FEE ATTORNEYS: ETHICAL AND LIABILITY

RELATED CONSIDERATIONS AFFECTING

PREMIUM-FEE PARTICIPATION IN TITLE

INSURANCE TRANSACTIONS

DAVID C. YOUNG

Executive Vice President and General Counsel

Stewart Title North Texas Division

Edited and presented by David C. Young,

based on materials and permission granted by:

Richard L. Black, Stewart Title Guaranty Company

and

Frank Oliver, Law Office of Frank Oliver, P.C.

2009 Texas Land Title Institute – Page 2

Fee Attorneys: Ethical and Liability-Related Considerations Affecting Premium-Fee

Participation in Title Insurance Transactions

David C. Young

Stewart Title North Texas Division

15950 Dallas Parkway, Suite 100

Dallas, Texas 75248

• Executive Vice President and General Counsel for Stewart Title North Texas Division, as

well as Vice President and Counsel for Stewart Title Guaranty Company.

• Received B.B.A. from the University of Texas, Arlington and J.D. from Southern Methodist

University School of Law, 1973.

• Have been in the Title Insurance Industry since 1973, including manager of title examination

department, manager of a branch escrow office, co-owner of an independent title agent, and

as General Counsel for an underwriter.

• Speaker at Title Association seminars, conventions, and the Land Title School.

• Provides further education to Stewart Title North Texas Escrow Officers for the purpose of

Continuing Education.

• Fellow, College of the State Bar of Texas.

• Has appeared as Expert Witness in both court suits and before the Texas Department of

Insurance.

• Served in the U.S. Army, 1968-1971, awarded Bronze Star for service in Viet Nam,

discharged as a 1

st

Lieutenant, Infantry.

• Have been chairman of many committees for the Texas Land Title Association, including:

¾ Rates, Rules and Forms

¾ Land Title School

¾ Dues and Finance

¾ By-Laws

¾ Surveyor Liaison

¾ Past Presidents Advisory Council

• Has previously held the following leadership roles:

¾ President, Fort Worth Title Association, 1982-1984

• President, Texas Land Title Association, 1988-1989

• Recognized as ‘Titleman of the Year’ by Texas Land Title Association in 1986.

2009 Texas Land Title Institute – Page 3

Fee Attorneys: Ethical and Liability-Related Considerations Affecting Premium-Fee

Participation in Title Insurance Transactions

FEE ATTORNEYS: ETHICAL AND LIABILITY-RELATED

CONSIDERATIONS AFFECTING PREMIUM-FEE

PARTICIPATION IN TITLE INSURANCE TRANSACTIONS

OUTLINE

I. TERMINOLOGY

A. Fee Attorney

B. Approved Attorney

C. Examining Attorney

D. Doc Prep Attorney

II. APPLICABLE REQUIREMENTS FOR RECEIVING A PORTION OF THE

TITLE INSURANCE PREMIUM

A. General Rules Concerning the Amount of the Premium Split

B. Tex. Title Insurance Act Sect. 2502.051 et seq.

C. Texas Title Insurance Basic Manual Procedural Rule P-22

D. Tex. Disciplinary Rules of Professional Conduct, Rule 1.04(a)

E. Tex. Comm. On Professional Ethics. Op. 408, V.47 Tex. B.J. 44 (1984)

F. Texas Department of Insurance Bulletin No. 167

III. THE TITLE INSURANCE COMPANY BECOMES A CLIENT

A. Tex. Comm. On Professional Ethics, Op. 408, V.47, Tex. B.J. 44 (1984)

B. Closing the Transaction is a Key Statutory Term of Art

C. Use of the P-22 Letter to Define the Scope of the Engagement with Title

Company

D. The Importance of Proper Completion of the Form T-00 Verification of

Services Rendered and the Itemized Statement of Services

E. Suggested Descriptive Model of the Fee Attorney or Approved Attorney

Relationship

IV. REPRESENTATION BY THE FEE ATTORNEY OR APPROVED ATTORNEY

OF MULTIPLE PARTICIPANTS IN THE REAL ESTATE TRANSACTION

A. Rule 1.06 Conflict of Interest: General Rule

B. Disclosure and Consent to Multiple Client Representation

C. Disclosure of Non-Representation to Non-Client Transaction Participants

D. Summary of Requirements

V. CONCLUSION

2009 Texas Land Title Institute – Page 4

Fee Attorneys: Ethical and Liability-Related Considerations Affecting Premium-Fee

Participation in Title Insurance Transactions

ETHICS AND LIABILITY

CONSIDERATIONS FOR FEE ATTORNEYS

AND APPROVED ATTORNEYS

The participation of an attorney in one or more aspects of the real estate closing process presents

a number of ethics and liability considerations and challenges. The participants in the typical real

estate transaction seller, buyer, borrower, lender, mortgage broker, title underwriter, title agent,

and real estate broker may have expectations or beliefs concerning the existence and scope of

legal representation by an attorney participating in the process that are completely at odds with

the limited role the attorney believes that he or she is actually performing or intending to

perform. A lack of clarity in defining and communicating regarding the existence and scope of

legal representation can give rise to serious ethics risks and the potential of malpractice and other

liability risks for the attorney.

The risk of confusion by a transaction participant concerning the existence and scope of an

attorney-client relationship is particularly acute for the attorney who closes the real estate

transaction as a fee attorney or approved attorney and receives a portion of the title insurance

premium from the title insurance company and an additional escrow closing fee or settlement fee

from the buyer and seller. If the attorney also prepares transaction documents, the risk of

confusion is only heightened.

This presentation is intended to discuss some of the principal ethics rules and liability

considerations that come into play when an attorney is functioning as, a fee attorney or approved

attorney, including consideration of those transactions in which the fee attorney or approved

attorney may also be representing one or more of the transaction participants.

I. Terminology

While there is geographic and title company variation in terminology, usage and practice,

for the purpose of convenience, the following terminology is used in this presentation:

A. Fee Attorney

:

• Business conducted under the name of the title company

• Uses title company signage, stationary, business cards, etc.

• Attorney and staff are licensed escrow officers of the title company

• Receives a percentage of the title insurance premium

• Charges an additional escrow fee for settlement services

• Operates under a detailed contract with the title company

• Escrow accounts subject to TDI auditing requirements

Insured closing service letter [Form T-50 or T-51] usually made available by the

title insurance company to cover escrow defalcations and failure to follow closing

instructions.

2009 Texas Land Title Institute – Page 5

Fee Attorneys: Ethical and Liability-Related Considerations Affecting Premium-Fee

Participation in Title Insurance Transactions

B. Approved Attorney:

• Does not operate under the title company's name

• Conducts business as an independent law firm

• Attorney and his staff are not licensed escrow officers of the title

company

• Receives a percentage of the title insurance premium

• Charges an additional escrow fee for settlement services

• Operates under a simple P-22 letter setting forth the attorney's schedule

of charges

• Escrow accounts not subject to TDI auditing requirements

• Insured closing service letter is not made available by the title

insurance company

C. Examining Attorney:

• Examines title for the title insurance company

• Some continued use in rural areas

D. “Doc Prep” Attorney:

• May be independent attorney representing only the lender for a fee paid

at closing by the borrower

• Maybe affiliated in some manner with a title company or title agent,

such as an owner of the title agent or an attorney-employee of the title

agent

II. Applicable Requirements for Receiving a Portion of the Title Insurance

Premium

When a portion of the title insurance premium is paid by the title insurance company

to the fee attorney or approved attorney, there are statutory, regulatory, and ethics

requirements that apply and must be followed by the fee attorney or approved attorney.

A. General Rules Concerning the Amount of the Premium Split:

i. The portion of the title insurance premium received by the fee attorney or

the approved attorney must be reasonable in amount and commensurate

with the services actually performed by the fee attorney or approved

attorney.

ii. A written schedule of the charges normally made by the attorney for such

services must be filed with the title insurance company at least thirty (30)

days before the services are rendered, and the schedule must have been

agreed to and approved by the title insurance company.

2009 Texas Land Title Institute – Page 6

Fee Attorneys: Ethical and Liability-Related Considerations Affecting Premium-Fee

Participation in Title Insurance Transactions

iii. At or prior to the time of receiving, payment of a portion of the premium,

the attorney must submit to the title insurance company a written itemized

statement or invoice, that details the services actually rendered.

B. Tex. Title Insurance Act Section 2502.051 et seq.

i. No commission, rebate, discount, portion of any title insurance premium,

or other thing of value shall be directly or indirectly paid, allowed or

permitted by any person doing, the business of title insurance or received

or accepted by any person for doing the business of title insurance or for

soliciting or referring title insurance business.

ii. This Article may not be construed as prohibiting: ... (4) payments for

services actually performed by an attorney in connection with title

examination or, closing a transaction, which, payment may not exceed a

reasonable charge for such services.

iii. The payment or receipt of a commission, rebate, discount, or other thing

of value to or by, any person for soliciting or referring title insurance

business in violation of this Article is engaging in the unauthorized

business of insurance, and in addition, to any other penalty, after

notice and opportunity for hearing, is subject to a monetary forfeiture

not less than the value nor more than three times the value of the

commission, rebate, discount, or other thing of value.

iv. No person shall give and no person shall accept any portion, split, or

percentage of any charge made or received for the rendering of a real

estate settlement or closing in connection with a transaction involving the

conveyance or mortgaging of real estate located in the State of Texas other

than for services actually performed.

C. Texas Title Insurance Basic Manual Procedural Rule P-22

:

NOTE

: THE FULL TEXT OF PROCEDURAL RULE P-22 IS ATTACHED AS

EXHIBIT A

TO THE APPENDIX FOR REFERENCE.

" No payment shall be made by a Title Insurance Company, Title Insurance Agent,

Escrow Officer or any employee or agent of any of them, to any Person who is not its

bona-fide employee, for examination of a title and/or closing a transaction unless:

(A) Such Person is (i) a Title Insurance Company as defined in Sect. 2501.003, Texas

Insurance Code, and qualified to do business in the State of Texas, (ii) a Title

Insurance Agent as defined in Section 2501.003, in Texas Insurance Code, and

licensed to do business in the State of Texas by the Texas Department of Insurance,

2009 Texas Land Title Institute – Page 7

Fee Attorneys: Ethical and Liability-Related Considerations Affecting Premium-Fee

Participation in Title Insurance Transactions

or (iii) an attorney at law duly licensed by the Supreme Court of Texas to practice

law in the State of Texas, to the extent not inconsistent with the Texas Insurance

Code, or (iv) any Person legally authorized to perform such services; and

(D) Any payment made must be commensurate with the services actually performed;

and

(E) The Person rendering the service shall have filed with the Company at least thirty

(30) days prior to the rendering of such service a written schedule of charges

normally' imposed by such Person for such services (Schedule) and such Schedule

shall have been agreed to and approved by the Company as being reasonable

charges for such services. However, payments to licensed title insurance agents

are excluded from the requirements of this paragraph (E); and

(F) The Person rendering the service shall have presented to the Company, at or

prior to the time of payment of said services, a written itemized statement or

invoice which clearly sets forth in detail the actual services rendered and billed for

in representing the Company in the respective settlement, closing and/or

examination, and such Company verifies, in writing, that such services were

actually rendered in accordance with form T-00; and

(G) In the event of collection of the title insurance premium by such Person, the

entirety of such premium shall have been remitted to the Company; and

(H) No portion of the charge for the services actually rendered shall be attributable to,

and no payment shall be made for the solicitation of, or as an inducement for the

referral or placement of the title insurance business with the Company; . . .”

D. Tex. Disciplinary Rules of Professional Conduct, Rule 1.04(a):

"A lawyer shall not enter into an arrangement for, charge, or collect an illegal

fee or unconscionable fee. A fee is unconscionable if a competent lawyer

could not form a reasonable belief that the fee is reasonable.

E. Tex. Comm. On Professional Ethics Op. 408, V. 47 Tex. B.J. 44 (1984)

:

NOTE: THE FULL TEXT OF OPINION 408 IS ATTACHED AS EXHIBIT D

TO THE APPENDIX FOR REFERENCE.

"An attorney may accept a fee from the title insurance company if the attorney

has actually performed services on behalf of the company.... In this regard, the

fee received by the attorney must be reasonable under Disciplinary Rule (DR)

2-106, whether based on a percentage or some other mode of calculation.

2009 Texas Land Title Institute – Page 8

Fee Attorneys: Ethical and Liability-Related Considerations Affecting Premium-Fee

Participation in Title Insurance Transactions

F. Texas Department of Insurance Bulletin No. 167

Prohibits the issuance of an Insured Closing Service Letter where an attorney not

licensed as an escrow officer closes the transaction, and the title company

disburses the loan funds.

NOTE: THE FULL TEXT OF BULLETIN 167 IS ATTACHED AS EXHIBIT G

TO THE APPENDIX FOR REFERENCE.

III. The Title Insurance Company Becomes a Client

By accepting a portion of the title insurance premium, which is only permissible for

services actually rendered, the fee attorney or the approved attorney establishes an attorney -

client relationship with the title insurance company. The existence of an attorney-client

relationship between the attorney and the title insurance company imposes upon the attorney

all of the duties and obligations that would attach in any other attorney-client relationship.

A. Tex. Comm. On Professional Ethics On. 408. V. 47, Tex. B.J. 44 (1984):

"An attorney representing a party to a real estate sale may accept a percentage of

the title insurance premium only for services actually rendered the title

company. The attorney becomes the attorney of the title company; the fee charged

the title company should therefore be reasonable.

The lawyer should make such disclosures to all his clients in the transaction as

the rules and statutes may require, depending on the facts in each situation, and

is bound by the usual and customary rules of multi-client representation as they

apply to the particular facts at hand."

B. "Closing the Transaction" is a Key Statutory Term of Art:

Sect. 2502.053 and Procedural Rule P-22 allows the fee attorney or approved

attorney to receive a portion of the title insurance premium for services

actually rendered in closing a transaction. It is important to remember that the

terminology "closing the transaction" is carefully defined in Texas Title

Insurance Act Sect. 2501.006 and has a very specific meaning as follows:

"Closing the Transaction" means the investigation made on behalf of a title

insurance company, title insurance agent, or direct operation before the actual

issuance of the title policy to determine proper execution, acknowledgment,

and delivery of all conveyances, mortgage papers, and other title instruments

which may be necessary to the consummation of the transaction and includes

the determination that all delinquent taxes are paid, all current taxes, based on

the latest available information, have been properly prorated between the

2009 Texas Land Title Institute – Page 9

Fee Attorneys: Ethical and Liability-Related Considerations Affecting Premium-Fee

Participation in Title Insurance Transactions

purchaser and seller in the case of an owner policy, the consideration has been

passed, all proceeds have been properly disbursed, a final search of the title

has been made, and all necessary papers have been fled for record.

Procedural Rule P-I(f) in the Basic Manual contains the same definition of "closing

the transaction."

"Closing the transaction" as defined in Sect. 2501.006 and Rule P-1(f) is synonymous

with or could be more accurately described as "closing the title insurance transaction." It is

not the same as "closing the real estate escrow transaction." In consideration for "closing the

transaction" within the technical meaning of the statute and Procedural Rule P-1 (f) [i.e.,

closing the title insurance transaction], the fee attorney or approved attorney receives a

portion of the title insurance premium: The language of Sect. 2502.053 and Procedural Rule

P-22 only allow the title insurance premium to be shared with an attorney who actually

renders services "in connection with title examination or closing a transaction."

Sect. 2501.006 and Procedural Rule P-1(f) carefully define "closing the transaction" to not

include the actual mechanical acts of closing the real estate escrow transaction (i.e., settlement or

escrow services). Thus, under the language used in the statutory and regulatory definition of

"closing the transaction," there is a sharp distinction drawn between an "investigation made on

behalf of a title insurance company" prior to issuance of the policy "to determine" whether

certain events have occurred (e.g., execution of documents, prorations, recording, etc.) and the

actual performance of those acts. Paragraph (F) of Procedural Rule P-22 further confirms this

distinction by separately listing the functions of "settlement, closing, and/or examination," which

indicates that these are three different activities.

Applicable case law also confirms that the issuance of the title insurance policy is a separate and

distinct transaction from the closing of the real estate transaction. Chicago Title Ins. Co. v.

Afford, 3 S.W.3d 164, 167 f.2 (Tex.App.-Eastland, 1999); See Southwest Title Insurance

company v. Northland Building Corporation, 552 S. W.2d 425, 428 (Tex. 1977); see also

"Garrett and McDaniel: DTPA Liability For Issuance of a Title Insurance Commitment," 26

TEX. TECH L. REV. 857, 863870 (1995).

For the service of closing the real estate escrow transaction, and performing the functions of an

escrow agent, the fee attorney or approved attorney typically charges and receives a separate

escrow fee or settlement fee from the seller and buyer that is not shared with the title insurance

company. This separate and additional fee is currently shown on line 1101 of the HUD-1

Settlement Statement as "Settlement or closing fee." This fee for settlement services is for a

service performed by the fee attorney or approved attorney that is separate and different from

"closing the transaction" in the technical statutory and regulatory, context, (i.e., closing the title

insurance transaction).

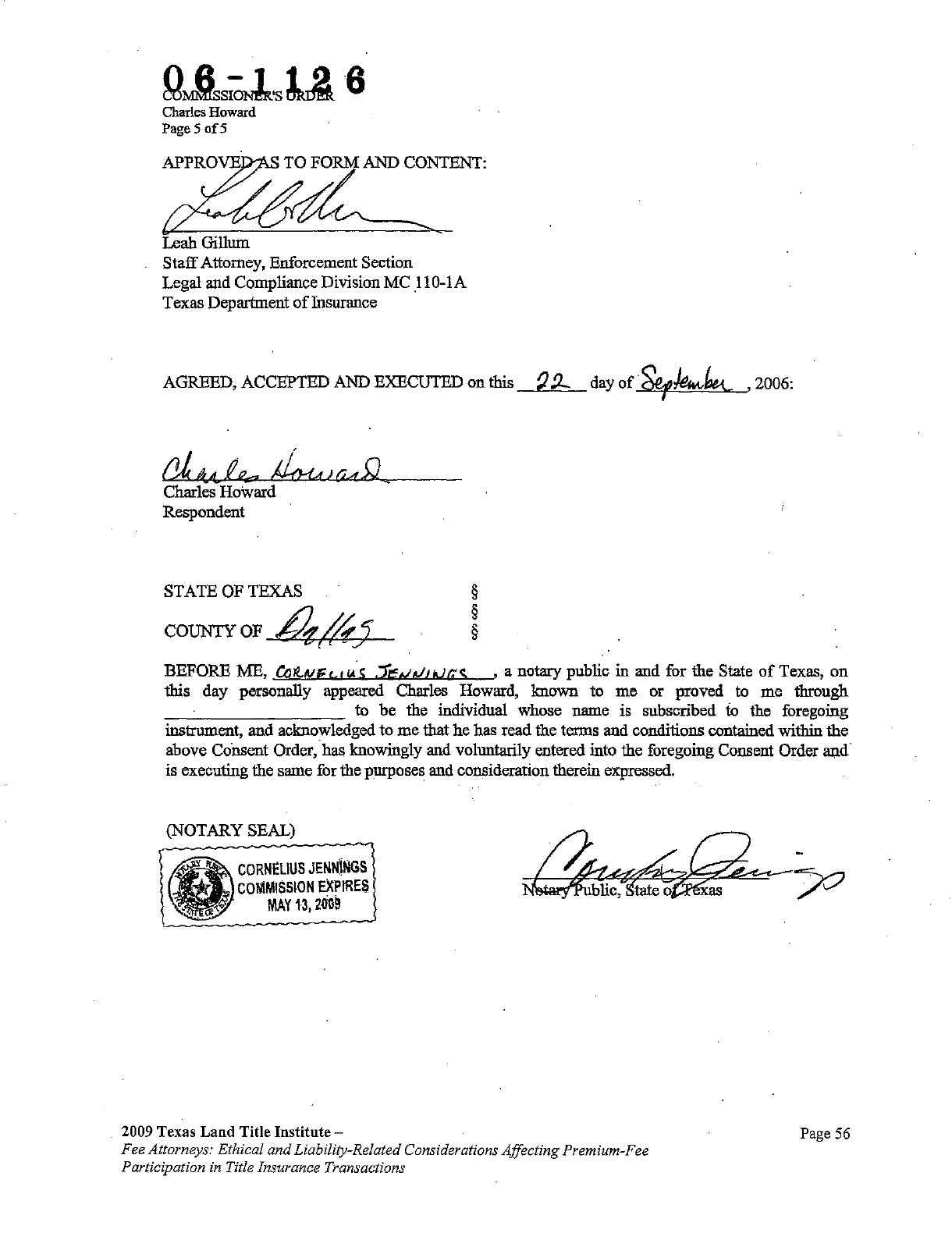

However, the fee attorney should only use bona fide employees in the performance of the closing

services, since Sect. 2652.003 requires such bona fide employees that close transactions to be

licensed as escrow officers. Failure to do so may result in disciplinary action, including

revocation of escrow officer’s license, as set forth in the examples of such Consent Orders

2009 Texas Land Title Institute – Page 10

Fee Attorneys: Ethical and Liability-Related Considerations Affecting Premium-Fee

Participation in Title Insurance Transactions

attached as Exhibits H and H-1 to the Appendix for reference.

C. Use-of-the P-22 Letter to Define the Scope of the Engagement With the Title

Company:

While the technical distinction made under Procedural Rule P-22(f) is often blurred in

existing practice, it is recommended by the author that consideration be given in the drafting of

the P-22 schedule of charges letter (or in the fee attorney contract as applicable) to recognize this

distinction by defining the services performed by the fee attorney or approved attorney for the

title insurance company or title insurance agent in the language of Sect. 2501.006 and Procedural

Rule P-1(f). See discussion draft of P-22 Letter attached as Exhibit B

to Appendix for reference.

Among other benefits, following such a convention conforms the description of services of the

fee attorney or approved attorney to the statutory and regulatory restrictions on sharing the title

insurance premium.

In addition to avoiding: a possible suggestion of a statutory or regulatory violation of the

antirebate prohibition, the benefit of such an approach to the fee attorney or approved attorney is

to define clearly and thereby limit the scope of engagement on behalf of the title insurance

company or title insurance agent. From the perspective of the title insurance company or title

insurance agent, conforming the P-22 letter to the statutory and regulatory definition at least

allows later argument that actionable conduct by a approved attorney in the closing of the real

estate escrow closing, as distinguished from "closing the transaction" (i.e., closing the title

insurance transaction), is not attributable to or imputed to the title insurance company or title

insurance agent.

The discussion draft of a P-22 letter attached as Exhibit B in the Appendix follows

this suggestion.

It is important, if for no other, reason than to reduce, the risk of confusion, to have a

clear written agreement defining the scope of the attorney's engagement. This admonition

applies equally to the attorney-client relationship that arises from the attorney's acceptance of

a portion of the title insurance premium for services rendered to the title insurance company

in connection with the title examination and/or closing the transaction.

As previously stated, Rule P-22 requires that the fee attorney and approved attorney

already have on file with the title insurance company a written schedule of charges normally

imposed by the attorney. There is no Texas Department of Insurance promulgated form for

this written schedule of charges, which is usually referred to simply as a "P-22 letter:" In the

case of many, if not most approved attorneys, the P-22 letter is the only written document

describing the relationship between the approved attorney and the title company.

However, a fee attorney agreement may be more contractual in nature, and contain

more clearly defined sections of expected practices. Again, there is no promulgated form of a

fee attorney agreement, but a discussion draft of a fee attorney agreement is attached as

Exhibit B-1 to the Appendix for reference.

2009 Texas Land Title Institute – Page 11

Fee Attorneys: Ethical and Liability-Related Considerations Affecting Premium-Fee

Participation in Title Insurance Transactions

In actual practice P-22 letters tend to be rather simple documents and rarely are they

given much scrutiny until a transaction participant makes a post-closing claim. It is strongly

suggested that the attorney operating under a P-22 letter pay close attention to the form of the

letter used. This should be done at the outset of the relationship between the fee attorney or

approved attorney and the title insurance company, and not for the first time when a

transaction participant makes a post-closing claim.

From the perspective of the fee attorney or approved attorney, the issues arising with

a P-22 letter that need to be considered at a minimum include the following:

(i) Does the P-22 letter mistakenly- describe your services broadly in the

language of Rule P-22 as "examination of a title and/or closing a transaction"?

Are you really "examining title"? This is normally done by the title company's

examination or plant personnel or by in-house counsel for the title company. If you are not

actually examining title, then the P-22 letter should not include title examination within the

scope of service for which you are receiving a portion of the title insurance premium.

Confirming that Schedule C items on the Commitment for Title Insurance have been satisfied

is not the same as "examination of a title." See definition of "title examination" contained in

Sect. 2501.003 ["the search and examination of a title to determine the conditions of the title

to be insured and to evaluate the risk to be undertaken in the issuance of the title insurance

policy or other title insurance form"].

If your P-22 letter setting forth your schedule of charges "normally imposed" includes

"examination of title" in the list of services and sets your premium split at 50%, but you do

not actually examine title, will a 50% split still be sustainable as commensurate with the

services actually rendered in the event that your charges later come under scrutiny?

(ii) Does the P-22 letter describe your services only as "closing services" or some

other similarly vague term?

The risk here is that the meaning of such vague terminology is left to later

determination and possible misconstruction by a court or jury.

(iii) Does the P-22 letter mistakenly describe services beyond the scone of

"examination of a title and/or closing a transaction"?

If the P-22 letter contains a laundry list of various services including statements such

as "review of survey" or "review of loan documents" or other activities that the fee attorney

or approved attorney does not in fact perform for the title insurance company, then the fee

attorney or approved attorney is inviting potential liability if there is something amiss with

the survey, the loan documents, etc. Avoid loose language in the P-22 letter that is inaccurate

and may unnecessarily increase the attorney's exposure to transaction participants. If a

specific service is listed in the P-22 letter, it will be difficult for the fee attorney or approved

attorney to convince a court or jury later that the language was a "mistake" or that the

particular service listed was not actually within the actual scope of services for the

2009 Texas Land Title Institute – Page 12

Fee Attorneys: Ethical and Liability-Related Considerations Affecting Premium-Fee

Participation in Title Insurance Transactions

transaction that has generated a post-closing claim.

(iv) Does the P-22- letter specifically identify- the title company as the party whom

the services are being performed?

The fee attorney or approved attorney should make sure that the P-22 letter clearly

states that the services are performed for the title insurance company or title insurance agent.

Care should be taken to make sure that the P-22 letter does not leave any ambiguity on this

point. It is the recommendation of the author that the P-22 letter specifically state that the

services are not being performed for other transaction participants.

D. The Importance of Proper Completion of the Form T-00 Verification of

Services Rendered and the Itemized Statement for Services:

Procedural Rule P-22 requires that the fee attorney or approved attorney present to the

title company:

at or prior to the time of payment of said services, a written itemized statement or

invoice which clearly sets forth in detail the actual services rendered and billed for

in representing the Company in the respective settlement, closing and/or

examination, and such Company verifies, in writing, that such services were actually

rendered in accordance with form T-00; ...

Form T-00 Verification of Services Rendered is promulgated by the Texas

Department of Insurance and is included in the Basic Manual [see copy of promulgated Form

T-00 Verification of Services attached as Exhibit C-1

to the Appendix for reference].

In completing the Form T-00 Verification of Services and the itemized statement for

services, the fee attorney or approved attorney should keep in mind the same admonitions

that apply to the P-22 letter, because they apply equally to the language used by the fee

attorney or approved attorney in completing the Form T-00 Verification of Services

Rendered and the itemized statement for services. As with the P-22 letter, scant attention is

sometimes given to the process of completing the Form T-00 Verification of Services

Rendered until a post-closing claim is made by a transaction participant and the language

used first comes under scrutiny. Poorly formulated language used by a fee attorney or

approved attorney in completing the itemized statement for services (or standard language

inserted by a title company employee and accepted without scrutiny by the fee attorney or

approved attorney) can result in ambiguity and later misconstruction by a court or jury with

respect to the existence and scope of the legal representation of the fee attorney or approved

attorney. Additionally, because most, if not all, of the benefits of a tightly drawn P-22 letter

or other engagement letter can be destroyed by a poorly completed itemized statement for

services and Form T-00 Verification of Services Rendered, it is recommended that careful

attention be given by the fee attorney and approved attorney to the language used in

completing these items.

2009 Texas Land Title Institute – Page 13

Fee Attorneys: Ethical and Liability-Related Considerations Affecting Premium-Fee

Participation in Title Insurance Transactions

The Form T-00 was amended a few years ago to remove the area for describing the

“services rendered”, and now only requires the checking of a box labeled either “Title

Examination” or “Closing the Transaction”, now defined terms.

Among the basic questions that should be considered by the fee attorney or approved

attorney in completing the Form T-00 Verification of Services Rendered and the itemized

statement for services are the following suggestions:

(i) Does the completed Form T-00 - Verification of Services and the itemized

statement for services describe accurately the services that were actually' rendered by the fee

attorney or approved attorney?

Procedural Rule P-22(F) imposes this requirement of describing the "actual services

rendered." At a minimum, the fee attorney or approved attorney should not check

"examination of title" on the Form T-00 Verification unless this service is actually being

rendered by the fee attorney or approved attorney to the title company. Because the fee

attorney or approved attorney is signing and submitting this document to his or her title

insurance client, inaccuracy also has serious ethics implications.

(ii) Does the written itemized statement or invoice set forth sufficient detail

regarding the services?

Procedural Rule P-22(F) requires that the itemized statement or invoice "clearly set

forth in detail" the services actually rendered. Aside from the problems of ambiguity and

later misconstruction by a court or jury presented by cursory descriptions such as

"closing services" or some other similarly vague term, these general statements, while

often used, would not appear to meet the requirement in Procedural Rule P-22(F) that the

services actually rendered be set forth "in detail." See sample Itemized Statement of

Services attached as Exhibit C-2 to the Appendix for reference.

(iii) Does the description of services in the itemized statement for services go too far?

The itemized statement for services should not mistakenly describe services outside

the scope of those actually rendered and "billed for in representing the [title insurance

company] in the respective settlement, closing and/or examination." See Procedural Rule

P-22(F).

Care should be taken to ensure that the itemized statement for services, in an effort to

provide the required detail or justify the charges made, does not mistakenly include

statements such as "review survey" or "review of loan documents" or "preparation and

review of closing documents for buyer and seller" or other generic descriptions of services

and activities that the fee attorney and approved attorney do not in fact perform in

representing the title company within the scope of "settlement, closing and/or

examination."

2009 Texas Land Title Institute – Page 14

Fee Attorneys: Ethical and Liability-Related Considerations Affecting Premium-Fee

Participation in Title Insurance Transactions

In the same vein, the itemized statement for services should not include services that

the fee attorney or approved attorney may perform for a Transaction participant other than

the title insurance company or title insurance agent. This admonition would extend to the

statements such as "prepare earnest money contract" or "prepare closing documents" or

"prepare deed, etc." or other similar type statements. The fee attorney or approved attorney is

not receiving a portion of the title insurance premium for these activities.

A fee attorney or approved attorney does not want to become liable or make his title

company client liable to' a transaction participant by reason of mistakenly included or unclear

language used in completing the itemized statement for services.

(iv) Should the itemized statement for services include "settlement services" or "escrow

services" - or some breakdown of those kinds of settlement services in the description of

services actually rendered?

Texas Title Insurance Act Section 2502.053, and Procedural Rule P-22 authorize

sharing the title insurance premium with a fee attorney or approved attorney for services

actually rendered "in connection with title examination or closing a transaction." "Closing the

transaction" is a defined term by statute, and administrative rule that does not include

"settlement" services. See discussion above in section III (B) of this presentation. Thus, there is

no stated statutory authorization for sharing the title insurance premium with the fee attorney

or approved attorney for the performance of "settlement" services. The service of "settlement"

is not listed in the statutory authorization (exemption) that allows sharing the title insurance

premium with the fee attorney or approved attorney.

However, the language used later in Procedural Rule P-22(F) draws a distinction

between "settlement, closing and/or examination" in stating the requirements for completion of

the itemized statement and the Form T-00 Verification of Services Rendered. Procedural Rule

P22(F) requires a detailed description of "the actual services rendered and billed for in

representing the Company in the respective settlement, closing and/or examination." Therefore,

if the fee attorney or approved attorney in fact represents the title company in performing

settlement services and such services are "billed for," then they are required to be detailed in

the itemized statement for services.

The dilemma is that it is unclear whether the fee attorney or approved attorney may

lawfully receive a portion of the title insurance premium for performing the "settlement" as

distinguished from "closing the transaction." Procedural Rule P-22(F) appears to be subject to

an interpretation that "settlement" services should be included in the description of "the actual

services rendered" on the itemized statement for services if the title insurance company is

billed an additional separate charge (over and above the premium split) for such settlement

services, which would be an extremely rare event in actual custom and practice. Alternatively,

the settlement services performed by the fee attorney or approved attorney might be considered

as being paid for in whole by the settlement fee charged the seller and buyer, with the fee

attorney or approved attorney also representing the title insurance company at no additional

charge. As another alternative, the fee attorney or closing attorney may be viewed as

performing settlement services (the escrow function) solely for the transaction participants

2009 Texas Land Title Institute – Page 15

Fee Attorneys: Ethical and Liability-Related Considerations Affecting Premium-Fee

Participation in Title Insurance Transactions

other than the title insurance company.

There is not any one correct formulation of language to be used in completing the

itemized statement for services. The language used in completing the itemized statement for

services may vary widely from one fee attorney or approved attorney to another and from one

title company to another. There are a number of different considerations and issues that enter

into the analysis of the proper descriptive language to be used, and some of the issues are not

clearly resolved either by the statute, the Basic Manual, or existing custom and practice in the

industry. The primary consideration, however, should be for the fee attorney or approved

attorney to consider carefully the language used in completing the itemized statement for services

to ensure accuracy and to consider the potential impact of the language used in the event a

transaction participant makes a post-closing claim.

E. Suggested Descriptive Model of the Fee Attorney or Approved

Attorney Relationship:

The fee attorney and approved attorney should consider the following (which is only a

recommendation) as the preferred description of the true relationship between the fee attorney or

approved attorney and the title insurance company or the title insurance agent and the other

transaction participants:

(a) By receiving a portion of the title insurance premium, the fee attorney or

approved attorney steps into an attorney-client relationship with the title insurance company. This

seems clear under Opinion 408. The fee attorney and the approved attorney should treat the fee

attorney contract or the P-22 schedule of charges letter with the same care and attention as any

other engagement letter setting forth the attorney-client relationship between the attorney and a

client.

(b) The premium split received by the fee attorney or approved attorney from the

title insurance company is only for "closing the title insurance transaction" in the purely technical

sense of those words; that is, closing the title insurance transaction by undertaking the

"investigation" for the title insurance company or title insurance agent that is described in Section

2501.006, Procedural Rule P1 (f). In closing the title insurance transaction, the fee attorney or

approved attorney is only representing the title insurance company and none of the other

transaction participants. The P-22 schedule of charges letter used by the fee attorney or approved

attorney should confirm these matters and should affirmatively disclaim representation of other

transaction participants in "closing the transaction."

(c) The fee attorney or approved attorney is not examining title, which is really

done by the title insurance company's title examination or title plant staff or by in-house

underwriting counsel employed by the title insurance company. The P-22 letter used by the fee

attorney or approved attorney should specifically disclaim any responsibility by the fee attorney to

examine title for the title insurance company or any other transaction participant. This same

admonition applies to the process of completing the itemized statement for services.

2009 Texas Land Title Institute – Page 16

Fee Attorneys: Ethical and Liability-Related Considerations Affecting Premium-Fee

Participation in Title Insurance Transactions

(d) The settlement services undertaken by the fee attorney or approved attorney are

performed for the separate settlement fee paid by the buyer and seller and separately charged on

the settlement statement; that is, no portion of the title insurance premium is paid to the fee

attorney or approved attorney for settlement services. Alternatively, if the fee attorney or approved

attorney is performing settlement services for the title insurance company or title insurance agent,

these are performed at no additional charge to the title insurance company or title insurance agent.

(e) In performing "settlement" services (as distinguished from "closing the

transaction" for the title insurance company), the fee attorney or approved attorney is acting as an

escrow agent for the seller, buyer, and, if applicable, borrower and lender. The relationship of

escrow agent to these parties is a separate and distinct relationship from the attorney-client

relationship existing between the fee attorney or approved attorney and the title insurance company

and the attorney-client relationship perhaps existing between the fee attorney or approved attorney

and other transaction participants. The fiduciary duties owed by an escrow agent to the parties to

the real estate transaction are discussed in numerous Texas cases. See Bell v. SafecoTitle Ins.

Co., 830 S. W.2d 157,160 (Tex.App.--Dallas 1992, writ denied); Boatright v. Texas Am. Title

Co., 790 S.W.2d 722,728 (Tex.App.--El Paso 1990, writ dism'd); Chilton v. Pioneer National

Title Insurance Company, 554 S.W.2d 246,249 (Tex.Civ.App. -Waco 1977, writ ref’d n.r.e.).

(f) The fee attorney or approved attorney may also represent in the capacity of

an attorney another transaction participant in performing legal services in connection with the

real estate transaction or loan transaction. The fee attorney or approved attorney may charge

separately for such legal services. The requirements of disclosure and consent to multiple

client representation in a real estate transaction would, of course apply in the event of multiple

client representation. These requirements are discussed separately in the next section of this

presentation.

The discussion form of the Rule P-22 schedule of charges letter attached as Exhibit B to

the Appendix and the discussion sample of a completed itemized statement for services

attached as Exhibit C-2 to the Appendix are based upon this suggested model of the

relationship of the fee attorney to the title insurance company and the other transaction

participants.

In summary, the fee attorney or approved attorney should give careful attention to the

P-22 schedule of services letter and the itemized statement for services to ensure that both

documents accurately describe the actual services rendered by the fee attorney or approved

attorney in representing the title insurance company or title insurance agent. The same care and

attention should be given to the fee attorney contract or, if there is one in addition to the P-22

letter, the approved attorney contract.

IV. Representation by the Fee Attorney or Approved Attorney of

Multiple Participants in the Real Estate Transaction

The Texas Disciplinary Rules of Professional Conduct allow an attorney to represent

multiple clients with adverse interests under certain specified conditions. Prior ethics opinions

also support the common practice of multiple client representation by fee attorneys and

2009 Texas Land Title Institute – Page 17

Fee Attorneys: Ethical and Liability-Related Considerations Affecting Premium-Fee

Participation in Title Insurance Transactions

approved attorneys. See Opinion 408 attached as Exhibit D to the Appendix).

Ethics Opinion 359 issued in December 1971 by the Professional Ethics Committee of

the Supreme Court examined the issue of whether a law firm could permissibly represent the

lender and the title insurance company. A member of the law firm was the president of the

lender. Another member of the law firm closed the transactions. The law firm prepared the

loan documents used in the transaction, with the costs of preparation paid by the borrowers at

closing. Opinion 359 allows the joint representation, assuming that full disclosure is made to

both clients and that both clients agree to the joint representation.

Ethics Opinion 408 issued in 1984 similarly recognizes the propriety of multiple

representation, including representation of the title company, so long as the general rules

applicable to multi-client representation are adhered' to by the attorney. The full text of Ethics

Opinion 408 is attached as Exhibit D

to the Appendix for reference.

Generally stated, the applicable standard for permissible representation by an attorney

of multiple clients in the same transaction requires that: (a) the lawyer reasonably believes that

the representation will not adversely affect his or her ability to exercise independent

professional judgment with respect to the interests of each client; and (b) all clients consent to the

representation after full disclosure of the potential conflicts, including the advantages and

disadvantages of the joint representation by the attorney.

Multiple representations of the title insurance company and another transaction participant

by the fee attorney or approved attorney are fairly common. However, like many common

practices in the industry that have developed over time, a review of the' applicable rules and

requirements is useful and important to ensure continued compliance by the fee attorney or

approved attorney with the governing ethics rules.

The reader is recommended to the website maintained by the Texas Center for Legal Ethics

and Professionalism that can be found at http://www.txethics.org

. The Center's website has the

Disciplinary Rules, Ethics Opinions, and other materials available in searchable format.

A. Rule 1.06 Conflict of Interest: General Rule

The present rule governing multiple client representation is found in Rule 1.06 of the Texas

Disciplinary Rules of Professional Conduct, which states as follows in pertinent part:

(a) A lawyer shall not represent opposing parties to the same litigation.

(b) In other situations and except to the extent permitted by paragraph (c), a lawyer shall

not represent a person if the representation of that person:

(1) involves a substantially related matter in which that persons interests are

materially and directly adverse to the interests of another client of the lawyer or the lawyers firm;

or

2009 Texas Land Title Institute – Page 18

Fee Attorneys: Ethical and Liability-Related Considerations Affecting Premium-Fee

Participation in Title Insurance Transactions

(2) reasonably appears to be or become adversely limited by the lawyers or law

firm's responsibilities to another client or to a third person or by the lawyer's or law firm's own

interests.

(c) A lawyer may represent a client in the circumstances described in (b) if:

(1) the lawyer reasonably believes the representation of each client will not he

materially affected, and

(2) each affected or potentially, affected client consents to such representation

after full disclosure of the existence, nature, implications, and possible adverse consequences of

the common representation and the advantages involved, if any.

DR 1.06(c) imposes a two-step procedure. First, the attorney must first make his or her own

determination, which is subject to a standard of reasonableness, that the representation of each

client will not be "materially affected" by the joint or multiple representation. Second, the attorney

must< make full disclosure to the affected or potentially affected clients and obtain consent to the

joint or multiple representation. It is very important to remember that DR1.06(c)(2) sets forth two

requirements--disclosure and consent.

The Texas, courts have considered the issue of multiple client representation in real estate

transactions on several occasions. For example, in Dillard v. Broyles, 633 S.W.2d 636 (Tex. App.-

-Corpus Christi 1982, no writ), the court of appeals approved an attorney representing both the

buyer and the seller in a real estate transaction (the attorney also served as the trustee under the

deed of trust securing the seller's note). This result approving the joint representation was

based upon the finding that the requirements of disclosure and consent had been satisfied.

While representing both the buyer and seller would seem to be inviting trouble, and has little to

recommend it, the opinion in Dillard at least shows how far permissible joint representation

may extend, assuming that effective disclosure and meaningful consent are accomplished. See

also Grundmeyer v. McFadin, 537 S.W.2d 764 (Tex.App.--Tyler 1976, writ reef’s n.r.e.),

and also the discussion in 17 St. Mary's L.J. 79, which discusses some of the cases from other

states.

B. Disclosure and Consent to Multiple Client Representation

Comment 8 to DR 1.06 confirms that the requirements of disclosure and consent are not

mere formalities:

8. Disclosure and consent are not formalities. Disclosure sufficient for sophisticated

clients may not be sufficient to permit less sophisticated clients to provide fully,

informed consent. While it is not required that the disclosure and consent be in

writing, it would be prudent for the lawyer to provide potential dual clients with at

least a written summary of the considerations disclosed.

When representing multiple transaction participants, such as the title insurance

company and the seller or buyer, the fee attorney or approved attorney should pay particularly

2009 Texas Land Title Institute – Page 19

Fee Attorneys: Ethical and Liability-Related Considerations Affecting Premium-Fee

Participation in Title Insurance Transactions

close attention to the admonition that disclosure and consent are not mere formalities.

Comment 8 confirms that there is not a requirement that disclosure and consent be written. In

the opinion of the author, however, it is foolish not to document the required disclosure and

consent in writing, and written disclosure, with consent evidenced by the signature of the

client, does appear to be standard practice.

With respect to the required disclosure and consent to be obtained by the fee attorney or

approved attorney from the title insurance company or title insurance agent, this can be

accomplished, as discussed above, in the fee attorney contract or in the P-22 schedule of

charges letter. Given the relative level of sophistication of the title insurance company or title

insurance agent compared with other clients, the same level of disclosure - and consent that

would be appropriate for an unsophisticated lay client is presumed unnecessary. With that said,

however, the fee attorney or approved attorney should always err on the side of full disclosure

and consent, bearing in mind the later scrutiny that will come in the event of a post-closing

claim made by a transaction participant.

With respect to the required disclosure and consent to be obtained from the non-title

company transaction participant who will also be represented by the fee attorney or the

approved attorney, the Real Estate Forms Committee of the State Bar of Texas does include in,

the Texas Real Estate Forms Manual a basic example of a "Letter Disclosing and Requesting

Waiver of Potential Conflict for Multiple Representation of Title Company and Third Party."

See Form 13, Texas Real Estate Forms Manual. It should be borne in mind that State Bar Form

1-3 is intended only as a "basic example" and the attorney is specifically cautioned to tailor the

details of the letter to the particular transaction and circumstances. In the opinion of the author,

simply copying State Bar Form 1-3 and not providing substantial additional detail to complete

the required disclosure to the level contemplated by DR 1.06(c) and comment 8 to the rule is

risky for the fee attorney or approved attorney, or any other attorney who is representing

multiple transaction participants with respect to a real estate closing or loan closing.

A copy of Form 1-3 (Letter Disclosing and Requesting Waiver of Potential Conflict for

multiple Representation of Title Company and Third Party) from the Texas Real Estate Forms

Manual is attached as Exhibit E

to the Appendix for reference and discussion.

In some transactions a serious dispute develops prior or at closing between the transaction

participants. If a conflict develops in the multiple client representation after the joint representation

has commenced by the fee attorney or approved attorney, then the attorney must withdraw from

the representation of one or more of the multiple clients to the extent necessary to cure the conflict.

This ethics requirement is stated in DR 1.06(e) as follows:

(e) ... if multiple representation properly accepted becomes improper under this Rule, the

lawyer shall promptly withdraw from one or more representations to the extent necessary for any

remaining representation not to be in violation of these Rules.

Further, in the unfortunate event that a dispute develops between the transaction

participants who have been jointly represented by the fee attorney or approved attorney, the fee

2009 Texas Land Title Institute – Page 20

Fee Attorneys: Ethical and Liability-Related Considerations Affecting Premium-Fee

Participation in Title Insurance Transactions

attorney or approved attorney may not represent any of the parties in the dispute in the absence of

further disclosure and consent. This requirement is set forth in DR 1.06(d) as follows:

(d) A lawyer who has represented multiple parties m a matter shall not thereafter represent

any of such' parties in a dispute among the parties arising out of the matter, unless prior consent is

obtained from all such parties to the dispute.

In representing the Title Company and another transaction participant, the fee attorney or

approved attorney must take care in making full disclosure and obtaining meaningful consent to

the multiple client representation. As in most situations, the lack of clear and sometimes

necessarily blunt communication at the outset of the relationship sows the seeds for later

misunderstanding and risk for the fee attorney or approved attorney.

C. Disclosure of Non-Representation to Non-Client Transaction Participants

Strictly speaking, DR 1.06(c) only requires disclosure and consent for clients. For the fee

attorney or approved attorney who is conducting a volume of residential transactions in which the

fee attorney or approved attorney is representing the title insurance company and also the seller,

and the buyers usually are not represented by an attorney, the fee attorney has the additional

challenge of making sure that the buyer is not inadvertently misled into believing that he or she is

also represented by the fee attorney or approved attorney. There are numerous other transaction

scenarios in which unrepresented transaction participants might easily be led into mistaken beliefs

regarding the existence and scope of legal representation.

The applicable Texas case law recognizes that an attorney can be liable to a non-client for

legal malpractice if, in certain circumstances, the attorney fails to advise the non-client of the

absence of representation. The case of Burnap v. Linnartz, 914 S.W.2d 142, 148-9 (Tx.App.-San

Antonio 1995, writ denied), sets forth the applicable rules:

Absent fraud or collusion, an attorney owes a duty only to those parties in privity of

contract with the attorney. Berry v. Dodson, Nunley & Taylor, P. C, 7]7 S.W.2d 716, 718

(Tex.App.--San Antonio 1986), judgm't vacated by agr., 729 S.W.2d 690 : (Tex.] 987).

Thus a non-client generally has no cause of action against an attorney for negligent,

performance of legal work. Parker v. Carnahan, 772 S.W.2d 151, 156 (Tex.App.--

Texarkana 1989, writ denied). An attorney client relationship may be implied in some

cases from the conduct of the parties. EF Hutton v. Brown, 305 F.Supp. 371, 388

(S.D.Tex.1969); Duval County Ranch Co. v. Alamo Lumber Co., 663 S.W.2d 627, 633

(Tex.App. -Amarillo 1983, writ ref'd n.r.e.).

Even in the absence of an attorney-client relationship, an attorney may be held negligent

for failing to advise a party that be, is not representing the party. Kotzur v. Kelly, 791

S.W.2d 254,258 (Tex.App.-Corpus Christi 1990); Parker v. Carnahan, 772 S.W.2d at

157. Generally such negligence cannot be established in the absence of evidence that the

attorney knew the party had assumed that he was representing them in a matter. See

Dillard v. Broyles, 633 S.W.2d 636, 643 (Tex.App.--Corpus Christi 1982, writ ref'd

n.r.e.), cert. denied, 463 U.S. 1208, 103 S.Ct. 3539, 77 L.Ed.2d 1389 (1983). If

2009 Texas Land Title Institute – Page 21

Fee Attorneys: Ethical and Liability-Related Considerations Affecting Premium-Fee

Participation in Title Insurance Transactions

circumstances lead a party to believe that they are represented by an attorney, however,

the attorney may be held negligent for failing to advise that party of the attorney's non-

representation. E.F. Hutton v. Brown, 305 F.Supp. at 396; Parker v. Carnahan, 772

S.W.2d at 157; Rice v. Forestier, 415-S.W.2d 711, 713 (Tex.Civ.App.--San Antonio

1967, writ ref'd n.r.e.). The fact finder must determine whether the attorney was aware or

should have been aware that his conduct would have led a reasonable person to believe

that the attorney was representing that person. Parker v. Carnahan, 772 S.W.2d at 157.

(emphasis added)

These authorities present a real risk for the fee attorney or approved attorney who

prepares closing documents for the transaction, particularly the preparation of the deed from the

seller to the buyer. Even in those transactions in which the fee attorney or approved attorney is

only representing the title insurance company, there can be potential liability to the seller (who

later disputes his warranty obligation) or the buyer (who is unsatisfied with the warranties given

by the seller) if the circumstances led the seller or buyer to believe that the attorney was

providing legal representation and the attorney did not advise the party of the non-representation.

Needless to say, there are many areas of disagreement that can develop after closing between the

transaction participants in which a transaction participant can assert that the fee attorney or

approved attorney was providing legal representation, unless the attorney effectively (that means

in writing) communicates the fact of non-representation.

The Real Estate Forms Committee of the State Bar of Texas has included in the Texas

Real Estate Forms Manual a sample form of non-representation letter for use when the attorney

is representing the title company or a lender. Form 1-10 (Nonrepresentation Letter When

Representing Lender or Title Company) from the Texas Real Estate Forms Manual is attached as

Exhibit F the Appendix for reference and discussion. As with Form 1-3 discussed above, Form

1-10 must be regarded only as a starting point. The specifics of the particular transaction must

always be taken into account in deciding whether or not a specific form is suitable for use by the

fee attorney or approved attorney.

In dealing with unrepresented transaction participants, there are additional ethics rules

that must be kept in mind by the fee attorney or approved attorney. There is a basic requirement

of truthfulness in communicating with third parties that every attorney must meet. This

requirement is set forth in Rule 4.01 of the Texas Disciplinary Rules of Professional Conduct:

4.01 Truthfulness in Statements to Others

In the course of representing a client a lawyer shall not knowingly:

(a) make a false statement of material fact or law to a third person; or

(b) fail to disclose a material fact to a third person when disclosure is

necessary to avoid making the lawyer a party to a criminal act or

knowingly assisting a fraudulent act perpetrated by a client.

2009 Texas Land Title Institute – Page 22

Fee Attorneys: Ethical and Liability-Related Considerations Affecting Premium-Fee

Participation in Title Insurance Transactions

Additional requirements for dealing with an unrepresented transaction participant are set

forth in Rule 4.03 of the Texas Disciplinary Rules of Professional Conduct:

4.03 Dealing with Unrepresented Person

In dealing on behalf of a client with a person who is not represented by counsel, a

lawyer shall not state or imply that the lawyer is disinterested. When the lawyer

knows or reasonably should know that the unrepresented person misunderstands

the lawyer's role in the matter, the lawyer shall make reasonable efforts to correct

the misunderstanding.

It is recommended that the fee attorney or approved attorney give careful attention to the

documentation used to communicate non-representation to ensure that the communication is

effective, which means use of written and signed documentation that will be convincing to a

court or jury later in the event a transaction participant asserts that there was representation.

While important in all cases, this is particularly the case with unsophisticated transaction

participants in residential purchase transactions and home equity loan transactions. Additionally,

the employees of the fee attorney and approved attorney must be educated by the attorney to be

sensitive to these issues and to avoid making oral statements to transaction participants that

create the false impression of legal representation.

D. Summary of Requirements

In light of the requirements of DR 1.06(c) and the applicable case law that extends

potential malpractice exposure to claims by non-clients who mistakenly believe they are

represented by an attorney, which is needless to say determined by a court or jury after the fact,

the fee attorney or approved attorney is (a) mandated by the disciplinary rules to make full

disclosure and obtain consent to joint representation from all actually or potentially affected

clients, preferably in writing, and (b) required by the dictates of common prudence to advise all

other transaction participants that they are not represented by the fee attorney or approved

attorney, again, preferably in writing and signed by the non-client.

V. Conclusion

Fee attorneys and approved attorneys are confronted with numerous statutory, regulatory,

and ethics requirements. Careful attention must be paid to these requirements to avoid enhancing

the risks of ethics violations or other liability to participants in the real estate transaction. By

taking the time to think through and analyze the ethics and liability issues, always keeping in

mind the different roles played by the fee attorney or approved attorney and the different

statutory, regulatory, common law, and ethics duties that are owed to the various transaction

participants, the fee attorney or approved attorney can prudently manage these risks.

This process of analysis should be undertaken in advance and not for the first time

after a transaction participant has made a post-closing claim. Particularly close scrutiny must

be given by the fee attorney or approved attorney to the key documents that establish and

define the attorney-client relationship with the title insurance company or title insurance

2009 Texas Land Title Institute – Page 23

Fee Attorneys: Ethical and Liability-Related Considerations Affecting Premium-Fee

Participation in Title Insurance Transactions

agent. Additionally, the fee attorney or approved attorney must comply with the disciplinary

requirement of full disclosure and consent in the event of multiple client representation.

Extra care is also important to ensure that non-client transaction participants do not

mistakenly believe that they are represented by the fee attorney or approved attorney.

2009 Texas Land Title Institute – Page 24

Fee Attorneys: Ethical and Liability-Related Considerations Affecting Premium-Fee

Participation in Title Insurance Transactions

APPENDIX-EXHIBIT A

TEXAS TITLE INSURANCE BASIC MANUAL PROCEDURAL RULE P-22

P-22. Payment of a Fee for Examination and/or Closing

No payment shall be made by a Title Insurance Company, Title Insurance Agent, Escrow Officer or any

employee or agent of any of them, to any Person who is not its bona-fide employee, for examination of a title and/or

closing a transaction unless:

(A) Such Person is (i) a Title Insurance Company as defined in Article 9.02 Insurance Code, and qualified to do business

in the State of Texas, (ii) a Title Insurance Agent as defined in Article 9.02 Insurance Code, and licensed to do business

in the State of Texas by the Texas Department of Insurance, or (iii) an attorney at law duly licensed by the Supreme

Court of Texas to practice law in the State of Texas, to the extent not inconsistent with Article 9.34, Texas Insurance

Code, or (iv) any Person legally authorized to perform such services; and

(B) Such Person has performed all of the services described in P-1, paragraph f, that such Person is legally authorized to

perform, and/or the examination of the title required for the issuance of a commitment for title insurance prior to the

issuance of any such commitment, construction binder, policy or other contract of title insurance, to determine the

condition of the title to be insured. If the parties to the transaction are located in different counties, this paragraph of

this rule does not prohibit payment to a Person who has actually performed all the services described in P-1, paragraph f

in relation to either (i) the seller(s) or the buyer(s) or (ii) the mortgagor(s) or the mortgagee(s) for closing the transaction

and issuance of the policy; and

(C) Timely disclosures of such payment have been made as required by Rule P-21 and Article 9.53; and

(D) Any payment made must be commensurate with the services actually performed; and

(E) The Person rendering the service shall have filed with the Company at least thirty (30) days prior to the rendering of

such service a written schedule of charges normally imposed by such Person for such services (Schedule) and such

Schedule shall have been agreed to and approved by the Company as being reasonable charges for such services.

However, payments to licensed title insurance agents are excluded from the requirements of this paragraph (E); and (F)

The Person rendering the service shall have presented to the Company, at or prior to the time of payment of said

services, a written itemized statement or invoice which clearly sets forth in detail the actual services rendered and billed

for in representing the Company in the respective settlement, closing and/or examination, and such Company verifies,

in writing, that such services were actually rendered in accordance with form T-00; and .

(G) In the event of collection of the title insurance premium by such Person, the entirety of such premium shall have

been remitted to the Company; and

(H) No portion of the charge for the services actually rendered shall be attributable to, and no payment shall be made

for the solicitation of, or as an inducement for the referral or placement of the title insurance business with the

Company, and

(I) Any portion of any payment inconsistent with the requirements hereof, or any payment by the Company to any

Person for the solicitation of, or as an inducement for the referral or placement of title insurance business, is deemed to

be a violation of Article 9.30; and

(J) The Company shall keep written itemized statements or invoices, and the Schedule, in its official records for a period

of three years and shall make such copies thereof available to the Texas Department of Insurance and its representatives

for inspection and duplication upon request.

2009 Texas Land Title Institute – Page 25

Fee Attorneys: Ethical and Liability-Related Considerations Affecting Premium-Fee

Participation in Title Insurance Transactions

APPENDIX – EXHIBIT B

DISCUSSION DRAFT OF RULE P-22 SCHEDULE OF CHARGES LETTER

[LETTERHEAD OF ATTORNEY]

Re: Schedule of Charges for "Closing the Transaction"

Dear Title Company:

In accordance with the requirements of Procedural Rule P-22 of the Texas Title Insurance

Basic Manual, this letters sets forth my written schedule of charges normally imposed by me for

"Closing the Transaction." As used in this letter, the term "Closing the Transaction" has the same

meaning in this letter as defined in Texas Title Insurance Act Section 2501.006 and Procedural Rule

P-1(f).

My services in "Closing the Transaction" on your behalf are limited to the following specific

services, unless otherwise specifically agreed in writing by me:

The investigation on your behalf to determine proper execution, acknowledgment, and delivery of all

conveyances, mortgages, and other title instruments which may be necessary to the consummation of

the transaction. It also includes the determination that all delinquent taxes are paid, all current taxes,

based on the latest available information, have been prorated properly between purchaser and seller (in

the case of an Owner’s Policy), the consideration has passed, all proceeds haw been properly

disbursed, a final search of the title has been made, and all necessary papers have been properly filed

for record or properly delivered to the appropriate parties.

LIMITATION ON MY SERVICES

:

A In "Closing the Transaction" I am acting solely on your behalf and not on behalf of

any seller, buyer, borrower, or lender.

B. I am not undertaking any examination of title for you. You shall be solely

responsible for the examination of title and the determination of insurability of title in accordance with

sound title underwriting practices as required by Texas Title Insurance Act Section 2704.001.

C. [OPTIONAL: CHECK ONE ONLY]

[__] I am not performing settlement or escrow services for you. Any settlement or escrow

closing services performed by me for the seller, buyer, borrower, and/or lender shall be subject to

separate charge by me, if any, made to one or more of those parties.

[__] I am performing settlement or escrow services for you at no additional charge. I

reserve the right also to perform settlement or escrow closing services for the seller, buyer, borrower,

and/or lender, which shall be subject to separate charge by me,

if any, made to one or more of those

parties.

My fees for "Closing the Transaction" on your behalf are as follows:

1.

% of the premium charged for title polices with a liability of less than $

;

2.

% of the premium charged for title polices with a liability of $

or more, but less than $

;

3.

% of the premium charged for title polices with a liability of $

or more, but less than $ ; and

4.

% of the premium charged for title polices with a liability of $

or more.

Pursuant to Procedural Rule P-22, please evidence your approval of my charges for "Closing the

Transaction" as being reasonable for such services by signing this Schedule of Charges.

2009 Texas Land Title Institute – Page 26

Fee Attorneys: Ethical and Liability-Related Considerations Affecting Premium-Fee

Participation in Title Insurance Transactions

Sincerely,

, .ATTORNEY

The schedule of charges for "Closing the Transaction" stated above is hereby approved as reasonable:

TITLE INSURANCE COMPANY

Date

2009 Texas Land Title Institute – Page 27

Fee Attorneys: Ethical and Liability-Related Considerations Affecting Premium-Fee

Participation in Title Insurance Transactions

APPENDIX – EXHIBIT B-1

FEE ATTORNEY AGREEMENT

THE STATE OF TEXAS

COUNTY OF

This agreement made effective this ____ day of , 20 , by

and between OLD STANDARD TITLE INSURANCE COMPANY, hereinafter called

"COMPANY" and LAW OFFICES OF JOHN SMITH, P.C., hereinafter called

"ATTORNEY".

WITNESSETH

I.

COMPANY does hereby appoint ATTORNEY as its duly authorized Closing

Attorney to represent COMPANY in the closing of title insurance transactions involving

real property situated in Dallas, Tarrant, Collin and Denton County, Texas.

II.

Upon request of ATTORNEY, COMPANY shall furnish a Title Commitment and

any other necessary evidence of title, including tax information if requested, on any

property located in a county where COMPANY operates an abstract plant, on which

ATTORNEY has a pending order for a policy of title insurance to be written through

COMPANY. ATTORNEY shall be entitled to rely on the correctness of such title

commitment and tax information in the settlement of that transaction.

III.

ATTORNEY agrees to conduct the closing and settlement of any such real estate

transaction on which a Title Policy is to be issued through COMPANY in accordance

with the definition of "Closing Services" in the Schedule of Charges attached hereto as

2009 Texas Land Title Institute – Page 28

Fee Attorneys: Ethical and Liability-Related Considerations Affecting Premium-Fee

Participation in Title Insurance Transactions

Exhibit A, and incorporated herein for all purposes. Nothing herein is intended (nor shall

it be construed), to constitute ATTORNEY an issuing agent of COMPANY as the same

is defined under the Insurance Code of the State of Texas or under the regulations

promulgated by the Texas Department of Insurance concerning the operations of title

companies and title insurance companies, nor shall ATTORNEY have any authority to

waive, release, or not fully dispose of any item as an exception in a commitment for title

insurance without the proper authorization of COMPANY.

IV.

COMPANY agrees to provide ATTORNEY with accounting assistance and in the

processing of escrow transactions.

V.

ATTORNEY understands that it is responsible for the accuracy of closing all title

insurance transactions in which title policies are issued through COMPANY and shall

save COMPANY harmless from loss or damage occasioned by its own errors, omission,

and/or failure to follow the terms of any contract, Commitment for Title Insurance,

closing instructions, or COMPANY or its underwriter requirements applicable to a

particular transaction.

VI.

COMPANY agrees to furnish ATTORNEY all necessary forms relating to the

title insurance business and ATTORNEY agrees to use the same strictly in accordance

with all applicable provisions of the Texas Insurance Code and the regulations