Department of Revenue

Sports Betting

Performance Audit

April 2022

2166P

1

525 S

h

erman Street, 7t

h

F

l

oo

r

•

D

enver, Co

l

orado 80203-170

0

•

303

.

869

.

2800

•

osa

.g

a

@

state

.

co

.

us

• www.colorado.gov

/

audito

r

LEGISLATIVE AUDIT COMMITTEE

Senator Jim Smallwood

Chair

Representative Rod Bockenfeld

Senator Julie Gonzales

Representative Colin Larson

Senator Robert Rodriguez

Vice Chair

Representative Dafna Michaelson Jenet

Representative Dylan Roberts

Senator Rob Woodward

OFFICE OF THE STATE AUDITOR

Working to improve government for the people of Colorado.

State Auditor

Deputy State Auditor

Audit Manager

Auditors

Other Contributors

Kerri L. Hunter

Michelle Colin

Jenny Atchley

Annalisa Triola

Monica Bowers

Austin Earp

Adrien Kordas

April 28, 2022

Members of the Legislative Audit Committee:

This report contains the results of a performance audit of the Division of Gaming within the

Department of Revenue. The audit was conducted pursuant to Section 44-30-1510, C.R.S., which

requires that the Sports Betting Fund be audited at least once before May 1, 2022, and at least every 5

years thereafter, as well as Section 2-7-204(5), C.R.S., which requires the State Auditor to annually

conduct performance audits of one or more specific programs or services in at least two departments

for purposes of the SMART Government Act. The report presents our findings, conclusions, and

recommendations, and the responses of the Division of Gaming.

1

3

3

5

6

8

11

12

29

33

40

42

Contents

Report Highlights

Chapter 1

Sports Betting

Regulation and Operation of Sports Betting

Licensing

Sports Betting Taxes

Audit Purpose, Scope, and Methodology

Chapter 2

Regulation of Sports Betting

Finding 1–Sports Betting Licensing

Recommendation 1

Finding 2–Verification of Sports Betting Tax Liability

Recommendation 2

Finding 3–Policy Consideration Related to Operating Loss Deductions

Policy Consideration 48

Colorado Office of the State Auditor 1

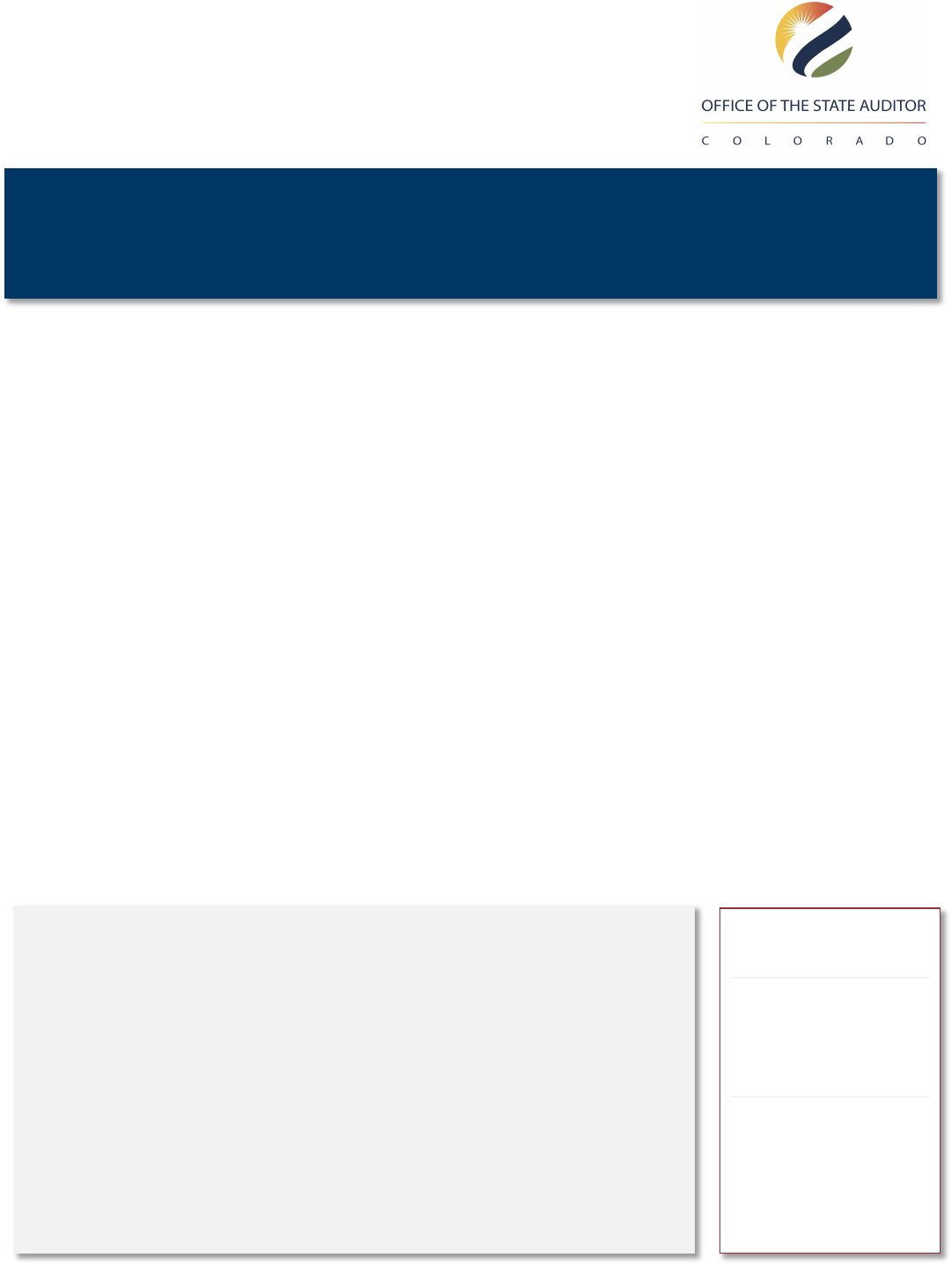

Report Highlights

Sports Betting

Department of Revenue, Division of Gaming

Performance Audit • April 2022 • 2166P

Key Findings

• As of March 2022, 35 out of the 39 (90 percent) licensed

retail and internet sports betting operators held

temporary licenses, which the Colorado Limited Gaming

Control Commission (Commission) issued on the basis

of limited background investigations the Division

conducted. While a temporary license allows operators

the same privileges as a permanent license, the Division’s

background investigations may not have provided

assurance that the operators were suitable for licensure.

• The Division did not complete minimum background

investigative procedures for the 5 licensed operators we

sampled, and the procedures that were completed may

not have provided relevant information needed to fully

inform the Division’s licensing recommendations to the

Commission.

• We sampled 22 sports betting tax filings from May 2020

through April 2021 and found wide variation between

the amount of wagering activity (i.e., bets, free bets, and

payments to players) that operations reported after each

gaming day compared to the totals they reported in their

monthly tax filings. These variances ranged from an

operation reporting $1.4 million more in net sports

betting proceeds in its daily wager reports than it

reported in its monthly tax filing, to an operation that

reported $1 million less in net sports betting proceeds in

its daily wager reports compared to its monthly tax filing.

While some variation is expected since wagers may be

altered, voided, or canceled after they are placed,

operations do not always submit supporting

documentation to substantiate changes to their reported

net sports betting proceeds. As a result, the Division

could not demonstrate if or how it verified that the tax

filings were based on accurate data.

• The General Assembly may want to consider the effects

of a Commission rule that allows sports betting

operations to deduct and carry forward monthly

operating losses, thereby reducing their sports betting tax

liability, and whether that practice aligns with voters’ and

legislative intent. Between May 2020 and April 2021, the

State collected $6.6 million in sports betting tax. Our

analysis of the 324 tax filings reported during this time

period determined that if operations had not been

allowed to deduct and carry forward operating losses, the

State would have collected $7.3 million, or an additional

$706,600, in sports betting tax during that first year.

Background

• In 2019, Colorado voters approved the legalization of sports betting in the state.

• The Commission and the Division are responsible for the regulation of sports betting

activities in Colorado, including issuing licenses to operators, vendors, and employees

involved in sports betting; collecting fees and taxes; and conducting audits to ensure

proper reporting of wagers and taxes.

• Adults age 21 and older can place sports betting wagers in person at a licensed

Colorado casino or online through a licensed Internet sports betting platform.

• The State imposes a 10 percent tax on the net sports betting proceeds reported by

operators. Revenue generated from sports betting taxes is distributed to beneficiaries

including entities that can demonstrate revenue loss attributable to sports betting, the

Department of Human Services, and the Water Plan Implementation Cash Fund.

Key Concern

During the first year of regulating sports betting, the Division of Gaming (Division), within the Department of Revenue

(Department), did not have an effective process to investigate sports betting operations for temporary licensure, or to collect

sufficient documentation to determine if sports betting operations’ monthly tax filings were accurate.

Recommendations

Made

10

Responses

Agree: 10

Partially Agree: 0

Disagree: 0

Colorado Office of the State Auditor 3

Chapter 1

Sports Betting

In 2018, the U.S. Supreme Court struck down the Professional and Amateur Sports Protection Act,

which had barred states from authorizing sports betting since 1993. Following the Supreme Court

decision, through the passage of House Bill 19-1327, the General Assembly referred a ballot

measure to voters that would legalize sports betting in Colorado. During the 2019 election, voters

approved Proposition DD, which legalized sports betting for individuals physically located in

Colorado who are aged 21 or older.

Starting in May 2020, individuals could place wagers on the outcome of a Colorado Limited Gaming

Control Commission (Commission)-approved sports or athletic event, including amateur,

professional, collegiate, international, and Olympic events [Section 44-30-1501(10) and (12), C.R.S.].

In addition, patrons could wager on any portion of an approved athletic event (e.g., the score at the

end of a specific quarter played during a football game) or the individual performance statistics of

athletes in one or a combination of sports events [Sections 44-30-1501(10) and (12), C.R.S.].

The Division of Gaming (Division) reported that from May 2020 to April 2021, the first full year of

sports betting in Colorado, patrons wagered $2.3 billion in Colorado on authorized sporting events,

with the National Basketball Association basketball, National Collegiate Athletic Association

(NCAA) basketball, and National Football League football having the most money wagered. Patrons

can place wagers in person at a licensed Colorado casino or online through a licensed Internet sports

betting platform. About 98 percent of sports betting wagers are made online. Patrons must be

physically present in Colorado to bet on authorized sporting events [Section 44-30-1506(8), C.R.S.].

Sports betting operators that offer online betting are required to use geolocation technology to

verify the physical location of patrons when they place wagers and block wagers made outside the

state [1 C.C.R. 207-2 Rule 7.10]. The Division also uses geolocation technology to monitor the

location of wagering activities for licensed operators.

Regulation and Operation of Sports Betting

In 1990, Colorado voters approved Article XVIII, Section 9 of the Colorado Constitution to legalize

limited-stakes casino-style gaming (limited gaming) in the Colorado cities of Black Hawk, Central

City, and Cripple Creek. The Limited Gaming Act of 1991 (Senate Bill 91-149) created the Division,

within the Department of Revenue (Department), to license, implement, regulate, and supervise the

conduct of limited gaming in the state. The bill also created the Commission within the Division.

The Commission is composed of five members appointed by the Governor who are responsible for

4 Colorado Office of the State Auditor

promulgating rules and regulations governing the licensing, conducting, and operating of limited

gaming, among other duties [Section 44-30-301, C.R.S.].

When sports betting was legalized, the General Assembly charged the Division and Commission

with supervision of that industry, with the intent that sports betting could be seamlessly

incorporated into the existing regulatory and taxing system for limited gaming [Section 44-30-

102(3)(c), C.R.S.]. As such, the Division’s oversight responsibilities to license, implement, regulate,

and supervise the conduct of sports betting are similar to its responsibilities to oversee limited

gaming [Section 44-30-202(1), C.R.S.]. With respect to sports betting, the Commission’s

responsibilities include:

• Promulgating rules governing the licensing, conducting, and operating of sports betting

activities.

• Establishing and collecting fees and taxes upon persons, licenses, and gaming devices used in, or

participating in, sports betting.

• Issuing temporary or permanent licenses to those involved in the ownership, participation, or

conduct of sports betting.

• Upon complaint, or upon its own motion, levying fines and suspending or revoking licenses

[Section 44-30-302, C.R.S.].

• Approving all sporting events (e.g., football games, golf tournaments, table tennis competitions,

etc.) and leagues (e.g., National Football League, Professional Golf Association, International

Table Tennis Federation, etc.) that can be wagered on, as well as types of bets (e.g., single game

bets, parlays, over-under, pools, etc.)[1 C.C.R. 207-2, Rule 5.1].

In Fiscal Year 2022, the Division was appropriated $39.6 million, although $23.8 million (60 percent)

of that amount was for distributions to gaming cities and counties. From its remaining budget of

$15.8 million, the Division allocated $3.1 million to the sports betting unit. The sports betting unit

consists of 18.8 full-time-equivalent employees who carry out administrative, compliance, auditing,

and investigative activities, including:

• Conducting background investigations of businesses and individuals who apply for sports

betting licenses.

• Performing pre-launch certifications of licensed sports betting operators.

• Conducting audits to ensure proper reporting of wagers and taxes.

• Inspecting sports betting operation facilities, servers, and systems.

Colorado Office of the State Auditor 5

• Investigating violations of sports betting statutes and rules [Sections 44-30-203, 204, and 1505,

C.R.S., and 1 CCR 207-2, Rules 7.5 and 7.12].

Unless continued by the General Assembly, the Division’s powers, duties, and functions are

scheduled to be repealed on September 1, 2022 [Section 44-30-206, C.R.S.]. In October 2021, the

Department of Regulatory Agencies issued a sunset review recommending that the Division be

continued until 2033. In addition, the review recommended continuing the Division’s regulation of

sports betting until 2027, by which time the Division would undergo another sunset review after

establishing a longer history of regulating sports betting in Colorado. As of April 25, 2022,

legislation had not been introduced to continue the Division’s powers, duties, and functions beyond

August 31, 2022.

Licensing

The Commission is required to issue, deny, suspend, revoke, and renew sports betting licenses to

individuals, firms, associations, or corporations, whether for-profit or not-for-profit, who engage in

sports betting activities [Sections 44-30-1503(1)(a) and (3), C.R.S.]. The Commission issues several

types of licenses depending on the type of sports betting activity that entities or individuals wish to

conduct. For example, casinos that are licensed to operate limited gaming activities can obtain

master licenses, which allow them to operate retail sports betting onsite in a casino and Internet

sports betting through a branded online platform, or to contract with a third-party operator to

operate retail or internet sports betting activities on the master licensee’s behalf [Section 44-30-

1505(2)(a), C.R.S.]. The Commission also issues licenses to retail and Internet sports betting

operators, employees who manage or work for sports betting operators, and vendors that provide

services to sports betting operators [Section 44-30-1505(2)(b), C.R.S., and 1 C.C.R. 207-2, Rule 3.1].

Licenses are valid for 2 years [Section 44-30-1505(4), C.R.S.].

Sports betting license applicants must pay an application fee as well as the costs of Division

investigations into their backgrounds, suitability, and qualifications for licensure [1 C.C.R. 207-2,

Rule 3.4 and 3.5]. Master and operator licensees must also pay annual operating fees every fiscal

year in July to defray the increased costs to the Division and Commission of regulating sports

betting [1 C.C.R. 207-2 Rule 7.1]. Licensing requirements vary by license type, but generally

applicants with a criminal, financial, or licensing history that may undermine the public interest or

trust in the integrity of sports betting are ineligible for licensure [Section 44-30-1503, C.R.S.]. After

conducting its background investigation, the Division compiles the results into a report that is

presented to the Commission with a recommendation regarding the applicant’s suitability for

licensure.

Following voter approval of proposition DD on November 5, 2019, the Commission adopted

emergency sports betting rules approximately 2 weeks later on November 21 that allowed the

Division to begin accepting license applications as of November 27, 2019. Although the legislation

6 Colorado Office of the State Auditor

that established a regulatory structure for sports betting (House Bill 19-1327) did not specify when

sports betting activities had to begin, according to the Division, it interpreted the law’s effective date

(May 1, 2020) as the deadline for operationalizing sports betting in Colorado based on discussions

with the General Assembly during the legislative process. In order to operationalize sports betting

by its planned date of May 1, 2020, the Commission granted permanent “master” licenses to casinos

that were already licensed to offer limited gaming, but granted temporary licenses to other applicants

that applied for permanent licensure. The temporary licenses, which were valid for 2 years, were

granted based on the results of limited investigations the Division conducted within several weeks,

rather than the more thorough investigations that the Division planned to complete before issuing

permanent licenses, which could take up to a year [1 C.C.R. 207-2, Rule 3.12]. When Colorado’s

sports betting industry began operating on May 1, 2020, the Commission had granted permanent

licenses to 33 master licensees, in addition to 29 temporary licenses to retail and Internet sports

betting operators.

Once a sports betting operator has been issued a license, it must obtain the Division’s approval to

launch sports betting activities. The pre-launch approval includes a Division review of the operator’s

required internal control procedures and house rules, certification of sports betting systems, review

of vendors, and verification of financial reserves. Once approved, operators are required to

prominently display their license and house rules to the public within the operators’ licensed

premises or Internet betting platforms, in addition to displaying responsible gaming information for

the public [1 C.C.R. 207-2, Rules 6.8, 6.10, and 9.1].

Sports Betting Taxes

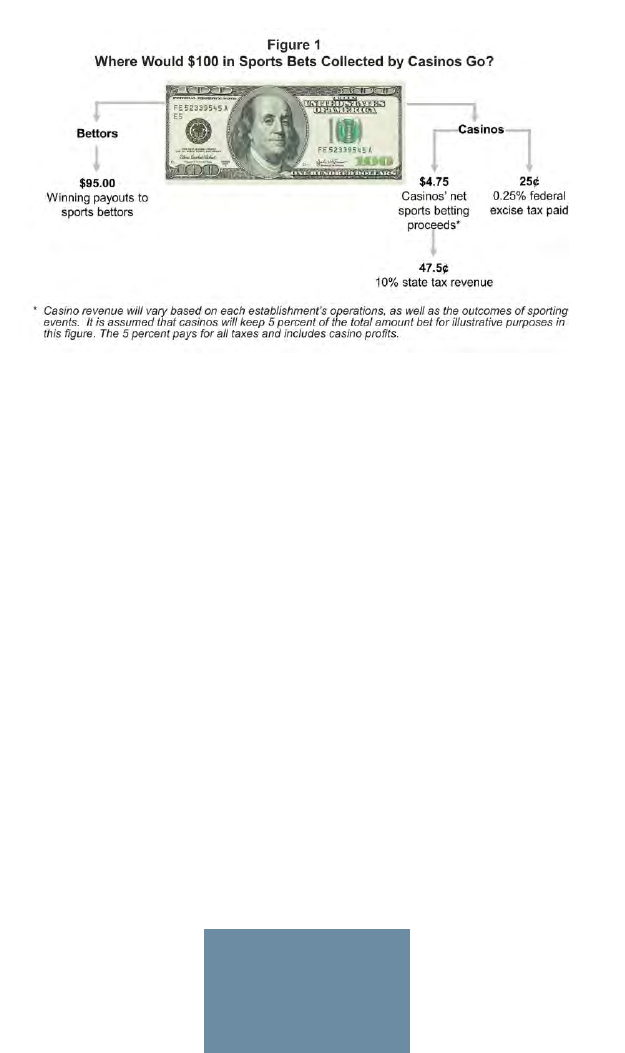

Statute imposes a 10 percent tax on each operator’s net sports betting proceeds, which is defined as

the total amount of all bets placed, excluding free bets (i.e., bets made using non-cashable vouchers,

coupons, electronic credits, or promotions provided by sports betting operators), less all payments

to players and less a 0.25 percent federal excise tax [Sections 44-30-1501(7) and 1508(1), C.R.S., and

26 U.S.C. 4401(a)(1)]. Based on our analysis of data from the Colorado Operations Resource Engine

(CORE), the State’s accounting system, from July 2020 through February 2022 (i.e., Fiscal Year 2021

and the first 8 months of Fiscal Year 2022), the Division reported about $16.1 million in revenue

from sports betting taxes.

Sports betting tax revenue is deposited into the Sports Betting Fund (Fund), along with the

Division’s other revenue sources, which include license fees, fines, and penalties [Section 44-30-

1509(1)(a), C.R.S.]. Statute [Section 44-30-1509(2), C.R.S.] creates a prioritized order of expenditures

to be paid from the Fund as follows:

• Repay the General Fund for the Division’s start-up costs related to regulating sports betting. In

Fiscal Year 2020, the Division was appropriated $1.6 million from the General Fund for start-up

costs and transferred that amount back to the General Fund in March 2021.

Colorado Office of the State Auditor 7

Office of

Behaviorial

Health

$130,000

Wagering

Revenue

Recipients Hold-

Ha

rmless Fund

$488,800

Water Plan

Implementation

Cash Fund

$7,945,800

Office of Behaviorial Health

Wagering Revenue Recipients Hold-Harmless Fund

Water Plan Implementation Cash Fund

• Pay the ongoing expenses related to administering sports betting that are incurred by the

Department, Division, Commission, or any other state agency from whom assistance is

requested by the Commission or Division Director.

• Transfer 6 percent of annual sports betting tax revenue to the Wagering Revenue Recipients

Hold-Harmless Fund, which was created so lump-sum payments could be made to offset any

demonstrable loss of revenue attributable to sports betting. Entities that are eligible to apply for

those payments are the State Historical Fund; Colorado’s community colleges; Black Hawk,

Central City, and Cripple Creek; Gilpin and Teller Counties; and any persons or entities who

benefit from purse funds collected from horse racing.

• Transfer $130,000 annually to the Office of Behavioral Health in the Department of Human

Services for the operation of a crisis hotline for gamblers and to support counselors certified in

the treatment of gambling disorders or individuals seeking that certification.

• Transfer the remaining unexpended and unencumbered funds to the Water Plan

Implementation Cash Fund. The Colorado Water Conservation Board uses these funds to award

grants for projects related to implementing the state water plan and to ensure compliance with

requirements related to interstate storage and release, apportionment, and allocation of water

[Sections 37-60-123.3 and 37-60-106.3(6), C.R.S.].

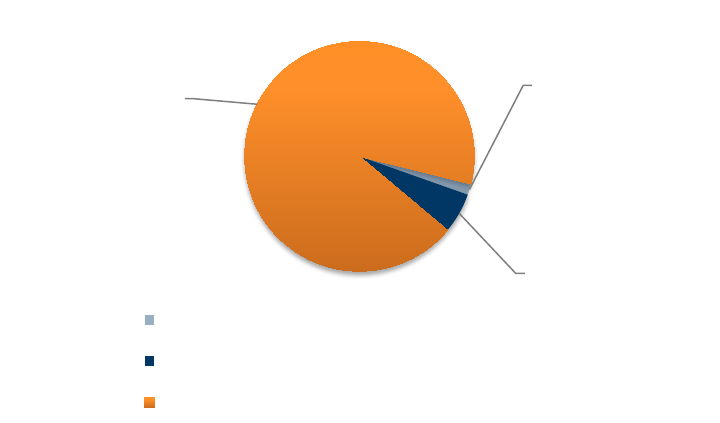

Exhibit 1.1 shows the distribution of sports betting revenue to beneficiaries during Fiscal Year 2021.

Exhibit 1.1

Distribution of Sports Betting Revenue to Beneficiaries

Fiscal Year 2021

Source: Division of Gaming.

8 Colorado Office of the State Auditor

Audit Purpose, Scope, and Methodology

We conducted this performance audit pursuant to Section 44-30-1510, C.R.S., which requires that

the Sports Betting Fund be audited at least once before May 1, 2022, and at least every 5 years

thereafter, as well as the State Measurement for Accountable, Responsive, and Transparent

(SMART) Government Act [Section 2-7-204(5), C.R.S.]. Audit work was performed from May 2021

through April 2022. We appreciate the cooperation and assistance provided by the management and

staff of the Department, Division, and Commission during this audit.

We conducted this performance audit in accordance with generally accepted government auditing

standards (GAGAS). Those standards require that we plan and perform the audit to obtain

sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based

on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our

findings and conclusions based on our audit objectives.

The key objectives of the audit were to determine whether (1) the State collects the appropriate

amount of taxes from sports betting operators and (2) the Division has effective processes to ensure

that only eligible sports betting operators are licensed.

The scope of this audit did not include work related to the Division’s pre-launch review of sports

betting operators, the Commission’s process for authorizing specific sports for wagering, the

Commission’s methodology for setting licensing fees or distributions from the Sports Betting Fund,

or the Division’s monitoring and enforcement activities.

To accomplish our objectives, we performed the following audit work:

• Reviewed relevant state and federal laws; Commission rules; and the Division’s policies and

procedures, training materials, and other internal guidance.

• Interviewed Division management and staff and a member of the Commission to understand

processes related to licensing and sports betting tax collection; staff from two sports betting

operators to understand their tax accounting and reporting procedures; and staff from the Office

of Legislative Legal Services to understand the extent to which Commission rules underwent

legal review before they went into effect in April 2020.

• Analyzed tax filing and payment data from GenTax, the Department’s tax processing system, as

well as information that sports betting operators submitted to the Division with wager data, to

determine whether sports betting taxes were calculated correctly, paid on time, and paid in full.

Colorado Office of the State Auditor 9

• Analyzed aggregate licensing data from MyLO, the Department’s electronic licensing database,

to perform a data match between the MyLO and GenTax data to verify that all licensed sports

betting operators with a potential tax liability paid taxes.

• Analyzed the Division’s investigative files and licensing documentation to assess how license

applications are processed; how background investigations for temporary licenses are conducted;

the scope and content of the Division’s background investigations; how the Division and

Commission determine whether an applicant is qualified for licensure; and how the Division’s

investigative process informs the Commission’s licensing decisions.

• Reviewed information about how other states with legalized sports betting calculate operators’

tax liability.

We relied on sampling techniques to support our audit work as follows:

• We selected a random sample of 22 monthly tax filings that seven sports betting operators

submitted from the population of 324 monthly tax filings that 28 operators submitted from May

2020 through April 2021. This sample included 12 filings in which operators were profitable and

owed sports betting tax and 10 filings in which operators lost money and did not owe tax.

Filings in which no wager activity was reported were excluded from the population before we

selected the sample. For each sampled tax filing, we compared wager data that sports betting

operators submitted to the Division to the operators’ monthly tax filing, and we reviewed

documentation of any communication that occurred between Division and operators’ staff

related to discrepancies among those documents.

• We selected a random sample of five of the 19 Internet sports betting operators that had been

issued temporary licenses and were active as of April 2021. We reviewed all of the investigative

file documentation the Division had for the sampled operators to evaluate whether the

Division’s processes provided assurance that approved applicants are qualified for licensure,

based on requirements in statute and rule.

The results of our samples cannot be projected to the population. However, the sample results are

valid for confirming whether the Division has effective processes to license sports betting

operations and verify the accuracy of their reported tax liability and, along with the other audit work

performed, provide sufficient, reliable evidence as the basis for our findings, conclusions, and

recommendations.

As required by GAGAS, we planned our audit work to assess the effectiveness of those internal

controls that were significant to our audit objectives. Details about the audit work supporting our

findings and conclusions, including any deficiencies in internal control that were significant to our

audit objectives, are described in the remainder of this report.

10 Colorado Office of the State Auditor

A draft of this report was reviewed by the Department, Division, and a member of the Commission.

We have incorporated the Department’s, Division’s, and Commission’s comments into the report

where relevant. The written responses to the recommendations and the related implementation dates

are the sole responsibility of the Division.

Colorado Office of the State Auditor 11

Chapter 2

Regulation of Sports Betting

In 2019, the General Assembly enacted House Bill 19-1327, which authorized sports betting in

Colorado and charged the Colorado Limited Gaming Control Commission (Commission) and

Division of Gaming (Division) with the regulation of legal sports betting. It was the intent of the

General Assembly that by doing so, sports betting would be seamlessly integrated into the regulatory

and taxing system established for limited gaming [Section 44-30-102(3)(c), C.R.S.]. It was declared by

the General Assembly that “the success of sports betting is dependent upon public confidence and

trust that activities related to sports betting are conducted honestly and competitively; that the rights

of the creditors of licensees are protected; and that sports betting is free from criminal and

corruptive elements. Public confidence and trust can be maintained only by strict regulation of

sports betting” [Section 44-30-102(3)(e), C.R.S.]. The General Assembly also intended through

enacting House Bill 19-1327 that sports betting revenues would be taxed and that the revenue would

be directed to public purposes—primarily the state water plan.

The Commission is required by statute to promulgate rules governing sports betting. Statute states

that those rules should address various aspects of sports betting activities, including the types of

sports betting activities to be conducted and the rules for those activities; requirements,

qualifications, and grounds for the issuance, revocation, and suspension of permanent and

temporary sports betting licenses; the scope and conditions for investigations into the background

of licensees and applicants for licenses; the ongoing operation of sports betting activities; and the

percentage of the adjusted gross proceeds to be paid by each licensee to the commission, in addition

to license fees and taxes [Section 44-30-302(2), C.R.S.]. The Division is charged with the

responsibility to license, implement, regulate, and supervise sports betting [Section 44-30-202(1),

C.R.S]. The Division ensures the integrity of sports betting primarily through investigation of sports

betting license applicants, in order to provide the Commission with the information it needs to reach

a determination as to whether an applicant is suitable for a sports betting license. The Division also

requires each licensed operation to submit documentation of their daily wager activity and monthly

sports betting tax liability as one way of monitoring their operations.

Our audit work evaluated the effectiveness of the Division’s processes for licensing Internet sports

betting operations and collecting sports betting tax. We focused our audit work on sports betting

activities that occurred from January 2020 through April 2021, which was the first year after

legalized sports betting became operational in Colorado. The Division reported that it faced several

significant challenges getting sports betting up and running between the November 2019 election,

when voters approved legalized sports betting, and the industry’s May 1, 2020, launch date in

12 Colorado Office of the State Auditor

Colorado. These challenges included an ambitious 5-month timeline to complete the rulemaking

process and get a new unit implemented; challenges associated with the COVID-19 pandemic,

including difficulties obtaining information from government agencies and businesses that were

closed or operating in a limited capacity; travel restrictions that prevented Division investigators

from obtaining information overseas about license applicants with international headquarters;

transitioning to full-time remote working; moving hard copy files because the Division’s physical

office location changed; and a hiring freeze that prevented the Division from hiring additional staff

to support the Sports Betting Unit. While we acknowledge these challenges, our audit work still

identified opportunities for the Division to improve the effectiveness of background investigations

of license applicants and ensure the accuracy of operations’ tax payments. The remainder of this

chapter includes our findings and recommendations, as well as a policy consideration for the

General Assembly about whether the Commission’s rules for computing operations’ monthly tax

liability align with voter and legislative intent.

Finding 1—Sports Betting Licensing

The Commission is responsible for issuing, denying, suspending, revoking, and renewing sports

betting licenses [Section 44-30-1503(1)(a), C.R.S.]. The Commission issues licenses to sports betting

operators (operators), which are persons who run a sports betting operation (operation) or wagering

operation in which bets are placed on sports events through any system or method of wagering

[Sections 44-30-1501(10) and (11), C.R.S.]. The Commission also licenses individuals working for an

operation and vendors working with operators in Colorado. An entity may hold multiple types of

licenses, including for multiple operations. Exhibit 2.1 details the types of sports betting licenses the

Commission issues.

Colorado Office of the State Auditor 13

Exhibit 2.1

Types of Sports Betting Licenses

Sports Betting

License Type

Who is this license for?

Master

Anyone with a retail gaming license (i.e., a casino). This license allows the holder to: (1)

operate onsite retail sports betting on their casino premises, (2) operate Internet sports

betting through an online gaming platform; or (3) contract with Retail operations and

Internet operations to operate sports betting on the Master licensee’s behalf. A master

licensee is permitted to contract with no more than one Retail operation and one Internet

operation at a time.

Internet Sports

Betting Operator

1

An entity contracted with a Master licensee to operate sports betting through an online

platform using a computer, mobile, or interactive device. Internet operations are not

permitted to operate sports betting independently – only under a contract with a Master

licensee.

Retail Sports Betting

Operator

1

An entity contracted with a Master licensee to operate retail sports betting on the Master

licensee’s premises. Retail operations are not permitted to operate sports betting

independently – only under a contract with a Master licensee.

Vendor Major

Any vendor that contracts with, or acts on behalf of, a Master, Internet operation, or

Retail operation, licensee to manage, administer, or control bets made on a sports betting

system; maintain or operate sports betting system software and hardware; or supply

products or services.

Vendor Minor

Any vendor that contracts with, or acts on behalf of, a Master licensee, Internet

operation, or Retail operation to carry out activities other than those of a Vendor Major

licensee.

Key Employee

2

Any executive, employee, or agent of a sports betting business licensee who will be

involved in the management of sports betting business operations.

Support Employee

2

All employees of a sports betting licensee not otherwise required to hold a key employee

license, a vendor major license, or a vendor minor license.

Source: Section 44-30-1505, C.R.S., and 1 CCR 207-2 Rule 3.1

1

An entity may hold both Retail operation and Internet operation licenses and can operate sports betting activities on behalf of

multiple Master licensees at any time, but is required to have a separate license for each type of operation for each Master.

2

Any person holding 10 percent or more effective ownership interest in the licensee business, and officers and directors,

regardless of ownership interest or involvement in sports betting business operations that do not need a Key or Support

Employee license must also apply as an “Associated Person” to the licensee and must be found suitable, but will not be issued a

license. Additionally, any person holding less than 10 percent effective ownership in a privately held corporation (limited

owner) must apply and be found suitable.

Colorado voters approved Proposition DD authorizing sports betting in Colorado in the November

2019 statewide election. The Commission adopted emergency rules on November 21, 2019, that

allowed the Division to begin accepting applications on November 27 and the Commission to grant

temporary licenses. The Division began accepting applications for all sports betting license types in

December 2019. The process of licensing a new business to operate sports betting in Colorado

begins with the business submitting an application to the Division. The application requires

disclosure of information about the business’s prior history, including its gaming ventures in other

locations; its ownership and control structure; the names of key directors, managers, and investors;

and financial history. The business must also provide information on the owners, directors,

corporate officers, and managers of the business, known as associated persons, and on the

business’s holding, intermediary, and subsidiary companies, known as associated businesses.

14 Colorado Office of the State Auditor

The Division is then responsible for conducting background investigations into the applicants,

including the associated persons and businesses. Under statute, the Division is authorized to

conduct investigations into the character, record, and reputation of all applicants for sports betting

licenses [Section 44-30-204(1)(f), C.R.S.] The Division uses the application as a starting point for its

investigations. According to the Division, background investigations are an in-depth process that

can take up to 1 year to complete for each licensee. However, the duration of each license

investigation is determined by the complexity of the business. Prior to May 2020, the Division

employed a staff of 13 criminal and financial investigators with the authority to “conduct

investigations into the character, record, and reputation of all applicants” [Section 44-30-204(f),

C.R.S.]. The Division reported that these investigators worked primarily for the Limited Gaming

Background Unit, but the Division also leveraged them to conduct investigations of applicants for

sports betting licenses. After May 2020, the Division reported that staff turnover and the

Department’s hiring freeze resulted in the sports betting unit having only three investigators and one

supervisor for most of Fiscal Year 2021. As of March 2022, the Division reported that it had seven

sports betting investigators. The criminal investigators on staff are permitted to investigate the

criminal, regulatory, and litigation history of businesses and people, in addition to the financial

history of individuals, while the financial investigators carry out the financial investigation of

businesses.

In order to operationalize sports betting by the planned May 1, 2020, launch date, the Commission

used its authority to grant temporary licenses to applicants. The Commission’s decision of whether

or not to approve an applicant for a temporary license was predicated on the results of limited

preliminary investigations (temporary investigations) conducted by the Division and the Division’s

recommendation on the suitability of the applicant. The Division reported that it restricted each

temporary investigation to 3 weeks in order to operationalize the sports betting industry by May 1,

2020. The temporary investigations consisted of basic checks of the applicant’s business and one to

two associated persons of the applicant (known as principals) to give the Commission assurance that

the applicant was suitable. Temporary licenses are valid for 2 years and allow holders the same

privileges as a permanent license, meaning that the licensees may commence sport betting activities,

which include accepting wagers. According to the Division, after a temporary license is approved,

the Division resumes its investigation of the applicant, their associated businesses, and other

associated persons, and conducts additional investigative procedures that need to be completed as

part of the final investigation. Rules allow the Commission to issue consecutive temporary licenses

at their discretion and subsequently convert a temporary license to a permanent license upon

completion of the final investigation.

The Division reported that its goal was to complete 10 final investigations per year for new

operators in order for the Commission to convert the temporary licenses to permanent licenses. In

the first 4 months of 2020, the Division received a total of 31 Internet and Retail sports betting

operator applications, and the Commission granted its first temporary operator license on March 5,

2020. By May 1, 2020, the Commission had granted 29 temporary Internet and Retail sports betting

operator licenses. During this time, the Division reported facing workload challenges because its

Colorado Office of the State Auditor 15

limited gaming investigations team had to conduct sports betting investigations, in addition to their

regular limited gaming workload, until the pandemic-related hiring freeze was lifted and the Division

could hire a sports betting investigation team. Along with processing sports betting operator license

applications, the limited gaming investigation team had to process major and minor vendor license

applications, which were necessary so that operators could begin operating.

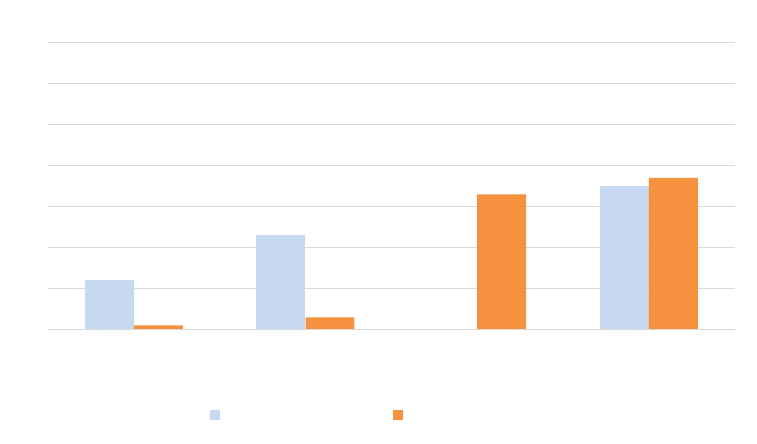

As of March 2022, the Commission had approved the following licenses, by type, as shown in

Exhibit 2.2.

Exhibit 2.2

Sports Betting Operator Licenses

January 2020 through March 2022

Source: Office of the State Auditor analysis of Division of Gaming licensing information.

What audit work was performed and what was the purpose?

We selected a random sample of 5 of the 19 Internet operators that had been issued temporary

licenses and were active as of April 2021. The Commission issued temporary licenses to the sampled

operators between March and May 2020. Although temporary licenses are only valid for 2 years, the

Commission can reissue consecutive temporary licenses, and as of February 2022, Division staff

reported that they were in the process of reissuing temporary licenses to all of the operators in our

sample. We chose to limit our sample to only Internet operators because 98 percent of total sports

betting wagers were placed online, as of April 2021, and Internet operators do not have the

extensive regulatory history with the Division as Master licensees that conduct limited gaming

activities. Of the five operators in our sample, four are established gaming companies with extensive

licensing history outside of Colorado, while one was a startup company with no prior license history.

12 23 0 351 3 33 37

13

26

33

72

0

10

20

30

40

50

60

70

Retail Sports Betting

Operator

Internet Sports Betting

Operator

Master Total

Temporary licenses Permanent Licenses

16 Colorado Office of the State Auditor

In addition, four of the five operators are subsidiaries of holding companies based outside of the

United States, two of which are new to the United States, having only established U.S.-based

subsidiaries to enter into the expanding domestic sports betting market since 2018, when the U.S.

Supreme Court decision allowed sports betting to occur.

We reviewed all of the investigative file documentation the Division had for the sampled operators,

including application materials provided by the applicants, Division-generated documentation of the

investigative procedures carried out, correspondence with the applicants, and the reports presented

to the Commission. Our review included the investigation materials for the associated businesses

(intermediary and holding companies) of each applicant business in the sample and the associated

people, including key licensees and limited owners. For the five operators in our sample, we also

reviewed the documentation included in the Division’s investigative files associated with the 10

principals investigated for temporary licensure. Further, we reviewed statutes; Commission-

promulgated rules; and Division policies, procedures, written guidelines, and training materials

related to gaming and sports betting; and interviewed Division staff about the sports betting

investigation and licensing processes.

The purpose of our audit work was to determine if the Division has effective and efficient processes

for investigating sports betting applicants that provide assurance that approved applicants are

qualified for licensure.

How were the results of the audit work measured?

The goal of investigating sports betting license applicants is to determine whether they meet the

qualifications established in Commission rules and their suitability for licensure. In statute,

“suitability” or “suitable” means, in relation to a person, the ability to be licensed by the

Commission and, in relation to acts or practices, lawful acts or practices [Section 44-30-103(33),

C.R.S.]. Conversely, “unsuitability” or “unsuitable” means, in relation to a person, “the inability to

be licensed by the Commission because of prior acts, associations, or financial conditions, and, in

relation to acts or practices, those that violate or would violate the statutes or rules or are or would

be contrary to the declared legislative purposes” of the Colorado Limited Gaming Act [Section 44-

30-103(34), C.R.S.]. According to the Division, it is using the existing limited gaming policies and

procedures as a general guide for investigating sports betting applicants; and has adopted an

abbreviated version of its typical background investigation process to conduct the limited

investigations for temporary sports betting licenses. The Division reported that it discussed the

scope of the temporary license investigations with the Commission before putting them into

practice. The Division’s guidelines and statute address the following areas:

Criminal History. Statute prohibits individuals with specified criminal histories (and the businesses

they have substantial control over) from obtaining a sports betting license. This includes anyone

convicted of a crime involving gambling or misrepresentation; who makes money through criminal

means; or who has engaged in illegal gambling [Sections 44-30-1503(3) and 44-30-509(1)(e), C.R.S.].

Colorado Office of the State Auditor 17

Each associated person to a sports betting business applicant, and key and support license applicants

are required by statute to submit fingerprints to the Division [Section 44-30-1504(7)(a), C.R.S.]. The

Division’s license application requires each associated person to a sports betting business applicant,

and key and support license applicants, to further disclose all arrests, convictions, and serious traffic

offenses.

For purposes of a temporary investigation, the Division directed staff to submit applicants’

fingerprints to the Colorado Bureau of Investigation (CBI) for both state and national criminal

history record checks and to check other sources of criminal records, including CBI intelligence and

Colorado arrest reports; the Colorado Criminal Information Center (CCIC) and National Criminal

Information Center (NCIC); and CLEAR and Accurint reports, which compile public records from

hundreds of databases. Investigators were directed to use these sources to verify an applicant’s

disclosures and identify sources of further information. According to the Division, it is necessary to

check multiple sources, as not all records may be complete or different sources will have different

details, to help the Division build a more complete profile of the applicant. Investigators were also

directed to inquire with local law enforcement agencies in locations where the applicant or principals

have lived, worked, or studied in the United States over the past 10 years to determine the

disposition of disclosed criminal charges and identify any other criminal activities in those locations

that were not disclosed.

Regulatory History. Although statute, rules, and policies do not explicitly prohibit an applicant

from licensure based on regulatory violations, statute does allow the Commission to consider an

applicant’s regulatory history in deciding to approve or deny licensure [Section 44-30-505, C.R.S.].

Further, under statute, anyone who has been denied a gaming license of any type by the Commission

once in the last year or twice in the last 3 years is not eligible for a sports betting license; statute

precludes them from reapplying during these timeframes. [Section 44-30-519(1), C.R.S.] On the

Division’s application form, applicants are required to disclose their licensing history, including any

gaming-related disciplinary actions, in any jurisdiction, foreign or domestic; the disclosures must

include associated businesses.

For purposes of a temporary investigation, the Division directed staff to review MyLO, the

Department’s electronic licensing database, for the applicant’s Colorado licensing history and to

query the Department’s case reporting system, Public Safety Records. Public Safety Records

contains information on any negative contact a licensed entity or person has had with the

Department, such as past disciplinary actions. Finally, the Division instructed investigators to

contact gaming regulators in other U.S. jurisdictions where the applicant had applied for or held a

sports betting license to gather information on their license status and conduct.

Financial Capacity and Operations. According to the Division and Commission, the financial

review and analysis portion of an investigation is intended to provide information on the applicant’s

financial stability and capability to carry out their planned business operations; help determine

whether the applicant and its principals conduct business professionally, legally, and ethically; and

18 Colorado Office of the State Auditor

ensure that the applicant’s funds are derived from legitimate sources—meaning they are lawfully

earned or obtained. Commission rules require that applicants for an operator license disclose a

variety of financial information including whether the applicant, a principal, or an associated

business has ever been involved in bankruptcy; was ever the subject of a complaint for violating

antitrust, trade, or security laws; is delinquent on any government obligations; or has ever been a

party to litigation. Applicants are also required to submit loan documents, business tax filings,

financial statements, and documents showing the status of any litigation. In addition, statute and

Commission rules require applicants to submit all contracts or proposed contracts with all other

sports betting licensees, including the master licensee the applicant will be operating under, for the

Division’s approval [Section 44-30-1505(3), C.R.S. and 1 CCR 207-2, Rule 3.6].

For purposes of a temporary investigation, the Division directed staff to check the Colorado child

support database; send inquiries to the IRS; and check GenTax, the Department’s tax processing

system, to verify payment of government obligations (e.g., child support, taxes, business fees) for the

selected principals, and to obtain a credit report on each principal. The Division’s guidance directs

investigators to conduct a comprehensive review and analysis of an applicant’s financial situation,

which generally includes reviewing several years of tax returns, financial statements, bank statements,

and funding information for the applicant and associated businesses; and reviewing tax returns, bank

statements, and credit card statements for associated persons. The financial investigation also

includes a series of financial analyses, such as financial statement comparison, break-even analysis,

and cash flow assessment. With respect to litigation, the minimum investigation requirements in

Division policy direct investigators to follow up on significant civil litigation disclosed by the

applicant or principals to reveal information about personal habits, business practices, or other

aspects of character and suitability.

Conflicts of Interest. Statute prohibits the following persons from having any ownership interest in

or control of, or being employed by, a sports betting licensee: (1) anyone involved with a sports

event upon which wagers can be placed, such as athletes, coaches, trainers, referees, teams, and

managers for the event or of the sport’s governing body that sanctions or governs the event; (2)

anyone who advocates for players, referees, or others involved with the conduct of a sports event

upon which wagers can be placed; or (3) a person who holds a position of influence or has access to

nonpublic information that could affect the performance of a participant or the outcome of a sports

event upon which wagers can be placed. These prohibitions do not apply to persons with less than a

10 percent ownership interest in the licensee or to an operation that does not offer wagers on the

conflicting events, athletes, or teams [Sections 44-30-1502, C.R.S.].

The Division’s investigative work in each of these areas is documented in both hard copy and

electronic files, which are used to prepare the reports for the Commission. The Division does not

have written guidance on documenting investigations or on the contents of the temporary

investigation reports presented to the Commission. The only references to the investigative files and

reports were (1) in the Division’s background investigations guidelines, which state “Assembling the

investigative report will be a simple task if the investigators have…documented all the information

Colorado Office of the State Auditor 19

that was gathered” and (2) in Division training materials, which direct the investigator to ensure that

the report is accurate and supported by documentation in the investigative file. In the absence of

Division policies, we evaluated the adequacy of the investigative documentation to the extent that

minimum investigation requirements were documented and the documentation reflected the content

of the Commission reports. In addition, we evaluated the adequacy of the temporary investigative

reports to assess whether they were supported by evidence in the investigative files and provided

assurance of the applicant’s suitability. Thoroughly documenting investigations is necessary for

Division management to ensure that the work is complete and accurate and that no disqualifying

circumstances were overlooked by the investigator. Preparing complete and accurate Commission

reports is necessary for ensuring the Commission’s licensing decisions are consistent, fair, and

justifiable.

What problems did the audit work identify?

Overall, we found that during the first year of regulating sports betting, the Division did not have an

effective process for investigating sports betting applicants for temporary licensure that provided

assurance that approved applicants were qualified. Specifically, we found that the temporary

investigations conducted by the Division of new sports betting business applicants during this time

did not clearly provide assurance that the applicants met all the requirements in statute and rules to

be qualified for licensure. The issues we identified include:

Planned investigatory work was not completed. We found that, for each of the approved

applicants in our sample, the Division did not have evidence to show that all of the minimum checks

that were expected as part of their temporary investigations were completed.

Criminal History. For three of the five (60 percent) operators and eight of the 10 (80 percent)

principals in our sample, the Division did not have evidence that it had completed the minimum

required criminal history procedures that it had established for temporary investigations. Specifically,

we found the following:

• For five principals and three operators, the Division did not obtain CLEAR reports.

• For two principals, the Division did not obtain Accurint reports.

• For one principal, the Division did not conduct CCIC or NCIC checks.

• For three of the six U.S.-based principals, the Division did not obtain criminal history

information from any local U.S. law enforcement agencies where the principal had lived,

worked, or studied in the last 10 years. For two of those three principals, the Division did not

provide evidence that it sent inquiries to local law enforcement agencies. For the other principal,

the Division sent inquiries to law enforcement agencies but had not received any responses

before recommending the applicant for licensure. Further, for the 3 U.S.-based principals where

20 Colorado Office of the State Auditor

the Division conducted at least one local law enforcement inquiry, only one had complete

history from the law enforcement jurisdictions where the principal lived or worked in the past 10

years.

Regulatory History. For three of the five (60 percent) operators and six of the 10 (60 percent)

principals in our sample, we found that the Division did not complete the minimum regulatory

history procedures that it had established for temporary investigations. Specifically, we found the

following:

• For one operator and six principals, there was no evidence that the Division reviewed the

operator’s and principals’ licensing histories in the Department’s MyLO system.

• For one operator, there was no evidence that the Division reviewed the Department’s Public

Safety Records (for past contact with the Division, such as disciplinary actions).

• For two of the four operators that reported having applied for or held a sports betting license in

at least one other U.S. jurisdiction, the Division did not conduct any inquiries with gaming

authorities in those jurisdictions. Additionally, for one operator that disclosed having applied for

or holding sports betting licenses in several U.S. jurisdictions, the Division sent inquiries to

some, but not all, of the jurisdictions that the applicant disclosed.

• For one operator that disclosed that they, or an associated business, had been subject to

disciplinary actions related to sports betting activities by gaming regulators in four other states,

the Division sent general inquiries to regulators in the four jurisdictions, but only had

documented responses from one of the four.

• For one operator, we found the Division discovered violations that occurred in another gaming

jurisdiction that the operator did not disclose, even though the operator was required to do so.

Specifically, Division staff learned during its temporary investigation process that the operator’s

holding company was required to pay £6.2 million in regulatory settlements resulting from a

2018 investigation by the U.K. Gaming Commission, which identified a number of violations,

including deficient anti-money laundering controls. However, the Division did not follow up on

these violations with either the applicant or the U.K. Gaming Commission to determine if the

operator’s omission was deliberate or could have affected the operator’s suitability for licensure.

According to the Division, large fines are not out of the ordinary in the gaming business, and

since the operator was still licensed and operating in the U.K., the Division assumed that the

applicant was suitable for a temporary license in Colorado. The Division reported that it

informed the Commission of its findings and conclusion.

Financial Capacity and Operations. For three of the five (60 percent) operators and three of the 10

(30 percent) principals in our sample, the Division did not have evidence that it had completed the

Colorado Office of the State Auditor 21

minimum financial procedures that it had established for temporary investigations. Specifically, the

Division did not have documentation of the following:

• For two operators and two principals, there was no evidence that the Division had queried

GenTax to ensure that the businesses and principals were not delinquent on Colorado tax

obligations.

• For three operators and one principal, there was no evidence that the Division had submitted

inquiries to the IRS to verify the businesses and applicants were not delinquent on their federal

taxes. However, the Division told us that it began phasing out these queries around February

2020 as part of the standard investigation procedures because the IRS was not consistently

responsive and subsequent closures of some IRS offices due to COVID-19 added further

difficulties.

Temporary investigations did not provide adequate assurance of suitability. While the

Division did not complete a number of investigative procedures that were planned for the

temporary investigations, we also found that some checks that were completed may not have

provided reasonable assurance of an applicant’s suitability or they omitted risk areas.

International Investigations. All five operators in our sample had some type of international

presence, either because they were headquartered overseas or because they were licensed to conduct

sports betting activities internationally. We found that the Division had no procedures to verify the

financial history of these operators’ international business activities. Further, although the Division

sent an inquiry to an international regulator to obtain information about one operator in our sample,

the Division did not conduct any other inquiries with gaming regulators, or any inquiries with local

law enforcement agencies outside the United States. The Division told us that its investigators

prioritized domestic regulator checks and were not expected to follow up on operators’ international

licensing or criminal history, including disciplinary actions, due to time constraints and challenges

obtaining information from outside of the United States while COVID-19 restrictions were in place.

As a result, the Division only had a limited picture of these applicants and their principals, which did

not provide assurance that the applicants were qualified or suitable for licensure. The Division

reported that it plans to complete international checks as part of the final investigations. Further, the

Division told us that privacy laws in many countries present complications in obtaining criminal and

financial information, and conducting inquiries with entities outside of the United States is a time-

consuming process since most inquiries are sent by postal mail, rather than electronically.

In terms of the individuals who are associated with our sampled operators, four of the 10 principals

in our sample are located outside of the United States, and four of the five business applicants in our

sample are held by parent businesses outside of the country. Since the Division did not pursue

international checks, the Division was not able to verify the criminal history of the four international

principals. Further, we found that some of the checks that were completed were likely of limited

relevance to the international principals, particularly for those who had not had a significant

22 Colorado Office of the State Auditor

presence in the United States, such as for school, work, or past residency. This is because most

standard checks included in the temporary investigation contain only Colorado or U.S.-specific

records, or are queried based on a subject’s Social Security Number, such as the CLEAR report,

credit history report, or Colorado child support records. The Division has not established alternative

or supplementary procedures for international applicants.

Further, we found that the Division did not have processes to translate documents in other

languages during the temporary background investigations. For example, one of the applicants in

our sample provided tax returns in Spanish, however there was no indication that the Division was

able to read the returns as provided or had them translated. The Division reported that it plans to

pay for translation services as part of the final licensing investigations.

Financial Investigations. We found that financial procedures in the temporary investigations did not

verify the applicants’ financial capabilities, and the Division told us that the financial procedures

were the most limited portion of the temporary license investigations. For example, the documented

financial procedures generally only verified any bankruptcies the applicants disclosed and that the

applicants and their principals were current on their government payment obligations in the United

States. As a result, virtually all of the financial details included in the temporary license reports,

which the Commission relies on to verify that an applicant is financially capable of their planned

business operations, were self-reported by the applicants, rather than based on the conclusions of a

Division investigator.

According to the Division, there were no financial investigators conducting financial analysis for

temporary investigations in 2020, so financial investigations were limited to what could be carried

out by the criminal investigators on staff. The Division reported that more in-depth financial

procedures conducted by a financial investigator are included in the final investigations.

Incomplete Documentation. We identified problems with the Division’s documentation related to

conflicts of interest, investigations, and Commission reports.

Conflicts of Interest. We were unable to verify that the Division had vetted the applicants in our

sample, including their associated businesses and persons, for statutorily prohibited connections

with sporting events or organizations. The Division told us that it met with businesses before they

submitted applications to inquire about any potential conflicts of interest and identify solutions if

conflicts did exist. However, the Division did not have documentation of any these meetings for any

of the applicants in our sample.

Investigative Files. We found that the investigative files the Division had for the sample of five

operators and 10 principals that we reviewed was inconsistent and incomplete. In addition to the

specific items of evidence the Division did not have, as noted in the previous bullets, the Division

did not have documentation of interviews for six principals, and the Division also did not keep all

relevant emails. Further, the investigative files did not contain notes or other documentation

Colorado Office of the State Auditor 23

reflecting the investigators’ reasoning, decision-making, areas of concern, or barriers encountered in

the investigation. For example, the Division told us that it declined to follow up on disclosed or

discovered gaming violations in the United Kingdom because political changes there had resulted in

a stricter and more punitive regulatory environment. While the Division indicated that any violations

and resulting disciplinary actions were low-risk and not potential areas of concern, and the Division

reported that it provided this information to the Commission, the Division had no documentation

of the reasoning for this decision.

Commission Reports. We found that four of the operator investigative reports in our sample

contained statements that either conflicted with evidence in the investigative file or for which there

was no supporting evidence. For example:

• Four reports contained statements that the Division had carried out procedures for which there

was no documentation or that were not complete at the time the report was written. These

procedures included fingerprint-based background checks, local law enforcement inquiries, and

NCIC and CCIC database inquiries. For example, one report stated that local law enforcement

inquiries had been completed on one of the principals and no areas of concern were found.

However there was no evidence that any local law enforcement inquiries had been completed.

• Two reports included licensing details that were inaccurate. According to the Division,

investigators were only expected to include domestic sports betting licenses in the report but, we

found the licensing information included in two reports was inconsistent with this and further

conflicted with information disclosed by the applicant. For example, one report stated that the

applying business held current gaming licenses in seven other U.S. states. However, the

business’s application disclosed that only one of these licenses was current, and all of the other

licenses had expired before the application was submitted.

• One report stated that the applying business had no current or pending legal matters, but the

application disclosed that the business was a party to an ongoing lawsuit.

Further, the reports did not contain language notifying the Commission about any limitations on the

investigation that led to information in the report being unverified or incomplete. For example, the

Division told us that they were not able to verify the financial details included in the reports during

the temporary investigations and these figures were self-reported by the applicant. The Division told

us that the Commission was aware that the temporary investigations were limited and of what

specific areas were not covered. However, because we found the work completed for each

temporary investigation was not consistent among operators and principles in our sample, the

Commission may not have had a clear picture of what information was self-reported by applicants

and what had been substantiated by the Division. Nonetheless, Division management and the

Commission Chair stated that they believe the Commission was provided a detailed picture of the

licensees’ information.

24 Colorado Office of the State Auditor

Why did these problems occur?

The Division told us that several factors outside its control affected its investigations of sports

betting applicants. First, the Division said it received a higher-than-expected volume of applications

between December 2019 and May 2020 and did not have enough licensing staff and investigators to

handle the workload. The increased workload was further exacerbated by a Department-wide hiring

freeze in early 2020 resulting from COVID-19-related budget constraints, as well as staff turnover

and retirements that resulted in the Sports Betting Unit having three investigators and one

supervisor for most of Fiscal Year 2021. Second, COVID-19 restrictions beginning in mid-March

2020 meant that investigators were unable to obtain certain documents and information from

government agencies and businesses that were closed or operating at a diminished level. In addition,

some investigative information was lost when the Division started storing information electronically,

rather than in hard copy, during the COVID-19 pandemic. As a result of these challenges, the

Division narrowed the scope of its Sports Betting license investigations, deferring the majority of the

work until after temporary licenses were issued. While it was clear from our work that these factors

did create hurdles for the Division, we also identified underlying shortcomings in the Division’s

investigation processes that contributed to the problems we found, as described below.

Lack of a Documented Risk-Based Investigation Approach. The Division had initially planned

to follow the existing limited gaming model for its sports betting investigations. The Division also

reported that prior to receiving sports betting license applications, Division investigators conducted

an overall review to develop a risk-based background investigation process and standardized report

template for the temporary licensing process and reporting to the Commission. However, the

Division did not provide documentation to show that the process it envisioned was formalized or

communicated to all investigators. Further, the procedures for limited gaming investigations have

not been reviewed for possible revisions since 2016, at the most recent, and more importantly, do

not reflect a risk-based approach to investigations that are tailored to the sports betting industry. As

a result, the Division’s sports betting investigations were not designed to consider the risks inherent

to that industry, achieve defined objectives to address such risks, or ensure the investigations

provided the right type and amount of information for prudent licensing decisions. The lack of such

a risk-based system affected both the limited investigations for temporary licenses and has the

potential to impact the final investigations for permanent licenses.

First, the Division told us that the scope of the temporary investigations was guided primarily by

what work could be conducted within roughly 3 weeks; the Division did not evaluate the overall

investigation process to decide what work needed to be done to provide a sound, if minimal, basis

for licensing decisions, and what could reasonably be postponed. However, the Division told us that

it has already recognized that some investigative procedures are unproductive, such as sending

inquiries to the IRS because the agency was not responsive, and has deliberately omitted the related

procedures from the temporary investigations. According to the Division, there is information in the

applications and likely other procedures and sources it has long used in investigations that do not

provide useful information or are no longer accessible.

Colorado Office of the State Auditor 25

Second, the temporary investigation process has provided the Division an opportunity to evaluate

the importance of much of its traditional investigatory work. By recommending licenses based on

these limited investigations, which did not include review or follow up on a substantial amount of

evidence and documentation provided by the applicants, the Division has recognized that some of

the work traditionally done in an investigation may not be necessary. For example, according to the

Division, some of the documentation that we found was missing from the investigative files was

deemed by the Division as not essential or low priority and too time consuming for the temporary

investigation. This raises a question as to how much of this information is needed for a permanent

license, which offers the licensee no more rights or privileges than a temporary license. Furthermore,

since the Division has not established guidance for sports betting license investigations, staff

conducting investigations for sports betting licenses rely on the Division’s existing guidance for

limited gaming. That guidance directs investigators to pursue many avenues of investigation and

allows them discretion in the work they complete, but does not identify priorities to target work to

address areas of risk. The Division told us that investigators and their supervisors may discuss

potential risks and brainstorm ideas for each investigation, but this risk-based approach has been an

informal process that is not documented in the investigative files or reports, which may lead to

inconsistencies in the rigor of different investigations.

The Division confirmed that the final investigation process, while prolonging the work, does not

always result in investigators obtaining meaningful information and may not be the most efficient

use of an investigator’s time.

Lack of Written Policies for Sports Betting Investigations. The Division reported that it has

relied on its existing process for conducting limited gaming investigations to complete investigations

for sports betting licenses. In May 2021, the Division issued some sports betting specific policies

and procedures, but these do not address licensing and investigations. Since sports betting was

legalized, the Division has not methodically reviewed the limited gaming investigation procedures to

incorporate or develop separate written guidance that is relevant to sports betting investigations.

One area we identified in our audit where the Division needs to develop written procedures is the

investigation of applicants from outside the United States. The Division told us that there are several

barriers to collecting information from other countries, but did not have alternative procedures in

place to compensate. For example, investigations of businesses and individuals in other countries

can be difficult due to strict privacy laws, some of which do not allow certain records to be released

to regulatory agencies. The Division has not established alternate means of acquiring essential

information, such as routinely asking applicants from other countries to acquire the records

themselves and submit them to the Division. The Division has additionally not provided

investigators with any written guidance or additional training on how to navigate international

investigations and available sources, and instead relies on each investigator to do their own research