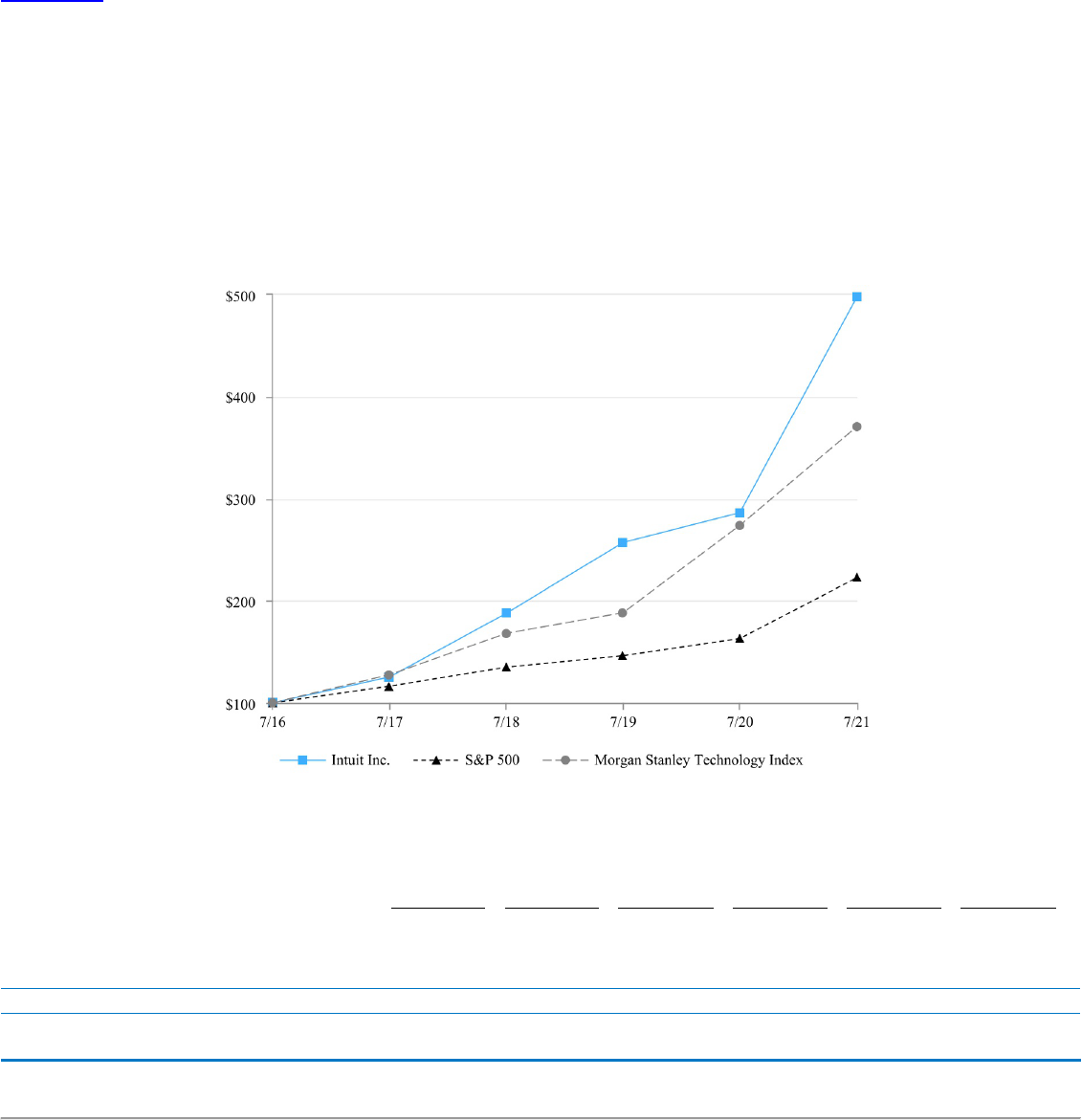

ITEM 5: Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities 32

ITEM 6: Selected Financial Data 33

ITEM 7: Management’s Discussion and Analysis of Financial Condition and Results of Operations 34

ITEM 7A: Quantitative and Qualitative Disclosures About Market Risk 52

ITEM 8: Financial Statements and Supplementary Data 53

ITEM 9: Changes in and Disagreements with Accountants on Accounting and Financial Disclosure 97

ITEM 9A: Controls and Procedures 97

ITEM 9B: Other Information 98

ITEM 9C: Disclosure Regarding Foreign Jurisdictions that Prevent Inspections 98

PART III

ITEM 10: Directors, Executive Officers and Corporate Governance 99

ITEM 11: Executive Compensation 99

ITEM 12: Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters 99

ITEM 13: Certain Relationships and Related Transactions, and Director Independence 99

ITEM 14: Principal Accountant Fees and Services 99

PART IV

ITEM 15: Exhibits and Financial Statement Schedules 100

ITEM 16: Form 10-K Summary 103

Signatures 104

Intuit, the Intuit logo, QuickBooks, TurboTax, Mint, Lacerte, ProSeries, Intuit ProConnect, Credit Karma, and the Credit Karma logo, among others, are registered trademarks and/or registered service

marks of Intuit Inc., or one of its subsidiaries, in the United States and other countries. Other parties’ marks are the property of their respective owners.

Intuit Fiscal 2021 Form 10-K 2

Tables of Contents

Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements that involve risks and uncertainties. These risks and uncertainties may be amplified by the coronavirus

(“COVID-19”) pandemic, which has caused significant global economic instability and uncertainty. The extent to which the COVID-19 pandemic impacts Intuit’s business,

operations, financial results, and financial condition, including the duration and magnitude of such effects, will depend on numerous evolving factors, which are highly uncertain

and cannot be predicted, including, but not limited to, the duration and spread of the pandemic, its severity, the actions to contain the virus or respond to its impact, and how

quickly and to what extent normal economic and operating conditions can resume. Please also see the section entitled “Risk Factors” in Item 1A of Part I of this Annual Report for

important information to consider when evaluating these statements. All statements in this report, other than statements that are purely historical, are forward-looking statements.

Words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “forecast,” “estimate,” “seek,” and similar expressions also identify forward-looking statements. In this report,

forward-looking statements include, without limitation, the following:

• our expectations and beliefs regarding future conduct and growth of the business;

• statements regarding the impact of the COVID-19 pandemic on our business;

• our beliefs and expectations regarding seasonality, competition and other trends that affect our business;

• our expectation that we will continue to invest significant resources in our product development, marketing and sales capabilities;

• our expectation that we will continue to invest significant management attention and resources in our information technology infrastructure and in our privacy and

security capabilities;

• our expectation that we will work with the broader industry and government to protect our customers from fraud;

• our expectation that we will generate significant cash from operations;

• our expectation that total service and other revenue as a percentage of our total revenue will continue to grow;

• our expectations regarding the development of future products, services, business models and technology platforms and our research and development efforts;

• our assumptions underlying our critical accounting policies and estimates, including our judgments and estimates regarding revenue recognition; the fair value of

goodwill; and expected future amortization of acquired intangible assets;

• our intention not to sell our investments and our belief that it is more likely than not that we will not be required to sell them before recovery at par;

• our belief that the investments we hold are not other-than-temporarily impaired;

• our belief that we take prudent measures to mitigate investment related risks;

• our belief that our exposure to currency exchange fluctuation risk will not be significant in the future;

• our assessments and estimates that determine our effective tax rate;

• our belief that our income tax valuation allowance is sufficient;

• our belief that it is not reasonably possible that there will be a significant increase or decrease in our unrecognized tax benefits over the next 12 months;

• our belief that our cash and cash equivalents, investments and cash generated from operations will be sufficient to meet our seasonal working capital needs, capital

expenditure requirements, contractual obligations, debt service requirements and other liquidity requirements associated with our operations for at least the next

12 months;

• our expectation that we will return excess cash generated by operations to our stockholders through repurchases of our common stock and the payment of cash

dividends, after taking into account our operating and strategic cash needs;

• our plan to continue to provide ongoing enhancements and certain connected services for all future versions of our QuickBooks Desktop software products;

• our judgments and assumptions relating to our loan portfolio;

• our belief that the credit facilities will be available to us should we choose to borrow under them; and

• our assessments and beliefs regarding the future developments and outcomes of pending legal proceedings and inquiries by regulatory authorities, the liability, if any,

that Intuit may incur as a result of those proceedings and inquiries, and the impact of any potential losses or expenses associated with such proceedings or inquiries on

our financial statements.

We caution investors that forward-looking statements are only predictions based on our current expectations about future events and are not guarantees of future performance.

We encourage you to read carefully all information provided in this report and in our other filings with the Securities and Exchange Commission before deciding to invest in our

stock or to

Intuit Fiscal 2021 Form 10-K 3

Tables of Contents

PART I

ITEM 1 - BUSINESS

CORPORATE BACKGROUND

General

Intuit helps consumers, small businesses, and the self-employed prosper by delivering financial management and compliance products and services. We also provide specialized

tax products to accounting professionals, who are key partners that help us serve small business customers.

Our global products and platforms, including TurboTax, QuickBooks, Mint, and Credit Karma, are designed to help consumers and small businesses manage their finances, save

money, pay off debt and do their taxes with ease and confidence so they are receiving the maximum refund they deserve. For those customers who run small businesses, we are

focused on helping them get paid faster, pay their employees, access capital, ensure their books are done right and find and keep customers. We serve approximately 100

million customers across our product offerings and platforms. We had revenue of $9.6 billion in our fiscal year which ended July 31, 2021.

Intuit Inc. was incorporated in California in March 1984. We reincorporated in Delaware and completed our initial public offering in March 1993. Our principal executive offices are

located at 2700 Coast Avenue, Mountain View, California, 94043, and our main telephone number is 650-944-6000. When we refer to “we,” “our” or “Intuit” in this Annual Report

on Form 10-K, we mean the current Delaware corporation (Intuit Inc.) and its California predecessor, as well as all of our consolidated subsidiaries.

Available Information

Our corporate website, www.intuit.com, provides materials for investors and information relating to Intuit’s corporate governance. The content on any website referred to in this

filing is not incorporated by reference into this filing unless expressly noted otherwise.

We file reports required of public companies with the Securities and Exchange Commission (SEC). These include annual reports on Form 10-K, quarterly reports on Form 10-Q,

current reports on Form 8-K, proxy statements and other reports, and amendments to these reports. The SEC maintains a website at www.sec.gov that contains reports, proxy

and information statements, and other information regarding issuers that file electronically with the SEC. We make available free of charge on the Investor Relations section of

our corporate website all of the reports we file with or furnish to the SEC as soon as reasonably practicable after the reports are filed or furnished. Copies of this Annual Report

on Form 10-K may also be obtained without charge by contacting Investor Relations, Intuit Inc., P.O. Box 7850, Mountain View, California 94039-7850 or by calling 650-944-6000

or by emailing [email protected].

BUSINESS OVERVIEW

Intuit’s Mission

At Intuit, our mission is to power prosperity around the world. All of our customers have a common set of needs. They are trying to make ends meet, maximize their tax refund,

save money and pay off debt.

Those who have made the bold decision to become entrepreneurs, and go into business for themselves, have an additional set of needs. They want to find and keep customers,

get paid for their hard work, access capital to grow and ensure their books are right.

Across our platform, we use the power of technology to deliver three core benefits to our customers: helping put more money in their pockets, eliminating work and saving people

time so they can focus on what matters to them, and ensuring that they have complete confidence in every financial decision they make.

The rise of Artificial Intelligence (AI) is fundamentally reshaping our world — and Intuit is taking advantage of this technological revolution to find new ways to deliver on our

mission. We are focused on capitalizing on this opportunity to improve prosperity globally and inspire our workforce, while investing in our company’s reputation and durable

growth in the future.

Intuit Fiscal 2021 Form 10-K 5

Tables of Contents

Our Business Portfolio

We organize our businesses into four reportable segments:

Small Business & Self-Employed: This segment serves small businesses and the self-employed around the world, and the accounting professionals who assist and

advise them. Our offerings include QuickBooks financial and business management online services and desktop software, payroll solutions, time tracking, merchant

payment processing solutions, and financing for small businesses.

Consumer: This segment serves consumers and includes do-it-yourself and assisted TurboTax income tax preparation products and services sold in the U.S. and

Canada. Our Mint offering is a personal finance offering which helps customers track their finances and daily financial behaviors.

Credit Karma: This segment serves consumers with a personal finance platform that provides personalized recommendations of credit card, home, auto and personal

loan, and insurance products; online savings and checking accounts through our partner, MVB Bank, Inc., member FDIC; and access to their credit scores and reports,

credit and identity monitoring, credit report dispute, and data-driven resources.

ProConnect: This segment serves professional accountants in the U.S. and Canada, who are essential to both small business success and tax preparation and filing. Our

professional tax offerings include Lacerte, ProSeries, and ProConnect Tax Online in the U.S., and ProFile and ProTax Online in Canada.

Our Growth Strategy

At Intuit, our strategy starts with customer obsession. We listen to and observe our customers, understand their challenges, and then use advanced technology, including AI, to

develop innovative solutions designed to solve their most important financial problems. For more than three decades, we have reinvented and disrupted ourselves in order to

ensure our customers are armed with the technology they need to grow and prosper.

Our strategy for delivering on our bold goals is to become an AI-driven expert platform where we and others can solve our customers’ most important problems. We plan to

accelerate the development of the platform by applying AI in three key areas:

• An Open Platform: None of us can do it alone, including Intuit. The best way to deliver for customers is by creating an open, collaborative platform. It’s the power of

partnerships that accelerates the world’s success. Our open technology platform integrates with partners so together we can deliver value and benefits that matter the

most to our customers.

• Application of AI: AI helps our customers work smarter because we can automate, predict and personalize their experience. Using AI technologies, we are: leveraging

machine learning to build decision engines and algorithms that learn from rich datasets to transform user experiences; applying knowledge engineering and turning

compliance rules into code; and using natural language processing to revolutionize how customers interact with products and services.

• Incorporating Experts: One of the biggest problems our customers face is confidence. Even with current advances in technology that deliver personalized tools and

insights, many people want to connect with a real person to help give them the confidence they are making the right decision. By bringing experts onto our platform we

can solve this massive problem for customers. The power of our virtual expert platform allows us to scale the intelligence of our products, elevating experts to advisors

and delivering big benefits for customers.

As we build our AI-driven expert platform, we are prioritizing our resources on five strategic priorities across the company. These priorities focus on solving the problems that

matter most to customers and include:

• Revolutionizing speed to benefit: When customers use our products and services, we aim to deliver value instantly by making the interactions with our offerings

frictionless, without the need for customers to manually enter data. We are accelerating the application of AI with a goal to revolutionize the customer experience. This

priority is foundational across our business, and execution against it positions us to succeed with our other four strategic priorities.

• Connecting people to experts: The largest problem our customers face is lack of confidence to file their own taxes or to manage their books. To build their confidence,

we are connecting our customers to experts. We offer customers access to experts to help them make important decisions – and experts, such as accountants, gain

access to new customers so they can grow their businesses.

• Unlocking smart money decisions: Crippling high-cost debt and lack of savings are at unprecedented levels across the U.S. To address these challenges, we are

creating a personal financial assistant that helps consumers find the right financial products, put more money in their pockets and access financial expertise and advice.

Our acquisition of Credit Karma accelerates our ability to achieve this vision, by combining two trusted brands, customer reach, data and platform capabilities to deliver

breakthrough benefits that will power prosperity for customers around the world.

• Be the center of small business growth: We are focused on helping customers grow their businesses by offering a broad, seamless set of tools that are designed to

help them get paid faster, manage and get access to capital, pay

Intuit Fiscal 2021 Form 10-K 6

Tables of Contents

employees with confidence, and use third-party apps to help run their businesses. At the same time, we want to position ourselves to better serve product-based

businesses to benefit customers who sell products through multiple channels.

• Disrupt the small business mid-market: We aim to disrupt the mid-market with QuickBooks Online Advanced, our online offering designed to address the needs of

small business customers with 10 to 100 employees. This offering enables us to increase retention of these larger customers, and attract new mid-market customers

who are over-served by available offerings.

As the external environment evolves, we continue to innovate and adapt our strategy and anticipate our customers’ needs. For more than 35 years, we have been dedicated to

developing innovative financial and compliance products and services that are easy to use and are available where and when customers need them. As a result, our customers

actively recommend our products and solutions to others, which is one important way that we measure the success of our strategy.

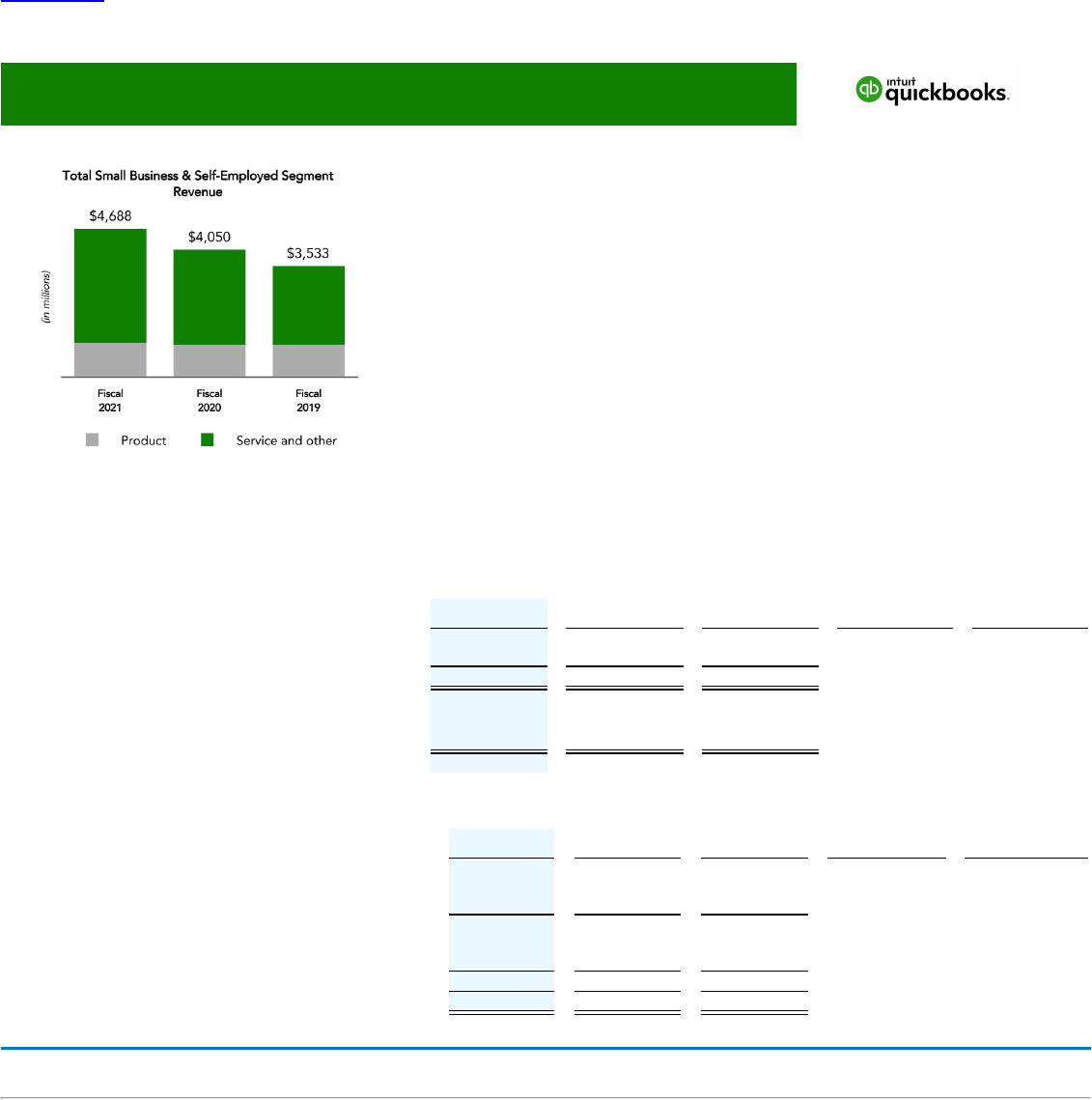

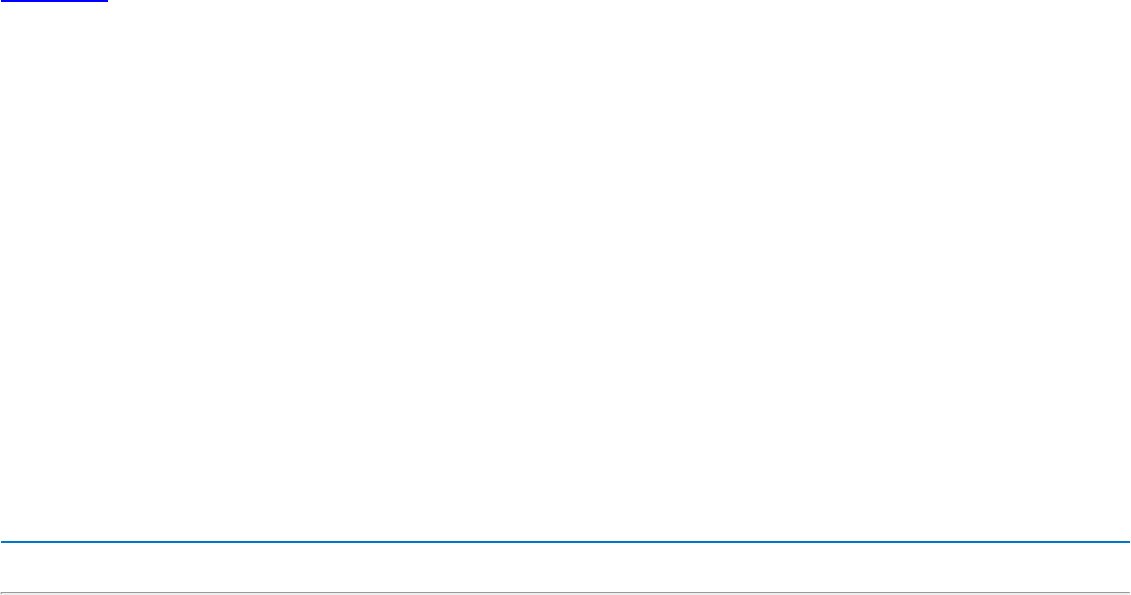

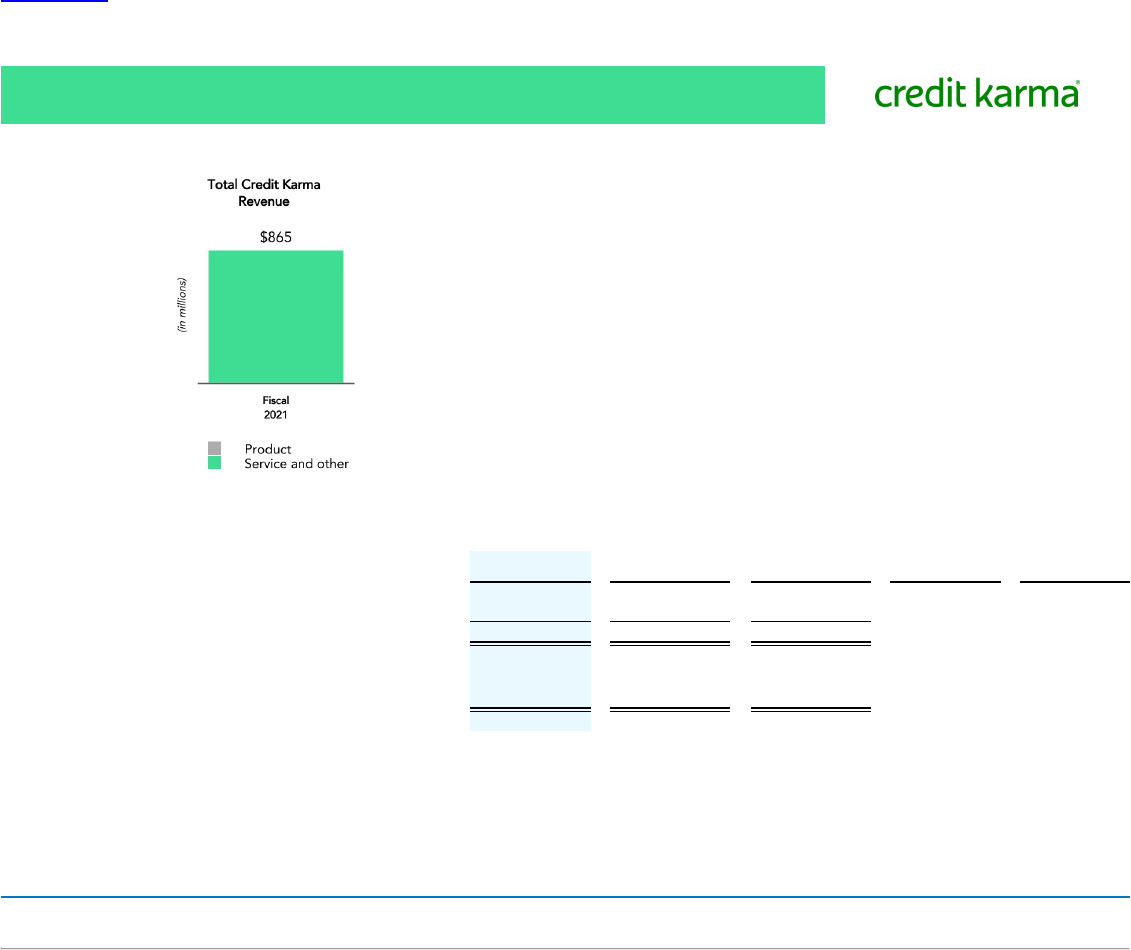

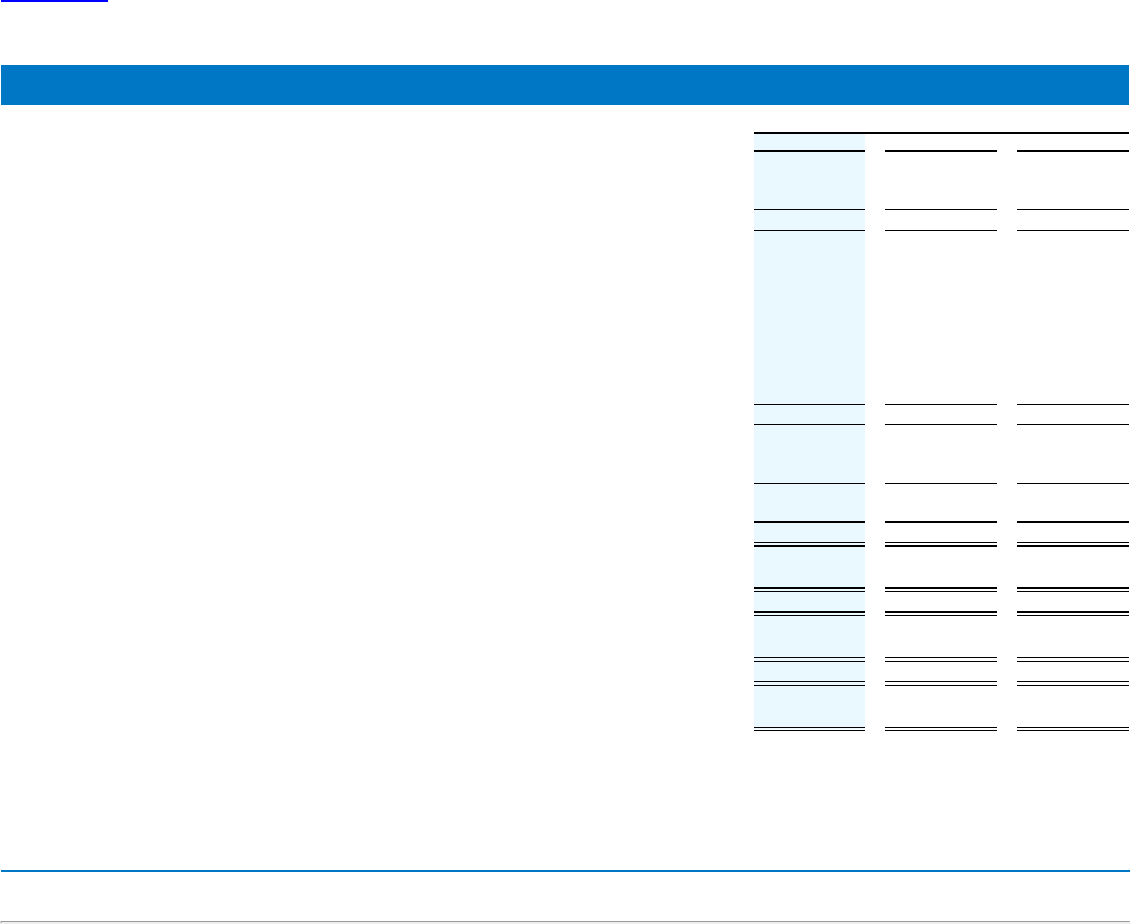

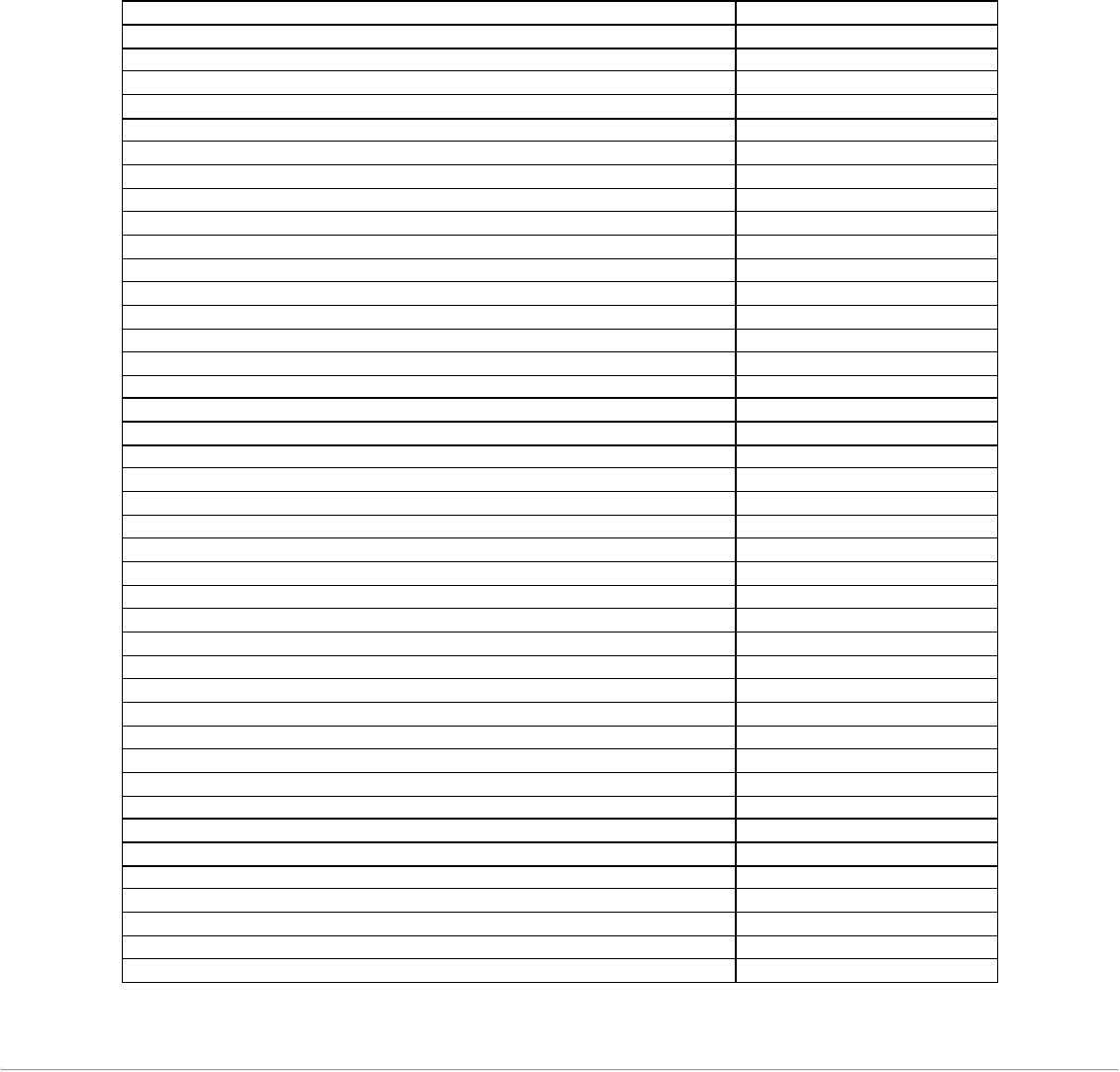

PRODUCTS AND SERVICES

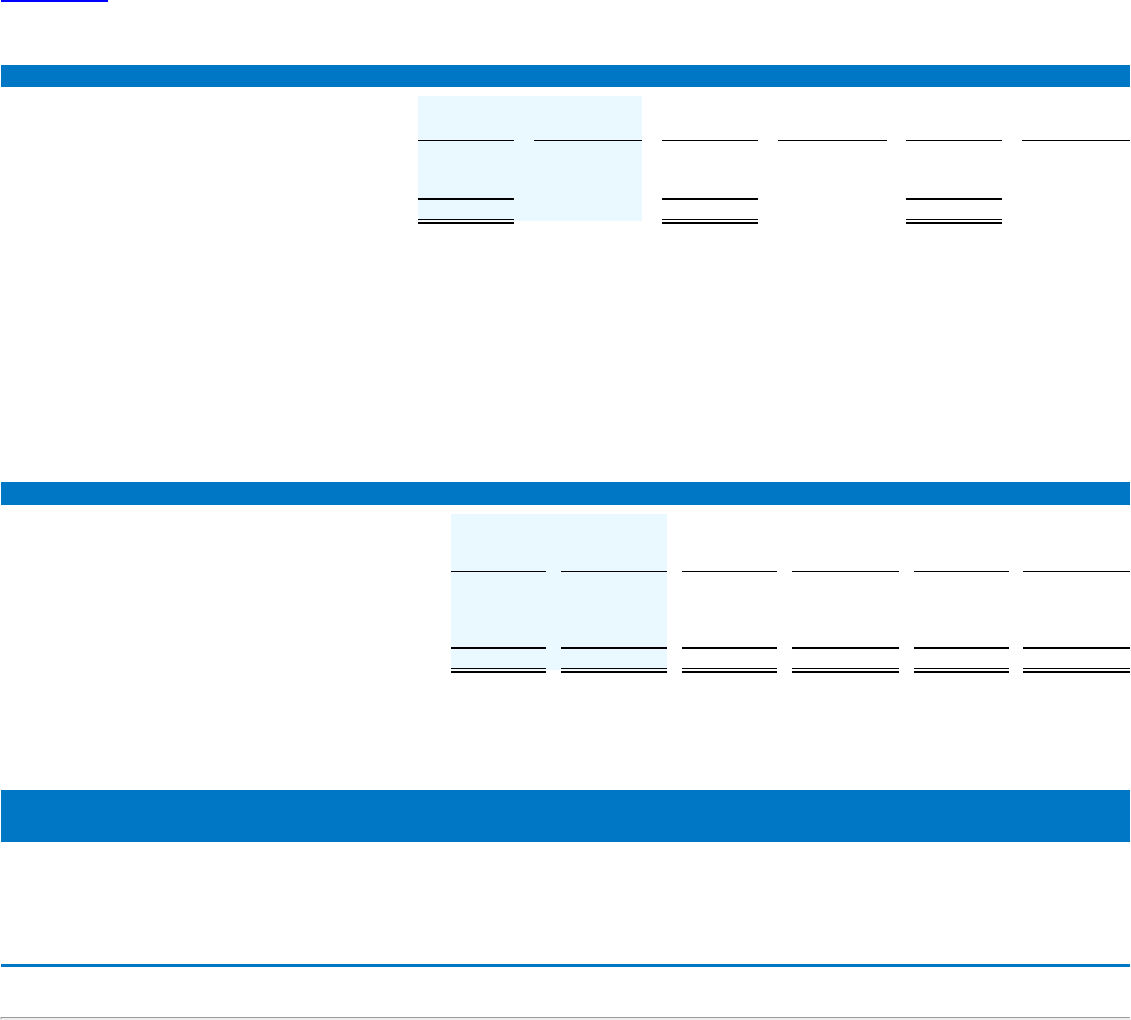

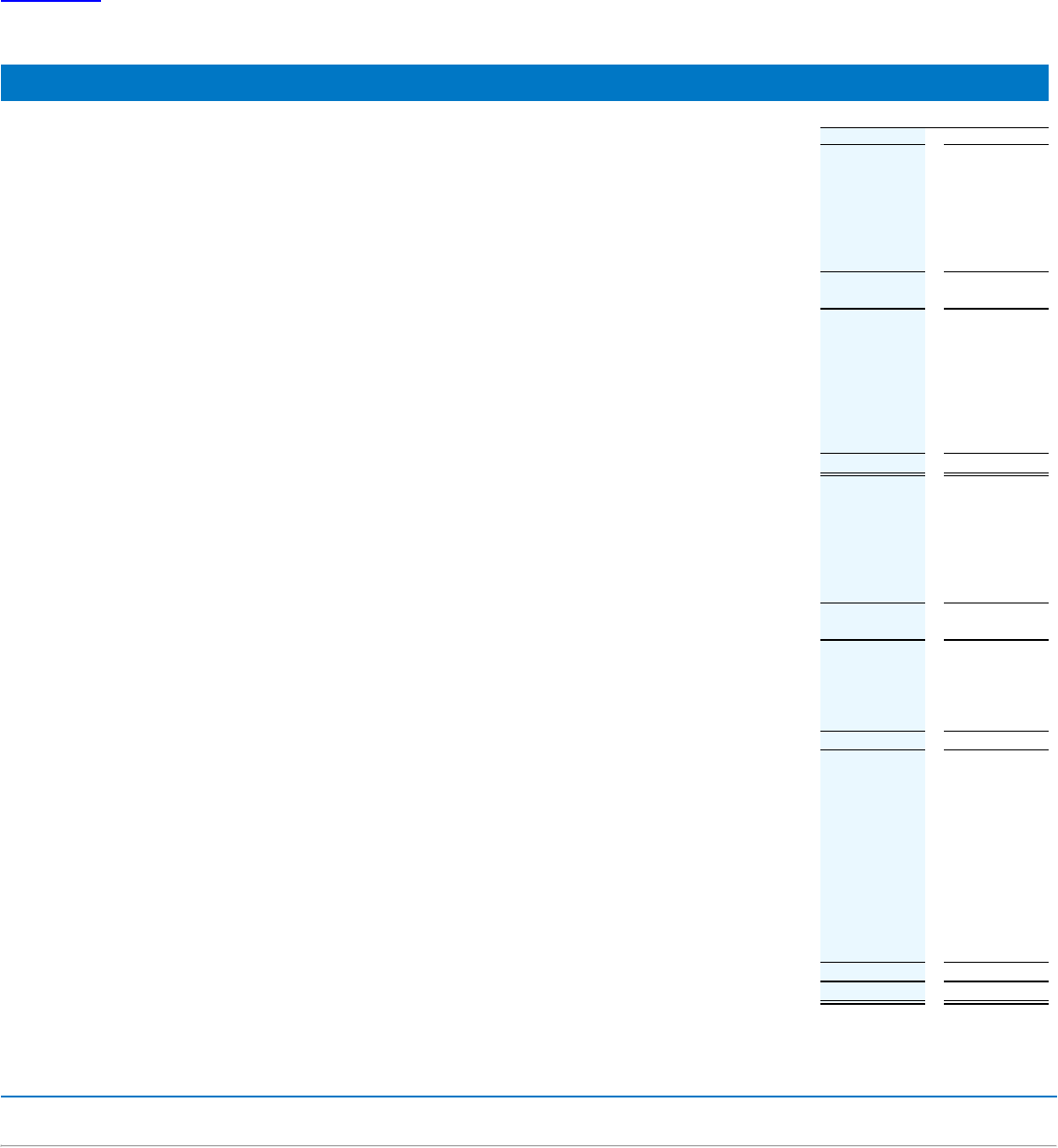

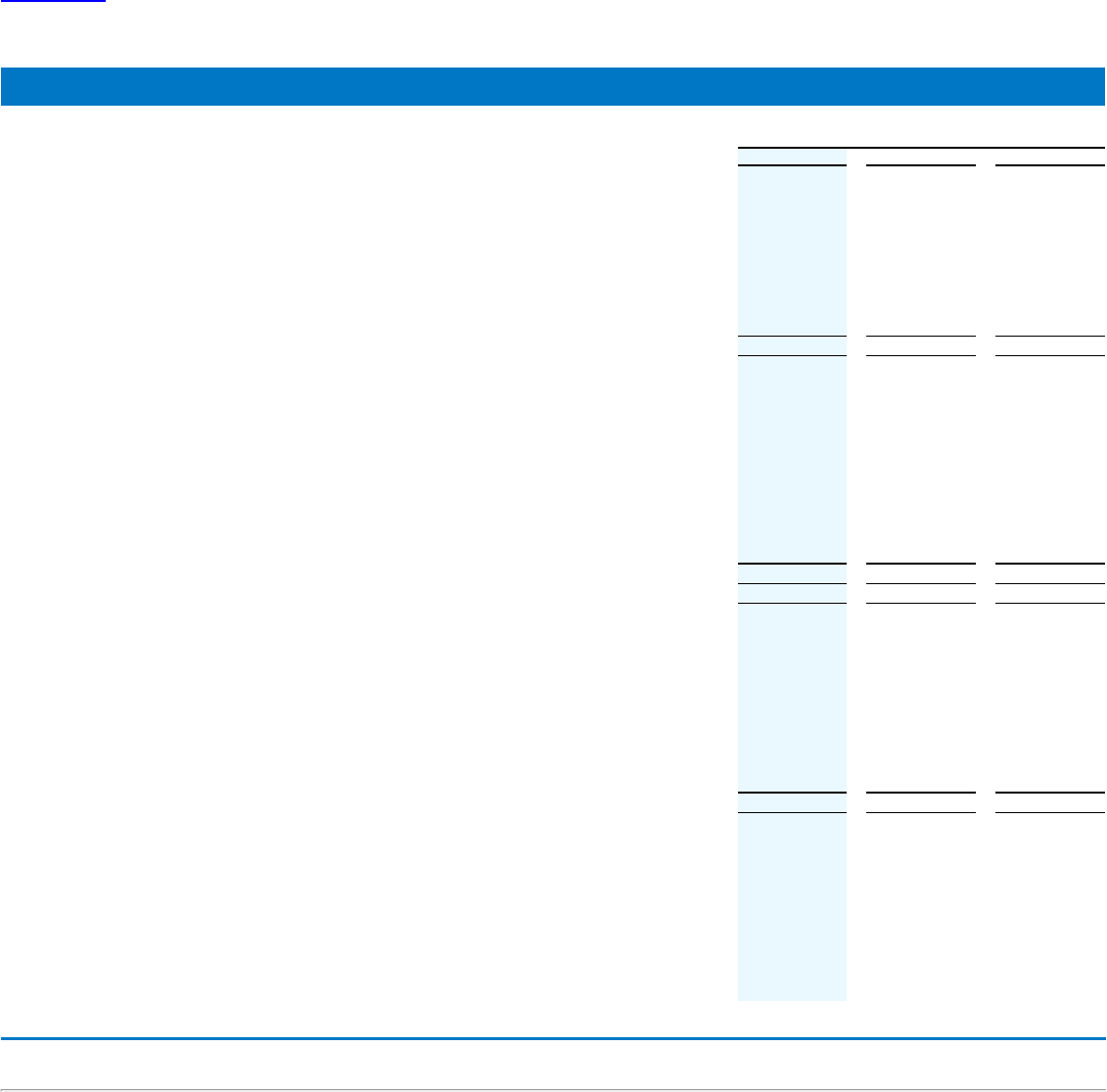

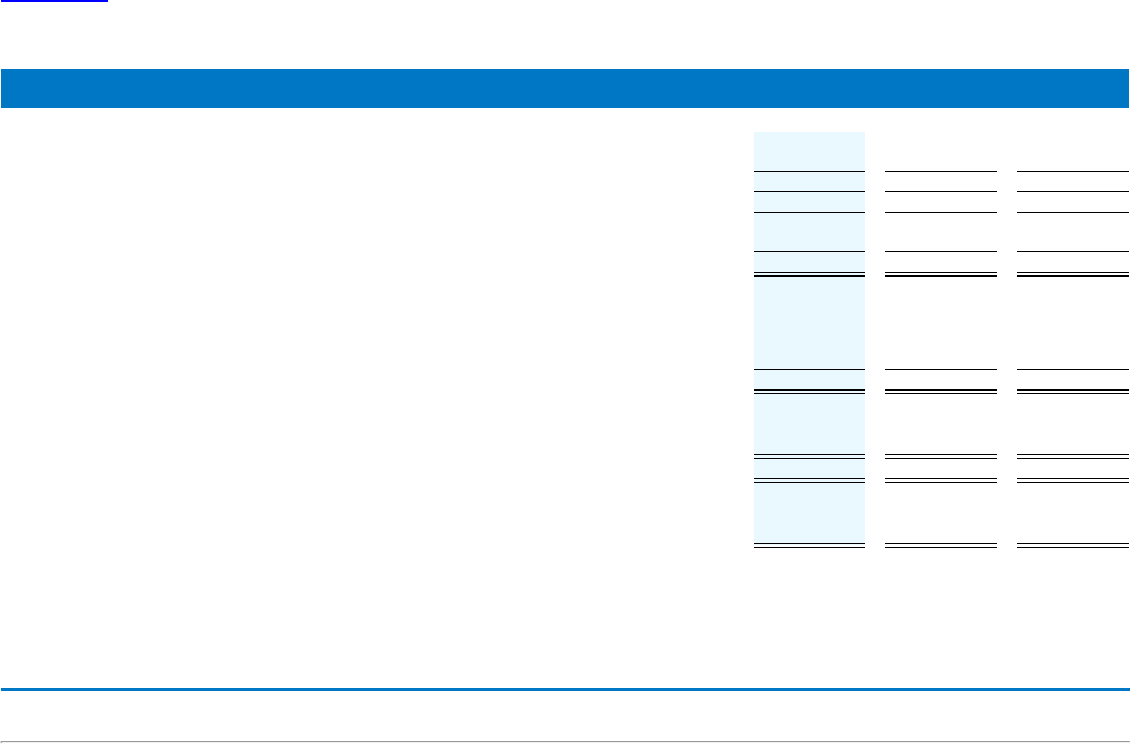

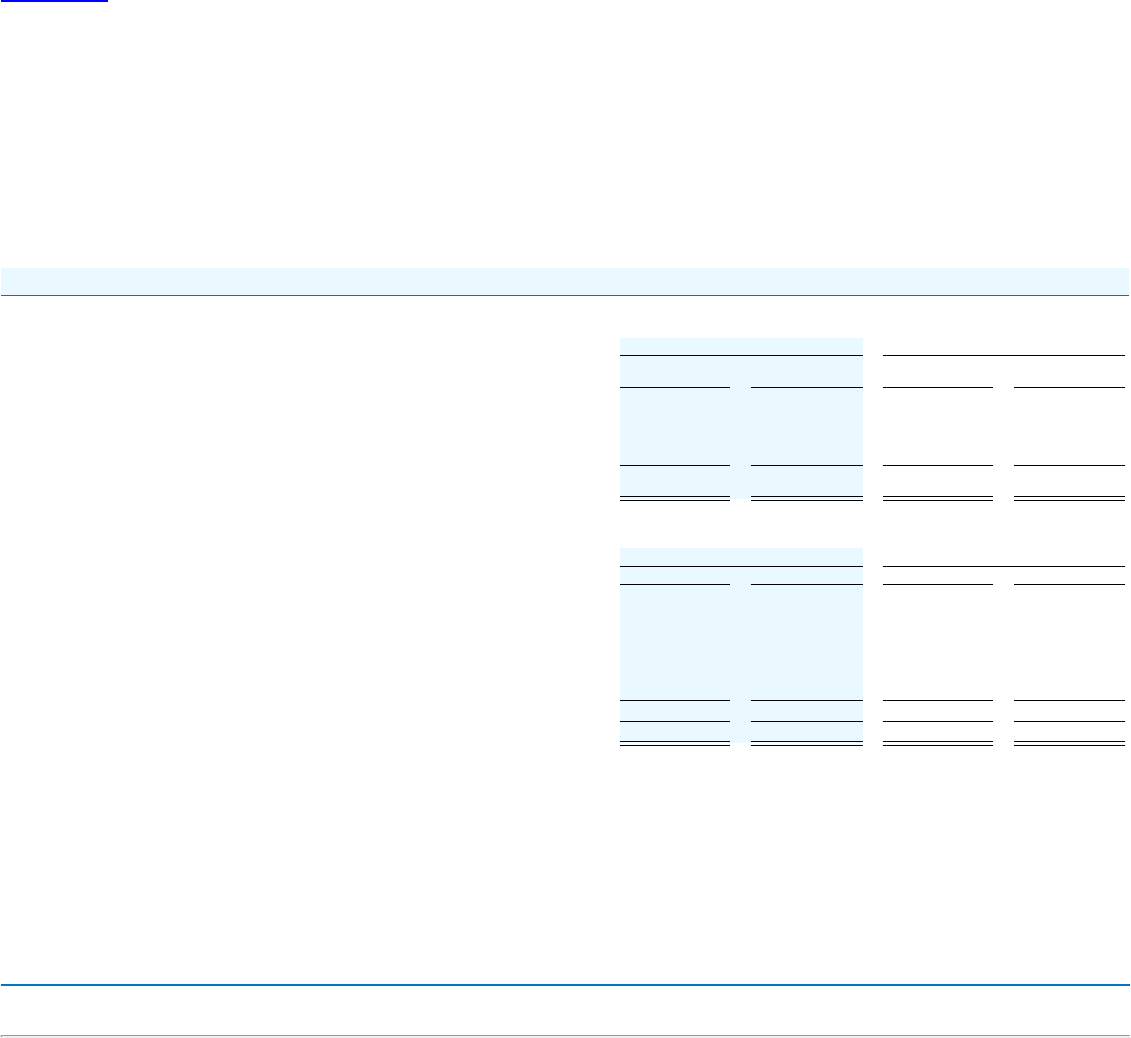

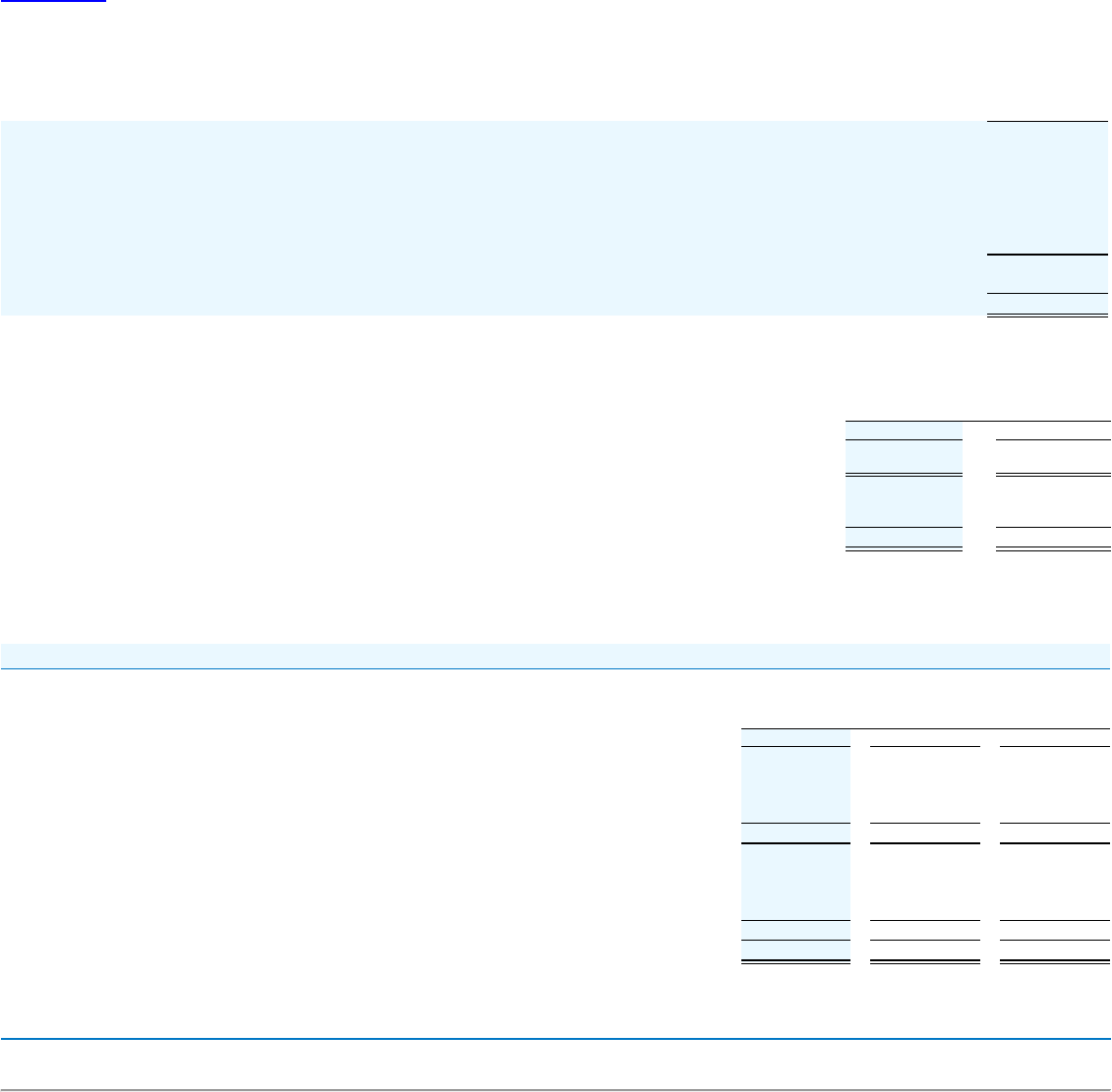

During fiscal 2021 we offered our products and services in the four segments described in “Business Overview” above. The following table shows the revenue for each of these

segments over the last three fiscal years.

Fiscal 2021 Fiscal 2020 Fiscal 2019

Small Business & Self-Employed 49 % 53 % 52 %

Consumer 37 % 41 % 41 %

Credit Karma 9 % — % — %

ProConnect 5 % 6 % 7 %

(1) Credit Karma revenue from December 3, 2020

Total international net revenue was less than 5% of consolidated total net revenue for the twelve months ended July 31, 2021, 2020 and 2019.

For financial information about our reportable segments, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Item 7 and Note 14 to

the financial statements in Item 8 of this Annual Report.

Small Business & Self-Employed

Our Small Business & Self-Employed segment serves small businesses and the self-employed around the world, and the accounting professionals who assist and advise them.

Our goal is for QuickBooks to be the source of truth for each small business customer who uses our integrated platform. We work to make this a reality through our three-pillared

growth strategy: Grow the Core by transforming financial management software and meeting customers where they are; Connect the Ecosystem, by meeting a wider range of

customer needs with a single integrated platform; and expand our geographic footprint globally, by serving small businesses around the world. With this strategy we enable a

powerful ecosystem, personalized using artificial intelligence, to deliver a suite of right-for-me solutions to a wide range of customers globally.

Our integrated platform includes:

QuickBooks Online. Our QuickBooks financial management solutions help small businesses, the self-employed, and accountants solve financial and compliance problems,

make more money and reduce unnecessary work, while giving them complete confidence in their actions and decisions. Users can track income and expenses, create and send

invoices and estimates, manage and pay bills, and review a variety of financial reports. QuickBooks Live enables our customers to obtain live bookkeeping advice from

professionals. QuickBooks Online also comes with a powerful mobile app available on iOS and Android which enables customers to run their entire business from their phone.

The app provides the customers instant access to their QuickBooks data and includes powerful features that take advantage of mobile technology such as automatically tracking

business miles or the ability to upload a picture of a receipt.

QuickBooks Online is an open platform, enabling third-party developers to create online and mobile applications that integrate with our offering. A growing number of companies

offer applications built for our QuickBooks platform, including PayPal, Shopify and Square.

QuickBooks Desktop Software. Our QuickBooks financial management solutions are also available as desktop versions for small businesses.

In addition to our core QuickBooks offering, we also offer specific solutions for the following customer segments:

• Mid-Market Small Businesses. Our QuickBooks Online Advanced and QuickBooks Enterprise offerings are designed for small businesses with 10 to 100 employees that

have more complex needs. QuickBooks Online Advanced, Intuit’s cloud-based offering, is specifically designed for high-growth, mid-market small businesses and

leverages AI, automation and data insights to deliver more ways for them to grow and scale. QuickBooks Enterprise is available for

(1)

Intuit Fiscal 2021 Form 10-K 7

Tables of Contents

download and can also be provided as a hosted solution. This offering provides industry-specific reports and features for a range of industries, including Contractor,

Manufacturing and Wholesale, Nonprofit, and Retail.

• Self-Employed. QuickBooks Self-Employed is designed specifically for self-employed customers whose needs are different than small businesses that use QuickBooks.

Features include categorizing business and personal transactions, identifying and classifying tax deductible expenses, tracking mileage, calculating estimated quarterly

taxes and sending invoices. QuickBooks Self-Employed can be combined with TurboTax to export and pay year-end taxes. QuickBooks Self-Employed is available both

online and via a mobile application.

• Product-Based Businesses. With QuickBooks Commerce, product-based businesses such as online sellers are able to access inventory and sales from multiple sales

channels, manage orders and fulfillment, sync inventory across online and offline channels to avoid stockouts and gain profitability insights. QuickBooks Commerce also

helps small businesses attract and sell to new customers across multiple channels and ultimately grow their business.

• Accountants. QuickBooks Online Accountant and QuickBooks Accountant Desktop Plus are available to accounting professionals who use QuickBooks offerings and

recommend them to their small business clients. These offerings provide the tools and file-sharing capabilities that accounting professionals need to efficiently complete

bookkeeping and financial reporting tasks as well as manage their practices. We also offer memberships to the QuickBooks ProAdvisor program, which provides

accountants access to QuickBooks Online Accountant, QuickBooks Accountant Desktop Plus, QuickBooks Desktop Enterprise Accountant, QuickBooks Point of Sale

Desktop, technical support, training, product certification, marketing tools, and discounts on Intuit products and services purchased on behalf of clients.

Ecosystem Services

Employer Solutions (Payroll and Time Tracking). Our payroll solutions are sold on a subscription basis and integrate with our QuickBooks Online and QuickBooks Desktop

offerings. All of our payroll offerings allow customers to perform payroll processing, direct deposit of employee paychecks, payroll reports, electronic payment of federal and state

payroll taxes, and electronic filing of federal and state payroll tax forms. Our QuickBooks Online payroll offerings include automated tax payments and filings, as well as access to

employee benefits offerings like health insurance and 401ks. Certain online offerings also include same day direct deposit, access to human resource advice, and access to

additional expert-powered services like Tax Penalty Protection. QuickBooks Desktop payroll is available in both a self-service and an assisted version, depending on whether

customers want to do their own taxes or leverage automated tax payments and filings. We also offer QuickBooks Time which seamlessly integrates with QuickBooks Payroll and

third-party payroll products to help businesses easily and accurately track time across a mobile workforce, including tools for project planning, job costing, and tracking per-client

billable hours.

Payment Processing Solutions. Our full range of merchant services for small businesses includes credit card, debit card, Apple Pay, and ACH payment services for in person

and card not present payments. We offer instant deposit options for eligible customers. QuickBooks Payments is deeply integrated into QuickBooks through seamless

onboarding and automated transaction reconciliation, and is the default payment solution for QuickBooks invoicing. Our Payments offering is also connected with QuickBooks

Cash, our small business banking solution, through integrated onboarding and instant funds availability. In addition to transaction processing services, our services include broad

customer support, merchant and consumer collections, chargeback and retrieval support, and fraud and loss prevention screening.

Capital for Small Businesses. We offer financing options for small businesses to help them get the capital they need to succeed. The financing process provides small

businesses the ability to use their QuickBooks data to qualify to borrow capital.

QuickBooks Cash. The QuickBooks Cash business bank account with debit card adds banking capabilities to QuickBooks’ robust business offerings. QuickBooks Cash, when

used with the QuickBooks suite of business services, takes the complexity and latency out of managing finances for small business owners. QuickBooks Cash has no account

opening fees, maintenance fees, minimum balances, overdraft fees, or other recurring fees. QuickBooks Cash includes a machine-learning powered finance planner which helps

small businesses plan for the future by making 90-day cash flow projections, including predictions on when invoices are likely to be paid, enabling small business customers to

better manage their cash flow.

Financial Supplies. We offer a range of financial supplies designed for individuals and small businesses that use our QuickBooks offerings. These include standard paper

checks and Secure Plus checks with CheckLock fraud protection features, a variety of stationery, tax forms and related supplies.

Consumer

Our Consumer segment includes our TurboTax products and services that are designed to enable customers to prepare and file their federal and state income tax returns quickly

and accurately. These offerings are available either online or as desktop versions. They are designed to be easy to use, yet sophisticated enough for complex tax returns. For

customers using our online offerings and looking for additional advice or guidance along the way, we have experts standing by to offer tax review and advice all year round. We

also have experts available to prepare, sign and file tax returns for customers who prefer to have

Intuit Fiscal 2021 Form 10-K 8

Tables of Contents

their taxes prepared for them. Within this segment, we also offer Mint, which is an online personal finance offering aimed at helping customers track their finances and daily

financial behaviors. Our online offerings can be accessed on mobile devices.

Tax Return Preparation Offerings. For the 2020 tax season, we offered a variety of commercial software products and tax filing services to meet the different needs of our

customers, including those filing simple returns, those who itemize deductions, own investments or rental property, and small business owners. Customers can electronically file

their federal and state income tax returns through our electronic filing service. We also offered TurboTax Live for customers seeking to obtain tax advice from professionals,

TurboTax Live Full Service for customers seeking to have their tax returns prepared for them, as well as audit defense and audit support services. Our online tax preparation and

filing services were offered through the websites of thousands of financial institutions, electronic retailers, and other online merchants. Financial institutions can offer our online

tax preparation and filing services to their customers through a link to TurboTax Online. Our TurboTax U.S. and Canada offerings consist of desktop, online, and mobile offerings.

In addition to our commercial product offerings, for the 2020 tax season we were a member of the Free File Alliance, a consortium of private sector companies that has entered

into an agreement with the federal government to donate free online federal tax preparation and filing services to the IRS, which the IRS then markets to eligible consumers on

an IRS website. At the conclusion of this tax season in October, we will no longer participate in the Free File Alliance. See also “Competition – Consumer Segment” later in this

Item 1 for more information on the Free File Alliance.

Credit Karma

Our Credit Karma segment provides consumers with a financial platform that helps them find the right financial products and put more money in their pockets. The platform offers

a number of free services to its members: access to their credit scores and reports, credit and identity monitoring, credit report dispute, data-driven resources, personalized

recommendations of credit card, loan, and insurance products and online savings and checking accounts through our bank partner, MVB Bank, Inc., Member FDIC. To provide

these services to its members, Credit Karma works with a variety of partners, including credit bureaus, banks, credit card issuers, and other financial institutions and lending

partners. Additionally, Credit Karma leverages Lightbox, a first-of-its-kind enterprise platform which allows lenders to leverage thousands of de-identified data points from Credit

Karma members to help provide its members with greater certainty that they will be approved if they apply for a financial product.

ProConnect

Our ProConnect segment includes our professional tax offerings and serves professional accountants in the U.S. and Canada, who are essential to both small business success

and tax preparation and filing. Our professional tax offerings consist of Lacerte, ProSeries, and ProConnect Tax Online in the U.S., and ProFile and ProTax Online in Canada.

These offerings enable accountants to accurately and efficiently complete and electronically file a full range of consumer, small business, and commercial federal and state tax

returns. Lacerte is designed for full-service year-round accounting firms who handle more complex returns. ProSeries is designed for year-round tax practices handling

moderately complex tax returns. ProConnect Tax Online is our cloud-based solution, which is designed for full-service year-round practices who prepare all forms of consumer

and small business returns and integrates with our QuickBooks Online offerings. ProFile is our Canadian desktop tax offering, which serves year-round full-service accounting

firms for both consumer and business tax returns. ProTax Online is our Canadian cloud based tax solution, which is designed for full-service year-round practices who prepare all

forms of consumer and business tax returns, and is fully integrated into QuickBooks Online Accountant to provide seamless integration of data across books and tax through our

Workpapers solution. We also offer a variety of tax-related services that complement the tax return preparation process including year-round document storage, collaboration

services, e-signature, and bank products, and additional capabilities such as fixed asset management, desktop hosting, and third party solutions for practice management for

some of our U.S. tax offerings.

PRODUCT DEVELOPMENT

The markets for software and related services are characterized by rapid technological change, shifting customer needs and frequent new product introductions and

enhancements. Continuous investment is required to innovate and develop new products and services as well as enhance existing offerings to be successful in these markets.

Our product development efforts are more important than ever as we pursue our growth strategy.

We develop many of our products and services internally, and we have a number of United States and foreign patents and pending applications that relate to various aspects of

our products and technology. We also supplement our internal development efforts by acquiring or licensing products and technology from third parties, and establishing other

relationships that enable us to enhance or expand our offerings more rapidly. We expect to expand our third-party technology relationships as we continue to pursue our growth

strategy.

Our online offerings and mobile applications have rapid development cycles, while our traditional desktop software products tend to have predictable annual development and

product release cycles. In addition, developing consumer and professional tax software and services presents unique challenges because of the demanding development cycle

required to accurately incorporate federal and state tax law and tax form changes within a rigid timetable. The development timing for our small

Intuit Fiscal 2021 Form 10-K 9

Tables of Contents

business payroll and merchant payment processing services offerings varies with business needs and regulatory requirements, and the length of the development cycle depends

on the scope and complexity of each project.

We continue to make substantial investments in research and development, and we expect to focus our future research and development efforts on enhancing existing products

and services with financial recommendations, personalization, and ease of use enabled by AI and other advanced technologies. We continue to focus on developing new

products and services, including new mobile and global offerings, and significant research and development efforts for ongoing projects to update the technology platforms for

several of our offerings.

SEASONALITY

Our Consumer and ProConnect offerings have a significant and distinct seasonal pattern as sales and revenue from our income tax preparation products and services are

typically concentrated in the period from November through April. This seasonal pattern typically results in higher net revenues during our second and third quarters ending

January 31 and April 30, respectively.

Due to the COVID-19 pandemic, the timing of tax filing seasons for fiscal 2021 and fiscal 2020 varied significantly. In fiscal 2019, the IRS began accepting returns on January 28,

2019 and the tax filing deadline was April 15, 2019. In fiscal 2020, the IRS began accepting returns on January 27, 2020 and the tax filing deadline was July 15, 2020. In fiscal

2021, the IRS began accepting returns on February 12, 2021 and the tax filing deadline was May 17, 2021. These changes to the tax filing seasons impacted our quarterly

financial results during fiscal 2021 and fiscal 2020.

We expect the seasonality of our Consumer and ProConnect businesses to continue to have a significant impact on our quarterly financial results in the future.

MARKETING, SALES AND DISTRIBUTION CHANNELS

Markets

Our primary customers are consumers, small businesses, and the self-employed. We also provide specialized tax and accounting products to professional accountants, who are

key partners to help us reach small business customers. The markets in which we compete have always been characterized by rapid technological change, shifting customer

needs, and frequent new product introductions and enhancements by competitors. Over the past several years, the widespread usage of mobile devices and the explosion of

social media have accelerated the pace of change and revolutionized the way that customers learn about, evaluate, and purchase products and services.

Real-time, personalized online and mobile shopping experiences are the standard. In addition, many customers now begin shopping in one channel and ultimately purchase in

another. This has created a need for integrated, multi-channel, shop-and-buy experiences. Market and industry changes quickly make existing products and services obsolete.

Our success depends on our ability to respond rapidly to these changes with new business models, updated competitive strategies, new or enhanced products and services,

alternative distribution methods, and other changes in the way we do business.

Marketing Programs

We use a variety of marketing programs to generate direct sales, develop leads, increase general awareness of our product portfolio, and drive sales in retail. These programs

include digital marketing such as display and pay-per-click advertising, search engine optimization, and social and affiliate marketing; mobile marketing through online app stores;

email marketing; offline marketing such as TV, radio, billboard, magazine and newspaper advertising; retail marketing; public relations; and in product marketing to drive

awareness of related products and services. Our campaigns are designed to attract new users, retain existing users, and cross sell additional offerings.

Sales and Distribution Channels

Multi-Channel Shop-and-Buy Experiences. Our customers use the web and mobile devices to research products and services. Some customers buy and use our products and

services entirely online or through their mobile devices. Others research online but make their purchase at a retail location. Because many customers shop across multiple

channels, we continue to coordinate our online, offline, and retail presence and promotions to support an integrated, multi-channel, shop-and-buy model. We also focus on cross-

selling complementary Intuit and third-party offerings online and in-product.

Direct Sales Channel. We sell many of our products and services directly through our websites and call centers. Direct, online sales are an effective channel for customers who

can make purchase decisions based on content provided on our websites, via other online content or word of mouth recommendations. Telesales continues to be an effective

channel for serving customers that want live help to select the products and services that are right for their needs. We also have a direct sales force that calls on U.S. and

international accounting firms and seeks to increase their awareness, usage, and recommendation of our small business and professional tax solutions. For mid-market

businesses, we have implemented and expanded on our omni channel go to market strategy by diversifying and growing our technology partner channel and industry focused

direct sales teams.

Intuit Fiscal 2021 Form 10-K 10

Tables of Contents

Mobile Application Stores. We distribute many of our offerings for mobile devices through proprietary online stores that provide applications for specific devices. These include

the Apple App Store and Google’s Play Store.

Partner and Other Channels. We sell our products and services through partners including value-added resellers, system integrators (including accountants), and managed

service providers who help us reach new customers at the point of need and drive growth and market share by extending our online reach. These partners combine our products

and services with marketing, sales, and technical expertise to deliver a complete solution at the local level. We also sell our QuickBooks and TurboTax desktop software as well

as payroll services at retail locations across the United States and Canada and on retailer websites. In Canada, we also rely on distributors who sell products into the retail

channel.

COMPETITION

Overview

We face intense competition in all of our businesses, both domestically and internationally. Competitive interest and expertise in many of the markets we serve have grown

markedly over the past few years and we expect this trend to continue. Some of our existing competitors have significantly greater financial, technical and marketing resources

than we do. In addition, the competitive landscape can shift rapidly as new companies enter and existing companies expand their businesses to include the markets in which we

compete. This is particularly true for online and mobile products and services, where the barriers to entry are lower than they are for desktop software products and services. To

attract customers, many online and mobile competitors are offering free or low-priced products which we must take into account in our pricing strategies.

Given the breadth of the products and services that we offer as a global technology company, we compete with the offerings from a variety of companies across a range of

industries. Our most obvious competition comes from other companies that currently offer technology solutions similar to ours. In our Small Business & Self-Employed segment,

we face competition from a variety of companies that provide products or services to address the problems that we help our customers to solve, including getting paid faster,

paying their employees, accessing capital and ensuring their books are done right. Our Consumer segment competes with companies that offer products and services to help

customers file their taxes, better manage their money and reduce their debt. We may also face competition from companies with platforms that could be developed to offer

competing technology solutions to any of the problems that our customers may face, such as Facebook, Amazon and Google. In addition, for many of our products and services,

other competitive alternatives for customers are third-party service providers such as professional accountants and seasonal tax preparation businesses. Manual tools and

processes, or general-purpose software, are also important competitive alternatives. In some cases, a competitor in one of our segments may be our partner in another one of

our segments. In other cases, a company may compete with us in more than one of our segments.

Competition Specific to Segments

Small Business & Self-Employed Segment. QuickBooks is a leading small business financial management software in the U.S. Small businesses often look to several companies

to address their problems. Therefore, our small business products and services face competitive challenges from a variety of companies that provide products or services that

address one or more of their problems. We compete to help small businesses get their books right with Xero, The Sage Group plc, and FreshBooks, among others, which offer

software and associated services as well as online accounting offerings that directly serve small business customers. For small businesses with more complex financial

management needs, our competitors include The Sage Group plc’s Intacct offering and Microsoft Dynamics. We also compete with free or low-cost online accounting offerings,

and free online banking and bill payment services offered by financial institutions and others. In our payroll business we compete directly with Automatic Data Processing, Inc.

(ADP), Paychex, Gusto, and many other companies that help small businesses to pay their employees. In our merchant services business we help our customers get paid faster

and compete directly with large financial institutions such as Wells Fargo, JP Morgan Chase, and Bank of America and with many payment processors, including First Data

Corporation, Elavon, Global Payments, Fidelity National Information Services, PayPal, and Square. Our QuickBooks Capital offering, which helps small businesses to access

capital, competes with a range of lending enterprises, including large financial institutions, such as the ones listed above, fintech companies, such as Square and PayPal, and

others.

Consumer Segment. In our Consumer segment, we compete to help our customers to file their taxes. Our future growth depends on our ability to attract new customers to the

self-preparation tax category and to our assisted offering, TurboTax Live, from tax stores and other tax preparers. In the U.S. private sector we face intense competition from

H&R Block, which provides tax preparation services in its stores and a competing software offering. We also face competition from several other large tax preparation service

providers, from a myriad of small tax preparers, and from numerous online self-preparation offerings, including Blucora’s TaxAct, Free Tax USA, TaxSlayer, and Square. Some of

these competitors are offering electronic tax preparation and filing services at no cost to individual taxpayers. In Canada, our TurboTax Canada offerings face competition from

H&R Block, SimpleTax, StudioTax, and UFile, among others. These competing offerings subject us to significant price pressure in both the U.S. and Canada. We also face

competitive challenges from government entities that offer publicly funded electronic tax preparation and filing services with no fees to individual taxpayers. Our Mint offering

competes with numerous personal financial management companies and large financial institutions to help our customers track their finances and better manage their money.

Intuit Fiscal 2021 Form 10-K 11

Tables of Contents

For the 2020 tax season, we were a member of the Free File Alliance, a consortium of private sector companies that has entered into an agreement with the federal government.

Under this agreement, the member companies donate online federal tax preparation and filing services to eligible users at no cost to the government or individual users separate

and apart from the member companies’ commercial free offerings, which the IRS then offers to eligible consumers on an IRS website. Approximately 22 states and the District of

Columbia have also entered public-private partnerships with the Free File Alliance. Additionally, certain member companies, including Intuit, provided online state tax preparation

and filing services at no cost if the taxpayer qualified for the free federal return under this program. We will no longer participate in the Free File Alliance after the conclusion of

the 2020 tax season in October. We continue to actively work with others in the private and public sectors to support successful public-private partnerships that reinforce the

voluntary compliance tax system, encourage electronic filing, and inform consumers of free filing options. However, future administrative, regulatory, or legislative activity in this

area could seek to replace the voluntary compliance tax system with return preparation, or self preparation options, provided by government agencies which could harm our

Consumer business.

Credit Karma Segment. Credit Karma faces significant competition for member growth and partnerships. Credit Karma competes against many companies to attract and engage

members, including the credit bureaus as well as companies that provide personal finance management products and tools which offer a variety of credit-score monitoring and

personal finance services and content. Credit Karma faces competition with some elements of businesses of LendingTree, Red Ventures, NerdWallet, Square, Chime, among

others. However, the personal finance industry is evolving rapidly and is becoming increasingly competitive. An increasing number of companies are competing directly with

Credit Karma.

ProConnect Segment. In the U.S., Lacerte professional tax offerings face competition from competitively-priced tax and accounting solutions that include integration with non-tax

functionality. These include CCH’s ProSystem fx Office Suite and Thomson Reuters’ CS Professional Suite and GoSystem Tax. Our ProSeries professional tax offerings face

competition from CCH’s ATX and TaxWise offerings, Drake, and other smaller providers. In Canada, our ProFile professional tax offerings face competition from CCH’s Cantax

and Taxprep offerings, TaxCycle, and Thomson Reuters’ DTMax and UFile Pro offerings. We also face growing competition from online tax and accounting offerings in the U.S.

and Canada, which may be marketed more effectively or have lower pricing than our offerings for accounting professionals.

Competitive Factors

We believe the most important competitive factors for our core offerings – QuickBooks, TurboTax, Lacerte, ProSeries, and Credit Karma – are ease of use, product features, size

of the installed customer base, size of membership base, member engagement, brand name recognition, value proposition, cost, reliability, security, and product and support

quality. Access to distribution channels is also important for our QuickBooks and TurboTax desktop software products. In addition, support from accounting professionals and the

ability for customers to upgrade within product families as their businesses grow are significant competitive factors for our QuickBooks products. Productivity is an important

competitive factor for the full-service accounting firms to which we market our Lacerte software products. We believe we compete effectively on these factors as our QuickBooks

and TurboTax products are the leading products in the U.S. for their respective categories.

For our service offerings such as small business payroll and merchant payment processing, we believe the most important competitive factors are functionality, ease of use, high

availability, security, the integration of these products with related software, brand name recognition, effective distribution, quality of support, and cost.

CUSTOMER SUCCESS

For our QuickBooks, TurboTax, ProConnect and Mint offerings, we provide product support and technical support through channels including telephone, e-mail, online and video

chat, text messaging, our customer support websites, self-help assets embedded in our products, and online communities where consumers can share knowledge and product

advice with each other.

We also provide access to experts, through our TurboTax and QuickBooks Live offerings, who provide tax advice, tax preparation and bookkeeping services.

Our customer success staff predominantly consists of Intuit-employed and outsourced experts. We supplement with seasonal employees and additional outsourcing during

periods of peak call volumes, such as during the tax return filing season or following a major product launch. We outsource to several firms domestically and internationally. Most

of our internationally outsourced small business customer success personnel are currently located in the Philippines.

We also source staff through our Prosperity Hub program, which is designed to spark economic prosperity for people and communities in need. One part of this program is our

socially responsible sourcing model, where we both directly and through customer success partner-employers, hire, train, and retain workers who deliver support and services for

our customers.

Self-help information is offered for free in-product and on our support websites for our QuickBooks, TurboTax, Mint and professional tax offerings. Support alternatives and fees

vary by product. For example, some product subscriptions receive 24x7 support and additional contact channel options.

Intuit Fiscal 2021 Form 10-K 12

Tables of Contents

PARTNER SUCCESS

For our Credit Karma offerings we have a Partner Success team that is dedicated to ensuring that our financial institution partners operate efficiently and safely on our platform.

This team consists of program management, operations, and compliance professionals, who interface directly with lending partners to facilitate new product launches; maintain

product offers, including any updates to existing offers and compliance monitoring; manage and maintain data required for offers and partner invoicing; support audits and

compliance reviews; and manage and resolve incidents to mitigate any potential negative impact on either Credit Karma’s or the partner’s platform.

MANUFACTURING AND DISTRIBUTION

Online Products and Services

Our online offerings include QuickBooks Online, online payroll services, merchant payment processing services, TurboTax Online, ProConnect Tax Online, consumer and

professional electronic tax filing services, Mint, and Turbo. We recently completed the transition of our systems, networks and databases used to operate these online offerings to

public cloud providers, such as Amazon Web Services (AWS). Currently, all of our online offerings are operating using AWS.

Desktop Software and Supplies

Although an increasing proportion of our desktop software customers choose to electronically download software, many customers continue to choose to purchase these

products in the form of physical media. The key processes in manufacturing desktop software are manufacturing compact discs (CDs) and digital video discs (DVDs), printing

boxes and related materials, and assembling and shipping the final products.

For retail manufacturing and distribution, we have agreements with Arvato Digital Services, Inc. (Arvato), a division of Bertelsmann AG, under which Arvato provides a majority of

the manufacturing volume for our launches of QuickBooks and TurboTax and day-to-day replenishment after product launches, as well as our retail distribution logistics. Arvato

also provides most of the manufacturing volume and distribution services for our direct desktop software orders.

Customers typically receive desktop software electronically. However, when physical product is ordered, we typically ship the physical product within a few days of receiving an

order and backlog is minimal.

PRIVACY AND SECURITY OF CUSTOMER AND WORKFORCE INFORMATION AND TRANSACTIONS

We are stewards of our customers’ data and have designed data stewardship principles to align our organization in collecting, using and protecting such information. As we

believe strongly in being good stewards of our customers’ data, we operate our program to comply with laws and regulations that govern our use, sharing and protection of

customers’ personal information, including, for example, laws with respect to financial services and the handling of tax data. We have established guidelines and practices to help

ensure that customers and members of our workforce are aware of, and can control, how we use information about them. We also use privacy statements to provide notice to

customers of our privacy practices, as well as provide them the opportunity to furnish instructions with respect to use of their personal information. We participate in industry

groups whose purpose is to develop or shape industry best practices, and to inform public policy for privacy and security.

We use security safeguards to help protect the systems and the information that customers and members of our workforce give to us from loss, misuse and unauthorized

alteration. We use technical, logical and procedural measures, such as multi-factor authentication, which are designed to help detect and prevent fraud and misuse of customer

information. Whenever customers transmit sensitive information to us, such as credit card information or tax return data, through one of our websites or products, we follow

current industry standards to encrypt the data as it is transmitted to us, and when we store it at rest. We routinely patch our systems with security updates and we work to protect

our systems from unauthorized internal or external access using numerous commercially available computer security products as well as internally developed security

procedures and practices.

GOVERNMENT REGULATION

Our Consumer and ProConnect segments are subject to federal, state and international government requirements, including regulations related to the electronic filing of tax

returns, the provision of tax preparer assistance, and the use and disclosure of customer information. Our Small Business & Self-Employed segment offers products and services

to small businesses and consumers, such as payroll, payments, and financing, which are also subject to certain regulatory requirements. Our Credit Karma segment offers

personal finance products and services to consumers, such as recommendations of credit card, loan and insurance products and access to credit scores and reports, which are

also subject to certain regulatory requirements.

Intuit Fiscal 2021 Form 10-K 13

Tables of Contents

INTELLECTUAL PROPERTY

Our success depends on the proprietary technology embodied in our offerings. We protect this proprietary technology by relying on a variety of intellectual property mechanisms,

including copyright, patent, trade secret and trademark laws, restrictions on disclosure and other methods. For example, we regularly file applications for patents, copyrights and

trademarks and service marks in order to protect intellectual property that we believe is important to our business. We hold a growing patent portfolio that we believe is important

to Intuit’s overall competitive advantage, although we are not materially dependent on any one patent or particular group of patents in our portfolio at this time. We also have a

number of registered trademarks that include Intuit, QuickBooks, Lacerte, TurboTax, QB, ProSeries, ProConnect, Mint, and Credit Karma. We have registered these and other

trademarks and service marks in the United States and, depending on the relevance of each brand to other markets, in many foreign countries. Most registrations can be

renewed perpetually at 10-year intervals. We also license intellectual property from third parties for use in our products.

Although our portfolio of patents is growing, the patents that have been issued to us could be determined to be invalid and may not be enforceable against competitive products

in every jurisdiction. In addition, third parties have asserted and may, in the future, assert infringement claims against us and our customers. These claims and any litigation may

result in invalidation of our proprietary rights or a finding of infringement along with an assessment of damages. Litigation, even if without merit, could result in substantial costs

and diversion of resources and management attention. In addition, third-party licenses may not continue to be available to us on commercially acceptable terms, or at all.

HUMAN CAPITAL

We consider our employees one of our four True North key stakeholders because they help us deliver for the customers, shareholders and the communities we serve. As of July

31, 2021, we had approximately 13,500 employees in 10 countries. During fiscal 2021, we employed on average approximately 7,700 seasonal employees from January to May

primarily to support our Consumer segment customers during the peak of tax season. We believe our future success and growth will depend on our ability to attract and retain a

qualified workforce in all areas of our business.

Intuit’s workforce development strategies are developed and managed by our Chief People & Places Officer, who reports to the CEO. The Compensation and Organizational

Development Committee of the Board of Directors has oversight with respect to company-wide organization and talent assessment, employee recruitment, engagement and

retention, leadership development, management depth and strength assessment, workplace environment and culture, employee health and safety, and pay equity. Of the total

number of employees, approximately 1,300 are employed by Credit Karma, which was acquired by Intuit in December 2020 and has certain unique compensation and workforce

development programs. We regularly collect, measure and share the sentiment of our workforce through multiple channels, including engagement surveys, and other touch

points, which help to guide the work we do to support our workforce.

Culture and Values

In order to deliver on our mission to power prosperity around the world, we are guided by our company values as we strive to create a culture where employees can do the best

work of their lives. Our value of Courage means being bold and fearless in how we think and act, holding a high bar for performance and valuing speed, a bias for learning and

action. Our value of Stronger Together means championing diversity, inclusion and a respectful environment, thriving on diverse voices to challenge and inform decisions and

delivering exceptional work so others can count on us. Consistent with our value of We Care and Give Back, we provide eligible full-time employees five days of paid time off

every year that can be used to do volunteer work during normal work hours for vetted non-profits. Our We Care and Give Back program also provides donation matching up to an

annual limit.

Diversity, Equity and Inclusion

At the foundation of our culture is a commitment to diversity, equity and inclusion (“DEI”). We believe that diversity is a fact, but treating people equitably and inclusively are

choices we make. To deliver for our customers, we seek to foster a workforce that is as diverse as the communities we serve. When we do this, we believe we develop deeper

empathy, accelerating innovation to solve the biggest problems our customers face. We have had a designated role dedicated to diversity and inclusion since 2015. In fiscal

2021, we invested additional resources into DEI and appointed our first Chief Diversity, Equity & Inclusion Officer (“CDEIO”) who leads a new dedicated and specialized team in

our DEI efforts. Our Compensation and Organizational Development Committee oversees Intuit’s DEI initiatives in support of organizational development. Our strategy is

operationalized through the following elements:

• Goals and transparency: We have set short- and long-term goals for increasing the representation of women and under-represented minorities (which we define as

Black/African-American, Latino/Hispanic, Native American, Native Alaskan and Native Hawaiian) in our workforce. Our progress is reviewed monthly with all executives

and we have shared our diversity externally since 2015;

Excludes Credit Karma, which we acquired in December 2020.

1

1

Intuit Fiscal 2021 Form 10-K 14

Tables of Contents

• Center of Excellence: We have a cross-functional team led by the CDEIO with expertise in enterprise leadership, strategy, human resources and communications all

focused on driving a more diverse and inclusive workplace;

• Employee Resource Groups: 13 employee resource groups aid in creating community, recruiting, on-boarding and providing safe spaces for our diverse workforce;

• Engagement: A dedicated DEI survey focused on the experiences of our workforce;

• REAL Team: A Racial Equity Leadership Team focused on helping us drive durable change as we strive to continue advancing racial equity and equality;

• Education: All senior leaders have attended multiple DEI workshops, including C-suite training on racial equity. We have manager and employee training on leading

inclusively and a guide for managers on how to have conversations about difficult and polarizing external events;

• Assessment: Biannual formal talent reviews, including succession plans and diversity assessments;

• Talent acquisition: We have developed a program team to drive diversity strategy and initiatives; and

• Accountability: The Compensation and Organizational Development Committee reviews our progress towards our goals and workforce diversity initiatives at least

annually.

As of July 31, 2021:

• Women constituted 40% of our total employees, 35% of our leadership roles, and 30% of our technology roles; and

• Our under-represented minority employees represent 13% of our U.S. employees, 8% of our U.S. leadership roles, and 7% of our U.S. technology roles.

The company performs an ongoing pay equity analysis, conducted twice a year by an independent, third-party vendor. This analysis allows us to review each job code where

there are enough employees that have the same or similar job duties and compensation mix. We compare base pay by gender and ethnicity, while factoring in location and time

spent in the role, and make adjustments when there are unexplained statistical differences. We are transparent about our pay equity results and have multiple avenues for

employees to use for any questions about their pay.

Developing Talent and Training

We are committed to creating a high-performing culture that consistently delivers for our customers, shareholders and communities while providing an experience for our

workforce that values leadership, innovation, and collaboration. We promote the development of all of our employees through our One Intuit Learning Vision that every employee

has a personalized learning plan based on their needs and interests, and are provided the resources they need to grow, thrive and reinvent themselves over time.

In addition, we are invested in growing our current and future leaders. Our Learning and Development teams design programs and resources to develop our employees and

measure their progress.

All full-time employees have access to opportunities to develop and learn through over 1,400 Intuit-sponsored learning paths and online courses on topics ranging from artificial

intelligence to manager essentials in support of an employee’s ability to adapt to any work environment. In fiscal 2021, our full-time employees completed over 170,000 pieces of

learning content.

Employees set goals and measure progress through our goal setting tool and have opportunities to focus on growth both during year-end conversations and ongoing monthly

check-ins.

Total Rewards

Our compensation philosophy aims to attract and retain top talent for today and the future. Intuit’s total target compensation includes base hourly pay or salary at market-

competitive rates, equity and a range of incentive plans that vary based on role. Incentive compensation plans are part of our pay for performance philosophy and closely align

with company performance and reward top performance. Most year-round employees are eligible for equity, which allows the majority of our employees to share in the

company’s success.

Additional benefits and rewards include an employee stock purchase plan, healthcare and retirement benefits, paid time off, annual paid recharge days, family and parental

leave.

COVID Response and Well-being

The health and well-being of our employees and their families has never been more important. We offer our employees (excluding experts) a reimbursement incentive to cover

the costs of purchases made to support their physical, emotional and financial well-being. Employees also have access to other resources to help with their well-being, including

a well-minds program for resilience, mindfulness and counseling, back-up childcare, financial education programs and access to an Employee Assistance Program.

Amid the unprecedented environment caused by the COVID-19 pandemic, management’s top priority has been the health and safety of our employees. We shifted nearly all our

workforce from office locations to work from home environments. We also increased leave benefits for all employees to allow them to take care of what matters most to them. We

provided our

Intuit Fiscal 2021 Form 10-K 15

Tables of Contents

employees with resources to have a complete and comfortable home workspace, to offset certain pandemic-related expenses and to promote physical and emotional health.

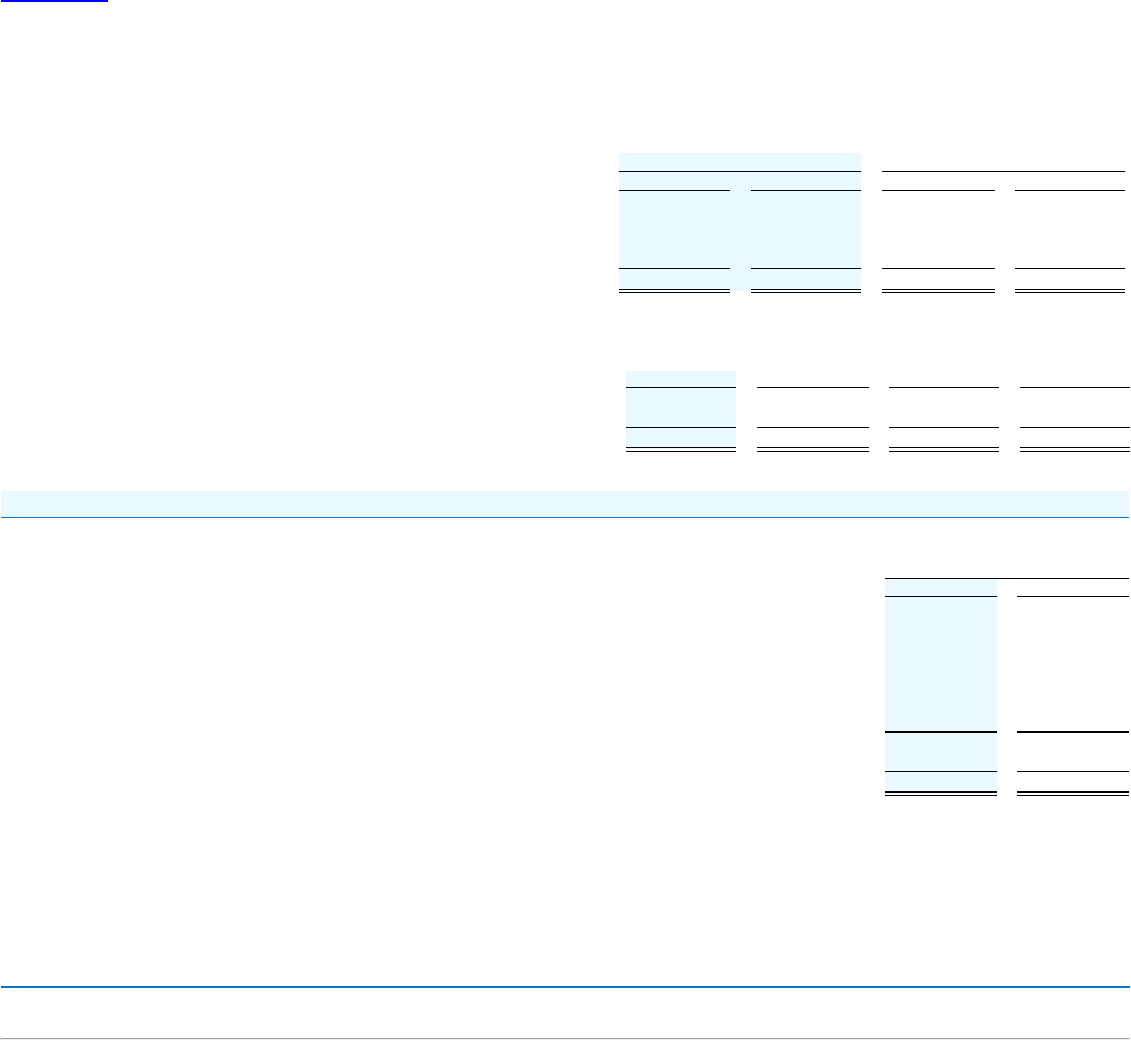

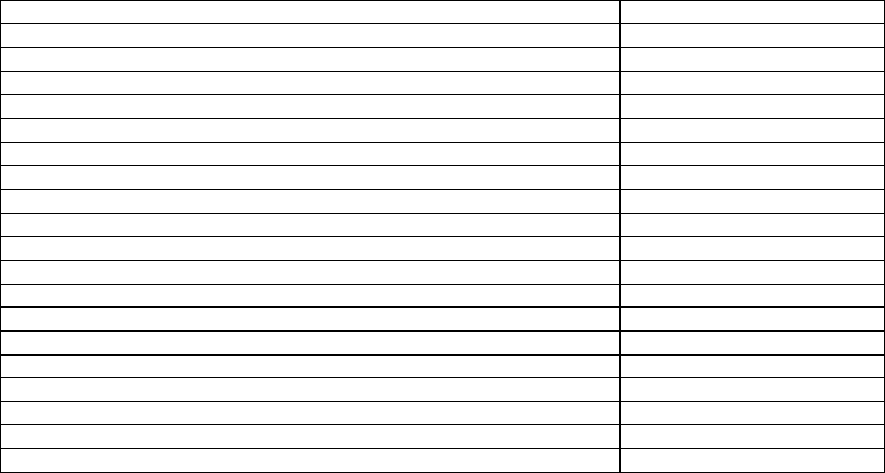

INFORMATION ABOUT OUR EXECUTIVE OFFICERS

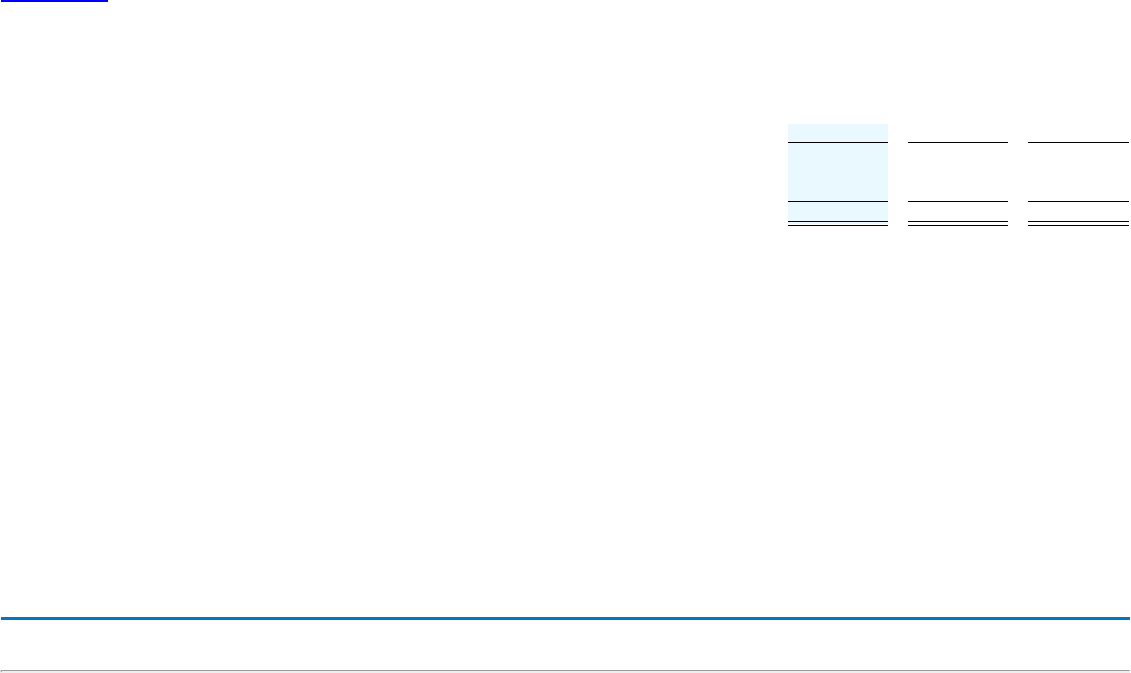

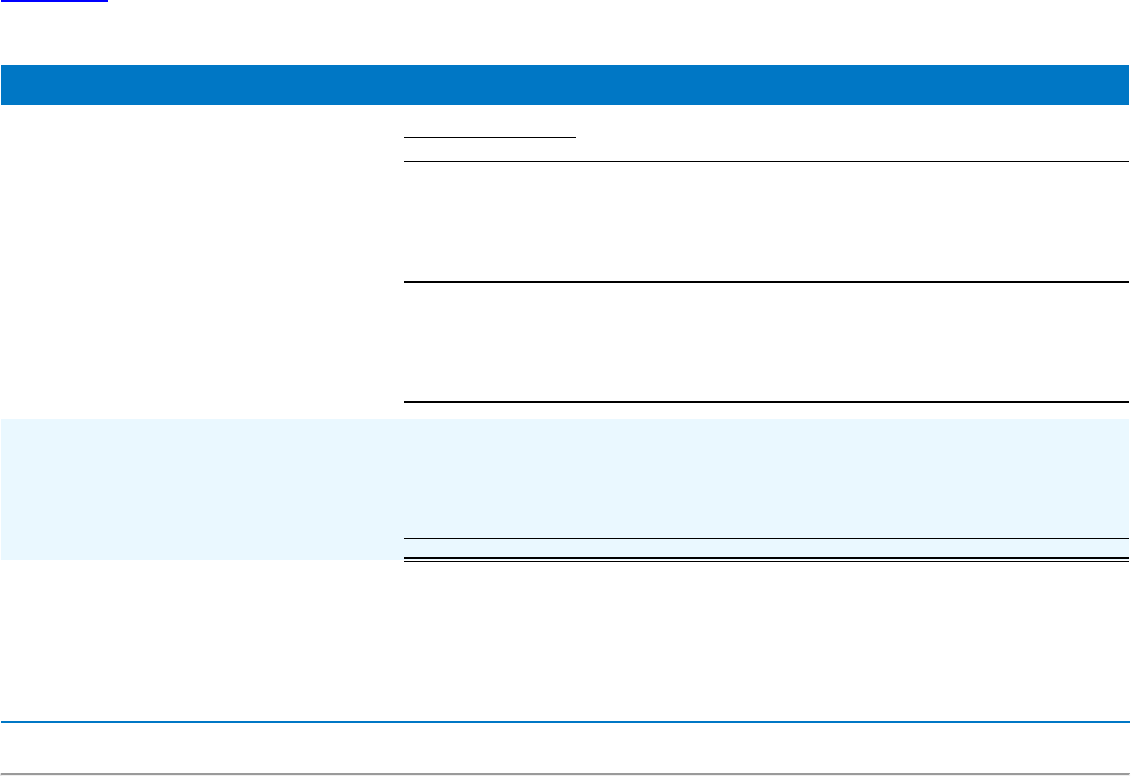

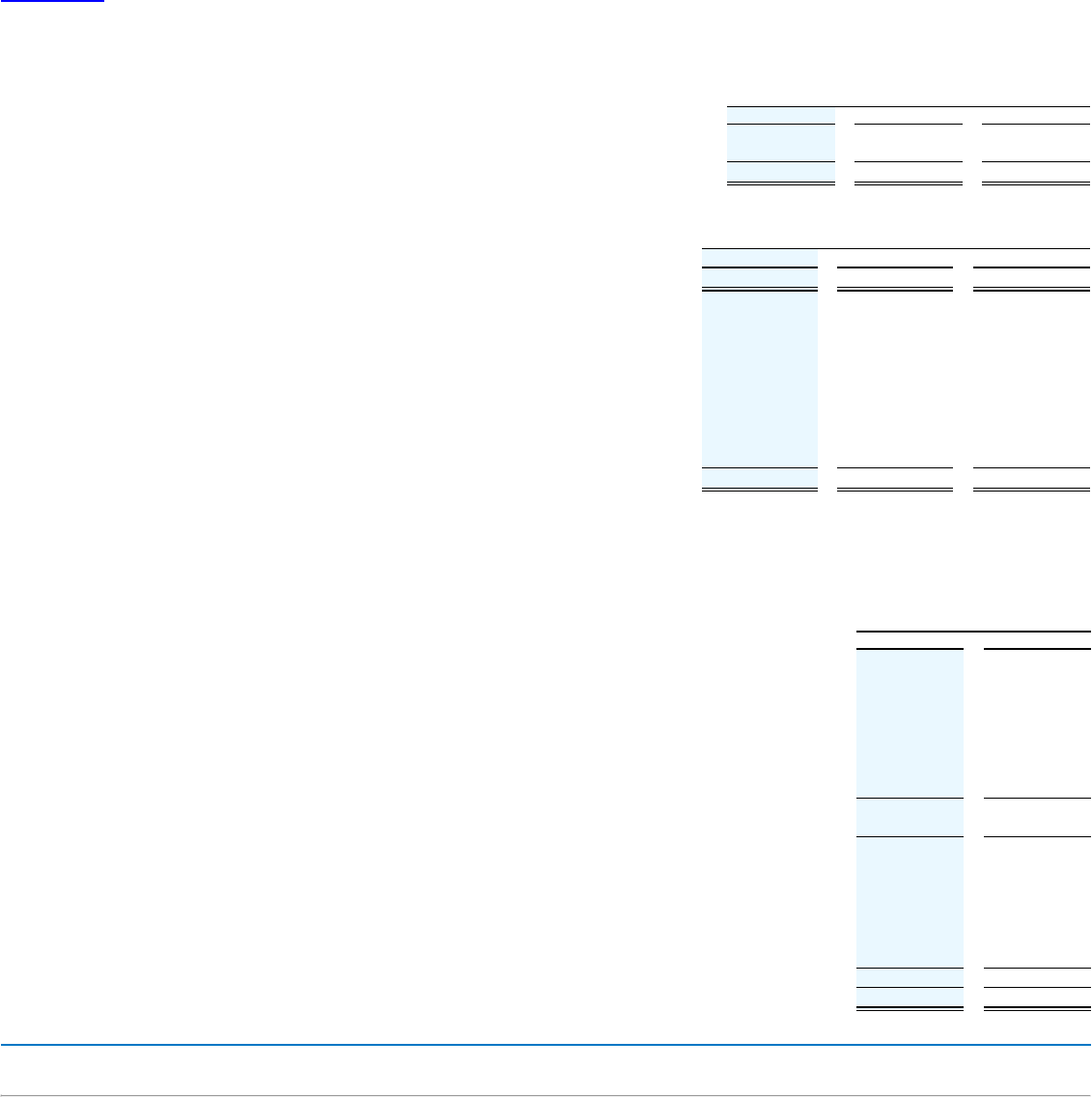

The following table shows Intuit’s executive officers and their areas of responsibility as of July 31, 2021 . Their biographies follow the table.

Name Age Position

Sasan K. Goodarzi 53 President, Chief Executive Officer and Director

Brad D. Smith 57 Executive Chairman of the Board of Directors

Scott D. Cook 69 Chairman of the Executive Committee

Michelle M. Clatterbuck 53 Executive Vice President and Chief Financial Officer

J. Alexander Chriss 44 Executive Vice President and General Manager, Small Business & Self-Employed Group

Laura A. Fennell 60 Executive Vice President, Chief People & Places Officer

Gregory N. Johnson 53 Executive Vice President and General Manager, Consumer Group

Marianna Tessel 54 Executive Vice President and Chief Technology Officer

Kerry J. McLean 57 Executive Vice President, General Counsel and Corporate Secretary

Mark J. Flournoy 55 Senior Vice President and Chief Accounting Officer

Mr. Goodarzi has been President and Chief Executive Officer and a member of the Board of Directors since January 2019 and previously served as Executive Vice President and

General Manager of Intuit’s Small Business Group since May 2016. He previously was Executive Vice President and General Manager of Intuit’s Consumer Tax Group from

August 2015 through April 2016 and from August 2013 to July 2015 served as Senior Vice President and General Manager of the Consumer Tax Group. He served as Intuit’s

Senior Vice President and Chief Information Officer from August 2011 to July 2013, having rejoined Intuit after serving as CEO of Nexant Inc., a privately held provider of

intelligent grid software and clean energy solutions, beginning in November 2010. During his previous tenure at Intuit from 2004 to 2010, Mr. Goodarzi led several business units

including Intuit Financial Services and the professional tax division. Prior to joining Intuit, Mr. Goodarzi worked for Invensys, a global provider of industrial automation,

transportation and controls technology, serving as global president of the products group. He also held a number of senior leadership roles in the automation control division at

Honeywell Inc. He serves on the board of Atlassian Corporation Plc and chairs the Compensation and Leadership Development Committee. Mr. Goodarzi holds a Bachelor’s

degree in Electrical Engineering from the University of Central Florida and a Master’s degree in Business Administration from the Kellogg School of Management at Northwestern

University.

Mr. Smith has been an Intuit director since 2008, Chairman of the Board from January 2016 through December 2018, and Executive Chairman from January 2019. He served as

President and CEO of the Company from January 2008 through December 2018. Mr. Smith joined Intuit in 2003 and has served as Senior Vice President and General Manager,

Small Business Division from 2006 to 2007, Senior Vice President and General Manager, QuickBooks from 2005 to 2006, Senior Vice President and General Manager,

Consumer Tax Group from 2004 to 2005 and as Vice President and General Manager of Intuit’s Accountant Central and Developer Network from 2003 to 2004. Before joining

Intuit, Mr. Smith held the position of Senior Vice President of Marketing and Business Development of ADP, where he held several executive positions from 1996 to 2003. Mr.

Smith served on the board of directors of Yahoo! Inc. from 2010 until 2012. Mr. Smith was elected to the board of directors of Nordstrom, Inc. in June 2013, where he is a

member of the Compensation Committee and Corporate Governance and Nominating Committee and has served as Chairman of the Board since November 2018. Mr. Smith

was also elected to the board of directors of Momentive (formerly known as SurveyMonkey) in May 2017 and is chair of its Compensation Committee. Mr. Smith holds a

Bachelor’s degree in Business Administration from Marshall University and a Master’s degree in Management from Aquinas College.

Mr. Cook, a founder of Intuit, has been an Intuit director since March 1984 and is currently Chairman of the Executive Committee. He served as Intuit’s Chairman of the Board

from February 1993 to July 1998. From April 1984 to April 1994, he served as Intuit’s President and Chief Executive Officer. Mr. Cook served on the board of directors of The

Procter & Gamble Company from 2000 to 2020. Mr. Cook was also a director of eBay Inc. from 1998 to 2015. Mr. Cook holds a Bachelor of Arts degree in Economics and

Mathematics from the University of Southern California and a Master’s degree in Business Administration from Harvard Business School.

Ms. Clatterbuck has been Executive Vice President and Chief Financial Officer since February 2018. She manages the financial strategy and operations across the company,

including Treasury, Procurement, Investor Relations and Finance Operations. Ms. Clatterbuck served as acting finance leader for Intuit’s Small Business Group from June 2017

through January 2018, led finance for the Consumer Tax Group beginning in September 2012 and was promoted to Senior Vice President for that group in August 2016. Her

earlier roles at Intuit include Vice President of finance for the Professional Tax business in 2006 and finance director in October 2004. Ms. Clatterbuck joined Intuit in March 2003

as a senior finance manager. Prior to Intuit, Ms.

Intuit Fiscal 2021 Form 10-K 16

Tables of Contents