2

Table of Contents

Student Checklist ..............................................................................................................................................3

PART 1 - RESPONSIBILITIES ..............................................................................................................................4

Definition of an Assistantship: ..........................................................................................................................4

First-time Teaching Assistant Orientation ........................................................................................................4

Acceptance of a Graduate Appointment..........................................................................................................5

To Accept Your Award ......................................................................................................................................5

Enrollment ........................................................................................................................................................5

Verification of Employment Eligibility ..............................................................................................................6

For graduate assistants being newly appointed ..............................................................................................6

For international graduate appointees ............................................................................................................6

Acknowledgement of Pay Information ............................................................................................................6

Payments and Taxes .........................................................................................................................................6

Social Security Numbers ...................................................................................................................................6

Weekly and Semi-Monthly Pay Periods Payment Dates: .................................................................................7

Direct Deposit of Payments for Services ..........................................................................................................7

FICA Taxes on Payments for Services Made to Graduate Assistants ...............................................................8

Income Taxes on Payments for Services Made to Graduate Assistants ..........................................................8

U.S. Citizens and Permanent Residents ............................................................................................................8

Nonresident Aliens ...........................................................................................................................................8

Tax Status of Tuition Reduction Credits ...........................................................................................................8

Graduate Tuition Reduction Credits and Their Use .........................................................................................9

Academic Progress and Tuition Reduction Credits ..........................................................................................9

Changes in Degree Program .............................................................................................................................9

Loss of a Graduate Assistant Position ..............................................................................................................9

Grievance Procedure ........................................................................................................................................9

PART 2 - BENEFITS ..........................................................................................................................................10

Auditing Courses .............................................................................................................................................10

Syracuse University Health Services ...............................................................................................................10

Health History and Immunization Forms .......................................................................................................11

Disability Benefits ...........................................................................................................................................11

Vacations and Holidays...................................................................................................................................12

Syracuse University Bookstore Discount ........................................................................................................12

3

Student Checklist

for Accepting a Graduate Research or Teaching Assistantship

at Syracuse University

The following checklist represents important actions you need to complete. The attached document

provides instructions and important information regarding benefits, rules and responsibilities

accompanying your assistantship. Check your Syracuse University email address regularly for updates.

If you have questions regarding your award, you may contact the department that has offered the

assistantship or Graduate Awards at Grad Awards. Be sure to include your name and Syracuse University

ID.

Before You Begin Employment:

A formal offer letter should be presented to you

Sign and return acceptance page to the hiring department

Determine if you need medical insurance coverage, instructions are included in this handbook

International students: should also enroll in MEDEX through the Slutzker Center Website, see

Slutzker Center forms

Enroll for classes BEFORE the first day of classes or you will not be able to begin work

Make sure the tuition credits listed in your offer letter match your enrollment each semester

FINANCIAL DEADLINE – Make sure you know this date every semester in case you need to drop

courses. Search the Syracuse University Website by typing in “Academic Calendar” and the

year and term

When you arrive on campus, you should:

Understand the work requirements and expectations of your assistantship by speaking with

your supervisor

Understand your department’s holiday and vacation policies by speaking with the department

staff

If you fail to receive your payments for work you are performing, contact Graduate Awards

immediately at Grad Awards

Contact Grad Awards immediately if you have questions– don’t wait!

4

Benefits and Responsibilities for Teaching and

Research Graduate Assistant Appointments

PART 1 - RESPONSIBILITIES

Definition of an Assistantship:

Graduate teaching and research assistants provide services to an academic or administrative

department of the University as defined in their appointment letters. A full-time graduate teaching or

research assistant appointment shall not require a total workload exceeding 20 hours a week, on

average. The combination of service, study, and research performed by those holding full-time, 20

hours/week graduate teaching or research assistantships constitutes a full-time assignment; it is

expected that you will accept no other work for pay. If you have been awarded a full-time

assistantship, a request to perform other work is an exception to this policy, and must be approved by

your department chair or program director. This requirement does not apply to students with a part-

time teaching or research assistantship (less than 20 hours per week). Note: Graduate Assistants

with a full-time assistantship (20 hours) may not hold a second assistantship.

First-time Teaching Assistant Orientation: For new graduate teaching assistants, participation is

required in the University's Teaching Assistant orientation held prior to the start of the fall semester.

New graduate teaching assistants are not exempt from this requirement. Refer to your graduate

assistant offer letter for more detail. You should also receive more detail about this event by email; if

you do not, please speak with someone in your department prior to the start of your appointment.

Graduate teaching or research assistants may also be offered tuition reduction credits as specified in

their appointment letters. Typically students do not register for more than three (3) courses or a

combined total of nine (9) credits of thesis, dissertation, independent study and variable credit courses

in any fall or spring semester of appointment. Graduate teaching or research assistants wishing to

alter the distribution of credits must consult their academic department before the semester ends

(see page 6).

5

Acceptance of a Graduate Appointment

Syracuse University subscribes to the following Council of Graduate Schools Resolution concerning

Graduate Scholars, Fellows, and Assistants. Most Council of Graduate Schools members recognize this

resolution.

Acceptance of an offer of financial aid (such as a graduate scholarship, fellowship, or assistantship) for

the next academic year by a prospective or enrolled graduate student completes an agreement that

both student and graduate school expect to honor. In that context, the conditions affecting such offers

and their acceptance must be defined carefully and understood by all parties.

Students are under no obligation to respond to offers of financial support prior to April 15; earlier

deadlines for acceptance of such offers violate the intent of this Resolution. In those instances in which

a student accepts an offer before April 15, and subsequently desires to withdraw that acceptance, the

student may submit in writing a resignation of the appointment at any time through April 15. However,

an acceptance given or left in force after April 15 commits the student not to accept another offer

without first obtaining a written release from the institution to which a commitment has been made.

Similarly, an offer by an institution after April 15 is conditional on presentation by the student of the

written release from any previously accepted offer. It is further agreed by the institutions and

organizations subscribing to the above Resolution that a copy of this Resolution should accompany

every scholarship, fellowship, and assistantship offer.

To Accept Your Award:

The assistantship offer letter has a section at the end for your signature of acceptance. Please review

the letter and instructions on the signature page. If you have been offered a graduate teaching or

research assistant appointment and tuition reduction credits and wish to accept them, you must sign,

date and provide your University ID number on the lines indicated and return the letter by the

deadline date; return the signed letter and acceptance page to the person indicated on the signature

page.

Enrollment – Students Must Be Registered: Full-Time Status & Registration

Full-time status: All graduate students holding an assistantship in a given semester will be considered

full-time students for that semester by virtue of their holding the award.

Graduate Assistants MUST BE REGISTERED. Students should consult with their advisors to determine

the minimum number of credits of enrollment for any given semester. If you have completed all

credit-bearing courses required for your degree, you must maintain your official student status by

registering for GRD 998 zero credit hours degree in progress. To receive the benefits associated with

an assistantship position, you must be a registered student.

IMPORTANT: REGISTRATION MUST BE COMPLETE BY THE FIRST DAY OF CLASSES. Graduate assistants

will not be allowed to work if not registered. It is recommended that you take advantage of early

registration if you are a returning student.

6

Verification of Employment Eligibility

The Immigration Reform and Control Act of 1986 require that the University verify employment

eligibility. Appointments to assistantships are contingent upon the appointee's providing adequate

employment-eligibility documentation as defined by that Act.

For graduate assistants being newly appointed within Syracuse University for all or part of the

2015-2016 academic year:

Complete the required Employment Eligibility Verification form (I-9) for employment at one of the

Human Resources Service Centers (locations indicated below). Students may go to Human

Resources prior to their start date, but no later than three business days from their start date. The

Human Resources Service Center is located at Skytop Office Building, South Campus, Room 101,

(315) 443.4042 option 1. For I-9 purposes, you may also visit Student Employment Services at 210

Steele Hall.

For international graduate appointees (those who attest they are an “alien authorized to work” on

the I-9 Form):

Must also go to the Human Resources Satellite Office located in Room 210 Steele Hall to complete the

Employment Eligibility Verification Form I-9. Presentations of a valid passport and Form I-20 or DS-

2019 are possible documents to present for this purpose. If you do not already have a Social Security

number or have lost your Social Security Card, you will need to apply for a Social Security number.

Please see the Slutzker Center for International Services website for more details: Slutzker Center I-9

Employment Eligibility

Acknowledgement of Pay Information

New York State requires that all new employees acknowledge their pay information before starting a

new position. A notification of your pay rate and other relevant information (Pay Notice) will be

created for you when your appointment information is accepted into the Human Resources system.

You will receive an email to your syr.edu email account to notify you that the notice will be viewable

within 24-48 hours. The pay notice is accessed through the View My Pay Notice link in My Slice.

Please follow the instructions in the email, and review and acknowledge your pay information online.

The process will take only a few minutes, so we encourage you to log in within 24 – 48 hours of

receiving the email to avoid any issues on your first day. If you do not have access to a computer or

need general assistance with the process, there is a computer kiosk outside of the Office of Human

Resources in Skytop Office Building. A Human Resources representative will be able to assist you

during normal business hours. For any questions regarding the pay notice process, please contact the

HR Service Center at Human Resources Service or (315)443-4042 option 1.

Payments and Taxes

Social Security Numbers: International appointees without a Social Security number must

immediately apply for a Social Security number upon arrival at the University, and provide a copy of

the receipt of application from the Social Security Administration to the Payroll Service Center. You

may click on the following link for further information on Social Security Numbers Syracuse University-

7

International Student-Social Security Info or contact the Slutzker Center for assistance. Once you

receive your Social Security card, a copy of the assigned number must be provided to the Payroll

Service Center. For any other questions on Social Security numbers, please contact the Payroll Service

Center at (315)443-4042 or email Payroll.

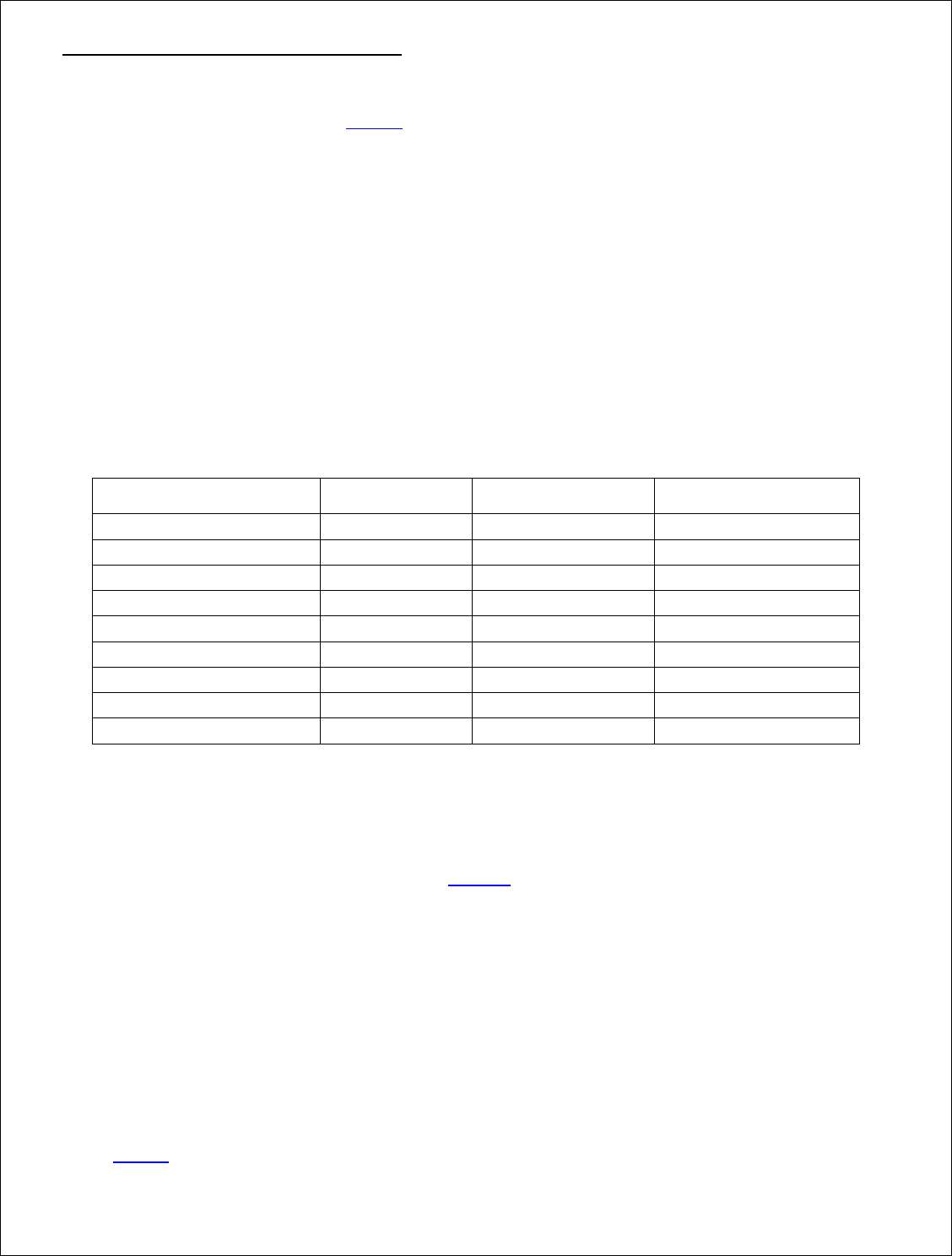

Weekly and Semi-Monthly Pay Periods Payment Dates:

WEEKLY: Graduate assistants that are paid weekly are paid on Wednesday following the week in

which they worked. The workweek begins on Thursday and ends on Wednesday.

SEMI-MONTHLY: Graduate assistants (GAs) that are paid on a semi-monthly basis are paid on the

business day closest to the 15th calendar day of the month and the last business day of the month.

Number of Pays for Semi-Monthly or Weekly:

The number of pays is determined by both the appointment period and funding. If students do not

begin work at the start of a semester, the payment schedule in the table below may be revised by

their department.

2015-2016

# of Payments

Payments Begin

Payments End

FULL Year Appointment

Weekly

40

August 21

st

May 21

st

Semi-Monthly

18

August 31

st

May 15

th

Fall Appointment

Weekly

20

August 21

st

December 31

st

Semi-Monthly

9

August 31

st

December 31

st

Spring Appointment

Weekly

20

January 8

th

May 21

st

Semi-Monthly

9

January 15

th

May 15

th

Direct Deposit of Payments for Services:

Payments may be directly deposited into an individual’s bank account(s). This is strongly encouraged.

All employees have the capability to log on to Myslice and select the link View/Update My Direct

Deposit under Employee Services. This allows:

Employees currently receiving a paycheck, to set up a direct deposit of their pay for the first time.

Employees who currently have direct deposit, to view their existing distribution.

Employees who currently have direct deposit, to add new bank account(s) and remove or make

changes to their existing distribution

All Graduate Assistants that have direct deposit will receive an email notification of payment on

payday, in place of a paper pay stub.

For more information on Direct Deposit, please contact the Payroll Service Center at (315)443-4042 or

email Payroll.

8

FICA Taxes on Payments for Services Made to Graduate Assistants

FICA (Federal Insurance Contributions Act-Social Security and Medicare) taxes will not be withheld by

the University from payments for services to Graduate Assistants who are registered for 6 or more credit

hours or dissertation (GRD 998) per semester during the academic year or summer. Students MUST be

registered to receive this exemption.

Income Taxes on Payments for Services Made to Graduate Assistants

U.S. Citizens and Permanent Residents: Payments to U.S. Citizens and Permanent Residents for

services as a Graduate Assistant are taxable income, subject to Federal and New York State Income Tax

withholding based upon the withholding forms completed online by the employee. All employees have

the capability to log on to Myslice and select the links View/Update My Federal Tax or View/Update My

NY Tax under Employee Services. This will allow employees to view their current federal or NY state tax

status and withholding allowance and to change their status and/or allowances. The University is

required to report wage payments and taxes withheld on Form W-2 to the recipient and to the Internal

Revenue Service.

Nonresident Aliens: Generally, payments to a Nonresident Alien for services as a Graduate Assistant

are taxable income, subject to withholding. The University is required to report these wage payments

and taxes withheld on Form W-2 to the recipient and to the Internal Revenue Service.

The existence of a tax treaty between the individual's country of residence and the U.S. with a provision

for payments as a Graduate Assistant may result in an exception to the withholding requirement, if the

individual meets the terms of the treaty. These terms may pertain to length of stay in the U.S. and/or

the amount of the payment. Wage payments exempt from withholding by treaty are required to be

reported to the recipient and the Internal Revenue Service on Form 1042-S.

To enable the University to determine the proper tax status for a Nonresident Alien Graduate

Assistant, for each calendar year it is necessary for the individual to complete a Nonresident Alien

Information Form. Information about the form is available on the Comptroller’s Office website:

Syracuse University Comptroller's Office. Any additional required forms will be sent to the individual

for completion/signature and require to be returned to the Payroll Service Center for processing.

Tax Status of Tuition Reduction Credits

The tuition reduction credits provided to graduate research assistants and graduate teaching

assistants at the University have been structured to satisfy the requirements for tax-free treatment

under the Internal Revenue Code. Each year the University will review those tuition reduction

credits, and will verify that such requirements are satisfied.

9

Graduate Tuition Reduction Credits and Their Use

Graduate tuition reduction credits may be applied to tuition charges for graduate courses. In rare cases,

undergraduate courses can be approved by the student’s advisor. Approval for use of tuition reduction

credits for undergraduate courses must be sought PRIOR to registration by submitting a Petition to the

Faculty form. Tuition will be charged at the graduate rate.

The tuition reduction credits may NOT be applied to the following: noncredit courses; courses of

individual instruction such as applied music (with the exception of students majoring in music);

workshop courses where fees normally cover expenses other than tuition; undergraduate courses

(except as provided in the preceding paragraph); courses of physical education that will not count

toward degree requirements; any courses audited during summer; and courses taken at the SUNY

College of Environmental Science and Forestry or SUNY Upstate Medical Center at Syracuse, unless

certified as required in a degree program.

Tuition reduction credits are awarded in a variety of configurations, depending on a graduate

assistantship terms of appointment. In order to alter the configuration of credits, the award holder must

seek the permission of his/her academic department and once approved, the academic unit must

submit the change to Graduate Awards to update the record. Unused tuition reduction credits will

become void if unused. Students should always check their Student Bursar Account to ensure

requested changes have been applied. It is a student’s responsibility to be aware of other academic

and financial deadlines. These deadlines may affect the use of tuition credits.

Academic Progress and Tuition Reduction Credits

Awards of tuition reduction credits are made by academic departments under the condition that the

appointee makes satisfactory academic progress in the degree program in which he/she was enrolled

at the time of the award offer. Consult with your department on questions of academic progress.

Changes in Degree Program

Recipients of awards of tuition reduction credits must seek the permission of their academic

department (or graduate program director, if appropriate) and the hiring department if different, to

initiate any change in degree program and still retain such an award.

Loss of a Graduate Assistant Position

Students should contact Graduate Awards for assistance if an assistantship might be lost. Credits

cannot be taken away if tuition charges already exist. Contact Grad Awards for more information.

Grievance Procedure

Any graduate student with a grievance regarding improper treatment by the graduate mentor, any

other faculty member or a faculty committee should seek to resolve the grievance within the

10

academic unit of study. The student may also contact the Associate Dean of the Graduate School to

discuss concerns; discussions will remain confidential at the student’s request.

If the graduate student wishes to appeal a decision of the school or college, the appeal may be

addressed to the Dean of the Graduate School. The Dean of the Graduate School shall have the

authority to investigate all relevant aspects of the grievance with the objective of seeking fair

resolution. If the findings or recommendations of the Dean of the Graduate School are not agreeable

to the Dean of the school or college, then the grievance will be referred to the Provost, who will make

a final decision. The authority of the Dean of the Graduate School extends to investigations of

compliance with rules and procedures, and shall include authority to investigate allegations of

misconduct or inappropriate treatment of students, but shall not extend to matters of academic

assessment. The Graduate School is not an appropriate venue for review of decisions made by the

Office of Academic Integrity or through the student judicial process.

PART 2 - BENEFITS

Auditing Courses

Graduate students holding an assistantship are entitled to audit courses during the fall and spring

semesters at no charge. Permission of the instructor must be obtained by completing a “Grading

Option Application Form” with the instructor’s signature. The form is then returned to the Student

Records Office at 106 Steele Hall. (Forms are available at the Student Records Office, or your academic

department.) Auditing courses during a Summer Session is NOT free; students will be charged 60%

of graduate tuition.

Syracuse University Health Services

The health and wellness fee is a mandatory fee for all full-time students and is included with billing from

the Bursar’s Office. Syracuse University Health Services provides student-centered ambulatory health

care to full-time students who have paid the mandatory health and wellness fee. Part-time students

are eligible to use Health Services on a fee for service basis. The health and wellness fee is remitted for

full graduate assistant appointments and prorated for partial appointments. Payment of the health and

wellness fee entitles eligible students to the following:

Office visits at SU Health Services

Syracuse University Ambulance (SUA)

SU Medical Transport

Counseling Center

Short-term psychiatric assessment and intervention

Nutritional counseling

Flu Vaccinations

Health education and wellness promotion services

Public health monitoring and oversight

11

Additional fees are charged for laboratory services, certain clinical procedures and pharmacy items. The

charge may be added to the bursar account, paid by cash, check, MasterCard/Visa at the time of service

or in some instances directly billed to your insurance carrier. Charges billed to the bursar account

appear as a “Health Services” charge. Itemized statements are available from the Health Services

Medical Records Department.

The health and wellness fee is not health insurance. Syracuse University strongly recommends that

students carry health insurance to cover expenses not covered by the health and wellness fee and

medical expenses incurred outside of Health Services, such as emergency room care, hospitalization,

referrals to outside providers, prescriptions and eye/dental care. If your health care coverage is

provided by a health maintenance organization or managed care program, you should determine what

coverage is available while outside the network. Students should always carry their health insurance

card with them when seeking care, and be familiar with how to access services under their policy. Please

note Health Services does not bill all insurances directly. Currently we direct bill Aetna, BC&BS Bluecard,

Pomco and HTH. For questions, call Health Services at (315)443-9005.

Health Services Pharmacy bills many insurances. Please visit our Pharmacy or contact them at (315)443-

5691 or email Syracuse University Pharmacy to inquire about your insurance.

Health History and Immunization Forms

Syracuse University is obligated to enforce student immunization requirements, as defined by New York

State Public Health Law, which requires all students to provide proof of immunity to Measles, Mumps

and Rubella. This information may be obtained by contacting your High School or Primary Care Provider.

In addition, a completed response form related to Meningococcal Meningitis vaccine is required. To

download the Health History and Immunization Form, please visit the Health Services website at

Syracuse University Health Services. Forms must be mailed (111 Waverly Ave, Syracuse NY 13244),

faxed (315-443-9010) or emailed ([email protected]) by June 30.

Disability Benefits

As a Graduate Research or Teaching Assistant, you may be eligible for New York State Disability

benefits.

HOW TO APPLY FOR BENEFITS: If you are removed from work by your Physician for a non-work

related illness or injury, contact Risk Management and obtain the appropriate paperwork and

instruction. Complete, sign, and date part A

(Claimant's Statement) of the "Notice and Proof of Claim for Disability Benefits" form DB-450. Have

your doctor complete and sign Part B (Doctor's Statement). Please note that this is not the "Return to

Work" form and does not satisfy the return to work requirements.

In accordance with New York State Law, within 30 days of the date you become disabled, you must

return the completed DB-450 to the Risk Management Department. Failure to file your claim on time

may result in the loss of some or all of your benefits.

It is also advisable to keep in touch with your Department while you are out.

PAYMENTS: When your disability is confirmed, you will be paid according to the New York State

Disability Benefits Law. The statutory benefit rate is 50% of your base wage up to a maximum of

12

$170.00 per week. The maximum allowable benefit is 26 weeks within a 52-week period. Please, be

advised that you will be required to submit continuing medical documentation on a monthly basis, or

as requested by Risk Management. Should your disability extend longer than the maximum of 26

weeks, you will need to contact your department or the Department of Human Resources to discuss a

leave of absence.

Payments are processed through the payroll system and are subject to income taxes and withholdings.

Syracuse University may pay your health premiums while you are on Disability, in accordance with

University policy. For further information regarding the Premium Waiver benefits, please contact the

University’s Human Resources Department at (315)443-4042.

If you have any questions, please contact Sheera Buckley in the Risk Management Office at (315)443-

5106.

Vacations and Holidays

Graduate assistants generally are not required to work on standard holidays or on bonus holidays as

defined by the Office of Human Resources. Standard holidays are days in which the University is not in

session. These include Labor Day, Thanksgiving Day, Christmas Day, New Year’s Day, and Martin Luther

King Day for the academic year—and additionally Memorial Day and Independence Day for the calendar

year. Bonus holidays (typically three per year) are "floating" holidays that are scheduled proximate to

Thanksgiving, Christmas, and/or Independence Day, to allow for longer recesses. In cases where the

nature of the agreed upon responsibilities requires a graduate assistant to work on standard or bonus

holidays (for example, to attend to critical laboratory functions), compensatory time will be provided by

the employing unit.

On days when classes are not in session but the University is open for business (Yom Kippur,

Thanksgiving Break, the December-January intermission and Spring Break), graduate assistants may

take vacations at times that are mutually agreeable to them and their supervisors on the basis of their

responsibilities communicated in advance. These will be considered paid vacations. (Approved by the

Board of Graduate Studies, April 1990.)

Department Policies – It is important for graduate assistants to know department policies about

missing work due to illness, traveling away from campus, etc. Check with your academic department

for policies specific to them.

Syracuse University Bookstore Discount

Assistants who are benefits eligible receive a 10% discount at the Syracuse University Bookstores. To

obtain your discount card, you must bring your appointment letter to the customer service counter at

the Schine Student Center Bookstore located at 303 University Place.

Please Note: Benefits are subject to change without notice. If there are any inconsistencies between

the benefits described above and the formal plan, policy, contract or program that specifies the

applicable requirements for such benefits, the terms of that formal plan, policy, contract or program shall

control.