State of the

Industry Report

on Mobile Money

2018

Copyright © 2019 GSM Association

The GSMA represents the interests of mobile operators

worldwide, uniting more than 750 operators with over

350 companies in the broader mobile ecosystem,

including handset and device makers, software companies,

equipment providers and internet companies, as well as

organisations in adjacent industry sectors. The GSMA also

produces the industry-leading MWC events held annually in

Barcelona, Los Angeles and Shanghai, as well as the Mobile

360 Series of regional conferences.

For more information, please visit the GSMA corporate

website at www.gsma.com

Follow the GSMA on Twitter: @GSMA

Lead author:

Francesco Pasti

Senior Manager, Mobile Money Services, GSMA,

with the support of the wider GSMA Mobile Money team

The GSMA’s Mobile Money programme works to

accelerate the development of the mobile money

ecosystem for the underserved.

For more information, please contact us:

Web: www.gsma.com/mobilemoney

Twitter: @GSMAMobileMoney

Email: mobilemoney@gsma.com

Mobile Money

THE MOBILE MONEY PROGRAMME IS SUPPORTED BY THE BILL & MELINDA GATES FOUNDATION,

THE MASTERCARD FOUNDATION, AND OMIDYAR NETWORK

2018 State of the Industry Report on Mobile Money

FOREWORD 2

EXECUTIVE SUMMARY 4

MOBILE MONEY IN 2018 7

THE BIG PICTURE 8

2018 MOBILE MONEY HIGHLIGHTS 12

REGIONAL GROWTH 13

REACHING THE UNDERSERVED THROUGH

INNOVATION

14

FOUR TRENDS SHAPING THE MOBILE MONEY

INDUSTRY

18

CONCLUSION 34

Contents

2018 State of the Industry Report on Mobile Money

Foreword

2018 State of the Industry Report on Mobile Money

2

For over a decade, mobile money has been

transforming access to financial services

around the world. The scale of mobile money

continues to grow, with more than 866

million registered accounts in 90 countries

and $1.3 billion transacted every day. The

progress, challenges and most ground-

breaking industry trends are explored in this

year’s flagship report from the GSMA’s Mobile

Money team.

For the world’s most vulnerable, especially

displaced persons and women, the benefits

of mobile money are real and far reaching.

Fifty-five per cent of surveyed mobile

money providers have now partnered

with humanitarian organisations, an

initiative closely supported by our Mobile

for Humanitarian Innovation programme.

In August 2018, our Connected Women

team released the Gender Analysis and

Identification Toolkit (GAIT), a machine

learning algorithm that analyses mobile

usage patterns, to assist operators in reaching

underserved female customers with relevant

and tailored products and services.

We were also honoured to launch the

GSMA Mobile Money Certification in April

2018, demonstrating the mobile industry’s

commitment to bringing safe, transparent,

and resilient financial services to mobile

money users around the world. To date,

nine providers across three continents have

successfully certified, collectively covering

over 133 million mobile money accounts.

The mobile money industry is now fast-

evolving against a backdrop of increasing

internet access and smartphone adoption.

Successful providers are moving towards a

'payments as a platform approach', expanding

their value proposition to a full range of third-

party products and services to suit customers

with diverse needs. This signals the start of

a major shift in the mobile money industry,

which will promote digitisation more broadly:

mobile money customers will not just have

access to an account, but rather to a full suite

of services that are relevant to their daily

lives, encouraging them to keep their funds in

digital form and building resilience to financial

shocks.

Now more than ever, mobile’s unparalleled

global scale provides a tremendous

opportunity to reach the 1.7 billion people

who remain financially excluded. I am pleased

to have been appointed to the United Nations

Secretary-General's Task Force on Digital

Financing of the Sustainable Development

Goals to harness this potential, and I look

forward to working closely with fellow Task

Force members to unleash the power of

technology and digital financing in all corners

of the world.

I hope that you enjoy exploring the 2018

State of the Industry Report on Mobile

Money, which has been produced with the

generous support of the Bill & Melinda Gates

Foundation, The Mastercard Foundation and

Omidyar Network.

Mats Granryd

Director General, GSMA

Foreword

3

2018 State of the Industry Report on Mobile Money

Executive

Summary

2018 State of the Industry Report on Mobile Money

4

Providers are attracting new investments

and forming strategic partnerships,

leveraging data and innovative financial

technologies, and developing robust and

interoperable payments systems to diversify

their revenue, product oerings and

customer base.

In 2018, following a decade of incredible

growth, the mobile money industry is still

getting the fundamentals right. Mobile money

accounts continue to provide a gateway to

life-enhancing services, such as healthcare,

education, financial services, employment

and social protections, which are reaching

customers who have traditionally been

underserved by the financial system. Many

industry players have reached scale, and

account registrations, activity rates and

transaction values continue to grow steadily.

While cash-in and cash-out transactions still

represented the majority of mobile money

flows in 2018, digital transactions grew at

twice the rate, driven largely by bill payments

and bulk disbursements. Successful providers

are now looking to strengthen their value

proposition with a full suite of use cases

that serve diverse customer needs. This shift

towards a 'payments as a platform' approach

is at the heart of the industry’s new direction.

This year’s State of the Industry Report looks

at how providers are navigating this dynamic

and shifting ecosystem, which was shaped by

four key trends in 2018:

An enhanced customer experience. 2018 saw

a dramatic increase in smartphone adoption

in emerging markets, unlocking access

to a broader customer base and allowing

providers to oer a wider range of financial

products and services through user-friendly

apps. Interoperability also continued to be

a strategic priority for the industry, not only

to increase the utility of mobile money for

users, but also to allow increasingly important

use cases to scale up faster. The main

drivers of digital growth in 2018 were bulk

disbursements and bill payments — a signal

that mobile money providers are becoming

strong partners for enterprises.

Diversification of the financial services

landscape. While large MNO groups still

dominate Africa’s mobile money ecosystem,

in Asia, fintechs and tech giants have entered

the payments space and developed a

range of customer-centric use cases, from

transportation to food, medical and financial

services, and amassed a vast number of

partners, including financial institutions.

Mobile money providers in both Asia and

Latin America, including fintech players,

are driving growth in the mobile payment

ecosystem, and expanding from e-commerce

to oer financial services such as credit.

Now processing over $1.3 billion a day, the

mobile money industry added a record

143 million registered customers in 2018.

Executive Summary

5

2018 State of the Industry Report on Mobile Money

Increasingly complex regulation. As the number

of players in the digital financial services ecosystem

grows exponentially, regulation is becoming

increasingly complex. Five main themes dominated

the mobile money regulatory landscape in

2018: taxation, KYC requirements, cross-border

remittances, national financial inclusion strategies

and data protection. These developments call for a

more nuanced evaluation of regulatory frameworks

and collaboration between providers and regulators

to achieve the mutual aim of expanding mobile

money services.

Expansion of the mobile money value proposition.

In our 2018 Global Adoption Survey, close to

80 per cent of providers reported that most of

their revenues are driven by customer fees. Many

providers are now seeking to strengthen their

value proposition with a 'payments as a platform'

model. This connects consumers and businesses

with a range of third-party services to meet their

evolving needs, from enterprise solutions for micro-,

small- and medium-sized enterprises (MSMEs) to

e-commerce, credit, savings and insurance.

It was not only these trends that captured our

attention in 2018. Other compelling developments

include reforms in Africa’s three most populated

countries, Nigeria, Ethiopia and Egypt, which we

expect to spark a wave of adoption which could

lead to over 110 million new mobile money accounts

in the next five years.

Mobile money continues to play a vital role in

financial inclusion. Globally, around 1.7 billion

people still lack access to safe, reliable and

convenient financial services.

1

However, 31 emerging

markets have seen an impressive increase in

financial inclusion rates, which can be attributed to

simultaneous growth in active mobile money use.

Although much work remains to be done in closing

the mobile money gender gap, there is evidence

from the 2017 Global Findex that the mobile

money gender gap has narrowed in 17 countries

in Sub-Saharan Africa and in one country in Latin

America (Bolivia). Our Global Adoption Survey data

revealed a strong positive correlation between the

percentage of female agents in a provider’s network

and female customers.

In this report, we take a closer look at these trends

and unfolding industry stories. The full findings of

this year’s State of the Industry Report on Mobile

Money are based on the analysis of data collected

through the GSMA’s Annual Global Adoption Survey.

272

MOBILE MONEY DEPLOYMENTS

ARE LIVE IN

COUNTRIES

90

62

MOBILE MONEY

DEPLOYMENTS

HAVE MORE THAN

866m

MOBILE MONEY IN 2018

REGISTERED MOBILE MONEY ACCOUNTS

20% increase from 2017

processed daily

$1.3bn

by the mobile money industry

Grew at

more than

TWICE the

rate of

cash-in/

cash-out

values

$206

PER MONTH

A TYPICAL ACTIVE MOBILE

MONEY CUSTOMER MOVES

1m

90-DAY

ACTIVE

ACCOUNTS

90m

NEW REGISTERED ACCOUNTS

31% increase from 2017

x2

compared to 54 in 2017 and 13 in 2013

54%

GHANA, CÔTE D’IVOIRE,

BENIN AND SENEGAL

OF THE COMBINED

ADULT POPULATION OF

use mobile money on an active basis

ASIA

DIGITAL TRANSACTION

VALUES

1. World Bank Group (2018). The Global Findex Database 2017.

6

2018 State of the Industry Report on Mobile Money

272

MOBILE MONEY DEPLOYMENTS

ARE LIVE IN

COUNTRIES

90

62

MOBILE MONEY

DEPLOYMENTS

HAVE MORE THAN

866m

MOBILE MONEY IN 2018

REGISTERED MOBILE MONEY ACCOUNTS

20% increase from 2017

processed daily

$1.3bn

by the mobile money industry

Grew at

more than

TWICE the

rate of

cash-in/

cash-out

values

$206

PER MONTH

A TYPICAL ACTIVE MOBILE

MONEY CUSTOMER MOVES

1m

90-DAY

ACTIVE

ACCOUNTS

90m

NEW REGISTERED ACCOUNTS

31% increase from 2017

x2

compared to 54 in 2017 and 13 in 2013

54%

GHANA, CÔTE D’IVOIRE,

BENIN AND SENEGAL

OF THE COMBINED

ADULT POPULATION OF

use mobile money on an active basis

ASIA

DIGITAL TRANSACTION

VALUES

2018 State of the Industry Report on Mobile Money

7

THE BIG PICTURE:

Availability,

adoption,

accessibility

and usage

2018 State of the Industry Report on Mobile Money

8

In 2018, the mobile money industry added

another 143 million registered customers

globally with the total number of accounts

reaching 866 million — a 20 per cent year-

on-year increase. As in 2017, most of this

growth came from Asia, where 90 million new

accounts were opened. East Asia and Pacific

experienced the highest year-on-year account

growth at 38 per cent, and the region now

represents 11 per cent of registered accounts

globally (Figure 1).

Activity rates are stable at the global level:

34.5 per cent of the world’s registered

accounts are now active,

3

up from 33.9 per

cent in 2017. Activity rates are once again

highest in Latin America and the Caribbean

(48.5 per cent), while the biggest increases

are in Asia (East Asia and Pacific and South

Asia) where activity rates in several countries

increased by more than 10 per cent. While

activity rates in Sub-Saharan Africa remain

stable at 36.8 per cent, largely unchanged

from 2017, the region added over 17.5 million

new active accounts in 2018. In 13 African

countries,

4

over a third of adults are active

mobile money users.

Transaction values increased by 17 per cent

in 2018, with 272 live deployments in 90

countries transacting $40.8 billion in the

month of December. The industry is therefore

now processing over $1.3 billion per day, and

while cash-in and cash-out transactions still

represent the majority of mobile money flows,

digital transactions

5

grew at more than twice

the rate driven largely by bill payments and

bulk disbursements. For the average active

mobile money customer, this equates to 12

transactions a month worth $206.

In its second decade, mobile money

continues to reach new heights. Many

industry players have scaled,

2

growth

in transactions and accounts is steady,

and innovative solutions are being

implemented to reach customers who

have traditionally been underserved by

the financial system.

THE BIG PICTURE:

Availability, adoption,

accessibility and usage

2. Scale implies onboarding and activating a large proportion of a provider’s customer base and increasing the number of transactions per customer.

3. An ‘active’ mobile money account is one that has been used to conduct at least one transaction during a 90-day period.

4. Benin, Botswana, Burkina Faso, Côte d’Ivoire, Gabon, Ghana, Kenya, Lesotho, Rwanda, Swaziland, Tanzania, Uganda and Zimbabwe.

5. Digital transactions are transactions which enter, leave or circulate the mobile money ecosystem in digital form,

rather than through a cash conversion (cash-in or cash-out).

9

2018 State of the Industry Report on Mobile Money

3.1%

Latin America

& the Caribbean

45.6%

Sub-Saharan

Africa

5.6%

MENA

33.2%

South Asia

11.0%

East Asia & Pacific

1.4%

Europe

& Central Asia

6. Only countries with live mobile money services are represented.

7. World Bank Group (2018). The Global Findex Database 2017.

8. Ibid.

Global spread of registered mobile money customers, December 2018

6

Figure 1.

The potential of India’s payments banks

While almost 80 per cent of India’s population

is now banked,

7

the country has one of the

world’s highest inactivity rates, with nearly

half of banked customers (48 per cent) yet to

perform a withdrawal or transaction.

8

This is

the context in which payments banks began

operating in 2016, and today there are seven in

operation, three of which are MNO-led.

Payments banks are financial institutions that

accept small-scale deposits (up to Rs1 lakh, or

about $1,407 each), but are not allowed to lend.

They began operating after the central bank,

the Reserve Bank of India (RBI), granted in-

principle payments bank licences to introduce

unbanked and underserved customers to more

formal channels.

Three years on, the sector has yet to show its

true potential. Actions including a ban on new

customer registration, the imposition of certain

penalties, slow deposit collection and delayed

launches were exacerbated when customer

onboarding also became more complex. A

recent Supreme Court ruling has created

uncertainty around the extent to which the

private sector may continue to use Aadhaar,

India’s digital identification system, to link

accounts.

As a financial services platform, payments

banks could re-bundle a host of innovative

third-party services and leverage the services

that traditional banks oer while also attracting

unbanked customers, allowing India’s payments

banks to live up to their true potential.

10

2018 State of the Industry Report on Mobile Money

Egypt Nigeria Ethiopia

9. GSMA Intelligence and World Bank.

10. World Bank Group (2018). The Global Findex Database 2017.

11. This refers to the Authorisation, KYC and Infrastructure and Investment Environment

dimensions of the Mobile Money Regulatory Index.

12. In October 2018, The Central Bank of Nigeria ocially proposed the creation of Payment Service Banks.

13. Alliance for Financial Inclusion (2018) Financial inclusion through digital financial services and fintech:

the case of Egypt.

14. GSMA analysis

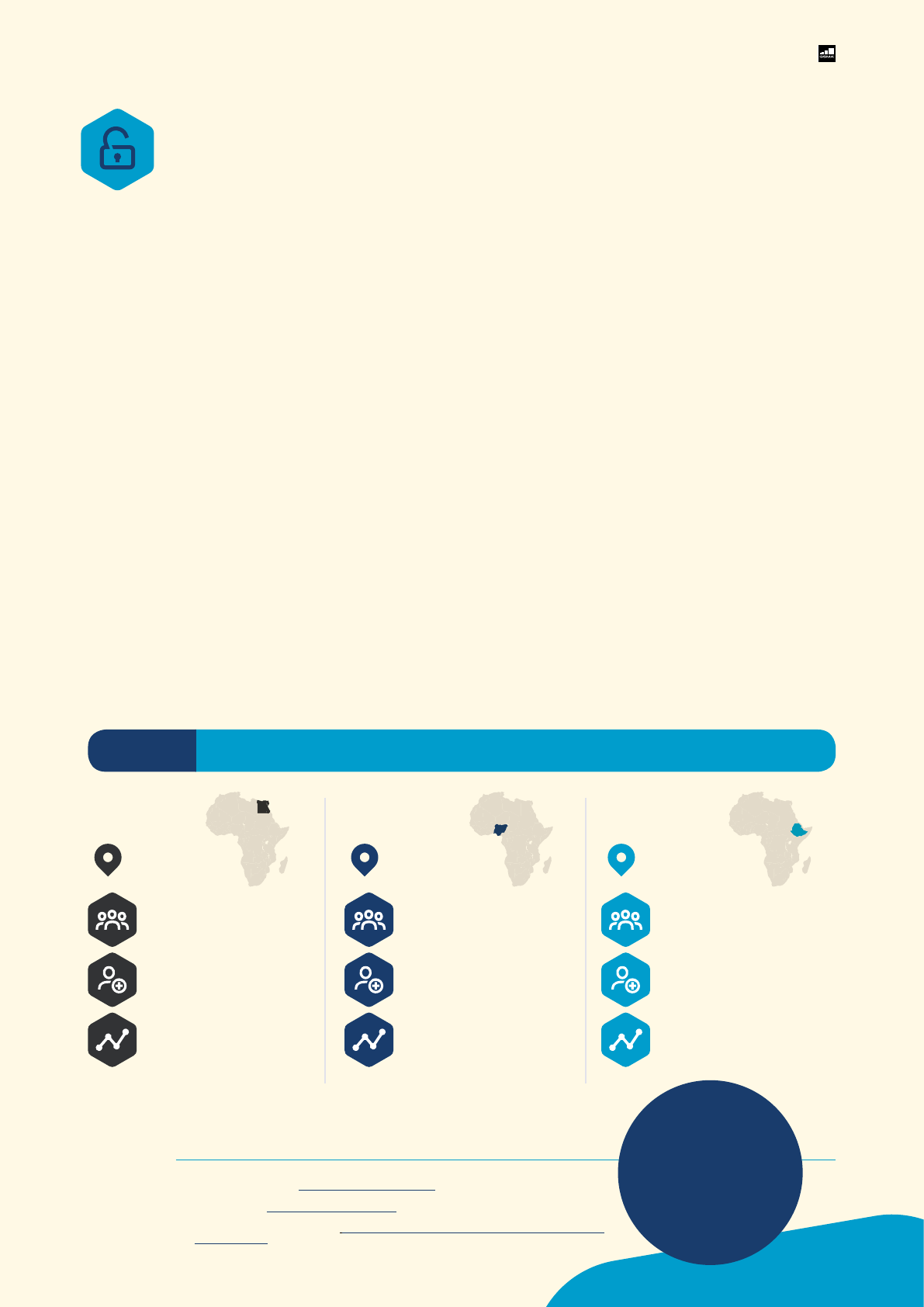

Africa’s mobile money sleeping giants

Figure 2.

Adult population: Adult population: Adult population:

Adults with

an account:

Adults with

an account:

Adults with

an account:

Mobile Money

Regulatory

Index Score:

Mobile Money

Regulatory

Index Score:

Mobile Money

Regulatory

Index Score:

67m 111m 64m

32.8% 39.7% 34.8%

67.21 65.67 65.83

Unlocking future growth: Africa’s mobile money sleeping giants

In a growing number of countries in Sub-

Saharan Africa, a traditional stronghold of

mobile money, over 60 per cent of the adult

population has a mobile money account.

While providers in these countries are still

driving growth in registered accounts, rates

will slow as the majority of the population

gains access to mobile money. However,

there is still a tremendous opportunity to

unlock growth and increase financial inclusion

in the continent’s mobile money sleeping

giants: Nigeria, Ethiopia and Egypt. Home

to a combined adult population of over

242 million,

9

Africa’s three most populated

countries have had limited availability of

mobile money services and low rates of

financial inclusion (Figure 2).

10

The reasons for this vary. In Nigeria and

Egypt, regulatory frameworks have allowed

few players to oer mobile money services,

resulting in lower levels of investment and

fewer innovative products and services. In

Ethiopia, a strictly regulated telco, restrictions

on competition, lack of internet connectivity,

and low levels of consumer trust and financial

literacy have created barriers to uptake

and market entry. The unfavourable market

conditions in these countries are reflected

in their low scores on the GSMA’s Mobile

Money Regulatory Index (see page 29). These

scores are due to factors such as restrictive

or unclear legal frameworks, lack of flexibility

and clarity around innovation and investment,

and disproportionate Know Your Customer

(KYC) requirements.

11

But change is coming. In 2018, regulatory

reforms were introduced in Nigeria

12

and

Egypt

13

to harness the potential of mobile

money to drive financial inclusion, and

reforms and an ambitious financial inclusion

strategy in Ethiopia have been attracting the

attention of both MNOs and non-MNO-led

players.

Despite the challenges to overcome, we

anticipate that these reforms could spark a

wave of adoption in these three countries —

over 110 million new mobile money accounts

14

in the next five years — and help to achieve

the financial inclusion targets set out in

their respective national financial inclusion

strategies.

11

2018 State of the Industry Report on Mobile Money

Across Egypt,

Ethiopia and

Nigeria, over 110m

mobile money

accounts can be

unlocked in the

next five years

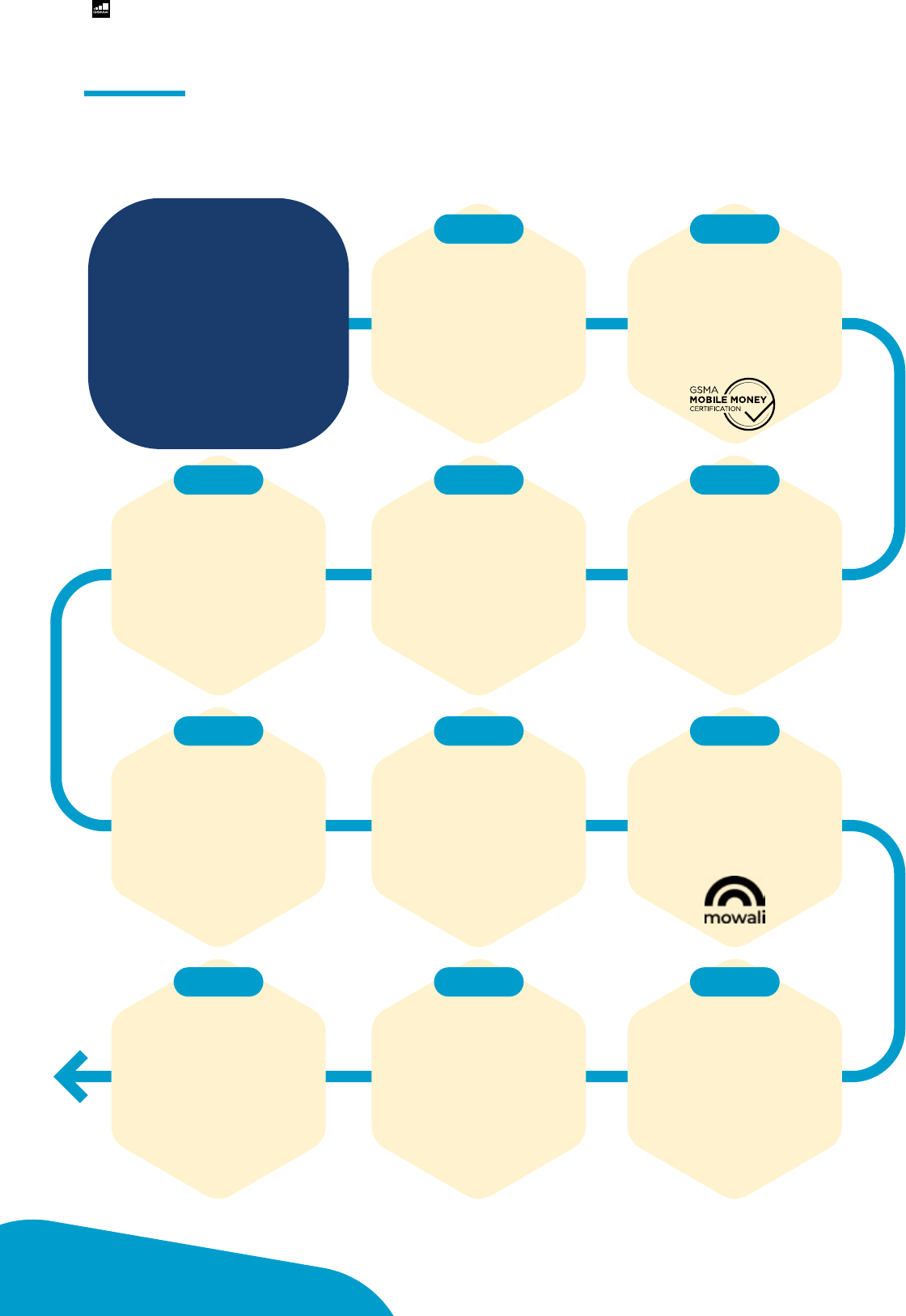

MARCH APRIL

APRILSEPTEMBER APRIL

OCTOBERSEPTEMBER NOVEMBER

NOVEMBERDECEMBER NOVEMBER

MOBILE MONEY HIGHLIGHTS IN 2018

2018 saw eorts to pursue

new investments and

strategic partnerships, to

leverage data and innovative

financial technologies,

and to develop robust and

interoperable payments

systems to support a range

of use cases and financial

products.

INVESTMENT.

Telenor Group and Ant

Financial enter a strategic

partnership to deliver inclusive

financial services in Pakistan.

INVESTMENT.

Ant Financial invests in

Bangladesh’s bKash to expand

the capabilities of the platform

to ultimately boost financial

inclusion.

REGULATION.

The Central Bank of Nigeria

issues guidelines for the

licensing, regulation and

operations of payment service

banks, enabling mobile

operators to lead financial

inclusion eorts.

INTERNATIONAL

COMMITMENT.

The United Nations announces

the launch of a global task

force on Digital Financing of

the Sustainable Development

Goals, with the GSMA as a

member.

INVESTMENT.

American investment

conglomerate Berkshire

Hathaway acquires a four per

cent stake in Paytm, India’s

largest digital payments

company.

INNOVATIVE

USE CASES.

84.6 per cent of Ghanaian

investors buy shares for MTN

Ghana’s Initial Public Oer

(IPO) using the MTN Mobile

Money Portal.

INVESTMENT.

Econet Wireless demerges and

lists Cassava Smartech (which

includes its EcoCash mobile money

operation) separately on the

Zimbabwe Stock Exchange (ZSE)

valued at around $3.9 billion soon

after listing.

CONSUMER

PROTECTION.

GSMA launches the GSMA Mobile

Money Certification scheme. Over

the course of the year, nine mobile

money providers become certified,

collectively covering over 133

million customer accounts.

STRATEGIC

PARTNERSHIP.

PayPal, Safaricom and TransferTo

announce a collaboration

enabling M-Pesa users in Kenya

to securely transfer funds

between PayPal and M-Pesa

accounts.

REGIONAL

INTEROPERABILITY.

Orange and MTN launch a

pan-African mobile money

interoperability venture, Mowali, to

scale up mobile financial services

across Africa.

STRATEGIC

PARTNERSHIP.

Safaricom and Western Union

partner to allow M-Pesa users to

transfer money to and from 200

countries. Kenya’s Family Bank Ltd

and fintech SimbaPay also partner

to enable M-Pesa customers in

Kenya to send money to

WeChat users

in China.

12

2018 State of the Industry Report on Mobile Money

MARCH APRIL

APRILSEPTEMBER APRIL

OCTOBERSEPTEMBER NOVEMBER

NOVEMBERDECEMBER NOVEMBER

AS OF

DECEMBER

NUMBER OF

DEPLOYMENTS

REGISTERED

ACCOUNTS

ACTIVE 90-DAY

ACCOUNTS

TRANSACTION

VOLUME

VALUE

US$

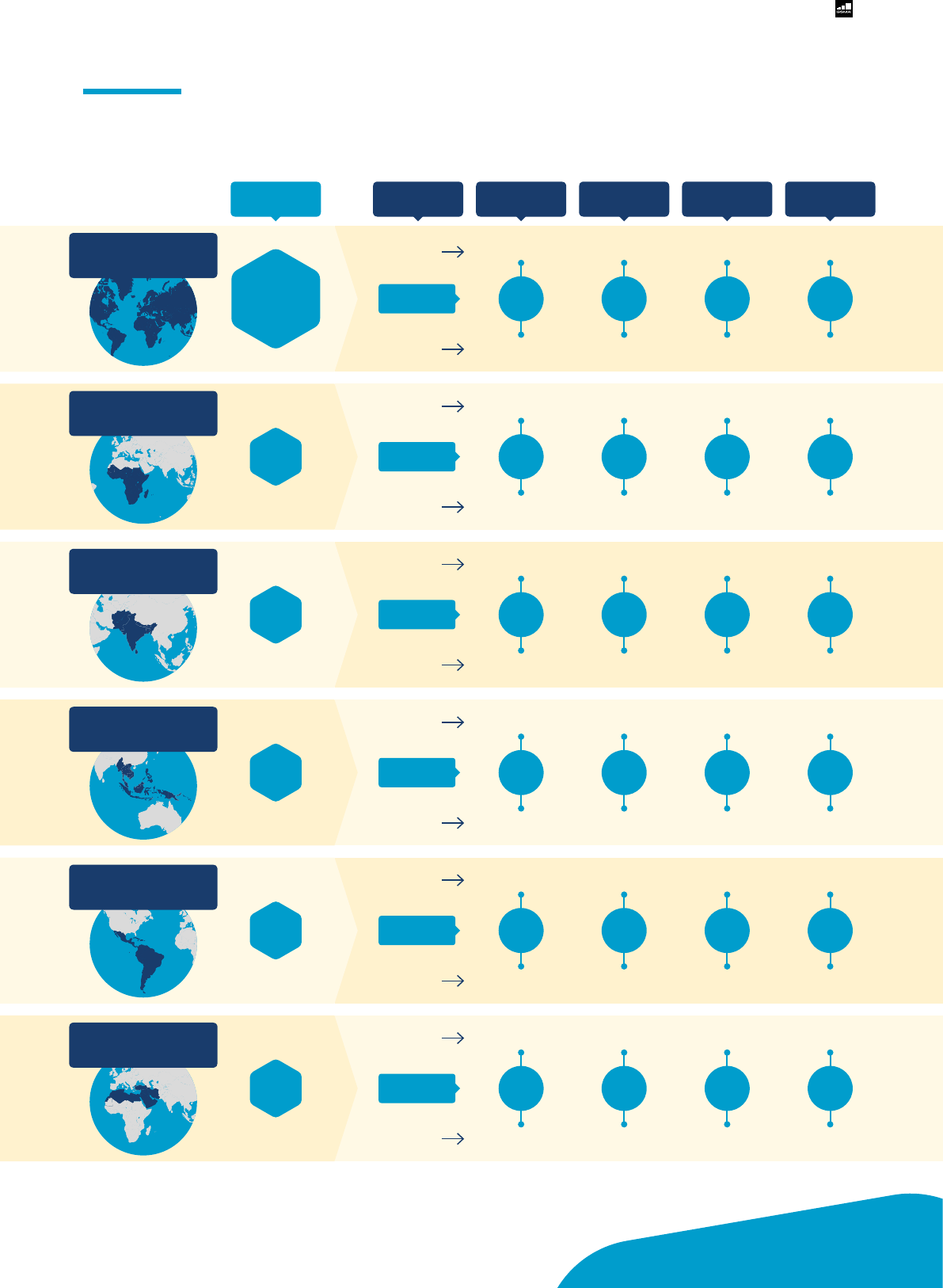

REGIONAL GROWTH IN 2018

YEAR-ON-YEAR

GROWTH

23.5m 11.6m

66.4m 1.0bn

27m 13.1m

46.5m 945m

2017

2018

14.7% 10.3% -29.9% -7.9%

28

LATIN AMERICA &

THE CARIBBEAN

YEAR-ON-YEAR

GROWTH

47.3m 18.0m 39.7m 376.2m

48.9m 18.6m 41.0m 473.0m

2017

2018

3.4% 3.5% 5.6% 25.7%

20

MIDDLE EAST &

NORTH AFRICA

YEAR-ON-YEAR

GROWTH

223.7m 63.9m 447.5m 7.5bn

287.6m 89.3m 565.1m 8.8bn

2017

2018

28.5% 39.9% 26.3% 17.9%

43

SOUTH ASIA

YEAR-ON-YEAR

GROWTH

722.9m 244.9m 2.1bn 34.9bn

866.2m 298.7m 2.4bn 40.8bn

2017

2018

19.8% 21.9% 14.4% 16.8%

272

GLOBAL

(TOTAL)

YEAR-ON-YEAR

GROWTH

68.5m 21.1m 74.9m 2.7bn

94.6m 29.8m 103.6m 3.7bn

2017

2018

38% 41.5% 38.3% 35.7%

41

EAST ASIA

& PACIFIC

YEAR-ON-YEAR

GROWTH

348.3m 128.3m 1.5bn 23.3bn

395.7m 145.8m 1.7bn 26.8bn

2017

2018

13.6% 13.6% 11.8% 15.3%

132

SUB-SAHARAN

AFRICA

13

2018 State of the Industry Report on Mobile Money

Reaching the

underserved

through

innovation

2018 State of the Industry Report on Mobile Money

14

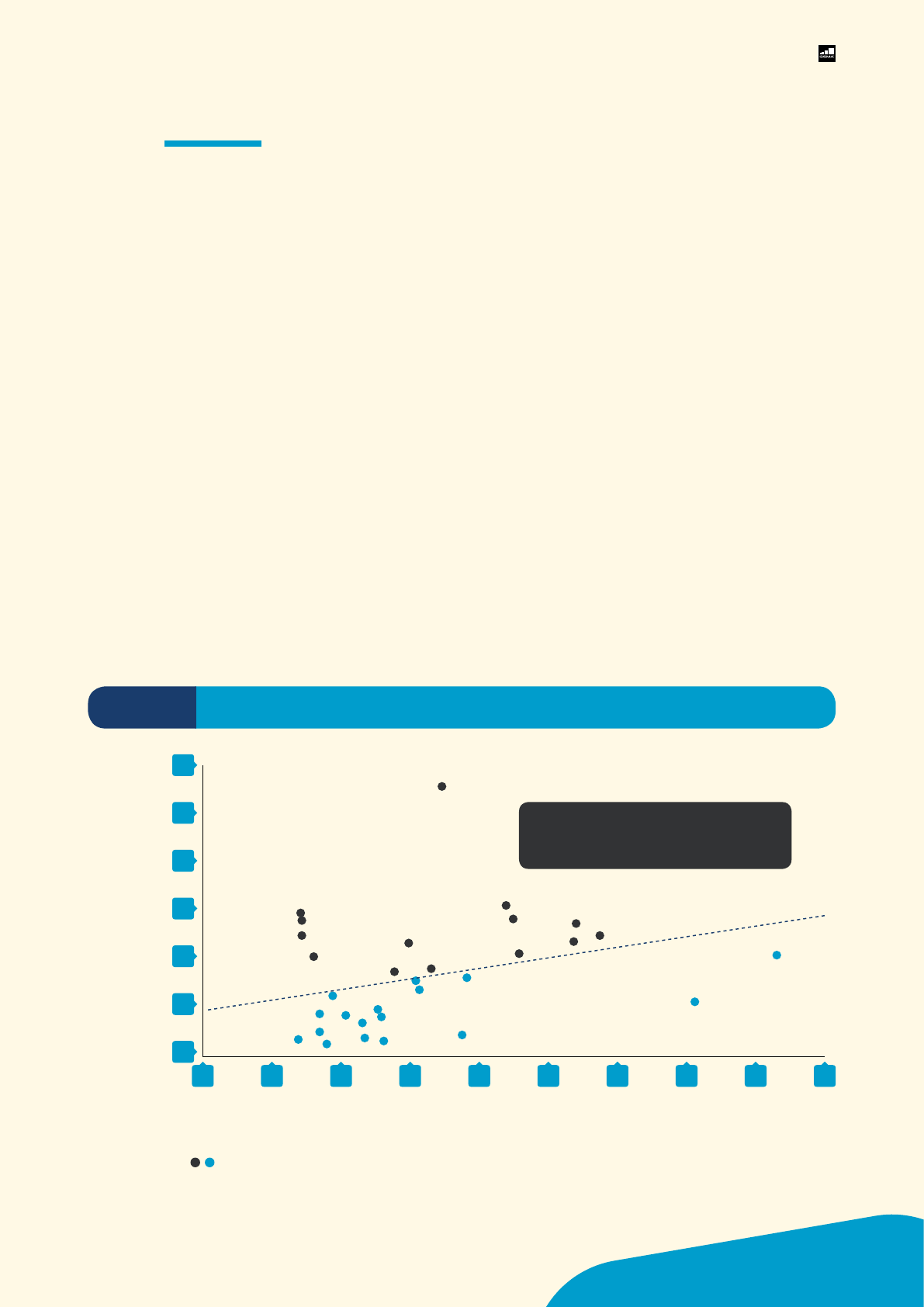

Thirty-one markets saw an impressive

increase of more than five percentage points

in account ownership at financial institutions

between 2014 and 2017 (Figure 3), which can

be attributed to the simultaneous growth in

active mobile money use. In fact, in almost

half these markets, growth in active mobile

money use exceeded eight percentage points,

and a third of the 31 countries analysed were

in either Asia or Latin America, demonstrating

that the impact of mobile money on financial

inclusion has extended beyond Sub-Saharan

Africa.

Countries where mobile money’s contribution

to the overall growth of financial accounts is

not as significant tend to have a lower than

average Regulatory Index score (see page 29).

This highlights the importance of establishing

a more level regulatory playing field which

allows for innovative market-led solutions to

increase financial inclusion.

Reaching the underserved

through innovation

Growth of active 90-day mobile money accounts as

a proportion of adult population, 2014–2017 (percentage points)

Growth of all accounts as a proportion of adult population, 2014-2017 (percentage points)

= Country

Throughout 2018, mobile money

continued to play a critical role in

enhancing financial inclusion in emerging

markets.

The contribution of mobile money to financial inclusion

Figure 3.

0 5 10 15 20 25 30 35 40 45

0

5

10

15

20

25

30

In these countries, mobile money

has been the main driver of financial

inclusion growth

15

2018 State of the Industry Report on Mobile Money

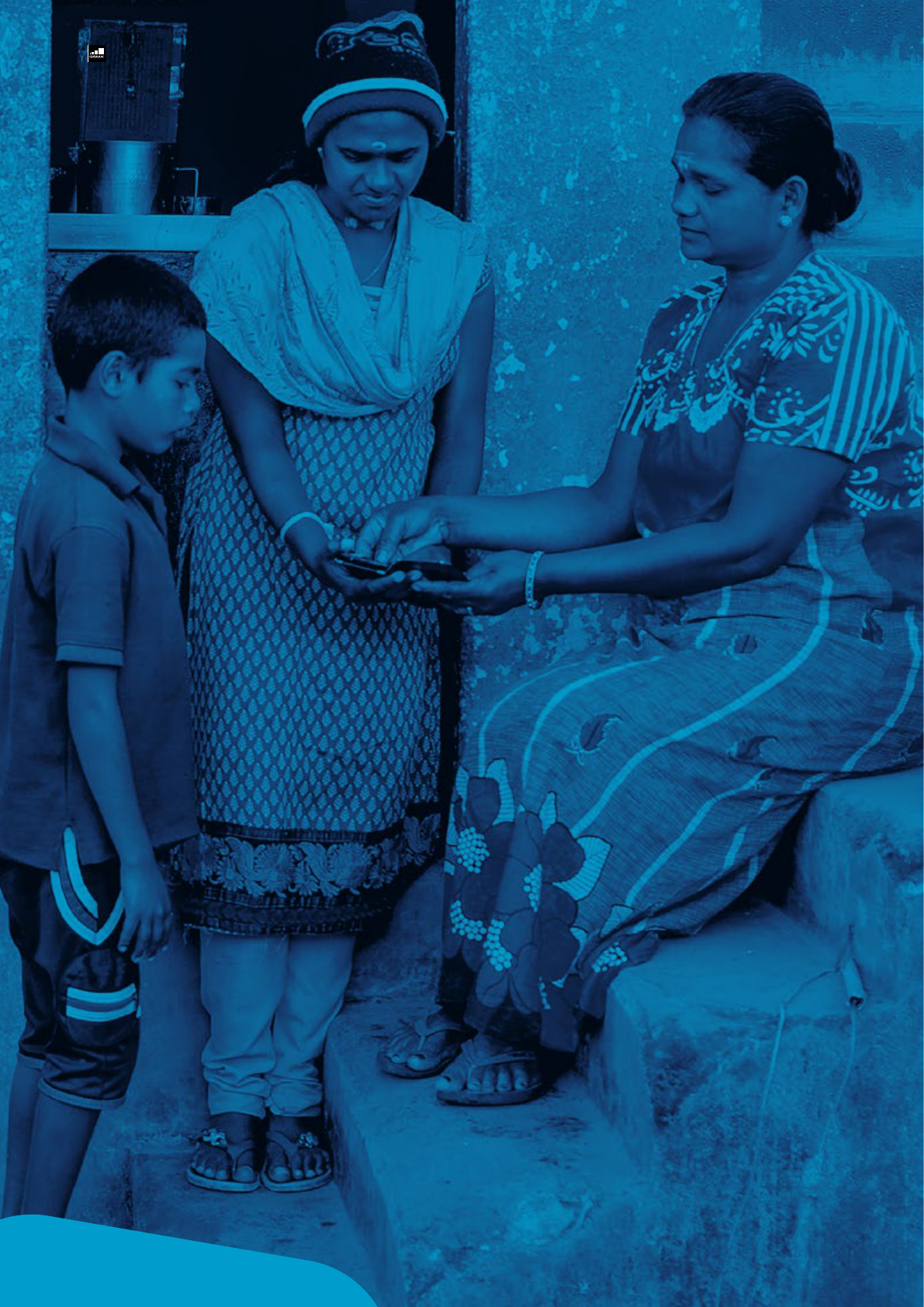

For populations traditionally excluded from the formal financial system — women, the rural poor and

displaced persons — the spread of mobile money accounts is providing a gateway to transformative services

including healthcare, education, financial services, employment and social protections, and bringing more

people online than ever before.

Rural market penetration and the

digitisation of agricultural value chains

is a priority for a growing number of mobile

money providers. While in developing

economies about 15 per cent of adults receive

payments from the sale of agricultural

products, the vast majority of these payments

are made in cash, which can be risky,

inecient and inconvenient to collect. In

Ghana, Kenya and Zambia, the share of adults

receiving agricultural payments is about twice

the average for developing economies, and

about 40 per cent receive these payments

into an account, in most cases a mobile

money account.

15

Over 50 per cent of survey

respondents reported having a product

specifically targeted to rural customers or

plan to launch one in 2019.

Mobile money is increasingly a vehicle

for reaching forcibly displaced persons,

including refugees. Over 135 million

16

people required humanitarian assistance

and protection in 2018. To respond to these

demands, humanitarian organisations are

seeking to deliver services more eciently

and eectively and turning to digital financial

services to replace in-kind aid with direct

cash transfers. Our survey found that over

55 per cent of mobile providers in aected

countries are partnering with humanitarian

organisations, often to facilitate bulk

disbursements or provide access to basic

financial services.

Closing the gender gap in financial

inclusion will deliver broad benefits to

individuals, societies and economies, and

represents a considerable commercial

opportunity for mobile operators. There is

evidence that the mobile money gender gap

is narrowing: according to the 2017 Global

Findex, between 2014 and 2017, the gender

gap has narrowed in 17 countries in Sub-

Saharan Africa and in one country in Latin

America (Bolivia). However, much work

remains to be done as women in low- and

middle-income countries are still 33 per cent

less likely than men to use mobile money

17

and 10 per cent less likely to own a mobile

phone.

18

Our 2018 Global Adoption Survey data

showed that providers are leveraging their

core assets to address the persistent gender

gap in mobile ownership and use, with

female agents emerging as powerful assets

for reaching female customers. For those

respondents providing data on both the

percentage of their female agent base and

female customer base, we found a strong

positive correlation

19

between these two

variables.

15. World Bank Group (2018). The Global Findex Database 2017.

16. UNOCHA (2018). Global Humanitarian Overview.

17. World Bank Group (2018). The Global Findex Database 2017.

18. GSMA (2018). The Mobile Gender Gap Report 2018.

19. +0.7 on the Pearson Product-Moment Correlation Coecient. If the value of r is close to +1, this indicates a strong positive correlation. This was among survey re-

spondents based in East Asia and Pacific, Sub-Saharan Africa, Latin America and the Caribbean, and South Asia, who answered both questions on their registered

female customer base and percentage of female agents.

16

2018 State of the Industry Report on Mobile Money

Predicting the gender of mobile

subscribers using machine learning

Understanding the nature and scale of the

mobile gender gap is a prerequisite for closing

it, but a widespread absence of accurate

gender-disaggregated data is a consistent

barrier to measuring and evaluating mobile

ownership and mobile money use. This limits

the ability of operators to target underserved

female customers with eective, relevant and

tailored products and services.

To address this issue, the GSMA Connected

Women programme, in conjunction with

Dalberg Data Insights, developed the Gender

Analysis and Identification Toolkit (GAIT),

20

a machine learning algorithm that analyses

mobile usage patterns and allows operators to

predict the gender of its subscribers. By training

the algorithm on a small but accurately gender-

tagged sample of a customer base, operators

can see usage patterns by gender and identify

the gender of each of its subscribers with little

need for expensive primary research.

Once an operator has implemented GAIT across

its subscriber base, the gender estimates can

be applied to mobile money customers at an

individual subscriber level. In Bangladesh, a

GAIT pilot achieved 84.5 per cent accuracy in

gender prediction. Figure 4 below illustrates

how mobile usage diered between male and

female subscribers for two key indicators.

20. To access the GAIT toolkit and full technical documentation, see: “The GSMA’s Gender Analysis and Identification Toolkit (GAIT)”.

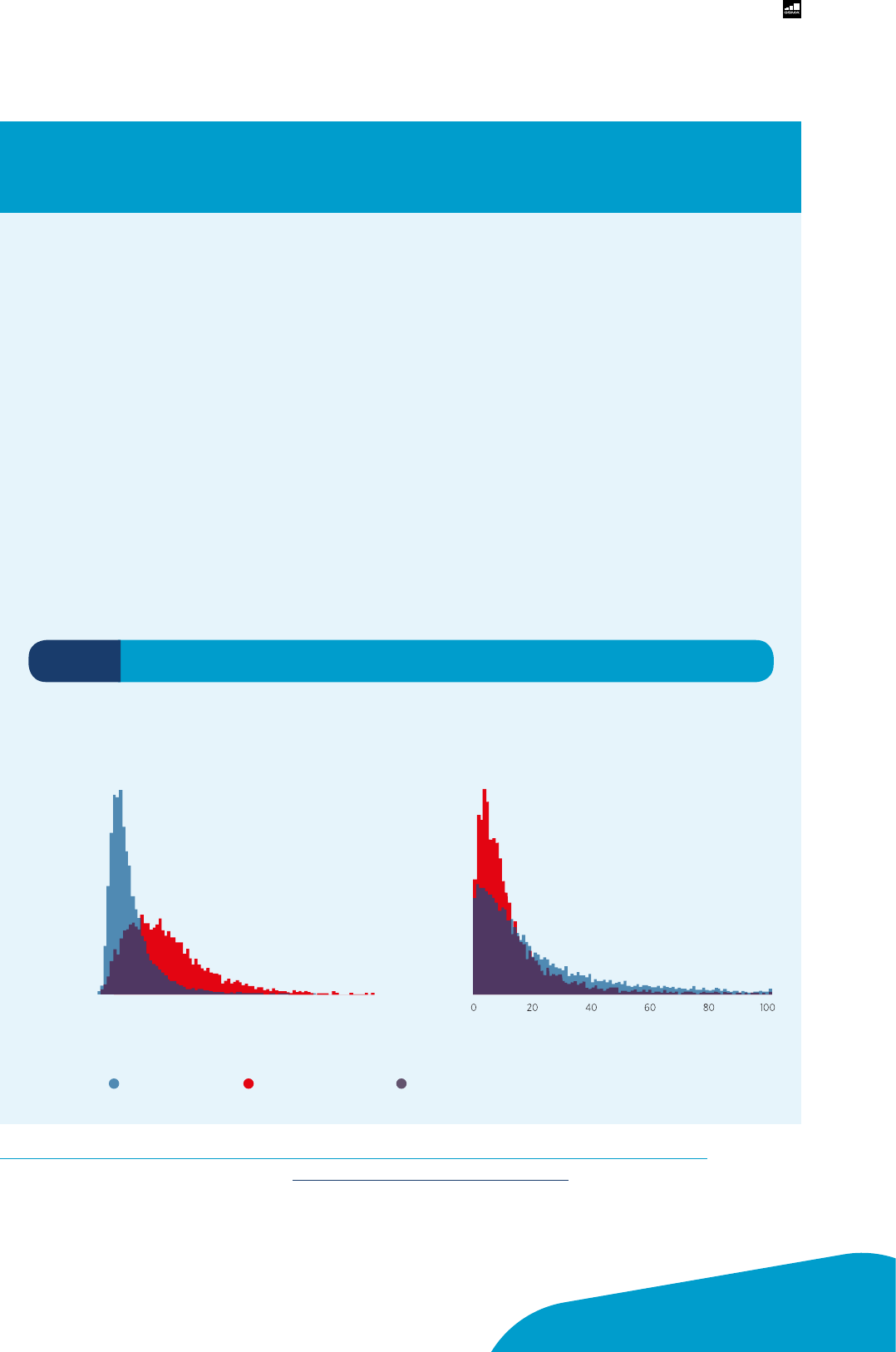

Average duration of incoming calls

by subscriber gender

Number of distinct cell towers visited

by subscriber gender

Proportion of subscribers

Duration (seconds)

0.10-

0.08-

0.06-

0.04-

0.02-

0.00-

0 100 200 300 400 500 600

Number of towers

Proportion of subscribers

0.08-

0.07-

0.06-

0.05-

0.04-

0.03-

0.02-

0.01-

0.00-

Key gender-disaggregated mobile usage indicators from the GAIT pilot in Bangladesh

Figure 4.

Male customers Female customers Overlap between male and female customers

17

2018 State of the Industry Report on Mobile Money

Four trends

shaping

the mobile

money

industry

2018 State of the Industry Report on Mobile Money

18

Mobile money is on the cusp of a

transformation. Today, providers are

navigating a dynamic and shifting

ecosystem shaped by four key trends:

an enhanced customer experience;

diversification of the financial services

ecosystem; increasingly complex

regulation; and the expansion of the

mobile money value proposition.

Four trends shaping the mobile

money industry

While cash-in and cash-out transactions

still represent the majority of mobile money

flows in 2018 and grew by 11 per cent year

on year, digital transaction values grew

more than twice as fast (24 per cent).

The main drivers of digital growth in 2018

were bulk disbursements, which grew by 29

per cent, and bill payments, which grew by

41 per cent — a signal that mobile money

providers are becoming strong partners for

enterprises (Figure 5). Around 68 per cent

of all bulk disbursements are originated by

a business and, on average, every mobile

money provider performing business-to-

person (B2P) disbursements is connected to

237 organisations. This number of connected

organisations can be as high as 4,000 to

6,000 for the best-performing providers

(based mainly in Latin America), which can

have close to 30 per cent of their active

customer base receiving salaries digitally

through mobile money.

Meanwhile, mobile money providers

oering bill payments are connected to 102

companies on average. Bill payments are

also an eective way to digitise government

payments and increase revenues. However,

for our survey respondents, just over 17 per

cent of all bill payments in 2018 were directed

to government agencies. The opportunity is

ripe for governments to follow the lead of

private sector players in digitising payments

and revenue collection, to benefit from the

transparency, eciency and profitability that

mobile money delivers.

An enhanced customer

experience

1

19

2018 State of the Industry Report on Mobile Money

A strategic focus on interoperability

Account-to-account (A2A) interoperability,

which gives users the ability to transfer

between customer accounts held with

dierent mobile money providers and other

financial system players, continued to scale in

2018.

To lower barriers to access, mobile money

providers must continue to develop robust

interoperable payments systems that bridge

the gap between banked and unbanked

consumers and accelerate financial inclusion.

Interoperability continues to be a strategic

priority for the industry, not only to increase

the utility of mobile money for users (by

enabling the seamless movement of value

between institutions), but also to enable

increasingly important use cases, such as bulk

disbursements and bill payments, to scale up

faster.

Providers in several key markets have

expanded interoperability use cases, including

in Kenya and Ghana, bringing the total

number of markets that enable person-

to-person (P2P) transactions between

mobile money deployments to nineteen.

22

In

comparison, in 2013, this was only possible in

one market. Overall, o-net P2P transaction

volumes more than doubled from 2017 to

2018, and in interoperable markets, on-net

transaction volumes did not decline.

The agent distribution network, which has

been vital to the growth of the mobile money

industry over the last decade, shows no sign

of diminishing.

21

In 2018, the global number of

registered mobile money agents grew 18 per

cent to reach 6.6 million, 57 per cent of whom

are active on a monthly basis.

The role of the agent network is evolving

to support adjacent service oerings. An

increasing number of providers are investing

in data collection and analytics, e-learning and

technologies, including online dashboards,

mobile apps, and conversational interfaces.

In addition to enhancing user experience

and enabling greater digital inclusion, these

new services help to streamline operational

processes by upgrading agent onboarding

and training, and enhancing agent monitoring

and engagement.

$16.1 bn

Total Value

$11.1 bn

Total Value

$13.6 bn

Total Value

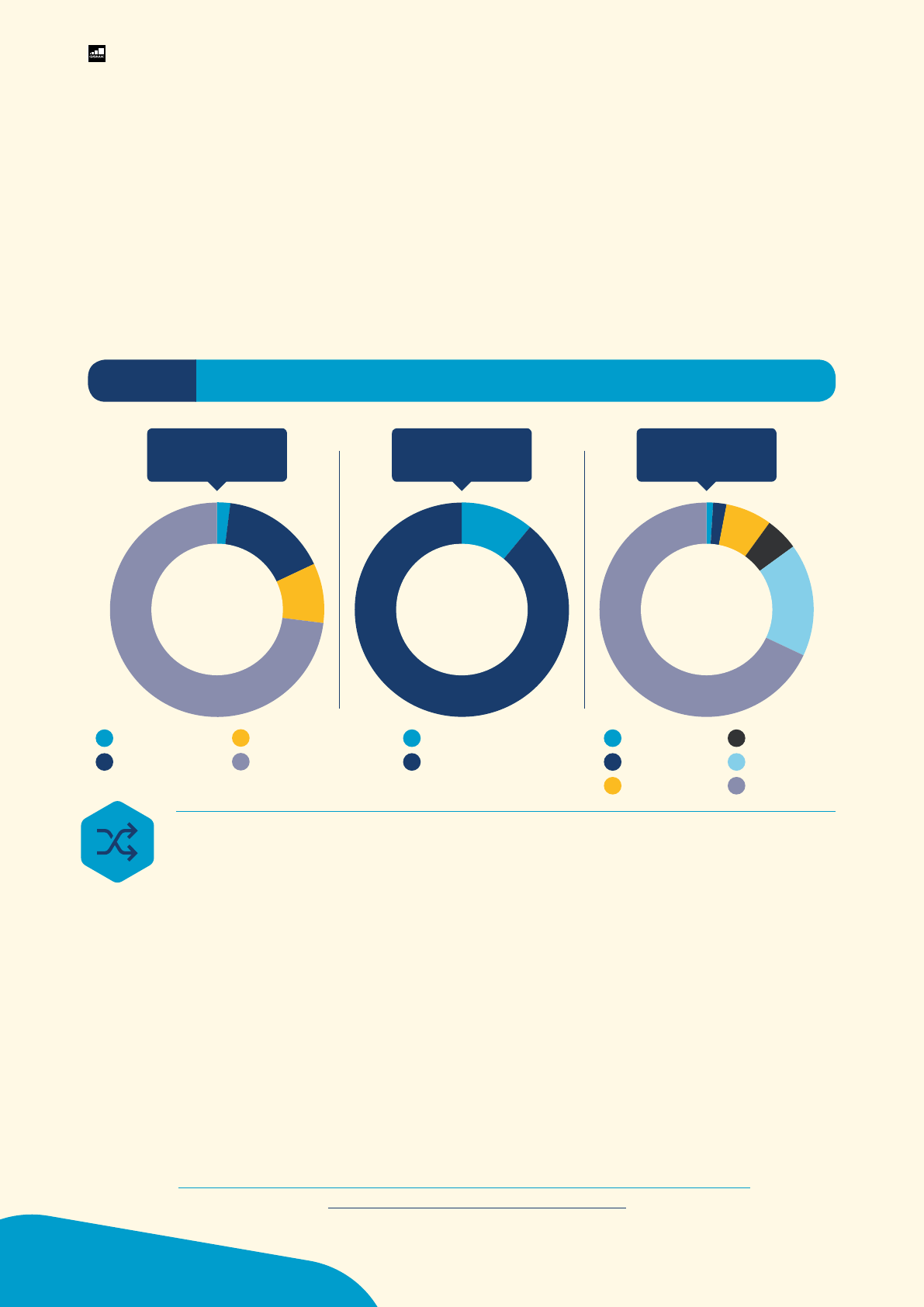

An overview of the mobile money ecosystem, December 2018

Figure 5.

1.3%

16.4%

9.1%

73.2%

89.2%

0.9%

2.1%

7.6%

4.5%

17.0%

67.9%

10.8%

International

remittances

International

remittances

Bulk disbursements

Bank-to-mobile

Cash-in

Incoming

transactions

Circulating

value

Outgoing

transactions

Merchant payments

P2P transfers

O-net transfers

Mobile-to-bank

Airtime top-ups

Bill payments

Cash-out

21. Juma. J. and Wasunna. N. (2018). Distribution 2.0: The future of mobile money agent distribution networks. GSMA.

22. Bolivia, Egypt, Ghana, Jordan, India, Indonesia, Kenya, Madagascar, Malawi, Mexico, Nigeria, Pakistan, Peru, Philippines, Rwanda, Sri Lanka,

Thailand, Tanzania, Uganda.

20

2018 State of the Industry Report on Mobile Money

Mobile money-to-bank account interoperability

has continued to grow significantly, increasing

by 47 per cent year on year in 2018. On average,

mobile money providers with bank integrations

are connected to 10 banks, which has dramatically

increased volumes moving between mobile money

and banking systems. Whereas a few years ago

flows into the mobile money ecosystem vastly

outweighed those going out, today they are more

balanced: a bank can now help large numbers

of MSMEs with mobile money accounts to move

money out of the system, for example, to save or

pay suppliers.

Interoperability continues to see strong growth as

the industry matures into a multi-sided financial

system oering a suite of use cases and products.

However, innovative solutions will be needed to

integrate mobile money providers with the broader

financial ecosystem. There are an increasing number

of options around central switching infrastructure

for the industry to enable nascent use cases to

scale, including merchant payments and ecient

connections to domestic and international financial

system players.

However, much of the existing bank-focused

infrastructure is not optimal for mobile money. In an

eort to solve this, MTN Group and Orange Group

launched Mowali in 2018. Mowali aims to act as an

open industry utility to facilitate interoperability

and provide the optimal technical, commercial

and governance environments in which the mobile

money industry can continue to thrive.

Expanding regional

interoperability through Mowali

In 2018, with the support of the GSMA, MTN

and Orange launched a joint venture to enable

interoperable payments across Africa. Known

as Mowali (‘mobile wallet interoperability’), the

service is open to any mobile money provider

in Africa, as well as to banks, money transfer

operators and other financial services providers.

Built on top of the Bill & Melinda Gates

Foundation’s open-source platform Mojaloop,

Mowali oers an industry-owned and industry-

governed payments hub that is technically and

commercially designed specifically for mobile

money. With its pan-African footprint allowing

for economies of scale and a cost-recovery

commercial model, Mowali has the potential

to drive down the prices of services oered

to lower-income customers. Additionally, by

creating a common mobile money acceptance

brand, and with the potential to provide one

connection for all mobile money providers,

banks, merchants and other digital service

financial providers to reach the 396 million

mobile money accounts across Africa, Mowali

aims to lay the foundation for the future of the

mobile money ecosystem.

As of early 2019, Mowali will be available to all

MTN and Orange mobile money customers in

22 of Sub-Saharan Africa’s 46 markets, with

more mobile money providers expected to join

in the next year.

21

2018 State of the Industry Report on Mobile Money

The disruptive nature of smartphones has

already transformed service models in the

communications, entertainment and transport

industries, and competition is now poised to

disrupt the traditional banking and payments

industry. Smartphone adoption is increasing

dramatically in emerging markets, especially

where mobile operators are investing heavily

in connectivity and vendors are pushing

aordable devices to market.

23

In several markets where mobile money

has scaled, users are more likely to own a

smartphone than a feature/basic phone.

24

Global smartphone adoption was 60 per cent

in 2018 and is predicted to increase to over

79 per cent by 2025. Dramatic uptake is also

expected in:

• Emerging markets: Currently at 56%, set

to rise to 78% by 2025

• South Asia: 48% by end of 2018, set to rise

to 75% by 2025

• Sub-Saharan Africa: 39% by end of 2018,

set to rise to 66% by 2025

For mobile money providers, smartphones

unlock access to a broader customer base

and allow them to oer an enhanced user

experience and a wider range of financial

products and services. To capture the

smartphone opportunity, more and more

providers are oering apps to perform

transactions. The total number of customers

using a smartphone app to transact has more

than doubled (2.6 times) year on year.

In Asia, Latin America and Middle East and

North Africa, one in three mobile money

providers that oer a smartphone app are

seeing 20 per cent or more of their active

customer base transacting through the app,

and a growing number of deployments in

Asia and Latin America are seeing over half of

transactions performed through smartphone

apps.

These deployments also have higher average

revenue per user (ARPU) as smartphone

customers typically transact twice as much

as customers using traditional feature phones

and register higher ticket sizes (owing to

typically higher incomes) — an attractive

target segment. The story is very dierent

in Africa, where over 90 per cent of mobile

money transactions are still driven by USSD.

However, with smartphones and data-enabled

devices becoming more aordable and

equipped with longer battery life, growth is

likely to accelerate.

The dramatic rise in smartphone adoption

23. Baah. B and Naghavi, N. (2018). Beyond the basics: How smartphones will drive future opportunities for the mobile money industry. GSMA.

24. GSMA Intelligence consumer survey

x2.6

The total number of customers

using a smartphone app to

transact has more than doubled

(2.6 times) year on year.

22

2018 State of the Industry Report on Mobile Money

2018 saw many non-financial players

diversify and invest in mobile-based payment

businesses in order to gain market access in

the payments space and then leverage their

experience to strengthen portfolio companies.

While this underscores the commercial

potential of mobile money, not to mention

the social benefits, it is also a sign of growing

competition.

In recent years, the share of the combined

adult population in Asia with a mobile money

account has increased rapidly. South Asia

has seen the fastest growth in the region — a

compound annual growth rate (CAGR) of 63

per cent between 2013 and 2018 — which

today means that more than a fifth of the

population has a mobile money account

(Figure 6). Meanwhile, in Southeast Asia,

account registration rates among the main

ASEAN

25

economies have grown at a CAGR

of 44 per cent, resulting in a similar adult

population penetration rate of close to 20 per

cent.

While the growth in registered accounts in Asia is remarkable, rates of account ownership and

usage are still low in many countries, providing a very real and sizeable opportunity for MNOs

and other financial services providers. Although competition and consolidation in Asia are

increasing, the addressable market is by all accounts substantial enough to accommodate both

MNO and non-MNO players.

Diversification of the financial

services ecosystem

25. ASEAN stands for the Association for the Southeast Asian Nations. Cambodia, Indonesia, Malaysia, Myanmar, Philippines, Singapore, Thailand and Vietnam (not

included: Laos and Brunei).

2,1% 22% 3,3% 19%

CAGR

(2013-18)

63%

CAGR

(2013-18)

44%

% of adult population registered for

a mobile money account

% of adult population registered for

a mobile money account

2013 2018 2013 2018

South Asia

2

Mobile money account registration growth in Asia

Figure 6.

East Asia

& Pacific

23

2018 State of the Industry Report on Mobile Money

The looming opportunity for Asian mobile money providers

Asia’s financial ecosystem sets itself apart

by the role played by non-banks, which

constitute a significantly dierent set of

players than in markets in Sub-Saharan

Africa or Middle East and North Africa,

for example. While large MNO groups still

dominate Africa’s mobile money ecosystem,

providing an expanding range of innovative

digital solutions to more urban and tech-

savvy customers, the competitive landscape

in Asia has changed substantially. In addition

to mobile money providers, the Asian market

also hosts a sizeable number of fintechs such

as Alipay and tech giants such as Tencent.

These players have raised significant capital

in the last few years, which has allowed them

to connect with a wide variety of partners

and develop many customer-centric use

cases, including transportation and food,

medical and financial services. Alipay alone

has partnered with more than 200 financial

institutions and oers over 2,500 mutual

investment funds and is integrated with over

100,000 merchants outside China.

While mobile money providers in Asia are

connected to more online merchants than

the average global mobile money service,

deployments have fewer integrations with

companies leveraging mobile money for bill

and bulk payments. On average, Asian mobile

money providers are connected to 33 billers,

less than a third of the global average of

102, while the dierence in bulk payments is

even greater (69 versus 237). This presents a

significant and largely untapped opportunity

for Asian mobile money providers to

expand their service oering. The disparity

in bulk disbursements and bill payments is

particularly noteworthy as these services have

historically been the main drivers behind the

digitisation of mobile money ecosystems in

other markets.

With this looming opportunity in Asia,

deployments in the region stand to

benefit tremendously from increasing

their investments in mobile money and

concentrating on expanding integrations and

use cases.

24

2018 State of the Industry Report on Mobile Money

The evolving financial services ecosystem

Ant Financial.

In Southeast Asia, Ant

Financial has announced

a string of acquisitions,

including Paytm in India, Mynt in the Philippines

and bKash in Bangladesh. It has also entered

into a strategic partnership with MoneyGram,

and in Kenya partnered with Equitel and Red

Dot Payments to serve Chinese tourists in that

market. While these investments provide new

market access to global organisations, mobile-

based payment businesses also benefit. For

example, bKash, a mobile money provider in

Bangladesh, plans to leverage Ant Financial’s

investment to add capabilities around product

oering and technological enhancements like

artificial intelligence (AI).

GrabPay and

Go-Pay.

Over-the-

top (OTT) players are

expanding rapidly as

international and regional competition stiens.

Singapore-based ride-hailing giant, Grab, first

expanded into mobile payment services in 2017

with the launch of GrabPay. The mobile wallet

service is now available in major Southeast

Asian markets such as Indonesia, Malaysia, the

Philippines and Vietnam, and in early 2018, the

company purchased all of Uber’s Southeast

Asian operations. Grab’s rapid expansion

should be seen in the context of another ride-

hailing service, Go-Jek in Indonesia, which

has launched a mobile wallet, Go-Pay, and

announced a $500 million regional expansion

plan in 2018. Grab’s most recent move in digital

payments is partnering with MasterCard to

oer its 110 million+ registered users a virtual

prepaid card to enable online payments and the

possibility to cash-out.

MercadoLibre. In Latin

America, Argentina-based

MercadoLibre has become the

most popular e-commerce

platform in the region. As of 2017, the service

had 212 million registered users across 18

countries in the Americas. With its marketplace,

Mercado Pago, at its centre, MercadoLibre has

expanded into oering a range of payment

and financial services, such as credit and

wealth management, serving both MSMEs and

individual users.

Telecom Social platform

Commercial

platform

Payment

services

Non-tr

ansactional

financial services

Mobile operators

New business models emerging in the global financial services ecosystem (illustrative)

Figure 7.

Source: GSMA / Sofrecom

25

2018 State of the Industry Report on Mobile Money

Enabling regulation has a tangible influence

on the adoption and use of mobile money

services. The most successful providers

today overwhelmingly operate in markets

where regulation is enabling. Conversely,

restrictive regulatory frameworks can stifle

investment, limit the roll out of new services

and raise costs for consumers, all of which

can negatively aect adoption and activity

rates. In several cases, 2018 regulatory

developments appeared encouraging at first

glance, yet their layers of complexity reveal

increasingly restrictive requirements.

The Bangladeshi government, for example,

released a new regulatory framework in

July 2018

26

that allows non-banks, such as

NGOs, investment and fintech companies, to

participate as equity partners (maximum 49

per cent) with scheduled commercial banks.

Although a welcome concession, MNOs are

specifically prohibited from partnering with

scheduled commercial banks to oer mobile

financial services. Their role is limited to the

distribution of mobile money services as

agents or super agents.

Regulatory change also came to Indonesia

in June 2018, which despite increasing

transaction limits for deposits by unregistered

users, has so far not made the market any

more enabling for mobile money providers.

Regulations have been tightened with new

provisions for IDR 3 billion minimum capital,

limits on foreign shareholding (49 per cent)

and a mandatory requirement to link all

foreign remittance providers through the

national payments gateway.

Globally, the mobile money industry

encountered developments in five main areas

of regulation in 2018, all of which aect the

provision of mobile money services: taxation;

Know Your Customer (KYC) requirements;

cross-border remittances; national financial

inclusion strategies; and data regulation. Each

of these areas are explored in more detail

below.

Increasingly complex regulation

26. Bangladesh Mobile Financial Services Regulations (2018).

3

26

2018 State of the Industry Report on Mobile Money

Taxation

The mobile industry is already one of

the highest taxed in Sub-Saharan Africa.

Throughout the region, mobile money

providers encounter three layers of taxation:

general taxes, such as value-added taxes;

mobile sector-specific taxes, such as excise

duties on airtime usage, and mobile money

taxes.

27

In 2018, industry concerns intensified

regarding the introduction of taxes on

mobile money transactions throughout the

region and beyond. Aected markets include

Uganda, Kenya, Zimbabwe and Gabon.

Our analysis has shown that taxing mobile

money does little to support public

finances and to advance the many positive

contributions of mobile money.

28

Moreover,

excessive taxation undermines prospective

investment into mobile money, at a time when

mobile operators already face considerable

cost pressures to enhance service quality,

expand networks and meet new regulatory

requirements. As an alternative to excessive

taxation, governments should consider

supporting the growth of mobile money

services by digitising the payment of fees,

rates, taxes and levies due from taxpayers.

Mobile money taxation in Uganda

Mobile money is an accelerator for payments

and money transfers in Uganda, with over 30

per cent of the population actively using the

service and over 200,000 jobs directly created

by the mobile money industry. As a result, the

introduction of a one per cent tax on mobile

money deposits, withdrawals, transfers and

payments by the Ugandan government in July

2018 made mobile money transactions more

expensive for a significant number of users.

While the introduction of a 10 per cent excise

duty in 2013 only aected mobile money

transaction fees, this new initiative aims to tax

both the transaction fee and the transaction

value.

The new tax had an almost immediate

negative eect: the value of P2P transactions

declined by 50 per cent within two months

of implementation while the value of all

transactions dropped by around 25 per cent.

Around 100,000 agents saw their earnings

decline by 35 to 40 per cent, and around

30,000 agents went out of business completely.

Customers have resorted to using cash or

agency banking while others are transferring

smaller amounts via mobile money. This tax will

also have an impact on mobile money account-

to-bank transfers that enable commercial banks

to capture around US $19 million in deposits,

which stand to decline. Also at risk are mobile

money use cases: 60 per cent of electricity

and national water payments are made via

mobile money; around 5,000 savings and credit

cooperatives collect deposits and disburse

microloans using mobile money; 12,000 to

15,000 farmers receive daily microloans via

mobile money; and 40,000 to 50,000 transfers

are made to refugees every month.

By attempting to introduce a tax-boosting

measure to meet fiscal targets for 2018–19,

the Ugandan government has put the existing

tax base at risk. The government has since

attempted to redress the issue by reducing

the tax to 0.5 per cent of the transaction value

of withdrawals only. However, rather than tax

mobile money transaction values directly,

the government could tax mobile money in a

less punitive manner or, even better, leverage

mobile money to increase collection of existing

taxes in a digital and ecient way.

27. Muthiora, B. and Raithatha, R. (2017). “Rethinking mobile money taxation.” Mobile for Development Blog. GSMA.

28. Ibid

27

2018 State of the Industry Report on Mobile Money

Know Your Customer (KYC) requirements

Cross-border remittances

The ability to conduct KYC eciently and

eectively is key to expanding access to

mobile money. However, the mobile money

industry’s capacity to scale services is

challenged by onerous KYC requirements. To

address these challenges, providers are taking

two approaches:

• Simplifying customer onboarding:

In markets without ubiquitous

identification systems, mobile money

providers struggle to onboard prospective

customers who are unable to provide

sucient proof of identity. While ensuring

universal ID coverage remains a long-

term endeavour, a careful relaxation of

regulatory restrictions in the short term can

bring more people into the financial system

without substantially increasing risks; for

example, by using SIM registration data for

mobile money account opening. Pakistan,

Ghana, Sri Lanka and Haiti are all examples

of countries that permit the use of SIM

registration data for mobile money KYC.

• Use of digital IDs to enable electronic

KYC (e-KYC): To meet the needs of an

increasingly digitised user base, mobile

money providers — and the broader

financial services industry — are looking to

innovative technologies for ID verification,

such as queryable digital ID systems

and biometric authenticators. Some

countries, such as Kenya, have ID systems

that already oer e-KYC, and several

others are well positioned to oer such

services should governments embrace the

opportunity.

29

Mobile money remittances can be a

lifeline and vital source of income for poor

communities in developing countries.

The total value of mobile money-enabled

international remittances processed in

2018 was $4.3 billion. Results from a study

conducted in August 2017 showed that

mobile money-enabled remittance services

are available across 184 unique corridors,

and there is growing awareness among

governments, regulators and the industry

itself that mobile money can lower the costs

of sending international remittances.

The average cost of sending $200 via mobile

money is 1.7 per cent, a reduction of nearly

40 per cent since 2016.

30

Recognising the

role of mobile money in lowering the costs of

sending remittances, there has been a greater

push for interregional operating models to

ensure more people can benefit from the

cost savings. In Sub-Saharan Africa, regional

economic communities SADC, EAC and

UEMOA are leveraging the ease of movement

of people and trade by creating integrated

payments systems.

This progress in mobile money-enabled

international remittances has been facilitated

in part by regulators’ willingness to allow

market entry for non-traditional providers.

However, in many markets, regulation

remains a barrier to further expansion.

These challenges are dierent from country

to country, ranging from the acquisition of

a license that allows mobile money to be

used for international remittances, to more

complex issues that can hamper the opening

of new corridors such as data localisation

requirements, or dierences between

international and domestic KYC requirements.

Against this backdrop, establishing an open

and level playing field and encouraging

competition through conducive regulation

will be crucial in unlocking the full potential of

mobile money for international remittances.

29. Naghavi, N. (2019). Competing with informal channels to accelerate the digitisation of remittances. GSMA.

30. GSMA (2017). Working Paper: Guidelines on International Remittances through Mobile Money.

28

2018 State of the Industry Report on Mobile Money

National financial inclusion strategies

Data regulation

Governments across developing economies

have initiated policy reforms to improve the

quality, access and availability of financial

services through national financial inclusion

strategies (NFIS). An NFIS sets milestones

and defines roadmaps for public- and private-

sector stakeholders to achieve financial

inclusion targets. As of December 2018,

36 countries have adopted an NFIS, and

Jordan, Palestine and Russia are planning

to launch their strategies within the year.

A good NFIS is regularly reviewed against

defined objectives and updated within agreed

timelines, as Tanzania demonstrated in 2018.

31

Other qualities of an eective NFIS include

technology neutrality, gender inclusion and

proportionate regulation.

For mobile money providers, customer

data provides an important opportunity

to diversify and improve service oerings,

bridge the financial inclusion gap and

ultimately boost profits. At the same time,

these developments inevitably increase

the risks of data breaches and reputational

damage, so maintaining consumer confidence

in mobile money services is vital to leverage

new commercial opportunities and safeguard

broader financial inclusion eorts.

Mobile money providers will need to consider

recent changes in data protection regulation

that may have an impact on the provision of

mobile money services, particularly relating

to data localisation, data security, the lawful

basis for data processing and data sharing.

For example, data localisation requirements

stipulate that customers’ personal data

collected within a particular jurisdiction

must be stored or processed within that

jurisdiction’s boundaries, which may result in

prohibitive costs for providers, disincentivising

market entry and compromising innovation.

For regulators, the challenge of strengthening

data protection without stifling innovation

requires collaboration with industry players to

strike the right balance.

31. The Alliance for Financial Inclusion (2018). Tanzania: National Financial Inclusion Framework 2018-2022.

29

2018 State of the Industry Report on Mobile Money

100100

The Mobile Money Regulatory Index

The Index comprises six dimensions and 27

indicators weighted by impact. These six

dimensions, or enablers, have the biggest

influence on the development of scalable and

responsible mobile money businesses that

can sustainably reach the underserved and

foster digital financial inclusion. They include:

Authorisation, KYC, Consumer Protection,

Agent Networks, Transaction Limits, and

Investment and Infrastructure. The Index

also provides a foundation for public- and

private-sector dialogue on reforms that

can promote market growth. For instance,

data on transaction limits could be used to

set appropriate transaction limits for entry-

level accounts based on global benchmarks

extracted from the Index.

Pakistan

Authorisation: 75.53

Consumer Protection 72.5

Transaction Limits: 84.1

KYC: 70

Agent Network: 93.33

Infrastructure and

Investment environment:

Regulatory Index Score:

80.65

The fast-evolving regulatory landscape calls

for a more nuanced evaluation of regulatory

frameworks, which extends beyond a binary

categorisation of regulation as enabling or non-

enabling. Recognising this, over the last year,

the GSMA has studied regulatory frameworks in

more than 80 countries and developed a tool,

the Mobile Money Regulatory Index, to assess

the eectiveness of regulatory frameworks

in creating enabling environments for mobile

money operations (Figure 8). The Index

provides regulators and other stakeholders

with insights into improving their regulatory

environment and ultimately expanding mobile

money services. Figure 8 provides an example

of a country's Regulatory Index Score and

composite dimension scores.

The Mobile Money Regulatory Index

Figure 8.

100

30

2018 State of the Industry Report on Mobile Money

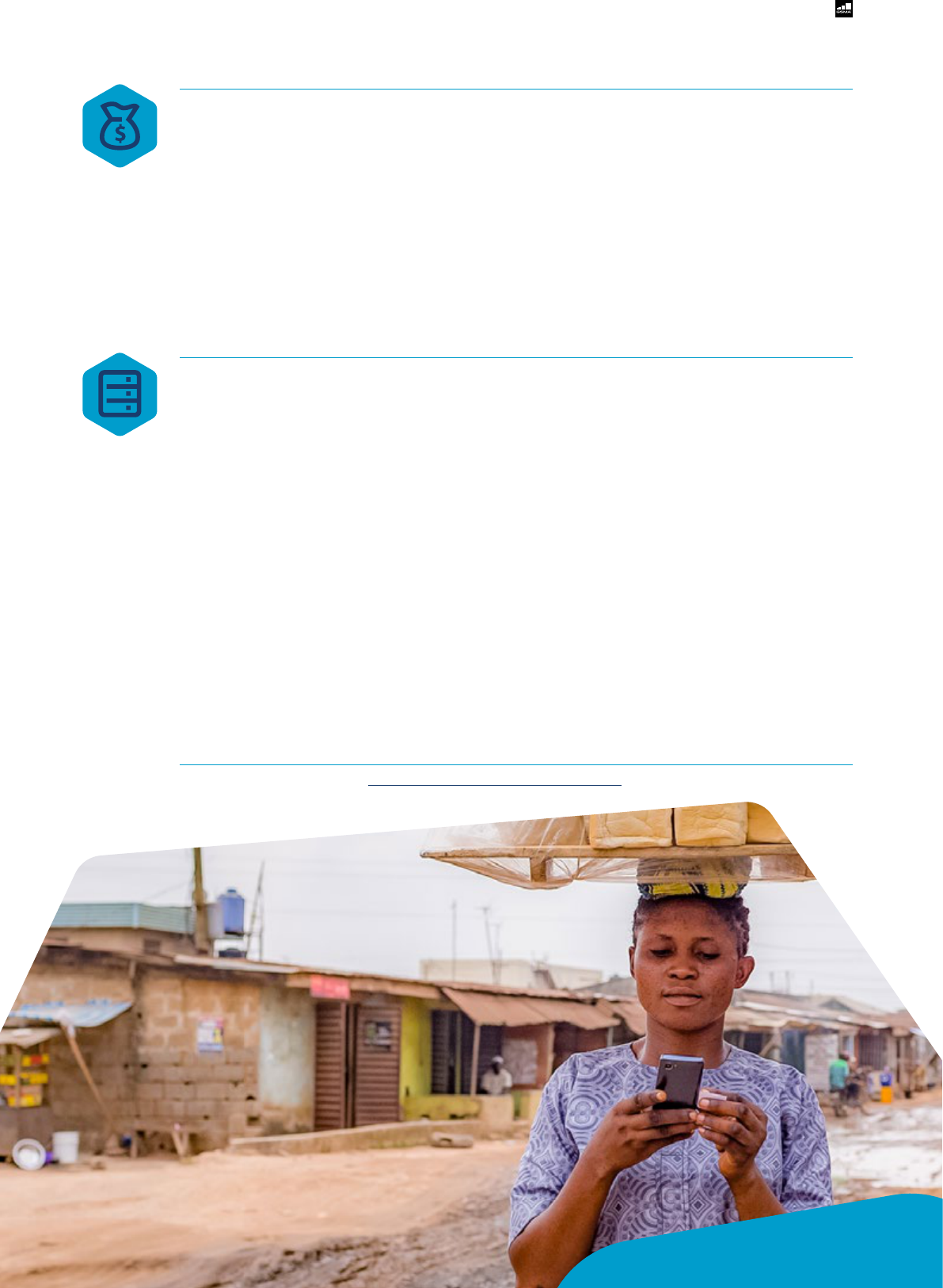

Mobile money providers responding to our

Global Adoption Survey reported steady

year-on-year revenue growth (23.9 per cent

on average) and profitability (30 per cent of

providers reported EBITDA margins of over

25 per cent). However, with close to 80 per

cent of providers reporting that most of their

revenues are driven by customer fees, they

are increasingly seeking to strengthen their

value proposition to meet the evolving needs

of individuals and small businesses.

This has moved us towards a significant

evolution of the mobile money business

model: a 'payments as a platform' approach

that connects consumers with third-party

services across a range of industries.

Recognising the compelling opportunity to

increase and diversify revenue streams and

reach new and broader customer bases,

providers are seeking to develop a diversified,

multi-sided model of adjacent services,

enterprise solutions and personalised services.

Expansion of the mobile

money value proposition

79%

46%

26%

Growth in e-commerce

transactions facilitated by

mobile money

Customer activity rate among

providers oering a credit, savings

or insurance product (compared to

26% customer activity rate among

providers who do not)

Mobile money deployments

for whom building enterprise

solutions is a strategic

priority

24%

Dierence in ARPU for providers with

a credit, savings or insurance product

compared to providers without

4

The expanding mobile money proposition

Figure 9.

31

2018 State of the Industry Report on Mobile Money

Enterprise solutions

E-commerce

While only a few mobile money providers

have developed a customised oering for

businesses, they are well placed to serve

MSMEs thanks to their strong presence

on the ground. Despite being tailored for

individual needs, GSMA research in two

Sub-Saharan African countries has found

that approximately 80 per cent of MSMEs

have a mobile money account and, of these,

83 per cent were using it for business needs.

MSMEs reported performing transactions

more frequently than individual mobile

money users, with over three in ten receiving

payments several times a day for a variety

of use cases, including receiving customer

payments and paying utility bills and

suppliers.

32

More and more customers are coming online.

In just four years, global mobile internet

penetration has risen sharply, from 29 per

cent in 2013 to 43 per cent in 2017, and is

projected to increase to 61 per cent by 2025.

In Sub-Saharan Africa, this has risen even

faster, doubling in the last five years to 21 per

cent. An additional 280 million subscribers

are estimated to come online between now

and 2025. South Asia has seen similar growth,

with subscribers doubling over the last five

years and another 470 million users expected

by 2025.

In 2018, e-commerce transactions facilitated

by mobile money grew 79 per cent in

value. This strong growth has meant more

integrations are happening directly between

operators and providers or through gateways.

Operators are also looking to launch their own

marketplaces, such as Safaricom with Masoko

(see below).

Masoko by Safaricom

Launched in November 2017, Masoko became

the first e-commerce platform in Africa to

be launched independently by an MNO. The

platform has allowed Safaricom to leverage

the reputation and trust of its highly successful

mobile money service, M-Pesa. At a time when

MNOs around the world are seeking to digitise

their operations, Safaricom has put its focus on

e-commerce, with Masoko now an integral part

of its plan to sustain future growth.

As a mobile money provider, Safaricom brings

several unique strengths to the e-commerce

domain. For example, while Safaricom oers

several payment methods other than M-Pesa

(such as VISA and MasterCard), Masoko does

not oer the payment option of cash on

delivery. As a payment service provider itself,

Safaricom can guarantee payment for an order

the moment it is placed — a core added value.

Another strength is its unique data capabilities

and insights, which allows it to oer customers

a more relevant and tailored experience online.

As of November 2018, Masoko had 120

(pre-approved) active vendors and oered

over 30,000 products or stock-keeping

units (enhanced by the recently launched

Masoko Fresh, a new part of the portal that

oers delivery of fruits, vegetables and dairy

products). As in other developing countries,

Safaricom’s main e-commerce challenge has

been logistics. The MNO is addressing this by

using its sizeable agent network (160,000+)

as delivery and collection points, as well as

multiple delivery partners. This has been a

success; Masoko is now delivering products to

45 of 47 counties in Kenya.

32. Pasti, F. and Nautiyal, A. (2019) Addressing the financial services needs of MSMEs in Sub-Saharan Africa. GSMA.

32

2018 State of the Industry Report on Mobile Money

Credit, savings and insurance

While financial account ownership has seen

remarkable growth in recent years, little

progress has been made in access to savings,

credit and insurance services. By oering

adjacent services such as credit, savings,

insurance and wealth management, mobile

money providers better serve the varied

needs of their customers while reducing their

reliance on revenues from customer fees.

In 2018, providers increasingly embraced

this opportunity. Currently, 23 per cent of

providers oer a credit service through

partnership models with banks or credit

providers, and 41 per cent are planning

to launch one in 2019. Several of the

deployments that launched a digital credit

oering in the last 18 months saw an average

of 11 per cent of their registered customer

base take out digital credit loans.

Our survey also showed a healthy appetite

among mobile money providers to oer

insurance; at least 45 per cent of providers

currently oer an insurance service or are

planning to launch one in the next 12 months.

The platform-based approach is uniquely

positioned to facilitate this, as it involves a

shift from one-on-one negotiations and one-

o integrations to a platform that is open

to all potential third parties that pass the

required checks. As a result, smaller financial

institutions and microfinance institutions

(MFIs) with a more niche focus will also be

able to oer their services to mobile money

users.

Providers stand to benefit from expanding

their value proposition to adjacent services

in two key respects. First, mobile money

providers that also oer savings, credit or

insurance products have on average 24 per

cent higher ARPU than providers that do

not oer any of these products. Second,

the same providers are also likely to have a

higher activity rate (45.7 per cent) than those

who do not (27.0 per cent). The synergies

created by oering these products are just

as significant as the increased direct revenue

opportunities; these new services will help

providers acquire new customers, reduce

customer churn and cross-sell services.

Mobile money providers already possess the necessary skills and resources to move towards

a platform-based model. However, to transition fully and position themselves strategically

for simple integrations and quick access to customers, providers will need to address several

key organisational and technological challenges.

33

These include empowering third parties to

directly embed and implement their catalogue of services through mobile money apps, and

leveraging their datasets eectively and responsibly to glean insights from new usage patterns.

33. Nika Naghavi (2018). Embracing payments as a platform for the future of mobile money. GSMA.

33

2018 State of the Industry Report on Mobile Money

Conclusion

2018 State of the Industry Report on Mobile Money

34

The enduring strength of the agent network, an

increased focus on interoperability and widespread

access to digital tools such as smartphones will help

to further ease this transition. The merchant network

will also become increasingly important as mobile

money providers connect customers to MSMEs,

both retail and online. Smartphones will be a key

enabler of this model as they provide an enhanced

user experience and open access to a wider range of

financial products and services through third-party

apps. In countries where feature phones are still

the primary channel for accessing mobile money,

however, providers will need to determine how to

oer the core benefits of the platform model to this

enduring customer segment.

As in previous years, regulation designed to enable

low-cost services for the financially excluded has

proven essential to the success of mobile money.

There were some encouraging trends in financial

services regulation in 2018 as national financial

inclusion strategies gained momentum and

collaborative sub-regional initiatives worked to