Credit Default Swaps

Pamela Heijmans

Matthew Hays

Adoito Haroon

Credit Default Swaps – Definition

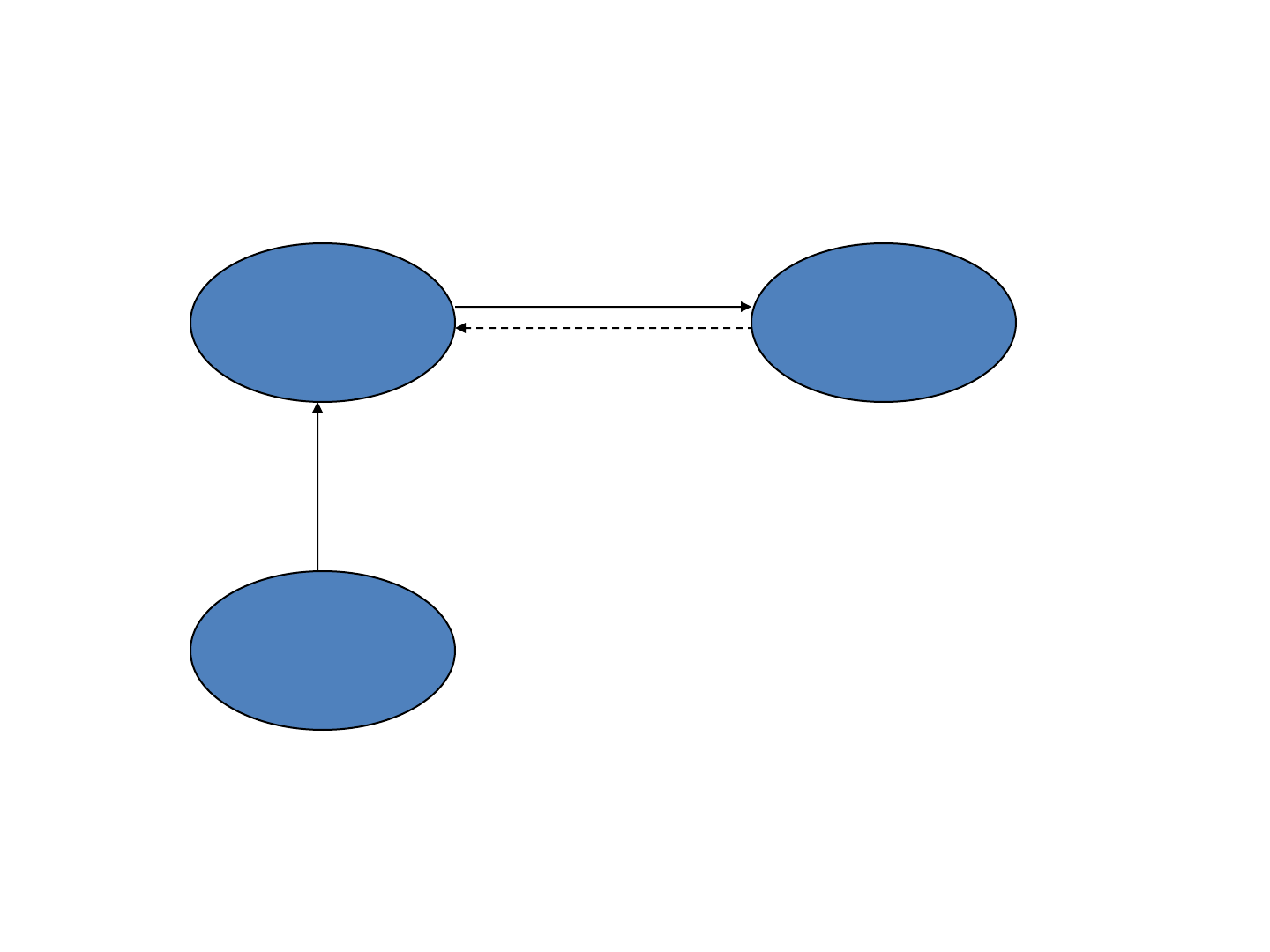

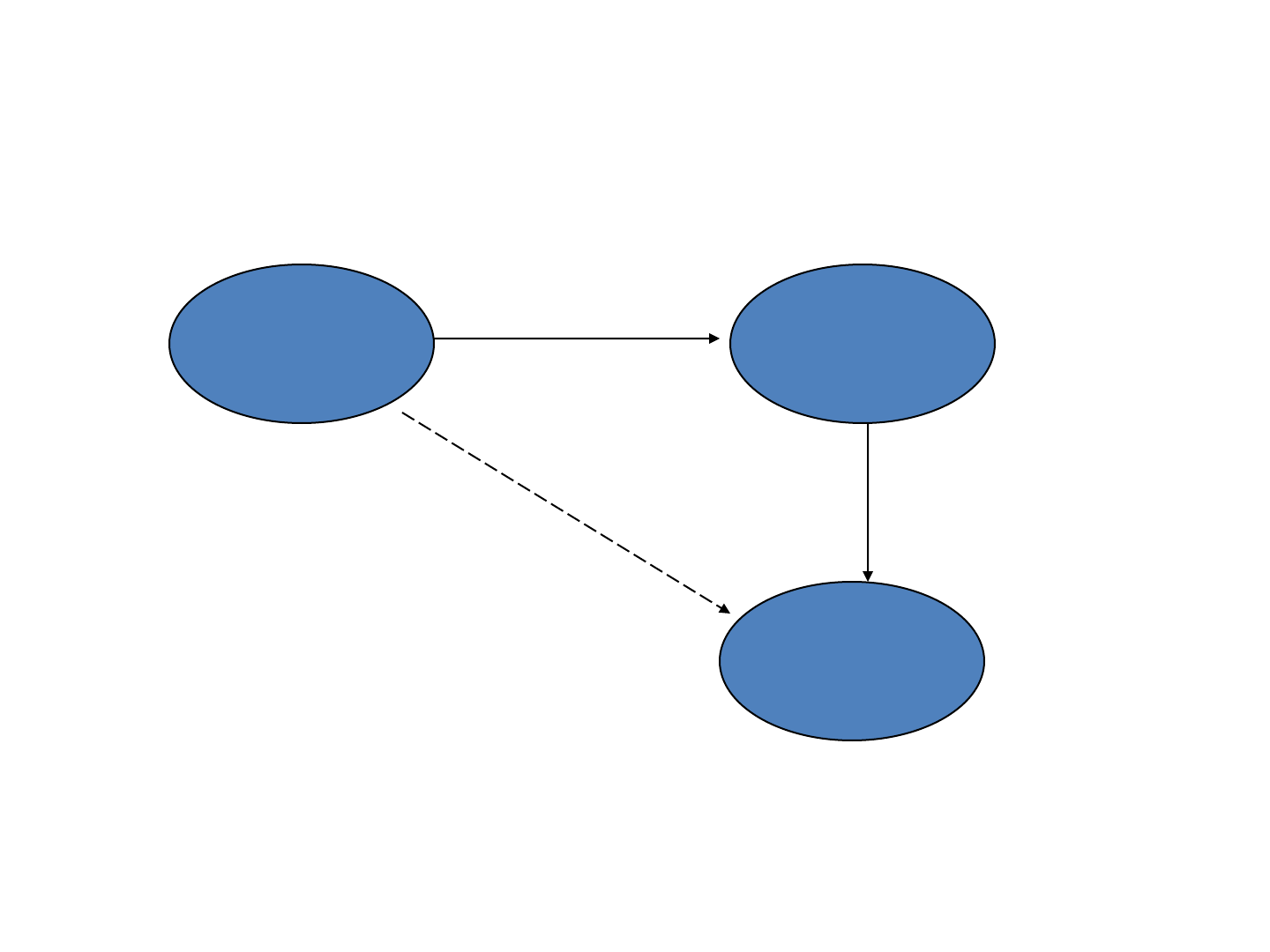

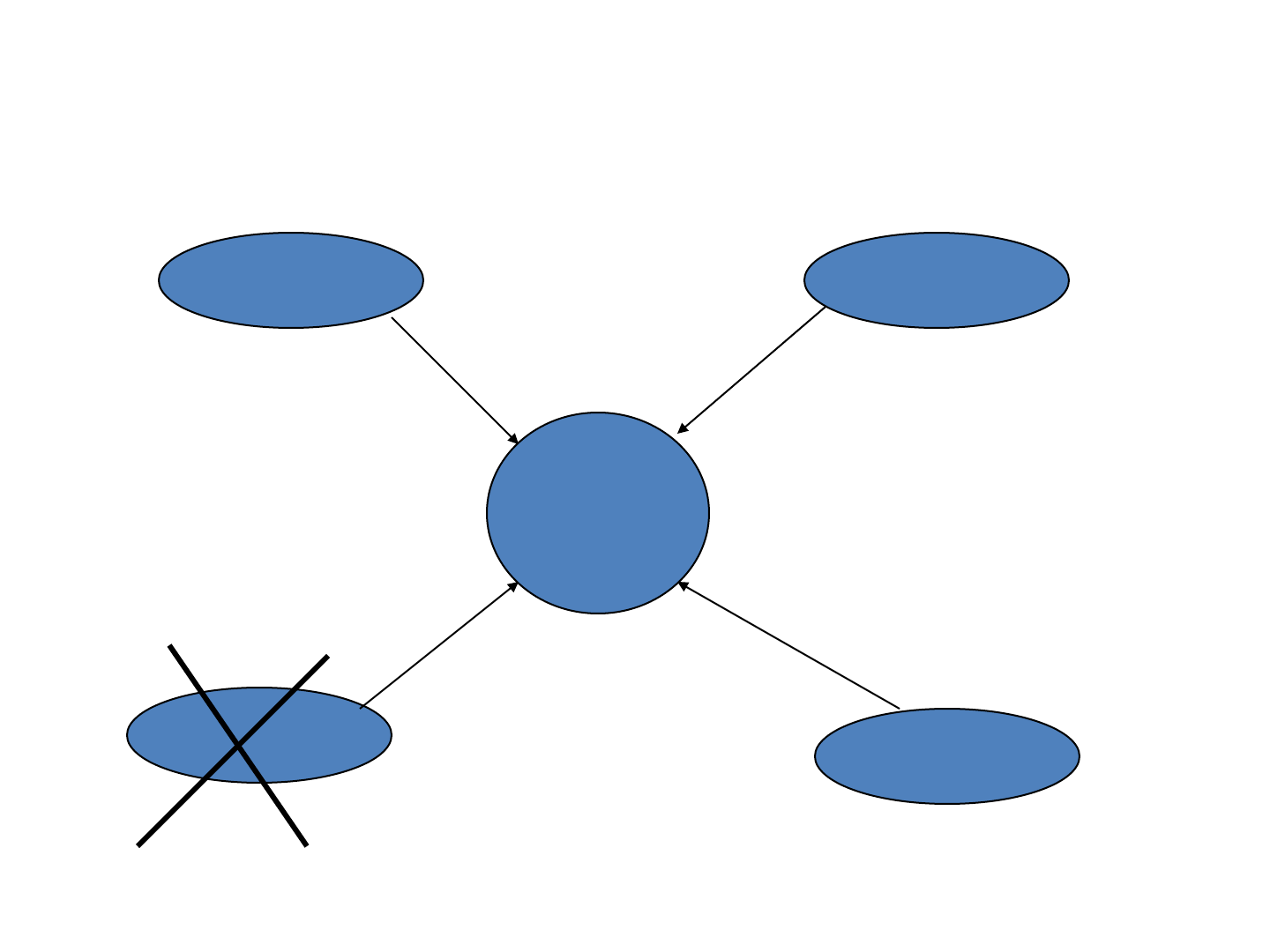

• A credit default swap (CDS) is a kind of

insurance against credit risk

– Privately negotiated bilateral contract

– Reference Obligation, Notional, Premium

(“Spread”), Maturity specified in contract

– Buyer of protection makes periodic payments to

seller of protection

– Generally, seller of protection pays compensation

to buyer if a “credit event” occurs and contract is

terminated.

Spread, b basis

points per annum

Protection

Seller

Protection

Buyer

Reference

Entity

Total return less

credit loss on the

reference entity

Payment on credit event

Credit Default Swaps – Example

Example:

Notional: $10 million dollars

Spread: 100 bps per annum

Quarterly payment frequency

Payment of $25,000 quarterly

Credit Default Swaps - Types

• Exist for both corporate reference entities and

Asset Backed Securities (ABS)

– Corporate CDS are relatively simple; first emerged

round about 1993; became widely used by late

90’s/early 2000’s, particularly after introduction of

ISDA template in July 1999

– ABS CDS are more complex; first appeared around

2003; grew substantially in 2005 after introduction of

ISDA “Pay as you go” template in June of that year

• Exist for a variety of types of ABS; most common for

Residential Mortgage Backed Securities (RMBS); but, size of

markets for CDS on CDOs and CDS on CMBS also substantial.

Credit Default Swaps – Credit Events

• For corporates, quite straightforward

– Credit event results in payment from protection seller to

buyer and termination of contract

– Most common types of credit events are the following

• Bankruptcy

– Reference entity’s insolvency or inability to repay its debt

• Failure to Pay

– Occurs when reference entity, after a certain grace period, fails to make

payment of principal or interest

• Restructuring

– Refers to a change in the terms of debt obligations that are adverse to

creditors

– If credit event does not occur prior to maturity of contract

(typically, 2/5/7/10 years for corporates), protection seller

does not make a payment to buyer

Credit Default Swaps - Settlement

• For corporates, settlement process is rather

simple

– Cash Settlement

• Dealer poll conducted to establish value of reference

obligation (for example, x percent of par)

• Protection seller pays buyer 100 – x percent of Notional

– CDS can be thought of as a put option on a corporate bond.

Protection buyer is protected from losses incurred by a

decline in the value of the bond as a result of a credit event.

Example of Cash Settlement

• The protection buyer in a 5,000,000 USD CDS,

upon the reference entity’s filing for

bankruptcy protection, would notify the

protection seller. A dealer poll would then be

conducted and if, for instance, the value of the

reference obligation were estimated to be

20% of par, the seller would pay the buyer

4,000,000 USD.

Credit Default Swaps – Settlement -

Continued

– Physical Settlement

• Protection buyer sells acceptable obligation to

protection seller for par

– Buyer of protection can choose, within certain limits, what

obligation to deliver. Allows buyer to deliver the obligation

that is “cheapest to deliver.” Generally, the following

obligations can be delivered

» Direct obligations of the reference entity

» Obligations of a subsidiary of the reference entity

» Obligations of a third party guaranteed by the reference

entity

Credit Default Swaps – Payment Events

for CDS on ABS

• CDS referencing ABS are more complex

– Attempt to replicate cash flows of reference

obligations

• Reflective of growing importance of ABS CDO market in

early/mid 2000’s

• Floating Amount Events: Do not terminate

contract

– Writedown

• Reduction in principal of reference obligation

• Implied writedown

– Calculated based on under-collateralization of reference

obligation

– Optional for CDS on CDOs

Example of an Implied Writedown

• Consider a CDO with two tranches; senior

tranche has notional of 150,000,000 USD;

Subordinate tranche has notional of

150,000,000 USD. If there’s only 225,000,000

USD of collateral backing the deal,

subordinate tranche will experience a 50%

implied writedown.

Credit Default Swaps – Payment Events

for CDS on ABS - continued

– Principal Shortfall

• Reference Obligation fails to pay off principal by its legal

final maturity (typically approximately 30 years)

– Interest Shortfall

• Amount of interest paid on reference obligation is less

than required

• Three options for determining size of payment from

seller to buyer: Fixed Cap, Variable Cap, No Cap

Credit Default Swaps – Payment Events

for CDS on ABS - continued

• Fixed Cap: Maximum amount that the protection seller

has to pay buyer is the Fixed Rate

• Variable Cap: Protection seller has to make up any

interest shortfall on the bond up to LIBOR plus the

Fixed Rate

• No Cap: Protection seller has to make up any interest

shortfall on the bond

Comparison of Fixed, Variable and No

Cap – Assuming CDS Spread of 200 bps

Bond Coupon Fixed Cap-Max Pmt Variable Cap-Max Pmt No Cap-Max Pmt

LIBOR + 150 bps 200 bps LIBOR +200 bps LIBOR + 150 bps

LIBOR + 200 bps 200 bps LIBOR +200 bps LIBOR + 200 bps

LIBOR + 250 bps 200 bps LIBOR + 200 bps LIBOR + 250 bps

Credit Default Swaps – Payment Events

for CDS on ABS - continued

• Physical Settlement Option – Buyer has option

to terminate contract

– Writedown

– Failure to Pay Principal

– Distressed Ratings Downgrade

• Reference obligation is downgraded to CCC/Caa2 or

below or rating is withdrawn by one or more agencies

CDS on ABS – Additional Fixed

Payments

• In corporate CDS, protection buyer will never

owe seller anything other than premium

• Not necessarily the case for CDS on ABS

– Recovery of interest shortfall or reversal of

principal writedown can result in protection buyer

reimbursing protection seller

CDS Pricing and Valuation

• Premium, “spread” – quoted as an annual

percentage in basis points of the contract’s

notional value, but usually paid quarterly.

• Like the premium on a put option, where the

payment of the premium is spread over the

term of the contact.

• Model expected payments and expected

losses

– Likelihood of default

– Recovery rate in the event of default

– Liquidity, regulatory and market sentiment about

the credit

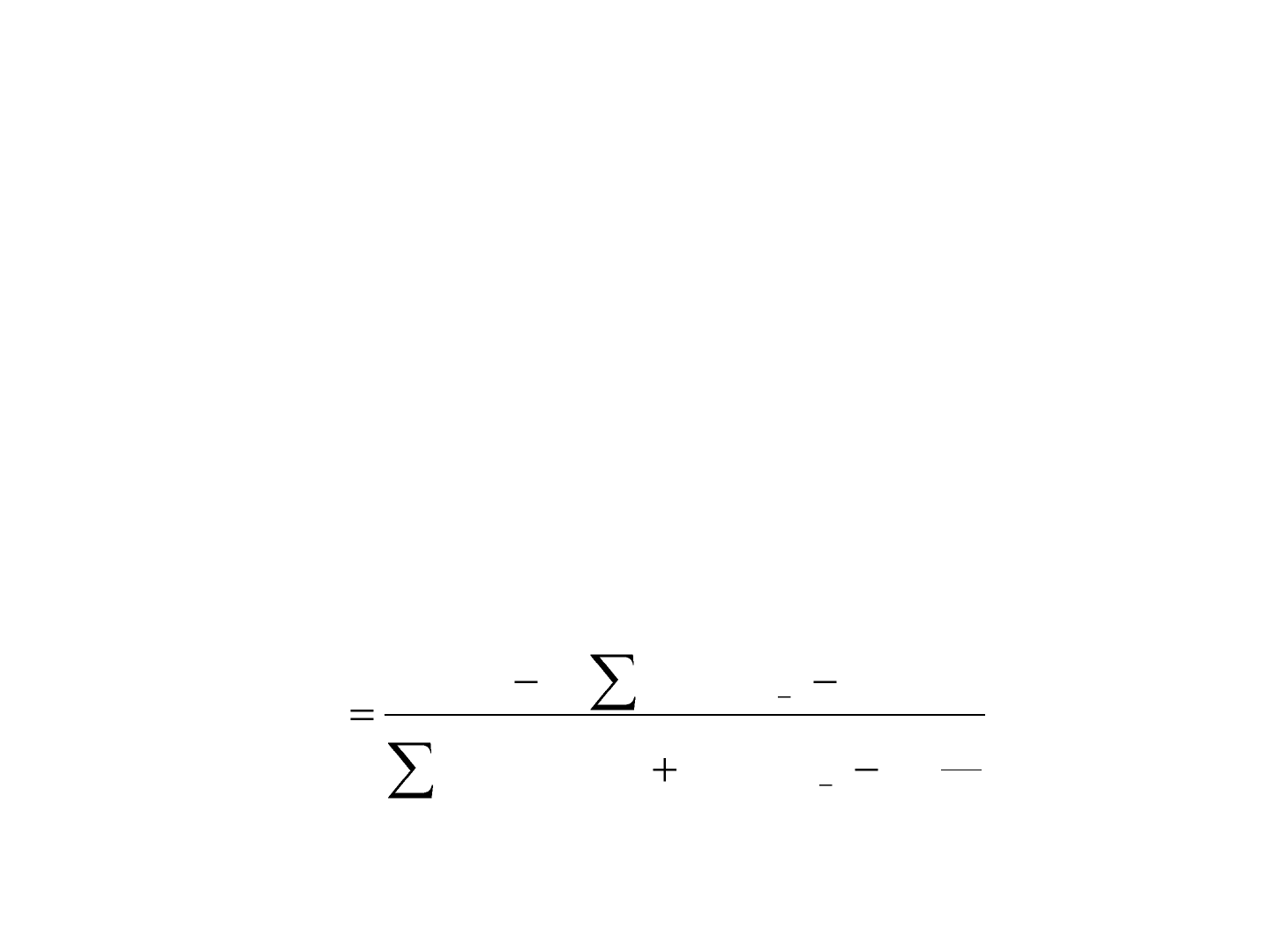

CDS Pricing – Continued

• Value of CDS (to protection buyer) = Expected

PV of contingent leg – Expected PV of fixed

leg.

Expected PV of fixed leg:

ΣD(t

i

)q(t

i

)Sd + ΣD(t

i

){q(t

i-1

)-q(t

i

)}S*d

i

/2

Where: D(t)=discount factor for date t, q(t)=survival

probability at time t, S=annual premium, d=accrual

days (i.e., 0.25), Notional of $1 million

The present values of the sum of all payments to

the extent they will likely be paid (i.e., taking into

account survival probability)

The present values of all

expected accrued payments

CDS Pricing – Continued

• Expected PV of contingent leg:

(1-R)ΣD(t

i

){q(t

i-1

)-q(t

i

)}

• The spread is set initially so that the value of the CDS is 0.

ΣD(t

i

)q(t

i

)Sd + ΣD(t

i

){q(t

i-1

)-q(t

i

)}S*d

i

/2=(1-R)ΣD(t

i

){q(t

i-1

)-q(t

i

)}

2

))(()()(

))(()1(

1

1

i

iiiiii

iii

d

qqtDdtqtD

qqtDR

S

Two portfolios – same maturity, par and nominal values of $100

Portfolios should provide identical returns at time T

1

CDS spread = corporate bond spread

T

1

– No Default:

Risk free bond’s payoff: $100 Corporate bond’s payoff: $100

No payment made on CDS

T

1

– Credit event: Assume a recovery rate of 45%

Risk free bond’s payoff: $100 Corporate bond’s payoff: $45

Payment on CDS: 55% of $100 notional

T

0

– Portfolio A: T

0

– Portfolio B:

Long: Risk Free Bond Long: Company’s Corporate Bond

Short: CDS of a Company

(i.e., “Selling Protection”)

CDS Pricing – Example

Negative Basis Trades

• Investor buys a bond and buys protection on the

same entity. If the basis is negative – the credit

default swap spread is less than the bond spread –

the trader can receive a spread without taking on any

default risk. However, the investors takes on

counterparty risk.

• For example, suppose a bank structures a CDO and

takes down a AAA tranche paying a spread of 27bps.

The bank can then buy protection from an insurer

(such as AIG) for 17 bps, pocketing 10 bps.

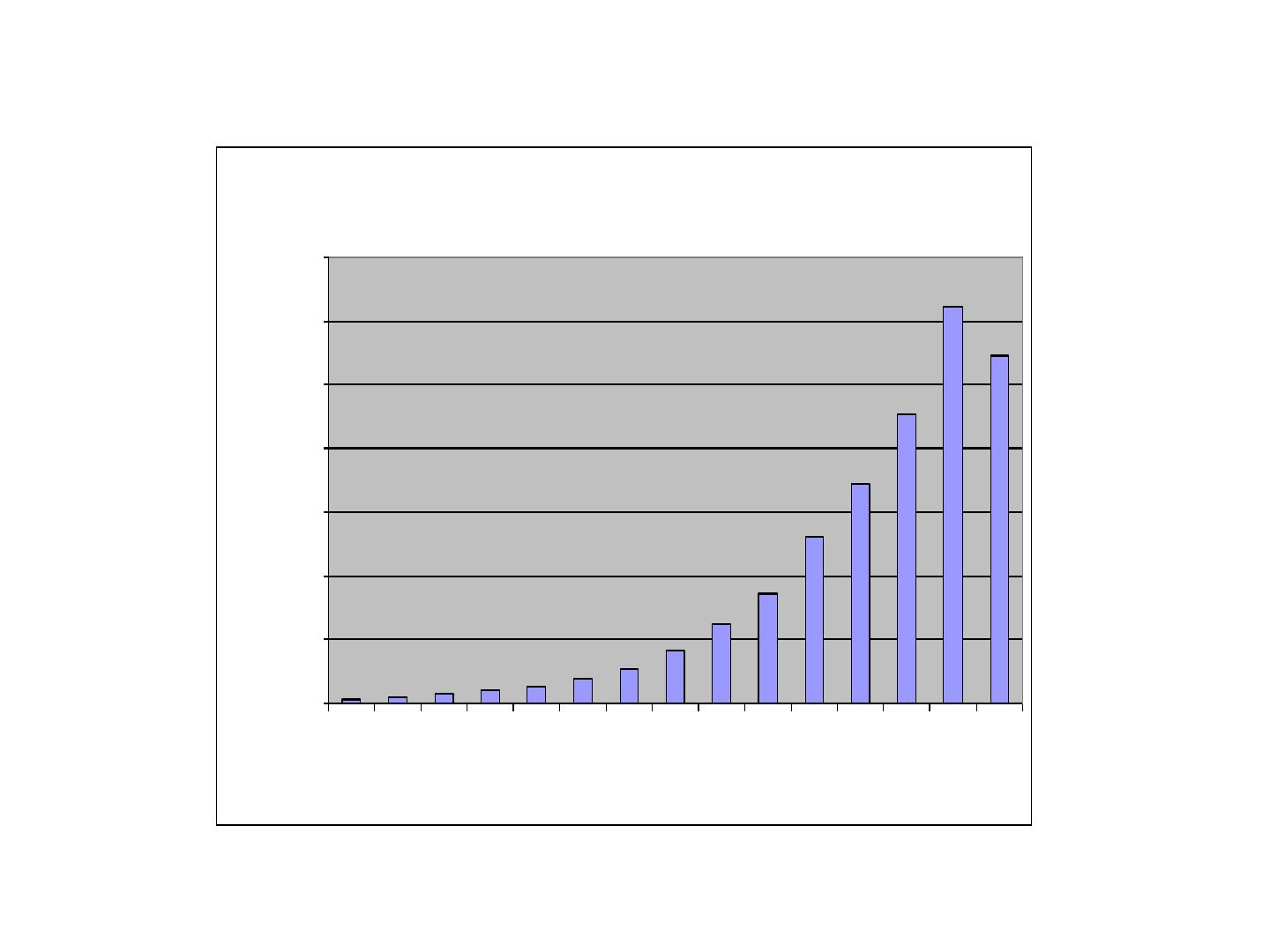

Growth So Far

CDS Outstanding Notional (billions)

-

10,000.00

20,000.00

30,000.00

40,000.00

50,000.00

60,000.00

70,000.00

1H01 2H01 1H02 2H02 1H03 2H03 1H04 2H04 1H05 2H05 1H06 2H06 1H07 2H07 1H08

Semi-Annual breakdown

Billions outstanding

Systemic risks

• Risks that threaten the broader financial

market not just individual participants

• Previous examples where mechanisms caused

systemic risk

– Bank runs

– Portfolio insurance – stop-loss failures

• Works individually but not if everyone does it

Measuring risks in the CDS market

• Do we know the total risk exposure out in the

market?

• Notional does not give us a good measure:

– Actual payment is measured in basis points of

notional.

– In case of credit event, made whole on the

underlying bond

• Double counting each side of contract

• Netting

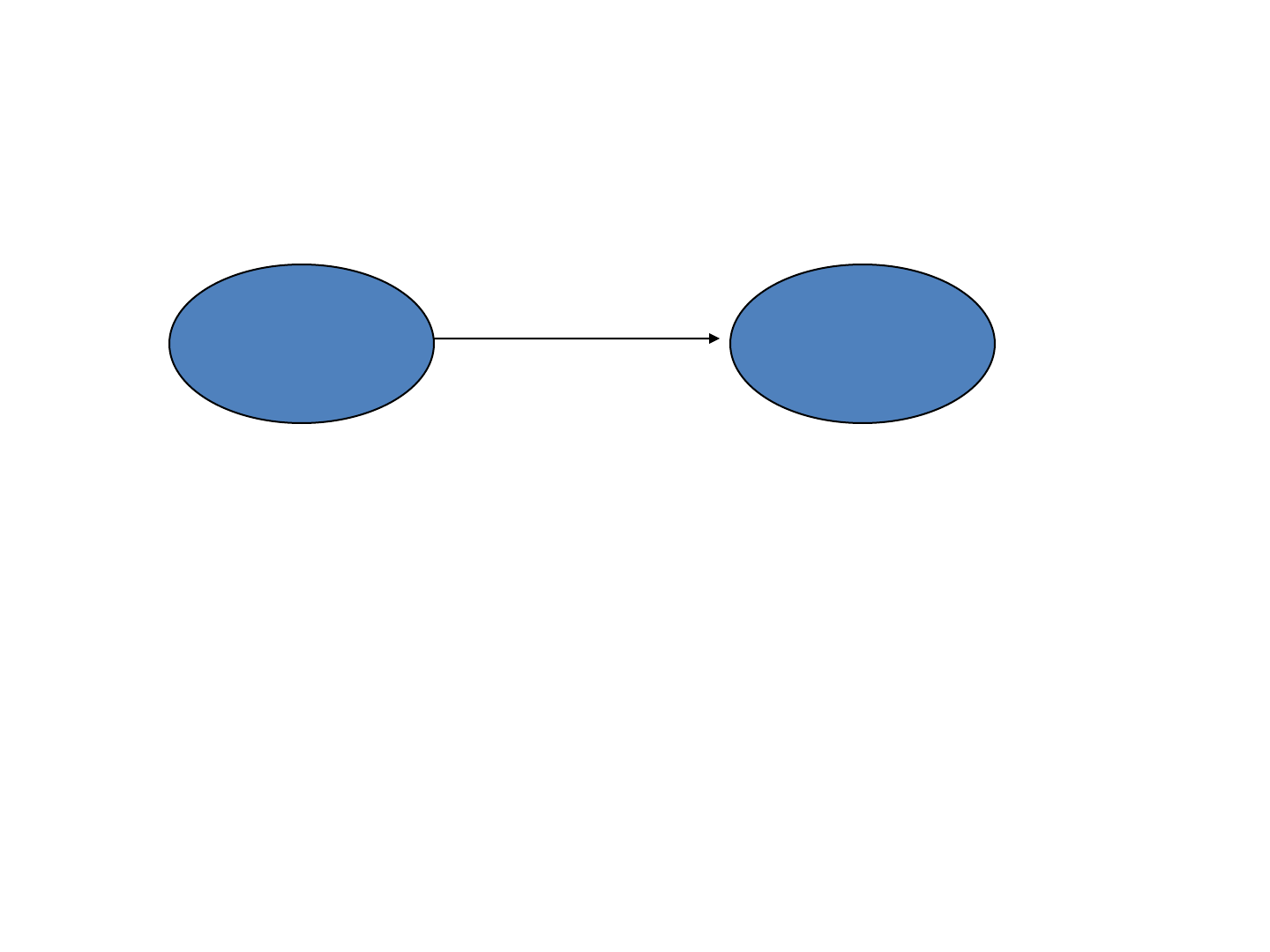

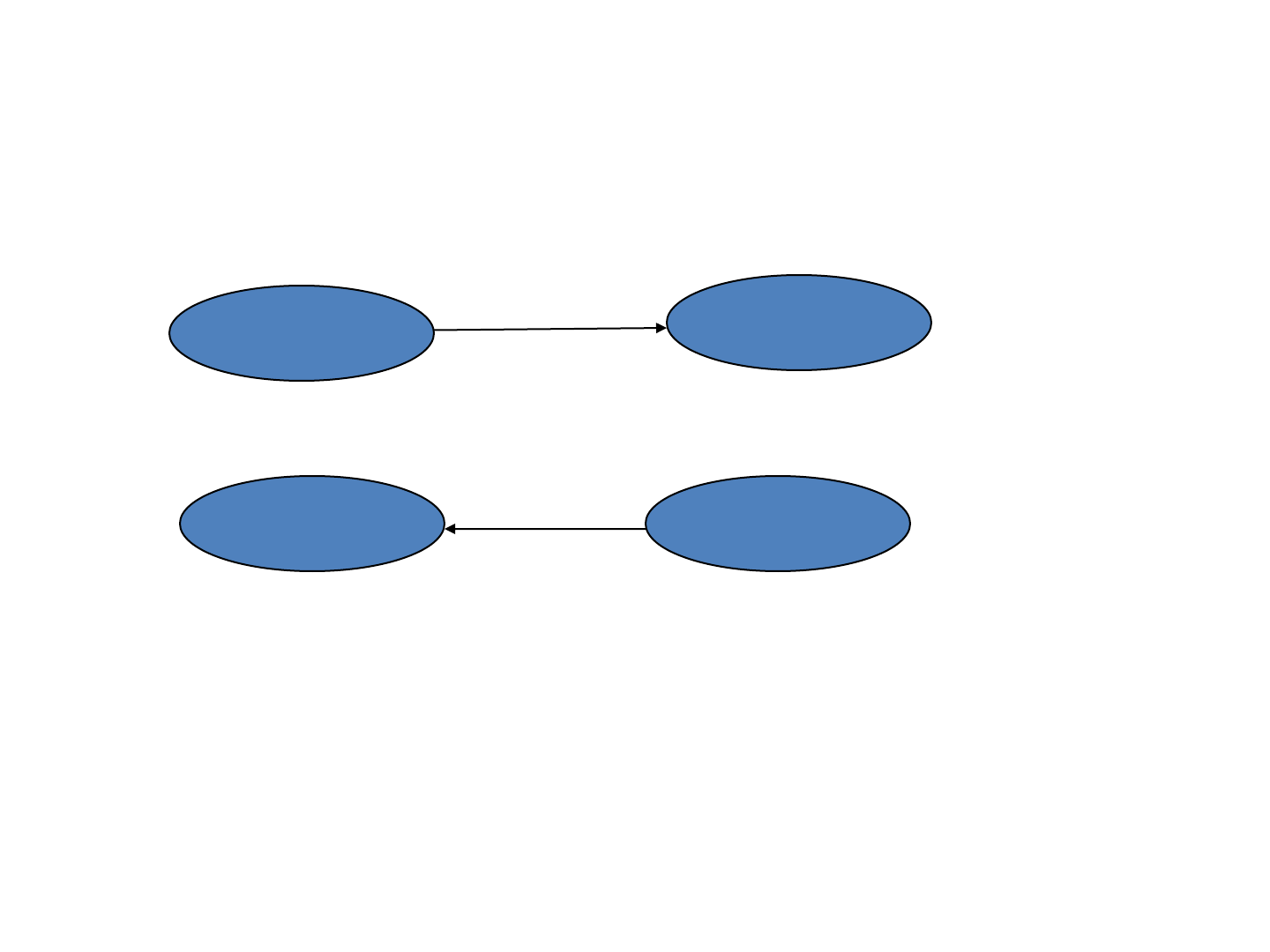

Netting

Buys CDS

protection on Delta

Airlines

Bear StearnsGoldman

Netting

Buys CDS

protection on Delta

Airlines

Bear StearnsGoldman

JP Morgan

After couple of

months: Buys CDS

protection on Delta

Airlines

Netting

Buys CDS

protection on Delta

Airlines

Bear StearnsGoldman

JP Morgan

After couple of

months: Buys CDS

protection on Delta

Airlines

Effectively

Goldman has

bought CDS

protection from

JPMorgan

What are the risks in this market?

• Network effects

– CDS are bilateral contracts often sold and resold

among parties

– Buyers may not be as financially sound to cover

the obligation in case of a credit event specially

without collateral

– In 2005 NY Fed advised that counterparties tell

their trading partners when they’ve assigned the

contract to others

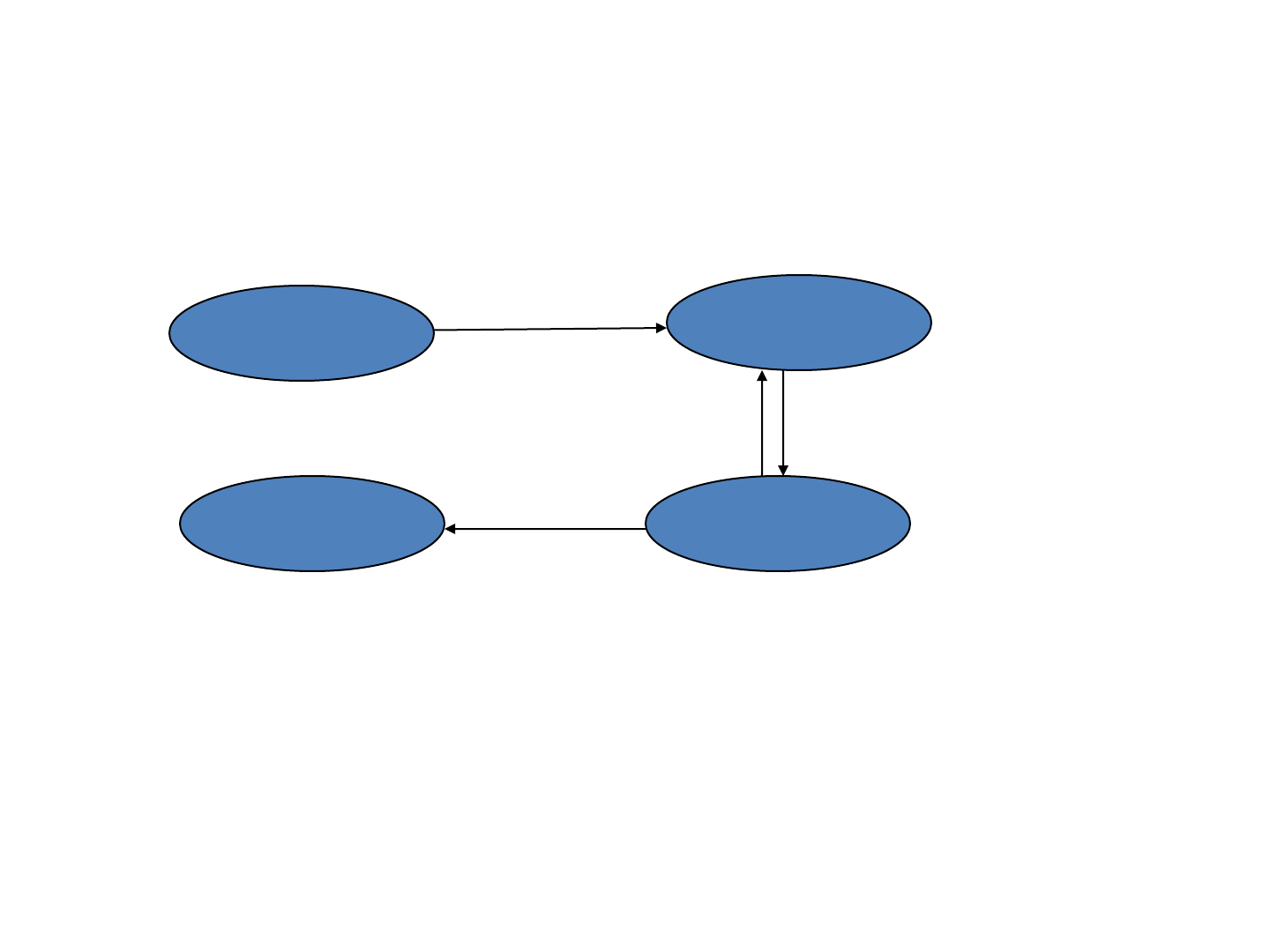

Network (domino) effects

Buys CDS

Bear Stearns

Goldman

JP MorganLehman

Buys CDS

Network (domino) effects

Buys CDS

Bear Stearns

Goldman

JP Morgan

After couple of

months: Buys CDS

Lehman

Buys CDS

JP sells CDS

protection

Network (domino) effects

• Bear Stearns and JPMorgan could have stepped out

• Can lead to contagion and liquidity dry-ups

Buys CDS

Bear Stearns

Goldman

JP Morgan

After couple of

months: Buys CDS

Lehman

Buys CDS

JP sells CDS

protection

Suppose Delta

defaults and

Lehman took

massive write-

downs

What are the risks in this market (contd.)?

• Counterparty concentration risk

– Risk that the counterparty will default and not pay what is

owed under the contract

– If a major counterparty like AIG fails, it leaves a large

number of market participants un-hedged and exposed to

losses

– Can have a domino effect: can lead to mistrust and freeze

up of market, systemic risk

• Hedging risk

– Could hedge by selling short bond

– If everyone does it together, it does not work

• Similar to portfolio insurance in 1987

• Cascading effect

What are the risks in this market (contd.)?

• Collateral and margin spirals

– Some “blue-chips” like “AAA” AIG and Lehman, were not required to post collateral

– However, even with collateral

• Asset values may be correlated with CDS protection sold and broader economy

• Have to post more collateral

– De-leveraging: selling assets at the worst time

• Everyone does this together

– Margin spiral

• Excessive speculation

– Excess speculation without adequate collateral can cause contagion in case of credit

event

– Actual size of market (not notional) is estimated to be 10x size of underlying cash bond

market

• This should imply most bonds are cash settled since not enough bonds to settle

physically.

• Irony is single name CDS in US still states physical settlement on term sheets

– Risk of squeeze on underlying bonds in case of credit event.

• Though not certainty, this suggests speculation

– Not actually hedging against bonds you own

Quantifying risks

• Actual size of market (not notional) is estimated to

be 10x size of underlying cash bond market

• Modeling is hard:

–Illiquid

–True default probabilities hard to judge

–Default correlations very hard to judge

making it difficult to aggregate risks

–Asymmetric, Fat-tailed (left-skew)

distribution makes it even harder to model

Example: Lehman

• September 15, 2008 bankruptcy resulting from its

investments in subprime mortgages.

• “Event of Default” – CDS where Lehman was the

counterparty – special trading session on September

14.

• “Credit Event” – CDS where Lehman was the

reference party – approximately $400 billion in CDS

contracts.

Lehman – Auction

• Auction: Allows cash settlement when the notional amount of

CDS on a reference entity is in excess of its outstanding debt.

– Avoids valuation disagreements and need for market polls.

– Mitigates risk of outstanding debt trading up due to

artificial scarcity. Delphi, 2005, had $2.2 billion in bonds,

$28 billion in credit derivatives outstanding. The debt

traded up from 57 cents on the dollar to a high of 71 cents

before falling back to 60 cents

• Lehman Auction on October 10 to determine the value of

Lehman bonds: 8.625 cents on the dollar. Sellers of

protection needed to pay out 91.375 cents for every dollar of

insurance sold.

• Ultimately, the auction settled with a net payout of $5.2

billion.

Lehman Bankruptcy – Other Effects

• Commercial paper market

– First time in 14 years that a money market fund

had “broken the buck.”

• CDS market: Average cost of 5-year insurance on $10

million debt increased from $152,000 the previous

Friday to $194,000 (CDX Index).

– Sellers of insurance had to post extra collateral: $140

billion in market calls.

Examples: AIG

• AIG sold $447 billion in un-hedged, relatively under-margined (i.e. no

collateral) (due to AAA credit) CDS coverage

• In 2005 and early 2006, head of the financial products unit, Joe Cassano

pushed AIG into writing protection on AAA portion of CDO’s

– Models stated very low default probability

– High fees without posting collateral

• As write-downs grew, starting summer of 2007, the counterparties

demanded collateral.

– Started off write-downs (as asset prices lowered) and further margin calls.

– Eventually margin calls rose to $50 billion by September when AIG was

downgraded to single-A and had to seek government bailout because it did

not have the short-term liquidity to meet margin calls

• Aside: cash collateral left by traders and hedge funds was used to invest in

sub-prime and Alt-A mortgage paper. As they crashed in value, and as the

traders returned stock, AIG could not give the collateral back.

• Classic margin, loss spiral we talked about in class

What is the solution in light of this?

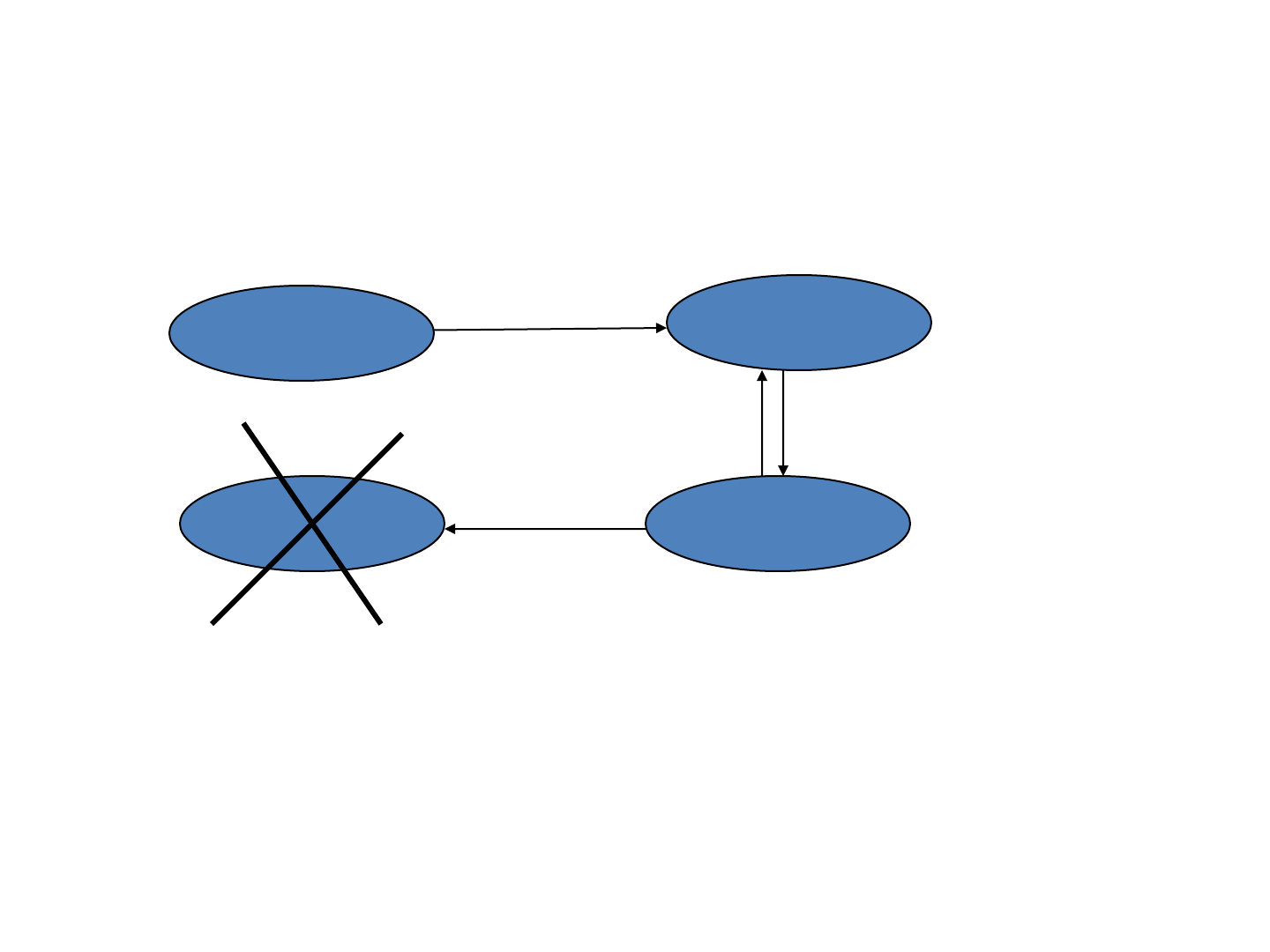

• Clearinghouse to reduce counterparty credit risk:

– The idea of the clearing house like clearing house for futures

– Collateral is continuously posted in the form of margin, to cover the

drop in market value according to CDS spreads widening or narrowing.

• AIG allowed to sell protection without posting collateral.

– Automatic netting

• Avoids domino effect outlined before

– Clearinghouse effectively guarantees payment in a default event,

avoids the contagion of non-payments and spiraling margin calls.

– Will also illuminate size of the effective exposure of the counterparty

to the clearinghouse.

– A clearinghouse also provides enhanced liquidity and price discovery

through standardization and centralized trading.

What is the solution in light of this?

Bear StearnsGoldman

JP Morgan

Lehman

Clearinghouse

Post collateral.

Automatic netting.

Current state of clearinghouse

• As of Nov 12., the Fed wants to be the regulator for clearing

trades.

• Two competing platforms:

– The CME (Chicago Mercantile Exchange):

• Entered into joint venture with Citadel

• They are waiting for regulatory approval to begin clearing CDS

trades.

– The ICE (Intercontinental Exchange) is also competing. It

has bought Clearing Corp. a company which specializes in

clearing trades.

• Has a trade clearing platform (“Concero”) and is owned partly by

some of the major dealers like Goldman Sachs, Deutsche Bank,

Morgan Stanley etc.

Ending thoughts

As we know, there are known knowns; there

are things we know we know. We also know

there are known unknowns; that is to say we

know there are some things we do not know.

But there are also unknown unknowns—the

ones we don’t know we don’t know. (Donald

Rumsfeld, US dept of defense 2002)

References

• http://www.securitization.net/pdf/content/Nomura_CDS_Primer_12May04.pdf

• http://www.securitization.net/pdf/Nomura/SyntheticABS_7Mar06.pdf

• http://www.quantifisolutions.com/History%20of%20Credit%20Derivatives.php

• Fitch Ratings, Special Report: A Brief Review of “The Basis,” January 10, 2008.

• Fitch Ratings, Special Report: The CDS Market and Financial Guarantors – Current Issues, February 27, 2008

• Laing, J. R., Defusing the Credit-Default Swap, in Barron’s, November 17, 2008.

• Morgenson, G., Arcane Market is Next to Face Big Credit Test, in The New York Times, February 17, 2008.

• RECOMMENDED: Federal Reserve Bank of Atlanta, Economic Review, Fourth Quarter 2007:

– Preface – Credit Derivatives: Where’s the Risk

– Credit Derivatives: An Overview

– Credit Derivatives and Risk Management

– Credit Derivatives, Macro Risks, and Systemic Risks

• Clearinghouse News:

– http://www.bloomberg.com/apps/news?pid=20601087&sid=awdIS.zeotuY&refer=home

– http://www.bloomberg.com/apps/news?pid=20601087&sid=apgBhmu_U.Fo&refer=home

• ISDA statistics - http://www.isda.org/statistics/historical.html

• Federal Reserve Board presentation - www.frbsf.org/economics/conferences/0611/Nelson.ppt

• General paper about systemic risk by ECB - http://www.ecb.int/pub/pdf/scpwps/ecbwp035.pdf

• Counterparty Risk Management Policy Group (Policy report from Gerald Corrigan of Goldman Sachs & Douglas Flint of HSBC

to Secretary Paulson & Mario Draghi of the Bank of Italy) - http://www.crmpolicygroup.org/docs/CRMPG-III.pdf

• AIG downfall - http://www.forbes.com/2008/09/28/croesus-aig-credit-biz-cx_rl_0928croesus.html

• http://www.nytimes.com/2008/09/28/business/28melt.html?sq=aig%20cds%20london&st=cse&scp=2&pagewanted=all

• Nouriel Roubini’s website - http://www.rgemonitor.com/economonitor-

monitor/253566/would_lehmans_default_be_a_systemic_cds_event