2019

CONSUMER COMPLAINT RATIO REPORT

ILLINOIS DEPARTMENT OF INSURANCE

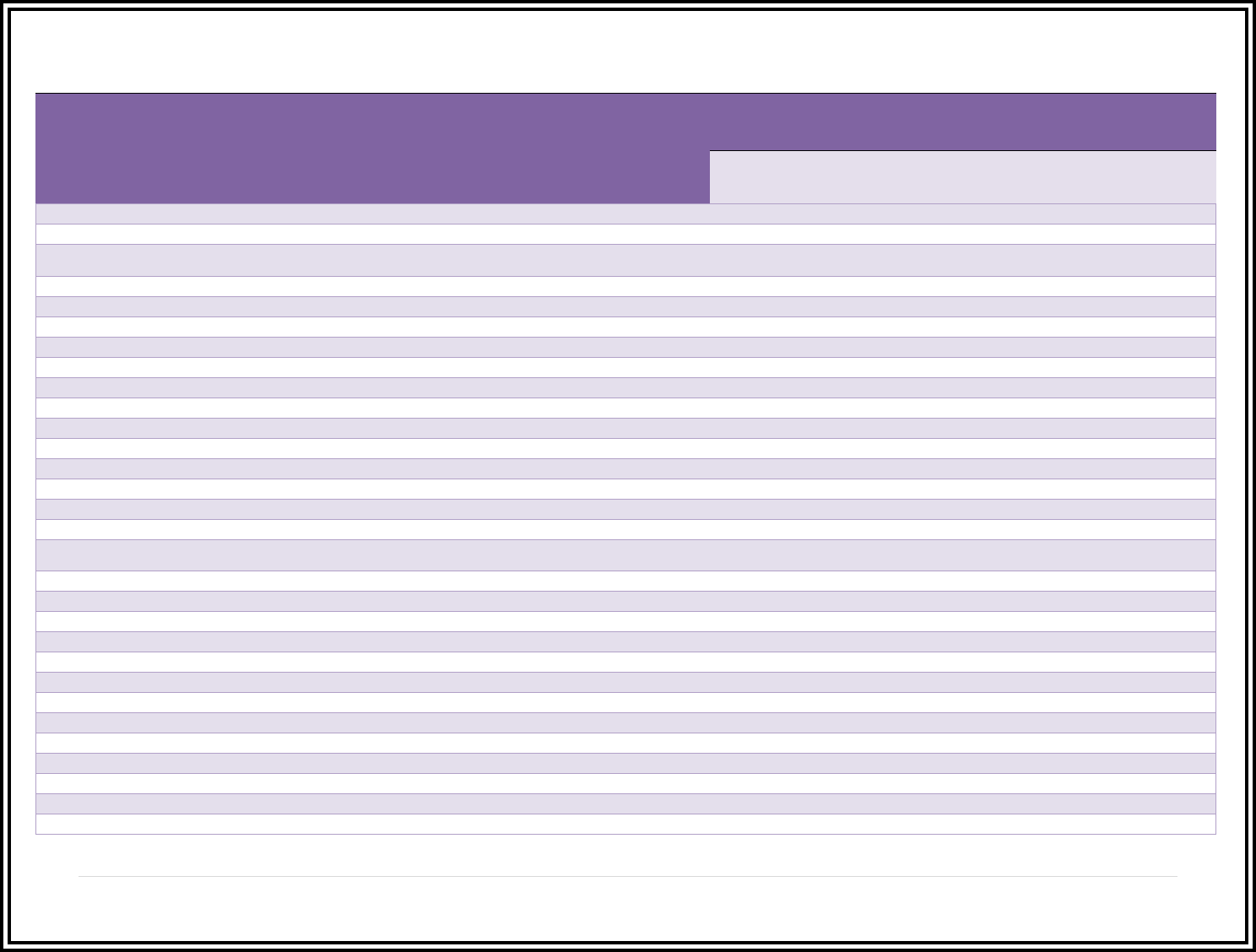

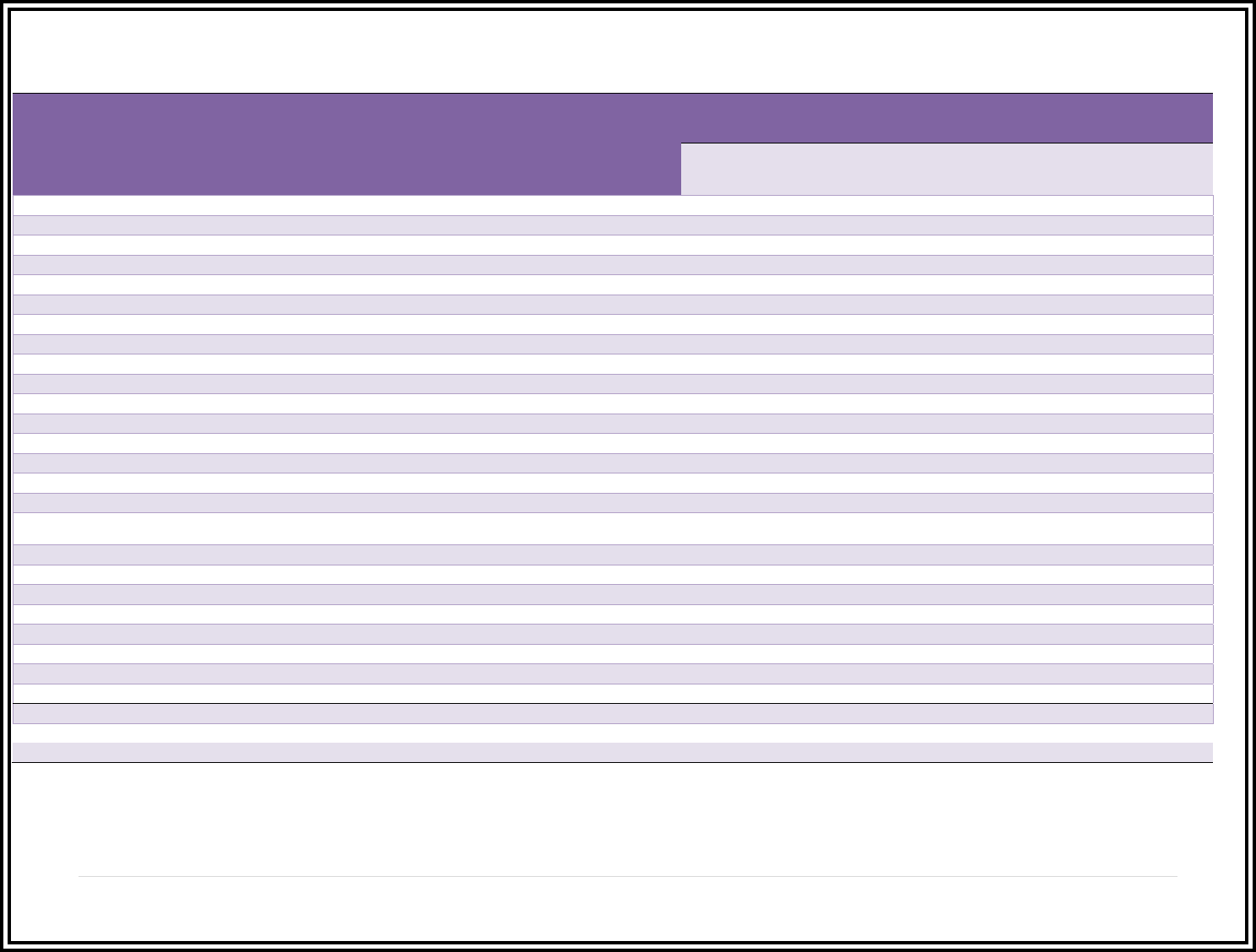

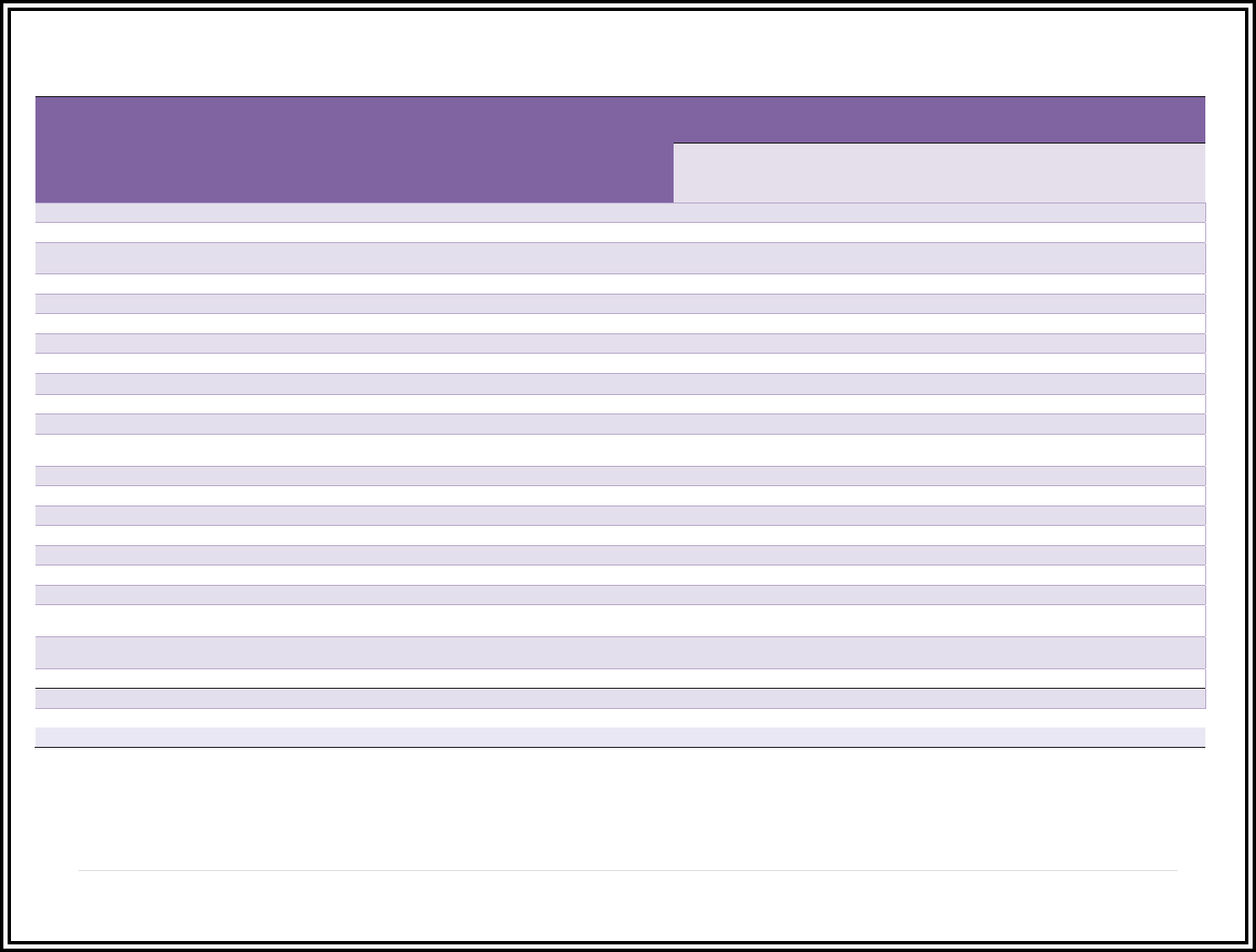

HOMEOWNERS COMPLAINTS BY COMPANY NAME

1 | P a g e

A single complaint can have multiple major reasons; however, a complaint is only counted once in the Number of Complaints column.

Companies Showing 5 or More Complaints for

Homeowners Coverage

Number of

Complaints

2019 Illinois

Direct Written

Premium (DWP)

Complaint

Ratio per

$1 Millions

in DWP

Major Reason for Complaints

Underwriting Marketing

&

Sales

Claims

Handling

Policyholder

Service

Reason

Other

Reason

Not

Indicated

Allstate Indemnity Company 49 $109,115,919 0.4491 3 0 45 1 0 0

Allstate Insurance Company 21 $81,069,063 0.2590 6 1 14 0 0 0

Allstate Property and Casualty Insurance

Company 16 $36,513,602 0.4382 0 0 16 0 0 0

Allstate Vehicle and Property Insurance Company 89 $218,266,538 0.4078 9 5 74 1 0 0

American Bankers Insurance Company of Florida 11 $11,061,433 0.9944 0 0 7 4 0 0

American Family Insurance Company 15 $43,944,797 0.3413 2 1 11 1 0 0

American Family Mutual Insurance Company S I 45 $130,950,403 0.3436 6 1 37 1 0 0

American Strategic Insurance Corp. 8 $19,362,311 0.4132 1 0 6 1 0 0

Amguard Insurance Company 5 $13,266,349 0.3769 0 0 5 0 0 0

Auto Owners Insurance Company 14 $65,829,995 0.2127 3 0 11 0 0 0

Country Mutual Insurance Company 47 $323,740,745 0.1452 3 2 42 0 0 0

Erie Insurance Company 8 $57,453,928 0.1392 3 0 5 0 0 0

Erie Insurance Exchange 10 $16,945,629 0.5901 2 1 7 0 0 0

Esurance Insurance Company 10 $9,528,618 1.0495 1 0 8 1 0 0

Farmers Automobile Insurance Association (The) 12 $45,177,483 0.2656 0 1 11 0 0 0

Farmers Insurance Exchange 25 $155,759,611 0.1605 3 1 20 1 0 0

Foremost Insurance Company Grand Rapids,

Michigan 13 $20,406,259 0.6371 2 2 9 0 0 0

Homesite Insurance Company of Florida 11 $35,782,051 0.3074 4 0 7 0 0 0

Illinois Farmers Insurance Company 7 $37,510,213 0.1866 1 1 5 0 0 0

Liberty Insurance Corporation 32 $63,638,641 0.5028 6 1 20 5 0 0

Liberty Mutual Fire Insurance Company 5 $17,399,326 0.2874 3 0 2 0 0 0

Madison Mutual Insurance Company 5 $7,994,747 0.6254 2 0 3 0 0 0

MemberSelect Insurance Company 12 $43,339,179 0.2769 3 1 8 0 0 0

MIC General Insurance Corporation 10 $33,221,971 0.3010 7 0 3 0 0 0

Pekin Insurance Company 6 $9,723,184 0.6171 0 0 6 0 0 0

Property & Casualty Insurance Co of Hartford 5 $12,385,183 0.4037 1 0 4 0 0 0

Safeco Insurance Company of Illinois 13 $57,682,772 0.2254 2 0 10 1 0 0

Shelter Mutual Insurance Company 9 $10,740,387 0.8380 1 0 8 0 0 0

State Farm Fire & Casualty Company 259 $1,283,332,950 0.2018 80 8 165 6 0 0

Travco Insurance Company 5 $39,614,810 0.1262 4 0 1 0 0 0

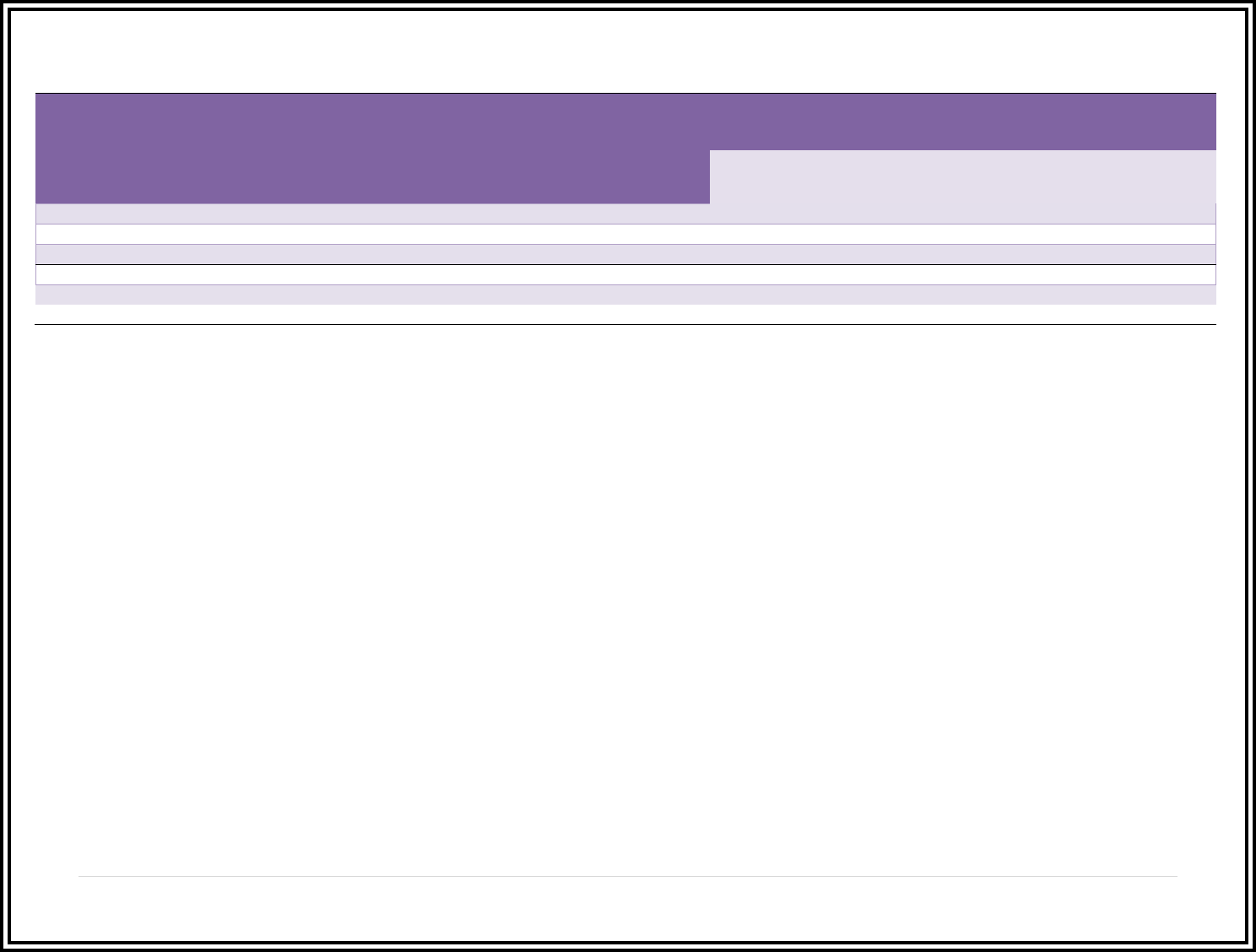

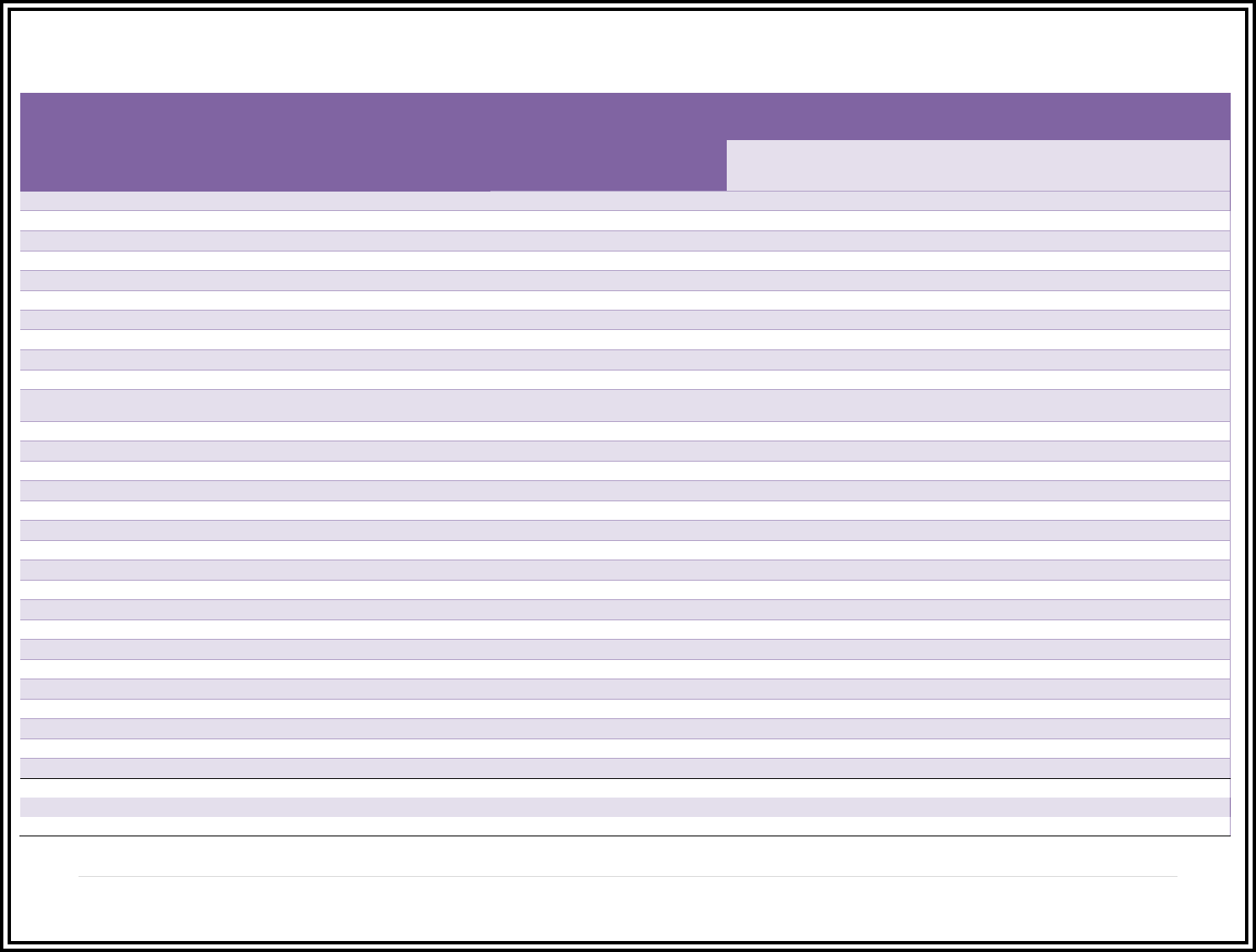

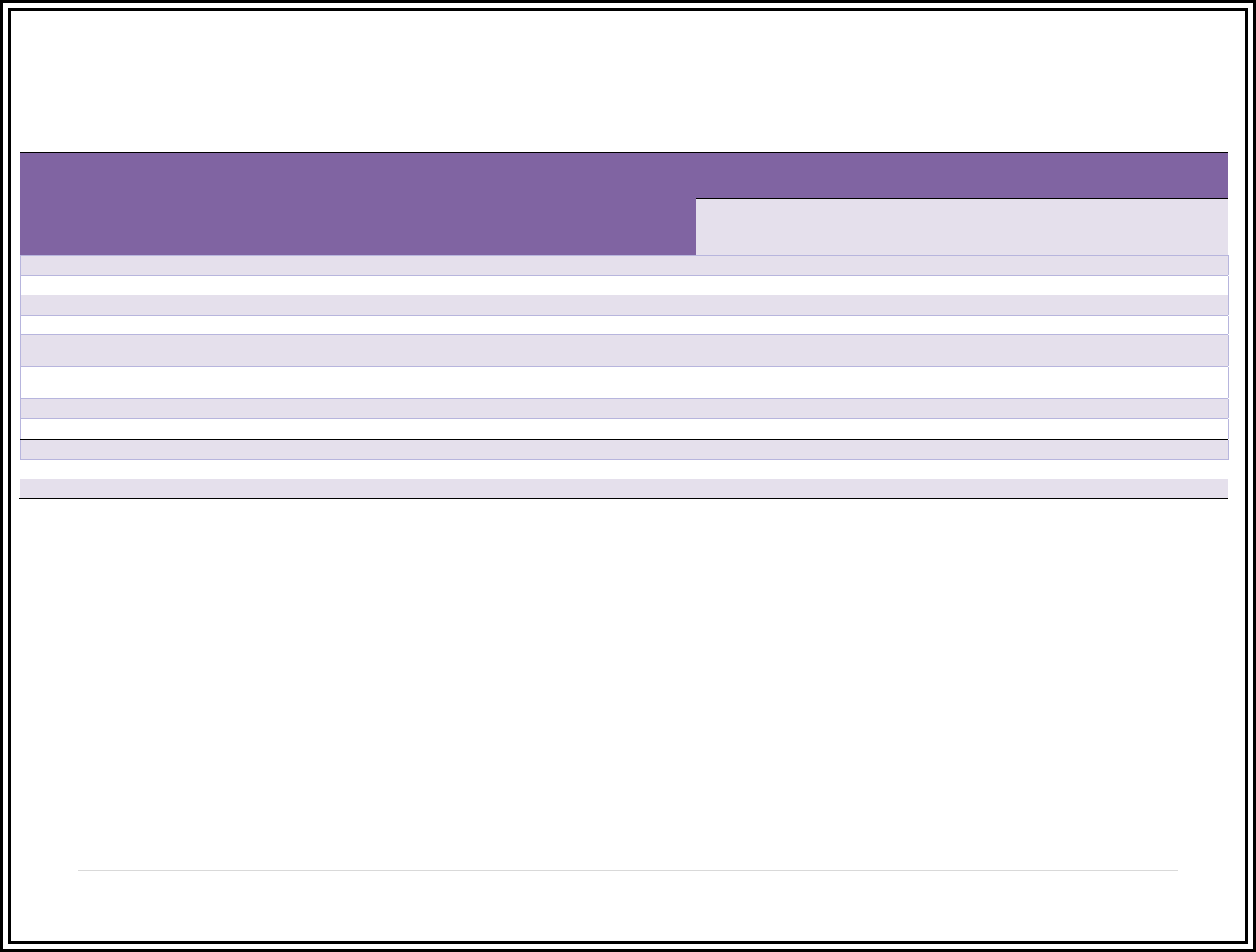

HOMEOWNERS COMPLAINTS BY COMPANY NAME

2 | P a g e

A single complaint can have multiple major reasons; however, a complaint is only counted once in the Number of Complaints column.

Companies Showing 5 or More Complaints for

Homeowners Coverage

Number of

Complaints

2019 Illinois

Direct Written

Premium (DWP)

Complaint

Ratio per

$1 Millions

in DWP

Major Reason for Complaints

Underwriting Marketing

&

Sales

Claims

Handling

Policyholder

Service

Reason

Other

Reason

Not

Indicated

Travelers Home And Marine Ins Co (The) 17 $76,825,882 0.2213 1 1 15 0 0 0

Trumbull Insurance Company 13 $22,164,041 0.5865 3 0 10 0 0 0

United Services Automobile Association 13 $50,522,238 0.2573 6 0 6 1 0 0

Grand total 820 $3,160,270,258 13.1882 168 27 601 24 0 0

MEAN (The “average” of complaint ratios)

0.3996

MEDIAN (The “middle” of complaint ratios)

0.3413

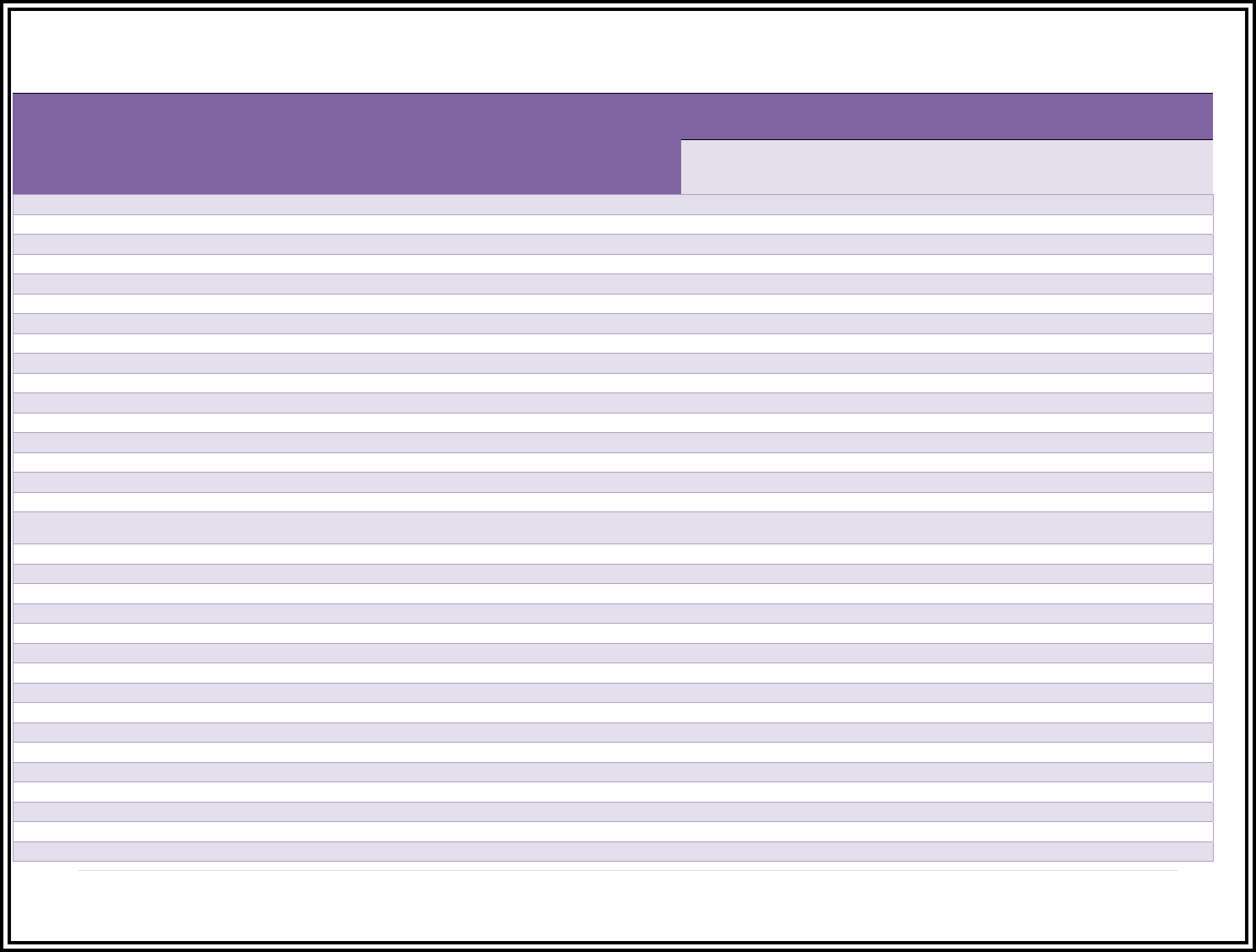

PRIVATE PASSENGER AUTO COMPLAINTS BY COMPANY NAME

5 | P a g e

A single complaint can have multiple major reasons; however, a complaint is only counted once in the Number of Complaints column.

Companies Showing 5 or More Complaints for

Private Passenger Auto Coverage

Number of

Complaints

2019 Illinois

Direct Written

Premium (DWP)

Complaint

Ratio per

$1 Millions

in DWP

Major Reason for Complaints

Underwriting Marketing

&

Sales

Claims

Handling

Policyholder

Service

Reason

Other

Reason

Not

Indicated

Allmerica Financial Alliance Insurance Company 7 $57,800,401 0.1211 1 0 6 0 0 0

Allstate Fire and Casualty Insurance Company 110 $642,486,973 0.1712 10 5 91 4 0 0

Allstate Indemnity Company 9 $18,744,322 0.4801 0 0 7 2 0 0

Allstate Insurance Company 22 $90,669,026 0.2426 1 0 19 2 0 0

American Access Casualty Company 79 $67,380,712 1.1724 3 0 74 2 0 0

American Alliance Casualty Company 235 $61,927,992 3.7947 10 0 220 5 0 0

American Family Insurance Company 15 $133,987,908 0.1120 2 0 13 0 0 0

American Family Mutual Insurance Company S I 16 $186,046,989 0.0860 1 1 14 0 0 0

American Freedom Insurance Company 140 $36,882,119 3.7959 9 0 128 3 0 0

American Heartland Insurance Company 68 $11,730,886 5.7967 2 0 66 0 0 0

Apollo Casualty Company 6 $8,542,634 0.7024 1 0 5 0 0 0

Auto Club Insurance Association 13 $78,086,603 0.1665 3 1 6 3 0 0

Bristol West Insurance Company 14 $31,692,427 0.4417 1 3 8 2 0 0

Country Mutual Insurance Company 16 $152,626,357 0.1048 3 0 13 0 0 0

Country Preferred Insurance Company 14 $364,967,546 0.0384 0 0 14 0 0 0

Direct Auto Insurance Company 149 $43,655,044 3.4131 5 0 141 3 0 0

Echelon Property & Casualty Insurance

Company 15 $4,802,644 3.1233 2 0 13 0 0 0

Encompass Home & Auto Insurance Company 5 $14,540,208 0.3439 1 0 3 1 0 0

Esurance Insurance Company 6 $2,036,643 2.9460 0 0 6 0 0 0

Esurance Property & Casualty Ins Co 13 $73,759,792 0.1762 2 0 10 1 0 0

Falcon Insurance Company 11 $4,416,188 2.4908 1 0 10 0 0 0

Farmers Automobile Insurance Association (The) 7 $75,426,276 0.0928 0 0 5 2 0 0

First Acceptance Insurance Company Inc. 5 $4,324,172 1.1563 0 1 3 1 0 0

First Chicago Insurance Company 45 $19,923,910 2.2586 5 0 39 1 0 0

Founders Insurance Company 61 $50,611,331 1.2053 3 0 57 1 0 0

Geico Casualty Company 52 $450,252,037 0.1155 9 0 39 4 0 0

Geico General Insurance Company 22 $55,637,169 0.3954 1 0 20 1 0 0

Illinois Farmers Insurance Company 24 $267,160,826 0.0898 2 0 18 4 0 0

Liberty Mutual Fire Insurance Company 5 $10,788,465 0.4635 0 0 5 0 0 0

Liberty Mutual Insurance Company 5 $1,656,691 3.0181 3 0 1 1 0 0

LM General Insurance Company 19 $99,065,258 0.1918 7 0 12 0 0 0

Loya Insurance Company 15 $10,460,848 1.4339 0 0 14 1 0 0

Metropolitan Group Property & Casualty Ins Co 5 $35,093,743 0.1425 2 1 2 0 0 0

PRIVATE PASSENGER AUTO COMPLAINTS BY COMPANY NAME

6 | P a g e

A single complaint can have multiple major reasons; however, a complaint is only counted once in the Number of Complaints column.

Companies Showing 5 or More Complaints for

Private Passenger Auto Coverage

Number of

Complaints

2019 Illinois

Direct Written

Premium (DWP)

Complaint

Ratio per

$1 Millions

in DWP

Major Reason for Complaints

Underwriting Marketing

&

Sales

Claims

Handling

Policyholder

Service

Reason

Other

Reason

Not

Indicated

MIC General Insurance Corporation 6 $31,027,033 0.1934 0 0 6 0 0 0

National General Insurance Company 5 $3,008,193 1.6621 1 0 4 0 0 0

National Heritage Insurance Company 6 $2,387,193 2.5134 0 0 6 0 0 0

Nationwide General Insurance Company 5 $20,631,873 0.2423 2 0 3 0 0 0

Omni Indemnity Company 6 $818,390 7.3315 1 0 5 0 0 0

Permanent General Assurance Corporation 13 $10,499,644 1.2381 0 0 12 1 0 0

Progressive Casualty Insurance Company 44 $3,423 0.0000 6 0 37 1 0 0

Progressive Direct Insurance Company 9 $12,885,011 0.6985 2 1 6 0 0 0

Progressive Northern Insurance Company 21 $269,905,873 0.0778 3 1 17 0 0 0

Progressive Universal Insurance Company 39 $333,686,790 0.1169 11 0 25 3 0 0

Safe Auto Insurance Company 6 $12,416,366 0.4832 2 0 4 0 0 0

Safeco Insurance Company of Illinois 8 $90,839,162 0.0881 2 0 5 1 0 0

Safeway Insurance Company 29 $22,582,144 1.2842 0 0 27 2 0 0

Shelter Mutual Insurance Company 5 $22,320,316 0.2240 0 0 4 1 0 0

State Auto Property and Casualty Ins Co 6 $570,309 10.5206 0 0 5 1 0 0

State Farm Fire & Casualty Company 46 $123,463,619 0.3726 8 2 28 8 0 0

State Farm Mutual Automobile Insurance

Company 241 $2,188,979,892 0.1101 45 2 181 13 0 0

Stonegate Insurance Company 10 $11,177,245 0.8947 1 0 9 0 0 0

Trumbull Insurance Company 23 $59,953,042 0.3836 9 1 11 2 0 0

Unique Insurance Company 286 $61,566,481 4.6454 4 2 266 14 0 0

United Equitable Insurance Company 141 $17,357,641 8.1232 5 0 135 1 0 0

United Services Automobile Association 8 $69,212,870 0.1156 2 0 6 0 0 0

USAA Casualty Insurance Company 12 $61,486,123 0.1952 0 0 11 1 0 0

USAA General Indemnity Company 8 $47,440,093 0.1686 2 0 6 0 0 0

V

iva Seguros Insurance Company 136 $19,837,590 6.8557 1 0 130 5 0 0

Grand Total 2347 $6,661,240,456 88.8221 197 21 2031 98 0 0

MEAN (The “average” of complaint ratios)

1.5314

MEDIAN (The “middle” of complaint ratios)

0.4186

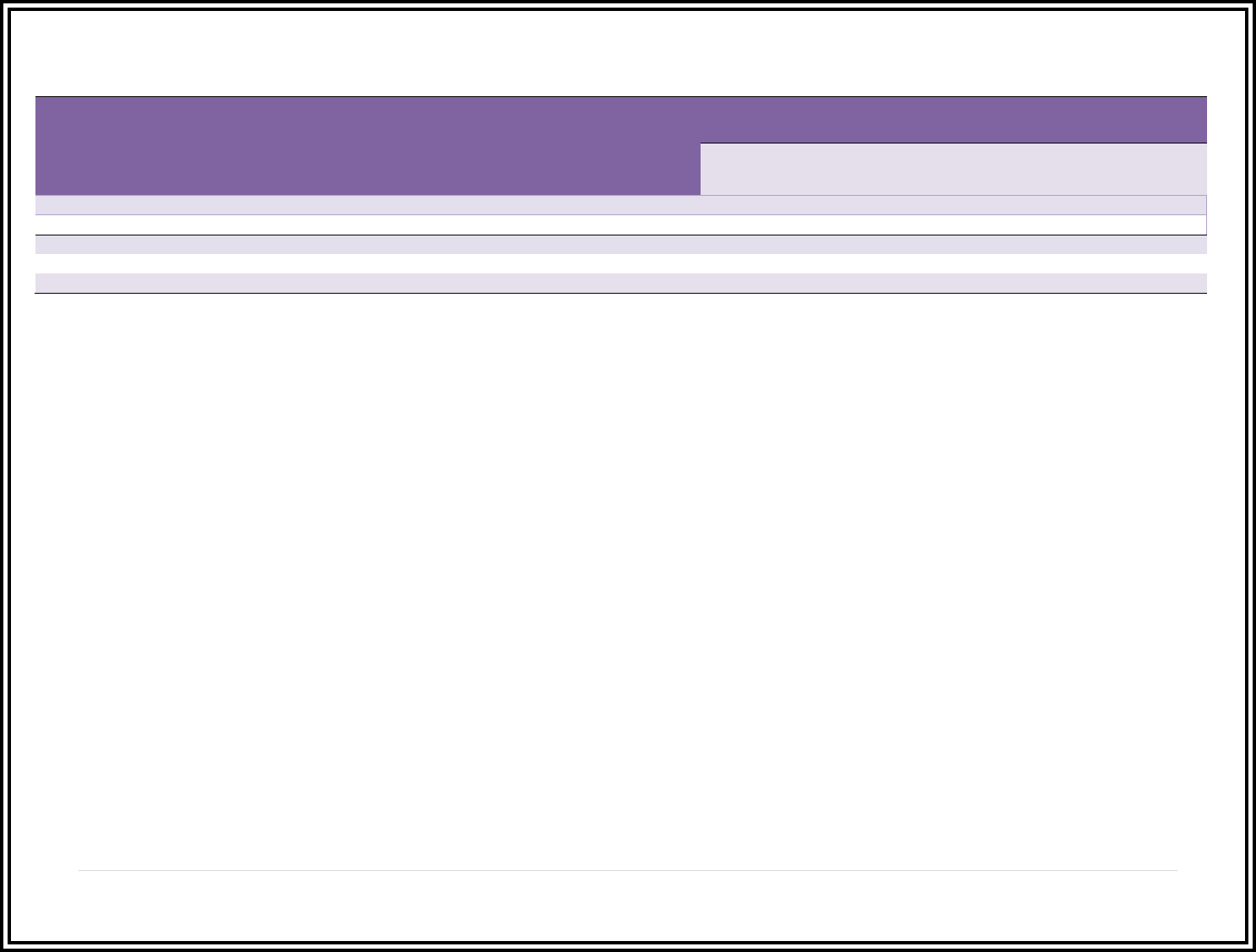

INDIVIDUAL LIFE COMPLAINTS BY COMPANY NAME

5 | P a g e

A single complaint can have multiple major reasons; however, a complaint is only counted once in the Number of Complaints column.

Companies Showing 5 or More Complaints for

Individual Life Coverage

Number of

Complaints

Policies in

Force as of

12/31/2019

Complaint

Ratio per

10,000 Policies

in Force

Major Reason for Complaints

Underwriting Marketing

&

Sales

Claims

Handling

Policyholder

Service

Reason

Other

Reason

Not

Indicated

Allstate Life Insurance Company 11 41,505 2.6503 3 1 1 6 0 0

American General Life Insurance Company 34 174,937 1.9436 0 2 11 20 1 0

American Income Life Insurance Company 20 111,647 1.7914 3 4 3 10 0 0

American National Insurance Company 7 33,159 2.1110 2 1 2 2 0 0

Athene Annuity and Life Company 8 7,059 11.3331 1 0 0 7 0 0

Atlanta Life Insurance Company 8 27,340 2.9261 0 0 1 7 0 0

Bankers Life & Casualty Company 12 34,732 3.4550 1 1 3 7 0 0

Colonial Penn Life Insurance Company 8 4,075 19.6319 1 0 0 7 0 0

Country Life Insurance Company 13 388,861 0.3343 8 1 0 4 0 0

Farmers New World Life Insurance Company 9 66,479 1.3538 3 3 0 3 0 0

Fidelity Life Association, A Legal Reserve Life

Insurance Company 6 8,433 7.1149 1 2 0 2 1 0

Genworth Life Insurance Company 15 13,102 11.4486 14 1 0 0 0 0

Globe Life & Accident Insurance Company 26 396,705 0.6554 5 1 8 12 0 0

Jackson National Life Insurance Company 18 44,273 4.0657 1 2 7 8 0 0

John Hancock Life Insurance Company U.S.A. 20 72,413 2.7619 10 2 1 7 0 0

Massachusetts Mutual Life Insurance Company 7 76,908 0.9102 2 0 1 4 0 0

Metropolitan Life Insurance Company 73 257,339 2.8367 14 2 18 39 0 0

Minnesota Life Insurance Company 6 36,762 1.6321 2 0 1 2 1 0

Northwestern Mutual Life Insurance Co 9 433,334 0.2077 2 2 1 4 0 0

Primerica Life Insurance Company 17 85,023 1.9995 2 3 7 4 1 0

Protective Life Insurance Company 8 75,745 1.0562 1 0 0 7 0 0

Prudential Insurance Company of America 27 271,228 0.9955 3 4 3 16 1 0

State Farm Life Insurance Company 22 479,288 0.4590 6 3 3 9 1 0

Transamerica Life Insurance Company 33 88,043 3.7482 8 1 10 13 1 0

Transamerica Premier Life Insurance Company 28 155,015 1.8063 5 1 6 16 0 0

United Insurance Company Of America 14 134,800 1.0386 3 1 3 7 0 0

United of Omaha Life Insurance Company 11 121,382 0.9062 3 1 3 3 1 0

Washington National Insurance Company 6 6,102 9.8328 1 0 0 5 0 0

Wilco Life Insurance Company 8 6,531 12.2493 3 0 1 4 0 0

Grand Total 484 3,652,220 113.2553 108 39 94 235 8 0

MEAN (The “average” of complaint ratios)

3.9054

MEDIAN (The “middle” of complaint ratios)

1.9995

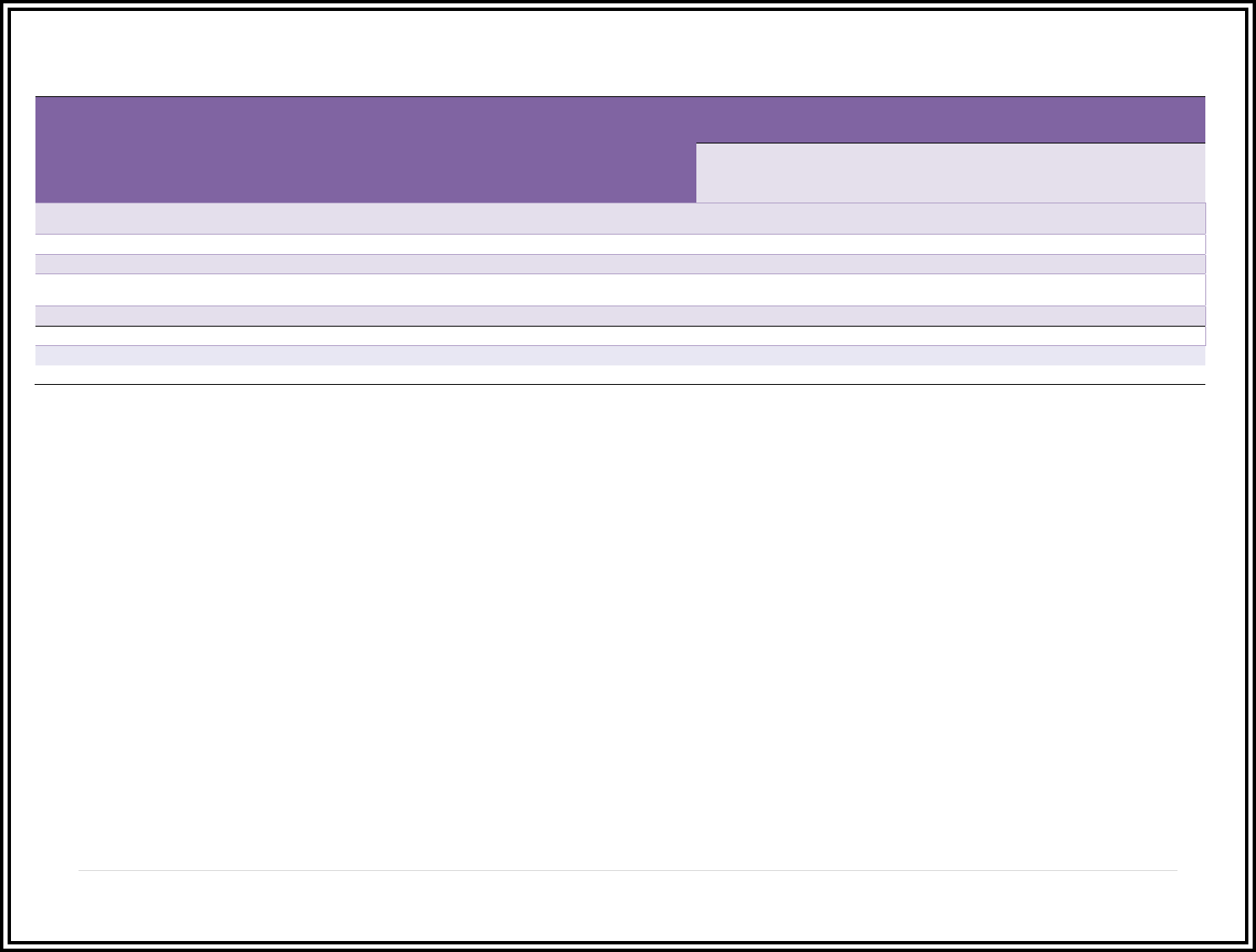

ANNUITY COMPLAINTS BY COMPANY NAME

7 | P a g e

A single complaint can have multiple major reasons; however, a complaint is only counted once in the Number of Complaints column.

Companies Showing 5 or More Complaints for

Annuity Coverage

Number of

Complaints

Policies in

Force as of

12/31/2019

Complaint

Ratio per

10,000 Policies

in Force

Major Reason for Complaints

Underwriting Marketing

&

Sales

Claims

Handling

Policyholder

Service

Reason

Other

Reason

Not

Indicated

American General Life Insurance Company 6 1,540,542 0.0389 0 0 2 4 0 0

Protective Life Insurance Company 7 233,663 0.2996 0 1 1 4 1 0

Grand total 13 1,774,205 0.3385 0 1 3 8 1 0

MEAN (The “average” of complaint ratios)

0.1693

MEDIAN (The “middle” of complaint ratios)

0.1693

INDIVIDUAL ACCIDENT & HEALTH COMPLAINTS BY COMPANY NAME

8 | P a g e

A single complaint can have multiple major reasons; however, a complaint is only counted once in the Number of Complaints column.

Companies Showing 5 or More Complaints for

Individual Accident & Health Coverage

Number of

Complaints

Policies in

Force as of

12/31/2019

Complaint

Ratio per

10,000 Policies

in Force

Major Reason for Complaints

Underwriting Marketing

&

Sales

Claims

Handling

Policyholder

Service

Reason

Other

Reason

Not

Indicated

American Family Life Assurance Company of

Columbus 10 9,444,064 0.0106 2 0 8 0 0 0

Cigna Health And Life Insurance Company 5 683,359 0.0732 1 1 0 3 0 0

Golden Rule Insurance Company 8 455,963 0.1755 5 0 3 0 0 0

Health Care Service Corporation (Blue Cross

Blue Shield of Illinois) 55 1,295,627 0.4245 3 0 41 7 4 0

Mutual of Omaha Insurance Company 5 1,150,082 0.0435 0 1 4 0 0 0

Grand Total 83 13,029,095 0.7273 11 2 56 10 4 0

MEAN (The “average” of complaint ratios)

0.1455

MEDIAN (The “middle” of complaint ratios)

0.0732

GROUP ACCIDENT & HEALTH COMPLAINTS BY COMPANY NAME

9 | P a g e

A single complaint can have multiple major reasons; however, a complaint is only counted once in the Number of Complaints column.

Companies Showing 5 or More Complaints for

Group Accident & Health Coverage

Number of

Complaints

Policies in

Force as of

12/31/2019

Complaint

Ratio per

10,000 Policies

in Force

Major Reason for Complaints

Underwriting Marketing

&

Sales

Claims

Handling

Policyholder

Service

Reason

Other

Reason

Not

Indicated

Aetna Health Insurance Company 12 17,622 6.8097 1 1 10 0 0 0

Aetna Life Insurance Company 16 7,989,505 0.0200 0 0 16 0 0 0

American Family Life Assurance Company of

Columbus 7 13,505 5.1833 1 0 6 0 0 0

American Heritage Life Insurance Company 8 2,925,620 0.0273 2 0 6 0 0 0

Ameritas Life Insurance Corporation 7 36,819 1.9012 0 0 7 0 0 0

Cigna Health And Life Insurance Company 11 125,114 0.8792 1 0 10 0 0 0

Continental American Insurance Company 6 2,538,430 0.0236 1 0 5 0 0 0

Golden Rule Insurance Company 12 205,284 0.5846 1 1 8 1 1 0

Guardian Life Insurance Company of America 23 12,973,418 0.0177 0 0 23 0 0 0

Hartford Life & Accident Insurance Company 9 123,638 0.7279 0 0 8 0 1 0

Health Alliance Medical Plans Inc. 13 57,841 2.2475 1 0 12 0 0 0

Health Care Service Corporation (Blue Cross

Blue Shield of Illinois) 324 2,307,711 1.4040 15 2 286 11 10 0

Humana Insurance Company 19 1,587,445 0.1197 2 0 15 2 0 0

Life Insurance Company of North America 8 24,501 3.2652 1 0 7 0 0 0

Lincoln National Life Insurance Company 6 65,993 0.9092 0 0 5 1 0 0

Metropolitan Life Insurance Company 21 125,648 1.6713 1 0 19 1 0 0

Principal Life Insurance Company 15 3,917,191 0.0383 0 0 14 1 0 0

Prudential Insurance Company of America 5 5,715 8.7489 1 0 4 0 0 0

UnitedHealthcare Insurance Company 49 11,001,499 0.0445 4 0 44 0 1 0

UnitedHealthcare Insurance Company of

Illinois 132 119,819 11.0166 4 1 121 5 1 0

UnitedHealthcare Insurance Company of the

River Valley 9 113,300 0.7944 1 0 6 2 0 0

Unum Life Insurance Company of America 8 143,184 0.5587 0 0 8 0 0 0

Grand Total 720 46,418,802 46.9928 37 5 640 24 14 0

MEAN (The “average” of complaint ratios)

2.1360

MEDIAN (The “middle” of complaint ratios)

0.8368

HEALTH MAINTENANCE ORGANIZATIONS (HMO’S) COMPLAINTS

BY COMPANY NAME

10 | P a g e

A single complaint can have multiple major reasons; however, a complaint is only counted once in the Number of Complaints column.

Companies Showing 5 or More Complaints

for Health Maintenance Organizations

(HMO's) with Illinois Members

Number of

Complaints

Total

Enrollment

Count

Adjusted IL

Enrollment

Count

Complaint

Ratio

Major Reason for Complaints

Underwriting Marketing

&

Sales

Claims

Handling

Policyholder

Service

Reason

Other

Reason

Not

Indicated

Celtic Insurance Company 20 23,162 23,162 8.6348 2 0 18 0 0 0

CIGNA Healthcare Of Illinois Inc. 16 14,545 14,545 11.0003 1 0 14 1 0 0

Delta Dental of Illinois 13 585,011 585,011 0.2222 0 0 13 0 0 0

Health Alliance Medical Plans Inc. 36 141,394 139,781 2.5755 3 0 33 0 0 0

Health Care Service Corporation (Blue

Cross Blue Shield HMO) 121 1,143,803 667,645 1.8123 12 0 99 7 3 0

Health Care Service Corporation (Blue

Cross Blue Shield of Illinois)

42 64,735 64,735 6.4880 2 0 38 2 0 0

Humana Health Plan Inc. 8 37,412 14,373 5.5660 0 0 8 0 0 0

UnitedHealthcare Of Illinois Inc. 17 33,795 33,793 5.0306 0 1 14 1 1 0

Grand Total 273 2,043,857 1,543,045 41.3297 41.3297 1 237 11 4 0

MEAN (The “average” of complaint ratios)

5.1662

MEDIAN (The “middle” of complaint ratios)

5.2983