BUILDING BLOCKS TEACHER GUIDE

Borrowing money for a house

Students “buy” a local home and calculate payments based on

the principal, interest rate, and length of mortgage loans to learn

how different loan terms affect the overall cost.

Learning goals

Big idea

The amount actually paid for a home is

determined by the price and the mortgage

loan’s specic terms.

Essential questions

§ How do the principal, interest rate, and loan

term affect mortgage payments?

§ How do you compare loan offers to get the

b

est deal?

Objectives

§ Make informed choices about mortgages

§ Calculate monthly payments for loans based

o

n the principal, interest rate, and loan term

KEY INFORMATION

Building block:

Financial knowledge and

decision-making skills

Grade level: Middle school (6–8)

Age range: 11–14

Topic: Borrow (Getting loans, Managing

credit)

School subject: CTE (Career and

technical education), Math

Teaching strategy: Direct instruction,

Project-based learning

Bloom’s Taxonomy level: Understand,

Apply, Evaluate

Activity duration: 45–60 minutes

National Standards for Personal

Financial Education, 2021

Spending: 4-1, 4-2, 8-1, 8-2, 12-1, 12-2, 12-6

Managing credit: 4-1, 4-2, 8-1, 8-2, 8-3,

8-6, 12-3, 12-3

These standards are cumulative, and topics are not

repeated in each grade level. This activity may include

information students need to understand before

exploring this topic in more detail.

NOTE

Please remember to consider your students’

accommodations and special needs to ensure

that all students are able to participate in a

meaningful way.

Summer 2022

1 of 6

Consumer Financial

Protection Bureau

To nd this and other activities, go to:

consumernance.gov/teach-activities

Summer 2022

BUILDING BLOCKS TEACHER GUIDE

2 of 6

Borrowing money for a house

What students will do

§ Calculate monthly payments on three mortgage loans.

§ C

ompare the three loans to identify the best deal for them.

§ R

eect on ways to reduce the amount owed on a loan.

Preparing for this activity

□ While it’s not necessary, completing the “Being a responsible borrower” activity

rst may make this one more meaningful.

□ P

rint copies of all student materials for each student, or prepare for students to

access them electronically.

□ E

nsure students have access to calculators.

□ T

o customize this activity for your local area, visit websites that list homes for

sale near you.

°

Print pictures and prices of four to six houses that vary in size and price.

°

Y

ou can further customize the activity by visiting the Consumer

Financial Protection Bureau’s “Explore interest rates” page at

https://www.consumernance.gov/owning-a-home/explore-rates/

to nd current interest rates in your state.

°

F

or each house you printed out, choose three interest rates for loans

available near you.

°

M

ake sure some loan options are 15-year mortgages and some are

30-year mortgages.

°

W

rite the three interest rates and terms on the pictures you printed for

each house.

□ M

ake enough copies of the sample house pictures for each student to have one.

Summer 2022

BUILDING BLOCKS TEACHER GUIDE

3 of 6

Borrowing money for a house

What you’ll need

THIS TEACHER GUIDE

§ Borrowing money for a house (guide)

cfpb_building_block_activities_borrow-money-for-house_guide.pdf

STUDENT MATERIALS

§ Borrowing money for a house (worksheet)

cfpb_building_block_activities_borrow-money-for-house_worksheet.pdf

§ Calculators

§ Pictures and prices of local homes

Exploring key nancial concepts

Most people don’t make enough money or have enough in

savings to buy something as expensive as a house. Instead, they

take out a loan that allows them to make payments, usually each

month, until the item is paid off. To buy a house, people usually

use some of their own money as a down payment and borrow the

rest of the money (the principal) they need. A loan that people

use to buy a house is called a mortgage.

Banks, credit unions, and other nancial institutions offer

mortgages with different interest rates and terms. Interest is the

fee the lender charges for borrowing money. The interest rate

can be higher or lower depending on your borrowing history.

Mortgages also come in different terms. The term is the amount

of time the loan is supposed to last. Generally, mortgages have a

term of 15 years or 30 years.

The lower the loan numbers are, the better the outcome for you:

§ Lower principal = less money you borrow and therefore less money you’ll repay

§ Lower interest rate = less interest you’ll be charged to borrow money

§ Shorter term = fewer total payments you’ll have to make, but each payment

i

s higher

TIP

Because products, terms, and

laws related to mortgages

change, students should

be encouraged to always

look for the most up-to-date

information.

Summer 2022

BUILDING BLOCKS TEACHER GUIDE

4 of 6

Borrowing money for a house

When people are thinking of buying a house, it’s a good idea for them to track

their spending and create a budget if they’re not already doing this. This will help

them gure out how much they can spend on their mortgage each month. It’s also

a good idea to shop around for mortgage loans to get the best deal.

Understanding the real costs of borrowing money can help you make informed

credit and loan decisions.

Teaching this activity

Whole-class introduction

§ Ask the students to raise their hands if they would like to buy a home when

they are adults.

§ T

ell students that they’ll learn about borrowing money to buy a home.

°

Y

ou can read the “Exploring key nancial concepts” section of this guide

aloud to the class to introduce the idea of mortgages.

§ R

eview with students how to use an oversimplied interest formula of principal x

rate x term to calculate monthly payments. This oversimplied interest formula

is often written as I = P × R × T:

°

I = t

he amount of simple interest

°

P = t

he principal (the amount borrowed)

°

R = t

he interest rate of the loan

°

T = t

he period of time (in years) from the date the money

was borrowed to the date it was repaid

§ Di

stribute the “Borrowing money for a house” worksheet

to students.

°

It’s recommended that students use calculators to do the

math on the worksheet.

§ B

e sure students understand key vocabulary:

°

P

rincipal: In the lending context, principal is the amount

of money that you originally received from the lender and

agreed to pay back on the loan with interest.

°

I

nterest: A fee charged by a lender, and paid by a borrower,

for the use of money.

NOTE

This is an oversimplied

approach to determining

interest. The actual math will

likely be more complicated.

TIP

Visit CFPB’s nancial

education glossary at

consumernance.gov/

nancial-education-glossary/.

Summer 2022

BUILDING BLOCKS TEACHER GUIDE

5 of 6

Borrowing money for a house

°

Interest rate: A percentage of a sum borrowed that is charged by a lender or

merchant for letting you use its money.

°

L

oan: Money that needs to be repaid by the borrower, generally with interest.

°

M

ortgage: Mortgage loans are used to buy a home or to borrow money

against the value of a home you already own.

°

Te

rm: A xed or limited period of time for which something lasts or is

intended to last (for example, a ve-year loan, a three-year certicate of

deposit, a one-year insurance policy, a 30-year mortgage).

Individual work

§ Students will work independently to complete the worksheet.

°

I

f you have customized the activity based on the instructions in the “Preparing for

this activity” section, tell students to come to you to “buy” a home and use the

information you’ve provided instead of the loan information on the worksheet.

You’ll provide them with a picture and the price of a home listed for sale in your

area, along with the principal and three interest rate and term options.

§ S

tudents will then answer the reection questions.

Wrap-up

§ Bring students together and ask them to share their results.

°

Y

ou might consider documenting their results in a chart that shows

the original price of their house and how much they actually ended

up paying for it.

§ Ask students to share their answers to the reection questions.

Suggested next steps

Consider searching for other CFPB activities that address the topic of borrowing,

including getting loans and managing credit. Suggested activities include

“Asking for a loan” and “Understanding ways to pay for education after high school.”

Measuring student learning

Students’ answers on their worksheets and during discussion can give you a

sense of their understanding.

Summer 2022

BUILDING BLOCKS TEACHER GUIDE

6 of 6

Borrowing money for a house

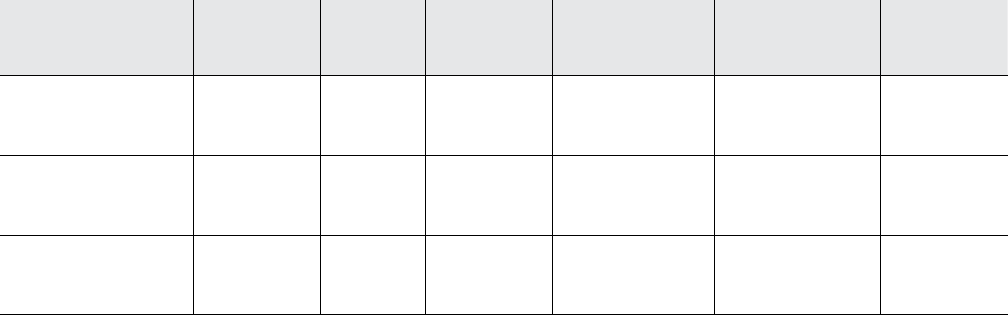

This answer guide provides possible answers for the “Borrowing money for a

house” worksheet.

Keep in mind that students’ answers to reection questions may vary, as

there may not be only one right answer. The important thing is for students

to have reasonable justication for their answers.

Answer guide

This cell is

empty.

Principal Rate Term

Interest

charged

Total amount

paid

Monthly

payment

House loan

option 1

$299,400 3.69% 30 years $331,435.80 $630,835.80 $1,752.32

House loan

option 2

$299,400 3.15% 15 years $141,466.50 $440,866.50 $2,449.26

House loan

option 3

$299,400 3.35% 30 years $300,897.00 $600,297.00 $1, 667.49