320 W. Washington Street

Springfield, Illinois 62767

(217) 782-4515

http://insurance.illinois.gov

Illinois Department of Insurance

JB Pritzker

Governor

Dana Popish Severinghaus

Director

June 23, 2022

Mr. Matthew

Dutkanych, President

Producers National Group

7400 North Caldwell

Niles, IL. 60714

Re: Stonegate Insurance Company, NAIC 14012

U

nique Insurance Company, NAIC 10655

Viva Seguros Insurance Company, NAIC 14941

Market Conduct Examination Verified Report

D

ear Mr. Dutkanych,

A

Market Conduct Examination of your companies was conducted by an authorized examiner designated by the

Director of the Illinois Department of Insurance (“Department”) pursuant to Illinois Insurance Code (“Code”)

Sections 132, 132.5(f), 404(1)(a) and 404(1)(c). This examination covered the period of January 1, 2019, through

March 31, 2022. Enclosed with this letter is a copy of the verified examination report.

The

examination report is a public document under the Freedom of Information Act (“FOIA”) [5 ILCS 140/1 et

seq.] and will be posted on the Department’s website. To the extent that the examination report contains information

that your Company deems private, personal, or trade secret pursuant to Sections 7(1)(b), (c), or (g) of FOIA [5 ILCS

140/7(b), (c), and (g)], your Company may request that the Department redact such information from the report

prior to making it public. In making a request for confidentiality, your Company must provide a factual basis for

its assertion of confidentiality. The Department will consider the request and determine whether such information

is exempt from disclosure under Section 7 of FOIA.

N

o company, corporation, or individual shall use this report or any statement, excerpt, portion, or section thereof

for any advertising, marketing or solicitation purpose. Any company, corporation or individual action contrary to

the above shall be deemed a violation of Section 149 of the Illinois Insurance Code (215 ILCS 5/149).

P

lease contact me if you have any questions.

S

incerely,

E

rica Weyhenmeyer

Chief Market Conduct Examiner

Illinois Department of Insurance

320 West Washington St., 5th Floor

Springfield, IL 62767

Phone: 217-782-1790

Erica.Weyhenmey[email protected]

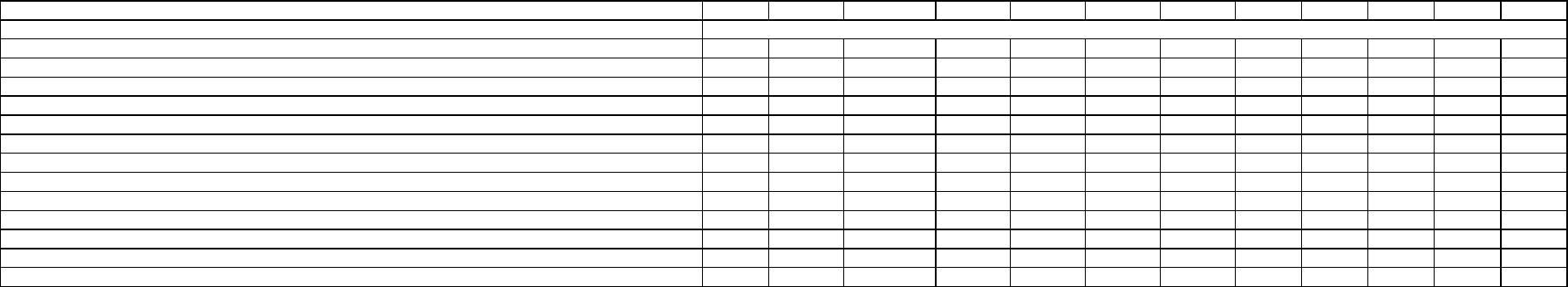

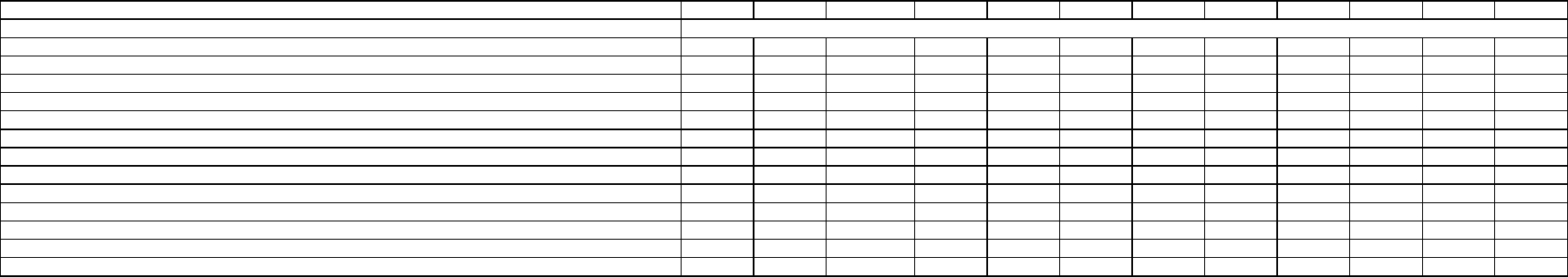

Company Name: STONEGATE INSURANCE COMPANY

CoCode: 14012

Group Code: 4717

Private Passenger Auto Liability

Statewide data (Illinois only) as of 3/31/2022 Q1 - 2019 Q2 -2019 Q3 - 2019 Q4 - 2019 Q1 - 2020 Q2 - 2020 Q3 - 2020 Q4 - 2020 Q1 - 2021 Q2 - 2021 Q3 - 2021 Q4 - 2021

(2) All expenses other than loss adjustment expenses, excluding amounts from item 5 below

(3) Net Earned Premium Before Application of any COVID-19 Related Premium Credit/Refund/Dividend $925,974 $1,218,474 $1,414,772

$1,558,925 $1,577,140

$1,257,961

$1,025,754 $818,244 $673,346 $662,116 $676,973 $680,672

(4) The Amount of any COVID-19 Related Premium Credit/Refund/Dividend accounted for as premium $0 $0 $0 $0 $0 $0

$0 $0 $0 $0 $0 $0

(5) The Amount of any COVID-19 Related Credit/Refund/Dividend accounted for as expense

(6) Net Ultimate Incurred Losses and Defense and Cost Containment Expenses $193,496 $375,946 $598,122 $601,742 $869,524 $297,776 $499,134 $756,860 $788,362

$750,732 $683,544 $961,996

(7) Net Ultimate Adjusting & Other

(8) Ultimate Reported Claim Counts (excluding Claims Closed without Payment) 21 48 119 227 173 305 123 99 81 76 42 26

(9) Open Claim Counts 157 365 531

611 746 546 516 508

468 458 488 523

Post-refund combined ratio (6+7+2+5)/(3-4) 20.9% 30.9% 42.3% 38.6% 55.1% 23.7% 48.7% 92.5% 117.1%

113.4% 101.0% 141.3%

Pre-refund combined ratio (6+7+2)/(3) 20.9% 30.9% 42.3% 38.6% 55.1% 23.7% 48.7% 92.5% 117.1% 113.4% 101.0% 141.3%

Claims severity (6)/(8)

9,214

7,832 5,026 2,651 5,026 976 4,058 7,645 9,733

9,878 16,275 37,000

Notes:

All data provided in rows (2)-(9) will be considered public.

"Net" refers to net of reinsurance and salvage & subrogation.

Claim counts should be reported net of quota share reinsurance.

Accident Quarter

Data from row (1) will be made available on an all company weighted average frequency basis. Data will not be publicly released on an individual company basis.

Company Name: STONEGATE INSURANCE COMPANY CoCode: 14012 Group Code: 4717

Private Passenger Auto Physical Damage

Statewide data (Illinois only) as of 3/31/2022 Q1 - 2019

Q2 -2019 Q3 - 2019 Q4 - 2019 Q1 - 2020 Q2 - 2020 Q3 - 2020 Q4 - 2020 Q1 - 2021

Q2 - 2021 Q3 - 2021

Q4 - 2021

(2) All expenses other than loss adjustment expenses, excluding amounts from item 5 below

(3) Net Earned Premium Before Application of any COVID-19 Related Premium Credit/Refund/Dividend $859,668 $1,006,899 $1,094,397 $1,126,702 $1,118,414 $862,328 $739,192 $598,714 $493,615 $482,586 $494,889 $500,771

(4) The Amount of any COVID-19 Related Premium Credit/Refund/Dividend accounted for as premium

$0

$0 $0 $0 $0 $0 $0 $0 $0

$0 $0 $0

(5) The Amount of any COVID-19 Related Credit/Refund/Dividend accounted for as expense

(6) Net Ultimate Incurred Losses and Defense and Cost Containment Expenses $355,342 $667,805 $667,596 $603,195 $725,249 $527,990 $476,635 $440,917 $302,311 $302,348 $348,995 $417,326

(7) Net Ultimate Adjusting & Other

(8) Ultimate Reported Claim Counts (excluding Claims Closed without Payment) 25 54 70

122 77 75 59 56 45 34 20 22

(9) Open Claim Counts 82 149 170 192 169 122 98 83 66 64 95 122

Post-refund combined ratio (6+7+2+5)/(3-4) 41.3% 66.3% 61.0% 53.5% 64.8%

61.2% 64.5% 73.6% 61.2% 62.7% 70.5% 83.3%

Pre-refund combined ratio (6+7+2)/(3) 41.3% 66.3% 61.0% 53.5% 64.8% 61.2% 64.5% 73.6%

61.2% 62.7% 70.5% 83.3%

Claims severity (6)/(8) 14,214 12,367 9,537 4,944 9,419 7,040 8,079 7,874 6,718 8,893 17,450 18,969

Notes:

All data provided in rows (2)-(9) will be considered public.

"Net" refers to net of reinsurance and salvage & subrogation.

Claim counts should be reported net of quota share reinsurance.

Accident Quarter

Data from row (1) will be made available on an all company weighted average frequency basis. Data will not be publicly released on an individual company basis.

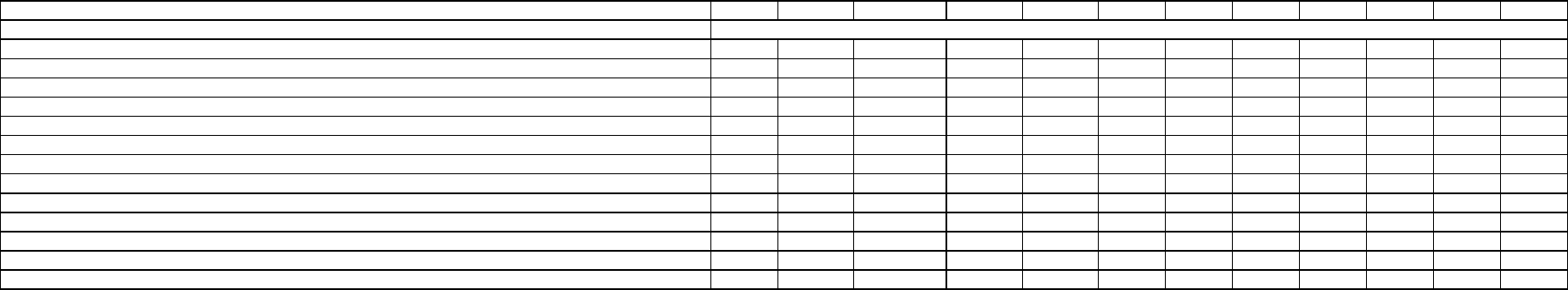

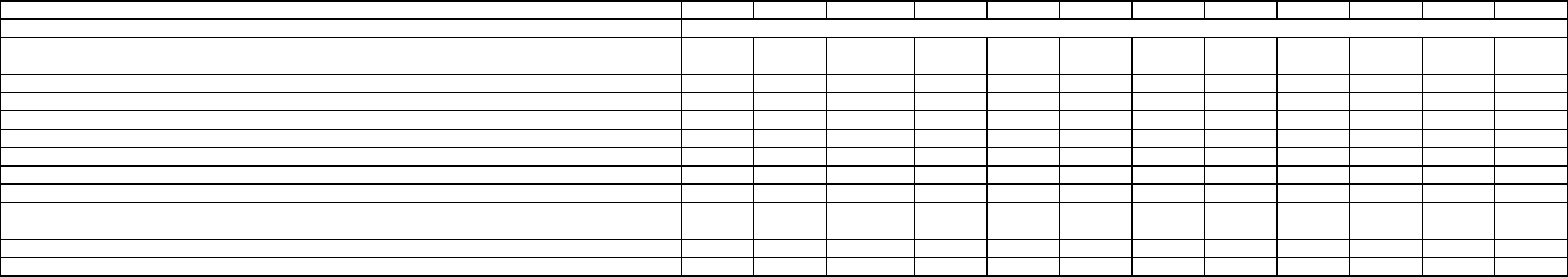

Company Name: UNIQUE INSURANCE COMPANY CoCode: 10655

Group Code: 4717

Private Passenger Auto Liability

Statewide data (Illinois only) as of 3/31/2022 Q1 - 2019 Q2 -2019 Q3 - 2019 Q4 - 2019 Q1 - 2020 Q2 - 2020 Q3 - 2020 Q4 - 2020 Q1 - 2021 Q2 - 2021 Q3 - 2021 Q4 - 2021

(2) All expenses other than loss adjustment expenses, excluding amounts from item 5 below

(3) Net Earned Premium Before Application of any COVID-19 Related Premium Credit/Refund/Dividend $11,369,091 $11,113,876 $10,331,460 $9,771,999 $9,207,728 $8,983,334 $9,771,447 $9,311,033 $8,583,487 $8,654,890 $8,046,274 $7,649,761

(4) The Amount of any COVID-19 Related Premium Credit/Refund/Dividend accounted for as premium $0 $0 $0 $0 $0 $532,645 $900,242 $104,959 $43,679 $14,136 $1,767 -$24

(5) The Amount of any COVID-19 Related Credit/Refund/Dividend accounted for as expense

(6) Net Ultimate Incurred Losses and Defense and Cost Containment Expenses $2,776,598 $4,362,336 $4,666,337 $4,756,049 $5,317,467 $3,860,189 $4,407,472 $5,897,621 $6,334,107 $6,700,527 $6,991,995 $9,566,355

(7) Net Ultimate Adjusting & Other

(8) Ultimate Reported Claim Counts (excluding Claims Closed without Payment) 361 889 1386 1447 1742 1783 1389 1319 1285 1188 798 709

(9) Open Claim Counts 1461 2976 4062 4775 4816 4003 4096 4160 4114 4295 4640 4813

Post-refund combined ratio (6+7+2+5)/(3-4) 24.4% 39.3% 45.2% 48.7% 57.8% 45.7% 49.7% 64.1% 74.2% 77.5% 86.9% 125.1%

Pre-refund combined ratio (6+7+2)/(3) 24.4% 39.3% 45.2% 48.7% 57.8% 43.0% 45.1% 63.3% 73.8% 77.4% 86.9% 125.1%

Claims severity (6)/(8) 7,691 4,907 3,367 3,287 3,053 2,165 3,173 4,471 4,929 5,640 8,762 13,493

Notes:

All data provided in rows (2)-(9) will be considered public.

"Net" refers to net of reinsurance and salvage & subrogation.

Claim counts should be reported net of quota share reinsurance.

Accident Quarter

Data from row (1) will be made available on an all company weighted average frequency basis. Data will not be publicly released on an individual company basis.

Company Name: UNIQUE INSURANCE COMPANY CoCode:

10655 Group Code:

4717

Private Passenger Auto Physical Damage

Statewide data (Illinois only) as of 3/31/2022 Q1 - 2019

Q2 -2019 Q3 - 2019

Q4 - 2019 Q1 - 2020 Q2 - 2020 Q3 - 2020 Q4 - 2020 Q1 - 2021 Q2 - 2021

Q3 - 2021

Q4 - 2021

(2) All expenses other than loss adjustment expenses, excluding amounts from item 5 below

(3) Net Earned Premium Before Application of any COVID-19 Related Premium Credit/Refund/Dividend $7,544,887

$7,155,888 $6,271,832 $5,596,574 $5,004,225 $4,657,069 $4,883,489 $4,477,627

$3,977,498 $3,932,664

$3,514,662

$3,145,448

(4) The Amount of any COVID-19 Related Premium Credit/Refund/Dividend accounted for as premium $0 $0 $0 $0 $0 $261,402 $512,497

$81,499

$37,717 $12,934 $1,981 $0

(5) The Amount of any COVID-19 Related Credit/Refund/Dividend accounted for as expense

(6) Net Ultimate Incurred Losses and Defense and Cost Containment Expenses $2,165,089 $3,185,897 $2,648,305 $2,200,847 $2,138,864 $1,200,584 $2,172,398 $2,208,753 $2,244,403 $2,204,489 $2,043,541 $1,898,666

(7) Net Ultimate Adjusting & Other

(8) Ultimate Reported Claim Counts (excluding Claims Closed without Payment) 669 747 764 818 752 673 703 620 624 501 478 415

(9) Open Claim Counts 455 602 892 910 752 616 669 558 475 472 457 541

Post-refund combined ratio (6+7+2+5)/(3-4) 28.7% 44.5% 42.2% 39.3%

42.7% 27.3% 49.7% 50.2% 57.0%

56.2% 58.2% 60.4%

Pre-refund combined ratio (6+7+2)/(3) 28.7% 44.5%

42.2% 39.3% 42.7% 25.8% 44.5% 49.3% 56.4%

56.1% 58.1% 60.4%

Claims severity (6)/(8) 3,236

4,265 3,466 2,691 2,844 1,784

3,090 3,563 3,597 4,400 4,275 4,575

Notes:

All data provided in rows (2)-(9) will be considered public.

"Net" refers to net of reinsurance and salvage & subrogation.

Claim counts should be reported net of quota share reinsurance.

Accident Quarter

Data from row (1) will be made available on an all company weighted average frequency basis. Data will not be publicly released on an individual company basis.

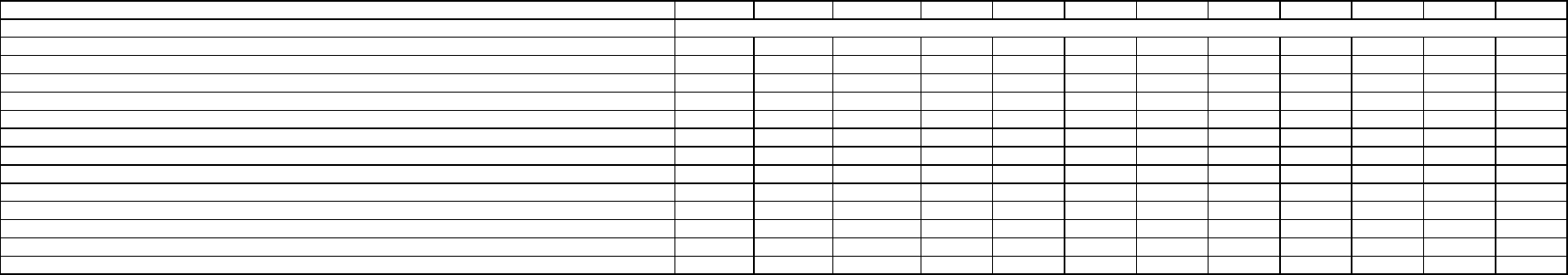

Company Name: VIVA SEGUROS INSURANCE COMPANY CoCode:

14941 Group Code:

4717

Private Passenger Auto Liability

Statewide data (Illinois only) as of 3/31/2022 Q1 - 2019

Q2 -2019 Q3 - 2019

Q4 - 2019 Q1 - 2020 Q2 - 2020 Q3 - 2020 Q4 - 2020 Q1 - 2021 Q2 - 2021

Q3 - 2021

Q4 - 2021

(2) All expenses other than loss adjustment expenses, excluding amounts from item 5 below

(3) Net Earned Premium Before Application of any COVID-19 Related Premium Credit/Refund/Dividend $5,913,251

$5,137,753 $4,138,491 $3,590,556 $3,906,790 $4,595,963 $5,466,919 $5,439,470

$5,020,446 $5,053,663

$4,836,970

$4,604,926

(4) The Amount of any COVID-19 Related Premium Credit/Refund/Dividend accounted for as premium $0 $0 $0 $0 $0 $340,393 $487,082

$65,372

$23,827 $5,987 $698 $0

(5) The Amount of any COVID-19 Related Credit/Refund/Dividend accounted for as expense

(6) Net Ultimate Incurred Losses and Defense and Cost Containment Expenses $1,841,563 $2,173,741 $2,325,118 $2,317,861 $2,806,801 $1,744,145 $2,436,512 $2,739,812 $3,063,138 $3,764,273 $4,108,007 $5,166,872

(7) Net Ultimate Adjusting & Other

(8) Ultimate Reported Claim Counts (excluding Claims Closed without Payment) 100 429 625 547 692 833 712 672 630 571 377 404

(9) Open Claim Counts 995 1609 1915 2264 2400 2008 2086 2047 2116 2275 2564 2610

Post-refund combined ratio (6+7+2+5)/(3-4) 31.1% 42.3% 56.2% 64.6%

71.8% 41.0% 48.9% 51.0% 61.3%

74.6% 84.9% 112.2%

Pre-refund combined ratio (6+7+2)/(3) 31.1% 42.3%

56.2% 64.6% 71.8% 37.9% 44.6% 50.4% 61.0%

74.5% 84.9% 112.2%

Claims severity (6)/(8) 18,416

5,067 3,720 4,237 4,056 2,094

3,422 4,077 4,862 6,592 10,897 12,789

Notes:

All data provided in rows (2)-(9) will be considered public.

"Net" refers to net of reinsurance and salvage & subrogation.

Claim counts should be reported net of quota share reinsurance.

Accident Quarter

Data from row (1) will be made available on an all company weighted average frequency basis. Data will not be publicly released on an individual company basis.

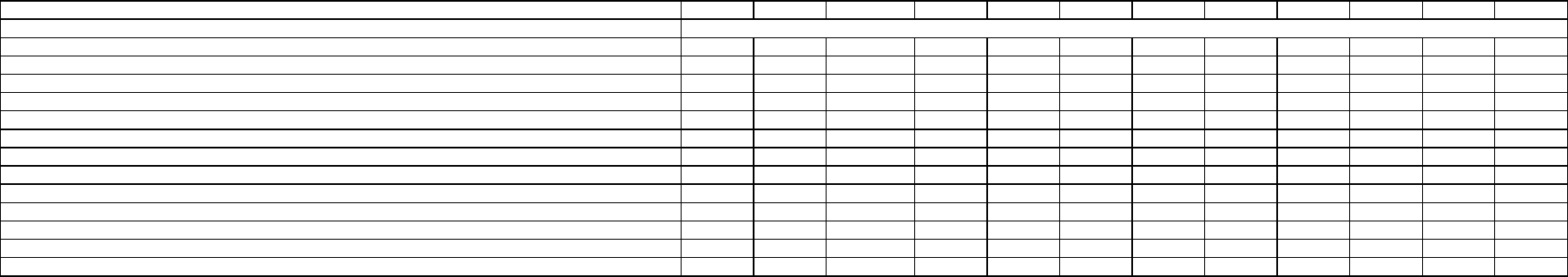

Company Name: VIVA SEGUROS INSURANCE COMPANY CoCode:

14941 Group Code:

4717

Private Passenger Auto Physical Damage

Statewide data (Illinois only) as of 3/31/2022 Q1 - 2019

Q2 -2019 Q3 - 2019

Q4 - 2019 Q1 - 2020 Q2 - 2020 Q3 - 2020 Q4 - 2020 Q1 - 2021 Q2 - 2021

Q3 - 2021

Q4 - 2021

(2) All expenses other than loss adjustment expenses, excluding amounts from item 5 below

(3) Net Earned Premium Before Application of any COVID-19 Related Premium Credit/Refund/Dividend $1,793,071

$1,605,940 $1,281,824 $1,099,960 $1,254,043 $1,623,306 $2,086,670 $2,080,363

$1,955,115 $2,073,928

$2,040,643

$1,940,053

(4) The Amount of any COVID-19 Related Premium Credit/Refund/Dividend accounted for as premium $0 $0 $0 $0 $0 $139,664 $191,681

$32,075

$11,978 $3,569 $519 $0

(5) The Amount of any COVID-19 Related Credit/Refund/Dividend accounted for as expense

(6) Net Ultimate Incurred Losses and Defense and Cost Containment Expenses $488,238 $597,289 $551,624 $435,098 $472,429 $406,102 $824,493 $1,000,314 $1,036,913 $1,283,504 $1,391,127 $1,427,255

(7) Net Ultimate Adjusting & Other

(8) Ultimate Reported Claim Counts (excluding Claims Closed without Payment) 89 169 152 146 174 222 287 283 288 279 235 216

(9) Open Claim Counts 130 134 204 205 206 228 251 224 227 248 257 321

Post-refund combined ratio (6+7+2+5)/(3-4) 27.2% 37.2% 43.0% 39.6%

37.7% 27.4% 43.5% 48.8% 53.4%

62.0% 68.2% 73.6%

Pre-refund combined ratio (6+7+2)/(3) 27.2% 37.2%

43.0% 39.6% 37.7% 25.0% 39.5% 48.1% 53.0%

61.9% 68.2% 73.6%

Claims severity (6)/(8) 5,486

3,534 3,629 2,980 2,715 1,829

2,873 3,535 3,600 4,600 5,920 6,608

Notes:

All data provided in rows (2)-(9) will be considered public.

"Net" refers to net of reinsurance and salvage & subrogation.

Claim counts should be reported net of quota share reinsurance.

Accident Quarter

Data from row (1) will be made available on an all company weighted average frequency basis. Data will not be publicly released on an individual company basis.