Application for Property Tax Exemption

REV 63 0001 (08/05/2024) 1 of 8

Department of Revenue use only

Post/email:

Scan:

Fee:

Registraon number:

County number:

1

Applicant organizaon informaon

Name:

Mailing address:

City:

State:

Zip:

Contact person: Phone:

Website:

Email:

UBI number: Federal Employer Idencaon Number:

Does your organizaon currently have a property tax exempon on any property in Washington?

Yes No Unknown If yes, what is your registraon number?

Is your organizaon currently exempt from federal income tax under 501(c)? Yes No

2

Property informaon

County:

I am claiming exempon for (check all that apply):

Real property tax (building and land) Owned Leased

Personal property tax (furnishings and equipment) Owned Leased

Leasehold excise tax (lease of government owned property) Leased

Government owner/lessor:

Name of site occupant (if dierent from applicant):

Site locaon address:

City:

State:

Zip:

Parcel numbers:

State the current and/or planned use of the property:

1. On what date did your organizaon purchase/lease this property?

2. On what date did your organizaon begin to conduct the exempt acvity at this locaon?

Application for Property Tax Exemption

(RCW 84.36)

See page 6 for complete instrucons and

general informaon.

Aenon: Before lling out form, download and

save to your computer.

Form 63 0001

To request this document in an alternate format, please complete the form

dor.wa.gov/AccessibilityRequest or call 360-705-6705. Teletype (TTY) users please dial 711.

Reset formReset form

Print form

Application for Property Tax Exemption

REV 63 0001 (08/05/2024) 2 of 8

3. Was this property exempt to the previous owner or lessee? Yes No Unknown

4. Does your organizaon rent/sublease the property or a poron of the property? Yes No

5. Does your organizaon rent/loan the property to individuals or groups for events or meengs?

Yes No

If yes, please provide a list of renters and fees:

6. Does this property include a parsonage, convent, or caretaker residence? Yes No

7. Has there been any change to parcel(s) including a change in non-exempt use, parcel segregaon, or

lot line adjustment?

Yes No

If yes, please provide addional details.

8. Are any buildings under construcon,

remodel, or

planned to be built? Yes No

If yes, what is/was the start date?

When is the esmated compleon date?

Application for Property Tax Exemption

REV 63 0001 (08/05/2024) 3 of 8

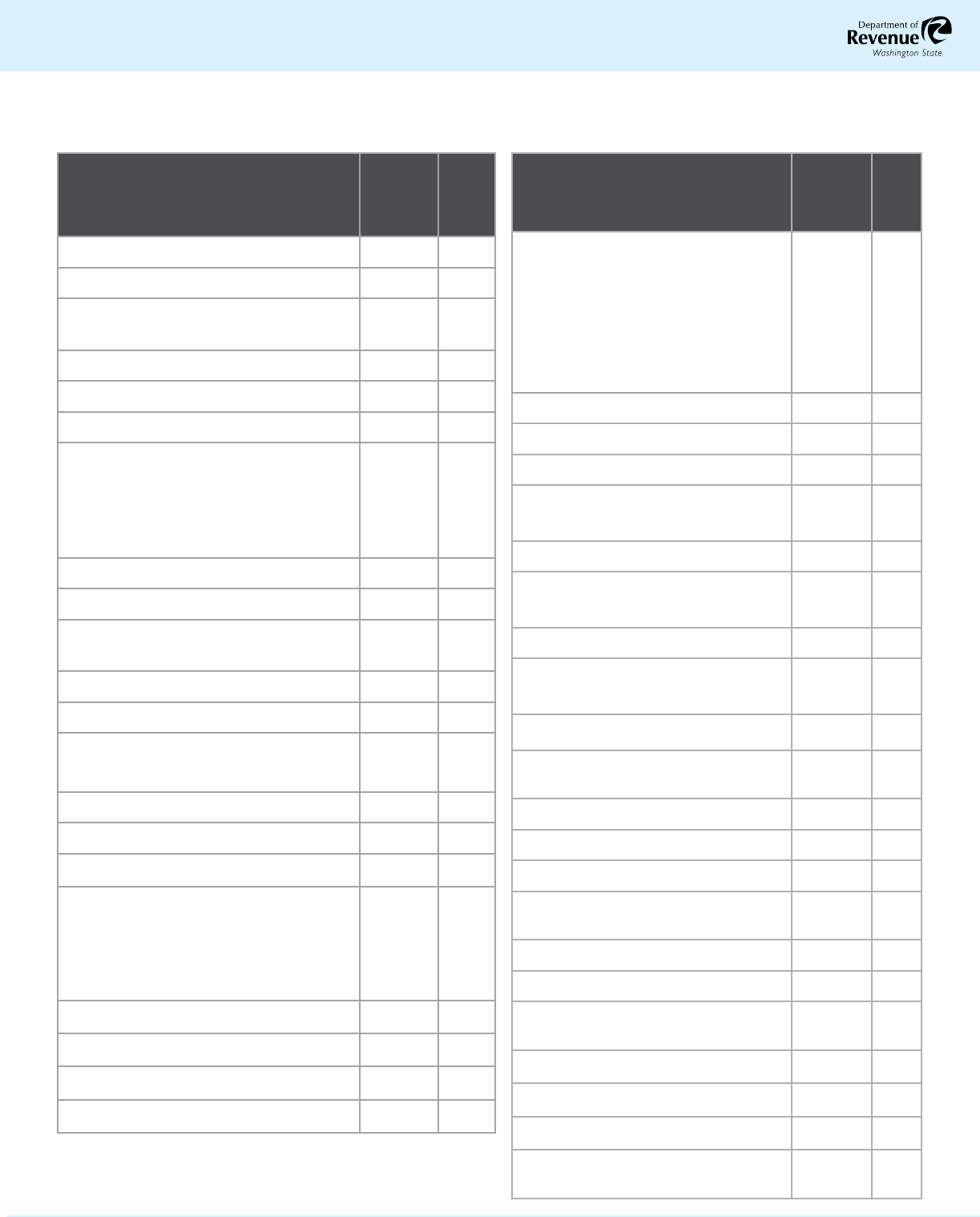

3 Exempon matrix

Please use the checkbox to idenfy the exempted acvity under which you are applying.

Exempt acvity or use

Statute

RCW

84.36

Rule

WAC

458-

16-

Administrave oces of a religious org.

032

Agricultural research or educaon facility

570

Arsts – Property used to solicit or collect

money for arsts

650

Blood/Tissue bank

035

Cancer clinic or center

046

Cemetery*

020(1) 180

Church building*

Future church site (land only) *

Parsonage/Caretaker res.*

Convent*

020(2) 190,

200

Church camp*

030(2) 220

Community celebraon facility*

037 310

Community center (surplus school

district property)

010

Consul oce/residence

010(1)

Child day care center*

040(1)(a) 260

Emergency/Transional housing*

Recovery housing facility*

043 320

Fair associaon*

480

Federally incorporated relief organizaon

030(5)

Fire company

060(1)(c) 284

Home for the aging*

HUD nanced facility

Tax exempt bond nancing

Non-HUD or bond: income vericaon

041 A-010

A-020

Home for the developmentally disabled*

042

Home for the sick or inrm*

040 260

Homeownership development

049

Humane society

060 286

Exempt acvity or use

Statute

RCW

84.36

Rule

WAC

458-

16-

Income qualifying households*

Rental housing facility

Future housing facility or cooperave

Mobile or manufactured home

cooperave

Converng exempon from future to

occupied.

560 560

Library (open to the public & free)*

040 260

Limited equity cooperave housing*

675

Military housing facility

665

Museum

Future museum site*

060(1)(a) 280

Nature conservancy land*

260, 262 290

Nonprot hospital*

Public hospital* (leased property)

040 260

Outpaent dialysis facility*

040 260

Performing arts facility

Future performing arts facility*

060(1)(b) 282

Public assembly hall or meeting facility*

037 300

Rebroadcast government radio/TV

signal

047

Senior cizen center

670

School or college*

050 270

College foundaon

050 270

Sheltered workshop for the

handicapped

350 330

Social service organizaon*

030(1) 210

Soil/Water conservaon district

240

Solicitaon & distribuon of gis,

donaons, or grants*

550 215

Student loan agency

030(6) 245

Veteran’s organizaon*

030(4) 240

Water distribuon organizaon*

250

Youth character building organizaon

(18 or younger) *

030 (3) 230

*Addional documents required. Please see Secon 6.

Application for Property Tax Exemption

REV 63 0001 (08/05/2024) 4 of 8

4 Documentaon conrmaon

Check the box to indicate that the following required documentaon is included with this applicaon

packet. Incomplete applicaons cannot be processed and will be returned.

A copy of your IRS leer, only if your organizaon has been granted exempon from federal income

tax under secon 501(c).

A copy of the ownership deed for real property or a copy of the lease agreement, if the property

is being leased. Note: Do not submit a Deed of Trust, as it is a nancing document and does not

demonstrate ownership. Please submit a Warranty, Quit Claim, Bargain and Sale, or similar deed to

document ownership.

All addional documents listed in Secon 6 of this applicaon for the acvity/exempon claimed.*

If your organizaon rents/sub-leases the property or a poron of the property, please provide the

following:

• A copy of all rental/sub-lease agreements, use agreements, or occupancy agreements.

If your organizaon rents or loans the property or a poron of the property for meengs, pares,

or similar events, for more than 15 days in a calendar year, please provide the following:

• A copy of your rental policies and rates.

• A list of all individuals or organizaons that used/rented from you during the previous

calendar year. The list must include the dates your property was used, the name of the user,

the purpose for which the property was used, the amount of rental/donaon received,

duraon/hours of use, and whether the funcon was open to the public.

• Maintenance and operaon expenses aributed to the rental space.

A copy of the property site map and/or oor plans.

5 Cercaon and refund request

By signing this document, I cerfy that I am an authorized representave of the applicant. I cerfy that

the statements in this applicaon and the informaon aached are true and correct to the best of my

knowledge and belief, and are made for the purpose of having the property described here on or a part

thereof, exempt from taxaon. I cerfy that I have reviewed, and can produce upon request, a statement

of the receipts and disbursement of the applicant which shows that the income and receipts (including

donaons) have been applied to the actual expenses of operang and maintaining the exempt acvity

or for its capital expenditures and to no other purpose. If applicable, I request a refund of property taxes

under the provisions of RCW 84.36.815 and RCW 84.69.020 and RCW 84.69.030.

Signature:

Date:

Print name:

Title:

Phone: Email:

Application for Property Tax Exemption

REV 63 0001 (08/05/2024) 5 of 8

6 Addional documents required

In addion to the documents requested in secon 4,

you must also provide the documents listed for your

specic acvity.

Cemetery (nonprot & for-prot) - Please provide:

• A copy of the cemetery plat or map.

• A copy of your cemetery license issued by the

Department of Licensing.

Future church site - Please provide:

• Clearly established plans for nancing the

construcon.

• The proposed architectural plans showing what

poron of the property will be under actual exempt

use.

• A copy of your site survey, building permit, other

documents relevant to conrming an acve building

program.

Church – Please provide:

• A copy of the arcles of formaon and/or bylaws if the

church is not recognized as a 501c with the IRS.

Parsonage - Please provide documentaon

conrming:

• The occupant is a licensed or ordained member of

the clergy.

• The occupant is responsible for holding regularly

scheduled worship services.

Convent - Please provide documentaon conrming:

• The occupants are licensed or ordained members of

clergy devoted to religious life under a superior (i.e.

convent formaon document and resident guide).

Caretaker residence - Please provide:

• A copy of your caretaker’s contract/occupancy

agreement.

• A list of your caretaker’s dues.

Child day care center - Please provide:

• A copy of your Child Care license from the

Department of Early Learning.

Church camp - Please provide:

• A list of all groups, organizaons, or individuals

(including your organizaon) that used the facility

during the previous calendar year. This informaon

should contain the dates of use, name of the user, the

acvies provided or conducted, and the rental or

donaon amount received.

Community celebraon facility - Please provide:

• Documentaon conrming the property has been

primarily used to conduct an annual community

celebraon event for 10 or more years.

Emergency/Transional housing facility - Please

provide:

• A descripon of your program or a list of the

supporve services provided by your organizaon.

• A copy of your length of stay policy.

• A copy of your tenant agreement.

• A tenant list showing names of occupants, their

move- in/move-out dates, and the rental fee.

• Maintenance/operaon expenses of the housing

facility.

Registered Recovery Residences - Please provide:

• Documentaon demonstrang your registraon with

the Washington State Health Care Authority as an

approved recovery residence.

• Tenant list with rental rates.

• Maintenance/operaon expenses of the residence.

Fair associaon - Please provide:

• Documentaon demonstrang your organizaon

sponsors a fair, which receives support from the

Department of Agriculture Fair Fund.

Home for the aging HUD assisted facility - Please

provide:

• A lisng of the varying levels of care and supervision

provided or coordinated by the home.

• Documentaon demonstrang the facility is assisted

by a HUD Project Based Program.

• A residenal tenant list showing the unit number;

name of the resident(s) occupying the unit as of

January 1, age of resident(s), an indicaon if the

resident is disabled; the annual household income,

and a descripon of the assisted living services (if

provided).

Home for the aging non-HUD or bond nanced

facility (Income Veried) - Please provide:

• A lisng of the varying levels of care and supervision

provided or coordinated by the home.

• A completed Tenant List Template showing the unit

number; name of the resident(s) occupying the unit

as of January 1 of the current year, age of resident(s),

an indicaon if the resident is disabled; the annual

household income, and a descripon of the assisted

living services (if provided).

• Applicant must also le an income vericaon form

REV 64 0043 with their County Assessor’s Oce for

each eligible resident.

Application for Property Tax Exemption

REV 63 0001 (08/05/2024) 6 of 8

Home for the aging tax exempt bond nanced facility

Please provide:

• A lisng of the varying levels of care and supervision

provided or coordinated by the home.

• A copy of the regulatory agreement between the

home and the enty that issued the bonds.

• A residenal tenant list showing the unit number;

name of the resident(s) occupying the unit as of

December 31 of the previous year, age of resident(s),

an indicaon if the resident is disabled; and the

annual household income.

Home for the developmentally disabled - Please

provide:

• A tenant lisng showing the names of all occupants,

and move-in dates.

• Proof of tenant eligibility (provided by DSHS –

Division of Developmental Disabilies).

Home for the sick or inrm - Please provide:

• A copy of the facility’s license issued by the

Department of Health.

Housing facilies or mobile/manufactured home

cooperaves with income qualifying households

(exisng or future) - Please provide:

• Copy of agreements that dene the applicant’s

interest in the ownership and operaon of the

facility/coop (i.e. formaon/ownership structures,

operang agreements, regulatory agreements etc.).

• Documentaon conrming the project was insured,

nanced, or assisted through one of the following

sources:

Ê A federal or state housing program administered by

the Department of Commerce.

Ê A federal housing program administered by a city

or county government.

Ê An aordable housing levy authorized by RCW

84.52.105 or RCW 84.55.050.

Ê The surcharges authorized by RCW 36.22.250 or

Chapter 43.185C RCW.

Ê Washington State Housing Finance Commission.

Ê City or county funds designated for aordable housing.

• A tenant list showing the type of unit, unit number,

name of the tenant occupying the unit as of

December 31 of the previous year, total number of

tenants in unit, and their annual combined household

income. Not necessary to include for a future very

low-Income housing facility.

• Converng from Future to Occupied, include updated

site plan and parcel details.

Note: If applying as a future very low-income housing

facility then please provide a site map showing the facility

to be constructed and a meline of planned construcon.

Library (free) - Please provide:

• A copy of your policies regarding use/membership,

library hours, and material loan.

Limited equity cooperave housing - Please provide:

• Copy of agreements/documents that dene the

applicant’s interest in the ownership and operaon

of the owned cooperave housing, including sale

restricons (i.e. formaon/ownership structures,

operang agreements, regulatory agreements, etc.).

• Site plan demonstrang at least 95% of the property

is used for dwelling units or other noncommercial

purposes.

• A tenant list showing the unit number, name of

occupant as of January 1 of the assessment year,

or the rst date of occupancy in the rst year of

operaon, annual household income, and number of

occupants in each unit.

• Documentaon conrming the housing is insured,

nanced, or assisted through one of the following

sources:

Ê A federal or state housing program administered by

the Department of Commerce.

Ê A federal or state housing program administered

by the federal department of housing and urban

development.

Ê A federal housing program administered by a city

or county government.

Ê An aordable housing levy authorized under RCW

84.52.105.

Ê The surcharges authorized by RCW 36.22.250 or

Chapter 43.185C RCW.

Ê The Washington State Housing Finance Commission.

Museum (future only) - Please provide:

• Clearly established plans for nancing the

construcon.

• The proposed architectural plans showing what

poron of the property will be under actual use.

• A copy of your site survey, building permit, other

documents relevant to conrming an acve building

program.

Nature conservancy - Please provide:

• A descripon of the specic resource(s) preserved on

the property.

• A copy of your policy statement on the availability of

the property to the public.

Nonprot or public hospital - Please provide:

• A copy of Department of Health Cercate of Need.

• A copy of Department of Health Construcon Review

Packet.

• A copy of Department of Health Hospital Acute Care

License for the address under applicaon.

Application for Property Tax Exemption

REV 63 0001 (08/05/2024) 7 of 8

Outpaent dialysis facility - Please provide:

• A copy of your license issued by the Department

of Health.

Performing arts facility (future only) - Please provide:

• Clearly established plans for nancing the

construcon.

• The proposed architectural plans showing what

poron of the property will be under actual

exempt use.

• A copy of your site survey, building permit, other

documents relevant to conrming an acve

building program.

Public assembly hall/meeng facility - Please

provide:

• A copy of the facility’s rental policies and rates.

• Samples of public adversement concerning the

rental facility.

• A list of individuals/groups that used your facility

during the previous calendar year including uses

by your organizaon. The list must include the

dates the property was used, the hours/duraon

of each use, the names of the user, the purpose

for which the property was used, whether the

event was open to the public, and the amount of

rental/donaon received.

School or college - Please provide:

• Documents which show accreditaon by

the Superintendent of Public Instrucon or

cercaon by an external agency that ceres

educaonal instuons such as the U.S.

Department of Educaon.

• A copy of course catalog, schedule, and student

handbook.

Social Service Organizaon - Please provide:

• A general descripon of the goods/services

provided.

• A copy of your sliding fee scale or other charity

care/reduced fee schedule or policy.

• A spreadsheet showing the total number of

clients served at the locaon during the previous

year categorized by primary payer (see example).

Note: Instead of providing items 2 & 3 above

you may submit documentaon conrming your

organizaon contributed at least 10% of the total

annual income received from the property under

applicaon towards the support of social services.

Solicitaon of gis, donaons, or grants for

nonprots - Please provide:

• Proof of your aliaon with a state or naonal

volunteer charitable fund-raising organizaon.

• A list of the organizaons receiving gis, grants,

or donaons from your organizaon.

Veteran’s organizaon - Please provide:

• A copy of your organizaon’s naonal charter

document.

Water distribuon organizaon - Please provide:

• A list of members and their addresses.

• A list showing addresses receiving water.

Youth Character Building Organizaon

Please provide:

• A copy of your policy statement that shows the

maximum age of parcipants served by your

organizaon.

7 Submial instrucons

The aached applicaon is used by nonprot

organizaons seeking exempon from real property

tax, personal property tax and leasehold excise tax (a

tax on the use of government owned property).

1. Read the enre form.

2. Review the table on page 2 and select the

exempon that best ts your organizaon’s

acvies.

3. Compile or prepare the documents requested in

secons 4 & 6 of this applicaon.

4. Complete Secons 1, 2 and 3 of the applicaon.

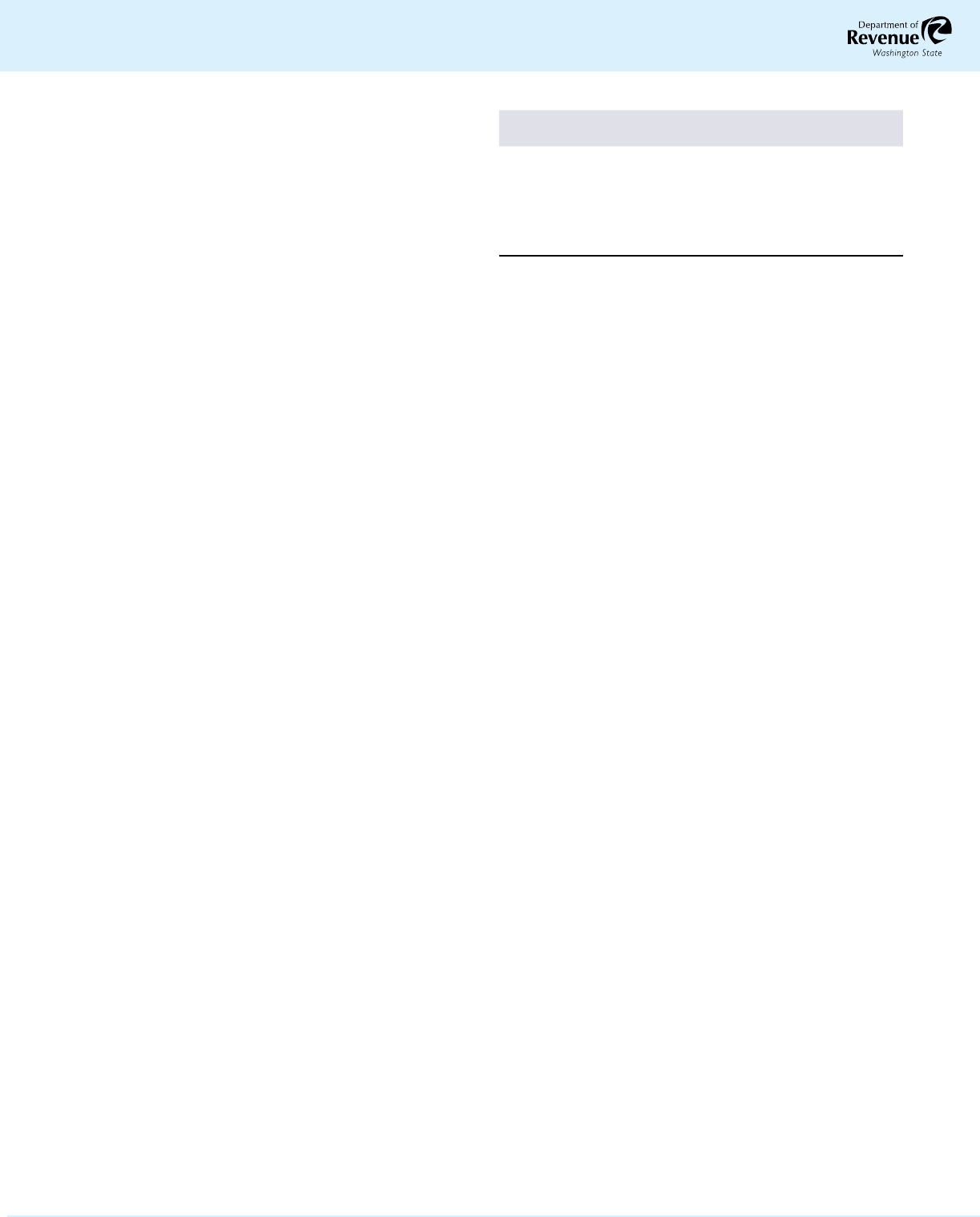

Cost

Number of

clients

Reduced by

at least 20%

Uninsured Free 81 12.52%

Medicaid 80 12.36%

Medicare 22

Private insurance 412

Total clients: 647 *24.88%

Gi and giving example:

*Because this amount is greater than 15%, it would qualify for the exempon.

Application for Property Tax Exemption

REV 63 0001 (08/05/2024) 8 of 8

5. Scan and email the completed applicaon form

along with the addional documentaon to:

dornonprotapplicaon@dor.wa.gov or send by

U.S. mail to:

Department of Revenue

Property Tax Division/Exempt Property

PO Box 47471

Olympia WA 98504-7471

8 General informaon

Nonprot organizaons, even though they may be

exempt from federal taxes, are not generally exempt

from property taxes in Washington state. Unless

the nonprot organizaon is exclusively using the

property to conduct an acvity specically exempted

by the Legislature, it is required to pay property

taxes in the same manner as other enes. The

exempt acvies are found in Chapter 84.36 of

the Revised Code of Washington (RCW). Addional

informaon regarding these exempons is located

in Chapter 458-16 of the Washington Administrave

Code (WAC). A helpful reference matrix is included

with this applicaon.

Ownership

Generally, ownership by a nonprot enty is

required to qualify for exempon. However, some

statutes allow nonprot organizaons to lease

property and remain eligible for exempon. In these

cases the lease must transfer the responsibility for

the property taxes to the nonprot.

Filing date

Applicaons are due within 60 days of acquiring

the property and/or converng the property to an

exempt use. Applicaons requesng a retroacve

exempon are accepted as long as the applicaon is

led within three years of the date the taxes were

due. Late or retroacve applicaons are subject to

late ling penales.

Appeal process

Aer the department reviews your inial applicaon

and/or renewal, they will issue a determinaon of

taxability. If you do not agree with the Department

of Revenue’s determinaon, you have the right

to appeal to the Washington State Board of Tax

Appeals (Board). Your appeal must be led with

the Board within 30 calendar days of the date the

determinaon was mailed or emailed. You must

allow for mailing me within the 30 day period. To

obtain an appeal form, call the Board at 360-753-

5446 or visit their website at www.bta.state.wa.us.

Annual renewals due March 31

To keep your property tax exempon, you are

required to submit an annual renewal. The

Department of Revenue (department) sends a noce

each year in January, reminding nonprots to renew

their exempon online (www.dor.wa.gov) prior to

the March 31 deadline. The renewal process cannot

be used to add property to an exisng exempon.

Organizaons wanng to add previously taxed

property to an exisng exempon must submit a

new applicaon.

Report changes in use

Aer the exempon has been granted, any change in

use or ownership must be reported to the Property

Tax division of the Department of Revenue within 60

days of the change.

Jeopardizing the exempon

Washington’s laws and rules restrict the manner in

which exempt property may be used. To qualify for

and maintain exempt status the property must be

exclusively used to conduct the exempted acvity.

All other acvies including commercial acvies

must be severely restricted. Property may be

exempt in part if a poron of the property does not

inially qualify, or fails to connue to qualify for the

exempon.

Tax rollback

When an exempt property is no longer used for the

purpose under which an exempon was granted,

and has not been exempt for the required number

of years, the property may be subject to rollback

provisions. This means taxes, plus interest, may

be assessed for the current year plus the three

previous years. There are several excepons to this

rule. Please contact the Department of Revenue’s

Property Tax division for more informaon.

For assistance or quesons on this form

Please contact the Exempt Property Tax secon of

the Department of Revenue at 360-534-1400.