1

Standard CDS Examples

Supporting Document for the Implementation of the ISDA CDS Standard Model

Contacts

Purpose

This document goes through some simple examples meant to clarify behavior of the Standard CDS and the

Standard CDS Converter. It is meant to be used in conjunction with the ISDA CDS Standard Model.

Sections

Standardizing coupon dates

Converter assumptions

Standardizing coupon dates

1. Standard maturity dates are unadjusted – always Mar/Jun/Sep/Dec 20th.

Example: As of Feb09, the 1y standard CDS contract would protect the buyer through Sat 20Mar10.

2. Coupon payment dates are like standard maturity dates, but business day adjusted following.

Examples: The 1Q09 payment date is Fri 20Mar09. The 2Q09 payment date is Mon 22Jun09.

3. Coupon payments are also standardized:

a) Each coupon is equal to (annual coupon/360) × (# of days in accrual period).

b) The accrual period always stretches from (previous coupon payment date) through (this coupon

payment date–1), inclusive; except a contract's last accrual period, which ends with (and includes) the

unadjusted maturity date.

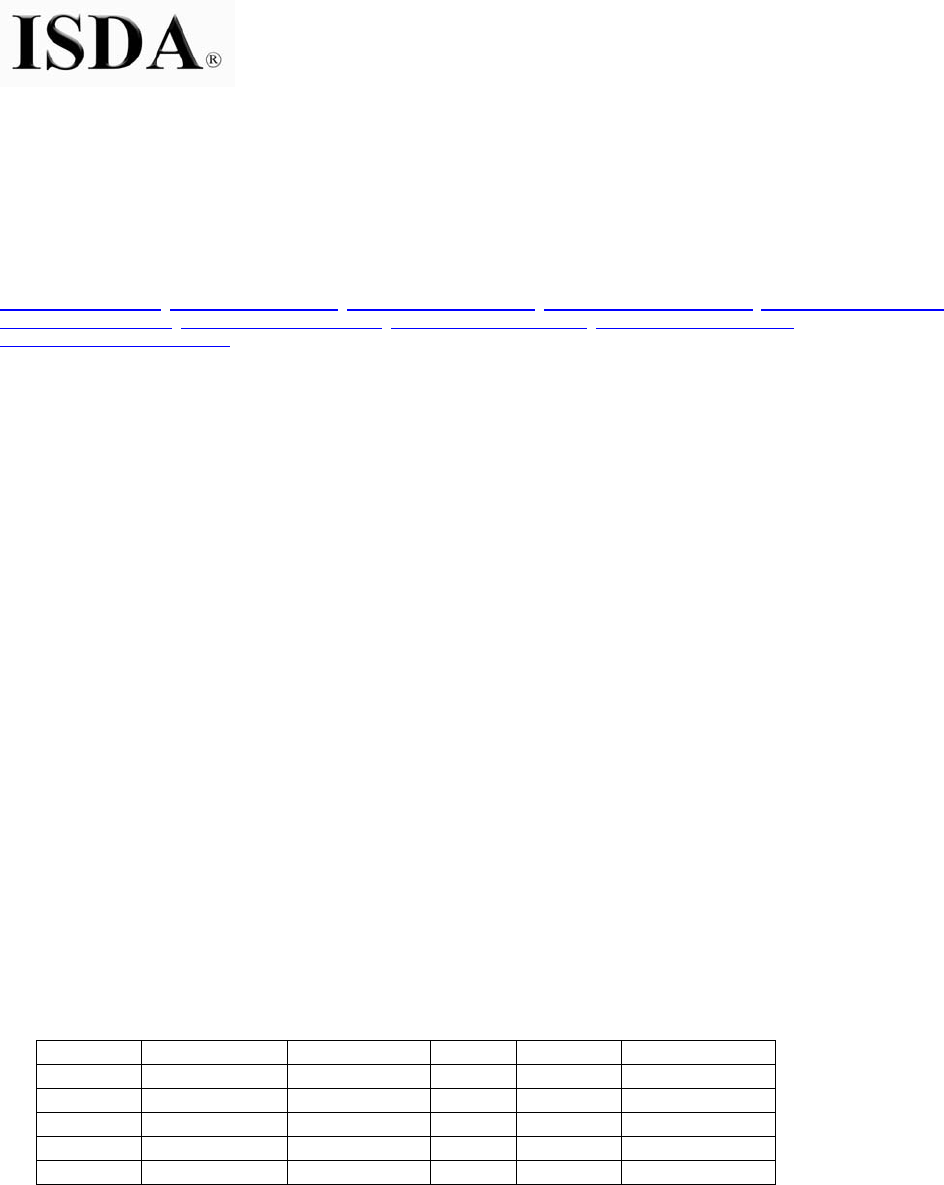

Example (Table 1): Consider a 1y $36mm 100bp standard CDS traded in Feb09, maturing 20Mar10:

Coupon Accrual Start Accrual End # Days Payment Payment Date

1st Mon 22Dec08 Thu 19Mar09 88 $88k Fri 20Mar09

2nd Fri 20Mar09 Sun 21Jun09 94 $94k Mon 22Jun09

3rd Mon 22Jun09 Sun 20Sep09 91 $91k Mon 21Sep09

4th Mon 21Sep09 Sun 20Dec09 91 $91k Mon 21Dec09

5th (final) Mon 21Dec09 Sat 20Mar10 90 $90k Mon 22Mar10

See also the separate table of all 2009-2013 US coupon payment, accrual start, and accrual end dates.

2

4. Standardizing rates (100/500), coupon payment dates, and accrual start dates maximizes fungibility and

ease of coupon processing.

Examples:

a) Every $10mm 100bp standard CDS contract will pay the exact same 2Q09 coupon, $26,111, on the

same date, Mon 22Jun09 – regardless of trade date, maturity, or reference entity. (One exception: any

trades maturing 20Jun09, which would pay their final $25,833 coupon on 22Jun09.)

b) A $10mm 100bp 20Mar14 (5y) contract hedged by a $10mm 100bp 20Mar15 (6y) contract will have

exactly offsetting cashflows until the first unhedged coupon, 2Q14 on 20Jun14.

5. A trade's first coupon payment date is determined by the trade date (T): it's the first coupon payment date

after T+1 (calendar, unadjusted). This is consistent with the first coupon dates of, eg, CDX.

Examples:

a) A standard CDS trade on T=Fri 20Feb09 pays its first coupon Fri 20Mar09 (paying annual coupon/360 ×

88, as per Table 1 above).

b) A trade on Wed 18Mar09 also pays its first coupon Fri 20Mar09 – exact same coupon as in (a).

c) But a trade on Thu 19Mar09 pays its first coupon three months later, Mon 22Jun09 (for 94 days).

d) Similarly, a trade on Sat 20Jun09 pays on Mon 22Jun09, but a trade on Sun 21Jun09 doesn't pay its

first coupon till Mon 21Sep09.

Converter assumptions

1. The converter is based on the ISDA CDS Standard Model code, with simpler assumptions. In particular, it

assumes a single flat hazard rate rather than a term structure of flat spreads.

2. The converter assumes that credit risk begins at the end of the trade date (T). That is, it divides a

contract's coupon days – from first accrual start date, to maturity date – into two types:

a) Riskless (aka accrual) days include the first accrual start date through T. They are assumed to have 0

chance of a credit event. They only contribute to fee through their coupon.

b) Risky days include T+1 through maturity. They are assumed to have some chance of a credit event,

quantified by the flat hazard rate. They contribute to fee through both their coupon and their chance of

payout on a credit event. Points upfront (and clean price) include only the value of risky days.

Example 1: The CDS from Table 1 above includes 454 coupon days. Suppose it's booked on 20Feb09.

Then, 22Dec08-20Feb09 (61 days) are assumed to be riskless, and 21Feb09-20Mar10 (393 days) are

assumed to be risky.

Example 2: Now suppose that, later on the day of T=20Feb09, a credit event occurs. The buyer is

protected, since the contract takes effect from the moment of the trade confirm (and protects against events

60 days back). The "first day free" assumption that T is riskless is just a converter simplification and does

not affect contract terms.

3. It follows from 2 above that:

a) The converter's fee (aka price) is dirty: it includes the value of the riskless accrual coupon days.

b) The converter's points upfront are clean: they exclude the riskless accrued.

3

Example: Suppose the CDS from Table 1 is quoted at 2 points upfront. This means:

Buyer pays clean price = 2% × $36mm notional = $720k

Seller pays accrued = (# of riskless coupon days = 61)/360 × $36mm notional × 100bp rate = $61k

Net, buyer pays $659k.

4. When converting between clean points and dirty fee, the converter follows CDSW in making the simplifying

assumption that riskless accrued is in settlement date dollars, when in fact it's in next coupon payment date

dollars. This is convenient for back-of-envelope, and the omitted discounting is rarely significant.

Example: In 3 above, the quoted clean price of $720k was reduced to $659k, to compensate the buyer for

paying for 61 days of coupon accrued by the seller. But the buyer will only pay that $61k at the next coupon

payment date (20Mar09). Expressed in settlement date (T+3 = 25Feb09) dollars, the fair value of that future

payment is closer to $60.95k.