Report on

Employer Firms

FEDERAL

RESERVE

BANKS of

MARCH 2016

2015

SMALL

BUSINESS

CREDIT

SURVEY

NEW YORK

ATLANTA

BOSTON

CLEVELAND

PHILADELPHIA

RICHMOND

ST. LOUIS

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

TABLE OF CONTENTS

i ACKNOWLEDGEMENTS

iii EXECUTIVE SUMMARY

1 DEMOGRAPHICS

3 PERFORMANCE

4 EMPLOYMENT

5 BUSINESS CHALLENGES

6 FINANCING AND DEBT

7 DEMAND FOR FINANCING

8 NON-APPLICANTS

9 FINANCING SEARCH

10 CREDIT APPLICATIONS

11 CREDIT SOURCES

12 CREDIT OUTCOMES

13 FINANCING APPROVAL

14 LENDER SATISFACTION

15 FINANCING SHORTFALLS

17 METHODOLOGY

18 APPENDIX

18 A. BUSINESS CONDITIONS

23 B. OUTSTANDING DEBT AND

STARTUP FUNDING

28 C. NON-APPLICANTS

33 D. DEMAND FOR FINANCING

38 E. APPLICATIONS

43 F. FINANCING SUCCESS AND

SOURCES OF CREDIT

49 G. FINANCING SHORTFALLS

54 H. DATA FOR SELECT STATES

70 I. PARTNER ORGANIZATIONS

i

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

ACKNOWLEDGEMENTS

Our hope is that this report contributes to policymakers’ and service providers’ understanding of the business conditions, credit needs,

and borrowing experiences of small business owners. A survey and report of this scope are made possible only through an extensive

network of partners and collaborators, for which we are truly grateful. The Federal Reserve Banks of New York, Atlanta, Boston, Cleveland,

Philadelphia, Richmond, and St. Louis thank the community partners in our Districts that distribute and promote the survey and share

valuable insights with us about nancing and service needs in their communities.

1

We also wish to thank the National Opinion Research

Center (NORC) at the University of Chicago for assistance with the weighting methodology used to make the Small Business Credit Survey

(SBCS) statistically representative.

2

We also thank colleagues within the Federal Reserve System, especially the Community Affairs Ofcers, and representatives from the U.S.

Department of the Treasury, U.S. Small Business Administration, The Aspen Institute, and Urban Institute for their feedback and support.

We particularly wish to thank the following people:

Prabal Chakrabarti, Senior Vice President and Community Affairs

Ofcer, Federal Reserve Bank of Boston

Nathan Dietz, Senior Research Associate, Urban Institute

Gwendy Donaker Brown, Vice President, Research and Policy,

Opportunity Fund

Donna Fabiani, Executive Vice President, Knowledge Sharing,

Opportunity Finance Network

Joseph Firschein, Deputy Associate Director and Community

Affairs Ofcer, Federal Reserve Board of Governors

Todd Greene, Vice President and Community Affairs Ofcer,

Federal Reserve Bank of Atlanta

Tammy Halevy, Senior Vice President, New Initiatives,

Association for Enterprise Opportunity

Kausar Hamdani, Senior Vice President,

Federal Reserve Bank of New York

Gina Harman, CEO, Accion USA

Paul Kaboth, Vice President and Community Affairs Ofcer,

Federal Reserve Bank of Cleveland

David Kaufmann, Community Development Manager,

Federal Reserve Board of Governors

Marysol McGee, Senior Community Affairs Analyst,

Federal Reserve Board of Governors

Jessica Milano, Deputy Assistant Secretary,

U.S. Department of the Treasury

Joyce Klein, Director, FIELD, The Aspen Institute

Karen Leone de Nie, Assistant Vice President,

Federal Reserve Bank of Atlanta

Tameka Montgomery, Associate Administrator,

U.S. Small Business Administration

Paul Quintero, CEO, AccionEast

Theresa Singleton, Vice President and Community Affairs Ofcer,

Federal Reserve Bank of Philadelphia

Yvonne Sparks, Assistant Vice President and Community Affairs

Ofcer, Federal Reserve Bank of St. Louis

Jeffrey Stout, Director, State Small Business Credit Initiative,

U.S. Department of the Treasury

Laura Temel, Policy Advisor, U.S. Department of the Treasury

Sandra Tormoen, Assistant Vice President and Community Affairs

Ofcer, Federal Reserve Bank of Richmond

Charlene van Dijk, Senior Portfolio Manager, CDFI Fund,

U.S. Department of the Treasury

Eric Weaver, CEO, Opportunity Fund

Ann Marie Wiersch, Senior Policy Analyst,

Federal Reserve Bank of Cleveland

1

For a full list of community partners, please see the Appendix.

2

For complete information about the Survey Methodology, please see p. 17.

ii

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

ACKNOWLEDGEMENTS (CONTINUED)

This report is the result of the collaborative effort, input, and analysis of the following individuals.

REPORT TEAM

Brett Barkley, Federal Reserve Bank of Cleveland

Claire Kramer Mills, Federal Reserve Bank of New York

Maria Carmelita Recto, Federal Reserve Bank of New York

Ellyn Terry, Federal Reserve Bank of Atlanta

Emily Wavering, Federal Reserve Bank of Richmond

OUTREACH TEAM

Kyan Bishop, Federal Reserve Bank of Atlanta

Bonnie Blankenship, Federal Reserve Bank of Cleveland

Jeanne Milliken Bonds, Federal Reserve Bank of Richmond

Nathaniel Borek, Federal Reserve Bank of Philadelphia

Brian Clarke, Federal Reserve Bank of Boston

Chelsea Cruz, Federal Reserve Bank of New York

Eileen Divringi, Federal Reserve Bank of Philadelphia

Shannon McKay, Federal Reserve Bank of Richmond

Drew Pack, Federal Reserve Bank of St. Louis

E. Kathleen Ranalli, Federal Reserve Bank of Cleveland

Javier Silva, Federal Reserve Bank of New York

Ann Marie Wiersch, Federal Reserve Bank of Cleveland

We thank all of the above for another successful collaboration. Our intention is to eld the next survey in Q3 2016 when we expect even broader

coverage. The views expressed here are those of the authors and do not necessarily represent the views of the Federal Reserve System.

Claire Kramer Mills, PhD

Assistant Vice President and Community Affairs Ofcer

Federal Reserve Bank of New York

iii

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

EXECUTIVE SUMMARY

Despite the signicance of small businesses

to the U.S. economy and to local communi-

ties, information on small business nancing

conditions is limited, leaving important

knowledge gaps for policymakers and service

providers. Although several sources report

aggregate lending volumes and lender per-

ceptions,

1

timely data about business owners’

nancing decisions are rare. Furthermore, as

previous studies have shown, credit demand,

sources, and outcomes vary considerably

within the small business sector.

Since 2010, the Federal Reserve has helped

to address this gap through regional surveys

of business owners. Beginning in 2014, the

Federal Reserve Banks of New York, Atlanta,

Cleveland, and Philadelphia collaborated on

a joint Small Business Credit Survey (SBCS)

to cover much of the eastern region of the

U.S. The collaboration has now expanded

to include seven Reserve Banks: Atlanta,

Boston, Cleveland, New York, Philadelphia,

Richmond, and St. Louis. In 2015, the

SBCS yielded 5,420 responses from busi-

nesses in 26 states. Responses from

the sample’s 3,459 employer rms are

featured in this report.

2,3

The SBCS offers insight on business condi-

tions and the credit environment from the

perspective of small business owners. This

report sheds additional light on three sub-

segments of the small business population—

startups, microbusinesses, and growing

rms

4

—each of which affects employment

and growth in local and regional economies.

Overall, the 2015 survey nds that

for employer rms:

FINANCING SUCCESS

IMPROVED IN 2015

Both rm performance and nancing suc-

cess rates improved year over year. Still,

half of applicant rms reported nancing

shortfalls between Q3 2014 and Q3 2015,

meaning they were approved for less than

the amount requested. Microbusinesses

and startups had the largest unmet nanc-

ing needs with 63% and 58%, respectively,

reporting a nancing shortfall.

SMALL BANKS ARE THE

CHOICE LENDER

Traditional bank lending continues to be

the primary source of nancing for small

businesses. Credit applicants were most

successful and most satised with their

borrowing experience at small banks. Small

banks approved at least some of the amount

requested for 76% of applicants, while large

banks approved 58% of applicants. Further,

small banks earned a satisfaction score

(the net percent satised with their overall

experience) of 75 among approved rms

compared to a score of 51 for large banks.

ONLINE LENDERS ARE POPULAR—

BUT HAVE LOWEST BORROWER

SATISFACTION LEVELS

Overall, 20% of employer rms applied at

an online lender.

5

While the approval rate

was relatively high for applicants (71% were

approved for at least some credit), approved

rms were not very satised with their

experience. The satisfaction score was just

15—far below that of small and large banks.

Dissatised rms reported concerns with

high interest rates and unfavorable repay-

ment terms.

More detailed ndings on employer rms

from the 2015 survey include:

a. Cash flow is a common challenge for

small rms.

22% of employer rms say managing cash

flow is their top business challenge, above

business costs and far above government

regulations and taxes.

Talent is an issue for growing rms. 24%

say that nding/retaining qualied staff

is their top challenge.

b. The majority of employer respondents,

63%, hold debt. Most debt is in

small amounts and secured with

personal assets.

More than half hold $100K or less in debt.

63% of rms pledged personal assets or

guarantee to secure debt.

Use of personal assets as collateral is very

common, even among larger and more

mature rms. 58% of employer rms with

more than $10 million in revenues and

63% of rms that started 11 or more years

ago used personal assets or guarantees to

secure their nancing.

1

See Ofce of Advocacy. "Small Business Lending in the United States," 2013. By Victoria Williams, Washington, D.C.: U.S. Small Business Administration, 2014.;

"Federal Financial Institutions Examination Council (FFIEC) Consolidated Reports of Condition and Income" (Call Reports); and The Board of Governors of the

Federal Reserve System. "Senior Loan Ofcer Opinion Survey on Bank Lending Practices."

2

Employer rms are those reporting they have at least one employee, excluding the owner(s) and contract workers.

3

A subsequent report will focus on the self-employed respondents and is scheduled for release in Q2 2016.

4

Startups are dened as rms 0-2 years of age. Microbusinesses are those with less than $100K in annual revenue. Growing rms are those reporting increased

revenues and employment in the prior year, and that expect to maintain or increase the number of employees in the next 12 months.

5

The questionnaire describes online lenders as nonbank online lenders including alternative and marketplace lenders.

2015 SMALL BUSINESS CREDIT SURVEY: EMPLOYER FIRM REPORT

iv

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

EXECUTIVE SUMMARY (CONTINUED)

c. 47% of rms applied for credit in the

past 12 months

6

The top two reasons for borrowing are to

expand the business or to meet operating

expenses (i.e., cash flow).

Demand is highest among young rms

(0–5 years of age), growing, and higher

revenue rms.

Among non-applicants, nearly half indi-

cated they have sufcient nancing.

Debt aversion is fairly common—25%

of non-applicants said they didn’t want

to take on debt, including 20% of non-

applicant growing rms.

16% of all non-applicants reported being

discouraged, meaning they did not apply

for nancing because they believed they

would be turned down.

d. 50% of applicant rms received all

of the credit they sought.

A larger share of applicants reported prof-

itability and revenue growth than in the

2014 survey, two indicators of improved

applicant quality.

In the 2015 survey, half of applicants

reported receiving all of the nancing they

applied for, while 18% of applicants were

not approved for any nancing.

e. Banks are the dominant advisory and

credit channel, but there is noteworthy

use of loan brokers and online lenders

by the smallest and weakest applicants.

The majority of small business applicants,

73%, turned to a banker or lender for ad-

vice. However, microbusiness applicants

also relied heavily on Small Business

Development Centers (SBDCs), friends

and family, and loan brokers. 22% of

microbusinesses sought advice from

loan brokers compared to just 7% of

applicant rms with more than $10

million in annual revenues.

The majority of applicant rms sought

traditional loans or lines of credit from

banks, but 30% of microbusiness

applicants and 22% of small rms

applicants ($100K–$1M in annual rev-

enues) applied to an online lender.

Firms unable to obtain traditional bank

nancing were more likely to apply for

credit cards and for nancing at online

lenders. Only 38% were able to secure

nancing elsewhere and most of those

were approved for only some of the

nancing requested.

f. 50% of applicants had a nancing

shortfall, securing less than the full

amount requested.

Growing rms reported insufcient credit

history and collateral as the main reasons

they were approved for less than the

amount requested.

32% of growing rms reported that they

had to delay expansion as a result of their

nancing shortfall. 21% said they used

personal funds to nance their business.

Startups approved for less than the

full amount of requested nancing

used personal funds to cover their

nancing shortfall or were unable

to meet their expenses.

g. Satisfaction levels are highest for

applicants at small banks and lowest

at online lenders.

Successful applicants at small banks were

the most satised with their experience.

Online lenders and large banks both had

much lower net satisfaction scores.

Unfavorable repayment terms and high

interest rates were common reasons

for dissatisfaction with online lenders.

Transparency issues were cited across

all lenders. 31% of rms dissatised

with their experience pointed to a lack

of transparency.

ABOUT THE SURVEY

The Small Business Credit Survey (SBCS) is a

survey of rms, collecting information about

business performance, nancing needs and

choices, and borrowing experiences of rms

with fewer than 500 employees. Responses

to the SBCS provide insight into the dynamics

behind aggregate lending trends and shed

light on noteworthy segments of small busi-

nesses. The results are weighted to reflect the

full population of small businesses in the 26

states of coverage. The SBCS is not a random

sample; therefore, results should be viewed as

suggestive and analyzed with awareness of

potential methodological biases.

6

Respondents were asked about application experiences during the Q3 2014 to Q3 2015 time frame.

1

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

DEMOGRAPHICS

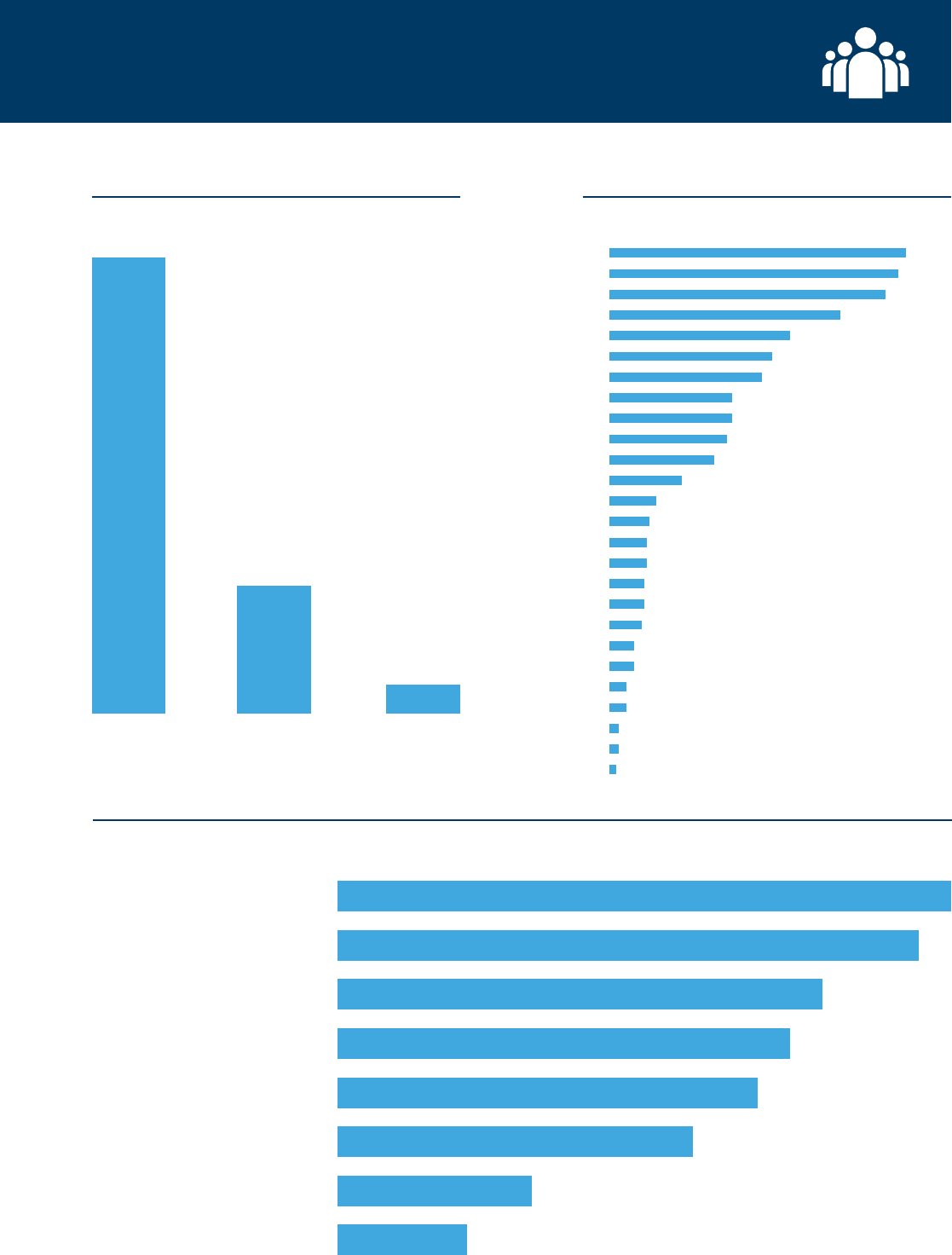

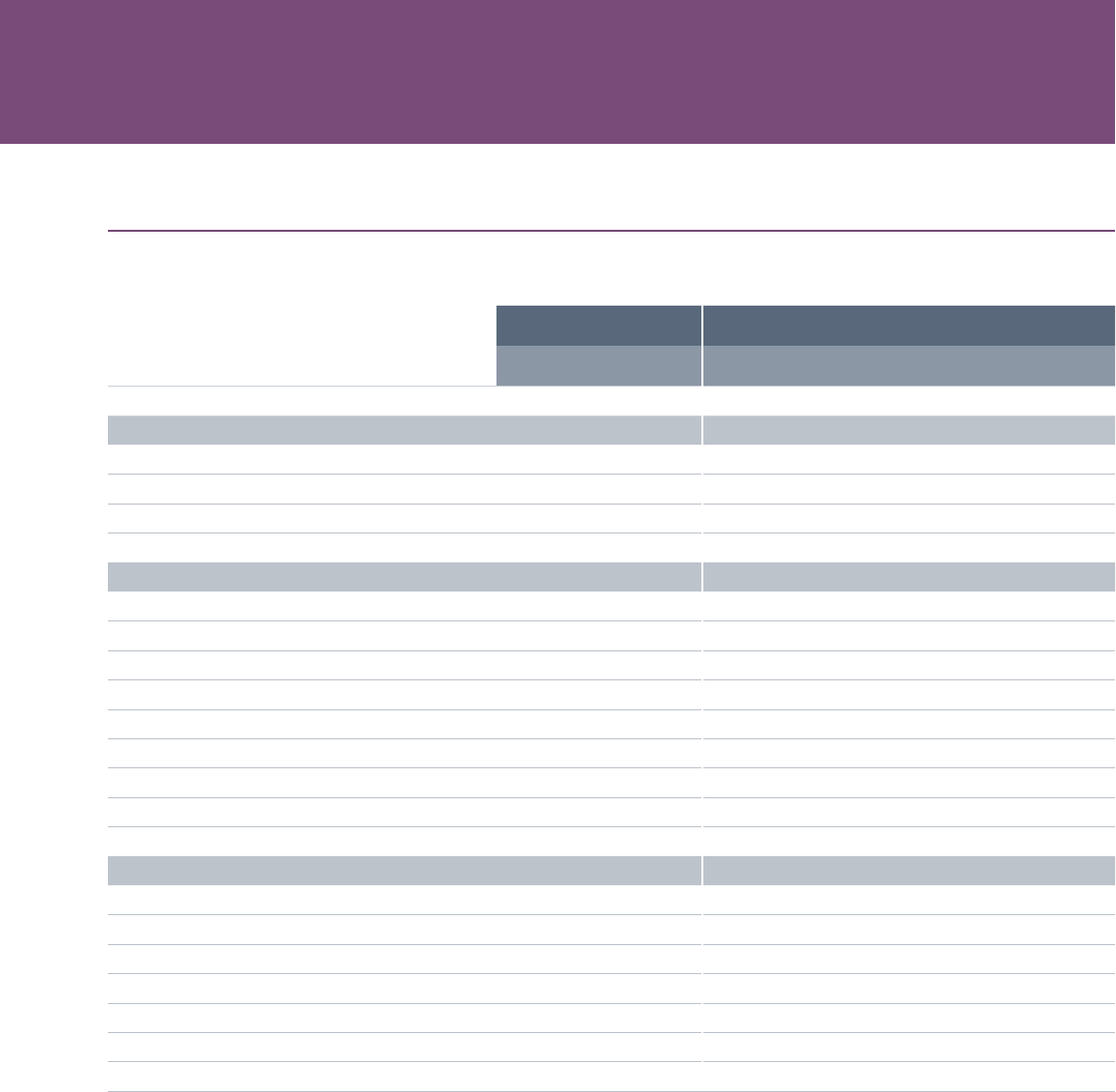

STATE DISTRIBUTION (% of employer rms) N=3459NUMBER OF EMPLOYEES (% of employer rms) N=3459

1–9 10–49 50+

74%

21%

5%

INDUSTRY DISTRIBUTION (% of employer rms) N=3459

Professional services

and real estate

Non-manufacturing goods

production and associated services

Business support and

consumer services

Retail

Healthcare and education

Leisure and hospitality

Finance and insurance

Manufacturing

19%

18%

15%

14%

13%

11%

6%

4%

11.8%

11.5%

11%

9.2%

7.2%

6.5%

6.1%

4.9%

4.9%

4.7%

4.2%

2.9%

1.9%

1.6%

1.5%

1.5%

1.4%

1.4%

1.3%

1%

1%

0.7%

0.7%

0.4%

0.4%

0.3%

NY

FL

MA

NC

GA

OH

PA

AR

TN

AL

CT

IL

IN

NJ

KS

MS

MO

SC

VA

KY

LA

ME

MD

CA

CO

TX

EMPLOYEES

2

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

DEMOGRAPHICS (CONTINUED)

1

Source: Ewing Marion Kauffman Foundation. "The Importance of Young Firms for Economic Growth." By Jason Wiens and Chris Jackson. 2015.

2 In this report, microbusinesses are dened as rms with <$100K in annual revenues. In the 2014 report, the denition included rms with up to $250K in annual revenues.

3 Source: The Aspen Institute, FIELD (Microenterprise Fund for Innovation, Effectiveness, Learning and Dissemination). "Microenterprise Development as Job Creation."

By Elaine L. Edgecomb and Tamra Thetford. 2013.

4

Past 12 months. Approximately Q3 2014 through Q3 2015.

5

Next 12 months. Q3 2015 through Q3 2016.

6

Source: Ewing Marion Kauffman Foundation. "The Importance of Young Firms for Economic Growth." By Jason Wiens and Chris Jackson. 2015.

Spotlight on key business types: Throughout the report, we highlight data

on three groups of small businesses that affect employment and growth

in local and regional economies. Understanding their challenges, credit

needs, and credit experiences is important for their continued vitality.

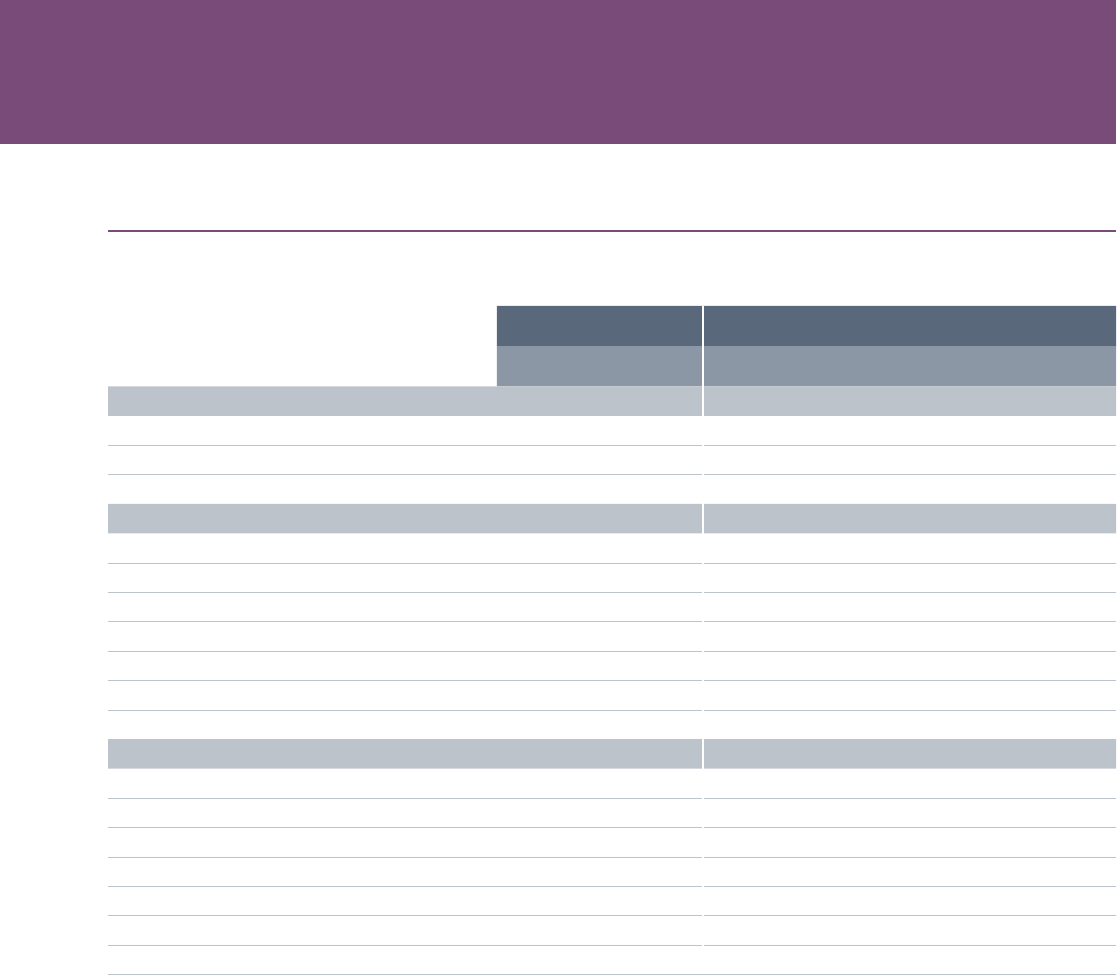

AGE OF FIRM (% of employer rms) N=3459 REVENUE SIZE OF FIRM (% of employer rms) N=3297

YEARS

0–2 3–5 6–10 11+

<$100K $100K–$1M $1M–$10M >$10M

21%

49%

25%

5%

21%

14%

20%

45%

Startups

New and young rms are the

economy’s primary job creator.

1

Microbusinesses

Microbusinesses create jobs

for their owners and others—

often workers disadvantaged in

the broader labor market.

2,3

GROWING FIRMS (% of employer rms) N=3296

Dened as:

Increased revenues

4

Increased employees

4

Plan to increase or maintain

number of employees

5

29%

Growing

71%

Not

growing

Firm

Growth

Growing Firms

Growing small businesses

are important engines

of dynamism in local

economies—adding jobs

and spurring innovation.

6

3

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

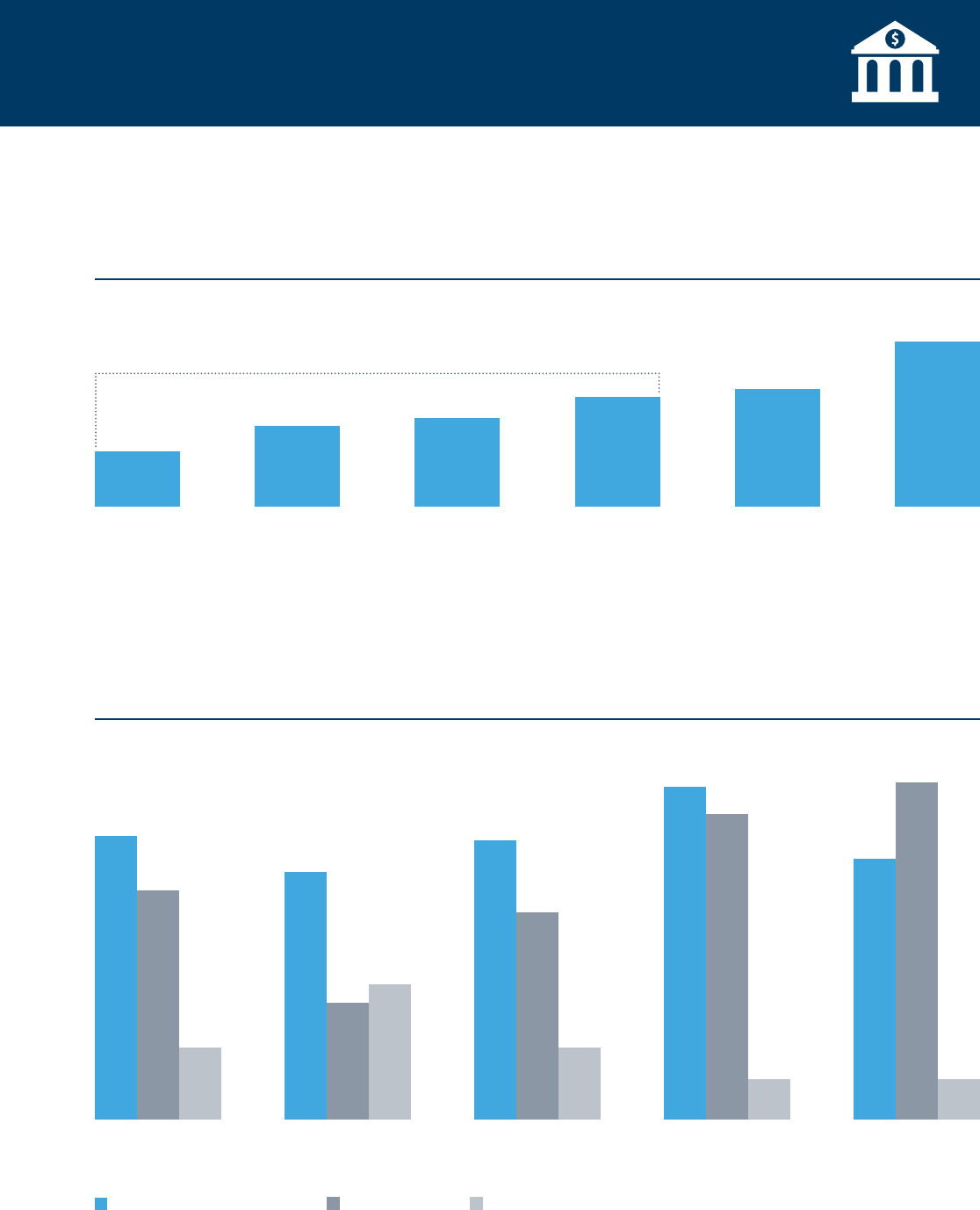

PERFORMANCE

1

For revenue and employment growth, the index is the share reporting positive growth minus the share reporting negative growth.

For protability, it’s the share protable minus the share not protable.

2

Approximately Q3 2014 through Q3 2015.

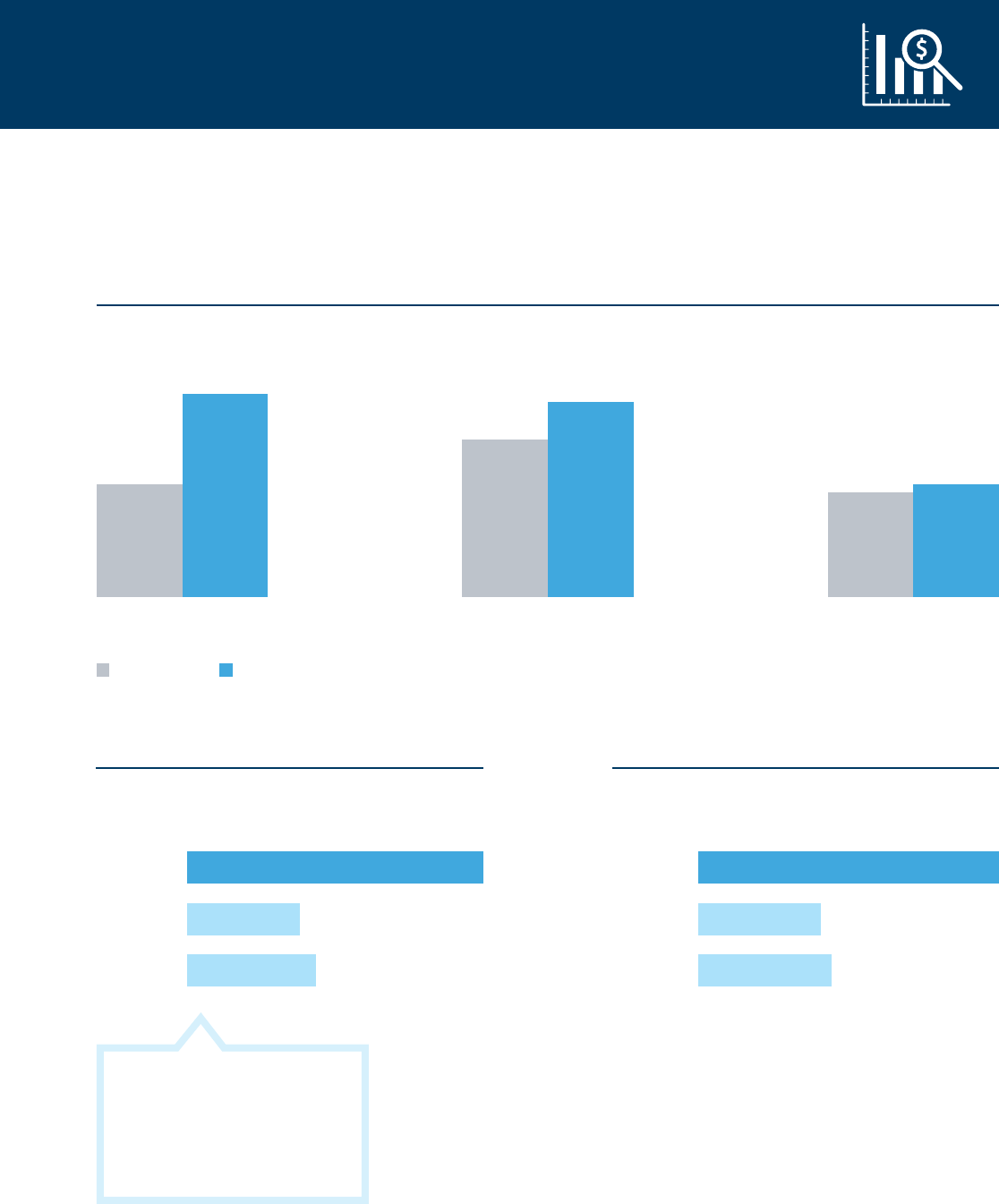

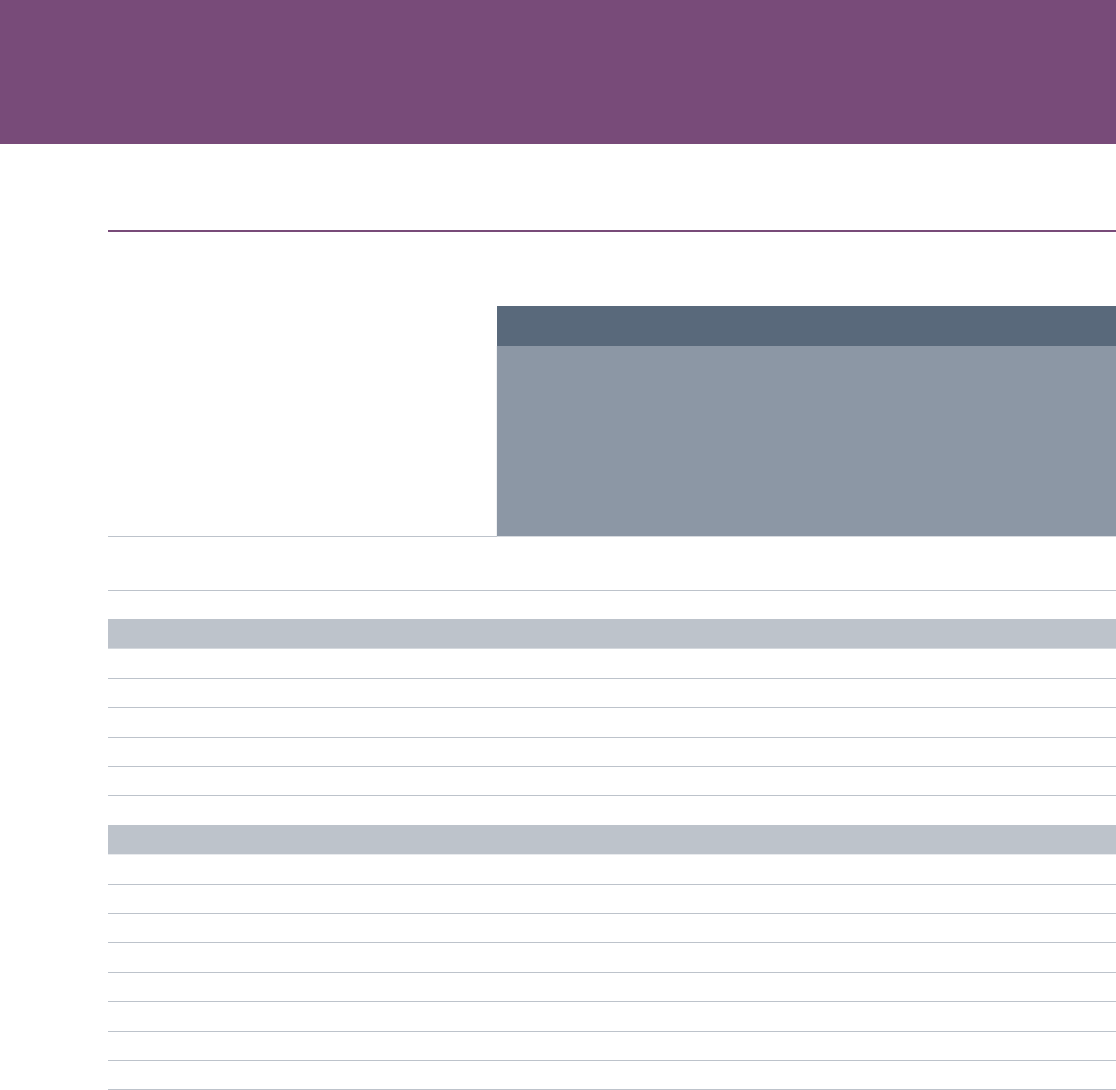

In 2015, small businesses reported positive nancial performance on a

number of indicators, including revenue growth, protability, and job growth.

EMPLOYER FIRM PERFORMANCE INDEX,

1

2014 Survey and 2015 Survey (% of employer rms)

Limited to states surveyed in both years

2014

(N=1379) 2015 (N=2078)

Profitability Revenue growth Employment growth

27%

15%

26%

21%

15%

14%

PROFITABILITY, End of 2014 N=3354

(% of employer rms)

REVENUE CHANGE, Past 12 Months

2

N=3375

(% of employer rms)

At a profit 55%

Break even 21%

At a loss 24%

Increased 54%

No change 22%

Decreased 24%

The Startup Struggle

52% of startups (0–2 years)

reported operating at a loss

compared with only 15% of

rms over 10 years old.

4

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

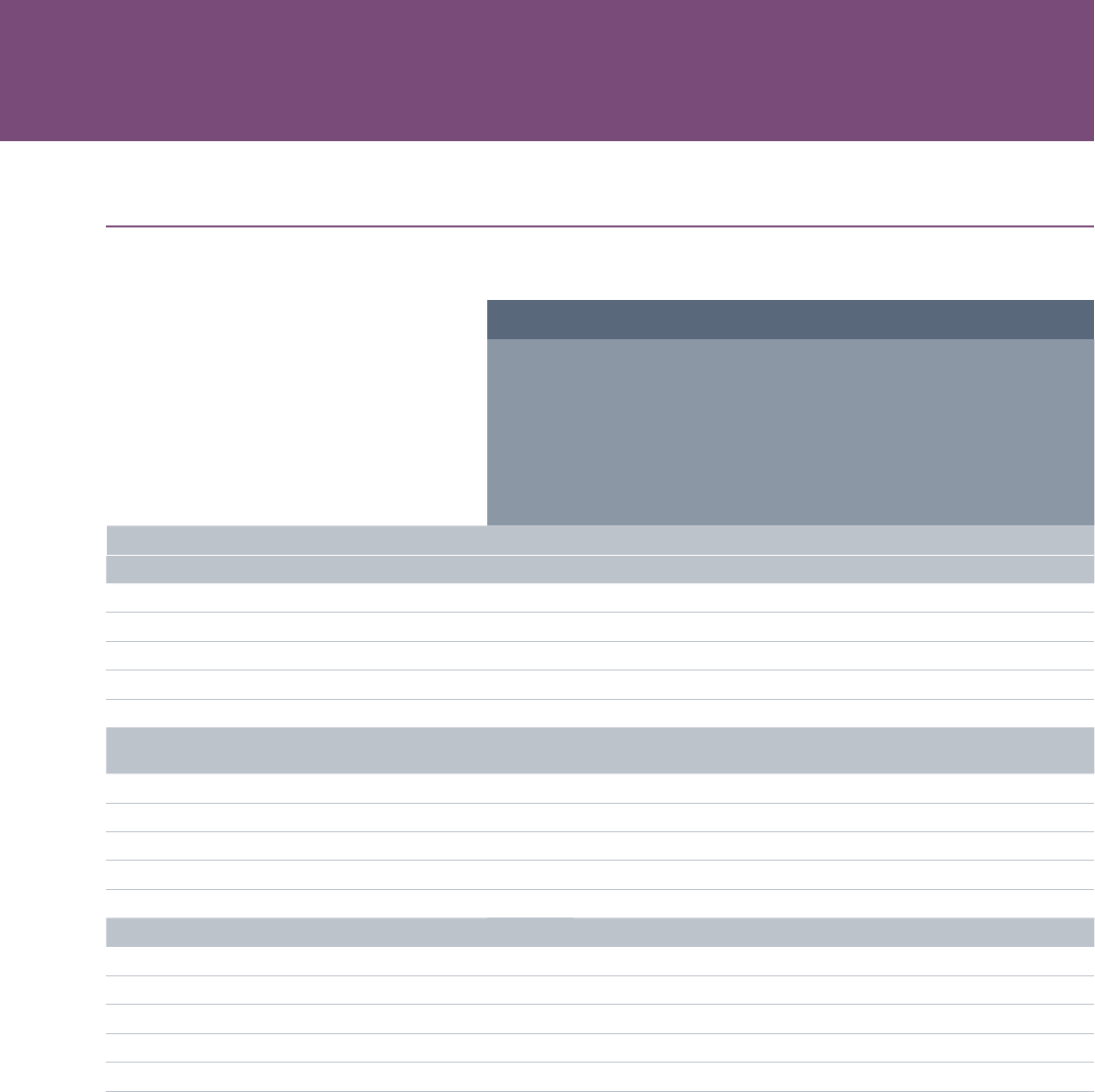

EMPLOYMENT

74% of employer rms reported having less than 10 employees.

45% of employer rms plan to add jobs in the next 12 months.

Small businesses are using contractors.

34%

of employer rms use

contract workers.

3

median number of contractors

per employer rm.

1

Approximately Q3 2014 through Q3 2015.

2

Expected change, Q3 2015 through Q3 2016.

CHANGE IN EMPLOYMENT (% of employer rms)

51%

No change

14%

Decreased

34%

Increased

Past

12 Months

1

48%

No change

45%

Will

increase

7%

Will decrease

Next

12 Months

2

N=3386 N=3396

5

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

BUSINESS CHALLENGES

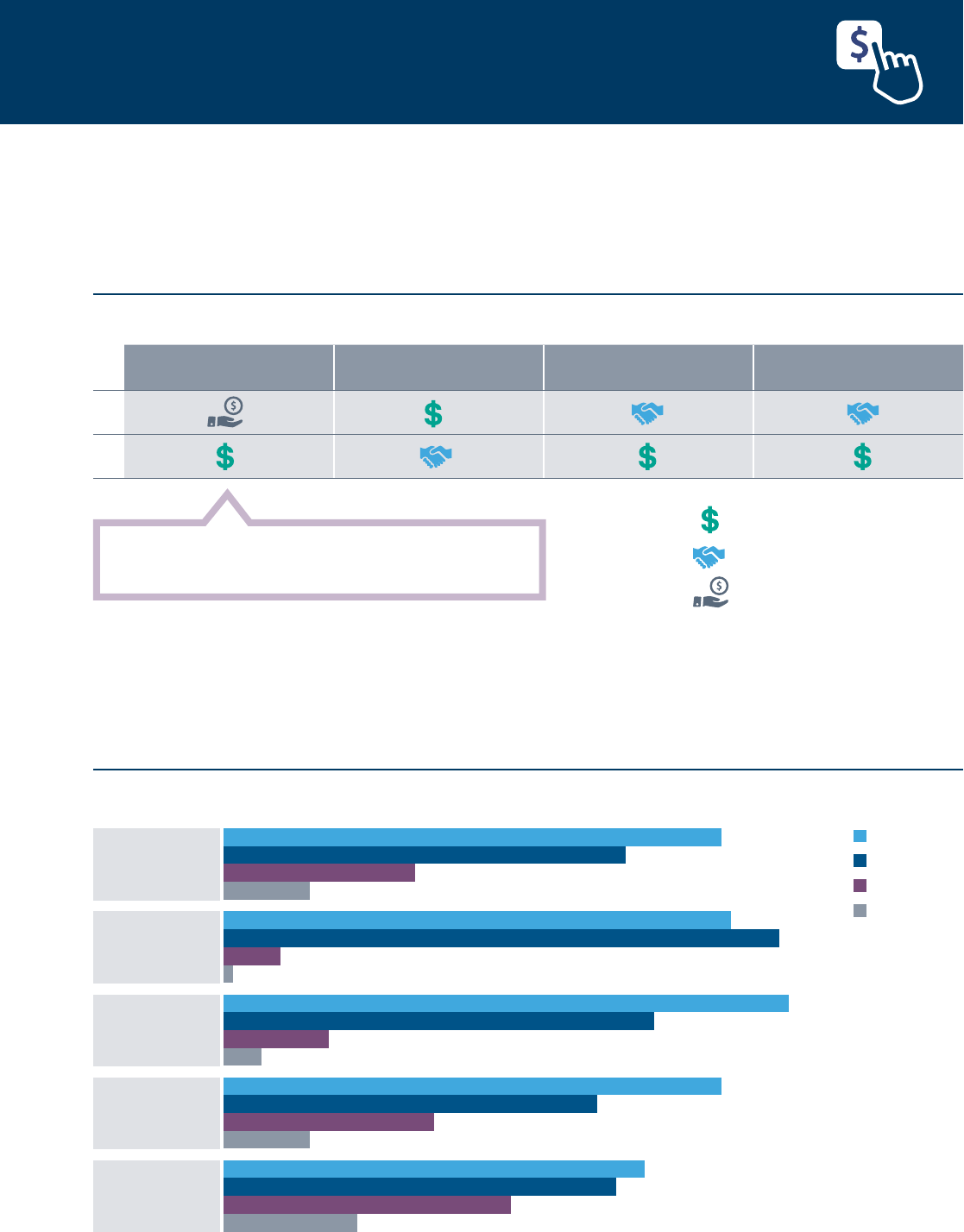

TOP BUSINESS CHALLENGE BY TYPE OF FIRM, Past 12 Months

1

(% of employer rms)

In order of importance

Costs of running business

Growing

2

N=803

Hiring and/or retaining qualified staff

Government regulations

Taxes

Credit availability

Other

3

Startup (0–2 years)

N=280

Revenues/sales

Micro (<$100K)

N=316

Cash flow

19%

17%

10%

9%

9%

2%

13%

22%

23%

16%

9%

8%

6%

3%

12%

24%

23%

15%

10%

9%

4%

2%

13%

25%

22%

16%

9%

7%

4%

3%

13%

26%

All firms

N=2940

1

Approximately Q3 2014 through Q3 2015.

2

Growing rms are dened as those with increased revenues over the past 12 months, increased employees over the past 12 months,

and plans to increase or maintain number of employees over the next 12 months.

3

“Other” includes costs related to employee benets, business climate, and market competition.

Note: Because of rounding, percentages sum to >100%.

24% of growing employer rms reported that hiring and/or

retaining staff is their top challenge to doing business.

6

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

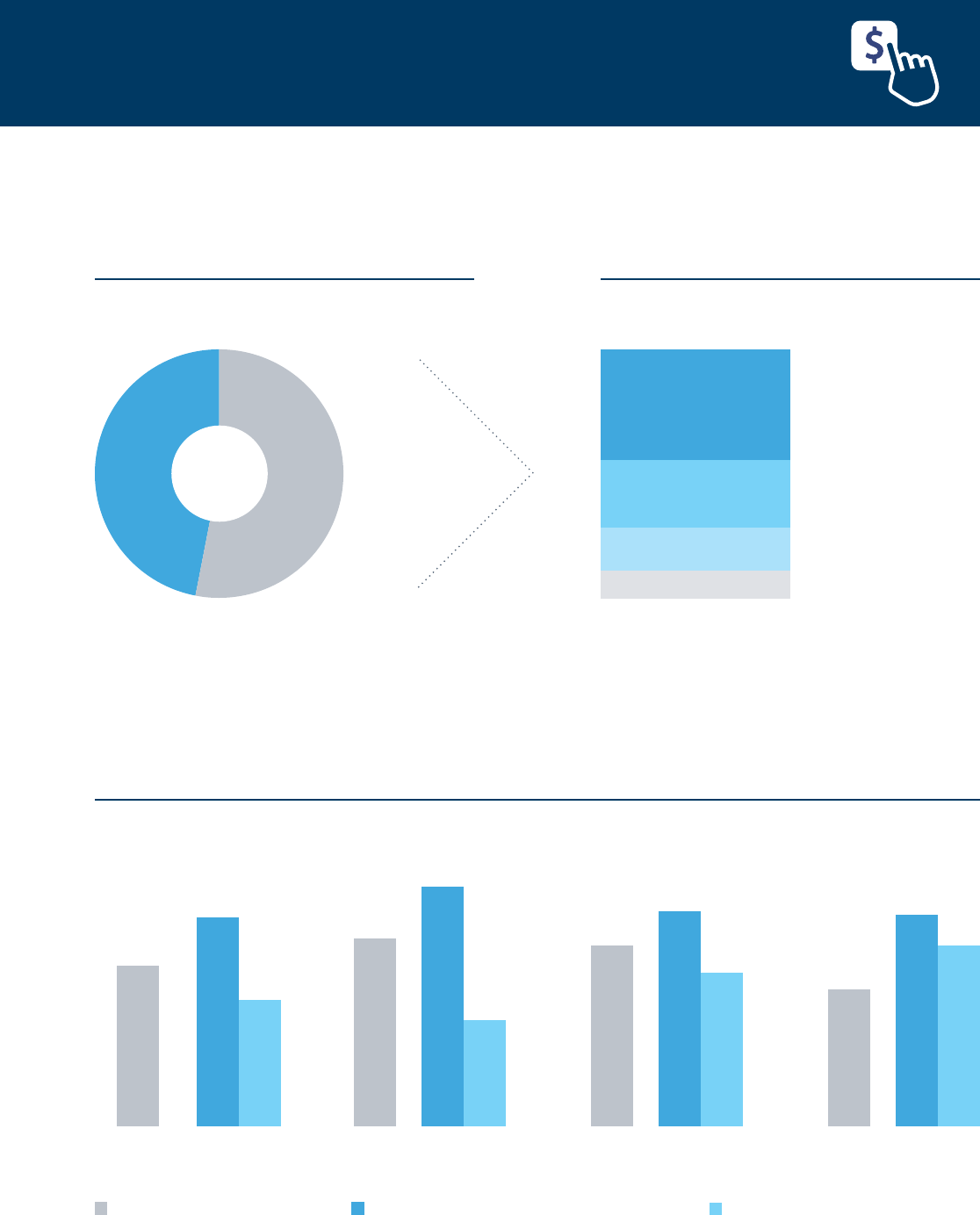

FINANCING AND DEBT

AMOUNT OF DEBT, At Time of Survey (% of employer rms with debt) N=2154

$1–$10K $10K–$25K $25K–$50K $50K–$100K $100K–$250K >$250K

9%

13%

14%

18%

19%

27%

54% hold less than $100K

63% of employer rms have outstanding debt.

Securing debt with personal assets is common,

even among higher revenue rms.

COLLATERAL USED

1

TO SECURE DEBT BY REVENUE SIZE OF FIRM (% of employer rms with debt)

Personal assets or guarantee

Business assets

Unsecured

All firms

N=2250

Micro (<$100K)

N=187

$100K–$1M

N=906

$1M–$10M

N=843

>$10M

N=239

63%

51%

26%

46%

68%

75%

16%

30%

16%

9% 9%

55%

62%

74%

58%

1

Select answer choices shown. See appendix for more detail. Respondents could select multiple options.

7

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

DEMAND FOR FINANCING

47% of employer rms applied for nancing.

DEMAND FOR FINANCING N=3454

(% of employer rms)

61% Expand business/

new opportunity

37% Operating expenses

15% Other

24% Renance

REASON(S) FOR APPLYING

2

N=1671

(% of applicants)

53%

Didn't

Apply

47%

Applied

Past

12 Months

1

1

Approximately Q3 2014 through Q3 2015.

2

Respondents could select multiple answers.

3

Growing rms are dened as those with increased revenues over the past 12 months, increased employees over the past 12 months,

and plans to increase or maintain number of employees over the next 12 months.

61% of applicants were borrowing to expand their

business or pursue a new opportunity.

DEMAND FOR FINANCING BY TYPE OF FIRM

Application rate

(% of employer rms)

Expand business/new opportunity

(% of applicants)

Operating expenses

(% of applicants)

All firms

N=3454

Micro (<$100K)

N=391

40%

53%

62%

Startup (0–2 years)

N=326

53%

45%

63%

Growing

3

N=949

55%

70%

31%

Application rate

47%

37%

61%

Reason(s) for applying

8

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

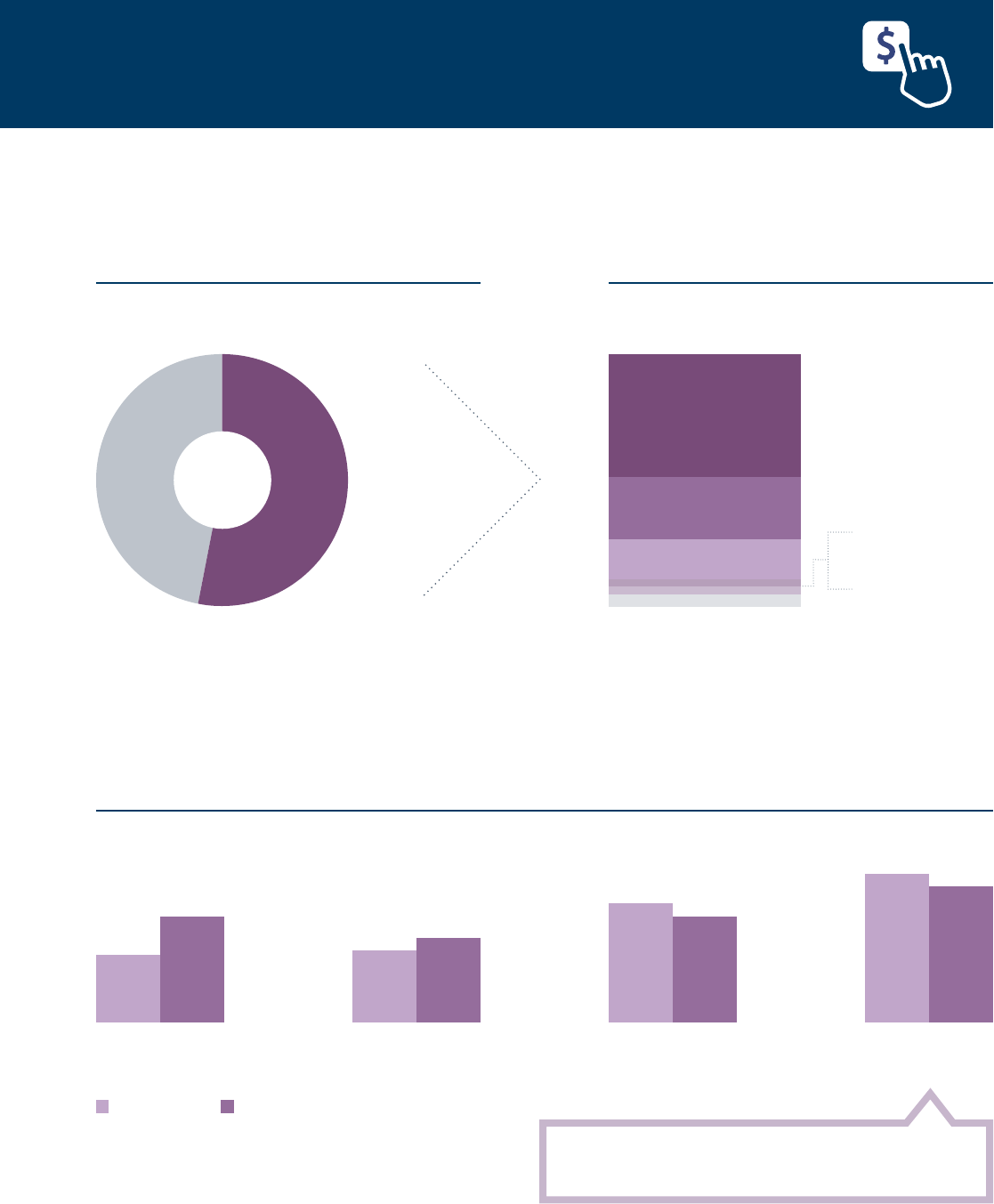

NON-APPLICANTS

53% of employer rms did not apply for nancing.

PRIMARY REASON FOR NOT APPLYING N=1763

(% of non-applicants)

49% Sufcient nancing

25% Debt averse

16% Discouraged

5% Other

3% Search too difcult

3% Credit cost high

53%

Didn't

Apply

47%

Applied

25% of non-applicants did not apply because

they were averse to taking on debt.

Past

12 Months

1

1

Approximately Q3 2014 through Q3 2015.

2

Growing rms are dened as those with increased revenues over the past 12 months, increased employees over the past 12 months,

and plans to increase or maintain number of employees over the next 12 months.

3

Discouraged rms are those that did not apply for nancing because they believed they would be turned down.

DEMAND FOR FINANCING N=3454

(% of employer rms)

DISCOURAGED AND DEBT AVERSE BY TYPE OF FIRM (% of non-applicants)

Discouraged

3

Debt averse

Growing

2

N=401

All firms

N=1763

Startup (0–2 years)

N=152

Micro (<$100K)

N=238

16%

25%

35%

32%

25%

28%

17%

20%

Microbusinesses are less likely to seek nancing,

and more likely to be discouraged and debt averse.

9

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

FINANCING SEARCH

1

Select answer choices shown. See appendix for more detail. Respondents could select multiple options.

2

44% (SBDCs) and 22% (loan brokers)

73% of applicants asked lenders for nancing advice.

TOP SOURCE(S)

1

OF FINANCING ADVICE (% of applicants) N=1762

Banker or lender

Accountant, consultant,

or business advisor

Small Business Develop-

ment Center (SBDC)

Friends, family,

or colleagues

Loan broker

None

Chamber of commerce

or industry association

73%

40%

29%

25%

15%

9%

8%

FINANCING AND CREDIT PRODUCTS

1

SOUGHT (% of applicants) N=1671

Loan/line of credit

Credit cards

Leasing

Trade credit

Equity investment

Factoring

Other

89%

30%

11%

9%

4%

4%

3%

Loans and lines of credit are the most sought-after nancing products.

Microbusinesses (<$100K)

are more likely to seek

advice from multiple

sources, including SBDCs

and loan brokers.

2

10

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

CREDIT APPLICATIONS

1

Select answer choices shown. See appendix for more detail. Respondents could select multiple options.

2

Growing rms are dened as those with increased revenues over the past 12 months, increased employees over the past 12 months,

and plans to increase or maintain number of employees over the next 12 months.

APPLICATIONS

1

FOR LOANS AND LINES OF CREDIT BY TYPE OF FIRM (% of loan/line of credit applicants)

All firms

N=1497

Micro

(<$100K)

N=127

Startup

(0–2 years)

N=145

Growing

2

N=490

Line of credit

Business loan

SBA loan/line of credit

Commerical mortgage

Merchant cash advance

57%

60%

53%

47%

52%

49%

58%

63%

21%

27%

37%

36%

10%

11%

9%

6%

7%

6%

9%

10%

Microbusinesses and startups are more likely to

apply for SBA-backed loans or lines of credit and

merchant cash advances than larger revenue rms.

11

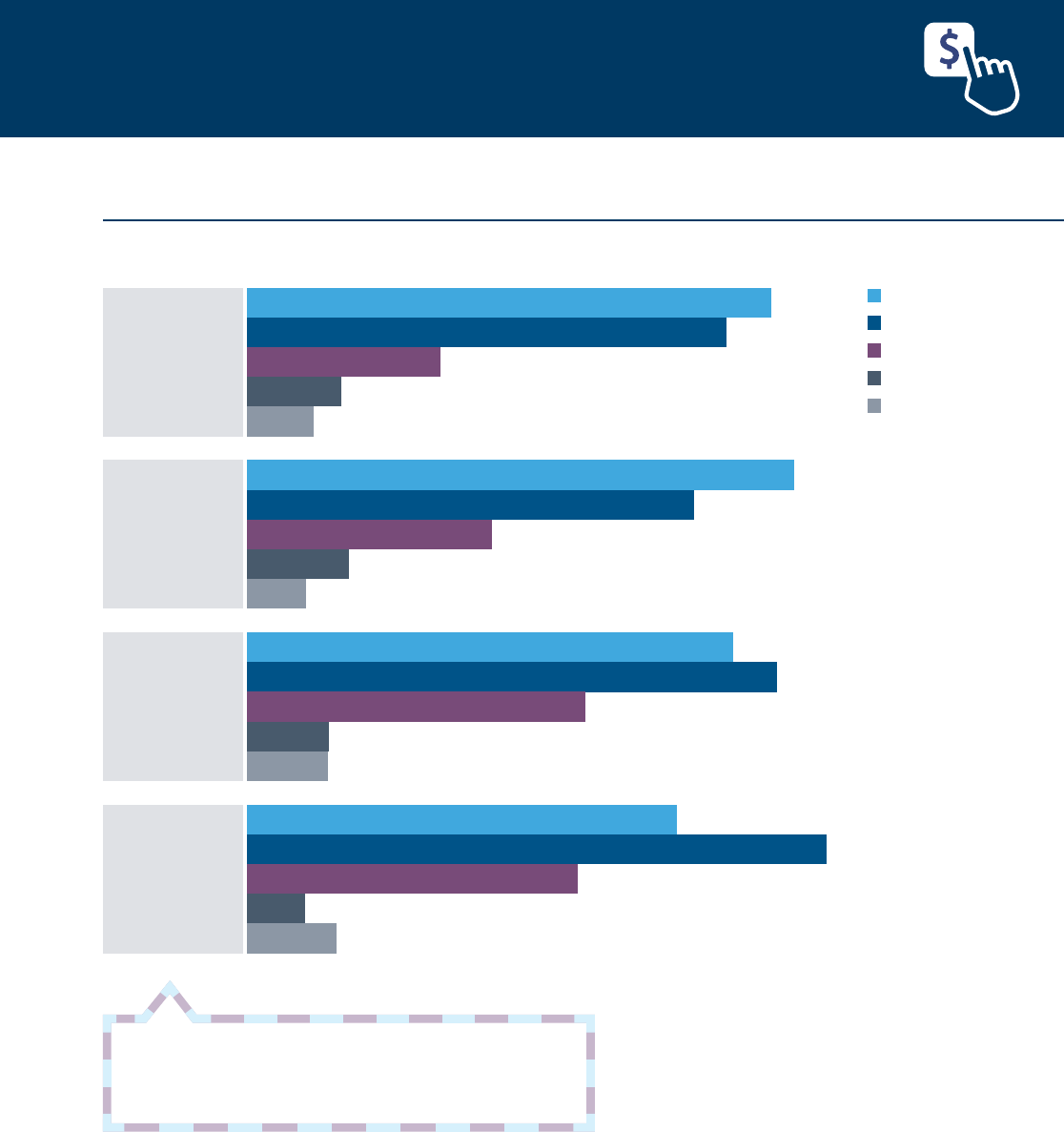

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

CREDIT SOURCES

Employer rms primarily base their application decisions

on relationships with lenders and the price of credit.

TOP TWO FACTORS

1

INFLUENCING WHERE FIRMS APPLY

Micro (<$100K)

N=148

$100K–$1M

N=635

$1M–S10M

N=629

>$10M

N=195

1

2

1

Select answer choices shown. See appendix for more detail. Respondents could select multiple options.

2

"Online lenders" are dened as nonbank alternative and marketplace lenders, including Lending Club, OnDeck, CAN Capital, and PayPal Working Capital.

Banks are the dominant credit source overall but online lending is a

noteworthy source for employer rms with less than $1 million in revenues.

CREDIT SOURCES

1

APPLIED TO BY REVENUE SIZE OF FIRM (% of loan/line of credit applicants)

All firms

N=1487

$100K–$1M

N=564

Micro (<$100K)

N=126

$1M–$10M

N=564

>$10M

N=181

Small bank

Large bank

Online lender

2

Credit union

53%

58%

6%

1%

52%

42%

20%

9%

59%

45%

11%

4%

52%

39%

22%

9%

44%

41%

30%

14%

Price

Perceived chance of being funded

Existing relationship with lender

Microbusinesses are more likely to make application

decisions based on perceived chance of funding.

12

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

79% of employer rms that applied for a loan or line

of credit were approved for at least SOME nancing.

CREDIT OUTCOMES

APPROVAL RATE BY LOAN OR LINE OF CREDIT PRODUCT (% applicants receiving at least some credit)

Auto or equipment loan

N=61

Mortgage

N=178

Line of credit

N=869

Cash advance

N=68

Business loan

N=702

SBA loan/line of credit

N=216

89%

73%

71%

71%

69%

59%

1

Select answer choices shown. See appendix for more detail. Respondents could select multiple options.

2

The observation count ranges from 48 to 869, depending on the source and type of nancing.

Applicants had greater success at small banks than large banks.

APPROVAL RATE BY SELECT

1

SOURCE AND TYPE OF LOAN/LINE OF CREDIT N=48–869

2

(% applicants receiving at least some credit)

All Firms Micro (<$100K) $100K–$1M $1M–$10M >$10M

Source

Large bank 58% 33% 49% 72% 88%

Small bank 76% 60% 69% 88% 96%

Type

Business loan 69% 54% 65% 81% 92%

Line of credit 71% 55% 65% 82% 91%

MIDDLE PERCENTILETOP PERCENTILE BOTTOM PERCENTILE

Microbusinesses and rms with $100K–$1M in revenue had

much greater diculty obtaining credit than larger rms.

13

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

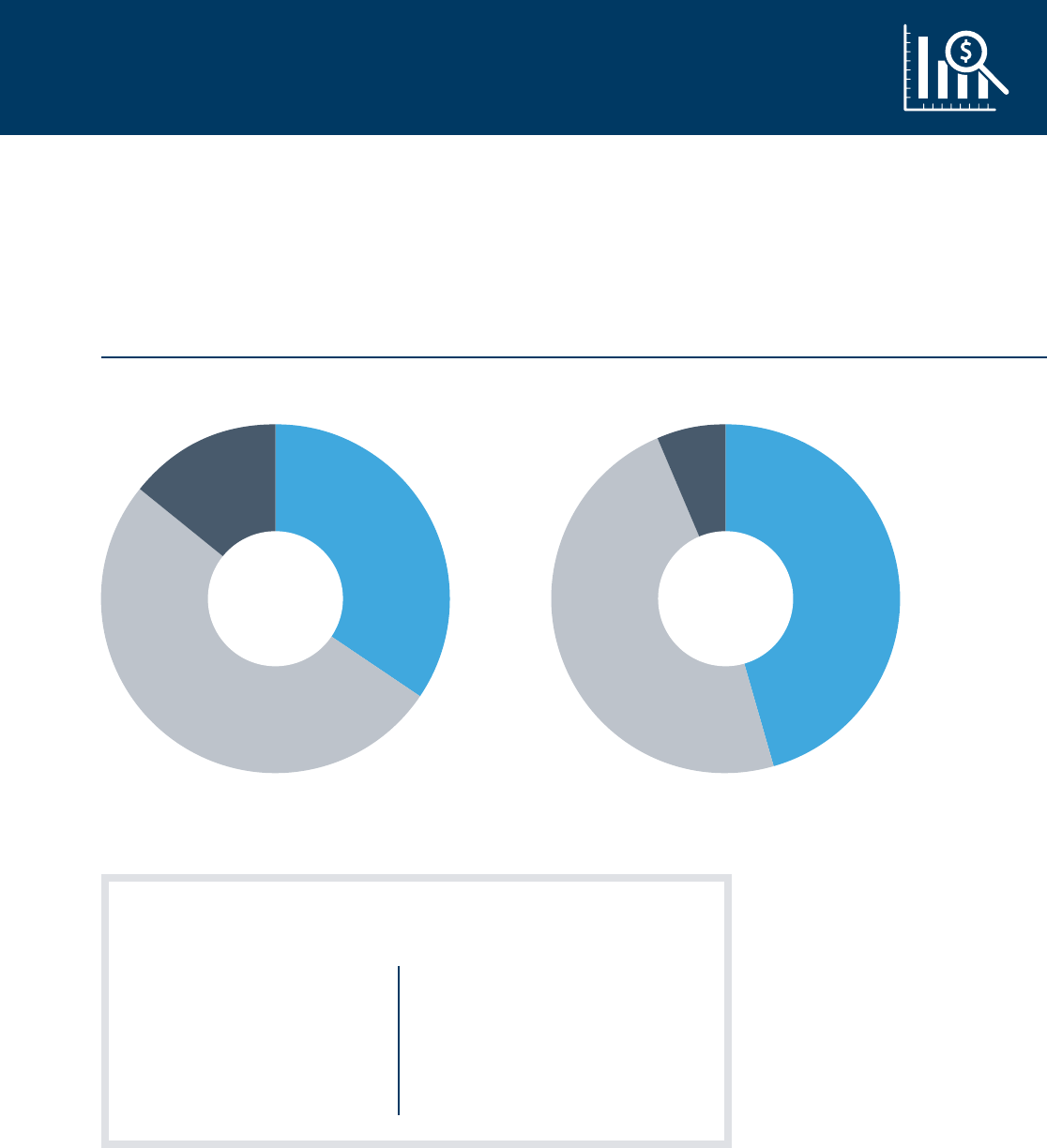

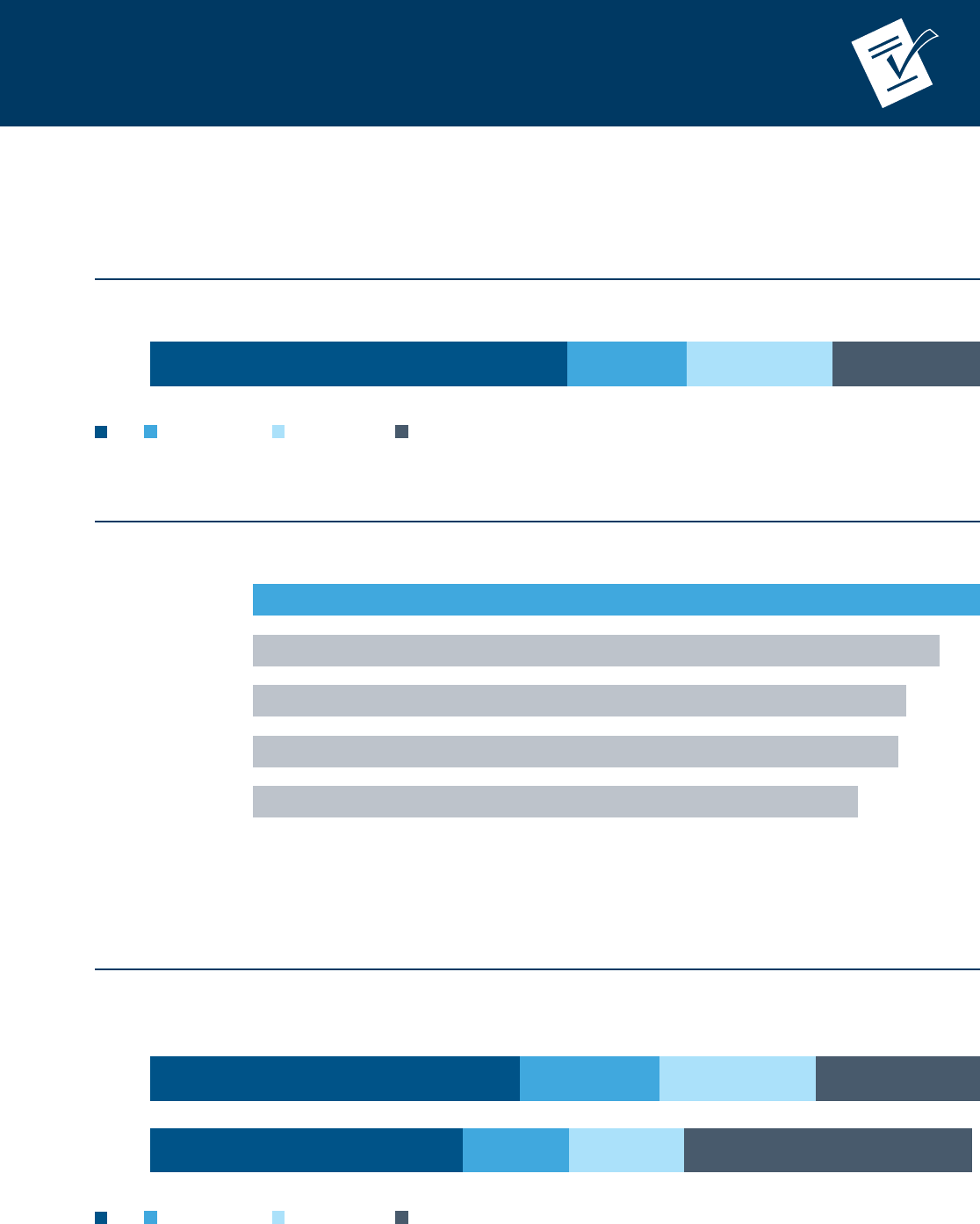

FINANCING APPROVAL

50% of applicants were approved for the full amount of nancing.

1

Firms that were unsure how much they were approved for are excluded from the chart. In 2014, the approval rate pertained

to applications submitted in the rst half of the year. In 2015, the time period was the previous twelve months.

TOTAL FINANCING APPROVED, 2015 Survey (% of applicants)

1

2015

N=1580

18%18%14%50%

All

Most (>=50%)

Some (<50%)

None

Survey responses show greater success in 2015 than in 2014.

2015

N=997

2014

N=574

20%19%17%45%

35%14%13%38%

All

Most (>=50%)

Some (<50%)

None

TOTAL FINANCING APPROVED, 2015 Survey versus 2014 Survey (% of applicants)

1

Limited to states surveyed in both years

APPROVAL RATE BY FINANCIAL PRODUCT, 2015 Survey (% of applicants approved for at least some nancing)

Leasing

N=209

Trade credit

N=159

Credit card

N=373

Loan or line of credit

N=1428

Equity

N=68

89%

84%

80%

79%

74%

14

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

LENDER SATISFACTION

Applicants that were approved for nancing from

small banks reported the highest satisfaction.

LENDER SATISFACTION SCORE

1

(% of rms approved at source)

Small bank

N=619

Credit union

N=46

Large bank

N=424

Online lender

2

N=140

Other

3

N=117

75%

56%

51%

33%

15%

Dissatised rms reported issues with banks’ application

processes and online lenders’ interest rates.

1

Satisfaction score is the share satised with lender minus the share dissatised.

2

"Online lenders" are dened as alternative and marketplace lenders, including Lending Club, OnDeck, CAN Capital, and PayPal Working Capital.

3

"Other" includes government loan funds and community development nancial institutions.

4

Respondents could select multiple options.

5

Select answer choices shown due to low observation count.

SUCCESSFUL APPLICANTS' REASON(S) FOR DISSATISFACTION,

4

Select Lenders

5

(% of employer rms dissatised with lender)

Online lender

N=67

Small bank

N=119

Large bank

N=217

Lack of

transparency

Long wait for

credit decision

Difficult application

process

Unfavorable

repayment terms

High interest rate

33%

45%

32%

22%

22%

43%

51%

16%

18%

21%

51%

70%

52%

15%

15%

15

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

FINANCING SHORTFALLS

50% of applicants had a nancing shortfall, meaning

they received less nancing than the amount sought.

APPLICATION OUTCOMES BY SIZE OF FIRM (% of applicants)

>$10M

N=191

$1M–$10M

N=601

$100K–$1M

N=595

Micro (<$100K)

N=137

27% 73%

37% 63%

55% 45%

63% 37%

All firms

N=1580

50%

50%

Financing shortfall

Fully funded

Microbusinesses had the largest unmet need.

16

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

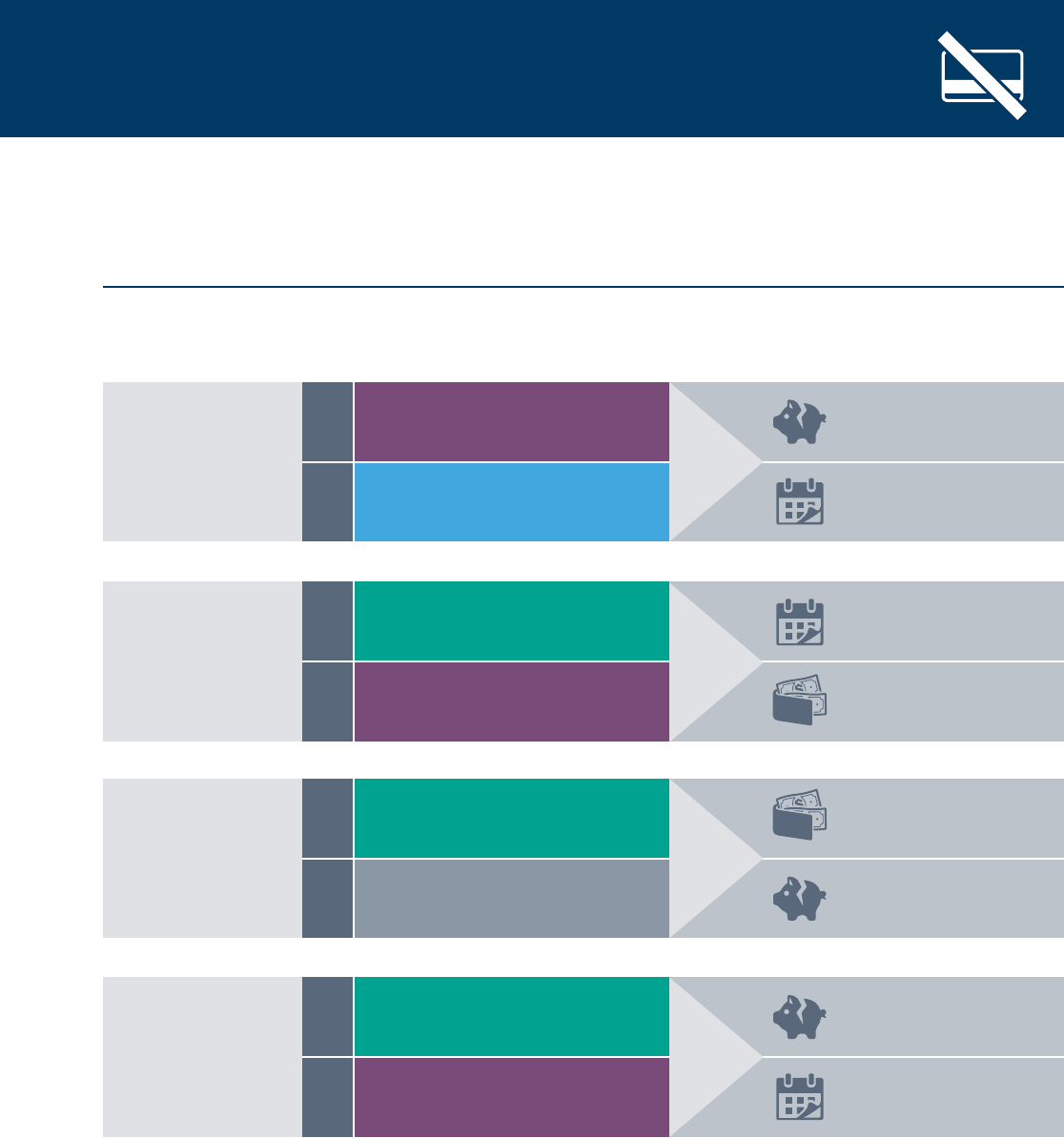

FINANCING SHORTFALLS (CONTINUED)

TOP TWO REASONS

1

FOR DENIAL AND TOP TWO

1

EFFECTS OF DENIAL

Unable to meet expenses

Delayed expansion

Used personal funds

Unable to meet expenses

Delayed expansion

Used personal funds

Unable to meet expenses

Delayed expansion

Reported impact on businessTop reasons for credit denial

Insufficient collateral

Insufficient credit history

Insufficient credit history

Insufficient credit history

Weak business performance

Insufficient collateral

Other

3

Insufficient collateral

All rms

(N=445)

Growing

2

(N=141)

Startup (0–2 years)

(N=62)

Micro (<$100K)

(N=48)

Insucient collateral is the top barrier to obtaining nancing.

1

2

1

2

1

2

1

2

1

Select answer choices shown. See appendix for more detail. Respondents could select multiple options.

2

Growing rms are dened as those with increased revenues over the past 12 months, increased employees over the past 12 months,

and plans to increase or maintain number of employees over the next 12 months.

3

"Other” includes owner’s personal credit worthiness and length of time in operation.

17

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

METHODOLOGY

OVERVIEW

The Small Business Credit Survey

(SBCS) is a convenience survey con-

ducted by the Federal Reserve Banks

of New York, Atlanta, Boston, Cleveland,

Philadelphia, Richmond, and St. Louis.

The SBCS reports information about

the business performance, nancing

needs and choices, and borrowing

experiences of businesses with fewer

than 500 employees.

In total, 3,459 employer rms responded

to the survey, which was elded between

September 28, 2015 and November

27, 2015. 1,961 responses from non-

employers were also captured, but are

not featured in this report. A separate

non-employer report reporting on is-

sues specic to non-employers will be

released later this year. The results are

weighted to reflect the full population

of small businesses in the 26 states

of coverage

1

along the dimensions of

industry, age, and employee size.

DATA COLLECTION

The SBCS is a convenience survey of

establishments. Businesses are con-

tacted by email through organizations

that serve the small business community

in participating Federal Reserve Districts.

The survey is conducted online and typi-

cally takes 6 to 12 minutes to complete,

depending upon the intensity of a rm’s

search for nancing. Likewise, the num-

ber of responses for each question varies

according to how many rms received

and completed a particular question.

WEIGHTING

The SBCS is not a random sample of

small employer rms, and therefore

suffers from a greater set of biases than

surveys that contact rms randomly. We

attempt to correct for biases resulting

from the convenience sample by weight-

ing the results by industry, age, and

employee size so that the distribution of

rms in the survey match the distribu-

tion of the small (1 to 500 employees)

rm population in the coverage area.

Still, caution should be taken when

interpreting the results. The data are

not a statistical representation of small

businesses. The data used for weighting

comes from 2013 demographic data

collected by the US Census Bureau.

2

COMPARISONS TO 2014 REPORT

In last year’s report (https://www.newy-

orkfed.org/smallbusiness/joint-small-

business-credit-survey-2014.html) both

employer and non-employer rms were

included in the results. This year’s report

features only employer rms. Therefore

comparisons between this year’s report

and last year’s should not be made. For

comparisons of 2014 and 2015 data see

pages 3 and 13 of the report. The 2014

data on these pages feature only em-

ployer rm data from 2014 and the 2015

data are restricted to include states that

are present in both survey years, allowing

for direct comparison.

1

See Demographics section for a complete list.

2

Age of rm data come from Business Dynamics Statistics. Industry and employee size data are from County Business Patterns.

18

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

APPENDIX

A. BUSINESS CONDITIONS

All Employer Firms Growth Stage

Weighted percent Not growing Growing

N=3459 N=2347 N=949

PROFITABILITY, END OF 2014

At a loss 24% 24% 22%

Break even 21% 24% 15%

At a prot 55% 52% 63%

REVENUE CHANGE, PAST 12 MONTHS

Decreased 24% 33% 0%

No change 22% 31% 0%

Increased 54% 36% 100%

EMPLOYEE CHANGE, PAST 12 MONTHS

Decreased 14% 20% 0%

No change 51% 72% 0%

Increased 34% 8% 100%

EXPECTED REVENUE CHANGE, NEXT 12 MONTHS

Will decrease 9% 13% 1%

No change 19% 24% 7%

Will increase 72% 64% 93%

EXPECTED EMPLOYEE CHANGE, NEXT 12 MONTHS

Will decrease 7% 9% 0%

No change 48% 56% 29%

Will increase 45% 35% 71%

TOP BUSINESS CHALLENGE

Government regulations 10% 10% 9%

Taxes 9% 10% 8%

Credit availability 9% 8% 12%

Cash flow 22% 21% 23%

Costs of running business 19% 19% 16%

Revenues/sales 13% 15% 6%

Hiring and/or retaining qualied staff 17% 15% 24%

Other 2% 2% 3%

Data with fewer than 45 observations are not shown.

19

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

A. BUSINESS CONDITIONS (CONTINUED)

APPENDIX (CONTINUED)

Firm Age

0–2 years 3–5 years 6–10 years 11+ years

N=326 N=353 N=517 N=2263

PROFITABILITY, END OF 2014

At a loss 52% 28% 17% 15%

Break even 18% 25% 21% 22%

At a prot 30% 47% 62% 64%

REVENUE CHANGE, PAST 12 MONTHS

Decreased 12% 18% 25% 30%

No change 22% 19% 17% 25%

Increased 66% 63% 58% 45%

EMPLOYEE CHANGE, PAST 12 MONTHS

Decreased 10% 14% 13% 17%

No change 44% 44% 49% 58%

Increased 46% 42% 38% 25%

EXPECTED REVENUE CHANGE, NEXT 12 MONTHS

Will decrease 4% 5% 8% 13%

No change 8% 10% 17% 29%

Will increase 88% 86% 76% 58%

EXPECTED EMPLOYEE CHANGE, NEXT 12 MONTHS

Will decrease 3% 3% 6% 9%

No change 35% 39% 45% 58%

Will increase 62% 58% 49% 32%

TOP BUSINESS CHALLENGE

Government regulations 4% 8% 7% 14%

Taxes 9% 7% 10% 10%

Credit availability 13% 18% 7% 5%

Cash flow 25% 30% 23% 17%

Costs of running business 23% 12% 15% 20%

Revenues/sales 10% 10% 14% 14%

Hiring and/or retaining qualied staff 15% 13% 20% 19%

Other 2% 2% 3% 2%

Data with fewer than 45 observations are not shown.

20

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

A. BUSINESS CONDITIONS (CONTINUED)

APPENDIX (CONTINUED)

Number of Employees

1–9 employees 10–49 employees 50+ employees

N=1838 N=1250 N=371

PROFITABILITY, END OF 2014

At a loss 26% 19% 8%

Break even 23% 19% 11%

At a prot 51% 63% 81%

REVENUE CHANGE, PAST 12 MONTHS

Decreased 24% 24% 20%

No change 24% 18% 11%

Increased 52% 58% 69%

EMPLOYEE CHANGE, PAST 12 MONTHS

Decreased 13% 18% 16%

No change 57% 39% 25%

Increased 30% 44% 59%

EXPECTED REVENUE CHANGE, NEXT 12 MONTHS

Will decrease 9% 9% 12%

No change 19% 20% 16%

Will increase 72% 72% 72%

EXPECTED EMPLOYEE CHANGE, NEXT 12 MONTHS

Will decrease 6% 8% 12%

No change 51% 41% 32%

Will increase 43% 51% 56%

TOP BUSINESS CHALLENGE

Government regulations 8% 11% 25%

Taxes 10% 9% 5%

Credit availability 9% 8% 5%

Cash flow 25% 17% 8%

Costs of running business 20% 16% 14%

Revenues/sales 13% 13% 10%

Hiring and/or retaining qualied staff 14% 25% 32%

Other 2% 2% 2%

Data with fewer than 45 observations are not shown.

21

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

A. BUSINESS CONDITIONS (CONTINUED)

APPENDIX (CONTINUED)

Annual Revenues

<$100K $100K–$1M $1M–$10M >$10M

N=391 N=1368 N=1198 N=340

PROFITABILITY, END OF 2014

At a loss 47% 22% 12% 11%

Break even 26% 23% 17% 10%

At a prot 26% 55% 71% 79%

REVENUE CHANGE, PAST 12 MONTHS

Decreased 19% 26% 27% 22%

No change 23% 21% 21% 19%

Increased 58% 53% 53% 59%

EMPLOYEE CHANGE, PAST 12 MONTHS

Decreased 11% 15% 17% 17%

No change 50% 56% 46% 33%

Increased 38% 30% 37% 50%

EXPECTED REVENUE CHANGE, NEXT 12 MONTHS

Will decrease 6% 9% 12% 11%

No change 11% 22% 22% 23%

Will increase 83% 69% 66% 66%

EXPECTED EMPLOYEE CHANGE, NEXT 12 MONTHS

Will decrease 5% 6% 9% 9%

No change 40% 52% 48% 41%

Will increase 56% 42% 43% 49%

TOP BUSINESS CHALLENGE

Government regulations 4% 8% 15% 22%

Taxes 7% 11% 9% 7%

Credit availability 13% 9% 7% 5%

Cash flow 26% 26% 16% 6%

Costs of running business 22% 17% 17% 19%

Revenues/sales 16% 11% 13% 13%

Hiring and/or retaining qualied staff 9% 16% 24% 27%

Other 3% 2% 1% 2%

Data with fewer than 45 observations are not shown.

22

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

A. BUSINESS CONDITIONS (CONTINUED)

APPENDIX (CONTINUED)

Industry

Non-manufacturing

goods production &

associated services

Manufacturing

Retail

Leisure and hospitality

Finance and insurance

Healthcare and education

Professional services

and real estate

Business support and

consumer services

N=

689

N=

581

N=

502

N=

281

N=

114

N=

244

N=

705

N=

343

PROFITABILITY, END OF 2014

At a loss 20% 26% 28% 37% 10% 28% 19% 23%

Break even 22% 18% 24% 23% 14% 20% 20% 24%

At a prot 57% 57% 48% 40% 76% 52% 62% 53%

REVENUE CHANGE, PAST 12 MONTHS

Decreased 28% 32% 31% 22% 17% 21% 20% 21%

No change 22% 21% 26% 17% 31% 17% 21% 22%

Increased 50% 47% 43% 62% 52% 62% 59% 58%

EMPLOYEE CHANGE, PAST 12 MONTHS

Decreased 14% 18% 16% 18% 11% 14% 13% 14%

No change 52% 46% 61% 50% 62% 42% 48% 51%

Increased 34% 35% 23% 32% 27% 44% 39% 36%

EXPECTED REVENUE CHANGE, NEXT 12 MONTHS

Will decrease 11% 12% 12% 6% 13% 5% 9% 8%

No change 21% 22% 24% 15% 21% 14% 18% 20%

Will increase 68% 66% 64% 79% 66% 81% 74% 72%

EXPECTED EMPLOYEE CHANGE, NEXT 12 MONTHS

Will decrease 7% 9% 9% 6% 7% 4% 6% 6%

No change 47% 47% 61% 46% 62% 42% 44% 42%

Will increase 45% 44% 31% 48% 31% 53% 50% 52%

TOP BUSINESS CHALLENGE

Government regulations 11% 7% 4% 8% 25% 14% 10% 7%

Taxes 9% 10% 12% 8% 11% 6% 8% 11%

Credit availability 12% 7% 7% 13% 2% 11% 8% 7%

Cash flow 23% 22% 26% 18% 12% 26% 20% 21%

Costs of running business 17% 13% 21% 24% 15% 19% 14% 21%

Revenues/sales 10% 24% 17% 10% 13% 9% 17% 8%

Hiring and/or retaining qualied staff 17% 13% 13% 14% 22% 12% 20% 25%

Other 2% 4% 1% 5% 0% 2% 3% 1%

Data with fewer than 45 observations are not shown.

23

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

APPENDIX (CONTINUED)

B. OUTSTANDING DEBT AND STARTUP FUNDING

All Employer Firms Growth Stage

Weighted percent Not growing Growing

Share with outstanding debt 63% 61% 65%

AMOUNT OF OUTSTANDING DEBT

Less than $10K 9% 10% 8%

$10K–$25K 13% 13% 13%

$25K–$50K 14% 15% 13%

$50K–$100K 18% 18% 18%

$100K–$250K 19% 19% 21%

$250K–$500K 11% 10% 10%

$500K–$1M 7% 7% 8%

$1M–$2M 4% 5% 4%

Over $2M 5% 4% 5%

COLLATERAL USED TO SECURE DEBT

Personal assets or guarantee 63% 62% 68%

Business assets 51% 51% 49%

Portions of future sales 8% 8% 7%

Unsure 1% 1% 1%

None 16% 16% 16%

Other 5% 4% 6%

FUNDING USED DURING FIRST

TWO YEARS OF OPERATIONS

Retained business earnings 30% 31% 29%

Personal funds of owner(s) 53% 52% 56%

External nancing 17% 17% 15%

Data with fewer than 45 observations are not shown.

24

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

B. OUTSTANDING DEBT AND STARTUP FUNDING (CONTINUED)

APPENDIX (CONTINUED)

Firm Age

0–2 years 3–5 years 6–10 years 11+ years

Share with outstanding debt 61% 67% 61% 63%

AMOUNT OF OUTSTANDING DEBT

Less than $10K 14% 13% 8% 5%

$10K–$25K 19% 16% 14% 9%

$25K–$50K 12% 17% 17% 13%

$50K–$100K 17% 21% 15% 19%

$100K–$250K 20% 17% 22% 18%

$250K–$500K 9% 8% 11% 13%

$500K–$1M 6% 2% 6% 10%

$1M–$2M 2% 4% 4% 6%

Over $2M 1% 4% 1% 8%

COLLATERAL USED TO SECURE DEBT

Personal assets or guarantee 64% 60% 67% 63%

Business assets 42% 34% 48% 61%

Portions of future sales 9% 7% 10% 6%

Unsure 1% 0% 2% 1%

None 16% 24% 16% 13%

Other 6% 5% 4% 4%

FUNDING USED DURING FIRST

TWO YEARS OF OPERATIONS

Retained business earnings 31% 37% 32% 27%

Personal funds of owner(s) 55% 50% 53% 53%

External nancing 14% 14% 15% 20%

Data with fewer than 45 observations are not shown.

25

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

B. OUTSTANDING DEBT AND STARTUP FUNDING (CONTINUED)

APPENDIX (CONTINUED)

Number of Employees

1–9 employees 10–49 employees 50+ employees

Share with outstanding debt 60% 70% 75%

AMOUNT OF OUTSTANDING DEBT

Less than $10K 12% 3% 2%

$10K–$25K 16% 6% 3%

$25K–$50K 18% 7% 2%

$50K–$100K 21% 13% 5%

$100K–$250K 18% 23% 12%

$250K–$500K 9% 18% 11%

$500K–$1M 4% 13% 14%

$1M–$2M 1% 9% 17%

Over $2M 1% 8% 35%

COLLATERAL USED TO SECURE DEBT

Personal assets or guarantee 60% 73% 65%

Business assets 44% 65% 77%

Portions of future sales 8% 8% 8%

Unsure 1% 1% 1%

None 19% 10% 6%

Other 5% 4% 5%

FUNDING USED DURING FIRST

TWO YEARS OF OPERATIONS

Retained business earnings 32% 27% 23%

Personal funds of owner(s) 53% 52% 53%

External nancing 15% 21% 24%

Data with fewer than 45 observations are not shown.

26

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

B. OUTSTANDING DEBT AND STARTUP FUNDING (CONTINUED)

APPENDIX (CONTINUED)

Annual Revenues

<$100K $100K–$1M $1M–$10M >$10M

Share with outstanding debt 50% 66% 68% 70%

AMOUNT OF OUTSTANDING DEBT

Less than $10K 23% 8% 2% 6%

$10K–$25K 24% 15% 4% 4%

$25K–$50K 18% 19% 5% 5%

$50K–$100K 13% 23% 16% 3%

$100K–$250K 16% 21% 21% 11%

$250K–$500K 3% 8% 21% 8%

$500K–$1M 1% 5% 15% 11%

$1M–$2M 1% 2% 9% 15%

Over $2M 1% 1% 7% 38%

COLLATERAL USED TO SECURE DEBT

Personal assets or guarantee 55% 62% 74% 58%

Business assets 26% 46% 68% 75%

Portions of future sales 6% 8% 7% 9%

Unsure 3% 1% 1% 0%

None 30% 16% 9% 9%

Other 7% 4% 6% 2%

FUNDING USED DURING FIRST

TWO YEARS OF OPERATIONS

Retained business earnings 30% 33% 29% 23%

Personal funds of owner(s) 60% 51% 50% 48%

External nancing 10% 17% 21% 29%

Data with fewer than 45 observations are not shown.

27

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

B. OUTSTANDING DEBT AND STARTUP FUNDING (CONTINUED)

APPENDIX (CONTINUED)

Industry

Non-manufacturing

goods production &

associated services

Manufacturing

Retail

Leisure and hospitality

Finance and insurance

Healthcare and education

Professional services

and real estate

Business support and

consumer services

Share with outstanding debt 64% 73% 71% 69% 43% 63% 55% 63%

AMOUNT OF OUTSTANDING DEBT

Less than $10K 4% 3% 5% 6% – 13% 12% 16%

$10K–$25K 11% 5% 12% 14% – 17% 15% 11%

$25K–$50K 13% 9% 14% 17% – 10% 14% 20%

$50K–$100K 21% 10% 21% 16% – 18% 15% 17%

$100K–$250K 19% 23% 23% 16% – 17% 19% 18%

$250K–$500K 12% 16% 12% 12% – 11% 10% 9%

$500K–$1M 9% 14% 7% 9% – 4% 6% 6%

$1M–$2M 5% 10% 2% 6% – 6% 4% 2%

Over $2M 6% 11% 4% 5% – 4% 5% 1%

COLLATERAL USED TO SECURE DEBT

Personal assets or guarantee 65% 66% 68% 66% 55% 56% 64% 61%

Business assets 54% 72% 52% 52% 52% 46% 46% 47%

Portions of future sales 10% 6% 8% 8% 8% 6% 7% 7%

Unsure 2% 1% 0% 1% 0% 4% 1% 0%

None 12% 9% 15% 14% 19% 23% 18% 16%

Other 5% 6% 3% 7% 2% 5% 4% 5%

FUNDING USED DURING FIRST

TWO YEARS OF OPERATIONS

Retained business earnings 26% 20% 32% 30% 31% 30% 33% 32%

Personal funds of owner(s) 56% 59% 47% 53% 50% 53% 54% 53%

External nancing 19% 21% 21% 17% 19% 17% 13% 15%

Data with fewer than 45 observations are not shown.

28

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

APPENDIX (CONTINUED)

C. NON-APPLICANTS

All Employer Firms Growth Stage

Weighted percent Not growing Growing

PRIMARY REASON FOR NOT APPLYING,

NON-APPLICANTS

Sufcient nancing 49% 47% 54%

Discouraged 16% 16% 17%

Debt averse 25% 27% 20%

Credit cost high 3% 2% 2%

Search too difcult 3% 3% 2%

Other 5% 5% 5%

SOURCE(S) OF FINANCING ADVICE,

NON-APPLICANTS

Accountant, consultant, or business advisor 28% 26% 32%

Loan broker 2% 2% 4%

Banker or lender 24% 22% 28%

Friends, family, or colleagues 15% 14% 18%

Chamber of commerce or industry association 5% 4% 5%

SBDC (Small Business Development Center) 14% 12% 22%

Other source of advice 2% 2% 2%

None 50% 53% 45%

SCORE (Service Corps of Retired Executives) 3% 3% 3%

Data with fewer than 45 observations are not shown.

29

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

C. NON-APPLICANTS (CONTINUED)

APPENDIX (CONTINUED)

Firm Age

0–2 years 3–5 years 6–10 years 11+ years

PRIMARY REASON FOR NOT APPLYING,

NON-APPLICANTS

Sufcient nancing 35% 37% 46% 58%

Discouraged 28% 20% 22% 9%

Debt averse 25% 31% 26% 24%

Credit cost high 2% 5% 2% 2%

Search too difcult 4% 4% 2% 2%

Other 7% 4% 3% 6%

SOURCE(S) OF FINANCING ADVICE,

NON-APPLICANTS

Accountant, consultant, or business advisor 28% 35% 27% 26%

Loan broker 3% 1% 4% 2%

Banker or lender 22% 20% 26% 24%

Friends, family, or colleagues 24% 25% 18% 8%

Chamber of commerce or industry association 5% 8% 7% 3%

SBDC (Small Business Development Center) 29% 21% 14% 7%

Other source of advice 1% 3% 3% 2%

None 36% 43% 50% 58%

SCORE (Service Corps of Retired Executives) 5% 6% 1% 1%

Data with fewer than 45 observations are not shown.

30

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

C. NON-APPLICANTS (CONTINUED)

APPENDIX (CONTINUED)

Number of Employees

1–9 employees 10–49 employees 50+ employees

PRIMARY REASON FOR NOT APPLYING,

NON-APPLICANTS

Sufcient nancing 45% 57% 78%

Discouraged 18% 12% 3%

Debt averse 27% 21% 14%

Credit cost high 3% 3% 0%

Search too difcult 3% 2% 2%

Other 5% 5% 4%

SOURCE(S) OF FINANCING ADVICE,

NON-APPLICANTS

Accountant, consultant, or business advisor 27% 30% 29%

Loan broker 3% 2% 1%

Banker or lender 21% 33% 34%

Friends, family, or colleagues 16% 13% 6%

Chamber of commerce or industry association 5% 5% 3%

SBDC (Small Business Development Center) 15% 11% 11%

Other source of advice 2% 3% 1%

None 52% 45% 50%

SCORE (Service Corps of Retired Executives) 3% 3% 0%

Data with fewer than 45 observations are not shown.

31

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

C. NON-APPLICANTS (CONTINUED)

APPENDIX (CONTINUED)

Annual Revenues

<$100K $100K–$1M $1M–$10M >$10M

PRIMARY REASON FOR NOT APPLYING,

NON-APPLICANTS

Sufcient nancing 22% 49% 66% 71%

Discouraged 35% 14% 8% 11%

Debt averse 32% 28% 18% 15%

Credit cost high 3% 3% 2% 0%

Search too difcult 2% 3% 2% 0%

Other 6% 4% 5% 4%

SOURCE(S) OF FINANCING ADVICE,

NON-APPLICANTS

Accountant, consultant, or business advisor 27% 25% 31% 31%

Loan broker 4% 2% 1% 1%

Banker or lender 19% 22% 32% 34%

Friends, family, or colleagues 25% 13% 10% 10%

Chamber of commerce or industry association 8% 4% 4% 5%

SBDC (Small Business Development Center) 26% 10% 10% 3%

Other source of advice 1% 2% 2% 2%

None 44% 56% 48% 50%

SCORE (Service Corps of Retired Executives) 6% 2% 1% 0%

Data with fewer than 45 observations are not shown.

32

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

C. NON-APPLICANTS (CONTINUED)

APPENDIX (CONTINUED)

Industry

Non-manufacturing

goods production &

associated services

Manufacturing

Retail

Leisure and hospitality

Finance and insurance

Healthcare and education

Professional services

and real estate

Business support and

consumer services

PRIMARY REASON FOR NOT APPLYING,

NON-APPLICANTS

Sufcient nancing 50% 45% 41% 43% 67% 52% 50% 45%

Discouraged 18% 12% 17% 19% 9% 18% 17% 14%

Debt averse 23% 30% 33% 24% 16% 22% 26% 26%

Credit cost high 2% 3% 2% 3% 2% 2% 3% 2%

Search too difcult 3% 3% 2% 4% 0% 1% 1% 7%

Other 5% 6% 5% 7% 6% 4% 3% 6%

SOURCE(S) OF FINANCING ADVICE,

NON-APPLICANTS

Accountant, consultant, or business advisor 25% 29% 32% 22% 27% 34% 29% 23%

Loan broker 2% 1% 3% 4% 3% 2% 3% 1%

Banker or lender 30% 31% 22% 24% 20% 19% 25% 20%

Friends, family, or colleagues 12% 12% 14% 21% 7% 23% 16% 14%

Chamber of commerce or industry association 4% 4% 3% 4% 5% 7% 5% 6%

SBDC (Small Business Development Center) 12% 11% 11% 28% 9% 19% 10% 16%

Other source of advice 2% 2% 2% 3% 1% 1% 3% 1%

None 54% 48% 50% 45% 57% 44% 53% 51%

SCORE (Service Corps of Retired Executives) 1% 3% 2% 2% 3% 2% 3% 4%

Data with fewer than 45 observations are not shown.

33

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

APPENDIX (CONTINUED)

D. DEMAND FOR FINANCING

All Employer Firms Growth Stage

Weighted percent Not growing Growing

Share that applied for nancing

47%

43%

55%

REASON(S) FOR SEEKING FINANCING

Operating expenses 37% 40% 31%

Renance 24% 27% 18%

Other reason 15% 14% 16%

Expand business/new opportunity 61% 56% 70%

SOURCE(S) OF FINANCING ADVICE, APPLICANTS

Accountant, consultant, or business advisor 40% 39% 44%

Loan broker 15% 15% 17%

Banker or lender 73% 73% 76%

Friends, family, or colleagues 25% 24% 26%

Chamber of commerce or industry association 8% 8% 9%

SBDC (Small Business Development Center) 29% 25% 36%

Other source of advice 5% 4% 5%

None 9% 10% 6%

SCORE (Service Corps of Retired Executives) 5% 6% 3%

FACTOR(S) INFLUENCING APPLICATION DECISION

Existing relationship with lender 55% 57% 51%

Cost 54% 54% 55%

Flexibility of the credit product(s) 37% 37% 37%

Speed of the decision process 35% 34% 36%

Ease of the application process 37% 38% 38%

Perceived chance of being funded 40% 38% 42%

Other 4% 3% 5%

Data with fewer than 45 observations are not shown.

34

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

D. DEMAND FOR FINANCING (CONTINUED)

APPENDIX (CONTINUED)

Firm Age

0–2 years 3–5 years 6–10 years 11+ years

Share that applied for nancing 53% 55% 43% 43%

REASON(S) FOR SEEKING FINANCING

Operating expenses 45% 39% 40% 30%

Renance 17% 22% 30% 27%

Other reason 19% 7% 13% 16%

Expand business/new opportunity 63% 72% 59% 57%

SOURCE(S) OF FINANCING ADVICE, APPLICANTS

Accountant, consultant, or business advisor 37% 38% 39% 43%

Loan broker 18% 14% 23% 11%

Banker or lender 73% 72% 75% 73%

Friends, family, or colleagues 42% 26% 25% 14%

Chamber of commerce or industry association 13% 9% 8% 6%

SBDC (Small Business Development Center) 44% 41% 29% 15%

Other source of advice 5% 6% 5% 4%

None 5% 6% 6% 13%

SCORE (Service Corps of Retired Executives) 7% 8% 4% 2%

FACTOR(S) INFLUENCING APPLICATION DECISION

Existing relationship with lender 39% 49% 54% 66%

Cost 53% 53% 53% 56%

Flexibility of the credit product(s) 36% 42% 39% 34%

Speed of the decision process 39% 35% 35% 33%

Ease of the application process 37% 37% 41% 35%

Perceived chance of being funded 48% 42% 46% 32%

Other 4% 4% 5% 2%

Data with fewer than 45 observations are not shown.

35

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

D. DEMAND FOR FINANCING (CONTINUED)

APPENDIX (CONTINUED)

Number of Employees

1–9 employees 10–49 employees 50+ employees

Share that applied for nancing 43% 56% 59%

REASON(S) FOR SEEKING FINANCING

Operating expenses 40% 33% 22%

Renance 24% 25% 23%

Other reason 14% 15% 19%

Expand business/new opportunity 61% 63% 62%

SOURCE(S) OF FINANCING ADVICE, APPLICANTS

Accountant, consultant, or business advisor 38% 44% 49%

Loan broker 17% 12% 13%

Banker or lender 71% 77% 80%

Friends, family, or colleagues 27% 22% 13%

Chamber of commerce or industry association 10% 7% 3%

SBDC (Small Business Development Center) 32% 23% 13%

Other source of advice 6% 4% 2%

None 9% 8% 11%

SCORE (Service Corps of Retired Executives) 5% 4% 0%

FACTOR(S) INFLUENCING APPLICATION DECISION

Existing relationship with lender 50% 62% 73%

Cost 51% 59% 65%

Flexibility of the credit product(s) 37% 37% 36%

Speed of the decision process 35% 35% 33%

Ease of the application process 38% 36% 32%

Perceived chance of being funded 45% 31% 26%

Other 4% 3% 2%

Data with fewer than 45 observations are not shown.

36

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

D. DEMAND FOR FINANCING (CONTINUED)

APPENDIX (CONTINUED)

Annual Revenues

<$100K $100K–$1M $1M–$10M >$10M

Share that applied for nancing 40% 47% 50% 55%

REASON(S) FOR SEEKING FINANCING

Operating expenses 53% 37% 32% 24%

Renance 18% 28% 25% 22%

Other reason 14% 12% 16% 15%

Expand business/new opportunity 62% 61% 61% 62%

SOURCE(S) OF FINANCING ADVICE, APPLICANTS

Accountant, consultant, or business advisor 34% 36% 49% 41%

Loan broker 22% 17% 12% 7%

Banker or lender 61% 73% 80% 81%

Friends, family, or colleagues 37% 23% 20% 12%

Chamber of commerce or industry association 16% 8% 5% 2%

SBDC (Small Business Development Center) 44% 32% 15% 8%

Other source of advice 7% 4% 6% 2%

None 8% 9% 9% 10%

SCORE (Service Corps of Retired Executives) 11% 5% 2% 0%

FACTOR(S) INFLUENCING APPLICATION DECISION

Existing relationship with lender 38% 52% 65% 80%

Cost 52% 53% 56% 61%

Flexibility of the credit product(s) 35% 38% 37% 35%

Speed of the decision process 34% 35% 37% 29%

Ease of the application process 41% 37% 36% 33%

Perceived chance of being funded 61% 42% 31% 18%

Other 4% 4% 4% 2%

Data with fewer than 45 observations are not shown.

37

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

D. DEMAND FOR FINANCING (CONTINUED)

APPENDIX (CONTINUED)

Industry

Non-manufacturing

goods production &

associated services

Manufacturing

Retail

Leisure and hospitality

Finance and insurance

Healthcare and education

Professional services

and real estate

Business support and

consumer services

Share that applied for nancing 55% 52% 42% 52% 34% 50% 39% 49%

REASON(S) FOR SEEKING FINANCING

Operating expenses 38% 36% 40% 34% 37% 45% 34% 33%

Renance 21% 22% 32% 25% 31% 28% 15% 25%

Other reason 14% 12% 11% 14% 14% 18% 12% 19%

Expand business/new opportunity 64% 65% 53% 65% 49% 56% 66% 62%

SOURCE(S) OF FINANCING ADVICE, APPLICANTS

Accountant, consultant, or business advisor 41% 41% 40% 30% – 47% 49% 40%

Loan broker 16% 11% 16% 17% – 16% 15% 12%

Banker or lender 72% 80% 73% 70% – 70% 75% 78%

Friends, family, or colleagues 17% 18% 25% 33% – 32% 28% 19%

Chamber of commerce or industry association 3% 11% 6% 10% – 14% 10% 9%

SBDC (Small Business Development Center) 22% 27% 27% 31% – 50% 28% 25%

Other source of advice 5% 7% 5% 5% – 6% 5% 5%

None 11% 8% 7% 5% – 5% 9% 8%

SCORE (Service Corps of Retired Executives) 4% 5% 6% 4% – 6% 4% 5%

FACTOR(S) INFLUENCING APPLICATION DECISION

Existing relationship with lender 64% 59% 59% 46% – 41% 57% 52%

Cost 54% 48% 52% 62% – 49% 60% 52%

Flexibility of the credit product(s) 35% 34% 33% 40% – 39% 41% 37%

Speed of the decision process 35% 38% 36% 36% – 36% 36% 26%

Ease of the application process 37% 33% 36% 39% – 46% 34% 36%

Perceived chance of being funded 36% 38% 39% 42% – 51% 41% 36%

Other 4% 7% 1% 5% – 4% 1% 7%

Data with fewer than 45 observations are not shown.

38

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

APPENDIX (CONTINUED)

E. APPLICATIONS

All Employer Firms Growth Stage

Weighted percent Not growing Growing

NUMBER OF APPLICATIONS SUBMITTED

1 54% 57% 46%

2 23% 22% 26%

3 or more 23% 22% 27%

APPLICATION RATE BY FINANCIAL PRODUCT

Loan/line of credit 89% 89% 89%

Credit card 30% 28% 35%

Equity investment 4% 3% 7%

Leasing 11% 9% 13%

Trade credit 9% 7% 12%

Other 4% 4% 4%

Factoring 3% 3% 4%

APPLICATION RATE BY TYPE OF LOAN/LINE OF CREDIT

Business loan 52% 54% 49%

SBA loan/line of credit 21% 19% 27%

Line of credit 57% 56% 60%

Mortgage 10% 10% 11%

Cash advance 7% 8% 6%

Other product 4% 3% 5%

Auto or equipment loan 5% 5% 5%

Data with fewer than 45 observations are not shown.

39

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

E. APPLICATIONS (CONTINUED)

APPENDIX (CONTINUED)

Firm Age

0–2 years 3–5 years 6–10 years 11+ years

NUMBER OF APPLICATIONS SUBMITTED

1 48% 55% 52% 59%

2 23% 20% 25% 22%

3 or more 30% 25% 23% 19%

APPLICATION RATE BY FINANCIAL PRODUCT

Loan/line of credit 85% 90% 92% 89%

Credit card 44% 34% 27% 21%

Equity investment 6% 5% 4% 4%

Leasing 8% 11% 9% 13%

Trade credit 10% 7% 10% 9%

Other 4% 3% 2% 5%

Factoring 2% 6% 3% 3%

APPLICATION RATE BY TYPE OF LOAN/LINE OF CREDIT

Business loan 58% 55% 52% 48%

SBA loan/line of credit 37% 29% 19% 10%

Line of credit 53% 58% 56% 59%

Mortgage 9% 5% 6% 15%

Cash advance 9% 8% 13% 4%

Other product 4% 4% 4% 3%

Auto or equipment loan 2% 4% 5% 6%

Data with fewer than 45 observations are not shown.

40

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

E. APPLICATIONS (CONTINUED)

APPENDIX (CONTINUED)

Number of Employees

1–9 employees 10–49 employees 50+ employees

NUMBER OF APPLICATIONS SUBMITTED

1 55% 51% 59%

2 22% 27% 18%

3 or more 23% 23% 23%

APPLICATION RATE BY FINANCIAL PRODUCT

Loan/line of credit 88% 88% 95%

Credit card 33% 24% 20%

Equity investment 4% 6% 7%

Leasing 8% 17% 17%

Trade credit 8% 11% 8%

Other 4% 4% 2%

Factoring 3% 4% 3%

APPLICATION RATE BY TYPE OF LOAN/LINE OF CREDIT

Business loan 53% 49% 56%

SBA loan/line of credit 23% 19% 9%

Line of credit 54% 63% 65%

Mortgage 8% 13% 24%

Cash advance 9% 4% 1%

Other product 5% 2% 1%

Auto or equipment loan 5% 5% 2%

Data with fewer than 45 observations are not shown.

41

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

E. APPLICATIONS (CONTINUED)

APPENDIX (CONTINUED)

Annual Revenues

<$100K $100K–$1M $1M–$10M >$10M

NUMBER OF APPLICATIONS SUBMITTED

1 47% 56% 53% 58%

2 17% 25% 25% 21%

3 or more 37% 19% 22% 21%

APPLICATION RATE BY FINANCIAL PRODUCT

Loan/line of credit 83% 90% 89% 93%

Credit card 48% 27% 24% 16%

Equity investment 8% 3% 4% 6%

Leasing 6% 9% 18% 14%

Trade credit 12% 7% 12% 11%

Other 4% 4% 4% 2%

Factoring 3% 4% 3% 3%

APPLICATION RATE BY TYPE OF LOAN/LINE OF CREDIT

Business loan 63% 51% 49% 50%

SBA loan/line of credit 36% 20% 15% 8%

Line of credit 47% 56% 64% 70%

Mortgage 6% 8% 15% 20%

Cash advance 10% 9% 5% 0%

Other product 6% 4% 2% 3%

Auto or equipment loan 3% 6% 5% 1%

Data with fewer than 45 observations are not shown.

42

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

E. APPLICATIONS (CONTINUED)

APPENDIX (CONTINUED)

Industry

Non-manufacturing

goods production &

associated services

Manufacturing

Retail

Leisure and hospitality

Finance and insurance

Healthcare and education

Professional services

and real estate

Business support and

consumer services

NUMBER OF APPLICATIONS SUBMITTED

1 50% 47% 55% 63% 54% 50% 51% 62%

2 24% 27% 24% 20% 29% 19% 24% 21%

3 or more 26% 26% 21% 16% 17% 31% 25% 18%

APPLICATION RATE BY FINANCIAL PRODUCT

Loan/line of credit 91% 91% 89% 86% 83% 89% 89% 88%

Credit card 30% 21% 30% 24% 34% 35% 29% 32%

Equity investment 6% 7% 2% 4% 0% 4% 9% 2%

Leasing 10% 17% 9% 11% 5% 12% 12% 11%

Trade credit 16% 12% 11% 3% 6% 7% 6% 6%

Other 4% 4% 3% 7% 1% 5% 4% 2%

Factoring 4% 5% 3% 1% 3% 2% 4% 4%

APPLICATION RATE BY TYPE OF LOAN/LINE OF CREDIT

Business loan 46% 51% 51% 58% 61% 56% 52% 51%

SBA loan/line of credit 13% 19% 27% 27% 10% 33% 18% 18%

Line of credit 66% 64% 54% 41% 66% 50% 67% 52%

Mortgage 9% 12% 9% 14% 15% 11% 10% 9%

Cash advance 7% 4% 8% 5% 7% 9% 4% 12%

Other product 3% 4% 4% 4% 6% 4% 3% 4%

Auto or equipment loan 11% 3% 3% 1% 0% 2% 2% 7%

Data with fewer than 45 observations are not shown.

43

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

APPENDIX (CONTINUED)

F. FINANCING SUCCESS AND SOURCES OF CREDIT

All Employer Firms Growth Stage

Weighted percent Not growing Growing

Overall approval rate

(% receiving at least some nancing)

82% 79% 86%

Share receiving the full amount requested 50% 48% 52%

APPROVAL RATE BY FINANCIAL PRODUCT

Credit card 80% 76% 86%

Equity 74% – –

Leasing 89% 83% 96%

Trade credit 84% 80% 90%

Other type of nancing 73% – –

Loan or line of credit 79% 77% 82%

APPROVAL RATE BY TYPE OF LOAN/LINE OF CREDIT

Business loan 69% 65% 75%

SBA loan/line of credit 59% 53% 65%

Line of credit 71% 69% 72%

Mortgage 73% 70% 78%

Cash advance 71% 70% –

Other type of loan or line of credit – – –

Auto or equipment loan 89% – –

SOURCE(S) OF LOANS AND LINES OF CREDIT

APPLICATION RATE BY SOURCE OF LOAN/LINE OF CREDIT

Large bank 42% 43% 42%

Small bank 52% 51% 54%

Credit union 9% 9% 8%

Online lender 20% 20% 18%

Other source 14% 14% 13%

APPROVAL RATE BY SOURCE OF LOAN/LINE OF

CREDIT

Large bank 58% 55% 60%

Small bank 76% 73% 81%

Credit union 59% – –

Online lender 71% 69% 77%

Other source 71% 70% 68%

NET PERCENT SATISFIED WITH LENDER, APPROVED FIRMS

Large bank 51% 49% 53%

Small bank 75% 76% 71%

Online lender 15% 7% 20%

Other lender 33% 18% –

Credit union 56% – –

Data with fewer than 45 observations are not shown.

44

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

F. FINANCING SUCCESS AND SOURCES OF CREDIT (CONTINUED)

APPENDIX (CONTINUED)

Firm Age

0–2 years 3–5 years 6–10 years 11+ years

Overall approval rate

(% receiving at least some nancing)

79% 75% 79% 88%

Share receiving the full amount requested 42% 39% 45% 61%

APPROVAL RATE BY FINANCIAL PRODUCT

Credit card 77% 84% 81% 82%

Equity – – – –

Leasing – – – 97%

Trade credit – – – 87%

Other type of nancing – – – –

Loan or line of credit 73% 72% 76% 87%

APPROVAL RATE BY TYPE OF LOAN/LINE OF CREDIT

Business loan 56% 64% 71% 77%

SBA loan/line of credit – – 56% 66%

Line of credit 62% 62% 64% 80%

Mortgage – – – 83%

Cash advance – – – –

Other type of loan or line of credit – – – –

Auto or equipment loan – – – 95%

SOURCE(S) OF LOANS AND LINES OF CREDIT

APPLICATION RATE BY SOURCE OF LOAN/LINE OF CREDIT

Large bank 40% 45% 42% 43%

Small bank 51% 43% 46% 58%

Credit union 14% 11% 10% 4%

Online lender 26% 21% 30% 11%

Other source 14% 17% 13% 13%

APPROVAL RATE BY SOURCE OF LOAN/LINE OF

CREDIT

Large bank 46% 47% 49% 71%

Small bank 67% 64% 75% 84%

Credit union – – – –

Online lender – – 69% 73%

Other source – – – 80%

NET PERCENT SATISFIED WITH LENDER, APPROVED FIRMS

Large bank – – – 57%

Small bank 79% 66% 66% 78%

Online lender – – – 7%

Other lender – – – 53%

Credit union – – – –

Data with fewer than 45 observations are not shown.

45

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

F. FINANCING SUCCESS AND SOURCES OF CREDIT (CONTINUED)

APPENDIX (CONTINUED)

Number of Employees

1–9 employees 10–49 employees 50+ employees

Overall approval rate

(% receiving at least some nancing)

79% 88% 96%

Share receiving the full amount requested 45% 59% 72%

APPROVAL RATE BY FINANCIAL PRODUCT

Credit card 76% 92% –

Equity – – –

Leasing 82% 95% –

Trade credit 82% 88% –

Other type of nancing – – –

Loan or line of credit 75% 87% 96%

APPROVAL RATE BY TYPE OF LOAN/LINE OF CREDIT

Business loan 63% 76% 92%

SBA loan/line of credit 54% 72% –

Line of credit 64% 78% 96%

Mortgage 62% 80% –

Cash advance 69% – –

Other type of loan or line of credit – – –

Auto or equipment loan – – –

SOURCE(S) OF LOANS AND LINES OF CREDIT

APPLICATION RATE BY SOURCE OF LOAN/LINE OF CREDIT

Large bank 40% 43% 59%

Small bank 50% 57% 49%

Credit union 10% 7% 1%

Online lender 23% 15% 4%

Other source 16% 12% 7%

APPROVAL RATE BY SOURCE OF LOAN/LINE OF

CREDIT

Large bank 48% 68% 91%

Small bank 71% 82% 98%

Credit union 57% – 59%

Online lender 67% 86% –

Other source 69% 75% –

NET PERCENT SATISFIED WITH LENDER, APPROVED FIRMS

Large bank 49% 50% 60%

Small bank 72% 81% 75%

Online lender 12% 27% –

Other lender 18% – –

Credit union – – 56%

Data with fewer than 45 observations are not shown.

46

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

F. FINANCING SUCCESS AND SOURCES OF CREDIT (CONTINUED)

APPENDIX (CONTINUED)

Annual Revenues

<$100K $100K–$1M $1M–$10M >$10M

Overall approval rate

(% receiving at least some nancing)

70% 79% 92% 96%

Share receiving the full amount requested 37% 45% 63% 73%

APPROVAL RATE BY FINANCIAL PRODUCT

Credit card 76% 79% 87% –

Equity – – – –

Leasing – 85% 94% –

Trade credit – 88% 94% –

Other type of nancing – – – –

Loan or line of credit 65% 76% 89% 96%

APPROVAL RATE BY TYPE OF LOAN/LINE OF CREDIT

Business loan 54% 65% 81% 92%

SBA loan/line of credit – 54% 75% –

Line of credit 55% 65% 82% 91%

Mortgage – – 84% –

Cash advance – – – 71%

Other type of loan or line of credit – – – –

Auto or equipment loan – – – –

SOURCE(S) OF LOANS AND LINES OF CREDIT

APPLICATION RATE BY SOURCE OF LOAN/LINE OF CREDIT

Large bank 41% 39% 45% 58%

Small bank 44% 52% 59% 53%

Credit union 14% 9% 4% 1%

Online lender 30% 22% 11% 6%

Other source 27% 13% 10% 6%

APPROVAL RATE BY SOURCE OF LOAN/LINE OF

CREDIT

Large bank 33% 49% 72% 88%

Small bank 60% 69% 88% 96%

Credit union – – – –

Online lender – 80% 89% –

Other source – 69% 90% –

NET PERCENT SATISFIED WITH LENDER, APPROVED FIRMS

Large bank – 37% 60% 71%

Small bank – 76% 76% 74%

Online lender – 18% – –

Other lender – 23% – –

Credit union – – – –

Data with fewer than 45 observations are not shown.

47

2015 SMALL BUSINESS CREDIT SURVEY | REPORT ON EMPLOYER FIRMS

F. FINANCING SUCCESS AND SOURCES OF CREDIT (CONTINUED)