Payday loans

after the cap

Are consumers getting a better deal?

August 2016

Contents

Summary 2

Key Findings 3

Introduction 5

Methodology 7

Analysis of firms’ treatment of consumers 8

Treatment of payday loan borrowers 8

Affordability checks / irresponsible lending 9

Firms’ treatment of borrowers experiencing difficulty including

customer service 14

High interest rates, fees and charges 16

Repeat borrowing and spiraling debt 17

Complex terms and conditions 20

Payment methods 21

Access to payday loans 23

Being turned down for a payday loan 24

Conclusion 30

1

Summary

Between 2006 and 2013, payday loans were everywhere; their advertisements

staples of daytime television, city buses and billboards. At it’s peak in 2013, the

payday loan market was worth £2.5 billion. Citizens Advice saw a ten-fold

increase in the numbers of people coming for help with these loans and urged

the new regulator, the FCA, to take firm action against unscrupulous lenders. A

price cap and other regulations followed and the number of payday loan

problems coming through the Citizens Advice network halved. The question

remained - what happened to the payday market after the cap? This report

finds that many payday lenders are still failing to conduct adequate affordability

checks. Worryingly, borrowers who didn’t have an affordability check were

nearly twice as likely to have trouble repaying their loan as those who did

remember being asked about their ability to repay.

We look at Citizens Advice data alongside primary research to understand how

borrowers are being treated by payday lenders after the cap and what levels of

detriment are occurring. We also explore whether consumers are finding it more

difficult to access credit and what happens when consumers are turned down.

To ensure that payday loan borrowers get a better deal we have made 5

recommendations:

1. The FCA should make its guidance on responsible lending into a rule(s).

Creditworthiness assessments should require, as a minimum, proof of

income and expenditure.

2. Firms should ensure that borrowers can easily and transparently

understand how much they will owe in monetary terms if they fail to

repay. The FCA should add this into the Consumer Credit rulebook.

3. Firms should ensure that borrowers can easily and transparently

understand how much they will save in monetary terms if they repay

installment type payday loans early. The FCA should add this into the

Consumer Credit rulebook.

4. The FCA should look in depth at new developing business models in the

High Cost Short Term credit (HCSTC) market to fully understand the risks

they pose to borrowers and potentially ban those that result in significant

detriment.

2

5. Firms should adopt best practice in regard to debt collection to encourage

borrowers to engage with them when experiencing difficulties.

Key findings

Borrowers are less likely to get into extreme difficulty using payday loans than

before regulation but there is still room for improvement and borrowers are not

always being treated fairly.

We found that payday lenders may not be carrying out robust affordability and

creditworthiness assessments. While firms are asking for more information

about borrowers’ finances than before FCA regulation:

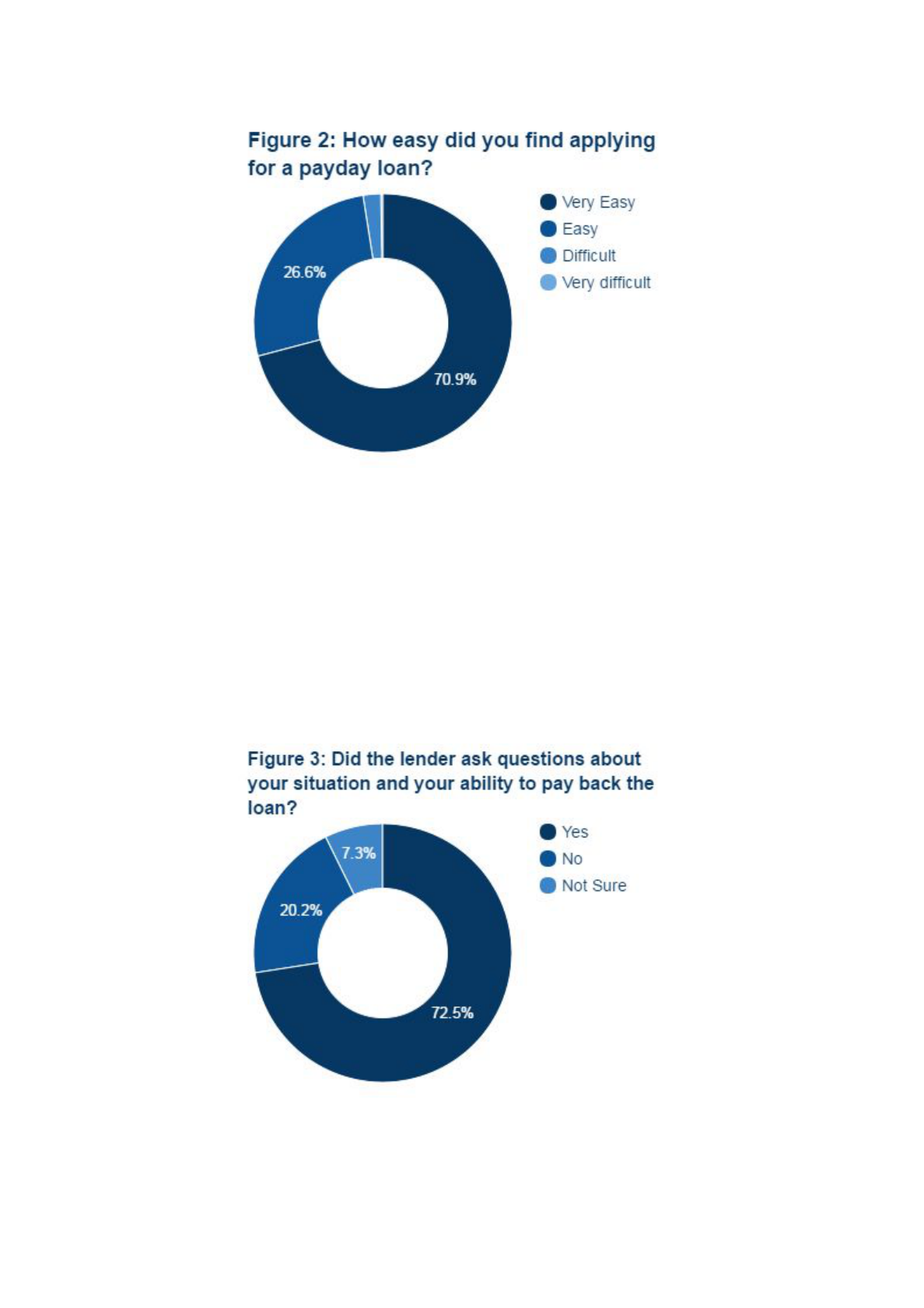

● 98% of borrowers said accessing payday loans was easy

● A quarter of borrowers did not remember having their affordability

assessed

● Most firms do not require proof of income and expenditure.

● Borrowers who were not appropriately affordability assessed are nearly

twice as likely to experience repayment difficulty

Despite some progress, half the borrowers experienced difficulty in repaying

their payday loan. Borrowers also remained reluctant, due to feeling

embarrassed, stressed and ashamed, to contact their lenders to agree

alternative repayment arrangements. Only half of those in difficulty spoke to

their lender. Firms need to consider this finding and should operate more

sympathetic and borrower focussed debt collection.

We saw varying practice from firms in dealing with their borrowers who

experienced difficulties:

● 44% of borrowers in difficulty who spoke to their lender agreed an

affordable alternative repayment plan

● 49% of those borrowers who agreed affordable repayment plans had

their interest and charges frozen

● 60% of borrowers who agreed affordable repayment plans were also

signposted to not for profit debt advice

We found evidence that firms are complying with the price cap rules and only

charging borrowers interest rates and fees within its limits. We also identified

much lower numbers of borrowers getting into repeat borrowing cycles. This is

3

driven by the changing business models of firms from short term credit to more

medium term installment loans.

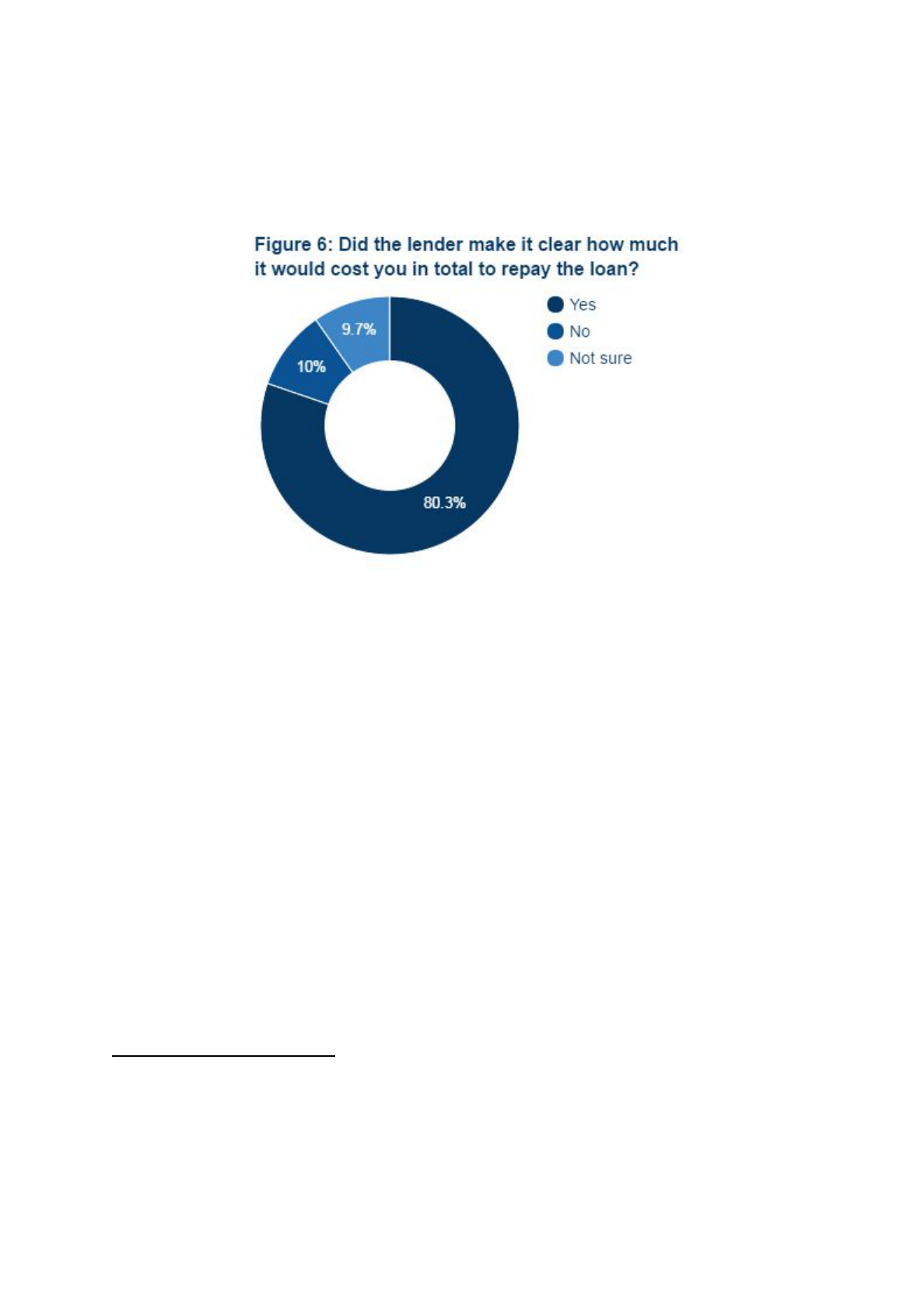

Borrowers are now finding it easier to understand how much their loan will cost

when they take out the agreement. Eighty one per cent told us it was clear what

they would owe. We did however find that more could be done to highlight what

borrowers would owe if they failed to pay on time or if they paid off early. This

would help consumers make more informed borrowing choices.

While firms have improved how they use continuous payment authorities to

collect loan repayments, there are a very small number of examples where firms

are using other potentially dangerous models for collecting repayments, such as

taking control of borrowers’ internet banking.

Our evidence shows that the tightening of regulation has led to a small

proportion of consumers no longer being able to access payday loans. As a

result, many are having to make difficult financial decisions, falling behind on

household bills and priority debts. What can be done to help these consumers

requires more work and will be the focus of a forthcoming project.

The positive developments we identified in our previous report of fewer clients

having payday loan issues is reflective of a market with improved practices and

lower numbers of borrowers suffering significant detriment. However, there are

still areas where firms need to improve to ensure they lend responsibly and

treat borrowers fairly.

4

Introduction

Payday loan borrowing rose dramatically between 2006 and 2013, when the

market value peaked at £2.5 billion. Citizens Advice witnessed a ten-fold

increase in clients experiencing payday loan issues and in 2012 launched a

campaign to highlight the issues being faced. After witnessing unfair treatment

and irresponsible lending Citizens Advice worked to raise awareness and lobby

for change. The market, as part of the consumer credit sector, was subsequently

subjected to a change in regulation with the FCA taking over responsibility in

April 2014. A number of interventions followed aimed at improving the market.

This report is our second looking at the payday loan market since the FCA took

responsibility for oversight. We wanted to understand the success of the

changes the FCA made to regulation of payday lending and any potential

unintended consequences.

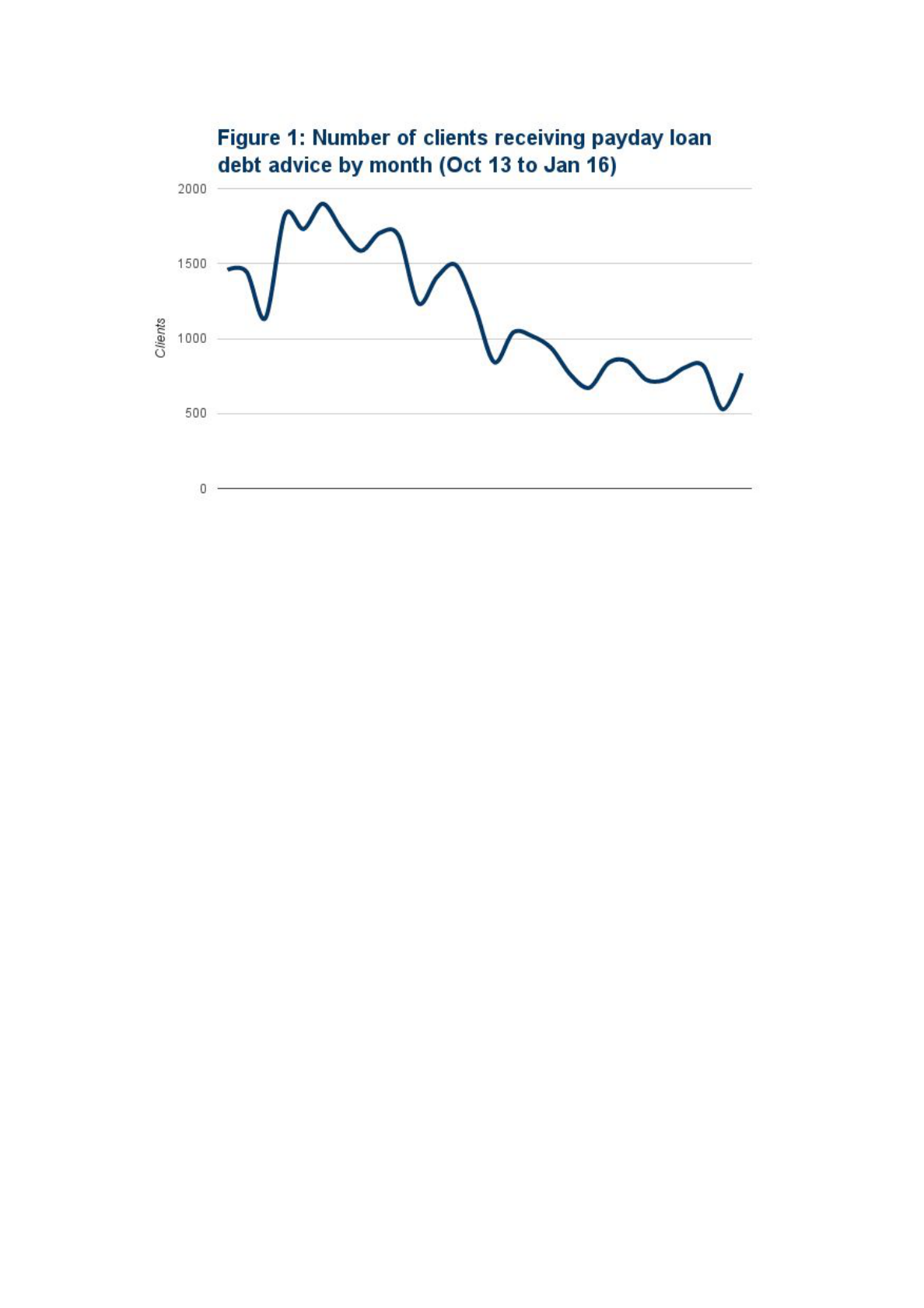

Our first report examined the payday lending market both pre and post price

cap, utilising Citizens Advice and market data. We found that the market had

1

gone through significant change with 38% of payday lenders having left and 45%

fewer clients coming to Citizens Advice with a payday loan problem (see figure 1

below). We also found that those still requiring payday loan advice had complex

debt problems and were still most likely to be young, single people on lower

incomes.

1

Payday loans: An improved market? Part 1, Citizens Advice, 2016.

5

▲ Source: Citizens Advice.

This report builds on those findings and looks in depth at borrowers’

experiences of payday loans since the changes: from application procedures,

treatment if accepted, any detriment experienced and the outcome of their

payday loan. Where possible we have compared how this has differed before

and after the regulatory changes. We also assess whether regulation has had

unintended consequences, such as whether cost-capping has led to increases in

other sources of detriment like lack of forbearance or poor debt collection

practices. We also explore what the changes have meant in terms of access,

looking at how many pre-regulation borrowers are still using payday loans and

what is happening to those people who can no longer use them.

6

Methodology

We used a combination of Citizens Advice data and primary research:

● A survey of payday loan borrowers - 432 consumers who had attempted

to use payday loans since January 2015 completed our online survey on

the payday loan application process, experience and outcomes. The

survey ran from 1 March to 29 July 2016, and was promoted on the

Citizens Advice website and by key external organisations such as Money

Saving Expert.

● A survey of our network of advisers - we used the Citizens Advice network

panel in May 2016 to understand what advisers are seeing in their

interactions with our clients relating to payday loans. The Citizens Advice

Network Panel is a monthly survey sent to over 800 staff and volunteers

across England and Wales, asking about their experiences of and views on

policy issues.

● Qualitative depth interviews with payday loan borrowers - we undertook

15 semi structured interviews with borrowers who had experience of

accessing the payday loan market since the changes. The interviews

explored the detail of their experience including how they accessed loans,

their wider credit situation, their experience and how the firm treated

them, and the outcomes that resulted from accessing payday loans.

● Qualitative views on the market from our network - we ran facilitated

workshops with a range of colleagues from across our network to

understand what local offices are seeing in their interactions with our

clients relating to payday loans.

● We searched our collection of anonymised case studies for cases that

contained either the words ‘payday loan’ or the name of any payday loan

firm. Any cases that referred to a payday in some other capacity (e.g.

employment payments) were removed to leave a total of 53 case studies

between January 2015 and May 2016.

● Statistical data from the Citizens Advice service in England and Wales

about consumer credit and household bill issues over the past four years.

7

Analysis of firms’ treatment of

consumers

Treatment of payday loan borrowers

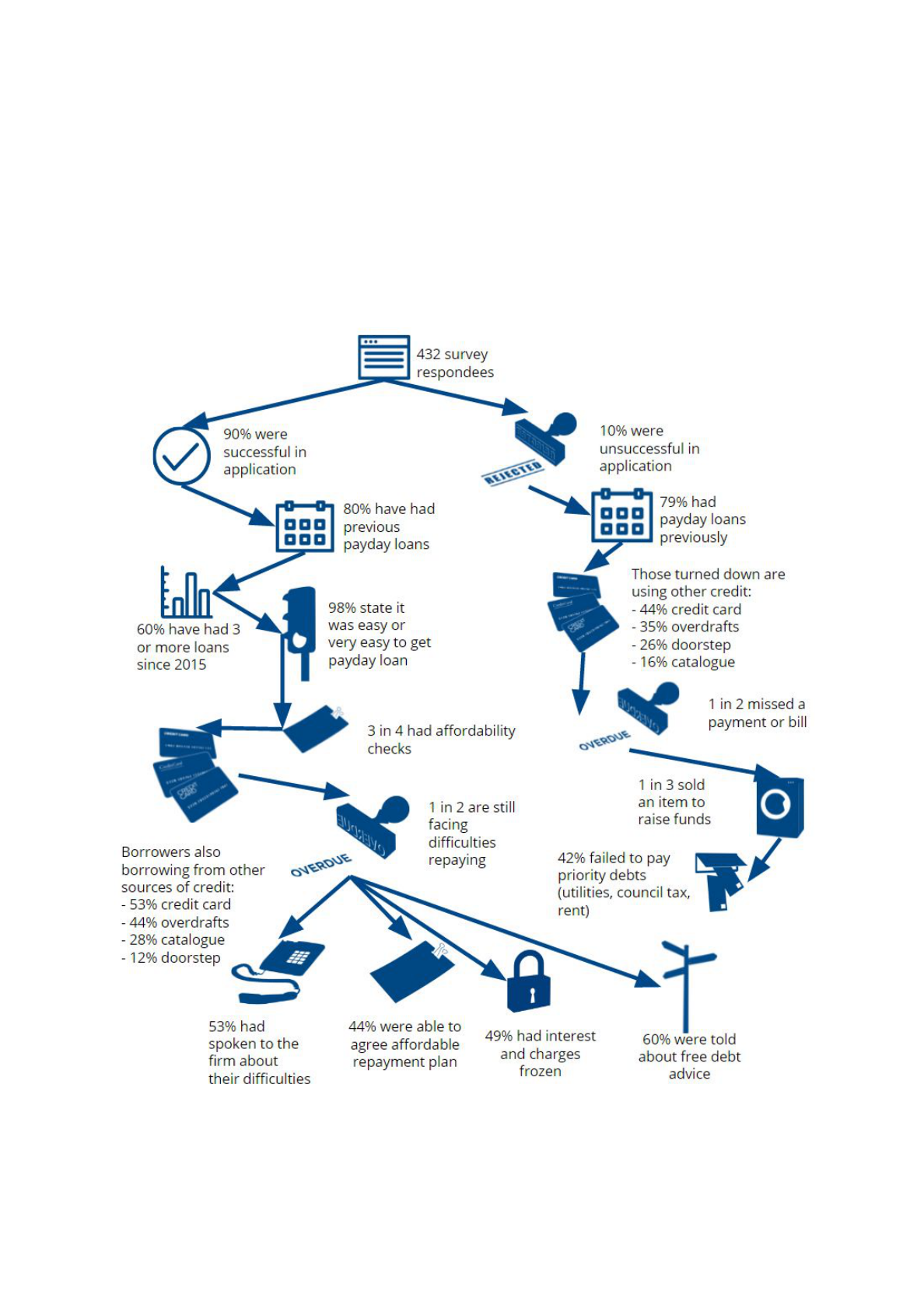

The graphic below shows a high level summary of borrowers’ payday loan

experiences.

▲ Source: Citizens Advice Payday Loan Consumer Survey 2016.

8

Affordability checks and irresponsible lending

The change in regulation has increased the pressure on payday lenders to carry

out more thorough affordability checks to ensure they are lending

appropriately. The Consumer Credit Sourcebook (CONC), which applies to all

firms operating in the payday loan market, outlines the expectations regarding

firms carrying out affordability checks to assess borrowers’ creditworthiness.

Chapter 5 of the FCA’s Consumer Credit Sourcebook (CONC) which sets out the

FCA’s rules and guidance for consumer credit firms makes reference to firms

ensuring that ‘creditworthiness assessments’ should take into account more

than assessing the borrower's ability to repay the credit. The guidance indicates

that the check must be based on information obtained from the borrower and

where necessary a credit reference agency, taking into account factors such as

the borrower's income and expenditure, financial situation, credit history, future

financial commitments, potential vulnerability and previous dealing with the

company.

CONC 5.2.4 also makes reference to the types of evidence and information the

firm may want to use to make the assessment. This includes evidence of

expenditure, evidence of income, credit score, credit reference agency report

and information provided by the borrower. The rules however stop short of

being prescriptive and leave this open to interpretation by the firm on a case by

case basis.

Historic evidence of how the payday loan market carried out affordability checks

showed that firms were not being thorough in their checks and asking potential

borrowers for very little of information and no proof. Clients in our depth

interviews told us that in most cases prior to 2015 they simply required

borrowers to manually input their income only. In a few cases borrowers were

also asked to outline their expenditure and occasionally any other debts they

had. For example:

A 44 year old man who accessed over 100 payday loans during the period

from 2006 to 2013 said “It is very easy to get, there are no checks, they are

just willing to give you money

.”

A 28 year old woman who took out payday loans with four companies

while at university between 2008 and 2012 said payday loans were “Easy

9

to get as they believe whatever you tell them and do not carry out any obvious

check

”.

Other borrowers we interviewed stated that the process for applying - before

regulation - was too easy. The firms carried out very few checks and never

asked for proof. Some borrowers said that they could have lied in the

information supplied and the company would not have known. Most borrowers

applied online and never interacted with someone from the company.

We also asked payday loan borrowers about the application process

post-regulation. In most cases firms were now asking for more detail on income

and expenditure, and asking borrowers about their circumstances more often.

In some cases borrowers were called back by the firm to check on some of the

details given. For example:

A 45 year old woman with a long history of debt and payday loan use

stated “There were now better checks done by phone and they also queried my

ability to pay

”.

A 44 year old man with a long history of repeat payday loan use explained

“it is a more stringent drawn out process

” and they “asked for more

information like bills, income, debts and spare cash

”.

While these are positive examples, there is still strong evidence that adequate

checks on affordability are not always being carried out. As Figure 2 shows,

almost all (98%) payday loan borrowers said it was still easy or very easy to apply

for a payday loan. When borrowers in depth interviews were asked what made

the process easy, they told us that online websites and phone applications were

easy to use and few required any proof. Borrowers indicated that they assumed

there were credit checks being carried out but the process was not visible and

they were not certain if it was happening.

10

▲ Source: Citizens Advice Payday Loan Consumer Survey 2016. Base of 362.

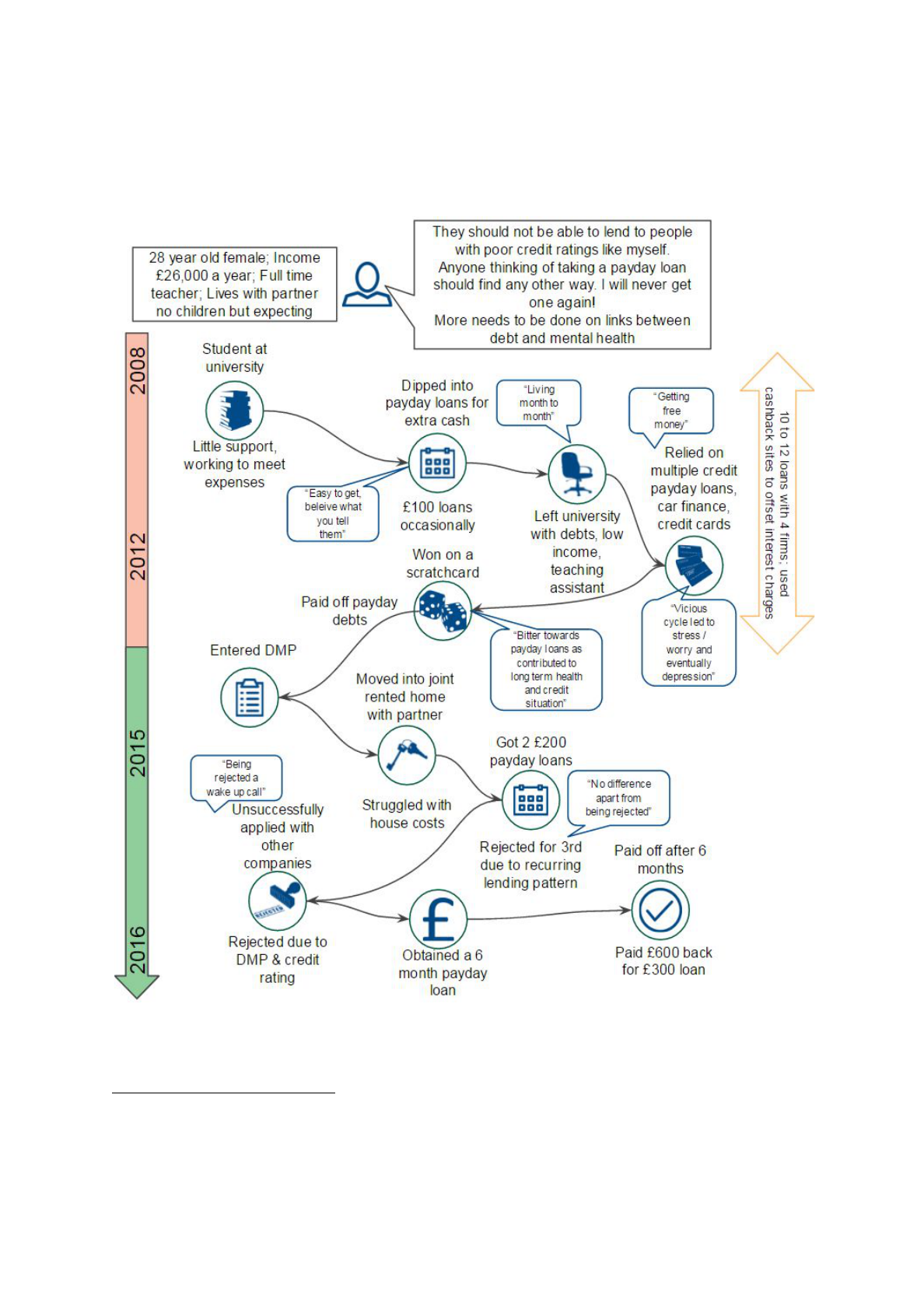

We looked to understand whether borrowers felt the firm had appropriately

checked their creditworthiness and their ability to repay the loan. Nearly three

quarters (see figure 3 below) remembered clearly being asked questions about

their situation and ability to pay back the loan. However, in the depth interviews

borrowers who had been successful in applying indicated that the affordability

checks were still based on information input by them, with lenders rarely asking

for evidence and proof of financial circumstances.

▲ Source: Citizens Advice Payday Loan Consumer Survey 2016. Base of 356.

11

We also asked the Citizens Advice network of advisers about affordability checks

for payday loans. The overwhelming view from advisers was that a lack of

rigorous affordability assessments was still an issue, if not quite as prevalent as

previously. As a result they were still seeing clients experiencing difficulty in

paying back the loans. Around a quarter (27%) of advisers identified inadequate

affordability checks as the biggest cause of detriment to their clients using

payday loans.

Local Citizens Advice also reported cases where firms were still lending

irresponsibly despite having carried out affordability and creditworthiness

checks, highlighting weaknesses in their lending criteria. The issues included

clients obtaining multiple payday loans despite having other debts, firms not

taking into account vulnerabilities like mental health or learning difficulties

before lending and borrowers’ income being at a level that meant they would

never have been able to manage the repayments effectively. Below are some

examples, all seen since regulations were changed in January 2015.

A 37 year old woman from Birmingham with two dependent children was

given multiple payday loans. This was despite numerous existing debts

including priority bills, and being on a zero hours contract and in receipt of

benefits. The client fell into a cycle of borrowing due to her inability to pay,

all of which had a detrimental effect on her mental health.

A 33 year old single man from Northumberland was successful in

obtaining a payday loan despite suffering from depression and

alcoholism, having no permanent address, being previously declared

bankrupt and having only benefit income.

A 25 year old woman was asked only limited questions on her initial

application for a payday loan that did not identify the multiple debts she

had at the time. Her application was approved, and subsequently, she fell

into arrears with the loan. She has not been able to agree an affordable

repayment plan with the lender.

This evidence from advisers was supported by evidence from the depth

interviews with payday loan borrowers. People we interviewed outlined a

number of situations in which a payday lender had not robustly checked their

situation. We found examples in which the borrower had managed to obtain a

12

payday loan despite having an existing debt management plan in place. The

2

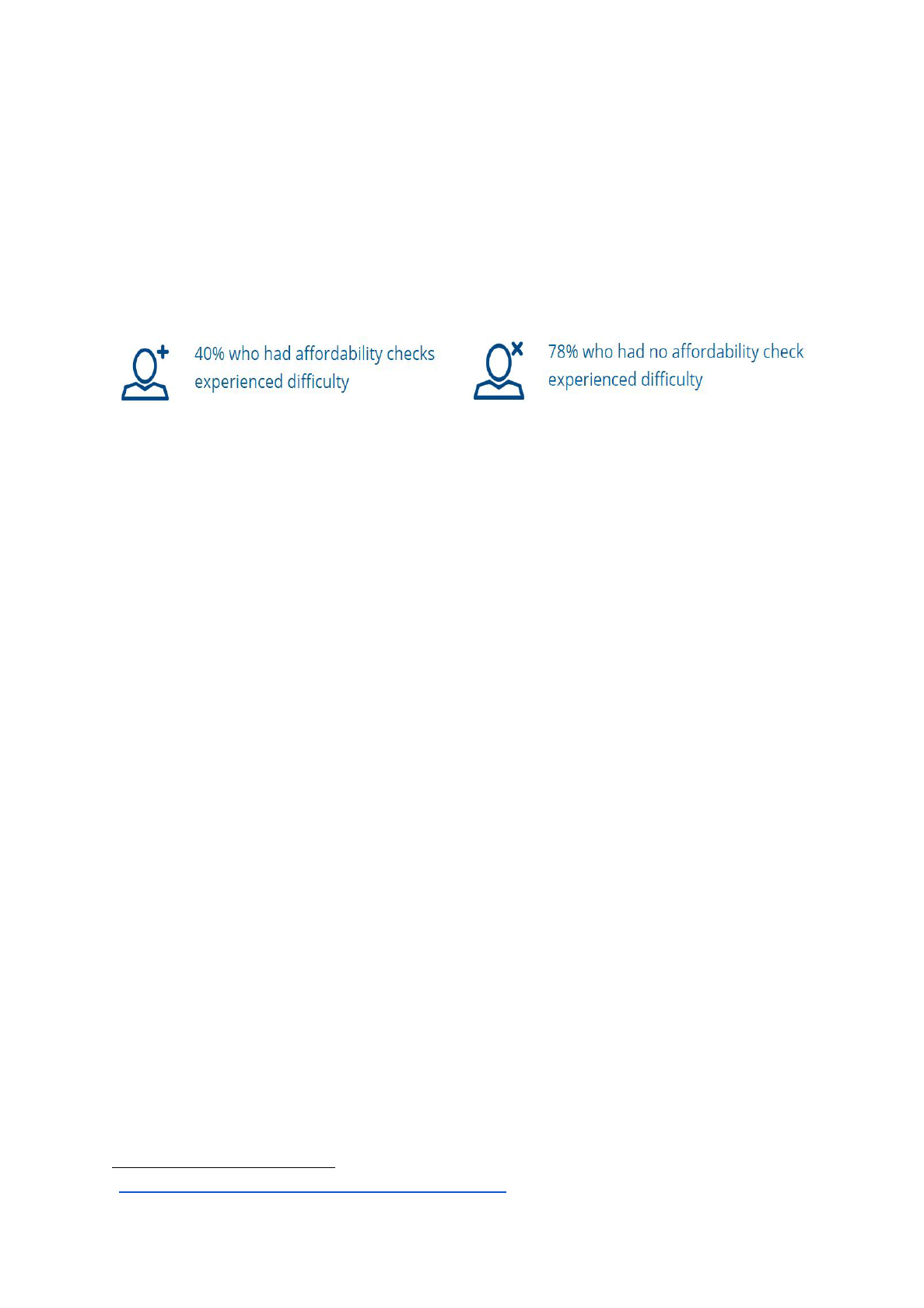

customer journey on the next page shows one such example.

▲ Figure 4: Consumer journey illustration from a depth interview carried out in May 2016. Showing

success in obtaining loans despite having an active DMP.

2

A debt management plan (DMP) is an informal agreement between a debtor and their creditors

for paying back non-priority debts e.g. credit cards, loans. Debts are paid in one set monthly

payment, which is divided between all creditors. Most DMPs are managed by a DMP provider who

deals with the creditors. A DMP is not legally binding, meaning debtors are not tied in for a

minimum period and can cancel it at any time.

13

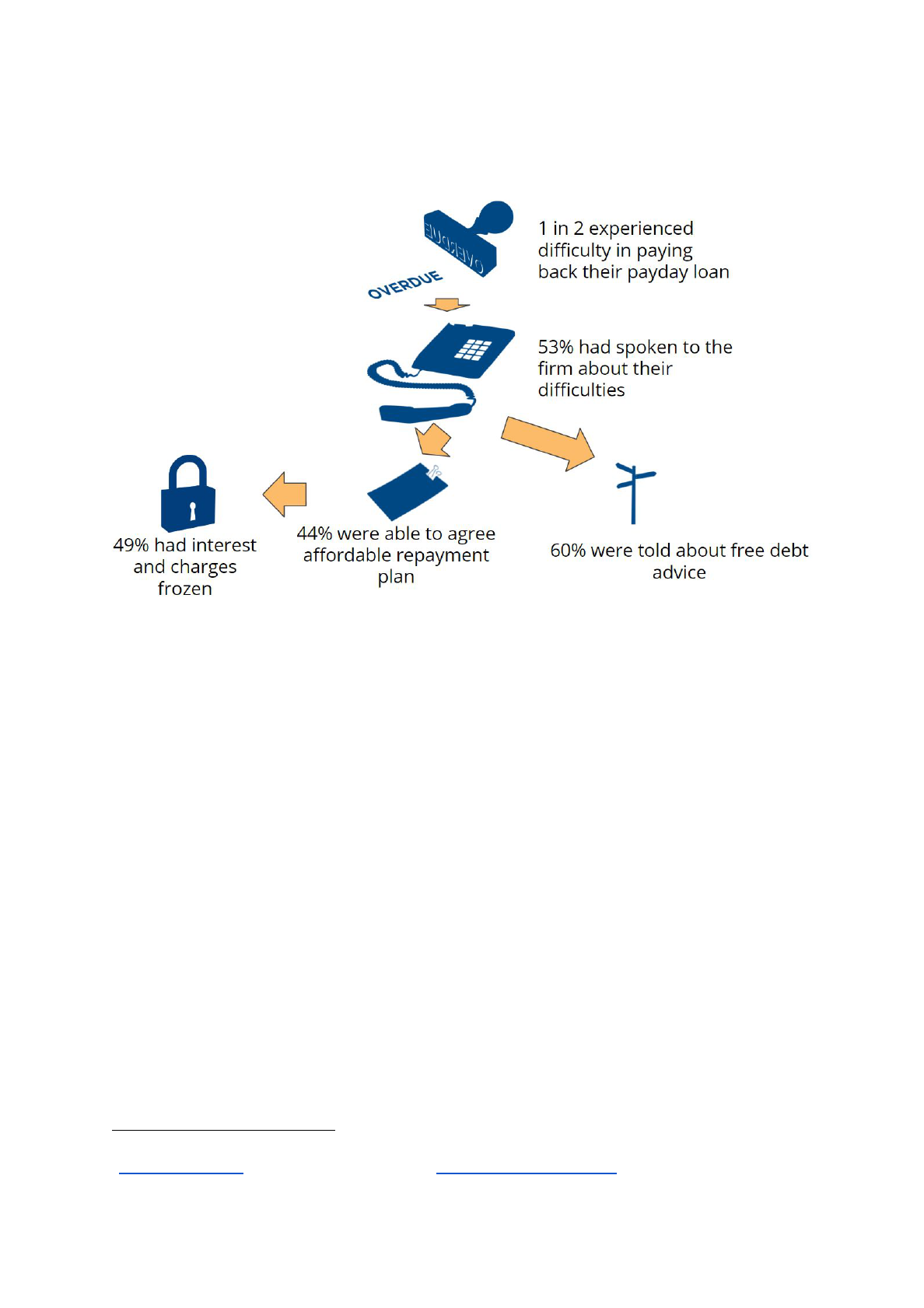

It is worth noting that we also saw examples where the firm rejected consumers

due to poor credit histories. The importance of firms carrying out these

affordability checks appropriately and thoroughly is shown when we see the

strong correlation between borrowers who remember being asked about their

ability to repay and those who end up facing difficulty. We found 78% of those

who didn’t have an affordability check experienced difficulty compared to only

40% who remembered having an affordability check.

In summary, our research finds that there has been some improvement in

affordability checks, with most borrowers indicating that they were asked for

more information than pre-regulation, and some evidence of borrowers being

challenged on their ability to repay. However, lenders could do more to obtain

proof and undertake a more thorough assessment of borrowers’ potential

vulnerability. This indicates that the FCA responsible lending rules need to be

stronger to ensure that firms routinely carry out rigorous affordability checks.

Firms’ treatment of borrowers experiencing

financial difficulty

Firms have a responsibility to ensure that they treat borrowers who have

difficulty repaying their loan fairly. This includes ensuring they take appropriate

and proportionate forbearance measures and work with borrowers to set up

plans that enable the borrower to pay back the loan and any associated charges.

It was expected that the number of payday loan borrowers with difficulty

repaying would fall due to FCA rules to reduce the amount of interest, limit the

default fees and ensure that borrowers only ever paid back double the amount

borrowed. The image below (figure 5) shows the proportion of borrowers who

3

faced difficulty in paying back their most recent payday loan. These are still

significant numbers: we found half of borrowers were getting into difficulty with

their payday loans despite the changes. As noted above, this increases when

looking just at borrowers who stated they had no affordability check. This

3

Proposals for a price cap on high cost short term credit, FCA July 2014

14

reinforces our finding that firms are not always lending responsibly and

highlights the need for robust affordability and creditworthiness checks.

▲ Figure 5: Graphic highlighting the number of borrowers still facing difficulties and how the firms’

treated them when they were in difficulty. Source: Source: Citizens Advice Payday Loan Consumer

Survey 2016.

Firms have responsibilities when dealing with borrowers in financial difficulty to

consider alternative payment plans, allow more time and freeze interest and

charges. Only 53% (see figure 5) of borrowers who experienced difficulty had

4

actually spoken to the company. From the depth interviews, borrowers indicated

that they sometimes felt embarrassed, stressed and ashamed about getting into

difficulty and could not face asking for help either from friends and family or the

firm. This indicates a need for payday lenders to use best practice in debt

collection. All communications need to encourage borrowers to engage with

5

firms.

Under the rules and guidance set out in CONC 7.3, the FCA expects firms to treat

borrowers fairly, allowing them such things as reasonable time and opportunity

to repay the debt, the ability to defer payments and consider token payments.

4

CONC 7.3.5 and CONC 7.3.6

5

Do the right thing. Citizens Advice et al 2010. How to do the right thing. Addressing Financial

Difficulties group 2011.

15

FCA guidance requires firms to accept reasonable repayment proposals made by

borrowers.

Over half (56%) of those who had spoken to the firm about difficulties had not

managed to arrange a repayment plan that they felt was affordable. These

findings show that there is still evidence of poor practice in the treatment of

those experiencing financial difficulty in the payday market. This type of

behaviour can exacerbate the borrower's debt situation and force them into

repeat borrowing or to prioritise payment of the payday loan over other more

important commitments.

The FCA guidance in CONC 7.3.5 states that firms should ‘consider suspending,

reducing, waiving or cancelling any further interest or charges’ for borrowers in

financial difficulty. Half (49%) of payday loan borrowers said that when they

spoke to firms to agree repayment plans after falling behind on payments the

company did freeze the interest and charges. This shows that firms in some

cases are adopting the guidance. It does, however, mean that the other half are

not receiving forbearance even after they provide proof of financial difficulty.

CONC also includes guidance encouraging firms to signpost or directly refer

borrowers in default or arrears to sources of not for profit debt advice. Figure 4

6

shows that 60% of borrowers who were experiencing financial difficulty were

informed about available debt advice following contact with their lender about

their difficulties in paying back their loan. As with affordability checks and

forbearance, this shows a picture of mixed practice by payday lenders, with

many failing to fully comply with FCA guidance.

High interest rates, fees and charges

The payday price cap that was introduced at the start of January 2015 was aimed

at bringing an end to the extortionate interest rates and fees associated with

payday loans. The cap set the maximum interest rates, charges and total

7

amounts for high cost short term credit products. In summary, this means that

borrowers never have to pay back more than twice what they have borrowed,

interest is capped at 0.8% per day and default fees do not exceed £15. The

expectation was that this would affect profitability for firms.

6

CONC 7.3.7 (a)

7

FCAconfirmspricecaprulesforpaydaylenders,FCApressrelease,November2014

16

The FCA predicted that the introduction of the cap would protect borrowers

whose financial position had worsened through use of payday loans. It also

identified it would reduce those who struggle to pay due to spiraling costs and to

reduce costs for borrowers. It was also predicted that this would lead to a

reduction in the number of consumers able to access loans, encourage firms to

lend responsibly and reduce the cost of credit. This section explores how firms

have implemented the cap and what impact this has had for borrowers.

Historically the interest and charges levied on payday loans were very high.

Payday loan borrowers frequently ended up owing thousands of pounds for

relatively small loans of a couple of hundred pounds. Often, this resulted in

repeat borrowing to pay off the original loan and borrowers became stuck in a

cycle of recurring and spiralling debt.

We saw examples from our depth interviews where it was clear that the firm had

been compliant with the price cap. For example, the borrower in the example

below paid back 100% of the original value borrowed.

A 28 year old woman turned to payday loans after moving in with her

partner in 2015 and struggling with the initial costs needed to set up

home. She was successful in an application for a £300 loan and paid back

a total of £600 at the end of the 6 month term.

Despite the price cap, Citizens Advice advisers identified high interest rates as

the largest cause of detriment in the current payday loan market, with 37% of

the panel identifying this as the main issue. The evidence collected has not

shown any cases where it is obvious that the firm has charged interest and fees

that are above the levels stated in the price cap. There is however still a

perception from borrowers that the interest rates remain high, mirroring the

adviser view that interest rates are the biggest issue.

Repeat borrowing and spiraling debt

The FCA payday price cap consultation and the CMA payday lending market

investigation reported that repeat borrowing was an issue for payday loan

borrowers prior to the regulatory changes. Borrowers have three options open

8

to them in terms of repeat borrowing: taking out a new loan with the same or

8

PAYDAYLENDINGMARKETINVESTIGATIONRepeatborrowingandcustomers’useofmultiple

lendersworkingpaper,CompetitionandMarketsAuthority.

17

different provider; rolling over an existing loan amount or drawing down funds

to top up an outstanding loan.

Clients in our depth interviews told us that pre-cap they needed to borrow from

multiple lenders to pay off their existing borrowing. They told us that they had

multiple loans with the same company and had rolled over their loans, causing

the fees and charges to spiral and becoming involved in cycles of payday loan

debt where they could not cope. For example:

A 44 year old man took out over 100 payday loans over a five year period

from 2007 with ten different firms. He took them out to pay for household

bills and rent after being made redundant. After finding another job, the

man ended up using payday loans for living expenses, as his wages were

all going to pay off the debt leaving him no money to live on. The

mounting fees from rollovers made it impossible to get out of the cycle of

debt.

A 28 year old woman turned to payday loans while at university to cover

expenses after spending her student loans. Over the four years of her

degree she took out a dozen payday loans with six firms and from month

to month would rollover the loans. She was taking out loans to cover the

high interest rates and charges. This led to an ongoing reliance on credit.

After leaving university she relied on credit to pay off debts.

The CMA market investigation in 2015 found that over 80% of loans made by

payday lenders were to borrowers who had taken out a loan with them

previously. Similarly, we found that 83% of those who successfully applied for a

payday loan had previously used payday loans in the past and the majority had

borrowed multiple times either with the same firm or with different providers.

Significantly fewer borrowers are getting into financial difficulty through repeat

lending and rollovers, post cap. We have, however, seen some evidence of

borrowers being offered increasing amounts of credit by payday lending firms.

Depth interviews revealed cases where the borrower had not requested the

extra credit, did not need it, but given the money was there they felt compelled

to use the extra amount. This can lead to customers borrowing more money

than they can afford. It is not clear that lenders are carrying out affordability

assessments at this point and instead may be supplying the additional amount

18

based on the borrower’s lending history with the firm. The case below shows an

example of this:

A 50 year old woman had taken out a payday loan for £180 in mid 2015 to

cover costs and bills due to her partner being off work for an operation.

Then she took another loan of the same amount from a different

company the next month. Since then both firms have increased the credit

limit each month and now the borrower has two loans with two

companies with available funds of £400 on each.

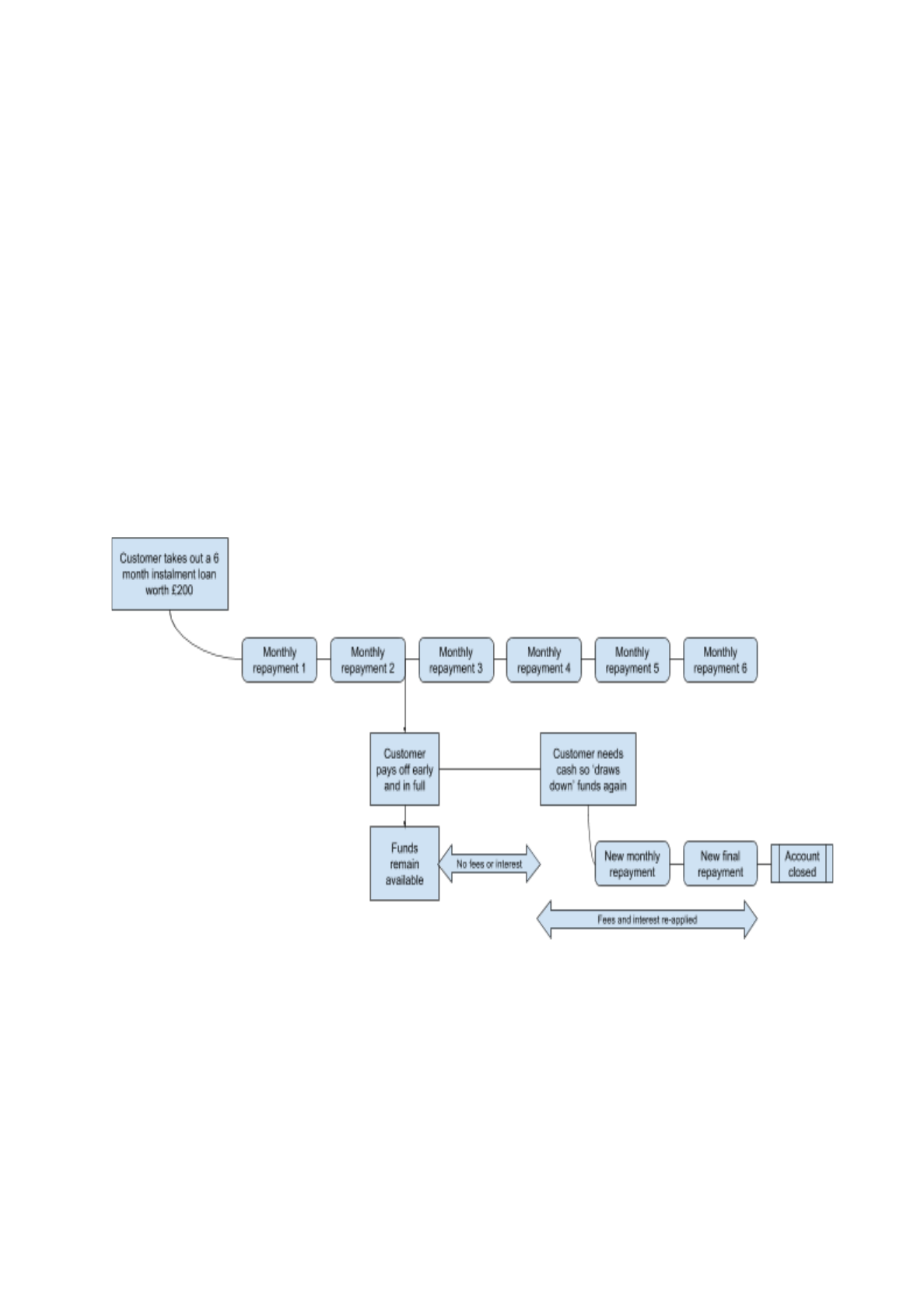

This appears to be a consequence of the change of business models some

payday lenders have made since the change in regulations. Many firms have

changed from the typical short term month loan option to a three to six month

installment loan model. The diagram below highlights how some of these

appear to be working.

The hidden consequence of this development is that firms are keeping

borrowers’ funds available despite them paying off in full early. This means that

borrowers have an opportunity to take this credit out again allowing the firm to

charge interest again until the borrower pays off in full.

19

Complex terms and conditions

Many financial products disclose a large amount of information to the borrower

upon them taking out or using a product in terms and conditions, and payday

9

loans are no different. It is a challenge for firms and regulators to get the

balance right between disclosing enough information to the borrower to enable

them to make an informed decision and not overwhelming the borrower or

making the terms so complex that they do not understand them. The way that

information is presented can significantly affect consumer preferences and the

decisions that they subsequently make. Researchers use the term ‘framing

effects’ to describe the phenomenon of individuals’ preferences shifting when

the same choice is framed in different ways. Payday loan borrowers often face

10

long and complex terms and conditions that appear online when taking out a

loan. Clients in our depth interviews said that they did not understand the terms,

or some specific conditions like interest rates and in some cases did not read

them at all and just ticked the agreement.

Below are some quotes from borrowers we spoke to regarding the terms and

conditions for their payday loans:

“[T&C’s] they are just long biblical text”

45 year old female payday loan borrower, payday loan taken out in 2011

“I don’t look at them [interest rates and terms]”

25 year old female payday loan borrower, payday loan taken out in 2015

“It’s just jargon and not understandable” [terms & conditions]

50 year old female payday loan borrower, payday loan taken out in 2016

“Even though I was told the lending rate, I didn’t understand. I have learning

difficulties and I don’t have much knowledge of money”

40 year old male payday loan borrower, payday loan taken out in 2016.

We asked borrowers how clear the firm was in telling them how much they

would owe. We targeted this aspect of the terms and conditions as it tends to be

the most important part of the agreement to borrowers. Historically firms have

used representative APRs, which borrowers told us they do not really

understand. Lots of firms have adapted and developed simple ‘sliders’ that

9

BBA insight into clearer terms and conditions. BBA 2015.

10

Applying behavioural insights to regulated markets. Citizens Advice 2016.

20

identify the cost of the loan in a simple and adaptable way to help borrowers

understand what they will owe. The results suggest that this has helped as 81%

of borrowers stated that the cost was clear to them on taking out the loan.

▲ Source: Citizens Advice Payday Loan Consumer Survey 2016. Base of 359.

However, more needs to be done to aid borrower understanding of their

agreement. Payday lenders should enhance visual representations like sliders to

also show:

● What they would owe if they could not pay in full in the same way or

● What they would save if they paid back earlier

This would drive up informed decision making on the part of borrowers and

would also be a welcome statement of intent from the industry of putting

borrowers at the heart of their business.

Payment methods

CONC 7.6 sets out the FCA’s requirements in relation to the use of continuous

payment authorities (CPA) with specific rules relating to their use by lenders in

11

11

A continuous payment authority is a type of regular automatic payment that can be set up using a

debit or credit card. This method of payment is set up by giving your debit or credit card details to

the company you wish to make a regular payment to. This can be done over the phone, in person

or online. Often there is no written record of the authority being set up. A continuous payment

authority gives the company the mandate to take payments on dates of their choosing and take

payments for different amounts.

21

the High Cost Short Term Credit market. Historically we saw evidence of firms

using their CPA access to clear funds from their borrowers outside of agreed

payment cycles. For example, one borrower during our depth interviews

explained how a firm did this in 2012 with significant impact.

A 45 year old woman had taken out a payday loan for £100 but had to

extend and rollover multiple times. Then the company took all of the

money from her bank account, about £650. This meant she had no money

for transport to and from work or for collecting her child from school that

week. She didn’t want to ask for help from colleagues due to the shame.

As a result, she was unable to pay her mortgage and other loans, resulting

in significant arrears charges.

Some cases post-regulation show firms clearing funds from borrowers’ accounts.

A woman from the West Midlands had three payday loans at the same

time in 2015 when one firm, which had originally failed to send any loan

paperwork, took the last of her money from her account without any prior

notice and no permission.

The FCA tightened the rules to ensure that firms could only attempt to collect

payment via CPA unsuccessfully twice and re-asserting the borrower’s right to

cancel such agreements. While the evidence suggests that firms are continuing

to use CPAs to collect funds from their borrowers, we have only seen a few

cases where this is being abused. We have however seen a small number of

cases regarding specific firms openly using unsatisfactory methods to collect

repayments. We found example cases where firms were using their access to

borrowers internet banking to put funds into their account, despite the

borrower not requesting additional funds. For example:

A 50 year old woman had taken out a payday loan for £180 in mid 2015 to

cover costs and bills due to her partner being off work for an operation.

Upon application, the firm required her to share her internet banking

details including login, password and memorable characters. From this

point the firm had on multiple occasions accessed the woman's account to

either take funds once the bank balance was above a certain amount or

putting additional funds into the account when the balance dropped

below £50, all without the specific consent or request from the borrower.

22

Access to Payday Loans

The FCA consultation on the payday loan price cap assumed that if their rule

changes were implemented, 11% of consumers who had previously used payday

loans would no longer be able to access them.

12

The results of our survey were broadly in line with this. Ten per cent of

respondents were turned down when applying for new loans. Of those turned

down, the majority (79%) had previously taken out payday loans and the

remainder were trying to access them for the first time. It is impossible to tell if

these people would have been successful before regulation.

Those who were unsuccessful in applying for a loan had also taken out other

credit in the period:

● 42% had used credit cards

● 35% had used an overdraft

● 26% had borrowed from doorstep lenders

● 14% had used catalogue credit or online retail credit for purchases

● 12% had turned to pawnbrokers

● 12% bought goods through rent to own stores

We asked our network of advisers whether they had seen a difference in how

easy it was for clients to access payday loans. Only a fifth thought that it had

become more difficult.

● 72% identified having seen no difference

● 20% indicated it had become harder

● 4% felt it is now easier

Taken together, these findings suggest that payday loans have become slightly

more difficult for consumers to access.

Being turned down for a payday loan

While improved outcomes for payday loan customers post-regulation is a

positive development, it is also important to understand the experiences of

those who are no longer lent to. We asked our advisers what their clients were

doing after being turned down for payday loans. Nearly half (40%) of advisers

12

Proposals for a price cap on high-cost short-term credit, FCA, July 2014

23

were unsure. The most common response from the other advisers was that

clients are relying on their friends and family for borrowing (28%). Only a small

number (6%) indicated that borrowers were turning to illegal lending or

unauthorised credit. Advisers were unable to supply significant evidence that

this was happening and we cannot conclude that many consumers are turning

to illegal lenders after being turned down for payday loans.

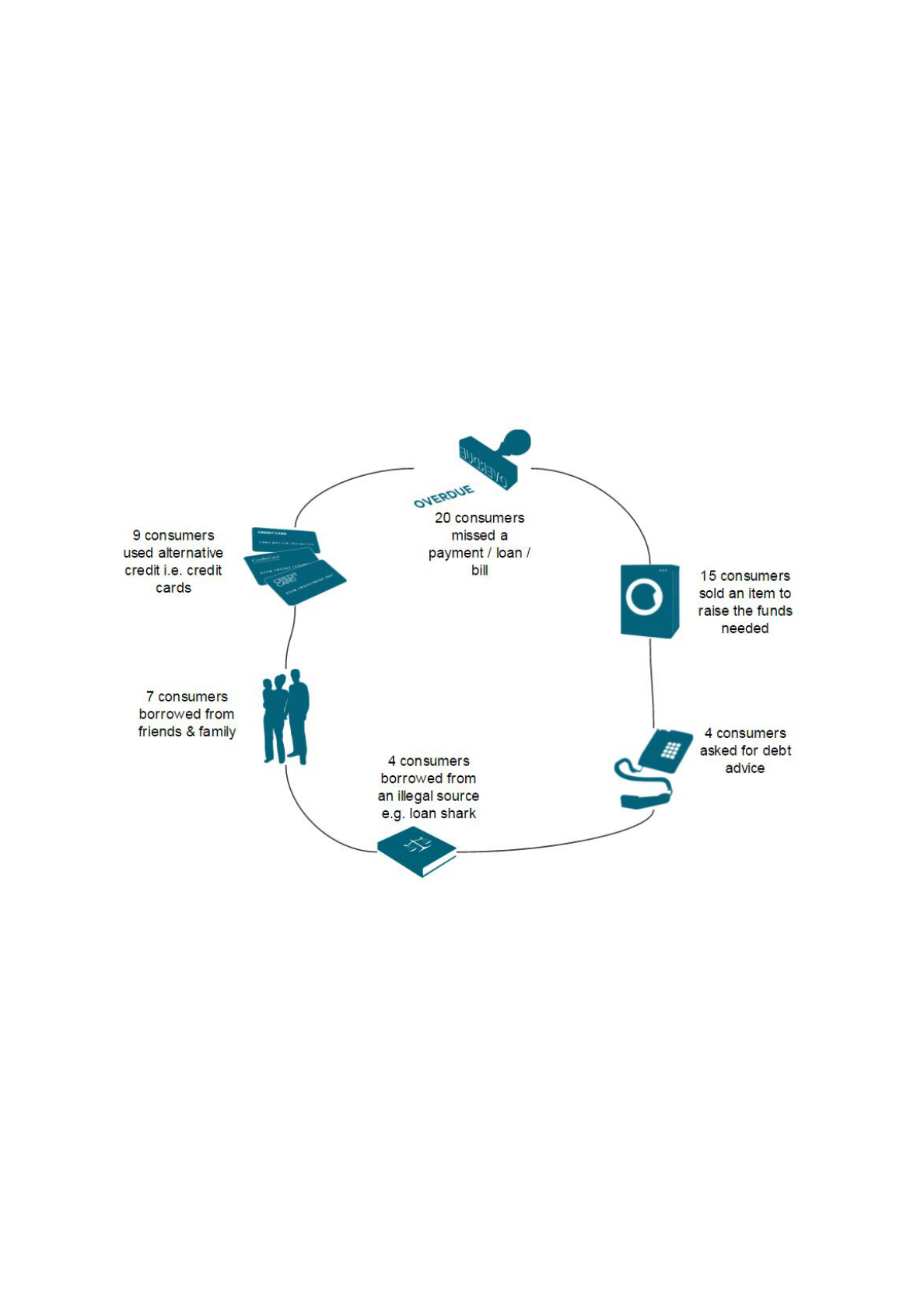

We asked consumers what they did when they were turned down for a payday

loan. As shown below, nearly half (47%) missed a payment on a loan or

household bill and a third (35%) sold an item to raise funds.

▲ Figure 7: Overview of what consumers did when they were turned down when applying for a

payday loan. Source: Citizens Advice Payday Loan Consumer Survey 2016.

Many consumers were doing several of these things. A third of those who

missed a payment were also using alternative credit and selling items. Only one

respondent to our survey told us that they went without the item or service that

the payday loan was intended to pay for. The decision to miss a payment on a

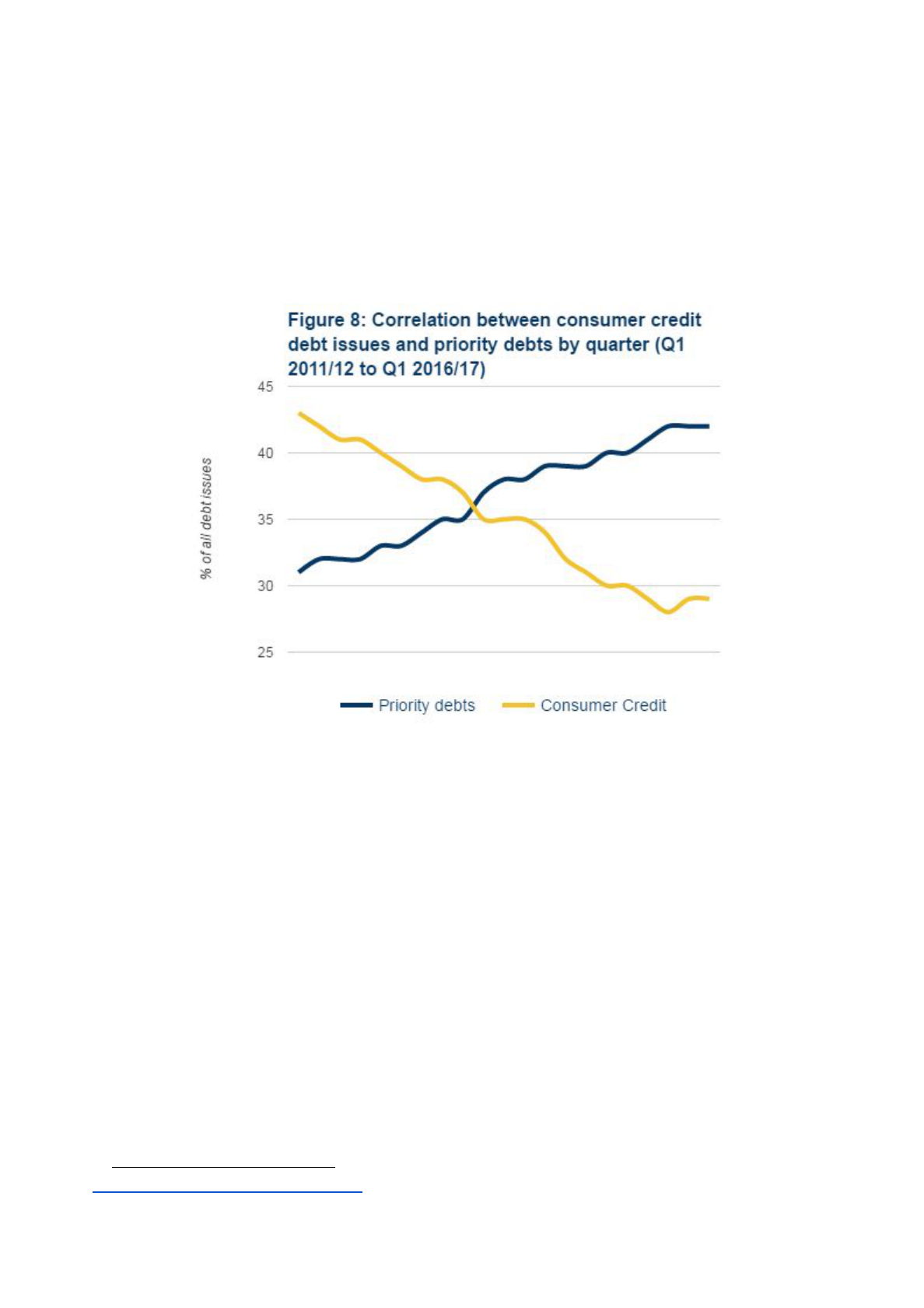

bill as part of a strategy when faced with credit refusal is illustrative of the shift

24

in debt problems in the Citizens Advice network away from consumer credit

debts and towards priority debts such as rent and council tax arrears. This is a

problem as the consequences of not dealing with priority debts are more

serious than for other debts. Failure to pay a priority debt can mean losing your

home, bailiffs taking goods or even ending up in prison. This trend is

demonstrated in Figure 8.

▲ Figure 8: Analysis of the correlation between consumer credit debt issues and household bill

issues. Source: Citizens Advice impact report .

13

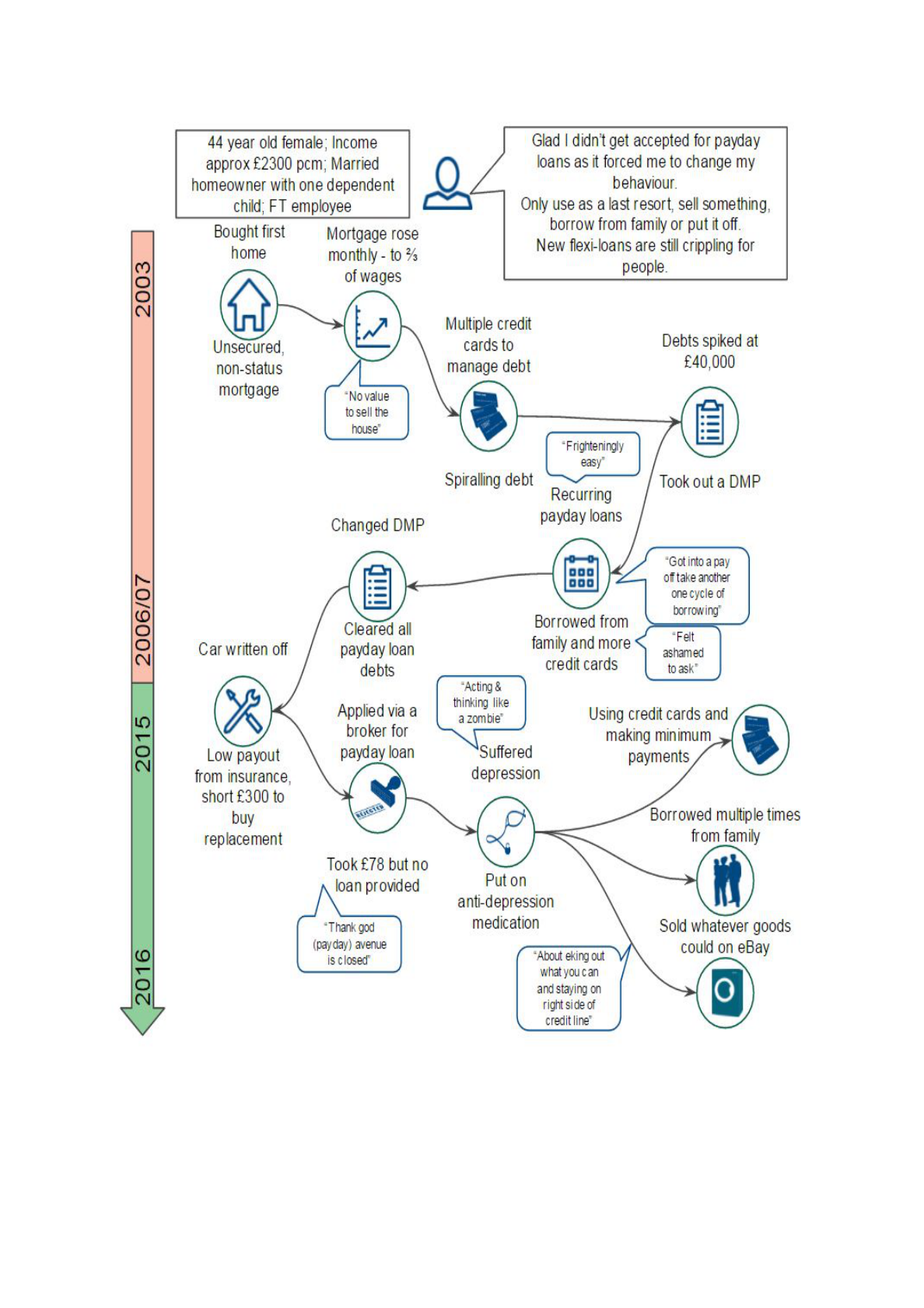

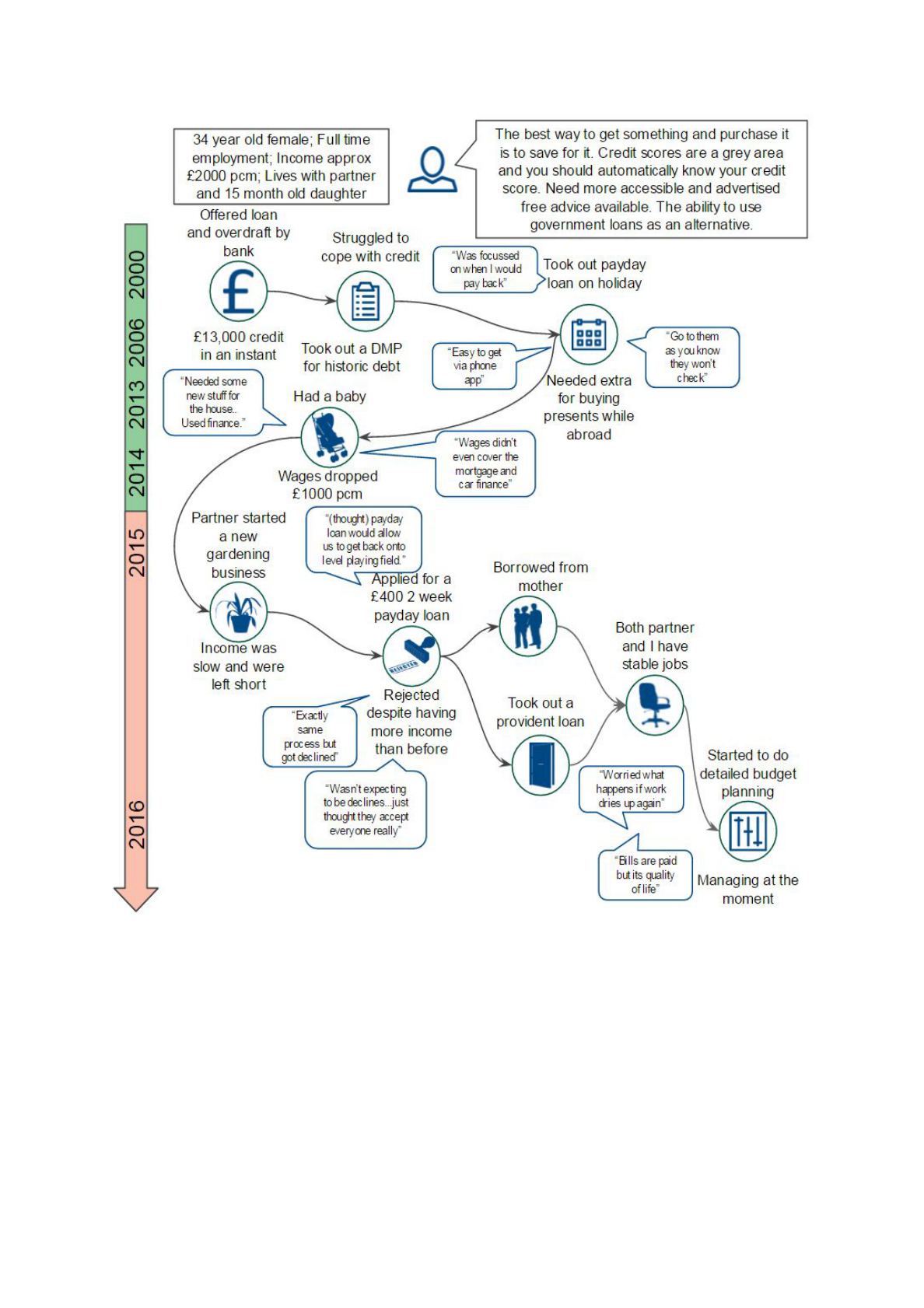

In the following two pages we display the financial journeys of two clients who

took part in depth interviews. Figure 9 shows the journey of a consumer pleased

that she was turned down for a payday loan despite having to sell items and

borrow from friends and family. Figure 10 shows another case of a consumer

who was turned down but was pleased, as it prompted her to get better at

budgeting. None of the clients we conducted depth interviews with felt that they

were worse off as a result of being turned down for a payday loan.

13

Citizens Advice Impact Report 2015/16. Citizens Advice 2016.

25

▲ Figure 9: Consumer journey illustration from a depth interview carried out in June 2016. Showing

where the consumer turned once they were rejected for a payday loan.

26

▲ Figure 10: Consumer journey illustration from a depth interview carried out in June 2016.

Showing the consumers changed behaviour and tactics following a payday loan rejection.

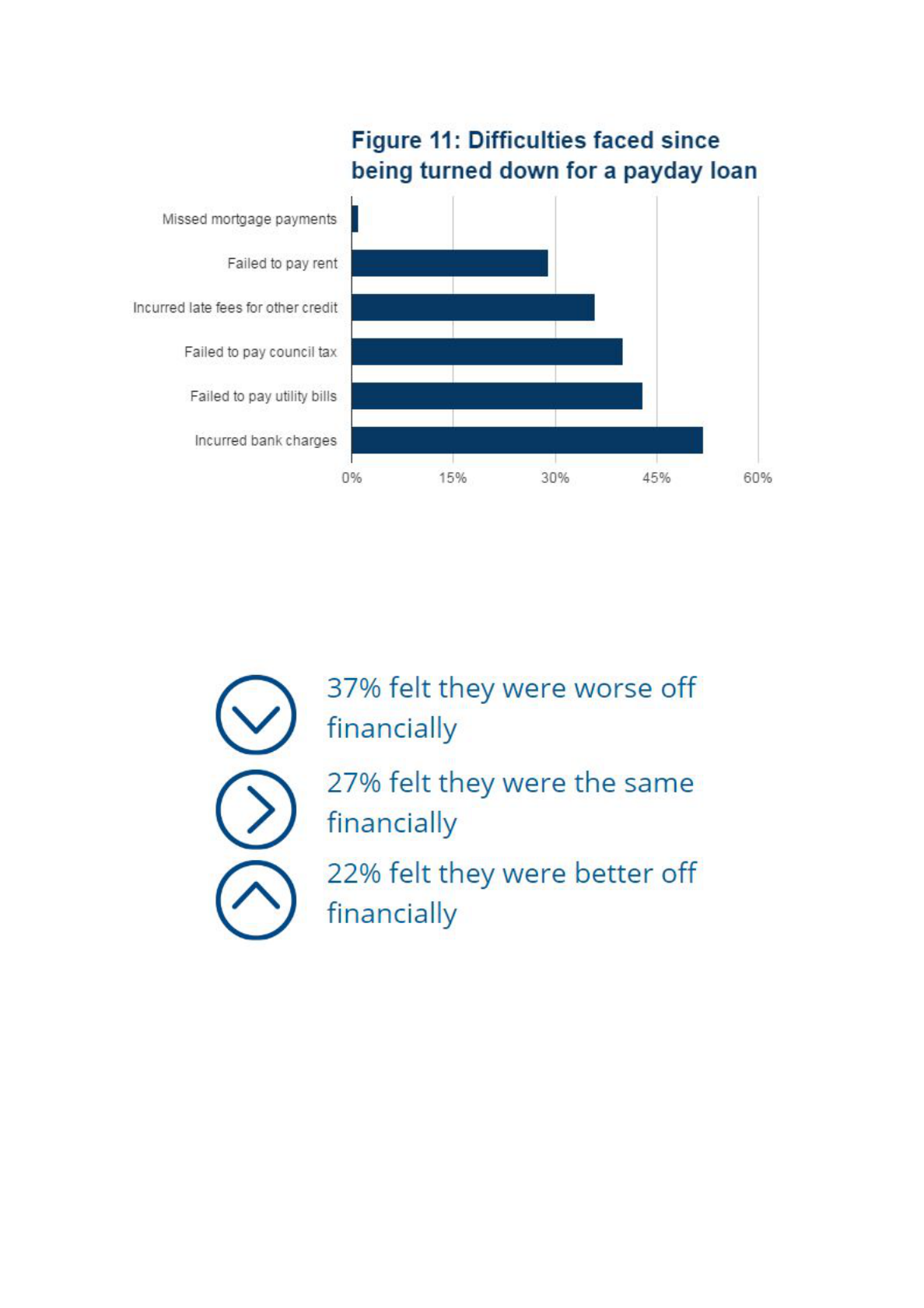

Our survey of payday loan borrowers suggested that those who are turned down

for loans sometimes turn to other forms of credit (figure 7). Others fall behind

on priority bills such as housing and utility costs (figure 11). Advisers also report

seeing this response: 37% stated that clients who could not access payday loans

fell behind with priority debts.

27

▲ Figure 11: Consumer survey results regarding the difficulties that have been faced since being

refused a payday loan. (n=42)

We also asked consumers about the impact of being turned down for a payday

loan on their financial situation and more generally.

▲ Figure 12: Scale outlining consumer survey results regarding the impact of being turned down

for a payday loan on the consumer's financial situation. Source: Citizens Advice Payday Loan

Consumer Survey 2016. Base of 41.

Figure 12 shows that fewer than half (37%) of consumers we surveyed felt

financially worse off as a result of being turned down for a payday loan.

Nonetheless, it is important to understand their experiences and how any

detriment they suffer could be addressed. A smaller proportion of one in five

actually felt that being turned down had a positive impact on their finances.

28

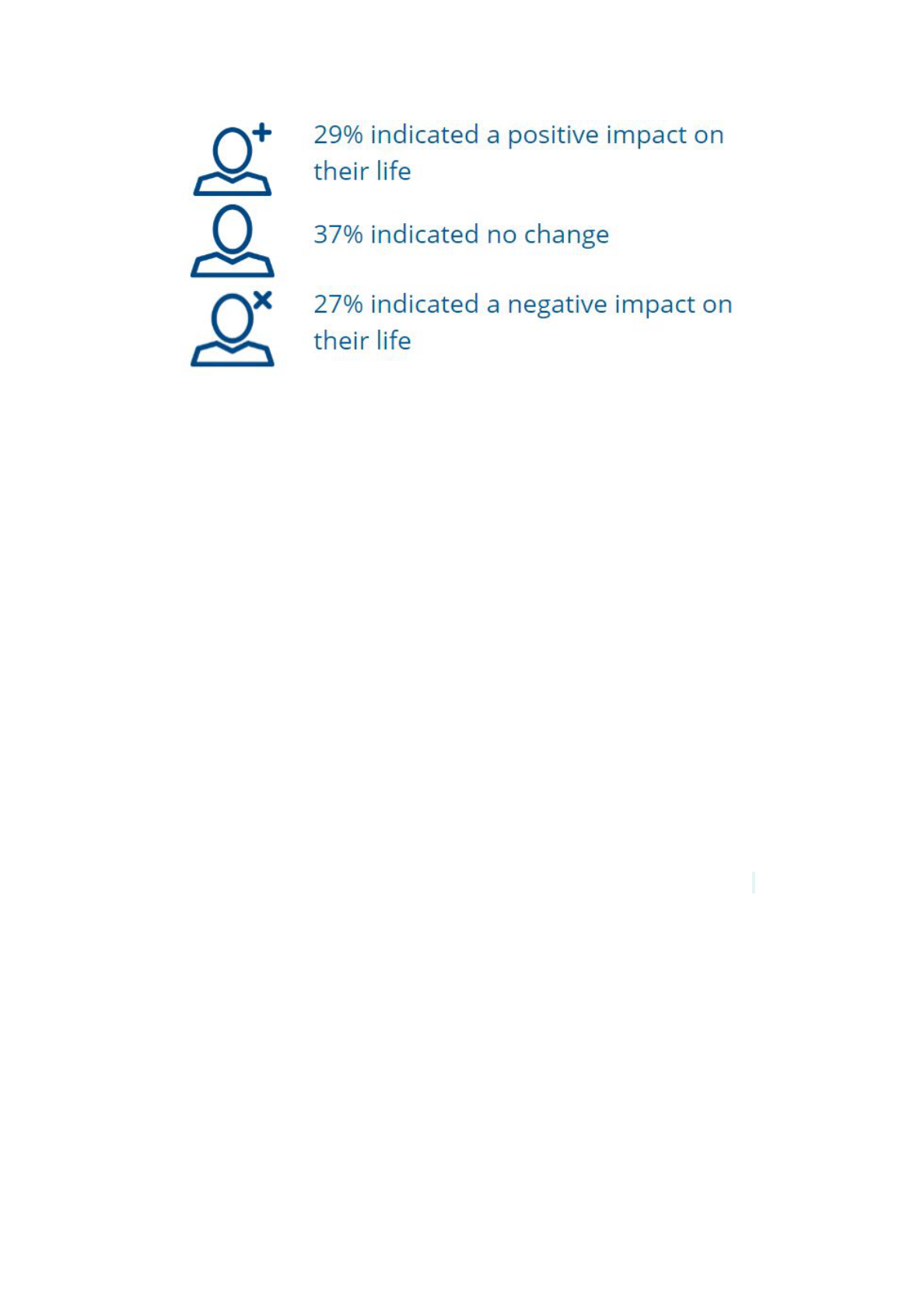

▲ Figure 13: Scale outlining consumer survey results regarding the impact of being turned down

for a payday loan on the consumer's overall life situation. Source: Citizens Advice Payday Loan

Consumer Survey 2016. Base of 41.

Figure 13 shows how consumers in our survey felt that being turned down for a

payday loan has affected them in general. As with the question on financial

circumstances, a minority (27%) of consumers felt that being turned down for a

payday loan had a negative impact on their life. These consumers were more

likely to have used other credit, missed payments on council tax, rent or

utilities, or incurred bank fees and charges, than those who felt that being

turned down had had no impact or a positive impact on their life.

The quotes from survey respondents below show the impact of being turned

down for a payday loan.

“the crackdown on payday loans was made with no regard as to where people

could borrow if the loans were refused. I have poor credit as a result of having

acted as a guarantor for the rent of an adult child who was unable to pay, the

landlord took out a CCJ against me and I can now not get credit. I used payday

loans in the past and paid them back they were useful for short term

emergencies now when something goes wrong I have no access to credit

.

”

A woman from North West, refused a payday loan in 2015

The case below highlights a consumer who responded that being turned down

had left them worse off financially but actually in the long term it had a positive

impact on them.

“By being refused the loan it caused financial difficulty. However it made me

face up to my issues. CAB helped me to budget and cut back on items which

freed up monies and they contacted creditors to help the situation”

A woman from South East, refused a payday loan in 2015

29

It is a positive development that lenders are making more responsible lending

decisions. However, if one consequence is a rise in priority debts, high levels of

consumer detriment are likely to remain. Citizens Advice is concerned that the

debt collection practices of non-consumer creditors are often punitive and

counter-productive. This can include excessive use of bailiffs and a failure to

negotiate affordable payments. We must also ask if the wider credit industry is

14

doing enough for people struggling with debt. As well as a lower availability of

short term credit more mainstream credit options remain expensive too. Other

research identified, for example, that overdrafts can be more expensive than

payday loans and credit card users who only pay the minimum payments or

15

carry persistent debt are going to take more than 10 years to pay off their debt.

16

Conclusion

This report has found that many payday lenders have improved their practices

post regulation with fewer payday loan borrowers getting into significant

financial difficulty or suffering detriment. Improvements have been made to

practices around repeat lending, high interest rates and charges, dealing with

borrowers in financial difficulty and the use of CPAs. There is still, however,

some evidence of borrowers not being treated fairly. The main area of concern

is around the robustness of affordability checks and the subsequent lending to

borrowers who have limited ability to repay. We also believe that more needs to

be done to enable consumers to make informed borrowing decisions by firms

being more explicit about the cost of failing to repay and the benefit of paying

back early. A number of different and new models have been developed in

response to the tighter regulation and restrictions on lending rates and fees. We

are concerned that these new practices are not in the interest of borrowers.

We therefore recommend a number of changes to further improve lending and

debt collection practices by payday lenders:

14

The state of debt collection: The case for fairness in government debt collection practices.

Citizens Advice 2016; Catching up: Improving council tax arrears collection. Citizens Advice 2016;

Falling behind: An assessment of debt collection practices in the mobile phone market. Citizens

Advice 2016

15

Unarranged overdraft fees that cost more than a payday loan. Which? 2016

16

FCA Credit Card Market Study - Final Findings Report. FCA 2016

30

1. The FCA should make its guidance on responsible lending into a rule(s).

Creditworthiness assessments should require, as a minimum, proof of

income and expenditure.

2. Firms should ensure that borrowers can easily and transparently

understand how much they will owe in monetary terms if they fail to

repay. The FCA should add this into the Consumer Credit rulebook.

3. Firms should ensure that borrowers can easily and transparently

understand how much they will save in monetary terms if they repay

installment type payday loans early. The FCA should add this into the

Consumer Credit rulebook.

4. The FCA should look in depth at new developing business models in the

High Cost Short Term credit (HCSTC) market to fully understand the risks

they pose to borrowers and potentially ban those that result in significant

detriment.

5. Firms should adopt best practice in regard to debt collection to encourage

borrowers to engage with them when experiencing difficulties.

While we have gone someway to exploring issues around access to credit, more

work is needed to understand the needs of those no longer able to access

payday loans. We are planning to work with industry and regulators to

understand what options there are to meet the need for affordable short term

credit and what more can be done to help those getting behind with priority bills

like utilities and council tax.

31

Free, confidential advice.

Whoever you are.

We help people overcome their problems and

campaign on big issues when their voices need

to be heard.

We value diversity, champion equality, and

challenge discrimination and harassment.

We’re here for everyone.

citizensadvice.org.uk

Published June 2016

Citizens Advice is an operating name of The National Association of Citizens

Advice Bureaux.

Registered charity number 279057.

32