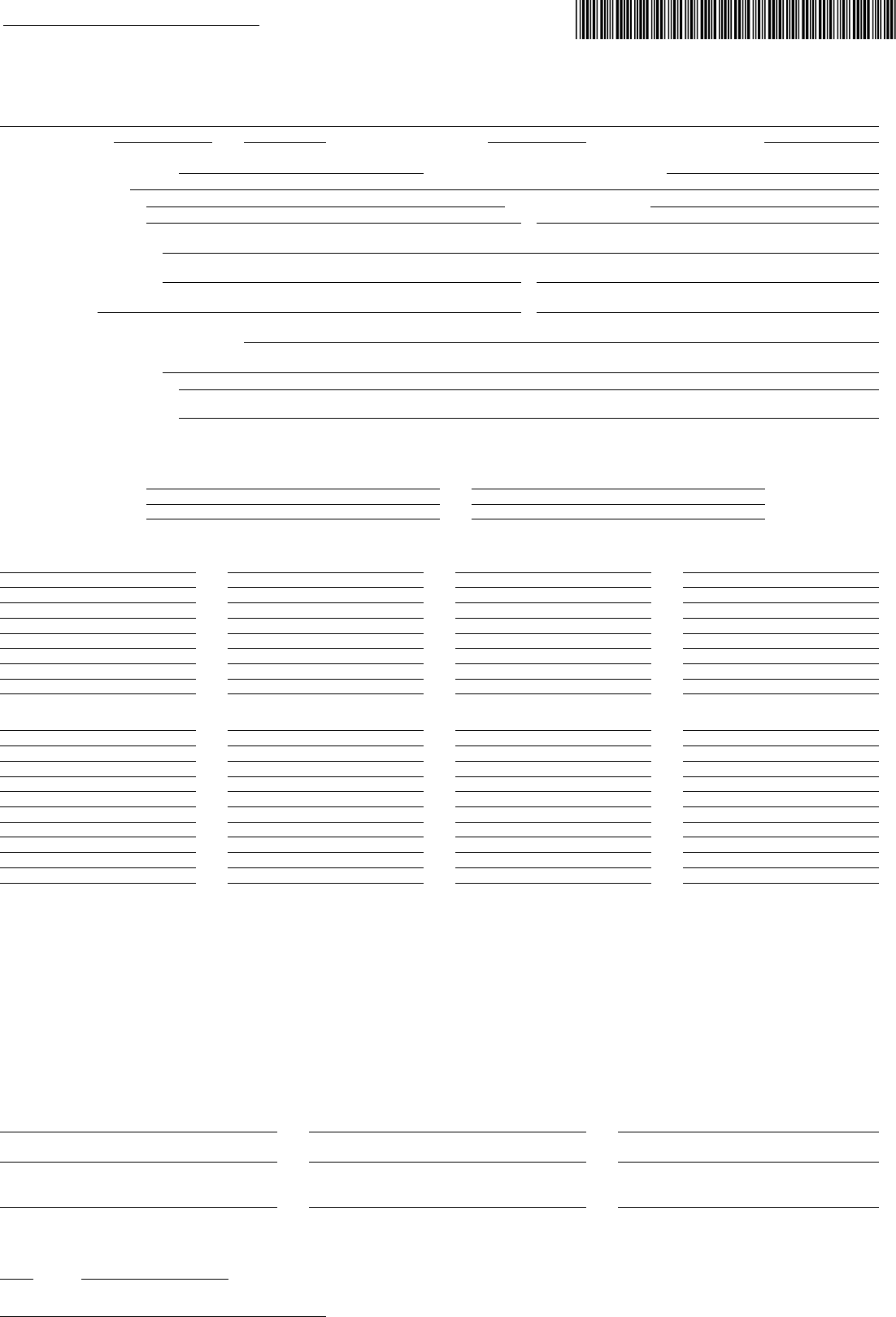

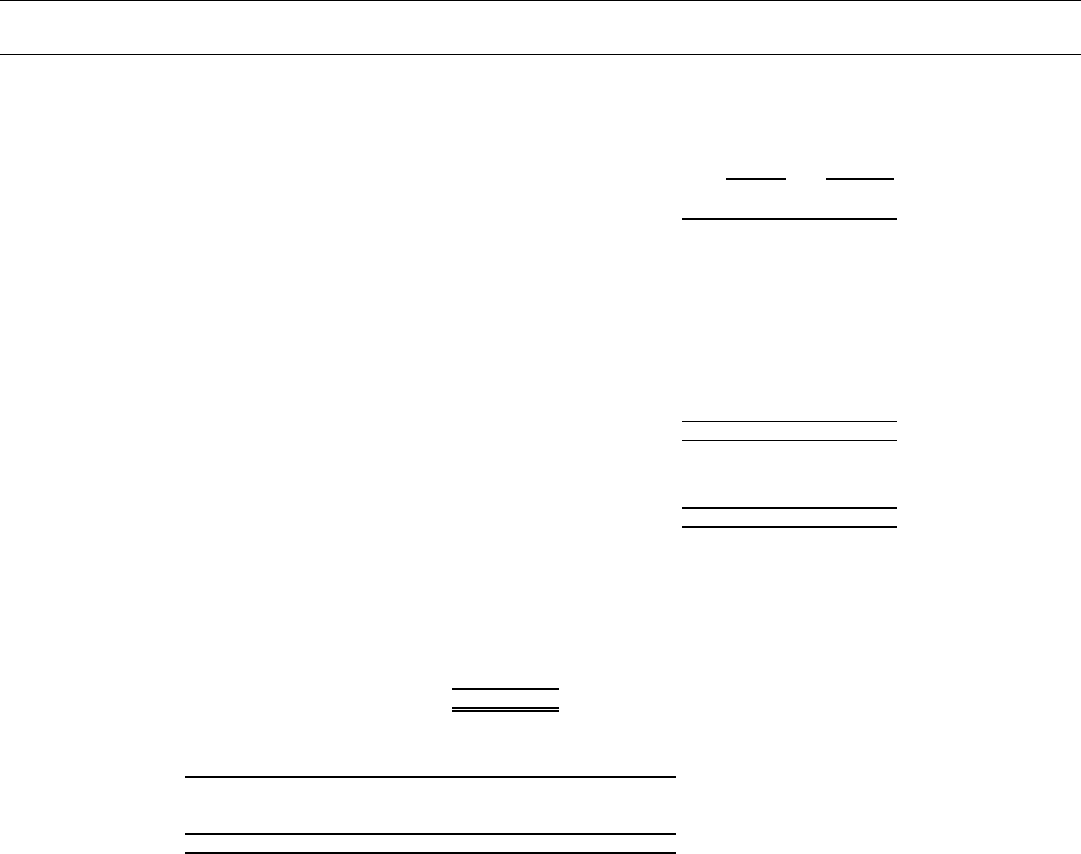

QUARTERLY STATEMENT

OF THE

STEWART

Title Guaranty Company

of HOUSTON

in the state of TEXAS

TO THE

Insurance Department

OF THE

STATE OF

FOR THE QUARTER ENDED

September 30, 2020

TITLE

2020

TITLE INSURANCE COMPANIES - ASSOCIATION EDITION

QUARTERLY STATEMENT

AS OF SEPTEMBER 30, 2020

OF THE CONDITION AND AFFAIRS OF THE

Stewart Title Guaranty Company

NAIC Group Code 0340 , 0340 NAIC Company Code 50121 Employer's ID Number 74-0924290

(Current Period) (Prior Period)

Organized under the Laws of Texas , State of Domicile or Port of Entry TX

Country of Domicile US

Incorporated/Organized February 20, 1908 Commenced Business March 11, 1913

Statutory Home Office 1360 Post Oak Boulevard , Houston, TX US 77056

(Street and Number) (City or Town, State, Country and Zip Code)

Main Administrative Office 1360 Post Oak Boulevard

(Street and Number)

Houston, TX US 77056 713-625-8044

(City or Town, State, Country and Zip Code) (Area Code) (Telephone Number)

Mail Address P. O. Box 2029 , Houston, TX US 77252

(Street and Number or P.O. Box) (City or Town, State, Country and Zip Code)

Primary Location of Books and Records 1360 Post Oak Boulevard Houston, TX US 77056 713-625-8539

(Street and Number) (City or Town, State, Country and Zip Code) (Area Code) (Telephone Number)

Internet Website Address www.stewart.com

Statutory Statement Contact Kim Peterson 713-625-8044

(Name) (Area Code) (Telephone Number) (Extension)

[email protected] 713-629-2330

(E-Mail Address) (Fax Number)

OFFICERS

Name Title

1. Frederick H Eppinger President and CEO

2. Denise Carraux Secretary

3. Scott Gray Treasurer

VICE-PRESIDENTS

Name Title Name Title

David Hisey Chief Financial Officer John L Killea General Counsel and Chief Compliance Offi

Brad Rable Chief Information Officer Emily Kain Chief Human Resources Officer

Genady Vishnevetsky Chief Information Security Officer Brian K Glaze Corporate Controller, Assistant Treasurer -

Nathaniel D Otis Sr. Vice President - Finance and Director of James L Gosdin Sr. Vice President - Chief Underwriting Cou

Pamela B OBrien Sr. Vice President - Chief Litigation Counsel Ted C Jones Sr. Vice President - Chief Economist

Thomas Konkel Sr. Vice President - Commercial Services Cynthia J Madole Deputy General Counsel

Marty D Albertson Group Senior Vice President Steven M Lessack Group President

Tara Smith Group President - Agency Operations Kim Peterson Asst. Secretary - Treasurer

Mark V Borst Sr. Vice President - Chief Claims Counsel Mary P Thomas Chief Regulatory Counsel and Deputy Chief

DIRECTORS OR TRUSTEES

Frederick H Eppinger John L Killea David Hisey Tara Smith

Brian K Glaze Pamela B O'Brien Steven M Lessack Mary P Thomas

State of Texas

County of Harris ss

The officers of this reporting entity being duly sworn, each depose and say that they are the described officers of said reporting entity, and that on the reporting period stated above, all of the herein described

assets were the absolute property of the said reporting entity, free and clear from any liens or claims thereon, except as herein stated, and that this statement, together with related exhibits, schedules and

explanations therein contained, annexed or referred to, is a full and true statement of all the assets and liabilities and of the condition and affairs of the said reporting entity as of the reporting period stated above,

and of its income and deductions therefrom for the period ended, and have been completed in accordance with the NAIC Annual Statement Instructions and Accounting Practices and Procedures manual except

to the extent that: (1) state law may differ; or, (2) that state rules or regulations require differences in reporting not related to accounting practices and procedures, according to the best of their information,

knowledge and belief, respectively. Furthermore, the scope of this attestation by the described officers also includes the related corresponding electronic filing with the NAIC, when required, that is an exact copy

(except for formatting differences due to electronic filing) of the enclosed statement. The electronic filing may be requested by various regulators in lieu of or in addition to the enclosed statement.

(Signature) (Signature) (Signature)

Frederick H. Eppinger Denise Carraux Scott Gray

(Printed Name) (Printed Name) (Printed Name)

1. 2. 3.

President and CEO Secretary Treasurer

(Title) (Title) (Title)

Subscribed and sworn to before me this a. Is this an original filing? [ X ] Yes [ ] No

day of , 2020 b. If no: 1. State the amendment number

2. Date filed

3. Number of pages attached

50121202020100103

1

.....................

.....................

.........

.........

.........

Stewart Title Guaranty Company

..............................................................

Statement as of September 30, 2020 of the

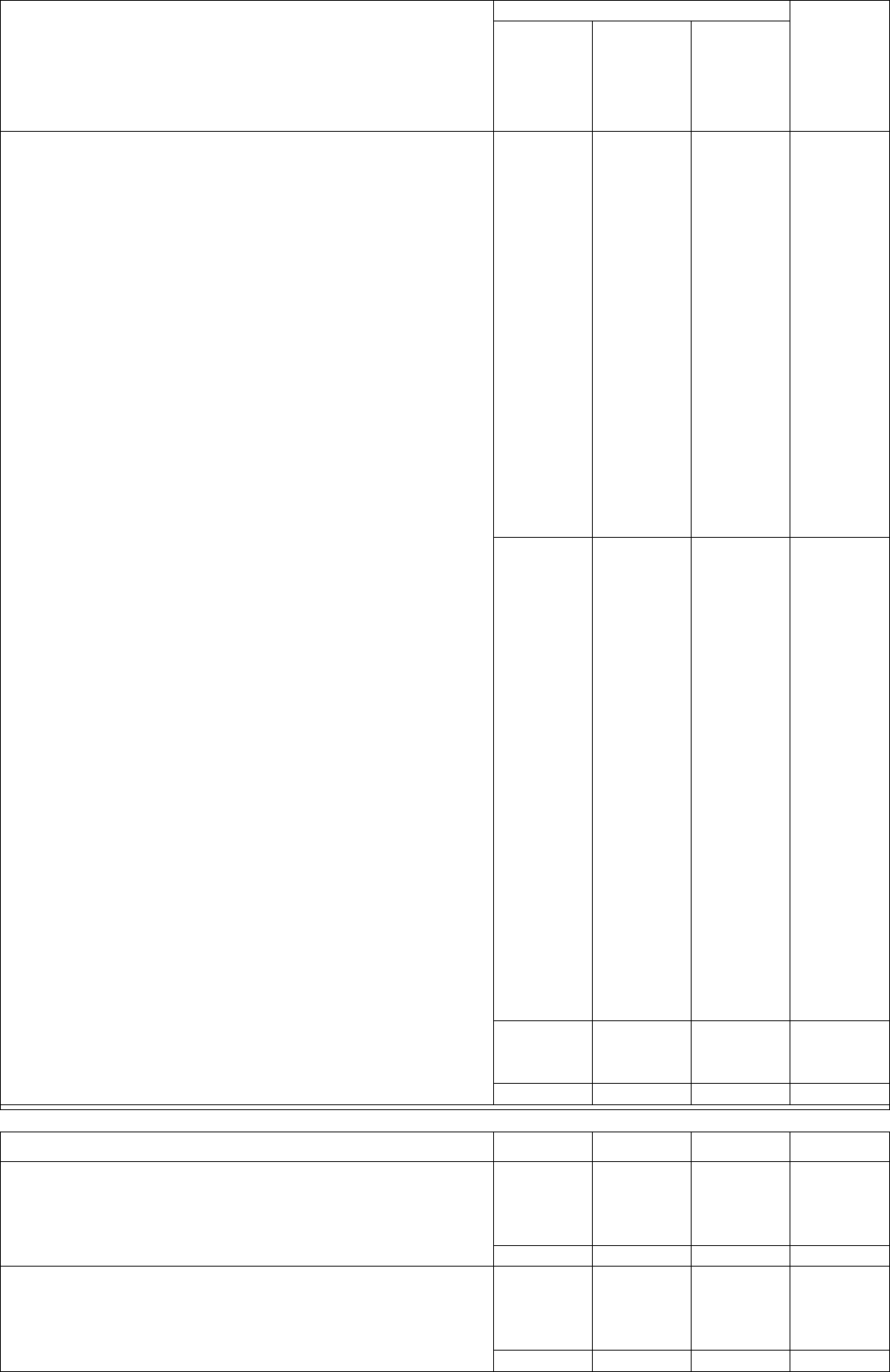

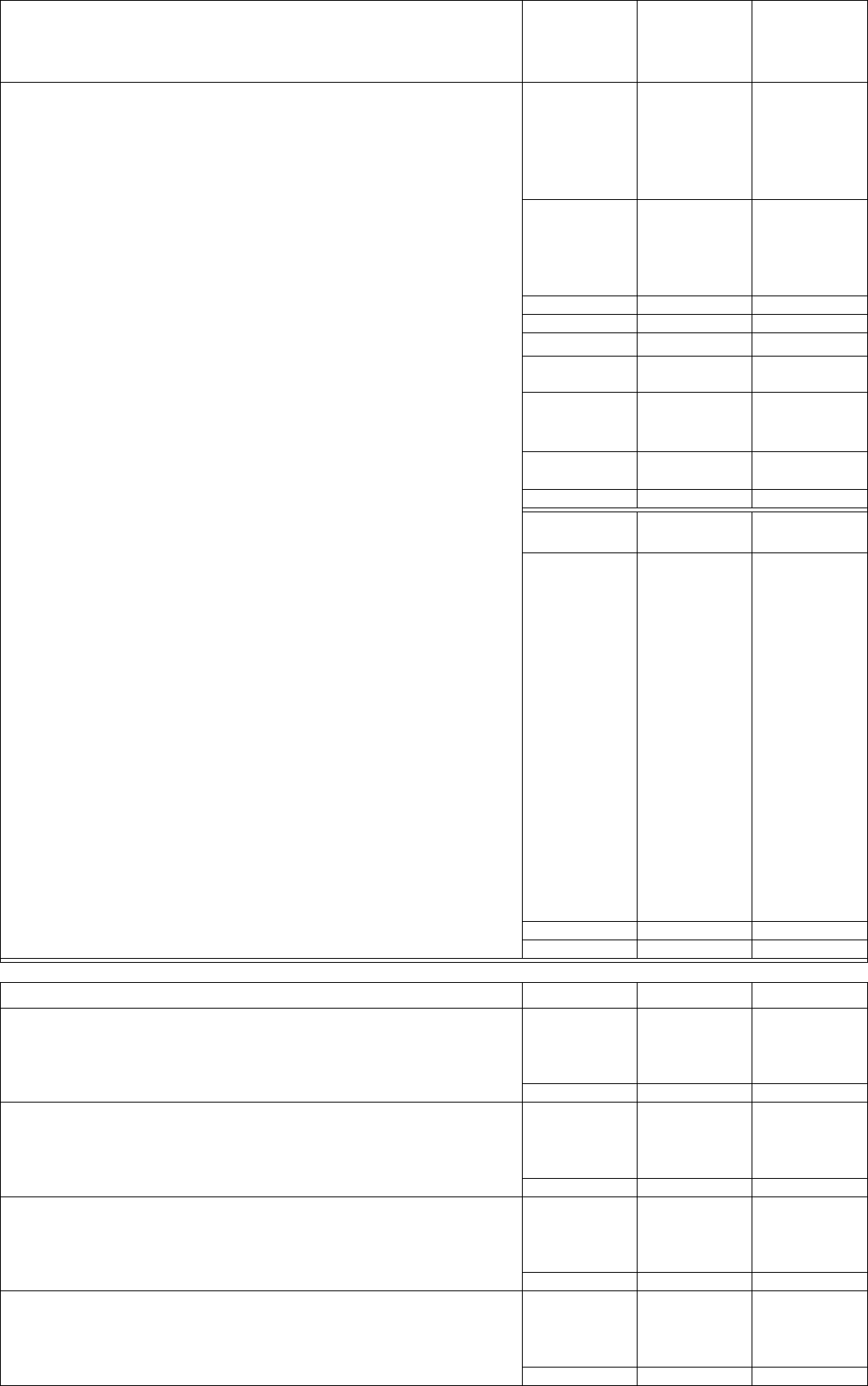

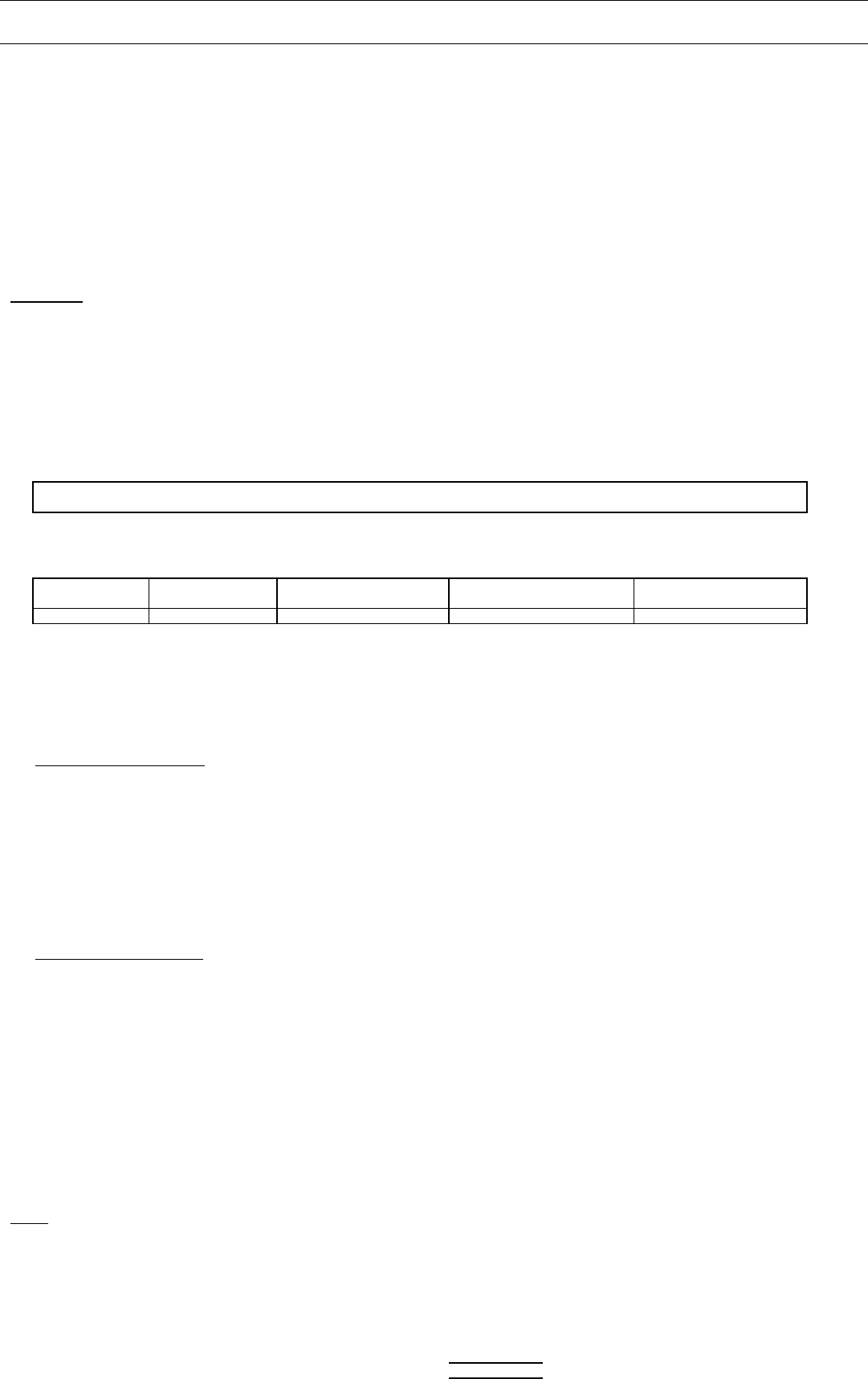

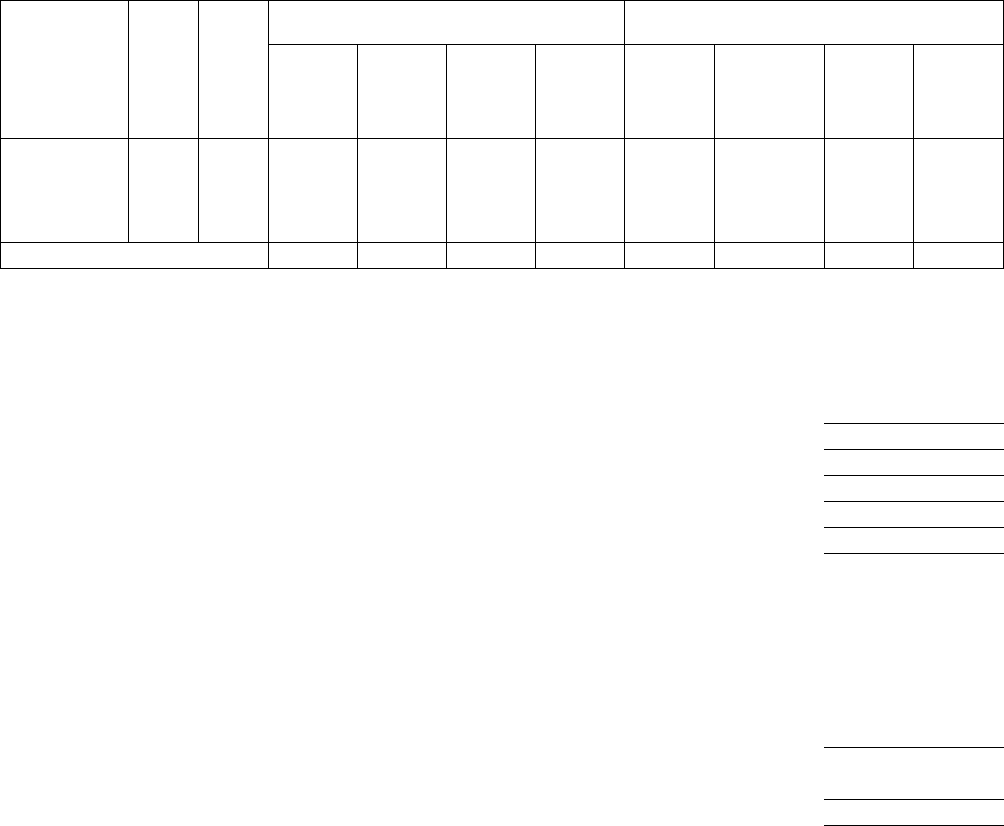

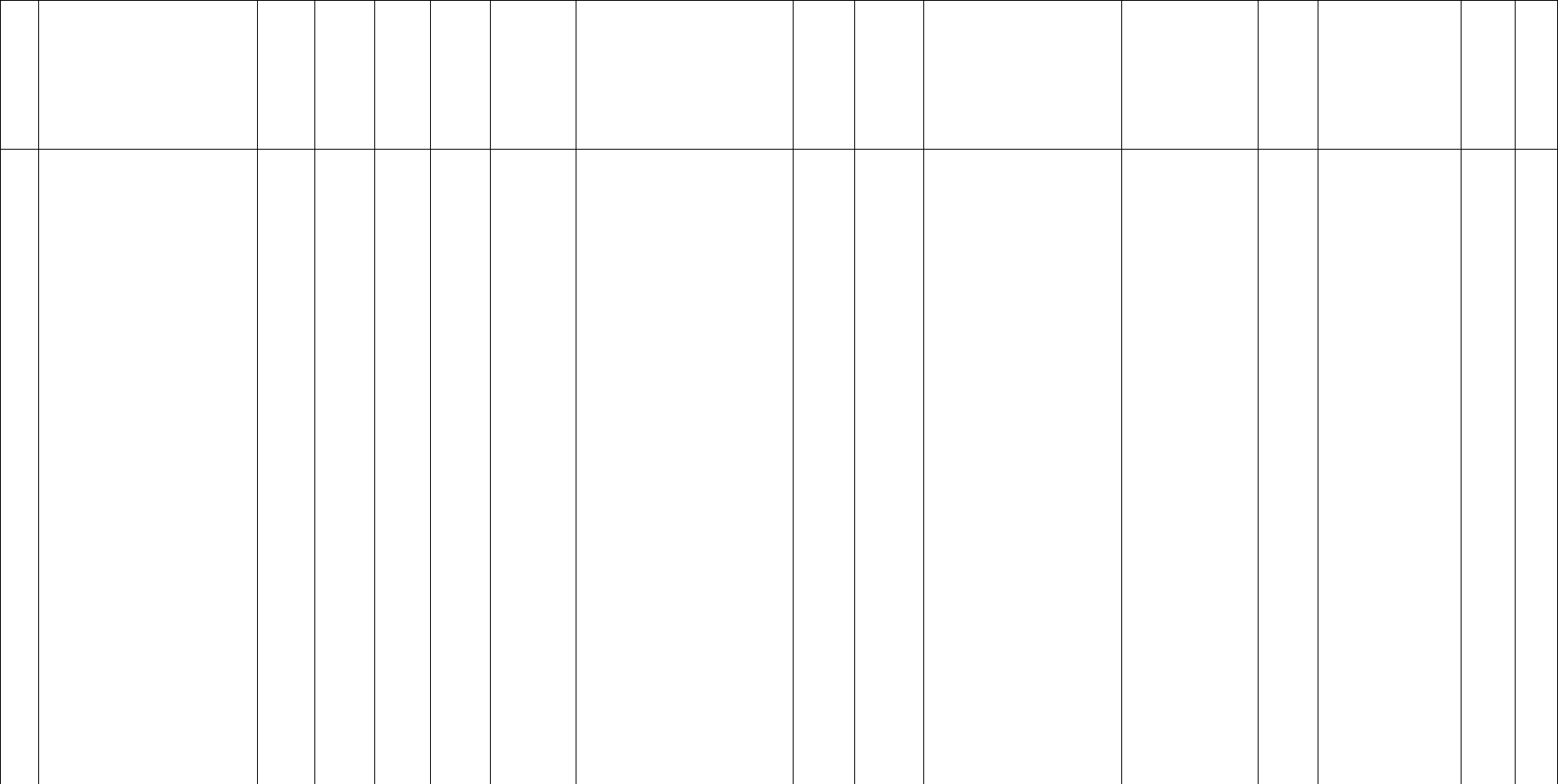

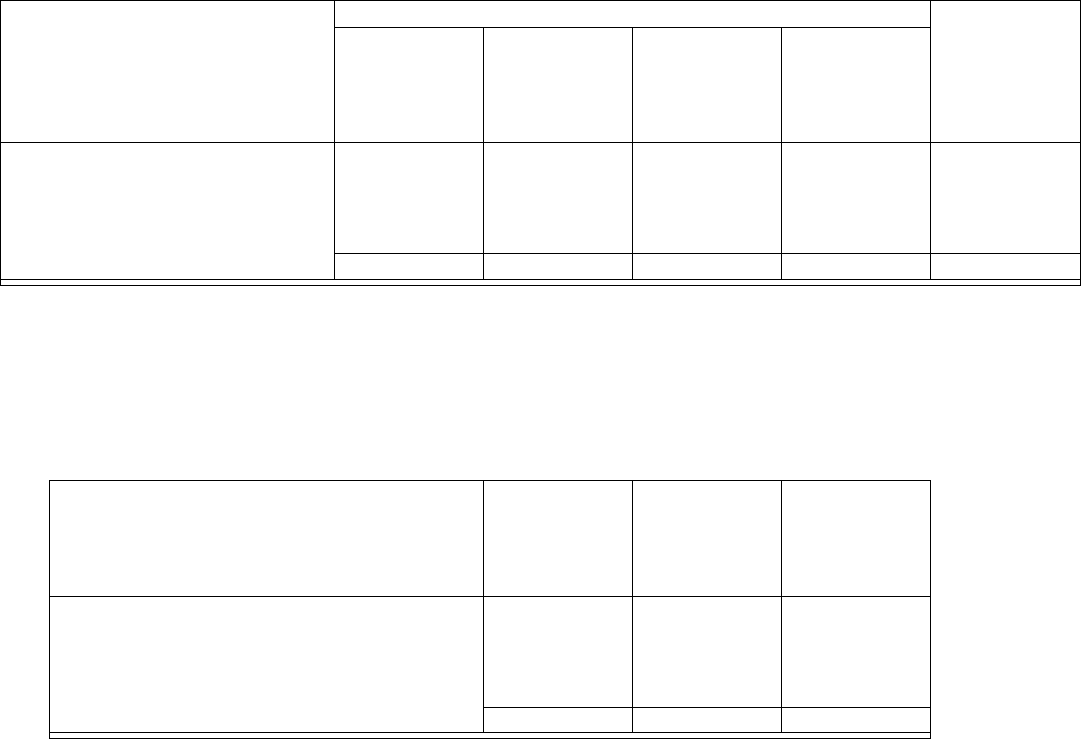

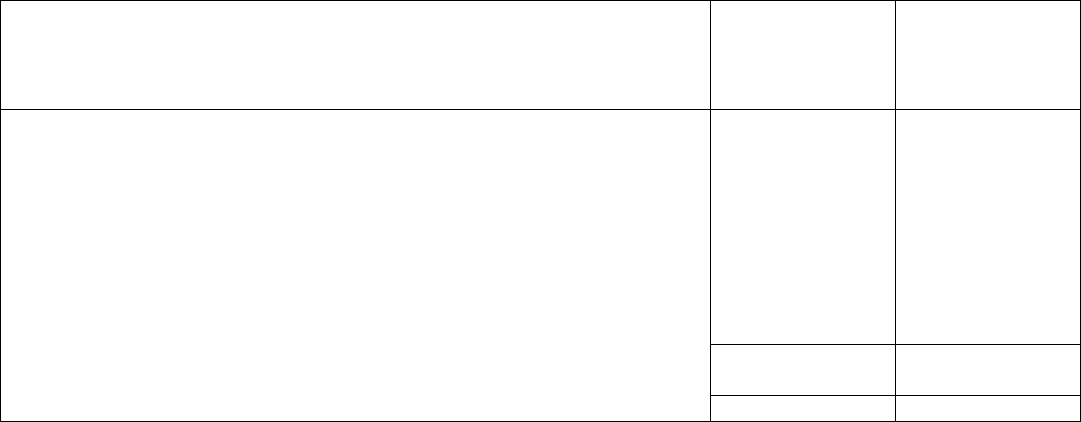

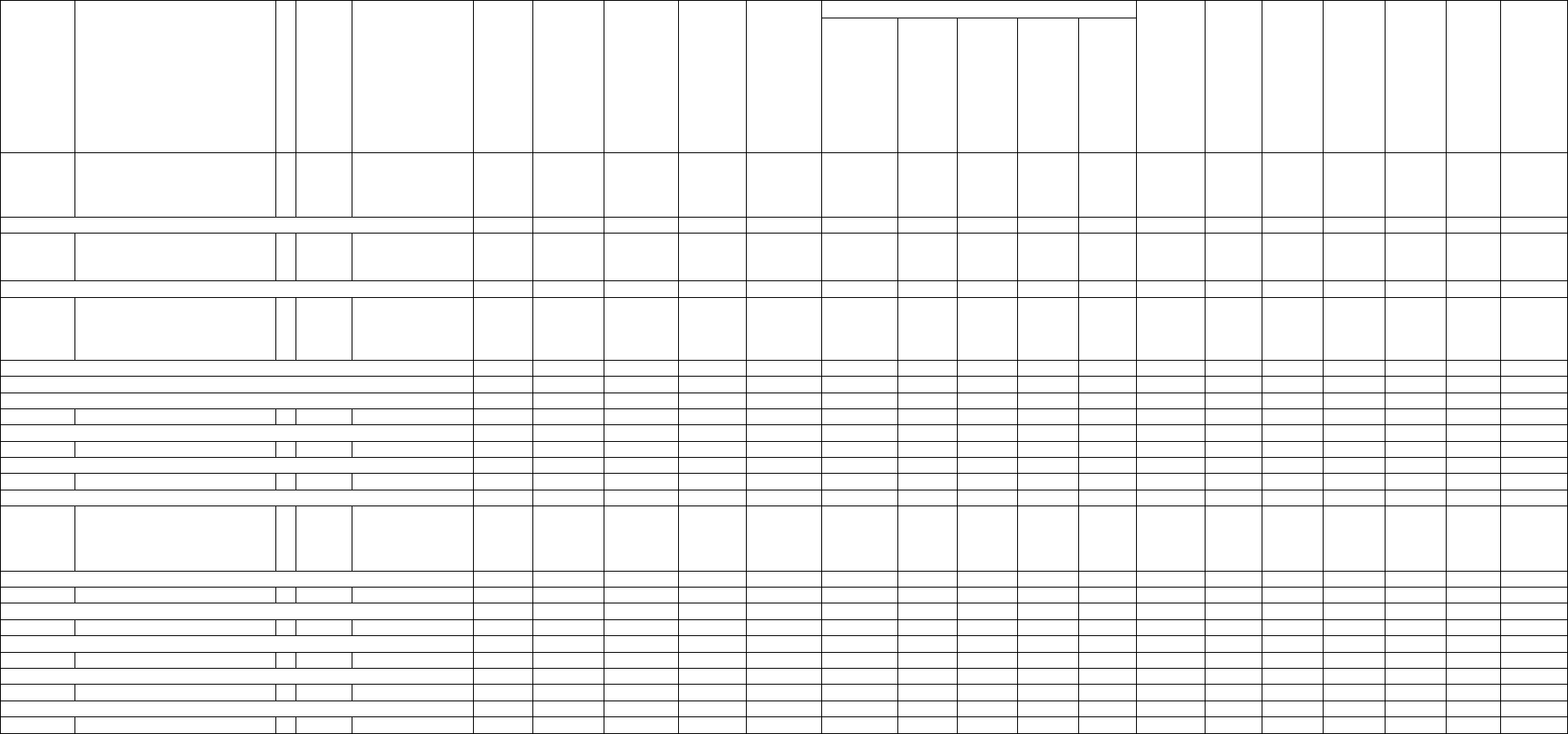

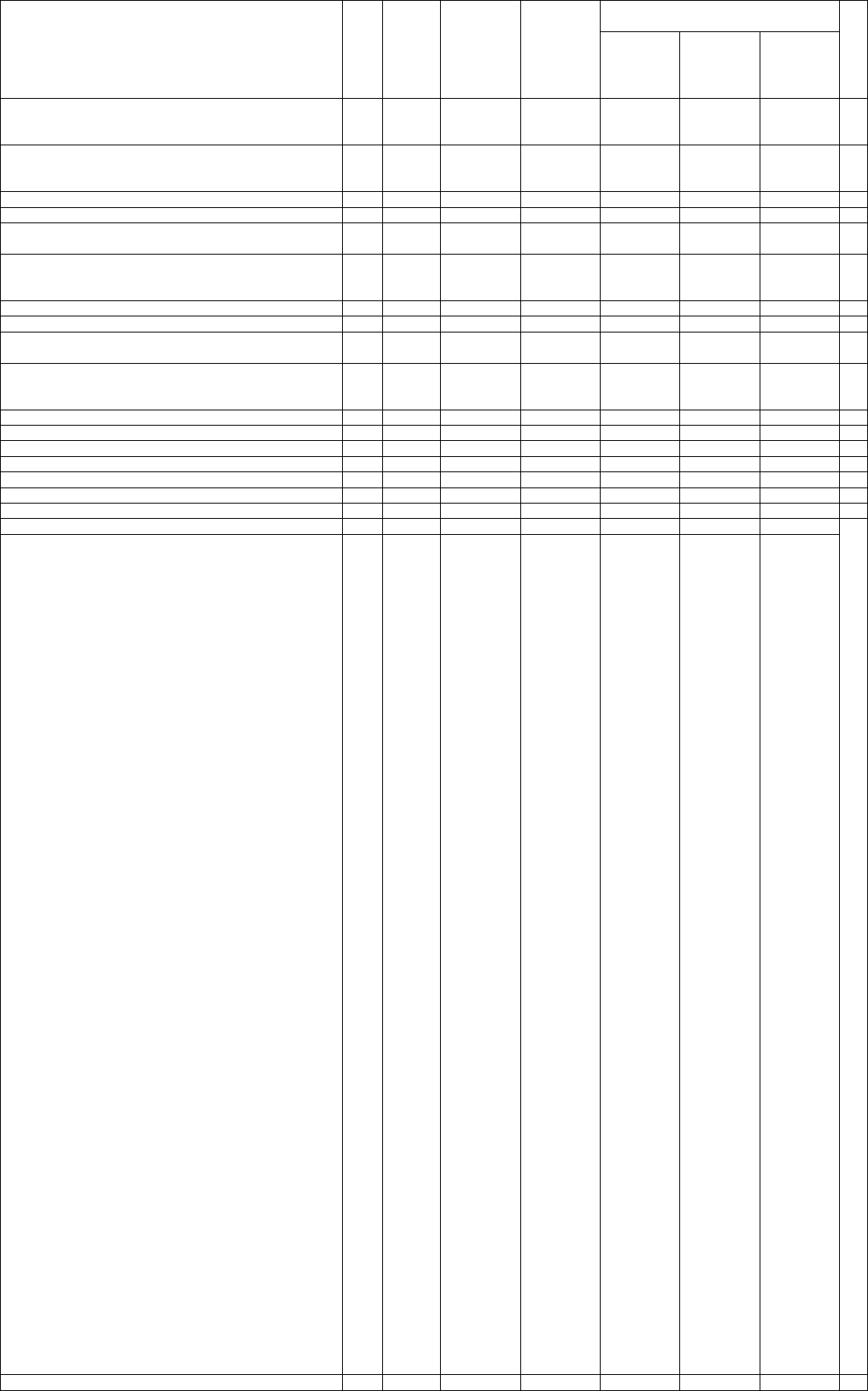

ASSETS

Current Statement Date

1 2 3 4

Net Admitted December 31

Nonadmitted Assets Prior Year Net

Assets Assets (Cols. 1 - 2) Admitted Assets

1. Bonds 477,195,051 477,195,051 482,627,623

2. Stocks:

2.1 Preferred stocks

2.2 Common stocks 501,776,187 501,776,187 495,728,766

3. Mortgage loans on real estate:

3.1 First liens 29,035 29,035 178,980

3.2 Other than first liens

4. Real estate:

4.1

0

...........

Properties occupied by the company (less $ encumbrances)

4.2

0

...........

Properties held for the production of income (less $ encumbrances)

4.3

0

...........

Properties held for sale (less $ encumbrances) 411 411 411

5.

171,573,278

...........

839,258

...........

Cash ($ ), cash equivalents ($ ), and short-term

0

...........

investments ($ ) 172,412,536 172,412,536 138,794,251

6.

0

...........

Contract loans (including $ premium notes)

7. Derivatives

8. Other invested assets

9. Receivables for securities

10. Securities lending reinvested collateral assets

11. Aggregate write-ins for invested assets

12. Subtotals, cash and invested assets (Lines 1 to 11) 1,151,413,220 1,151,413,220 1,117,330,031

13.

0

...........

Title plants less $ charged off (for Title insurers only) 6,688,646 100,001 6,588,645 6,588,645

14. Investment income due and accrued 3,432,142 73,384 3,358,758 4,392,155

15. Premiums and considerations:

15.1 Uncollected premiums and agents' balances in the course of collection 33,416,789 1,392,117 32,024,672 32,051,888

15.2 Deferred premiums, agents' balances and installments booked but deferred

0

...........

and not yet due (including $ earned but unbilled premiums)

15.3

0

...........

Accrued retrospective premiums ($ ) and contracts

0

...........

subject to redetermination ($ )

16. Reinsurance:

16.1 Amounts recoverable from reinsurers

16.2 Funds held by or deposited with reinsured companies

16.3 Other amounts receivable under reinsurance contracts 384,615 14,643 369,972 1,141,231

17. Amounts receivable relating to uninsured plans

18.1 Current federal and foreign income tax recoverable and interest thereon 402,583

18.2 Net deferred tax asset 16,896,288 6,064,540 10,831,748 11,460,623

19. Guaranty funds receivable or on deposit

20. Electronic data processing equipment and software 1,050,921 740,773 310,148 657,905

21.

0

...........

Furniture and equipment, including health care delivery assets ($ ) 1,723,229 450,377 1,272,852 1,490,696

22. Net adjustment in assets and liabilities due to foreign exchange rates 9,880,858 9,880,858 7,460,574

23. Receivables from parent, subsidiaries and affiliates 15,558,529 2,351,752 13,206,777 2,946,824

24.

0

...........

Health care ($ ) and other amounts receivable 727,972 727,972 505,838

25. Aggregate write-ins for other-than-invested assets 7,730,557 5,803,171 1,927,386 1,692,665

26. Total assets excluding Separate Accounts, Segregated Accounts and

Protected Cell Accounts (Lines 12 to 25) 1,248,903,766 16,990,758 1,231,913,008 1,188,121,658

27. From Separate Accounts, Segregated Accounts and Protected Cell Accounts

28. Total (Lines 26 and 27) 1,248,903,766 16,990,758 1,231,913,008 1,188,121,658

DETAILS OF WRITE-IN LINES

1101.

1102.

1103.

1198. Summary of remaining write-ins for Line 11 from overflow page

1199. Totals (Lines 1101 through 1103 plus 1198) (Line 11 above)

2501. Other nonadmitted assets 5,526,648 5,526,648

2502. State tax credits 1,339,677 1,339,677 1,082,895

2503. Other assets & deposits 864,232 276,523 587,709 609,770

2598. Summary of remaining write-ins for Line 25 from overflow page

2599. Totals (Lines 2501 through 2503 plus 2598) (Line 25 above) 7,730,557 5,803,171 1,927,386 1,692,665

NONE

2

......................................................................................................................

..........................................................................................................

..........................................................................................................

...............................................................................................................

.......................................................................................................

..............................................................

........................................................

.......................................................................

...................................................................................................

...............................................................................

...................................................................................................................

...........................................................................................................

........................................................................................................

..........................................................................................

.......................................

......................................................................................

........................................................................

................................................................................................

...................................................................

..............................................................

....................................................................................

...........................................................................................

...............................................................................

..............................................................................

.........................................................................................

.......................................................................

...........................................................................................................

..............................................................................................

......................................................................................

...............................................................

.........................................................................

......................................................................................

.............................................................................

...............................

.............................................................................................

...........

...........................................................................................................................

...........................................................................................................................

...........................................................................................................................

.....................

...........................................................................................................................

...........................................................................................................................

...........................................................................................................................

.....................

Stewart Title Guaranty Company

..............................................................

Statement as of September 30, 2020 of the

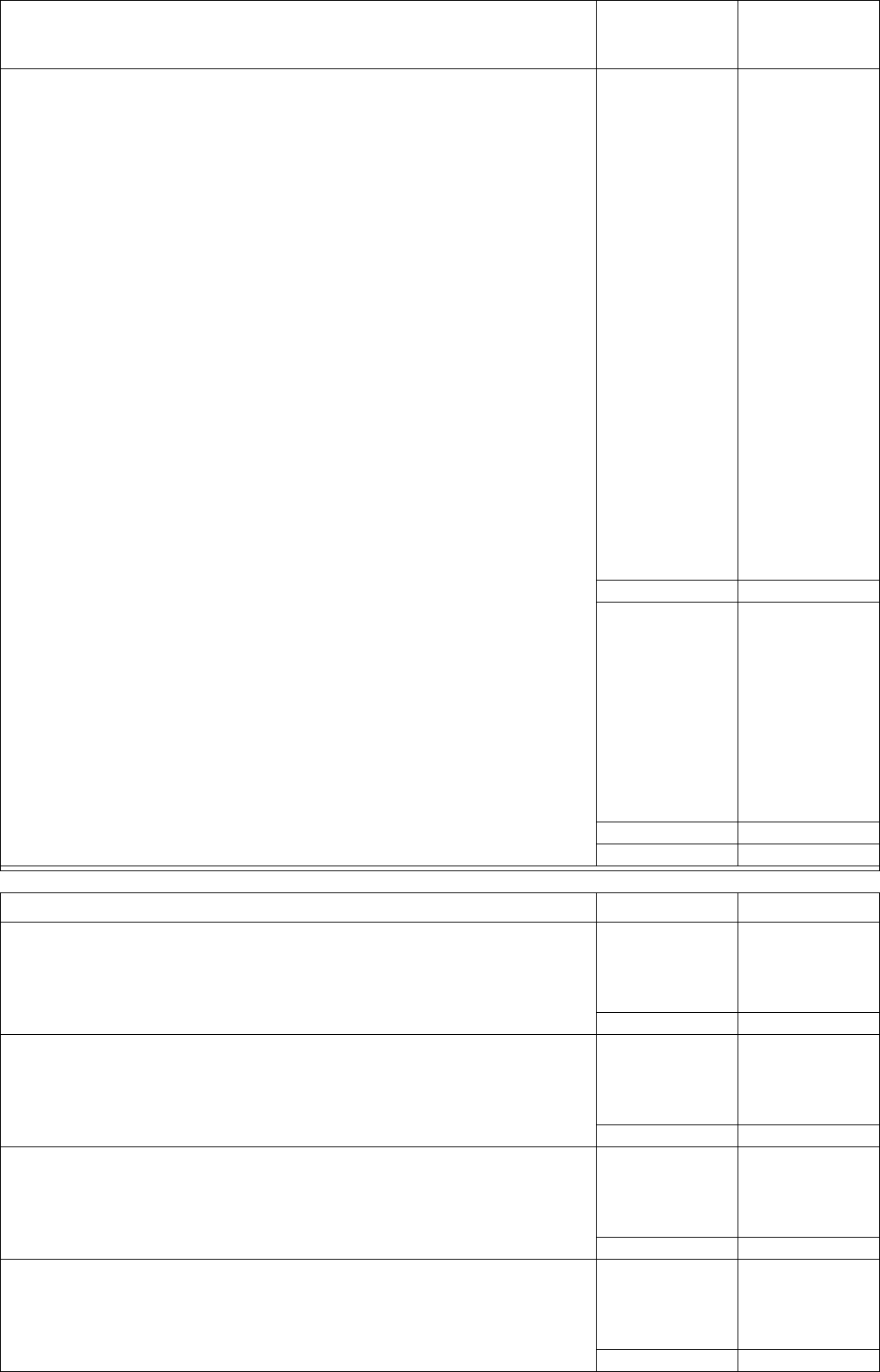

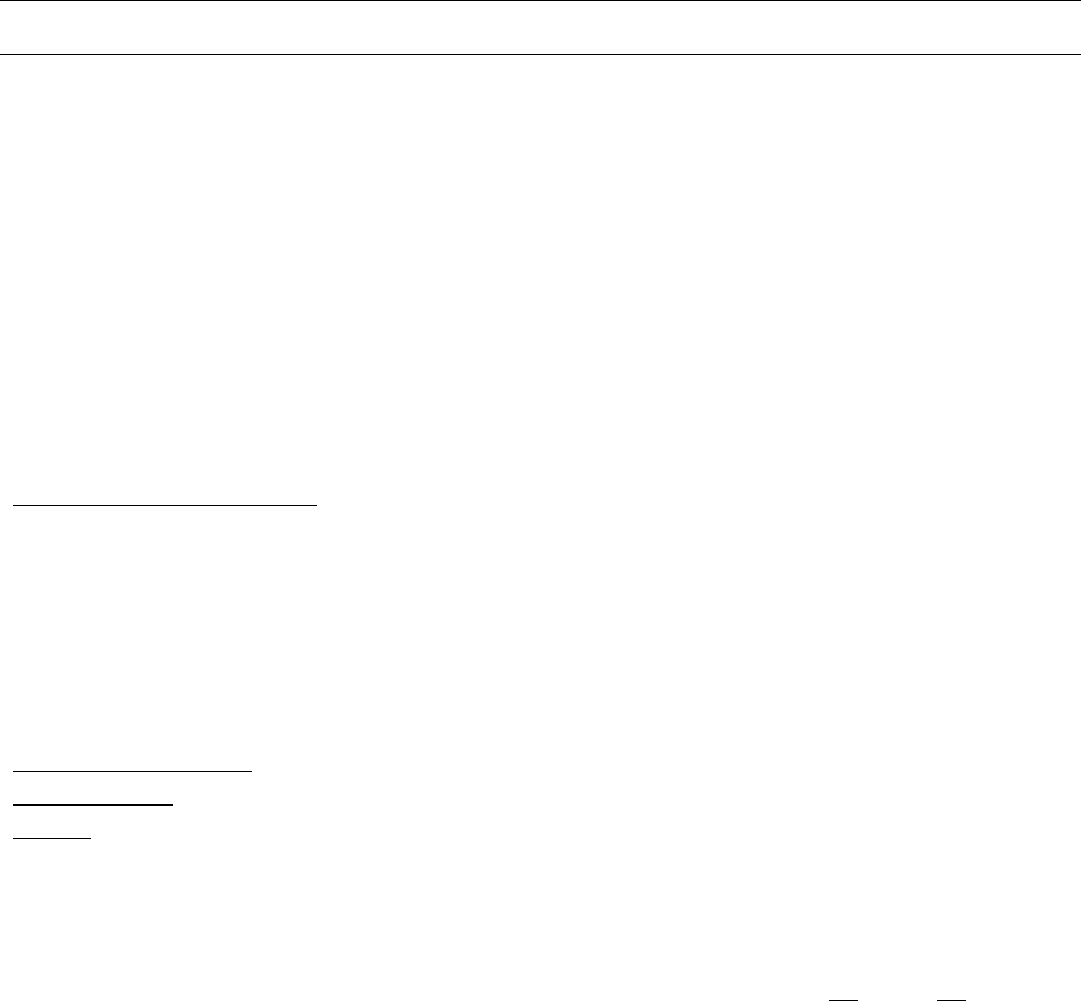

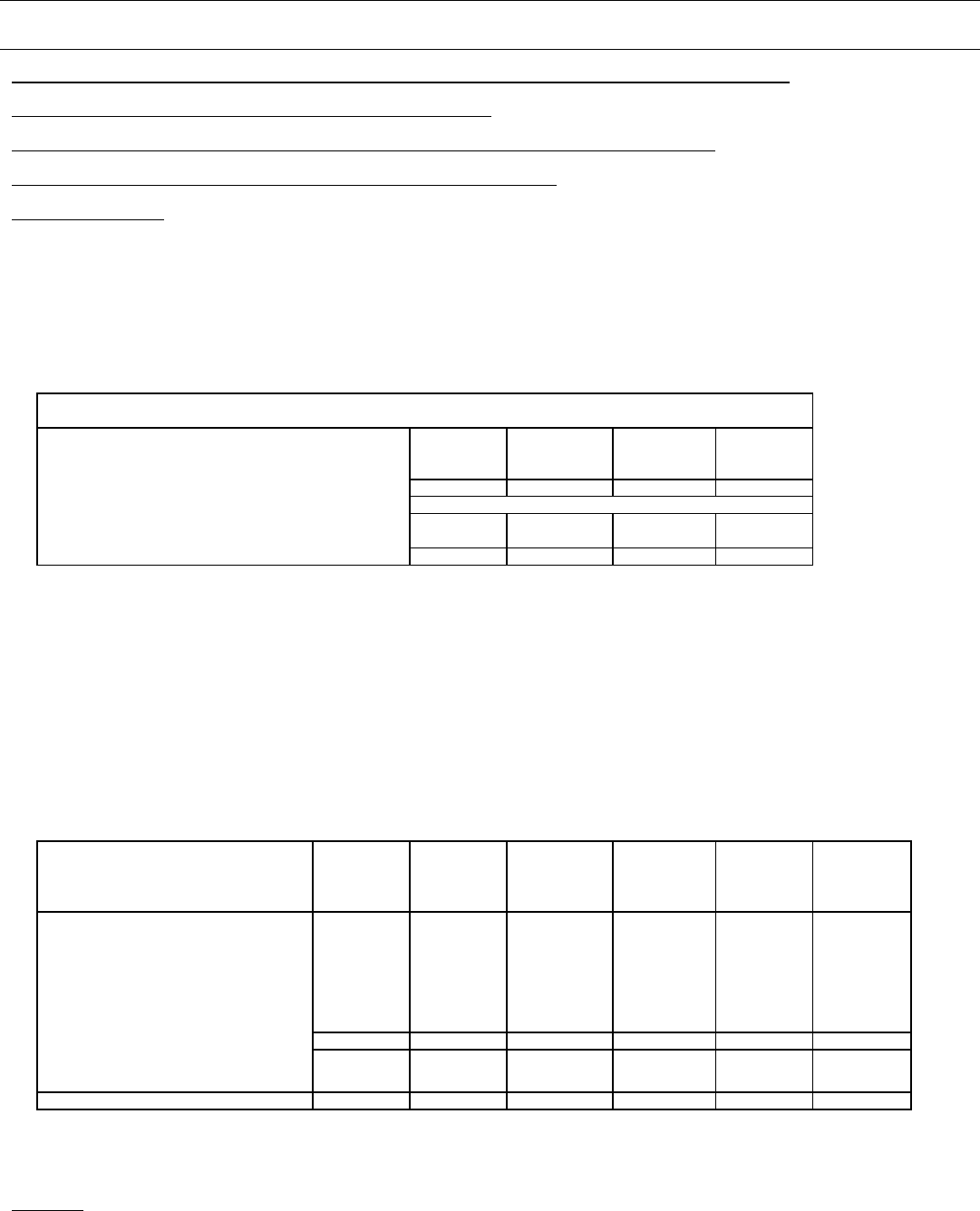

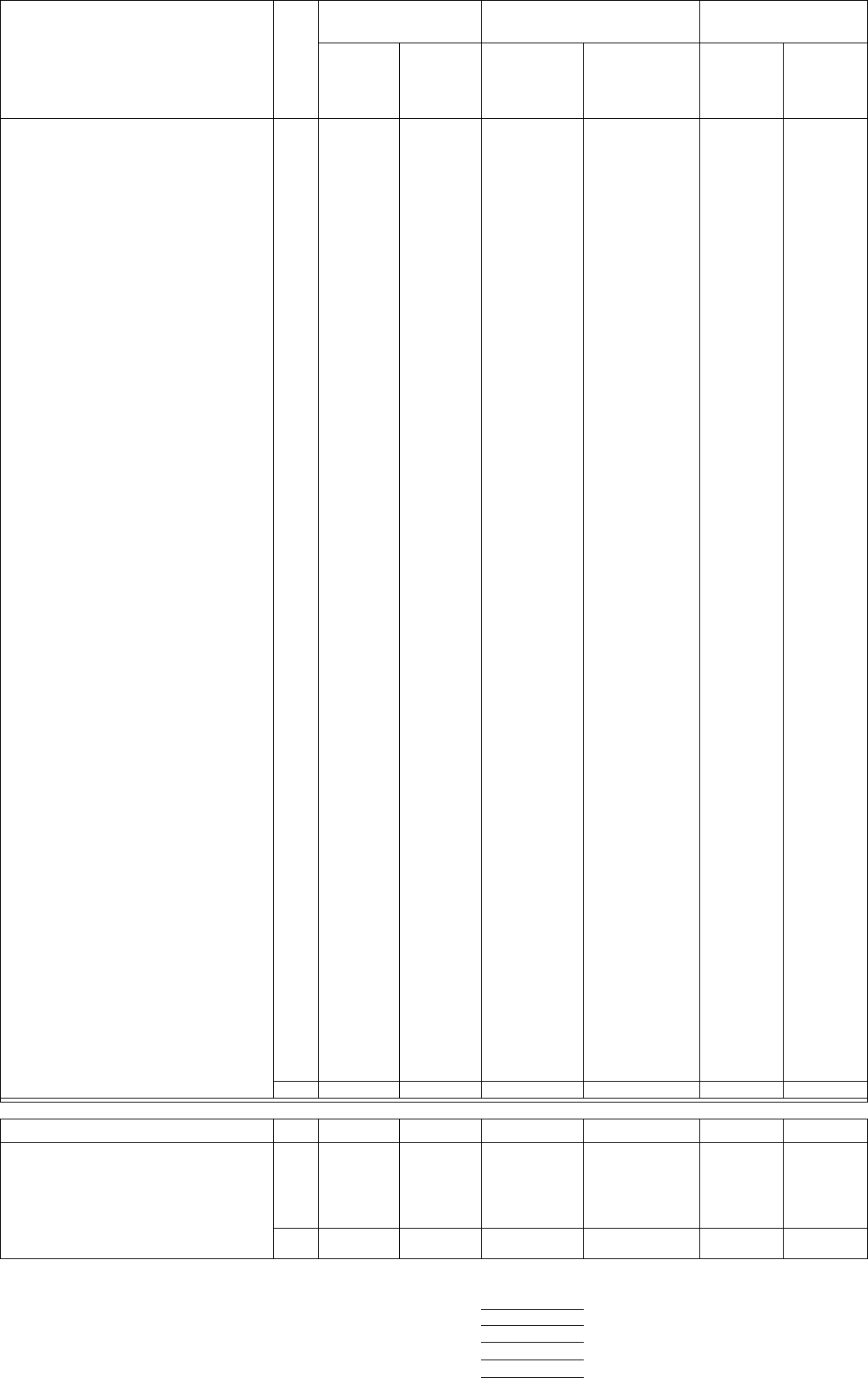

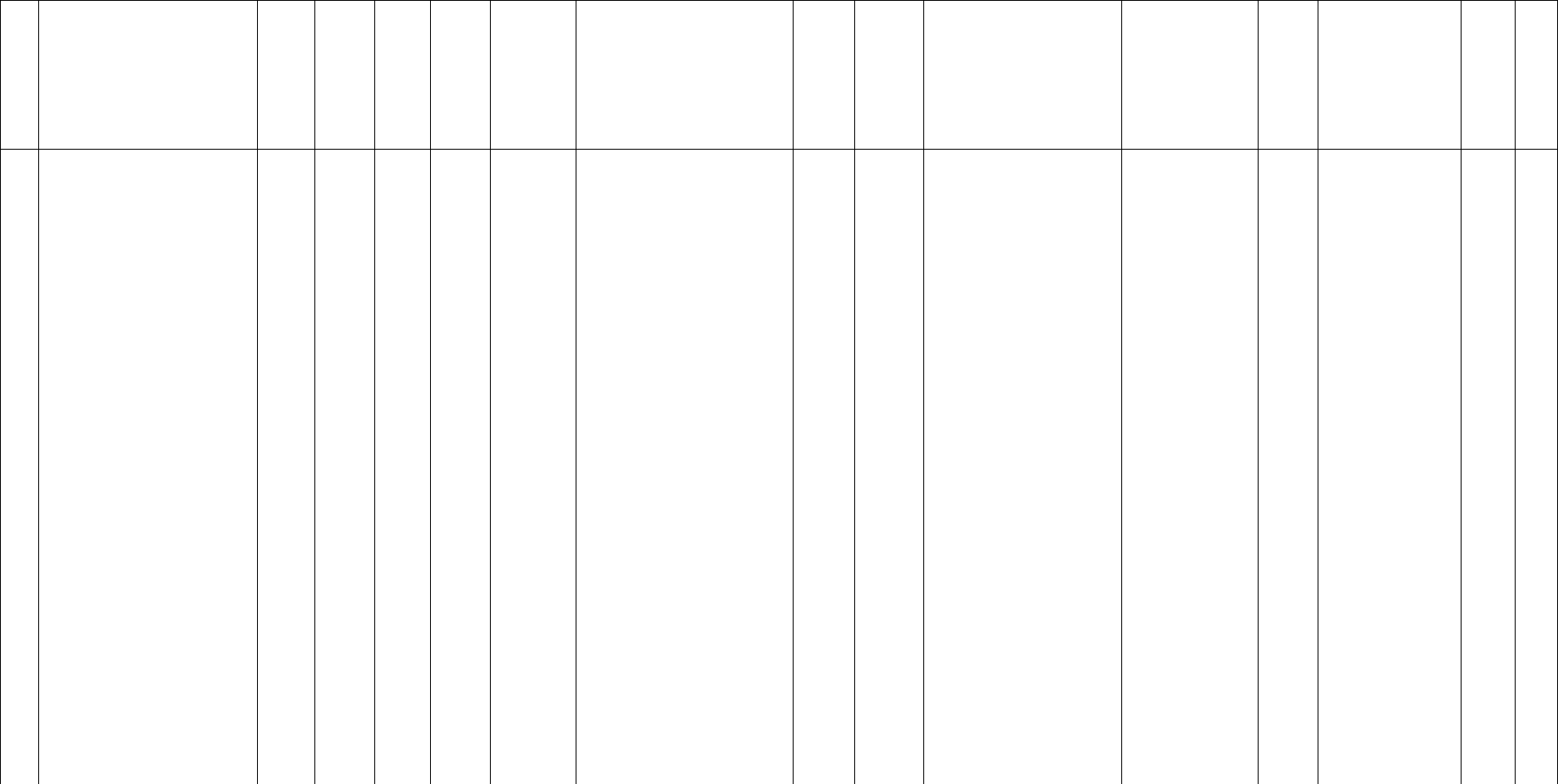

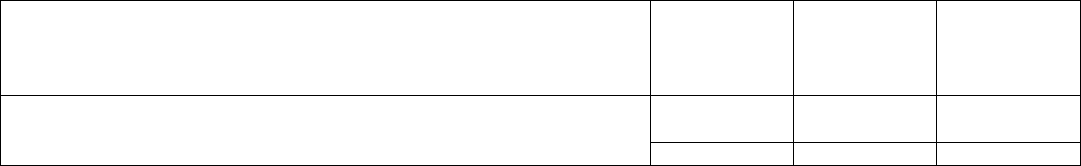

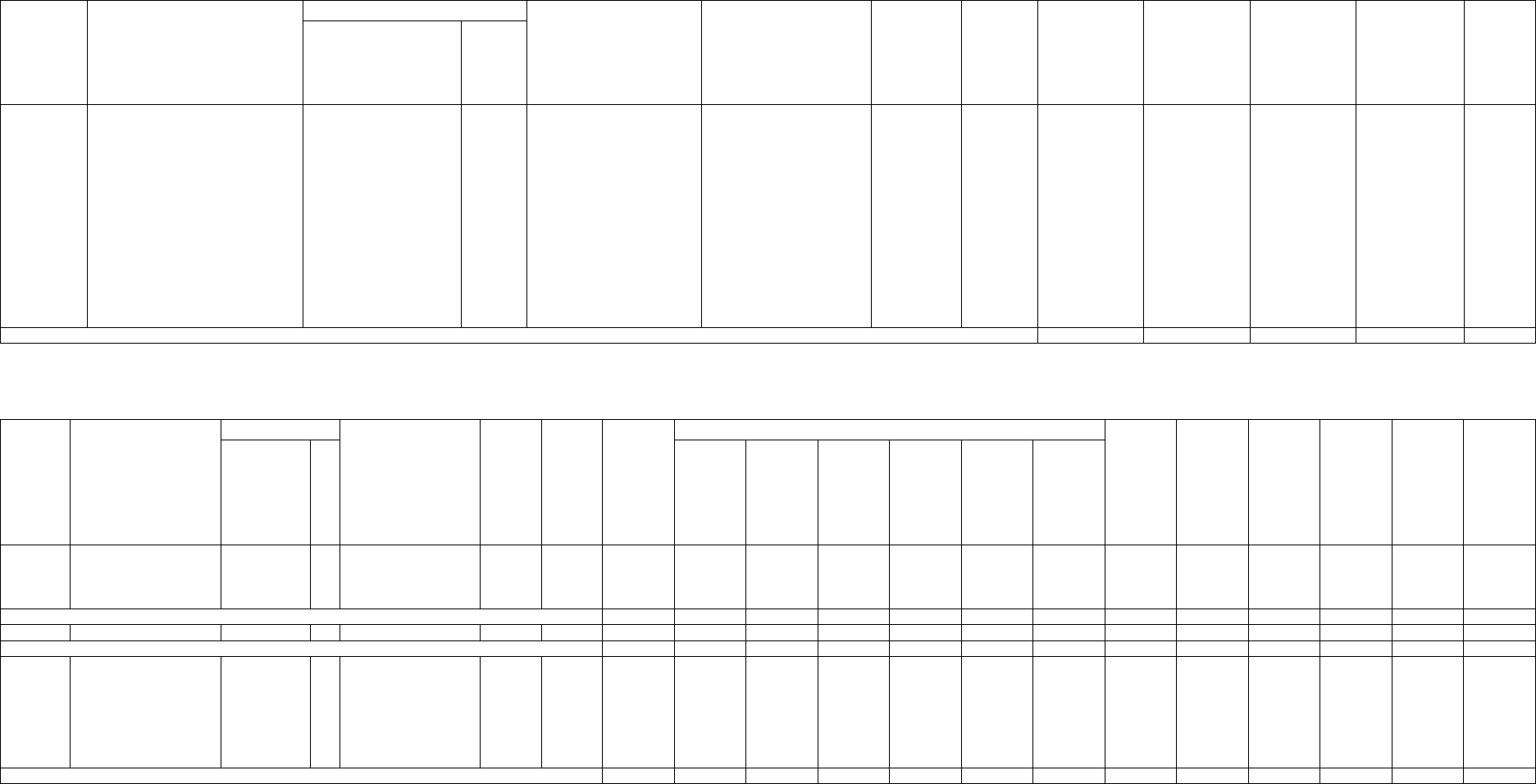

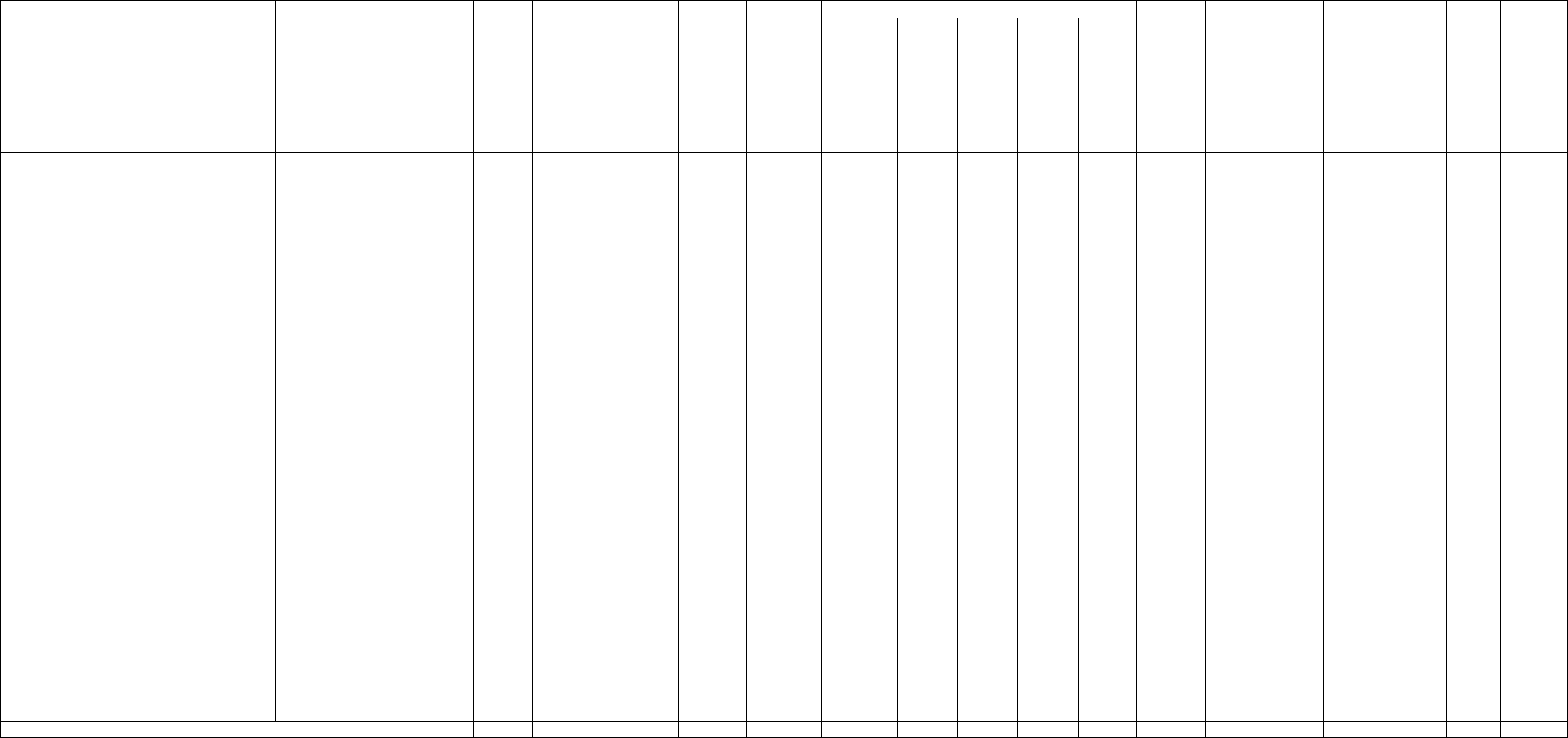

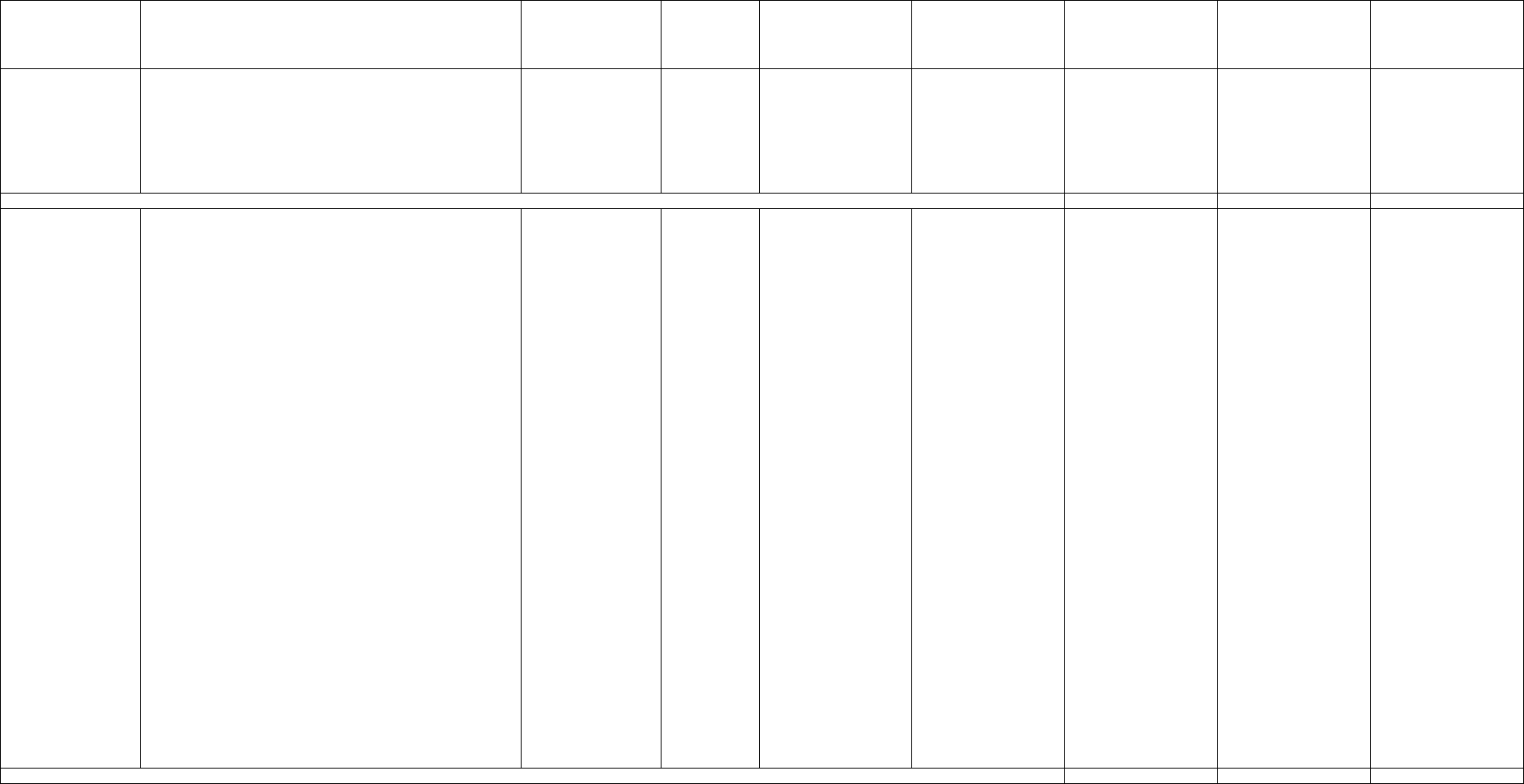

LIABILITIES, SURPLUS AND OTHER FUNDS

1 2

Current December 31

Statement Date Prior Year

1. Known claims reserve 49,157,410 54,607,473

2. Statutory premium reserve 472,419,925 458,420,350

3. Aggregate of other reserves required by law

4. Supplemental reserve

5. Commissions, brokerage and other charges due or accrued to attorneys, agents and real estate brokers

6. Other expenses (excluding taxes, licenses and fees) 31,444,642 38,072,894

7. Taxes, licenses and fees (excluding federal and foreign income taxes) 6,779,651 6,972,923

8.1

(3,015)

...........

Current federal and foreign income taxes (including $ on realized capital gains (losses)) 10,203,785 8,091,610

8.2 Net deferred tax liability

9.

0

...........

0

...........

Borrowed money $ and interest thereon $

10. Dividends declared and unpaid

11. Premiums and other consideration received in advance

12. Unearned interest and real estate income received in advance

13. Funds held by company under reinsurance treaties

14. Amounts withheld or retained by company for account of others

15. Provision for unauthorized and certified reinsurance

16. Net adjustment in assets and liabilities due to foreign exchange rates

17. Drafts outstanding

18. Payable to parent, subsidiaries and affiliates 967,141 2,981,793

19. Derivatives

20. Payable for securities 278,790

21. Payable for securities lending

22. Aggregate write-ins for other liabilities 974,486 1,073,244

23. Total liabilities (Lines 1 through 22) 572,225,830 570,220,287

24. Aggregate write-ins for special surplus funds 501,405 501,405

25. Common capital stock 8,500,000 8,500,000

26. Preferred capital stock

27. Aggregate write-ins for other-than-special surplus funds

28. Surplus notes

29. Gross paid in and contributed surplus 207,561,483 204,574,622

30. Unassigned funds (surplus) 443,124,290 404,325,344

31. Less treasury stock, at cost:

31.1

0

...........

0

...........

shares common (value included in Line 25 $ )

31.2

0

...........

0

...........

shares preferred (value included in Line 26 $ )

32. Surplus as regards policyholders (Lines 24 to 30 less 31) 659,687,178 617,901,371

33. Totals (Page 2, Line 28, Col. 3) 1,231,913,008 1,188,121,658

DETAILS OF WRITE-INS

0301.

0302.

0303.

0398. Summary of remaining write-ins for Line 03 from overflow page

0399. Totals (Lines 0301 through 0303 plus 0398) (Line 03 above)

2201. Deferred rent 886,490 970,326

2202. Reinsurance payable 87,996 102,918

2203.

2298. Summary of remaining write-ins for Line 22 from overflow page

2299. Totals (Lines 2201 through 2203 plus 2298) (Line 22 above) 974,486 1,073,244

2401. Surplus arising from increase in book value of title plants 501,384 501,384

2402. Mineral interest-assigned value 21 21

2403.

2498. Summary of remaining write-ins for Line 24 from overflow page

2499. Totals (Lines 2401 through 2403 plus 2498) (Line 24 above) 501,405 501,405

2701.

2702.

2703.

2798. Summary of remaining write-ins for Line 27 from overflow page

2799. Totals (Lines 2701 through 2703 plus 2798) (Line 27 above)

NONE

NONE

3

.............................................................................................................

..........................................................................................................

.............................................................................................

.............................................................................................................

..................................................

.......................................................................................

..........................................................................

.................................................

............................................................................................................

......................................................................

.......................................................................................................

.....................................................................................

................................................................................

........................................................................................

...............................................................................

........................................................................................

...........................................................................

................................................................................................................

.............................................................................................

.....................................................................................................................

..............................................................................................................

........................................................................................................

........................................................

..........................................................

.............................................................................................

.............................................................................................................

............................................................................................................

.....................................................................................

...................................................................................................................

..................................................................................................

.........................................................................................................

..............................................................

....................

..........................................

..............................................................................................................................

..............................................................................................................................

..............................................................................................................................

......................................

..............................................................................................................................

..............................................................................................................................

..............................................................................................................................

......................................

..............................................................................................................................

..............................................................................................................................

..............................................................................................................................

......................................

..............................................................................................................................

..............................................................................................................................

..............................................................................................................................

......................................

Stewart Title Guaranty Company

..............................................................

Statement as of September 30, 2020 of the

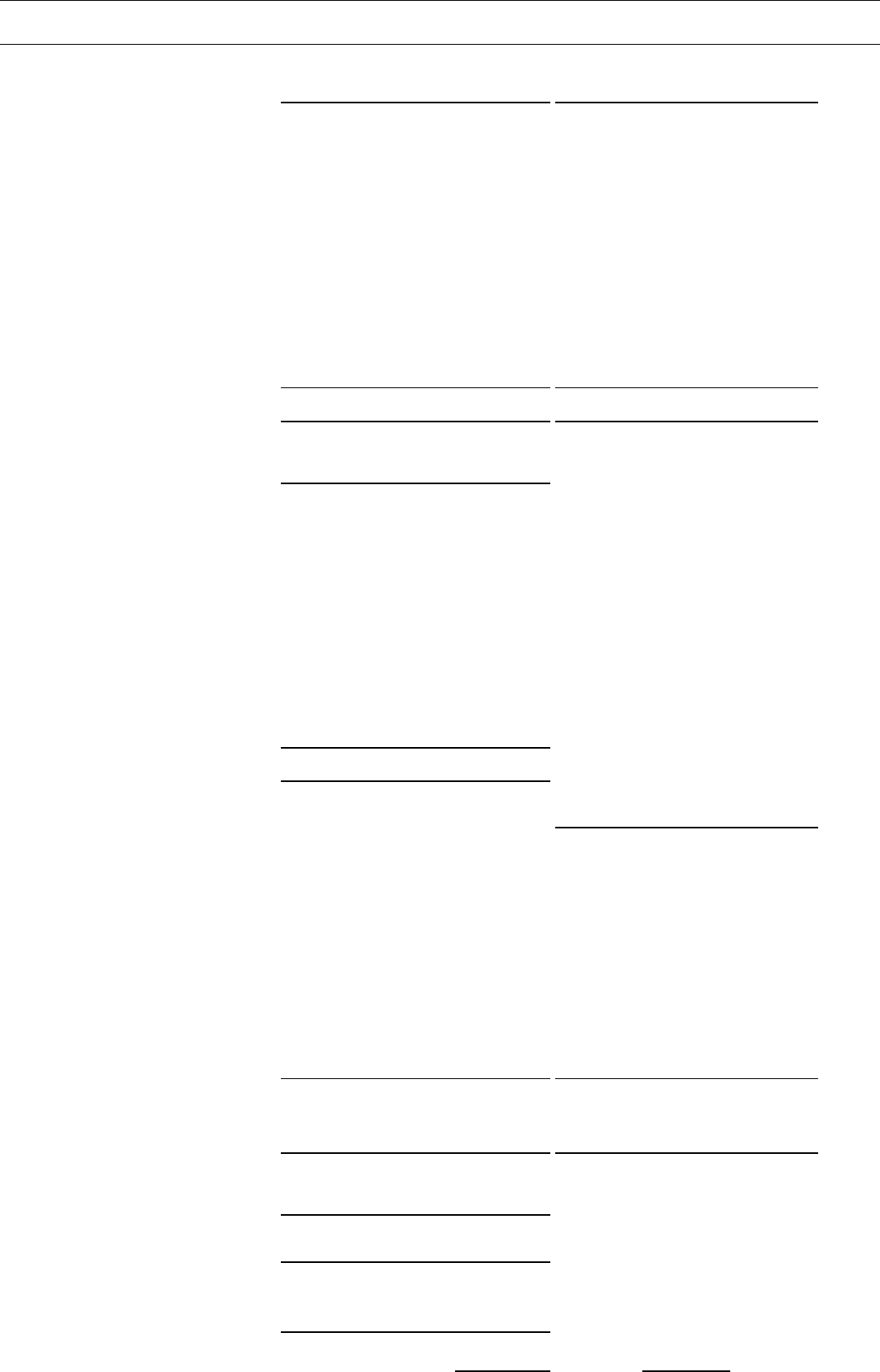

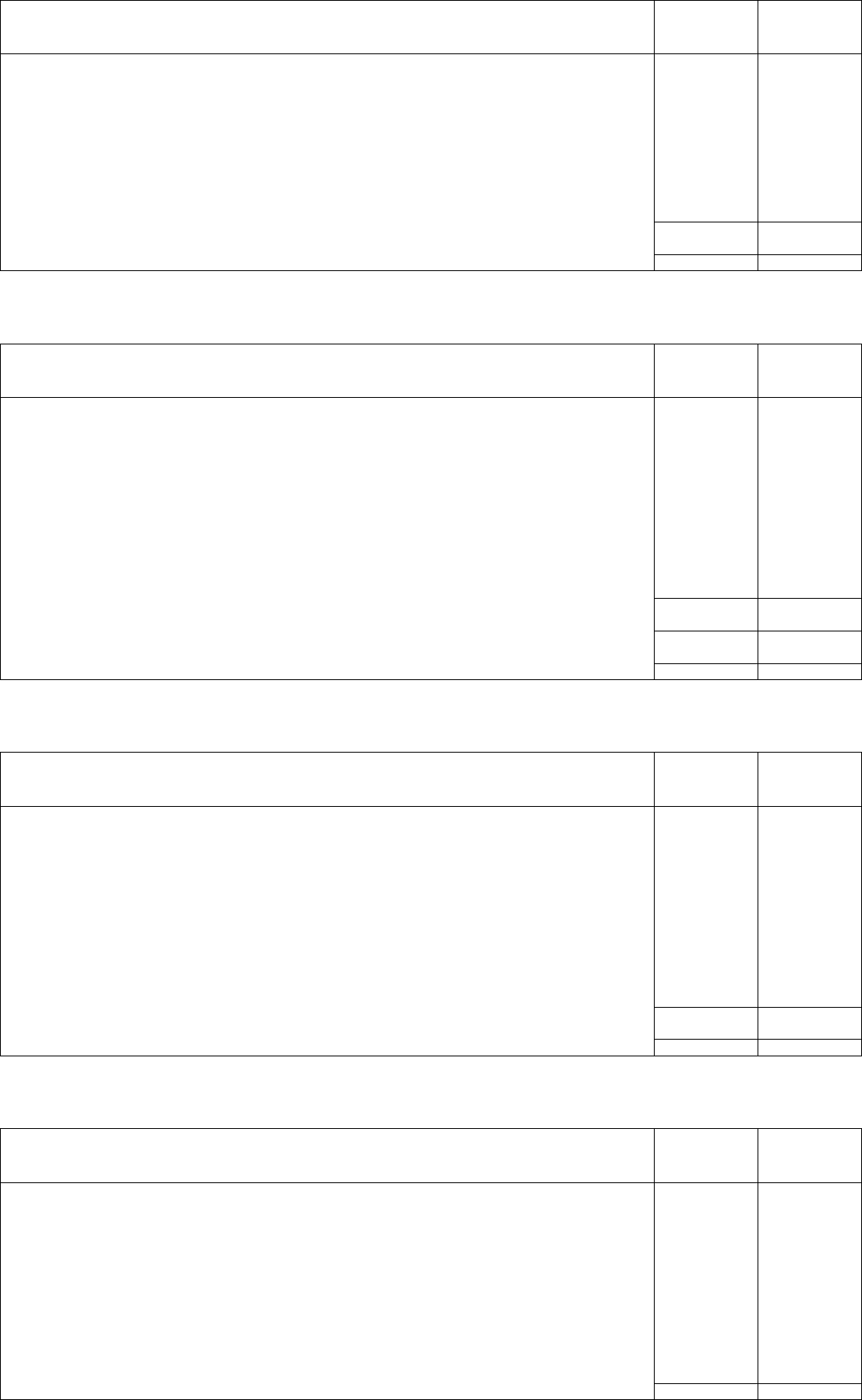

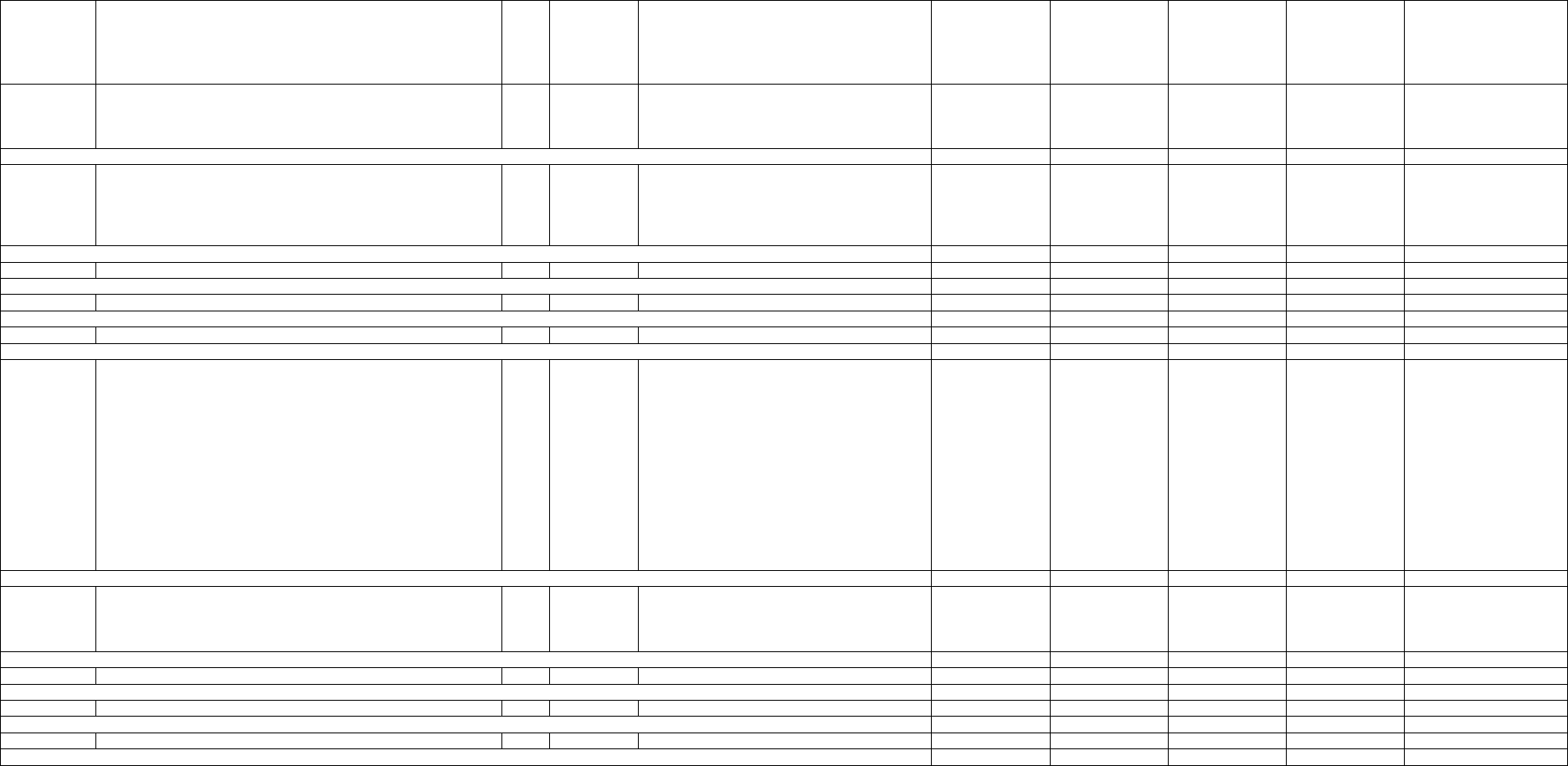

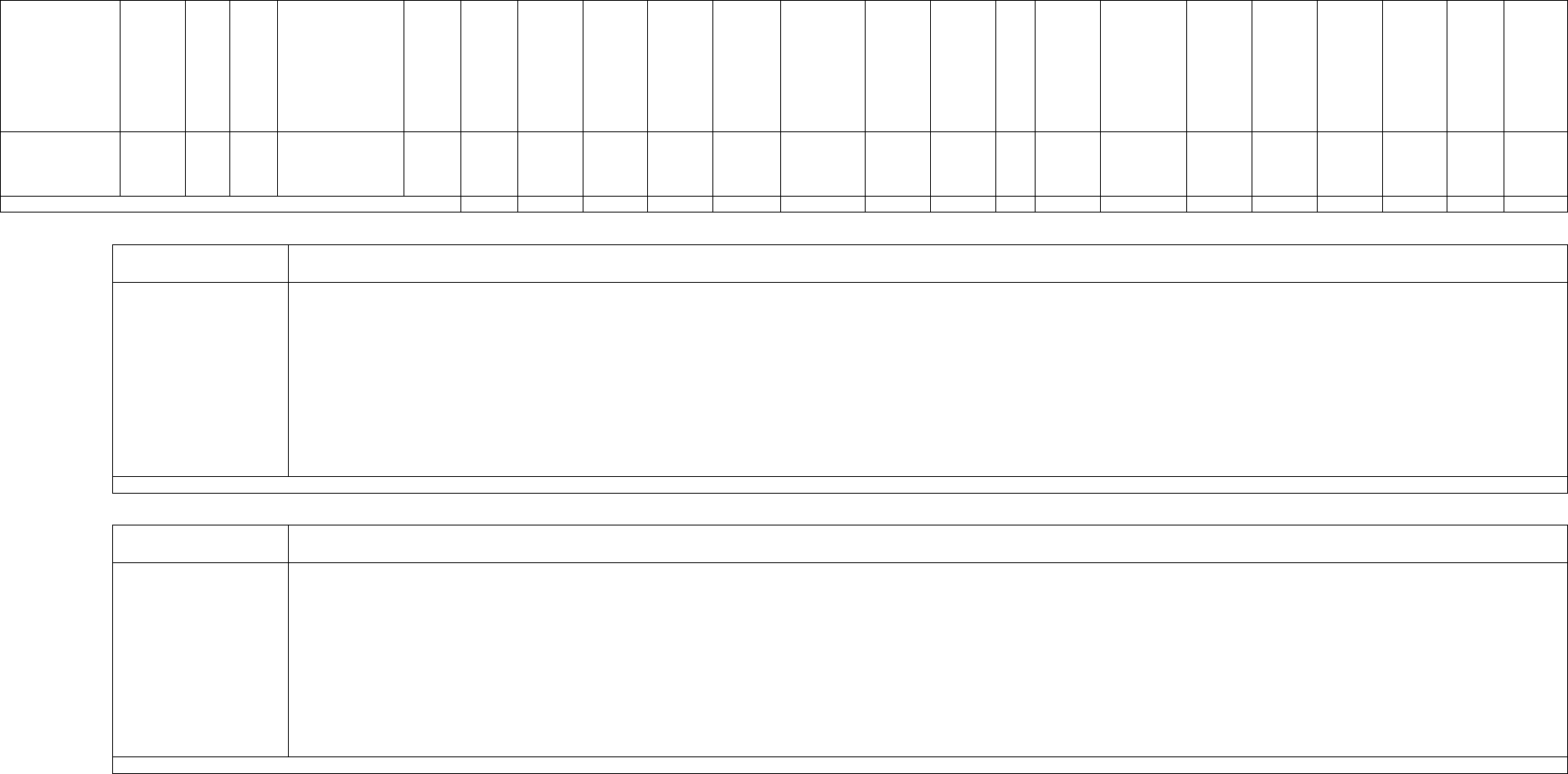

OPERATIONS AND INVESTMENT EXHIBIT

1 2 3

STATEMENT OF INCOME Current Year Prior Year Prior Year Ended

To Date To Date December 31

OPERATING INCOME

1. Title insurance and related income:

1.1 Title insurance premiums earned 1,116,097,095 970,845,799 1,333,705,788

1.2 Escrow and settlement services 16,801,143 11,978,559 17,698,658

1.3 Other title fees and service charges 29,707,901 31,224,906 46,093,615

2. Aggregate write-ins for other operating income

3. Total Operating Income (Lines 1 through 2) 1,162,606,139 1,014,049,264 1,397,498,061

EXPENSES:

4. Losses and loss adjustment expenses incurred 48,709,760 58,908,700 79,624,340

5. Operating expenses incurred 1,048,390,843 924,559,512 1,281,232,270

6. Aggregate write-ins for other operating expenses

7. Total Operating Expenses 1,097,100,603 983,468,212 1,360,856,610

8. Net operating gain or (loss) (Lines 3 minus 7) 65,505,536 30,581,052 36,641,451

INVESTMENT INCOME

9. Net investment income earned 20,818,552 10,653,941 14,502,606

10.

(3,015)

...........

Net realized capital gains (losses) less capital gains tax of $ (281,392) 109,386 2,236,249

11. Net investment gain (loss) (Lines 9 + 10) 20,537,160 10,763,327 16,738,855

OTHER INCOME

12. Aggregate write-ins for miscellaneous income or (loss) or other deductions 1,161,792 163,440 (1,214,981)

13. Net income, after capital gains tax and before all other federal income taxes (Lines 8 + 11 + 12) 87,204,488 41,507,819 52,165,325

14. Federal and foreign income taxes incurred 17,663,191 10,778,221 13,829,264

15. Net income (Lines 13 minus 14) 69,541,297 30,729,598 38,336,061

CAPITAL AND SURPLUS ACCOUNT

16. Surplus as regards policyholders, December 31 prior year 617,901,371 574,837,386 574,837,386

17. Net income (from Line 15) 69,541,297 30,729,598 38,336,061

18.

0

...........

Change in net unrealized capital gains or (losses) less capital gains tax of $ 5,233,392 10,821,587 (3,150,231)

19. Change in net unrealized foreign exchange capital gain (loss) (3,132,723) 3,726,139 7,089,783

20. Change in net deferred income taxes 1,426,119 (907,377) (2,757,593)

21. Change in nonadmitted assets (4,269,139) (2,108,974) 2,561,558

22. Change in provision for unauthorized and certified reinsurance

23. Change in supplemental reserves

24. Change in surplus notes

25. Cumulative effect of changes in accounting principles

26. Capital Changes:

26.1 Paid in

26.2 Transferred from surplus (Stock Dividend)

26.3 Transferred to surplus

27. Surplus Adjustments:

27.1 Paid in 2,986,861 2,501,209 984,407

27.2 Transferred to capital (Stock Dividend)

27.3 Transferred from capital

28. Dividends to stockholders (30,000,000)

29. Change in treasury stock

30. Aggregate write-ins for gains and losses in surplus

31. Change in surplus as regards policyholders for the year (Lines 17 through 30) 41,785,807 44,762,182 43,063,985

32. Surplus as regards policyholders as of statement date (Lines 16 plus 31) 659,687,178 619,599,568 617,901,371

DETAILS OF WRITE-IN LINES

0201.

0202.

0203.

0298. Summary of remaining write-ins for Line 02 from overflow page

0299. Totals (Lines 0201 through 0203 plus 0298) (Line 02 above)

0601.

0602.

0603.

0698. Summary of remaining write-ins for Line 06 from overflow page

0699. Totals (Lines 0601 through 0603 plus 0698) (Line 06 above)

1201. Title Plant rent income 607,040 5,342 762,109

1202. Miscellaneous income 456,339 571,618 (1,597,585)

1203. Ceded reimbursement from agents 165,704 93 50,543

1298. Summary of remaining write-ins for Line 12 from overflow page (67,291) (413,613) (430,048)

1299. Totals (Lines 1201 through 1203 plus 1298) (Line 12 above) 1,161,792 163,440 (1,214,981)

3001. True-up of current taxes owed the company pursuant to tax sharing agreement

3002.

3003.

3098. Summary of remaining write-ins for Line 30 from overflow page

3099. Totals (Lines 3001 through 3003 plus 3098) (Line 30 above)

NONE

NONE

4

...............................................................................................

................................................................................................

.............................................................................................

.......................................

.............................................................................................

..........................................................................................

.......................................................................................................

......................................

......................................................

........................................

......................................................................................................

.................

...............................................................................................

...................

.......................................................

..........................................

..................................................

...............................

.........................................................................................................

.........................................................

................................................................................

.................................................................................................

......................................................................................................

...............................................................................

....................................................................................................

..........................................................................................................

.....................................................................................

..................................................................................................................

........................................................................................

......................................................................................................

.................................................................................................................

..........................................................................................

.....................................................................................................

.........................................................................................................

..........................................................................................................

....................................

.................

............................................................................................................................

............................................................................................................................

............................................................................................................................

...........................

............................................................................................................................

............................................................................................................................

............................................................................................................................

...........................

............................................................................................................

............................................................................................................

............................................................................................................................

...........................

...................................................................

............................................................................................................................

............................................................................................................................

...........................

Stewart Title Guaranty Company

..............................................................

Statement as of September 30, 2020 of the

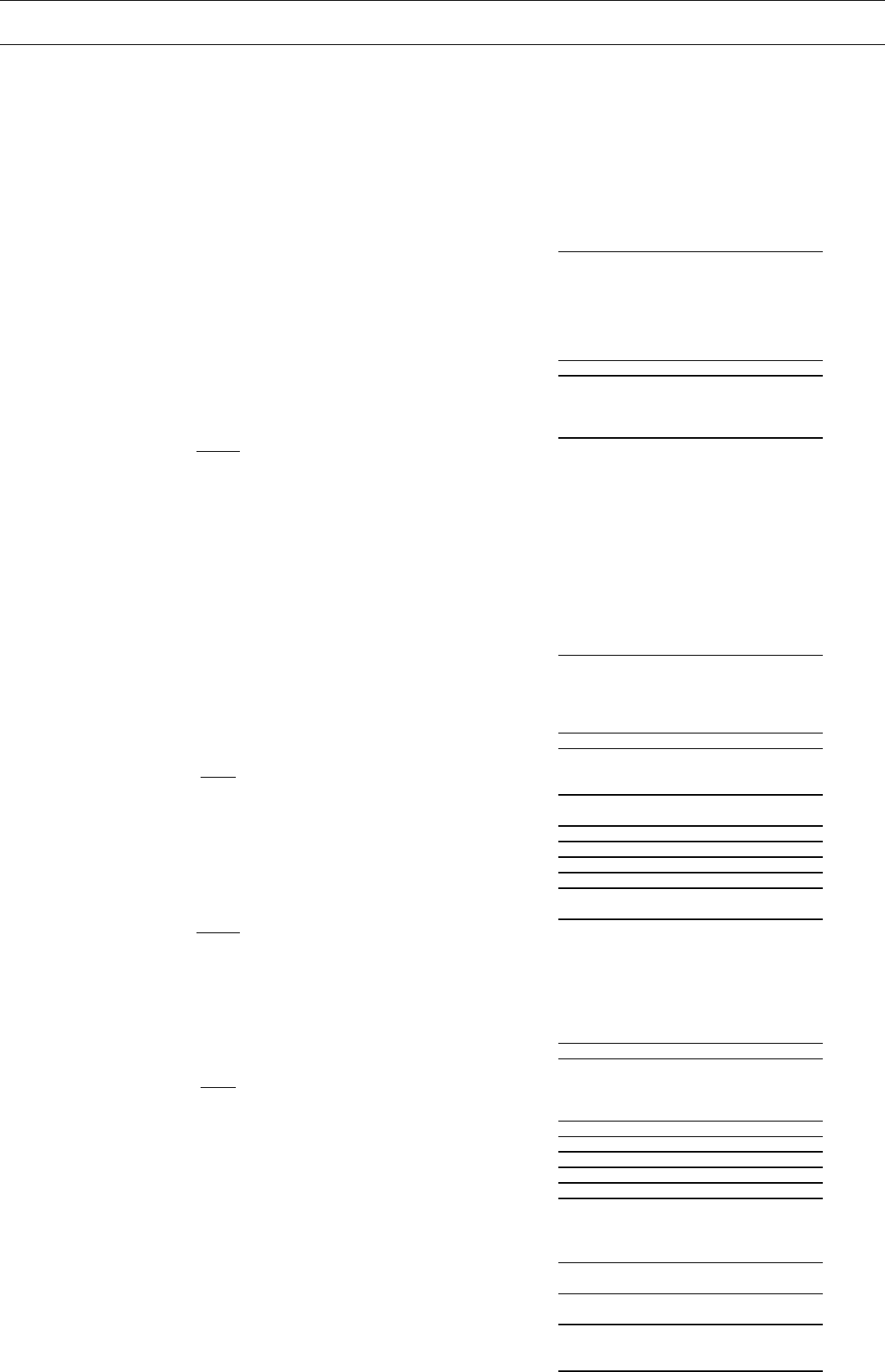

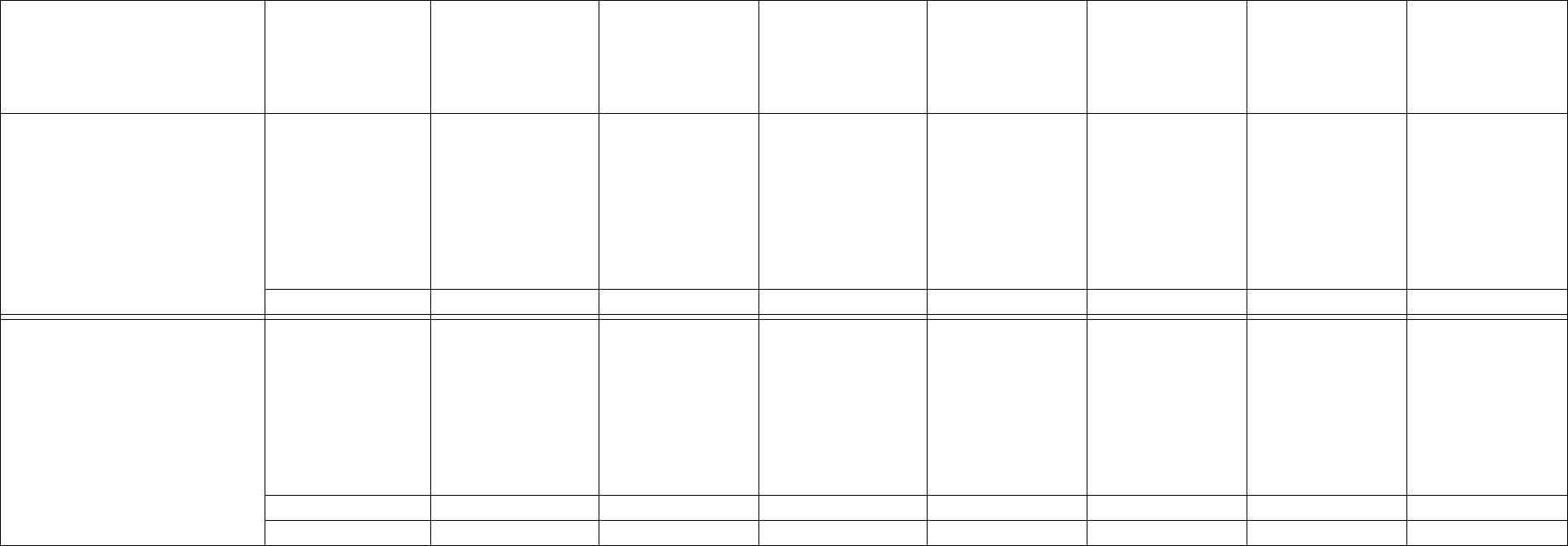

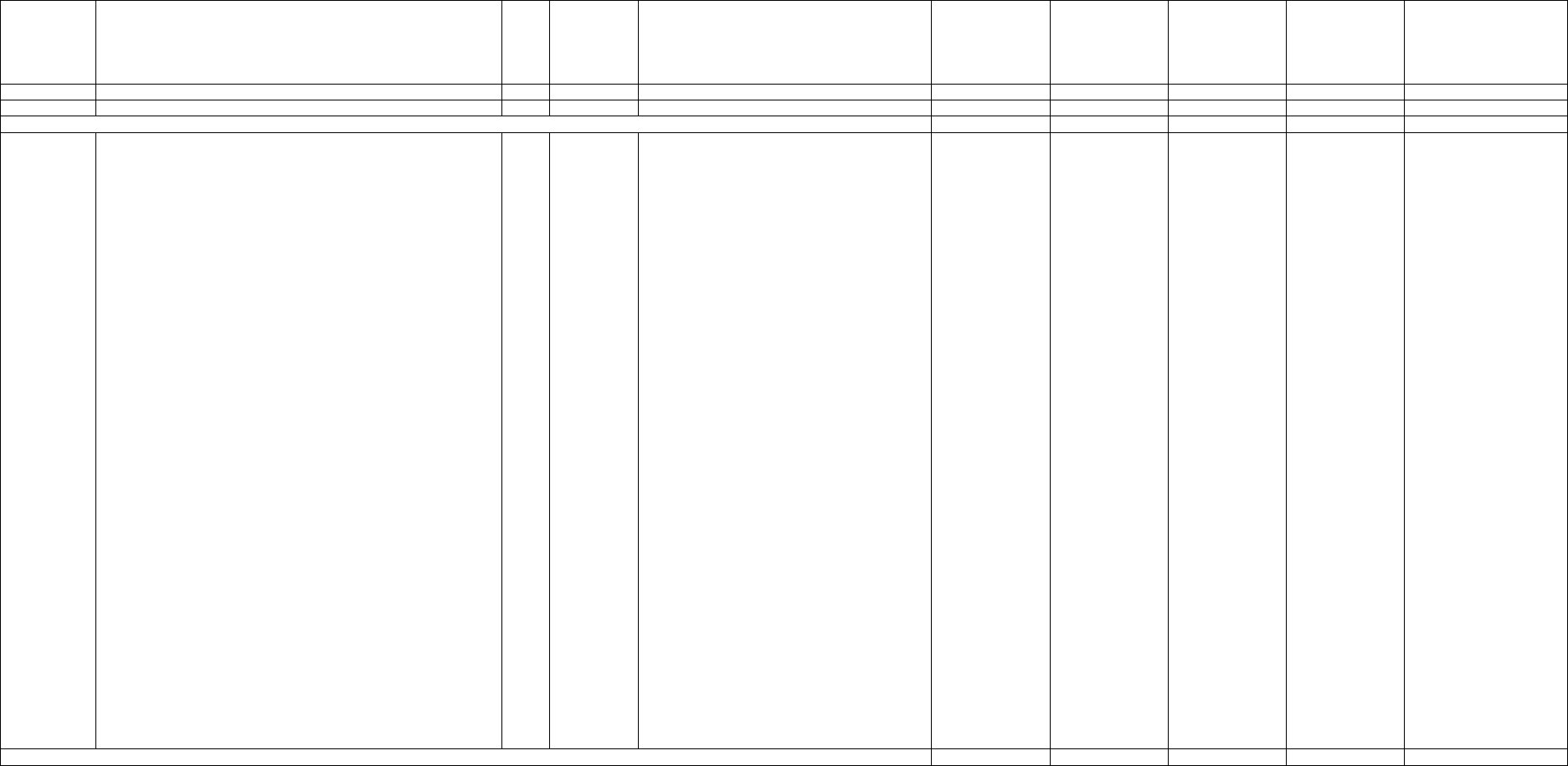

CASH FLOW

1 2 3

Cash from Operations Current Year Prior Year Prior Year

To Date To Date Ended December 31

1. Premiums collected net of reinsurance 1,130,861,538 963,750,032 1,338,429,424

2. Net investment income 24,245,006 15,748,245 19,360,421

3. Miscellaneous income 47,675,447 43,365,396 62,575,783

4. Total (Lines 1 to 3) 1,202,781,991 1,022,863,673 1,420,365,628

5. Benefit and loss related payments 48,159,823 51,294,690 69,062,871

6. Net transfers to Separate Accounts, Segregated Accounts and Protected Cell Accounts

7. Commissions, expenses paid and aggregate write-ins for deductions 1,073,478,525 944,112,832 1,264,625,481

8. Dividends paid to policyholders

9.

0

..........

Federal and foreign income taxes paid (recovered) net of $ tax on capital gains (losses) 15,145,418 9,024,114 15,524,395

10. Total (Lines 5 through 9) 1,136,783,766 1,004,431,636 1,349,212,747

11. Net cash from operations (Line 4 minus Line 10) 65,998,225 18,432,037 71,152,881

Cash from Investments

12. Proceeds from investments sold, matured or repaid:

12.1 Bonds 62,157,737 51,277,713 80,844,140

12.2 Stocks 586,528 1,805,324 3,490,033

12.3 Mortgage loans 149,945 9,926 14,056

12.4 Real estate 3,109 3,109

12.5 Other invested assets 561,389 13,802 31,386

12.6 Net gains (or losses) on cash, cash equivalents and short-term investments

12.7 Miscellaneous proceeds

12.8 Total investment proceeds (Lines 12.1 to 12.7) 63,455,599 53,109,874 84,382,724

13. Cost of investments acquired (long-term only):

13.1 Bonds 64,356,379 71,678,271

13.2 Stocks 1,479,160 2,462,671 23,550,823

13.3 Mortgage loans

13.4 Real estate

13.5 Other invested assets

13.6 Miscellaneous applications

13.7 Total investments acquired (Lines 13.1 to 13.6) 65,835,539 2,462,671 95,229,094

14. Net increase (or decrease) in contract loans and premium notes

15. Net cash from investments (Line 12.8 minus Line 13.7 and Line 14) (2,379,940) 50,647,203 (10,846,370)

Cash from Financing and Miscellaneous Sources

16. Cash provided (applied):

16.1 Surplus notes, capital notes

16.2 Capital and paid in surplus, less treasury stock

16.3 Borrowed funds

16.4 Net deposits on deposit-type contracts and other insurance liabilities

16.5 Dividends to stockholders 30,000,000

16.6 Other cash provided (applied)

17. Net cash from financing and miscellaneous sources (Line 16.1 through Line 16.4 minus

Line 16.5 plus Line 16.6) (30,000,000)

RECONCILIATION OF CASH, CASH EQUIVALENTS AND SHORT-TERM INVESTMENTS

18. Net change in cash, cash equivalents and short-term investments (Line 11, plus Lines 15 and 17) 33,618,285 69,079,240 60,306,511

19. Cash, cash equivalents and short-term investments:

19.1 Beginning of year 138,794,251 78,487,740 78,487,740

19.2 End of period (Line 18 plus Line 19.1) 172,412,536 147,566,980 138,794,251

Note: Supplemental disclosures of cash flow information for non-cash transactions:

20.0001 Line 13.2 includes non-cash contributions to affiliates 702,866 613,110 984,407

20.0002

20.0003

5

..................................................................................................

............................................................................................................

......................................................

...............................................................................................................

.....................................................................................................

..................................................................

..............................................................................

.......................................................................................................

.

.....................................................

.....................................

..................................................................................................................

.................................................................................................................

............................................................................................................

..............................................................................................................

........................................................................................................

.....................................................................

................................................

.......................................................................................

..................................................................................................................

.................................................................................................................

............................................................................................................

..............................................................................................................

........................................................................................................

..............................................

.......................................................................................

...........................

.........................

....................................................................................................

.......................................................................................

...........................................................................................................

.........................................................................

.....................................................................................................

............................................

.....................................................

............................................................

....................................................

...........................................................................................................................

...........................................................................................................................

...........................................................................................................................

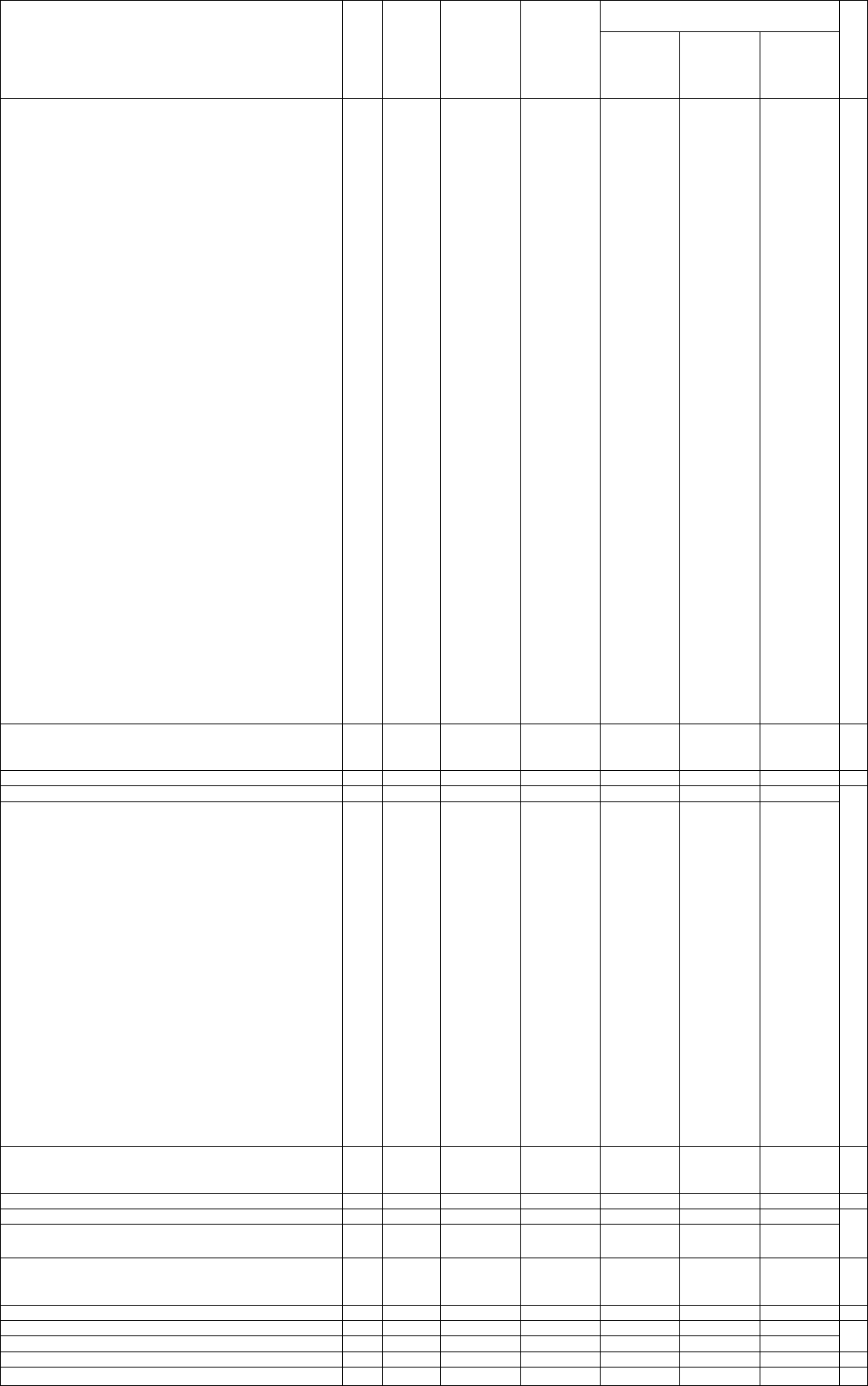

1 Accounting Practices

A.

SSAP# F/S Page F/S Line#

9/30/2020

12/31/2019

Net Income(loss), Texas State Basis XXX XXX XXX 69,541,297$ 38,336,061$

State Prescribed Practices:

Statutory Premium Reserve Recovery, net of tax 57 4 1.1 700,904$ 276,934$

State Permitted Practices: -$ -$

Net Income(loss), NAIC SAP XXX XXX XXX 70,242,201$ 38,612,995$

Statutory Surplus, Texas State Basis 659,687,178$ 617,901,371$

State Prescribed Practices:

Statutory Premium Reserve Recovery, net of tax 57 3 30 42,334,484$ 41,633,580$

Furniture & Fixtures 19 1 21 (1,272,852)$ (1,490,696)$

Real Estate 40 1 4.3 (411)$ (411)$

State Permitted Practices: -$ -$

Statutory Surplus, NAIC SAP XXX XXX XXX 700,748,399$ 658,043,844$

B. Use of Estimates in the Preparation of the Financial Statements

C. Accounting Policies

In addition, the company uses the following accounting policies:

(1)

Short-term investments are stated at cost.

(2)

Bonds not backed by other loans are stated at amortized cost using the scientific method.

(3)

Unaffiliated common stocks are stated at market except investments in stocks that are not publicly traded, are valued at zero or cost.

(4)

Investments in Preferred stock, excluding investments in preferred stock of subsidiary, controlled, or affiliated entities - None.

(5)

Mortgage loans on real estate are stated at the aggregate unpaid balance.

(6)

Loan-backed securities, if any, are valued at amortized cost using the retrospective method.

(7)

(8)

The Company has no ownership interest in any joint venture or limited liability companies.

The financial statements of Stewart Title Guaranty Company are presented on the basis of accounting practices prescribed or permitted by the Texas Department

of Insurance.

The Texas Department of Insurance recognizes statutory accounting practices prescribed or permitted by the State of Texas for determining and reporting the

financial condition and results of operations of a title insurance company, for determining its solvency under the Texas Insurance Law. The National

Association of Insurance Commissioners' (the NAIC) Accounting Practices and Procedures Manual , (NAIC SAP) has been adopted as a component of

prescribed or permitted practices by the state of Texas. The state has adopted certain prescribed accounting practices that differ from those found in NAIC SAP.

Specifically, (A) the timing of amounts released from the statutory premium reserve under the Texas Code Section 2551.253, (B) home office furniture and

fixtures acquired after December 31, 2000 is an admitted asset as permitted by Texas Administrative Code 7.18 section (c)(3), depreciated in full over a period

not to exceed five years. Home office fixed assets acquired prior to January 1, 2001 are an admitted asset as permitted by Texas Insurance Code Articles 3.01,

6.12, 8.07 and any other applicable laws, and shall be depreciated in full over a period not to exceed ten years. In NAIC SAP 19, furniture and fixtures are not

admissible. (C) real-estate owned prior to October 1, 1967 continue to qualify as an admitted asset per Texas Insurance Code Article 2551.151. In NAIC SAP

40, appraisals must be no more than five years old or the property will not be admitted.

The preparation of financial statements in conformity with Statutory Accounting Principles require management to make estimates and assumptions that affect

the reported amounts of assets and liabilities. It also requires disclosure of contingent assets and liabilities at the date of the financial statements and the reported

amounts of revenue and expenses during the period. Actual results could differ from those estimates.

Revenue recognition and related expenses - Premiums are earned at the time of the closing of the related real estate transaction. Premiums on title insurance

policies written by agents are recognized primarily when policies are reported to the Company. In addition, where reasonable estimates can be made, the

Company accrues for policies issued but not reported until after period end. The Company believes that reasonable estimates can be made when recent and

consistent policy issuance information is available. Estimates are based on historical reporting patterns and other information obtained about agencies, as well as

current trends in direct operations and in the title industry. In this accrual, future transactions are not being estimated. The Company is estimating revenues on

policies that have already been issued by agencies but not yet reported to or received by the Company. The Company has consistently followed the same basic

method of estimating unreported policy revenues for more than 10 years. The Company assumes and cedes reinsurance with various title companies, on an

individual basis, utilizing standard facultative agreements provided by the American Land Title Association and also has in effect several excess reinsurance

agreements wherein the Company assumes or may cede liability automatically under the terms of the treaty. In addition, the Company has in place an excess of

loss ceded reinsurance agreement which is on a claims made basis. Statutory Premium Reserves (SPR) are established to protect title insurance policyholders in

the event of insolvency or dissolution of a title insurer. SPR is computed based on Article 2551.253 of the Texas Insurance Code. Expenses incurred in

connection with issuing the policies, including the establishment of statutory premium reserves, are charged to operations as an expense in the current period.

The Company owns 100% of Stewart Title Insurance Company, a title insurance company, which is valued based on SSAP 97, Section 8(b)(i) of the NAIC

Accounting Practices and Procedures Manual .

The Company owns 100% of the common stock of Stewart Title Company, a non-insurance company. This stock is valued on the audited GAAP equity

basis as described in the NAIC Accounting Practices and Procedures Manual SSAP 97, section 8(b)(iii).

The Company owns 100% of Stewart Title Limited (UK) and 99.99% of Stewart Title Guaranty de Mexico, S.A., which are foreign title insurance

companies. These investments are valued based on SSAP 97, Section 8(b)(iv) of the NAIC Accounting Practices and Procedures Manual .

The Company owns 10.16% of Title Reinsurance Company, a reinsurance company that provides primary liability insurance, which is valued based on

SSAP 97, Section 8(b)i.

Stewart Title Guaranty Company

..............................................................

Statement as of September 30, 2020 of the

NOTES TO FINANCIAL STATEMENTS

6

(9)

Derivatives - None

(10)

Anticipated investment income used as a factor in the premium deficiency calculation. - Not applicable

(11)

(12)

The Company has not modified its capitalization policy from the prior period.

2.

Accounting Changes and Corrections of Errors

A. There were no material changes in accounting principles.

B.

3.

Business Combinations and Goodwill - Not Applicable

4.

Discontinued Operations - Not Applicable

5.

Investments

A. Mortgage Loans

(1)

(2)

(3)

Current Prior

Year Year

(4)

29,035$ -

1,122$ -

(5)

- -

(6)

- -

(7)

- -

(8)

- -

(9)

- -

(10)

- -

(11)

(12) Recognizing interest income on impaired loans - Not applicable

B. Debt Restructuring - Not applicable

C. Reverse Mortgages - Not applicable

D. Loan-Backed Securities - Not applicable

E. Dollar Repurchase Agreements and/or Securities Lending Transactions - Not applicable

F. Repurchase Agreements Transactions Accounted for as Secured Borrowing - Not applicable

G. Reverse Repurchase Agreements Transactions Accounted for as Secured Borrowing - Not applicable

H. Repurchase Agreements Transactions Accounted for as a Sale - Not applicable

I. Reverse Repurchase Agreements Transactions Accounted for as a Sale - Not applicable

J. Real Estate

(1)

Impairment Loss - Not applicable

.

(2)

a.

The statutory premium reserve is based on Section 2551.253 of the Texas Insurance Code, which was amended with an effective date of September 1,

2005. The amended Section 2551.253 requires the Company to reserve an amount equal to 18.5 cents per $1,000 of net retained liability assumed for

policies written on or after January 1, 2005. Previously, the required reserve was 6.2% of total charges for title policies written or assumed for calendar

year 1997 and 25 cents per $1,000 in net retained liability assumed on or after January 1, 1998 and before January 1, 2005.

The reserve is subsequently reduced by 26% of the addition in the first year succeeding the year of addition, 20% in the second year, 10% in the third year,

9% in the fourth year, 5% in the fifth and sixth years, 3% in the seventh through the ninth year, 2% in the tenth through fourteenth year and 1% in the last

six years.

At December 31, 2019 the total of the Company's known claims reserves and statutory premium reserve was $108.0 million greater than the loss reserve as

stated in Schedule P, column 24, on which the Company's appointed actuary has provided a loss reserve opinion.

Allowance for credit losses - Not applicable

Unpaid losses and loss adjustment expenses include an amount for known claims and a formula-driven statutory premium reserve. Known claim reserves

consist of a reserve for payment of the loss and costs of defense of the insured and other costs expected to be paid to other parties in the defense,

settlement, or processing of the claim under the terms of the title insurance policy for each specific known claim.

The Company prepares its statutory financial statements in conformity with accounting practices prescribed or permitted by the State of Texas. The State of

Texas requires that insurance companies domiciled in the State of Texas prepare their statutory basis financial statements in accordance with the NAIC

Accounting Practices and Procedures Manual , subject to any deviations prescribed or permitted by the State of Texas insurance commissioner.

Accounting changes adopted to conform to the provisions of the NAIC Accounting Practices and Procedures Manual are reported as changes in accounting

principles. The cumulative effect of changes in accounting principles is reported as an adjustment to unassigned funds (surplus) in the period of the change in

accounting principle. The cumulative effect is the difference between the amount of capital and surplus at the beginning of the year and the amount of capital

and surplus that would have been reported at that date if the new accounting principles had been applied retroactively for all prior periods. There were no

material changes in accounting principles in 2019 or 2018.

None

The maximum percentage of any one loan to the value of security at the time of the loan, exclusive of insured or guaranteed or purchase money mortgages

was 110%.

The maximum and minimum lending rates for real estate loans are 7.75% and 4.0%.

At September 30, 2020, the Company held mortgage loans with interest more than 180 days past due with a recorded

investment excluding accrued interest of:

Taxes, assessments and any amounts advances and not included in the mortgage loan total.

Amount of interest income recognized on a cash basis during the period the loans were impaired.

Average recorded investment in impaired loans.

Interest income recognized during the period on loans impaired.

Impaired mortgage loans without an allowance for credit losses.

Current year impaired loans with related allowance for credit losses.

Total interest due on mortgages with interest more than 180 days past due equals:

Sold or Held for Sale

In the ordinary course of business, the Company occasionally acquires real estate in settlement of claims. It is not the Company's

intention to hold these properties for investment or administrative purposes, but rather to dispose of them as market conditions

warrant. These properties are disclosed on Schedule A, Part 1 of the Annual Statement.

Stewart Title Guaranty Company

..............................................................

Statement as of September 30, 2020 of the

NOTES TO FINANCIAL STATEMENTS

6.1

(3)

Changes to plans for sale - Not applicable

(4)

Retail land sales - Not applicable

(5)

Participating mortgage loan features - Not applicable

K. Low-Income Housing Tax Credits (LIHTC) - Not applicable

L. Restricted Assets - Refer to General Interrogatories Part 2; No 9.2.

M. Working Capital Finance Investments - Not applicable

N. Offsetting and Netting of Assets and Liabilities - Not applicable

O. 5GI Securities - Not applicable

P. Short Sales - Not applicable

Q. Prepayment Penalty and Acceleration fees:

General Account

1 Number of CUSIPs

2

2 Aggregate Amount of Investment Income 127,523$

6.

Joint Ventures, Partnerships and Limited Liability Companies

A.

B.

7.

Investment Income

A.

B.

The total amount excluded at September 30, 2020 was $73,384.

8.

Derivative Instruments

- None

9.

Income Taxes

A.

9/30/2020 12/31/2019

(1)

Ordinary Capital Total Ordinary Capital Total

(a) Total gross deferred tax assets

30,655,374 3,518,520 34,173,894 23,887,999 2,831,702 26,719,701

(b)

(3,527,031) 0 (3,527,031) (3,088,039) 0 (3,088,039)

(c) Adjusted gross deferred tax assets

27,128,343 3,518,520 30,646,863 20,799,960 2,831,702 23,631,662

(d) Deferred tax assets nonadmitted

(2,546,020) (3,518,520) (6,064,540) (1,177,844) (2,831,702) (4,009,546)

(e)

24,582,323 0 24,582,323 19,622,116 0 19,622,116

(f) Deferred tax liabilities

(13,419,259) (331,317) (13,750,576) (6,207,588) (1,953,905) (8,161,493)

(g)

11,163,064 (331,317) 10,831,747 13,414,528 (1,953,905) 11,460,623

Change Change Change

Ordinary Capital Total

(a) Total gross deferred tax assets

6,767,375 686,818 7,454,193

(b)

(438,992) 0 (438,992)

(c)

6,328,383 686,818 7,015,201

(d)

(1,368,176) (686,818) (2,054,994)

(e)

4,960,207 0 4,960,207

(f)

(7,211,671) 1,622,588 (5,589,083)

(g)

(2,251,464) 1,622,588 (628,876)

The Company has no investments in Joint Ventures, Partnerships or Limited Liability Companies that exceeds 10% of its admitted assets.

The Company did not recognize any impairment write down for its investments in Joint Ventures, Partnerships and Limited Liability Companies during the

statement period.

All investment income due and accrued with amounts that are over 90 days past due with the exception of mortgages loans in default and all interest accrued on

unsecured notes and certificates of deposit are excluded from surplus.

Statutory Valuation Allowance

Adjustments

Subtotal net admitted deferred tax

Components of the net deferred tax asset

or net deferred tax liability

Net admitted deferred tax assets (net

deferred tax liabilities)

Statutory Valuation Allowance

Adjustments

Adjusted gross deferred tax assets

Deferred tax assets nonadmitted

Subtotal net admitted deferred tax

Deferred tax liabilities

Net admitted deferred tax assets (net

deferred tax liabilities)

Stewart Title Guaranty Company

..............................................................

Statement as of September 30, 2020 of the

NOTES TO FINANCIAL STATEMENTS

6.2

9/30/2020 12/31/2019

(2)

Ordinary Capital Total Ordinary Capital Total

(a)

17,109,028 0 17,109,028 9,332,454 0 9,332,454

(b)

(6,277,280) 0 (6,277,280) 2,128,169 0 2,128,169

(c)

97,222,775 0 97,222,775 90,825,756 0 90,825,756

(d)

(6,277,280) 0 (6,277,280) 2,128,169 0 2,128,169

(e)

13,750,575 0 13,750,575 8,161,493 0 8,161,493

(f)

24,582,323 0 24,582,323 19,622,116 0 19,622,116

Change Capital Change

Ordinary Capital Total

(a)

7,776,574 0 7,776,574

(b)

(8,405,449) 0 (8,405,449)

(c)

6,397,019 0 6,397,019

(d)

(8,405,449) 0 (8,405,449)

(e)

5,589,082 0 5,589,082

(f)

4,960,207 0 4,960,207

(3)

Disclosure of ratios used for threshold limitation for ¶11.b.above

9/30/2020 12/31/2019 Change

(a)

15% 15% 0%

(b)

5% 4% 1%

(c)

648,151,831 605,505,039 42,646,792

(4)

9/30/2020 12/31/2019

Ordinary Capital Total Ordinary Capital Total

Percentage Percentage Percentage Percentage Percentage Percentage

(a)

N/A N/A 0 N/A N/A 0

(b)

N/A N/A 0 N/A N/A 0

Change

Ordinary Capital Total

Percentage

Percentage Percentage

(a)

N/A N/A 0

(b)

N/A N/A 0

(c)

Yes No

X

Federal income taxes paid in prior years

recoverable through loss carrybacks

admitted under ¶11.a.

Adjusted gross DTAs expected to be

realized under ¶11.b.i.

Adjusted gross DTAs allowed per

limitation threshold under ¶11.b.ii.

Adjusted gross DTAs admitted under

¶11.b. (lessor of ¶11.b.i. or¶11.b.ii.

above)

Admission Calculation Components

under ¶11.a.-¶11.c.

Adjusted gross DTAs offset by gross

DTL under ¶11.c.

Net admitted deferred tax

asset/liability under ¶11.a. - ¶11.c.

Ratio percentage used to determine recovery period and threshold limitation amount in ¶11.b.

above.

Other Non-RBC reporting Entities Adj Gross DTA/Adj Capital & Surplus%

Amount of adjusted capital and surplus used to determine recovery period threshold limitation

in ¶11.b. above

Impact of Tax Planning Strategies On

the Determination of: Section 4. Is not

applicable

Adjusted gross DTAs offset by gross

DTLs under ¶11.c.

Net admitted deferred tax

asset/liability under ¶11.a.- ¶11.c.

Federal income taxes paid in prior years

recoverable through loss carrybacks

admitted under ¶11.a.

Adjusted gross DTAs expected to be

realized under ¶11.b.i.

Adjusted gross DTAs allowed per

limitation threshold under ¶11.b.ii.

Adjusted gross DTAs admitted under

¶11.b. (lessor of ¶11.b.i. or¶11.b.ii.

above)

Adjusted Deferred Tax Assets

(Percentage of Total Adjusted Gross

Deferred Tax Assets)

Net Admitted Adjusted Gross Deferred

Tax Assets (Percentage of Total Net

Admitted Adjusted Gross Deferred Tax

Assets)

Adjusted Deferred Tax Assets

(Percentage of Total Adjusted Gross

Deferred Tax Assets)

Net admitted Adjusted Gross Deferred

Tax Assets (Percentage of Total Net

Admitted Adjusted Gross Deferred Tax

Assets)

Do the Company's tax-planning

strategies include reinsurance?

Stewart Title Guaranty Company

..............................................................

Statement as of September 30, 2020 of the

NOTES TO FINANCIAL STATEMENTS

6.3

B.

Unrecognized Deferred Tax Liabilities:

(1)

(2)

(3)

(4)

C.

The significant components of income taxes incurred and the changes in DTAs and DTLs include:

(1) Current tax expenses incurred:

9/30/2020 12/31/2019 Change

(a) Current year federal tax expense(benefit)- ordinary income 12,973,554 7,473,170 5,500,384

(b) Current year foreign tax expense(benefit)- ordinary income 6,022,301 4,843,559 1,178,742

(c) Subtotal 18,995,855 12,316,729 6,679,126

(d) Current year tax expense(benefit)- net realized capital gains(losses) (3,015) 618,440 (621,455)

(e) Change in estimate of income taxes recoverable 0 0 0

(f) True-up current taxes (1,332,664) 1,512,535 (2,845,199)

(g) Federal and foreign income taxes incurred 17,660,176 14,447,704 3,212,472

(2) Deferred income tax assets and liabilities consist of the following major components

Deferred tax assets: 9/30/2020 12/31/2019 Change

Ordinary

(a)

Discounting Statutory Premium Reserve

14,407,135 14,408,525 (1,390)

(b) Discounting Loss Reserve 162,568 185,307 (22,739)

(c) Fixed Assets 0 464,372 (464,372)

(d) Canadian Reserves 0 0 0

(e) Litigation Reserves 99,066 274,362 (175,296)

(f) Bonus Accrual 594,082 937,204 (343,122)

(g) Foreign Tax Credit Carryforward 3,527,031 3,088,039 438,992

(h) Nonadmitted Assets 2,294,506 1,829,535 464,971

(i) Other Accruals 150,077 408,541 (258,464)

(j) Deferred Rent 186,163 203,768 (17,605)

(k) U.S. Deferred Tax Offset to Canadian Tax Liability 8,095,112 730,815 7,364,297

(l) Capitalized Expenses 262,271 1,147,530 (885,259)

(m)

Other 877,364 210,000 667,364

(n) Subtotal 30,655,375 23,887,999 6,767,376

(o) Statutory Valuation Allowance Adjustment (3,527,031) (3,088,039) (438,992)

(p) Nonadmitted ordinary deferred tax assets (2,546,020) (1,177,844) (1,368,176)

(q) Admitted ordinary deferred tax assets 24,582,324 19,622,116 4,960,208

Capital

(r) Unrealized Capital Gains 3,518,520 2,831,702 686,818

(s) Subtotal 3,518,520 2,831,702 686,818

(t) Nonadmitted capital deferred tax assets (3,518,520) (2,831,702) (686,818)

(u) Admitted capital deferred tax assets 0 0 0

(v) Admitted deferred tax assets 24,582,324 19,622,116 4,960,208

(3) Deferred tax liabilities:

9/30/2020 12/31/2019 Change

Ordinary

(a) Canadian Reserves (10,257,663) (928,135) (9,329,528)

(b) Retention Payments (7,231) (7,000) (231)

(c) Bonus Accrual 0 0 0

(d) Intangibles (97,136) (97,136) 0

(e) U.S. Deferred Tax Offset to Canadian Deferred Tax Asset 0 0 0

(f) TCJA Adjustment - SPR discounting (2,613,841) (5,175,317) 2,561,476

(g) Fixed Assets (443,388)

(h) Subtotal (13,419,259) (6,207,588) (6,768,283)

Capital

(i) Unrealized Capital Gains 0 (1,367,067) 1,367,067

(j) Investments (331,317) (586,838) 255,521

(k) Subtotal (331,317) (1,953,905) 1,622,588

(l) Deferred tax liabilities (13,750,576) (8,161,493) (5,145,695)

(4)

Net deferred tax assets (liabilities)

10,831,748 11,460,623 (185,487)

9/30/2020 12/31/2019 Change

Total deferred tax assets 34,173,894 26,719,701 7,454,193

Total deferred tax liabilities (13,750,575) (8,161,493) (5,589,082)

Net deferred tax assets/liabilities 20,423,319 18,558,208 1,865,111

Statutory valuation allowance adjustment (3,527,031) (3,088,039) (438,992)

Net deferred tax assets/liabilities after SVA 16,896,288 15,470,169 1,426,119

Tax effect of unrealized gains(losses) 0 0 0

Statutory valuation allowance adjustment allocated to unrealized 0 0 0

Net deferred tax assets( liabilities) 16,896,288 15,470,169 1,426,119

There is no unrecognized DTL for temporary differences in investments in foreign subsidiaries and corporate JV's that are permanent in duration.

The amount of the DTL for temporary differences other than those in item (3) above that is not recognized is -0-.

The cumulative amount of each type of temporary difference is -0-.

There are no temporary differences for which deferred tax liabilities are not recognized.

The change in the net deferred income taxes is comprised of the following (this analysis is exclusive of the nonadmitted DTAs as the Change in

Nonadmitted Assets is reported separately from the Charge in Net Deferred Income Taxes in the Surplus section of the Annual Statement).

Stewart Title Guaranty Company

..............................................................

Statement as of September 30, 2020 of the

NOTES TO FINANCIAL STATEMENTS

6.4

D.

Reconciliation of federal income tax rate to actual effective rate:

9/30/2020 12/31/2019

Income before taxes 87,201,473 52,783,765

Effective tax rate 21% 21%

Tax Effect 18,312,309 11,084,591

Dividends received deduction (2,167,807) (87,709)

Nondeductible expenses 1,160,962 1,459,335

Tax-exempt interest income (81,286) (118,398)

Foreign income tax expense 6,159,662 4,843,559

Return-to-provision and other true up adjustments (1,569,242) 975,513

Currency translation adjustment (657,872) 1,488,854

U.S. foreign tax credit (4,425,877) (3,231,974)

Change in deferred taxes on non-admitted assets (464,971) 939,287

Other (31,821) (147,760)

Total 16,234,057 17,205,298

Federal and foreign income taxes incurred 17,663,191 13,829,264

Tax on capital gains(losses) (3,015) 618,440

Change in net deferred taxes (1,426,119) 2,757,593

Total statutory taxes 16,234,057 17,205,298

E.

Carryforward recoverable taxes and IRC section 6603 deposits:

As of September 30, 2020, the Company has the following foreign tax credit carryforward available for tax purposes:

Origination Year

Expiration Year

Amount

2020

2030

1,733,785

2019

2029

620,286

2018

2028

1,609,783

Total 3,963,854

The amount of Federal income taxes incurred that are available for recoupment in the event of future losses is:

Ordinary Total

2020 12,833,178 12,833,178

2019 8,091,610 8,091,610

2018 3,198,880 3,198,880

Total 24,123,668 24,123,668

The aggregate amount of deposits admitted under Section 6603 of the Internal Revenue code is $0.

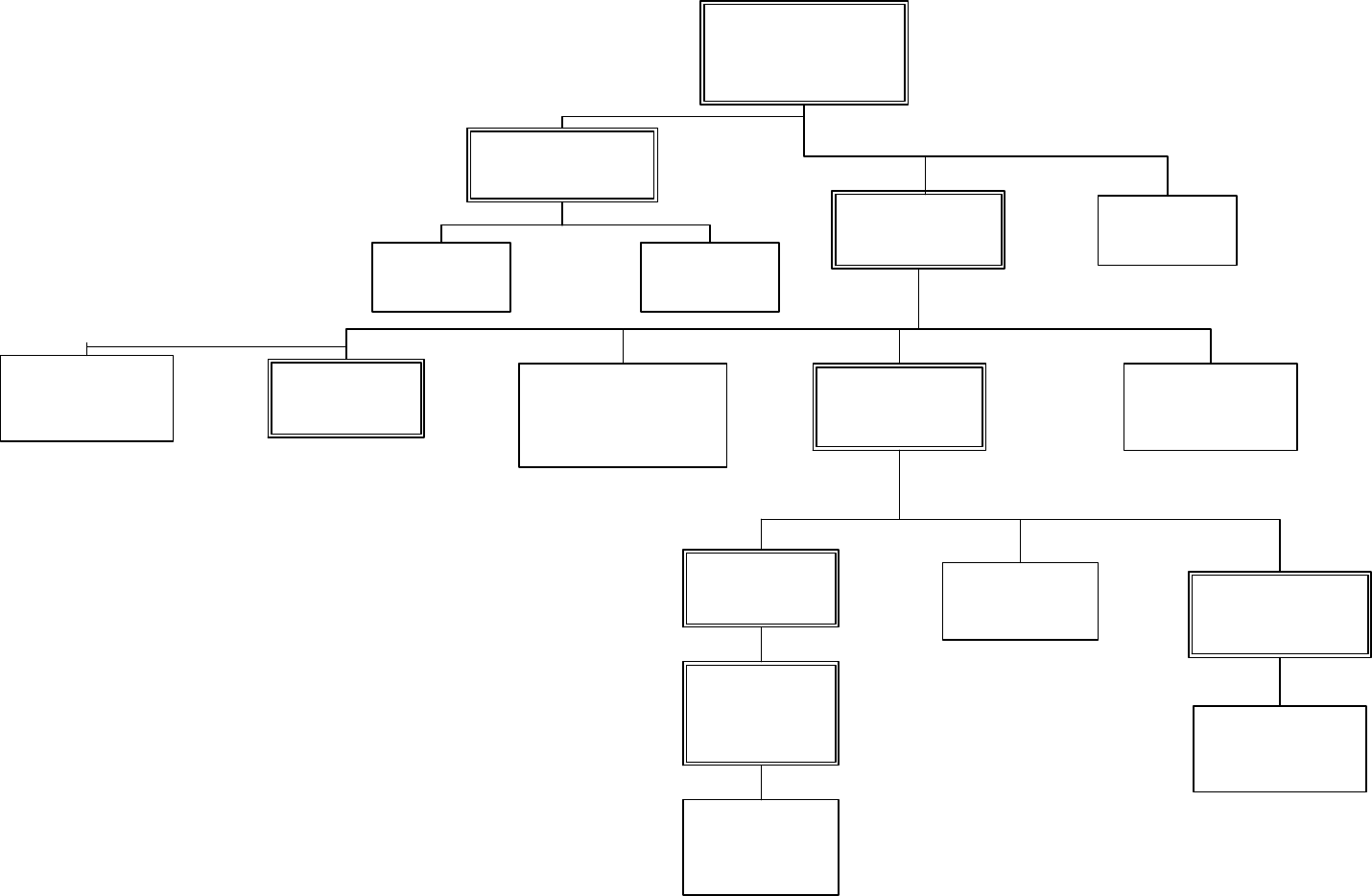

F. Consolidated federal income tax return:

Stewart Information Services Corporation

Stewart Title Company

Stewart Title of Utah, Inc.

Fulghum, Inc.

InterCity Capital Corporation

InterCity Escrow Services

PropertyInfo Corporation

Red River Title Services, Inc.

Stewart Title of Oklahoma, Inc.

Stewart Financial Services, Inc.

Stewart Lender Services, Inc.

Home Retention Services, Inc.

Stewart Title & Settlement Services, Inc.

Stewart Title of California, Inc.

Stewart Title of Lubbock, Inc.

Stewart Title of Maryland, Inc.

Stewart Title of the Coastal Bend, Inc.

Texarkana Title & Abstract Company, Inc.

Yankton Title Company

Asset Preservation, Inc.

Parked Properties NY, Inc.

Stewart Properties of Tampa, Inc.

Stewart Institutional Exchange Services LLC

Stewart Title & Trust of Phoenix

Stewart Title & Trust of Tucson

Landsafe Default, Inc.

Chadco Builders, Inc.

Brazos Insurance Company

SIES OS Holdings LLC

Stewart Title and Escrow, Inc.

API PA Holdings LLC

API NC Holdings I LLC

PPNY MS LLC

Parked OS LLC

API NR 1 LLC

API NR 2 LLC

API NC Holdings II LLC

API NR 3 LLC

API NR 4 LLC

Stewart Title Insurance Company

The provision for federal income taxes incurred is different from that which would be obtained by applying the statutory federal income tax rate to income

before income taxes. The significant items causing the difference are as follows:

Below is the list of names of the entities with whom the reporting entity's federal income tax return is consolidated for the current year:

0

0

0

Capital

Stewart Title Guaranty Company

..............................................................

Statement as of September 30, 2020 of the

NOTES TO FINANCIAL STATEMENTS

6.5

G. Federal or Foreign Income Tax Loss Contingencies

H. Repatriation Transition Tax (RTT)

The Company does not have any tax on untaxed foreign earnings of certain foreign subsidiaries.

I. Alternative Minimum Tax (AMT) Credit

The Company does not have AMT carryforward to recover.

10.

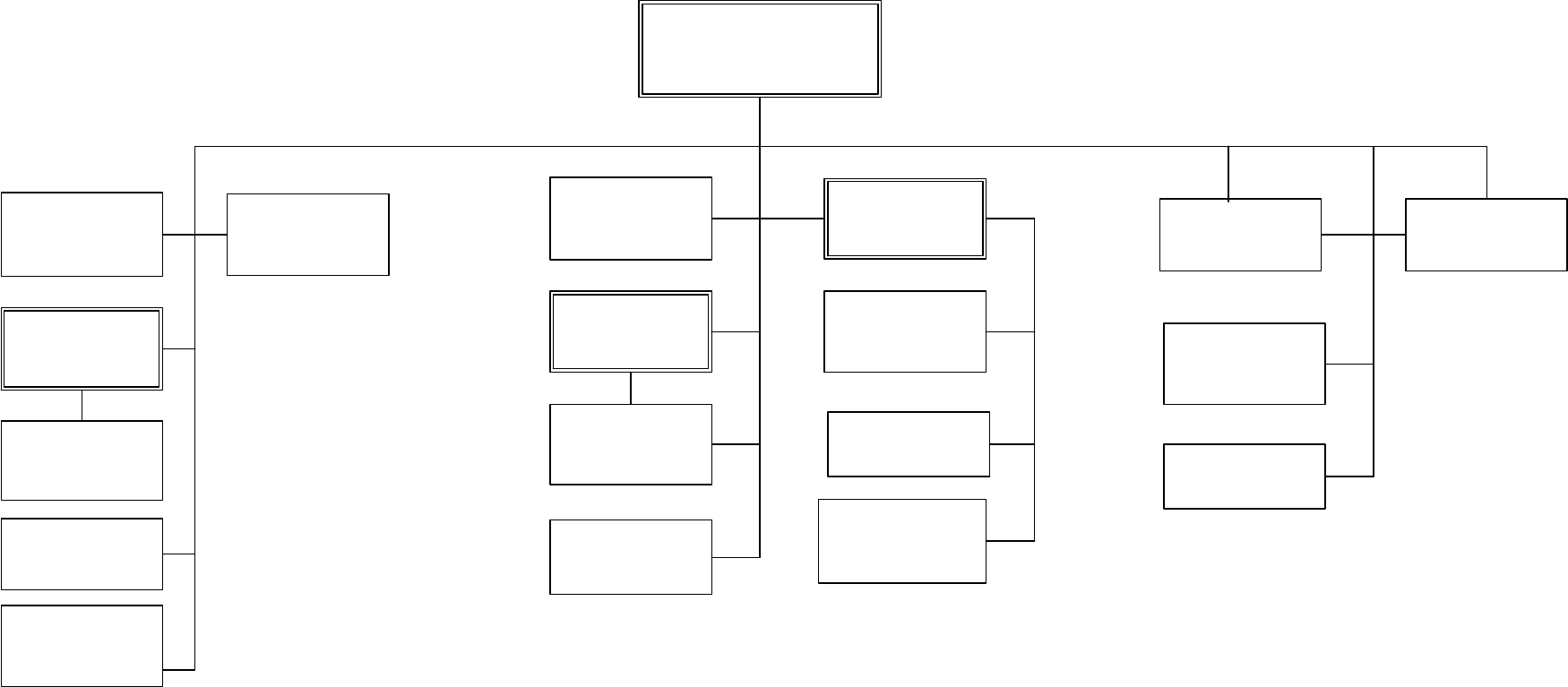

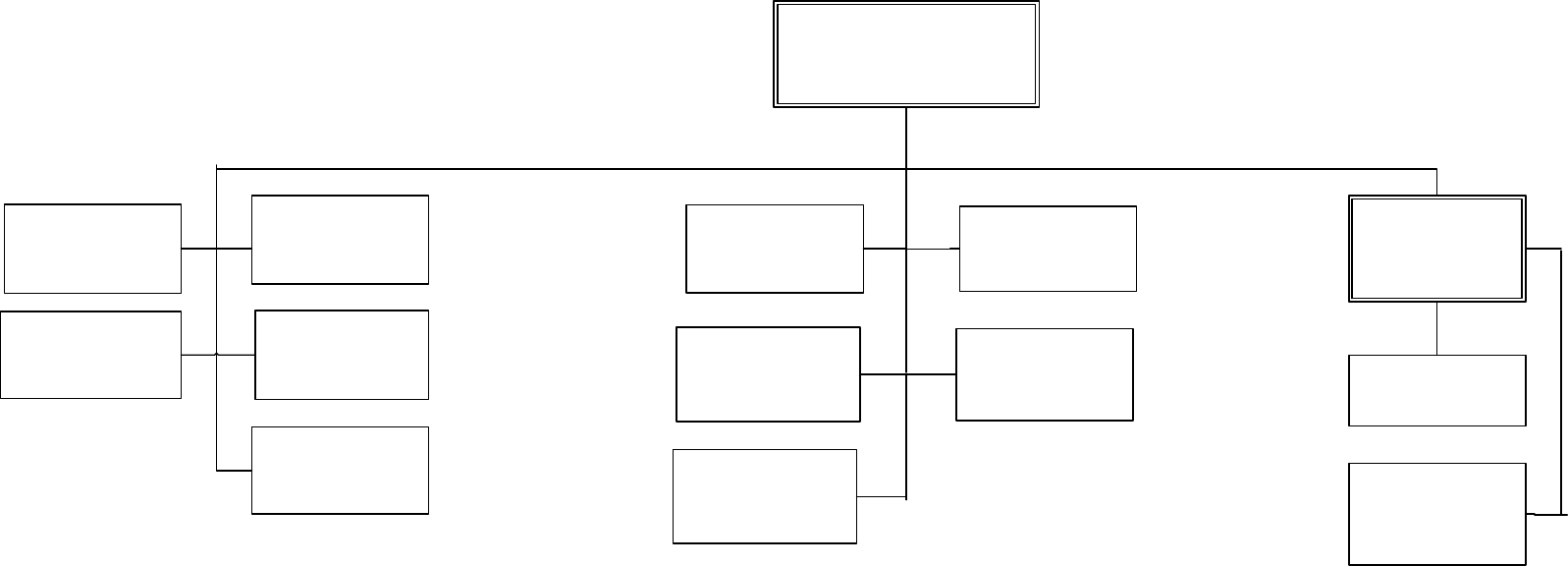

Information Concerning Parent, Subsidiaries and Affiliates

A.

B. & C.

-

D.

E. There are no guarantees or undertakings for the benefit of an affiliate or related party.

F.

The Company's Federal income tax return is consolidated with Stewart Information Services Corporation and subsidiaries (SISCO). The method of allocation is

detailed in the Eighth Restated Consolidated Federal Income Tax Return Settlement Agreement effective for the tax year 2011 and subsequent years. Such

Agreement was filed previously with the Texas Department of Insurance.

SISCO's (and therefore the Company's) Federal income tax returns open to examination are for calendar years 2016, 2017, 2018 and 2019. During July 2018,

SISCO received notification from the Internal Revenue Service that it's (and therefore the Company's) 2015 tax return was under examination. During February

2019, the IRS indicated it was closing the audit without any adjustments. The Company expects no material adjustments from any tax return examination.

The Company does not have any tax loss contingencies for which it is reasonably possible that the total liability will significantly increase within twelve months

of the reporting date.

During the nine months ended September 30, 2020, our parent, Stewart Information Services Corporation, made noncash capital contributions to us, which were

related to stock compensation. This resulted in a net increase to surplus in the amount of $2,986,861.

During the nine months ended September 30, 2020, the Company recorded noncash capital contributions to Stewart Title Company related to stock

compensation of $637,329. The Company also made net noncash capital contributions to Stewart Title Insurance Company in the amount of $65,534 related to

stock compensation.

In the first quarter of 2019, the Company advanced $10,000,000 to its wholly owned subsidiary, Stewart Title Company ("STC") under an unsecured line of

credit. The terms of the loan required payments of interest only on June 1st, September 1st, December 1st, at published LIBOR rates plus 2% on each of those

dates. During December 2019, the remaining unpaid total of $10,000,000 owed under the line was reclassified as a capital contribution to STC. There was no

outstanding balance or interest due on the line of credit at December 31, 2019.

The Company paid a common stock dividend of $30,000,000 to its parent company, Stewart Information Services Corporation, in the first quarter of 2020. The

Company did not pay a common stock dividend in 2019.

Amounts due from and amounts payable to related parties at September 30, 2020 are $15,943,144 and $967,141, respectively.

The Company has agreed to provide Stewart Information Services Corporation certain management and accounting services as described in the Cost Allocation

Agreement with Stewart Information Services Corporation dated January 1, 1974, as amended by Amendment No. 1, dated January 1, 1980, Amendment No. 2,

dated January 1, 1986, Amendment No. 3, dated January 1, 1991, Amendment No. 4, dated January 1, 1996, Amendment No. 5, dated January 1, 2001,

Amendment No.6, dated June 6, 2005 (HCS # 34302) and Amendment No. 7, dated September 8, 2010 (HCS # 38937).

The Company has entered into a service agreement with Stewart International Spolka Z Orgraniconza dated June 30, 2004. Such agreement was filed with the

Texas Insurance Department on May 1, 1998, under Holding Company Section # 33570.

The Company has entered into a service agreement with Stewart Lender Services covering issued title policies which require conversion from paper documents

to computer image for storage and retrieval. Such agreement was filed with the Texas Insurance Department on May 1, 1998, under Holding Company Section

# 28563, as amended by Amendment No. 2 under HCS # 32547, dated December 21, 2002, and Amendment No. 3, under HCS # 33616 dated July 24, 2004.

The Company has entered into a service agreement with First Data Systems, Inc. for a computer related services as described in the Service Agreement dated

April 13, 2004. Such agreement was filed with the Texas Insurance Department on April 16, 2004, under Holding Company Section # 33343. On September

17, 2007 the Texas Department of Insurance approved the name change from First Data Systems, Inc. to Property Info Corporation.

The Company has entered into a service agreement with Stewart Transactions Solutions, Inc. for a computer related services as described in the Service

Agreement dated March 12, 2004. Such agreement was filed with the Texas Insurance Department on April 16, 2004, under Holding Company Section #

33341. On September 17, 2007 the Texas Department of Insurance approved the name change from Stewart Transaction Solutions, Inc. to Property Info

Corporation.

The Company has entered into a hosted service agreement with Stewart Transactions Solutions, Inc. for a hosted tech related services as described in the Service

Agreement dated September 15, 2006. Such agreement was filed with the Texas Insurance Department on September 15, 2006, under Holding Company Section

# 35343. On September 17, 2007 the Texas Department of Insurance approved the name change from Stewart Transactions Solutions, Inc. to Property Info

Corporation.

The Company has agreed to provide Stewart Title Company certain management and accounting services as described in the Cost Allocation Agreement with

Stewart Title Company and subsidiaries dated October 29, 2013 (HCS #940066).

The Company has entered into a sublease agreement with Western American Title Services, LLC. Such agreement was filed with the Texas Insurance

Department on November 8, 2011, under Holding Company Section #40132.

The Company has entered into a service agreement with Landata Systems, Inc. for certain computer and software services as described in the Service Agreement

dated January 1, 2000 which replaced the original service agreement, dated February 16, 1978. Such Agreement was filed with the Texas Insurance Department

on February 3, 2000, under Holding Company Section # 30240. The Service Agreement was further amended effective March 12, 2004, under HCS # 33340,

and effective October 1, 2004, under HCS # 33907. On September 17, 2007 the Texas Department of Insurance approved the name change from Landata

Systems, Inc. to Property Info Corporation.

The Company has entered into a service agreement with Ultima Corporation for a certain computer and software services as described in the Service Agreement

dated April 16, 2004. Such agreement was filed with the Texas Insurance Department on April 19, 2004, under Holding Company Section # 33342. On

September 17, 2007 the Texas Department of Insurance approved the name change from Ultima Corporation to Property Info Corporation.

Stewart Title Guaranty Company

..............................................................

Statement as of September 30, 2020 of the

NOTES TO FINANCIAL STATEMENTS

6.6

G.

H.

I.

J.

The Company has entered into a service agreement with REI Data, Inc. for a converting title policies from paper documents into computer image as described in

the Service Agreement dated July 13, 2005. Such agreement was filed with the Texas Insurance Department on July 15, 2005, under Holding Company Section

# 34337. On September 17, 2007 the Texas Department of Insurance approved the name change from REI Data, Inc. to Property Info Corporation.

The Company has entered into a service agreement with Property Info Corporation for computer related services as described in the agreement dated August 27,

2007. Such agreement was filed with the Texas Insurance Department on September 1, 2007, under Holding Company Section # 36180.

The Company has entered into an agreement with Property Info Corporation for title search services in Florida dated July 14, 2011. Such agreement was filed

with the Texas Insurance Department on August 4, 2011, under Holding Company Section # 39880.

The Company has entered into a title plant agreement with Property Info Corporation dated August 27, 2010. Such agreement was approved with the Texas

Insurance Department on September 28, 2010, under Holding Company Section # 38962.

The Company has entered into a sublease agreement with The Guarantee Title Company, LLC. Such agreement was filed with the Texas Insurance Department

on November 18, 2010, under Holding Company Section # 39234.

The Company has entered into a title plant posting agreement with Property Info Corporation dated February 3, 2011. Such agreement was filed with the Texas

Insurance Department on February 7, 2011, under Holding Company Section # 39430.

The Company has entered into an account reconciliation services agreement with Stewart Financial Services dated June 20, 2011. Such agreement was filed

with the Texas Insurance Department on August 4, 2011, under Holding Company Section # 39821.

The Company has entered into a service agreement with REI Data, Inc. for a computer related services as described in the Service Agreement dated May 6,

2005. Such agreement was filed with the Texas Insurance Department on May 11, 2005, under Holding Company Section # 34216, as amended by Amendment

No. 1 and 2, dated August 2, 2006 (HCS # 35205). On September 17, 2007 the Texas Department of Insurance approved the name change from REI Data, Inc.

to Property Info Corporation.

The Company has entered into a service agreement with REI Data, Inc. for a subscription service as described in the Service Agreement dated October 4, 2006.

Such agreement was filed with the Texas Insurance Department on October 10, 2006, under Holding Company Section # 35368 as amended February 22, 2008

under Holding Company Section # 36551. On September 17, 2007 the Texas Department of Insurance approved the name change from REI Data, Inc. to

Property Info Corporation.

The Company has entered into an agreement with Stewart Title Limited, a United Kingdom insurance corporation, as described in the Net Worth Maintenance

Agreement dated March 13, 2006. Such agreement was filed with the Texas Insurance Department on July 19, 2006, under Holding Company Section # 35118.

The Company has entered into a sublease agreement with Stewart Lender Services, Inc. Such agreement was filed with the Texas Insurance Department on April

4, 2007, under Holding Company Section # 35818, as amended by Amendment No. 1 dated July 9, 2009 under Holding Company Section # 37726.

The Company has entered into a shared service agreement with Stewart Lender Services, Inc. Such agreement was filed with the Texas Insurance Department on

April 21, 2010, under Holding Company Section # 38524, dated January 28, 2010, as amended by Amendment No. 1 dated December 15, 2010 under Holding

Company Section # 39311.

The Company has entered into a title plant conveyance agreement and service agreement with Property Info Corporation for computer related services and sale

of copies of back title plants in Bexar County, Texas as described in the agreement dated February 12, 2008. Such agreement was filed with the Texas Insurance

Department on February 28, 2008, under Holding Company Section # 36550.

The Company has entered into a sublease agreement with Western American Title Service, LLC dated January 28, 2016. Such agreement was filed with the

Texas Insurance Department on January 13, 2016 under Holding Company Section #991407.

All outstanding shares of the Company are owned by Stewart Information Services Corporation, an insurance holding company, domiciled in the State of

Delaware.

The Company owns no shares of stock of its ultimate parent company.