1

Introduction

More than eight million people, who get monthly Social

Security benets or Supplemental Security Income (SSI)

payments, need help managing their money.

In these cases, we can appoint a relative, friend, or

other interested party to serve as the “representative

payee.” We thoroughly investigate those who apply to be

representative payees to protect the interests of Social

Security beneciaries. This is because a representative

payee receives the beneciary’s payments and is given

the authority to use them on the beneciary’s behalf.

If you agree to serve as a representative payee, you’ve

taken on an important responsibility that can make a

positive difference in the beneciary’s life.

With certain exceptions, a payee may not collect a fee

for services provided to the beneciary. You can’t collect

a fee for services from the beneciary, unless Social

Security allows it, or you’re the legal guardian authorized

by a court to charge a guardian fee.

This booklet provides information on how to be a

representative payee. It isn’t intended to answer all

questions. For specic information about your situation,

you should talk with a representative at your local

Social Security ofce.

Helping you manage your new responsibility

As a representative payee, you must know what the

beneciary’s needs are so you can decide the best use

of benets for their care and well-being. This is especially

important if the beneciary doesn’t live with you.

Each year, we will ask you to complete a form to account

for the benets you have received. For additional

information, see our “Keeping records ” section.

2

A Protection and Advocacy agency in your state may also

contact you to review your receipts and records of income

and expenses.

As a representative payee, you’ll also need to tell us

about changes that may affect the beneciary’s eligibility.

To view a list of things you need to inform us about, see

our “Changes to report ” section.

Remember, the law requires representative payees to use

the benets in the beneciary’s best interest. If a payee

misuses benets, they must repay the misused funds. A

payee who’s convicted of misusing funds may be ned

and imprisoned.

NOTE: We appoint a representative payee to manage

Social Security and SSI funds only. A payee has

no legal authority to manage non-Social Security

income or medical matters. A representative payee,

however, may need to help a beneciary get medical

services or treatment.

Family members often use a power of attorney as another

way to handle a family member’s nances. For our

purposes, a power of attorney isn’t an acceptable way

to manage a person’s monthly benets. We recognize

only a designated representative payee for handling the

beneciary’s funds.

A special note about children who get

Supplemental Security Income (SSI) payments

If you’re a payee for a child receiving SSI payments, you

must seek treatment for the child’s medical condition

when it’s necessary. If you don’t get medical treatment for

the child, we may appoint a new representative payee.

3

How you must use monthly benets

First, you must take care of the beneciary’s day-to-day

needs for food and shelter. Then, you must use the

money for the beneciary’s medical and dental care that’s

not covered by health insurance. You can also pay for

the beneciary’s personal needs, such as clothing and

recreation. You must save any money left after you pay

for the beneciary’s needs, preferably in U.S. Savings

Bonds or an interest-paying bank account. This must be

insured under either federal or state law.

If the beneciary is in a nursing home or institution, use

their benets to pay the fees. In this case, you should

set aside a minimum of $30 each month to use for the

beneciary’s personal needs.

If the beneciary is in an institution and gets Medicaid,

or is a member of a family on Temporary Assistance for

Needy Families (TANF), contact us. We can inform you

about using benets for the family.

You may not take a fee from the beneciary for your

services as a representative payee. If you have questions

about this, contact your local Social Security ofce.

How to handle a large payment of

past-due benets

In certain instances, we will pay past-due benets all

at once in a lump sum, which may be a large amount.

First, you must spend the money on the beneciary’s

current needs such as rent and a security deposit, food,

or furnishings. After paying these expenses, you may

spend the money to improve the beneciary’s daily living

conditions or for better medical care. Spend the money

wisely. You should use the money in the beneciary’s

best interests. Then, if there’s money left over, you

4

must save it, preferably in U.S. Savings Bonds or an

interest-paying bank account, insured under either federal

or state law.

Improve daily living conditions

After you’ve provided for the beneciary’s needs, you may

spend the money to improve the beneciary’s daily living

conditions or for better medical care.

You may decide to use the beneciary’s funds for

major health-related expenses, if they’re not covered

by the beneciary’s health insurance. Examples of

these expenses are reconstructive dental care, a

motorized wheelchair, rehabilitation expenses, or

insurance premiums.

You could use the money to arrange for the beneciary to

go to school or get special training.

You may also spend some of the money for the

beneciary’s recreation, such as movies, concerts, or

magazine subscriptions.

Special purchases

You may want to make some of the following special

purchases for the beneciary.

• A home — Use funds for a down payment. Use

the money for payments on a house owned by

the beneciary.

• Home improvements — Pay for repairs and changes

to make the beneciary’s home safer and more

accessible. For example, the installation of a ramp or

widening of doorways for wheelchair access.

• Furniture — Buy furniture for the beneciary’s personal

use. You can buy items such as a television the

beneciary can share with others in the household.

5

• A car — Use funds for a down payment. Use the

money for car payments as long as the car is used for

and owned by the beneciary.

If you’re not sure if it’s okay to use money for a specic

item (for example, paying a bill owed before you became

payee), contact us before you spend the money.

A special note about SSI payments

To continue receiving SSI, a recipient must not have

resources worth more than $2,000 ($3,000 for couples).

We don’t count all resources. However, some items you

buy could cause the recipient to lose their SSI payments.

Any money you don’t spend could also count as a

resource. Check with us before making major purchases

for an SSI recipient.

A special note about children who are blind or

have a disability and receive SSI

Sometimes, blind or children with a qualifying disability will

receive large, past-due SSI payments covering more than

six months of benets. Usually, these payments must go

directly into a separate banking account. We call this a

“dedicated account” because funds in this account are

only for certain expenses related to the child’s disability.

The child’s dedicated account must be separate from

other accounts. Except for certain past-due payments, no

other funds may be put into the account. We don’t count

money in the dedicated account as a resource, and we

don’t count interest earned on the money as income or

as a resource. You can only use money in a dedicated

account for the following expenses:

• Medical treatment and education or job skills training.

• Personal needs related to the child’s qualifying

disability — such as therapy and rehabilitation, special

equipment, and housing modications.

6

• Necessary items or services related to the child’s

qualifying disability, such as legal fees for the child’s

benet claim.

You should get approval from us before spending

money on any items other than medical treatment,

education, jobs training, or personal needs related to the

child’s disability.

You must keep a record of all money taken from this

account. Save the receipts for all items or services bought

because we’ll review these records at least once a year.

If you knowingly use money from the dedicated account

for anything other than the expenses listed above, you

must repay us from your own funds. If you have questions

about dedicated accounts, contact us.

How to hold funds

The Treasury Department requires all federal benet

payments to be made using a form of electronic payment.

We recommend that you hold benets in a checking or

savings account to protect against loss or theft. Also, don’t

mix the beneciary’s funds with your own or other funds.

You must save any money left over after meeting the

beneciary’s day-to-day and personal needs. The

preferred way of saving is through U.S. Savings Bonds

or an interest-paying bank account that’s insured under

either federal or state law. Interest earned belongs

to the beneciary.

The checking or savings account title must show the

beneciary’s ownership of the funds and show you as the

nancial agent. Neither you as the payee, nor another

third party, can have any ownership of the account. The

beneciary must never have direct access to the account.

Any account title (under state law) that shows beneciary

7

ownership of the account with you as the nancial agent is

acceptable. Don’t use joint accounts. We recommend that

you title the account in one of the following ways:

• (Beneciary’s name) by (your name),

representative payee.

• (Your name), representative payee for

(beneciary’s name).

Your bank will provide help if you have more questions.

An exception for parents and spouses who are

representative payees

A common checking account for all family members living

in the same household who receive benets may show a

parent or spouse as the owner of the account. Children’s

savings, however, must be in separate savings accounts

for each child, showing the child as the account owner.

Organizations that serve as payees

Sometimes nursing homes or other organizations place

funds for several beneciaries in a single checking

or savings account known as a “collective account.”

This is usually acceptable, but special rules apply to

these accounts:

• Account titles must show the funds belong to the

beneciaries and not the representative payee.

• The account must be separate from the organization’s

operating account.

• Any interest earned belongs to the beneciaries.

• There must be proper procedures to document credits

and debits with clear and current records of each

beneciary’s share.

• The organization must make the account and

supporting records available to us when we ask

for them.

8

• The organization must obtain approval from us before

establishing the account.

Some examples of collective account titles are:

• “Sunnydale Nursing Home for Social Security

Beneciaries.”

• “Sunnydale Nursing Home Resident Trust Account.”

If you have any questions about collective accounts,

contact us.

You’ll need approval from us rst if your organization

serves as payee and wants to charge a beneciary for the

cost of past care. We also need to approve any decision

to “pool” the funds of several beneciaries for an item

such as a television that will benet the group.

More information about being a payee is available in

the Guide for Organizational Representative Payees

available at www.ssa.gov/payee or from any local Social

Security ofce. You can also order a copy by calling

1-800-772-1213 (TTY 1-800-325-0778).

Keeping records

As a representative payee, you’re responsible for

keeping records and reporting on how you spend

the benets by completing a Representative Payee

Report (Form SSA-623, SSA-6230, or SSA-6233).

We’ll mail the proper form to you once a

year. You can also le the report online at

www.ssa.gov/myaccount/rep-payee.html.

You must complete the report unless you are exempt.

The following types of payees are exempt from the annual

accounting requirements:

• A natural or adoptive parent of a minor child

who primarily resides in the same household as

the beneciary.

9

• A legal guardian of a minor child who primarily resides

in the same household as the beneciary.

• A natural or adoptive parent of a person with a

disability who primarily resides in the same household

as the beneciary.

• The spouse of an individual.

You can use the “Income and Expenses Worksheet ”

on the last page of this publication to keep track of what

you spend. When you ll out the Representative Payee

Report, you can add the amounts in each column of

your worksheet and put the totals on the accounting

form. If you need extra worksheets, call 1 -800-772-1213

(TTY 1-800-325-0778).

To supplement our annual accounting process, we may

select you for an onsite review. Protection and Advocacy

agencies in each state that receive annual grants from us

may contact you to schedule a review. This is meant to

ensure satisfactory oversight of funds and performance of

payee duties.

Paying income tax

Some people who get Social Security benets have to

pay federal income tax on them. At the beginning of

each year, we mail each beneciary a Social Security

Benet Statement (Form SSA-1099) that shows the total

benets they received during the previous year. Give this

statement to the beneciary’s tax preparer to determine if

any taxes are due on the benets.

A special note about SSI recipients in a

medical facility

If Medicaid pays more than half the cost for an SSI

recipient in a medical facility, we limit SSI payments to

$30 a month, plus any extra money the state pays. We

also apply this limit to children under age 18, if private

health insurance — or both private insurance and

10

Medicaid — pay more than half the cost of their care

in a medical facility. You must use the entire payment

for the recipient’s personal needs. After meeting all the

recipient’s needs, you must save any money left over on

their behalf.

Changes to report

You need to tell us about any changes that may affect

benet payments. As payee, you’re responsible for

repaying money you receive for the beneciary if you

don’t report any of the events listed below. You must

tell us if:

• The beneciary moves.

• The beneciary starts or stops working, no matter how

little the earnings amount.

• The beneciary’s medical condition improves.

• The beneciary starts receiving another government

benet or the benet amount changes.

• The beneciary travels outside the United States

for 30 days or more.

• The beneciary is imprisoned for a crime that carries a

sentence of more than one month.

• The beneciary is committed to an institution by

court order for a crime committed because of a

mental impairment.

• Custody of a child beneciary changes or a

child is adopted.

• The beneciary is entitled as a stepchild, and the

parents’ divorce.

• The beneciary gets married.

• The beneciary no longer needs a payee.

• The beneciary dies.

11

You must also tell us if:

• You’re no longer responsible for the beneciary.

• You move.

• You no longer wish to be payee.

• You’re convicted of a felony.

• You’re violating a condition of your probation or parole

imposed under federal or state law.

You must tell us if you or the beneciary have an

outstanding arrest warrant for a felony in the state

where you or the beneciary live. In states that don’t

classify crimes as felonies, you must also tell us if you

or the beneciary have an outstanding warrant for a

crime punishable by death or imprisonment for more

than one year.

A special note about reporting changes for

SSI recipients

If the beneciary gets SSI benets, you must also report

the following changes:

• The beneciary moves to or from a hospital, nursing

home, correctional facility, or other institution.

• A married beneciary separates from their spouse, or

they begin living together again after a separation.

• Someone moves into or out of the beneciary’s

household.

• The beneciary or their spouse has a change in

income or resources.

A child’s SSI payment amount may change if there are

any changes in the family’s income or resources.

If you fail to report any actions to us, we may pay the

beneciary too much money. In that case, you may

have to return the money the beneciary wasn’t due

and the payments may stop. If you intentionally withhold

12

information to continue to receive payments, you may

face criminal prosecution. Criminal penalties can include

nes and imprisonment.

Also, payees for people on SSI should remember the

limits for savings and resources are $2,000 for singles

and $3,000 for couples. All interest earned on savings

counts toward that limit. Money in a child’s dedicated

savings account doesn’t count toward the resource limit.

For more information, see our section titled “A special

note about children who are blind or have a disability

and receive SSI .” Also, read What You Need to Know

When You Get Supplemental Security Income (SSI)

(Publication No. 05-11011).

If you stop being a payee

If you’ll no longer be the payee, you must notify us

immediately. This is important, because we’ll have to

select a new payee as soon as possible. When you’re no

longer responsible for the beneciary, you must return

any benets, including interest and any cash you have,

to us. We’ll reissue the funds to the beneciary or the

new payee.

If the beneciary dies

If the beneciary dies, you must give any saved benets

to the legal representative of the estate. Otherwise, the

savings must be managed according to state law. If you

need information about state law, contact the probate

court or an attorney.

When a person who receives Social Security benets

dies, no check is payable for the month of death, even

if they die on the last day of the month. You must return

any check received for the month the beneciary died.

An SSI check, however, is payable the month of death.

But you must return any SSI checks that come after the

month of death.

13

Medicare and Medicaid

Payees may need to help beneciaries get medical

services or treatment. This is a requirement for the payees

of children receiving SSI. You should keep a record of

medical services and medical expenses not covered by

Medicare and Medicaid. For information about Medicare

coverage, read Medicare (Publication No. 05-10043).

If the beneciary has low income and few resources,

the state may pay Medicare premiums and some

out-of-pocket medical expenses. A person may qualify

even if their income or resources are too high for SSI. For

information, contact the state or local medical assistance

(Medicaid) agency or social services ofce.

The beneciary may also be able to get Extra Help

paying for the annual deductibles, monthly premiums,

and prescription co-payments related to the Medicare

prescription drug program. The beneciary may qualify

for Extra Help if they have limited resources and income.

These resource and income limits usually change

each year.

Beneciaries will automatically get Extra Help and don’t

have to apply if:

• They have both Medicaid with prescription drug

coverage and Medicare.

• They have Medicare and Supplemental

Security Income.

• The state pays for their Medicare premiums.

For more information about getting Extra Help with

Medicare prescription drug plan costs, call our

toll-free number, or visit our website. You can also

help the beneciary apply for Extra Help online at

Social Security’s website.

14

Contacting Social Security

There are several ways to contact us, such as online,

by phone, and in person. We’re here to answer your

questions and to serve you. For more than 85 years,

Social Security has helped secure today and tomorrow

by providing benets and nancial protection for millions

of people throughout their life’s journey.

Visit our website

The most convenient way to conduct Social Security

business is online at www.ssa.gov. You can accomplish

a lot.

• Apply for Extra Help with Medicare prescription drug

plan costs.

• Apply for most types of benets.

• Find copies of our publications.

• Get answers to frequently asked questions.

When you create a personal my Social Security account,

you can do even more.

• Review your Social Security Statement.

• Verify your earnings.

• Get estimates of future benets.

• Print a benet verication letter.

• Change your direct deposit information.

• Request a replacement Medicare card.

• Get a replacement SSA-1099/1042S.

• Request a replacement Social Security card, if you

meet certain requirements.

Access to your personal my Social Security account may

be limited for users outside the United States.

15

Call us

If you cannot use our online services, we can help you

by phone when you call your local Social Security ofce

or our National toll-free 800 Number. We provide free

interpreter services upon request. You can nd your

local ofce information by entering your ZIP code on our

ofce locator webpage.

You can call us at 1-800-772-1213 — or at our

TTY number, 1-800-325-0778, if you’re deaf or hard

of hearing — between 8:00 a.m. – 7:00 p.m., Monday

through Friday. Wait times to speak to a representative

are typically shorter Wednesdays through Fridays

or later in the day. We also offer many automated

telephone services, available 24 hours a day, so you do

not need to speak with a representative.

If you have documents we need to see, remember that

they must be original or copies that are certied by the

issuing agency.

16

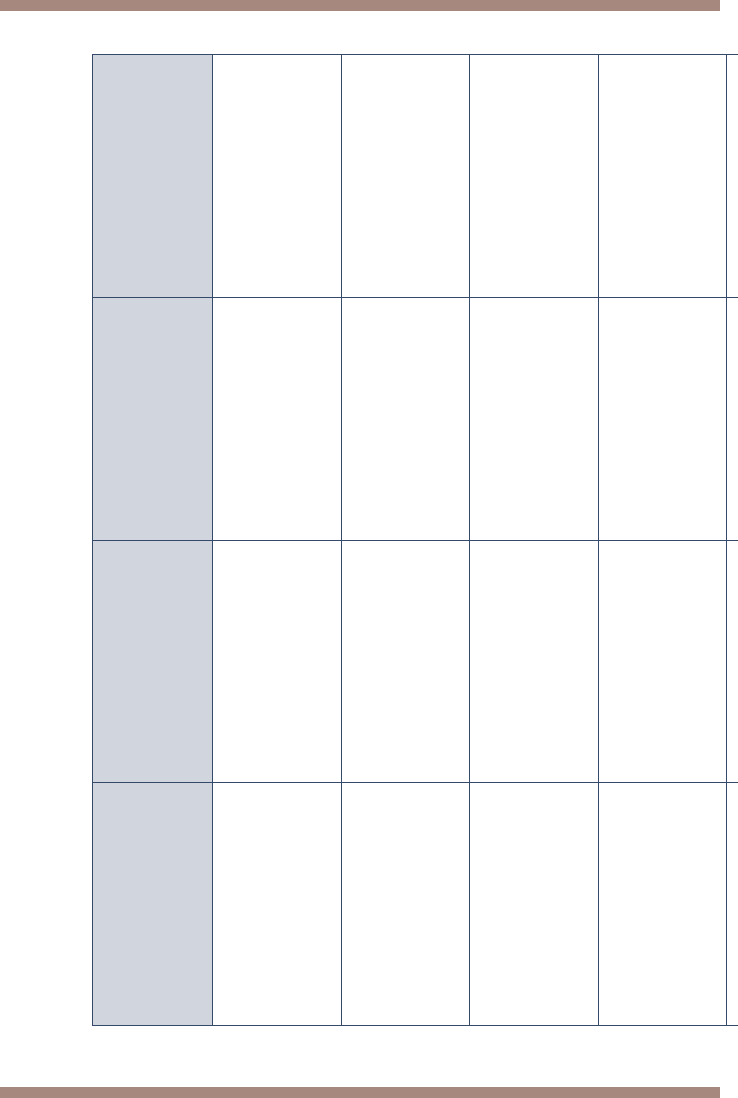

Income and Expenses Worksheet

Month and year

Amount of

Social Security

benets or SSI

payments received

Expenses for food

and housing

Expenses for

clothing, medical/

dental, personal

items, recreation,

miscellaneous

Totals for report period $______________

$______________

Put this gure on line 3B

of Form SSA-623

$______________

Put this gure on line 3C

of Form SSA-623

Show the total of any benets you saved for the beneciary, including any

interest earned.

$______________

Put this gure on line 3D

of Form SSA-623

For extra worksheets, please copy this page before you use it or contact your local Social Security ofce to get

more copies.

17

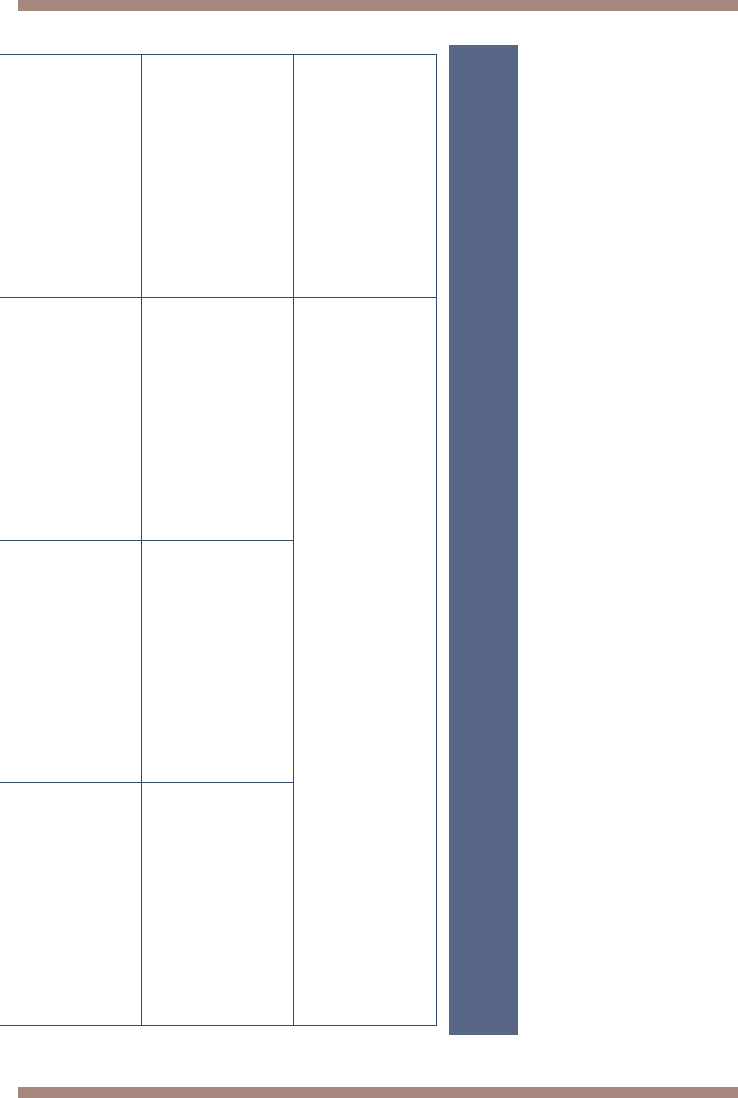

Income and Expenses Worksheet

Month and year

Amount of

Social Security

benets or SSI

payments received

Expenses for food

and housing

Expenses for

clothing, medical/

dental, personal

items, recreation,

miscellaneous

Totals for report period $______________

$______________

Put this gure on line 3B

of Form SSA-623

$______________

Put this gure on line 3C

of Form SSA-623

Show the total of any benets you saved for the beneciary, including any

interest earned.

$______________

Put this gure on line 3D

of Form SSA-623

For extra worksheets, please copy this page before you use it or contact your local Social Security ofce to get

more copies.

18

Notes

19

Notes

Social Security Administration | Publication No. 05-10076

March 2022 (Recycle prior editions)

A Guide for Representative Payees

Produced and published at U.S. taxpayer expense