1

Docket No. RIN 3064-ZA04

DLC Response

8860 W. Sunset Road, Suite 100, Las Vegas, NV 89148

702-947-4396 Phone --- 702-407-1167 Fax

VIA Electronic Filing

January 22, 2019

Robert E. Feldman, Executive Secretary

Attention: Comments

Federal Deposit Insurance Corporation

550 17th Street NW

Washington, DC 20429

Re: Request for Information on Small-Dollar Lending, Docket No. RIN 3064-ZA04

Dear Mr. Feldman:

This response is directed to the request for information (“RFI”) by the Federal Deposit Insurance

Corporation (the “FDIC”) regarding small-dollar lending and, in particular, steps that can be taken to

encourage small-dollar credit products that are responsive to consumers’ needs and that are underwritten

and structured prudently and responsibly. Dollar Loan Center, LLC (“DLC”) provides the following

comments in response the FDIC’s request.

DLC is the market leader in providing small-dollar short term loans in Nevada and Utah. DLC serves

over 180,000 customers per year from fifty retail locations and its online lending portal. DLC’s small-

dollar credit products give customers advantages DLC’s competitors do not: DLC’s interest rates are

one-third of the average rates of its competitors, DLC’s loans have no hidden fees, and DLC provides

flexibility in payment terms.

DLC’s low default rates are another indicia of its success. Indeed, most DLC customers repay their

loans without penalty long before their maturity date. Further, DLC’s loans are unsecured, and in the

State of Nevada, DLC has no right to sue to collect on defaulted debt. DLC achieves this result because

its underwriting and customer service functions are finely-tuned to serve the small-dollar loan market.

As a result, DLC’s operations give it a valuable perspective as it relates to the RFI. In particular, DLC

can speak to its experience serving borrowers who rely on alternative lenders to meet their small-dollar

lending needs. Likewise, DLC can provide suggestions on how to encourage banks to offer more and

better small-dollar credit products without jeopardizing their prudential lending and capital

requirements.

2

Docket No. RIN 3064-ZA04

DLC Response

I. Executive Summary

Banks are failing at small-dollar lending. There is a clear need for these products in the United States.

Subprime borrowers are increasingly turning to alternative lenders. And other non-subprime borrowers

such as millennials, entrepreneurs, and minority borrowers turn to alternative lenders for a host of

reasons including: (1) a perception that alternative lenders make credit decisions faster and with more

fee transparency; (2) they are more likely to qualify for lending products with alternative lenders; and

(3) the ease of doing business is greater in comparison to opening up a checking account with a bank.

Paradoxically, banks have many advantages over alternative lenders including product flexibility, low

cost of capital, a wide retail footprint, and federal regulatory preemption status. Yet, banks have failed

to secure this market. We believe this is due to several factors:

• Banks have rigid underwriting criteria that do not account for personal or community factors;

• Banks focus more on FICO than borrower relationship factors, such as prior loan payment

history;

• Banks require onerous ancillary requirements, such as W-2 income, direct deposit, or ACH

withdrawals;

• Banks loan too much principal with too little data; and

• Banks charge hidden fees and impose loan terms that create mistrust in the lending relationship.

The result is that more borrowers are turning to alternative lenders to meet their small-dollar lending

needs. The FDIC has contributed to this dynamic in two ways. First, the FDIC has failed to appreciate

the diverse borrower characteristics of those that turn to alternative lenders. Not all borrowers are

subprime. Many alternative borrowers report annual incomes above $40,000 with steady wages, but

they have failed to develop a relationship of trust and convenience with their bank. Others have

experienced discrimination. Minority borrowers in particular report higher levels of credit denials, and

thus distrust banks. Others, like millennials and entrepreneurs, prefer alternative and online lenders

because they view these lenders as more convenient, transparent, and offering products that better suit

their borrowing needs.

Second, the FDIC has perpetuated the myth of a sustainable 36 percent interest rate cap on lending

products. Short-term small-dollar loans are more expensive to underwrite and service than other types

of larger and secured long-term loans. The clientele is more diverse than in other lending categories—

many of which are subprime, unbanked, underbanked, or present additional lending risks. And

universally, customers expect instant approvals, quick access to funds, and convenient repayment

options. This costs more in technology, personnel, and footprint. Banks can’t make a profit, cover their

losses, and provide the service levels necessary to compete in this market if they can charge only 36%

APR on their loans.

To overcome these barriers, we propose three broad recommendations:

• First, the FDIC should study borrowers who turn to alternative lenders so it has a better

understanding of the trends underlying this market dynamic and can help inform banks on how

to target these borrowers.

• Second, the FDIC should encourage banks to revise their underwriting standards.

• Third, the FDIC should encourage banks to offer short term, higher interest introductory loans.

3

Docket No. RIN 3064-ZA04

DLC Response

Together, we believe these recommendations will provide a host of benefits not only to the borrowers

who can turn to insured institutions for their small-dollar lending needs, but also for banks who are able

to regain market share, develop relationships with borrowers who graduate to different lending products,

and in turn, better serve their communities.

II. The Problem: Traditional banks do not meet consumer demand for small-dollar

credit products.

DLC’s experience shows there is significant unmet consumer demand for small-dollar credit products.

In the past 12 months, over 180,000 individuals have sought credit at DLC, and yet 80% of DLC’s

customers report they already have bank accounts. The fact that DLC’s customers do not borrow from

their own banks – but instead from alternative lenders like DLC – is evidence that they have unmet

credit needs.

DLC’s experience is supported by market research. National surveys report that about 20% of

households use some sort of nonbank credit for short-term emergency and purchase-money loans.

1

Moreover, a reported 24.2 million Americans were “underbanked,” meaning they had a checking or

savings account but rely on an alternative lender to meet their banking needs. These borrowers use a

host of products that traditional banks do not provide, including money orders, check cashing,

international remittances, payday loans, refund anticipation loans, rent-to-own services, pawn shop

loans, and auto title loans, to bridge their month-to-month funding gaps.

2

Ten years after the 2008-09 recession, the number of subprime borrowers who turn to non-bank lenders

continues to increase. According to a recent TransUnion survey, subprime consumer loan originations

grew 28% from the second quarter of 2017 to 2018 alone.

3

This dynamic is only likely to increase as

more borrowers turn to alternative, online lenders in the future.

Besides subprime borrowers, other underbanked and unbanked individuals include minorities,

millennials and entrepreneurs, as discussed in more detail below. Survey data shows minority borrowers

experience credit denials at a higher rate than non-minority borrowers. Relatedly, minority borrowers

report higher levels of distrust with traditional banking options.

Millennials and entrepreneurs present another set of lending challenges. Many of them have

unestablished credit, high levels of debt (e.g. student loans or business debt), and/or are suspicious of

traditional funding options. At the same time, these borrowers have higher levels of income than

traditional payday loan borrowers. Further complicating the picture, as discussed below, many

millennials and entrepreneurs actually prefer online lenders because they consider them to be more

1

Experian’s Clarity Services, “The Evolution of Credit Risk Evaluation,” (August 22, 2018) (citing 2015 FDIC National

Survey of Unbanked and Underbanked Households).

2

FDIC, “FDIC National Survey of Unbanked and Underbanked Households,” (Oct. 2018), 17.

3

TransUnion Industry Report, “Lenders Extending More Loans to Subprime Consumers as Credit Market Continues to

Exhibit Signs of Strength,” (Nov. 15, 2018), available at: https://newsroom.transunion.com/lenders-extending-more-loans-

to-subprime-consumers--as-credit-market-continues-to-exhibit-signs-of-strength/ (last viewed Dec. 20, 2018).

4

Docket No. RIN 3064-ZA04

DLC Response

transparent and convenient.

4

Some borrowers rely on a patchwork of alternative financing options to meet their credit needs. A

recent analysis from Clarity Services, a division of Experian, reported that more than 17% of borrowers

who opened a “single payday loan” or short-term installment loan, also turned to online lending

options.

5

Use of online lending is particularly alarming, as many online lenders exist outside of the

United States, are completely unregulated, and present a high risk of consumer abuse. Yet, these

borrowers averaged 13 inquiries over the course of the year, meaning on a month-to-month basis, they

may be turning to a host of alternative lenders.

6

In DLC’s experience, there are two broad challenges in the regulatory and legislative environment that

have contributed to this dynamic:

• First, small-dollar lending policy and bank products are largely uninformed about alternative

lending borrowers and what these borrowers need in a short term loan product.

• Second, the regulatory community has determined that a 36% APR loan is acceptable and that

loans above this rate are unacceptable. This hard line is arbitrary. It does not account for many

common loan pricing factors such as cost of the lender’s liquidity, inflation, the lender’s

overhead, the borrower’s risk profile, recourse of the loan, or quality of the collateral. Frankly,

in any other lending context, the FDIC would call it an unsound practice to price all loans within

a category at an inflexible rate that did not include liquidity and risk considerations. The FDIC

has perpetuated the myth of the 36% APR with no economic evidence to support it.

Challenge 1: Regulators and banks see small-dollar borrowers as a singular group instead

of many different types of consumers.

Contrary to popular belief, alternative-finance consumers are not destitute. Rather, most are employed

with an average annual income of around $40,000.

7

Alternative-finance borrowers use small-dollar

loans to purchase non-essentials like gifts and vacations. Some borrowers use small-dollar loans to

purchase materials for their small businesses, such as lumber or landscaping projects. For example, a

200% APR loan for a few days is an affordable means for an independent contractor to finance materials

with significantly less underwriting hassle than a small business loan at a bank. Other borrowers receive

project-based “1099” income and use alternative lending to bridge expenses while waiting for payment.

Many borrowers find that alternative financial institutions are more convenient than traditional banks

because lending decisions are often instant and online. Other borrowers find that alternative lenders are

more transparent about their fees. A recent survey from Mercator Advisory Group finds that millennials

4

Indeed, a recent report from Cambridge University’s Center for Alternative Finance reports the online consumer balance

sheet lending to be $3 billion in 2016. “2017 Americas Alternative Finance Industry Report – Hitting a Stride.” Cambridge

University’s Centre for Alternative Finance. https://www.jbs.cam.ac.uk/

fileadmin/user_upload/research/centres/alternative-finance/downloads/2017-05-americas-alternative-finance-industry-

report.pdf. 2017.

5

Clarity Services, Inc. “2018 Alternative Financial Services Lending Trends: Insights into the Industry and Its Consumers,”

(2018), 9.

6

Id.

7

Id.

5

Docket No. RIN 3064-ZA04

DLC Response

and entrepreneurs report higher levels of comfort with applying for an online lending product:

8

“Notably, businesses owned by Millennials, aged 18-34, are nearly twice as

likely as businesses owned by older owners to use alternative lenders to

finance their businesses, as 48% of Millennial owners report they currently

have a loan from an alternative lender compared to 25% of businesses that are

run by owners aged 35 or older. The primary reason for using alternative

lenders, they say, is that the loan approval process is easier with such a

lender and they get their funding faster. Only 7% say they use alternative

lenders for a better interest rate.”

9

Indeed, companies such as SoFi, Prosper, and Lending Club market their products through creative and

effective digital ad campaigns and have high levels of customer satisfaction. As a result, these entities

are expanding from their small-dollar credit products, and offering borrowers alternative lending

products.

10

Banks are simply failing to keep up.

More problematically, many minority borrowers prefer online or alternative finance lenders because

they think they are less likely to experience discrimination. A recent report from the Board of

Governors of the Federal Reserve System highlights the disparities between white and non-white,

minority borrowers

11

:

• Whereas 95% of all adults have a bank or credit union account, 10% of blacks and Hispanics

lack a bank account, and 30% have an account but use alternative financial services such as

money orders and check cashing;

• Whereas 25% of blacks lack confidence that a new credit card application for them would be

approved, only 12% of whites reported the same concern.

12

8

Mercator Advisory Group “U.S. Small Business Payments and Banking Survey” (Feb. 19, 2018), available at:

https://www.mercatoradvisorygroup.com/Reports/Business-Banking-Services--Keeping-Up-with-Millennial-Owners/ (last

viewed Dec. 20, 2018).

9

Mercator Advisory Group “U.S. Small Business Payments and Banking Survey” (Feb. 19, 2018), available at:

https://www.mercatoradvisorygroup.com/Reports/Business-Banking-Services--Keeping-Up-with-Millennial-Owners/ (last

viewed Dec. 20, 2018) (emphasis added).

10

See e.g., Penny Crosman, “Prosper Branches Out, Shifts Strategy As It Launches Second Product,” American Banker

(Nov. 14, 2018).

11

Board of Governors of the Federal Reserve System, “Report on the Economic Well-Being of U.S. Households in 2017”

(May 2018), 10.

12

Id.

6

Docket No. RIN 3064-ZA04

DLC Response

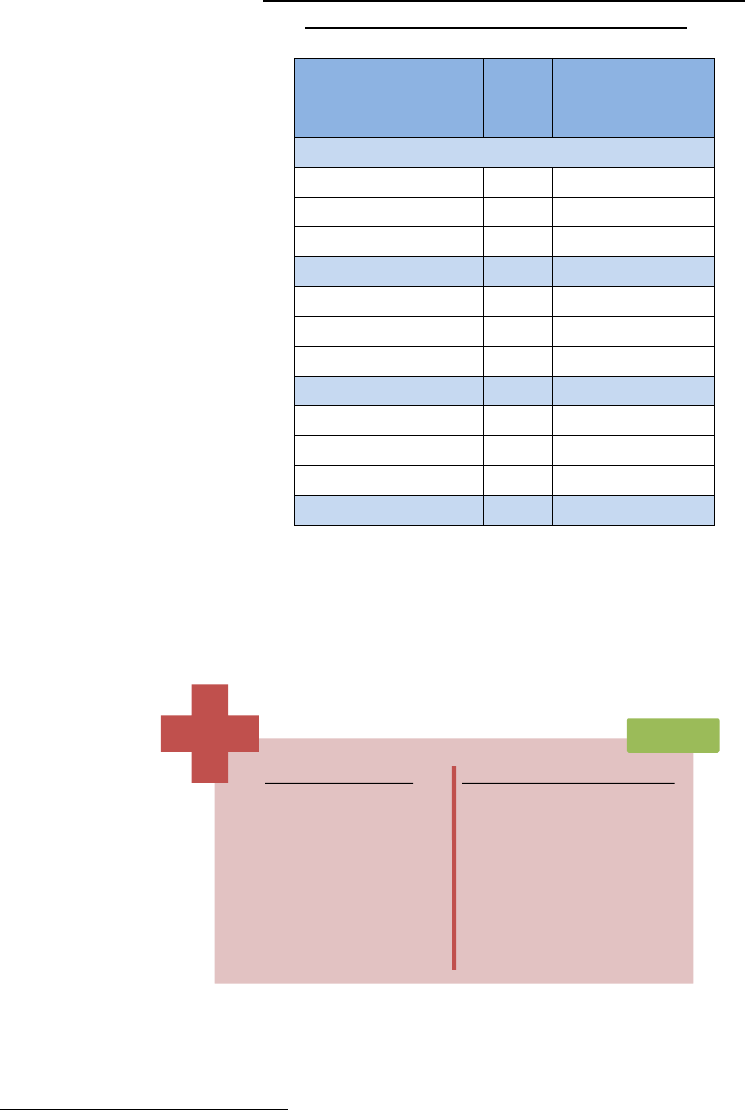

Even controlling for income, minority borrowers had disproportionately higher denial rates or approvals

for less credit than requested, as shown below:

Credit applicants with adverse credit outcomes

(by family income and race/ethnicity)

13

Characteristic Denied

Denied or approved

for less credit than

requested

(combined)

Income less than $40,000

White 33% 40%

Black 53% 70%

Hispanic 43% 52%

$40,000-$100,000

White 17% 24%

Black 30% 43%

Hispanic 27% 42%

Greater than $100,000

White 9% 12%

Black 14% 21%

Hispanic 23% 33%

Overall 24% 32%

Likewise, a recent report from the Federal Reserve Bank of New York found that Latino-owned

businesses applied for financing in 2017 at slightly higher rates than non-Latino white-owned

businesses, but Latinos were much more likely to have adverse actions and were forced to resort to

personal assets to support their businesses.

14

In sum, in order to better serve all borrowers, banks need to develop a more nuanced understanding of

alternative borrower characteristics and lending needs. By simply categorizing all alternative borrowers

13

Id. at 35.

14

Federal Reserve Bank of New York, Clair Kramer Mills, et al. “Latino-Owned Businesses, Shining a Light on National

Trends,” (November 2018).

Latino-Owned Businesses

-47% applied for financing in 2017

-28% received full funding

-47% use personal guarantees than

business assets to secure financing

-40% receive no financing

Non-latino White-Owned Businesses

-40% applied for financing in 2017

-49% received full funding

-34% use personal guarantees than

business assets to secure financing

-28% receive no financing

7

Docket No. RIN 3064-ZA04

DLC Response

as subprime, banks miss the opportunity to tailor their products to match borrowers’ preferences, driving

them to alternative and/or online lenders that are modernizing their lending decisions to keep up with the

next generation of borrowers.

Challenge 2: The myth of a sustainable 36 percent cap on interest rates.

Regulators and consumer groups have long-defined 36 percent Annual Percentage Rate (“APR”) as the

threshold for whether a loan’s terms are predatory. This presumption has carried through to state law,

where according to a report by the National Consumer Law Center, over 35 jurisdictions – 70% of states

– still provide for annual interest rate caps at a 36% APR benchmark or less.

15

These caps do not adjust

for inflation or changes to the Federal Reserve’s borrowing rate.

A 36% APR interest rate cap makes small-dollar lending unsustainable as a business model. Take for

example a short-term, small-dollar loan for $100 that comes with an APR of 180%; if the borrower pays

back the loan in two weeks, the bank will collect less than $7. This fee will fall short of the lender’s

costs and, indeed, will likely fail to even cover the costs of paperwork allocated to setting up the loan.

Had the loan been capped at 36% the lender would have made even less: $1.38.

Unfortunately, the FDIC has helped perpetuate the myth of a sustainable 36% cap. In 2007, the FDIC

announced its Small-Dollar Loan Guidelines, encouraging lenders to offer loans at rates less than 36%

with low or no fees.

16

In 2008, the FDIC followed up with a two-year pilot program to study sound,

small-dollar loan products based on the 2007 guidelines.

17

The FDIC deemed a 36% APR, as well as

the other features set forth in its guidelines, to be helpful for institutions to “meet the goal of safe and

sound small-dollar credit programs, which is to provide customers with credit that is both reasonably

priced and profitable.”

18

The problem is that the 36 percent interest rate cap is a red herring. The theory behind the cap is that

lenders will offer loans terms with interest rates under 36 percent for longer terms. Many state law

formulations often couple these limits with a pre-payment barrier or penalty. Consider the following

argument used for a 36% rate cap:

One of the benefits of a 36% rate cap is that it forces lenders to offer longer term,

installment loans that have a more affordable structure. Lenders are also

encouraged to do more careful underwriting to ensure that the borrower can afford

the loan. Payday loans are unaffordable not only because of their rate but also

because of their short term and single balloon payment structure.

19

As demonstrated, advocates of the 36 percent interest rate cap often conflate the real source for high

default rates: the combination of high interest rates and generic underwriting standards that result in

uniformly short and predatory terms.

15

Lauren K. Sanders, National Consumer Law Center, “Why 36%? The History, Use, and Purpose of the 36% Interest Rate

Cap” (April 2013).

16

Id.

17

Id.

18

Id.

19

Id.

8

Docket No. RIN 3064-ZA04

DLC Response

As discussed further below, DLC and other installment loan competitors have developed products that,

while carrying interest rates higher than 36 percent, better capture the credit risks involved in short term

lending.

In sum, the FDIC should move beyond the constructs of an arbitrary 36 percent APR cap and instead

focus on ways to encourage insured and regulated depository institutions to offer products that appeal to

borrowers and are affordable based on each borrower’s individual characteristics.

III. Recommendations

To address two small-dollar credit challenges discussed above, DLC makes three broad

recommendations:

1) The FDIC should collect data about borrowers who turn to online and alternative lenders to

determine the loan features they demand;

2) Banks should modernize underwriting standards so they can make more personalized

underwriting decisions; and,

3) Banks should offer a low principal introductory loan that charges an interest rate that is

determined by the borrower’s underwriting risk, not an arbitrary catch-all cap.

Recommendation 1: The FDIC should collect data about borrowers who turn to online

and alternative lenders.

In the past, the FDIC has focused on the percentage of borrowers who are unbanked and underbanked as

evidence of the need for increased small-dollar lending products. While this population provides a

portion of individuals who would be better served by more of these products, this picture is incomplete.

That is because, as discussed above, many borrowers who use alternative financial service providers are

not unbanked and underbanked, but instead prefer online lenders.

Thus, the FDIC should start tracking the profiles of borrowers who seek alt-finance and online lending

to help banks better understand why some borrowers are turning to alternative lenders for their small

dollar lending needs. Unfortunately, the FDIC is seemingly failing to track this growing trend. A recent

search for “online lender” through the FDIC website returned non-related search results such as

“Educational Resources Online” and “FDIC Consumer Resources.”

The failure to include these types of borrowers in the small-dollar lending analysis creates the

misperception that small-dollar loans only appeal to high risk, thin- and poor-credit borrowers. This

distorts the risk analysis banks must make in order to determine if they can viably offer small-dollar

products. In addition, a distorted risk analysis for small-dollar loans also impacts the amount of capital

the FDIC will require a bank to maintain to support these assets.

In sum, to effectively evaluate the option for small-dollar credit products vis à vis the banking

population at large, the FDIC cannot ignore a key and growing segment of the small-dollar short-term

credit industry.

9

Docket No. RIN 3064-ZA04

DLC Response

Recommendation 2: Banks must modernize underwriting standards.

For banks to capture market share from alternative finance lenders, they must streamline underwriting

by asking for fewer documents and using relationship underwriting or expensive forms of third party

data. Banks must also explore alternative formulas for credit approval decisions that incorporate

additional data beyond traditional measures of credit viability and risk.

For example, Clarity Services, a division of Experian, provides alternative data analysis and fraud

prevention services to help financial institutions make informed and appropriately risk-adjusted lending

decisions that do not exclude unbanked, underbanked and thin-credit borrowers.

20

On the other end of

the spectrum, banks should consider a manual underwriting model that provides small amounts of credit

to new customers and increases loans amounts after positive payment history. Over-reliance on standard

credit performance measures like the FICO Beacon score make Banks too rigid for this market.

By revising their credit decision formulas, banks will approve not only “credit-thin” borrowers, but also

millennial and entrepreneurial borrowers who find the alternative banking solutions more convenient,

more tech-savvy, quicker, and easier to use.

Recommendation 3: A low principal introductory loan is the key to meeting the credit

needs of consumers while maintaining prudent underwriting.

DLC’s experience is that introductory loans that are made based on quick lending decisions and

transparent terms and conditions, even if they come with higher interest rates, are the best way to reach

the small-dollar borrower market. Indeed, DLC’s “Signature Loan” is an introductory loan that requires

no credit history and nothing but a signature. A key feature of this loan from both a marketing and

consumer protection perspective is that there are no fees involved in taking out this kind of loan: No

application fee, no credit check fee, no approval fee, no funding fee, no late fee, no default fee, no

collection fee, absolutely no additional fees to the daily interest that is computed in a simple interest

calculation. These fully amortized loans are written for 65 week periods with payments being applied to

interest and principal.

The risk of default of this type of product is reflected in the 199% APR. While a 199% APR seems like

a large APR, for consumers with poor credit scores and a history of not repaying their bills, this is an

opportunity to access credit without using offshore Internet sites or other more dangerous unregulated

products.

The loan terms result in nominal and much more transparent borrowing costs. As a result, DLC’s

experience is that many borrowers pay their loans off in days, thus reducing and/or eliminating the

lending churn and “debt treadmill” that has so notoriously been a source of concern with the payday

lending industry.

20

Clarity reports itself as the leading source of alternative credit data with more than twice the amount of unique subprime

and near prime consumer identities in its database than its nearest competitor. See Experian’s Clarity Services, “The

Evolution of Credit Risk Evaluation,” (August 22, 2018).

10

Docket No. RIN 3064-ZA04

DLC Response

Loan Amount Interest per day

$1,000.00 Daily cost to a borrower $5.49

$500.00 Daily cost to a borrower $2.75

Banks should explore other product offerings that encourage unbanked and underbanked customers to

borrow, repay their loans, and establish good credit. In addition to traditional loans, banks should

consider offering other products such as access to prepaid credit cards, traditional credit cards, and

mobile lines of credit.

IV. Benefits of Adopting these Recommendations

Benefit 1: Banks will develop relationships with borrowers who will in turn graduate to

more profitable lending products while also meeting their CRA objectives.

Banks that develop lending relationships with small-dollar borrowers will be able to grow those

relationships in the future. This in turn offers the prospect of graduating those borrowers to more

profitable lending products, such as mortgages, car loans, and non-lending products including annuities,

retirement accounts, and interest-bearing savings accounts. This process is made possible because

small-dollar lending opens up opportunities for borrowers to break the cycles of high-cost loans and get

back on financial track. This evolution in turn allows borrowers to accomplish other financial goals.

Relatedly, banks that provide more small-lending products may be better positioned to meet their

Community Reinvestment Act (“CRA”) goals. Providing greater access to small-dollar lending

products will help institutions meet the CRA’s intention of encouraging lending to low and medium

income borrowers in the bank’s assessment area. CRA exams, regardless of institution size, share the

requirement that banks must be responsive to community needs. Considering the need for increased

small-dollar loans, as detailed above, expanding the offerings of such products will assist banks in

meeting this exam criteria. For this reason, the FDIC has specifically called on banks to include small-

dollar loan products and micro-lending in their CRA strategic plans.

21

Benefit 2: For consumers, the benefits of increased access to small-dollar loans outweigh

the risks.

Many critics of the FDIC’s efforts to expand small-dollar lending will point to the dangerous cycle of

high-cost loans than can be caused by many “payday” products. We agree that some balloon loan

products are structured to be unfair and surprisingly expensive. But recent public policies have ignored

economic theory and tried to solve a product-pricing problem by limiting the product supply instead of

21

Janet Gordon, “Supervisory Highlights: Not Just Adding Up the Numbers: Achieving CRA Objectives in Challenging

Times,” FDIC (Winter 2009) available at:

https://www.fdic.gov/regulations/examinations/supervisory/insights/siwin09/siwinter09-article2.pdf (last viewed Dec. 24,

2018), 21.

11

Docket No. RIN 3064-ZA04

DLC Response

increasing it. This approach is contrary to the laws of supply and demand.

22

Research from the

Community Financial Services Association of America reports that when small-dollar loans are not

accessible or are removed as an option, consumers bounce more checks, complain more about lenders

and debt collectors, and file for Chapter 7 bankruptcy at higher rates.

23

Many consumers will look to

illegal, offshore, or otherwise unregulated lenders, which further increases their financial exposure and

risk.

24

It is fundamental that Americans at all income levels should have access to credit. This can only be

accomplished if there is a competitive credit market so consumers can shop for the best options among

many alternatives. Currently, the market is fractured on a state-by-state basis and fails to meet

consumers’ needs.

Support from the FDIC will enable more community banks to profitably enter the small-dollar short-

term lending market. Only the federal government can reverse the anti-competitive lawmaking that has

trapped consumers into fewer and fewer legal credit options.

Banks are best positioned to improve the small-dollar credit market. First, banks aren’t hindered by

arcane state laws that limit the dollar amount, loan term, and pricing of small dollar consumer loans.

This allows banks to offer products that suit the borrowers’ credit needs and the bank’s appetite for risk.

Many states prevent non-bank lenders from offering very small loans (e.g. $100). But these are

precisely the loans that help the very poor or very risky borrower build credit history with a lender while

also reducing the lender’s risk in the event of non-payment.

Although consumers face the risk that a greater availability of small-dollar loan options will provide

more exposure to high-interest accounts, which in turn could drive up default rates and lower consumer

credit performance metrics, such risks would be present regardless of expanded access to small-dollar

loan products from traditional financial institutions. This is because without these options from

traditional lenders consumers will turn to alternative lenders, including online and offshore lenders, as

discussed above. These lenders face less regulation than their traditional banking peers and thus present

greater risks to consumers.

25

Moreover, these entities are uninsured, a fact that borrowers may not

appreciate, which in turn creates greater loss exposure.

Nor do we predict that such a reallocation of risk would have a systemic impact on the banking industry

as a whole. Indeed, the number of potential subprime borrowers makes up a fraction of bank lending

activity compared to traditional lending relationships between banks and businesses, institutional

22

See, e.g., Federal Reserve Bank of Atlanta, “Supply & Demand: How Do Markets Determine Prices”

https://www.frbatlanta.org/education/classroom-economist/infographics/supply-and-demand.aspx (last viewed Jan. 18,

2019).

23

Community Financial Services Association of America, “Policymaker Resources,” https://www.cfsaa.com/policymaker-

resources (last viewed 12/18/2018).

24

Id.

25

See e.g., Kelly Riddell “Consumers fear online lenders as option if feds squeeze paydays out,” Washington Times (Sept. 2,

2015) https://www.washingtontimes.com/news/2015/sep/2/online-lenders-unconstrained-by-state-laws-fill-vo/ (last viewed

Jan. 1, 2019) (“Online payday lenders may not be subject to any regulation under your state law, they can ignore any state-

issued consumer protections on the industry, like capped interest rates, rollovers and repayment plans,” said Ed Mierzwinski,

consumer program director for the U.S. Public Interest Research Group. “Online payday lenders think they’re beyond the

reach of state enforcers and often act like it.”)

12

Docket No. RIN 3064-ZA04

DLC Response

investors, and prime borrowers.

26

Rather, this is an opportunity for traditional banks to re-take market

share that has been lost to alternative, online and offshore lenders.

V. Conclusion

DLC appreciates the opportunity to provide commentary in response to the RFI. More importantly,

DLC appreciates the FDIC’s attention to this critical topic; without expanding banks’ provisions of

small-dollar credit products, an increasing number of consumers are likely to turn to alternative lenders,

many of whom may be offshore and that are less focused on consumer protection issues. This in turn

will likely lead to a greater risk of default, thus compounding the divide between the banked and

underbanked (and unbanked) populations.

**********************

Respectfully submitted,

Dollar Loan Center, LLC

26

See e.g., Gene Amromin and Anna Paulson, “Default Rates on Prime and Subprime Mortgages: Differences and

Similarities,” Federal Reserve Bank of Chicago (Sept. 2010) (reporting that 75% of mortgage loans are made to borrowers

with good credit); Jason P. Brown and Colton Tousey, “Auto Loan Delinquency Rates Are Risky, but Mostly Among

Subprime Borrowers,” Federal Reserve Bank of Kansas City (Aug. 15, 2018) (reporting that prime borrowers account for the

bulk of outstanding auto debt).