Redundancy and

Covid-19 Related Lay-off

Payment Schemes on Welfare

Partners

Employer and Employer

Representative Guide

12.10.2023

Table of Contents

1.

Redundancy and Covid-19 Related Lay-off Payment Schemes overview. ....................... 3

2.

Application process overview .......................................................................................... 5

3.

Accessing Welfare Partners ............................................................................................7

4.

Accessing the Redundancy and Covid-19 Related Lay-off Payment Schemes service 12

5.

Creating an Employer Profile .......................................................................................... 15

5A: Create an Employer Profile (Employer) ................................................................... 16

Step 1: Employer details, Employer Contact Details ....................................................... 17

Step 2: Contact, Scheme details .................................................................................... 18

Step 3: Transfer of Undertakings, Declaration and Register ........................................... 19

5B: Create and Employer Profile (Employer Representative) ....................................... 21

Step 1 of 3 - Employer Representative role and employer’s PAYE number ..................... 21

Step 2 of 3 - Employer details. ........................................................................................ 23

Step 3 of 3 - Employer Representative details ................................................................ 27

6.

Submitting employer documents ..................................................................................... 31

Required documents ...................................................................................................... 32

Other documents (optional) ............................................................................................ 34

7.

Creating a Redundancy Payments Scheme application ................................................... 35

Step 1: Employee PPS number ..................................................................................... 37

Step 2: Employee details ............................................................................................... 37

Step 3: Application details .............................................................................................. 41

Step 4: Employee documents - Employee Declaration ................................................... 45

Step 4: Employee documents - Uploading employee documents ................................... 48

Application summary .................................................................................................... 50

8.

Creating a Covid-19 Related Lay-off Payments Scheme application. ............................. 52

Step 1: Employee PPS number .................................................................................... 54

Step 2: Employee details .............................................................................................. 54

Step 3: Application details .............................................................................................. 59

Step 4: Employee documents - Employee Declaration ................................................... 61

Step 4: Employee documents - Uploading employee documents ................................... 63

Application summary ...................................................................................................... 65

9.

Employee applications .................................................................................................... 67

10.

Editing an Employer Profile............................................................................................. 70

11.

Employer list .................................................................................................................... 73

Appendix A – Checklist of required information ................................................................... 76

Appendix B - Employee Declaration samples .................................................................... 78

Page 2

Page 3

Section 01

Redundancy and Covid-19

Related Lay-off Payment

Schemes overview

1. Redundancy and Covid-19 Related Lay-off

Payment Schemes overview

Redundancy Payments Scheme

The purpose of the Redundancy Payments Scheme is to ensure that

eligible employees, who have lost their employment by reason of

redundancy, receive their statutory redundancy if their employer is

unable to pay.

It is the responsibility of the employer to make statutory redundancy

payments to employees. If the employer has paid or is able to pay

their employees’ statutory redundancy payments, they should not

apply for the Redundancy Payments Scheme.

All payments made to employees through the Redundancy Payments

Scheme become a debt against the employer, which the Department

will seek to recover at a later stage.

Covid-19 Related Lay-off Payment Scheme

The Covid-19 Related Lay-off Payment Scheme is a once off, lump

sum payment for employees who have been made redundant; or are

made redundant and have lost the opportunity to build reckonable

service due to temporary lay-offs caused by the COVID-19 restrictions.

The employer will not be liable for a debt for payments made under

the Covid-19 Related Lay-off Payment Scheme.

Further details can be found on gov.ie at Redundancy Payments

Scheme and Covid-19 Related Lay-off Payment Scheme.

Contact information

If you encounter an unexpected error message at any stage, contact

the section directly:

• Email:

redundancypayments@welfare.ie

• Telephone: 0818 11 11 12 (option 4)

Page 4

Section 02

Application process overview

2. Application process overview

To submit an application for the Redundancy and Covid-19 Related

Lay-off Payments Schemes the main steps are:

Employer information

• Log in to Welfare Partners using a valid sub cert, which is

generated on ROS.ie.

• Enter employer information and register an ‘Employer Profile’ for a

company you’ve been appointed to. A notification will issue when

this information has been registered

• Upload and submit employer documents on the ‘Employer

Documents’ dashboard. A statement of affairs will always be a

required document for the Redundancy Payment Scheme. It is not

required for the Covid-19 Related Lay-off Payment Scheme.

• Upload and submit documentation in relation to the company’s

liquidation and your appointment, such as forms E2, E8, G2 or a

High Court Order.

Employee information

• Add a ‘New application’ on the ‘Employee Applications’ dashboard

to create an application for an employee.

• Generate and download a PDF summary of the application and

send it to the employee.

• Once the employee has confirmed details of the claim, upload the

confirmation.

• Review the application.

• Press ‘Submit’ and the application will be sent to the DSP.

Page 6

Section 03

Accessing Welfare Partners

Page 9

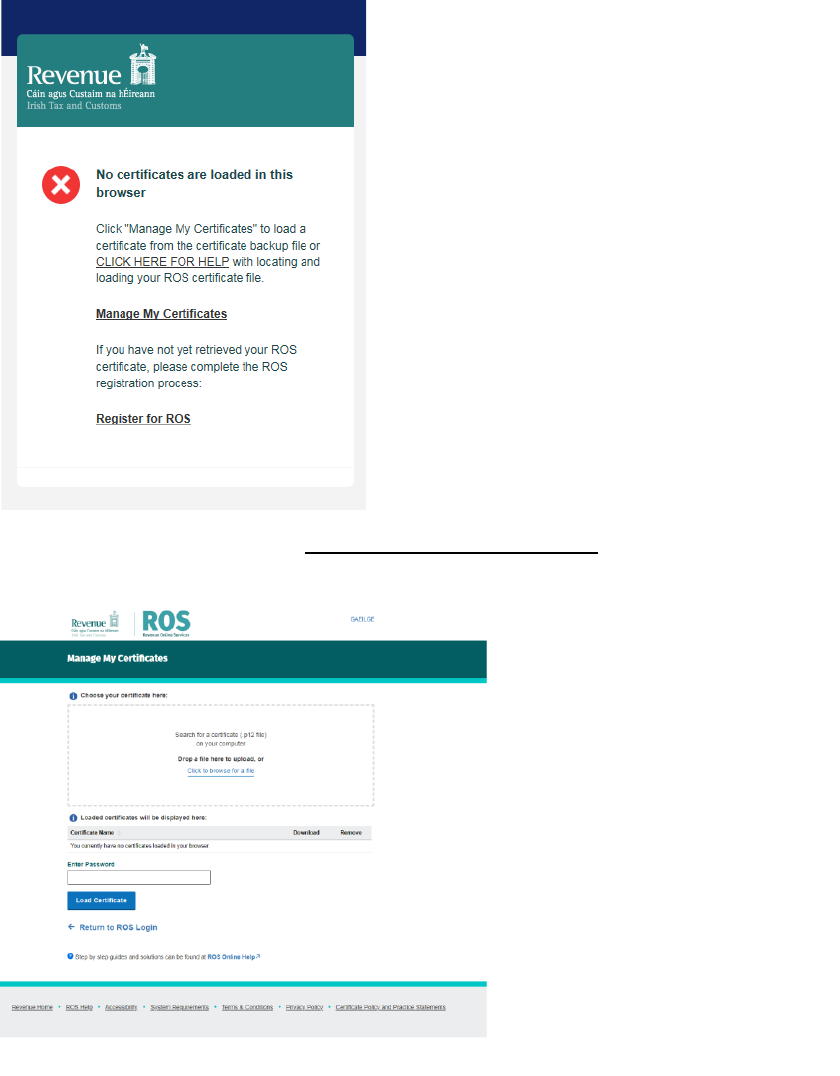

3.2

Installing a ROS DSP sub-certificate

1. If this is the first time you are attempting to log on to Welfare

Partners, you may be presented with the following screen and error

message.

(If you do have a certificate loaded into your browser, proceed to

step 3.3)

2. If this happens, click on ‘Manage My Certificates’ and the following

screen will open:

3. Find and select the ROS DSP sub-cert that you have saved to your

PC by first clicking on the ‘Browse’ button in the ‘Choose

Page 10

Certificate’ field.

4. When you have selected the ROS DSP sub-cert, you must enter

the password for that cert.

5. When you have selected the correct cert and entered the

password, click on ‘Load Certificate’. This loads the certificate to

your browser for future use.

6. Select ‘Return to Login’, and you’ll be brought to the next step.

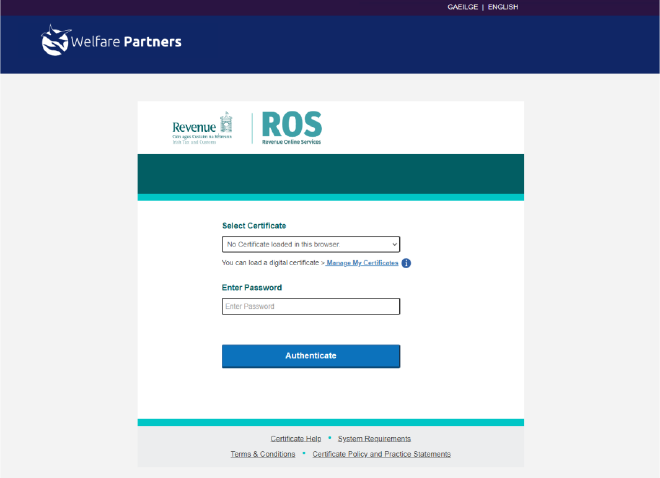

3.3

Log In with a ROS DSP sub-certificate

1. You’ll be presented with the following screen:

2. Ensure the correct certificate is selected in the ‘Select Certificate’

dropdown.

3. Enter the certificate password, and click ‘Authenticate’.

4. If this is the first time you are logging on to Welfare Partners with

this ROS DSP Sub-cert, you will be presented with the following

screen:

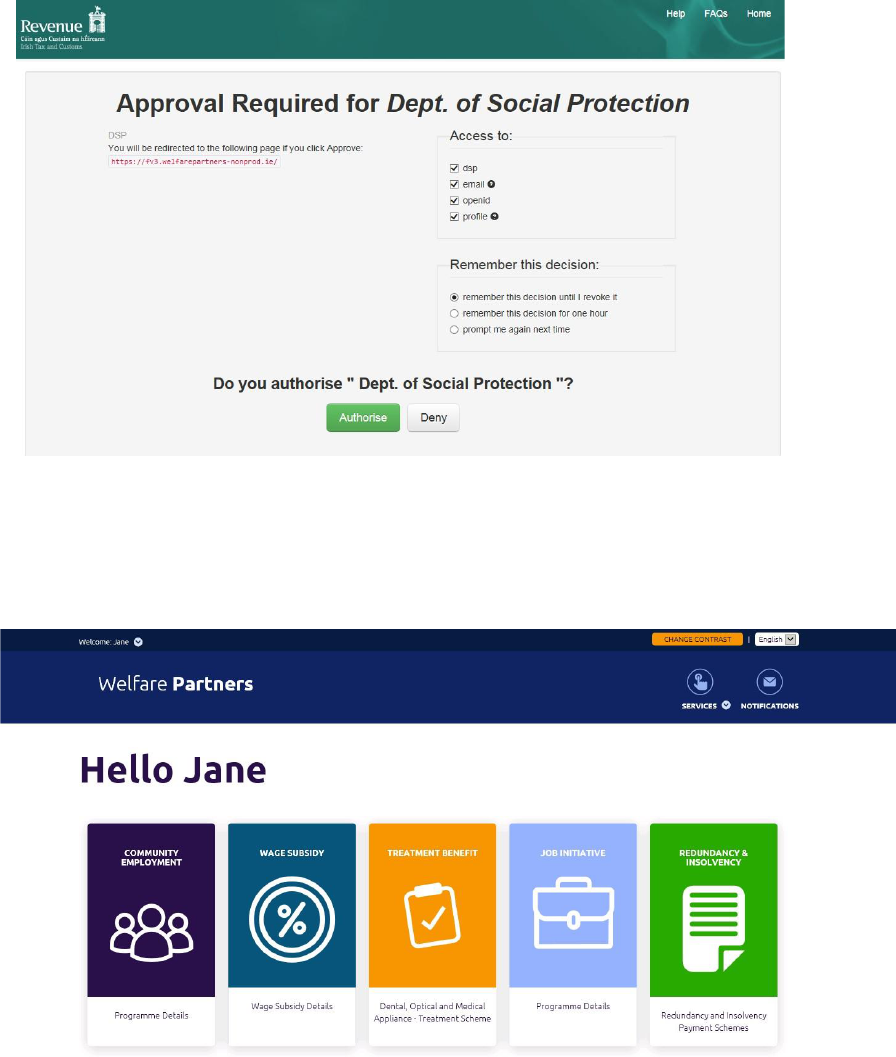

Page 11

5. You should click on ‘Authorise’ without changing any options.

6. You should now have access to the Welfare Partners site, and be

presented with the following screen:

Page 7

Section 04

Accessing the Redundancy

and Covid-19 Related Lay-

off Payment Schemes

service

Page 13

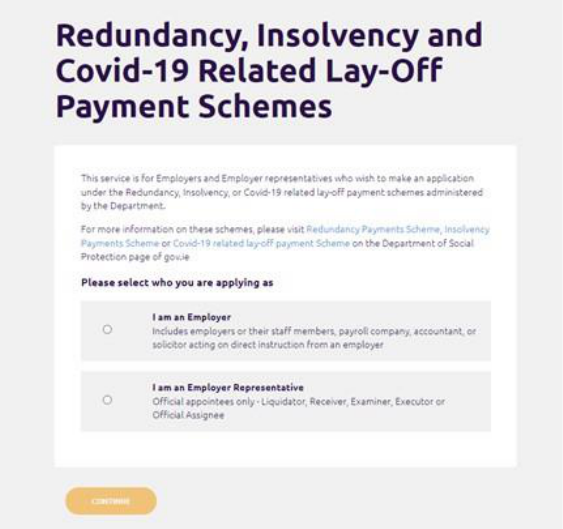

4. Accessing the Redundancy and Covid-19

Related Lay-off Payment Schemes service

1. Once you have logged on to Welfare Partners successfully, select

Redundancy and Insolvency Payment Schemes Tile.

2. Select who you are applying as.

‘As an Employer’

Select this option if you are the employer, a member of their staff,

or you are contracted by the employer and making applications on

their instruction - a payroll company, accountant, or solicitor firm

hired by the employer.

‘As an Employer Representative’

Select this option if you are an official appointee who has been

appointed to manage the affairs of the employer.

An Employer Representative must have been appointed by the

court or another official entity to fulfil one of the following roles:

o Liquidator

o Receiver

o Examiner

Page 14

o Foreign Liquidator/Insolvency practitioner (EU or UK)

o Official Assignee (Bankruptcy)

o Executor of Estate

o Appointment by Minister

3. As an Employer or Employer Representative, Select the

appropriate option followed by ‘Continue’.

4. You will be presented with an overview of the Redundancy and

Insolvency and Covid-19 Related Lay-off Payment Schemes and a

selection of the information that you will need to provide as part of

your application(s).

5. Read the overview carefully. You can also see a list of all the

information that will be required in Appendix A.

6. Once you have read and understood what will be required, select

‘Ready to start’.

Section 05

Creating an Employer Profile

Page 16

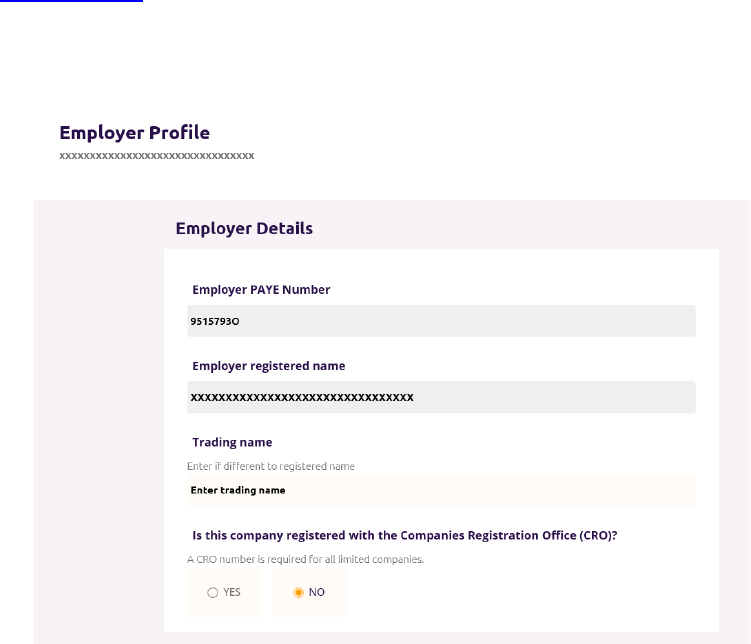

5A. Creating an employer profile (Employer)

The employer profile holds employer information. The information

entered here is common to all Redundancy Payment Scheme

applications for the same employer, so it only needs to be entered

once.

See Appendix A for a list of all the information required for the employer

profile.

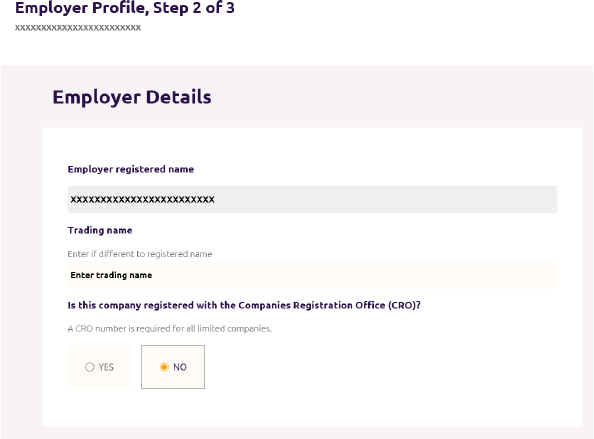

Employer details

1. On the Employer Profile screen, the PAYE number associated with

your sub-cert and the Employer Registered Name from Revenue’s

records will be pre-populated.

2. If there is a Trading Name on record, it will appear here. If there

isn’t, you can enter a value for the Trading Name.

3. Company Registration Office (CRO): You should answer ‘Yes’ or

‘No’ to a question asking if the employer is registered with the CRO.

If the employer is a limited company, they will be registered with the

CRO and you are required to enter details here.

• If you selected ‘Yes’, you will be asked for the employer’s

CRO number. Enter the CRO number in the field, and press

‘Search’.

Page 17

• If the CRO number entered exists in the CRO’s records, you

will be presented with the name(s) on record for that number.

Select the name that applies to this employer before

proceeding to the next section.

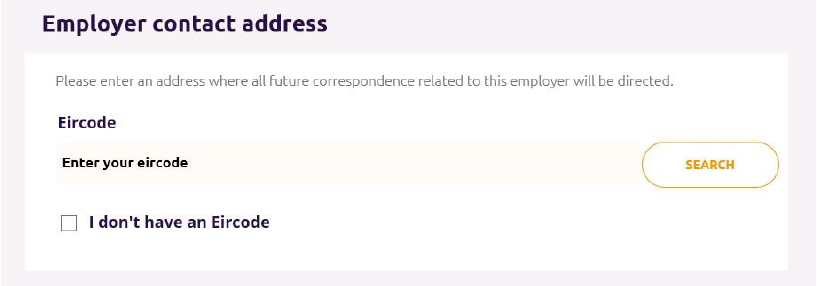

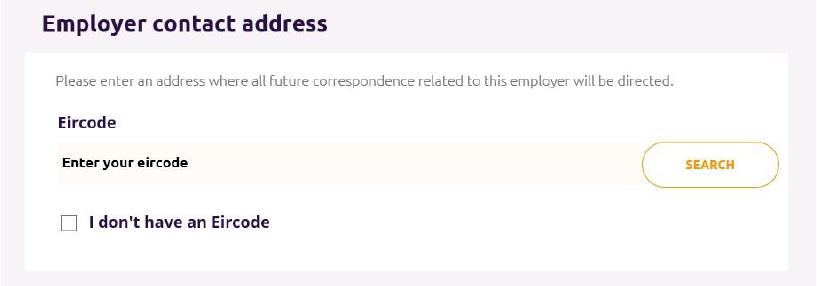

Employer contact address

4. This is the address where any future correspondence from the

Department will be sent.

5. If there is a correspondence address on record with the

Department, you can either retain the existing address for

correspondence and proceed to the next section, or opt to ‘Change

this address’.

6. If you don’t have a correspondence address on record, or you opt

to change it, you will be presented with a field where you can enter

an Eircode and an option to select ‘I don’t have an Eircode’.

• EIRCODE: If you have an Eircode, enter it in the field and select

‘Search’. You will be presented with the address on record for that

Eircode and you can proceed to the next section.

7. If you select ‘I don’t have an Eircode’, you’ll be presented with

fields where you can enter the contact address manually.

Page 18

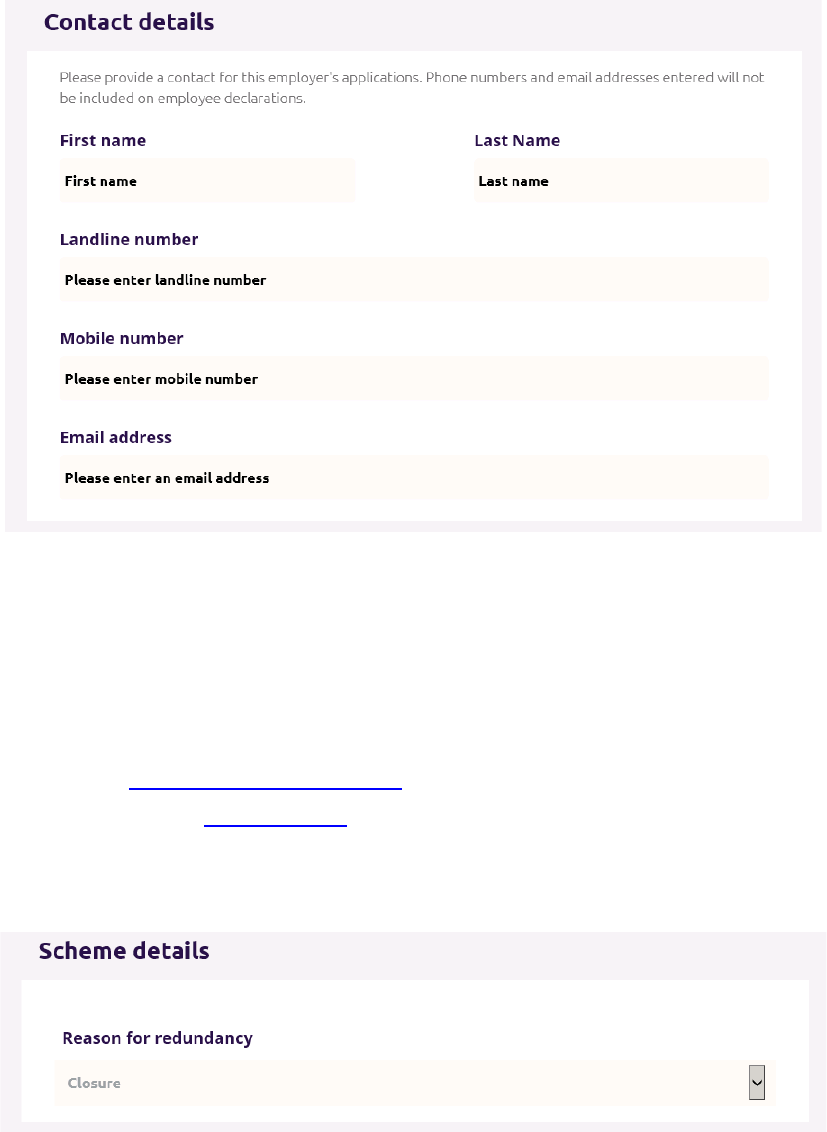

Contact details

8. Enter ‘First name’, ‘Last name’, and ‘Email address’ fields.

9. Either a ‘Landline number’ or ‘Mobile number’ is required. The

‘First name’ and ‘Last name’ will be shared with the employee

on the Employee Declaration. The email address and contact

number is not shared with the employee.

See the Employee Declaration section and a sample Employee

Declaration in Appendix B.

Scheme details

10. ‘Redundancy Reason’: You are required to select a reason from

the dropdown.

Page 19

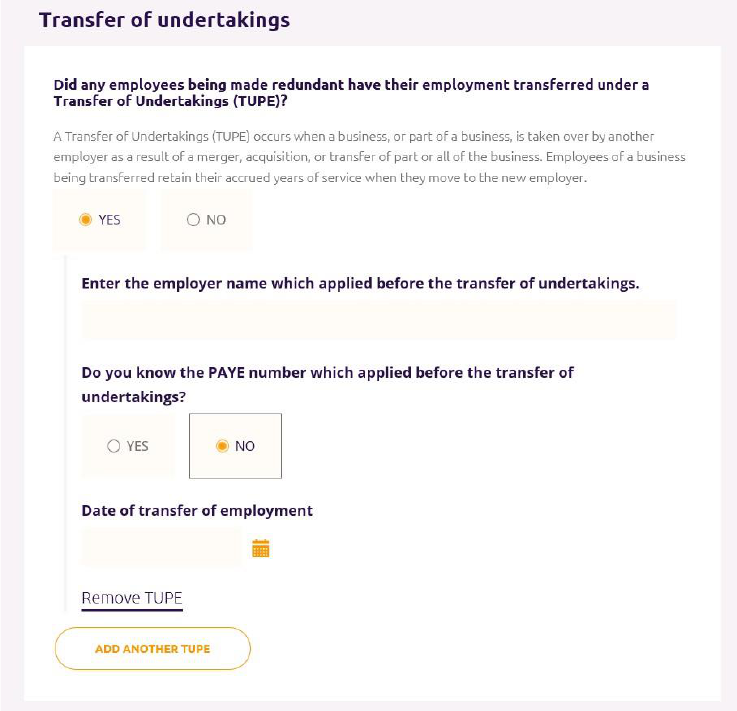

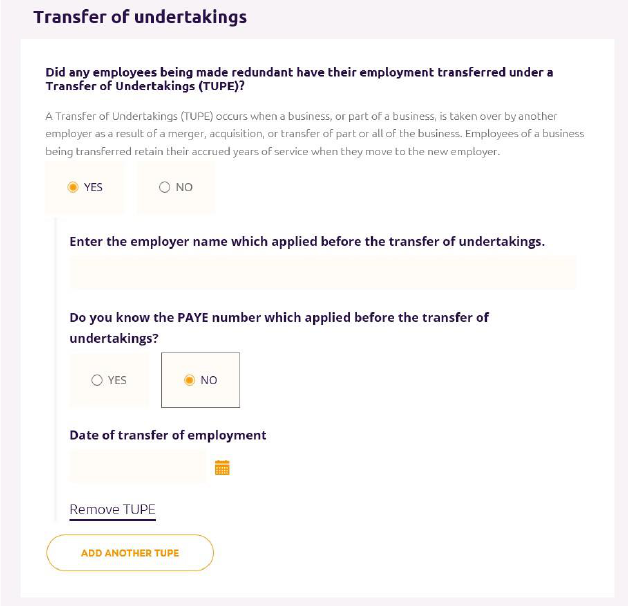

Transfer of undertakings (TUPE)

11. You’ll be asked if Any transfer of undertakings (TUPE) apply to

the employment of any of the employees being made redundant.

A Transfer of Undertakings (TUPE) occurs when a business, or

part of a business, is taken over by another employer as a result of

a merger, acquisition, or transfer of part or all of the business.

Employees of a business being transferred retain their accrued

years of service when they move to the new employer.

This information is requested because when a transfer of

undertakings occurs, Revenue creates a new employment in their

records for each employee that is impacted. The start date for this

new employment will be the date of the transfer of undertaking. The

Department needs to know if a TUPE impacted an employee’s

employment to confirm why the employment start date on the

employee’s application is earlier than the date on record.

Ensure that all relevant TUPEs are entered at this point. On the

Redundancy Payments Scheme application, you will only be

Page 20

able to select TUPEs previously entered on the employer

profile. If you need to add more TUPEs later, you should edit

your employer profile.

Declaration and ‘Register’

12. Next, you must tick a box to declare that all the information that

you’ve entered as part of your employer profile is accurate.

13. Once you’re ready to register your employer profile, select

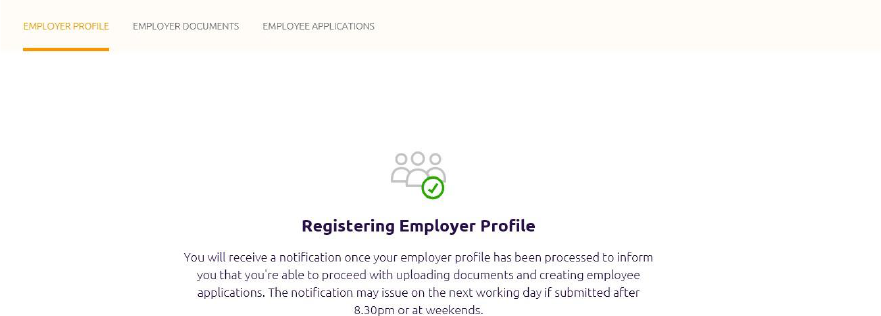

‘Register’.

14. You will be brought to the ‘Registering Employer Profile’ screen.

You cannot create Scheme applications or submit employer

documents until registration is completed.

15. You will receive a notification on Welfare Partners when your

employer profile has been successfully registered. An email will be

sent to inform you that you’ve received a notification on Welfare

Partners.

If the employer profile is registered after 8:30pm or on a weekend,

it may be the next working day before registration is completed.

Page 21

5B. Creating an Employer Profile (Employer

Representative

The Employer Profile holds employer information. Create an Employer

Profile by:

• Selecting ‘Ready to start’ on the overview screen, if no Employer

Profile has been created previously by your organisation.

• Selecting the ‘New profile’ button on the ‘Employer list’

dashboard.(You can’t create more than one Employer Profile for

the same employer.)

Information for the Employer Profile is entered across three pages:

1. Employer Representative role and employer’s PAYE number

2. Employer details

3. Employer Representative details

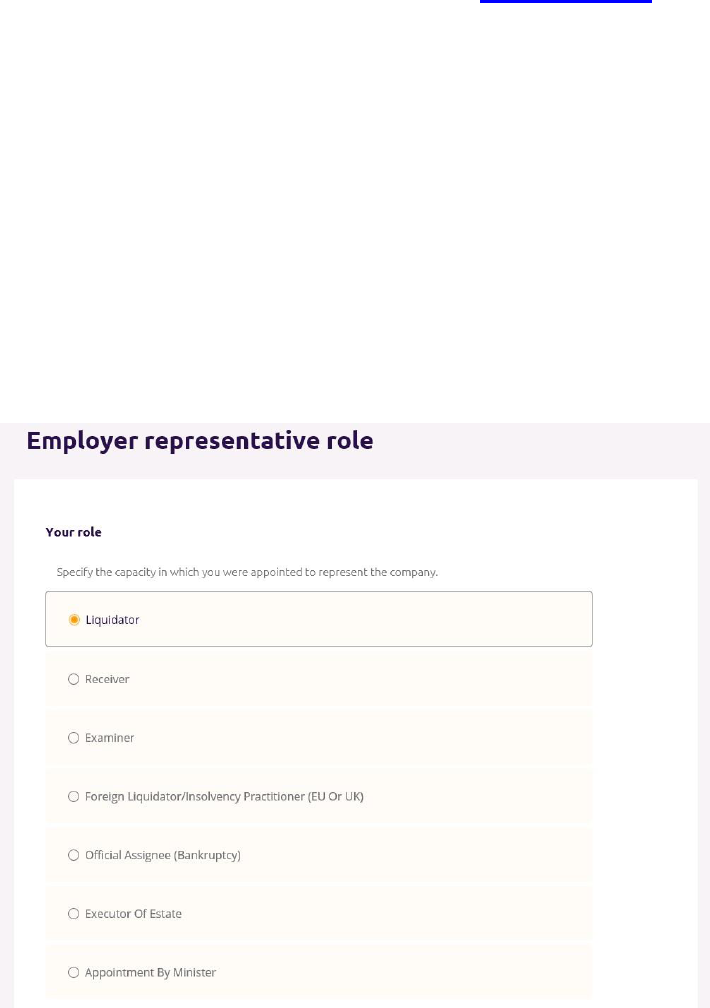

Step 1 of 3 - Employer Representative role and employer’s

PAYE number

Employer Representative role

1. Firstly, select the Employer Representative role you have been

appointed to fulfil on behalf of the employer.

Page 22

2. If you select ‘Executor of Estate’, a question will appear asking

you if you’re applying using the sub-cert of the employer you’ve

been appointed on behalf of:

• Company: If your organisation has been appointed as the

executor on behalf of an employer, you must login using the

sub cert associated with your organisation.

• Individual: As an executor, you log in using the employer’s

sub cert if you’ve been appointed as an individual.

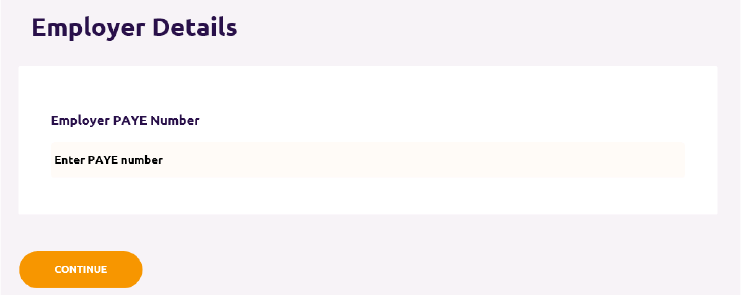

Employer details

3. In the ‘Employer details’ section, the PAYE number for the

employer you are representing must be filled in.

The PAYE number is pre-populated if you are an:

• Executor of Estate who selected ‘Yes’ to applying with the

employer’s sub cert

• Foreign Liquidator/Insolvency practitioner (EU or UK)

4. Once the mandatory fields are all populated, press ‘Continue’.

5. PAYE number validation: An error will display if:

• The PAYE number entered does not match any employers in

Revenue’s records.

• The PAYE number is the same as that on the sub cert that

was used to log in. (This error will not appear if the role

selected was ‘Foreign Liquidator/Insolvency practitioner (EU

or UK)’ or ‘Executor of Estate’ and ‘Yes’ was selected to

applying with the employer’s sub cert.) This error will appear

for one of two reasons:

• You’ve entered your organisation’s PAYE number

instead of the employer’s PAYE number.

Page 23

• You’ve logged in using the employer’s sub cert, when,

based on the role you selected, your organisation

should be able to generate a DSP sub cert associated

with its own PAYE number. You should start the

application process again after logging in with a sub

cert associated with your organisation.

• The same PAYE number has been used by your organisation

before to create an Employer Profile. Instead of creating a

new Employer Profile, you should update the existing

Employer Profile.

Step 2 of 3 - Employer details

Employer details

6. Employer registered name: The registered name associated with

the employer’s PAYE number in the Department’s records will be

pre-populated.

7. Trading name: If there is a Trading Name on record it will appear

here. If there isn’t, you can enter a value for the Trading Name.

Note, you will not be able to edit the data in this field once the

profile is registered.

8. CRO number. You be asked to answer ‘Yes’ or ‘No’ to a question

asking if the employer is registered with the Company Registration

Office (CRO).

If the employer is a limited company, they will have been

registered with the CRO, and you are required to answer ‘Yes’ to

this question.

Page 24

9. Enter the CRO number in the field, and press ‘Search’.

10. If the CRO number entered exists in the CRO’s records, you will

be presented with the name(s) on record for that number. Select

the one that applies to this employer before proceeding to the next

section.

Employer contact address

11. This is the address where any future correspondence in relation to

this employer from the DSP will be sent.

12. If there is a correspondence address on record with the

Department, you can either retain the existing address for

correspondence and proceed to the next section, or opt to ‘Change

this address’.

13. If there is no correspondence address on record with the DSP, or

you’ve opted to ‘Change this address’, you’ll be presented with a

field where you can enter an Eircode and an option to select ‘I don’t

have an Eircode’.

• If you have an Eircode, enter it in the field and select

‘Search’. You will be presented with the address on record for

that Eircode and you can proceed to the next section.

• If you select ‘I don’t have an Eircode’, you’ll be presented

with fields where you can enter the contact address manually.

Once you’ve entered the new contact address, you can

proceed to the next section.

Page 25

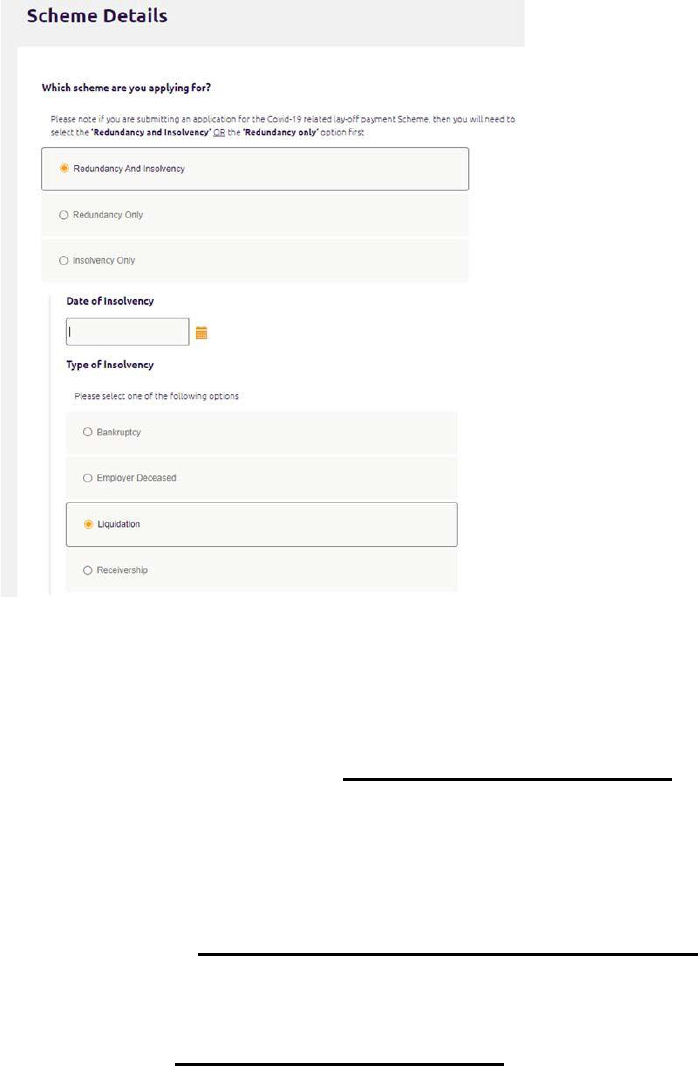

Scheme details

14. You’ll be required to select what schemes you’ll be applying for.

• Redundancy and Insolvency: Employer Representatives

select this if applications will be submitted under any of the

three schemes, even if they will be submitted weeks apart.

(Redundancy, Insolvency and Covid-19 related lay-off

Payments Schemes)

• Redundancy only: Employers or Employer Representatives

select this if only Redundancy or Covid-19 related lay-off

payment applications will be submitted for any employees.

• Insolvency only. Employer Representatives select this if no

Redundancy or Covid-19 related lay-off payment applications

will be submitted for any employees.

15. If you select ‘Redundancy and Insolvency’ or ‘Insolvency only’,

you’ll be asked to enter the ‘Date of insolvency’ and select the

correct ‘Insolvency type’.

16. If you select ‘Redundancy only, you’ll be asked to select a reason

from the ‘Redundancy reason’ dropdown field.

Page 26

Transfer of undertaking

17. You’ll be asked if any transfer of undertakings apply to the

employment of any of the employees.

A Transfer of Undertakings (TUPE) occurs when a business, or

part of a business, is taken over by another employer as a result of

a merger, acquisition, or transfer of part or all of the business.

Employees of a business being transferred retain their accrued

years of service when they move to the new employer.

This information is requested as when a transfer of undertakings

occurs, the employees records are stored under a different PAYE

number; Revenue creates a new employment in their records for

each employee that is impacted. The start date for this new

employment will be the date of the transfer of undertaking. The

Department needs to know if a TUPE impacted an employee’s

employment so they know why the employment start date on the

employee’s application is earlier than the date on record.

Ensure that you enter all relevant TUPEs at this point. On the

application, you will only be able to select TUPEs previously

entered on the Employer Profile. If you need to add more

TUPEs later, you should edit your Employer Profile.

18. Once the mandatory fields are all populated, press ‘Continue’.

Page 27

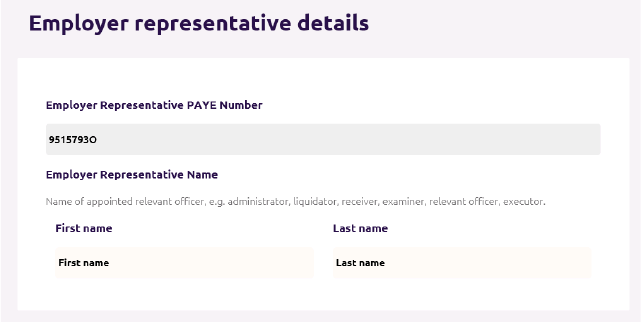

Step 3 of 3 - Employer Representative details

Employer Representative details

19. The Employer Representative PAYE will be pre-populated from

the PAYE number on your sub cert (provided you’re using your

organisation’s sub cert and not the employer’s sub cert).

20. If the role you selected was ‘Foreign Liquidator/Insolvency

practitioner (EU or UK)’ or ‘Executor of Estate’ and ‘Yes’ was

selected to applying with the employer’s sub cert, you’ll be asked to

confirm that you don’t have a PAYE number before you’re allowed

to proceed.

21. If your role is ‘Foreign Liquidator/Insolvency practitioner (EU or

UK)’, you will be asked to enter your organisation’s company

name.

22. Employer Representative name: You should enter the name of

the appointed relevant officer, e.g. administrator, liquidator,

receiver, examiner, or executor.

Page 28

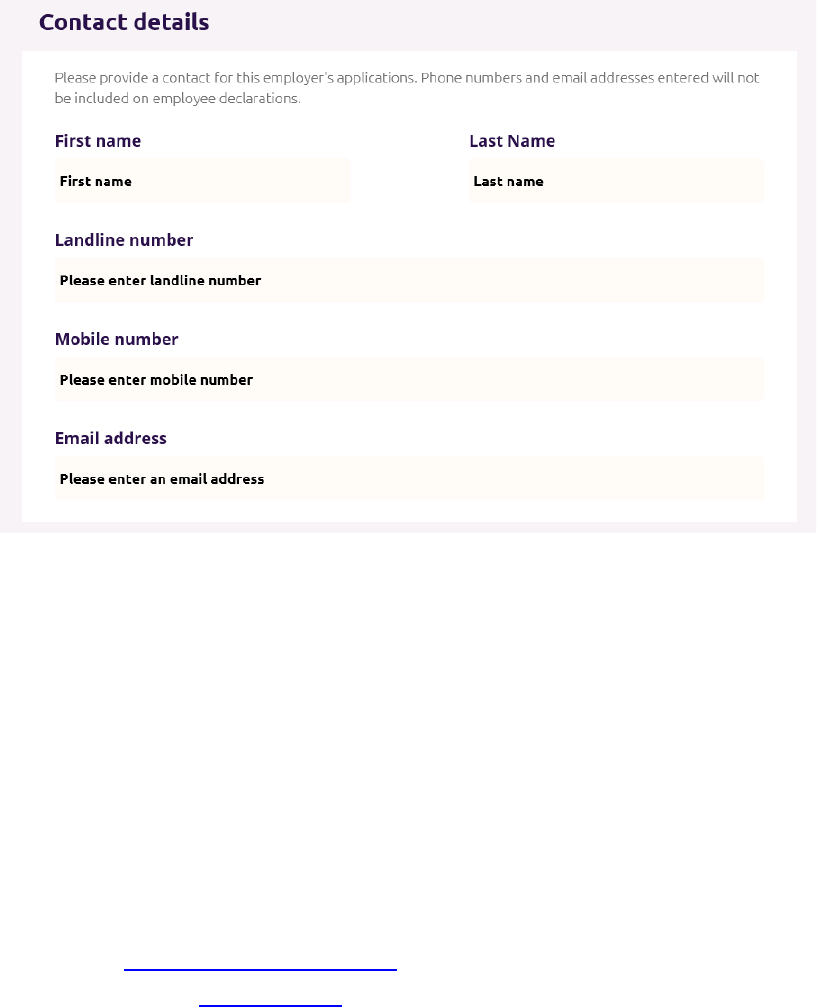

Contact details

23. Enter the name of the appointed relevant officer, e.g.

administrator, liquidator, receiver, examiner, or executor, into

the ‘First name’ and ‘Last name’ fields here again. Do not enter

the name of the point of contact in this field.

24. Enter the ‘Email address’ of the point of contact for any

applications.

25. Either a ‘Landline number’ or ‘Mobile number’ for the point of

contact for any applications is required.

The ‘First name’ and ‘Last name’ will be shared with the employee

on the Employee Declaration. The email address and contact

number is not shared with the employee.

See the Employee Declaration section and a sample Employee

Declaration in Appendix B.

Page 29

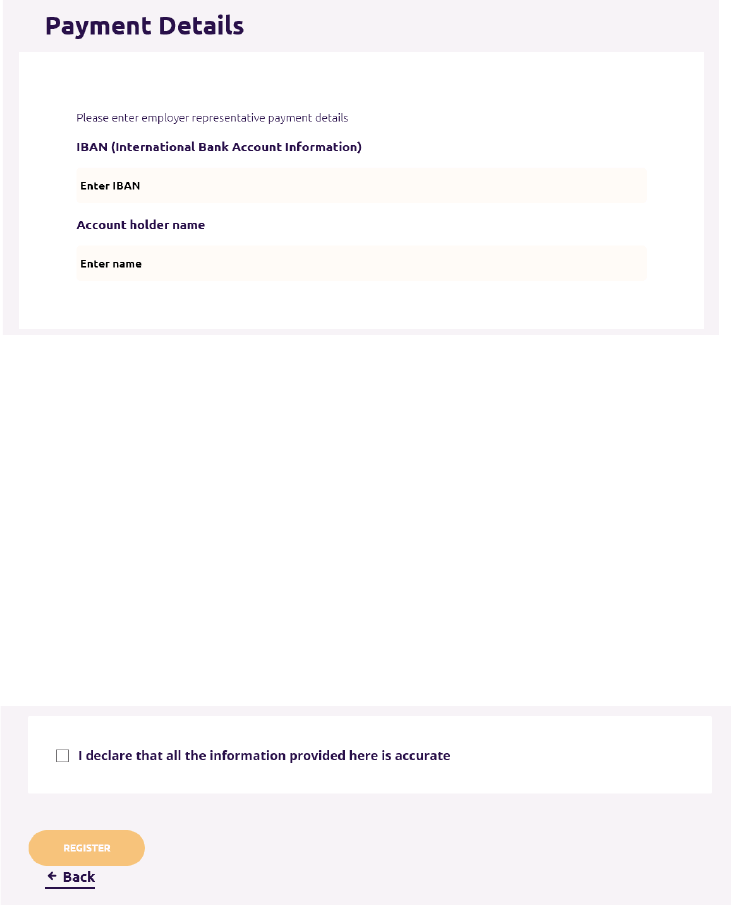

Payment details

26. If you selected that you’re applying for ‘Redundancy and

Insolvency’ or ‘Insolvency only’, employer representative payment

details are required. Enter the IBAN and account holder name for

the account where Insolvency Payments Scheme payments

associated with this employer should be directed. All other

payments are made directly to the employee payment details as

submitted.

Declaration and ‘Register’

27. Confirm that all the information that you’ve entered as part of the

Employer Profile is accurate by checking the box.

28. Once you’re ready to register the Employer Profile, select

‘Register’.

29. The Employer Profile information is then issued to the DSP to be

registered on the DSP’s system.

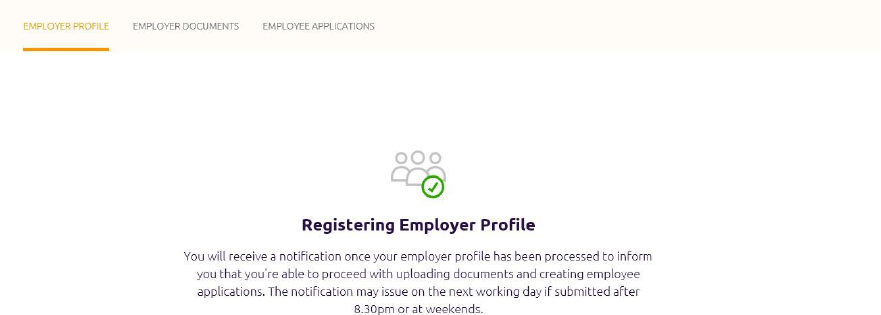

30. You will be brought to the ‘Registering Employer Profile’ screen.

You cannot create employee applications or submit employer

documents where applicable, until registration is completed and

notification issues.

Page 30

31. Notification: You will receive a notification on Welfare Partners

when your Employer Profile has been successfully registered. An

email will be sent to inform you that you’ve received a notification

on Welfare Partner.

Registering Employer Profile out of hours: If the Employer

Profile is registered after 8:30pm or on a weekend, it may be the

next working day before registration is completed.

Section 06

Submitting employer documents

6. Submitting employer documents

Once you’ve received a notification that your profile is registered,

you’ll be able to proceed to uploading employer documents, if

applicable; and create employee applications.

While you can create applications without submitting all required

employer documents, the DSP will not be able to process

applications until all required employer documents, if applicable

are received.

‘Employer documents’ dashboard

1. You can access the ‘Employer documents’ dashboard by:

• Selecting the ‘Upload Documents’ button in the notification

you received.

• Selecting ‘View’ on the employer on your ‘Employer list’

dashboard, if all required employer documents haven’t been

submitted.

• Selecting the ‘Employer documents’ tab when on the

‘Employer profile’ or ‘Employee applications’ dashboards for

the relevant employer.

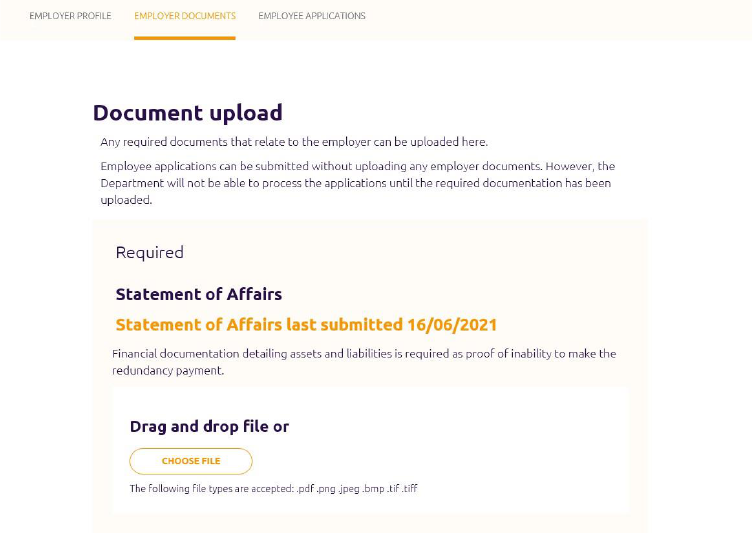

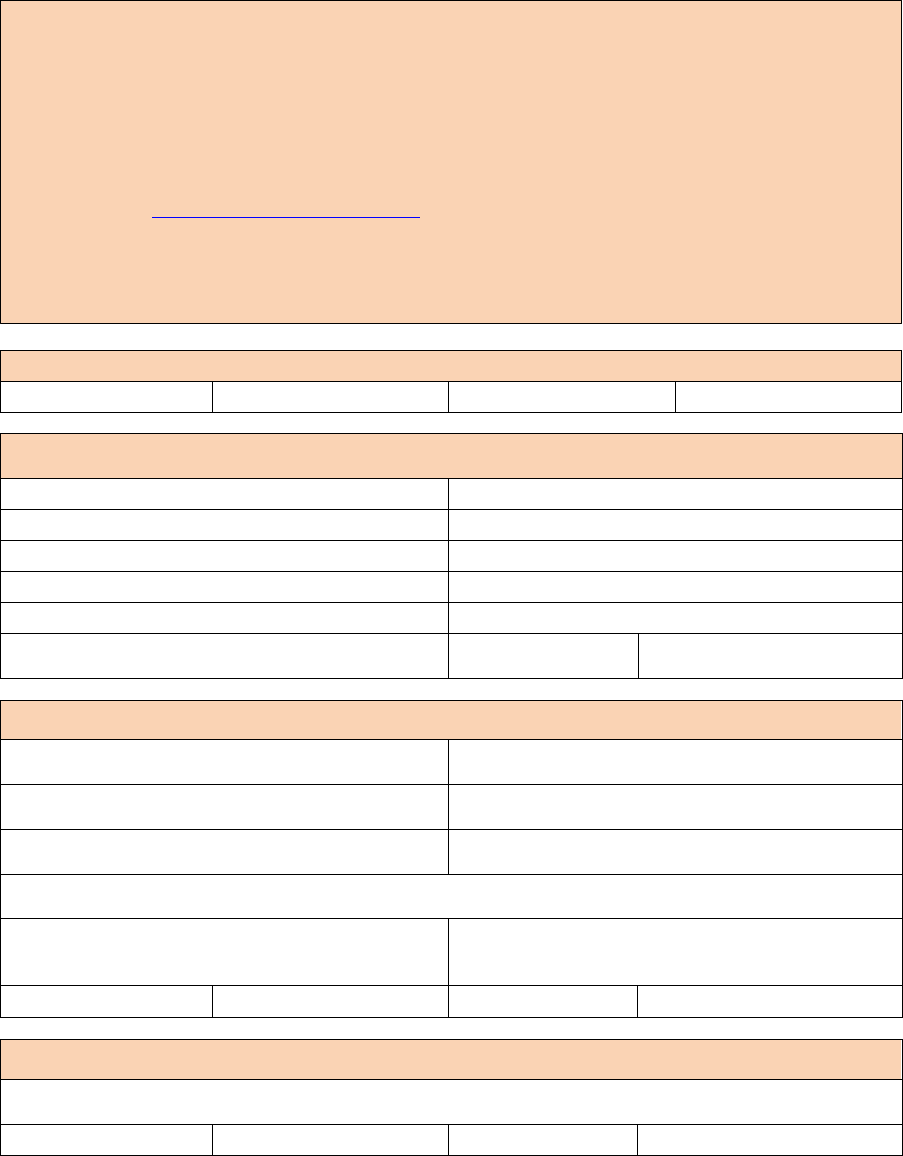

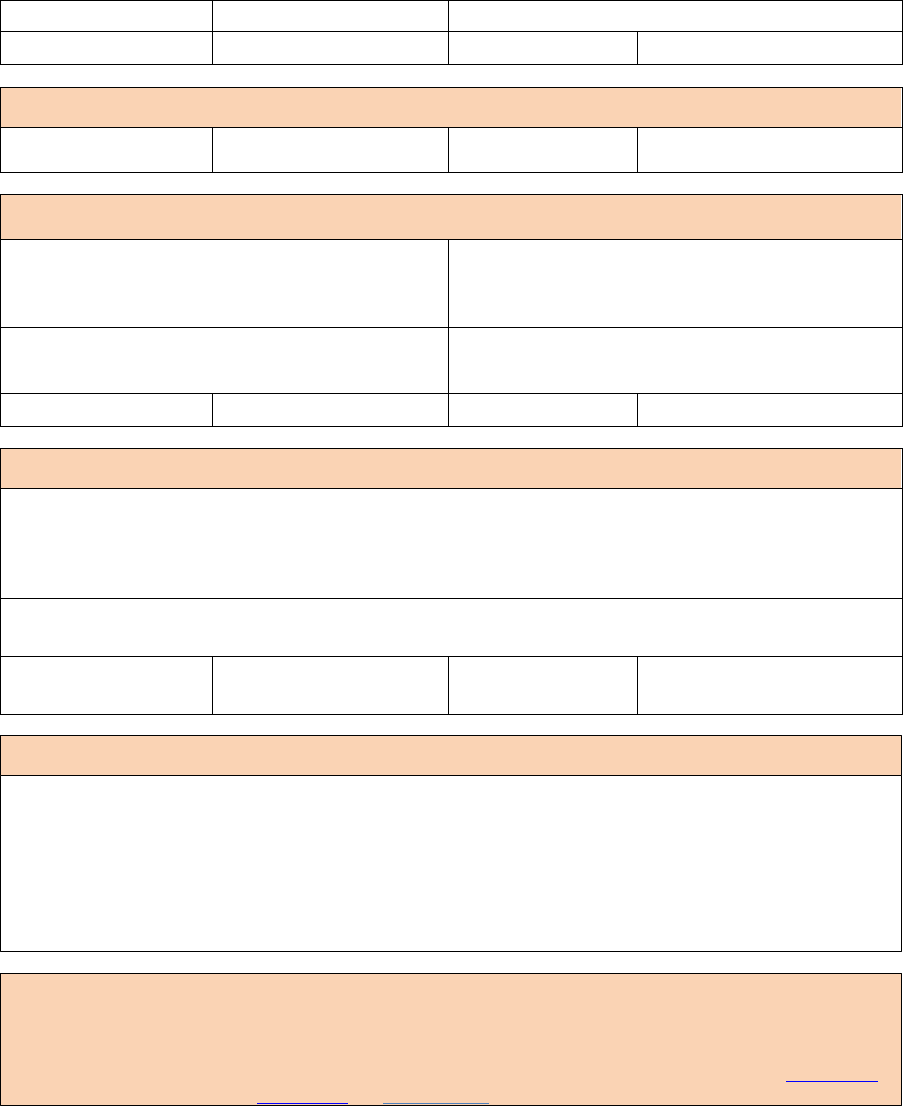

Required documents

Page 32

2. On the ‘Employer documents’ dashboard, you will be shown a list

of ‘Required’ documents that you must submit to enable any

employee applications to be successfully processed.

As part of this, you will be required to upload certain documents.

The documents that are ‘required’ are dependent on the

information entered as part of the Employer Profile. You can see a

list of the document types and the circumstances under which

they’re required below.

Document Type

When required

Statement of Affairs

Always for Redundancy

Not for CRLP

Notice/Court Order Appointing Employer

Representative

Always

TUPE Documentation

If any TUPEs added

CRO E2

If ‘Liquidator’ or ‘Foreign

Liquidator/Insolvency

practitioner (EU or UK)’ role

CRO G1/G2

If ‘Liquidator’ or ‘Foreign

Liquidator/Insolvency

practitioner (EU or UK)’ role

CRO E8

If ‘Receiver’ role

CRO E24

If ‘Examiner’ role

Scheme of Arrangement

If ‘Examiner’ role

Statement from executor of estate

(Inability to pay and accepting liability to

SIF)

If ‘Executor’ role

Death Certificate

If ‘Executor’ role

Bankruptcy Documents

If ‘Official Assignee

(Bankruptcy)’ role

Page 33

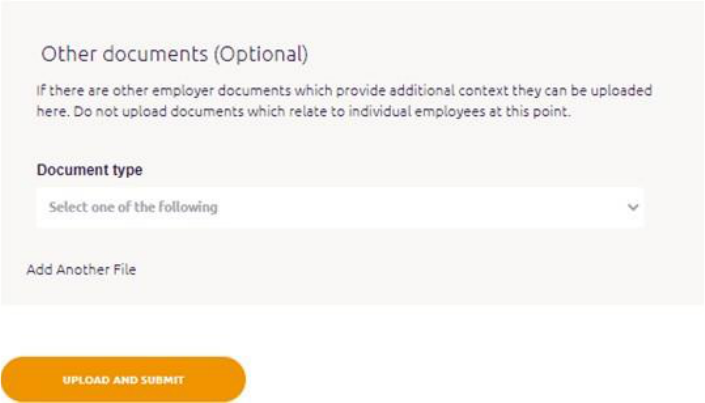

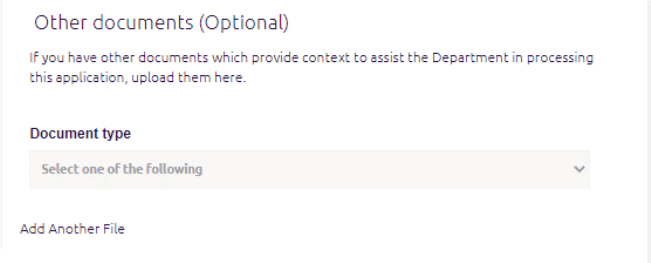

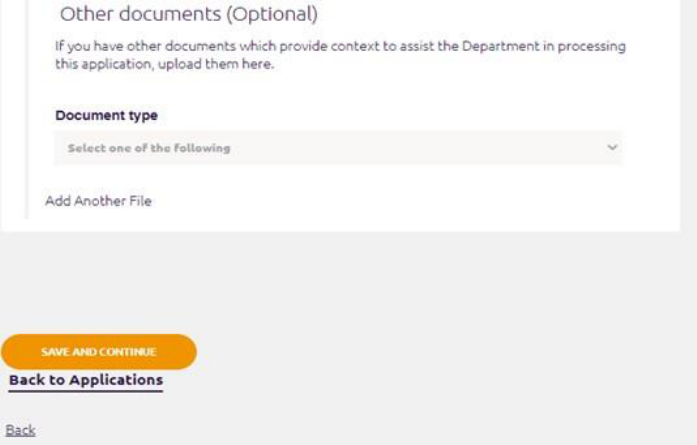

Other documents (optional)

3. You can upload ‘Other’ documents relevant to the employer.

An ‘Other’ document should be uploaded if it supports the

employer’s eligibility for the scheme.

Only upload documents specific to the employer at this point.

Employee related documents are uploaded separately at a different

stage.

Submitting employer documents

4. Once you’ve uploaded the documentation that you’re ready to issue

to the DSP at this time, select ‘Upload and submit’.

You don’t need to submit all documentation in one sitting. You can

return to this screen later and upload and submit any outstanding

documentation.

5. Your documents will be sent to the DSP and you’ll be brought to

the submission screen for employer documents.

To start creating employee applications, select ‘Continue to employee

applications’.

Page 34

Page 29

Section 07

Creating a Redundancy Payments

Scheme Application

Page 36

7. Creating a Redundancy Payments Scheme

application

Once you receive a notification that your profile is registered, you can

proceed to uploading employer documents and creating Redundancy

Payments Scheme applications.

See Appendix A for a list of all the information required for the

application.

You can create and submit applications without uploading all required

employer documents. However, the Department will not be able to

process the applications until all required employer documents are

received.

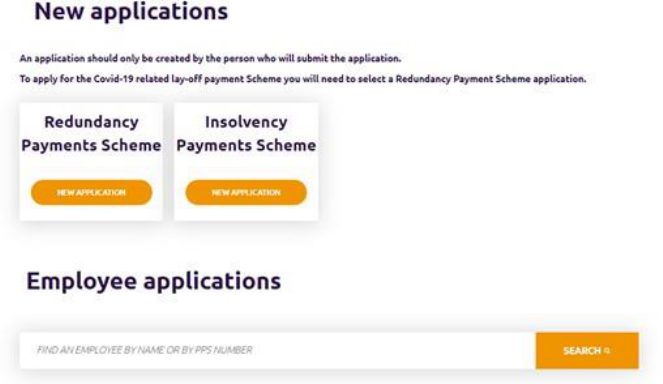

‘Employee applications’ dashboard

Start creating Redundancy Payments Scheme applications from the

‘Employee applications’ dashboard. You can access this dashboard by

either:

• Selecting the ‘Go to applications’ button in the notification you

received when the Employer Profile was registered.

• Selecting the Redundancy and Insolvency Payments

Schemes tile on the Welfare Partners homepage or header. If

all required employer documents have been submitted, you

are always brought to the ‘Employee applications’ dashboard

first after selecting ‘Ready to start’ on the Redundancy,

Insolvency and Covid-19 related lay-off Payments Scheme

overview page.

• Selecting the ‘Employee applications’ tab when on the

‘Employer profile’ or ‘Employer documents’ dashboards.

On the dashboard, select ‘New application’ to create a new Redundancy

Payments Scheme application.

Page 37

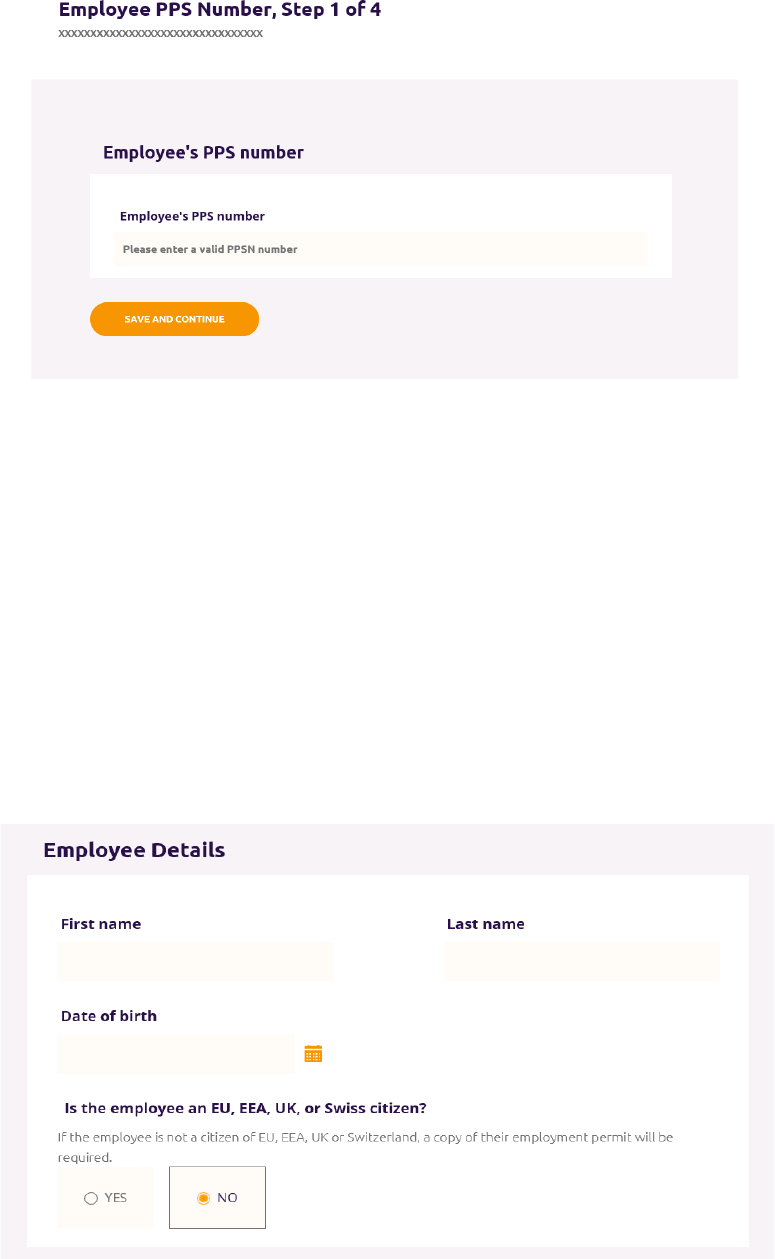

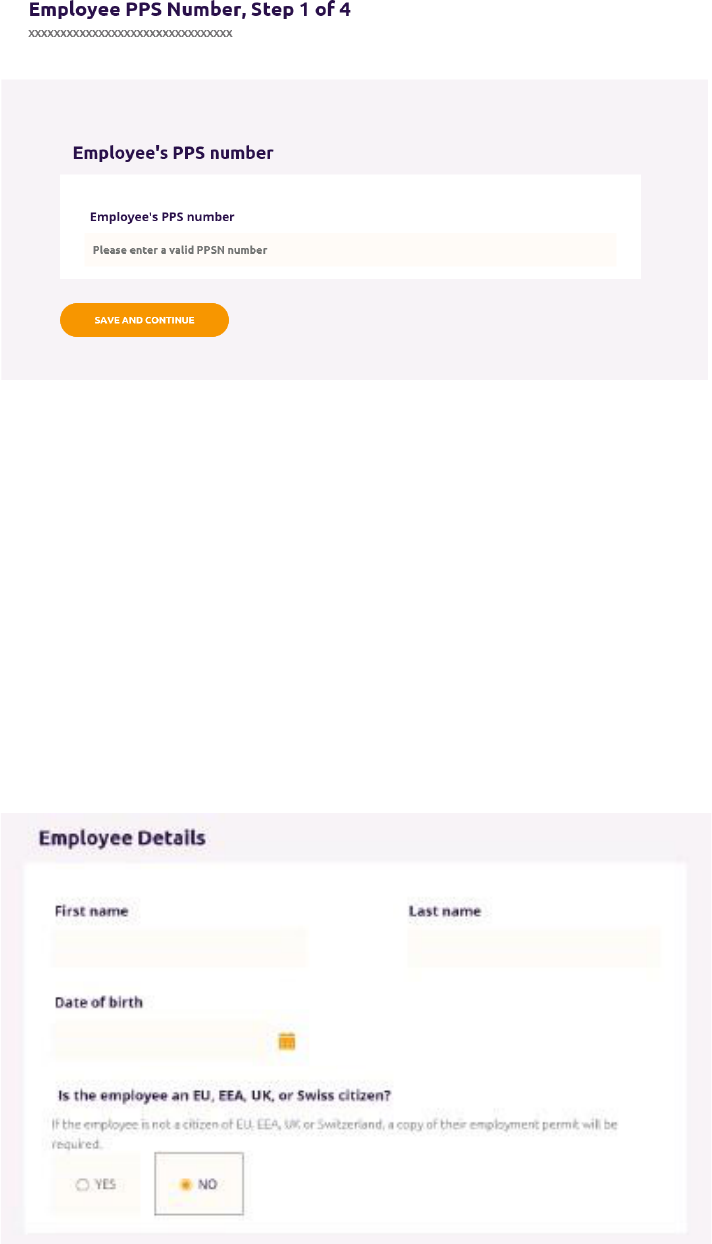

Step 1: Employee PPS number

1. Enter the employee’s PPS number in the PPSN field.

2. Select ‘Save and continue’.

3. You will receive an error if:

• The PPSN does not exist

• The PPSN does not refer to an employee associated with this

employer in the Department’s records.

• An application for the Redundancy Payments Scheme has

already been started for this employee and it is in progress.

Step 2: Employee details

Employee details

Page 38

4. If the employer has submitted an application before for this

employee the information on this screen will be pre-populated with

the information that was entered previously.

5. The following is required:

• Employee’s name

• Employee’s date of birth.

• Select if they’re an EU, EEA, UK, or Swiss citizen.

If it’s stated that the employee is not an EU, EEA, UK, or

Swiss citizen, an Irish residency permit or employment permit

will be required on the ‘Employee Documents’ page later in

the application.

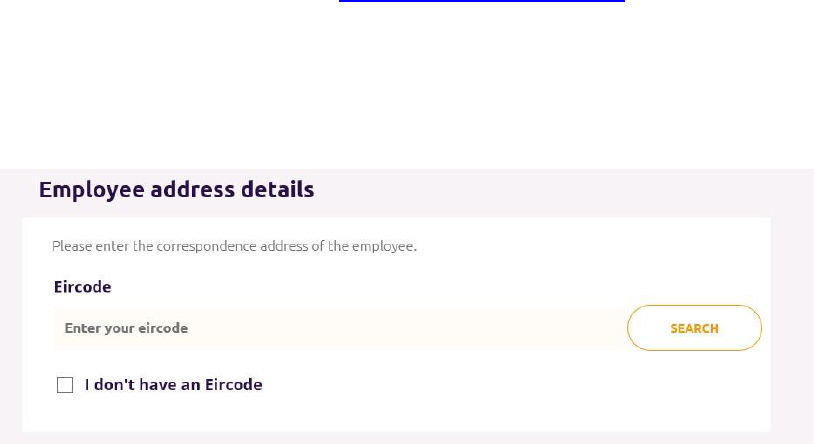

Employee address details

6. Any correspondence the Department issues for the employee will

be sent to this address.

You’ll be presented with a field where you can enter an Eircode and

an option to select ‘I don’t have an Eircode’.

• If you have an Eircode, enter it in the field and select

‘Search’

You will be presented with the address on record for that

Eircode and you will be able to proceed to the next section. If

the address on record is incorrect you can edit it.

• If you select ‘I don’t have an Eircode’, you’ll be presented with

fields where you can enter the address. Once you’ve entered

the address, you can proceed to the next section.

Page 39

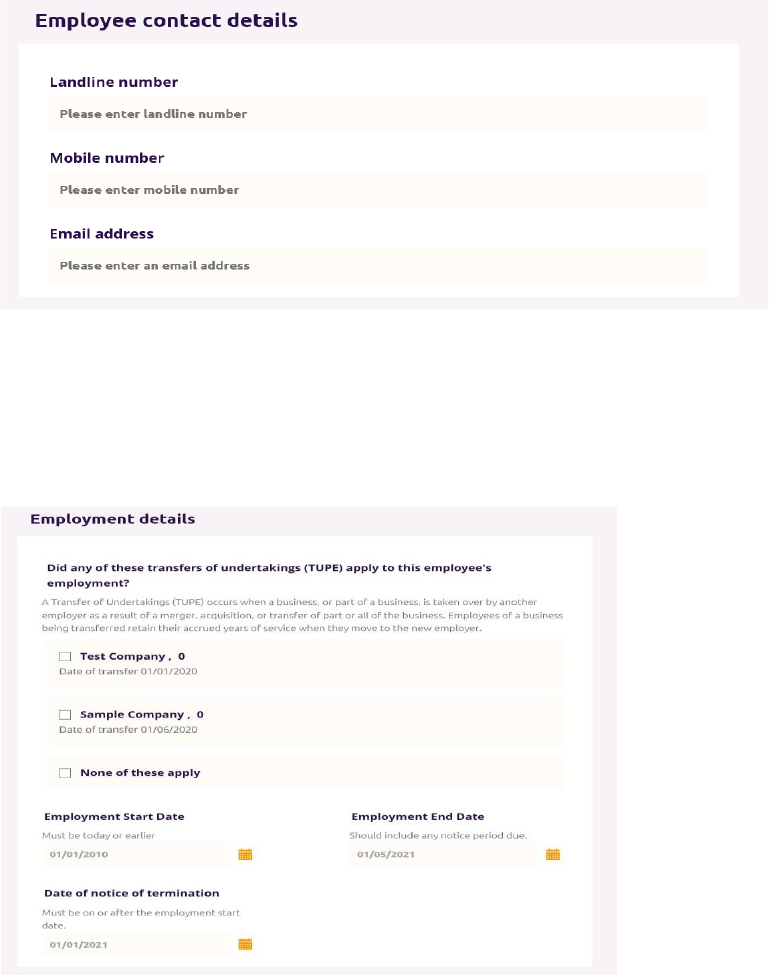

Employee contact details

7. You are required to enter either a mobile number or landline

number for the employee.

8. You also have the option to enter an email address for the

employee.

Employment Details

9. The following information is required:

• Transfer of Undertakings (TUPE): A transfer of employment

can occur where the ownership of a company was transferred

but the employee continued in the same employment without

any changes. In such cases, the service, terms, and

conditions of employment transfer over to the new employer.

These transfers are usually formal agreements and the

employee would receive a written notice of the transfer. If the

employee was affected by TUPE, select the transfer of

undertakings (TUPEs) which apply to this employee’s

employment. If none of the TUPEs apply to this employee,

you’ll be required to select ‘None of these apply’.

Page 40

• Start date of employment for this employee.

• End date of employment for this employee.

• Date of notice of termination: A warning will display if the

date of notice of termination entered indicates that the

employee wasn’t given their statutory minimum notice

entitlement.

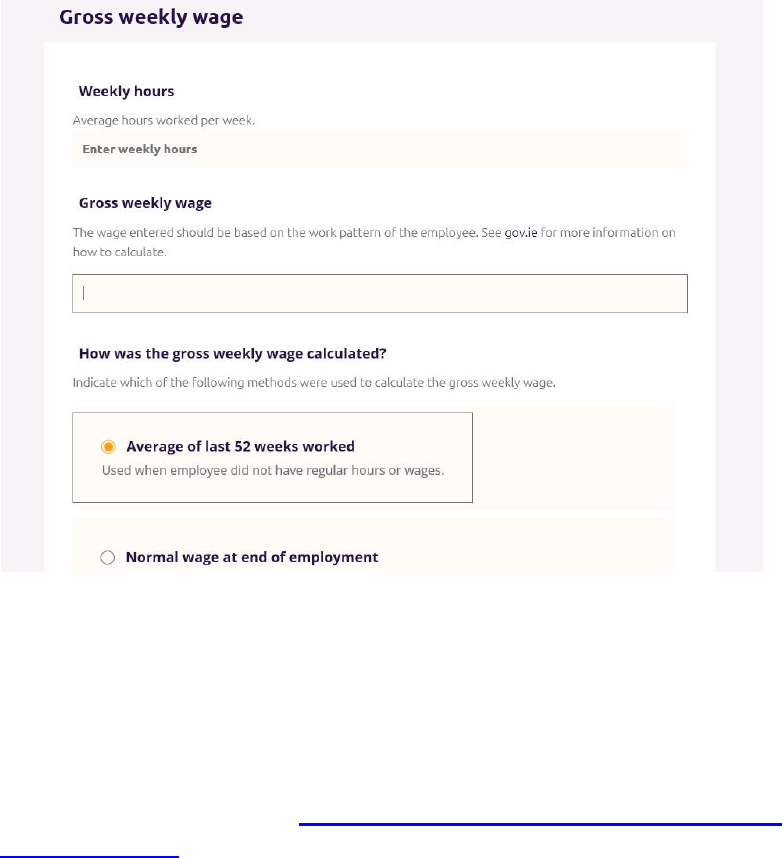

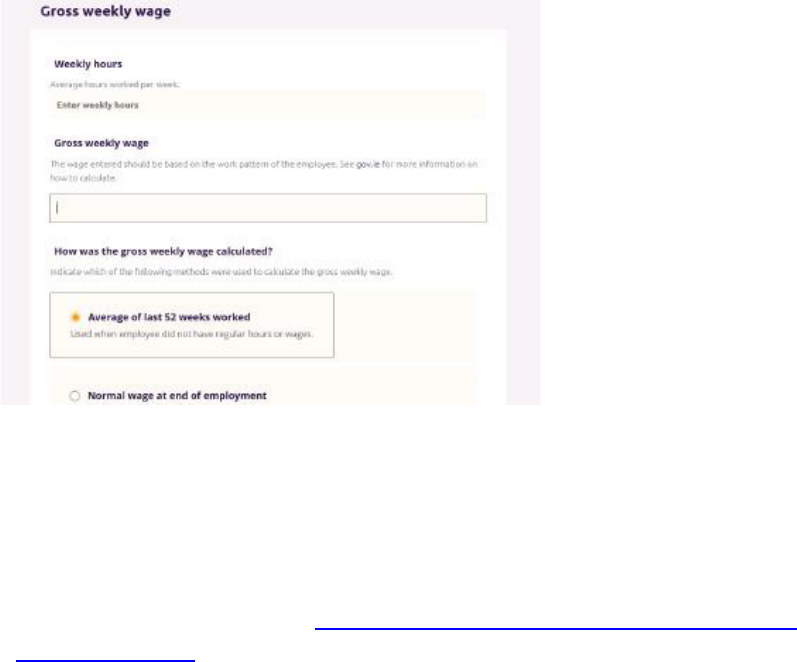

Gross weekly wage

10. Weekly hours: Enter the number of hours normally worked per

week.

11. Gross weekly wage. Enter the employee’s gross weekly wage.

The gross weekly wage will depend on the normal work pattern of

the employee. For more information on the calculation of the gross

weekly wage, go to the ‘Redundancy Payments Scheme Gross

Weekly Wage’ page on gov.ie

12. Calculation used for gross weekly wage: The calculation can

vary depending on the type of employment as follows:

Page 41

• Average of last 52 weeks worked.

Used when employee did not have regular hours or wages.

Hours and wages varied from week to week. Weeks where

the employee did not work are included in the average.

• Normal wage at end of employment.

Used when hours worked or wages did not vary from week to

week. May include average bonus or commission.

• Includes overtime averaged over the 26 week period

which ended 13 weeks before date of termination.

Where the employee worked overtime, the average overtime

worked over a 26 week period is added to the basic weekly

wage. The 26 week period excludes the last 13 weeks before

the employment was terminated.

• Piece worker whose pay depends on the amount of work

carried out.

Calculation is based on the average wage for hours worked in

the 26 week period which ended 13 weeks before date of

termination.

13. Gross weekly wage additional information: Enter any additional

information that will help to explain how the gross weekly wage was

calculated.

This section is optional, but very important where the wage entered

varies; does not match the regular wage or where an absence has

to be considered, such as a period on short-time, parental leave, or

carer’s leave. Go to the ‘Redundancy Payments Scheme Gross

Weekly Wage’ page on gov.ie for more information on the

calculation.

14. Select ‘Save and continue’.

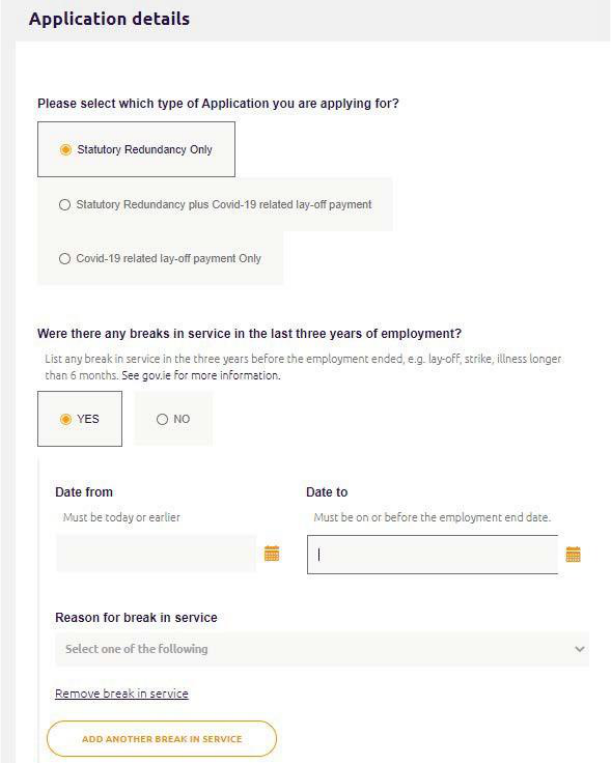

Step 3: Application details

15. The next step of the application, ‘Application details’, opens.

Application details

Page 42

16. Select if this employee had any breaks in service in the last three

years.

17. If so, the from date and to date will be required.

18. Breaks in service reason: Some absences from employment are

excluded from the calculation of the redundancy payment. Any

absences (called breaks in service) in the last three years of

employment should be entered here. The break in service reason

for the CRLP scheme is a 'temporary lay-off due to Covid-19

restrictions' and this option will only appear if the relevant scheme

has been selected at the start of the process.

Non-reckonable breaks in service reasons:

• Layoff

• Strike

• Occupational illness (first 52 weeks are reckonable)

• Ordinary illness (first 26 weeks are reckonable)

Page 43

Reckonable break in service reasons:

• Adoptive leave

• Career break

• Carer's leave

• Force majeure leave

• Maternity leave - the employee cannot receive notice of

termination of employment while they are on maternity

leave.

• Occupational illness (first 52 weeks are reckonable)

• Ordinary illness (first 26 weeks are reckonable)

• Parental leave

• Paternity leave

• Parents leave (7 weeks increasing to 9 weeks from August 2024)

• Reserve Defence Forces

• Temporary lay-off due to Covid-19 restrictions

19. Add another break in service: Select this button if there are

further breaks in service. Up to twelve breaks in service can be

added.

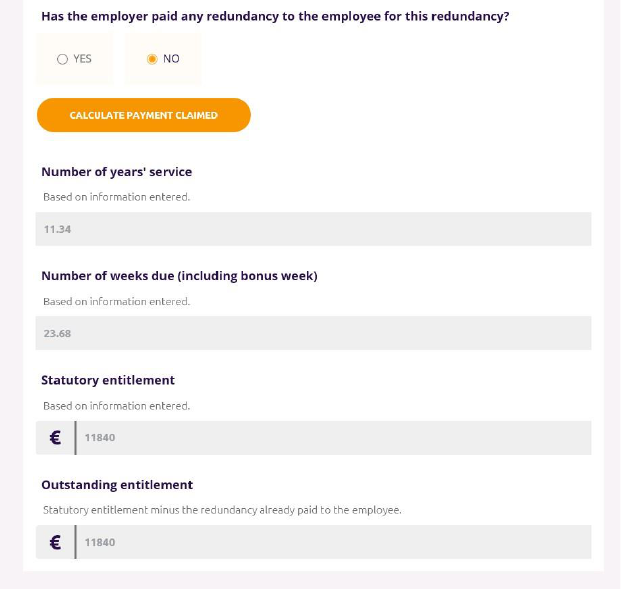

20. Has employer has made any redundancy payments to this

employee: Sometimes an employer has been able to pay a portion

of the redundancy payment.

• Select ‘Yes’ if some of the redundancy payment has been

made and enter the amount already paid. This amount will

be deducted from the total due.

• Select ‘No’ if none of the redundancy payment has been

made.

21. Click ‘Calculate payment claimed’.

Page 44

22. Once ‘Calculate payment claimed’ has been selected, a calculation

is done based on the information entered. This will estimate the:

• Employee’s number of years’ service

• Number of weeks of statutory redundancy owed to the

employee

• Total statutory entitlement owed to the employee

• Remaining statutory entitlement owed to the employee. (This

is the redundancy payment being claimed on the employee’s

behalf.)

You cannot proceed to the next screen without selecting ‘Calculate

payment claimed’.

If you change any information in the ‘Application details’ section

after selecting ‘Calculate payment claimed’, you cannot proceed to

the next step without selecting ‘Calculate payment claimed’ again.

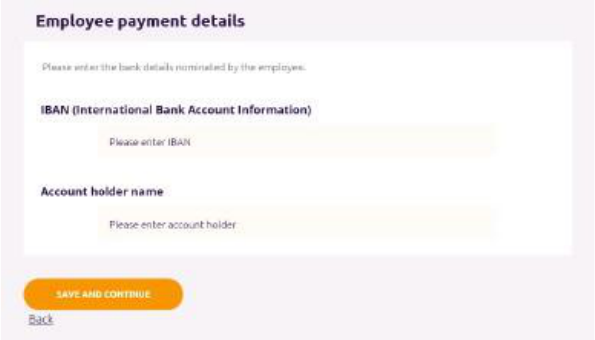

Employee payment details

23. Redundancy payments are sent directly to the employee using

the payment details supplied.

24. IBAN: Enter an IBAN for the employee’s bank account. The field

is non mandatory so if an employee does not have an IBAN a

separate page can be uploaded with the claim.

25. Account holder name: Enter the name on the employee’s bank

account.

26. Select ‘Save and continue’.

Page 45

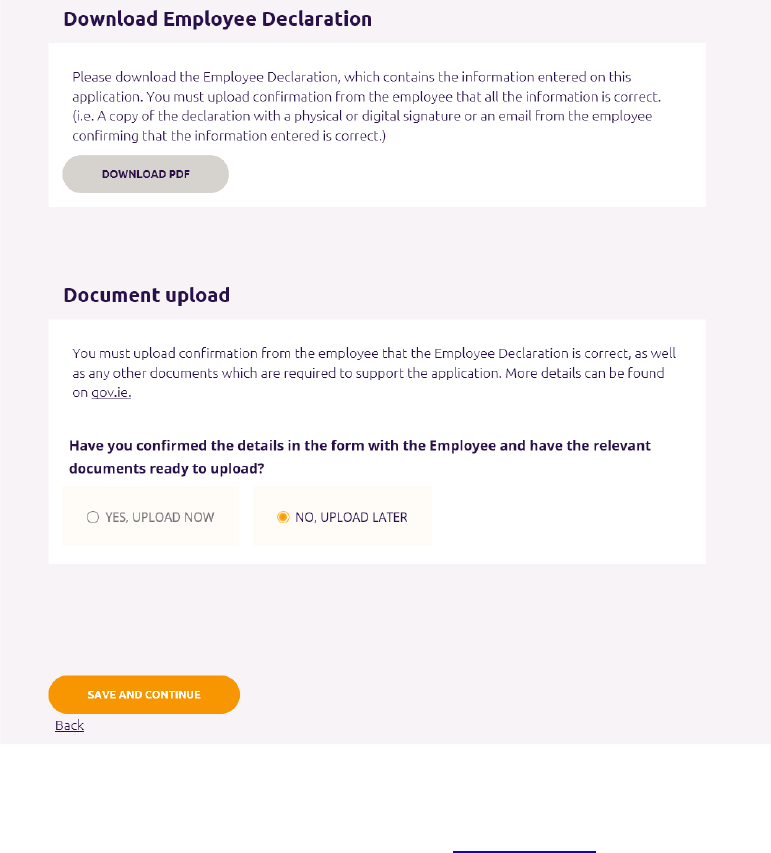

Step 4: Employee documents - Employee Declaration

27. The next step of the application, ‘Employee documents’, opens.

Download Employee Declaration

28. Select ‘Download PDF’ to download a copy of the Employee

Declaration, which contains the information entered as part of this

application. (A sample is included in Appendix B.)

29. Once you’ve downloaded the Employee Declaration, select ‘No,

upload later’ under the ‘Document upload’ section (as the employee

has not confirmed the information yet)

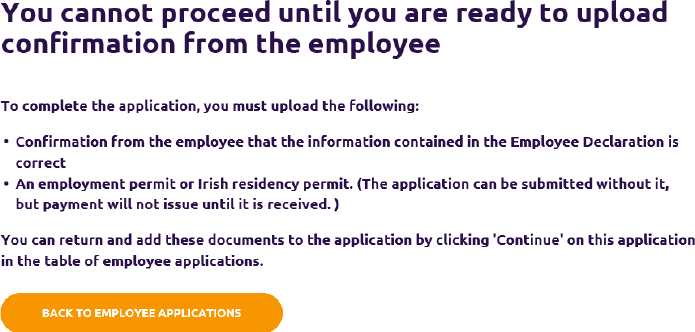

30. Select ‘Save and continue’ and you’ll be brought to a screen

which lists the required employee documents.

Page 46

31. Select ‘Back to employee applications’ to be returned to the

‘Employee Applications’ dashboard.

32. The Employee Declaration must be sent to the employee, either

online or by post.

33. You are then required to upload confirmation from the employee

that all the information on the declaration is correct. This

confirmation can take the form of a:

• scanned copy of the signed Employee Declaration

• Email from the employee containing the following information:

‘The attached form for the Redundancy Payment Scheme

dated (insert date) is accurate. Based on that information,

I am claiming a redundancy payment to the amount of

(insert amount), (name), and (PPSN).

34. Applications that are not submitted will expire if they have not been

opened for 364 days. The ‘Last updated’ column in the employee

applications table indicates when an application was last opened.

Generating a new Employee Declaration

35. A new copy of the Employee Declaration can be generated by

selecting ‘Continue’ on the ‘Employee applications’ dashboard. The

‘Employee documents’ step will open, and you can select

‘Download PDF’ again.

36. If the employee wants information on the application to be

updated, select ‘Continue’ on the ‘Employee applications’

dashboard.

37. The ‘Employee documents’ step will open.

Page 47

38. Select the ‘Back’ button at the bottom of the screen, and all

subsequent screens (Application details, then Employee details,

then Employee PPS number) until you reach the first screen where

employee information can be updated.

39. Update the information on that screen and press ‘Save and

continue’.

40. Repeat until you reach the ‘Employee documents’ step again.

41. There, select ‘Download PDF’ to download an Employee

Declaration with the updated information included.

Page 48

Step 4: Employee documents - Uploading employee

documents

42. Once the Employee Declaration has been received, return to the

Employee Dashboard. This can be done by:

• Select the ‘Go to applications’ button in the notification you

received.

• Select the Redundancy and Insolvency Payments Schemes

card on the Welfare Partners homepage or header. If all

required employer documents have been submitted, you are

always brought to the ‘Employee applications’ dashboard

first after selecting ‘Ready to start’ on the Redundancy,

Insolvency and Covid-19 Related Lay-off Payments Scheme

overview page.

• Select the ‘Employee applications’ tab when on the

‘Employer profile’ or ‘Employer documents’ dashboards.

43. Select ‘Continue’ on the application you wish to proceed with

under the ‘Employee applications’ table.

44. You’ll be returned to the ‘Employee documents’ step.

45. Select ‘Yes, upload now’.

Page 49

46. You’ll be presented with a slot for each ‘Required’ document type

and a slot where you can upload ‘Other’ documents (optional).

47. For the ‘Required’ documents:

• Confirmation from the employee that all information on

the Employee Declaration is correct must be uploaded

before you submit your application.

• If the employee is not a citizen of the EU, UK, Iceland,

Norway or Liechtenstein or Switzerland, an employment

permit or Irish residency permit is required. The

application can be submitted without it, but payment will not

issue until it is received.

48. You can also upload ‘Other’ documents (optional).

You should only upload an ‘other’ document if you believe it will

add additional context that the Department of Social Protection

does not have, but will help to establish the employee’s eligibility

for the scheme or the amount of the statutory redundancy

payment.

49. Once the required employee documents have been uploaded,

select ‘Save and continue’.

Page 50

Application summary

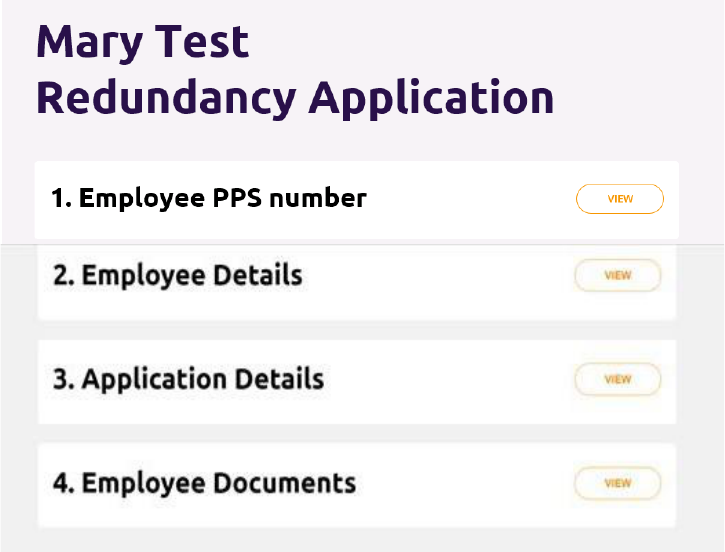

50. The ‘Application summary’ step will open.

51. You will see a tile for each step:

• Employee PPS number

• Employee details

• Application details

• Employee documents

52. View: Select ‘View’ to preview the information entered on each

step.

Edit: If any information is incorrect, select ‘Edit’ within the card to

return to that step. You can edit information on that screen and

press ‘Save and continue’.

If information is changed you must generate an updated Employee

Declaration and issue it to the employee again to get their

confirmation.

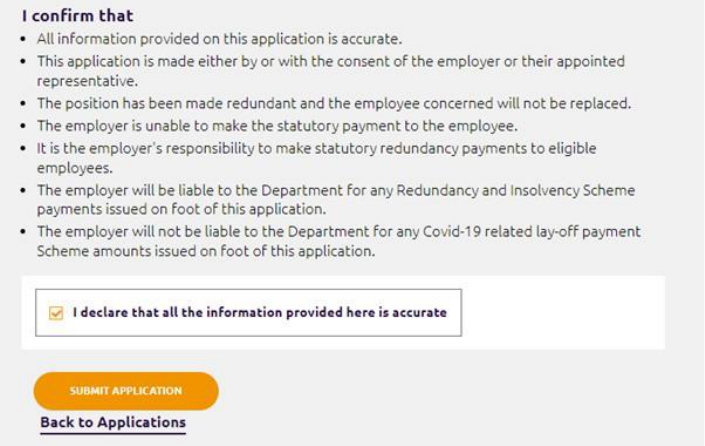

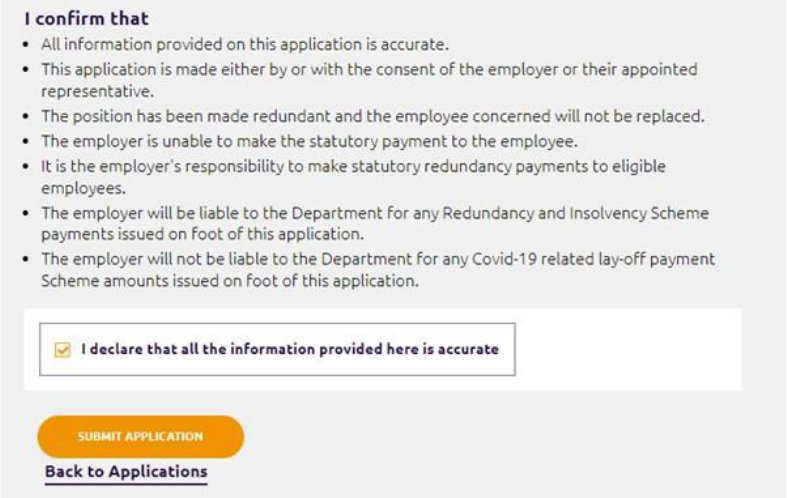

53. Review the declaration. If you agree with all the information in the

declaration, check the box.

Page 51

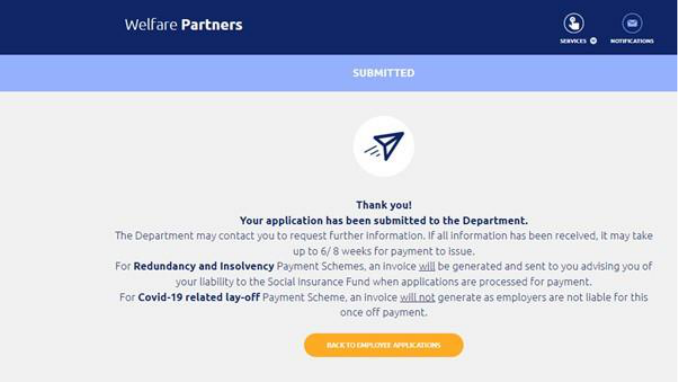

54. Press ‘Submit application’.

55. The application will be submitted to the Department and the

‘Submitted’ screen for the application will open.

If further information is required to process the application, an

officer from the Department will be in contact using the contact

information entered on the employer profile.

56. Select ‘Back to employee applications’ to return to the ‘Employee

applications’ dashboard.

57. The status of this application will now read ‘Submitted’.

The details of an application cannot be changed or viewed once it’s

been submitted. The Employee Declaration can be used as a

record of the information that was submitted.

6.

Page 47

Section 08

Creating a Covid-19 Related

Lay-off Payment Scheme

Application

Page 53

8. Creating a Covid-19 Related Lay-off

Payment Scheme application

Once you receive a notification that your profile is registered, you can

proceed to creating a Covid-19 Related Lay-off Payment

Scheme application.

See Appendix A for a list of all the information required for the

application.

You can create and submit applications without uploading all required

employee documents. However, the Department will not be able to

process the applications until all required employee documents are

received.

‘Employee applications’ dashboard

You can start creating Covid-19 Related Lay-off Payment Scheme

applications from the ‘Employee applications’ dashboard. You can

access this dashboard by either:

• Selecting the ‘Go to applications’ button in the notification you

received when the Employer Profile was registered.

• Selecting the Redundancy and Insolvency Payments

Schemes tile on the Welfare Partners homepage or header. If

all required employee documents have been submitted, you

are always brought to the ‘Employee applications’ dashboard

first after selecting ‘Ready to start’ on the Redundancy,

Insolvency and Covid-19 Related Lay-off Payments Scheme

overview page.

• Selecting the ‘Employee applications’ tab when on the

‘Employer profile’ dashboard.

On the dashboard, select ‘New application’ Redundancy Payments

Scheme tile to create a new Covid-19 Related Lay-off Payment

Scheme application.

Page 54

Step 1: Employee PPS number

1. Enter the employee’s PPS number in the PPSN field.

2. Select ‘Save and continue’.

3. You will receive an error if:

• The PPSN does not exist

• The PPSN does not refer to an employee associated with this

employer in the Department’s records.

• An application for the Redundancy Payments Scheme has

already been started for this employee and it is in progress.

Step 2: Employee details

Employee details

Page 55

4. If the employer has submitted an application before for this

employee, the information on this screen will be pre-populated with

the information that was entered previously.

5. The following is required:

a. Employee’s name

b. Employee’s date of birth.

c. Selecting if they’re an EU, EEA, UK, or Swiss citizen.

If it’s stated that the employee is not an EU, EEA, UK, or

Swiss citizen, an Irish residency permit or employment permit

will be required on the ‘Employee Documents’ page later in

the application.

Employee address details

6. Any correspondence the Department issues for the employee will

be sent to this address.

You’ll be presented with a field where you can enter an Eircode and

an option to select ‘I don’t have an Eircode’.

• If you have an Eircode, enter it in the field and select

‘Search’

You will be presented with the address on record for that

Eircode and you will be able to proceed to the next section.

If the address on record is incorrect you can edit it.

• If you select ‘I don’t have an Eircode’, you’ll be presented

with fields where you can enter the address. Once you’ve

entered the address, you can proceed to the next section.

Page 56

Employee contact details

7. You’re required to enter either a mobile number or landline

number for the employee.

8. You also have the option to enter an email address for the

employee.

Employment Details

9. The following information is required:

a. Transfer of Undertakings (TUPE): A transfer of employment

can occur where the ownership of a company was transferred

but the employee continued in the same employment without

any changes. In such cases, the service, terms, and

conditions of employment transfer over to the new employer.

These transfers are usually formal agreements and the

employee would receive a written notice of the transfer.

Page 57

If the employee was affected by TUPE, select the transfer of

undertakings (TUPEs) which apply to this employee’s

employment. If none of the TUPEs apply to this employee,

you’ll be required to select ‘None of these apply’.

b. Start date of employment for this employee.

c. End date of employment for this employee.

d. Date of notice of termination: A warning will display if

the date of notice of termination entered indicates

that the employee wasn’t given their statutory

minimum notice entitlement.

Gross weekly wage

10. Weekly hours: Enter the number of hours normally worked per

week.

11. Gross weekly wage. Enter the employee’s gross weekly wage.

The gross weekly wage will depend on the normal work pattern of

the employee. For more information on the calculation of the gross

weekly wage, go to the ‘Redundancy Payments Scheme Gross

Weekly Wage’ page on gov.ie

Page 58

12. Calculation used for gross weekly wage: The calculation can vary

depending on the type of employment as follows:

• Average of last 52 weeks worked.

Used when employee did not have regular hours or wages. Hours and

wages varied from week to week. Weeks where the employee did not work

are not used to calculate the average.

• Normal wage at end of employment.

Used when hours worked or wages did not vary from week to week. May

include average bonus or commission.

• Includes overtime averaged over the 26 week period

• Which ended 13 weeks before date of termination.

Where the employee worked overtime, the average overtime worked over a

26 week period is added to the basic weekly wage. The 26 week period

excludes the last 13 weeks before the employment was terminated.

• Piece worker whose pay depends on the amount of work carried

out.

Calculation is based on the average wage for hours worked in the 26

week period which ended 13 weeks before date of termination.

13. Gross weekly wage additional information: Enter any additional

information that will help to explain how the gross weekly wage was

calculated.

This section is optional, but very important where the wage entered

varies; does not match the regular wage or where an absence has

to be considered, such as a period on short-time, parental leave, or

carer’s leave. Go to the ‘Redundancy Payments Scheme Gross

Weekly Wage’ page on gov.ie for more information on the

calculation.

14. Select ‘Save and continue’.

Page 59

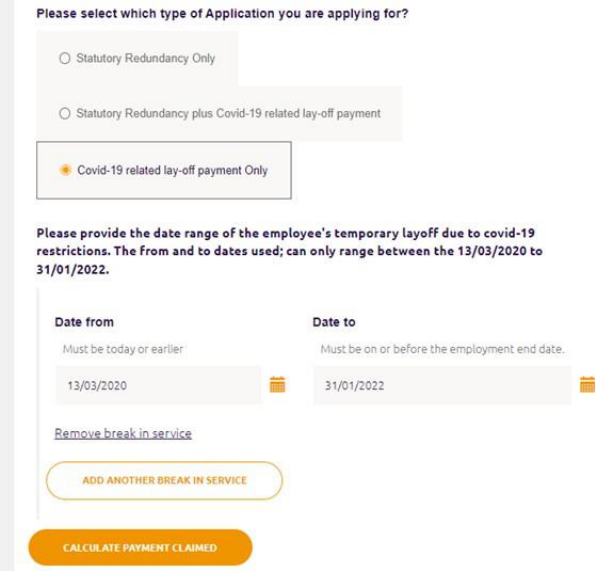

Step 3: Application details

1. The next step of the application, ‘Application details’, opens. Select

the relevant option you would like to submit an application for

• Covid-19 Related Lay-off Payment Only (Redundancy

Payment already made to an employee who was made

redundant and eligible for a redundancy payment

between the 13th March 2020 and the 31st January 2025.)

2. Insert the relevant date ranges of the employee's temporary lay-off

due to Covid-19 restrictions; add another break in service if applicable

(maximum of 12)

3. Break in service reason: make sure 'Temporary lay-off due to

Covid -19' is selected for the Covid-19 related lay-off payment

scheme; as the other 'layoff' reason does not qualify for reckonable

service.

4. Select ‘Calculate Payment Claimed’.

You cannot proceed to the next screen without selecting

‘Calculate Payment Claimed’. If you edit any information in the

section after selecting ‘Calculate Payment Claimed’, you

cannot proceed to the next screen without selecting

‘Calculate Payment Claimed’ again.

Page 60

6. The payment due field will populate, and will display an

estimated amount of what the employee is due, calculated based

on the information that you’ve entered.

The DSP will pay the lowest of:

▪ Amount claimed

▪ Estimated amount due

Employee payment details

1. Covid-19 related lay-off payments are sent directly to the employee

using the payment details supplied.

2. Account holder name: Enter the name on the employee’s bank

account.

3. IBAN: Enter an IBAN for the employee’s bank account. The field is

non mandatory so if an employee does not have an IBAN a

separate page can be uploaded with the claim.

4. Select ‘Save and continue’.

Page 61

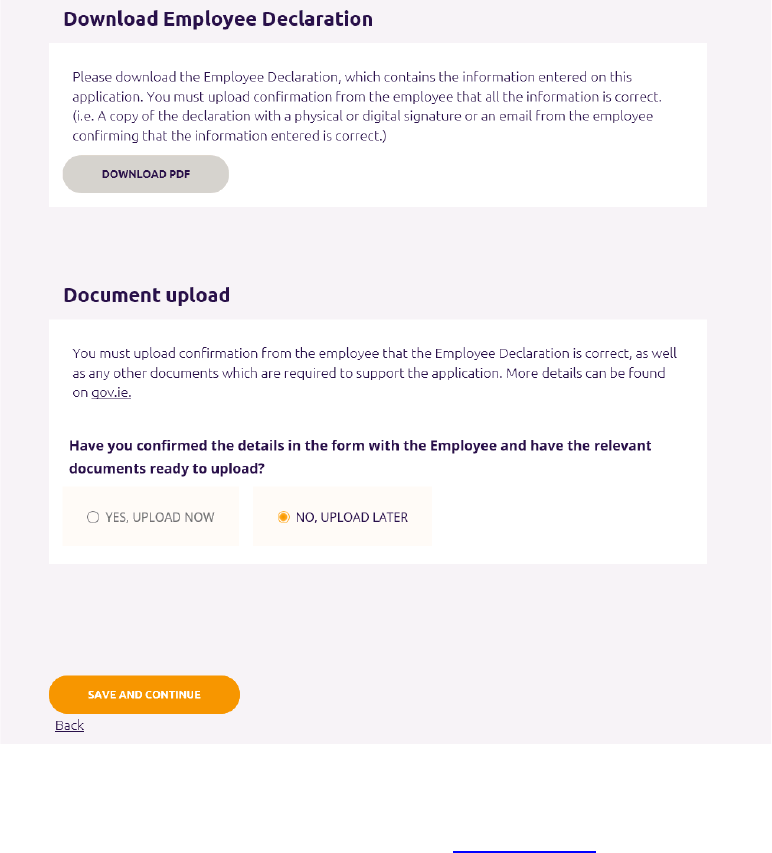

Step 4: Employee documents - Employee Declaration

1. The next step of the application, ‘Employee documents’, opens.

Download Employee Declaration

2. Select ‘Download PDF’ to download a copy of the Employee

Declaration, which contains the information entered as part of this

application. (A sample is included in Appendix B.)

3. Once you’ve downloaded the Employee Declaration, select ‘No,

upload later’ under the ‘Document upload’ section (as the employee

has not confirmed the information yet)

4. Select ‘Save and continue’ and you’ll be brought to a screen which

lists the required employee documents.

Page 62

5. Select ‘Back to employee applications’ to be returned to the

‘Employee Applications’ dashboard.

6. Applications that are not submitted will expire if they have not been

opened for 364 days. The ‘Last updated’ column in the employee

applications table indicates when an application was last opened

7. The Employee Declaration must be sent to the employee, either

online or by post.

8. You are then required to upload confirmation from the employee

that all the information on the declaration is correct. This

confirmation can take the form of a:

• Signed Employee Declaration

• Email from the employee containing the following information:

‘The attached form for the Covid-19 Related Lay-off

Payment Scheme dated (insert date) is accurate. Based

on that information, I am claiming a Covid-19 Related

Lay-off payment to the amount of (insert amount), (name)

& (PPSN).

Generating a new Employee Declaration

9. You can create a new copy of the Employee Declaration by

selecting ‘Continue’ on the ‘Employee applications’ dashboard. The

‘Employee documents’ step will open, and you can select

‘Download PDF’ again.

10. If the employee wants information on the application to be

updated, select ‘Continue’ on the ‘Employee applications’

dashboard.

Page 63

11. The ‘Employee documents’ step will open.

12. Select the ‘Back’ button at the bottom of the screen, and all

subsequent screens (Application details, then Employee details,

then Employee PPS number) until you reach the first screen where

employee information can be updated.

13. Update the information on that screen and press ‘Save and

continue’.

14. Repeat until you reach the ‘Employee documents’ step again.

15. There, select ‘Download PDF’ to download an Employee

Declaration with the updated information included.

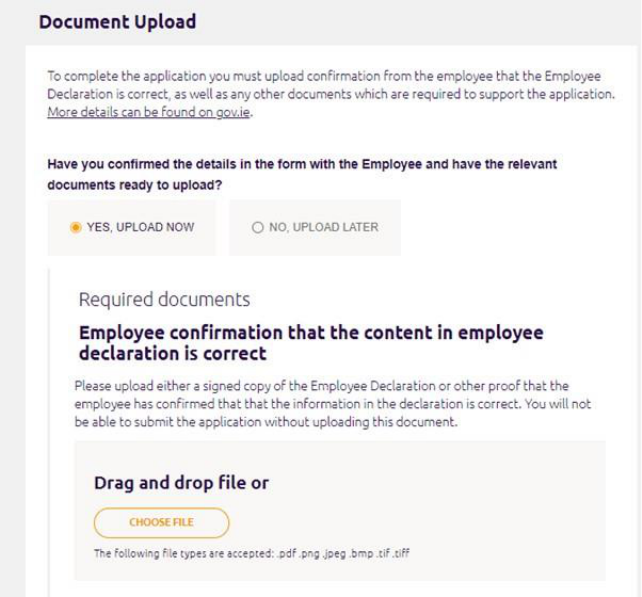

Step 4: Employee documents - Uploading employee

documents

19. Once the Employee Declaration has been received, return to the

Employee Dashboard. This can be done by:

• Select the ‘Go to applications’ button in the notification you

received.

• Select the Redundancy and Insolvency Payments Schemes

tile on the Welfare Partners homepage or header. If all

required employer documents have been submitted, you are

always brought to the ‘Employee applications’ dashboard

first after selecting ‘Ready to start’ on the Redundancy,

Insolvency and Covid-19 Related Lay-off Payments

Schemes overview page.

• Select the ‘Employee applications’ tab when on the

‘Employer profile’ or ‘Employer documents’ dashboards.

20. Select ‘Continue’ on the application you wish to proceed with

under the ‘Employee applications’ table.

21. You’ll be returned to the ‘Employee documents’ step.

22. Select ‘Yes, upload now’.

Page 64

23. You’ll be presented with a slot for each ‘Required’ document type

and a slot where you can upload ‘Other’ documents.

24. For the ‘Required’ documents:

• Confirmation from the employee that all information on

the Employee Declaration is correct must be uploaded

before you submit your application.

• If the employee is not a citizen of the EU, UK, Iceland,

Norway or Liechtenstein or Switzerland, an employment

permit or Irish residency permit is required. The

application can be submitted without it, but payment will not

issue until it is received.

25. You can also upload ‘Other’ documents (optional).

You should only upload an ‘Other’ document if you believe it will

add additional context that the Department of Social Protection

does not have, but will help to establish the employee’s eligibility

for the scheme.

Page 65

26. Once the required employee documents have been uploaded,

select ‘Save and continue’.

Application summary

27. The ‘Application summary’ step will open.

28. You will see a tile for each step:

a. Employee PPS number

b. Employee details

c. Application details

d. Employee documents

29. View: Select ‘View’ to preview the information entered on each

step.

Edit: If any information is incorrect, select ‘Edit’ within the tile to

return to that step. You can edit information on that screen and

press ‘Save and continue’.

If information is changed you must generate an updated Employee

Declaration and issue it to the employee again to get their

confirmation.

30. Review the declaration. If you agree with all the information in the

declaration, check the box.

Page 66

31. Press ‘Submit application’.

32. The application will be submitted to the Department and the

‘Submitted’ screen for the application will open.

If further information is required to process the application, an

officer from the Department will be in contact using the contact

information entered on the employer profile.

33. Select ‘Back to employee applications’ to return to the ‘Employee

applications’ dashboard.

34. The status of this application will now read ‘Submitted’.

35. The application will be submitted to the Department and the

‘Submitted’ screen for the application will open.

The details of an application cannot be changed or viewed

once it’s been submitted. The Employee Declaration can be

used as a record of the information that was submitted.

Section 9

Employee Applications

Page 68

9. Employee applications

Accessing the dashboard

You can access the ‘Employee applications’ dashboard by:

• Selecting ‘View’ on the employer on your ‘Employer list’ dashboard,

if all required employer documents have been submitted.

• Selecting the ‘Employee applications’ tab when on the ‘Employer

profile’ or ‘Employer documents’ dashboards for the relevant

employer.

Employee applications table

• The ‘Employee applications’ table has five columns.

a. Employee name

b. PPS number

c. Last updated (the date the application was last updated)

d. Application status (can be ‘New’, ‘In progress’, ‘Submitted’, or

‘Completed’)

• Applications that are not submitted will expire if they have not been

opened for 364 days. The ‘Last updated’ column in the employee

applications table indicates when an application was last opened

Page 69

• In the search bar, you can search for applications by PPSN. You

must search using the full PPSN you’re looking for. Entering part of

a PPSN will not return a result.

• A maximum of five applications can be displayed per page. To see

more applications, select the right arrow to see the next five

applications.

Application status

• You can select ‘Continue’ on applications with a status of ‘New’ or

‘In progress’ and you’ll be returned to the last step you were on

within the application.

• An application can only be progressed and submitted by the

user that creates/starts them. If there is an expected change in

staff it would be beneficial to have staff members who are leaving

or going on extended leave to review all started applications and

have them updated and submitted. Otherwise any 'started' or 'In

Progress' applications will need to be deleted and started again.

• You cannot edit or view the information entered on a

submitted application.

• An application moves to a status of ‘Submitted’ once you press

‘Submit’ on the summary page of an application.

• An application moves to a status of ‘Completed’ once the

application successfully reaches the Department’s system and it is

available for an officer to review.Once an application has been

started it can be saved and at a later point you can continue with

or update that application as appropriate. Once all information is

accurate and correct you can submit the application.

Section 10

Editing an Employer Profile

Page 71

10. Editing an Employer Profile

1. Edit an Employer Profile by going to the ‘Employer profile’

dashboard for an employer

2. Access the dashboard by selecting the ‘Employer Profile’ tab when

on the ‘Employer documents’ or ‘Employee applications’

dashboards.

3. Select the ‘Edit’ button.

4. You’ll be brought to the ‘Employer Profile – Step 1 of 3’ screen. The

fields will be pre-populated with the information you entered

previously.

5. Update any information that you want to change and select

‘Continue’.

6. You’ll be brought to the ‘Employer Profile – Step 2 of 3’ screen. The

fields will be pre-populated with the information you entered

previously.

The exception to this is if you changed information on the previous

screen that invalidated previously entered information or made

additional questions mandatory. You will be required to fill in these

questions before you can proceed.

7. Update any information that you want to change and select

‘Continue’.

8. You’ll be brought to the ‘Employer Profile – Step 3 of 3’ screen. The

fields will be pre-populated with the information you entered

previously.

The exception to this is if you changed information on a previous

screen that invalidated previously entered information or made

additional questions mandatory. You will be required to fill in these

questions before you can proceed.

9. Update any information that you want to change.

Page 72

10. Next, tick the box to declare that all the information that you’ve

entered as part of the Employer Profile is accurate.

11. Once you’re ready to register the updated Employer Profile, select

‘Save and register’.

12. The updated Employer Profile information will then be issued to

the DSP to be registered on the DSP’s system.

13. You will be brought to the ‘Registering Employer Profile’ screen.

You cannot create employee applications or submit employer

documents until the update is completed.

You will receive a notification on Welfare Partners when the

Employer Profile has been successfully updated. An email will be

sent to inform you that you’ve received a notification on Welfare

Partners.

If you update the Employer Profile after 8:30pm or on a

weekend, it may be the next working day before registration is

completed.

Section 11

Employer List

11. Employer list

Accessing the dashboard

You can access the ‘Employer list’ dashboard by:

• Selecting ‘Ready to start’ on the Redundancy,Insolvency and

Covid-19 Related Lay-off Payments Schemes overview screen.

• Selecting ‘Employers’ button in the header of the ‘Employer profile’,

‘Employer documents’, and ‘Employee applications’ dashboards.

Employers table

• The ‘Employers’ table has four columns.

a. Employer name

b. PAYE number

c. Profile last updated (the date the Employer Profile was last

registered)

d. Application status (always shows a status of ‘New’)

• In the search bar, you can search for employers by PAYE number.

You must search using the full PAYE number you’re looking for.

Entering part of a PAYE number will not return a result.

• A maximum of five employers can be displayed per page. To see

more employers, select the right arrow to see the next five

employers.

• Select ‘View’ on an employer to be brought to the ‘Employer

documents’ or ‘Employee applications’ dashboard for that

employer (depending on whether all required employer documents

have been uploaded).

Application status

Select the ‘New profile’ button to create a new Employer Profile, so

you can create employee applications for that employer.

Page 74

Page 82

Appendices

A – Checklist of required information

B – Sample Employee Declaration

Appendix A – Checklist of required information

Information required for Employer or Employer Representative

Profiles

Employer Representative role; if applicable

Employer’s PAYE number

Trading name (if none on record with Revenue)

Companies Registration Office (CRO) number (if registered with CRO)

Contact address for employer

Reason for redundancy (if applying for Redundancy Payments Scheme)

Type and date of insolvency (if applying for Insolvency Payments Scheme)

Details of any transfers of undertaking (TUPE) which impacted the employment of

any employees being made redundant:

• Previous PAYE number (if available) and previous employer name

• Date of transfer of employment

Employer Representative name

Point of contact for applications for this employer:

• Contact name

• Contact number

• Email address

Employee information required for Redundancy and Covid-19

related lay-off payment Schemes

Employee's PPS number

Employee Name

Employee’s date of birth

Whether employee is an EU, EEA, UK, or Swiss citizen (Yes/No)

Employee contact address

Contact number

Employee’s email address

Transfers of undertaking (TUPE) that applied to the employee’s employment; if

applicable

Employment start date

Employment end date

Date of notice of termination of employment

Details of any temporary lay-off due to Covid-19 restrictions breaks in service in the

last three years of employment:

• From and to date

• Reason for break in service

Average weekly hours

Gross weekly wage

How the gross weekly wage was calculated

Option to provide further detail to explain the calculation of the gross weekly wage

Employee payment details

• Employee’s IBAN (International Bank Account Information)

• Account holder name for employee’s account

Breaks in Service - Redundancy Payments Scheme

Details of any breaks in service in the last three years of employment:

• From and to date

• Reason for break in service

Breaks in Service - Covid-19 Related Lay-off Payments Scheme

How much, if any, redundancy was paid to the employee in relation to this

redundancy

Page 78

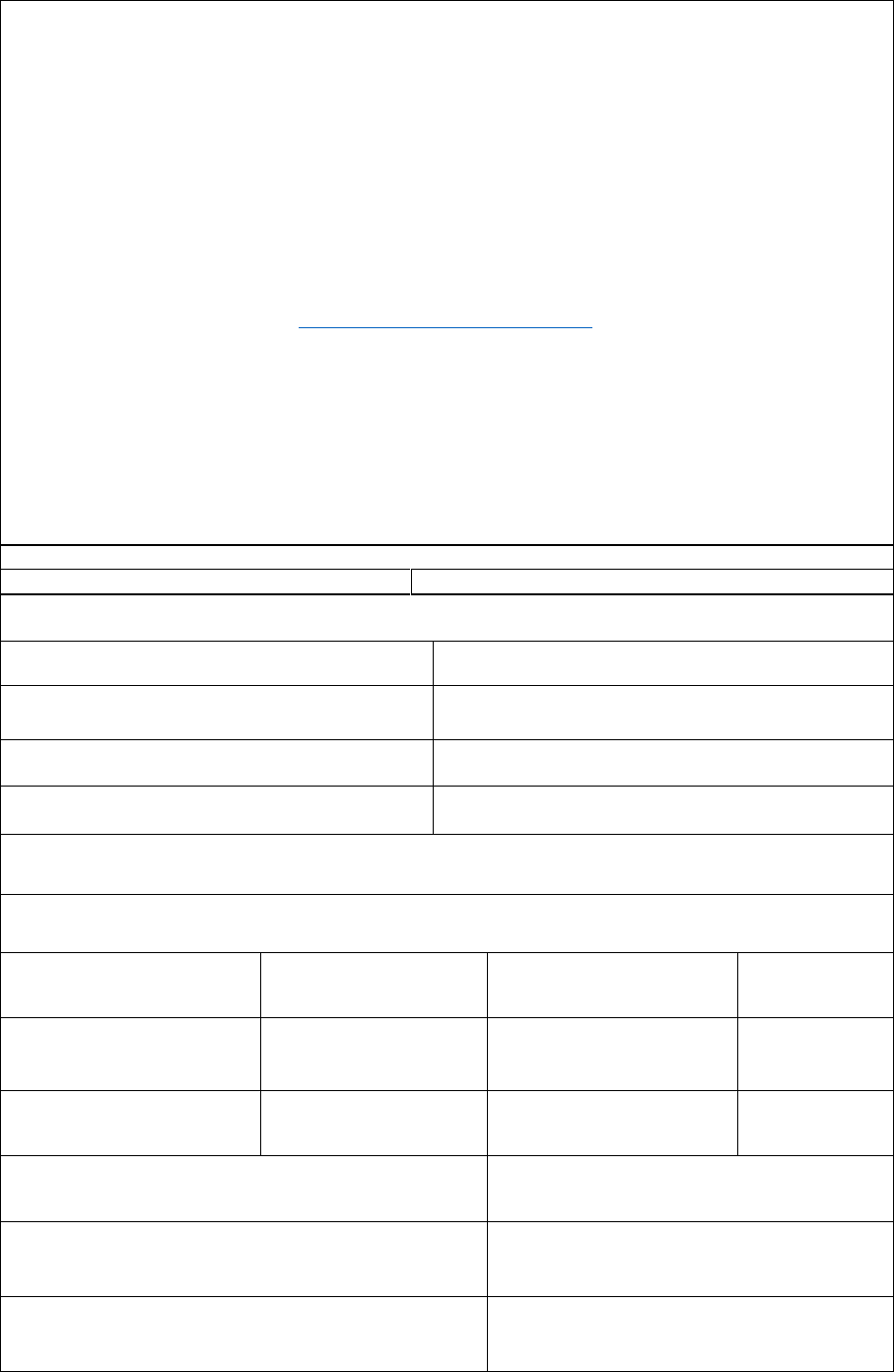

Redundancy Payment Scheme – Employee Declaration

<Login Profile>:

This notice is used to confirm details of an application for the Redundancy Payment Scheme. It

should be sent to the employee named below to confirm that the following information is

accurate.

Employee:

Your employer or their representative intends to submit an application under the Redundancy

Payment Scheme. This form is used to confirm details of that application.

• Check the content of the form to ensure that the information is correct

• If any content is incorrect, inform your employer or their representative so that errors can be rectified

or email [email protected]

• If all content is correct, confirm that to your employer or their representative.

• Your employer or their representative will submit that confirmation to the Department of Social

Protection in support of the application for the Redundancy Payments Scheme.

• On receipt of this application, the Department may contact either the employer or their representative

to verify the provided information and request additional documentation.

Appendix B: Employee Declaration

Sample - Statutory Redundancy Payment

Scheme

PAYE number: <PAYE Number>

Employer:

<Registered Name>

Trading as:

<Trading Name>

Employee:

<Firstname>

<Surname>

PPSN:

<PPSN>

Date of birth:

<Date of birth>

Address:

<Address line1>

<Address line2>

<Address line3>

County:

<County>

Postcode:

<Postcode>

Country:

<Country>

Contact number:

<Contact Number>

Email address:

<Email Address>

Citizen of European Economic

Area/Switzerland/UK:

<Yes or No>

Employment details

Weekly hours

worked:

<Weekly Hours>

Gross weekly

wage:

<Gross weekly wage>

Date of notice of

termination:

<Date of notice of

termination>

Employment start

date:

<Employment Start

Date>

Employment

end date:

<Employment end date>

Does any service with a previous employer apply to this

employee's employment?

<Yes or No>

Previous Employer <Previous Employer

name/Employer Name> <PAYE

number: Number.>

Date of transfer

of employment:

<Date of transfer of

employment>

ADD more +

Breaks in service

Were there any breaks in service in the three years before

<Yes or No>

the employment end date?

From

To

Reason

Page 79

If returning by post, sign and return to

<Applicant Contact Name> at <Applicant Company Name>.

If returning by email, include the following text in your email reply:

The attached form for the Redundancy Payment Scheme dated <system date> is accurate.

Based on that information I am claiming a redundancy payment to the amount of (insert

amount), (name) & (PPSN).

Please return to:

Data Protection Statement

The Department of Social Protection administers Ireland's social protection system. Customers

are required to provide personal data to determine eligibility for relevant payments/benefits.

Personal data may be exchanged with other Government Departments/Agencies where provided

for by law. The Department of Social Protection’s Privacy Statement is available at DSP Data

Protection on www.gov.ie. or in hard copy.

<Date>

<Date>

<BIS Reason1>

ADD more +

Payment details

Employee IBAN:

<Employee IBAN>

Name of

account holder:

< Name of Account

Holder>

Redundancy Payment Scheme claim summary

(Based on details provided and subject to review by Department of Social Protection)

Number of

Number of years’

<Number of years’

weeks due

<Number of weeks due:

service:

service>

(including

(Including Bonus Week)>

bonus week):

Estimated

statutory

entitlement:

<Estimated Statutory

entitlement>

Amount paid by

employer:

<Amount Paid by

Employer>

Payment claimed:

<Payment Claimed>

Employee Declaration:

I confirm that:

• All information provided on this form is accurate.

• I have been made redundant by my employer.

• I will be liable for any overpayment that issues.

• The balance of <Payment Claimed> in now due to me (subject to review by the Department).

This form was generated on the <system date> on behalf of <Applicant Company Name>.

Employee

Signature:

Date:

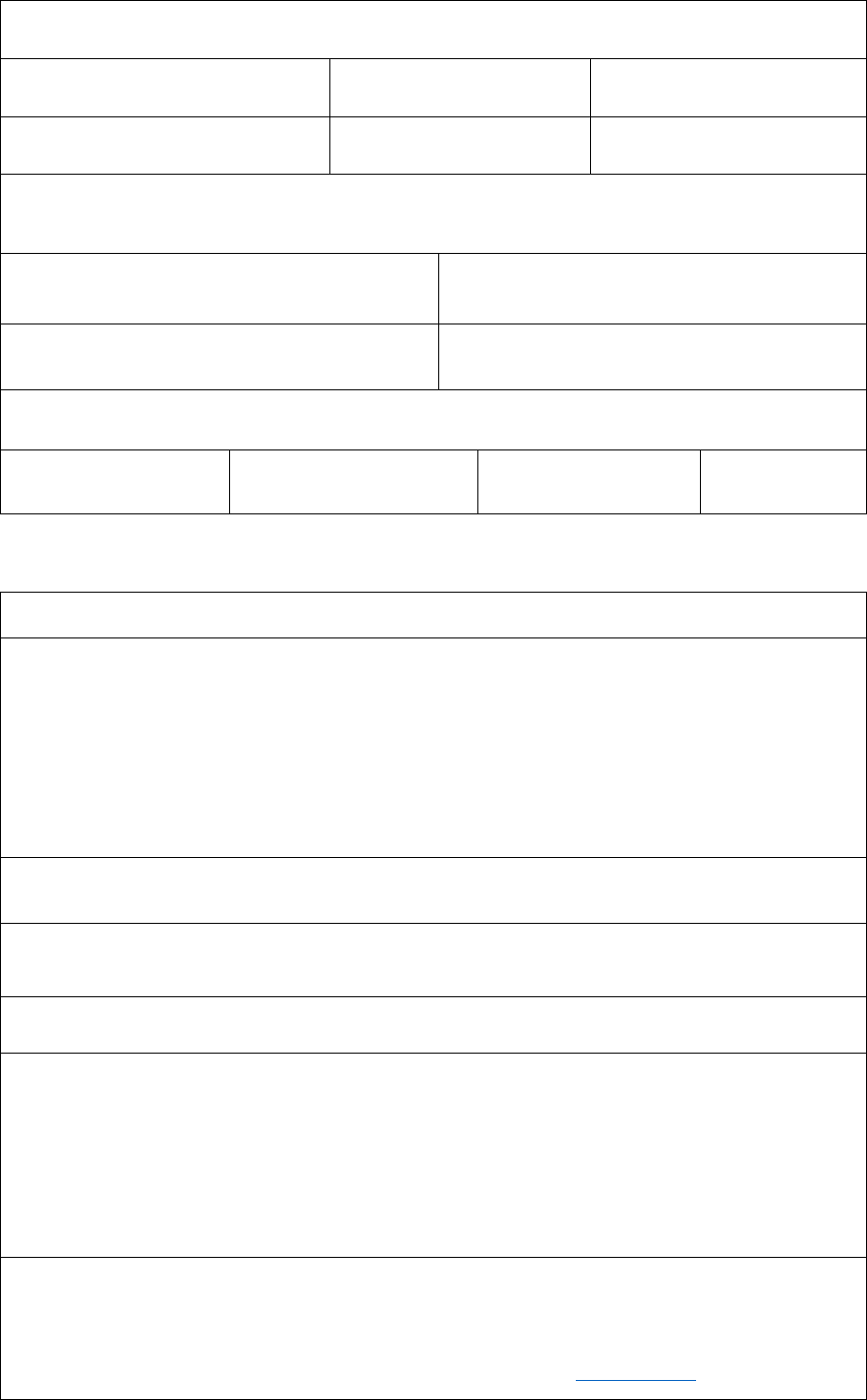

Employee Declaration Sample -

COVID-19 RELATED LAY-OFF PAYMENT SCHEME

<Login Profile>:

This notice is used to confirm details of an application for the Covid-19 related lay-off payment

Scheme. It should be sent to the employee named below to confirm that the following information is

accurate.

Employee:

Your employer or employer representative intends to submit an application under the Covid-19

related lay-off payment Scheme. This form is used to confirm details of that application.

•

Check the content of the form to ensure that the information is correct

•

If any content is incorrect, inform your employer or employer representative so that errors

can be rectified or email redundancypayments@welfare.ie

•

If all content is correct, confirm that to your employer or employer representative.

•

Your employer or employer representative will submit that confirmation to the Department

of Social Protection in support of the application for the Covid-19 related lay-off payment

Scheme.

On receipt of this application, the Department may contact either the employer or employer

representative to verify the provided information and request additional documentation.

PAYE number: <PAYE Number>

Employer:

<Registered Name>

Trading as:

<Trading Name>

Employee:

<Firstname>

<Surname>

PPSN: <PPSN>

Date of birth: <Date of birth>

Address:

<Address line1>

<Address line2> <Address line3>

County:

<County>

Postcode:<Postcode> Country:<Country>

Contact number: <Contact Number>

Email address: <Email Address>

Citizen of EU/European Economic Area/Switzerland/UK: <Yes or No>

Employment details

Weekly hours worked:

<Weekly Hours>

Gross weekly wage:

<Gross weekly

wage>

Date of notice of

termination:

<Date of notice of

termination>

Employment start date:

<Employment Start

Date>

Employment end date:

<Employment

end date>

Does any service with a previous employer apply

to this employee's employment?

<Yes or No>

Previous Employer name/Employer number:

<Previous Employer Name> <PAYE

Number.>

Date of transfer of employment:

<Date of transfer of employment>

Breaks in service

From

To

Reason

<Date>

<Date>

<BIS Reason1>

Covid-19 related lay-off payment Scheme claim summary

(Based on details provided and subject to review by the Department of Social Protection)

Number of years’ service: <Number of years’

service>

Number of weeks due <Number of weeks

due>

Payment Due: <Payment Due>

Payment details

Employee IBAN:

<Employee IBAN>

Name of account

holder:

< Name of

Account Holder>

COVID-19 RELATED LAY-OFF PAYMENT SCHEME - Employee Declaration

Employee Declaration:

I confirm that:

•

All information provided on this form is accurate.

•

I have been made redundant by my employer.

•

I will be liable for any overpayment that issue