2024

Benefits Guide

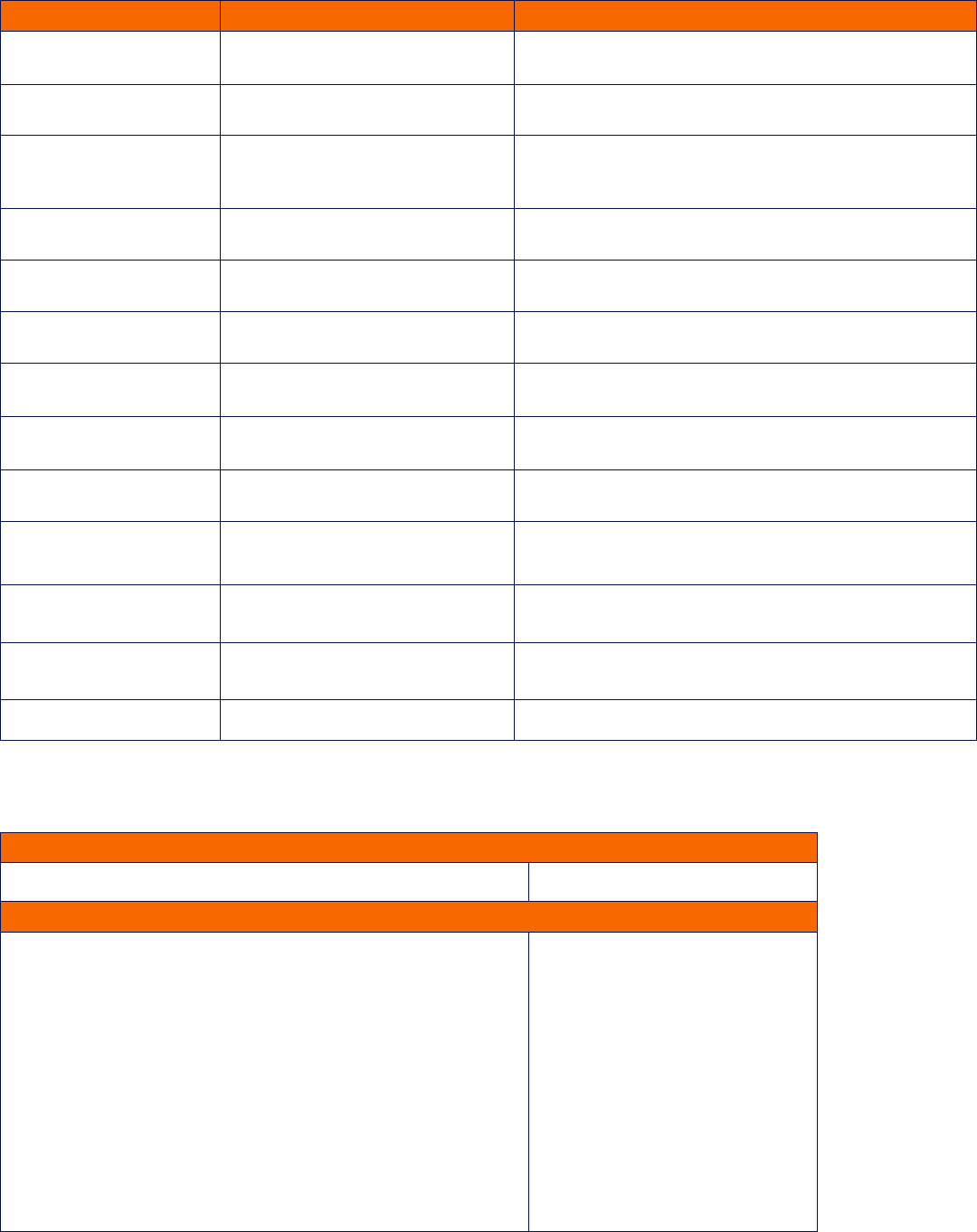

Benefit Administrators: Contact Information

Plan Provider Contact information

Medical Benefit Excellus BlueCross BlueShield (BCBS) 800.493.0318 (TTY: 800.662.1220)

ExcellusBCBS.com/syredu

Prescription Drug

Benefit

Optum Rx 866.854.2945 (TTY: 711)

optumrx.com

Flexible Spending

Accounts

HealthEquity 877.924.3967

(TTY: 866.353.8058 / International TTY: 602.267.3826)

wageworks.com

Dental Benefit Delta Dental 800.932.0783 (TTY: 711)

deltadentalins.com

Vision Benefit VSP Vision 800.877.7195 (TTY: 800.428.4833)

vsp.com

Dental/Vision and Disability

Plan for SEIU Members

Service Employees Benefit Fund (SEBF) 855.835.9720

sebf.org

Life Insurance MetLife (HR Shared Services is

record keeper)

315.443.4042 or hrservice@syr.edu

HR Shared Services

Auto and Home

Insurance

Farmers Insurance Group 800.438.6388

Long Term Disability

Insurance

The Standard 800.426.4332

Retirement Benefit Plan TIAA 855.842.2873 (TTY: 800.842.2755)

tiaa.org/syr

Dependent and Remitted

Tuition

Syracuse University 315.443.4042 or hrservice@syr.edu

HR Shared Services

Faculty and Staff Assistance

Program (FSAP)

Carebridge 800.437.0911 (TTY: 711)

Care. for Business Care. for Business 855.781.1303 or Care. for Business

Helpful University Contact Information

Syracuse University Office of Human Resources – hr.syr.edu

HR Shared Services 315.443.4042 or hrservice@syr.edu

Other Syracuse University Departments

Barnes Center at The Arch Recreation

College of Professional Studies

Equal Opportunity, Inclusion and Resolution Services

Hazard Communication Training

I.D. Card Services

Information Technology Services

Lesbian, Gay, Bisexual, Transgender and Queer (LGBTQ) Resource Center

Parking and Transportation Services

Payroll

Public Safety (Communications Center)

Real Estate Office

315.443.8000

315.443.9378

315.443.4018

315.443.4132

315.443.2721

315.443.2677

315.443.0228

315.443.4652

315.443.4042

315.443.2224

315.443.2104

1

SYRACUSE UNIVERSITY

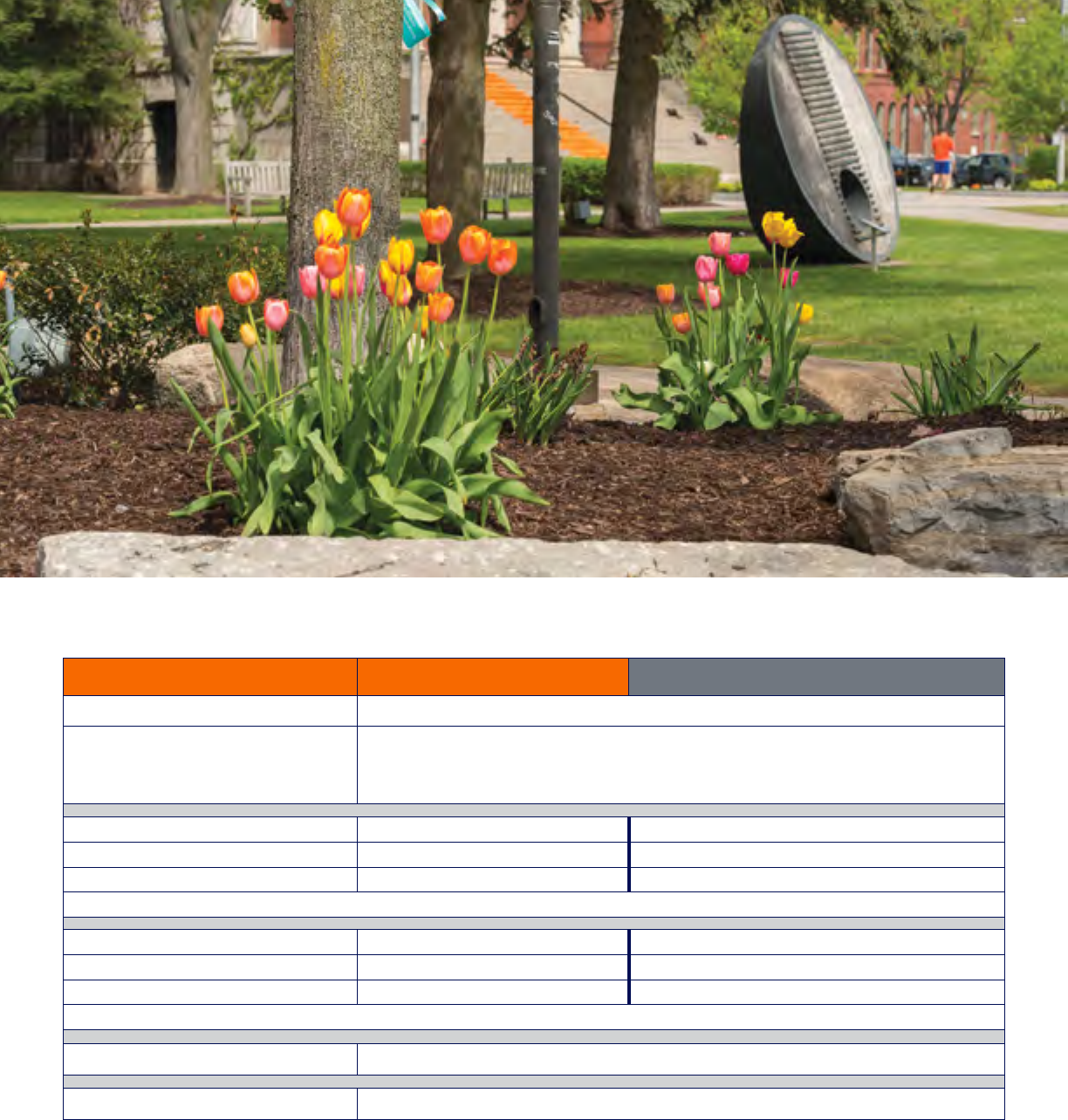

Welcome to Syracuse University

We are pleased to have you join our team of talented faculty and staff who work to deliver the best

experience possible for our students—on campus, across the country and around the world.

This booklet provides an overview of the comprehensive benefits program that provides flexibility and

choice to meet the unique needs of our employees. Beyond the basics found in this guide, you’ll want to

review the details found on the Human Resources website, hr.syr.edu, which is continually updated with

the most current benefit information.

Should you have any questions, or require accommodations to access any information within this

booklet, please reach out to HR Shared Services at 315.443.4042 or via email at hrservice@syr.edu.

We hope you find this information to be a valuable resource as you begin your University career, and

we wish you much success in your new role.

Sincerely,

Office of Human Resources

2

BENEFITS GUIDE

Table of Contents

New Employee Checklist ............................................................................................................................................................3

Benefits Quick Guide ...................................................................................................................................................................5

Retirement Planning .....................................................................................................................................................................6

Health Benefits .............................................................................................................................................................................8

Dental and Vision Benefits ......................................................................................................................................................13

Flexible Spending Accounts (FSAs) .....................................................................................................................................16

Wellness and WorkLife Resources ........................................................................................................................................ 16

Life Insurance .............................................................................................................................................................................. 17

Disability Benefits ......................................................................................................................................................................18

Workers’ Compensation .......................................................................................................................................................... 18

Voluntary Long Term Disability Insurance ...........................................................................................................................18

Remitted Tuition Benefits.........................................................................................................................................................19

Dependent Tuition Benefits ....................................................................................................................................................20

Paid Time Off for Staff ..............................................................................................................................................................21

Leaves of Absence ..................................................................................................................................................................... 21

Caregiving Resources ...............................................................................................................................................................21

Live Local .....................................................................................................................................................................................21

Auto and Home Insurance .......................................................................................................................................................21

Travel Resources ........................................................................................................................................................................21

Identification Cards ...................................................................................................................................................................21

Adoption Assistance ................................................................................................................................................................. 21

Lesbian, Gay, Bisexual, Transgender and Queer (LGBTQ) Resource Center .............................................................22

Information Technology Services...........................................................................................................................................22

Notice of Special Enrollment Rights......................................................................................................................................23

Continuation of Health Coverage/COBRA ........................................................................................................................24

Notice of Privacy Practices .....................................................................................................................................................27

Notice Regarding the Women’s Health and Cancer Rights Act of 1998 .....................................................................30

Summary of Benefits and Coverage (SBC) ......................................................................................................................... 30

3

SYRACUSE UNIVERSITY

New Employee Checklist

On or Before Your First Day:

n

Complete your Employment Eligibility Verification (I-9) form at Human Resources (HR). Bring your required documentation.

n

Activate your NetID at netid.syr.edu, so that you have access to online resources and services such as:

• Email

• Electronic documents

• MySlice, the University web portal where you access the University’s benefits enrollment site and other employee services

n

Obtain an identification card from the Office of Housing, Meal Plan and I.D. Card Services. Submit your photo by emailing

idcard@syr.edu and follow the guidelines for photo submission by viewing housingmealplans.syr.edu/idcards/photo-submission.

When your new card is ready, you will receive an email directing you when and where to pick up the card.

n

Complete your Pay Notice Acknowledgment in the Payroll section of MySlice.

n

Complete a retirement plan waiting period waiver form, if applicable.

First Week:

n

Sign up for direct deposit of your pay and update your federal and/or state tax withholding status and allowances in the Payroll section

of MySlice.

n

Review the Orange Alert information and provide your preferred contact information in the Personal Profile section of MySlice.

n

Schedule your Hazard Communication Training online at ehss.syr.edu/about/training.

n

If your duties will include accounting and payroll tasks, visit bfas.syr.edu/comptroller/resources/training/ to register for applicable

training. For additional training regarding the General Ledger Financial Reports, please contact General Accounting at 315.443.2522

or genacctg@syr.edu.

First Month:

n

Review benefits information and enroll as soon as possible.

IMPORTANT: You must enroll within the first 31 days of employment to commence benefits as of your hire date.

n

Attend New Employee Orientation. New Employee Orientation sessions are regularly held, and you should receive an

email from Human Resources with details about the next session.

4

BENEFITS GUIDE

5

SYRACUSE UNIVERSITY

Benefits Quick Guide

Eligibility

You are eligible for benefits the day you begin your benefits-

eligible position. Refer to the University’s benefits eligibility policy

(hr.syr.edu/eligibility) to determine which dependents are eligible

for coverage.

Retirement

You may contribute to the University's 403(b) retirement plan

immediately upon hire by electing pre-tax and/or after-tax Roth

403(b) contributions. Upon reaching your one-year anniversary, the

University will contribute 10% of your eligible pay, subject to annual

IRS maximums. The one-year waiting period may be waived for those

who qualify.

Health Insurance

Three comprehensive medical options are available through

Excellus BCBS (hr.syr.edu/medical), with prescription drug coverage

through Optum Rx (hr.syr.edu/rx).

Dental and Vision

Preventive and comprehensive coverage is available through Delta

Dental. You can add vision coverage to your dental coverage through

VSP (hr.syr.edu/dental).

Flexible Spending Accounts

Withhold salary on a pre-tax basis for reimbursement of eligible out-

of-pocket health care expenses and dependent care expenses. The

maximum withholding is $3,200 for medical expenses and $5,000

per household for dependent care (hr.syr.edu/fsa).

Wellness

The Syracuse University Wellness Initiative provides learning

opportunities, activities, programs and other resources to empower

and encourage you to make decisions that lead to a balanced

and healthy lifestyle. Learn about upcoming programs at

wellness.syr.edu.

Faculty and Staff Assistance Program

Counselors are available for confidential consultation, assessment,

referrals and counseling through Carebridge. Licensed, credentialed

counselors are available 24 hours a day, seven days a week, 365 days

a year by calling 800.437.0911 (TTY: 711).

Disability and Life Insurance

Income replacement benefits are available for short and long term

disabilities. The University also provides basic life and accidental

death & dismemberment (AD&D) protection, with the option to

purchase additional coverage for you and your dependents

(hr.syr.edu/life-and-disability).

Tuition

Dependent tuition is available after you complete the equivalent

of three full-time years of service for eligible dependent children

attending Syracuse University or other participating institutions.

In addition, remitted tuition benefits for you and your eligible

spouse/same-sex domestic partner may be used toward graduate

and undergraduate coursework. Visit hr.syr.edu/tuition for more

information.

Paid Time Off

The University provides you with time to enjoy away from work, as

well as to protect you and your loved ones in times of sickness. Be sure

to review and understand the time off that you are eligible for through

your University benefits (hr.syr.edu/timeoff).

Caregiving Resources

The University provides a variety of support to assist with child and

dependent care needs, including access to a free premium membership

to the caregiving website Care. for Business, a dependent care

subsidy program, flexible work arrangements and more.

Additional Benefits

Auto and home insurance, recreational facilities, travel assistance,

career development, will preparation services, adoption assistance

and a guaranteed mortgage program are also available as part of the

University’s comprehensive benefits program.

6

BENEFITS GUIDE

Retirement Planning

The University offers you the opportunity to save in tax-deferred and tax-advantaged accounts and will contribute to those accounts if you

are eligible. The accounts are administered by TIAA and you can select from a variety of investment options. You can change your contribution

amount and investment elections at any time. For assistance with changing your contributions contact HR Shared Services at 315.443.4042

or hrservice@syr.edu. For assistance with changing your investment elections visit tiaa.org/syr or contact TIAA at 855.842.CUSE (2873)/

TTY: 800.842.2755.

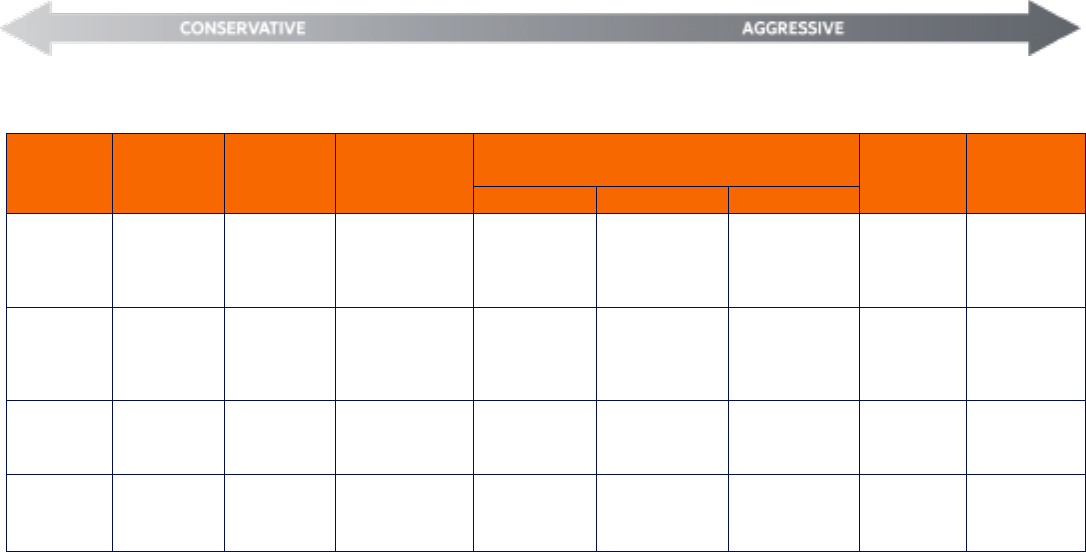

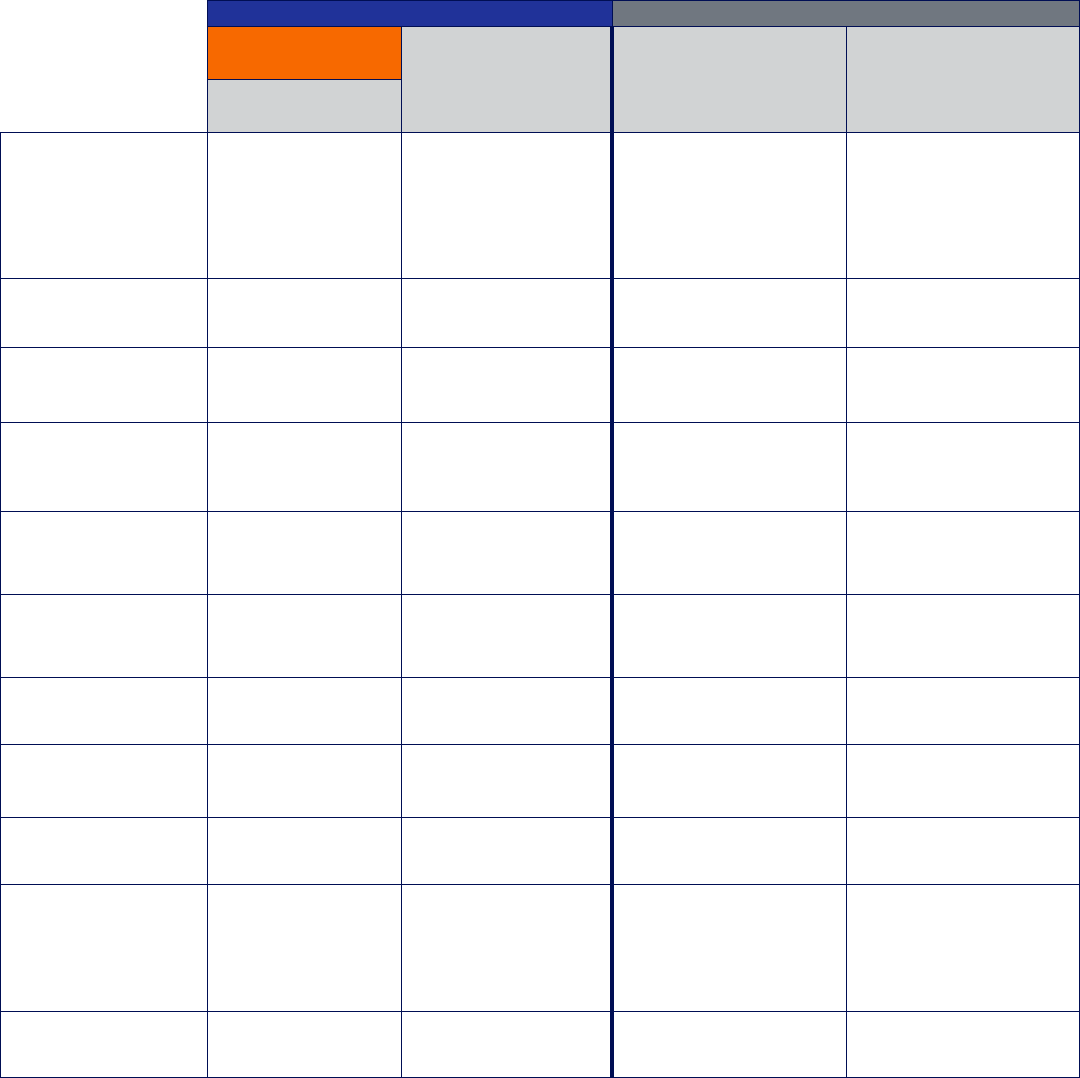

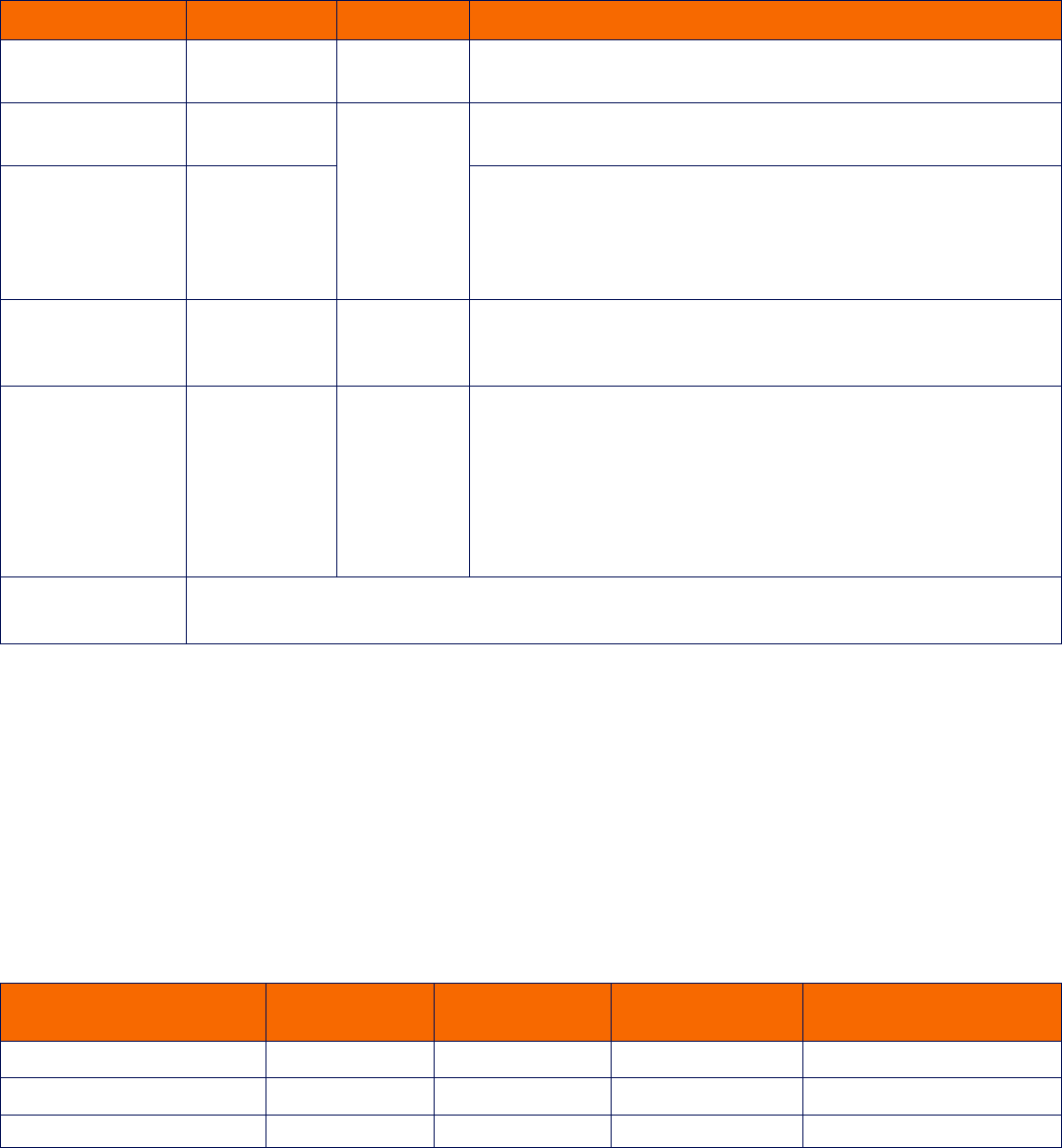

Retirement Plan Investment Options

One-step investing is easy when you select a single lifecycle fund. Select the T. Rowe Price Target Date Fund for the year closest to your

anticipated retirement date. The fund invests more aggressively the longer you have until retirement and will adjust its mix of assets (stocks,

bonds and cash) to become more conservative as retirement approaches.

Want to design your own investment mix? Choose from actively managed or passive funds, including fixed and variable annuities, mutual funds,

inflation-protected securities and real estate funds.

If you do not select your investments when you first enroll, contributions will automatically go into the T. Rowe Price Target Date Fund for the

year closest to the year you will reach age 65.

Categories to the left have potentially more inflation risk

and less investment risk

Categories to the right have potentially less inflation risk

and more investment risk

Guaranteed

Money

Market

Fixed Income/

Bond Funds

Hybrid and Target

Date Funds

Domestic Equity

Real Estate

International/

Global Equity

Value Blend Growth

TIAA

Traditional*

CREF Money

Market

Account*

BlackRock

High Yield

Bond Fund

CREF Social

Choice

Account*

Delaware

Small-Cap

Value

CREF Stock

Account*

MFS Mid-Cap

Growth Fund

TIAA Real

Estate

Account*

American

Funds

EuroPacific

Growth

TIAA Stable

Value**

Vanguard

Federal

Money

Market

CREF

Inflation-

Linked Bond

Account*

T. Rowe Price

Target Date

Funds

JP Morgan

Equity

Income

TIAA-CREF

Small-Cap

Equity

T. Rowe Price

Blue Chip

Growth

TIAA Real

Estate

Securities

Fund*+

Vanguard

Total

International

Stock Index

PIMCO

Total Return

Victory

Established

Value

Vanguard

Extended

Market Index

Vanguard

Total Bond

Market Index

Vanguard

Institutional

Index

Syracuse University's retirement plan investment options are subject to change. For more information and a complete list of investment options available, please visit tiaa.org/syr.

*Any guarantees under annuities issued by Teachers Insurance Annuity Association of America ("TIAA") are subject to its claims-paying ability. TIAA Traditional is a guaranteed

insurance contract and not an investment for federal securities law purposes. Payments under CREF and the TIAA Real Estate Account are variable and will rise or fall based

on investment performance. The TIAA Real Estate Account is a portfolio that has a direct investment exposure to commercial real estate. Returns are derived from properties

appreciating in value and rental income and will generally be more fixed income-like.

**The TIAA Stable fund is only available for University contributions to the Syracuse University Noncontributory Retirement Plan (101201).

*+The TIAA-CREF Real Estate Securities Fund is a mutual fund which invests primarily in real estate investment trusts (REITs). The volatility of this fund is equity-like and therefore

significantly higher than the TIAA Real Estate Account.

Your Retirement Plan Contributions

Upon employment, you are immediately eligible to contribute to

the University’s retirement plan. You can contribute either a flat

dollar amount or a percentage of your pay each pay period, up to the

maximum amount permitted by law, which is adjusted each year. This

year’s limits can be found by visiting hr.syr.edu/retirement-planning.

If you made contributions to a previous employer’s plan during the

calendar year, the combination of all of your contributions cannot

exceed the annual maximum.

To enroll, complete your new hire enrollment through MySlice

or return the 403(b) Salary Reduction Form to HR, which can be

found at hr.syr.edu/forms. You may elect pre-tax and/or after-tax

Roth 403(b) contributions.

University Retirement Plan Contributions

Upon completion of your first year of employment, the University will

contribute 10% of your eligible pay, subject to annual IRS maximums

and the terms of the Syracuse University Noncontributory Retirement

Plan.

Making Changes to Your Investments

If you do not make an investment election, the University’s

contribution will automatically be invested in a T. Rowe Price Target

Date Fund for the year closest to the year you reach age 65. You

can make changes to this investment and the investments of your

own contributions online at tiaa.org/syr or by contacting TIAA at

855.842.CUSE (2873)/TTY: 800.842.2755.

Waiving the One-Year Waiting Period

In general, the one-year waiting period to receive the University

contribution may be waived for faculty and staff joining the

University from another accredited four-year institution that confers

a baccalaureate degree, certain affiliates or research organizations. In

order to waive the University’s one-year waiting period, you must meet

the criteria provided on the waiver form. The waiver form, which must

be completed by you and your previous employer, can be found at

hr.syr.edu/forms. Once the waiver form has been completed by your

previous employer, you should review it for accuracy, sign and date

it, and return it to HR Shared Services either by fax (315.443.1063)

or email (hrservice@syr.edu). This waiver will go into effect and

the University’s contributions will begin after the completed form

is approved and processed by HR Shared Services. Please keep in

mind that there is no retroactive contribution of the University’s

contribution, so you are encouraged to complete the waiver form as

soon as possible to maximize the amount you are eligible to receive

from the University.

Financial Counseling at No Additional Cost

TIAA offers personalized advice and education services to help

you reach your retirement goals at no additional cost. To schedule

a meeting with one of the University’s dedicated TIAA financial

consultants, or for assistance with your account, contact TIAA at

855.842.CUSE (2873)/TTY: 800.842.2755, or sign up online

at tiaa.org/syr. In addition, the University provides a variety of

resources to help you plan for a successful retirement. Be sure to check

out hr.syr.edu/financial-wellness to see the many tools available to

support your personal financial goals.

Designate a Beneficiary

A beneficiary is the person or organization who will receive the money

in your accounts if you pass away. You can name primary beneficiaries,

who receive the money if they are alive when you pass away, and

contingent beneficiaries, who receive the money if your primary

beneficiaries pass away before you. You can update your beneficiary

designations at any time.

In general, if you’re married, your spouse must consent in writing if you

choose to name someone else as your primary beneficiary. If you don’t

name a beneficiary, the plan rules will determine who receives your

account. Naming a beneficiary ensures that your wishes are followed.

7

SYRACUSE UNIVERSITY

8

BENEFITS GUIDE

Health Benefits

Syracuse University is committed to providing comprehensive health

plan options for our faculty and staff. Three health insurance options

are available: SUBlue, SUOrange and SUPro. All three options include

medical coverage administered by Excellus BCBS and prescription

drug coverage administered by Optum Rx. In general, the same

services are covered under all three plans, but with a different

deductible and copay/coinsurance structure.

Benefits Eligibility

You are eligible to enroll as of your date of hire. Generally, you

may cover your legal spouse or eligible domestic partner, and your

children up to age 26 under your health coverage. Please refer to the

University’s Benefits Eligibility Policy online at hr.syr.edu/eligibility

to determine if your dependents are eligible for coverage. You must

show documentation of your dependent’s relationship to you before

your dependent will be approved for coverage.

Medical Benefits

SUBlue and SUPro allow members to receive services from any

provider, subject to certain plan restrictions. When you receive health

care, your coverage will be determined by whether the provider

participates in the network, as described below.

• In-Network: Services must be performed by a provider

that participates with the local Excellus BCBS network or

the national BlueCard network, regardless of their location.

Coordination with your Primary Care Physician (PCP) is not

required.

• Out-of-Network: Services are performed by a provider that

does not participate in the Excellus BCBS network.

SUOrange restricts coverage to only those providers that participate

with Excellus BCBS or the national BlueCard network.

Coverage for International Travel: When traveling outside the

United States, you have access to in-network providers in over

200 countries worldwide. If you receive health care services from

a participating BCBS Global Core provider, generally you can

present your ID card and pay the applicable deductible and copay/

coinsurance under SUBlue, SUOrange or SUPro.

If you see an international provider who doesn’t participate in the

BCBS Global Core network, you will need to pay for those services

at the time they are rendered. If you’re enrolled in SUBlue or SUPro,

you can submit those claims to Excellus BCBS for reimbursement as

though the providers were participating; however, there is no coverage

for non-participating providers in the SUOrange plan.

Online Tools and Resources for Medical Benefits: Set up an account

through the excellusBCBS.com/syredu secure member website for

a full suite of online tools. You can view your benefits, eligibility and

claims and search for participating providers and facilities. You can

also download the Excellus BCBS mobile app for instant access to

your member ID card and claims information. Excellus BCBS also

offers member assistance through their dedicated customer service

unit at 800.493.0318 (TTY: 800.662.1220).

Prescription Drug Benefits

Optum Rx is the pharmacy benefit manager for Syracuse University.

The benefit provides many convenient ways to obtain your

prescriptions. Visit hr.syr.edu/rx for coverage details.

Generic Drugs

To encourage the appropriate use of generic medications, if a generic

equivalent is available and you choose to have the brand name drug, or

your doctor writes “Dispense As Written” (DAW) on your prescription

to ensure that you get the brand name drug, generally you will be

required to pay the generic, tier one copay plus the difference in cost

between the brand name drug and the generic drug.

Biotech/Specialty Drugs

Prescription drugs in the biotech/specialty class are required to be

filled through mail order by Optum Specialty Pharmacy and may be

limited to a 30-day supply per refill. Your cost will follow the mail

order schedule for your medical plan option, but for a 30-day supply.

Contact Optum Specialty Pharmacy at 844.265.1761 (TTY: 711) to

learn more about specialty medications.

Home Delivery

If you take certain prescription medications on an ongoing basis,

you can fill your prescriptions using home delivery, which offers

convenient mail order service with free standard shipping. Enroll in

home delivery online at optumrx.com.

Have your doctor write your prescription for up to a 90-day supply

with three refills. Your doctor can call, fax or electronically prescribe

your medication for home delivery. Some medications, including

pre-packaged medications and controlled substances, may not be

available in a supply greater than 30 days per order. Home delivery

orders are generally received within 14 days, but you will be notified

if there will be a delay with your shipment. Call Optum Rx at

866.854.2945 (TTY: 711) for assistance with home delivery.

When you use mail order, the plan’s mail order cost sharing applies,

which is different than the cost sharing at a retail pharmacy. This may

result in significant savings in your out-of-pocket costs, but savings

vary for each medication and savings are not guaranteed.

Retail 90-Day Network

You may fill a 90-day supply at a local participating pharmacy, instead

of using the mail order option, and pay the retail cost share for your

plan option.

Online Tools and Resources for Prescription Drug Benefits

Set up your account at optumrx.com, the secure member website for

prescription drug benefits. Then you can view your claim history, view/

print your member ID card, find participating pharmacies, estimate

the cost of prescriptions and much more. The Optum Rx mobile app

gives you access from anywhere.

9

SYRACUSE UNIVERSITY

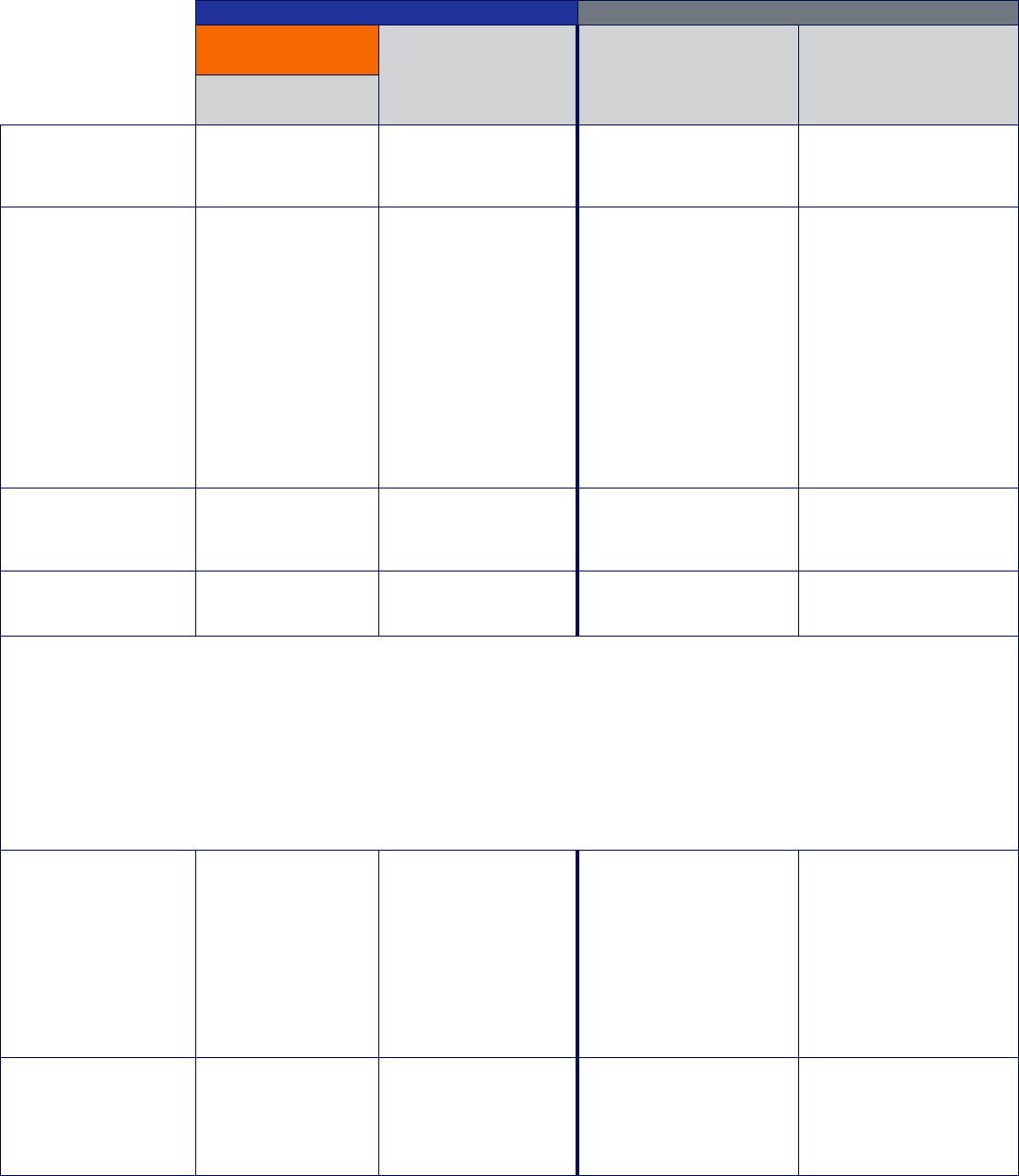

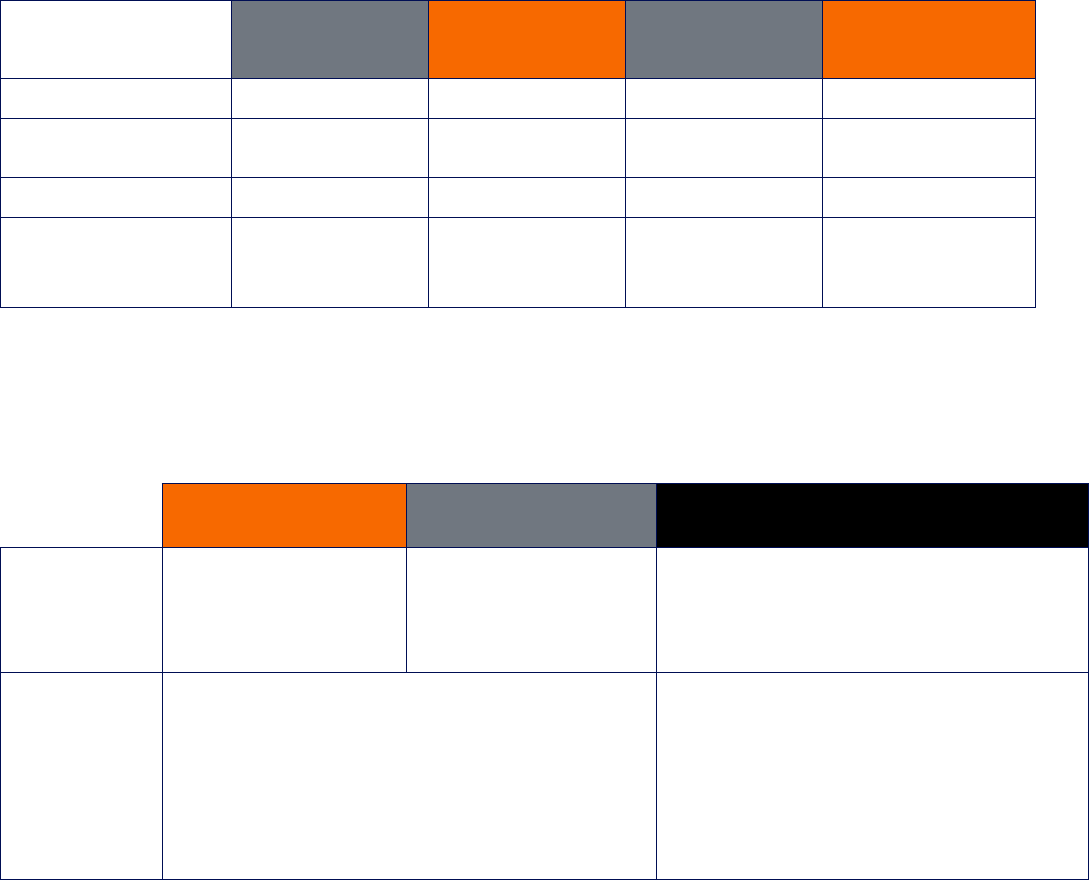

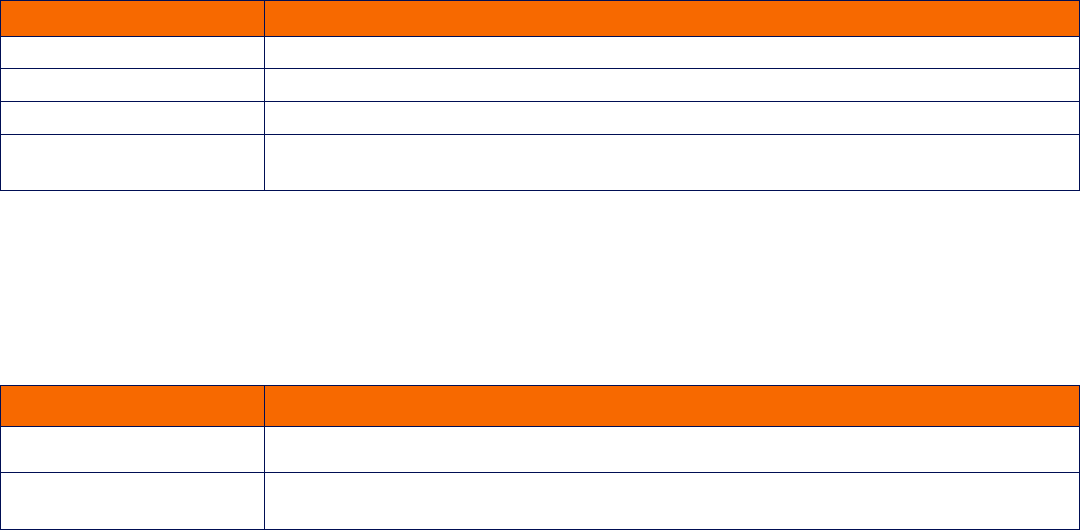

2024 Health Plan: Monthly Employee Contributions

SUBlue SUOrange SUPro

Schedule A Schedule B Schedule A Schedule B Schedule A Schedule B

Employee $165.21 $140.66 $160.40 $136.56 $150.67 $128.27

Employee + Spouse/Domestic Partner $421.60 $309.43 $409.49 $300.43 $386.89 $282.20

Employee + Child(ren) $367.37 $271.46 $356.80 $263.56 $336.91 $247.57

Employee + Spouse/Domestic Partner +

Child(ren)

$608.24 $440.24 $590.82 $427.43 $558.84 $401.49

Contributions listed here are based on the 12-month calendar year. The actual deduction from your paycheck depends on your deduction cycle.

Reduced Medical Contributions: Schedule B

Employees will pay the Schedule A contribution rates for health plan coverage unless they qualify, apply and are approved for reduced Schedule

B contributions. Applications must be received within 31 days of your date of hire and resubmitted each year during Open Enrollment. Eligibility

for Schedule B contributions is based on household income and household size according to the chart below (subject to change each year).

For 2024, the eligibility guidelines are:

Household Size Household Income

1 Less than $53,250

2 Less than $74,550

3 Less than $95,850

4 Less than $117,150

5 Less than $138,450

6 and up Less than $159,750

Household size is the number of individuals declared on your most recent federal income tax return and the return for your spouse or domestic

partner, if filed separately. Included in household size are your children who are not declared on your tax return, but are either under age 19 and

living with you, or age 19 or older and enrolled on your medical plan. Household income is the combined adjusted gross income reported on your

(combined) federal income tax returns.

Additional information about Schedule B contributions, including the application form, is available online at hr.syr.edu/scheduleb.

10

BENEFITS GUIDE

2024 Health Plan: Schedule of Benefits

The following chart shows your cost sharing for some commonly used health care services. The complete benefit summary and coverage features

of each plan option can be found in the Medical Booklet, posted online in MySlice.

SUBlue SUPro

SUOrange

Out-of-Network In-Network Out-of-NetworkIn-Network

Annual

Deductible

1

$150 per individual

with a maximum of

$300 per family

$300 per individual with

a maximum of $1,000

per family

$200 per individual

with a maximum of

$400 per family

$300 per individual with

a maximum of $1,000

per family

Coinsurance Generally, no

coinsurance. Certain

exceptions apply. See

the Medical Booklet

for information.

30% allowable amount

plus the difference

between provider’s

charge and the allowable

amount. Certain

exceptions apply.

See the Medical Booklet

for information.

5% of allowable amount for

inpatient hospitalization

- or -

20% of allowable amount

for other services, except

as otherwise noted in the

Medical Booklet

5% of allowable amount for

inpatient hospitalization

- or -

30% of allowable amount

for other services, except

as otherwise noted in the

Medical Booklet

- plus -

Difference between

provider's charge and the

allowable amount

Annual Out-of-Pocket

Maximum

2

$2,000 per individual

with a maximum of

$4,000 for a family

$6,000 per individual

with a maximum of

$12,000 for a family

$1,500 per individual with

a maximum of $3,000 for

a family

$6,000 per individual

with a maximum of

$12,000 for a family

Routine Preventive

Screenings

No deductible or

copay; paid in full

Deductible plus

coinsurance

No deductible or

coinsurance; paid in full

Deductible plus

coinsurance

Routine Preventive Screenings include, but are not limited to, the following (certain restrictions apply, contact Excellus BCBS

with any questions):

• Breast Cancer Screenings (one per calendar year for ages 35 and older, with exceptions if high risk; both preventive and diagnostic

screenings are covered in full through an in-network provider)

• Prostate Cancer (one per calendar year for ages 50 and older, with exceptions if high risk)

• Cervical Cancer (one per calendar year for ages 18 and older)

• Colonoscopy

This list is subject to change based on guidelines issued by the United States Preventive Services Task Force and the Advisory Committee

on Immunization Practices.

Well Child Visits

Birth to 2nd birthday:

11 visits

2nd birthday to

3rd birthday: 2 visits

3rd birthday to

19th birthday: 1 visit

per calendar year

No deductible or

copay; paid in full

Deductible plus the

difference between

provider’s charge and

allowable amount

No deductible or

coinsurance; paid in full

Deductible plus

coinsurance

Routine Adult Physical

(one per calendar year)

No deductible or

copay; paid in full

Deductible plus the

difference between

provider’s charge and

allowable amount

No deductible or

coinsurance; paid in full

Deductible plus

coinsurance

The plan’s payments for covered out-of-network benefits described in the booklet section titled “SPECIAL OUT-OF-NETWORK BENEFITS/PROTECTION AGAINST

SURPRISE MEDICAL BILLS” will be determined in accordance with the provisions of that section and may be different than the description in this schedule.

11

SYRACUSE UNIVERSITY

SUBlue SUPro

SUOrange

Out-of-Network In-Network Out-of-NetworkIn-Network

Physician Office Visits Deductible plus $35

copay (PCP)

3

or

deductible plus $50

copay (Specialist)

Deductible plus $35

copay and coinsurance

(PCP) or deductible

plus $50 copay and

coinsurance (Specialist)

Deductible plus

coinsurance

Deductible plus

coinsurance

Urgent Care Facility

Visit

Deductible plus $50

copay

Deductible, $50 copay

and coinsurance

Deductible plus

coinsurance

Deductible plus

coinsurance

Hospital Emergency

Room

Deductible plus

$150 copay

In-network deductible

plus $150 copay

Deductible plus

coinsurance

In-network deductible plus

in-network coinsurance

Inpatient Hospital Deductible plus $350

copay per admission

Deductible, $350

copay per admission

and coinsurance

Deductible plus

coinsurance

Deductible plus

coinsurance

Outpatient Surgery

(performed at a

hospital)

Deductible plus $200

copay

Deductible, $200

copay and coinsurance

Deductible plus

coinsurance

Deductible plus

coinsurance

Diagnostic Machine

Tests, X-Rays and

Radiology Services

Deductible plus $50

copay

Deductible, $50 copay

and coinsurance

Deductible plus

coinsurance

Deductible plus

coinsurance

Diagnostic Laboratory

Tests

No deductible or

copay; paid in full

Deductible and

coinsurance

Deductible plus

coinsurance

Deductible plus

coinsurance

Physical

Therapy

Deductible plus $35

copay

Deductible, $35 copay

and coinsurance

Deductible plus

coinsurance

Deductible plus

coinsurance

Maternity No deductible or

copay; paid in full

Deductible and

coinsurance

No deductible or

coinsurance; paid in full

Deductible plus

coinsurance

Telehealth (including

MDLIVE services and

provider-facilitated

visits)

Deductible plus

copay associated

with in-person visit

Deductible plus copay

associated with in-person

visit plus coinsurance

Deductible plus

coinsurance

Deductible plus

coinsurance

Chiropractic Services Deductible plus $50

copay

Deductible, $50 copay

and coinsurance

Deductible plus

coinsurance

Deductible plus

coinsurance

The plan’s payments for covered out-of-network benefits described in the booklet section titled “SPECIAL OUT-OF-NETWORK BENEFITS/PROTECTION AGAINST

SURPRISE MEDICAL BILLS” will be determined in accordance with the provisions of that section and may be different than the description in this schedule.

1

Unless otherwise noted, all plan options require the employee to pay an annual

deductible before any other cost sharing is determined. After the annual deductible

is satisfied, the employee must pay the copay or coinsurance, if applicable. For out-

of-network services, the coinsurance and/or copay is then applied to the balance of

the allowable amount. The employee is also responsible for the difference between

the provider’s charge and the allowable amount as defined by Excellus BCBS. Review

examples of how the deductible, copays and coinsurance apply at hr.syr.edu/medical.

2

Out-of-pocket maximum refers to the maximum amount of out-of-pocket expenses

an employee would pay in a calendar year. The out-of-pocket expenses are defined as

the deductibles, coinsurance and copayment amounts. Any member payment for the

difference between provider charges and the allowable amounts for out-of-network

services does not count toward the out-of-pocket maximum.

3

Copays for outpatient treatment related to mental health and substance use in SUBlue

and SUOrange are consistent with that of a PCP office visit.

12

BENEFITS GUIDE

Prescription Drug Coverage

SUBlue and SUOrange SUPro

Annual Deductible No deductible

Out-of-Pocket Maximum

(separate from the medical

out-of-pocket maximum)

$2,000 per individual with a maximum of $4,000 for a family

Retail: Tier 1 20% coinsurance* 15% coinsurance*

Retail: Tier 2 25% coinsurance 25% coinsurance

Retail: Tier 3 45% coinsurance 40% coinsurance

Receive up to a 30-day supply or up to a 90-day supply of maintenance medications at a retail pharmacy.

Mail Order: Tier 1 $20* Lesser of $15 or 15% coinsurance*

Mail Order: Tier 2 $50 Lesser of $45 or 25% coinsurance

Mail Order: Tier 3 $90 Lesser of $90 or 40% coinsurance

Receive up to a 90-day supply of maintenance medication through home delivery.

Specialty Mail Order Same as mail order except 30-day supply for most medications

Infertility Medications Follows above schedule for retail, mail order and specialty with a $20,000 lifetime maximum

* Certain prescription drugs are available at $0 copay (age, gender and other restrictions may apply; contact Optum Rx for more details

at 866.854.2945, TTY: 711).

13

SYRACUSE UNIVERSITY

Dental and Vision Benefits

There are two dental plan options offered by Delta Dental: Preventive and Comprehensive. Enrollment in a Delta Dental option is a two-year

commitment. A new two-year commitment cycle for the University’s dental and vision plans started Jan. 1, 2023. Elections made during

calendar year 2024 will be in effect through Dec. 31, 2024. In order to enroll in vision benefits with Vision Service Plan (VSP), you must first

enroll in a dental plan. Vision coverage is not available as a separate option.

2024 Dental With or Without Vision Plan: Monthly Employee Contributions

Preventive

Preventive

Plus Vision

Comprehensive

Comprehensive

Plus Vision

Employee $9.19 $13.91 $32.04 $36.76

Employee + Spouse/

Domestic Partner

$22.91 $32.36 $74.49 $83.94

Employee + Child(ren) $25.92 $36.18 $73.58 $83.84

Employee + Spouse/

Domestic Partner +

Child(ren)

$42.98 $59.37 $114.95 $131.34

Contributions listed here are based on the 12-month calendar year. The actual deduction from your paycheck depends on your deduction cycle.

Summary of University Dental Benefits

Regardless of which dental plan you choose, you can visit any licensed dentist, but you’ll maximize plan value by using a dentist who participates

in a Delta Dental network.

Delta Dental

PPO Dentist

Delta Dental

Premier Dentist

Non-Participating

Dentist

Plan

Allowance

Dentists are paid PPO

contracted fees. Your costs

are usually lowest.

Dentists are paid Premier

contracted fees. Your costs

are usually moderate.

Claims for services provided by non-participating

dentists will be processed using a maximum fee level

that may be higher than Delta Dental’s maximum plan

allowance. Your costs are usually highest.

Payment

Responsibilities

By agreement, participating dentists must accept contracted

fees as payment in full for covered services and cannot balance

bill you. Delta Dental’s benefit is a percentage of the maximum

plan allowance, which may require a coinsurance amount.

Deductibles may also apply. You are also responsible for costs

related to services that are not covered.

The benefit payment is sent directly to you. You are

responsible for any applicable coinsurance and/

or deductibles, plus any difference between Delta

Dental’s payment (the maximum plan allowance) and

the amount billed that exceeds this allowance. You are

also responsible for costs related to services that are

not covered.

Online Tools and Resources for Dental Benefits

Visit Delta Dental’s website at deltadentalins.com to:

• Locate participating dentists by location, specialty and

network type;

• Obtain eligibility and benefit information; or

• Check the status of a claim.

From a mobile phone, the website is streamlined so you can access

your ID card, benefit and claim information with just a few clicks. Call

Delta Dental at 800.932.0783 (TTY: 711) with any questions.

14

BENEFITS GUIDE

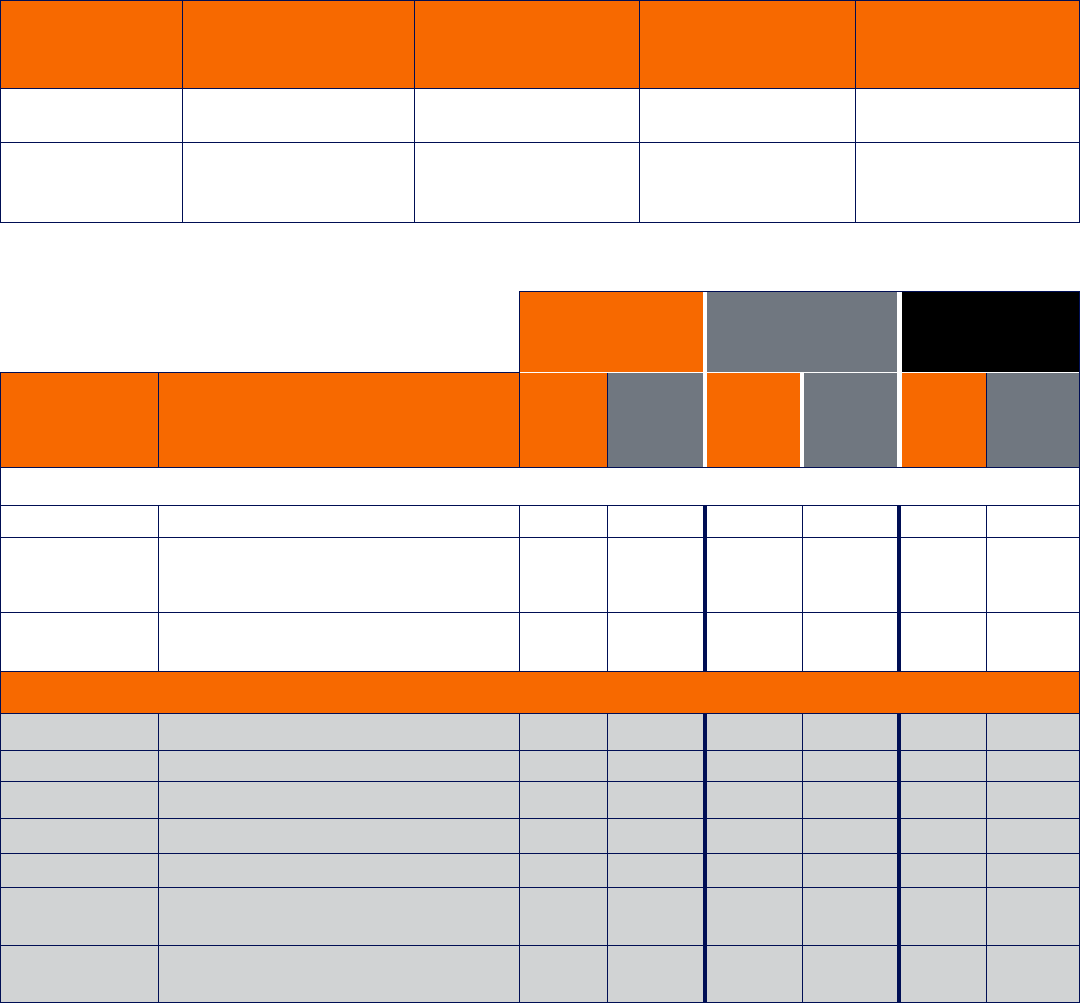

Summary of Delta Dental Benefits

The Preventive plan covers two annual exams and cleanings per calendar year. Coverage for basic and major dental care, including fillings,

scaling, extractions and root canals, is available if you select the Comprehensive plan.

Plan

Annual Deductible Per

Person

Family Deductible

Deductible for

Diagnostic and

Preventive Services

Annual Maximum Per

Person

Preventive

$0 $0 Waived $500

Comprehensive $50 (does not apply to

preventive services)

$150 (does not apply to

preventive services)

Waived $2,000

Delta Dental

PPO Dentist

Delta Dental

Premier Dentist

Non-Participating

Dentist

Service Examples of Covered Services

Paid by

Delta

Dental

Paid by

Patient

Paid by

Delta

Dental

Paid by

Patient

Paid by

Delta

Dental

Paid by

Patient

Preventive Plan Coverage

Diagnostic Exam and X-rays (two per calendar year) 100% 0% 100% 0% 100% 0%

Preventive Fluoride treatments (to age 19),

teeth cleaning, sealants (to age 14)

100% 0% 100% 0% 100% 0%

TMJ Temporomandibular joint

dysfunction treatment

50% 50% 50% 50% 50% 50%

Additional Coverage for Comprehensive Plan Only

Basic Restorative Fillings 80% 20% 60% 40% 60% 40%

Oral Surgery Extractions 80% 20% 60% 40% 60% 40%

Endodontics Root canal therapy 80% 20% 60% 40% 60% 40%

Periodontics Treatment of gum disorders 80% 20% 60% 40% 60% 40%

Prosthodontics Dentures, bridgework 50% 50% 50% 50% 50% 50%

Major

Restorative

Crowns 50% 50% 50% 50% 50% 50%

Stainless Steel

Crowns

On temporary teeth (only for children) 80% 20% 60% 40% 60% 40%

15

SYRACUSE UNIVERSITY

Summary of University Vision Benefits

The following is a summary of vision services and benefits provided through VSP:

Coverage Frequency Copay Plan Information

Exam Every calendar

year

$15 Routine exam only

Prescription Glasses

(lenses)

Every calendar

year

$25*

Single vision, lined bifocal and lined trifocal lenses

Polycarbonate lenses for dependent children

Prescription Glasses

(frames)

Every other

calendar year

$150 allowance for a wide selection of frames

$170 allowance for featured frame brands

20% savings on the amount over your allowance

$150 Walmart/Sam's Club frame allowance

$80 Costco frame allowance

Lens Options Every calendar

year

$0

$95-$105

$150-$175

Standard progressive lenses

Premium progressive lenses

Custom progressive lenses

Contact Lens Care Every calendar

year

Up to $60 $150 allowance for contacts.

Copay applies to contact lens exam (fitting and evaluation). Either frames or

contact lenses are covered in a calendar year. If you choose contact lenses,

you will be eligible for a frame one calendar year from the date the contact

lenses were obtained. Current soft contact lens wearers may qualify for

a special program that includes a contact lens exam and initial supply of

replacement lenses.

Additional Coverage Primary Eyecare Program

*A $25 copay applies for prescription glasses; if frames or lenses are purchased separately, a $25 copay applies. If frames and lenses are purchased at the same time,

only one copay of $25 is charged.

Service Employees Benefit Fund (SEBF) Dental and Vision Plans

Employees represented by the SEIU bargaining unit have the choice

of participating in either the University’s dental and vision plans as

outlined above, or the SEBF dental plan, with or without vision. The

SEBF plan is administered by the union and coverage is provided

through SEBF Dental and Davis Vision, respectively. Enrollment in

the SEBF plan is a one-year commitment. In order to enroll in vision

benefits, you must first enroll in a dental plan. Vision coverage is not

available as a separate option. For information about the SEBF plan

benefits, visit hr.syr.edu/sebf.

SEBF With or Without Vision Plan: Monthly Employee Contributions

Basic

Basic Plus

Vision

Comprehensive Comprehensive

Plus Vision

Employee $21.74 $27.45 $28.99 $34.70

Employee + 1 $43.20 $56.02 $49.04 $61.86

Family $62.06 $74.88 $71.52 $84.34

Contributions listed here are based on the 12-month calendar year. The actual deduction from your paycheck depends on your deduction cycle.

16

BENEFITS GUIDE

Flexible Spending Accounts (FSAs)

If you expect to have health care or dependent care expenses next year, setting aside money in an FSA is a great way to save on taxes—whether

you enroll in the University’s health plans or have other coverage.

Which type of FSA do you need?

Health Care FSA Dependent Care FSA

What can you use it for? • Copays, coinsurance and deductibles from

your health plans

• Dental and vision expenses

• Prescriptions and eligible health care products

Day care expenses for a child under age 13,

or an adult dependent, so you (and your spouse/

partner) can work

How much can you contribute? $3,200 per employee $5,000 per household

What if you don’t claim the

full amount?

Roll over up to $640 to the next year

(lose any amount over $640 not claimed by

April 30 of the following year)

Lose any amount not claimed by April 30 of

the following year

Health Care and Dependent Care FSAs have different rules. Be sure you read and understand which expenses are eligible, when you can access the funds and how to file claims by

the annual deadline. Details, online calculators and tips can be found on the HealthEquity website (wageworks.com) or at hr.syr.edu/fsa.

Syracuse University Wellness and WorkLife Resources

Syracuse University cares about the health and wellness of our entire

campus community. There are several University departments and

programs that provide you with a variety of wellness and worklife

related programs, tools and resources. Please visit hr.syr.edu/

worklife for more information on worklife opportunities at the

University.

• The Syracuse University Wellness Initiative provides learning

opportunities, activities, programs and other resources needed to

empower and encourage you to make decisions that lead to a balanced

and healthy lifestyle. Learn more and subscribe to the email list at

wellness.syr.edu.

• Financial Wellness—Whether you’re just beginning your career or

planning for retirement, the University provides assistance with meeting

the financial demands of many of life’s most significant events. You can

find resources to help plan for a financially secure future on the Financial

Wellness website (hr.syr.edu/financial-wellness). Be on the lookout

for upcoming opportunities to increase your financial know-how and

understand the steps toward retirement readiness.

• Carebridge, our Faculty and Staff Assistance Program,

provides comprehensive counseling, worklife services and resources

to you and your dependents. This partnership enables the University

to offer independent, confidential counseling (both in person, using a

telehealth platform and by phone) and other resources to help people

manage challenges at work and in their personal lives. Licensed,

credentialed counselors are available 24 hours a day, seven days a week,

365 days a year by calling Carebridge at 800.437.0911 (TTY: 711).

• Healthy Monday Syracuse is part of a national initiative to help end

chronic preventable diseases by offering weekly prompts and programs

to support people in starting and sustaining healthy behaviors. Many

people view Monday as a “fresh start.” Plus, those who begin the week

with a healthy habit are more likely to keep it up all week long, which

creates long lasting, healthy change. Sign up for the Healthy Monday

Syracuse weekly email newsletter for tips on improving wellbeing.

Check out Central New York Monday Mile walking routes and

Meatless Monday dining options. Visit maxwell.syr.edu/research/

lerner-center/healthy-monday for more information.

• Barnes Center at The Arch offers free access to fitness floors in

an accessible and centralized space on campus with your Syracuse

University I.D. Additional opportunities such as drop-in fitness classes,

personal training and memberships for dependents, spouses and

partners are competitively priced and available for purchase. Learn more

at ese.syr.edu/bewell/billing-and-fees.

– Barnes Center at The Arch Pharmacy is a full-service

pharmacy on campus that is available to you. The pharmacy

provides a wide selection of prescription and over-the-counter

medications, vitamins and dietary supplements in addition to

pharmaceutical education and counseling. Learn more at

ese.syr.edu/bewell/pharmacy.

– Help a Student with the assistance of the Barnes Center at

The Arch health and wellness team. Faculty and staff members

may be the first to recognize that a student is in distress or be

the first to introduce a student to the many available health and

wellness campus resources. Available resources include workshops,

programs, wellness supplies and referral consultation services.

Learn more at ese.syr.edu/bewell/campus-community.

• Hendricks Chapel: As the heart of Syracuse University, Hendricks

Chapel is the student-centered global home for religious, spiritual, moral

and ethical life. As a central contributor to holistic life and learning

at Syracuse University, Hendricks Chapel helps to prepare engaged

citizens, scholars and leaders for participation in a changing global

society. Learn more about Hendricks Chapel and view the meditation

schedule at chapel.syracuse.edu or call 315.443.2901.

17

SYRACUSE UNIVERSITY

Life Insurance

Upon employment, Syracuse University provides $50,000 basic group life insurance at no cost for faculty members and $10,000 basic group

life insurance at no cost for staff. At age 65, coverage reduces to $32,500 for faculty and $6,500 for staff. All life and AD&D insurance is

administered through MetLife. Your personalized rate will be exhibited in MySlice during your enrollment.

Supplemental Life Insurance

You can purchase additional life insurance in increments of one to 10

times your annual salary, not to exceed $2,000,000. A Statement

of Health is required if you elect supplemental life coverage above

$250,000 upon hire, or if you decide in the future to increase your

supplemental life insurance coverage. The Statement of Health form

can be found at hr.syr.edu/lifesoh.

Will Preparation Service

If you choose to enroll in supplemental life insurance, you have

access to another service—free will preparation. Like life insurance, a

carefully prepared will is important. With a will, you can define your

most important decisions, such as who will care for your children or

inherit your property. The will preparation service also includes the

preparation of living wills and power of attorney. By enrolling for

supplemental life coverage, you’ll have access to MetLife Legal Plans,

a network of more than 17,000 participating attorneys for preparing

or updating these documents at no additional cost to you if you use a

MetLife Legal Plans participating attorney.

Using the Will Preparation Service is easy.

Step 1: Call MetLife Legal Plans at 800.821.6400 and a client service

representative will assist you in locating a participating plan attorney

in your area and provide you with a case number.

Step 2: Call and make an appointment with a participating attorney—

many plan attorneys have evening and weekend appointments for

your convenience.

Step 3: That’s it. When you use a plan attorney, you don’t need

to submit any claim forms. You also have the flexibility of using a

non-network attorney and being reimbursed for covered services

according to a set fee schedule.

Basic and Supplemental AD&D Insurance

Upon employment, Syracuse University provides you with $3,000

of basic AD&D coverage at no cost to you. You have the opportunity

to purchase additional AD&D coverage in increments of one to 10

times your annual salary. Total coverage must not exceed the amount

of supplemental life insurance. With the purchase of supplemental

AD&D coverage, you will also enjoy the benefits of MetLife’s travel

assistance program, which provides a range of travel concierge

services to you and your dependents. For more information, visit

hr.syr.edu/travel.

Dependent Life Insurance: Spouse/Same-Sex

Domestic Partner

You may purchase life insurance for your spouse/same-sex domestic

partner in an amount not to exceed your own coverage (basic and

supplemental life combined). You can choose coverage for your

spouse/same-sex domestic partner in the amounts of $10,000 or

$20,000 without providing a Statement of Health. Coverage levels

of $40,000, $60,000, $80,000 and $100,000 may also be elected;

however, your spouse/same-sex domestic partner must complete

and submit a Statement of Health form which can be found at

hr.syr.edu/lifesoh and have it approved by MetLife. Coverage will

not go into effect until MetLife notifies HR Shared Services of its

approval.

Dependent Life Insurance: Child(ren)

You may purchase life insurance for your unmarried child(ren) under

age 26 who are dependent upon you for more than half of their

support in the amount of $10,000 as long as this coverage does not

exceed your own amount. A Statement of Health is not required.

If both parents are University employees, each can elect child life

insurance. The monthly premium is $0.63, based on a 12-month

calendar year and remains the same regardless of the number of

children covered. The actual deduction from your paycheck depends

on your deduction cycle.

18

BENEFITS GUIDE

Disability Benefits

Salary Continuation Disability Benefits for Exempt Employees

Upon employment, the Syracuse University Salary Continuation Plan for faculty and exempt staff provides benefits for qualifying short term

disabilities, maternity leaves and long term disabilities. There is no employee contribution required.

Period of Disability Benefits Paid by Syracuse University (taxable)

Weeks 0-16 100% of current salary

Weeks 17-26 60% of current salary

Weeks 27-52 50% of current salary

Weeks 53+

50% of current salary if Social Security disability award has been granted before week 53 and if the

eligible employee has completed at least 12 months of active employment

Questions about the Salary Continuation Plan should be directed to HR Shared Services at 315.443.4042 or hrservice@syr.edu.

Disability Benefits Plan for Non-Exempt Employees

Syracuse University provides income replacement in excess of Statutory New York State Disability Benefits and Workers’ Compensation for a

non-exempt employee absent from work due to occupational or non-occupational injury or illness, as indicated in the table below. There is no

employee contribution required.

Period of Disability Benefits Paid by Syracuse University (taxable)

Weeks 0-1 First week waiting period (five consecutive days), sick pay benefits payable if eligible.

Weeks 2-26

New York State Statutory benefits up to a maximum of $170 per week, if eligible.

Supplemental Benefit up to a maximum of $170 per week, if eligible.

Workers’ Compensation

Syracuse University provides coverage (Statutory Benefits) for all employees, on a non-contributory basis, that provides protection for

occupational illness or injury. Questions about non-exempt disability benefits and Workers’ Compensation should be directed to the Office of

Institutional Risk Management at 315.443.4011.

Voluntary Long Term Disability (LTD) Insurance

The LTD plan complements Syracuse University’s Salary Continuation Plan and the Disability Benefits Plan, both of which cover the first six

months of disability before the LTD plan begins payments. Learn more about coverage and rates for voluntary LTD coverage at hr.syr.edu/ltd.

It is important to consider the advantages of seeking coverage

beyond the University’s plans alone. Voluntary LTD insurance

helps protect you and your lifestyle and further helps you to meet

your financial commitments in a time of need. You may purchase

additional coverage for long term disabilities at group rates through

the Voluntary LTD Plan, insured by The Standard. This program is

designed to provide you with a benefit of 60% of your pre-disability

earnings, payable monthly, if you have an illness or injury that prevents

you from working for more than six months. Voluntary LTD benefit

payments are not taxable because you pay the full premium cost on an

after-tax basis.

The benefit amount you receive may be reduced by other income such

as Social Security Disability benefits. If you are covered under both

the Voluntary LTD insurance and the University’s Salary Continuation

Plan, disability benefits shall first be provided under the Voluntary LTD

insurance, and benefits under the Salary Continuation plan would be

reduced by the amount you receive under the Voluntary LTD plan.

You are guaranteed acceptance if you apply for Voluntary LTD

insurance during your first 45 days of benefit eligibility. However, if

you don’t enroll when you are first eligible and later decide to elect the

benefit, you must wait for the annual Open Enrollment period to elect

coverage. You will need to submit a Medical History Statement to The

Standard and may be asked to supply additional medical information

and/or have a physical exam.

The Voluntary LTD program offers you the advantages of:

• Convenience. With premiums deducted directly from your paycheck

after-tax, you don’t have to worry about mailing monthly payments.

• Savings. Typically, group insurance rates are lower than the rates for

individual insurance plans.

• Peace of mind. You can take comfort in knowing that you have help

meeting your financial obligations if you become disabled and are unable

to work for an extended period of time.

19

SYRACUSE UNIVERSITY

Remitted Tuition Benefits

Syracuse University offers Remitted Tuition Benefits (RTB), which

may be applied to tuition charges for undergraduate and graduate

courses at Syracuse University, including the College of Professional

Studies, with certain restrictions. You may use RTB credits for yourself,

or you may transfer them to your eligible spouse or same-sex domestic

partner. When you use RTB, you receive a full tuition waiver. RTB

credits transferred to a spouse or same-sex domestic partner are

valued at 85%. Credit hours are awarded in July each year and are

available for use during the academic year immediately following.

Please visit the Syracuse University Remitted Tuition Policy online at

hr.syr.edu/rtbpolicy for more information.

Getting Started

The number of credit hours available depends upon your

employment status:

• Full-time employees receive 12 credit hours annually.

• Part-time employees receive nine credit hours annually.

Your RTB will be prorated during your first year of employment,

according to the following schedule:

Credits Hours Available Upon Hire

Employment Date Full-Time Part-Time

July 1-Sept. 30 12 9

Oct. 1-Dec. 31 8 6

Jan. 1-March 31 4 3

April 1-June 30 0 0

There are no forms or applications to complete to use RTB, unless

you are transferring credits to an eligible spouse/same-sex domestic

partner. To transfer credits to an eligible spouse or same-sex domestic

partner, complete a Remitted Tuition Transfer Authorization Form

(available at hr.syr.edu/forms) and return it to HR Shared Services

prior to the start of the semester in which the benefits are to be used.

A new form will only need to be completed if you wish to make a

change in the number of credits assigned, or to change the recipient,

including transferring credits back to yourself.

RTB credits may be used for courses offered through Syracuse

University, including the College of Professional Studies, according to

the following guidelines:

• Credit hours do not carry over from year to year; credits not used are

forfeited.

• Credit hours may not be borrowed from a future year to be used in a

current year.

• Up to six credit hours may be taken per semester or summer session. You

may exceed six credit hours in a single semester only with the permission

of your supervisor. You may take classes during regular work hours only

with the permission of your supervisor.

• Remitted tuition applies to tuition charges only.

• College of Professional Studies registrants must pay a processing fee

that is not covered by RTB.

• Syracuse University reserves the right to restrict the use

of RTB for certain workshops, non-credit courses and

special programs.

• Spouses/same-sex domestic partners receiving RTB must have a

United States-issued Social Security number or an individual tax

identification number.

Benefits Eligibility Status Change

RTB will be adjusted based upon any changes in your eligibility status

(e.g., moving from full- to part-time employment). If you separate from

the University, the total year benefit will be prorated based upon your

termination date according to the chart below and no benefits for

future semesters, including Maymester or Summer Sessions, will be

authorized. If you terminate during a semester when RTB were used

by you or your spouse/same-sex domestic partner, you will be billed

for any remaining balance after the prorated remitted tuition credits

have been applied. If you terminate in the same year in which you were

hired, the remitted tuition credits will be the lesser of the credit hours

available upon hire and those available upon termination.

Credit Hours Available Upon Termination

Termination Date Full-Time Part-Time

July 1-Sept. 30 0 0

Oct. 1-Dec. 31 4 3

Jan. 1-March 31 8 6

April 1-June 30 12 9

Tax Implications

For information on remitted tuition taxability rules, please refer to

the Comptroller’s Office website at bfas.syr.edu/comptroller/

resources/tax-compliance/tax-procedures/#remitted. You are

encouraged to determine whether you’re eligible to claim the federal

Lifetime Learning Tax Credit to help offset your share of tuition

costs paid for a participating spouse or same-sex domestic partner

(if claimed as a dependent on your tax return).

Dependent Tuition Benefits

After the equivalent of three years of full-time employment as determined by the Office of Human Resources, the University provides

educational benefits to your eligible dependent children to assist them in pursuing their first baccalaureate degree. Benefits are available for

dependents attending Syracuse University through the Tuition Waiver Program and for dependents attending other educational institutions

through the Tuition Exchange Program and the Cash Grant Program.

Benefits are limited to tuition expenses and are applicable to undergraduate coursework only. Students are eligible for only one program at a

time, must meet academic and admission requirements and be matriculated in a program of study leading to the first bachelor’s degree. The

following is a brief description of each Dependent Tuition Benefit Program available. Please visit the Syracuse University Dependent Tuition

Policy online at hr.syr.edu/dependenttuitionpolicy for complete details.

Tuition Waiver Program

An eligible dependent who is matriculated and enrolled as a full-time

undergraduate student at Syracuse University may apply to receive a

tuition waiver. The waiver can be applied only to the minimum number

of credit hours required for completion of the first baccalaureate

degree and includes Summer Session courses. The value of the tuition

waiver for the current academic year is posted online at hr.syr.edu/

dependent-tuition.

Tuition Exchange Program

An eligible dependent who is matriculated as a full-time

undergraduate student pursuing their first baccalaureate degree at

an institution that participates with Tuition Exchange, Inc. may apply

to receive a Tuition Exchange Scholarship. The program is limited

to a maximum of eight semesters and excludes Summer Session

courses. Scholarships are not guaranteed as they are awarded

by the participating member institutions according to their own

criteria. Students denied a Tuition Exchange scholarship may apply

to participate in the Cash Grant Program. Please visit hr.syr.edu/

dependent-tuition for more information.

Cash Grant Program

Eligible Dependents who are full-time undergraduate students and are

matriculated into an Eligible Accredited Post-Secondary Institution

of Learning may apply to have up to $1,250 per semester applied

toward tuition charges (Summer Session courses are excluded) for a

maximum of eight semesters. An Eligible Accredited Post-Secondary

Institution of Learning is an institution that offers courses of study

leading to an associate’s or baccalaureate degree and is accredited in

the United States by an agency recognized by the University. Awards

are made payable directly to the institution.

How to Apply

All applicants must complete and submit the Dependent Tuition

Application form, available at hr.syr.edu/forms.

In addition to the Dependent Tuition Application, all Syracuse

University Tuition Waiver Program applicants are required to file

an application for the New York State Tuition Assistance Program

(TAP) within state deadlines. An exemption from this requirement

is available if certain criteria are met. Consult the Dependent Tuition

Policy for complete details.

Applicants for the Tuition Exchange Program must also complete the

Tuition Exchange Request form, available at hr.syr.edu/forms.

New applicant applications are due no later than:

Tuition Waiver

Early Decision Freshman Nov. 15

Regular Decision Freshman Feb. 1

Tuition Exchange Nov. 15

Cash Grant May 1

Renewal applications are due no later than:

Tuition Waiver March 1

Tuition Exchange Feb. 1

Cash Grant May 1

20

BENEFITS GUIDE

21

SYRACUSE UNIVERSITY

Paid Time Off for Staff

Syracuse University generally provides paid time off in the form

of floating holidays, personal days, sick time and vacation time

which may differ for exempt and non-exempt employees. Consult

the specific time off policies for further information by visiting

hr.syr.edu/timeoff. Bargaining unit staff employees should consult

their collective bargaining unit agreement for additional details about

their paid time off.

Holidays: The University provides the following eight paid

holidays each calendar year: New Year’s Day, Martin Luther King

Jr. Day, Memorial Day, Juneteenth, Independence Day, Labor Day,

Thanksgiving Day and Christmas Day. In addition, at certain times of

year, paid bonus days are assigned to certain days. These assigned

days may vary from year to year depending upon how these holidays

fall on the calendar. You are eligible for these holidays immediately

upon employment. The University also provides paid time off as

Orange Appreciation days around Christmas and New Year's.

Leaves of Absence

You may request short-term leaves of absence, with pay, for court

and jury duty, military training, volunteer fire fighting, the funeral

of an immediate relative (as defined in the University’s Funeral/

Bereavement Leave Policy), special public service assignments or

unusual personal business that cannot be accomplished outside of

working hours. The University recognizes statutory Paid Family Leave

benefits that provide support when employees need time away from

work for certain family matters. In addition, employees who have

completed one year of continuous service are eligible to request a

leave of absence, without pay, for family, health and other personal

reasons for a period of up to one year. Bargaining unit staff employees

should consult the collective bargaining agreement for additional

details about their leaves.

Other Benefits

Caregiving Resources

The University provides a variety of support to assist with child and

dependent care needs. Eligible faculty and staff have access to a

free premium membership to Care. for Business where they can get

help finding childcare providers, elder caregivers, pet sitters, house

cleaners and more. More information can be found at hr.syr.edu/

care. Additionally, the Dependent Care Subsidy Program is available

to those with annual household incomes of less than $150,000. The

subsidy amount provided is per dependent: $1,500 for children under

6, $750 for children age 6 through 12 and $750 for adult disabled

dependents. The annual household maximum benefit is $3,000. More

information can be found at hr.syr.edu/dependentcaresubsidy.

Live Local

The University provides expanded home ownership assistance

to employees seeking to purchase, improve and live in homes in

convenient proximity to campus. The program allows borrowers

to receive favorable interest rates, to choose whether or not to

make a down payment and does not require the purchase of private

mortgage insurance. Additionally, borrowers can receive a forgivable

home improvement loan for qualified home improvements. More

information can be found at bfas.syr.edu/real-estate/live-local or by

contacting the Real Estate Office.

Auto and Home Insurance

You are eligible upon employment to participate in the University’s

Group Auto and Home insurance program through Farmers Insurance

Group. You can apply to purchase insurance coverage for your home,

automobile and other personal property at special group rates. You

can receive an additional discount if you pay your premium through

payroll deduction. More information can be found at hr.syr.edu/

home-and-auto-insurance.

Travel Resources

Travel Registration: All travelers on University business must

register their travel at travelregistry.syr.edu. Further, the University

recommends that you download the Alert Traveler app from your

profile page on the registry website. Alert Traveler will push safety

messages directly to your mobile device while traveling.

Worldwide Travel Support International SOS (ISOS) provides

worldwide travel, medical and security assistance for faculty, staff and

students traveling outside the United States on University business,

sanctioned academic work or research. ISOS serves as a resource to

enhance your safety and to help facilitate communication in the event

of emergency situations. Visit Global Safety and Support at bfas.

syr.edu/campus-safety-and-emergency-management-services/

global-safety-and-support or contact the office at 315.443.1968

for more information.

Travel Insurance: The University has insurance resources for faculty

and staff traveling domestic or abroad, including international travel

insurance, workers’ compensation and health insurance. For more

information please reach out to the Office of Institutional Risk

Management at 315.443.4011 or riskadmin@syr.edu.

Identification Cards

You will be issued a Syracuse University identification card upon

employment. The I.D. card enables you to obtain a discount on

certain purchases at the Syracuse University Campus Store and

on tickets for certain athletic and cultural events. It also facilitates

borrowing privileges at the University Libraries and access to campus

recreational facilities.

Adoption Assistance

Syracuse University offers adoption assistance reimbursement grants

to cover eligible expenses up to $5,000 for the adoption of one child

or $8,000 for simultaneous adoption of more than one child. To

qualify, the child being adopted must be under 18 years of age and not

biologically related to either parent. More information can be found at

hr.syr.edu/adoption.

22

BENEFITS GUIDE

Lesbian, Gay, Bisexual, Transgender and

Queer (LGBTQ) Resource Center

Syracuse University values diversity in all its forms and welcomes

faculty and staff members who are members of the lesbian, gay,

bisexual, transgender, queer, questioning, intersex and asexual

community. The LGBTQ Resource Center strives to build a socially

conscious community that is inclusive of and accessible to students

with marginalized genders and sexualities and the complex

intersections of race, class, disability and underrepresented identities

that impact their success at Syracuse University. The LGBTQ Resource

Center provides resources and hosts programs that benefit staff and

faculty through individual consultations about LGBTQ-inclusion

workshops, reference materials and advocacy efforts through

campuswide committees. The center also hosts a bi-weekly staff and

faculty affinity group. To stay informed or get involved, please join its

weekly newsletter by emailing lgbtq@syr.edu or stop by its offices in

132 Schine Student Center.

Information Technology

Services (ITS)

ITS provides a wide range of services for faculty and staff, including