International Journal for Multidisciplinary Research (IJFMR)

E-ISSN : 2582-2160 ● Website: www.ijfmr.com ● Email: editor@ijfmr.com

IJFMR23011662

Volume 5, Issue 1, January-February 2023

1

A Study on Marginal Costing In TATA Steel Ltd

Dr. Neeraj K. Gupta

Assistant Professor, SCM (IIMT, University, Meerut, U.P.)

ABSTRACT

Finance is considered as the lifeblood OF any business enterprise. No business enterprise can survive

without finance. The owners are always all always willing to know the financial position of their

business, which can be acquainted with the help of financial statements.

Marginal costing is the techniques of cost and Management accounting which is used to analysis the

relationship between cost, volume and profit. The model of marginal cost is based on the classification

of production cost between variable and fixed. Variable expenses are related with the volume of sales

and production of the company, while fixed costs are related with a particular period. Generally,

marginal costing depends on the contribution, where contribution is calculated as the difference between

the sales and the variable cost of the production. When contribution of any company is more than its

fixed cost, it is considered as more profitable.

Keyword: Fixed cost, Variable cost, Break-even, Margin of safety

INTRODUCTION

Marginal Costing is significant technique to solve various managerial problems. For this purpose,

profitability of two or more alternative options is compared and such alternate is selected which provides

maximum profitability and also fulfillment of objectives of the organization. In simple language, it is a

process of identifying, measuring, accumulation analyzing, preparing, interpretation and communicating

of information which help the management in planning, evaluating and controlling within a unit. It also

helps the management in deciding the proper utilization of its resources.

THEORY OF MARGINAL COSTING

CIMA, London in its report explain the theory of marginal costing as:

In a given volume of output, any additional output can normally be obtained at less than proportionate

cost because within limits, the aggregate of certain items of cost will tend to remain fixed and only the

aggregate of the remainder will tend to rise proportionately with an increase in output. A decrease in the

output will normally be accompanied by less than proportionate fall in the aggregate cost. The theory of

marginal costing can be explained in the following two steps:

1. If the volume of output increases, the cost per unit in normal situation reduces. on the other hand, if

there is decrease in output, the cost per unit increases.

2. If output volume increase by more than one, the total increase in cost divided by the total increase in

output will be equal to marginal cost per unit.

Marginal cost may be considered as the cost of one more or one less unit produced in addition existing

level of production. In this relation a unit may consider as a single commodity, a dozen, and a gross or

any other measure of goods. The marginal cost is directly related with the volume of output and

International Journal for Multidisciplinary Research (IJFMR)

E-ISSN : 2582-2160 ● Website: www.ijfmr.com ● Email: editor@ijfmr.com

IJFMR23011662

Volume 5, Issue 1, January-February 2023

2

marginal cost per unit remains the same. It includes prime cost, which includes cost of direct materials,

direct labor and all variable overheads. It does not consider any element of fixed cost .

Marginal costing may be measured as the method in which total cost are shown separately as variable

costs and fixed costs for managerial decision-making. It is simply a method for analyzing of cost

information for the management which tries to detect an effect on profit due to changes in the volume of

output. Marginal costing is also named as Variable costing. Marginal costing technique is related with

the concept of contribution where contribution is given by: Sales revenue less variable cost (marginal

cost) Contribution may be defined as the profit before the recovery of fixed costs. Thus, contribution

goes toward the recovery of fixed cost and profit, and is equal to fixed cost plus profit (C = F + P).

OBJECTIVE OF THE STUDY:

To Analysis the financial performance of Tata Steel Ltd

To Analysis Profit Volume ratio, Break Evan and margin of Safety of Sample Unit

To analysis the marginal cost and Profitability of Tata Steel Ltd.

PERIOD OF THE STUDY:

The study period is taken for five years from 2017-18 to 2021-22. These are the financial years

commencing from April 1, and ending to March 31

st

each year.

METHODOLOGY:

The present study is based on secondary data. The data have been collected from sample steel; ltd,

mainly annual reports, journals; periodicals are available websites in the field.

The collected data is grouped tabulated and analyzed in order to judge the impact of marginal cost. If

output increase by more than one, the total increase in cost divided by the total increase in output will be

equal to the average marginal cost per unit.

ASSUMPTIONS:

Marginal costing is used as a technique in decision making in managerial practice. However, Marginal

Costing depends on some assumptions which are as follows-

(1) In Marginal Costing Method, The total cost is divided into two parts which are called fixed cost

and variable cost.

(2) Fixed costs are stable and are not affected with the change in production units. It means there is

no change on fixed cost in relation to production units changed.

(3) Variable cost increase and decrease as per the change in production.

(4) Selling price is fixed. There is no change in selling price due to change in production capacity.

(5) only variable cost is considered while calculating production cost whereas fixed costs are

absorbed from contribution .

(6) There is no change in other related Conditions like Material, Labor, Management policy etc.

SIGNIFICANCE OF MARGINAL COSTING:

(1) Marginal costs remain Constant-Variable costs vary from time to time, but in the long run,

marginal costs are constant. Marginal costs remain the same. It is not affected with the volume

of production.

International Journal for Multidisciplinary Research (IJFMR)

E-ISSN : 2582-2160 ● Website: www.ijfmr.com ● Email: editor@ijfmr.com

IJFMR23011662

Volume 5, Issue 1, January-February 2023

3

(2) Easy and Simple calculation- In marginal costing method calculation is very easy and

understandable. We have to calculate only variable costs which is comparatively easy.

(3) Effective cost control – It divides total cost into fixed and variable. Fixed cost remains same

with Production while variable cost are related with the out pit of Production level. As such,

management can control marginal cost effectively.

(4) Treatment of overheads simplified – It reduces the degree of over or under-recovery of

overheads due to the separation of fixed overheads from production cost.

(5) Realistic valuation – As the fixed overhead costs are not included in product cost, the valuation

of work-in-progress and finished goods become more realistic.

(6) Better results – When used with standard costing, it gives better results.

(7) Helps in production planning – we can Calculate the profit at every level of output with the

help of cost volume profit relationship.

(8) Fixation of selling price – The differentiation between fixed costs and variable costs is very

helpful in determining the selling price of the products or services.

(9) Helpful in budgetary control – The classification of expenses is very helpful in budgeting and

flexible budget for various levels of activities.

(10) Profit Planning- Another importance application of marginal costing is the area of profit

planning. Profit planning, generally known as budget or plan of operation may be defined as the

planning of future operations to attain a defined profit good.

(11) For Decision making- This technique is very applicable for decision making for managers. It is

useful to select an appropriate choice from various best choices relating to production and profit

of the organization.

(12) Make or Buy- Sometimes a decision has to be made whether to manufacture a component or a

product or to buy it ready-made from the market. The decision for purchasing depends on the

price paid recovers some of the fixed expenses.

(13) Preparing tenders – Many business enterprises have to compete in the market in quoting the

lowest price. If variable cost is calculated separately, they are called „floor price‟. Any price

decided above floor price ,may be quoted to increase the total contribution.

(14) Key Factor- Marginal costing is also useful to decide how many units of a certain product to

produce where there is a scarcity of either materials or labour and also machine hours.

(15) For Differentiate cost- In the factory from different levels of production, which volume of

production is profitable one is easily decided. Flexible budget about different units is also

prepared with application of marginal costing

(16) In Inflation time- In Inflation time, maximum profit can be made by maximum production and

selling. In these circumstances, Marginal costing helps in deciding an actual level of production

at which optimum profit can be earned.

(17) In Deflation time- In Deflation time, maximum loss may arise. So marginal costing helps in

deciding the actual level of production and selling of products at which no loss assume.

(18) Better presentation – The statements and graphs prepared under marginal costing are better

understood by management executives. The break-even analysis presents the calculation of cost,

sales, contribution etc. in terms of charts and graphs. And, thus the results can easily be grasped.

International Journal for Multidisciplinary Research (IJFMR)

E-ISSN : 2582-2160 ● Website: www.ijfmr.com ● Email: editor@ijfmr.com

IJFMR23011662

Volume 5, Issue 1, January-February 2023

4

IMPORTANT FORMULAS- The following formula are used in break even analysis

(1) Contribution : It denotes the difference between the sales amount and variable cost

Contribution = Selling Price – variable Costs

C = S – V

(2) Profit Volume Ratio : It shows the relationship between the sales amount and Contribution.

Contribution *100

Profit Volume Ratio = -----------------------

Selling Price

C

P/V ratio = ---* 100

S

(3) Break Even Point (B.E.P.) : when a firm is able to recovered its expenses from its sales revenue

that particular point is called breakeven point. At this stage a firm has no profit and no loss.

Break Even Point (B.E.P.)

Fixed Costs

(A) (In Units) B.E.P.= ---------------------

Contribution per unit

F

(B) (In Rupees) B.E.P. = ------------------

P/V Ratio

(4) Margin of Safety = Actual sales- Break Even sales

(5) Operating Leverage = Contribution/ Operating Profit

(6) Financial Leverage = Operating Profit/ Profit before Tax

(7) Composit Leverage =Contribution / Profit before tax

Table-1

Income Statements of TATA Steel for Five Years (Rs in Crore)

Particulars

2017-18

2018-19

2019-20

2020-21

2021-22

Sales

- Variable Cost

60,519

34,239

70,611

39,673

60,436

37,862

84,133

42,990

1,29,021

63,258

Contribution

- Fixed Cost

26,280

12,756

30,938

12,105

22,574

11,651

41,143

13,657

65,663

19,442

Operating Profit

13,524

18,833

10,923

27,486

46,221

Source: Capital Market

International Journal for Multidisciplinary Research (IJFMR)

E-ISSN : 2582-2160 ● Website: www.ijfmr.com ● Email: editor@ijfmr.com

IJFMR23011662

Volume 5, Issue 1, January-February 2023

5

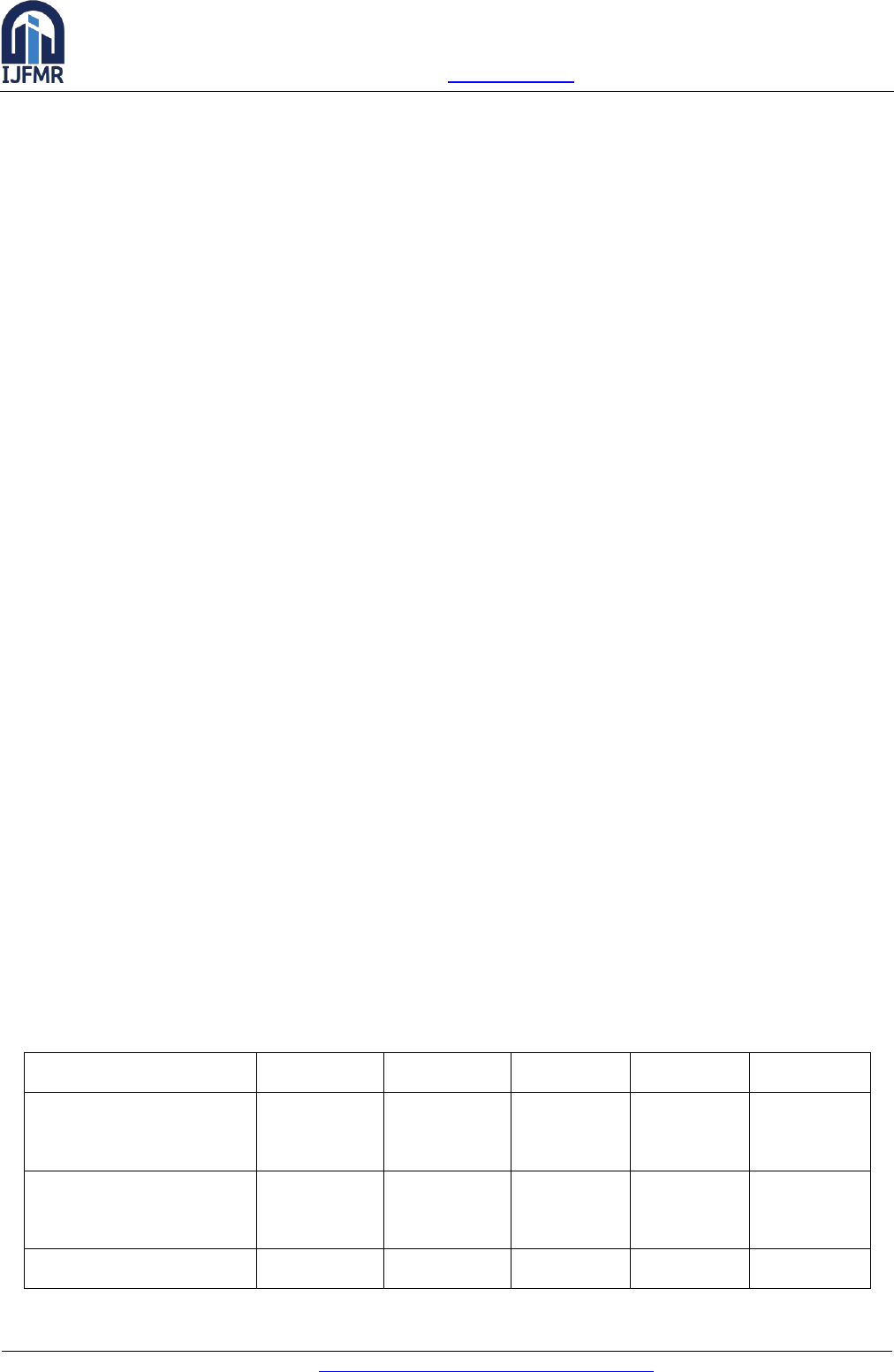

Table-2

Profit- Volume Ratio of TATA Steel for Five Years

Particulars

2017-18

2018-19

2019-20

2020-21

2021-22

- P/V Ratio

43%

43.8%

37.35%

48.9%

50.89%

Source: Capital Market

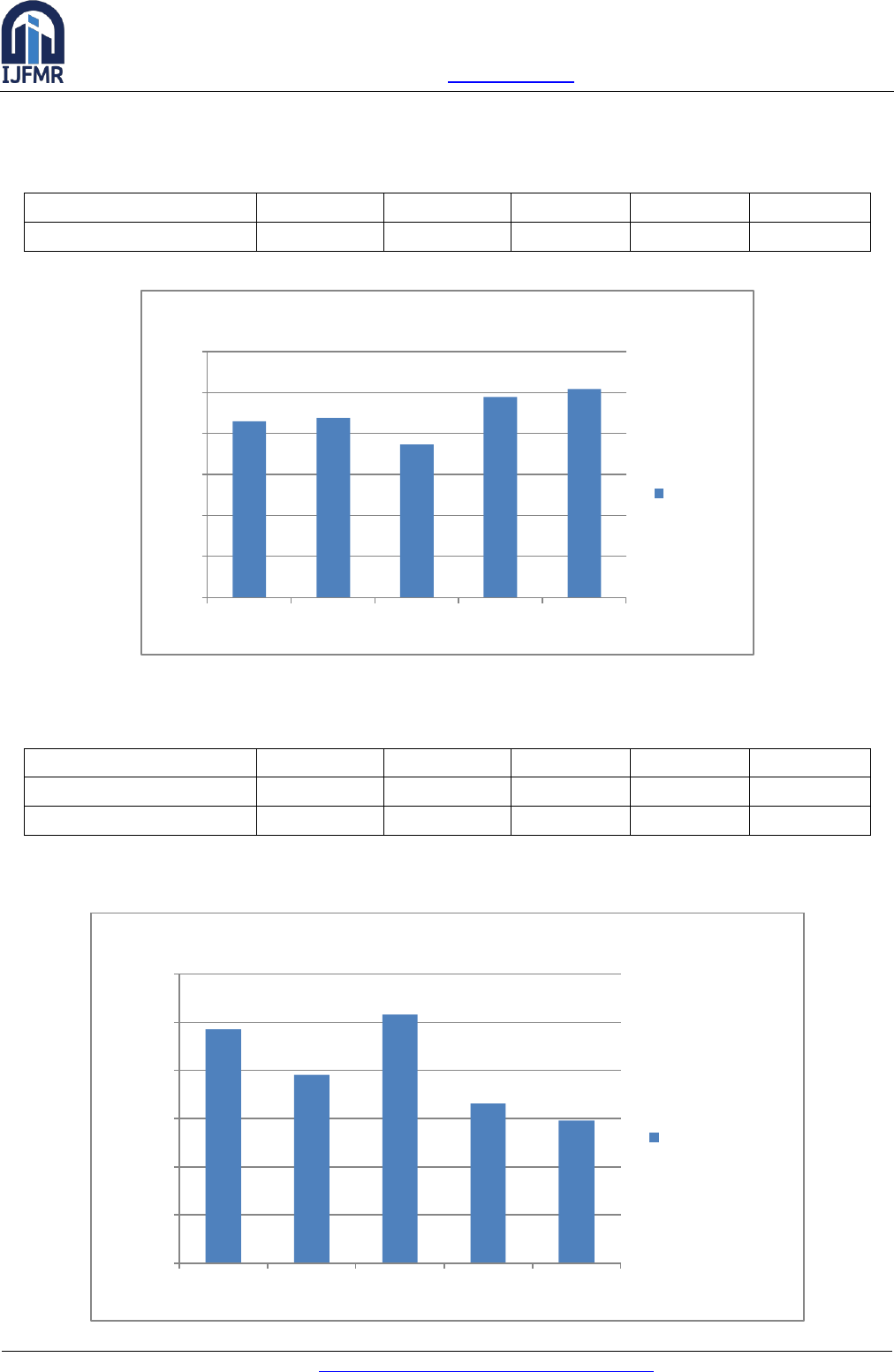

Table-3

Break Even Point of TATA Steel for Five Years

Particulars

2017-18

2018-19

2019-20

2020-21

2021-22

BEP (Rs)

29,375

27,628

31,192

27,927

38,202

BEP (%)

48.53%

39.13%

51.61%

33.19%

29.61%

Source: Capital Market

0%

10%

20%

30%

40%

50%

60%

2017-2018

2018-2019

2019-2020

2020-2021

2021-22

P/V Ratio

P/V Ratio

0.00%

10.00%

20.00%

30.00%

40.00%

50.00%

60.00%

2017-18

2018-19

2019-20

2020-21

2021-22

Break-even point

Break-even point

International Journal for Multidisciplinary Research (IJFMR)

E-ISSN : 2582-2160 ● Website: www.ijfmr.com ● Email: editor@ijfmr.com

IJFMR23011662

Volume 5, Issue 1, January-February 2023

6

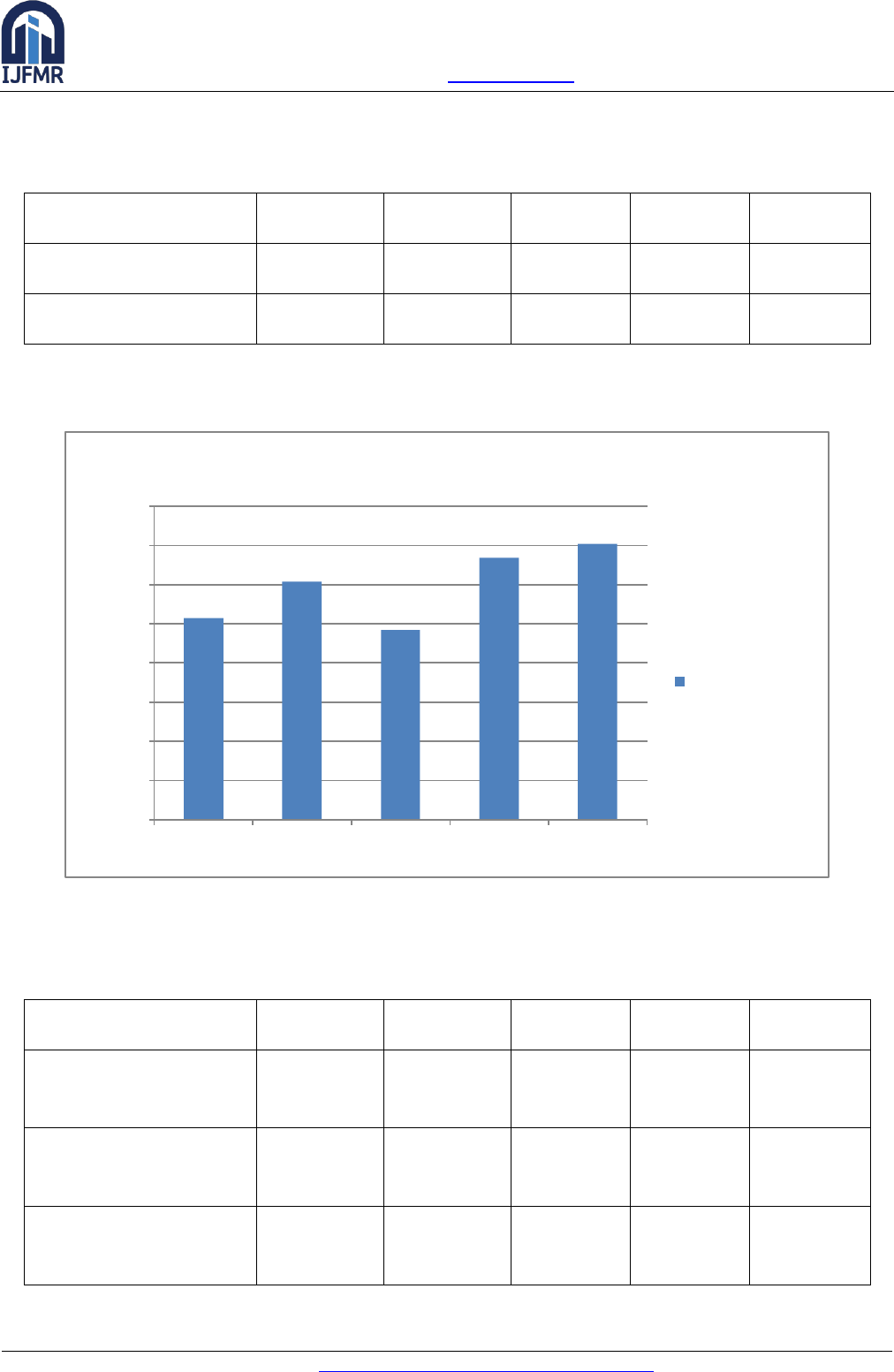

Table-4

Margin of safety of TATA Steel for Five Years

Particulars

2017-18

2018-19

2019-20

2020-21

2021-22

BEP (Rs)

31,144

42,938

29,244

56,206

90,819

BEP (%)

51.46%

60.80%

48.39%

66.81%

70.39%

Source: Capital Market

Source: Capital Market

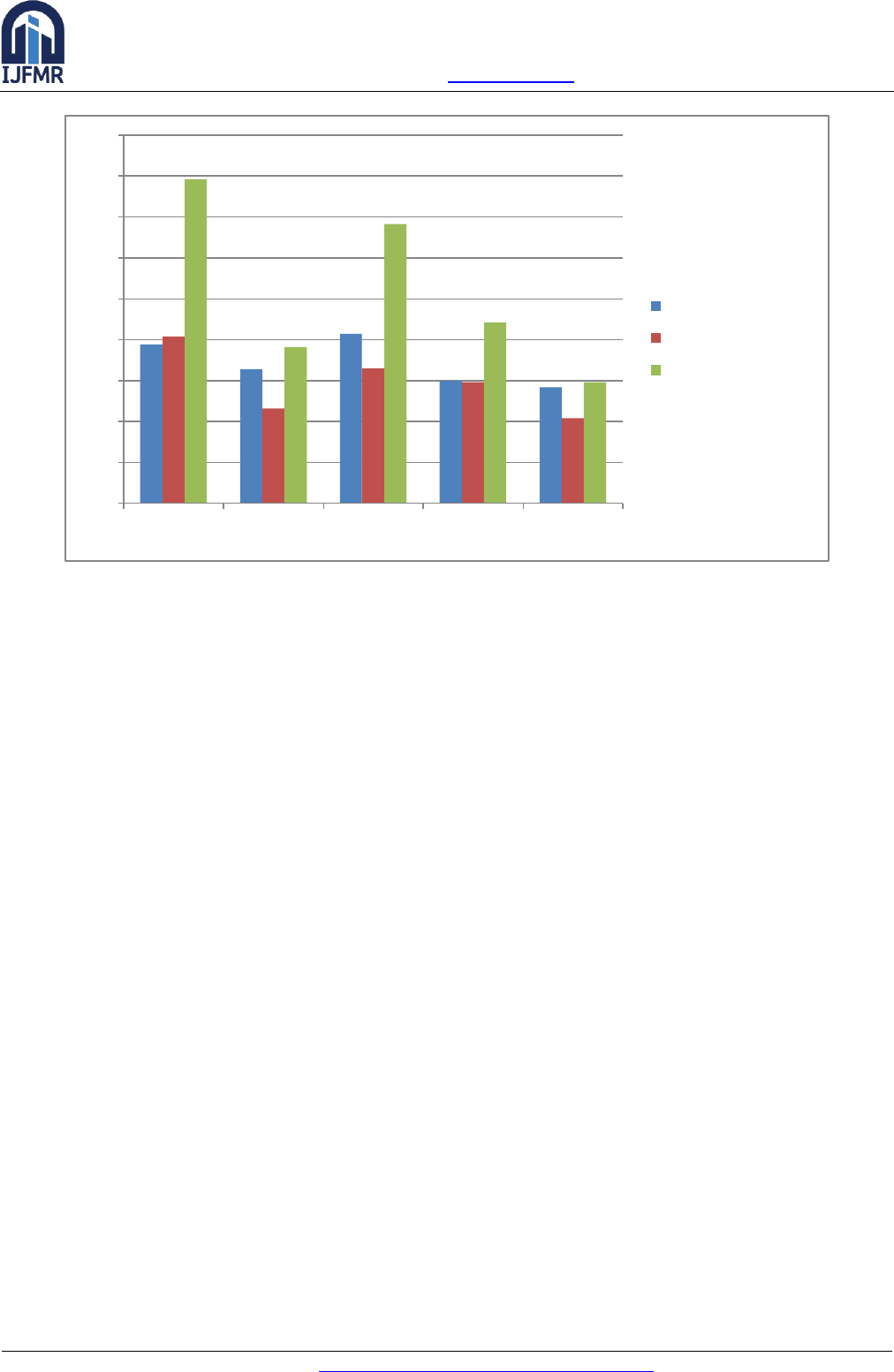

Table-5

0.00%

10.00%

20.00%

30.00%

40.00%

50.00%

60.00%

70.00%

80.00%

2017-18

2018-19

2019-20

2020-21

2021-22

Margin og Safety

Margin og Safety

Particulars

2017-18

2018-19

2019-20

2020-21

2021-22

Operating

Leverage

1.94

1.64

2.07

1.50

1.42

Financial

Leverage

2.04

1.16

1.65

1.48

1.04

Composite

Leverage

3.96

1.91

3.41

2.21

1.48

International Journal for Multidisciplinary Research (IJFMR)

E-ISSN : 2582-2160 ● Website: www.ijfmr.com ● Email: editor@ijfmr.com

IJFMR23011662

Volume 5, Issue 1, January-February 2023

7

INTERPRETATION:

(1) It can be observed from the table no- 1 the operating profit for the industry was at healthy level

of 2017 -18 and 2018-19. In Year 2019-20 a significant decline is noticed in operating profit. For

the year 2020-21 and r 2021-22 again the operating profit for Tata Steel shows at healthy level.

(2) It can be observed from the table no- 2 that profit volume ratio is in increasing order for the

Tata steel except the year 2019-20 where a significant decline in p/v ratio is noticed.

(3) It can be observed from the table no- 3 that BEP is in decreasing order for the Tata steel except

the year 2019-20 where a significant increase in BEP ratio is noticed.

(4) It can be observed from the table no- 4 that Margin of safety is in increasing order for the Tata

steel except the year 2019-20 where a significant decline in margin of safety ratio is noticed.

(5) The operating leverage is observed in decreasing order except the year 2019-20 where an

increase was noticed. During 2019-20 the highest operating leverage 2.07 was shown and 1.42

was the lowest for the year 2021-22.the result indicates that Tata steel Ltd has a good control on

fixed cost.

(6) The financial leverage of the Tata steel ltd shows mixed Trend. During 2017-18 it was at peak

that is 2.04 and lowest was 1.04 was in year 2021-22.

(7) The Composite leverage of the Tata steel ltd shows mixed Trend. During 2017-18 it was at peak

that is 3.96 and lowest was 1.48 was in year 2021-22

SUGGESTIONS

1. It is a general suggestion for the company to get better the financial position and for the better

performance.

2. In order to increase the profitability of the companies, it is suggested to control the cost of goods

sold and operating expenses.

0

0.5

1

1.5

2

2.5

3

3.5

4

4.5

2017-18

2018-19

2019-20

2020-21

2021-22

Operating Leverage

Financial Leverage

Composite Leverage

International Journal for Multidisciplinary Research (IJFMR)

E-ISSN : 2582-2160 ● Website: www.ijfmr.com ● Email: editor@ijfmr.com

IJFMR23011662

Volume 5, Issue 1, January-February 2023

8

3. The management should try to accept cost reduction techniques in their companies to get over

this dangerous situation.

4. To reduce power and fuel Cost Company have to find out other alternative for this.

5. Financial leverage of Tata Steel Ltd should be termed into a positive through raising EBIT

CONCLUSION

In the present Study, the impact of marginal cost and leverages of the company analyzed at various

parameters and it is found satisfactory. The impact of marginal cost can be improved by the given

recommendations. It is very essential for the Tata steel Ltd to achieve good financial performance.

REFERENCES

1. S.G. Vahora , 2018: “An analytical marginal cost study of Tata Steel”, Vol. 6 issue 2, ijcrt.org

2. Dr. L. Leo franklin & Dr. K. Uma., “Impact of Marginal Costing and leverages for cement

Industries”, International Journal of advance Research in management and Social Science.

3. I.M. Panday , “Fianncial management” Vikas Publishing House, U.P.

4. M.A Shaf “ Management Accounting Principles and practices” Vikas Publishing House

5. S.N. maheswari “ Financial & Management Accounting” Sultan Chand and Sons, New Delhi

6. R.M. Srivastava “ Financial management” Himalaya Publishing House, Mumbai

7. Reddy & Hary Pradas Reddy “ Financial management” Margham Publication, Chennai

8. K.K.Sharma, „Cement industry from pains of scarcity of Problems of surplus‟ The Management

Accountant ,

9. Ramachandira reddy and Yuvaraja reddy “ Fianncial performance through market value added

approach” The Management Accountant

10. https://www.sundaramfinance.in/

11. https://www.niftycentral.in/

12. https://www.financialadvisor.org/

13. https://www.themarket.com/

14. https://www.capitalmarket.com/