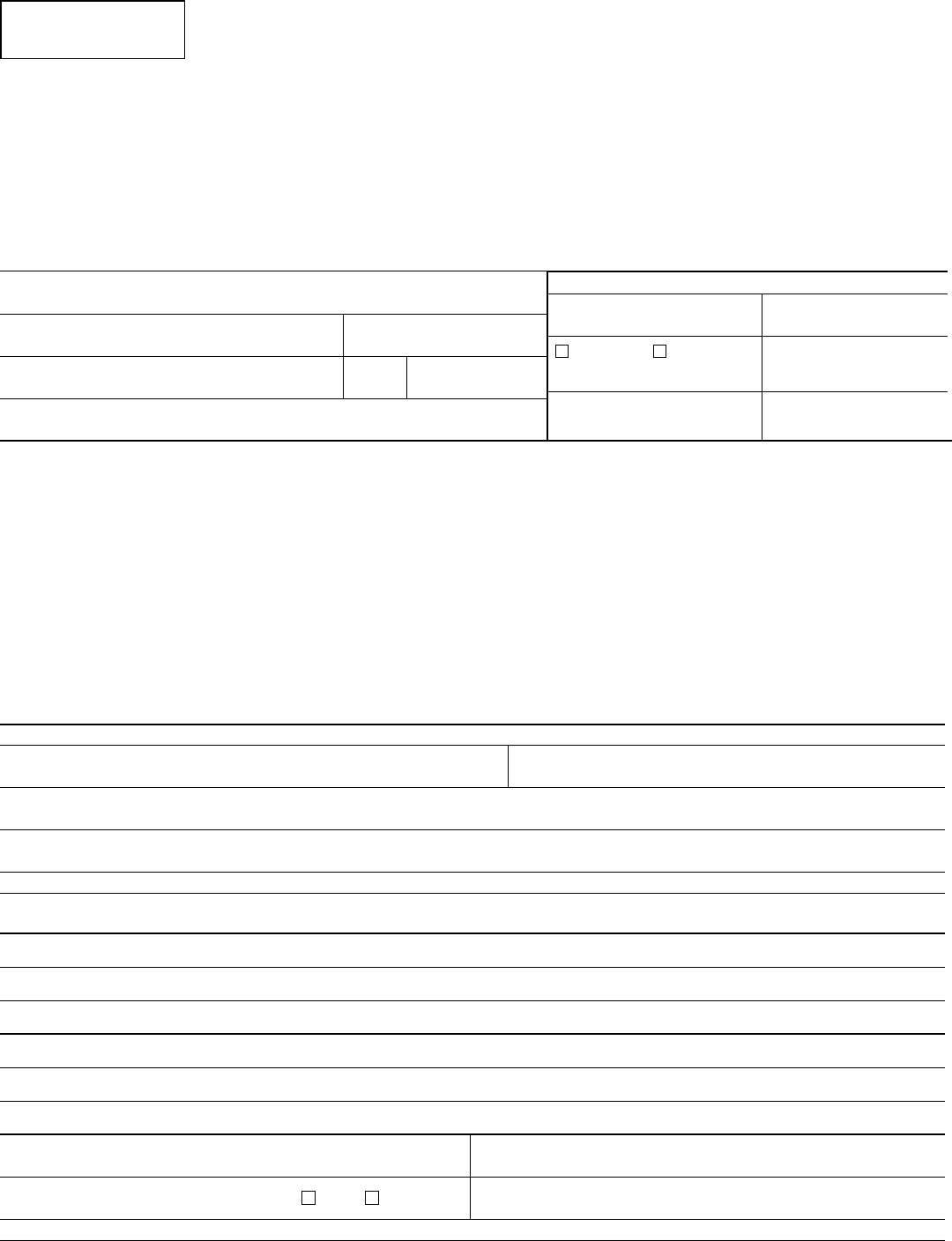

Page 1 of 4150-310-087 (Rev. 02-29-24) Form OR-AP-RPPTE-L

Application for Real and Personal Property Tax Exemption

For lease, sublease, or lease-purchased property owned by a taxable owner and leased to an

exempt public body, institution, or organization, other than the state of Oregon or the

U.S. Government, ORS 307.112.

• The lessee, sublessee, or lease-purchaser of the property must le this form with the county assessor on or before April 1 for the

ensuing tax year. See page 4 of this form for late ling information.

• The applicant is obligated to prove the property meets the requirements for exemption. Include all documents or information that

show the exemption is appropriate.

• See ORS 307.112 on page 4 of this form.

• Complete both sides of this form.

• This form is available online on the Department of Revenue’s website at: www.oregon.gov/dor.

Name of organization

Mailing address

City

ZIP code

Phone

( )

State

I am claiming a property tax exemption under the following Oregon Revised Statute (mark one box):

Note: If applying for exemption for affordable housing owned by a religious organization under 307.140(4) use Form OR-A-PTE,

Application for Property Tax Exemption,150-303-006.

c 307.090 Public body

(other than state of Oregon or the U.S. government) c 307.140 Religious organizations*

c 307.130 Literary, benevolent, charitable, scientic c 307.145 Child care facilities, schools, student housing*

institutions, volunteer re departments*

c 307.147 Senior services centers*

c 307.136 Fraternal organizations* c 307.580 Industry apprenticeship or training trust*

c Other (provide ORS number) _________________________

*You must attach current copies of your organization's Articles of Incorporation, By-Laws, and proof of your status as a non-profit corporation.

Email

For assessor’s use only

Date received Account number

Approved Denied

By ____________________

Late ling fee

$

Exemption applies

to tax year 20 _______ – _______

Lease expiration date

Property description

Account number (as shown on owner's property tax statement) Name of property owner

Physical address (street address, city)

You must attach a list of all real and personal property you are claiming for exemption. Include detailed and complete descriptions of all

property claimed and costs.

Property use

To qualify for this exemption, the lessee, sublessee, or entity in possession of the property must be using the property for their exempt

purposes. Property not used for qualied purposes before July 1 is taxable.

Describe the purpose of this organization:

Describe how you will use the property, such as, church services, ofces, classrooms, student housing, etc.:

Does the property include a parking area?

c Yes c No

What is the fee for using the parking

area?

$

Is any portion of the property you lease

used by others?

Yes No

If yes, what is the square footage of the

area used by others:

_____________square feet

If yes, explain and identify the area that is used by others:

Form

OR-AP-RPPTE-L

Complete both sides of this form.

Reset Form

Print Form

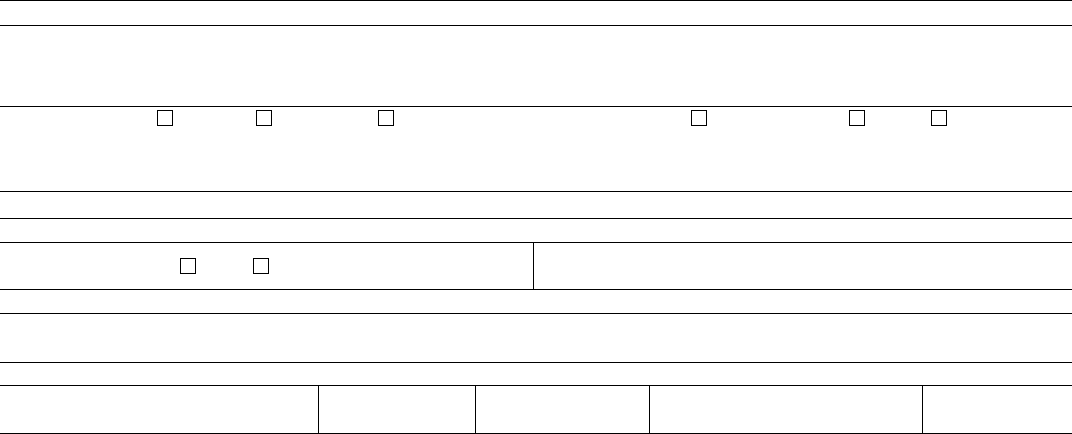

Page 2 of 4150-310-087 (Rev. 02-29-24) Form OR-AP-RPPTE-L

Lease or sublease

Your lease or sublease must be for a period of at least one year. A month-to-month tenancy or general rental agreement won't qualify for this exemption.

The lease document must state that any tax savings resulting from the exemption shall inure solely to the benet of the lessee, or the lessee and lessor

must complete the Tax Savings Agreement on page 3. A new application must be led by the due date if a new lease, sublease, or lease-purchase

agreement or extension or modication to the existing lease, sublease, or lease-purchase agreement is made.

Is property under:

Lease Sublease Lease-purchase Type of lease: Modied gross Net Triple-net

Beginning date: _______________ Expiration date: _______________ Square footage of area leased, subleased, or lease-purchased:____________

You must attach a current signed copy of your lease, sublease, or lease-purchase agreement.

Late fee

If this form is led after April 1, a late ling fee must accompany the form. See page 3 of this form for late ling information.

A late fee is attached:

Yes No

Exemption requested for tax years:

Declaration

I declare under the penalties for false swearing [ORS 305.990(4)] that I have examined this document (and attachments) and to the best of my

knowledge they are true, correct, and complete.

Must be signed by the president, proper officer, head official, or authorized delegate of the organization.

Name (print or type) Title Phone Signature Date

( ) X / /

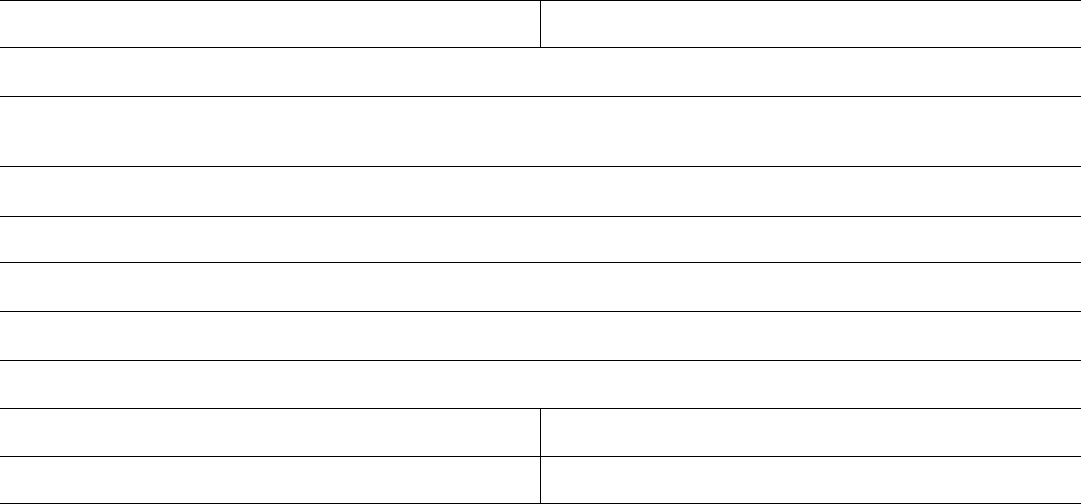

Page 3 of 4150-310-087 (Rev. 02-29-24) Form OR-AP-RPPTE-L

Tax Savings Agreement

This form may be used as documentary proof under ORS 307.112(3) that the tax savings resulting from an exemption under ORS 307.112 will inure

solely to the benet of the institution, organization or public body that has been granted the exemption.

Name of lessee Name of lessor

Property address

The lessor acknowledges that the lessee is applying for exemption on the property described above under provisions of ORS 307.112. If the prop-

erty tax exemption is granted, the lessee and lessor of property described above agree that any savings resulting from the tax exemption shall solely

benet the lessee.

The tax savings will be passed on to the lessee by (describe the manner in which the lessee will receive the benet of the tax savings):

Signature of lessee Signature of lessor

Date Date

/ / / /

Page 4 of 4150-310-087 (Rev. 02-29-24) Form OR-AP-RPPTE-L

Oregon Revised Statute (ORS) and Oregon Administrative Rule (OAR)

ORS 307.112. (1) Real or personal property of a taxable owner

held under lease, sublease or lease purchase agreement by an

institution, organization or public body, other than the State of

Oregon, or a public university listed in ORS 352.002, granted

exemption or the right to claim exemption for any of its property

under ORS 307.090, 307.130, 307.136, 307.140, 307.145, 307.147

or 307.181 (3), is exempt from taxation if:

(a) The property is used by the lessee or, if the lessee is not in

possession of the property, by the entity in possession of the

property, in the manner, if any, required by law for the exemp-

tion of property owned, leased, subleased or being purchased

by it; and

(b) It is expressly agreed under the terms of the lease, sublease

or lease-purchase agreement that any tax savings resulting from

the exemption granted under this section shall inure solely to

the benet of the institution, organization or public body.

(2) To obtain the exemption under this section, the lessee or, if

the lessee is not in possession of the property, the entity in pos-

session of the property, must le a claim for exemption with

the county assessor, veried by the oath or afrmation of the

president or other proper ofcer of the institution or organiza-

tion, or head ofcial of the public body or legally authorized

delegate, showing:

(a) A complete description of the property for which exemption

is claimed.

(b) If applicable, all facts relating to the use of the property by

the lessee or, if the lessee is not in possession of the property,

by the entity in possession of the property.

(c) A true copy of the lease, sublease or lease-purchase agreement

covering the property for which exemption is claimed.

(d) Any other information required by the claim form.

(3) If the assessor is not satised that the tax savings resulting

from the exemption granted under this section will inure solely

to the benet of the institution, organization or public body,

before the exemption may be granted the lessor must provide

documentary proof, as specied by rule of the Department of

Revenue, that resulting from the exemption will inure solely to

the benet of the institution, organization or public body.

(4)(a) The claim must be led on or before April 1 preceding the

tax year for which the exemption is claimed, except:

(A) If the lease, sublease or lease-purchase agreement is entered

into after March 1 but not later than June 30, the claim must be

led within 30 days after the date the lease, sublease or lease-

purchase agreement is entered into if exemption is claimed for

that year; or

(B) If a late ling fee is paid in the manner provided in ORS

307.162 (2), the claim may be led within the time specied in

ORS 307.162 (2).

(b) The exemption rst applies for the tax year beginning July

1 of the year for which the claim is led.

(5)(a) An exemption granted under this section continues as

long as the use of the property remains unchanged and during

the period of the lease, sublease or lease purchase agreement.

(b) If the use changes, a new claim must be led as provided

in this section.

(c) If the use changes due to sublease of the property or any

portion of the property from the tax exempt entity described in

subsection (1) of this section to another tax exempt entity, the

entity in possession of the property must le a new claim for

exemption as provided in this section.

(d) If the lease, sublease or lease-purchase agreement expires

before July 1 of any year, the exemption termin

ates as of January

1 of the same calendar year.

OAR 150-307-0060

Property Held Under Lease

(1) A new claim must be filed with the county assessor, as

required under ORS 307.112(4), when a new lease, new lease-

purchase agreement, extension of current lease, extension of

current lease-purchase agreement or any modication to the

existing lease or lease-purchase agreement is made.

(2) The new claim must meet all the requirements of ORS

307.112.

(3) Late ling as provided in ORS 307.162(2) is permitted.

(4) The State of Oregon and the United States government are

not permitted to le a claim for exemption under ORS 307.112.

(5) When used in reference to real property or tangible personal

property, a lease is a contract of at least one year by which the

owner of a property grants the rights of possession, use, and

enjoyment of the property to another for a specied period of

time in exchange for payment.

(6) Month-to-month tenancy or a general rental agreement is

not considered the same as a lease for purposes of an exemption

under this statute and will not qualify in an exemption claim.

(7) The assessor must be satised that the tax savings resulting

from the exemption will inure solely to the benet of the lessee.

(8) Sufcient documentary proof must be submitted at the time

of application. Documentary proof to show the property tax

savings is passed on to the lessee includes:

(a) A form prescribed by the department stating that the lessee

and lessor agree that the tax savings resulting from the exemp-

tion will inure solely to the benet of the lessee;

(A) The form must be signed by the lessor and lessee; and

(B) The form must specify how the tax savings inures to the

lessee.

(b) Other documentation the county assessor deems necessary

to prove that the lessee is receiving the full benet of the tax

savings; or

(c) An agreement under the terms of the lease that any tax

savings resulting from the exemption will inure solely to the

benet of the lessee.

(9) Insufcient proof or failure to show the tax savings inures

to the lessee as described above is grounds for denial of the

exemption.

Late ling information:

ORS 307.162 provides for late ling as follows:

1. If you are ling before December 31 for the current tax year,

the late ling fee is $200.00 or one-tenth of one percent of

the real market value of the property, whichever is greater.

2. If you are ling before April 1 of the current tax year, for

the current tax year only, and you are a rst-time ler, have

good and sufcient cause for ling late, or are a government

entity described in ORS 307.090, the late ling fee is $200.00.

3. If you are ling for the current tax year and up to ve prior

tax years and you are a rst-time ler, have good and suf-

cient cause for ling late, or are a government entity de-

scribed in ORS 307.090, and are either ling within 60 days

of the mailing date of a notice of additional tax or are ling

at any time if no notice was mailed, then the late ling fee is

the greater of $200.00 or one-tenth of one percent of the real

market value as of the most recent assessment date, multi-

plied by the number of prior years claimed.