Userid: CPM Schema:

i1040x

Leadpct: 100% Pt. size: 10

Draft Ok to Print

AH XSL/XML

Fileid: … /i1040scha/2023/a/xml/cycle05/source (Init. & Date) _______

Page 1 of 17 14:49 - 3-Jan-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Department of the Treasury

Internal Revenue Service

2023 Instructions for Schedule A

Itemized

Deductions

Use Schedule A (Form 1040) to figure your itemized deductions. In most cases, your

federal income tax will be less if you take the larger of your itemized deductions or

your standard deduction.

If you itemize, you can deduct a part of your medical and dental expenses, and

amounts you paid for certain taxes, interest, contributions, and other expenses. You

can also deduct certain casualty and theft losses.

If you and your spouse paid expenses jointly and are filing separate returns for

2023, see Pub. 504 to figure the portion of joint expenses that you can claim as itemiz-

ed deductions.

Don't include on Schedule A items deducted elsewhere, such as on Form

1040, Form 1040-SR, or Schedule C, E, or F.

CAUTION

!

Section references are to the Internal

Revenue Code unless otherwise noted.

Future developments. For the latest in-

formation about developments related to

Schedule A (Form 1040) and its instruc-

tions, such as legislation enacted after

they were published, go to

IRS.gov/

ScheduleA.

What’s New

Standard mileage rates. The standard

mileage rate allowed for operating ex-

penses for a car when you use it for

medical reasons is 22 cents a mile. The

rate for use of your vehicle to do volun-

teer work for certain charitable organiza-

tions remains at 14 cents a mile.

Medical and Dental

Expenses

You can deduct only the part of your

medical and dental expenses that ex-

ceeds 7.5% of the amount of your adjus-

ted gross income on Form 1040 or

1040-SR, line 11.

If you received a distribution

from a health savings account

or a medical savings account in

2023, see Pub. 969 to figure your deduc-

tion.

Deceased taxpayer. Certain medical

expenses paid out of a deceased taxpay-

er's estate can be claimed on the de-

ceased taxpayer's final return. See Pub.

502 for details.

CAUTION

!

More information. Pub. 502 discusses

the types of expenses you can and can’t

deduct. It also explains when you can

deduct capital expenses and special care

expenses for disabled persons.

Examples of Medical and

Dental Payments You Can

Include in Calculating Your

Total Medical Expenses

To the extent you weren't reimbursed in

calculating your total medical expenses,

you can include what you paid for:

•

Insurance premiums for medical

and dental care, including premiums for

qualified long-term care insurance con-

tracts as defined in Pub. 502. But see

Limit on long-term care premiums you

can deduct, later. Reduce the insurance

premiums by any self-employed health

insurance deduction you claimed on

Schedule 1 (Form 1040), line 17. You

can't include insurance premiums paid

by making a pre-tax reduction to your

employee compensation because these

amounts are already being excluded

from your income by not being included

in box 1 of your Form(s) W-2. If you are

a retired public safety officer, you can't

include any premiums you paid to the

extent they were paid for with a tax-free

distribution from your retirement plan.

•

Prescription medicines or insulin.

•

Acupuncturists, chiropractors, den-

tists, eye doctors, medical doctors, occu-

pational therapists, osteopathic doctors,

physical therapists, podiatrists, psychia-

trists, psychoanalysts (medical care on-

ly), and psychologists.

•

Medical examinations, X-ray and

laboratory services, and insulin treat-

ments your doctor ordered.

•

Diagnostic tests, such as a

full-body scan, pregnancy test, or blood

sugar test kit.

•

Nursing help (including your share

of the employment taxes paid). If you

paid someone to do both nursing and

housework, you can deduct only the cost

of the nursing help.

•

Hospital care (including meals and

lodging), clinic costs, and lab fees.

•

Qualified long-term care services

(see Pub. 502).

•

The supplemental part of Medicare

insurance (Medicare Part B).

•

The premiums you pay for Medi-

care Part D insurance.

•

A program to stop smoking and for

prescription medicines to alleviate nico-

tine withdrawal.

•

A weight-loss program as treat-

ment for a specific disease (including

obesity) diagnosed by a doctor.

•

Medical treatment at a center for

drug or alcohol addiction.

•

Medical aids such as eyeglasses,

contact lenses, hearing aids, braces,

crutches, wheelchairs, and guide dogs,

including the cost of maintaining them.

•

Surgery to improve defective vi-

sion, such as laser eye surgery or radial

keratotomy.

•

Lodging expenses (but not meals)

while away from home to receive medi-

cal care provided by a physician in a

Dec 13, 2023 Cat. No. 53061X

A-1

Page 2 of 17 Fileid: … /i1040scha/2023/a/xml/cycle05/source 14:49 - 3-Jan-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

hospital or a medical care facility related

to a hospital, provided there was no sig-

nificant element of personal pleasure,

recreation, or vacation in the travel.

Don't deduct more than $50 a night for

each person who meets the requirements

in Pub. 502 under Lodging.

•

Ambulance service and other trav-

el costs to get medical care. If you used

your own car, you can include what you

spent for gas and oil to go to and from

the place you received the care; or you

can include 22 cents a mile. Add parking

and tolls to the amount you claim under

either method.

•

Cost of breast pumps and supplies

that assist lactation.

•

Personal protective equipment

(such as masks, hand sanitizer and sani-

tizing wipes), for the primary purpose of

preventing the spread of Coronavirus.

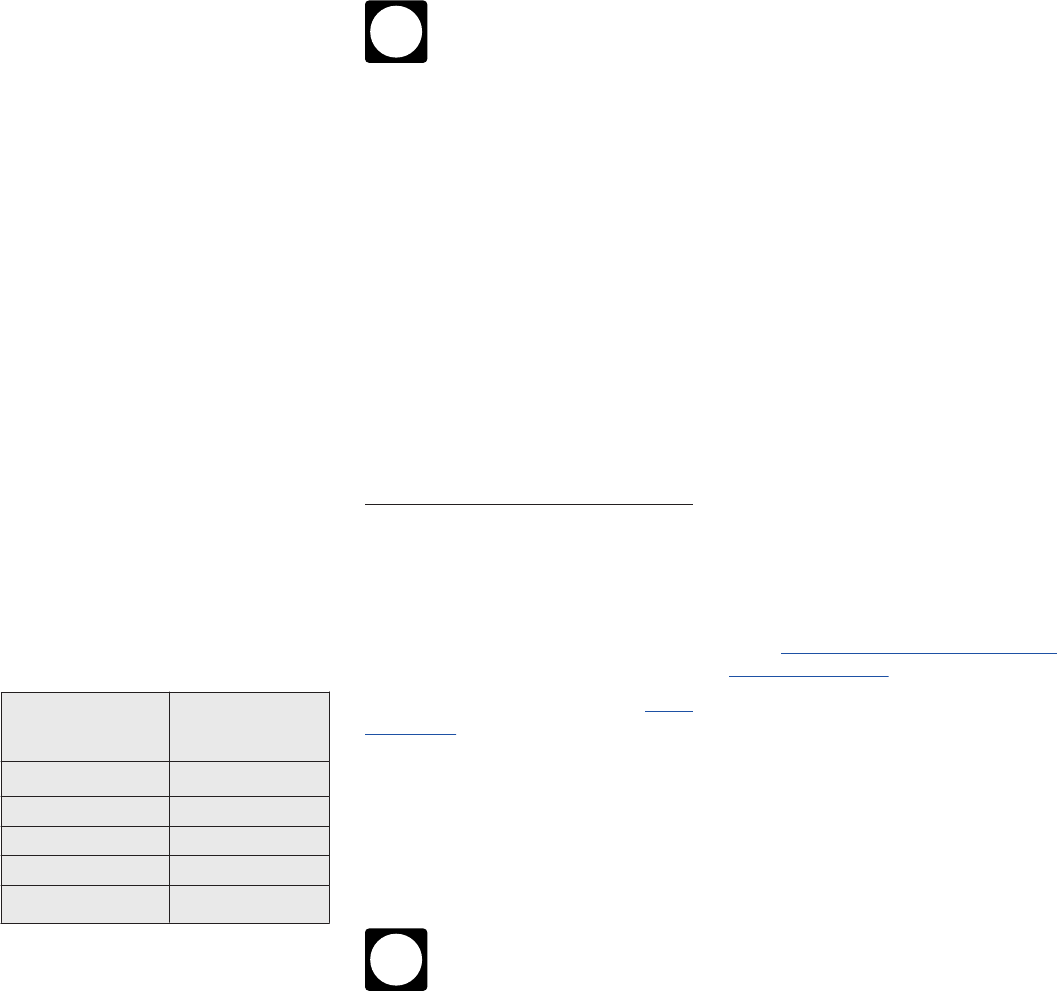

Limit on long-term care premiums

you can include. The amount you can

include for qualified long-term care in-

surance contracts (as defined in Pub.

502) depends on the age, at the end of

2023, of the person for whom the premi-

ums were paid. See the following chart

for details.

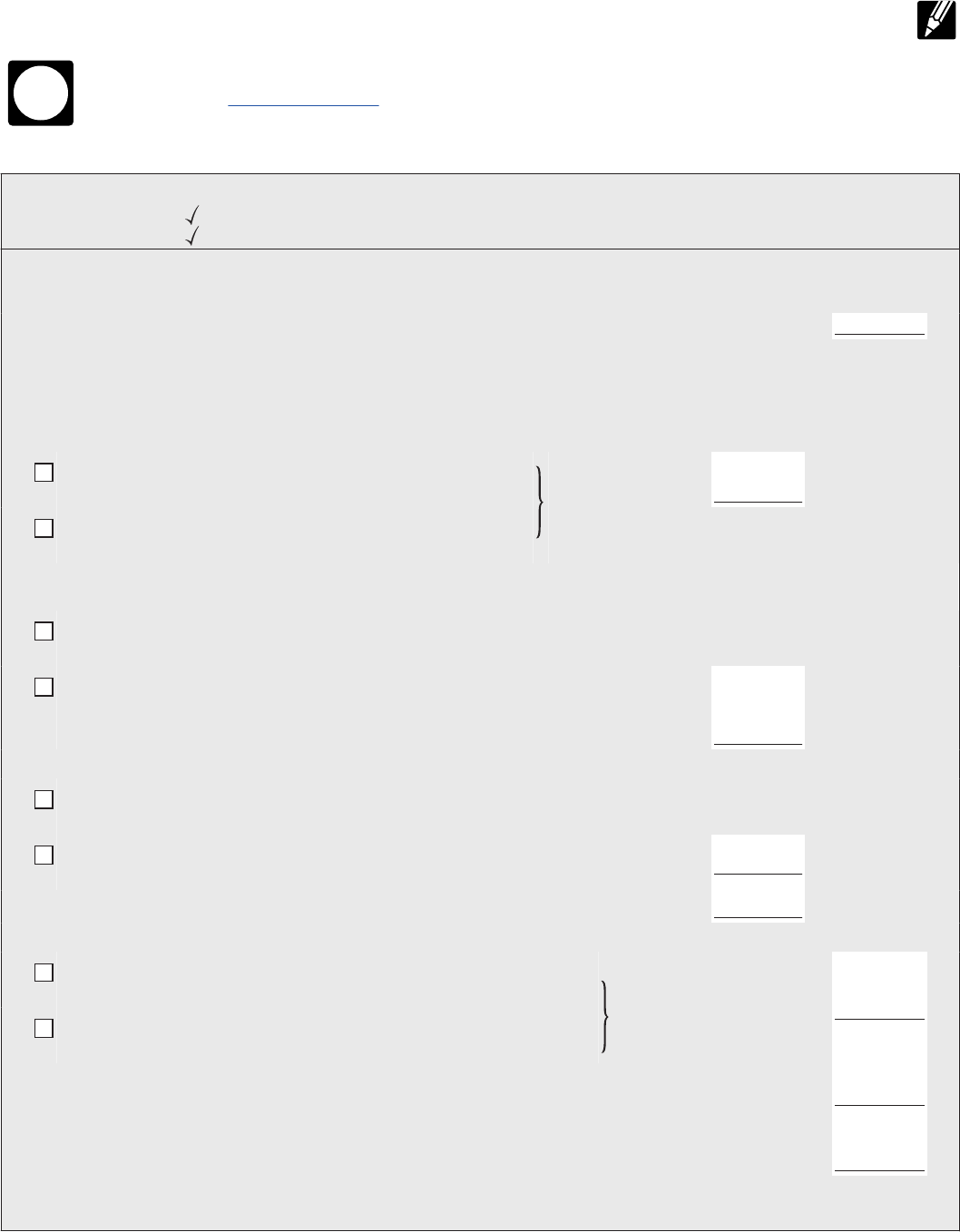

IF the person was,

at the end of 2023,

age . . .

THEN the most

you can include

is . . .

.

40 or under $ 480

41–50 $ 890

51–60 $ 1,790

61–70 $ 4,770

71 or older $ 5,960

Examples of Medical and

Dental Payments You Can't

Include

•

The cost of diet food.

•

Cosmetic surgery unless it was

necessary to improve a deformity related

to a congenital abnormality, an injury

from an accident or trauma, or a disfig-

uring disease.

•

Life insurance or income protec-

tion policies.

•

The Medicare tax on your wages

and tips or the Medicare tax paid as part

of the self-employment tax or household

employment taxes.

If you were age 65 or older but

not entitled to social security

benefits, you can include pre-

miums you voluntarily paid for Medi-

care Part A coverage.

•

Nursing care for a healthy baby.

But you may be able to take a credit for

the amount you paid. See the Instruc-

tions for Form 2441.

•

Illegal operations or drugs.

•

Imported drugs not approved by

the U.S. Food and Drug Administration

(FDA). This includes foreign-made ver-

sions of U.S.-approved drugs manufac-

tured without FDA approval.

•

Nonprescription medicines, other

than insulin (including nicotine gum and

certain nicotine patches).

•

Travel your doctor told you to take

for rest or a change.

•

Funeral, burial, or cremation costs.

Line 1

Medical and Dental

Expenses

Enter the total of your medical and den-

tal expenses, after you reduce these ex-

penses by any payments received from

insurance or other sources. See Reim-

bursements, later.

If advance payments of the premium

tax credit were made, or you think you

may be eligible to claim a premium tax

credit, fill out Form 8962 before filling

out Schedule A, line 1. See Pub. 502 for

how to figure your medical and dental

expenses deduction.

Don't forget to include insur-

ance premiums you paid for

medical and dental care. How-

ever, if you claimed the self-employed

health insurance deduction on Schedule

1 (Form 1040), line 17, reduce the pre-

miums by the amount on line 17.

Whose medical and dental expenses

can you include? You can include

medical and dental bills you paid in

2023 for anyone who was one of the fol-

lowing either when the services were

provided or when you paid for them.

•

Yourself and your spouse.

•

All dependents you claim on your

return.

•

Your child whom you don't claim

as a dependent because of the rules for

children of divorced or separated pa-

TIP

TIP

rents. See Child of divorced or separa-

ted parents in Pub. 502 for more infor-

mation.

•

Any person you could have claim-

ed as a dependent on your return except

that person received $4,700 or more of

gross income or filed a joint return.

•

Any person you could have claim-

ed as a dependent except that you, or

your spouse if filing jointly, can be

claimed as a dependent on someone

else's 2023 return.

Example. You provided over half of

your parent's support but can't claim

your parent as a dependent because they

received wages of $4,700 in 2023. You

can include on line 1 any medical and

dental expenses you paid in 2023 for

your parent.

Insurance premiums for certain non-

dependents. You may have a medical

or dental insurance policy that also cov-

ers an individual who isn't your depend-

ent (for example, a nondependent child

under age 27). You can't deduct any pre-

miums attributable to this individual, un-

less this individual is a person described

under Whose medical and dental expen-

ses can you include, earlier. However, if

you had family coverage when you add-

ed this individual to your policy and

your premiums didn't increase, you can

enter on line 1 the full amount of your

medical and dental insurance premiums.

See Pub. 502 for more information.

Reimbursements. If your insurance

company paid the provider directly for

part of your expenses, and you paid only

the amount that remained, include on

line 1 only the amount you paid. If you

received a reimbursement in 2023 for

medical or dental expenses you paid in

2023, reduce your 2023 expenses by this

amount. If you received a reimburse-

ment in 2023 for prior year medical or

dental expenses, don't reduce your 2023

expenses by this amount. However, if

you deducted the expenses in the earlier

year and the deduction reduced your tax,

you must include the reimbursement in

income on Schedule 1 (Form 1040),

line 8z. See Pub. 502 for details on how

to figure the amount to include.

Cafeteria plans. You can’t deduct

amounts that have already been exclu-

ded from your income, so don’t include

on line 1 insurance premiums paid by an

employer-sponsored health insurance

plan (cafeteria plan) unless the

A-2

Page 3 of 17 Fileid: … /i1040scha/2023/a/xml/cycle05/source 14:49 - 3-Jan-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

premiums are included in box 1 of your

Form(s) W-2. Also, don't include any

other medical and dental expenses paid

by the plan unless the amount paid is in-

cluded in box 1 of your Form(s) W-2.

Taxes You Paid

Taxes You Can't Deduct

•

Federal income and most excise

taxes.

•

Social security, Medicare, federal

unemployment (FUTA), and railroad re-

tirement (RRTA) taxes.

•

Customs duties.

•

Federal estate and gift taxes. How-

ever, see Line 16, later, if you had in-

come in respect of a decedent.

•

Certain state and local taxes, in-

cluding tax on gasoline, car inspection

fees, assessments for sidewalks or other

improvements to your property, tax you

paid for someone else, and license fees

(for example, marriage, driver's, and

pet).

•

Foreign personal or real property

taxes.

Line 5

The deduction for state and local taxes is

generally limited to $10,000 ($5,000 if

married filing separately). State and lo-

cal taxes subject to this limit are the tax-

es that you include on lines 5a, 5b, and

5c.

Safe harbor for certain charitable

contributions made in exchange for a

state or local tax credit. If you made a

charitable contribution in exchange for a

state or local tax credit and your charita-

ble contribution deduction must be re-

duced as a result of receiving or expect-

ing to receive the tax credit, you may

qualify for a safe harbor that allows you

to treat some or all of the disallowed

charitable contribution as a payment of

state and local taxes.

The safe harbor applies if you meet

the following conditions.

1. You made a cash contribution to

an entity described in section 170(c).

2. In return for the cash contribu-

tion, you received a state or local tax

credit.

3. You must reduce your charitable

contribution amount by the amount of

the state or local tax credit you receive.

If you meet these conditions, and to the

extent you apply the state or local tax

credit to this or a prior year's state or lo-

cal tax liability, you may include this

amount on line 5a, 5b, or 5c, whichever

is appropriate. To the extent you apply a

portion of the credit to offset your state

or local tax liability in a subsequent year

(as permitted by law), you may treat this

amount as state or local tax paid in the

year the credit is applied.

For more information about this safe

harbor and examples, see Treas. Reg.

1.164-3(j).

U.S. territory taxes. Include taxes im-

posed by a U.S. territory with your state

and local taxes on lines 5a, 5b, and 5c.

However, don't include any U.S. territo-

ry taxes you paid that are allocable to

excluded income.

You may want to take a credit

for U.S. territory tax instead of

a deduction. See the instruc-

tions for Schedule 3 (Form 1040), line 1,

for details.

Line 5a

You can elect to deduct state

and local general sales taxes

instead of state and local in-

come taxes. You can't deduct both.

State and Local Income

Taxes

If you don't elect to deduct general sales

taxes, include on line 5a the state and lo-

cal income taxes listed next.

•

State and local income taxes with-

held from your salary during 2023. Your

Form(s) W-2 will show these amounts.

Forms W-2G, 1099-G, 1099-R,

1099-MISC, and 1099-NEC may also

show state and local income taxes with-

held; however, don't include on line 5a

any withheld taxes you deducted on oth-

er forms, such as Schedule C, E or F.

•

State and local income taxes paid

in 2023 for a prior year, such as taxes

paid with your 2022 state or local in-

come tax return. Don't include penalties

or interest.

•

State and local estimated tax pay-

ments made during 2023, including any

TIP

CAUTION

!

part of a prior year refund that you chose

to have credited to your 2023 state or lo-

cal income taxes.

•

Mandatory contributions you made

to the California, New Jersey, or New

York Nonoccupational Disability Bene-

fit Fund, Rhode Island Temporary Disa-

bility Benefit Fund, or Washington State

Supplemental Workmen's Compensation

Fund.

•

Mandatory contributions to the

Alaska, California, New Jersey, or Penn-

sylvania state unemployment fund.

•

Mandatory contributions to state

family leave programs, such as the New

Jersey Family Leave Insurance (FLI)

program and the California Paid Family

Leave program.

Don't reduce your deduction by any:

•

State or local income tax refund or

credit you expect to receive for 2023; or

•

Refund of, or credit for, prior year

state and local income taxes you actually

received in 2023. Instead, see the in-

structions for Schedule 1 (Form 1040),

line 1.

State and Local General

Sales Taxes

If you elect to deduct state and local

general sales taxes instead of income

taxes, you must check the box on

line 5a. To figure your state and local

general sales tax deduction, you can use

either your actual expenses or the op-

tional sales tax tables.

Actual Expenses

Generally, you can deduct the actual

state and local general sales taxes (in-

cluding compensating use taxes) you

paid in 2023 if the tax rate was the same

as the general sales tax rate.

Food, clothing, and medical supplies.

Sales taxes on food, clothing, and medi-

cal supplies are deductible as a general

sales tax even if the tax rate was less

than the general sales tax rate.

Motor vehicles. Sales taxes on motor

vehicles are deductible as a general sales

tax even if the tax rate was different than

the general sales tax rate. However, if

you paid sales tax on a motor vehicle at

a rate higher than the general sales tax,

you can deduct only the amount of the

A-3

Page 4 of 17 Fileid: … /i1040scha/2023/a/xml/cycle05/source 14:49 - 3-Jan-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

tax that you would have paid at the gen-

eral sales tax rate on that vehicle. In-

clude any state and local general sales

taxes paid for a leased motor vehicle.

Motor vehicles include cars, motor-

cycles, motor homes, recreational vehi-

cles, sport utility vehicles, trucks, vans,

and off-road vehicles.

You must keep your actual re-

ceipts showing general sales

taxes paid to use this method.

Trade or business items. Don't include

sales taxes paid on items used in your

trade or business. Instead, go to the in-

structions for the form you are using to

report business income and expenses to

see if you can deduct these taxes.

Refund of general sales taxes. If you

received a refund of state or local gener-

al sales taxes in 2023 for amounts paid

in 2023, reduce your actual 2023 state

and local general sales taxes by this

amount. If you received a refund of state

or local general sales taxes in 2023 for

prior year purchases, don't reduce your

2023 state and local general sales taxes

by this amount. However, if you deduc-

ted your actual state and local general

sales taxes in the earlier year and the de-

duction reduced your tax, you may have

to include the refund in income on

Schedule 1 (Form 1040), line 8z. See

Recoveries in Pub. 525 for details.

Optional Sales Tax Tables

Instead of using your actual expenses,

you can use the 2023 Optional State

Sales Tax Table and the 2023 Optional

Local Sales Tax Tables at the end of

these instructions to figure your state

and local general sales tax deduction.

You may also be able to add the state

and local general sales taxes paid on cer-

tain specified items.

To figure your state and local general

sales tax deduction using the tables,

complete the State and Local General

Sales Tax Deduction Worksheet or use

the Sales Tax Deduction Calculator at

IRS.gov/SalesTax.

CAUTION

!

If your filing status is married

filing separately, both you and

your spouse elect to deduct

sales taxes, and your spouse elects to

use the optional sales tax tables, you al-

so must use the tables to figure your

state and local general sales tax deduc-

tion.

Instructions for the State and

Local General Sales Tax

Deduction Worksheet

Line 1. If you lived in the same state

for all of 2023, enter the applicable

amount, based on your 2023 income and

family size, from the 2023 Optional

State Sales Tax Table for your state.

Read down the “At least–But less than”

columns for your state and find the line

that includes your 2023 income. If mar-

ried filing separately, don't include your

spouse's income.

Note. The family size column refers to

the number of dependents listed on

page 1 of Form 1040 or Form 1040-SR

(and any continuation sheets) plus you

and, if you are filing a joint return, your

spouse. If you are married and not filing

a joint return, you can include your

spouse in family size only in certain cir-

cumstances, which are described in Pub.

501.

Income. Your 2023 income is the

amount shown on your Form 1040 or

1040-SR, line 11, plus any nontaxable

items, such as the following.

•

Tax-exempt interest.

•

Veterans' benefits.

•

Nontaxable combat pay.

•

Workers' compensation.

•

Nontaxable part of social security

and railroad retirement benefits.

•

Nontaxable part of IRA, pension,

or annuity distributions. Don't include

rollovers.

•

Public assistance payments.

What if you lived in more than one

state? If you lived in more than one

state during 2023, use the following

steps to figure the amount to put on

line 1 of the worksheet.

1. Look up the table amount for

each state using the rules stated earlier.

(If there is no table for a state, the table

amount for that state is considered to be

zero.)

CAUTION

!

2. Multiply the table amount of each

state by a fraction, the numerator of

which is the number of days you lived in

the state during 2023 and the denomina-

tor of which is the total number of days

in the year (365).

3. If you also lived in a locality dur-

ing 2023 that imposed a local general

sales tax, complete a separate worksheet

for each state you lived in using the pro-

rated amount from step (2) for that state

on line 1 of its worksheet. Otherwise,

combine the prorated table amounts

from step (2) and enter the total on

line 1 of a single worksheet.

Example. You lived in State A from

January 1 through August 31, 2023 (243

days), and in State B from September 1

through December 31, 2023 (122 days).

The table amount for State A is $500.

The table amount for State B is $400.

You would figure your state general

sales tax as follows.

State A: $500 x 243/365 = $333

State B: $400 x 122/365 = 134

Total = $467

If none of the localities in which you

lived during 2023 imposed a local gen-

eral sales tax, enter $467 on line 1 of

your worksheet. Otherwise, complete a

separate worksheet for State A and State

B. Enter $333 on line 1 of the State A

worksheet and $134 on line 1 of the

State B worksheet.

Line 2. If you checked the “No” box,

enter -0- on line 2, and go to line 3. If

you checked the “Yes” box and lived in

the same locality for all of 2023, enter

the applicable amount, based on your

2023 income and family size, from the

2023 Optional Local Sales Tax Tables

for your locality. Read down the “At

least–But less than” columns for your

locality and find the line that includes

your 2023 income. See the instructions

for line 1 of the worksheet to figure your

2023 income. The family size column

refers to the number of dependents listed

on page 1 of Form 1040 or Form

1040-SR (and any continuation sheets)

plus you and, if you are filing a joint re-

turn, your spouse. If you are married and

not filing a joint return, you can include

A-4

Page 5 of 17 Fileid: … /i1040scha/2023/a/xml/cycle05/source 14:49 - 3-Jan-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

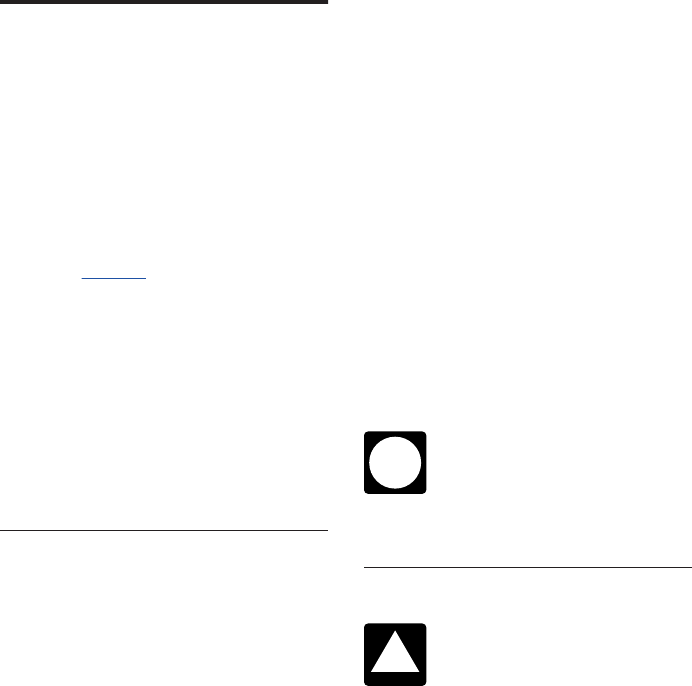

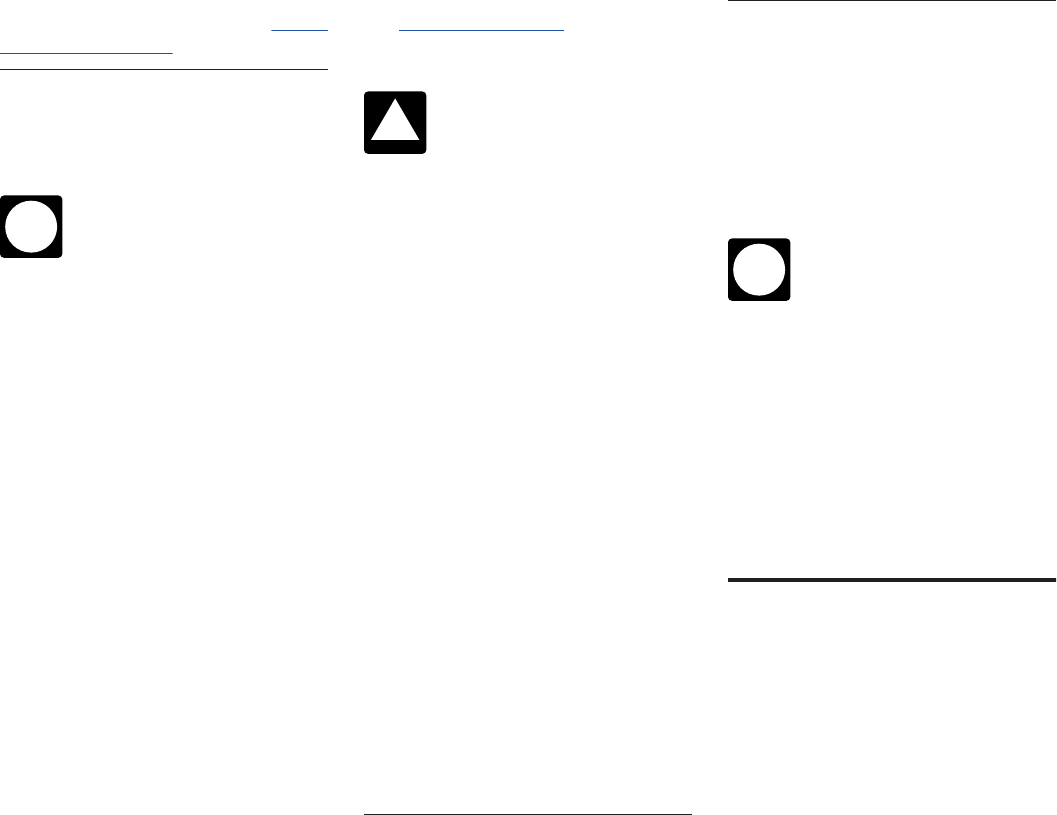

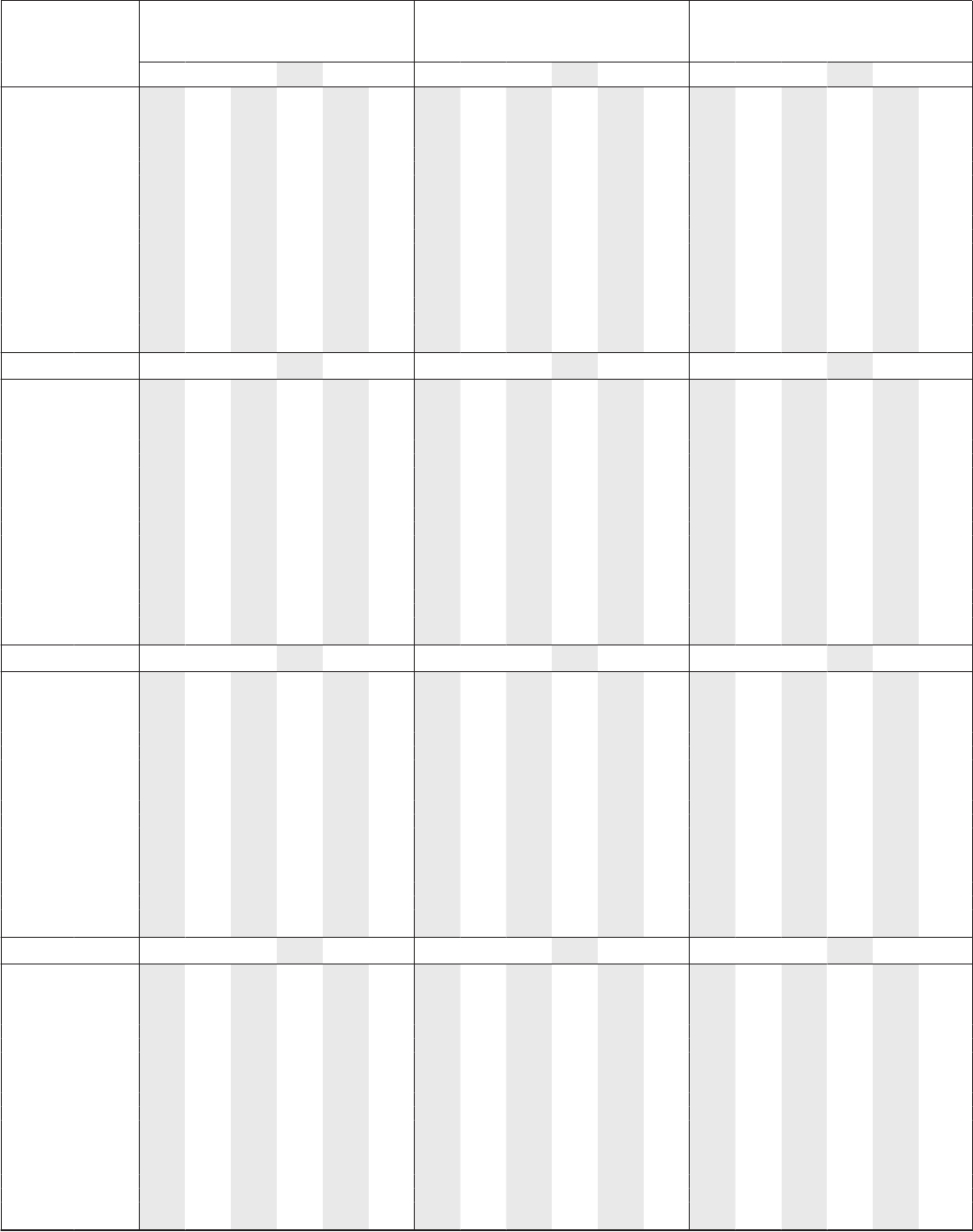

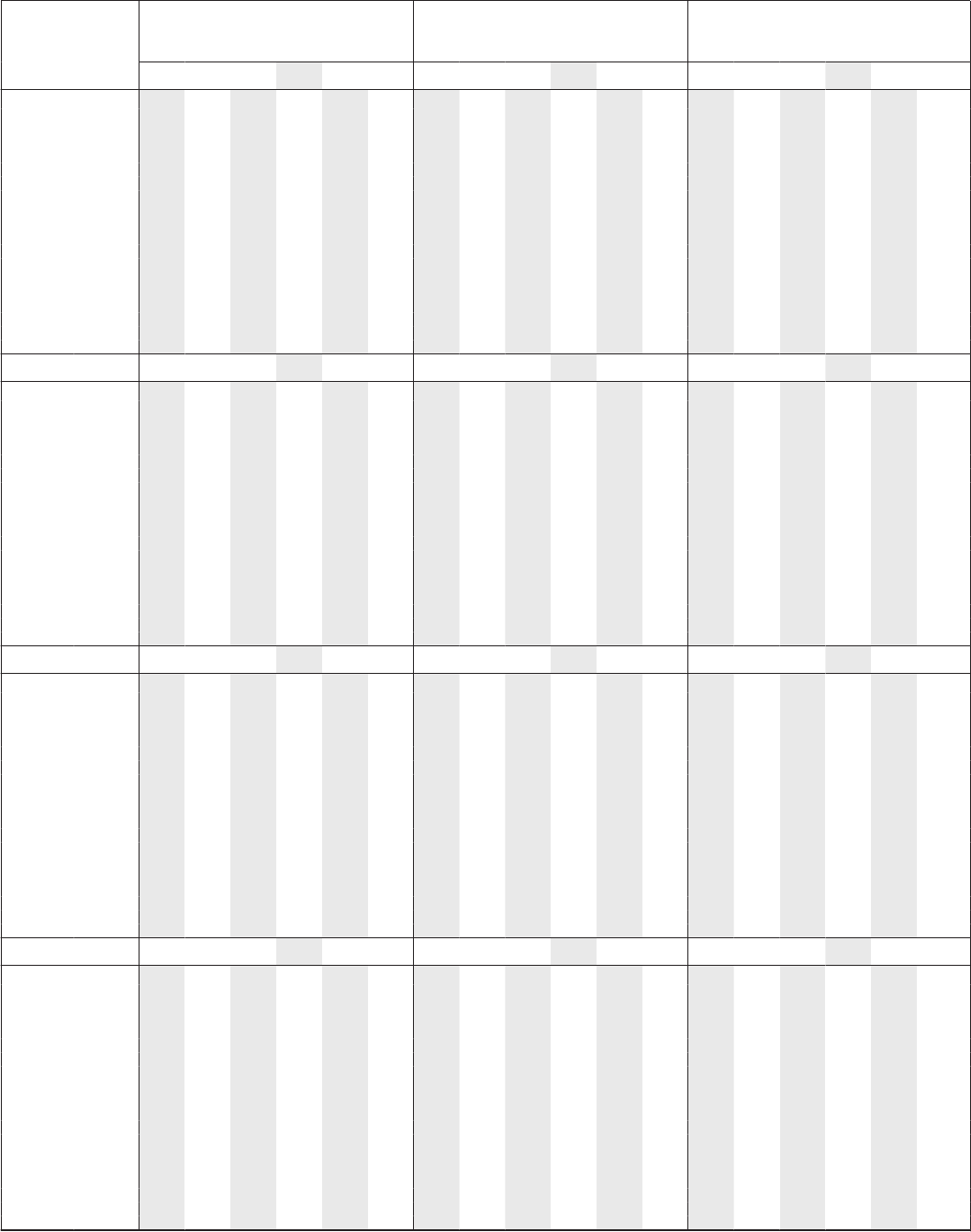

State and Local General Sales Tax Deduction

Worksheet—Line 5a

Keep for Your Records

TIP

Instead of using this worksheet, you can find your deduction by using the Sales Tax Deduction

Calculator at IRS.gov/SalesTax.

See the instructions for line 1 of the worksheet if you:

Lived in more than one state during 2023, or

Had any nontaxable income in 2023.

Before you begin:

1. Enter your state general sales taxes from the 2023 Optional State Sales Tax Table .................................

1.

Next. If, for all of 2023, you lived only in Connecticut, the District of Columbia, Indiana, Kentucky, Maine, Maryland,

Massachusetts, Michigan, New Jersey, or Rhode Island, skip lines 2 through 5, enter -0- on line 6, and go to line 7. Otherwise, go

to line 2.

2. Did you live in Alabama, Alaska, Arizona, Arkansas, Colorado, Georgia, Illinois, Kansas, Louisiana, Mississippi, Missouri, New

York, North Carolina, South Carolina, Tennessee, Utah, or Virginia in 2023?

No. Enter -0-.

.............. 2.

Yes. Enter your base local general sales taxes from the 2023 Optional Local

Sales Tax Tables.

3. Did your locality impose a local general sales tax in 2023? Residents of California and Nevada, see the

instructions for line 3 of the worksheet.

No. Skip lines 3 through 5, enter -0- on line 6, and go to line 7.

Yes. Enter your local general sales tax rate, but omit the percentage sign. For example, if your local

general sales tax rate was 2.5%, enter 2.5. If your local general sales tax rate changed or you lived in

more than one locality in the same state during 2023, see the instructions for line 3 of the

worksheet ................................................................ 3.

.

4. Did you enter -0- on line 2?

No. Skip lines 4 and 5 and go to line 6.

Yes. Enter your state general sales tax rate (shown in the table heading for your state), but omit the

percentage sign. For example, if your state general sales tax rate is 6%, enter 6.0 ................

4.

.

5. Divide line 3 by line 4. Enter the result as a decimal (rounded to at least three places) ................

5.

.

6. Did you enter -0- on line 2?

No. Multiply line 2 by line 3.

.................... 6.

Yes. Multiply line 1 by line 5. If you lived in more than one locality in the same state

during 2023, see the instructions for line 6 of the worksheet.

7. Enter your state and local general sales taxes paid on specified items, if any. See the instructions for line 7 of the

worksheet .................................................................................. 7.

8. Deduction for general sales taxes. Add lines 1, 6, and 7. Enter the result here and the total from all your state and local general

sales tax deduction worksheets, if you completed more than one, on Schedule A, line 5a. Be sure to check the box on

that line ................................................................................... 8.

A-5

Page 6 of 17 Fileid: … /i1040scha/2023/a/xml/cycle05/source 14:49 - 3-Jan-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

your spouse in family size only in cer-

tain circumstances, which are described

in Pub. 501.

What if you lived in more than one

locality? If you lived in more than one

locality during 2023, look up the table

amount for each locality using the rules

stated earlier. If there is no table for your

locality, the table amount is considered

to be zero. Multiply the table amount for

each locality you lived in by a fraction.

The numerator of the fraction is the

number of days you lived in the locality

during 2023 and the denominator is the

total number of days in the year (365). If

you lived in more than one locality in

the same state and the local general sales

tax rate was the same for each locality,

enter the total of the prorated table

amounts for each locality in that state on

line 2. Otherwise, complete a separate

worksheet for lines 2 through 6 for each

locality and enter each prorated table

amount on line 2 of the applicable work-

sheet.

Example. You lived in Locality 1

from January 1 through August 31, 2023

(243 days), and in Locality 2 from Sep-

tember 1 through December 31, 2023

(122 days). The table amount for Locali-

ty 1 is $100. The table amount for Lo-

cality 2 is $150. You would figure the

amount to enter on line 2 as follows.

Note that this amount may not equal

your local sales tax deduction, which is

figured on line 6 of the worksheet.

Locality 1: $100 x 243/365 = $ 67

Locality 2: $150 x 122/365 = 50

Total = $117

Line 3. If you lived in California, check

the “No” box if your combined state and

local general sales tax rate is 7.2500%.

Otherwise, check the “Yes” box and in-

clude on line 3 only the part of the com-

bined rate that is more than 7.2500%.

If you lived in Nevada, check the

“No” box if your combined state and lo-

cal general sales tax rate is 6.8500%.

Otherwise, check the “Yes” box and in-

clude on line 3 only the part of the com-

bined rate that is more than 6.8500%.

What if your local general sales tax

rate changed during 2023? If you

checked the “Yes” box and your local

general sales tax rate changed during

2023, figure the rate to enter on line 3 as

follows. Multiply each tax rate for the

period it was in effect by a fraction. The

numerator of the fraction is the number

of days the rate was in effect during

2023 and the denominator is the total

number of days in the year (365). Enter

the total of the prorated tax rates on

line 3.

Example. Locality 1 imposed a 1%

local general sales tax from January 1

through September 30, 2023 (273 days).

The rate increased to 1.75% for the peri-

od from October 1 through December

31, 2023 (92 days). You would enter

“1.189” on line 3, figured as follows.

January 1 –

September 30: 1.00 x 273/365 = 0.748

October 1 –

December 31: 1.75 x 92/365 =

0.441

Total = 1.189

What if you lived in more than one

locality in the same state during 2023?

Complete a separate worksheet for lines

2 through 6 for each locality in your

state if you lived in more than one local-

ity in the same state during 2023 and

each locality didn't have the same local

general sales tax rate.

To figure the amount to enter on

line 3 of the worksheet for each locality

in which you lived (except a locality for

which you used the 2023 Optional Local

Sales Tax Tables to figure your local

general sales tax deduction), multiply

the local general sales tax rate by a frac-

tion. The numerator of the fraction is the

number of days you lived in the locality

during 2023 and the denominator is the

total number of days in the year (365).

Example. You lived in Locality 1

from January 1 through August 31, 2023

(243 days), and in Locality 2 from Sep-

tember 1 through December 31, 2023

(122 days). The local general sales tax

rate for Locality 1 is 1%. The rate for

Locality 2 is 1.75%. You would enter

“0.666” on line 3 for the Locality 1

worksheet and “0.585” for the Locality

2 worksheet, figured as follows.

Locality 1: 1.00 x 243/365 = 0.666

Locality 2: 1.75 x 122/365 = 0.585

Line 6. If you lived in more than one

locality in the same state during 2023,

you should have completed line 1 only

on the first worksheet for that state and

separate worksheets for lines 2 through

6 for any other locality within that state

in which you lived during 2023. If you

checked the “Yes” box on line 6 of any

of those worksheets, multiply line 5 of

that worksheet by the amount that you

entered on line 1 for that state on the

first worksheet.

Line 7. Enter on line 7 any state and lo-

cal general sales taxes paid on the fol-

lowing specified items. If you are com-

pleting more than one worksheet,

include the total for line 7 on only one

of the worksheets.

1. A motor vehicle (including a car,

motorcycle, motor home, recreational

vehicle, sport utility vehicle, truck, van,

and off-road vehicle). Also include any

state and local general sales taxes paid

for a leased motor vehicle. If the state

sales tax rate on these items is higher

than the general sales tax rate, only in-

clude the amount of tax you would have

paid at the general sales tax rate.

2. An aircraft or boat, but only if the

tax rate was the same as the general

sales tax rate.

3. A home (including a mobile

home or prefabricated home) or substan-

tial addition to or major renovation of a

home, but only if the tax rate was the

same as the general sales tax rate and

any of the following applies.

a. Your state or locality imposes a

general sales tax directly on the sale of a

home or on the cost of a substantial ad-

dition or major renovation.

b. You purchased the materials to

build a home or substantial addition or

to perform a major renovation and paid

the sales tax directly.

c. Under your state law, your con-

tractor is considered your agent in the

construction of the home or substantial

addition or the performance of a major

renovation. The contract must state that

the contractor is authorized to act in

your name and must follow your direc-

tions on construction decisions. In this

case, you will be considered to have pur-

chased any items subject to a sales tax

and to have paid the sales tax directly.

A-6

Page 7 of 17 Fileid: … /i1040scha/2023/a/xml/cycle05/source 14:49 - 3-Jan-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Don't include sales taxes paid on

items used in your trade or business. If

you received a refund of state or local

general sales taxes in 2023, see Refund

of general sales taxes, earlier.

Line 5b

State and Local Real Estate

Taxes

If you are a homeowner who

received assistance under a

State Housing Finance Agency

Hardest Hit Fund program or an Emer-

gency Homeowners' Loan program, see

Pub. 530 for the amount you can include

on line 5b.

Enter on line 5b the state and local

taxes you paid on real estate you own

that wasn't used for business, but only if

the taxes are assessed uniformly at a like

rate on all real property throughout the

community, and the proceeds are used

for general community or governmental

purposes. Pub. 530 explains the deduc-

tions homeowners can take.

Don't include the following amounts

on line 5b.

•

Foreign taxes you paid on real es-

tate.

•

Itemized charges for services to

specific property or persons (for exam-

ple, a $20 monthly charge per house for

trash collection, a $5 charge for every

1,000 gallons of water consumed, or a

flat charge for mowing a lawn that had

grown higher than permitted under a lo-

cal ordinance).

•

Charges for improvements that

tend to increase the value of your prop-

erty (for example, an assessment to

build a new sidewalk). The cost of a

property improvement is added to the

basis of the property. However, a charge

is deductible if it is used only to main-

tain an existing public facility in service

(for example, a charge to repair an exist-

ing sidewalk, and any interest included

in that charge).

If your mortgage payments include

your real estate taxes, you can include

only the amount the mortgage company

actually paid to the taxing authority in

2023.

If you sold your home in 2023, any

real estate tax charged to the buyer

should be shown on your settlement

TIP

statement and in box 6 of any Form

1099-S you received. This amount is

considered a refund of real estate taxes.

See Refunds and rebates, later. Any real

estate taxes you paid at closing should

be shown on your settlement statement.

You must look at your real es-

tate tax bill to decide if any

nondeductible itemized charg-

es, such as those listed earlier, are inclu-

ded in the bill. If your taxing authority

(or lender) doesn't furnish you a copy of

your real estate tax bill, ask for it.

Prepayment of next year's property

taxes. Only taxes paid in 2023 and as-

sessed prior to 2024 can be deducted for

2023. State or local law determines

whether and when a property tax is as-

sessed, which is generally when the tax-

payer becomes liable for the property

tax imposed.

Refunds and rebates. If you received a

refund or rebate in 2023 of real estate

taxes you paid in 2023, reduce your de-

duction by the amount of the refund or

rebate. If you received a refund or rebate

in 2023 of real estate taxes you paid in

an earlier year, don't reduce your deduc-

tion by this amount. Instead, you must

include the refund or rebate in income

on Schedule 1 (Form 1040), line 8z, if

you deducted the real estate taxes in the

earlier year and the deduction reduced

your tax. See Recoveries in Pub. 525 for

details on how to figure the amount to

include in income.

Line 5c

State and Local Personal

Property Taxes

Enter on line 5c the state and local per-

sonal property taxes you paid, but only

if the taxes were based on value alone

and were imposed on a yearly basis.

Example. You paid a yearly fee for

the registration of your car. Part of the

fee was based on the car's value and part

was based on its weight. You can deduct

only the part of the fee that was based

on the car's value.

Prepayment of next year's property

taxes. Only taxes paid in 2023 and as-

sessed prior to 2024 can be deducted for

2023. State or local law determines

whether and when a property tax is as-

sessed, which is generally when the tax-

CAUTION

!

payer becomes liable for the property

tax imposed.

Line 6

Other Taxes

Enter only one total on line 6, but list the

type and amount of each tax included.

Include on this line income taxes you

paid to a foreign country and generation

skipping tax (GST) imposed on certain

income distributions.

You may want to take a credit

for the foreign tax instead of a

deduction. See the instructions

for Schedule 3 (Form 1040), line 1, for

details.

Don't include taxes you paid to a U.S.

territory on this line; instead, include

U.S. territory taxes on the appropriate

state and local tax line.

Don't include federal estate tax on in-

come in respect of a decedent on this

line; instead, include it on line 16.

Interest You Paid

The rules for deducting interest vary, de-

pending on whether the loan proceeds

are used for business, personal, or in-

vestment activities. See Pub. 535 for

more information about deducting busi-

ness interest expenses. See Pub. 550 for

more information about deducting in-

vestment interest expenses. You can't

deduct personal interest. However, you

can deduct qualified home mortgage in-

terest (on your Schedule A) and interest

on certain student loans (on Schedule 1

(Form 1040), line 21), as explained in

Pub. 936 and Pub. 970.

If you use the proceeds of a loan for

more than one purpose (for example,

personal and business), you must allo-

cate the interest on the loan to each use.

You allocate interest on a loan in the

same way as the loan is allocated. You

do this by tracing disbursements of the

debt proceeds to specific uses. For more

information on allocating interest, see

Pub. 535.

In general, if you paid interest in

2023 that applies to any period after

2023, you can deduct only amounts that

apply for 2023.

TIP

A-7

Page 8 of 17 Fileid: … /i1040scha/2023/a/xml/cycle05/source 14:49 - 3-Jan-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Use Schedule A to deduct qualified

home mortgage interest and investment

interest.

Line 8

Home Mortgage Interest

If you are a homeowner who

received assistance under a

State Housing Finance Agency

Hardest Hit Fund program or an Emer-

gency Homeowners' Loan program, see

Pub. 530 for the amount you can deduct

on line 8a or 8b.

A home mortgage is any loan that is

secured by your main home or second

home, regardless of how the loan is la-

beled. It includes first and second mort-

gages, home equity loans, and refi-

nanced mortgages.

A home can be a house, condomini-

um, cooperative, mobile home, boat, or

similar property. It must provide basic

living accommodations including sleep-

ing space, toilet, and cooking facilities.

Check the box on line 8 if you had

one or more home mortgages in 2023

with an outstanding balance and you

didn't use all of your home mortgage

proceeds from those loans to buy, build,

or substantially improve your home. In-

terest paid on home mortgage proceeds

used for other purposes isn’t deductible

on lines 8a or 8b.

See Limits on home mortgage inter-

est, later, for more information about

what interest you can include on lines 8a

and 8b.

If you used any home mortgage

proceeds for a business or in-

vestment purpose, interest you

paid that is allocable to those proceeds

may still be deductible as a business or

investment expense elsewhere on your

return.

Limits on home mortgage interest.

Your deduction for home mortgage in-

terest is subject to a number of limits. If

one or more of the following limits ap-

plies, see Pub. 936 to figure your deduc-

tion.

Limit for loan proceeds not used to

buy, build, or substantially improve

your home. You can only deduct home

mortgage interest to the extent that the

loan proceeds from your home mortgage

TIP

TIP

are used to buy, build, or substantially

improve the home securing the loan

("qualifying debt"). Make sure to check

the box on line 8 if you had one or more

home mortgages in 2023 with an out-

standing balance and you didn't use all

of the loan proceeds to buy, build, or

substantially improve the home. The on-

ly exception to this limit is for loans tak-

en out on or before October 13, 1987;

the loan proceeds for these loans are

treated as having been used to buy,

build, or substantially improve the

home. See Pub. 936 for more informa-

tion about loans taken out on or before

October 13, 1987.

See Pub. 936 to figure your deduction

if you must check the box on line 8.

Limit on loans taken out on or be

fore December 15, 2017. For qualify-

ing debt taken out on or before Decem-

ber 15, 2017, you can only deduct home

mortgage interest on up to $1,000,000

($500,000 if you are married filing sepa-

rately) of that debt. The only exception

is for loans taken out on or before Octo-

ber 13, 1987; see Pub. 936 for more in-

formation about loans taken out on or

before October 13, 1987.

See Pub. 936 to figure your deduction

if you have loans taken out on or before

December 15, 2017, that exceed

$1,000,000 ($500,000 if you are married

filing separately).

Limit on loans taken out after De

cember 15, 2017. For qualifying debt

taken out after December 15, 2017, you

can only deduct home mortgage interest

on up to $750,000 ($375,000 if you are

married filing separately) of that debt. If

you also have qualifying debt subject to

the $1,000,000 limitation discussed un-

der Limit on loans taken out on or be-

fore December 15, 2017, earlier, the

$750,000 limit for debt taken out after

December 15, 2017, is reduced by the

amount of your qualifying debt subject

to the $1,000,000 limit. An exception

exists for certain loans taken out after

December 15, 2017, but before April 1,

2018. If the exception applies, your loan

may be treated in the same manner as a

loan taken out on or before December

15, 2017; see Pub. 936 for more infor-

mation about this exception.

See Pub. 936 to figure your deduction

if you have loans taken out after October

13, 1987, that exceed $750,000

($375,000 if you are married filing sepa-

rately).

Limit when loans exceed the fair

market value of the home. If the total

amount of all mortgages is more than

the fair market value of the home, see

Pub. 936 to figure your deduction.

Line 8a

Enter on line 8a mortgage interest and

points reported to you on Form 1098 un-

less one or more of the limits on home

mortgage interest apply to you. For

more information about these limits, see

Limits on home mortgage interest, earli-

er.

Home mortgage interest limited. If

your home mortgage interest deduction

is limited, see Pub. 936 to figure the

amount of mortgage interest and points

reported to you on Form 1098 that are

deductible. Only enter on line 8a the de-

ductible mortgage interest and points

that were reported to you on Form 1098.

Refund of overpaid interest. If your

Form 1098 shows any refund of over-

paid interest, don't reduce your deduc-

tion by the refund. Instead, see the in-

structions for Schedule 1 (Form 1040),

line 8z.

More than one borrower. If you and

at least one other person (other than

your spouse if you file a joint return)

were liable for and paid interest on a

mortgage that was your home, you can

only deduct your share of the interest.

Shared interest reported on your

Form 1098. If the shared interest was

reported on the Form 1098 you received,

deduct only your share of the interest on

line 8a. Let each of the other borrowers

know what their share is.

Shared interest reported on someone

else's Form 1098. If the shared interest

was reported on the other person's Form

1098, report your share of the interest on

line 8b (as explained in Line 8b, later).

Form 1098 doesn’t show all interest

paid. If you paid more interest to the re-

cipient than is shown on Form 1098, in-

clude the larger deductible amount on

line 8a and explain the difference. If you

are filing a paper return, explain the dif-

ference by attaching a statement to your

paper return and printing “See attached”

to the right of line 8a.

A-8

Page 9 of 17 Fileid: … /i1040scha/2023/a/xml/cycle05/source 14:49 - 3-Jan-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

If you are claiming the mort-

gage interest credit (for holders

of qualified mortgage credit

certificates issued by state or local gov-

ernmental units or agencies), subtract

the amount shown on Form 8396, line 3,

from the total deductible interest you

paid on your home mortgage. Enter the

result on line 8a.

Line 8b

If you paid home mortgage interest to a

recipient who didn’t provide you a Form

1098, report your deductible mortgage

interest on line 8b. Your deductible

mortgage interest may be less than what

you paid if one or more of the limits on

home mortgage interest apply to you.

For more information about these limits,

see Limits on home mortgage interest,

earlier.

Seller financed mortgage. If you paid

home mortgage interest to the person

from whom you bought the home and

that person didn’t provide you a Form

1098, write that person's name, identify-

ing number, and address on the dotted

lines next to line 8b. If the recipient of

your home mortgage payment(s) is an

individual, the identifying number is

their social security number (SSN). Oth-

erwise, it is the employer identification

number (EIN). You must also let the re-

cipient know your SSN.

If you don't show the required

information about the recipient

or let the recipient know your

SSN, you may have to pay a $50 penalty.

Interest reported on someone else’s

Form 1098. If you and at least one oth-

er person (other than your spouse if fil-

ing jointly) were liable for and paid in-

terest on the mortgage, and the home

mortgage interest paid was reported on

the other person’s Form 1098, identify

the name and address of the person or

persons who received a Form 1098 re-

porting the interest you paid. If you are

filing a paper return, identify the person

by attaching a statement to your paper

return and printing “See attached” to the

right of line 8b.

CAUTION

!

CAUTION

!

Line 8c

Points Not Reported on

Form 1098

Points are shown on your settlement

statement. Points you paid only to bor-

row money are generally deductible

over the life of the loan. See Pub. 936 to

figure the amount you can deduct.

Points paid for other purposes, such as

for a lender's services, aren't deductible.

Refinancing. Generally, you must de-

duct points you paid to refinance a mort-

gage over the life of the loan. This is

true even if the new mortgage is secured

by your main home.

If you used part of the proceeds to

improve your main home, you may be

able to deduct the part of the points rela-

ted to the improvement in the year paid.

See Pub. 936 for details.

If you paid off a mortgage ear-

ly, deduct any remaining points

in the year you paid off the

mortgage. However, if you refinanced

your mortgage with the same lender, see

Mortgage ending early in Pub. 936 for

an exception.

Line 8d

Reserved for future use

Line 9

Investment Interest

Investment interest is interest paid on

money you borrowed that is allocable to

property held for investment. It doesn't

include any interest allocable to passive

activities or to securities that generate

tax-exempt income.

Complete and attach Form 4952 to

figure your deduction.

Exception. You don't have to file Form

4952 if all three of the following apply.

1. Your investment interest expense

is less than your investment income

from interest and ordinary dividends mi-

nus any qualified dividends.

2. You have no other deductible in-

vestment expenses.

3. You have no disallowed invest-

ment interest expense from 2022.

TIP

Alaska Permanent Fund divi-

dends, including those reported

on Form 8814, aren't invest-

ment income.

For more details, see Pub. 550.

Gifts to Charity

You can deduct contributions or gifts

you gave to organizations that are reli-

gious, charitable, educational, scientific,

or literary in purpose. You can also de-

duct what you gave to organizations that

work to prevent cruelty to children or

animals. Certain whaling captains may

be able to deduct expenses paid in 2023

for Native Alaskan subsistence bowhead

whale hunting activities. See Pub. 526

for details.

To verify an organization's charitable

status, you can:

•

Check with the organization to

which you made the donation. The or-

ganization should be able to provide you

with verification of its charitable status.

•

Use our online search tool at

IRS.gov/TEOS to see if an organization

is eligible to receive tax-deductible con-

tributions (Publication 78 data).

Examples of Qualified

Charitable Organizations

The following list gives some examples

of qualified organizations. See Pub. 526

for more examples.

•

Churches, mosques, synagogues,

temples, and other religious organiza-

tions.

•

Scouts BSA, Boys and Girls Clubs

of America, CARE, Girl Scouts, Good-

will Industries, Red Cross, Salvation Ar-

my, and United Way.

•

Fraternal orders, if the gifts will be

used for the purposes listed under Gifts

to Charity, earlier.

•

Veterans' and certain cultural

groups.

•

Nonprofit hospitals and medical

research organizations.

•

Most nonprofit educational organi-

zations, such as colleges, but only if

your contribution isn't a substitute for

tuition or other enrollment fees.

•

Federal, state, and local govern-

ments if the gifts are solely for public

purposes.

CAUTION

!

A-9

Page 10 of 17 Fileid: … /i1040scha/2023/a/xml/cycle05/source 14:49 - 3-Jan-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Amounts You Can Deduct

Contributions can be in cash, property,

or out-of-pocket expenses you paid to do

volunteer work for the kinds of organi-

zations described earlier. If you drove to

and from the volunteer work, you can

take the actual cost of gas and oil or 14

cents a mile. Add parking and tolls to

the amount you claim under either meth-

od. But don't deduct any amounts that

were repaid to you.

Gifts from which you benefit. If you

made a gift and received a benefit in re-

turn, such as food, entertainment, or

merchandise, you can generally only de-

duct the amount that is more than the

value of the benefit. But this rule doesn't

apply to certain membership benefits

provided in return for an annual pay-

ment of $75 or less or to certain items or

benefits of token value. For details, see

Pub. 526.

Example. You paid $70 to a charita-

ble organization to attend a fund-raising

dinner and the value of the dinner was

$40. You can deduct only $30.

Gifts of $250 or more. You can deduct

a gift of $250 or more only if you have a

contemporaneous written acknowledg-

ment from the charitable organization

showing the information in (1) and (2)

next.

1. The amount of any money con-

tributed and a description (but not value)

of any property donated.

2. Whether the organization did or

didn’t give you any goods or services in

return for your contribution. If you did

receive any goods or services, a descrip-

tion and estimate of the value must be

included. If you received only intangible

religious benefits (such as admission to

a religious ceremony), the organization

must state this, but it doesn't have to de-

scribe or value the benefit.

In figuring whether a gift is $250 or

more, don't combine separate donations.

For example, if you gave your church

$25 each week for a total of $1,300,

treat each $25 payment as a separate

gift. If you made donations through pay-

roll deductions, treat each deduction

from each paycheck as a separate gift.

See Pub. 526 if you made a separate gift

of $250 or more through payroll deduc-

tion.

To be contemporaneous, you must

get the written acknowledgment from

the charitable organization by the date

you file your return or the due date (in-

cluding extensions) for filing your re-

turn, whichever is earlier. Don't attach

the contemporaneous written acknowl-

edgment to your return. Instead, keep it

for your records.

Limit on the amount you can deduct.

See Pub. 526 to figure the amount of

your deduction if any of the following

applies.

1. Your cash contributions or contri-

butions of ordinary income property are

more than 30% of the amount on Form

1040 or 1040-SR, line 11.

2. Your gifts of capital gain property

are more than 20% of the amount on

Form 1040 or 1040-SR, line 11.

3. You gave gifts of property that in-

creased in value or gave gifts of the use

of property.

Amounts You Can't Deduct

•

Certain contributions to charitable

organizations, to the extent that you re-

ceive a state or local tax credit in return

for your contribution. See Pub. 526 for

more details and exceptions.

See Safe harbor for certain

charitable contributions made

in exchange for a state or local

tax credit, earlier under Line 5, if your

cash contribution is disallowed because

you received or expected to receive a

credit.

•

An amount paid to or for the bene-

fit of a college or university in exchange

for the right to purchase tickets to an

athletic event in the college or universi-

ty's stadium.

•

Travel expenses (including meals

and lodging) while away from home

performing donated services, unless

there was no significant element of per-

sonal pleasure, recreation, or vacation in

the travel.

•

Political contributions.

•

Dues, fees, or bills paid to country

clubs, lodges, fraternal orders, or similar

groups.

•

Cost of raffle, bingo, or lottery

tickets. But you may be able to deduct

these expenses on line 16. See Line 16,

later, for more information on gambling

losses.

•

Value of your time or services.

TIP

•

Value of blood given to a blood

bank.

•

The transfer of a future interest in

tangible personal property. Generally, no

deduction is allowed until the entire in-

terest has been transferred.

•

Gifts to individuals and groups that

are operated for personal profit.

•

Gifts to foreign organizations.

However, you may be able to deduct

gifts to certain U.S. organizations that

transfer funds to foreign charities and

certain Canadian, Israeli, and Mexican

charities. See Pub. 526 for details.

•

Gifts to organizations engaged in

certain political activities that are of di-

rect financial interest to your trade or

business. See section 170(f)(9).

•

Gifts to groups whose purpose is

to lobby for changes in the laws.

•

Gifts to civic leagues, social and

sports clubs, labor unions, and chambers

of commerce.

•

Value of benefits received in con-

nection with a contribution to a charita-

ble organization. See Pub. 526 for ex-

ceptions.

•

Cost of tuition. However, you may

be able to take an education credit (see

Form 8863).

Line 11

Gifts by Cash or Check

Enter on line 11 the total value of gifts

you made in cash or by check (including

out-of-pocket expenses), unless a limit

on deducting gifts applies to you. For

more information about the limits on de-

ducting gifts, see Limit on the amount

you can deduct, earlier. If your deduc-

tion is limited, you may have a carry-

over to next year. See Pub. 526 for more

information.

Deduction for gifts by cash or check

limited. If your deduction for the gifts

you made in cash or by check is limited,

see Pub. 526 to figure the amount you

can deduct. Only enter on line 11 the de-

ductible value of gifts you made in cash

or by check.

Recordkeeping. For any contribution

made in cash, regardless of the amount,

you must maintain as a record of the

contribution a bank record (such as a

canceled check or credit card statement)

or a written record from the charity. The

written record must include the name of

the charity, date, and amount of the

A-10

Page 11 of 17 Fileid: … /i1040scha/2023/a/xml/cycle05/source 14:49 - 3-Jan-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

contribution. If you made contributions

through payroll deduction, see Pub. 526

for information on the records you must

keep. Don't attach the record to your tax

return. Instead, keep it with your other

tax records.

For contributions of $250 or more,

you must also have a contemporaneous

written acknowledgment from the chari-

table organization. See Gifts of $250 or

more, earlier, for more information. You

will still need to keep a record of when

you made the cash contribution if the

contemporaneous written acknowledg-

ment doesn't include that information.

Line 12

Other Than by Cash or

Check

Enter on line 12 the total value of your

contributions of property other than by

cash or check, unless a limit on deduct-

ing gifts applies to you. For more infor-

mation about the limits on deducting

gifts, see Limit on the amount you can

deduct, earlier. If your deduction is limi-

ted, you may have a carryover to next

year. See Pub. 526 for more information.

Deduction for gifts other than by cash

or check limited. If your deduction for

the contributions of property other than

by cash or check is limited, see Pub. 526

to figure the amount you can deduct.

Only enter on line 12 the deductible val-

ue of your contributions of property oth-

er than by cash or check.

Valuing contributions of used items.

If you gave used items, such as clothing

or furniture, deduct their fair market val-

ue at the time you gave them. Fair mar-

ket value is what a willing buyer would

pay a willing seller when neither has to

buy or sell and both are aware of the

conditions of the sale. For more details

on determining the value of donated

property, see Pub. 561.

Deduction more than $500. If the

amount of your deduction is more than

$500, you must complete and attach

Form 8283. For this purpose, the

“amount of your deduction” means your

deduction before applying any income

limits that could result in a carryover of

contributions.

Contribution of motor vehicle, boat,

or airplane. If you deduct more than

$500 for a contribution of a motor vehi-

cle, boat, or airplane, you must also at-

tach a statement from the charitable or-

ganization to your paper return. The or-

ganization may use Form 1098-C to pro-

vide the required information. If your to-

tal deduction is over $5,000 ($500 for

certain contributions of clothing and

household items (discussed next)), you

may also have to get appraisals of the

values of the donated property. See

Form 8283 and its instructions for de-

tails.

Contributions of clothing and house-

hold items. A deduction for these con-

tributions will be allowed only if the

items are in good used condition or bet-

ter. However, this rule doesn't apply to a

contribution of any single item for

which a deduction of more than $500 is

claimed and for which you include a

qualified appraisal and Form 8283 with

your tax return.

Recordkeeping. If you gave property,

you should keep a receipt or written

statement from the organization you

gave the property to, or a reliable written

record, that shows the organization's

name and address, the date and location

of the gift, and a description of the prop-

erty. For each gift of property, you

should also keep reliable written records

that include:

•

How you figured the property's

value at the time you gave it. If the value

was determined by an appraisal, keep a

signed copy of the appraisal.

•

The cost or other basis of the prop-

erty if you must reduce it by any ordina-

ry income or capital gain that would

have resulted if the property had been

sold at its fair market value.

•

How you figured your deduction if

you chose to reduce your deduction for

gifts of capital gain property.

•

Any conditions attached to the gift.

If the gift of property is $250 or

more, you must also have a contempora-

neous written acknowledgment from the

charity. See Gifts of $250 or more, earli-

er, for more information. Form 8283

doesn't satisfy the contemporaneous

written acknowledgment requirement,

and a contemporaneous written ac-

knowledgment isn't a substitute for the

other records you may need to keep if

you gave property.

If your total deduction for gifts

of property is over $500, you

gave less than your entire inter-

est in the property, or you made a quali-

fied conservation contribution, your re-

cords should contain additional infor-

mation. See Pub. 526 for details.

Line 13

Carryover From Prior Year

You may have contributions that you

couldn't deduct in an earlier year be-

cause they exceeded the limits on the

amount you could deduct. In most cases,

you have 5 years to use contributions

that were limited in an earlier year. Gen-

erally, the same limits apply this year to

your carryover amounts as applied to

those amounts in the earlier year. How-

ever, carryover amounts from contribu-

tions made in 2020 or 2021 are subject

to a 60% limitation if you deduct those

amounts in 2023. After applying those

limits, enter the amount of your carry-

over that you are allowed to deduct this

year. See Pub. 526 for details.

Casualty and Theft

Losses

Line 15

Complete and attach Form 4684 to fig-

ure the amount of your loss. Only enter

the amount from Form 4684, line 18, on

line 15.

Don't enter a net qualified dis-

aster loss from Form 4684,

line 15, on line 15. Instead, en-

ter that amount, if any, on line 16. See

Line 16, later, for information about re-

porting a net qualified disaster loss.

You can only deduct personal casual-

ty and theft losses attributable to a feder-

ally declared disaster to the extent that:

1. The amount of each separate

casualty or theft loss is more than $100,

and

2. The total amount of all losses dur-

ing the year (reduced by the $100 limit

discussed in (1)) is more than 10% of

the amount on Form 1040 or 1040-SR,

line 11.

CAUTION

!

CAUTION

!

A-11

Page 12 of 17 Fileid: … /i1040scha/2023/a/xml/cycle05/source 14:49 - 3-Jan-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

See the Instructions for Form 4684

and Pub. 547 for more information.

Other Itemized

Deductions

Line 16

Increased Standard

Deduction Reporting

If you have a net qualified disaster loss

on Form 4684, line 15, and you aren’t

itemizing your deductions, you can

claim an increased standard deduction

using Schedule A by doing the follow-

ing.

1. List the amount from Form 4684,

line 15, on the dotted line next to line 16

as "Net Qualified Disaster Loss," and at-

tach Form 4684.

2. List your standard deduction

amount on the dotted line next to line 16

as "Standard Deduction Claimed With

Qualified Disaster Loss."

3. Combine the two amounts on

line 16 and enter on Form 1040 or

1040-SR, line 12.

Do not enter an amount on any other

line of Schedule A. For more informa-

tion on how to determine your increased

standard deduction, see Pub. 976.

Net Qualified Disaster Loss

Reporting

If you have a net qualified disaster loss

on Form 4684, line 15, and you are

itemizing your deductions, list the

amount from Form 4684, line 15, on the

dotted line next to line 16 as "Net Quali-

fied Disaster Loss" and include with

your other miscellaneous deductions on

line 16. Also be sure to attach Form

4684.

Don't include your net qualified

disaster loss on line 15.

Other Itemized Deductions

List the type and amount of each ex-

pense from the following list next to

line 16 and enter the total of these ex-

penses on line 16. If you are filing a pa-

per return and you can't fit all your ex-

penses on the dotted lines next to

line 16, attach a statement instead show-

ing the type and amount of each ex-

pense.

Only the expenses listed next

can be deducted on line 16. For

more information about each of

these expenses, see Pub. 529.

•

Gambling losses (gambling losses

include, but aren't limited to, the cost of

non-winning bingo, lottery, and raffle

tickets), but only to the extent of gam-

bling winnings reported on Schedule 1

(Form 1040), line 8b.

•

Casualty and theft losses of in-

come-producing property from Form

4684, lines 32 and 38b, or Form 4797,

line 18a.

•

Federal estate tax on income in re-

spect of a decedent.

CAUTION

!

CAUTION

!

•

A deduction for amortizable bond

premium (for example, a deduction al-

lowed for a bond premium carryforward

or a deduction for amortizable bond pre-

mium on bonds acquired before October

23, 1986).

•

An ordinary loss attributable to a

contingent payment debt instrument or

an inflation-indexed debt instrument (for

example, a Treasury Inflation-Protected

Security).

•

Deduction for repayment of

amounts under a claim of right if over

$3,000. See Pub. 525 for details.

•

Certain unrecovered investment in

a pension.

•

Impairment-related work expenses

of a disabled person.

Total Itemized

Deductions

Line 18

If you elect to itemize for state tax or

other purposes even though your itemiz-

ed deductions are less than your stand-

ard deduction, check the box on line 18.

A-12

Page 13 of 17 Fileid: … /i1040scha/2023/a/xml/cycle05/source 14:49 - 3-Jan-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

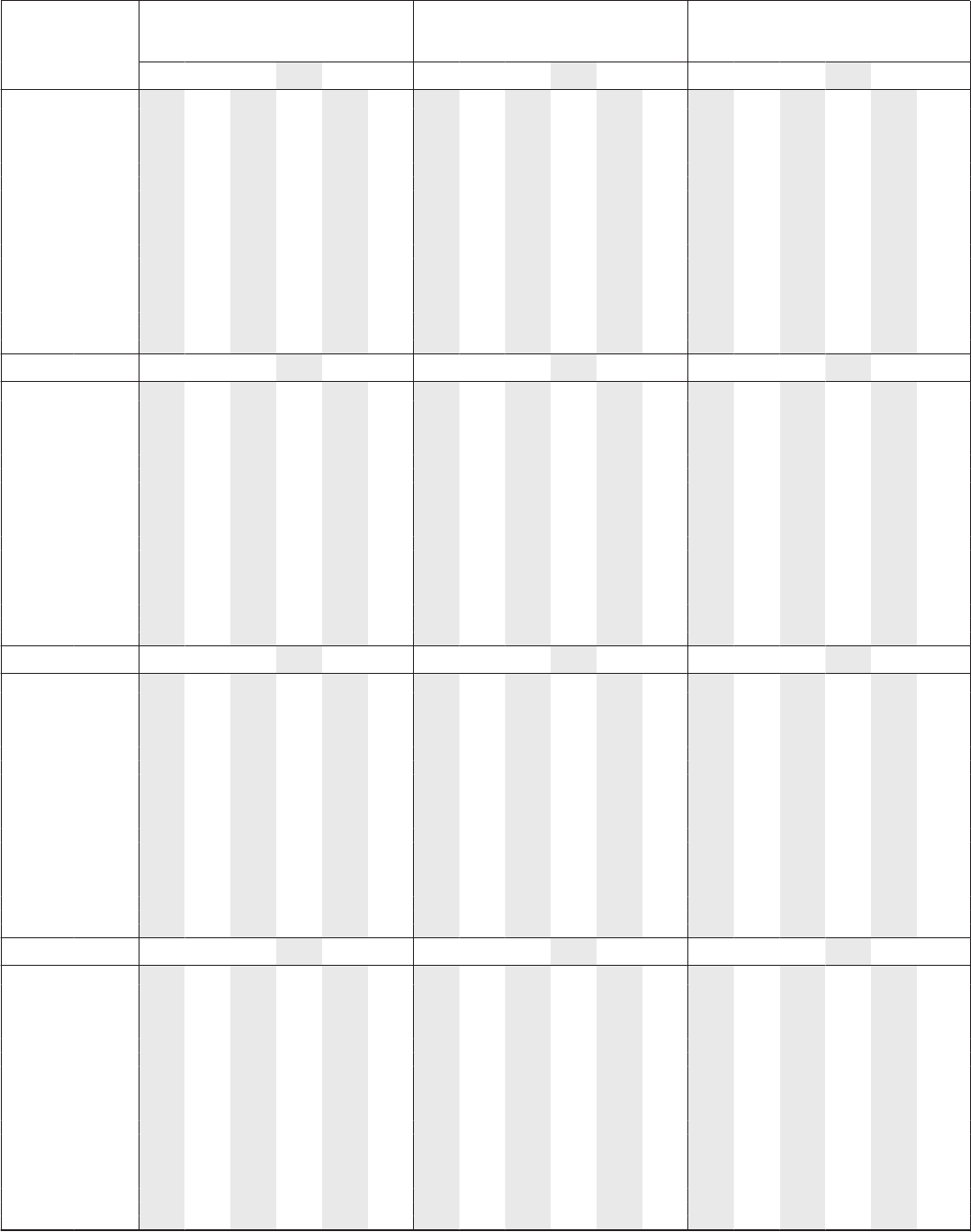

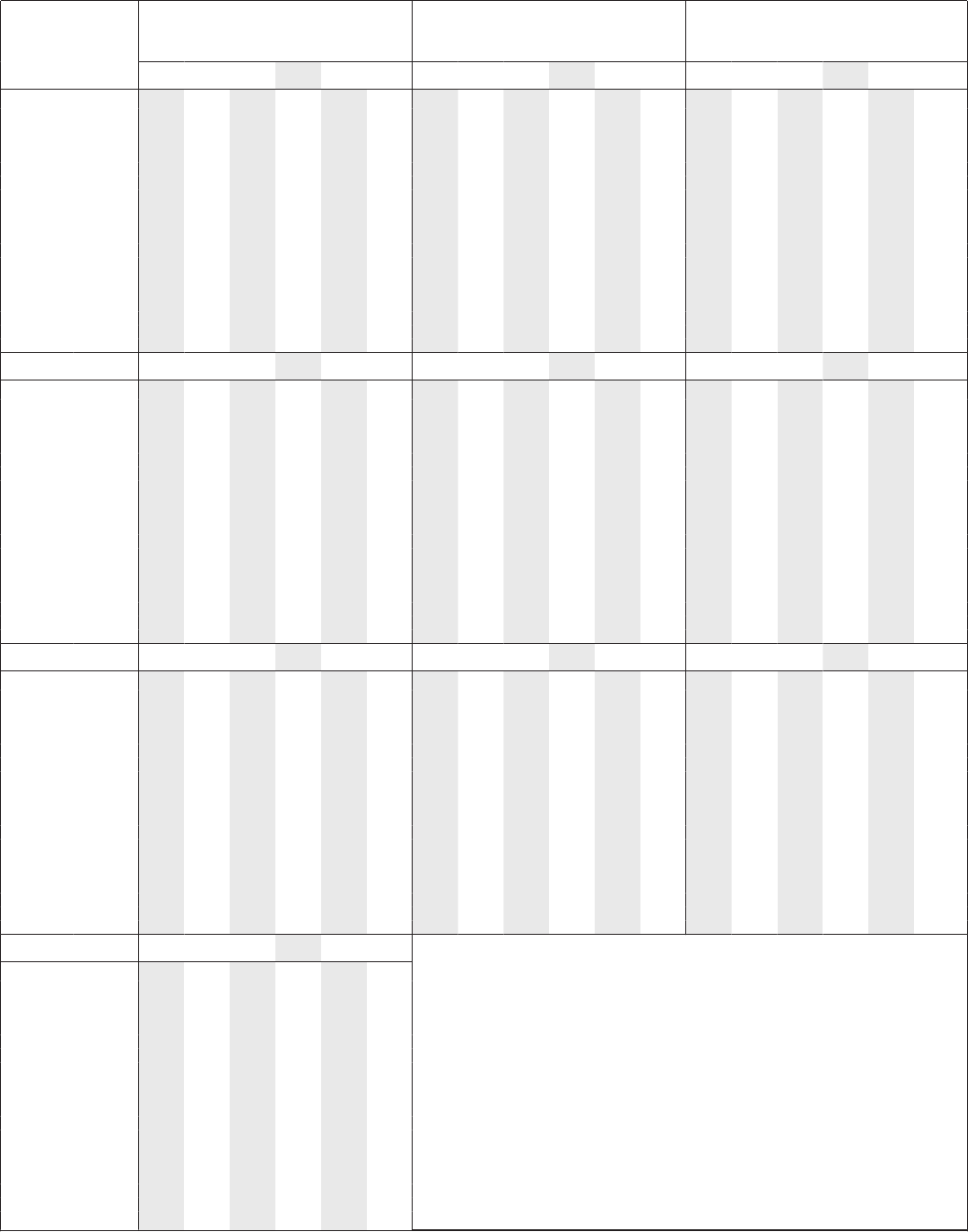

2023 Optional State Sales Tax Tables

Income Family Size Family Size Family Size

At

least

But

less

than

1 2 3 4 5

Over

5 1 2 3 4 5

Over

5 1 2 3 4 5

Over

5

Income Alabama 2 4.0000% Arizona 2 5.6000% Arkansas 2 6.5000%

$0 $20,000 365 436 485 523 555 600 382 428 458 480 498 522 470 532 572 603 628 662

$20,000 $30,000 490 583 646 696 738 796 547 612 654 686 711 746 667 755 812 855 890 938

$30,000 $40,000 551 654 725 780 826 891 630 705 753 790 819 859 766 867 932 981 1021 1076

$40,000 $50,000 602 714 790 850 899 970 701 784 837 878 910 955 850 961 1033 1088 1132 1193

$50,000 $60,000 646 765 847 910 963 1038 763 853 911 955 990 1039 923 1044 1122 1181 1229 1295

$60,000 $70,000 685 811 897 964 1020 1098 818 915 977 1024 1062 1114 989 1118 1202 1265 1316 1387

$70,000 $80,000 721 852 942 1012 1070 1153 869 972 1038 1087 1127 1182 1049 1186 1274 1341 1395 1470

$80,000 $90,000 753 890 983 1056 1117 1203 916 1024 1093 1145 1188 1245 1104 1248 1341 1411 1468 1547

$90,000 $100,000 783 925 1022 1097 1160 1249 959 1073 1145 1200 1244 1304 1156 1306 1403 1477 1536 1619

$100,000 $120,000 823 971 1072 1151 1217 1309 1017 1137 1214 1272 1318 1382 1223 1382 1485 1563 1626 1713

$120,000 $140,000 874 1030 1137 1220 1289 1387 1092 1220 1302 1364 1414 1483 1311 1481 1591 1674 1742 1835

$140,000 $160,000 920 1084 1196 1283 1355 1457 1160 1296 1384 1449 1503 1575 1392 1572 1688 1776 1848 1947

$160,000 $180,000 963 1134 1250 1340 1415 1522 1223 1366 1458 1528 1584 1660 1465 1655 1777 1870 1945 2049

$180,000 $200,000 1002 1179 1300 1393 1471 1581 1282 1432 1528 1601 1659 1740 1534 1733 1861 1958 2037 2145

$200,000 $225,000 1043 1227 1351 1448 1529 1643 1343 1500 1601 1677 1738 1822 1606 1813 1947 2048 2131 2244

$225,000 $250,000 1086 1277 1406 1506 1590 1708 1408 1573 1678 1757 1822 1910 1682 1899 2039 2145 2231 2349

$250,000 $275,000 1127 1323 1456 1560 1647 1769 1469 1640 1750 1833 1900 1992 1753 1979 2125 2235 2325 2448

$275,000 $300,000 1165 1367 1504 1611 1700 1826 1527 1705 1819 1905 1974 2070 1820 2055 2206 2321 2414 2542

$300,000 or more 1384 1620 1780 1905 2008 2154 1863 2080 2219 2323 2407 2523 2212 2496 2679 2818 2930 3085

Income California 3 7.2500% Colorado 2 2.9000% Connecticut 4 6.3500%

$0 $20,000 490 561 607 643 672 712 197 228 248 264 277 295 405 449 477 498 514 537

$20,000 $30,000 679 776 839 887 926 981 275 317 345 366 384 409 578 640 680 710 734 767

$30,000 $40,000 774 883 954 1008 1053 1114 314 362 393 417 437 465 665 737 783 817 845 882

$40,000 $50,000 853 972 1050 1110 1158 1226 347 399 434 460 482 513 738 819 869 907 938 980

$50,000 $60,000 923 1051 1135 1199 1251 1324 376 432 469 498 521 554 803 890 946 987 1020 1066

$60,000 $70,000 985 1121 1210 1278 1334 1410 402 461 501 531 556 591 861 955 1014 1058 1094 1142

$70,000 $80,000 1041 1185 1278 1350 1408 1489 425 488 530 562 588 625 914 1013 1076 1123 1161 1212

$80,000 $90,000 1093 1243 1341 1416 1477 1562 447 513 556 590 617 656 963 1067 1133 1183 1223 1277

$90,000 $100,000 1141 1298 1400 1478 1541 1630 467 535 581 616 645 685 1008 1117 1187 1239 1280 1337