1

Segal AmeriCorps Education Award

Fact Sheet & FAQs

FACTS ABOUT THE SEGAL EDUCATION AWARD

Extension to use the Education Award

Requests for extensions can be approved if the member:

• was unable to use the Award for a compelling reason during that seven-year period

• served another term of service within the seven-year period

• served in the Peace Corps or military within the sever-year period

To be considered for an extension, the request must be made before the Award expires.

Members can request extensions via the MyAmeriCorps Portal.

HOW TO USE THE SEGAL EDUCATION AWARD

The Education Award can be used all at once OR in smaller increments to repay qualified

student loans, pay for current educational expenses at eligible institutions, and GI Bill

Approved Programs.

The Segal Award amount

is based on two things:

the year in which a

member serves and their

term of service/slot type

To earn the Award,

members must successfully

complete their term of

service (serve to the end

date, required hours, and

paperwork)

Members can earn up to

the equivalent of 2 full

Segal Awards

Members have

7 years to use their

Education Award

The National Service

Trust sends Education

Awards to institutions

(not to members)

The Education Award is

taxable income

(the amount used,

in the year it is used)

Repay Qualified

Student Loans

Pay for Current

Educational Expenses

at Eligible Institutions

GI Bill Approved

Programs

Transfer Award

to a Child or

Grandchild

2

Repay Qualified Student Loans

Qualified Loans Include:

• Stafford Loans

• Perkins Loans

• William D. Ford Direct Loans

• Federal Consolidated Loans

• Supplemental Loans for Students

• Primary Care Loans

• Nursing Student Loans

• Health Education Assistance Loans

• Loans issued by state agencies, including state institutions of higher education

The Segal Award cannot repay any other type of loan, even if the loan was obtained for

educational purposes. AmeriCorps members can use their Award to repay student loans

that are in default, as long as the loan meets the definition of qualified student loan.

Ways to Apply Education Award to Qualified Student Loans

• Advance Payments: future monthly payments for a specific amount of time or for as

many payments as the Education Award payment will cover

o Benefits: get a break from making out-of-pocket monthly payments

o Downside: principal balance and/monthly monthly payment amount will likely not

decrease significantly after the break

• Pay the Principal: pay the principal balance only, not monthly payments

o Benefits: will likely lower principal balance and reduce monthly payments

o Downside: no break from making out-of-pocket monthly payments

AmeriCorps Benefits and Student Loans

Student Loan Forbearance

A temporary postponement of making student loan payments while serving as an AmeriCorps

member. This benefit does not impact the Segal Award.

Student Loan Interest Accrual Payment

Upon successful completion of service and earning an Education Award, the National Service Trust

will pay all or a portion of the interest that accrued on qualified student loans while they were in

forbearance during a member’s term of service. The portion that is paid is determined by the type

and length of service. This benefit does not impact the Segal Award. After their term of service ends,

members will go into their MyAmeriCorps Portal to request this Interest Accrual Payment.

Student Loan Consolidation

AmeriCorps members can choose to consolidate their student loans to make them “qualifying

student loans” and eligible for AmeriCorps benefits (forbearance, Education Award, interest accrual

payment, etc.). The National Service Trust can work with members who consolidate their student

loans during their service year. This benefit does not impact the Segal Award.

Public Service Loan Forgiveness Program

Forgives outstanding Federal Direct Loans for individuals who make 120 qualifying monthly payments,

under a qualifying repayment plan, and while working full-time in a “public service job” for 10 years

(120 months). Full-time AmeriCorps service counts as a “public service job” and members can

receive credit for qualifying monthly payments during their service term (even if their student loans

were in forbearance).

Income Based Repayment Plan

Makes student loan payments more affordable for low-income borrowers. AmeriCorps members who

opt-in to the IBR program can have monthly payments as low as $0/month – which can count

towards the 120 qualifying monthly payments for PSLF.

3

Pay for Current Educational Expenses at Eligible Institutions

Current – expenses incurred after a member began AmeriCorps service

Educational expenses – based on the school’s cost of attendance

Eligible Institutions – Title IV Schools LIST

AmeriCorps members can use their Education Award for traditional degree programs

(including study abroad programs), non-degree programs, individual courses, certification

programs, or career/technical programs at Title IV institutions.

The Education Award is disbursed to the institution in TWO equal installments

1

st

payment – beginning of enrollment period

2

nd

payment – midpoint date of enrollment period

If a student withdraws from a school where they used their Education Award…

• The school may be required to refund the money back to the National Service Trust

• The refunded Education Award is still subject to the original expiration date (7 years)

Schools of National Service

Provide incentives and additional benefits to AmeriCorps Alumni including:

• Matching the Segal Award dollar for dollar

• Scholarships for AmeriCorps Alumni

• Credit hours for AmeriCorps service

• Application fee waivers

Find the list of Schools of National Service here

FAQ: How can AmeriCorps members use their Education Award to purchase

books, supplies, laptops, etc.

Allowable expenses are based on “Cost of Attendance”

Cost of attendance may include tuition, books and supplies, transportation, room and

board, and other expenses that the institution determines to be part of their COA.

First, make sure that the educational expenses such as books, supplies, laptop, etc. are

included in the school’s cost of attendance. Contact the school’s financial aid office or

the bursar’s office – the staff in these offices will work with students to determine if they

are able to use their Education Award as payment for these specific items.

Once the request is approved and certified by the school’s financial aid or bursar’s

office, the payment is NOT made directly to the student, it is disbursed to the school and

depending on the school’s policy…

• Members may get reimbursed from their school once they receive the Award OR

• Members may be able to charge their expenses directly to their student account

with the school and the Award is then applied to their student account

Note: if a member receives financial aid, and the total amount of financial aid,

(including Education Awards) exceeds the student’s fees, then any excess funds may be

reimbursed to the student or applied to their student account. Contact the school’s

financial office to find out their policy.

4

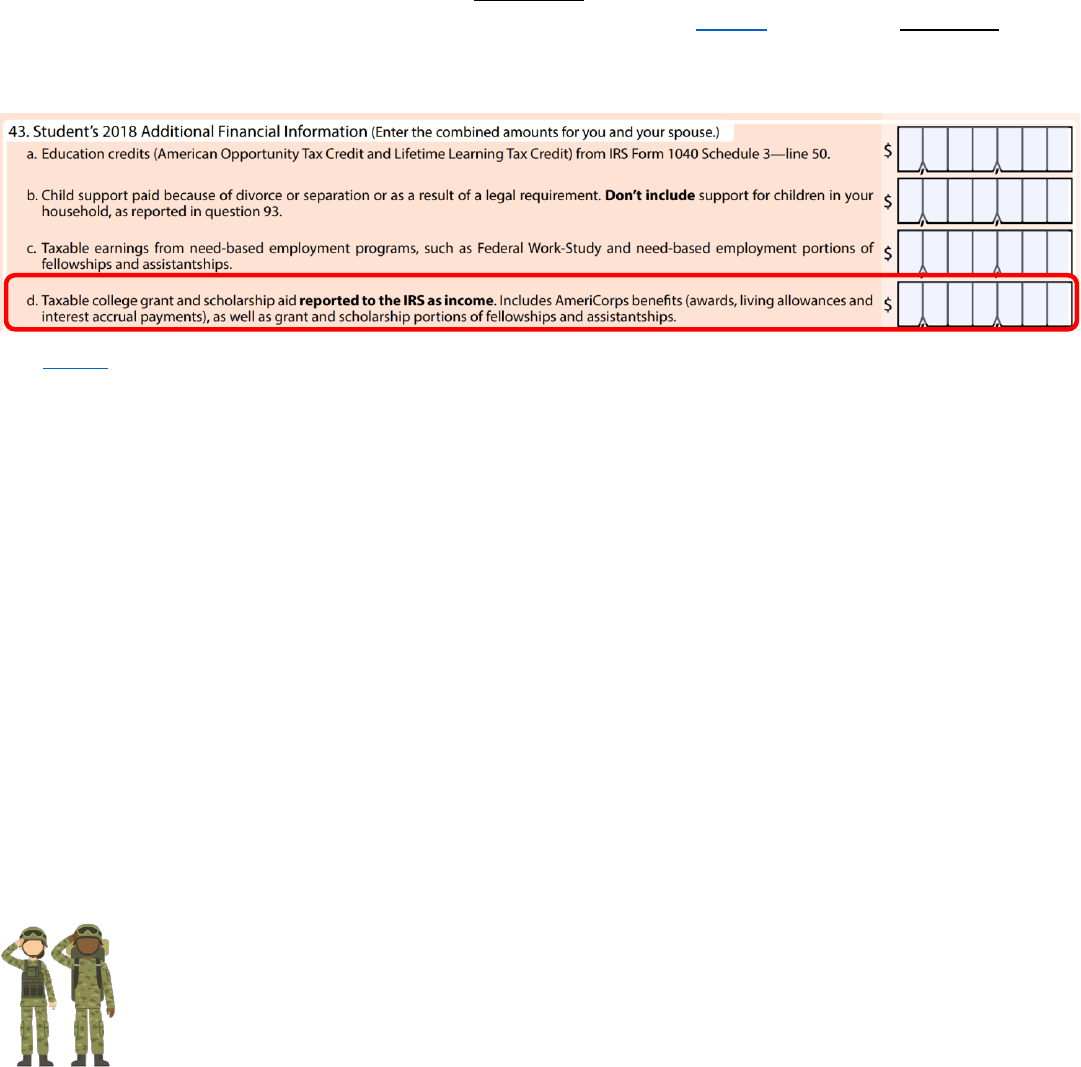

FINANCIAL AID

The Segal Education Award (as well as the living allowance and interest accrual payments)

can impact the process & eligibility of receiving additional financial aid:

• Under certain circumstances, the Segal Education Award, living allowance, and

interest accrual payments can be excluded from calculations determining a

member’s Expected Family Contribution (EFC) on the FAFSA. This could increase the

amount of "need-based" aid for which a student is eligible; therefore, it is important to

report this correctly on the FAFSA in the Additional Financial Information Section (43D)!

The FAFSA is used to apply for federal student financial aid, including grants, loans, and work-study.

Most states and schools also use it to award non-federal student financial aid.

• Under different circumstances, using the Segal AmeriCorps Education Award can

reduce the amount of other need-based student aid for which a student is eligible.

Financial aid offices must consider the Segal AmeriCorps Education Award as a

resource or funds that a student has available toward their cost of attendance, when

considering a student’s eligibility for campus-based aid (34 C.F.R. § 673.5(c)).

This includes:

o Federal Supplemental Educational Opportunity Grant (SEOG)

o Federal Work-Study Program

o Perkins Loans

Campus-based aid is distributed to schools in limited amounts and is not considered

an entitlement. A school will assist individuals to the extent resources are available.

When a student uses their Segal AmeriCorps Education Award as a resource, it may

reduce their eligibility for campus-based aid. Students should consult their institution’s

Financial Aid Office to ensure their financial assistance needs are properly addressed.

GI Bill Approved Programs

The Education Award can be used for educational expenses associated with

courses/programs approved for educational benefits under the Montgomery GI

Bill and Post 9/11 GI Bill. If the GI Bill Approved Program is offered at a Title IV

school, the Award can pay for educational expenses determined by the school’s

financial aid office or the VA-approved Certifying Official.

If the GI Bill Approved Program is NOT offered at a Title IV school, it is referred to as a “GI-Only

Program” and special rules apply. These courses/programs have been approved by the

Department of Veterans Affairs for GI Bill educational benefits. The educational institutions or

training establishments that offer these courses/programs will have a VA-approved Certifying

Official who can determine eligible expenses.

5

Transfer the Education Award to a Child or Grandchild

Under the Serve America Act, AmeriCorps State and National members who

are at least 55 years of age at the start of service are eligible to transfer their

Education Awards to family members under certain circumstances.

• The member must complete the transfer process via the MyAmeriCorps Portal before

the expiration date (within 7 years after earning)

• The beneficiary must be a child or grandchild (biological, adopted, or

stepchild/grandchild, or foster child)

• The child or grandchild beneficiary must meet AmeriCorps citizenship requirements

• The beneficiary has 10 years to use the Education Award, starting from the date the

member completes their term of service

• A transferred Award is treated like a standard Education Award with a few exceptions

THE EDUCATION AWARD AND TAXES

IRS Publication 970 - Tax Benefits for Education | IRS FAQ – 1099-MISC | Form 1040-ES

Is the Segal AmeriCorps Education Award taxable?

Yes. The Education Award is subject to federal and state taxes – for the amount that is used

in the year it is used. The Education Award is counted as taxable income regardless of how it

is used. AmeriCorps members must report the amount of Education Award they used as part

of their total income when they file their taxes.

AmeriCorps, the federal agency that administers the Segal AmeriCorps Education Award,

does not withhold taxes from the Award. AmeriCorps/CNCS will send an IRS 1099 Form to all

AmeriCorps members who have made payments from their Education Awards and for

whom interest payments have been made totaling $600 or more during the previous year.

The 1099 Form reflects the amount that AmeriCorps/CNCS reports to the IRS as taxable

miscellaneous income.

HOW TO ACCESS THE SEGAL EDUCATION AWARD

My AmeriCorps Portal:

https://my.americorps.gov

AmeriCorps Resources

AmeriCorps Segal Award webpage

AmeriCorps Segal Award FAQs

National service hotline 1-800-942-2677

The Trust is staffed by live operators from 9:00-7:00 EST

(closed Fridays)

6

Segal AmeriCorps Education Award FAQs

SEGAL AWARD FACTS

Do I have to finish my service first?

Yes, AmeriCorps members must complete their service term to earn an Education Award,

completing service means serving to the end date, serving the required number of hours,

and completing necessary paperwork.

How much is my Award?

Here are the Segal Award amounts for all slot types for the current program year.

Can anyone opt for the cash award instead of Segal Education Award?

The end of service cash stipend is an option for AmeriCorps VISTA members only.

Can we receive a physical check via mail after claiming our Segal Award?

No – the National Service Trust does not send checks directly to members; Segal Award must

be sent to an institution (loan servicer or a Title IV school).

Where do we receive the Award if we are no longer in school? Do we need to sign up for a

semester of college to be able to access this award?

The Segal Award will stay in the MyAmeriCorps Portal for 7 years. To access the award,

members must log in to their MyAmeriCorps account and complete the request to send the

Award to an institution. Current educational expenses do not have to be for a semester of

college, members can use their Award to pay for an individual course, a certification

program, non-degree programs, study abroad programs, or service-learning programs.

How many years can we be in this program and earn the Award?

There are limits on the Segal Award and terms of service. An individual may not receive more

than the aggregate (or total) value of two (2.0) full time Education Awards; AmeriCorps

State and National members can serve up to four terms.

What happens to the Segal Award if it is not used within the 7-year deadline?

The Segal Award will expire if it is not used within the 7-year deadline.

Does the 7 years start from the term you earned it, or the last term served? If you serve a

second term, do the 7 years restart for the Award from first service term?

Each Education Award has its own 7-year timeline that begins once a member completes

their term of service.

Example: a member completed a term of service and earned a Segal Award in 2023, that Award will

expire in 2030; then they serve another term the following year and earn another Segal Award in

2024, that second Award will expire in 2031.

If I’m completing my 2nd service term working 3/4ths, am I still eligible to receive an Award

for a 3rd term if I serve another 3/4ths term?

From AmeriCorps FAQs page: An individual can receive no more than the aggregate value

of 2.0 full time Education Awards. A member may be eligible to receive a portion of an

7

Award amount for serving an additional term if receiving the full amount would cause the

person to exceed the value of 2.0. The following conditions apply:

• The Award's dollar amount will be reduced (discounted), if necessary, to correspond to the

remaining value of Education Awards the individual is eligible to receive.

• The member must agree to serve the entire term of service in order to receive the

entire discounted amount.

• If a member is only eligible to receive a discounted amount, that dollar amount is determined

using this formula:

2.0 - [minus] the aggregate value of Education Awards the person previously

received x [times] the dollar amount of a full-time Education Award in the year the national

service position was approved

EXAMPLE: A member has received one half-time and one full-time Education Award. The

aggregate value of the two Awards the person has received is 1.5. The member is eligible to

receive up to the value of another .5 Award upon successful completion of an entire term of

service.

The maximum discounted dollar amount of the new Education Award this member can

receive is calculated this way: .5 multiplied by the dollar amount of a full-time Award

approved for that new term of service. In order to receive the entire discounted amount, the

member must successfully complete the entire required term of service.

Is there a minimum amount that we have to use?

There is no minimum amount of the Award that has to be used at a time, but there is a limit

on the time members must use their Award (seven years).

Can you transfer the Award to a sibling?

No, members who are 55 years or older have the option to transfer their Award to their child

or grandchild.

What if you want to gift the Award to your grandchildren, but they are not at an age to go to

college for some time (elementary school)?

When eligible members transfer their Award to their grandchild, the grandchild then has 10

years to use the gifted Award. An extension to use the transferred Award would not be

granted just because the beneficiary was not old enough to use the Award within that 10-

year period.

Where do I apply for the Segal Education Award?

Members do not have to apply for the Award, it is available to them upon successfully

completing their term of service and be exited from their program. Members should be able

to access their Award in their MyAmeriCorps Portal account approximately 30-60 days after

their last day of service.

I just logged on and I can only see the application page, not the Segal Award page?

After logging into https://my.americorps.gov, there’s a panel of options on the left side of the

MyAmeriCorps homepage, including “My Education Award.” One of the options is “Create

Education Award Payment Request.” Here’s a video on how to access the Award.

8

REPAY QUALIFIED STUDENT LOANS

Are federal loans still federal if they are switched to a new loaner servicer?

Even though loans servicers change, the student loans should still be federal loans.

Contact the new loan servicer to confirm.

Are any direct federal loans eligible? Are Direct PLUS loans eligible if they are going to me,

not my parents?

William D. Ford Federal Direct Loans are eligible and there are 4 types of Direct Loans:

• Direct Subsidized

• Direct Unsubsidized

• Direct PLUS loans (students)

• Direct Consolidation Loans

Direct PLUS loans for graduate students are federal loans and are qualified student loans.

PLUS loans for parents are ineligible loans for repayment with the Segal Award.

Do “qualified student loans” include loans from a state loan from another nation?

William D. Ford Federal Direct Loans are qualified student loans. Loans from another nation

are not qualified student loans.

If a student is graduating this semester without any type of loan or debt, will the Segal Award

be transferred to their personal bank account?

The Award must be sent to an institution, it cannot be transferred to an individual’s bank

account.

A quick google search says "graduate students are not eligible for federal title IV grants or

subsidized loans" does this make the award ineligible?

DIRECT PLUS student loans for graduate students are federal loans and are qualified student

loans that can be paid back with the Education Award. Graduate students can also use the

Award to pay for current educational expenses (keep in mind allowable expenses are

based on the cost of attendance at their school).

How do we apply for the AmeriCorps loan interest pause during service?

AmeriCorps members can put their qualified student loans in forbearance during their term

of service, which is a temporary postponement of making student loan payments while

serving as an AmeriCorps member. Additionally, upon successful completion of service and

earning an Education Award, the National Service Trust will pay all or a portion of the interest

that accrued on qualified student loans while they were in forbearance during a member’s

term of service. Members can apply for these benefits through their MyAmeriCorps Portal

account.

Doesn't interest not accrue during terms of service?

If a member requests student loan forbearance during their term of service, the payments on

their student loan is paused during the term of service; the interest on the loans may or may

not accrue during the service term. Members should contact their loan servicer to find out

how interest is accrued on their loans.

9

Would I still be eligible for the student loan interest accrual if interest on my loans has not

started due to the student loan payment pause and since I am still in school?

No, the National Service Trust only pays for the interest that accrued qualified student loans.

If no interest accrued, then no payment can be requested/made.

If you're a senior with no loans, can you use your Award?

Yes, seniors can use their Award for current educational expenses OR after they graduate,

they can use their Award to pay back qualified student loans.

Do the 120 payments need to be consecutive for Public Service Loan Forgiveness?

No, the 120 payments (under a qualifying repayment plan while working for a qualifying

employer) do not need to be consecutive. Be sure to certify qualifying employment/

payments every year for PSLF.

Does using my Segal Award to ‘Advance Payments’ on my student loans count towards the

120 qualifying payments toward loan forgiveness?

Yes, AmeriCorps members can receive credit for qualifying monthly payments for PSLF (when

they use some or all of their award to repay qualified student loans).

PAY FOR CURRENT EDUCATIONAL EXPENSES AT ELIGIBLE INSTITUTIONS

How do we request the money to be sent to the school? Is there a form?

Members can authorize their Education Award payment request to an institution through the

MyAmeriCorps Portal (https://my.americorps.gov)

In terms of the two installments that the Award is sent to a school, is the mid-point date based

on a semester, an academic year, or a degree?

The Segal Award is disbursed to schools in 2 installments – one that is sent at the beginning of

the semester/enrollment period and one that is sent halfway through the semester

Is there a specific list of current educational expenses?

Current educational expenses are based on a school’s cost of attendance, which varies

from school to school. Examples: tuition, fees, books, supplies, room and board,

transportation, etc.

Would I be able to purchase books or a laptop for school with the Segal Award?

Eligible expenses are based on each school’s Cost of Attendance; some schools’ COA

includes supplies like books or laptops. Contact the school's financial aid office to find out if

textbooks or a laptop is part of COA and what is their policy and process for utilizing the

Education Award to pay for school supply expenses.

When a member plans to use the Education Award as payment for books or a laptop, they

must contact their school’s financial aid or bursar’s office. The staff in these offices will work

with students to determine if they are eligible to use their Award as payment for these

specific items. Once the request is approved and certified by the school’s financial aid

representative or bursar (either through the My AmeriCorps portal or paper voucher), a

payment is remitted to the school. Payments are never made directly to a member. How the

10

money is reimbursed to the member or applied to a school account on their behalf is

completely between the member and the school.

What about art supplies for an arts degree?

If the school determines that art supplies are part of the cost of attendance for an arts

degree, program, or course then the Segal Award can be used to pay for the art supplies

because it would be an educational expense.

Can we use the award for living expenses/food?

If living expenses and food (room & board) are part of the school’s cost of attendance, they

would be an allowable expense to pay for with the Education Award.

Would off-campus housing count if it was included in the COA for the university?

If off campus housing is part of the school’s cost of attendance, possibly. Contact the

financial aid office for their policy and process.

If financial aid covers my tuition, what happens to the expenses that I make on a day-to-day

basis to cover for school expenses such as gas money, food, textbooks, regalia, etc.?

Depending on the school’s cost of attendance and financial aid policy, Education Awards

may be used to cover expenses like textbooks, food, transportation, etc. Contact the

school’s financial aid office to understand their policy with using/processing the Award for

other expenses.

Can I use my Award for any of the following:

• TEFL/CELTA training

• Extension classes

• Research conference

• Aviation education

• Online real estate

course

Current educational expenses are based on a Title IV school’s cost of attendance, which

varies from school to school and can include expenses such as tuition, fees, books, supplies,

room and board, and transportation for individual courses, certification programs, degree

programs, non-degree programs, study abroad programs, or service-learning programs.

If the course/program is offered at a Title IV institution, students should be able to pay for the

expenses for the course/program using their Award. Contact the school’s financial aid office

to find out if the course/program and the expenses can be covered by the Award.

Can the Segal Award pay for exams like the GRE, MCAT, LSAT, or the Bar Exam?

If exams are part of a course or program at a Title IV institution, the cost of the exam may be

an expense that can be paid for with the Award. If exams are not part of a course/program,

the cost of the exam is likely not eligible to be paid for with the Education Award

Can we use the Segal Award to pay for Grad School applications?

Admission applications are typically not costs associated with a course or program so it is

likely that the Award cannot be used to pay for grad school applications. There are ‘Schools

of National Service’ that offer benefits to AmeriCorps Alum such as application fee waivers.

Where can we find a list of eligible institutions? How do we make sure that a school is Title IV?

Title IV schools are education institutions that participate in the Department of Education’s

Title IV student aid program (accepts FAFSA). Here is the current list of Title IV schools.

11

Do international schools count? Is there a list of international universities that the Award can

be used for? How do I find out if an international university is title IV?

Here’s a list of International Schools that participate in the Federal Student Loan Programs.

Can we use the Award if we decide to study for our Master’s in another country?

If the master’s program is offered by an institution that participates in the US Department of

Education’s Title IV student aid program, the Award can be used to pay for educational

expenses.

My institution purposefully withheld my Education Award claiming that I must enroll for a

certain number of units. Can an institution withhold award funds for any reason?

The Segal Award can be used even if a student is not seeking a degree and can be used for

any classes taken at a Title IV school. The Award can be used for individual courses,

certification programs, degree programs, non-degree programs, study abroad programs, or

service-learning programs.

If you only take a few community college classes but stop before earning a degree, is that

considered withdrawing from the institution? Or do you mean withdraw in the middle of the

semester?

If a student withdraws from an individual course or degree program in the middle of the

semester at a school where they have used their Education Award, the school may be

required to refund the Award money back to the Trust.

Is there a strict rule on what the Award can cover at a college/university, or does it depend

on cost of attendance?

The Education Award can be used for educational expenses, which are based on each

school’s cost of attendance. Cost of attendance can vary from school to school; what

counts as an expense can depend on the school, the type of student you are, and the

courses or program of study. Contact your school’s financial aid office to find out what

expenses are part of their cost of attendance.

I am transferring to a four-year university this fall but currently attend a community college.

Can I apply the award to my new school?

Yes, if the new school is a Title IV school, the Award can be used at a school a student

transfers to.

Can I use my Awards for grad school? I have two awards (900 hours and 1200 hours)?

Yes, Education Awards can be used to pay for educational expenses for graduate programs

at Title IV schools. If members plan to ‘combine awards’ and use multiple awards at the

same time, they will need to make a request for each Award in their MyAmeriCorps Portal.

Before sending Awards to the institution, members should make sure they understand the

school’s policies for allowable expenses, financial aid, and disbursements.

What about studying abroad? Can you use this Award on a study abroad program?

If the study abroad program is part of a Title IV institution – yes.

12

Can you define service-learning programs?

The Segal Award can be used to pay for Service-Learning Programs such as Outward Bound,

National Outdoor Leadership School, and the International Partnership for Service-Learning.

What about non-Title IV courses?

In some cases, the Education Award can be used to pay for non-title IV courses offered at

Title IV schools; but the eligible educational expenses are more limited – tuition and fees

normally assessed to a student including costs for books and/or supplies that are required of

all students in the same course of study. See section 2520.20 of the Code of Federal

Regulations for additional information on students taking non-title IV courses.

Can the Award be used for schools outside of California?

Yes, the Segal Award can be used at any Title IV school, which include domestic and foreign

higher education institutions that participate in the Department of Education’s Title IV

student aid program.

If I already paid for a course/educational expenses, then AmeriCorps reimburses the school,

does the school then reimburse me?

It depends on the school’s financial aid policy. If a student paid for a course/expense while

waiting for the Segal Award to process, the school may reimburse them and/or apply the

funds to their student account. Some schools treat the Segal Award like other financial aid,

and excess financial aid (after all fees are paid) may be sent to the student (like other

financial aid). Contact the school to find out their policy.

I don’t have any student loan debt and I am not planning on going back to school. If I enroll

in a college class and pay for it with the Award, is it true I can cash the rest of the check out?

It depends on the school and their financial aid policy. Some schools treat the Award like

other financial aid and if the Education Award is used to pay for a college class and there is

‘leftover money’, the school may disburse it to the student (like other financial aid). Contact

the school to find out their policy with financial aid disbursements.

If I pay for a summer course with my living allowance now because the deadline to pay is

next week, can I get repaid back that amount with my Segal Award when it arrives?

See answer to previous FAQ. It depends on the school’s financial aid policy. Contact the

school to find out their policy and process.

What if I'm on a fellowship for my PhD program? Everything is paid for. Would the school just

pay me that money?

Many schools treat the Segal Award like other financial aid, contact the school to find out

their policy.

I have been accepted to a funded PhD program that includes an annual stipend. Will I be

able to use the Segal Award to pay for graduate housing or something else while in the

program, or does it depend on the university’s financial aid policy?

It depends on the university’s financial aid policy. Contact the school’s financial aid office

and speak to a financial aid advisor/counselor to see how the Award can be used for

expenses and if using the Award will impact the annual stipend.

13

I would like to transfer the Award to my daughter who is also receiving educational

scholarship assistance from our federally recognized tribe. Are there other considerations,

besides taxes, that might arise from this?

Besides taxes, using the Education Award could impact other financial aid that a student

receives. Before using the Award, students should check with a financial aid advisor to

explore their options and to avoid losing financial aid.

Can the Award be used without FAFSA/financial aid?

Yes, the Award can be used even if a student does not apply for financial aid.

Do we have to include AmeriCorps money on our FAFSA?

Yes, AmeriCorps-related earnings (living allowing, interest accrual payment, and/or

education award) should be reported on the FAFSA. There is a section on the FAFSA that

asks about income reported to the IRS from the previous year. There is a specific space in this

section that asks about AmeriCorps benefits (living allowing, interest accrual payment, or

education award).

How does reporting AmeriCorps-related earnings on the FAFSA increase your need-based

aid when it should not be taken into consideration when calculating your Expected Family

Contribution?

When AmeriCorps-related earnings (living allowing, interest accrual payment, or education

award) are reported on the FAFSA as regular income, a student’s need-based aid may not

be as much as it could be. When AmeriCorps-related earnings are reported on the FAFSA as

excludable income, students are eligible for a more accurate amount of need-based aid

because AmeriCorps-related earnings should not impact a student’s EFC.

Does the Segal Award have to be used after federal aid or could it be used before using

federal aid.

It depends on the school’s financial aid policy. Receiving certain types of financial aid and

using the Award can impact and reduce the amount of other need-based financial aid for

which a student is eligible (Marvin’s scenario).

Some schools treat the Award like other financial aid, and when other financial aid is used

first for tuition, fees, etc., the Award can be used for other eligible expenses that are not

tuition such as supplies. When schools treat the Award like other financial aid, the excess

financial aid (after all fees are paid) may be disbursed to the student.

Contact the school to find out their policy and to learn about how the Award may impact

other financial aid.

14

The Segal Education Award and Taxes

Are we given a W2 or something we can take to a CPA? How is the tax deduction applied?

Programs typically provide members with a W-2; taxes are different for everyone because

there are various factors. The Segal Award is considered taxable income – only the amount

that was used in a given tax year.

Would AmeriCorps send us a 1098 form?

If your education award and interest payments total more than $600 in a calendar year,

AmeriCorps will send you an IRS Form 1099 to be used in preparing your income tax return.

Is the Award exempt from federal taxes?

No, the Segal Award is not exempt from federal taxes (or state taxes).

Is the Award amount considered taxable income upon receiving the Award in our

AmeriCorps Portal, or upon spending the Award?

The Segal Award is subject to federal and state taxes only in the year(s) that it is used/spent.

Only the amount used in a calendar year is taxed.

How much of the Segal Award will be taxable?

How much of the Award that is taxable depends on the amount that is used within a year. It

also depends on the personal circumstances (marital status, veteran status, exemptions,

etc.)

Is it possible to get the government to treat this as non-taxable income?

The CORPS Act (federal) and CA SB-444 (state) are two policies that, if passed, would

exempt the Segal Award from federal and state income tax. If members would like to get

involved as civic participants, it must be on their own time (non-AmeriCorps hours).