Counterparty credit risk and the credit default swap market

$

Navneet Arora

a

, Priyank Gandhi

b

, Francis A. Longstaff

b,c,

n

a

American Century Investments, United States

b

UCLA Anderson School, United States

c

NBER, United States

article info

Article history:

Received 19 February 2010

Received in revised form

8 April 2011

Accepted 9 June 2011

Available online 19 October 2011

JEL classification:

G12

G13

G24

Keywords:

Counterparty credit risk

Credit default swaps

Collateralization

abstract

Counterparty credit risk has become one of the highest-profile risks facing participants

in the financial markets. Despite this, relatively little is known about how counterparty

credit risk is actually priced. We examine this issue using an extensive proprietary data

set of contemporaneous CDS transaction prices and quotes by 14 different CDS dealers

selling credit protection on the same underlying firm. This unique cross-sectional data

set allows us to identify directly how dealers’ credit risk affects the prices of these

controversial credit derivatives. We find that counterparty credit risk is priced in the

CDS market. The m agnitude of the effect, however, is vanishingly small and is

consistent with a market structure in which participants require collateraliza tion of

swap liabilities by counterparties.

& 2011 Elsevier B.V. All rights reserved.

1. Introduction

During the past several years, counterparty credit risk

has emerged as one of the most important factors driving

financial markets and contributing to the global credit crisis.

Concerns about counterparty credit risk were significantly

heightened in early 2008 by the collapse of Bear Stearns, but

then skyrocketed later in the year when Lehman Brothers

declared Chapter 11 bankruptcy and defaulted on its debt

and swap obligations.

1

Fears of systemic defaults were so

extreme in the aftermath of the Lehman bankruptcy that

Euro-denominated CDS contracts on the U.S. Treasury

were quoted at spreads as high as 100 basis points.

Despite the significance of counterparty credit risk in

the financial markets, however, there has been relatively

little empirical research about how it affects the prices of

contracts and derivatives in which counterparties may

default. This is particularly true for the $57.3 trillion

notional credit default swap (CDS) market in which

defaultable counterparties sell credit protection (essen-

tially insurance) to other counterparties.

2

The CDS markets

have been the focus of much attention recently because it

was AIG’s massive losses on credit default swap positions

Contents lists available at SciVerse ScienceDirect

journal homepage: www.elsevier.com/locate/jfec

Journal of Financial Econo mics

0304-405X/$ - see front matter & 2011 Elsevier B.V. All rights reserved.

doi:10.1016/j.jfineco.2011.10.001

$

The authors are grateful for the comments of Darrell Duffie, Chris

Jones, Peter Knez, Peter Meindl, Derek Schaeffer, Victor Wong, and

seminar participants at the 2010 NYU Moody’s Conference, the 2010

Moody’s Risk Practitioner Conference in San Francisco, the 2010 SIAM

conference on Financial Mathematics and Engineering, and the 2010

USC/UCLA Financial Research Conference. We are particularly grateful

for the comments and advice of the editor Bill Schwert and an

anonymous referee. All errors are our responsibility.

n

Corresponding author at: UCLA Anderson School, United States.

1

Lehman Brothers filed for Chapter 11 bankruptcy on September

15, 2008. During the same month, American International Group (AIG),

Merrill Lynch, Fannie Mae, and Freddie Mac also failed or were placed

under conservatorship by the U.S. government.

2

The size of the CDS market as of June 30, 2008 comes from

estimates reported by the Bank for International Settlements.

Journal of Financial Economics 103 (2012) 280–293

that led to the Treasury’s $182.5 billion bailout of AIG.

Furthermore, concerns about the extent of counterparty

credit risk in the CDS market underlie recent proposals to

create a central clearinghouse for CDS transactions.

3

This paper uses a unique proprietary data set to

examine how counterparty credit risk affects the pricing

of CDS contracts. Specifically, this data set includes con-

temporaneous CDS transaction prices and quotations

provided by 14 large CDS dealers for selling protection

on the same set of underlying reference firms. Thus, we

can use this cross-sectional data to measure directly how

a CDS dealer’s counterparty credit risk affects the prices at

which the dealer can sell credit protection. A key aspect of

the data set is that it includes most of 2008, a period

during which fears of counterparty defaults in the CDS

market reached historical highs. Thus, this data set

provides an ideal sample for studying the effects of

counterparty credit risk on prices in derivatives markets.

Four key results emerge from the empirical analysis.

First, we find that there is a significant relation between

the credit risk of the dealer and the prices at which the

dealer can sell credit protection. As would be expected,

the higher the dealer’s credit risk, the lower is the price

that the dealer can charge for selling credit protection.

This confirms that prices in the CDS market respond

rationally to the perceived counterparty risk of dealers

selling credit protection.

Second, although there is a significant relation

between dealer credit risk and the cost of credit protec-

tion, we show that the effect on CDS spreads is vanish-

ingly small. In particular, an increase in the dealer’s credit

spread of 645 basis points only translates into a one-

basis-point decline on average in the dealer’s spread for

selling credit protection. This small effect is an order of

magnitude smaller than what would be expected if swap

liabilities were uncollateralized. In contrast, the size of

the pricing effect is consistent with the standard practice

among dealers of having their counterparties fully col-

lateralize swap liabilities.

Third, the Lehman bankruptcy in September 2008 was

a major counterparty credit event in the financial mar-

kets. Accordingly, we examine how the pricing of counter-

party credit risk was affected by this event. We find that

counterparty credit risk was priced prior to the Lehman

bankruptcy. After the Lehman event, the point estimate of

the effect increases but remains very small in economic

terms. The increase is significant at the 10% level (but not

at the 5% level).

Fourth, we study whether the pricing of counterparty

credit risk varies across industries. In theory, the default

correlation between the firm underlying the CDS contract

and the CDS dealer selling protection on that firm should

affect the pricing. Clearly, to take an extreme example, no

investor would be willing to buy credit protection on

Citigroup from Citigroup itself. Similarly, to take a less

extreme example, we might expect the pricing of CDS

dealers’ credit risk to be more evident in selling credit

protection on other financial firms. Surprisingly, we find

that counterparty credit risk is priced in the CDS spreads

of all firms in the sample except for the financials.

These results have many implications for current pro-

posals to regulate the CDS market. As one example, they

argue that market participants may view current CDS risk

mitigation techniques such as the overcollateralization of

swap liabilities and bilateral netting as largely successful in

addressing counterparty credit risk concerns. Thus, propo-

sals to create a central CDS exchange may not actually be

effective in reducing counterparty credit risk further.

This paper contributes to an extensive literature on the

effect of counterparty credit risk on derivatives valuation.

Important research in this area includes Cooper and Mello

(1991), Sorensen and Bollier (1994), Duffie and Huang

(1996), Jarrow and Yu (2001), Hull and White (2001),

Longstaff (2004, 2010), and many others. The paper most

closely related to our paper is Duffie and Zhu (2009) who

study whether the introduction of a central clearing

counterparty into the CDS market could improve on

existing credit mitigation mechanisms such as bilateral

netting. They show that a central clearing counterparty

might actually increase the amount of credit risk in the

market. Thus, our empirical results support and comple-

ment the theoretical analysis provided in Duffie and Zhu.

The remainder of this paper is organized as follows.

Section 2 provides a brief introduction to the CDS market.

Section 3 discusses counterparty credit risk in the context

of the CDS markets. Section 4 describes the data. Section 5

examines the effects of dealers’ credit risk on spreads in

the CDS market. Section 6 summarizes the results and

presents concluding remarks.

2. The credit default swap market

In this section, we review briefly the basic features of a

typical CDS contract. We then discuss the institutional

structure of the CDS market.

2.1. CDS contracts

A CDS contract is best thought of as a simple insurance

contract on the event that a specific firm or entity defaults

on its debt. As an example, imagine that counterparty A

buys credit protection on Amgen from counterparty B by

paying a fixed spread of, say, 225 basis points per year for

a term of five years. If Amgen does not default during this

period of time, then B does not make any payments to A. If

there is a default by Amgen, however, then B pays A the

difference between the par value of the bond and the

post-default value (typically determined by a simple

auction mechanism) of a specific Amgen bond. In essence,

the protection buyer is able to put the bond back to the

protection seller at par in the event of a default. Thus, the

CDS contract ‘‘insures’’ counterparty A against the loss of

value associated with default by Amgen.

4

3

For example, see the speech by Federal Reserve Board Chairman

Ben S. Bernanke at the Council on Foreign Relations on March 10, 2009.

For an in-depth discussion of the economics of CDS clearinghouse

mechanisms, see Duffie and Zhu (2009).

4

For a detailed description of CDS contracts, see Longstaff, Mithal,

and Neis (2005).

N. Arora et al. / Journal of Financial Economics 103 (2012) 280 –293 281

2.2. The structure of the CDS market

Like interest rate swaps and other fixed income deri-

vatives, CDS contracts are traded in the over-the-counter

market between large financial institutions. During the

past 10 years, CDS contracts have become one of the

largest financial products in the fixed-income markets. As

of June 30, 2008, the total notional amount of CDS

contracts outstanding was $57.325 trillion. Of this

notional, $33.083 trillion is with dealers, $13.683 trillion

with banks, $0.398 trillion with insurance companies,

$9.215 trillion with other financial institutions, and

$0.944 trillion with nonfinancial customers.

5

Early in the development of the CDS market, partici-

pants recognized the advantages of having a standardized

process for initiating, documenting, and closing out CDS

contracts. The chartering of the International Swaps and

Derivatives Association (ISDA) in 1985 led to the devel-

opment of a common framework which could then be

used by institutions as a uniform basis for their swap and

derivative transactions with each other. Currently, ISDA

has 830 member institutions. These institutions include

virtually every participant in the swap and derivatives

markets. As the central organization of the privately

negotiated derivatives industry, ISDA performs many

functions such as producing legal opinions on the enfor-

ceability of netting and collateral arrangements, advan-

cing the understanding and treatment of derivatives and

risk management from public policy and regulatory capi-

tal perspectives, and developing uniform standards and

guidelines for the derivatives industry.

6

3. Counterparty credit risk

In this section, we first review some of the sources of

counterparty credit risk in the CDS market. We then

discuss ways in which the industry has attempted to

mitigate the risk of losses stemming from the default of a

counterparty to a CDS contract.

3.1. Sources of counterparty credit risk

There are at least three ways in which a participant in

the CDS market may suffer losses when their counter-

party enters into financial distress. First, consider the case

in which a market participant buys credit protection on a

reference firm from a protection seller. If the reference

firm underlying the CDS contract defaults, the protection

buyer is then owed a payment from the counterparty. If

the default was unanticipated, however, then the protec-

tion seller could suddenly be faced with a large loss. If the

loss was severe enough, then the protection seller could

potentially be driven into financial distress. Thus, the

protection buyer might not receive the promised protec-

tion payment.

Second, even if the reference firm underlying the CDS

contract does not default, a participant in the CDS market

could still experience a substantial loss in the event that

the counterparty to the contract entered financial distress.

The reason for this is that while CDS contracts initially

have value of zero when they are executed, their mark-to-

market values may diverge significantly from zero over

time as credit spreads evolve. Specifically, consider the

case where counterparty A has an uncollateralized mark-

to-market liability of X to counterparty B. If counterparty

A were to enter bankruptcy, thereby canceling the CDS

contract and making the liability immediately due and

payable, then counterparty B’s only recourse would be to

attempt to collect its receivable of X from the bankruptcy

estate. As such, counterparty B would become a general

unsecured creditor of counterparty A. Given that the debt

and swap liabilities of Lehman Brothers were settled at

only 8.625 cents on the dollar, this could result in

counterparty B suffering substantial losses from the

default of counterparty A.

7

A third way in which a market participant could suffer

losses through the bankruptcy of a counterparty is

through the collateral channel. Specifically, consider the

case where counterparty A posts collateral with counter-

party B, say, because counterparty B is counterparty A’s

prime broker. Now imagine that the collateral is either

not segregated from counterparty B’s general assets (as

was very typical prior to the Lehman default), or that

counterparty B rehypothecates counterparty A’s collateral

(also very common prior to the Lehman default). In this

context, a rehypothecation of collateral is the situation in

which counterparty B transfers counterparty A’s collateral

to a third party (without transferring title to the collat-

eral) in order to obtain a loan from the third party.

Buhlman and Lane (2009) argue that under certain cir-

cumstances, the rehypothecated securities become part of

the bankruptcy estate. Thus, if counterparty B filed for

bankruptcy after rehypothecating counterparty A’s collat-

eral, or if counterparty A’s collateral was not legally

segregated, then counterparty A would become a general

unsecured creditor of counterparty B for the amount of

the collateral, again resulting in large potential losses. An

even more precarious situation would be when the

rehypothecated collateral itself was seized and sold by

the third party in response to counterparty B’s default on

the loan obtained using the rehypothecated securities as

collateral. Observe that because of this collateral channel,

counterparty A could suffer significant credit losses from

counterparty B’s bankruptcy, even if counterparty B does

not actually have a mark-to-market liability to counter-

party A stemming from the CDS contract.

3.2. Mitigating counterparty credit risk

One of the most important ways in which the CDS

market attempts to mitigate counterparty credit risk is

5

Data obtained from Table 4 of OTC Derivatives Market Activity for

the First Half of 2008, Bank for International Settlements.

6

This discussion draws on the information about ISDA provided on

its Web site www.isda.org.

7

The settlement amount was based on the October 10, 2008

Lehman Brothers credit auction administered by Creditex and Markit

and participated in by 14 major Wall Street dealers. See the Lehman

auction protocol and auction results provided by ISDA.

N. Arora et al. / Journal of Financial Economics 103 (2012) 280–293282

through the market infrastructure provided by ISDA. In

particular, ISDA has developed specific legal frameworks

for standardized master agreements, credit support

annexes, and auction, closeout, credit support, and nova-

tion protocols. These ISDA frameworks are widely used by

market participants and serve to significantly reduce the

potential losses arising from the default of a counterparty

in a swap or derivative contract.

8

Master agreements are encompassing contracts between

two counterparties that detail all aspects of how swap and

derivative contracts are to be executed, confirmed, docu-

mented, settled, etc. Once signed, all subsequent swaps and

derivative transactions become part of the original master

swap agreement, thereby eliminating the need to have

separate contracts for each transaction. An important

advantage of this structure is that it allows all contracts

between two counterparties to be netted in the event of a

default by one of the counterparties. This netting feature

implies that when default occurs, the market value of all

contracts between counterparties A and B are aggregated

into a net amount, leaving one of the two counterparties

with a net liability to the other. Without this feature,

counterparties might have incentives to demand payment

on contracts on which they have a receivable, but repudiate

contracts on which they have a liability to the defaulting

counterparty.

Credit support annexes are standardized agreements

between counterparties governing how credit risk mitiga-

tion mechanisms are to be structured. For example, a

specific type of credit risk mitigation mechanism is the

use of margin calls in which counterparty A demands

collateral from counterparty B to cover the amount of

counterparty B’s net liability to counterparty A. The credit

support annex specifies details such as the nature and

type of collateral to be provided, the minimum collateral

transfer amount, how the collateral amount is to be

calculated, etc.

ISDA protocols specify exactly how changes to master

swap agreements and credit support annexes can be

modified. These types of modifications are needed from

time to time to reflect changes in the nature of the

markets. For example, the increasing tendency among

market participants to closeout positions through nova-

tion rather than by offsetting positions motivated the

development of the 2006 ISDA Novation Protocol II.

Similarly, the creation of a standardized auction mechan-

ism for settling CDS contracts on defaulting firms moti-

vated the creation of the 2005–2009 ISDA auction

protocols and the 2009 ISDA closeout amount protocol.

An important second way in which counterparty credit

risk is minimized is through the use of collateralization.

Recall that the value of a CDS contract can diverge

significantly from zero as the credit risk of the reference

firm underlying the contract varies over time. As a result,

each counterparty could have a significant mark-to-mar-

ket liability to the other at some point during the life of

the contract. In light of the potential credit risk, full

collateralization of CDS liabilities has become the market

standard. For example, the ISDA Margin Survey (2009)

reports that 74% of CDS contracts executed during 2008

were subject to collateral agreements and that the esti-

mated amount of collateral in use at the end of 2008 was

approximately $4.0 trillion. Typically, collateral is posted

in the form of cash or government securities. Participants

in the Margin Survey indicate that approximately 80% of

the ISDA credit support agreements are bilateral, implying

two-way transfers of collateral between counterparties. Of

the 20 largest respondents to the survey (all large CDS

dealers), 50% of their collateral agreements are with hedge

funds and institutional investors, 15% are with corpora-

tions, 13% are with banks, and 21% are with others.

The data set used in this study represents the CDS

spreads at which the largest Wall Street dealers actually

sell, or are willing to sell, credit protection. Both discus-

sions with CDS traders and margin survey evidence

indicate that the standard practice by these dealers is to

require full collateralization of swap liabilities by both

counterparties to a CDS contract. In fact, the CDS traders

we spoke with reported that the large Wall Street dealers

they trade with typically require that their non-dealer

counterparties overcollateralize their CDS liabilities

slightly. This is consistent with the ISDA Margin Survey

(2009) that documents that the 20 largest firms

accounted for 93% of all collateral received, but only 89%

of all collateral delivered, suggesting that there was a net

inflow of collateral to the largest CDS dealers. Further-

more, the degree of overcollateralization required can

vary over time. As an example, one reason for the liquidity

problems at AIG that led to emergency loans by the

Federal Reserve was that AIG would have been required

to post additional collateral to CDS counterparties if AIG’s

credit rating had downgraded further.

9

At first glance, the market standard of full collaterali-

zation seems to suggest that there may be little risk of a

loss from the default of a Wall Street credit protection

seller. This follows since the protection buyer holds

collateral in the amount of the protection seller’s CDS

liability. In actuality, however, the Wall Street practice of

requiring non-dealer protection buyers to slightly over-

collateralize their liabilities actually creates a subtle

counterparty credit risk. To illustrate this, imagine that a

protection buyer has a mark-to-market liability to the

protection seller of $15 per $100 notional amount.

Furthermore, imagine that the protection seller requires

the protection buyer to post $17 in collateral. Now

consider what occurs if the protection seller defaults.

The bankruptcy estate of the protection seller uses $15

of the protection buyer’s collateral to offset the $15 mark-

to-market liability. Rather than returning the additional

$2 of collateral, however, this additional capital becomes

part of the bankruptcy estate. This implies that the

protection buyer is now an unsecured creditor in the

8

Bliss and Kaufman (2006) provide an excellent discussion of the

role of ISDA and of netting, collateral, and closeout provisions in

mitigating systemic credit risk.

9

For example, see the speech by Federal Reserve Chairman Ben S.

Bernanke before the Committee on Financial Services, U.S. House of

Representatives, on March 24, 2009.

N. Arora et al. / Journal of Financial Economics 103 (2012) 280 –293 283

amount of the $2 excess collateral. Thus, in this situation,

the protection buyer could suffer a significant loss even

though the buyer actually owed the defaulting counter-

party on the CDS contract.

This scenario is far from hypothetical. In actuality, a

number of firms experienced major losses on swap con-

tracts in the wake of the Lehman bankruptcy because of

their net exposure (swap liability and offsetting collateral)

to Lehman.

10

4. The data

Fixed-income securities and contracts are traded pri-

marily in over-the-counter markets. For example, Treas-

ury bonds, agency bonds, sovereign debt, corporate bonds,

mortgage-backed securities, bank loans, interest rate

swaps, and CDS contracts are all traded in over-the-

counter markets. Because of the inherent decentralized

nature of these markets, however, actual transaction

prices are difficult to observe. This is why most of the

empirical research in the financial literature about fixed-

income markets has typically been based on the quotation

data available to participants in these markets.

We were fortunate to be given access to an extensive

proprietary data set of CDS prices by one of the largest

fixed-income asset management firms in the financial

markets. A unique feature of this data set is that it contains

both actual CDS transaction prices for contracts entered

into by this firm as well as actionable quotations provided

to the firm by a variety of CDS dealers. These quotations

are actionable in the sense that the dealers are keenly

aware that the firm expects to be able to trade (and often

does) at the prices quoted by the dealers (and there are

implicit sanctions imposed on dealers who do not honor

their quotations). Thus, these quotations should more

closely represent actual market prices than the indicative

quotes typically used in the fixed-income literature.

In this paper, we study the spreads associated with

contracts in which 14 major CDS dealers sell five-year

credit protection to the fixed-income asset management

firm on the 125 individual firms in the widely followed

CDX index. The sample period for the study is March 31,

2008 to January 20, 2009. This period covers the turbulent

Fall 2008 period in which Fannie Mae, Freddie Mac,

Lehman Brothers, AIG, etc. entered into financial distress

and counterparty credit fears reached their peak. Thus,

this sample period is ideally suited for studying the effects

of counterparty credit risk on financial markets.

The transactions data in the sample are taken from a

file recording the spreads on actual CDS contracts exe-

cuted by the firm in which the firm is buying credit

protection. There are roughly 1,000 transactions in this

file. The average transaction size is $6.5 million and the

average maturity of these contracts is 4.9 years. All 14 of

the major CDS dealers to be studied in this paper are

included in this file. Thus, all 14 of these dealers sold

credit protection to the asset management firm during the

sample period. Of these transactions, however, most

involve either firms that are not in the CDX index, or

contracts with maturities significantly different from five

years. Screening out these trades results in a sample of

several hundred observations.

To augment the sample, we also include quotes pro-

vided directly to the firm by the CDS dealers selling

protection on the firms in the CDX index. As described

above, these quotes represent firm offers to sell protection

and there can be sanctions for dealers who fail to honor

their quotes. For example, if the asset management firm

finds that a dealer is often not willing to execute new

trades (or unwind existing trades) at quoted prices, then

that dealer could be dropped from the list of dealers that

the firm’s traders are willing to do business with. Given

the large size of the asset management firm providing the

data, the major CDS dealers included in the study have

strong incentives to provide actionable quotes.

There are a number of clear indications that the deal-

ers respond to these incentives and provide reliable

quotes. First, the dealers included in the study frequently

update their quotes throughout the trading day. The total

number of quotations records in the data set for firms in

the CDX index is 673,060. This implies an average of 2.19

quotations per day per dealer for each of the firms in the

sample. Thus, quotes are clearly being refreshed through-

out the trading day. Second, the fact that all 14 of the CDS

dealers sold protection to the asset management firm

during the sample period suggests that each was active in

providing competitive and actionable quotes during this

period. Third, we compare our sample of transaction

prices directly to the quotes available in the market on

the same day. This comparison is necessarily a little noisy

since the transaction prices are not time-stamped within

the day, and we are comparing them to quotes available

in the market at roughly 11:30 AM. Despite this, however,

the average transaction price is only 0.26 basis points

below the minimum quote available in the market. The

standard deviation of the difference is 5.87 basis points

and the difference between the mean transaction price

and minimum quote is not statistically significant.

As mentioned, dealers frequently update their quota-

tions throughout the day to insure that they are current.

Since our objective is to study whether the cross-sectional

dispersion in dealer prices is related to counterparty

credit risk, it is important that we focus on dealer prices

that are as close to contemporaneous as possible. To this

end, we extract quotes from the data set in the following

way. First, we select 11:30 AM as the reference time. For

each of the 14 CDS dealers, we then include the quote

with time-stamp nearest to 11:30 AM, but within 15

minutes (from 11:15 to 11:45 AM). In many cases, of

course, there may not be a quote within this 30-minute

period. Thus, we will generally have fewer than 14 prices

or quotes available for each firm each day. For a firm to be

included in the sample for a particular day, we require

that there be two or more prices or quotes for that firm.

We repeat this process for all days and firms in the

sample.

10

From the October 7, 2008 Financial Times: ‘‘The exact amount of

any claim is determined by the difference between the value of the

collateral and the cost of replacing the contract.... Moreover, many

counterparties to Lehman who believe it owes them money have joined

the ranks of unsecured creditors.’’

N. Arora et al. / Journal of Financial Economics 103 (2012) 280–293284

This algorithm results in a set of 13,383 observation

vectors of synchronous prices or quotations by multiple CDS

dealers for selling protection on a common underlying

reference firm. Since there are 212 trading days in the

sample period, this implies that we have data for multiple

CDS dealers for an average of 63.13 firms each day. Table 1

presents summary statistics for the data. As shown, the

number of synchronous quotes ranges from two to nine. On

average, an observation includes 3.073 dealer quotes for the

reference firm for that day. Table 1 also shows that the

variation in the quotes provided by the various dealers is

relatively modest. For most of the observations, the range of

CDS quotations is only on the order of two to three basis

points, and the median range is three basis points.

In addition to the prices and quotes provided by the

dealers selling protection, we also need a measure of

the counterparty credit risk of the dealers themselves. To

this end, we obtain daily midmarket five-year CDS quotes

referencing each of the 14 major CDS dealers in the study.

The midmarket spreads for these CDS contracts are obtained

from the Bloomberg system and reflect the market’s percep-

tion of the counterparty credit risk of the dealers selling

credit protection to the asset management firm.

Table 2 reports summary statistics for the CDS spreads

for these dealers. As shown, the average CDS spread

ranges from a low of 59.40 basis points for BNP Paribas

to a high of 355.10 basis points for Morgan Stanley. Note

that CDS data for Lehman Brothers and Merrill Lynch are

included in the data set even though these firms either

went bankrupt or merged during the sample period. The

reason for including these firms is that both were actively

making markets in selling credit protection through much

of the sample period. Thus, their spreads may be particu-

larly informative about the impact of perceived counter-

party credit risk on CDS spreads.

5. Empirical analysis

In this section, we begin by briefly describing the

methodology used in the empirical analysis. We then test

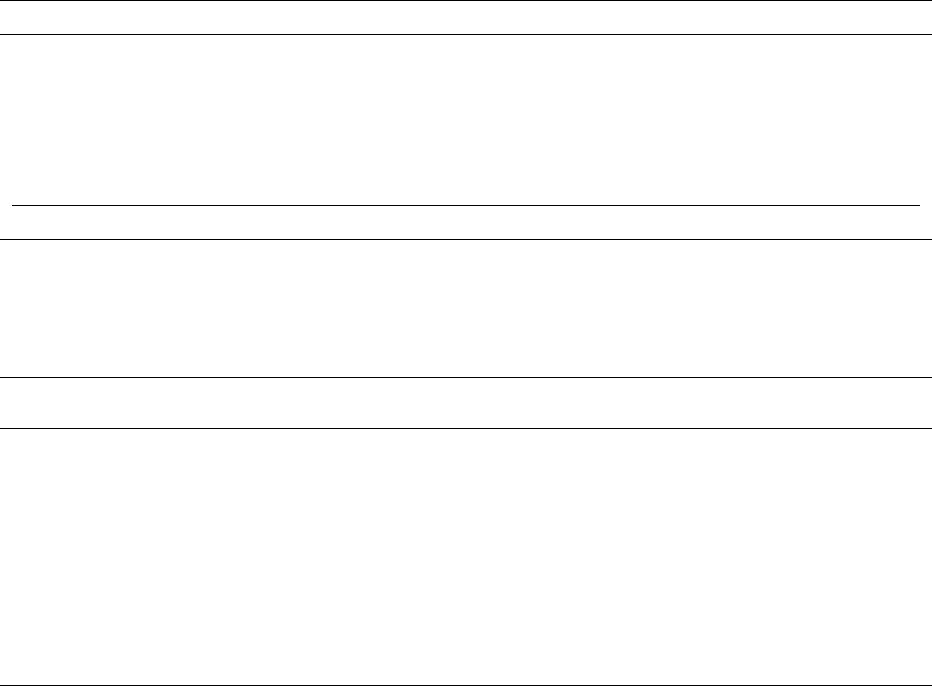

Table 1

The distribution of dealer prices and quotations.

This table provides summary statistics for the distribution of dealer prices or quotations for CDS contracts referencing the firms in the CDX index. The

panel on the left summarizes the distribution in terms of the number of dealer prices and quotations on a given day for a CDS contract referencing a

specific firm. The panel on the right summarizes the distribution in terms of the range R of prices and quotations (measured in basis points) provided by

dealers on a given day for a CDS contract on a specific reference firm. Only days on which two or more simultaneous prices or quotations are available for

a specific firm are included in the sample as an observation. The sample period is March 31, 2008 to January 20, 2009.

Number Observations Percentage Range Observations Percentage

2 4907 36.66 0 1175 8.78

3 4518 33.78 0o Rr 1 1952 14.59

4 2566 19.17 1o Rr2 2298 17.17

5 1012 7.56 2o Rr 3 1925 14.38

6 267 1.99 3o Rr 4 1065 7.96

7 84 0.62 4o R r 5 1800 13.44

8 21 0.16 5o Rr 10 2209 16.51

9 8 0.06 10o Rr 20 748 5.59

20o R 211 1.58

Total 13,383 100.00 Total 13,383 100.00

Table 2

Summary statistics for CDS contracts referencing dealers.

This table provides summary statistics for the CDS spreads (in basis points) for contracts referencing the dealers listed below. The spreads are basedon

daily observations obtained from the Bloomberg system. N denotes the number of days on which Bloomberg quotes are available for the indicated dealer.

The sample period is March 31, 2008 to January 20, 2009.

Standard

Dealer Mean deviation Minimum Median Maximum N

Barclays 122.65 43.33 53.27 122.17 261.12 212

BNP Paribas 59.40 13.29 34.24 59.08 107.21 212

Bank of America 121.60 35.77 61.97 119.75 206.85 209

Citigroup 180.67 71.13 87.55 162.90 460.54 207

Credit Suisse 111.66 37.20 57.59 101.40 194.22 212

Deutsche Bank 96.88 29.70 51.92 90.11 172.00 212

Goldman Sachs 230.58 110.62 79.83 232.69 545.14 177

HSBC 75.41 21.94 41.84 67.59 128.30 212

JP Morgan 110.86 27.96 62.54 107.68 196.34 209

Lehman 291.79 89.01 154.04 285.12 641.91 84

Merrill Lynch 243.19 71.34 114.35 218.43 472.72 193

Morgan Stanley 355.10 236.22 108.06 244.98 1360.00 187

Royal Bank of Scotland 116.45 45.16 55.17 110.69 304.89 212

UBS 139.09 56.81 55.45 126.24 320.80 212

N. Arora et al. / Journal of Financial Economics 103 (2012) 280 –293 285

whether counterparty credit risk is reflected in the prices

of CDS contracts. Finally, we study whether the pricing of

counterparty credit risk by dealers varies by industry as

would be implied by a correlation-based credit model.

5.1. Methodology

For each reference firm and for each date t in the

sample, we have simultaneous prices from multiple CDS

dealers for selling five-year credit protection on that firm.

Thus, we can test directly whether counterparty credit risk

is priced by a straightforward regression of the price of

protection sold or quoted by a dealer for a reference firm

on the price of protection for the dealer itself providing

that quotation. In this panel regression framework, we

allow for reference-firm-specific date fixed effects. Speci-

fically, we estimate the following regression:

CDS

i, j, t

¼

a

i, t

þ

b

Spread

j, t1

þ

E

i, j, t

, ð1Þ

where CDS

i, j, t

denotes the CDS spread for credit protection

on reference firm i sold or quoted by dealer j at date t,

a

i, t

is a fixed effect parameter specific to firm i at time t, and

Spread

j, t1

is the CDS spread for dealer j as of the end of

the previous day.

11

Under the null hypothesis that coun-

terparty credit risk is not priced, the slope coefficient

b

is

zero. The t-statistics for

b

reported in the tables are based

on the White (1980) heteroskedastic-consistent estimate

of the covariance matrix.

As shown in Table 1, there are a total of 13,383

observation vectors in the sample. On average, each

observation vector consists of 3.073 distinct quotations

for selling credit protection on the reference firm, giving a

total of 41,122 observations collectively. Thus, there are

339.85 observations on average for each of the 121

reference firms in the sample.

5.2. Is counterparty credit risk priced?

Although a formal model of the relation between a

dealer’s credit risk and the price at which the dealer could

sell credit protection could be developed, the underlying

economics of the transaction makes it clear that there

should be a negative relation between the two. Specifi-

cally, as the credit risk of a protection seller increases, the

value of the protection being sold is diminished and

market participants would not be willing to pay as much

for it. Thus, if counterparty credit risk is priced in the

market, the slope coefficient

b

in the regressions should

be negative.

Table 3 reports the results from estimating the regres-

sion in Eq. (1) (which is designated specification I). The

slope coefficient

b

is 0.001548 with a t-statistic of

7.31. Thus, the empirical results strongly support the

hypothesis that counterparty credit risk is priced in the

CDS market. Furthermore, the sign of the coefficient is

negative, consistent with economic intuition.

We acknowledge, however, that we cannot completely

rule out the possibility that the relation between CDS

spreads and the credit risk of protection sellers may

actually be due to some other factor that is correlated

with dealer spreads.

12

For example, since CDS contracts

are traded in over-the-counter markets, the search costs

associated with finding trading partners could play a role

in determining equilibrium CDS spreads (see Duffie,

G

ˆ

arleanu, and Pedersen, 2002, 2005, 2008 and others). If

these search costs were inversely related to dealer CDS

spreads, then they could potentially affect CDS spreads in

a way consistent with the results reported in Table 3.We

will explore some of these possibilities in a later section

on robustness.

5.3. Why is the effect so small?

Although statistically very significant, the slope coeffi-

cient is relatively small in economic terms. In particular,

the value of 0.001548 implies that the credit spread of a

CDS dealer would have to increase by nearly 645 basis

points to result in a one-basis-point decline in the price of

credit protection. As shown in Table 2, credit protection

on most of CDS dealers in the sample never even reached

645 basis points during the period under study. These

results are consistent with the results in Table 1 suggest-

ing that the cross-sectional variation in the dealers’

quotes for selling credit protection on a specific reference

firm is only on the order of several basis points.

A number of papers have explored the theoretical

magnitude of counterparty credit risk on the pricing of

interest rate swaps. Important examples of this literatur e

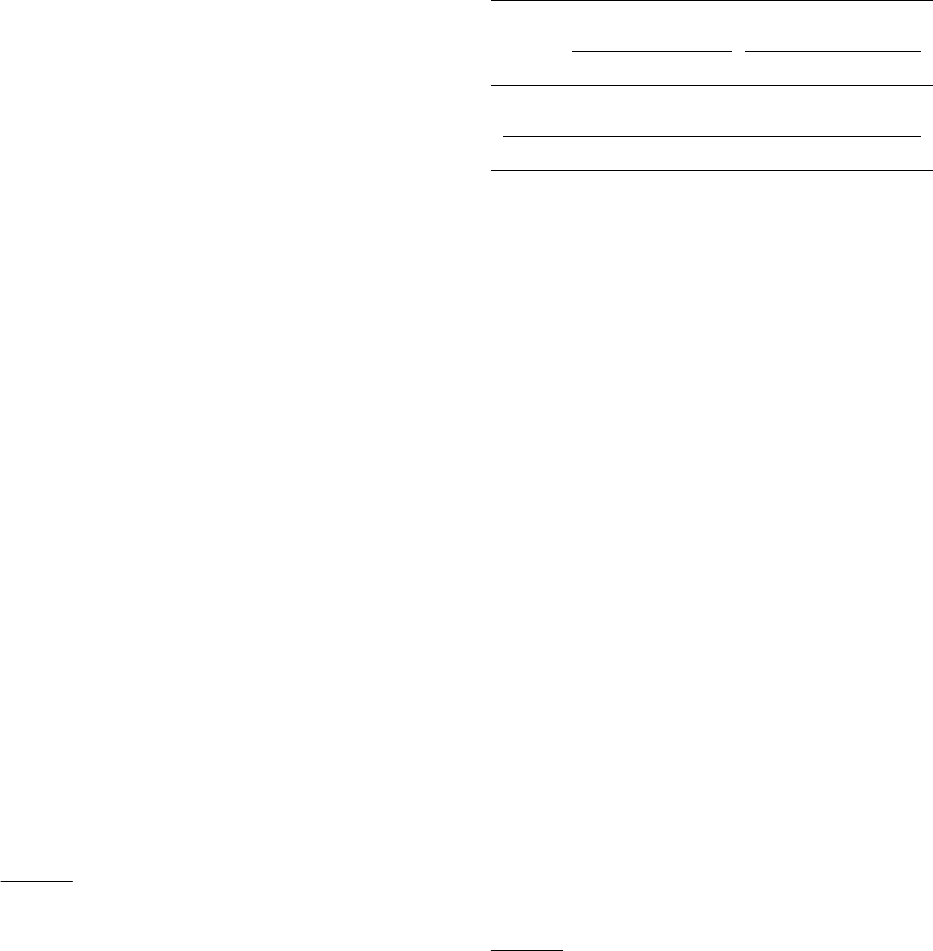

Table 3

Results from the regression of CDS spreads on the CDS spread of the

corresponding dealer.

This table reports the results from the regressions of CDS prices or

quotations for the firms in the CDX Index on the CDS spread of the dealer

providing the CDS price or quotation. The sample period is March 31,

2008 to January 20, 2009. Regression specification II includes a dummy

variable I

L

that takes value one for the post-Lehman period beginning

September 15, 2008, and zero otherwise. The t-statistics are based on

the White (1980) heteroskedasticity-consistent estimate of the covar-

iance matrix. The superscript

nn

denotes significance at the 5% level; the

superscript

n

denotes significance at the 10% level.

I : CDS

i,j, t

¼

a

i,t

þb Spread

j,t1

þ

E

i,j, t

,

II : CDS

i, j, t

¼

a

i,t

þb Spread

j,t1

þ

g

I

L,t

Spread

j,t1

þ

E

i,j, t

:

Regression specification II

Regression specification I with post-Lehman dummy

Variable Coefficient t-Statistic Coefficient t-Statistic

Spread 0.001548 7.31

nn

0.000991 3.73

nn

I

L

Spread 0.000713 1.92

n

N 41,122 41,122

11

We use the dealer’s spread as of t1 rather than t since the dealer

data are as of the end of the day while the CDS quotation data are taken

from a narrow timeframe centered at 11:30 AM. Thus, using the dealer’s

spread as of the end of day t1 avoids using ex post data in the

regression.

12

We are grateful to the referee for raising this issue.

N. Arora et al. / Journal of Financial Economics 103 (2012) 280–293286

include Cooper and Mello (1991), Sorensen and Bollier

(1994),andDuffie and Huang (1996). Typically, these

papers find that since the notional amount is not exchanged

in an interest rate swap, the effect of counterparty credit

risk on an interest rate swap is very small, often only a basis

point or two.

Unlike an interest rate swap, however, a CDS contract

could involve a very large payment by the protection

seller to the protection buyer. For example, sellers of

protection on Lehman Brothers were required to pay

$91.375 per $100 notional to settle their obligations to

protection buyers. Thus, the results from the interest rate

swap literature may not necessarily be directly applicable

to the CDS market.

A few recent papers have focused on the theoretical

impact of counterparty credit risk on the pricing of CDS

contracts. Important examples of these papers include

Jarrow and Yu (2001), Hull and White (2001), Brigo and

Pallavicini (2006), Kraft and Steffensen (2007), Segoviano

and Singh (2008), and Blanchet-Scalliet and Patras (2008).

In general, estimates of the size of the effect of counter-

party credit risk in this literature tend to be orders of

magnitude larger than those in the literature for interest

rate swaps. For example, estimates of the potential size of

the pricing effect range from 7.0 basis points in Kraft and

Steffensen to more than 20 basis points in Hull and White,

depending on assumptions about the default correlations

of the protection seller and the underlying reference firm.

Thus, this literature tends to imply counterparty credit

risk pricing effects many times larger than those we find

in the data.

It is crucial to recognize, however, that this literature

focuses almost exclusively on the case in which CDS

contract liabilities are not collateralized. As was discussed

earlier, the standard market practice during the sample

period would be to require full collateralization by both

counterparties to a CDS contract. This would be particu-

larly true for CDS contracts in which one counterparty

was a large Wall Street CDS dealer.

In theory, full collateralization of CDS contract liabil-

ities would appear to imply that there should be no

pricing of counterparty credit risk in CDS contracts. In

reality, however, there are several reasons why there

might still be a small pricing effect even if counterparties

require full collateralization. First, as became clear after

the Lehman bankruptcy, counterparties who post collat-

eral in excess of their liabilities risk becoming unsecured

creditors of a defaulting counterparty for the amount of

the excess collateral. As discussed earlier, however, Wall

Street CDS dealers often require a small amount of over-

collateralization from their counterparties (typically on

the order of several percent) thus creating the possibility

of a slight credit loss (ironically, however, only when the

counterparty owes the bankrupt firm money). Second, the

Lehman bankruptcy also showed that there were a num-

ber of legal pitfalls that many market participants had not

previously appreciated. These include the risk of unse-

gregated margin accounts or the disposition of rehypothe-

cated collateral.

In summary, the size of the counterparty pricing effect

in the CDS market appears too small to be explained by

models that abstract from the collateralization of CDS

contracts. Rather, the small size of the pricing effect

appears more consistent with the standard market prac-

tice of full collateralization, or even overcollateralization,

of CDS contract liabilities.

5.4. Did pricing of counterparty credit risk change?

The discussion above suggests that the Lehman bank-

ruptcy event may have forced market participants to

reevaluate the risks inherent in even fully collateralized

counterparty relationships. If so, then the pricing of

counterparty credit after the Lehman bankruptcy might

differ from the pricing in the CDS market previous to the

bankruptcy. To explore this possibility, we reestimate the

regression described above using a dummy slope coeffi-

cient for the post-Lehman period. Specifically, we esti-

mate the regression

CDS

i, j, t

¼

a

i, t

þ

b

Spread

j, t1

þ

g

I

L, t

Spread

j, t1

þ

E

i, j, t

, ð2Þ

where I

L

is a dummy variable that takes value one for the

post-Lehman period beginning September 15, 2008, and

zero otherwise. Table 3 also reports the results from this

regression (which is designated specification II). Note that

in this specification, the coefficient

b

represents the

regression slope during the pre-Lehman period, while

the coefficient

g

measures the change in the slope after

the Lehman bankruptcy. Thus, we can test for whether

there was a significant change in the pricing of counter-

party credit risk after the Lehman bankruptcy by simply

testing whether

g

is statistically significant. The regres-

sion slope during the post-Lehman period can be obtained

by simply summing the pre-Lehman slope coefficient

b

and the post-Lehman change in the slope coefficient

g

.

The results provide some support for the hypothesis that

the pricing of counterparty credit risk changed after the

Lehman bankruptcy. Specifically, the pre-Lehman slope

coefficient is 0.000991 and has a t-statistic of 3.73.

After the Lehman bankruptcy, the change in the slope

coefficient is 0.000713, making the pricing of counter-

party credit risk in the post-Lehman period roughly twice

as large as in the pre-Lehman period. The t-statistic for the

change, however, is only 1.92. Thus, the change is

significant at the 10% level, but not the 5% level.

5.5. Robustness of the results

To provide some robustness checks for these results,

we also estimate several alternative specifications. In the

first of these, we include the total number of trades

executed by each dealer each day as a control for trading

activity. Specifically, we estimate the following regression

specifications:

CDS

i, j, t

¼

a

i, t

þ

b

Spread

j, t1

þ

Z

Volume

j, t

þ

E

i, j, t

, ð3Þ

CDS

i, j, t

¼

a

i, t

þ

b

Spread

j, t1

þ

g

I

L, t

Spread

j, t1

þ

Z

Volume

j, t

þ

E

i, j, t

, ð4Þ

where Volume

j, t

denotes the total number of trades

executed by dealer j on date t. Table 4 reports the results

from the regressions.

N. Arora et al. / Journal of Financial Economics 103 (2012) 280 –293 287

Even after controlling for dealer trading activity,

Table 4 shows the regression coefficients and t-statistics

for the dealers’ CDS spreads are virtually the same as they

are in Table 3. Thus, the results provide evidence that the

dealer spread is not simply proxying for dealer liquidity

effects.

As another robustness check, we reestimate the

regressions in Table 3, but with dummy variables for

individual dealers. This specification controls for dealer

fixed effects. Thus, the relation between CDS spreads for

the firms in the CDX index and dealer CDS spreads is

identified using only the times-series variation in spreads.

The regressions estimated are

CDS

i, j, t

¼

a

i, t

þ

b

Spread

j, t1

þ

X

13

j ¼ 1

d

j

I

j

þ

E

i, j, t

, ð5Þ

CDS

i, j, t

¼

a

i, t

þ

b

Spread

j, t1

þ

g

I

L, t

Spread

j, t1

þ

X

13

j ¼ 1

d

j

I

j

þ

X

13

j ¼ 1

Z

j

I

j

I

L

þ

E

i, j, t

, ð6Þ

where I

j

is the dummy variable for the j-th dealer. Note

that we only include 13 dealer dummies rather than all

14. This is because inclusion of all 14 dummies results in a

collinearity with the firm and date fixed effects. Thus, the

regression coefficients for dealer dummies have the inter-

pretation of the marginal effect relative to that of the

omitted dealer, which is chosen to be the dealer with the

highest trading activity throughout the sample period.

The results from these regressions are reported in Table 5.

The results indicate that the previous results are

robust to the inclusion of dealer fixed effects. The coeffi-

cient for dealer CDS spread is 0.001338 for the first

specification, which is only slightly less than the

corresponding estimate in Table 3. The t-statistic for

dealer CDS spread in this regression is 4.49. In the

second specification with the post-Lehman dummy vari-

able, the CDS spread of the dealer is again significantly

negative during the pre-Lehman period, and there is no

significant change in the variable after the Lehman bank-

ruptcy. This again provides support for the result that

dealer credit risk is priced in the market, although the

effect is very small.

Table 4

Results from the regression of CDS spreads on the CDS spread of the

corresponding dealer with control for dealer trading volume.

This table reports the results from the regressions of CDS prices or

quotations for the firms in the CDX index on the CDS spread of the dealer

providing the CDS price or quotation and on the total number of trades

executed by the dealer in all CDX index firms that day as a control

variable (denoted as volume). The sample period is March 31, 2008 to

January 20, 2009. Regression specification II includes a dummy variable

I

L

that takes value one for the post-Lehman period beginning September

15, 2008, and zero otherwise. The t-statistics are based on the White

(1980) heteroskedasticity-consistent estimate of the covariance matrix.

The superscript

nn

denotes significance at the 5% level; the superscript

n

denotes significance at the 10% level.

I : CDS

i,j, t

¼

a

i,t

þb Spread

j,t1

þ

Z

Volume

j,t

þ

E

i, j, t

,

II : CDS

i,j, t

¼

a

i,t

þ

b

Spread

j,t1

þgI

L, t

Spread

j,t1

þZ Volume

j,t

þE

i,j, t

:

Regression specification II

Regression specification I with post-Lehman dummy

Variable Coefficient t-Statistic Coefficient t-Statistic

Spread 0.001548 7.30

nn

0.000990 3.73

nn

I

L

Spread 0.000714 1.92

n

Volume 0.008122 0.12 0.009988 0.14

N 41122 41122

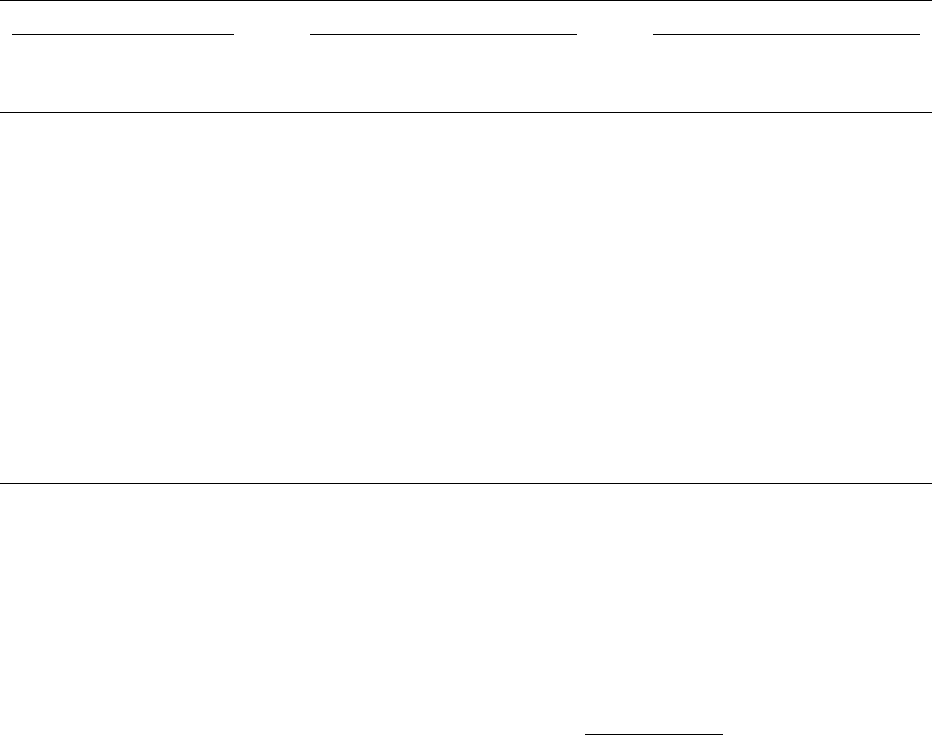

Table 5

Results from the regression of CDS spreads on the CDS spread of the

corresponding dealer with fixed effects for individual dealers.

This table reports the results from the regression of CDS prices or

quotations for the firms in the CDX index on the CDS spread of the dealer

providing the CDS price or quotation. The regression also includes a

separate fixed effect dummy variable for each dealer (except for the

dealer with the largest number of quotes, arbitrarily designated dealer

14). The sample period is March 31, 2008 to January 20, 2009. Regres-

sion specification II includes a dummy variable I

L

that takes value one for

the post-Lehman period beginning September 15, 2008, and zero

otherwise. The t-statistics are based on the White (1980) heteroskedas-

ticity-consistent estimate of the covariance matrix. The superscript

nn

denotes significance at the 5% level; the superscript

n

denotes signifi-

cance at the 10% level.

I : CDS

i,j, t

¼

a

i,t

þb Spread

j,t1

þ

X

13

j ¼ 1

d

j

I

j

þ

E

i,j, t

,

II : CDS

i, j, t

¼

a

i,t

þb Spread

j,t1

þ

g

I

L,t

Spread

j,t1

þ

X

13

j ¼ 1

d

j

I

j

þ

X

13

j ¼ 1

Z

j

I

j

I

L

þ

E

i,j, t

:

Regression specification II

Regression specification I with post-Lehman dummy

Variable Coefficient t-Statistic Coefficient t-Statistic

Spread 0.001338 4.49

nn

0.001786 2.35

nn

I

1

1.4154 3.87

nn

0.1130 0.23

I

2

0.6574 4.17

nn

0.7774 4.34

nn

I

3

0.1707 1.56 0.1923 1.88

n

I

4

0.4062 4.95

nn

0.5837 7.50

nn

I

5

0.2106 1.95

n

0.0086 0.09

I

6

0.0326 0.64 0.0461 0.82

I

7

0.4728 2.28

nn

0.4227 2.07

nn

I

8

0.6006 6.03

nn

0.2026 2.28

nn

I

9

0.1701 1.66

n

0.1136 0.82

I

10

0.1041 1.49 0.3960 3.75

nn

I

11

0.1862 3.60

nn

0.1982 3.05

nn

I

12

0.9453 6.96

nn

0.6462 3.74

nn

I

13

0.1922 1.64 0.0659 0.65

I

L

Spread 0.000347 0.36

I

1

I

L

1.4112 2.21

nn

I

2

I

L

1.0839 2.78

nn

I

3

I

L

0.0857 0.30

I

4

I

L

0.7415 2.90

nn

I

5

I

L

0.4342 1.47

I

6

I

L

0.7280 2.58

nn

I

7

I

L

0.5204 0.32

I

8

I

L

1.6748 4.68

nn

I

9

I

L

––

I

10

I

L

1.1010 4.79

nn

I

11

I

L

0.0423 0.17

I

12

I

L

0.6155 2.08

nn

I

13

I

L

2.6544 1.87

n

N 41,122 41,122

N. Arora et al. / Journal of Financial Economics 103 (2012) 280–293288

The coefficients for the individual dealer dummy vari-

ables are also interesting. Although many of the coeffi-

cients in the first specification are significant, almost all of

them are much less than one basis point in magnitude.

The same is also true for the pre-Lehman coefficients for

the second specification. On the other hand, the results

indicate that a number of the coefficients change in the

post-Lehman period by one or more basis points. These

changes, however, are essentially equally divided

between positive and negative values. Thus, these results

provide some evidence of greater heterogeneity in dealer

fixed effects in the post-Lehman period.

13

5.6. Are there differences across firms?

A number of recent papers have emphasized the role

that the default correlation between the protection seller

and the reference firm should play in determining CDS

spreads. To illustrate the importance of correlation, let us

take it to an extreme and imagine that Citigroup is willing

to sell credit protection against the event that Citigroup

itself defaults. Clearly, no one would be willing to pay

Citigroup for this credit protection.

14

Similarly, a financial

institution selling credit protection on another financial

institution might not be able to charge as much as a

nonfinancial seller might.

15

To explore the effects of correlation on the price of

credit protection, we do the following. First, we classify

the firms in the CDX index that are in our sample into one

of five broad industry sectors or categories: consumer,

energy, financials, industrials, and technology. We then

reestimate the regressions using the following specifica-

tions:

CDS

i, j, t

¼

a

i, t

þ

X

5

k ¼ 1

b

k

I

Sector

k

Spread

j, t1

þ

E

i, j, t

, ð7Þ

CDS

i, j, t

¼

a

i, t

þ

X

5

k ¼ 1

b

k

I

Sector

k

Spread

j, t1

þ

X

5

k ¼ 1

g

k

I

Sector

k

I

L

Spread

j, t1

þ

E

i, j, t

, ð8Þ

where I

Sector

k

are dummy variables that take value one if

firm i is in sector k, and zero otherwise. The regression

results are reported in Table 6.

As shown in the first specification, counterparty credit

risk is priced for the consumer, energy, industrial, and

technology firms in the sample. The t-statistics for the

corresponding coefficients are 4.83, 7.25, 3.61, and

5.41, respectively. These results are clearly consistent

with the previous results.

The most puzzling result, however, is that for the

financial sector. As described above, the correlation argu-

ment suggests that the counterparty credit risk for the

CDS dealers should be most evident when they are selling

protection on firms in the financial industry. In contrast to

this intuition, however, the results show that the CDS

dealers’ counterparty credit risk is not priced in the

spreads of CDS contracts on financial firms. Furthermore,

likelihood ratio tests strongly reject the hypotheses that

the slope coefficient for the financial sector is equal to

that of the consumer, energy, industrial, and technology

sectors, with p-values of 0.00026, 0.00000, 0.00012, and

0.00000, respectively. Thus, the pricing of counterparty

credit risk for financial firms is significantly different from

that of the other four categories of firms in the sample. In

summary, far from being the most sensitive to counter-

party credit risk, financial firms in the CDX index repre-

sent the only category in the sample for which

counterparty credit risk is not priced.

These patterns are repeated in the second specifica-

tion. As shown, counterparty credit risk is significantly

Table 6

Results from regression of CDS spreads on the CDS spreads of the

corresponding dealer interacted with sector dummy variables for the

underlying firms.

This table reports the results from the regression of CDS prices or

quotations for the firms in the CDX index on the CDS spread of the dealer

providing the CDS price or quotation interacted with five sector dummy

variables where the dummy variables take value one if firm i is in the

consumer, energy, financial, industrial, or technology sectors, respec-

tively, and zero otherwise. The sample period is March 31, 2008 to

January 20, 2009. Regression specification II includes a dummy variable

I

L

that takes value one for the post-Lehman period beginning September

15, 2008, and zero otherwise. The t-statistics are based on the White

(1980) heteroskedasticity-consistent estimate of the covariance matrix.

The superscript

nn

denotes significance at the 5% level; the superscript

n

denotes significance at the 10% level.

I : CDS

i,j, t

¼

a

i,t

þ

X

5

k ¼ 1

b

k

I

Sector

k

Spread

j,t1

þ

E

i,j, t

,

II : CDS

i,j, t

¼

a

i,t

þ

X

5

k ¼ 1

b

k

I

Sector

k

Spread

j,t1

þ

X

5

k ¼ 1

g

k

I

Sector

k

I

L

Spread

j,t1

þ

E

i,j, t

:

Regression specification II

Regression

specification I

with post-Lehman

dummy

Variable Coefficient t-Statistic Coefficient t-Statistic

I

Consumer

Spread 0.001161 4.83

nn

0.000015 0.04

I

Energy

Spread 0.002313 7.25

nn

0.002253 5.14

nn

I

Financial

Spread 0.001097 0.77 0.000910 0.67

I

Industrial

Spread 0.001324 3.61

nn

0.001245 2.42

nn

I

Technology

Spread 0.002553 5.41

nn

0.003173 4.69

nn

I

Consumer

I

L

Spread 0.001719 3.65

nn

I

Energy

I

L

Spread 0.000079 0.09

I

Financial

I

L

Spread 0.003183 1.27

I

Industrial

I

L

Spread 0.000096 0.14

I

Technology

I

L

Spread 0.000674 0.80

N 41,122 41,122

13

We are grateful to the referee for suggesting the robustness

checks discussed in this section.

14

It is interesting to note, however, that a number of European

banks sell credit protection on the iTraxx index which includes these

banks as index components.

15

Examples of recent papers discussing the role of correlation in the

pricing of CDS contracts include Hull and White (2001), Jarrow and Yu

(2001), Longstaff, Mithal, and Neis (2005), Yu (2007), and many others.

N. Arora et al. / Journal of Financial Economics 103 (2012) 280 –293 289

priced for the energy, industrial, and technology firms

during the pre-Lehman period. Furthermore, there is no

significant change in how counterparty credit risk is

priced for these firms in the post-Lehman period. Coun-

terparty credit risk for firms in the consumer sector is not

priced during the pre-Lehman period, but there is a

significant change in pricing for these firms after the

Lehman event. The results also show that counterparty

credit risk for the financial firms is not priced in the pre-

Lehman period, and that there is no significant change in

this relation after the Lehman event.

What factors might help account for the evidence that

counterparty credit risk is not priced for the financial

firms? First of all, the financial firms in the CDX index

consist primarily of insurance firms, industrial lenders,

consumer finance firms, and real estate companies. Thus,

it is possible that the default risk of these firms in the CDX

index may actually be much less correlated with that of

the CDS dealers than one might expect based on their

designation as financials. Second, counterparty credit risk

might not be priced in the cost of selling protection on the

large financial firms in the CDX index if the market

believed that the CDS dealers would not fail when the

large financial firms in the CDX index became vulnerable

to default. Thus, this possibility suggests that there might

be a state-contingent aspect to the default risk of CDS

dealers. Finally, it is important to acknowledge that there

is actually little empirical evidence in the literature about

default correlations. Thus, while intuition suggests that

the default correlation between financial firms should be

higher than the default correlation between financial and

nonfinancial firms, there is no direct empirical evidence

supporting this intuition. For this reason, the analysis in

this section should be viewed more as an exploratory

investigation, rather than as a test rejecting specific

empirical hypotheses about default correlations.

6. Comparison to model-implied values

The empirical results demonstrate that counterparty

credit risk is priced by the market, but that the size of the

effect is very small. A natural question to ask is whether

these empirical results can be reconciled with those

implied by theoretical models of counterparty credit

risk.

16

There is a large and rapidly growing literature on the

valuation of counterparty credit risk in CDS contracts

which is far too extensive for us to review fully here.

Gregory (2010) provides an excellent summary of the

literature and discusses a number of the modeling

approaches that have been applied to the problem of

valuing counterparty credit risk. In this section, we

compare our empirical results with those implied by a

simple simulation-based model of the effects of counter-

party credit risk. A key feature of this framework is that

it allows us to quantify the size of the effect when

CDS counterparties collateralize their mark-to-market

liabilities.

In this model, we take the perspective of the protection

buyer and model the losses arising from the default of the

protection seller. To model default, we use the reduced-

form framework of Duffie and Singleton (1997, 1999) in

which the default of a firm is triggered by the realization

of a jump process. Let

l

t

and

n

t

denote the risk-neutral

intensity processes of the firm underlying the CDS con-

tract and the firm selling credit protection (the CDS

counterparty), respectively. The risk-neutral dynamics

for these intensity processes are given by,

d

l

¼ð

a

bl

Þdt þ

s

ffiffiffi

l

p

dZ

l

, ð9Þ

d

n

¼ð

m

gn

Þdt þs

ffiffiffi

n

p

dZ

n

, ð10Þ

where

a

,

b

,

s

,

m

,

g

, and s are constant parameters, and Corr

ðdZ

l

, dZ

n

Þ¼

x

. Given this model, the marginal distribution

for the default time of the underlying firm has a hazard

function equal to the realized path of the intensity (see

Lando, 1998), and similarly for the firm selling default

protection. Modeling the simultaneous distribution of

defaults would require a specification of the probability

of simultaneous defaults. We will specify the joint dis-

tribution of defaults in our discrete-time simulation.

Following Gregory (2010), we distinguish between

three types of default scenarios. The first is the case in

which the underlying firm defaults but not the counter-

party. In this case, the protection buyer receives the

protection payment from the protection seller and does

not suffer any counterparty credit losses.

The second case is when the counterparty defaults, but

the underlying firm does not. For simplicity, we assume

that both counterparties are required to post full collat-

eral daily for CDS liabilities, where the mark-to-market

liability is computed under the assumption that both

counterparties are default free.

17

In addition, we assume

that there is zero recovery of uncollateralized liabilities in

the event that the protection seller defaults.

18

Given the

square-root dynamics in Eq. (9), the value of a CDS

contract can be obtained directly from the CDS valuation

model in Longstaff, Mithal, and Neis (2005, pp. 2221–

2222). There are now two ways in which a protection

buyer can suffer a loss when the protection seller defaults.

If the mark-to-market value is positive, but the collateral

posted the previous day (which equals the previous day’s

mark-to-market value of the CDS contract) is insufficient,

then the buyer’s loss is the difference between the two. As

discussed earlier, however, the buyer can also lose from a

counterparty default when he owes the counterparty on

the CDS contract and the amount of collateral posted with

the defaulting protection seller exceeds the amount of the

buyer’s liability. In this situation, the excess collateral

becomes part of the bankruptcy estate and represents the

protection buyer’s loss. Note that the loss of excess

collateral does not occur when CDS liabilities are

16

We are grateful to the referee for raising this issue.

17

This assumption greatly simplifies the analysis but has virtually

no effect on the total amount of collateral required.

18

This is consistent with the Lehman default in which CDS contracts

referencing Lehman were settled at 8.625 cents on the dollar.

N. Arora et al. / Journal of Financial Economics 103 (2012) 280–293290

uncollateralized. Thus, there are states in which a protec-

tion buyer may be worse off with full bilateral collater-

alization of CDS liabilities.

The third case occurs when both the underlying firm

and the counterparty default at the same time. We will

make the assumption that joint default occurs if both the

firm and the counterparty default within a two-business-

day timeframe. This assumption reflects the reality that a

discrete period of time is required operationally to post

collateral and settle trades. With collateralization, the

protection buyer’s loss is the difference between the loss

on the underlying firm and the amount of collateral held.

Again, since the buyer may have posted collateral with

the defaulting counterparty, the buyer could actually be

worse off in some states in this joint default scenario than

without collateralization.

Since we are simulating changes in the intensity

processes and the realization of defaults at each time

step, we only need to specify local or one-step joint

probabilities to simulate joint default events. In particu-

lar, conditional on no default having occurred before time

t, the marginal probability of the underlying firm default-

ing between time t and t þ

D

t is

l

t

D

t. Similarly, the

marginal probability of the firm selling credit protection

defaulting between time t and t þ

D

t is

n

t

D

t. Let a, b, c, and

d denote the joint probabilities that neither firm defaults,

that only the underlying firm defaults, that only the firm

selling credit protection defaults, and that both firms

default between time t and t þ

D

, respectively. The Appen-

dix shows that these joint probabilities are completely

determined by the two marginal probabilities and a

default correlation parameter

r

. Thus, we are in essence

assuming that the local joint distribution of default events

is given by a simple multinomial distribution. Further-

more, this approach explicitly allows for correlated

defaults to occur. Given these joint probabilities, we

simulate the model in steps of

D

t and sample the four

joint events based on their multinomial probabilities. We

repeat this process at each time step along a simulated

path until the first default occurs.

19

Turning to the issue of calibration, it is important to

stress that our objective is simply to provide general

estimates of the size of counterparty default effects rather

than to model specific contracts. As such, we adopt a

generic parameterization and estimate counterparty

default costs under a broad range of assumptions about

default intensities and correlations. The average value of

the CDX index during the sample period is 95 basis points,

while the average CDS spread for the dealers during the

same period is 145 basis points. These values, of course,

are high by historical standards but they do provide a

realistic benchmark for the calibration of the risk-neutral

intensity processes. Accordingly, we parameterize the

long-run values of

l

t

and

n

t

to be 100 and 150 basis

points, respectively. Furthermore, we assume

b

¼

g

¼0:50

and

s

¼s ¼0:20. These parameters are consistent with

the longer-term properties of the CDX index.

20

We also

assume that the spread correlation parameter

x

takes on

values of 2%, 6%, or 10%. Similarly, we assume that the

default correlation

r

takes on values of 2%, 6%, or 10%.

These values essentially bracket the default correlations

reported by Longstaff and Rajan (2008) implied from the

prices of CDX index tranches and the CDS spreads for the

constituents of the CDX index.

21

Table 7 reports the estimated basis-point cost of

counterparty default for a range of scenarios. Specifically,