Optimizing Faster

Payments

A Regional Payments Landscape Review

An industry Report by 4SiGHT Research & Analytics,

commissioned by Visa

April 2022

Foreword

3

Executive Summary

4

1. Introduction

11

2. Domestic Consumer P2P Payments

12

3. Intra-Africa Cross Border Consumer P2P Payments

14

4. What is the future for P2P payments?

23

5. Domestic Merchant Fund Disbursement

26

6. Intra-Africa Cross Border Merchant Fund Disbursement

30

7. What is the future for merchant fund disbursements?

32

Conclusion

36

Research Methodology

38

Table of Contents

2

© 2022 Visa, Inc.

3

© 2022 Visa, Inc.

Foreword

These are exciting times to be in payments as the world demands greater precision,

speed and reliability when sending and receiving funds. Stakeholders inside the

payments ecosystem continue to innovate to keep up with the demand and ensure

that their customers are in positions where they can benefit. This includes payment

networks, banks, technology companies and governments supporting myriad use cases,

geographies and industries. The progress made by the payments industry in recent years

has propelled the globe to expect fast, safe and seamless payment experiences, and so it

is now not a question of whether a faster payment solution or a global network is the right

method to use, but more a question of which solution and network is best.

Visa is the hub for much of this activity

, enabling its partners to exceed market

expectations through offering business, government, small merchants and individuals an

optimized payment experience. This concept is similar across markets and regions, be it,

Africa, the Middle East, or elsewhere. Visa understands the value of moving money faster,

getting it in the hands of small businesses, workers, constituents, and those that need it

most, and we believe the right solutions will have a profound impact on economies and

societies globally.

To that end, in an effort to refine market understanding of payment sender and receiver

preferences, Visa commissioned research with 4Sight Research and Analytics in Africa,

the Middle East, and Eastern Europe. The research sought to understand the preferences

of consumers and small businesses to receive payments, along with merchant priorities

for disbursing funds. Specifically, this analysis explored improving the customer

experience and methods to provide a smooth, digital experience that meets fast-

changing consumer pr

eferences and rising global payments challenges, covering funds

disbursements and person-to-person money transfers.

This research clarified solutions and a path forward to meet the requirements of

consumers and businesses. With Visa Direct, Visa is well positioned to meet the

momentum for faster and more reliable payment transfers and disbursements, providing

fast, secure and convenient solutions for Visa’s ecosystem of clients and partners. As the

concept of faster payments continues to evolve, we will keep investing in technologies

that make Visa the best way to pay and be paid.

Uttam Nayak

SVP, Visa Direct, CEMEA

Optimizing faster payments – a regional payments landscape review

4

© 2022 Visa, Inc.

Executive Summary

The payments landscape has seen a significant shift over the last two years. While

digitisation of the payments industry is certainly not new, a rapid acceleration brought on

by the COVID-19 pandemic has seen an increase in behaviour shifting away from traditional

payment methods to becoming increasingly cashless. It is estimated that global cashless

payment volumes are set to increase by more than 80% from 2020 to 2025 . With this shift,

consumer and business expectations have increased in relation to speed of transfer, with

expectation that funds should be reflected within minutes, if not seconds.

This report looks at the current payments landscape in Ghana, Nigeria, South Africa, the

UAE, and Serbia and examines what the future holds for payments across these markets. In

this paper, we examine the preference of consumers when it comes to Peer to Peer (P2P)

payments, as well as merchant fund disbursement.

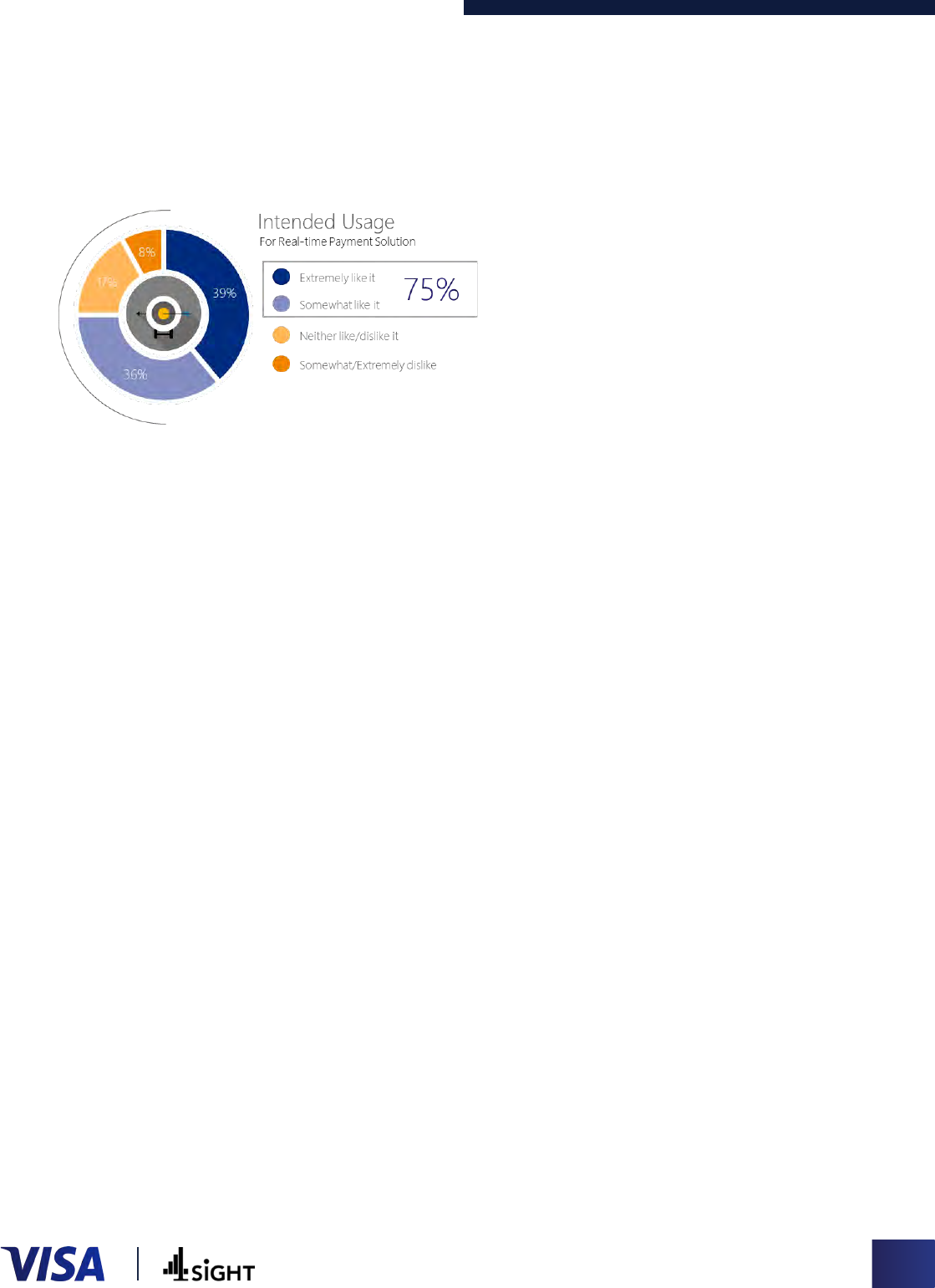

75%

of consumers are interested in switching

to a faster payments solution

70%

of merchants would request their payor to

pay them with a faster payments solution

69%

of merchants would be interested in a

faster payments solution that provides

instant transfer with real-time notifications

1

Analysis by PwC and Strategy & https://www.pwc.com/gx/en/industries/financial-services/publications/financial-

services-in-2025/payments-in-2025.html

Optimizing faster payments – a regional payments landscape review

5

© 2022 Visa, Inc.

Peer to Peer (P2P) transfer

• With the decline in cash usage, in most markets account-to-account transfers are the

predominant payment method used by consumers for domestic P2P transfers (Ghana

is the only market where this isn’t the case). The convenience of online banking and the

security provided by banks means this is the go-to choice. Additionally, speed of transfer

via this method has dramatically improved over the years, with consumers in most markets

perceiving their transaction to be instantaneous.

• However, frustrations still exist particularly in relation to the ease of adding beneficiaries

and the process of sending funds overseas. Additionally, in African markets consumers

are limited with payment options for those who don’t have a bank account, with account-

to-account irrelevant for these transactions. And while most domestic transactions

are considered to be fast, cross border transfers can still take several days to reach the

intended recipient.

• Across markets, new methods of payments are growing in popularity, with mobile

payments and e-wallets being the predominant growth players in African markets and

card-to-card in Serbia. In Ghana, MTN MoMo, a mobile money payment provider, has

virtual dominance of P2P transfers, with the vast majority (89%) of domestic consumer P2P

payments using this method. In South Africa and Nigeria, while still far behind account-to-

account and cash transactions, mobile payments and e-wallets are growing in popularity

filling the need gap for instant, low/no cost transfers for smaller value transactions.

• However, these new methods of payments come with their own drawbacks the most

significant being lack of valid proof of payment, or ability to easily track payments. As

well as a slow and cumbersome reversals process should anything go wrong with the

transaction.

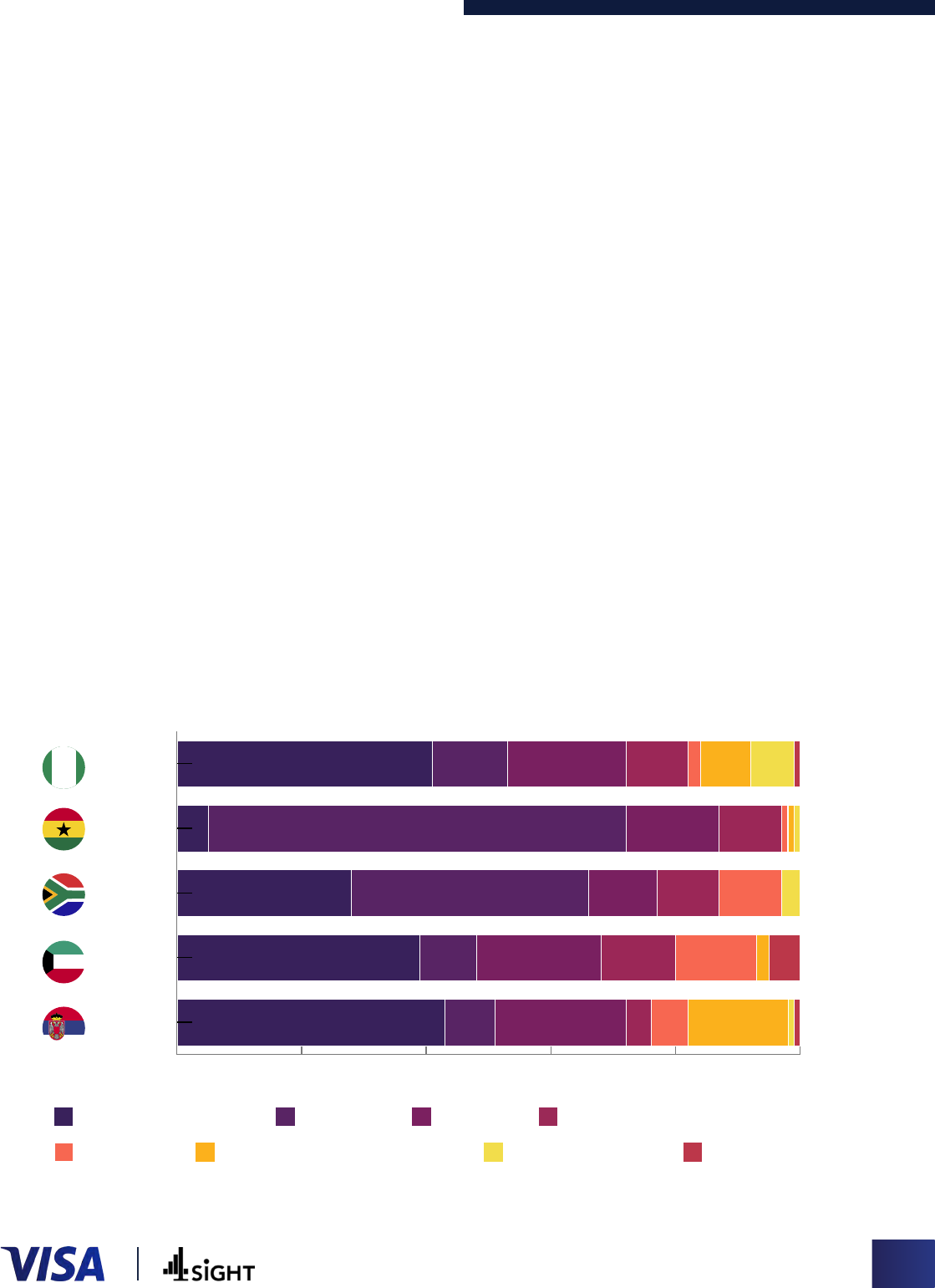

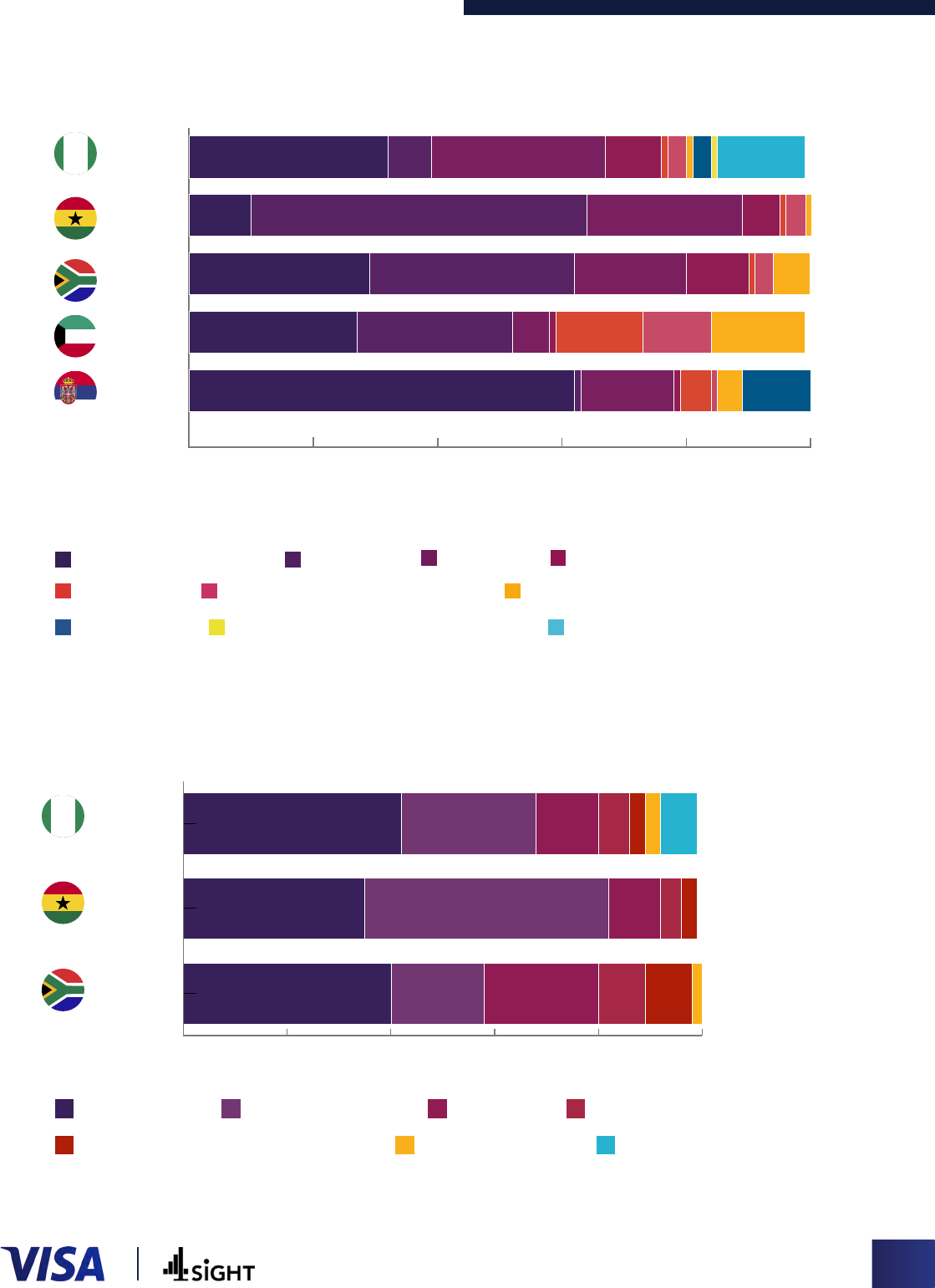

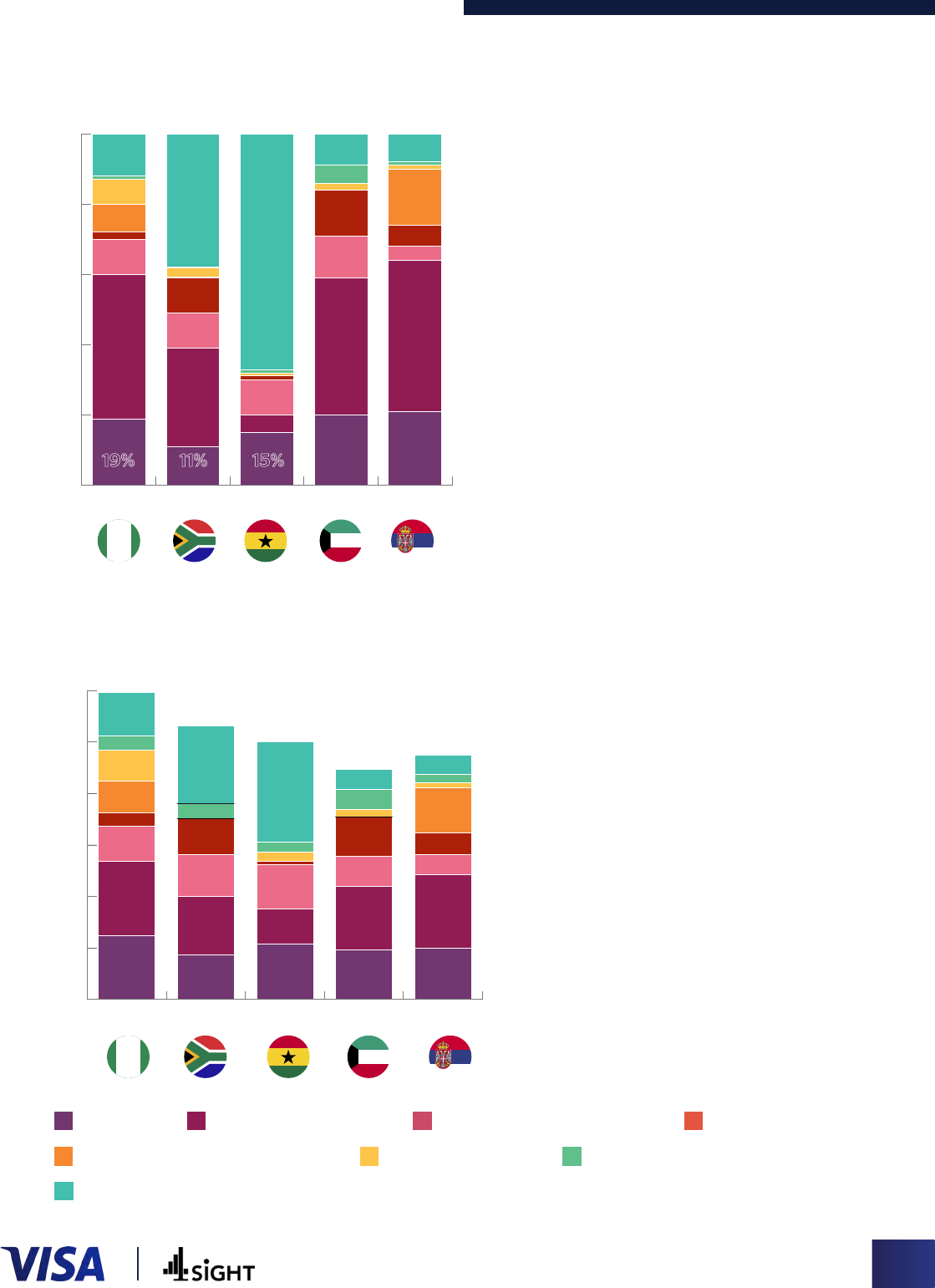

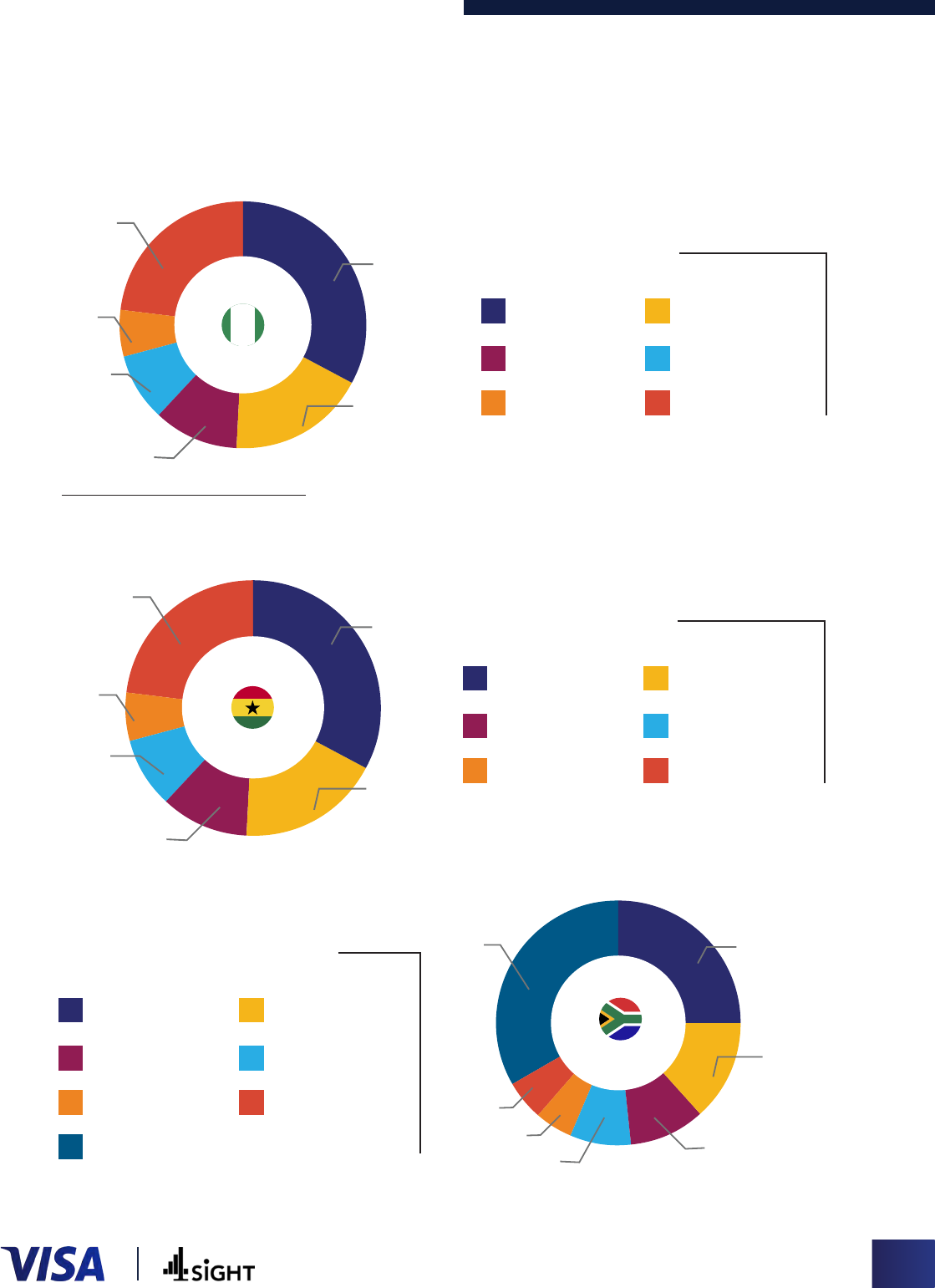

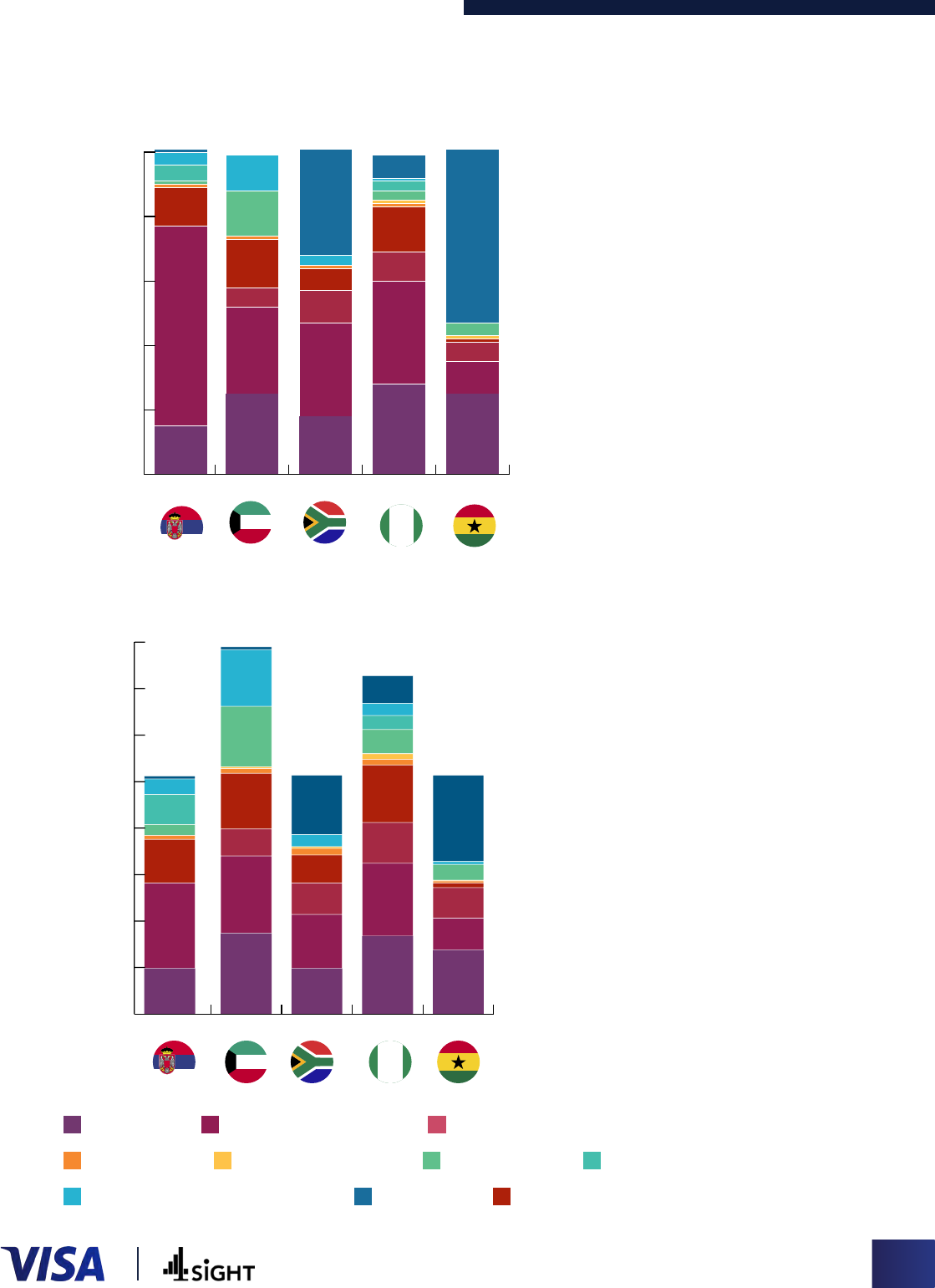

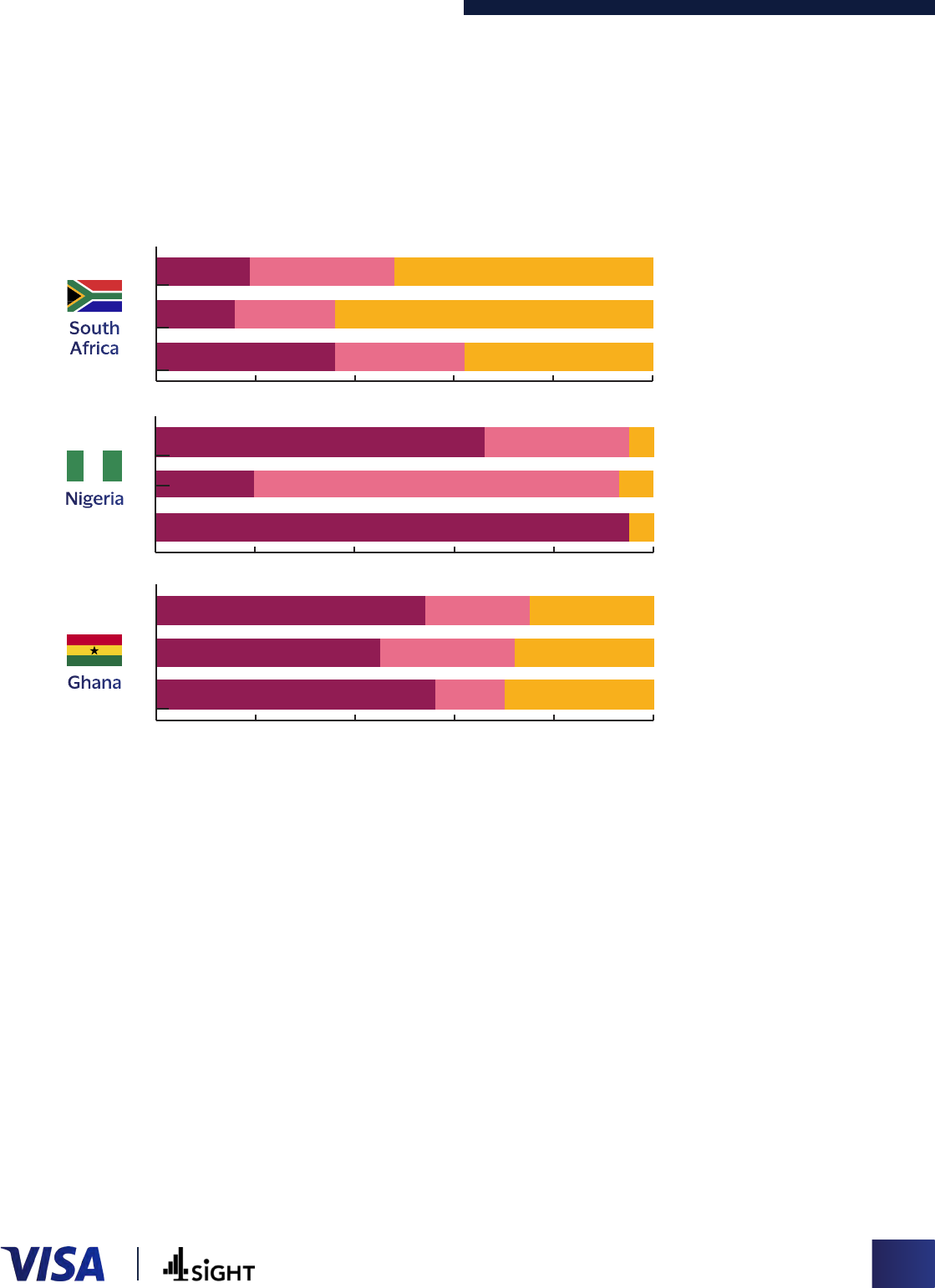

Figure 1: Domestic P2P Transfer Methods

by Volume of Transactions

Nigeria

41%

12% 19% 10% 8% 7%

Ghana

5%

67%

15% 10%

South Africa

28%

38% 11% 10% 10%

UAE

39%

9%

20% 12% 13% 5%

Serbia

43% 8% 21% 4% 6% 16%

0 20 40 60 80 100

Account to Account transfer

PayPal Transfers

Wallet transfer

Card to Card / Account to Card transfer

Cash transfer Account to Mobile number transfer

Cryptocurrency transfers Cheque Transfers

For more information, please see Annex on page 48

Optimizing faster payments – a regional payments landscape review

6

© 2022 Visa, Inc.

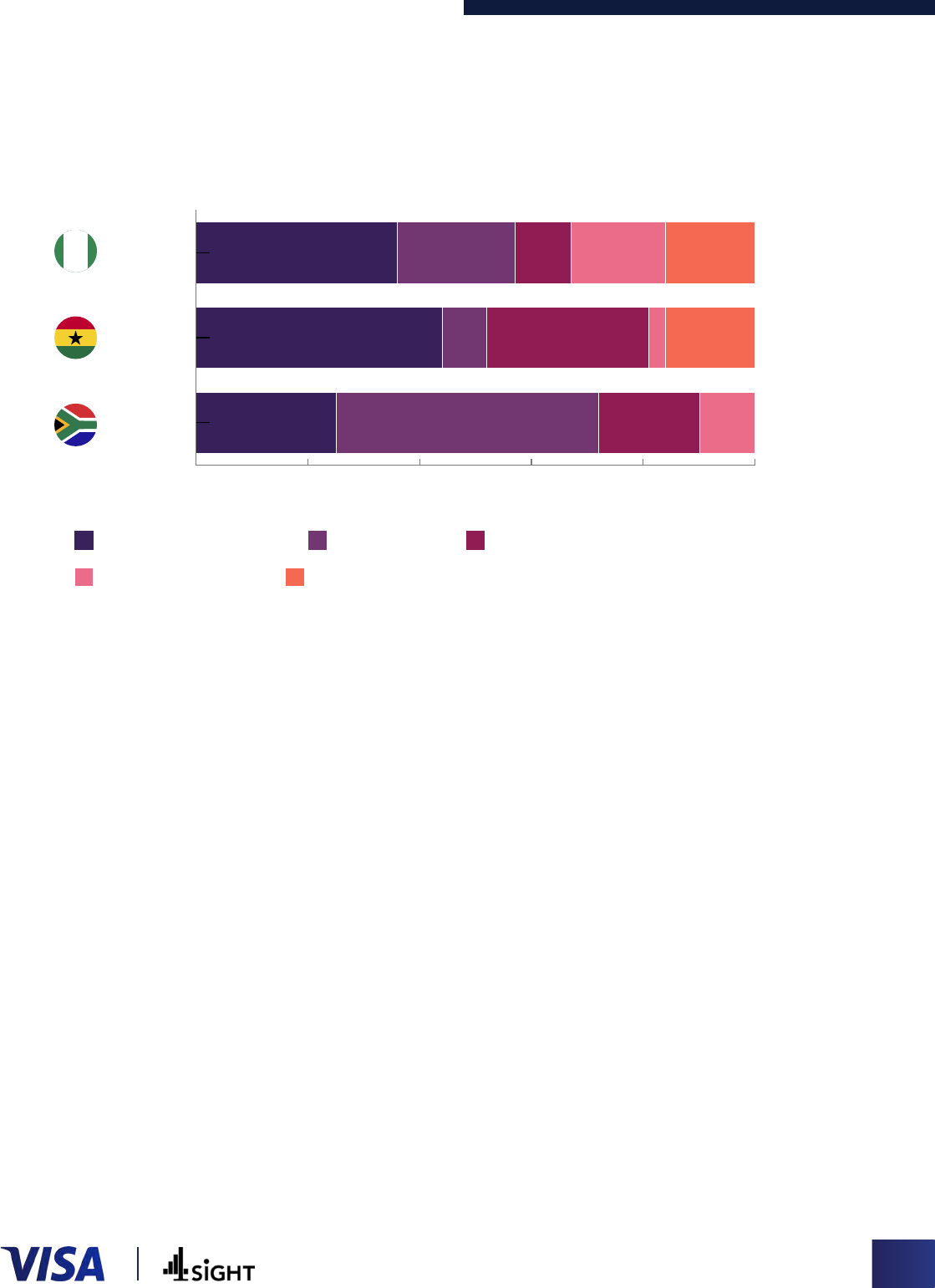

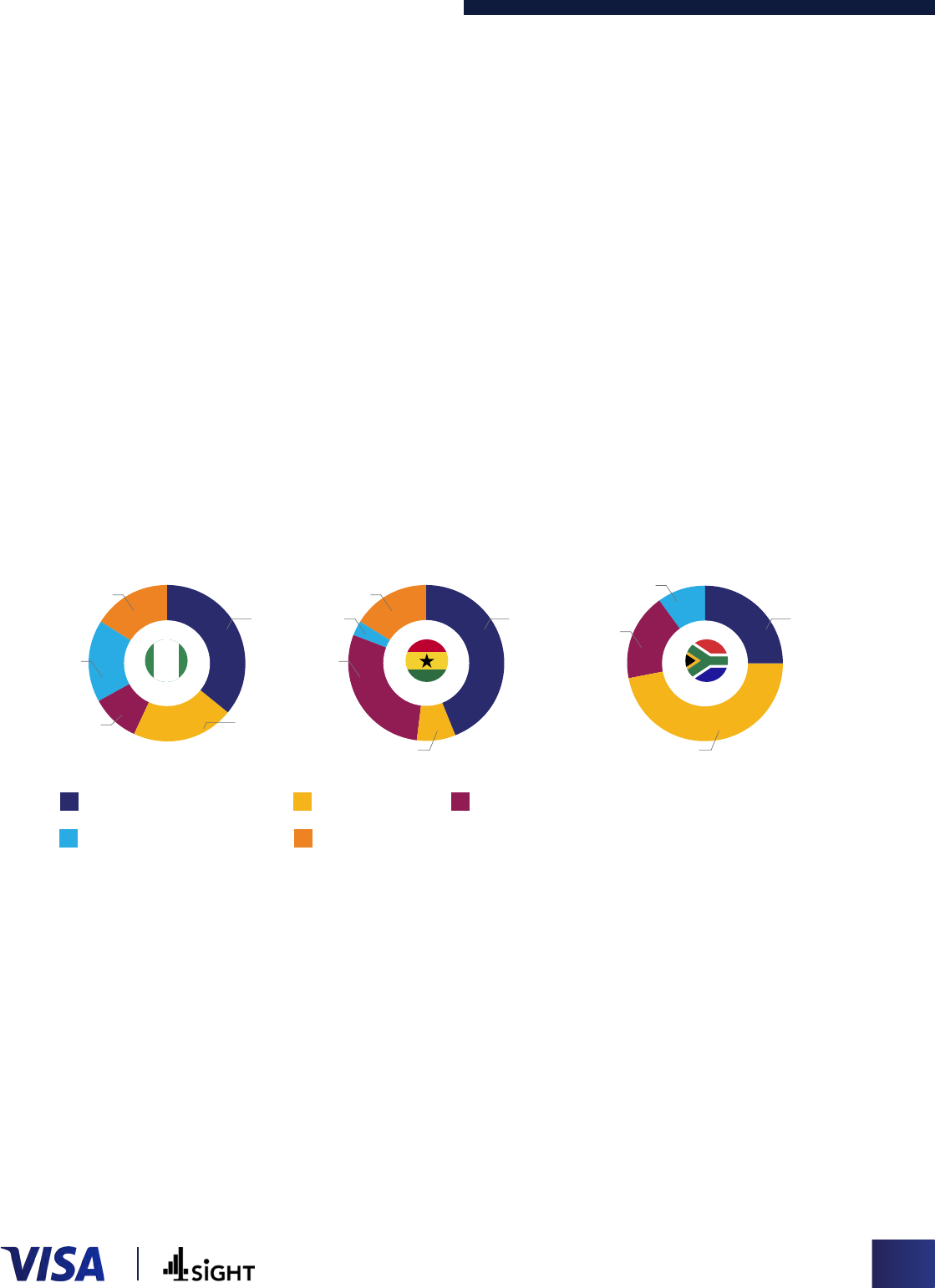

Nigeria

36% 21% 10%

17%

16%

Ghana

44% 8% 29% 16%

South Africa

25% 47% 18%

10%

0 20 40 60 80 100

Account to Account transfer

Cryptocurrency transfers

PayPal Transfers

Money Exchange Centres

Wallet Transfer

Figure 2: Intra-Africa Cross Border P2P

Transfer Methods

by Volume of Transactions

For more information, please see Annex on page 48

Merchant Fund Disbursement

• For merchants, their core focus for fund disbursement is on the security and

reliability of the recipient receiving the funds. While instant transfer is desirable,

proof of payment is absolutely critical as it provides reassurance of successful

transactions; 39% would choose a solution that gives better control over tracking

payments. Across most markets, difficulty managing cash flow in order to pay

suppliers was the biggest issue of delayed payments.

• Account-to-account transfers are the dominant payment method for domestic

funds disbursement, providing the necessary level of security and confidence in

the payment method, along with valid proof of payment. Interestingly, across all

markets, merchants perceive account-to-account transfers as slower compared to

consumers. This presents an important need gap for merchants, for a solution that

offers both security and reliability along with a faster speed of transfer.

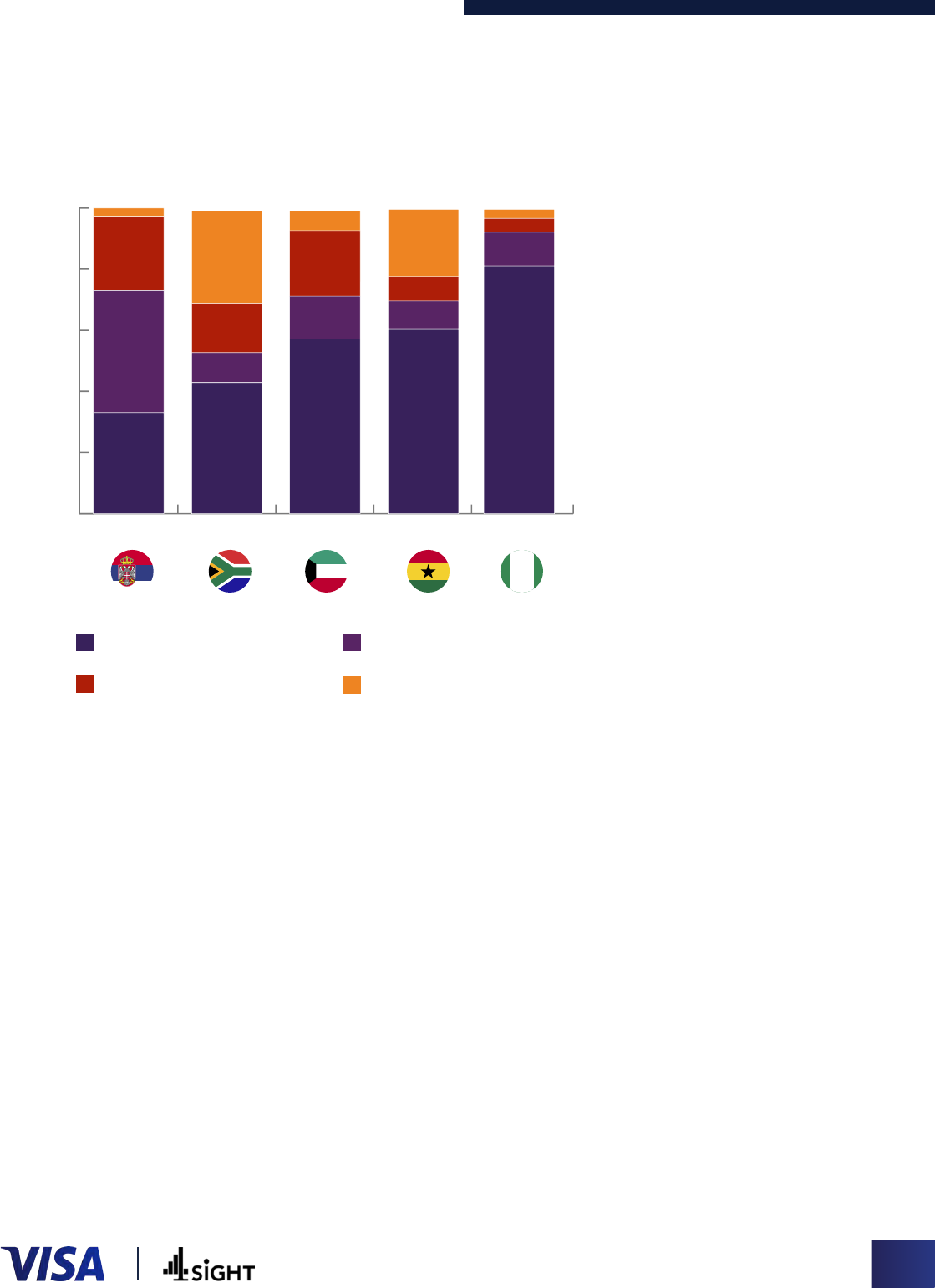

Nigeria

Ghana

South Africa

UAE

Serbia

Account to Account transfer Wallet Transfer Cash transfer Account to Mobile number transfer

PayPal Transfers Card to Card / Account to Card transfer Cryptocurrency transfers

Cheque Transfers Online payment (through card or netbanking) Card payment at POS

0 20 40 60 80 100

42% 26% 12% 6% 7%

35% 47% 10% 4%

40% 18% 22% 9% 9%

0 20 40 60 80 100

32% 7% 28% 9% 14%

10% 54% 25% 6% 4%

29% 33% 18% 10% 7%

27% 25% 6% 14% 11% 15%

62% 15% 5% 4% 11%

Nigeria

Ghana

South Africa

Account to Account

Money Exchange Centres

Wallet Transfer PayPal Transfers

Online payment (through card or netbanking)

Cryptocurrency transfers Card to Card / Account to Card transfer

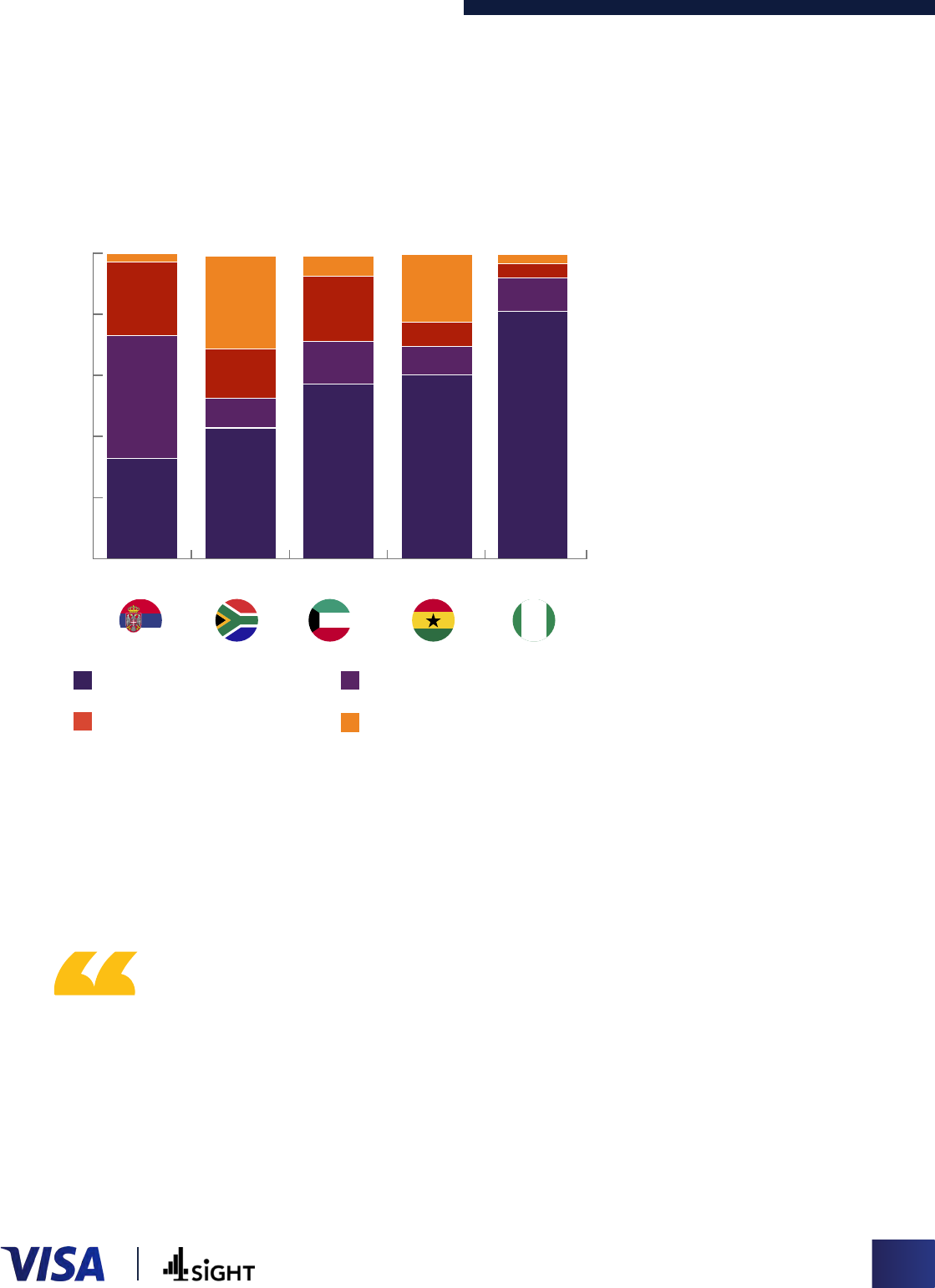

Figure 3: Domestic Merchant Fund Disbursement by Volume of Transactions

7

© 2022 Visa, Inc.

Optimizing faster payments – a regional payments landscape review

For more information, please see Annex on page 48

Figure 4:

Intra-Africa Cross Border Merchant Fund

Disbursement Methods

by Volume of Transactions

For more information, please see Annex on page 48

Optimizing faster payments – a regional payments landscape review

8

© 2022 Visa, Inc.

Instant (Less than 30 minutes) Half a day

1 Business day

More than 1 Business day

100

8%

23%

11%

80

24%

23%

36%

9%

16%

16%

12%

60

40%

9%

40

55%

52%

81%

33%

39%

20

0

Serbia South Africa UAE Ghana Nigeria

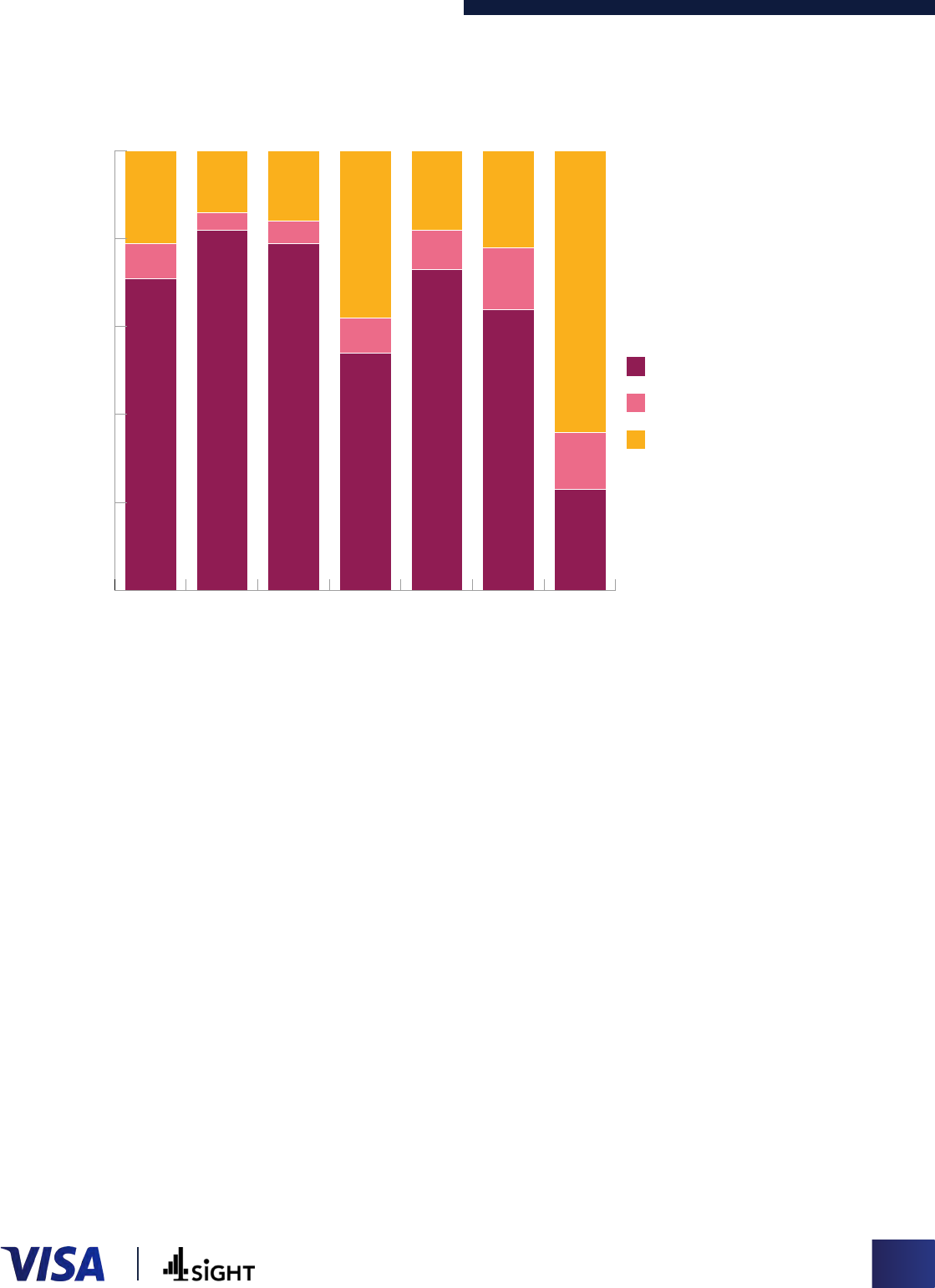

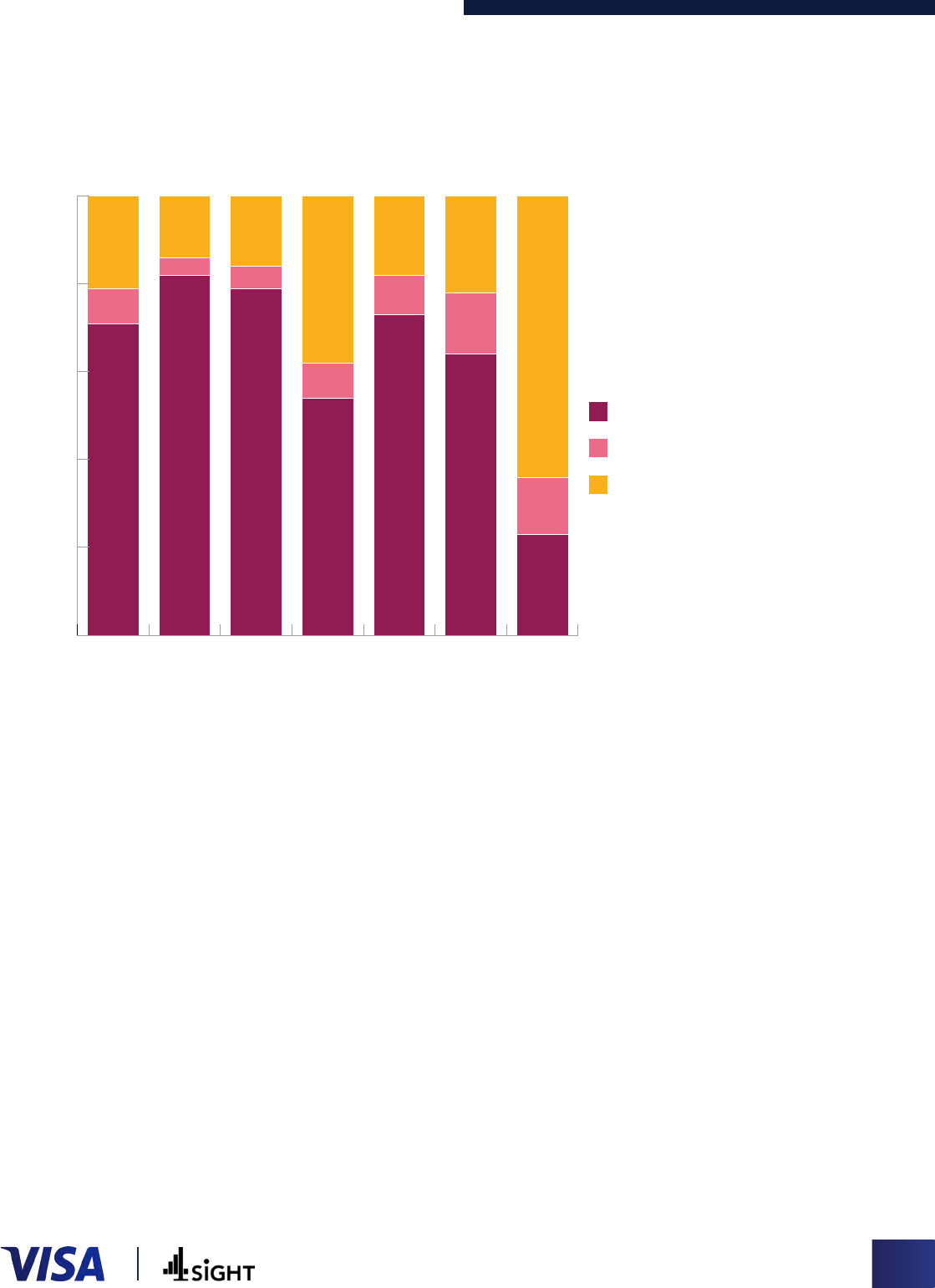

Figure 5: Time taken for Account-to-Account

Transfer (%)

by Volume of Transactions

For more information, please see Annex on page 49

• Intra-Africa cross-border transfers pose significant pain points with respect to the

time taken to receive funds, as well as high charges ranging anywhere between 3%

to 15% of the value of the transfer. Though options are available, satisfaction levels

are low. Registering an international beneficiary takes time (1-3 days in many cases),

and with respect to speed of transfer, the slower time to receive funds could mean

a big business opportunity loss not getting access to funds.

A delay of 2-3 days in receiving payments

causes anxiety and loss for business. But we

also need to be careful to use proper channels

for making large transfers.

Optimizing faster payments – a regional payments landscape review

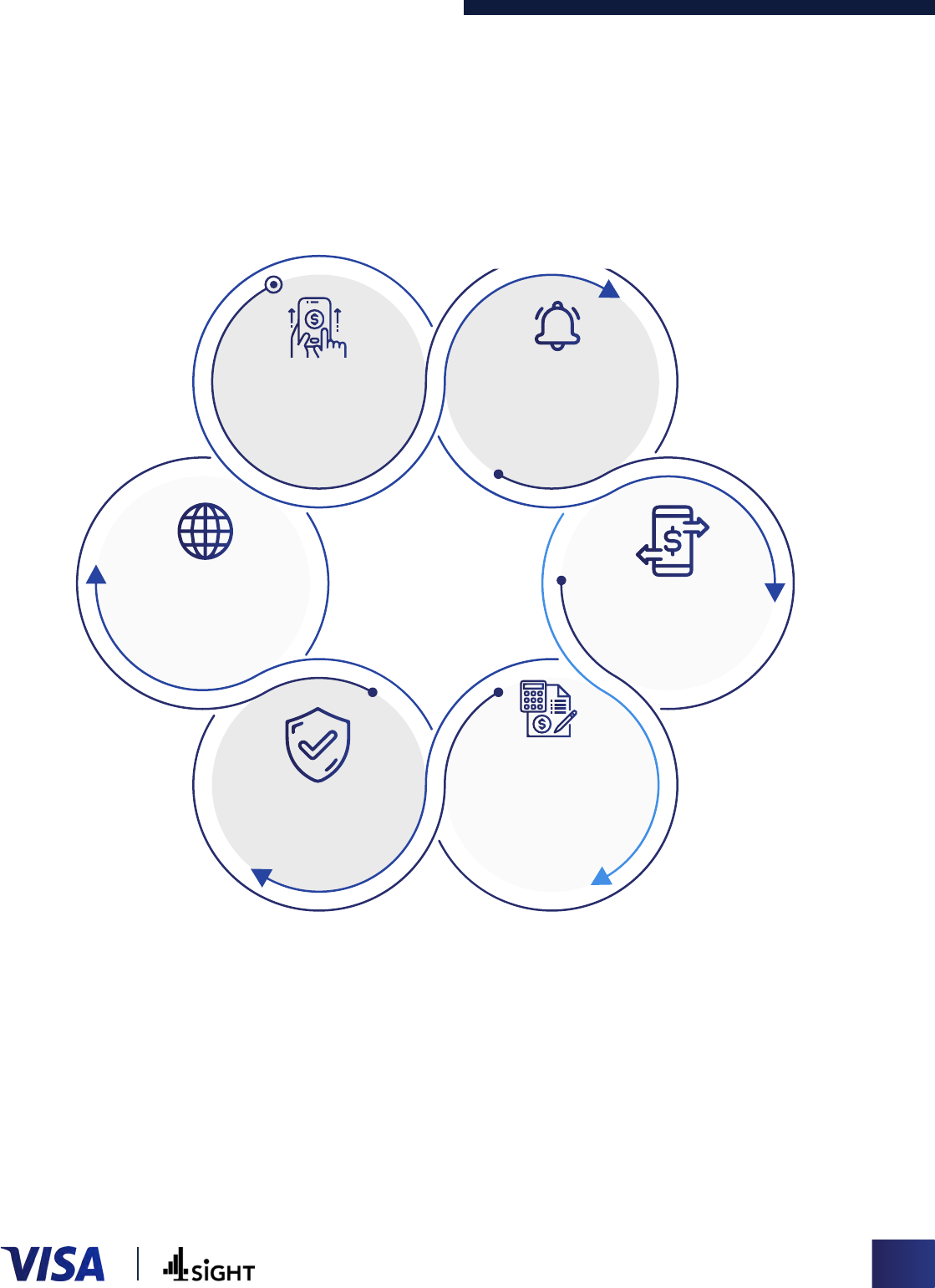

Our research with consumers and merchants revealed that none of the current

payment solutions are fully delivering to consumer and merchant needs, and that

there is room for a solution that delivers the following capabilities, which are absent

from most payout experiences:

Real-time and truly instant transfer with notifications:

End to end process completed within few seconds. The sender and

receiver are notified in real-time about the successful completion of

the transfer

Insights into account activity:

System to be able to track the movement of funds and generate

electronic records as valid proof of payment, and confirmation of

receipt

Faster and easier process for registration of beneficiary:

Registering a beneficiary can be done using just mobile number and

name, without a lengthy process of authentication required

Faster and easier refund process:

Refunds should be processed fast, almost instantly to within 24hrs

Faster and seamless international transactions:

Instant cross border transfers, or at least within 2-3hrs

Platforms independent of the internet:

For markets where internet is not reliable, a solution that can be

independent of internet connection is desired

© 2022 Visa, Inc.

9

Introduction

1

1

© 2022 Visa, Inc.

10

Optimizing faster payments – a regional payments landscape review

The payments landscape has changed dramatically over the last decade, with an

acceleration in behaviour change seen in the last two years due to the COVID-19

pandemic. The pandemic has driven digitization of almost all aspects of life, from

shopping and food delivery to education and working. This shift is reflected in the

total number of real-time transactions, which in 2020 was $70.3 bn, up 41 percent

compared to 2019. Additionally, the real-time share of global electronic transactions

in 2020 was 9.8 percent, up from 7.6 percent in 2019; it is predicted to be 17.4 percent

by 2025. Alongside this drive to real-time is mobile wallet adoption which rose to a

historic high of 46 percent in 2020, up from 40.6 percent in 2019 and 18.9 percent

in 2018. Total mobile wallet transactions amounted to $102.7 bn in 2020 and are

expected to reach $2,582.8 bn by 2025 .

Expectations have changed along with this shift to digitization, in particular the

expectation of the speed in which transfers should occur. With a proliferation of

faster payment options in the form of digital and mobile wallets, as well as the

improvement in payment processing of traditional account-to-account methods,

consumers and merchants alike now expect domestic payments to be within an

instant. This has implications to what the future of the payments industry looks like,

with speed no longer providing a differentiating factor, but more a basis on which

other benefits should be built.

For both consumer P2P payments and merchant fund disbursement, while many

transfer options are available for domestic payments, only a few are used frequently

and account for the major volume of payments within each market. These are often

ingrained payment methods that users are comfortable with and find convenient.

They provide speed and the perception of being a safe and secure method, however,

most have significant drawbacks. But while alternatives may provide an even better

speed, or perhaps are more accessible to larger sections of the unbanked population,

they fall down on critical aspects such as the perception of being ‘safe’. When it

comes to cross border solutions, there is a real lack of any solution that delivers to the

core need of speed, with most delivering on just security and convenience.

2

https://www.businesswire.com/news/home/20210329005045/en/Global-Real-Time-Payments-Transactions-

Surge-by-41-Percent-in-2020-as-COVID-19-Pandemic-Accelerates-Shift-to-Digital-Payments---New-ACI-Worldwide-

-Research-Reveals

© 2022 Visa, Inc.

11

2

Domestic Consumer P2P Payments

© 2022 Visa, Inc.

12

Optimizing faster payments – a regional payments landscape review

Digital as a way of life

Across all markets, dependence on and use of technology is omnipresent covering

almost every sphere of life. Everything is happening online, from grocery shopping,

food delivery, taxi services, online classes for students, money transfer, paying utility

bills… the list goes on. Along with this switch to digital is the increase in the usage of

smartphones for convenience. This widespread usage of apps for daily life, has had

the impact of increased confidence in doing payment transactions online.

Looking at specific markets, the UAE has one of the highest smartphone penetration

rates with high access to internet connectivity. Additionally, the Government is

driving a policy to make the U

AE a cashless society

, therefore there has been a move

in recent years to improve the digital payment ecosystem in the country.

Ghana and South Africa have high mobile penetration, and while internet access is

lower and strength of internet connection or mobile data is a concern, consumers

do not consider it a limitation and use their smartphone for almost everything from

online shopping, education, money transfer, to communicating with family.

Nigeria has fairly low mobile penetration, although this is growing at a rapid rate. And

like Ghana and South Africa, consumers are becoming more comfortable with living

life online and conducting daily transactions via the internet.

This shift is being reflected in the types of methods used for P2P payments across

markets. While frequency of using cash remains relatively high, the overall volume of

cash as a proportion of P2P payments is now much lower than other methods in each

market. This indicates that cash is only being used for smaller value transactions.

Ghana and South Africa have embraced new technologies with mobile and e-wallets

being the predominant method by volume, in particular in Ghana MTN MoMo,

a mobile money payment solution, accounts for two-thirds of the P2P payment

volume with close to 90% having used this method in the last 12 months. In other

markets of Nigeria, the UAE and Serbia, account-to-account transfers make up the

largest volume of P2P payment volume, although in terms of frequency of use it is at

a similar level to cash.

© 2022 Visa, Inc.

13

Before Covid-19, it was mandatory to go to

the bank or various offices to make payment,

but right now, making payments is easier with

just the tap of a button on your phone.

0

100

12%

9%

8%

7%

38%

16%

80

8%

13%

6%

10%

67%

12%

4%

60

10%

10%

40

39%

43%

41%

28%

10%

20

5%

19% 11% 15%

20%

21%

300

42%

250

76%

30%

18%

20%

200

31%

97%

44%

13%

34%

35% 38%

150

21%

20%

41%

29%

43%

100

72%

57% 34%

62%

71%

50

62% 43% 54% 48% 50%

0

Optimizing faster payments – a regional payments landscape review

Figure 6: Domestic P2P transfer methods

by Volume

For more information, please see Annex on page 49

Figure 7:

Domestic P2P transfer methods

used in the last 12 months

For more information, please see Annex on page 49

Nigeria South Africa Ghana UAE Serbia

PayPal Transfers

Cash transfer

Account to Account transfer

Account to Mobile number transfer

Cheque Transfers

Card to Card / Account to Card transfer

Cryptocurrency transfers

Wallet transfer

14

eria South A Nig frica Ghana

UAE

Serbia

© 2022 Visa, Inc.

Optimizing faster payments – a regional payments landscape review

For consumers, P2P payments are most commonly made to provide money as a

support to friends, family or colleagues (64%) or paying for services provided (61%).

Additionally, paying for house rent or household support services was done by half

(53%), while splitting a bill was cited by 39%.

Instant is an expectation, not a differentiator

A plethora of payment options are available for domestic P2P transfers that are

considered to be instant by consumers, including account-to-account, mobile

payments and digital wallets.

While many consumers still rely on cash transfer for smaller value transactions, as

seen above, its volume is now well below other methods across all markets.

We love to see instant! Money transfer is super fast these days

with the help of technology. Effort required is minimal and

everything is done in a few seconds.

Wallet payment, including digital wallets and mobile wallets, is growing in

prominence, especially in South Africa and Ghana where it accounts for the largest

volume of P2P domestic transfers. In the other markets of Nigeria, the UAE and

Serbia, account-to-account remains the predominant method.

Most consumers consider their P2P transfers to happen in an instant, with the most

popular payment method in each country supporting an almost immediate money

transfer. Wallet transfer remains the fastest method of domestic P2P payments,

with 82% of consumers claiming transactions using this method are processed

within 30 minutes. This has set the expectation of speed being a hygiene factor for

P2P domestic transfers, it is no longer a differentiator. However, compared to real-

time transfer, there is still scope for a future solution to further bridge the gap and

provide a faster transfer solution (i.e., within seconds).

© 2022 Visa, Inc.

15

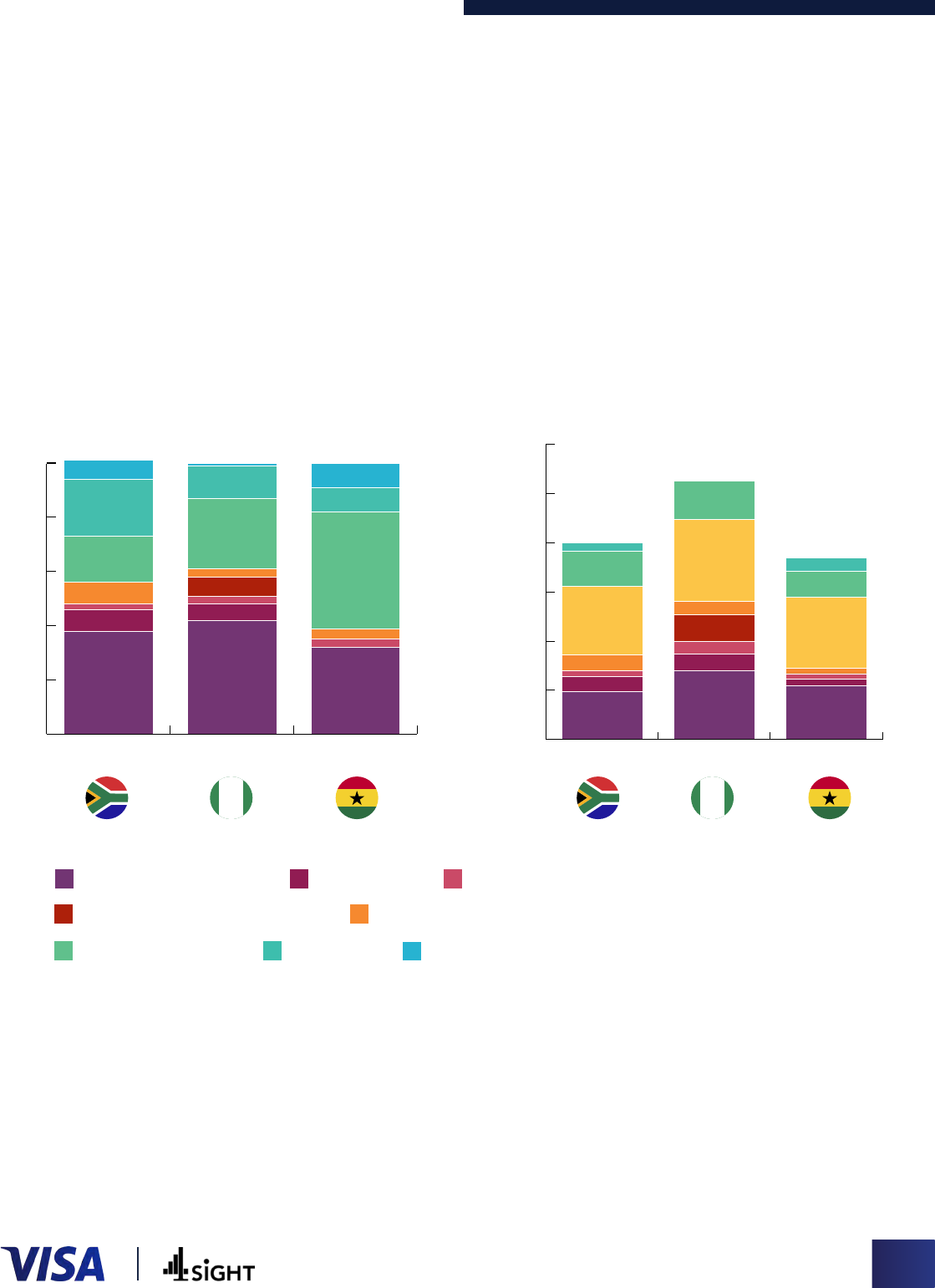

Figure 8: Time taken for different transfer methods

For more information, please see Annex on page 49

Benefits of P2P domestic payment methods

With speed of transfer being an expectation, other factors consumers are focused

on for P2P payments include the ease and convenience of conducting the transfer,

and how secure a method is. Ease and convenience relate to a number of different

aspects. Firstly, is the ability to do a transaction online or via a mobile phone, and

not having to visit a bank. Secondly, the method is quick to do; for example, adding a

beneficiary is a simple process that doesn’t need too many details, or sending money

can be done with just a few clicks of a button in an app. Thirdly, it means the method

is accessible to everyone, that your intended recipient has access to the funds.

Accessibility to all is a huge issue, particularly in the African markets we investigated.

The proportion of ‘unbanked’ consumers in Nigeria, Ghana and, to some extent,

South Africa means that new payment methods are required, other than account-

to-account transfers, to move consumers away from cash. The World Bank had a

goal under its United Financial Access program that by 2020, adults, who currently

aren’t part of the formal financial system, are able to have access to a transaction

account to store money, send and receive payments as the basic building block to

© 2022 Visa, Inc.

16

Optimizing faster payments – a regional payments landscape review

100

14%

16%

21% 18%

22%

4%

5%

38%

80

8%

9%

14%

64%

60

8%

Instant (Less than 30 minutes)

More than 30 mins less than a day

40

More than a day

13%

20

71% 82% 79% 54% 73% 64% 23%

0

Account to Wallet Account PayPal Card to Cryptocurrency Cheque

Account Transfer to Mobile Transfers Card / transfers transfer

transfer number Account

transfer to Card

transfer

Optimizing faster payments – a regional payments landscape review

manage their financial lives . While this is some way off, the growth of mobile and

e-wallets is beginning to fill that need gap when it comes to domestic P2P payments.

For a method to be considered secure, it has to be trusted that the method is reliable,

and the funds will reach the intended recipient, it has to be safe from fraud or hacking,

in case of reversals it has to be easy to get your money back, and you do not have to

disclose too many details to complete the transaction.

When it comes to the various payment methods currently in use, account-to-account

transfer, in general, is perceived as safe and secure since it involves the banking

infrastructure, there is trust that the funds will reach the recipient and it is secure

from fraud. Additionally, the proof of payment received is considered a valid form of

receipt, as well as the ability to easily keep track of payments. For markets such as

Serbia, government regulations with digital wallets have meant bank account-

to-account transfers are the safer option to ensure they are complying with latest

requirements.

On the other hand, mobile and digital wallet payments provide ease and accessibility.

Transactions can be done quickly and seamlessly through the phone and in markets

such as Ghana where penetration is very high, it is available to all.

Pain points of P2P domestic payment methods

All methods currently used have significant pain points associated, with no solution

delivering to all consumer needs. While there are common themes across markets,

each market also has its own unique issues with the payment methods available.

Issues faced while registering a

beneficiary

Challenges in refunds/reversals

Inconsistent internet hampers

online/app-based transactions

Restrictions on timing for

making transfers

Doesn’t generate a receipt /

valid proof of payment

International transfer can be a

tedious process

High transfer charges for local

and international transfer

3

https://www.worldbank.org/en/topic/financialinclusion/brief/achieving-universal-financial-access-by-2020

© 2022 Visa, Inc.

17

Optimizing faster payments – a regional payments landscape review

In South Africa, account-to-account transfer is the most commonly used method for

domestic P2P transfers and users have the option of traditional EFT which typically

takes 1-3 days to process, or instant RTC which is a real-time solution but comes at a

cost. Consumers choose this method for P2P payments due to the fast processing

(for a fee), the ability to track payments and save records, and the safety and security

provided by bank transactions. But they still face hurdles and pain points with this

method, most notably in relation to the speed versus cost, the process of adding

beneficiaries which can take several days, and the unreliability of internet causing

transactions to fail. Account to mobile and e-wallets are the growing opportunity

domestically, filling the need gap for instant, low/no cost transfers for smaller value

transactions. Currently these mobile payments and e-wallets are mostly dominated

by bank offerings. However, there are major pain points including a difficult reversals

process, difficulty in tracking payments, limits on funds transfer, and time limitations

on accessing the funds.

In Nigeria, account-to-account transfer is the dominant method which delivers fast

speed, is considered to be safe and secure, and allows for easy tracking of payments

made. However, with only 39.7% of consumers having a bank account accessibility is

a major issue with this method, as well as issues around the reliability of the internet.

Additionally, consumers trying to make an account-to-account transfer have to

provide a lot of information prior to the first transfer.

I am looking forward to seeing an application that is reliable, fast, secured

with minimal internet connection. The internet connection is really bad at

times and when transactions don’t go through.. it is really stressful.

In Ghana, MTN MoMo, a mobile money payment solution has complete dominance

over the P2P domestic transfer market because of its fast speed, ease of use,

accessibility to all and freedom from the internet (transfers can be made via USSD

rather than internet). However, lack of valid proof of payment and a long wait for

reversals or refunds are the major pain points for consumers.

In the UAE, account-to-account transfer is the dominant method due to fast

processing, the perception of safety with banking institutions, and the ability to track

and save records. However, frustrations include the 2pm cut off time for transfers

to be made in order to be processed the same-day, and the process of registering a

beneficiary which can take 1-2 days.

Finally, in Serbia, account-to-account is also the dominant method for P2P domestic

transfers, with approximately three-quarters believing these transactions to be

instant (<30mins). They are also seen as convenient, safe, secure, and importantly

it provides legitimacy to meet government requirements. In Serbia, the process of

registering a beneficiary is the biggest pain point for consumers.

© 2022 Visa, Inc.

18

3

3

© 2022 Visa, Inc.

19

Intra-Africa Cross Border Consumer

P2P Payments

The main markets which make up approximately 50% of the payment corridors for

each market were Ghana, South Africa and Benin for payments originating from

Nigeria; Nigeria and Togo for payments originating from Ghana; and Zimbabwe,

Botswana and Lesotho for payments originating from South Africa.

Optimizing faster payments – a regional payments landscape review

Figure 9:

From Nigeria

Ghana

25%

South Africa

16%

Benin

10%

Cameroon

7%

Kenya

6%

Others

37%

4

TBC

© 2022 Visa, Inc.

20

Figure 10:

From Ghana

Nigeria

33%

Togo

18%

Cote D’lvoire

11%

South Africa

9%

Burkina Faso

6%

Others

23%

Figure 11:

From South Africa

Zimbabwe

25%

Botswana

13%

Lesotho

10%

Nigeria

8%

Eswatini

5%

Mozambique

5%

Others

33%

Optimizing faster payments – a regional payments landscape review

Traditional methods dominate with limited new

solutions available

Account-to-account transfer accounts for a third of the cross-border money transfers

within the African markets investigated, mainly due to regulatory constraints in using

other payment modes. PayPal is a dominant method used in South Africa, as it is

considered safe, fast, and has lower transfer charges compared to other methods.

For account-to-account transfer, safety and security are the major drivers across the

three markets. Consumers have trust in bank facilitated transactions and they can

visit the bank in case of disputes. Additional driving factors are the ability to maintain

and generate records with the account-to-account transfer. With funds being

transferred within 24hrs to few days, consumers are comfortable opting for account-

to-account transfer for intra-Africa cross border.

Figure 12: Intra-Africa cross border P2P payment

methods by volume

For more information, please see Annex on page 50

36%

21%

10%

17%

16%

44%

8%

29%

16%

3%

25%

47%

18%

10%

Account-to-account

Paypal Transfers

Wallet Transfer

Money Exchange Centres

Cryptocurrency transfers

Although account-to-account Transfer accounts for the majority of intra-Africa

cross-border P2P transfers, it is not the perfect solution available. Instant transfer is

not as common for cross-border payments as is seen with domestic payments. Only

58% of consumers claim these transfers are completed within 30 minutes. Typically,

transactions can take up to days to be reflected in the receiver’s account, making it a

time-consuming process. Additionally, the complexity of the process is a significant

pain point. Adding beneficiaries is time-consuming (taking more than 2 days in some

cases) and may require consumers to visit the bank. Alongside the complexity,

account-to-account transfer incurs high transfer fees.

© 2022 Visa, Inc.

21

Optimizing faster payments – a regional payments landscape review

Figure 13: Time taken for different transfer methods

For more information, please see Annex on page

50

Another commonly used traditional method is money exchange centres. These are

seen as safe, secure and relatively convenient. The amount sent, is also the amount

received by the recipient with charges borne by the payer and no unexpected fees

being taken from the transferred fund. However, while the perception of the payer

may be that it is instant, for the receiver we know that actual use of the money may

not be possible for a day or more. Additionally, consumers may have to visit the

center to initiate the transfer, and it frequently incurs high transfer rates/commissions.

For PayPal transfers, consumers do not need to share banking details for the transfer,

making PayPal easy to use. PayPal also enables ease of transfer, with funds getting

transferred directly to the recipient’s PayPal wallet, making it fast and seamless. But

while PayPal has the benefit of being easy and convenient, safe, and with perceived

lower charges, it has several drawbacks. The major pain points being, standard

transfers take 1-3 days, or consumers have to pay a high cost for an ‘instant’ option,

and it doesn’t operate in all markets.

For intra-Africa cross-border P2P transfers, no single solution is delivering on being

consistently instant, easy and convenient, safe and secure, with reasonable transfer

charges.

© 2022 Visa, Inc.

22

100

14%

16%

21% 18%

22%

4%

5%

38%

80

8%

9%

14%

64%

60

8%

Instant (Less than 30 minutes)

More than 30 mins less than a day

40

More than a day

13%

20

71% 82% 79% 54% 73% 64% 23%

0

Account to Wallet Account PayPal Card to Cryptocurrency Cheque

Account Transfer to Mobile Transfers Card / transfers transfer

transfer number Account

transfer to Card

transfer

4

4

What Is The Future Of P2P Payments?

© 2022 Visa, Inc.

23

Optimizing faster payments – a regional payments landscape review

With account-to-account transfer not consistently fast and easy, and mobile and e-

wallets not providing the level of trust and security for many, there are opportunities for

next-generation transfer solutions to provide the best of both worlds. Additionally, the

lack of next-generation options currently available for intra-Africa cross-border P2P

payments indicates an opportunity for a solution to deliver both an enhanced domestic

transfer experience, as well as a new option for cross-border transfers. In particular a

solution is sought that would deliver the following benefits:

Real-time payment

processing is instant

The transfer would be

instantaneous, within

a window of 5-10

seconds

Real-time notification

Sy

stem to instantly

send real-time

updates to both the

banks/parties

Transfer charg

es

Minimal transfer

charges for local

and international

transfers

Insights into account

activity

System to be able

to track movement

of funds & generate

electronic records as

proof of payment

Layered fraud protection

Safe and secure

system that

cannot be hacked

Not dependent on internet

Not be dependent on

internet connectivity as the

connection might delay

the process {in African

markets}

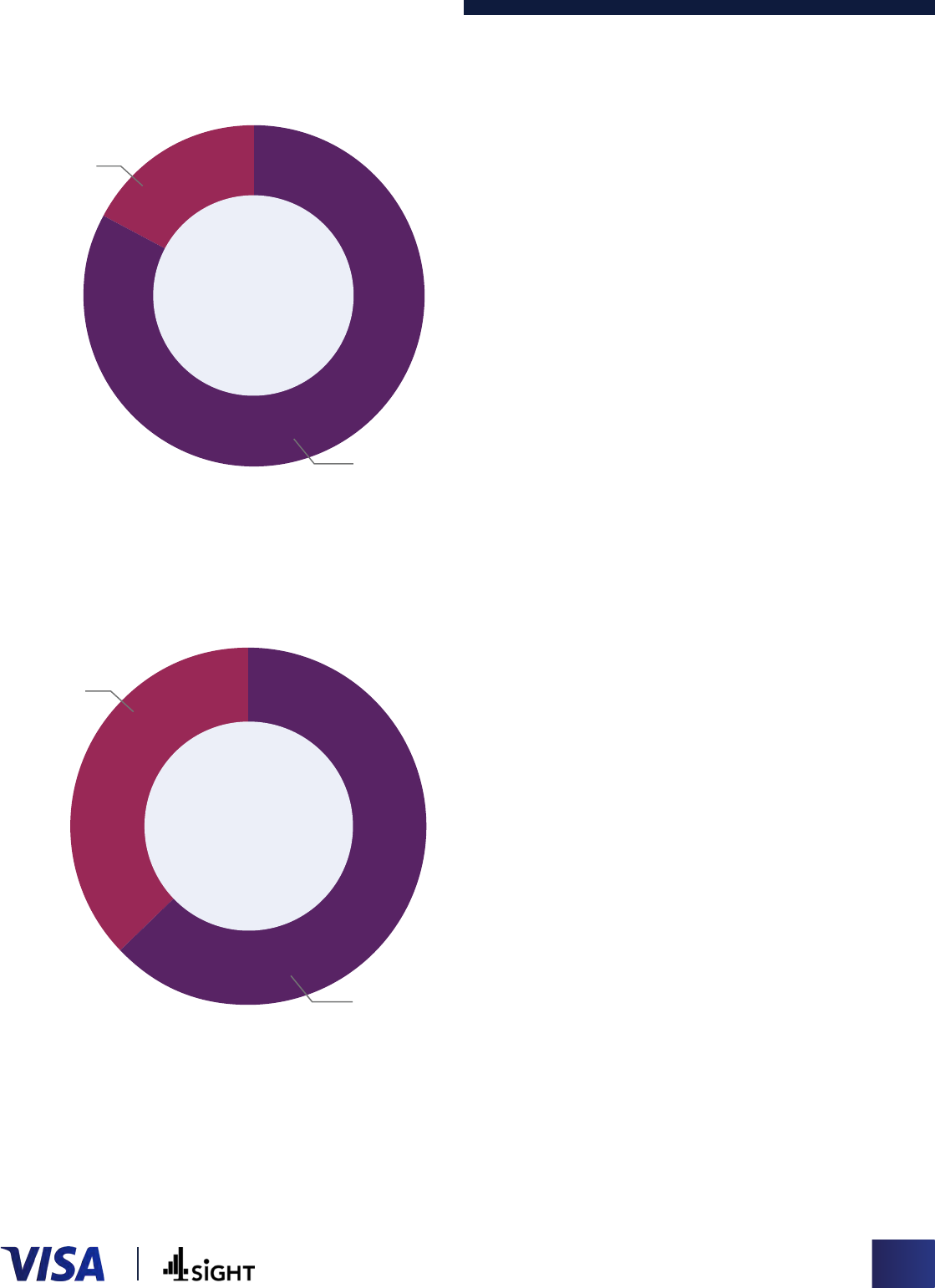

Interest in a new faster payments solution was relatively high across all markets, with

75% intending to use a solution that provided a fast, safe and secure transfer, which

allows for both domestic and cross border payments. Features that drove interest

were receiving notifications for both the payer and payee on completion of

transaction, capability of instant retrieval of payments in case of wrong transactions

and the solution being integrated with multiple banks and systems. This final feature

was seen to be beneficial due to a perception that if it is compatible with multiple banks

and systems, there would be no delay to payments, as well as indicating a level of

reliability and security of the solution.

© 2022 Visa, Inc.

24

Optimizing faster payments – a regional payments landscape review

Figure 14: Intended usage of a real-time payment

solution

For more information, please see Annex on page 50

Given the issues experienced with cross border payments such as slow speed, high transfer

charges and the hassle of either visiting the bank or money exchange centers, there is a

strong intent to switch for a faster payments solution that can deliver speed and security,

through an easy to use digital or mobile tool that would reshape P2P cross-border transfers.

© 2022 Visa, Inc.

25

Optimizing faster payments – a regional payments landscape review

26

© 20 22 Visa, Inc.

5

5

Domestic Merchant Fund Disbursement

© 2022 Visa, Inc.

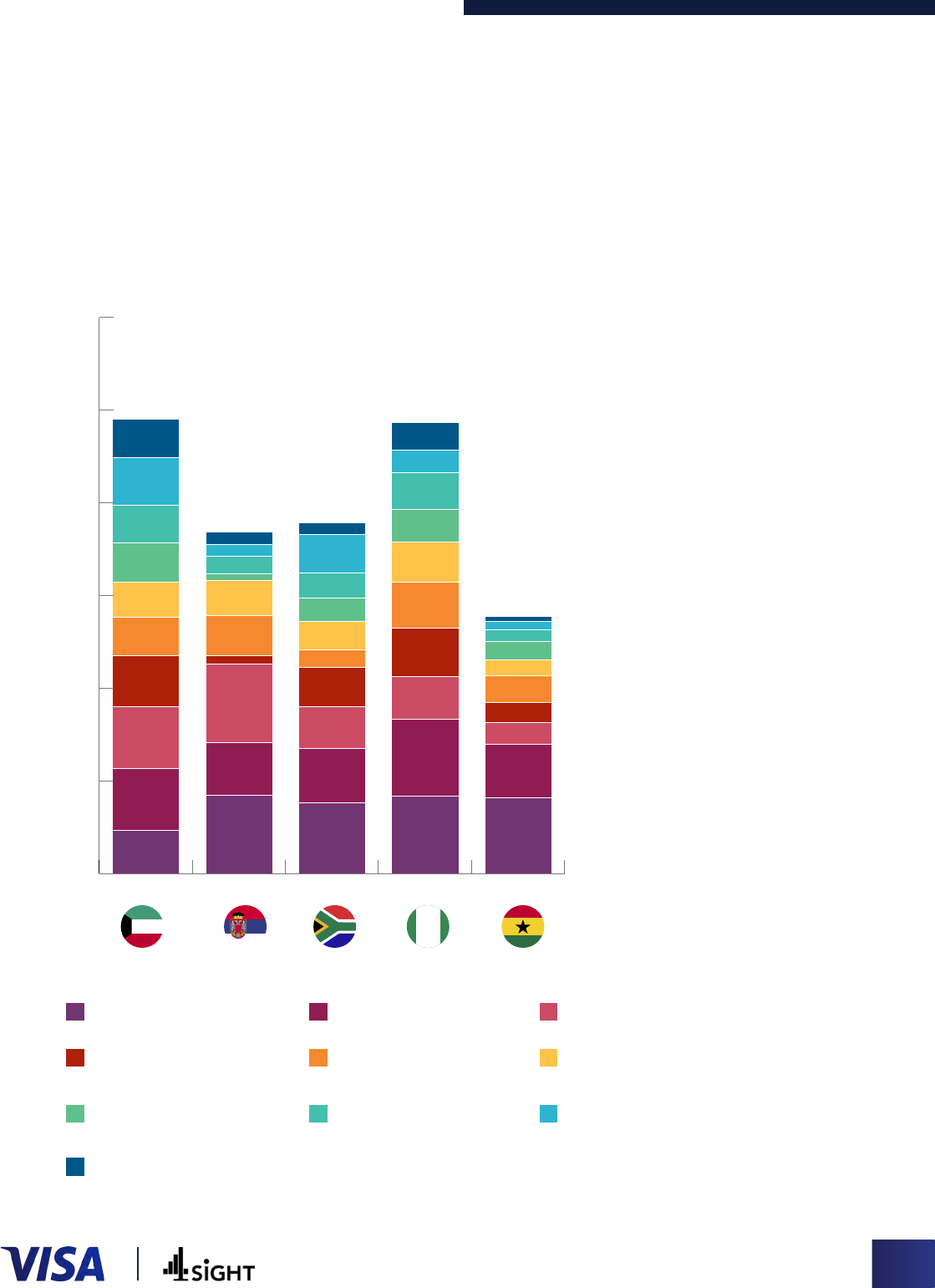

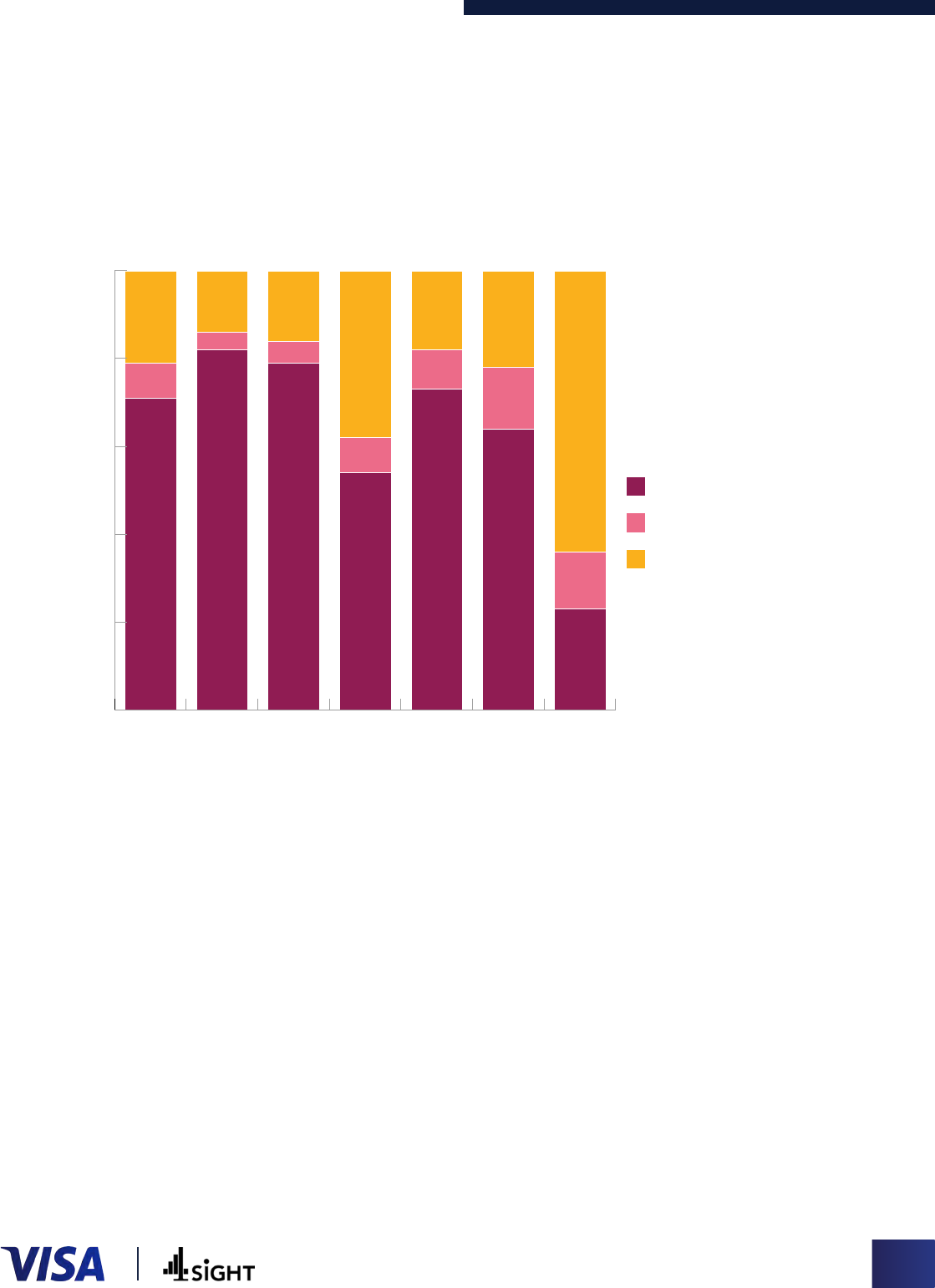

600

500

42

30

26

51

27

400

41

35

42

41

42

26

300

38 38

30

50

42 44

43

52

20

200

55

45

29

84

46

23

66

58

83

57 57

100

58

67

85

77

84

47

82

0

UAE Serbia South Africa Nigeria Ghana

Business expense reimbursement

to staff/employees

Courier companies

Rent

/sublet/vacation rental income

Optimizing faster payments – a regional payments landscape review

Payment made for products /

Product delivery charges

services received

Salary advance / Personal

loan

Settlement o

f card

payment transactions for a

small business

Freelance/GIG work/

independent contractor

Online/digital content payment to

individuals/freelancers

Commuting charges (Taxi

drivers, public transport

etc.)

© 2022 Visa, Inc.

27

Merchant fund disbursement transactions revolve around core business functions,

such as payment made for products/services, product delivery charges, and business

expense reimbursement to staff. Typically

, payments are being made several times a

week across all markets.

Figure 15: Reasons for making fund disbursements

For more information, please see Annex on page 50

Optimizing faster payments – a regional payments landscape review

Figure 16: Frequency of making fund disbursements

For more information, please see Annex on page 50

0

20

40

60

80

100

Serbia UAE South Africa Nigeria Ghana

Daily

1+ times a week

1+ times a month

24

33

42

39

65

24

27

15

40

32

27

50

19

46

The importance of reliability in payment method

Contrary to consumer P2P payments, merchants are less focused on the importance

of instant transfer. Instead, ease of transferring, convenience, and safe to use are the

key drivers for domestic fund disbursement.

When it comes to the preferred method for fund disbursement, merchants across

most markets rely on account-to-account transfers and cash as modes of transferring

money. Although as seen with consumer P2P payments, Ghana is dominated by MTN

MoMo as the predominant payment method for fund disbursements. In Nigeria and

UAE, cash is heavily used for small value domestic transfers as a convenient way to

pay suppliers and those who don’t have a bank account.

© 2022 Visa, Inc.

28

400

61

350

300

65 26

250

17

60 62

12

64

93

200

29

44

47

150

30 17

83

34

78

33

100

92 58

34

50

49 87

49 84 69

Optimizing faster payments – a regional payments landscape review

Figure 17: Domestic merchant fund disbursement methods

b

y Volume

For more information, please see Annex on page 51

Figure 1

8: Domestic merchant fund disbursement methods

used in the last 12 months

For more information, please see Annex on page 51

© 2022 Visa, Inc.

29

100

11

33

12

14

80

14

54

60

7

62

32

40

27

29

10

20

25

25

15

18

28

0

Serbia UAEAE

South Africa Nigeria

Ghana

0

Serbia

UAE South Africa Nigeria

Ghana

Cash Payment Account to Account transfer Account to Mobile number transfer

PayPal Transfers Cryptocurrency transfers Cheque Transfers Card to Card / Account to Card transfer

Card (credit/debit card) or Netbanking Wallet Transfer* Card payment (credit/debit card)

Optimizing faster payments – a regional payments landscape review

For account-to-account transfer, safety and convenience are the major driving factors.

The involvement of the bank makes the proof of transfer legitimate and secure. This is an

important factor for merchants who need that confidence that funds will be received by

the intended recipient, and if not, the process for tracking down the transaction is easier.

In the case of wallet transfers for merchant fund disbursement, freedom from the internet

(for African markets) and convenience are the major driving factors. It is considered

easy and quick to set up and doesn’t require much detail to make smaller payments to

merchants.

For card payment at POS, quick transfer and efficiency are the two major driving factors.

Another advantage of card payments is that money gets transferred directly into the

account and both parties have access to physical receipts confirming the transfer.

Key challenges of domestic merchant fund disbursement

methods

For fund disbursement, there is no one clear winner in terms of delivering to needs of

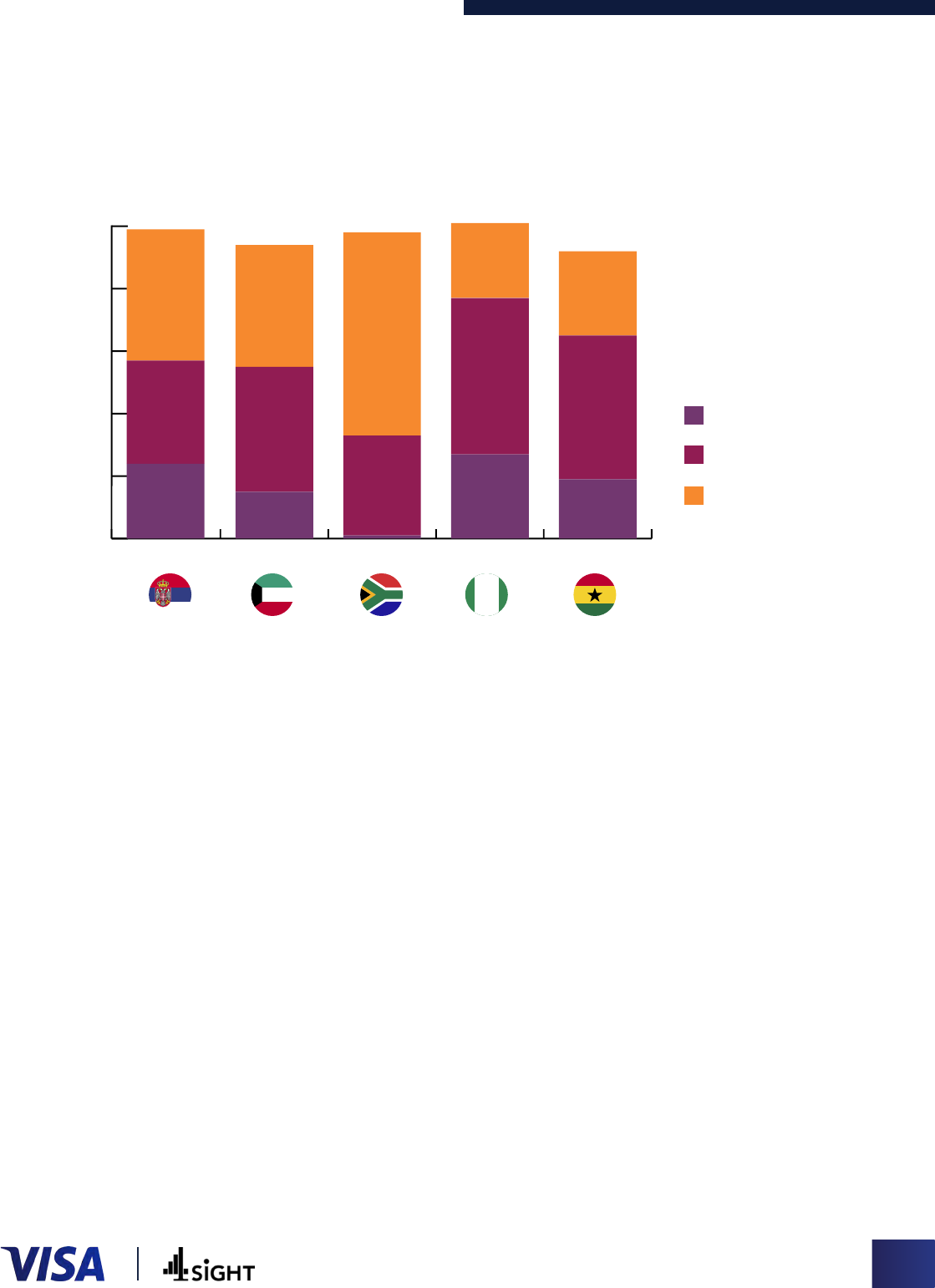

merchants. While account-to-account transfer is perceived to be safest, it is relatively

slow and can take time to be reflected in the beneficiaries’ account. Although merchants

focus less on the importance of ‘instant’ transfer, account-to-account (the predominant

disbursement method in most markets) it is interesting that they consider it to be much

slower than consumers do for P2P money transfers. Indicating there is a need gap for a

faster transfer option being available. Account-to-account is seen to be particularly slow

in Serbia, and South Africa where only 33%and 39%respectively state the transfer is

instant (received within 30 minutes). South Africa has a particular issue with over a third

(36%) saying it takes longer than 1 business day. While we know that safety and reliability

are the key drivers for merchants, this does indicate an opportunity for a faster payment

solution that is also safe and reliable.

Additionally, for account-to-account transfers in UAE, the cut-off time for making a

transfer is 2pm to ensure that the transaction goes through same-day. This has obvious

implications for merchants paying staff salaries, expenses, or other staff payments

where delays impact employees. In, account-to-account transfer can be arduous with

merchants being required to provide extensive details of the transaction including the

purpose of payment, as well as documents or contracts.

In South Africa and Nigeria, many beneficiaries don’t have a bank account, making

account-to-account transfer irrelevant, and driving the need for cash payments still.

In the case of mobile and e-wallet transfer for domestic fund disbursements, it is

considered fairly difficult to track as USSD codes don’t generate a receipt of transfer

and users don’t get a bank alert. Additionally, there is usually a transfer limit that can

be a restriction for merchants who have need to make payments of higher amounts.

In markets such as Serbia, the government hasplacedcertainrestriction ortax

implications on wallet transfers, again making these less desirable to merchants as a

legitimate form of payment. Finally, the difficult reversal process which can take days, or

even weeks, to get a refund in case of failed transfers means that these methods don’t

meet the needs of merchants.

© 2022 Visa, Inc.

30

Optimizing faster payments – a regional payments landscape review

Figure 19: Time taken for Account-to-Account transfer (%)

For more information, please see Annex on page 51

0

20

40

60

80

100

8%

23%

36%

11%

24%

23%

9%

16%

16%

12%

40%

9%

81%

33%

52%

55%

39%

Serbia South Africa UAE Ghana Nigeria

Instant (Less than 30 minutes) Half a day

1 Business day

More than 1 Business day

© 2022 Visa, Inc.

31

6

6

Intra-Africa Cross Border Merchant

Fund Disbursement

© 2022 Visa, Inc.

32

300

100

7

12

21

250

39

80

26

200

17 43

60

36 83

14

26

150

40

100

70

27

72

20

38 42 32

50

49 70 55

0

0

South Africa Nigeria Ghana

South Africa Nigeria Ghana

Account to Account transfer

Card to Card / Account to Card transfer

PayPal Transfers Cryptocurrency transfers

Card (credit/debit card) or Netbanking

Money Exchange Centres Wallet Transfer

Others

9

9

Optimizing faster payments – a regional payments landscape review

Intra-Africa cross-border payments are generally made for payments for product

delivery, courier companies, freelancing services received, or to the employees

working from offshore. Reliance is high on the traditional modes of payments for

cross-border transfers, with account-to-account transfer and money exchange

centres most commonly used to transfer money intra-Africa. In the status-quo,

every mode of payment available in the region either has a long waiting period for

the transfer or charges high transfer fees or charges.

by Volume

used in the las

t 12 months

In Nigeria, Ghana, and South Africa, account-to-account transfer remains the

dominant method followed by money exchange centres. In South Africa, Card to

Card/ Account to Card transfer is the second most used method. Time taken for

account-to-account and money exchange center intra-Africa funds disbursement is a

major issue for merchants in South Africa.

© 2022 Visa, Inc.

33

Figure 21: Methods of Intra-Africa

fund disbursement

Figure 20: Methods of Intra-Africa

fund disbursement

For more information, please see Annex on page 51

For more information, please see Annex on page 52

Figure 22: Time taken for transfer

methods – domestic payments

For more information, please see Annex on page 52

Optimizing faster payments – a regional payments landscape review

© 2022 Visa, Inc.

34

100

14%

16%

21% 18%

22%

4%

5%

38%

80

8%

9%

14%

64%

60

8%

Instant (Less than 30 minutes)

More than 30 mins less than a day

40

More than a day

13%

20

71% 82% 79% 54% 73% 64% 23%

0

Account to Wallet Account PayPal Card to Cryptocurrency Cheque

Account Transfer to Mobile Transfers Card / transfers transfer

transfer number Account

transfer to Card

transfer

Optimizing faster payments – a regional payments landscape review

Figure 23: Time Taken for Transfer Methods by

Market – Intra-Africa Cross Border Payments

For more information, please see Annex on page 51

Account-to-account

transfer

Wallet Transfer

Account-to-account

transfer

Money Exchange

Centres

Wallet Transfer

Account-to-account

transfer

Money Exchange

Centres

Wallet Transfer

South

Africa

19 29 52

16 20 64

36 26 38

0 20 40 60 80 100

66 29 5

20 73 8

95 5

0 20 40 60 80 100

54 21 25

45 27 28

56 14 30

0 20 40 60 80 100

Money Exchange

Centres

Nigeria

Ghana

Only 52% of merchants claim that transfers made using account-to-account transfers

are completed within 30 minutes. In South Africa, 52% of the transfers take more than

a day to be completed. Compared to Nigeria, the transfer rates increase to 66% being

completed within 30 minutes and 54% of transfers are completed within 30 minutes

in Ghana.

When it comes to these cross-border payments, security of the method is most

important for funds disbursement. For this, account-to-account transfer is seen as

the most safe, secure method of payment since it is facilitated by banks. It is also

convenient and seamless and generates valid proof of payment. Money exchange

centers are convenient as payments can be made to those who don’t have a bank

account. While the charges and fees do tend to be high, it is a trusted method that

merchants are comfortable with.

© 2022 Visa, Inc.

35

Optimizing faster payments – a regional payments landscape review

Key challenges of intra-Africa cross border merchant

fund disbursement methods

Many of the pain points for merchants, mirror those experienced by consumers

for P2P payments. Account-to-account is used for its safety, reliability and relative

speed. However, it incurs high charges as well as encounters currency shocks. Speed

is a major issue with most transfers taking 24 hours or more. This can lead to loss of

money due to currency conversions; often resulting in doing second transactions

which increases the cost. At the most extreme case, in South Africa, it can take 8-9

working days for the payment to be reflected in the recipients’ account.

In the case of money exchange centers, there is a high transfer fee which can go up to

15% of the transfer value. It is also inconvenient in the case of receiving a transfer from

money exchange centers. While it might appear quick for the sender, the recipients

on the other hand need to abide by the time limit which is within 24 hours to collect

money. This makes money exchange centers a slow process.

© 2022 Visa, Inc.

36

7

7

What is the future for merchant fund

disbursements?

© 2022 Visa, Inc.

37

Merchants are looking for a solution that marries both reliability and security, with a

real-time instant transfer. It is imperative that they feel confident that the payments

made would go through successfully, and that they receive instant notifications for

that peace of mind. Having a solution which allows them to easily track payments and

maintain records of payments made would build the sense of trust and reliability with

a method.

Additionally, there is no next generation solution that is a viable option for merchants

for intra-Africa cross-border payments. Therefore, opportunity exists for a solution

that can deliver both domestic and international instant (or near instant for

international) payments, via a secure and trusted network.

Interest in this type of real-time payment solution is fairly high, with 73% liking the

idea, and 70% would request a payor to use it to transfer funds to them. Merchants

see this type of global faster payments solution as much-needed faster, more

convenient system of payments, with flexibility to transfer between accounts both

domestically and internationally. For merchants, this is extremely important as it

means they would have funds available for use quicker (54%), it would make it easier

to track/manage receipts (51%), it would help in managing cash flow effectively (48%),

and it would enable them to better manage their business finances (46%).

Optimizing faster payments – a regional payments landscape review

54%

I would have funds available for my use quicker

51%

Would make it easier to track/manage receipts

48%

Help in managing cash flow effectively

46%

Enable me to better manage my business finances

46%

I can in turn transfer my vendor payments in real time

© 2022 Visa, Inc.

38

Optimizing faster payments – a regional payments landscape review

Across the markets, certain specific benefits were of interest when it comes to

the need for a global faster payments solution.

In Nigeria, opportunity exists for a solution to convert the small value cash

transactions made on a daily basis. Key benefits of the solution need to be an

instant 24/7 transfer solution, easy to use UX to make a payment and add a

beneficiary, and available for all recipients whether they own a bank account

or not. Additionally, a solution which is not 100% reliant on the inconsistent

internet would be a major bonus, such as mobile money wallets MTN MoMo or

Safaricom M-Pesa. Instant cross-border transfers at competitive rates, again

which can be available for all recipients whether they own a bank account or

not, would seek to convert the money exchange house users, as well as those

using account-to-account for cross border.

In Ghana, current cross border options are limited, slow, and you need to

either visit in person or not everyone has a bank account. Whilst MTN MoMo is

delivering on being instant, convenient and used by everyone, it has a difficult

reversals process and it cannot be used for cross border. This is where a next

generation solution can play to help businesses with faster payments which

replicates the ease of domestic payments, whilst solving existing pain points,

as well as providing a legitimate option for cross-border transfers.

In South Africa, account-to-account is the predominant method for domestic

payments, and while it provides security, convenience and ease of keeping

track of payments, it has the drawback of being slow or having to pay higher

charges for instant EFT. Account to mobile is growing domestically, filling the

need gap for instant, low/no cost transfers for smaller value transactions.

However, for merchants the major pain point is a concern about legitimacy/

security. Additional barriers include the difficult reversals process, difficult

to track payments, limit on funds transfer, and not available for cross-border

transfers. Whilst money exchange houses dominate the cross-border market,

they also have major pain points such as taking a while for the recipient to

receive the funds as well as higher charges for transfer. Opportunity exists for a

payment solution based on providing domestic transfers that are instant, safe

and secure with competitive rates, and also provides a convenient alternative

for cross-border payments.

In the UAE, a solution with instant 24/7 transfer capability for specific use cases

such as salary expenses and advance payments to staff, would fill a need gap

currently experienced by merchants. Additionally, with merchant use case

for digital wallets not yet being promoted, most merchants in UAE still using

cash and cheques for making payments, this presents an opportunity to

manage these payments through a new solution.opportunity to manage these

payments through a new solution.

In Serbia, despite speed being a pain point for account-to-account transfers,

this payment method dominates the merchant fund disbursement payments

landscape. With ease, convenience and the security and legitimacy provided

by bank account-to-account transfers, digital wallet solutions are yet to make

significant inroads into these markets. In Serbia, card-to-card is a growing

solution, given confidence and legitimacy by perception of global card network

providers. Those who have used the card-to-card solution are highly satisfied

with the experience (97%) and therefore interest in switching to this type of

solution is also high.

© 2022 Visa, Inc.

39

Optimizing faster payments – a regional payments landscape review

Figure 24

83%

17%

Satisfaction with card-to-card

(by those who have used in last 12

months):

63%

Extremely satisfied 83%

37%

Interest in card-to-card solution:

Likely to use 63%

© 2022 Visa, Inc.

40

8

8

Conclusion

41

© 2022 Visa, Inc.

Optimizing faster payments – a regional payments landscape review

42

© 2022 Visa, Inc.

While there are many options available in market for both consumer P2P payments and

merchant fund disbursements, there is no one method that meets needs for all domestic

and international payments. Account-to-account might be safe and reliable; however, it

incurs heavy charges and delays for international transfers. Mobile and e-wallets might be

quick and easy to use and available to all, but fail to keep a record or provide valid proof of

payment, or easy reversals process.

This gap between expectations and current benefits being delivered, provides an

opportunity for a next-generation transfer method to deliver on the pain points that are

seen across the various payment modes. No current payment solution is able to address all

issues faced. Some of the common issues faced in the status quo are:

• Real-time transfer: While many options are considered to be fast, this may come at a

high cost in some markets. True real-time instant transfers (completed within seconds)

are yet to be consistently delivered across all markets at a low cost. For example, while

instant RTC is available in South Africa, this comes at a cost (which can range anywhere

from R10 to R50) while the standard EFT takes 1-3 days. In Ghana, intra-Africa cross

border transfers can take between 24 hours to 3 days. For Merchants, suppliers do

not deliver products until the payment is complete therefore, they need to plan their

inventory well in advance to receive raw material/ stock in time. Delay in payments

leads to delayed deliveries by suppliers which affects business as customers become

dissatisfied.

• Registering a beneficiary: There are several issues faced while registering a

beneficiary for account-to-account transfers. Large amounts of information are

required (including recipient name, bank details – account number/IBAN/branch code),

in most cases the registration process can take up to 1-2 days for domestic payments

and more in the case of international transfers.

• Proof of payment and tracking: Solutions such as mobile and e-wallets, while easy to

use, don’t provide valid proof of transfer, or notifications of when a transfer has been

completed. This can lead to uncertainty amongst users. And for merchants particularly

who need confidence that transfers have gone through, this poses a major pain point.

• Slow and difficult reversals process: Those using mobile and e-wallets often face

challenges in getting refunds and reversals processed. Consumers and merchants

alike, fear losing money while transferring money to the wrong recipient. In Ghana,

MTN MoMo takes 21 days to refund the amount in the case of a failed transaction.

• Inconsistent and unstable internet: In markets such as Ghana, Nigeria and South

Africa, inconsistent and unreliable internet can cause transaction failure or delayed

transfers. Nigeria has one of the slowest broadband connection speeds globally,

ranked 105th in the world and 96th in mobile internet. This coupled with the

challenging reversals process is a major difficulty faced with the next-generation

payment methods available.

• High fees and charges: High transfer charges are seen for both instant domestic

payments in some markets (such as the RTC transfer in South Africa), as well as

international transfers across all markets.

• International transfer can be a tedious process: Time taken for international

transfers range from more than a day, up to 7 days or more in some markets. In South

Africa, Merchants claimed that it could take even up to 9 days for a transfer to reflect in

their bank account and be able to use the funds.

Key Expectations from a next-generation solution

With these pain points experienced from existing payment solutions in mind,

the next-generation solution is expected to not only fix these issues but provide

additional benefits that make the transfer a hassle-free and seamless process. The

emerging transfer solution is expected to deliver on the following expectations:

Real-time, truly instant transfer available 24/7 with real-time enabled

notifications:

End to end process completed within few seconds. The sender and

receiver are notified in real-time about the successful completion of the

transfer

Safe and secure provider:

The solution is supported by a trusted and known global payment

provider, who are a trusted network with strict and comprehensive risk

controls

Insights into account activity:

System to be able to track the movement of funds and generate

electronic records as valid proof of payment

Faster and easier process for registration of beneficiary:

Registering a beneficiary can be done using just mobile number and

name, without a lengthy process of authentication required

Consistent and transparent charges

Clearly communicated transfer charges that should be minimal, ideally 1%

of the total transaction value for international transfer and 0.5% for local

transfers

Faster and seamless international transactions:

As well as domestic payments, the solution should support instant cross

border transfers, or at least within 2-3hrs

Platforms independent of the internet:

For markets where internet is not reliable, a solution that can be

independent of internet connection is desired

Optimizing faster payments – a regional payments landscape review

43

© 2022 Visa, Inc.

Across all markets, a gap exists for a unified payment solution that addresses

expectations such as speed, security, and ease of transfer across both domestic

and cross border transfers. Whilst there are payment solutions in each market that

deliver on some expectations, all come with pain points outlined above. For example,

in African markets such as Ghana and South Africa, mobile money solutions have

filled the need gap for instant, low/no cost transfers for smaller value transactions.

However, they are not seen as secure, they have payment limits and, importantly,

are not available for cross border transactions. Other markets where traditional bank

account to account transfers dominate, SMBs and consumers benefit from security

and reliability with transfers, but are constrained by speed and high transaction

charges, particularly for cross border. A global platform solution such as Visa Direct

can fill this gap, allowing for sending and receiving money effciently, securely, and

seamlessly to billions of endpoints globally.

About Visa Direct

Visa Direct, a real-time push payments platform, provides multi-rail access to 5 billion

cards and accounts combined across more than 200 geographies, supporting 160

currencies, connecting to 16 card-based networks, 65 domestic Automated Clearing

House (ACH) schemes, seven Real-Time Payment (RTP) networks and five payment

gateways. For Visa Direct transactions, Visa offers value-added services, including

security and tokenization, bringing peace of mind for SMBs and consumers as they

pay and get paid, and move money internationally.

For more information and to connect with our team, please visit Visa Direct |

Overview | Visa

Optimizing faster payments – a regional payments landscape review

44

© 2022 Visa, Inc.

© 2022 Visa, Inc.

© 2022 Visa, Inc.

9

9

Research Methodology

Optimizing faster payments – a regional payments landscape review

46

© 2022 Visa, Inc.

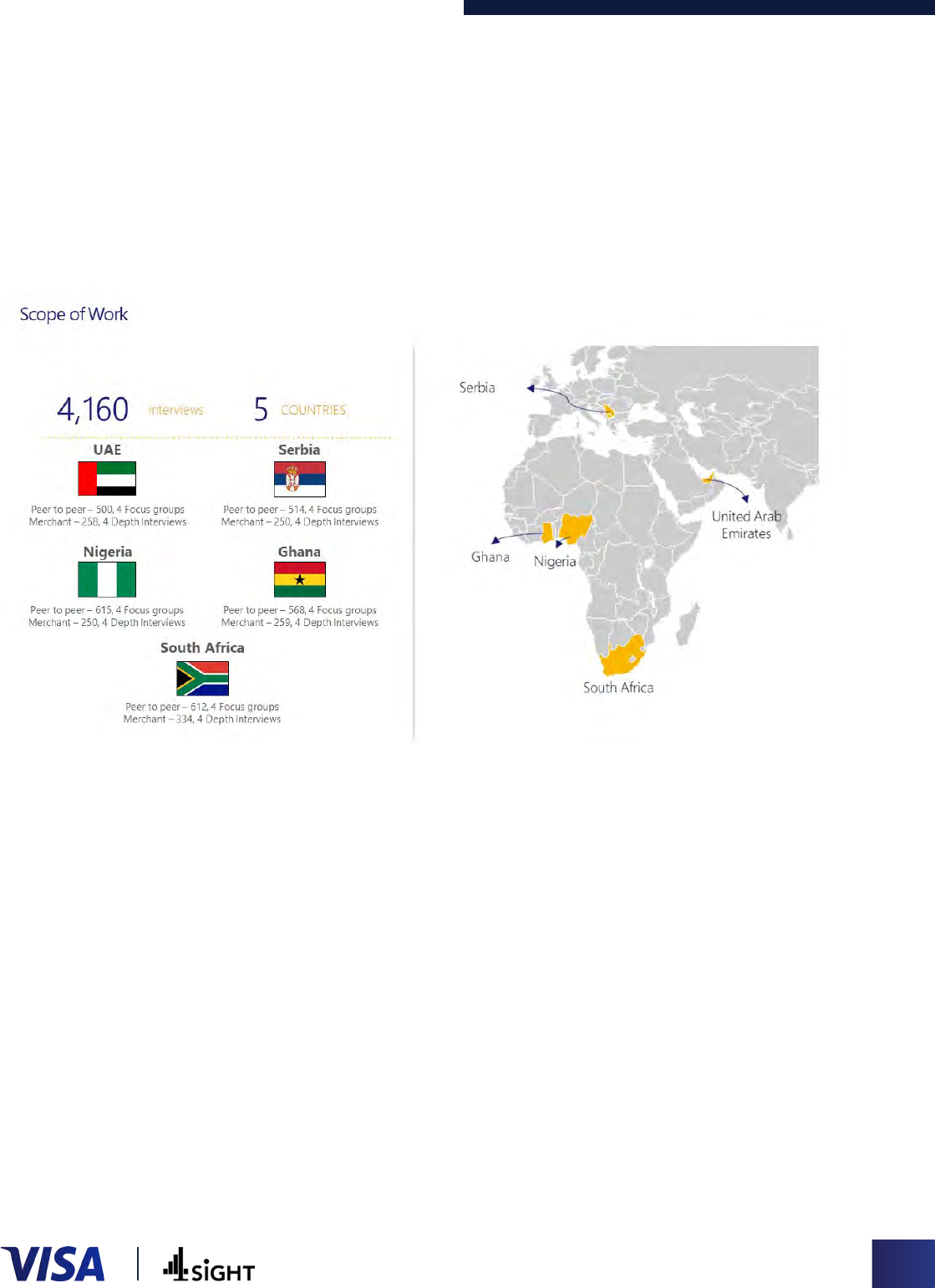

A research program was commissioned by Visa, conducted in August and September

2021. Five markets across Central Europe, the Middle East, and Africa were covered,

focusing on consumer P2P payments and merchant fund disbursements. In total,

4,160 interviews were conducted across 5 countries. Additionally, 4 focus groups

were conducted amongst consumers and 4 depth interviews with merchants in each

market.

Figure 24: Scope of Work

For more information, please see Annex on page 52

The consumer P2P transfer segment was conducted via an online survey from August

20th to September 12th 2021. To qualify, panel sourced respondents had to be aged

18+ and must have done some form of P2P payment in the last 3 months.

The merchant fund disbursement segment was conducted via face-to-face

interviews from August 20th to September 12th 2021. To qualify the merchants must

have done some form of fund disbursement in the last 3 months.

Optimizing faster payments – a regional payments landscape review

47

© 2022 Visa, Inc.

Figure 25: Profile of Consumers

For more information, please see Annex on page 53

Figure 26: Profile of Merchants

For more information, please see Annex on page 53

Optimizing faster payments - a regional payments landscape review

©2022 Visa, Inc.

48

Annex

Figure 1: Domestic P2P Transfer Methods by Volume of Transactions

Nigeria Ghana South Africa UAE Serbia

Account to Account transfer 41% 5% 28% 39% 43%

Wallet transfer 12% 67% 38% 9% 8%

Cash transfer 19% 15% 11% 20% 21%

Account to mobile number transfer 10% 10% 10% 12% 4%

PayPal transfers 2% 1% 10% 13% 6%

Card to Card / Account to Card transfer 8% 1% 0% 2% 16%

Cryptocurrency transfers 7% 1% 3% 0% 1%

Cheque transfers 1% 0% 0% 5% 1%

Figure 2: Intra-Africa Cross Border P2P Transfer Methods by Volume of Transactions

Nigeria Ghana South Africa

Account to Account transfer 36% 44% 25%

PayPal Transfers 21% 8% 47%

Wallet Transfer 10% 29% 18%

Cryptocurrency transfers 17% 3% 10%

Money Exchange Centres 16% 16% 0%

Figure 3: Domestic Merchant Fund Disbursement by Volume of Transactions

Nigeria Ghana South Africa UAE Serbia

Account to Account transfer 32% 10% 29% 27% 62%

Wallet transfer 7% 54% 33% 25% 1%

Cash transfer 28% 25% 18% 6% 15%

Account to mobile number transfer 9% 6% 10% 2% 1%

PayPal transfers 1% 0% 1% 14% 5%

Card to card/Account to Account transfer 4% 4% 2% 11% 1%

Cryptocurrency transfers 1% 1% 7% 15% 4%

Cheque transfers 3% 0% 0% 0% 11%

Online payment (through card or netbanking) 1% 0% 0% 0% 0%

Card payment at POS 14% 0% 0% 0% 0%

Figure 4: Intra-Africa Cross Border Merchant Fund

Disbursement Methods by Volume of Transactions

Nigeria Ghana South Africa

Account to Account transfer 42% 35% 40%

Money Exchange Centres 26% 47% 18%

Wallet transfer 12% 10% 22%

PayPal transfers 6% 4% 9%

Online payment (through card or netbanking) 3% 4% 9%

Cryptocurrency transfers 3% 0% 2%

Card to card/Account to Account transfer 7% 0% 0%

Optimizing faster payments - a regional payments landscape review

©2022 Visa, Inc.

49

Figure 5: Time taken for Account-to-Account Transfer (%) by Volume of Transactions

Nigeria South Africa Ghana UAE Serbia

Instant (<30 minutes) 81% 39% 55% 52% 33%

Half a day 11% 9% 12% 16% 40%

1 business day 4% 16% 9% 23% 24%

>1 business day 3% 36% 23% 8% 3%

Figure 6: Domestic P2P transfer methods by Volume

Nigeria South Africa Ghana UAE Serbia

Cash transfer 19% 11% 15% 20% 21%

Account to Account transfer 41% 28% 5% 39% 43%

Account to mobile number transfer 10% 10% 10% 12% 4%

PayPal transfers 2% 10% 1% 13% 6%

Card to card/Account to Account transfer 8% 3% 1% 0% 16%

Cryptocurrency transfers 7% 0% 1% 2% 1%

Cheque transfers 1% 0% 0% 5% 1%

Wallet transfer 12% 38% 67% 9% 8%

Figure 7: Domestic P2P transfer methods used in the last 12 months

Nigeria South Africa Ghana UAE Serbia

Cash transfer 62% 43% 54% 48% 50%

Account to Account transfer 72% 57% 34% 62% 71%

Account to mobile number transfer 34% 41% 43% 29% 20%

PayPal transfers 13% 35% 5% 38% 21%

Card to card/Account to Account transfer 31% 0% 0% 0% 44%

Cryptocurrency transfers 30% 0% 10% 10% 5%

Cheque transfers 15% 10% 10% 20% 10%

Wallet transfer 42% 73% 97% 20% 18%

Figure 8: Time taken for dierent transfer methods

Instant (less than 30 minutes)

More than 30 minutes, less than

a day

More than a day

Account to Account transfer 71% 8% 21%

Wallet transfer 82% 4% 14%

Account to mobile number transfer 79% 5% 16%

PayPal transfers 54% 8% 38%

Card to card/Account to Account transfer 73% 9% 18%

Cryptocurrency transfers 64% 13% 23%

Cheque transfers 23% 13% 64%

Optimizing faster payments - a regional payments landscape review

©2022 Visa, Inc.

50

Figure 12: Intra-Africa cross border P2P payment methods by volume

Nigeria Ghana South Africa

Account-to-account 36% 44% 25%

PayPal transfers 21% 8% 47%

Wallet transfers 10% 29% 18%

Cryptocurrency transfers 17% 3% 10%

Money Exchange Centres 16% 16% 0%

Figure 13: Time taken for dierent transfer methods

Instant (less than 30 minutes)

More than 30 minutes, less than

a day

More than a day

Account to Account transfer 71% 8% 21%

Wallet transfer 82% 4% 14%

Account to mobile number transfer 79% 5% 16%

PayPal transfers 54% 8% 38%

Card to card/Account to Account transfer 73% 9% 18%

Cryptocurrency transfers 64% 13% 23%

Cheque transfers 23% 13% 64%

Figure 14: Intended usage of a real-time payment solution

A pie chart illustrating 39% of those surveyed about a real-time payment solution “Extremely like it” and

36% “Somewhat like it,” totaling 75% who like it on some level. The remaining answers are “Neither like/

dislike it” at 17% and “Somewhat/Extremely dislike” at 8%.

Figure 15: Reasons for making fund disbursements

UAE Serbia South Africa Nigeria Ghana

Payment made for products/services received 47 85 77 84 82

Product delivery charges 67 57 57 83 85

Business expense reimbursement to sta/employees 66 84 58 46 23

Salary advance/Personal loan 55 9 45 52 23

Commuting charges (Taxi drivers, public transport, etc. 42 44 19 50 29

Courier companies 38 38 43 42 17

Freelance/gig work/independent contractor 42 7 30 35 20

Settlement of card payment transactions for a small business 41 19 26 27 13

Rent/sublet/vacation rental income 51 12 41 26 9

Online/digital content payment to individuals/freelancers 42 14 14 30 7

Figure 16: Frequency of making fund disbursements

Serbia UAE South Africa Nigeria Ghana

Daily 24 39 1 27 27

1+ times a week 33 40 32 50 46

1+ times a month 42 15 65 24 19

Optimizing faster payments - a regional payments landscape review

©2022 Visa, Inc.

51

Figure 1 7: Domestic merchant fund disbursement methods by Volume

Serbia UAE South Africa Nigeria Ghana

Cash payment 15 25 18 28 25

Account to account transfer 62 27 29 32 10

Account to mobile number transfer 0 6 10 9 6

PayPal transfers 12 15 7 14 1

Cryptocurrency transfers 0 0 0 1 1

Cheque transfers 1 14 0 3 4

Card to card / Account to card transfer 5 0 0 3 0

Card (credit/debit card) or netbanking 4 11 3 1 0

Wallet transfer* 1 0 33 7 54

Card payment (credit/debit card) 12 15 7 14 1

Figure 18: Domestic merchant fund disbursement methods used in the last 12 months

Serbia UAE South Africa Nigeria Ghana

Cash payment 49 87 49 84 69

Account to account transfer 92 83 58 78 34

Account to mobile number transfer 0 29 34 44 33

PayPal transfers 4 5 7 6 2

Cryptocurrency transfers 0 2 2 6 2

Cheque transfers 12 65 0 26 17

Card to card / Account to card transfer 12 0 0 15 0

Card (credit/debit card) or netbanking 17 61 13 13 3

Wallet transfer* 0 0 0 0 0

Card payment (credit/debit card) 3 3 64 30 93

Figure 19: Time taken for Account-to-Account transfer (%)

Serbia South Africa UAE Ghana Nigeria

Instant 33% 39% 52% 55% 81%

Half a day 40% 9% 16% 12% 11%

One business day 24% 16% 23% 9% 5%

More than one business day 3% 36% 8% 23% 3%

Figure 20: Methods of Intra-Africa fund disbursement by volume

South Africa Nigeria Ghana

Account to account transfer 38% 42% 32%

PayPal transfers 8% 6% 0%

Cryptocurrency transfers 1% 3% 3%

Card to card / Account to card transfer 0% 7% 0%

Card (credit/debit card) or netbanking 8% 3% 4%

Money exchange centres 17% 26% 43%

Wallet Transfer 21% 12% 9%

Others 7% 1% 9%

Optimizing faster payments - a regional payments landscape review

©2022 Visa, Inc.

52

Figure 21: Methods of Intra-Africa fund disbursement used in the last 12 months

South Africa Nigeria Ghana

Account to account transfer 49 70 55

PayPal transfers 15 17 7

Cryptocurrency transfers 6 13 5

Card to card / Account to card transfer 0 27 0

Card (credit/debit card) or netbanking 16 14 6

Unlabeled Value 70 83 72

Money exchange centres 36 39 26

Wallet Transfer 8 0 14

Others 0 0 0

Figure 22: Time taken for dierent transfer methods

Instant (less than 30 minutes)

More than 30 minutes, less than

a day

More than a day

Account to Account transfer 71% 8% 21%

Wallet transfer 82% 4% 14%

Account to mobile number transfer 79% 5% 16%

PayPal transfers 54% 8% 38%

Card to card/Account to Account transfer 73% 9% 18%

Cryptocurrency transfers 64% 13% 23%

Cheque transfers 23% 13% 64%

Figure 23: Time Taken for Transfer Methods by Market – Intra-Africa

Cross Border Payments

Instant (less than 30 minutes)

More than 30 minutes,

less than a day

More than a day

South Africa

Account-to-account transfer 19 29 52

Money exchange centres 16 20 64

Wallet transfer 36 26 38

Nigeria

Account-to-account transfer 95 0 5

Money exchange centres 20 73 8

Wallet transfer 66 29 5

Ghana

Account-to-account transfer 56 14 30

Money exchange centres 45 27 28

Wallet transfer 54 21 25

Figure 25: Scope of work

An infographic depicting the following stats 4,160 interviews conducted in ve countries:

Peer to peer Merchant

Interviews Focus Groups Interviews Depth Interviews

UAE 500 4 258 4

Serbia 514 4 250 4

Nigeria 615 4 250 4

Ghana 568 4 259 4

South Africa 612 4 334 4

Optimizing faster payments - a regional payments landscape review

©2022 Visa, Inc.

53

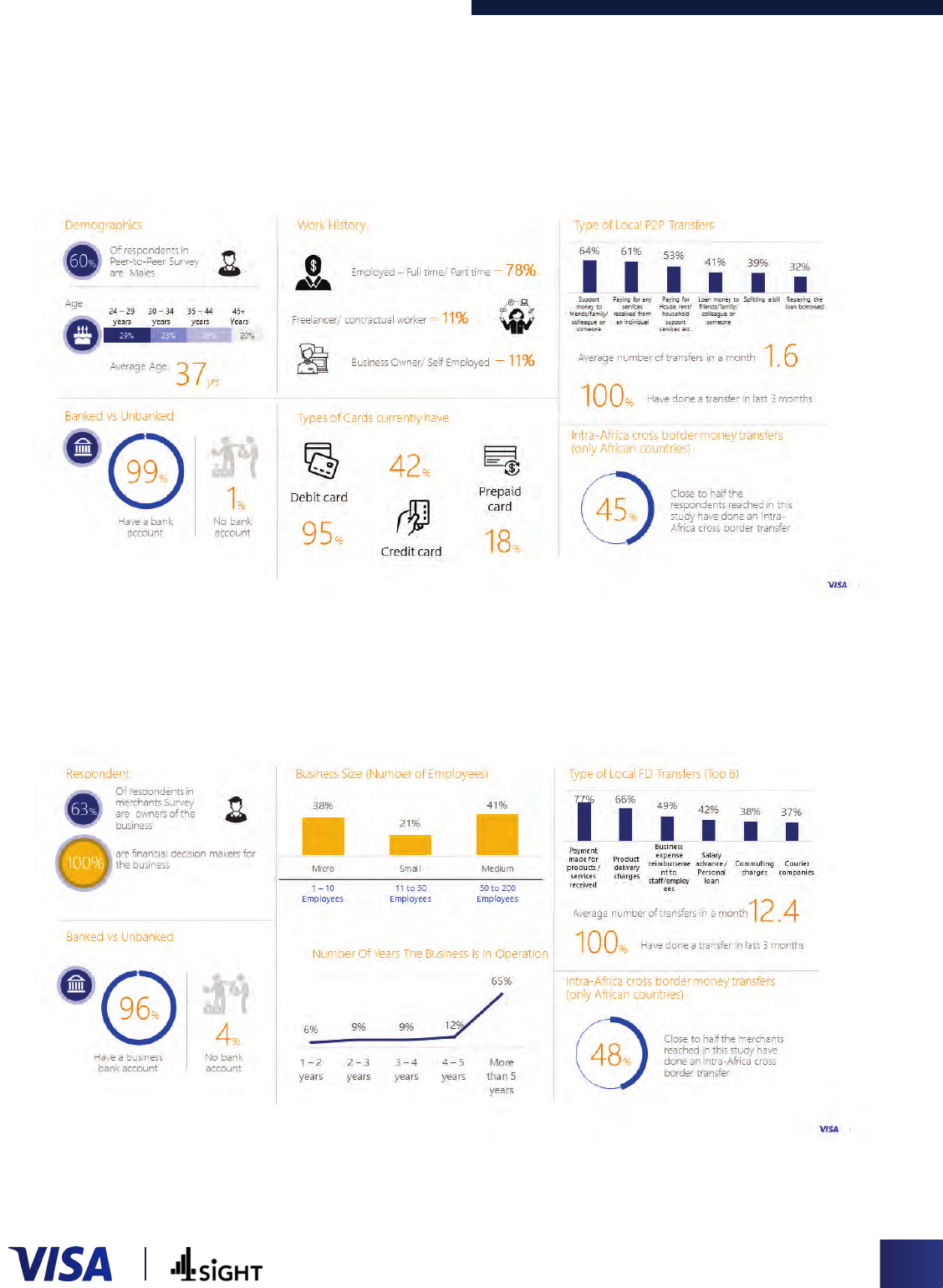

Figure 26: Prole of Consumers

An infographic depicting the following statistics:

Demographics

— 60% of respondents in Peer-to-

Peer Survey are Males

— Average age is 37 years (24–29 years: 29%; 30–34

years: 23%; 35–44 years: 28%; 45+ years: 20%)

Work History

— Employed, full time/part time: 78%

— Freelance/contractual workier: 11%

— Business owner/Self-emplpyed: 11%

Type of local P2P transfers

— Support money to friends/family/

colleage or someone: 64%