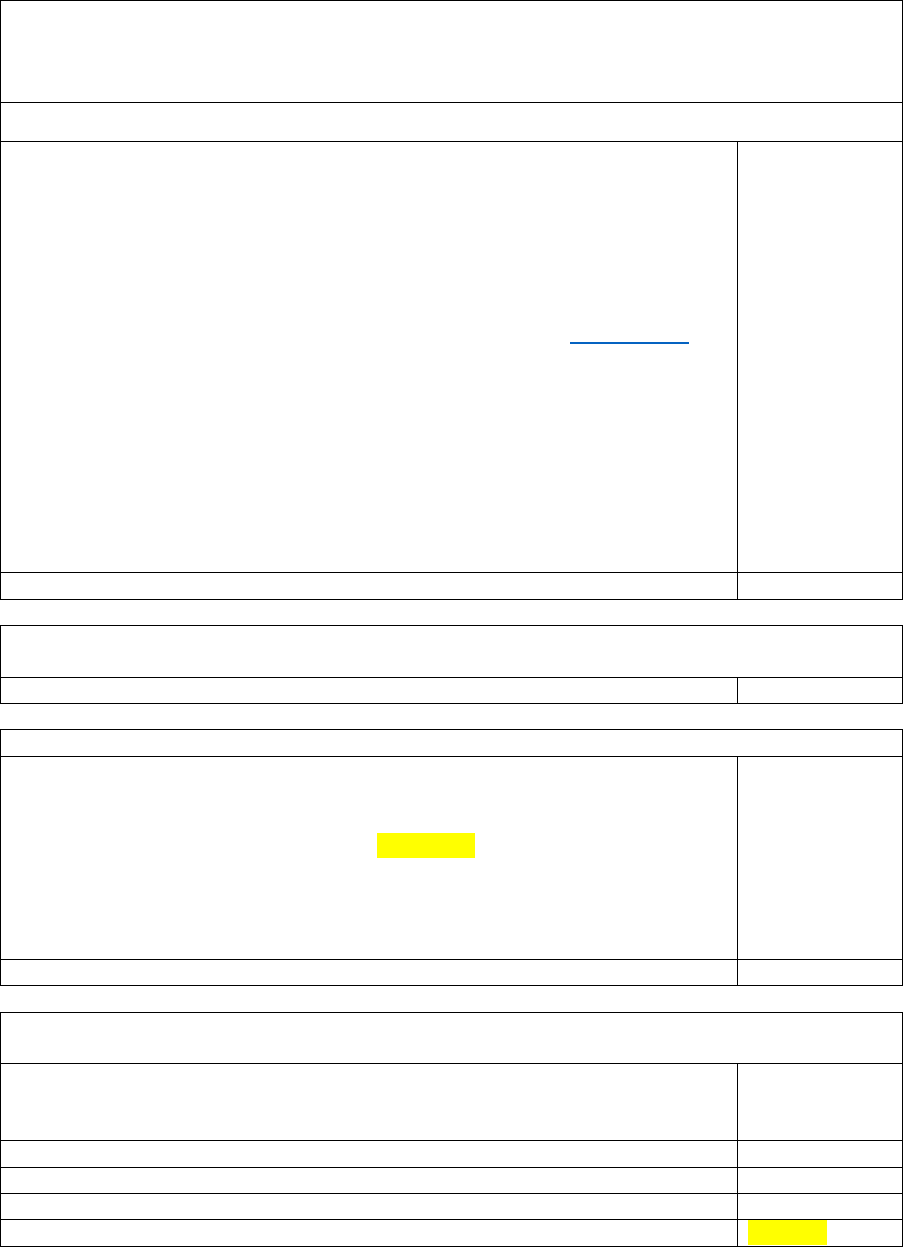

Example of a Universal Credit monthly award notice

How your Universal Credit payments are worked out

This is based on your circumstances between 1 December 2017 and 31 December 2017

1. First, we bring together the basic parts of Universal Credit that apply to you.

Standard Allowance for you and your partner

Housing Element

Child Element

From 06/04/2017 Universal Credit will only pay the child element for 2

children or qualifying young people unless certain exceptions apply. For

further information on when an exception may apply, see www.gov.uk

Children on your claim

XX

XX

We pay £277.08 for your first child or qualifying young person. For each

other eligible child or qualifying young person, we pay £231.67

ESFA note: there can be other/different elements in this section.

£498.89

£354.68

£508.75

Amount

£1,362.62

2. Next, we take account of any non-work income and other benefits you receive as

well as your savings and capital.

The total we take off for these items is:

£0.00

3. We then take account of your take-home pay

Take-home pay is what’s left after tax, National Insurance and any

pension contributions have been deducted.

Your take-home pay for this period is £1,352.85

The first £192.00 of your take-home pay doesn’t affect your Universal

Credit monthly amount. Every £1.00 you earn in take-home pay over this

£192.00 reduces your Universal Credit by 63 pence.

£731.34

The total we take off for take-home pay is:

£731.34

4. Lastly, we take account of any loans, advances, deductions and overpayments or

third party payments you have.

Social Fund

Budgeting Allowance

£22.15

£15.00

The total we take off for these items is:

£37.15

Total adjustments

£768.49

Your Universal Credit monthly payment for this period

£593.83

ESFA note: institutions should use the two highlighted figures, take-home pay and the

amount of Universal Credit after deductions, when assessing household income.