NBER WORKING PAPER SERIES

OWNER INCENTIVES AND PERFORMANCE IN HEALTHCARE:

PRIVATE EQUITY INVESTMENT IN NURSING HOMES

Atul Gupta

Sabrina T. Howell

Constantine Yannelis

Abhinav Gupta

Working Paper 28474

http://www.nber.org/papers/w28474

NATIONAL BUREAU OF ECONOMIC RESEARCH

1050 Massachusetts Avenue

Cambridge, MA 02138

February 2021, revised August 2023

We are grateful to Abby Alpert, Pierre Azoulay, Zack Cooper, Liran Einav, Paul Eliason, Arpit

Gupta, Jarrad Harford, Steve Kaplan, Holger Mueller, Aviv Nevo, Adam Sacarny, Albert Sheen,

Arthur Robin Williams, numerous seminar participants, and two anonymous referees for their

comments and suggestions. Jun Wong, Mei-Lynn Hua, and Sarah Schutz provided excellent

research assistance. A previous version of this paper was titled “Does Private Equity Investment

in Healthcare Benefit Patients: Evidence from Nursing Homes." Funding from the Wharton Mack

Institute and the Laura and John Arnold foundation (Gupta, Yannelis), the Kauffman Foundation

(Howell), and the Fama Miller Center at the University of Chicago (Yannelis) is greatly

appreciated. We gratefully acknowledge funding through National Institute of Aging pilot grant

P01AG005842-31. All remaining errors are our own. The views expressed herein are those of the

authors and do not necessarily reflect the views of the National Bureau of Economic Research.

NBER working papers are circulated for discussion and comment purposes. They have not been

peer-reviewed or been subject to the review by the NBER Board of Directors that accompanies

official NBER publications.

© 2021 by Atul Gupta, Sabrina T. Howell, Constantine Yannelis, and Abhinav Gupta. All rights

reserved. Short sections of text, not to exceed two paragraphs, may be quoted without explicit

permission provided that full credit, including © notice, is given to the source.

Owner Incentives and Performance in Healthcare: Private Equity Investment in Nursing Homes

Atul Gupta, Sabrina T. Howell, Constantine Yannelis, and Abhinav Gupta

NBER Working Paper No. 28474

February 2021, revised August 2023

JEL No. G3,G32,G34,G38,I1,I18

ABSTRACT

Amid an aging population and a growing role for private equity (PE) in elder care, this paper

studies how PE ownership affects U.S. nursing homes using patient-level Medicare data. We

show that PE ownership leads to lower-risk patients and increases mortality. After instrumenting

for the patient-nursing home match, we recover a local average treatment effect on mortality of

11%. Declines in measures of patient well-being, nurse staffing, and compliance with care

standards help to explain the mortality effect. Overall, we conclude that PE has nuanced effects,

with adverse outcomes for a subset of patients.

Atul Gupta

Wharton Health Care Management

3641 Locust Walk, CPC 306

Philadelphia, PA 19104

and NBER

Sabrina T. Howell

NYU Stern School of Business

KMC 9-93

44 West 4th Street

New York, NY 10012

and NBER

Constantine Yannelis

Booth School of Business

University of Chicago

5807 S. Woodlawn Avenue

Chicago, IL 60637

and NBER

Abhinav Gupta

UNC Chapel Hill

1 Introduction

The U.S. population, like that of many advanced economies, is aging rapidly. This has created

increasing demand for elderly care. Private equity (PE)-owned firms are playing a growing role

in meeting this need. In this paper, we examine how PE ownership of nursing homes affects

patients and taxpayers. Relative to independent private firms, PE ownership brings short-term,

high-powered incentives to maximize profits. Existing literature and the policy debate provide

opposing predictions.

On the one hand, there is evidence that for-profit healthcare firms can maintain long-term

implicit contracts with stakeholders (Duggan, 2000; Adelino, Lewellen and Sundaram, 2015).

Voices from the private sector suggest this may apply to PE; for example, a 2019 report from

consulting firm EY concluded that “Not only is PE perceived to have a beneficial overall impact

on health care businesses, it is also considered to positively influence the focus on quality and

clinical services” (EY, 2019). Finally, PE has been found to have positive effects in other

industries (Kaplan, 1989; Kaplan and Weisbach, 1992; Davis et al., 2014; Bloom et al., 2015;

Bernstein and Sheen, 2016; Hochberg and Rauh, 2013).

On the other hand, nursing home customers are particularly vulnerable and face severe

information frictions (Carlin, Umar and Yi, 2020). In contexts where financial literacy is

lacking or decision-making is impaired by cognitive decline, consumers may make choices

that are not in their interest (Carlin and Robinson, 2012). This could lead to different

outcomes than in other parts of healthcare and the economy more broadly. Theories of firm

behavior suggest that information frictions and non-contractible quality can weaken the

natural ability of a market to align firm incentives with consumer welfare (Arrow, 1963;

Hansmann, 1980; Hart, Shleifer and Vishny, 1997). In 2019, U.S. Senators asked about “the

role of PE firms in the nursing home care industry, and the extent to which these firms’

emphasis on profits and short-term return is responsible for declines in quality of care.”

1

In this paper, we present the first national study on the causal effects of PE ownership of

nursing homes and relax key limitations of the prior literature. Existing studies on the role of

PE in healthcare have faced challenges of limited geographies, a short sample period, a lack

of patient-level data, or rely on a small number of deals (Grabowski and Stevenson, 2008;

Harrington et al., 2012; Pradhan et al., 2013; Bos and Harrington, 2017; Huang and Bowblis,

2019). Our paper is the first to employ a national sample of PE acquisitions spanning nearly two

decades, to address both patient and (partially) facility-level selection, and to study mortality,

an unambiguous measure of patient welfare.

Within healthcare, nursing homes represent an extreme example of reliance on subsidy and

are characterized by severe market frictions. First, the average nursing home receives 75% of its

revenue from the government. Second, patients are especially vulnerable and exhibit a strong

1

The letter, from Sherrod Brown, Elizabeth Warren, and Mark Pocan, is available here

1

tendency to go to the closest facility (Grabowski et al., 2013). The sector is also independently

important, with spending at $166 billion in 2017 and projected to grow to $240 billion by

2025 (Martin et al., 2018). PE firms have acquired both large chains and independent facilities,

making it possible to isolate the effects of PE ownership from corporatization (Eliason et al.,

2020).

We use patient- and facility-level administrative data from the Centers for Medicare &

Medicaid Services (CMS), which we match to PE deal data. The data include about 12,400

unique for-profit nursing homes between 2000 and 2017. Of these, 1,674 were acquired by PE

firms in 128 unique deals. Our analysis sample contains 4.2 million unique short-stay patients.

We focus on Medicare, which accounts for about 60% of the unique patients that enter a nursing

home during our sample period.

There are two empirical challenges to estimating the causal effects of PE ownership. The

first is non-random selection of acquisition targets. We partially address this by including

facility fixed effects in estimation, which eliminates time invariant differences across facilities

and their local markets. We also include patient market-by-year fixed effects to mitigate

concerns about unobserved differential trends in market structure across locations. Finally, we

present event studies and assess pre-trends for all outcomes. The results point to causal effects

on treated firms, though these are not necessarily externally valid to a random firm in the

economy.

2

This interpretation is nonetheless important for social welfare as private equity has

a significant and growing footprint.

The second challenge is that the patient composition changes after PE buyouts. We find that

patient risk declines, which could reflect an effort to pursue more financially attractive patients.

While Medicare compensates nursing homes for the higher costs of serving more complex

patients by adjusting payments, these adjustments account for only a fraction of the variance

in costs (White, Pizer and White, 2002). Medicare also rewards physical therapy, which favors

healthier patients (Carter, Garrett and Wissoker, 2012). Following PE buyouts, we find declines

in measures associated with costly care such as cognitive impairments and inability to perform

daily living activities (Hackmann, Pohl and Ziebarth, 2021). To address potential unobserved

selection, we control for the patient-facility match with a differential distance instrumental

variables (IV) strategy (McClellan, McNeil and Newhouse 1994; Grabowski et al. 2013; Card,

Fenizia and Silver forthcoming), exploiting patient preference for a nursing facility close to

their home (the median distance is 4.8 miles). The distance-based instrument strongly predicts

facility choice and is uncorrelated with observed patient risk. It controls for selection within

the population of patients who go to a PE-owned facility because it is closer to their home.

We use both OLS and IV differences-in-differences models to examine the effects of PE

buyouts on patient welfare. The most important and objective measure in our context is short-

2

As we show below, PE target facilities were larger, located in urban markets, served more patients per bed

and had a more lucrative payer mix – all prior to the buyout.

2

term survival, which we define as the probability of death during the stay and the following 90

days (McClellan and Staiger, 1999; Hull, 2018). In OLS models, we show that PE ownership

leads to a 0.3 pp increase in mortality, about 2% of the mean. The IV approach finds that going

to a PE-owned nursing home has an increase in mortality of 11% of the mean. This effect is

detectable as early as 15 days following discharge and the magnitude is stable out to 365 days.

We take a step toward assessing the external validity of the IV results using a marginal

treatment effects (MTE) analysis. Unlike the LATE, the MTE analysis estimates parameters

that are not specific to the complier group and allows us to make more general statements

regarding the causal effects of PE ownership within the treated sample of facilities. The MTE

analysis recovers an average treatment effect similar to the LATE. This implies that the average

Medicare patient in our sample would also experience an 11% increase in the chance of short-

term mortality if she goes to a PE-owned nursing home. The MTE analysis reveals substantial

heterogeneity in treatment effects, including small beneficial effects for some patients.

We assess whether the results are driven by the related but distinct phenomenon of

corporatization. The coefficients remain intact when we restrict our attention to PE

acquisitions of the largest chains, in which chain size remained constant over the sample

period, implying that the effect captures the nature of ownership rather than consolidation or

corporatization. We also conduct standard robustness tests, including a placebo analysis,

where we show there are no pre-buyout effects. Together with the absence of pre-trends in

event studies, this suggests that the results do not reflect the targeted facilities being on track

to experience these effects regardless of the buyout.

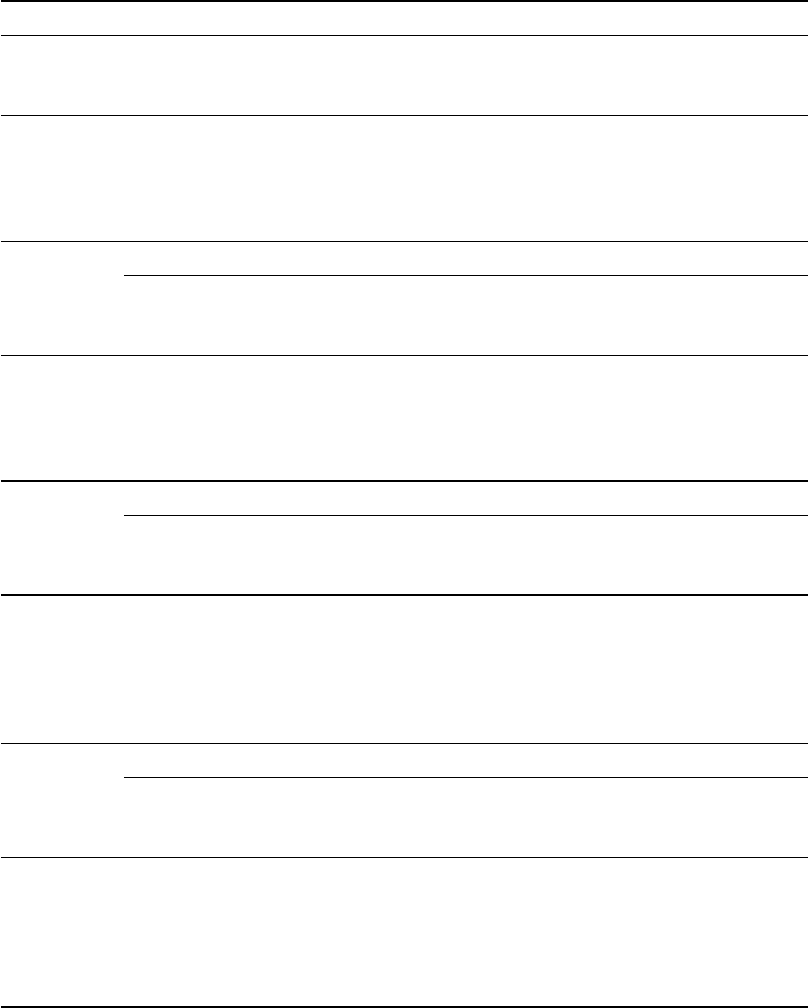

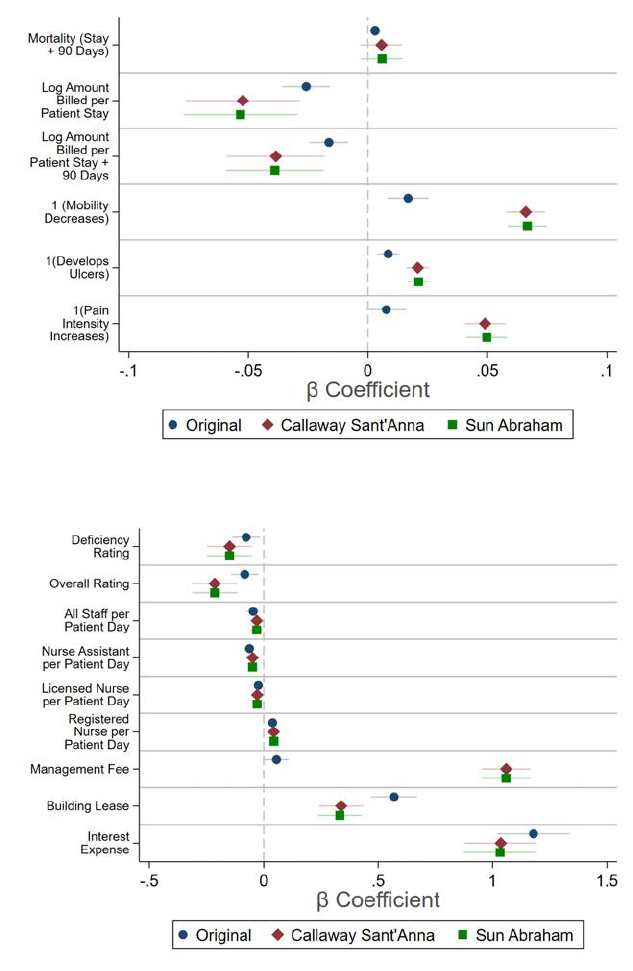

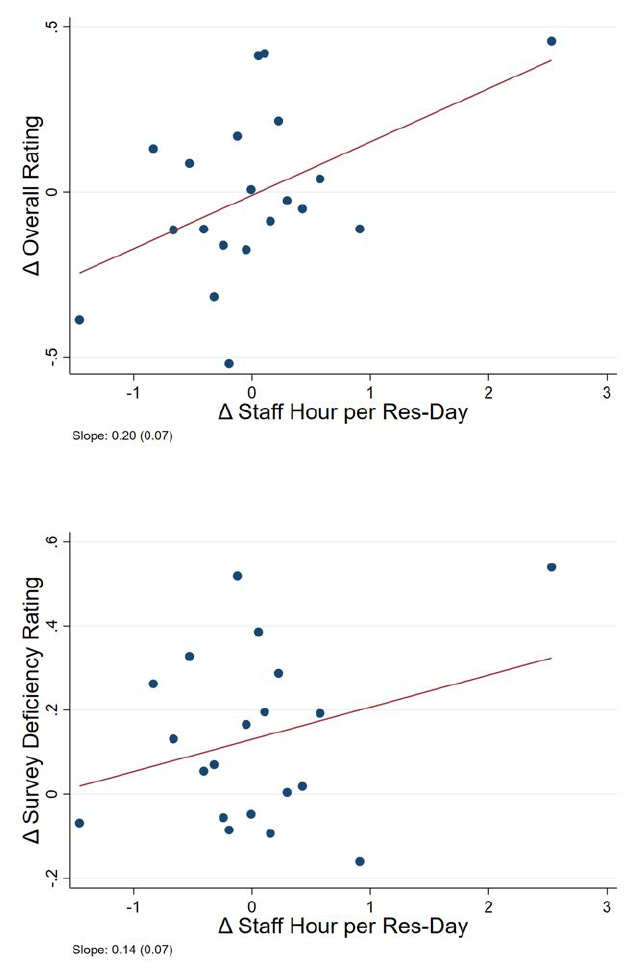

We examine three channels to explain and corroborate the effects on mortality. The first

is nurse availability, which is the most important determinant of quality of care (Zhang and

Grabowski, 2004; Lin, 2014a). PE ownership leads to a 3% decline in hours per patient-day

supplied by the frontline nursing assistants who provide the vast majority of caregiving hours

and perform crucial well-being services such as mobility assistance, personal interaction, and

cleaning to minimize infection risk. We also find that relatively lower risk patients drive the

negative average effects on mortality, which may reflect lower frontline nurse availability. PE-

owned nursing homes also keep low-risk patients longer, which would maximize Medicare

revenue but may be worse for the patient. Among high-risk cohorts, PE-owned nursing homes

appear to maintain quality, as they increase the number of RNs, who are responsible for the

most medicalized aspects of treatment.

The second channel is facility Five Star ratings, which are constructed by CMS to provide

summary information on quality of care. We find negative effects on these ratings. A

disconnect between demand and quality of care may reflect information frictions in nursing

home quality transparency. Existing work finds weak or no demand response to information

about nursing home care quality, including Five Star Ratings (Grabowski and Town, 2011;

Werner et al., 2012). Consistent with an important role for subsidies—which separate revenue

3

from the consumer—as a mechanism for the negative effects, we find that quality declines are

driven by nursing homes with above-median Medicare funding as a share of total revenue.

If PE ownership affects mortality by leading to a lower quality of care, we expect negative

effects on measures of patient well-being. To investigate this third channel, we consider three

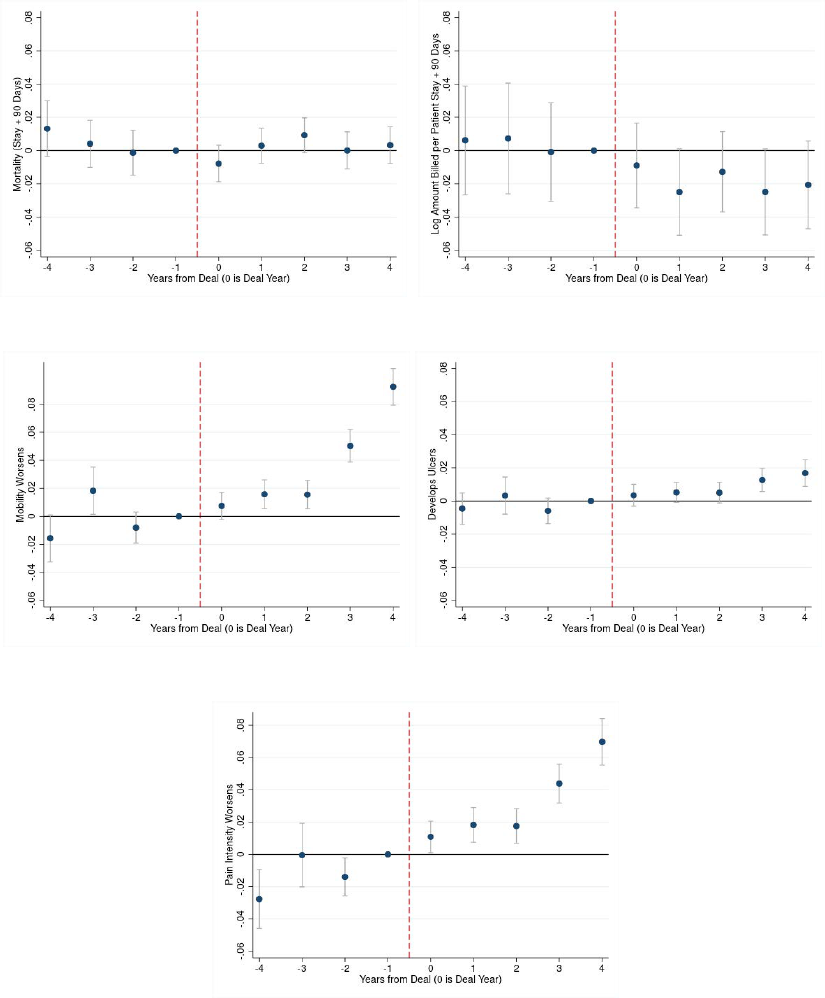

measures of patient well-being that are key standards for CMS. In OLS (IV) models, we find a

decrease in mobility of 6.2% (3%), increase in ulcer development of 8.5% (0%), and increase

in pain intensity of 10.5% (8.3%). Event studies indicate no pre-trends and show discontinuous

changes after the buyouts. This third channel corroborates the effect on mortality, even though

there are differences between the OLS and IV models.

Taken together, our results indicate nuanced effects of PE ownership. Patients become less

risky after PE buyouts and thus it is unsurprising to see a smaller effect on mortality in OLS

relative to IV analysis. The baseline OLS results and MTE analysis show that for some patients,

there is no appreciable effect on mortality. However, we do find a large increase in mortality

on average. Overall, it seems likely that PE ownership either does not affect or benefits more

sophisticated patients, but adversely affects those who face more information frictions, since

we find the greatest effect for patients most likely to go to a PE facility due to distance.

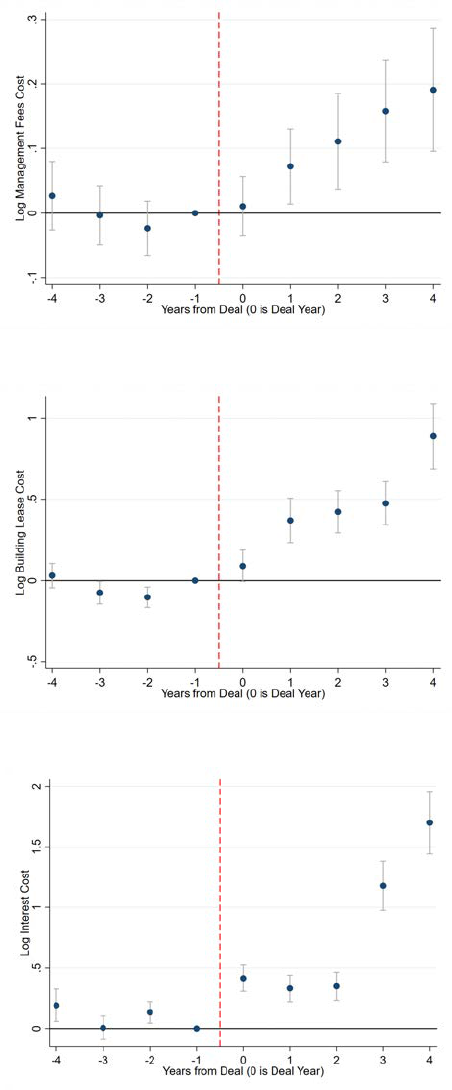

Finally, to understand implications for the taxpayer and to shed light on how PE firms create

value, we explore changing financial strategies. Consistent with patients being on average

lower risk, OLS models find small declines after buyouts in the amount billed to Medicare per

stay (note profits may increase if caring for these patients is less costly). In contrast, the IV

estimate is in the opposite direction, indicating a 8% increase in the amount billed. Facility

finances shed light on why nursing homes are attractive targets for PE buyouts given their

low and regulated profit margins, often cited at just 1-2%. Using CMS cost reports, we find

that there is no effect of buyouts on net income, which points to strategies maximizing longer

term profitability. There are three types of expenditures that are associated with PE profits

and tax strategies: “monitoring fees" charged to portfolio companies, lease payments after

real estate is sold to generate cash flows, and interest payments reflecting the importance of

leverage in the PE business model (Metrick and Yasuda, 2010; Phalippou, Rauch and Umber,

2018). We show that all three increase after buyouts, with interest payments rising by over

200%. Finally, the negative effects on quality of care measures are driven by facilities with

higher levels of financial liabilities and by those acquired by healthcare-focused PE funds,

consistent with a role for PE’s unique operational model in explaining the changes in quality.

While many aspects of facility finances, including labor costs and overall revenue, are either

sparsely populated or ambiguously documented in the cost reports, the elements that we can

analyze point to changing financial strategies that could enable attractive returns for the PE

fund without increasing reported net income of the facility.

In terms of policy implications, our results suggest that, in partial equilibrium, restricting

PE transactions would save lives. However, there are several important caveats that imply

4

a need for further study. First, it is possible that in the longer term, restricting acquisitions

could affect the incentives of providers to create new facilities, which could affect long term

health outcomes. Second, our empirical strategy does not fully address non-random targeting of

facilities. For example, it may be that some facilities not currently being acquired by PE funds

could benefit from such acquisition. Finally, a large literature shows that PE firms increase

efficiency in terms of profit maximization. If payments were designed to better align incentives

between firm owners and patients (as well as taxpayers), it seems likely that PE-owned nursing

homes would behave differently, leading to better outcomes for patients.

1.1 Contribution to the Literature

This paper contributes to multiple strands of the literature. Most broadly, our results imply

that high-powered incentives to maximize profits are not unambiguously beneficial in contexts

with market frictions and government subsidy, which may be helpful for policymakers

considering actions to improve transparency and accountability (Rose-Ackerman 1996;

Picone, Chou and Sloan 2002; Bénabou and Tirole 2006; Curto et al. 2019). In this way, we

expand on the literature describing how PE ownership affects target firm operations (Boucly,

Sraer and Thesmar, 2011), product quality (Lerner, Sorensen and Strömberg, 2011; Eaton,

Howell and Yannelis, 2020; Fracassi, Previtero and Sheen, 2022), and value (Gupta and

Van Nieuwerburgh, 2019; Bernstein, Lerner and Mezzanotti, 2019; Biesinger, Bircan and

Ljungqvist, 2020).

We also contribute to the healthcare economics literature, including how firm ownership

interacts with price incentives and regulation in healthcare (Dafny, Duggan and

Ramanarayanan 2012; Ho and Pakes 2014; Eliason et al. 2018; Ho and Lee 2019; Curto et al.

2021).

3

Within healthcare, our paper joins work on nursing homes, which grow more

economically important as the population ages (Grabowski, Gruber and Angelelli 2008;

Grabowski et al. 2013; Lin 2015; Hackmann 2019; Hackmann, Pohl and Ziebarth 2021). It is

also related to Liu (2021), who shows how PE ownership of hospitals affects price

negotiations with insurance companies. Our results imply that owner incentives are of

first-order importance, pointing to possible benefits from government reimbursements that

target patient outcomes.

To our knowledge, Stevenson and Grabowski (2008) were the first to study PE acquisitions

in health care using survey data. They find little correlation between PE ownership and quality

changes. A number of subsequent studies focus on case studies of PE acquisitions in health

care, including Bos and Harrington (2017). Gondi and Song (2019) provide a summary of

issues related to PE acquisitions of health care facilities. Harrington et al. (2012) study nurse

3

Also see Grabowski and Hirth (2003), Jones, Propper and Smith (2017), Hill, Slusky and Ginther (2019),

Kunz et al. (2020), and Capps, Carlton and David (2020).

5

staffing following PE acquisitions among the largest national for-profit chains. They find that

PE-owned facilities have higher staffing deficiencies, but that this does not change following

buyouts. Pradhan et al. (2013) and Pradhan et al. (2014) use survey data to study five

acquisitions in Florida between 2000 and 2007, and explore financial performance, staffing

and quality. They find higher operating margins and lower staffing levels. Cadigan et al.

(2015) study how investor acquisition of nursing homes impacts revenues and costs, and find

negligible effects. Casalino (2020) documents that PE has increasingly acquired

obstetrician-gynecologist medical groups.

Two closely related studies are Huang and Bowblis (2019) and Gandhi, Song and

Upadrashta (2020b). Huang and Bowblis (2019) study PE acquisitions of five nursing home

chains in Ohio, focusing on the health status of long-term stay residents between 2005 and

2010. They use a distance-based IV design similar to the one used in our paper to address

patient selection. They find little evidence of quality declines but do not explore patient

mortality. Gandhi, Song and Upadrashta (2020b) study how market structure affects the

impact of PE acquisitions in the nursing home sector. They find that PE has positive effects on

nurse availability in more competitive markets, but negative effects in concentrated markets.

Relative to these studies we make three contributions. First, we comprehensively examine

the effect on patient mortality using a national sample of PE acquisitions, demonstrating the

importance of accounting for patient composition changes in this setting. We also show that

there is considerable heterogeneity in the mortality effect across different types of facilities

and patients, which may help guide future studies in this area. Second, we identify channels

that help explain the effects on patient health, such as reductions in nurse availability and

adherence to standards following PE ownership. Third, we test and confirm the link between

these channels and specific aspects of PE ownership, such as specialization.

The economics of nursing homes garnered national attention when the COVID-19

pandemic exposed systemic flaws at long-term care facilities, which accounted for

approximately 20% of U.S. deaths from the virus.

4

Braun et al. (2020) and Gandhi, Song and

Upadrashta (2020a) find that PE-owned facilities fared as well or better under the COVID-19

pandemic. There are also papers more generally about the challenges at nursing homes during

COVID-19 (Shen et al., 2022). We do not study performance during COVID-19 for two

reasons. First, we do not have Medicare claims data during this period, and second, it is

difficult to control for PE selecting homes that would subsequently experience systematically

different covid intensities.

The paper proceeds as follows. Section 2 provides institutional background. Section 3

describes the data. The strategy for patient-level analysis is explained in Section 4, and the

results are in Section 5. The facility-level estimation is in Section 6. Section 7 concludes.

4

Source: Kaiser Family Foundation

6

2 Institutional Background

2.1 The Economics of Nursing Homes

Nursing homes provide both short-term rehabilitative stays—usually following a hospital

procedure—as well as long-term custodial stays for patients unable to live independently.

There are two unique features of the long-term care market in the U.S. relative to other

healthcare subsectors. First, government payers (Medicaid and Medicare) account for 75% of

revenue, while private insurance plays a much larger role in other subsectors (Johnson, 2016).

5

Second, about 70% of nursing homes are for-profit, which is a much larger share than other

subsectors. For example, fewer than one-third of hospitals are for-profit. Policymakers have

long been concerned about low-quality care at nursing homes in the U.S. and for-profit

ownership has often been proposed as a causal factor (Institute of Medicine, 1986; Grabowski

et al., 2013).

6

As with any business, the economics of nursing homes are shaped by the nature of demand,

the cost structure, and the regulatory environment. On the demand side, nursing homes serve

elderly patients but are paid by third-party, largely government payers. Over 95% of facilities

treat both Medicare and Medicaid patients (Harrington et al., 2018). Both programs pay a

prospectively set amount per day of care for each covered patient (‘per diem’), which does not

incorporate quality of care, reputation, or other determinants that would be considered by a

well-functioning market. These rates are non-negotiable, and facilities simply choose whether

they will accept the beneficiaries of these programs. Medicare fee-for-service pays much more,

at roughly $515 per patient day relative to $209 per patient day from Medicaid.

7

Medicaid still

pays more than the marginal cost of treatment per day. Hackmann (2019) calculates that the

marginal cost of treatment per-day is about $160 on average. Overall profit margins are in the

low single digits (MedPAC, 2017), a topic we return to at the end of the paper.

Nursing homes provide institutional care and so have high fixed costs, making the

occupancy rate an important driver of profitability. Nursing staff represent the largest

component of operating cost, at about 50% (Dummit, 2002). Broadly speaking, there are three

types of nurses. Low-skill Certified Nurse Assistants (CNAs) account for about 60% of total

staff hours and provide most of the direct patient care. Licensed Practical Nurses (LPNs) have

5

Medicare is an entitlement health insurance program for Americans above age 65. It covers short-term rehab

care following hospital inpatient care, and accounts for about 60% of the unique patients that enter a nursing home,

and 15% of overall patient-days in our data. Medicaid is a means-tested insurance program targeted at low income

and disabled non-elderly individuals, accounting for about 60% of nursing home patient-days.

6

This concern is frequently reflected in the popular media, including as a reason for high death rates from

Covid-19 in nursing homes. For example, a New York Times article in December, 2020 asserted that: “Long-term

care continues to be understaffed, poorly regulated and vulnerable to predation by for-profit conglomerates and

private-equity firms. The nursing aides who provide the bulk of bedside assistance still earn poverty wages, and

lockdown policies have forced patients into dangerous solitude" (Kim, 2020).

7

See here

7

more training and experience than CNAs but cannot manage patients independently.

Registered Nurses (RNs) have the highest skill and experience levels, and can independently

determine care plans for patients. LPNs and RNs each account for about 20% of nurse hours.

Nurse availability is crucial to the quality of care and there is a consensus that low ratios of

nursing staff to residents are associated with higher patient mortality and other adverse clinical

outcomes (Tong, 2011; Lin, 2014b; Friedrich and Hackmann, 2021). Staffing ratios are

therefore standard metrics to examine nursing home quality.

There is information asymmetry between patients and healthcare providers (McGuire,

2000). As comparing nursing homes on quality is difficult and price is not a helpful signal,

reputation may play a large role in nursing home demand (Arrow, 1963). Profit maximizing

facilities might invest in high-quality care to build and sustain their reputation, yet face a

dynamic incentive problem because they can generate higher profits in the short-term by

cutting patient care costs. It is unclear which inputs affect nursing home reputation, but prior

studies suggest that patient demand does not respond to poor quality scores on government

mandated report cards, potentially leaving short-term incentives to prevail (Grabowski and

Town, 2011; Werner et al., 2012).

2.2 The Economics of Private Equity Control

PE ownership has different financial incentives and business strategies than other types of for-

profit ownership, such as independent or publicly-traded firms. Compared to preexisting for-

profit owners, private equity owners have higher-powered incentives to maximize firm value

because fund managers are compensated through a call option-like share of the profits, employ

substantial amounts of leverage, usually aim to liquidate investments within a short time frame,

and do not have existing relationships with target firm stakeholders.

A central deal type in PE, which composes the transactions we study, is the leveraged

buyout (LBO). In an LBO, the target firm is acquired primarily with debt financing, which is

placed on the target firm’s balance sheet, and a small portion of equity.

8

One way that PE

creates value, sometimes placed under the header of “financial engineering,” is to exploit the

favorable tax treatment of debt (Spaenjers and Steiner, 2020). The reliance on debt means

that PE-owned companies have much higher leverage ratios (i.e., debt relative to equity or firm

value) than other types of companies, which structurally creates incentives to take risks and

requires the company to dedicate a large portion of its cash flows to interest payments (Metrick

and Yasuda, 2010).

PE is also associated with particularly high-powered incentives to maximize profits because

the General Partners (GPs) who manage PE funds are compensated through a call option-like

8

See Metrick and Yasuda (2010) and Kaplan and Strömberg (2009), who provide a detailed discussion of the

PE business model and review the academic evidence on their effects.

8

share of the profits (Kaplan and Strömberg, 2009). Specifically, their compensation stems

primarily from the right to 20% of profits from increasing portfolio company value between

the time of the buyout and an exit, when the company is sold to another firm or taken public.

Since most funds have 10-year time horizons to return cash to investors, assets are typically

held for three to seven years. A modern PE deal is typically not successful if the business

continues as-is, motivating aggressive and short-term value-creation strategies. In contrast, a

traditional business owner running the firm as a long-term going concern with less leverage

may prefer lower but more stable profits.

A large literature in finance has shown that PE buyouts increase productivity, operational

efficiency, and generate high returns.

9

Boucly, Sraer and Thesmar (2011) show how PE

ownership can alleviate credit constraints, enabling more investment. Governance

engineering, in the parlance of Kaplan and Strömberg (2009), includes changes to the

compensation, benefits, and composition of the management team at the target firm to align

their incentives with those of the PE owners, for example instituting equity-based

compensation (Gompers, Kaplan and Mukharlyamov, 2016). Bloom et al. (2015) show that

PE-owned firms are better managed than similar firms that are not PE-owned. In operations

engineering, GPs apply their business expertise to add value to their investments. For

example, they might invest in new technology, expand to new markets, and cut costs (Gadiesh

and MacArthur, 2008; Acharya et al., 2013; Bernstein and Sheen, 2016). Davis et al. (2014)

show that after PE buyouts, manufacturing firms expand efficient operations while closing

inefficient ones. Work has also found positive effects on product quality (Bernstein and Sheen,

2016), workplace safety (Cohn, Nestoriak and Wardlaw, 2021), and product breadth (Fracassi,

Previtero and Sheen, 2022), among other metrics.

Considering these changes in the context of nursing homes, the effects of PE ownership on

patients are theoretically ambiguous. On the one hand, better management, stronger

incentives, and access to credit may lead to improvements in care quality. On the other hand,

the literature finding positive effects has primarily studied settings with low information

frictions and little government subsidy. In contrast, nursing homes feature severe information

frictions and misaligned incentives. The intensive government subsidy separates revenue from

the consumer. There is also low price elasticity of demand; cost is not salient because

Medicare or Medicaid shoulder much of the payment burden. Care quality is opaque, leading

to benefits from reallocating care resources to marketing.

Previous owners may have had to commit to implicit contracts with stakeholders, for

example promising that in exchange for government revenue, they would provide quality care

at a reasonable cost. They may have been unable or unwilling to take advantage of new

opportunities for value creation that would violate these implicit contracts. As a new owner

9

See Kaplan (1989); Kaplan and Schoar (2005); Guo et al. (2011); Acharya et al. (2013); Harris et al. (2014);

Robinson and Sensoy (2016); Korteweg and Sorensen (2017); Eaton et al. (2020).

9

with higher-powered incentives to maximize profits, superior management capability, and a

shorter time frame for ownership, the PE investor may be well-positioned to take advantage of

these opportunities for value creation.

The higher debt load and incentive misalignment discussed above could act via three

dimensions to adversely affect quality. First, cost-cutting measures and a focus on capturing

subsidies could come at the expense of quality improvement. Second, large interest payments

stemming from the new debt obligations may reduce cash available for care. Relatedly, since

PE owners often sell real estate assets shortly after the buyout to generate cash that can be

returned to investors, the nursing home may also take on the additional cost of rent. Such cash

flows early in the deal’s lifecycle boost ultimate discounted returns. For example, in one of the

largest PE deals in our sample, the Carlyle Group bought HCR Manorcare for about $6.3

billion in 2007, of which roughly one quarter was equity and three-quarters were debt. Four

years later, Carlyle sold the real estate assets for $6.1 billion, offering investors a substantial

return on equity (Keating and Whoriskey, 2018). Afterward, HCR Manorcare rented its

facilities; the monthly lease payments are essentially another debt obligation, and a

Washington Post investigation found that quality of care deteriorated following the real estate

sale (Keating and Whoriskey, 2018). The third force is the relatively short-term time horizon,

which could push managers to maximize short-term profits at the expense of long term

performance. In the case of HCR Manorcare, the nursing home chain was ultimately unable to

make its interest and lease payments and entered bankruptcy proceedings in the spring of

2018. Carlyle sold its stake to the landlord.

3 Data and Descriptive Statistics

In this section we briefly summarize our data sources and provide descriptive statistics on the

sample, including an analysis of PE targeting. In Appendix A, we describe these elements in

comprehensive detail. Since non-profit nursing homes may have other objectives in addition

to profit maximization, comparing their behavior to that of for-profit (and PE-owned) facilities

may be misleading. We therefore limit our analysis sample only to for-profit facilities. Our

results should accordingly be interpreted as the differential effects of PE ownership relative to

other for-profit owners.

3.1 Data

We obtain facility-level annual data between 2000 and 2017 from publicly-available CMS

sources. In each year we observe about 12,400 unique skilled nursing facilities (we use the

term “nursing home” interchangeably), for a total of approximately 227,000 observations.

These data include variables such as patient volume, nurse availability, and various

10

components of the Five Star ratings, which first appear in 2009. Approximately half of the PE

deals in our sample occurred after 2009.

Our second data source consists of patient-level data for Medicare beneficiaries from 2004

to 2016. We use the Medicare enrollment and claims files (hospital inpatient, outpatient, and

nursing homes) for the universe of fee-for-service Medicare beneficiaries. We merge these files

with detailed patient assessments recorded in the Minimum Data Set (MDS). These data are

confidential and were accessed under a data use agreement with CMS. They include patient

enrollment details, demographics, mortality, and information about nursing home and hospital

care during this period.

In patient-level analysis, the unit of observation is a nursing home stay that begins during

our sample period, which starts in 2005 in order to have at least one look-back year. We

consider only the patient’s first nursing home stay in our entire sample period so that we can

unambiguously attribute outcomes to one facility and make our patient sample more

homogeneous. This produces a sample of about 4.2 million patients over 12 years. We are

most interested in the effect on mortality, which is an unambiguously bad outcome, has little

measurement error, and is difficult to “game” on the part of a facility or government agency.

For these and other reasons, short-term mortality (with suitable risk adjustment) has become

the gold-standard measure of provider quality in the health economics and policy literature

(McClellan and Staiger, 1999; Hull, 2018). We use an indicator for death within 90 days

following discharge, including deaths that occur in the nursing home. There is a high level of

short-term mortality—one in six patients die in the facility or within three months of

discharge—indicating the general morbidity of this patient cohort.

We use two measures of spending: the amount billed to Medicare just for the nursing

home stay, and the total amount including the stay and all care received in the following 90

days, in case better quality care leads to lower subsequent spending (expressed in 2016

dollars). Medicare covers all costs until the 21

st

day of stay, when the patient begins paying a

coinsurance. About 90% of total payments in our data are from Medicare, with patients

bearing the remainder. We complement the mortality analysis with three ancillary measures of

patient well-being, which CMS uses when computing the Five Star quality ratings for nursing

homes. The first is an indicator for the patient’s self-reported mobility score declining during

the stay. The second is an indicator for developing a pressure ulcer. The third is an indicator

for the patient’s self-reported pain intensity score increasing during the stay.

To identify nursing homes acquired in PE deals, we make use of a proprietary list of

transactions in the “elder and disabled care” sector compiled by Pitchbook Inc., a leading

market intelligence firm in this space. The deals span 2004 to 2015, so that we will have

sufficient time to evaluate outcomes. We match the target names to individual nursing

facilities using name (facility or corporate owner) and address as recorded in the CMS data.

This process yields 128 deals, which correspond to a change in ownership to PE for 1,674

11

facilities. The vast majority of deals in Pitchbook are not at hazard of matching, as they

concern assisted living or other elder care companies that are not Medicare-accepting skilled

nursing facilities. (See Appendix A for details.)

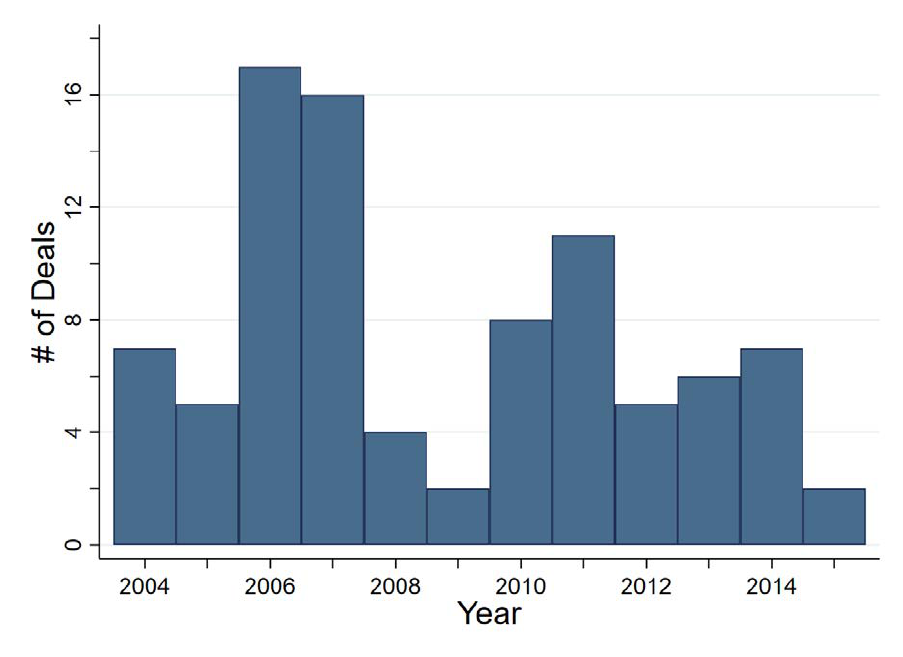

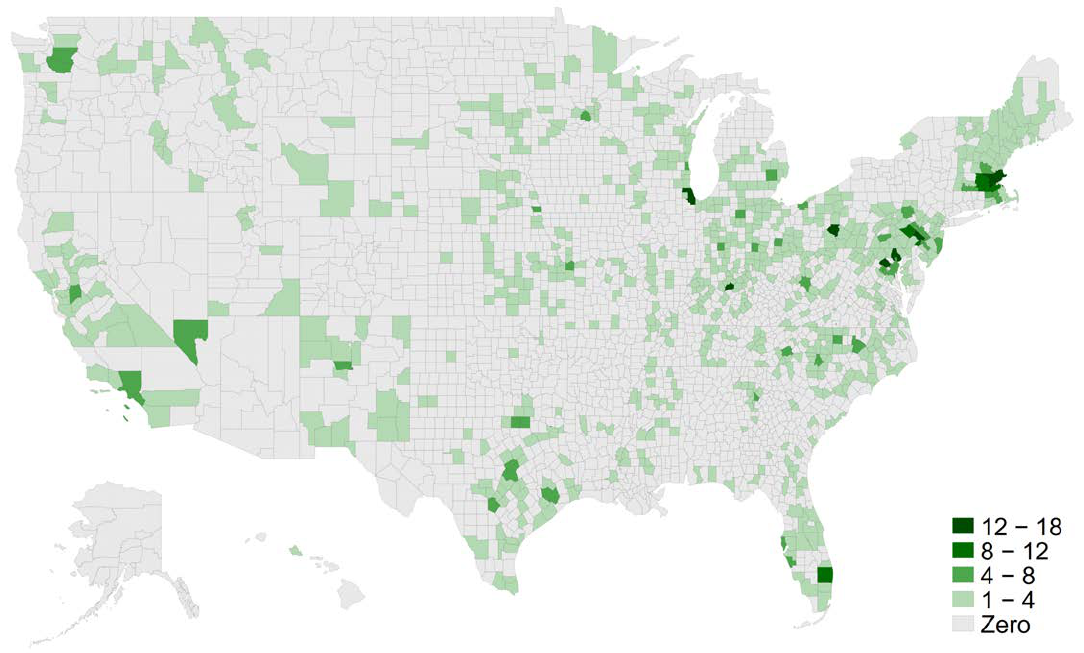

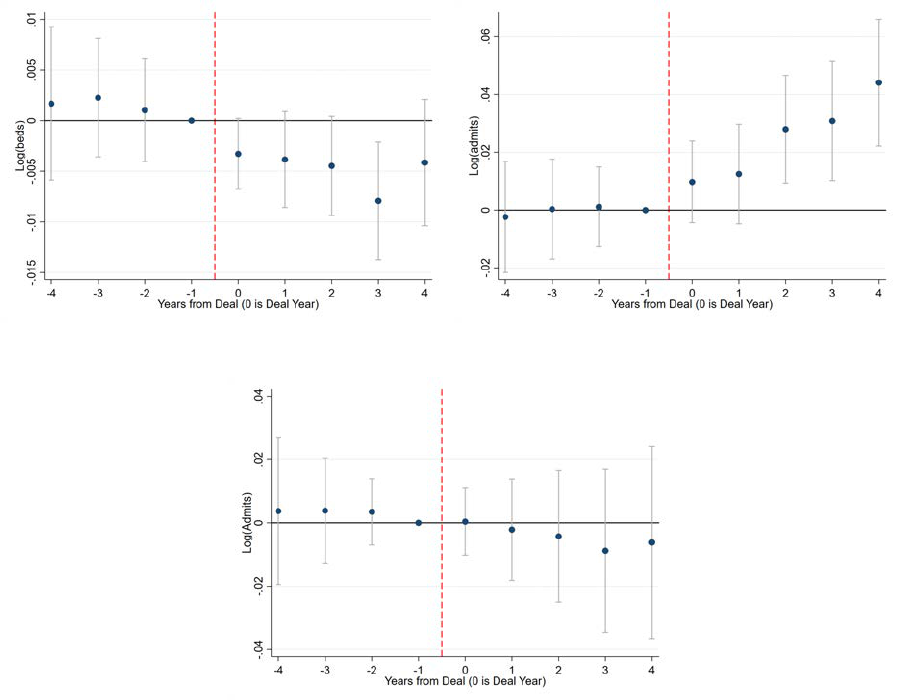

Figure C.1 shows the number of deals by year. We observe about 90 unique PE firms that

acquired nursing homes. Most deals are syndicated and involve multiple PE firms. Table C.1

presents the top five deals by number of facilities acquired. Deal sizes are skewed, with the

top 5 deals accounting more than half of the facilities acquired. On average, we observe PE-

owned facilities for eight years post-acquisition, so the results should be interpreted as medium

to long-term effects of PE ownership. While we likely underestimate PE’s presence in this

sector, our sample size is similar to an estimate of 1,876 nursing homes reportedly acquired

by PE firms over a similar duration, 1998–2008 (GAO, 2010). The PE investors in our sample

include very large funds, smaller funds, and specialized healthcare PE investment funds. The

firms which account for the most deals are the Carlyle Group and Formation Capital.

3.2 Descriptive Statistics

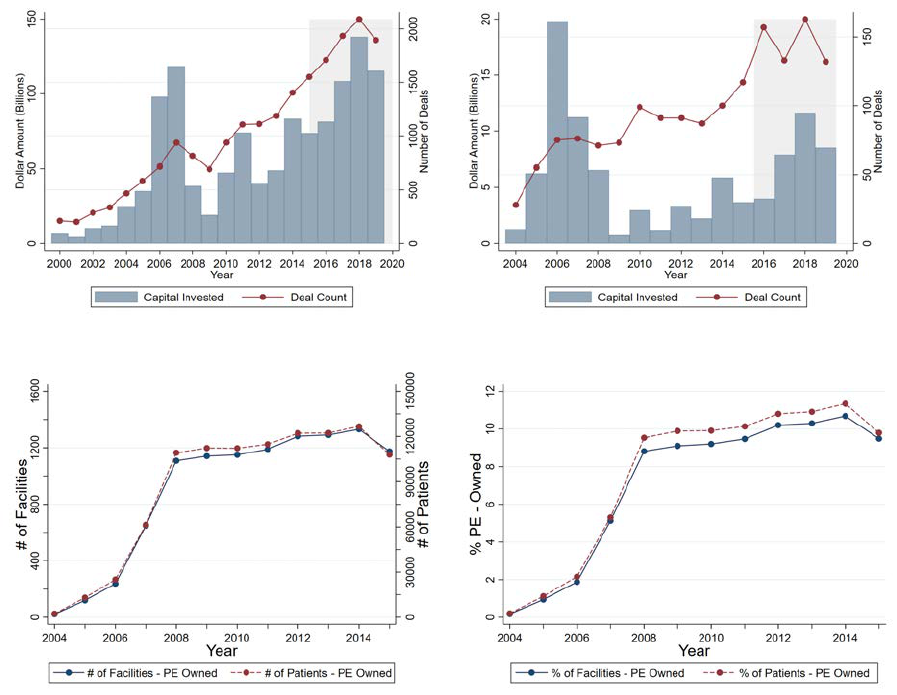

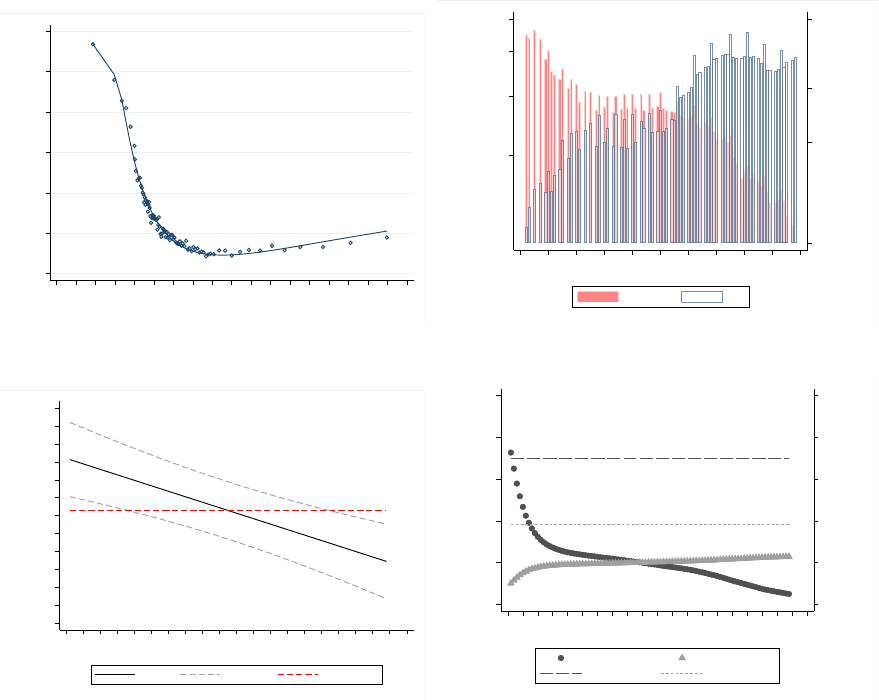

Overall, PE investment in healthcare has increased dramatically in recent decades, as shown

using Pitchbook data in Panel A of Figure 1. Panel B focuses on the Elder and Disabled

Care sub-sector, which includes the nursing homes that we study as well as assisted living and

other types of care. The shaded areas in the graphs correspond to years after our sample ends,

and indicate that deal activity continued to accelerate beyond 2015. The bottom two panels

describe the skilled nursing facilities in our CMS data that are PE-owned. As of 2015, PE-

owned facilities represented about 10% of all for-profit nursing facilities, corresponding to an

annual flow of about 100,000 patients. Note that the large spike in the mid-2000s seen in all the

graphs reflects an economy-wide PE boom during this period, and is not specific to healthcare.

Similarly, the flat lining in Panels C and D starting in 2010 reflects the lull in deal activity due

to the Great Recession. Given the patterns in Panel B, the share of facilities that are PE-owned

is likely substantially higher today.

Table 1 Panel A presents summary statistics on key variables observed at the facility-year

level, where a facility is a single nursing home. Panel B presents summary statistics at the

unique patient level on the final Medicare patient sample (recall we focus on a patient’s first

stay). PE targets are slightly larger, have fewer staff hours per resident, and a lower Overall

Five Star rating. At the sector level, ratings and staffing have secularly increased over time.

For staffing, this reflects more stringent regulatory standards. As the PE deals occur later in

the sample on average, it is remarkable that they have lower average ratings. Panel B shows

that demographic measures are similar across the types of facilities, such as patient age and a

high-risk indicator.

10

PE-owned facilities bill about 3% more per stay than non-PE facilities.

10

We use the Charlson Comorbidity Index, a standard measure of patient mortality risk based on co-morbidities.

12

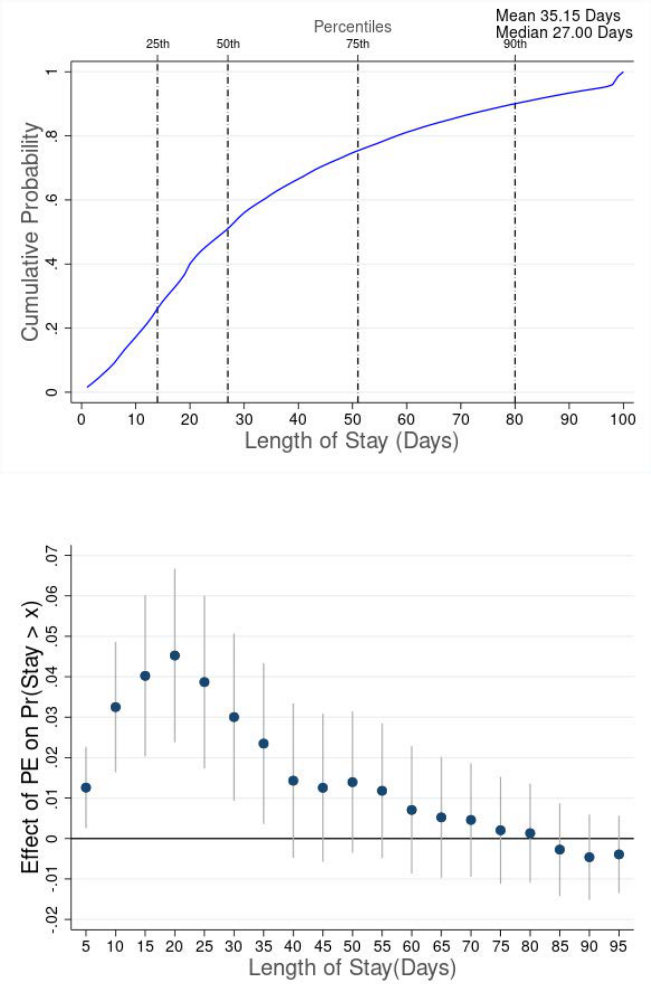

Appendix Figure C.2 panel A presents the CDF of stay lengths for Medicare patients in our

sample. Medicare stays are relatively short, with a median length of 27 days. We limit the

sample to stays less than 100 days because Medicare does not pay for longer stays.

We describe which characteristics—measured in the year prior to the deal—are associated

with buyouts in Table A.1. Facilities in more urban counties and in states with higher elderly

population shares are more likely to be targeted.

11

County-level percent black does not predict

buyouts, nor do income and home-ownership (not presented). Larger, chain- and hospital-

owned facilities are more likely to be acquired than independent facilities, likely reflecting

the fixed costs of executing a PE deal. Finally, the Five Star overall rating has a negative

relationship with buyouts, indicating that PE firms target relatively low-performing nursing

homes. These factors remain statistically significant predictors when included simultaneously

in the same model, shown in column 5. These results highlight the need to estimate the effects

of PE ownership within-facility.

4 Empirical Strategy for Patient-Level Analysis

There are two primary concerns related to measuring the causal effects of PE ownership on

patient-level outcomes. First, PE funds may target facilities that are different in ways the

econometrician cannot observe. To partly address this concern, we include facility fixed

effects, eliminating time-invariant differences across facilities. We also include

market-by-year fixed effects, identifying PE effects off of variation among patients in the same

market and in the same year. This common design does not fully account for unobservables

driving PE targeting. Therefore, we focus our causality argument on treatment effects for the

treated, rather than external validity to a random firm in the economy. Our evidence suggests

that treated firms were not on track to the outcomes we observe and would have continued, at

least in the medium term, on their pre-existing path in the absence of the LBO. This

interpretation is important for social welfare as private equity has a significant and growing

footprint in the economy.

The second concern is that following a PE buyout, the composition of patients may

change, further confounding the analysis. Differential customer selection following PE

ownership could reflect both supply-side channels such as changes in advertising and hospital

referrals, or patient perceptions about PE ownership. Recent studies have documented that

nursing homes selectively admit less costly patients (Gandhi, 2022). Hackmann, Pohl and

Ziebarth (2021) find that patients with cognitive impairments and who need help with more

activities of daily living (ADL) are the most expensive to serve. Further, CMS payment

adjustment emphasized rehabilitation therapy, which favors healthier patients who can tolerate

We create a high-risk indicator that is equal to one if the previous-year Charlson score is greater than two.

11

The map in Figure C.3 shows that deals are not excessively concentrated in particular areas of the country.

13

therapy (Carter, Garrett and Wissoker 2012; Castelluci 2019).

12

We first demonstrate that

compositional changes do occur and then introduce an instrumental variables approach to

address it.

For patient-level OLS analyses, we use the following difference-in-differences model,

which exploits variation in the timing of the PE deals across facilities:

Y

i, j,r,t

= α

j

+ α

r,t

+ φPE

i, j,r,t

+ X

0

i,z

γ + ε

i, j,r,t

. (1)

Here, PE

i, j,r,t

is an indicator set to one if patient i in Hospital Referral Region (HRR), r,

chooses PE-owned facility j in year t. Our preferred model includes facility fixed effects (α

j

)

and patient HRR-by-year fixed effects (α

r,t

). We allow markets to evolve on different trends to

mitigate the possibility of differences in market structure confounding the results. The vector

X

i,z

denotes patient risk controls including age, indicators for gender, marital status, dual

eligible, and 17 disease categories.

13

Standard errors are clustered by facility to account for

unobserved correlation in outcomes across patients treated at the same nursing home. To

address potential concerns with staggered treatment, we use the Callaway and Sant’Anna

(2021) and Sun and Abraham (2021) estimators in robustness tests.

14

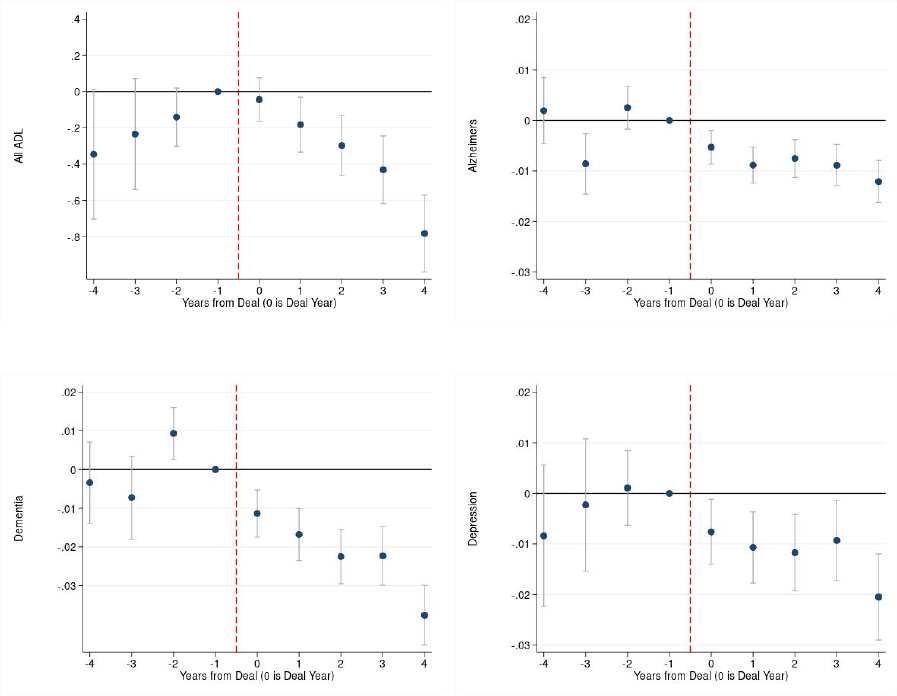

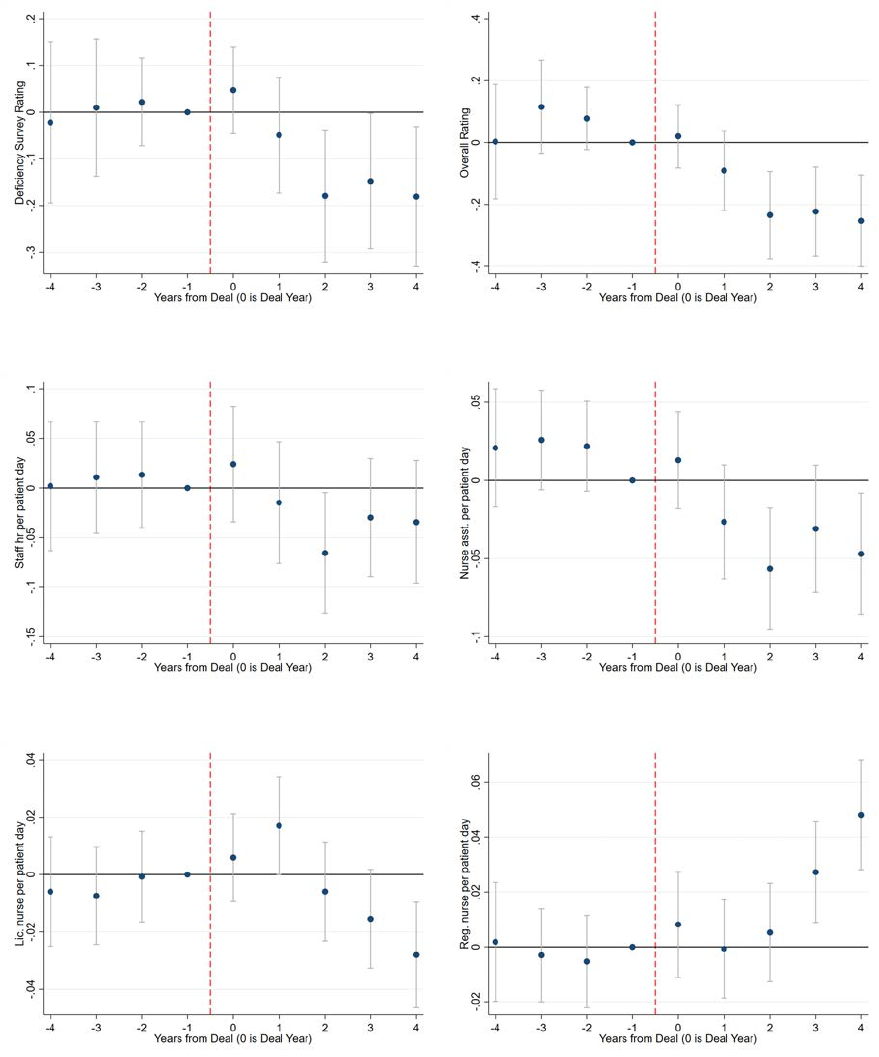

Consistent with the existing literature cited above, we show that patient risk declines

following PE ownership. Table 2 Panel A presents point estimates for patient risk measures.

Specifically, we test for changes in initial patient risk (assessed at the time of admission)

following acquisition. We examine effects on a mix of co-morbidities to broadly capture

changes in patient risk. The coefficients indicate that admitted patients are less likely to suffer

from cognitive impairments (depression, dementia, Alzheimers) and need help with fewer

ADLs following PE ownership, factors which strongly predict treatment costs. Figure 2

presents the corresponding event study plots, which generally suggest flat or increasing trends

in patient risk prior to the deal but declining trends following the acquisition. We are

concerned that this shift toward a healthier patient composition will lead to downward bias in

mortality and spending effects. Therefore, we develop an instrument for the match between

patients and nursing homes.

12

Medicare’s payment adjustments were heavily tied to additional minutes of physical therapy until 2019.

Unlike prospective payment for hospitals, there was no provision for outlier payments for the most expensive

patients. For more details on payment adjustment, see https://www.cms.gov/Research-Statistics-Data-

and-Systems/Computer-Data-and-Systems/MDS20SWSpecs/Downloads/44-Group-Worksheet.pdf.

Carter, Garrett and Wissoker (2012) notes this approach created incentives for additional therapy and against

admitting clinically complex patients.

13

We construct these indicators with diagnosis codes recorded in claims from the three months prior to the

index nursing home stay (hospital stays, ED visits, and outpatient visits). “Dual eligible” is a common term used

to describe patients eligible for both Medicare and Medicaid.

14

The former compares the outcomes of treated facilities with never-treated facilities, to ensure that using ever-

treated facilities as controls does not bias the results. The latter corrects for treatment effect heterogeneity by

re-weighting observations according to the share of facilities that are treated in each year.

14

4.1 Distance-based Instrument

We combine the differences-in-differences model above with a differential distance instrument

(McClellan, McNeil and Newhouse, 1994) to control for endogenous patient selection into

nursing homes. The thought experiment we approximate is to randomly draw a patient who

goes to a PE facility after the buyout relative to a randomly drawn patient who went to that

facility before the buyout, and then compare this difference to an analogous one in the same

set of years for patients at non-PE facilities. The instrument to simulate randomly drawing

patients exploits patient preference for healthcare providers located nearby (Einav, Finkelstein

and Williams 2016; Card, Fenizia and Silver forthcoming; Currie and Slusky 2020). This

is especially true for nursing homes; for example, Hackmann (2019) finds that the median

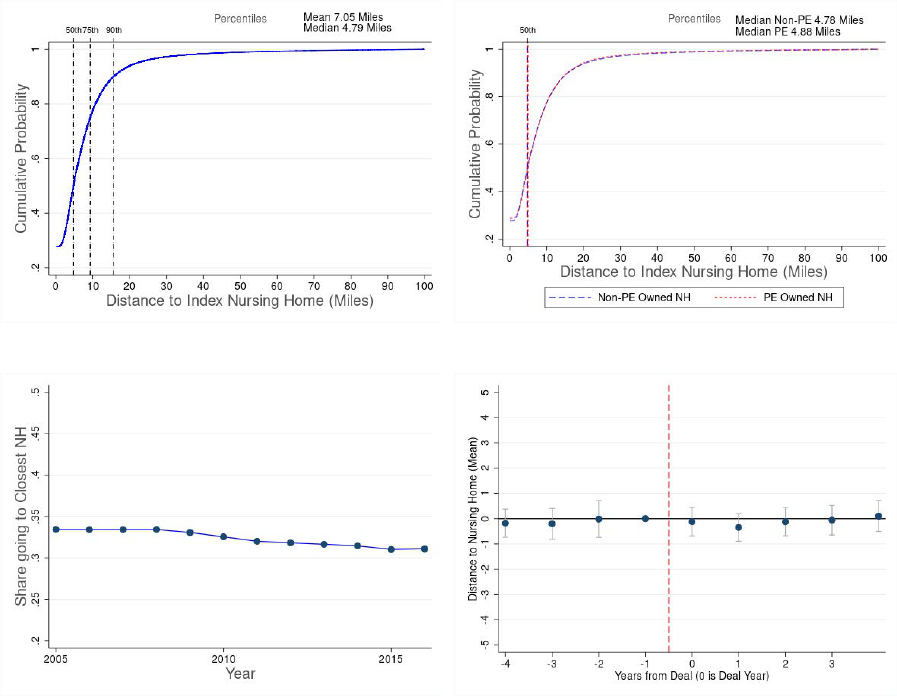

distance between a senior’s residence and her nursing home is under 4.3 miles. In our data, the

median and 90

th

percentile distances between a patient and her nursing home are 4.8 and 18

miles, respectively. About 33% of all patients choose the facility located closest to them (see

Figure C.4).

15

As a result of these patterns, this instrument has been used to control for patient

selection into nursing homes (Grabowski et al., 2013; Huang and Bowblis, 2019).

The differential distance instrument is the difference (in miles) between two distances:

from a patient’s home zip code to the closest PE-owned facility zip code; and from the

patient’s residence to the nearest non-PE facility zip code. Lower values of the instrument

mean the patient is relatively closer to a PE-owned facility. When it is negative, the nearest

PE-owned facility is closer than the nearest non-PE-owned facility. PE ownership evolves

over time as more deals take place (and some PE funds exit their investments), creating

variation across years in differential distance for individuals residing in the same zip code.

Following convention, we drop patients facing a large differential distance value, specifically,

one of more than 20 miles.

16

This also has two benefits: First, included patients plausibly live

in markets targeted by PE firms and are thus more homogeneous; Second, the instrument has

more power because it excludes inframarginal patients in places where facility choice is not

sensitive to differential distance.

We estimate the first and second stages using Equations (2) and (3), respectively. The

endogenous regressor of interest PE

i, j,r,t

is, as above, an indicator set to one if patient i in

Hospital Referral Region (HRR), r, chooses PE-owned facility j in year t. We instrument with

linear and squared differential distance, D

i

, applicable to patient i based on her zip code, z, in

15

Distance patterns remain remarkably stable over time in our sample. Mean distance to facility is unaffected

by PE buyout, as shown in Figure C.4D.

16

We exclude zip codes based on the absolute magnitude of the differential distance, treating patients very

close to PE facilities the same as those very far away. In practice differential distance is rarely lower than -20.

Differential distance values update for some zip codes over time as facilities are acquired or sold by PE firms. We

exclude such zip codes only if their differential distance remains more than 20 miles in magnitude throughout.

15

the year the stay begins, t.

PE

i, j,r,t

= α

j

+ α

r,t

+ ζ

1

D

i

+ ζ

2

D

2

i

+ X

0

i,z

ξ + ν

i, j,r,t

, (2)

Y

i, j,r,t

= α

j

+ α

r,t

+ φ

ˆ

PE

i, j,r,t

+ X

0

i,z

γ + ε

i, j,r,t

. (3)

The other variables are as described for Equation (1). It is crucial to include facility fixed effects

here (α

j

) in order to control for level characteristics that attract PE ownership but are not caused

by it. Our setting departs from that in McClellan, McNeil and Newhouse (1994), the canonical

paper that used differential distance, because they study the causal effect of using a particular

clinical procedure rather than a facility-level attribute of ownership.

The instrument is strongly predictive of nursing home type. The first stage results are

reported in Table 3. Column 2 presents the estimates from our preferred specification. A five

mile decrease in differential distance (0.4 s.d.) increases the probability of going to a PE-owned

nursing home by 2.6 percentage points (pp), about 20% of the mean. The F-statistic exceeds

220, well above conventional rule-of-thumb thresholds for weak instruments.

17

We conduct

multiple robustness checks, which include adding time-varying socioeconomic variables at the

patient’s zipcode-year level (z) and omitting all controls other than fixed effects.

18

IV estimation differs from randomized controlled trials because it requires two untestable

assumptions. The first is conditional random assignment, under which unobserved

characteristics correlated with the outcomes of interest are not correlated with differential

distance after conditioning on covariates. This subsumes the exclusion restriction, which is

that the patient’s differential distance to a PE facility affects outcomes only by influencing her

probability of being treated at a PE facility.

To provide support for the conditional randomization assumption, we examine the

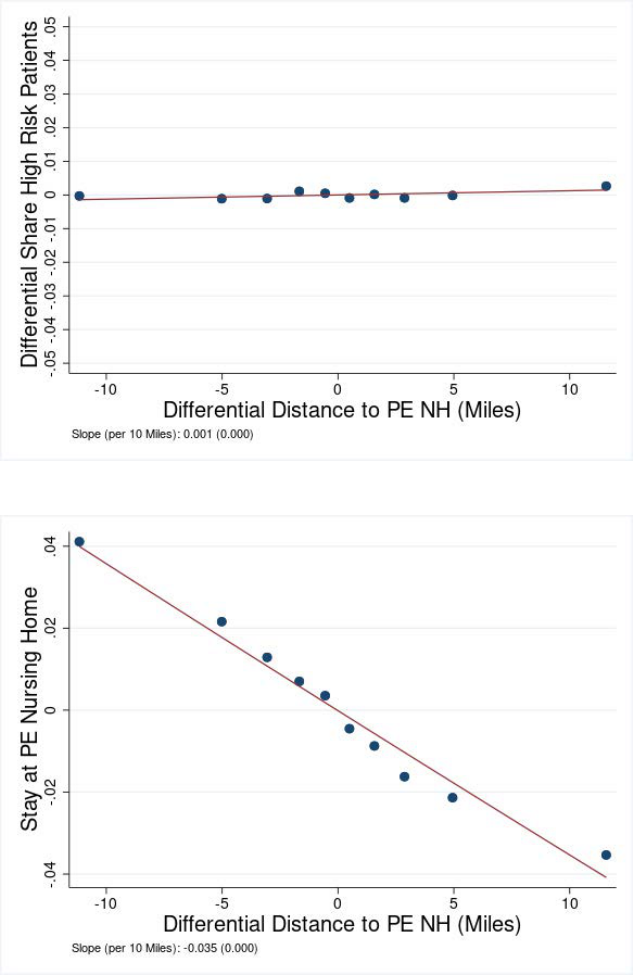

correlation between the instrument and patient observables, particularly covariates which may

affect mortality, such as risk. Figure 3 Panel A presents the relationship between patient risk

and the instrument and indicates little or no correlation.

19

The figure shows that the probability

of being a high-risk patient (Charlson score > 2) increases by 0.1% for a 10 mile increase in

differential distance. This is small in absolute terms and negligible compared to the proportion

17

An alternative approach to constructing differential distance is to consider distance from the hospital where

the patient was treated prior to the nursing home stay, rather than her residence. However, this has found to be a

weaker instrument (Rahman, Norton and Grabowski 2016, Cornell et al. 2019).

18

The socioeconomic variables, from the American Community Survey, are annual median household income,

the share of the population that are white, that are renters rather than home-owners, and that are below the Federal

poverty line. In unreported analyses, we find similar results if we use a linear model in differential distance rather

than quadratic.

19

We project the high-risk indicator (see Section A.2) on the controls we use in our main regression, and collapse

the residuals into ten bins. Similarly, we run a regression of differential distance on the controls and collapse the

residuals into ten bins. We plot the means of each bin, with the risk residuals on the Y-axis and distance residuals

on the X-axis. The figure also presents a fitted line and the slope coefficient.

16

of high risk patients in the sample: 27%. Table 3 columns 1 and 2 show that the coefficients

on differential distance are unaffected by including patient-level controls, corroborating this

interpretation. One important test adds time-varying zip code-level socioeconomic controls in

case PE firms target places on track to different demographic profiles (Table 3 column 3). We

also confirm that we find similar patterns when we use a much more granular market

definition, to mitigate the concern of within-market targeting of patients (Table 3 column 4).

20

Under random assignment, characteristics of patients with above- and below-median

differential distance should be similar. Table 4, where we summarize patient characteristics for

the two groups, suggests this is the case. The top two rows of the table show that, consistent

with a strong instrument, the probability of going to a PE-owned facility declines from 24%

for the below-median group to 4% for the above-median group. The patient characteristics in

the subsequent rows are extremely similar between the two groups. For example, the two

groups have nearly identical mean ages and shares of patients that are female or married. The

instrument also appears to balance patients on the same four measures of cognitive

impairments and activities of daily living that decline post-buyout. Appendix B describes

evidence on random assignment in more detail. For example, one test in the spirit of Angrist,

Lavy and Schlosser (2010) and Grennan et al. (2021) shows that differential distance lacks

predictive power for inframarginal patients, in the first stage and in the outcome equations.

The second assumption is monotonicity, under which lower differential distance makes all

patients more likely to choose a PE-owned facility. This is true on average, but the assumption

is at the patient-level which is untestable. Monotonicity is necessary to interpret the IV estimate

as a well-defined local average treatment effect (LATE). Figure 3 Panel B contains a binscatter

plot of the first stage, showing that the likelihood of going to a PE-owned facility increases

nearly linearly with differential distance. It is estimated in the same way as Panel A described

above, except that the outcome is an indicator for the facility being PE-owned. The linear

pattern is consistent with monotonicity. Appendix B describes further evidence supporting this

assumption.

5 Patient-Level Effects

This section presents the main results of the paper, which are the effects of PE ownership

on short-term mortality and spending per patient. It then considers observed and unobserved

heterogeneity in these effects. Finally, it examines measures of patient well-being.

20

We use Hospital Service Areas (HSAs) as an alternate, more granular definition of nursing home markets.

There are nearly 3,400 HSAs in the US, while there are only about 300 HRRs. Both HRRs and HSAs were

defined by the Dartmouth Atlas group based on healthcare use patterns by Medicare beneficiaries so that they are

relatively self-contained.

17

5.1 Effects on Mortality and Spending

We begin with OLS models using Equation (1), which includes patient-level controls, facility

fixed effects, and patient HRR-by-year fixed effects. The results are in Table 2 Panel B. We find

an OLS effect on mortality of 0.3 pp, which is about 2% of the mean. There are small, negative

effects on spending of 1-3% (columns 2–3). We expect that the selection on unobservedly lower

risk should bias these OLS results down, as discussed in Section 4 and as indicated by the risk

measures in Figure 2. The corresponding event studies, in Figure C.6, suggest no pre-trends,

supporting the parallel trends assumption that underlies our empirical model (i.e., targeted and

control facilities would continue on parallel trends absent the buyout).

21

The IV effects using Equation (3) are reported in Table 2 Panel C. Consistent with

downward bias in OLS, we see much larger effects in IV analysis. However, it is important to

emphasize that the IV effects are for compliers with the instrument who go to a PE facility

because it is closer, and thus could experience larger effects than a randomly selected patient.

Column 1 shows that going to a PE-owned nursing home increases the probability of death

during the stay and the following 90 days by about 2 pp, or 11% of the mean. In the context of

the health economics literature, this is a very large effect. Next, the amount billed per nursing

home stay per patient—which is almost all paid by Medicare—increases by 8% (column 2).

As Table 1 shows, on average PE-owned nursing homes bill $13,400 per stay, while non-PE

nursing homes bill $13,000. Higher costs do not seem to reflect additional preventive care that

enables lower costs later, because the total amount billed for the stay and the subsequent 90

days increases by 6%. The IV estimates imply that the reduced form effects should decline as

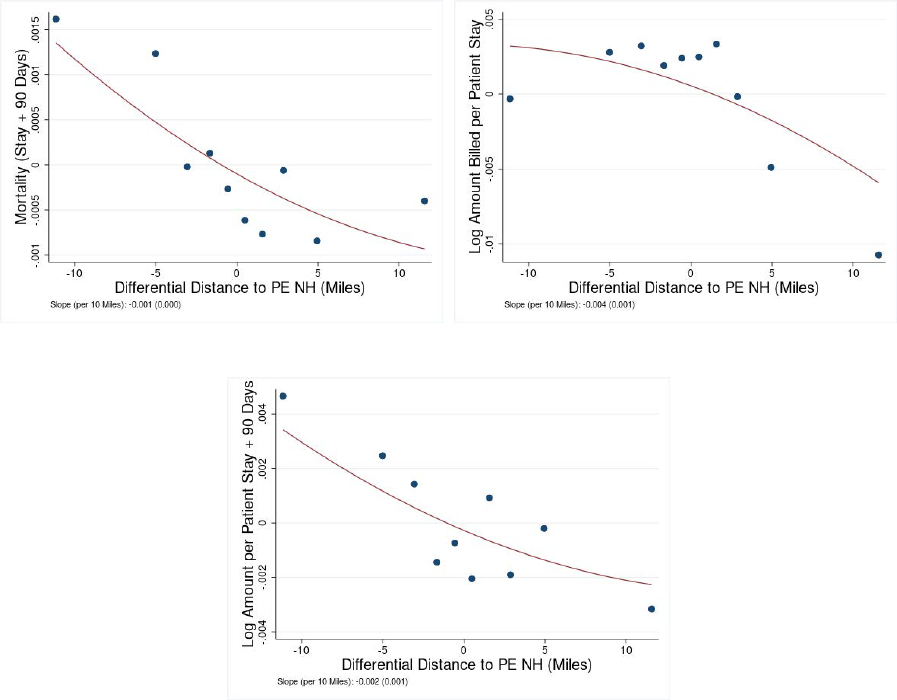

differential distance grows larger (i.e., relative to the nearest alternative, a PE facility is farther

away). Figure 4 provides non-parametric evidence of such a pattern, using the same approach

as in Figure 3 except that the y-axis variables are the patient outcomes. Consistent with the IV

results, mortality and spending are highest among patients with the lowest differential distance

and decline as patients are relatively further away from PE facilities.

We calculate the implied cost in statistical value of life-years in Table C.3 Panel C. The IV

coefficients are mapped to lives and life-years lost using the number of index stays at PE-owned

nursing homes during our sample period. This calculation implies that about 22,500 additional

deaths occurred due to PE ownership over the twelve-year sample period. To estimate life-years

lost, we rely on observed survival rates for Medicare patients at all nursing homes. This leads to

an estimate of about 172,400 lost life-years.

22

Applying a standard estimate of statistical value

21

These figures are constructed by collapsing data to the facility-year level and estimating an event study version

of Equation (1).

22

As life expectancy differs substantially between men and women, we estimate the effect separately by gender.

We calculate the average life expectancy at discharge by gender by observing the actual life span for each patient

in our data. For patients still alive at the end of our sample period, we approximate the year of death based on

patient gender and age using Social Security actuarial tables. We adjust this downward to account for the fact that

decedents tend to be older on average (by about 2 years). We then applied this mean life expectancy to the number

18

of a life-year of $100,000 (Cutler and McClellan, 2001) inflated to 2016 dollars, we arrive at a

mortality cost of $22.4 billion.

We present a range of robustness tests in Appendix B, and summarize the most important

ones here. First, we use a placebo analysis to assess whether pre-existing trends might explain

the results. We artificially set the PE dummy to turn on before the deal and drop observations

after the true deal year. Table 2 Panel D finds economically small and insignificant or

marginally significant placebo effects, consistent with no differential trends prior to

acquisition. Table 5 row 2 reports specification checks that vary the controls and market

definition. Importantly, we expect that if the instrument does not randomly assign patient risk,

including patient controls should substantially affect the results. In row 2.A, we omit all

patient controls. In row 2.B., we include zip-year socioeconomic controls.

23

Across all of the

tests, the coefficients remain robust and similar in magnitude to the baseline estimates in row

1. Appendix B presents other checks that validate the instrument, such as showing that it is

very weak among patients who are relatively very far or very close to PE-owned facilities or

equally close to PE and non-PE facilities, and does not explain mortality for these patient

groups (Table C.4). The effect on mortality is robust to using alternative durations to define the

metric. Table C.5 shows that the effect varies between 9% and 12% of the mean mortality rate

for horizons ranging from 15 to 365 days. Finally, we present the alternative OLS Callaway

and Sant’Anna (2021) and Sun and Abraham (2021) estimators in Figure C.5 Panel A.

The results so far point to nuanced effects of PE ownership. Since patients become less risky

after PE buyouts, there may be either cream-skimming on the part of the facility or changes in

how patients select the nursing home. We find a very large IV effect on mortality and a small

OLS effect, consistent with the OLS capturing some compositional shifts towards less risky

patients. The IV result represents a causal effect within the subset of patients who comply with

the instrument by going to the closest facility; these patients may be more vulnerable, in the

sense that they do not opt to travel farther to find the best match, and may face more information

frictions. In this subset, we find a very large, positive effect on mortality. We discuss the IV

effects further below in a marginal treatment effects analysis.

Alternative Explanations We assess the plausibility of several alternative interpretations of

our main results. First, PE ownership could bring economies of scale or corporatization, which

Eliason et al. (2020) propose to explain the negative effects of dialysis center mergers. We

of deaths computed above and obtained the number of life-years lost. This approach may overstate the true value

if the incremental deaths at PE facilities are of older patients. This approach also understates the true value since

we don’t account for the loss in longevity not resulting in death during our sample.

23

The other tests are as follows. In row 2.C, we use more granular HSAs instead of HRRs to define patient

markets. In rows 3A and 3B, we test sensitivity to varying the maximum threshold of differential distance for

sample inclusion. The coefficients are robust to using a narrower (15 miles) or wider (25 miles) threshold than the

baseline value of 20 miles. In row 4, we use an indicator for above-median differential distance rather than the

continuously varying value. In row 5, we cluster standard errors by deal rather than by facility.

19

conduct two tests for this in Table 5. The first adds to our main model a control for being

a chain versus an independent facility (about 15% of PE owned facilities remain independent

post-buyout). If our effects are explained by the “rolling-up" of independent facilities into more

efficient chains, the estimates should attenuate. Instead, they are essentially unchanged (row

6.A). Second, we use only the top five deals to define PE ownership. In these deals, the target

chains already owned more than 100 facilities and stayed nearly the same size over the sample

period. Therefore, in this model chain size is held constant and we evaluate the effect of a

change in ownership. The effects remain large and significant (row 6.B). In sum, it does not

seem that chain corporate structures or synergies in large firms explain our results.

Second, it may be that only select large deals or PE firms drive the results. However, the

estimates remain large and significant when we exclude facilities bought in the top two deals,

each involving more than 300 facilities (row 7.A). Similarly, the results are robust to excluding

facilities bought by Formation Capital and Filmore Capital, which may not be representative of

the average PE firm given their specialization in nursing homes (row 7.B).

Third, we test whether the results are limited to states with rapid changes in the aged share

of the population during our sample period due to heavy inflow or outflow of retirees. PE firms

may disproportionately target or avoid facilities in such states if they expect them to experience

rapid growth or decline in nursing home demand. Therefore, we exclude the five states with

highest net inflows and outflows of retirees during this period, respectively, from our sample

and estimate our main results.

24

The results, in row 8, remain very similar to our main estimates.

Finally, if PE firms also acquire hospitals in the same market along with nursing homes,

they might also affect hospital quality and the share of patients discharged to nursing homes.

In other words, changes in the upstream hospital market could bias our estimates. To assess

this, we conduct two tests. The first examines how PE entry into a market affects hospital

quality, measured as changes in 90-day mortality rates for all Medicare heart attack patients

admitted to hospitals, a standard hospital quality metric used by CMS and the economics

literature (Chandra et al., 2016). Table C.6 Panel A presents OLS estimates from patient-level

models in which the outcome is an indicator for 90-day mortality of Medicare heart attack

patients. We detect small, statistically insignificant, but precisely estimated effects, regardless

of how we define the market. Second, Panel B presents the corresponding effect on the

proportion of hospital patients that are discharged to a nursing home. These coefficients are

also small and statistically insignificant. Hence, we do not find evidence to support this

concern.

24

The states with highest net inflows are Arizona, Florida, Idaho, Nevada, and South Carolina. The states with

highest net outflows are Wyoming, Vermont, New York, New Jersey, and Illinois. These states were identified by

the US Census as having the highest and lowest net migration rates for the population over 65 years in its Current

Population Report (Mateyka and He 2022 Figure 1).

20

5.2 Heterogeneity in the IV Mortality Effect

The selection on risk we document above raises the question of whether the effects are larger

for some groups than for others. This section explores heterogeneity both on observed

attributes and on unobserved resistance to treatment, using a Marginal Treatment Effects

(MTE) framework.

Observed attributes To assess heterogeneity in the IV analysis, we split the sample based

on observed characteristics in Table 6. Panel A presents results for different patient groups,

while Panel B presents a companion analysis for different groups based on market or facility

characteristics. We also report the mean mortality rates for each sub-group to help interpret

the magnitudes. We begin by describing heterogeneity across patients reported in Panel A.

First, higher risk as measured by disease burden should be associated with more need for

high-skill, medicalized RN care. Lower risk patients might be more sensitive to changes in

staff attentiveness (for example helping them to use the toilet or minimizing infection risk).

Therefore, we split the sample into two groups around the high-risk indicator (Charlson score

above two), which isolates patients with higher mortality (29% vs. 14%). The results indicate

that relative to the mean mortality rate, lower risk patients experience a much greater increase

in mortality (0.02/0.14 ≈ 14% vs. 0.02/0.29 ≈ 8%, row 1).

We consider gender in Panel A row 2 and find similar effects among men and women.

Third, we divide the sample at the median length of stay. Note that length of stay could be

affected by PE ownership, so this analysis should be thought of as relevant to understanding the

mechanism. The mortality effect is driven by patients with below median stays, consistent with

the previous result that lower risk patients experience worse mortality effects. It also contradicts

a potential concern that PE facilities appear worse on mortality because of sicker patients who

require long stays and are independently more likely to die.

We explore this further by studying the impact of PE ownership on length of stay at different

parts of the length of stay distribution. We estimate a series of IV regressions (using Equation

(2)) in which we adjust the dependent variable to be an indicator for the stay being longer

than X days. Figure C.2 panel B presents the estimated effects. We plot the X values on the

x-axis and the coefficient from the model is plotted on the y-axis. For example, the coefficient

on x = 15 days implies a 4 pp increase in the probability of stays becoming longer than 15

days following PE ownership. The figure documents that PE-owned facilities keep very short

stayers longer, with little or no effect on stays becoming longer than 35 or more days. This

would maximize Medicare revenue, because Medicare pays fully for only the first 20 days of

care and then tapers off. Tying this to the mortality results above, it may be that extending short

stays plays an important role in elevating mortality.

25

25

We also find an increase in length of stay only for low-risk patients (results not reported). Since we found the

21

Panel A row 4 of Table 6 examines mortality effects for patients discharged to different

destinations. The mortality effect is driven by patients discharged to facilities (predominantly

hospitals), though the coefficients are positive for all destinations. Note that we do not find

significant changes in the proportions of patients sent to the different destinations (see Table

C.6 Panel C). However, there could be changes in the composition of patients sent to different

locations. In Panel A row 5 we disaggregate patients discharged to hospitals by the category of

the reason for hospitalization, and find the largest effect on mortality occurs for patients with

an injury or infection, which may be consistent with lower quality care.

Table 6 Panel B further explores heterogeneity on three dimensions. First, we test whether

there are differences in the mortality effect between urban and rural counties. Row 1 shows

that the mortality effect is substantially larger at facilities in urban counties, even though

baseline mortality levels are a bit lower. This pattern is consistent with the finding above that

the mortality effect is greater among less riskier patients. Second, we examine heterogeneity

by facility bed size. The results in row 2 show that the mortality effect is substantially larger at

facilities below the median bed size (129 beds), implying that these facilities experience

greater disruption to patient care due to PE ownership. Larger facilities may also benefit from

having access to better managerial personnel. In row 3 we explore heterogeneity on a related

dimension, the facility’s patient throughput, which may partly reflect operational excellence.

Indeed, we find that facilities admitting more patients per bed than the median on average (4

patients per bed) have a substantially smaller mortality effect.

26