ATTENTION: Please bear in mind that guidelines issued by the VAT Committee are merely views of

a consultative committee. They do not constitute an official interpretation of EU law and do not

necessarily have the agreement of the European Commission. They do not bind the European

Commission or the Member States who are free not to follow them.

Reproduction of this document is subject to mentioning this Caveat.

1

GUIDELINES RESULTING FROM MEETINGS

OF THE VAT COMMITTEE

Up until 10 July 2024

This document has to be

read together with the

INDEX which shows

COMMENTS as well as

the ARTICLES referred

to and which is also

published on the DG

TAXUD Website

ATTENTION: Please bear in mind that guidelines issued by the VAT Committee are merely views of

a consultative committee. They do not constitute an official interpretation of EU law and do not

necessarily have the agreement of the European Commission. They do not bind the European

Commission or the Member States who are free not to follow them.

Reproduction of this document is subject to mentioning this Caveat.

2

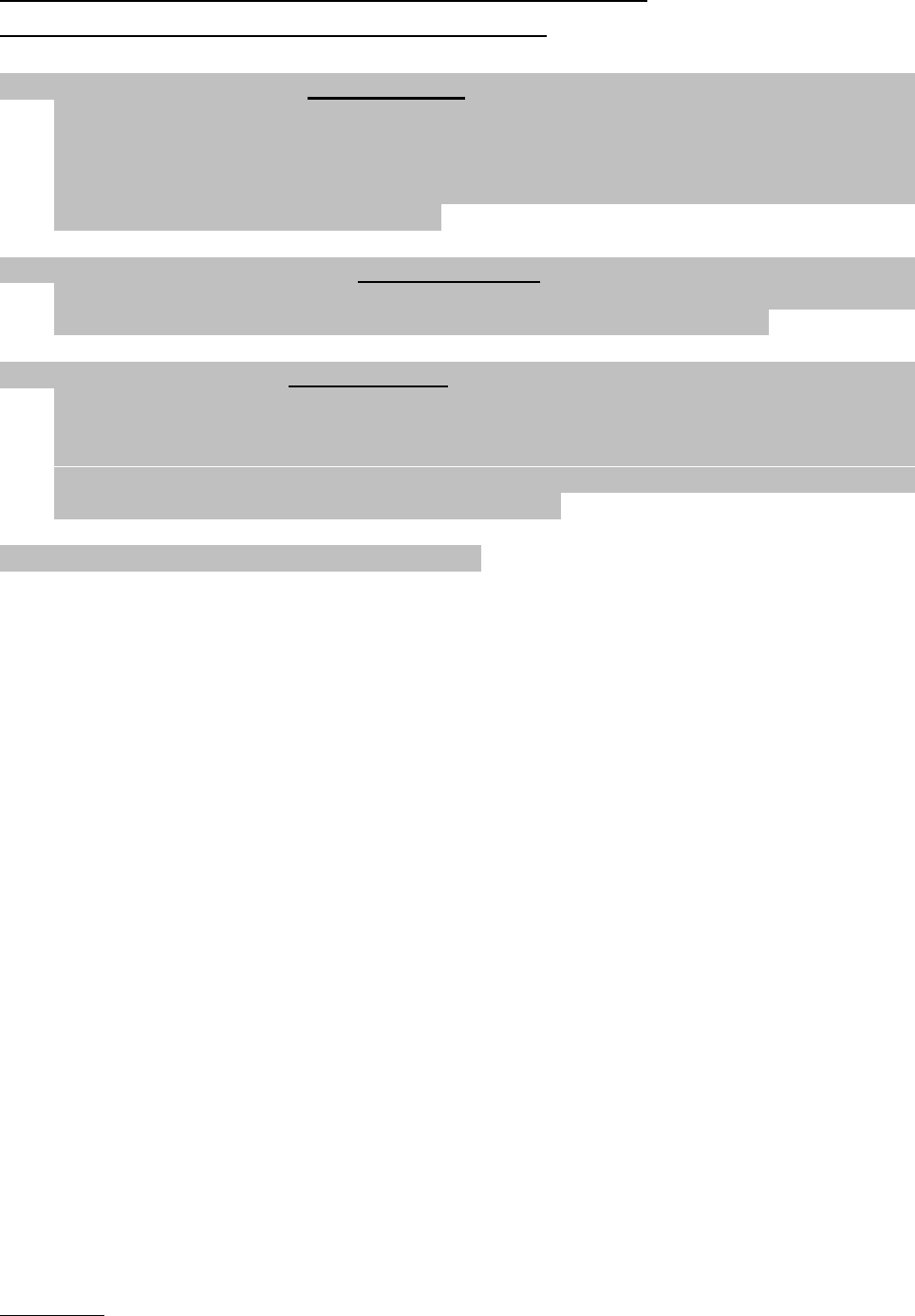

CONTEXT

The VAT Committee was set up under Article 398 of the VAT Directive (Council Directive

2006/112/EC of 28 November 2006 on the common system of value added tax) to promote the

uniform application of the provisions of the VAT Directive. It consists of representatives of

Member States and of the Commission.

Because it is an advisory committee only and has not been attributed any legislative powers, the

VAT Committee cannot take legally binding decisions. It can give guidance on the application of

the Directive which is not, however, in any way binding on the European Commission nor on

Member States.

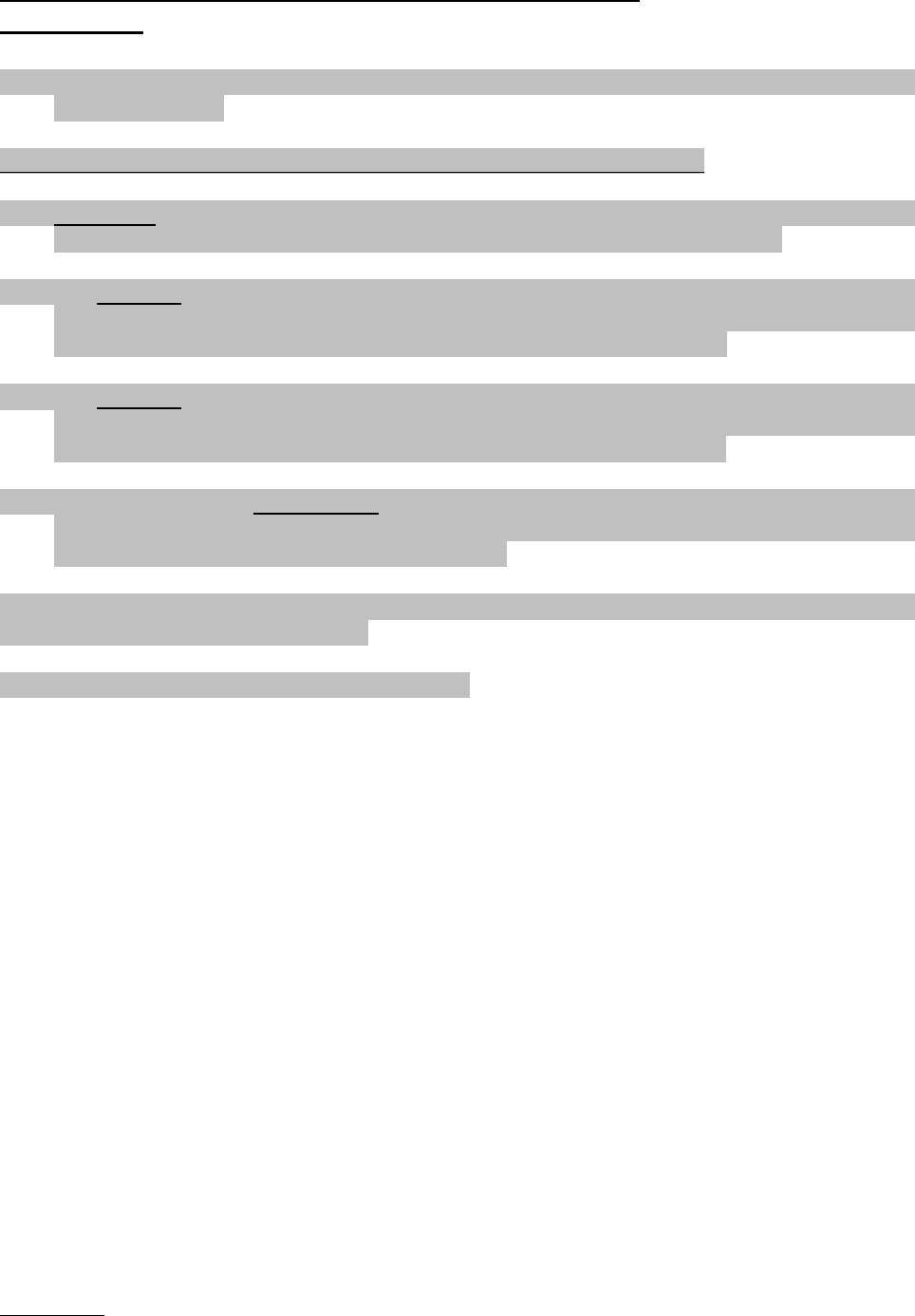

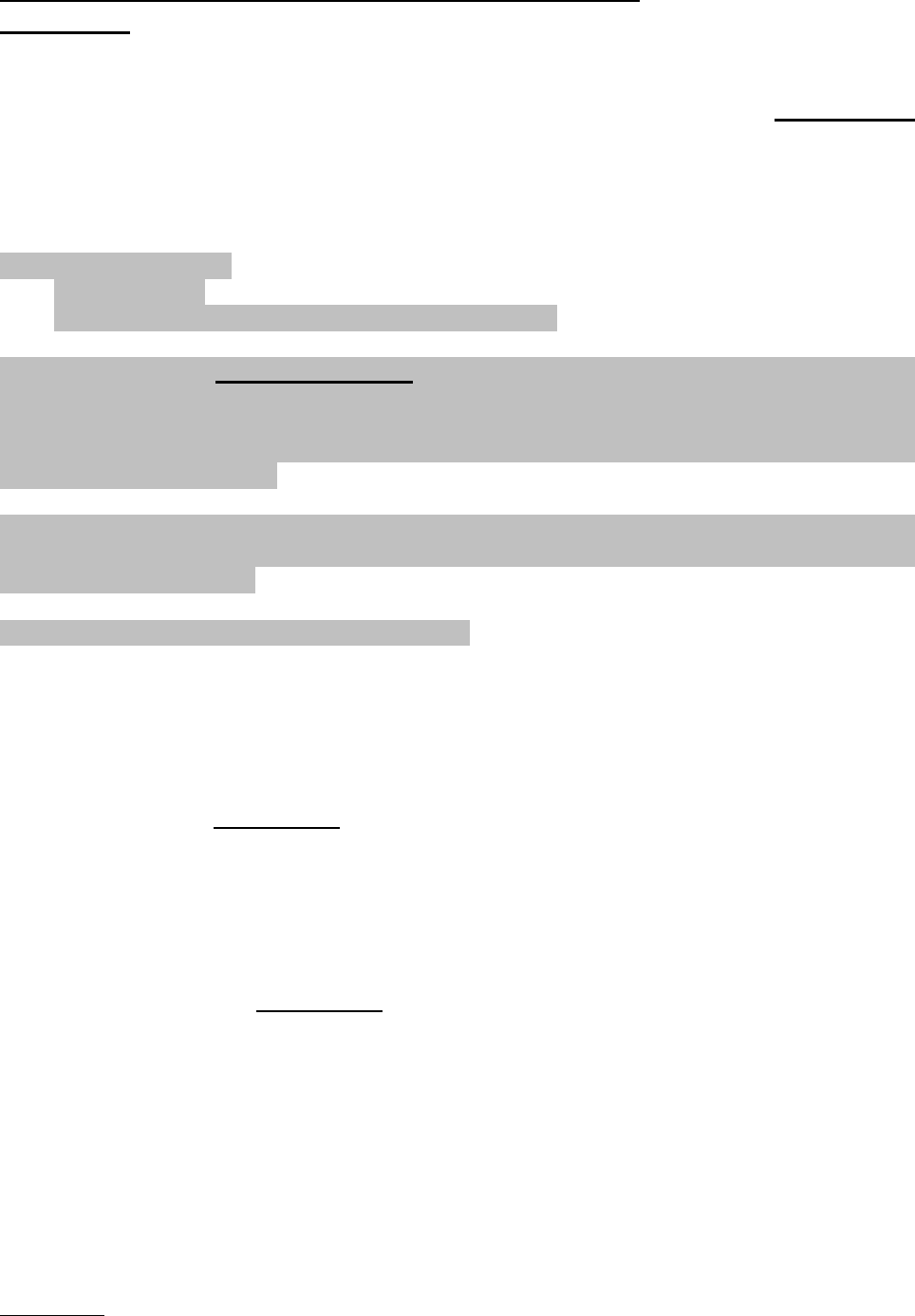

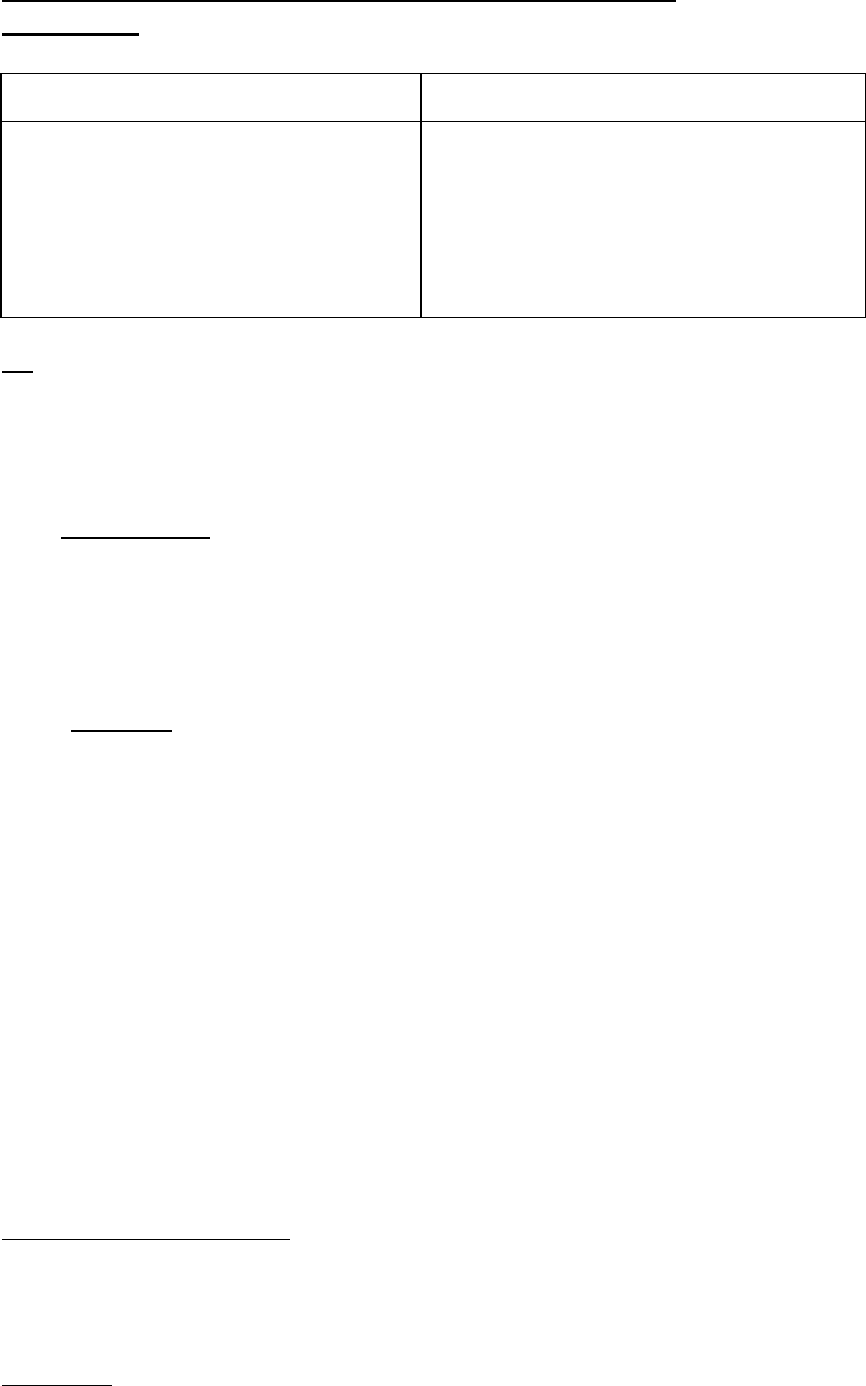

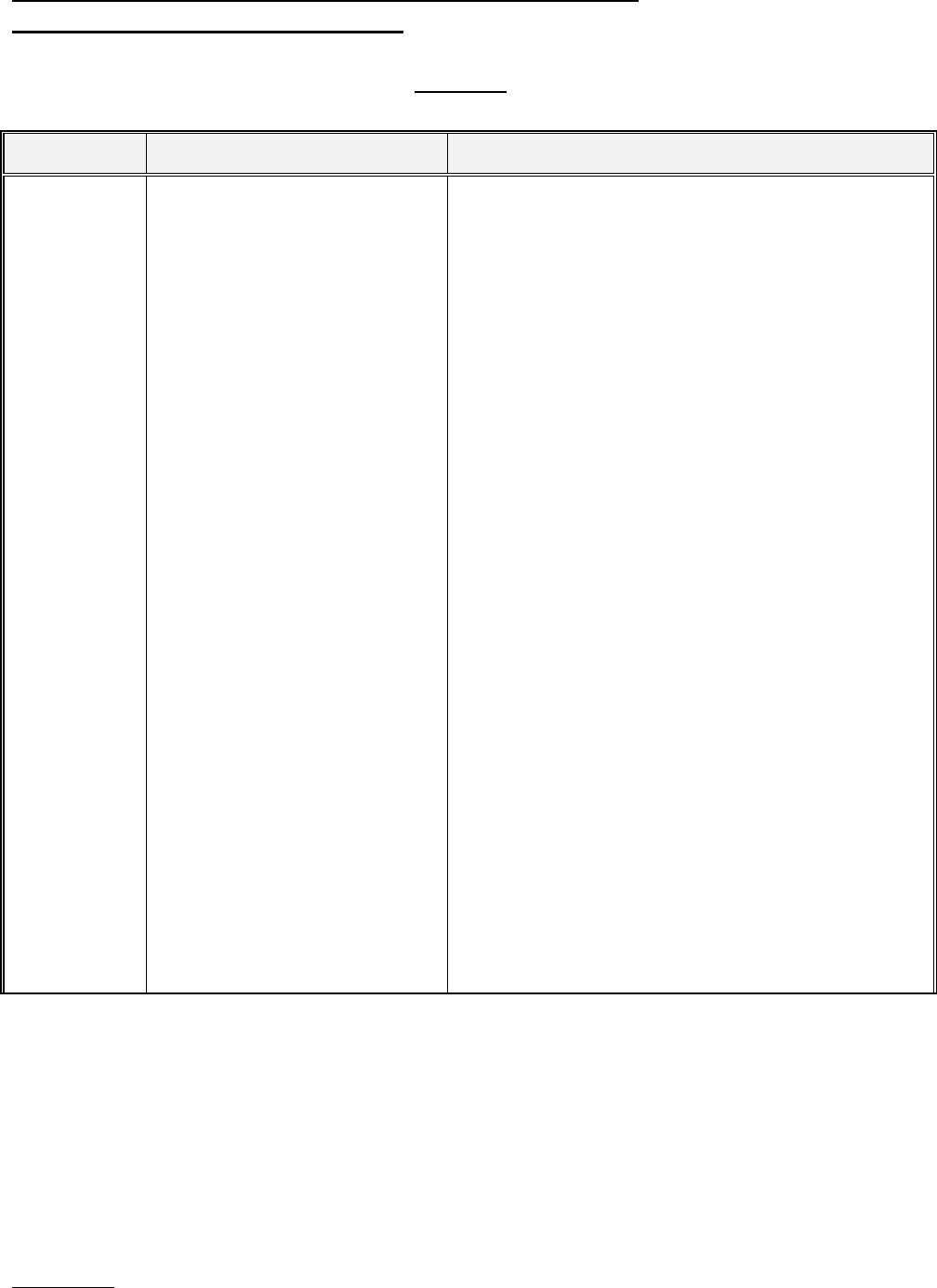

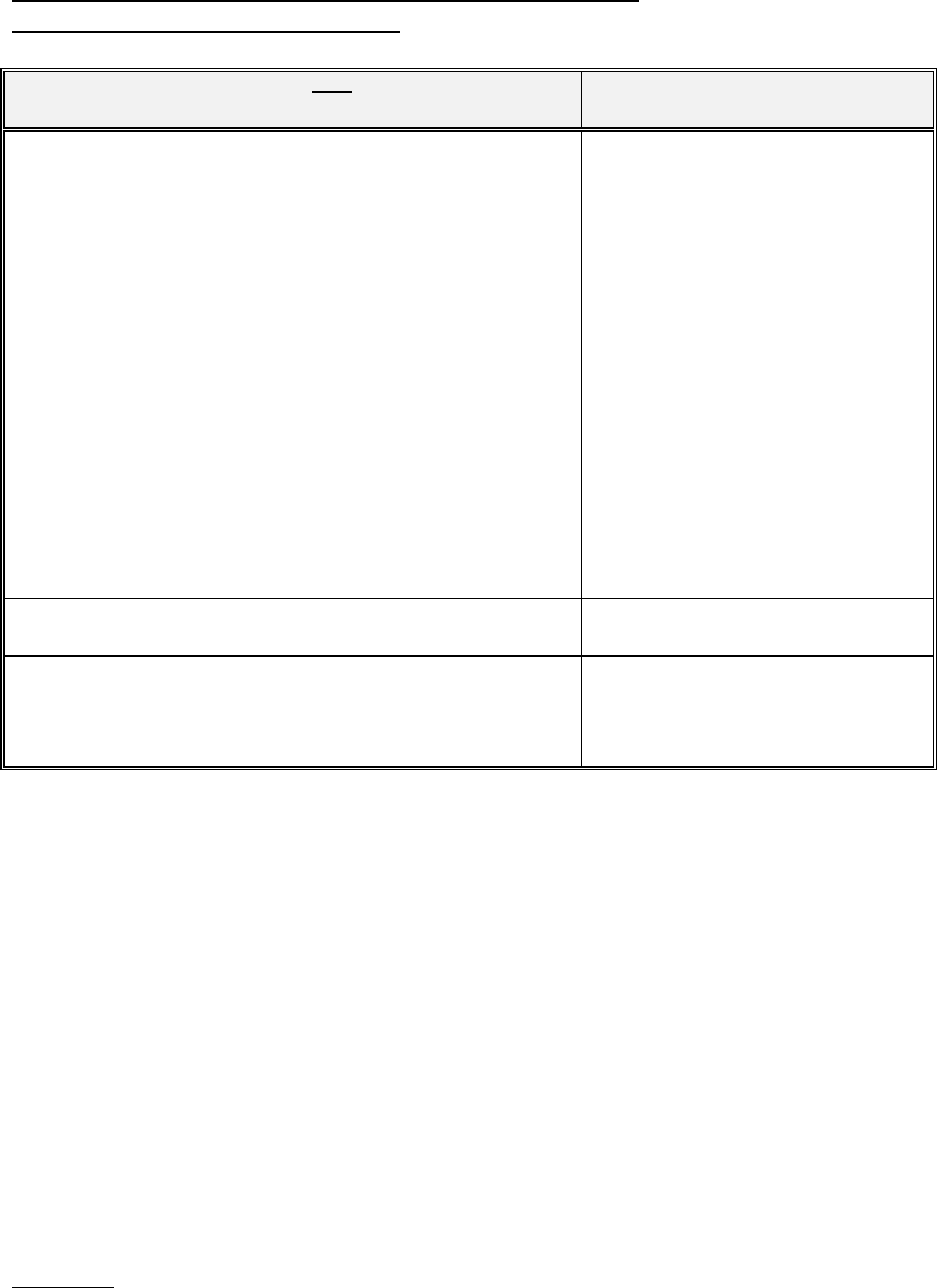

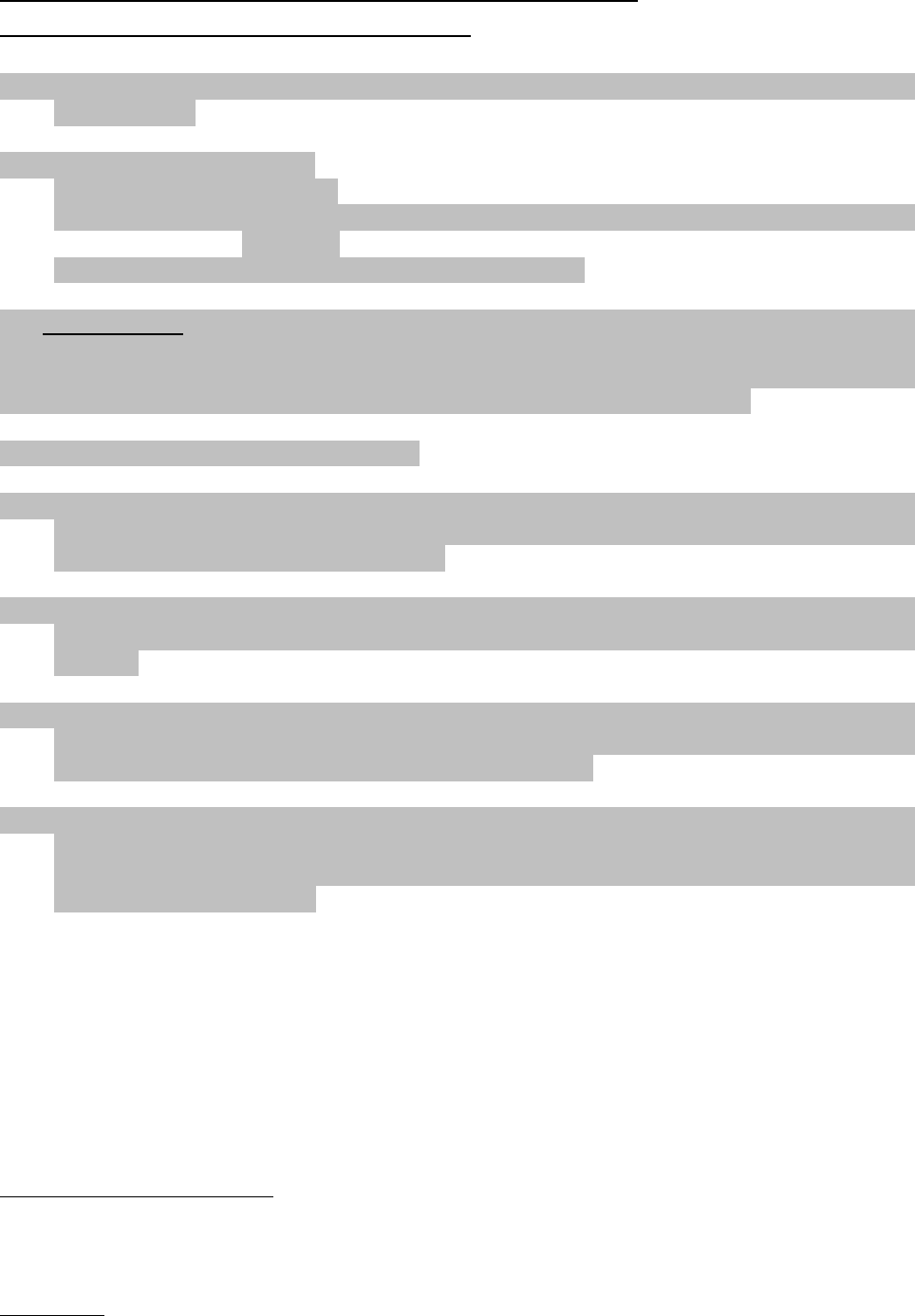

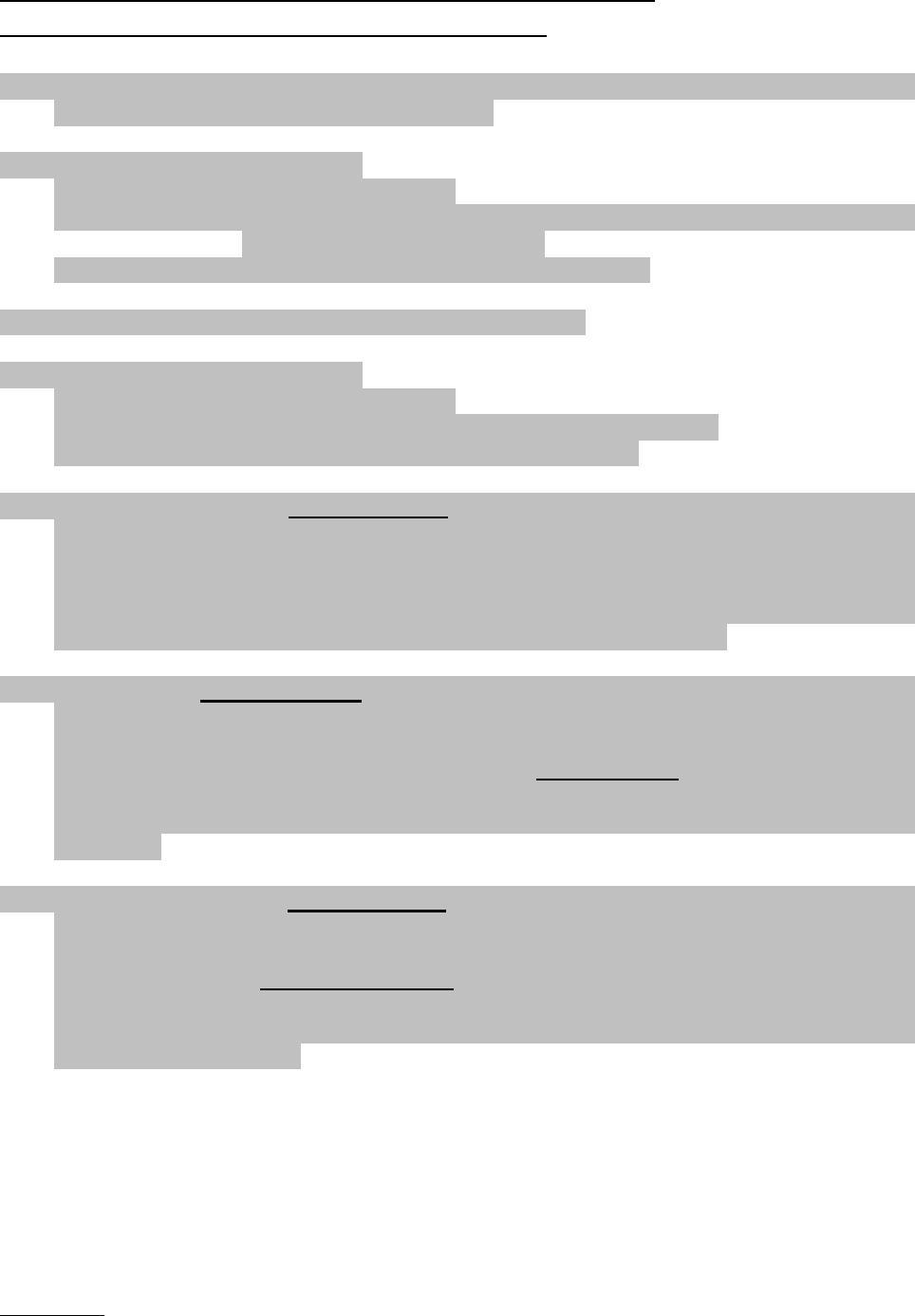

The guidance takes the form of guidelines agreed by the VAT Committee by varying majority:

unanimously, almost unanimously or by large majority.

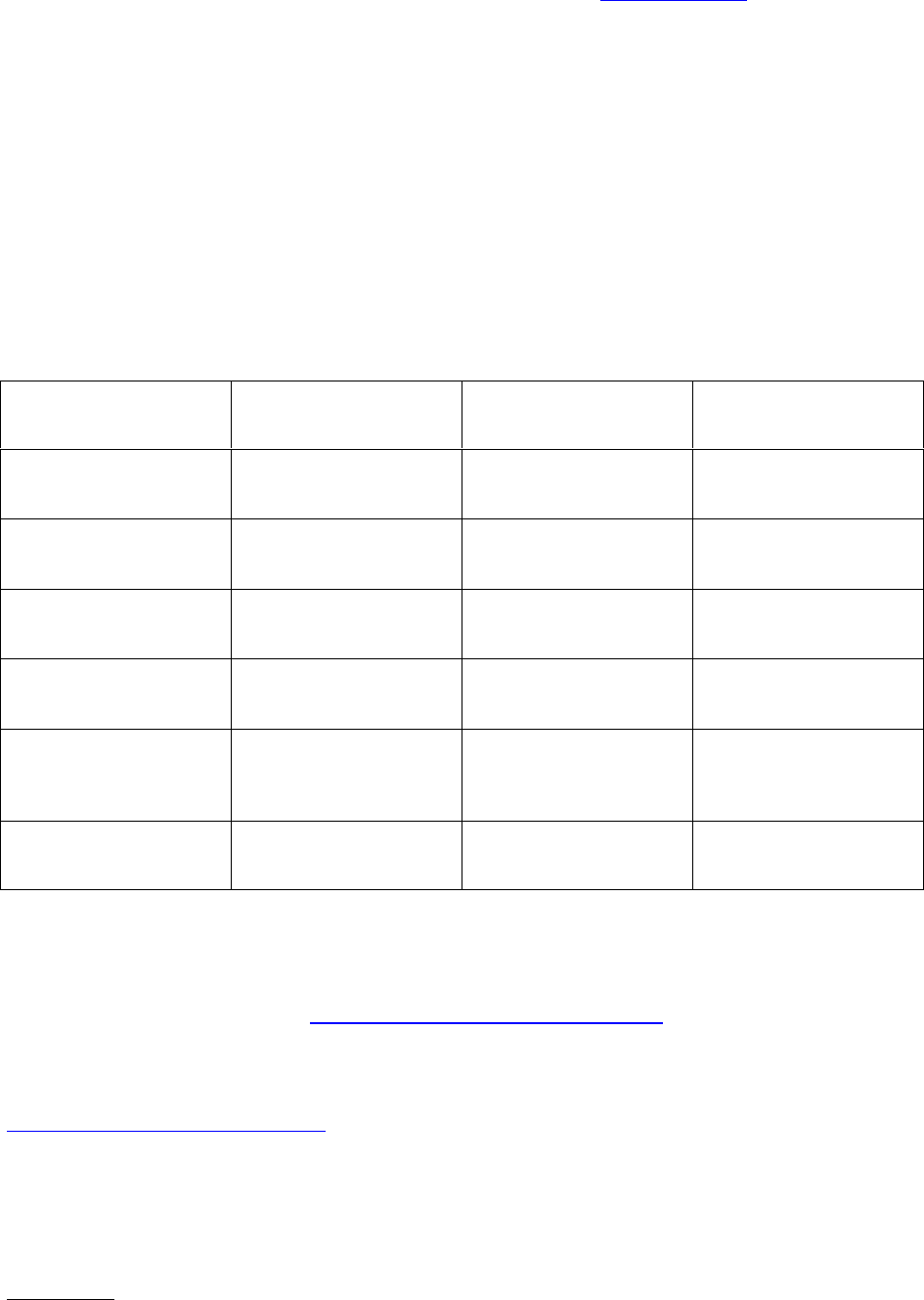

Majority is constituted as follows:

unanimously/all

almost unanimously

a large majority

→ 55

th

meeting

–

–

–

55

th

→ 75

th

meeting

15 Member States

14-13 Member States

12-10 Member States

76

th

→ 81

st

meeting

25 Member States

24-22 Member States

21-17 Member States

82

nd

→ 98

th

meeting

27 Member States

26-24 Member States

23-18 Member States

99

th

meeting → 114

th

meeting

28 Member States

27-24 Member States

23-19 Member States

115

th

meeting →

27 Member States

26-24 Member States

23-18 Member States

Guidelines agreed result from the discussion of a specific issue raised before the VAT Committee

but do not necessarily cover all aspects of the issue mentioned by the heading. Discussion is

conducted on the basis of documents prepared by the Commission services. Since 2013, all

documents are published on the Public Documents Repository – VAT.

Some guidelines have been transformed into legally binding implementing measures based on the

procedure laid down in Article 397 of the VAT Directive. Those measures can be found in the

VAT Implementing Regulation (Council Implementing Regulation (EU) No 282/2011 of

15 March 2011).

ATTENTION: Please bear in mind that guidelines issued by the VAT Committee are merely views of

a consultative committee. They do not constitute an official interpretation of EU law and do not

necessarily have the agreement of the European Commission. They do not bind the European

Commission or the Member States who are free not to follow them.

Reproduction of this document is subject to mentioning this Caveat.

3

Certain guidelines may have been overtaken by time. As some date back quite many years, they

can have been rendered obsolete by one or the other event (legislation, case-law ...). They should

therefore be taken with all the necessary precaution.

ATTENTION: Please bear in mind that guidelines issued by the VAT Committee are merely views of

a consultative committee. They do not constitute an official interpretation of EU law and do not

necessarily have the agreement of the European Commission. They do not bind the European

Commission or the Member States who are free not to follow them.

Reproduction of this document is subject to mentioning this Caveat.

4

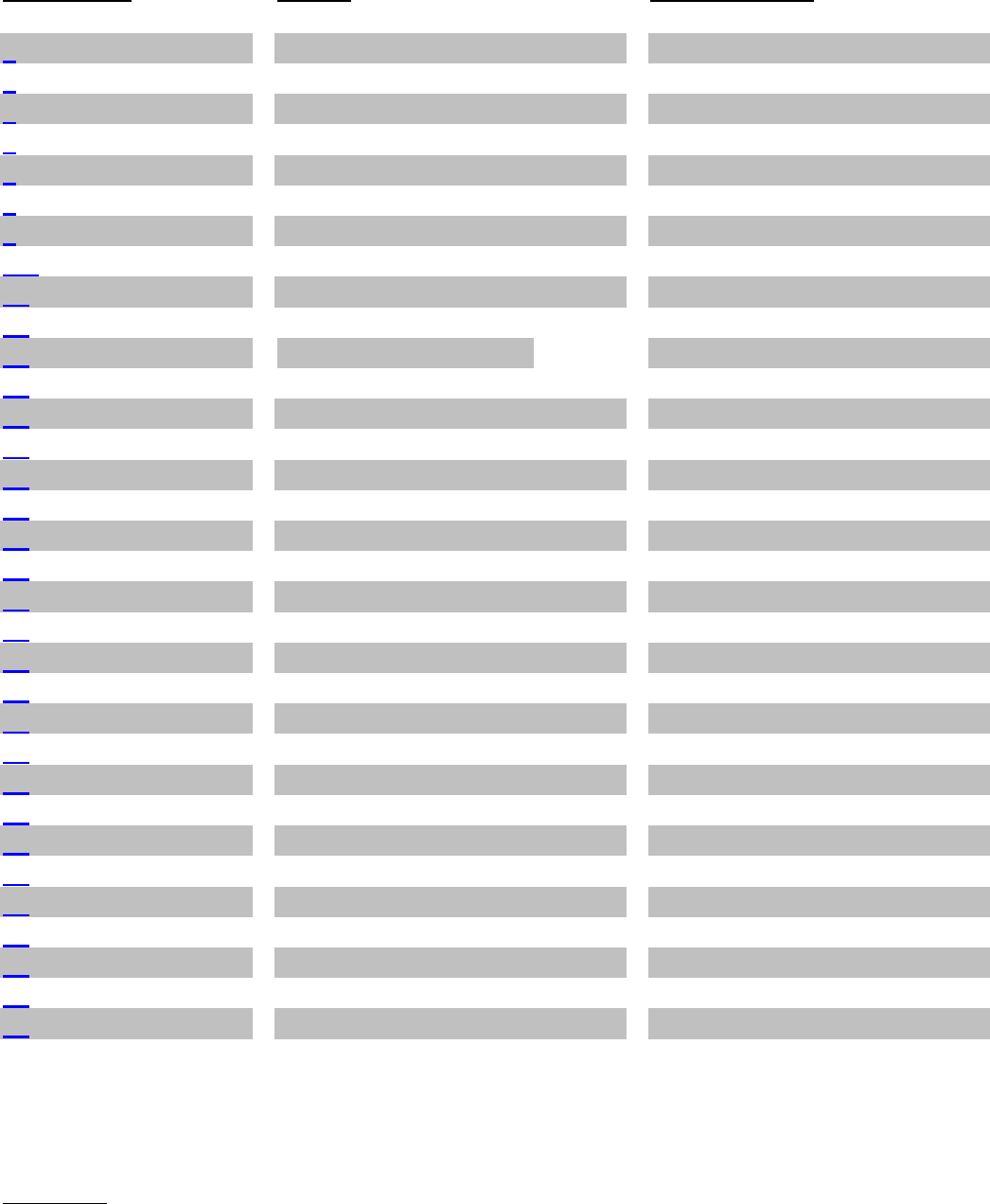

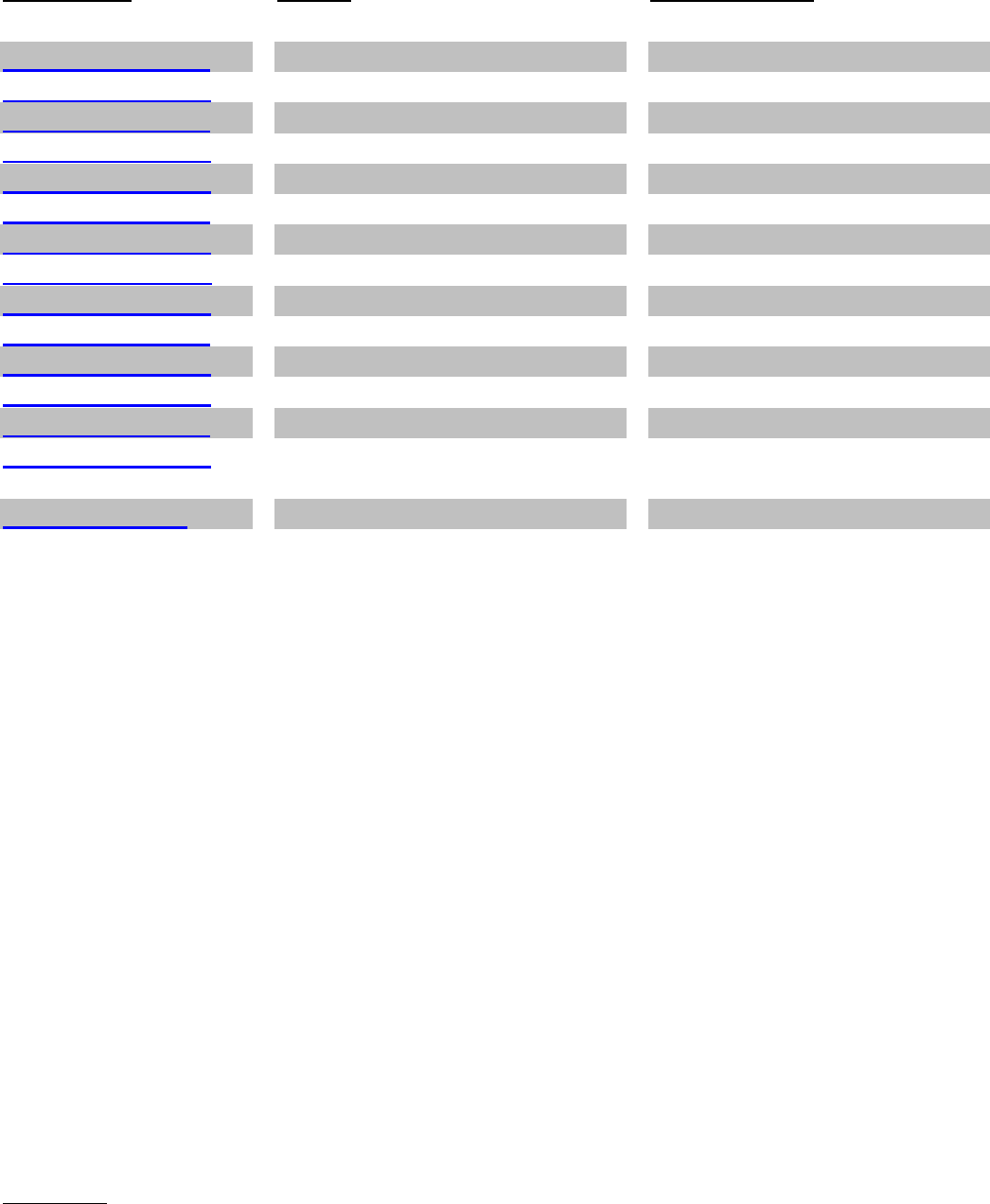

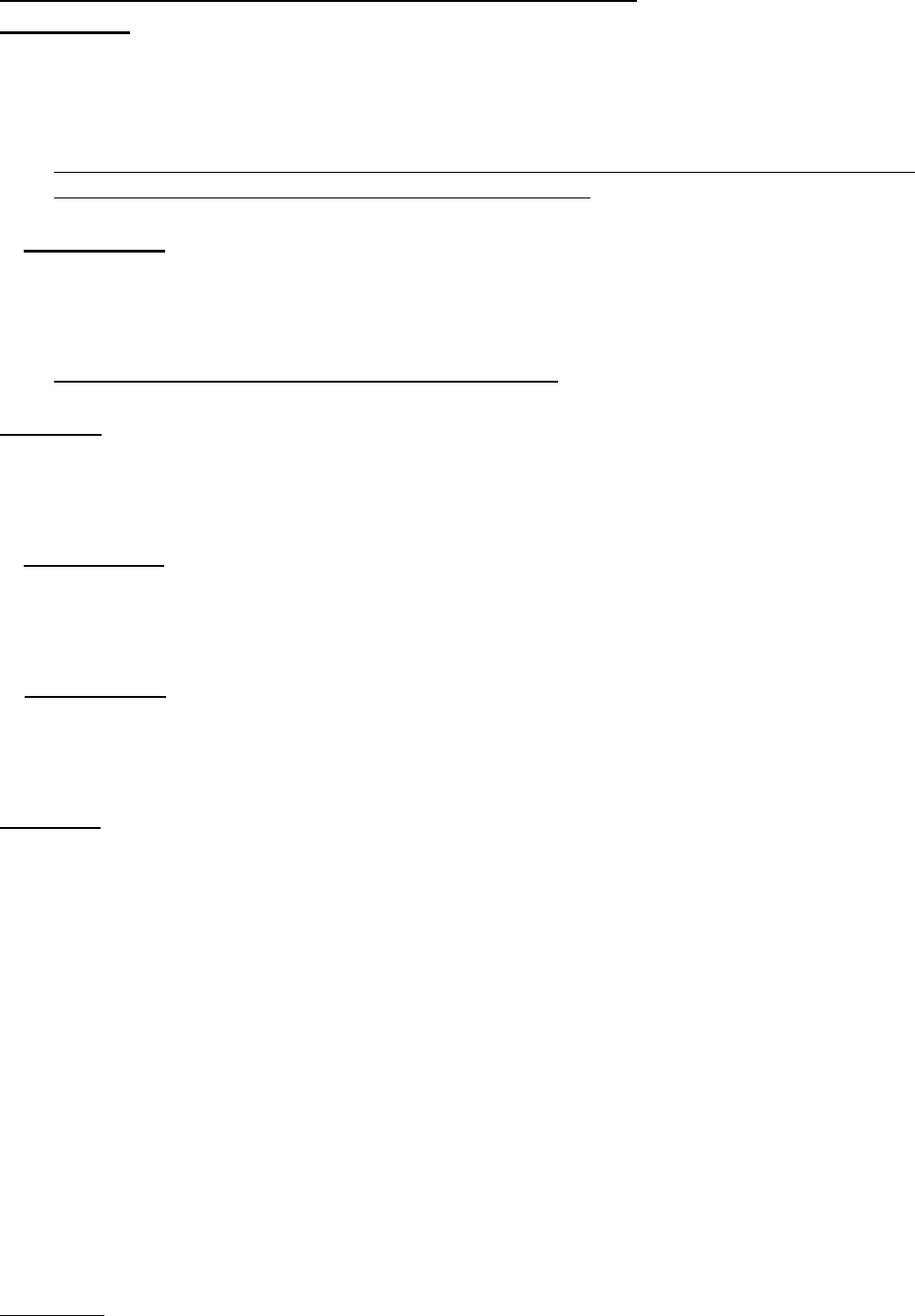

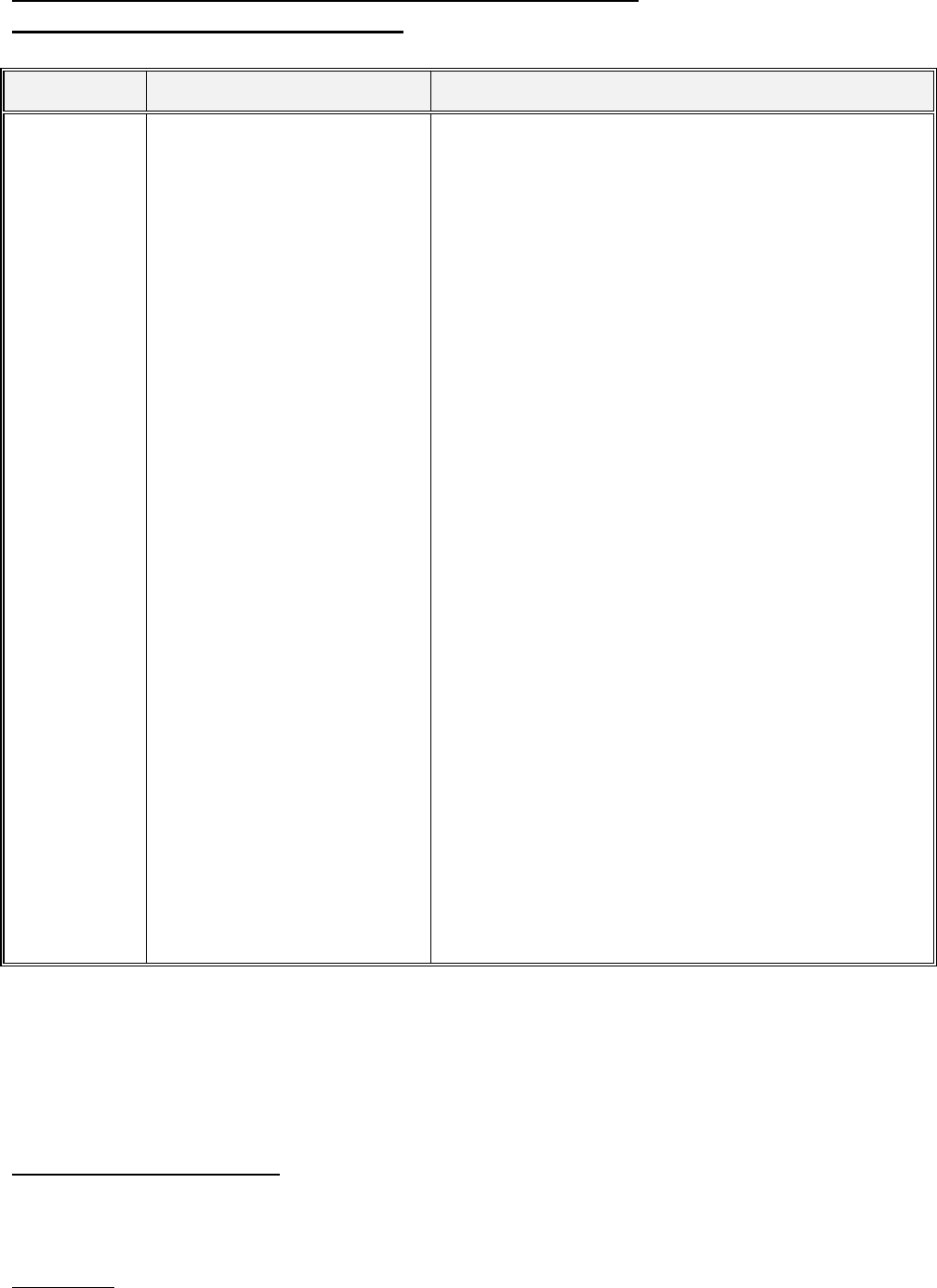

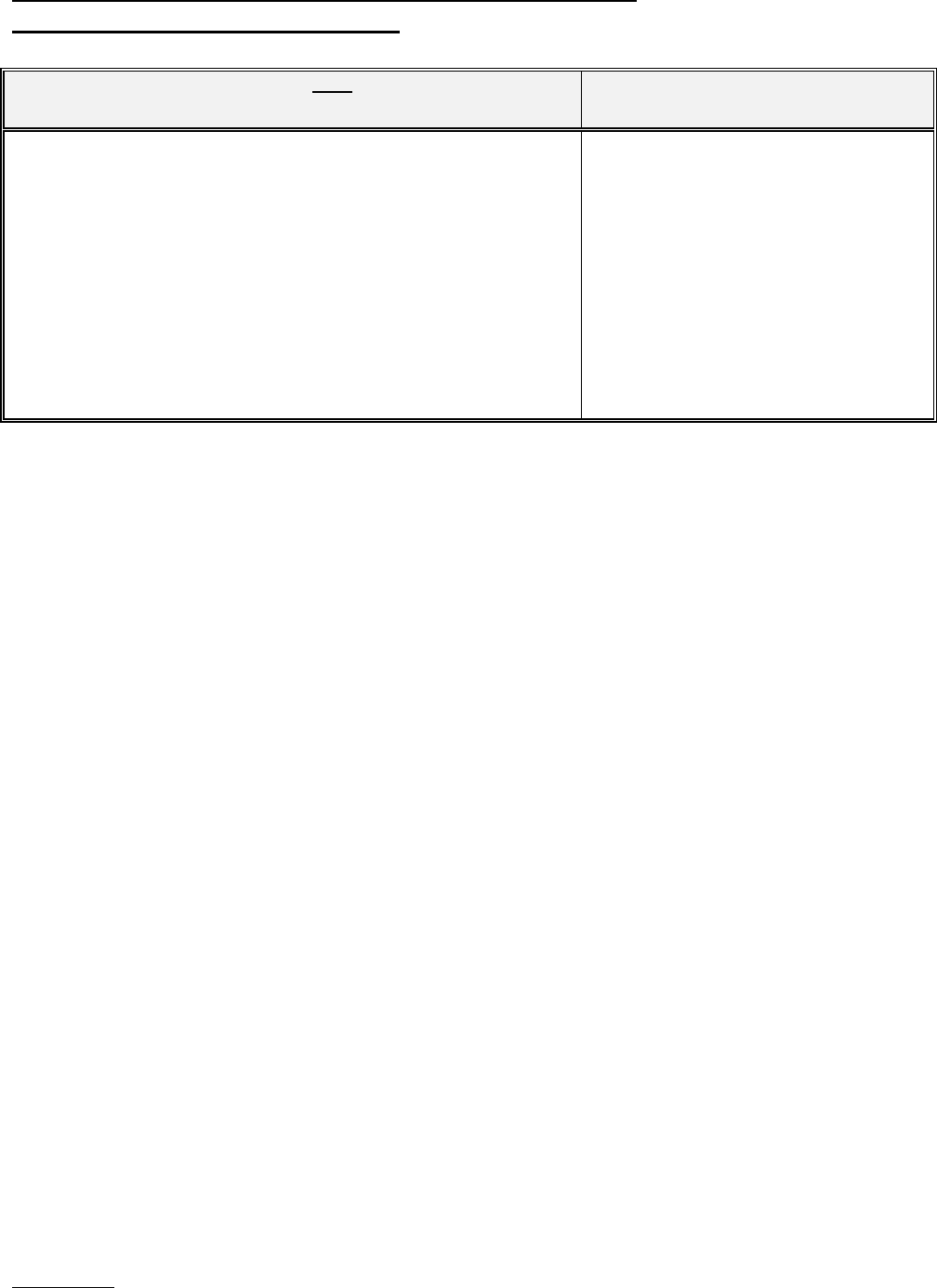

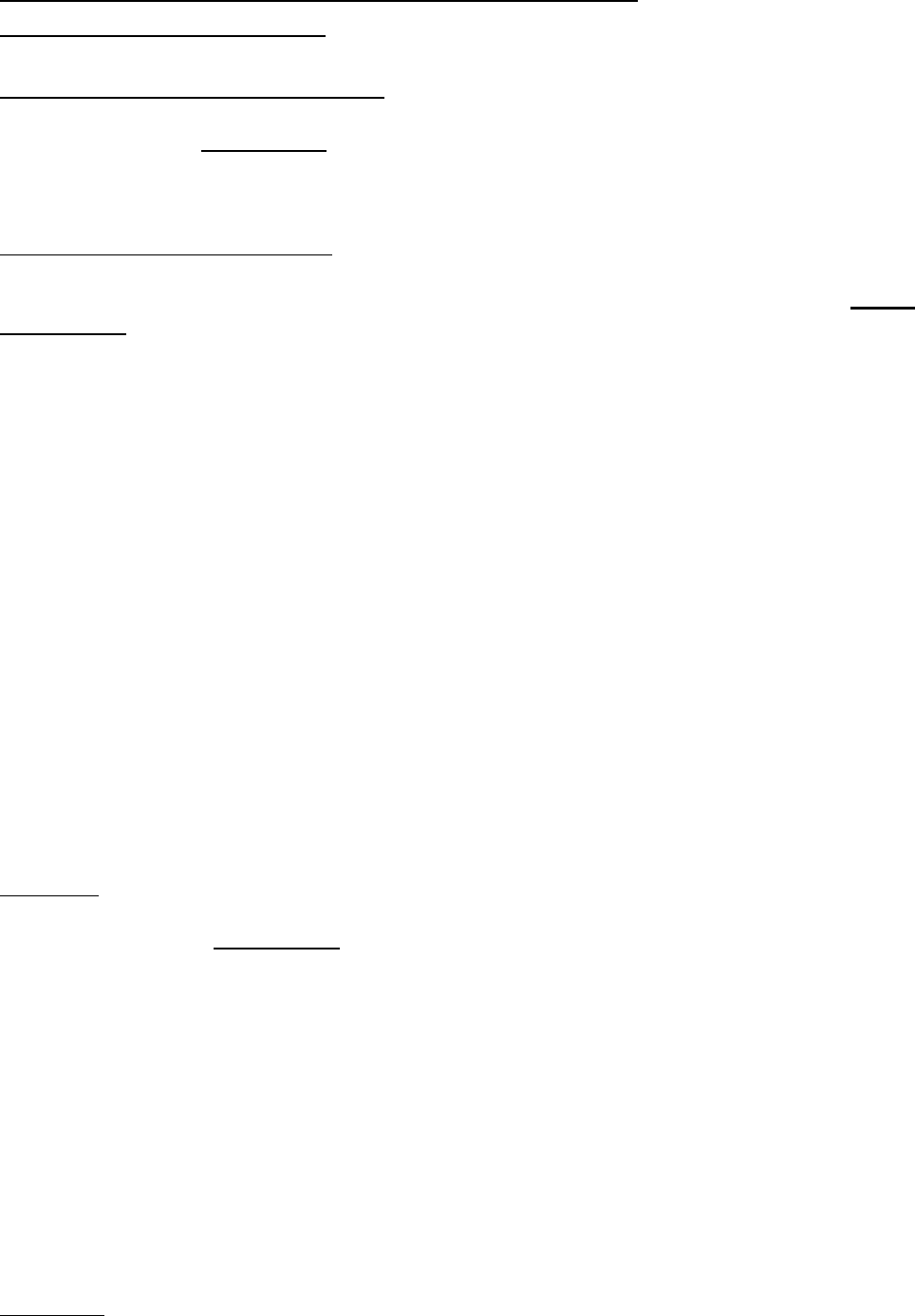

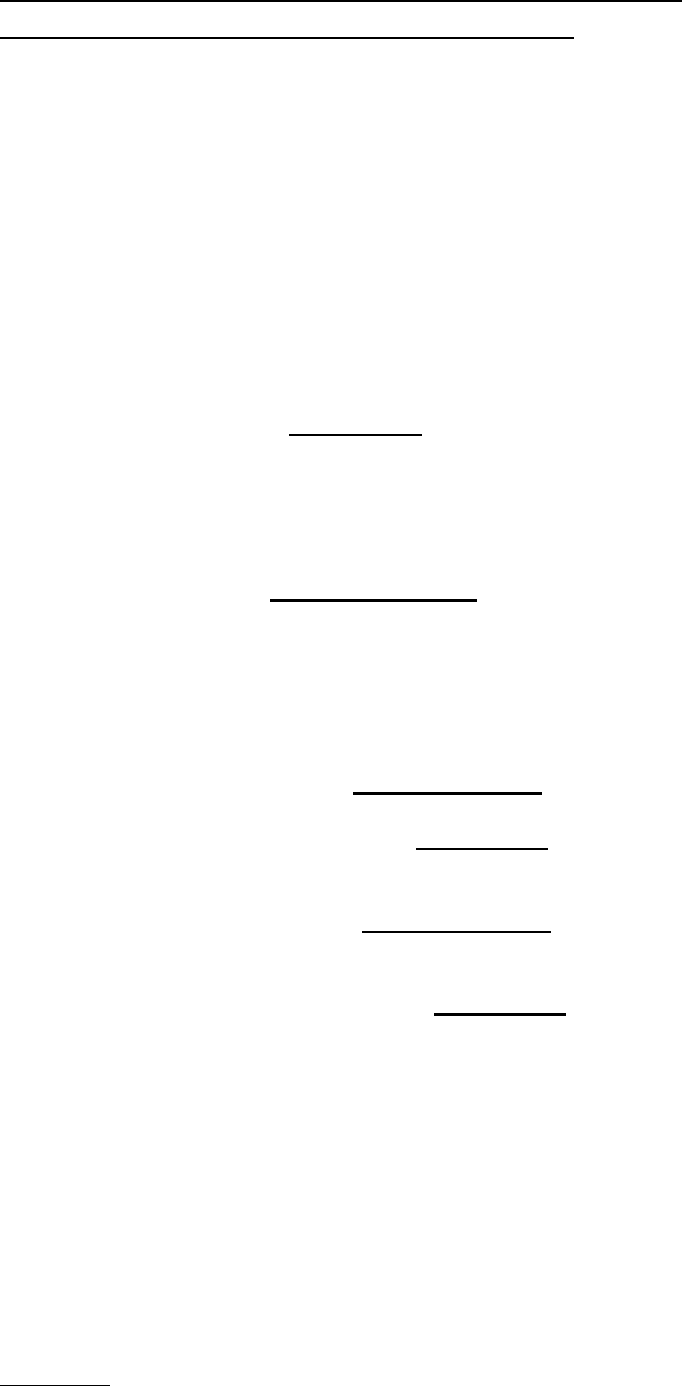

MEETING

1

2

3

4

5

6

7

8-9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

34

38

CONTENTS (1/6)

DATE

23-24 November 1977

13-14 June 1978

28 June 1978

9-10 November 1978

14-15 June 1979

9-10 January 1980

4-5 March 1980

6-7 May and 4 June 1980

23-24 October 1980

10-11 March 1981

30 June and 1 July 1981

15-16 December 1981

23-24 June 1982

8-9 December 1983

30 November-1 December 1983

4-5 July 1984

8-9 March 1985

12 November 1985

4-5 June 1986

12-13 December 1986

19-20 March 1987

1-2 February 1988

14-15 November 1989

10-11 April 1989

13 July 1989

11-12 December 1989

9-10 July 1990

17-18 December 1990

13-14 May 1991

27-28 January 1992

25 February 1992

23-24 November 1992

25 May 1993

REFERENCE

XV/27/78

XV/227/78

XV/226/78

XV/339/78

XV/196/79

XV/9/80

XV/85/80

XV/205/80

XV/353/80

XV/79/81

XV/182/81

XV/37/82

XV/150/82

XV/38/83

XV/40/84

XV/234/84

XV/199/85

XV/32/86

XXI/1072/86

XXI/108/87

XXI/889/87

XXI/632/88

XXI/1653/88

XXI/652/89

XXI/1113/89

XXI/370/90

XXI/1334/90

XXI/385/91

XXI/1324/91

XXI/732/92

XXI/733/92

XXI/157/93

XXI/1084/963

ATTENTION: Please bear in mind that guidelines issued by the VAT Committee are merely views of

a consultative committee. They do not constitute an official interpretation of EU law and do not

necessarily have the agreement of the European Commission. They do not bind the European

Commission or the Member States who are free not to follow them.

Reproduction of this document is subject to mentioning this Caveat.

5

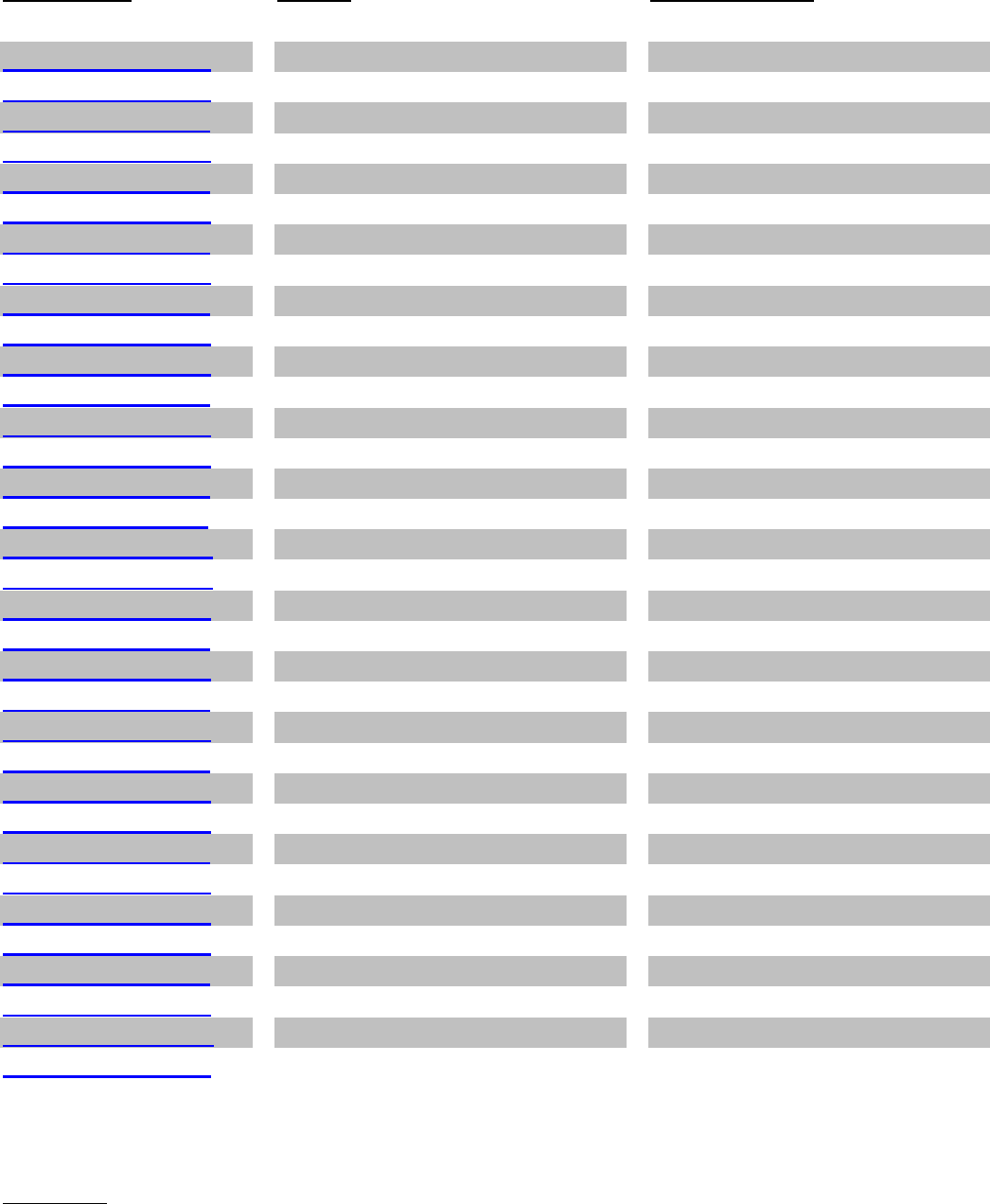

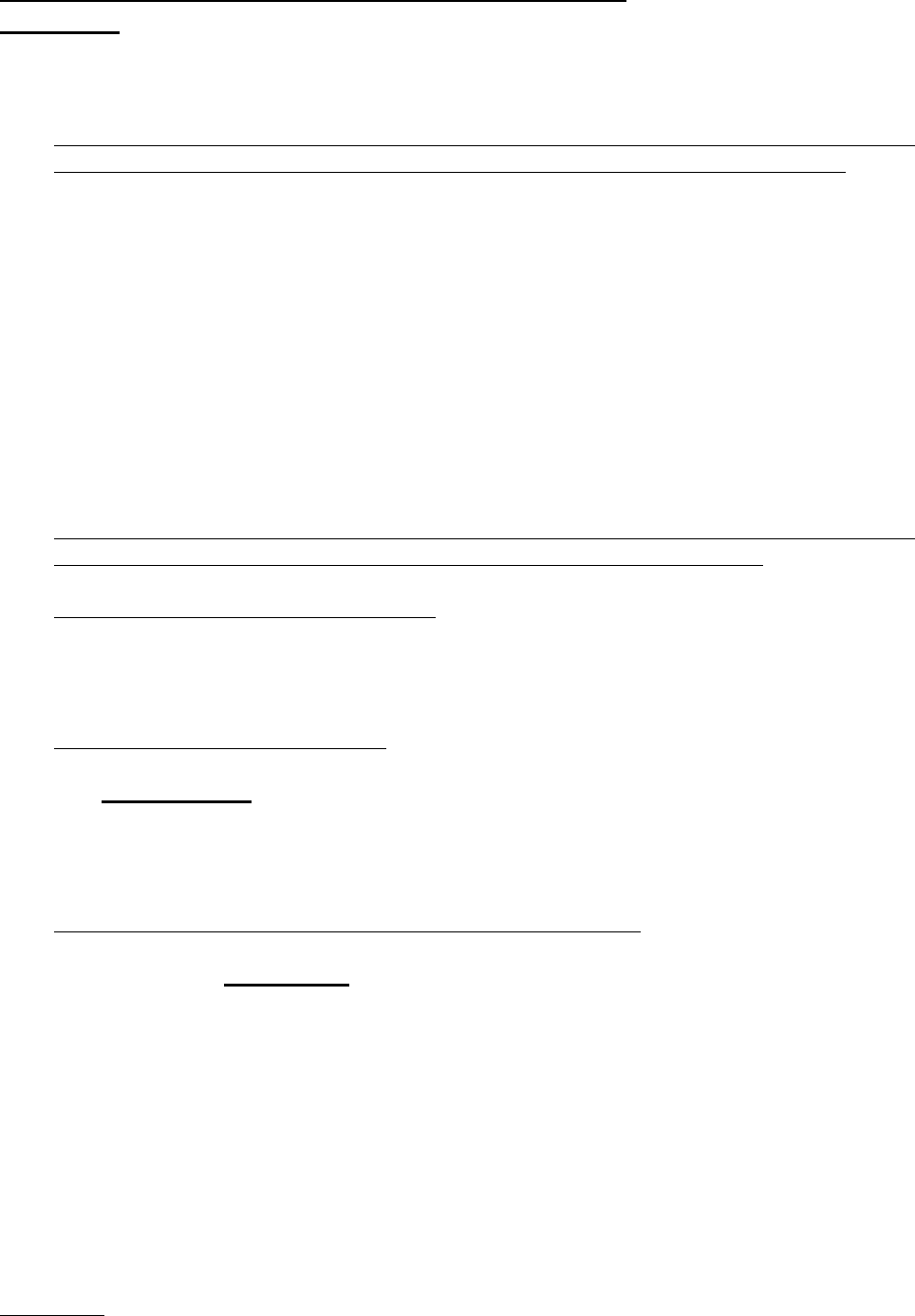

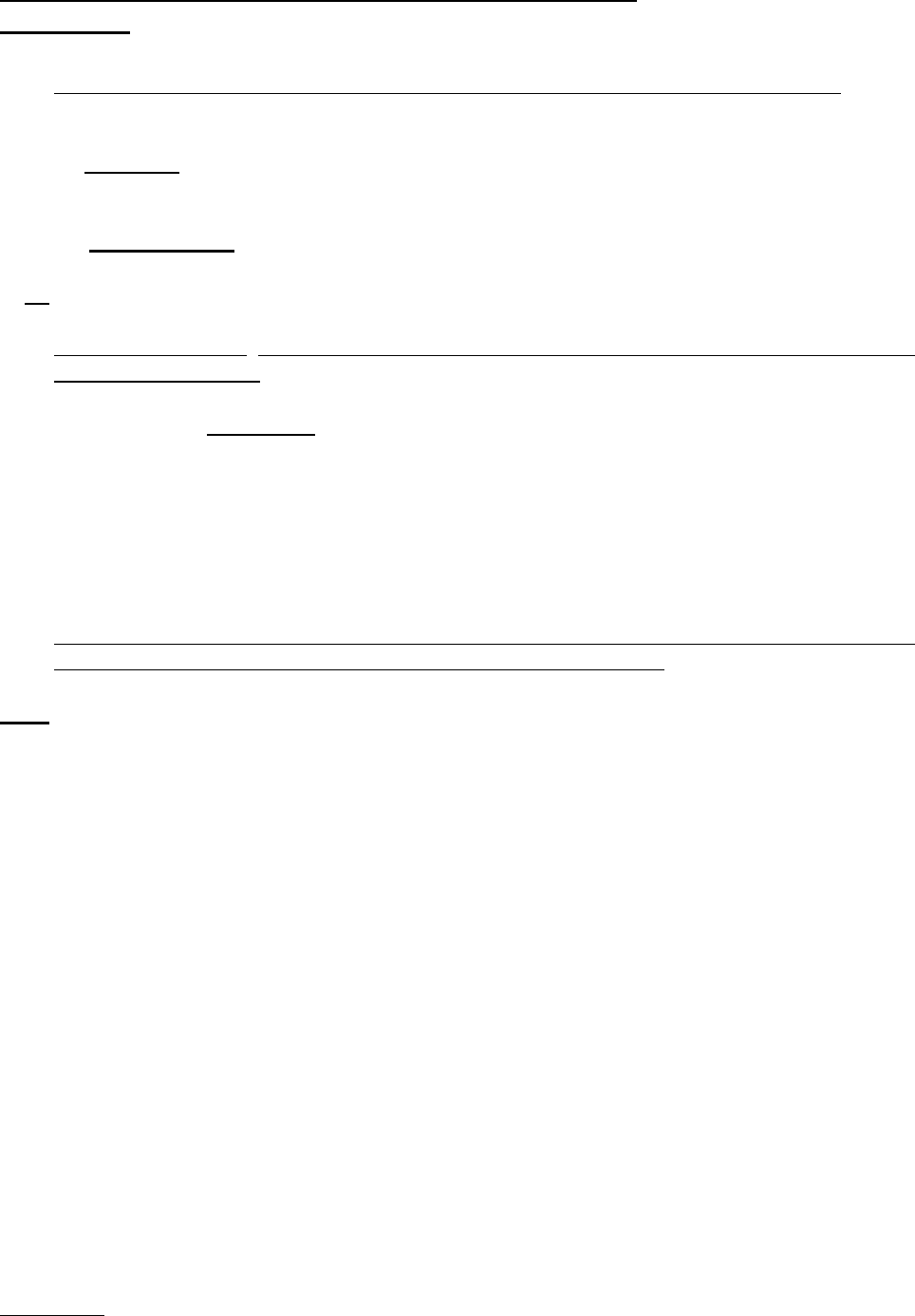

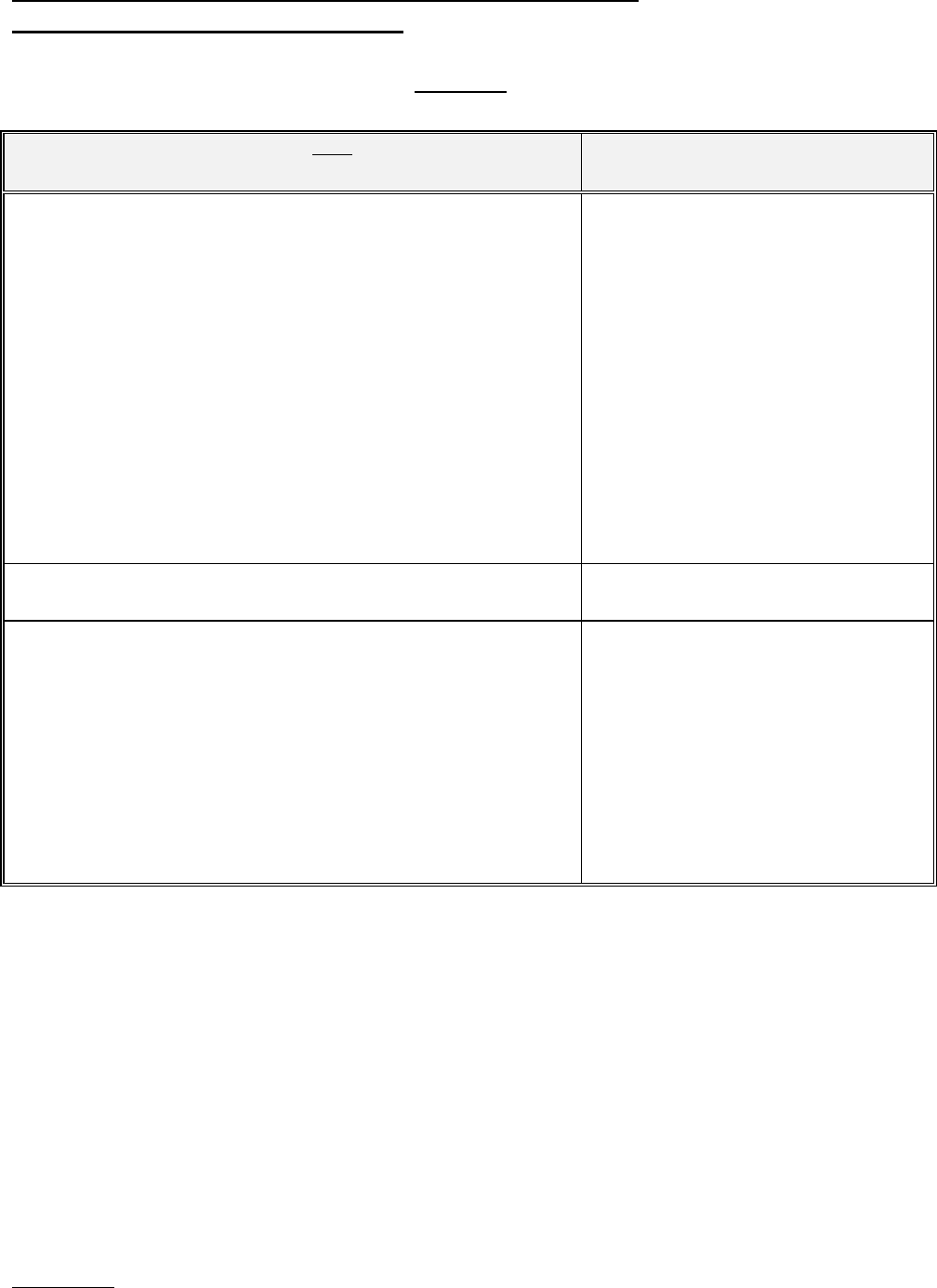

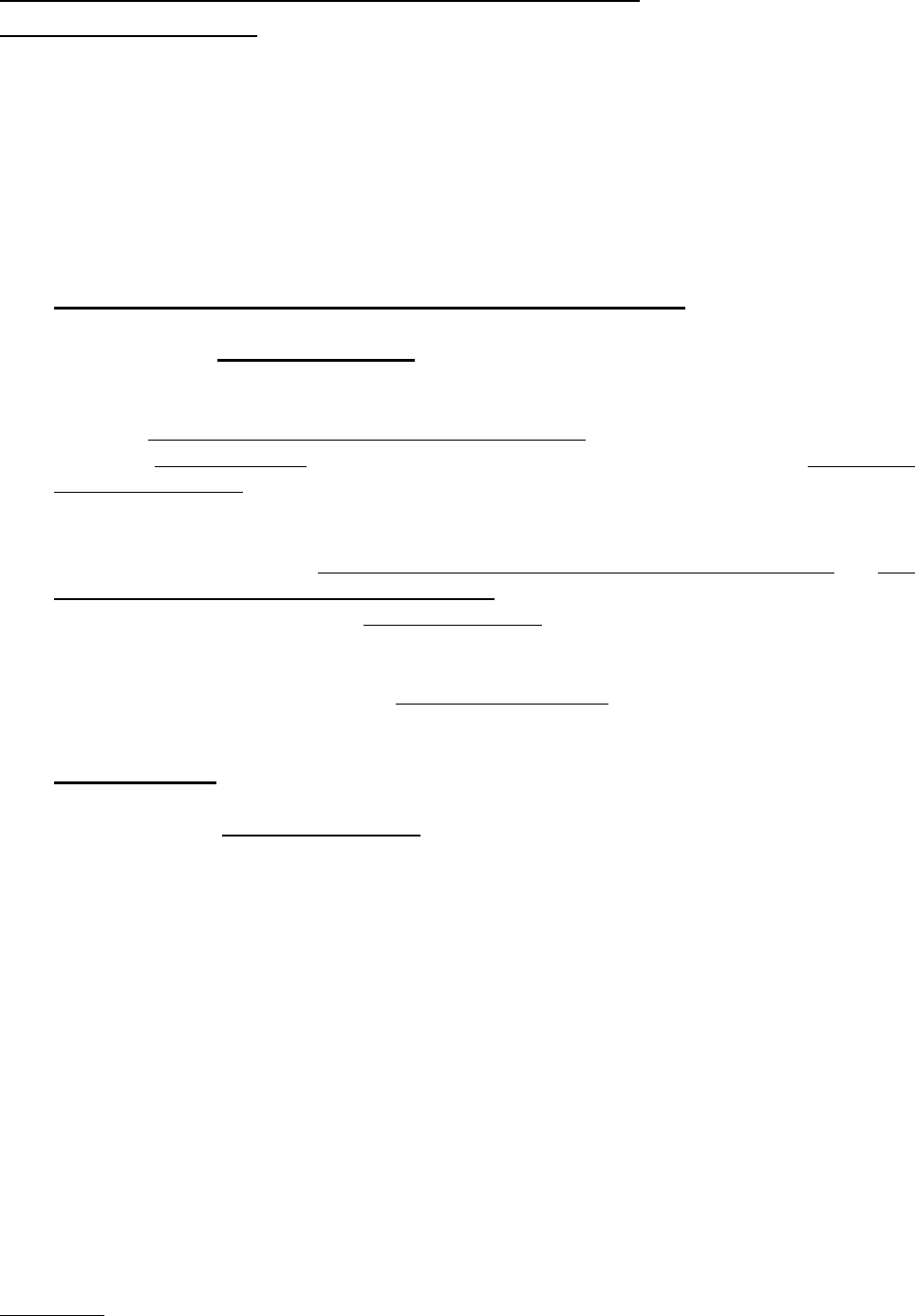

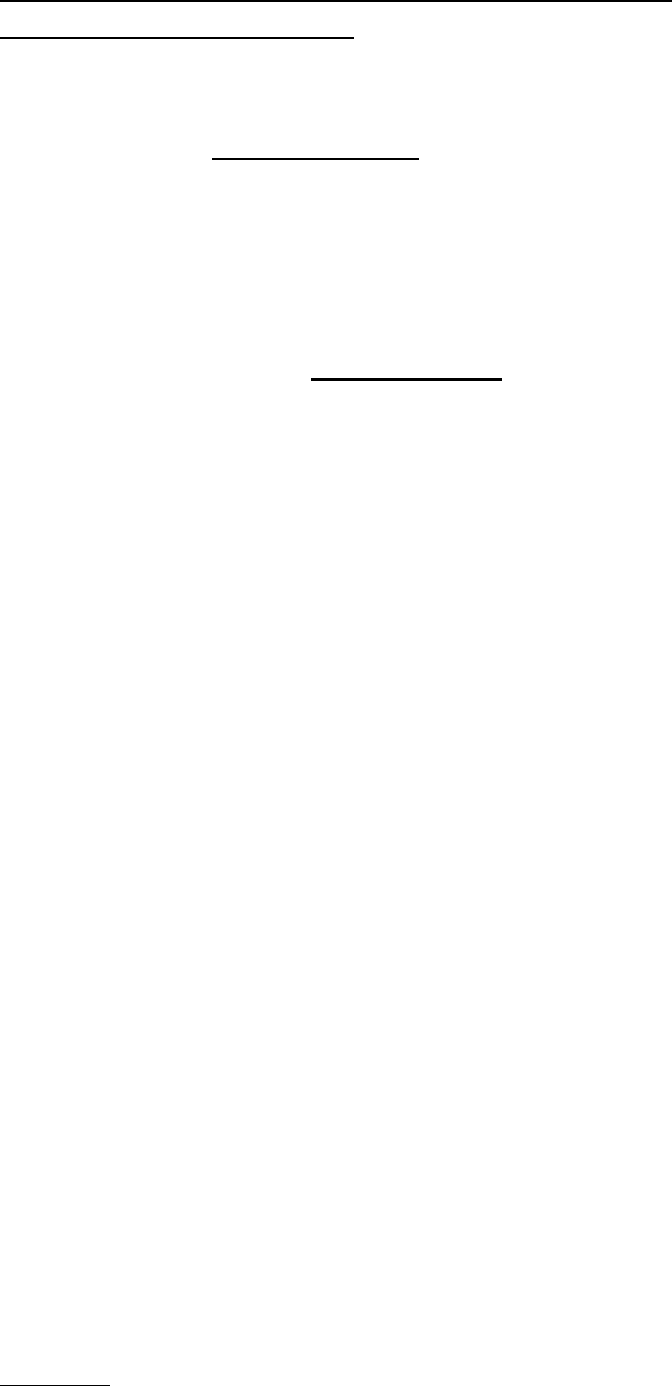

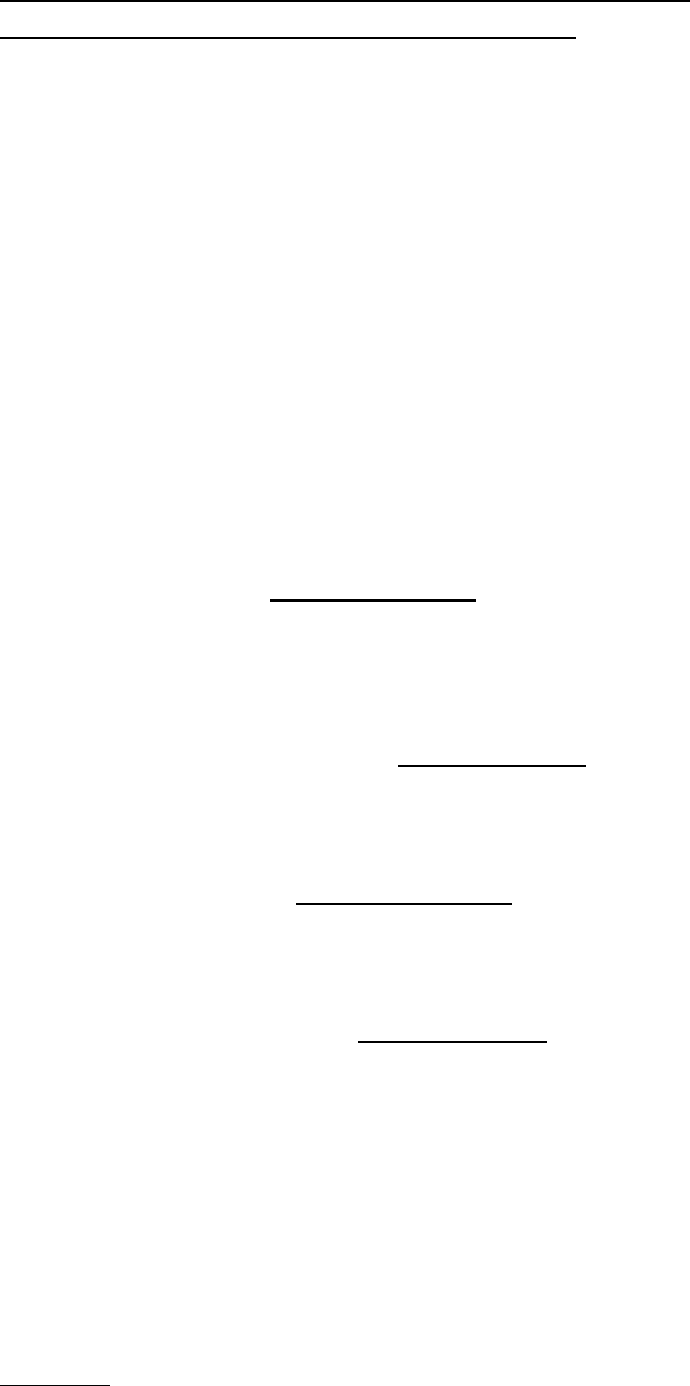

MEETING

39

41

43

44

45

46

47

48

49

50

51

52

53

54

56

57

58

60

61

62

63

64

65

67 – Document A

67 – Document B

69 – Document C

70

75

80

83 – Document A

83 – Document B

86

87

CONTENTS (2/6)

DATE

5-6 July 1993

28 February-1 March 1994

23 November 1994

23 January 1995

25-26 April 1995

16 October 1995

11-12 March 1996

25 June and 8 July 1996

8-9 October 1996

7 November 1996

13 March 1997

28-29 May 1997

4-5 November 1997

16-18 February 1998

13-14 October 1998

16-17 December 1998

23 June 1999

20-21 March 2000

27 June 2000

14 November 2000

17 July 2001

20 March 2002

19 June 2002

8 January 2003

8 January 2003

4 June 2003

25 September 2003

14 October 2004

8 November 2006

28-29 February 2008

28-29 February 2008

18-19 March 2009

22 April 2009

REFERENCE

XXI/1352/93

XXI/711/94

XXI/567/95

XXI/340/95

XXI/95/1.269

XXI/96/0.218

XXI/96/1.279

XXI/97/177

XXI/97/178

XXI/97/870

XXI//97/871

XXI/97/1.566

XXI/97/2.454

XXI/98/881

XXI/98/1871

XXI/99/641

XXI/99/2006

TAXUD/1876/2000

TAXUD/1934/00

TAXUD/2306/01

TAXUD/2441/01

TAXUD/2352/02

TAXUD/2390/02

TAXUD/2303/03

TAXUD/2304/03

390 – TAXUD/2337/03

428 – TAXUD/2426/03

480 – TAXUD/1607/05

542 – TAXUD/2109/07

569 – TAXUD/2420/08

573 – TAXUD/2421/08

614 – taxud.d.1(2009)357988

615 – TAXUD/2423/09

ATTENTION: Please bear in mind that guidelines issued by the VAT Committee are merely views of

a consultative committee. They do not constitute an official interpretation of EU law and do not

necessarily have the agreement of the European Commission. They do not bind the European

Commission or the Member States who are free not to follow them.

Reproduction of this document is subject to mentioning this Caveat.

6

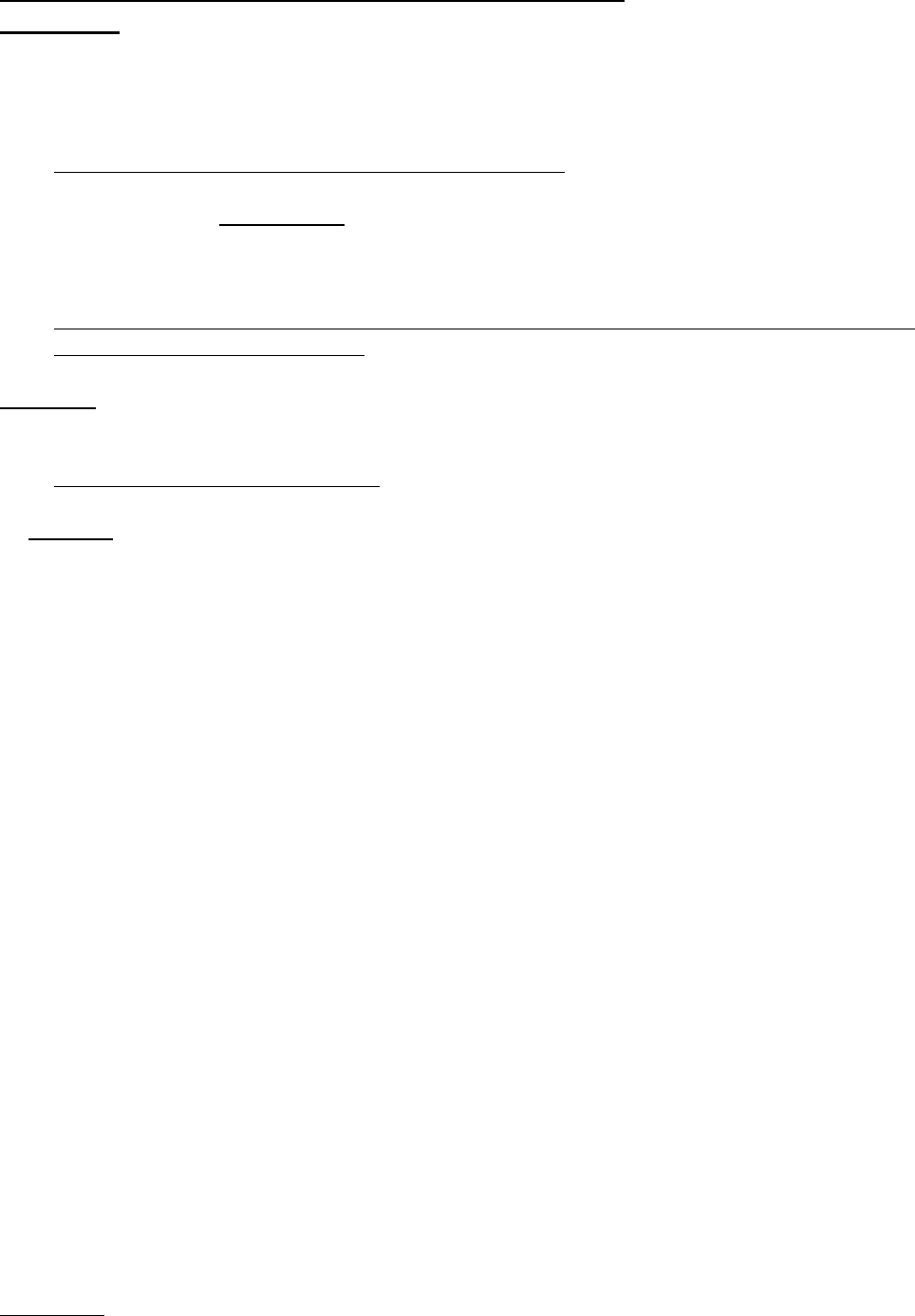

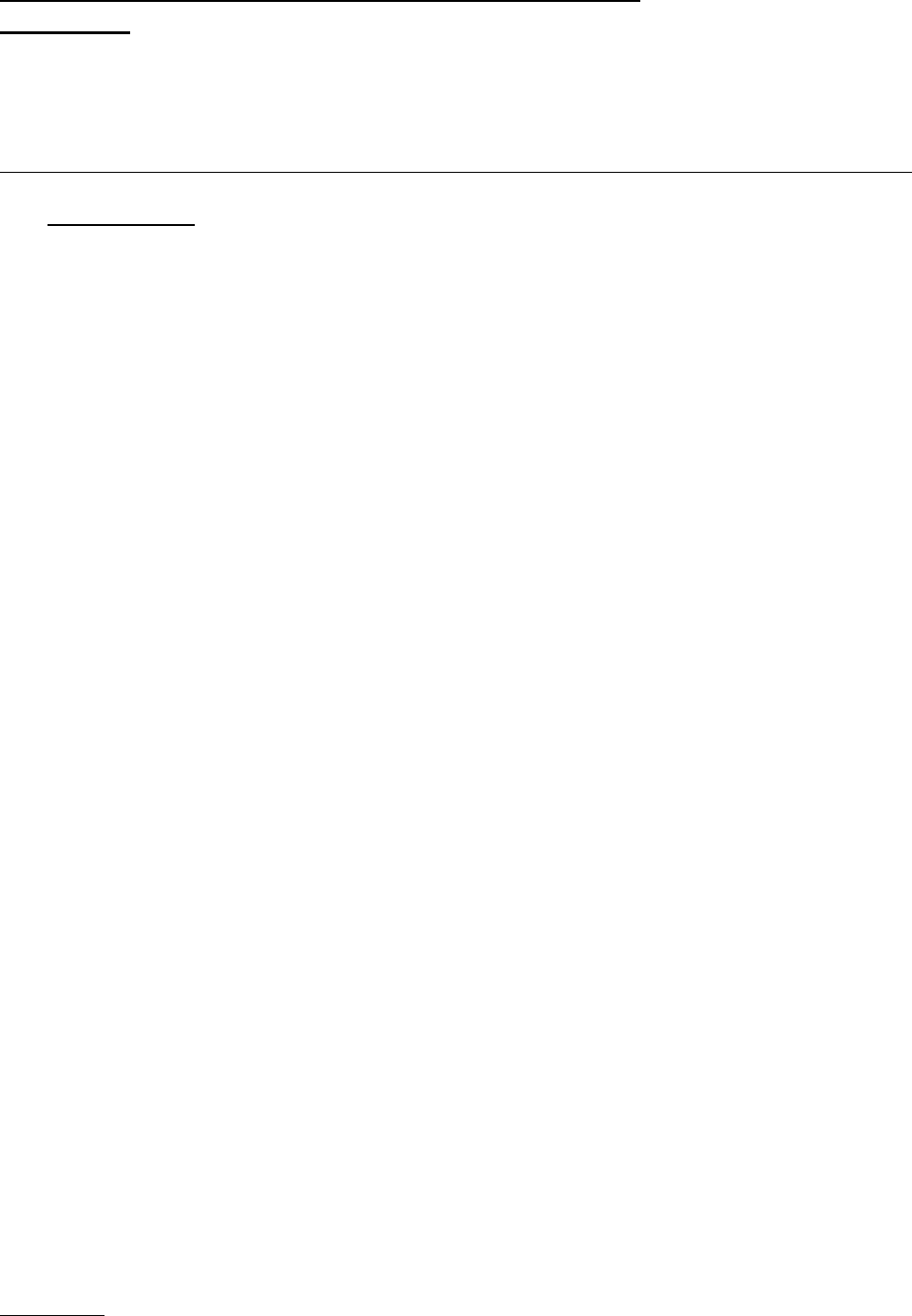

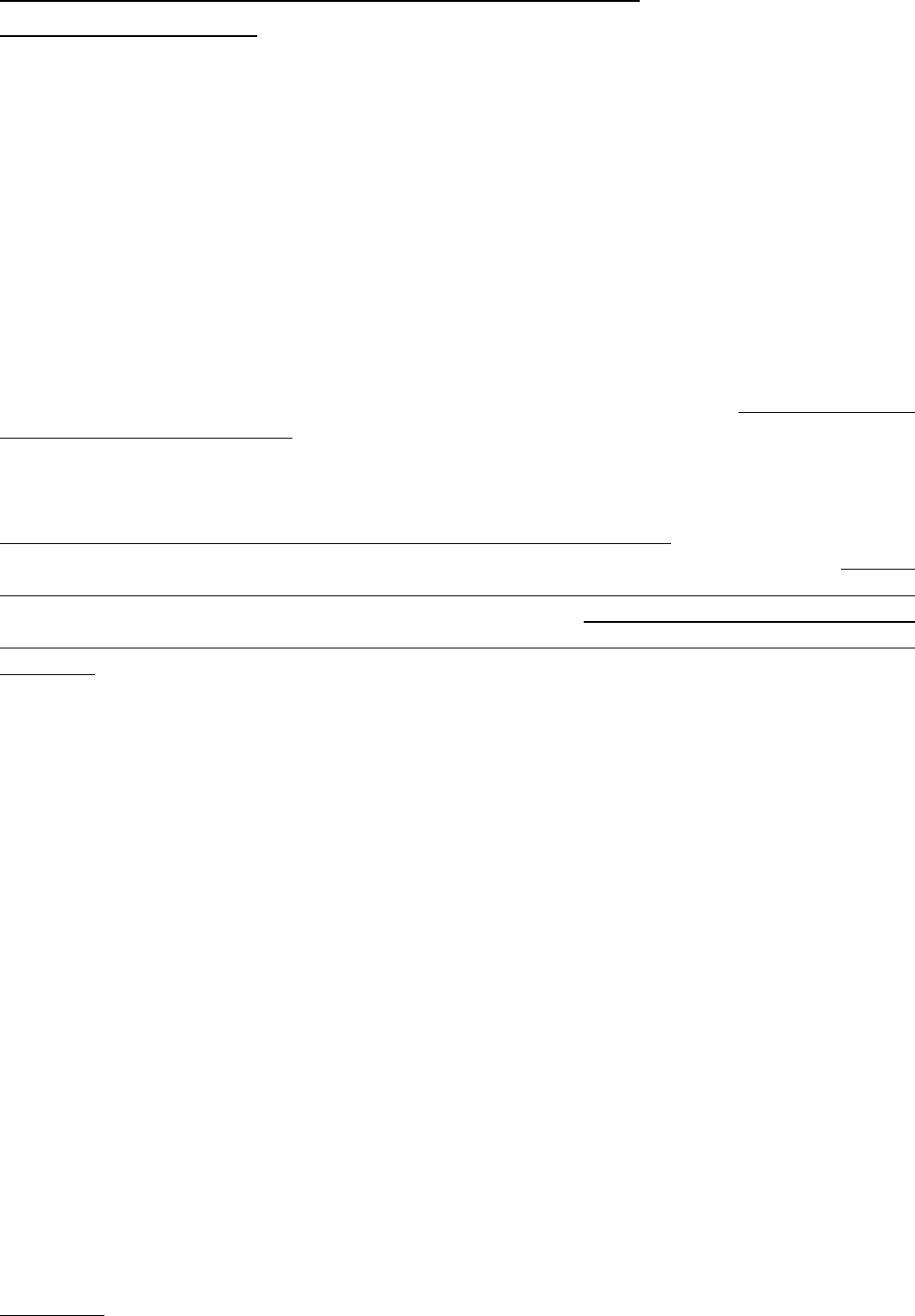

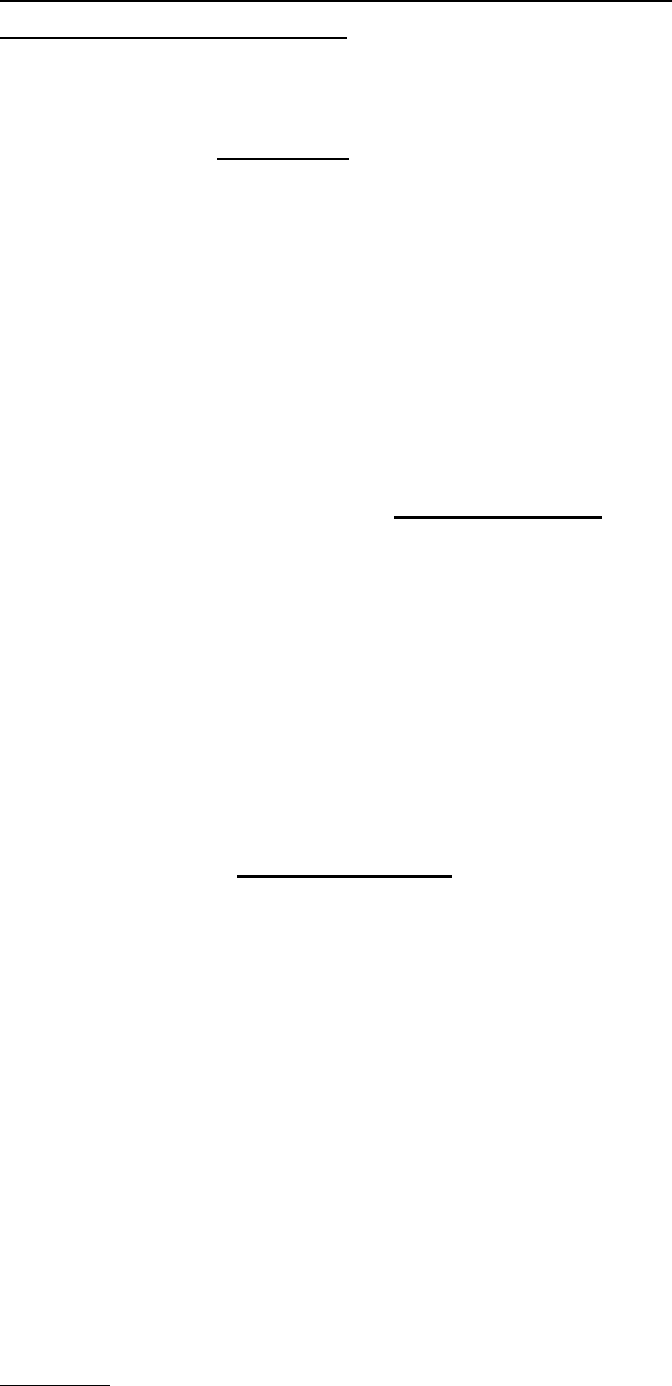

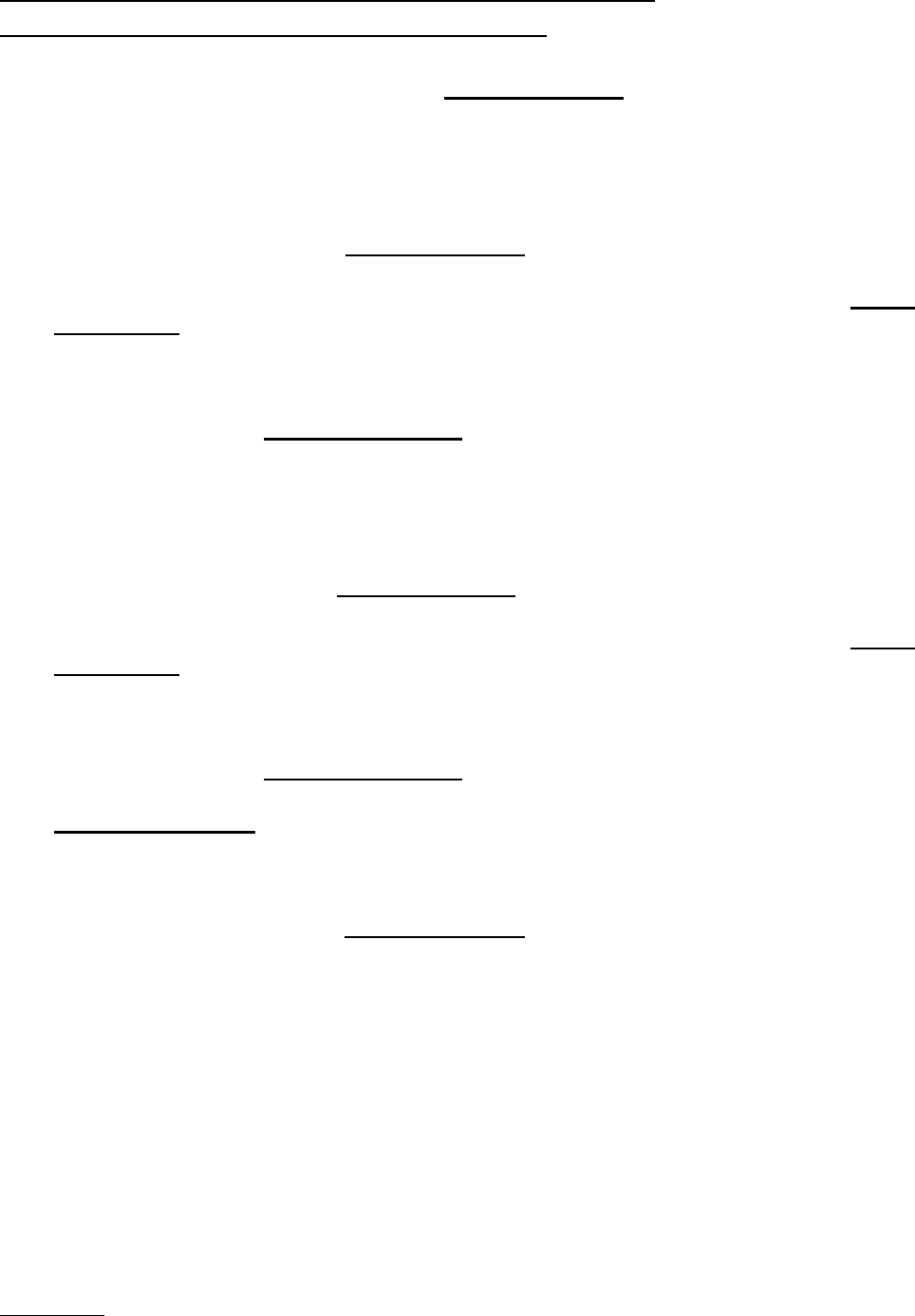

MEETING

88

89 – Document A

89 – Document B

90 – Document A

90 – Document B

90 – Document B ADD

91 – Document A

91 – Document B

91 - Document D

91 – Document E

92 – Document A

92 – Document B

92 – Document C

93 – Document A

93 – Document B

93 – Document C

93 – Document D

93 – Document E

94 – Document A

94 – Document B

94 – Document C

94 – Document D

96 – Document A

96 – Document B

96 – Document C

97 – Document A

97 – Document B

97 – Document C

98 – Document A

98 – Document B

98 – Document C

98 – Document D

99 – Document A

CONTENTS (3/6)

DATE

13-14 July 2009

30 September 2009

30 September 2009

11 December 2009

11 December 2009

11 December 2009

10-12 May 2010

10-12 May 2010

10-12 May 2010

10-12 May 2010

7-8 December 2010

7-8 December 2010

7-8 December 2010

1 July 2011

1 July 2011

1 July 2011

1 July 2011

19 October 2011

19 October 2011

19 October 2011

19 October 2011

19 October 2011

26 March 2012

26 March 2012

26 March 2012

7 September 2012

7 September 2012

7 September 2012

18 March 2013

18 March 2013

18 March 2013

18 March 2013

3 July 2013

REFERENCE

634 – taxud.d.1(2009)358416

639 – taxud.d.1(2009)405067

645 – taxud.d.1(2010)176579

650 – taxud.d.1(2010)179436

662 – taxud.c.1(2010)637456

662 ADD – taxud.c.1(2010)252529

668 – taxud.c.1(2010)426874

667 – taxud.c.1(2010)451758

678 – taxud.c.1(2011)280394

681 – taxud.c.1(2011)1054234

684 – taxud.c.1(2011)157667

689 – taxud.c.1(2011)1235994

725 – taxud.c.1(2012)644698

707 – taxud.c.1(2012)400557

708 – taxud.c.1(2012)389021

709 – taxud.c.1(2012)1410604

711 – taxud.c.1(2011)1212515

722 REV – taxud.c.1(2012)553296

714 – taxud.c.1(2012)97732

715 – taxud.c.1(2012)73142

716 – taxud.c.1(2012)243615

726 – taxud.c.1(2012)641164

728 – taxud.c.1(2012)905196

729 – taxud.c.1(2012)916513

759 – taxud.c.1(2013)1579242

743 – taxud.c.1(2012)1453230

744 – taxud.c.1(2013)1512595

745 – taxud.c.1(2012)1701663

765 – taxud.c.1(2013)11581796

767 – taxud.c.1(2013)3409064

769 – taxud.c.1(2013)2573830

770 ADD – taxud.c.1(2014)2717057

778 – taxud.c.1(2013)3770682

ATTENTION: Please bear in mind that guidelines issued by the VAT Committee are merely views of

a consultative committee. They do not constitute an official interpretation of EU law and do not

necessarily have the agreement of the European Commission. They do not bind the European

Commission or the Member States who are free not to follow them.

Reproduction of this document is subject to mentioning this Caveat.

7

MEETING

99 – Document B

100 – Document A

100 – Document B

100 – Document D

101 – Document A

101 – Document B

101 – Document C

101 – Document E

101 – Document F

101 – Document G

101 – Document H

101 – Document I

102 – Document A

102 – Document B

102 – Document C

102 – Document D

102 – Document G

102 – Document H

102 – Document I

103 – Document A

103 – Document C

104 – Document A

104 – Document B

104 – Document C

105 – Document A

105 – Document B

105 – Document C

105 – Document D

106 – Document A

107 – Document A

107 – Document B

107 – Document C

107 – Document D

108 – Document A

108 – Document B

108 – Document C

CONTENTS (4/6)

DATE

3 July 2013

24-25 February 2014

24-25 February 2014

24-25 February 2014

20 October 2014

20 October 2014

20 October 2014

20 October 2014

20 October 2014

20 October 2014

20 October 2014

20 October 2014

30 March 2015

30 March 2015

30 March 2015

30 March 2015

30 March 2015

30 March 2015

30 March 2015

20 April 2015

20 April 2015

4-5 June 2015

4-5 June 2015

4-5 June 2015

26 October 2015

26 October 2015

26 October 2015

26 October 2015

14 March 2016

8 July 2016

8 July 2016

8 July 2016

8 July 2016

27-28 March 2017

27-28 March 2017

27-28 March 2017

REFERENCE

782 – taxud.c.1(2014)137905

797 – taxud.c.1(2014)986483

798 – taxud.c.1(2014)1870542

803 – taxud.c.1(2014)2716782

821 – taxud.c.1(2014)4583592

823 – taxud.c.1(2014)4704598

824 – taxud.c.1(2015)46844

828 – taxud.c.1(2015)615518

829 – taxud.c.1(2015)307157

831 – taxud.c.1(2015)553554

832 REV – taxud.c.1(2016)1136484

848 – taxud.c.1(2015)1778402

851 – taxud.c.1(2015)2610654

858 – taxud.c.1(2015)3055842

859 – taxud.c.1(2015)3130399

862 – taxud.c.1(2015)4128689

867 – taxud.c.1(2015)6550378

870 – taxud.c.1(2015)5528628

874 – taxud.c.1(2015)4754627

868 – taxud.c.1(2015)3366194

871 – taxud.c.1(2015)4499050

873 – taxud.c.1(2015)4606583

875 – taxud.c.1(2015)4694162

876 – taxud.c.1(2015)4820441

886 – taxud.c.1(2016)7465801

889 – taxud.c.1(2016)1162824

890 – taxud.c.1(2020)1339908

902 – taxud.c.1(2016)3213107

904 – taxud.c.1(2016)3604550

910 – taxud.c.1(2016)6526943

911 – taxud.c.1(2016)7297391

913 – taxud.c.1(2016)7692140

914 – taxud.c.1(2017)1402399

926 – taxud.c.1(2017)5533687

928 – taxud.c.1(2017)6692583

930 – taxud.c.1(2018)2397450

ATTENTION: Please bear in mind that guidelines issued by the VAT Committee are merely views of

a consultative committee. They do not constitute an official interpretation of EU law and do not

necessarily have the agreement of the European Commission. They do not bind the European

Commission or the Member States who are free not to follow them.

Reproduction of this document is subject to mentioning this Caveat.

8

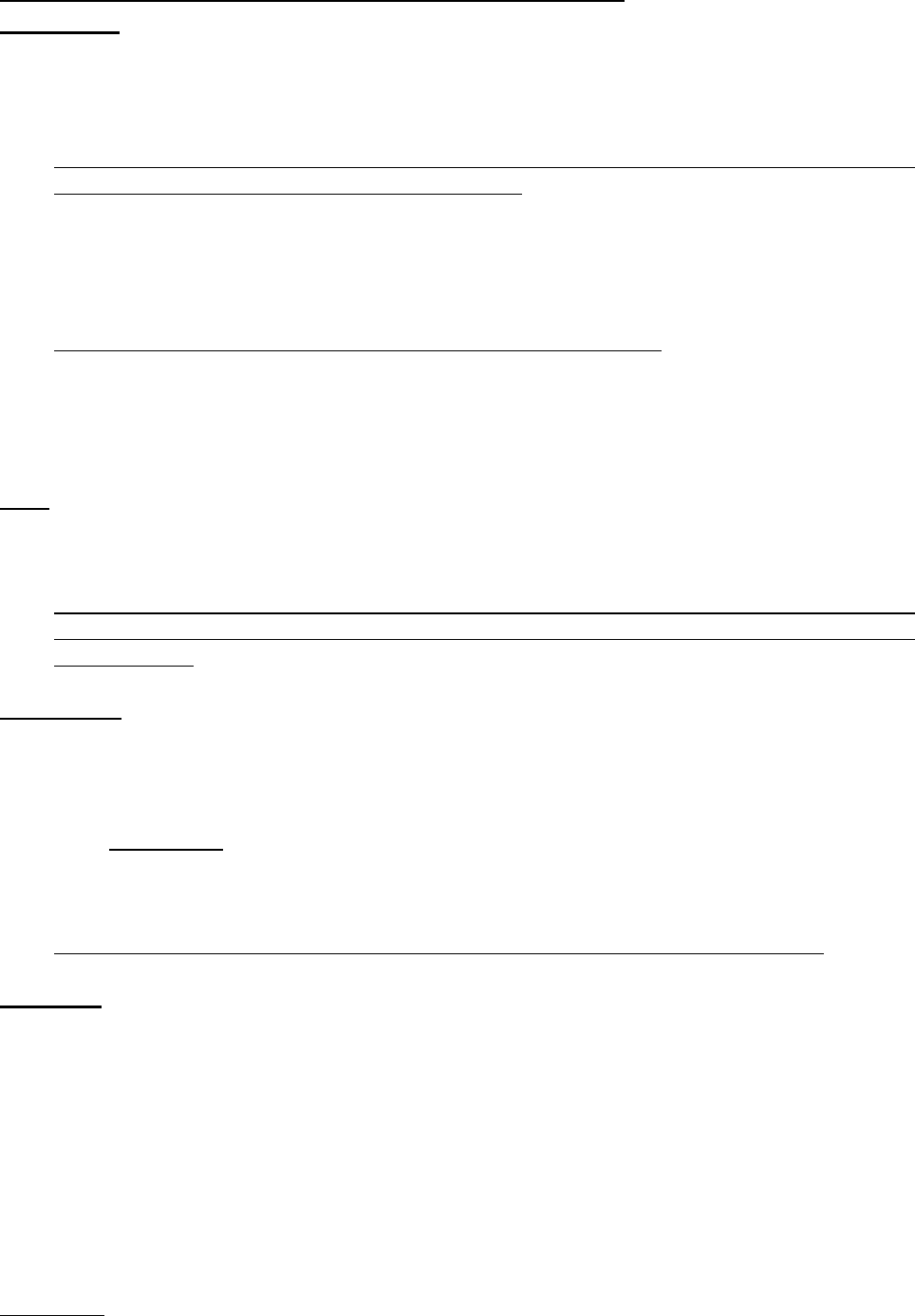

MEETING

108 – Document D

109 – Document A

109 – Document B

109 – Document C

109 – Document E

110 – Document A

110 – Document B

111 – Document A

111 – Document B

112 – Document A

113 – Document A

113 – Document B

113 – Document C

113 – Document D

113 – Document E

113 – Document F

113 – Document G

113 – Document H

114 – Document A

114 – Document B

116 – Document A

116 – Document B

117 – Document A

117 – Document B

117 – Document C

118 – Document A

118 – Document B

118 – Document C

118 – Document D

119 – Document A

119 – Document B

119 – Document C

Outside meeting A

120 – Document A

CONTENTS (6/6)

DATE

27-28 March 2017

1 December 2017

1 December 2017

1 December 2017

1 December 2017

13 April 2018

13 April 2018

30 November 2018

30 November 2018

12 April 2019

3 June 2019

3 June 2019

3 June 2019

3 June 2019

3 June 2019

3 June 2019

3 June 2019

3 June 2019

2 December 2019

2 December 2019

12 June 2020

12 June 2020

16 November 2020

16 November 2020

16 November 2020

21 April 2021

21 April 2021

21 April 2021

21 April 2021

22 November 2022

22 November 2022

22 November 2022

28 February 2022

28 March 2022

REFERENCE

938 – taxud.c.1(2018)1844010

940 – taxud.c.1(2018)1835539

949 – taxud.c.1(2018)3869725

950 – taxud.c.1(2018)3518602

954 – taxud.c.1(2018)5913820

955 – taxud.c.1(2018)6540764

956 – taxud.c.1(2018)7386249

964 – taxud.c.1(2019)4045223

967 – taxud.c.1(2019)3722302

980 – taxud.c.1(2019)8721302

972 – taxud.c.1(2019)6589787

973 – taxud.c.1(2019)7898019

974 – taxud.c.1(2019)7898957

975 – taxud.c.1(2019)7899573

976 – taxud.c.1(2019)7900313

977 – taxud.c.1(2019)7900872

978 – taxud.c.1(2019)7901495

979 – taxud.c.1(2019)7901898

986 – taxud.c.1(2020)2254683

994 – taxud.c.1(2020)5395036

995 – taxud.c.1(2020)6875829

1043 –taxud.c.1(2023)4439781

1006 – taxud.c.1(2021)1757771

1011 – taxud.c.1(2021)3163376

1014 – taxud.c.1(2021)5072408

1015 REV – taxud.c.1(2021)8178888

1016 – taxud.c.1(2021)6378389

1018 – taxud.c.1(2021)6657618

1021 – taxud.c.1(2021)8354974

1033 – taxud.c.1(2022)3546849

1034 – taxud.c.1(2022)2315070

1041 – taxud.c.1(2022)3482689

1036 – taxud.c.1(2022)1657365

1044 – taxud.c.1(2023)3629452

ATTENTION: Please bear in mind that guidelines issued by the VAT Committee are merely views of

a consultative committee. They do not constitute an official interpretation of EU law and do not

necessarily have the agreement of the European Commission. They do not bind the European

Commission or the Member States who are free not to follow them.

Reproduction of this document is subject to mentioning this Caveat.

9

MEETING

120 – Document B

121 – Document A

121 – Document B

121 – Document C

122 – Document A

122 – Document B

122 – Document C

Outside meeting B

123 – Document A

123 – Document B

123 – Document C

123 – Document D

123 – Document E

124 – Document A

Outside meeting

CONTENTS (6/6)

DATE

28 March 2022

21 October 2022

21 October 2022

21 October 2022

20 March 2023

20 March 2023

20 March 2023

6 September 2023

20 November 2023

20 November 2023

20 November 2023

20 November 2023

20 November 2023

11 April 2024

12 March 2019

REFERENCE

1045 – taxud.c.1(2023)3625373

1055 – taxud.c.1(2023)3139286

1056 – taxud.c.1(2023)5257065

1063 – taxud.c.1(2023)5499576

1065 – taxud.c.1(2024)497946

1066 – taxud.c.1(2023)10135076

1074 – taxud.c.1(2024)438498

1068 REV – taxud.c.1(2023)11114065

1075 – taxud.c.1(2024)794997

1076 – taxud.c.1(2024)800132

1077 – taxud.c.1(2024)5028879

1078 – taxud.c.1(2024)4333871

1081 – taxud.c.1(2024)5356387

1086 – taxud.c.1(2024)5318839

962 – taxud.c.1(2019)1857557

ATTENTION: Please bear in mind that guidelines issued by the VAT Committee are merely views of

a consultative committee. They do not constitute an official interpretation of EU law and do not

necessarily have the agreement of the European Commission. They do not bind the European

Commission or the Member States who are free not to follow them.

Reproduction of this document is subject to mentioning this Caveat.

10

GUIDELINES RESULTING FROM THE 1

ST

MEETING of 23-24 November 1977

XV/27/78 (1/2)

I. QUESTIONS RAISED ON THE INTERPRETATION OF THE SIXTH DIRECTIVE

1. Questions raised by the United Kingdom delegation

1) Is it possible to apply a standard value in respect of the importation and supply of racehorses

and is it possible to exempt racehorse training fees?

a) The Committee endorsed unanimously: the position of the Commission’s staff on the questions

raised

− on importation, the application of a standard value would be compatible with Article 11(B)(2)

of the Sixth Directive only where this did not involve a systematic reduction of the taxable

amount;

− for internal supplies, as for imports, the application of a standard value could not be justified

by using Article 27 of the Sixth Directive unless this was genuinely a case of a simplification

procedure, with no significant impact on the tax due at the final consumption stage.

In this connection it was argued that Article 27 could be invoked to simplify the procedure for

charging the tax on imports or successive supplies, using as a basis the value which the horse would

have on final consumption, i.e. the carcass value. However, the majority of the delegations

questioned the compatibility of this interpretation with the above mentioned provisions of the

Directive.

b) The Committee also felt that the exemption of racehorse training fees could not be justified by

Article 13 (Exemptions within the territory of the country). However, certain delegations, subject

to carrying out an examination in greater depth, would not be opposed to the idea that the provisions

of Article 28(3)(b) (Transitional provisions) could, if necessary, permit such an exemption to be

retained where racehorse training was regarded as a profession.

c) The majority of the delegations were doubtful as to the compatibility with the Directive of

arrangements permitting application of the scheme for farmers to racehorse training.

2) Right to exempt supplies of gold coins

Further consideration of this point will be necessary. Many participants felt that under the Sixth

Directive all gold coins were taxable, but it was also found that certain Member States were

interpreting Annex F to mean that it permitted Member States which applied the exemption to

continue to do so under existing conditions.

ATTENTION: Please bear in mind that guidelines issued by the VAT Committee are merely views of

a consultative committee. They do not constitute an official interpretation of EU law and do not

necessarily have the agreement of the European Commission. They do not bind the European

Commission or the Member States who are free not to follow them.

Reproduction of this document is subject to mentioning this Caveat.

11

GUIDELINES RESULTING FROM THE 1

ST

MEETING of 23-24 November 1977

XV/27/78 (2/2)

3) Scope of the right of option provided for in Article 13(C) and Annex G to the Sixth VAT

Directive with respect to clubs and associations

It was not possible to examine this point owing to lack of time.

2. Question sent in by the office of the Italian Permanent Representative

Tax treatment of monetary compensatory amounts (MCAs)

Discussion provided an opportunity for several delegations to outline the legal, administrative and

common agricultural policy problems posed by the inclusion of MCAs in the taxable amount.

However, a tentative examination of the question made it clear that even when these amounts were

taxable and taxed in the Member States, the dangers of distortion of competition were virtually nil

when the transaction was a sale to a taxable person, though this might not be the case for

non-taxable persons or flat-rate farmers.

The Committee will re-examine this question in the light of the arguments put forward on the

subject at this meeting.

ATTENTION: Please bear in mind that guidelines issued by the VAT Committee are merely views of

a consultative committee. They do not constitute an official interpretation of EU law and do not

necessarily have the agreement of the European Commission. They do not bind the European

Commission or the Member States who are free not to follow them.

Reproduction of this document is subject to mentioning this Caveat.

12

GUIDELINES RESULTING FROM THE 2

ND

MEETING of 13-14 June 1978

XV/227/78 (1/2)

I. QUESTIONS RAISED ON THE INTERPRETATION OF THE SIXTH DIRECTIVE

4. Question from the United Kingdom delegation concerning the scope of the right of option in

Article 13(C) and Annex G to the Sixth Directive with regard to clubs and associations

It was noted that, during the transitional period, the situations could vary from one Member State to

another with regard to the activities of clubs and associations referred to in Article 13(A)(1) at (f)

and (m), because they were covered both by Annex E (possibility of continuing to tax) and by

Annex G (possibility of retaining the right of option), but that for those activities coming under

letters (l) and (o), there was only one possibility, since exemption must be provided for as soon as

the directive was implemented.

In addition, with regard to the treatment, on the basis of Article 13(A)(1)(l), of employers’

associations, it was noted that this question linked up with that concerning the interpretation of the

words “of trade union nature” used in this clause of the directive, a question which would be on the

agenda of the next meeting.

5. Problems in connection with the application of the common method for calculating the VAT

rate in agriculture (Article 25 of the Sixth Directive and Annexes A, B and C)

a) Terms used for the method of calculation:

The Committee agreed that the definitions used in the SOEC’s agricultural accounts should be those

used for the method of calculation.

b) Services supplied listed in Annex B:

There was near unanimity in the Committee in favour of the exclusion from data research – solely

for the purposes of the implementation of the common method of calculation – of data concerning

“hiring out for a agricultural purposes, of equipment normally used in agricultural, forestry or

fisheries undertakings” and “technical assistance”.

c) Nature of packing and storage services for agricultural products:

The Committee agreed unanimously that the nature of the services in connection with Annex B

should be determined on the basis of the following distinctions:

1. Packing and storage by the farmer of agricultural products belonging to him: services

included in the delivery price of agricultural produce;

2. Packing and storage by the farmer on behalf of others but using facilities related to his own

requirements: agricultural services;

ATTENTION: Please bear in mind that guidelines issued by the VAT Committee are merely views of

a consultative committee. They do not constitute an official interpretation of EU law and do not

necessarily have the agreement of the European Commission. They do not bind the European

Commission or the Member States who are free not to follow them.

Reproduction of this document is subject to mentioning this Caveat.

13

GUIDELINES RESULTING FROM THE 2

ND

MEETING of 13-14 June 1978

XV/227/78 (2/2)

3. Same supplies of services on behalf of others but with facilities exceeding those normally

used by the farmer: this work would not constitute supplies of services.

d) References to the activities defined in Annexes A and B

The Committee agreed unanimously that final production and total inputs referred to in Point I(1)

and (2) of Annex C, were, as for gross fixed asset formation, those in connection with the activities

listed in Annexes A and B.

e) Products deriving from the processing activities referred to in Point V of Annex A and

referred to again in Annex C(I)(1)

Nearly all the members of the Committee acknowledged the difficulty of identifying the production

in question.

f) Accounting data concerning fishing

A majority of the delegations stated that there was no problem in their respective countries

concerning these data, either because the data could be supplied or because the normal scheme was

applied in this sector.

ATTENTION: Please bear in mind that guidelines issued by the VAT Committee are merely views of

a consultative committee. They do not constitute an official interpretation of EU law and do not

necessarily have the agreement of the European Commission. They do not bind the European

Commission or the Member States who are free not to follow them.

Reproduction of this document is subject to mentioning this Caveat.

14

GUIDELINES RESULTING FROM THE 3

RD

MEETING of 28 June 1978

XV/226/78 (1/1)

II. QUESTIONS FROM THE FRENCH DELEGATION CONCERNING THE TAXABLE

AMOUNT FOR TRAVEL AGENTS

The French delegation raised the problem of how to interpret Article 26 as regards determining the

taxable amount for the supply of services by travel agents.

ATTENTION: Please bear in mind that guidelines issued by the VAT Committee are merely views of

a consultative committee. They do not constitute an official interpretation of EU law and do not

necessarily have the agreement of the European Commission. They do not bind the European

Commission or the Member States who are free not to follow them.

Reproduction of this document is subject to mentioning this Caveat.

15

GUIDELINES RESULTING FROM THE 4

TH

MEETING of 9-10 November 1978

XV/339/78 (1/1)

II. MATTERS RAISED CONCERNING THE INTERPRETATION OF THE SIXTH

DIRECTIVE

Matters raised by the Belgian delegation concerning the interpretation of the concept “of a

trade-union nature” referred to in Article 13(A)(1)(1)

Most of the delegations preferred a broad interpretation of the concept that covered both workers’

and employers’ associations.

As for the general scope of the exemption provided for in Article 13(A)(1)(1), the Committee was

of the unanimous opinion that this would not ipso facto confer the status of taxable person on the

bodies referred to, the only criterion determining their tax status being that set out in Article 4,

which stipulates that, to be regarded as a taxable person, a person has to carry out an economic

activity.

However, the Committee had to acknowledge that reference to the concept of economic activity

resulted in non-taxation of the services referred to in Article 13(A)(1)(1), and this in various ways

depending on whether the concept was interpreted in a broader or narrower fashion by the Member

States and whether it covered all or only some of the activities of the bodies referred to.

In view of the position adopted by several delegations it was agreed to pursue examination of this

item with the aid of a memorandum.

ATTENTION: Please bear in mind that guidelines issued by the VAT Committee are merely views of

a consultative committee. They do not constitute an official interpretation of EU law and do not

necessarily have the agreement of the European Commission. They do not bind the European

Commission or the Member States who are free not to follow them.

Reproduction of this document is subject to mentioning this Caveat.

16

GUIDELINES RESULTING FROM THE 5

TH

MEETING of 14-15 June 1979

XV/196/79 (1/2)

II. MATTERS RAISED CONCERNING THE INTERPRETATION OF THE SIXTH

DIRECTIVE

1. Matters raised by Denmark concerning the exemptions referred to in Article 15(10):

exemptions granted under diplomatic arrangements

In order to permit an exchange of information and to establish whether there was a need for

harmonisation in this field, the Chairman asked the different delegations to furnish him with replies

to a questionnaire which will be drawn up with this end in mind.

2. Matter raised concerning. the taxable person status of lawyers, etc.

The question had been raised, in the context of own resources, as to whether certain professions

whose members had power to draw up documents in the exercise of a public office (e.g. lawyers)

were taxable persons (with or without exemption) for the purposes of VAT.

Most delegations felt that the persons concerned were members of the liberal professions and were

therefore subject to VAT in respect of all their activities. However, services supplied by them could

be exempted during the transitional period pursuant to Article 28 and Annex F.

3. Matter raised by the United Kingdom delegation concerning the services of consultants,

engineers, etc and data processing and the supplying of information (third indent of

Article 9(2)(e))

Virtually all the delegations were of the opinion that the mention of consultants, etc. under this

provision did not mean that the services referred to had to be supplied by persons who were

members of such professions.

On the second matter of whether or not the supplying of information was necessarily linked to data

processing, virtually all of the delegations again replied in the negative. Consequently, any services

relating to the supplying of information for consideration must be subject to tax by virtue of the

provisions of Article 9(2)(e).

4. Matter raised by the French delegation concerning the hiring of stands at exhibitions

Almost all the delegations decided that the hiring of stands at exhibitions should be considered as

such for the purposes of Article 9 (place of supply of services).

ATTENTION: Please bear in mind that guidelines issued by the VAT Committee are merely views of

a consultative committee. They do not constitute an official interpretation of EU law and do not

necessarily have the agreement of the European Commission. They do not bind the European

Commission or the Member States who are free not to follow them.

Reproduction of this document is subject to mentioning this Caveat.

17

GUIDELINES RESULTING FROM THE 5

TH

MEETING of 14-15 June 1979

XV/196/79 (2/2)

5. Matter raised by the Italian delegation concerning the tax treatment in Member States of the

purchase or importation of vessels intended for breaking up

In view of the positions adopted by the delegations, it was agreed to continue discussion of this

matter at a later meeting.

ATTENTION: Please bear in mind that guidelines issued by the VAT Committee are merely views of

a consultative committee. They do not constitute an official interpretation of EU law and do not

necessarily have the agreement of the European Commission. They do not bind the European

Commission or the Member States who are free not to follow them.

Reproduction of this document is subject to mentioning this Caveat.

18

GUIDELINES RESULTING FROM THE 6

TH

MEETING of 9-10 January 1980

XV/9/80 (1/4)

I. MATTERS RAISED CONCERNING THE INTERPRETATION OF THE SIXTH

DIRECTIVE

A. Matters raised, in the context of determining the VAT base for own resources purposes,

concerning

a) the scope of the exemptions laid down in Article 13(A)(1)(m) and (n) (“certain services

closely linked to sport” and “certain cultural services”)

The conclusions drawn by the Committee were as follows:

1. the services exempted under Article 13(A)(1)(m) and (n) are indeterminate;

2. under points 4 and 5 of Annex E to the Directive, Member States may, during the transitional

period referred to in Article 28(4), subject to tax the services exempted under

Article 13(A)(1)(m), and (n);

3. it will therefore be impossible to lay down any parameter allowing financial compensations to

be determined so long as there is no list of exempt services.

b) the scope of the exemptions laid down in Article 13(A)(1)(b) comparable social conditions

The conclusions drawn following discussion of this matter were as follows:

1. under Article 13, the services supplied by “public” hospitals are in any case exempt;

2. the services supplied by “private sector” bodies providing care under social conditions

comparable to those of the public sector are also exempt; such conditions should be

determined for each Member State – on the basis of answers to a questionnaire, for example –

if it is wished to establish precisely what private sector services qualify for exemption;

3. other services should be subject to VAT, but may be exempted pursuant to Article 28(3)(b)

and Annex F.

ATTENTION: Please bear in mind that guidelines issued by the VAT Committee are merely views of

a consultative committee. They do not constitute an official interpretation of EU law and do not

necessarily have the agreement of the European Commission. They do not bind the European

Commission or the Member States who are free not to follow them.

Reproduction of this document is subject to mentioning this Caveat.

19

GUIDELINES RESULTING FROM THE 6

TH

MEETING of 9-10 January 1980

XV/9/80 (2/4)

c) The system applying in Member States regarding the private use of passenger cars

So as to allow the Committee on Own Resources to obtain a more accurate picture of the situation

in Member States in this area and to seek a Community solution for determining the oven resources

basis, possibly by fixing a standard percentage to convert the private use of passengers cars forming

part of a company’s assets, the delegations were asked to telex the Directorate-General for Budgets,

by 15 February at the latest, a brief outline of the arrangements in force in their respective countries

for taxing the private use of such cars and the relevant proportion of fuel, stating the approximate

percentage put on private use in relation to such expenses as a whole.

d) Taxation of transactions concerning gold other than gold for industrial use

During the first exchange of views the Committee reached the following conclusions:

1. Gold pieces

Several Member States exempt the supply of gold pieces which are legal tender in their country of

origin because they took the view that these represented gold for investment purposes covered by

point 26 of Annex F. One delegation wondered if collectors’ items could be exempted under

Article 32.

Most of the delegations were, however, in favour of taxing such transactions basing their

interpretation on a strict application of Article 13(B)(d)(4).

2. System applicable to agents

The conclusion was drawn that those Member States availing themselves of the option provided for

in Article 28(3)(e), which allows derogation from Article 5(4)(c) in particular, should only tax the

agents’, commission even where it concerns transactions which are exempt or are carried out by

non-taxable persons.

ATTENTION: Please bear in mind that guidelines issued by the VAT Committee are merely views of

a consultative committee. They do not constitute an official interpretation of EU law and do not

necessarily have the agreement of the European Commission. They do not bind the European

Commission or the Member States who are free not to follow them.

Reproduction of this document is subject to mentioning this Caveat.

20

GUIDELINES RESULTING FROM THE 6

TH

MEETING of 9-10 January 1980

XV/9/80 (3/4)

3. Double charge to VAT

The Committee found that, where a private person sold gold acquired VAT-paid to a taxable person

who then resold it to another private person, a double charge to VAT could indeed result, but that

this particular situation should rather be regarded as a distortion of competition. The Committee

was obliged to conclude, however, that gold transactions should in all cases be taxed in accordance

with the Sixth Directive, with the possibility of maintaining the exemption provided for in point 26

of Annex F. The possibility of regarding resold gold as second-hand goods was raised, although the

proposal for a Seventh Directive did not cover such transactions.

e) Scope of point 19 of Annex F (supplies of some capital goods after the expiry of the

adjustment period for deductions)

Almost all the delegations took the view that supplies of movable capital goods after the adjustment

period should be made subject to the tax and that exemption could be granted only within the

framework of Annex F. Two delegations, however, felt that supplies of such goods could come

under Article 32.

The Committee also stated its position on the more general problem of what legal basis should be

applied for the purposes of own resources and in particular of financial compensations where two

provisions of the Directive could be used as a legal basis to cover the same situation and where only

one of the two provisions gave rise to compensation. Almost all the delegations stated that, in such

circumstances, it would seem equitable to apply the legal basis that gave rise to compensation,

which in this particular instance meant Article 28 and the Annexes relating to it.

B. Matter raised by the Italian delegation concerning the tax treatment in Member States of the

purchase or importation of vessels for breaking up

Almost all the delegations took the view that, under the provisions of Article 15(4) and (5), supplies

of vessels for breaking up could be exempted, stating that such exemption was granted de facto if

not de jure in their own countries.

The Chairman reserved the Commission’s position regarding, firstly, the rules to be applied to such

supplies, which in his view (he announced that he intended to consult the Legal Service on this

question) should be taxed in accordance with the Sixth Directive and, secondly, the possibility of

granting exemption on the basis of Article 27 (simplification procedures).

ATTENTION: Please bear in mind that guidelines issued by the VAT Committee are merely views of

a consultative committee. They do not constitute an official interpretation of EU law and do not

necessarily have the agreement of the European Commission. They do not bind the European

Commission or the Member States who are free not to follow them.

Reproduction of this document is subject to mentioning this Caveat.

21

GUIDELINES RESULTING FROM THE 6

TH

MEETING of 9-10 January 1980

XV/9/80 (4/4)

C. Matters raised by the Danish delegation concerning the amendment of Article 11(B)(2) so as

to take account of the new Regulation on the valuation of goods for customs purposes

Several delegations felt that this problem should be examined by Working Party No 1 on the basis

of a Commission staff paper and the draft of the new Regulation on the valuation of goods for

customs purposes. However, they stated from the outset that, for legal reasons, the reference to

Regulation No 803/68 could be amended only by a new Directive applying solely to VAT.

ATTENTION: Please bear in mind that guidelines issued by the VAT Committee are merely views of

a consultative committee. They do not constitute an official interpretation of EU law and do not

necessarily have the agreement of the European Commission. They do not bind the European

Commission or the Member States who are free not to follow them.

Reproduction of this document is subject to mentioning this Caveat.

22

GUIDELINES RESULTING FROM THE 7

TH

MEETING of 4-5 March 1980

XV/85/80 (1/1)

I. MATTERS RAISED CONCERNING THE INTERPRETATION OF THE SIXTH

DIRECTIVE

The scope of the exemptions laid down in Article 13(A)(1)(l)

The Committee drew the following conclusions

1. All the delegations were theoretically in favour of taxing individualisable transactions carried

out on behalf of a member rather than in the collective interest.

2. The majority of delegations considered that the activities of such organisations which had the

protection of collective professional interest as their aim were outside of the scope. But it was

stressed that there was no right to deduct in respect of these “out-of-scope” transactions and

that goods acquired by organisations for realisation would therefore carry the full weight of

the tax.

The other delegations stated that for practical and control reasons they preferred to include all

these transactions within the scope even if they were then exempted under Article 13.

3. After hearing the opinion of the Commission’s Legal Service which states that the idea of

“trade union” in Article 13(A)(1)(l) should be interpreted in a broad fashion to include

workers, employers and professional associations, the large majority of the delegations

expressed the same view.

The Committee noted however that there were differences between the various language

versions of the text and that those differences could lead to different literal interpretations. It

was also pointed out that any Member State who had allowed organisations to opt for taxation

under Annex G of the Sixth Directive could maintain this system until 1 January 1981.

ATTENTION: Please bear in mind that guidelines issued by the VAT Committee are merely views of

a consultative committee. They do not constitute an official interpretation of EU law and do not

necessarily have the agreement of the European Commission. They do not bind the European

Commission or the Member States who are free not to follow them.

Reproduction of this document is subject to mentioning this Caveat.

23

GUIDELINES RESULTING FROM THE 8

TH

-9

TH

MEETINGS of 6-7 May and 4 June 1980

XV/205/80 (1/3)

II. QUESTIONS RAISED CONCERNING THE INTERPRETATION OF THE SIXTH

DIRECTIVE

a) The system of VAT applicable to transactions concerning gold, and payments to professional

agents

i) The Committee stated that several Member States tax transactions concerning gold ingots or

bars whilst others exempt such transactions under the transitional provisions of Article 28;

two Member States have no gold market;

ii) The Committee unanimously agreed on the inevitable consequences of the application of the

transitional provisions of the 6

th

Directive in respect of agents, acknowledging that the

remuneration of such agents should either be included in the taxable amount of the transaction

in respect of which they are acting (under Article 5(4)(c)) or taxed separately on the basis of

Article 28(3)(e). In addition the large majority of Member States considered that they could

give exemption under Annex F(26) if the principal transaction itself is covered by this

provision.

b) The interpretation of the directive in respect of repairs carried out under guarantee

The Committee considered that this problem is solved by the 8

th

Directive.

c) The application of VAT to competitions for architects

The Committee reached the following conclusions

i) the delegations were unanimously in favour of taxing the consideration paid for competitions

by invitation as well as payments made to the architects’ professional body if it ranks as a

taxable person for VAT purposes, in the sense of Article 4 of the 6

th

Directive.

ii) the majority of delegations also agree that the value of prizes awarded in open competitions

should be taxed but bearing in mind the conditions laid down for each competition. From this

point of view the problem is whether the prize constitutes a taxable supply or should be

treated solely as a “gift” with no supply given in return, and therefore out of the scope of the

tax.

ATTENTION: Please bear in mind that guidelines issued by the VAT Committee are merely views of

a consultative committee. They do not constitute an official interpretation of EU law and do not

necessarily have the agreement of the European Commission. They do not bind the European

Commission or the Member States who are free not to follow them.

Reproduction of this document is subject to mentioning this Caveat.

24

GUIDELINES RESULTING FROM THE 8

TH

-9

TH

MEETINGS of 6-7 May and 4 June 1980

XV/205/80 (2/3)

d) Indication by the supplier of a service of the VAT rate in force in the country of a person to

whom services in the sense of Article 9(2)(c) of the 6

th

Directive are supplied by a taxable

person established abroad

The majority of the delegations considered that where the tax has to be paid in the country of the

person to whom the services are supplied that person should remain the principal person liable to

pay the tax, and the supplier established in another country cannot be compelled to show the tax on

the invoice.

Some delegations pointed out that, at least legally speaking, they preferred to retain the possibility,

by means of joint and several liability, of obliging the supplier to indicate the tax at the rate

applicable in the country of the person receiving the services. Although the solutions retained by

Member States are based on different legal analyses the Committee considers that both conform

with the corresponding provisions of the 6

th

Directive.

e) Application of VAT to slot machines etc.

The Committee reached the following conclusions

i) nearly all the delegations agree that the “activity” of the person who allows these machines to

be installed should be taxed as a supply of services;

ii) the large majority of delegations consider that Article 13(B)(f) does not apply to the machine

owners, given that the machines in question are not solely games of chance or games for

money;

iii) the majority of delegations agree that the amount put into the slot machine should form the

taxable amount corresponding moreover to the ides of turnover. This turnover can be

established most effectively by applying a coefficient to the amount remaining in the

machine.

f) Common VAT arrangements applicable to “travel and entertainment cards” issued by certain

organisations

It was decided to defer any decisions on this point to a future meeting.

ATTENTION: Please bear in mind that guidelines issued by the VAT Committee are merely views of

a consultative committee. They do not constitute an official interpretation of EU law and do not

necessarily have the agreement of the European Commission. They do not bind the European

Commission or the Member States who are free not to follow them.

Reproduction of this document is subject to mentioning this Caveat.

25

GUIDELINES RESULTING FROM THE 8

TH

-9

TH

MEETINGS of 6-7 May and 4 June 1980

XV/205/80 (3/3)

g) The place where advertising services are supplied

The Committee unanimously decided that newspaper announcements in respect of private

individuals are not affected by the provisions of Article 9(2)(e), but that these provisions do apply

in respect of all “commercial” announcements place by taxable persons. The restriction also applies

in respect of property advertisements.

h) System of deductions to be applied in banking and financial fields

An initial exchange of views was made; the Committee will take up the point again during a future

meeting.

ATTENTION: Please bear in mind that guidelines issued by the VAT Committee are merely views of

a consultative committee. They do not constitute an official interpretation of EU law and do not

necessarily have the agreement of the European Commission. They do not bind the European

Commission or the Member States who are free not to follow them.

Reproduction of this document is subject to mentioning this Caveat.

26

GUIDELINES RESULTING FROM THE 10

TH

MEETING of 23-24 October 1980

XV/353/80 (1/2)

I. QUESTIONS RAISED CONCERNING THE INTERPRETATION OF THE

6

TH

DIRECTIVE

a) The system of deductions to be applied in banking and financial fields

The Committee continued the examination of this point but did not, however, arrive at any

guideline to enable those delegations who so wished to study the schemes which had been outlined

more closely and to make any necessary contact with their governments and other interested parties.

b) Common VAT arrangements applicable to “travel and entertainment cards” issued by certain

organisations

The Committee was in favour of exempting under Article 13(B)(d)(1) (granting of credit) of the

6

th

Directive those services supplied by the issuing organisation to the card holder.

The large majority of delegations were also in favour of exempting under Article 13(B)(d)(2)

(guarantee of payment) supplies of services between issuing organisations and dealers.

The Committee did however state that option under Article 13(C) might result in inevitable

distortions.

c) The consequences of defining gold coins eligible for exemption under point (26) of Annex F

of the 6

th

Directive

The delegations of those Member States who tax gold coins considered that it was both necessary

and sufficient when referring to the exemption in Annex F(26) to keep to the provisions of

Article 28(3)(b) and exempt only those transactions relating to coins which were already exempted

when the 6

th

Directive came into force. This point of view means therefore that it is impossible to

determine a uniform scope for those transactions relating to gold coins referred to in Annex F(26).

d) The connection between Article 9 and Article 21(1)(a) of the 6

th

Directive in the case of a

taxable person established abroad

The Committee unanimously agreed that Article 21(1)(a) could only be applied in respect of

supplies of goods effected by a taxable person established abroad and those services envisaged in

Article 9(2)(a), (b), (c) and (d) of the 6

th

Directive.

ATTENTION: Please bear in mind that guidelines issued by the VAT Committee are merely views of

a consultative committee. They do not constitute an official interpretation of EU law and do not

necessarily have the agreement of the European Commission. They do not bind the European

Commission or the Member States who are free not to follow them.

Reproduction of this document is subject to mentioning this Caveat.

27

GUIDELINES RESULTING FROM THE 10

TH

MEETING of 23-24 October 1980

XV/353/80 (2/2)

e) The place where auction services are supplied

The Committee almost unanimously considered that the place where an auctioneer’s services are

supplied should be determined in accordance with the general rule laid down in the first paragraph

of Article 9 of the 6

th

Directive.

f) A definition of the territory of the Community

All delegations agreed with the analysis that those territories in Article 3 of the 6

th

Directive should

be treated as third countries in applying both that directive and the 8

th

which refers to the refund of

value added tax to taxable persons not established in the territory of the country. However they

acknowledged that problems still remained regarding the application of the “travellers allowances”,

“small consignments” directives and these difficulties will be brought up by the Committee at a

later date.

g) The data to be taken into account for the calculation of the flat-rate compensation percentages

in agriculture

Whilst taking into account the problems which could arise in practice, the Committee unanimously

considered that in determining flat-rate compensation percentages in agriculture, statistical data for

the three years preceding the current year should be taken into account in order to reach an average

figure for the three years. However, where such data is not yet available, statistics for the last three

available years should be used.

ATTENTION: Please bear in mind that guidelines issued by the VAT Committee are merely views of

a consultative committee. They do not constitute an official interpretation of EU law and do not

necessarily have the agreement of the European Commission. They do not bind the European

Commission or the Member States who are free not to follow them.

Reproduction of this document is subject to mentioning this Caveat.

28

GUIDELINES RESULTING FROM THE 11

TH

MEETING of 10-11 March 1981

XV/79/81 (1/2)

II. QUESTIONS RAISED ON THE INTERPRETATION OF THE 6

TH

DIRECTIVE

a) The system of deductions to be applied in banking and financial fields

Most delegations agreed that, for credit transactions, the total amount of interest received should be

included in the denominator of the fraction in calculating the deductible proportion for banks.

Delegations almost unanimously agreed that as far as sales of shares where a bank acts as an agent

are concerned, the gross margin (i.e. the difference between the sale price and the purchase price)

arising from such transactions should be included in the denominator of the fraction.

The Committee went on to discuss other factors which might be used to calculate the deductible

proportion but did not reach a final conclusion; discussion will therefore be resumed at the next

meeting.

b) The place where auction services are supplied and the taxable amount to be taken into account

The Committee almost unanimously agreed that where the auctioneer is acting in the name and for

the account of the vendor, the taxable amount is the total amount of commission received by the

auctioneer but that if the vendor is a taxable person, the taxable amount is the total amount (not

including VAT) paid by the purchaser including the total amount of commission received by the

auctioneer.

c) Definition of the term “means of transport” used in Article 15(2)

The Committee was unanimously in favour of a broad interpretation of “means of transport for

private use” (Article 15(2) of the 6

th

Directive) to include means of transport used for non-business

purposes by persons other than natural persons such as associations and bodies governed by public

law within the meaning of Article 4(5) of the 6

th

Directive.

d) Tax arrangements applicable to the hiring out of containers

The Committee considered unanimously that the hiring of containers constitutes an equipment

hiring service unrelated to the supply of transport services and that consequently the tax

arrangements to be applied should be based either on Article 9(1) if containers are deemed to be

means of transport, or on Article 9(2) if they are not considered as such, With Article 15(13) or

16(1) making it possible in many cases to solve these problems in the form of exemption of the

service in the case of exports.

ATTENTION: Please bear in mind that guidelines issued by the VAT Committee are merely views of

a consultative committee. They do not constitute an official interpretation of EU law and do not

necessarily have the agreement of the European Commission. They do not bind the European

Commission or the Member States who are free not to follow them.

Reproduction of this document is subject to mentioning this Caveat.

29

GUIDELINES RESULTING FROM THE 11

TH

MEETING of 10-11 March 1981

XV/79/81 (2/2)

e) The authority competent to stamp invoices or other supporting evidence certifying the

exportation of goods contained in the personal luggage of travellers bound for third countries

The majority of delegations took a negative view of the possibility of replacing the customs

authority stamp with a stamp by the captain or purser of an international ferry, and considered that

the responsibility for checking should remain with the custom’s authorities.

f) i) Derogation from the provisions of the Sixth Directive in respect of agreements between

Member States and third countries

The Committee unanimously agreed that an agreement concerning international road transport of

goods established by a Member State with a third country cannot contain any provision to exclude

from the taxable amount for importation for import transactions other than those covered by

Article 14(1) and 16(A) of the directive, those transport costs corresponding to the transport

effected between the place of entry of the goods into the territory of that Member State and the first

place of destination as defined by Article 11(B)(3)(b). Derogations should be allowed only pursuant

to Article 30 of the 6

th

Directive.

ii) Definition of the first place of destination within the meaning of Article 11(B)(3)(b) of the

6

th

Directive

The Committee was unanimously in favour of adopting the following definitions to establish the

first place of destination within a country

− either the place shown on the road transport document made out abroad under cover of which

the goods are brought into the country,

− or, where the place shown on the road transport document differs from the destination the

destination itself,

− or in the absence of such details the first transfer of cargo in the country by a road vehicle.

ATTENTION: Please bear in mind that guidelines issued by the VAT Committee are merely views of

a consultative committee. They do not constitute an official interpretation of EU law and do not

necessarily have the agreement of the European Commission. They do not bind the European

Commission or the Member States who are free not to follow them.

Reproduction of this document is subject to mentioning this Caveat.

30

GUIDELINES RESULTING FROM THE 12

TH

MEETING of 30 June-1 July 1981

XV/182/81 (1/2)

I. QUESTIONS RAISED ON THE INTERPRETATION OF THE 6

TH

DIRECTIVE

a) The interpretation of Article 16(2) of the Sixth Directive

(i) The extent of the option

As far as the extent of the option was concerned, the Committee almost unanimously agreed that

where a Member State opts for the use of Article 16(2) then all relevant exporters should be allowed

(under certain conditions) to benefit from the provision

(ii) Persons covered by the provisions of Article 16(2)

The Committee unanimously agreed that Article 16(2) can only be used in respect of the taxable

persons actually exporting the goods and should not be used to apply an exemption at an earlier

stage.

In addition where Member States have applied Article 28(3) to derogate from Article 5(4) of the

6

th

Directive then the provisions of Article 16(2) cannot be applied to the person supplying the

exporting agent.

(iii) Goods and services which can benefit from Article 16(2)

The majority of the Committee considered that the phrase “as they are or after processing” should

be interpreted to include not only goods in their natural state or after processing but also goods

which contribute to the processing operation. As far as the suspension of tax in respect of services

was concerned, however, the Committee was in favour of a relatively restrictive interpretation,

limited to those services directly linked with the goods being exported.

b) The meaning of the term “means of transport” used in Articles 9 and 15 of the Sixth Directive

The Committee was unanimously agreed that motor vehicles and other equipment and devises

which might be pulled or drawn by such vehicles and which are normally used for carrying out a

transport contract should be regarded as means of transport within the meaning of Article 9 and 15

of the Sixth Directive.

ATTENTION: Please bear in mind that guidelines issued by the VAT Committee are merely views of

a consultative committee. They do not constitute an official interpretation of EU law and do not

necessarily have the agreement of the European Commission. They do not bind the European

Commission or the Member States who are free not to follow them.

Reproduction of this document is subject to mentioning this Caveat.

31

GUIDELINES RESULTING FROM THE 12

TH

MEETING of 30 June-1 July 1981

XV/182/81 (2/2)

The large majority of delegations were also in favour of treating the following items as means of

transport;

− containers;

− private motor vehicles, pleasure craft, trailers and caravans actually used as vehicles;

− vehicles for military, surveillance or civil defence purposes used for the movement of goods

or persons;

− cycles (including delivery tricycles);

− mechanically propelled invalid carriages;

− saddle horses.

c) Questions on arrangements for the refund of value added tax in the context of the Eighth

Directive – authorisation given by a taxable person to his representative to submit the

application for refund and/or to receive payment of the refund

The Committee unanimously agreed that in the case of such services, the place of supply should be

determined by the 3

rd

indent of Article 9(2)(e) of the 6

th

Directive (covering services of accountants

and other similar services) i.e. the place where the customer (the principal) has established his

business.

ATTENTION: Please bear in mind that guidelines issued by the VAT Committee are merely views of

a consultative committee. They do not constitute an official interpretation of EU law and do not

necessarily have the agreement of the European Commission. They do not bind the European

Commission or the Member States who are free not to follow them.

Reproduction of this document is subject to mentioning this Caveat.

32

GUIDELINES RESULTING FROM THE 13

TH

MEETING of 15-16 December 1981

XV/37/82 (1/1)

II. QUESTIONS RAISED ON THE INTERPRETATION OF THE 6

TH

DIRECTIVE

a) Application of point (2) of Annex F to the activity of colour-scheme consultant

The Committee concluded that the temporary exemption provided in Article 28(3)(b) could only

apply in respect of exemptions which were already in existence when the 6

th

Directive was

introduced.

b) Incidence of certain banking transactions on the right to deduct VAT

1. Interest on credit transactions

The Committee was almost unanimously in favour of taking the gross amount of interest into

account in the denominator of the deductible proportion.

2. Transactions in shares

The Committee unanimously agreed that where the bank acts as an agent in the name of a third

party the total remuneration received by the bank for its services as an agent should be taken into

account in the deductible proportion.

The Committee also almost unanimously agreed that, where the bank acts in its own name, the

difference between the sale price and the purchase price should be taken into account in the

deductible proportion.

3. Exchange transactions

This matter was discussed in detail and guidelines will be agreed at a later data.

4. Problem of interpreting Article 17(5)(c)

The majority of the Committee was in favour of using Article 17(5)(c) on the basis of strictly

objective criteria.

c) Application of mutual assistance (inspection of taxable person"

The large majority of the Committee considers that mutual assistance should be developed where

there exists a possibility of evasion and that information should be supplied to a Member State on

request from another Member State. The Committee agreed that under Article 4(1)(a) of the

directive dated 19/12/77 concerning mutual assistance, Member States agreed to undertake

spontaneous exchanges of information where the competent authority of one Member State has

grounds for supposing that there may be a loss of tax in another Member State.

ATTENTION: Please bear in mind that guidelines issued by the VAT Committee are merely views of

a consultative committee. They do not constitute an official interpretation of EU law and do not

necessarily have the agreement of the European Commission. They do not bind the European

Commission or the Member States who are free not to follow them.

Reproduction of this document is subject to mentioning this Caveat.

33

GUIDELINES RESULTING FROM THE 14

TH

MEETING of 23-24 June 1982

XV/150/82 (1/1)

I. QUESTIONS RAISED ON THE INTERPRETATION OF THE 6

TH

DIRECTIVE

a) Territorial scope of the 6

th

VAT Directive

The Committee agreed unanimously that the principality of Monaco, Principality of Andorra,

Republic of San Marino, Channel Islands and the Isle of Man are excluded from the territorial scope

of the 6

th

Directive.

b) Eight Directive refunds of VAT incurred on expenditure associated with the installation of

goods

A large majority of the Committee agreed that the normal provisions of the 6

th

Directive should be

applied to allow deduction or refund of input tax paid on expenditure incurred by a person

established in one Member State and carrying out installation operations in another Member State.

The provisions of the 8

th

Directive not being applicable in respect of such cases. The Committee

agreed to continue examining this question in order to solve practical problems.

c) Credit cards

The Committee reaffirmed its almost unanimous view that the service between the card company

and the retailer should be exempt under Article 13(B)(d) of the 6

th

Directive and in particular under

paragraphs 2 and 3 of that Article, since the principal activity is a financial one, all other aspects

being of a secondary nature.

d) Taxation of hotel and restaurant services

The Committee is for reasons of principle unanimously opposed to exempting restaurant and

overnight stay services which, the Committee considers, should be taxed in the country in which

they are supplied whether or not the person receiving the service is established in that country.

ATTENTION: Please bear in mind that guidelines issued by the VAT Committee are merely views of

a consultative committee. They do not constitute an official interpretation of EU law and do not

necessarily have the agreement of the European Commission. They do not bind the European

Commission or the Member States who are free not to follow them.

Reproduction of this document is subject to mentioning this Caveat.

34

GUIDELINES RESULTING FROM THE 15

TH

MEETING of 8-9 December 1983

XV/38/83 (1/2)

I. QUESTIONS ON THE INTERPRETATION OF THE SIXTH DIRECTIVE

a) Incidence of certain banking transactions on the right to deduct VAT: Exchange transactions

The majority of the Committee considers that, with regard to exchange transactions, the total

remuneration (margin, commission and costs) should be taken into account in the pro-rate

calculation.

b) Pleasure boats: Place at which certain hiring-out transactions are taxed (interpretation of

Article 9(1))

The majority of the Committee considers that the hiring-out of a pleasure boat may be taxed only

in the country in which the actual head office of an economic activity is situated or in which there is

a permanent establishment from which the services are supplied.

c) Telephone calls on board ships on the high seas

A large majority of the Committee took the view that the services offered by a shipowner in

permitting members of the crew to use such telephones for private calls should be considered to be

outside the territorial scope of the tax.

d) VAT arrangements applicable to transactions involving foreign participants at fairs and

exhibitions

A large majority of the Committee decided that in all cases the taxation of services supplied by the

organisers of fairs and exhibitions should occur in the country where these events are held whether

on the basis of Article 9(2)(c).

e) Definition of “fixed establishment” for the purposes of applying the common system of VAT

A large majority of the Committee considers that fixed establishment must be defined as settled

premises, without reference to the capacity to effect taxable transactions.

ATTENTION: Please bear in mind that guidelines issued by the VAT Committee are merely views of

a consultative committee. They do not constitute an official interpretation of EU law and do not

necessarily have the agreement of the European Commission. They do not bind the European

Commission or the Member States who are free not to follow them.

Reproduction of this document is subject to mentioning this Caveat.

35

GUIDELINES RESULTING FROM THE 15

TH

MEETING of 8-9 December 1983

XV/38/83 (2/2)

f) Interpretation of Article 15(2) of the Sixth Directive and Article 6 of Directive 69/l69/EEC, as

amended, relating to tax-free allowances for travellers

A large majority of the Committee considers that Article 6 of Directive 69/169/EEC also applies to

equipment for means of private transport use and that exemption must be granted by the exporting

country if the conditions provided for by the above mentioned Article are fulfilled.

II. REFUND OF VAT TO GREEK FIRMS UNDER THE EIGHTH VAT DIRECTIVE

The Committee unanimously agreed that the provisions of the Eighth VAT Directive should apply

to Greek firms provided that the Greek tax authorities were able to certify that such firms carried

out business activities and were subject to turnover tax.

ATTENTION: Please bear in mind that guidelines issued by the VAT Committee are merely views of

a consultative committee. They do not constitute an official interpretation of EU law and do not

necessarily have the agreement of the European Commission. They do not bind the European

Commission or the Member States who are free not to follow them.

Reproduction of this document is subject to mentioning this Caveat.

36

GUIDELINES RESULTING FROM THE 16

TH

MEETING of 30 November-1 December 1983

XV/40/84 (1/1)

II. QUESTIONS ON THE INTERPRETATION OF THE SIXTH DIRECTIVE

a) Place of taxation of international telecommunications services supplies

The Committee held unanimously that the place of supply of international telecommunications

services is in the country of the person paying for the communication (rule of the place where the

supplier has established his business).

b) Taxable amount for certain passenger transport operations

A large majority of the Committee felt for practical reasons that, where, in the case of passengers

travelling by sea or air between departure and arrival points situated in the same Member State, part

of the journey is made through international waters or above the territory of another State, such

journeys should be deemed to take place entirely within the Member State concerned.

c) Place of taxation of the hiring of railway wagons

The Committee unanimously considered that, in accordance with Article 9(1) of the Sixth

Directive, the hiring of railway wagons must be taxed in the place where the supplier of the service

had physically and effectively established his business. It also took the view that where the lessor

invoiced for VAT a lessee established in another Member State, the Eighth Directive was

applicable.

d) Territorial scope of VAT in respect of certain services supplied by travel agents acting as

intermediaries: application of Article 9 of the Sixth Directive

On the specific case of an owner of a holiday home situated in Member State A who lets it to a

travel agent in Member State B, with the agent acting as intermediary and receiving his commission

from the owner, the overwhelming majority of the Committee considered that, as VAT law stood

at present, Article 9(2)(a) must apply. The Committee also agreed to determine the scope of

Article 26 and of associated problems which might follow in connection with Article 9, and if

necessary to re-examine the situation.

[Replaced by guidelines agreed at the 93

rd

meeting]

e) Application of the Eighth Directive