700 Fifth Avenue | PO Box 34018 | Seattle, WA 98124-4018 | 206-684-3000 | seattle.gov/utilities

NOTICE OF RULE REVISIONS

Proposed temporary suspension of rules and procedures on

utility billing, payment and collections

August 5, 2022

Seattle Public Utilities is committed to addressing the needs of our most disadvantaged customers as we move

through the COVID-19 recovery period after over two years of widespread financial hardship, increased utility

account delinquencies, and growing debt and arrears for customers.

Background and overview

In March 2020, former Mayor Jenny Durkan issued the COVID-19 Emergency Declaration placing a

moratorium on utility shutoffs and waiving late fees on delinquent utility account balances. Mayor Bruce

Harrell extended the utility shutoff moratorium until April 15, 2022, when it was allowed to expire. During

this time, Seattle Public Utilities continued to issue bills and collect payments but did not engage in the

disconnection process for nonpayment. As of June 30, 2022, approximately 8 percent of SPU customers had

past due balances totaling roughly $18 million in arrears.

Under the direction of Mayor Bruce Harrell and in coordination with Seattle City Light, SPU has developed

flexible repayment options to address customer needs during our transition back to normal collection

activities, understanding that many customers may have overlapping arrearages with accrued back rent or

other expenses caused by the economic disruption of the pandemic. SPU and SCL have engaged in a multi-

channel outreach campaign that will continue through 2022 to help ensure that customers are aware of their

repayment options, emergency assistance for past due bills and the Utility Discount Program to reduce the

cost of future bills.

Mayor Bruce Harrell and the Seattle City Council have continued the suspension of late fees and interest

charges for SPU and SCL customers five times through Ordinances 126058, 126182, 126254, 126355, and

126583; late fees have been waived through June 30, 2023 to help customers who have accrued arrearages

during the pandemic to repay their obligations as we move through this recovery period.

Mayor Bruce Harrell and the Seattle City Council have also authorized continued expansion of SPU’s

Emergency Assistance Program through Ordinance 126585 to allow all income-eligible SPU customers with

delinquencies access to two emergency assistance credits (up to $954) each year for 2022 and 2023. In

addition, SPU expects to receive a grant from the Washington State Department of Commerce that will further

help to address account delinquencies of low-income customers.

SPU will approach the resumption of collection activities in phases. The first half of 2022 has included broad

general awareness outreach, plus targeted encouragement to delinquent customers to repay through

mailings and door hangers. Beginning in August 2022, we will begin to issue Urgent and Final disconnection

notices to customers who remain $1,000 or more in arrears who have not engaged in a repayment option.

Through June 2023, SPU will be deferring any service disconnections related to nonpayment for customers

enrolled in the Utility Discount Program while we apply for and distribute the Washington State Grant to

Utilities for Residential Customer Arrearages.

Page 2 of 3

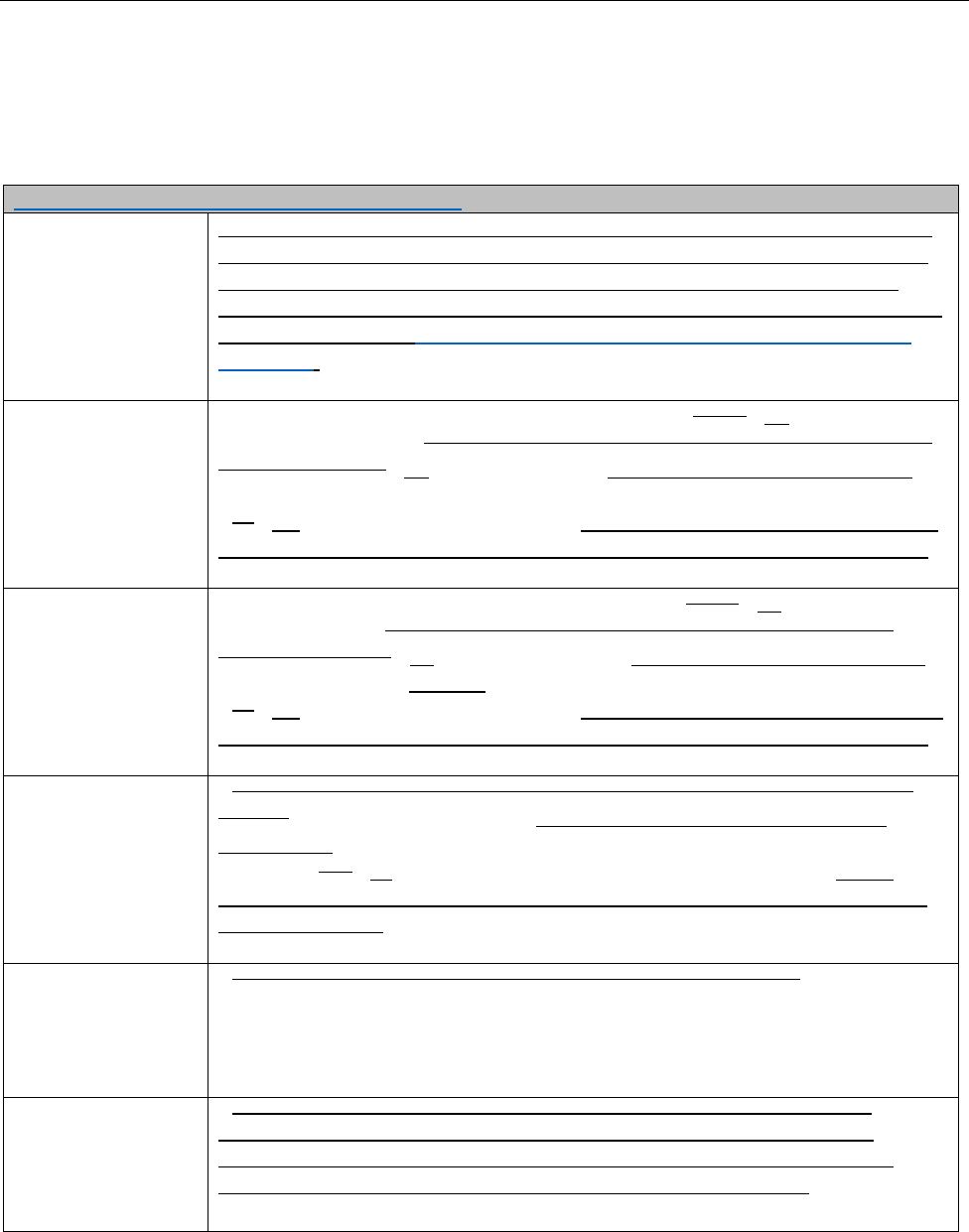

Proposed rule/procedure changes

Resuming collection activities in a way that acknowledges the financial hardships caused by the pandemic

requires SPU to adjust our normal business processes during the recovery period.

Under the authority of the Seattle Municipal Code 3.02 and 3.32.020, SPU proposes to temporarily amend or

suspend sections of the following rules/procedures to apply through June 2023, subject to extension. Text

with strikethroughs is to be suspended; underlined text is to be temporarily added.

CS-310.1: Customer Billing, Payments, Collections

Section 2

Definitions

Payment arrangement. An agreement between SPU and the property owner, his

or her agent, or designated account holder, used to pay higher than normal bills

or for circumstances as determined by the General Manager/Chief Executive

Officer. A down payment is not required and payment may extend up to three (3)

years. See Procedure CS-360: Pay Plans and Payment Arrangements for Retail

Customers.

Section 3. C. (2)

Urgent Notice

Once an Urgent Notice is generated, customers can ((either)) (1) pay their past

due balance in full or ((pay a minimum of 50 percent of their past due balance in

certified funds and)) (2) establish a pay plan with a 25 percent down payment to

pay the remaining past due balance within 60 calendar days from the date the

((50)) 25 percent down payment is made or (3) establish a payment arrangement

to pay the past due balance within three years with no required down payment.

Section 3. C. (3)

Final Shutoff Notice

Once a Shutoff Notice is generated, customers can ((either)) (1) pay their past due

balance in full or ((pay a minimum of 50 percent of their past due balance in

certified funds, and)) (2) establish a pay plan ((with a 25 percent down payment))

to pay the remaining past due balance within 60 calendar days from the date the

((50)) 25 percent down payment is made, or (3) establish a payment arrangement

to pay the past due balance within three years with no required down payment.

Section 3. D.

Water Shut off

(Severance)

((If water services have been shut off for nonpayment, Pay Plans are no longer

allowed.)) To restore water services if water services have been shut off for

nonpayment, the property owner, his or her agent, or designated account holder

must pay ((100)) 25 percent of the Past Due Balance in certified funds and is

strongly encouraged to establish a pay plan or payment arrangement to pay the

remaining balance.

Section 3. E (1)

Pay Plans

((If an Urgent Notice or Shut off Notice has not been generated, a)) A pay plan can

be granted if the customer pays a down payment of 25 percent of their account

balance in certified funds. The remaining balance must be paid in installments or

in full within 60 calendar days from the date the down payment is made

Section 3. E. (2)

Pay Plans

((If an Urgent Notice has been generated, a pay plan can be granted if the

customer pays a down payment of 50 percent of their past due balance in

certified funds. The remaining balance must be paid in installments or in full

within 60 calendar days from the date the down payment is made.))

Page 3 of 3

CS-360: Pay Plans and Payment Arrangements for Retail Customers

Section 4: Payment

Arrangements

• Must be agreed upon between SPU and the property owner, his or her

agent, or authorized designee.

• May extend up to three (3) years. Extension may be granted based on

circumstances as approved by Utility Account Services (UAS)

management.

• Customers are eligible to enter a payment arrangement in the following

circumstances:

o Receipt of an unexpected, higher than normal bill (e.g. back billing)

o Exceptional circumstances as approved by the GM/CEO or authorized

designee

o Customer has a delinquent account balance.

FIN-160 Customer Account and Billing Management

Section 4. D.

((Late fees and interest will be assessed as a flat fee or percentage to a

customer’s account when the amount of the account becomes delinquent.))

[Note: Late fees and interest are being waived through June 30, 2023 per

Ordinance 126583.]

FIN-220.1: Customer Charges

Section 3. B. (1)

Property visit............................................................... (($30)) no charge

Section 3. B. (2)

Meter shutoff for nonpayment of utility bill .............. (($60)) no charge

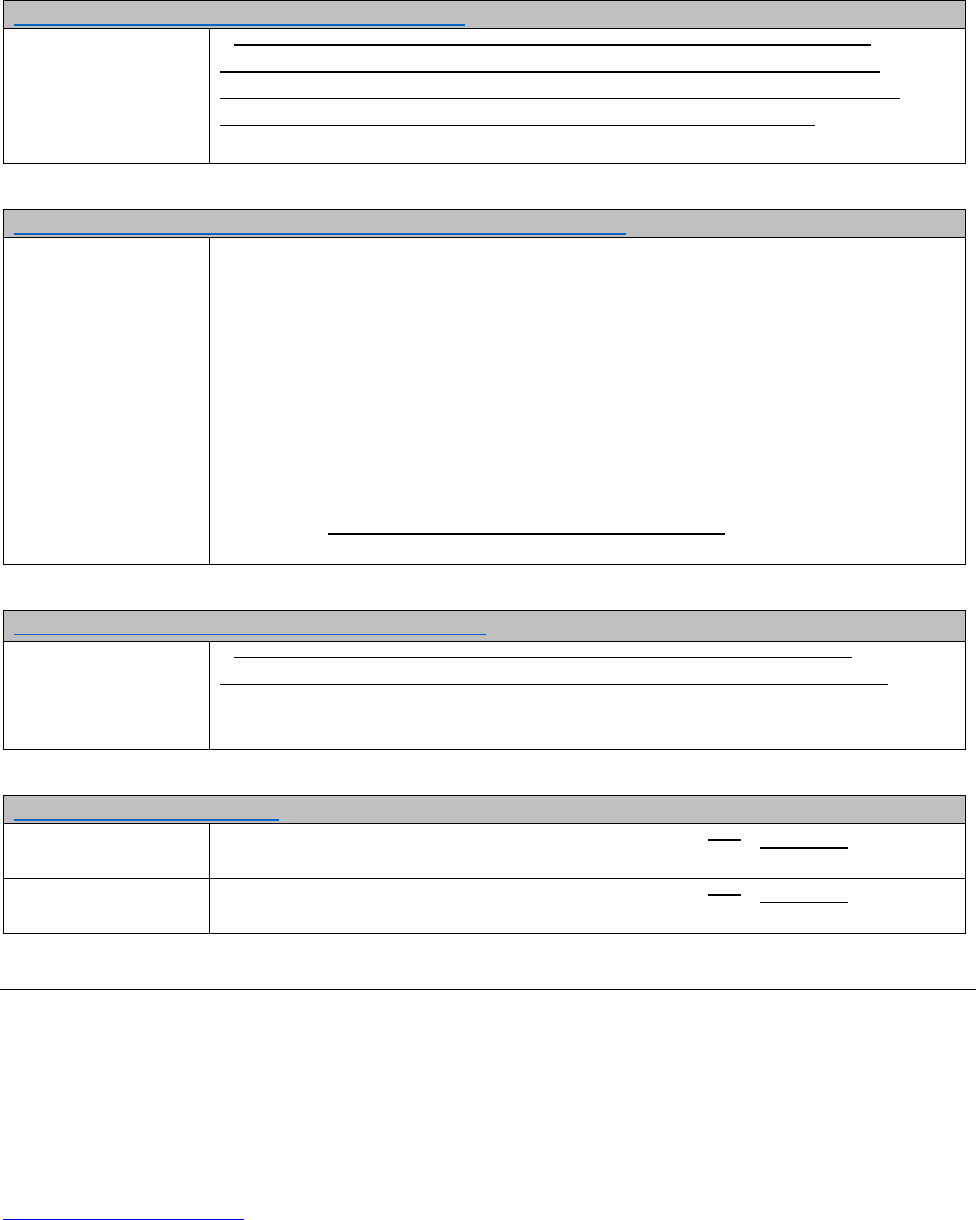

Public comment

SPU invites interested parties to review the temporary revisions and send comments to

Leslie Brinson

Senior Policy Advisor, Affordability & Customer Assistance

Seattle Public Utilities

P.O. Box 34018

Seattle, WA 98124-4018

Leslie.Brinson@seattle.gov

206-615-1367

Deadline for comments: August 23, 2022

CS-310.1: Customer Billing, Payments, Collections

Section 3. E. (3)

Pay Plans

((If a Shutoff Notice has been generated, a pay plan can be granted if the

customer pays a down payment of 50 percent of their past due balance in

certified funds. The remaining balance must be paid in installments or in full

within 60 calendar days from the date the down payment is made.))