1

UTILITY COSTS AND AFFORDABILITY OF THE GRID OF THE FUTURE

AN EVALUATION OF ELECTRIC COSTS, RATES AND EQUITY ISSUES

PURSUANT TO P.U. CODE SECTION 913.1

Contributors:

Bridget Sieren-Smith

Ankit Jain

Alireza Eshraghi

Simon Hurd

Julia Ende

Josh Huneycutt

Andrew Ngo

Mark LeBel (Associate, Regulatory Assistance Project)

Carl Linvill (Principal, Regulatory Assistance Project)

David Roland-Holst (Professor, UC Berkeley)

Special thanks to:

Nathan Barcic, Franz Cheng, Dorothy Duda, Beth LaCour, Paul Phillips, Jean Spencer, Elaine

Sison-Lebrilla, Erica Petrofsky, Christopher Westling, Ari Gold-Parker (E3), Nick Zanjani, Kristina

Abadjian, Love Asiedu-Akrofi, Amardeep Assar, Gelila Berhane, Kevin Flaherty, Renee Guild,

Nathaniel Kinsey, Karin Sung, Carlos Velasquez, and Charles Ward

2

I. EXECUTIVE SUMMARY 3

PROBLEM STATEMENT 7

KEY FINDINGS 7

ORGANIZATION 8

II. HISTORICAL COST AND RATE TRENDS 10

2.1 SECTION SUMMARY 10

2.2 HISTORICAL TRENDS IN ELECTRIC RATES AND BILLS 13

2.3 HISTORICAL UTILITY COSTS AND TRANSPARENCY 19

2.4 NET ENERGY METERING COSTS AND BENEFITS 29

2.5 HISTORICAL DISTRIBUTION COSTS 31

2.6 HISTORICAL TRANSMISSION COSTS 37

2.7 LEGISLATIVE POLICY PROGRAM COSTS 42

III. MODELING ASSUMPTIONS AND FRAMEWORKS FOR EVALUATING FORECASTED UTILITY COSTS 45

3.1 SECTION SUMMARY 45

3.2 COST AND RATE TRACKING TOOLS (CRT) 47

3.3 EN BANC BUNDLED RESIDENTIAL CUSTOMER RATES FORECAST 49

3.4 WILDFIRE MITIGATION PLAN PROJECTED COSTS 58

3.5 TRANSPORTATION ELECTRIFICATION PROGRAMS PROJECTED COST 67

3.6 RESIDENTIAL ENERGY COST CALCULATOR 71

3.7 AFFORDABILITY FRAMEWORK 88

IV. UTILITY COST CUTTING PROPOSALS IN FULFILLMENT OF PU CODE SEC 913.1 96

V. CONCLUSION 97

APPENDIX A: ENERGY COSTS FOR ABOVE AVERAGE ENERGY USAGE HOME ON SCE/SOCALGAS

AND SDG&E RATES 98

APPENDIX B: FORECASTED BUNDLED RESIDENTIAL RATES - EMBEDDED RATE COMPONENTS BY

NOMINAL $/KWH 99

NOTE ON ADDENDA 101

ADDENDUM 1: NATURAL GAS COST AND RATE TRENDS 102

ADDENDUM 2: EN BANC HEARING AND COMMENT SUMMARY 116

ADDENDUM 3: ADDITIONAL CONSIDERATIONS ON CUSTOMER EQUITY AND THE AFFORDABILITY

EVALUATION FRAMEWORK – DAVID ROLAND-HOLST (UC BERKELEY) 134

ADDENDUM 4: CONCEPTS FOR EQUITABLE COST ALLOCATION AND EFFICIENT PRICING – MARK

LEBEL AND CARL LINVILL (REGULATORY ASSISTANCE PROJECT) 147

3

UTILITY COSTS AND AFFORDABILITY OF THE GRID

OF THE FUTURE

I. EXECUTIVE SUMMARY

Senate Bill (SB) 695 (Kehoe, 2009) requires the CPUC to prepare an annual report addressing electric and gas

cost and rate trends as well as actions to limit or reduce utility costs.

1

For 2021, the CPUC is taking a different

approach to this report in order to provide a longer-term rate forecast and to leverage a wider array of subject

matter expertise from within the CPUC as well as externally in academia and the energy industry. The goal is

to evaluate longer term system costs and policy risks.

The draft of this report (the SB 695 Report or White

Paper) laid the foundation for an “En Banc Meeting on Cost and Rate Trends” held on February 24, 2021,

which provided a venue for discussing potential options for addressing the trends and impacts identified

herein.

The CPUC faces multiple intersecting policy mandates that require a delicate balance to avoid unintended

consequences. If handled incorrectly, California’s policy goals could result in rate and bill increases that

would make other policy goals more difficult to achieve and could result in overall energy bills becoming

unaffordable for some Californians. Electrification goals and wildfire mitigation planning are among the

near-term needs, for example, that place upward pressure on rates and bills.

Another regulatory risk that has been identified in prior SB 695 reports and is further detailed in this white

paper is a continuing increase in capital investments that are recovered in rate base by the investor-owned

utilities (IOUs). While capital investments by IOUs will be necessary to meet California’s energy and climate

policy goals, they can result in higher bills for customers. Evaluating the reasonableness of these

investments in a cleaner, more efficient grid raises affordability and equity implications that merit further

investigation.

While this white paper does not explore a comprehensive, detailed breakout of all essential cost categories

and their incremental impacts on IOU rates, it evaluates select areas of projected costs of specific programs

and policy priorities, including transportation electrification (TE) and wildfire mitigation plan (WMP)

implementation. The decision to highlight these specific areas of cost is informed by recent findings of staff

analysis and the desire to bring their relative impacts on overall rate forecasts into sharper focus within the

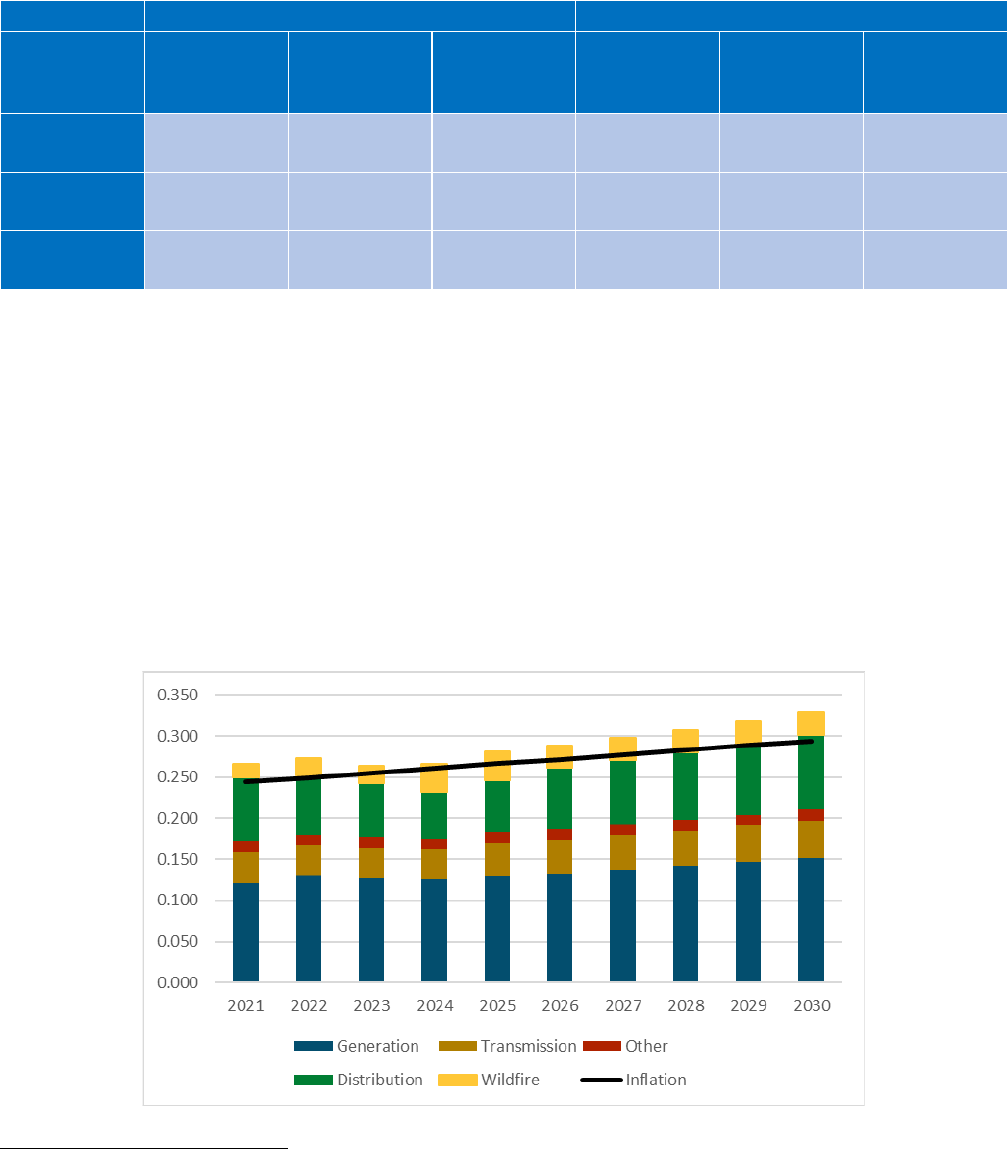

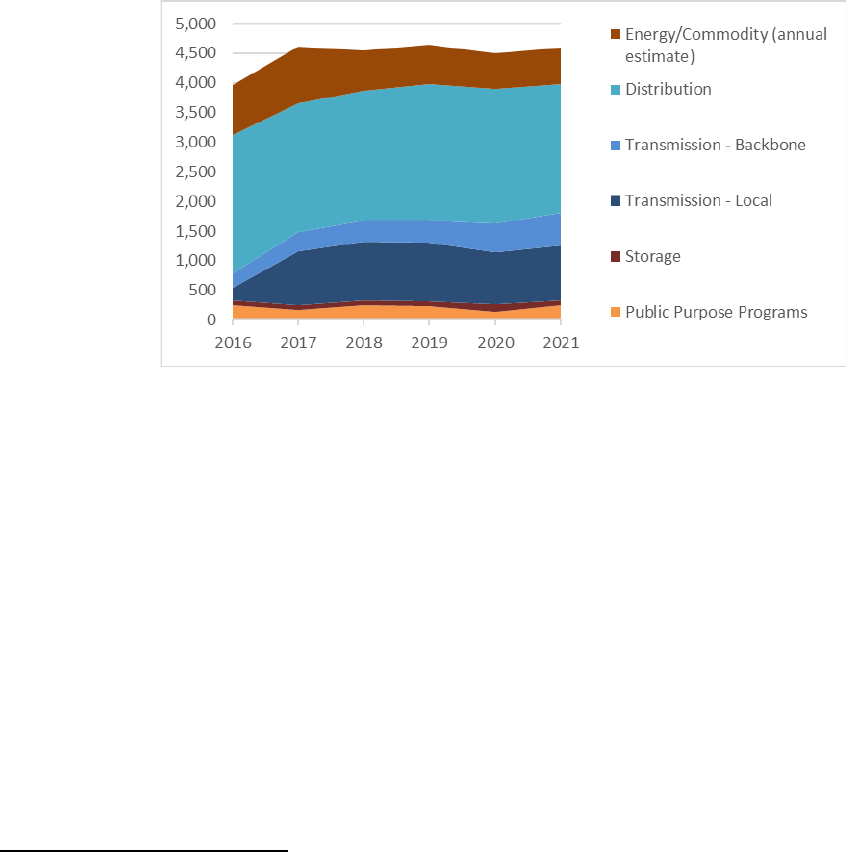

broader operations and revenue requirements of California’s IOUs. The figures below provide the

1

Public Utilities Code Section 913.1(b) states, “In preparing the report required by subdivision (a), the commission shall require electrical

corporations with 1,000,000 or more retail customers in California, and gas corporations with 500,000 or more retail customers in California, to

study and report on measures the corporation recommends be undertaken to limit costs and rate increases.”

4

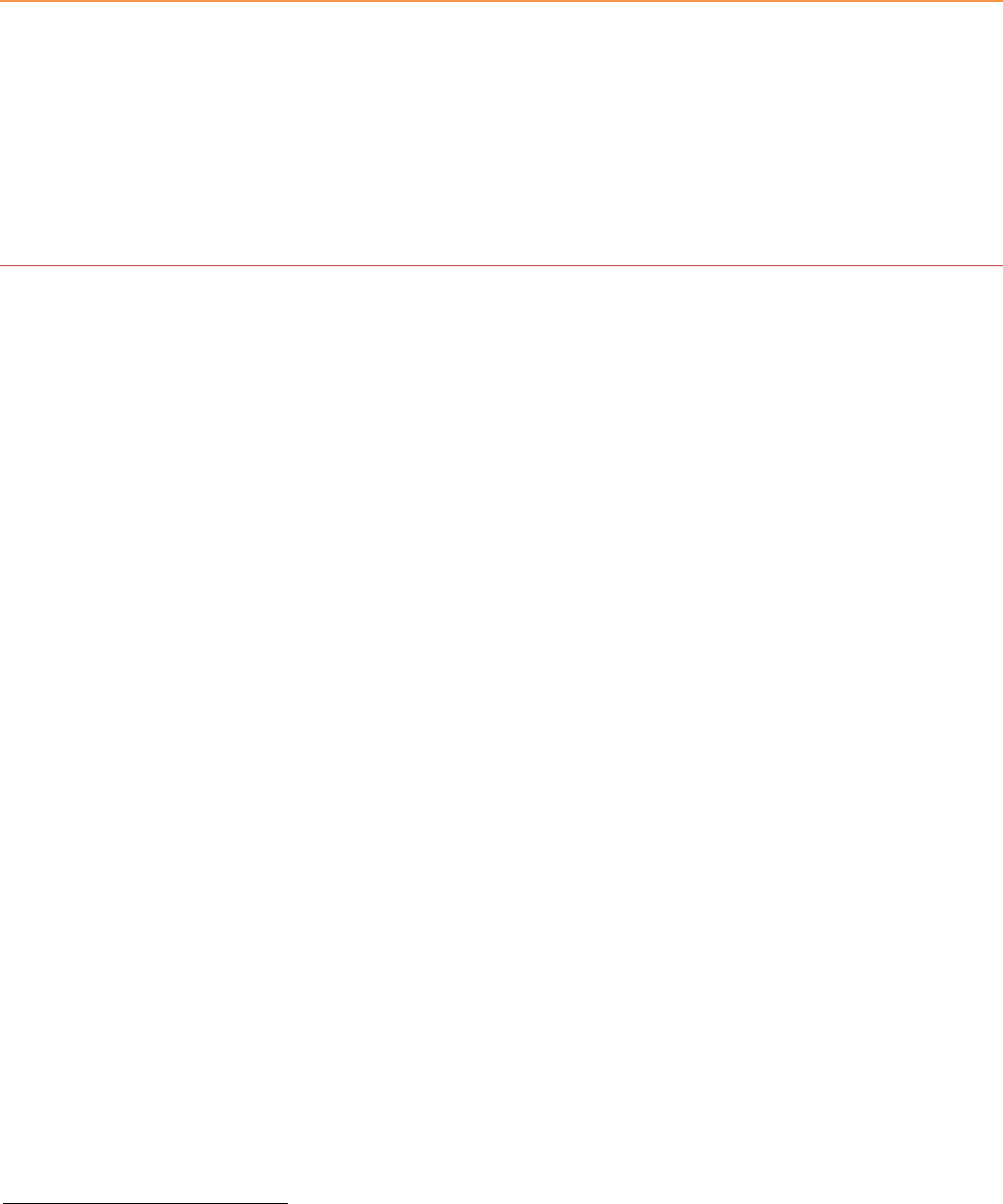

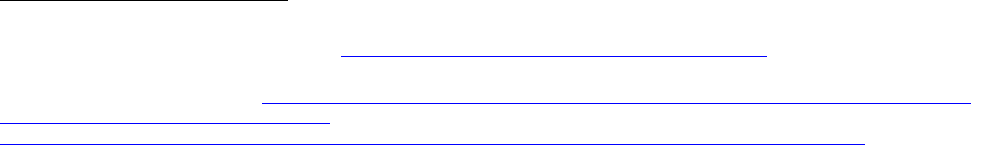

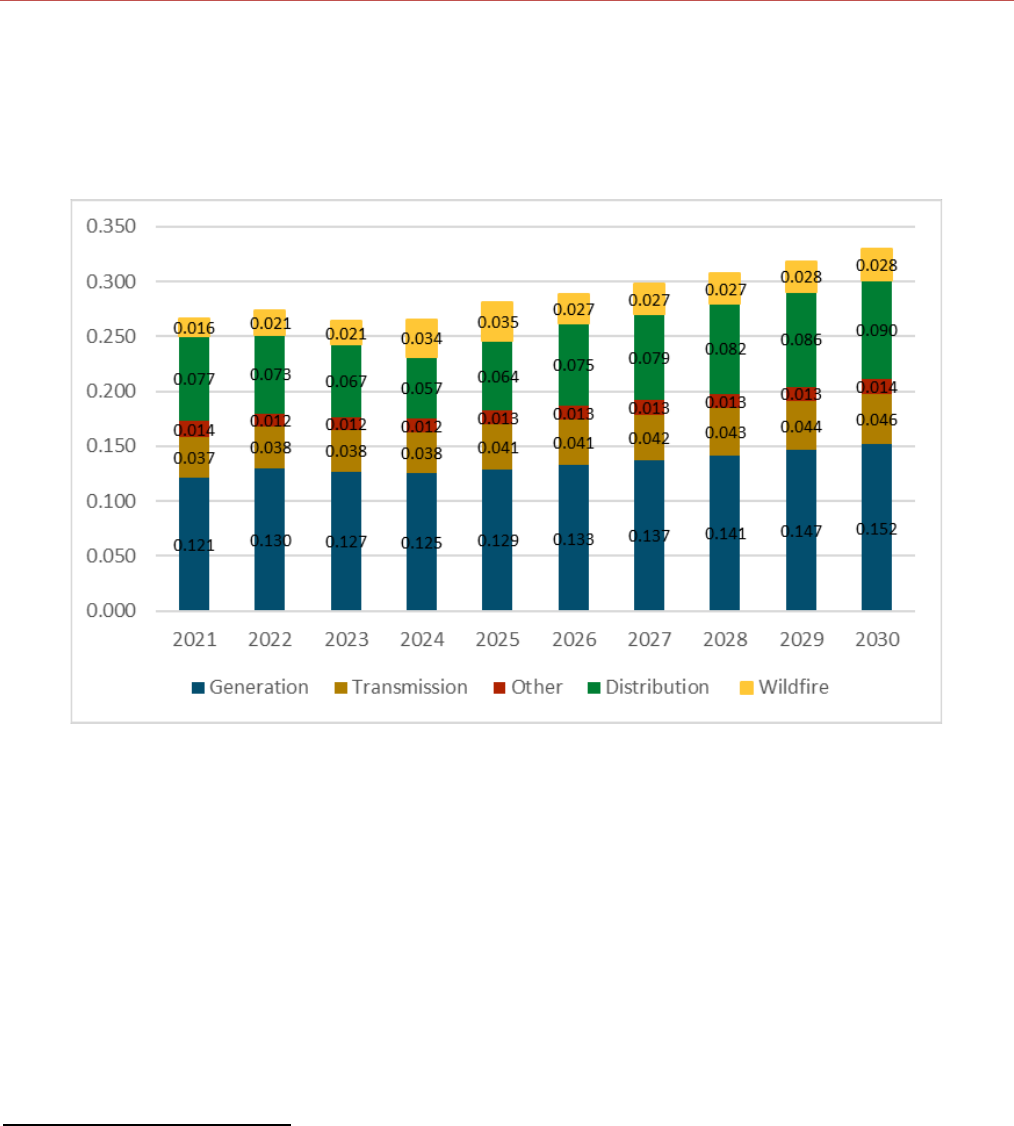

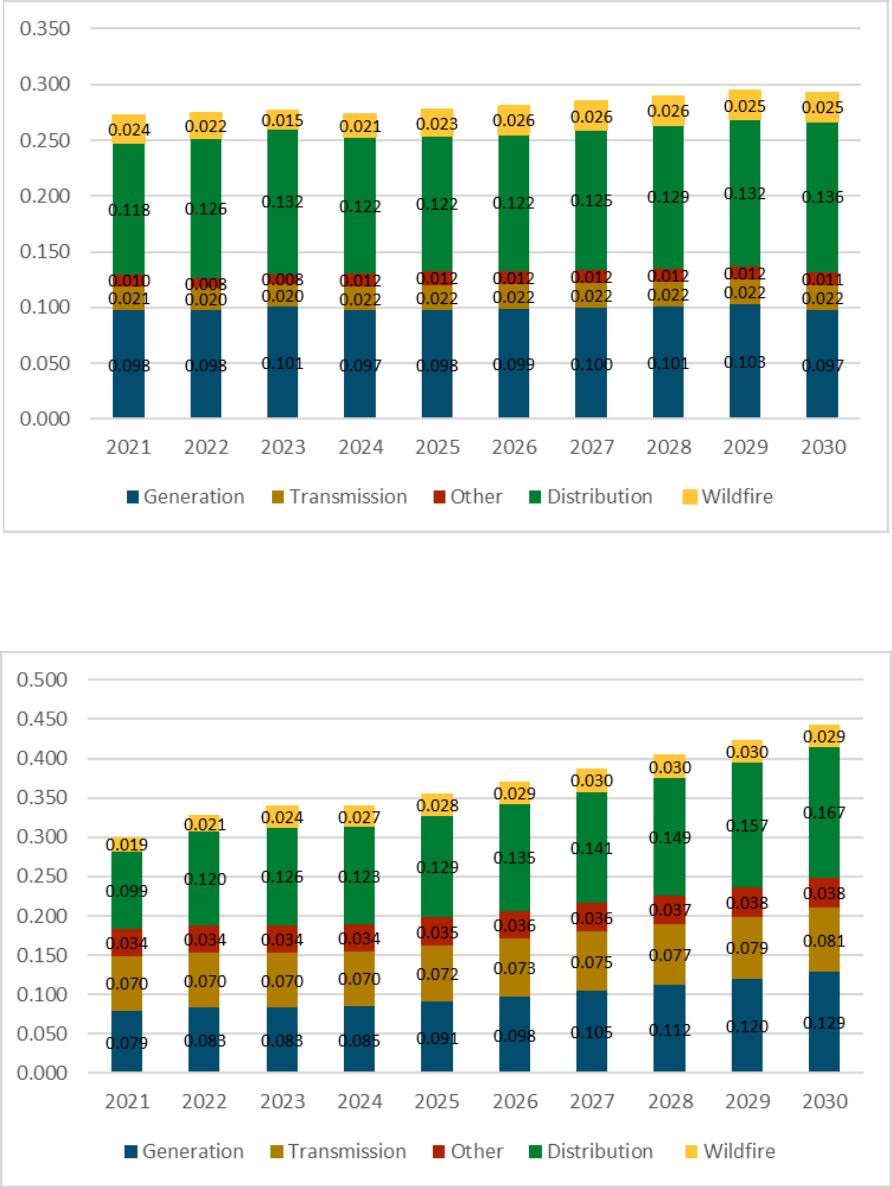

illustrative impacts of projected wildfire spending relative to the other major bundled

2

residential rate

components from 2021 through 2030.

3

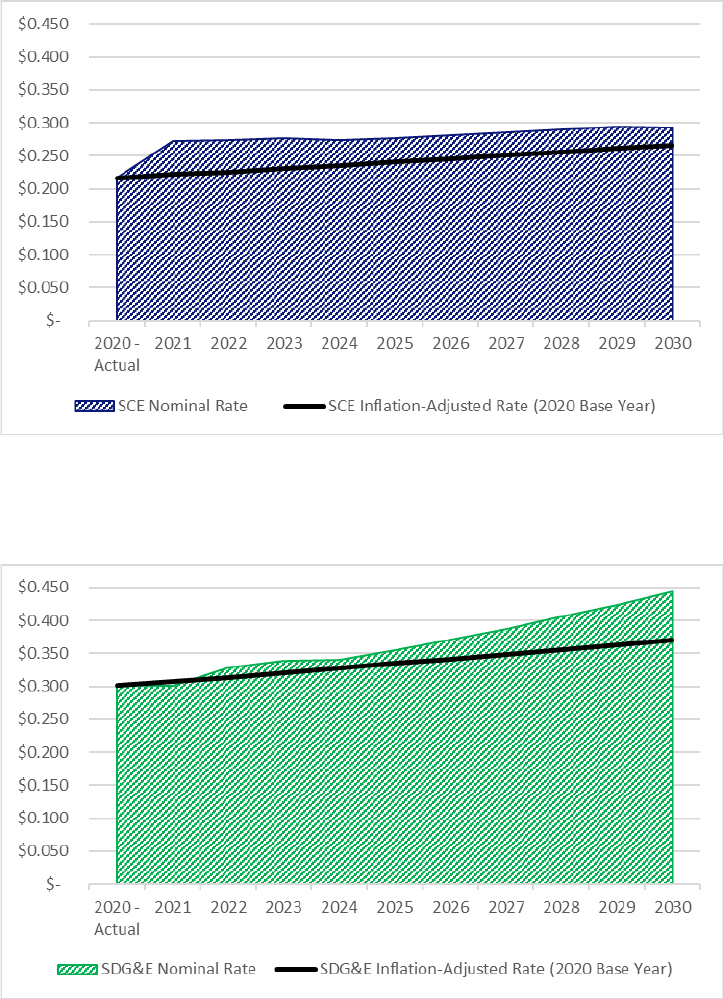

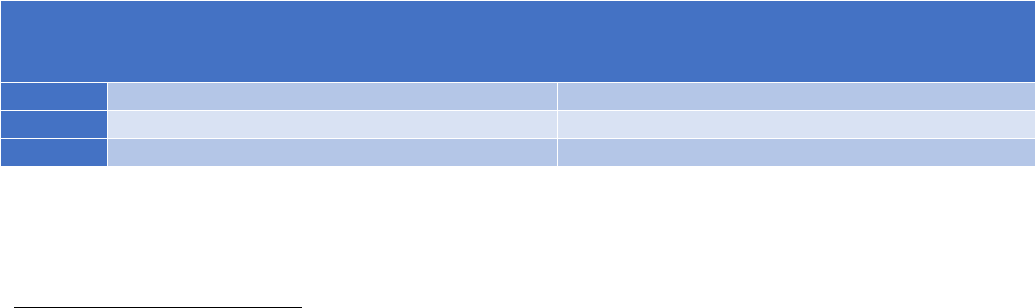

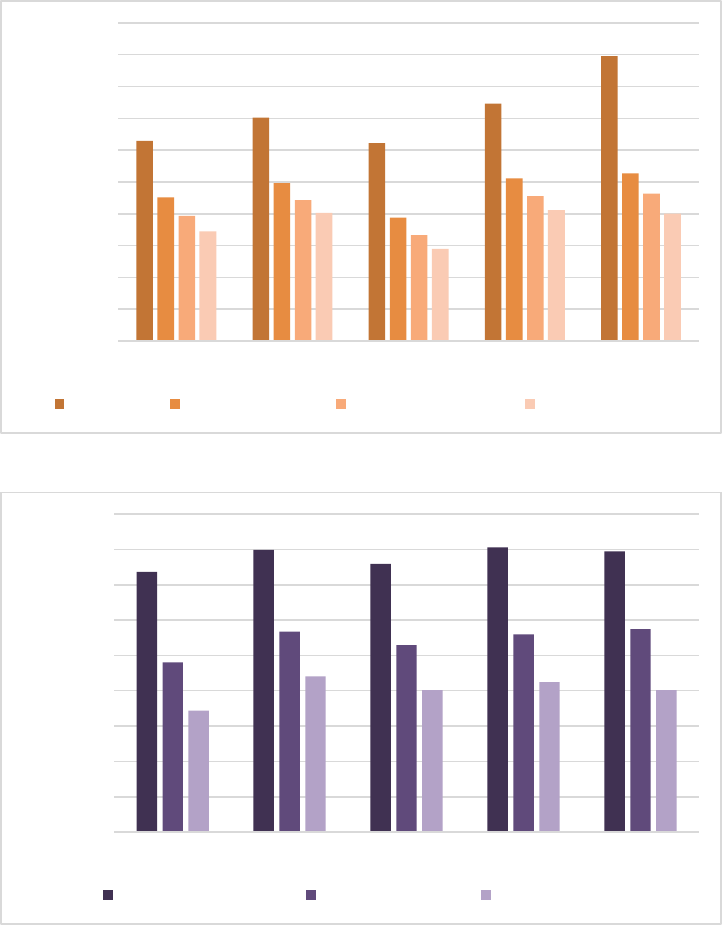

Figure ES-1: PG&E Forecasted Bundled Residential Rates ($ nominal/kWh), Wildfire Rate

Relative to All-Other (Non-Wildfire) Rate

Figure ES-2: SCE Forecasted Bundled Residential Rates ($ nominal/kWh), Wildfire Rate Relative

to All-Other (Non-Wildfire) Rate

2

Bundled IOU customers receive all services — generation, transmission, and distribution services — from the IOU.

3

The inflation-adjusted forecasted rate line is based on 2020 actual rates. The rates in Figures ES-1 through ES-3 are intended solely to facilitate

discussion related to this white paper and are not to be used for any other purpose.

5

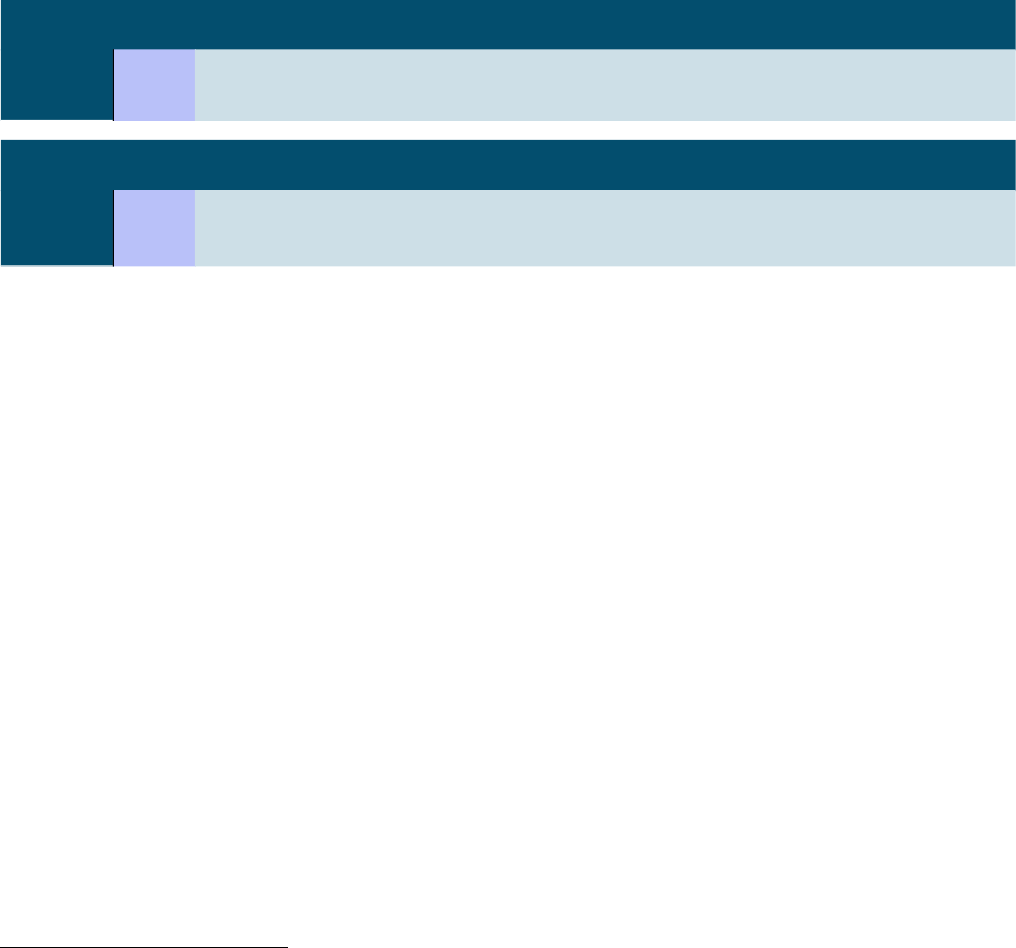

Figure ES-3: SDG&E Forecasted Bundled Residential Rates ($ nominal/kWh), Wildfire Rate

Relative to All-Other (Non-Wildfire) Rate

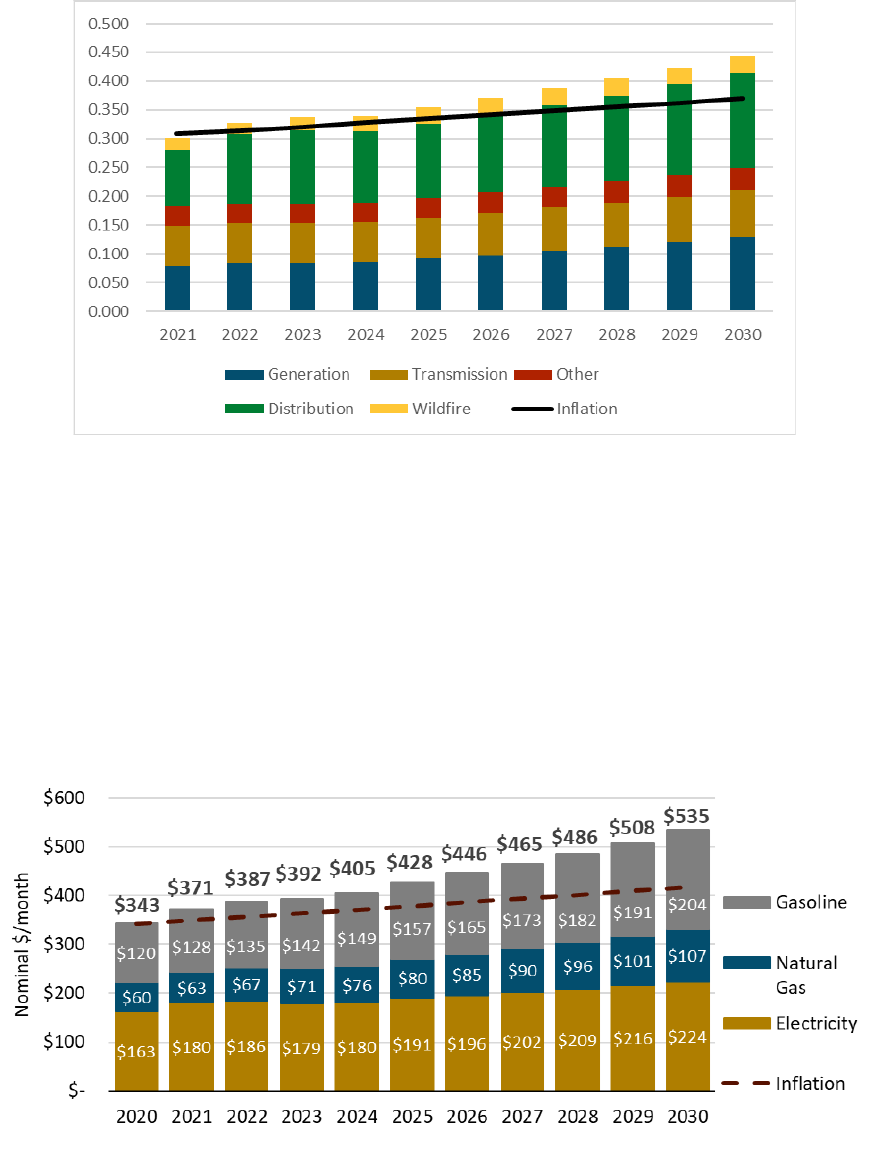

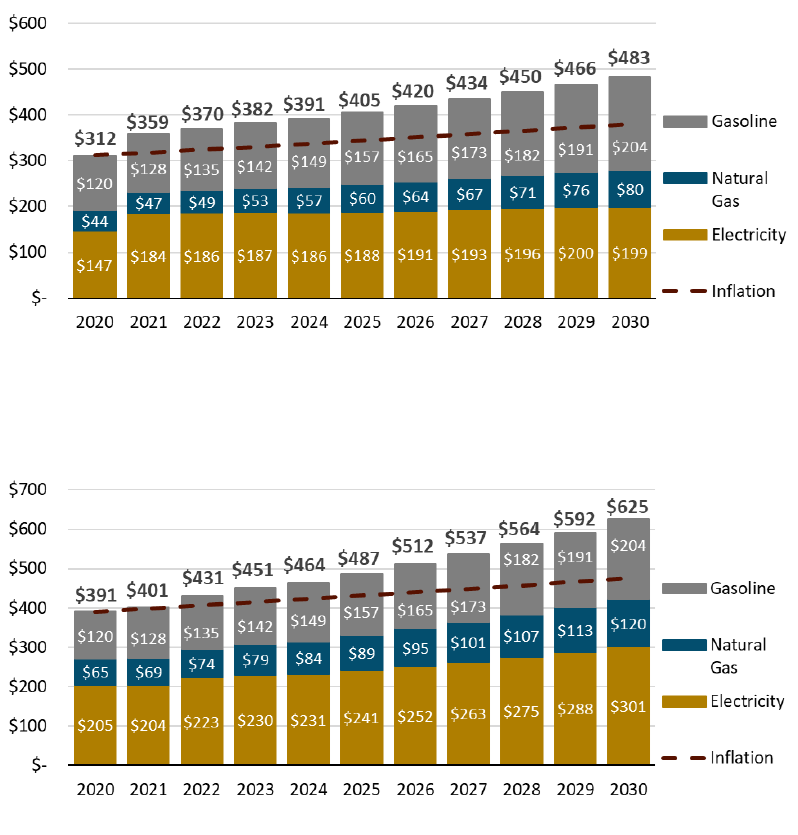

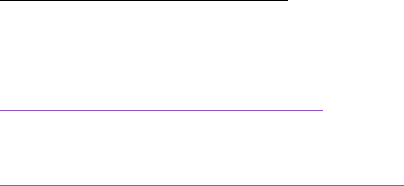

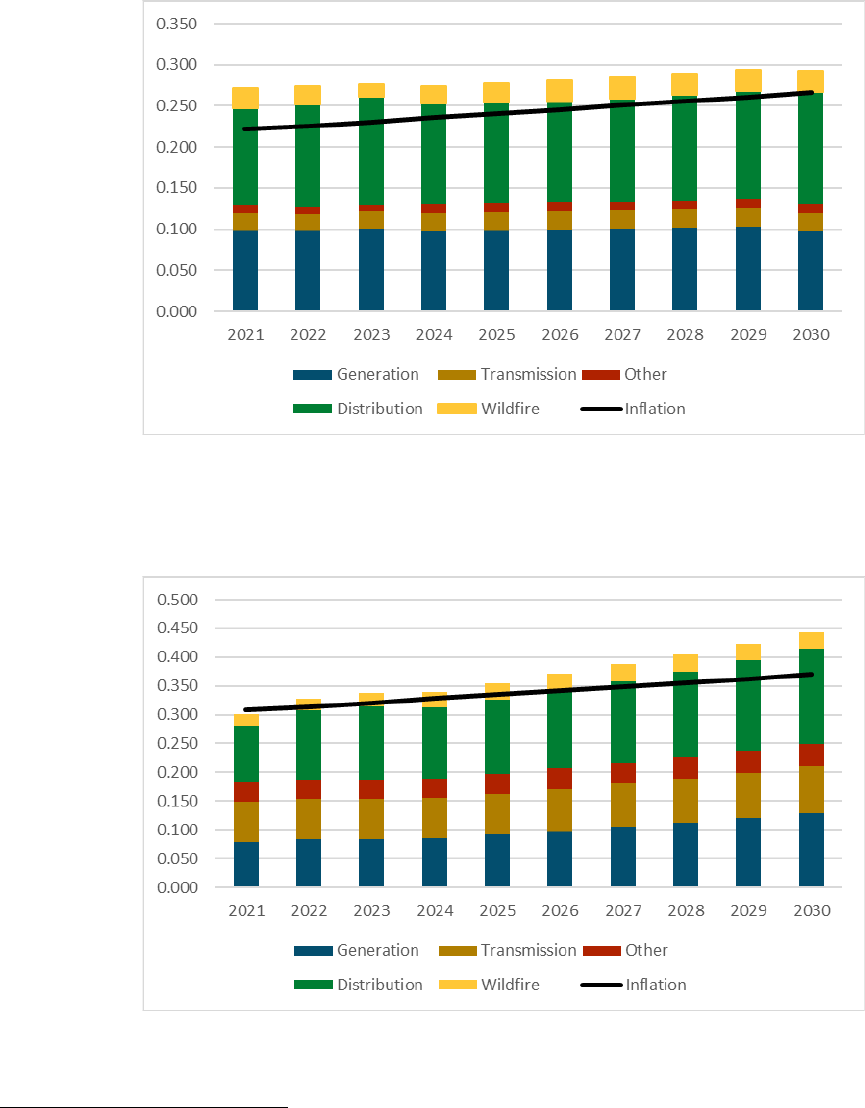

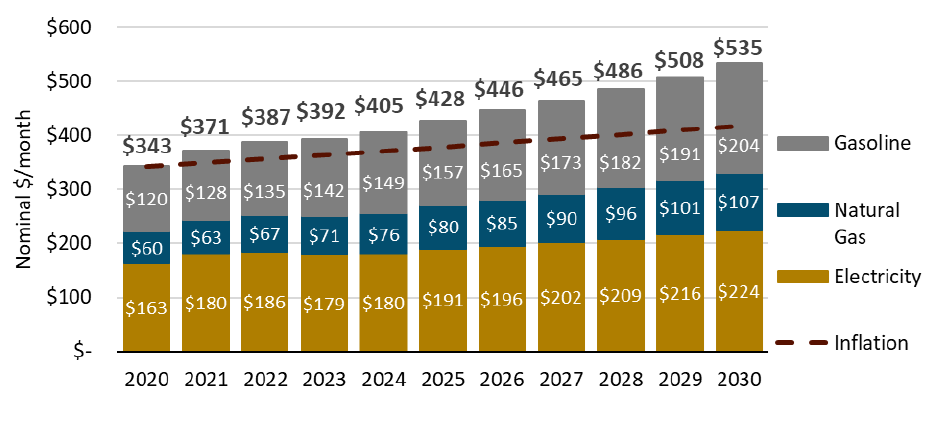

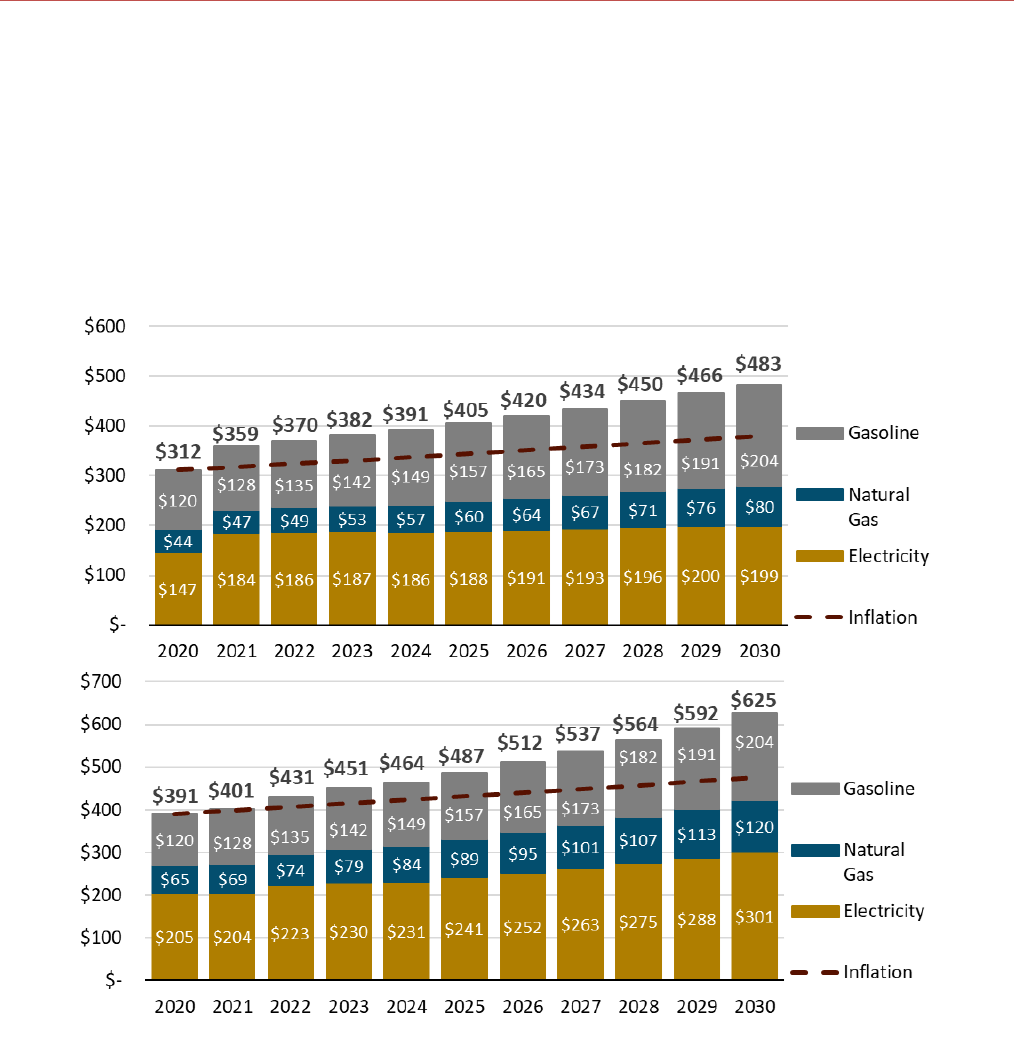

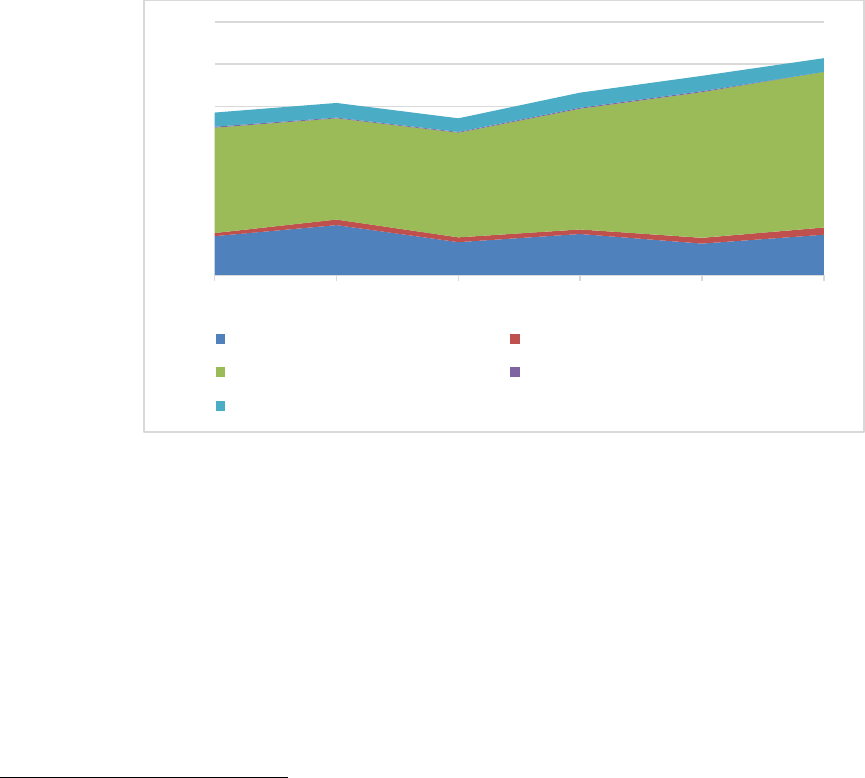

The rate forecasts developed as part of this white paper, in conjunction with estimates of natural gas rates

and gasoline prices, were used to project total energy bills for a representative high energy usage household

located in a hot climate zone based on rates for each of the major IOUs, as presented in the figures below.

These projections show that, for energy price sensitive households, bills are expected to outpace inflation

over the coming decade. The implication is that, if household incomes are expected to generally increase at

the rate of inflation, energy bills will become less affordable over time.

Figure ES-4: Average Monthly Energy Costs from 2020-2030 for Representative Above Average

Energy Usage Home in a Hot Climate Zone on PG&E Rates

PG&E

6

Figure ES-5: Average Monthly Energy Costs from 2020-2030 for Representative Above Average

Energy Usage Home in a Hot Climate Zone on SCE/SoCalGas Rates

Figure ES-6: Average Monthly Energy Costs from 2020-2030 for Representative Above Average

Energy Usage Home in a Hot Climate Zone on SDG&E Rates

The policy goals and regulatory requirements that create upward cost pressures appear manageable over a

longer time horizon, but if not managed correctly, they could trigger equity and affordability concerns for

vulnerable customer populations over the short- to mid-term horizon. There is the potential for a growing

divide in the cost of service between customers participating in behind-the-meter (BTM) or distributed

energy resources (DER) and those who are less likely to do so. Moderate- to higher-income customers are

more likely to invest in DERs such as solar photovoltaic (PV) systems, electric vehicles (EV), and storage

technologies, and the advanced rate offerings that support them. This enables them to shift load and take

advantage of potential structural billing benefits, which often results in a cost shift onto lower-income and

otherwise vulnerable customers. Without the prudent management of IOU revenue requirements, rate base,

SCE/SoCalGas

SDG&E

7

rate structures, and DER incentives, California’s continued progress toward the optimized grid of the future

may widen this chasm between participants and non-participants of DER opportunities.

There are three critical and overlapping regulatory fronts that must be actively managed to address this

fundamental equity risk for vulnerable customers:

1. The costs and timing of fulfilling clean energy and electrification mandates;

2. The relatively rapid pace of rate base growth; and,

3. Revenue shifts to lower-income non-participants from Net Energy Metering (NEM) and other DER

incentives.

PROBLEM STATEMENT

The need to improve the safety and reliability of the electric system while meeting California’s climate goals

and various statutory mandates will require careful management of rate and bill impacts to ensure that

electric services remain affordable. As California continues transitioning to a more robust distributed energy

resources marketplace with greater deployment of electric vehicles, it will be essential to employ aggressive

actions to minimize growth in utility rate base and to protect lower-income ratepayers from cost shifts and

bill impacts. This white paper explores the affordability of the grid of the future and is intended to stimulate

discussion of potential solutions that will be necessary to ease this transition, particularly for California’s

most vulnerable customers.

KEY FINDINGS

Across all three IOUs since 2013, rates have increased by 37% for PG&E, 6% for SCE, and 48% for

SDG&E.

4

The growth in rates can be largely attributed to increases in capital additions driven by rising

investments in transmission by PG&E and distribution by SCE and SDG&E. While the utilities have made

major financial commitments to wildfire mitigation and transportation electrification, these costs have not

been fully reflected in rates so far. This paper finds that transportation electrification investments are not

expected to contribute to significant rate growth in the near term, but that wildfire mitigation efforts will.

Furthermore, higher than national average returns on equity (ROE) are a more modest but not insignificant

factor that has amplified the three IOUs’ revenue growth in recent years.

While tracking rates is important, customers care more about their bills than rates. California bills have

typically been lower than most of the country in recent years, but those trends are changing. In 2019,

SDG&E’s bundled residential average monthly bill ranked 142

nd

highest out of about 200 IOUs, even

though its rate was among the top 20 highest. PG&E, however, is showing a 2018 and 2019 monthly bill

ranking of 94

th

highest and 70

th

highest, respectively, meaning PG&E’s bills are higher than most of the

IOUs being ranked. Further, SCE’s bills, while still lower than the median (#100 ranking), moved up in the

rankings from 136

th

highest to 122

nd

highest between 2018 and 2019.

4

Bundled system average rate. Bundled IOU customers receive all services — generation, transmission, and distribution services — from the

IOU. These increases on an average annual basis from 2013 to 2020 are about: PG&E 5.3 percent; SCE 0.8 percent; SDG&E 6.8 percent.

8

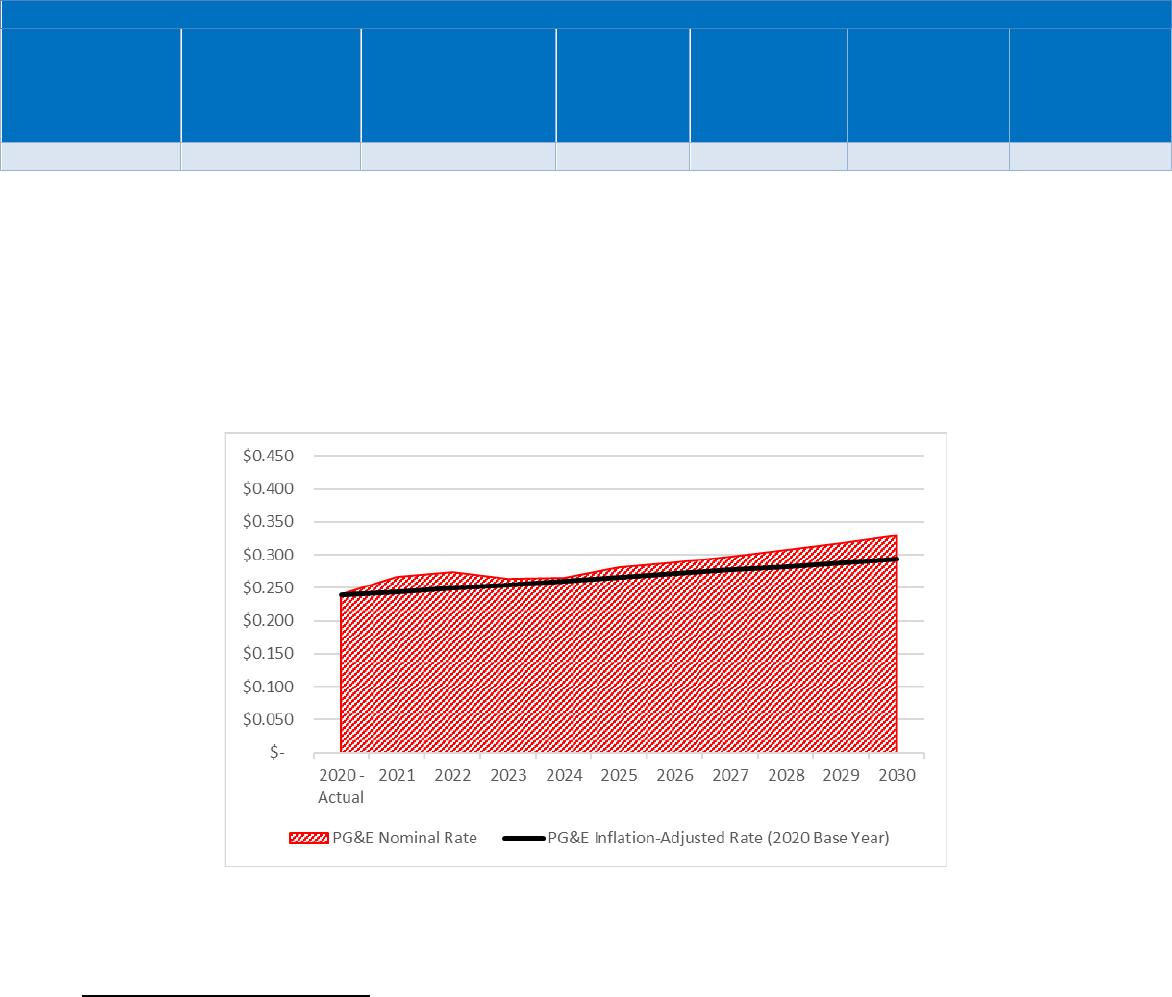

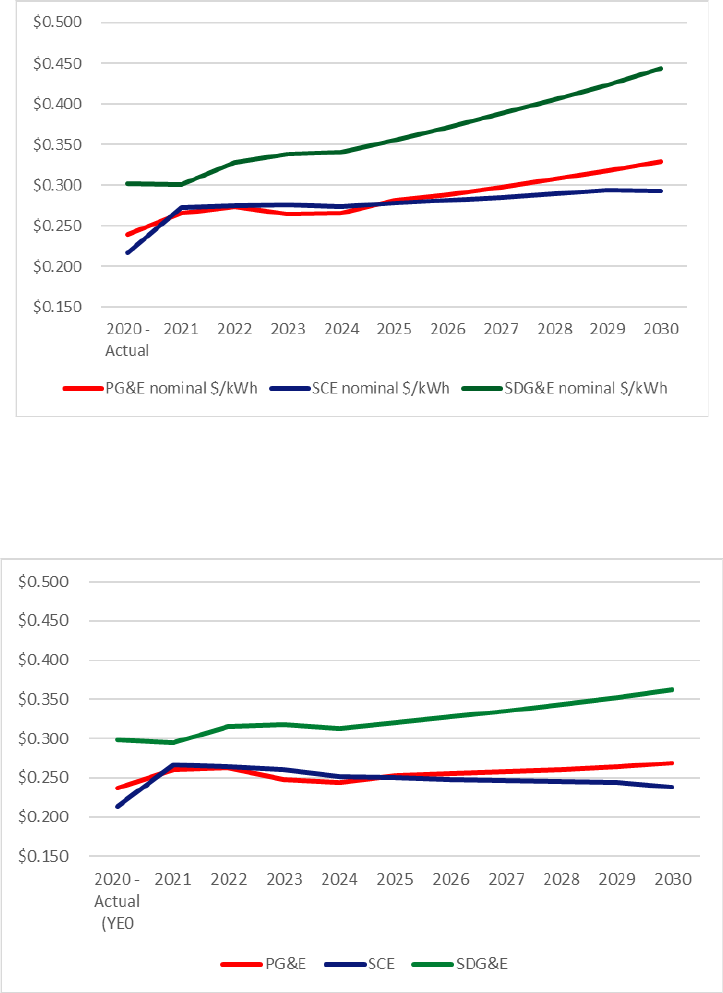

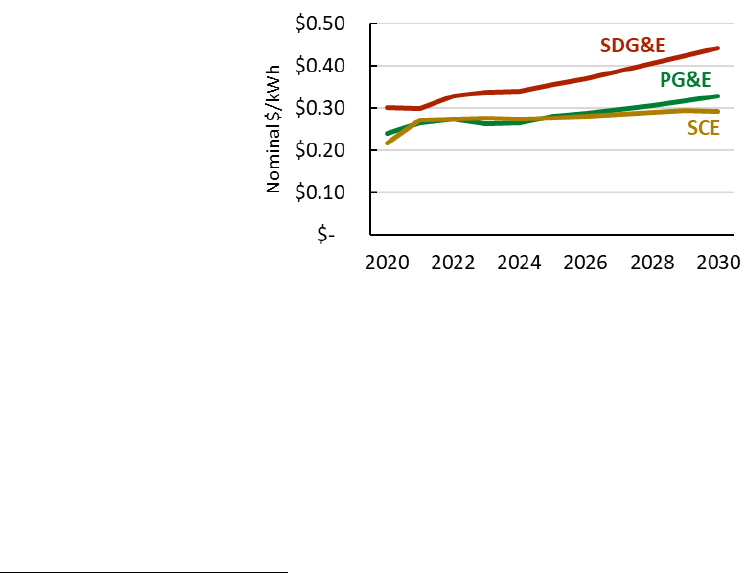

Looking forward, the paper’s 10-year baseline forecast shows steady growth in customer rates (nominal

$/kWh) between 2020 and 2030 for the three IOUs:

• PG&E: $0.240 to $0.329, or about an annual average increase of 3.7 percent

• SCE: $0.217 to $0.293, or about an annual average increase of 3.5 percent

• SDG&E: $0.302 to $0.443, or about an annual average increase of 4.7 percent

By 2030, bundled residential rates are forecasted to be approximately 12 percent, 10 percent, and 20 percent

higher, respectively, than they would have been if 2020 actual rates for each IOU had grown at the rate of

inflation.

5

However, when the analysis focuses on households in the hotter regions of the state, household

bills (electric, natural gas, and gasoline) are forecasted to rise at an annual rate of 4.5 percent, as compared to

a 1.9% inflation rate.

While the cost to further reduce GHG emissions in the electric sector to 38 million metric tons (MMT)

compared to a target of 46 MMT would increase bills by $4 to $9 a month, a well-managed effort to move

customers to all electric homes and electric vehicles could result in over a $100 a month reduction in overall

energy bills. This means that, in order to avoid large increases in energy bills, customers will need to adopt

technologies that require large up-front investments. In the absence of subsidies and low-cost financing

options, this could create equity concerns for low- to moderate-income households and exacerbate existing

disparities in electricity affordability.

ORGANIZATION

The remainder of this white paper is organized as follows:

▪ Section II: A foundational review of historical trends in costs, rates, and bills with a focus on longer-

term, capital-related costs and impacts on bills from clean energy programs, and statutory mandates

that have historically resulted in additional ratepayer costs are presented.

▪ Section III: An evaluation of cost and rate projections with a particular focus on two areas:

transportation electrification and wildfire mitigation costs. In addition, this section highlights

affordability concerns and distributional equity in low to moderate income households.

▪ Section IV: Information provided by the IOUs to fulfill the requirements of Public Utilities Code

Section 913.1(b).

▪ Section V: Conclusion.

▪ Addenda: Critical addenda are included on natural gas cost and rate trends as well as summaries of

En Banc panelist discussions and stakeholder comments on this white paper.

5

2020 rates are actual rates in effect at yearend 2020; if 2020 rates were to increase at the rate of inflation (approximately 1.9% per year), rates in

2030 would be: PG&E 0.294; SCE 0.266; SDG&E 0.370. Inflation is approximately 1.9% per year.

9

10

II. HISTORICAL COST AND RATE TRENDS

2.1 Section Summary

In past years, the SB 695 Report has provided a historical review of IOU revenue requirements at the

functional area of utility operations

6

level to illustrate the major drivers of electric cost and rate growth. This

functional-level revenue requirement review, generally presented as a percentage change in the generation

revenue requirement, distribution revenue requirement, etc., is a high-level view of overall trends; the review

does not quantitatively analyze underlying cost data that may categorically

7

form part of historical General

Rate Case (GRC) costs or stand-alone

8

program costs.

For the 2021 SB 695 Report embodied in this white paper, transportation electrification and wildfire-related

costs are highlighted as potential cost drivers.

9

Both of these cost categories involve capital costs i.e.,

investment in IOU infrastructure, prompting a discussion of the IOUs’ continually increasing capital

investments. While IOU capital investments (generally known as “rate base”) will be necessary to meet

California’s policy goals, balancing major investments in a cleaner, more efficient grid while sustaining

affordable rates is more challenging as IOU rate base grows.

In keeping with past SB 695 Reports, rates and bills for the bundled

10

residential customer class are

highlighted in this white paper. Compared to IOUs in the rest of the country, California IOUs Pacific Gas

& Electric (PG&E), Southern California Edison (SCE), and San Diego Gas & Electric (SDG&E) bundled

residential rates are higher than most while bills are lower than most. For 2018 and 2019,

11

bundled

residential electric rates for PG&E and SDG&E customers increased faster than the rate of inflation.

SDG&E’s residential rates in particular have seen increases in recent years due to departing load as a result

of high rates of solar adoption. Further, bundled residential and small business customers generally have

higher average rates than the bundled system average and bundled large industrial and agricultural customers

generally have lower average rates.

12

Across all three IOUs, rate base is increasing, meaning that net capital additions have been outpacing

depreciation of existing assets. The growth in rate base has been driven by rising transmission investments

for PG&E and distribution investments for SCE and SDG&E. This rise in rate base has been coupled with

a growth of solar adoption, which in turn has led to residential costs being shifted from customers who have

6

Functional areas of utility operations include generation, distribution, etc.

7

Some of these categories could broadly fall under Safety, Affordability (reasonable rates), Reliability, and Clean Energy, with potentially other

subcategories of analytical interest, such as Wildfire Mitigation (i.e. Safety) and Transportation Electrification (i.e. Clean Energy).

8

Stand-alone here means not included in a GRC or Energy Resource Recovery Account (ERRA) proceeding. Stand-alone costs can include

legislative policy program costs such as those in the “Legislative Policy Program Costs” sub-section.

9

A functional area of utility operations revenue requirement review was not performed, but rather, specific cost categories were selected for

further examination; Electrification goals and wildfire mitigation planning are among the near-term needs may that place upward pressure on

rates and bills.

10

Bundled IOU customers receive all services — generation, transmission, and distribution services — from the IOU.

11

2019 is the most recent year for which national-level data is available.

12

All other things being equal, a class average rate is generally higher than the system average rate when the class in question contributes a higher

proportion of revenue requirement relative to the system average and to other classes.

11

installed rooftop solar to customers who have not.

13

The result is that growing electric rates have been offset

to some extent for NEM customers, who are disproportionately older homeowners in high-income areas,

while non-NEM customers have shouldered some of the cost of maintaining the grid. In addition,

continued adoption of other distributed energy resources (storage, EVs, etc.) and advanced rate offerings

that promote improved load management may add to costs shifted to non-participating customers.

However, this requires a deeper examination of the long-term savings and benefits to the system of a more

efficient grid with greater penetration of behind-the-meter (BTM) resources.

This section also considers the impact that transportation electrification (TE) programs, wildfire mitigation-

related costs, and Federal Energy Regulatory Commission (FERC) transmission costs have had on electric

rates. The analysis found:

▪ TE programs have had little impact on bundled residential rates, and the TE portion of forecasted

bundled residential rates is not expected to grow significantly in the near-term.

▪ Historical experience with wildfire mitigation-related costs is largely based on SDG&E, since

SDG&E’s experience with wildfire spending precedes that of the other two IOUs; despite a decade

of spending on wildfire mitigation, SDG&E’s wildfire costs have continued to increase, which may

indicate what is in store for PG&E and SCE.

▪ FERC transmission revenue requirements have increased significantly over the past few years in a

number of categories.

14

California Utilities Compared to the Rest of the U.S.

California leadership in advancing clean energy policy in the United States must be considered in any

discussion of both past and future rates and bill trends:

▪ The state’s per capita energy consumption is the fourth lowest in the nation, due in part to

California’s mild climate but more importantly due to a commitment to energy efficiency.

15

▪ California ranks first in the nation as a producer of electricity from solar, geothermal, and biomass

resources and fourth in the nation in conventional hydroelectric power generation.

16

▪ California has the most operating utility-scale battery storage capacity in the nation at over 200 MW,

about twice as much as the installed capacity of the state with the next largest amount.

17

13

The cost shift results in shifts in revenue requirements among different customer groups.

14

Transmission revenue requirements have risen a total of 38.1 percent over the period from 2016 to 2021 across the three IOUs.

15

See U.S. Energy Information Administration (EIA), California State Profile and Energy Estimates

https://www.eia.gov/state/print.php?sid=CA (last updated January 16, 2020, accessed January 5, 2021).

16

Id.

17

See EIA bar graph, “U.S. operating utility-scale battery storage by state (top 10, March 2019)”

https://www.eia.gov/todayinenergy/detail.php?id=40072 (accessed January 5, 2021).

12

▪ About one-fourth of the nation’s electric vehicle charging stations are in California.

18

▪ California leads the nation in installed flexible distributed energy resource capacity of 4.7 GW, or

one tenth of statewide grid demand, and may have up to 13.5 GW by 2025.

19

Many of these efforts have resulted in a cleaner electricity portfolio but have also led to declines in electricity

sales due to energy efficiency, energy conservation, and customer generation of electricity. Declines in

electricity sales have had the effect of raising electric rates as fixed costs are spread over a smaller usage

base.

Historically, the bundled Residential Average Rates (RAR) of the California IOUs have been higher than

those of most United States IOUs.

20

Table 1 shows for 2018 and 2019

21

the simple volumetric bundled

residential average rate for PG&E, SCE, and SDG&E, compared to approximately 200 total IOUs

nationally, ranked from highest rates (#1 ranking) to lowest rates (#200 ranking). For example, in 2019

SDG&E’s bundled residential average rate ranked 17

th

highest out of about 200 IOUs.

However, while rates are an important measure of the cost of providing electricity, looking at actual bills

provides a clearer picture of affordability. California IOU bundled residential customer bills have generally

been lower than about half of all U.S. IOUs, as shown by the rankings. For example, in 2019 SDG&E’s

bundled residential average monthly bill ranked 142

nd

highest out of about 200 IOUs, even though its rate

was among the top 20 highest. PG&E, however, is showing a 2018 and 2019 monthly bill ranking of 94

th

highest and 70

th

highest, respectively, meaning PG&E’s bills are higher than most of the IOUs being ranked.

Further, SCE’s bills, while still lower than the median (#100 ranking), moved up in the rankings from 136

th

highest to 122

nd

highest between 2018 and 2019.

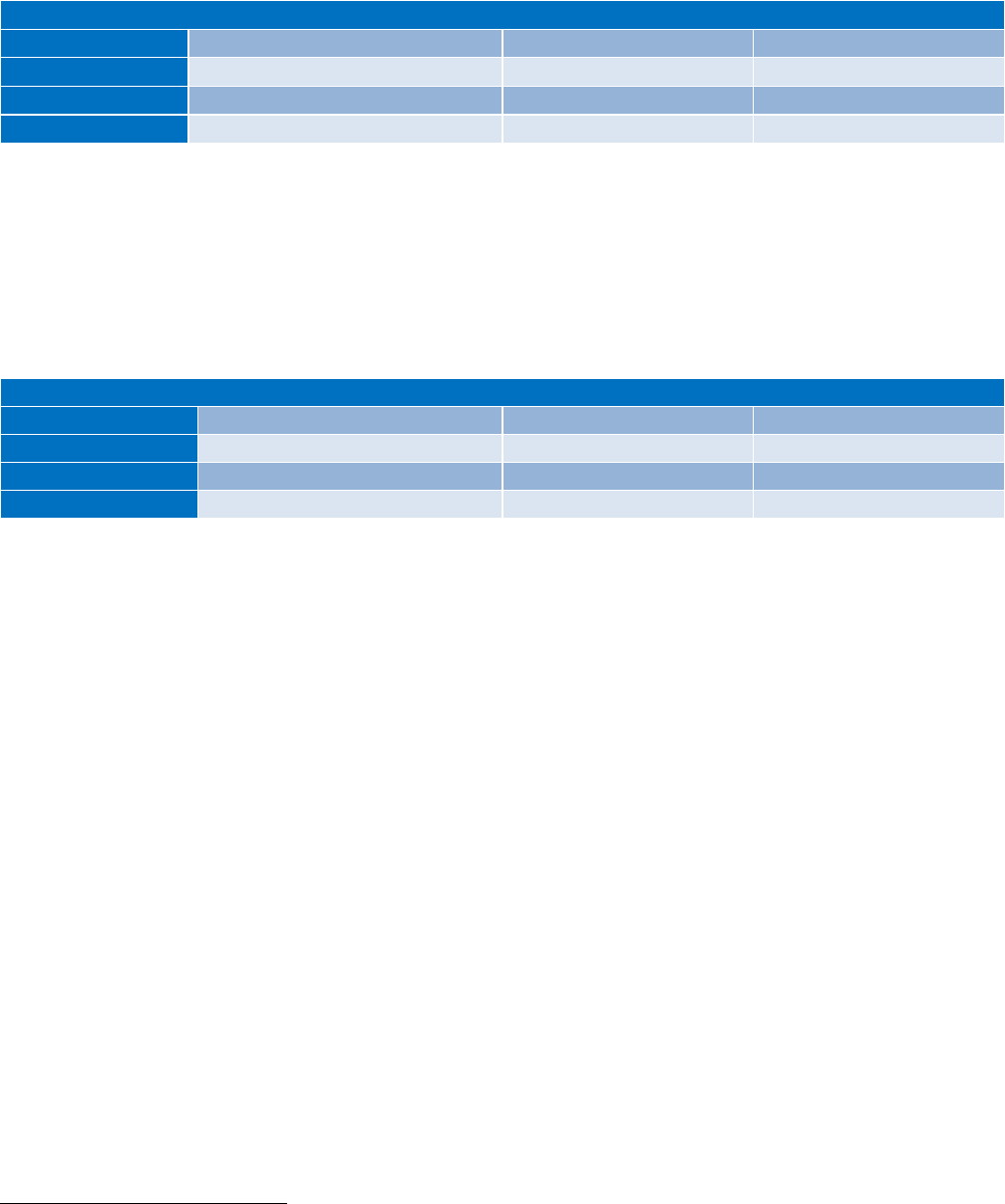

Table 1: U.S. IOU Ranking of PG&E, SCE, and SDG&E, Bundled Residential Average Rates and

Monthly Bills (2018, 2019)

U.S. IOU Ranking – Highest to Lowest

(out of approximately 200 IOUs)

Bundled Residential Average Rate

Bundled Residential Average Monthly Bill

2018

2019

2018

2019

PG&E

15

24

94

70

SCE

31

42

136

122

SDG&E

9

17

108

142

18

See U.S. Energy Information Administration (EIA), California State Profile and Energy Estimates.

19

See “Unlocking California’s Gigawatt-Scale Distributed Energy Potential”, Greentech Media, September 22, 2020. Available at:

https://www.greentechmedia.com/articles/read/unlocking-californias-gigawatt-scale-distributed-energy-potential

20

“Higher than most” is the same as “higher than the median,” or “higher than half of the items being ranked.” In other words, because the

ranking is from highest to lowest, the lower the ranking number, the higher the rate or bill.

21

2019 is the most recent year for which national-level data is available. See U.S. Energy Information Administration (U.S. EIA)

https://www.eia.gov/electricity/sales_revenue_price/, Table 6.

13

2.2 Historical Trends in Electric Rates and Bills

Electric rates measure price per kilowatt hour paid by electric customers, and historical rate trends allow

comparison of how an IOU’s rates track another metric, inflation, over time. The reason inflation is typically

used as a benchmark for electric rate growth is because it has traditionally been assumed that household

incomes rise at about the rate of inflation, thus if electric rates increase at the same rate then the

affordability of electric service should remain unchanged for the average household.

22

Bundled System Average Rate

Rates may be viewed at system level for all customer classes or at customer class level, such as residential

class level. Bundled System Average Rate (SAR) is a high-level measure of an IOU’s authorized

bundled

23

customer revenue requirement expected to be recouped through authorized forecasted sales to

bundled customers.

Bundled customers authorized revenue requirement ($)

Bundled SAR =

Bundled authorized forecasted sales (kWh)

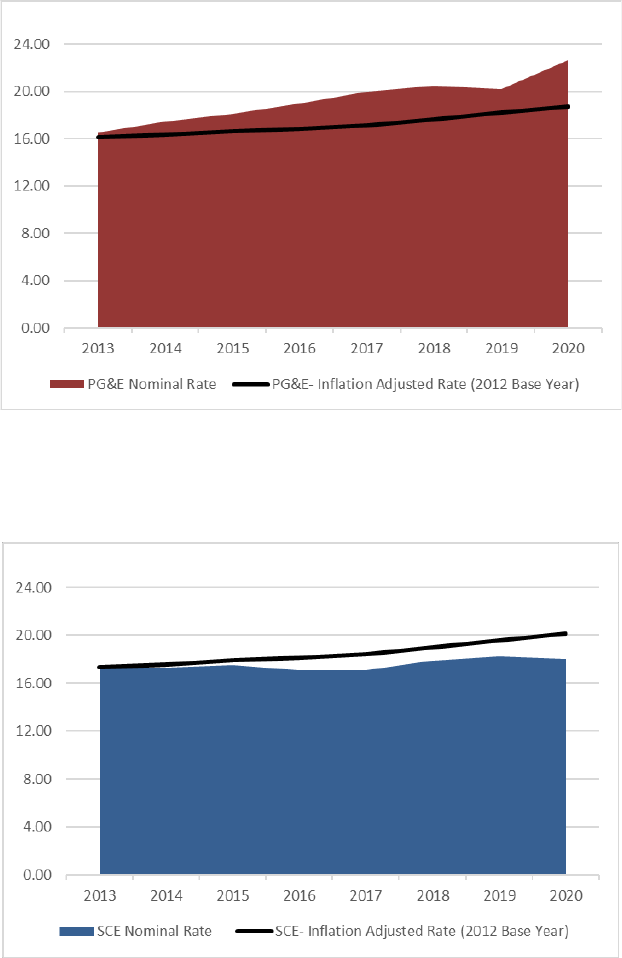

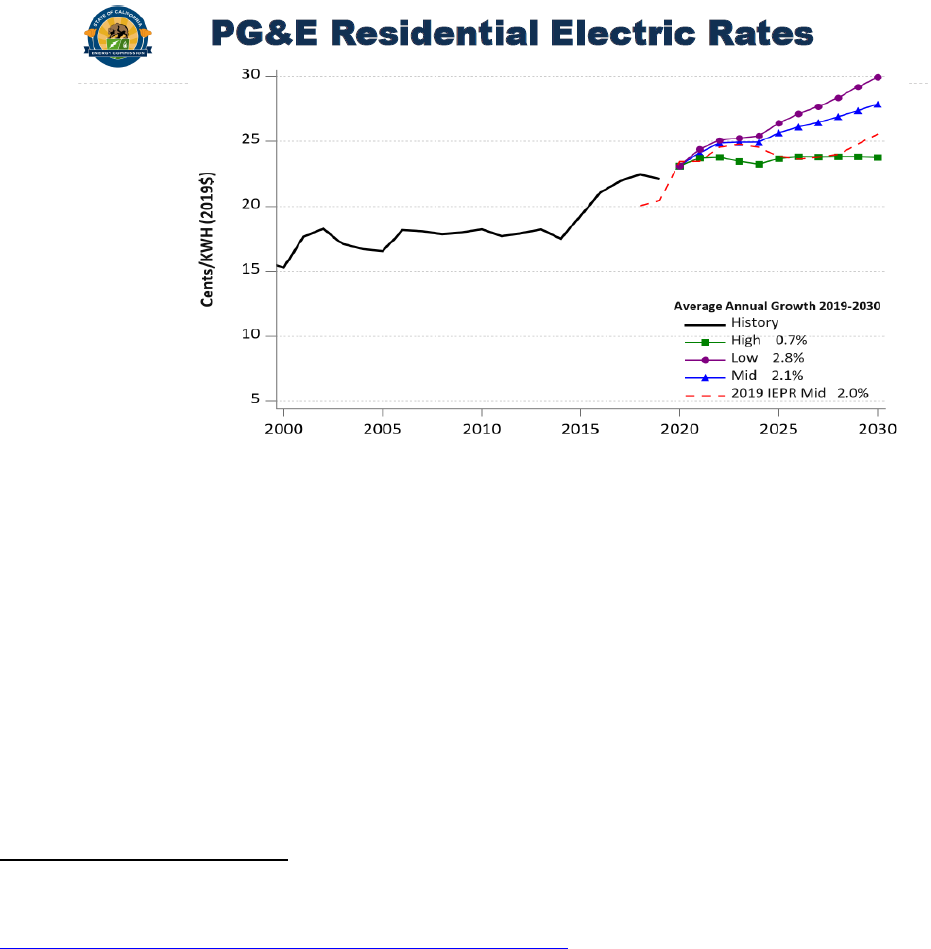

Figure 1 through Figure 3 show each IOU’s nominal rates in the color-shaded portion of the figure, with the

IOU’s inflation-adjusted rates shown by the black line. Nominal rates trending below the black line indicate

that the IOU’s bundled SARs are tracking favorably to inflation-adjusted rates. Nominal rates trending

above the black line indicate that the IOUs’ bundled SARs are increasing higher than the rate of inflation.

22

Rates are tracked from the base year 2012 by applying the Consumer Price Index (CPI) to the previous year’s bundled SAR to show inflation-

adjusted bundled SAR. CPI reported by the U.S. Department of Labor, Bureau of Labor Statistics, West Region, All Items, All Urban

Consumers (not seasonally adjusted). 2020 CPI data reflects 11 months of data.

23

Bundled IOU customers receive all services — generation, transmission, and distribution services — from the IOU.

14

Figure 1: PG&E Bundled System Average Rate (¢/kWh), Nominal and Inflation-Adjusted, Rates in

Effect January 1

Figure 2: SCE Bundled System Average Rate (¢/kWh), Nominal and Inflation-Adjusted, Rates in

Effect January 1

15

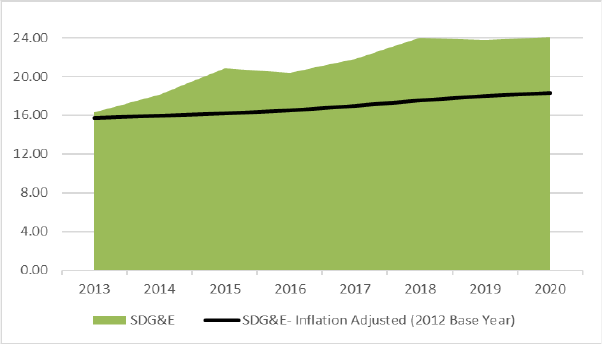

Figure 3: SDG&E Bundled System Average Rate (¢/kWh), Nominal and Inflation-Adjusted, Rates

in Effect January 1

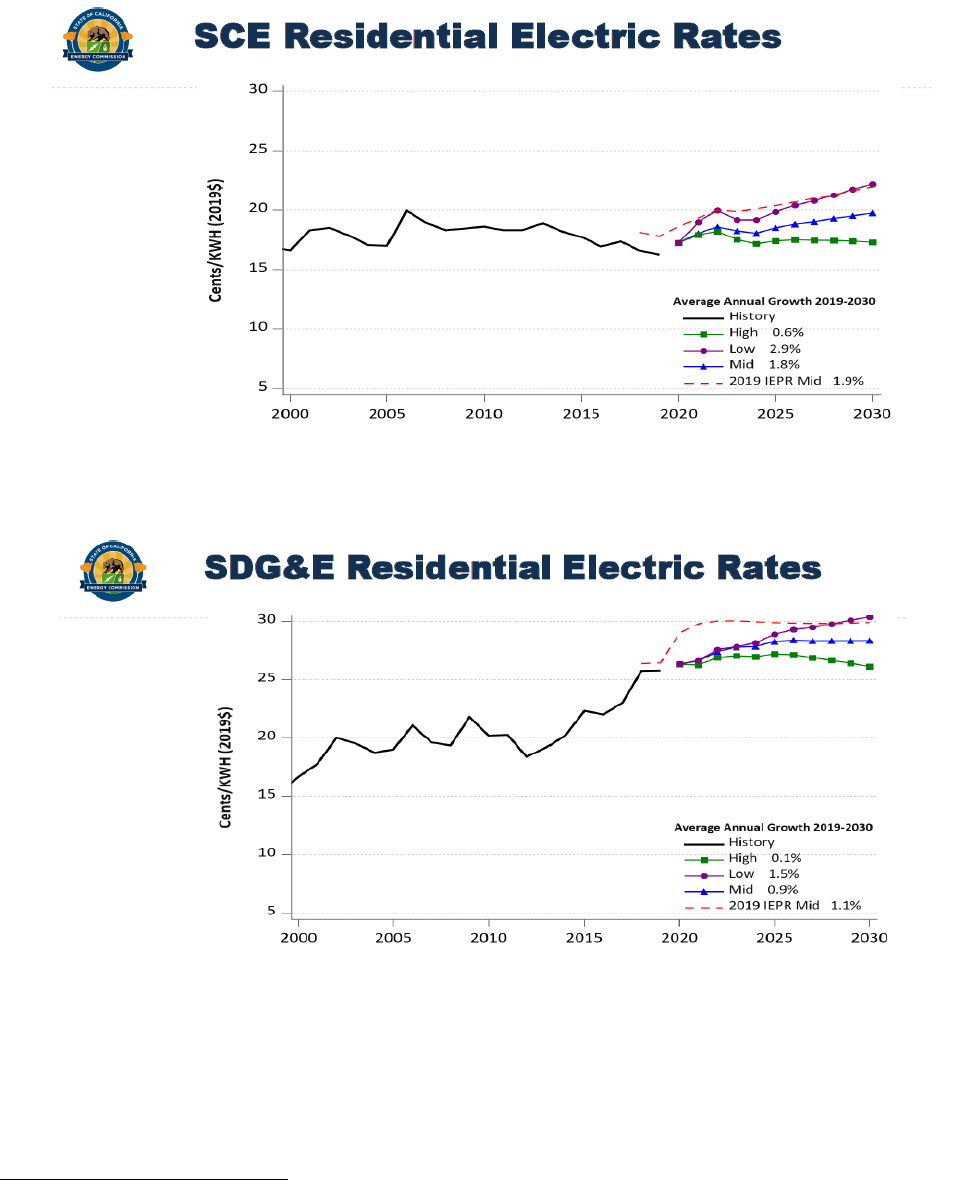

The variance in Figure 3 between SDG&E’s inflation-adjusted SAR and its nominal SAR may be due to the

effect of diminishing kWh sales. SDG&E has a larger share of customers investing in rooftop solar compared

to PG&E and SCE. This high rate of photo-voltaic (PV) adoption affects the denominator (kWh sales) of

SDG&E’s bundled SAR, as customers are purchasing less electricity from the utility, although they may still

be consuming the same amount from their PV system. While the decreased demand from the utility allows it

to avoid some costs of procuring generation, a utility still has fixed costs that cannot be fully eliminated. As a

result, declining utility sales result in larger rate increases as utility fixed costs are now spread across fewer

units of usage.

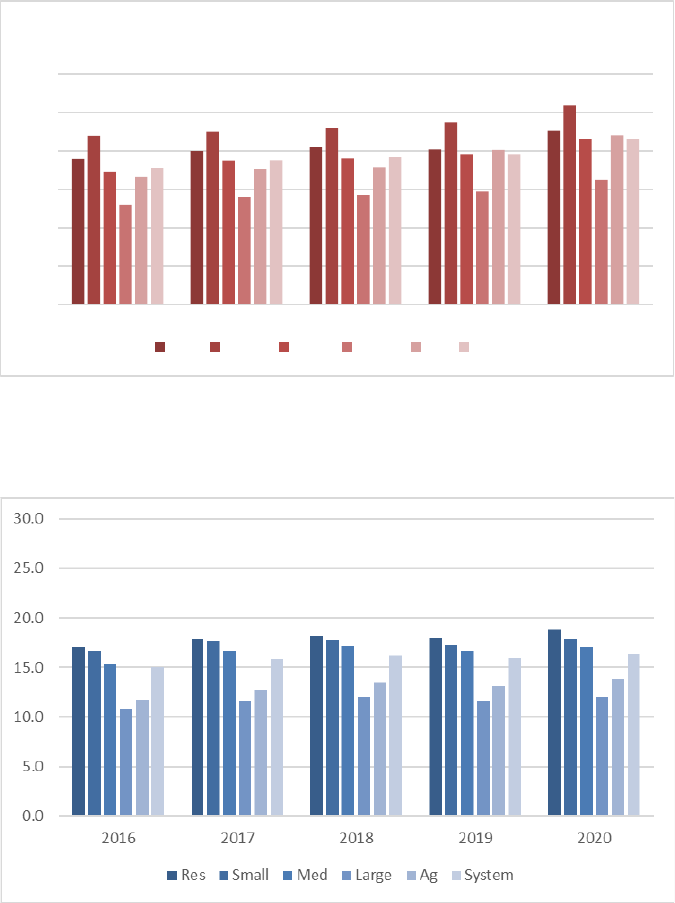

Bundled System Average Rate by Customer Class

A breakdown of the bundled system average rate by customer class is shown for each IOU in Figure 4

through

Figure 6. Each class shows the same upward trend as the system average rate over this period, with the

residential and small business customers generally having higher average rates than the system average and

the large industrial and agricultural customers generally having lower average rates.

16

Figure 4: PG&E Bundled System Average Rate (¢/kWh) By Class, Nominal Rates

in Effect January 1

Figure 5: SCE Bundled System Average Rate (¢/kWh) By Class, Nominal Rates

in Effect January 1

0.0

5.0

10.0

15.0

20.0

25.0

30.0

2016 2017 2018 2019 2020

Res Small Med Large Ag System

17

Figure 6: SDG&E Bundled System Average Rate (¢/kWh) By Class, Nominal Rates

in Effect January 1

Residential and Select Small Commercial Bundled Average Monthly Bills

The major determinant in calculating bills is electricity usage.

24

Residential usage tends to cluster around

typical usage profiles, which vary by climate zone.

25

However, typical load profiles for non-residential

customers can vary substantially, depending on their usage patterns in the commercial, industrial, or

agricultural customer class.

26

Nevertheless, small business customers may be grouped by commercial

customer group using standard industry codes such as the North American Industry Classification System

(NAICS) in order to get a sense of typical usage for customers with the same industry code.

27

Figure 7

through Figure 9 show for each IOU typical bundled average monthly bills for residential customers

28

as

well as for commercial customers representing Food Services and Drinking Places (NAICS 722),

Ambulatory Health Care Services (NAICS 621), and Real Estate (Property Management, NAICS 531).

29

Bundled small business customers with industry subsector code Food Services (NAICS 722) show typical

average monthly bills in the mid- to high triple-digits.

30

24

Usage (in kWh) multiplied by a rate factor equals the volume of electricity billed. Other bill elements such as fixed charges and taxes are

outside the scope of this analysis.

25

For residential, usage includes electricity consumption (kWh). For this analysis, average monthly usage for each IOU is based on average

monthly usage reported for bill impacts presented in bill inserts.

26

For non-residential, usage may include electricity consumption (kWh) or demand (kW). Demand usage is outside the scope of this analysis.

27

Grouping by industry code does not definitively determine typical usage profiles as several other factors such as climate zone, size of

establishment, age of establishment, and energy efficiency of equipment may significantly affect usage.

28

Residential customers not enrolled in the California Alternate Rates for Energy CARE (Non-CARE). Lower-income residential customers

enrolled in the CARE program receive up to a 35 percent discount on bills.

29

See U.S. Bureau of Labor Statistics for more information about NAICS subsector codes. These NAICS subsector codes were selected by the

IOUs as being representative of small commercial customers and are not exhaustive for the customer class.

30

Typical average monthly bills are for illustrative purposes only.

0.0

5.0

10.0

15.0

20.0

25.0

30.0

2016 2017 2018 2019 2020

Res Small Med Large Ag System

18

Figure 7: PG&E Typical Bundled Average Monthly Bills ($/Month), Residential and Select Small

Commercial, Nominal Rates in Effect January 1

Figure 8: SCE Typical Bundled Average Monthly Bills ($/Month), Residential and Select Small

Commercial, Nominal Rates in Effect January 1

19

Figure 9: SDG&E Typical Bundled Average Monthly Bills ($/Month), Residential and Select Small

Commercial, Nominal Rates in Effect January 1

2.3 Historical Utility Costs and Transparency

Capital Costs and Capital-Related Revenue Requirements

The CPUC annually issues the California Electric and Gas Utility Cost Report, also known as the Assembly Bill

(AB) 67 Report, which publishes the costs to ratepayers of all utility programs and activities currently

recovered in retail rates.

31

These costs are presented at the authorized revenue requirement level, which is

the level at which costs go into rates. Recorded costs authorized for recovery during ratesetting proceedings

include both capital expenditures and operations and maintenance (O&M) expenses, both of which

must be converted to revenue requirement as part of rates implementation.

Operations & Maintenance Expenses

O&M expenses are generally passed-through to ratepayers without profit markup and are recovered from

ratepayers on a dollar-for-dollar basis with no amortized cost recovery over time, meaning the utility earns

no profit on O&M expenses and recovers those costs in the same year they were incurred. These expenses

include all labor and non-labor expenses for a utility’s operation and maintenance of its generation plants

and distribution and transmission systems. O&M expenses also include general and administrative expenses

such as personnel costs and purchased materials and services.

31

The 2019 AB 67 Report is available at: https://www.cpuc.ca.gov/General.aspx?id=6442460031 . The most recently available year of this

report is 2019.

20

Capital Expenditures

The utility earns profits on capital expenditures, and capital expenditures are recovered over a long period of

time as the related asset depreciates. Because of the multi-year recovery timeframe for capital investments,

the revenue requirement in any given year is a fraction of the total capital-related revenue requirement.

This fractional approach makes conversion of capital expenditures into annual capital-related revenue

requirement a complicated process, and limits the transparency of the full costs that ratepayers will pay over

time for capital expenditures. For example, if the utility were to spend $1 billion in one year on wildfire

mitigation costs that include both capital expenditures (e.g. undergrounding electric lines) and O&M costs

(e.g. vegetation management) the rate impact in that first year would be far less than $1 billion since only the

O&M cost would be recovered in the first year, but the capital costs will be included in rates for many years

and will ultimately be higher than $1 billion since the capital investment is recovered over time and includes

the utility’s profits.

To understand how capital-related revenue requirement is calculated, one must first understand the concept

of rate base which is essentially the book value of the utility’s assets taking accumulated depreciation into

account. Depreciation spreads the cost to ratepayers of the capital investment over the assets’ useful life.

The IOU’s rate base is the value of the company’s undepreciated assets at a specific point in time and

provides a basis for computing rates of return. The measurement of rate base is dependent on two main

components, net capital additions and accumulated depreciation.

Rate Base = Net capital additions – Accumulated depreciation

Thus, rate base is the amount that remains after accumulated depreciation

32

is subtracted from net capital

additions. When net capital additions exceed accumulated depreciation, which has generally been the case

for PG&E, SCE, and SDG&E, rate base and the related capital revenue requirements increase:

Net capital additions > Accumulated depreciation = Increase in rate base

Capital-Related Revenue Requirement

Capital-related revenue requirements are comprised of depreciation expense revenue requirement

(including related tax effects) and return on rate base revenue requirement:

Capital-related revenue requirement = Depreciation expense (including related tax effects) revenue requirement + Return on

rate base revenue requirement

Return on rate base represents the cost to the utility of financing the capital investment, including the cost

of the authorized profit, known as return on equity.

33

Depreciation expense is calculated according to the

IOU’s depreciation rate schedules. Return on rate base is calculated by multiplying the IOU’s authorized

rate of return by rate base:

Return on rate base revenue requirement = Authorized rate of return (a percentage) x Rate base

32

Related tax effects are grouped with accumulated depreciation.

33

Other costs included in return on rate base are interest on debt, which represents the cost of borrowing from a bond investor.

21

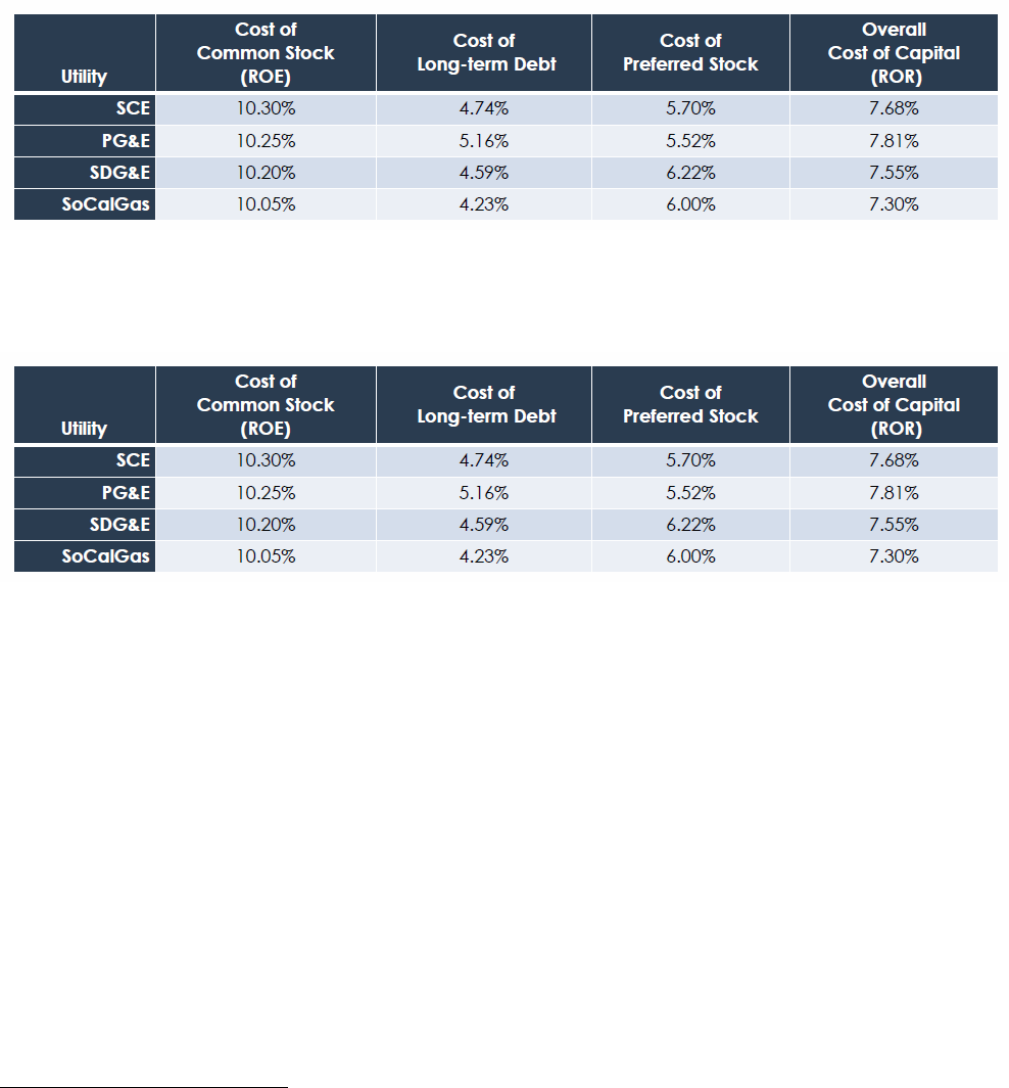

California IOUs’ Authorized Return on Equity Has Been Above the National Average

The CPUC establishes capital structure for each utility by setting the percentages of common stock, long-

term debt, and preferred stock to total capital that the utility should hold. Within each utility’s capital

structure, the CPUC also sets the cost of each capital component, which results in an overall cost of capital

(also known as rate of return) as shown in Table 2: SCE, PG&E, SDG&E, SoCalGas Cost of Capital

.

34

Table 2: SCE, PG&E, SDG&E, SoCalGas Cost of Capital

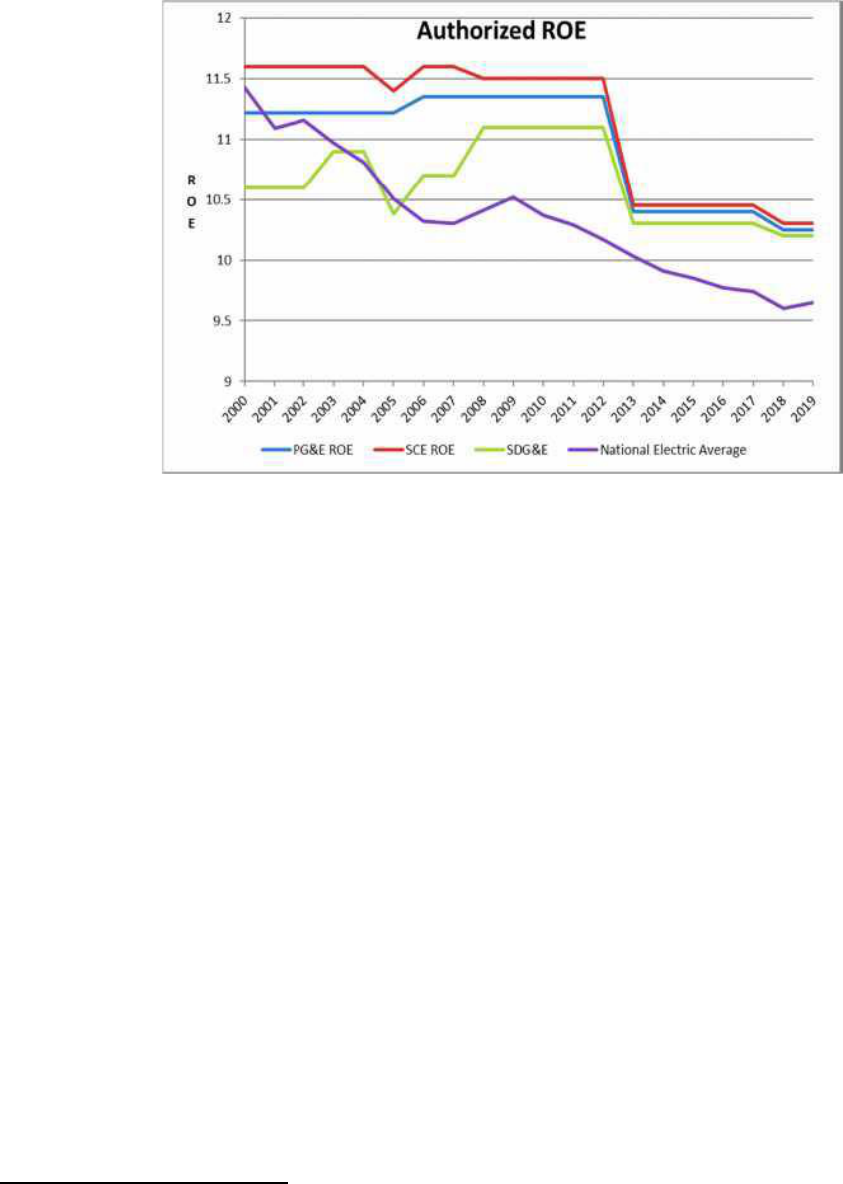

The cost of common stock or return on equity (ROE) is a large component of the overall cost of capital.

The CPUC sets ROE by estimating expected return on alternative investments of comparable risk in capital

markets using financial models. Figure 10 shows that even though the authorized ROE for each utility

declined in 2013 from previous years, the ROEs remain higher than national average ROE.

Figure 10: PG&E, SCE, and SDG&E Authorized Return on Equity, Compared to National Electric

Average Return on Equity (2000 – 2019)

34

Each capital component is weighted by its percentage of total capital in arriving at the overall cost of capital.

22

Rate Base is Increasing

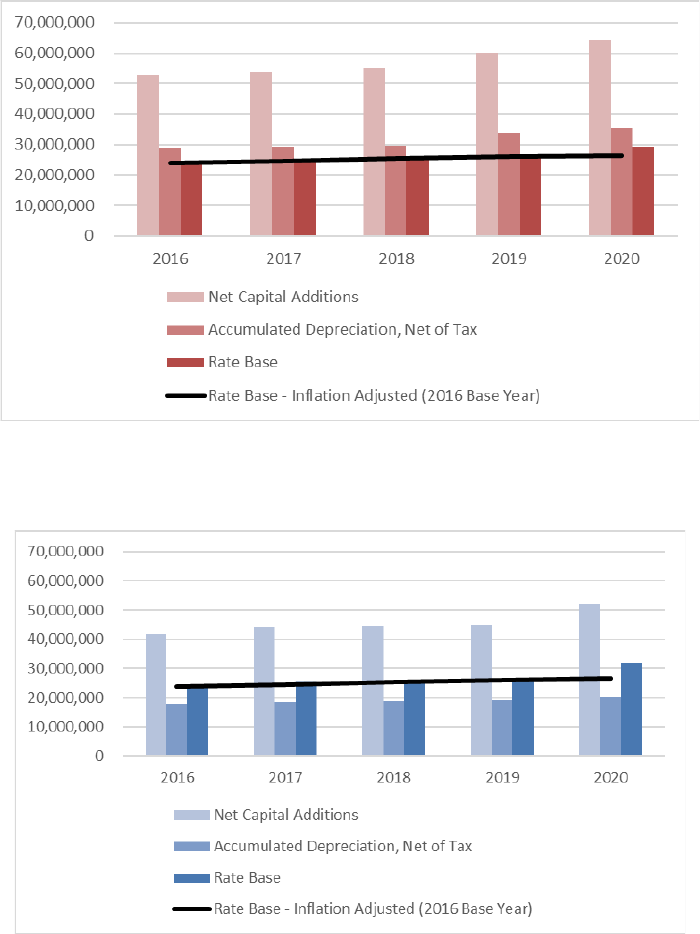

Figure 11 through Figure 13

35

show the total annual rate base for each of the IOUs from 2016 through

2020.

36

Net capital additions are greater than accumulated depreciation in all figures, with corresponding

increases in rate base. Increases in rate base over time result in higher depreciation expense revenue

requirement and return on rate base revenue requirement as depreciation and return on rate base are now

being calculated over an increasing base amount. Rate base has been increasing on average by approximately

5 percent per year for PG&E, 8 percent per year for SCE, and 7 percent per year for SDG&E since 2016,

despite relatively flat load growth.

37

35

SDG&E rate base data is from AB 67 Report data responses and does not include a breakout of net capital additions and accumulated

depreciation. PG&E and SCE data are from Energy Division data responses.

36

“Other” rate base (working capital, other non-fixed asset adjustments) not material and not included.

37

Percentages in nominal terms. Real terms would be slightly lower to account for inflation.

23

Figure 11: PG&E, Total Electric Rate Base ($000), Nominal and Inflation-Adjusted, January 1

Figure 12: SCE, Total Electric Rate Base ($000), Nominal and Inflation-Adjusted, January 1

24

Figure 13: SDG&E, Total Electric Rate Base ($000), Nominal and Inflation-Adjusted, January 1

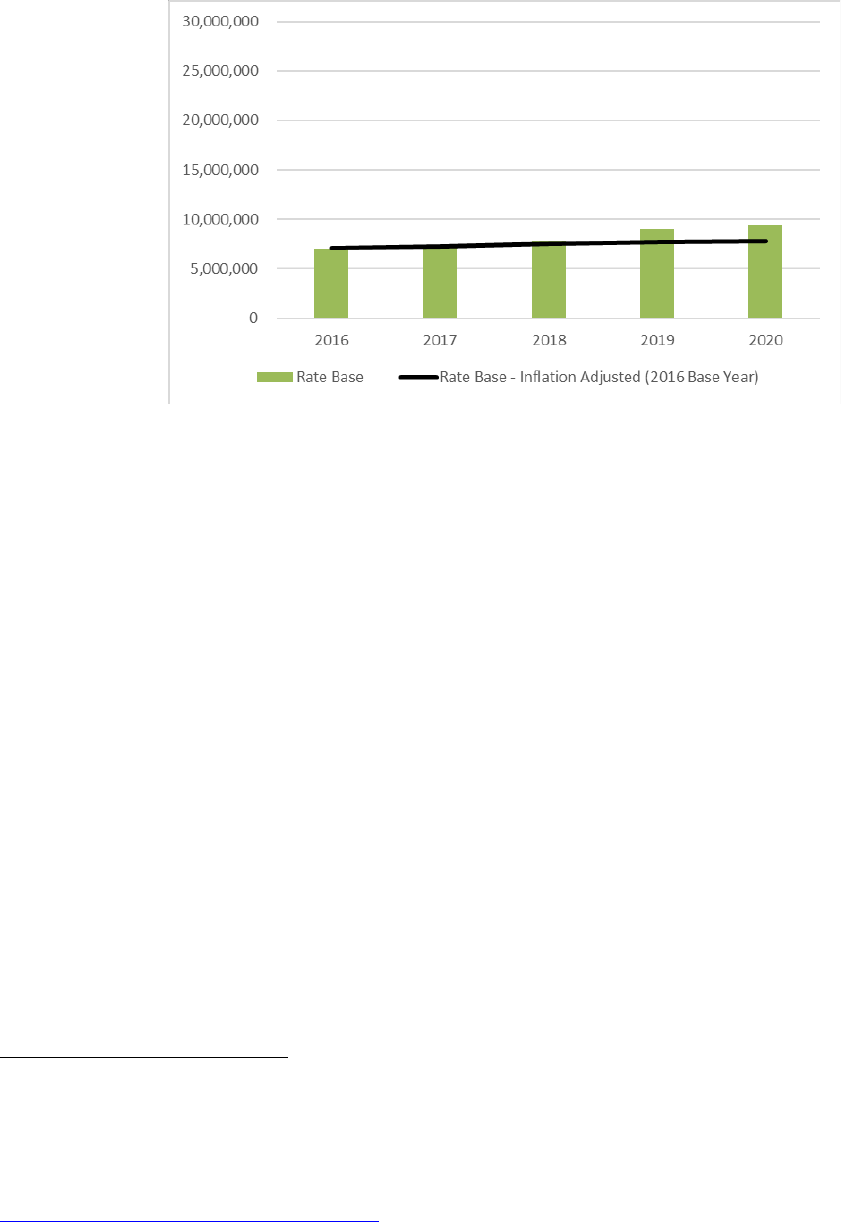

A Comparison of California Utilities’ and Select U.S. Utilities’ Electric Net Utility Plant

Electric net utility plant data may be examined to compare PG&E, SCE and SDG&E electric rate base

growth to that of other U.S. IOUs. Data obtained from the Federal Energy Regulatory Commission (FERC)

Form 1 presents net utility plant data, which is plant-in-service

38

data net of accumulated depreciation.

39

The net utility plant data is not directly comparable with the IOU rate base data presented above.

40

However, using net utility plant data for comparison illustrates the California IOUs’ net utility plant

investments relative to that of other IOUs with similar bundled revenues.

Figure 14 shows 2016 - 2019

41

net utility plant data for PG&E and SCE compared with five other U.S.

IOUs grouped by the U.S. Energy Information Administration (EIA) 2019 bundled revenue rankings.

42

In

other words, Florida Power & Light had the highest bundled retail revenue and is ranked #1, with SCE at

#2. Figure 15 similarly shows 2016 – 2019 net utility plant data for SDG&E compared with three other U.S.

IOUs in the U.S. EIA 2019 bundled revenue rankings. For example, Entergy Louisiana comes in at #16

ranking and SDG&E at #17.

38

Plant-in-service includes certain capital lease data as well as construction work-in-process data, among other line items.

39

Accumulated amortization and depletion is reported along with accumulated depreciation.

40

It is unknown what methodology the IOUs use for reporting plant-in-service and accumulated depreciation data to FERC.

41

FERC Form 1 data is reported at quarter and yearend. Data presented for 2016 – 2019 is as of yearend (2020 yearend data not yet available).

42

Bundled revenue ($000) = Sales (MWh) x Rate (cents/kWh). Revenue data from U.S. Energy Information Administration (U.S. EIA). See

https://www.eia.gov/electricity/sales_revenue_price/, Table 10 for bundled revenue data. Note: the #18 ranked utility is not an IOU and is not

included in this analysis.

25

Figure 14: Net Electric Utility Plant, PG&E, SCE, and Five Other U.S. IOUs ($000), Ranked by

Bundled Revenue (Highest to Lowest) (2016 – 2019)

Figure 15: Net Electric Utility Plant, SDG&E and Three Other U.S. IOUs ($000), Ranked by

Bundled Revenue (Highest to Lowest) (2016 – 2019)

For the utility grouping with PG&E and SCE, all IOUs show an increase in net utility plant from 2016 to

2019. Average annual increases over this period (from highest to lowest) are: Florida Power & Light 8.5

percent; PG&E 8.4 percent; Alabama Power 8.2 percent; SCE 7.6 percent; DTE Electric 7.1 percent;

Georgia Power 7.1 percent; and Virginia Electric & Power 6.4 percent. Even though SCE shows the highest

26

overall net utility plant over this period, its average annual increases are less than those of PG&E and two

other IOUs.

The SDG&E utility grouping similarly shows an increase in net utility plant from 2016 to 2019 across all

IOUs. Average annual increases over this period (from highest to lowest) are: Entergy Louisiana 10.5

percent; SDG&E 8.0 percent; Commonwealth Edison 5.6 percent; and Arizona Public Service 5.4 percent.

SDG&E shows the lowest overall net utility plant over this period, however its average annual increase is

the second highest compared to the three other IOUs.

Return on Rate Base Revenue Requirement is Increasing

As previously shown,

43

rate base has a direct relationship with the return on rate base revenue requirement

that is recovered from ratepayers. The return on rate base revenue requirement reflects the opportunity for

the IOU to earn a profit.

44

Return on rate base may represent a return to shareholders paid by ratepayers;

however, having a set

45

rate of return ensures that IOUs are able to raise sufficient capital to make

improvements to infrastructure and provide safe and reliable service to all customers. On the flip side, by

having a set rate of return, IOUs are inherently incentivized to make investments to drive an increase in

their rate base and therefore, their profitability.

46

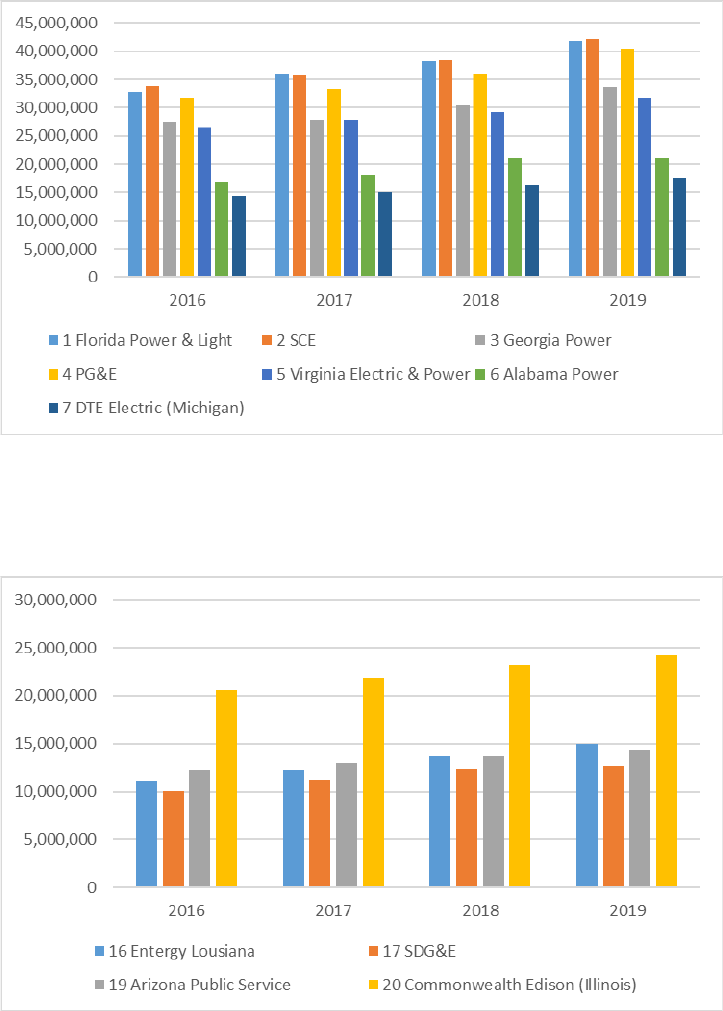

Figure 16 through Figure 18

47

show for each IOU the return on rate base revenue requirement by functional

category. The return on rate base revenue requirement for distribution is showing an increasing trend for

SCE and SDG&E. PG&E’s distribution return on rate base revenue requirement has been fairly constant,

while its transmission return on rate base revenue requirement spiked in 2020, having roughly doubled since

2016.

48

Total annual return on rate base revenue requirement since 2016 grew by approximately 5 percent

per year for PG&E, 7 percent per year for SCE, and 5 percent per year for SDG&E.

43

See Return on Rate Base Revenue Requirement equation under “Capital-Related Revenue Requirement” heading.

44

Profit is earned after the service of debt acquired to finance capital additions.

45

Return on equity is set by the CPUC; debt-service return is determined by the bond market.

46

This is known as the Averch-Johnson effect: the perception that the rate of return is higher than what the utility actually needs to ensure

that shareholders continue to provide capital for investment, and the utility increases its returns to shareholders by making investments beyond

the need threshold.

47

SDG&E return on rate base data 2016 - 2018 is from AB 67 Report data responses; data for 2019 – 2020 is extrapolated from 2016 – 2018

data. PG&E and SCE data are from Energy Division data responses.

48

This increase of about 50 percent in 2020 over 2019 is due to the implementation of Transmission Owner (TO) 20 formula rate as of January

2020.

27

Figure 16: PG&E, Return on Electric Rate Base Revenue Requirement ($000), Nominal Rates in

Effect January 1

Figure 17: SCE, Return on Rate Electric Base Revenue Requirement ($000), Nominal Rates in

Effect January 1

28

Figure 18: SDG&E, Return on Electric Rate Base Revenue Requirement ($000), Nominal Rates in

Effect January 1

IOU net capital additions, accumulated depreciation, rate base, depreciation expense (including related tax

effects) revenue requirement, and return on rate base revenue requirement are reviewed in Phase I of each

General Rate Case (GRC) cycle,

49

except for transmission capital additions, which are reviewed in FERC

rate cases. Currently, there are no known projected rate base schedules with corresponding projected

depreciation expense and return on rate base revenue requirements for periods extending beyond the current

GRC cycle. Better transparency into the full costs that ratepayers will pay over time for capital expenditures

may facilitate analysis of the effects of projected capital-related revenue requirement escalation on projected

utility rates.

Transparency into program areas with large capital investments such as Transportation Electrification (TE)

is important for the CPUC and stakeholders to have a clear understanding of how an IOU’s proposed

capital spending will impact revenue requirements beyond the initial years of the program. SCE and

SDG&E maintain projected capital cost and capital-related revenue requirements data for certain TE stand-

alone programs beyond the year the program terminates.

50

After program termination, the ongoing capital-

related revenue requirements will become part of GRC filings.

51

It is unknown at this time if these ongoing

capital-related revenue requirements will be tracked separately in GRC filings.

49

The IOUs are in the process of switching over to a four-year cycle from a three-year cycle. PG&E will file its next GRC in 2023, SCE is

expected to file a petition requesting the filing of its next GRC in 2025, and SDG&E has filed a petition requesting the filing of its next GRC in

2024.

50

SCE and SDG&E provided to Energy Division by data request TE program costs beyond the years the programs terminate out to the year

2030.

51

TE programs generally have lengths of about five years. Programs initiated as early as 2017 may be terminating, for which the capital-related

revenue requirements will roll into the subsequent GRC cycle.

29

2.4 Net Energy Metering Costs and Benefits

California’s net energy metering (NEM) program started in 1997, prompted by Senate Bill 656 (1995,

Alquist). It allows customers who install eligible renewable electrical generation facilities to serve onsite

energy needs and receive credits on their electric bills for surplus energy sent to the electric grid. Most

customer-sited, grid-connected solar in California is interconnected through NEM tariffs. California’s first

NEM program, now colloquially known as “NEM 1.0,” was revised in 2016 via Decision (D).16-01-044

52

per Assembly Bill (AB) 327 (2013, Perea). Customers on the “NEM successor tariff,” or “NEM 2.0,” pay

for their cost to connect to the grid; take service on a “time-of-use” rate plan; and pay “non-bypassable”

charges that cannot be offset with surplus energy credits, in order to contribute their fair share toward

public purpose programs and other initiatives.

To achieve the mandates of AB 327, the CPUC opened a new proceeding in August 2020 (Rulemaking

(R).20-08-020) to revisit the NEM 2.0 tariff.

53

The proceeding will be guided by the statutory mandates of

AB 327 to ensure the sustainable growth of distributed renewable energy, with benefits approximately equal

to costs.

NEM 2.0 Costs and Benefits Study

An independent research firm, Verdant Associates, recently completed an evaluation study of the costs and

benefits of NEM 2.0 on behalf of the CPUC.

54

The CPUC directed this study to gather information in

preparation for its planned revisit of the tariff.

55

The study found that, over time, NEM 2.0 customers

usually save more money on their electric bills than they pay for their generation facilities (e.g. a rooftop

solar system).

The study also found that the cost to the electric utilities—and their customers—of providing these extra

electric bill savings is greater than the energy’s value, i.e. the utility pays more to NEM customers than it

would pay elsewhere for the same amount of energy and other electric grid benefits. This is illustrated by the

CPUC’s total resource cost (TRC) test, which compares an energy resource’s benefits and costs to both

participants and utilities. Using a model representing the NEM 2.0 population, the study found a statewide

weighted average TRC ratio of 0.84, meaning the total benefits, $7.96 billion, are about one-sixth lower than

the total costs, $9.46 billion. A related test, the CPUC’s ratepayer impact measure (RIM) test, calculates

effects of an energy resource on customer bills. The model had a NEM 2.0 weighted average RIM ratio of

0.37, with total benefits of $7.58 billion and total costs of $20.58 billion. A RIM ratio below 1.0 means that

NEM 2.0 increases non-participant bills. Non-NEM customers’ bills rise most, not being offset by onsite

52

D.16-01-044 can be accessed at: https://docs.cpuc.ca.gov/PublishedDocs/Published/G000/M158/K181/158181678.pdf.

53

Documents in R.20-08-020 can be accessed at:

https://apps.cpuc.ca.gov/apex/f?p=401:56:0::NO:RP,57,RIR:P5_PROCEEDING_SELECT:R2008020.

54

Verdant was previously part of Itron, Inc., the firm that won the competitive solicitation to conduct the NEM 2.0 evaluation study. The study

can be accessed at: https://www.cpuc.ca.gov/General.aspx?id=6442463430.

55

D.18-09-044 can be accessed at: https://docs.cpuc.ca.gov/PublishedDocs/Published/G000/M230/K892/230892616.pdf.

30

energy generation. Table 3 shows the TRC and RIM weighted average benefit-cost ratios for the residential

customer sector and all sectors.

Table 3: Weighted Average Benefit-Cost Ratios

Residential

All Sectors (Including Residential)

TRC Ratio

RIM Ratio

TRC Ratio

RIM Ratio

PG&E

0.69

0.31

0.80

0.33

SCE

0.80

0.43

0.91

0.49

SDG&E

0.76

0.29

0.84

0.31

The evaluation study found that, as compared to the general California population, NEM customers are

disproportionately older, located in high-income areas, likely to own their home, and less likely to live in a

disadvantaged community. Consequently, the costs of NEM are disproportionately paid by younger, less

wealthy, and more disadvantaged ratepayers, many of whom are renters. To address these concerns, the

CPUC is considering modifying the structure of the NEM 2.0 tariff to achieve California’s social and

environmental goals for distributed renewable energy while allocating its costs and benefits in a more

equitable manner.

NEM Cost Shift Equity Considerations

All residential non-NEM or non-participating customers, including California Alternate Rates for Energy

(CARE) customers, shoulder an additional rate burden as a result of the cost shift from NEM customers.

56

Potential equity concerns related to the NEM cost shift include the following:

57

▪ As of November 2020, PG&E had approximately 519,000 residential NEM customers and 1.3

million CARE customers. Of these CARE customers, only about 5 percent are NEM participants,

meaning approximately 95 percent of CARE customers did not participate and therefore bear the

cost responsibility of compensating NEM customers.

▪ SCE had, as of December 2020, approximately 361,000 residential NEM customers and 1.5 million

CARE customers. Of these CARE customers, only 4 percent participate in NEM, meaning over 1.4

million CARE customers, or about 96 percent, shoulder the additional cost burden from all NEM

customers.

56

NEM cost shift reflects the cost shift created by residential NEM customers that non-NEM customers (also referred to as “non-

participating” customers) may be paying in higher rates. NEM Cost Shift = NEM Customer Bill Savings – Avoided Costs

where “Bill Savings” is the yearly dollar amount that NEM customer avoid paying because of their self-generation and netting (compensation)

and “Avoided Costs” are fixed and variable costs of service that the utility should avoid incurring as a result of distributed generation.

57

This information was gleaned from IOU data responses submitted to Energy Division.

31

▪ As of November 2020, SDG&E had approximately 199,000 residential NEM customers and

320,000 CARE customers. Of these CARE customers, only 8 percent are NEM participants. CARE

customers are currently seeing bills that are 13 percent higher as a result of the NEM cost shift.

2.5 Historical Distribution Costs

Distribution costs include O&M and capital-related costs associated with distribution infrastructure. This

reflects the costs to distribute power to customers and includes power lines, poles, transformers, repair

crews and emergency services, as well as certain wildfire mitigation costs related to grid reliability and safety.

In addition, the CPUC has authorized the IOUs to recover funding related to specific public policy

objectives such as transportation electrification and demand response through the distribution rate

component. Here we focus on distribution costs associated with transportation electrification and wildfire

mitigation.

Historical Transportation Electrification Costs

Legislative Background

The CPUC is responding to several legislative mandates and gubernatorial directives to support and

accelerate widespread transportation electrification (TE).

58

SB 350 directed the CPUC to require the

investor-owned utilities (IOUs) to submit applications for programs that leverage ratepayer funding to

support electric vehicle (EV) adoption.

59

To date, the CPUC has authorized the IOUs to implement many

TE programs to help meet California’s zero-emission vehicle (ZEV) targets of five million ZEVs on the

road by 2030 and 250,000 installed publicly available EV charging stations and 200 publicly available

hydrogen fueling stations in the state by 2025.

60

In September 2020, Governor Newsom pushed these state goals further by issuing Executive Order N-79-

20 to require all in-state sales of new passenger vehicles be zero-emission by 2035. The Executive Order

also set a further goal that 100 percent of medium- and heavy-duty vehicles in the state be zero-emission by

2045 for all operations where feasible and by 2035 for drayage trucks. Further, it sets a state goal to

transition to 100 percent zero-emission off-road vehicles and equipment by 2035 where feasible.

Additionally, AB 841 (Ting, 2020) was signed into law in September 2020. The bill directs the establishment

of new electric rules or tariffs that authorize each IOU to design and deploy all utility-side electrical

distribution infrastructure for customers installing separately metered EV charging. This changes the CPUC

practice of authorizing utility-side, electrical distribution infrastructure needed to charge EVs

61

on a case-by-

58

SB 350 defined TE as any vehicle fueled by electricity generated outside of the vehicle, including light-duty vehicles, medium- and heavy-duty

vehicles, off-road vehicles, and shipping vessels.

59

Such as multi-unit dwellings, workplaces, destination centers, disadvantaged communities, and low/medium income residential communities.

60

Executive Order (E.O.) B-48-18.

61

Section 740.19(b) defines “electrical distribution infrastructure” as including poles, vaults, service, drops, transformers, mounting pads,

trenching, conduit, wire, cable, meters, other equipment as necessary, and associated engineering and civil construction work.

32

case basis through individual program applications, to authorization of that infrastructure and associated

design, engineering, and construction costs on an ongoing basis in an IOU’s general rate case (GRC). The

bill also makes permanent the exemption to CPUC Electric Rules 15 and 16, which allows service facility

upgrade costs resulting from residential EV charging to be treated as a common cost paid for by all

ratepayers.

Costs in Rates

As of fourth quarter 2020, the CPUC has authorized the IOUs to spend approximately $1.6 billion on EV

charging infrastructure to support the state’s TE goals and is considering another application from SDG&E

for approximately $44 million in TE funding.

62

▪ Out of the authorized IOU funding to date, $238 million has been spent.

▪ Another $1.29 billion is still available for TE investment.

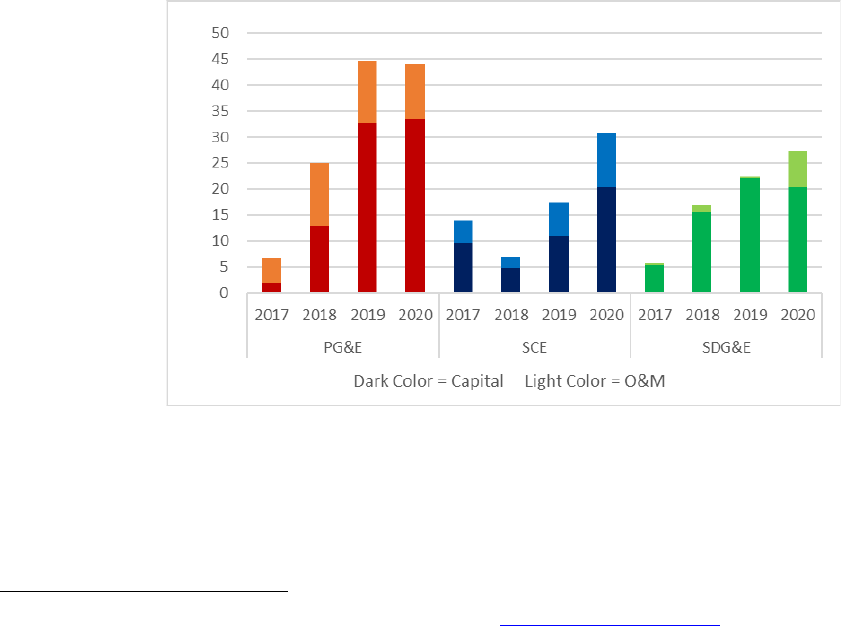

Figure 19 shows each IOU’s transportation electrification program spending by O&M and capital cost

classification and by the year implemented in rates.

Figure 19: PGE, SCE, and SDG&E Transportation Electrification Program Costs in Rates

($ million) (2017 -2020)

62

See “Transportation Electrification Investments” on CPUC website: https://www.cpuc.ca.gov/zev/ .

33

Table 4 shows the rate attributable to transportation electrification costs embedded in the bundled average

residential rate for the period 2017 to 2020.

63

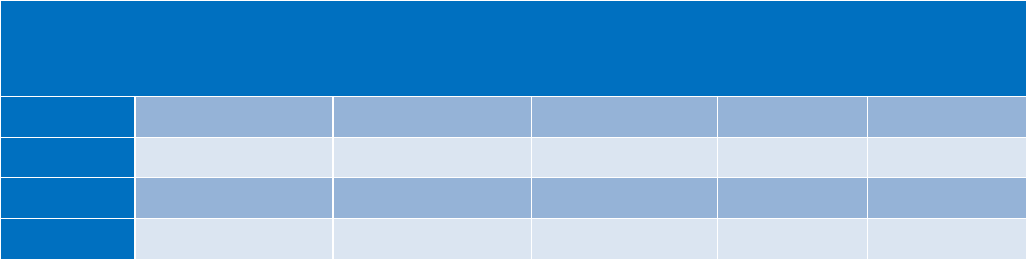

Table 4: Transportation Electrification Rate Embedded in Bundled Residential Average Rate

(nominal $/kWh) (2017 – 2020)

Transportation Electrification Rate

Embedded in Bundled Residential

Average Rate (nominal $/kWh)

Bundled Residential Average Rate

(nominal $/kWh)

2017

2018

2019

2020

2017

2018

2019

2020

PG&E

0.00004

0.00027

0.00049

0.00033

0.204

0.205

0.220

0.230

SCE

0.00010

0.00005

0.00019

0.00025

0.177

0.181

0.183

0.209

SDG&E

0.00017

0.00043

0.00057

0.00139

0.249

0.276

0.263

0.271

With California’s aggressive goals for transportation electrification over the next decade, significant

upgrades to the distribution grid may be necessary to accommodate charging demand. While there is an

ongoing policy discussion regarding the extent of ratepayer responsibility for TE costs, there is the potential

for these costs to drive rate increases.

Historical Wildfire-Related Costs

Wildfire-related costs fall into several categories. First, the IOUs incur costs to implement wildfire

mitigation activities. The costs associated with wildfire mitigation activities are recovered by the IOUs in

General Rate Cases or through separate applications.

The CPUC also allows the IOUs to recover certain wildfire-related costs for liabilities, including insurance

premiums. These costs are tracked through a mechanism called a Wildfire Expense Memorandum Account

(WEMA). WEMAs track wildfire related liability costs, and no other category. WEMAs are designed to

allow the utility the ability to track its costs incurred for claims made against the company as a result of

property losses, in addition to other incremental liability costs including (but not limited to) higher-than-

forecasted insurance premiums and legal fees.

In 2019, the Legislature also established a Wildfire Fund for excess liabilities. This is discussed in more detail

below in the section on legislative background.

Legislative Background

63

Year-end effective rates. Transportation Electrification rates expanded to five decimal places as the three decimal place convention in this

paper produces 0.000 and 0.001 rates. To get an estimate of the portion of the monthly bill to which the transportation electrification rate

corresponds, multiply the rate by 500 kWh, the monthly usage data that is used in legal bill inserts for PG&E’s 2020 GRC Phase II, SCE’s 2021

GRC Phase II, and SDG&E’s 2019 GRC Phase II applications.

34

SB 901 (Dodd, 2018) and AB 1054 (Holden, 2019) require electric utilities to prepare and submit wildfire

mitigation plans (WMP), which describe the level of wildfire risk in their service territories and how they

intend to address those risks.

64

The WMPs cover a three-year period with new comprehensive plans to be

filed at least once every three years and annual updates to the plans in between.

AB 1054 Wildfire Fund and Securitization

AB 1054 created a $21 billion Wildfire Fund to be funded equally by ratepayers and utilities. Utility

shareholders will contribute approximately $10.5 billion to the Wildfire Fund through annual payments until

2030. Ratepayer funding amounts to an additional $10.5 billion which will be funded through a new non-

bypassable charge (NBC). D.20-09-023 adopted a charge of $0.0058 per kWh from October 1, 2020-

December 31, 2020 to support the Wildfire Fund and D.20-12-024 adopted the same charge for calendar

year 2021. This amounts to approximately $3 per month for an average residential customer using 500 kwh

per month.

65

The Wildfire Fund is designed to act as an insurance fund for the utilities and can be used to pay costs

resulting from utility caused wildfires provided that certain conditions are meet by the utility. While the fund

represents an ongoing surcharge to rate payers it could reduce costs to ratepayer over time by creating more

certainty for utility investors and thus reducing utility operating and borrowing costs.

AB 1054 Securitization and Rate Payer Savings

In addition, AB 1054 contains two separate benefits for ratepayers related to Wildfire Mitigation Plan

(WMP) capital spending. AB 1054 requires the first $5 billion of WMP capital spending be excluded from

earning a Return on Equity (ROE). This reduces rates directly by eliminating the shareholder profit portion

of the return on rate base on the $5 billion WMP capital spending. Of the $5 billion in capital expenditures

total, PG&E’s share is $3.21 billion, SCE’s share is $1.575 billion, and SDG&E’s share is $215 million.

AB 1054 also allows for this $5 billion capital spending to be securitized through a CPUC financing order

rather than being financed through the more traditional unsecured bond offerings. This securitization benefits

ratepayers by allowing the utility to obtain a lower interest rate than would otherwise be available to finance

WMP capital expenditures. On July 8, 2020, SCE filed A.20-07-008 with the CPUC, becoming the first utility

to file for this securitization provision of AB 1054. In D.20-11-007, the CPUC granted forming the Financing

Order allowing the securitization, subject to certain conditions.

Costs in Rates

SB 901 and AB 1054 permitted the IOUs to open accounts in 2019 to track spending to implement their

WMPs. The IOUs are allowed to seek recovery of this spending in their General Rate Cases or through a

64

See each IOU’s WMP at https://www.cpuc.ca.gov/2019wmp/ .

65

CARE and Medical Baseline customers are exempt from paying the non-bypassable charge.

35

separate application, after the conclusion of the time period covered by the plan. Therefore, there is lag

between when spending takes place and when it is reflected in rates.

Table 5 shows spending related to the WMPs that is reflected in 2019 and 2020 rates is minimal compared to

increases expected in future years for PG&E and SCE. SDG&E’s spending is higher relative to their revenue

requirement as a result of programs adopted in response to fires in their service territory in 2007.

66

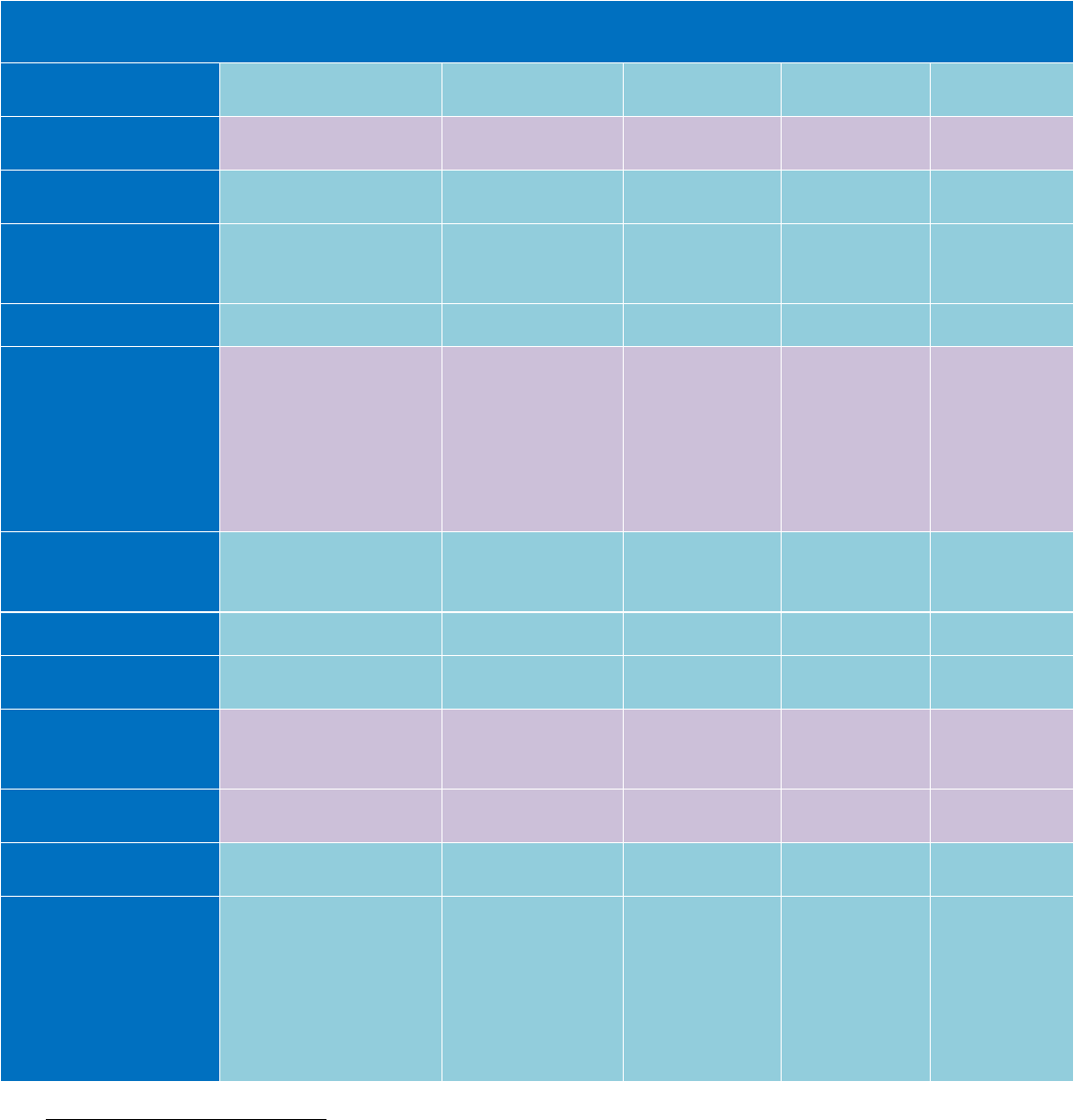

Table 5: Wildfire Mitigation Plan Costs in Rates (2019 - 2020)

2019

2020

O&M Costs

in Rates

Capital Costs

in Rates

O&M Costs

in Rates

Capital Costs

in Rates

PG&E

-

$13.7 million

$20.3 million

$15.8 million

SCE

$33.9 million

$3.0 million

$173.1 million

$82.4 million

SDG&E

$25.8 million

-

$28.3 million

-

After destructive fires in SDG&E’s service territory in 2007, the CPUC approved SDG&E cost recovery

applications for a total of about $1.7 billion dollars over the period 2007 – 2018 for grid hardening, situational

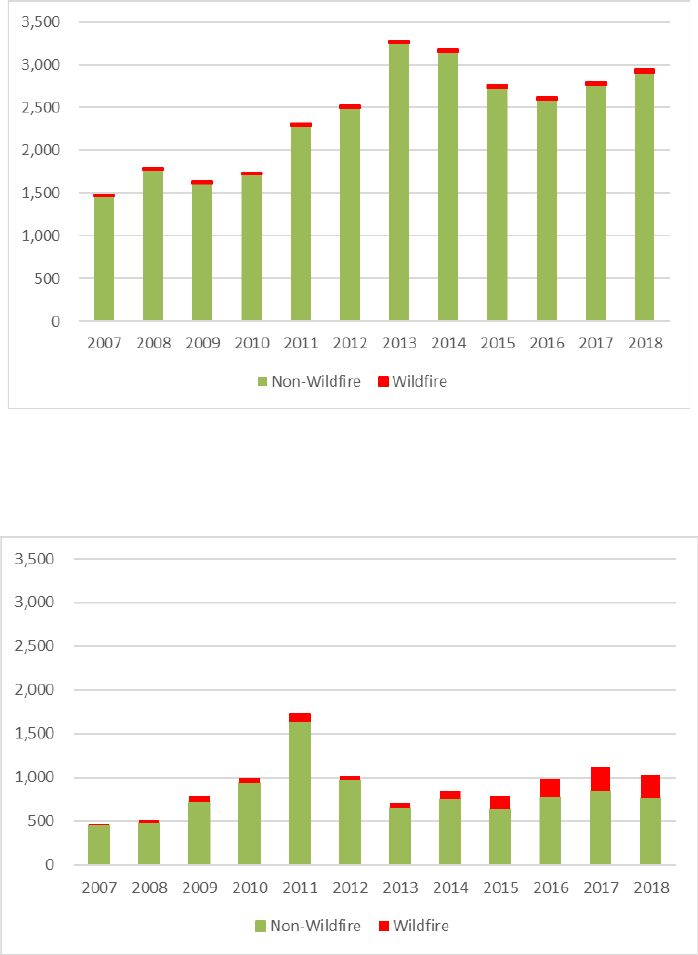

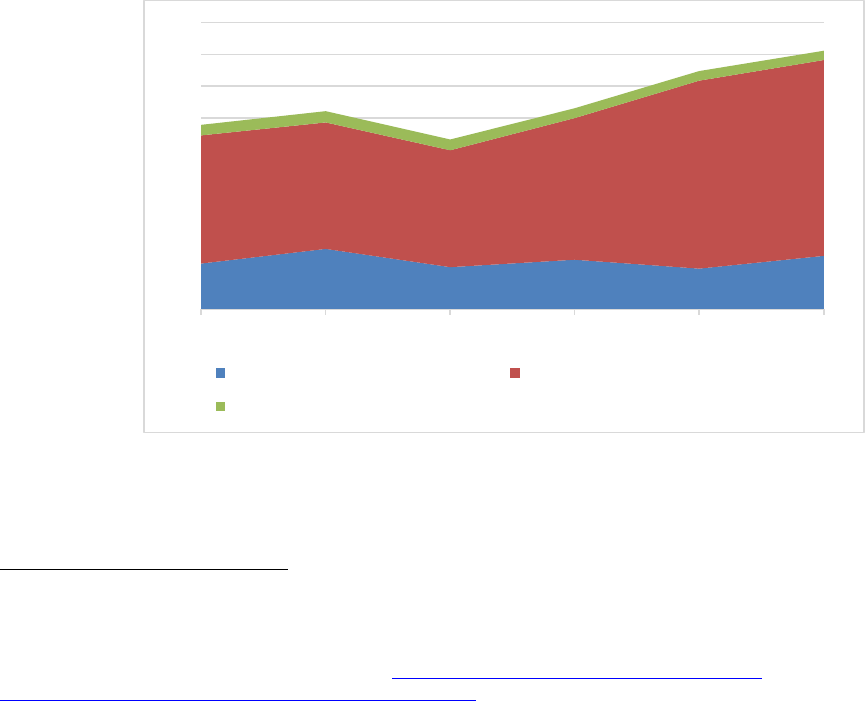

awareness, and vegetation management to better address the risk of wildfires. Figure 20 and Figure 21 show

O&M and capital costs incurred

67

for wildfire prevention over the period 2007 – 2018 relative to all other

non-wildfire costs, with wildfire prevention distribution spending directly representing over half of the total

wildfire prevention costs.

68

66

FERC-related costs are not included in SDG&E's filed WMPs.

67

Costs may be implemented in rates in a different year than year incurred.

68

Other wildfire prevention costs represented include FERC-jurisdictional and mixed CPUC GRC and FERC Common costs.

36

Figure 20: SDG&E Wildfire Prevention O&M Costs Relative to All Other O&M Costs (Non-

Wildfire), ($ million)

Figure 21: SDG&E Wildfire Prevention Capital Costs Relative to All Other Capital Costs (Non-

Wildfire), ($ million)

Figure 21 shows SDG&E’s wildfire prevention capital expenditures increasing over time, particularly after

2013. Table 6 shows this wildfire prevention capital spend by SDG&E-designated cost categories for the

years 2016 to 2018.

37

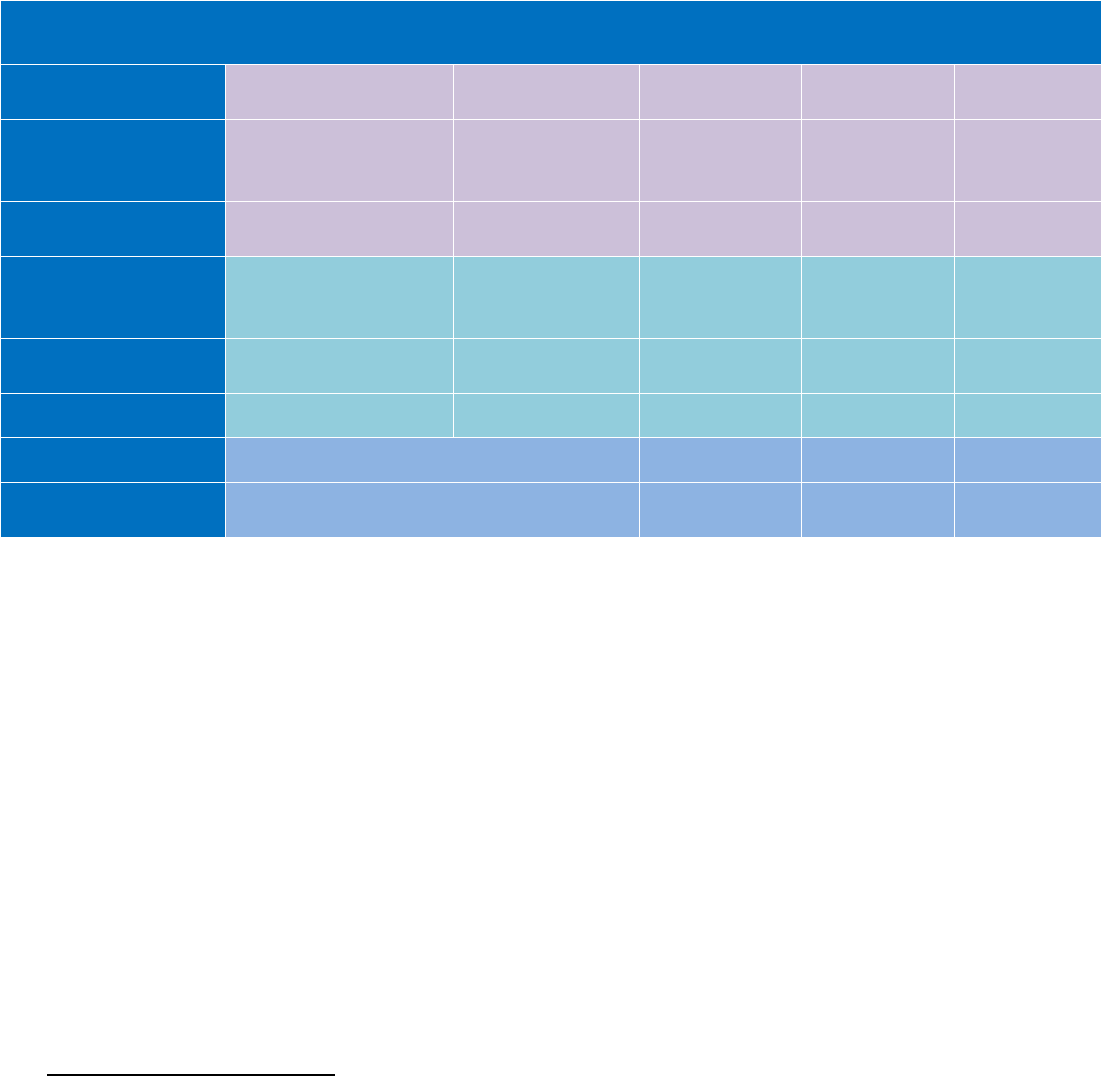

Table 6: SDG&E Wildfire Prevention Capital Expenditures by Cost Category ($ million) (2016 –

2018)

Cost Category ($ million)

2016

2017

2018

Wood-to-Steel (WTS) Pole Replacement Program

46.5

42.3

45.5

Cleveland National Forest (CNF) Projects

84.8

125.8

120.5

Fire Risk Mitigation (FiRM) Program

86.2

89.6

94.3

IntelliRupters

0.2

0.3

0.2

Emergency Communications/Trailers

0.1

0.4

0

Weather Modeling & Analytics

1.4

3.4

0.4

Pole Risk Mitigation Engineering (PRiME) Program

0

0

5

Total

219.2

261.8

265.9

The spending trends in Figure 20 and Figure 21 reflect SDG&E’s increased focus in the last decade on

hardening its electric system in high fire threat areas. These programs have expanded in recent years in

response to the catastrophic wildfires of 2017-19. SDG&E wildfire mitigation costs since its destructive

2007 fires have not declined; in fact, they have continued to increase. This trend of wildfire spending by

SDG&E may be informative of future spending by PG&E and SCE as these utilities ramp up their wildfire

mitigation programs and harden their systems.

2.6 Historical Transmission Costs

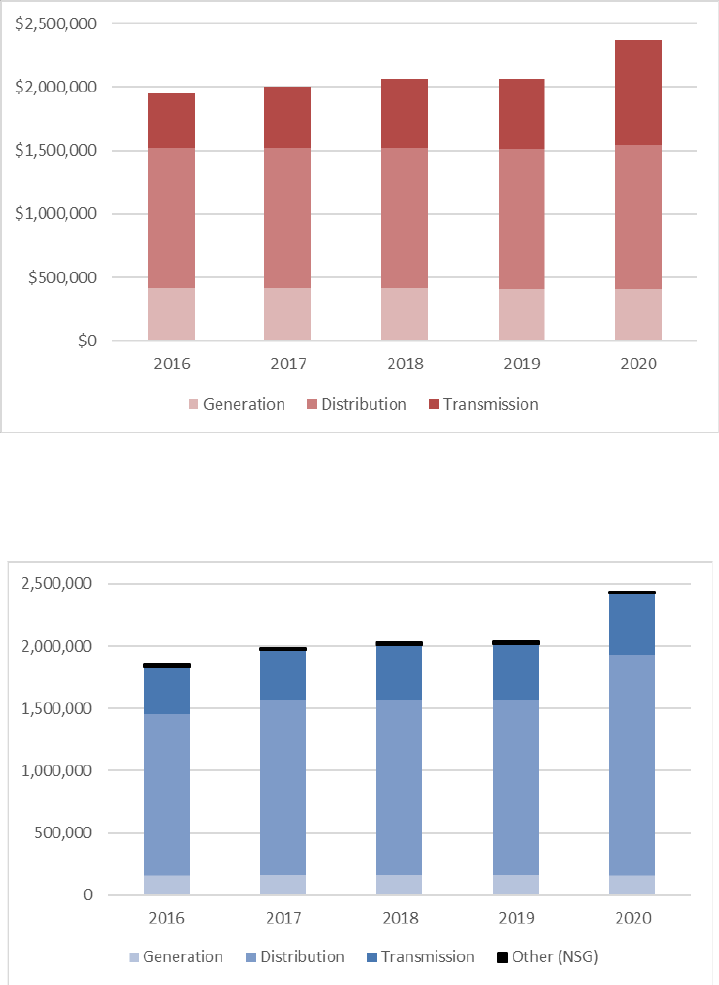

Transmission revenue requirements (TRR) have been on the rise in recent years, driven largely by Capital

Additions, Operations & Maintenance (O&M) costs, and Administrative & General (A&G) expenses.

Collectively, the three big IOUs’ annual spending has increased by approximately 60 percent on capital

additions, 80 percent on O&M, and nearly 30 percent on A&G. The resulting Transmission Access Charge

(TAC) that is paid by all ratepayers has been increasing while the total annual gross load has been declining

in the California Independent System Operator (CAISO) control area.

Background

Transmission costs are set by the Federal Energy Regulatory Commission (FERC) and not by the CPUC,

and Transmission Owners (TO) in the CAISO control area file at FERC to recover costs through

transmission rates. At FERC, the CPUC represents California ratepayers as an advocate for just and

reasonable rates. In the Transmission Owner rate cases, FERC approves revenue requirements recovered

from both wholesale and retail transmission customers of larger IOUs such as PG&E, SCE, and SDG&E,

as well as smaller merchant TOs. As explained in the CPUC’s 2020 California Electric and Gas Utility Cost

38

Report (AB 67 Report), the proportion of a retail customer’s’ cost per kilowatt hour attributed to

transmission in 2019 was 16.6 percent for PG&E, 9.1 percent for SCE, and 15.1 percent for SDG&E.

69

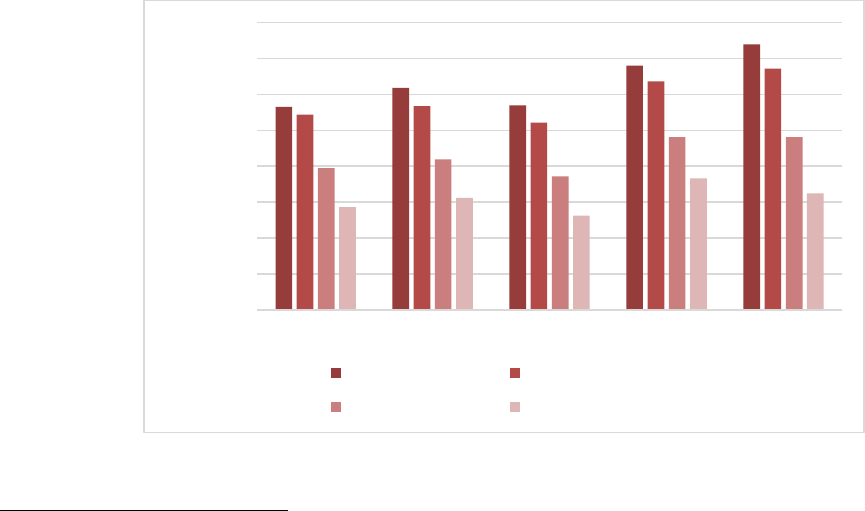

Transmission Revenue Requirements Are Increasing Rapidly

In recent years, the sum of the three IOUs’ transmission revenue requirements (TRR) has increased 38.1

percent, from $3.14 billion in 2016 to $4.34 billion in 2021 as forecasted in the three IOUs’ rate filings at

FERC on December 1, 2020. While this is a total increase of 38.1 percent, PG&E’s TRR has increased over

66 percent during that time and SDG&E’s by nearly 45 percent. After a dip during this period, SCE’s TRR

is at the same level it was in 2016. Further, the TRR and resulting electric transmission rates are driven by

Operations & Maintenance costs and Administrative & General expenses. While the sum of operations and

maintenance (O&M) costs for the three IOUs was $375.5 million in 2016, O&M costs have increased to a

forecasted $674.6 million in 2021 – a nearly 80 percent increase. A&G also increase by almost 30 percent

across the three IOUs. Table 7 through Table 10 show this data.

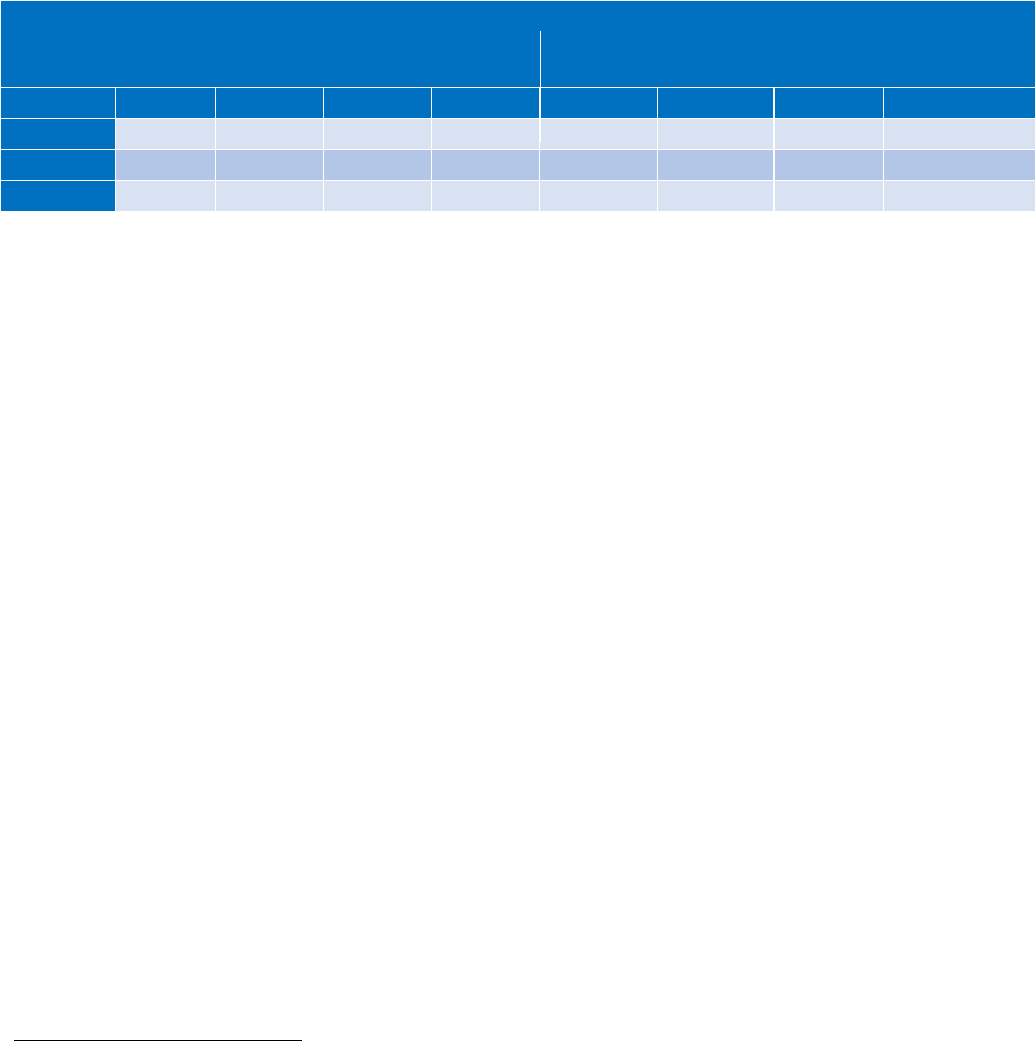

Table 7 shows the differences in transmission revenue requirements between 2016 and the 2021 forecast in

total and for the individual utilities, reflecting increasing revenue requirements with the exception of SCE.

Table 7: Transmission Revenue Requirements in Settled TO Rate Cases at FERC

Utility

2016

2021

Percentage Change

SDG&E

$ 716 million

$ 1.036 billion

44.7%

SCE

$ 1.092 billion

$ 1.087 billion

-0.5%

PG&E

$ 1.331 billion

$ 2.214 billion

66.3%

Total

$ 3.139 billion

$ 4.336 billion

38.1%

Each IOUs’ rate base, meaning the transmission capital investment on which the utility receives an

approved rate of return, has significantly increased over the same period, as shown in Table 8.

Table 8: Transmission Rate Base

Utility

2016

2021

Percentage Change

SDG&E

$ 2.896 billion

$ 4.342 billion

49.9%

SCE

$ 5.171 billion

$ 6.428 billion

24.3%

PG&E

$ 5.846 billion

$ 8.476 billion

45.0%

Total

$ 13.914 billion

$ 19.246 billion

38.3%

Table 9 shows the overall increase of nearly 80 percent in annual O&M costs since 2016, with PG&E’s rate

base increasing a staggering 118 percent. O&M costs are also impacted by the substantial increases in rate

base, but the primary driver of these costs is wildfire mitigation work, including enhanced inspections and

vegetation management efforts.

69

CPUC’s 2020 California Electric and Gas Utility Cost Report: AB 67 Report to the Governor and Legislature, p.10 (April 2020).

39

Table 9: Operations & Maintenance Expenses

Utility

2016

2021

Percentage Change

SDG&E

$ 62.5 million

$ 85.6 million

37.0%

SCE

$ 93.5 million

$ 110.9 million

18.6%

PG&E

$ 219.5 million

$ 478.1 million

117.8%

Total

$ 375.5 million

$ 674.6 million

79.7%

The most variable transmission cost category is Administrative & General (A&G) expenses, which have

fluctuated substantially from year-to-year. As these expenses have been influenced by injuries and damages

related to wildfires for SCE and PG&E in recent years, SDG&E’s A&G costs have declined as more time

has passed since it experienced major wildfire impacts, as shown in Table 10.

Table 10: Administrative & General Expenses

Utility

2016

2021

Percentage Change

SDG&E

$ 79.9 million

$ 70.0 million

-12.4%

SCE

$ 49.7 million

$ 81.8 million

64.5%

PG&E

$ 73.6 million

$ 111.1 million

50.9%

Total

$ 203.2 million

$ 262.8 million

29.3%

Growth in Transmission Capital Additions

As described above, FERC reviews and approves transmission owner rate cases, which allow recovery of

costs of service for the network transmission system under the CAISO’s operative control. A critical driver

of these overall transmission increases has been a continual rise in annual capital investment by the utilities,

also referred to as “capital additions,” from $2.14 billion in 2016 to a forecasted capital addition of $2.59

billion in 2021, an approximately 21 percent increase.

The rate of return (ROR) on capital additions allows utility shareholders to earn profits for shareholders’

benefit. Utilities have an incentive to seek FERC approval for the highest possible ROR. The more capital

additions that go into operation, the more profit the IOUs can attain. Conservative assumptions indicate

that every dollar put into transmission rate base costs ratepayers in excess of $3.50 over the life of a

transmission asset. For example, the $2.75 billion in capital additions for the three IOUs in 2020 alone can

be expected to cost ratepayers at least $9.7 billion over the lives of the assets, using a conservative asset life

estimate of 36 years.

70

Utilities do not start collecting revenue for capital investments in transmission projects until the projects are

completed and put into service. This means that ratepayers can see a large increase in the transmission

portion of their bill when expensive projects are complete. Table 11 shows the in-service date of the largest

transmission projects over the past 10 years. For two of the three projects in Table 11, the final total costs

70

Transmission asset lives typically range between 30 to 50 years, and 36 years is chosen as a conservative mid-range estimate.

40

that were approved by FERC exceeded the original total cost estimates provided to the CAISO and the

CPUC as part of the planning process.

Table 11: Large CAISO-approved Transmission Projects

Project

Original Est. Cost

Cost

In Service

Date

IOU

Territory

Sunrise Powerlink

$1.9 billion

$1.9 billion

2012

SDG&E

Devers-Colorado River

$545 million

$775 million

2013

SCE

Tehachapi Renewable

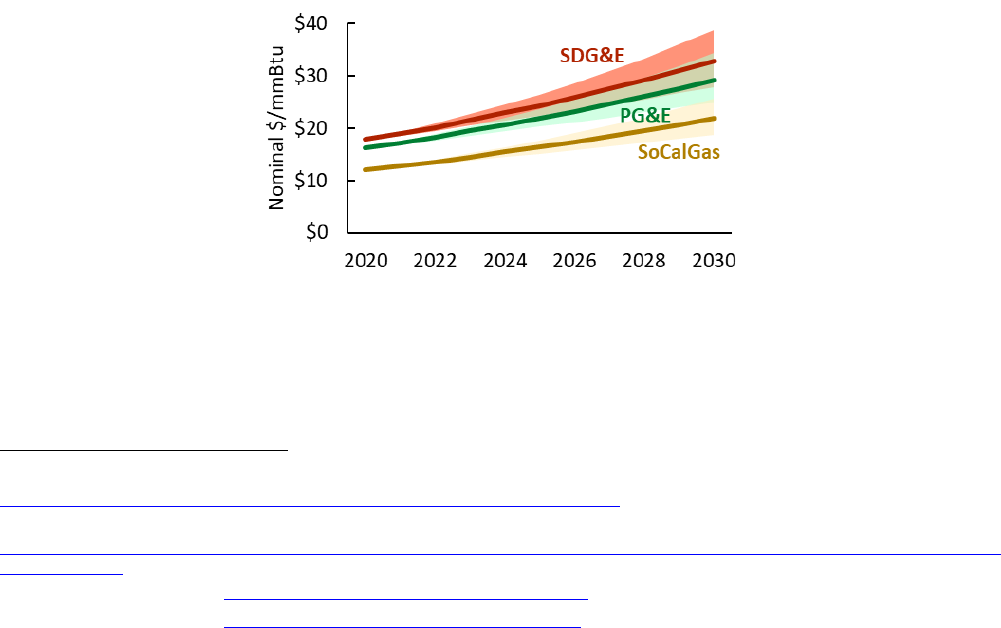

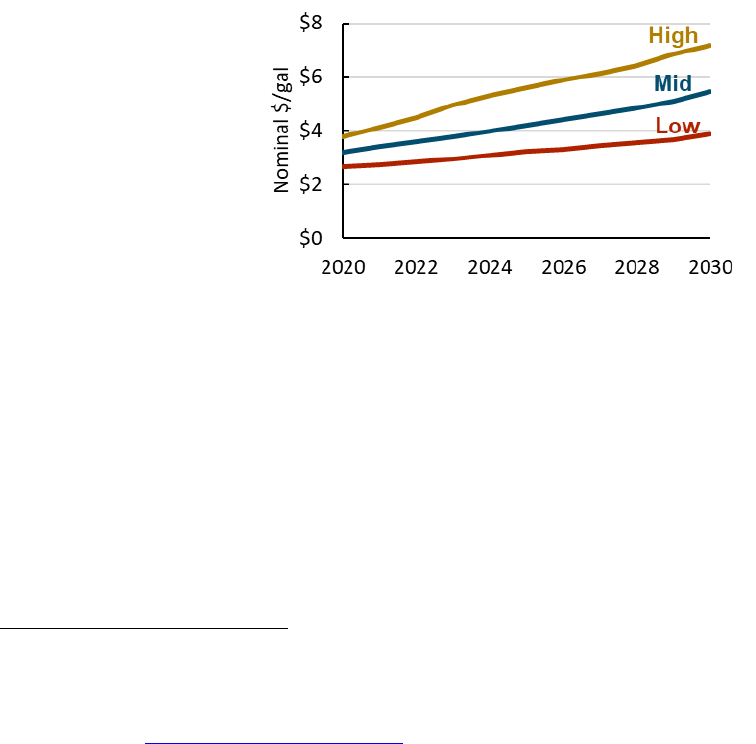

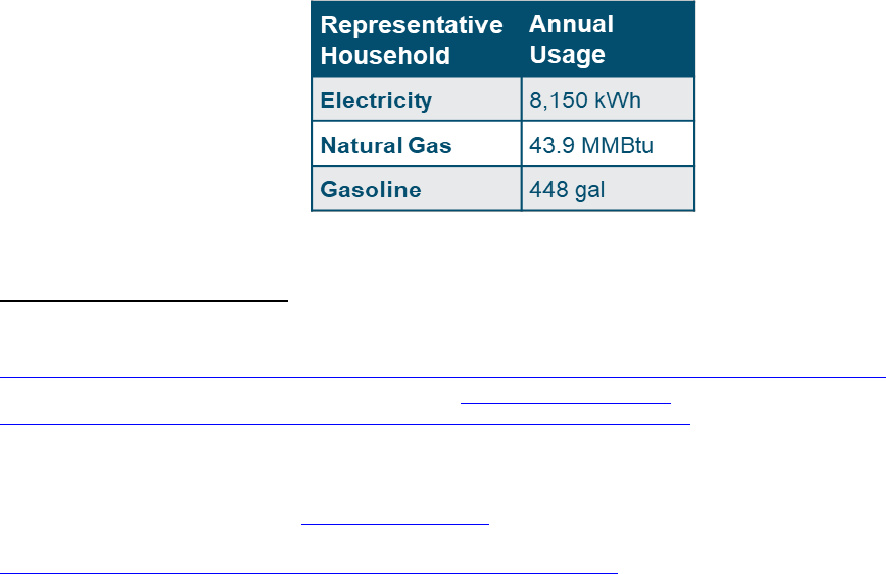

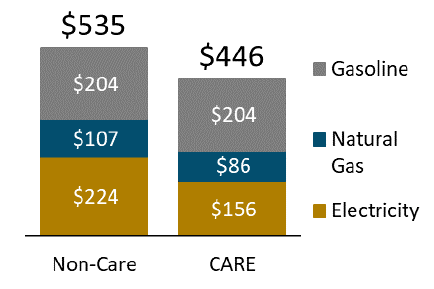

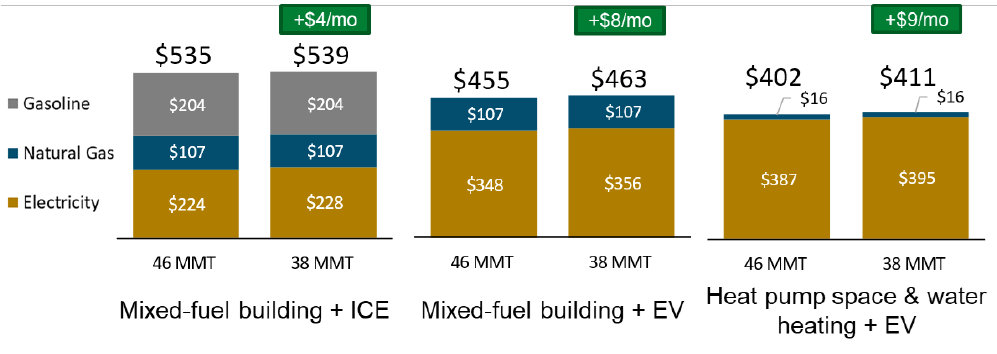

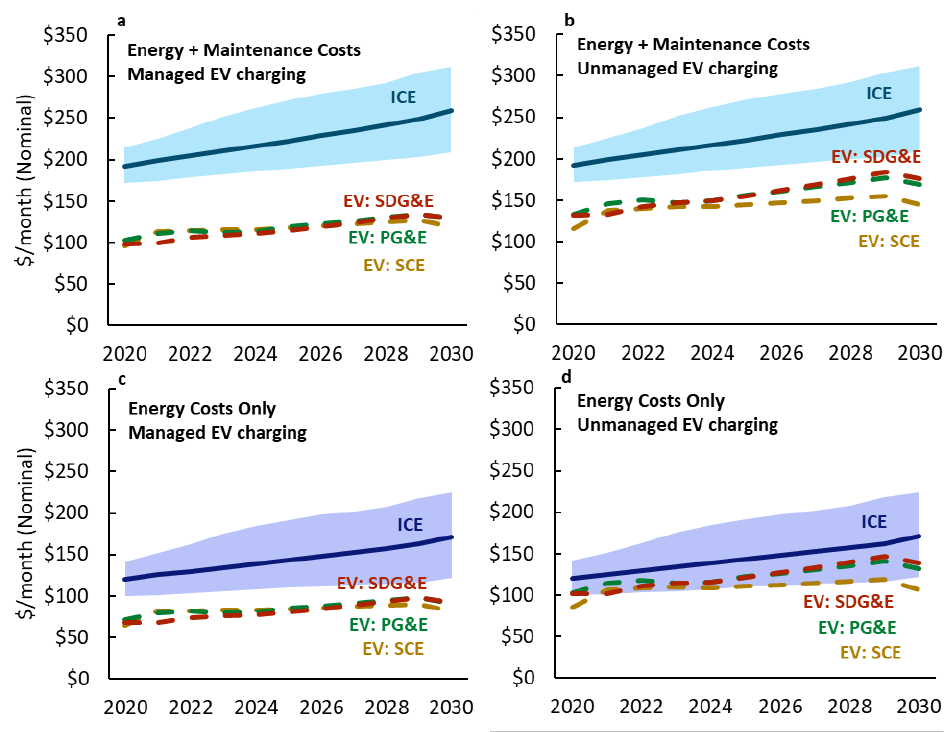

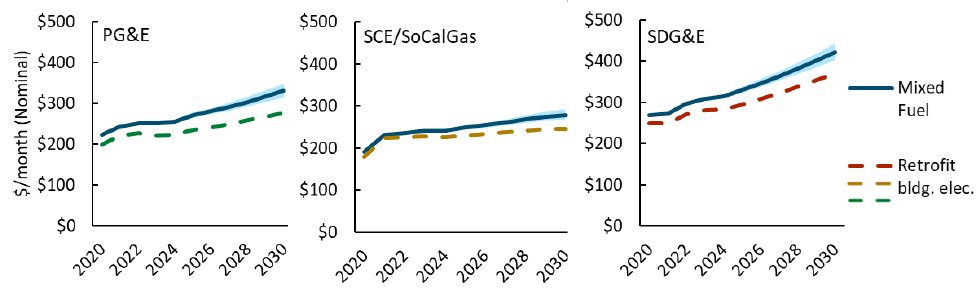

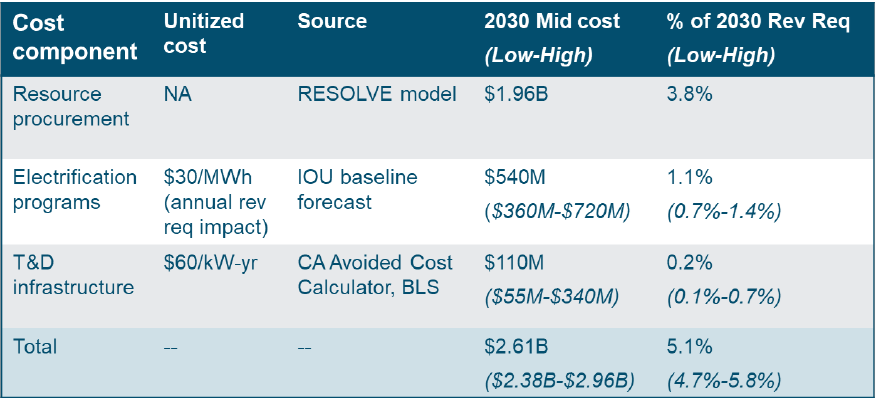

Transmission Project