1

Rev 2/2019

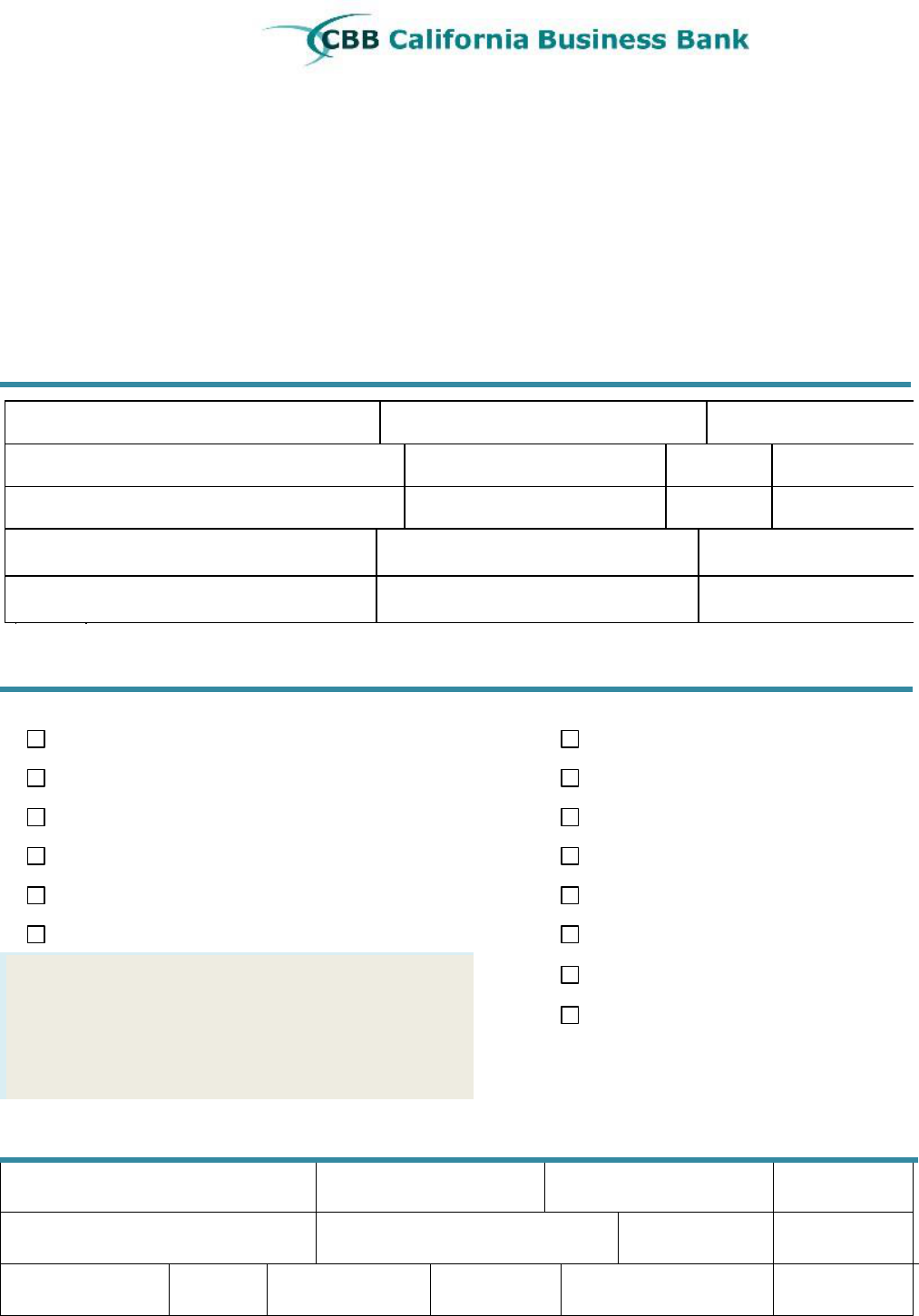

For Bank Use Only

Business Name Account Number Account Officer

Instructions

1. Assist customer in completing the account application, principally in the following 3 areas:

Explain products and services. It is important to align the customer’s needs and

expectations with our products and services. Not all customers will qualify, based on their

business activity or industry, for all of the services we offer. This is also an opportunity to

cross sell customer for services they may need and did not know we offer.

Define expected account activity. Ask questions about the business to determine the

account activity level that will be expected from the business. ( Transactions for an

operating account will be different than ones in a payroll account) Remember, it is all in

the delivery. We can use this opportunity to learn about their business in a friendly and

respectful manner. This can be tricky as the customer may feel the questions are over-

reaching or intrusive, however, we have to comply with BSA/AML requirements.

Define entity structure. Ask questions about the ownership structure so the beneficial

ownership is addressed up front and the forms are completely correctly. If the business

entity is owned by another entity then we have to obtain additional information to

appropriately document the file. This applies to both loans and deposits. By using this

opportunity to discuss the business in a friendly manner, we can mitigate t

he risk

by knowing

our customer while establishing a rapport with our customer.

2. Obtain any additional application forms required based on the products and services

requested. For example, if the customer is requesting remote deposit capture then an

additional agreement is required.

3. Complete the BSA/AML form (Expected Transaction Activity & Beneficial Owner/Control)

4. Complete the BSA Risk Assessment.

5. Complete the ATM Information Form, if applicable. (Obtain copies of ATM contract and photos)

6. Obtain the entity documentation.

7. Verify CIP for each individual and entity involved and sign off when completed.

8. Review the BDO section of the checklist to ensure application is complete.

9. Scan package and submit to Operations electronically.

2

Rev 2/2019

3

Rev 2/2019

Business Name

DBA (if applicable)

Date Established

Address

City

State

Zip

Mailing Address (if different)

City

State

Zip

Business Phone

Business Website

Tax ID #

Contact Name

Contact Email

Contact Phone

Business Deposit Account Application

IMPORTANT INFORMATION ABOUT PROCEDURES FOR OPENING A NEW ACCOUNT. To help the

government fight the funding of terrorism and money laundering activities, Federal law requires all financial

institutions to obtain, verify, and record information that on personal accounts identifies each person who opens an

account. In addition, on legal entity accounts, we will require identification on beneficial owners and controlling

person.

What this means for you: When you open an account, we will ask for your name, address, date of birth, and other

information that will allow us to identify you. We may also ask to see your driver's license or other identifying

documents.

Account Information

Services Requested

PRODUCTS

OTHER SERVICES

Checking – Free 50

On-line Banking

Checking – Interest First

Cash Management*

Checking – Optimized (Analysis)

Mobile Banking

IOLTA Account

Debit Card*

Virtual Vault Checking**

Checks

Business MMA

ACH Origination**

Certificate of Deposit Term ______ Month(s)

CD Interest Credit to:

☐ Compound (Add back to CD)

☐ Credit to ☐Internal ☐External Account (Enter RTN below)

☐DDA ☐SAV Acct# ___________ Bank RTN____________

Acct#____________

Remote Deposit Capture (RDC)*

Wire Transfers*

*CBB Agreement Required

**Additional Approval Required

Business Type Information

Type of Business: (i.e. Retail, Wholesale,

Manufacturing, Service Provider)

Number of locations: Attach a list

of location addresses.

Nature of the Business:

(Please briefly describe

what you do, your product or services)

What is the NAICS

code?

Number of Employees:

#

Annual Revenues (Sales)

$

Any likely seasonal factors?

(tourists, summer or winter related

business?)

4

Rev 2/2019

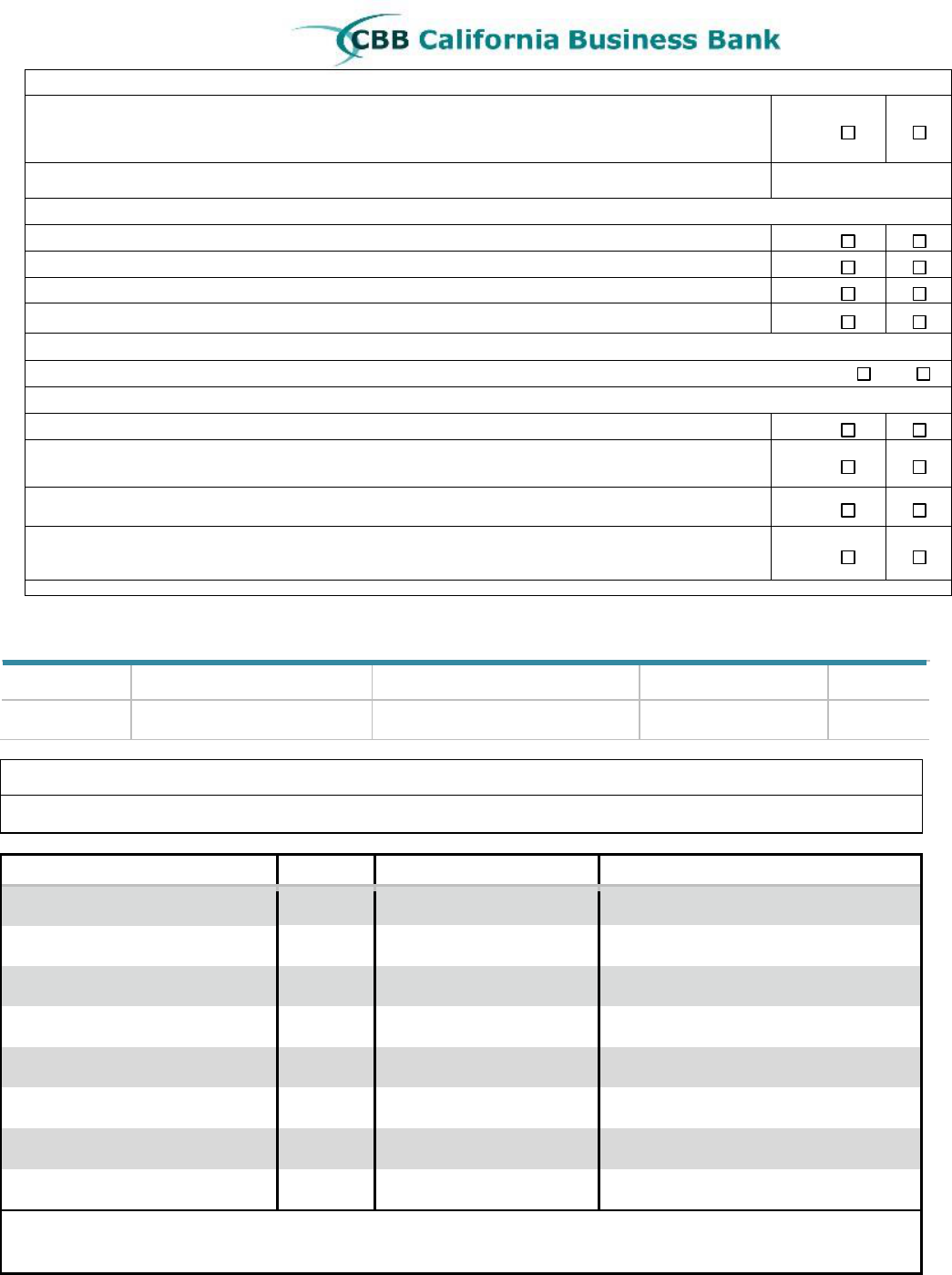

How were you introduced to California Business Bank?

Does the business, principals or affiliates currently have accounts with CBB?

If yes, list accounts below.

If no, please provide the last 3 months of bank statements from your current banking

institution.

Yes

No

Account Name(s)

Account Number(s)

List the Markets or Areas serviced:

Does the Business/Entity serve International Markets?

Yes

No

Is the Business/Entity based out of a residence?

Yes

No

Does your business engage in Internet gambling?

Yes

No

Does your business provide remittance services? Circle below if applicable.

Yes

No

(Check Cashing, Western Union, Money Orders, Prepaid/Payroll cards or similar services)

Is your business/profession in any of the following industries? Circle below if applicable. Yes No

(Casino/Card Club, Jewelry/Precious Metals, Travel Agency, Vehicle Seller, Pawn Broker, Loan/Finance Company)

Is the business engaged in or associated with the marijuana industry?

Yes

No

Does your business have an on-site ATM? If yes, complete the Privately Owned ATM Info Form, provide copy

of your ATM contract and photos.

Yes

No

Is your business incorporated in another state? If yes, please provide filed authorization to conduct business in this

state.

Yes

No

Do any of the signers on the account hold or have they ever held political office in a foreign country? If yes, please

include the name(s) of signer(s) and name of country:

Yes

No

Business Entity

☐ Sole Proprietor

☐ Limited Liability Company (LLC)

☐ Limited Liability Partnership (LLP)

☐ Non-Profit Corporation

☐ Trust

☐ Corporation

☐ Limited Partnership (LP)

☐ General Partnership (GP)

☐ Non-Profit Organization

☐ IOLTA

Account Expected Transaction Activity

Purpose of Account: ☐ General/Operating ☐Payroll ☐Other (Specify Wires, Escrow, etc.)______________________

Transaction Types

# per month

Total Monthly Amount

Total Debits

Sources

Check Deposits (RDC/Mobile)

$

Cash Deposits

$

Cash Withdrawals

$

Automatic Credits (ACH)

$

Automatic Debits (ACH)

$

Incoming Wires

$

Outgoing Wires

$

International (list Countries)

$

Please provide names of primary trade partners if applicable (i.e. Buyers, Suppliers, Distributors, Creditors…etc.)

5

Rev 2/2019

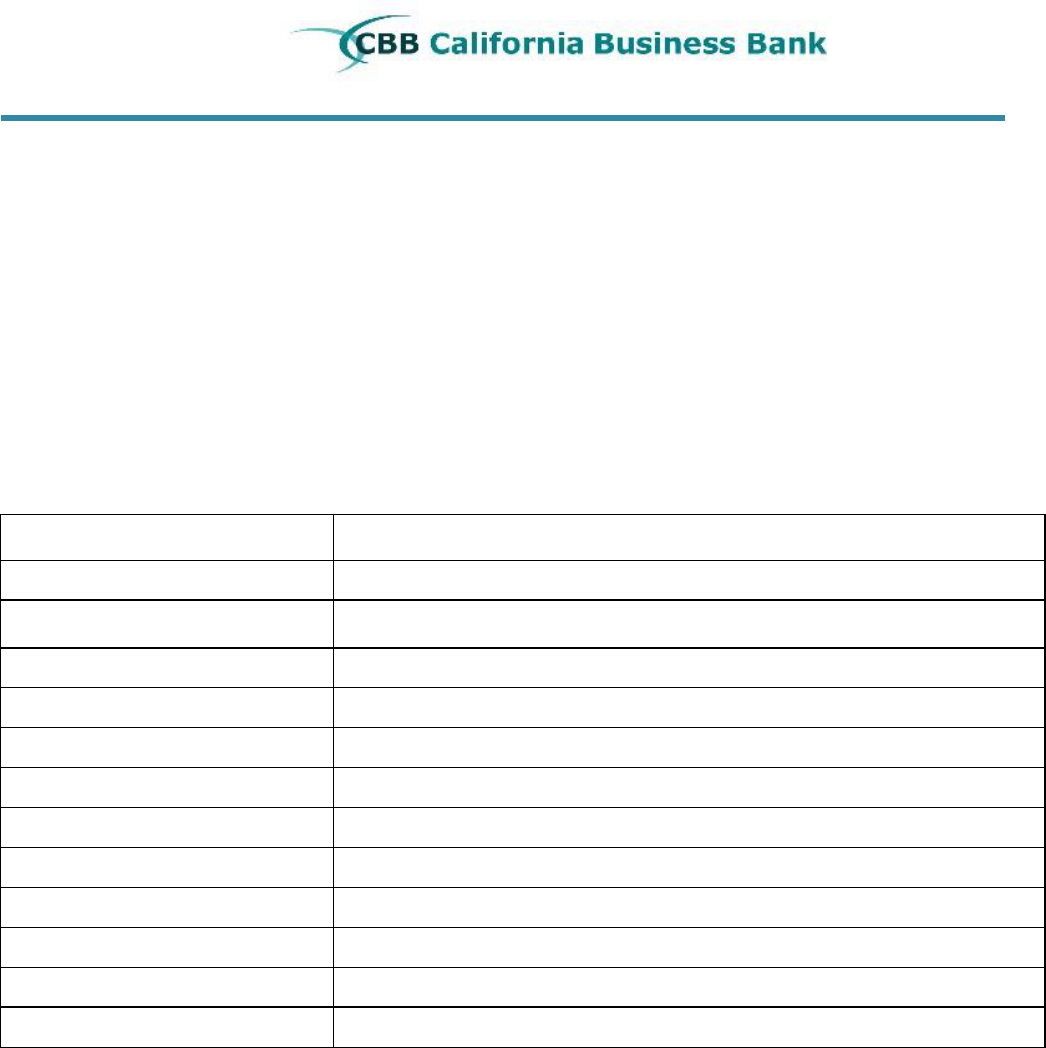

Business Structure and Ownership Information

This section must be completed by the person opening the account on behalf of the account holder.

Name of person opening the account: _____________________________________________________

Name of Legal Entity for which the account is being opened: __________________________________________

Step 1: Significant Responsibility

Please provide the following information for one individual with significant responsibility for managing the legal entity named

above such as an executive officer or senior manager (e.g. Chief Executive Officer, President, Executive Vice president, Vice

President, Chief Financial Officer, Chief Operations Officer, Managing Member, or General Partner) or any other individual

who performs similar functions.

Note: If applicable, this person may be one of the owners listed on page 3.

Name

Title

Home Street Address (Not a P.O. Box)

Home City, State, Zip

Home Phone Number

Work Phone Number

Cellular Phone Number

Social Security Number (for U.S.

persons)

Date of Birth

Passport number and country of

issuance (for foreign person)

Government Issued Identification #

Issue Date

Expiration

6

Rev 2/2019

Step 2: Ownership

Please list each individual owner (if any) who, directly or indirectly, through any contract, arrangement, understanding,

relationship or otherwise, owns 25% of the equity interests of the legal entity listed above.

Note: If any percentage of ownership is owned by any entity other than an individual (natural person), please complete an

additional ownership worksheet for every non-natural person owning 25% or more.

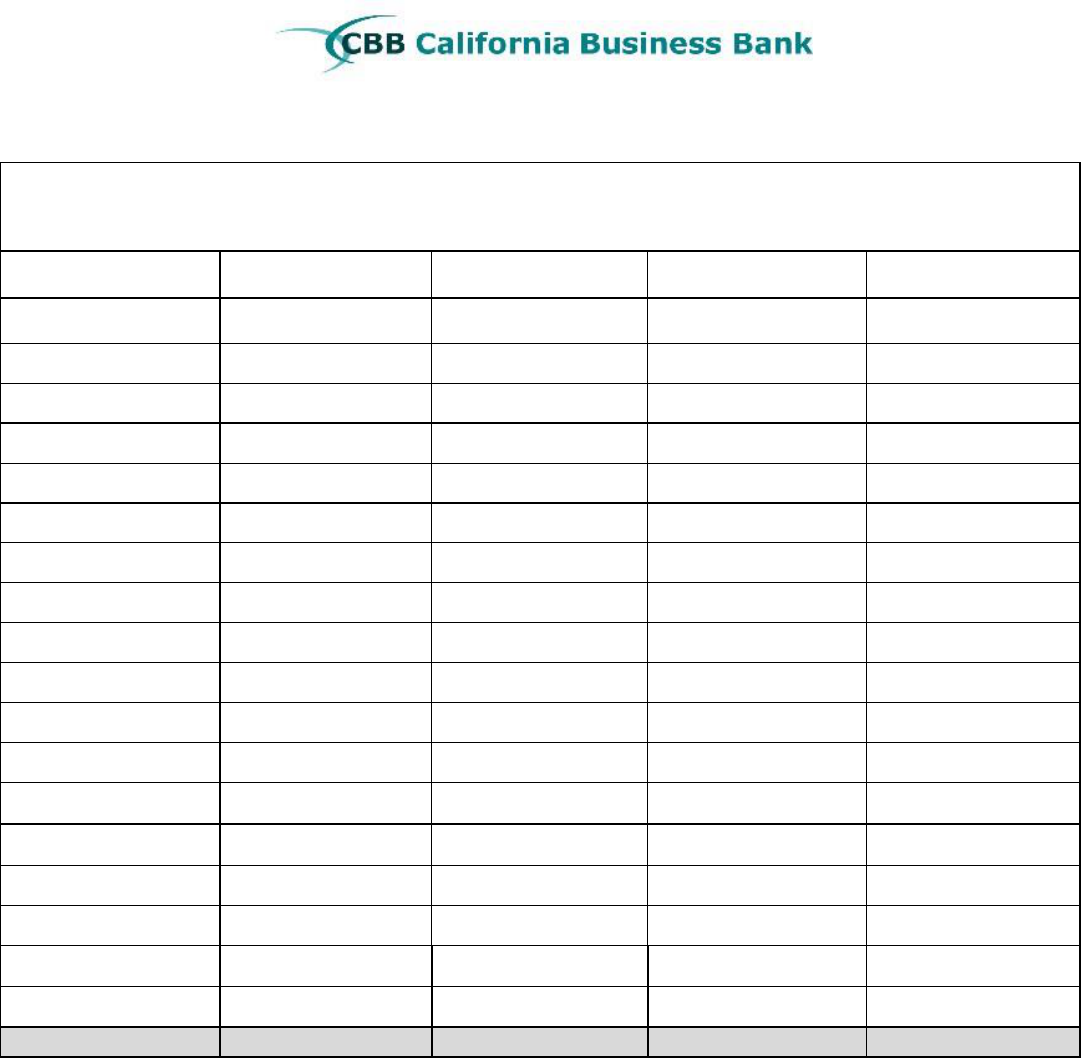

Business Name

Owner #1

Owner #2

Owner #3

Owner #4

Name

Title

% of Ownership

Home Street Address

(Not a P.O. Box)

Home City, State, Zip

Mailing Street Address

(If different)

Mailing City, State, Zip

Home Phone Number

Work Phone Number

Cellular Phone Number

Social Security Number

(for U.S. persons)

Date of Birth

Passport No &

Country issued (for

foreign persons)

Identification Issuing

Agency

Government Issued

Identification #

Issue Date

Expiration date

City & State of Birth

Mother’s Maiden Name

Will you be an authorized

signer on the account?

Yes☐ No☐

Yes☐ No☐

Yes☐ No☐

Yes☐ No☐

I, (insert name of person and title authorized by business

entity) hereby certify, to the best of my knowledge, that the information provided above is

complete and correct.

x Date: _____________

Please print name:

Please print title:

7

Rev 2/2019

Step 3: Authorized Signers: Please complete the worksheet below for all authorized signers that are NOT

listed as owners on page 6.

Authorized Signers

(All authorized signers that are NOT owners listed above)

Authorized Signer

#1

Authorized Signer

#2

Authorized Signer

#3

Authorized Signer

#4

Name

Title

Role in Business

Home Street Address

Home City, State, Zip

Mailing Street Address

(If different)

Mailing City, State, Zip

Home Phone Number

Work Phone Number

Cellular Phone Number

Social Security Number

Date of Birth

Identification Issuing

Agency

Government Issued

Identification #

Issue Date

Expiration date

City & State of

Birth

Mother’s Maiden Name

8

Rev 2/2019

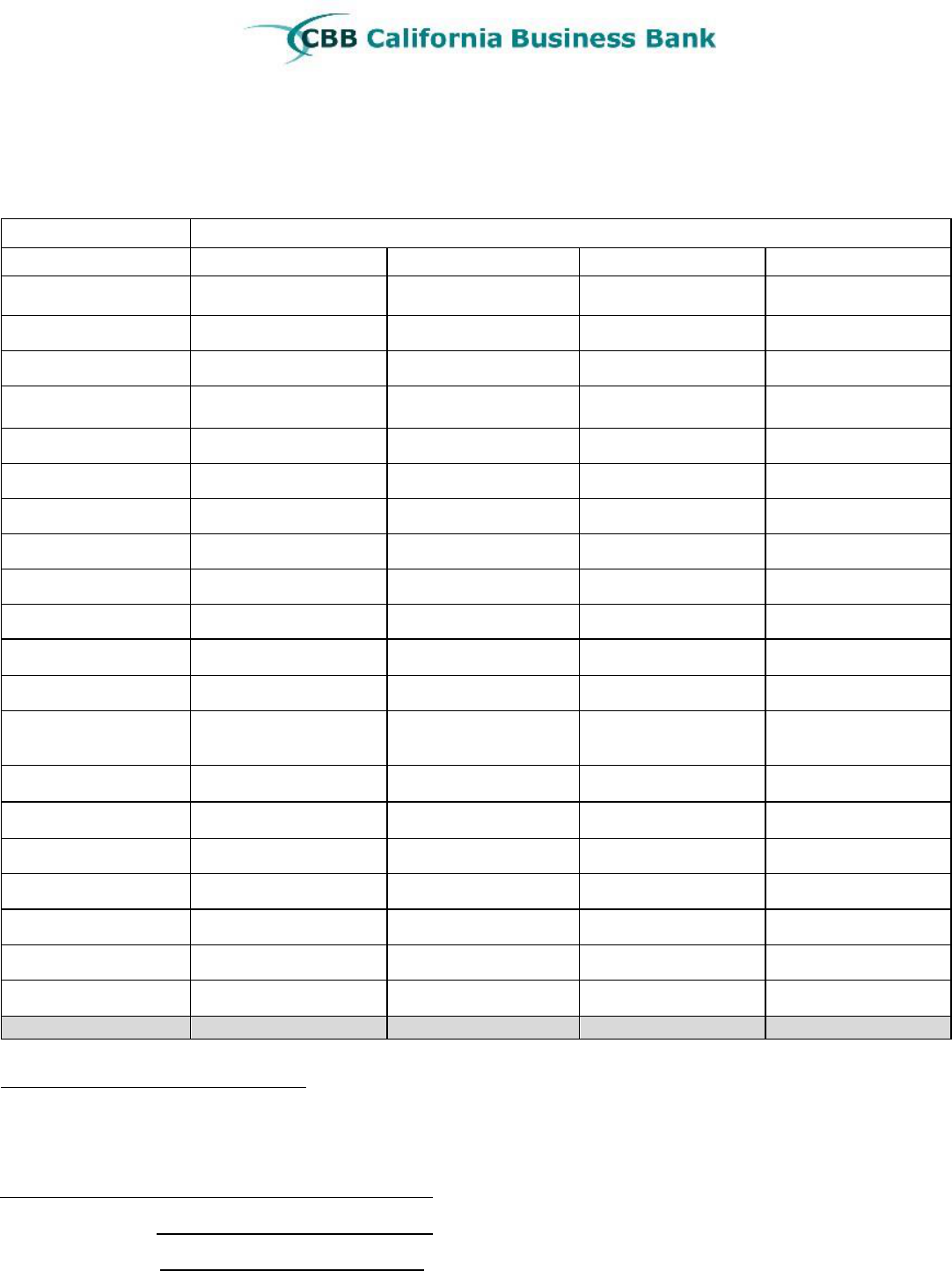

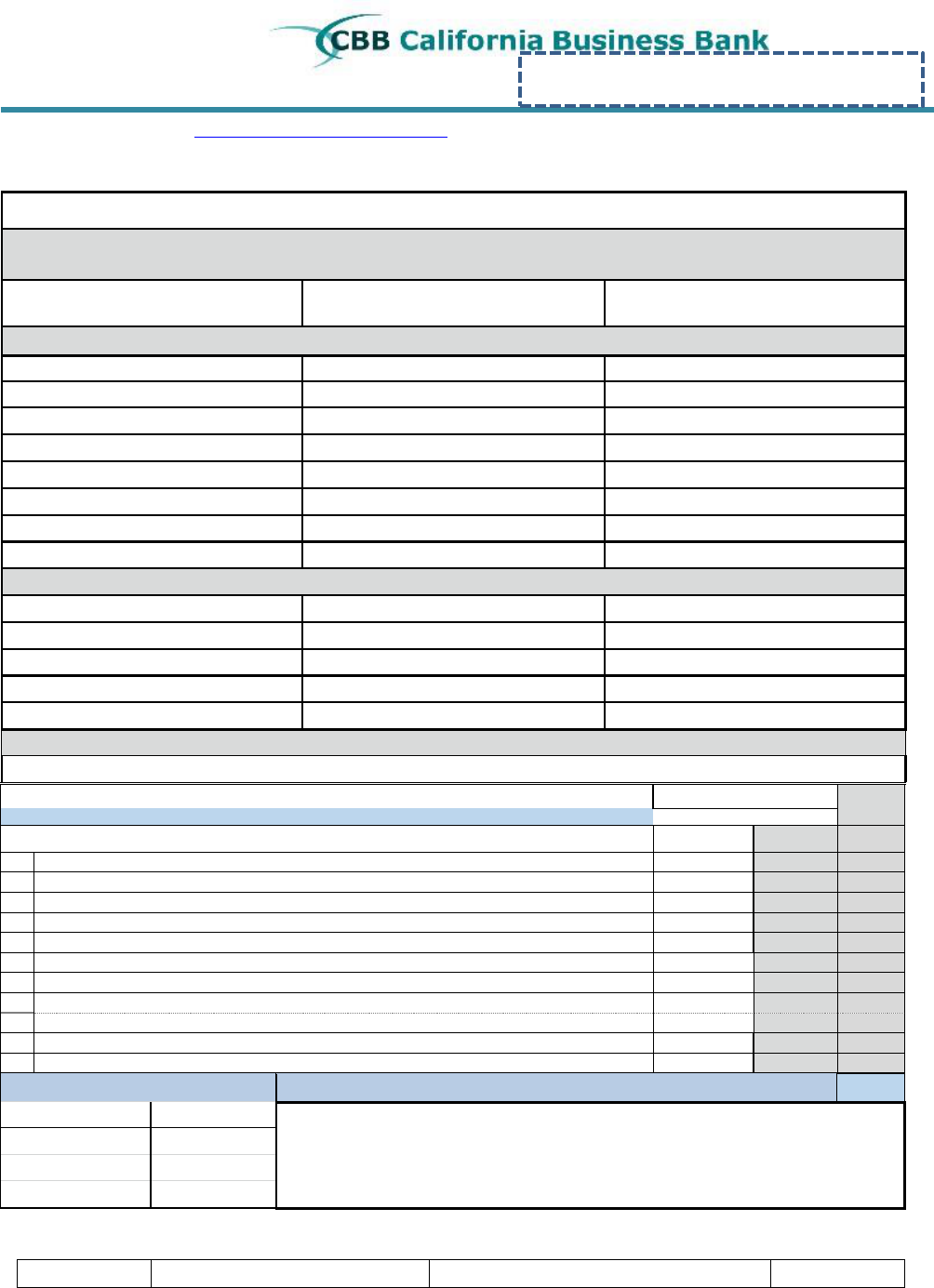

BSA/AML DEPOSIT Risk Rating Analysis

NAICS Code (2007) website: http://www.census.gov/eos/www/naics/

1. Is customer a prohibited High Risk Industry business - Check Cashing; Currency Exchanger; Money Service

Business (MSB)? _____If yes, then do not open the account as it is prohibited by bank policy.

2. If you answered “No” to question #1 above, then proceed with assessing a BSA Risk Rating of the business account below.

Industry Risk Score

Chart

Automatic High Risk Industry =

9

Do not open the account without prior approval of President, BSA Officer, or Chief Compliance Officer per bank

po

li

cy

.

Off Shore Corporation

Non-Governmental

Organization / Chari

t

y /

Non-Profit

(Foreign)

Wire (money) Transmitter

High Risk Industry Score =

7

Accountants and Bookkeepers

Gas

Stations

Parking Garages

Airplane Dealers (New and Used)

Fire arms and Ammo

Other Non-Bank Financial Institutions

Attorneys and Paralegals

Heavy Equipment Sales (New and Used)

Pawn

Brokers

Automobile Sales (New and Used)

Import/Export Companies

Restaurants

Casinos and Card Clubs

Investment Brokers and Advisors

Ship, Bus, and Plane Operators

Convenience/Liquor Store

Jewel, Gem, or Precious Metal Dealers

Travel Agencies

Doctors, Physicians, and Nurse Practitioners

Machine Parts Manufacturers

Trucking Companies

Farm Equipment Sales (New and Used)

Motorcycle Dealers (New and Used)

Medium Risk Industry Score = 6

1031 Exchange Accommodators

Hotels/Motels

Retail

S

t

ores

Auctioneers

Large Vehicle Dealers (RV, Trailers, ATVs,

MC)

Salvage/Recycling

Boat Dealers (New and Used)

Leather Goods Store

Telemarketers

Brokers/Dealers (including Insurance)

Non-Gov.

Org / Charities

/

Non-Profits

(Domestic)

Wholesale Distributors

Deposit Brokers

Property Management

Low Risk Industry =

0

All other

industries

Industry Score from Chart above:

Industry Score:

Circle Y/N – Enter Pts

*

The term “local” refers to CBB’s Core or Expanded Service Area,

1.

Are business locations local?

Y = 0

N = 1

2.

Are major customers local?

Y = 0

N = 1

3

Do owners reside locally?

Y = 0

N = 1

4.

Is business older than 2 years? (If not original owner, date of purchase. ____/____/____)

Y = 0

N = 1

5.

Does business operate in local trade area?

Y = 0

N = 1

6.

Is Business an International Entity?

Y = 6

N = 0

7.

Will Business send/receive International Wire Transfers?

Y = 6

N = 0

8.

Is stated cash volume inappropriate for business?

Y = 6

N = 0

9.

Is stated wire activity volume inappropriate for business?

Y = 6

N = 0

10.

Are monthly cash transactions > $15,0000?

Y = 6

N = 0

11.

Are ACH transactions (incoming/outgoing) inappropriate for business?

Y = 6

N = 0

BSA RISK RATING

Total points (including the industry score) and enter here →

SCORE

RATING

0 – 3

Low

4 – 8

Medium

9 and above

High

Note: You must copy the BSA Officer with the electronic submission of any Medium or High Risk Account

Risk Rating Performed By:

Employee Name

Signature

Date

NAICS CODE: ___ ___ ___ ___ ___ ___

For Bank Use Only

9

Rev 2/2019

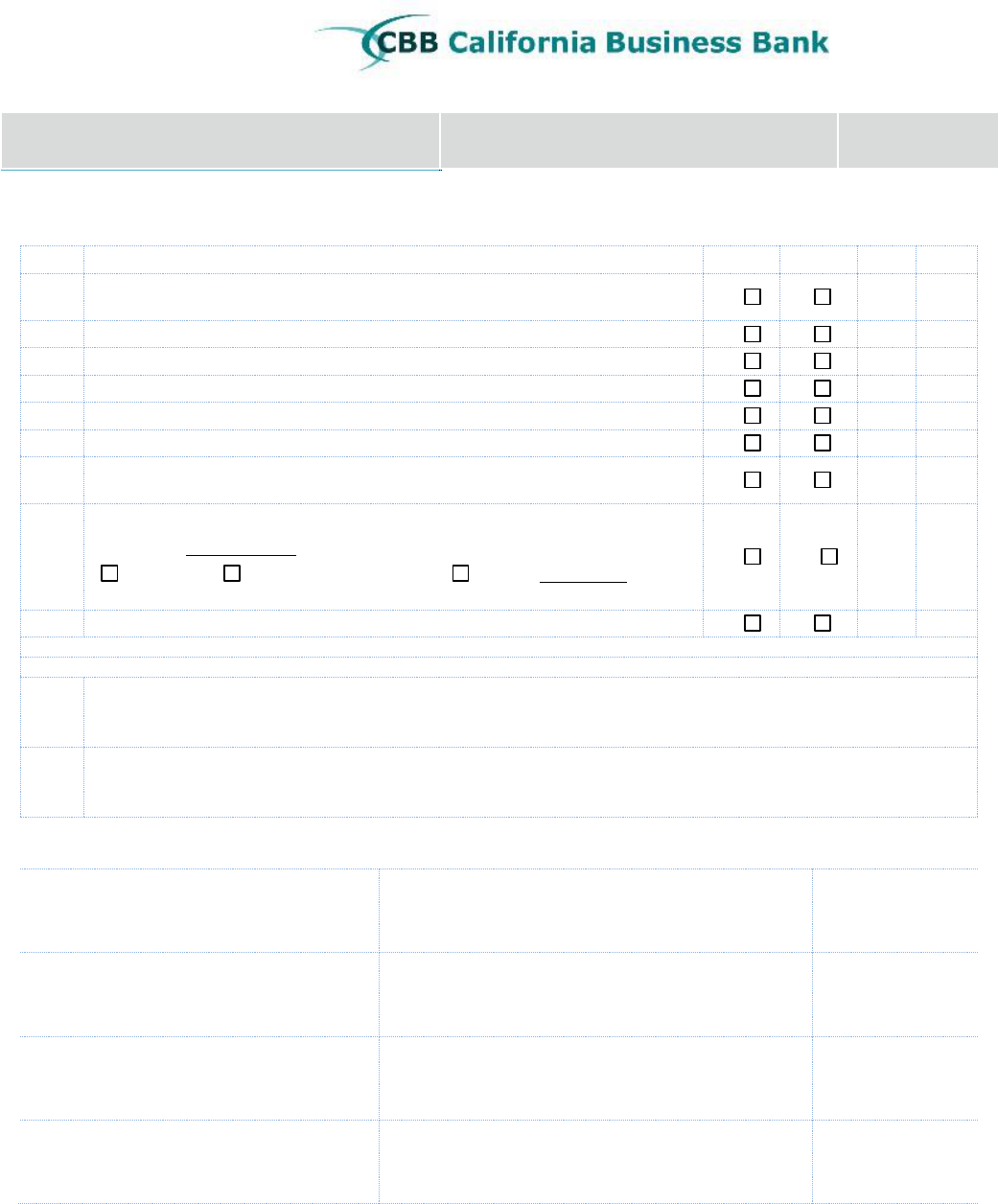

Business Name Account Number Account Officer

Application Checklist

BDO

OPS

1.

Application completed, reviewed for accuracy, completion and signed by

customer?

Yes

No

2.

Ownership identified correctly?

Yes

No

3.

Complete entity documentation obtained and reviewed?

Yes

No

4.

CIP completed, reviewed, verified and signed by bank employee?

Yes

No

5.

BSA/AML Risk Analysis completely correctly?

Yes

No

6.

Review questionnaire (Internet gambling, Marijuana, Remittance industries)

Yes

No

7.

Conduct site visit for all cash intensive businesses (ideally with photos of store

front and Private ATM).

Yes

No

8.

On-site ATM on premises?

If YES, are required forms received?

PATM Form, Copy of ATM Contract and Site visit with photos.

If NO, (No ATM is on site and is confirmed via site visit photos) check N/A

Yes

N/A

9.

Have 3 months of bank statements been collected?

Yes

No

If any question is answered “No”, please provided explanation below:

No.

No.

If BSA Risk Rating is “Medium” or “High”, BSA Officer MUST be notified PRIOR to opening the account

Name of BDO

Signature

Date

Name of Ops

Signature

Date

BSA Review (when applicable)

Signature

Date

Note: Package must be scanned and submitted electronically to operations. If medium or high risk

please copy BSA officer on application submission. If package is incomplete, the application will not

be accepted and returned the submitting officer.